Document

ABERCROMBIE & FITCH CO. REPORTS FIRST QUARTER FISCAL 2024 RESULTS

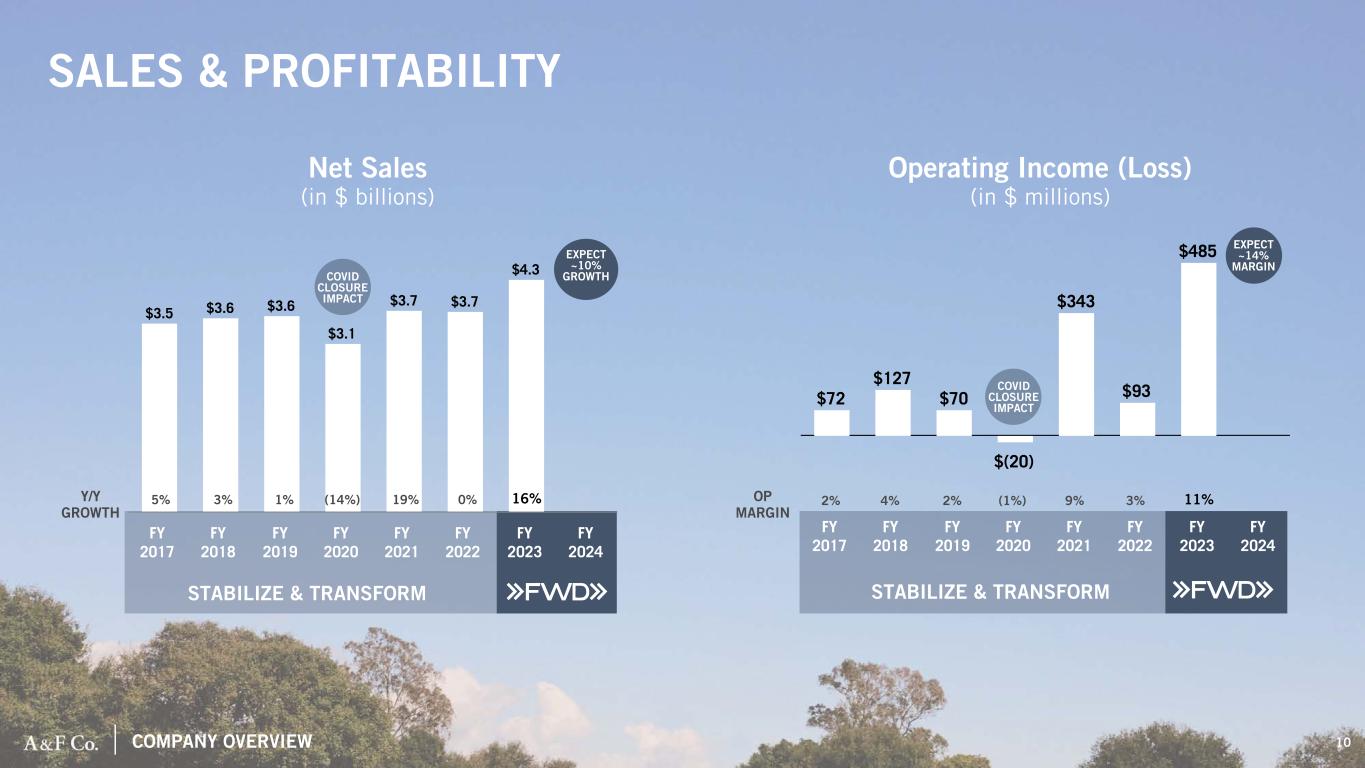

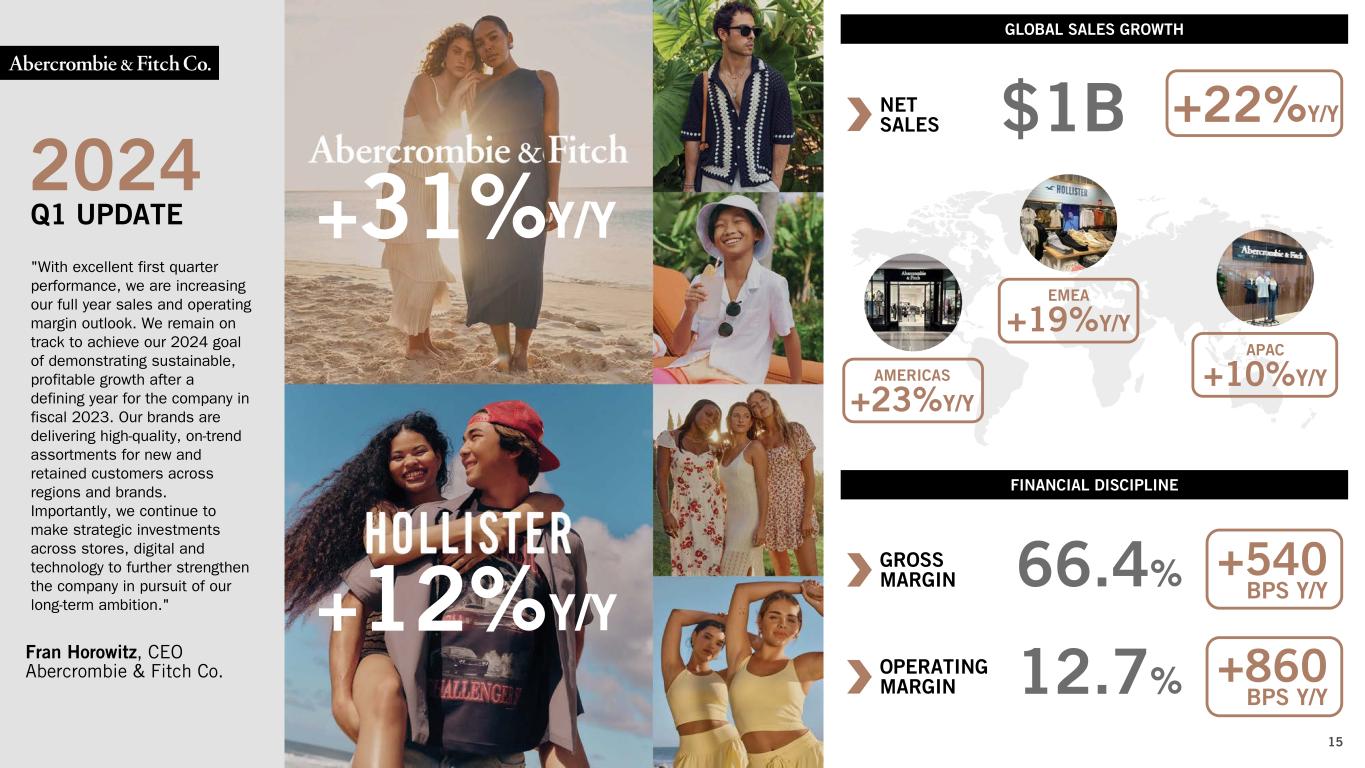

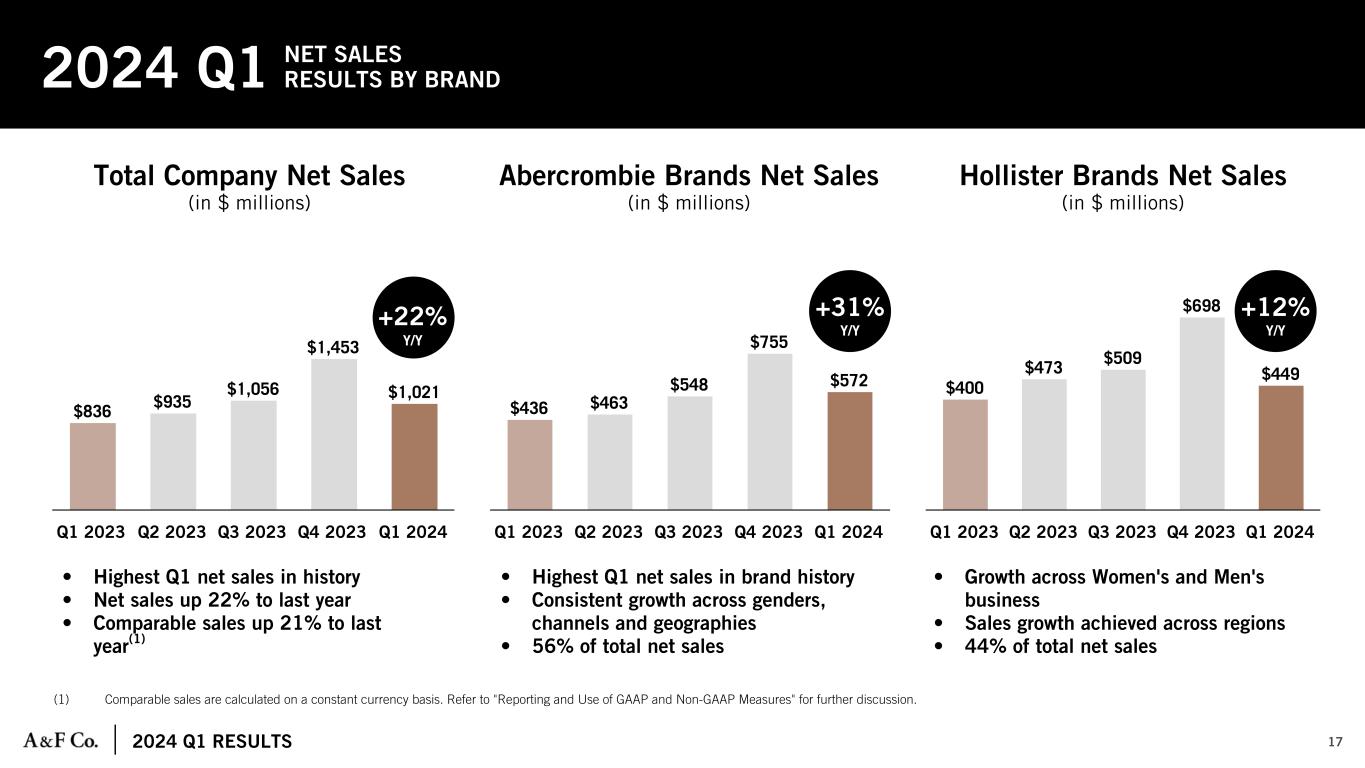

•Net sales of $1.0 billion, up 22% from last year with comparable sales growth of +21%, resulting in the highest first quarter net sales in company history

•Broad-based net sales growth across regions and brands; with Abercrombie brands growth of +31%

