Enterprise Financial Services Corp 2023 Third Quarter Investor Presentation Exhibit 99.1

Forward-Looking Statements Some of the information in this report may contain “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include projections based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, liquidity, yields and returns, loan diversification and credit management, shareholder value creation and the impact of acquisitions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: the Company’s ability to efficiently integrate acquisitions, including the First Choice acquisition, into its operations, retain the customers of these businesses and grow the acquired operations, as well as credit risk, changes in the appraised valuation of real estate securing impaired loans, outcomes of litigation and other contingencies, exposure to general and local economic and market conditions, high unemployment rates, higher inflation and its impacts (including U.S. federal government measures to address higher inflation), U.S. fiscal debt, budget and tax matters, and any slowdown in global economic growth, risks associated with rapid increases or decreases in prevailing interest rates, our ability to attract and retain deposits and access to other sources of liquidity, consolidation in the banking industry, competition from banks and other financial institutions, the Company’s ability to attract and retain relationship officers and other key personnel, burdens imposed by federal and state regulation, changes in legislative or regulatory requirements, as well as current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including rules and regulations relating to bank products and financial services, changes in accounting policies and practices or accounting standards, changes in the method of determining LIBOR and the phase out of LIBOR, natural disasters, terrorist activities, war and geopolitical matters (including the war in Israel and potential for a broader regional conflict and the war in Ukraine and the imposition of additional sanctions and export controls in connection therewith), or pandemics, or health emergencies, and their effects on economic and business environments in which we operate, including the ongoing disruption to the financial market and other economic activity; and other factors and risks referenced from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and the Company’s other filings with the SEC. The Company cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the Company’s results. For any forward-looking statements made in this press release or in any documents, EFSC claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Readers are cautioned not to place undue reliance on any forward-looking statements. Except to the extent required by applicable law or regulation, EFSC disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made. 2

Enterprise Financial Services Corp Guiding People to a Lifetime of Financial Success Company Highlights Vision To be a company where our associates are proud to work, that delivers ease of navigation to our customers and value to our investors, while helping our communities flourish. Target Market Privately held businesses, business owners and professionals in vibrant and high growth markets of Arizona, California, Kansas, Missouri, Nevada and New Mexico. • EFSC incorporated in 1996 • Enterprise Bank & Trust chartered as a Missouri trust company • 1,100+ associates • Nasdaq listed: ◦ Common stock trading symbol EFSC ◦ Depositary shares trading symbol EFSCP Growth History $5.3 $5.6 $7.3 $9.8 $13.5 $13.1 $4.4 $6.1 $8.5 $11.3 $0.9 $1.2 $1.3 $2.2 EFSC Assets Merger Contribution 2017 2018 2019 2020 2021 2022 In Billions 3

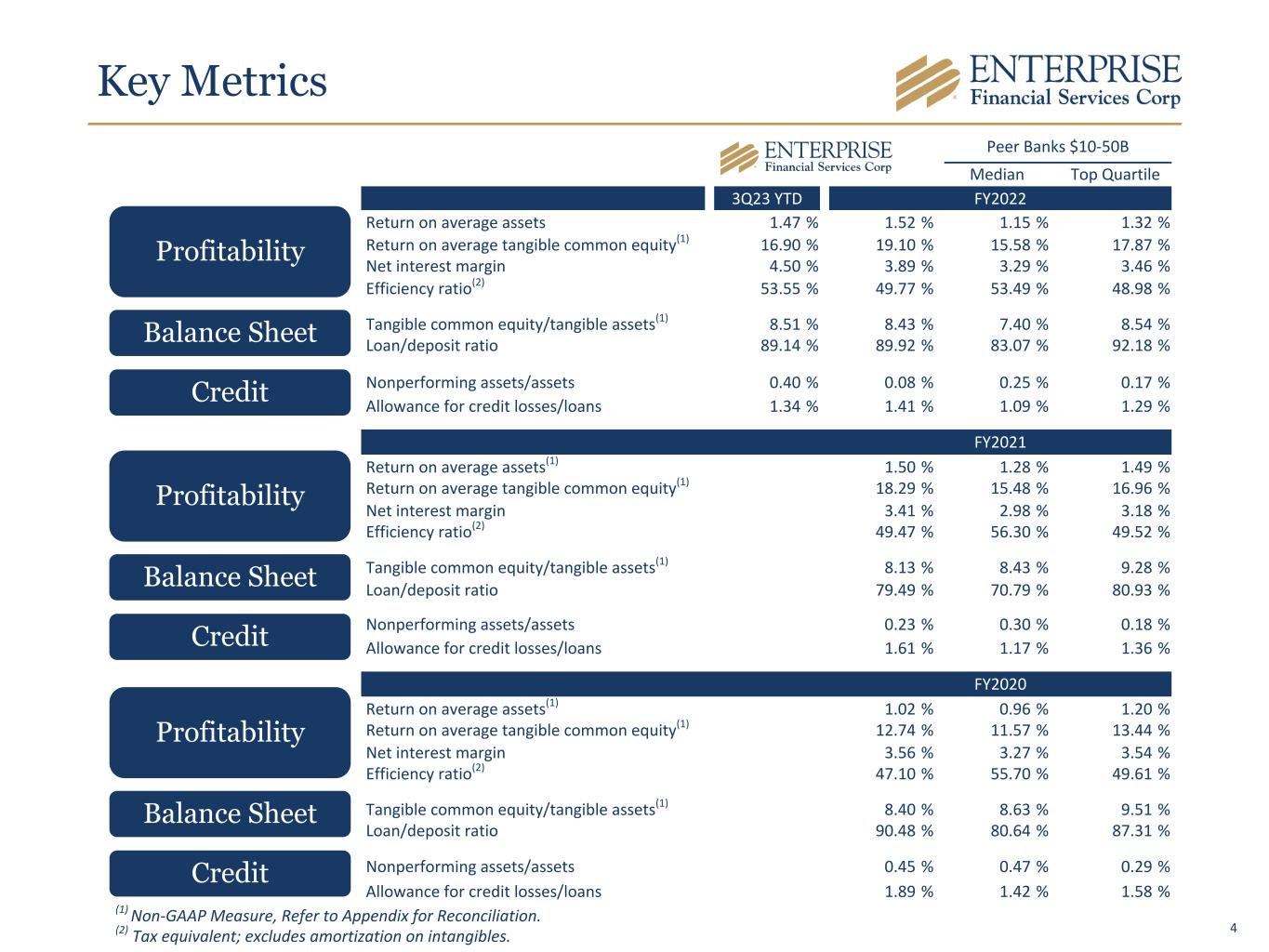

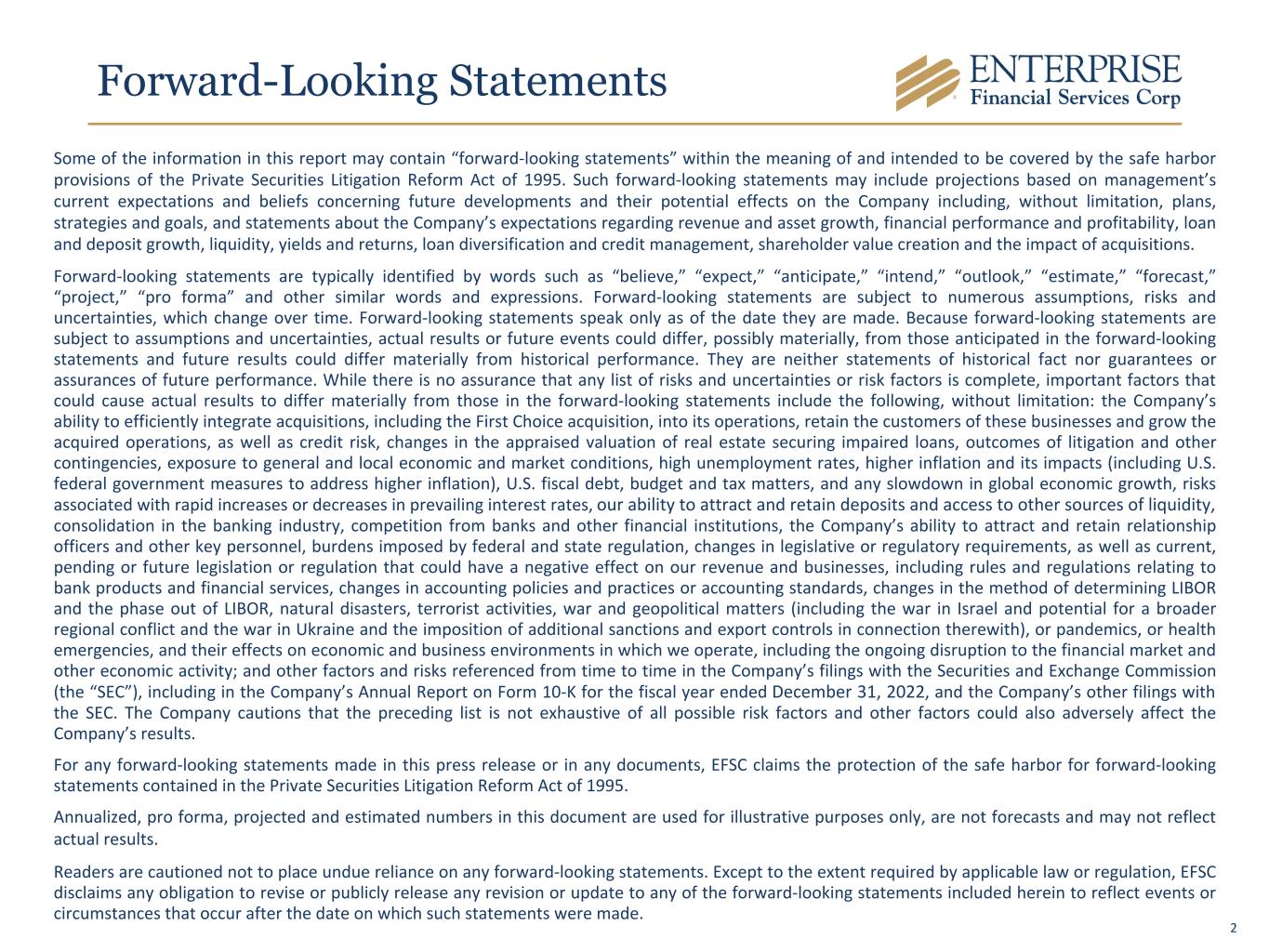

Peer Banks $10-50B Median Top Quartile 3Q23 YTD FY2022 Return on average assets 1.47 % 1.52 % 1.15 % 1.32 % Return on average tangible common equity(1) 16.90 % 19.10 % 15.58 % 17.87 % Net interest margin 4.50 % 3.89 % 3.29 % 3.46 % Efficiency ratio(2) 53.55 % 49.77 % 53.49 % 48.98 % Tangible common equity/tangible assets(1) 8.51 % 8.43 % 7.40 % 8.54 % Loan/deposit ratio 89.14 % 89.92 % 83.07 % 92.18 % Nonperforming assets/assets 0.40 % 0.08 % 0.25 % 0.17 % Allowance for credit losses/loans 1.34 % 1.41 % 1.09 % 1.29 % FY2021 Return on average assets(1) 1.50 % 1.28 % 1.49 % Return on average tangible common equity(1) 18.29 % 15.48 % 16.96 % Net interest margin 3.41 % 2.98 % 3.18 % Efficiency ratio(2) 49.47 % 56.30 % 49.52 % Tangible common equity/tangible assets(1) 8.13 % 8.43 % 9.28 % Loan/deposit ratio 79.49 % 70.79 % 80.93 % Nonperforming assets/assets 0.23 % 0.30 % 0.18 % Allowance for credit losses/loans 1.61 % 1.17 % 1.36 % FY2020 Return on average assets(1) 1.02 % 0.96 % 1.20 % Return on average tangible common equity(1) 12.74 % 11.57 % 13.44 % Net interest margin 3.56 % 3.27 % 3.54 % Efficiency ratio(2) 47.10 % 55.70 % 49.61 % Tangible common equity/tangible assets(1) 8.40 % 8.63 % 9.51 % Loan/deposit ratio 90.48 % 80.64 % 87.31 % Nonperforming assets/assets 0.45 % 0.47 % 0.29 % Allowance for credit losses/loans 1.89 % 1.42 % 1.58 % Key Metrics Credit Profitability Balance Sheet (1) Non-GAAP Measure, Refer to Appendix for Reconciliation. (2) Tax equivalent; excludes amortization on intangibles. Credit Profitability Balance Sheet Credit Profitability Balance Sheet 4

Executive Leadership Team JAMES B. LALLY 55, President & Chief Executive Officer, EFSC Enterprise Tenure – 20 years KEENE S. TURNER 44, SEVP, Chief Financial Officer, EFSC Enterprise Tenure – 10 years SCOTT R. GOODMAN 60, SEVP, President, Enterprise Bank & Trust Enterprise Tenure – 20 years DOUGLAS N. BAUCHE 54, SEVP, Chief Credit Officer, Enterprise Bank & Trust Enterprise Tenure – 23 years MARK G. PONDER 53, SEVP, Chief Administrative Officer, Enterprise Bank & Trust Enterprise Tenure – 11 years NICOLE M. IANNACONE 43, SEVP, Chief Legal Officer, Enterprise Bank & Trust Enterprise Tenure – 9 years BRIDGET HUFFMAN 41, SEVP, Chief Risk Officer, Enterprise Bank & Trust Enterprise Tenure – 13 years 5

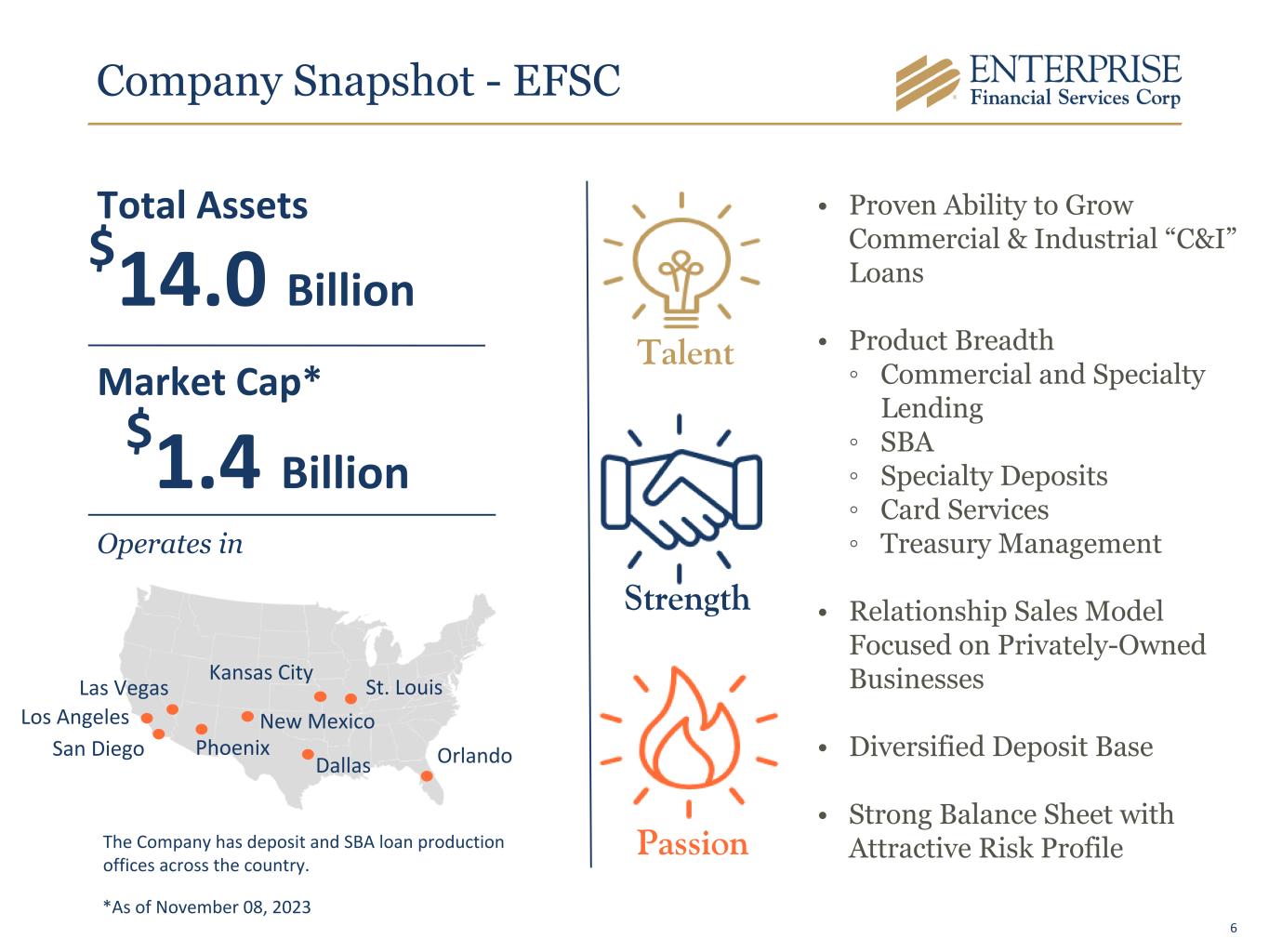

Company Snapshot - EFSC Total Assets $14.0 Billion Market Cap* Operates in St. Louis Kansas City Phoenix $1.4 Billion • Proven Ability to Grow Commercial & Industrial “C&I” Loans • Product Breadth ◦ Commercial and Specialty Lending ◦ SBA ◦ Specialty Deposits ◦ Card Services ◦ Treasury Management • Relationship Sales Model Focused on Privately-Owned Businesses • Diversified Deposit Base • Strong Balance Sheet with Attractive Risk Profile Talent Strength Passion New MexicoLos Angeles Las Vegas The Company has deposit and SBA loan production offices across the country. San Diego Dallas *As of November 08, 2023 Orlando 6

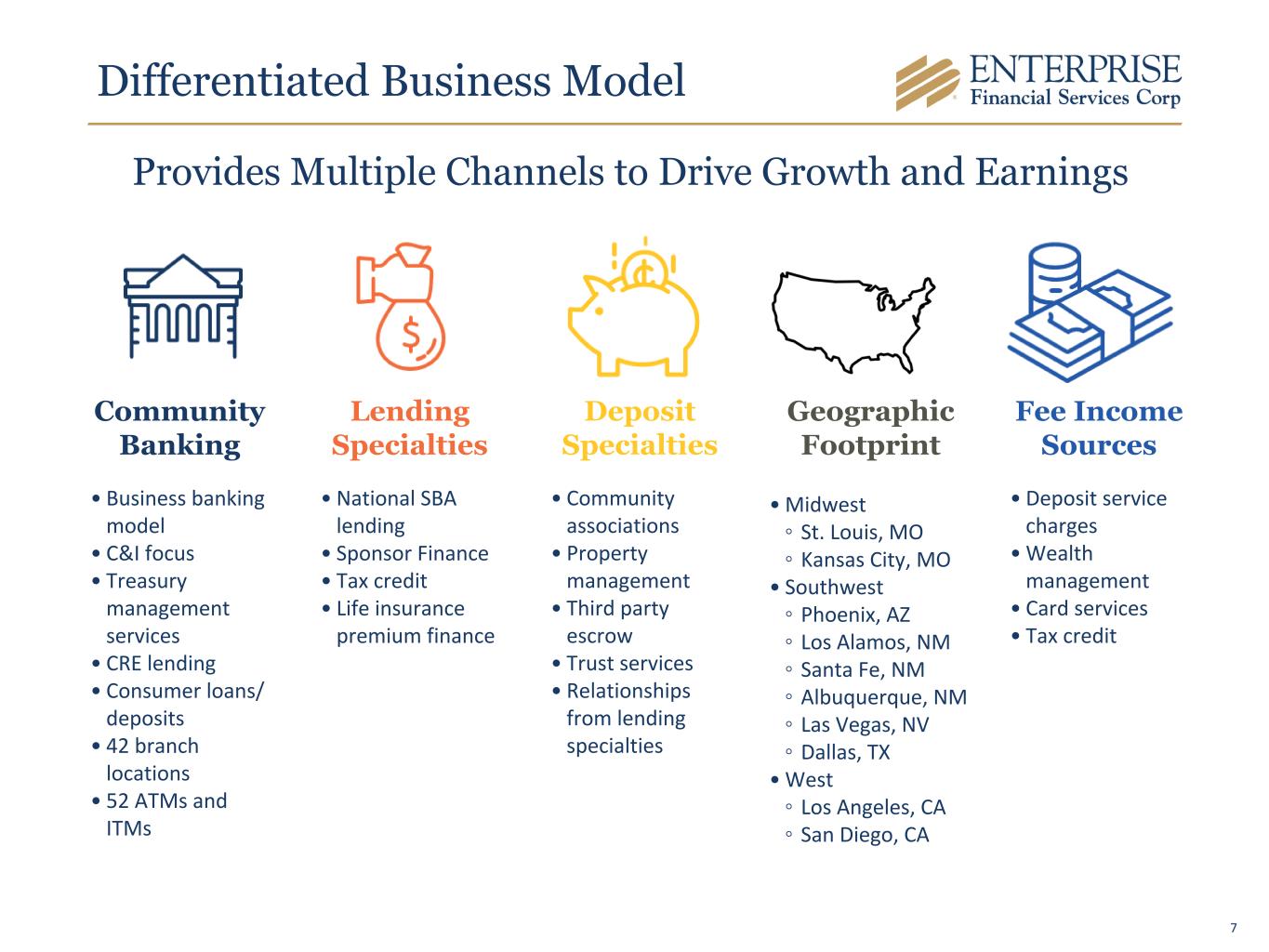

Differentiated Business Model Focused and Well-Defined Strategy Aimed at Business Owners, Executives and Professionals. Experienced Bankers and Advisors Community Banking • Business banking model • C&I focus • Treasury management services • CRE lending • Consumer loans/ deposits • 42 branch locations • 52 ATMs and ITMs Lending Specialties • National SBA lending • Sponsor Finance • Tax credit • Life insurance premium finance Deposit Specialties • Community associations • Property management • Third party escrow • Trust services • Relationships from lending specialties Geographic Footprint •Midwest ◦ St. Louis, MO ◦ Kansas City, MO • Southwest ◦ Phoenix, AZ ◦ Los Alamos, NM ◦ Santa Fe, NM ◦ Albuquerque, NM ◦ Las Vegas, NV ◦ Dallas, TX •West ◦ Los Angeles, CA ◦ San Diego, CA Fee Income Sources • Deposit service charges •Wealth management • Card services • Tax credit Provides Multiple Channels to Drive Growth and Earnings 7

Best-In-Class Technology Partnerships Client journey supported by a competitive digital product set. Customer surveys Salesforce integrated with core for 360 client view Client Portal Online Banking integrated with treasury products Integrations for APIs for HOA/PM Positive Pay (Check & ACH) TARGET ONBOARD SERVICE PROTECT GROW Weiland Account Analysis 8

Diversified Revenue (2022 financial data) Treasury Management $1.9B in Assets Under Management Card Services Tax Credit Services Mortgage Banking Community Development Other Services Midwest Southwest West Specialty Lending Net Interest Income Noninterest Income Midwest 35.8% Southwest 16.3% West 15.5% Specialty Lending 32.4% $474 Million Wealth Management 16.9% Card Services 19.6% Tax Credit Income 4.4% Deposit Service Charges 30.9% BOLI 5.6% Community Development 8.9%Other income 13.7% $533 Million 3.89% NIM 49.8% Core Efficiency Ratio(1) 1.9% PPNR ROAA(1) 19.1% ROATCE(1) Diversified Revenue Streams $59 Million Operating Revenue (1)A Non-GAAP Measure, Refer to Appendix for Reconciliation. 9

