Document

EXHIBIT 99.1

ENTERPRISE FINANCIAL REPORTS FIRST QUARTER 2023 RESULTS

First Quarter Results

•Net income of $55.7 million, $1.46 per diluted common share

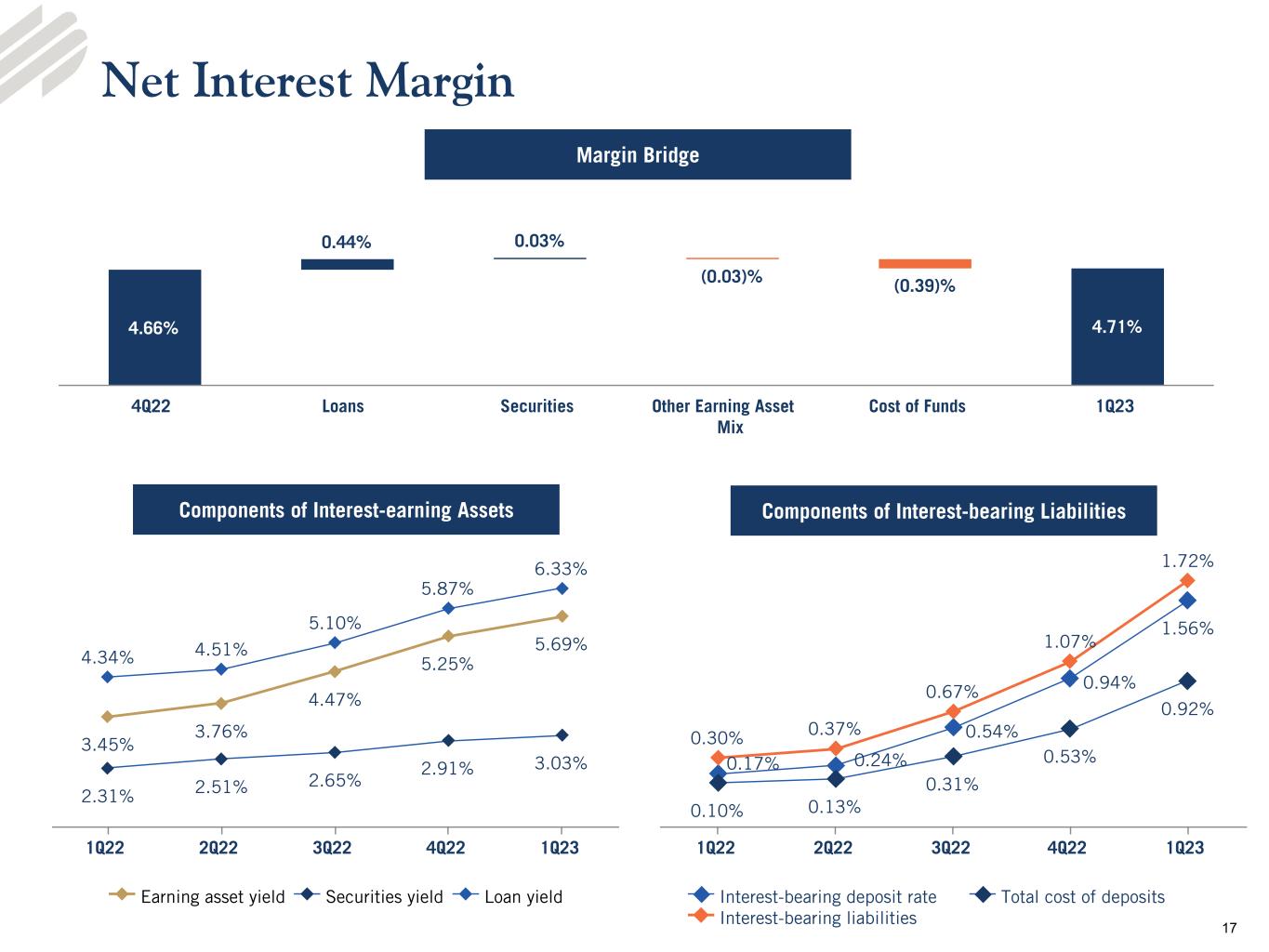

•Net interest margin of 4.71%, quarterly increase of five basis points

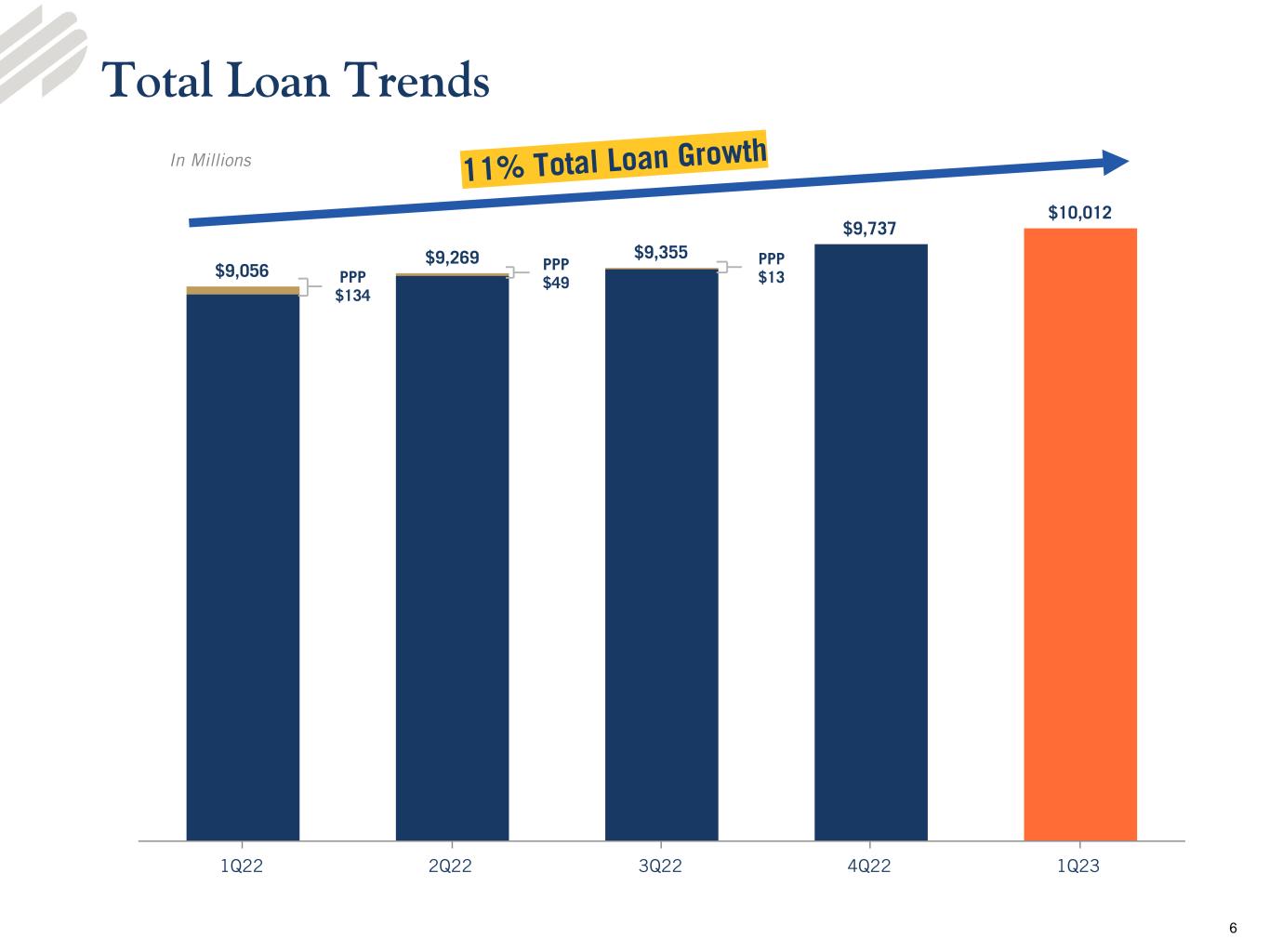

•Total loans of $10.0 billion, quarterly increase of $274.8 million

•Total deposits of $11.2 billion, quarterly increase of $325.5 million

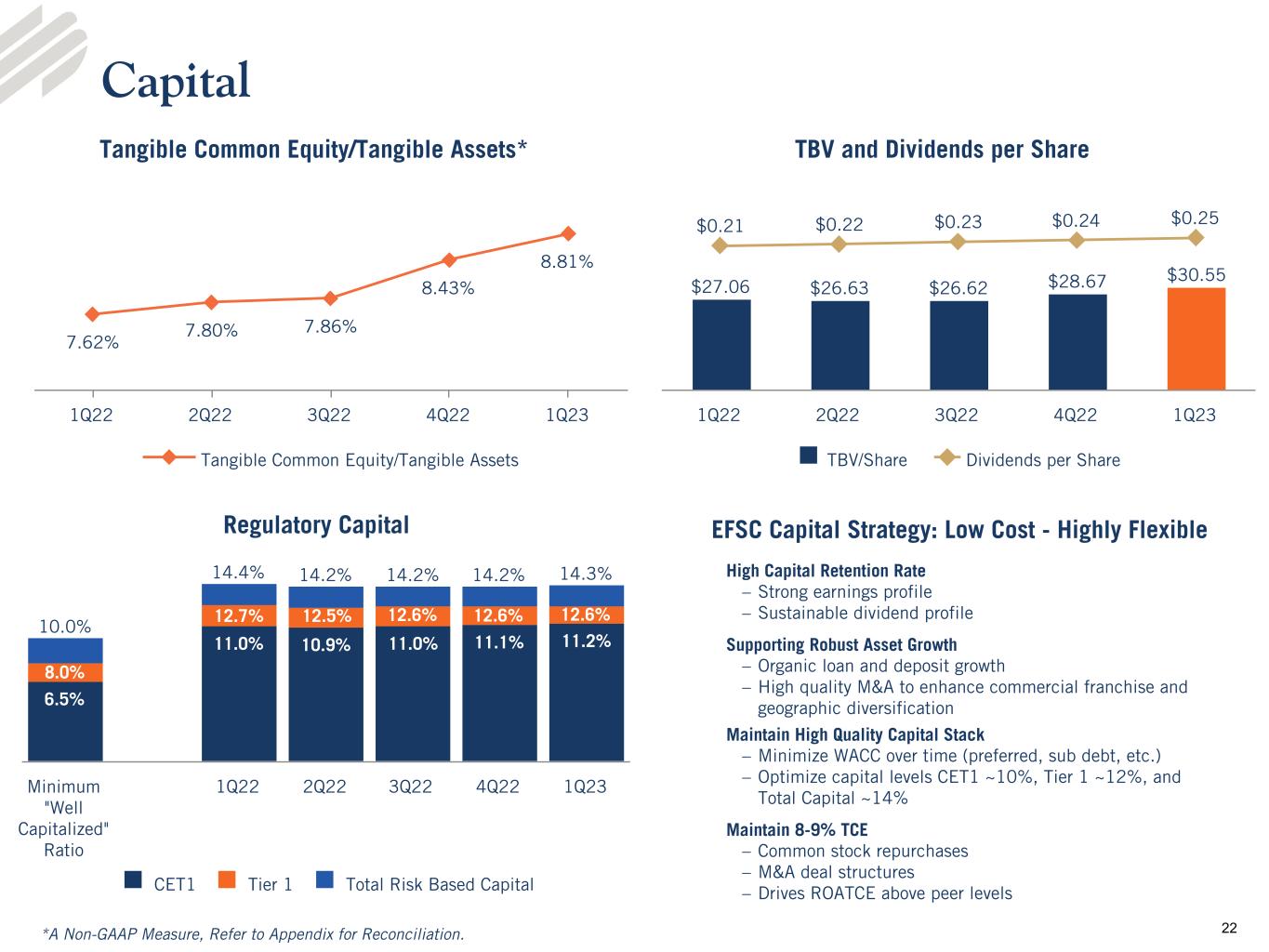

• Tangible common equity to tangible assets1 of 8.81%

St. Louis, Mo. April 24, 2023 – Jim Lally, President and Chief Executive Officer of Enterprise Financial Services Corp (Nasdaq: EFSC) (the “Company” or “EFSC”), said today upon the release of EFSC’s first quarter earnings, “We delivered strong results in the first quarter, with high quality loan growth, enhanced liquidity and an improved capital position. In a competitive and challenging environment, we have continued to serve our customers with products and relationship-based services that meet their needs, driving a $75 million increase in customer deposits in the first quarter. Our focus in these areas resulted in a return on assets of 1.7% and a return on tangible common equity1 of 20% for the first quarter. As we look to the remainder of 2023, we believe the strength of our balance sheet and our diversified business model have us well positioned.”

Highlights

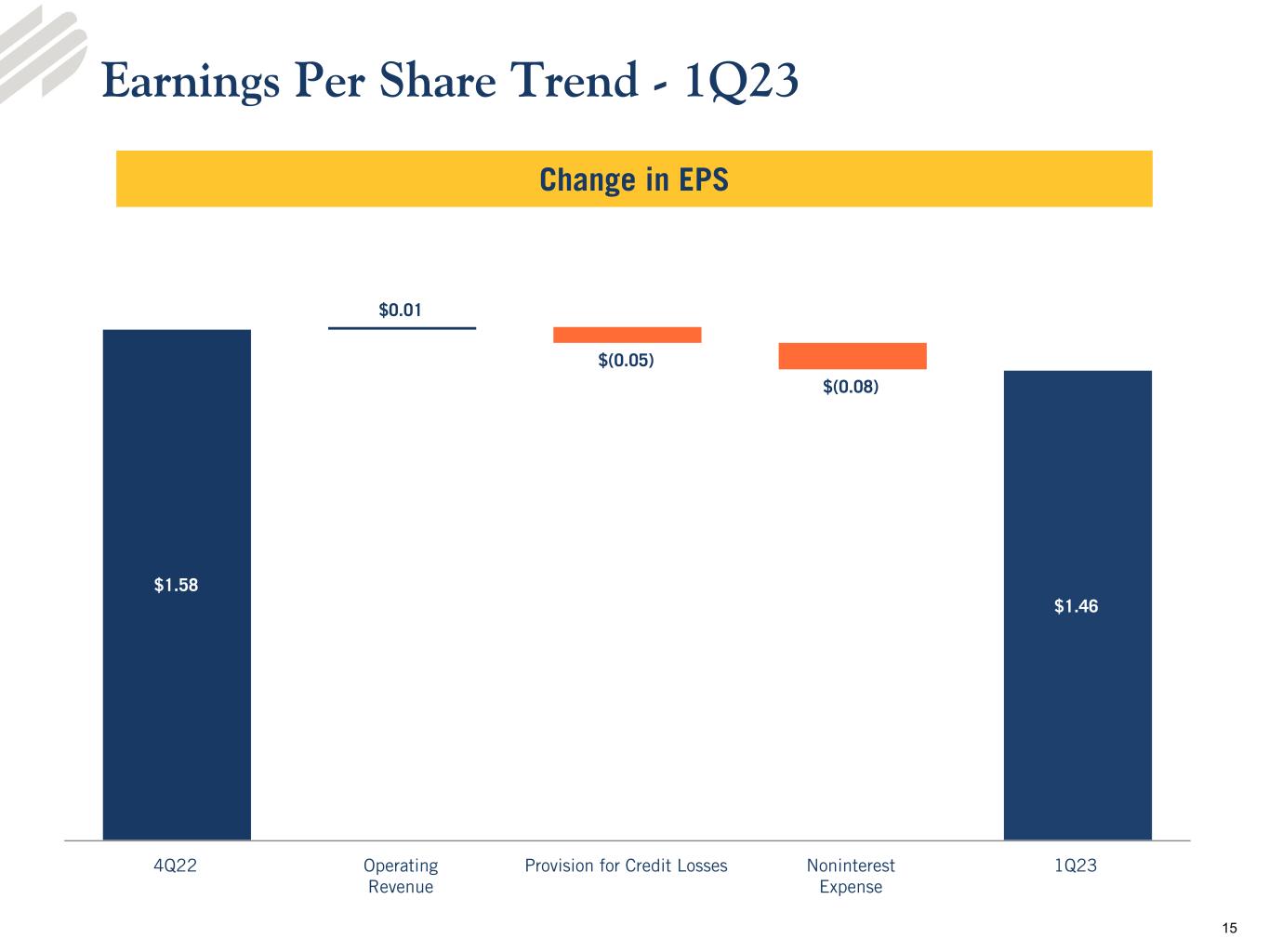

•Earnings - Net income in the first quarter 2023 was $55.7 million, a decrease of $4.3 million compared to the linked quarter and an increase of $8.0 million from the prior year quarter. Earnings per share (“EPS”) was $1.46 per diluted common share for the first quarter 2023, compared to $1.58 and $1.23 per diluted common share for the linked and prior year quarters, respectively.

