00010235122024FYT3FALSE0.50.25xbrli:sharesiso4217:ZARiso4217:ZARxbrli:sharesxbrli:pureiso4217:USDutr:Rateutr:Ydrd:votedrd:legalProceedingdrd:summonsdrd:respondentiso4217:ZARutr:kgutr:l00010235122023-07-012024-06-300001023512dei:BusinessContactMember2023-07-012024-06-300001023512drd:AmericanDepositarySharesMember2023-07-012024-06-300001023512ifrs-full:OrdinarySharesMember2023-07-012024-06-3000010235122024-06-3000010235122022-07-012023-06-3000010235122021-07-012022-06-3000010235122023-06-300001023512ifrs-full:IssuedCapitalMember2021-06-300001023512ifrs-full:RetainedEarningsMember2021-06-3000010235122021-06-300001023512ifrs-full:RetainedEarningsMember2021-07-012022-06-300001023512ifrs-full:IssuedCapitalMember2021-07-012022-06-300001023512ifrs-full:IssuedCapitalMember2022-06-300001023512ifrs-full:RetainedEarningsMember2022-06-3000010235122022-06-300001023512ifrs-full:RetainedEarningsMember2022-07-012023-06-300001023512ifrs-full:IssuedCapitalMember2022-07-012023-06-300001023512ifrs-full:IssuedCapitalMember2023-06-300001023512ifrs-full:RetainedEarningsMember2023-06-300001023512ifrs-full:RetainedEarningsMember2023-07-012024-06-300001023512ifrs-full:IssuedCapitalMember2023-07-012024-06-300001023512ifrs-full:IssuedCapitalMember2024-06-300001023512ifrs-full:RetainedEarningsMember2024-06-300001023512ifrs-full:CommodityPriceRiskMember2024-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CommodityPriceRiskMember2023-07-012024-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CommodityPriceRiskMember2022-07-012023-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CommodityPriceRiskMember2021-07-012022-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CommodityPriceRiskMember2023-07-012024-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CommodityPriceRiskMember2022-07-012023-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CommodityPriceRiskMember2021-07-012022-06-300001023512ifrs-full:CurrencyRiskMember2024-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CurrencyRiskMember2023-07-012024-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CurrencyRiskMember2022-07-012023-06-300001023512ifrs-full:TopOfRangeMemberifrs-full:CurrencyRiskMember2021-07-012022-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CurrencyRiskMember2023-07-012024-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CurrencyRiskMember2022-07-012023-06-300001023512ifrs-full:BottomOfRangeMemberifrs-full:CurrencyRiskMember2021-07-012022-06-300001023512drd:RandRefineryProprietaryLimitedMemberdrd:SibanyeStillwaterMember2024-06-300001023512drd:SupplyOfWaterAndElectricityMemberdrd:SibanyeStillwaterMember2023-07-012024-06-300001023512drd:SupplyOfWaterAndElectricityMemberdrd:SibanyeStillwaterMember2022-07-012023-06-300001023512drd:SupplyOfWaterAndElectricityMemberdrd:SibanyeStillwaterMember2021-07-012022-06-300001023512drd:GoldSmeltingAndRelatedChargesMemberdrd:SibanyeStillwaterMember2023-07-012024-06-300001023512drd:GoldSmeltingAndRelatedChargesMemberdrd:SibanyeStillwaterMember2022-07-012023-06-300001023512drd:GoldSmeltingAndRelatedChargesMemberdrd:SibanyeStillwaterMember2021-07-012022-06-300001023512drd:OtherChargesRelatedPartiesMemberdrd:SibanyeStillwaterMember2023-07-012024-06-300001023512drd:OtherChargesRelatedPartiesMemberdrd:SibanyeStillwaterMember2022-07-012023-06-300001023512drd:OtherChargesRelatedPartiesMemberdrd:SibanyeStillwaterMember2021-07-012022-06-300001023512drd:GoldRefiningAndRelatedChargesMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2023-07-012024-06-300001023512drd:GoldRefiningAndRelatedChargesMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2022-07-012023-06-300001023512drd:GoldRefiningAndRelatedChargesMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2021-07-012022-06-300001023512drd:SibanyeStillwaterMember2022-07-012023-06-300001023512drd:ErgoOperationsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2023-07-012024-06-300001023512drd:ErgoOperationsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2022-07-012023-06-300001023512drd:ErgoOperationsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2021-07-012022-06-300001023512drd:ErgoOperationsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2023-07-012024-06-300001023512drd:ErgoOperationsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2022-07-012023-06-300001023512drd:ErgoOperationsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2021-07-012022-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2023-07-012024-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2022-07-012023-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:BottomOfRangeMemberifrs-full:MiningAssetsMember2021-07-012022-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2023-07-012024-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2022-07-012023-06-300001023512drd:FarWestGoldRecoveriesProprietaryLimitedMiningAssetsMemberifrs-full:TopOfRangeMemberifrs-full:MiningAssetsMember2021-07-012022-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:GrossCarryingAmountMember2024-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:GrossCarryingAmountMember2024-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:GrossCarryingAmountMember2024-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:GrossCarryingAmountMember2024-06-300001023512ifrs-full:GrossCarryingAmountMember2024-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:GrossCarryingAmountMember2023-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:GrossCarryingAmountMember2023-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:GrossCarryingAmountMember2023-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:GrossCarryingAmountMember2023-06-300001023512ifrs-full:GrossCarryingAmountMember2023-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:GrossCarryingAmountMember2023-07-012024-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:GrossCarryingAmountMember2023-07-012024-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:GrossCarryingAmountMember2023-07-012024-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:GrossCarryingAmountMember2023-07-012024-06-300001023512ifrs-full:GrossCarryingAmountMember2023-07-012024-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2024-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2024-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2024-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2024-06-300001023512ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2024-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-06-300001023512ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-07-012024-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-07-012024-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-07-012024-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-07-012024-06-300001023512ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2023-07-012024-06-300001023512ifrs-full:MiningAssetsMember2024-06-300001023512drd:MinePropertyAndDevelopmentMember2024-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMember2024-06-300001023512drd:CapitalWorkInProgressMember2024-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberifrs-full:MiningAssetsMember2024-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberdrd:MinePropertyAndDevelopmentMember2024-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberifrs-full:ExplorationAndEvaluationAssetsMember2024-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberdrd:CapitalWorkInProgressMember2024-06-300001