UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 001-40133

ENVOY MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-1369123 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4875 White Bear Parkway, White Bear Lake, MN 55110

(Address of principal executive offices)

(877) 900-3277

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A Common Stock, par value $0.0001 per share | COCH | The Nasdaq Stock Market LLC | ||

| Redeemable Warrants, each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | COCHW | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☒ | Smaller Reporting Company | ☒ |

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s Class A common stock, par value $0.0001 per share, held by non-affiliates of the registrant computed by reference to the last sales price of such stock, as of the last business day of the registrant’s most recently completed second fiscal quarter, which was June 30, 2024, was approximately $16.7 million. This calculation excludes shares of Class A common stock held by the registrant’s officers and directors and each person known by the registrant to beneficially own more than 5% of the registrant’s outstanding shares, as such persons may be deemed to be affiliates. This determination of affiliate status should not be deemed conclusive for any other purpose.

There were 21,326,619 shares of the registrant’s Class A common stock, par value $0.0001 per share, outstanding as of March 24, 2025.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

ENVOY MEDICAL, INC.

Annual Report on Form 10-K

For the Year Ended December 31, 2024

Table of Contents

CERTAIN TERMS

Unless otherwise stated in this Annual Report on Form 10-K (this “Report”), or the context otherwise requires, references to:

| ● | “Acclaim CI” means the Acclaim® fully implantable cochlear implant; |

| ● | “Anzu” means Anzu Special Acquisition Corp I, a Delaware corporation, which was renamed “Envoy Medical, Inc.” upon the closing of the Business Combination; |

| ● | “Anzu Class A Common Stock” means Anzu’s Class A common stock, par value $0.0001 per share, prior to the closing of the Business Combination; |

| ● | “Anzu Class B Common Stock” means Anzu’s Class B common stock, par value $0.0001 per share; |

| ● | “Board” means the board of directors of the Company; |

| ● | “Business Combination” means the merger and the other transactions contemplated by the Business Combination Agreement; |

| ● | “Business Combination Agreement” means the Business Combination Agreement, dated as of April 17, 2023, as amended by Amendment No. 1 to the Business Combination Agreement, dated May 12, 2023, and Amendment No. 2 to the Business Combination Agreement, dated August 31, 2023, by and among Anzu, Merger Sub and Legacy Envoy; |

| ● | “Bylaws” means the amended and restated bylaws of the Company; |

| ● | “Charter” means the second amended and restated certificate of incorporation of the Company; |

| ● | “Class A Common Stock” means the Company’s Class A common stock, par value $0.0001 per share; |

| ● | “Closing” means the closing of the Merger; |

| ● | “Esteem FI-AMEI” means the Esteem® fully implanted active middle ear implant (FI-AMEI); |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| ● | “Forward Purchase Agreement” means the Forward Purchase Agreement, dated April 17, 2023, as amended by Amendment No. 1 to the Forward Purchase Agreement, dated as of May 25, 2023, and Amendment No. 2 to the Forward Purchase Agreement, dated as of September 28, 2023, by and among Anzu, Legacy Envoy and the Meteora FPA Parties; |

| ● | “GAAP” means accounting principles generally accepted in the United States; |

| ● | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended; |

| ● | “Legacy Envoy” means Envoy Medical Corporation, a Minnesota corporation, prior to the closing of the Business Combination; |

| ● | “Legacy Envoy Common Stock” means Legacy Envoy’s common stock, par value $0.01 per share; |

| ● | “Legacy Envoy Preferred Stock” means Legacy Envoy’s preferred stock, par value $0.01 per share; |

| ● | “Merger Sub” means Envoy Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Anzu; |

| ● | “Meteora FPA Parties” means Meteora Special Opportunity Fund I, LP, Meteora Capital Partners, LP, Meteora Select Trading Opportunities Master, LP and Meteora Strategic Capital, LLC; |

| ● | “Nasdaq” means The Nasdaq Capital Market; |

| ● | “Private Warrants” means warrants issued by Envoy Medical in 2024 in connection with debt financing transactions; |

| ● | “Public Warrants” means warrants issued by Anzu as part of its initial public offering; |

| ● | “Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended; |

| ● | “SEC” means the Securities and Exchange Commission; |

| ● | “Securities Act” means the Securities Act of 1933, as amended; |

| ● | “Series A Preferred Stock” means the Company’s Series A convertible preferred stock, par value $0.0001 per share; |

| ● | “Shortfall Warrants” means warrants issued to the Meteora FPA Parties for no additional consideration pursuant to the Forward Purchase Agreement; |

| ● | “Sponsor” means Anzu SPAC GP I LLC, a Delaware limited liability company and an affiliate of certain of Anzu’s officers and directors; |

| ● | “Subscription Agreement” means the subscription agreement, dated as of April 17, 2023, as amended by Amendment No. 1 to the Subscription Agreement, dated as of May 12, 2023, and Amendment No. 2 to the Subscription Agreement, dated as of August 23, 2023, by and between Anzu and the Sponsor; and |

| ● | “Warrants” means the Public Warrants, Shortfall Warrants, and Private Warrants. |

Additionally, references in this Report to the “Company,” the “registrant,” “Envoy Medical,” “we,” “us” and “our” in this Report refer to Envoy Medical, Inc. (formerly known as Anzu Special Acquisition Corp I), and references to our “management” or our “management team” refer to our officers and directors, other than certain historical information which refers to Legacy Envoy prior to the consummation of the Business Combination.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact contained in this Report, including statements as to future results of operations and financial position, revenue and other metrics, products, business strategy and plans, objectives of management for future operations of the Company, market size and growth, competitive position and technological and market trends, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. All forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to:

| ● | Unpredictability in the medical device industry, the regulatory process to approve medical devices, and the clinical development process of the Company’s products; |

| ● | Potential need to make design changes to products to meet desired safety and efficacy endpoints; |

| ● | Changes in federal or state reimbursement policies that would adversely affect sales of the Company’s products; |

| ● | Introduction of other scientific advancements, including gene therapy or pharmaceuticals, that may impact the need for hearing devices such as cochlear implants or fully implanted active middle ear implants; |

| ● | Competition in the medical device industry, and the failure to introduce new products and services in a timely manner or at competitive prices to compete successfully against competitors; |

| ● | Disruptions in relationships with the Company’s suppliers, or disruptions in the Company’s own production capabilities for some of the key components and materials of its products; |

| ● | Changes in the need for capital and the availability of financing and capital to fund these needs; |

| ● | Changes in interest rates or rates of inflation; |

| ● | Legal, regulatory and other proceedings could be costly and time-consuming to defend; |

| ● | Changes in applicable laws or regulations, or the application thereof on the Company; |

| ● | A loss of any of the Company’s key intellectual property rights or failure to adequately protect intellectual property rights; |

| ● | The Company’s ability to maintain the listing of its securities on Nasdaq following the Business Combination; |

| ● | The effects of catastrophic events, including war, terrorism and other international conflicts; and |

| ● | Other risks and uncertainties indicated in this Report, including those set forth under the section entitled “Risk Factors.” |

Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. Nothing in this Report should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on these forward-looking statements. The Company does not give any assurance that it will achieve its expected results and does not undertake any duty to update these forward-looking statements, except as required by law.

