| Abercrombie & Fitch Co. | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 1-12107 | 31-1469076 | ||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||||||||

| 6301 Fitch Path | New Albany | Ohio | 43054 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| Registrant’s telephone number, including area code: | (614) | 283-6500 | ||||||||||||||||||

| Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, $0.01 Par Value | ANF | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 99.4 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Abercrombie & Fitch Co. | |||||||||||

Dated: November 26, 2025 |

By: | /s/ Robert J. Ball | |||||||||

| Robert J. Ball | |||||||||||

| Senior Vice President, Chief Financial Officer | |||||||||||

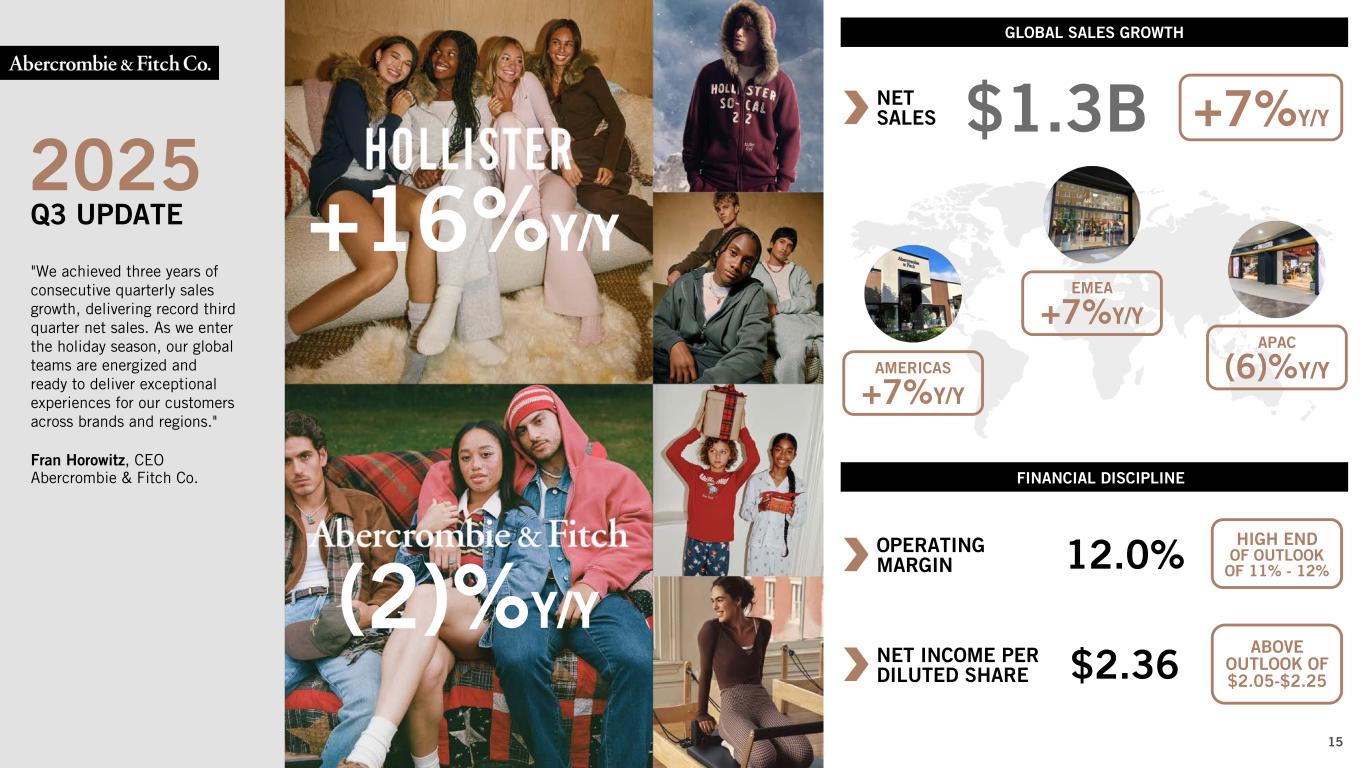

