UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March 2025

Commission File Number: 001-42484

ASCENTAGE PHARMA GROUP INTERNATIONAL

(Translation of Registrant’s name into English)

68 Xinqing Road

Suzhou Industrial Park

Suzhou, Jiangsu

China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

The information in this Report on Form 6-K (this “Report”) of Ascentage Pharma Group International (the “Company”), including Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

Press Release

On March 27, 2024, the Company issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2024 and a business update. A copy of the press release is furnished as Exhibit 99.1 to this Report.

Announcement

On March 27, 2025, the Company issued a Hong Kong Stock Exchange announcement entitled, “ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED DECEMBER 31, 2024”. A copy of the announcement is furnished as Exhibit 99.2 to this Report.

INDEX TO EXHIBITS

| Exhibit Number | Exhibit Title | |

| 99.1 | Press Release dated March 27, 2025 | |

| 99.2 | Hong Kong Stock Exchange Announcement dated March 27, 2025 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ASCENTAGE PHARMA GROUP INTERNATIONAL | ||

| Date: March 27, 2025 | /s/ Dajun Yang | |

| Name: | Dajun Yang | |

| Title: | Chief Executive Officer | |

3

Exhibit 99.1

ASCENTAGE PHARMA REPORTS FULL YEAR 2024 UNAUDITED FINANCIAL RESULTS AND BUSINESS UPDATES

| ● | Revenue in 2024 increased 342% year-over-year to US$134.3 million (RMB980.7 million), attributable in part to Takeda’s option payment and strong sales growth of olverembatinib |

| ● | Sales of olverembatinib in China in 2024 increased 52% year-over-year to US$33.0 million |

| ● | Completion of U.S. initial public offering on Nasdaq in January 2025, resulting in US$132.5 million in net proceeds |

| ● | Lisaftoclax accepted for New Drug Application (NDA) review with Priority Review designation in China |

| ● | Ten registrational trials in progress, including two cleared by FDA |

| ● | English conference call and webcast at 8:00 am EDT / 8:00 pm HKT on March 27, 2025 and Chinese (Mandarin) investor event with simultaneous conference call and webcast at 9:30 am HKT on March 28, 2025 / 9:30 pm EDT on March 27, 2025 |

ROCKVILLE, MD and SUZHOU, China, March 27, 2025 – Ascentage Pharma Group International (Ascentage Pharma) (NASDAQ: AAPG; HKEX: 6855) (referred hereinto as “Ascentage Pharma,” the “Company,” “we,” “us” or “our”), a global, integrated biopharmaceutical company engaged in discovering, developing and commercializing therapies to address global unmet medical needs primarily in hematological malignancies, today reported its unaudited financial results for the year ended December 31, 2024, and provided updates on key clinical and commercial developments.

Dr. Dajun Yang, Chairman and Chief Executive Officer of Ascentage Pharma, said, “As we reflect on our achievements in 2024, I am delighted to report that Ascentage Pharma has made remarkable strides in advancing our mission to deliver innovative therapies to patients worldwide. The commercialization of olverembatinib in China has gained significant traction in 2024 and is poised for growth in 2025 as all approved indications of olverembatinib are now covered under China’s National Reimbursement Drug List (NRDL), markedly enhancing affordability and accessibility for patients across China.”

He continued, “Our momentum continued with the advancement of lisaftoclax. In November 2024, the New Drug Application (NDA) for lisaftoclax for the treatment of relapsed and/or refractory chronic lymphocytic leukemia (R/R CLL) and small lymphocytic lymphoma (SLL) was accepted by the Center of Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA) with Priority Review designation. This acceptance marks a pivotal step toward bringing this novel therapy to patients in need.”

“Our clinical development programs also achieved significant progress over the past year. In February 2024, olverembatinib received clearance by the U.S. Food and Drug Administration (FDA) to initiate a global registrational Phase III clinical trial (POLARIS-2), for patients with Chronic Myeloid Leukemia in Chronic Phase (CML-CP) with or without T315I mutation who have previously failed tyrosine kinase inhibitor (TKI) treatment. In 2024, we also received clearance to commence two registrational Phase III clinical trials for APG-2449, a focal adhesion kinase (FAK), third generation anaplastic lymphoma kinase (ALK) and receptor tyrosine kinase C-ros oncogene 1 (ROS1) inhibitor, for treatment of patients with non-small cell lung cancer (NSCLC). At the moment, we are conducting ten global registrational trials, including two that were cleared by the FDA, for our three late-stage products, olverembatinib, lisaftoclax and APG-2449. These milestones highlight our commitment to addressing unmet medical needs through rigorous clinical innovation.”

“We believe Ascentage Pharma is on a transformative path to becoming a global leader in oncology innovation. The commercialization of olverembatinib in China, the progress of lisaftoclax, the continued development of our other clinical-stage small molecule drug assets, and our strategic agreement with Takeda Pharmaceuticals International AG (Takeda) reflect the strength of our pipeline and our ability to execute on our goals. In 2025, we remain focused on accelerating the development and delivery of life-changing therapies, expanding our global footprint, and creating sustainable value for all stakeholders.”

Key Business and Pipeline Updates

Olverembatinib (HQP1351), a novel, next-generation TKI and the first third-generation BCR-ABL1 TKI, has been approved in China for treatment of patients with CML-CP or Chronic Myeloid Leukemia in Accelerated Phase (CML-AP) with T315I mutations and CML-CP that is resistant and/or intolerant to first and second-generation TKIs.

Commercial progress

| ● | Revenue from sales of olverembatinib in China was US$33.0 million for the year ended December 31, 2024, compared to US$21.9 million for the year ended December 31, 2023, which represented an increase of US$11.1 million, or 52%. As of December 31, 2024, the number of direct-to-pharmacy (DTP) pharmacies and hospitals where olverembatinib is on formulary reached 734. In particular, the number of hospitals where olverembatinib is on formulary increased 86% compared to December 31, 2023. |

| ● | In November 2024, a new indication – adult patients with CML-CP resistant and/or intolerant of first-and second-generation TKIs – for olverembatinib was included in China’s NRDL through the simplified contract renewal procedure. Concurrently, the contracts for indications of olverembatinib which has been included China’s NRDL since 2022 were renewed successfully. The current indications of olverembatnib eligible for reimbursement includes adult patients with CML-CP or CML-AP with T315I mutation, and adult patients with CML-CP that are resistant and/or intolerant of first-and second-generation TKIs. |

Clinical progress

| ● | After receiving clearance from the CDE of China’s NMPA in May 2024, we commenced enrollment in a registrational Phase III clinical trial of olverembatinib for the treatment of patients with succinate dehydrogenase (SDH)-deficient gastrointestinal stromal tumor (GIST) who have failed prior systemic treatment (POLARIS-3). |

| ● | After receiving clearance from the FDA in February 2024, we commenced enrollment in a registrational Phase III clinical trial of olverembatinib for previously treated CML-CP patients, both with and without T315I mutation (POLARIS-2). |

| ● | We continue enrollment in a registrational Phase III clinical trial of olverembatinib in combination with chemotherapy versus imatinib in combination with chemotherapy in patients with newly diagnosed Philadelphia chromosome-positive ALL (Ph+ ALL) (POLARIS-1). |

| ● | We obtained Breakthrough Therapy Designation (BTD) for olverembatinib in March 2025 from the CDE of China’s NMPA for combination with low-intensity chemotherapy for the first-line treatment of newly-diagnosed patients with Ph+ ALL. |

Anticipated progress

| ● | We plan to seek clearance from the FDA to initiate a registrational Phase III clinical trial in newly diagnosed Ph+ ALL patients. |

Lisaftoclax (APG-2575) is a novel, oral Bcl-2 inhibitor developed to treat a variety of hematologic malignancies and solid tumors by selectively blocking Bcl-2 to restore the normal apoptosis process in cancer cells.

Regulatory progress

| ● | NDA for lisaftoclax monotherapy for the treatment of R/R CLL or small SLL was accepted with Priority Review designation by the CDE of China’s NMPA in November 2024. |

Clinical progress

| ● | After lisaftoclax received initial clearance by the CDE of China’s NMPA in May 2024, we commenced enrollment of patients in a global, multicenter, registrational Phase III clinical trial of lisaftoclax in combination with azacitidine for the treatment of patients who are newly diagnosed with higher risk (HR) myelodysplastic syndrome (MDS) (GLORA-4). |

| ● | We continue enrollment in a global registrational Phase III clinical trial of lisaftoclax for the treatment of newly diagnosed old or unfit patients with acute myeloid leukemia (AML) (GLORA-3). |

| ● | We continue enrollment in a global registrational Phase III clinical trial to evaluate lisaftoclax in combination with the BTK inhibitor acalabrutinib, versus immunochemotherapy in treatment-naïve patients with CLL/SLL (GLORA-2) to validate a fixed duration of combination regimen as a first-line treatment. |

| ● | We continue enrollment in a global registrational Phase III clinical trial of lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors (GLORA). |

| ● | We continue Phase 1b/2 clinical trials of lisaftoclax in combination therapies for the treatment of patients with multiple myeloma (MM) in China and the United States. |

Anticipated progress

| ● | We plan to seek clearance from the FDA to initiate a registrational Phase III clinical trial for the treatment of patients who are newly diagnosed with HR MDS. |

APG-2449 is a novel, orally active, small-molecule FAK, the third generation of ALK and receptor tyrosine kinase ROS1 triple ligase TKI.

