| Abercrombie & Fitch Co. | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 1-12107 | 31-1469076 | ||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||||||||

| 6301 Fitch Path | New Albany | Ohio | 43054 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| Registrant’s telephone number, including area code: | (614) | 283-6500 | ||||||||||||||||||

| Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, $0.01 Par Value | ANF | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 99.4 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Abercrombie & Fitch Co. | |||||||||||

Dated: August 29, 2024 |

By: | /s/ Scott D. Lipesky | |||||||||

| Scott D. Lipesky | |||||||||||

| Executive Vice President, Chief Financial Officer and Chief Operating Officer | |||||||||||

| 2024 | 2023 | |||||||||||||

| GAAP | $ | 2.50 | $ | 1.10 | ||||||||||

Impact from changes in foreign currency exchange rates (1) |

— | (0.02) | ||||||||||||

| Adjusted non-GAAP constant currency | $ | 2.50 | $ | 1.08 | ||||||||||

| Net Sales | ||

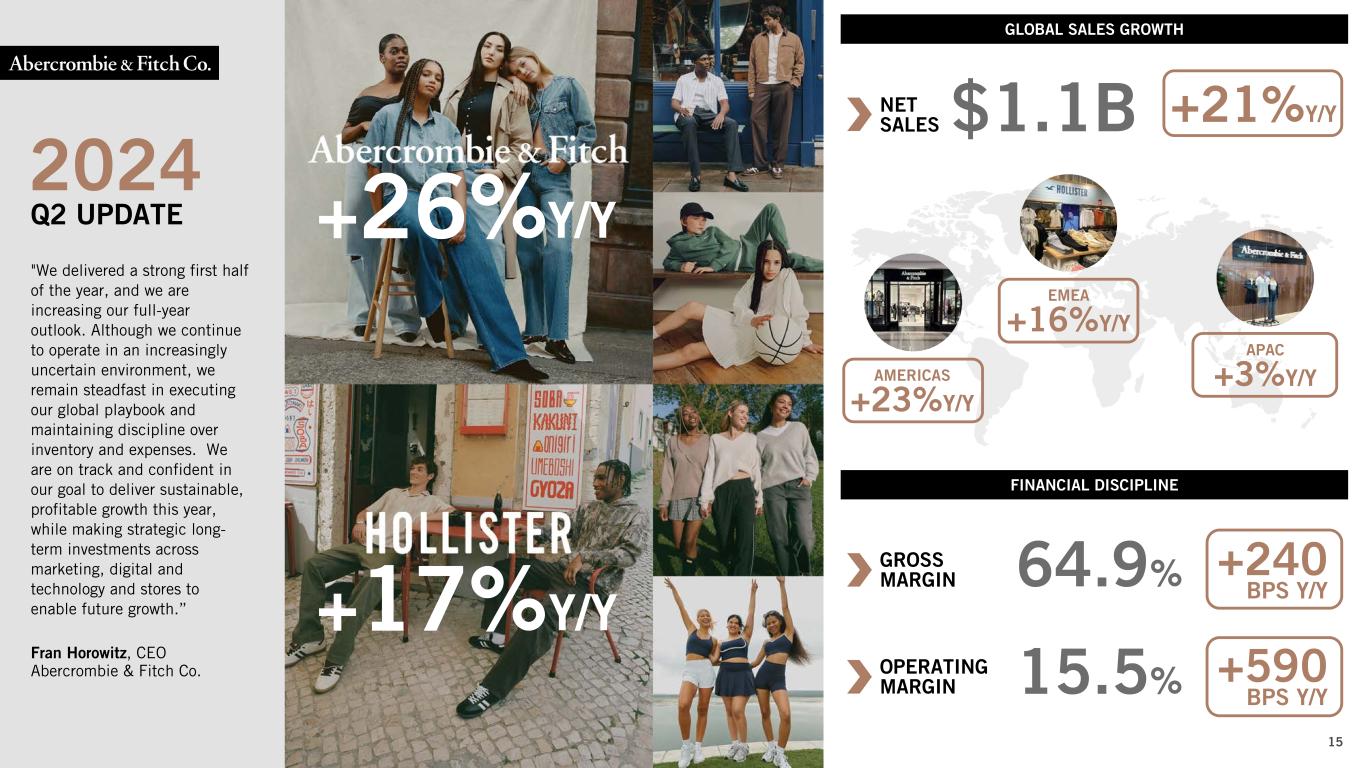