023512drd:PropertyPlantAndEquipmentOwnedMember2024-06-300001023512ifrs-full:RightofuseAssetsMemberifrs-full:MiningAssetsMember2024-06-300001023512ifrs-full:RightofuseAssetsMemberdrd:MinePropertyAndDevelopmentMember2024-06-300001023512ifrs-full:RightofuseAssetsMemberifrs-full:ExplorationAndEvaluationAssetsMember2024-06-300001023512ifrs-full:RightofuseAssetsMemberdrd:CapitalWorkInProgressMember2024-06-300001023512ifrs-full:RightofuseAssetsMember2024-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:GrossCarryingAmountMember2022-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:GrossCarryingAmountMember2022-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:GrossCarryingAmountMember2022-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:GrossCarryingAmountMember2022-06-300001023512ifrs-full:GrossCarryingAmountMember2022-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:GrossCarryingAmountMember2022-07-012023-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:GrossCarryingAmountMember2022-07-012023-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:GrossCarryingAmountMember2022-07-012023-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:GrossCarryingAmountMember2022-07-012023-06-300001023512ifrs-full:GrossCarryingAmountMember2022-07-012023-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-06-300001023512ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-06-300001023512ifrs-full:MiningAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-07-012023-06-300001023512drd:MinePropertyAndDevelopmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-07-012023-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-07-012023-06-300001023512drd:CapitalWorkInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-07-012023-06-300001023512ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-07-012023-06-300001023512ifrs-full:MiningAssetsMember2023-06-300001023512drd:MinePropertyAndDevelopmentMember2023-06-300001023512ifrs-full:ExplorationAndEvaluationAssetsMember2023-06-300001023512drd:CapitalWorkInProgressMember2023-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberifrs-full:MiningAssetsMember2023-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberdrd:MinePropertyAndDevelopmentMember2023-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberifrs-full:ExplorationAndEvaluationAssetsMember2023-06-300001023512drd:PropertyPlantAndEquipmentOwnedMemberdrd:CapitalWorkInProgressMember2023-06-300001023512drd:PropertyPlantAndEquipmentOwnedMember2023-06-300001023512ifrs-full:RightofuseAssetsMemberifrs-full:MiningAssetsMember2023-06-300001023512ifrs-full:RightofuseAssetsMemberdrd:MinePropertyAndDevelopmentMember2023-06-300001023512ifrs-full:RightofuseAssetsMemberifrs-full:ExplorationAndEvaluationAssetsMember2023-06-300001023512ifrs-full:RightofuseAssetsMemberdrd:CapitalWorkInProgressMember2023-06-300001023512ifrs-full:RightofuseAssetsMember2023-06-300001023512drd:ErgoSolarPowerPlantMember2024-06-300001023512drd:ErgoSolarPowerPlantMember2023-06-300001023512drd:FWGRRTSFConstructionMember2024-06-300001023512drd:FWGRRTSFConstructionMember2023-06-300001023512ifrs-full:NotLaterThanOneYearMember2024-06-300001023512ifrs-full:NotLaterThanOneYearMember2023-06-300001023512ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2024-06-300001023512ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2023-06-300001023512ifrs-full:LaterThanFiveYearsMember2024-06-300001023512ifrs-full:LaterThanFiveYearsMember2023-06-300001023512drd:ProvisionForDecommissioningCostsMember2023-07-012024-06-300001023512drd:ProvisionForDecommissioningCostsMember2022-07-012023-06-300001023512drd:ProvisionForRestorationCostsMember2023-07-012024-06-300001023512drd:ProvisionForRestorationCostsMember2022-07-012023-06-300001023512ifrs-full:GuaranteesMember2024-06-300001023512ifrs-full:GuaranteesMember2023-06-300001023512drd:EnvironmentalRehabilitationMember2024-06-300001023512drd:EnvironmentalRehabilitationMember2023-06-300001023512drd:DirectorsAndOfficersInsuranceMember2024-06-300001023512drd:DirectorsAndOfficersInsuranceMember2023-06-300001023512drd:OtherFundsMember2024-06-300001023512drd:OtherFundsMember2023-06-300001023512drd:InvestmentsInObligationFundMemberifrs-full:InterestRateRiskMember2023-07-012024-06-300001023512drd:InvestmentsInObligationFundMemberifrs-full:InterestRateRiskMember2022-07-012023-06-300001023512ifrs-full:BottomOfRangeMember2023-07-012024-06-300001023512ifrs-full:TopOfRangeMember2023-07-012024-06-300001023512ifrs-full:ContingentLiabilityForDecommissioningRestorationAndRehabilitationCostsMember2024-06-300001023512ifrs-full:OtherContingentLiabilitiesMember2024-06-300001023512drd:CashAndCashEquivalents1Memberifrs-full:InterestRateRiskMember2023-07-012024-06-300001023512drd:CashAndCashEquivalents1Memberifrs-full:InterestRateRiskMember2022-07-012023-06-300001023512drd:ForeignDenominatedMember2024-06-300001023512drd:ForeignDenominatedMember2023-06-300001023512drd:StrengtheningOfTheRandAgainstTheUSDollarMember2023-07-012024-06-300001023512drd:StrengtheningOfTheRandAgainstTheUSDollarMember2022-07-012023-06-300001023512drd:WeakeningOfTheRandAgainstTheUSDollarMember2023-07-012024-06-300001023512drd:WeakeningOfTheRandAgainstTheUSDollarMember2022-07-012023-06-300001023512ifrs-full:AccumulatedImpairmentMember2024-06-300001023512ifrs-full:AccumulatedImpairmentMember2023-06-300001023512ifrs-full:FinancialInstrumentsNotCreditimpairedMember2024-06-300001023512ifrs-full:FinancialInstrumentsCreditimpairedMember2024-06-300001023512ifrs-full:FinancialInstrumentsNotCreditimpairedMember2023-06-300001023512ifrs-full:FinancialInstrumentsCreditimpairedMember2023-06-300001023512ifrs-full:FinancialInstrumentsNotCreditimpairedMemberifrs-full:AccumulatedImpairmentMember2024-06-300001023512ifrs-full:FinancialInstrumentsNotCreditimpairedMemberifrs-full:AccumulatedImpairmentMember2023-06-300001023512ifrs-full:AccumulatedImpairmentMember2022-06-300001023512ifrs-full:AccumulatedImpairmentMember2023-07-012024-06-300001023512ifrs-full:AccumulatedImpairmentMember2022-07-012023-06-300001023512drd:SibanyeStillwaterMember2024-06-300001023512drd:SibanyeStillwaterMember2023-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2023-06-300001023512drd:ErgoOperationsMember2023-07-012024-06-300001023512drd:ErgoOperationsMember2022-07-012023-06-300001023512drd:FwgrMember2023-07-012024-06-300001023512drd:FwgrMember2022-07-012023-06-300001023512drd:ErgoOperationsMember2021-07-012022-06-300001023512drd:FwgrMember2021-07-012022-06-3000010235122020-07-012021-06-300001023512ifrs-full:PropertyPlantAndEquipmentMember2024-06-300001023512ifrs-full:PropertyPlantAndEquipmentMember2023-06-300001023512ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2024-06-300001023512ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2023-06-300001023512drd:InvestmentsTemporaryDifferenceMember2024-06-300001023512drd:InvestmentsTemporaryDifferenceMember2023-06-300001023512ifrs-full:OtherProvisionsMember2024-06-300001023512ifrs-full:OtherProvisionsMember2023-06-300001023512ifrs-full:OtherTemporaryDifferencesMember2024-06-300001023512ifrs-full:OtherTemporaryDifferencesMember2023-06-300001023512drd:EstimatedTaxLossesMember2024-06-300001023512drd:EstimatedTaxLossesMember2023-06-300001023512drd:EstimatedTaxLossesCapitalNatureMember2024-06-300001023512drd:EstimatedTaxLossesCapitalNatureMember2023-06-300001023512drd:UnredeemedCapitalExpenditureMember2024-06-300001023512drd:UnredeemedCapitalExpenditureMember2023-06-300001023512drd:ConditionalSharesMember2023-06-300001023512drd:ConditionalSharesMember2022-06-300001023512drd:ConditionalSharesMember2022-07-012023-06-300001023512drd:ConditionalSharesMember2023-07-012024-06-300001023512ifrs-full:TreasurySharesMemberdrd:ErgoMiningOperationsProprietaryLimitedMember2023-07-012024-06-300001023512ifrs-full:TreasurySharesMemberdrd:ErgoMiningOperationsProprietaryLimitedMember2022-07-012023-06-300001023512drd:ConditionalSharesMember2024-06-300001023512drd:December22022Memberdrd:ConditionalSharesMember2024-06-300001023512drd:December22022Memberdrd:ConditionalSharesMember2023-06-300001023512drd:October222023Memberdrd:ConditionalSharesMember2024-06-300001023512drd:October222023Memberdrd:ConditionalSharesMember2023-06-300001023512drd:October202024Memberdrd:ConditionalSharesMember2024-06-300001023512drd:October202024Memberdrd:ConditionalSharesMember2023-06-300001023512drd:October192025Memberdrd:ConditionalSharesMember2024-06-300001023512drd:October192025Memberdrd:ConditionalSharesMember2023-06-300001023512srt:ScenarioForecastMember2025-10-192025-10-190001023512srt:ScenarioForecastMember2024-10-202024-10-200001023512srt:ScenarioForecastMember2023-10-262023-10-260001023512drd:NedbankGBFMember2024-06-300001023512drd:NedbankRevolvingCreditFacilityWithAccordionOptionMember2024-06-300001023512drd:NedbankGBFESKOMGuaranteeMember2024-06-300001023512drd:StellarEnergySolutionsSPVMember2024-06-300001023512ifrs-full:TopOfRangeMember2024-06-300001023512ifrs-full:BottomOfRangeMember2024-06-300001023512ifrs-full:OrdinarySharesMember2024-06-300001023512ifrs-full:OrdinarySharesMember2023-06-300001023512ifrs-full:PreferenceSharesMember2024-06-300001023512ifrs-full:PreferenceSharesMember2023-06-300001023512ifrs-full:PreferenceSharesMember2022-06-300001023512ifrs-full:OrdinarySharesMember2022-06-300001023512ifrs-full:TreasurySharesMember2024-06-300001023512ifrs-full:TreasurySharesMember2023-06-300001023512ifrs-full:TreasurySharesMember2022-06-300001023512ifrs-full:TreasurySharesMemberdrd:ErgoMiningOperationsProprietaryLimitedMember2021-07-012022-06-300001023512ifrs-full:MajorOrdinaryShareTransactionsMember2023-07-012024-06-300001023512drd:ErgoOperationsMemberifrs-full:OperatingSegmentsMember2023-07-012024-06-300001023512drd:FwgrMemberifrs-full:OperatingSegmentsMember2023-07-012024-06-300001023512ifrs-full:MaterialReconcilingItemsMember2023-07-012024-06-300001023512drd:ErgoOperationsMemberifrs-full:OperatingSegmentsMember2022-07-012023-06-300001023512drd:FwgrMemberifrs-full:OperatingSegmentsMember2022-07-012023-06-300001023512ifrs-full:MaterialReconcilingItemsMember2022-07-012023-06-300001023512drd:ErgoOperationsMemberifrs-full:OperatingSegmentsMember2021-07-012022-06-300001023512drd:FwgrMemberifrs-full:OperatingSegmentsMember2021-07-012022-06-300001023512ifrs-full:MaterialReconcilingItemsMember2021-07-012022-06-3000010235122014-12-012014-12-310001023512drd:SummonFirstMember2024-06-300001023512drd:SummonSecondMember2024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:Level3OfFairValueHierarchyMember2024-06-300001023512drd:WestWitsMiningLimitedWWMMemberifrs-full:Level1OfFairValueHierarchyMember2024-06-300001023512drd:WestWitsMiningLimitedWWMMemberifrs-full:BottomOfRangeMemberifrs-full:Level1OfFairValueHierarchyMember2024-06-300001023512drd:WestWitsMiningLimitedWWMMemberifrs-full:Level1OfFairValueHierarchyMember2023-06-300001023512ifrs-full:Level1OfFairValueHierarchyMember2024-06-300001023512ifrs-full:Level1OfFairValueHierarchyMember2023-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:Level3OfFairValueHierarchyMember2023-06-300001023512drd:RandmutualassurancecompanylimitedMemberifrs-full:Level3OfFairValueHierarchyMember2024-06-300001023512drd:RandmutualassurancecompanylimitedMemberifrs-full:Level3OfFairValueHierarchyMember2023-06-300001023512drd:Guardriskinsurancecompanylimitedcellcaptivea170Memberifrs-full:Level3OfFairValueHierarchyMember2024-06-300001023512drd:Guardriskinsurancecompanylimitedcellcaptivea170Memberifrs-full:Level3OfFairValueHierarchyMember2023-06-300001023512drd:ChamberOfMinesBuildingCompanyProprietaryLimitedMemberifrs-full:Level3OfFairValueHierarchyMember2024-06-300001023512drd:ChamberOfMinesBuildingCompanyProprietaryLimitedMemberifrs-full:Level3OfFairValueHierarchyMember2023-06-300001023512ifrs-full:Level3OfFairValueHierarchyMember2024-06-300001023512ifrs-full:Level3OfFairValueHierarchyMember2023-06-300001023512drd:WestWitsMiningLimitedWWMMember2023-07-012024-06-300001023512drd:WestWitsMiningLimitedWWMMember2022-07-012023-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:AtFairValueMember2023-07-012024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:AtFairValueMember2022-07-012023-06-300001023512drd:RandmutualassurancecompanylimitedMember2023-07-012024-06-300001023512drd:RandmutualassurancecompanylimitedMember2022-07-012023-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2023-07-012024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2022-07-012023-06-300001023512drd:WestWitsMiningLimitedWWMMemberifrs-full:TopOfRangeMemberifrs-full:Level1OfFairValueHierarchyMember2024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:AtFairValueMember2023-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:AtFairValueMember2022-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMemberifrs-full:AtFairValueMember2024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2023-07-012024-06-300001023512drd:RandRefineryProprietaryLimitedRandRefineryMember2022-07-012023-06-300001023512drd:TerminalGrowthRateMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512drd:TerminalGrowthRateMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2023-06-300001023512ifrs-full:WeightedAverageCostOfCapitalMeasurementInputMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512ifrs-full:WeightedAverageCostOfCapitalMeasurementInputMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2023-06-300001023512drd:InvestmentInPrestigeBullionMemberdrd:DiscountPeriodMeasurementInputMember2024-06-300001023512drd:InvestmentInPrestigeBullionMemberdrd:DiscountPeriodMeasurementInputMember2023-06-300001023512drd:InvestmentInPrestigeBullionMemberdrd:CostOfEquityRateMeasurementInputMember2024-06-300001023512drd:InvestmentInPrestigeBullionMemberdrd:CostOfEquityRateMeasurementInputMember2023-06-300001023512drd:OperatingCostsMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512drd:MinorityDiscountMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512drd:MarketabilityDiscountMemberdrd:RandRefineryProprietaryLimitedRandRefineryMember2024-06-300001023512drd:InvestmentInPrestigeBullionMemberdrd:PrestigeBullionDividendForecastMember2024-06-300001023512ifrs-full:OtherEnvironmentRelatedContingentLiabilityMember2024-06-300001023512drd:EkurhuleniMetropolitanMunicipalityElectricityTariffDisputeMember2024-06-300001023512drd:BGMDamageClaimFirstMember2024-06-300001023512drd:BGMDamageClaimSecondMember2024-06-300001023512ifrs-full:MajorOrdinaryShareTransactionsMember2023-08-232023-08-230001023512ifrs-full:MajorOrdinaryShareTransactionsMember2023-09-182023-09-180001023512drd:ConditionalSharesMemberifrs-full:MajorOrdinaryShareTransactionsMember2023-10-250001023512drd:DJPretoriusMemberdrd:ConditionalSharesMemberifrs-full:MajorOrdinaryShareTransactionsMember2023-10-250001023512drd:AJDavelMemberdrd:ConditionalSharesMemberifrs-full:MajorOrdinaryShareTransactionsMember2023-10-250001023512drd:WJSchoemanMemberdrd:ConditionalSharesMemberifrs-full:MajorOrdinaryShareTransactionsMember2023-10-25

