00010231282023FYfalseP5DP1Yhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations11111http://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpenseP1YP3Yhttp://fasb.org/us-gaap/2023#OtherAssetsCurrenthttp://fasb.org/us-gaap/2023#OtherAssetsCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrent http://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrent http://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00010231282023-01-012023-12-3100010231282023-06-30iso4217:USD00010231282024-02-23xbrli:shares00010231282023-12-3100010231282022-12-310001023128lad:DebtExcludingNotesPayableMember2023-12-310001023128lad:DebtExcludingNotesPayableMember2022-12-310001023128us-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:NotesPayableOtherPayablesMember2022-12-310001023128lad:NewVehicleRetailMember2023-01-012023-12-310001023128lad:NewVehicleRetailMember2022-01-012022-12-310001023128lad:NewVehicleRetailMember2021-01-012021-12-310001023128lad:UsedRetailVehicleMember2023-01-012023-12-310001023128lad:UsedRetailVehicleMember2022-01-012022-12-310001023128lad:UsedRetailVehicleMember2021-01-012021-12-310001023128lad:UsedWholesaleVehicleMember2023-01-012023-12-310001023128lad:UsedWholesaleVehicleMember2022-01-012022-12-310001023128lad:UsedWholesaleVehicleMember2021-01-012021-12-310001023128lad:FinanceAndInsuranceMember2023-01-012023-12-310001023128lad:FinanceAndInsuranceMember2022-01-012022-12-310001023128lad:FinanceAndInsuranceMember2021-01-012021-12-310001023128lad:ServiceBodyAndPartsMember2023-01-012023-12-310001023128lad:ServiceBodyAndPartsMember2022-01-012022-12-310001023128lad:ServiceBodyAndPartsMember2021-01-012021-12-310001023128lad:FleetAndOtherMember2023-01-012023-12-310001023128lad:FleetAndOtherMember2022-01-012022-12-310001023128lad:FleetAndOtherMember2021-01-012021-12-3100010231282022-01-012022-12-3100010231282021-01-012021-12-31iso4217:USDxbrli:shares00010231282021-12-3100010231282020-12-310001023128us-gaap:CommonStockMember2022-12-310001023128us-gaap:CommonStockMember2021-12-310001023128us-gaap:CommonStockMember2020-12-310001023128us-gaap:CommonStockMember2023-01-012023-12-310001023128us-gaap:CommonStockMember2022-01-012022-12-310001023128us-gaap:CommonStockMember2021-01-012021-12-310001023128us-gaap:CommonStockMember2023-12-310001023128us-gaap:AdditionalPaidInCapitalMember2022-12-310001023128us-gaap:AdditionalPaidInCapitalMember2021-12-310001023128us-gaap:AdditionalPaidInCapitalMember2020-12-310001023128us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001023128us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001023128us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001023128us-gaap:AdditionalPaidInCapitalMember2023-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001023128us-gaap:RetainedEarningsMember2022-12-310001023128us-gaap:RetainedEarningsMember2021-12-310001023128us-gaap:RetainedEarningsMember2020-12-310001023128us-gaap:RetainedEarningsMember2023-01-012023-12-310001023128us-gaap:RetainedEarningsMember2022-01-012022-12-310001023128us-gaap:RetainedEarningsMember2021-01-012021-12-310001023128us-gaap:RetainedEarningsMember2023-12-310001023128us-gaap:NoncontrollingInterestMember2022-12-310001023128us-gaap:NoncontrollingInterestMember2021-12-310001023128us-gaap:NoncontrollingInterestMember2020-12-310001023128us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001023128us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001023128us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001023128us-gaap:NoncontrollingInterestMember2023-12-31lad:storelad:brand0001023128srt:MinimumMember2023-01-012023-12-310001023128srt:MaximumMember2023-01-012023-12-310001023128us-gaap:LoansReceivableMemberus-gaap:AutomobileLoanMember2023-12-31xbrli:pure0001023128srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001023128srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001023128srt:MinimumMemberus-gaap:EquipmentMember2023-12-310001023128srt:MaximumMemberus-gaap:EquipmentMember2023-12-310001023128srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001023128srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001023128lad:ContractsInTransitMember2023-12-310001023128lad:ContractsInTransitMember2022-12-310001023128us-gaap:TradeAccountsReceivableMember2023-12-310001023128us-gaap:TradeAccountsReceivableMember2022-12-310001023128lad:VehicleReceivablesMember2023-12-310001023128lad:VehicleReceivablesMember2022-12-310001023128lad:ManufacturerReceivablesMember2023-12-310001023128lad:ManufacturerReceivablesMember2022-12-310001023128lad:OtherCurrentReceivablesMember2023-12-310001023128lad:OtherCurrentReceivablesMember2022-12-310001023128lad:NewVehicleRetailMember2023-12-310001023128lad:NewVehicleRetailMember2022-12-310001023128lad:UsedVehicleMember2023-12-310001023128lad:UsedVehicleMember2022-12-310001023128lad:PartsAndAccessoriesMember2023-12-310001023128lad:PartsAndAccessoriesMember2022-12-310001023128srt:MinimumMemberlad:FloorPlanNotesPayableMember2023-12-310001023128srt:MaximumMemberlad:FloorPlanNotesPayableMember2023-12-310001023128us-gaap:LandMember2023-12-310001023128us-gaap:LandMember2022-12-310001023128us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001023128us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001023128us-gaap:EquipmentMember2023-12-310001023128us-gaap:EquipmentMember2022-12-310001023128us-gaap:FurnitureAndFixturesMember2023-12-310001023128us-gaap:FurnitureAndFixturesMember2022-12-310001023128lad:AssetBackedTermFundingMember2023-12-310001023128lad:AssetBackedTermFundingMember2022-12-310001023128lad:WarehouseFacilitiesMember2023-12-310001023128lad:WarehouseFacilitiesMember2022-12-310001023128lad:OtherManagedReceivablesMember2023-12-310001023128lad:OtherManagedReceivablesMember2022-12-310001023128us-gaap:AutomobileLoanMemberlad:FICOScoreLessThan599Member2023-12-310001023128us-gaap:AutomobileLoanMemberus-gaap:FicoScore600To699Member2023-12-310001023128us-gaap:AutomobileLoanMemberlad:FICOScore700To774Member2023-12-310001023128lad:FICOScoreGreaterThan775Memberus-gaap:AutomobileLoanMember2023-12-310001023128us-gaap:AutomobileLoanMember2023-12-310001023128lad:OtherFinanceReceivablesMember2023-12-310001023128us-gaap:AutomobileLoanMemberlad:FICOScoreLessThan599Member2022-12-310001023128us-gaap:AutomobileLoanMemberus-gaap:FicoScore600To699Member2022-12-310001023128us-gaap:AutomobileLoanMemberlad:FICOScore700To774Member2022-12-310001023128lad:FICOScoreGreaterThan775Memberus-gaap:AutomobileLoanMember2022-12-310001023128us-gaap:AutomobileLoanMember2022-12-310001023128lad:OtherFinanceReceivablesMember2022-12-3100010231282023-06-122023-06-120001023128lad:VehicleOperationsMember2021-12-310001023128lad:FinancingOperationsMember2021-12-310001023128lad:VehicleOperationsMember2022-01-012022-12-310001023128lad:FinancingOperationsMember2022-01-012022-12-310001023128lad:VehicleOperationsMember2022-12-310001023128lad:FinancingOperationsMember2022-12-310001023128lad:VehicleOperationsMember2023-01-012023-12-310001023128lad:FinancingOperationsMember2023-01-012023-12-310001023128lad:VehicleOperationsMember2023-12-310001023128lad:FinancingOperationsMember2023-12-310001023128lad:A2021AcquisitionsMember2022-01-012022-12-310001023128lad:A2022AcquisitionMember2023-01-012023-12-310001023128lad:A2023AcquisitionMember2023-01-012023-12-310001023128us-gaap:FranchiseRightsMember2021-12-310001023128us-gaap:FranchiseRightsMember2022-01-012022-12-310001