UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 27, 2025

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39395 | 84-4720320 | ||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||

| of incorporation) | Identification No.) |

| 18455 S. Figueroa Street | ||

| Gardena, CA | 90248 | |

| (Address of principal executive offices) | (Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | FFAI | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share | FFAIW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On March 27, 2025, Faraday Future Intelligent Electric Inc. (the “Company”) issued a press release in which the Company provided certain fourth quarter and full year 2024 financial results, as well as its 2025 outlook. The full text of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

In connection with the conference call to be held by the Company on March 27, 2025 to discuss certain fourth quarter and full year 2024 financial results, as well as its 2025 outlook, the Company will reference the presentation furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information contained in Items 2.02 and 7.01 in this Current Report on Form 8-K and the information in Exhibits 99.1 and 99.2 hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

| No. | Description of Exhibits | |

| 99.1 | Press Release of Faraday Future Intelligent Electric Inc. issued on March 27, 2025 | |

| 99.2 | Investor Presentation (Fiscal Fourth Quarter and Full Year 2024 Earnings Release), dated March 27, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FARADAY FUTURE INTELLIGENT ELECTRIC INC. | ||

| Date: March 27, 2025 | By: | /s/ Koti Meka |

| Name: | Koti Meka | |

| Title: | Chief Financial Officer | |

2

Exhibit 99.1

FARADAY FUTURE REPORTS FINANCIAL RESULTS FOR FOURTH QUARTER AND FULL YEAR 2024

| ● | Successful 2024 marked by new funding, Faraday X (FX) brand and product strategy, advances with prototype mules testing phase, Middle East expansion, and continued FF 91 2.0 deliveries. |

| ● | Net loss from operations in 2024 was significantly reduced vs. 2023, including a 55.3% improvement in Q4 vs the prior year quarter. |

| ● | The FX Super One is anticipated to be unveiled in June of 2025, and expects to start collecting paid reservations thereafter in preparation for the first planned FX to roll off the line by the end of 2025. |

| ● | The second potential FX product has benchmarked leading products in its potential segments, including the Toyota RAV4, and plans to have a product that equals the leaders in its segment. |

| ● | First two FX 6 prototype mules shipped to the U.S. showing progress for FX brand ramp up. |

| ● | Recently changed Company Nasdaq ticker symbol to “FFAI” reflecting strategic focus on AI technology. |

| ● | Recent U.S. automotive tariff policy changes may help create favorable conditions for FX, to further strengthen its market positioning and price competitiveness. |

Los Angeles, CA (March 27, 2025) -- Faraday Future Intelligent Electric Inc. (Nasdaq: FFAI) (“FF”, “Faraday Future”, or the “Company”), a California-based global shared intelligent electric mobility ecosystem company, today announced its financial results for its fourth quarter and full year 2024, highlighted by securing two rounds of funding commitments in September and December 2024, a total of more than $70 million, to support its FF and FX strategic developments. FF also made significant progress in FX product development with two prototype mules shipped to the U.S. in November 2024, and the recent change of its ticker symbol to “FFAI” reflecting its focus on AI technology.

During 2024, the Company implemented significant cost reduction measures across its operations, including a substantial decrease in personnel-related costs, professional services expenses, and general expenses such as rent and insurance. These initiatives contributed to a 75% reduction in year-over-year general and administrative expenses compared to 2023, while maintaining operational effectiveness.

RESULTS FOR FOURTH QUARTER 2024

| ● | Net Loss from Operations: $30.3 million, a 55.3% improvement from $67.8 million in Q4 2023. |

| ● | Operating Cash Outflow: decreased by 51.3% to $18.4 million, compared to $37.8 million in Q4 2023. |

| ● | Financing Cash Inflow: totaled $25 million, exceeding operating cash outflows. |

As a result, financial stability improved significantly relative to the end of the first half of 2024.

RESULTS FOR FULL YEAR 2024

| ● | Net Loss: $355.8 million, 58.0% of which was driven by a $206.4 million in non-operating loss and non-cash expenses rather than core business performance. |

| ● | Net Loss from Operations: $149.7 million, a 47.7% reduction from $286.1 million in 2023, reflecting ongoing efforts to control R&D and G&A expenses. |

| ● | Operating Cash Outflow: $70.2 million, a 75% reduction compared to $278.2 million in 2023, highlighting FF’s continued focus on cost control and operational efficiency. |

| ● | Cost of Revenue: increased by $41.4 million year-over-year, driven by depreciation expenses that were $29.3 million greater than in 2023, as additional equipment was placed into service to enhance production capabilities, particularly in paint and body. |

| ● | R&D Expenses: decreased by $106.8 million year-over-year, primarily driven by: |

| - | $53.6 million reduction due to salary and headcount reductions because many R&D personnel were reassigned to production roles. |

| - | $35.2 million reduction in engineering, design, and testing costs. |

| - | $14.9 million gain from the settlement of prior year accrued R&D expenses with Palantir. |

| ● | Sales and Marketing Expenses: decreased by $13.6 million year-over-year, primarily due to: |

| - | $7.7 million reduction in compensation expense. |

| - | $5.3 million total reduction in general expenses and advertising expenses. |

| ● | General and Administrative Expenses: decreased by $39.7 million year-over-year, primarily driven by: |

| - | $23.2 million reduction in professional service fees. |

| - | $10.7 million reduction in insurance costs, primarily related to directors’ and officers’ insurance. |

| ● | Non-Operating Loss: $206.4 million, primarily driven by accounting-related, non-operating and non-cash items: |

| - | $188.3 million valuation true-up related to existing and settled convertible notes and warrants. |

| - | $16.6 million in interest expense. |

Overall, FF saw a clear trend of improving financial stability. In both Q3 and Q4 of 2024, financing cash inflows exceeded operating cash outflows. This positive cash flow dynamic, combined with a 75% year-over-year reduction in operating cash burn and meaningful cost reductions across R&D and SG&A, reflects the tangible progress FF has made in aligning cost structure with operational priorities, while positioning it for long-term scalability and financial resilience.

2024 SUMMARY

OVERALL:

FF built Light, Swift, and Empowering Model:

Light: Resource-efficient in assets, capital, and marketing

Swift: Agile decision-making, execution, and production

Empowering: Products, team members, users, and our global strategy

OPERATIONS:

FX Cooperation Agreements with Major OEMs: Established collaborations with several leading OEMs, enabling the launch of potential FX product development and testing.

FF 91’s In-House Development and Upgrades: Features extensive proprietary technology and nearly 1,600 software upgrades, including the vehicle’s AI system, laying the groundwork for FX’s future empowerment.

Top-Tier User and Co-Creator Deliveries: Delivering FF91 to high-end users sets the stage for FX’s potential future market success.

FINANCIAL:

Largely Improved Operation Efficiency:

| ● | 2024 operating loss: $149.7 million, reduced 47.7% from 2023. |

| ● | 2024 operating cash outflow: $70.2 million, reduced 75% from 2023. |

| ● | 58.0% of 2024 net loss driven by non-operating losses and non-cash expenses, rather than business performance. |

CAPITAL:

Capital market performance underwent a fundamental improvement:

| ● | Regained Nasdaq full compliance. |

| ● | Surge in retail investor participation—registered stockholders (based on NOBO list) grew by approximately 163% from mid-2023 to January 2025, suggesting rising retail investor interest and engagement. |

| ● | Total Capital Raised (2024): $76.7 million—surpassing the Company’s operating and investing cash outflows and strengthening the balance sheet. |

Grow Fandor Initiatives: The Company’s founder, YT Jia, donated a 10% equity stake in Grow Fandor, a global IP commercialization company, to the Company as a gift, and the Company entered into an exclusive licensing agreement with Grow Fandor relating to the commercialization of the Company’s merchandise.

The fourth quarter of 2024 represented continued progress for FF with significant advancements in its dual-brand strategy. New capital raised in 2024 will help fund critical initiatives in 2025, including ongoing production and deliveries of the FF 91 2.0 while simultaneously advancing development of the potential mass-market FX lineup. This approach strengthens FF’s position in the premium AIEV segment while accelerating FF’s potential expansion into the broader consumer market through its FX brand.

In 2024, FF saw significant progress in strengthening its financial position, which has been critical to advancing FF’s strategic goals. On September 4, 2024, Nasdaq officially confirmed that FF had regained compliance with its bid price requirement in Listing Rule 5550(a)(2) and the periodic filing requirement in Listing Rule 5250(c)(1). This achievement followed a series of strategic actions to address previously identified deficiencies. Restoring compliance reflects the resilience and determination of our team, along with our unwavering commitment to transparency and strong governance. It also strengthens investor confidence in our ability to deliver on our long-term strategic vision.

FX BRAND DEVELOPMENT AND PRODUCT STRATEGY

FF unveiled the FX Super One concept in January 2025, an innovative first-class AI-MPV, expanding a potential product lineup alongside the previously announced FX 5 and FX 6 concept models. Targeting distinct price segments, the FX 5 (target base price of $20,000-$30,000) and FX 6 (target base price of $30,000-$50,000) could feature two dual powertrain options: range-extended AIEV and battery-electric AIEV. With aggressive development timelines, FX aims to have one of these models roll off the line by the end of 2025, contingent on securing appropriate funding and finalizing necessary agreements.

The Company has achieved significant milestones in FX product development, with two Super One camouflaged prototype mules shipped to the U.S. in November 2024, marking the commencement of comprehensive development and testing operations on U.S. soil. These prototype mules will undergo rigorous validation across multiple systems, including ADAS capabilities, autonomous driving functions, propulsion performance, intelligent cabin features, and holistic user experience evaluation.

The FX brand strategy aims to seize what the Company has identified as “four blue ocean markets” in the U.S. AIEV market: range-extended vehicles, intelligent vehicles defined as mobile living spaces, AIEV’s priced between $20,000 to $40,000, and luxury AI-MPVs.

STRATEGIC RELATIONSHIPS AND COMMERCIAL MILESTONES

Earlier in the fourth quarter of 2024, the Company’s wholly owned subsidiary, Faraday X (FX), signed agreements with top original equipment manufacturers (OEMs) relating to two planned products. These collaborations aim to jointly advance plans for the development, testing, regulatory compliance, supply chain, and production planning of two potential models.

