| Abercrombie & Fitch Co. | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 1-12107 | 31-1469076 | ||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||||||||

| 6301 Fitch Path | New Albany | Ohio | 43054 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| Registrant’s telephone number, including area code: | (614) | 283-6500 | ||||||||||||||||||

| Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, $0.01 Par Value | ANF | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 99.4 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Abercrombie & Fitch Co. | |||||||||||

Dated: August 28, 2025 |

By: | /s/ Robert J. Ball | |||||||||

| Robert J. Ball | |||||||||||

| Senior Vice President, Chief Financial Officer | |||||||||||

| 2025 | 2024 | |||||||||||||

| GAAP | $ | 2.91 | $ | 2.50 | ||||||||||

Excluded item, net of tax effect (1) |

0.59 | — | ||||||||||||

| Adjusted non-GAAP | $ | 2.32 | $ | 2.50 | ||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | 0.03 | ||||||||||||

| Adjusted non-GAAP constant currency | $ | 2.32 | $ | 2.53 | ||||||||||

| Net Sales | ||

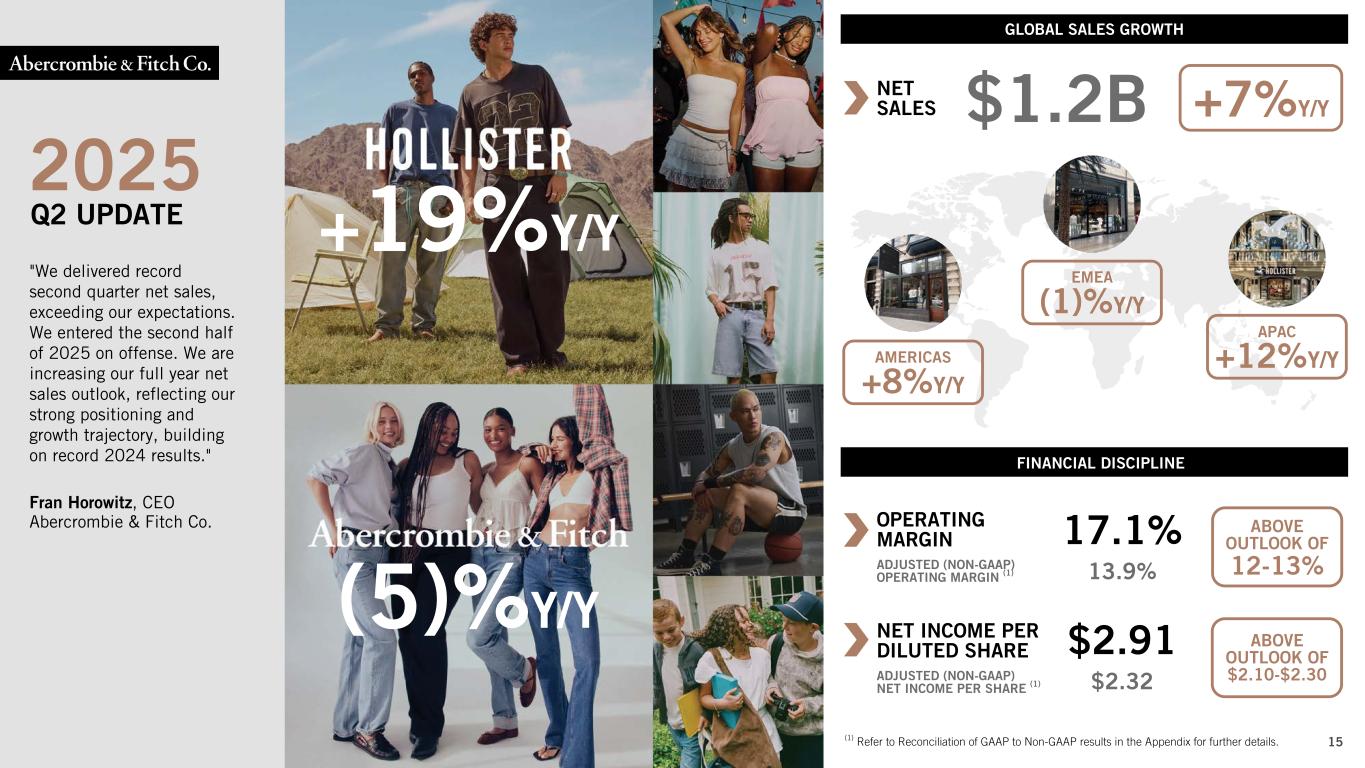

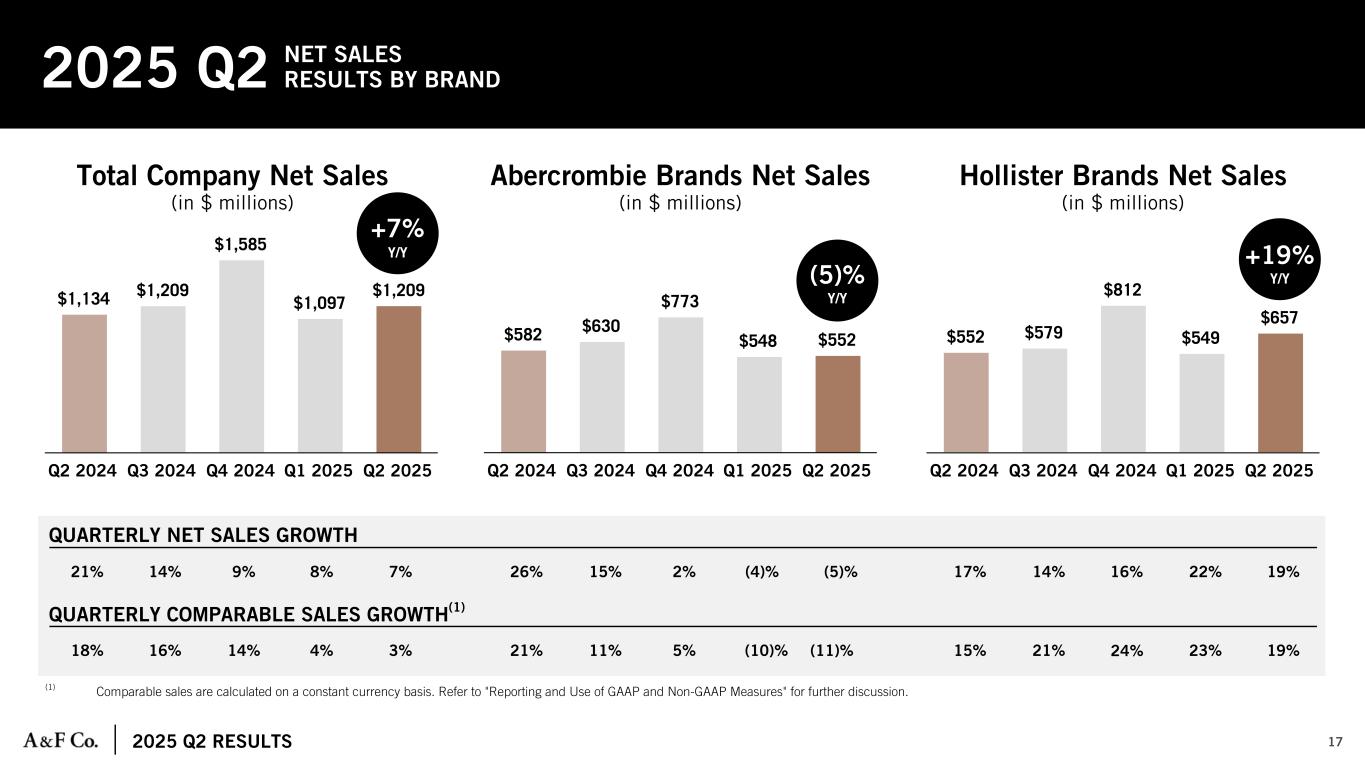

| (in thousands) | 2025 | 2024 | 1 YR % Change | Comparable sales (2) |

|||||||||||||||||||

Net sales by segment: (1) |

|||||||||||||||||||||||

Americas (3) |

$ | 974,200 | $ | 901,224 | 8% | 5% | |||||||||||||||||

EMEA (4) |

197,210 | 199,682 | (1)% | (5)% | |||||||||||||||||||

APAC (5) |

37,150 | 33,068 | 12% | 1% | |||||||||||||||||||