•First quarter operating margin of 12.7%, up 860 basis points from last year

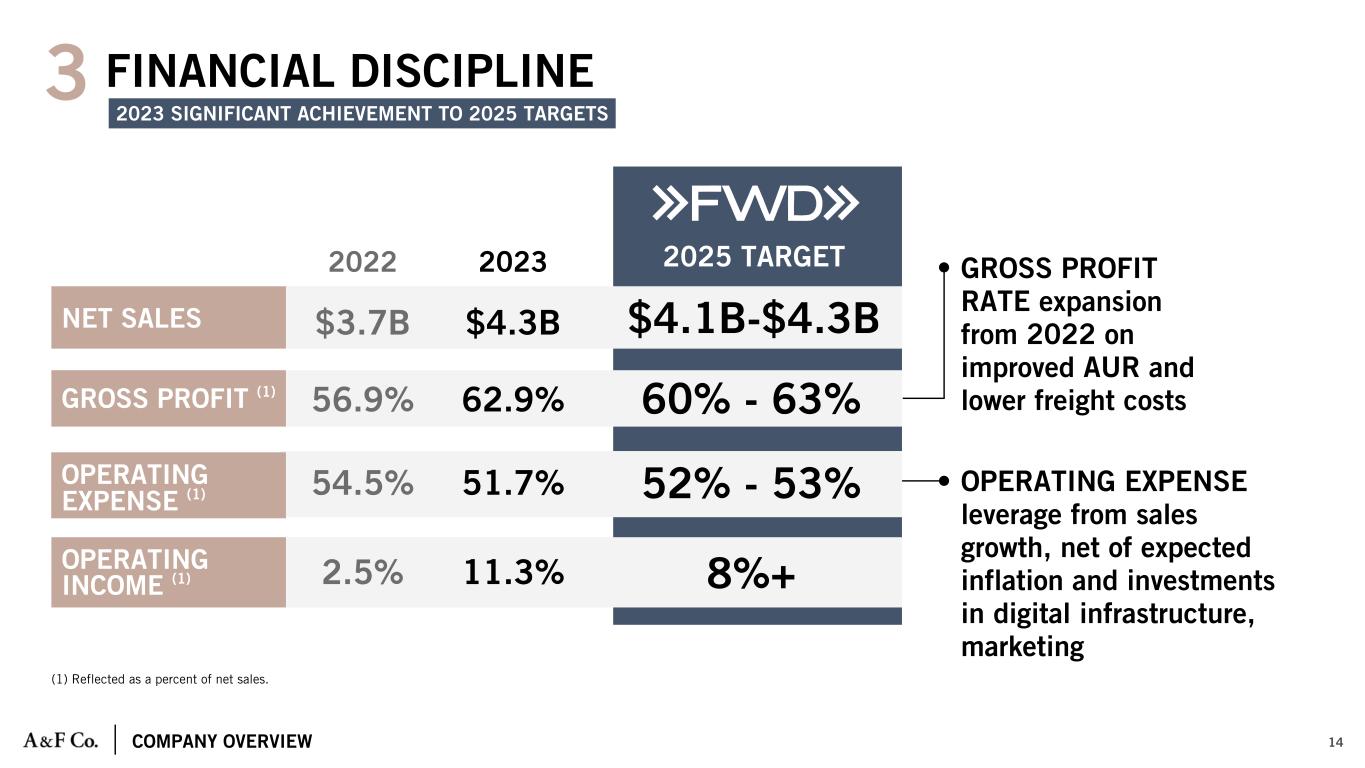

•Increases full year outlook to net sales growth of around 10%, and operating margin of around 14%

New Albany, Ohio, May 29, 2024: Abercrombie & Fitch Co. (NYSE: ANF) today announced results for the first quarter ended May 4, 2024. These compare to results for the first quarter ended April 29, 2023. Descriptions of the use of non-GAAP financial measures and reconciliations of GAAP and non-GAAP financial measures accompany this release.

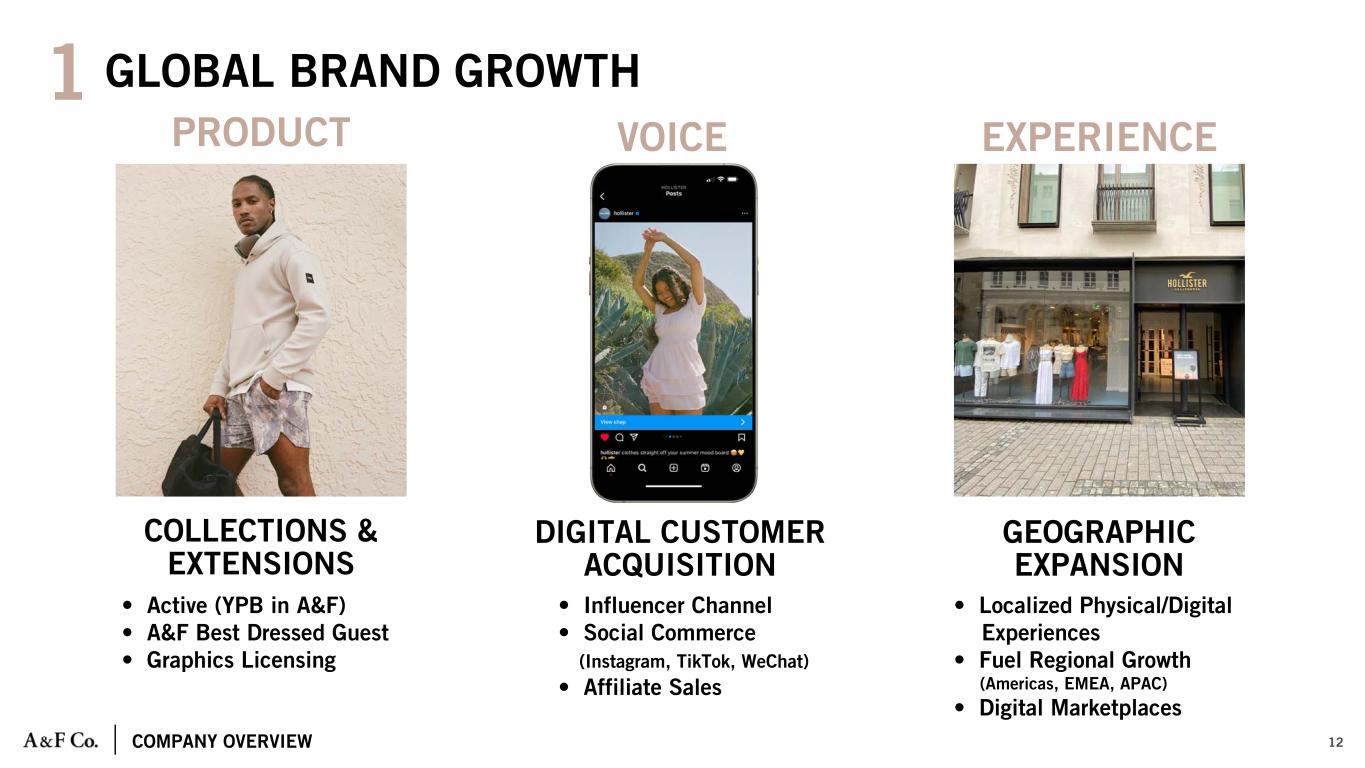

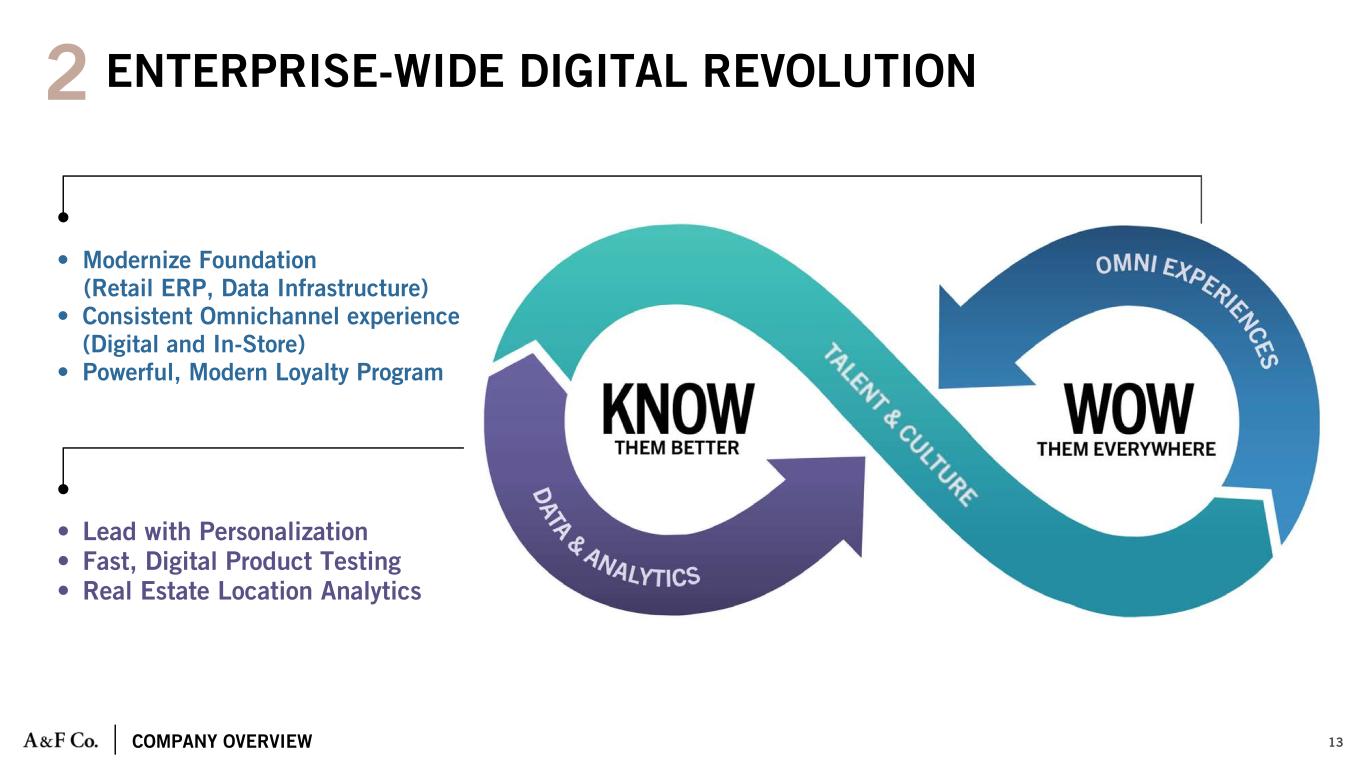

Fran Horowitz, Chief Executive Officer, said, “Our outstanding first quarter results reflect the power of our brands and strong execution of our global playbook. We successfully navigated seasonal transitions with relevant assortments and compelling marketing, leveraging agile chase capabilities and inventory discipline, driving sales above our expectations. Growth was broad-based across regions and brands with Abercrombie brands registering 31% growth and Hollister brands delivering growth of 12%. Strong top-line growth, along with gross profit rate expansion, led to record first quarter operating income and an operating margin of 12.7%.

With excellent first quarter performance, we are increasing our full year sales and operating margin outlook. We remain on track to achieve our 2024 goal of demonstrating sustainable, profitable growth after a defining year for the company in fiscal 2023. Our brands are delivering high-quality, on-trend assortments for new and retained customers across regions and brands. Importantly, we continue to make strategic investments across stores, digital and technology to further strengthen the company in pursuit of our long-term ambition.”