023128us-gaap:FranchiseRightsMember2022-12-310001023128us-gaap:FranchiseRightsMember2023-01-012023-12-310001023128us-gaap:FranchiseRightsMember2023-12-310001023128us-gaap:FranchiseRightsMemberlad:A2021AcquisitionsMember2022-01-012022-12-310001023128lad:A2022AcquisitionMemberus-gaap:FranchiseRightsMember2023-01-012023-12-310001023128us-gaap:FranchiseRightsMemberlad:A2023AcquisitionMember2023-01-012023-12-310001023128srt:MinimumMember2023-12-310001023128srt:MaximumMember2023-12-3100010231282024-01-012023-12-3100010231282025-01-012023-12-3100010231282026-01-012023-12-3100010231282027-01-012023-12-3100010231282028-01-012023-12-3100010231282029-01-012023-12-310001023128us-gaap:LineOfCreditMemberlad:UsedAndServiceLoanerVehicleInventoryFinancingCommitmentsMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:UsedAndServiceLoanerVehicleInventoryFinancingCommitmentsMember2022-12-310001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001023128us-gaap:LineOfCreditMemberlad:WarehouseCreditFacilitiesMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:WarehouseCreditFacilitiesMember2022-12-310001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2023-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2022-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2031Member2023-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2031Member2022-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2022-12-310001023128lad:RealEstateMortgagesFinanceLeaseObligationAndOtherDebtMember2023-12-310001023128lad:RealEstateMortgagesFinanceLeaseObligationAndOtherDebtMember2022-12-310001023128us-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-09lad:financialInstitutionlad:financeCompany0001023128us-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityUponExpansionOfOriginalLineOfCreditMember2023-02-090001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:LineOfCreditMemberlad:NewVehicleInventoryFloorplanFinancingMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:LineOfCreditMemberlad:ServiceLoanerVehicleFloorplanFinancingMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberlad:NewVehicleInventoryFloorplanFinancingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:ServiceLoanerVehicleFloorplanFinancingMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberlad:NewVehicleInventoryFloorplanFinancingMemberlad:SyndicatedCreditFacilityMember2023-12-310001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:ServiceLoanerVehicleFloorplanFinancingMemberlad:SyndicatedCreditFacilityMember2023-12-310001023128us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberlad:SyndicatedCreditFacilityMember2023-12-310001023128lad:BankOfNovaScotiaCreditAgreementMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMember2022-06-03iso4217:CAD0001023128lad:WorkingCapitalAndGeneralCorporatePurposesFinancingMemberus-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:NewVehicleInventoryFloorplanFinancingMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:UsedMotorVehiclesForSaleInCanadaAndForExportToUnitedStatesMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:WholesaleLeaseFinancingMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:MotorVehicleLeasesFinancingMember2022-06-030001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:WholesaleFlooringFacilityMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:UsedMotorVehiclesForSaleInCanadaAndForExportToUnitedStatesMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:MotorVehicleLeasesFinancingMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMemberlad:WholesaleLeaseFinancingMember2023-12-310001023128lad:WorkingCapitalAndGeneralCorporatePurposesFinancingMemberus-gaap:LineOfCreditMemberlad:BankOfNovaScotiaCreditAgreementMember2023-12-310001023128us-gaap:LineOfCreditMemberlad:WFBCreditFacilityMember2023-02-090001023128us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:WFBCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:WFBCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:WFBCreditFacilityMember2023-02-092023-02-090001023128us-gaap:LineOfCreditMemberlad:WFBCreditFacilityMember2023-12-310001023128us-gaap:RevolvingCreditFacilityMemberlad:AllyCreditFacilityMember2022-12-280001023128us-gaap:PrimeRateMemberus-gaap:RevolvingCreditFacilityMemberlad:AllyCreditFacilityMember2022-12-282022-12-280001023128us-gaap:LineOfCreditMemberlad:AllyCreditFacilityMember2023-12-310001023128lad:SecuritizationFacilityMemberlad:JPMWarehouseFacilityMember2023-07-200001023128srt:MinimumMemberlad:SecuritizationFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:JPMWarehouseFacilityMember2023-07-202023-07-200001023128srt:MaximumMemberlad:SecuritizationFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:JPMWarehouseFacilityMember2023-07-202023-07-200001023128us-gaap:LineOfCreditMemberlad:SecuritizationFacilityMemberlad:JPMWarehouseFacilityMember2023-12-310001023128lad:MizuhoWarehouseFacilityMemberlad:SecuritizationFacilityMember2023-07-200001023128lad:MizuhoWarehouseFacilityMemberlad:SecuritizationFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-07-202023-07-200001023128us-gaap:LineOfCreditMemberlad:MizuhoWarehouseFacilityMemberlad:SecuritizationFacilityMember2023-12-310001023128us-gaap:CollateralizedAutoLoansMemberus-gaap:NonrecourseMember2023-01-012023-12-310001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20211ClassADMember2023-12-310001023128srt:MinimumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20211ClassADMember2023-12-310001023128srt:MaximumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20211ClassADMember2023-12-310001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassACMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MinimumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassACMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MaximumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassACMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128lad:AutoReceivablesTrust20231ClassADMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128lad:AutoReceivablesTrust20231ClassADMembersrt:MinimumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128lad:AutoReceivablesTrust20231ClassADMembersrt:MaximumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MinimumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MaximumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20233ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MinimumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20233ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128srt:MaximumMemberus-gaap:NonrecourseMemberlad:AutoReceivablesTrust20233ClassADMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20234ClassADMember2023-12-310001023128srt:MinimumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20234ClassADMember2023-12-310001023128srt:MaximumMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20234ClassADMember2023-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2023-01-012023-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-01-012023-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2031Member2023-01-012023-12-310001023128us-gaap:SeniorNotesMember2023-12-310001023128srt:MinimumMemberus-gaap:MortgagesMember2023-12-310001023128srt:MaximumMemberus-gaap:MortgagesMember2023-12-310001023128us-gaap:MortgagesMember2023-12-310001023128lad:OtherDebtMembersrt:MinimumMember2023-12-310001023128lad:OtherDebtMembersrt:MaximumMember2023-12-310001023128us-gaap:OtherDebtSecuritiesMember2023-12-310001023128lad:LongTermDebtExcludingLinesOfCreditAndNotesPayableMember2023-12-310001023128us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001023128us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:EquityFundsMember2023-12-310001023128us-gaap:FairValueInputsLevel2Memberus-gaap:EquityFundsMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:EquityFundsMember2023-12-310001023128us-gaap:EquityFundsMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberlad:LiabilityDrivenInstrumentMember2023-12-310001023128us-gaap:FairValueInputsLevel2Memberlad:LiabilityDrivenInstrumentMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberlad:LiabilityDrivenInstrumentMember2023-12-310001023128lad:LiabilityDrivenInstrumentMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashMember2023-12-310001023128us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashMember2023-12-310001023128us-gaap:DefinedBenefitPlanCashMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentsMember2023-12-310001023128us-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:InvestmentsMember2023-12-310001023128us-gaap:InvestmentsMember2023-12-310001023128lad:LiabilityMatchingMember2023-12-310001023128lad:SecureIncomeMember2023-12-310001023128lad:DiversifiedReturnSeekingMember2023-12-310001023128us-gaap:NondesignatedMemberus-gaap:InterestRateCapMember2021-06-15lad:derivative0001023128us-gaap:NondesignatedMemberus-gaap:InterestRateCapMember2020-10-022021-06-150001023128us-gaap:NondesignatedMemberus-gaap:InterestRateCapMember2023-12-310001023128us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2023-12-31lad:vote0001023128us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001023128us-gaap:RestrictedStockUnitsRSUMember2023-12-310001023128us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001023128us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-3100010231282021-01-012021-03-3100010231282021-04-012021-06-3000010231282021-07-012021-09-3000010231282021-10-012021-12-3100010231282022-01-012022-03-3100010231282022-04-012022-06-3000010231282022-07-012022-09-3000010231282022-10-012022-12-3100010231282023-01-012023-03-3100010231282023-04-012023-06-3000010231282023-07-012023-09-3000010231282023-10-012023-12-310001023128lad:The2009ESPPMember2023-12-310001023128lad:The2009ESPPMember2023-01-012023-12-310001023128lad:The2009ESPPMember2022-01-012022-12-310001023128lad:The2009ESPPMember2021-01-012021-12-310001023128lad:A2013StockIncentivePlanMember2023-12-310001023128srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128us-gaap:RestrictedStockUnitsRSUMember2022-12-310001023128lad:TimeVestingRSUMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128us-gaap:RestrictedStockUnitsRSUMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128lad:PerformanceAndTimeVestingRSUsMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128srt:MinimumMemberlad:PerformanceAndTimeVestingRSUsMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128srt:MaximumMemberlad:PerformanceAndTimeVestingRSUsMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMemberlad:A2013StockIncentivePlanMember2023-01-012023-12-310001023128lad:TimeVestingRSUsMember2023-01-012023-12-310001023128lad:TimeVestingRSUsMember2022-01-012022-12-310001023128lad:TimeVestingRSUsMember2021-01-012021-12-310001023128lad:PerformanceAndTimeVestingRSUsMember2023-01-012023-12-310001023128lad:PerformanceAndTimeVestingRSUsMember2022-01-012022-12-310001023128lad:PerformanceAndTimeVestingRSUsMember2021-01-012021-12-310001023128us-gaap:RestrictedStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001023128us-gaap:RestrictedStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001023128us-gaap:RestrictedStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001023128us-gaap:EmployeeStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001023128us-gaap:EmployeeStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001023128us-gaap:EmployeeStockMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001023128us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001023128us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001023128us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001023128us-gaap:RestrictedStockUnitsRSUMemberlad:A2013StockIncentivePlanMember2023-12-310001023128lad:ShiftTechnologiesIncMember2023-01-012023-12-310001023128lad:ShiftTechnologiesIncMember2022-01-012022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Member2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMemberlad:SeniorNotesDue2031Member2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMemberlad:SeniorNotesDue2031Member2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2031Member2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel2Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel2Memberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2023-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2023-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2023-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2022-12-310001023128us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2022-12-310001023128us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMember2022-12-310001023128us-gaap:FranchiseRightsMember2021-07-012021-09-300001023128lad:InvestmentInShiftTechnologiesIncMember2023-12-310001023128lad:StateNetOperatingLossesMember2023-12-310001023128lad:InvestmentInShiftTechnologiesIncMember2023-01-012023-12-310001023128lad:StateNetOperatingLossesMember2023-01-012023-12-310001023128us-gaap:StateAndLocalJurisdictionMember2023-12-310001023128us-gaap:CapitalLossCarryforwardMember2023-12-310001023128country:CA2023-12-310001023128lad:A2022AcquisitionMember2022-01-012022-12-310001023128lad:A2023AcquisitionMember2023-12-310001023128lad:A2022AcquisitionMember2022-12-31lad:segment0001023128lad:VehicleOperationsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001023128lad:VehicleOperationsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001023128lad:VehicleOperationsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001023128us-gaap:OperatingSegmentsMember2023-01-012023-12-310001023128us-gaap:OperatingSegmentsMember2022-01-012022-12-310001023128us-gaap:OperatingSegmentsMember2021-01-012021-12-310001023128us-gaap:OperatingSegmentsMemberlad:FinancingOperationsMember2023-01-012023-12-310001023128us-gaap:OperatingSegmentsMemberlad:FinancingOperationsMember2022-01-012022-12-310001023128us-gaap:OperatingSegmentsMemberlad:FinancingOperationsMember2021-01-012021-12-310001023128lad:CorporateAndEliminationsMember2023-01-012023-12-310001023128lad:CorporateAndEliminationsMember2022-01-012022-12-310001023128lad:CorporateAndEliminationsMember2021-01-012021-12-310001023128us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310001023128us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001023128us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001023128lad:PendragonsUKMotorDivisionAndVehicleManagementDivisionAndPinewoodTechnologiesMemberus-gaap:SubsequentEventMember2024-01-312024-01-31iso4217:EUR0001023128us-gaap:NonrecourseMemberus-gaap:SubsequentEventMember2024-02-012024-02-230001023128srt:MinimumMemberus-gaap:NonrecourseMemberus-gaap:SubsequentEventMember2024-02-230001023128srt:MaximumMemberus-gaap:NonrecourseMemberus-gaap:SubsequentEventMember2024-02-23