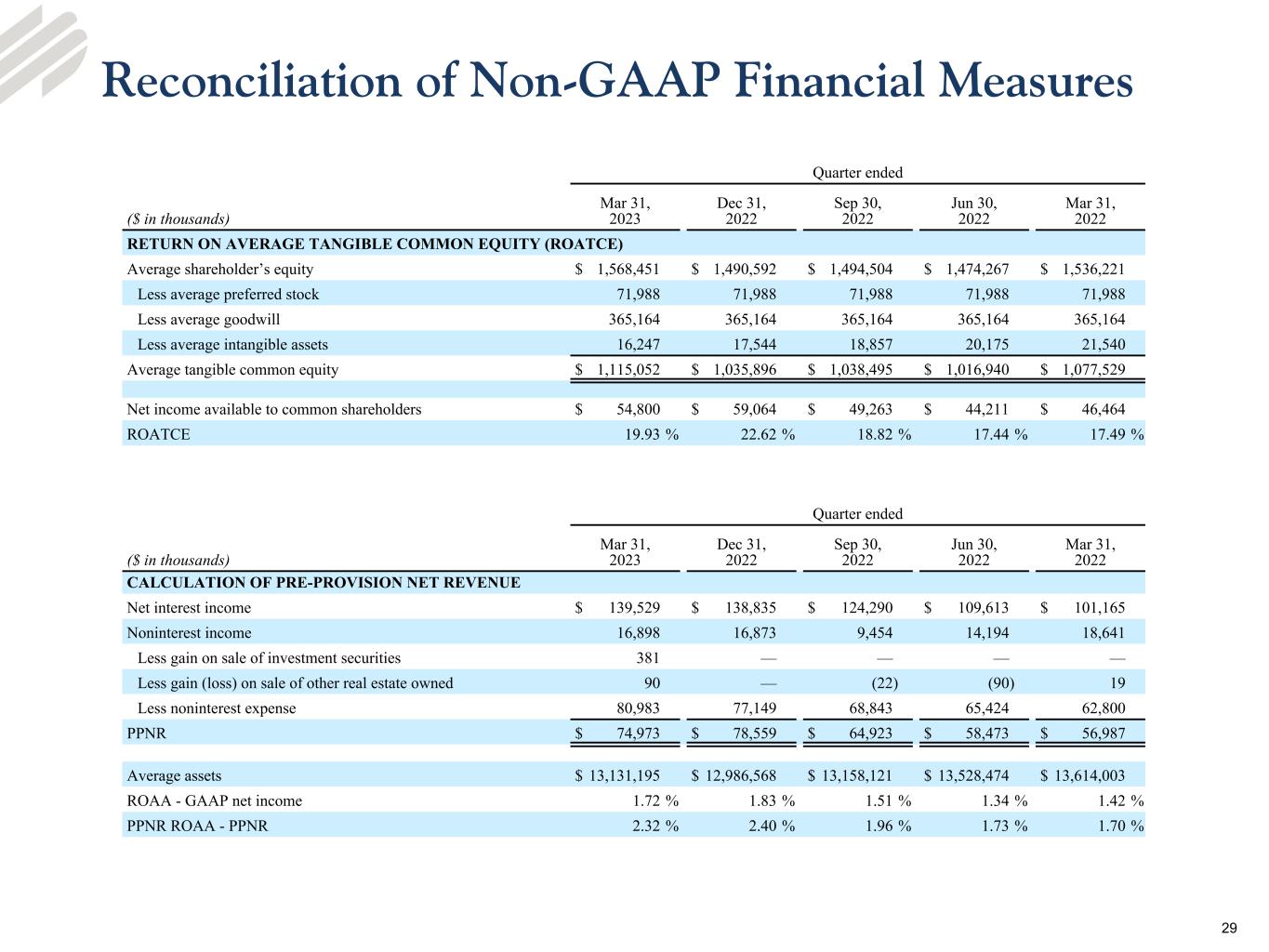

•Pre-provision net revenue2 (“PPNR”) - PPNR of $75.0 million in the first quarter 2023 decreased $3.6 million from the linked quarter and increased $18.0 million from the prior year quarter, respectively. The decrease from the linked quarter was primarily due to a seasonal increase in noninterest expense, partially offset by an increase in net interest income. The increase compared to the prior year quarter was primarily due to an increase in net interest income, partially offset by an increase in noninterest expense.

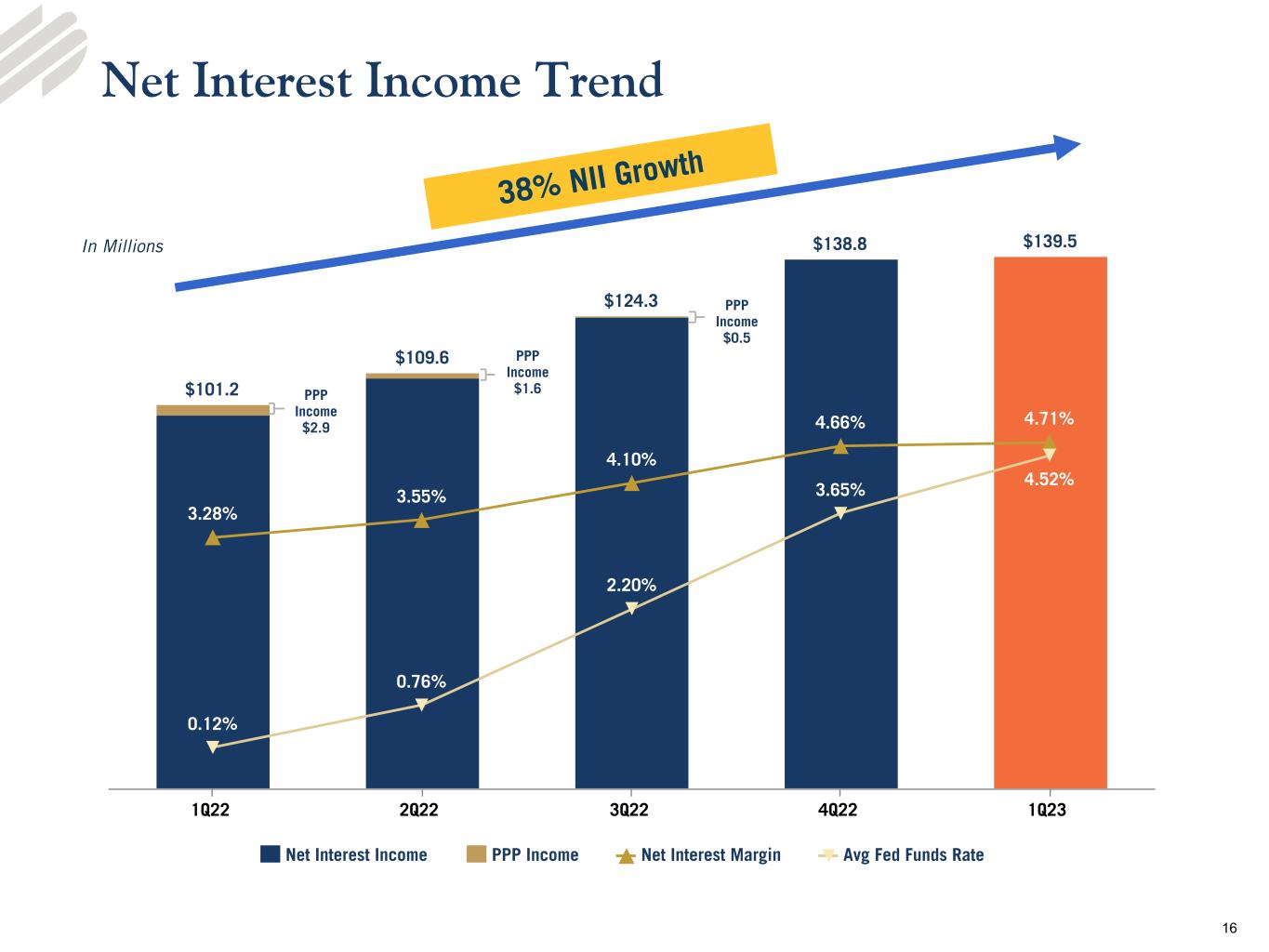

•Net interest income and net interest margin (“NIM”) - Net interest income of $139.5 million for the first quarter 2023 increased $0.7 million and $38.4 million from the linked and prior year quarters, respectively. NIM was 4.71% for the first quarter 2023, compared to 4.66% and 3.28% for the linked and prior year quarters, respectively. Net interest income and NIM benefited from higher average loan and investment balances combined with expanding yields on earning assets, partially offset by higher deposit costs and a decline in average interest-earning cash balances.

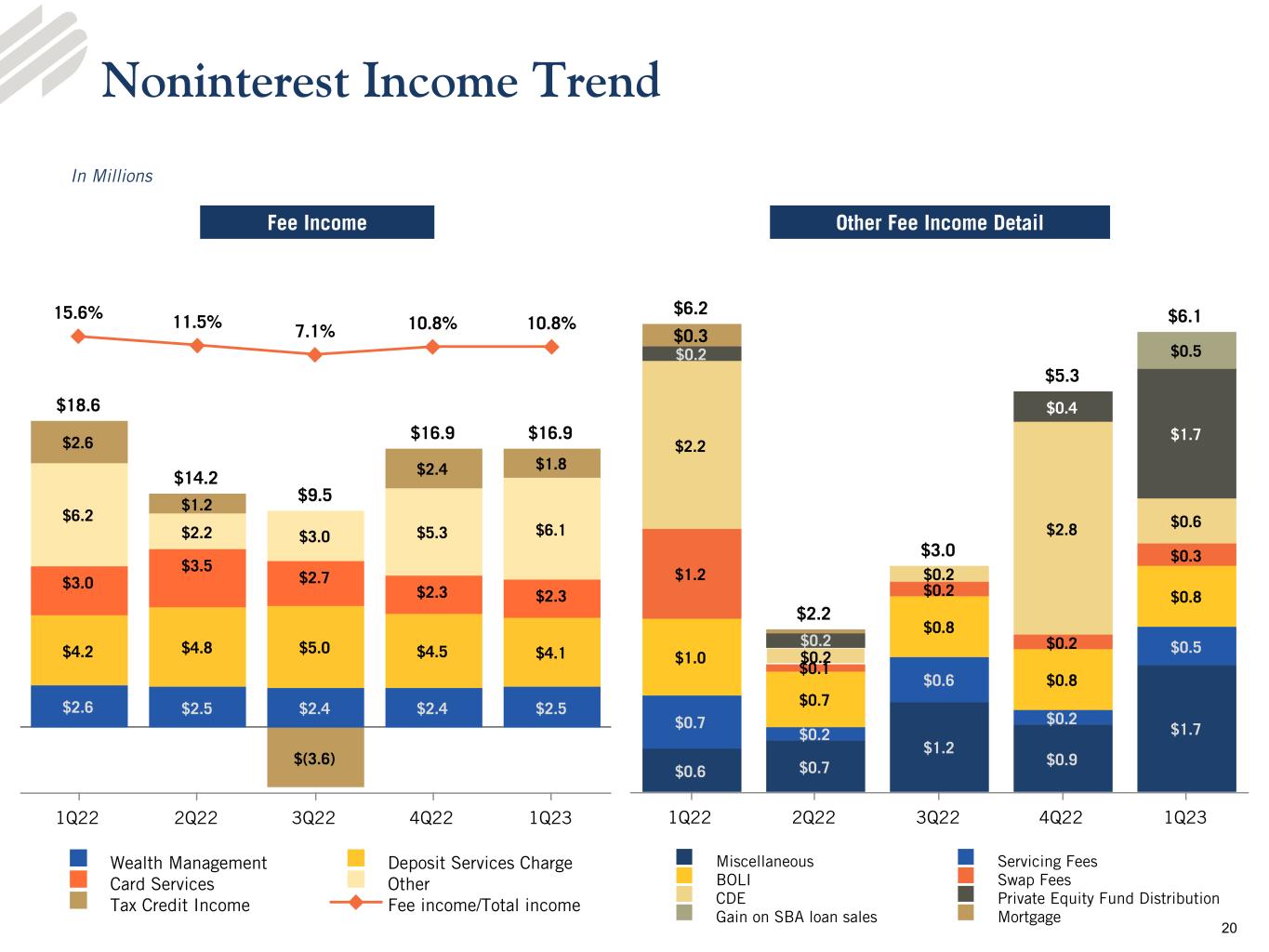

•Noninterest income - Noninterest income of $16.9 million for the first quarter 2023 was stable compared to the linked quarter and decreased $1.7 million from the prior year quarter. The decline from the prior year quarter was primarily due to a decrease in customer swap fee income, card services revenue and tax credit income. Lower transaction volumes led to the decrease in customer swap fee income and tax credit income, and the Durbin Amendment cap on debit card income limited card services revenue since July 1, 2022.

1 Tangible common equity to tangible assets and return on tangible common equity are non-GAAP measures. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

2 Pre-provision net revenue is a non-GAAP measure. Refer to discussion and reconciliation of this measure in the accompanying financial tables.