Details related to reported net income per diluted share and adjusted net income per diluted share for the first quarter are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

| GAAP |

|

$ |

2.14 |

|

|

$ |

0.32 |

|

Excluded items, net of tax effect (1) |

|

— |

|

|

(0.06) |

|

| Adjusted non-GAAP |

|

$ |

2.14 |

|

|

$ |

0.39 |

|

Impact from changes in foreign currency exchange rates (2) |

|

— |

|

|

— |

|

| Adjusted non-GAAP constant currency |

|

$ |

2.14 |

|

|

$ |

0.39 |

|

(1)Excluded items consist of pre-tax store asset impairment charges in the prior year.

(2)The estimated impact from foreign currency is calculated by applying current period exchange rates to prior year results using a 26% tax rate.

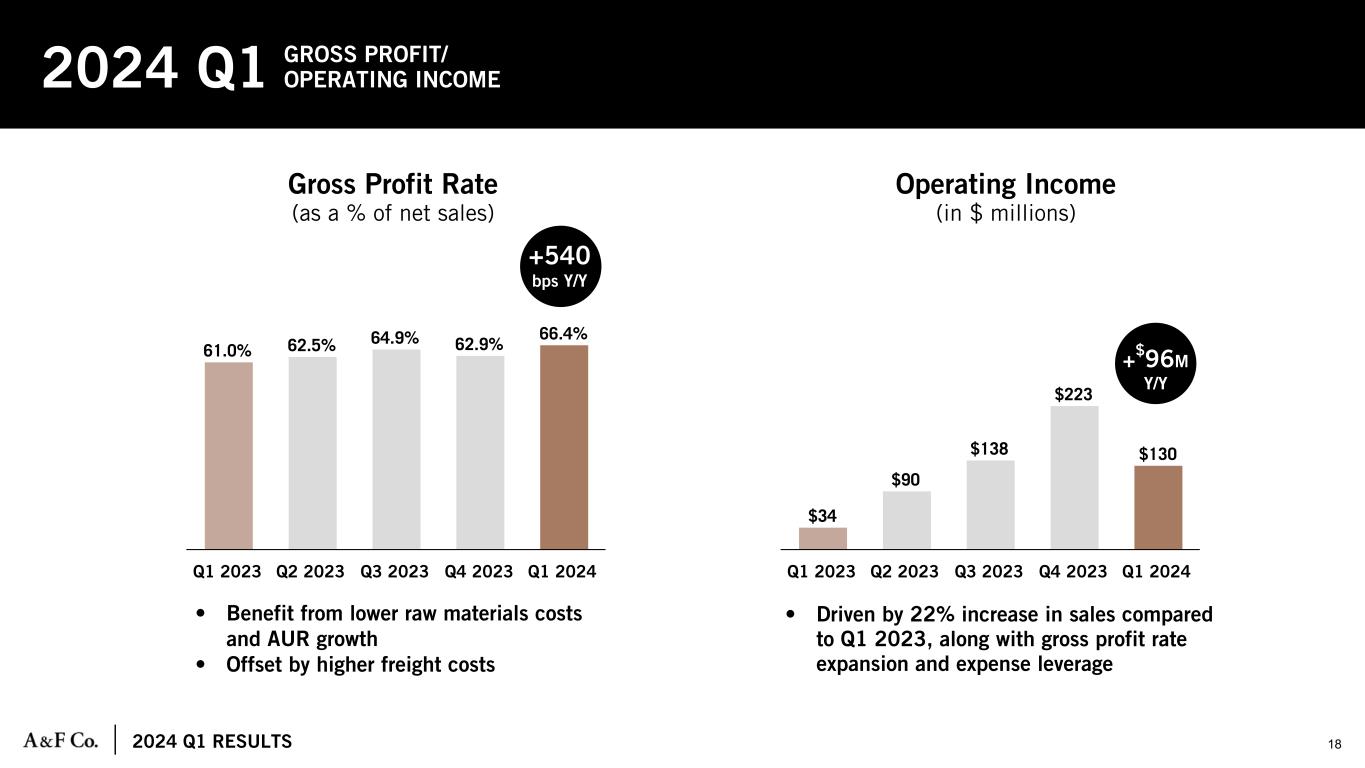

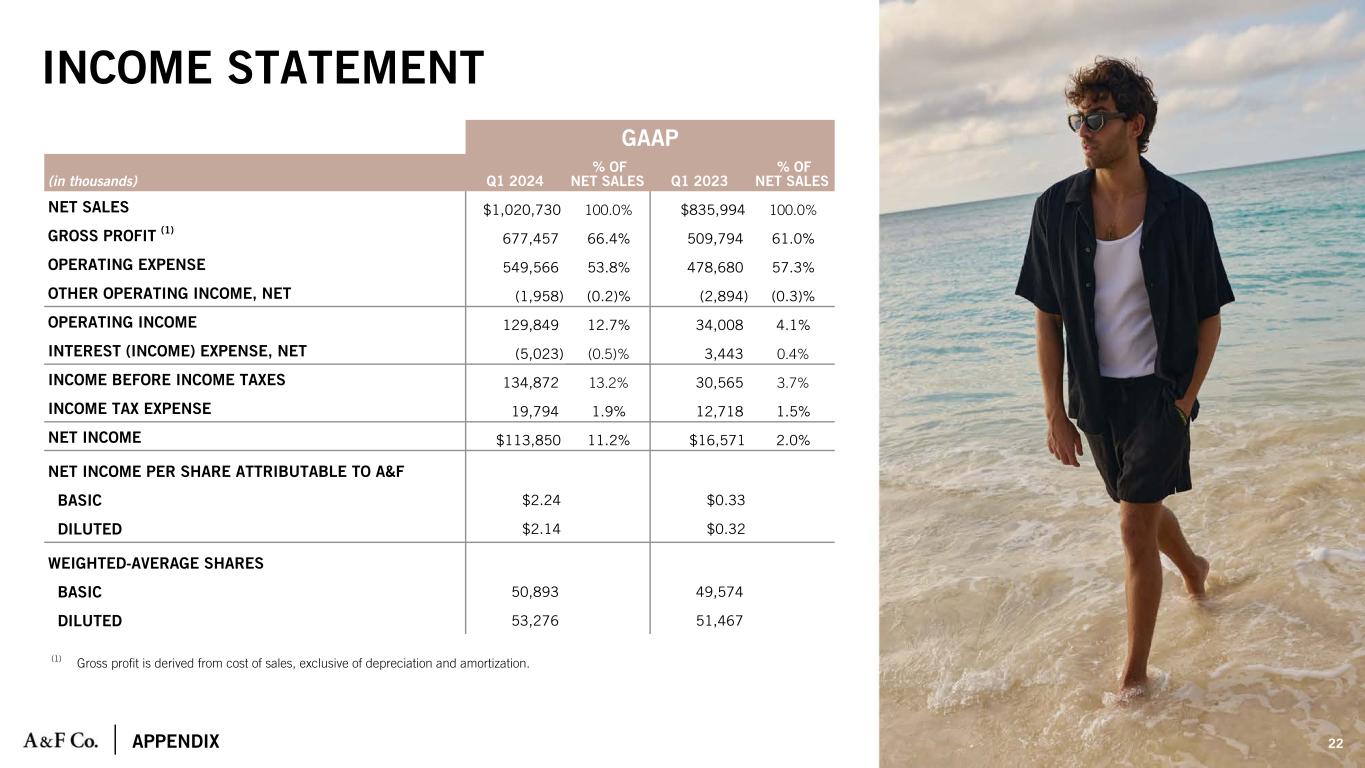

A summary of results for the first quarter ended May 4, 2024 as compared to the first quarter ended April 29, 2023:

•Net sales of $1.0 billion, up 22% as compared to last year on a reported basis and constant currency basis.

•Comparable sales up 21%.

•Gross profit rate of 66.4%, up approximately 540 basis points as compared to last year.

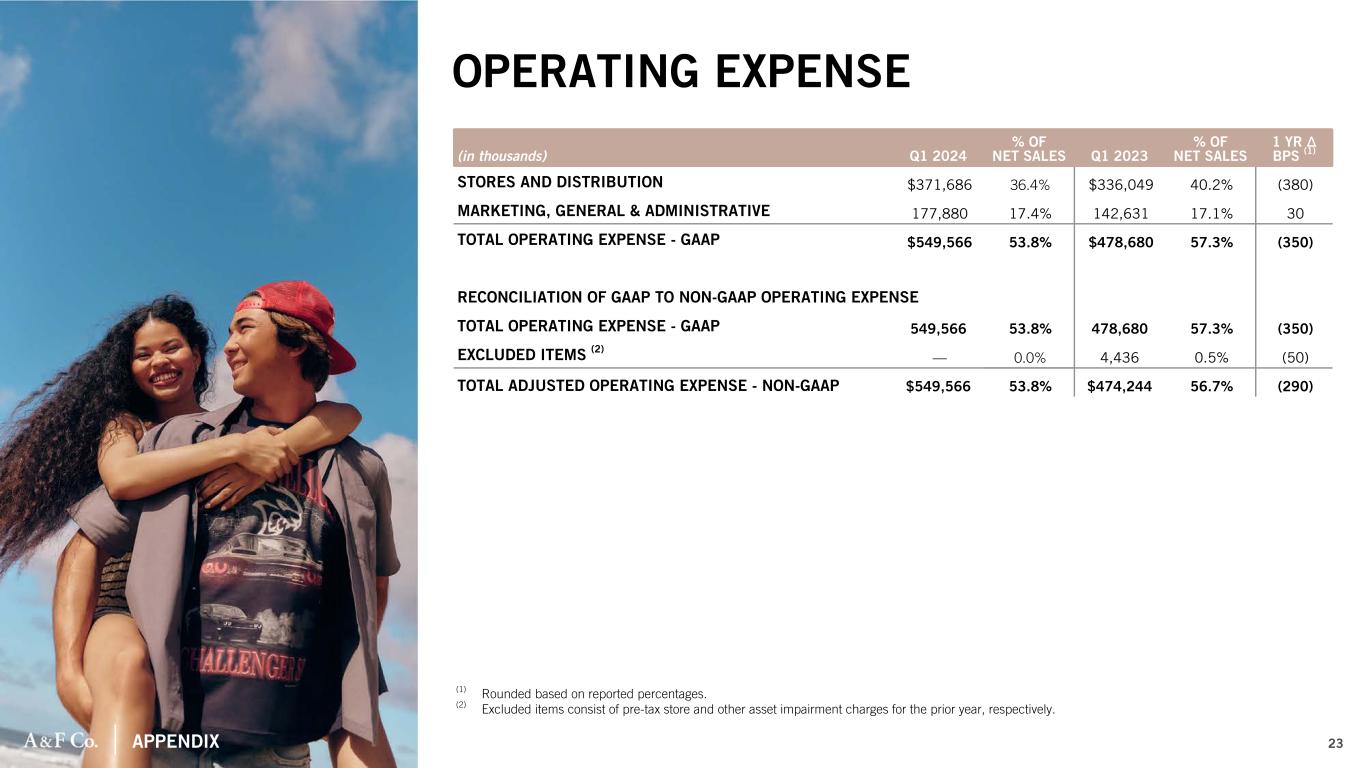

•Operating expense, excluding other operating income, net, of $549.6 million for the quarter, decreased to 53.8% of sales from 57.3% last year.