| 2025 | 2024 | |||||||||||||

| GAAP | $ | 2.36 | $ | 2.50 | ||||||||||

Impact from changes in foreign currency exchange rates (1) |

— | (0.03) | ||||||||||||

| Adjusted non-GAAP constant currency | $ | 2.36 | $ | 2.47 | ||||||||||

| Net Sales | ||

| (in thousands) | 2025 | 2024 | 1 YR % Change | Comparable sales (2) |

|||||||||||||||||||

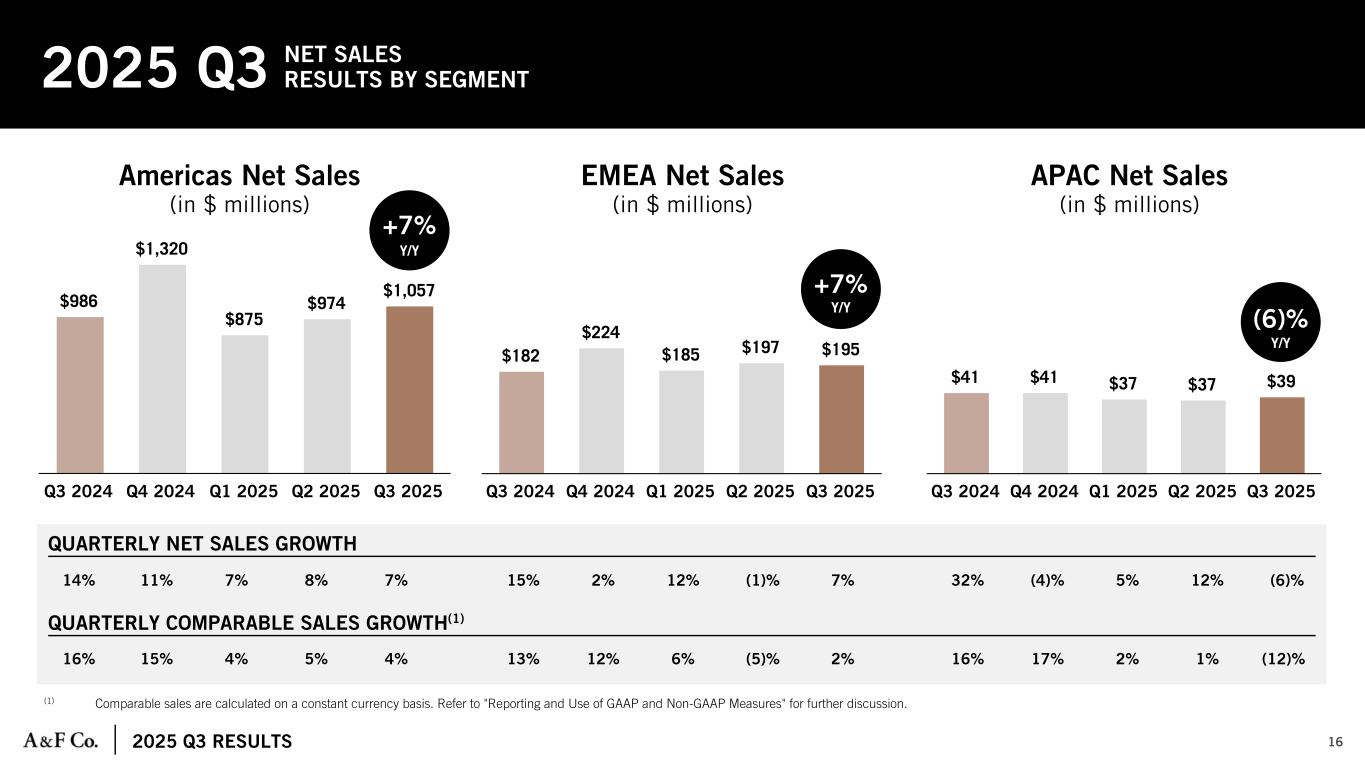

Net sales by segment: (1) |

|||||||||||||||||||||||

Americas (3) |

$ | 1,057,448 | $ | 986,449 | 7% | 4% | |||||||||||||||||

EMEA (4) |

194,510 | 181,592 | 7% | 2% | |||||||||||||||||||

APAC (5) |

38,661 | 40,925 | (6)% | (12)% | |||||||||||||||||||

| Total company | $ | 1,290,619 | $ | 1,208,966 | 7% | 3% | |||||||||||||||||

| 2025 | 2024 | 1 YR % Change | Comparable sales (2) |