| Total company | $ | 1,208,560 | $ | 1,133,974 | 7% | 3% | |||||||||||||||||

| 2025 | 2024 | 1 YR % Change | Comparable sales (2) |

||||||||||||||||||||

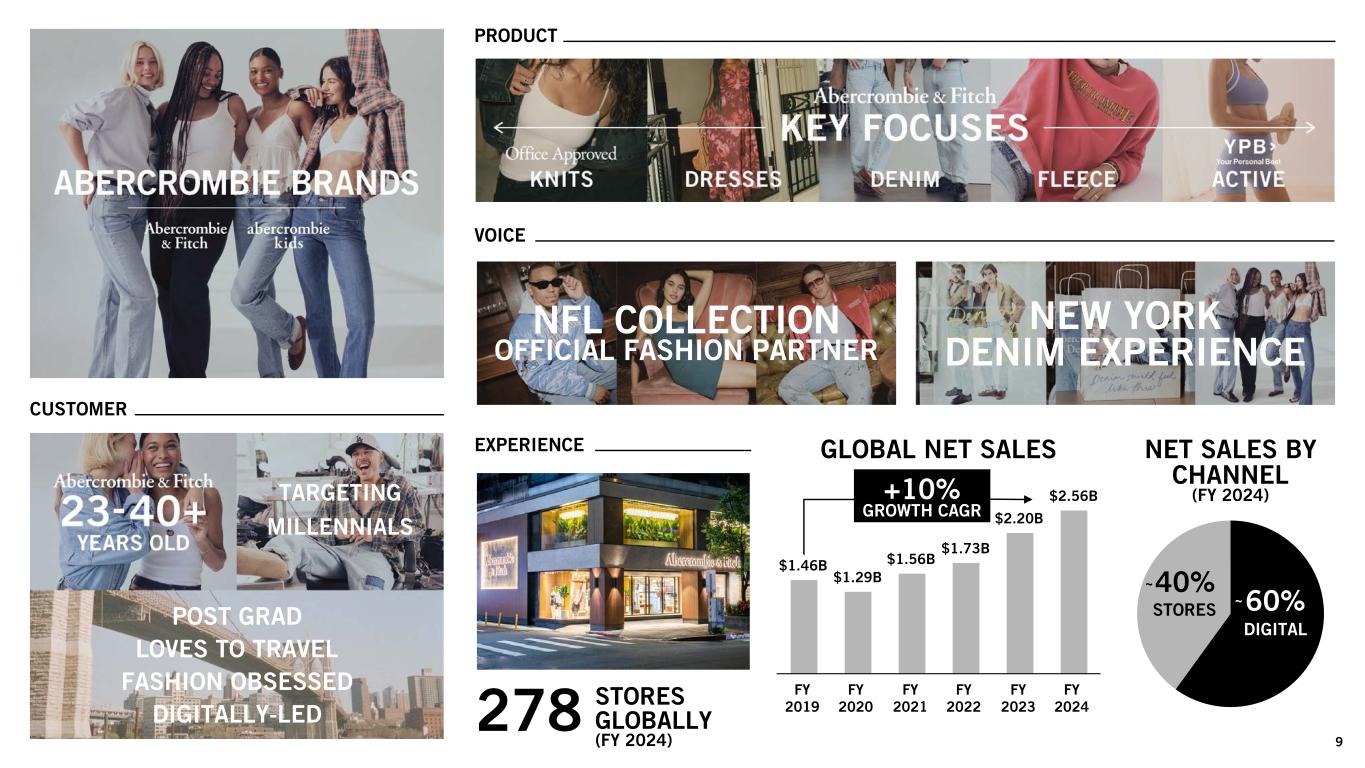

Net sales by brand family: |

|||||||||||||||||||||||

Abercrombie |

$ | 551,868 | $ | 582,416 | (5)% | (11)% | |||||||||||||||||

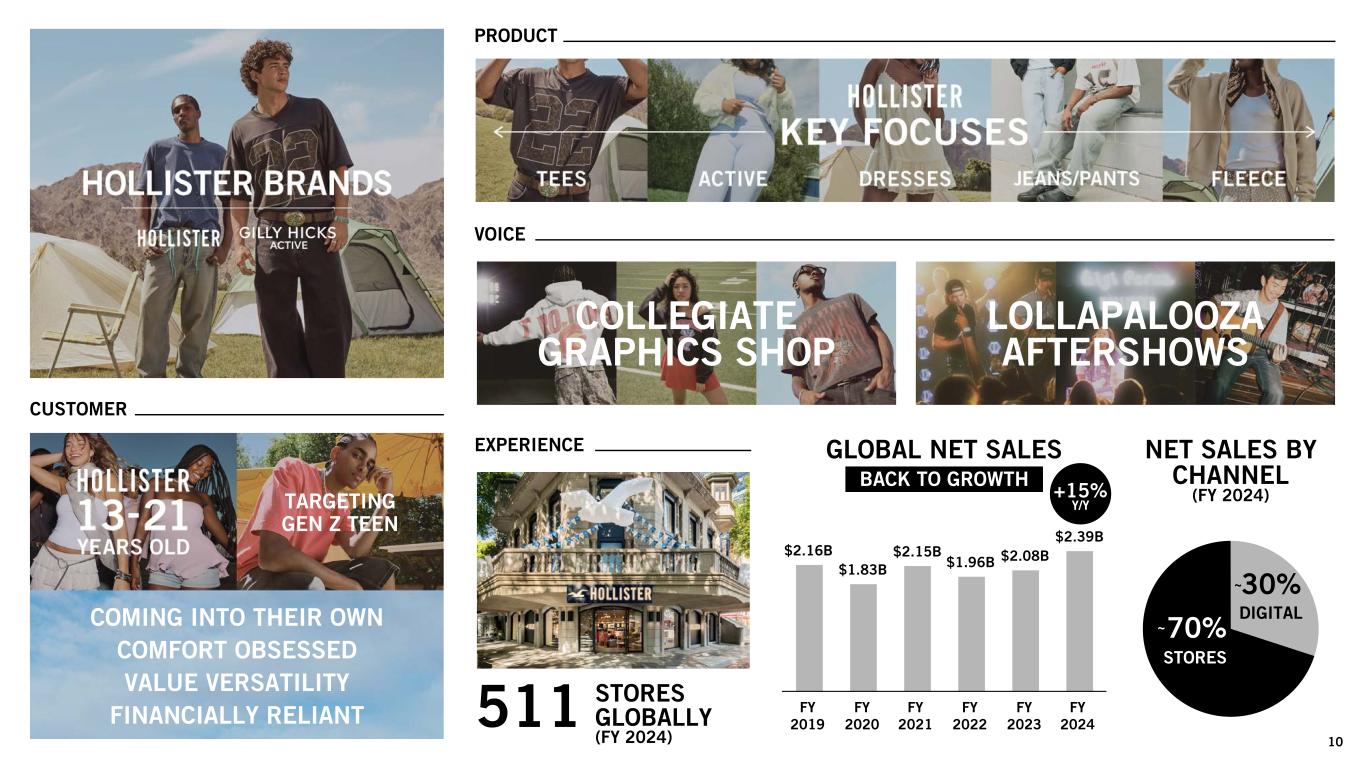

Hollister |

656,692 | 551,558 | 19% | 19% | |||||||||||||||||||

| Total company | $ | 1,208,560 | $ | 1,133,974 | 7% | 3% | |||||||||||||||||

| Financial Position and Liquidity | ||

Cash Flow and Capital Allocation | ||

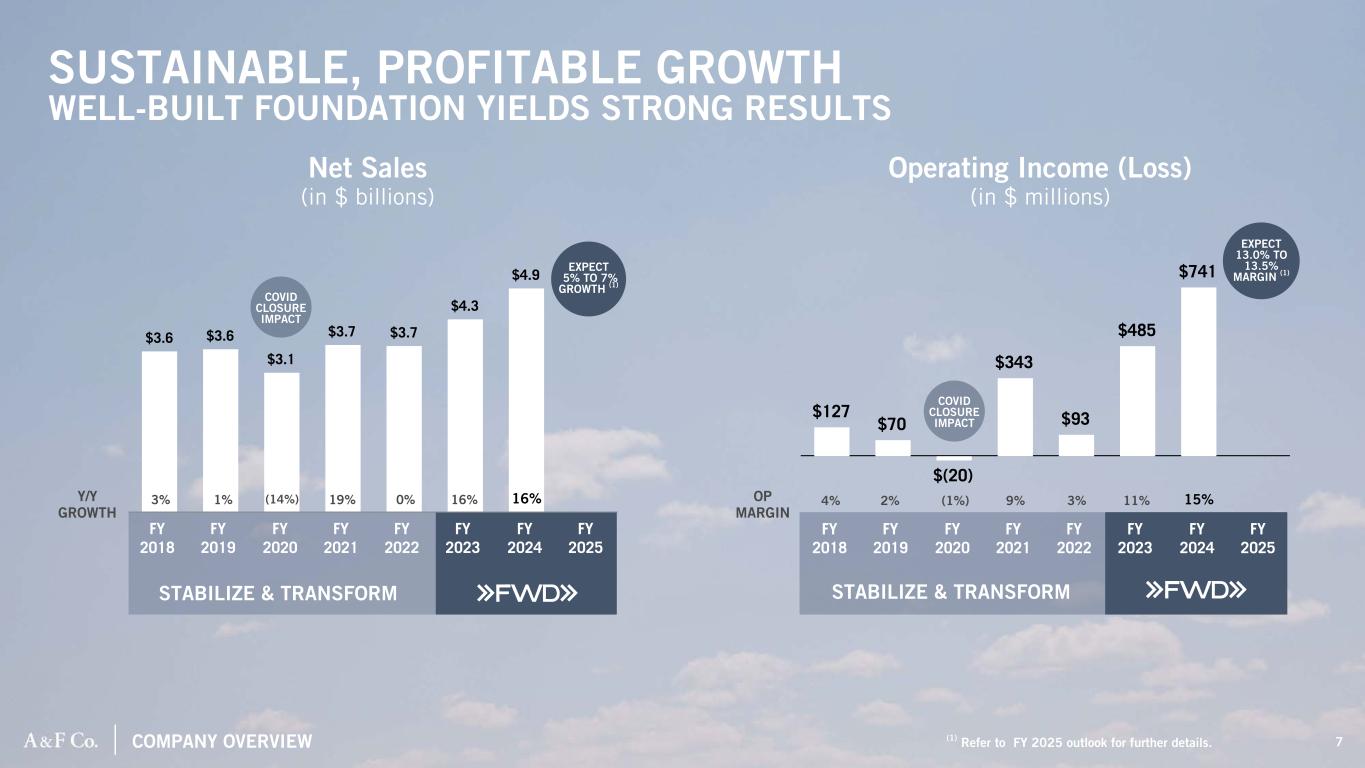

Fiscal 2025 Outlook | ||

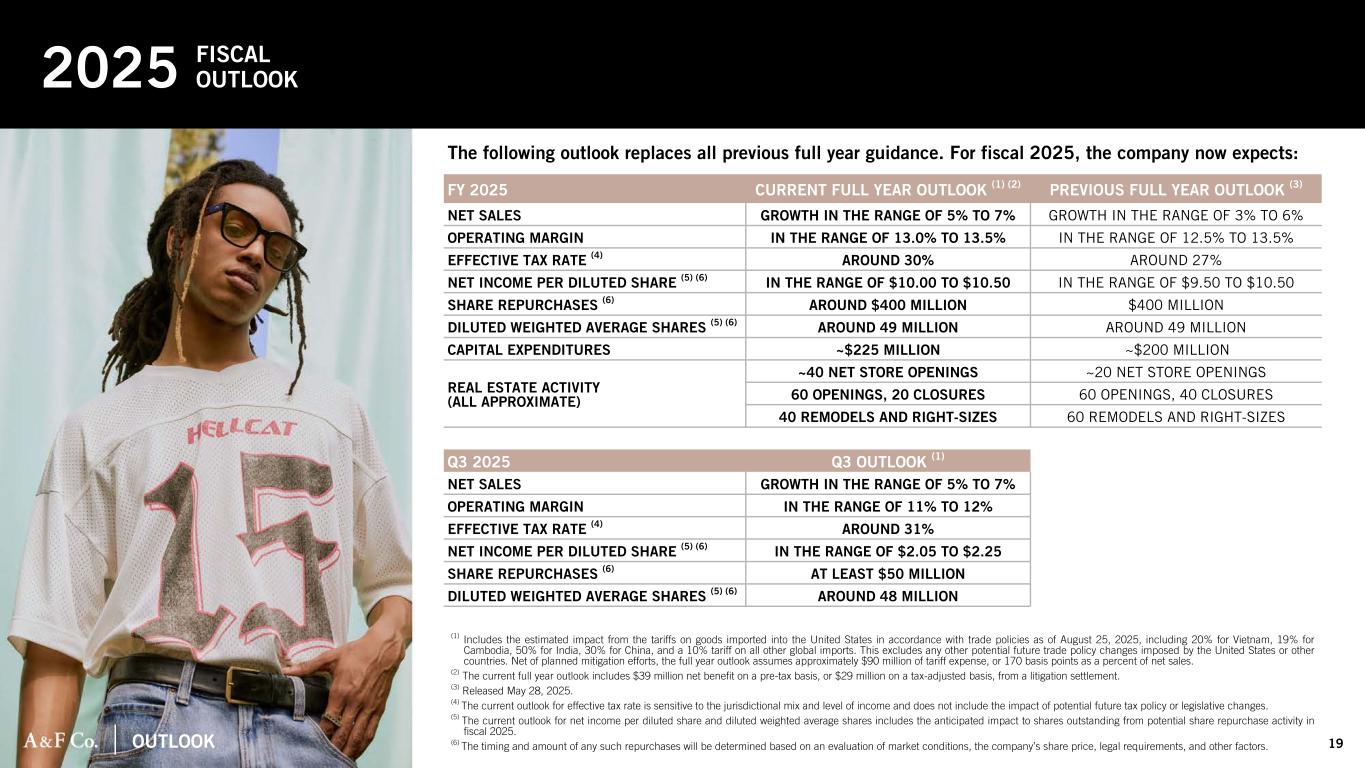

The following outlook replaces all previous full year guidance. For fiscal 2025, the company now expects: | ||||||||

Current Full Year Outlook (1) (2) |

Previous Full Year Outlook (3) |

|||||||

Net sales |

Growth In The Range of 5% to 7% |

Growth In The Range of 3% to 6% |

||||||

Operating margin |

In The Range of 13.0% to 13.5% |

In The Range of 12.5% to 13.5% |

||||||

Effective tax rate (4) |

Around 30% |

Around 27% |

||||||

Net income per diluted share (5) (6) |

In The Range of $10.00 to $10.50 |

In The Range of $9.50 to $10.50 |

||||||

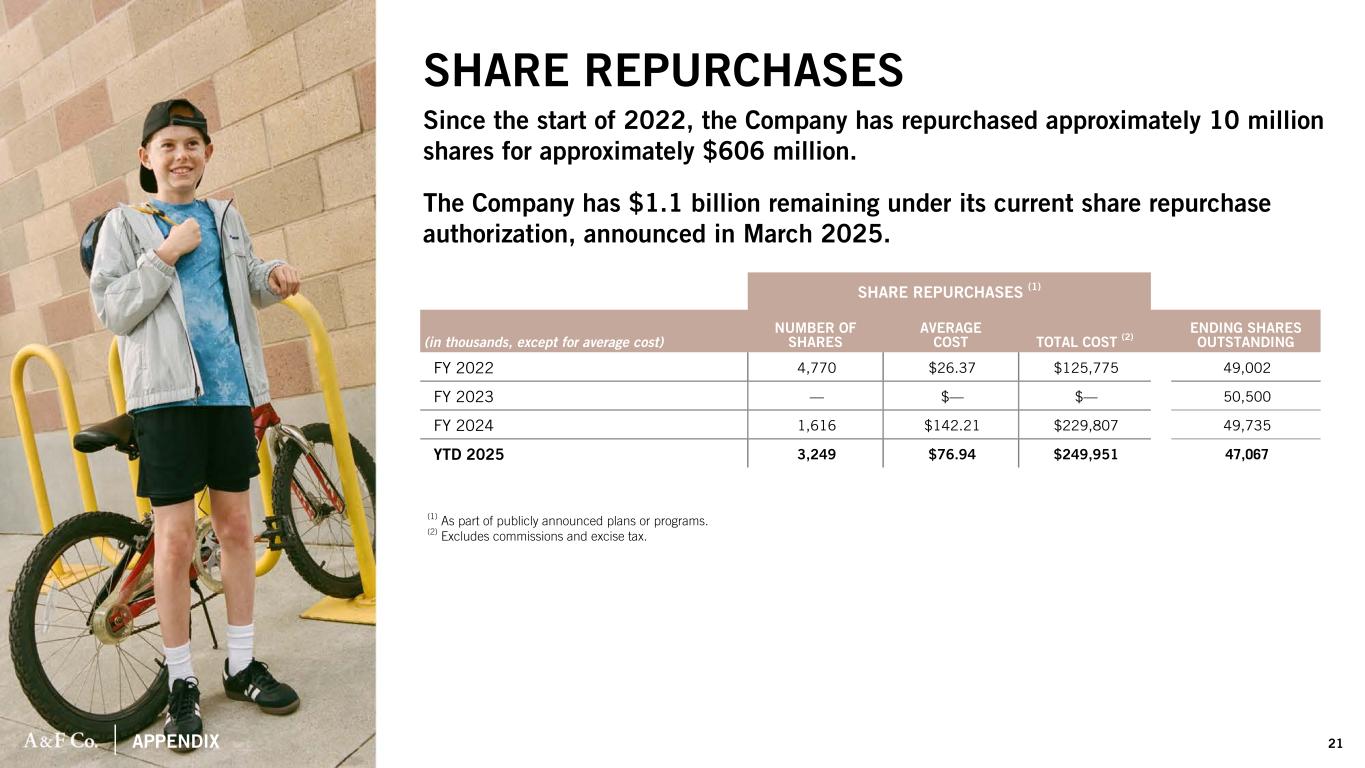

Share repurchases (6) |

Around $400 million |

$400 million |

||||||

Diluted weighted average shares (5) (6) |

Around 49 million |

Around 49 million |

||||||

Capital expenditures |

~$225 million |