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-14733

Lithia Motors, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Oregon |

|

93-0572810 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| 150 N. Bartlett Street, |

Medford, |

Oregon |

97501 |

| (Address of principal executive offices) |

(Zip Code) |

(541) 776-6401

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock without par value |

|

LAD |

|

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

Non-accelerated filer |

Accelerated filer |

Smaller reporting company |

Emerging growth company |

| ☒ |

☐ |

☐ |

☐ |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicated by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was approximately $8,371,919,000 computed by reference to the last sales price ($304.11) as reported by the New York Stock Exchange for the Registrant’s common stock, as of the last business day of the Registrant’s most recently completed second fiscal quarter (June 30, 2023). As of February 23, 2024, there were 27,530,936 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant has incorporated into Part III of Form 10-K, by reference, portions of its Proxy Statement for its 2024 Annual Meeting of Shareholders.

LITHIA MOTORS, INC.

2023 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| Item Number |

Item |

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

None |

Item 1C. |

Cybersecurity |

|

|

|

|

|

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Results of operations |

|

|

Liquidity and capital resources |

|

|

Critical accounting estimates |

|

|

|

|

|

|

|

|

|

None |

|

|

|

|

|

None |

|

|

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 16. |

Form 10-K Summary |

None |

|

|

|

| SIGNATURES |

|

|

PART I

Item 1. Business

As used in this Annual Report, the terms “Lithia,” “Lithia and Driveway,” “LAD,” “the Company,” “we,” “us,” and “our” refer collectively to Lithia Motors, Inc. and its subsidiaries, unless otherwise required by the context. Our store operations are conducted by our subsidiaries.

Forward-Looking Statements

Certain statements in this Annual Report, including in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” constitute forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Generally, you can identify forward-looking statements by terms such as “project,” “outlook,” “target,” “may,” “will,” “would,” “should,” “seek,” “expect,” “plan,” “intend,” “forecast,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “likely,” “goal,” “strategy,” “future,” “maintain,” and “continue” or the negative of these terms or other comparable terms. Examples of forward-looking statements in this Form 10-K include, among others, statements regarding:

•Future market conditions, including anticipated car and other sales levels and the supply of inventory

•Our business strategy and plans, including our achieving our 2025 Plan and related targets

•The growth, expansion, make-up, and success of our network, including our finding accretive acquisitions and acquiring additional stores

•Annualized revenues from acquired stores

•The growth and performance of our Driveway e-commerce home solution and Driveway Finance Corporation (DFC), their synergies and other impacts on our business and our ability to meet Driveway and DFC-related targets

•The impact of sustainable vehicles and other market and regulatory changes on our business

•Our capital allocations and uses and levels of capital expenditures in the future

•Expected operating results, such as improved store performance, continued improvement of selling, general and administrative expenses (SG&A) as a percentage of gross profit and any projections

•Our anticipated financial condition and liquidity, including from our cash and the future availability of our credit facilities, unfinanced real estate, and other financing sources

•Our continuing to purchase shares under our share repurchase program

•Our compliance with financial and restrictive covenants in our credit facilities and other debt agreements

•Our programs and initiatives for employee recruitment, training, and retention

•Our strategies and targets for customer retention, growth, market position, operations, financial results, and risk management

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Forward-looking statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity and development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements in this Annual Report. Therefore, you should not rely on any of these forward-looking statements. The risks and uncertainties that could cause actual results to differ materially from estimated or projected results include, without limitation, the factors as discussed in Part I, Item 1A. Risk Factors, and in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and, from time to time, in our other filings we make with the Securities and Exchange Commission (SEC).

Any forward-looking statement made by us in this Annual Report is based only on information currently available to us and speaks only as of the date on which it is made. Except as required by law, we undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Business Overview

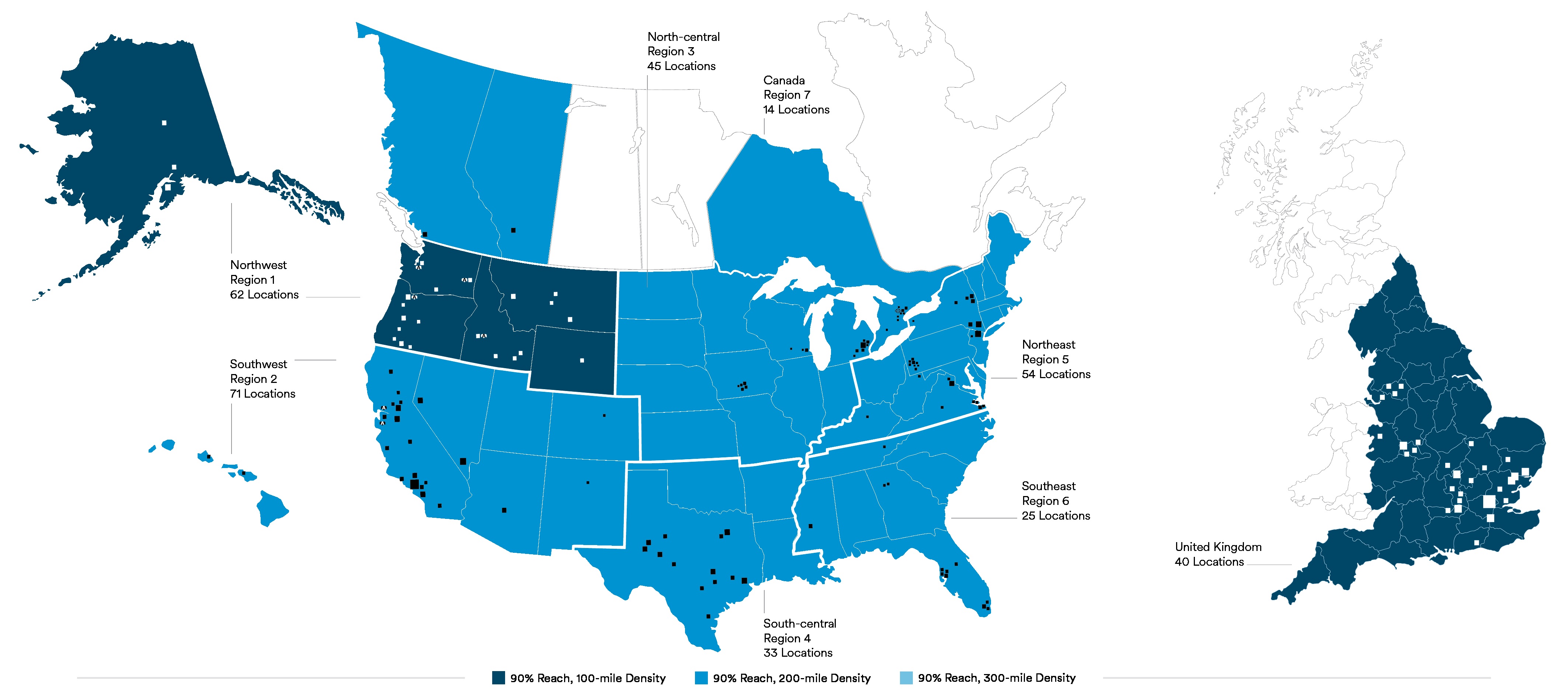

Lithia Motors, Inc. is one of the largest global automotive retailers providing an array of products and services throughout the vehicle ownership lifecycle. Convenient and hassle-free experiences are offered through our comprehensive network of physical locations, e-commerce platforms, captive finance solutions and other synergistic adjacencies. We have delivered consistent profitable growth in a massive and unconsolidated industry. Our highly

diversified and competitively differentiated design provides us the flexibility and scale to pursue our vision to modernize personal transportation solutions wherever, whenever and however consumers desire. As of December 31, 2023, we operated 344 locations representing 47 brands across the United States, United Kingdom, and Canada.