||||||||||||||||||||

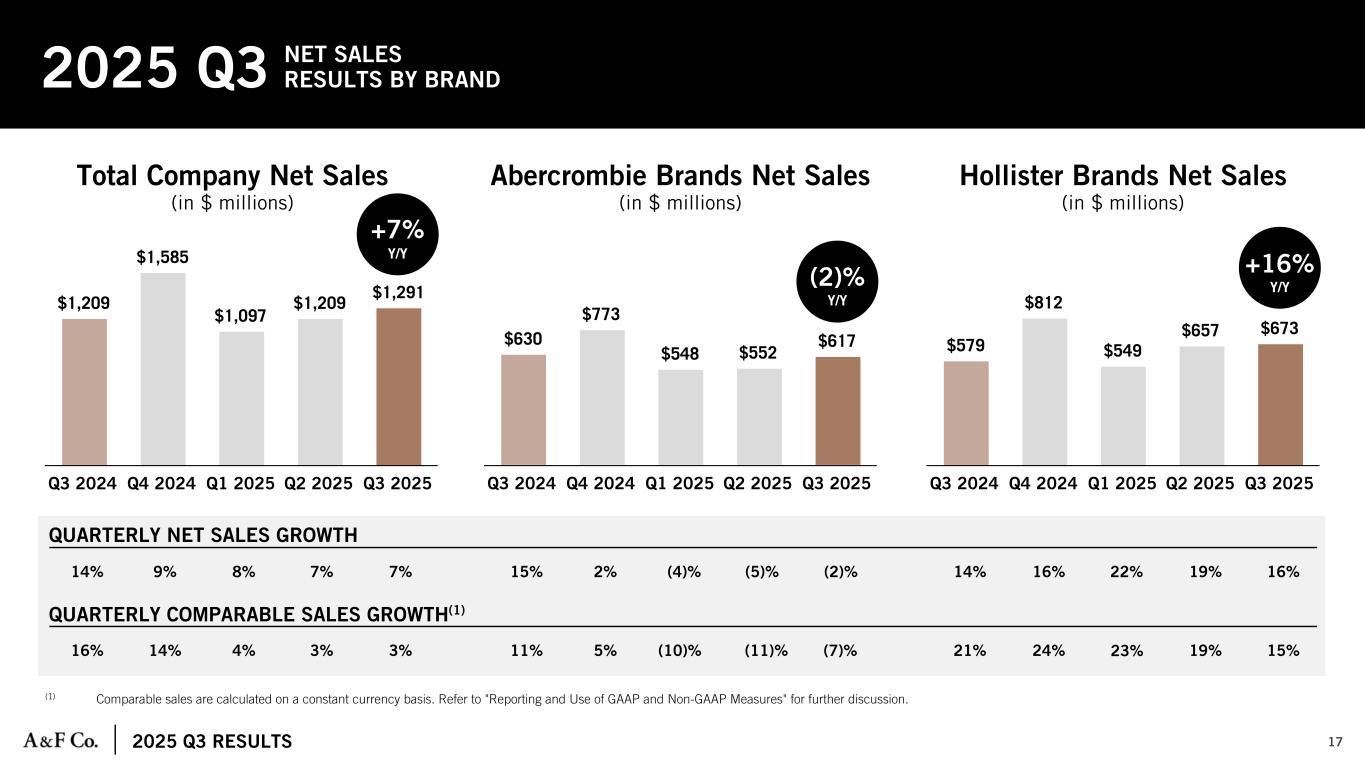

Net sales by brand family: |

|||||||||||||||||||||||

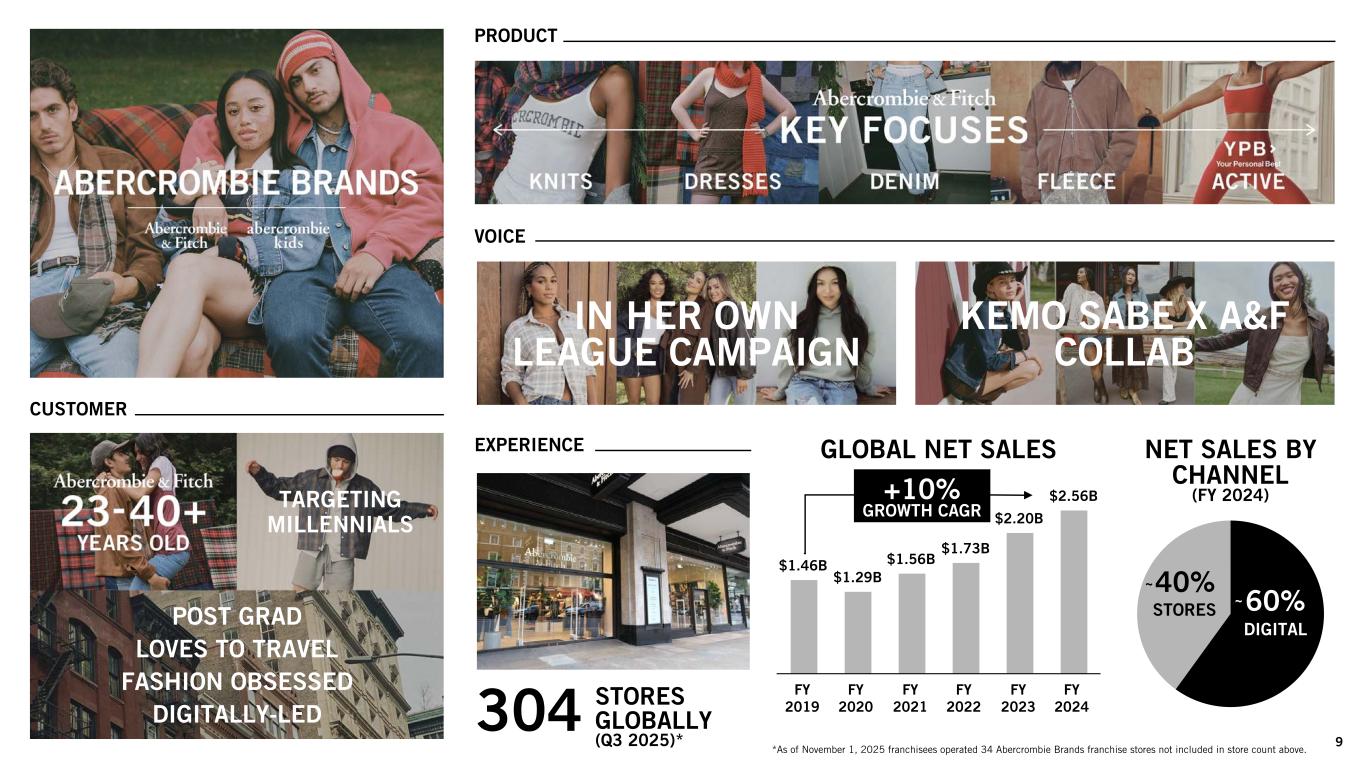

Abercrombie |

$ | 617,345 | $ | 629,835 | (2)% | (7)% | |||||||||||||||||

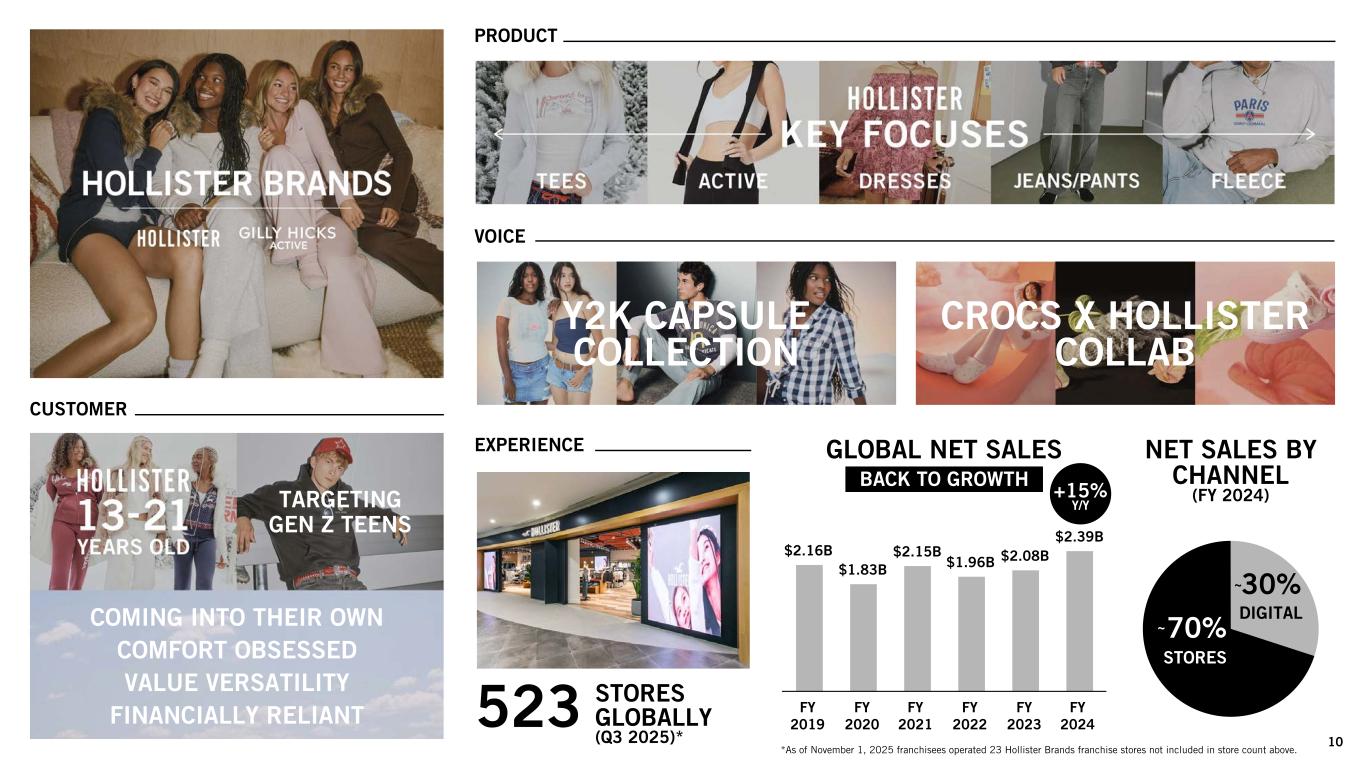

Hollister |

673,274 | 579,131 | 16% | 15% | |||||||||||||||||||

| Total company | $ | 1,290,619 | $ | 1,208,966 | 7% | 3% | |||||||||||||||||

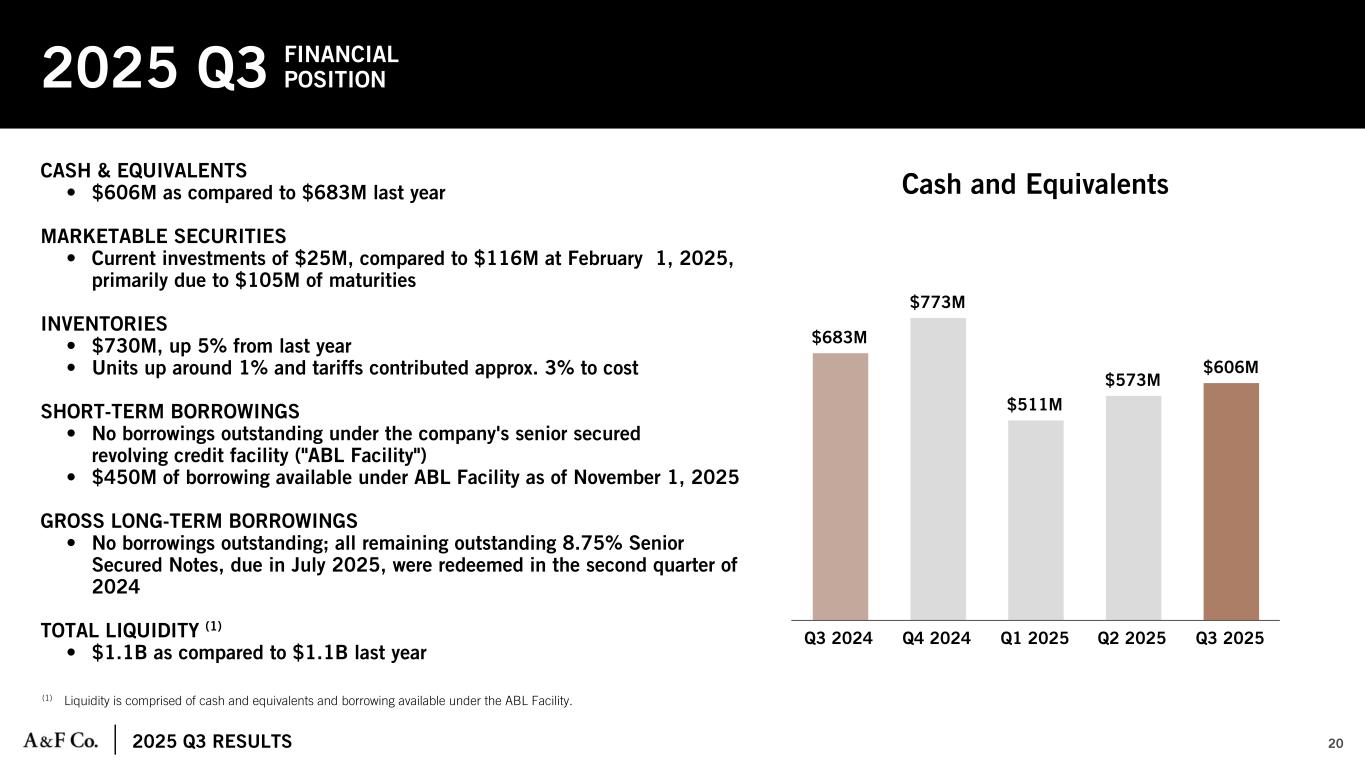

| Financial Position and Liquidity | ||

Cash Flow and Capital Allocation | ||

Fiscal 2025 Outlook | ||

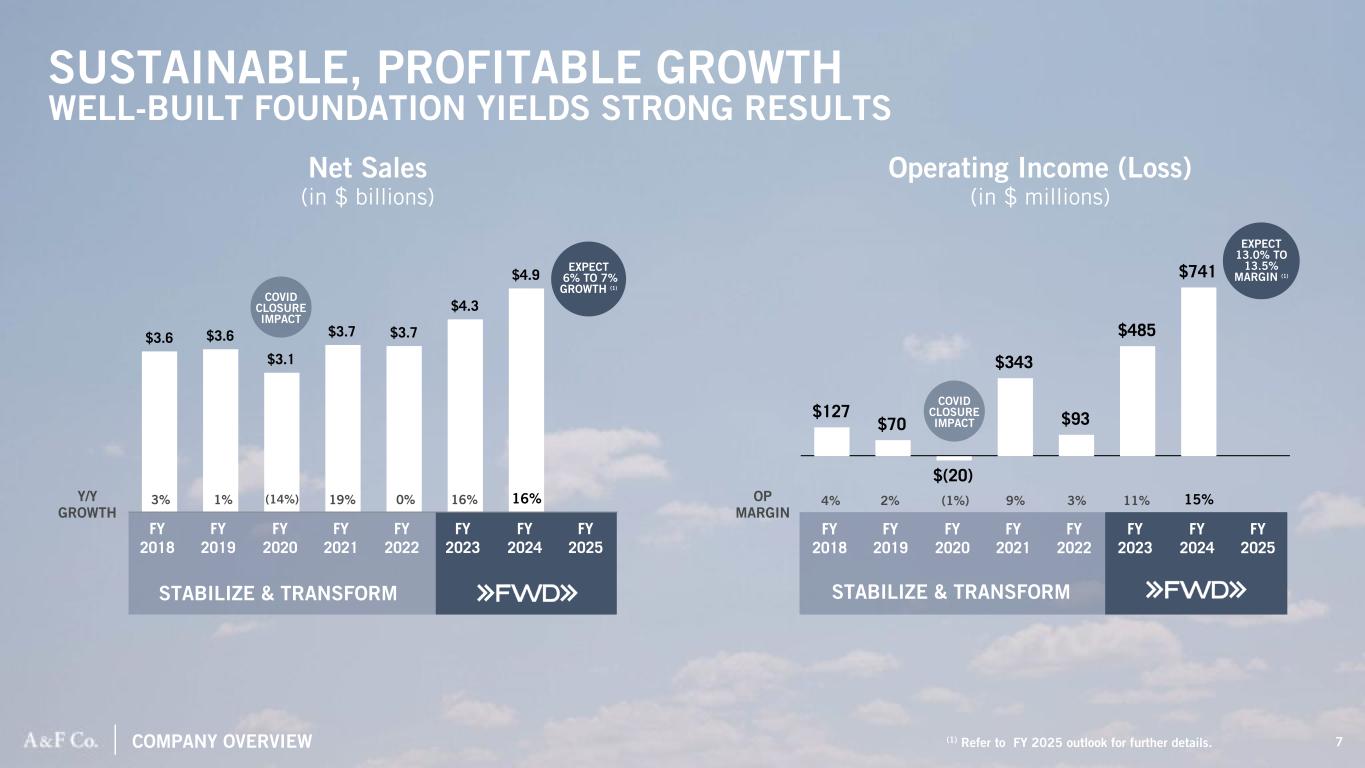

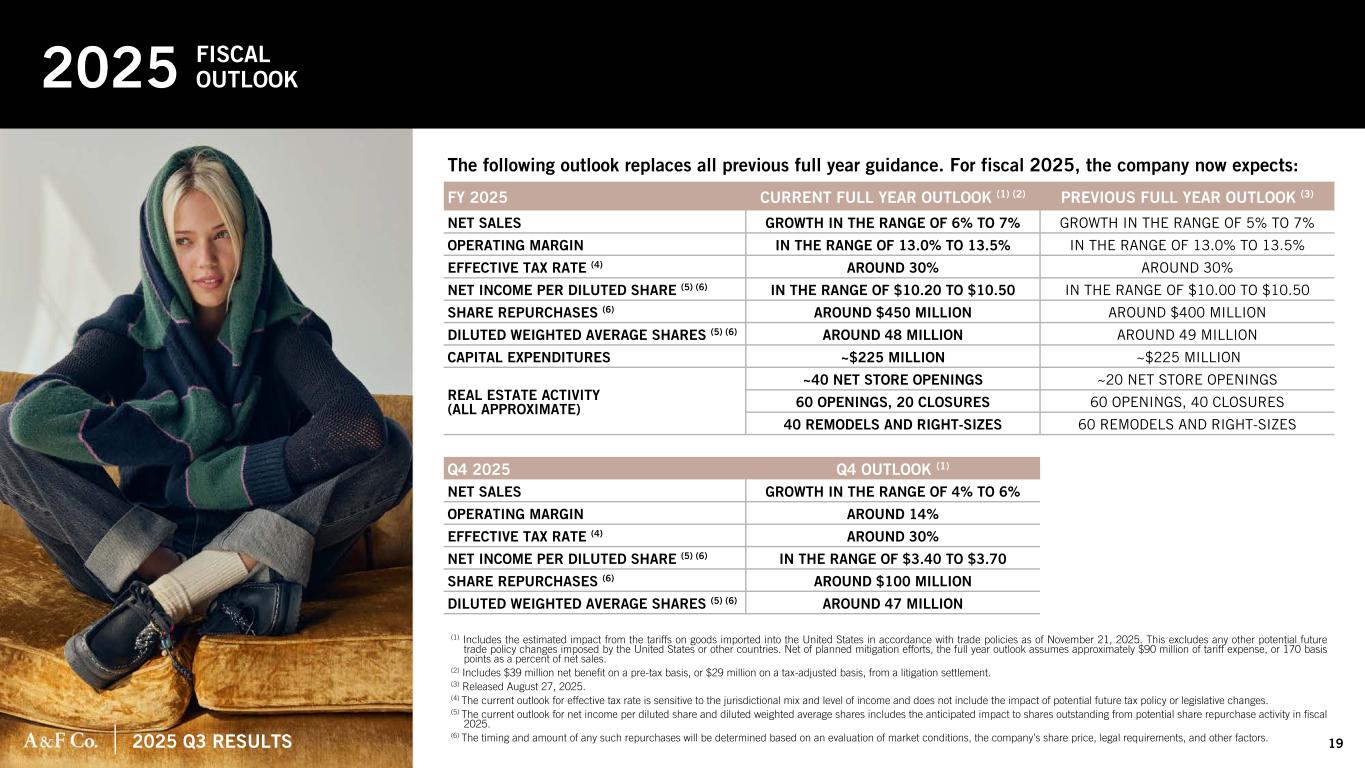

The following outlook replaces all previous full year guidance. For fiscal 2025, the company now expects: | ||||||||