~$200 million |

||||||

|

Real estate activity

(all approximate)

|

~40 Net Store Openings |

~40 Net Store Openings |

||||||

60 Openings, 20 Closures |

60 Openings, 20 Closures |

|||||||

40 Remodels And Right-Sizes |

40 Remodels And Right-Sizes |

|||||||

Third Quarter Outlook (1) |

||||||||

Net sales |

Growth In The Range of 5% to 7% |

|||||||

Operating margin |

In The Range of 11% to 12% |

|||||||

Effective tax rate (4) |

Around 31% |

|||||||

Net income per diluted share (5) (6) |

In The Range of $2.05 to $2.25 |

|||||||

Share repurchases (6) |

At least $50 million |

|||||||

Diluted weighted average shares (5) (6) |

Around 48 million |

|||||||

| Conference Call | ||

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 | ||

| Other Information | ||

| About Abercrombie & Fitch Co. | ||

| Investor Contact: | Media Contact: | |||||||

| Mo Gupta | Kate Wagner | |||||||

| Abercrombie & Fitch Co. | Abercrombie & Fitch Co. | |||||||

| (614) 283-6751 | (614) 283-6192 | |||||||

| Investor_Relations@anfcorp.com | Public_Relations@anfcorp.com | |||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Thirteen Weeks Ended | Thirteen Weeks Ended | ||||||||||||||||||||||

| August 2, 2025 | % of Net Sales |

August 3, 2024 | % of Net Sales |

||||||||||||||||||||

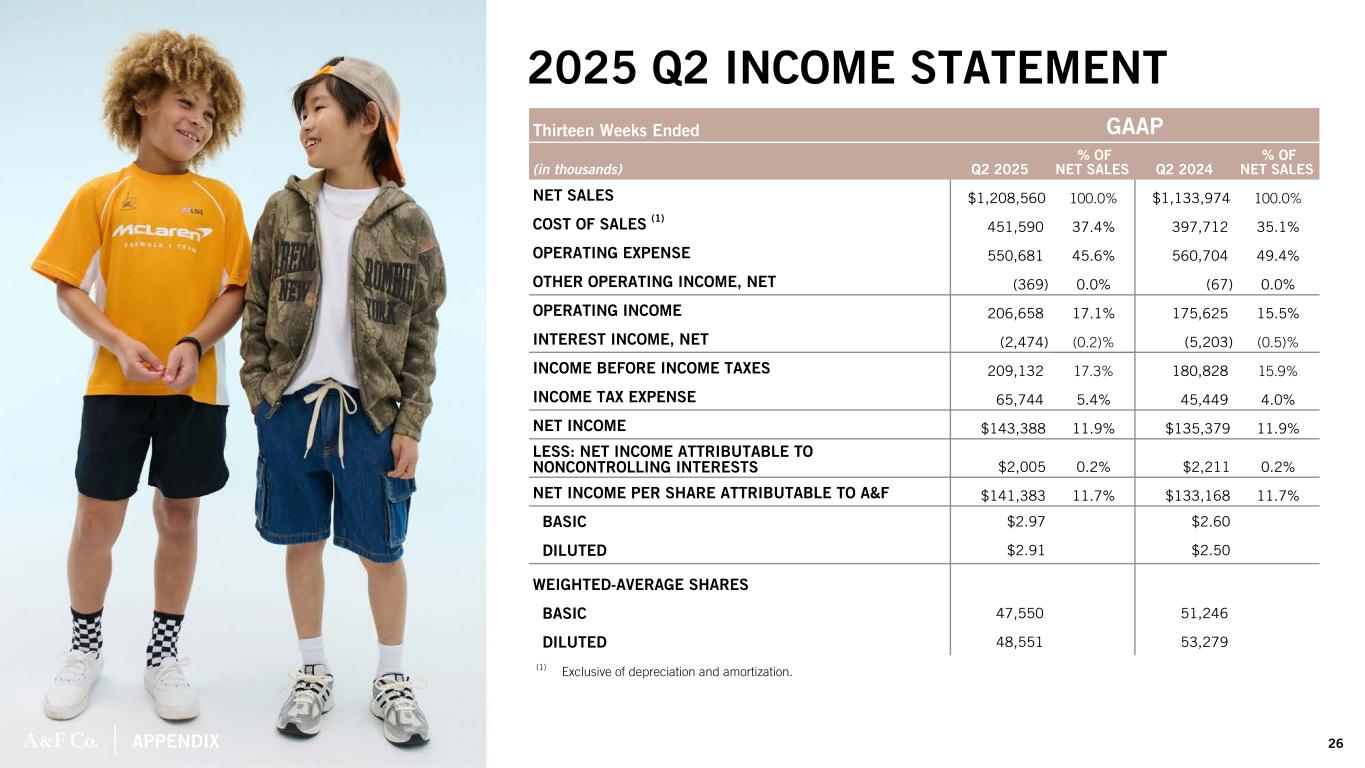

| Net sales | $ | 1,208,560 | 100.0 | % | $ | 1,133,974 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 451,590 | 37.4 | % | 397,712 | 35.1 | % | |||||||||||||||||