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

2023 |

|

Total Revenue |

|

Total Gross Profit |

United States |

90 |

% |

|

92 |

% |

United Kingdom |

6 |

% |

|

5 |

% |

Canada |

4 |

% |

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

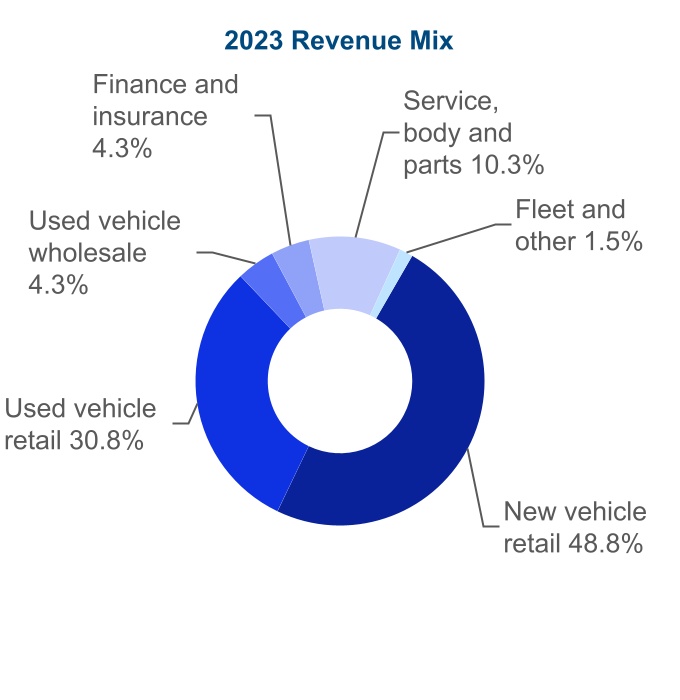

Lithia and Driveway (LAD) offers a wide array of products and services fulfilling the entire vehicle ownership lifecycle including new and used vehicles, finance and insurance products and automotive repair and maintenance. We strive for diversification in our products, services, brands and geographic locations to reduce dependence on any one manufacturer, reduce susceptibility to changing consumer preferences, manage market risk and maintain profitability. Our diversification, along with our operating structure, provides a resilient and nimble business model.

Founded in 1946 and incorporated in Oregon in 1968, we completed our initial public offering in 1996.

Business Strategy

We seek to provide customers choice with a seamless, blended online and physical retail experience, broad selection and access to specialized expertise and knowledge. Our comprehensive network enables us to provide convenient touch points for customers and provide services throughout the vehicle life cycle. We seek to increase market share and optimize profitability by focusing on the consumer experience and applying proprietary performance measurement systems to drive high performance. Our Driveway and GreenCars brands compliment our in-store experiences and provide convenient, simple, and transparent platforms that serve as our e-commerce home solutions. Diversifying our business with Driveway Finance Corporation (DFC), our captive auto finance division, allows us to provide financing solutions for customers and diversify our business model with an adjacent product.

Our long-term strategy to create value for our customers, employees and shareholders includes the following elements:

Driving operational excellence, innovation and diversification

LAD builds magnetic brand loyalty in our 344 stores and with Driveway, our e-commerce home delivery experience, and GreenCars, our electric vehicle learning resource and marketplace. Operational excellence is achieved by focusing the business on convenient and transparent consumer experiences supported by proprietary data science to improve market share, consumer loyalty, and profitability. By promoting an entrepreneurial model with our in-store experiences, we build strong businesses responsive to each of our local markets. Utilizing performance-based action plans, we develop high-performing teams and foster manufacturer relationships.

In response to evolving consumer preferences, we invest in modernization that supports and expands our core business. These digital strategies combine our experienced, knowledgeable workforce with our owned inventory and physical network of stores, enabling us to be agile and adapt to consumer preferences and market specific conditions. Additionally, we systematically explore transformative adjacencies, which are identified to be synergistic and complementary to our existing business such as DFC, our captive auto loan portfolio.

Our investments in modernization are well under way and are taking hold with our teams as they provide digital shopping experiences including finance, contactless test drives and home delivery or curbside pickup for vehicle purchases. Our people and these solutions power our national brands, overlaying our physical footprint in a way that we believe attracts a larger population of digital consumers seeking transparent, empowered, flexible and simple buying and servicing experiences.

Our performance-based culture is geared toward an incentive-based compensation structure for a majority of our personnel. We develop pay plans that are measured based upon various factors such as customer satisfaction, profitability and individual performance metrics. These plans serve to reward team members for creating customer

loyalty, achieving store potential, developing high-performing talent, meeting and exceeding manufacturer requirements and living our core values.

We have centralized many administrative functions to drive efficiencies and streamline store-level operations. The reduction of administrative functions at our stores allows our local managers to focus on customer-facing opportunities to increase revenues and gross profit. Our operations are supported by regional and corporate management, as well as dedicated training and personnel development programs which allow us to share best practices across our network and develop management talent.

Growth through acquisition and network optimization

Our acquisition growth strategy has been successful both financially and culturally. Our disciplined approach focuses on acquiring new vehicle franchises, which operate in markets ranging from mid-sized regional markets to metropolitan markets. Acquisition of these businesses increases our proximity to consumers throughout North America and the United Kingdom. While we target annual after tax return of more than 15% for our acquisitions, we have averaged over a 25% return by the third year of ownership due to a disciplined approach focusing on accretive, cash flow positive targets at reasonable valuations. In addition to being financially accretive, acquisitions aim to drive network growth that improves our ability to serve customers through vast selection, greater density and access to customers and ability to leverage national branding and advertising.

As we focus on expanding our physical network of stores, one of the criteria we evaluate is a valuation multiple between 3x to 7x of investment in intangibles to estimated annualized adjusted EBITDA, with various factors including location, ability to expand our network and talent considered in determining value. We also target an investment in intangibles as a percentage of annualized revenues in the range of 15% to 30%.

During 2023, we acquired 56 stores and divested eight stores. We invested $1.1 billion, net of floor plan debt, to acquire these stores and we anticipate these acquisitions to add nearly $3.8 billion in annualized revenues.

We regularly optimize and balance our network through strategic divestitures to ensure continued high performance. We believe our disciplined approach provides us with attractive acquisition opportunities and expanded coast-to-coast coverage.