FF entered into a strategic licensing agreement with Grow Fandor, an IP commercialization company. As FF’s exclusive licensee for ecosystem products, Grow Fandor will manage the design, development, sales, and operations for certain ecosystem products bearing the FF and FX brands. This collaboration represents a potential new growth driver without requiring FF to contribute any resources for development.

The FF 91 2.0 program demonstrated continued momentum with successful deliveries to high-profile customers, including entrepreneur and community leader Luke Hans in January 2025, and influential fashion model and designer Suede Brooks in December 2024.

AI STRATEGY AND INNOVATION

FF changed its Nasdaq ticker symbol to “FFAI” on March 10, 2025, and hosted an “FF Open AI Day” on March 16, 2025, reflecting the Company’s unwavering commitment to its core AI strategy. The Company is making significant progress in developing its All-AI Mobility Ecosystem, including Personalized AI and Bespoke AI initiatives. The AI-driven in-vehicle interaction system, built on large-model architecture, could be integrated into the FF 91 2.0 and into potential FX models.

MANUFACTURING AND PRODUCT IMPROVEMENTS

In manufacturing, the Company made significant strides in improving efficiency, quality, and scalability. In 2024, FF used two newly manufactured vehicles for crash tests to validate its self-produced body-in-white. The successful testing validated FF’s self-manufacturing ability and helped to ensure the safety, durability, and performance of FF’s vehicles. The Company’s Hanford, CA factory made several key improvements in 2024, including: reduced production cycle time by 40%; improved Customer Craftsmanship Audit (CCA) scores by 50%; and enhanced quality control with in-process quality gates, increasing quality checks by 200% times. These advancements reflect FF’s unwavering focus on quality over quantity, ensuring that every FF 91 meets the highest standards of excellence.

UAE Factory Progress was another critical milestone in 2024, as FF expands its footprint and prepares for potential future growth. FF reserved a 108,000 sq. ft. facility in the Ras Al Khaimah Economic Zone (RAKEZ), marking a significant step in our international strategy and also held the first of multiple face-to-face meetings with RAKEZ to advance the completion of the facility, ensuring alignment with local stakeholders. FF has also completed the equipment supplier selection phase, awarded Phase 1 equipment procurement to a UAE-based supplier, and introduced program management tools and a project charter, securing stakeholder approval for the estimated UAE program schedule.

These steps lay the foundation for a facility that could support our long-term growth and global ambitions. The Company continued to improve manufacturing efficiency by announcing plans to insource the manufacturing of its FF 91 2.0 vehicle seats at its Hanford, CA factory. This initiative represents FF’s ongoing efforts to optimize operations, reduce costs, and improve product quality. In December 2024, FF released new in-car software updates for the FF 91, enhancing both the in-vehicle infotainment experience and user-focused control features, including improved navigation, expanded voice controls, and enhanced display interfaces.

LEADERSHIP APPOINTMENTS

The Company has also made key personnel appointments and strengthened the leadership team to drive the Company and the FX strategy: Tin Mok was appointed as Head of FF UAE, overseeing our operations in the region; Koti Meka was named Chief Financial Officer; Aaron Ma became Acting Head of EV R&D; Dr. Lei Gu was named as President of the FX Global EV R&D Center; Xiao (Max) Ma was named as CEO of FX; and in 2025, Jerry Wang was named as President of FF. These leaders bring deep expertise and vision to their roles, supporting FF’s execution of its strategies with precision and innovation.

2025 OUTLOOK

OVERALL:

FX First Vehicle to Roll Off the Line by 2025: First FX vehicle targeted to start by the end of 2025. The Company plans to hold the first vehicle launch event and start to collect refundable paid reservations in Q2 2025.

FF 91 2.0 Futurist: Continue to maintain deliveries to spire users and co-creators.

OPERATIONS:

Second Potential FX Product Kick Off: A second FX product could be a category-defining, high-volume electric SUV, designed for the age of intelligent mobility. The Company plans to kick off development in Q2 2025. FX has benchmarked some of the best products in the segment, including the Toyota RAV4, and plan to have a product that equals the leaders in this segment on all merits.

Continuing FF AI Technology Development: Including AI-Powered Smart Cabin, AI Hybrid System, Autonomous Driving and U.S. regulatory compliance with a planned start in Q2 2025.

Democratizing Hyper Cars in Future FX Models: Making high-performance vehicles more accessible and affordable.

FINANCIAL:

Revenue Generation: The Company is targeting for the FX vehicles to start generating revenue in 2025.

Targeting Positive Gross Margins: Aiming for FX models to achieve positive gross margins relatively quickly, with upcoming funding to support production costs.

CAPITAL:

Enhancing Stockholder Value: Targeted FFAI stock market performance improvements continue through 2025.

Maintaining Nasdaq Compliance: Anticipated meeting of Nasdaq requirements without a reverse stock split.

Optimizing Funding Costs: Plan to secure funding with a reduced cost compare to historical, to meet the needs of both FX and FF.

Increased Investor Interaction in 2025: Planning higher-frequency engagement activities, including connecting the Annual Shareholder Meeting with an Investor Community Day with more interactive events.

Looking ahead to the remainder of 2025, the Company’s focus remains on delivering high-performance, intelligent electric vehicles of both FF and FX brands, while strengthening manufacturing capabilities, advancing technology and AI initiatives, and enhancing financial stability. As FF looks to the future, the Company’s focus is clear. First, the Company plans for the first FX vehicle to roll off the line by the end of 2025 and start taking refundable prepaid orders from Q2 2025. With the FX strategy, the Company expects to make high-performance, technology and AI equipped vehicles more accessible and affordable. In the meantime, the Company will continue to deliver the FF 91 2.0 to serve the newest spire users and co-creators.

As global trade dynamics continue to evolve, including the recent announced U.S. automotive tariff, FX’s flexible and forward-driven model positions the Company to respond swiftly to regulatory changes while optimizing cost efficiency and supply chain agility.

FF has also committed to initiate AI Hybrid Extended-Range Electric Powertrain development which could be applied to potential FX models pre-production. The Company recently announced the establishment of Future AIHER AI Hybrid Extended-Range Electric Powertrain Systems Inc. (“Future AIHER”). This newly formed wholly owned indirect subsidiary of FF is dedicated to the design and development of AI-driven range extender systems and solutions for Extended Range Electric Vehicles (EREVs).

Additionally, FF is focused on optimizing funding costs—ensuring the Company secures the capital it needs without excessive dilution. FF is also committed to maintaining Nasdaq compliance without a reverse stock split.

The completion of the Company’s first-generation smart cabin, powered by AI Agent technology, could be fully deployed in the FF 91 and prepared for integration into its potential FX series models, by the end of 2025.

FF is taking a forward-looking approach to self-driving technology, focusing on: preliminary research into end-to-end autonomous driving using large-scale AI models; and defining the autonomous driving technology roadmap for the FX series and next-generation models.

In summary, 2025 will be a pivotal year for FF. With a strong focus on driving technological innovation, and maintaining financial discipline, the Company is positioning itself for long-term growth and success in the EV market. And above all, fighting to enhance stockholder value for both institutional and retail investors.

EARNINGS WEBCAST

Faraday Future management will host a webcast today, March 27, 2025, at 8:00 p.m. Eastern time (5:00 p.m. Pacific time). Interested investors and other parties can listen to a webcast of the conference call by logging onto the Investor Relations section of the Company’s website at https://investors.ff.com/. A replay of the webcast will be available on the Company’s website shortly thereafter. More detail on FF’s 2024 Q4 and full year financials, when filed, can be found in our SEC filings and online at https://investors.ff.com/financial-information/sec-filings

ABOUT FARADAY FUTURE

Faraday Future is a California-based global shared intelligent electric mobility ecosystem company. Founded in 2014, the Company’s mission is to disrupt the automotive industry by creating a user-centric, technology-first, and smart driving experience. Faraday Future’s flagship model, the FF91, exemplifies its vision for luxury, innovation, and performance. The new FX strategy aims to introduce mass production models equipped with state-of-the-art luxury technology similar to the FF 91, targeting a broader market with middle-to-low price range offerings. For more information, please visit https://www.ff.com/us/.

FORWARD LOOKING STATEMENTS

This communication includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include but are not limited to statements regarding the Company’s Bridge Strategy, the Company’s growth strategy and the development of the markets in which it operates and/or plans to operate, the continued production and delivery of the FF 91, the Faraday (FX) brand, the Company’s capital raising strategy, the development and commercialization of EREVs, integrating existing third-party range extender technology into the FX vehicles, future compliance with Nasdaq listing requirements, optimizing funding costs, increasing investor interaction, and enhancing stockholder value, are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include, among others: the Company’s ability to secure the necessary funding to execute on the FX strategy, which will be substantial; the Company’s ability to secure necessary agreements to license and/or produce Super One, FX 5 or FX 6 vehicles in the U.S., the Middle East, or elsewhere, none of which have been secured; the Company’s ability to homologate the Super One, FX 5 or FX 6 for sale in the U.S., the Middle East, or elsewhere; the Company’s ability to secure necessary permits at its Hanford, CA production facility; the Company’s ability to successfully design and develop an EREV; the Company’s ability to continue as a going concern and improve its liquidity and financial position; the Company’s ability to pay its outstanding obligations; the Company’s ability to remediate its material weaknesses in internal control over financial reporting and the risks related to the restatement of previously issued consolidated financial statements; the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s vehicles; the Company’s ability to cover future warrant claims; the success of other competing manufacturers; the performance and security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s ability to receive funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of future financing efforts, the failure of any of which could result in the Company seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s ability to cover future warranty claims; the Company’s ability to use its “at-the-market” program; insurance coverage; general economic and market conditions impacting demand for the Company’s products; potential negative impacts of a reverse stock split; potential cost, headcount and salary reduction actions may not be sufficient or may not achieve their expected results; circumstances outside of the Company’s control, such as natural disasters, climate change, health epidemics and pandemics, terrorist attacks, and civil unrest; risks related to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; and the ability of the Company to attract and retain employees, any adverse developments in existing legal proceedings or the initiation of new legal proceedings, and volatility of the Company’s stock price. You should carefully consider the foregoing factors, and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Form 10-K filed with the SEC on May 28, 2024, as amended on May 30, 2024, and June 24, 2024, as updated by the “Risk Factors” section of the Company’s first quarter 2024 Form 10-Q filed with the SEC on July 30, 2024, and other documents filed by the Company from time to time with the SEC.