| Selling expense | 375,356 | 31.1 | % | 382,557 | 33.7 | % | |||||||||||||||||

| General and administrative expense | 175,325 | 14.5 | % | 178,147 | 15.7 | % | |||||||||||||||||

| Other operating income, net | (369) | — | % | (67) | — | % | |||||||||||||||||

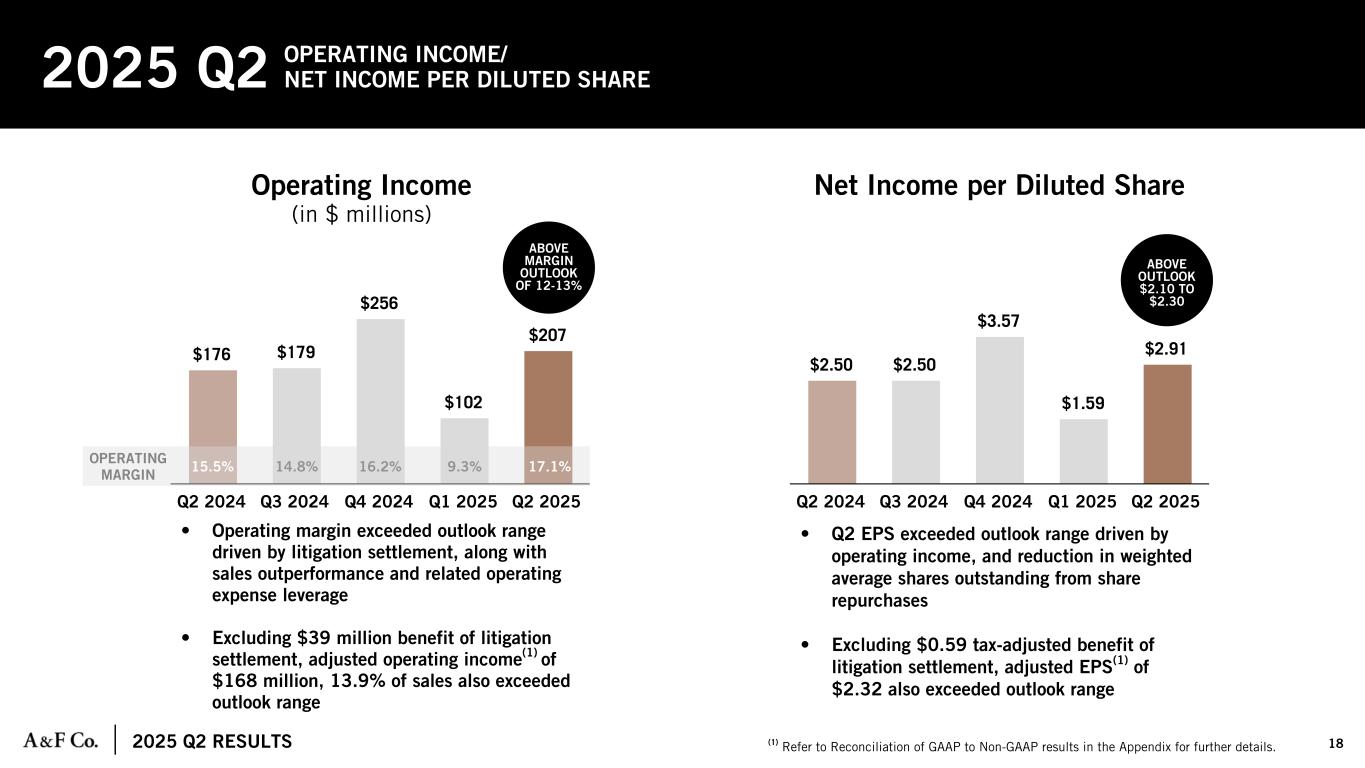

| Operating income | 206,658 | 17.1 | % | 175,625 | 15.5 | % | |||||||||||||||||

| Interest expense | 620 | 0.1 | % | 5,189 | 0.5 | % | |||||||||||||||||

| Interest income | (3,094) | (0.3) | % | (10,392) | (0.9) | % | |||||||||||||||||

| Interest income, net | (2,474) | (0.2) | % | (5,203) | (0.5) | % | |||||||||||||||||

| Income before income taxes | 209,132 | 17.3 | % | 180,828 | 15.9 | % | |||||||||||||||||

| Income tax expense | 65,744 | 5.4 | % | 45,449 | 4.0 | % | |||||||||||||||||

| Net income | 143,388 | 11.9 | % | 135,379 | 11.9 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 2,005 | 0.2 | % | 2,211 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 141,383 | 11.7 | % | $ | 133,168 | 11.7 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 2.97 | $ | 2.60 | |||||||||||||||||||

| Diluted | $ | 2.91 | $ | 2.50 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 47,550 | 51,246 | |||||||||||||||||||||

| Diluted | 48,551 | 53,279 | |||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Twenty-Six Weeks Ended | Twenty-Six Weeks Ended | ||||||||||||||||||||||

| August 2, 2025 | % of Net Sales |

August 3, 2024 | % of Net Sales |

||||||||||||||||||||

| Net sales | $ | 2,305,871 | 100.0 | % | $ | 2,154,704 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 868,723 | 37.7 | % | 740,985 | 34.4 | % | |||||||||||||||||

| Selling expense | 775,293 | 33.6 | % | 742,575 | 34.5 | % | |||||||||||||||||

| General and administrative expense | 350,250 | 15.2 | % | 367,695 | 17.1 | % | |||||||||||||||||

| Other operating loss (income), net | 3,414 | 0.1 | % | (2,025) | (0.1) | % | |||||||||||||||||

| Operating income | 308,191 | 13.4 | % | 305,474 | 14.2 | % | |||||||||||||||||

| Interest expense | 1,281 | 0.1 | % | 10,969 | 0.5 | % | |||||||||||||||||

| Interest income | (10,538) | (0.5) | % | (21,195) | (1.0) | % | |||||||||||||||||

| Interest income, net | (9,257) | (0.4) | % | (10,226) | (0.5) | % | |||||||||||||||||

| Income before income taxes | 317,448 | 13.8 | % | 315,700 | 14.7 | % | |||||||||||||||||

| Income tax expense | 92,321 | 4.0 | % | 65,243 | 3.0 | % | |||||||||||||||||

| Net income | 225,127 | 9.8 | % | 250,457 | 11.6 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 3,331 | 0.1 | % | 3,439 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 221,796 | 9.6 | % | $ | 247,018 | 11.5 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 4.58 | $ | 4.84 | |||||||||||||||||||

| Diluted | $ | 4.47 | $ | 4.64 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 48,382 | 51,069 | |||||||||||||||||||||

| Diluted | 49,592 | 53,277 | |||||||||||||||||||||

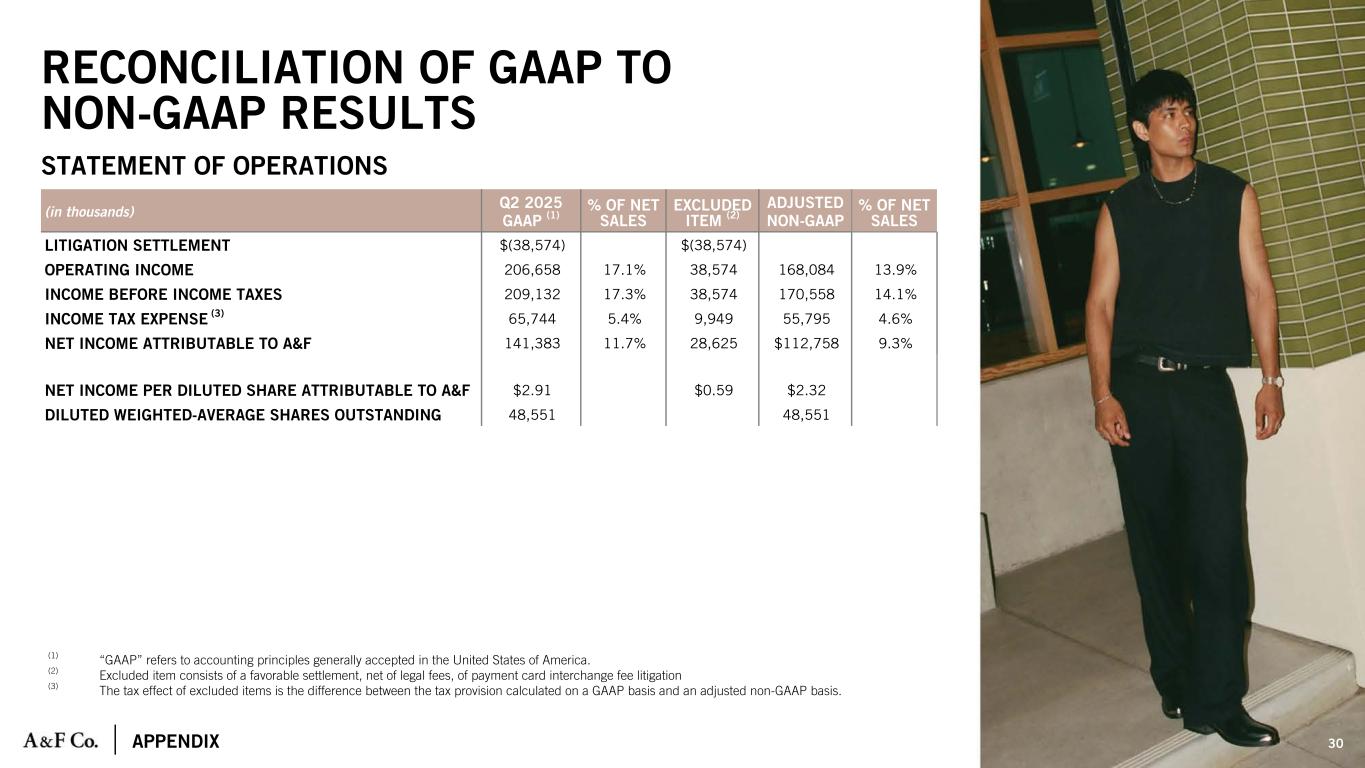

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||

| Schedule of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| Thirteen Weeks Ended August 2, 2025 | |||||||||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||