Current Full Year Outlook (1) (2) |

Previous Full Year Outlook (2) (3) |

|||||||

Net sales |

Growth In The Range of 6% to 7% |

Growth In The Range of 5% to 7% |

||||||

Operating margin |

In The Range of 13.0% to 13.5% |

In The Range of 13.0% to 13.5% |

||||||

Effective tax rate (4) |

Around 30% |

Around 30% |

||||||

Net income per diluted share (5) (6) |

In The Range of $10.20 to $10.50 |

In The Range of $10.00 to $10.50 |

||||||

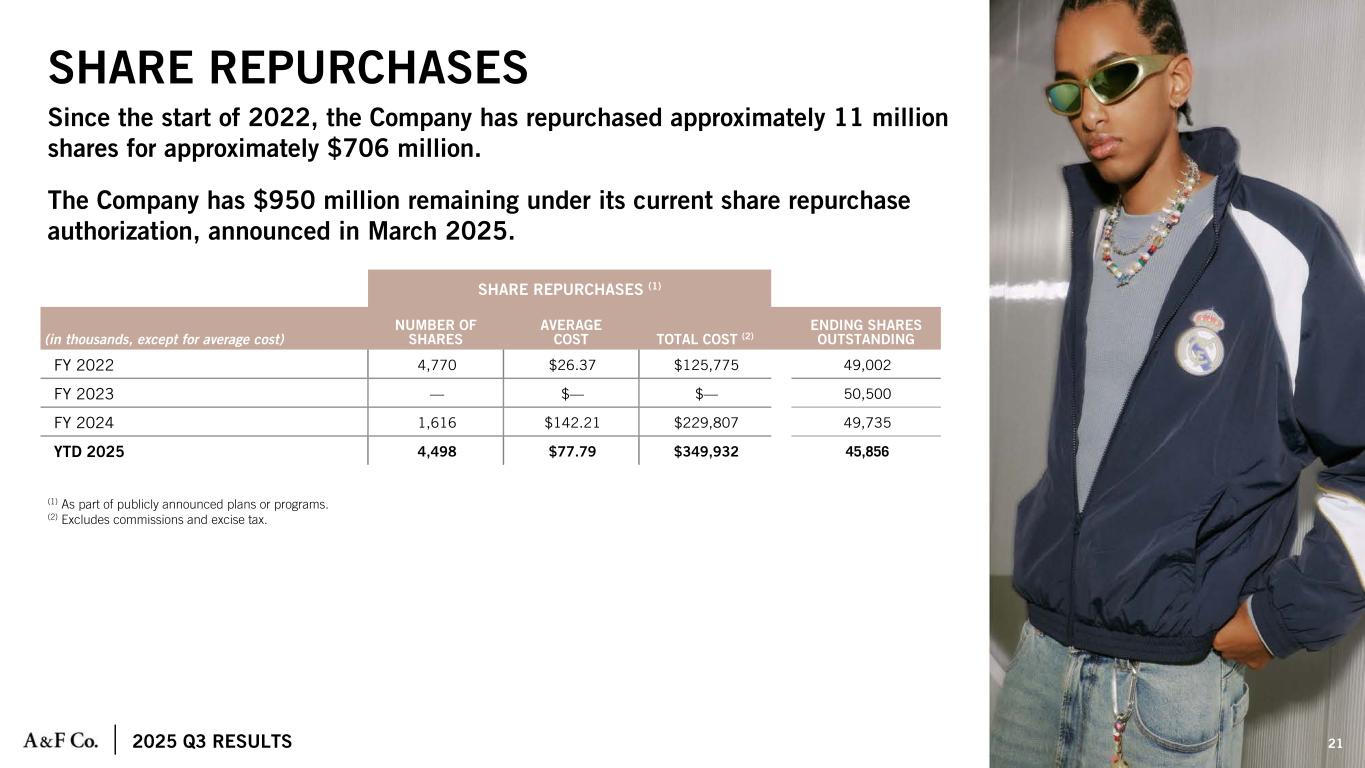

Share repurchases (6) |

Around $450 million |

Around $400 million |

||||||

Diluted weighted average shares (5) (6) |

Around 48 million |

Around 49 million |

||||||

Capital expenditures |

~$225 million |

~$225 million |

||||||

|

Real estate activity

(all approximate)

|

~40 Net Store Openings |

~40 Net Store Openings |

||||||

60 Openings, 20 Closures |

60 Openings, 20 Closures |

|||||||

40 Remodels And Right-Sizes |

40 Remodels And Right-Sizes |

|||||||

Fourth Quarter Outlook (1) |

||||||||

Net sales |

Growth In The Range of 4% to 6% |

|||||||

Operating margin |

Around 14% |

|||||||

Effective tax rate (4) |

Around 30% |

|||||||

Net income per diluted share (5) (6) |

In The Range of $3.40 to $3.70 |

|||||||

Share repurchases (6) |

Around $100 million |

|||||||

Diluted weighted average shares (5) (6) |

Around 47 million |

|||||||

| Conference Call | ||

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 | ||

| Other Information | ||

| About Abercrombie & Fitch Co. | ||

| Investor Contact: | Media Contact: | |||||||

| Mo Gupta | Kate Wagner | |||||||

| Abercrombie & Fitch Co. | Abercrombie & Fitch Co. | |||||||

| (614) 283-6751 | (614) 283-6192 | |||||||

| Investor_Relations@anfcorp.com | Public_Relations@anfcorp.com | |||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