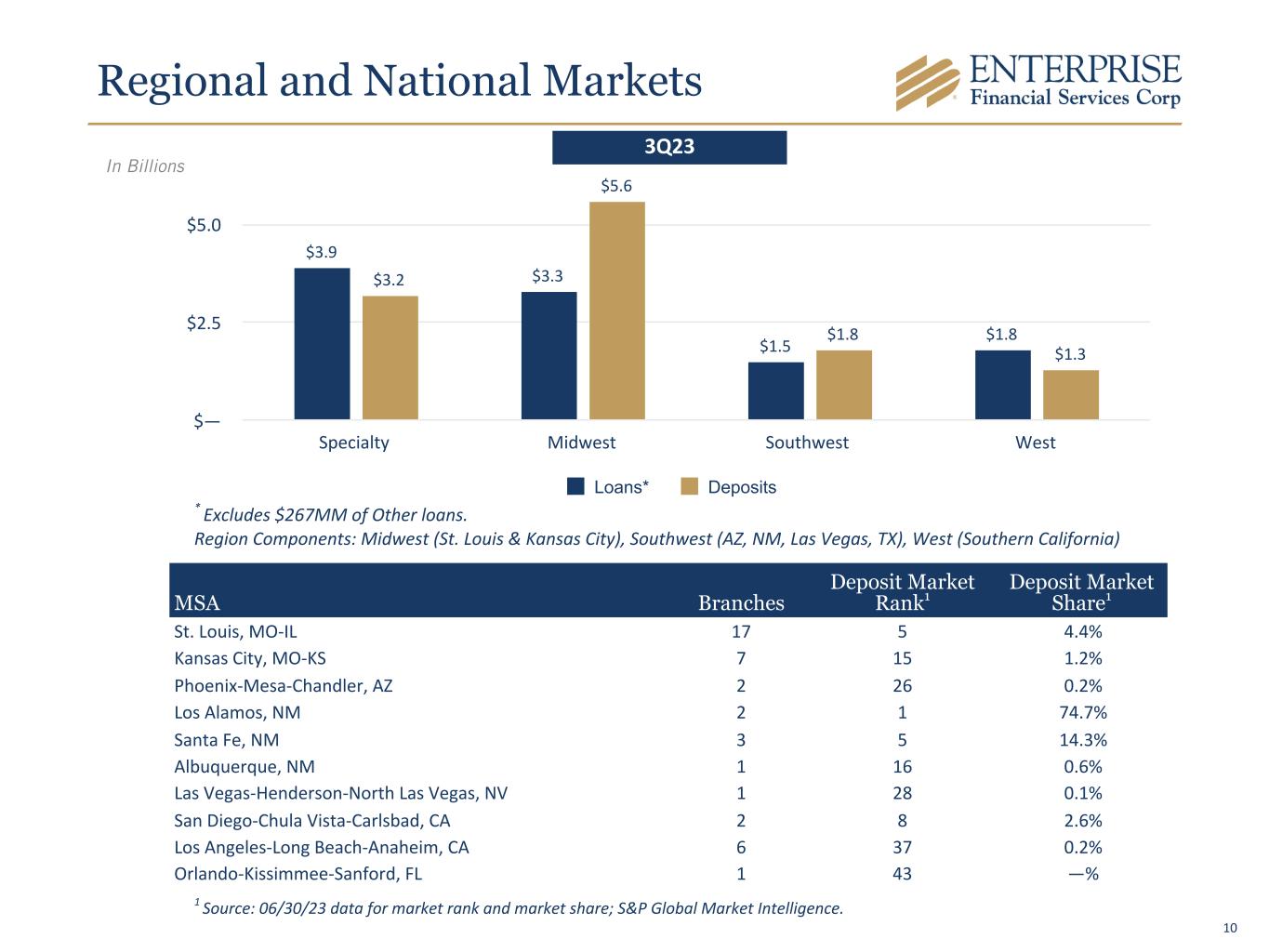

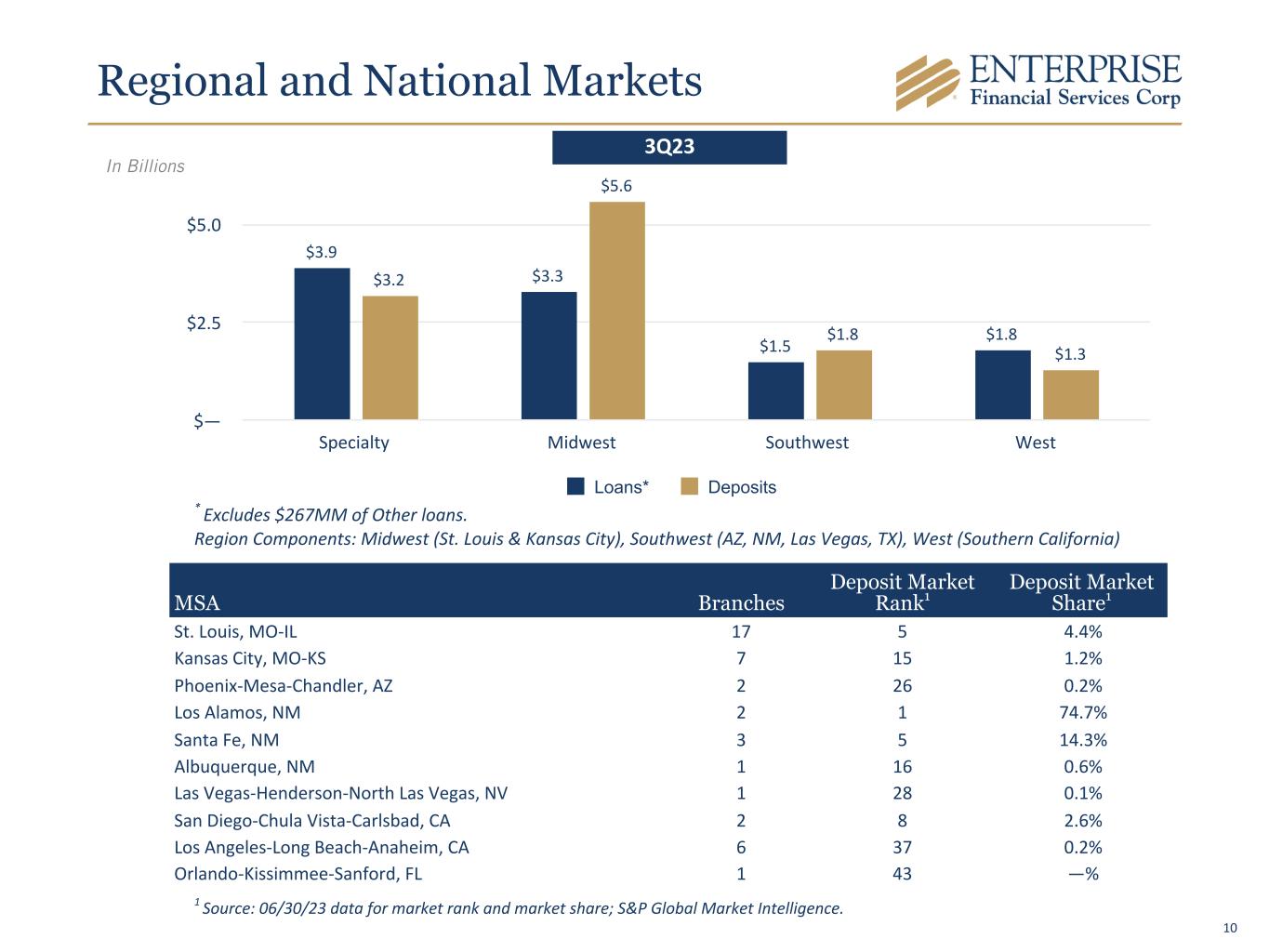

Regional and National Markets 1 Source: 06/30/23 data for market rank and market share; S&P Global Market Intelligence. $3.9 $3.3 $1.5 $1.8 $3.2 $5.6 $1.8 $1.3 Loans* Deposits Specialty Midwest Southwest West $— $2.5 $5.0 MSA Branches Deposit Market Rank1 Deposit Market Share1 St. Louis, MO-IL 17 5 4.4% Kansas City, MO-KS 7 15 1.2% Phoenix-Mesa-Chandler, AZ 2 26 0.2% Los Alamos, NM 2 1 74.7% Santa Fe, NM 3 5 14.3% Albuquerque, NM 1 16 0.6% Las Vegas-Henderson-North Las Vegas, NV 1 28 0.1% San Diego-Chula Vista-Carlsbad, CA 2 8 2.6% Los Angeles-Long Beach-Anaheim, CA 6 37 0.2% Orlando-Kissimmee-Sanford, FL 1 43 —% In Billions * Excludes $267MM of Other loans. 3Q23 Region Components: Midwest (St. Louis & Kansas City), Southwest (AZ, NM, Las Vegas, TX), West (Southern California) 10

6.4% 8.4% 8.7% 12.3% Focused Loan Growth Strategies Total Loans Specialty market segments represent 36% of total loans, offering competitive advantages, risk adjusted pricing and fee income opportunities. Tax Credit Programs $684 million in loans outstanding related to Federal, Historic, and Affordable Housing tax credits. $303 million in Federal & State New Market tax credits awarded to date. Sponsor Finance $888 million in M&A related loans outstanding, partnering with SBIC and PE firms. Life Insurance Premium Finance $928 million in loans outstanding related to high net worth estate planning. Expectations for future growth includes continued focus in these specialized market segments. SBA Loans $1.3 billion in loans outstanding in SBA 7(a) loans, including $927 million guaranteed. 11

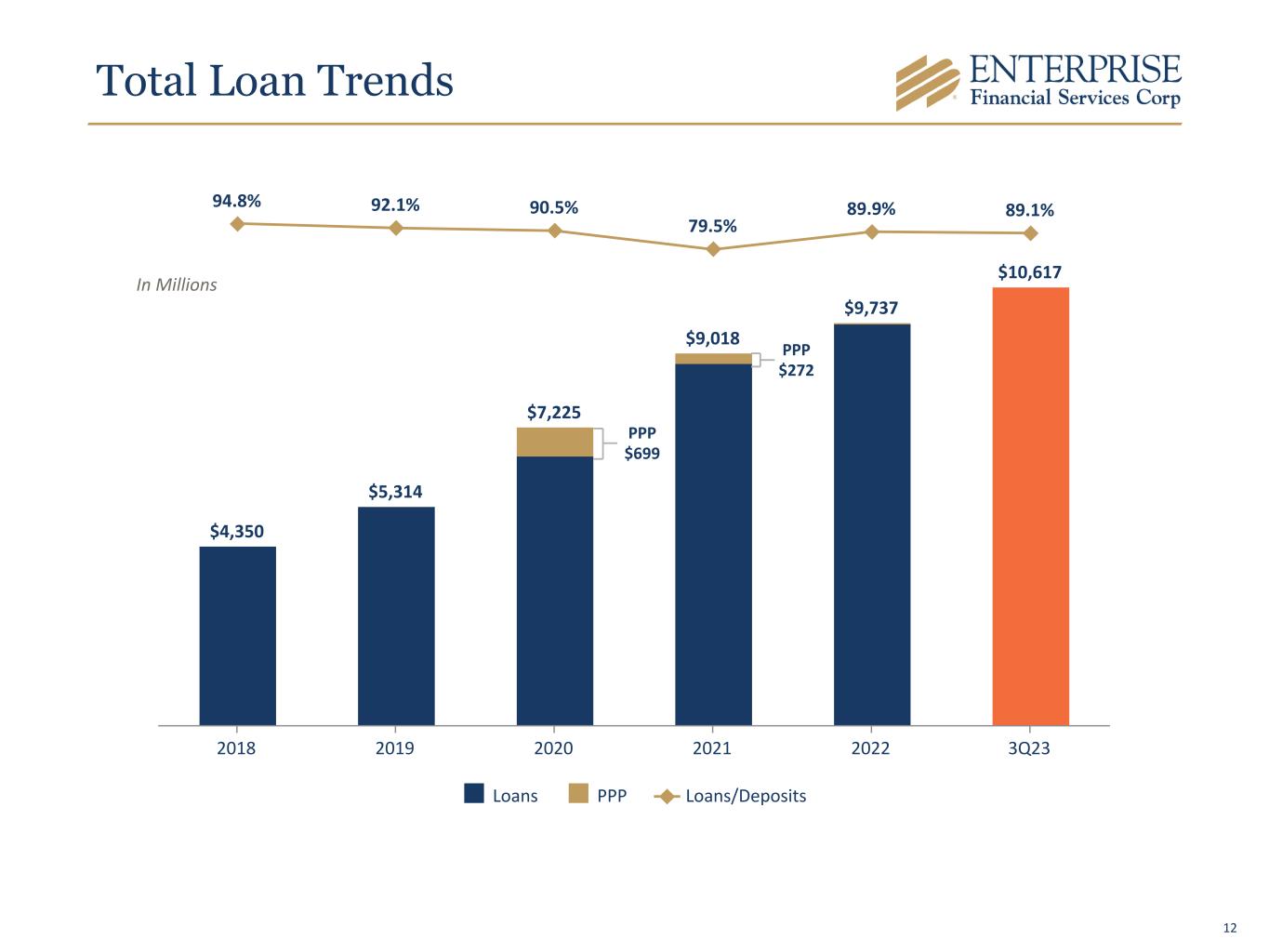

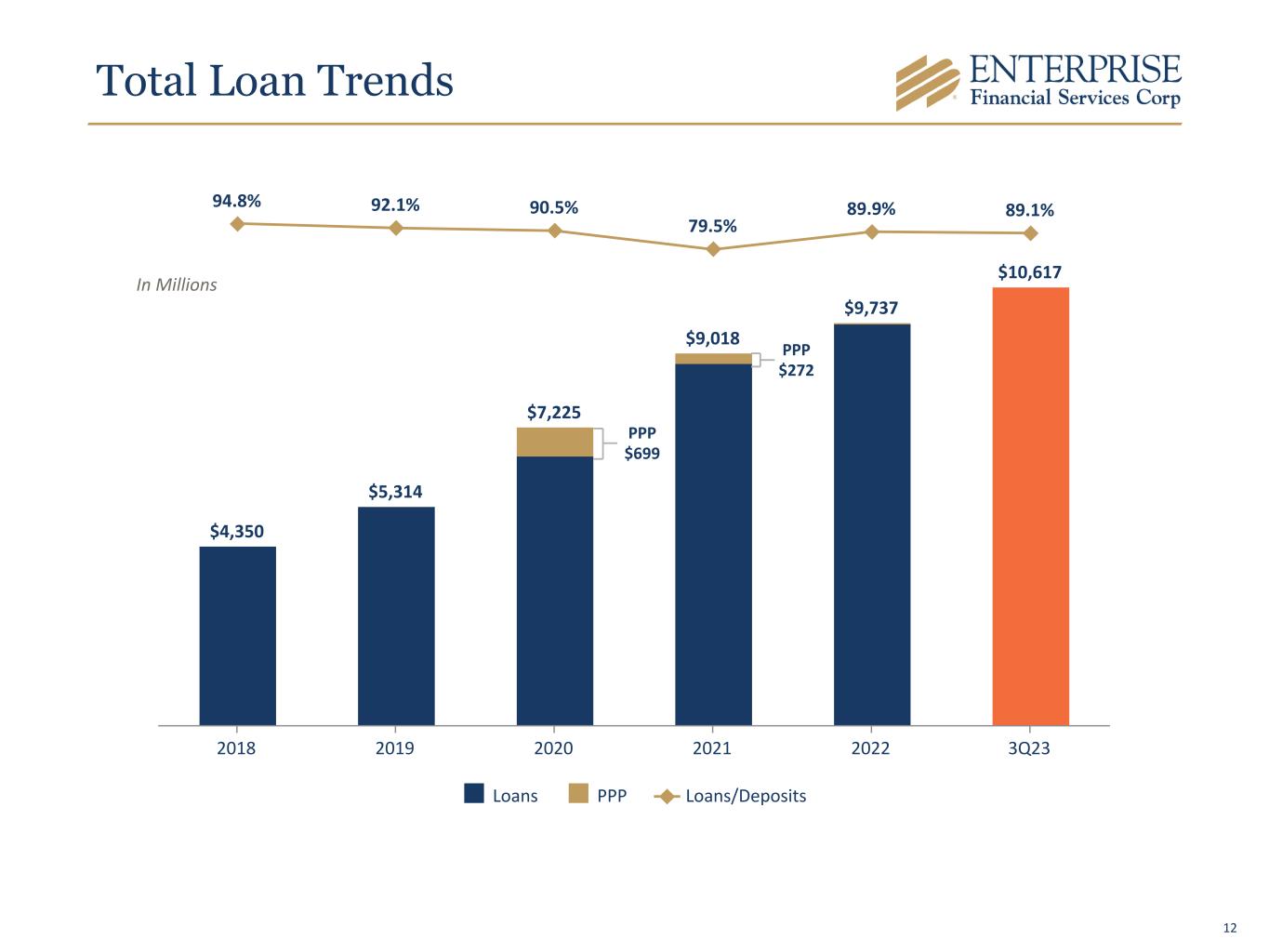

Total Loan Trends $4,350 $5,314 $7,225 $9,018 $9,737 $10,617 94.8% 92.1% 90.5% 79.5% 89.9% 89.1% Loans PPP Loans/Deposits 2018 2019 2020 2021 2022 3Q23 In Millions PPP $272 PPP $699 12

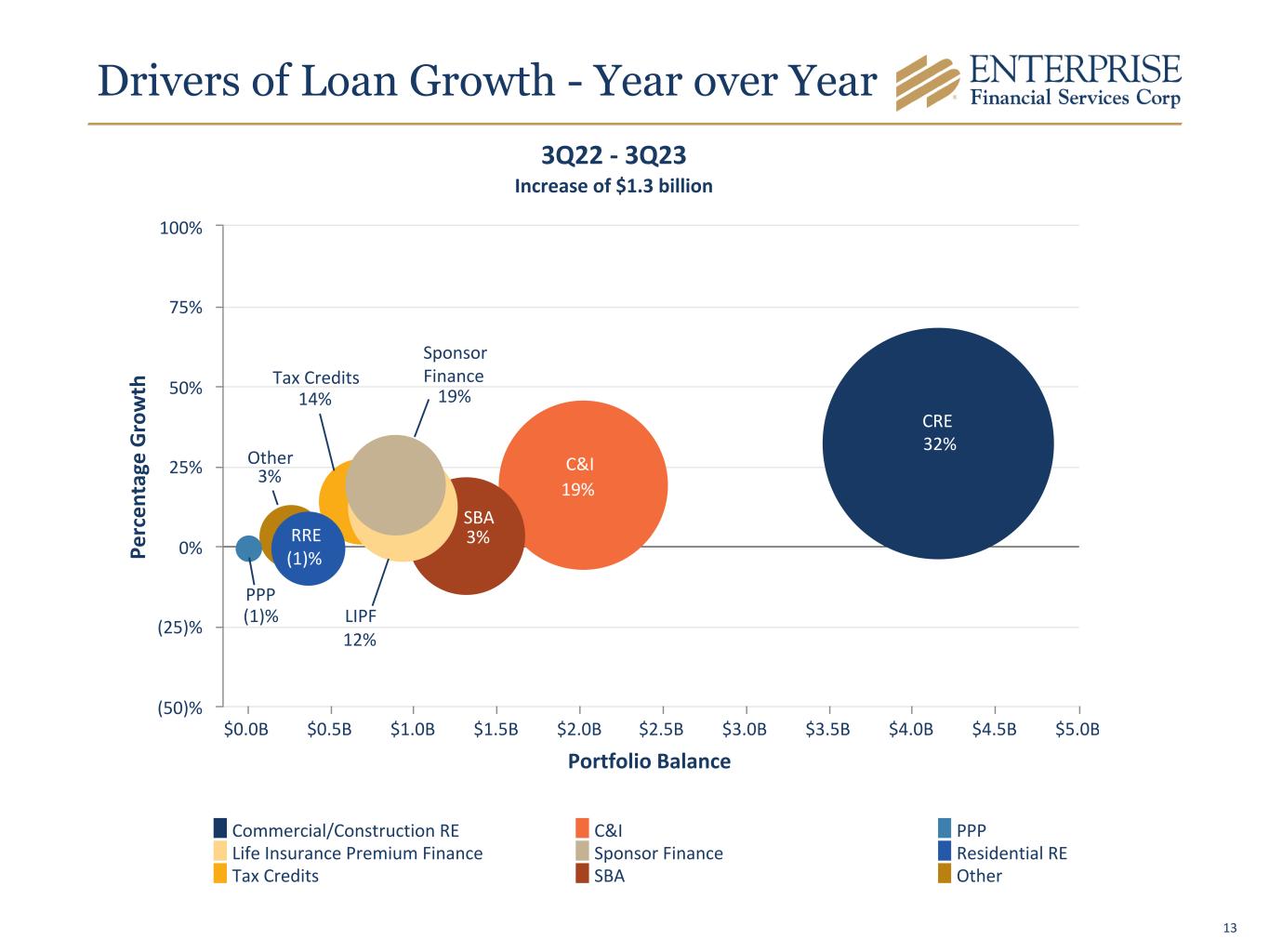

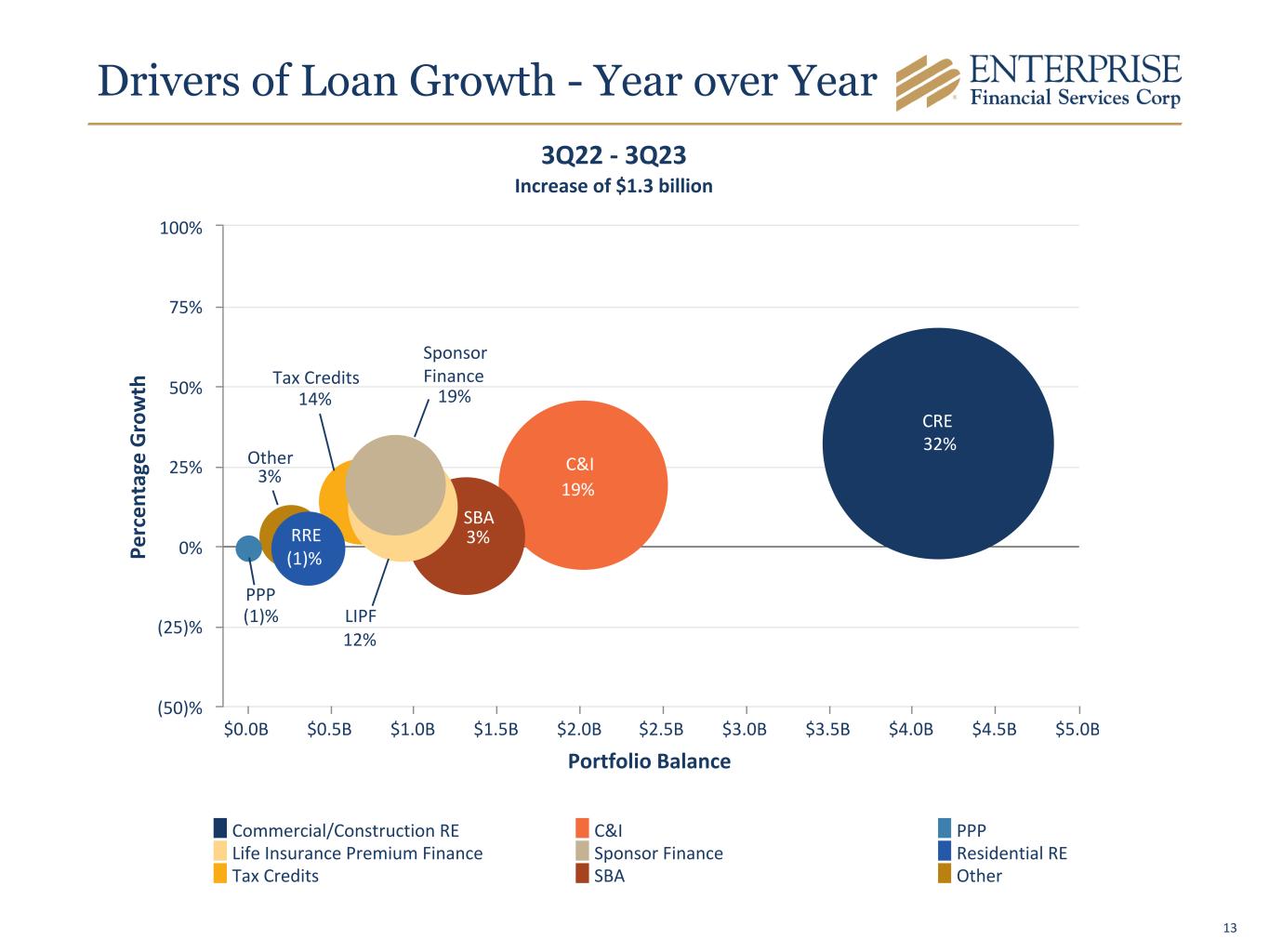

Portfolio Balance Pe rc en ta ge G ro w th $0.0B $0.5B $1.0B $1.5B $2.0B $2.5B $3.0B $3.5B $4.0B $4.5B $5.0B (50)% (25)% 0% 25% 50% 75% 100% Drivers of Loan Growth - Year over Year 32% Commercial/Construction RE C&I PPP Life Insurance Premium Finance Sponsor Finance Residential RE Tax Credits SBA Other 19% 3Q22 - 3Q23 Increase of $1.3 billion 3% (1)% 12% 19% 3% 14% CRE C&I SBA PPP LIPF Tax Credits Other RRE Sponsor Finance (1)% 13