•Operating income of $130 million as compared to operating income last year of $34 million and $38 million, on a reported and adjusted non-GAAP basis, respectively.

•Net income per diluted share of $2.14 as compared to net income per diluted share last year of $0.32 and $0.39 on a reported and adjusted non-GAAP basis, respectively.

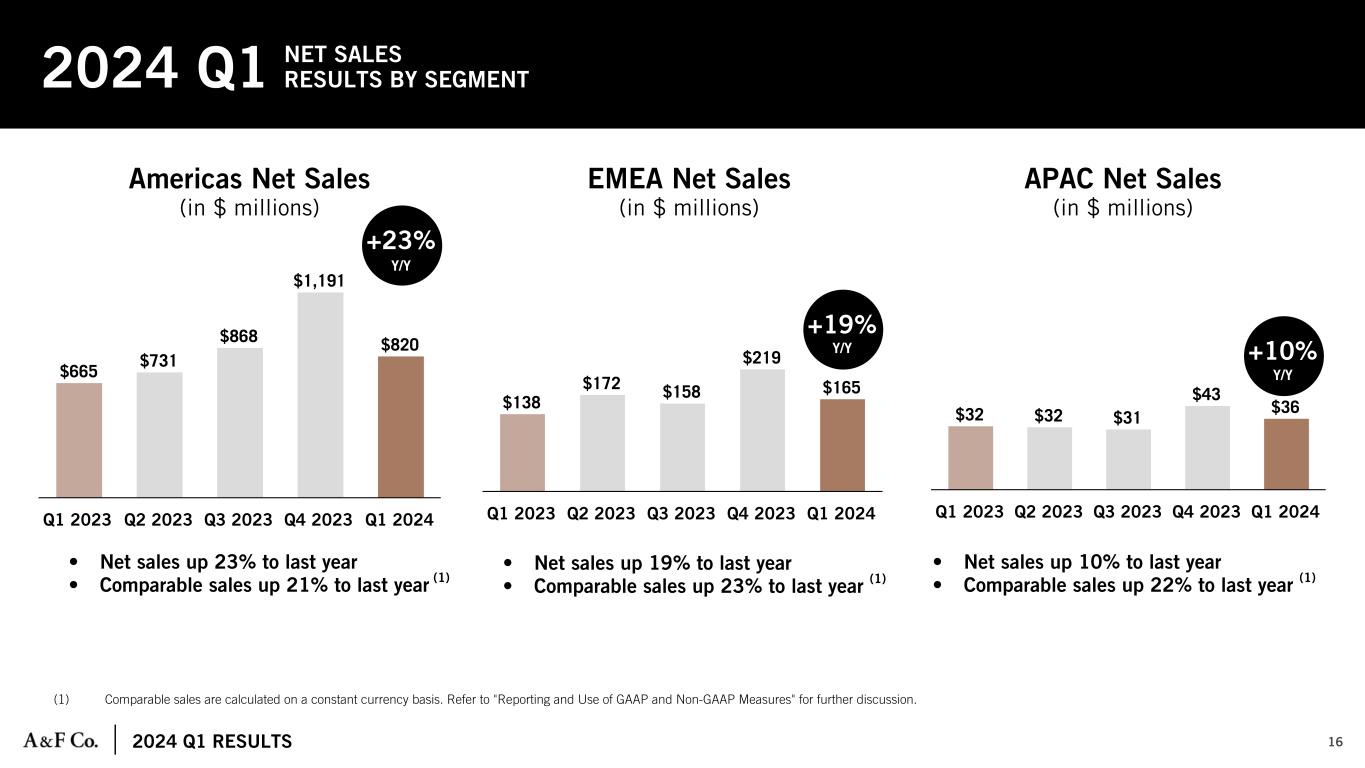

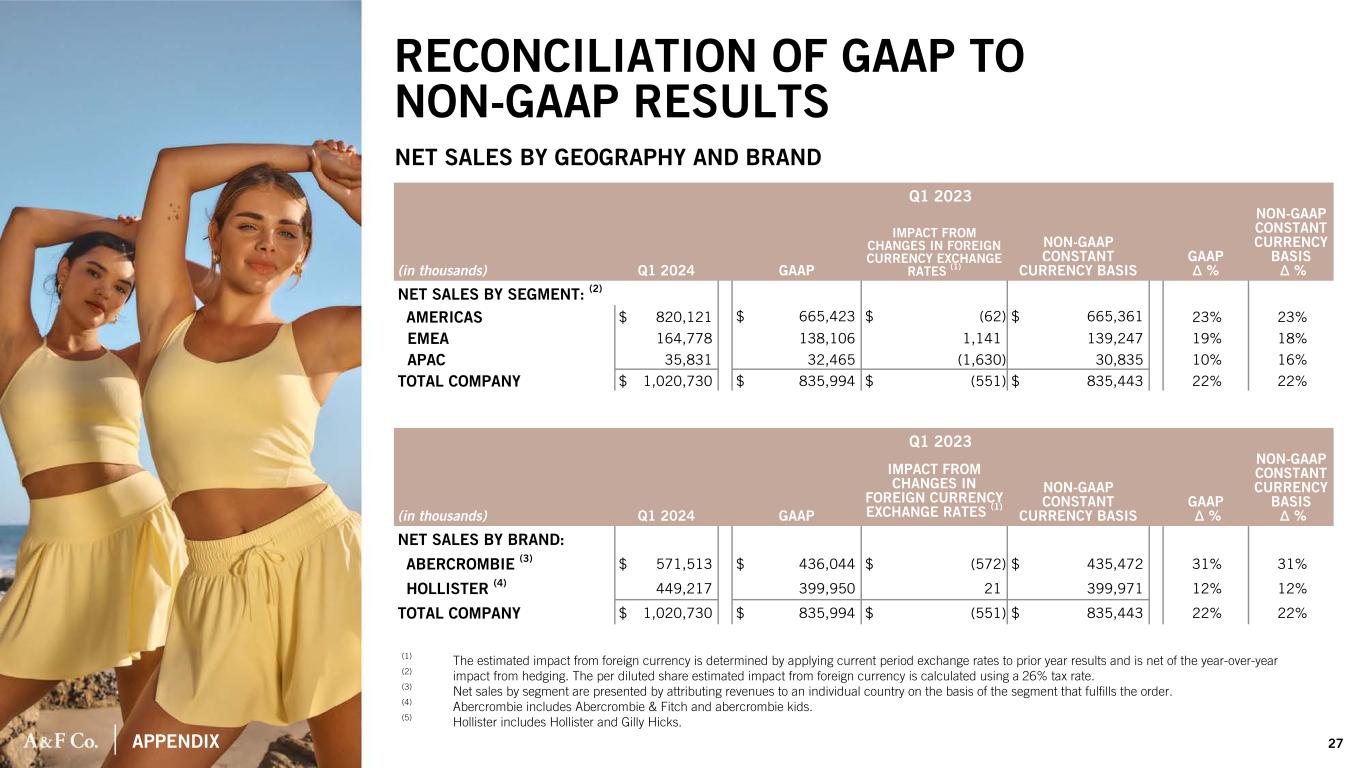

Net sales by segment and brand for the first quarter are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

2024 |

|

2023 |

|

1 YR % Change |

|

Comparable sales (2) |

Net sales by segment: (1) |

|

|

|

|

|

|

|

|

|

Americas (3) |

$ |

820,121 |

|

|

|

$ |

665,423 |

|

|

|

23% |

|

21% |

EMEA (4) |

164,778 |

|

|

|

138,106 |

|

|

|

19% |

|

23% |

APAC (5) |

35,831 |

|

|

|

32,465 |

|

|

|

10% |

|

22% |

| Total company |

$ |

1,020,730 |

|

|

|

$ |

835,994 |

|

|

|

22% |

|

21% |

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

1 YR % Change |

|

Comparable sales (2) |

| Net sales by brand: |

|

|

|

|

|

|

|

|

|

Abercrombie (6) |

571,513 |

|

|

|

436,044 |

|

|

|

31% |

|

29% |

Hollister (7) |

$ |

449,217 |

|

|

|

$ |

399,950 |

|

|

|

12% |

|

13% |

| Total company |

$ |

1,020,730 |

|

|

|

$ |

835,994 |

|

|

|

22% |

|

21% |

(1) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order.

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion.

(3) The Americas segment includes the results of operations in North America and South America.

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa.

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania.

(6) For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids.

(7) For purposes of the above table, Hollister includes Hollister and Gilly Hicks.