Thoughtful capital allocation

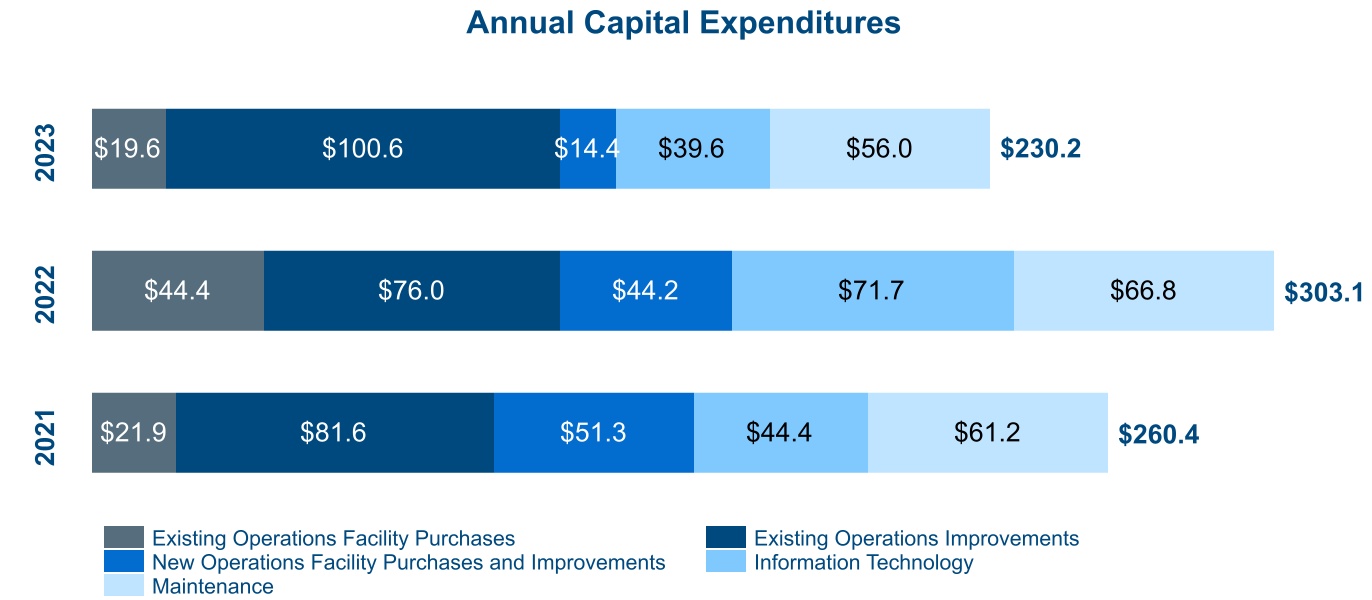

We manage our liquidity and available cash to support our long-term plan focused on growth through acquisitions and investments in our existing business, technology and adjacencies that expand and diversify our business model. Our free cash flow deployment strategy targets an allocation of 65% investment in acquisitions, 25% investment in capital expenditures, innovation, and diversification and 10% in shareholder return in the form of dividends and share repurchases. During 2023, we utilized $230.2 million for capital expenditures investing in our existing business and paid $52.8 million in dividends. As of December 31, 2023, we had available liquidity of $1.7 billion, which was comprised of $825.0 million in cash and $870.4 million availability on our credit facilities. In addition, our unfinanced real estate could provide additional liquidity of approximately $0.4 billion.

Marketing

Lithia & Driveway’s core value, “Earn Customers for Life”, drives our marketing strategy to empower consumers throughout the vehicle ownership lifecycle. To place ease and value at our customers’ fingertips, we are constantly evolving the retail experience where customers can choose transparent, convenient ways to buy, sell, or service their vehicles wherever, whenever, and however they desire.

Our national, regional, and local brands connect with consumers through advertising tailored to the individual brand and market. Utilizing data and omnichannel communications, we strive to create deeper and richer offerings to build lifelong loyalty throughout the vehicle ownership life cycle.

With a vast selection represented by the largest U.S. new and preowned vehicle inventory for sale online, we employ search engine optimization, search engine marketing, online display, retargeting, social advertising, traditional media, and direct marketing to reach consumers.

Most consumers begin their shopping, buying, or selling activity on our store websites, Driveway, and GreenCars. With the importance of keeping consumer communications relevant, based on where they are in the shopping process or lifecycle of ownership, we have built a proprietary customer lifecycle communication platform. In an

industry where the competition often relies on third parties to manage their customer data, we manage our data internally. This goes beyond automotive needs, allowing us to leverage our customer insights across many revenue streams.

These online channels provide customers with simple, transparent ways to manage their vehicle ownership including search new-and-used inventories, view current pricing, apply incentives and offers, calculate payments for purchase or lease, apply for financing, buy online, sell their vehicle, offering the consumer to schedule service appointments both in store or at home, schedule vehicle pick-up and delivery, and provide us feedback about their experience. In 2023, our unique visitors increased over 30% on a same store basis from 2022.

Driveway, our online experience, puts customers in control of every aspect of their car ownership. They can browse a vast nationwide inventory of new, used, and certified pre-owned vehicles (CPO), then get a vehicle shipped straight to their driveway or pick it up from one of Lithia’s 300+ stores. In 2023, approximately 31.5 million unique users visited Driveway.com, a 46% increase from 2022. We believe no-haggle pricing transparency and a 7-day money-back guarantee make Driveway the better way to buy, sell, finance, or trade in a car online.

With the industry transitioning to more sustainable practices and alternative-fuel vehicles, we are excited that GreenCars, our online education resource for sustainable mobility, had approximately 5.9 million unique visitors in 2023 at GreenCars.com, a 58% increase from 2022. GreenCars is a leading source of knowledge designed to promote the acceleration of electric vehicle (EV) adoption by educating the consumer on such topics as (1) fuel-efficient offerings from model comparisons, (2) personalized incentives, and (3) local rebates to charging network. GreenCars even connects consumers with the largest new-and-preowned inventory for when they are ready to purchase their sustainable vehicle.

Total advertising expense, net of manufacturer credits, was $248.2 million in 2023, $253.6 million in 2022 and $162.2 million in 2021. Over 82% of our advertising spent in 2023 was on digital, social, listings, and one-to-one owner communications. In all of our communications, we seek to convey the promise of a positive customer experience, competitive pricing, and wide selection. Our manufacturer partners influence a significant portion of our advertising expense. Certain advertising and marketing expenditures are offset by manufacturer cooperative programs, which require us to submit requests for reimbursement to manufacturers for qualifying advertising expenditures. These advertising credits are not tied to specific vehicles and are earned as qualifying expenses are incurred. These reimbursements are recognized as a reduction of advertising expense. Manufacturer cooperative advertising credits were $54.2 million in 2023, $46.3 million in 2022 and $35.6 million in 2021.

Franchise Agreements

Each of our stores operates under a separate franchise agreement with the manufacturer of the new vehicle brand it sells.

Typical vehicle franchise agreements specify the locations within a designated market area at which the store may sell vehicles and related products and perform approved services. The designation of the market areas and the allocation of new vehicles among stores are at the discretion of the manufacturer. Franchise agreements do not, however, guarantee exclusivity within a specified territory.