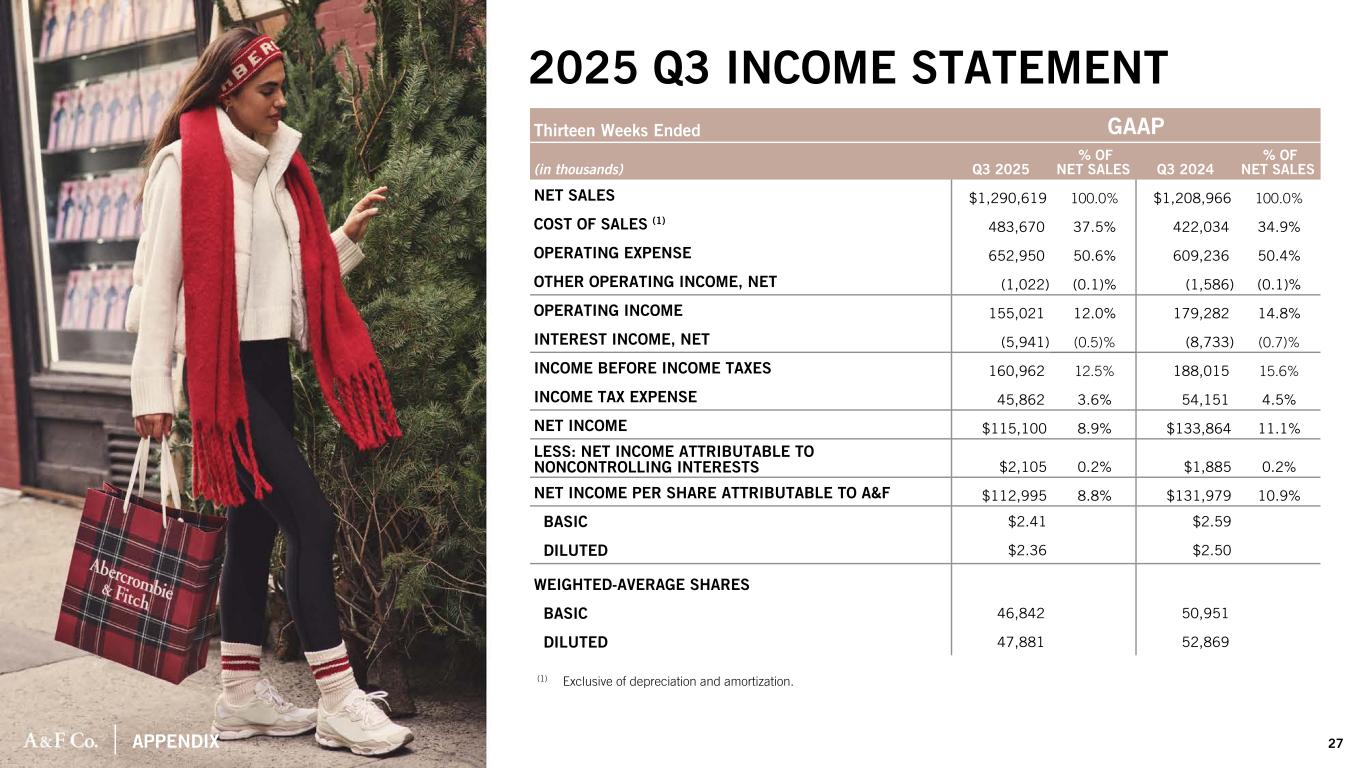

| Thirteen Weeks Ended | Thirteen Weeks Ended | ||||||||||||||||||||||

| November 1, 2025 | % of Net Sales |

November 2, 2024 | % of Net Sales |

||||||||||||||||||||

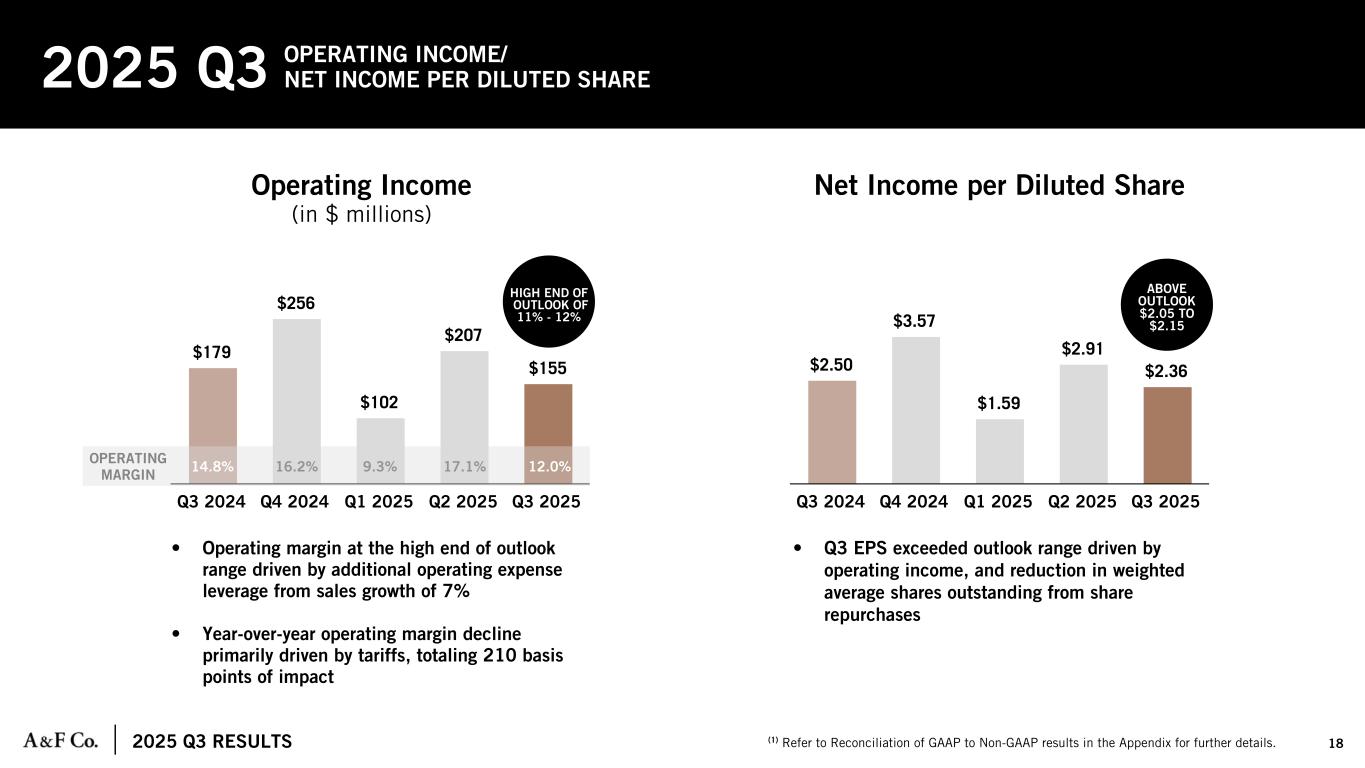

| Net sales | $ | 1,290,619 | 100.0 | % | $ | 1,208,966 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 483,670 | 37.5 | % | 422,034 | 34.9 | % | |||||||||||||||||

| Selling expense | 459,548 | 35.6 | % | 420,990 | 34.8 | % | |||||||||||||||||

| General and administrative expense | 193,402 | 15.0 | % | 188,246 | 15.6 | % | |||||||||||||||||

| Other operating income, net | (1,022) | (0.1) | % | (1,586) | (0.1) | % | |||||||||||||||||

| Operating income | 155,021 | 12.0 | % | 179,282 | 14.8 | % | |||||||||||||||||

| Interest expense | 550 | — | % | 569 | — | % | |||||||||||||||||

| Interest income | (6,491) | (0.5) | % | (9,302) | (0.8) | % | |||||||||||||||||

| Interest income, net | (5,941) | (0.5) | % | (8,733) | (0.7) | % | |||||||||||||||||

| Income before income taxes | 160,962 | 12.5 | % | 188,015 | 15.6 | % | |||||||||||||||||

| Income tax expense | 45,862 | 3.6 | % | 54,151 | 4.5 | % | |||||||||||||||||

| Net income | 115,100 | 8.9 | % | 133,864 | 11.1 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 2,105 | 0.2 | % | 1,885 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 112,995 | 8.8 | % | $ | 131,979 | 10.9 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 2.41 | $ | 2.59 | |||||||||||||||||||

| Diluted | $ | 2.36 | $ | 2.50 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 46,842 | 50,951 | |||||||||||||||||||||

| Diluted | 47,881 | 52,869 | |||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

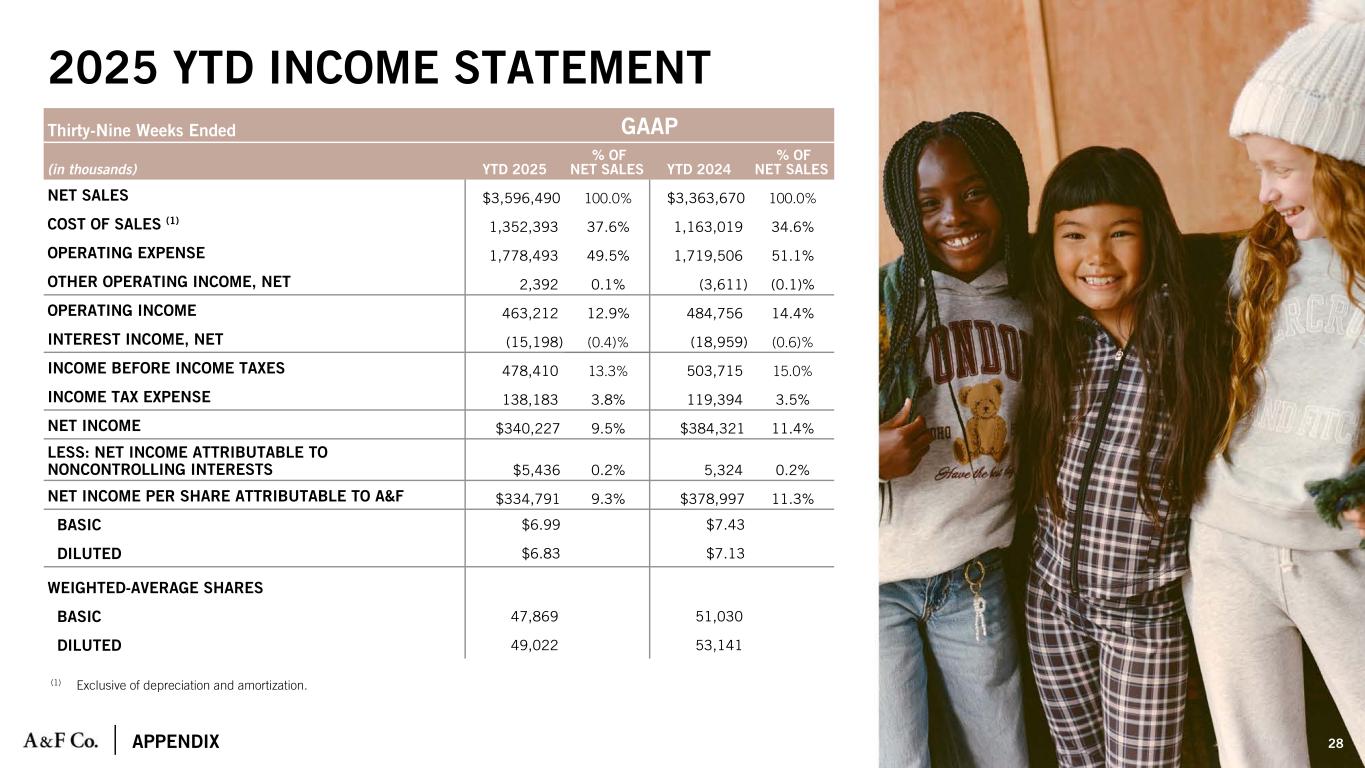

| Thirty-Nine Weeks Ended | Thirty-Nine Weeks Ended | ||||||||||||||||||||||

| November 1, 2025 | % of Net Sales |

November 2, 2024 | % of Net Sales |

||||||||||||||||||||

| Net sales | $ | 3,596,490 | 100.0 | % | $ | 3,363,670 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 1,352,393 | 37.6 | % | 1,163,019 | 34.6 | % | |||||||||||||||||

| Selling expense | 1,234,841 | 34.3 | % | 1,163,565 | 34.6 | % | |||||||||||||||||

| General and administrative expense | 543,652 | 15.1 | % | 555,941 | 16.5 | % | |||||||||||||||||

| Other operating loss (income), net | 2,392 | 0.1 | % | (3,611) | (0.1) | % | |||||||||||||||||

| Operating income | 463,212 | 12.9 | % | 484,756 | 14.4 | % | |||||||||||||||||

| Interest expense | 1,831 | 0.1 | % | 11,538 | 0.3 | % | |||||||||||||||||

| Interest income | (17,029) | (0.5) | % | (30,497) | (0.9) | % | |||||||||||||||||

| Interest income, net | (15,198) | (0.4) | % | (18,959) | (0.6) | % | |||||||||||||||||

| Income before income taxes | 478,410 | 13.3 | % | 503,715 | 15.0 | % | |||||||||||||||||

| Income tax expense | 138,183 | 3.8 | % | 119,394 | 3.5 | % | |||||||||||||||||

| Net income | 340,227 | 9.5 | % | 384,321 | 11.4 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 5,436 | 0.2 | % | 5,324 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 334,791 | 9.3 | % | $ | 378,997 | 11.3 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 6.99 | $ | 7.43 | |||||||||||||||||||

| Diluted | $ | 6.83 | $ | 7.13 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 47,869 | 51,030 | |||||||||||||||||||||