CONTACTS

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

8

Exhibit 99.2

© 2024 FARADAYFUTURE Faraday Future Intelligent Electric Inc.

(Nasdaq: FFAI) Fiscal Fourth Quarter 2024 Earnings Presentation March 27, 2025 X © 2024 FARADAYFUTURE X LEGAL DISCLAIMERS © 2024 FARADAYFUTURE 2 Forward Looking Statements This presentation includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 . When used in this video, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward - looking statements . These forward - looking statements, which include statements regarding Faraday Future Intelligent Electric Inc.’s (the “Company’s”) “Bridge Strategy,” the Company’s growth strategy, fundraising activities and prospects, the development of markets in which the Company operates or seeks to operate, the production and delivery of the FF 91, the Faraday X(FX) brand, and future compliance with Nasdaq listing requirements, are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward - looking statements. These forward - looking statements speak only as of the date of this call, and the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward - looking statement contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Important factors, among others, that may affect actual results or outcomes include, among others: the Company’s ability to continue as a going concern and improve its liquidity and financial position; the Company’s ability to regain compliance with, and thereafter continue to comply with, the Nasdaq listing requirements; the Company’s ability to pay its outstanding obligations; the Company’s ability to raise necessary capital, including but not limited to the capital required to fund production of the FF 91 and the Bridge Strategy; the Company’s ability to remediate its material weaknesses in internal control over financial reporting and the risks related to the restatement of previously issued consolidated financial statements; the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s vehicles; the Company’s ability to cover future warrant claims; the success of other competing manufacturers; the performance and security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s abi lity to receive funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of future financing efforts, the failure of an y of which could result in the Company seeking protection under the Bankruptcy Code ; the Company’s indebtedness ; the Company’s ability to cover future warranty claims ; insurance coverage ; general economic and market conditions impacting demand for the Company’s products ; potential negative impacts of a reverse stock split ; potential cost, headcount and salary reduction actions may not be sufficient or may not achieve their expected results ; circumstances outside of the Company’s control, such as natural disasters, climate change, health epidemics and pandemics, te rrorist attacks, and civil unrest ; risks related to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; the ability of the Company to attract and retain employees; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; and volatility of the Company’s stock price. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Form 10 - K filed with the Securities and Exchange Commission (“SEC”) on May 28, 2024, as amended on May 30, 2024, and June 24, 2024, as updated by the “Risk Factors” section of the Company’s first quarter 2024 Form 10 - Q filed with the SEC on July 30, 2024, and other documents filed by the Company from time to time with the SEC. No Offer or Solicitation This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

TABLE OF CONTENTS 1. Company Overview 2. 2024 Highlight s and 2025 Outlook 03. 2024 Financial Highlights 4. 2024 Q4 Key Accomplishments 5. 2024 Full Year Accomplishments and Subsequent Events 6. 2025 Technology & AI Development Planning 07.

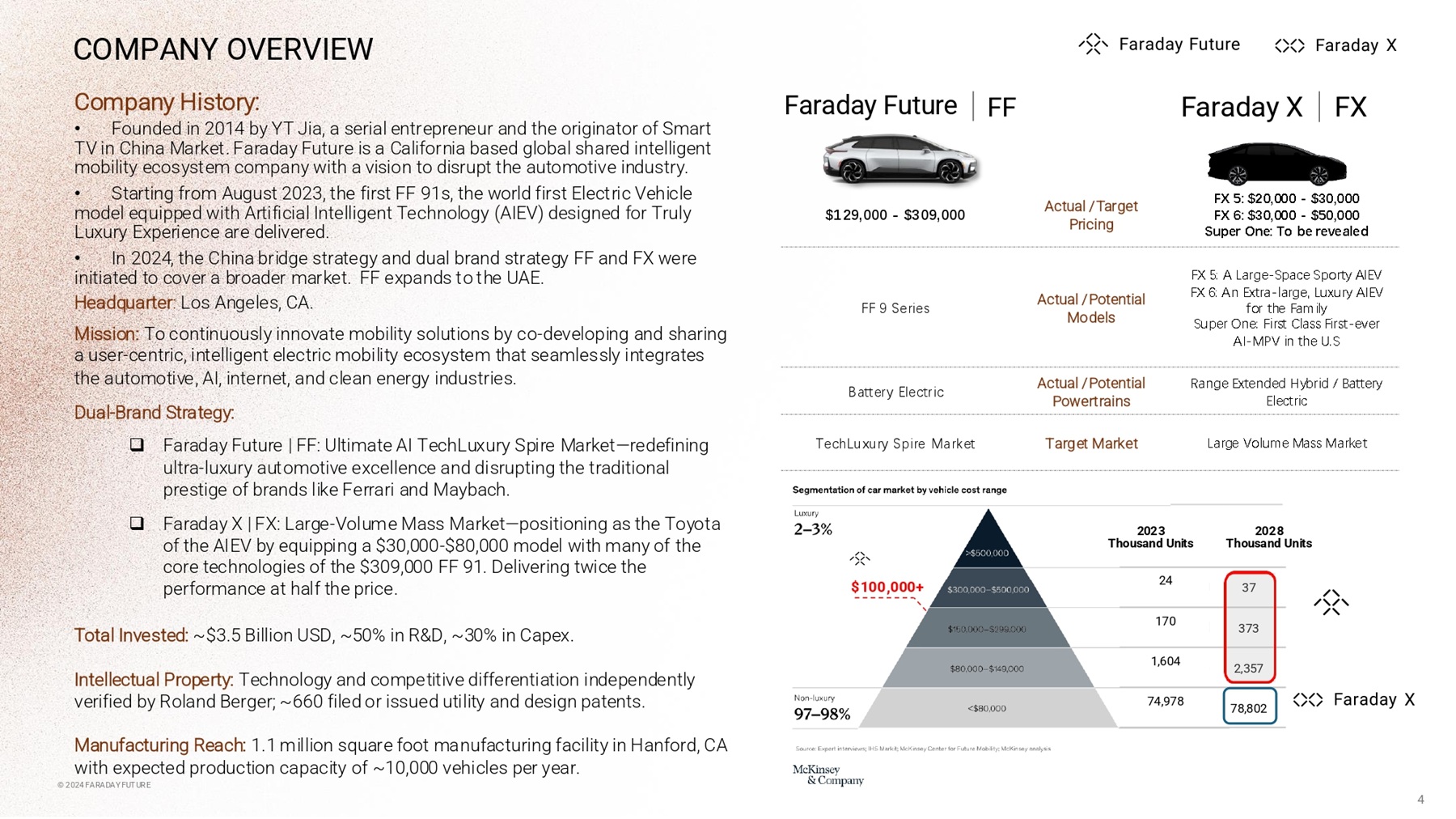

Appendix X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 3 X © 2024 FARADAYFUTURE COMPANY OVERVIEW Company History: • Founded in 2014 by YT Jia, a serial entrepreneur and the originator of Smart TV in China Market . Faraday Future is a California based global shared intelligent mobility ecosystem company with a vision to disrupt the automotive industry . • Starting from August 2023 , the first FF 91 s, the world first Electric Vehicle model equipped with Artificial Intelligent Technology (AIEV) designed for Truly Luxury Experience are delivered . • In 2024 , the China bridge strategy and dual brand strategy FF and FX were initiated to cover a broader market . FF expands to the UAE . Headquarter : Los Angeles, CA . Mission: To continuously innovate mobility solutions by co - developing and sharing a user - centric, intelligent electric mobility ecosystem that seamlessly integrates the automotive, AI, internet, and clean energy industries. Dual - Brand Strategy: □ Faraday Future | FF: Ultimate AI TechLuxury Spire Market — redefining ultra - luxury automotive excellence and disrupting the traditional prestige of brands like Ferrari and Maybach. □ Faraday X | FX: Large - Volume Mass Market — positioning as the Toyota of the AIEV by equipping a $30,000 - $80,000 model with many of the core technologies of the $309,000 FF 91. Delivering twice the performance at half the price. Total Invested: ~$3.5 Billion USD, ~50% in R&D, ~30% in Capex. Intellectual Property: Technology and competitive differentiation independently verified by Roland Berger; ~660 filed or issued utility and design patents. Manufacturing Reach: 1.1 million square foot manufacturing facility in Hanford, CA with expected production capacity of ~10,000 vehicles per year. X X FX 5: $20,000 - $30,000 FX 6: $30,000 - $50,000 Super One: To be revealed Actual /Target Pricing $129,000 - $309,000 FX 5: A Large - Space Sporty AIEV FX 6: An Extra - large, Luxury AIEV for the Family Super One: First Class First - ever AI - MPV in the U.S Actual /Potential Models FF 9 Series Range Extended Hybrid / Battery Electric Actual /Potential Powertrains Battery Electric Large Volume Mass Market Target Market TechLuxury Spire Market $100,000+ 1.3 2.5 2028 Thousand Units 2023 Thousand Units 37 24 373 170 2,357 1,604 78,802 74,978 X X © 2024 FARADAYFUTURE 4 X © 2024 FARADAYFUTURE 2024 HIGHLGHTS & 2025 OUTLOOK FF built Light, Swift, and Empowering Model: Light: Resource - efficient in assets, capital, and marketing Swift: Agile decision - making, execution, and production Empowering: Products, team members, users, and our global strategy FX Cooperation Agreements with Major OEMs: Established collaborations with several leading OEMs, enabling the launch of FX product development and testing.

