| Maryland | 001-12675 | 95-4598246 | |||||||||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (I.R.S. Employer Identification No.) |

|||||||||

| (Registrant's telephone number, including area code) | ||||||||

| N/A | ||||||||

| (Former name, former address and former fiscal year, if changed since last report) | ||||||||

| Securities registered pursuant to Section 12(b) of the Act: | |||||||||||

| Registrant | Title of each class | Name of each exchange on which registered | Ticker Symbol | ||||||||

| Kilroy Realty Corporation | Common Stock, $.01 par value | New York Stock Exchange | KRC | ||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| (a) | Financial statements of businesses acquired: None. |

|||||||

| (b) | Pro forma financial information: None. | |||||||

| (c) | Shell company transactions: None. | |||||||

| (d) | Exhibits: | |||||||

| Exhibit No. | Description | |||||||

| 99.1* | ||||||||

| 99.2* | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Kilroy Realty Corporation | ||||||||||||||||||||

Date: February 5, 2024 |

||||||||||||||||||||

| By: | /s/ Merryl E. Werber | |||||||||||||||||||

| Merryl E. Werber Senior Vice President, Chief Accounting Officer and Controller |

||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Page | |||||

7-8

|

|||||

Q4 2023 Supplemental Financial Report |

|||||

| Board of Directors | Executive and Senior Management Team | Investor Relations | ||||||||||||||||||

| John Kilroy | Chair | John Kilroy | Chief Executive Officer through January 21, 2024 (1) |

12200 W. Olympic Blvd., Suite 200 Los Angeles, CA 90064 (310) 481-8400 Web: www.kilroyrealty.com E-mail: investorrelations@kilroyrealty.com |

||||||||||||||||

| Edward F. Brennan, PhD | Lead Independent | Angela M. Aman | Chief Executive Officer effective January 22, 2024 (1) |

|||||||||||||||||

| Angela M. Aman | Justin W. Smart | President | ||||||||||||||||||

| Jolie Hunt | Eliott Trencher | Executive VP, Chief Financial Officer and Chief Investment Officer | ||||||||||||||||||

| Scott S. Ingraham | ||||||||||||||||||||

| Louisa G. Ritter | Robert Paratte | Executive VP, Chief Leasing Officer and Senior Advisor to the Chair | Bill Hutcheson |

|||||||||||||||||

| Gary R. Stevenson | Senior VP, Investor Relations & Capital Markets | |||||||||||||||||||

| Peter B. Stoneberg | Heidi R. Roth | Executive VP, Chief Administrative Officer | ||||||||||||||||||

| John Osmond | Executive VP, Head of Asset Management | |||||||||||||||||||

| Merryl Werber | Senior VP, Chief Accounting Officer and Controller | |||||||||||||||||||

| Equity Research Coverage | ||||||||||||||

| BofA Securities | Jefferies LLC | |||||||||||||

| Camille Bonnel | (646) 855-5042 | Peter Abramowitz | (212) 336-7241 | |||||||||||

| BMO Capital Markets Corp. | J.P. Morgan | |||||||||||||

| John P. Kim | (212) 885-4115 | Anthony Paolone | (212) 622-6682 | |||||||||||

| BTIG | Keybanc Capital Markets | |||||||||||||

| Thomas Catherwood | (212) 738-6140 | Upal Rana | (917) 368-2316 | |||||||||||

| Citigroup Investment Research | Mizuho Securities USA LLC | |||||||||||||

| Michael Griffin | (212) 816-5871 | Vikram Malhotra | (212) 282-3827 | |||||||||||

| Deutsche Bank Securities, Inc. | RBC Capital Markets | |||||||||||||

| Omotayo Okusanya | (212) 250-9284 | Mike Carroll | (440) 715-2649 | |||||||||||

| Evercore ISI | Scotiabank | |||||||||||||

| Steve Sakwa | (212) 446-9462 | Nicholas Yulico | (212) 225-6904 | |||||||||||

| Goldman Sachs & Co. LLC | Wells Fargo | |||||||||||||

| Caitlin Burrows | (212) 902-4736 | Blaine Heck | (443) 263-6529 | |||||||||||

| Green Street Advisors | Wolfe Research | |||||||||||||

| Dylan Burzinski | (949) 640-8780 | Andrew Rosivach | (646) 582-9250 | |||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Quarterly Financial Highlights | Quarterly Operating Highlights | |||||||

• Revenues of $269.0 million |

• Stabilized portfolio was 85.0% occupied and 86.4% leased at quarter-end |

|||||||

• Net income available to common stockholders per diluted share of $0.40 |

• Approximately 369,000 square feet of leases commenced |

|||||||

• FFO per diluted share of $1.08 |

• Approximately 588,000 square feet of leases executed, including short-term | |||||||

| leases | ||||||||

• Same Store NOI decreased 10.6% compared to the prior year. Same Store Cash |

||||||||

decreased 1.2% compared to the prior year |

◦GAAP and cash rents increased 21.7% and 1.6%, respectively, from |

|||||||

| prior levels, excluding short-term leases | ||||||||

◦Same Store NOI was negatively impacted by $6.4 million of rental income |

||||||||

| reversals related to placing tenants on a cash basis of revenue recognition | ||||||||

| Capital Markets Highlights | Strategic Highlights | |||||||

| • In January, completed a public offering of $400.0 million of 12-year unsecured | • In December, added Indeed Tower, comprised of approximately 759,000 square | |||||||

| senior notes at an interest rate of 6.250% due January 2036 | feet in the Austin CBD to the stabilized portfolio. The project is currently 78% |

|||||||

leased and 65% occupied |

||||||||

| • As of February 5, 2024, approximately $2.2 billion of total liquidity comprised | ||||||||

| of approximately $1.1 billion of cash and short term investments and | ||||||||

| approximately $1.1 billion available under the unsecured revolving credit facility | ||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| 12/31/2022 | 3/31/2023 | 6/30/2023 | 9/30/2023 | 12/31/2023 | |||||||||||||||||||||||||||||||

| INCOME ITEMS AND DIVIDENDS: | |||||||||||||||||||||||||||||||||||

| Capitalized Interest and Debt Costs | $ | 19,216 | $ | 17,731 | $ | 19,470 | $ | 20,056 | $ | 21,510 | |||||||||||||||||||||||||

Cash Lease Termination Fees (1) |

$ | 503 | $ | — | $ | 225 | $ | 1,329 | $ | 3,437 | |||||||||||||||||||||||||

Net Income Available to Common Stockholders per common share – diluted (2) |

$ | 0.45 | $ | 0.48 | $ | 0.47 | $ | 0.45 | $ | 0.40 | |||||||||||||||||||||||||

Funds From Operations per common share – diluted (3) |

$ | 1.17 | $ | 1.22 | $ | 1.19 | $ | 1.12 | $ | 1.08 | |||||||||||||||||||||||||

Dividends per common share (2) |

$ | 0.54 | $ | 0.54 | $ | 0.54 | $ | 0.54 | $ | 0.54 | |||||||||||||||||||||||||

EBITDA, as adjusted (4) |

$ | 174,421 | $ | 184,577 | $ | 178,020 | $ | 173,798 | $ | 171,387 | |||||||||||||||||||||||||

| RATIOS: | |||||||||||||||||||||||||||||||||||

| Net Operating Income Margins | 70.3 | % | 71.2 | % | 69.9 | % | 68.2 | % | 68.7 | % | |||||||||||||||||||||||||

| Fixed Charge Coverage Ratio - Net Income | 1.5x | 1.6x | 1.4x | 1.2x | 1.0x | ||||||||||||||||||||||||||||||

| Fixed Charge Coverage Ratio - EBITDA | 4.4x | 4.6x | 4.1x | 3.7x | 3.4x | ||||||||||||||||||||||||||||||

| Net Income Payout Ratio | 107.2 | % | 97.9 | % | 104.3 | % | 108.8 | % | 120.5 | % | |||||||||||||||||||||||||

| FFO Payout Ratio | 45.6 | % | 43.8 | % | 45.0 | % | 47.7 | % | 49.5 | % | |||||||||||||||||||||||||

| FAD Payout Ratio | 60.9 | % | 48.2 | % | 53.4 | % | 53.9 | % | 58.4 | % | |||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Full Year 2024 Range | ||||||||||||||||||||

| Low End | High End | |||||||||||||||||||

| Net income available to common stockholders per share - diluted | $ | 1.45 | $ | 1.61 | ||||||||||||||||

Weighted average common shares outstanding - diluted (1) |

118,000 | 118,000 | ||||||||||||||||||

| Net income available to common stockholders | $ | 171,000 | $ | 190,000 | ||||||||||||||||

| Adjustments: | ||||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | 1,900 | 2,000 | ||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | 20,500 | 21,000 | ||||||||||||||||||

| Depreciation and amortization of real estate assets | 330,000 | 330,000 | ||||||||||||||||||

| Funds From Operations attributable to noncontrolling interests in consolidated property partnerships | (30,000) | (32,000) | ||||||||||||||||||

Funds From Operations (2) |

$ | 493,400 | $ | 511,000 | ||||||||||||||||

Weighted average common shares and units outstanding - diluted (3) |

120,250 | 120,250 | ||||||||||||||||||

FFO per common share/unit - diluted (3) |

$ | 4.10 | $ | 4.25 | ||||||||||||||||

| Key Assumptions | 2023 Actuals | 2024 Assumptions | ||||||||||||||||||

Change in same store cash NOI (2) |

4.4% | (4.0%) to (6.0%) | ||||||||||||||||||

| Average full year occupancy | 87.3% | 82.5% to 84.0% | ||||||||||||||||||

| General and administrative expenses | $93 million | $72 million to $80 million | ||||||||||||||||||

| Total development spending | $394 million | $200 million to $300 million | ||||||||||||||||||