| Diluted | 49,022 | 53,141 | |||||||||||||||||||||

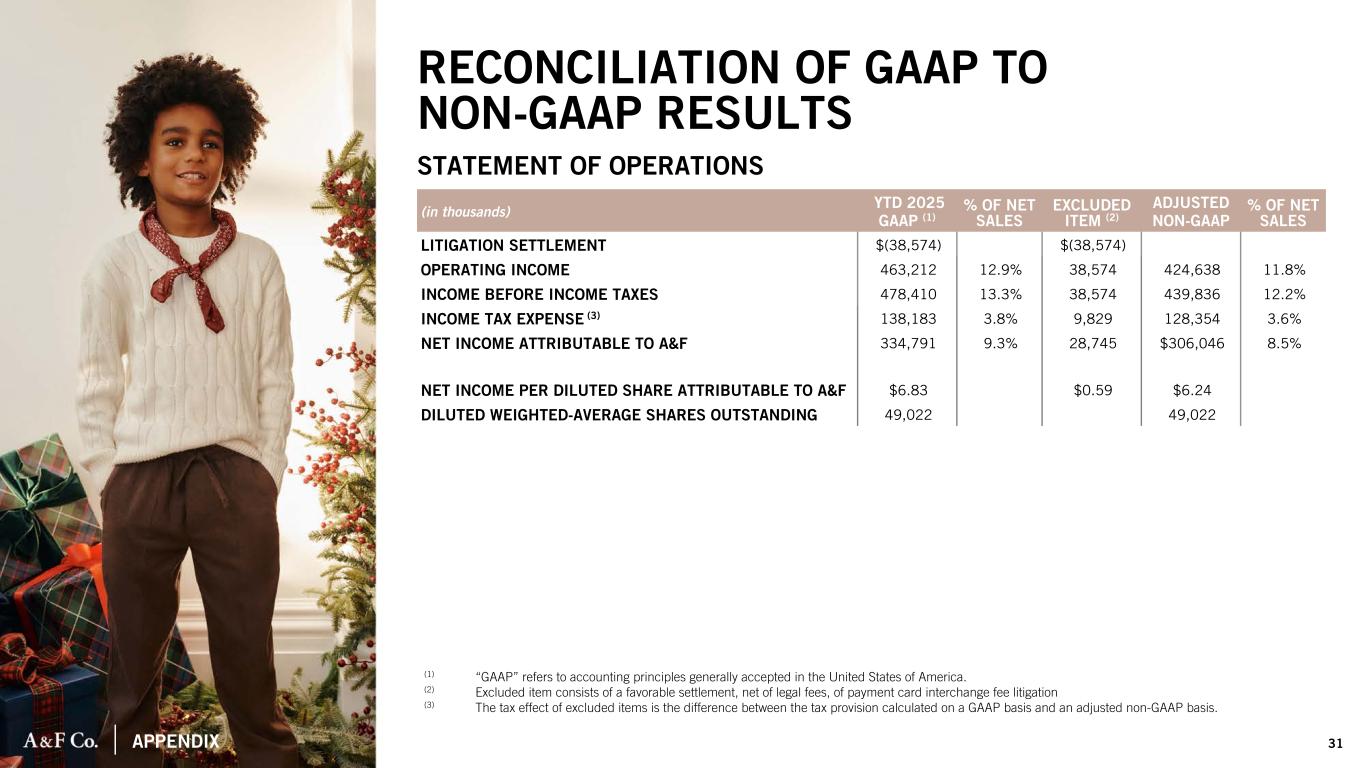

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||

| Schedule of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| Thirty-Nine Weeks Ended November 1, 2025 | |||||||||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||

GAAP (1) |

% of Net Sales |

Excluded item (2) |

Adjusted non-GAAP |

% of Net Sales |

|||||||||||||||||||||||||

Litigation settlement |

$ | (38,574) | $ | (38,574) | $ | — | |||||||||||||||||||||||

Operating income |

463,212 | 12.9 | % | 38,574 | 424,638 | 11.8 | % | ||||||||||||||||||||||

Income before income taxes |

478,410 | 13.3 | % | 38,574 | 439,836 | 12.2 | % | ||||||||||||||||||||||

Income tax expense (3) |

138,183 | 3.8 | % | 9,829 | 128,354 | 3.6 | % | ||||||||||||||||||||||

Net income attributable to A&F |

334,791 | 9.3 | % | 28,745 | 306,046 | 8.5 | % | ||||||||||||||||||||||

Net income per diluted share attributable to A&F |

$ | 6.83 | $ | 0.59 | $ | 6.24 | |||||||||||||||||||||||

Diluted weighted-average shares outstanding |

49,022 | 49,022 | |||||||||||||||||||||||||||

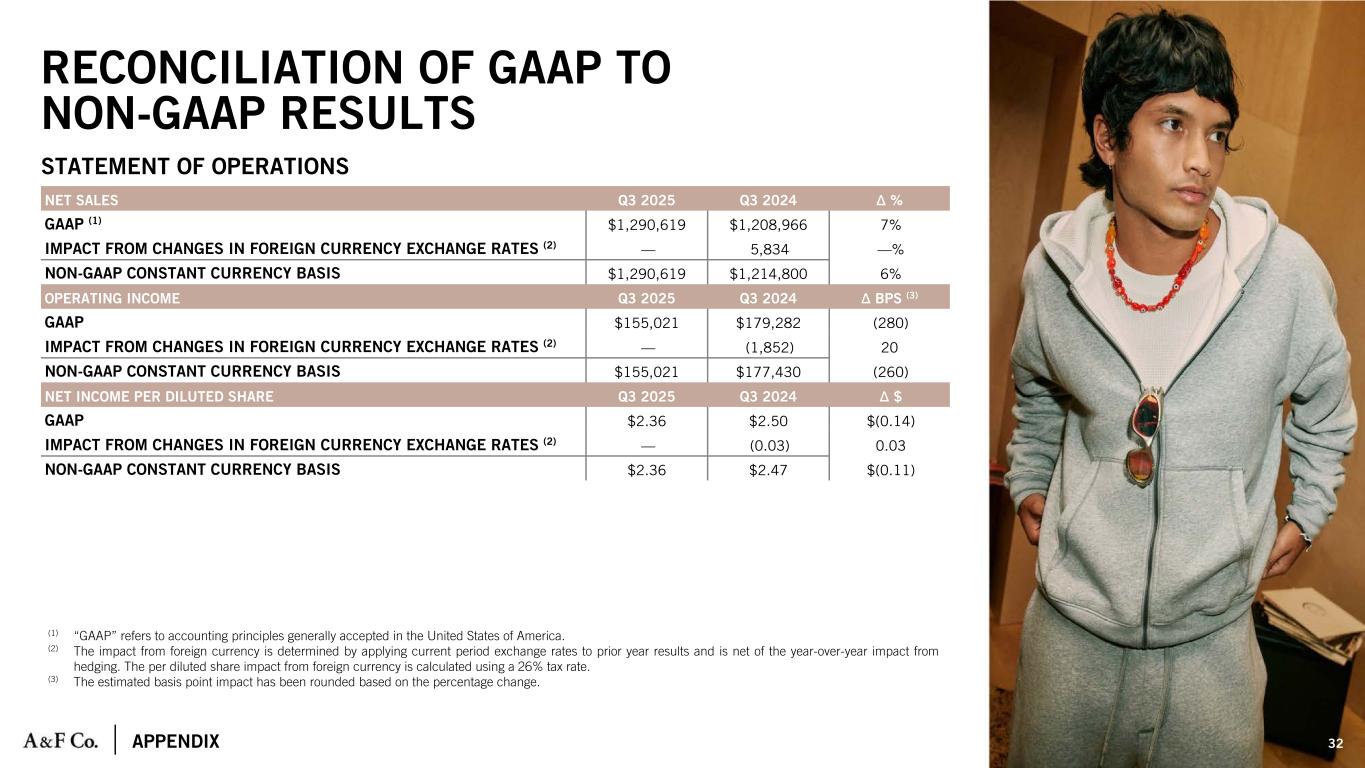

| Abercrombie & Fitch Co. | |||||||||||||||||

| Reconciliation of Constant Currency Financial Measures | |||||||||||||||||

Thirteen Weeks Ended November 1, 2025 and November 2, 2024 | |||||||||||||||||

| (in thousands, except percentage and basis point changes and per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| 2025 | 2024 | % Change | |||||||||||||||

| Net sales | |||||||||||||||||

GAAP (1) |

$ | 1,290,619 | $ | 1,208,966 | 7% | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | 5,834 | — | ||||||||||||||

| Net sales on a constant currency basis | $ | 1,290,619 | $ | 1,214,800 | 6% | ||||||||||||

| Operating income | 2025 | 2024 | BPS Change (3) |

||||||||||||||

GAAP (1) |

$ | 155,021 | $ | 179,282 | (280) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (1,852) | 20 | ||||||||||||||

Non-GAAP constant currency basis |

$ | 155,021 | $ | 177,430 | (260) | ||||||||||||

| Net income per share attributable to A&F | 2025 | 2024 | $ Change | ||||||||||||||

GAAP (1) |

$ | 2.36 | $ | 2.50 | $(0.14) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (0.03) | 0.03 | ||||||||||||||

Non-GAAP constant currency basis |

$ | 2.36 | $ | 2.47 | $(0.11) | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

Thirteen Weeks Ended November 1, 2025 and November 2, 2024 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2025 | % of Net Sales |

2024 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 115,100 | 8.9 | % | $ | 133,864 | 11.1 | % | ||||||||||||

| Income tax expense | 45,862 | 3.6 | 54,151 | 4.5 | ||||||||||||||||

Interest income, net |

(5,941) | (0.5) | (8,733) | (0.7) | ||||||||||||||||

Depreciation and amortization |

38,566 | 3.0 | 39,566 | 3.2 | ||||||||||||||||

| EBITDA | $ | 193,587 | 15.0 | % | $ | 218,848 | 18.1 | % | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

Thirty-Nine Weeks Ended November 1, 2025 and November 2, 2024 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2025 | % of Net Sales |

2024 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 340,227 | 9.5 | % | $ | 384,321 | 11.4 | % | ||||||||||||

| Income tax expense | 138,183 | 3.8 | 119,394 | 3.5 | ||||||||||||||||

| Interest (income) expense, net | (15,198) | (0.4) | (18,959) | (0.6) | ||||||||||||||||

| Depreciation and amortization | 114,566 | 3.2 | 116,610 | 3.6 | ||||||||||||||||