|

|

|

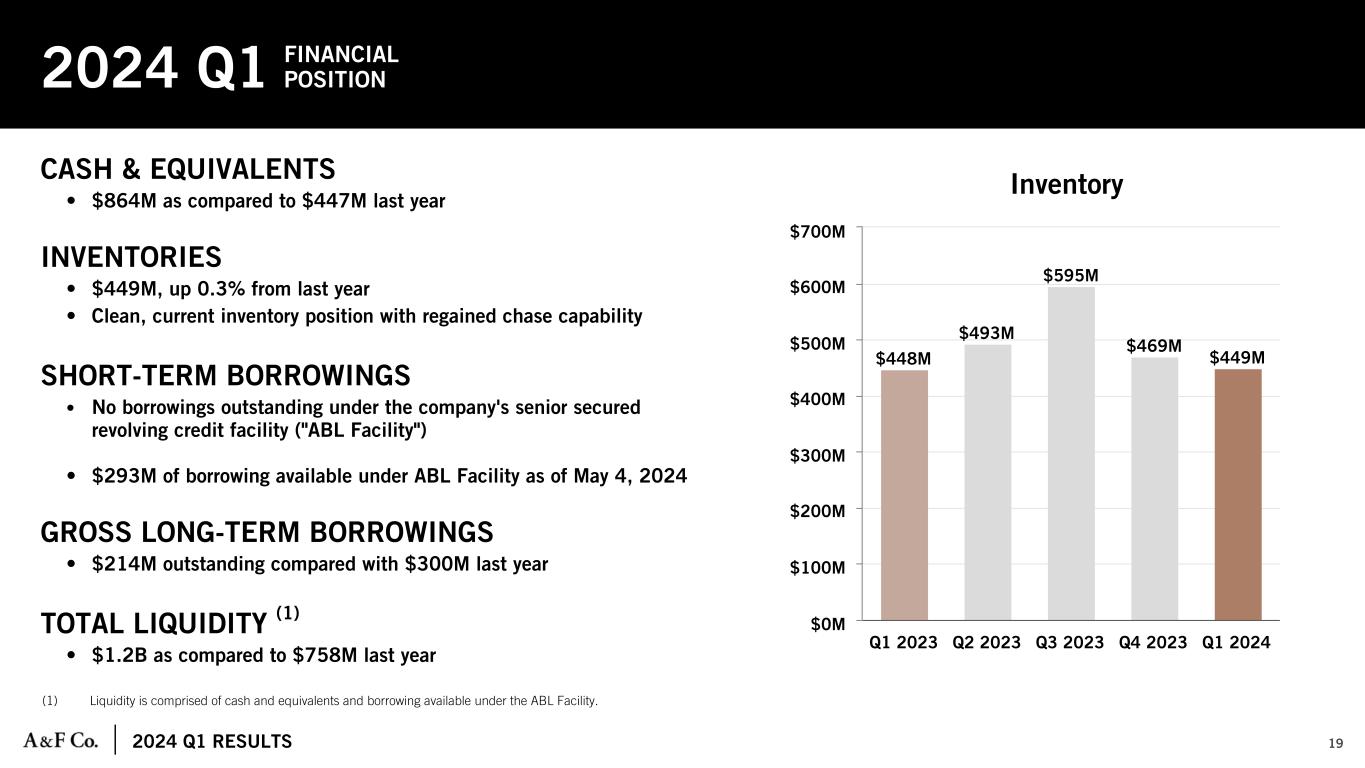

| Financial Position and Liquidity |

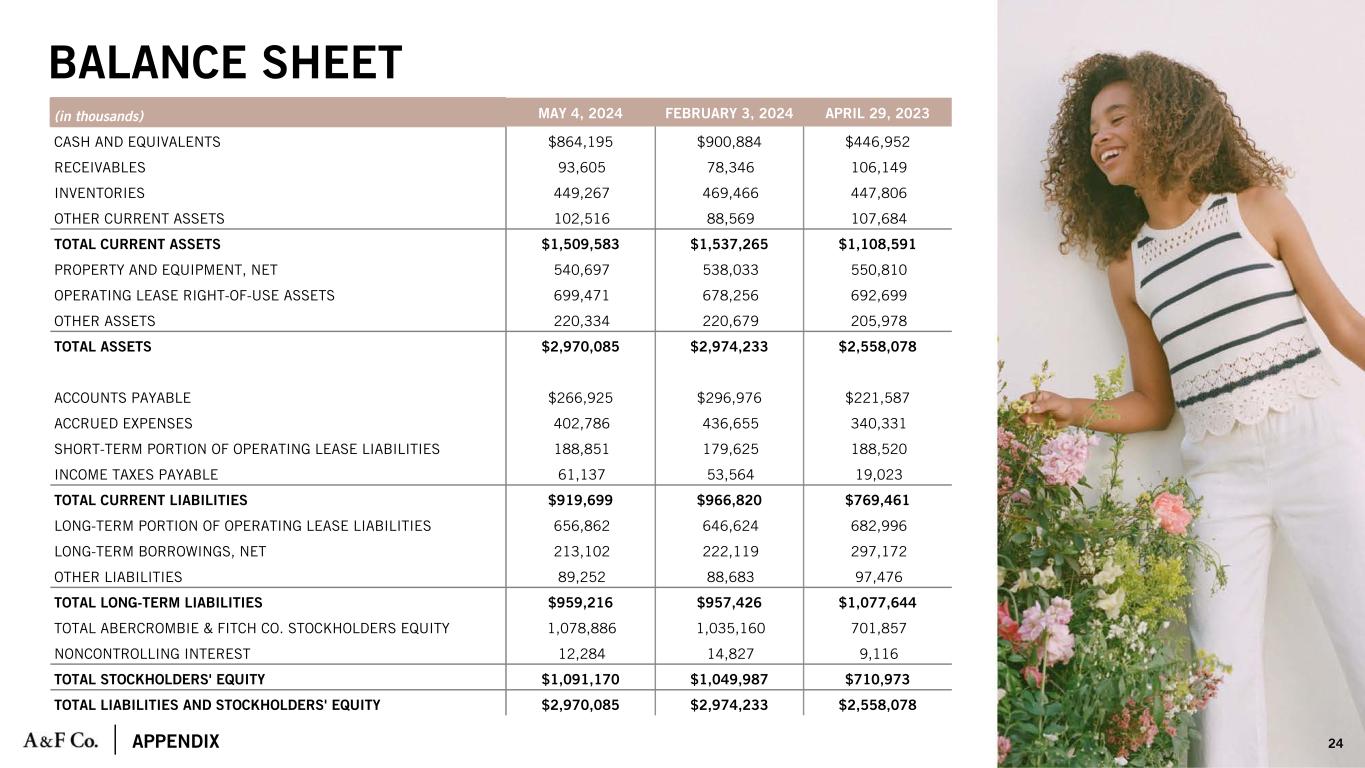

As of May 4, 2024 the company had:

•Cash and equivalents of $864 million. This compares to cash and equivalents of $901 million and $447 million as of February 3, 2024 and April 29, 2023, respectively.

•Inventories of $449 million. This compares to inventories of $469 million and $448 million as of February 3, 2024 and April 29, 2023, respectively.

•Long-term gross borrowings under the company’s senior secured notes of $214 million (the “Senior Secured Notes”) which mature in July 2025 and bear interest at a rate of 8.75% per annum.

•Borrowing available under the senior-secured asset-based revolving credit facility (the “ABL Facility”) of $293 million.

•Liquidity, comprised of cash and equivalents and borrowing available under the ABL Facility, of approximately $1.2 billion. This compares to liquidity of $1.2 billion and $0.8 billion as of February 3, 2024 and April 29, 2023, respectively.

|

|

|

Cash Flow and Capital Allocation |

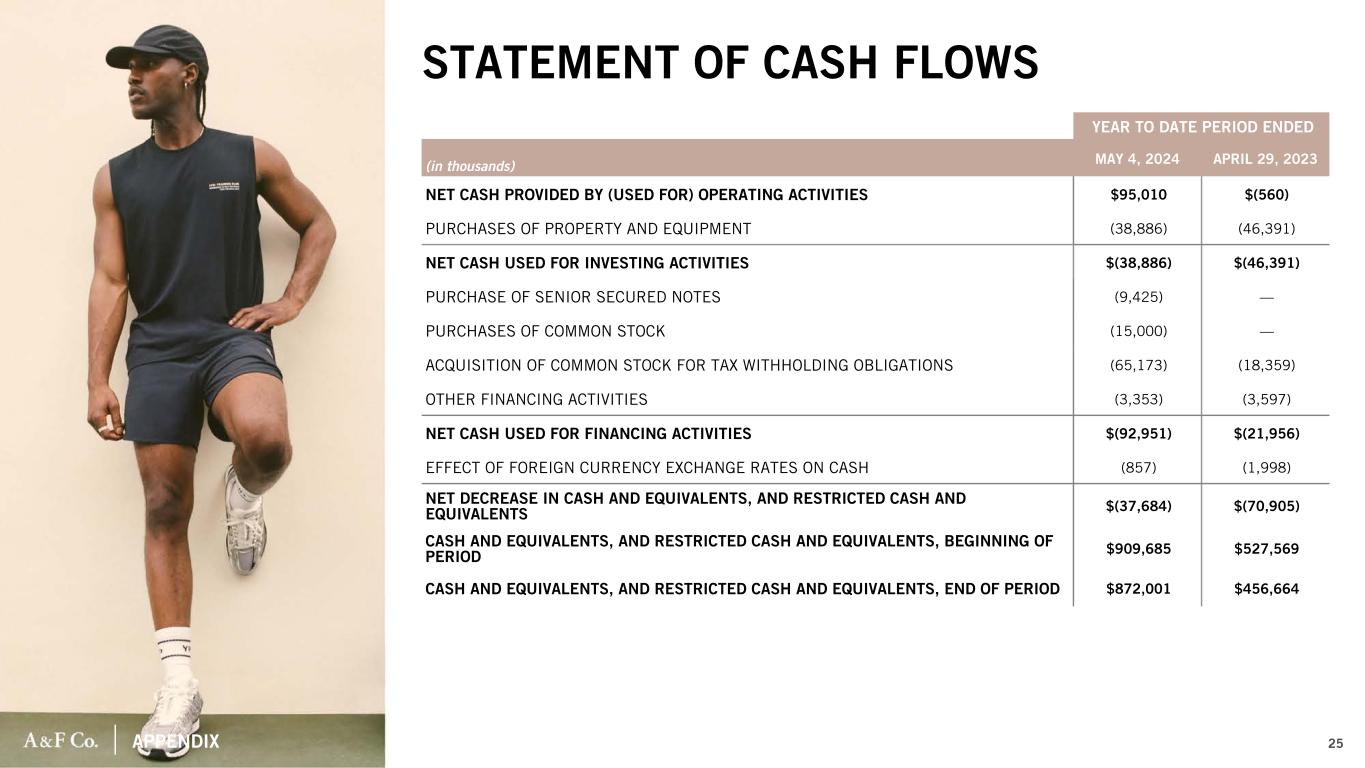

Details related to the company’s cash flows for the year-to-date period ended May 4, 2024 are as follows:

•Net cash provided by operating activities of $95 million.

•Net cash used for investing activities of $39 million.

•Net cash used for financing activities of $93 million.

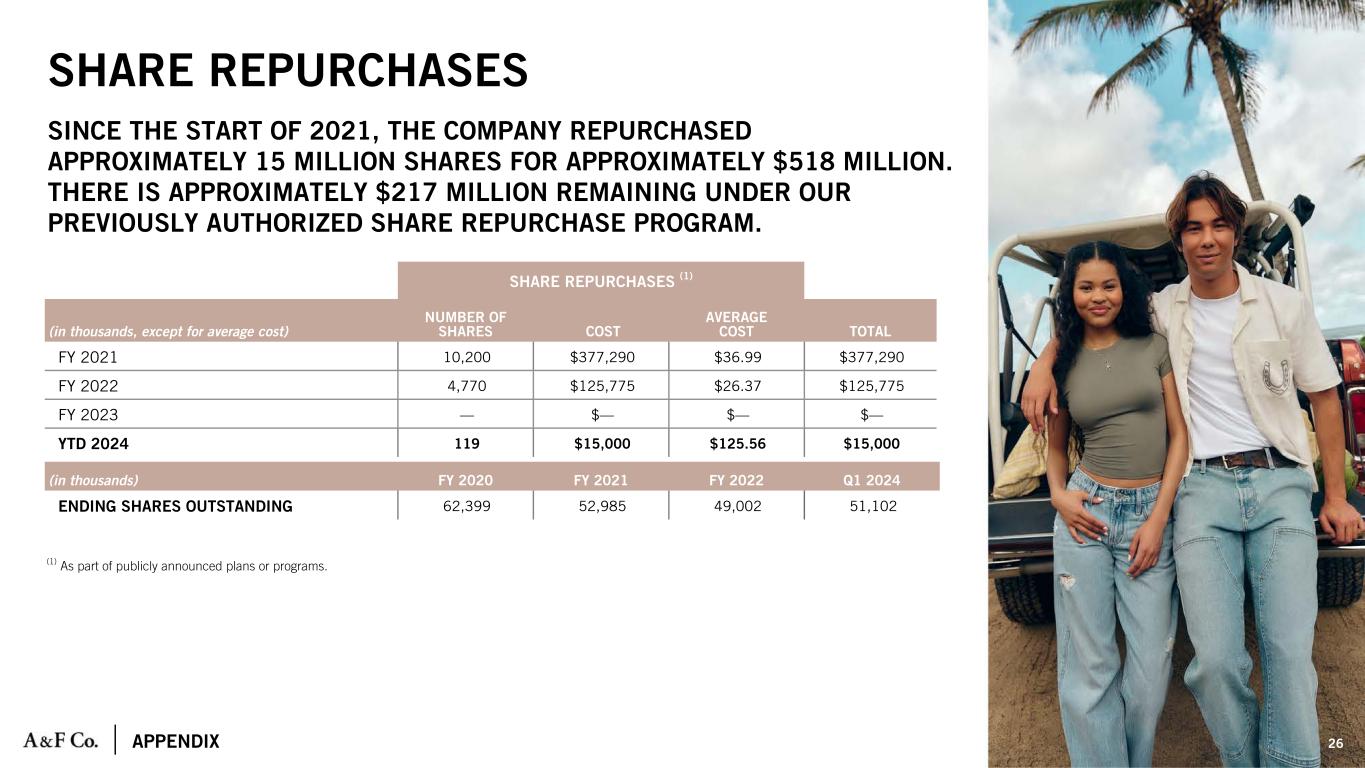

During the first quarter of 2024, the company purchased approximately $9 million, at a slight premium to par value, of its outstanding Senior Secured Notes. In addition, in the 2024 first quarter, the company repurchased 119,000 shares for approximately $15 million. The company has $217 million remaining on the share repurchase authorization established in November 2021.