| (in thousands) | 2024 | 2023 | 1 YR % Change | Comparable sales (2) |

|||||||||||||||||||

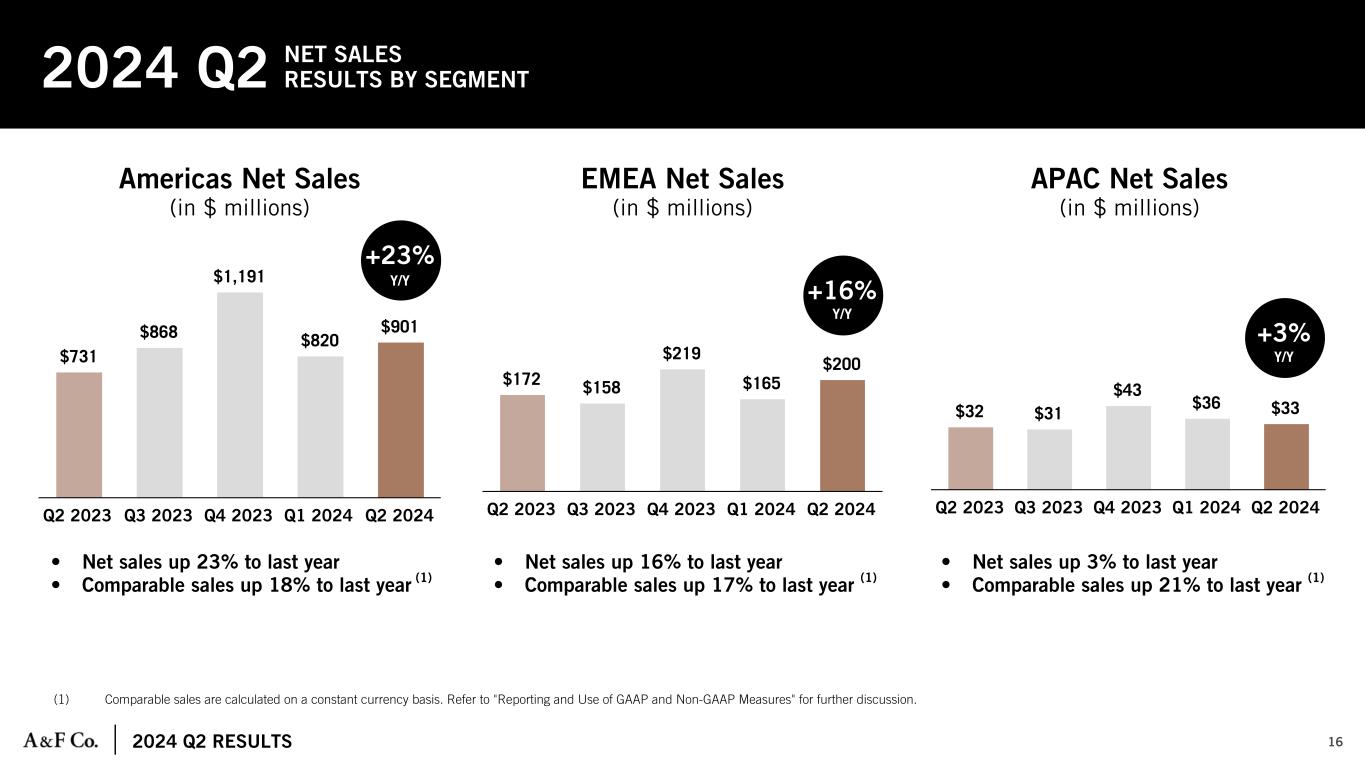

Net sales by segment: (1) |

|||||||||||||||||||||||

Americas (3) |

$ | 901,224 | $ | 731,427 | 23% | 18% | |||||||||||||||||

EMEA (4) |

199,682 | 171,962 | 16% | 17% | |||||||||||||||||||

APAC (5) |

33,068 | 31,956 | 3% | 21% | |||||||||||||||||||

| Total company | $ | 1,133,974 | $ | 935,345 | 21% | 18% | |||||||||||||||||

| 2024 | 2023 | 1 YR % Change | Comparable sales (2) |

||||||||||||||||||||

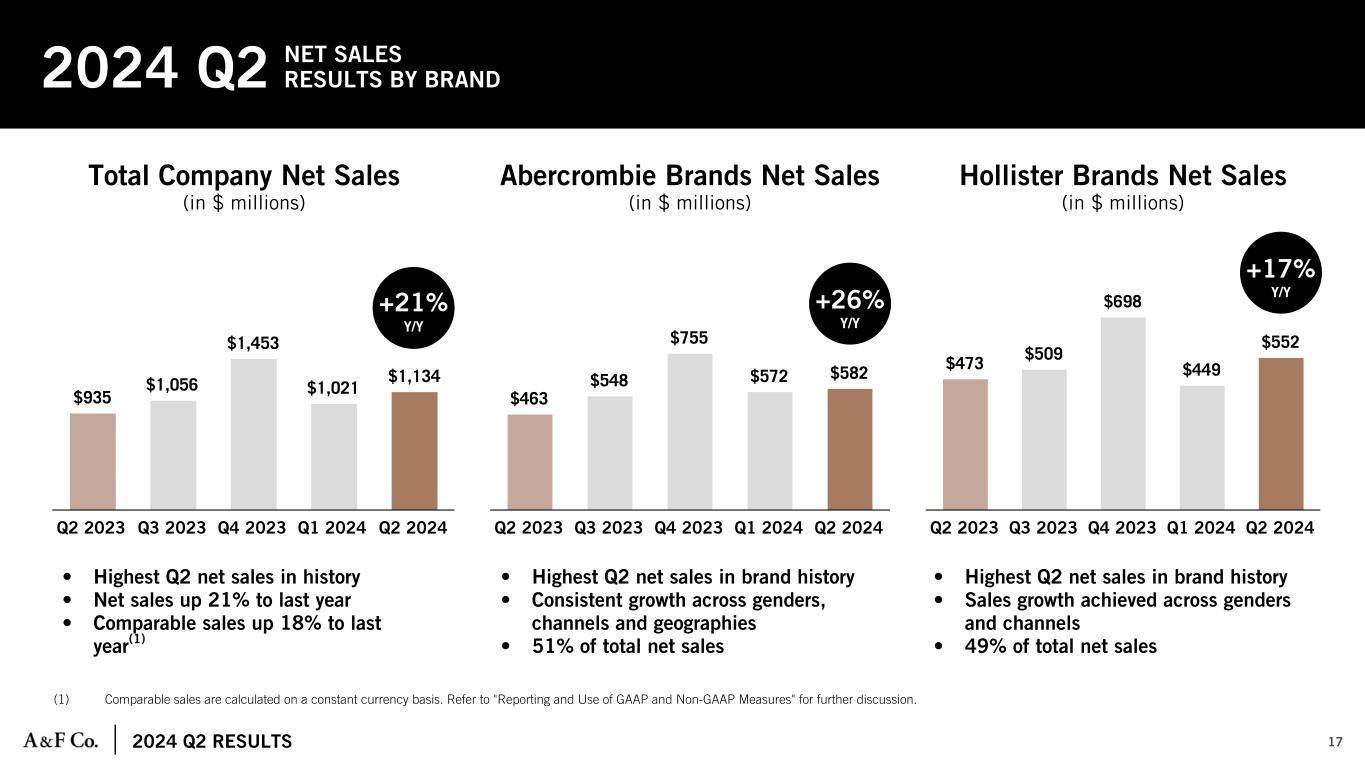

| Net sales by brand: | |||||||||||||||||||||||

Abercrombie (6) |

$ | 582,416 | $ | 462,711 | 26% | 21% | |||||||||||||||||

Hollister (7) |

551,558 | 472,634 | 17% | 15% | |||||||||||||||||||

| Total company | $ | 1,133,974 | $ | 935,345 | 21% | 18% | |||||||||||||||||

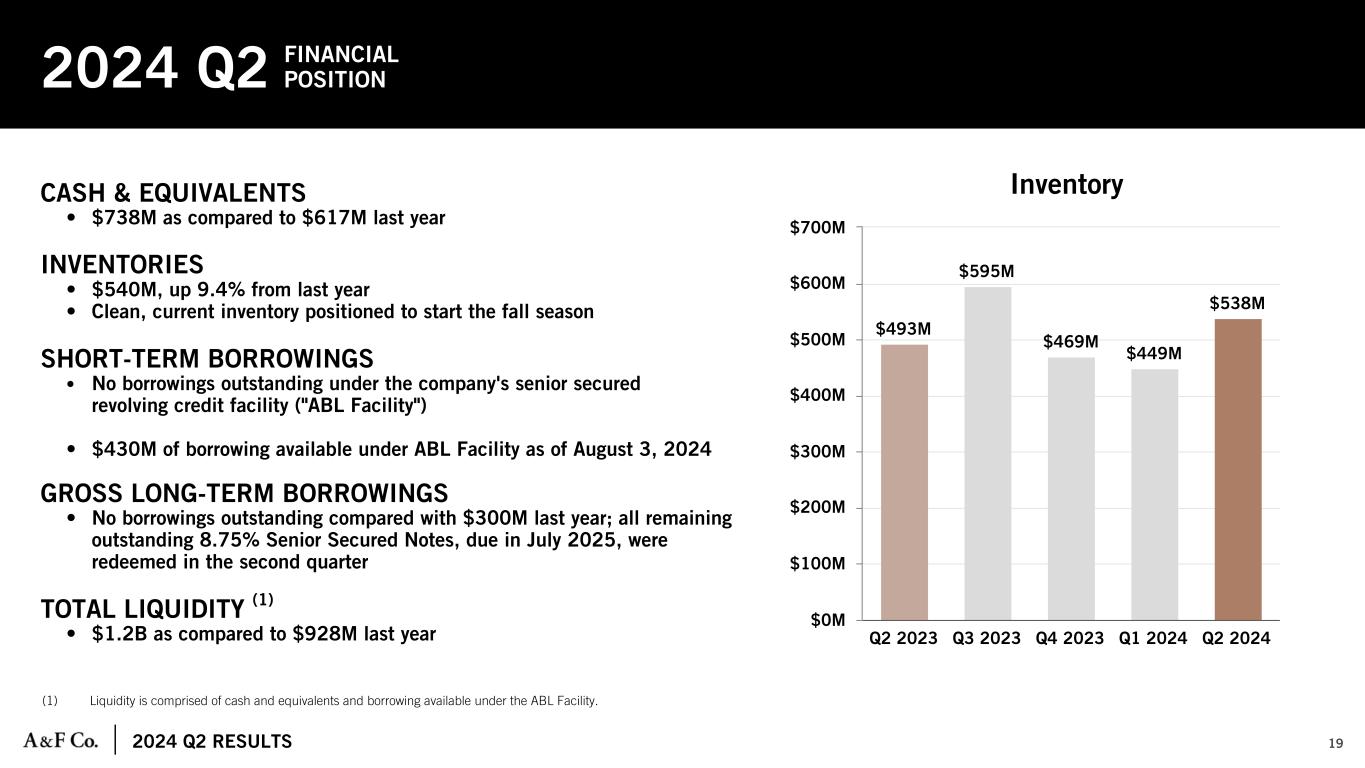

| Financial Position and Liquidity | ||

Cash Flow and Capital Allocation | ||

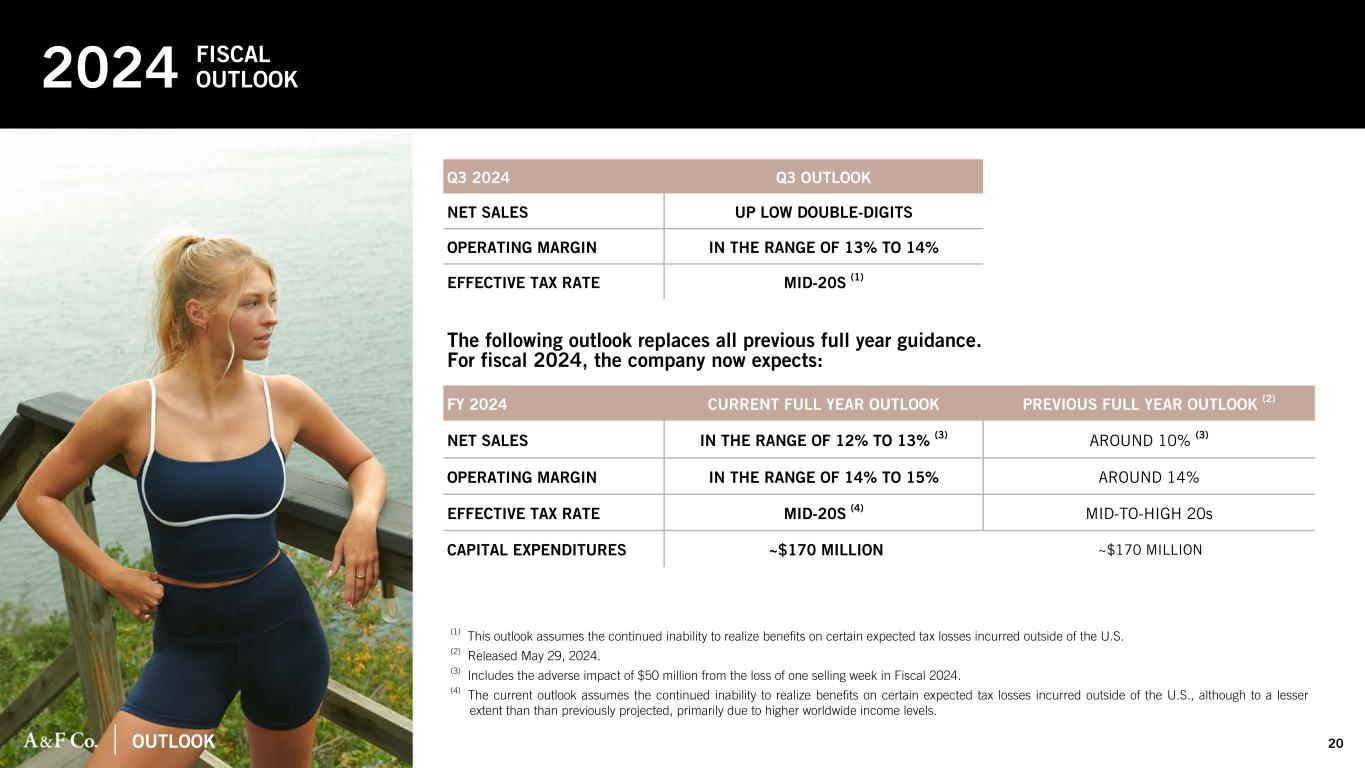

Fiscal 2024 Full Year Outlook | ||

| Q1 | Q2 | Q3 | Q4 | Fiscal 2024 | |||||||||||||