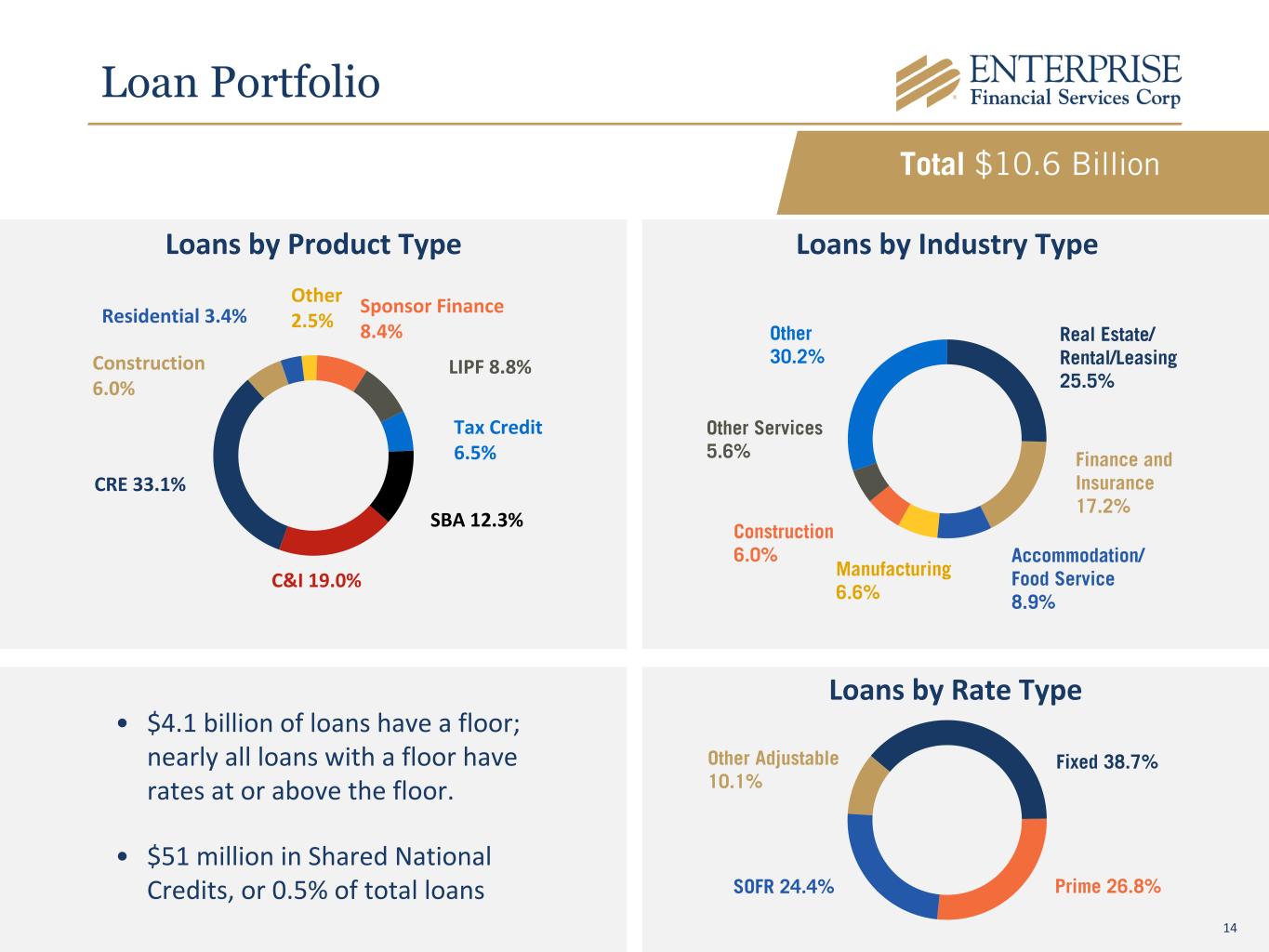

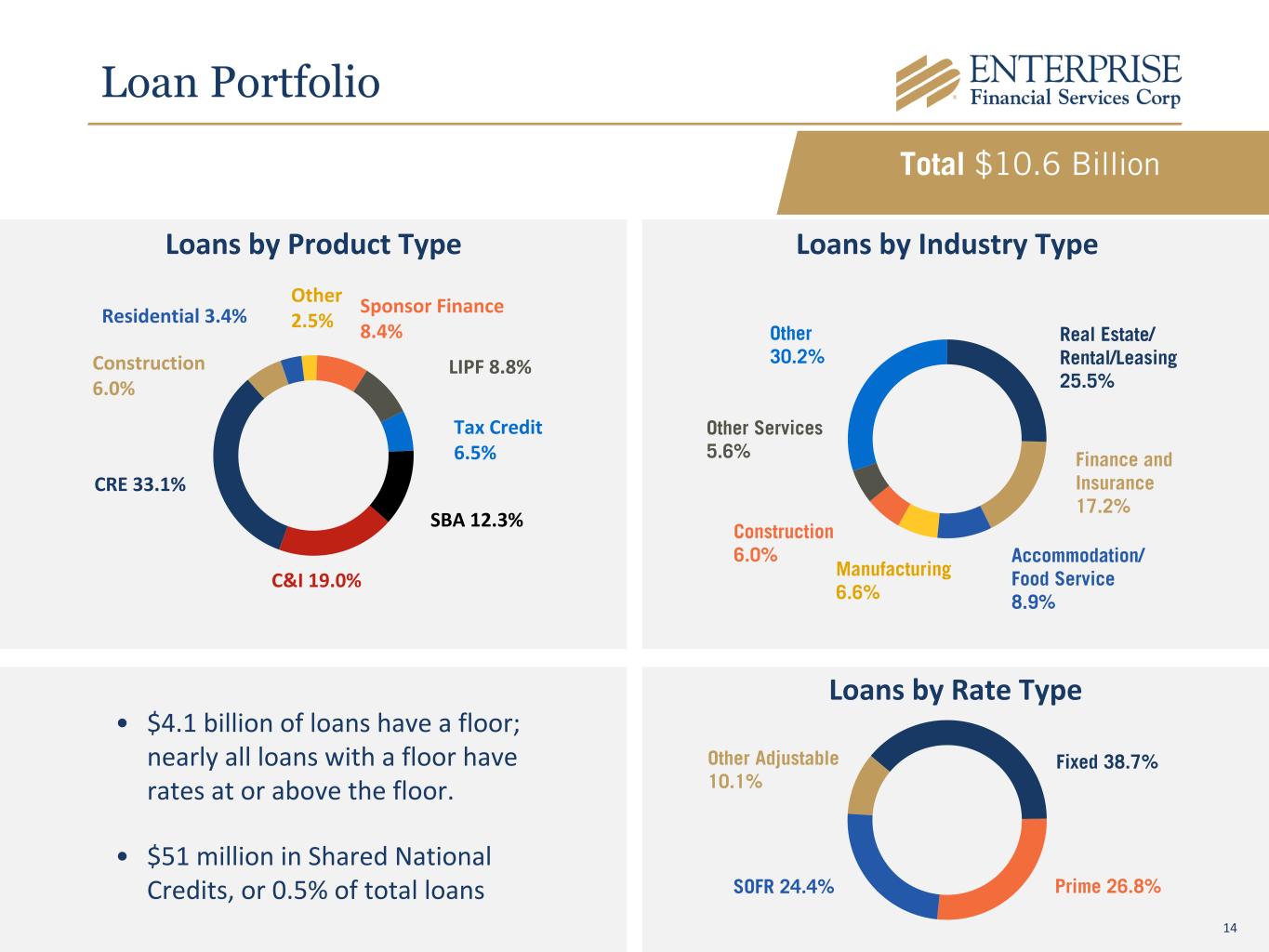

Loan Portfolio Total $10.6 Billion CRE 33.1% Construction 6.0% Residential 3.4% Other 2.5% Sponsor Finance 8.4% LIPF 8.8% Tax Credit 6.5% SBA 12.3% C&I 19.0% Loans by Product Type Real Estate/ Rental/Leasing 25.5% Finance and Insurance 17.2% Accommodation/ Food Service 8.9% Manufacturing 6.6% Construction 6.0% Other Services 5.6% Other 30.2% Loans by Industry Type Fixed 38.7% Prime 26.8%SOFR 24.4% Other Adjustable 10.1% Loans by Rate Type • $4.1 billion of loans have a floor; nearly all loans with a floor have rates at or above the floor. • $51 million in Shared National Credits, or 0.5% of total loans 14

Office CRE (Non-owner Occupied) Total $483.6 Million Midwest 50.2% Southwest 29.6% West 14.9% Specialty 5.3% Office CRE Loans by Location Real Estate/ Rental/Leasing 85.8% Information 1.8% Health Care and Social Assistance 3.3% Professional Services 1.9% Wholesale Trade 1.8% Finance and Insurance 1.1% Other 4.3% Office CRE Loans by Industry Type Size Average Risk Rating Number of Loans Balance Average Balance > $10 Million 5.30 10 $ 145.4 $ 14.5 $5-10 Million 5.00 14 90.9 6.5 $2-5 Million 5.17 42 128.2 3.1 < $2 Million 5.17 206 119.1 0.6 Total 5.17 272 $ 483.6 $ 1.8 Office CRE Loans by Size $ In Millions• Average loan-to-origination value 49% • 71% of loans have recourse to owners • Average debt-service coverage ratio (DSCR) of 1.48x (2022) • Average market occupancy of 88%; average rents of $24 psf • 42% Class A, 54% Class B, 4% Class C • $14.2 million unfunded commitments 15

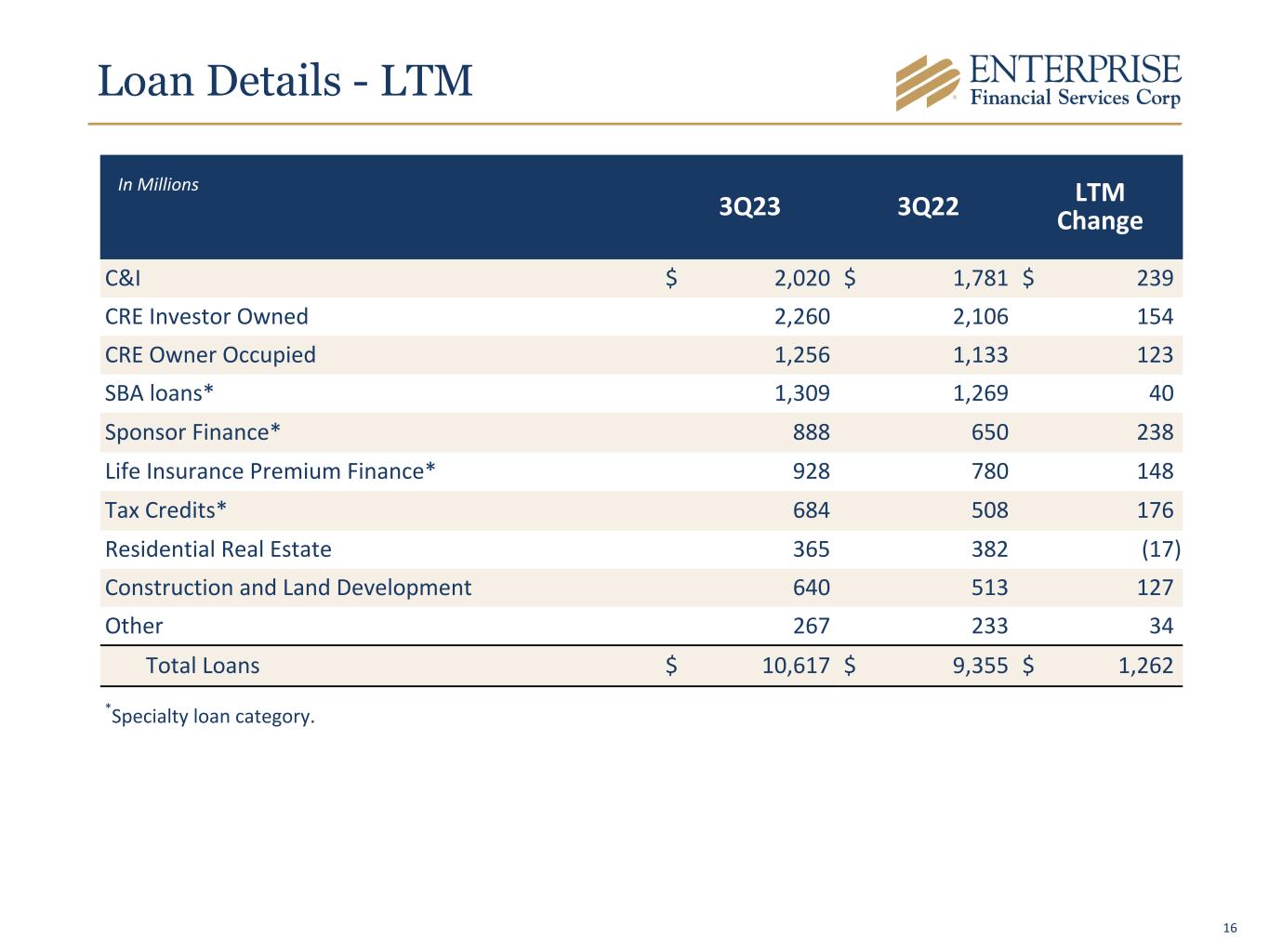

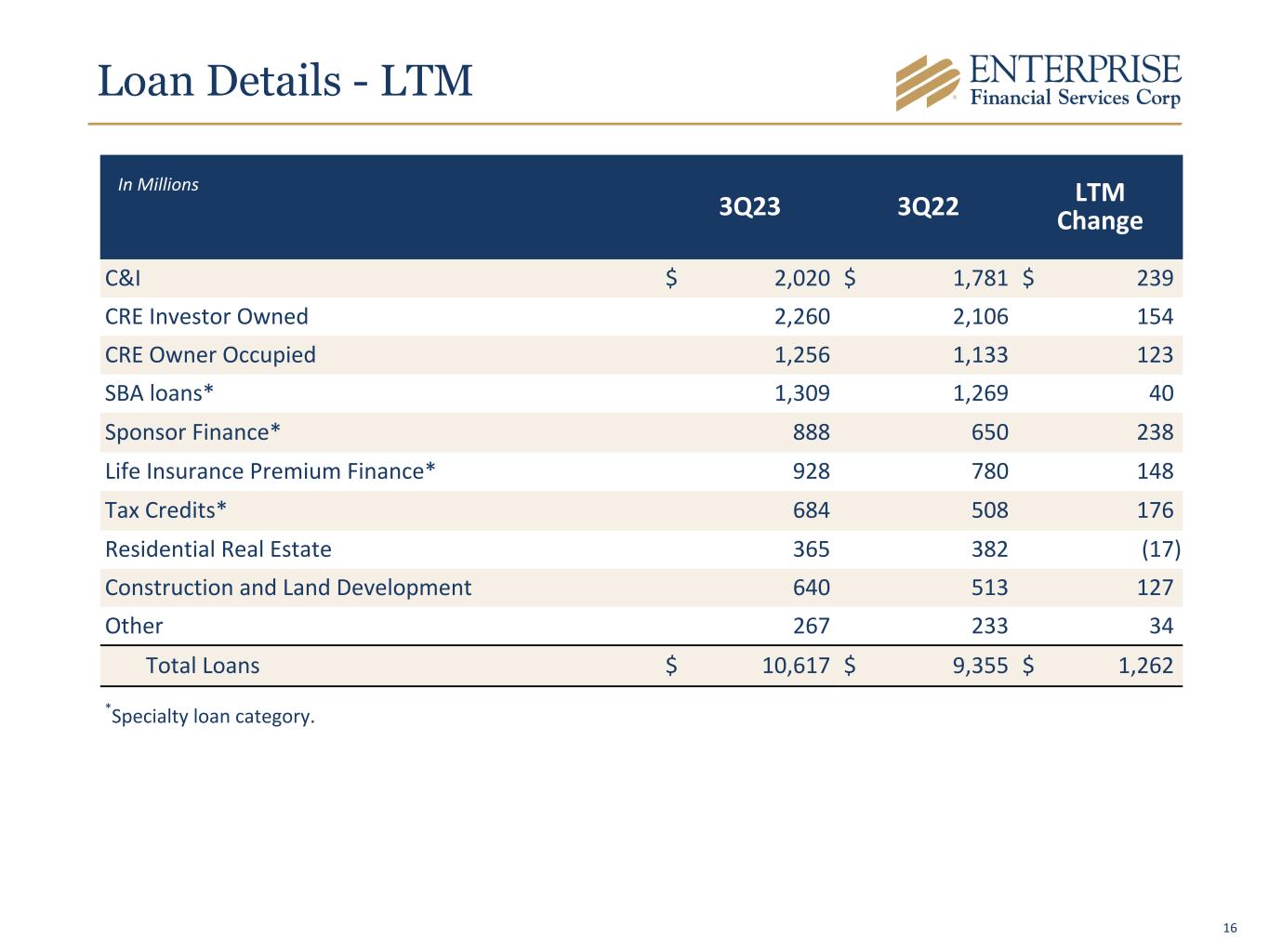

Loan Details - LTM 3Q23 3Q22 LTM Change C&I $ 2,020 $ 1,781 $ 239 CRE Investor Owned 2,260 2,106 154 CRE Owner Occupied 1,256 1,133 123 SBA loans* 1,309 1,269 40 Sponsor Finance* 888 650 238 Life Insurance Premium Finance* 928 780 148 Tax Credits* 684 508 176 Residential Real Estate 365 382 (17) Construction and Land Development 640 513 127 Other 267 233 34 Total Loans $ 10,617 $ 9,355 $ 1,262 *Specialty loan category. In Millions 16

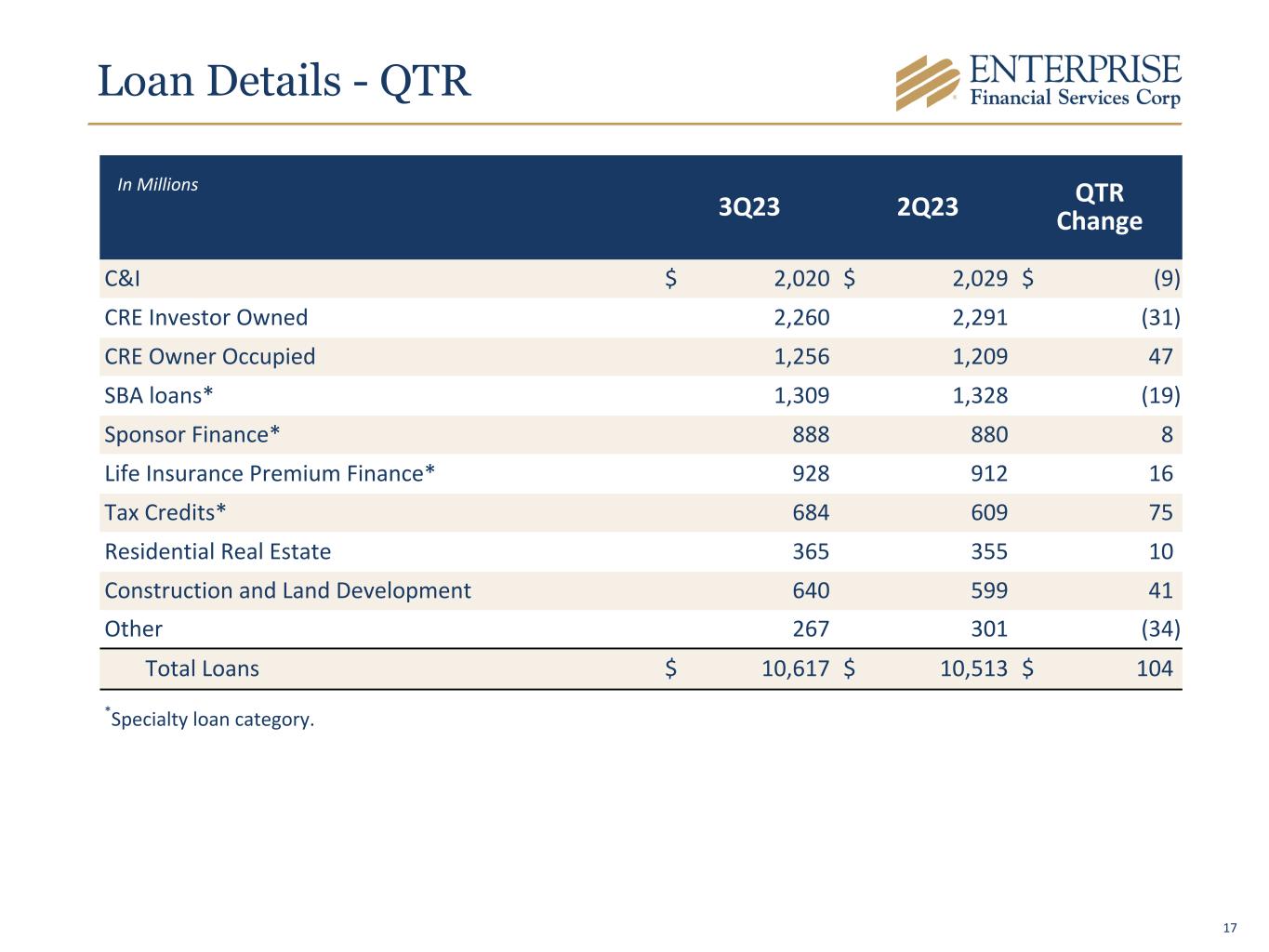

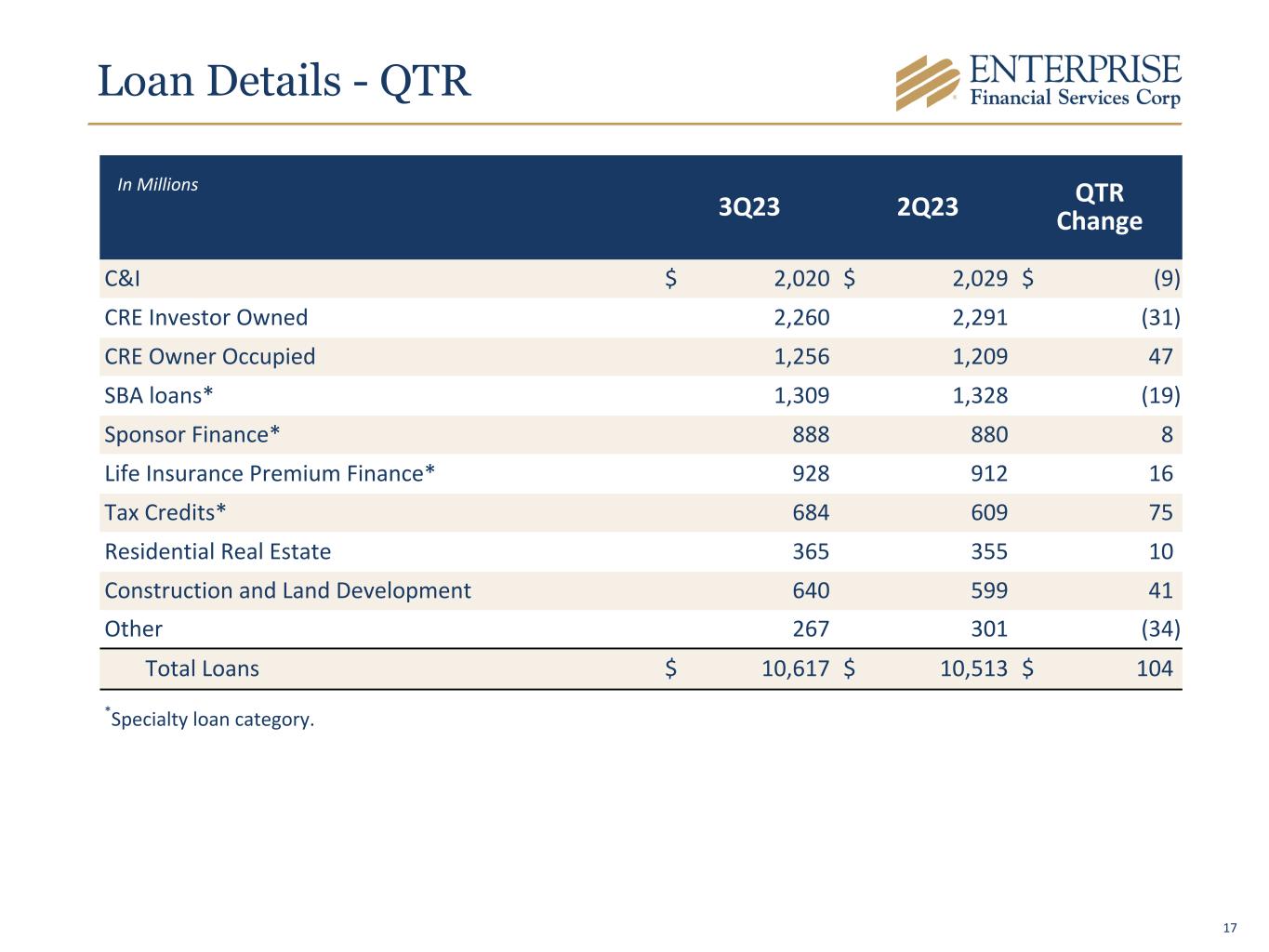

Loan Details - QTR 3Q23 2Q23 QTR Change C&I $ 2,020 $ 2,029 $ (9) CRE Investor Owned 2,260 2,291 (31) CRE Owner Occupied 1,256 1,209 47 SBA loans* 1,309 1,328 (19) Sponsor Finance* 888 880 8 Life Insurance Premium Finance* 928 912 16 Tax Credits* 684 609 75 Residential Real Estate 365 355 10 Construction and Land Development 640 599 41 Other 267 301 (34) Total Loans $ 10,617 $ 10,513 $ 104 *Specialty loan category. In Millions 17

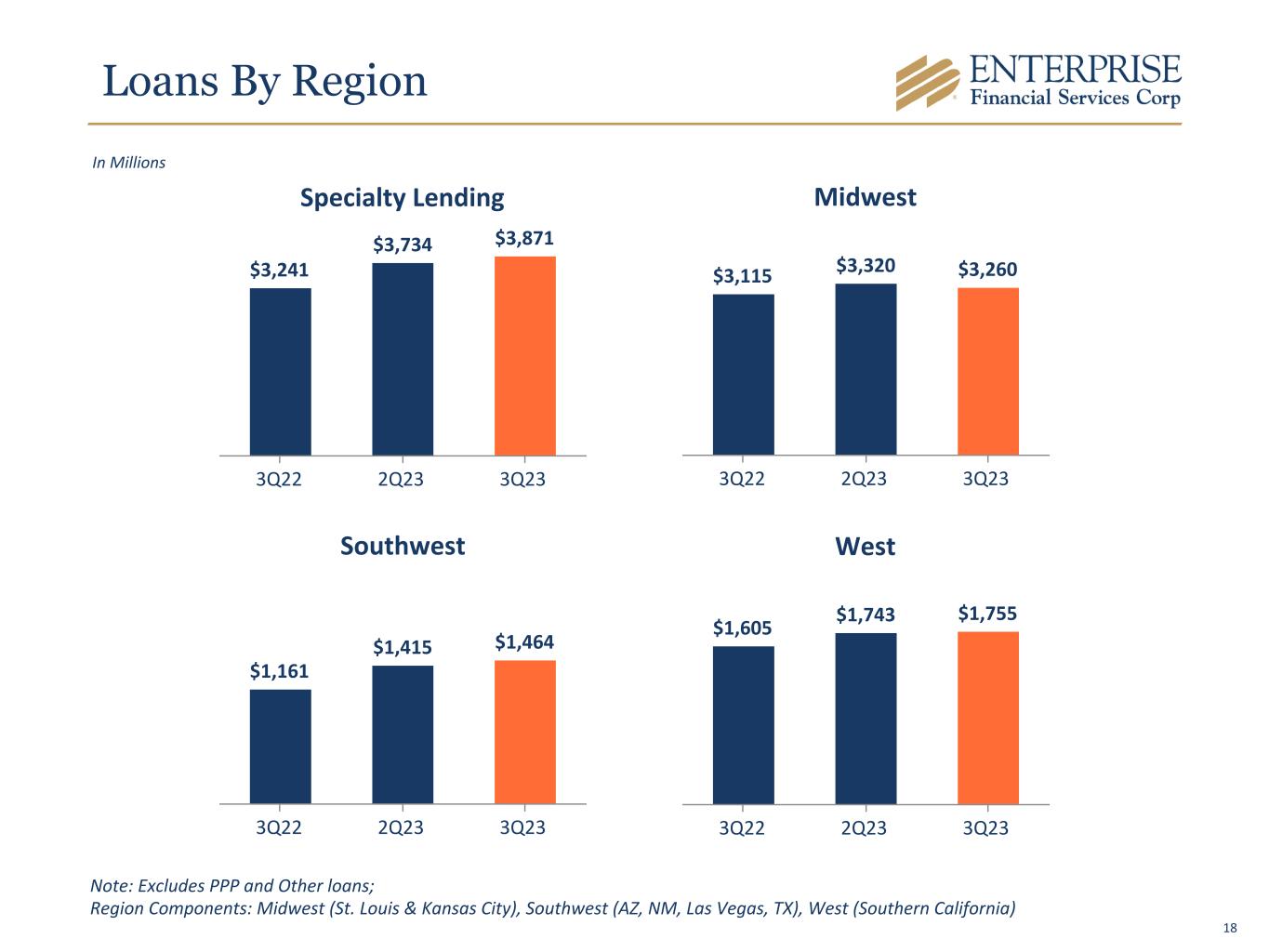

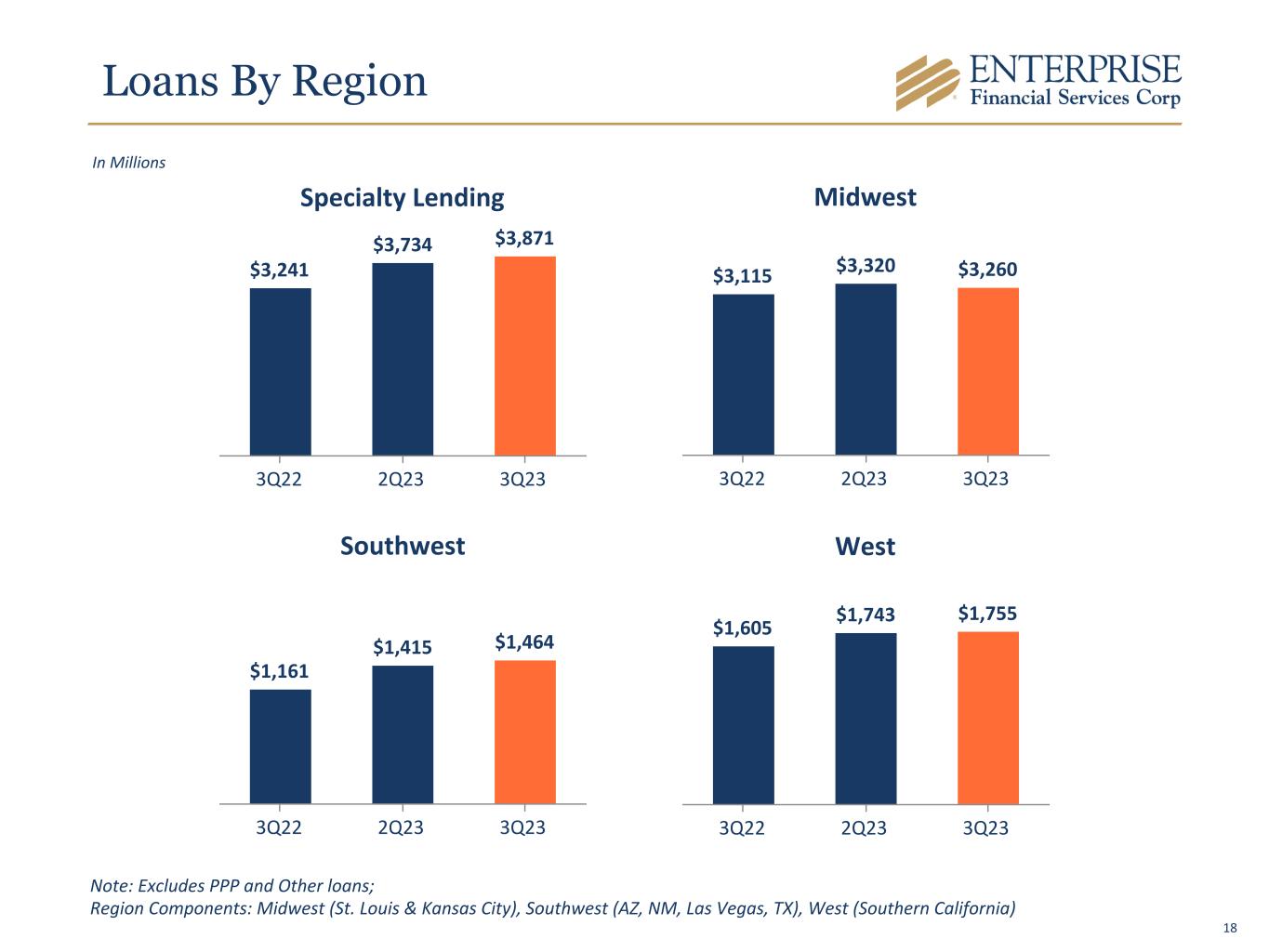

Loans By Region Specialty Lending $3,241 $3,734 $3,871 3Q22 2Q23 3Q23 In Millions Midwest $3,115 $3,320 $3,260 3Q22 2Q23 3Q23 Southwest $1,161 $1,415 $1,464 3Q22 2Q23 3Q23 Note: Excludes PPP and Other loans; Region Components: Midwest (St. Louis & Kansas City), Southwest (AZ, NM, Las Vegas, TX), West (Southern California) West $1,605 $1,743 $1,755 3Q22 2Q23 3Q23 18

Deposit Details - LTM 3Q23 3Q22 LTM Change Noninterest-bearing demand accounts $ 3,852 $ 4,643 $ (791) Interest-bearing demand accounts 2,750 2,271 479 Money market accounts 3,211 2,793 418 Savings accounts 626 824 (198) Certificates of deposit: Brokered 696 129 567 Other 775 398 377 Total Deposits $ 11,910 $ 11,058 $ 852 Specialty Deposits (included in total deposits) $ 3,164 $ 2,422 $ 742 In Millions 19

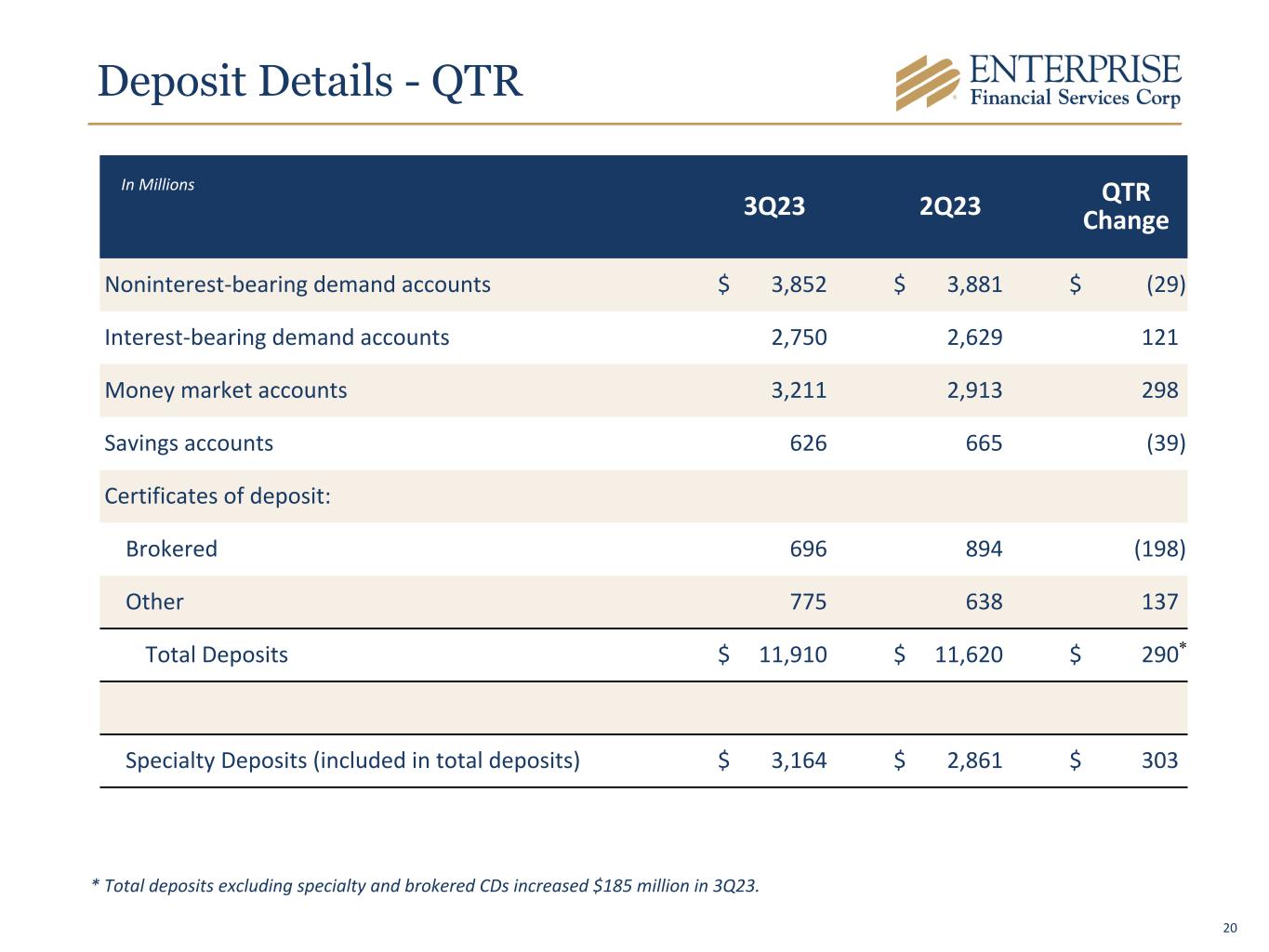

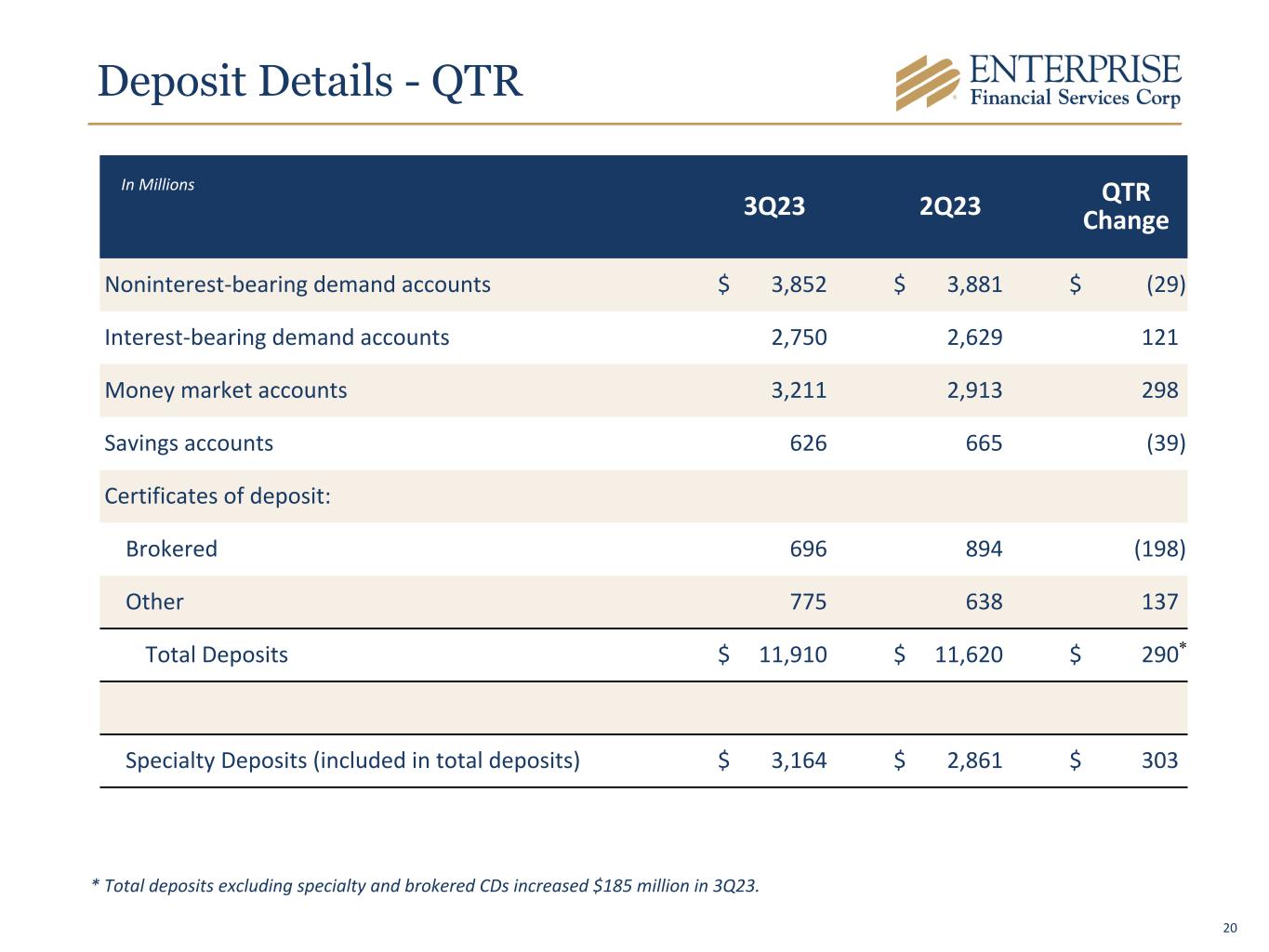

Deposit Details - QTR 3Q23 2Q23 QTR Change Noninterest-bearing demand accounts $ 3,852 $ 3,881 $ (29) Interest-bearing demand accounts 2,750 2,629 121 Money market accounts 3,211 2,913 298 Savings accounts 626 665 (39) Certificates of deposit: Brokered 696 894 (198) Other 775 638 137 Total Deposits $ 11,910 $ 11,620 $ 290 Specialty Deposits (included in total deposits) $ 3,164 $ 2,861 $ 303 In Millions * Total deposits excluding specialty and brokered CDs increased $185 million in 3Q23. * 20

Deposits By Region Specialty Deposits $2,422 $2,861 $3,164 3Q22 2Q23 3Q23 In Millions Midwest* $5,221 $5,640 $5,627 3Q22 2Q23 3Q23 Southwest $1,827 $1,811 $1,802 3Q22 2Q23 3Q23 West* $1,588 $1,308 $1,317 3Q22 2Q23 3Q23 Note: Region Components: Midwest (St. Louis & Kansas City), Southwest (AZ, NM, Las Vegas, TX), West (Southern California) *Includes brokered balances 21