Summary Risk Factors

Our Company is subject to numerous risks described in Item 1A. Risk Factors and elsewhere in this Report. You should carefully consider these risks before making an investment. Some of these risks relating to our business objectives, our organization and structure and our securities include:

| ● | We are an early-stage company with a history of losses. We have not been profitable historically and may not be able to achieve profitability in the future. |

| ● | We have generated limited revenue from product sales and may never be profitable. |

| ● | If the Acclaim CI contains design or manufacturing defects, our business and financial results could be harmed. |

| ● | We expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product development efforts or other operations. |

| ● | Raising additional capital would cause dilution to our existing stockholders and may adversely affect the rights of existing stockholders. |

| ● | Failure of a key information technology system, process or site could have an adverse effect on our business. |

| ● | We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or if we identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and the value of our stock. |

| ● | Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all. |

| ● | Clinical failure can occur at any stage of clinical development. Our clinical experience to date does not necessarily predict future results and may not have revealed certain potential limitations of the technology or potential complications from the Acclaim CI and may require further clinical validation. Any product version we advance through clinical trials may not have favorable results in later clinical trials or receive regulatory approval. |

| ● | The successful commercialization of the Acclaim CI, if it receives FDA approval, will depend in part on the extent to which governmental authorities and health insurers establish coverage, adequate reimbursement levels and favorable pricing policies. Failure to obtain or maintain coverage and adequate reimbursement for our product candidates could limit our ability to market those products and decrease our ability to generate revenue. |

| ● | We operate in a very competitive business environment, and if we are unable to compete successfully against our existing or potential competitors, our business, financial condition and results of operations may be adversely affected. |

| ● | We expect to derive most of our revenues from sales of the Acclaim CI. Our inability to successfully commercialize this product, or any subsequent decline in demand for this product, could severely harm our ability to generate revenues. |

| ● | If healthcare professionals do not recommend the Acclaim CI to their patients, the Acclaim CI may not achieve market acceptance and we may not become profitable. |

| ● | We will be dependent upon contract manufacturing organizations and material suppliers, making us vulnerable to supply shortages and problems, increased costs and quality or compliance issues, any of which could harm our business. |

| ● | Our business plan relies on certain assumptions about the market for our product; however, the size and expected growth of our addressable market has not been established with precision and may be smaller than we estimate, and even if the addressable market is as large as we estimate, we may not be able to capture market share. |

| ● | We depend on third parties to manage our pre-clinical studies and clinical trials, perform related data collection and analysis, and to enroll patients for our clinical trials, and, as a result, we may face costs and delays that are beyond our control. |

| ● | We are highly dependent on key members of our executive management team. Our inability to retain these individuals could impede our business plan and growth strategies, which could have a negative impact on our business and the value of your investment. |

| ● | The market price of our Class A Common Stock and Public Warrants has been and may continue to be extremely volatile, which could cause purchasers of our securities to incur substantial losses. |

| ● | While we will pay dividends on shares of Series A Preferred Stock pursuant to the Certificate of Designation, we do not intend to pay dividends on shares of Class A Common Stock for the foreseeable future. |

| ● | We have been and in the future may become a defendant in one or more stockholder derivative, class-action and other litigation, and any such lawsuits may adversely affect our business, financial condition, results of operations and cash flows. |

PART I

ITEM 1. Business

Overview

We are a hearing health company focused on providing innovative medical technologies across the hearing loss spectrum. Our technologies are designed to shift the paradigm within the hearing industry and bring both providers and patients the hearing devices they desire. We are dedicated to pushing beyond the status quo to provide patients with improved access, usability, independence, and quality of life. We were founded in 1995 to create a fully implanted hearing device that leveraged the natural ear - not an artificial microphone - to pick up sound. The ear itself is an ideal way to capture sound from our environment.

To leverage the natural ear’s benefits, an implanted sensor was created to pick up incoming sound energy from the ossicular chain (i.e., the three tiny hearing bones that connect the eardrum to the cochlea). The sensor absorbs the mechanical energy from ossicular chain and turns it into a signal that can be processed, improved, and increased for a patient’s particular hearing needs.

Our first product, the Esteem Fully Implanted Active Middle Ear Implant (“Esteem FI-AMEI”), received FDA approval in 2010. The Esteem FI-AMEI remains the only FDA approved fully implanted active hearing device on the market. The Esteem FI-AMEI failed to gain commercial traction, primarily because the Centers for Medicaid and Medicare Services (“CMS”) classified it as a hearing aid and therefore not eligible for coverage. At an average total price (i.e., device and surgery) of over $25,000, very few individuals were willing or able to pay out-of-pocket for the Esteem FI-AMEI. We believe hearing aid classification is improper for the Esteem FI-AMEI and we continue to work towards having the Esteem FI-AMEI properly classified as a Fully Implanted Active Middle Ear Implant.

Despite the commercial challenges of the Esteem FI-AMEI, roughly 1,000 devices were implanted globally. Some devices were implanted in the early 2000s during clinical trials, providing us with nearly two decades of experience with its implantable sensor technology. Throughout our experience, our sensor technology proved a viable alternative to external or implanted microphones.

In late 2015, we made the decision to shift our focus from the Esteem FI-AMEI to a new product that would leverage our sensor technology and incorporate it into a cochlear implant. As a result, we have developed the investigational fully implanted Acclaim CI. We now believe we have the possibility to disrupt the cochlear implant market currently dominated by a small number of incumbents.

Business Combination

In September 2023, we completed the Business Combination pursuant to the Business Combination Agreement between Anzu and Legacy Envoy. As contemplated by the Business Combination Agreement: (a) each share of Legacy Envoy Preferred Stock issued and outstanding immediately prior to the Closing was converted into shares of Legacy Envoy Common Stock; (b) each share of Merger Sub Common Stock issued and outstanding immediately prior to the Closing was converted into and exchanged for one share of Legacy Envoy Common Stock; (c) each outstanding option to purchase shares of Legacy Envoy Common Stock outstanding as of immediately prior to the Closing was cancelled in exchange for nominal consideration; (d) each outstanding warrant to purchase shares of Legacy Envoy Common Stock outstanding as of immediately prior to the Closing automatically, depending on the applicable exercise price, was cancelled or exercised on a net exercise basis and converted into shares of Legacy Envoy Common Stock in accordance with its terms; (e) each outstanding Legacy Envoy convertible promissory note was automatically converted into shares of Legacy Envoy Common Stock in accordance with its terms; (f) each share of Legacy Envoy Common Stock issued and outstanding immediately prior to the Closing was cancelled and converted into the right to receive a number of shares of our Class A Common Stock equal to the Exchange Ratio; (g) the Sponsor forfeited 5,510,000 shares of Anzu Class B Common Stock and all 12,500,000 private warrants pursuant to the Sponsor Support Agreement; (h) the Sponsor exchanged 2,500,000 shares of Anzu Class B Common Stock for 2,500,000 shares of our Series A Preferred Stock; (i) an aggregate of 2,615,000 shares of Anzu Class B Common Stock held by the Sponsor and Anzu’s former independent directors automatically converted into our Class A Common Stock; (j) the Sponsor transferred an aggregate of 490,000 shares of our Class A Common Stock to the Legacy Forward Purchasers and the Extension Support Parties pursuant to the Side Letter Agreements and Extension Support Agreements, respectively; and (k) the Company issued an aggregate of 8,512 shares of Class A Common Stock to the Meteora FPA Parties pursuant to the Forward Purchase Agreement.