Depreciation and amortization was $38 million for the year-to-date period ended May 4, 2024.

|

|

|

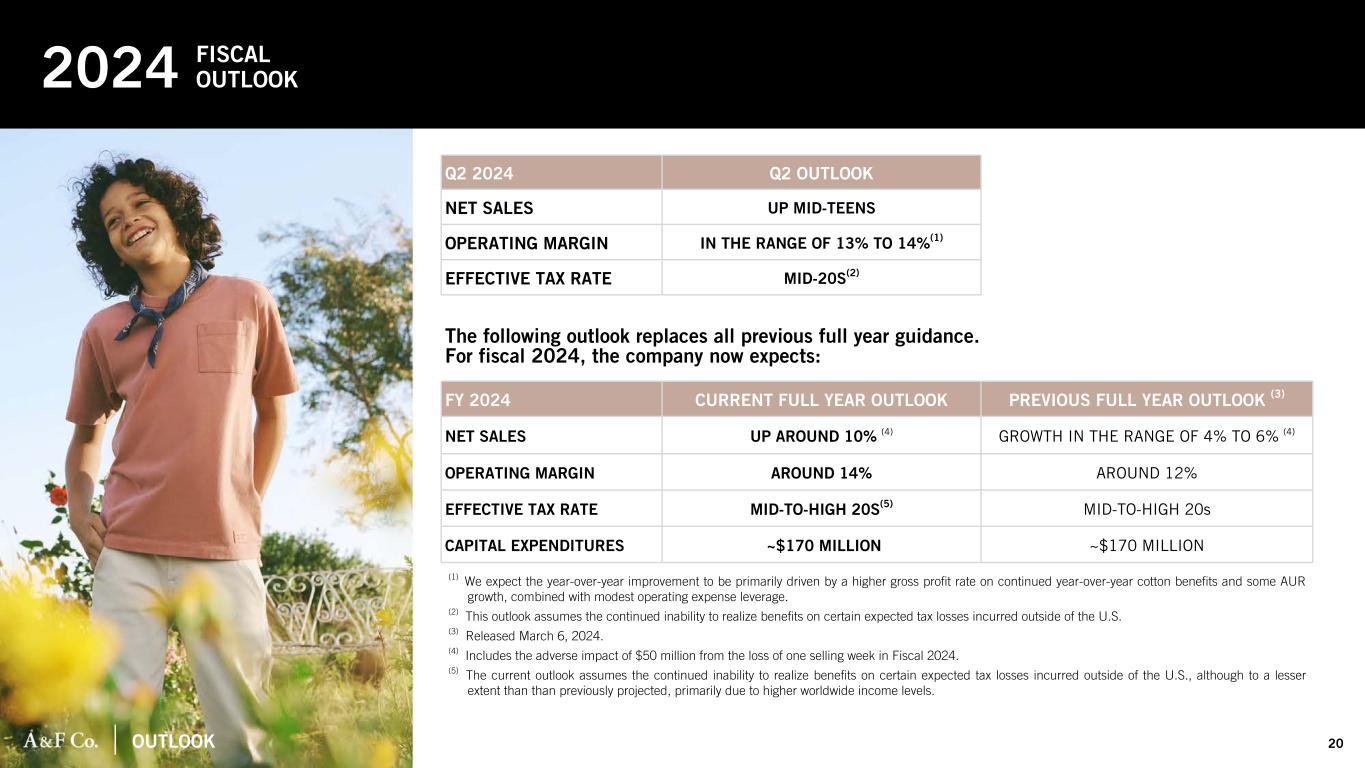

Fiscal 2024 Full Year Outlook |

The following outlook replaces all previous full year guidance. For fiscal 2024, the company now expects:

•Net sales up around 10% from $4.3 billion in fiscal 2023. This is an increase to the previous outlook of growth in the range of 4% to 6%. We expect Abercrombie brands will continue to outperform Hollister brands and the Americas will continue to lead the regional performance.

The following table illustrates the expected quarterly and full year net sales and related basis point impact of the calendar shift and loss of one selling week in fiscal 2024 compared to fiscal 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

Q2 |

Q3 |

Q4 |

Fiscal 2024 |

Net sales impact (in millions) |

$+10M |

$+30M |

$-10M |

$-80M |

$-50M |

Basis point impact |

+120 bps |

+320 bps |

-90 bps |

-550 bps |

-120 bps |

•Operating margin to be around 14%. This range improves from the previous outlook of around 12%. We expect the year-over-year improvement to be driven by a higher gross profit rate and some operating expense leverage.

•Effective tax rate to be in the mid-to-high 20s, with the rate being sensitive to the jurisdictional mix and level of income.

•Capital expenditures of approximately $170 million.

|

|

|

Fiscal 2024 Second Quarter Outlook |

For the second quarter of fiscal 2024, the company expects:

•Net sales growth to be up mid-teens compared to fiscal second quarter 2023 level of $935 million.

•Operating margin to be in the in the range of 13% to 14% compared to an operating margin of 9.6% in Q2 2023.

•Effective tax rate to be mid-20s, with the rate being sensitive to the jurisdictional mix and level of income.

Today at 8:30 a.m. ET, the company will conduct a conference call and provide additional details around its quarterly results and its outlook for the second quarter. To access the call by phone, participants will need to register at the following URL address to obtain a dial-in number and passcode:

https://register.vevent.com/register/BIc2b07a146008478c825c3b93c929d4ac

A presentation of first quarter results will be available in the “Investors” section at corporate.abercrombie.com at approximately 7:30 a.m. ET, today. Important information may be disseminated initially or exclusively via the website; investors should consult the site to access this information.

|

|

|

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 |

This Press Release and related statements by management or spokespeople of Abercrombie & Fitch Co. (A&F) contain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements, including, without limitation, statements regarding our second quarter and annual fiscal 2024 results, relate to our current assumptions, projections and expectations about our business and future events. Any such forward-looking statements involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. The inclusion of such information should not be regarded as a representation by the company, or any other person, that the objectives of the company will be achieved. Words such as “estimate,” “project,” “plan,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could,” “outlook,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise any forward-looking statements, including any financial targets or estimates, whether as a result of new information, future events, or otherwise. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to, the factors disclosed in Part I, Item 1A. “Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024, and otherwise in our reports and filings with the Securities and Exchange Commission, as well as the following factors: risks related to changes in global economic and financial conditions, including inflation, and the resulting impact on consumer spending generally and on our operating results, financial condition, and expense management, and our ability to adequately mitigate the impact; risks related to geopolitical conflict, armed conflict, the conflicts between Russia and Ukraine or Israel and Hamas and the expansion of conflict in the surrounding areas, including the impact of such conflicts on international trade, supplier delivery or increased freight costs, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience; risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory; risks related to our failure to operate effectively in a highly competitive and constantly evolving industry; risks related to our ability to execute on, and maintain the success of, our strategic and growth initiatives, including those outlined in our Always Forward Plan; risks related to fluctuations in foreign currency exchange rates; risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our global operations, may result in volatility in our results of operations; risks and uncertainty related to adverse public health developments; risks associated with climate change and other corporate responsibility issues; risks related to reputational harm to the company, its officers, and directors; risks related to actual or threatened litigation; risks related to cybersecurity threats and privacy or data security breaches; and the potential loss or disruption to our information systems.

This document includes certain adjusted non-GAAP financial measures where management believes it to be helpful in understanding the company's results of operations or financial position. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures can be found in the "Reporting and Use of GAAP and Non-GAAP Measures" section. Sub-totals and totals may not foot due to rounding. Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests.

As used in this document, unless otherwise defined, "Abercrombie brands" refers to Abercrombie & Fitch and abercrombie kids and "Hollister brands" refers to Hollister and Gilly Hicks. Additionally, references to "Americas" includes North America and South America, "EMEA" includes Europe, the Middle East and Africa and "APAC" includes the Asia-Pacific region, including Asia and Oceania.