A franchise agreement may impose requirements on the store with respect to:

•facilities and equipment;

•inventories of vehicles and parts;

•minimum working capital;

•training of personnel; and

•performance standards for market share and customer satisfaction.

Each manufacturer closely monitors compliance with these requirements and requires each store to submit monthly financial statements. Franchise agreements also grant a store the right to use and display manufacturers’ trademarks, service marks and designs in the manner approved by each manufacturer.

We have determined the useful life of a franchise agreement is indefinite, even though certain franchise agreements are renewed after one to six years. In our experience, agreements are routinely renewed without substantial cost and there are legal remedies to help prevent termination. Certain franchise agreements have no termination date. In addition, state franchise laws protect franchised automotive retailers. Under certain laws, a manufacturer may not

terminate or fail to renew a franchise without good cause or prevent any reasonable changes in the capital structure or financing of a store.

Our typical franchise agreement provides for early termination or non-renewal by the manufacturer upon:

•a change of management or ownership without manufacturer consent;

•insolvency or bankruptcy of the dealer;

•death or incapacity of the dealer/manager;

•conviction of a dealer/manager or owner of certain crimes;

•misrepresentation of certain sales or inventory information to the manufacturer;

•failure to adequately operate the store;

•failure to maintain any license, permit or authorization required for the conduct of business;

•poor market share; or

•low customer satisfaction index scores.

Franchise agreements generally provide for prior written notice before a franchise may be terminated under most circumstances. We also sign master framework agreements with most manufacturers that impose additional requirements. See Item 1A. Risk Factors.

Competition

The retail automotive business is highly competitive. Currently, there are more than 16,500 new vehicle franchise dealers in the United States, 4,500 in the UK, and 3,400 in Canada. Many of these franchised dealers are independent stores managed by individuals, families or small retail groups. We compete primarily with other automotive retailers, both publicly- and privately-held and other used-only automotive retailers such as CarMax, Carvana, and Cazoo.

Vehicle manufacturers have designated specific marketing and sales areas within which only one dealer of a vehicle brand may operate. In addition, our franchise agreements typically limit our ability to acquire multiple dealerships of a given brand within a particular market area. Certain state franchise laws also restrict us from relocating our dealerships, or establishing new dealerships of a particular brand, within any area that is served by another dealer with the same brand. To the extent that a market has multiple dealers of a particular brand, as certain markets we operate in do, we are subject to significant intra-brand competition.

We are larger and have more financial resources than most private automotive retailers with which we currently compete in the majority of our regional markets. We compete directly with retailers with similar or greater resources in our existing metro and non-metro markets. We also compete based on dealer reputation in the various markets. If we enter other new markets, we may face competitors that have access to greater financial resources or have strong brands. We do not have any cost advantage in purchasing new vehicles from manufacturers. We rely on advertising and merchandising, pricing, our customer guarantees and sales model, our sales expertise, service reputation and the location of our stores to sell new vehicles.

Regulation

Automotive and Other Laws and Regulations

We operate in a highly regulated industry. A number of state and federal laws and regulations affect our business. In every state in which we operate, we must obtain various licenses to operate our businesses, including dealer, sales and finance and insurance licenses issued by state regulatory authorities. Numerous laws and regulations govern our business, including those relating to our sales, operations, financing, insurance, advertising and employment practices. These laws and regulations include state franchise laws and regulations, consumer protection laws, privacy laws, escheatment laws, anti-money laundering laws and federal and state wage-hour, anti-discrimination and other employment practices laws.

Our financing activities with customers are subject to numerous federal, state and local laws and regulations. In recent years, there has been an increase in activity related to oversight of consumer lending by the Consumer Financial Protection Bureau (CFPB), which has broad regulatory powers. The CFPB has supervisory authority over large non-bank auto finance companies, including DFC. The CFPB can use this authority to conduct supervisory examinations to ensure compliance with various federal consumer protection laws. The CFPB does not have direct authority over automotive dealers; however, its regulation of larger automotive finance companies and other financial institutions could affect our financing activities. Claims arising out of actual or alleged violations of law may

be asserted against us or our stores by individuals, a class of individuals, or governmental entities. These claims may expose us to significant damages or other penalties, including revocation or suspension of our licenses to conduct store operations and fines.

The vehicles we sell are also subject to rules and regulations of various federal and state regulatory agencies.

Environmental, Health, and Safety Laws and Regulations

Our operations involve the use, handling, storage and contracting for recycling and/or disposal of materials such as motor oil and filters, transmission fluids, antifreeze, refrigerants, paints, thinners, batteries, cleaning products, lubricants, degreasing agents, tires and fuel. Consequently, our business is subject to a complex variety of federal, state and local requirements that regulate the environment and public health and safety.

Most of our stores use above ground storage tanks, and, to a lesser extent, underground storage tanks, primarily for petroleum-based products. Storage tanks are subject to periodic testing, containment, upgrading and removal under the Resource Conservation and Recovery Act and its state law counterparts. Clean-up or other remedial action may be necessary in the event of leaks or other discharges from storage tanks or other sources. In addition, water quality protection programs under the federal Water Pollution Control Act (commonly known as the Clean Water Act), the Safe Drinking Water Act and comparable state and local programs govern certain discharges from our operations. Similarly, certain air emissions from operations, such as auto body painting, may be subject to the federal Clean Air Act and related state and local laws. Health and safety standards promulgated by the Occupational Safety and Health Administration of the United States Department of Labor and related state agencies also apply.

Certain stores may become a party to proceedings under the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, typically in connection with materials that were sent to former recycling, treatment and/or disposal facilities owned and operated by independent businesses. The remediation or clean-up of facilities where the release of a regulated hazardous substance occurred is required under CERCLA and other laws.

We incur certain costs to comply with environmental, health and safety laws and regulations in the ordinary course of our business. We do not anticipate, however, that the costs of compliance will have a material adverse effect on our business, results of operations, cash flows or financial condition, although such outcome is possible given the nature of our operations and the extensive environmental, public health and safety regulatory framework. We may become aware of minor contamination at certain of our facilities, and we conduct investigations and remediation at properties as needed. In certain cases, the current or prior property owner may conduct the investigation and/or remediation or we have been indemnified by either the current or prior property owner for such contamination. We do not currently expect to incur significant costs for remediation. However, we cannot provide assurance that material environmental commitments or contingencies will not arise in the future, or that they do not already exist but are unknown to us.

Human Capital

Inspired by our mission statement, “Growth Powered by People,” we prioritize the importance of every Lithia & Driveway associate’s professional success, well-being, and safety. Our approach to attracting, retaining, rewarding, and developing the best talent includes defining clear expectations, providing exceptional training, and recognizing employee milestones and metrics. These efforts are integral to building dynamic teams who will “Earn Customers for Life” and drive operational excellence. We foster an entrepreneurial, high-performance, customer-centric culture designed to encourage internal promotions, develop leadership skills, and offer professional growth opportunities.