As of the open of trading on October 2, 2023, the Class A Common Stock and Public Warrants of the Company, formerly those of Anzu, began trading on Nasdaq as “COCH” and “COCHW,” respectively.

Our Product

Cochlear Implants - Fully Implanted vs. Partially Implanted

The cochlea converts vibrations from the ossicular chain into nerve signals that are transmitted through the auditory nerve for processing by the brain. Cochlear implants use electronic signals to stimulate the auditory nerve.

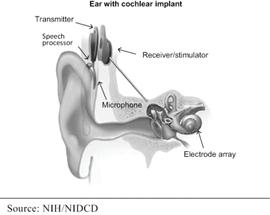

Partially implanted cochlear implants have two main components: a large external component that sits on or behind the patient’s ear and a surgically implanted internal component. The external component contains a microphone, sound processer, and batteries. A magnetic coil on the external component lines up with an internal magnetic coil in the internal component. The signal from the external component is transferred to the internal coil where it is delivered to the electrode array, which is implanted in the cochlea, to electrically stimulate the cochlea.

|

|

The Acclaim CI is fully implanted and does not have the need for any external component to be worn on the ear. Unlike partially implanted devices, the fully implanted Acclaim CI uses the ear to capture sound via a piezoelectric sensor that is implanted in the middle ear. The sound processor and power source are also implanted.

|

||

| CAUTION: Investigational Device – Limited by Federal (or United States) Law to Investigational Use. | ||

|

Acclaim CI - A Breakthrough Device

The fully implanted Acclaim CI received the Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA) in 2019. However, the process of medical device development is inherently uncertain and there is no guarantee that this designation will accelerate the timeline for approval or make it more likely that the Acclaim CI will be approved.

Hearing loss is currently an irreversible and debilitating human condition. Significant hearing loss is correlated with increased anxiety, depression, social isolation, falls, and other costly health issues. An article published in the journal Acta Otorhinolaryngol Italica in June 2016 suggests that untreated or undertreated hearing loss correlates with earlier loss of cognitive function and poorer cardiovascular health.2 While some solutions for hearing loss already exist (e.g., hearing aids, traditional cochlear implants) these have inherent limitations in being fully or partially external, which may limit patients in initial time to adoption, hours of use during the day (inherent compliance restrictions), lifestyle, or quality of life.

We believe that the Acclaim CI will be able to offer hearing benefit over the patient’s baseline condition and may also offer other important advantages over alternative hearing loss treatments, such as:

| ● | Increased daily usage. We believe that the fully implanted nature of the Acclaim CI may facilitate an increase in daily usage over other types of cochlear implants because the device can be used 24-hours a day. |

| ● | Hearing at night. Unlike other types of available cochlear implants, the Acclaim CI can be used at night. This capability may support audibility of alarms, sirens, telephones, and other people for an added sense of security while they sleep. |

| ● | Hearing in and around water. Patients using the Acclaim CI will not need to worry about removing their device when showering, at the beach, or swimming laps. They will also not need to worry about damaging the device if caught in the rain. |

| ● | Hearing in active situations. A patient using the Acclaim CI will not need to worry about the external processor falling off during exercise or other physical activities. The patient will not need to preemptively remove the device prior to engaging in these types of activities, thus retaining audibility of the surrounding environment. |

| 2 | Source: Fortunato S, et al.; A Review of New Insights on the Association Between Hearing Loss and Cognitive Decline in Ageing; Acta Otorhinolaryngologica Italica (Jun 2016), finding that increasing evidence has linked age related hearing loss to more rapid progression of cognitive decline and incidental dementia and that many aspects of daily living of elderly people have been associated to hearing abilities, showing that hearing loss affects the quality of life, social relationships, motor skills, psychological aspects and function and morphology in specific brain areas. |

| ● | Lowered battery maintenance. Other cochlear implants require near-daily battery replacement or battery charging. In addition to the logistical hassle of worrying about keeping the batteries charged, this can be challenging for patients who have issues with dexterity or neuropathy, as the batteries and components are small and can be hard to handle. The Acclaim CI is designed with a battery contained within the implanted system components intended to be charged wirelessly through the skin. The Acclaim CI battery is expected to last for several days between charges and will not require the patient to use or handle small components like current cochlear implant systems do. |

| ● | No need for backup or secondary processors. Many patients who have partially implanted cochlear implants with external hardware desire or need a backup processor. The backup processor provides the patient with a sense of security because they know if their primary processor is lost or damaged, they will be left without hearing for a period of time while they wait for a replacement. In addition, lost or damaged components can be expensive to replace, with the cost of replacement often not covered by insurance. The Acclaim CI processor is implanted and therefore not susceptible to damage, discomfort or issues associated with moisture, germs, dirt, or other external causes of loss or physical damage due to having an externally worn processor. |

| ● | Use of equipment and accessories. The externally worn components of currently available cochlear implants can make wearing equipment or accessories difficult for existing cochlear implant patients. For example, wearing helmets, hats, headphones, stethoscopes, or other accessories can interfere with the placement of the external components and cause “coil offs” or prevent the patient from using the device altogether. |

| ● | Earlier adoption of cochlear implant technology from reduced stigma. For many potential users of hearing instruments like hearing aids and cochlear implants, the perception of stigma associated with those technologies can prevent or delay the adoption of the technology. We believe that the Acclaim CI, with no externally worn components, may help reduce or perhaps even eliminate such stigma. We believe we can increase penetration rates for adult cochlear implants in the U.S. |

| ● | Potential to significantly reduce overall costs while improving net healthcare outcomes. We believe a fully implanted cochlear implant could reduce cochlear implant costs over time by eliminating costly external components that are frequently replaced at the expense of the patient, the insurer, Medicare, or other third-party payor. There is also reason to believe that increasing compliance and use of cochlear implants, reducing time to adoption for candidates, and helping to support safety and security by providing the ability for true all-day hearing may improve the net healthcare outcome for society over time. |

The Acclaim CI is implanted by a surgeon through a procedure that we believe will average around two and a half to three hours under general anesthesia. We expect that patients may experience mild to moderate discomfort after the procedure. A four to eight week waiting period is required before the Acclaim CI can be activated to allow the middle ear to heal and fluid from surgery to dissipate. It is expected that the Acclaim CI battery pack will be replaced every 8-12 years via a less invasive surgical procedure that only replaces the Acclaim CI battery pack in the pectoral region (i.e., the whole system does not need to be replaced, just the Acclaim CI battery pack).

All of the competitive advantages referred to above require that the Acclaim CI obtain FDA approval in its current form and substantially on our planned timeline. If FDA approval is materially delayed for any reason, it is possible that competitors will offer products with similar features before we are able to market the Acclaim CI.