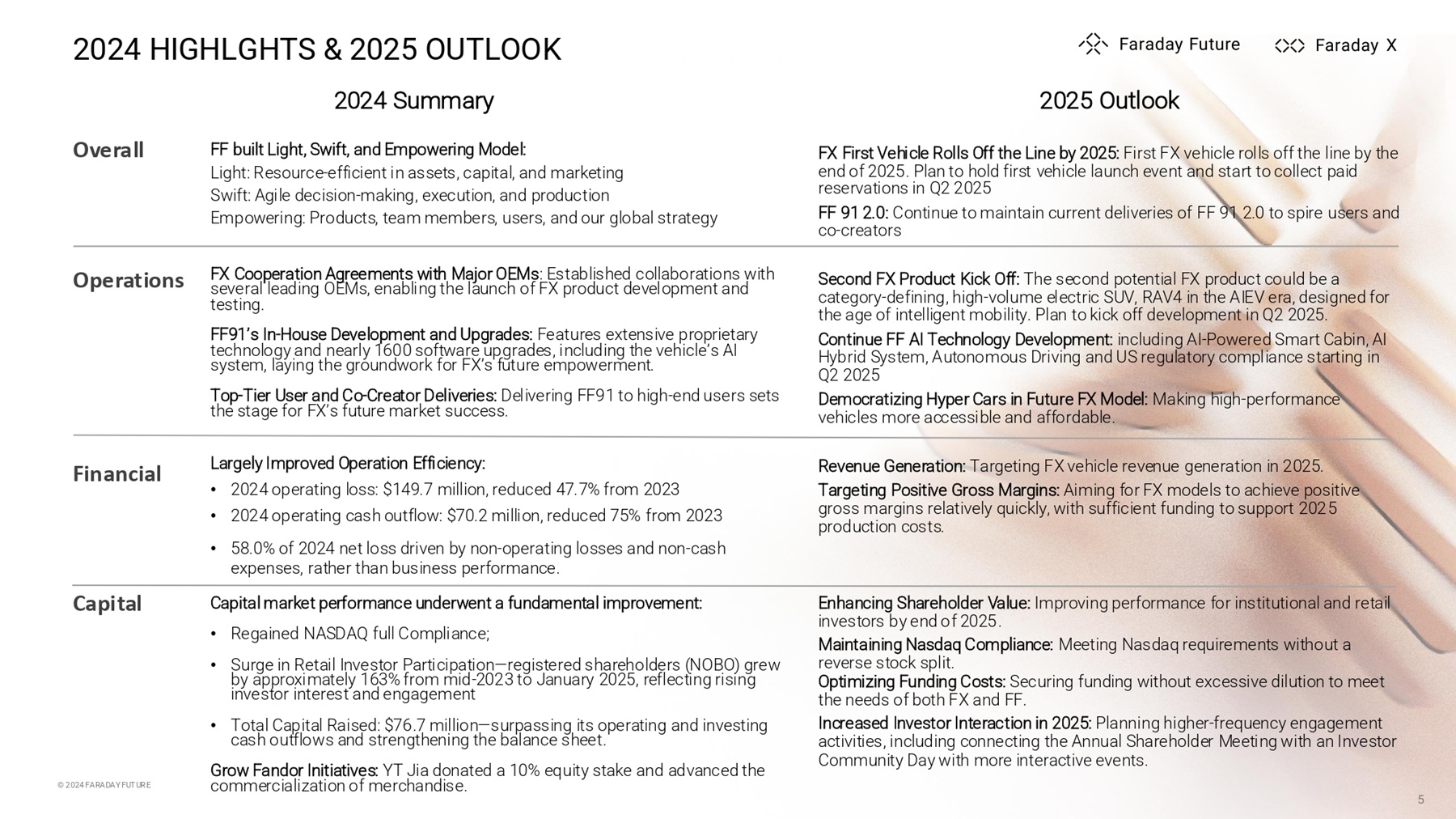

FF91’s In - House Development and Upgrades: Features extensive proprietary technology and nearly 1600 software upgrades, including the vehicle’s AI system, laying the groundwork for FX’s future empowerment. Top - Tier User and Co - Creator Deliveries: Delivering FF91 to high - end users sets the stage for FX’s future market success. Largely Improved Operation Efficiency: • 2024 operating loss: $149.7 million, reduced 47.7% from 2023 • 2024 operating cash outflow: $70.2 million, reduced 75% from 2023 • 58.0% of 2024 net loss driven by non - operating losses and non - cash expenses, rather than business performance. Capital market performance underwent a fundamental improvement: • Regained NASDAQ full Compliance; • Surge in Retail Investor Participation — registered shareholders (NOBO) grew by approximately 163% from mid - 2023 to January 2025, reflecting rising investor interest and engagement • Total Capital Raised: $76.7 million — surpassing its operating and investing cash outflows and strengthening the balance sheet. Grow Fandor Initiatives: YT Jia donated a 10% equity stake and advanced the commercialization of merchandise. Overall Operations Financial Capital X 5 2024 Summary 2025 Outlook FX First Vehicle Rolls Off the Line by 2025: First FX vehicle rolls off the line by the end of 2025. Plan to hold first vehicle launch event and start to collect paid reservations in Q2 2025 FF 91 2.0: Continue to maintain current deliveries of FF 91 2.0 to spire users and co - creators Second FX Product Kick Off: The second potential FX product could be a category - defining, high - volume electric SUV, RAV4 in the AIEV era, designed for the age of intelligent mobility. Plan to kick off development in Q2 2025. Continue FF AI Technology Development: including AI - Powered Smart Cabin, AI Hybrid System, Autonomous Driving and US regulatory compliance starting in Q2 2025 Democratizing Hyper Cars in Future FX Model: Making high - performance vehicles more accessible and affordable. Revenue Generation: Targeting FX vehicle revenue generation in 2025. Targeting Positive Gross Margins: Aiming for FX models to achieve positive gross margins relatively quickly, with sufficient funding to support 2025 production costs. Enhancing Shareholder Value: Improving performance for institutional and retail investors by end of 2025. Maintaining Nasdaq Compliance: Meeting Nasdaq requirements without a reverse stock split. Optimizing Funding Costs: Securing funding without excessive dilution to meet the needs of both FX and FF. Increased Investor Interaction in 2025: Planning higher - frequency engagement activities, including connecting the Annual Shareholder Meeting with an Investor Community Day with more interactive events. © 2024 FARADAYFUTURE Q4 2024: • Net Loss from Operations was $30.3m, a 55.3% improvement from $67.8m in Q4'23 • Operating Cash Outflow decreased by 51.3% to $18.4m, compared to $37.8m in Q4'23.

• Financing Cash Inflow totaled $25m in Q4'24, close to $26.6m in Q3'24, exceeding operating cash outflows for two consecutive quarters. As a result, financial stability has improved significantly since the end of the first half of 2024. 2024 Full - Year: • Net Loss : $355.8m, 58.0% of which driven by $206.4m in non - operating loss and non - cash expenses rather than core business performance. • Net Loss from Operations: $149.7m in 2024, a 47.7% reduction from $286.1m in 2023. reflecting ongoing efforts to control R&D and G&A expenses • Operating Cash Outflow: $70.2 million in 2024, a significant 75% reduction compared to $278.2m in 2023, highlighting Faraday's continued focus on cost control and operational efficiency. • Cost of Revenue increased by $41.4m YoY, driven by: $29.3m higher depreciation expenses as more equipment was placed into service to enhance production capabilities, particularly in the paint and body shop. • R&D Expenses decreased by $106.8m, primarily driven by: • $53.6m reduction due to salary and headcount reductions, along with the reassignment of R&D personnel to production roles. • $35.2m reduction in engineering, design, and testing costs. • $14.9 million gain from the settlement of prior year accrued R&D expenses with Palantir • Sales and Marketing Expenses decreased by $13.6m, primarily due to: • $7.7m reduction in compensation expense. • $5.3m total reduction in general expenses and advertising expenses • General and Administrative Expenses decreased by $39.7m, primarily driven by: • $23.2m reduction in professional service fees. • $10.7m reduction in insurance costs, primarily related to officers’ insurance. • Non - operating Loss was $206.4m, primarily driven by accounting - related, non - operating and non - cash items: • $188.3m valuation true - up related to existing and settled convertible notes and warrants. • $16.6m in interest expense 2024 FINANCIAL HIGHLIGHTS X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 6 KEY ACCOMPLISHMENTS: Q4 SNAPSHOT Vehicle Delivery FF 91 2.0 Futurist Alliance (FF 91) delivery including Suede Brooks, a YouTube influencer, fashion model, and designer, as well as Entrepreneur and community leader Luke Hans.

anufacturing • Vehicle Body Parts: FF secured 100 sets of FUJI vehicle body parts to support FF 91 manufacturing. • Insourcing FF 91 2.0 EV Seats: improved manufacturing efficiency • Partnership with JC Sportline: MOU signed to explore future collaborations, potentially improving customization capabilities. FX Business Development Launched two potential FX models (FX 5 with target base priced between $20,000 – $30,000 and FX 6 with target base priced between $30,000 – $50,000) with both range - extended and battery - electric powertrains. • Target rollout: End of 2025. • Prototype Development: First FX prototype mules were shipped to FF’s U.S. headquarters for product development and testing in November. • Agreements with Top OEMs: Successfully signed collaboration agreements with top OEMs, kicking off the product research phase. Fundraising • Funding Secured: • Secured an additional $30 million to strengthen its core business and support the rollout of the Faraday X (FX) strategy. • Signed a co - investment agreement with Master Investment Group, owned by Sheikh Abdulla Al Qassimi (UAE royal family member) for a commercial property development. • Funding Received: Received $30 million in previously committed financing Operational Progress • Stock Ticker Symbol Change: Announced stock ticker symbol change from FFIE to FFAI emphasizing the long existing AI focus. • Future Headquarters: Planning for FF’s future UAE headquarters in Ras Al Khaimah, UAE. • Events ▪ Co - Creation Event: participated in the 22nd SongZhuMei Thousand People Picnic, hosted by the Chinese University of Alumni Association Alliance of Southern California. ▪ SEMA Show: showcased two modified FF 91 2.0 Futurist Alliances at the 2024 Specialty Equipment Market Association (SEMA) Show. • Toy Drive Event: joined the annual Toy Drive event hosted by Sean Lee. ▪ AI Open Day: planned to host an “FF AI Open Day” event in early 2025. Leadershi p • Share Donations: YT Jia, FF Founder, 60% of his personal shares of Grow Fandor, a global IP commercialization company, which is 10% of Grow Fandor's total shares, to FF as a gift. • Stock Purchases: Global CEO Matthias Aydt and YT Jia purchased 10,455 shares of FF’s Class A common stock in September 2024, totaling $35,799. • New Appointments: Dr. Lei Gu appointed as President of FX Global EV R&D Center. Xiao Ma to be the CEO of FX. Other Business • Strategic Licensing Collaboration: FF and Grow Fandor entered into an exclusive licensing agreement, potentially creating a new growth driver.