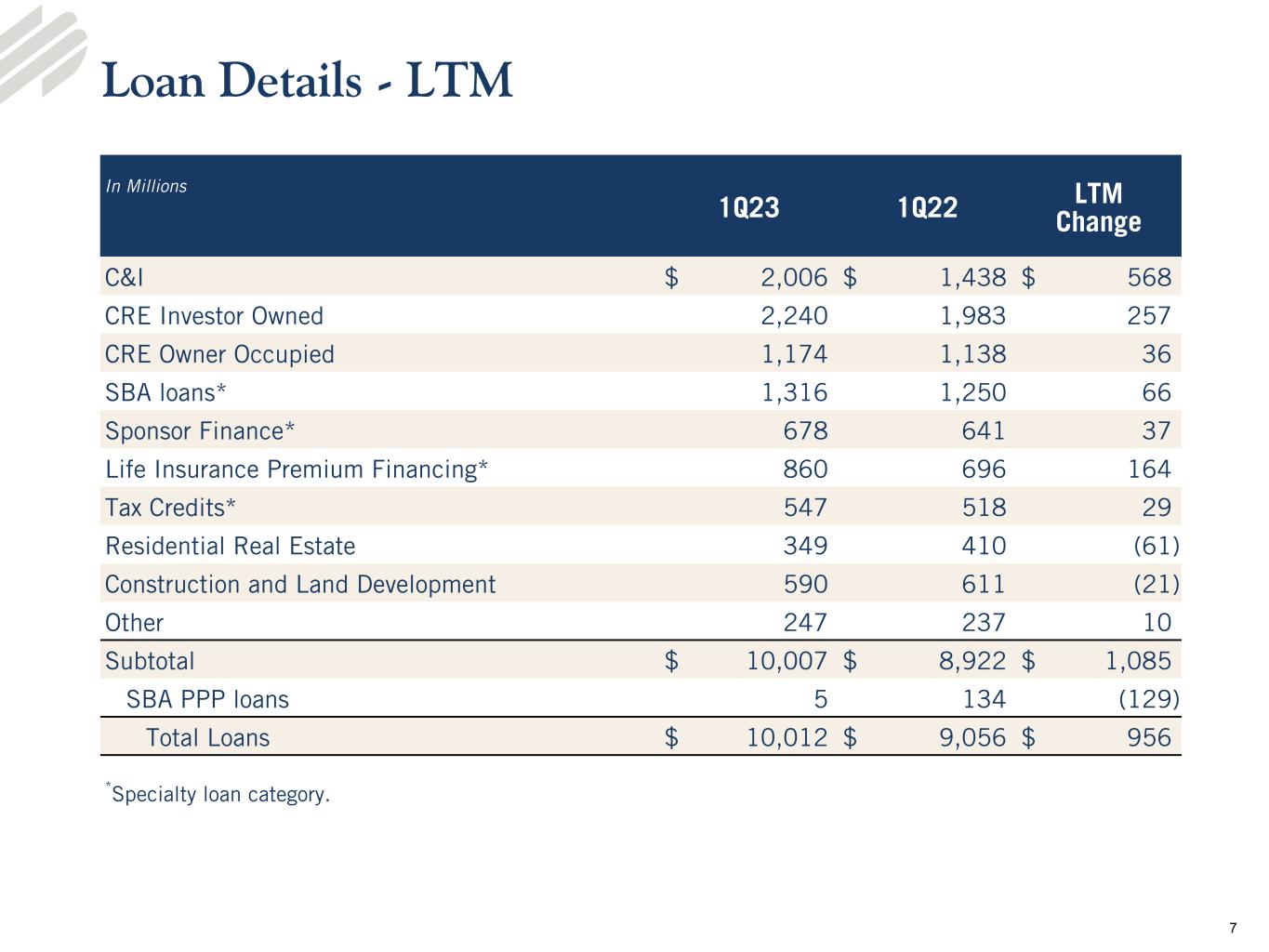

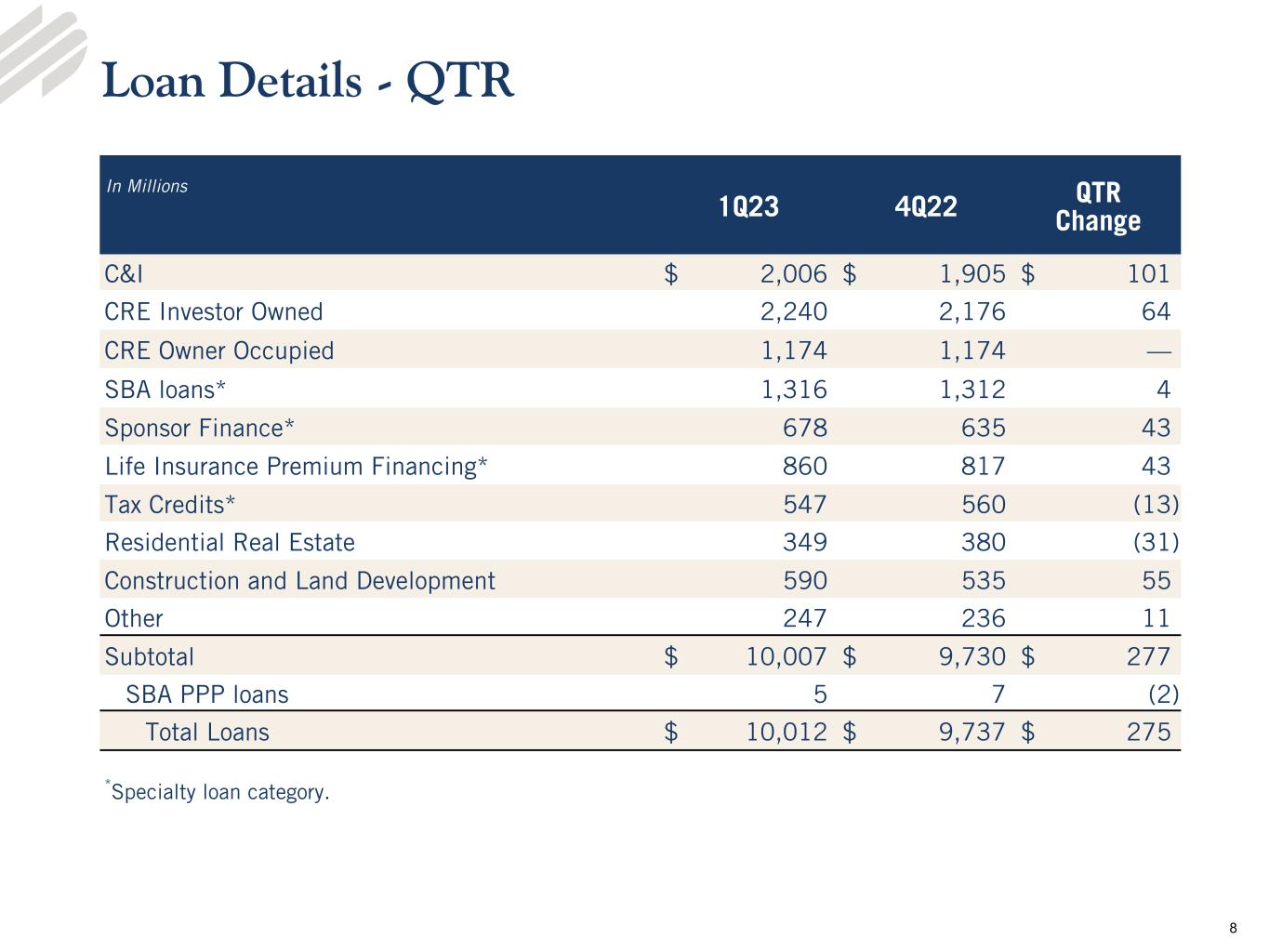

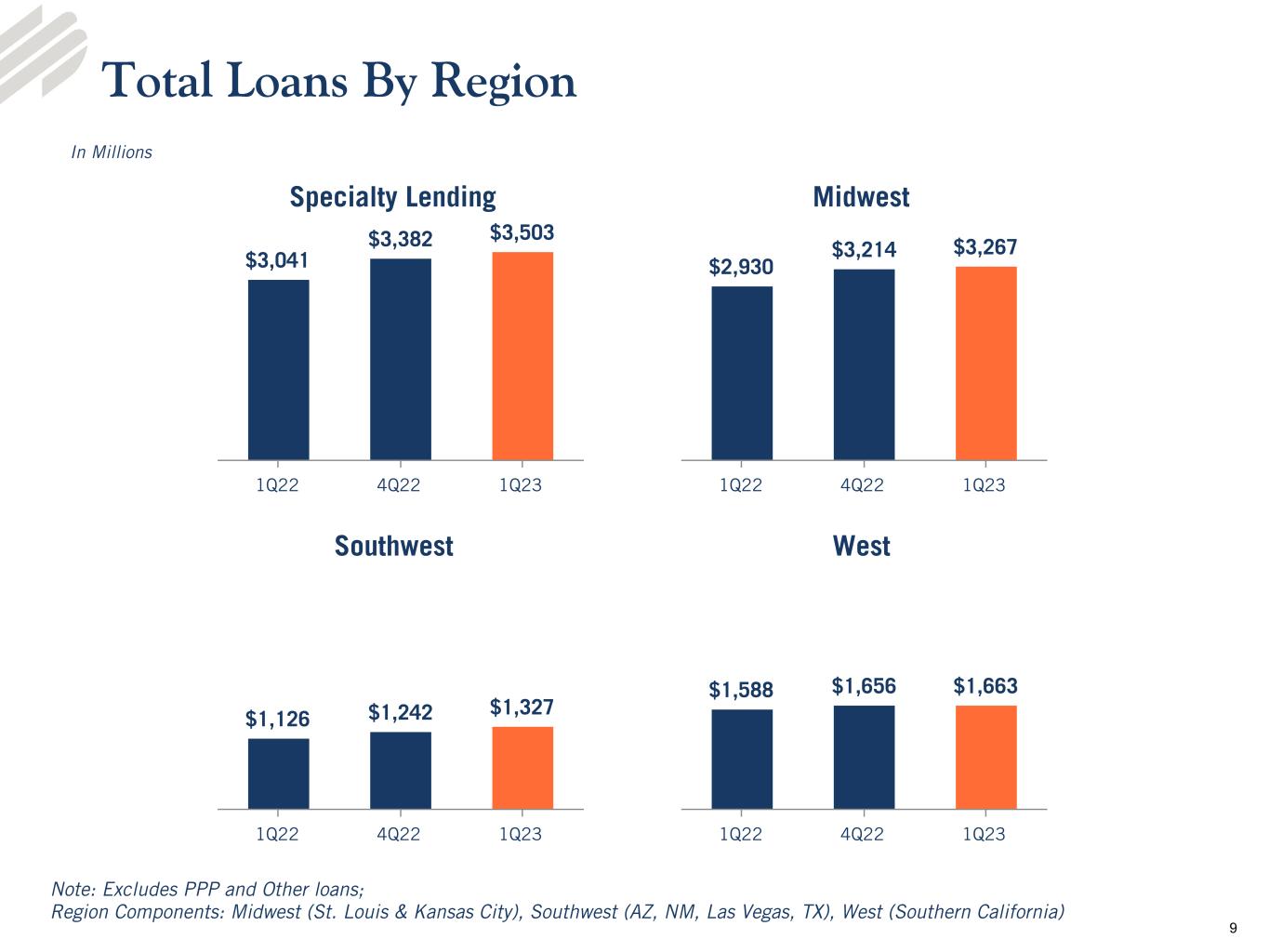

•Loans - Loans totaled $10.0 billion at March 31, 2023, an increase of $274.8 million, or 11.4% on an annualized basis, from the linked quarter and an increase of $955.8 million from the prior year period. Average loans totaled $9.8 billion for the quarter ended March 31, 2023, compared to $9.4 billion and $9.0 billion for the linked and prior year quarters, respectively.

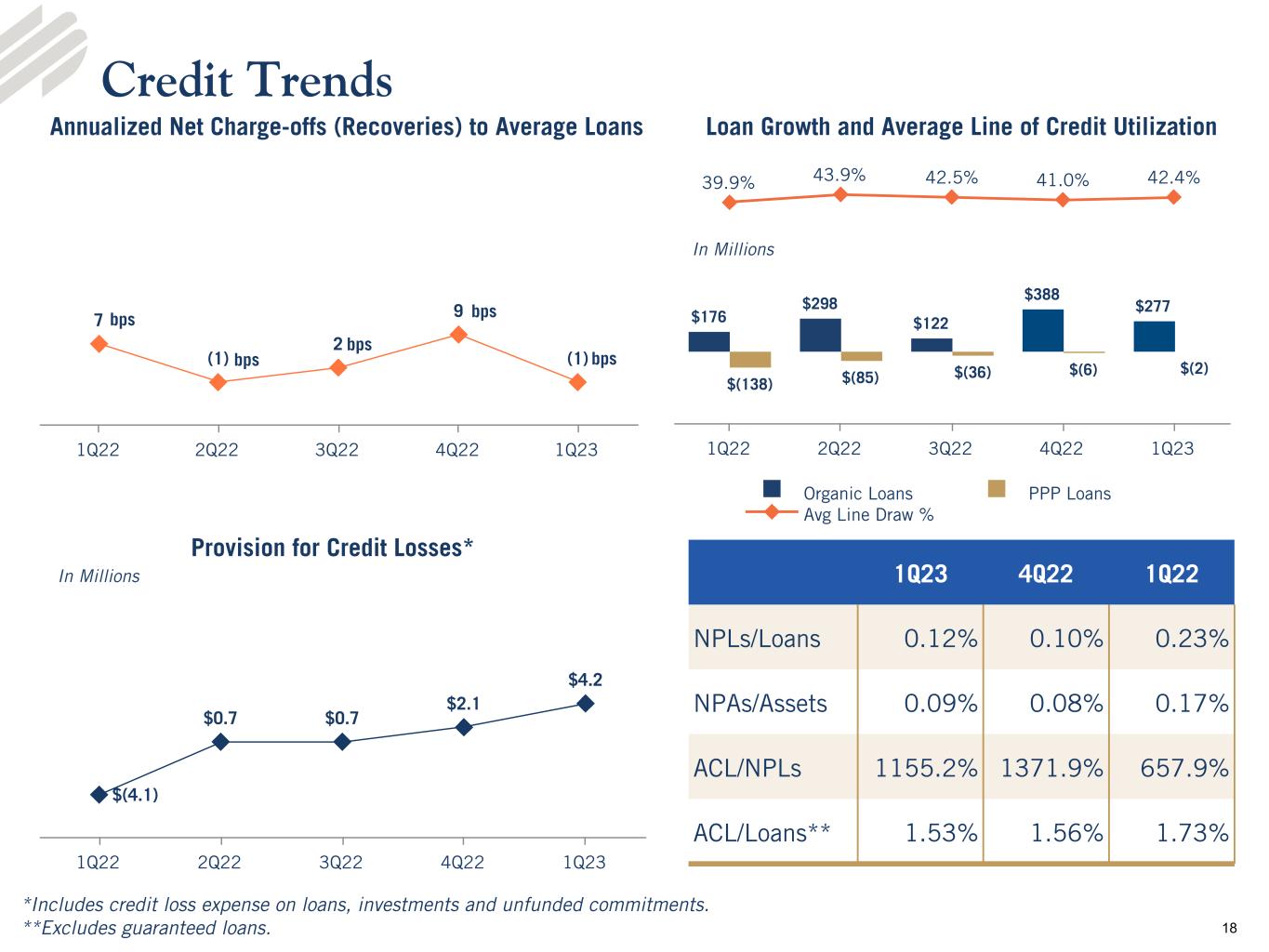

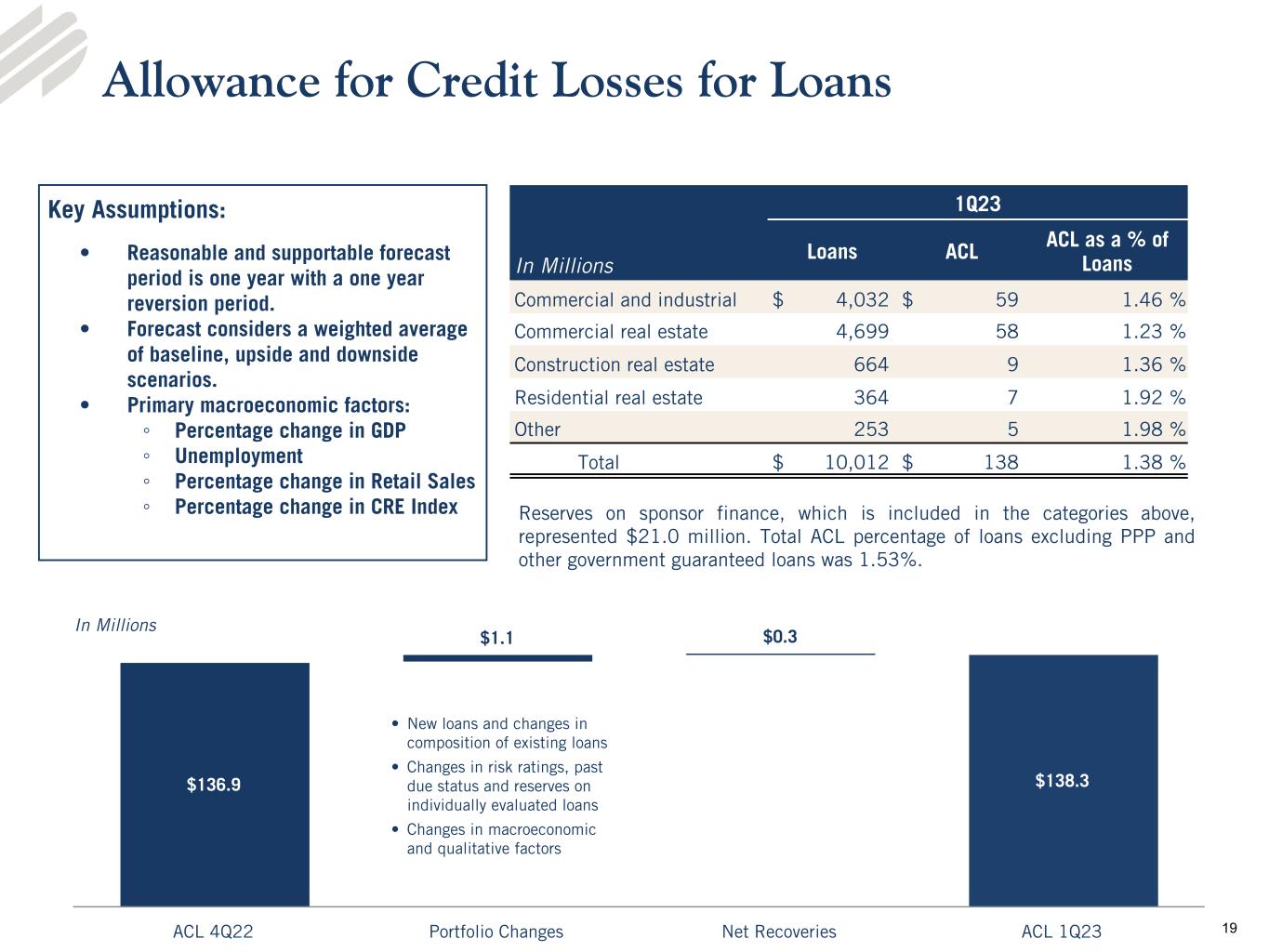

•Asset quality - The allowance for credit losses to total loans was 1.38% at March 31, 2023, compared to 1.41% at December 31, 2022 and 1.54% at March 31, 2022. Nonperforming assets to total assets was 0.09% at March 31, 2023, compared to 0.08% and 0.17% at December 31, 2022 and March 31, 2022, respectively. The provision for credit losses of $4.2 million recorded in the first quarter 2023 was primarily related to the credit impairment of an investment security in subordinated debt of a failed bank, and to loan growth, partially offset by a decrease in the reserve for unfunded commitments.