Clinical progress

| ● | APG-2449 was cleared by the CDE of NMPA in October 2024 to initiate two registrational Phase III clinical trials to evaluate APG-2449 in patients with NSCLC who are either resistant to or intolerant of second-generation ALK TKIs or treatment-naïve patients with ALK-positive advanced or locally advanced NSCLC. |

Business Updates

| ● | We entered into an exclusive option agreement in June 2024 with Takeda (Exclusive Option Agreement), pursuant to which Ascentage Pharma granted Takeda an exclusive option to enter into an exclusive license for olverembatinib. If exercised, the Exclusive Option Agreement would allow Takeda to license global rights to develop and commercialize olverembatinib in all territories outside of China, Hong Kong, Macau, Taiwan and Russia. |

| ● | We received a US$100 million intellectual property income and option payment from Takeda in July 2024 under the Exclusive Option Agreement. |

| ● | We completed a US$75 million equity investment from Takeda in June 2024. |

| ● | We completed Ascentage Pharma’s U.S. initial public offering of American depositary shares in January 2025, resulting in net proceeds of US$132.5 million, after deducting underwriting discounts and commissions. |

Full Year 2024 Unaudited Financial Results

Revenue for the year ended December 31, 2024 was US$134.3 million, compared to US$30.5 million for the year ended December 31, 2023, which represented an increase of US$103.8 million, or 342%. The increase in revenue was primarily attributable to an option payment of US$100 million received in June 2024 from Takeda pursuant to the Exclusive Option Agreement, sales of olverembatinib of US$33.0 million, a 52% year-over-year increase, commercialization rights income from Innovent Biologics (Suzhou) Co., Ltd. and management fee income.

Selling and distribution expenses for the year ended December 31, 2024 were US$26.9 million, compared to US$26.8 million for the year ended December 31, 2023, which represented an increase of US$0.1 million, or 0.3%. The increase was attributable to selling and distribution expenses incurred in the commercialization of olverembatinib and other products.

Research and development expenses for the year ended December 31, 2024 were US$129.8 million, compared to

US$97.3 million for the year ended December 31, 2023, which represented an increase of US$32.5 million, or 34.0%. The increase was attributable to higher clinical research expenses.

Administrative expenses for the year ended December 31, 2024 were US$25.6 million, compared to US$24.9 million for the year ended December 31, 2023, which represented an increase of US$0.7 million, or 3.3%. The increase was due to the increase in the agency fees for the U.S. initial public offering.

Finance costs for the year ended December 31, 2024 were US$8.8 million, compared to US$13.2 million for the year ended December 31, 2023, which represented a decrease of US$4.4 million, or 32.9%. The decrease was due to the interest rate incurred in relation to bank borrowings.

Other expenses for the year ended December 31, 2024 were US$1.2 million, compared to US$0.7 million for the year ended December 31, 2023, which represented an increase of US$0.5 million, or 74.4%. The increase was primarily attributable to the increase in donation expenses.

Loss for the year ended December 31, 2024 was US$55.6 million, compared to US$127.4 million for the year ended December 31, 2023, which represented a decrease of US$71.8 million, or 56.2%. The loss per share attributable to ordinary equity holders was $0.18 per ordinary share for the year ended December 31, 2024, compared to $0.45 per ordinary share for the year ended December 31, 2023.

Cash and bank balances for the year ended December 31, 2024 were US$172.8 million, compared to US$150.5 million for the year ended December 31, 2023, which represented an increase by US$22.3 million, or 15.3%. The increase was primarily due to the US$100.0 million intellectual property income and option payment under the Exclusive Option Agreement and US$75.0 million equity investment from Takeda. Part of the Takeda option payment was treated as intellectual property income.

Following our initial public offering in January 2025, which resulted in net proceeds of $132.5 million, as of March 27, 2025, we believe that these net proceeds, together with our existing cash and cash equivalents, our loan facilities, future sales and other potential payments, will enable us to fund our operating expenses and capital expenditure requirements through 2027.

Statement Regarding Unaudited Financial Information

This press release includes unaudited annual financial information as of and for the year ended December 31, 2024, which has not been audited or reviewed by the Company’s auditors. The unaudited information for the year ended December 31, 2024, is preliminary, based on the information available at this time and subject to changes in connection with the completion of the audit of the Company’s financial statements. As such, the Company’s actual results and financial condition as reflected in the financial statements that will be included in the Company’s Annual Report on Form 20-F for the year ended December 31, 2024, may be adjusted or presented differently from the financial information herein and the variations could be material. The unaudited consolidated financial statements include the accounts of the Company and its subsidiaries. All periods presented have been accounted for in conformity with IFRS accounting standard and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”).

Currency and Exchange Rate Information

Unless otherwise indicated, translations from RMB to U.S. dollars for 2024 and 2023 are made at RMB7.2993 to US$1.00 and RMB 7.2672 to US$1.00, representing the noon buying rate in the City of New York, as certified by the Federal Reserve Bank of New York, on December 31, 2024 and June 28, 2024, respectively. Ascentage Pharma makes no representation that the RMB or U.S. dollar amounts referred to in this press release could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Conference Call

Ascentage Pharma will be holding a conference call and audio webcast presentation to discuss its full-year results.

The English conference call and webcast will be held at 8:00 am EDT / 8:00 pm HKT on March 27, 2025. To access the English conference call, please register in advance here to obtain a local or toll-free phone number and your personal identification number. A live webcast of the English conference call will be available at: Full Year 2024 Financial Results.

Ascentage Pharma will host a Chinese (Mandarin) investor event at 9:30 am HKT on Friday, March 28, 2025 / 9:30 pm EDT on Thursday, March 27, 2025, which will also be available simultaneously via conference call and webcast. To access the Chinese investor event or conference call, please register in advance here.

The webcast for both conference calls will continue to be accessible on Ascentage Pharma’s website at www.ascentage.com for 30 days.

About Ascentage Pharma

Ascentage Pharma is a global, integrated biopharmaceutical company engaged in discovering, developing and commercializing therapies to address global unmet medical needs primarily in hematological malignancies. Ascentage Pharma has been listed on the Main Board of the Stock Exchange of Hong Kong Limited with the stock code 6855.HK since October 2019 and has also been listed on the Nasdaq Global Market under the ticker symbol “AAPG” since January 2025.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, contained in this press release may be forward-looking statements, including statements that express Ascentage Pharma’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition. These forward-looking statements are subject to a number of risks and uncertainties as discussed in Ascentage Pharma’s filings with the SEC, including those set forth in the sections titled “Risk factors” and “Special note regarding forward-looking statements and industry data” in its final prospectus for its U.S. initial public offering, filed with the SEC on January 24, 2025, and other filings with the SEC that the Company made or makes from time to time, and with respect to non-U.S. investors only, the sections headed “Forward-looking Statements” and “Risk Factors” in the prospectus of the Company for its Hong Kong initial public offering dated October 16, 2019, and other filings with The Stock Exchange of Hong Kong Limited it has made or it makes from time to time that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements contained in this presentation do not constitute profit forecast by the Company’s management.