Weighted average common shares and units outstanding - diluted (3) |

119,241 | 120,250 | ||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | |||||||||||||||||||||||||||||||

| ASSETS: | |||||||||||||||||||||||||||||||||||

| Land and improvements | $ | 1,743,170 | $ | 1,743,170 | $ | 1,738,242 | $ | 1,738,242 | $ | 1,738,242 | |||||||||||||||||||||||||

| Buildings and improvements | 8,463,674 | 8,431,499 | 8,353,596 | 8,335,285 | 8,302,081 | ||||||||||||||||||||||||||||||

| Undeveloped land and construction in progress | 2,034,804 | 1,950,424 | 1,894,545 | 1,788,542 | 1,691,860 | ||||||||||||||||||||||||||||||

| Total real estate assets held for investment | 12,241,648 | 12,125,093 | 11,986,383 | 11,862,069 | 11,732,183 | ||||||||||||||||||||||||||||||

| Accumulated depreciation and amortization | (2,518,304) | (2,443,659) | (2,369,515) | (2,294,202) | (2,218,710) | ||||||||||||||||||||||||||||||

| Total real estate assets held for investment, net | 9,723,344 | 9,681,434 | 9,616,868 | 9,567,867 | 9,513,473 | ||||||||||||||||||||||||||||||

| Cash and cash equivalents | 510,163 | 618,794 | 361,885 | 476,358 | 347,379 | ||||||||||||||||||||||||||||||

| Marketable securities | 284,670 | 278,789 | 25,786 | 23,288 | 23,547 | ||||||||||||||||||||||||||||||

| Current receivables, net | 13,609 | 11,383 | 10,686 | 15,926 | 20,583 | ||||||||||||||||||||||||||||||

| Deferred rent receivables, net | 460,979 | 466,073 | 463,640 | 457,870 | 452,200 | ||||||||||||||||||||||||||||||

| Deferred leasing costs and acquisition-related intangible assets, net | 229,705 | 228,742 | 230,559 | 238,184 | 250,846 | ||||||||||||||||||||||||||||||

| Right of use ground lease assets | 125,506 | 125,765 | 126,022 | 126,277 | 126,530 | ||||||||||||||||||||||||||||||

| Prepaid expenses and other assets, net | 53,069 | 60,141 | 75,588 | 63,622 | 62,429 | ||||||||||||||||||||||||||||||

| TOTAL ASSETS | $ | 11,401,045 | $ | 11,471,121 | $ | 10,911,034 | $ | 10,969,392 | $ | 10,796,987 | |||||||||||||||||||||||||

| LIABILITIES AND EQUITY: | |||||||||||||||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||||||||

| Secured debt, net | $ | 603,225 | $ | 604,480 | $ | 240,142 | $ | 241,547 | $ | 242,938 | |||||||||||||||||||||||||

| Unsecured debt, net | 4,325,153 | 4,330,326 | 4,172,833 | 4,171,029 | 4,020,058 | ||||||||||||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 371,179 | 426,662 | 377,733 | 418,902 | 392,360 | ||||||||||||||||||||||||||||||

| Ground lease liabilities | 124,353 | 124,517 | 124,678 | 124,837 | 124,994 | ||||||||||||||||||||||||||||||

| Accrued dividends and distributions | 64,440 | 64,423 | 64,438 | 64,461 | 64,285 | ||||||||||||||||||||||||||||||

| Deferred revenue and acquisition-related intangible liabilities, net | 173,638 | 178,542 | 185,429 | 195,629 | 195,959 | ||||||||||||||||||||||||||||||

| Rents received in advance and tenant security deposits | 79,364 | 74,646 | 78,187 | 80,565 | 81,432 | ||||||||||||||||||||||||||||||

| Total liabilities | 5,741,352 | 5,803,596 | 5,243,440 | 5,296,970 | 5,122,026 | ||||||||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||||||||

| Stockholders’ Equity | |||||||||||||||||||||||||||||||||||

| Common stock | 1,173 | 1,173 | 1,172 | 1,171 | 1,169 | ||||||||||||||||||||||||||||||

| Additional paid-in capital | 5,205,839 | 5,195,106 | 5,184,227 | 5,175,402 | 5,170,760 | ||||||||||||||||||||||||||||||

| Retained earnings | 221,149 | 237,665 | 248,695 | 257,079 | 265,118 | ||||||||||||||||||||||||||||||

| Total stockholders’ equity | 5,428,161 | 5,433,944 | 5,434,094 | 5,433,652 | 5,437,047 | ||||||||||||||||||||||||||||||

| Noncontrolling Interests | |||||||||||||||||||||||||||||||||||

| Common units of the Operating Partnership | 53,275 | 53,328 | 53,358 | 53,386 | 53,524 | ||||||||||||||||||||||||||||||

| Noncontrolling interests in consolidated property partnerships | 178,257 | 180,253 | 180,142 | 185,384 | 184,390 | ||||||||||||||||||||||||||||||

| Total noncontrolling interests | 231,532 | 233,581 | 233,500 | 238,770 | 237,914 | ||||||||||||||||||||||||||||||

| Total equity | 5,659,693 | 5,667,525 | 5,667,594 | 5,672,422 | 5,674,961 | ||||||||||||||||||||||||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 11,401,045 | $ | 11,471,121 | $ | 10,911,034 | $ | 10,969,392 | $ | 10,796,987 | |||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

| REVENUES | ||||||||||||||||||||||||||||||||

| Rental income | $ | 265,643 | $ | 281,688 | $ | 1,117,737 | $ | 1,086,018 | ||||||||||||||||||||||||

| Other property income | 3,373 | 2,656 | 11,957 | 10,969 | ||||||||||||||||||||||||||||

| Total revenues | 269,016 | 284,344 | 1,129,694 | 1,096,987 | ||||||||||||||||||||||||||||

| EXPENSES | ||||||||||||||||||||||||||||||||

| Property expenses | 60,731 | 55,323 | 228,964 | 202,744 | ||||||||||||||||||||||||||||

| Real estate taxes | 21,000 | 27,151 | 105,868 | 105,869 | ||||||||||||||||||||||||||||

| Ground leases | 2,560 | 2,092 | 9,732 | 7,565 | ||||||||||||||||||||||||||||

General and administrative expenses (1) |

22,078 | 25,217 | 93,434 | 93,642 | ||||||||||||||||||||||||||||

| Leasing costs | 1,956 | 1,404 | 6,506 | 4,879 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 86,016 | 91,396 | 355,278 | 357,611 | ||||||||||||||||||||||||||||

| Total expenses | 194,341 | 202,583 | 799,782 | 772,310 | ||||||||||||||||||||||||||||

| OTHER INCOME (EXPENSES) | ||||||||||||||||||||||||||||||||

| Interest and other income, net | 10,696 | 1,264 | 22,592 | 1,765 | ||||||||||||||||||||||||||||

| Interest expense | (32,325) | (23,550) | (114,216) | (84,278) | ||||||||||||||||||||||||||||

| Gain on sale of depreciable operating property | — | — | — | 17,329 | ||||||||||||||||||||||||||||

| Total other expenses | (21,629) | (22,286) | (91,624) | (65,184) | ||||||||||||||||||||||||||||

| NET INCOME | 53,046 | 59,475 | 238,288 | 259,493 | ||||||||||||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | (471) | (588) | (2,083) | (2,283) | ||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | (5,291) | (6,262) | (23,964) | (24,595) | ||||||||||||||||||||||||||||

| Total income attributable to noncontrolling interests | (5,762) | (6,850) | (26,047) | (26,878) | ||||||||||||||||||||||||||||

| NET INCOME AVAILABLE TO COMMON STOCKHOLDERS | $ | 47,284 | $ | 52,625 | $ | 212,241 | $ | 232,615 | ||||||||||||||||||||||||

| Weighted average common shares outstanding – basic | 117,240 | 116,878 | 117,160 | 116,807 | ||||||||||||||||||||||||||||

| Weighted average common shares outstanding – diluted | 117,816 | 117,389 | 117,506 | 117,220 | ||||||||||||||||||||||||||||

| NET INCOME AVAILABLE TO COMMON STOCKHOLDERS PER SHARE | ||||||||||||||||||||||||||||||||

| Net income available to common stockholders per share – basic | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.98 | ||||||||||||||||||||||||

| Net income available to common stockholders per share – diluted | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.97 | ||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

FUNDS FROM OPERATIONS: (1) |

||||||||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 47,284 | $ | 52,625 | $ | 212,241 | $ | 232,615 | ||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | 471 | 588 | 2,083 | 2,283 | ||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | 5,291 | 6,262 | 23,964 | 24,595 | ||||||||||||||||||||||||||||

| Depreciation and amortization of real estate assets | 84,402 | 89,536 | 348,064 | 350,665 | ||||||||||||||||||||||||||||

| Gain on sale of depreciable real estate | — | — | — | (17,329) | ||||||||||||||||||||||||||||

| Funds From Operations attributable to noncontrolling interests in consolidated property partnerships | (8,191) | (9,156) | (35,236) | (36,198) | ||||||||||||||||||||||||||||

Funds From Operations (1)(2) |

$ | 129,257 | $ | 139,855 | $ | 551,116 | $ | 556,631 | ||||||||||||||||||||||||

Weighted average common shares/units outstanding – basic (3) |

118,896 | 118,568 | 118,895 | 118,586 | ||||||||||||||||||||||||||||

Weighted average common shares/units outstanding – diluted (4) |

119,473 | 119,079 | 119,241 | 118,999 | ||||||||||||||||||||||||||||

FFO per common share/unit – basic (1) |

$ | 1.09 | $ | 1.18 | $ | 4.64 | $ | 4.69 | ||||||||||||||||||||||||

FFO per common share/unit – diluted (1) |

$ | 1.08 | $ | 1.17 | $ | 4.62 | $ | 4.68 | ||||||||||||||||||||||||

FUNDS AVAILABLE FOR DISTRIBUTION: (1) |

||||||||||||||||||||||||||||||||

Funds From Operations (1)(2) |

$ | 129,257 | $ | 139,855 | $ | 551,116 | $ | 556,631 | ||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Recurring tenant improvements, leasing commissions and capital expenditures | (31,411) | (28,480) | (87,546) | (81,328) | ||||||||||||||||||||||||||||

Amortization of deferred revenue related to tenant-funded tenant improvements (2)(5) |

(5,717) | (5,100) | (20,697) | (19,321) | ||||||||||||||||||||||||||||

| Net effect of straight-line rents | 5,143 | (9,214) | (8,578) | (47,936) | ||||||||||||||||||||||||||||

Amortization of net below market rents (6) |

(973) | (2,305) | (6,648) | (10,476) | ||||||||||||||||||||||||||||

| Amortization of deferred financing costs and net debt discount/premium | 1,279 | 1,215 | 5,200 | 3,657 | ||||||||||||||||||||||||||||

| Non-cash amortization of share-based compensation awards | 8,498 | 6,712 | 36,858 | 28,347 | ||||||||||||||||||||||||||||

Lease related adjustments, leasing costs and other (7) |

1,966 | 833 | 4,921 | 9,536 | ||||||||||||||||||||||||||||

| Adjustments attributable to noncontrolling interests in consolidated property partnerships | 1,486 | 1,223 | 5,679 | 5,687 | ||||||||||||||||||||||||||||

