UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-41247

SunCar Technology Group Inc.

(Translation of registrant’s name into English)

c/o Shanghai Feiyou Trading Co., Ltd.

Suite 209, No. 656 Lingshi Road

Jing’an District, Shanghai, 200072

People’s Republic of China

Tel: (86) 138-1779-6110

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Financial Statements and Exhibits

Exhibits.

| Number | ||

| 99.1 | A copy of the registrant’s Investor Presentation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SunCar Technology Group Inc. | ||

| Date October 23, 2023 | By: | /s/ Zaichang Ye |

| Name: | Zaichang Ye | |

| Title: | Chief Executive Officer | |

| (Principal Executive Officer) | ||

2

Exhibit 99.1

By SunCar Management October 2023 SunCar – Leading Service Platform for Automotive Owners Investor Presentation Disclaimer This presentation includes statements that are, or may be deemed, "forward - looking statements . " In some cases these forward - looking statements can be identified by the use of forward - looking terminology, including the terms "believes," "estimates," "anticipates," expects," "plans," intends," "may," "could," "might," "will," "should," "approximately," "potential," or in each case, their negative or other variations thereon or comparable terminology, although not all forward - looking statements contain these words . They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, the auto service and insurance market in China and the prospects of our business as stated herein . By their nature, forward - looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and regulatory developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated . Although we believe that we have a reasonable basis for each forward - looking statement contained in this presentation, we caution you that forward - looking statements are not guarantees of future performance and that our actual results of operation, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward - looking statements contained in this presentation as a result of, among other factors, the factors referenced in the "Risk Factors" section of the Form 20 - F for the year ended December 31 , 2022 (the "Annual Report") . In addition, even if our results of operation, financial conditions and liquidity, and the development of the industry in which we operate are consistent with the forward - looking statements contained in this presentation, they may not be predictive of results or developments in future periods . Any forward - looking statement that we make in this presentation speaks only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation . Because this presentation is a summary, it does not contain all of the information that you should consider before investing . You should read carefully the factors described in the "Risk Factors" section of the Annual Report to better understand the risks and uncertainties inherent in our business and any forward - looking statements . This Presentation includes certain statements, estimates and projections with respect to the anticipated future performance of the Company . Such statements, estimates and projections are based on significant assumptions and subjective judgment concerning anticipated results . These assumptions and judgments are inherently subject to risks, variability and contingencies, many of which are beyond the Company’s control . These assumptions and judgments may or may not prove to be correct and there can be no assurance that any projected results are obtainable or will be realized . Actual results likely will vary from those projected, and such variations may be material . In addition, this Presentation does not describe certain risks associated with the Company’s business .