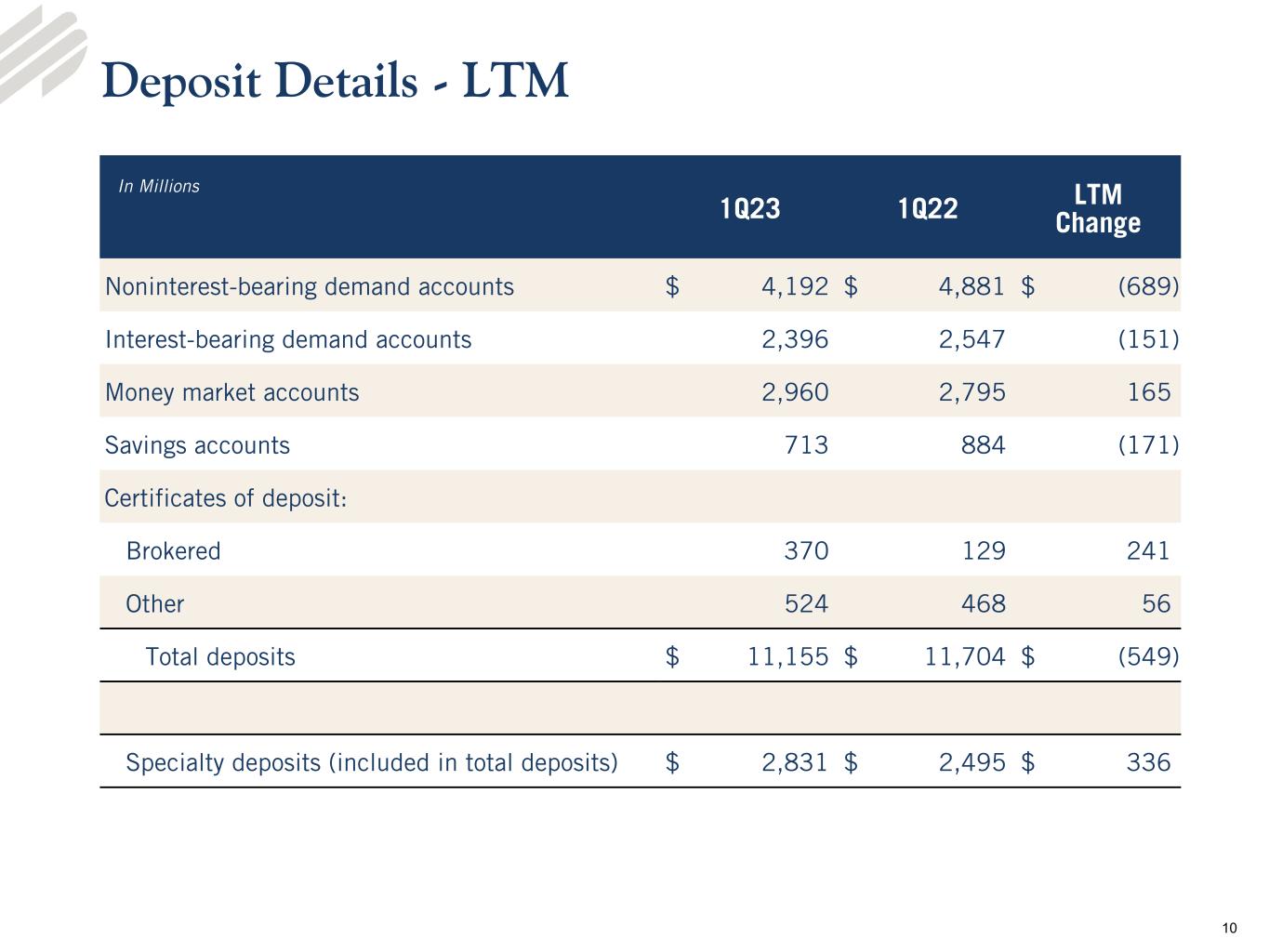

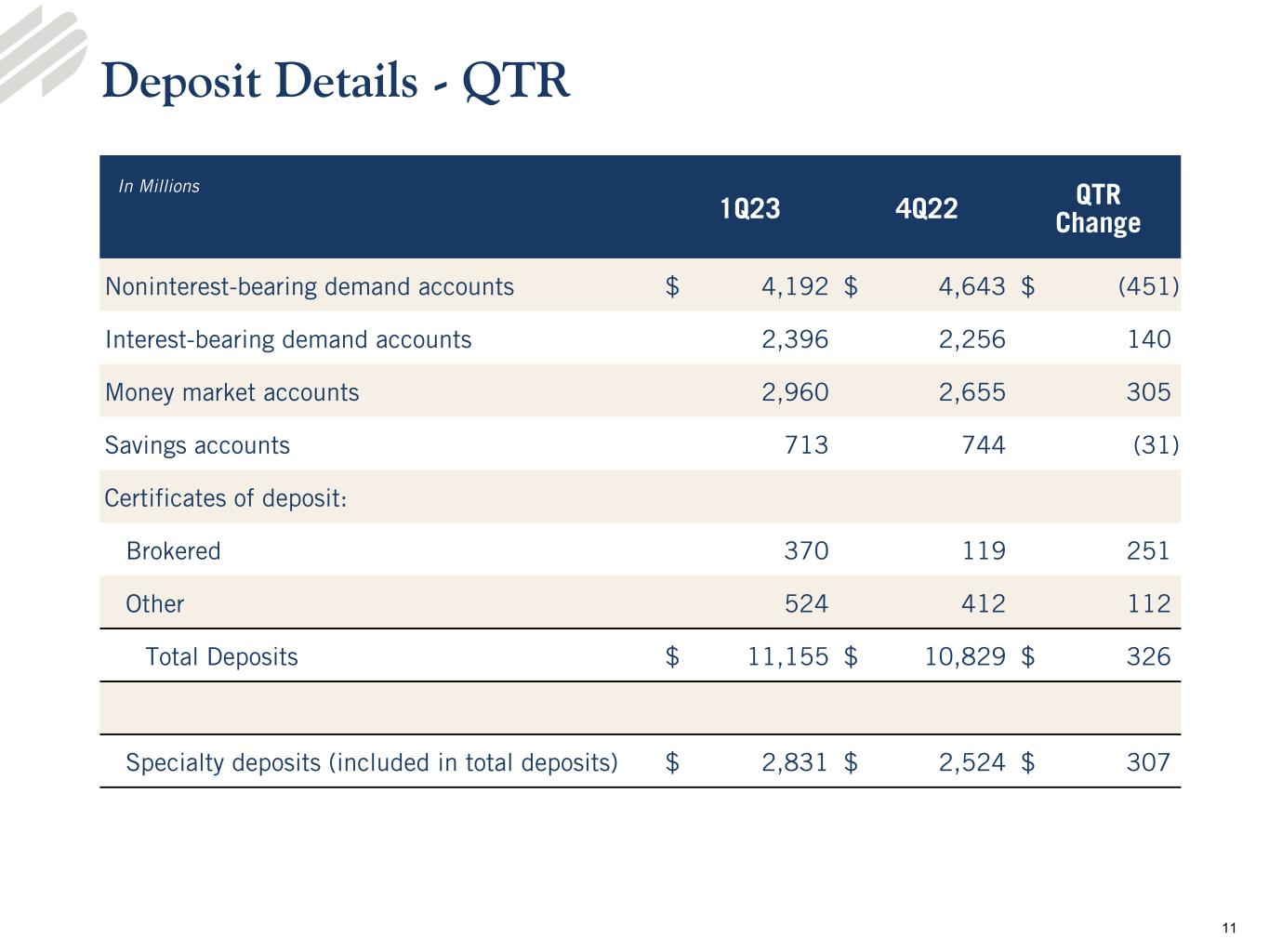

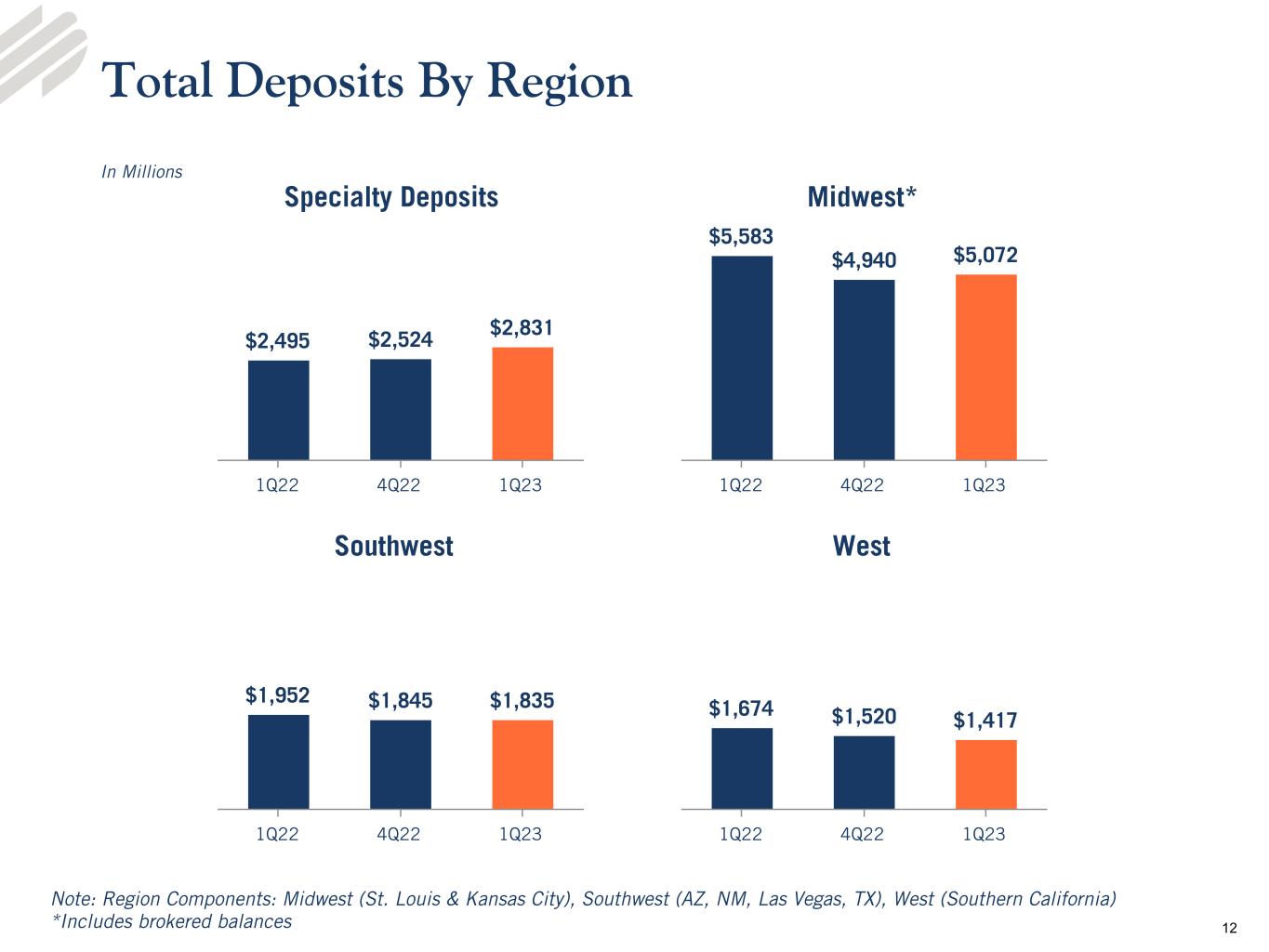

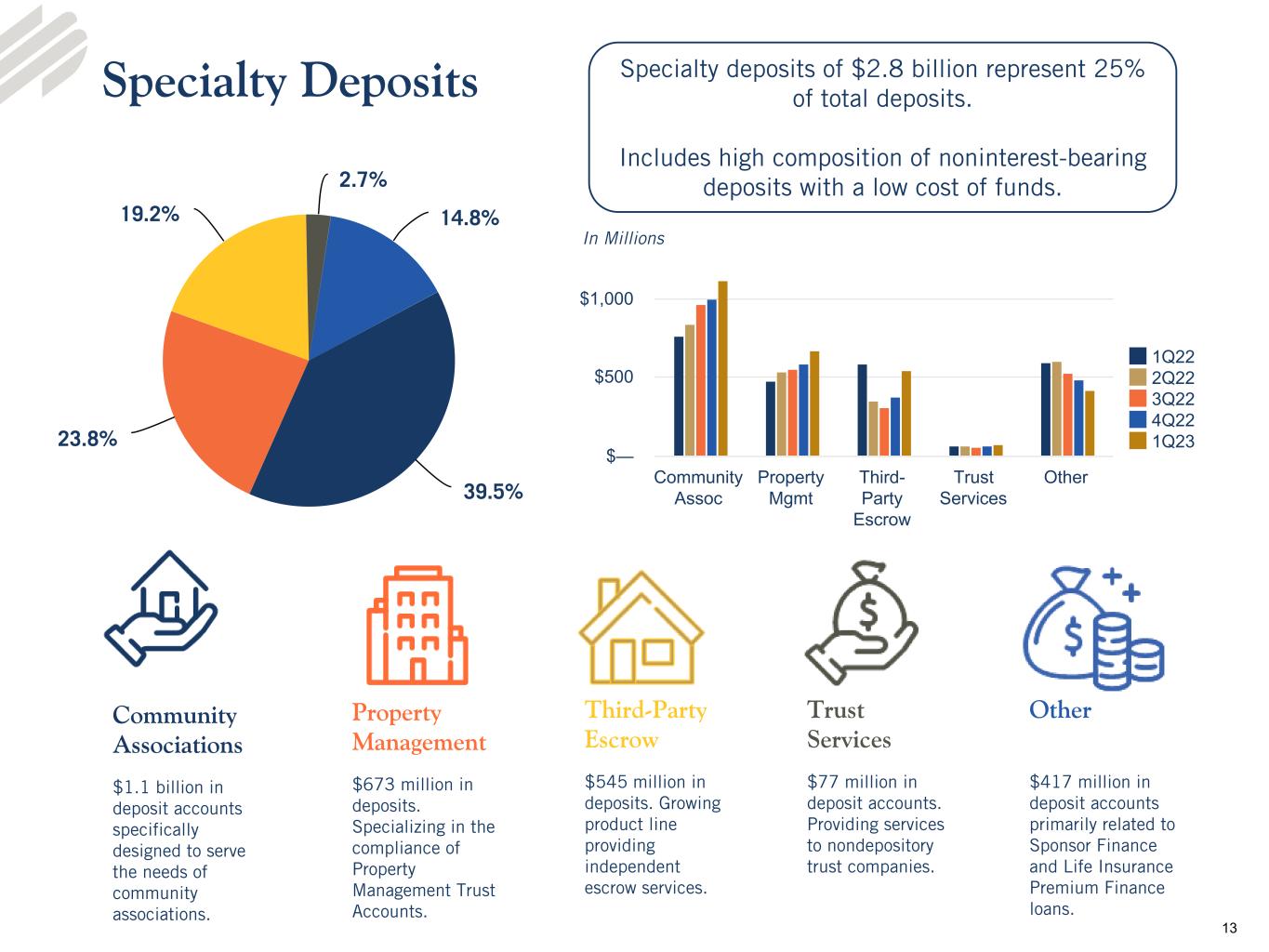

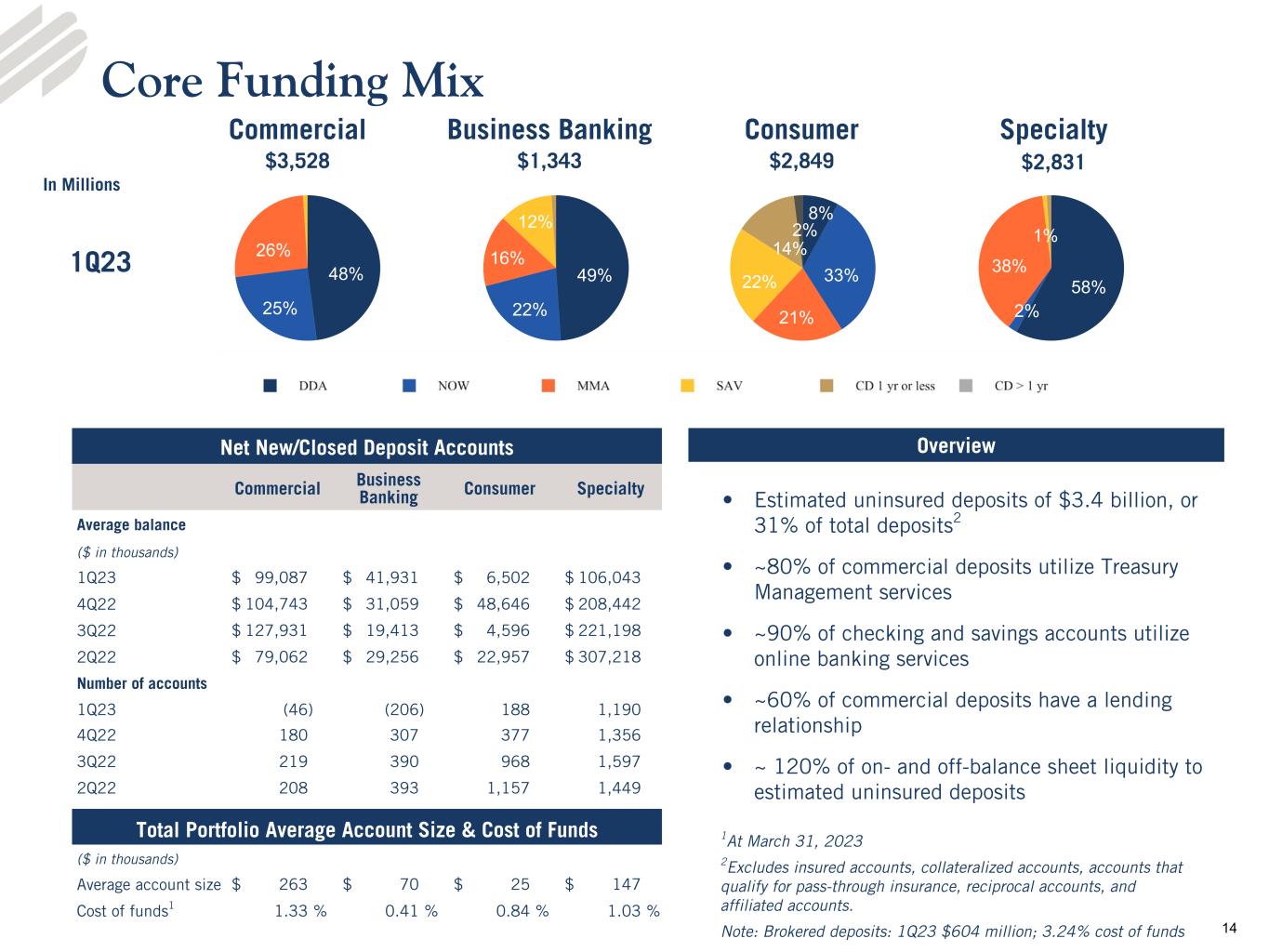

•Deposits - Total deposits increased $325.5 million from the linked quarter to $11.2 billion as of March 31, 2023. Total estimated insured deposits, which includes collateralized deposits and accounts that qualify for pass through insurance, totaled $7.7 billion at March 31, 2023. Average deposits totaled $10.9 billion for the quarter ended March 31, 2023 compared to $11.0 billion and $11.5 billion for the linked and prior year quarters, respectively. At March 31, 2023, noninterest-bearing deposit accounts represented 37.6% of total deposits, and the loan to deposit ratio was 89.8%.

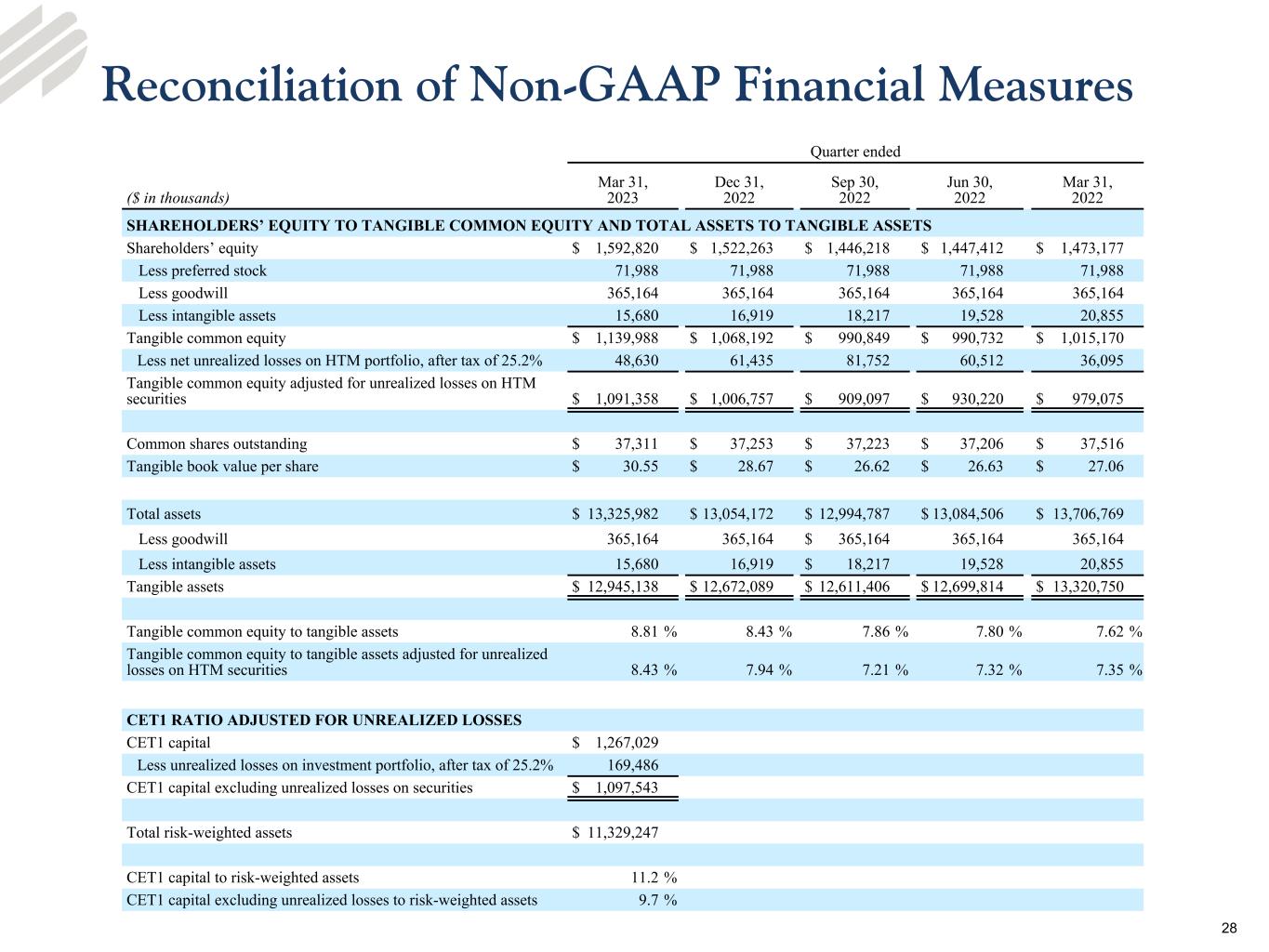

•Capital - Total shareholders’ equity was $1.6 billion and the tangible common equity to tangible assets ratio was 8.8% at March 31, 2023, compared to 8.4% at December 31, 2022. The tangible common equity to tangible assets ratio, adjusted for unrealized losses on held-to-maturity securities,3 was 8.4% at March 31, 2023 and 7.9% at December 31, 2022. Enterprise Bank & Trust remains “well-capitalized,” with a common equity tier 1 ratio of 12.0% and a total risk-based capital ratio of 13.1% as of March 31, 2023. The Company’s common equity tier 1 ratio and total risk-based capital ratio was 11.2% and 14.3%, respectively, at March 31, 2023.

