UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16

OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

MOBILICOM LIMITED

Commission File Number 001-41427

(Translation of registrant’s name into English)

1 Rakefet Street

Shoham, Israel 6083705

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

Attached hereto and incorporated herein is the Registrant’s Australian Securities Exchange (“ASX”) announcement, dated October 12, 2023.

EXHIBIT INDEX

| Exhibit No. | ||

| 99.1 | ASX Announcement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MOBILICOM LIMITED | |||

| Date: October 12, 2023 | By: | /s/ Oren Elkayam | |

| Name: | Oren Elkayam | ||

| Title: | Chairman | ||

Exhibit 99.1

Letter to shareholders – Delisting conversion process update

12 October 2023

Dear Shareholder,

Further to our previous notification concerning the Delisting of Mobilicom Limited (the Company) from the Australian Stock Exchange (ASX), we wish to provide the following additional information concerning the process for conversion of your shares into American Depositary Shares (ADS) prior to the Delisting Date.

If you choose to wait until after the Delisting Date of 19th October 2023 to convert your shares to ADS, a different process will apply. Details to be provided with your share certificate which will be posted within 2-3 business days of delisting.

Do I need to have a US broker to be able to convert to ADS?

In order to settle any sale of ADSs you are issued you will need to have an account with a US broker who is a DTC Participant and who can hold the ADS on your behalf in DTC. It is possible to have the ADS registered into your own name, however holding the securities via a US broker is considered the most efficient from an investor perspective (refer to the section below for information in respect of this option).

What is DTC?

DTC is the Depository Trust Company, and is the standard electronic settlement system for equity securities in the US. Similar to the CHESS settlement system in Australia, broker participants use DTC to settle trades and hold securities on behalf of their clients.

I do not have an account with a US Broker. How do I get one?

As a first step you can talk to your Australian broker to see if they can assist, as many offer trading and settlement options for international securities. Your Australian broker may have a relationship with a US broker, which would allow you to establish and account.

Otherwise, you could visit the:

Moomoo Website - click here and establish an account.

Please note this is for information only. We are not providing a recommendation. You should make your own enquiries to determine whether they suit your requirements.

Once I have the account with a US broker, what should I do?

(a) Prior to Delisting from ASX

If you are a shareholder whose shares are held in a holding sponsored by your broker, after you have established your account (or if you had an existing account) you can ask that they make arrangements with HSBC Australia, the Australian custodian appointed to hold shares on behalf of the Bank of New York Mellon, the issuer of the ADS, to transfer your shares to HSBC. Your broker will also have to provide HSBC with details of the ADS delivery instructions: the name of your US broker, the broker's DTC Participant number and your account number with that US broker.

If you have established an account with Moomoo, the DTC details are shown below:

DTC Participant Firm Name: Futu Clearing Inc.

DTC Participant ID: 4272

DTC Account Number: 6801014

Client ID: (This

will be provided to you by Moomoo once your account is established.)

Holder Account Name - DTC participant/broker: FUTU

Securities (AU) Ltd

Email Address of the DTC participant/broker: transfers@futuclearing.com

Once BNY Mellon receives confirmation from HSBC that your underlying ordinary shares have been deposited, new ADSs are issued and delivered to your nominated U.S. broker, in accordance with the program's "Deposit Agreement". To help facilitate this process, BNY Mellon has agreed to waive the ADS issuance fees until 30 November for investors.