Net sales increase (decrease) (in millions) |

$10 | $30 | $(10) | $(80) | $(50) | ||||||||||||

Basis point increase (decrease) |

120 | 320 | (90) | (550) | (120) | ||||||||||||

Fiscal 2024 Third Quarter Outlook | ||

| Conference Call | ||

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 | ||

| Other Information | ||

| About Abercrombie & Fitch Co. | ||

| Investor Contact: | Media Contact: | |||||||

| Mo Gupta | Kate Wagner | |||||||

| Abercrombie & Fitch Co. | Abercrombie & Fitch Co. | |||||||

| (614) 283-6751 | (614) 283-6192 | |||||||

| Investor_Relations@anfcorp.com | Public_Relations@anfcorp.com | |||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

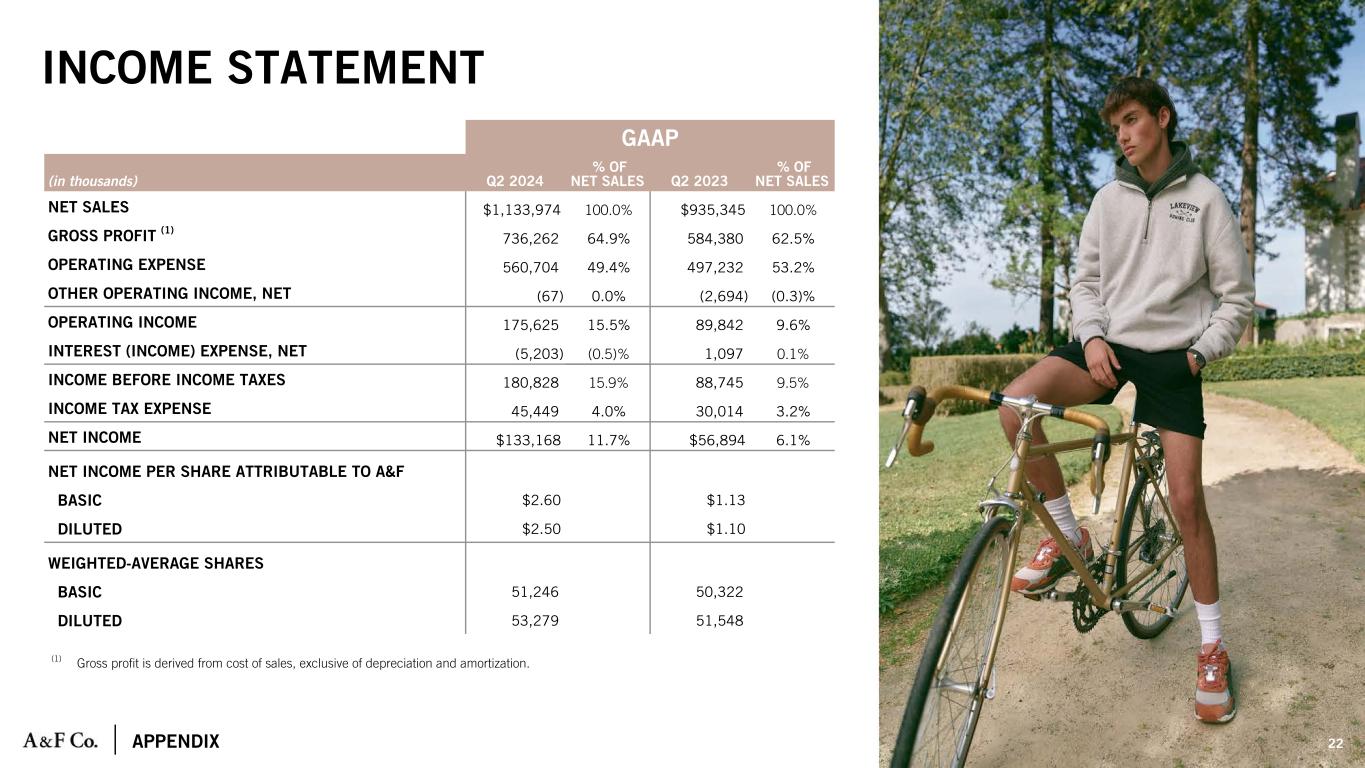

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Thirteen Weeks Ended | Thirteen Weeks Ended | ||||||||||||||||||||||

| August 3, 2024 | % of Net Sales |

July 29, 2023 | % of Net Sales |

||||||||||||||||||||

| Net sales | $ | 1,133,974 | 100.0 | % | $ | 935,345 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 397,712 | 35.1 | % | 350,965 | 37.5 | % | |||||||||||||||||