Funds Available for Distribution (1) |

$ | 109,528 | $ | 104,739 | $ | 480,305 | $ | 444,797 | ||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

GAAP Net Cash Provided by Operating Activities |

$ | 110,223 | $ | 108,005 | $ | 602,589 | $ | 592,235 | ||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Recurring tenant improvements, leasing commissions and capital expenditures | (31,411) | (28,480) | (87,546) | (81,328) | ||||||||||||||||||||||||||||

| Depreciation of non-real estate furniture, fixtures and equipment | (1,614) | (1,860) | (7,214) | (6,946) | ||||||||||||||||||||||||||||

Net changes in operating assets and liabilities (1) |

39,064 | 36,343 | 1,816 | (12,634) | ||||||||||||||||||||||||||||

Noncontrolling interests in consolidated property partnerships’ share of FFO and FAD |

(6,705) | (7,933) | (29,557) | (30,511) | ||||||||||||||||||||||||||||

| Cash adjustments related to investing and financing activities | (29) | (1,336) | 217 | (16,019) | ||||||||||||||||||||||||||||

Funds Available for Distribution (2) |

$ | 109,528 | $ | 104,739 | $ | 480,305 | $ | 444,797 | ||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | % Change | 2023 | 2022 | % Change | |||||||||||||||||||||||||||||||||||||||

| Operating Revenues: | ||||||||||||||||||||||||||||||||||||||||||||

Rental income (2) |

$ | 223,835 | $ | 237,884 | (5.9) | % | $ | 933,492 | $ | 923,780 | 1.1 | % | ||||||||||||||||||||||||||||||||

Tenant reimbursements (2) |

41,808 | 43,804 | (4.6) | % | 184,245 | 162,238 | 13.6 | % | ||||||||||||||||||||||||||||||||||||

| Other property income | 3,373 | 2,656 | 27.0 | % | 11,957 | 10,969 | 9.0 | % | ||||||||||||||||||||||||||||||||||||

| Total operating revenues | 269,016 | 284,344 | (5.4) | % | 1,129,694 | 1,096,987 | 3.0 | % | ||||||||||||||||||||||||||||||||||||

| Operating Expenses: | ||||||||||||||||||||||||||||||||||||||||||||

| Property expenses | 60,731 | 55,323 | 9.8 | % | 228,964 | 202,744 | 12.9 | % | ||||||||||||||||||||||||||||||||||||

| Real estate taxes | 21,000 | 27,151 | (22.7) | % | 105,868 | 105,869 | 0.0 | % | ||||||||||||||||||||||||||||||||||||

| Ground leases | 2,560 | 2,092 | 22.4 | % | 9,732 | 7,565 | 28.6 | % | ||||||||||||||||||||||||||||||||||||

| Total operating expenses | 84,291 | 84,566 | (0.3) | % | 344,564 | 316,178 | 9.0 | % | ||||||||||||||||||||||||||||||||||||

| Net Operating Income | $ | 184,725 | $ | 199,778 | (7.5) | % | $ | 785,130 | $ | 780,809 | 0.6 | % | ||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | % Change | 2023 | 2022 | % Change | |||||||||||||||||||||||||||||||||||||||

| Total Same Store Portfolio | ||||||||||||||||||||||||||||||||||||||||||||

| Office Portfolio | ||||||||||||||||||||||||||||||||||||||||||||

| Number of properties | 115 | 115 | 115 | 115 | ||||||||||||||||||||||||||||||||||||||||

| Square Feet | 15,063,419 | 15,063,419 | 15,063,419 | 15,063,419 | ||||||||||||||||||||||||||||||||||||||||

| Percent of Stabilized Portfolio | 88.4 | % | 93.0 | % | 88.4 | % | 93.0 | % | ||||||||||||||||||||||||||||||||||||

| Average Occupancy | 86.3 | % | 91.7 | % | 87.7 | % | 91.6 | % | ||||||||||||||||||||||||||||||||||||

| Operating Revenues: | ||||||||||||||||||||||||||||||||||||||||||||

Rental income (2) |

$ | 199,295 | $ | 218,276 | (8.7) | % | $ | 840,013 | $ | 863,577 | (2.7) | % | ||||||||||||||||||||||||||||||||

Tenant reimbursements (2) |

38,552 | 40,751 | (5.4) | % | 166,020 | 153,745 | 8.0 | % | ||||||||||||||||||||||||||||||||||||

| Other property income | 3,084 | 2,465 | 25.1 | % | 10,874 | 9,820 | 10.7 | % | ||||||||||||||||||||||||||||||||||||

| Total operating revenues | 240,931 | 261,492 | (7.9) | % | 1,016,907 | 1,027,142 | (1.0) | % | ||||||||||||||||||||||||||||||||||||

| Operating Expenses: | ||||||||||||||||||||||||||||||||||||||||||||

| Property expenses | 56,119 | 51,824 | 8.3 | % | 213,788 | 193,353 | 10.6 | % | ||||||||||||||||||||||||||||||||||||

| Real estate taxes | 19,064 | 24,428 | (22.0) | % | 93,383 | 98,266 | (5.0) | % | ||||||||||||||||||||||||||||||||||||

| Ground leases | 1,915 | 1,897 | 0.9 | % | 7,588 | 7,162 | 5.9 | % | ||||||||||||||||||||||||||||||||||||

| Total operating expenses | 77,098 | 78,149 | (1.3) | % | 314,759 | 298,781 | 5.3 | % | ||||||||||||||||||||||||||||||||||||

Net Operating Income (3)(4) |

$ | 163,833 | $ | 183,343 | (10.6) | % | $ | 702,148 | $ | 728,361 | (3.6) | % | ||||||||||||||||||||||||||||||||

| Same Store Analysis (Cash Basis) | ||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | % Change | 2023 | 2022 | % Change | |||||||||||||||||||||||||||||||||||||||

| Total operating revenues | $ | 246,716 | $ | 249,807 | (1.2) | % | $ | 1,005,711 | $ | 960,820 | 4.7 | % | ||||||||||||||||||||||||||||||||

| Total operating expenses | 77,000 | 78,049 | (1.3) | % | 314,360 | 298,354 | 5.4 | % | ||||||||||||||||||||||||||||||||||||

Cash Net Operating Income (4)(5) |

$ | 169,716 | $ | 171,758 | (1.2) | % | $ | 691,351 | $ | 662,466 | 4.4 | % | ||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Portfolio Breakdown | Occupied at | Leased at | ||||||||||||||||||||||||||||||||||||||||||||||||

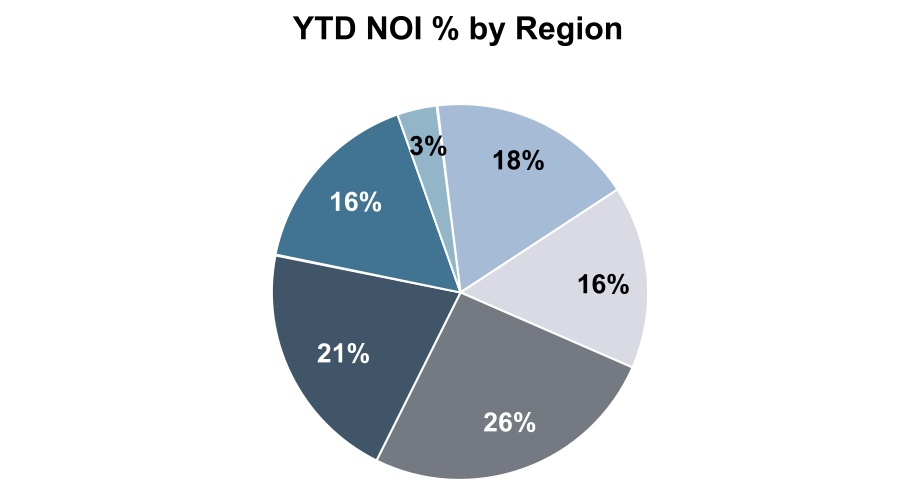

STABILIZED PORTFOLIO (1) (2) |

Buildings | YTD NOI % | SF % | Total SF | 12/31/2023 | 9/30/2023 | 12/31/2023 | |||||||||||||||||||||||||||||||||||||||||||

| Greater Los Angeles | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Culver City | 19 | 0.7 | % | 1.0 | % | 166,207 | 71.9 | % | 78.9 | % | 71.9 | % | ||||||||||||||||||||||||||||||||||||||

| El Segundo | 5 | 2.7 | % | 6.5 | % | 1,103,595 | 75.4 | % | 75.4 | % | 75.6 | % | ||||||||||||||||||||||||||||||||||||||

| Hollywood | 10 | 6.9 | % | 7.0 | % | 1,200,631 | 87.3 | % | 87.4 | % | 91.1 | % | ||||||||||||||||||||||||||||||||||||||

| Long Beach | 7 | 2.1 | % | 5.6 | % | 957,706 | 85.7 | % | 82.6 | % | 85.7 | % | ||||||||||||||||||||||||||||||||||||||

| West Hollywood | 4 | 1.0 | % | 1.1 | % | 189,459 | 91.3 | % | 87.4 | % | 92.5 | % | ||||||||||||||||||||||||||||||||||||||

| West Los Angeles | 8 | 4.2 | % | 4.3 | % | 726,975 | 60.0 | % | 76.5 | % | 60.0 | % | ||||||||||||||||||||||||||||||||||||||

| Total Greater Los Angeles | 53 | 17.6 | % | 25.5 | % | 4,344,573 | 79.0 | % | 81.2 | % | 80.1 | % | ||||||||||||||||||||||||||||||||||||||

| San Diego County | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Del Mar | 17 | 13.4 | % | 10.5 | % | 1,791,486 | 96.9 | % | 96.7 | % | 97.1 | % | ||||||||||||||||||||||||||||||||||||||

| I-15 Corridor | 3 | 0.9 | % | 2.5 | % | 433,851 | 82.6 | % | 68.0 | % | 85.5 | % | ||||||||||||||||||||||||||||||||||||||

| Little Italy / Point Loma | 2 | — | % | 1.8 | % | 313,983 | 41.6 | % | 41.0 | % | 43.8 | % | ||||||||||||||||||||||||||||||||||||||

| University Towne Center | 2 | 1.3 | % | 1.4 | % | 231,060 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| Total San Diego County | 24 | 15.6 | % | 16.2 | % | 2,770,380 | 88.6 | % | 86.1 | % | 89.5 | % | ||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Menlo Park | 6 | 2.0 | % | 1.9 | % | 329,944 | 86.1 | % | 86.1 | % | 93.1 | % | ||||||||||||||||||||||||||||||||||||||