As a result of these factors, you should not rely on these forward-looking statements as predictions of future events. The forward-looking statements contained in this press release are based on Ascentage Pharma’s current expectations and beliefs concerning future developments and their potential effects and speak only as of the date of such statements. Ascentage Pharma does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact Information

Investor Relations:

Hogan Wan, Head of IR and Strategy

Ascentage Pharma

Hogan.Wan@ascentage.com

+86 512 85557777

Stephanie Carrington

ICR Healthcare

Stephanie.Carrington@icrhealthcare.com

(646) 277-1282

Media Relations:

Sean Leous

ICR Healthcare

Sean.Leous@icrhealthcare.com

(646) 866-4012

Ascentage Pharma Group International

Consolidated statements of profit or loss

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollar (“US$“), except for number of shares and per share data)

| For the years ended December 31 | ||||||||||||||||

| 2022 | 2023 | 2024 | 2024 | |||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| REVENUE | ||||||||||||||||

| Intellectual property | - | - | 678,415 | 92,942 | ||||||||||||

| Products | 174,931 | 193,535 | 260,835 | 35,734 | ||||||||||||

| Others | 34,780 | 28,449 | 41,400 | 5,672 | ||||||||||||

| Total revenue | 209,711 | 221,984 | 980,650 | 134,348 | ||||||||||||

| Cost of sales | ||||||||||||||||

| Products | (18,926 | ) | (29,342 | ) | (27,031 | ) | (3,703 | ) | ||||||||

| Others | (3,072 | ) | (1,201 | ) | (2,054 | ) | (281 | ) | ||||||||

| Total cost of sales | (21,998 | ) | (30,543 | ) | (29,085 | ) | (3,984 | ) | ||||||||

| Gross profit | 187,713 | 191,441 | 951,565 | 130,364 | ||||||||||||

| Other income and gains | 66,972 | 59,316 | 57,359 | 7,858 | ||||||||||||

| Selling and distribution expenses | (157,421 | ) | (195,387 | ) | (195,998 | ) | (26,852 | ) | ||||||||

| Administrative expenses | (170,595 | ) | (181,076 | ) | (187,125 | ) | (25,636 | ) | ||||||||

| Research and development expenses | (743,104 | ) | (706,972 | ) | (947,245 | ) | (129,772 | ) | ||||||||

| Other expenses | (17,674 | ) | (5,203 | ) | (9,075 | ) | (1,243 | ) | ||||||||

| Finance costs | (52,785 | ) | (96,057 | ) | (64,455 | ) | (8,830 | ) | ||||||||

| Share of (loss)/profit of a joint venture | (278 | ) | 1,076 | (281 | ) | (38 | ) | |||||||||

| LOSS BEFORE TAX | (887,172 | ) | (932,862 | ) | (395,255 | ) | (54,149 | ) | ||||||||

| Income tax credit/(expense) | 4,248 | 7,150 | (10,425 | ) | (1,428 | ) | ||||||||||

| LOSS FOR THE YEAR | (882,924 | ) | (925,712 | ) | (405,680 | ) | (55,577 | ) | ||||||||

| Attributable to: | ||||||||||||||||

| Ordinary equity holders of the Company | (882,924 | ) | (925,637 | ) | (405,433 | ) | (55,543 | ) | ||||||||

| Non-controlling interests | - | (75 | ) | (247 | ) | (34 | ) | |||||||||

| (882,924 | ) | (925,712 | ) | (405,680 | ) | (55,577 | ) | |||||||||

| LOSS PER SHARE ATTRIBUTABLE TO ORDINARY EQUITY HOLDERS OF THE COMPANY | ||||||||||||||||

| Basic and diluted | (3.35 | ) | (3.28 | ) | (1.34 | ) | (0.18 | ) | ||||||||

Ascentage Pharma Group International

Consolidated statements of comprehensive loss

(Amounts in thousands of Renminbi and U.S. dollar, except for number of shares and per share data)

| For the years ended December 31 | ||||||||||||||||

| 2022 | 2023 | 2024 | 2024 | |||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| LOSS FOR THE YEAR | (882,924 | ) | (925,712 | ) | (405,680 | ) | (55,577 | ) | ||||||||

| OTHER COMPREHENSIVE INCOME | ||||||||||||||||

| Other comprehensive income that may be reclassified to profit or loss in subsequent periods, net of tax: | ||||||||||||||||

| Exchange differences on translation of foreign operations | 25,832 | 20,593 | 2,829 | 388 | ||||||||||||

| Other comprehensive income that will not be reclassified to profit or loss in subsequent periods, net of tax: | ||||||||||||||||

| Exchange differences on translation of non-foreign operations | 35,665 | 5,666 | 4,120 | 564 | ||||||||||||

| OTHER COMPREHENSIVE INCOME FOR THE YEAR, NET OF TAX | 61,497 | 26,259 | 6,949 | 952 | ||||||||||||

| TOTAL COMPREHENSIVE LOSS FOR THE YEAR | (821,427 | ) | (899,453 | ) | (398,731 | ) | (54,625 | ) | ||||||||

| Attributable to: | ||||||||||||||||

| Ordinary equity holders of the Company | (821,427 | ) | (899,378 | ) | (398,484 | ) | (54,592 | ) | ||||||||

| Non-controlling interests | - | (75 | ) | (247 | ) | (34 | ) | |||||||||

| (821,427 | ) | (899,453 | ) | (398,731 | ) | (54,625 | ) | |||||||||

Ascentage Pharma Group International

Consolidated statements of financial position

(Amounts in thousands of Renminbi and U.S. dollar, except for number of shares and per share data)

| As at December 31 | ||||||||||||

| 2023 | 2024 | 2024 | ||||||||||

| RMB | RMB | US$ | ||||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| NON-CURRENT ASSETS | ||||||||||||

| Property, plant and equipment | 905,815 | 849,450 | 116,374 | |||||||||

| Right-of-use assets | 51,252 | 56,109 | 7,687 | |||||||||

| Goodwill | 24,694 | 24,694 | 3,383 | |||||||||

| Other intangible assets | 85,446 | 75,998 | 10,412 | |||||||||

| Investment in a joint venture | 16,998 | 32,717 | 4,482 | |||||||||

| Financial assets at fair value through profit or loss (“FVTPL”) | 1,951 | 1,141 | 156 | |||||||||

| Deferred tax assets | 59,842 | 44,236 | 6,060 | |||||||||

| Other non-current assets | 10,217 | 59,303 | 8,125 | |||||||||

| Total non-current assets | 1,156,215 | 1,143,648 | 156,679 | |||||||||

| CURRENT ASSETS | ||||||||||||

| Inventories | 16,167 | 6,597 | 904 | |||||||||

| Trade receivables, net | 145,893 | 83,143 | 11,390 | |||||||||

| Prepayments, other receivables and other assets | 88,285 | 123,211 | 16,880 | |||||||||

| Cash and bank balances | 1,093,833 | 1,261,211 | 172,785 | |||||||||

| Total current assets | 1,344,178 | 1,474,162 | 201,959 | |||||||||

| CURRENT LIABILITIES | ||||||||||||

| Trade payables | 72,445 | 91,966 | 12,599 | |||||||||

| Other payables and accruals | 206,914 | 258,098 | 35,360 | |||||||||

| Contract liabilities | 38,410 | 37,485 | 5,135 | |||||||||

| Interest-bearing bank and other borrowings | 616,404 | 779,062 | 106,731 | |||||||||

| Total current liabilities | 934,173 | 1,166,611 | 159,825 | |||||||||

| NET CURRENT ASSETS | 410,005 | 307,551 | 42,134 | |||||||||

| TOTAL ASSETS LESS CURRENT LIABILITIES | 1,566,220 | 1,451,199 | 198,813 | |||||||||

| NON-CURRENT LIABILITIES | ||||||||||||

| Contract liabilities | 251,189 | 248,460 | 34,039 | |||||||||

| Interest-bearing bank and other borrowings | 1,179,191 | 889,435 | 121,852 | |||||||||

| Deferred tax liabilities | 10,549 | 5,368 | 735 | |||||||||

| Long-term payables | 18,299 | - | - | |||||||||

| Deferred income | 36,360 | 27,500 | 3,767 | |||||||||

| Other non-current liabilities | - | 6,274 | 860 | |||||||||

| Total non-current liabilities | 1,495,588 | 1,177,037 | 161,253 | |||||||||

| TOTAL LIABILITIES | 2,429,761 | 2,343,648 | 321,078 | |||||||||

| EQUITY | ||||||||||||

| Equity attributable to ordinary equity holders of the Company | ||||||||||||

| Ordinary shares (par value of US$0.0001 per share as of December 31, 2023 and 2024; 290,196,560 and 315,224,993 shares authorized, issued and outstanding as of December 31, 2023 and 2024, respectively) | 197 | 214 | 29 | |||||||||

| Treasury shares | (21,351 | ) | (8 | ) | (1 | ) | ||||||

| Share premium | 5,951,154 | 6,545,129 | 896,679 | |||||||||

| Capital and reserves | (371,441 | ) | (384,515 | ) | (52,678 | ) | ||||||

| Exchange fluctuation reserve | (133,020 | ) | (126,071 | ) | (17,272 | ) | ||||||

| Accumulated losses | (5,365,122 | ) | (5,770,555 | ) | (790,563 | ) | ||||||

| 60,417 | 264,194 | 36,194 | ||||||||||

| Non-controlling interests | 10,215 | 9,968 | 1,366 | |||||||||

| Total equity | 70,632 | 274,162 | 37,560 | |||||||||

Exhibit 99.2

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

ASCENTAGE PHARMA GROUP INTERNATIONAL

亞盛醫藥集團

(Incorporated in the Cayman Islands with limited liability)