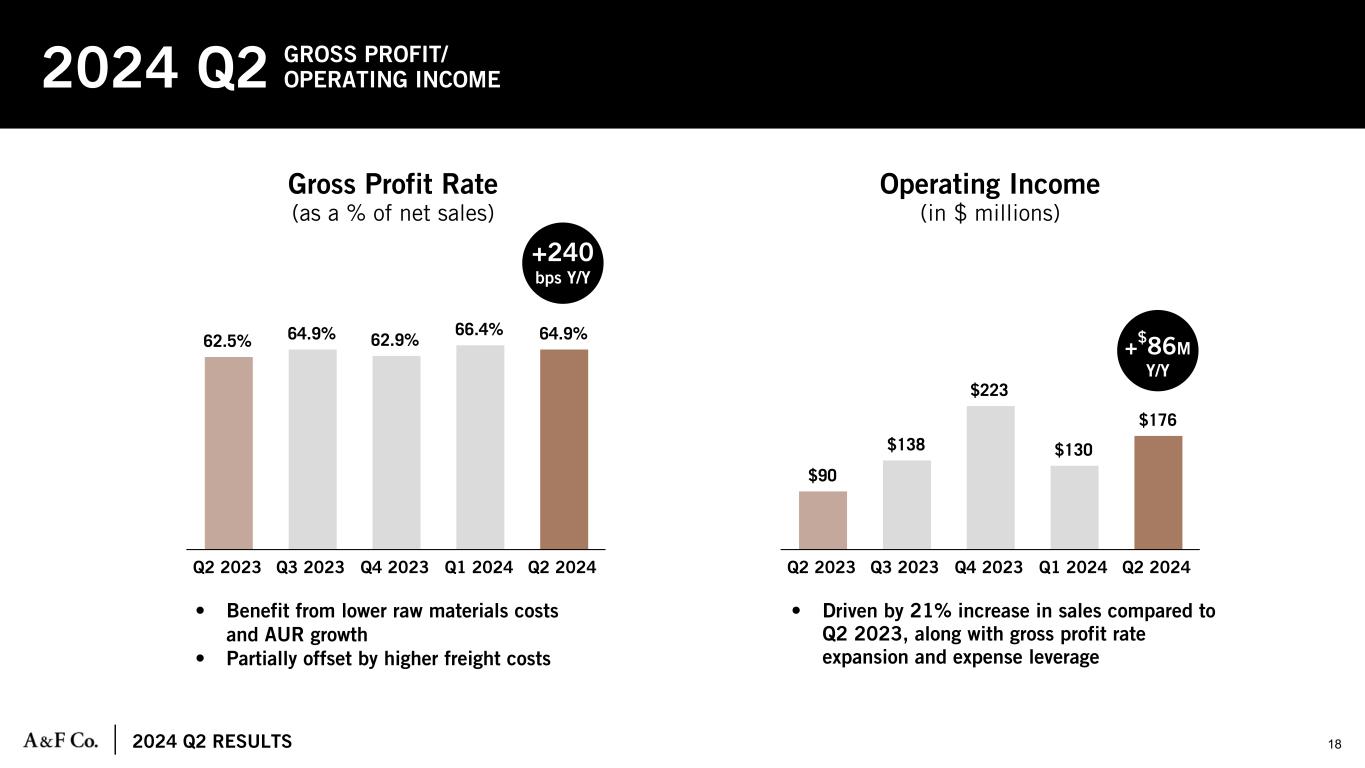

| Gross profit | 736,262 | 64.9 | % | 584,380 | 62.5 | % | |||||||||||||||||

| Stores and distribution expense | 390,233 | 34.4 | % | 352,730 | 37.7 | % | |||||||||||||||||

| Marketing, general and administrative expense | 170,471 | 15.0 | % | 144,502 | 15.4 | % | |||||||||||||||||

| Other operating income, net | (67) | — | % | (2,694) | (0.3) | % | |||||||||||||||||

| Operating income | 175,625 | 15.5 | % | 89,842 | 9.6 | % | |||||||||||||||||

| Interest expense | 5,189 | 0.5 | % | 7,635 | 0.8 | % | |||||||||||||||||

| Interest income | (10,392) | (0.9) | % | (6,538) | (0.7) | % | |||||||||||||||||

| Interest (income) expense, net | (5,203) | (0.5) | % | 1,097 | 0.1 | % | |||||||||||||||||

| Income before income taxes | 180,828 | 15.9 | % | 88,745 | 9.5 | % | |||||||||||||||||

| Income tax expense | 45,449 | 4.0 | % | 30,014 | 3.2 | % | |||||||||||||||||

| Net income | 135,379 | 11.9 | % | 58,731 | 6.3 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 2,211 | 0.2 | % | 1,837 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 133,168 | 11.7 | % | $ | 56,894 | 6.1 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 2.60 | $ | 1.13 | |||||||||||||||||||

| Diluted | $ | 2.50 | $ | 1.10 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 51,246 | 50,322 | |||||||||||||||||||||

| Diluted | 53,279 | 51,548 | |||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Twenty-Six Weeks Ended | Twenty-Six Weeks Ended | ||||||||||||||||||||||

| August 3, 2024 | % of Net Sales |

July 29, 2023 | % of Net Sales |

||||||||||||||||||||

| Net sales | $ | 2,154,704 | 100.0 | % | $ | 1,771,339 | 100.0 | % | |||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 740,985 | 34.4 | % | 677,165 | 38.2 | % | |||||||||||||||||

| Gross profit | 1,413,719 | 65.6 | % | 1,094,174 | 61.8 | % | |||||||||||||||||

| Stores and distribution expense | 761,919 | 35.4 | % | 688,779 | 38.9 | % | |||||||||||||||||

| Marketing, general and administrative expense | 348,351 | 16.2 | % | 287,133 | 16.2 | % | |||||||||||||||||

| Other operating income, net | (2,025) | (0.1) | % | (5,588) | (0.3) | % | |||||||||||||||||

| Operating income | 305,474 | 14.2 | % | 123,850 | 7.0 | % | |||||||||||||||||

| Interest expense | 10,969 | 0.5 | % | 15,093 | 0.9 | % | |||||||||||||||||

| Interest income | (21,195) | (1.0) | % | (10,553) | (0.6) | % | |||||||||||||||||

| Interest (income) expense, net | (10,226) | (0.5) | % | 4,540 | 0.3 | % | |||||||||||||||||

| Income before income taxes | 315,700 | 14.7 | % | 119,310 | 6.7 | % | |||||||||||||||||

| Income tax expense | 65,243 | 3.0 | % | 42,732 | 2.4 | % | |||||||||||||||||

| Net income | 250,457 | 11.6 | % | 76,578 | 4.3 | % | |||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 3,439 | 0.2 | % | 3,113 | 0.2 | % | |||||||||||||||||