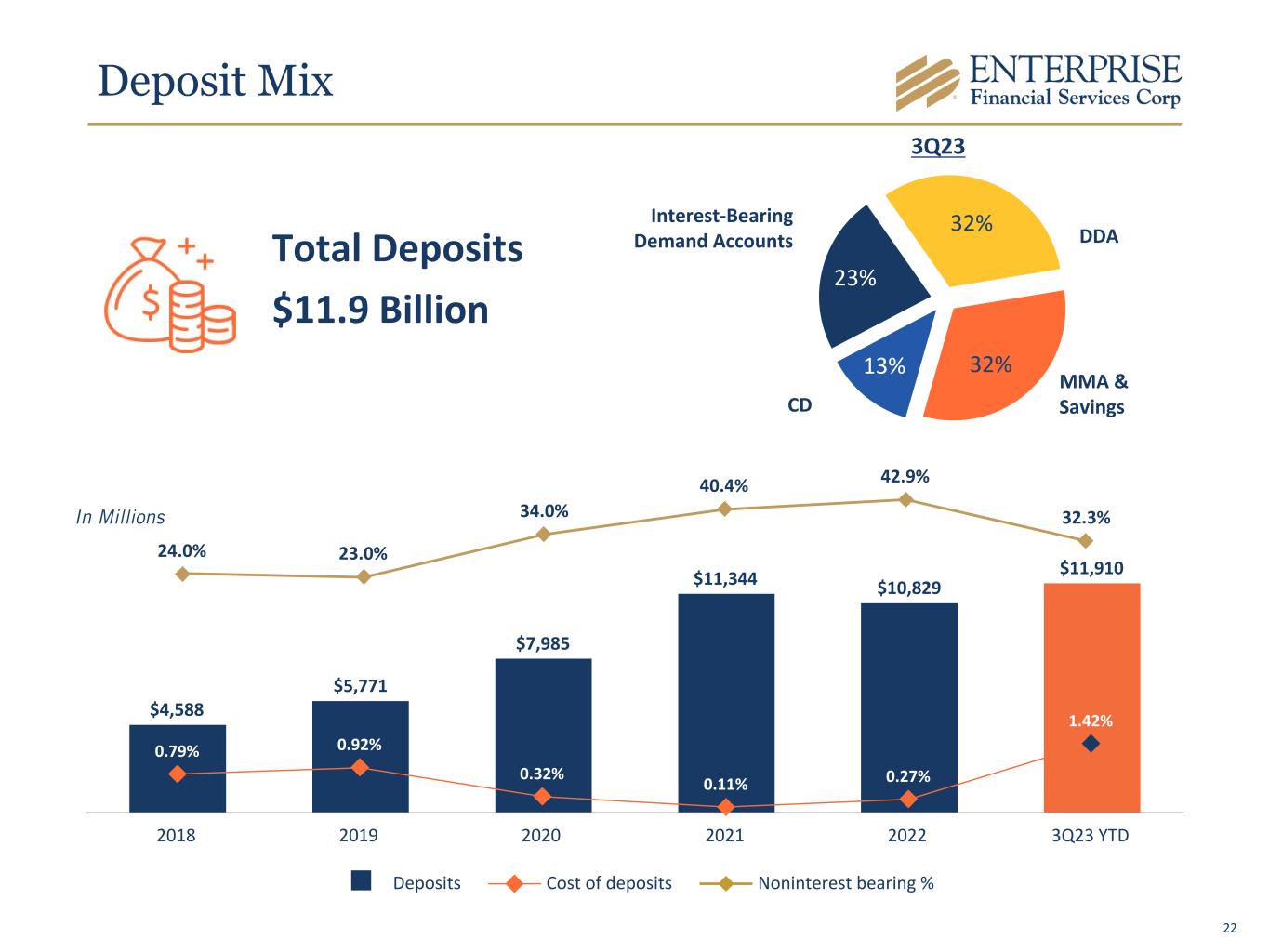

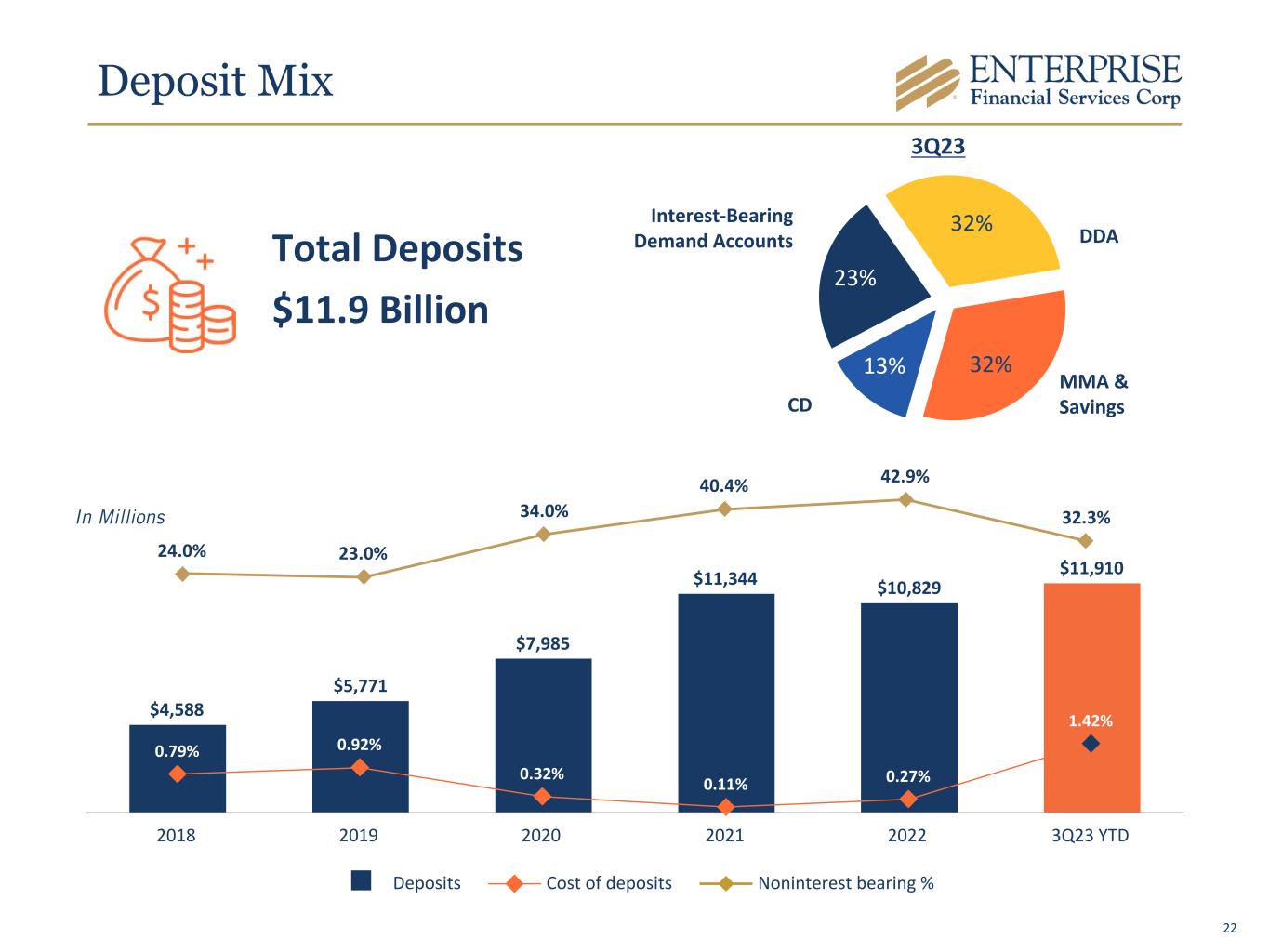

24.0% 23.0% 34.0% 40.4% 42.9% 32.3% 32% 32%13% 23% $4,588 $5,771 $7,985 $11,344 $10,829 $11,910 0.79% 0.92% 0.32% 0.11% 0.27% 1.42% Deposits Cost of deposits Noninterest bearing % 2018 2019 2020 2021 2022 3Q23 YTD Deposit Mix CD Interest-Bearing Demand Accounts DDA MMA & Savings In Millions Total Deposits $11.9 Billion 3Q23 22

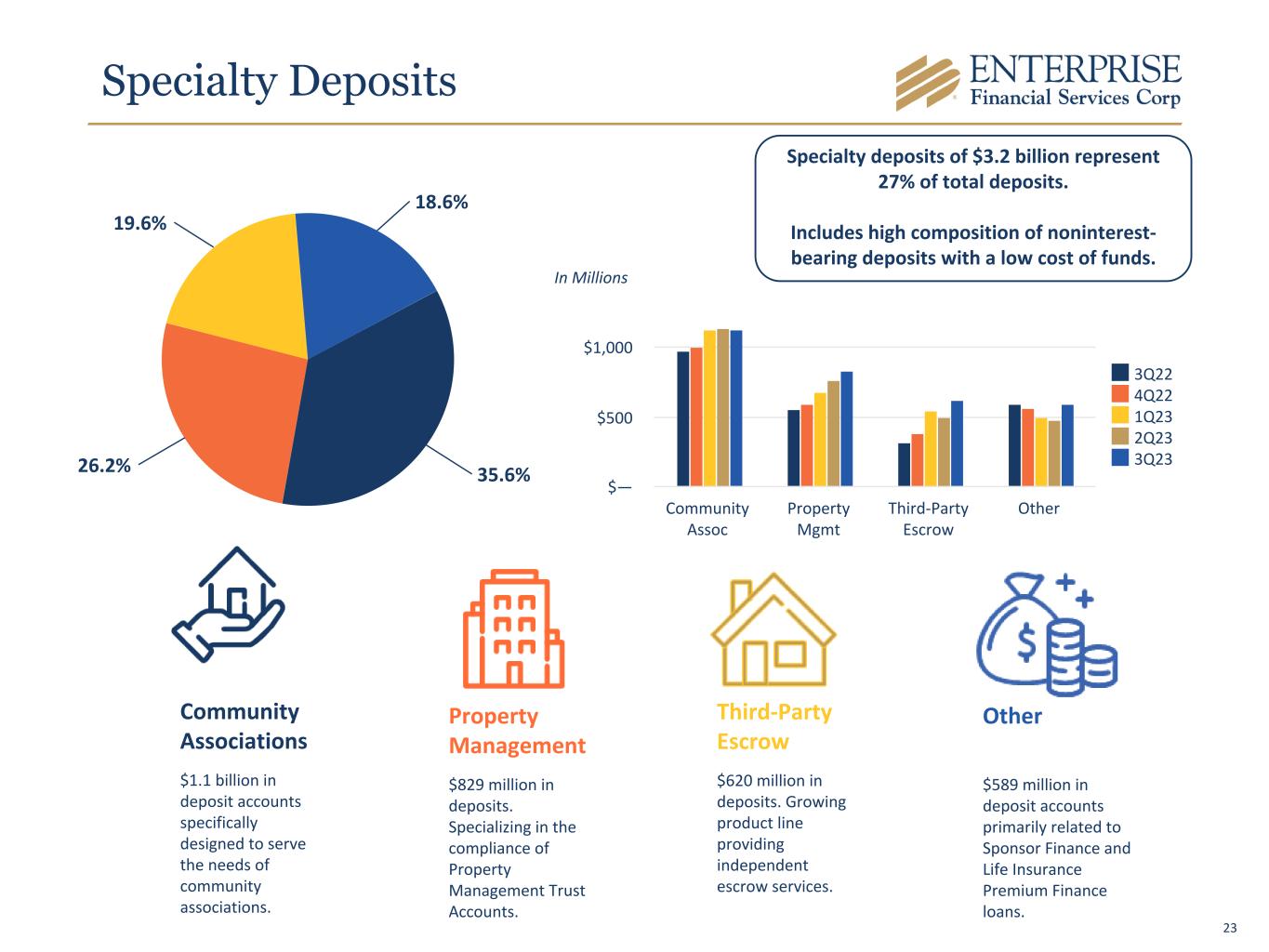

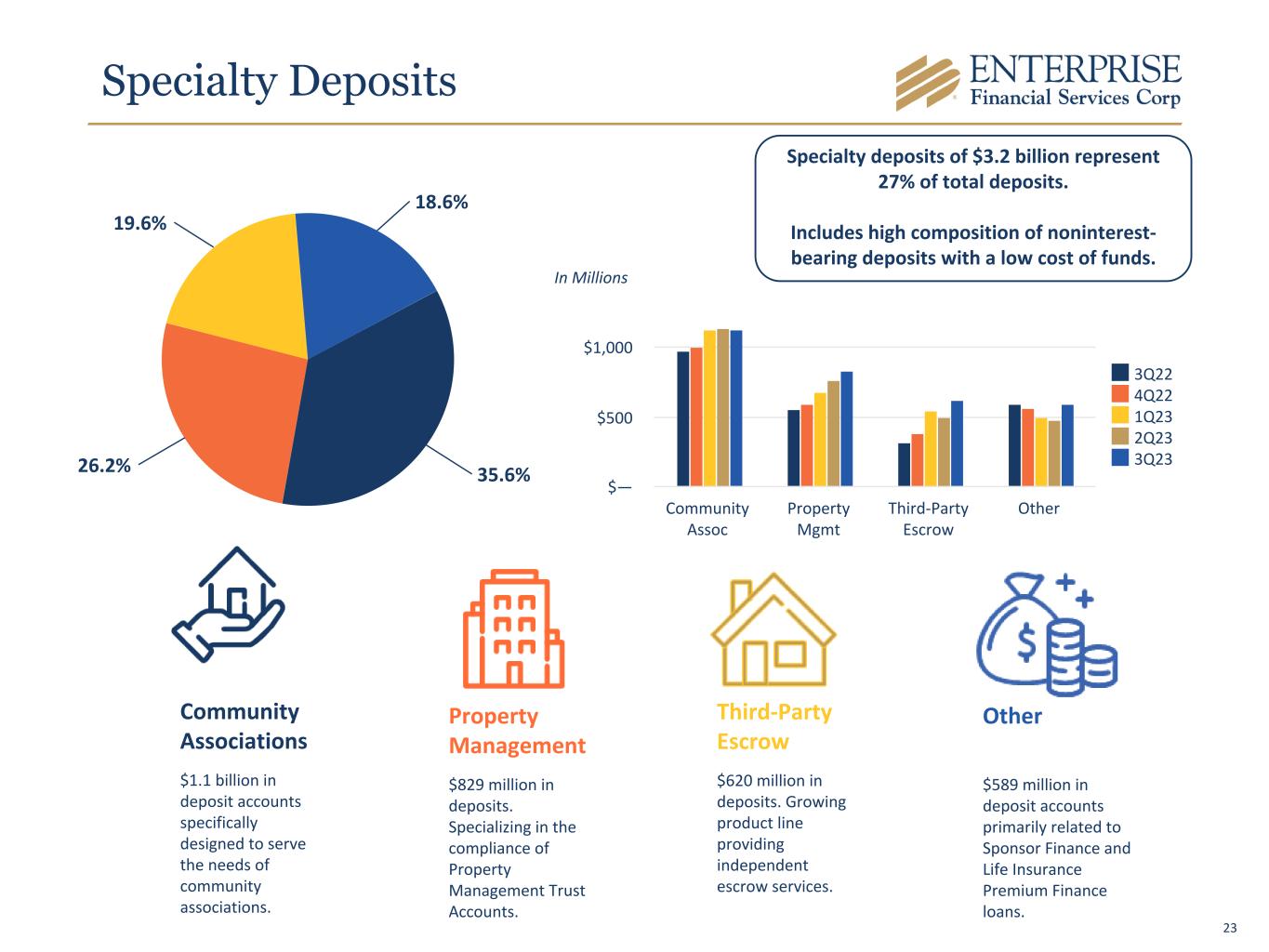

Specialty Deposits 35.6%26.2% 19.6% 18.6% Community Associations $1.1 billion in deposit accounts specifically designed to serve the needs of community associations. Property Management $829 million in deposits. Specializing in the compliance of Property Management Trust Accounts. Third-Party Escrow $620 million in deposits. Growing product line providing independent escrow services. Trust Services $75 million in deposit accounts. Providing services to nondepository trust companies. Specialty deposits of $3.2 billion represent 27% of total deposits. Includes high composition of noninterest- bearing deposits with a low cost of funds. Other $589 million in deposit accounts primarily related to Sponsor Finance and Life Insurance Premium Finance loans. 3Q22 4Q22 1Q23 2Q23 3Q23 Community Assoc Property Mgmt Third-Party Escrow Other $— $500 $1,000 In Millions 23

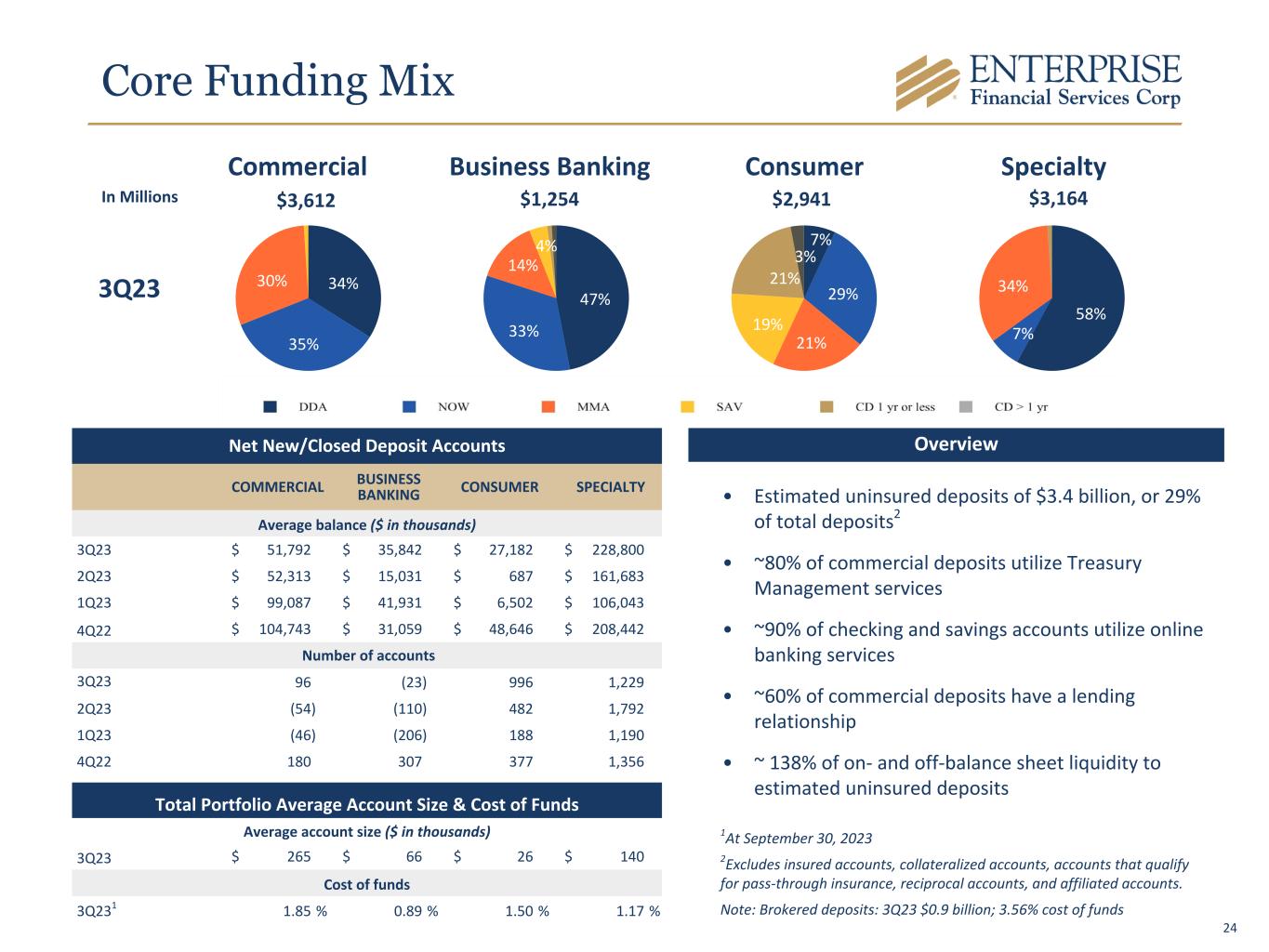

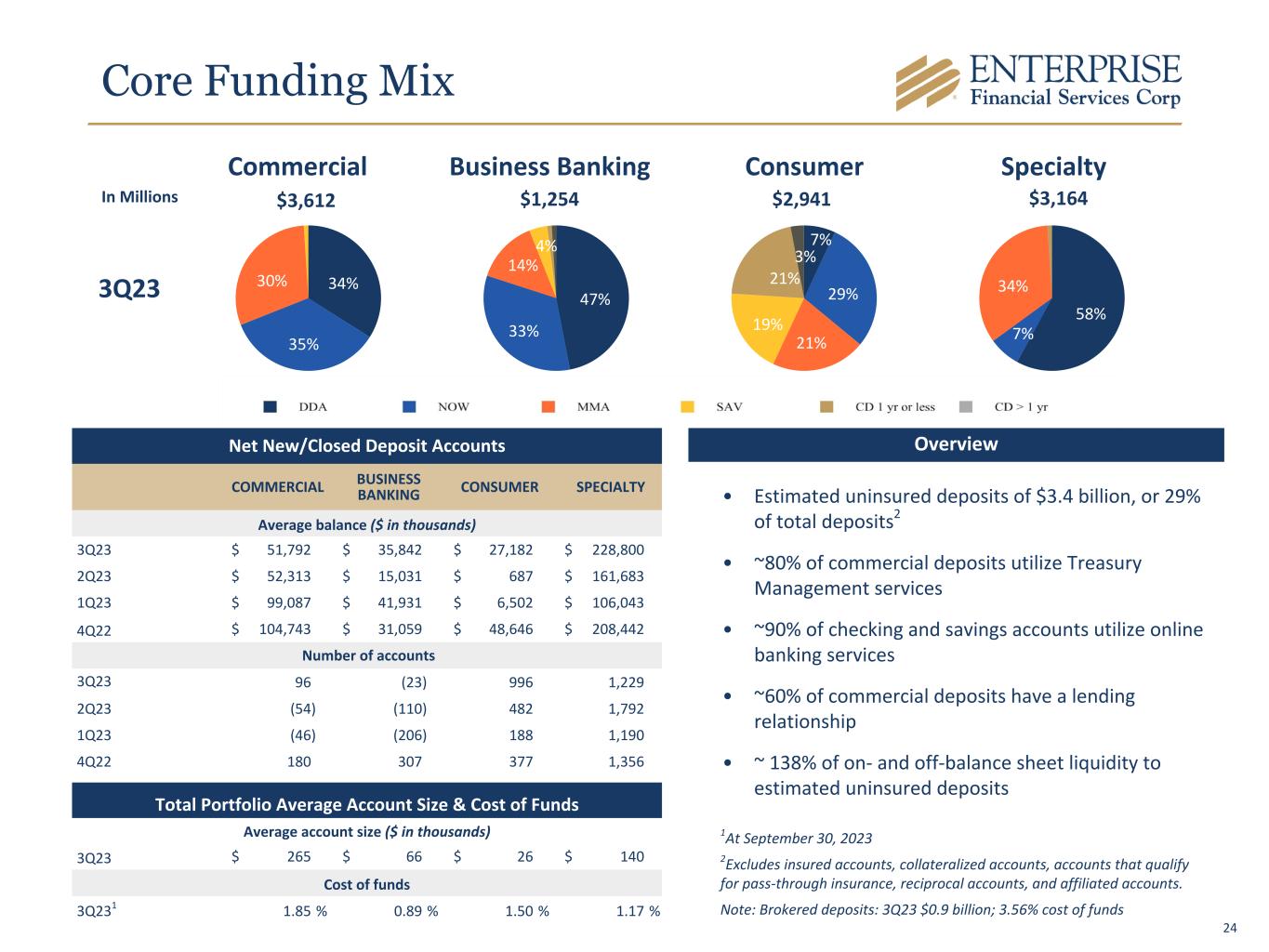

34% 35% 30% 47% 33% 14% 4% 7% 29% 21% 19% 21% 3% Core Funding Mix Commercial Business Banking Consumer In Millions $2,941$1,254$3,612 1At September 30, 2023 2Excludes insured accounts, collateralized accounts, accounts that qualify for pass-through insurance, reciprocal accounts, and affiliated accounts. Note: Brokered deposits: 3Q23 $0.9 billion; 3.56% cost of funds Specialty $3,164 58% 7% 34%3Q23 Net New/Closed Deposit Accounts COMMERCIAL BUSINESS BANKING CONSUMER SPECIALTY Average balance ($ in thousands) 3Q23 $ 51,792 $ 35,842 $ 27,182 $ 228,800 2Q23 $ 52,313 $ 15,031 $ 687 $ 161,683 1Q23 $ 99,087 $ 41,931 $ 6,502 $ 106,043 4Q22 $ 104,743 $ 31,059 $ 48,646 $ 208,442 Number of accounts 3Q23 96 (23) 996 1,229 2Q23 (54) (110) 482 1,792 1Q23 (46) (206) 188 1,190 4Q22 180 307 377 1,356 Total Portfolio Average Account Size & Cost of Funds Average account size ($ in thousands) 3Q23 $ 265 $ 66 $ 26 $ 140 Cost of funds 3Q231 1.85 % 0.89 % 1.50 % 1.17 % • Estimated uninsured deposits of $3.4 billion, or 29% of total deposits2 • ~80% of commercial deposits utilize Treasury Management services • ~90% of checking and savings accounts utilize online banking services • ~60% of commercial deposits have a lending relationship • ~ 138% of on- and off-balance sheet liquidity to estimated uninsured deposits Overview 24