The Company’s Board of Directors approved a quarterly dividend of $0.25 per common share, payable on June 30, 2023 to shareholders of record as of June 15, 2023. The Board of Directors also declared a cash dividend of $12.50 per share of Series A Preferred Stock (or $0.3125 per depositary share) representing a 5% per annum rate for the period commencing (and including) March 15, 2023 to (but excluding) June 15, 2023. The dividend will be payable on June 15, 2023 to holders of record of Series A Preferred Stock as of May 31, 2023.

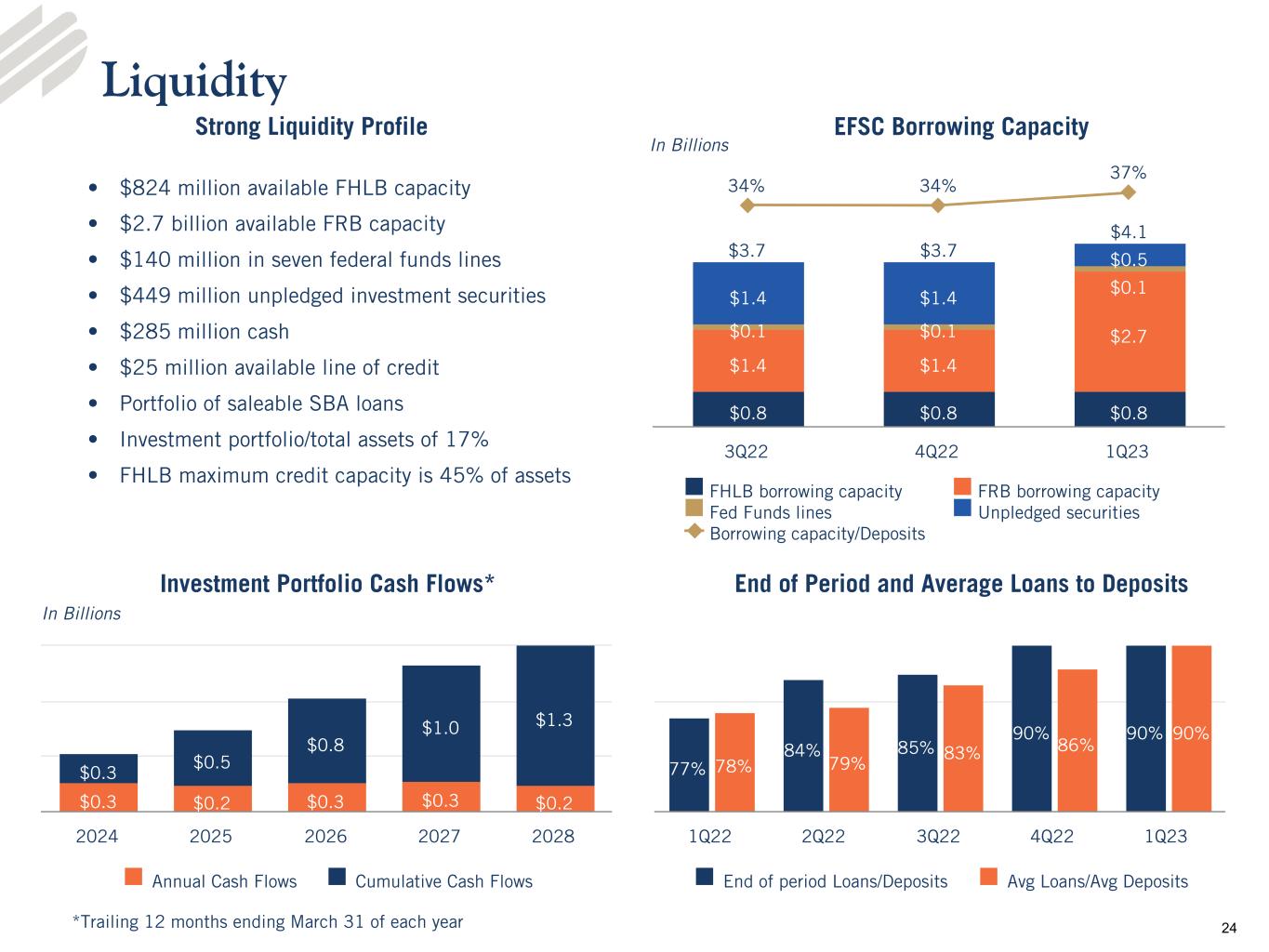

•Liquidity - The Company’s total available on- and off-balance-sheet liquidity was approximately $4.4 billion at March 31, 2023. On-balance-sheet liquidity consisted of cash of $285.1 million and unpledged investment securities with a fair value of $449.2 million at March 31, 2023. In the first quarter 2023, the Company pledged additional securities to the Federal Reserve to increase its available borrowing capacity. The Company also has $937.4 million of SBA guaranteed loans, a portion of which could be sold in the secondary market to generate earnings and liquidity. Off-balance-sheet liquidity consisted of $824.1 million available through the Federal Home Loan Bank, $2.7 billion through the Federal Reserve and $140.0 million through correspondent bank lines. The Company also has an unused $25.0 million revolving line of credit and maintains a shelf registration allowing for the issuance of various forms of equity and debt securities.