| Mountain View | 3 | 3.1 | % | 2.7 | % | 457,066 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| Palo Alto | 2 | 1.3 | % | 1.0 | % | 165,574 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| Redwood City | 2 | 2.9 | % | 2.0 | % | 347,269 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| San Francisco | 10 | 25.5 | % | 20.0 | % | 3,400,600 | 85.0 | % | 85.3 | % | 85.5 | % | ||||||||||||||||||||||||||||||||||||||

| South San Francisco | 6 | 8.3 | % | 4.7 | % | 806,109 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| Sunnyvale | 4 | 4.0 | % | 3.9 | % | 663,460 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||||||||||||||

| Total San Francisco Bay Area | 33 | 47.1 | % | 36.2 | % | 6,170,022 | 91.0 | % | 91.1 | % | 91.6 | % | ||||||||||||||||||||||||||||||||||||||

| Greater Seattle | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Bellevue | 2 | 5.3 | % | 5.4 | % | 919,295 | 93.6 | % | 94.0 | % | 95.4 | % | ||||||||||||||||||||||||||||||||||||||

| Lake Union / Denny Regrade | 8 | 11.0 | % | 12.2 | % | 2,080,883 | 78.9 | % | 78.9 | % | 78.9 | % | ||||||||||||||||||||||||||||||||||||||

| Total Greater Seattle | 10 | 16.3 | % | 17.6 | % | 3,000,178 | 83.4 | % | 83.5 | % | 84.0 | % | ||||||||||||||||||||||||||||||||||||||

| Austin | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Austin CBD | 1 | 3.4 | % | 4.5 | % | 758,975 | 64.9 | % | — | % | 78.2 | % | ||||||||||||||||||||||||||||||||||||||

| Total Austin | 1 | 3.4 | % | 4.5 | % | 758,975 | 64.9 | % | — | % | 78.2 | % | ||||||||||||||||||||||||||||||||||||||

| TOTAL STABILIZED PORTFOLIO | 121 | 100.0 | % | 100.0 | % | 17,044,128 | 85.0 | % | 86.2 | % | 86.4 | % | ||||||||||||||||||||||||||||||||||||||

| Average Occupancy | ||||||||

| Quarter-to-Date | Year-to-Date | |||||||

| 85.9% | 87.3% | |||||||

Q4 2023 Supplemental Financial Report |

|||||

| Submarket | Square Feet | Occupied | Leased | |||||||||||||||||||||||||||||

| Greater Los Angeles, California | ||||||||||||||||||||||||||||||||

| 3101-3243 La Cienega Boulevard | Culver City | 166,207 | 71.9 | % | 71.9 | % | ||||||||||||||||||||||||||

| 2240 E. Imperial Highway | El Segundo | 122,870 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 2250 E. Imperial Highway | El Segundo | 298,728 | 46.2 | % | 46.2 | % | ||||||||||||||||||||||||||

| 2260 E. Imperial Highway | El Segundo | 298,728 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 909 N. Pacific Coast Highway | El Segundo | 244,880 | 78.6 | % | 79.3 | % | ||||||||||||||||||||||||||

| 999 N. Pacific Coast Highway | El Segundo | 138,389 | 58.1 | % | 58.1 | % | ||||||||||||||||||||||||||

| 1350 Ivar Avenue | Hollywood | 16,448 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1355 Vine Street | Hollywood | 183,129 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1375 Vine Street | Hollywood | 159,236 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1395 Vine Street | Hollywood | 2,575 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1500 N. El Centro Avenue | Hollywood | 113,447 | 41.4 | % | 63.6 | % | ||||||||||||||||||||||||||

| 1525 N. Gower Street | Hollywood | 9,610 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1575 N. Gower Street | Hollywood | 264,430 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 6115 W. Sunset Boulevard | Hollywood | 26,238 | 53.0 | % | 53.0 | % | ||||||||||||||||||||||||||

| 6121 W. Sunset Boulevard | Hollywood | 93,418 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 6255 W. Sunset Boulevard | Hollywood | 332,100 | 77.9 | % | 84.1 | % | ||||||||||||||||||||||||||

| 3750 Kilroy Airport Way | Long Beach | 10,718 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3760 Kilroy Airport Way | Long Beach | 166,761 | 77.0 | % | 77.0 | % | ||||||||||||||||||||||||||

| 3780 Kilroy Airport Way | Long Beach | 221,452 | 91.4 | % | 91.4 | % | ||||||||||||||||||||||||||

| 3800 Kilroy Airport Way | Long Beach | 192,476 | 89.3 | % | 89.3 | % | ||||||||||||||||||||||||||

| 3840 Kilroy Airport Way | Long Beach | 138,441 | 77.6 | % | 77.6 | % | ||||||||||||||||||||||||||

| 3880 Kilroy Airport Way | Long Beach | 96,923 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3900 Kilroy Airport Way | Long Beach | 130,935 | 78.7 | % | 78.7 | % | ||||||||||||||||||||||||||

| 8560 W. Sunset Boulevard | West Hollywood | 76,558 | 87.6 | % | 87.6 | % | ||||||||||||||||||||||||||

| 8570 W. Sunset Boulevard | West Hollywood | 49,276 | 94.5 | % | 99.0 | % | ||||||||||||||||||||||||||

| 8580 W. Sunset Boulevard | West Hollywood | 6,875 | 59.0 | % | 59.0 | % | ||||||||||||||||||||||||||

| 8590 W. Sunset Boulevard | West Hollywood | 56,750 | 97.4 | % | 97.4 | % | ||||||||||||||||||||||||||

| 12100 W. Olympic Boulevard | West Los Angeles | 155,679 | 74.1 | % | 74.1 | % | ||||||||||||||||||||||||||

| 12200 W. Olympic Boulevard | West Los Angeles | 154,544 | 32.0 | % | 32.0 | % | ||||||||||||||||||||||||||

| 12233 W. Olympic Boulevard | West Los Angeles | 156,746 | 52.7 | % | 52.7 | % | ||||||||||||||||||||||||||

| 12312 W. Olympic Boulevard | West Los Angeles | 76,644 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 2100/2110 Colorado Avenue | West Los Angeles | 104,853 | 55.4 | % | 55.4 | % | ||||||||||||||||||||||||||

| 501 Santa Monica Boulevard | West Los Angeles | 78,509 | 68.4 | % | 68.4 | % | ||||||||||||||||||||||||||

| Total Greater Los Angeles | 4,344,573 | 79.0 | % | 80.1 | % | |||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Submarket | Square Feet | Occupied | Leased | |||||||||||||||||||||||||||||

| San Diego County, California | ||||||||||||||||||||||||||||||||

| 12225 El Camino Real | Del Mar | 58,401 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12235 El Camino Real | Del Mar | 53,751 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12340 El Camino Real * | Del Mar | 109,307 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12390 El Camino Real | Del Mar | 73,238 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12770 El Camino Real | Del Mar | 75,035 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12780 El Camino Real | Del Mar | 140,591 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12790 El Camino Real | Del Mar | 87,944 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12830 El Camino Real | Del Mar | 196,444 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12860 El Camino Real | Del Mar | 92,042 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12348 High Bluff Drive | Del Mar | 39,192 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 12400 High Bluff Drive * | Del Mar | 216,518 | 91.7 | % | 91.7 | % | ||||||||||||||||||||||||||

3579 Valley Centre Drive |

Del Mar | 54,960 | 94.7 | % | 94.7 | % | ||||||||||||||||||||||||||

| 3611 Valley Centre Drive | Del Mar | 132,425 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3661 Valley Centre Drive | Del Mar | 131,662 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3721 Valley Centre Drive | Del Mar | 115,193 | 78.4 | % | 78.4 | % | ||||||||||||||||||||||||||

| 3811 Valley Centre Drive | Del Mar | 118,912 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3745 Paseo Place | Del Mar | 95,871 | 89.6 | % | 93.2 | % | ||||||||||||||||||||||||||

| 13480 Evening Creek Drive North | I-15 Corridor | 143,401 | 54.5 | % | 63.1 | % | ||||||||||||||||||||||||||

| 13500 Evening Creek Drive North | I-15 Corridor | 143,749 | 92.9 | % | 92.9 | % | ||||||||||||||||||||||||||

| 13520 Evening Creek Drive North | I-15 Corridor | 146,701 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 2100 Kettner Boulevard * | Little Italy | 206,527 | 20.5 | % | 23.8 | % | ||||||||||||||||||||||||||

| 2305 Historic Decatur Road | Point Loma | 107,456 | 82.1 | % | 82.1 | % | ||||||||||||||||||||||||||

| 9455 Towne Centre Drive | University Towne Center | 160,444 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 9514 Towne Centre Drive * | University Towne Center | 70,616 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| Total San Diego County | 2,770,380 | 88.6 | % | 89.5 | % | |||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Submarket | Square Feet | Occupied | Leased | |||||||||||||||||||||||||||||

| San Francisco Bay Area, California | ||||||||||||||||||||||||||||||||

| 4100 Bohannon Drive | Menlo Park | 47,643 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 4200 Bohannon Drive | Menlo Park | 43,600 | 69.4 | % | 69.4 | % | ||||||||||||||||||||||||||

| 4300 Bohannon Drive | Menlo Park | 63,430 | 48.8 | % | 85.1 | % | ||||||||||||||||||||||||||

| 4500 Bohannon Drive | Menlo Park | 63,429 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 4600 Bohannon Drive | Menlo Park | 48,413 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 4700 Bohannon Drive | Menlo Park | 63,429 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1290-1300 Terra Bella Avenue | Mountain View | 114,175 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 680 E. Middlefield Road | Mountain View | 171,676 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 690 E. Middlefield Road | Mountain View | 171,215 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 1701 Page Mill Road | Palo Alto | 128,688 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 3150 Porter Drive | Palo Alto | 36,886 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 900 Jefferson Avenue | Redwood City | 228,505 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 900 Middlefield Road | Redwood City | 118,764 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 100 Hooper Street | San Francisco | 417,914 | 95.5 | % | 95.5 | % | ||||||||||||||||||||||||||

| 100 First Street | San Francisco | 480,457 | 98.3 | % | 98.3 | % | ||||||||||||||||||||||||||

| 303 Second Street | San Francisco | 784,658 | 71.1 | % | 73.5 | % | ||||||||||||||||||||||||||