GAAP (1) |

% of Net Sales |

Excluded item (2) |

Adjusted non-GAAP |

% of Net Sales |

|||||||||||||||||||||||||

Litigation settlement |

$ | (38,574) | $ | (38,574) | $ | — | |||||||||||||||||||||||

Operating income |

206,658 | 17.1 | % | 38,574 | 168,084 | 13.9 | % | ||||||||||||||||||||||

Income before income taxes |

209,132 | 17.3 | % | 38,574 | 170,558 | 14.1 | % | ||||||||||||||||||||||

Income tax expense (3) |

65,744 | 5.4 | % | 9,949 | 55,795 | 4.6 | % | ||||||||||||||||||||||

Net income attributable to A&F |

141,383 | 11.7 | % | 28,625 | 112,758 | 9.3 | % | ||||||||||||||||||||||

Net income per diluted share attributable to A&F |

$ | 2.91 | $ | 0.59 | $ | 2.32 | |||||||||||||||||||||||

Diluted weighted-average shares outstanding |

48,551 | 48,551 | |||||||||||||||||||||||||||

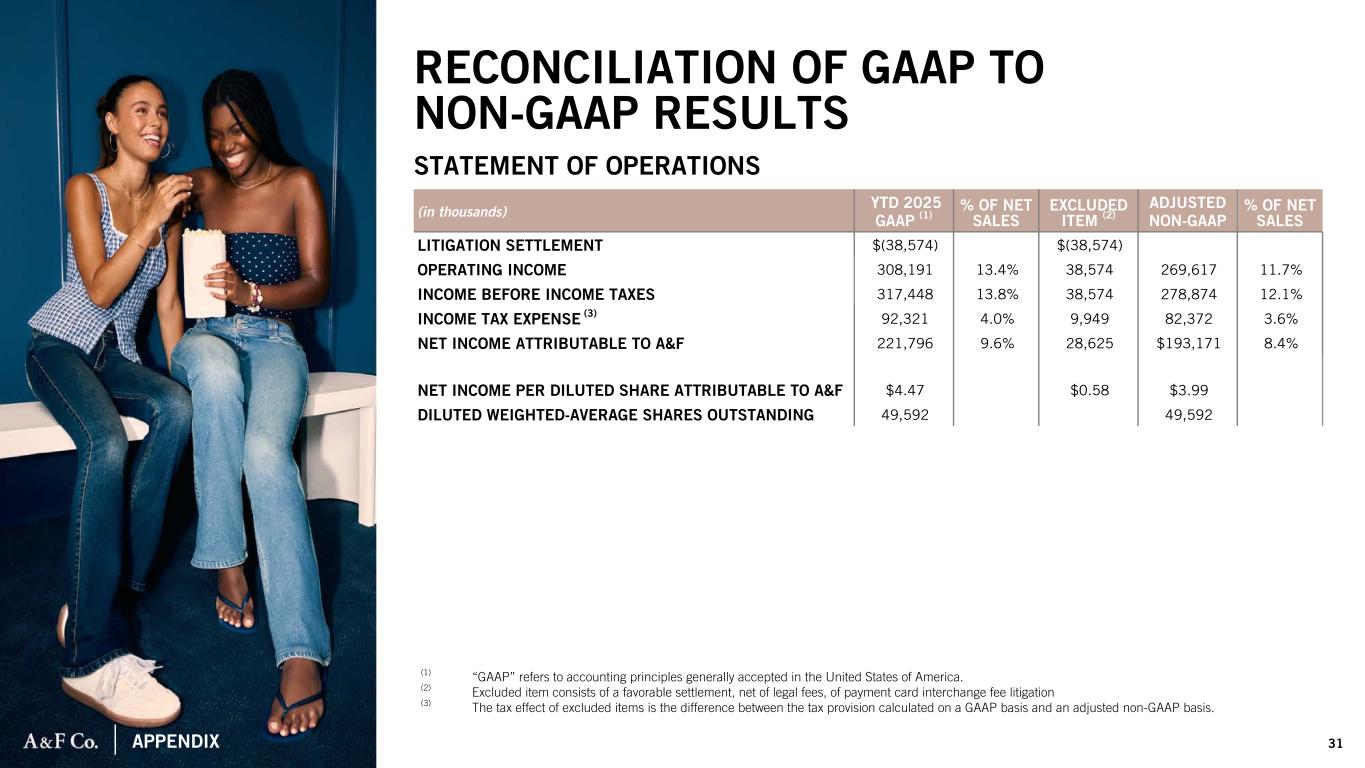

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||

| Schedule of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| Twenty-Six Weeks Ended August 2, 2025 | |||||||||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||

GAAP (1) |

% of Net Sales |

Excluded item (2) |

Adjusted non-GAAP |

% of Net Sales |

|||||||||||||||||||||||||

Litigation settlement |

$ | (38,574) | $ | (38,574) | $ | — | |||||||||||||||||||||||

Operating income |

308,191 | 13.4 | % | 38,574 | 269,617 | 11.7 | % | ||||||||||||||||||||||

Income before income taxes |

317,448 | 13.8 | % | 38,574 | 278,874 | 12.1 | % | ||||||||||||||||||||||

Income tax expense (3) |

92,321 | 4.0 | % | 9,949 | 82,372 | 3.6 | % | ||||||||||||||||||||||

Net income attributable to A&F |

221,796 | 9.6 | % | 28,625 | 193,171 | 8.4 | % | ||||||||||||||||||||||

Net income per diluted share attributable to A&F |

$ | 4.47 | $ | 0.58 | $ | 3.90 | |||||||||||||||||||||||

Diluted weighted-average shares outstanding |

49,592 | 49,592 | |||||||||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||

| Reconciliation of Constant Currency Financial Measures | |||||||||||||||||

Thirteen Weeks Ended August 2, 2025 and August 3, 2024 | |||||||||||||||||

| (in thousands, except percentage and basis point changes and per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

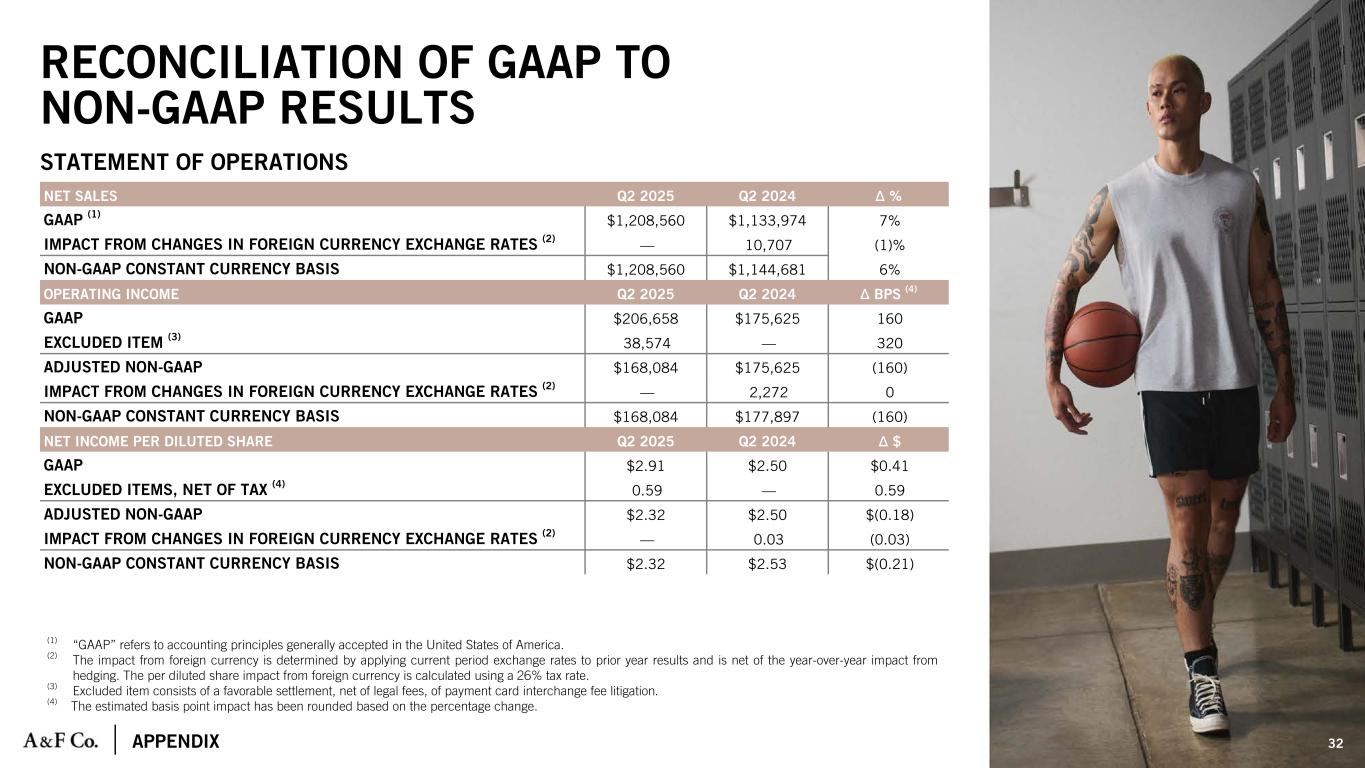

| 2025 | 2024 | % Change | |||||||||||||||

| Net sales | |||||||||||||||||

GAAP (1) |

$ | 1,208,560 | $ | 1,133,974 | 7% | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | 10,707 | (1) | ||||||||||||||

| Net sales on a constant currency basis | $ | 1,208,560 | $ | 1,144,681 | 6% | ||||||||||||

| Operating income | 2025 | 2024 | BPS Change (4) |

||||||||||||||

GAAP (1) |

$ | 206,658 | $ | 175,625 | 160 | ||||||||||||

Excluded item (3) |

38,574 | — | 320 | ||||||||||||||

| Adjusted non-GAAP | $ | 168,084 | $ | 175,625 | (160) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | 2,272 | 0 | ||||||||||||||