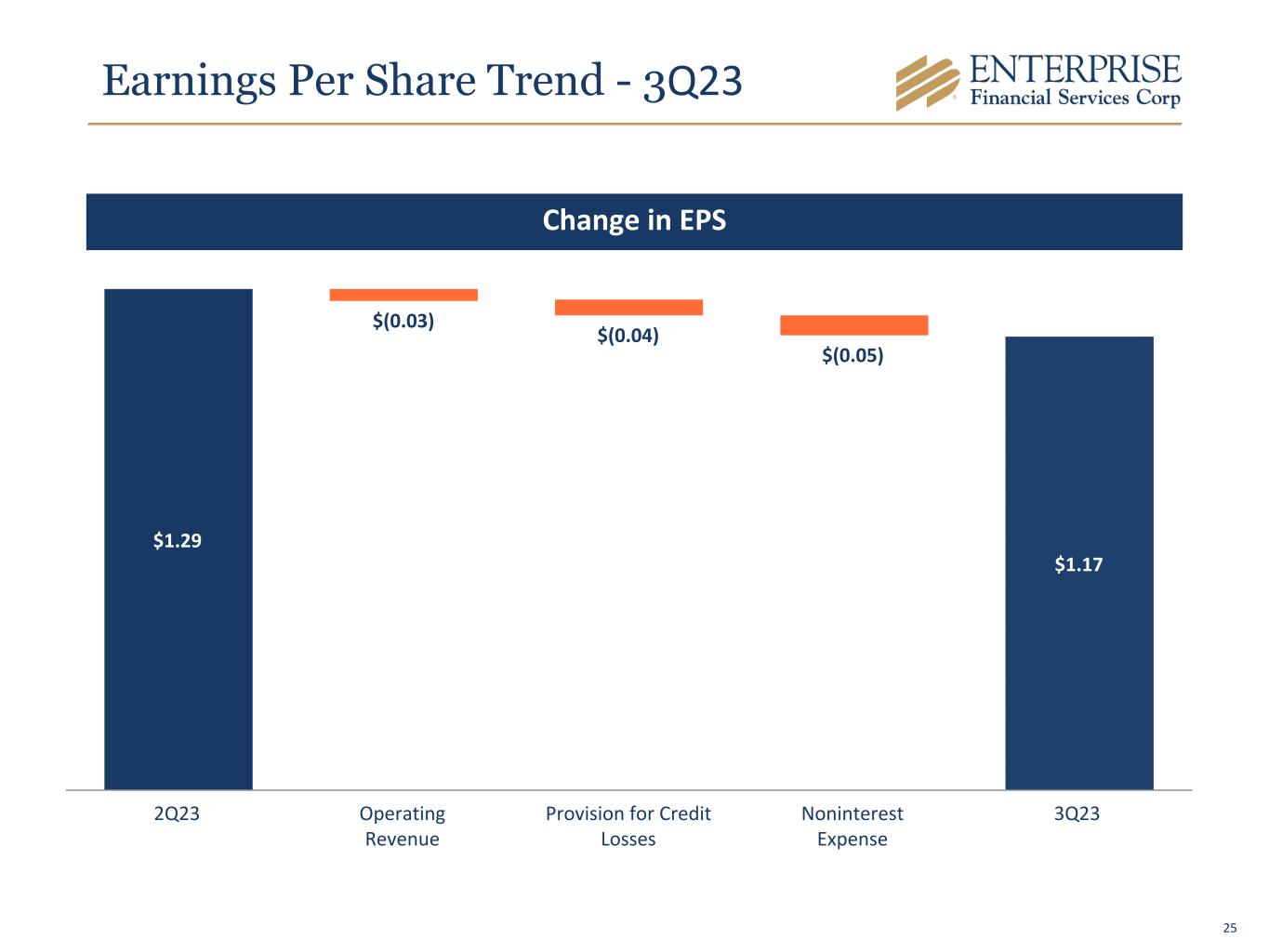

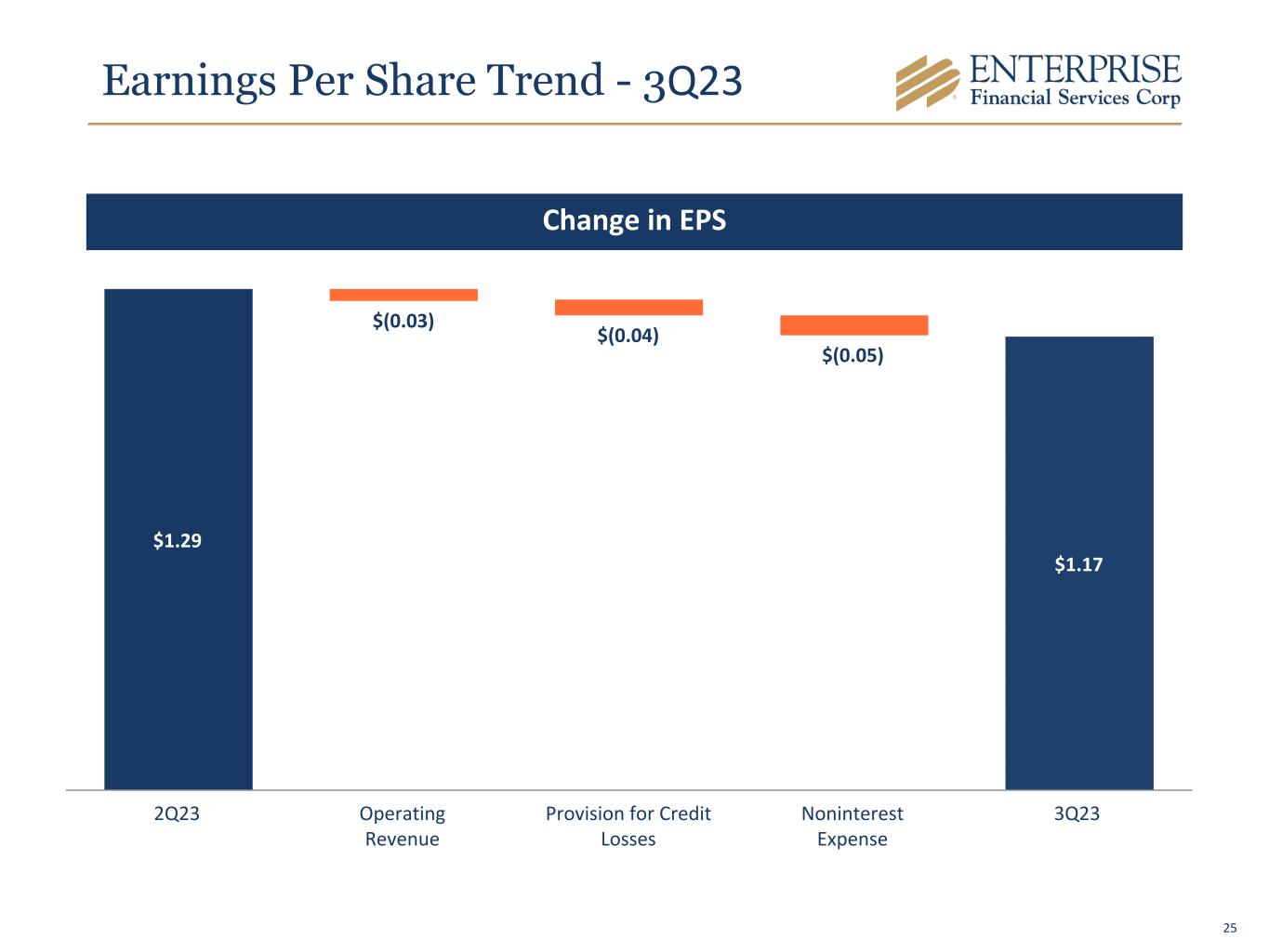

Earnings Per Share Trend - 3Q23 $1.29 $(0.03) $(0.04) $(0.05) $1.17 2Q23 Operating Revenue Provision for Credit Losses Noninterest Expense 3Q23 Change in EPS 25

Net Interest Income Trend In Millions $191.9 $238.7 $270.0 $360.2 $473.9 $421.9 3.82% 3.80% 3.56% 3.41% 3.89% 4.50% 1.83% 2.16% 0.36% 0.08% 1.68% 4.93% Net Interest Income Net Interest Margin Avg Federal Funds Rate 2018 2019 2020 2021 2022 3Q23 YTD 26

Credit Trends for Loans 2018 2019 2020 2021 2022 3Q23 YTD NPLs/Loans 0.38% 0.50% 0.53% 0.31% 0.10% 0.46% NPAs/Assets 0.30% 0.45% 0.45% 0.23% 0.08% 0.40% Criticized & Classified Loans/Loans 6.40% 5.03% 6.42% 5.52% 4.09% 3.38% ACL/NPLs 2.596 1.638 3.549 5.176 13.719 2.905 ACL/Loans* $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Provision expense (benefit) 6.6 6.4 65.4 13.4 -0.6 18.6 NCO/Average loans** 0.13% 0.13% 0.03% 0.14% 0.04% 0.13% *Excludes guaranteed loans for 2020 - 2023. A Non-GAAP Measure, Refer to Appendix for Reconciliation. **Excludes guaranteed loans. 3Q23 annualized. In Millions 27

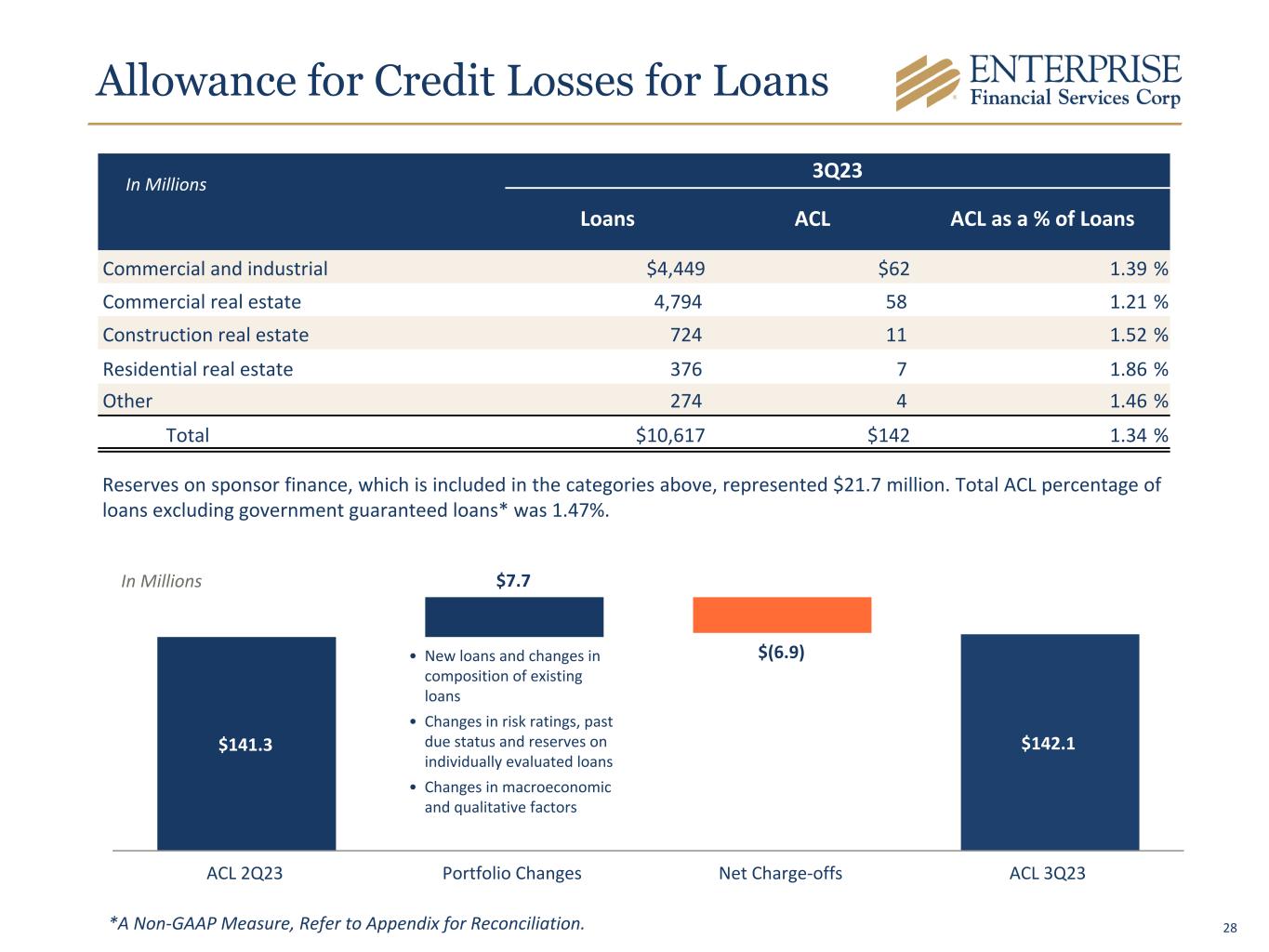

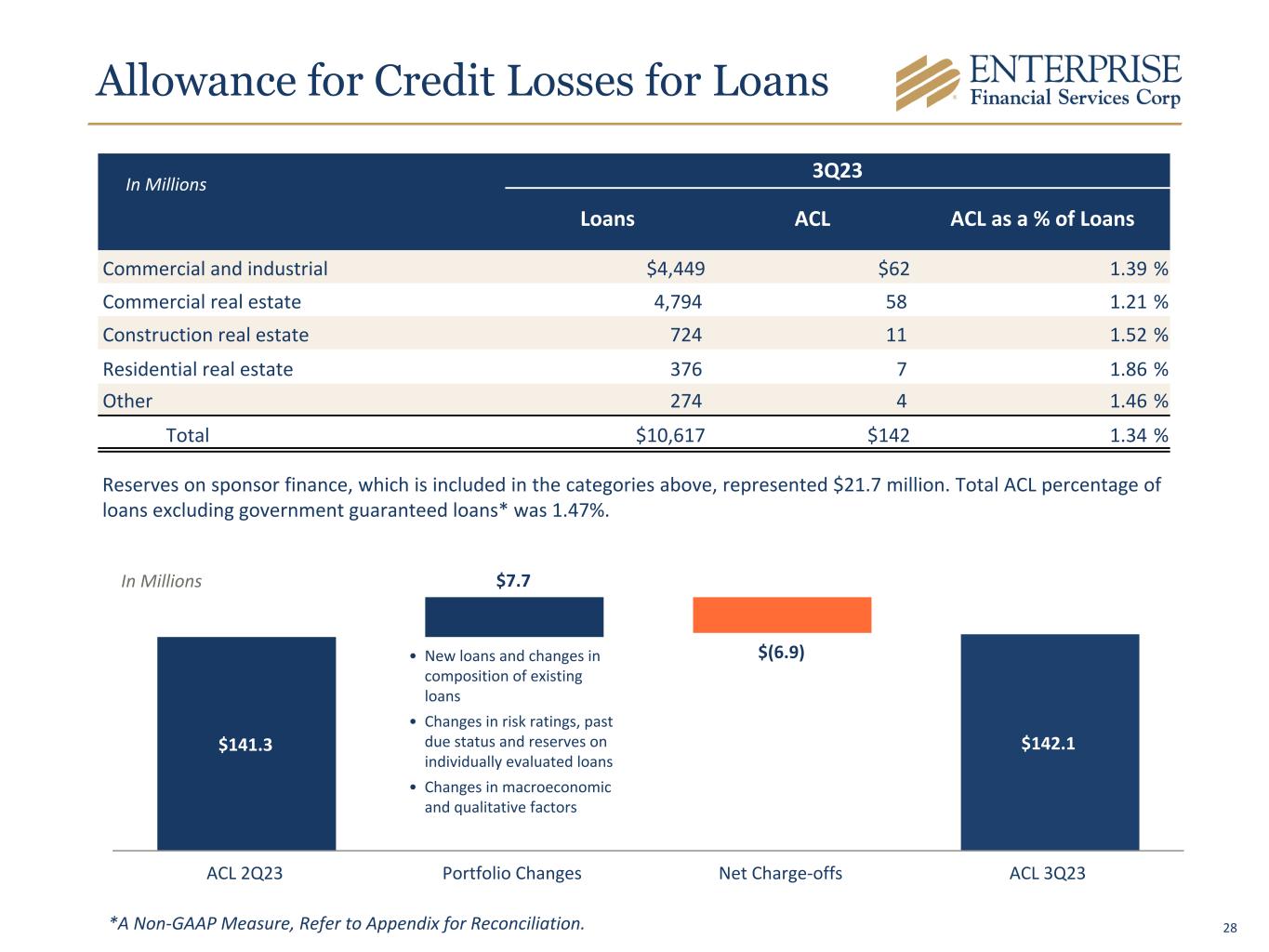

$141.3 $7.7 $(6.9) $142.1 ACL 2Q23 Portfolio Changes Net Charge-offs ACL 3Q23 Allowance for Credit Losses for Loans • New loans and changes in composition of existing loans • Changes in risk ratings, past due status and reserves on individually evaluated loans • Changes in macroeconomic and qualitative factors 3Q23 Loans ACL ACL as a % of Loans Commercial and industrial $4,449 $62 1.39 % Commercial real estate 4,794 58 1.21 % Construction real estate 724 11 1.52 % Residential real estate 376 7 1.86 % Other 274 4 1.46 % Total $10,617 $142 1.34 % Reserves on sponsor finance, which is included in the categories above, represented $21.7 million. Total ACL percentage of loans excluding government guaranteed loans* was 1.47%. *A Non-GAAP Measure, Refer to Appendix for Reconciliation. In Millions In Millions 28

Noninterest Income Trend In Millions $43.3 $38.3 $49.2 $54.5 $67.7 $59.2 $8.2 $9.9 $9.7 $10.3 $10.0 $7.6 $11.7 $12.8 $11.7 $15.4 $18.3 $12.2 $6.7 $9.2 $9.5 $11.9 $11.6 $7.4 $8.9 $11.9 $17.0 $22.1 $16.7 $16.6$2.8 $5.4 $6.6 $8.0 $2.6 $(0.5) 16.7% 17.1% 16.8% 15.8% 11.1% 9.3% Wealth Management Deposit Services Charge Card Services Other Tax Credit Income Noninterest income/Total income 2018 2019 2020 2021 2022 3Q23 YTD 29

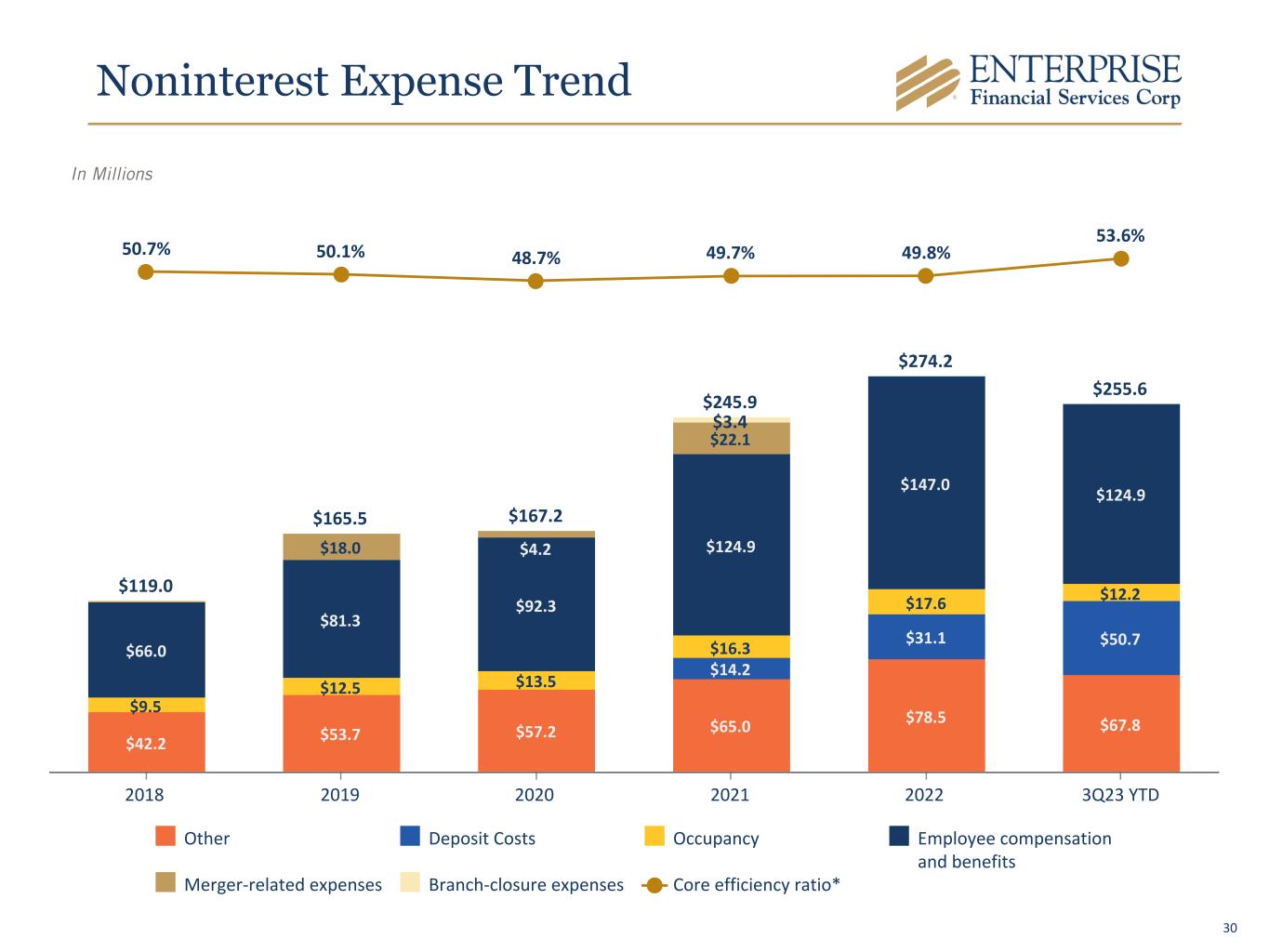

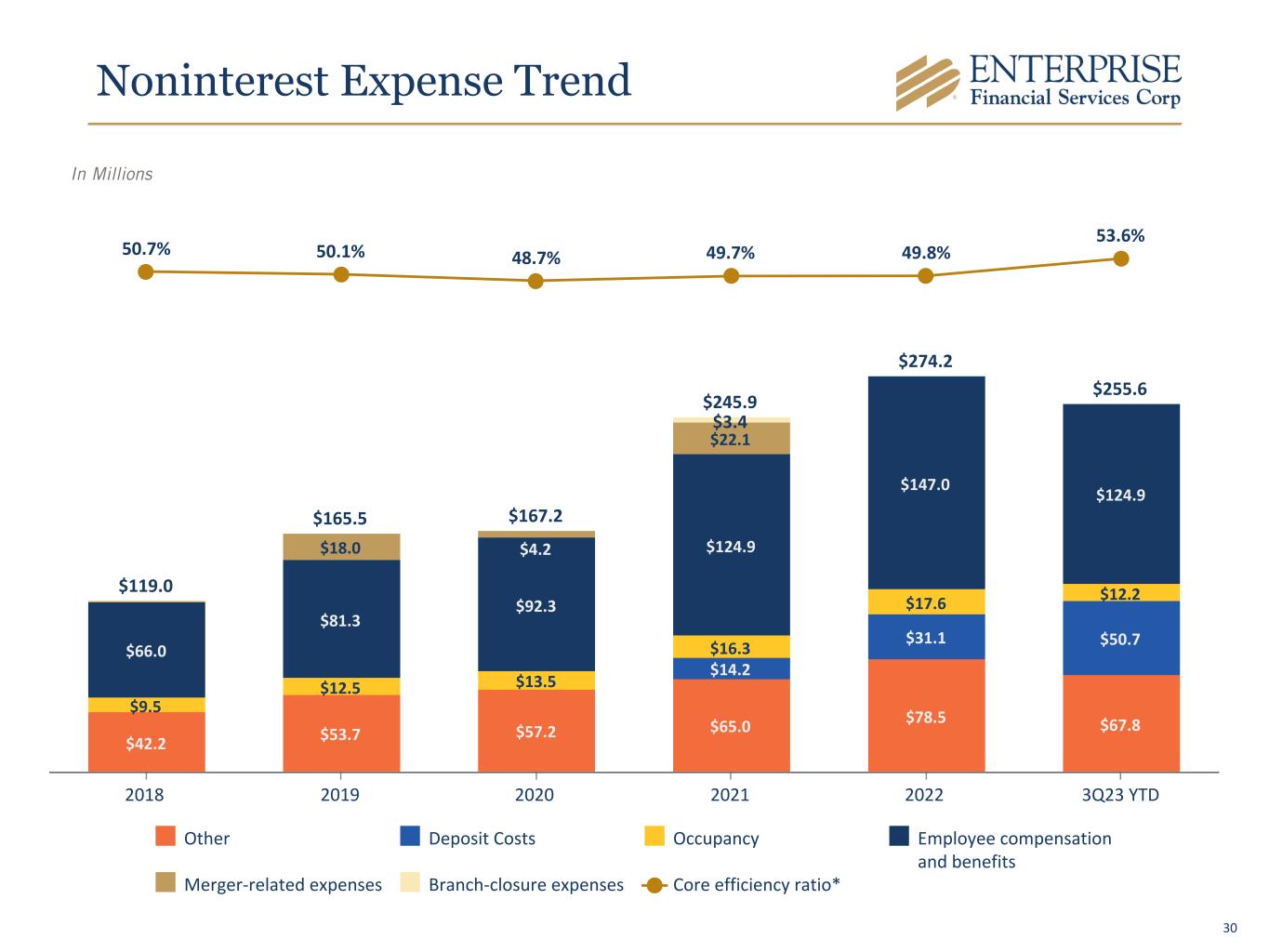

Noninterest Expense Trend In Millions $119.0 $165.5 $167.2 $245.9 $274.2 $255.6 $42.2 $53.7 $57.2 $65.0 $78.5 $67.8 $14.2 $31.1 $50.7 $9.5 $12.5 $13.5 $16.3 $17.6 $12.2 $66.0 $81.3 $92.3 $124.9 $147.0 $124.9 $18.0 $4.2 $22.1 $3.4 50.7% 50.1% 48.7% 49.7% 49.8% 53.6% Other Deposit Costs Occupancy Employee compensation and benefits Merger-related expenses Branch-closure expenses Core efficiency ratio* 2018 2019 2020 2021 2022 3Q23 YTD 30