| 201 Third Street | San Francisco | 346,538 | 68.2 | % | 68.2 | % | ||||||||||||||||||||||||||

| 360 Third Street | San Francisco | 436,357 | 66.6 | % | 66.6 | % | ||||||||||||||||||||||||||

| 250 Brannan Street | San Francisco | 100,850 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 301 Brannan Street | San Francisco | 82,834 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 333 Brannan Street | San Francisco | 185,602 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 345 Brannan Street | San Francisco | 110,050 | 99.7 | % | 99.7 | % | ||||||||||||||||||||||||||

| 350 Mission Street | San Francisco | 455,340 | 99.7 | % | 99.7 | % | ||||||||||||||||||||||||||

| 345 Oyster Point Boulevard | South San Francisco | 40,410 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 347 Oyster Point Boulevard | South San Francisco | 39,780 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 349 Oyster Point Boulevard | South San Francisco | 65,340 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 350 Oyster Point Boulevard | South San Francisco | 234,892 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 352 Oyster Point Boulevard | South San Francisco | 232,215 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 354 Oyster Point Boulevard | South San Francisco | 193,472 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 505 Mathilda Avenue | Sunnyvale | 212,322 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 555 Mathilda Avenue | Sunnyvale | 212,322 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 599 Mathilda Avenue | Sunnyvale | 76,031 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 605 Mathilda Avenue | Sunnyvale | 162,785 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| Total San Francisco Bay Area | 6,170,022 | 91.0 | % | 91.6 | % | |||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Submarket | Square Feet | Occupied | Leased | |||||||||||||||||||||||||||||

| Greater Seattle, Washington | ||||||||||||||||||||||||||||||||

| 601 108th Avenue NE | Bellevue | 490,738 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 10900 NE 4th Street | Bellevue | 428,557 | 86.2 | % | 90.1 | % | ||||||||||||||||||||||||||

| 2001 West 8th Avenue | Denny Regrade | 539,226 | 20.0 | % | 20.0 | % | ||||||||||||||||||||||||||

| 333 Dexter Avenue North * | Lake Union | 618,766 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 701 N. 34th Street | Lake Union | 141,860 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 801 N. 34th Street | Lake Union | 173,615 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 837 N. 34th Street | Lake Union | 112,487 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 320 Westlake Avenue North | Lake Union | 184,644 | 96.1 | % | 96.1 | % | ||||||||||||||||||||||||||

| 321 Terry Avenue North | Lake Union | 135,755 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| 401 Terry Avenue North | Lake Union | 174,530 | 100.0 | % | 100.0 | % | ||||||||||||||||||||||||||

| Total Greater Seattle | 3,000,178 | 83.4 | % | 84.0 | % | |||||||||||||||||||||||||||

| Austin | ||||||||||||||||||||||||||||||||

| 200 W. 6th Street * | Austin CBD | 758,975 | 64.9 | % | 78.2 | % | ||||||||||||||||||||||||||

| Total Austin | 758,975 | 64.9 | % | 78.2 | % | |||||||||||||||||||||||||||

| TOTAL STABILIZED PORTFOLIO | 17,044,128 | 85.0 | % | 86.4 | % | |||||||||||||||||||||||||||

| Average Residential Occupancy | ||||||||||||||||||||||||||||||||

| RESIDENTIAL PROPERTIES | Submarket | Total No. of Units | Quarter-to-Date | Year-to-Date | ||||||||||||||||||||||||||||

| Greater Los Angeles | ||||||||||||||||||||||||||||||||

| 1550 N. El Centro Avenue | Hollywood | 200 | 91.7% | 92.7% | ||||||||||||||||||||||||||||

| 6390 De Longpre Avenue | Hollywood | 193 | 91.2% | 92.2% | ||||||||||||||||||||||||||||

| San Diego County | ||||||||||||||||||||||||||||||||

| 3200 Paseo Village Way | Del Mar | 608 | 93.1% | 93.0% | ||||||||||||||||||||||||||||

| TOTAL RESIDENTIAL PROPERTIES | 1,001 | 92.5% | 92.8% | |||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Quarter to Date | # of Leases (2) |

Square Feet (2) |

Weighted Average Lease Term (Mo.) |

TI/LC

Per Sq.Ft. (3)

|

TI/LC

Per Sq.Ft. /Year (3)

|

Changes in GAAP Rents |

Changes in Cash Rents |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | Renewal | New | Renewal | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Generation | 12 | 9 | 153,006 | 180,926 | 333,932 | 70 | $ | 59.54 | $ | 10.21 | 18.8 | % | 2.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Development Leasing (4) |

2 | — | 35,002 | — | 35,002 | 112 | $ | 102.20 | $ | 10.95 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | 14 | 9 | 188,008 | 180,926 | 368,934 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year to Date | # of Leases (2) |

Square Feet (2) |

Weighted Average Lease Term (Mo.) |

TI/LC

Per Sq.Ft. (3)

|

TI/LC

Per Sq.Ft. /Year (3)

|

Changes in GAAP Rents |

Changes in Cash Rents |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | Renewal | New | Renewal | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Generation | 45 | 47 | 512,626 | 568,443 | 1,081,069 | 72 | $ | 54.70 | $ | 9.12 | 14.9 | % | 0.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Development Leasing (4) |

5 | — | 139,018 | — | 139,018 | 137 | $ | 116.82 | $ | 10.23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | 50 | 47 | 651,644 | 568,443 | 1,220,087 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

Quarter to Date (2) |

# of Leases (3) |

Square Feet (3) |

Weighted Average Lease Term (Mo.) |

TI/LC

Per Sq.Ft. (4)

|

TI/LC

Per Sq.Ft. /Year (4)

|

Changes in GAAP Rents |

Changes in Cash Rents |

Retention Rates |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | Renewal | New | Renewal | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Generation | 11 | 9 | 273,501 | 180,926 | 454,427 | 75 | $ | 49.95 | $ | 7.99 | 21.7 | % | 1.6 | % | 46.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Development Leasing (5) |

3 | — | 35,467 | — | 35,467 | 122 | $ | 133.54 | $ | 13.13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | 14 | 9 | 308,968 | 180,926 | 489,894 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year to Date (6) |

# of Leases (3) |

Square Feet (3) |

Weighted Average Lease Term (Mo.) |

TI/LC

Per Sq.Ft. (4)

|

TI/LC

Per Sq.Ft. /Year (4)

|

Changes in GAAP Rents |

Changes in Cash Rents |

Retention Rates |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | Renewal | New | Renewal | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Generation | 46 | 47 | 615,477 | 568,443 | 1,183,920 | 68 | $ | 52.96 | $ | 9.35 | 14.8 | % | 0.1 | % | 29.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Development Leasing (5) |

7 | — | 64,919 | — | 64,919 | 127 | $ | 149.44 | $ | 14.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | 53 | 47 | 680,396 | 568,443 | 1,248,839 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Total 2023 | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | |||||||||||||||||||||||||||||||

1st Generation (Nonrecurring) Capital Expenditures: (1) |

|||||||||||||||||||||||||||||||||||

| Capital Improvements | $ | 1,797 | $ | 206 | $ | 1,091 | $ | 153 | $ | 347 | |||||||||||||||||||||||||

Tenant Improvements & Leasing Commissions (2) |

(329) | (329) | — | — | — | ||||||||||||||||||||||||||||||

| Total | $ | 1,468 | $ | (123) | $ | 1,091 | $ | 153 | $ | 347 | |||||||||||||||||||||||||

| Total 2023 | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | |||||||||||||||||||||||||||||||

2nd Generation (Recurring) Capital Expenditures: (1) |

|||||||||||||||||||||||||||||||||||

| Capital Improvements | $ | 33,793 | $ | 12,872 | $ | 6,361 | $ | 7,263 | $ | 7,297 | |||||||||||||||||||||||||

Tenant Improvements & Leasing Commissions (2) |

53,753 | 18,539 | 14,158 | 10,587 | 10,469 | ||||||||||||||||||||||||||||||

| Total | $ | 87,546 | $ | 31,411 | $ | 20,519 | $ | 17,850 | $ | 17,766 | |||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| # of Expiring Leases | 19 | 15 | 19 | 17 | 18 | 13 | 17 | 17 | 61 | 70 | 51 | 36 | 39 | 40 | 15 | 13 | 16 | ||||||||||||||||||||||||||||||||||||

| % of Total Leased Sq. Ft. | 1.7 | % | 1.0 | % | 2.0 | % | 2.6 | % | 1.4 | % | 0.8 | % | 1.0 | % | 1.6 | % | 13.5 | % | 7.5 | % | 7.8 | % | 8.2 | % | 10.8 | % | 14.6 | % | 7.8 | % | 8.1 | % | 9.6 | % | |||||||||||||||||||

| Annualized Base Rent | $11,594 | $6,837 | $9,896 | $23,869 | $9,075 | $4,938 | $6,980 | $12,738 | $90,656 | $43,736 | $68,568 | $62,676 | $91,673 | $137,161 | $73,937 | $69,315 | $84,155 | ||||||||||||||||||||||||||||||||||||

% of Total Annualized Base Rent (3) |

1.4 | % | 0.8 | % | 1.2 | % | 3.0 | % | 1.1 | % | 0.6 | % | 0.9 | % | 1.6 | % | 11.2 | % | 5.4 | % | 8.5 | % | 7.8 | % | 11.3 | % | 17.0 | % | 9.2 | % | 8.6 | % | 10.4 | % | |||||||||||||||||||

| Annualized Rent per Sq. Ft. | $48.41 | $46.90 | $35.08 | $61.72 | $47.96 | $44.45 | $46.91 | $55.78 | $47.18 | $41.10 | $61.97 | $53.92 | $59.56 | $65.78 | $66.29 | $59.93 | $62.11 | ||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