Market Overview

Overview of Hearing Loss

According to the National Center for Health Statistics, hearing loss impacts about 15% of the adult population in the United States.3 Among older adults, nearly 25% of people aged 65 to 74 have disabling hearing loss, and 50% of those aged 75 and older have disabling hearing loss, according to the National Institute on Deafness and Other Communications Disorders.4 Organizations such as the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) have recognized significant hearing loss as one of the most common disabilities impacting people around the world.5 The WHO estimates economic impact of untreated or undertreated hearing loss is approximately $750 billion each year.6

In common parlance, the terms “hearing loss,” “hard of hearing,” or “deafness” are often used to describe a variety of types, levels, and causes of hearing loss that are treated differently clinically. The hearing loss market can be classified based on causes and severity of hearing loss.

There are three main types of hearing loss: sensorineural, conductive, and mixed. Sensorineural hearing loss is due to problems of the inner ear and is often caused by damage to “hearing hair cells” in the cochlea. Common causes include normal aging, excessive noise exposure, viral infections, and exposure to drugs that are toxic to the hearing system. According to data published in the Journal of the American Medical Association, sensorineural hearing loss is the most common form of hearing loss, representing approximately 90% of all hearing loss.7

Conductive hearing loss is due to mechanical or structural problems with a part of the hearing system, generally a result of congenital issues with or damage to the ear canal, ear drum, or ossicular chain. Common causes include malformation of a particular part of the hearing system, middle ear infection, perforation of the eardrum, wax buildup, or dislocation of the ossicles. Conductive hearing loss represents approximately 10% of all hearing loss, according to data published in the Journal of the American Medical Association.8 Finally, mixed hearing loss has some combination of both sensorineural and conductive components.

In addition to the three main types of hearing loss, there are generally five levels of hearing loss severity: normal, mild, moderate, severe, and profound. Normal hearing is often defined as 0-20 decibels (dB) of hearing loss and even with a slight loss most people do not notice any impact. Mild hearing loss is often defined as 20-40 dB of hearing loss with some people reporting difficulty hearing soft spoken people. Most people with mild hearing loss do not address their hearing loss.

As hearing loss progresses, the impact on the individual becomes more noticeable. Moderate hearing loss is often defined as 40-70 dB of hearing loss and begins to show up with people reporting the ability to “hear but not understand” speech. More words are missed in conversations, and it is harder to hear in certain environments.

Severe hearing loss is often defined as 70-90 dB of hearing loss. People with severe hearing loss are unable to hear most speech and miss large portions of conversations without assistance. People with severe hearing loss may find that even with hearing aids they are not getting enough benefit to hear and understand most of the words in a conversation.

Profound hearing loss is often defined as 90 dB or more of hearing loss. People with profound hearing loss cannot hear speech or loud sounds such as sirens or horns. Most people who are considered clinically “deaf” would have severe to profound hearing loss.

| 3 | Source: National Health Interview Survey; Center For Disease Control And Prevention: National Center For Health Statistics (2022), finding that as of 2022 15.5% of US adults reported some level of difficulty hearing. |

| 4 | Source: Quick Statistics About Hearing; National Institute Of Health; National Institute On Deafness And Other Communications Disorders (https://www.nidcd.nih.gov/health/statistics/quick-statistics-hearing), summarizing statistics on hearing loss, including that 25% of people aged 65 to 74 have disabling hearing loss, and 50% of those aged 75 and older have disabling hearing loss. |

| 5 | Source: Preventing Noise-Induced Hearing Loss; Center For Disease Control And Prevention (2022); and Deafness and Hearing Loss, World Health Organization (2023), each providing an overview of the prevalence of hearing loss. |

| 6 | Source: Global Costs of Unaddressed Hearing Loss and Cost-Effectiveness of Intervention; World Health Organization (2017), providing an overview of the global costs of hearing loss, including components of cost and the monetary values attributable to such elements as costs typically incurred by health-care systems and patients, respectively, and reaching the conclusion that the cost of untreated or undertreated hearing loss is approximately $750 billion each year. |

| 7 | Source: Yueh B, et al.; Screening and Management of Adult Hearing Loss in Primary Care: Scientific Review; Journal Of The American Medical Association (2003), providing an epidemiology of types of hearing loss and identifying sensorineural hearing loss as the cause of 90% of hearing loss. |

| 8 | Source: Yueh B, et al.; Screening and Management of Adult Hearing Loss in Primary Care: Scientific Review; Journal Of The American Medical Association (2003), providing an epidemiology of hearing loss, including the allocation of hearing loss between sensorineural hearing loss and other types. |

Overview of Hearing Devices

There are several different types of hearing devices to address hearing loss. It is common for hearing loss to progress – continue to get worse – over the course of an individual’s life, so it is possible that a patient may have one or more hearing devices during the course of their lives.

Personal Sound Amplification Devices (PSAPs) are small electronic devices used to make sounds louder but with little sophistication. They are limited in ability and are only suitable for normal to mild hearing loss.

Hearing aids are the most common form of hearing device. These are small sound-amplifying devices that come in a variety of shapes and sizes. They are always external and pick up sound through a microphone and amplify the sound through a speaker in the ear canal. There are over-the-counter hearing aids (no prescription required) designed to treat mild to moderate hearing loss and prescription hearing aids designed to treat more significant hearing loss. Hearing aids can be used for all types of hearing loss and are typically the first device a person with hearing loss will try.

Active middle ear implants are implanted fully or partially in the middle ear (i.e., where the three ossicles or hearing bones are located). They are typically designed to treat moderate to severe sensorineural hearing loss, but some also can address a certain level of mixed hearing loss. Middle ear implants use mechanical energy to directly drive the cochlea with mechanical energy. Middle ear implants are not common due to the lack of reimbursement coverage throughout the world. The Esteem FI-AMEI is the only fully implanted active middle ear device currently with FDA approval and commercially available in the United States.

Cochlear implants are electrical hearing devices. They deliver electrical stimulation to the cochlea via an electrode array. The electrical stimulation is picked up by the hearing nerve and patients are able to perceive sound. Traditionally, all cochlear implants were partially implanted with an external component. We believe the fully implanted Acclaim CI will be the first-of-a-kind cochlear implant with no external component worn on the ear or required for daily hearing and that leverages the ear to pick up sound (i.e., versus a microphone).

Auditory osseointegrated implants (bone conduction implants) are used for conductive or certain types of mixed hearing loss. They are not used for sensorineural hearing loss. They address a patient’s conductive hearing loss by transferring sound information through the patient’s skull via vibration.

Acclaim CI’s Market Opportunity

The Acclaim CI is designed to address severe to profound sensorineural hearing loss that is not adequately addressed by hearing aids. We anticipate that the Acclaim CI will only be indicated for adults who have been deemed adequate candidates by a qualified physician.