Company Profile 3

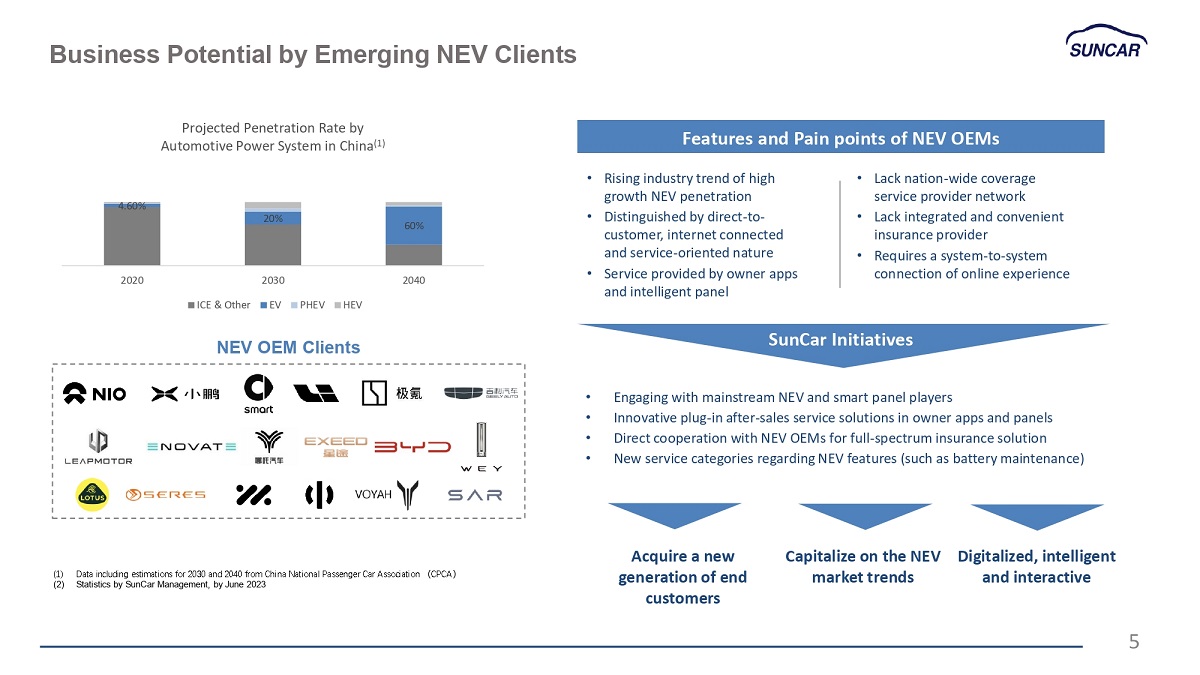

Leading Digitalized Platform in China Providing Enterprise After - Sales Services SunCar Master Platform provides full spectrum after - sales services via over 46,000 (1) supplier network, connecting over 1,350 (1) client apps through advanced multi - tenant digital systems No.1 in China for B2B after - sales services Leading Online Auto Insurance Platform in China 4 (1) Till June 2023 ͫ by SunCar Management SunCar Insurance Platform engage with over 62,000 (1) service partners and NEV sales center, offering customers fast, simple, transparent and fully online experience accessing products from 85 (1) insurers in single application No.1 in China for NEV insurance sales Business Potential by Emerging NEV Clients 4.60% 20% 60% 2020 2030 2040 Projected Penetration Rate by Automotive Power System in China (1) ICE & Other EV PHEV HEV • Engaging with mainstream NEV and smart panel players • Innovative plug - in after - sales service solutions in owner apps and panels • Direct cooperation with NEV OEMs for full - spectrum insurance solution • New service categories regarding NEV features (such as battery maintenance) Capitalize on the NEV market trends Features and Pain points of NEV OEMs (1) Data including estimations for 2030 and 2040 from China National Passenger Car Association ͧ CPCA ͨ (2) Statistics by SunCar Management, by June 2023 • Rising industry trend of high growth NEV penetration • Distinguished by direct - to - customer, internet connected and service - oriented nature • Service provided by owner apps and intelligent panel • Lack nation - wide coverage service provider network • Lack integrated and convenient insurance provider • Requires a system - to - system connection of online experience SunCar Initiatives Acquire a new generation of end customers Digitalized, intelligent and interactive NEV OEM Clients 5 SunCar – Leading Digital Platform for After - sales Services SunCar Master After - sales Solution Supplier Network Enterprise Clients API H5 APPLET APP After - sales Suppliers Car Owners 300+ (1) services provided by 46,000 + (1) suppliers in all provinces in mainland China (1) 700 + (1) independent digital systems fully automatically operated by multi - tenant platform 1350 + (1) clients, over 96 million (1) service orders in the last 5 years (1) Till June 2023, by SunCar Management 6