|

|

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

WASHINGTON, D.C. 20549

FORM 20-F

|

|

|

|

|

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2024 |

OR |

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-28800

DRDGOLD LIMITED

(Exact name of Registrant as specified in its charter and translation of Registrant's name into English)

|

|

|

|

REPUBLIC OF SOUTH AFRICA

(Jurisdiction of incorporation or organization)

|

|

Constantia Office Park Cnr 14th Avenue and Hendrik Potgieter Road, Cycad House, Building 17, Ground Floor, Weltevreden Park, 1709, South Africa

(Address of principal executive offices)

Riaan Davel, Chief Financial Officer, Tel. no.+27 11 470 2600, Email riaan.davel@drdgold.com

Mpho Mashatola, Group Financial Manager Tel. no. +27 11 470 2600, Email mpho.mashatola@drdgold.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

|

Securities registered or to be registered pursuant to Section 12(b) of the Act

|

|

|

|

|

|

|

|

|

| Title of each class: |

Trading symbol |

Name of each exchange on which registered: |

American Depositary Shares, each representing ten ordinary shares |

DRD |

New York Stock Exchange |

Ordinary shares |

|

New York Stock Exchange* |

* Not for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. 864,588,711 ordinary shares of no par value outstanding as of June 30, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐No ☑

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☑

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing. U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☑ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

|

|

|

|

|

|

|

|

|

| TABLE OF CONTENTS |

|

|

Page |

| PART I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TABLE OF CONTENTS |

|

|

Page |

| PART II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PART III |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparation of Financial Information

We are a South African company and currently all our operations are located in South Africa. Accordingly, our books of account are maintained in South African Rand. Our financial statements included in our corporate filings are prepared in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB).

Our consolidated financial statements included in this Annual Report are prepared in accordance with IFRS as issued by the IASB. All financial information in this Annual Report, except as otherwise noted is prepared in accordance with IFRS as issued by the IASB.

We present our financial information in rand, which is our presentation and reporting currency. All references to “dollars” or “$” herein are to United States Dollars and references to “rand” or “R” are to South African rands. Solely for your convenience, this Annual Report contains translations of certain rand amounts into dollars at specified rates. These rand amounts do not represent actual dollar amounts, nor could they necessarily have been converted into dollars at the rates indicated. Unless otherwise indicated, rand amounts have been translated into dollars at the rate of R18.19 per $1.00, the year end exchange rate on June 30, 2024.

In this Annual Report, we present certain non-IFRS financial measures including "Adjusted EBITDA", "cash operating costs", “cash operating costs per kilogram”, "all-in sustaining costs", “all-in sustaining costs per kilogram”, "all-in costs", “all-in costs per kilogram”, "growth capital expenditure" and "sustaining capital expenditure". The non-IFRS measures "cash operating costs", “cash operating costs per kilogram”, "all-in sustaining costs", “all-in sustaining costs per kilogram”, "all-in costs" and “all-in costs per kilogram” have been determined using industry guidelines promulgated by the World Gold Council, and are used to determine costs associated with producing gold, cash generating capacities of the mines and to monitor the performance of our mining operations. An investor should not consider these items in isolation or as alternatives to, operating costs, cash generated from operating activities, profit/(loss) for the year or any other measure of financial performance presented in accordance with IFRS or as an indicator of our performance. While the World Gold Council has provided definitions for the calculation of these measures, the calculation of cash operating costs per kilogram, all-in sustaining costs per kilogram and all-in costs per kilogram may vary significantly among gold mining companies, and these definitions by themselves do not necessarily provide a basis for comparison with other gold mining companies. See Glossary of Terms and Explanations and Item 5A. Operating Results – “Cash operating costs, all-in sustaining costs and all-in costs” and “Reconciliation of cash operating costs per kilogram, all-in sustaining costs per kilogram, all-in costs per kilogram”.

DRDGOLD Limited

When used in this Annual Report, the term the “Company” refers to DRDGOLD Limited and the terms “we,” “our,” “us” or “the Group” refer to the Company and its subsidiaries as appropriate in the context.

Special Note Regarding Forward-Looking Statements

This Annual Report contains certain “forward-looking” statements within the meaning of Section 21E of the U.S. Securities Exchange Act of 1934, regarding expected future events, circumstances, trends and expected future financial performance and information relating to us that are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. Some of these forward-looking statements include phrases such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “should,” or “will continue,” or similar expressions or the negatives thereof or other variations on these expressions, or similar terminology, or discussions of strategy, plans or intentions, including statements in connection with, or relating to, among other things:

•our reserve calculations and underlying assumptions;

•the trend information discussed in Item 5D.- Trend Information, including target gold production and cash operating costs;

•life of mine and potential increase in life of mine;

•statements made in or with respect to the Technical Report Summaries (“TRS” or “TRSs”) including statements with respect to Mineral Reserves and Resources and assumptions, gold prices, projected revenue and cash flows and capital expenditures and other forward looking statements in the TRSs;

•estimated future throughput capacity and production;

•expected trends in our gold production as well as the demand for and the price of gold;

•our anticipated labor, electricity, water, crude oil and steel costs;

•our expectation that existing cash will be sufficient to fund our operations in the next 12 months including our anticipated commitments;

•estimated production costs, cash operating costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce;

•expectations on future gold price, supply and pricing trends, including long term trends, expected impact of the global environment on gold prices;

•expected gold production and cash operating costs expected in fiscal year 2025;

•statements with respect to agreements with unions;

•our prospects in litigation and disputes;

•statements with respect to the legal review for recommissioning the Withok Tailings Storage Facility (“Withok TSF”) to increase Ergo's deposition capacity and the construction of the Regional Tailings Storage Facility (“RTSF”), and expected potential increase in capacity and life of mine;

•statements with respect to the Solar Power Project (“Solar Plant”) being developed by Ergo, and the Flotation Fine Grind program ("FFG");

•expected deposition capacity from improvements in our dams and new tailings facility construction; and

•expected effective gold mining tax rate.