We believe there is a significant population of adults in the United States who are cochlear implant candidates but choose not to get the therapy because of the external component required for daily hearing. We believe this is one of the main reasons why industry sources, such as a 2018 paper published in the journal Trends in Hearing, and our own market research estimate 5-8% penetration rate for cochlear implants in the adult population.9

| 9 | Sources: Holder JT, et al., Current Profile of Adults Presenting for Preoperative Cochlear Implant Evaluation; Trends In Hearing (2018), providing an analysis of implantation rates of cochlear implants among adults receiving preoperative screening, including a determination that “the market penetration for cochlear implantation was just 7.7% in the adult population of individuals with severe-to-profound sensory hearing loss.” We have also commissioned market research by S2N Health, which analyzed available literature and estimates from other market participants to reach the 5 - 8% penetration rate, based in part on an expansion of candidacy criteria since the publication of the Holder article. As an example of the effect of changing candidacy criteria, Nassiri AM, et al., determined penetration rates to be 12.1% based on the prior more restrictive criteria and 2.1% based on the current, broader criteria. Current Estimates of Cochlear Implant Utilization in the United States, Otol Neurotol (June 2022). |

Based on published literature and industry sources (prior to candidacy expansion for cochlear implant candidates), including the American Journal of Public Health, we believe there are approximately 6.6 million Americans age 12 or older with severe to profound hearing loss in at least one ear.10 Incorporating estimates for clinical indications (including limited benefit from hearing aids), we believe there are approximately 2.8 million adults in the United States who could qualify for a cochlear implant. Based on an assumed selling price in the United States for a traditional cochlear implant of $30,000 (a $5,000 premium over the average sale price of current partially-implanted devices), we believe the adult cochlear implant market in the United States alone represents a potential market opportunity of over $80 billion.

Based on the published literature and industry sources previously referenced, we believe there will be roughly 25,000 - 30,000 adults implanted with a cochlear implant in the United States every year by 2026. Based on an assumed selling price of $30,000, that is an annual market opportunity that exceeds $750 million for just the United States adult population.

In addition, many estimates from published literature and industry sources were made prior to changing candidacy within the cochlear implant market. Two major shifts in clinical candidacy have likely increased the market sizes: (a) the CMS has expanded coverage from 40% word recognition scores to 60% word recognition scores and (b) there is more acceptance of treating single sided deafness with a cochlear implant.

While these numbers represent the entire adult cochlear implant market in the United States, we believe that if we are able to establish distribution channels and strategic relationships with clinics and healthcare professionals the Acclaim CI will be in a unique position to capture existing market share quickly and to also capture a healthy portion of the unserved market - those who are not pursuing a cochlear implant because of the external components. Moreover, it is reasonable to believe that Acclaim CI will demand a higher average selling price than existing partially implanted cochlear implants.

We also believe there are substantial total market and annual market opportunities outside the United States. Currently, our analysis estimates that approximately 50% of the hearing device market is international. Given the greater number of hearing loss patients outside the United States, we also believe the international market is currently significantly underserved and offers significant opportunity for expansion if we are able to obtain the necessary regulatory approvals and expand our international distribution capabilities. However, we will be unable to expand into international markets if we are unable to obtain these regulatory approvals.

Market Competition

There are currently three major cochlear implant manufacturers - Cochlear Ltd., Advanced Bionics (Sonova), and Med-El. There are a few other minor regional players, such as Nurotron in China, which appears to be focused on developing countries.

Cochlear Ltd. (ASX: COH) is the leading cochlear implant device manufacturer with approximately 60% of global market share and a market capitalization of approximately $12 billion (US Dollars) as of December 31, 2024.

In comparison to Envoy Medical, the three current primary providers of cochlear implants have a greater penetration into the hearing loss treatment market, which has allowed them to develop relationships with audiologists, otolaryngologists (ENT physicians), hearing loss centers, and the other physicians on whom providers rely for referrals. The current providers also have existing relationships with patients who have used their devices. In addition, current providers also have substantially greater financial and operational resources, which may give them an advantage in capitalizing on new technology and responding to other changes to the marketplace.

| 10 | Source: Goman, AM and Frank RL, Prevalence of Hearing Loss by Severity in the United States, AMERICAN JOURNAL OF PUBLIC HEALTH (Oct 2016), estimating that 6.6 million (2.5%) of Americans aged 12 years or older have severe to profound hearing loss in at least one ear, with three quarters of these individuals being older than 60 years. We do not plan to market the Acclaim CI to patients under age 18. |

If we are able to obtain regulatory approval of the Acclaim CI, we believe physicians and patients may be receptive to it being a fully implanted cochlear implant. However, based on our lack of history in the market, we will need to make material investments in patient advertising, provider education and training, distribution capabilities, and physician strategic relationships to capitalize on such advantages and gain market share. We will be unable to begin investing in these areas until we obtain FDA approval.

Market Trends

The first documented cochlear implant was completed in 1961. The initial devices were crude single electrode cochlear implants with the intended purpose of giving some basic environmental and situational awareness to adults with profound hearing loss. A few years later, multi-channel devices were introduced. Over time, multi-channel devices evolved more quickly and allowed for more robust processing and mapping strategies. By the 1980s, cochlear implants were an accepted standard of care for adults with profound hearing loss with the multi-channel devices becoming the preferred design by most healthcare professionals.

The next two to three decades focused on the evolution of multi-channel electrodes and creating new sound processing and electrode mapping techniques to focus on speech understanding. As a result, most cochlear implant patients can understand speech quite well with the appropriate follow-up and speech therapy. Candidacy was expanded to include children and people with different levels or types of hearing loss.

Over the last few years, the trends of the cochlear implant industry have mirrored that of the hearing aid industry, with less emphasis on hardware design and more placed on appearance and usability. The physical form and function have not changed significantly, although new sound processing strategies have been implemented to improve patient outcomes. While product reliability has gradually improved, clinical efficacy seems to have plateaued.

To increase market share, manufacturers have focused on making cochlear implants more visibly appealing (e.g., slightly smaller external components, color “kits” for the external components), user friendly (e.g., connectivity), environmentally robust (e.g., water resistance), and more reliable (e.g., fewer recalls).

We believe that the trend over the next decade will be a continuation of the focus on usability, connectivity, lifestyle, and miniaturization. Artificial Intelligence and Machine Learning may also come into play as those technologies evolve. As cochlear implants become more accepted as a therapy for individuals with moderate to profound sensorineural hearing loss, manufacturers will pay attention to ways of making patients interested in their device over a similarly performing competing device.

Another major trend within the industry is a loosening of the clinical candidacy requirements. In addition to people with “better” hearing levels being considered for cochlear implants (e.g., people with moderate hearing in the lower frequencies) there has also been a movement to implant people with “single sided deafness” (“SSD”). Both Med El (in 2019) and Cochlear (in 2021) achieved FDA approval for treatment of those with SSD and asymmetric hearing loss. As a result, more patients are eligible for cochlear implants than ever before.

Finally, industry participants have made material investments to inform more adult candidates about cochlear implants to increase usage. Currently, industry sources, including a 2018 paper published in the journal Trends in Hearing,11 and our own market research estimate that less than 10% of adults who meet the indications for cochlear implant candidacy are implanted, leaving more than 90% of the current adult market as untapped potential for new technologies. However, we will require FDA approval for the Acclaim CI and significant investment in our training and distribution network before we can access such market.