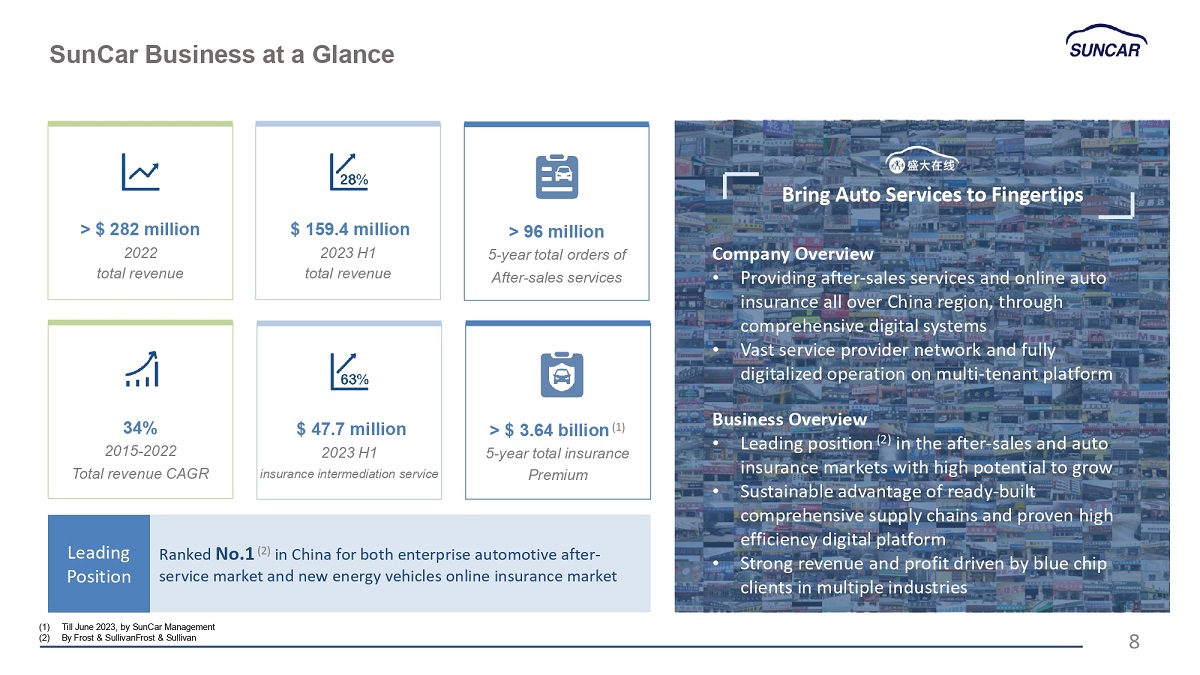

SunCar Insurance Online Insurance Solution Digital Platform API H5 APPLET APP Insurance Companies Service Partners Car Owners Over 85 (1) insurance companies including 32 (1) Insurance HQs Providing a wide selection of products via intelligent, efficient, fully online and user - friendly applications Cooperated with 62,000 + (1) service partners creating over 9 million (1) policies in the last 5 years SunCar – Leading Digital Platform for Auto Insurance (1) Till June 2023, by SunCar Management 7 NEV Sales Center SunCar Business at a Glance Ranked No.1 (2) in China for both enterprise automotive after - service market and new energy vehicles online insurance market Leading Position Bring Auto Services to Fingertips Company Overview • Providing after - sales services and online auto insurance all over China region, through comprehensive digital systems • Vast service provider network and fully digitalized operation on multi - tenant platform Business Overview • Leading position (2) in the after - sales and auto insurance markets with high potential to grow • Sustainable advantage of ready - built comprehensive supply chains and proven high efficiency digital platform • Strong revenue and profit driven by blue chip clients in multiple industries (1) Till June 2023, by SunCar Management (2) By Frost & SullivanFrost & Sullivan 8 > $ 3.64 billion (1) 5 - year total insurance Premium $ 47.7 million 2023 H1 insurance intermediation service 34% 2015 - 2022 Total revenue CAGR > 96 million 5 - year total orders of After - sales services $ 159.4 million 2023 H1 total revenue > $ 282 million 2022 total revenue Passionate, Experienced and Innovative Management Team • Over 20 years management experience • Software development and product innovation Mr. LEI Zhunfu CTO • Over 20 years experience of business management • Over 15 years automotive service operation Ms. Gu Saiye VP – Auto Insurance Mr. YE Zaizhang Chairman & CEO • Over 20 years management & entrepreneurship experience • Over 10 years automotive service experience Mr. QIAN Yizhi VP – After - sales • 15 years business management experience • Experienced in team setup and channel management Mr. DU Bohong CFO • 23 years enterprise operation and management experience Our Management is experienced in automotive service industries with deep understanding and innovative mindsets regarding industry value chain and client needs. All of our core managements has over 10 years’ working experience with SunCar. 9