Such statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others:

•limited deposition capacity;

•adverse changes or uncertainties in general economic conditions in South Africa;

•the future of power security from South Africa's power utility and intensity of load shedding

•regulatory developments adverse to us or difficulties in maintaining necessary licenses or other governmental approvals;

•future performance relating to the Far West Gold Recoveries ("FWGR") Phase 2 assets and the reclamation sites on the east of Ergo’s plant;

•damage to tailings storage facilities and excessive maintenance and rehabilitation costs;

•a disruption in information technology systems, including incidents related to cyber security;

•changes in the demand for and the price of gold;

•changes in, or that affect, our business strategy;

•that assumptions underlying our Mineral Reserves and Mineral Resources as set forth in this report and our TRSs prove to be incorrect;

•challenges in replenishing mineral reserves;

•our ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions;

•the success of our business strategy, development activities and other initiatives;

•changes in technical and economic assumptions underlying our Mineral Reserve estimates;

•any major disruption in production at our key facilities;

•adverse changes in foreign exchange rates;

•adverse environmental or environmental regulatory changes;

•adverse changes in ore grades and recoveries, and to the quality or quantity of reserves;

•unforeseen technical production issues, industrial accidents and theft;

•anticipated or unanticipated capital expenditure on property, plant and equipment; and

•various other factors, including those set forth in Item 3D. Risk Factors.

For a discussion of such risks, see Item

3D. Risk Factors. The risk factors described above and in Item 3D. could affect our future results, causing these results to differ materially from those expressed in any forward-looking statements. These factors are not necessarily all of the important factors that could cause our results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results.

Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. We do not undertake any obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

Special Note Regarding Websites

References in this document to information on websites (and/or social media sites) are included as an aid to their location and such information is not incorporated in, and does not form part of, this annual report. Any links to external, or third-party websites, are provided solely for convenience. We take no responsibility whatsoever for any third-party information contained in such third-party websites, and we specifically disclaim adoption or incorporation by reference of such information into this report and no websites are incorporated by reference into this report.

Imperial units of measure and metric equivalents

The table below sets forth units stated in this document, which are measured in Imperial and Metric.

|

|

|

|

|

|

|

|

|

|

|

|

| Metric |

Imperial |

Imperial |

Metric |

| 1 metric tonne |

1.10229 short tons |

1 short ton |

0.9072 metric tonnes |

| 1 kilogram |

2.20458 pounds |

1 pound |

0.4536 kilograms |

| 1 gram |

0.03215 troy ounces |

1 troy ounce |

31.10353 grams |

| 1 kilometer |

0.62150 miles |

1 mile |

1.609 kilometers |

| 1 meter |

3.28084 feet |

1 foot |

0.3048 meters |

| 1 liter |

0.26420 gallons |

1 gallon |

3.785 liters |

| 1 hectare |

2.47097 acres |

1 acre |

0.4047 hectares |

| 1 centimeter |

0.39370 inches |

1 inch |

2.54 centimeters |

| 1 gram/tonne |

0.0292 ounces/ton |

1 ounce/ton |

34.28 grams/tonnes |

| 0 degree Celsius |

32 degrees Fahrenheit |

0 degrees Fahrenheit |

- 18 degrees Celsius |

|

|

|

|

|

|

|

|

| Glossary of Terms and Explanations |

|

|

| The table below sets forth a glossary of terms used in this Annual Report: |

|

|

| Adjusted EBITDA |

Adjusted EBITDA means earnings before interest, tax, depreciation, amortisation, share-based payment (benefit)/expense, change in estimate of environmental rehabilitation recognised in profit or loss, gain/(loss) on disposal of property, plant and equipment, gain/(loss) on financial instruments, IFRS 16 lease payments, exploration expenses and transaction costs, and retrenchment costs. This is a non-IFRS financial measure and should not be considered a substitute measure of net income reported by us in accordance with IFRS. |

| Administration expenses and other costs excluding non-recurring items |

Administration expenses and other costs excluding loss on disposal of property, plant and equipment and transaction costs. |

| All-in sustaining costs |

All-in sustaining costs is a measure on which guidance is provided by the World Gold Council and includes cash operating costs of production, plus movement in gold in process on a sales basis, corporate administration expenses and other (costs)/income, the accretion of rehabilitation costs and sustaining capital expenditure. Costs other than those listed above are excluded. All-in sustaining costs per kilogram are calculated by dividing total all-in sustaining costs by kilograms of gold produced. This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| All-in costs |

All-in costs is a measure on which guidance is provided by the World Gold Council and includes all-in sustaining costs, retrenchment costs, care and maintenance costs, ongoing rehabilitation expenditure, growth capital expenditure and capital recoupments. Costs other than those listed above are excluded. All-in costs per kilogram are calculated by dividing total all-in costs by kilograms of gold produced. This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| Assaying |

The chemical testing process of rock samples to determine mineral content. |

Recommissioning of the Withok TSF |

The Withok Tailings Storage Facility design is the engineering design that ultimately brings the tailings storage facility to its finality in terms of extent, operation, rehabilitation and management. The implemented final design would result in alignments with the Global Industry Standard on Tailings Management (“GISTM”) and regulatory bodies, increase deposition capacity, improve operation/management and bring about the sustainable closure of the facility. |

| $/oz |

US dollar per ounce. |

| Called gold content |

The theoretical gold content of material processed. |

| Care and maintenance costs |

Costs to ensure that the Ore Reserves are open, serviceable and legally compliant after active mining activity at a shaft has ceased. |

| Cash operating costs |

Cash operating costs of production are operating costs less ongoing rehabilitation expenses, care and maintenance costs and net other operating costs/(income). This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| Cash operating costs per kilogram |

Cash operating costs are operating costs incurred directly in the production of gold and include labor costs, contractor and other related costs, inventory costs and electricity costs. Cash operating costs per kilogram are calculated by dividing cash operating costs by kilograms of gold produced. This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| Cut‑off grade |

The grade (i.e., the concentration of metal or mineral in rock) that distinguishes material deemed to have no economic value from material deemed to have economic value. |

| CIL Circuit |

Carbon-in-leach circuit. |

|

|

|

|

|

|

Definitive Feasibility Study ("DFS") |

A definitive engineering estimate of all costs, revenues, equipment requirements and production at a -5% to +10% level of accuracy. The study is used to define the economic viability of a project and to support the search for project financing. |

| Depletion |

The decrease in the quantity of ore in a deposit or property resulting from extraction or production. |

| Deposition |

Deposition is the geological process by which material is added to a landform or land mass. Fluids such as wind and water, as well as sediment flowing via gravity, transport previously eroded sediment, which, at the loss of enough kinetic energy in the fluid, is deposited, building up layers of sediment. Deposition occurs when the forces responsible for sediment transportation are no longer sufficient to overcome the forces of particle weight and friction, creating a resistance to motion. |

| Dilution |

Waste or material below the cut-off grade that contaminates the ore during the course of mining operations and thereby reduces the average grade mined. |

| Doré |

Unrefined gold and silver bullion bars consisting of approximately 90% precious metals which will be further refined to almost pure metal. |

| Footwall |

The underlying side of a stope or ore body. |

| Grade |

The amount of gold contained within auriferous material generally expressed in ounces per ton or grams per tonne of ore. |

| Growth capital expenditure |

Capital additions that are not sustaining capital expenditure. This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| g/t |

Grams per tonne. |

| Indicated Mineral Resources |

That part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated Mineral Resource has a lower level of confidence than the level of confidence of a measured Mineral Resource, an indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

| Inferred Mineral Resources |

That part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred Mineral Resource may not be considered when assessing the economic viability of a mining project and may not be converted to a Mineral Reserve. |

| Measured Mineral Resources |

That part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured Mineral Resource has a higher level of confidence than the level of confidence of either an indicated Mineral Resource or an inferred Mineral Resource, a measured Mineral Resource may be converted to a proven Mineral Reserve or to a probable Mineral Reserve. |

| Metallurgical plant |

A processing plant (mill) erected to treat ore and extract the contained gold. |

| Mineral Reserves |

An estimate of tonnage and grade or quality of indicated and measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, the economically mineable part of a measured or indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Mineral Resources |

A concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

| Mine call factor |

The gold content recovered expressed as a percentage of the called gold content. |

| Modifying factors |

The factors that a qualified person must apply to indicated and measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated Mineral Resources to proven and probable Mineral Reserves. These factors include, but are not restricted to: Mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project |

| Mt |

Million tonnes. |

| Ore |

A mixture of valuable and worthless materials from which the extraction of at least one mineral is technically and economically viable. |

| Other operating costs / (income) |

Expenses incurred, and income generated in the course of operating activities, which are not directly attributable to production activities. |

| Operating costs |

Operating costs are cost of sales less depreciation, change in estimate of rehabilitation provision, movement in gold in process and finished inventory – gold bullion, ongoing rehabilitation expenditure, care and maintenance, other operating income and retrenchment costs. |

| oz/t |

Ounces per ton. |

|

|

|

|

|

|

Prefeasibility study ("PFS") |

A comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a competent person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A prefeasibility study is at a lower confidence level than a feasibility study. |

| Proven Mineral Reserves |

The economically mineable part of a measured Mineral Resource and can only result from conversion of a measured Mineral Resource and can only result from conversion of a measured Mineral Resource. |

| Probable Mineral Reserves |

The economically mineable part of an indicated and in some cases, a measured Mineral Resource. |

| Qualified Person |

An individual who is a mineral industry professional with at least 5 years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant, and an eligible member or licensee in a good standing of a recognized professional organization at the time the technical report is prepared. |

| Refining |

The final purification process of a metal or mineral. |

| Rehabilitation |

The process of restoring mined land to a condition approximating its original state. |

| Reserves |

That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

| Sediment |

The deposition of solid fragmental material that originated from weathering of rocks and was transported from a source to a site of deposition. |

| Slimes |

The tailings discharged from a processing plant after the valuable minerals have been recovered. |

| Sustaining capital expenditure |

Sustaining capital expenditure are those capital additions that are necessary to maintain current gold production. This is a non‑IFRS financial measure and should not be considered a substitute measure of costs and expenses reported by us in accordance with IFRS. |

| T’000 |

Tonnes in thousands. |

| Tailings |

Finely ground rock from which valuable minerals have been extracted by milling, or any waste rock, slimes or residue derived from any mining operation or processing of any minerals. |

Tailings facility |

A dam created from waste material of processed ore after the economically recoverable gold has been extracted. |

| Tonnage/Tonne |

Quantities where the metric tonne is an appropriate unit of measure. Typically used to measure reserves of gold‑bearing material in‑situ or quantities of ore and waste material mined, transported or milled. |

| Tpm |

Tonne per month. |

| Yield |

The amount of recovered gold from production generally expressed in ounces or grams per ton or tonne of ore. |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3A. [Reserved]

3B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

3C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

3D. RISK FACTORS

In conducting our business, we face many risks that may interfere with our business objectives. Some of these risks relate to our operational processes, while others relate to our business environment. It is important to understand the nature of these risks and the impact they may have on our business, financial condition and operating results. Some of these risks are summarized below and have been organized into the following categories:

•Risks related to our business and operations;

•Risks related to the gold mining industry;

•Risks related to doing business in South Africa;

•Risks related to Environmental, Social and Governance (ESG) performance including climate change;

•Risks related to government regulation; and

•Risks related to ownership in our ordinary shares or American Depositary Shares (ADSs).

Risks related to our business and operations

Limited deposition capacity

Our operations are based on ultra-volume and almost nano-gold extraction. The volume of reclaimed material delivered has one of the most profound impacts on the gold output of our metallurgical plants. The large volumes of material that are processed at our operations are deposited on tailings facilities which have a finite capacity. The Brakpan/Withok TSF is a Category 3 dam, described as “Large” and carrying a Hazard Rating of “Significant”, which renders it subject to a strict safety monitoring and reporting regime and that imposes the obligation on the operator to periodically compile and submit independent Dam Safety Audit Reports. Whilst Ergo has not received any directive that restricts or inhibits its current and future deposition regime, the Brakpan/Withok TSF is a mature facility subject to a strict compliance regime, and it may attract more onerous conditions from the regulator. Additionally, Ergo plans to eventually move onto the adjacent Withok TSF, and has filed an application with Department of Water and Sanitation to have it recommissioned. Alternative facilities will be required to ensure adequate deposition capacity for the current life of mine and for the future. Key projects to increase such a deposition capacity include the development of the RTSF as part of Phase 2 FWGR project, as well as obtaining regulatory approvals for the recommissioning of the Withok TSF at Ergo to expand its deposition capacity. The timing to have the new facilities on line is critical as a delay may result in reduced deposition rates or a halt in deposition which will have an adverse financial impact on the business if interim alternative deposition facilities cannot be obtained.

Our large projects, most notably the development of FWGR Phase 2 to expand our operations to the western side of Johannesburg and the Solar Plant and recommissioning of Withok TSF to enable mining on the east of the Ergo plant, are subject to schedule delays and cost overruns, and we may face constraints in financing our existing projects or new business opportunities, which could render our projects unviable or less profitable than planned.

The development of our projects are capital intensive processes carried out over long durations and requires us to commit significant capital expenditure and allocate considerable management resources in utilizing our existing experience and know-how.

Projects like the development of Phase 2 of the FWGR assets acquired from Sibanye-Stillwater, the Solar Plant and the recommissioning of the Withok TSF are subject to the risk of delays, regulatory approvals and cost overruns which are inherent in any large construction project including, inter alia:

• unforeseen increases in the cost of equipment, labor and raw materials;

• delays or disruptions in the supply of equipment and raw materials

• unforeseen design and engineering problems;

• changes in construction plans that may require new or amended planning permissions;

• unforeseen construction problems;

• unforeseen delays commissioning sections of the project;

• inadequate phasing of activities;

• labor disputes and social challenges;

• security issues

• inadequate workforce planning or productivity of workforce;

• inadequate management practices;

• natural disasters and adverse weather conditions;

• failure or delay of third-party service providers; and

• changes to regulations, such as environmental regulations.

We also face the risk that expected benefits of our projects are not achieved.

The construction of the RTSF commenced towards the end of fiscal year 2024 and the early works for Driefontein Plant 2 ("DP2") expansion commenced during the first quarter of fiscal year 2025, both related to Phase 2. A delay in the construction of the RTSF may result in deposition capacity to be reduced as the Driefontein 4 TSF is expected to reach capacity at the end of fiscal year 2026 at the current deposition rate, where after the deposition rate would have to decrease materially. A delay in the DP2 expansion project may result in the under utilisation of the RTSF resulting in lower returns being generated.

Ergo is currently developing a Solar Power Project to reduce its reliance on Eskom and to reduce its future cost of electricity. The Solar Plant definitive feasibility study was completed during fiscal year 2022 and is currently under development. A significant capital investment was needed for the project and the purchase of imported solar panels and battery energy storage system subject to fluctuations in the USD and euros to the rand exchange rate. The solar panels are all installed and have been progressively started to generate and supply power towards the end of current fiscal year. It is estimated that the full benefit from the project, in reduced electricity costs and reduced carbon footprint, will materialise during the second quarter of fiscal year 2025.

Regulatory approvals for the recommissioning of the Withok TSF are yet to be obtained. The implementation of the design is expected to be crucial to sustain and increase the life of mine of Ergo as it will accommodate material toward the east of the Ergo plant.

In addition, if the assumptions we make in assessing the viability of our projects, including those relating to commodity prices, exchange rates, interest rates, inflation rates and discount rates, prove to be incorrect or need to be significantly revised, this may adversely affect the profitability or even the viability of our projects. The uncertainty and volatility in the gold market makes it more difficult to accurately evaluate the project economics and increases the risk that the assumptions underlying our assessment of the viability of the project may prove incorrect.

As the development of FWGR, the Solar Power Project and the recommissioning of the Withok TSF are particularly material to DRDGOLD, significant cost overruns or adverse changes in assumptions affecting the viability of these projects could have a material adverse effect on our business, cash flows, financial condition and prospects.

Our operating cash flow, available banking facilities and ability to raise funds from banks or the capital markets may be insufficient to meet our capital expenditure plans and requirements, depending on the timing and cost of development of our existing projects and any further projects we may pursue. As a result, new sources of capital may be needed to meet the funding requirements of these projects and to fund ongoing business activities. Our ability to raise and service significant new sources of capital will be a function of, inter alia, macroeconomic conditions, rising cost of debt, our credit rating, our gearing and other risk metrics, the condition of the financial markets, future gold prices, the prospects for our industry, our operational performance and operating cash flow and debt position. Inability to raise these funds may place a burden on the Group cash reserves.

In the event of operating or financial challenges, any dislocation in financial markets or new funding limitations, our ability to pursue new business opportunities, invest in existing and new projects, fund our ongoing business activities and pay dividends, could be constrained, any of which could have a material adverse effect on our business, operating results, cash flows and financial condition.

Damage to tailings storage facilities and excessive maintenance and rehabilitation costs could result in lower production and health, safety and environmental liabilities.

Our tailings storage facilities are exposed to numerous risks and events, the occurrence of which may result in the failure, breach or damage of such a facility. These may include sabotage, piping or seepage failures, failure by our employees to adhere to the codes of practice and natural disasters such as excessive rainfall and seismic events, any of which could force us to stop or limit operations. This is further impacted and expected to intensify with the effects of climate change. In addition, the facilities could overflow or a side wall could collapse jeopardizing the health and safety of our employees and communities living around these facilities and potentially resulting in extensive property and environmental damage.

In the event of damage to, or any failure of, our tailings facilities, we could face legal proceedings (including criminal proceedings and public civil actions) and investigations for significant amounts of damages. Such actions would also likely entail significant costs and potentially involve the need for large expenditures to help regions and people affected to recover. The occurrence of any of these risks could adversely affect our operations and this in turn could have a material adverse effect on our business, operating results and financial condition.

The potential elimination of conventional wet tailings could also lead to large additional expenditures on research and development of new technologies. Changes in law and regulation, to impose more stringent standards, may also lead to increased capital expenditure to update our facilities, be able to expand our facilities in the future or continue to meet existing or more stringent legal (including permit) requirements.

Due to the nature of our business, our operations face extensive health and safety risks and regulation of those risks.

Gold mining is exposed to numerous risks and events, the occurrence of which may result in the death of, or personal injury, to employees or others. These risks and events include seismic events, heat, ground or slope failures, rock bursts, sink holes, fires, falls of ground and blockages, flooding, discharges of gases and toxic substances as well as radioactivity, unplanned detonation of explosives, blasting and the transport, storage and handling of hazardous materials.

According to section 54 of the Mine, Health and Safety Act of 1996, if an inspector believes that any occurrence, practice or condition at a mine endangers or may endanger the health or safety of any person at the mine, the inspector may give any instruction necessary to protect the health or safety of persons at the mine. These instructions could include the suspension of operations at the whole or part of the mine. Health and safety incidents could lead to mine operations being halted and that will increase our unit production costs, which could have a material adverse effect on our business, operating results and financial condition.

As with environmental incidents, so too may the occurrence of health and safety risks result in increased regulator and stakeholder scrutiny, which may lead to increases in compliance costs, and could result in enforcement actions and litigation (by regulators, affected stakeholders and others) that could lead to the imposition of significant fines or liabilities or otherwise adversely impact our operations through revocation of permits and approvals, the imposition of new conditions, and reputational impacts. The occurrence of such risks could have a material adverse effect on our business, operating results and financial condition.

After five years of operating without a fatality, we very sadly lost a colleague at Ergo due to fatal injuries sustained on April 13, 2024 when a side-wall slip at the 5L27 dump impacted the loader he was operating. On behalf of the board of directors and management of DRDGOLD, we extend our deepest sympathies to the family and friends of our deceased colleague.

A disruption in our information technology systems, including incidents related to cyber security, could adversely affect our business operations.

We rely on the accuracy, availability and security of our information technology systems. Despite the measures that we have implemented, including those related to cyber security, our systems could be breached or damaged by computer viruses and systems attacks, natural or man-made incidents, disasters or unauthorised physical or electronic access.

Any system failure, accident or security breach could result in business disruption, theft of our intellectual property, trade secrets (including our proprietary technology), unauthorised access to, or disclosure of, personnel or supplier information, corruption of our data or of our systems, reputational damage or litigation. We may also be required to incur significant cost to protect against or repair the damage caused by these disruptions or security breaches in the future, including, for example, rebuilding internal systems, implementing additional threat protection measures, defending against litigation, responding to regulatory inquiries or actions, paying damages, or taking other remedial steps with respect to third parties. (Refer to Item 16K. ‘‘Cyber Security")

These threats are constantly evolving, thereby increasing the difficulty of successfully defending against them or implementing adequate preventative measures and we remain subject to additional known or unknown threats. In some instances, we may be unaware of an incident or its magnitude and effects. We may be susceptible to cyber-attacks, including phishing and ransomware attacks, in the evolving landscape of cybersecurity threats. Cyber security attacks have recently become more prevalent in the mining industry, which has increased the likelihood of DRDGOLD being targeted for cyber security attacks in the future. An extended failure of critical system components, caused by accidental, or malicious actions, including those resulting from a cyber security attack, could result in a significant environmental incident, commercial loss or interruption to operations as well as loss or misappropriation of confidential information, including personal data relating to DRDGOLD's current or former employees. Such information could also be made public in a manner that harms DRDGOLD’s reputation and financial results and, particularly in the case of personal data, could lead to regulators imposing significant fines on DRDGOLD.

In addition, from time to time, we implement updates to our information technology systems and software, which can disrupt or shutdown our information technology systems. Information technology system disruptions, if not appropriately addressed or mitigated, could have a material adverse effect on our operations.

Any interruption in gold production at any of our two mining operations generating cash flows, will have an adverse effect on the Company.

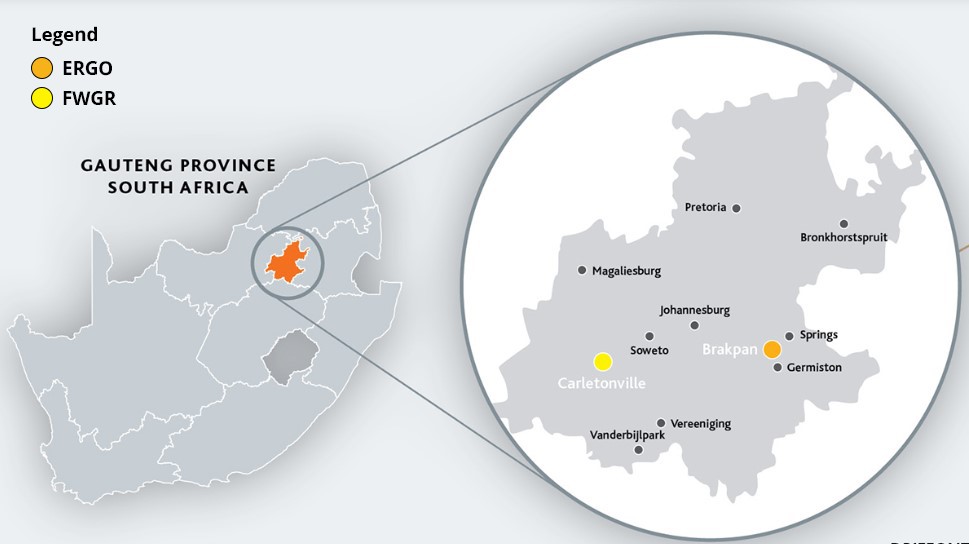

We have two mining operations generating cash flows, namely Ergo and FWGR. Ergo’s reclamation sites, processing plants, pump stations and the Brakpan/Withok TSF are linked through pipeline infrastructure. The Ergo plant is currently our major processing plant. FWGR’s reclamation sites, DP2 processing plant, pump stations and the Driefontein 4 Tailings Storage Facility are linked through pipeline infrastructure.

Our reclamation sites, plants, pipelines infrastructure and the tailings storage facilities are exposed to numerous risks, including operational down time due to planned or unplanned maintenance and possible load shedding or power dips, adverse weather, destruction of infrastructure, spillages, higher than expected operating costs, or lower than expected production as a result of decreases in extraction efficiencies due to imbalances in the metallurgical process as well as inconsistent volume throughput or other factors.

Our FWGR operations are reliant on the use and access to Sibanye-Stillwater Limited’s ("Sibanye-Stillwater") mining infrastructure, related services including the smelting and recovery of gold from gold loaded carbon produced at FWGR (FWGR has the option to transfer gold loaded carbon to Ergo's Knights plant as an alternative to Sibanye-Stillwater) as well as the use of various rights, permits and licenses held by Sibanye Gold Proprietary Limited (wholly owned subsidiary of Sibanye-Stillwater) pursuant to which FWGR operates, pending the transfer to FWGR of those that are transferable. Any disruption in the supply of, or our ability to use and access the Sibanye-Stillwater mining infrastructure, related services and rights, permits and licenses, could have an adverse impact on our operations.

Any of the risks above or other interruptions could adversely impact our operations which could have a material adverse effect on our business, operating results and financial condition.

Changes in the market price for gold and exchange rate fluctuations, both of which have fluctuated widely in the past, affect the profitability of our operations and the cash flows generated by those operations.

Our results are significantly impacted by the price of gold and the USD-rand exchange rate. Any sustained decline in the market price of gold from the current levels would adversely affect us, and any sustained decline in the price of gold below the cost of production could result in the closure of some or all of our operations which would result in significant costs and expenditure, such as, incurring retrenchment costs earlier than expected which could lead to a decline in profits, or losses, as well as impairment losses. In addition, as most of our production costs are in rands, while gold is sold in dollars and then converted to rands, our results of operation and financial condition have been and could be in the future materially affected by an appreciation in the value of the rand. Accordingly, any sustained decline in the dollar price of gold and/or the strengthening of the South African rand against the dollar would negatively and adversely affect our business, operating results and financial condition.

As US inflation started to recover there was uncertainty whether the US Federal Reserve would halt interest rate hikes and the collapsing of Silicon Valley Bank meant that gold remained a safe haven for investors which kept the gold price high in fiscal year 2023. During fiscal year 2024 the recovery of the US inflation continued. With inflation starting to decrease, the US Federal Reserve lowered interest rates by 50 basis points during September 2024 and further decreases are expected over fiscal year 2025. The uncertainty around the lowering of interest rates and the extent of the lowering, meant that the gold price remained high, this was further fueled by the conflict between Israel and Gaza. In addition, we are impacted by movements in the exchange rate of the rand against the dollar as described below.