Non-GAAP constant currency basis |

$ | 168,084 | $ | 177,897 | (160) | ||||||||||||

| Net income per share attributable to A&F | 2025 | 2024 | $ Change | ||||||||||||||

GAAP (1) |

$ | 2.91 | $ | 2.50 | $0.41 | ||||||||||||

Excluded item, net of tax (3) |

0.59 | — | 0.59 | ||||||||||||||

| Adjusted non-GAAP | $ | 2.32 | $ | 2.50 | $(0.18) | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | 0.03 | (0.03) | ||||||||||||||

Non-GAAP constant currency basis |

$ | 2.32 | $ | 2.53 | $(0.21) | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

Thirteen Weeks Ended August 2, 2025 and August 3, 2024 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2025 | % of Net Sales |

2024 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 143,388 | 11.9 | % | $ | 135,379 | 11.9 | % | ||||||||||||

| Income tax expense | 65,744 | 5.4 | 45,449 | 4.0 | ||||||||||||||||

Interest income, net |

(2,474) | (0.2) | (5,203) | (0.5) | ||||||||||||||||

Depreciation and amortization |

37,424 | 3.1 | 39,355 | 3.6 | ||||||||||||||||

EBITDA (1) |

$ | 244,082 | 20.2 | % | $ | 214,980 | 19.0 | % | ||||||||||||

| Adjustments to EBITDA | ||||||||||||||||||||

Litigation settlement |

(38,574) | (3.2) | — | — | ||||||||||||||||

Adjusted EBITDA (1) |

$ | 205,508 | 17.0 | % | $ | 214,980 | 19.0 | % | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

Twenty-Six Weeks Ended August 2, 2025 and August 3, 2024 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2025 | % of Net Sales |

2024 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 225,127 | 9.8 | % | $ | 250,457 | 11.6 | % | ||||||||||||

| Income tax expense | 92,321 | 4.0 | 65,243 | 3.0 | ||||||||||||||||

| Interest (income) expense, net | (9,257) | (0.4) | (10,226) | (0.5) | ||||||||||||||||

| Depreciation and amortization | 76,000 | 3.3 | 77,044 | 3.7 | ||||||||||||||||

EBITDA (1) |

$ | 384,191 | 16.7 | % | $ | 382,518 | 17.8 | % | ||||||||||||

| Adjustments to EBITDA | ||||||||||||||||||||

| Litigation settlement | (38,574) | (1.7) | % | — | — | % | ||||||||||||||

Adjusted EBITDA (1) |

$ | 345,617 | 15.0 | % | $ | 382,518 | 17.8 | % | ||||||||||||

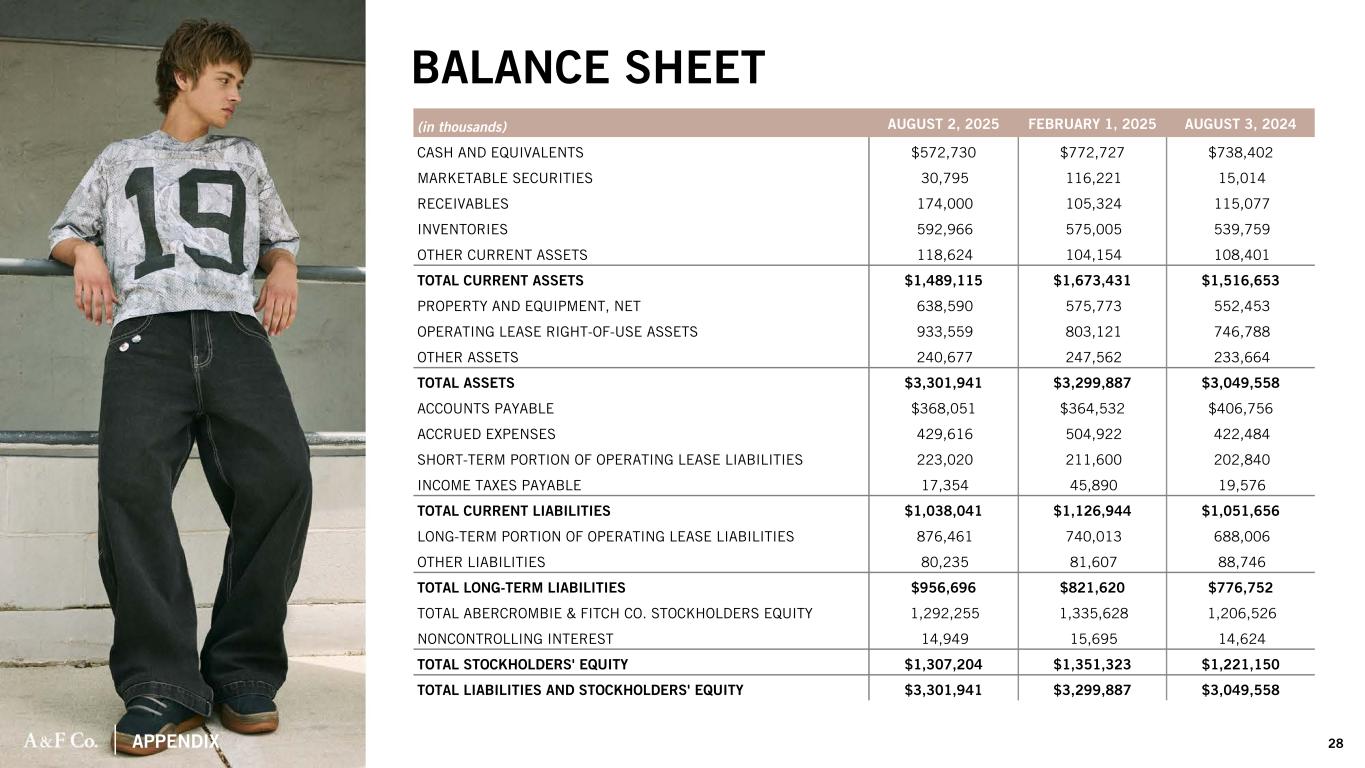

| Abercrombie & Fitch Co. | |||||||||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||||||||

| (in thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| August 2, 2025 | February 1, 2025 | August 3, 2024 | |||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

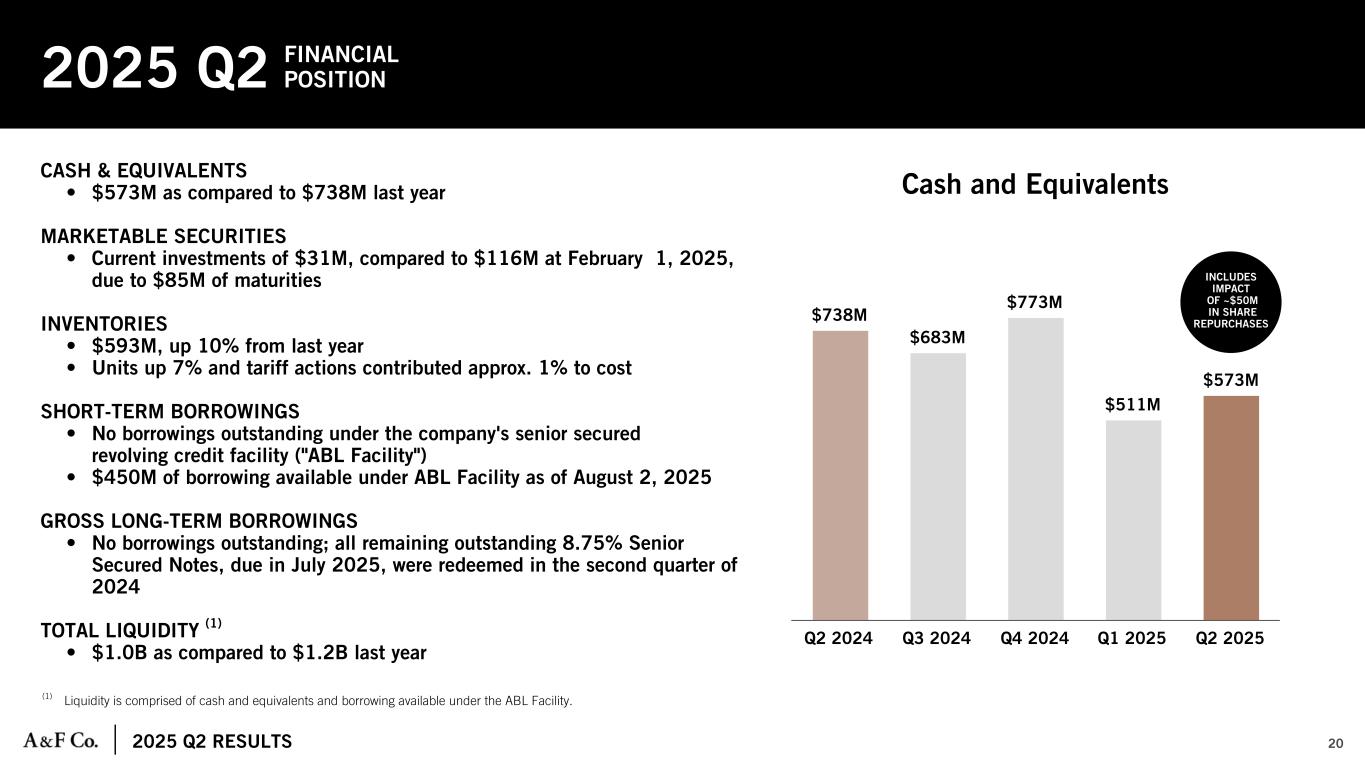

| Cash and equivalents | $ | 572,730 | $ | 772,727 | $ | 738,402 | |||||||||||

| Marketable securities | 30,795 | 116,221 | 15,014 | ||||||||||||||

| Receivables | 174,000 | 105,324 | 115,077 | ||||||||||||||

| Inventories | 592,966 | 575,005 | 539,759 | ||||||||||||||

| Other current assets | 118,624 | 104,154 | 108,401 | ||||||||||||||

| Total current assets | 1,489,115 | 1,673,431 | 1,516,653 | ||||||||||||||

| Property and equipment, net | 638,590 | 575,773 | 552,453 | ||||||||||||||

| Operating lease right-of-use assets | 933,559 | 803,121 | 746,788 | ||||||||||||||