Business Overview 10

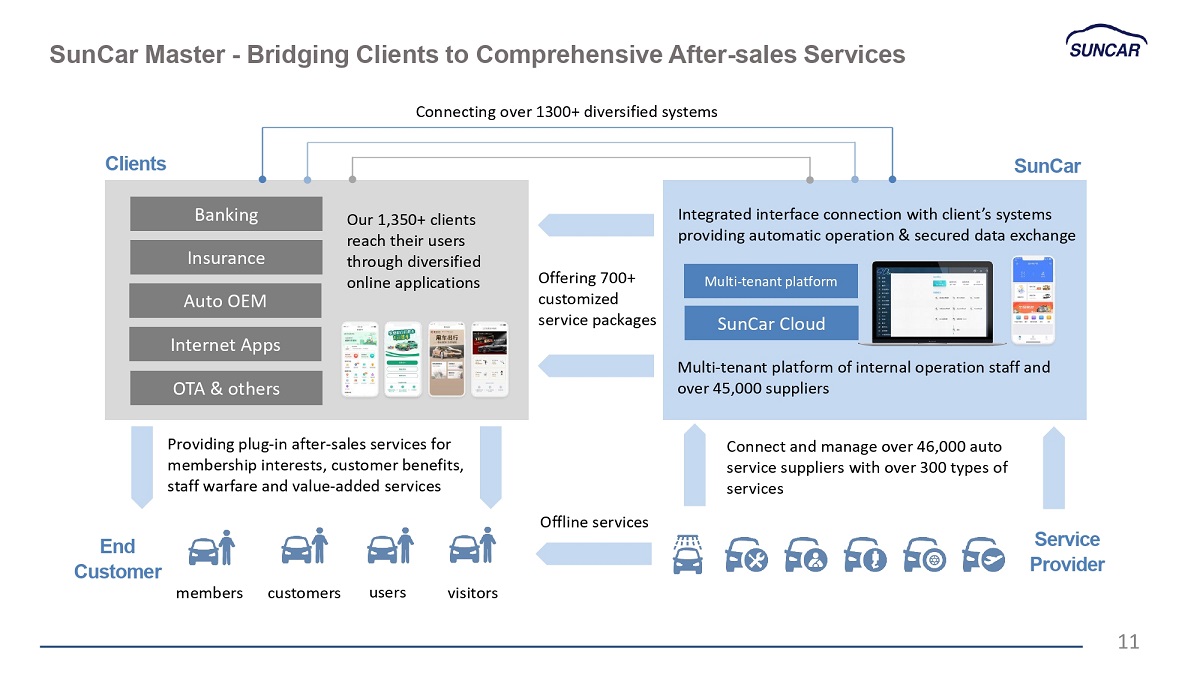

SunCar Master - Bridging Clients to Comprehensive After - sales Services Banking Insurance Auto OEM Internet Apps OTA & others Our 1,350+ clients reach their users through diversified online applications Integrated interface connection with client’s systems providing automatic operation & secured data exchange Multi - tenant platform of internal operation staff and over 45,000 suppliers Multi - tenant platform SunCar Cloud Connecting over 1300+ diversified systems Offering 700+ customized service packages members customers users visitors Providing plug - in after - sales services for membership interests, customer benefits, staff warfare and value - added services Connect and manage over 46,000 auto service suppliers with over 300 types of services Clients SunCar End Customer Service Provider Offline services 11 SunCar Master - Sustainable Advantage of Established Supplier Network Full Location Coverage 46,000+ service stations Over 30 provinces 2,500+ districts and counties Serving nation - wide customers • No.1 in China (1) in terms of number of service stations as well as geographic coverage – serving customers anywhere • The services suppliers are connected by platform and managed through digital systems Full Service Coverage Regular Maintenance • Carwash • Oil maintenance • Car beautification • Tire repair • … Reserved Services • Flight pickup • Driver service • Road assistance • Car overhaul • … Offering full spectrum after - sales services • Over 300 types of services • Covering regular maintenance and reserved services for both high frequency requirements and emergency assistance 12 (1) By Frost & Sullivan Frost & Sullivan

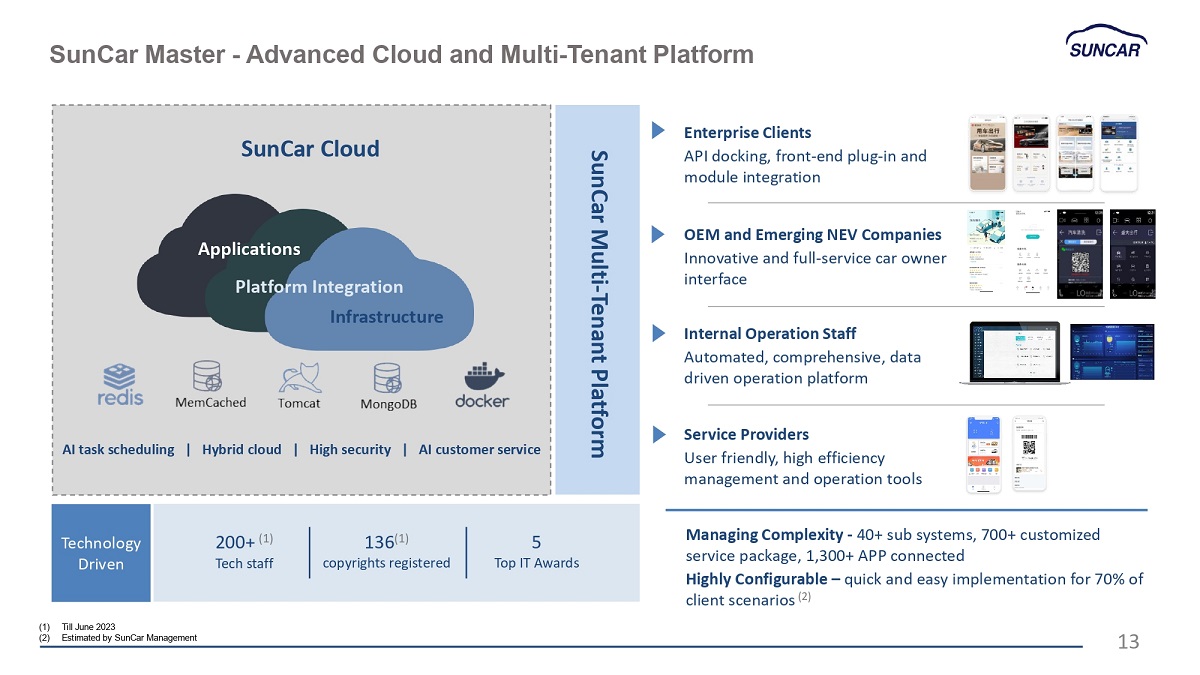

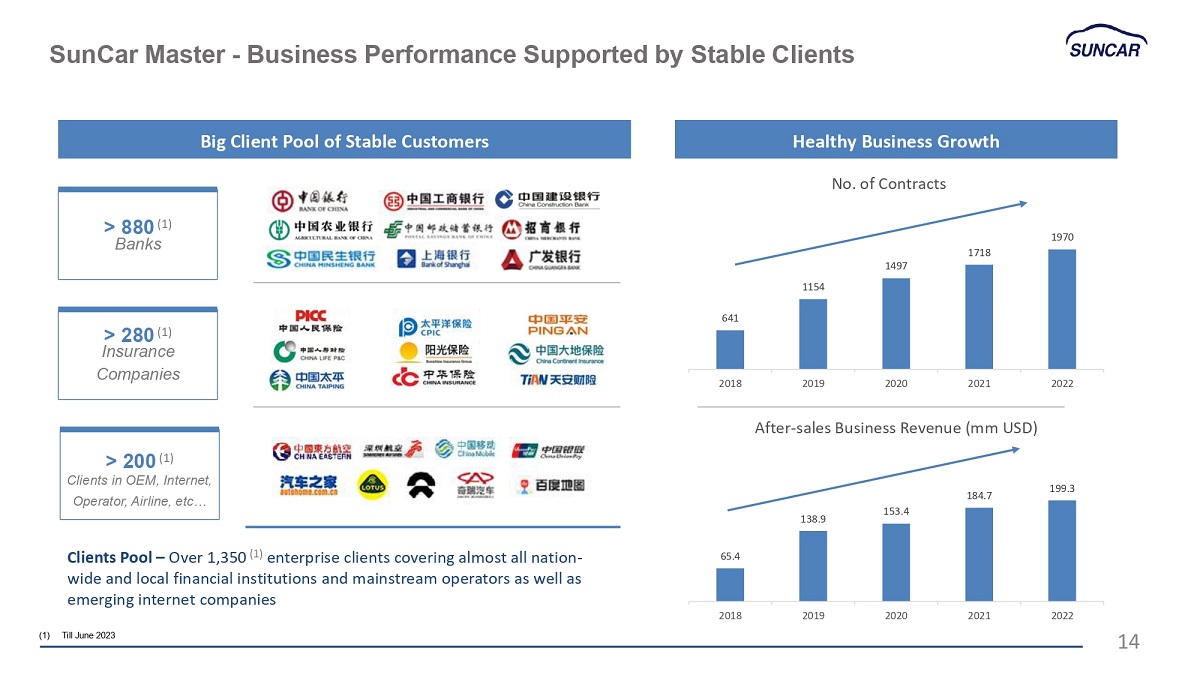

SunCar Master - Advanced Cloud and Multi - Tenant Platform SunCar Cloud Applications Platform Integration Infrastructure AI task scheduling | Hybrid cloud | High security | AI customer service SunCar Multi - Tenant Platform Enterprise Clients API docking, front - end plug - in and module integration OEM and Emerging NEV Companies Innovative and full - service car owner interface Internal Operation Staff Automated, comprehensive, data driven operation platform Service Providers User friendly, high efficiency management and operation tools Technology Driven 200+ (1) Tech staff 136 (1) copyrights registered 5 Top IT Awards Managing Complexity - 40+ sub systems, 700+ customized service package, 1,300+ APP connected Highly Configurable – quick and easy implementation for 70% of client scenarios (2) (1) Till June 2023 (2) Estimated by SunCar Management 13 641 1497 1154 1718 1970 2018 2019 2020 2021 2022 65.4 138.9 153.4 184.7 199.3 2018 2019 2020 2021 2022 After - sales Business Revenue (mm USD) Big Client Pool of Stable Customers Healthy Business Growth SunCar Master - Business Performance Supported by Stable Clients > 880 (1) Banks > 280 (1) Insurance Companies > 200 (1) Clients in OEM, Internet, Operator, Airline, etc… Clients Pool – Over 1 , 350 ( 1 ) enterprise clients covering almost all nation - wide and local financial institutions and mainstream operators as well as emerging internet companies (1) Till June 2023 No.

of Contracts 14

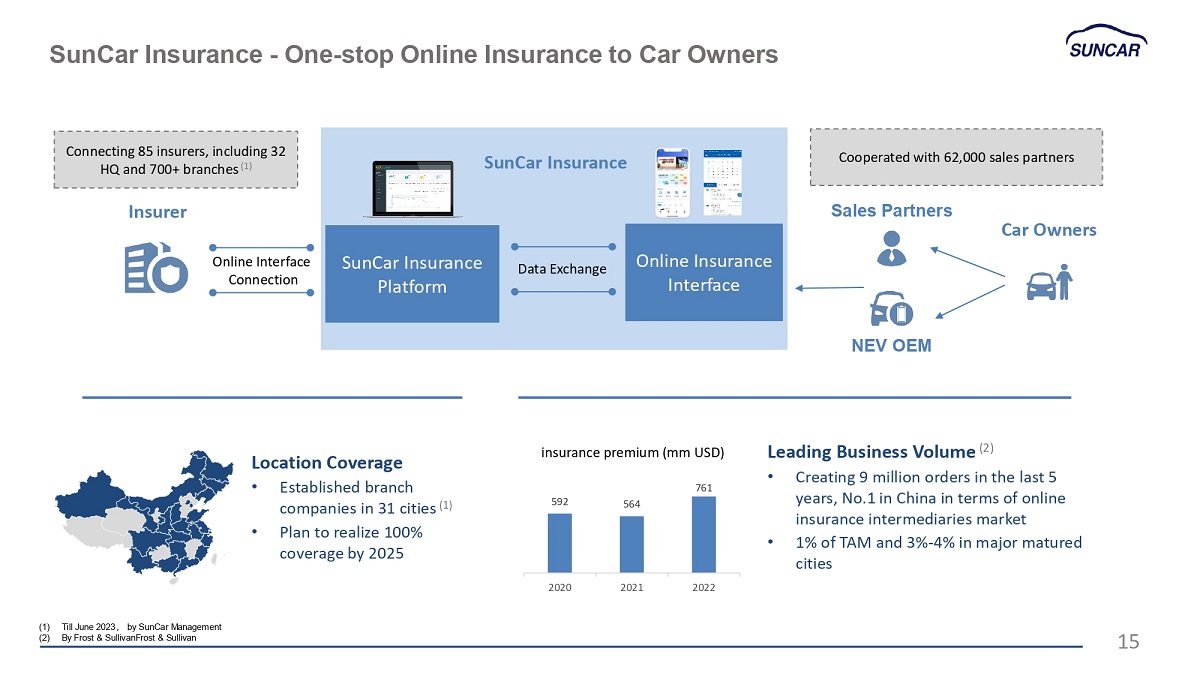

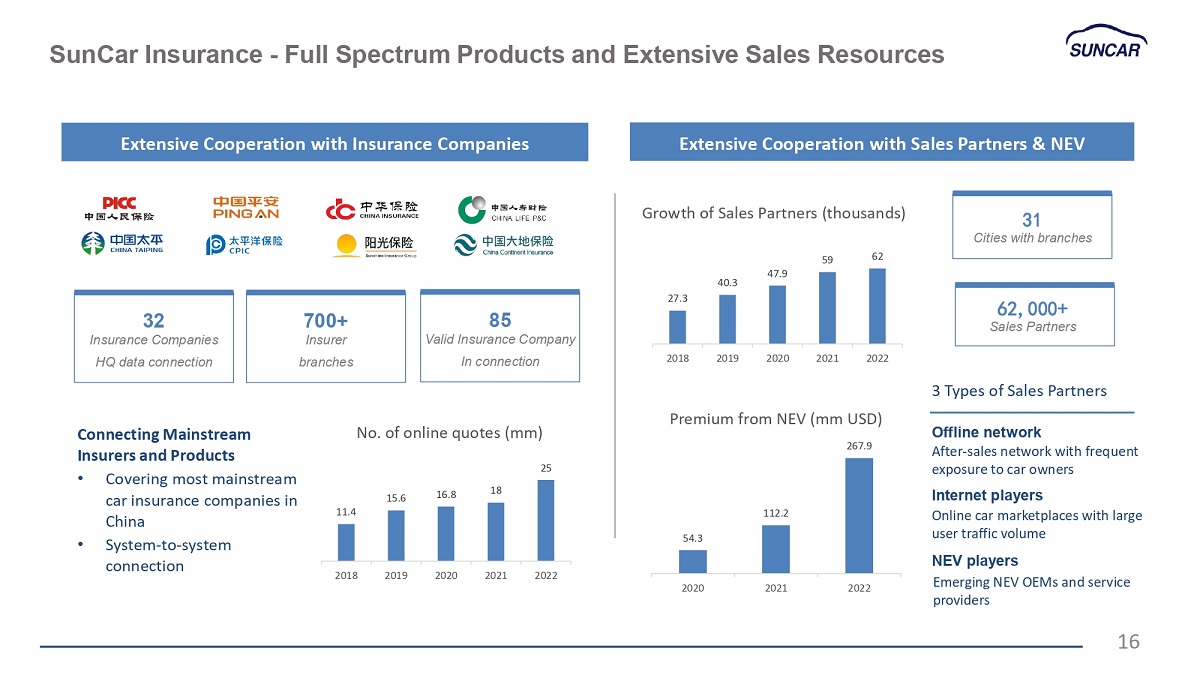

SunCar Insurance - One - stop Online Insurance to Car Owners SunCar Insurance Platform Online Insurance Interface Insurer Car Owners Online Interface Connection SunCar Insurance Data Exchange Location Coverage • Established branch companies in 31 cities (1) • Plan to realize 100% coverage by 2025 Leading Business Volume (2) • Creating 9 million orders in the last 5 years, No.1 in China in terms of online insurance intermediaries market • 1% of TAM and 3% - 4% in major matured cities Connecting 85 insurers, including 32 HQ and 700+ branches (1) Cooperated with 62,000 sales partners Sales Partners NEV OEM insurance premium (mm USD) (1) Till June 2023 ͫ by SunCar Management (2) By Frost & SullivanFrost & Sullivan 15 592 564 761 2020 2021 2022 SunCar Insurance - Full Spectrum Products and Extensive Sales Resources Extensive Cooperation with Insurance Companies 32 Insurance Companies HQ data connection 700+ Insurer branches 85 Valid Insurance Company In connection Connecting Mainstream Insurers and Products • Covering most mainstream car insurance companies in China • System - to - system connection Extensive Cooperation with Sales Partners & NEV 31 Cities with branches 62,000+ Sales Partners Offline network After - sales network with frequent exposure to car owners Internet players Online car marketplaces with large user traffic volume NEV players Emerging NEV OEMs and service providers 3 Types of Sales Partners No.