EBITDA (1) |

$ | 577,778 | 16.1 | % | $ | 601,366 | 17.9 | % | ||||||||||||

| Adjustments to EBITDA | ||||||||||||||||||||

| Litigation settlement | (38,574) | (1.1) | % | — | — | % | ||||||||||||||

Adjusted EBITDA (1) |

$ | 539,204 | 15.0 | % | $ | 601,366 | 17.9 | % | ||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||||||||

| (in thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| November 1, 2025 | February 1, 2025 | November 2, 2024 | |||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

| Cash and equivalents | $ | 605,783 | $ | 772,727 | $ | 683,089 | |||||||||||

| Marketable securities | 25,255 | 116,221 | 55,790 | ||||||||||||||

| Receivables | 131,741 | 105,324 | 111,583 | ||||||||||||||

| Inventories | 730,453 | 575,005 | 692,596 | ||||||||||||||

| Other current assets | 116,303 | 104,154 | 112,709 | ||||||||||||||

| Total current assets | 1,609,535 | 1,673,431 | 1,655,767 | ||||||||||||||

| Property and equipment, net | 661,646 | 575,773 | 570,440 | ||||||||||||||

| Operating lease right-of-use assets | 965,919 | 803,121 | 798,290 | ||||||||||||||

| Other assets | 242,818 | 247,562 | 245,375 | ||||||||||||||

| Total assets | $ | 3,479,918 | $ | 3,299,887 | $ | 3,269,872 | |||||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Accounts payable | $ | 461,528 | $ | 364,532 | $ | 466,303 | |||||||||||

| Accrued expenses | 458,075 | 504,922 | 469,148 | ||||||||||||||

| Short-term portion of operating lease liabilities | 225,847 | 211,600 | 210,335 | ||||||||||||||

| Income taxes payable | 17,557 | 45,890 | 36,303 | ||||||||||||||

| Total current liabilities | $ | 1,163,007 | $ | 1,126,944 | $ | 1,182,089 | |||||||||||

| Long-term liabilities: | |||||||||||||||||

| Long-term portion of operating lease liabilities | $ | 905,041 | $ | 740,013 | $ | 734,918 | |||||||||||

| Other liabilities | 80,460 | 81,607 | 92,405 | ||||||||||||||

| Total long-term liabilities | 985,501 | 821,620 | 827,323 | ||||||||||||||

| Total Abercrombie & Fitch Co. stockholders’ equity | 1,316,843 | 1,335,628 | 1,247,133 | ||||||||||||||

| Noncontrolling interests | 14,567 | 15,695 | 13,327 | ||||||||||||||

| Total stockholders’ equity | 1,331,410 | 1,351,323 | 1,260,460 | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | 3,479,918 | $ | 3,299,887 | $ | 3,269,872 | |||||||||||

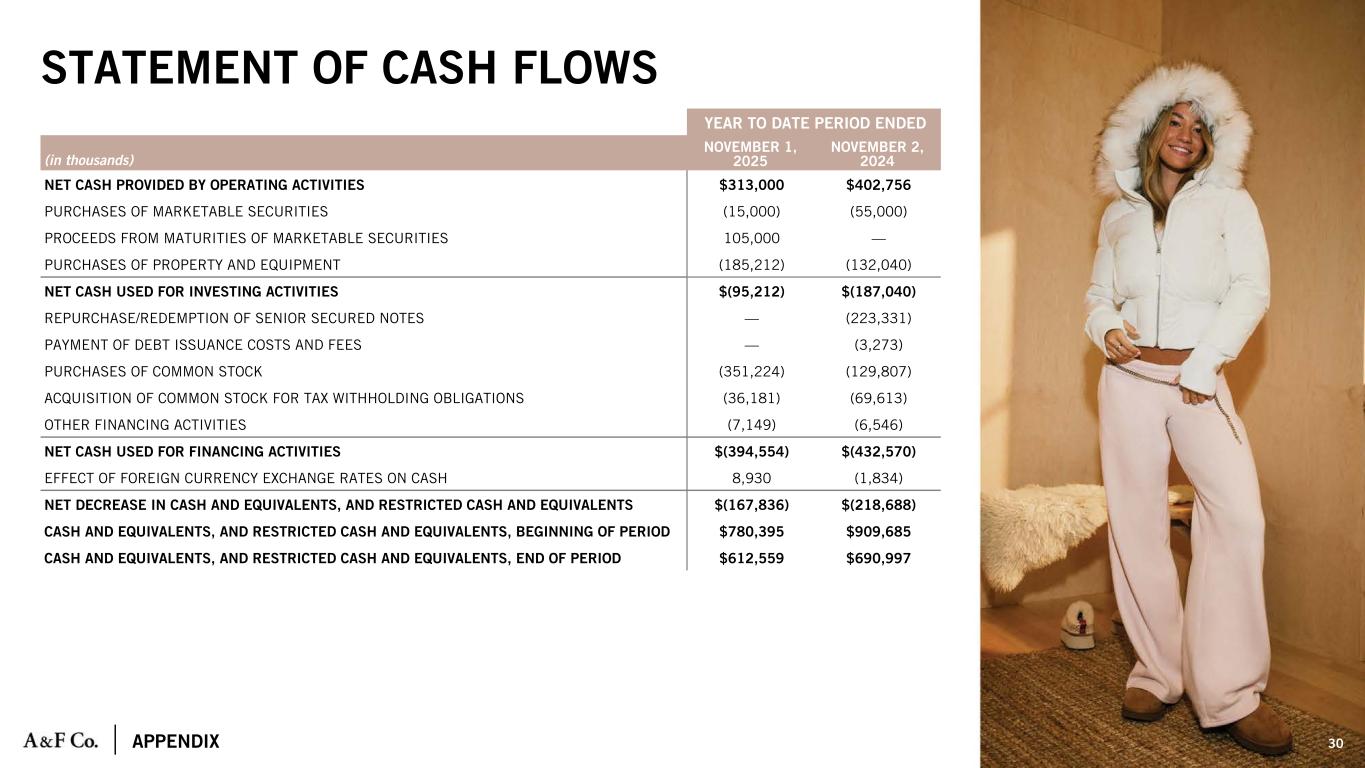

| Abercrombie & Fitch Co. | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (in thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Thirty-Nine Weeks Ended | |||||||||||

| November 1, 2025 | November 2, 2024 | ||||||||||

| Operating activities | |||||||||||

| Net cash provided by operating activities | $ | 313,000 | $ | 402,756 | |||||||

| Investing activities | |||||||||||

Purchases of marketable securities |

$ | (15,000) | $ | (55,000) | |||||||

Proceeds from maturities of marketable securities |

105,000 | — | |||||||||

| Purchases of property and equipment | (185,212) | (132,040) | |||||||||

| Net cash used for investing activities | $ | (95,212) | $ | (187,040) | |||||||

| Financing activities | |||||||||||

Redemption of senior secured notes |

$ | — | $ | (223,331) | |||||||

| Payment of debt modification costs and fees | — | (3,273) | |||||||||

| Purchases of common stock | (351,224) | (129,807) | |||||||||

| Acquisition of common stock for tax withholding obligations | (36,181) | (69,613) | |||||||||

| Other financing activities | (7,149) | (6,546) | |||||||||

| Net cash used for financing activities | $ | (394,554) | $ | (432,570) | |||||||

| Effect of foreign currency exchange rates on cash | $ | 8,930 | $ | (1,834) | |||||||

| Net decrease in cash and equivalents, and restricted cash and equivalents | $ | (167,836) | $ | (218,688) | |||||||

| Cash and equivalents, and restricted cash and equivalents, beginning of period | $ | 780,395 | $ | 909,685 | |||||||

| Cash and equivalents, and restricted cash and equivalents, end of period | $ | 612,559 | $ | 690,997 | |||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||||||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||||||||

| Fiscal 2024 | Fiscal 2025 | |||||||||||||||||||||||||||||||||||||||||||

| 2023 | Q1 | Q2 | Q3 | Q4 | 2024 | Q1 | Q2 | Q3 | 2025 | |||||||||||||||||||||||||||||||||||

| Net sales | $ | 4,280,677 | $ | 1,020,730 | $ | 1,133,974 | $ | 1,208,966 | $ | 1,584,917 | $ | 4,948,587 | $ | 1,097,311 | $ | 1,208,560 | $ | 1,290,619 | $ | 3,596,490 | ||||||||||||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 1,587,265 | 343,273 | 397,712 | 422,034 | 610,907 | 1,773,926 | 417,133 | 451,590 | 483,670 | 1,352,393 | ||||||||||||||||||||||||||||||||||

Selling expense |

1,533,438 | 360,018 | 382,557 | 420,990 | 526,423 | 1,689,988 | 399,937 | 375,356 | 459,548 | 1,234,841 | ||||||||||||||||||||||||||||||||||

General and administrative expense |

681,176 | 189,548 | 178,147 | 188,246 | 194,544 | 750,485 | 174,925 | 175,325 | 193,402 | 543,652 | ||||||||||||||||||||||||||||||||||

| Other operating (income) loss, net | (5,873) | (1,958) | (67) | (1,586) | (3,021) | (6,632) | 3,783 | (369) | (1,022) | 2,392 | ||||||||||||||||||||||||||||||||||

Operating income |

484,671 | 129,849 | 175,625 | 179,282 | 256,064 | 740,820 | 101,533 | 206,658 | 155,021 | 463,212 | ||||||||||||||||||||||||||||||||||

Interest expense |

30,352 | 5,780 | 5,189 | 569 | 539 | 12,077 | 661 | 620 | 550 | 1,831 | ||||||||||||||||||||||||||||||||||

Interest income |

(29,980) | (10,803) | (10,392) | (9,302) | (9,437) | (39,934) | (7,444) | (3,094) | (6,491) | (17,029) | ||||||||||||||||||||||||||||||||||

Interest (income) expense, net |

372 | (5,023) | (5,203) | (8,733) | (8,898) | (27,857) | (6,783) | (2,474) | (5,941) | (15,198) | ||||||||||||||||||||||||||||||||||

Income before income taxes |

484,299 | 134,872 | 180,828 | 188,015 | 264,962 | 768,677 | 108,316 | 209,132 | 160,962 | 478,410 | ||||||||||||||||||||||||||||||||||

Income tax expense |

148,886 | 19,794 | 45,449 | 54,151 | 75,267 | 194,661 | 26,577 | 65,744 | 45,862 | 138,183 | ||||||||||||||||||||||||||||||||||

Net income |

335,413 | 115,078 | 135,379 | 133,864 | 189,695 | 574,016 | 81,739 | 143,388 | 115,100 | 340,227 | ||||||||||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 7,290 | 1,228 | 2,211 | 1,885 | 2,469 | 7,793 | 1,326 | 2,005 | 2,105 | 5,436 | ||||||||||||||||||||||||||||||||||

Net income attributable to Abercrombie & Fitch Co. |

$ | 328,123 | $ | 113,850 | $ | 133,168 | $ | 131,979 | $ | 187,226 | $ | 566,223 | $ | 80,413 | $ | 141,383 | $ | 112,995 | $ | 334,791 | ||||||||||||||||||||||||