3 Tangible common equity to tangible assets ratio and the tangible common equity to tangible assets ratio adjusted for unrealized losses on held-to-maturity securities are non-GAAP measures. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

2

Net Interest Income and NIM

Average Balance Sheets

The following table presents, for the periods indicated, certain information related to our average interest-earning assets and interest-bearing liabilities, as well as the corresponding average interest rates earned and paid, all on a tax-equivalent basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

| ($ in thousands) |

Average

Balance |

|

Interest

Income/

Expense |

|

Average Yield/ Rate |

|

Average

Balance |

|

Interest

Income/

Expense |

|

Average Yield/ Rate |

|

Average

Balance |

|

Interest

Income/

Expense |

|

Average Yield/ Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans1, 2 |

$ |

9,795,045 |

|

|

$ |

152,762 |

|

|

6.33 |

% |

|

$ |

9,423,984 |

|

|

$ |

139,432 |

|

|

5.87 |

% |

|

$ |

9,005,875 |

|

|

$ |

96,301 |

|

|

4.34 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities2 |

2,288,451 |

|

|

17,117 |

|

|

3.03 |

|

|

2,204,211 |

|

|

16,191 |

|

|

2.91 |

|

|

1,923,969 |

|

|

10,969 |

|

|

2.31 |

|

| Interest-earning deposits |

106,254 |

|

|

1,195 |

|

|

4.56 |

|

|

367,100 |

|

|

3,097 |

|

|

3.35 |

|

|

1,781,272 |

|

|

817 |

|

|

0.19 |

|

| Total interest-earning assets |

12,189,750 |

|

|

171,074 |

|

|

5.69 |

|

|

11,995,295 |

|

|

158,720 |

|

|

5.25 |

|

|

12,711,116 |

|

|

108,087 |

|

|

3.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-earning assets |

941,445 |

|

|

|

|

|

|

991,273 |

|

|

|

|

|

|

902,887 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

13,131,195 |

|

|

|

|

|

|

$ |

12,986,568 |

|

|

|

|

|

|

$ |

13,614,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand accounts |

$ |

2,201,910 |

|

|

$ |

5,907 |

|

|

1.09 |

% |

|

$ |

2,242,268 |

|

|

$ |

4,136 |

|

|

0.73 |

% |

|

$ |

2,505,319 |

|

|

$ |

536 |

|

|

0.09 |

% |

| Money market accounts |

2,826,836 |

|

|

15,471 |

|

|

2.22 |

|

|

2,696,417 |

|

|

9,509 |

|

|

1.40 |

|

|

2,872,302 |

|

|

1,460 |

|

|

0.21 |

|

| Savings |

732,256 |

|

|

230 |

|

|

0.13 |

|

|

775,488 |

|

|

100 |

|

|

0.05 |

|

|

817,431 |

|

|

66 |

|

|

0.03 |

|

| Certificates of deposit |

670,521 |

|

|

3,053 |

|

|

1.85 |

|

|

524,938 |

|

|

1,017 |

|

|

0.77 |

|

|

607,133 |

|

|

797 |

|

|

0.53 |

|

| Total interest-bearing deposits |

6,431,523 |

|

|

24,661 |

|

|

1.56 |

|

|

6,239,111 |

|

|

14,762 |

|

|

0.94 |

|

|

6,802,185 |

|

|

2,859 |

|

|

0.17 |

|

| Subordinated debentures |

155,497 |

|

|

2,409 |

|

|

6.28 |

|

|

155,359 |

|

|

2,376 |

|

|

6.07 |

|

|

154,959 |

|

|

2,220 |

|

|

5.81 |

|

| FHLB advances |

110,928 |

|

|

1,332 |

|

|

4.87 |

|

|

8,864 |

|

|

104 |

|

|

4.65 |

|

|

50,000 |

|

|

195 |

|

|

1.58 |

|

| Securities sold under agreements to repurchase |

215,604 |

|

|

749 |

|

|

1.41 |

|

|

182,362 |

|

|

282 |

|

|

0.61 |

|

|

262,252 |

|

|

60 |

|

|

0.09 |

|

| Other borrowings |

53,885 |

|

|

353 |

|

|

2.66 |

|

|

26,993 |

|

|

378 |

|

|

5.56 |

|

|

22,841 |

|

|

82 |

|

|

1.46 |

|

| Total interest-bearing liabilities |

6,967,437 |

|

|

29,504 |

|

|

1.72 |

|

|

6,612,689 |

|

|

17,902 |

|

|

1.07 |

|

|

7,292,237 |

|

|

5,416 |

|

|

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

4,481,966 |

|

|

|

|

|

|

4,763,503 |

|

|

|

|

|

|

4,692,027 |

|

|

|

|

|

| Other liabilities |

113,341 |

|

|

|

|

|

|

119,784 |

|

|

|

|

|

|

93,518 |

|

|

|

|

|

| Total liabilities |

11,562,744 |

|

|

|

|

|

|

11,495,976 |

|

|

|

|

|

|

12,077,782 |

|

|

|

|

|

| Shareholders' equity |

1,568,451 |

|

|

|

|

|

|

1,490,592 |

|

|

|

|

|

|

1,536,221 |

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

13,131,195 |

|

|

|

|

|

|

$ |

12,986,568 |

|

|

|

|

|

|

$ |

13,614,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net interest income |

|

|

$ |

141,570 |

|

|

|

|

|

|

$ |

140,818 |

|

|

|

|

|

|

$ |

102,671 |

|

|

|

| Net interest margin |

|

|

|

|

4.71 |

% |

|

|

|

|

|

4.66 |

% |

|

|

|

|

|

3.28 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Average balances include nonaccrual loans. Interest income includes loan fees of $3.7 million, $3.7 million, and $5.2 million for the three months ended March 31, 2023, December 31, 2022, and March 31, 2022, respectively. |

2 Non-taxable income is presented on a fully tax-equivalent basis using a 25.2% tax rate. The tax-equivalent adjustments were $2.0 million, $2.0 million, and $1.5 million for the three months ended March 31, 2023, December 31, 2022, and March 31, 2022, respectively. |

Net interest income for the first quarter was $139.5 million, an increase of $0.7 million compared to the linked quarter and an increase of $38.4 million from the prior year period. The increase from the linked and prior year quarters reflects the benefit of higher market interest rates on the Company’s asset sensitive balance sheet combined with organic growth. The effective federal funds rate for the first quarter 2023 was 4.52%, an increase of 87 basis points compared to the linked quarter, and a 440 basis point increase over the prior year quarter.

Interest income increased $12.3 million during the first quarter 2023 primarily due to higher interest earned on a larger loan base resulting in a $13.3 million sequential expansion. This increase was partially offset by a $1.9 million decrease in interest on cash balances. Interest on loans benefited from a 46 basis point increase in yield and a $371.1 million increase in average loans compared to the linked quarter. The average interest rate of new loan originations in the first quarter 2023 was 6.53%. The yield on interest-earning cash deposits increased 121 basis points in the quarter but was offset by a $260.8 million decrease in the average balance which reduced interest income in the first quarter 2023.

Interest expense increased $11.6 million in the first quarter 2023 primarily due to a $9.9 million increase in deposit interest expense and a $1.2 million increase in interest expense on FHLB borrowings. The increase in interest expense reflects a shift in the deposit mix from demand deposits and interest-bearing demand deposits to money market accounts and certificates of deposit, as well as higher rates paid on deposits. This deposit shift principally occurred during March following the turmoil in the banking markets. The interest-bearing liability rate was 1.72%, an increase of 65 basis points compared to the linked quarter. The average cost of interest-bearing deposits was 1.56%, an increase of 62 basis points over the linked quarter. The increase was primarily due to higher rates paid on commercial money market accounts, which increased 82 basis points to 2.22% in the current quarter. The total cost of deposits, including noninterest-bearing demand accounts, was 0.92% during the first quarter 2023, compared to 0.53% in the linked quarter.

NIM, on a tax equivalent basis, was 4.71% in the first quarter 2023, an increase of five basis points from the linked quarter and an increase of 143 basis points from the prior year quarter. For the month of March 2023, the loan portfolio yield was 6.40% and the cost of total deposits was 1.04%.

Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

| ($ in thousands) |

Carrying Value |

|

Net Unrealized Loss |

|

Carrying Value |

|

Net Unrealized Loss |

|

Carrying Value |

|

Net Unrealized Loss |

| Available-for-sale (AFS) |

$ |

1,555,109 |

|

|

$ |

(161,572) |

|

|

$ |

1,535,807 |

|

|

$ |

(193,247) |

|

|

$ |

1,392,444 |

|

|

$ |

(99,304) |

|

| Held-to-maturity (HTM) |

720,694 |

|

|

(65,013) |

|

|

709,915 |

|

|

(82,133) |

|

|

541,039 |

|

|

(48,255) |

|

| Total |

$ |

2,275,803 |

|

|

$ |

(226,585) |

|

|

$ |

2,245,722 |

|

|

$ |

(275,380) |

|

|

$ |

1,933,483 |

|

|

$ |

(147,559) |

|

|

|

|

|

|

|

|

|

|

|

|

|

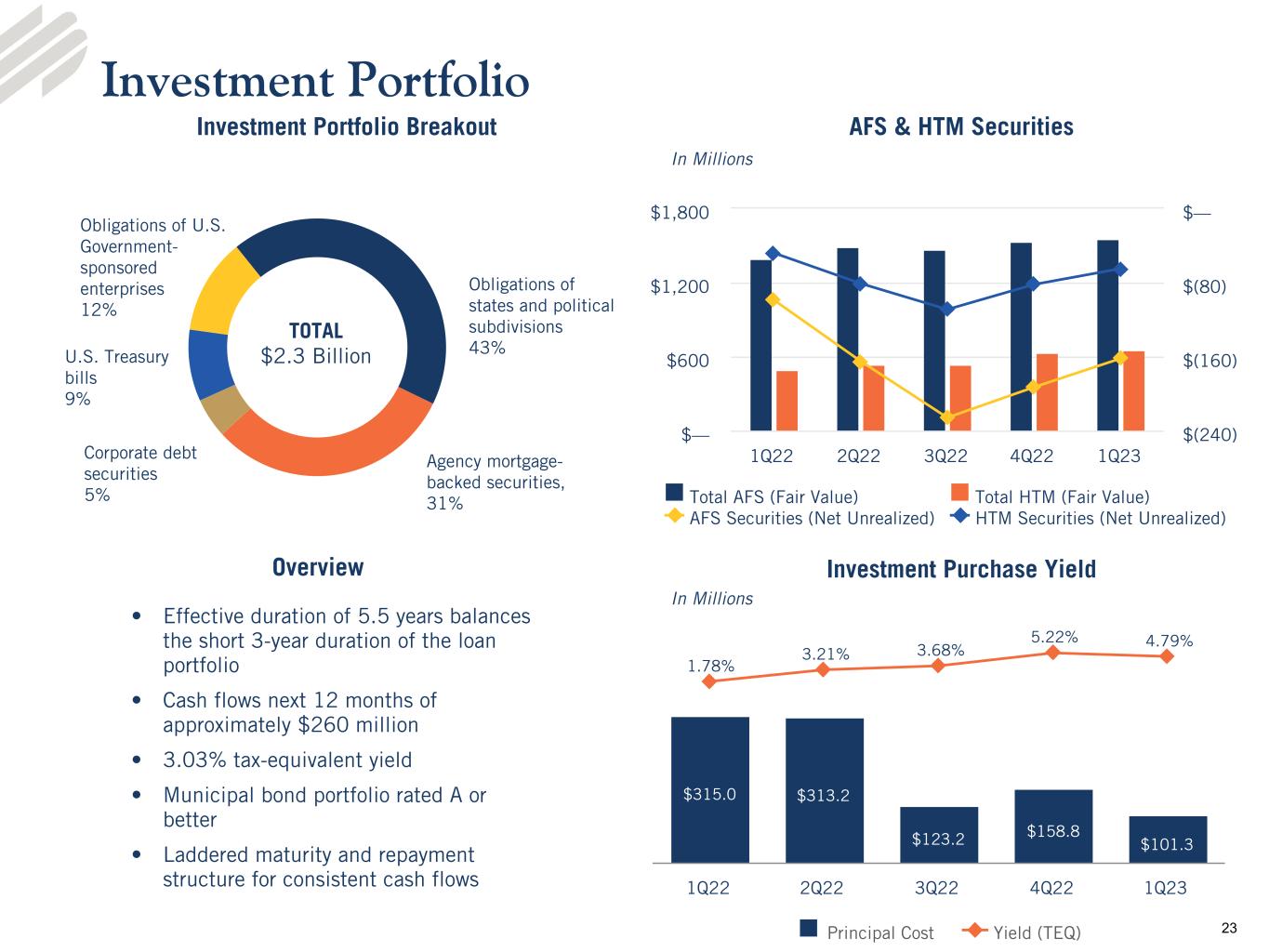

Investment securities totaled $2.3 billion at March 31, 2023, an increase of $30.1 million from the linked quarter. The increase was primarily due to a $31.7 million decrease in the unrealized loss on available-for-sale securities primarily due to a decline in longer-term rates in the quarter. Investment purchases in the quarter had a weighted average, tax equivalent yield of 4.79%. In January 2023, $28.4 million of available-for-sale investment securities with a tax equivalent yield of 4.0% were sold at a net gain of $0.4 million and were reinvested in securities with a 4.5% yield.

The average duration of the investment portfolio was 5.5 years at March 31, 2023. Due to the shorter average duration of the loan portfolio, approximately 3 years, the Company leverages the investment portfolio to lengthen the overall duration of the balance sheet, primarily using high-quality municipal securities. The expected cash flow from pay downs, maturities and interest over the next 12 months is approximately $260 million. Investment securities represented 17% of total assets at the end of the current and linked quarters, which is comparable to the Company’s historical percentage dating back to 2019. The ratio of investments to assets was 14% in the prior year quarter and was lower primarily due to the high level of on-balance-sheet liquidity due to the low rate environment at that time. The tangible common equity to tangible assets ratio adjusted for unrealized losses on held-to-maturity securities2 was 8.4% at March 31, 2023, compared to 7.9% at December 31, 2022.

Loans

The following table presents total loans for the most recent five quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

| C&I |

$ |

2,005,539 |

|

|

$ |

1,904,654 |

|

|

$ |

1,780,677 |

|

|

$ |

1,641,740 |

|

|

$ |

1,438,607 |

|

| CRE investor owned |

2,239,932 |

|

|

2,176,424 |

|

|

2,106,458 |

|

|

1,977,806 |

|

|

1,982,645 |

|

| CRE owner occupied |

1,173,985 |

|

|

1,174,094 |

|

|

1,133,467 |

|

|

1,118,895 |

|

|

1,138,106 |

|

| SBA loans* |

1,315,732 |

|

|

1,312,378 |

|

|

1,269,065 |

|

|

1,284,279 |

|

|

1,249,929 |

|

| Sponsor finance* |

677,529 |

|

|

635,061 |

|

|

650,102 |

|

|

647,180 |

|

|

641,476 |

|

| Life insurance premium financing* |

859,910 |

|

|

817,115 |

|

|

779,606 |

|

|

748,376 |

|

|

695,640 |

|

| Tax credits* |

547,513 |

|

|

559,605 |

|

|

507,681 |

|

|

550,662 |

|

|

518,020 |

|

| SBA PPP loans |

5,438 |

|

|

7,272 |

|

|

13,165 |

|

|

49,175 |

|

|

134,084 |

|

| Residential real estate |

348,726 |

|

|

379,924 |

|

|

381,634 |

|

|

391,867 |

|

|

410,173 |

|

| Construction and land development |

590,509 |

|

|

534,753 |

|

|

513,452 |

|

|

626,577 |

|

|

610,830 |

|

| Other |

247,105 |

|

|

235,858 |

|

|

219,680 |

|

|

232,619 |

|

|

236,563 |

|

| Total loans |

$ |

10,011,918 |

|

|

$ |

9,737,138 |

|

|

$ |

9,354,987 |

|

|

$ |

9,269,176 |

|

|

$ |

9,056,073 |

|

|

|

|

|

|

|

|

|

|

|

| Total loan yield |

6.33 |

% |

|

5.87 |

% |

|

5.10 |

% |

|

4.51 |

% |

|

4.34 |

% |

|

|

|

|

|

|

|

|

|

|

| Variable interest rate loans to total loans |

63 |

% |

|

63 |

% |

|

63 |

% |

|

64 |

% |

|

63 |

% |

|

|

| *Specialty loan category |

|

Loans totaled $10.0 billion at March 31, 2023, increasing $274.8 million compared to the linked quarter. The increase was driven primarily by increases in C&I, CRE investor owned, construction and specialty loans. The increase in specialty loans was primarily in sponsor finance and life insurance. Each of the Company’s geographic regions increased loans during the quarter. Average line utilization was approximately 42% for the quarter ended March 31, 2023, compared to 41% and 40% for the linked and prior year quarters, respectively. The weighted average life of the loan portfolio is approximately 3 years.

Asset Quality

The following table presents the categories of nonperforming assets and related ratios for the most recent five quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

| ($ in thousands) |

March 31,

2023 |

|

December 31,

2022 |

|

September 30,

2022 |

|

June 30,

2022 |

|

March 31,

2022 |

| Nonperforming loans* |

$ |

11,972 |

|

|

$ |

9,981 |

|

|

$ |

18,184 |

|

|

$ |

19,560 |

|

|

$ |

21,160 |

|

| Other |

250 |

|

|

269 |

|

|

269 |

|

|

955 |

|

|

1,459 |

|

| Nonperforming assets* |

$ |

12,222 |

|

|

$ |

10,250 |

|

|

$ |

18,453 |

|

|

$ |

20,515 |

|

|

$ |

22,619 |

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans |

0.12 |

% |

|

0.10 |

% |

|

0.19 |

% |

|

0.21 |

% |

|

0.23 |

% |

| Nonperforming assets to total assets |

0.09 |

% |

|

0.08 |

% |

|

0.14 |

% |

|

0.16 |

% |

|

0.17 |

% |

| Allowance for credit losses to total loans |

1.38 |

% |

|

1.41 |

% |

|

1.50 |

% |

|

1.52 |

% |

|

1.54 |

% |

| Net charge-offs (recoveries) |

$ |

(264) |

|

|

$ |

2,075 |

|

|

$ |

478 |

|

|

$ |

(175) |

|

|

$ |

1,521 |

|

|

|

|

|

|

|

|

|

|

|

| *Guaranteed balances excluded |

$ |

6,835 |

|

|

$ |

6,708 |

|

|

$ |

6,532 |

|

|

$ |

6,063 |

|

|

$ |

3,954 |

|

Nonperforming assets increased $2.0 million during the first quarter 2023 and decreased $10.4 million from the prior year quarter. A net recovery to average loans of one basis point was recognized in the first quarter 2023, compared to nine basis points of net charge-offs in the linked quarter and seven basis points of net charge-offs in the prior year quarter.