(Stock Code: 6855)

ANNOUNCEMENT OF ANNUAL RESULTS FOR

THE YEAR ENDED DECEMBER 31, 2024

| ● | Revenue in 2024 increased 342% year-over-year to RMB980.7 million, attributable in part to Takeda’s option payment and strong sales growth of olverembatinib |

| ● | Sales of olverembatinib in China in 2024 increased 52% year-over-year to RMB241.0 million |

| ● | Completion of U.S. initial public offering on Nasdaq in January 2025, resulting in US$132.5 million in net proceeds |

| ● | Lisaftoclax accepted for New Drug Application (NDA) review with Priority Review designation in China |

| ● | Ten registrational trials in progress, including two cleared by FDA |

| ● | English conference call and webcast at 8:00 am EDT / 8:00 pm HKT on March 27, 2025, and Chinese (Mandarin) investor event with simultaneous conference call and webcast at 9:30 am HKT on March 28, 2025 / 9:30 pm EDT on March 27, 2025 |

ROCKVILLE, MD, USA and SUZHOU, China, March 27, 2025 – Ascentage Pharma Group International (Ascentage Pharma) (NASDAQ: AAPG; HKEX: 6855) (referred hereinto as “Ascentage Pharma,” the “Company,” the “Group,” “we,” “us” or “our”), a global, integrated biopharmaceutical company engaged in discovering, developing and commercializing therapies to address global unmet medical needs primarily in hematological malignancies, today reported its unaudited financial results for the year ended December 31, 2024, and provided updates on key clinical and commercial developments.

Dr. Dajun Yang, Chairman and Chief Executive Officer of Ascentage Pharma, said, “As we reflect on our achievements in 2024, I am delighted to report that Ascentage Pharma has made remarkable strides in advancing our mission to deliver innovative therapies to patients worldwide. The commercialization of olverembatinib has gained significant traction in 2024 and is poised for growth in 2025 as all approved indications of olverembatinib are now covered under China’s National Reimbursement Drug List (NRDL), markedly enhancing affordability and accessibility for patients across China.”

He continued, “Our momentum continued with the advancement of lisaftoclax. In November 2024, the NDA for lisaftoclax for the treatment of relapsed and/or refractory chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL) was accepted by the Center of Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA) with Priority Review designation. This acceptance marks a pivotal step toward bringing this novel therapy to patients in need.”

“Our clinical development programs also achieved significant progress over the past year. In February 2024, olverembatinib received clearance by the U.S. Food and Drug Administration (FDA) to initiate a global registrational Phase III clinical trial (POLARIS-2), for patients with Chronic Myeloid Leukemia in Chronic Phase (CML-CP) with or without T315I mutation who have previously failed tyrosine kinase inhibitor (TKI) treatment. In 2024, we also received clearance to commence two registrational Phase III clinical trials for APG-2449, a focal adhesion kinase (FAK), third generation anaplastic lymphoma kinase (ALK) and receptor tyrosine kinase C-ros oncogene 1 (ROS1) inhibitor, for treatment of patients with non-small cell lung cancer (NSCLC). At the moment, we are conducting ten registrational trials, including two that were cleared by the FDA, for our three late-stage products, olverembatinib, lisaftoclax and APG-2449. These milestones highlight our commitment to addressing unmet medical needs through rigorous clinical innovation.”

“We believe Ascentage Pharma is on a transformative path to becoming a global leader in oncology innovation. The commercialization of olverembatinib in China, the progress of lisaftoclax, the continued development of our other clinical-stage small molecule drug assets, and our strategic agreement with Takeda Pharmaceuticals International AG (Takeda) reflect the strength of our pipeline and our ability to execute on our goals. In 2025, we remain focused on accelerating the development and delivery of life-changing therapies, expanding our global footprint, and creating sustainable value for all stakeholders.”

FINANCIAL HIGHLIGHTS

Revenue for the year ended December 31, 2024 increased to RMB980.7 million compared to RMB222.0 million for the year ended December 31, 2023, representing an increase of RMB758.7 million, or 342%. It was primarily attributable to the intellectual property income from Takeda and the rise in sales of pharmaceutical products. For the year ended December 31, 2024, revenue was generated from the option payment from Takeda, the sales of pharmaceutical products, commercialization rights income from Innovent Suzhou and service income.

Selling and distribution expenses of the Group increased by RMB0.6 million or 0.3%, to RMB196.0 million for the year ended December 31, 2024, as compared to RMB195.4 million for the year ended December 31, 2023. The slight increase was attributable to the increase in selling and distribution expenses incurred in the commercialization of olverembatinib and other products.

Research and development expenses of the Group increased by RMB240.3 million, or 34.0%, to RMB947.2 million for the year ended December 31, 2024, from RMB707.0 million for the year ended December 31, 2023. The increase was attributable to the increase in clinical research expenses.

Administrative expenses of the Group increased by RMB6.0 million, or 3.3%, to RMB187.1 million for the year ended December 31, 2024, from RMB181.1 million for the year ended December 31, 2023. It was mainly due to the increase in the agency fee for US IPO.

Finance costs of the Group decreased by RMB31.6 million, or 32.9%, to RMB64.5 million for the year ended December 31, 2024, from RMB96.1 million for the year ended December 31, 2023. It was due to the decrease of the interest rate incurred in relation to bank borrowings.

For the year ended December 31, 2024, the Group reported other expenses of RMB9.1 million, as compared to other expenses of RMB5.2 million for the year ended December 31, 2023, which represented an increase of RMB3.9 million, or 74.4%. The increase was primarily attributable to the increase in donation expenses from RMB4.0 million for the year ended December 31, 2023 to RMB6.3 million for the year ended December 31, 2024.

As a result of the foregoing, the loss of the Group decreased by RMB520.0 million, or 56.2%, to RMB405.7 million for the year ended December 31, 2024, from RMB925.7 million for the year ended December 31, 2023.

For the year ended December 31, 2024, the Group’s cash and bank balances were RMB1,261.2 million, which increased by RMB167.4 million, or 15.3%, when compared with RMB1,093.8 million as at December 31, 2023. It was mainly due to cash inflow of US$100.0 million from Takeda related to intellectual property income and option payment under the Exclusive Option Agreement and US$75.0 million from the 2024 Share Subscription of Takeda.

Following our initial public offering on Nasdaq in January 2025, which resulted in net proceeds of US$132.5 million, after deducting underwriting discounts and commissions, as of March 27, 2025, we believe that these net proceeds, together with our existing cash and cash equivalents, our loan facilities, future sales and other potential payments, will enable us to fund our operating expenses and capital expenditure requirements through 2027.

BUSINESS HIGHLIGHTS

Commercialization of olverembatinib and acceptance of NDA of lisaftoclax in China

| ● | Revenue from sales of olverembatinib in China was RMB241.0 million for the year ended December 31, 2024, compared to RMB159.0 million for the year ended December 31, 2023, which represented an increase of RMB82.0 million, or 52%. As of December 31, 2024, the number of direct-to-pharmacy (DTP) pharmacies and hospitals where olverembatinib is on formulary reached 734. In particular, the number of hospitals where olverembatinib is on formulary increased 86% compared to December 31, 2023. |

| ● | In November 2024, a new indication – adult patients with CML-CP resistant and/or intolerant of first-and second-generation TKIs – for olverembatinib was included in China’s NRDL through the simplified contract renewal procedure. Concurrently, the contracts for indications of olverembatinib which has been included China’s NRDL since 2022 were renewed successfully. The current indications of olverembatnib eligible for reimbursement includes adult patients with CML-CP or CML-AP with T315I mutation, and adult patients with CML-CP that are resistant and/or intolerant of first-and second-generation TKIs. |

| ● | In November 2024, the NDA of lisaftoclax (APG-2575) for the treatment of relapsed and/ or refractory, or r/r, CLL and SLL, was accepted with priority review designation by the CDE of China’s NMPA. |

Exclusive option agreement with Takeda and equity investment

| ● | We entered into an exclusive option agreement in June 2024 with Takeda (Exclusive Option Agreement), pursuant to which Ascentage Pharma granted Takeda an exclusive option to enter into an exclusive license for olverembatinib. If exercised, the Exclusive Option Agreement would allow Takeda to license global rights to develop and commercialize olverembatinib in all territories outside of the PRC, Hong Kong, Macau, Taiwan and Russia. |

| ● | We received a US$100 million option payment from Takeda in June 2024 under the Exclusive Option Agreement, which is characterized in substantial part as intellectual property income. |

| ● | We completed a US$75 million equity investment from Takeda in June 2024. |

Clearance of registrational phase III trials for olverembatinib, lisaftoclax and APG-2449

| ● | In May 2024, olverembatinib received clearance from the CDE of China’s NMPA for a registrational Phase III trial of olverembatinib, in patients with succinate dehydrogenase (SDH)-deficient gastrointestinal stromal tumor (GIST) who had failed prior systemic treatment (POLARIS-3). In February 2024, olverembatinib received clearance from the FDA to initiate a Phase III registrational trial in previously treated patients with CML-CP, both with and without the T315I mutation (POLARIS-2). |

| ● | In May 2024, lisaftoclax received clearance from the CDE of China’s NMPA for a multicenter, registrational Phase III study of lisaftoclax in combination with azacitidine in patients with newly diagnosed higher risk myelodysplastic syndrome (MDS) (GLORA-4). |

| ● | In October 2024, APG-2449 was cleared by the CDE of China’s NMPA to initiate two registrational Phase III clinical trials that will separately evaluate APG-2449 in patients with NSCLC who are resistant to or intolerant of second-generation ALK TKIs and treatment-naïve patients with ALK-positive advanced or locally advanced NSCLC. |

Chemistry, manufacturing and control

| ● | In 2024, the Suzhou manufacturing center completed the technical transfer and process validation campaign of olverembatinib tablets. At the same time, we obtained the updated version of the Drug Manufacturing License (including certificates A, B and C) and passed GMP compliance inspection conducted by Jiangsu Medical Products Administration which allows us to manufacture and supply olverembatinib tablets for global clinical trials and commercial sales in China market from Ascentage owned facility. |

For details of any of the foregoing, please refer to the rest of this announcement and, where applicable, the Group’s prior announcements published on the websites of the Stock Exchange and the Group.

MANAGEMENT DISCUSSION & ANALYSIS OVERVIEW

We are a global, integrated biopharmaceutical company engaged in discovering, developing and commercializing therapies to address global unmet medical needs primarily in hematological malignancies.

Our lead assets, olverembatinib and lisaftoclax, have global potential to address the major hematological malignancies, including chronic myeloid leukemia, or CML, acute myeloid leukemia, or AML, chronic lymphocytic leukemia, or CLL, acute lymphocytic leukemia, or ALL, myelodysplastic syndrome, or MDS, and multiple myeloma, or MM, which is expected to exceed US$166 billion in aggregate market size by 2035, according to an industry report commissioned by us and independently prepared by Frost & Sullivan, or the F&S Report.

Our first lead asset, olverembatinib, is a novel, next-generation TKI. Olverembatinib was the first BCR-ABL1 TKI approved in China for treatment of patients with CML in chronic phase, or CML-CP, with T315I mutations, CML in accelerated phase, or CML-AP, with T315I mutations, and CML-CP that is resistant and/or intolerant to first and second-generation TKIs. We are currently commercializing olverembatinib in China. All commercialized indications of olverembatinib have been included in the NRDL, in China beginning January 2025. In June 2024, we entered into an Exclusive Option Agreement with Takeda, pursuant to which we granted Takeda an exclusive option to enter into an exclusive license agreement for olverembatinib. If exercised, the Option would allow Takeda to license global rights to develop and commercialize olverembatinib in all territories outside of the PRC, Hong Kong, Macau, Taiwan and Russia.

Our second lead asset, lisaftoclax, is a novel Bcl-2 inhibitor that we are developing for the treatment of various hematological malignancies. In November 2024, our NDA for the treatment of r/r CLL/SLL was accepted with priority review designation by the CDE of China’s NMPA. According to the F&S Report, this NDA is the second NDA filed in the world for a Bcl-2 inhibitor and the first in China for a Bcl-2 inhibitor for the treatment of patients with CLL/SLL that are resistant or intolerant to Bruton’s tyrosine kinase, or BTK, inhibitors. If approved, we plan to launch in China in 2025 and pursue regulatory approvals in multiple countries.

Backed by our strong scientific foundation, knowledge of small molecule discovery and capabilities to conduct clinical trials worldwide, we use state-of-the-art technologies to develop innovative therapeutic agents to treat cancers and address unmet medical needs within this patient population. Our initial focus has been to leverage our expertise in chemistry to synthesize inhibitors targeting proteins and pathways that drive the key hallmarks of cancer. Earlier in our pipeline, we are harnessing our understanding of protein degraders to develop therapies, such as proteolysis targeting chimera molecules, or PROTACs, that target traditionally undruggable proteins that are implicated in oncogenesis.

We are empowered by our technical expertise in structure-based drug design and our innovative drug discovery engine, which allows us to address unmet medical needs by targeting key apoptotic pathways and validated tyrosine kinases. These core competencies have allowed us to develop small molecule and degrader therapies targeted at Bcl-2, Bcl-2/Bcl-xL, IAP and MDM2, in addition to building next-generation cell signaling inhibitors (i.e., BCR-ABL1, ALK, FAK inhibitors) and epigenome-modifying agents (i.e., EED inhibitor). We are the only company in the world with active clinical programs targeting all three known classes of key apoptosis regulators, according to the F&S Report. Beyond our two lead assets, we have several other clinical-stage assets in U.S. or international clinical trials.

Leveraging our robust internal research and development capabilities, we have built a portfolio of global intellectual property rights. We have also established collaborations and other relationships with leading biotechnology and pharmaceutical companies around the world, including a collaboration and license agreement with Innovent and clinical collaboration agreements with AstraZeneca, Merck & Co., and Pfizer Inc., and research and development relationships with leading research institutions, including but not limited to Dana-Farber Cancer Institute, Mayo Clinic, MD Anderson Cancer Center, National Cancer Institute and the University of Michigan. As of December 31, 2024, we had 541 issued patents globally, among which 379 issued patents were issued outside of China.

BUSINESS REVIEW

Product Pipeline

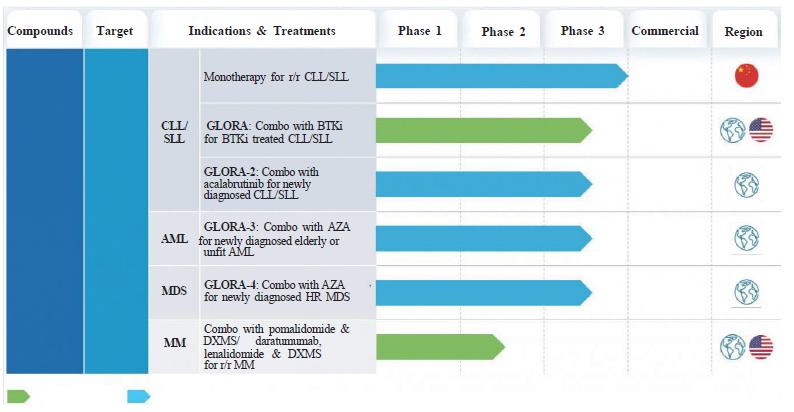

We have a pipeline of six clinical-stage small-molecule drug candidates. The following table summarizes our pipeline and the development status of each candidate as of December 31, 2024:

| (1) | Registrational Phase 2 trial completed, the NDA has been accepted with priority review designation by CDE of China’s NMPA. |

| (2) | Registrational trials for ongoing CLL/SLL, AML and MDS; Phase 2 trials ongoing for MM. |

| (3) | Two registrational trials ongoing for NSCLC; Phase 2 trials ongoing for ovarian cancer |

| (4) | The globe icon refers to trials that have received clearance, or for which we plan to obtain clearance, in two or more countries or regions. The U.S. flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted, currently conduct or plan to conduct only in China. |

| (5) | The globe icon indicates having global development and commercialization rights. |

Core Product Candidate

Olverembatinib (HQP1351)

Our first lead asset, olverembatinib, is a novel, next-generation TKI. Olverembatinib is the first third generation BCR-ABL1 TKI approved in China for treatment of patients with CML-CP with T315I mutations, CML-AP with T315I mutations and CML-CP that is resistant and/or intolerant to first and second-generation TKIs. Olverembatinib received support from the National Major New Drug Discovery and Manufacturing Program. Since January 2025, all approved indications of olverembatinib are covered by the China’s NRDL, which bolstered the affordability and accessibility of the drug in China.

Olverembatinib was included as an Emerging Treatment Option in the 2024 National Comprehensive Cancer Network USA, or NCCN, guidelines for the management of CML and received recommendation from the Chinese Society of Clinical Oncology, or CSCO, guideline for the treatment of CML and Ph+ ALL. As of the date of this announcement, the FDA has granted four ODDs to olverembatinib, including for CML, ALL, AML and GIST, and Fast-Track Designation for treatment of CML in patients with certain genetic markers who have failed to respond to prior TKIs. Olverembatinib was also granted an Orphan Designation by the European Medicines Agency, or EMA, for the treatment of CML.

The chart below summarizes the registrational trials completed or ongoing for olverembatinib:

| Note 1: | The globe icon as used in this table refers to trials that are currently taking place in at least 2 countries. The US flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted or currently conduct only in China. |

The recent progress of olverembatinib is as follows:

Commercial progress

| ● | Revenue from sales of olverembatinib in China was RMB241.0 million for the year ended December 31, 2024, compared to RMB159.0 million for the year ended December 31, 2023, which represented an increase of RMB82.0 million, or 52%. As of December 31, 2024, the number of DTP pharmacies and hospitals where olverembatinib is on formulary reached 734. In particular, the number of hospitals where olverembatinib is on formulary increased 86% compared to December 31, 2023. |

| ● | In November 2024, a new indication – adult patients with CML-CP resistant and/or intolerant of first-and second-generation TKIs – for olverembatinib was included in China’s NRDL through the simplified contract renewal procedure. Concurrently, the contracts for indications of olverembatinib which has been included China’s NRDL since 2022 were renewed successfully. The current indications of olverembatnib eligible for reimbursement includes adult patients with CML-CP or CML-AP with T315I mutation, and adult patients with CML- CP that are resistant and/or intolerant of first-and second-generation TKIs. |

| ● | In July 2024, olverembatinib was approved by the Pharmaceutical Administration Bureau (ISAF) of the Macau Special Administrative Region of the PRC for the treatment of adult patients with TKI-resistant CML-CP or CML-AP harboring the T315I mutation and adult patients with CML-CP resistant to and/or intolerant of first – and second-generation TKIs. |

| ● | In May 2024, olverembatinib was included in 2024 “CSCO guideline for Diagnosis and Treatment of Hematological Malignancies” guideline for the treatment of CML and Ph+ ALL. |

Clinical progress

| ● | After receiving clearance from the CDE of China’s NMPA in May 2024, we commenced enrollment in a registrational Phase III clinical trial of olverembatinib for the treatment of patients with SDH-deficient GIST who have failed prior systemic treatment (POLARIS-3). |

| ● | After receiving clearance from the FDA in February 2024, we commenced enrollment in a registrational Phase III clinical trial of olverembatinib for previously treated CML-CP patients, both with and without T315I mutation (POLARIS-2). |

| ● | We continue enrollment in a registrational Phase III clinical trial of olverembatinib in combination with chemotherapy versus imatinib in combination with chemotherapy in patients with newly diagnosed Philadelphia chromosome-positive ALL (Ph+ ALL) (POLARIS-1). |

| ● | We obtained Breakthrough Therapy Designation (BTD) for olverembatinib in March 2025 from the CDE of China’s NMPA for combination with low-intensity chemotherapy for the first-line treatment of newly-diagnosed patients with Ph+ ALL. |

Data publication

| ● | In December 2024, multiple clinical data of olverembatinib were presented at the 66th American Society of Hematology (ASH) Annual Meeting, including one oral presentation and seven poster presentations. The oral presentation showcased the latest clinical data of olverembatinib in the second-line treatment of patients with CML-CP, demonstrated that olverembatinib may be a safe and effective second-line therapy to patients with CML-CP, especially those who had failed on the second-generation TKIs as first-line treatment. This is the seventh consecutive year for studies of olverembatinib to be selected for oral presentation at the ASH Annual Meeting. |

| ● | On November 21, 2024, the data of a phase Ib multicenter clinical trial (NCT04260022) of olverembatinib was published in JAMA Oncology . The study aims to assess the pharmacokinetics, safety, efficacy, and recommended dose of olverembatinib in patients with CML or Ph+ALL resistant or intolerant to at least 2 TKIs. Among all evaluable patients with CML-CP, the complete cytogenetic response (CCyR) rate and the major molecular response (MMR) rate were approximately 61% and 42%, respectively. Cytogenetic and molecular responses were similar irrespective of the presence of the T315I mutation, which confers resistance against imatinib and all second-generation TKIs. In conclusion, olverembatinib had a favorable pharmacokinetic profile, was generally well tolerated, and showed strong antileukemic activity in patients with heavily pretreated chronic-phase CML with or without T315I variants, including prior ponatinib and/or asciminib failure. |

| ● | In June 2024, the updated results from three studies of olverembatinib in patients with CML and Ph+ ALL were presented as posters at the 2024 European Hematology Association Hybrid Congress (EHA 2024). |

| ● | In June 2024, we presented updated clinical data of olverembatinib, in patients with TKI-resistant SDH-deficient GIST, in an oral report at the 60th American Society of Clinical Oncology (ASCO) Annual Meeting. The oral report features the latest data that further validated the promising efficacy and manageable safety of olverembatinib in SDH-deficient GIST. This is the third consecutive year in which clinical data from this study of olverembatinib were selected for presentations at the ASCO Annual Meeting. |

| ● | In April 2024, we released updated clinical data of olverembatinib at the 2024 AACR annual meeting, demonstrating its superior antitumor activity in preclinical models of SDH-deficient neoplasms. |

The expected progress of olverembatinib is as follows:

| ● | We expect to continue to execute the registrational clinical trials, including POLARIS-2, POLARIS-1 and POLARIS-3. |

| ● | We plan to seek clearance from the FDA to initiate a registrational Phase III clinical trial in newly diagnosed Ph+ ALL patients. |

Key Product Candidates

Lisaftoclax (APG-2575)

Lisaftoclax is a novel, oral Bcl-2 inhibitor developed to treat a variety of hematologic malignancies and solid tumors by selectively blocking Bcl-2 to restore the normal apoptosis process in cancer cells. In November 2024, the NDA for lisaftoclax for the treatment of r/r CLL/SLL has been accepted with priority review designation by the CDE of China’s NMPA. According to the F&S Report, this NDA is the second NDA filed in the world for a Bcl-2 inhibitor and the first in China for a Bcl-2 inhibitor for the treatment of patients with CLL/SLL that are resistant or intolerant to Bruton’s tyrosine kinase, or BTK, inhibitors. Currently, lisaftoclax has received clearances and approvals for clinical studies in China, the United States, Australia, and Europe, with indications including CLL/SLL, non-Hodgkin’s lymphoma (NHL), AML, MM, Waldenström’s macroglobulinemia (WM), and certain solid tumors. Furthermore, FDA has granted five ODDs to lisaftoclax for the treatment of patients with follicular lymphoma (FL), WM, CLL, MM, or AML.

The chart below summarizes the registrational trials completed or ongoing for lisaftoclax:’

| Notes: | 1. | Registrational Phase 2 trial completed, with NDA submitted and accepted in 2024. |

| 2. | The globe icon as used in this table refers to trials that are currently taking place in at least 2 countries. The U.S. flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted or currently conduct only in China. |

The clinical development of lisaftoclax is as follows:

Clinical progress

| ● | After lisaftoclax received initial clearance by the CDE of China’s NMPA in May 2024, we commenced enrollment of patients in a global, multicenter, registrational Phase III clinical trial of lisaftoclax in combination with azacitidine for the treatment of patients who are newly diagnosed with higher risk MDS (GLORA-4). |

| ● | We continue enrollment in a global registrational Phase III clinical trial of lisaftoclax for the treatment of newly diagnosed old or unfit patients with AML (GLORA-3). |

| ● | We continue enrollment in a global registrational Phase III clinical trial to evaluate lisaftoclax in combination with the BTK inhibitor acalabrutinib, versus immunochemotherapy in treatment-naïve patients with CLL/SLL (GLORA-2) to validate a fixed duration of combination regimen as a first-line treatment. |

| ● | We continue enrollment in a global registrational Phase III clinical trial of lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors (GLORA). |

| ● | We continue Phase 1b/2 clinical trials of lisaftoclax in combination therapies for the treatment of patients with MM in China and the United States. |

| ● | Phase Ib/II studies of lisaftoclax as a single agent or in combinations for the treatment of patients with AML/MDS are ongoing in China. |

| ● | Phase Ib/II studies of lisaftoclax in combinations for the treatment of patients with AML/ MDS are also ongoing in the United States. |

| ● | A global Phase Ib/II study of lisaftoclax, both as a single agent and in combinations with BTK inhibitor ibrutinib/rituximab for the treatment of patients with WM, is ongoing in the United States, Australia, and China. |

Data publication

| ● | In December 2024, we presented updated results from three clinical studies of lisaftoclax at the 66th ASH Annual Meeting, including one oral report and four poster presentations. The oral report features the latest clinical data of lisaftoclax combined with novel therapeutic regimens in patients with relapsed or refractory multiple myeloma (r/r MM) or immunoglobulin light-chain (AL) amyloidosis, further demonstrated compelling clinical benefit and favorable safety profile of the combination regimen. According to the results, in the 36 evaluable patients who were heavily pretreated, the ORR was 63.9%; the very good partial response (VGPR) rate was 30.6%; and more importantly, the median progression-free survival (PFS) reached up to 9.7 months. In terms of safety, lisaftoclax, at doses ranged from 800-1200 mg, in combination with other therapeutic agents showed favorable tolerability and no drug-drug interactions (DDIs). This is the third consecutive year in which clinical results on lisaftoclax have been selected by the ASH Annual Meeting. |

| ● | In June 2024, we presented updated results from a global, multi-center Phase Ib/II study of lisaftoclax alone or in combinations for the treatment of patients with WM, in a poster presentation at the 60th ASCO Annual Meeting. This is the second consecutive year in which this study of lisaftoclax was selected for presentations at the ASCO Annual Meeting. We also released the latest results from a Phase Ib/II study of lisaftoclax in combination with azacitidine (AZA) in patients with treatment-naïve (TN) or r/r AML, in a poster presentation. Among the 39 elderly or unfit patients with newly diagnosed AML, ORR and the composite complete remission rate (CRc = CR + CRi) were 64.1% and 51.3%, respectively. 10.5% of patients reported febrile neutropenia. No tumor lysis syndrome (TLS) was reported, and the 30-/60-day mortality rates were 1.3% and 3.9%, respectively. |

The expected progress of lisaftoclax (APG-2575) is as follows:

| ● | If approved, we expect to launch lisaftoclax for the treatment of r/r CLL/SLL in China in 2025. |

| ● | We expect to continue to execute the registrational clinical trials including GLORA, GLORA-2, GLORA-3 and GLORA-4 trials. |

| ● | We plan to seek clearance from FDA to initiate registrational phase III clinical trial for the treatment of patients who are newly diagnosed with higher risk MDS. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET LISAFTOCLAX (APG-2575) SUCCESSFULLY.

Alrizomadlin (APG-115)

Alrizomadlin (APG-115) is a novel, orally bioavailable, highly selective, small-molecule inhibitor of MDM2-p53 protein-protein interactions (PPIs). Alrizomadlin (APG-115) was designed to restore activation of p53 tumor suppressor activity by blocking the MDM2-p53 interaction. It is undergoing multiple clinical studies in China, United States, and Australia as a single agent or in combination with immunotherapy or chemotherapy in treating solid tumors as well as hematologic malignancies.

The FDA has granted six ODDs for alrizomadlin (APG-115) for the treatment of soft-tissue sarcoma, gastric cancer (GC), AML, retinoblastoma, stage IIB-IV melanoma, and neuroblastoma. In addition, alrizomadlin (APG-115) has been granted two Rare Pediatric Disease Designations (RPDD) designation by the FDA for the treatment of neuroblastoma and retinoblastoma.

The recent progress of alrizomadlin (APG-115) is as follows:

Clinical progress

We are currently enrolling patients in several clinical studies of alrizomadlin (APG-115) in the United States and/or Australia:

| ● | A Phase 1b/2 study of alrizomadlin (APG-115) monotherapy or in combination with pembrolizumab in patients with unresectable or metastatic melanoma (in collaboration with Merck & Co.) or other advanced solid tumors. |

| ● | A phase 2a study evaluating the pharmacokinetics, safety and efficacy of APG-115 as a single agent or in combination with lisaftoclax in subjects with relapsed/refractory T-cell Prolymphocytic Leukemia (r/r T-PLL) or NHL. |

| ● | An investigator-initiated trial (IIT) of alrizomadlin (APG-115) monotherapy or in combination with chemotherapy in a Phase 2 study for the treatment of salivary gland cancer. |

In addition, CDE has granted approval for the following clinical trials of alrizomadlin (APG-115) in China:

| ● | A Phase 1b/2 clinical study of alrizomadlin (APG-115) in combination with anti-PD-1 antibody (JS001) toripalimab, for the treatment of patients with advanced liposarcoma (LPS) or other advanced solid tumors. |

| ● | A Phase 1b study of alrizomadlin (APG-115) single agent or in combination with azacitidine or cytarabine in patients with r/r AML and relapsed/progressed high-/very high-risk MDS. |

| ● | A phase 1 clinical study of alrizomadlin (APG-115) alone or in combination with lisaftoclax (APG-2575) in children with recurrent or refractory neuroblastoma or other solid tumors. |

Data publication

| ● | In July 2024, we published an article in Targeted Oncology (2024) on Malignant Peripheral Nerve Sheath Tumor (MPNST). The article highlights that MPNSTs are rare, aggressive soft-tissue sarcomas with a tendency for local recurrence and metastasis and have the poorest prognoses among all sarcomas. Overall outcomes with surgical and other treatments are suboptimal, establishing an urgent unmet medical need. |

| ● | In April 2024, we released updated data of APG-115 at 2024 AACR annual meeting, demonstrating that APG-5918 and APG-115 synergistically inhibit tumor growth in preclinical models of prostate cancer (PCa). |

| ● | In March 2024, the clinical results of a phase 1/2 study of APG-115 in progressive salivary gland cancer, including patients with adenoid cystic carcinoma (ACC), were presented during the 2024 Multidisciplinary Head and Neck Cancers Symposium. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET ALRIZOMADLIN (APG-115) SUCCESSFULLY.

Pelcitoclax (APG-1252)

Pelcitoclax (APG-1252) is a novel, highly potent, small-molecule drug designed to restore apoptosis through dual inhibition of the Bcl-2/Bcl-xL proteins for the treatment of small-cell lung cancer (SCLC), NSCLC, neuroendocrine tumor (NET), and NHL. It was granted an ODD by FDA for the treatment of SCLC.

In various clinical trials conducted in the United States, Australia and China, patients have been treated with pelcitoclax (APG-1252) as a monotherapy or in combination with other antitumor agents. Pelcitoclax (APG-1252) was well tolerated with either weekly or biweekly intermittent dosing schedules. Preliminary anti-tumor activity was observed as a single agent in heavily pretreated patients.

The recent progress of pelcitoclax (APG-1252) is as follows:

Clinical progress

Pelcitoclax (APG-1252) is currently under investigation in a variety of combination trials, including:

| ● | A Phase 1b study of pelcitoclax (APG-1252) plus osimertinib in patients with epidermal growth factor receptor (EGFR) mutant NSCLC in China; |

| ● | A Phase 1b/2 study of pelcitoclax (APG-1252) as a single agent or in combination with other therapeutic agents in patients with r/r NHL in China. |

Data publication

| ● | In February 2024, we published results of the first-in-human study with preclinical data of pelcitoclax (APG-1252) in locally advanced or metastatic solid tumors. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET PELCITOCLAX (APG-1252) SUCCESSFULLY.

APG-5918

APG-5918 is a potent, orally bioavailable, and highly selective embryonic ectoderm development (EED) inhibitor. EED is a core subunit of the Polycomb Repressive Complex 2 (PRC2). Preliminary study results from our preclinical models of anemia demonstrated that APG-5918 has the potential to improve hemoglobin (Hb) insufficiency induced by chronic kidney disease (CKD).

We have initiated an FDA-regulated, multi-center, open-label Phase I clinical trial to evaluate the safety, pharmacokinetics, and efficacy of APG-5918 in patients with advanced solid tumors or lymphomas, including non-Hodgkin’s lymphoma, who have progressed on or are intolerant to approved therapies, or for whom no standard treatments are available.

The recent progress of APG-5918 is as follows:

| ● | In December 2024, we released the updated preclinical results of APG-5918 at the 66th ASH Annual Meeting, demonstrates robust antitumor activity in preclinical models of T-Cell Lymphomas (TCLs). |

| ● | In June 2024, we released the updated preclinical results of APG-5918 at the 2024 European Hematology Association Hybrid Congress (EHA 2024), demonstrating that APG-5918 improves CKD-induced hemoglobin (Hb) insufficiency in preclinical models of anemia. |

| ● | In April 2024, we released updated preclinical data of APG-5918 at 2024 AACR annual meeting, demonstrating that APG-5918 and MDM2 inhibitor alrizomadlin (APG-115) synergistically inhibit tumor growth in preclinical models of PCa. |

| ● | In January 2023, APG-5918 obtained approval from CDE to initiate a clinical study in patients with anemia-related indications. The single ascending dose (SAD) study in healthy subjects has been completed, and the multiple ascending dose (MAD) phase in anemic subjects is ongoing. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET APG-5918 SUCCESSFULLY.

Other Clinical Candidate

APG-2449

APG-2449 is a novel, orally active, small-molecule FAK, the third generation of ALK and ROS1 triple ligase kinase inhibitor (TKI) designed and developed by Ascentage Pharma. It is the first FAK inhibitor approved by CDE for clinical study in China. In the first-in-human trial, cerebrospinal fluid pharmacokinetics (PK) analyses showed that APG-2449 was brain-penetrant. An updated study of APG-2449 demonstrated preliminary clinical benefit in patients with NSCLC whose disease was TKI naïve and resistant to 2G ALK inhibitors, especially in brain metastases. In addition, high pFAK expression levels in baseline tumor tissue correlated with improved APG-2449 treatment responses in patients with NSCLC resistant to second-generation ALK inhibitors, suggesting that the increase of pFAK may be associated with second-generation ALK TKI resistance.

The recent progress of APG-2449 is as follows:

Clinical progress

| ● | In October 2024, APG-2449 was cleared by the CDE of China’s NMPA to initiate two registrational Phase III clinical trials that will separately evaluate APG-2449 in patients with NSCLC who are resistant to or intolerant of second-generation ALK TKIs; and treatment-naïve patients with ALK-positive advanced or locally advanced NSCLC. |

| ● | A Phase 1b/2 study of APG-2449 in combination with liposomal doxorubicin hydrochloride in platinum-resistant ovarian cancer is ongoing. |

Data publication

| ● | In December 2024, we released updated data of APG-2449, in patients with AML in a poster presentation at the 66th ASH Annual Meeting. APG-2449 exhibits antileukemic activity and enhances lisaftoclax (APG-2575)-induced apoptosis in AML. |

| ● | In June 2024, we released updated data of APG-2449, in patients with NSCLC in a poster presentation at the 60th ASCO Annual Meeting. This is the third consecutive year in which clinical data from this study of APG-2449 were selected for presentations at the ASCO Annual Meeting. Preliminary efficacy was demonstrated in patients with NSCLC who were TKI naïve and resistant to second-generation ALK TKIs, as well as early antitumor activity in brain metastases. |

| ● | In April 2024, we released updated preclinical data of APG-2449 at 2024 AACR annual meeting, demonstrating that it inhibits metastasis and enhances the antitumor efficacy of PEGylated liposome doxorubicin (PLD) in epithelial ovarian cancer (EOC). |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET APG-2449 SUCCESSFULLY.

Discovery programs

Protein degraders

Our deep understanding of heterobifunctional molecules and ligase biology has allowed us to develop protein degraders targeting traditionally undruggable proteins of interest implicated in key oncologic pathways. We believe we have the ability to develop differentiated degraders with improved pharmacokinetic-pharmacodynamic (PK/PD) profiles that exhibit less off-target effects than other degraders in clinical development. Through our degrader platform, we also believe we can develop cancer therapeutics targeted at resistance mechanisms that have traditionally plagued small molecule inhibitors.

We have identified and nominated our first targeted protein degrader, or TPD, candidate for pre-clinical development. This orally bioavailable degrader is targeting the p53-MDM2 pathway. In the last twenty years, many highly potent and orally active MDM2 inhibitors have been developed as a way to activate the p53 tumor suppressor gene, and several are currently in clinical development, including alrizomadlin (APG-115). However, inhibition of p53 have often resulted in upregulation of MDM2, which has then limited the efficacy of these MDM2 inhibitors, so we believe that a degrader approach could be pursued as the next generation strategy.

We have also identified several compounds that are capable of rapidly reducing the levels of the Bcl-xL protein in human cancer cell lines and thereby inhibiting cancer cell growth in human cancer cell lines that are dependent on Bcl-xL. Based on our initial studies, we believe we are developing a Bcl-xL protein degrader that has the potential to exhibit strong activity with low levels of platelet toxicity. We are in the process of selecting and nominating our first Bcl-xL degrader as a candidate for pre-clinical development. The potential candidates exhibit high selectivity for the Bcl-xL target, demonstrating potent cellular and degradation activity, and showing remarkable in vivo efficacy in xenograft mice models.

RESEARCH AND DEVELOPMENT

We have a proven track record of accomplishment in researching, developing and commercializing biopharmaceuticals. We plan to continue to diversify and expand our product pipeline through both in-house research and development and collaboration with biotechnology and pharmaceutical companies, as well as academic institutions. We have an experienced scientific advisory board (SAB), chaired by Dr. Shaomeng Wang, our co-founder and non-executive director. Members of our scientific advisory board are physician scientists with expertise in cancer research and drug development. They are not our employees but periodically provide us with assistance and guide our clinical development programs through regularly scheduled SAB meetings.

For the years ended December 31, 2023 and 2024, our research and development expenses were RMB707.0 million and RMB947.2 million, respectively.

INTELLECTUAL PROPERTY RIGHTS

Intellectual property rights are fundamental to our business. Through our robust research and development, we have strategically developed a global intellectual property portfolio with exclusive rights to issue patents or patent applications worldwide with respect to our product candidates. As of December 31, 2024, we cumulatively had 541 issued patents globally, among which 379 issued patents were issued outside of China.

COMMERCIALIZATION

We attach great importance to building Ascentage Pharma’s commercialization capability, including developing sound strategies and feasible infrastructure.

Revenue from sales of our core product, olverembatinib, in China was RMB241.0 million for the year ended December 31, 2024, compared to RMB159.0 million for the year ended December 31, 2023, which represented an increase of RMB82.0 million, or 52%. We have established a fully functional commercialization team consisting of more than 100 staff. Our team, together with Innovent Biologics, Inc. (1801.HK) (“Innovent Biologics”), had covered 265 distributors and around 800 hospitals in China. By the end of December 31, 2024, we have entered 734 DTP pharmacies and hospitals. Ascentage Pharma’s commercial team organized a variety of online and offline promotional activities. They also educated health care professionals (HCPs) concerning olverembatinib’s clinical benefits, which enhanced brand awareness of olverembatinib among HCPs and patients.

In November 2024, the new indication of olverembatinib has been included into the China 2024 NRDL through the simple contract renewal process. Concurrently, the contracts for indications of olverembatinib which has been included China’s NRDL since 2022 were renewed successfully. The current reimbursable scope of olverembatinib is: adult patients with CML-CP or CML-AP harboring the T315I mutation, and adult patients with CML-CP resistant and/or intolerant of first-and second-generation TKIs. The new version of the NRDL became effective in January 2025, in China. The inclusion will bolster the accessibility of olverembatinib, allowing more CML patients to easily and affordably access the medication. We will continue to collaborate with Innovent Biologics to accelerate market penetration at hospitals and pharmacies, bolstering the accessibility of olverembatinib and laying a solid foundation for accessibility of our products for new approved indications in the future.

In July 2024, olverembatinib has been approved by the Pharmaceutical Administration Bureau (ISAF) of the Macau Special Administrative Region of the PRC for the treatment of adult patients with TKI-resistant CML-CP or CML-AP harboring the T315I mutation; and adult patients with CML-CP resistant to and/or intolerant of first-and second-generation TKIs.

Recently, olverembatinib was included in 2025 version of “Chinese Guidelines for Integrated Cancer Diagnosis and Treatment (CACA)” and 2024 version of “CSCO guideline for Diagnosis and Treatment of Hematological Malignancies” for the treatment of CML and Ph+ ALL. Olverembatinib was included as an Emerging Treatment Option in the 2024 NCCN guidelines for the management of CML. Ascentage Pharma is committed to the expansion of commercialization and availability of olverembatinib in the China market and abroad.

CHEMISTRY, MANUFACTURING AND CONTROL

We have established our own Suzhou facility as our global R&D center and manufacturing facility. The R&D center and the manufacturing centers were implemented into use in the second half of 2021 and the fourth quarter of 2022, respectively.

The Suzhou manufacturing center has more than 200,000 square feet of space, and the manufacturing capacity for both oral solid tablets and capsules is up to 250 million dosage units per year. We also maintain manufacturing capability for injectable drug products, including lyophilized formulations at the Suzhou center. In the fourth quarter of 2022, the Company obtained a Drug Manufacturing License (Certificate A). In 2024, the Suzhou manufacturing center completed the technical transfer and process validation campaign of olverembatinib tablets. At the same time, we obtained the updated version of the Drug Manufacturing Licenses (including certificates A, B and C) and passed GMP compliance inspection conducted by Jiangsu Medical Products Administration which allows us to manufacture and supply olverembatinib tablets for global clinical trials and commercial sales in China market from Ascentage owned facility.

In April 2023, the Company received a zero-deficiency report from the Good Manufacturing Practices (GMP) compliance audit of Ascentage Pharma’s global manufacturing center by a Qualified Person (QP) of the European Union (EU). We believe this report indicates that the Company’s Global Manufacturing Center and quality management system implemented at the site are compliant with the standards of the EU GMP, marking the achievement of a major milestone that will pave the way for the Company’s continued global expansion.

In 2023, we completed the technical transfer of the lisaftoclax (APG-2575) tablets, which allows us to internalize the production and supply of the drug for its global clinical trials. We completed the drug tablet coating and debossing development and the GMP production of olverembatinib tablets, preparing for the future applications to the global regulatory authorities including the FDA.