Year |

Region | # of Expiring Leases |

Total Square Feet |

% of Total Leased Sq. Ft. |

Annualized

Base Rent (1)

|

% of Total Annualized Base Rent |

Annualized Rent per Sq. Ft. |

|||||||||||||||||||||||||||||||||||||||||||

| 2024 | Greater Los Angeles | 45 | 516,779 | 3.6 | % | $ | 23,273 | 2.9 | % | $ | 45.03 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 6 | 45,597 | 0.3 | % | 1,759 | 0.2 | % | 38.58 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 11 | 318,262 | 2.2 | % | 20,752 | 2.6 | % | 65.20 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 8 | 173,458 | 1.2 | % | 6,412 | 0.7 | % | 36.97 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | — | — | — | % | — | — | % | — | ||||||||||||||||||||||||||||||||||||||||||

| Total | 70 | 1,054,096 | 7.3 | % | $ | 52,196 | 6.4 | % | $ | 49.52 | ||||||||||||||||||||||||||||||||||||||||

| 2025 | Greater Los Angeles | 28 | 168,613 | 1.2 | % | $ | 6,946 | 0.9 | % | $ | 41.19 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 18 | 243,773 | 1.7 | % | 12,508 | 1.5 | % | 51.31 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 9 | 124,246 | 0.9 | % | 8,725 | 1.1 | % | 70.22 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 10 | 140,831 | 1.0 | % | 5,552 | 0.7 | % | 39.42 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | — | — | — | % | — | — | % | — | ||||||||||||||||||||||||||||||||||||||||||

| Total | 65 | 677,463 | 4.8 | % | $ | 33,731 | 4.2 | % | $ | 49.79 | ||||||||||||||||||||||||||||||||||||||||

| 2026 | Greater Los Angeles | 23 | 398,506 | 2.8 | % | $ | 15,650 | 1.9 | % | $ | 39.27 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 11 | 186,397 | 1.3 | % | 9,515 | 1.2 | % | 51.05 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 16 | 941,332 | 6.6 | % | 49,294 | 6.1 | % | 52.37 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 11 | 395,359 | 2.8 | % | 16,197 | 2.0 | % | 40.97 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | — | — | — | % | — | — | % | — | ||||||||||||||||||||||||||||||||||||||||||

| Total | 61 | 1,921,594 | 13.5 | % | $ | 90,656 | 11.2 | % | $ | 47.18 | ||||||||||||||||||||||||||||||||||||||||

| 2027 | Greater Los Angeles | 37 | 731,395 | 5.1 | % | $ | 27,012 | 3.3 | % | $ | 36.93 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 18 | 172,477 | 1.3 | % | 8,730 | 1.1 | % | 50.62 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 5 | 73,790 | 0.5 | % | 4,729 | 0.6 | % | 64.09 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 10 | 86,543 | 0.6 | % | 3,265 | 0.4 | % | 37.73 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | — | — | — | % | — | — | % | — | ||||||||||||||||||||||||||||||||||||||||||

| Total | 70 | 1,064,205 | 7.5 | % | $ | 43,736 | 5.4 | % | $ | 41.10 | ||||||||||||||||||||||||||||||||||||||||

| 2028 | Greater Los Angeles | 21 | 112,683 | 0.8 | % | $ | 5,978 | 0.7 | % | $ | 53.05 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 13 | 221,434 | 1.6 | % | 12,635 | 1.6 | % | 57.06 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 9 | 711,066 | 5.0 | % | 48,028 | 6.0 | % | 67.54 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 8 | 61,231 | 0.4 | % | 1,927 | 0.2 | % | 31.47 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | — | — | — | % | — | — | % | — | ||||||||||||||||||||||||||||||||||||||||||

| Total | 51 | 1,106,414 | 7.8 | % | $ | 68,568 | 8.5 | % | $ | 61.97 | ||||||||||||||||||||||||||||||||||||||||

| 2029 and Beyond |

Greater Los Angeles | 39 | 1,361,741 | 9.5 | % | $ | 77,678 | 9.6 | % | $ | 57.04 | |||||||||||||||||||||||||||||||||||||||

| San Diego County | 52 | 1,572,621 | 11.1 | % | 96,782 | 12.0 | % | 61.54 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | 36 | 3,391,679 | 23.9 | % | 250,075 | 30.9 | % | 73.73 | ||||||||||||||||||||||||||||||||||||||||||

| Greater Seattle | 23 | 1,602,084 | 11.2 | % | 73,407 | 9.2 | % | 45.82 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | 9 | 485,538 | 3.4 | % | 20,975 | 2.6 | % | 43.20 | ||||||||||||||||||||||||||||||||||||||||||

| Total | 159 | 8,413,663 | 59.1 | % | $ | 518,917 | 64.3 | % | $ | 61.68 | ||||||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

Tenant Name (2) |

Region | Annualized Base Rental Revenue (3) |

Rentable Square Feet |

Percentage of Total Annualized Base Rental Revenue |

Percentage of Total Rentable Square Feet |

Year(s) of Significant Lease Expiration(s) (4) |

||||||||||||||||||||||||||||||||||||||

| Global technology company | Greater Seattle / San Diego County |

$ | 44,851 | 849,826 | 5.6 | % | 5.0 | % | 2032 - 2033 / 2037 | |||||||||||||||||||||||||||||||||||

| Cruise LLC | San Francisco Bay Area | 35,449 | 374,618 | 4.4 | % | 2.2 | % | 2031 | ||||||||||||||||||||||||||||||||||||

| Stripe, Inc. | San Francisco Bay Area | 33,110 | 425,687 | 4.1 | % | 2.5 | % | 2034 | ||||||||||||||||||||||||||||||||||||

Salesforce, Inc. (5) |

San Francisco Bay Area / Greater Seattle |

29,981 | 613,497 | 3.7 | % | 3.6 | % | 2024 / 2029 - 2030 / 2032 | ||||||||||||||||||||||||||||||||||||

LinkedIn Corporation / Microsoft Corporation (6) |

San Francisco Bay Area | 29,752 | 663,460 | 3.7 | % | 3.9 | % | 2024 / 2026 | ||||||||||||||||||||||||||||||||||||

| Adobe Systems, Inc. | San Francisco Bay Area / Greater Seattle |

27,897 | 522,879 | 3.5 | % | 3.1 | % | 2027 / 2031 | ||||||||||||||||||||||||||||||||||||

| Okta, Inc. | San Francisco Bay Area | 24,206 | 293,001 | 3.0 | % | 1.7 | % | 2028 | ||||||||||||||||||||||||||||||||||||

| DoorDash, Inc. | San Francisco Bay Area | 23,842 | 236,759 | 3.0 | % | 1.4 | % | 2032 | ||||||||||||||||||||||||||||||||||||

| Netflix, Inc. | Greater Los Angeles | 21,854 | 361,388 | 2.7 | % | 2.1 | % | 2032 | ||||||||||||||||||||||||||||||||||||

Box, Inc. (7) |

San Francisco Bay Area | 19,788 | 341,441 | 2.5 | % | 2.0 | % | 2024 / 2028 | ||||||||||||||||||||||||||||||||||||

| Cytokinetics, Inc. | San Francisco Bay Area | 18,167 | 234,892 | 2.3 | % | 1.4 | % | 2033 | ||||||||||||||||||||||||||||||||||||

| DIRECTV, LLC | Greater Los Angeles | 16,085 | 532,956 | 2.0 | % | 3.1 | % | 2026 - 2027 | ||||||||||||||||||||||||||||||||||||

| Synopsys, Inc. | San Francisco Bay Area | 15,492 | 342,891 | 1.9 | % | 2.0 | % | 2030 | ||||||||||||||||||||||||||||||||||||

| Amazon.com | Greater Seattle | 14,989 | 340,705 | 1.9 | % | 2.0 | % | 2029 - 2030 | ||||||||||||||||||||||||||||||||||||

Riot Games, Inc. (8) |

Greater Los Angeles | 14,628 | 218,824 | 1.8 | % | 1.3 | % | 2024 / 2031 | ||||||||||||||||||||||||||||||||||||

| Total Top Fifteen Tenants | $ | 370,091 | 6,352,824 | 46.1 | % | 37.3 | % | |||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

Property (1) |

Venture Partner | Submarket | Rentable Square Feet | KRC Ownership % | ||||||||||||||||||||||||||||

| 100 First Street, San Francisco, CA | Norges Bank Real Estate Management | San Francisco | 480,457 | 56% | ||||||||||||||||||||||||||||

| 303 Second Street, San Francisco, CA | Norges Bank Real Estate Management | San Francisco | 784,658 | 56% | ||||||||||||||||||||||||||||

900 Jefferson Avenue and 900 Middlefield Road, Redwood City, CA (2) |

Local developer | Redwood City | 347,269 | 93% | ||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| STABILIZED DEVELOPMENT PROJECTS | Location | Construction Start Date | Stabilization Date (1) |

Total Estimated Investment | Rentable Square Feet |

% Leased | Total Project % Occupied | |||||||||||||||||||||||||||||||||||||||||||

| 1st Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||

| None | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||

| None | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 3rd Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 9514 Towne Centre Drive | University Towne Center | 3Q 2021 | 3Q 2023 | $ | 60 | 70,616 | 100% | 100% | ||||||||||||||||||||||||||||||||||||||||||

| 4th Quarter | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 200 W. 6th Street | Austin CBD | 2Q 2021 | 4Q 2023 | 690 | 758,975 | 78% | 65% | |||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | $ | 750 | 829,591 | 80% | 68% | |||||||||||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| UNDER CONSTRUCTION | Location | Construction Start Date | Estimated Stabilization Date (1) |

Estimated Rentable Square Feet | Total Estimated Investment |

Total Cash Costs Incurred as of

12/31/2023 (2)(3)

|

% Leased | |||||||||||||||||||||||||||||||||||||||||||

| Office / Life Science | ||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco Bay Area | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Kilroy Oyster Point - Phase 2 | South San Francisco | 2Q 2021 | 4Q 2025 | 875,000 | $ | 1,000 | $ | 600 | —% | |||||||||||||||||||||||||||||||||||||||||

4400 Bohannon Drive (4) |

Menlo Park | 4Q 2022 | 3Q 2025 | 48,000 | 55 | 20 | —% | |||||||||||||||||||||||||||||||||||||||||||

| San Diego County | ||||||||||||||||||||||||||||||||||||||||||||||||||

4690 Executive Drive (4) |

University Towne Center | 1Q 2022 | 2Q 2025 | 52,000 | 25 | 19 | —% | |||||||||||||||||||||||||||||||||||||||||||

| TOTAL: | 975,000 | $ | 1,080 | $ | 639 | —% | ||||||||||||||||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| FUTURE DEVELOPMENT PIPELINE | Location |