| Net income attributable to A&F | $ | 247,018 | 11.5 | % | $ | 73,465 | 4.1 | % | |||||||||||||||

| Net income per share attributable to A&F | |||||||||||||||||||||||

| Basic | $ | 4.84 | $ | 1.47 | |||||||||||||||||||

| Diluted | $ | 4.64 | $ | 1.43 | |||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||

| Basic | 51,069 | 49,952 | |||||||||||||||||||||

| Diluted | 53,277 | 51,535 | |||||||||||||||||||||

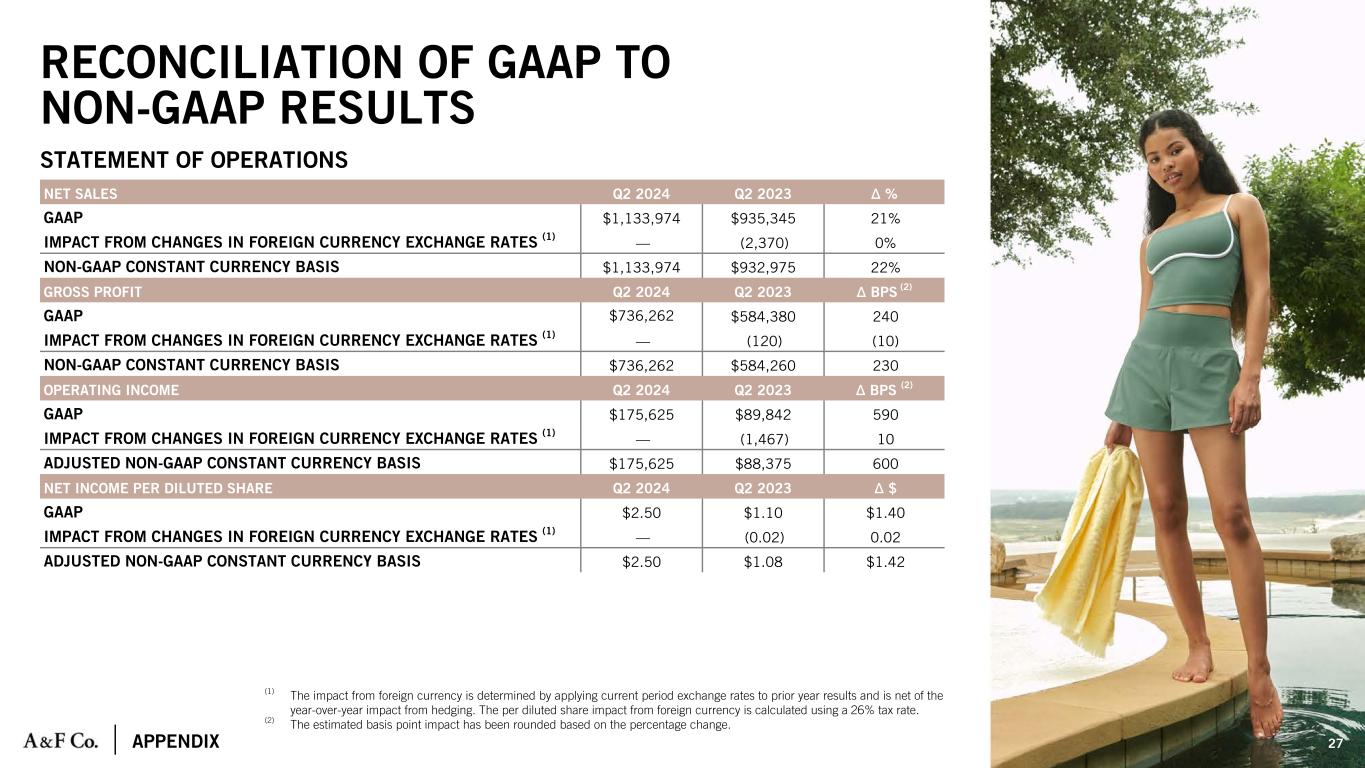

| Abercrombie & Fitch Co. | |||||||||||||||||

| Reconciliation of Constant Currency Financial Measures | |||||||||||||||||

Thirteen Weeks Ended August 3, 2024 and July 29, 2023 | |||||||||||||||||

| (in thousands, except percentage and basis point changes and per share data) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| Net sales | |||||||||||||||||

GAAP (1) |

$ | 1,133,974 | $ | 935,345 | 21% | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (2,370) | — | ||||||||||||||

| Net sales on a constant currency basis | $ | 1,133,974 | $ | 932,975 | 22% | ||||||||||||

| Gross profit | 2024 | 2023 | BPS Change (3) |

||||||||||||||

GAAP (1) |

$ | 736,262 | $ | 584,380 | 240 | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (120) | (10) | ||||||||||||||

| Gross profit on a constant currency basis | $ | 736,262 | $ | 584,260 | 230 | ||||||||||||

| Operating income | 2024 | 2023 | BPS Change (3) |

||||||||||||||

GAAP (1) |

$ | 175,625 | $ | 89,842 | 590 | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (1,467) | 10 | ||||||||||||||

| Adjusted non-GAAP constant currency basis | $ | 175,625 | $ | 88,375 | 600 | ||||||||||||

| Net income attributable to A&F | 2024 | 2023 | $ Change | ||||||||||||||

GAAP (1) |

$ | 2.50 | $ | 1.10 | $1.40 | ||||||||||||

Impact from changes in foreign currency exchange rates (2) |

— | (0.02) | 0.02 | ||||||||||||||

| Adjusted non-GAAP constant currency basis | $ | 2.50 | $ | 1.08 | $1.42 | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||||||||

| Reconciliation of Constant Currency Net Sales by Geography and Brand | ||||||||||||||||||||||||||

Thirteen Weeks Ended August 3, 2024 and July 29, 2023 | ||||||||||||||||||||||||||

| (in thousands, except percentage changes) | ||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||

| 2024 | 2023 | GAAP % Change |

Non-GAAP Constant Currency Basis % Change |

|||||||||||||||||||||||

| GAAP | GAAP |

Impact From Changes In

Foreign Currency Exchanges Rates (1)

|

Non-GAAP Constant Currency Basis |

|||||||||||||||||||||||

Net sales by segment: (2) |

||||||||||||||||||||||||||

Americas (3) |

$ | 901,224 | $ | 731,427 | $ | (833) | $ | 730,594 | 23% | 23% | ||||||||||||||||

EMEA (4) |

199,682 | 171,962 | (413) | 171,549 | 16% | 16% | ||||||||||||||||||||

APAC (5) |

33,068 | 31,956 | (1,124) | 30,832 | 3% | 7% | ||||||||||||||||||||

| Total company | $ | 1,133,974 | $ | 935,345 | $ | (2,370) | $ | 932,975 | 21% | 22% | ||||||||||||||||

| 2024 | 2023 | GAAP % Change |

Non-GAAP Constant Currency Basis % Change |

|||||||||||||||||||||||

| GAAP | GAAP |

Impact From Changes In

Foreign Currency Exchanges Rates (1)

|

Non-GAAP Constant Currency Basis |

|||||||||||||||||||||||

| Net sales by brand: | ||||||||||||||||||||||||||

Abercrombie (6) |

$ | 582,416 | $ | 462,711 | $ | (1,125) | $ | 461,586 | 26% | 26% | ||||||||||||||||

Hollister (7) |

551,558 | 472,634 | (1,245) | 471,389 | 17% | 17% | ||||||||||||||||||||

| Total company | $ | 1,133,974 | $ | 935,345 | $ | (2,370) | $ | 932,975 | 21% | 22% | ||||||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

Reconciliation of EBITDA and Adjusted EBITDA | ||||||||||||||||||||

Thirteen Weeks Ended August 3, 2024 and July 29, 2023 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2024 | % of Net Sales |