EFSC Borrowing Capacity $4.1 $4.2 $4.3 $0.8 $0.8 $0.9 $2.7 $2.6 $2.5 $0.1 $0.1 $0.1 $0.5 $0.7 $0.8 37% 36% 36% FHLB borrowing capacity FRB borrowing capacity Fed Funds lines Unpledged securities Borrowing capacity/Deposits 1Q23 2Q23 3Q23 In Billions End of Period and Average Loans to Deposits 85% 90% 90% 91% 89% 83% 86% 90% 90% 88% End of period Loans/Deposits Avg Loans/Avg Deposits 3Q22 4Q22 1Q23 2Q23 3Q23 • $945 million available FHLB capacity • $2.5 billion available FRB capacity • $120 million in seven federal funds lines • $791 million unpledged investment securities • $371 million cash • $25 million available line of credit • Portfolio of saleable SBA loans • Investment portfolio/total assets of 16% • FHLB maximum credit capacity is 45% of assets $0.3 $0.3 $0.3 $0.3 $0.2 $0.3 $0.6 $0.9 $1.1 $1.3 Annual Cash Flows Cumulative Cash Flows 2024 2025 2026 2027 2028 Investment Portfolio Cash Flows* In Billions Strong Liquidity Profile *Trailing 12 months ending September 30 of each year Liquidity 31

Investment Portfolio Breakout AFS & HTM Securities Obligations of U.S. Government- sponsored enterprises 13% Obligations of states and political subdivisions 42% Agency mortgage- backed securities, 31% Corporate debt securities 6% U.S. Treasury bills 8% TOTAL $2.2 Billion • Effective duration of 5.6 years balances the short 3-year duration of the loan portfolio • Cash flows next 12 months of approximately $270 million • 3.11% tax-equivalent yield • Municipal bond portfolio rated A or better • Laddered maturity and repayment structure for consistent cash flows Overview Total AFS (Fair Value) Total HTM (Fair Value) AFS Securities (Net Unrealized) HTM Securities (Net Unrealized) 3Q22 4Q22 1Q23 2Q23 3Q23 $— $600 $1,200 $1,800 $(320) $(160) $— $160 In Millions $123.2 $158.8 $101.3 $74.6 $53.9 3.68% 5.22% 4.79% 5.07% 5.60% Principal Cost Yield (TEQ) 3Q22 4Q22 1Q23 2Q23 3Q23 Investment Purchase Yield In Millions Investment Portfolio 32

Capital Strategy EFSC Capital Strategy: Low Cost - Highly Flexible High Capital Retention Rate Supports Robust Asset Growth Maintain High Quality Capital Stack Maintain 8-9% TCE • Strong earnings profile • Sustainable dividend profile • Organic loan and deposit growth • High quality M&A to enhance commercial franchise and geographic diversification • Minimize WACC over time (preferred, sub debt, etc.) • Optimize capital levels CET1 ~10%, Tier 1 ~12%, and Total Capital ~14% • Common stock repurchases • M&A deal structures • Drives ROATCE above peer levels 33

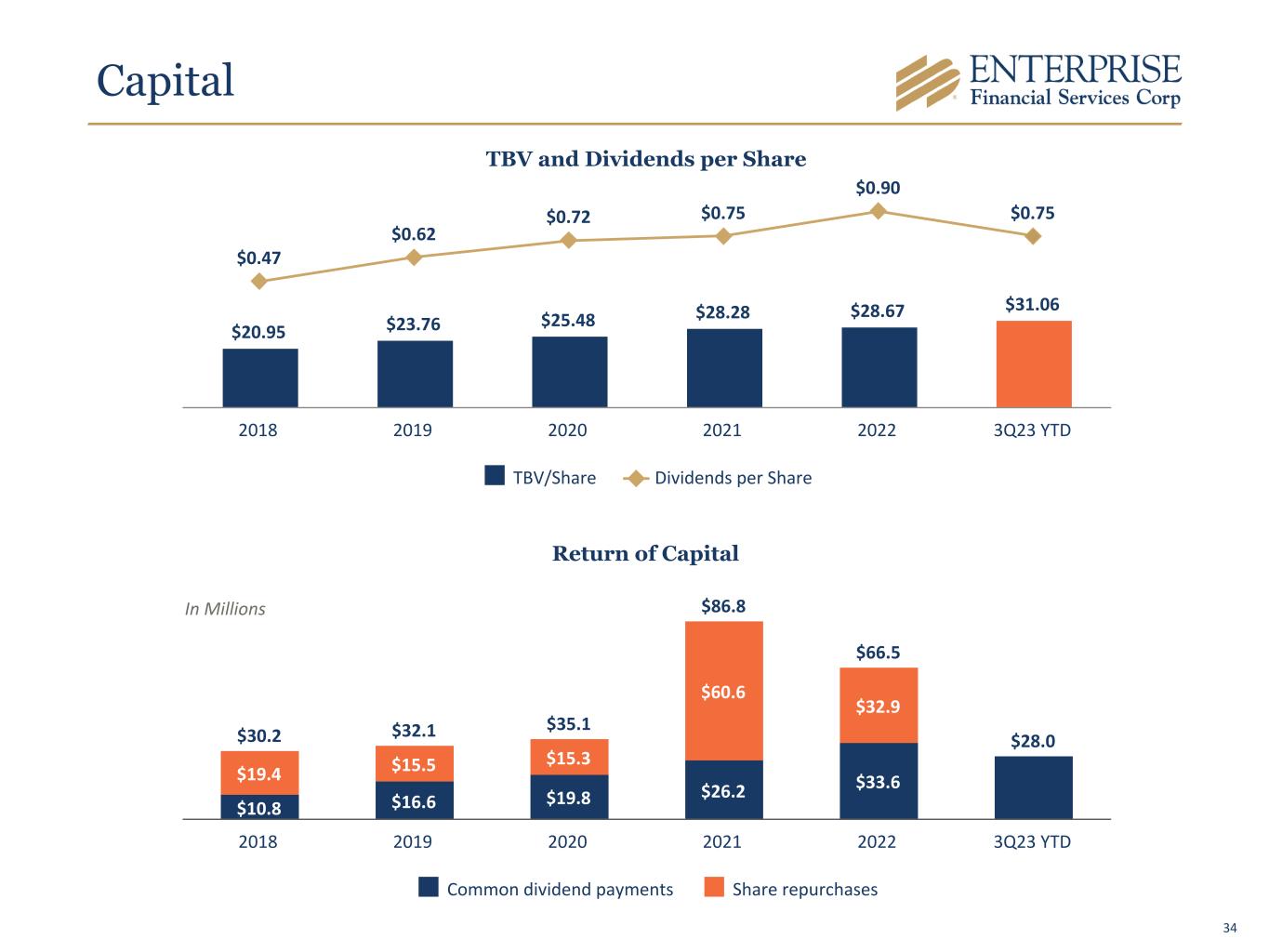

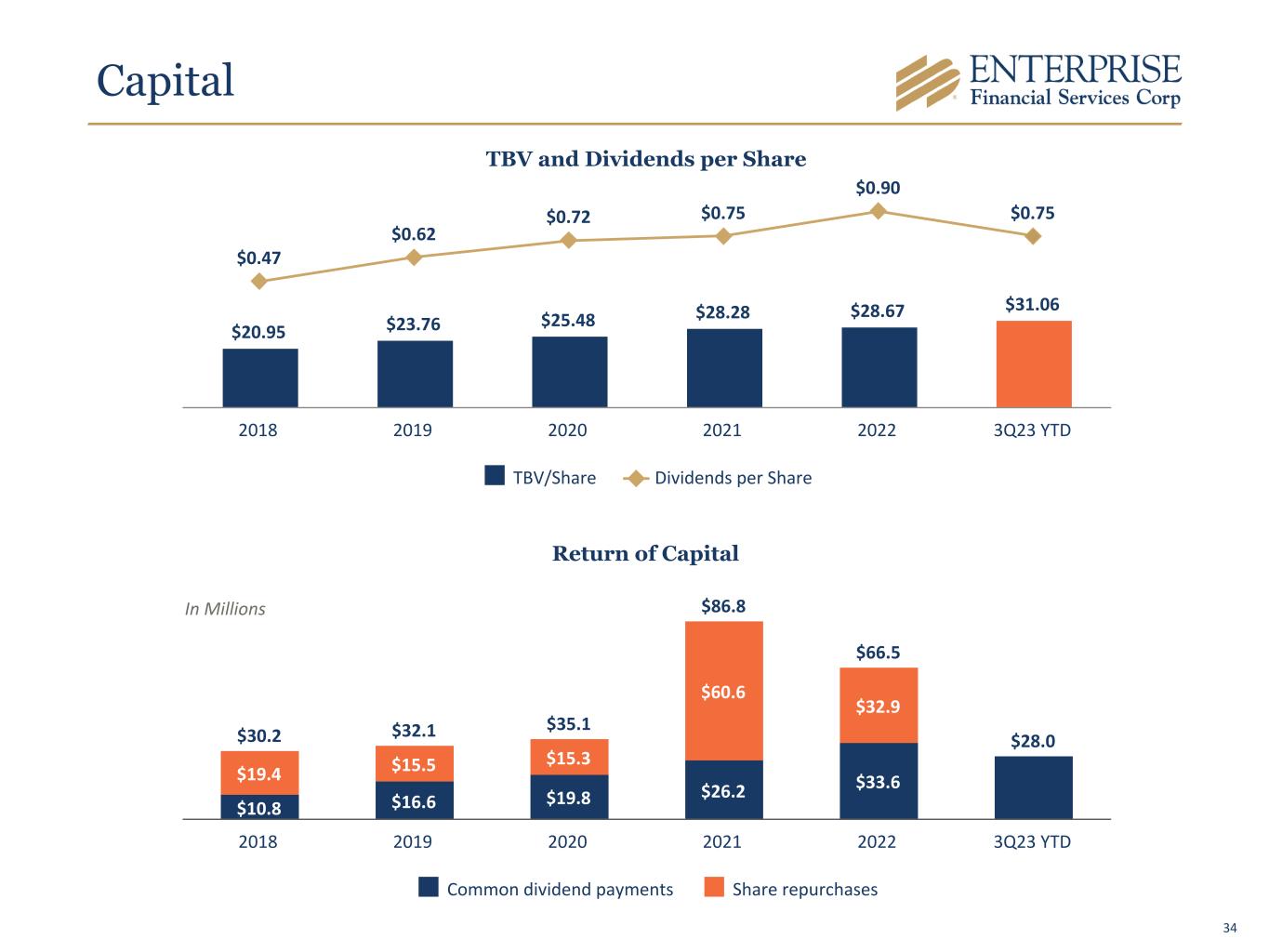

Capital TBV and Dividends per Share $20.95 $23.76 $25.48 $28.28 $28.67 $31.06 $0.47 $0.62 $0.72 $0.75 $0.90 $0.75 TBV/Share Dividends per Share 2018 2019 2020 2021 2022 3Q23 YTD Return of Capital $30.2 $32.1 $35.1 $86.8 $66.5 $28.0 $10.8 $16.6 $19.8 $26.2 $33.6$19.4 $15.5 $15.3 $60.6 $32.9 Common dividend payments Share repurchases 2018 2019 2020 2021 2022 3Q23 YTD In Millions 34

Regulatory Capital 10.0% 14.0% 13.0% 12.9% 14.9% 14.7% 14.2% 14.1% 6.5% 10.0% 9.8% 9.9% 10.9% 11.3% 11.1% 11.2% 9.6% 9.3% 9.1% CET1 Tier 1 Total Risk Based Capital CET1 excluding unrealized losses* Minimum "Well Capitalized" Ratio Optimal Capital Levels 2018 2019 2020 2021 2022 3Q23 8.0% 12.6%12.6% 11.1% 12.1% 13.0% 11.4%12.0% *CET1 excluding unrealized losses (when applicable) 35

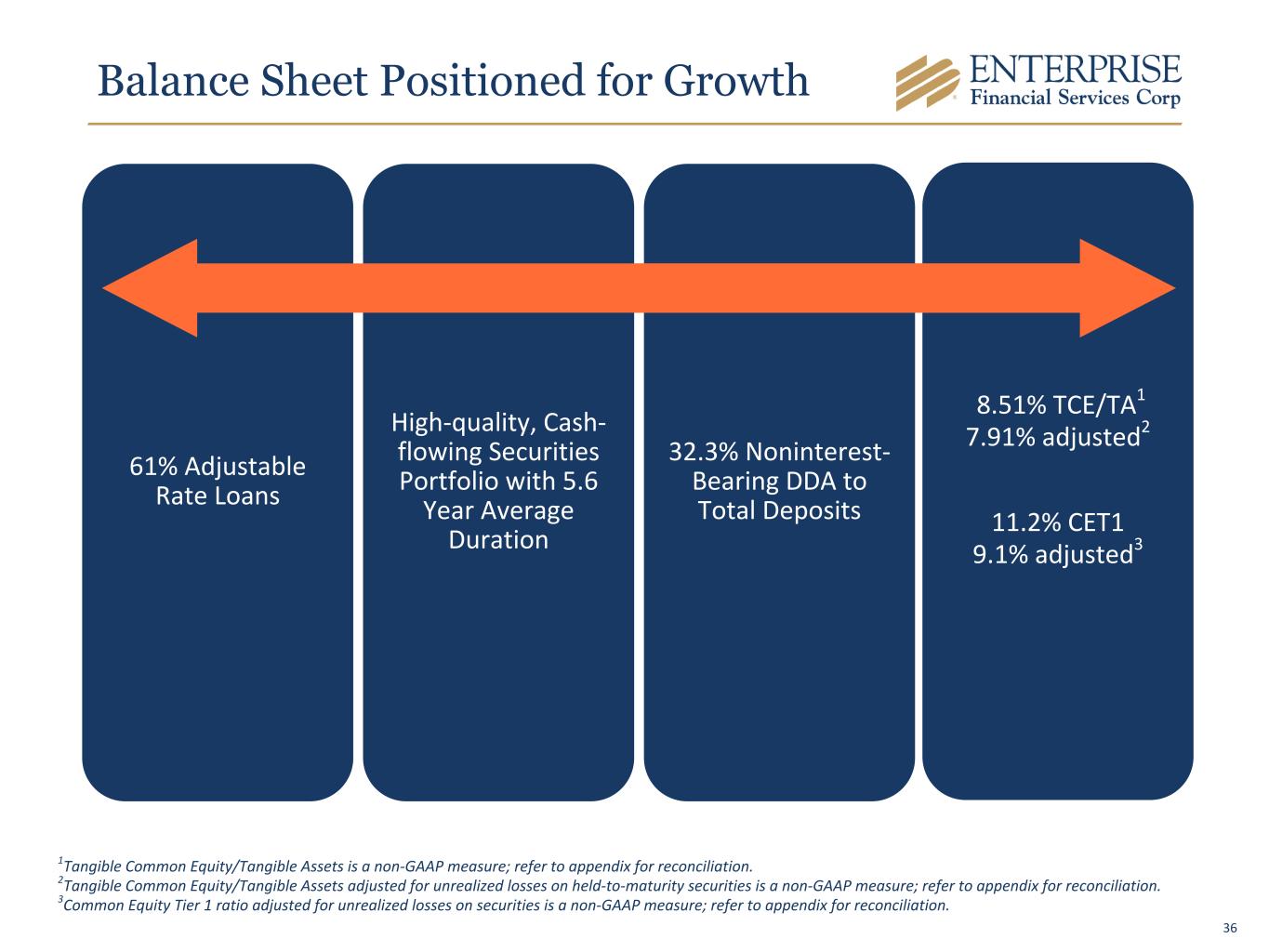

61% Adjustable Rate Loans High-quality, Cash- flowing Securities Portfolio with 5.6 Year Average Duration 32.3% Noninterest- Bearing DDA to Total Deposits 8.51% TCE/TA1 7.91% adjusted2 11.2% CET1 9.1% adjusted3 Balance Sheet Positioned for Growth 1Tangible Common Equity/Tangible Assets is a non-GAAP measure; refer to appendix for reconciliation. 2Tangible Common Equity/Tangible Assets adjusted for unrealized losses on held-to-maturity securities is a non-GAAP measure; refer to appendix for reconciliation. 3Common Equity Tier 1 ratio adjusted for unrealized losses on securities is a non-GAAP measure; refer to appendix for reconciliation. 36

Appendix

Financial Highlights - 3Q23* Capital • Tangible Common Equity/Tangible Assets** 8.51%, compared to 8.65% • Tangible Book Value Per Common Share $31.06, compared to $31.23 • CET1 Ratio 11.2%, compared to 11.1% • Quarterly common stock dividend of $0.25 per share in third quarter 2023 • Quarterly preferred stock dividend of $12.50 per share ($0.3125 per depositary share) • Net Income $44.7 million, down $4.5 million; EPS $1.17 • Net Interest Income $141.6 million, up $0.9 million; NIM 4.33% • PPNR** $65.1 million, down $3.8 million • ROAA 1.26%, compared to 1.44%; PPNR ROAA** 1.84%, compared to 2.02% • ROATCE** 14.49%, compared to 16.53% Earnings *Comparisons noted below are to the linked quarter unless otherwise noted. **A Non-GAAP Measure, Refer to Appendix for Reconciliation. 38

Financial Highlights, continued - 3Q23* *Comparisons noted below are to the linked quarter unless otherwise noted. ** Excludes insured accounts, collateralized accounts, accounts that qualify for pass-through insurance, reciprocal accounts, and affiliated accounts. Loans & Deposits • Loans $10.6 billion, up $104.2 million • Loan/Deposit Ratio 89% • Deposits $11.9 billion, up $290.0 million • Estimated uninsured deposits of $3.4 billion, or 29% of total deposits** • Noninterest-bearing Deposits/Total Deposits 32% Asset Quality • Nonperforming Loans/Loans 0.46% • Nonperforming Assets/Assets 0.40% • Allowance Coverage Ratio 1.34%; 1.47% adjusted for guaranteed loans 39

■ Selected by the Community Development Financial Institutions Fund (CDFI Fund) of the U.S. Department of the Treasury to receive $303 million of New Markets Tax Credits allocations since 2011. ■ In 2022 we invested over $1.8 billion in programs designed to promote small business and community development. ■ Enterprise University, which provides training courses, has helped more than 38,000 professionals. ■ The Company has been named a best bank to work for numerous times. ESG Highlights The 2022 Environmental, Social and Governance Report is available at https:// www.enterprisebank.com/about/corporate-responsibility. Our Framework Additional Policies We have a robust set of governance policies to guide the operation of our business in a socially responsible way. We not only operate in a highly regulated environment and seek to comply with the laws and regulations applicable to our businesses, but we also strive to operate with integrity and accountability consistent with our Guiding Principles. Our commitment to sustainability begins with the Board of Directors of Enterprise. As the governing body responsible for our general oversight and strategic direction, the Board establishes parameters to ensure that our interactions with society and the environment are considered in connection with all business activities. Governance Climate With the oversight of our Board and the Risk Committee, we are formulating processes for identifying, measuring and modeling the impact of climate-related risks and their potential significance to our ongoing business operations and long-term value. Community Involvement We are committed to managing our business and community relationships in ways that positively impact our associates, clients and the diverse communities where we live and work. We have a long-standing history of supporting our communities. Our Community Impact Report is available at enterprisebank.com/about/corporate-responsibility. Human Capital Several of our Guiding Principles focus on our associates and the communities in which they work and live. We focus on creating an open, diverse and transparent culture that celebrates teamwork and recognizes associates at all levels. Our Results 40