Approx. Developable

Square Feet (1)

|

Total Cash Costs Incurred as of 12/31/2023 (2) |

|||||||||||||||||||||||||||||

| Greater Los Angeles | ||||||||||||||||||||||||||||||||

| 1633 26th Street | West Los Angeles | 190,000 | $ | 15 | ||||||||||||||||||||||||||||

| San Diego County | ||||||||||||||||||||||||||||||||

| Santa Fe Summit South / North | 56 Corridor | 600,000 - 650,000 | 114 | |||||||||||||||||||||||||||||

| 2045 Pacific Highway | Little Italy | 275,000 | 54 | |||||||||||||||||||||||||||||

| Kilroy East Village | East Village | TBD | 68 | |||||||||||||||||||||||||||||

| San Francisco Bay Area | ||||||||||||||||||||||||||||||||

| Kilroy Oyster Point - Phases 3 and 4 | South San Francisco | 875,000 - 1,000,000 | 220 | |||||||||||||||||||||||||||||

| Flower Mart | SOMA | 2,300,000 | 567 | |||||||||||||||||||||||||||||

| Greater Seattle | ||||||||||||||||||||||||||||||||

| SIX0 | Denny Regrade | 925,000 | 183 | |||||||||||||||||||||||||||||

| Austin | ||||||||||||||||||||||||||||||||

| Stadium Tower | Stadium District / Domain | 493,000 | 70 | |||||||||||||||||||||||||||||

| TOTAL: | $ | 1,291 | ||||||||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

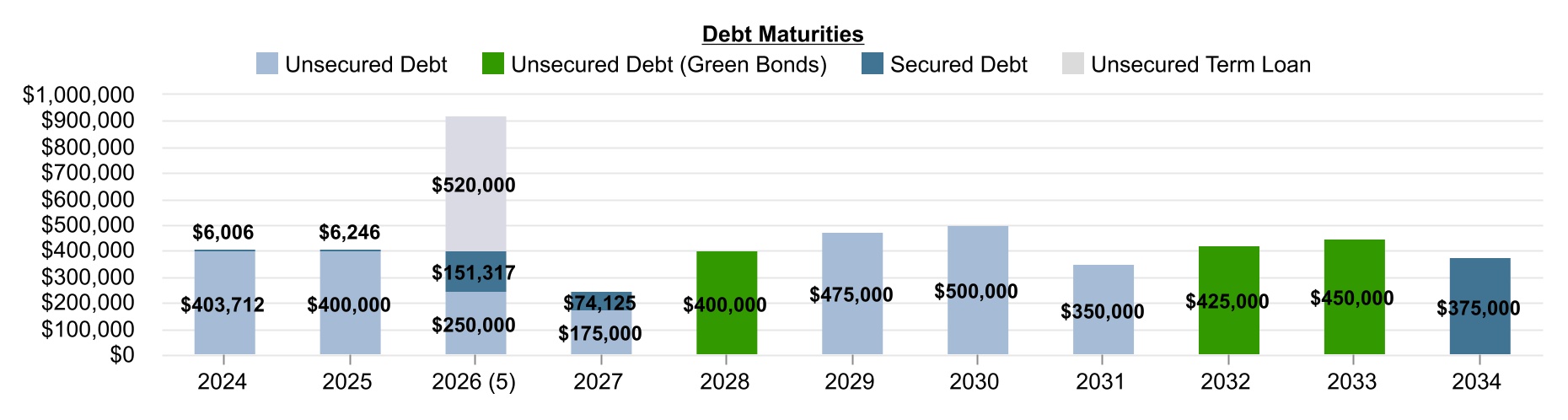

Debt Balance (3) |

Stated Rate | Maturity Date | ||||||||||||

Unsecured Debt (4) | ||||||||||||||

| $ | 403,712 | 3.45 | % | 12/15/2024 | ||||||||||

| $ | 400,000 | 4.38 | % | 10/1/2025 | ||||||||||

| $ | 50,000 | 4.30 | % | 7/18/2026 | ||||||||||

| $ | 520,000 | 6.41 | % | 10/3/2026 (5) |

||||||||||

| $ | 200,000 | 4.35 | % | 10/18/2026 | ||||||||||

| $ | 175,000 | 3.35 | % | 2/17/2027 | ||||||||||

| $ | 400,000 | 4.75 | % | 12/15/2028 | ||||||||||

| $ | 75,000 | 3.45 | % | 2/17/2029 | ||||||||||

| $ | 400,000 | 4.25 | % | 8/15/2029 | ||||||||||

| $ | 500,000 | 3.05 | % | 2/15/2030 | ||||||||||

| $ | 350,000 | 4.27 | % | 1/31/2031 | ||||||||||

| $ | 425,000 | 2.50 | % | 11/15/2032 | ||||||||||

| $ | 450,000 | 2.65 | % | 11/15/2033 | ||||||||||

| $ | 4,348,712 | 3.97 | % | |||||||||||

| Secured Debt | ||||||||||||||

| $ | 156,386 | 3.57 | % | 12/1/2026 | ||||||||||

| $ | 81,308 | 4.48 | % | 7/1/2027 | ||||||||||

| $ | 375,000 | 5.90 | % | 8/10/2034 | ||||||||||

| $ | 612,694 | 5.12 | % | |||||||||||

Q4 2023 Supplemental Financial Report |

|||||

TOTAL DEBT COMPOSITION (1) |

||||||||||||||||||||

| Weighted Average | ||||||||||||||||||||

| Interest Rate | Years to Maturity (2) |

|||||||||||||||||||

| Secured vs. Unsecured Debt | ||||||||||||||||||||

| Unsecured Debt | 4.0% | 5.1 | ||||||||||||||||||

| Secured Debt | 5.1% | 8.0 | ||||||||||||||||||

| Floating vs. Fixed-Rate Debt | ||||||||||||||||||||

| Floating-Rate Debt | 6.4% | 2.8 | ||||||||||||||||||

| Fixed-Rate Debt | 3.8% | 5.8 | ||||||||||||||||||

| Stated Interest Rate | 4.1% | 5.4 | ||||||||||||||||||

| GAAP Effective Rate | 4.1% | |||||||||||||||||||

| GAAP Effective Rate Including Debt Issuance Costs | 4.3% | |||||||||||||||||||

KEY DEBT COVENANTS (3) |

||||||||||||||||||||

| Covenant | Actual Performance as of December 31, 2023 |

|||||||||||||||||||

| Unsecured Credit and Term Loan Facility and Private Placement Notes: | ||||||||||||||||||||

| Total debt to total asset value | less than 60% | 29% | ||||||||||||||||||

| Fixed charge coverage ratio | greater than 1.5x | 3.5x | ||||||||||||||||||

| Unsecured debt ratio | greater than 1.67x | 3.42x | ||||||||||||||||||

| Unencumbered asset pool debt service coverage | greater than 1.75x | 3.96x | ||||||||||||||||||

Unsecured Senior Notes due 2024, 2025, 2028, 2029, 2030, 2032 and 2033: |

||||||||||||||||||||

| Total debt to total asset value | less than 60% | 39% | ||||||||||||||||||

| Interest coverage | greater than 1.5x | 6.5x | ||||||||||||||||||

| Secured debt to total asset value | less than 40% | 5% | ||||||||||||||||||

| Unencumbered asset pool value to unsecured debt | greater than 150% | 271% | ||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

Q4 2023 Supplemental Financial Report |

|||||

Q4 2023 Supplemental Financial Report |

|||||

Q4 2023 Supplemental Financial Report |

|||||

Q4 2023 Supplemental Financial Report |

|||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 47,284 | $ | 52,625 | $ | 212,241 | $ | 232,615 | ||||||||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | 471 | 588 | 2,083 | 2,283 | ||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | 5,291 | 6,262 | 23,964 | 24,595 | ||||||||||||||||||||||||||||

| Net Income | 53,046 | 59,475 | 238,288 | 259,493 | ||||||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| General and administrative expenses | 22,078 | 25,217 | 93,434 | 93,642 | ||||||||||||||||||||||||||||

| Leasing costs | 1,956 | 1,404 | 6,506 | 4,879 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 86,016 | 91,396 | 355,278 | 357,611 | ||||||||||||||||||||||||||||

| Interest income and other income, net | (10,696) | (1,264) | (22,592) | (1,765) | ||||||||||||||||||||||||||||

| Interest expense | 32,325 | 23,550 | 114,216 | 84,278 | ||||||||||||||||||||||||||||

| Gain on sale of depreciable operating property | — | — | — | (17,329) | ||||||||||||||||||||||||||||

Net Operating Income, as defined (1) |

184,725 | 199,778 | 785,130 | 780,809 | ||||||||||||||||||||||||||||

| Wholly-Owned Properties | 162,348 | 174,983 | 688,940 | 682,260 | ||||||||||||||||||||||||||||

Consolidated property partnerships: (2) |

||||||||||||||||||||||||||||||||

100 First Street (3) |

6,561 | 6,116 | 25,420 | 23,593 | ||||||||||||||||||||||||||||

303 Second Street (3) |

10,099 | 12,702 | 47,285 | 50,998 | ||||||||||||||||||||||||||||

Crossing/900 (4) |

5,717 | 5,977 | 23,485 | 23,958 | ||||||||||||||||||||||||||||

Net Operating Income, as defined (1) |

184,725 | 199,778 | 785,130 | 780,809 | ||||||||||||||||||||||||||||

Non-Same Store Net Operating Income (5) |

(20,892) | (16,435) | (82,982) | (52,448) | ||||||||||||||||||||||||||||

| Same Store Net Operating Income | 163,833 | 183,343 | 702,148 | 728,361 | ||||||||||||||||||||||||||||

| GAAP to Cash Adjustments: | ||||||||||||||||||||||||||||||||

GAAP Operating Revenues Adjustments, net (6) |

5,785 | (11,685) | (11,196) | (66,322) | ||||||||||||||||||||||||||||

| GAAP Operating Expenses Adjustments, net | 98 | 100 | 399 | 427 | ||||||||||||||||||||||||||||

| Same Store Cash Net Operating Income | $ | 169,716 | $ | 171,758 | $ | 691,351 | $ | 662,466 | ||||||||||||||||||||||||

Q4 2023 Supplemental Financial Report |

|||||

| Three Months Ended December 31, | ||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 47,284 | $ | 52,625 | ||||||||||||||||

| Interest expense | 32,325 | 23,550 | ||||||||||||||||||

| Depreciation and amortization | 86,016 | 91,396 | ||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | 471 | 588 | ||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | 5,291 | 6,262 | ||||||||||||||||||

EBITDA, as adjusted (1) |

$ | 171,387 | $ | 174,421 | ||||||||||||||||

| Contact: | FOR RELEASE: | ||||

| Eliott Trencher | February 5, 2024 | ||||

| Executive Vice President, | |||||

| Chief Financial Officer | |||||

| and Chief Investment Officer | |||||

| (310) 481-8587 | |||||

| or | |||||

| Bill Hutcheson | |||||

| Senior Vice President, | |||||

| Investor Relations & Capital Markets | |||||

| (415) 778-5678 | |||||

| Full Year 2024 Range | |||||||||||||||||

| Low End | High End | ||||||||||||||||

| $ and shares/units in thousands, except per share/unit amounts | |||||||||||||||||

| Net income available to common stockholders per share - diluted | $ | 1.45 | $ | 1.61 | |||||||||||||