Reimbursement Strategy

Cochlear implants enjoy a fully developed reimbursement pathway. Cochlear implants have been deemed a coverable benefit by CMS and enjoy an existing National Coverage Determination (“NCD”). In the United States, many private and public payors cover at least one cochlear implant per adult. There is existing coding, coverage, and payment for cochlear implants.

| 11 | Source: Holder JT, et al., Current Profile of Adults Presenting for Preoperative Cochlear Implant Evaluation; TRENDS IN HEARING (2018). |

Unlike the Esteem FI-AMEI, which was classified as a hearing aid by CMS and therefore statutorily excluded from being a coverable benefit under Medicare and Medicaid, the Acclaim CI is expected to be eligible for Medicare and Medicaid coverage as a cochlear implant.

As mentioned above, the Acclaim CI received Breakthrough Device Designation. There are potential reimbursement-related benefits to the designation (i.e., the ability to receive higher reimbursements than are received by incumbent devices); however, the implementation of these benefits has not been finalized by Congress and CMS and there is no guarantee that Breakthrough Device Designation will offer any benefit with respect to reimbursement.

Timeline to Commercialization of Acclaim CI

In the United States, before we can market a new Class III medical device, which the Acclaim CI is, we must first receive FDA approval via the premarket application (“PMA”) approval process. We currently anticipate obtaining FDA approval in late 2027 or early 2028, although the process of obtaining FDA approval is uncertain, and we may not obtain approval on that timeline or at all.

A large component of our PMA will be a successful pivotal clinical study. In order to begin a pivotal clinical study, you must have an Investigational Device Designation (“IDE”) approved by the FDA. We received approval for our IDE on October 31, 2024. However, FDA approved our IDE based on a staged clinical study that will require approval from the FDA to move from the first stage to the second stage.

The objective of this pivotal clinical study is to demonstrate the safety and efficacy of the fully implanted Acclaim cochlear implant for the treatment of severe to profound sensorineural hearing loss and is designed as a prospective, multicenter, non-randomized, open label clinical trial to evaluate the safety and efficacy of the Acclaim CI. The pivotal clinical study protocol currently requires 56 total patients enrolled and followed for 12 months. The first stage will have 10 patients enrolled. We will then provide a summary of effectiveness outcomes for these 10 patients to the FDA and request approval from the FDA to proceed to the second stage to implant the remaining 46 patients. There is no guarantee that the FDA will approve expansion to the second stage or that eventual PMA approval will be obtained.

The pivotal clinical study has a primary efficacy endpoint, a safety endpoint, many secondary endpoints and a couple of exploratory endpoints. The primary efficacy endpoint will compare speech perception (CNC words) from baseline to twelve-month follow-up and the safety endpoint will characterize incidence and frequency of adverse events. The total pivotal clinical study duration is estimated to be approximately two and a half years. There is no guarantee that we will meet any of the safety, efficacy, secondary, or exploratory endpoints or that the clinical study will proceed to the second stage or enroll all patients.

Once the pivotal study is completed, the data will be analyzed and sent to the FDA with the PMA submission. The FDA review may take 6-12 months depending on what comes up during the review and if the FDA review team recommends the device for a Panel Track review. There is no guarantee that PMA approval will be obtained.

If FDA approval is delayed, we will be unable to move forward with expansion of our corporate infrastructure, development of distribution capabilities, and implementation of product technical support and provider training, and the costs associated with delayed approval may limit the funds available for investment in these areas. Regulatory delays would also put us further behind our established competitors in the market and may allow additional competitors into the market with products that have competitive advantages over ours.

Moreover, if FDA approval is delayed beyond our current plan or if delay is based on safety or efficacy concerns that require product redesign, we will be required to raise significant additional capital to continue our operations. We may be unable to raise these additional funds on favorable terms or at all, especially if approval is delayed based on device performance or other issues with the Acclaim CI. Because the Acclaim CI is currently our only product candidate that we believe can be commercialized, we would be unable to continue operations if it were determined that we could not obtain FDA approval for the Acclaim CI.

Early Feasibility Study

The Acclaim CI has undergone extensive benchtop and laboratory testing throughout the design and development process. Animal testing was done to demonstrate the reliability of the Acclaim CI’s rechargeable battery and charging safety algorithm.

In the third quarter of 2022, we received an IDE to undergo a small Early Feasibility Study (“EFS”) at Mayo Clinic in Rochester, Minnesota. The principal investigator is Dr. Colin Driscoll, a respected veteran in the global cochlear implant industry. There were three patients enrolled, implanted, and activated in the fourth quarter of 2022.

The purpose of this early feasibility study was to demonstrate that the Acclaim CI is capable of operating as it was designed. In other words, there are no safety or efficacy endpoints. The study is essentially designed to elicit patient and professional feedback regarding their experience using the device and inform any necessary design changes prior to beginning the pivotal clinical study.

We believe that the initial results of the EFS were promising. A few device shortcomings have been identified and are in process of being addressed or appropriately mitigated. The primary concern is a signal to noise issue that subjects identify as a gurgling or sizzling background noise. Mitigation and resolution strategies have been implemented and further work is ongoing. We believe we have identified strategies to improve the signal to noise ratio. We have tested and implemented some of these strategies in EFS patients and they have shown improvement. We will not know the extent of signal to noise improvement of these strategies until they have been developed, tested, implemented and implanted into patients with a new or improved device.

The EFS patients have been implanted for over two years. They all have made it passed their 24 month follow-up appointments. They all use their devices daily. There have been reported adverse events, but no serious or unanticipated device effects.

Two of the three patients choose to wear a hearing aid on top of their Acclaim CI. This combination helps to mitigate the noise and provide patients with a signal to noise ratio that allows them to use and enjoy the performance of the device. It was an unanticipated discovery during the EFS that a hearing aid on top of the Acclaim CI could provide patients with additional improvement. We are intrigued by the possibility of offering a fully implanted cochlear implant that could also allow for the use of a hearing aid or other ear accessory (e.g., ear buds) because the Acclaim CI leverages the ear to pick up sound.

Go-To-Market Strategy

Assuming PMA approval is received, our commercialization strategy will be quality over quantity to facilitate the Acclaim CI gaining a meaningful foothold in the marketplace without unnecessary complications stemming from attempting to grow too quickly.

The surgical professionals believed to be best suited to implant the Acclaim CI are otologists and neurotologists (i.e., sub-specialties of otolaryngologists). This community is relatively small compared to other specialties, with only a few hundred active professionals in the United States. We anticipate carefully selecting roughly 30 sites to be trained and ready to implant upon commercialization. These 30 sites are expected to be spread throughout the country and focus on quality of surgical care and capacity to serve a sufficient number of qualified patients. Following the initial 30 sites, we intend to add additional sites every year until there are roughly 120-150 sites actively implanting the Acclaim CI. However, this strategy will require significant investments in the development of our management team, corporate infrastructure, and manufacturing capabilities, as well as expansion of our sales, distribution, and training network. We do not anticipate offering the Acclaim CI at every cochlear implant center.