The provision for credit losses totaled $4.2 million in the current quarter, compared to $2.1 million in the linked quarter and a benefit of $4.1 million in the prior year quarter. The provision in the current quarter was primarily related to the impairment of an available-for-sale investment security of a failed bank and loan growth. The allowance for credit losses to total loans was 1.38% at March 31, 2023, compared to 1.41% and 1.54% in the linked and prior year quarters, respectively, and is reflective of the trend in credit quality.

Deposits

The following table presents deposits broken out by type for the most recent five quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

| Noninterest-bearing demand accounts |

$ |

4,192,523 |

|

|

$ |

4,642,732 |

|

|

$ |

4,642,539 |

|

|

$ |

4,746,478 |

|

|

$ |

4,881,043 |

|

| Interest-bearing demand accounts |

2,395,901 |

|

|

2,256,295 |

|

|

2,270,898 |

|

|

2,197,957 |

|

|

2,547,482 |

|

| Money market and savings accounts |

3,672,539 |

|

|

3,399,415 |

|

|

3,617,249 |

|

|

3,562,982 |

|

|

3,678,135 |

|

| Brokered certificates of deposit |

369,505 |

|

|

118,968 |

|

|

129,039 |

|

|

129,064 |

|

|

129,017 |

|

| Other certificates of deposit |

524,168 |

|

|

411,740 |

|

|

397,869 |

|

|

456,137 |

|

|

468,458 |

|

| Total deposit portfolio |

$ |

11,154,636 |

|

|

$ |

10,829,150 |

|

|

$ |

11,057,594 |

|

|

$ |

11,092,618 |

|

|

$ |

11,704,135 |

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits to total deposits |

37.6 |

% |

|

42.9 |

% |

|

42.0 |

% |

|

42.8 |

% |

|

41.7 |

% |

| Total costs of deposits |

0.92 |

% |

|

0.53 |

% |

|

0.31 |

% |

|

0.13 |

% |

|

0.10 |

% |

|

Total deposits at March 31, 2023 were $11.2 billion, an increase of $325.5 million from December 31, 2022, and a decrease of $549.5 million from March 31, 2022. The increase from the linked quarter includes $250.5 million in brokered certificates of deposit used for term liquidity purposes in place of FHLB borrowings. The mix of the deposit portfolio shifted from noninterest bearing demand deposits to higher yielding categories in the current quarter primarily due to the competitive interest rate environment. Excluding brokered certificates of deposit, total deposits increased $75.0 million in the current quarter. Reciprocal deposits, which are placed through third party programs to provide FDIC insurance on larger deposit relationships, totaled $486.7 million at March 31, 2023, compared to $205.8 million at December 31, 2022.

Total estimated insured deposits, which includes collateralized deposits, reciprocal accounts and accounts that qualify for pass-through insurance, totaled $7.7 billion at the end of March 31, 2023 compared to $4.9 billion in the linked quarter. The increase in insured deposits was the result of an increase in reciprocal deposits and accounts that qualify for pass-through insurance.

Noninterest Income and Expense

The following tables present a comparative summary of the major components of noninterest income, other income, and noninterest expense for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Linked quarter comparison |

|

Prior year comparison |

|

Quarter ended |

|

Quarter ended |

| ($ in thousands) |

March 31, 2023 |

|

December 31, 2022 |

|

Increase (decrease) |

|

March 31, 2022 |

|

Increase (decrease) |

| Deposit service charges |

4,128 |

|

|

4,463 |

|

|

$ |

(335) |

|

|

(8) |

% |

|

4,163 |

|

|

$ |

(35) |

|

|

(1) |

% |

| Wealth management revenue |

2,516 |

|

|

2,423 |

|

|

93 |

|

|

4 |

% |

|

2,622 |

|

|

(106) |

|

|

(4) |

% |

| Card services revenue |

2,338 |

|

|

2,345 |

|

|

(7) |

|

|

— |

% |

|

3,040 |

|

|

(702) |

|

|

(23) |

% |

| Tax credit income |

1,813 |

|

|

2,389 |

|

|

(576) |

|

|

(24) |

% |

|

2,608 |

|

|

(795) |

|

|

(30) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

6,103 |

|

|

5,253 |

|

|

850 |

|

|

16 |

% |

|

6,208 |

|

|

(105) |

|

|

(2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest income |

$ |

16,898 |

|

|

$ |

16,873 |

|

|

$ |

25 |

|

|

— |

% |

|

$ |

18,641 |

|

|

$ |

(1,743) |

|

|

(9) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest income was $16.9 million for the current quarter, stable with the linked quarter and a decrease of $1.7 million from the prior year quarter. The $1.7 million decrease from the prior year quarter was primarily due to decreases in tax credit income and card services revenue. Lower transaction volumes led to the decrease in tax credit income while the Durbin Amendment cap on debit card income limited card services revenue since July 1, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Linked quarter comparison |

|

Prior year comparison |

|

Quarter ended |

|

Quarter ended |

| ($ in thousands) |

March 31, 2023 |

|

December 31, 2022 |

|

Increase (decrease) |

|

March 31, 2022 |

|

Increase (decrease) |

| BOLI |

$ |

791 |

|

|

$ |

773 |

|

|

$ |

18 |

|

|

2 |

% |

|

$ |

1,034 |

|

|

$ |

(243) |

|

|

(24) |

% |

| Community development investments |

595 |

|

|

2,775 |

|

|

(2,180) |

|

|

(79) |

% |

|

2,166 |

|

|

(1,571) |

|

|

(73) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Private equity fund distribution |

1,749 |

|

|

433 |

|

|

1,316 |

|

|

304 |

% |

|

188 |

|

|

1,561 |

|

|

830 |

% |

| Servicing fees |

512 |

|

|

181 |

|

|

331 |

|

|

183 |

% |

|

658 |

|

|

(146) |

|

|

(22) |

% |

| Swap fees |

250 |

|

|

189 |

|

|

61 |

|

|

32 |

% |

|

1,156 |

|

|

(906) |

|

|

(78) |

% |

| Miscellaneous income |

2,206 |

|

|

902 |

|

|

1,304 |

|

|

145 |

% |

|

1,006 |

|

|

1,200 |

|

|

119 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income |

$ |

6,103 |

|

|

$ |

5,253 |

|

|

$ |

850 |

|

|

16 |

% |

|

$ |

6,208 |

|

|

$ |

(105) |

|

|

(2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community development and private equity distributions included in other income are not consistent sources of income and fluctuate based on distributions from the underlying funds. Servicing fee income may also fluctuate based on prepayment experience and changes to the discount rate used in the valuation of the servicing rights. Swap fee income is generated from customer hedging activities and was higher in the prior year quarter when market rates started to increase. The increase in miscellaneous income from the linked and prior year quarters was primarily due to a gain on the sale of SBA loans and a gain on the sale of investment securities. In the first quarter 2023, SBA loans totaling $8.8 million were sold and $28.4 million of lower-yielding investment securities were sold in January at a gain and the proceeds were reinvested at a higher yield.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Linked quarter comparison |

|

Prior year comparison |

|

Quarter ended |

|

Quarter ended |

| ($ in thousands) |

March 31, 2023 |

|

December 31,

2022 |

|

Increase (decrease) |

|

March 31, 2022 |

|

Increase (decrease) |

| Employee compensation and benefits |

$ |

42,503 |

|

|

$ |

38,175 |

|

|

$ |

4,328 |

|

|

11 |

% |

|

$ |

35,827 |

|

|

$ |

6,676 |

|

|

19 |

% |

| Occupancy |

4,061 |

|

|

4,248 |

|

|

(187) |

|

|

(4) |

% |

|

4,586 |

|

|

(525) |

|

|

(11) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit costs |

12,720 |

|

|

13,256 |

|

|

(536) |

|

|

(4) |

% |

|

4,260 |

|

|

8,460 |

|

|

199 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense |

21,699 |

|

|

21,470 |

|

|

229 |

|

|

1 |

% |

|

18,127 |

|

|

3,572 |

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest expense |

$ |

80,983 |

|

|

$ |

77,149 |

|

|

$ |

3,834 |

|

|

5 |

% |

|

$ |

62,800 |

|

|

$ |

18,183 |

|

|

29 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

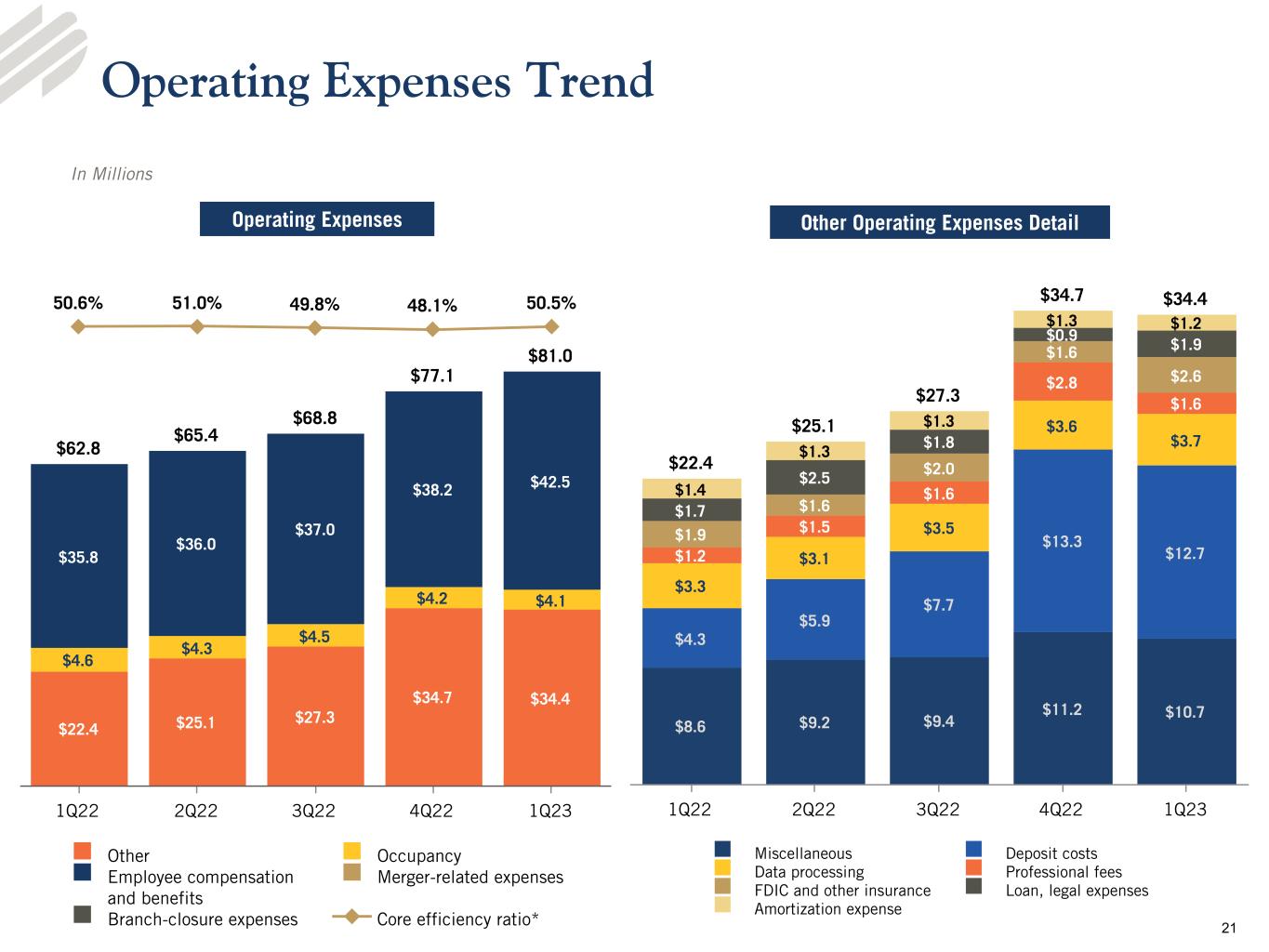

Noninterest expense was $81.0 million for the first quarter 2023, compared to $77.1 million for the linked quarter, and $62.8 million for the prior year quarter. Employee compensation and benefits increased $4.3 million from the linked quarter primarily due to a $3.4 million increase in employer payroll taxes and 401(k) matches that are seasonally higher in the first quarter each year, and a $3.3 million increase in salaries due to annual merit increases that became effective on March 1, 2023 and an increase in the associate base. These increases were partially offset by a $3.8 million decline in variable compensation that is typically higher in the fourth quarter each year. Deposit costs declined slightly from the linked quarter primarily due to higher year-end settlements that occurred in the linked quarter. Deposit costs relate to certain specialized deposit businesses that are impacted by higher interest rates as well as increasing average balances.

The increase in noninterest expense of $18.2 million from the prior year quarter was primarily an increase in the associate base, merit increases throughout 2022 and 2023, and an increase in variable deposit costs.

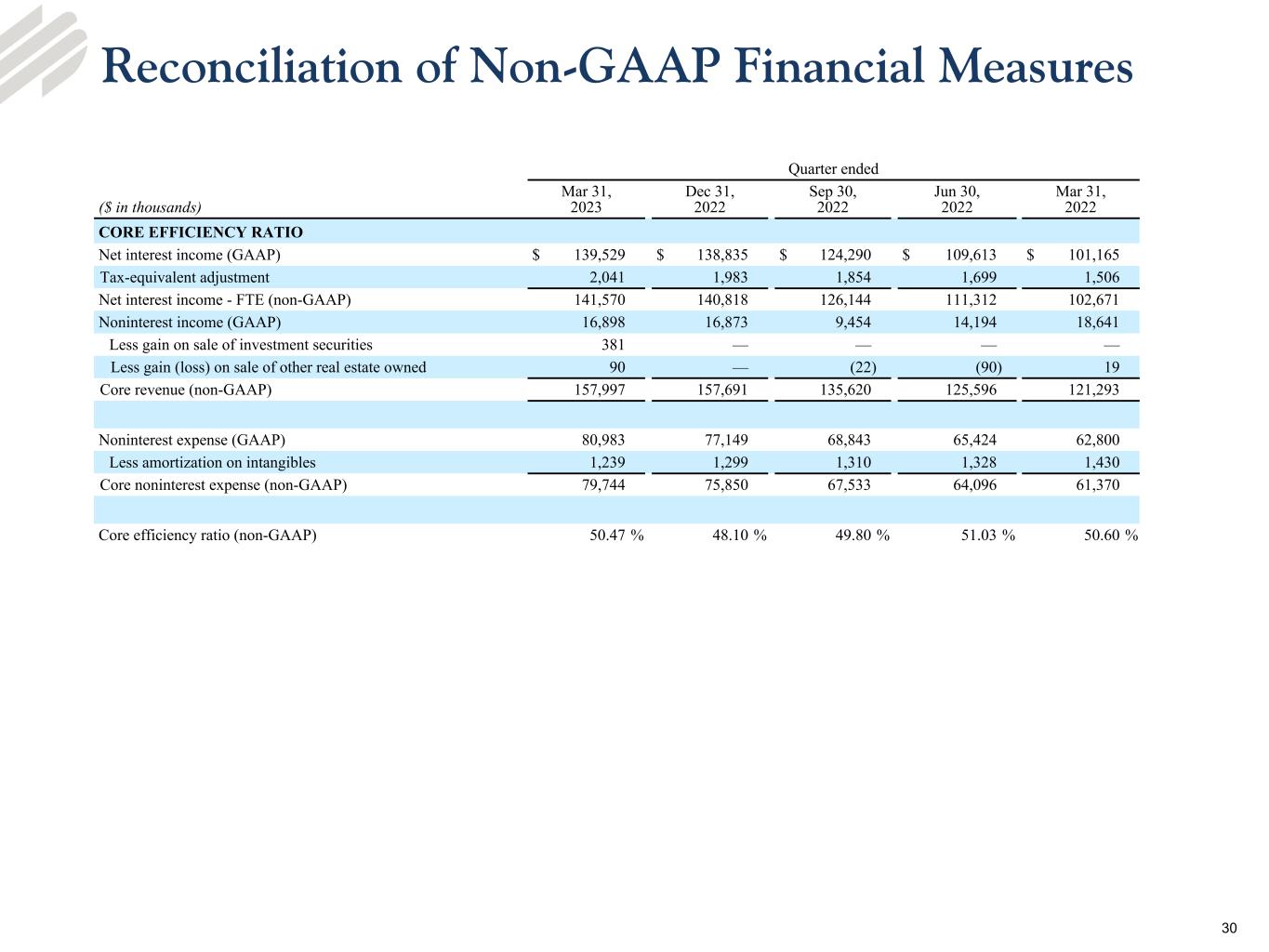

For the first quarter 2023, the Company’s efficiency ratio was 51.8%, compared to 49.6% and 52.4% for the linked quarter and prior year quarter, respectively. The Company’s core efficiency ratio4 was 50.5% for the quarter ended March 31, 2023, compared to 48.1% for the linked quarter and 50.6% for the prior year quarter.