Weighted average common shares outstanding - diluted (1) |

118,000 | 118,000 | |||||||||||||||

| Net income available to common stockholders | $ | 171,000 | $ | 190,000 | |||||||||||||

| Adjustments: | |||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | 1,900 | 2,000 | |||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | 20,500 | 21,000 | |||||||||||||||

| Depreciation and amortization of real estate assets | 330,000 | 330,000 | |||||||||||||||

| Gains on sales of depreciable real estate | — | — | |||||||||||||||

| Funds From Operations attributable to noncontrolling interests in consolidated property partnerships | (30,000) | (32,000) | |||||||||||||||

Funds From Operations (2) |

$ | 493,400 | $ | 511,000 | |||||||||||||

Weighted average common shares/units outstanding – diluted (3) |

120,250 | 120,250 | |||||||||||||||

Funds From Operations per common share/unit – diluted (3) |

$ | 4.10 | $ | 4.25 | |||||||||||||

| Key Assumptions | 2023 Actuals | 2024 Assumptions | ||||||||||||||||||

Change in same store cash NOI (4) |

4.4% | (4.0%) to (6.0%) | ||||||||||||||||||

| Average full year occupancy | 87.3% | 82.5% to 84.0% | ||||||||||||||||||

| General and administrative expenses | $93 million | $72 million to $80 million | ||||||||||||||||||

| Total development spending | $394 million | $200 million to $300 million | ||||||||||||||||||

|

Weighted average common shares/units outstanding – diluted

(in thousands) (3)

|

119,241 | 120,250 | ||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenues | $ | 269,016 | $ | 284,344 | $ | 1,129,694 | $ | 1,096,987 | |||||||||||||||

| Net income available to common stockholders | $ | 47,284 | $ | 52,625 | $ | 212,241 | $ | 232,615 | |||||||||||||||

| Weighted average common shares outstanding – basic | 117,240 | 116,878 | 117,160 | 116,807 | |||||||||||||||||||

| Weighted average common shares outstanding – diluted | 117,816 | 117,389 | 117,506 | 117,220 | |||||||||||||||||||

| Net income available to common stockholders per share – basic | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.98 | |||||||||||||||

| Net income available to common stockholders per share – diluted | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.97 | |||||||||||||||

Funds From Operations (1)(2) |

$ | 129,257 | $ | 139,855 | $ | 551,116 | $ | 556,631 | |||||||||||||||

Weighted average common shares/units outstanding – basic (3) |

118,896 | 118,568 | 118,895 | 118,586 | |||||||||||||||||||

Weighted average common shares/units outstanding – diluted (4) |

119,473 | 119,079 | 119,241 | 118,999 | |||||||||||||||||||

Funds From Operations per common share/unit – basic (2) |

$ | 1.09 | $ | 1.18 | $ | 4.64 | $ | 4.69 | |||||||||||||||

Funds From Operations per common share/unit – diluted (2) |

$ | 1.08 | $ | 1.17 | $ | 4.62 | $ | 4.68 | |||||||||||||||

| Common shares outstanding at end of period | 117,240 | 116,878 | |||||||||||||||||||||

| Common partnership units outstanding at end of period | 1,151 | 1,151 | |||||||||||||||||||||

| Total common shares and units outstanding at end of period | 118,391 | 118,029 | |||||||||||||||||||||

| December 31, 2023 | December 31, 2022 | ||||||||||||||||||||||

Stabilized office portfolio occupancy rates: (5) |

|||||||||||||||||||||||

| Greater Los Angeles | 79.0 | % | 85.2 | % | |||||||||||||||||||

| San Diego County | 88.6 | % | 86.2 | % | |||||||||||||||||||

| San Francisco Bay Area | 91.0 | % | 95.5 | % | |||||||||||||||||||

| Greater Seattle | 83.4 | % | 97.7 | % | |||||||||||||||||||

| Austin | 64.9 | % | — | % | |||||||||||||||||||

| Weighted average total | 85.0 | % | 91.6 | % | |||||||||||||||||||

Total square feet of stabilized office properties owned at end of period: (5) |

|||||||||||||||||||||||

| Greater Los Angeles | 4,345 | 4,332 | |||||||||||||||||||||

| San Diego County | 2,770 | 2,698 | |||||||||||||||||||||

| San Francisco Bay Area | 6,170 | 6,164 | |||||||||||||||||||||

| Greater Seattle | 3,000 | 3,000 | |||||||||||||||||||||

| Austin | 759 | — | |||||||||||||||||||||

| Total | 17,044 | 16,194 | |||||||||||||||||||||

| December 31, 2023 | December 31, 2022 | ||||||||||

| ASSETS | |||||||||||

| REAL ESTATE ASSETS: | |||||||||||

| Land and improvements | $ | 1,743,170 | $ | 1,738,242 | |||||||

| Buildings and improvements | 8,463,674 | 8,302,081 | |||||||||

| Undeveloped land and construction in progress | 2,034,804 | 1,691,860 | |||||||||

| Total real estate assets held for investment | 12,241,648 | 11,732,183 | |||||||||

| Accumulated depreciation and amortization | (2,518,304) | (2,218,710) | |||||||||

| Total real estate assets held for investment, net | 9,723,344 | 9,513,473 | |||||||||

| Cash and cash equivalents | 510,163 | 347,379 | |||||||||

| Marketable securities | 284,670 | 23,547 | |||||||||

| Current receivables, net | 13,609 | 20,583 | |||||||||

| Deferred rent receivables, net | 460,979 | 452,200 | |||||||||

| Deferred leasing costs and acquisition-related intangible assets, net | 229,705 | 250,846 | |||||||||

| Right of use ground lease assets | 125,506 | 126,530 | |||||||||

| Prepaid expenses and other assets, net | 53,069 | 62,429 | |||||||||

| TOTAL ASSETS | $ | 11,401,045 | $ | 10,796,987 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| LIABILITIES: | |||||||||||

| Secured debt, net | $ | 603,225 | $ | 242,938 | |||||||

| Unsecured debt, net | 4,325,153 | 4,020,058 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 371,179 | 392,360 | |||||||||

| Ground lease liabilities | 124,353 | 124,994 | |||||||||

| Accrued dividends and distributions | 64,440 | 64,285 | |||||||||

| Deferred revenue and acquisition-related intangible liabilities, net | 173,638 | 195,959 | |||||||||

| Rents received in advance and tenant security deposits | 79,364 | 81,432 | |||||||||

| Total liabilities | 5,741,352 | 5,122,026 | |||||||||

| EQUITY: | |||||||||||

| Stockholders’ Equity | |||||||||||

| Common stock | 1,173 | 1,169 | |||||||||

| Additional paid-in capital | 5,205,839 | 5,170,760 | |||||||||

| Retained earnings | 221,149 | 265,118 | |||||||||

| Total stockholders’ equity | 5,428,161 | 5,437,047 | |||||||||

| Noncontrolling Interests | |||||||||||

| Common units of the Operating Partnership | 53,275 | 53,524 | |||||||||

| Noncontrolling interests in consolidated property partnerships | 178,257 | 184,390 | |||||||||

| Total noncontrolling interests | 231,532 | 237,914 | |||||||||

| Total equity | 5,659,693 | 5,674,961 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 11,401,045 | $ | 10,796,987 | |||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| REVENUES | |||||||||||||||||||||||

| Rental income | $ | 265,643 | $ | 281,688 | $ | 1,117,737 | $ | 1,086,018 | |||||||||||||||

| Other property income | 3,373 | 2,656 | 11,957 | 10,969 | |||||||||||||||||||

| Total revenues | 269,016 | 284,344 | 1,129,694 | 1,096,987 | |||||||||||||||||||

| EXPENSES | |||||||||||||||||||||||

| Property expenses | 60,731 | 55,323 | 228,964 | 202,744 | |||||||||||||||||||

| Real estate taxes | 21,000 | 27,151 | 105,868 | 105,869 | |||||||||||||||||||

| Ground leases | 2,560 | 2,092 | 9,732 | 7,565 | |||||||||||||||||||

General and administrative expenses (1) |

22,078 | 25,217 | 93,434 | 93,642 | |||||||||||||||||||

| Leasing costs | 1,956 | 1,404 | 6,506 | 4,879 | |||||||||||||||||||

| Depreciation and amortization | 86,016 | 91,396 | 355,278 | 357,611 | |||||||||||||||||||

| Total expenses | 194,341 | 202,583 | 799,782 | 772,310 | |||||||||||||||||||

| OTHER INCOME (EXPENSES) | |||||||||||||||||||||||

| Interest and other income, net | 10,696 | 1,264 | 22,592 | 1,765 | |||||||||||||||||||

| Interest expense | (32,325) | (23,550) | (114,216) | (84,278) | |||||||||||||||||||

| Gain on sale of depreciable operating property | — | — | — | 17,329 | |||||||||||||||||||

| Total other expenses | (21,629) | (22,286) | (91,624) | (65,184) | |||||||||||||||||||

| NET INCOME | 53,046 | 59,475 | 238,288 | 259,493 | |||||||||||||||||||

| Net income attributable to noncontrolling common units of the Operating Partnership | (471) | (588) | (2,083) | (2,283) | |||||||||||||||||||

| Net income attributable to noncontrolling interests in consolidated property partnerships | (5,291) | (6,262) | (23,964) | (24,595) | |||||||||||||||||||

| Total income attributable to noncontrolling interests | (5,762) | (6,850) | (26,047) | (26,878) | |||||||||||||||||||

| NET INCOME AVAILABLE TO COMMON STOCKHOLDERS | $ | 47,284 | $ | 52,625 | $ | 212,241 | $ | 232,615 | |||||||||||||||

| Weighted average common shares outstanding – basic | 117,240 | 116,878 | 117,160 | 116,807 | |||||||||||||||||||

| Weighted average common shares outstanding – diluted | 117,816 | 117,389 | 117,506 | 117,220 | |||||||||||||||||||

| Net income available to common stockholders per share – basic | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.98 | |||||||||||||||

| Net income available to common stockholders per share – diluted | $ | 0.40 | $ | 0.45 | $ | 1.80 | $ | 1.97 | |||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||