X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 7 FULL YEAR ACCOMPLISHMENTS & SUBSQUENT EVENTS - VEHICLE DELIVERY, MANUFACTURING & IMPROVEMENTS Vehicle Delivery In 2024, FF delivered 6 FF 91 vehicles Users Includes: • Born Leaders Entertainment in Hollywood • Motev, a B2B Co - Creation Partner Founded by Robert Gaskill and Morgan Freeman • Fashion Model and Designer Suede Brooks • Entrepreneur and Community Leader Luke Hans Co - Creation Officer Program: Added 4 Co - Creation Officers, bringing diverse resources and industry influence on the brand, strengthening FF’s brand influence and industry connections. Product Optimization: Valuable feedback from Co - Creation Officers contributed to continuous product improvements and enhanced user experience. Key achievements include: • Introduction of a sport game replay feature. • Added synchronized video playback across 3 screens. anufacturing Delivered 8 vehicles, two of which were used for crash testing purposes to validate FF self - produced body in white. Hanford Plant Improvements • Production cycle time reduced by 40%. • Customer Craftsmanship Audit (CCA) score improved by 50%. • Enhanced quality control with in - process quality gates: 200% more quality checks. United Arab Emirates (UAE) Factory Progress Facility Secured: Finaled the lease for a 108,000 sq ft facility in RAKEZ Stakeholder Engagement: FF Advanced Manufacturing Engineering (AME) held its first face - to - face meeting with Ras Al Khaimah Economic Zone (RAKEZ) municipality to advance the completion of the manufacturing facility. Equipment Procurement: • Completed the equipment supplier selection. • Awarded Phase One equipment procurement to a UAE - based supplier. Program Management: • Introduced program management tools and project charter. • Presented and secured stakeholder approval for the estimated UAE program schedule. Subsequent Events Vehicle Delivery: Completed the first FF 91 lease in the East Coast, entering the New York market in March 2025. Manufacturing: Hanford Plant Progress: Fuji completed 100 body panels in Japan, with shipments to Hanford, CA beginning in March 2025. UAE Factory Progress: Received keys to the RAKEZ facility in the UAE in February 2025. X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 8 FULL YEAR ACCOMPLISHMENTS & SUBSQUENT EVENTS - TECHNOLOGY & AI Enhanced the FF 91's capabilities through nearly 1600 software upgrades through several Ove - the - air (OTA) updates.

User Feedback Optimization Feedback submission directly through the FFAI voice assistant, simplifying the process of sharing insights and suggestions. Navigation Improvements The maps app now provides clearer turn - by - turn guidance, ensuring a more intuitive and stress - free driving experience. Entertainment Upgrades Streaming video playback is now available on the center display when parked, with access to major sports events, including NFL, MLB, NBA, NHL, and more. Control & Interface Enhancements • Door Panel Interface: Revamped for easier seat adjustments. FFAI assistant activation is now accessible via rear seat controls. • Seat Comfort: Smoother leg support and seat adjustment mechanisms for enhanced comfort. • Pillar Screen Controls: New interactive features allow flexible control of all doors. • Center Display: Updated interface with drag - and - drop app customization, improved color contrast, and better readability. • Rear Display: Now shows Bluetooth connection status, simplifying headphone pairing and management. Connectivity Enhancements Clearer signal strength display and support for wireless carrier name visibility, ensuring better connectivity management. Product Quality & Stability Significant improvements in overall build quality and system stability, delivering a more reliable and refined driving experience. Technology Improvements AI - Driven Advancements AI - Powered In - Car Interaction System: A next - generation in - car interaction system based on large AI models, also referred to as an AI OS powered by AI Agents. End - to - End Pure Vision Advanced Autonomous Driving: Research on advanced autonomous driving solutions using end - to - end pure vision technology. AI Applications in Vehicle Control and Traditional Driving : Exploring AI applications in areas such as vehicle control and traditional driving, including projects like AI Range Extension . Subsequent Events FF 91 Software Updates: • Completed the newest external release version 57 of FF 91 vehicle software with enhanced user experience and product performance. • Finalized the next round version 58 of the software, which is now in the internal testing phase. AI Product Strategy: • Completed the strategic planning for upcoming AI products. • Delivered the first internal development version of an AI - powered system based on AI Agent technology. • Launched Future AI Hybrid Extended - Range (AIHER) subsidiary, which aims to design and develop the world’s first AI Hybrid Extended - Range Electric Powertrain System. FX Product Compliance: Conducted compliance analysis for the U.S. market with multiple FX partners. Delivered design change proposals to ensure compliance with U.S. market regulations.

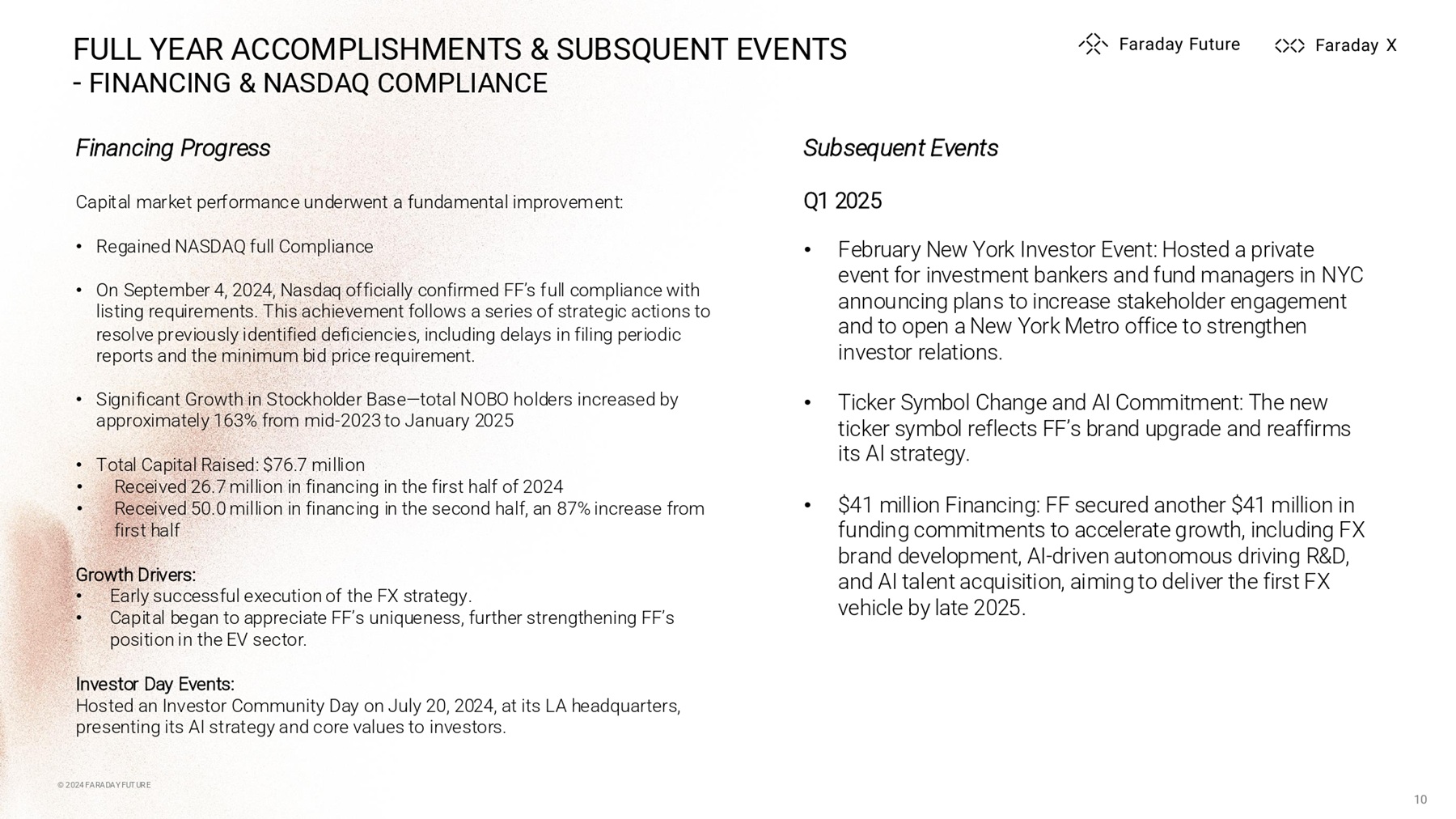

X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 9 FULL YEAR ACCOMPLISHMENTS & SUBSQUENT EVENTS - FINANCING & NASDAQ COMPLIANCE Capital market performance underwent a fundamental improvement: • Regained NASDAQ full Compliance • On September 4, 2024, Nasdaq officially confirmed FF’s full compliance with listing requirements. This achievement follows a series of strategic actions to resolve previously identified deficiencies, including delays in filing periodic reports and the minimum bid price requirement. • Significant Growth in Stockholder Base — total NOBO holders increased by approximately 163% from mid - 2023 to January 2025 • Total Capital Raised: $76.7 million • Received 26.7 million in financing in the first half of 2024 • Received 50.0 million in financing in the second half, an 87% increase from first half Growth Drivers: • Early successful execution of the FX strategy. • Capital began to appreciate FF’s uniqueness, further strengthening FF’s position in the EV sector. Investor Day Events: Hosted an Investor Community Day on July 20, 2024, at its LA headquarters, presenting its AI strategy and core values to investors. Financing Progress Subsequent Events Q1 2025 • February New York Investor Event: Hosted a private event for investment bankers and fund managers in NYC announcing plans to increase stakeholder engagement and to open a New York Metro office to strengthen investor relations. • Ticker Symbol Change and AI Commitment: The new ticker symbol reflects FF’s brand upgrade and reaffirms its AI strategy. • $41 million Financing: FF secured another $41 million in funding commitments to accelerate growth, including FX brand development, AI - driven autonomous driving R&D, and AI talent acquisition, aiming to deliver the first FX vehicle by late 2025. X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 10 X © 2024 FARADAYFUTURE FULL YEAR ACCOMPLISHMENTS & SUBSQUENT EVENTS - OPERATIONAL & HUMAN RESOURCES Operational Operational Resilience • Sustained FF 91 deliveries despite global supply chain and tariff challenges.