Income Taxes

The Company’s effective tax rate was 22% for each of the current, linked and prior year quarters.

Capital

The following table presents total equity and various EFSC capital ratios for the most recent five quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

| ($ in thousands) |

March 31, 2023* |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

| Shareholders’ equity |

$ |

1,592,820 |

|

|

$ |

1,522,263 |

|

|

$ |

1,446,218 |

|

|

$ |

1,447,412 |

|

|

$ |

1,473,177 |

|

| Total risk-based capital to risk-weighted assets |

14.3 |

% |

|

14.2 |

% |

|

14.2 |

% |

|

14.2 |

% |

|

14.4 |

% |

| Tier 1 capital to risk weighted assets |

12.6 |

% |

|

12.6 |

% |

|

12.6 |

% |

|

12.5 |

% |

|

12.7 |

% |

| Common equity tier 1 capital to risk-weighted assets |

11.2 |

% |

|

11.1 |

% |

|

11.0 |

% |

|

10.9 |

% |

|

11.0 |

% |

| Tangible common equity to tangible assets |

8.8 |

% |

|

8.4 |

% |

|

7.9 |

% |

|

7.8 |

% |

|

7.6 |

% |

| Leverage ratio |

11.1 |

% |

|

10.9 |

% |

|

10.4 |

% |

|

9.8 |

% |

|

9.6 |

% |

*Capital ratios for the current quarter are preliminary and subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review.

Total equity was $1.6 billion at March 31, 2023, an increase of $70.6 million from the linked quarter. The increase was primarily due to current period net income of $55.7 million and a $24.4 million increase in accumulated other comprehensive income, primarily due to a net fair value increase in the Company’s fixed-rate, available-for-sale investment portfolio. These increases were partially offset by common and preferred stock dividends of $10.3 million. The Company’s tangible common book value per share was $30.55 at March 31, 2023, compared to $28.67 and $27.06 in the linked and prior year quarters, respectively.

The Company’s regulatory capital ratios continue to exceed the “well-capitalized” regulatory benchmark. Capital ratios for the current quarter are subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review.

Use of Non-GAAP Financial Measures

The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as tangible common equity, PPNR, ROATCE, PPNR return on average assets (“PPNR ROAA”), core efficiency ratio, the tangible common equity ratio, and tangible book value per common share, in this release that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

The Company considers its tangible common equity, PPNR, ROATCE, PPNR ROAA, core efficiency ratio, the tangible common equity ratio, and tangible book value per common share, collectively “core performance measures,” presented in this earnings release and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures exclude certain other income and expense items, such as merger-related expenses, facilities charges, and the gain or loss on sale of investment securities, that the Company believes to be

4 Core efficiency ratio is a non-GAAP measure. Refer to discussion and reconciliation of this measure in the accompanying financial tables.

8

not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated.

Conference Call and Webcast Information

The Company will host a conference call and webcast at 10:00 a.m. Central Time on Tuesday, April 25, 2023. During the call, management will review the first quarter 2023 results and related matters. This press release as well as a related slide presentation will be accessible on the Company’s website at www.enterprisebank.com under “Investor Relations” prior to the scheduled broadcast of the conference call. The call can be accessed via this same website page, or via telephone at 1-888-550-5279 (Conference ID #7004515). A recorded replay of the conference call will be available on the website approximately two hours after the call’s completion. Visit https://bit.ly/EFSC1Q2023earnings to register. The replay will be available for approximately two weeks following the conference call.

About Enterprise Financial Services Corp

Enterprise Financial Services Corp (Nasdaq: EFSC), with approximately $13.3 billion in assets, is a financial holding company headquartered in Clayton, Missouri. Enterprise Bank & Trust, a Missouri state-chartered trust company with banking powers and a wholly-owned subsidiary of EFSC, operates branch offices in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico, and SBA loan and deposit production offices throughout the country. Enterprise Bank & Trust offers a range of business and personal banking services and wealth management services. Enterprise Trust, a division of Enterprise Bank & Trust, provides financial planning, estate planning, investment management and trust services to businesses, individuals, institutions, retirement plans and non-profit organizations. Additional information is available at www.enterprisebank.com.

Enterprise Financial Services Corp’s common stock is traded on the Nasdaq Stock Market under the symbol “EFSC.” Please visit our website at www.enterprisebank.com to see our regularly posted material information.

Forward-looking Statements

Readers should note that, in addition to the historical information contained herein, this press release contains “forward-looking statements” within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, liquidity, yields and returns, loan diversification and credit management, shareholder value creation and the impact of acquisitions.

Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: the Company’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses and grow the acquired operations, as well as credit risk, changes in the appraised valuation of real estate securing impaired loans, outcomes of litigation and other contingencies, exposure to general and local economic and market conditions, high unemployment rates, higher inflation and its impacts (including U.S. federal government measures to address higher inflation), U.S. fiscal debt, budget and tax matters, and any slowdown in global economic growth, risks associated with rapid increases or decreases in prevailing interest rates, our ability to attract and retain deposits and access to other sources of liquidity, consolidation in the banking industry, competition from banks and other financial institutions, the Company’s ability to attract and retain relationship officers and other key personnel, burdens imposed by federal and state regulation, changes in legislative or regulatory requirements, as well as current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including rules and regulations relating to bank products and financial services, changes in accounting policies and practices or accounting standards, changes in the method of determining LIBOR and the phase out of LIBOR, natural disasters, terrorist activities, war and geopolitical matters (including the war in Ukraine and the imposition of additional sanctions and export controls in connection therewith), or pandemics, including the COVID-19 pandemic, and their effects on economic and business environments in which we operate, including the ongoing disruption to the financial market and other economic activity caused by the continuing COVID-19 pandemic, and those factors and risks referenced from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and the Company’s other filings with the SEC. The Company cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the Company’s results.

For any forward-looking statements made in this press release or in any documents, EFSC claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Readers are cautioned not to place undue reliance on any forward-looking statements. Except to the extent required by applicable law or regulation, EFSC disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made.

For more information contact

Investor Relations: Keene Turner, Executive Vice President and CFO (314) 512-7233

Media: Steve Richardson, Senior Vice President (314) 995-5695

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

| (in thousands, except per share data) |

Mar 31,

2023 |

|

Dec 31,

2022 |

|

Sep 30,

2022 |

|

Jun 30,

2022 |

|

Mar 31,

2022 |

|

|

|

|

| EARNINGS SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

139,529 |

|

|

$ |

138,835 |

|

|

$ |

124,290 |

|

|

$ |

109,613 |

|

|

$ |

101,165 |

|

|

|

|

|

| Provision (benefit) for credit losses |

4,183 |

|

|

2,123 |

|

|

676 |

|

|

658 |

|

|

(4,068) |

|

|

|

|

|

| Noninterest income |

16,898 |

|

|

16,873 |

|

|

9,454 |

|

|

14,194 |

|

|

18,641 |

|

|

|

|

|

| Noninterest expense |

80,983 |

|

|

77,149 |

|

|

68,843 |

|

|

65,424 |

|

|

62,800 |

|

|

|

|

|

| Income before income tax expense |

71,261 |

|

|

76,436 |

|

|

64,225 |

|

|

57,725 |

|

|

61,074 |

|

|

|

|

|

| Income tax expense |

15,523 |

|

|

16,435 |

|

|

14,025 |

|

|

12,576 |

|

|

13,381 |

|

|

|

|

|

| Net income |

55,738 |

|

|

60,001 |

|

|

50,200 |

|

|

45,149 |

|

|

47,693 |

|

|

|

|

|

| Preferred stock dividends |

938 |

|

|

937 |

|

|

937 |

|

|

938 |

|

|

1,229 |

|

|

|

|

|

| Net income available to common shareholders |

$ |

54,800 |

|

|

$ |

59,064 |

|

|

$ |

49,263 |

|

|

$ |

44,211 |

|

|

$ |

46,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share |

$ |

1.46 |

|

|

$ |

1.58 |

|

|

$ |

1.32 |

|

|

$ |

1.19 |

|

|

$ |

1.23 |

|

|

|

|

|

| Return on average assets |

1.72 |

% |

|

1.83 |

% |

|

1.51 |

% |

|

1.34 |

% |

|

1.42 |

% |

|

|

|

|

| Return on average common equity |

14.85 |

% |

|

16.52 |

% |

|

13.74 |

% |

|

12.65 |

% |

|

12.87 |

% |

|

|

|

|

ROATCE1 |

19.93 |

% |

|

22.62 |

% |

|

18.82 |

% |

|

17.44 |

% |

|

17.49 |

% |

|

|

|

|

| Net interest margin (tax equivalent) |

4.71 |

% |

|

4.66 |

% |

|

4.10 |

% |

|

3.55 |

% |

|

3.28 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio |

51.77 |

% |

|

49.55 |

% |

|

51.47 |

% |

|

52.84 |

% |

|

52.42 |

% |

|

|

|

|

Core efficiency ratio1 |

50.47 |

% |

|

48.10 |

% |

|

49.80 |

% |

|

51.03 |

% |

|

50.60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

10,011,918 |

|

|

$ |

9,737,138 |

|

|

$ |

9,354,987 |

|

|

$ |

9,269,176 |

|

|

$ |

9,056,073 |

|

|

|

|

|

| Average loans |

$ |

9,795,045 |

|

|

$ |

9,423,984 |

|

|

$ |

9,230,738 |

|

|

$ |

9,109,131 |

|

|

$ |

9,005,875 |

|

|

|

|

|

| Assets |

$ |

13,325,982 |

|

|

$ |

13,054,172 |

|

|

$ |

12,994,787 |

|

|

$ |

13,084,506 |

|

|

$ |

13,706,769 |

|

|

|

|

|

| Average assets |

$ |

13,131,195 |

|

|

$ |

12,986,568 |

|

|

$ |

13,158,121 |

|

|

$ |

13,528,474 |

|

|

$ |

13,614,003 |

|

|

|

|

|

| Deposits |

$ |

11,154,636 |

|

|

$ |

10,829,150 |

|

|

$ |

11,057,594 |

|

|

$ |

11,092,618 |

|

|

$ |

11,704,135 |

|

|

|

|

|

| Average deposits |

$ |

10,913,489 |

|

|

$ |

11,002,614 |

|

|

$ |

11,154,895 |

|

|

$ |

11,530,432 |

|

|

$ |

11,494,212 |

|

|

|

|

|

| Period end common shares outstanding |

37,311 |

|

|

37,253 |

|

|

37,223 |

|

|

37,206 |

|

|

37,516 |

|

|

|

|

|

| Dividends per common share |

$ |

0.25 |

|

|

$ |

0.24 |

|

|

$ |

0.23 |

|

|

$ |

0.22 |

|

|

$ |

0.21 |

|

|

|

|

|

| Tangible book value per common share |

$ |

30.55 |

|

|

$ |

28.67 |

|

|

$ |

26.62 |

|

|

$ |

26.63 |

|

|

$ |

27.06 |

|

|

|

|

|

Tangible common equity to tangible assets1 |

8.81 |

% |

|

8.43 |

% |

|

7.86 |

% |

|

7.80 |

% |

|

7.62 |

% |

|

|

|

|

| Total risk-based capital to risk-weighted assets |

14.3 |

% |

|

14.2 |

% |

|

14.2 |

% |

|

14.2 |

% |

|

14.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Refer to Reconciliations of Non-GAAP Financial Measures table for a reconciliation of these measures to GAAP. |

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

|

|

| ($ in thousands, except per share data) |

Mar 31,

2023 |

|

Dec 31,

2022 |

|

Sep 30,

2022 |

|

Jun 30,

2022 |

|

Mar 31,

2022 |

|

|

|

|

| INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

$ |

169,033 |

|

|

$ |

156,737 |

|

|

$ |

135,695 |

|

|

$ |

116,069 |

|

|

$ |

106,581 |

|

|

|

|

|

| Interest expense |

29,504 |

|

|

17,902 |

|

|

11,405 |

|

|

6,456 |

|

|

5,416 |

|

|

|

|

|

| Net interest income |

139,529 |

|

|

138,835 |

|

|

124,290 |

|

|

109,613 |

|

|

101,165 |

|

|

|

|

|

| Provision (benefit) for credit losses |

4,183 |

|

|

2,123 |

|

|

676 |

|

|

658 |

|

|

(4,068) |

|

|

|

|

|

| Net interest income after provision (benefit) for credit losses |

135,346 |

|

|

136,712 |

|

|

123,614 |

|

|

108,955 |

|

|

105,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit service charges |

4,128 |

|

|

4,463 |

|

|

4,951 |

|

|

4,749 |

|

|

4,163 |

|

|

|

|

|

| Wealth management revenue |

2,516 |

|

|

2,423 |

|

|

2,432 |

|

|

2,533 |

|

|

2,622 |

|

|

|

|

|

| Card services revenue |

2,338 |

|

|

2,345 |

|

|

2,652 |

|

|

3,514 |

|

|

3,040 |

|

|

|

|

|

| Tax credit income (loss) |

1,813 |

|

|

2,389 |

|

|

(3,625) |

|

|

1,186 |

|

|

2,608 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

6,103 |

|

|

5,253 |

|

|

3,044 |

|

|

2,212 |

|

|

6,208 |

|

|

|

|

|

| Total noninterest income |

16,898 |

|

|

16,873 |

|

|

9,454 |

|

|

14,194 |

|

|

18,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employee compensation and benefits |

42,503 |

|

|

38,175 |

|

|

36,999 |

|

|

36,028 |

|

|

35,827 |

|

|

|

|

|

| Occupancy |

4,061 |

|

|

4,248 |

|

|

4,497 |

|

|

4,309 |

|

|

4,586 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit costs |

12,720 |

|

|

13,256 |

|

|

7,661 |

|

|

5,905 |

|

|

4,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense |

21,699 |

|

|

21,470 |

|

|

19,686 |

|

|

19,182 |

|

|

18,127 |

|

|

|

|

|

| Total noninterest expense |

80,983 |

|

|

77,149 |

|

|

68,843 |

|

|

65,424 |

|

|

62,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

71,261 |

|

|

76,436 |

|

|

64,225 |

|

|

57,725 |

|

|

61,074 |

|

|

|

|

|

| Income tax expense |

15,523 |

|

|

16,435 |

|

|

14,025 |

|

|

12,576 |

|

|

13,381 |

|

|

|

|

|

| Net income |

$ |

55,738 |

|

|

$ |

60,001 |

|

|

$ |

50,200 |

|

|

$ |

45,149 |

|

|

$ |

47,693 |

|

|

|

|

|

| Preferred stock dividends |

938 |

|

|

937 |

|

|

937 |

|

|

938 |

|

|

1,229 |

|

|

|

|

|

| Net income available to common shareholders |

$ |

54,800 |

|

|

$ |

59,064 |

|

|

$ |

49,263 |

|

|

$ |

44,211 |

|

|

$ |

46,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

$ |

1.47 |

|

|

$ |

1.59 |

|

|

$ |

1.32 |

|

|

$ |

1.19 |

|

|

$ |

1.23 |

|

|

|

|

|

| Diluted earnings per common share |

$ |

1.46 |

|

|

$ |

1.58 |

|

|

$ |

1.32 |

|

|

$ |

1.19 |

|

|

$ |

1.23 |

|

|

|

|

|

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended |

| ($ in thousands) |

Mar 31,

2023 |

|

Dec 31,

2022 |

|

Sep 30,

2022 |

|

Jun 30,

2022 |

|

Mar 31,

2022 |

| BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |