Putting Clients First Drives Growth And Fuels Innovation INVESTOR DAY NOVEMBER 14, 2023 NASDAQ: SLP

Agenda + OPENING REMARKS | SHAWN O’CONNOR, CEO + CLINICAL PHARMACOLOGY & PHARMACOMETRICS | JILL FIEDLER-KELLY, M.S., FISoP, JONATHAN CHAUVIN, PH.D. + PBPK & CHEMINFORMATICS | JOHN DIBELLA, M.S. + QSP | BRETT HOWELL, PH.D.+ M&A | SHAWN O’CONNOR, STEVE CHANG, M.S. + SALES STRATEGY AND CLIENT APPROACH | JOSH FOHEY + FINANCIAL OVERVIEW & GUIDANCE | WILL FREDERICK, CFO+ ESG | WILL FREDERICK, CFO + CLOSING REMARKS | SHAWN O’CONNOR, CEO+ Q&A+ REGULATORY STRATEGIES | JOHN DIBELLA, M.S. 2

With the exception of historical information, the matters discussed in this presentation are forward-looking statements that involve a number of risks and uncertainties. Words like “believe,” “expect” and “anticipate” mean that these are our best estimates as of this writing, but that there can be no assurances that expected or anticipated results or events will actually take place, so our actual future results could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: our ability to maintain our competitive advantages, acceptance of new software and improved versions of our existing software by our clients, the general economics of the pharmaceutical industry, our ability to finance growth, our ability to continue to attract and retain highly qualified technical staff, our ability to successfully integrate the recently acquired Immunetrics business with our own, as well as expenses we may incur in connection therewith, and a sustainable market. Further information on our risk factors is contained in our quarterly and annual reports and filed with the U.S. Securities and Exchange Commission. 3 Safe Harbor Statement

Opening Remarks 4 SHAWN O’CONNOR, CEO

Key Messages 5 + WE HAVE A LONG HISTORY OF INNOVATION IN BIOSIMULATION THAT IS TRANSFORMING DRUG DEVELOPMENT AND R&D + WE HAVE A RICH FUTURE FOR GROWTH OPPORTUNITIES + WE HAVE A HIGHLY EXPERIENCED SCIENTIFIC LEADERSHIP TEAM + WE ARE ALIGNED WITH OUR CLIENTS TO MEET DEMAND FOR FUTURE GROWTH + WE HAVE A STRONG FINANCIAL POSITION TO FUND OUR GROWTH

Leading Provider of Software and Consulting Services in the Biosimulation Market AI-powered technology solutions optimize the outcomes of drug discovery, development, research, and regulatory submissions processes. Our software-based technology both models and simulates how drugs and diseases behave in humans and in other species. 25+ YEARS OVER 25 YEARS IN BUSINESS AND CONTINUING THE COMMITMENT TO IMPROVE PUBLIC HEALTH THROUGH INNOVATIVE SOLUTIONS OUR CLIENTS TRUST OUR EXPERT CONSULTING THAT SUPPORTS DRUG RECOVERY, CLINICAL DEVELOPMENT RESEARCH AND REGULATORY SUBMISSIONS 300+ CLIENTS WE PROVIDE VALIDATED AI AND MACHINE LEARNING, MODELING AND SIMULATION SOFTWARE FOR NOVICE AND EXPERT USERS ALIKE 18+ SOFTWARE SOLUTIONS SLP At A Glance 6

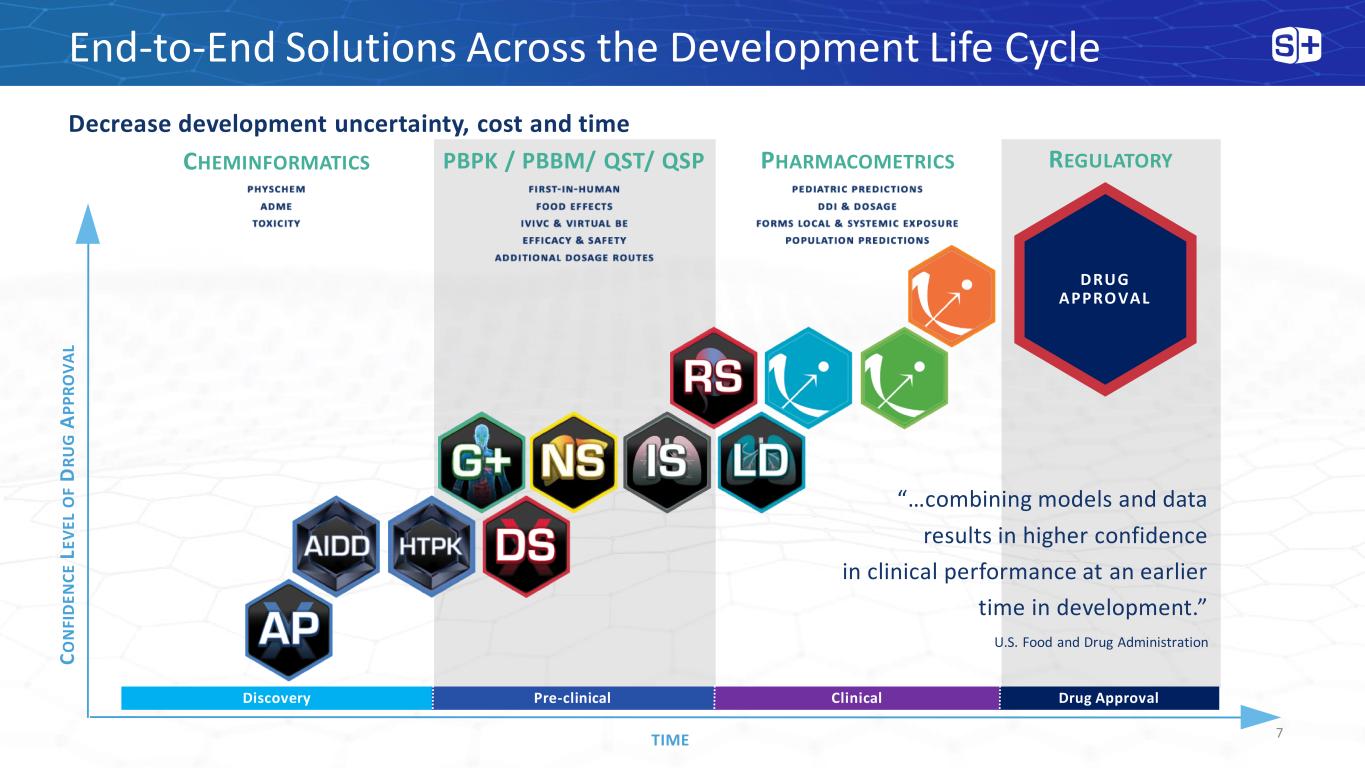

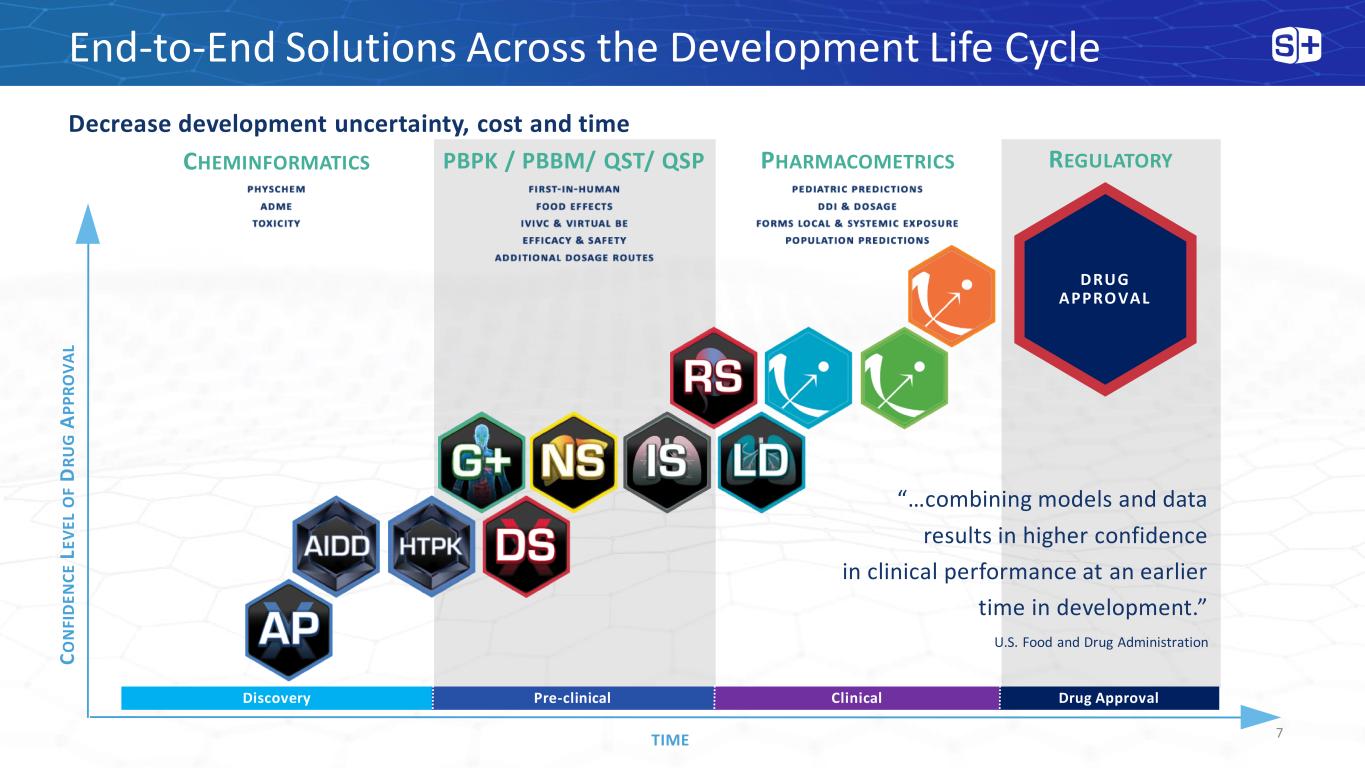

End-to-End Solutions Across the Development Life Cycle Decrease development uncertainty, cost and time C O N FI D E N C E L E V E L O F D R U G A P P R O V A L TIME DRUG APPROVAL Discovery Pre-clinical Clinical Drug Approval CHEMINFORMATICS PHARMACOMETRICS PBPK / PBBM/ QST/ QSP “…combining models and data results in higher confidence in clinical performance at an earlier time in development.” U.S. Food and Drug Administration REGULATORY 7

Our Goal Today To give you a better understanding of our expertise and capabilities in each of these scientific domains, future developments and directions and how we deliver value to our clients PUTTING CLIENTS FIRST DRIVES GROWTH AND INNOVATION 8

Leader in Large and Growing Market Spending for biosimulation products continues to increase given need to bring drugs to market faster Biosimulation market valued at $2.8B in 2022 and is expected to expand at a 16.9% CAGR from 2022 - 20301 Strategy to grow addressable market within the Biosimulation TAM through both internal R&D investment and strategic acquisitions • SLP is growing faster than the Biosimulation TAM • Biosimulation growing at 4-5x total R&D spend Highly fragmented and underpenetrated market with only a few larger players • The global biosimulation market is segmented based on product, application, delivery model, and end users. 1 Company research, SkyQuest $200B GLOBAL PHARMA AND BIOTECH SPEND (3% CAGR)1 + + + $9.8B BIOSIMULATION1 TAM BY 2030 $700M-$800M SLP ADDRESSABLE 9

Drug Development Challenges | Biosimulation Solution Our core mission – accelerating the development and delivery of better, safer, and more effective drugs SIMULATIONS PLUS SOLUTIONS Simulations Plus offers AI-powered technology solutions to help optimize the outcomes of the drug discovery, development, research and regulatory approval processes to bring drugs to market faster Simulations Plus solutions can help increase the number of candidates approved by streamlining the drug development process, creating efficiencies that lead to drug efficacy and safety, higher regulatory approval, improved commercial success and much more CHALLENGES The median cost of developing a new drug averages $1.5 to $2 billion and the timeline can range from 10-15 years. On average only 11% of all drug candidates are approved Source: Company research – – + + 10

▪ We have been utilizing AI technics and approaches in our solutions since our beginning ▪ Data is key: our tenure in serving the drug development industry has provided significant access to data necessary to perfect and refine predictive algorithms with key partnerships and collaborations with industry leaders and regulatory agencies ▪ ADMET Predictor is the best example of our AI predictive capabilities ▪ AI enhancements that improve data analytics are a component of each of our scientific domains with improvements currently planned into the future ▪ We embrace the excitement and potential improvements that AI can and will bring to drug development ▪ We have and will continue to utilize AI technologies to enhance our products and services How We View Artificial Intelligence 11

Strategic Objectives 12 + MAINTAIN LEADERSHIP IN MIDD + EXPAND OUR PRODUCTS AND SERVICES + PURSUE STRATEGIC ACQUISITIONS + GROW AT OR ABOVE MARKET + GROW PROFITABILITY AT OR ABOVE TOP LINE GROWTH

New Organizational Structure 13 CEO & President Business Units Clinical Pharmacology & Pharmacometrics (CPP) Physiologically Based Pharmacokinetics (PBPK) Quantitative Systems Pharmacology (QSP) Cheminformatics Shared Services Chief Revenue Officer Sales Marketing Chief Financial Officer G&A Regulatory Strategies

Seasoned Management Team and Scientific Leadership Highly experienced management team with deep life science industry expertise, track record of growth and strong returns 18 Shawn O’Connor Chief Executive Officer Will Frederick Chief Financial Officer Brett Howell, Ph.D. President Quantitative Systems Pharmacology Solutions (QSP) Jill Fiedler-Kelly, M.S., FISoP President Clinical Pharmacology & Pharmacometrics Services Solutions (CPP) John DiBella, M.S President Physiologically Based Pharmacokinetic (PBPK) Solutions, Cheminformatics Solutions, Regulatory Strategies Solutions Jonathan Chauvin, Ph.D. President Clinical Pharmacology & Pharmacometrics Software Solutions (CPP) Josh Fohey Vice President, Business Development Steve Chang, M.S. President Immunetrics

VIDEO

Cheminformatics & PBPK 16 JOHN DIBELLA, M.S.

ADMET Predictor® Physicochemical and Biopharmaceutical (PCB) Metabolism Toxicity Transporters HTPK Simulation AIDD ADMET Modeler MedChem Studio Cheminformatics | ADME-Tox Property Predictions and AIDD Functionality Usability ADMET Predictor Performance 17

ADMET Predictor By the Numbers 80+ Companies licensing worldwide 170+ ML property prediction models in version 11 70000+ Data points in the pKa and ionization-related descriptor models 300+ Universities in 50+ countries with access to software 5+ Data sharing and AIDD partnerships in fiscal 2023 55+ Peer-reviewed journal publications over past 12 months 18

▪ pKa models have been rebuilt using proprietary data received from three new industrial partners – Partner 1: ~19,000 compounds – Partner 2: ~2,400 compounds – Partner 3: ~4,100 compounds ▪ Total number of ionization constants has increased from 33,640 to 70,810 ▪ Continues successful record of industrial partnerships that originated with Bayer’s 2011 contribution of 17,000 proprietary compounds 19 Cheminformatics Partnerships in Fiscal 2023

▪ Expansion of machine learning models to inform inputs into other software offerings at the company ▪ Explore new AI/ML technologies to improve model performance and assist with data compilation/curation ▪ Develop additional descriptors (2D and 3D) to extend chemical coverage space into new territories ▪ Enhance AIDD approaches with new functionalities – retrosynthesis predictions, novelty searches ▪ …and more 20 Cheminformatics | The Future

▪ We’re ranked #1 for accuracy in published independent comparisons for different ADME endpoints ▪ Simulations Plus has the top-rated machine learning + top-rated PBPK models tightly integrated in ways no other company can accomplish ▪ We have generative AI with embedded GastroPlus PBPK simulations to uniquely design/optimize molecules ▪ Access to premium, carefully curated data, which others do not have, to feed our machine learning models ▪ Hundreds of peer-reviewed journal articles published citing ADMET Predictor ▪ Flexible licensing & deployment models provides options to a wide range of clients across industries ▪ Expert team of data scientists, developers, and support staff provides the coaching, maintenance, and training companies need to successfully incorporate AI/ML modeling into their discovery programs 21 Cheminformatics | Why We Win

▪ Physiologically based pharmacokinetic (PBPK) models represent animals and humans virtually as a collection of organs and tissues, each defined by a system of mathematical equations ▪ PBPK models are developed using quantitative values (“parameters”) and equations that describe characteristics (e.g., body weight, blood flow rate, physicochemical properties, formulation) and mechanisms (e.g., dissolution, precipitation, absorption, metabolism) ▪ PBPK models built for animals can often be extrapolated to humans – and, in a similar vein, models built for healthy adults can often be extrapolated to other populations (e.g., pediatrics, disease states) © 2023 The Cure Starts Now. All Rights Reserved. What Do We Mean When Describing PBPK Modeling? 22

PBPK Modeling to Support Regulatory Interaction | The Push 2018 2018 2020 2020 23

Common PBPK M&S Industry Applications FIH Exposure Formulation Optimization Metabolism-based DDIs Drug Product Specifications Special Populations Food/pH-dependent DDI Effects CMC Changes/Oral BE CMC Changes/Complex BE FIH dose selection and clinical development plans based on preclinical data Support for optimal formulation selection based on preclinical data Predictions of DDI liability; DDI study design support and biowaiver plans Development of biopredictive dissolution methods and drug product specifications Simulations to support dose adjustments in special populations and related product labelling Design studies and biowaiver plans Design of BE studies and biowaiver plans for oral route of administration Design of BE studies and biowaiver plan for complex products 24

GastroPlus By the Numbers 200+ Companies licensing worldwide 15+ Regulatory agencies with reviewers trained on software 120+ Services projects executed over past 12 months 300+ Universities in 50+ countries with access to software 500+ Scientists received software training over past 12 months 80+ Peer-reviewed journal publications over past 12 months 25

FDA: Virtual BE trial workflows FDA: Dermal model extensions FDA: Ocular model extensions FDA: Oral cavity model extensions FDA: Long-acting injection model extensions Large Pharma: Local GI disease extensions FDA: Oral absorption model extensions FDA: Pulmonary model extensions Partners Driving PBPK | Funded Scientific Collaborations 26

Regulatory Applications of GastroPlus (2020-22) Client Survey Results 69 Success Stories (n = 31 innovator & generic companies) 27

Examples of Approved Drugs Supported By GastroPlus pH-dependent DDI metabolic DDI drug product specifications / pH-dependent DDIs pH-dependent DDI transporter DDI pH-dependent DDI transporter DDIdrug product specifications pediatric dose support drug product specificationsdrug product specifications food effect 28

A Recent Regulatory Win Problem Statement: – Commercial tablets for 2 dose strengths were being submitted by a mid-size pharma company – Both FDA and EMA pushed back on the proposed Q80% time point of 45 minutes – Dissolution testing of production batches showed dissolution rates close or failing proposed agency limits which would have led to OOS batches during routine manufacturing The Solution: GastroPlus® PBBM – Model was validated across clinical datasets and applied to run VBE and justify, together with a risk analysis based on ER data, wider proposed dissolution specifications for both dose strengths – Cost = $0.25M USD (one-time charge) ▪ What Were the Alternatives? 1. Do nothing and accept standard dissolution specs • Estimated 5-10% OOS batches = loss of $1M USD/year 2. OR Run a clinical trial to justify dissolution specifications • Manufacture clinical batches across 2 dose strengths at the proposed dissolution specifications • Conduct 2 human BE studies on 42 subjects in fed and fasted state for both drug products Scenario 1. Do Nothing Estimated Cost = 5-10% OOS batches Loss of $1M USD/Year Scenario 2. Run a Clinical Trial Estimated cost = $0.5M USD (manufacturing) + $7M USD (clinical studies) + 6-12 months to complete study & analysis Scenario Costs: 29

Celebrating the 25th Anniversary of GastroPlus 30 30

The trusted science of GastroPlus is the same – the workflows & logic will be around for years to come! The Future of GastroPlus 31

▪ Integration of QSP and CPP technologies within the GastroPlus environment to expand product and service offerings ▪ Application of AI to provide expert PBPK coaching and support to users on a real-time basis to expand our client base ▪ Mechanistic delivery models around the body for different molecule types ▪ True polypharmacy simulation capabilities to mimic a patient’s real-world medication schedule and better assess drug-drug interactions, fixed dose combination products, and more 32 PBPK | The Future

▪ Ranked #1 for accuracy in all published independent comparisons of PBPK software – laser focus on science and innovation for 25+ years ▪ 1000+ peer-reviewed journal articles published citing GastroPlus ▪ Over 20 funded grant partnerships with the FDA since 2015 – reflects significant trust and confidence from regulators expert team of modelers, developers, and support staff provides the coaching, maintenance, and training companies need to successfully incorporate PBPK modeling into their R&D programs ▪ Our expert team of modelers, developers, and support staff ▪ Flexible licensing models provides access to a wide range of clients across industries 33 PBPK | Why We Win

Clinical Pharmacology & Pharmacometrics (CPP) 34 JILL FIEDLER-KELLY, M.S., FISoP, JONATHAN CHAUVIN, PH.D.

Jill Fiedler-Kelly – CPP Services ▪ Co-founded Cognigen in 1992 ▪ Joined Simulations Plus when it acquired Cognigen in 2014 ▪ +30 years of modeling and simulation experience ▪ Co-author of a textbook on population PK/PD modeling ▪ Adjunct Professor of Pharmaceutical Sciences at the University at Buffalo (SUNY Buffalo) Jonathan Chauvin – CPP Software ▪ Lixoft in 2015 ▪ Joined Simulations Plus when it acquired Lixoft in 2020 ▪ Filed +30 patents and directed 20 publications in refereed committees, newspaper articles, and 50 conference papers 35 The Clinical Pharmacology & Pharmacometrics Leadership Team

Clinical Pharmacology & Pharmacometrics | Introduction Software and consulting synergy – benefits of MonolixSuite capabilities and efficiencies ▪ Combining the most user-friendly modeling and simulation software with the extensive experience of the highly respected consulting team offers an unmatched level of support for model-informed drug development programs ▪ ~$19M in revenue; 62% services, 38% software in fiscal 2023 ▪ Over 95% client renewal rate based on fees for MonolixSuite ▪ Growth in fiscal 2023: >100 companies using MonolixSuite, 12 new consulting clients and 5 consultants in fiscal 2023 ▪ Highly experienced leadership team with advanced technical degrees, >30 years experience in consulting and >20 years experience in the pharmaceutical industry 36

▪ Quantitative support of model-informed drug development – Pharmacometric modeling to understand and explore variability in PK, PK/PD and exposure-response – Support for development and regulatory decision making: providing confidence in the rationale for next phase planning and providing support for regulatory challenges through quantitative analyses, technical reports, written responses, briefing books, and attendance at meetings – Embedded clinical pharmacology and pharmacometrics team member support – Comprehensive quality management system with validated and secure systems for data handling and analysis – Committed and supportive team partnering with our clients and working with integrity to turn clinical data into actionable insights Pharmacometrics Services… Clinical Pharmacology & Pharmacometrics | Services 37

▪ MonolixSuite is the gold standard for user-friendly pharmacometric modeling and simulation software – Non-compartmental analysis with PKAnalix – Nonlinear mixed effects population PK/PD modeling with Monolix – Model-based, high performance clinical trial simulations with Simulx ▪ Intentional design offers seamless and efficient workflow across analysis steps ▪ Intuitive graphical user interface, extensive documentation and dedicated support team facilitates a shorter learning curve for modelers and quicker time to gain confidence in capabilities 38 Pharmacometrics Software… Clinical Pharmacology & Pharmacometrics | Software

Collaborative team support on many fronts Our pharmacometric consultants performed PK/PD modeling in support of a highly-anticipated novel therapy being investigated to treat a rare disease affecting children. Our team of experts subsequently assisted the Sponsor with preparation for an Advisory Committee meeting resulting in the successful attainment of accelerated approval granted by FDA. Leveraging the strength of the software A team of modeling experts from the CPP business unit are using Monolix to develop a PK/PD platform model framework that will enable our client to quantitatively support go-no go decision making for oncology compounds based on linking early biomarker data to predict late clinical endpoints. 39 Support for decision making across all development stages Modeling support provided to a client applying AI to precision engineer medicines was used to make critical decisions to enable development-related decision making for pipeline candidates. The services team provided pharmacokinetic and exposure-response modeling support for a compound offering novel treatment for a rare genetic disease affecting children and adults; following approval by FDA, the modeling work was used to support labelling statements that describe dosing recommendations for the compound. Clinical Pharmacology & Pharmacometrics | Success Stories

▪ Investing in expanding MonolixSuite functionality with input from in-house consultant users as well as the entire client base to: – Support further integration into the global environment and ecosystem of tools supporting model-informed drug development – Provide continual improvement of workflow and interoperability across application domains ▪ Opportunities for collaboration between QSP and CPP scientific areas of focus to support client needs: – Leveraging mechanistic QSP models developed to support early decision making to expedite the analysis of clinical data from first-in-human studies – Leveraging empirical PK/PD models by adding complexity with the characterization of additional endpoints and pathways ▪ Incorporation of AI and ML methods in pharmacometric analyses and associated data processing activities may allow for further increases in efficiency and streamlining of workflows to expedite the generation of results 40 Clinical Pharmacology & Pharmacometrics | The Future

Unparalleled Offering ▪ Synergistic combination of extensive experience and expertise in providing quantitative support for model-informed drug development programs across therapeutic areas and the best-in-class, most user-friendly software tool for efficient modeling & simulation workflow ▪ Consulting teams believe that the relationships we build with our clients are essential to our success: communicating with transparency and integrity and commitment to support for confident decision-making supported by high-quality modeling and simulation from beginning to end ▪ Software and services supported by solid infrastructure and quality management system 41 Clinical Pharmacology & Pharmacometrics | Why We Win

Quantitative Systems Pharmacology Solutions (QSP) 42 BRETT HOWELL, PH.D.

▪ QSP is an exciting and rapidly growing field of biomedical research ▪ Our QSP team combines a knowledge of mathematics, disease pathophysiology and pharmacology to help our clients make better decisions ▪ Our QSP team now has the broadest range of therapeutic area coverage of any QSP team in the industry Software and consulting synergy... QSP | Introduction 43

QSP | Library of Existing QSP and QST Models ▪ Non-alcoholic fatty liver disease / steatohepatitis (NAFLD/NASH) ▪ Idiopathic pulmonary fibrosis (IPF) ▪ Interstitial lung disease (ILD) associated with systemic sclerosis ▪ Wound healing after myocardial infarction (MI) ▪ Uric acid disposition in gout ▪ Dysregulation of alternative and terminal pathways (AP, TP) of complement ▪ Drug induced liver injury (DILI) ▪ Drug induced acute kidney injury ▪ Acute myeloid leukemia (AML) ▪ Multiple myeloma (MM) ▪ Solid tumor (NSCLC, melanoma) ▪ Diffuse large B-cell lymphoma (DLBCL) ▪ Rheumatoid arthritis (RA) ▪ Psoriatic arthritis (PSA) ▪ Psoriasis (PSO) ▪ Atopic dermatitis (AD) ▪ Systemic lupus erythematosus (SLE) ▪ Ulcerative colitis (UC) ▪ Crohn’s disease (CD) QSP: Inflammatory and Fibrotic Diseases QST: Liver and Kidney Safety QSP: Autoimmune Diseases QSP: Immuno-Oncology 44

▪ Platforms across therapeutic development landscape including diseases ▪ Our coverage positions us to increase engagements ▪ Unique combined understanding of: – Drug effectiveness at treating disease – Safety – Negative drug side effects ▪ Optimize the balance between a therapies positive and negative impacts on the patient ▪ Offer milestone-based consulting project structures QSP | Services 45

QSP | Software 46 ▪ Includes proprietary infrastructure built within these environments: – Thales: drives oncology and autoimmune models – MATLAB: drives pharmacology focused models – Julia: drives our NASH / NAFLD model – C++: drives our liver and kidney safety platforms ▪ All of our platforms are available for licensing by our clients, enabling our clients with QSP teams inhouse to partner with us in a collaborative way

QSP | Success Stories 47

▪ Big emphasis on expansion into more indications within oncology ▪ Therapeutic area expansion in other arenas ▪ New client sponsored development is ongoing in neurology ▪ Combination of AI with QSP modeling 48 Several Exciting QSP Initiatives QSP | The Future

1. Focused on diseases of relevance to our clients and the flow of capital 2. The QSP group is composed of a large team of knowledgeable experts, making the offering scalable and adaptable 3. Software + services: these two offerings allow us to tailor our solutions for large, medium, and small companies within Pharma and biotech 4. Ecosystem: the exposure modeling tools (e.g., PBPK and PMx) to feed drug concentrations into them is unparalleled in the industry 49 Four key reasons why our clients choose to work with our QSP team: QSP | Why We Win

Regulatory Strategies 50 JOHN DIBELLA, M.S.

Regulatory Strategies | What We Offer 51 Comprehensive knowledge of drug product development Expertise in regulatory milestones and requirements Holistic understanding of M&S regulatory requirements and applications

Regulatory Strategies | How We Help 52 A proven partner for regulatory strategies and M&S consulting support 65% FDA 5% EMA 19% Multiagency (e.g. FDA, EMA, PDMA) 4% ANVISA 3% CDE 2% CDSCO (India) 2% Unknown 58% NMEs 14% Generics 16% 505b2s 12% NDA Supplements 16% Clinical Pharmacology 60% Biopharmaceutics 24% Clinpharm & Biopharm

Sales Strategy and Client Approach 53 JOSH FOHEY VICE PRESIDENT, BUSINESS DEVELOPMENT

54 Sales Strategy and Client Approach Simulations Plus is a cutting-edge modeling and simulation company specializing in serving pharmaceutical companies at every stage, from early discovery to post-approval.

▪ Our expertise lies in harnessing the power of machine learning in chemistry, as well as employing advanced methodologies such as PBPK , QSP, QST, pharmacometrics, and regulatory support. ▪ Our mission is to accelerate the delivery of safe and efficacious medicines to patients worldwide, revolutionizing the pharmaceutical landscape through the integration of industry leading technologies and scientific expertise. 55 Sales Strategy and Client Approach | Expertise

▪ Bringing together strategic partnerships ▪ Bundling our solutions to maximize the value proposition of our partnership ▪ More therapeutic alignment with our partners to cater offerings 56 Sales Strategy and Client Approach | Growth

CHEMINFORMATICS CPP 57 Accuracy of property predictions Lead candidate selection and redesign with HTPK/AIDD Discovery services to accelerate development and scale ecosystem PBPK REGULATORY More versatility and enhanced functionality vs competitors Machine learning inputs Regulatory standard Consult and Coach Monolix Differential Experts to guide your program and learning Save experimental work when coupled with modeling Better design and optimize clinical trials Expertise to hold your hand through regulatory scrutiny Sales Strategy and Client Approach QSP Maximize therapeutic and disease understanding Optimize dose selection and clinical execution Prioritize your investments and mitigate program risk

New Structure Aligns with Client Needs 58 DRUG APPROVAL Discovery Pre-clinical Clinical Drug Approval QSP

▪ Increased bookings for large pharma partners ▪ Sold to over 400 accounts ▪ Increased client engagement in Alliance Management (Concierge Program) ▪ Over 90% of the bookings from Pharmaceutical companies ▪ Over 80% of software bookings were renewals with upsells or price increases ▪ Increased number of optional tasks on services projects 59 Sales Strategy and Client Approach | Fiscal 2023

M&A and Integration 60 SHAWN O’CONNOR, CEO STEVE CHANG, M.S.

▪ Target business expands our TAM or accelerates capture of market share in existing TAM ▪ Target technology/services are compatible with our existing capabilities ▪ Target culture is compatible with our culture ▪ Target valuation is reasonable ▪ Target is accretive 61 M&A Strategy Supplements Organic Growth

▪ QSP is a critical and growing field ▪ Immunetrics has increased the range of therapeutic areas addressed by our QSP software and services offerings by more than 50% ▪ Ideal fit as the business leverages our existing infrastructure by expanding its therapeutic resources into largely underserved areas, including immunology and oncology ▪ Immunetrics chose Simulations Plus for its well-respected reputation ▪ Integration is going very well 62 Integration and consolidation efficiencies M&A | Integration & Immunetrics Case Study

FINANCIAL OVERVIEW & GUIDANCE 63 WILL FREDERICK, CFO

Fiscal 2023 Highlights ▪ Strong revenue and earnings results for fiscal 2023 ▪ Conditions in our market remain similar to what we have seen past several quarters – Small biotech slowdown – Large Pharma spending cautiousness ▪ Integration of Immunetrics going well ▪ Achieved revenue and adjusted diluted earnings per share guidance $0.49 Diluted EPS $59.6M Revenue 35% Adj. EBITDA as % of Revenue $20M Backlog 64 $0.67 Adjusted Diluted EPS 1 Refer to Non-GAAP Disclosures in the appendix

Revenue Trends (in millions) Software RevenueTotal Revenue Services Revenue +11% +12% +8% FY23 Mix FY22 Mix 65

Gross Margin Trends 66

▪ Employee Engagement and Development ▪ Product Development ▪ ERP Processes and Technology ▪ Acquisitions (Immunetrics Q4) ▪ Investment Opportunities ▪ Strategic Partnerships and Alliances ▪ $0.06 per share paid Feb. 6th ▪ $0.06 per share paid May 1st ▪ $0.06 per share paid Aug. 7th ▪ $0.06 per share paid Nov. 6th ▪ $50M share repurchase program ▪ $20M accelerated share repurchase (ASR) in Q3 INTERNAL INVESTMENT CORPORATE DEVELOPMENT DIVIDEND PAYMENTS SHARE REPURCHASES We are committed to investing in our employees, products, and providing value to our shareholders Capital Allocation Strategy 67

Fiscal 2024 Guidance 68 Guidance Total Revenue $66M to $69M Total Revenue Growth 10% to 15% Software Revenue Mix 55% to 60% Services Revenue Mix 40% to 45% Diluted EPS $0.66 to $0.68

Financial Profile Delivering Double-Digit Revenue Growth / Industry Leading Margins REVENUE $ in millions $29.7 $34.0 $41.6 $46.4 $53.9 $59.6 12.3% GROSS MARGIN % EBITDA MARGIN % FY18 FY19 FY20 FY21 FY22 FY23 5 Yr CAGR FY18 FY19 FY20 FY21 FY22 FY23 6 Yr Avg 73.1% 73.4% 74.4% 77.2% 79.9% 80.0% 76.4% 43.3% 39.1% 34.4% 31.2% 33.3% 19.2% 33.4% Double digit revenue growth Strong recurring revenue supported by a 90%+ Software Fee Renewal Rate High gross/EBITDA margins to drive strong operating leverage High-margin, recurring revenue over the life of the client relationship Product mix skews toward higher margin software sales $115.5 million in cash and short- term investments to fund growth + + + + + + 69

ESG WILL FREDERICK, CFO 70

Sustainability Framework STRATEGIC PRIORITIES FORM THE FOUNDATION OF OUR SUSTAINABILITY FRAMEWORK 71

ENVIRONMENT HUMAN CAPITAL Reduced footprint of US-based facilities by 35% from 19,300 sf to 12,400 sf. Established a process to gather GHG emissions data points and set targets for expected SEC disclosure requirements. Implemented LearnUpon LMS and Adobe e-signature to reduce in- person training travel and printed materials with virtual on-demand programs using digital materials. SOCIAL GOVERNANCE Updated company privacy policy and processes in the PDP Program to reflect changes to global personal data protection laws. Developed and published Human Rights Policy to support our commitment to human rights. Expanded University+ program to 307 free software licenses across 51 countries to further education in our industry and support the next generation of scientists. Established a paid parental leave program to support working parents. Implemented employee engagement & recognition software to further promote and foster a culture of appreciation and inclusion. Conducted employee engagement survey to ensure culture alignment and success of internal programs and benefits. Engaged a third-party consulting firm to carry out a board evaluation process and joined NACD to support ongoing director education. Implemented pay vs. performance analysis for SEC disclosure of company financial performance measure used to determine executive compensation. Updated Code of Conduct policy to reflect that we and our business partners meet the standards of business governance, environmental sustainability, and human rights. Fiscal 2023 ESG Achievements 72

Questions

CLOSING REMARKS SHAWN O’CONNOR, CEO

▪ Unparalleled offerings and client-centric business model ▪ Leaders in model informed drug development because we are focused on areas that our clients find most important ▪ Continue to lead the industry in ease of use for our software offerings ▪ Continue to build upon our strong relationship- based model to expand existing clients and win new clients Our Path to Win 18 75

Conclusion | Key Messages 76 + WE HAVE A LONG HISTORY OF INNOVATION IN BIOSIMULATION THAT IS TRANSFORMING DRUG DEVELOPMENT AND R&D + WE HAVE A RICH FUTURE FOR GROWTH OPPORTUNITIES + WE HAVE A HIGHLY EXPERIENCED SCIENTIFIC LEADERSHIP TEAM + WE ARE ALIGNED WITH OUR CLIENTS TO MEET DEMAND FOR FUTURE GROWTH + WE HAVE A STRONG FINANCIAL POSITION TO FUND OUR GROWTH

77 Putting Clients First Drives Growth And Fuels Innovation

https://www.simulations-plus.com/ NASDAQ: SLP

Appendix

80 Workplace Recognition Awards

Adjusted EBITDA Adjusted EBITDA is defined as earnings (loss) before interest, taxes, depreciation and amortization, stock-based compensation, (gain) loss on currency exchange, any acquisition- or financial-transaction-related expenses, and any asset impairment charges. Currency exchange excluded represents the exchange rate fluctuations on the foreign currency denominated transactions. The impact of transactions in foreign currency represents the effect of converting revenue and expenses occurring in a currency other than the functional currency. The Company believes that the non-GAAP financial measures presented facilitate an understanding of operating performance and provide a meaningful comparison of its results between periods. The Company’s management uses non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. Adjusted EBITDA represents a measure that we believe is customarily used by investors and analysts to evaluate the financial performance of companies in addition to the GAAP measures that we present. Our management also believes that Adjusted EBITDA is useful in evaluating our core operating results. However, Adjusted EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States of America and should not be considered an alternative to net income or operating income as an indicator of our operating performance or to net cash provided by operating activities as a measure of our liquidity. The Company’s Adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in its industry, as other companies in its industry may calculate non-GAAP financial results differently, particularly related to nonrecurring, unusual items. Adjusted Diluted EPS Adjusted diluted EPS is calculated based on net income excluding the impact of any acquisition- or financial-transaction-related expenses, any asset impairment charges, and tax provisions / benefits related to the previous items. The Company excludes the above items because they are outside of the Company’s normal operations and/or, in certain cases, are difficult to forecast accurately for future periods. The Company believes that the use of non-GAAP measures helps investors to gain a better understanding of the Company’s core operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts. 81 Non-GAAP Definitions