| Other assets | 240,677 | 247,562 | 233,664 | ||||||||||||||

| Total assets | $ | 3,301,941 | $ | 3,299,887 | $ | 3,049,558 | |||||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Accounts payable | $ | 368,051 | $ | 364,532 | $ | 406,756 | |||||||||||

| Accrued expenses | 429,616 | 504,922 | 422,484 | ||||||||||||||

| Short-term portion of operating lease liabilities | 223,020 | 211,600 | 202,840 | ||||||||||||||

| Income taxes payable | 17,354 | 45,890 | 19,576 | ||||||||||||||

| Total current liabilities | $ | 1,038,041 | $ | 1,126,944 | $ | 1,051,656 | |||||||||||

| Long-term liabilities: | |||||||||||||||||

| Long-term portion of operating lease liabilities | $ | 876,461 | $ | 740,013 | $ | 688,006 | |||||||||||

| Other liabilities | 80,235 | 81,607 | 88,746 | ||||||||||||||

| Total long-term liabilities | 956,696 | 821,620 | 776,752 | ||||||||||||||

| Total Abercrombie & Fitch Co. stockholders’ equity | 1,292,255 | 1,335,628 | 1,206,526 | ||||||||||||||

| Noncontrolling interests | 14,949 | 15,695 | 14,624 | ||||||||||||||

| Total stockholders’ equity | 1,307,204 | 1,351,323 | 1,221,150 | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | 3,301,941 | $ | 3,299,887 | $ | 3,049,558 | |||||||||||

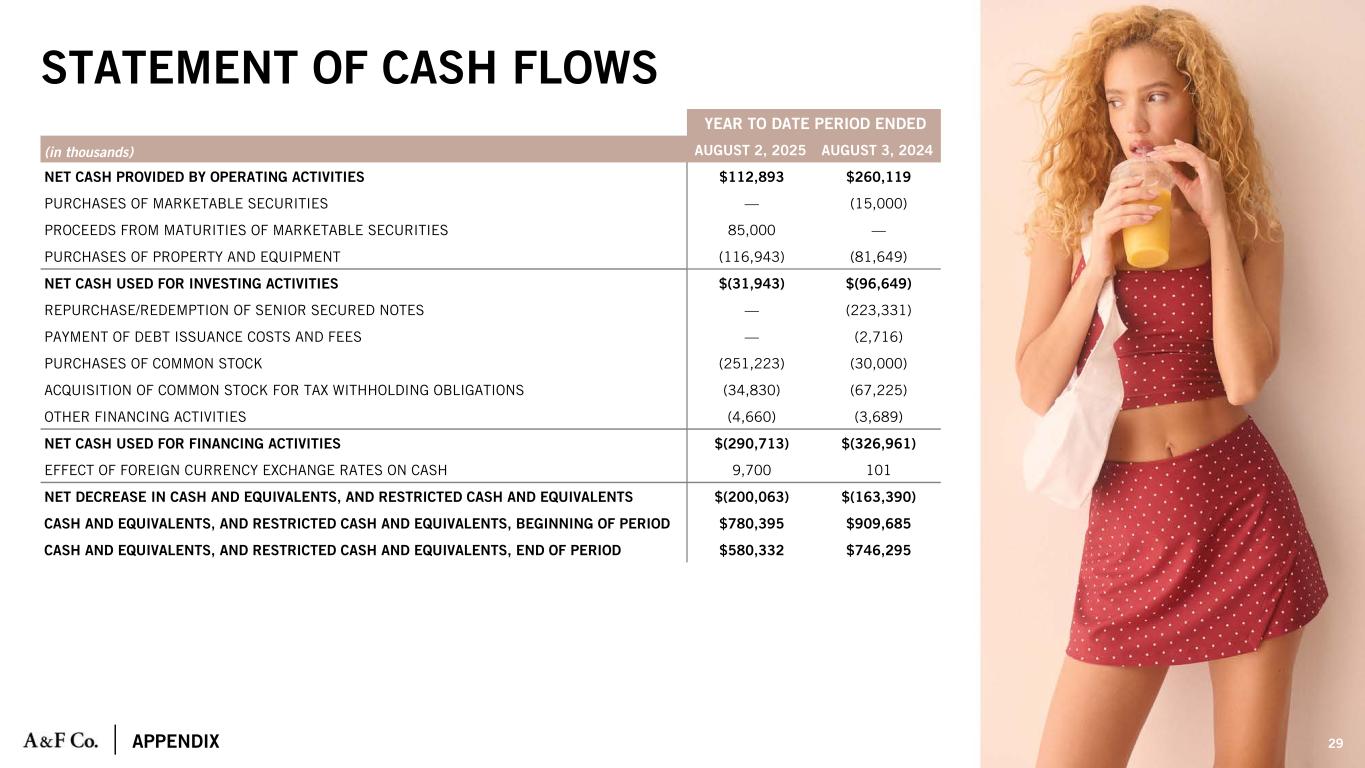

| Abercrombie & Fitch Co. | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (in thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Twenty-Six Weeks Ended | |||||||||||

| August 2, 2025 | August 3, 2024 | ||||||||||

| Operating activities | |||||||||||

| Net cash provided by operating activities | $ | 112,893 | $ | 260,119 | |||||||

| Investing activities | |||||||||||

Purchases of marketable securities |

$ | — | $ | (15,000) | |||||||

Proceeds from maturities of marketable securities |

85,000 | — | |||||||||

| Purchases of property and equipment | (116,943) | (81,649) | |||||||||

| Net cash used for investing activities | $ | (31,943) | $ | (96,649) | |||||||

| Financing activities | |||||||||||

Redemption of senior secured notes |

$ | — | $ | (223,331) | |||||||

| Payment of debt modification costs and fees | — | (2,716) | |||||||||

| Purchases of common stock | (251,223) | (30,000) | |||||||||

| Acquisition of common stock for tax withholding obligations | (34,830) | (67,225) | |||||||||

| Other financing activities | (4,660) | (3,689) | |||||||||

| Net cash used for financing activities | $ | (290,713) | $ | (326,961) | |||||||

| Effect of foreign currency exchange rates on cash | $ | 9,700 | $ | 101 | |||||||

| Net decrease in cash and equivalents, and restricted cash and equivalents | $ | (200,063) | $ | (163,390) | |||||||

| Cash and equivalents, and restricted cash and equivalents, beginning of period | $ | 780,395 | $ | 909,685 | |||||||

| Cash and equivalents, and restricted cash and equivalents, end of period | $ | 580,332 | $ | 746,295 | |||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||

| Fiscal 2024 | Fiscal 2025 | ||||||||||||||||||||||||||||||||||||||||

| 2023 | Q1 | Q2 | Q3 | Q4 | 2024 | Q1 | Q2 | 2025 | |||||||||||||||||||||||||||||||||

| Net sales | $ | 4,280,677 | $ | 1,020,730 | $ | 1,133,974 | $ | 1,208,966 | $ | 1,584,917 | $ | 4,948,587 | $ | 1,097,311 | $ | 1,208,560 | $ | 2,305,871 | |||||||||||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 1,587,265 | 343,273 | 397,712 | 422,034 | 610,907 | 1,773,926 | 417,133 | 451,590 | 868,723 | ||||||||||||||||||||||||||||||||

Selling expense |

1,533,438 | 360,018 | 382,557 | 420,990 | 526,423 | 1,689,988 | 399,937 | 375,356 | 775,293 | ||||||||||||||||||||||||||||||||

General and administrative expense |

681,176 | 189,548 | 178,147 | 188,246 | 194,544 | 750,485 | 174,925 | 175,325 | 350,250 | ||||||||||||||||||||||||||||||||

| Other operating (income) loss, net | (5,873) | (1,958) | (67) | (1,586) | (3,021) | (6,632) | 3,783 | (369) | 3,414 | ||||||||||||||||||||||||||||||||

Operating income |

484,671 | 129,849 | 175,625 | 179,282 | 256,064 | 740,820 | 101,533 | 206,658 | 308,191 | ||||||||||||||||||||||||||||||||

Interest expense |

30,352 | 5,780 | 5,189 | 569 | 539 | 12,077 | 661 | 620 | 1,281 | ||||||||||||||||||||||||||||||||

Interest income |

(29,980) | (10,803) | (10,392) | (9,302) | (9,437) | (39,934) | (7,444) | (3,094) | (10,538) | ||||||||||||||||||||||||||||||||

Interest (income) expense, net |

372 | (5,023) | (5,203) | (8,733) | (8,898) | (27,857) | (6,783) | (2,474) | (9,257) | ||||||||||||||||||||||||||||||||

Income before income taxes |

484,299 | 134,872 | 180,828 | 188,015 | 264,962 | 768,677 | 108,316 | 209,132 | 317,448 | ||||||||||||||||||||||||||||||||

Income tax expense |

148,886 | 19,794 | 45,449 | 54,151 | 75,267 | 194,661 | 26,577 | 65,744 | 92,321 | ||||||||||||||||||||||||||||||||

Net income |

335,413 | 115,078 | 135,379 | 133,864 | 189,695 | 574,016 | 81,739 | 143,388 | 225,127 | ||||||||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 7,290 | 1,228 | 2,211 | 1,885 | 2,469 | 7,793 | 1,326 | 2,005 | 3,331 | ||||||||||||||||||||||||||||||||