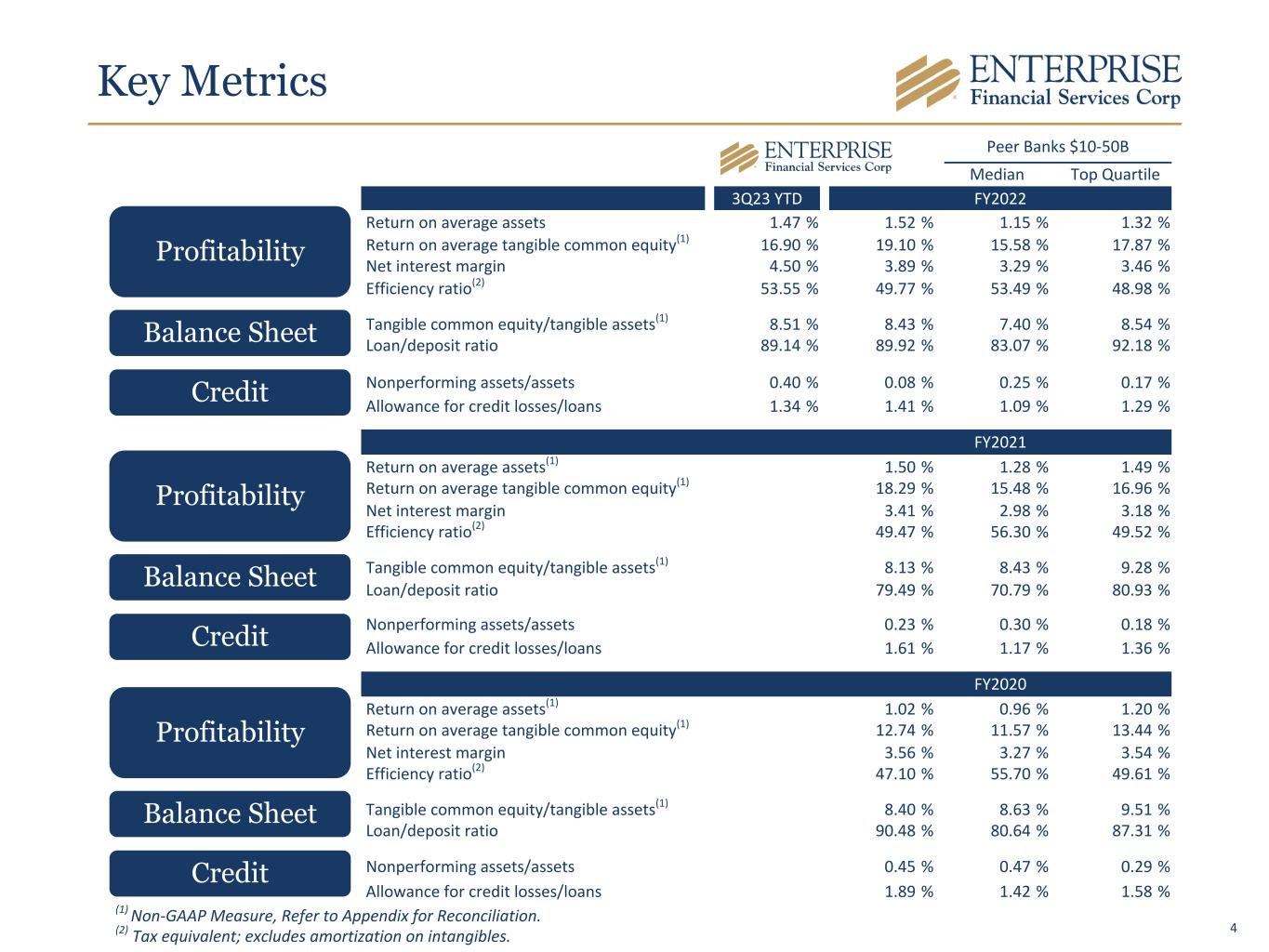

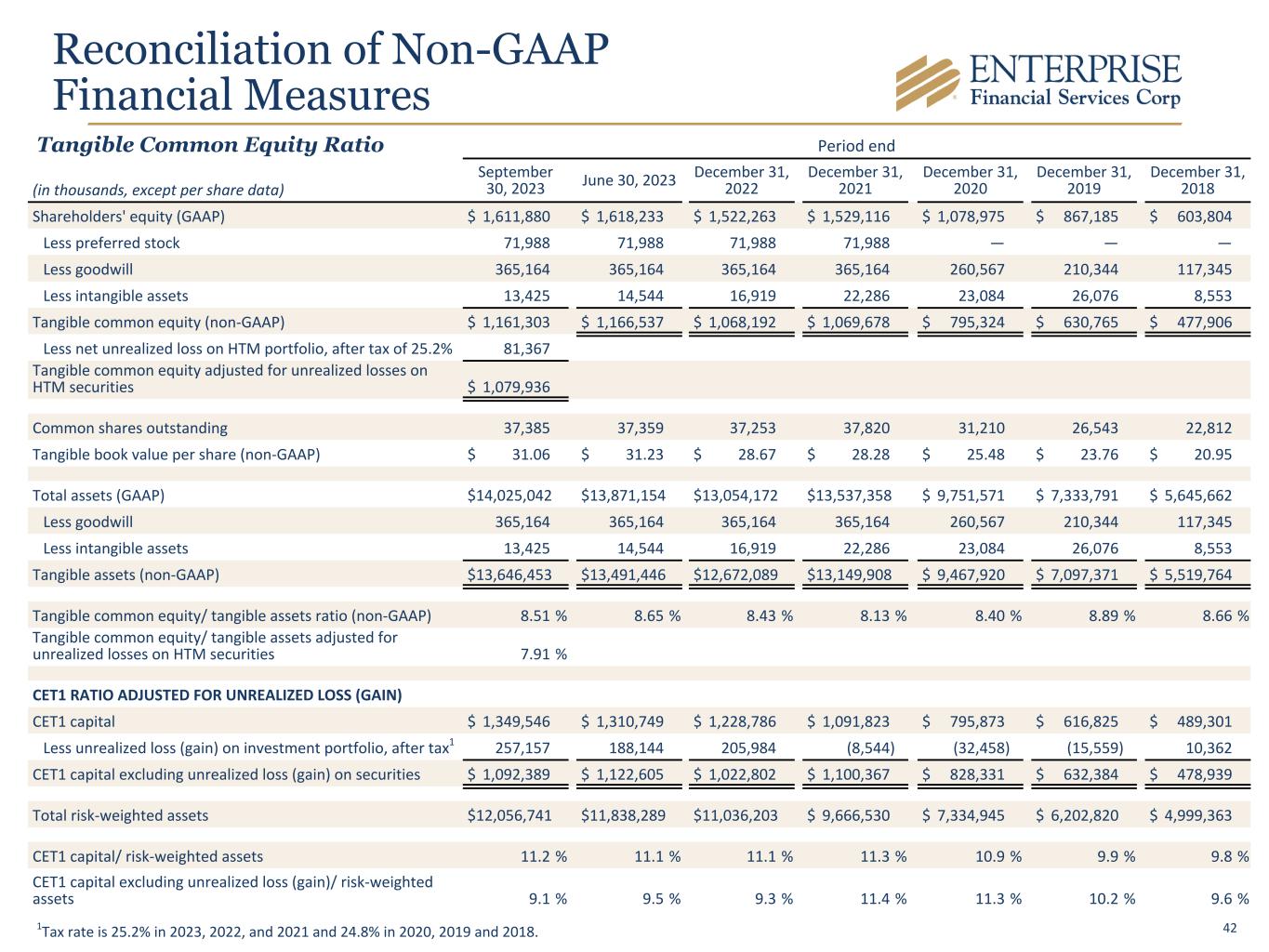

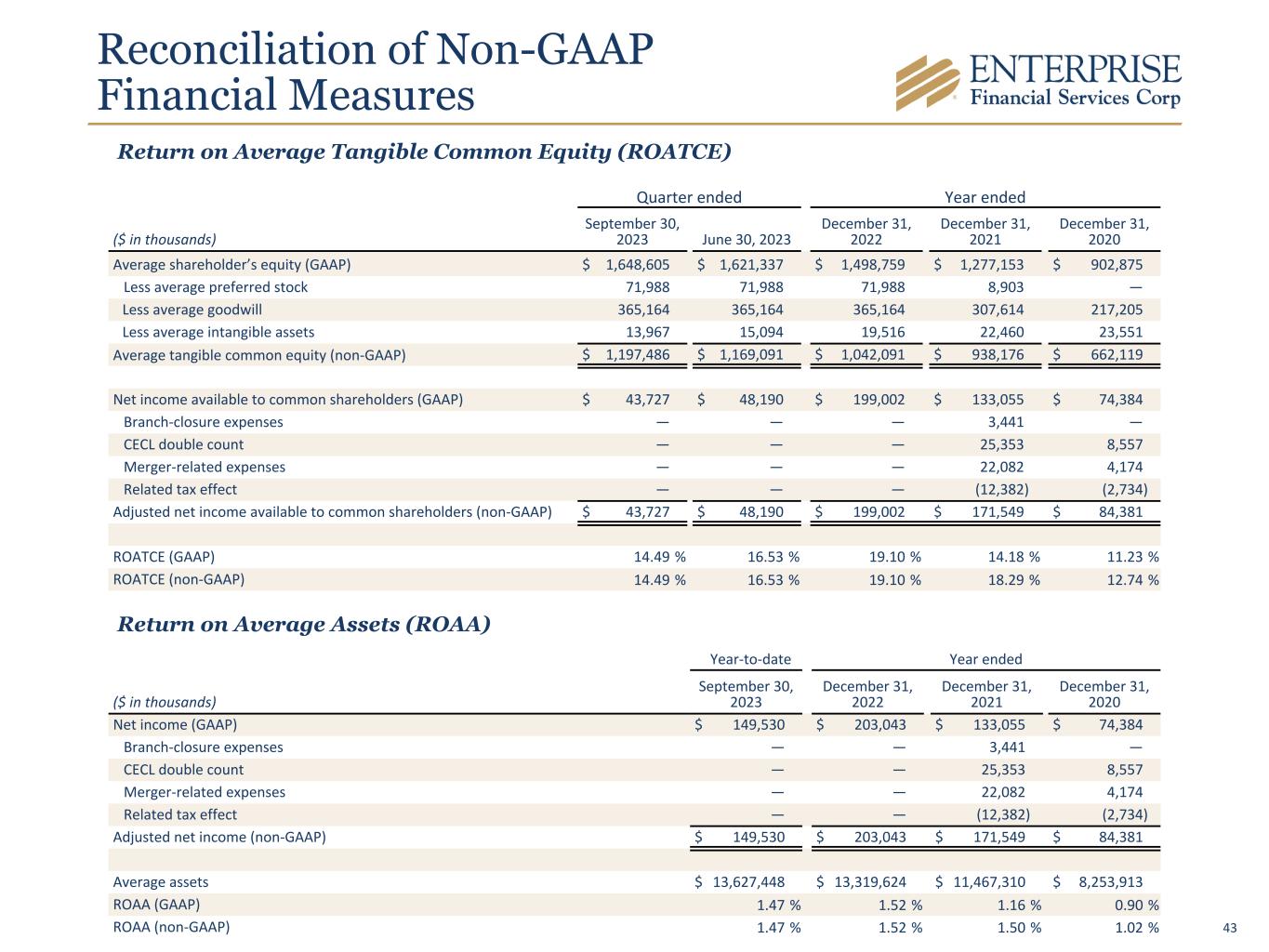

Use of Non-GAAP Financial Measures The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as tangible common equity, ROATCE, PPNR, PPNR return on average assets (“PPNR ROAA”), core efficiency ratio, tangible book value per share, and the tangible common equity ratio, in this presentation that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its tangible common equity, ROATCE, PPNR, PPNR ROAA, core efficiency ratio and the tangible common equity ratio, collectively “core performance measures,” presented in this report and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures include exclude certain other income and expense items, such as merger related expenses, facilities charges, impact of non-core acquired loans which were acquired from the FDIC and previously covered by loss share agreements, and the gain or loss on sale of investment securities, that the Company believes to be not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated. 41

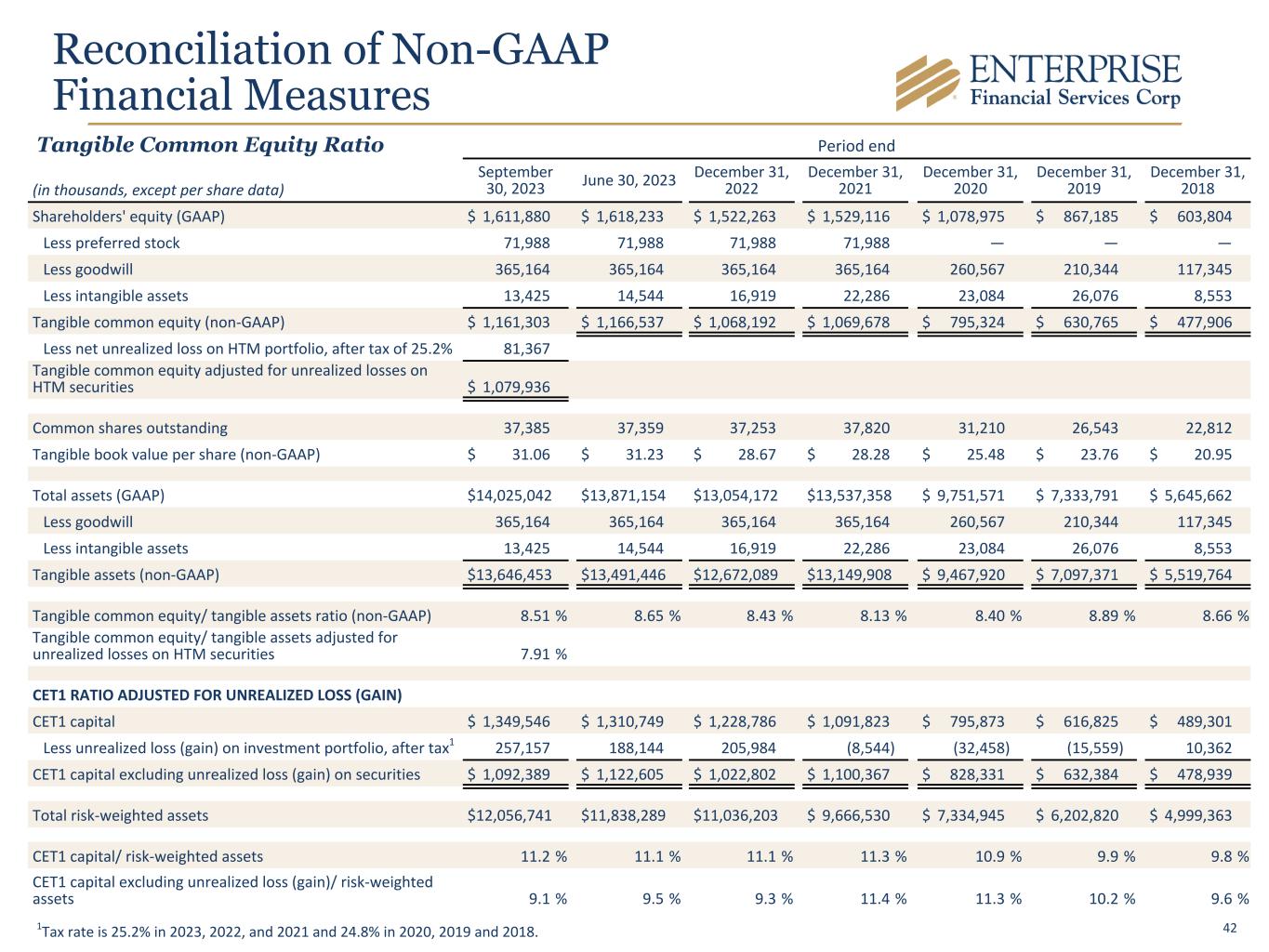

Reconciliation of Non-GAAP Financial Measures Period end (in thousands, except per share data) September 30, 2023 June 30, 2023 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2019 December 31, 2018 Shareholders' equity (GAAP) $ 1,611,880 $ 1,618,233 $ 1,522,263 $ 1,529,116 $ 1,078,975 $ 867,185 $ 603,804 Less preferred stock 71,988 71,988 71,988 71,988 — — — Less goodwill 365,164 365,164 365,164 365,164 260,567 210,344 117,345 Less intangible assets 13,425 14,544 16,919 22,286 23,084 26,076 8,553 Tangible common equity (non-GAAP) $ 1,161,303 $ 1,166,537 $ 1,068,192 $ 1,069,678 $ 795,324 $ 630,765 $ 477,906 Less net unrealized loss on HTM portfolio, after tax of 25.2% 81,367 Tangible common equity adjusted for unrealized losses on HTM securities $ 1,079,936 Common shares outstanding 37,385 37,359 37,253 37,820 31,210 26,543 22,812 Tangible book value per share (non-GAAP) $ 31.06 $ 31.23 $ 28.67 $ 28.28 $ 25.48 $ 23.76 $ 20.95 Total assets (GAAP) $ 14,025,042 $ 13,871,154 $ 13,054,172 $ 13,537,358 $ 9,751,571 $ 7,333,791 $ 5,645,662 Less goodwill 365,164 365,164 365,164 365,164 260,567 210,344 117,345 Less intangible assets 13,425 14,544 16,919 22,286 23,084 26,076 8,553 Tangible assets (non-GAAP) $ 13,646,453 $ 13,491,446 $ 12,672,089 $ 13,149,908 $ 9,467,920 $ 7,097,371 $ 5,519,764 Tangible common equity/ tangible assets ratio (non-GAAP) 8.51 % 8.65 % 8.43 % 8.13 % 8.40 % 8.89 % 8.66 % Tangible common equity/ tangible assets adjusted for unrealized losses on HTM securities 7.91 % CET1 RATIO ADJUSTED FOR UNREALIZED LOSS (GAIN) CET1 capital $ 1,349,546 $ 1,310,749 $ 1,228,786 $ 1,091,823 $ 795,873 $ 616,825 $ 489,301 Less unrealized loss (gain) on investment portfolio, after tax1 257,157 188,144 205,984 (8,544) (32,458) (15,559) 10,362 CET1 capital excluding unrealized loss (gain) on securities $ 1,092,389 $ 1,122,605 $ 1,022,802 $ 1,100,367 $ 828,331 $ 632,384 $ 478,939 Total risk-weighted assets $ 12,056,741 $ 11,838,289 $ 11,036,203 $ 9,666,530 $ 7,334,945 $ 6,202,820 $ 4,999,363 CET1 capital/ risk-weighted assets 11.2 % 11.1 % 11.1 % 11.3 % 10.9 % 9.9 % 9.8 % CET1 capital excluding unrealized loss (gain)/ risk-weighted assets 9.1 % 9.5 % 9.3 % 11.4 % 11.3 % 10.2 % 9.6 % Tangible Common Equity Ratio 1Tax rate is 25.2% in 2023, 2022, and 2021 and 24.8% in 2020, 2019 and 2018. 42

Quarter ended Year ended ($ in thousands) September 30, 2023 June 30, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Average shareholder’s equity (GAAP) $ 1,648,605 $ 1,621,337 $ 1,498,759 $ 1,277,153 $ 902,875 Less average preferred stock 71,988 71,988 71,988 8,903 — Less average goodwill 365,164 365,164 365,164 307,614 217,205 Less average intangible assets 13,967 15,094 19,516 22,460 23,551 Average tangible common equity (non-GAAP) $ 1,197,486 $ 1,169,091 $ 1,042,091 $ 938,176 $ 662,119 Net income available to common shareholders (GAAP) $ 43,727 $ 48,190 $ 199,002 $ 133,055 $ 74,384 Branch-closure expenses — — — 3,441 — CECL double count — — — 25,353 8,557 Merger-related expenses — — — 22,082 4,174 Related tax effect — — — (12,382) (2,734) Adjusted net income available to common shareholders (non-GAAP) $ 43,727 $ 48,190 $ 199,002 $ 171,549 $ 84,381 ROATCE (GAAP) 14.49 % 16.53 % 19.10 % 14.18 % 11.23 % ROATCE (non-GAAP) 14.49 % 16.53 % 19.10 % 18.29 % 12.74 % Reconciliation of Non-GAAP Financial Measures Return on Average Tangible Common Equity (ROATCE) Year-to-date Year ended ($ in thousands) September 30, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Net income (GAAP) $ 149,530 $ 203,043 $ 133,055 $ 74,384 Branch-closure expenses — — 3,441 — CECL double count — — 25,353 8,557 Merger-related expenses — — 22,082 4,174 Related tax effect — — (12,382) (2,734) Adjusted net income (non-GAAP) $ 149,530 $ 203,043 $ 171,549 $ 84,381 Average assets $ 13,627,448 $ 13,319,624 $ 11,467,310 $ 8,253,913 ROAA (GAAP) 1.47 % 1.52 % 1.16 % 0.90 % ROAA (non-GAAP) 1.47 % 1.52 % 1.50 % 1.02 % Return on Average Assets (ROAA) 43

Reconciliation of Non-GAAP Financial Measures Quarter ended Year ended ($ in thousands) September 30, 2023 June 30, 2023 December 31, 2022 Net interest income $ 141,639 $ 140,692 $ 473,903 Noninterest income 12,085 14,290 59,162 Less gain on sale of investment securities — — — Less gain (loss) on sale of other real estate owned — 97 (93) Less noninterest expense 88,644 85,956 274,216 PPNR (non-GAAP) $ 65,080 $ 68,929 $ 258,942 Average assets $ 14,068,860 $ 13,671,985 $ 13,319,624 ROAA (GAAP) 1.26 % 1.44 % 1.52 % PPNR ROAA (non-GAAP) 1.84 % 2.02 % 1.94 % PPNR & PPNR ROAA Allowance Coverage Ratio Adjusted for Guaranteed Loans Period end ($ in thousands) September 30, 2023 June 30, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Loans (GAAP) $ 10,616,820 $ 10,512,623 $ 9,737,138 $ 9,017,642 $ 7,224,935 Less PPP and other guaranteed loans, net 950,909 977,287 960,254 1,151,895 1,297,212 Adjusted loans (non-GAAP) $ 9,665,911 $ 9,535,336 $ 8,776,884 $ 7,865,747 $ 5,927,723 Allowance for credit losses $ 142,133 $ 141,319 $ 136,932 $ 145,041 $ 136,671 Allowance for credit losses/loans (GAAP) 1.34 % 1.34 % 1.41 % 1.61 % 1.89 % Allowance for credit losses/adjusted loans (non-GAAP) 1.47 % 1.48 % 1.56 % 1.84 % 2.31 % 44

Reconciliation of Non-GAAP Financial Measures Year-to-date Year ended ($ in thousands) September 30, 2023 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2019 December 31, 2018 Net interest income (GAAP) $ 421,860 $ 473,903 $ 360,194 $ 270,001 $ 238,717 $ 191,905 Tax-equivalent adjustment 6,164 7,042 5,151 3,190 1,611 820 Less incremental accretion income — — — 4,083 4,783 3,701 Net interest income - FTE (non-GAAP) 428,024 480,945 365,345 269,108 235,545 189,024 Noninterest income (GAAP) 43,273 59,162 67,743 54,503 49,176 38,347 Less gain on sale of investment securities 381 — — 421 243 9 Less gain (loss) on sale of other real estate owned 187 (93) 884 — — — Less other income from non-core acquired assets — — — — 1,372 1,048 Less other non-core income — — — 265 266 675 Core revenue (non-GAAP) $ 470,729 $ 540,200 $ 432,204 $ 322,925 $ 282,840 $ 225,639 Noninterest expense (GAAP) $ 255,583 $ 274,216 $ 245,919 $ 167,159 $ 165,485 $ 119,031 Less amortization on intangibles 3,493 5,367 5,691 5,673 5,543 2,503 Less other non-core expenses — — — — — 682 Less other expenses (benefits) related to non-core acquired loans — — — 57 257 (163) Less branch closure expenses — — 3,441 — — 239 Less merger-related expenses — — 22,082 4,174 17,969 1,271 Core noninterest expense (non-GAAP) $ 252,090 $ 268,849 $ 214,705 $ 157,255 $ 141,716 $ 114,499 Core efficiency ratio (non-GAAP) 53.55 % 49.77 % 49.68 % 48.70 % 50.10 % 50.74 % Core Efficiency Ratio 45