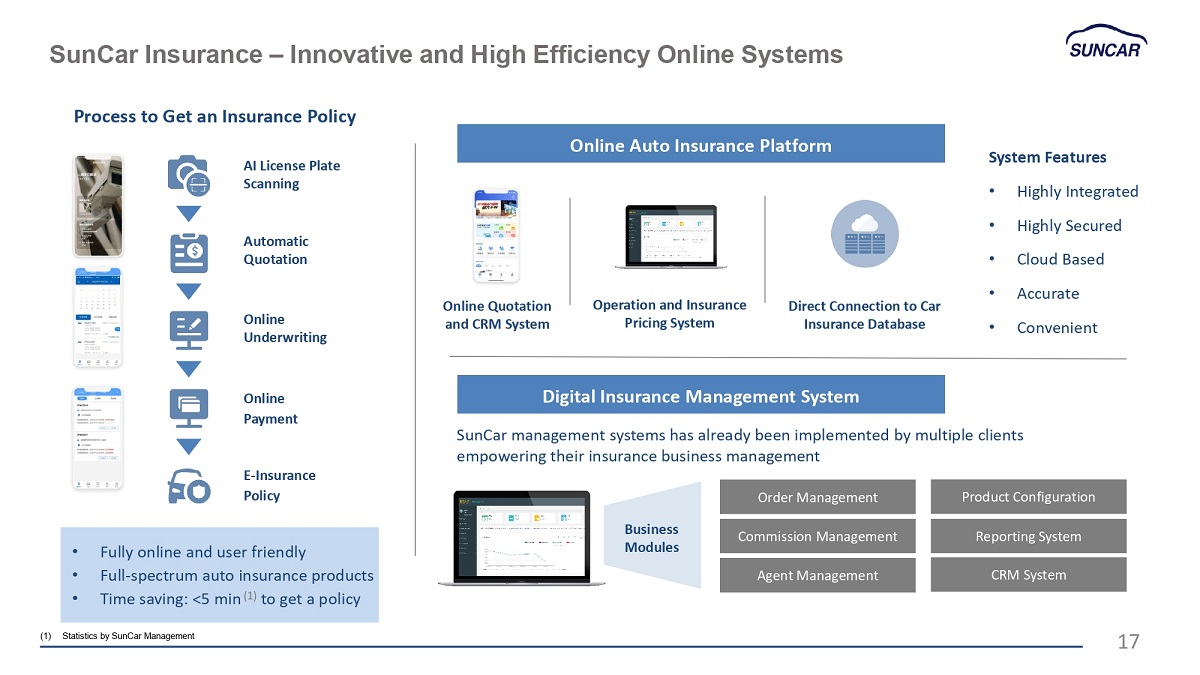

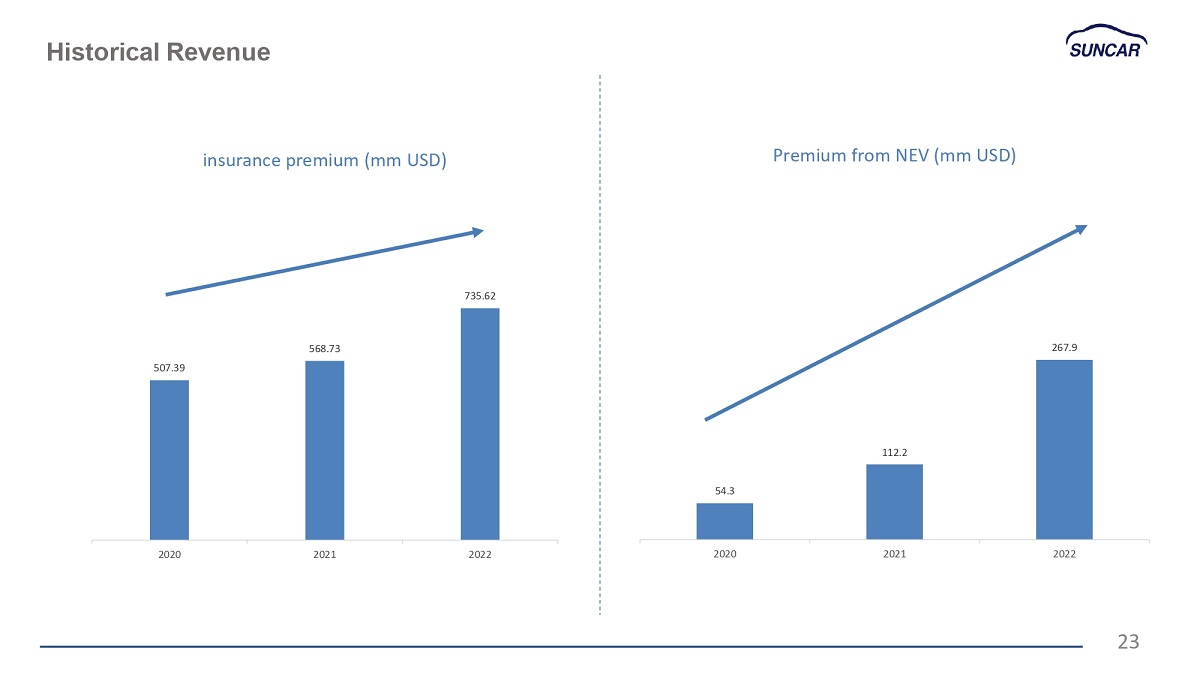

of online quotes (mm) Growth of Sales Partners (thousands) 16 11.4 15.6 16.8 18 25 2018 2019 2020 2021 2022 27.3 40.3 47.9 59 62 2018 2019 2020 2021 2022 54.3 112.2 Premium from NEV (mm USD) 267.9 2020 2021 2022 SunCar Insurance – Innovative and High Efficiency Online Systems AI License Plate Scanning Automatic Quotation Online Underwriting Online Payment E - Insurance Policy • Fully online and user friendly • Full - spectrum auto insurance products • Time saving: <5 min (1) to get a policy Online Auto Insurance Platform Process to Get an Insurance Policy Online Quotation and CRM System Operation and Insurance Pricing System Direct Connection to Car Insurance Database System Features • Highly Integrated • Highly Secured • Cloud Based • Accurate • Convenient Digital Insurance Management System Order Management Commission Management Agent Management Product Configuration Reporting System CRM System Business Modules SunCar management systems has already been implemented by multiple clients empowering their insurance business management (1) Statistics by SunCar Management 17 Opportunities in the World Biggest After - sale Market Huge Market and High Growth • China has the biggest car ownership in the world, with a CAGR of 11% from 2017 - 2022 • The after - sales market is big and still growing fast Opportunities for Market Integration • Most service providers in after - sale market are small and fragmented • Opportunity for cross - region and comprehensive service providers to integrate the small players Opportunities for Digitalization • Low digitalization penetration throughout the market • Opportunity for tech - driven companies to gain scale advantages and acquire more quality clients Opportunities for Sun Car by Market Tailwind 196 222 251 329 302 276 2017 2018 2019 2020 2021 2022 Car Ownership Volume in China (mm unit) 163 18 184 205 220 245 268 2017 2018 2019 2020 2021 2022 China After - sales Market Volume (billion USD)