As of December 31, 2023, our subsidiaries employed approximately 27,446 persons on a full-time equivalent basis in our global network of 344 retail locations. Our total workforce was comprised of approximately 21% female employees and approximately 45% of minorities. Our management consisted of approximately 21% females and approximately 36% minorities in leadership positions. In both 2023 and 2022, approximately 97% of our workforce earned above minimum wage.

Some examples of our key employee-focused programs and initiatives include:

•In 2023, we launched a company-wide Culture Poll to amplify the employee voice. With an 80% participation rate, the survey revealed engagement scores surpassing benchmarks, indicating positive

progress in creating a positive workplace experience. The survey also offered valuable insights, leading to the development of action plans by managers to address opportunities to “Improve Constantly.”

•The DART (Develop, Analyze, Research, and Transform) Program started in 2020 to build high-performing leaders who aid in achieving our goal to redefine the automotive industry by providing transportation solutions wherever, whenever, and however consumers desire. The DART Program is designed to give on-the-job exposure to various areas of the organization through rotations while providing supplemental training necessary to grow internal talent into leadership roles. The program identifies data-centric, customer-focused, proactive people who will push stores to be their best for our customers. DART participants learn the ins and outs of performance standards and build relationships cross-functionally to achieve milestones and accelerate their careers.

•Launched in 2016, the AMP (Accelerate My Potential) Program initially targeted general manager readiness. Since 2021, it has evolved to focus on preparing high performers for various leadership roles beyond general manager.

•Introduced in 2015, the Women LEAD (Learn, Explore, Achieve, and Develop) Program offers a platform for women within the organization to connect, learn, and grow together. Featuring events throughout the year, the program facilitates networking, role modeling, and learning opportunities aimed to foster professional development.

•Our learning and development initiatives are dedicated to promoting employee growth through curated content paths, specialized curriculums, and tuition reimbursement programs covering up to 75% of undergraduate or graduate tuition costs. Additional programs provide Master Automotive Service Excellence (ASE) training and certification, along with Original Equipment Manufacturer training for technicians.

As one of the largest global automotive retailers, we are committed to ongoing investments in expanding the roles and skills of our workforce to drive customer excellence and operational performance. As our business continues to evolve, our unwavering focus remains on ensuring that our human capital capabilities, systems, and processes are well-aligned with and in support of our strategic objectives and growth plans.

Seasonality and Quarterly Fluctuations

In a stable environment, the automotive industry has generally experienced higher volumes of vehicle unit sales in the second and third quarters of each year due to consumer buying trends and the introduction of new vehicle models and, accordingly, we expect our revenues and operating results to generally be higher during these periods. In addition, we generally experience higher volume of luxury vehicles, which have higher average selling prices and gross profit per vehicle, during the fourth quarter. The timing of our acquisition activity, which varies, and ability to integrate stores into our existing cost structure has moderated this seasonality. However, if conditions occur that weaken automotive sales, such as severe weather in the geographic areas in which our dealerships operate, war, high fuel costs, depressed economic conditions including unemployment or weakened consumer confidence or similar adverse conditions, or if our ability to acquire stores changes, our revenues for the year may be disproportionately adversely affected.

Available Information

We make available free of charge, on our website at www.lithiainvestorrelations.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after they are filed electronically with the SEC. The information found on our website is not part of this Annual Report on Form 10-K. You may also obtain copies of these reports by contacting Investor Relations at 877-331-3084.

Item 1A. Risk Factors

You should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones facing our company. Additional risks not presently known to us, or that we currently deem immaterial, may also impair our business operations.

Risks Related to Our Business

The automotive retail industry is sensitive to changing economic conditions and various other factors. Our business and results of operations are substantially dependent on new vehicle sales levels in the United

States and in our particular geographic markets and the level of gross profit margins that we can achieve on our sales of new vehicles, all of which are very difficult to predict.

Our business is heavily dependent on consumer demand and preferences. A downturn in overall levels of consumer spending may materially and adversely affect our revenues and gross profit margins. Retail vehicle sales are cyclical and historically have experienced periodic downturns characterized by weak demand. These cycles are often dependent on general economic conditions and consumer confidence, as well as the level of discretionary personal income and credit availability. Additionally, other economic factors, such as rising and sustained periods of high crude oil and fuel prices, may impact consumer demand and preferences. As we operate internationally, including across the U.S., Canada, and the U.K., changes in and the severity of economic conditions may vary by market. Economic conditions may be anemic for an extended period of time, or deteriorate in the future. This would have a material adverse effect on our retail business, particularly sales of new and used vehicles.

The economies of the United States, Canada and the United Kingdom have recently experienced heightened inflationary pressures, impacting the costs of labor, fuel and other costs. Additionally, recent increases in interest rates have impacted new and used vehicle sales and vehicle affordability due to the direct relationship between interest rates and monthly loan payments, a critical factor for many vehicle buyers, and the impact interest rates have on customers’ borrowing capacity and disposable income. Consumer demand may be further adversely impacted if interest rates continue to increase or are sustained at current levels. In an inflationary environment, depending on automotive industry and other economic conditions, we may be unable to raise prices to keep up with the rate of inflation, which would reduce our profit margins. A period of sustained inflationary and interest rate pressures could impact our profitability.

Approximately 15.6 million, 13.9 million, and 15.1 million new vehicles were sold in the United States in 2023, 2022, and 2021, respectively. Certain industry analysts have predicted that new vehicle sales will be approximately 15.7 million for 2024. If new vehicle production exceeds the rate at which new vehicles are sold, our gross profit per vehicle could be adversely affected by this excess and any resulting changes in manufacturer incentive and marketing programs. See the risk factor “If manufacturers or distributors discontinue or change sales incentives, warranties and other promotional programs, our business, results of operations, financial condition and cash flows may be materially adversely affected” below. Economic conditions and the other factors described above may also materially adversely impact our sales of used vehicles, parts and repair and maintenance services, and automotive finance and insurance products.

Natural disasters, adverse weather conditions, and public health emergencies can disrupt our business.

Our dealerships are in states and regions in the United States, Canada, and the U.K. in which actual or threatened natural disasters and severe weather events (such as hurricanes, earthquakes, fires, floods, landslides, wind and/or hail storms) or other extraordinary events have in the past, and may in the future, disrupt our dealership operations and impair the value of our dealership property. A disruption in our operations may adversely impact our business, results of operations, financial condition and cash flows. In addition to business interruption, the automotive retailing business is subject to substantial risk of property loss due to the significant concentration of property at dealership locations. The exposure on any single claim under our property and casualty insurance, medical insurance and workers’ compensation insurance varies based upon type of coverage. Our maximum exposure on any single claim is $5.5 million, subject to certain aggregate limit thresholds. Under our self-insurance programs, we retain various levels of aggregate loss limits, per claim deductibles and claims-handling expenses. Costs in excess of these retained risks may be insured under various contracts with third-party insurance carriers. As of December 31, 2023, we had total reserve amounts associated with these programs of $77.1 million.