2023 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 135,379 | 11.9 | % | $ | 58,731 | 6.3 | % | ||||||||||||

| Income tax expense | 45,449 | 4.0 | 30,014 | 3.2 | ||||||||||||||||

| Interest (income) expense, net | (5,203) | (0.5) | 1,097 | 0.1 | ||||||||||||||||

Depreciation and amortization |

39,355 | 3.6 | 36,383 | 3.9 | ||||||||||||||||

EBITDA (1) |

$ | 214,980 | 19.0 | % | $ | 126,225 | 13.5 | % | ||||||||||||

| Abercrombie & Fitch Co. | ||||||||||||||||||||

| Schedule of Non-GAAP Financial Measures | ||||||||||||||||||||

Twenty-Six Weeks Ended August 3, 2024 and July 29, 2023 | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| 2024 | % of Net Sales |

2023 | % of Net Sales |

|||||||||||||||||

| Net income | $ | 250,457 | 11.6 | % | $ | 76,578 | 4.3 | % | ||||||||||||

| Income tax expense | 65,243 | 3.0 | 42,732 | 2.4 | ||||||||||||||||

| Interest (income) expense, net | (10,226) | (0.5) | 4,540 | 0.3 | ||||||||||||||||

| Depreciation and Amortization | 77,044 | 3.7 | 72,411 | 4.1 | ||||||||||||||||

EBITDA (1) |

$ | 382,518 | 17.8 | % | $ | 196,261 | 11.1 | % | ||||||||||||

| Adjustments to EBITDA | ||||||||||||||||||||

| Asset impairment | — | — | % | 4,436 | 0.3 | % | ||||||||||||||

Adjusted EBITDA (1) |

$ | 382,518 | 17.8 | % | $ | 200,697 | 11.4 | % | ||||||||||||

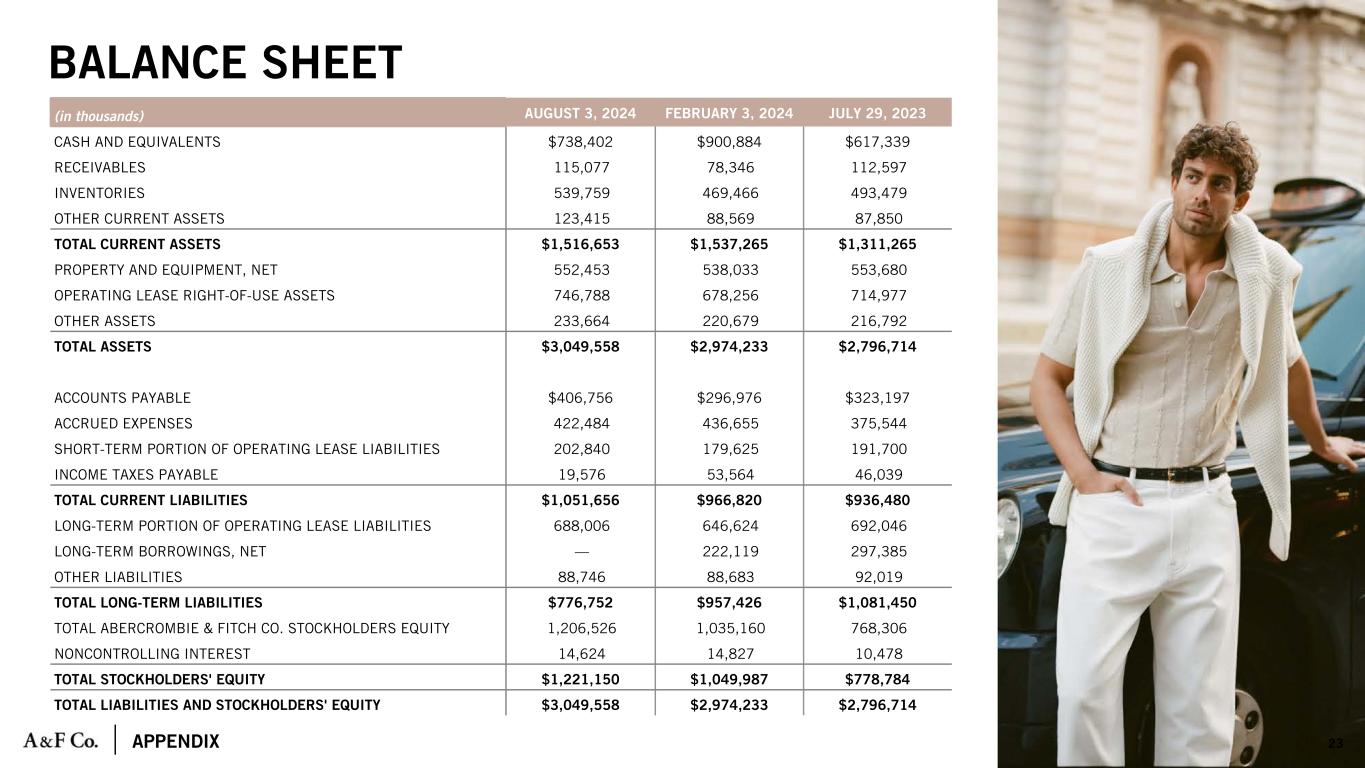

| Abercrombie & Fitch Co. | |||||||||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||||||||

| (in thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| August 3, 2024 | February 3, 2024 | July 29, 2023 | |||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

| Cash and equivalents | $ | 738,402 | $ | 900,884 | $ | 617,339 | |||||||||||

| Receivables | 115,077 | 78,346 | 112,597 | ||||||||||||||

| Inventories | 539,759 | 469,466 | 493,479 | ||||||||||||||

| Other current assets | 123,415 | 88,569 | 87,850 | ||||||||||||||

| Total current assets | 1,516,653 | 1,537,265 | 1,311,265 | ||||||||||||||

| Property and equipment, net | 552,453 | 538,033 | 553,680 | ||||||||||||||

| Operating lease right-of-use assets | 746,788 | 678,256 | 714,977 | ||||||||||||||

| Other assets | 233,664 | 220,679 | 216,792 | ||||||||||||||

| Total assets | $ | 3,049,558 | $ | 2,974,233 | $ | 2,796,714 | |||||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Accounts payable | $ | 406,756 | $ | 296,976 | $ | 323,197 | |||||||||||

| Accrued expenses | 422,484 | 436,655 | 375,544 | ||||||||||||||

| Short-term portion of operating lease liabilities | 202,840 | 179,625 | 191,700 | ||||||||||||||

| Income taxes payable | 19,576 | 53,564 | 46,039 | ||||||||||||||

| Total current liabilities | 1,051,656 | 966,820 | 936,480 | ||||||||||||||

| Long-term liabilities: | |||||||||||||||||

| Long-term portion of operating lease liabilities | $ | 688,006 | $ | 646,624 | $ | 692,046 | |||||||||||

| Long-term borrowings, net | — | 222,119 | 297,385 | ||||||||||||||

| Other liabilities | 88,746 | 88,683 | 92,019 | ||||||||||||||

| Total long-term liabilities | 776,752 | 957,426 | 1,081,450 | ||||||||||||||

| Total Abercrombie & Fitch Co. stockholders’ equity | 1,206,526 | 1,035,160 | 768,306 | ||||||||||||||

| Noncontrolling interests | 14,624 | 14,827 | 10,478 | ||||||||||||||

| Total stockholders’ equity | 1,221,150 | 1,049,987 | 778,784 | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | 3,049,558 | $ | 2,974,233 | $ | 2,796,714 | |||||||||||