116 123 129 130 114 125 2017 2018 2019 2020 2021 2022 Auto Insurance Volume in China (billion USD) Opportunities in China’s Massive Auto Insurance Market Big Market Driven by Growing Car Ownership • China has the biggest volume of new cars and ownership, creating a huge car insurance market Opportunities for Online Application • The commission rate stabilizes, resulting in fierce competition for insurers and sales channels, creating opportunities for online insurance intermediation in terms of cost and efficiency Opportunities for Digitalization and NEV • Low digitalization for existing insurance sales channels, leaving opportunities for commercialized SaaS tools and digital systems • Customized and direct - to - customer (DTC) insurance driven by NEV companies Opportunities of Market Growth and Transformation Commission rate drop 20% due to policy 19 Our Near - Term Growth Strategy Launch and expand technology based business Expand supplier network in key cities, seek overseas opportunities Keep investing in technology Strategic cooperation with more leading NEV companies Seek M&A opportunities Launch technology business by offering SaaS model software and expand sales into existing supplier networks • Strengthen and expand existing supplier network • Seek new opportunities with existing clients in cross - border business • Keep investing in R&D • Engage external R&D resources to enhance tech capability Seek opportunities to provide innovative services and insurance solutions to engage more NEV OEMs Seek M&A targets to enhance business lines or technologies 20

Financial Overview 21

36.9 76.5 199.8 138 224.9 238.9 246.5 320 2015 2016 2017 2018 2019 2020 2021 2022 Historical Total Revenue (mm USD) Historical Revenue 0.53 4.59 15.48 2020 2021 2022 Saas Servies revenue (mm USD) 65 138 153 184 199 2018 2019 2020 2021 2022 After - sales Business Revenue (mm USD) 282.4 CAGR 34% 22 Historical Revenue 507.39 568.73 735.62 2020 2021 2022 insurance premium (mm USD) 54.3 112.2 267.9 2020 2021 2022 Premium from NEV (mm USD) 23

No.1 market share in China for both digitalized enterprise automotive after - sales services as well as new energy vehicles (NEV) online insurance market 24 Established, nationwide service supplier network and massive institutional clients and insurance partners Proven, state - of - the - art, multi - tenant digital systems including innovative real - time online insurance platform Strong market tailwind, and poised to keep leadership in China with a pragmatic growth strategy globally Led by experienced and visionary management team 1 2 4 5 3 Beginning new era of expansion after Nasdaq listing 6 By SunCar Management October 2023 Thank you www.suncartech.com