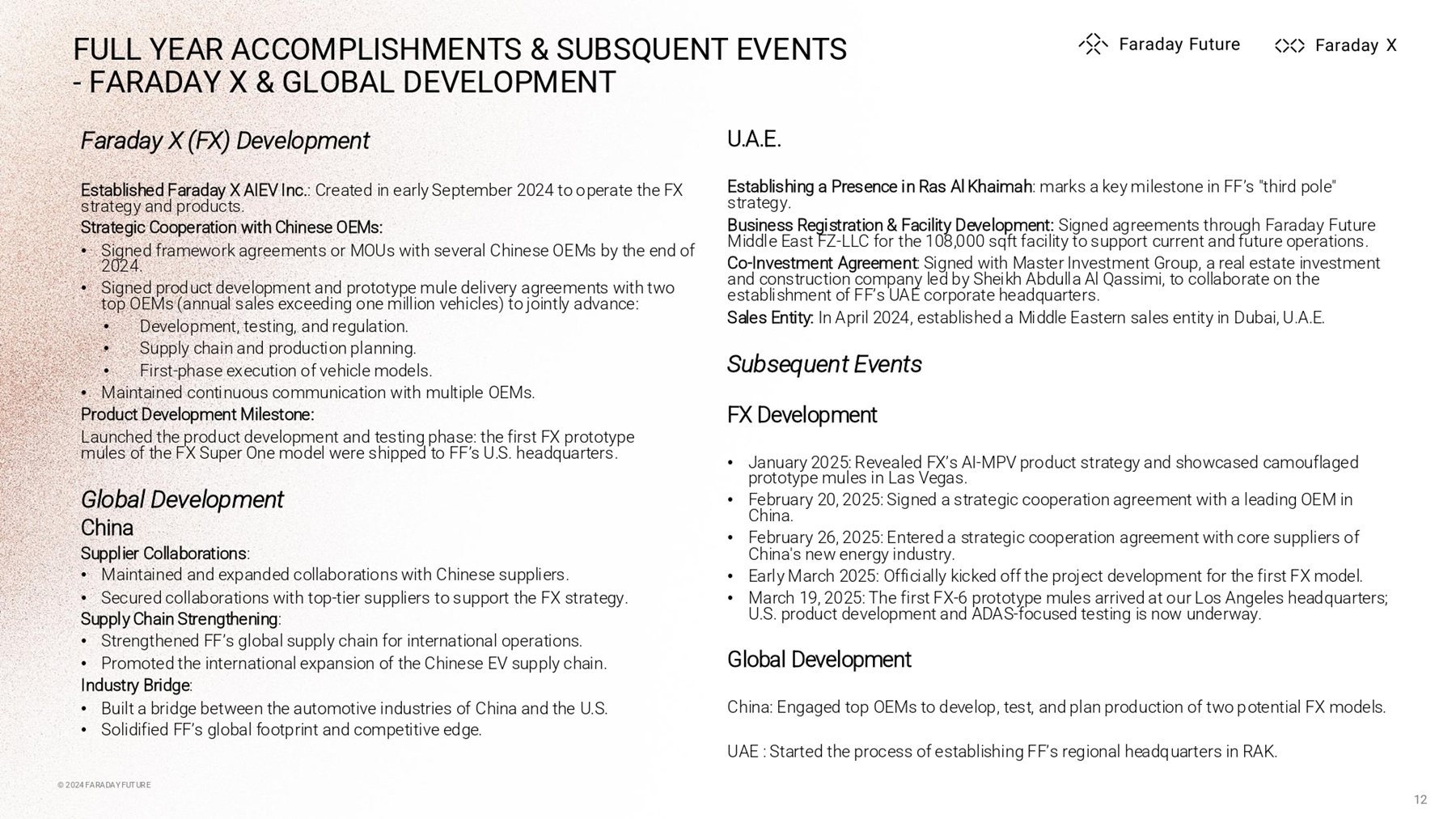

• Launched second brand (FX) and Bridge Strategy at a pivotal moment. • Strengthened market presence through partnerships with key Chinese industry players. Cost Reduction Achievements • Significant savings achieved across key areas: • Personnel costs. • Professional services. • General expenses (e.g., rent, insurance). • 72.9% reduction in operating expenses compared to 2023. • Maintained operational effectiveness while optimizing costs. • Disciplined cost management has improved financial health and positioned the company for sustainable growth Risk Management Strengthened risk management framework to ensure financial stability and regulatory compliance. AI for work efficiency launched the PPTIA (Policy, process, tools, IT, and AI) system to guide the overall company operation on a daily basis. As a key element of PPTIA, AI has been incorporated into the daily system build - up efforts, including data analysis and operational enhancement. Human Resources Several Management Appointments • Werner Wilhelm as Executive Launch Director • Tin Mok to Head of FF UAE • Koti Meka as Chief Financial Officer • Aaron Ma as Acting Head of EV R&D • Xiao (Max) Ma Global CEO of Faraday X • Dr. Lei Gu as President of FX Global EV R&D Center Subsequent Events Operational Improve Operational Systems: • Continuously enhance the five - step system build - up methodology and the PPTIA system to optimize daily operations. • Actively collaborate with top OEMs to advance the Bridge strategy. FF Focus • Prioritize vehicle delivery and user experience enhancement. • Ensure improved services for spire market users and maintain the brand's high - end positioning. • Use the continued delivery and sale of the FF 91 as a foundation for launching the second brand, FX. FX Focus • Collaborate with major top - tier OEMs to ensure the successful launch and delivery of FX vehicles. • Drive key progress to unlock the Company's inherent value and maximize shareholder value. Human Resources • Jerry Wang appointed President of Faraday Future X © 2024 FARADAYFUTURE 11 FULL YEAR ACCOMPLISHMENTS & SUBSQUENT EVENTS - FARADAY X & GLOBAL DEVELOPMENT Faraday X (FX) Development Established Faraday X AIEV Inc.: Created in early September 2024 to operate the FX strategy and products.

Strategic Cooperation with Chinese OEMs: • Signed framework agreements or MOUs with several Chinese OEMs by the end of 2024. • Signed product development and prototype mule delivery agreements with two top OEMs (annual sales exceeding one million vehicles) to jointly advance: • Development, testing, and regulation. • Supply chain and production planning. • First - phase execution of vehicle models. • Maintained continuous communication with multiple OEMs. Product Development Milestone: Launched the product development and testing phase: the first FX prototype mules of the FX Super One model were shipped to FF’s U.S. headquarters. Global Development China Supplier Collaborations: • Maintained and expanded collaborations with Chinese suppliers. • Secured collaborations with top - tier suppliers to support the FX strategy. Supply Chain Strengthening: • Strengthened FF’s global supply chain for international operations. • Promoted the international expansion of the Chinese EV supply chain. Industry Bridge: • Built a bridge between the automotive industries of China and the U.S. • Solidified FF’s global footprint and competitive edge. U.A.E . Establishing a Presence in Ras Al Khaimah: marks a key milestone in FF’s "third pole" strategy. Business Registration & Facility Development: Signed agreements through Faraday Future Middle East FZ - LLC for the 108,000 sqft facility to support current and future operations. Co - Investment Agreement: Signed with Master Investment Group, a real estate investment and construction company led by Sheikh Abdulla Al Qassimi, to collaborate on the establishment of FF’s UAE corporate headquarters. Sales Entity: In April 2024, established a Middle Eastern sales entity in Dubai, U.A.E. Subsequent Events FX Development • January 2025: Revealed FX’s AI - MPV product strategy and showcased camouflaged prototype mules in Las Vegas. • February 20, 2025: Signed a strategic cooperation agreement with a leading OEM in China. • February 26, 2025: Entered a strategic cooperation agreement with core suppliers of China's new energy industry. • Early March 2025: Officially kicked off the project development for the first FX model. • March 19, 2025: The first FX - 6 prototype mules arrived at our Los Angeles headquarters; U.S. product development and ADAS - focused testing is now underway. Global Development China: Engaged top OEMs to develop, test, and plan production of two potential FX models. UAE : Started the process of establishing FF’s regional headquarters in RAK. X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 12 2025 TECHNOLOGY & AI DEVELOPMENT PLANNING FF / FX Software Enhancements: Continue to improve system stability and user experience through multiple software version iterations.

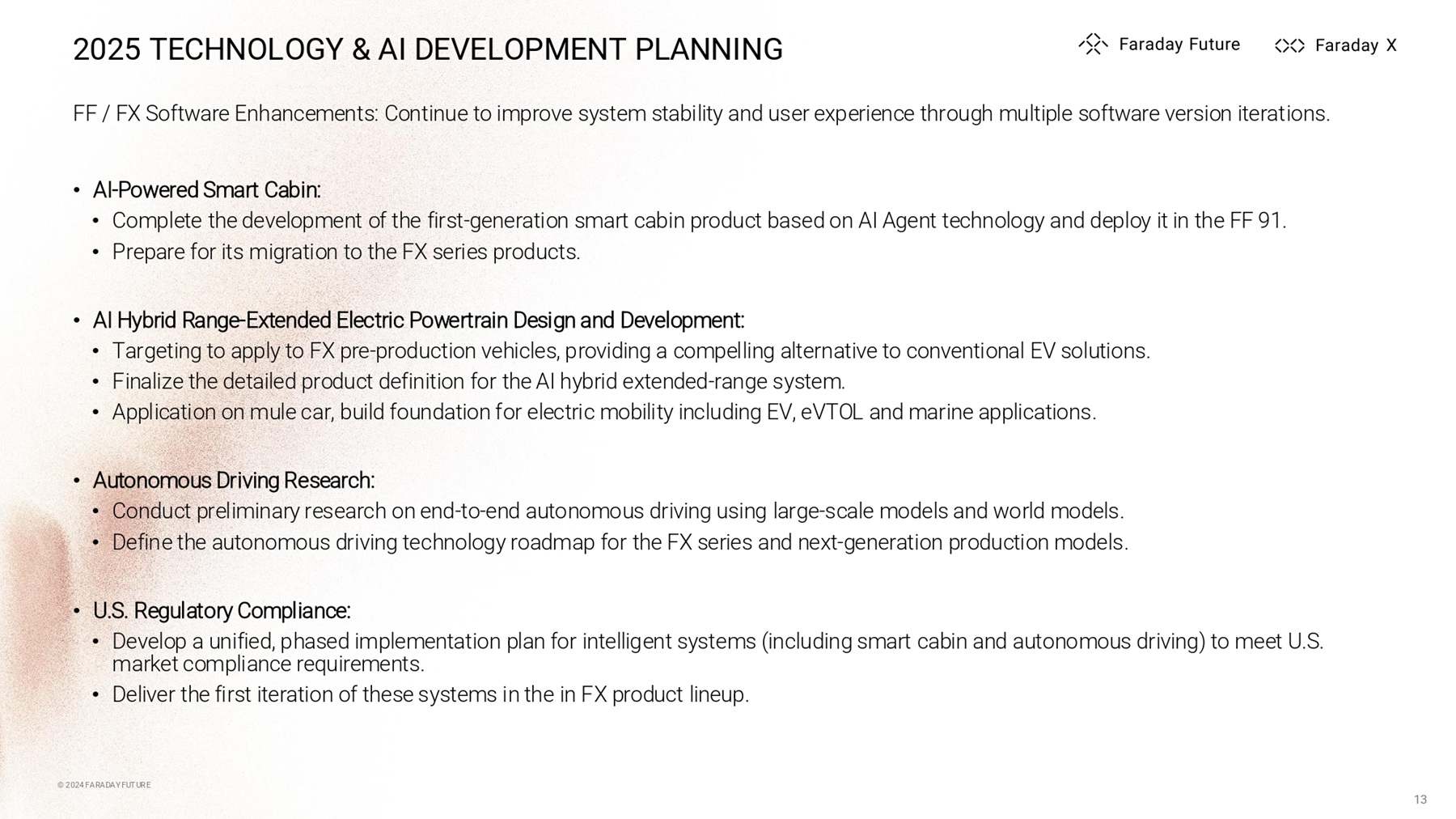

• AI - Powered Smart Cabin: • Complete the development of the first - generation smart cabin product based on AI Agent technology and deploy it in the FF 91. • Prepare for its migration to the FX series products. • AI Hybrid Range - Extended Electric Powertrain Design and Development: • Targeting to apply to FX pre - production vehicles, providing a compelling alternative to conventional EV solutions. • Finalize the detailed product definition for the AI hybrid extended - range system. • Application on mule car, build foundation for electric mobility including EV, eVTOL and marine applications. • Autonomous Driving Research: • Conduct preliminary research on end - to - end autonomous driving using large - scale models and world models. • Define the autonomous driving technology roadmap for the FX series and next - generation production models. • U.S. Regulatory Compliance: • Develop a unified, phased implementation plan for intelligent systems (including smart cabin and autonomous driving) to meet U.S. market compliance requirements. • Deliver the first iteration of these systems in the in FX product lineup. X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 13 © 2024 FARADAYFUTURE Faraday Future Intelligent Electric Inc. (Nasdaq: FFAI) Appendix March 27, 2025 X © 2024 FARADAYFUTURE