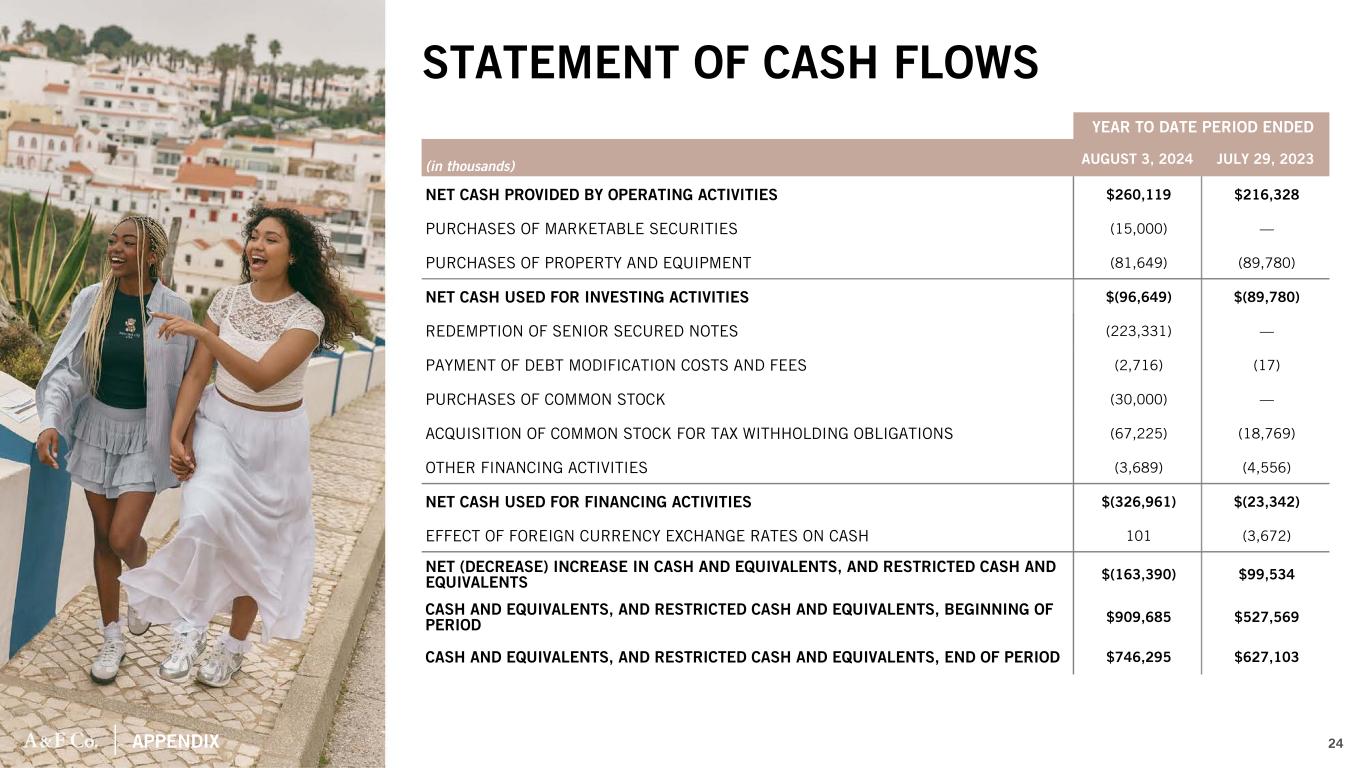

| Abercrombie & Fitch Co. | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (in thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Twenty-Six Weeks Ended | |||||||||||

| August 3, 2024 | July 29, 2023 | ||||||||||

| Operating activities | |||||||||||

| Net cash provided by operating activities | $ | 260,119 | $ | 216,328 | |||||||

| Investing activities | |||||||||||

Purchases of marketable securities |

$ | (15,000) | $ | — | |||||||

| Purchases of property and equipment | (81,649) | (89,780) | |||||||||

| Net cash used for investing activities | $ | (96,649) | $ | (89,780) | |||||||

| Financing activities | |||||||||||

Redemption of senior secured notes |

(223,331) | — | |||||||||

| Payment of debt modification costs and fees | (2,716) | (17) | |||||||||

| Purchases of common stock | (30,000) | — | |||||||||

| Acquisition of common stock for tax withholding obligations | (67,225) | (18,769) | |||||||||

| Other financing activities | (3,689) | (4,556) | |||||||||

| Net cash used for financing activities | $ | (326,961) | $ | (23,342) | |||||||

| Effect of foreign currency exchange rates on cash | $ | 101 | $ | (3,672) | |||||||

| Net (decrease) increase in cash and equivalents, and restricted cash and equivalents | $ | (163,390) | $ | 99,534 | |||||||

| Cash and equivalents, and restricted cash and equivalents, beginning of period | $ | 909,685 | $ | 527,569 | |||||||

| Cash and equivalents, and restricted cash and equivalents, end of period | $ | 746,295 | $ | 627,103 | |||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||