|

|

|

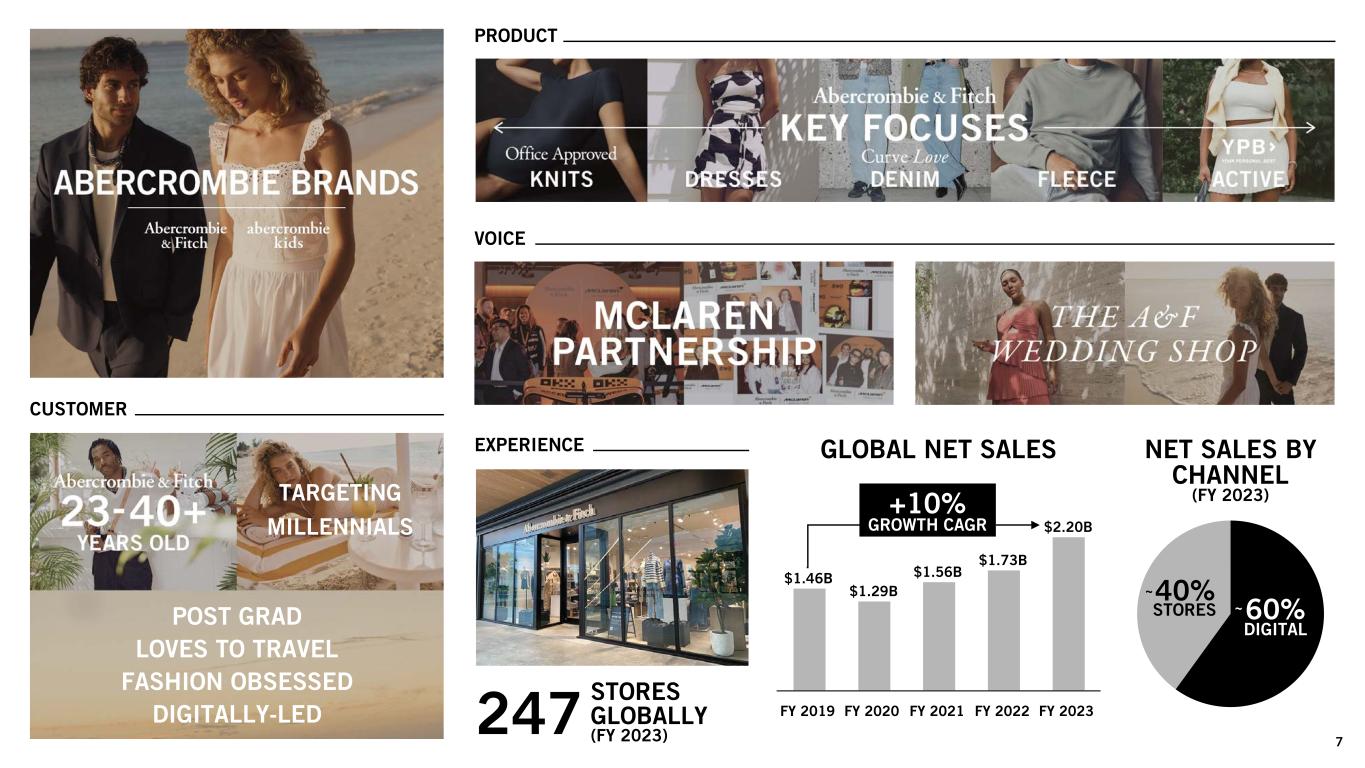

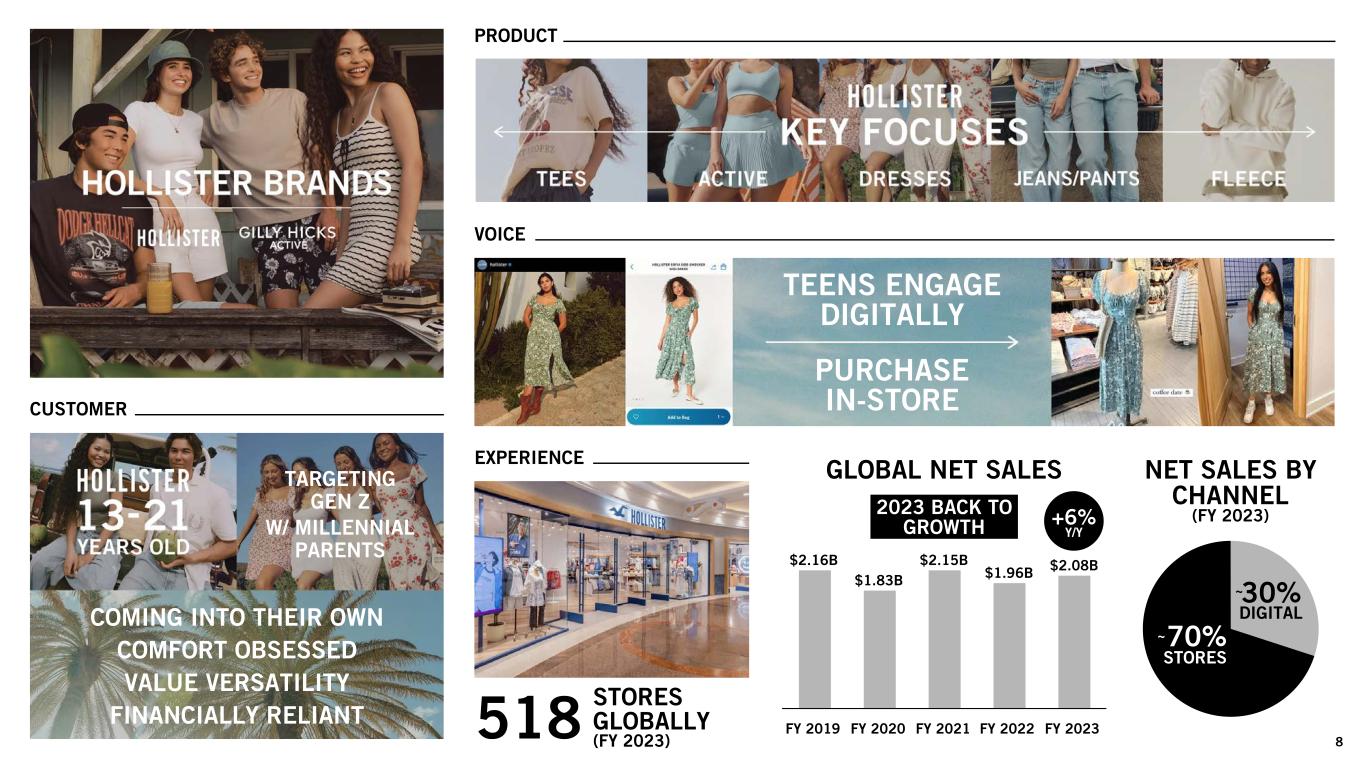

| About Abercrombie & Fitch Co. |

Abercrombie & Fitch Co. (NYSE: ANF) is a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids. Abercrombie & Fitch was born in 1892 and aims to make every day feel as exceptional as the start of a long weekend. abercrombie kids sees the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better anything. Hollister believes in liberating the spirit of an endless summer inside everyone and making teens feel celebrated and comfortable in their own skin. Gilly Hicks, offering active lifestyle products, is designed to create happiness through movement.

The brands share a commitment to offering products of enduring quality and exceptional comfort that allow consumers around the world to express their own individuality and style. Abercrombie & Fitch Co. operates approximately 750 stores under these brands across North America, Europe, Asia and the Middle East, as well as the e-commerce sites www.abercrombie.com, www.abercrombiekids.com, www.hollisterco.com and www.gillyhicks.com

|

|

|

|

|

|

|

|

|

| Investor Contact: |

|

Media Contact: |

|

|

|

| Mo Gupta |

|

Kate Wagner |

| Abercrombie & Fitch Co. |

|

Abercrombie & Fitch Co. |

| (614) 283-6751 |

|

(614) 283-6192 |

| Investor_Relations@anfcorp.com |

|

Public_Relations@anfcorp.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended |

|

Thirteen Weeks Ended |

|

May 4, 2024 |

|

% of

Net Sales |

|

April 29, 2023 |

|

% of

Net Sales |

| Net sales |

$ |

1,020,730 |

|

|

100.0 |

% |

|

$ |

835,994 |

|

|

100.0 |

% |

| Cost of sales, exclusive of depreciation and amortization |

343,273 |

|

|

33.6 |

% |

|

326,200 |

|

|

39.0 |

% |

| Gross profit |

677,457 |

|

|

66.4 |

% |

|

509,794 |

|

|

61.0 |

% |

| Stores and distribution expense |

371,686 |

|

|

36.4 |

% |

|

336,049 |

|

|

40.2 |

% |

| Marketing, general and administrative expense |

177,880 |

|

|

17.4 |

% |

|

142,631 |

|

|

17.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other operating income, net |

(1,958) |

|

|

(0.2) |

% |

|

(2,894) |

|

|

(0.3) |

% |

| Operating income |

129,849 |

|

|

12.7 |

% |

|

34,008 |

|

|

4.1 |

% |

| Interest expense |

5,780 |

|

|

0.6 |

% |

|

7,458 |

|

|

0.9 |

% |

| Interest income |

(10,803) |

|

|

(1.1) |

% |

|

(4,015) |

|

|

(0.5) |

% |

| Interest (income) expense, net |

(5,023) |

|

|

(0.5) |

% |

|

3,443 |

|

|

0.4 |

% |

| Income before income taxes |

134,872 |

|

|

13.2 |

% |

|

30,565 |

|

|

3.7 |

% |

| Income tax expense |

19,794 |

|

|

1.9 |

% |

|

12,718 |

|

|

1.5 |

% |

| Net income |

115,078 |

|

|

11.3 |

% |

|

17,847 |

|

|

2.1 |

% |

| Less: Net income attributable to noncontrolling interests |

1,228 |

|

|

0.1 |

% |

|

1,276 |

|

|

0.2 |

% |

| Net income attributable to A&F |

$ |

113,850 |

|

|

11.2 |

% |

|

$ |

16,571 |

|

|

2.0 |

% |

|

|

|

|

|

|

|

|

| Net income per share attributable to A&F |

|

|

|

|

|

|

|

| Basic |

$ |

2.24 |

|

|

|

|

$ |

0.33 |

|

|

|

| Diluted |

$ |

2.14 |

|

|

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

50,893 |

|

|

|

|

49,574 |

|

|

|

| Diluted |

53,276 |

|

|

|

|

51,467 |

|

|

|

|

|

|

|

|

|

|

|

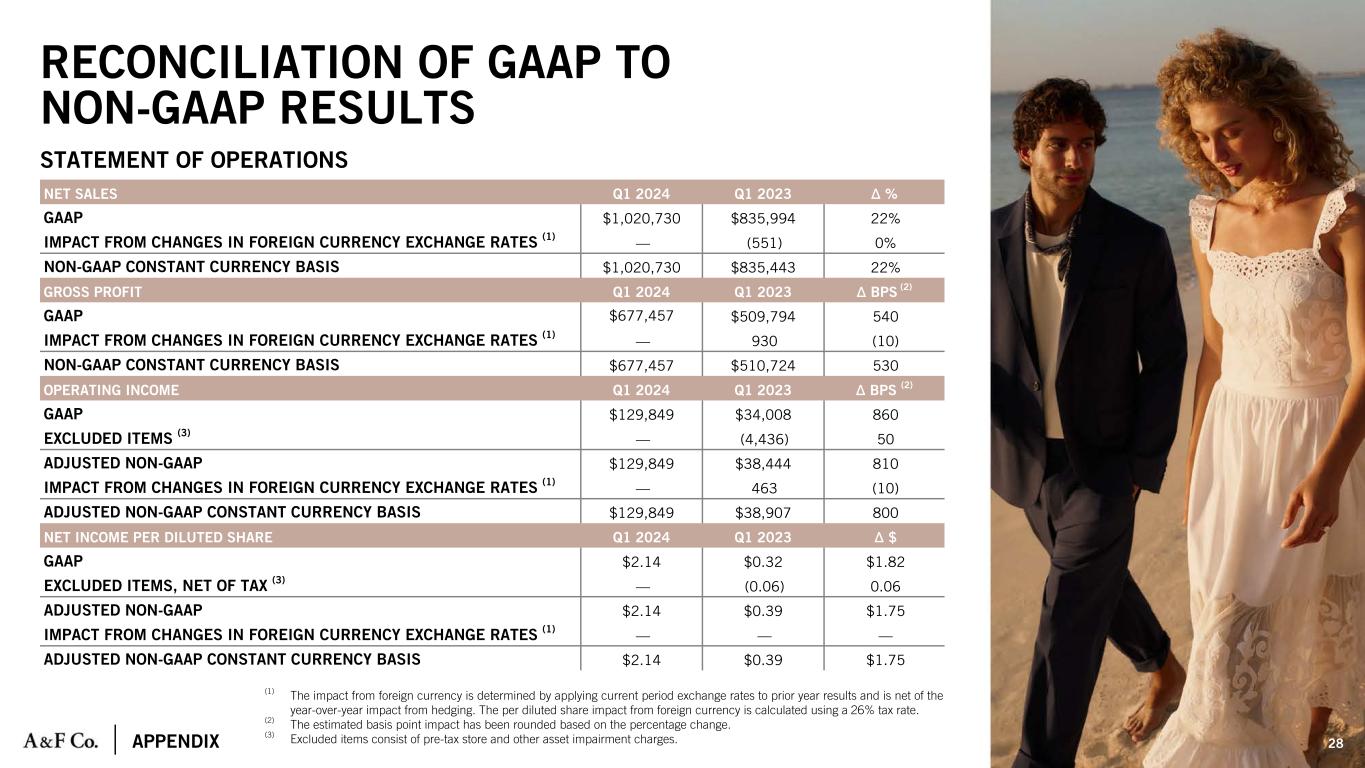

Reporting and Use of GAAP and Non-GAAP Measures

The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies.