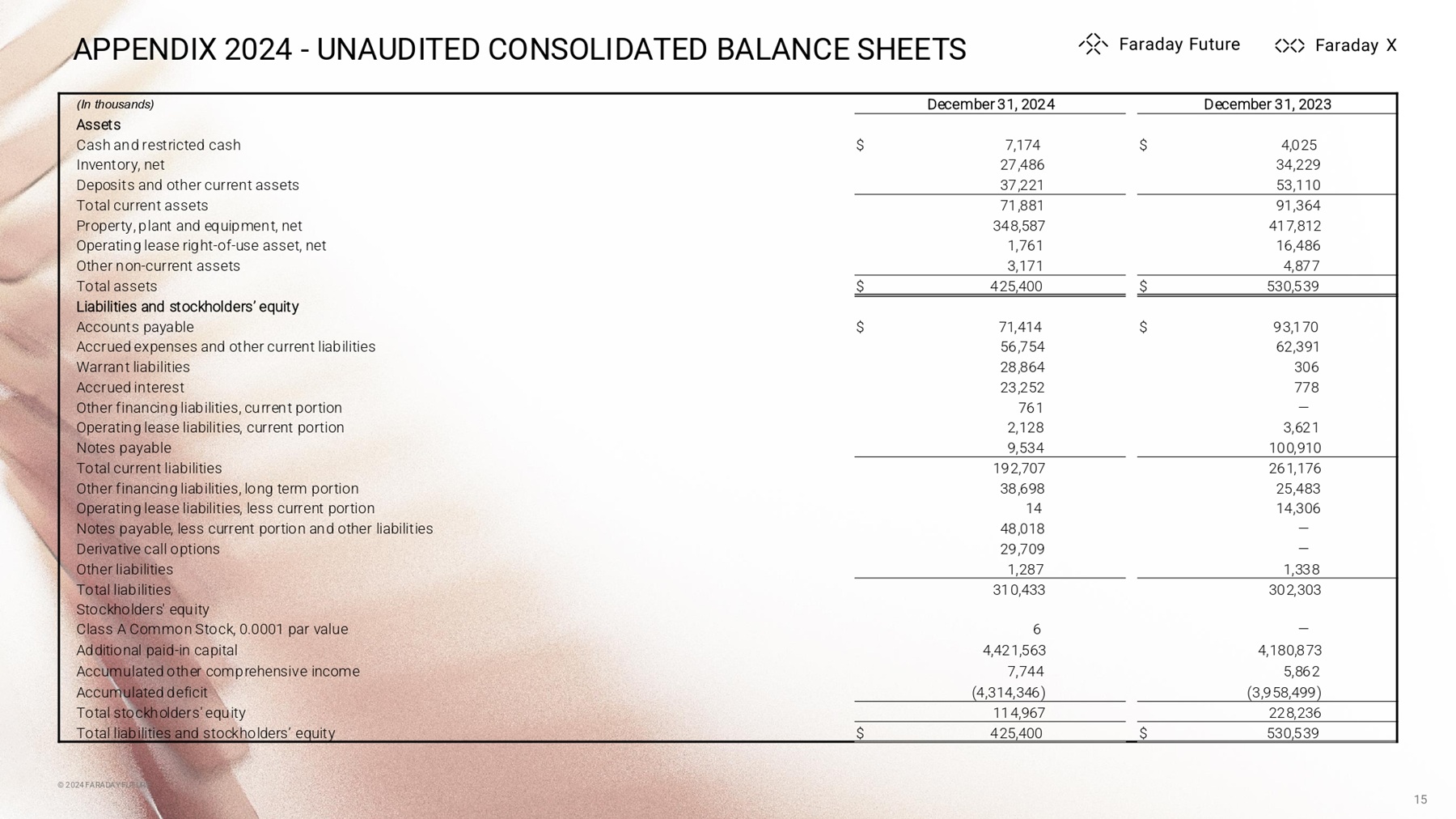

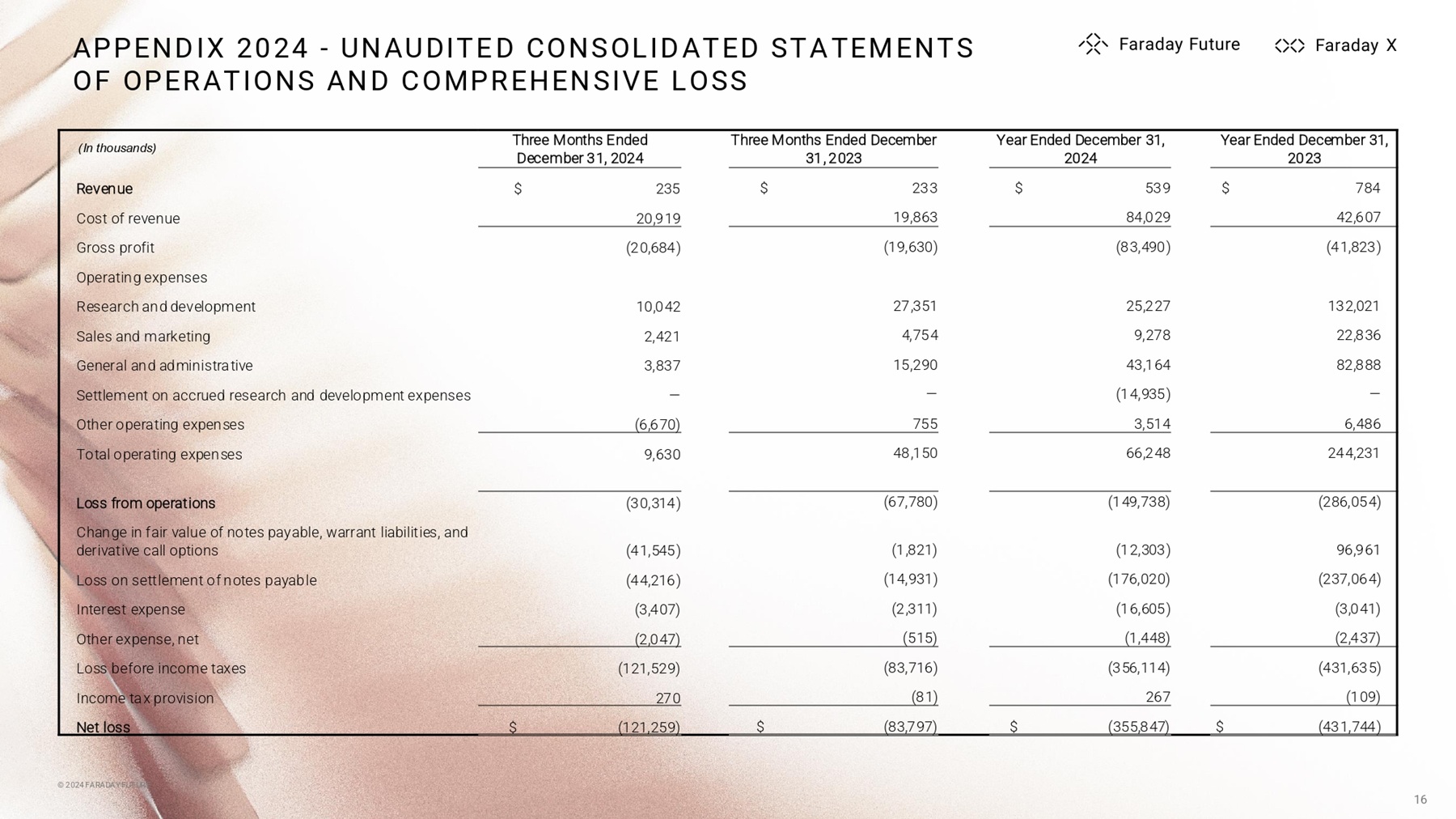

APPENDIX 2024 - UNAUDITED CONSOLIDATED BALANCE SHEETS December 31, 2023 December 31, 2024 (In thousands) Assets $ 4,025 $ 7,174 Cash and restricted cash 34,229 27,486 Inventory, net 53,110 37,221 Deposits and other current assets 91,364 71,881 Total current assets 417,812 348,587 Property, plant and equipment, net 16,486 1,761 Operating lease right - of - use asset, net 4,877 3,171 Other non - current assets $ 530,539 $ 425,400 Total assets Liabilities and stockholders’ equity $ 93,170 $ 71,414 Accounts payable 62,391 56,754 Accrued expenses and other current liabilities 306 28,864 Warrant liabilities 778 23,252 Accrued interest — 761 Other financing liabilities, current portion 3,621 2,128 Operating lease liabilities, current portion 100,910 9,534 Notes payable 261,176 192,707 Total current liabilities 25,483 38,698 Other financing liabilities, long term portion 14,306 14 Operating lease liabilities, less current portion — 48,018 Notes payable, less current portion and other liabilities — 29,709 Derivative call options 1,338 1,287 Other liabilities 302,303 310,433 Total liabilities Stockholders' equity — 6 Class A Common Stock, 0.0001 par value 4,180,873 4,421,563 Additional paid - in capital 5,862 7,744 Accumulated other comprehensive income (3,958,499) (4,314,346) Accumulated deficit 228,236 114,967 Total stockholders' equity $ 530,539 $ 425,400 Total liabilities and stockholders’ equity X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 15 Year Ended December 31, 2023 Year Ended December 31, 2024 Three Months Ended December 31, 2023 Three Months Ended December 31, 2024 (In thousands) $ 784 $ 539 $ 233 $ 235 Revenue 42,607 84,029 19,863 20,919 Cost of revenue (41,823) (83,490) (19,630) (20,684) Gross profit Operating expenses 132,021 25,227 27,351 10,042 Research and development 22,836 9,278 4,754 2,421 Sales and marketing 82,888 43,164 15,290 3,837 General and administrative — (14,935) — — Settlement on accrued research and development expenses 6,486 3,514 755 (6,670) Other operating expenses 244,231 66,248 48,150 9,630 Total operating expenses (286,054) (149,738) (67,780) (30,314) Loss from operations 96,961 (12,303) (1,821) (41,545) Change in fair value of notes payable, warrant liabilities, and derivative call options (237,064) (176,020) (14,931) (44,216) Loss on settlement of notes payable (3,041) (16,605) (2,311) (3,407) Interest expense (2,437) (1,448) (515) (2,047) Other expense, net (431,635) (356,114) (83,716) (121,529) Loss before income taxes (109) 267 (81) 270 Income tax provision $ (431,744) $ (355,847) $ (83,797) $ (121,259) Net loss APPEND IX 20 24 - UNAU DITE D CONSOL ID ATED STA TEM ENTS OF OPER ATIONS AND C OMPR EHENSIVE L OSS X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 16

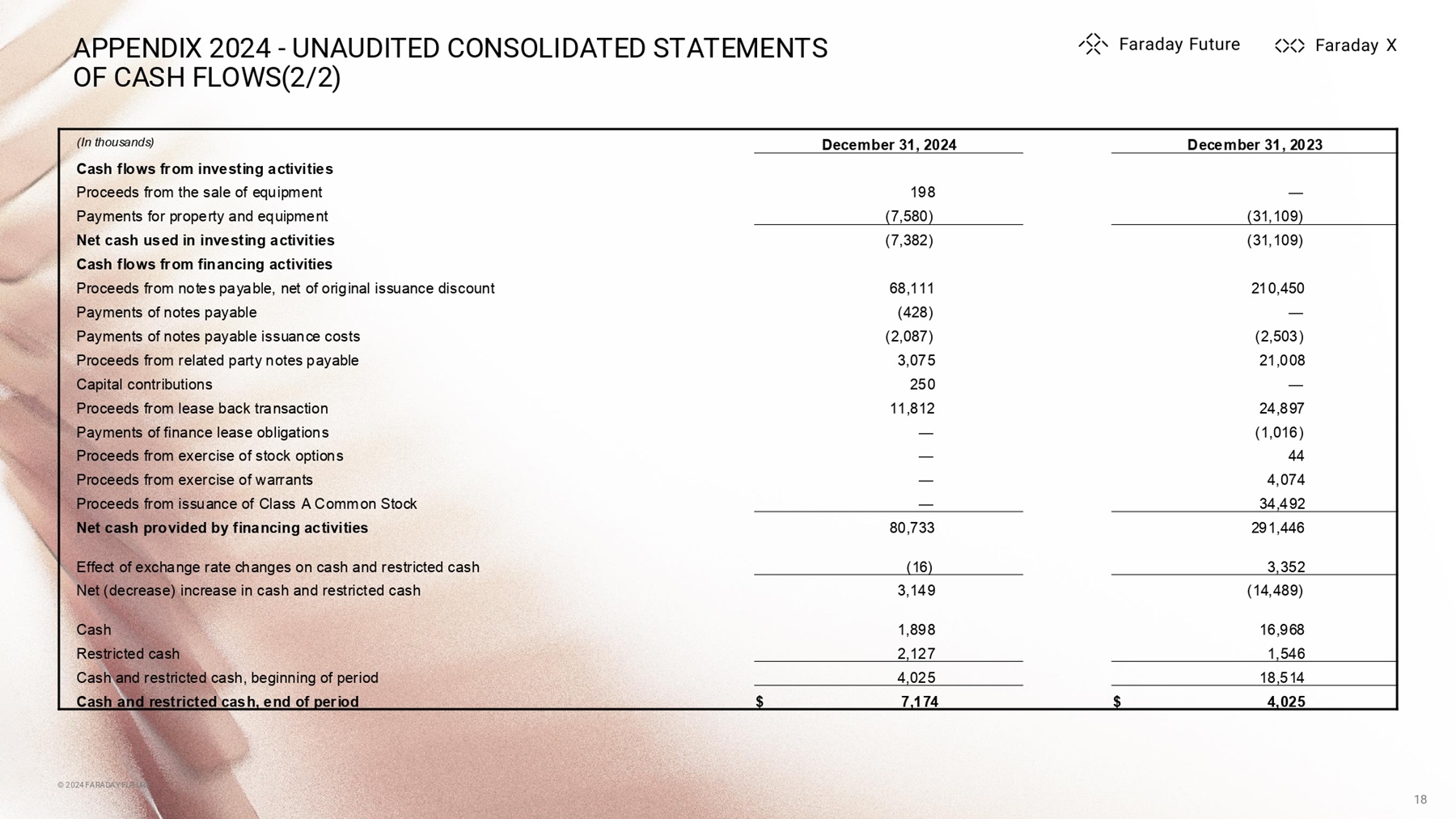

APPENDIX 2024 - UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS(1/2) December 31, 2023 December 31, 2024 (In thousands) Cash flows from operating activities $ (431,744) $ (355,847) Net loss Adjustments to reconcile net loss to net cash used in operating activities: 42,473 71,442 Depreciation and amortization expense 2,992 2,588 Amortization of operating lease right - of - use assets and intangible assets — 1,929 Non - cash interest expense 4,453 1,667 Loss on disposal of property, plant, and equipment — 476 Reserve on inventory 5,173 — Loss on lease impairment from leaseback arrangement — 1,847 Loss on lease impairment 9,167 8,382 Stock - based compensation 217,019 161,725 Loss on settlement of notes payable 20,045 14,295 Loss on settlement of related party notes payable — — Loss on forgiveness of accounts payable and deposits, net (2,068) — Gain on foreign exchange — (14,935) Gain on settlement on accrued research and development expenses (90,518) 15,058 Change in fair value of notes payable, warrant liabilities, and derivative call options (7,101) (253) Change in fair value of related party notes payable and related party warrant liabilities — — Change in fair value measurement of earnout liability 1,075 963 Other Changes in operating assets and liabilities: 14,337 (706) Deposits (29,772) 6,267 Inventory (2,884) 16,907 Other current and non - current assets 13,785 (8,804 㸧 Accounts payable (42,481) (1,573) Accrued expenses and other current and non - current liabilities 588 — Accrued interest expense — 8,710 Accrued related party interest expense — 2,876 Financial obligations on lease back transaction (2,717) (3,200) Operating lease liabilities $ (278,178) $ (70,186) Net cash used in operating activities X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 17 December 31, 2023 December 31, 2024 (In thousands) Cash flows from investing activities — 198 Proceeds from the sale of equipment (31,109) (7,580) Payments for property and equipment (31,109) (7,382) Net cash used in investing activities Cash flows from financing activities 210,450 68,111 Proceeds from notes payable, net of original issuance discount — (428) Payments of notes payable (2,503) (2,087) Payments of notes payable issuance costs 21,008 3,075 Proceeds from related party notes payable — 250 Capital contributions 24,897 11,812 Proceeds from lease back transaction (1,016) — Payments of finance lease obligations 44 — Proceeds from exercise of stock options 4,074 — Proceeds from exercise of warrants 34,492 — Proceeds from issuance of Class A Common Stock 291,446 80,733 Net cash provided by financing activities 3,352 (16) Effect of exchange rate changes on cash and restricted cash (14,489) 3,149 Net (decrease) increase in cash and restricted cash 16,968 1,898 Cash 1,546 2,127 Restricted cash 18,514 4,025 Cash and restricted cash, beginning of period $ 4,025 $ 7,174 Cash and restricted cash, end of period APPENDIX 2024 - UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS(2/2) X X © 2024 FARADAYFUTURE © 2024 FARADAYFUTURE 18

X APPENDIX 2024 KEY MOMENT SNAPSHOT © 2024 FARADAYFUTURE 19

Thank you for your time! See you next quarter X