| Fiscal 2023 | Fiscal 2024 | ||||||||||||||||||||||||||||||||||||||||

| 2022 | Q1 | Q2 | Q3 | Q4 | 2023 | Q1 | Q2 | 2024 | |||||||||||||||||||||||||||||||||

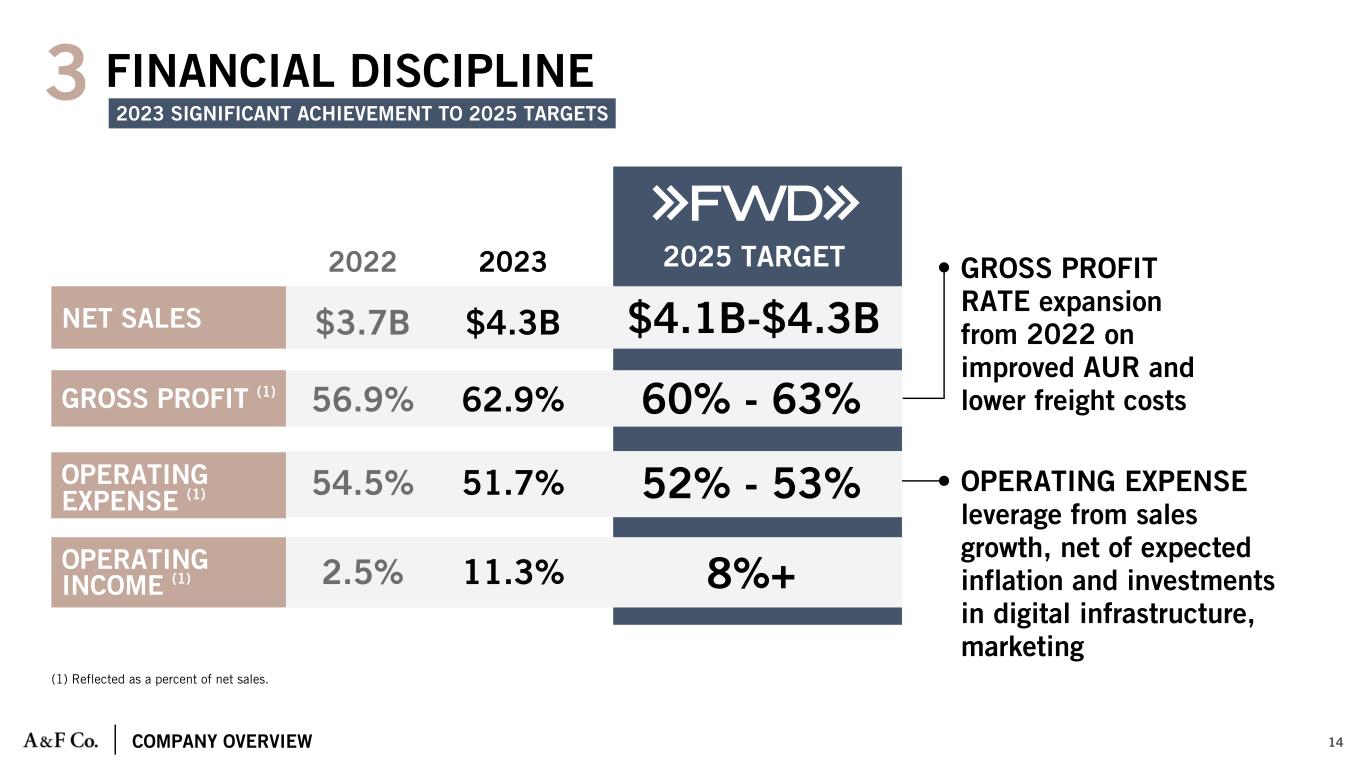

| Net sales | $ | 3,697,751 | $ | 835,994 | $ | 935,345 | $ | 1,056,431 | $ | 1,452,907 | $ | 4,280,677 | $ | 1,020,730 | $ | 1,133,974 | $ | 2,154,704 | |||||||||||||||||||||||

| Cost of sales, exclusive of depreciation and amortization | 1,593,213 | 326,200 | 350,965 | 370,762 | 539,338 | 1,587,265 | 343,273 | 397,712 | 740,985 | ||||||||||||||||||||||||||||||||

| Gross profit | 2,104,538 | 509,794 | 584,380 | 685,669 | 913,569 | 2,693,412 | 677,457 | 736,262 | 1,413,719 | ||||||||||||||||||||||||||||||||

| Stores and distribution expense | 1,496,962 | 336,049 | 352,730 | 383,883 | 499,075 | 1,571,737 | 371,686 | 390,233 | 761,919 | ||||||||||||||||||||||||||||||||

| Marketing, general and administrative expense | 517,602 | 142,631 | 144,502 | 162,510 | 193,234 | 642,877 | 177,880 | 170,471 | 348,351 | ||||||||||||||||||||||||||||||||

| Other operating (income) loss, net | (2,674) | (2,894) | (2,694) | 1,256 | (1,541) | (5,873) | (1,958) | (67) | (2,025) | ||||||||||||||||||||||||||||||||

| Operating income | 92,648 | 34,008 | 89,842 | 138,020 | 222,801 | 484,671 | 129,849 | 175,625 | 305,474 | ||||||||||||||||||||||||||||||||

| Interest expense | 30,236 | 7,458 | 7,635 | 8,568 | 6,691 | 30,352 | 5,780 | 5,189 | 10,969 | ||||||||||||||||||||||||||||||||

| Interest income | (4,604) | (4,015) | (6,538) | (7,897) | (11,530) | (29,980) | (10,803) | (10,392) | (21,195) | ||||||||||||||||||||||||||||||||

| Interest (income) expense, net | 25,632 | 3,443 | 1,097 | 671 | (4,839) | 372 | (5,023) | (5,203) | (10,226) | ||||||||||||||||||||||||||||||||

| Income before income taxes | 67,016 | 30,565 | 88,745 | 137,349 | 227,640 | 484,299 | 134,872 | 180,828 | 315,700 | ||||||||||||||||||||||||||||||||

| Income tax expense | 56,631 | 12,718 | 30,014 | 39,617 | 66,537 | 148,886 | 19,794 | 45,449 | 65,243 | ||||||||||||||||||||||||||||||||

| Net income | 10,385 | 17,847 | 58,731 | 97,732 | 161,103 | 335,413 | 115,078 | 135,379 | 250,457 | ||||||||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 7,569 | 1,276 | 1,837 | 1,521 | 2,656 | 7,290 | 1,228 | 2,211 | 3,439 | ||||||||||||||||||||||||||||||||

| Net income attributable to Abercrombie & Fitch Co. | $ | 2,816 | $ | 16,571 | $ | 56,894 | $ | 96,211 | $ | 158,447 | $ | 328,123 | $ | 113,850 | $ | 133,168 | $ | 247,018 | |||||||||||||||||||||||

| Net income per share attributable to Abercrombie & Fitch Co.: | |||||||||||||||||||||||||||||||||||||||||

| Basic | $0.06 | $0.33 | $1.13 | $1.91 | $3.13 | $6.53 | $2.24 | $2.60 | $4.84 | ||||||||||||||||||||||||||||||||

| Diluted | $0.05 | $0.32 | $1.10 | $1.83 | $2.97 | $6.22 | $2.14 | $2.50 | $4.64 | ||||||||||||||||||||||||||||||||

| Weighted-average shares outstanding: | |||||||||||||||||||||||||||||||||||||||||

| Basic | 50,307 | 49,574 | 50,322 | 50,504 | 50,559 | 50,250 | 50,893 | 51,246 | 51,069 | ||||||||||||||||||||||||||||||||

| Diluted | 52,327 | 51,467 | 51,548 | 52,624 | 53,399 | 52,726 | 53,276 | 53,279 | 53,277 | ||||||||||||||||||||||||||||||||

| Abercrombie & Fitch Co. | |||||||||||||||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Fiscal 2023 | Fiscal 2024 | ||||||||||||||||||||||||||||||||||||||||

| 2022 | Q1 | Q2 | Q3 | Q4 | 2023 | Q1 | Q2 | 2024 | |||||||||||||||||||||||||||||||||

Segment comparable sales (1) |

|||||||||||||||||||||||||||||||||||||||||

Americas comparable sales (2) (3) |

Not provided | Not provided | 14 | % | 16 | % | 17 | % | 13 | % | 21 | % | 18 | % | 19 | % | |||||||||||||||||||||||||

EMEA comparable sales (2) (4) |

Not provided | Not provided | 6 | % | 15 | % | 10 | % | 7 | % | 23 | % | 17 | % | 19 | % | |||||||||||||||||||||||||

APAC comparable sales (2) (5) |

Not provided | Not provided | 26 | % | 32 | % | 21 | % | 26 | % | 22 | % | 21 | % | 22 | % | |||||||||||||||||||||||||

Comparable sales (2) |

Not provided | 3 | % | 13 | % | 16 | % | 16 | % | 13 | % | 21 | % | 18 | % | 19 | % | ||||||||||||||||||||||||

| Branded comparable sales | |||||||||||||||||||||||||||||||||||||||||

Abercrombie comparable sales (2) (6) |

Not provided | 14 | % | 23 | % | 26 | % | 28 | % | 23 | % | 29 | % | 21 | % | 25 | % | ||||||||||||||||||||||||

Hollister comparable sales (2) (7) |

Not provided | (6) | % | 5 | % | 7 | % | 6 | % | 4 | % | 13 | % | 15 | % | 14 | % | ||||||||||||||||||||||||

Comparable sales (2) |

Not provided | 3 | % | 13 | % | 16 | % | 16 | % | 13 | % | 21 | % | 18 | % | 19 | % | ||||||||||||||||||||||||

(1) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order. | |||||||||||||||||||||||||||||||||||||||||

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion. The Company did not provide comparable sales results for fiscal 2022 due to temporary store closures as a result of COVID-19. | |||||||||||||||||||||||||||||||||||||||||

(3) The Americas segment includes the results of operations in North America and South America. | |||||||||||||||||||||||||||||||||||||||||

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa. | |||||||||||||||||||||||||||||||||||||||||

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania. | |||||||||||||||||||||||||||||||||||||||||

(6) For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids. | |||||||||||||||||||||||||||||||||||||||||

(7) For purposes of the above table, Hollister includes Hollister and Gilly Hicks. | |||||||||||||||||||||||||||||||||||||||||