The other key professional group is audiologists. Each surgical site will have its own audiology team familiar with cochlear implants. The audiology team is critical to the success of a surgical site’s performance. We will invest resources for in-person training, and technical and product support as well as virtual training, and technical and product support for audiologists servicing patients with our products.

Outside of surgical sites, there is a subset of audiologists who traditionally work with patients currently using hearing aids. These audiologists will be instrumental in identifying and referring potential Acclaim CI patients to surgical sites. One of the largest barriers to more cochlear implant candidates becoming cochlear implant recipients is the lack of awareness and understanding by the audiologists of the technology and associated benefits available for their patients. We believe strong relationships can be built with both surgical teams and audiologists to ensure both are able to understand the options and benefits of the technology and differentiate themselves from the marketplace by offering and working with the Acclaim CI. However, we will be unable to train, educate, and develop these relationships until we are able to obtain FDA approval for the Acclaim CI.

Commercial Activities Outside of the United States

We anticipate pursuing the Conformité Européenne mark (“CE Mark”) in the European Union shortly after FDA approval. The CE Mark will allow the Acclaim CI to be sold throughout the European Economic Area. We are currently focusing our resources on FDA approval and will address commercial activities outside of the United States when the FDA approval process is more advanced.

Eventually, we anticipate pursuing other markets based on the potential size of the markets and availability of reimbursement, such as Australia, Brazil, and parts of Asia, although no such approval is guaranteed, and approval may take longer and involve greater cost than we currently anticipate.

Product Evolution and Next Generation Products

The focus of research and development over the next several years will be to improve upon the existing product design of the Acclaim CI to aid the process of obtaining FDA approval. Quality and reliability will be a primary focus of the team in the initial years of market release. We will also focus on the growing need for robust software and user interfaces for both the patient and the professional.

It is possible that we will expand our portfolio to include a variety of cochlear electrode arrays similar to other cochlear implant companies. However, we do not anticipate expanding into as large of an electrode portfolio as some of our competitors as we are not convinced that a large electrode portfolio is efficient or effective.

Esteem FI-AMEI - a potentially viable product with reimbursement

The Esteem FI-AMEI is a unique technology that could serve a niche segment of the hearing market. FDA-approved since 2010, the Esteem FI-AMEI suffered from a lack of reimbursement due to categorization as a hearing aid. We believe that this categorization is inaccurate as, unlike a hearing aid which is essentially an externally worn microphone and speaker simply making sounds louder, the Esteem FI-AMEI is fully implanted and replaces the function of the middle ear. Although efforts to change that categorization have been unsuccessful to date, two bipartisan Congressional bills, both titled the Hearing Device Coverage Clarification Act were introduced in the House and the Senate in the 118th Congress. It is anticipated, although not guaranteed, that the bills will be reintroduced into the 119th Congress.

These bills seek to clarify that fully implanted active middle ear hearing devices (FI-AMEIs) are prosthetics and not subject to the current Medicare hearing aid coverage exclusion. If these bills are successful in clarifying that FI-AMEIs are eligible for coverage and a change does happen to reimbursement policy for fully implanted active middle ear implants, the Esteem FI-AMEI is an existing FDA approved product ready to capitalize on such a change.

Existing Esteem FI-AMEI patients and professionals who work with those patients will continue to be supported. It is not only important for the market to know our strategy for supporting patients for life, but it is the right thing to do for the patients.

New implantations of the Esteem FI-AMEI are not expected to be more than a few per year until, and if, the reimbursement policy changes. Absent a change in reimbursement policy, there only will be nominal revenue from replacement of the sound processor / battery assembly (the “Battery”) for existing patients who need a new Battery.

Intellectual Property

We rely on a combination of patent, copyright, trademark and trade secret laws and confidentiality and invention assignment agreements to protect our intellectual property rights. As of March 10, 2025, we had rights to 35 issued U.S. patents, which are estimated to expire between 2025 and 2043 assuming all required fees are paid, 13 pending U.S. patent applications, 33 issued foreign patents and 32 pending foreign and international patent applications. Our patents cover, among other things, aspects of our current Acclaim CI system and future product concepts. Some of the pending foreign and international patent applications preserve an opportunity to pursue patent rights in multiple countries.

Our pending patent applications may not result in issued patents, and we cannot assure you that any current or subsequently issued patents will protect our intellectual property rights or provide us with any competitive advantage. While there is no active litigation involving any of our patents or other intellectual property rights and we have not received any notices of patent infringement, we may be required to enforce or defend our intellectual property rights against third parties in the future. See Item 1A. Risk Factors - Risks Relating to our Intellectual Property for additional information regarding these and other risks related to our intellectual property portfolio and their potential effect on us.

Material Patents

As of March 10, 2025, our material patents, their jurisdiction, patent number, and expiration date are listed in the tables below:

| Jurisdiction | Patent No. | Expiration Date | Title | |||||

| U.S. | 7297101 | 01/17/2026 | Method and apparatus for minimally invasive placement of sensing and driver assemblies to improve hearing loss | |||||

| U.S. | 9782600 | 05/17/2033 | Self-regulating transcutaneous energy transfer | |||||

| U.S. | 7524278 | 08/15/2025 | Hearing aid system and transducer with hermetically sealed housing | |||||

| U.S. | 9497555 | 01/30/2035 | Implantable middle ear transducer having improved frequency response | |||||

| U.S. | 10129660 | 10/27/2028 | Implantable middle ear transducer having improved frequency response | |||||

| U.S. | 9036824 | 12/30/2033 | Transducer impedance measurement for hearing aid | |||||

| U.S. | 9521493 | 05/03/2032 | Transducer impedance measurement for hearing aid | |||||

| U.S. | 9682226 | 12/06/2033 | Electronic lead connection and related devices | |||||

| U.S. | 10549090 | 10/20/2037 | Communication system and methods for fully implantable modular cochlear implant system | |||||

| U.S. | 10646709 | 04/09/2038 | Fully implantable modular cochlear implant system | |||||

| U.S. | 10569079 | 09/04/2037 | Communication system and methods for fully implantable modular cochlear implant system | |||||

| U.S. | 10743812 | 03/25/2035 | Implantable middle ear diagnostic transducer | |||||

| U.S. | 11260220 | 02/28/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| U.S. | 11266831 | 06/13/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| U.S. | 9525949 | 03/16/2034 | Implantable middle ear transducer having diagnostic detection sensor | |||||

| Jurisdiction | Patent No. | Expiration Date | Title | |||||

| U.S. | 11051116 | 10/11/2032 | Implantable middle ear transducer having diagnostic detection sensor | |||||

| U.S. | 11471689 | 04/14/2041 | Cochlear implant stimulation calibration | |||||

| U.S. | 11564046 | 07/17/2041 | Programming of cochlear implant accessories | |||||

| U.S. | 9313590 | 03/13/2033 | Hearing aid amplifier having feed forward bias control based on signal amplitude and frequency for reduced power consumption | |||||

| U.S. | 9635478 | 03/09/2034 | Coulomb counter and battery management for hearing aid | |||||

| U.S. | 11672970 | 02/21/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| U.S. | 11697019 | 12/02/2040 | Combination hearing aid and cochlear implant system | |||||