Net income per share attributable to Abercrombie & Fitch Co.: |

||||||||||||||||||||||||||||||||||||||||||||

| Basic | $6.53 | $2.24 | $2.60 | $2.59 | $3.72 | $11.14 | $1.63 | $2.97 | $2.41 | $6.99 | ||||||||||||||||||||||||||||||||||

| Diluted | $6.22 | $2.14 | $2.50 | $2.50 | $3.57 | $10.69 | $1.59 | $2.91 | $2.36 | $6.83 | ||||||||||||||||||||||||||||||||||

| Weighted-average shares outstanding: | ||||||||||||||||||||||||||||||||||||||||||||

| Basic | 50,250 | 50,893 | 51,246 | 50,951 | 50,265 | 50,839 | 49,214 | 47,550 | 46,842 | 47,869 | ||||||||||||||||||||||||||||||||||

| Diluted | 52,726 | 53,276 | 53,279 | 52,869 | 52,461 | 52,971 | 50,634 | 48,551 | 47,881 | 49,022 | ||||||||||||||||||||||||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||||||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

| Fiscal 2024 | Fiscal 2025 | |||||||||||||||||||||||||||||||||||||||||||

| 2023 | Q1 | Q2 | Q3 | Q4 | 2024 | Q1 | Q2 | Q3 | 2025 | |||||||||||||||||||||||||||||||||||

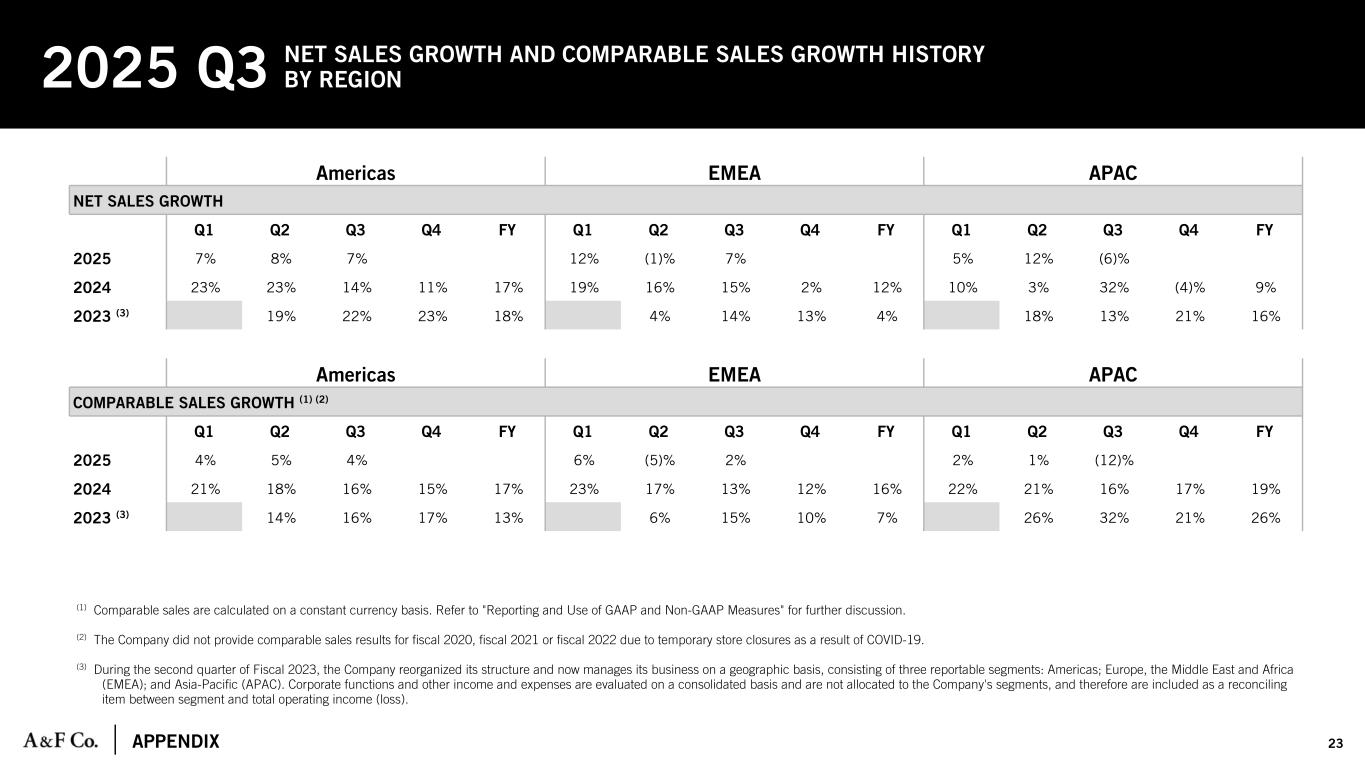

Comparable sales by segment: (1) |

||||||||||||||||||||||||||||||||||||||||||||

Americas comparable sales (2) (3) |

13 | % | 21 | % | 18 | % | 16 | % | 15 | % | 17 | % | 4 | % | 5 | % | 4 | % | 5 | % | ||||||||||||||||||||||||

EMEA comparable sales (2) (4) |

7 | % | 23 | % | 17 | % | 13 | % | 12 | % | 16 | % | 6 | % | (5) | % | 2 | % | — | % | ||||||||||||||||||||||||

APAC comparable sales (2) (5) |

26 | % | 22 | % | 21 | % | 16 | % | 17 | % | 19 | % | 2 | % | 1 | % | (12) | % | 2 | % | ||||||||||||||||||||||||

Comparable sales (2) |

13 | % | 21 | % | 18 | % | 16 | % | 14 | % | 17 | % | 4 | % | 3 | % | 3 | % | 4 | % | ||||||||||||||||||||||||

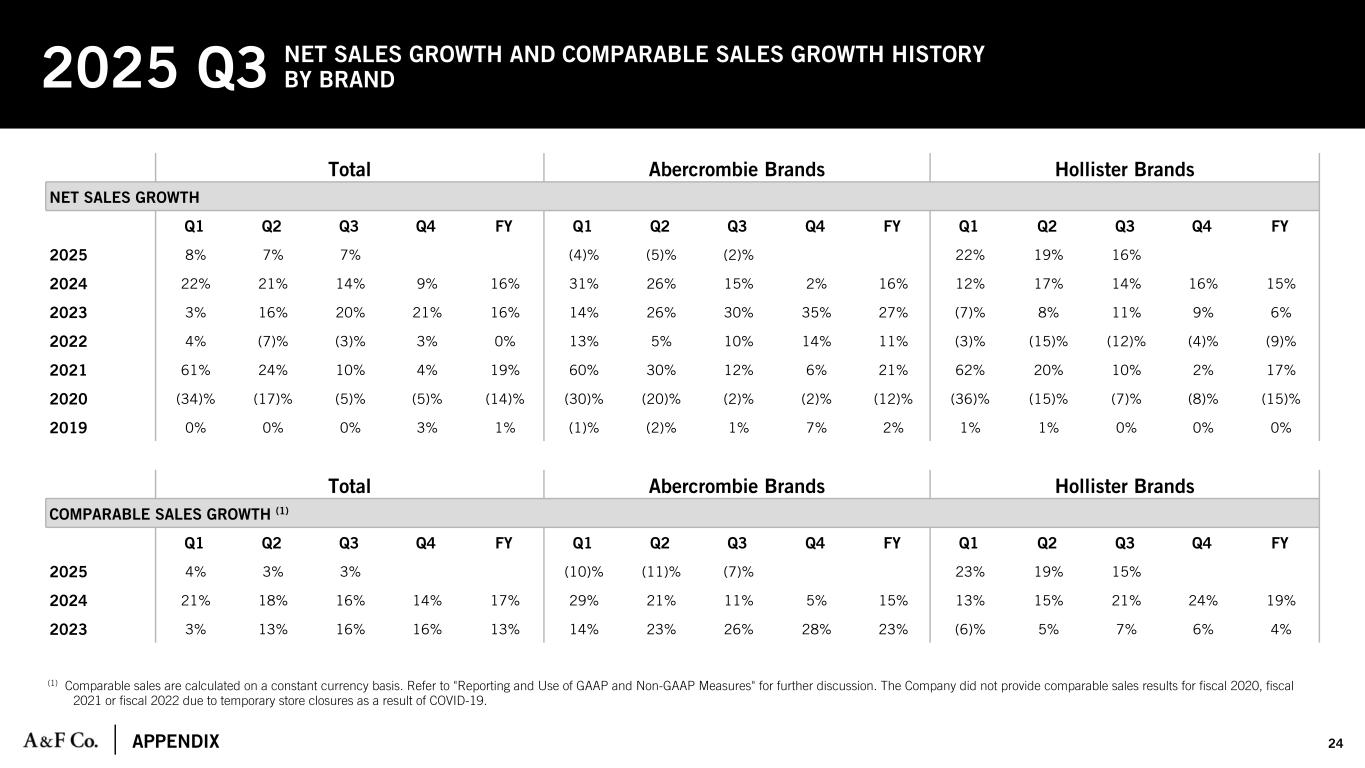

| Comparable sales by brand family: | ||||||||||||||||||||||||||||||||||||||||||||

Abercrombie comparable sales (2) |

23 | % | 29 | % | 21 | % | 11 | % | 5 | % | 15 | % | (10) | % | (11) | % | (7) | % | (10) | % | ||||||||||||||||||||||||

Hollister comparable sales (2) |

4 | % | 13 | % | 15 | % | 21 | % | 24 | % | 19 | % | 23 | % | 19 | % | 15 | % | 20 | % | ||||||||||||||||||||||||

Comparable sales (2) |

13 | % | 21 | % | 18 | % | 16 | % | 14 | % | 17 | % | 4 | % | 3 | % | 3 | % | 4 | % | ||||||||||||||||||||||||

(1) Comparable sales by segment are presented by attributing revenues to a physical store location or geographical region that fulfills the order. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion. | ||||||||||||||||||||||||||||||||||||||||||||

(3) The Americas segment includes the results of operations in North America and South America. | ||||||||||||||||||||||||||||||||||||||||||||

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa. | ||||||||||||||||||||||||||||||||||||||||||||

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania. | ||||||||||||||||||||||||||||||||||||||||||||