Net income attributable to Abercrombie & Fitch Co. |

$ | 328,123 | $ | 113,850 | $ | 133,168 | $ | 131,979 | $ | 187,226 | $ | 566,223 | $ | 80,413 | $ | 141,383 | $ | 221,796 | |||||||||||||||||||||||

Net income per share attributable to Abercrombie & Fitch Co.: |

|||||||||||||||||||||||||||||||||||||||||

| Basic | $6.53 | $2.24 | $2.60 | $2.59 | $3.72 | $11.14 | $1.63 | $2.97 | $4.58 | ||||||||||||||||||||||||||||||||

| Diluted | $6.22 | $2.14 | $2.50 | $2.50 | $3.57 | $10.69 | $1.59 | $2.91 | $4.47 | ||||||||||||||||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||||||||||||||||||||

| Basic | 50,250 | 50,893 | 51,246 | 50,951 | 50,265 | 50,839 | 49,214 | 47,550 | 48,382 | ||||||||||||||||||||||||||||||||

| Diluted | 52,726 | 53,276 | 53,279 | 52,869 | 52,461 | 52,971 | 50,634 | 48,551 | 49,592 | ||||||||||||||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Fiscal 2024 | Fiscal 2025 | ||||||||||||||||||||||||||||||||||||||||

| 2023 | Q1 | Q2 | Q3 | Q4 | 2024 | Q1 | Q2 | 2025 | |||||||||||||||||||||||||||||||||

Comparable sales by segment: (1) |

|||||||||||||||||||||||||||||||||||||||||

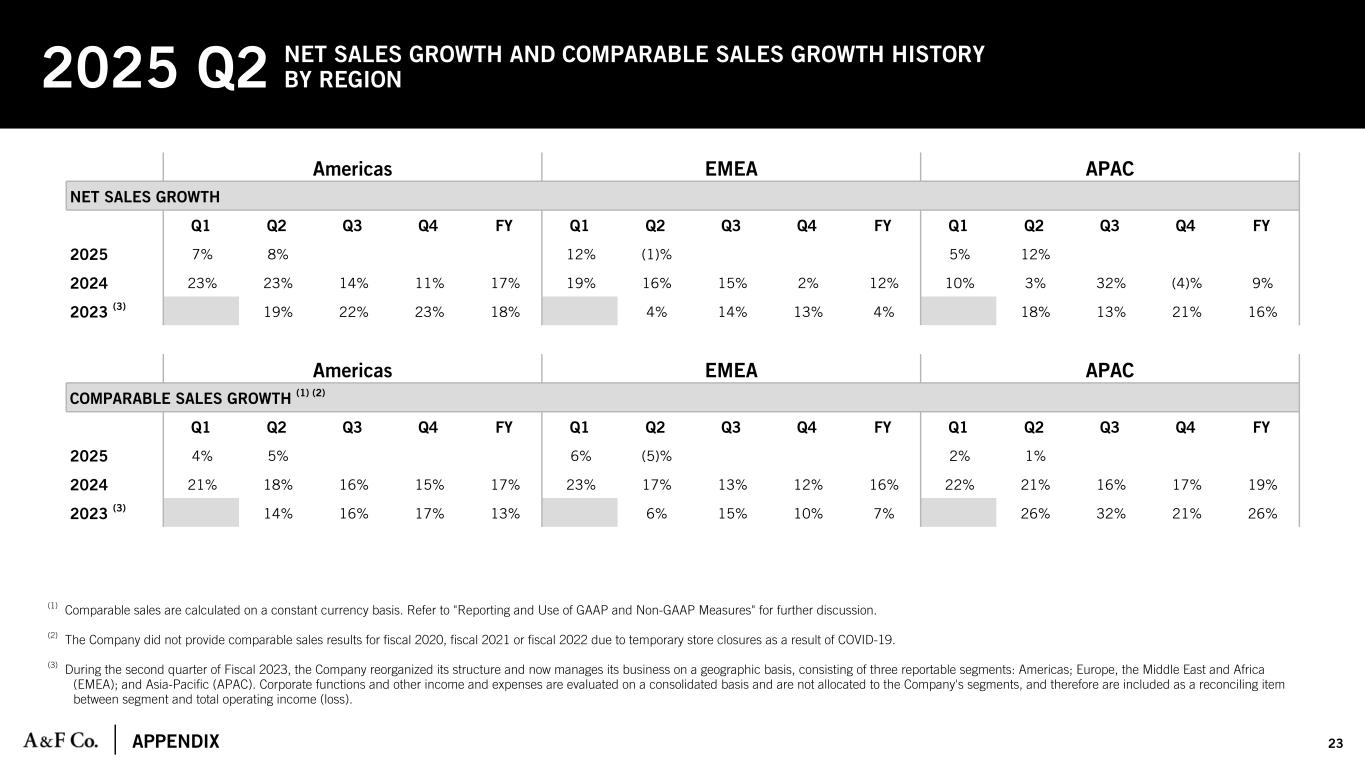

Americas comparable sales (2) (3) |

13 | % | 21 | % | 18 | % | 16 | % | 15 | % | 17 | % | 4 | % | 5 | % | 5 | % | |||||||||||||||||||||||

EMEA comparable sales (2) (4) |

7 | % | 23 | % | 17 | % | 13 | % | 12 | % | 16 | % | 6 | % | (5) | % | — | % | |||||||||||||||||||||||

APAC comparable sales (2) (5) |

26 | % | 22 | % | 21 | % | 16 | % | 17 | % | 19 | % | 2 | % | 1 | % | 2 | % | |||||||||||||||||||||||

Comparable sales (2) |

13 | % | 21 | % | 18 | % | 16 | % | 14 | % | 17 | % | 4 | % | 3 | % | 4 | % | |||||||||||||||||||||||

| Comparable sales by brand family: | |||||||||||||||||||||||||||||||||||||||||

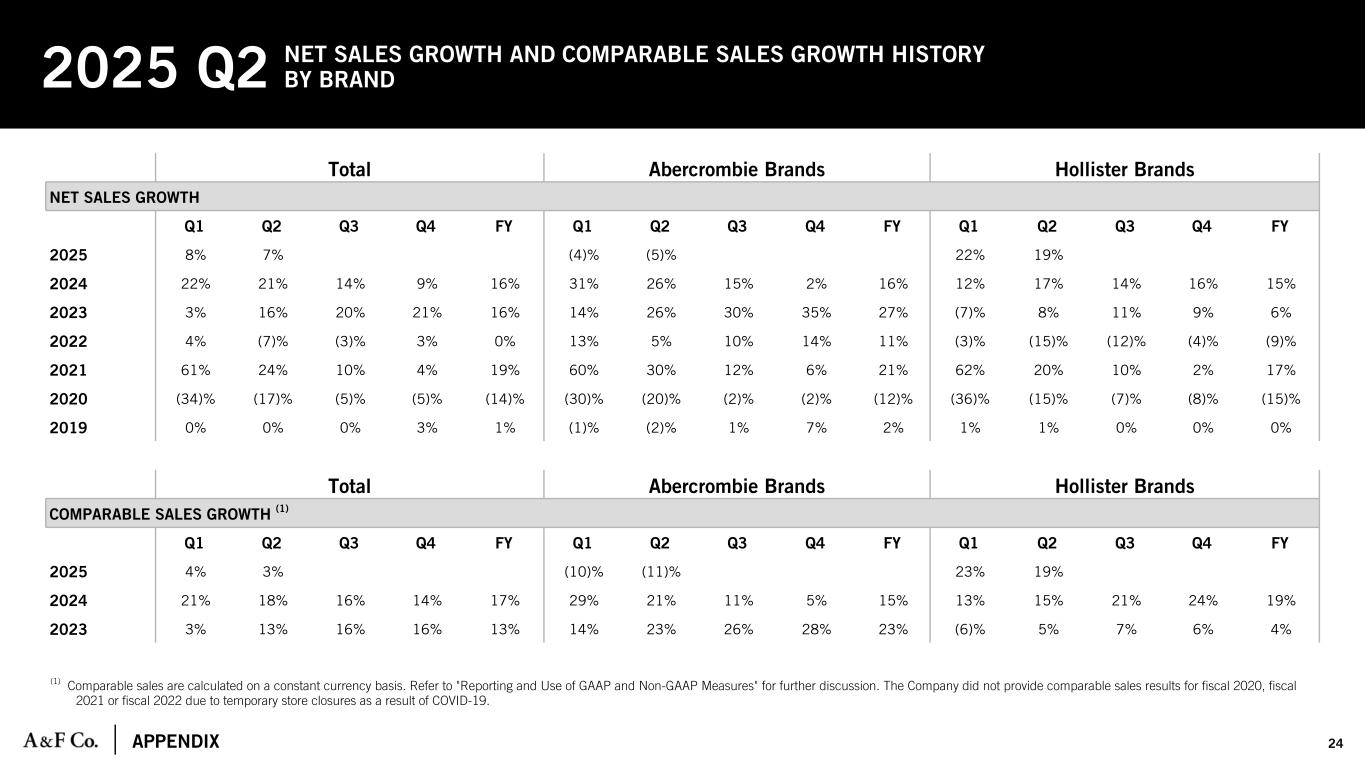

Abercrombie comparable sales (2) |

23 | % | 29 | % | 21 | % | 11 | % | 5 | % | 15 | % | (10) | % | (11) | % | (10) | % | |||||||||||||||||||||||

Hollister comparable sales (2) |

4 | % | 13 | % | 15 | % | 21 | % | 24 | % | 19 | % | 23 | % | 19 | % | 20 | % | |||||||||||||||||||||||

Comparable sales (2) |

13 | % | 21 | % | 18 | % | 16 | % | 14 | % | 17 | % | 4 | % | 3 | % | 4 | % | |||||||||||||||||||||||

(1) Comparable sales by segment are presented by attributing revenues to a physical store location or geographical region that fulfills the order. | |||||||||||||||||||||||||||||||||||||||||

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion. | |||||||||||||||||||||||||||||||||||||||||

(3) The Americas segment includes the results of operations in North America and South America. | |||||||||||||||||||||||||||||||||||||||||

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa. | |||||||||||||||||||||||||||||||||||||||||

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania. | |||||||||||||||||||||||||||||||||||||||||