The company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation.

The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

In addition, the company provides EBITDA and Adjusted EBITDA as supplemental measures used by the company's executive management to assess the company's performance. We also believe these supplemental performance measures are meaningful information for investors and other interested parties to use in computing the company's core financial performance over multiple periods and with other companies by excluding the impact of differences in tax jurisdictions, debt service levels and capital investment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Reconciliation of Constant Currency Financial Measures |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands, except percentage and basis point changes and per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

|

|

% Change |

| Net sales |

|

|

|

|

|

|

|

GAAP (1) |

$ |

1,020,730 |

|

|

$ |

835,994 |

|

|

|

|

22% |

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

(551) |

|

|

|

|

—% |

| Net sales on a constant currency basis |

$ |

1,020,730 |

|

|

$ |

835,443 |

|

|

|

|

22% |

|

|

|

|

|

|

|

|

| Gross profit |

2024 |

|

2023 |

|

|

|

BPS Change (3) |

GAAP (1) |

$ |

677,457 |

|

|

$ |

509,794 |

|

|

|

|

540 |

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

930 |

|

|

|

|

(10) |

| Gross profit on a constant currency basis |

$ |

677,457 |

|

|

$ |

510,724 |

|

|

|

|

530 |

|

|

|

|

|

|

|

|

| Operating income |

2024 |

|

2023 |

|

|

|

BPS Change (3) |

GAAP (1) |

$ |

129,849 |

|

|

$ |

34,008 |

|

|

|

|

860 |

Excluded items (4) |

— |

|

|

(4,436) |

|

|

|

|

50 |

| Adjusted non-GAAP |

$ |

129,849 |

|

|

$ |

38,444 |

|

|

|

|

810 |

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

463 |

|

|

|

|

(10) |

| Adjusted non-GAAP constant currency basis |

$ |

129,849 |

|

|

$ |

38,907 |

|

|

|

|

800 |

|

|

|

|

|

|

|

|

| Net income attributable to A&F |

2024 |

|

2023 |

|

|

|

$ Change |

GAAP (1) |

$ |

2.14 |

|

|

$ |

0.32 |

|

|

|

|

$1.82 |

Excluded items, net of tax (4) |

— |

|

|

(0.06) |

|

|

|

|

0.06 |

| Adjusted non-GAAP |

$ |

2.14 |

|

|

$ |

0.39 |

|

|

|

|

$1.75 |

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

— |

|

|

|

|

— |

| Adjusted non-GAAP constant currency basis |

$ |

2.14 |

|

|

$ |

0.39 |

|

|

|

|

$1.75 |

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate.

(3) The estimated basis point change has been rounded based on the percentage change.

(4) Excluded items consist of $4.4 million pre-tax store impairment charges for the prior year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Reconciliation of Constant Currency Net Sales by Geography and Brand |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands, except percentage changes) |

| (Unaudited) |

|

2024 |

|

2023 |

|

GAAP

% Change |

Non-GAAP Constant Currency Basis

% Change |

|

GAAP |

GAAP |

Impact From Changes In

Foreign Currency Exchanges Rates (1)

|

Non-GAAP Constant

Currency Basis |

Net sales by segment: (2) |

|

|

|

|

|

|

|

|

Americas (3) |

$ |

820,121 |

|

|

$ |

665,423 |

|

$ |

(62) |

|

$ |

665,361 |

|

|

23% |

23% |

EMEA (4) |

164,778 |

|

|

138,106 |

|

1,141 |

|

139,247 |

|

|

19% |

18% |

APAC (5) |

35,831 |

|

|

32,465 |

|

(1,630) |

|

30,835 |

|

|

10% |

16% |

| Total company |

$ |

1,020,730 |

|

|

$ |

835,994 |

|

$ |

(551) |

|

$ |

835,443 |

|

|

22% |

22% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

GAAP

% Change |

Non-GAAP Constant Currency Basis

% Change |

|

GAAP |

GAAP |

Impact From Changes In

Foreign Currency Exchanges Rates (1)

|

Non-GAAP Constant

Currency Basis |

| Net sales by brand: |

|

|

|

|

|

|

|

|

Abercrombie (6) |

571,513 |

|

|

436,044 |

|

(572) |

|

435,472 |

|

|

31% |

31% |

Hollister (7) |

$ |

449,217 |

|

|

$ |

399,950 |

|

$ |

21 |

|

$ |

399,971 |

|

|

12% |

12% |

| Total company |

$ |

1,020,730 |

|

|

$ |

835,994 |

|

$ |

(551) |

|

$ |

835,443 |

|

|

22% |

22% |

(1)The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging.

(2)Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order.

(3)The Americas segment includes the results of operations in North America and South America.

(4)The EMEA segment includes the results of operations in Europe, the Middle East and Africa.

(5)The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania.

(6)For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids.

(7)For purposes of the above table, Hollister includes Hollister and Gilly Hicks.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

Reconciliation of EBITDA and Adjusted EBITDA |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

2024 |

|

% of

Net Sales |

2023 |

|

% of

Net Sales |

| Net income |

$ |

115,078 |

|

|

11.3 |

% |

$ |

17,847 |

|

|

2.1 |

% |

| Income tax expense |

19,794 |

|

|

1.9 |

|

12,718 |

|

|

1.5 |

|

| Interest (income) expense, net |

(5,023) |

|

|

(0.5) |

|

3,443 |

|

|

0.4 |

|

Depreciation and amortization |

37,689 |

|

|

3.7 |

|

36,028 |

|

|

4.3 |

|

EBITDA (1) |

$ |

167,538 |

|

|

16.4 |

% |

$ |

70,036 |

|

|

8.4 |

% |

|

|

|

|

|

|

|

| Adjustments to EBITDA |

|

|

|

|

|

|

| Asset impairment |

— |

|

|

— |

|

4,436 |

|

|

0.5 |

|

Adjusted EBITDA (1) |

$ |

167,538 |

|

|

16.4 |

% |

$ |

74,472 |

|

|

8.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)EBITDA and Adjusted EBITDA are supplemental financial measures that are not defined or prepared in accordance with GAAP. EBITDA is defined as net income before interest, income taxes and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for asset impairment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Balance Sheets |

| (in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

May 4, 2024 |

|

February 3, 2024 |

|

April 29, 2023 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and equivalents |

$ |

864,195 |

|

|

$ |

900,884 |

|

|

$ |

446,952 |

|

| Receivables |

93,605 |

|

|

78,346 |

|

|

106,149 |

|

| Inventories |

449,267 |

|

|

469,466 |

|

|

447,806 |

|

| Other current assets |

102,516 |

|

|

88,569 |

|

|

107,684 |

|

| Total current assets |

1,509,583 |

|

|

1,537,265 |

|

|

1,108,591 |

|

| Property and equipment, net |

540,697 |

|

|

538,033 |

|

|

550,810 |

|

| Operating lease right-of-use assets |

699,471 |

|

|

678,256 |

|

|

692,699 |

|

| Other assets |

220,334 |

|

|

220,679 |

|

|

205,978 |

|

| Total assets |

$ |

2,970,085 |

|

|

$ |

2,974,233 |

|

|

$ |

2,558,078 |

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

| Accounts payable |

$ |

266,925 |

|

|

$ |

296,976 |

|

|

$ |

221,587 |

|

| Accrued expenses |

402,786 |

|

|

436,655 |

|

|

340,331 |

|

| Short-term portion of operating lease liabilities |

188,851 |

|

|

179,625 |

|

|

188,520 |

|

|

|

|

|

|

|

| Income taxes payable |

61,137 |

|

|

53,564 |

|

|

19,023 |

|

| Total current liabilities |

919,699 |

|

|

966,820 |

|

|

769,461 |

|

| Long-term liabilities: |

|

|

|

|

|

| Long-term portion of operating lease liabilities |

$ |

656,862 |

|

|

$ |

646,624 |

|

|

$ |

682,996 |

|

| Long-term borrowings, net |

213,102 |

|

|

222,119 |

|

|

297,172 |

|

| Other liabilities |

89,252 |

|

|

88,683 |

|

|

97,476 |

|

| Total long-term liabilities |

959,216 |

|

|

957,426 |

|

|

1,077,644 |

|

| Total Abercrombie & Fitch Co. stockholders’ equity |

1,078,886 |

|

|

1,035,160 |

|

|

701,857 |

|

| Noncontrolling interests |

12,284 |

|

|

14,827 |

|

|

9,116 |

|

| Total stockholders’ equity |

1,091,170 |

|

|

1,049,987 |

|

|

710,973 |

|

| Total liabilities and stockholders’ equity |

$ |

2,970,085 |

|

|

$ |

2,974,233 |

|

|

$ |

2,558,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Cash Flows |

| (in thousands, except per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

April 29, 2023 |

| Operating activities |

|

|

|

| Net cash provided by (used for) operating activities |

$ |

95,010 |

|

|

$ |

(560) |

|

|

|

|

|

| Investing activities |

|

|

|

| Purchases of property and equipment |

$ |

(38,886) |

|

|

$ |

(46,391) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

$ |

(38,886) |

|

|

$ |

(46,391) |

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of senior secured notes |

(9,425) |

|

|

— |

|

|

|

|

|

| Purchases of common stock |

(15,000) |

|

|

— |

|

|

|

|

|

| Acquisition of common stock for tax withholding obligations |

(65,173) |

|

|

(18,359) |

|

| Other financing activities |

(3,353) |

|

|

(3,597) |

|

| Net cash used for financing activities |

$ |

(92,951) |

|

|

$ |

(21,956) |

|

|

|

|

|

| Effect of foreign currency exchange rates on cash |

$ |

(857) |

|

|

$ |

(1,998) |

|

| Net decrease in cash and equivalents, and restricted cash and equivalents |

$ |

(37,684) |

|

|

$ |

(70,905) |

|

| Cash and equivalents, and restricted cash and equivalents, beginning of period |

$ |

909,685 |

|

|

$ |

527,569 |

|

| Cash and equivalents, and restricted cash and equivalents, end of period |

$ |

872,001 |

|

|

$ |

456,664 |

|