| U.S. | 11711658 | 10/11/2032 | Implantable middle ear transducer having diagnostic detection sensor | |||||

| EP | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| DE | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| DK | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| AT | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| GB | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| BE | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| FR | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| IT | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| SE | 3500337 | 08/17/2037 | Implantable modular cochlear implant system with communication system and network | |||||

| MX | 421017 | 2/21/20240 | Implantable cochlear system with integrated components and lead characterization | |||||

| EP | 3927420 | 2/21/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| UP | 3927420 | 2/21/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| GB | 3927420 | 2/21/2040 | Implantable cochlear system with integrated components and lead characterization | |||||

| U.S. | 11633591 | 8/3/2041 | Combination implant system with removable earplug sensor and implanted battery | |||||

| U.S. | 11806531 | 4/11/2041 | Implantable cochlear system with inner ear sensor | |||||

| U.S. | 11839765 | 1/23/2042 | Cochlear implant system with integrated signal analysis functionality | |||||

| U.S. | 11865339 | 6/22/2042 | Cochlear implant system with electrode impedance diagnostics | |||||

| EP | 3858425 | 08/17/2037 | Implantable Modular Cochlear Implant System with Communication System and Network | |||||

| GB | 3858425 | 08/17/2037 | Implantable Modular Cochlear Implant System with Communication System and Network | |||||

| UP | 3858425 | 08/17/2037 | Implantable Modular Cochlear Implant System with Communication System and Network | |||||

| U.S. | 12090318 | 02/21/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| U.S. | 12233256 | 10/09/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| Jurisdiction | Patent No. | Expiration Date | Title | |||||

| HK | HK40066136 | 02/21/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| JP | 7598401 | 02/21/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| JP | 7597846 | 02/21/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| JP | 7598327 | 02/21/2040 | Implantable Cochlear System with Integrated Components and Lead Characterization | |||||

| U.S. | 12081061 | 02/07/2043 | Recharge System For Implantable Battery | |||||

| U.S. | 12214195 | 12/02/2040 | Implantable Cochlear System with Inner Ear Sensor | |||||

| EP | 4204071 | 08/27/2041 | Programming Of Cochlear Implant Accessories | |||||

| GB | 4204071 | 08/27/2041 | Programming Of Cochlear Implant Accessories | |||||

| HK | HK40097814 | 08/27/2041 | Programming Of Cochlear Implant Accessories | |||||

| UP | 4204071 | 08/27/2041 | Programming Of Cochlear Implant Accessories | |||||

| U.S. | 12151102 | 12/02/2040 | Combination Hearing Aid and Cochlear Implant System | |||||

| EP | 4255554 | 11/24/2041 | Combination Hearing Aid and Cochlear Implant System | |||||

| GB | 4255554 | 11/24/2041 | Combination Hearing Aid and Cochlear Implant System | |||||

| UP | 4255554 | 11/24/2041 | Combination Hearing Aid and Cochlear Implant System | |||||

| EP | 4255555 | 11/24/2041 | Cochlear Implant Stimulation Calibration | |||||

| GB | 4255555 | 11/24/2041 | Cochlear Implant Stimulation Calibration | |||||

| UP | 4255555 | 11/24/2041 | Cochlear Implant Stimulation Calibration | |||||

| EP | 4319866 | 04/01/2042 | Cochlear Implant System with Electrode Impedance Diagnostics | |||||

| GB | 4319866 | 04/01/2042 | Cochlear Implant System with Electrode Impedance Diagnostics | |||||

| UP | 4319866 | 04/01/2042 | Cochlear Implant System with Electrode Impedance Diagnostics | |||||

Trademarks

As of February 28, 2025, we had trademark registrations, covering “Acclaim”, “Envoy”, “Envoy Medical”, “EnvoyCEM”, “Esteem”, “Invisible Hearing”, and “MEDCEM.” Our U.S. trademarks have registration dates between 2002 and 2021 and have upcoming renewal dates between 2027 and 2033. All of our trademarks are in current use, and we expect that they will remain in use for the foreseeable future. We also have pending trademark applications covering “Nature’s Microphone” and “Naturemic” with application dates in 2024 for use in 2025.

We also rely, in part, upon unpatented trade secrets, know-how and continuing technological innovation, and may in the future rely upon licensing opportunities, to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality and assignment agreements with suppliers, employees, consultants and others who may have access to our proprietary information.

Manufacturing and Supply

We currently do all final manufacturing at our facility in White Bear Lake, Minnesota. We rely on a limited number of technicians and have some critical equipment that would be difficult to replace in a timely manner. In order to scale quickly, we will need to expand our manufacturing capacity and add additional shifts.

We rely on third-party suppliers to manufacture some of our critical sub-assemblies. Outsourcing sub-assemblies manufacturing reduces our need for additional capital investment. We select our suppliers carefully and require they adhere to all applicable regulations. We monitor our suppliers and always inspect all components received. Our quality assurance process monitors and maintains supplier performance through qualification and periodic supplier reviews and audits.

Certain components used in our products are supplied by single-source suppliers, but we believe that we are able to plan supply in a manner that would minimize the effect of losing any of our existing suppliers. Our suppliers manufacture the components they produce for us and test our components and devices to our specifications. We intend to maintain sufficient levels of inventory to enable us to continue our operations while we qualify additional potential suppliers in the event that one or more of our single-source suppliers were to encounter a delay in supply or end supply. Due to our current limited production numbers, we order components and sub-assemblies on a purchase order basis and do not have supply agreements with any of our suppliers.

Government Regulation

The FDA’s policies may change and additional government laws and regulations may be enacted that could prevent, limit, or delay regulatory approval of our product candidates, that could limit the marketability of our product candidates, or that could impose additional regulatory obligations on us. For example, the current administration may implement new or revised laws, regulatory requirements, and associated compliance obligations, as well as postponed or frozen regulatory requirements. Changes in medical practice and standard of care may also impact the marketability of our product candidates. If we are slow or unable to adapt to changes in existing requirements, standards of care, or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained and be subject to regulatory enforcement action.

Our products and our operations are subject to extensive regulation by the FDA and other federal and state authorities in the U.S., as well as comparable authorities in the European Economic Area (“EEA”) and other countries in which we may sell our products. In the U.S., our products are subject to regulation as medical devices under the Federal Food, Drug, and Cosmetic Act (“FDCA”) as implemented and enforced by the FDA. The FDA regulates the development, design, non-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, import, export, adverse event reporting, advertising, promotion, marketing and distribution, and import and export of medical devices to ensure that medical devices distributed domestically are safe and effective for their intended uses and otherwise meet the requirements of the FDCA.

In addition to U.S. regulations, we are subject to a variety of regulations in the EEA governing clinical trials and the commercial sales and distribution of our products. Even if we obtain the required FDA clearance or approval for a product in the United States, we will be required to obtain authorization before commencing clinical studies and to obtain marketing authorization or approval of our products under the comparable regulatory authorities of countries outside of the U.S. before we can commence clinical studies or commercialize our products in those countries. The approval process varies from country to country and the time may be longer or shorter than that required for FDA clearance or approval.

FDA Premarket Clearance and Approval Requirements