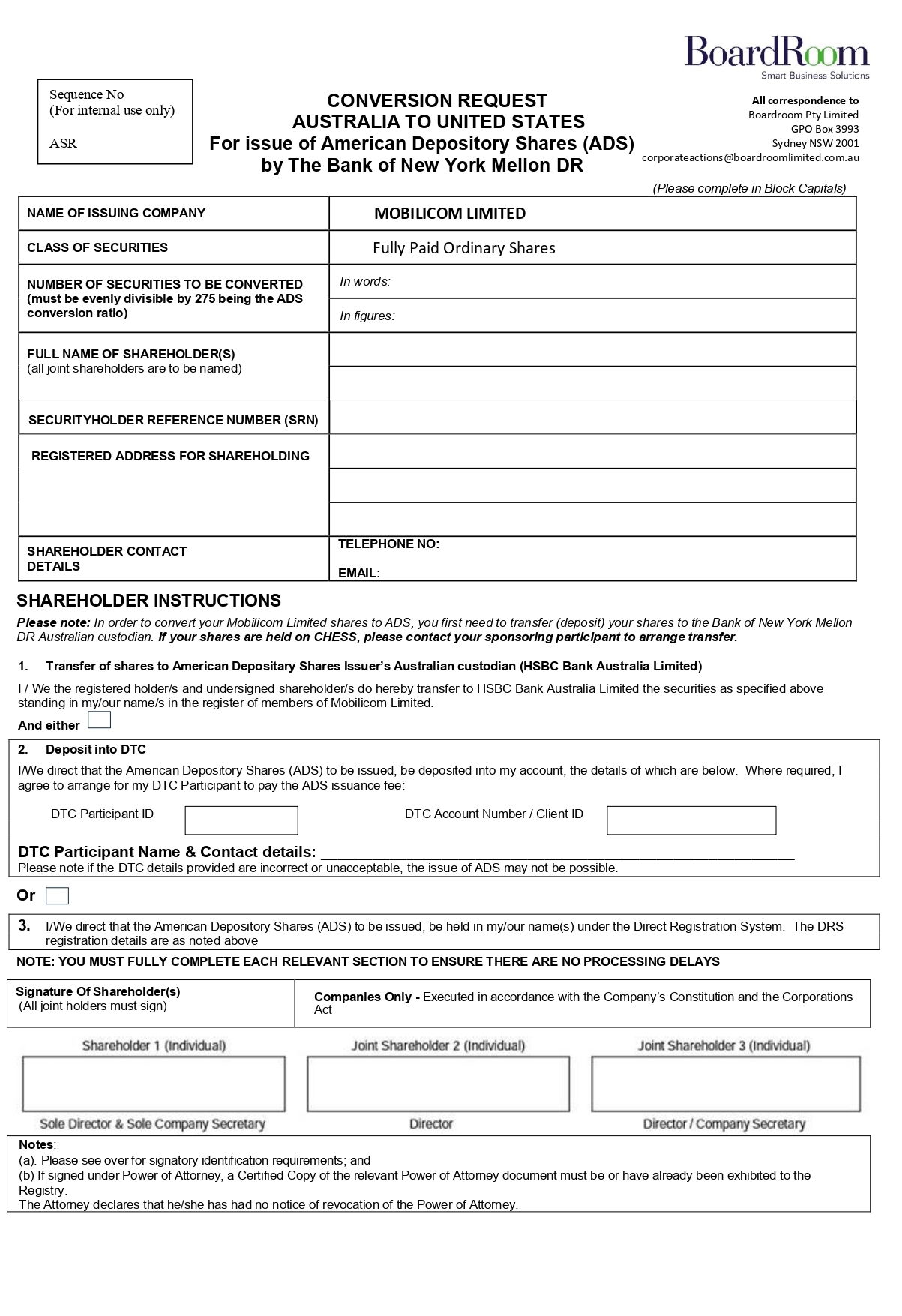

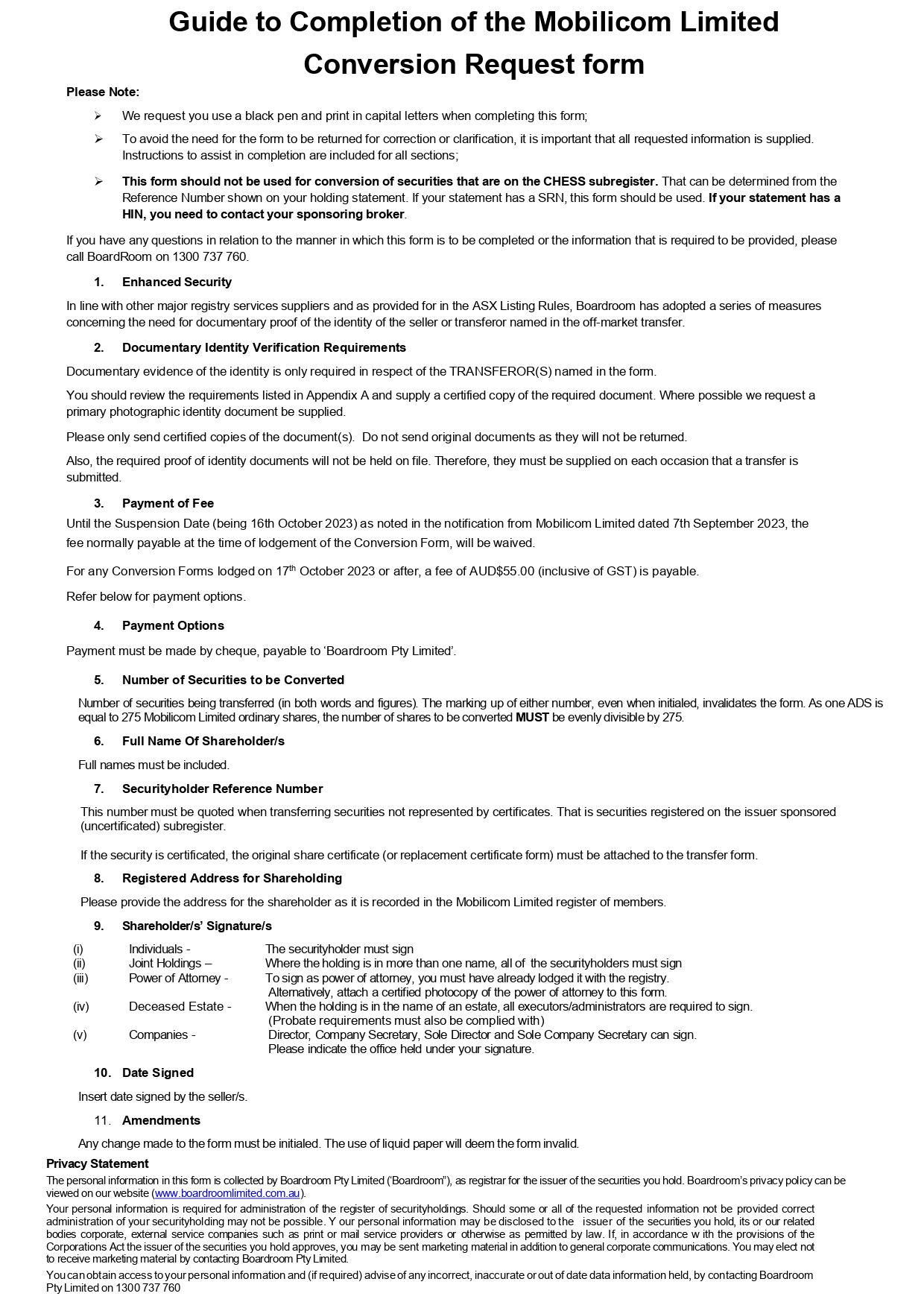

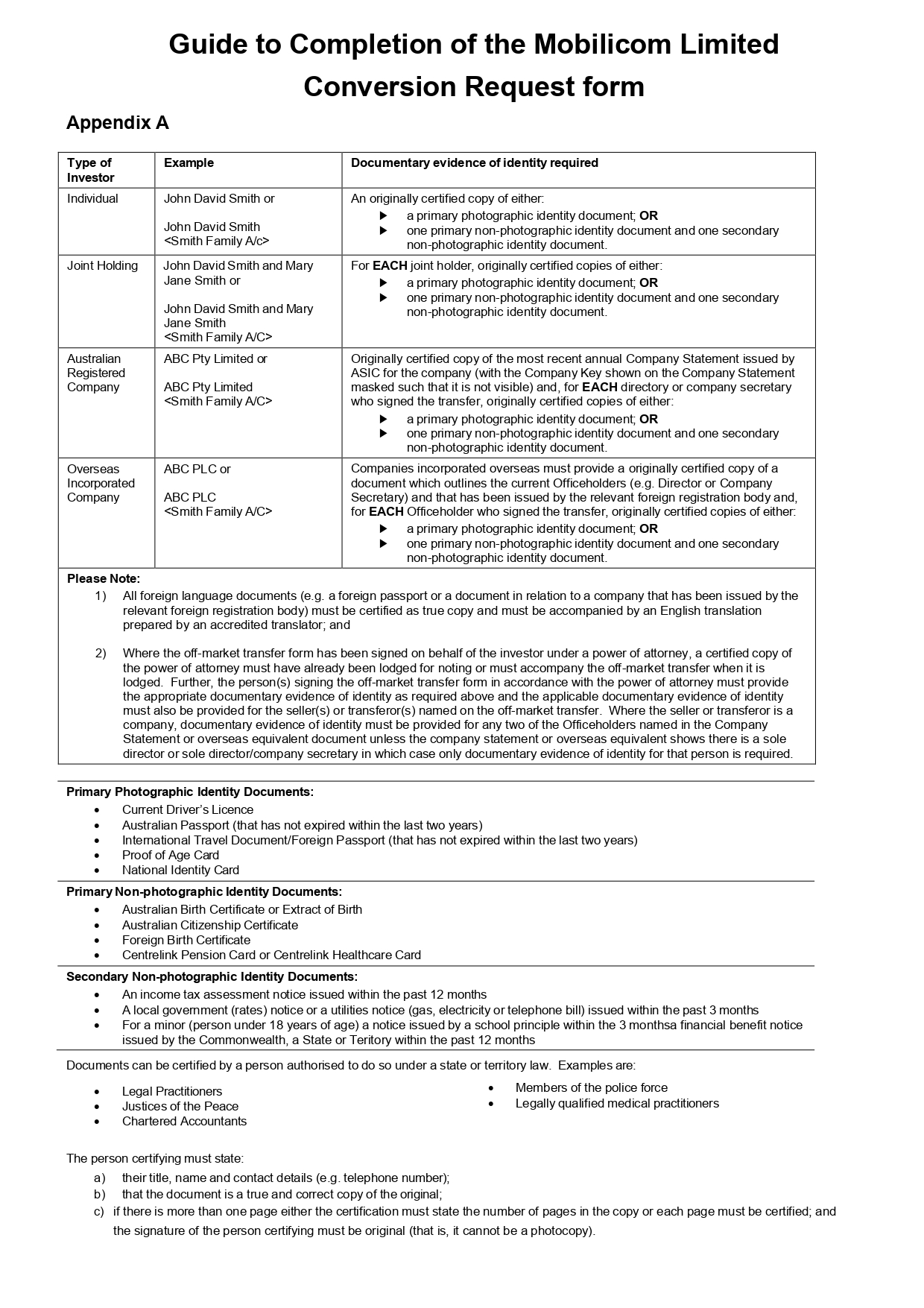

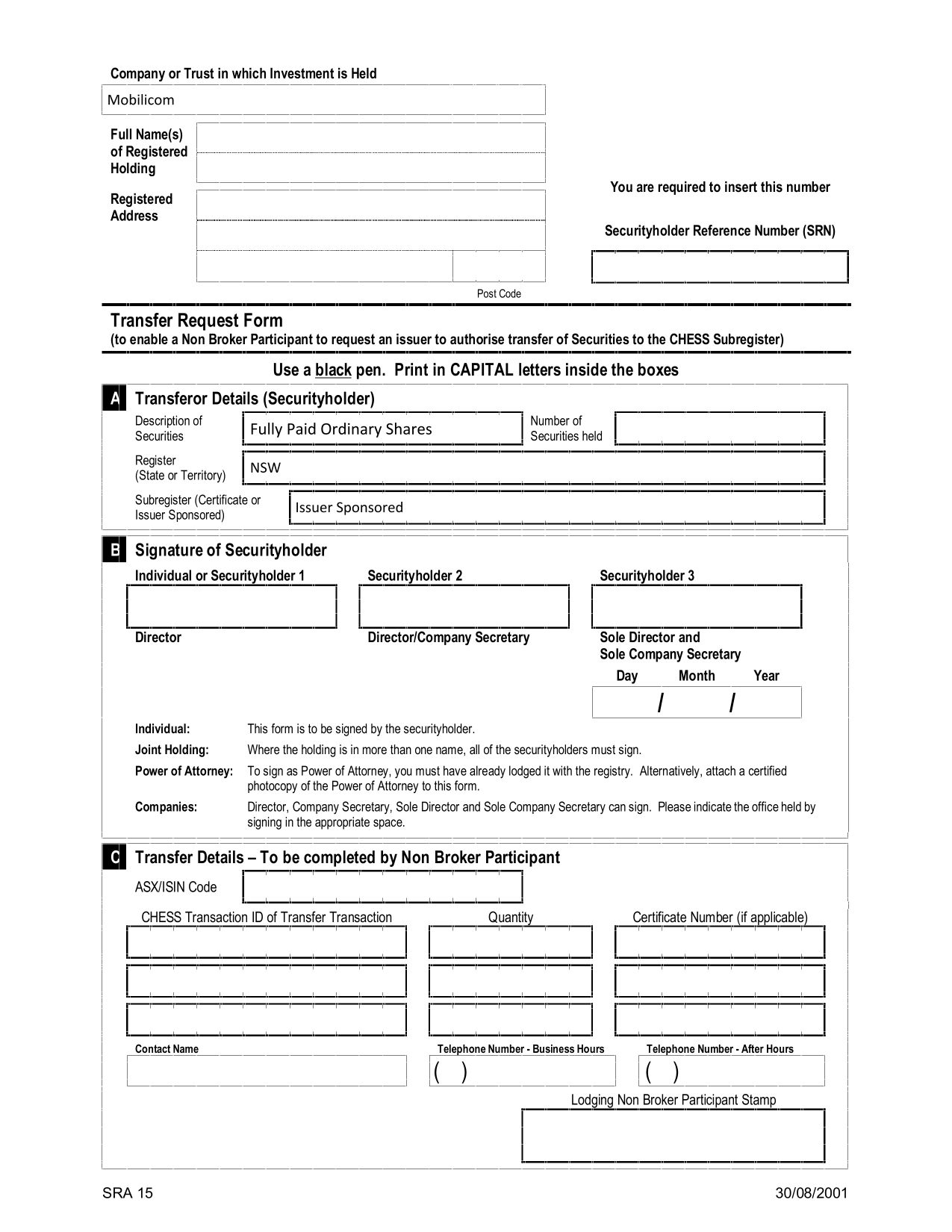

If your shares are not held in a holding sponsored by a broker but are held on the Issuer Sponsored sub- register, you will need to complete the form previously provided. You must include on the form all of the requested information; including the DTC Participant number and your account number. Return that form to the Company's share registrar; Boardroom Pty Limited. Please do not send the form directly to the ADS issuer (the Bank of New York Mellon) or their Australian custodian (HSBC). The Company's registrar will check the form for correct completion and, if appropriate, pass the information onto the Bank of New York Mellon, the ADS issuer.

(b) After delisting from ASX

You will be contacted after the proposed Delisting date of 19 October 2023 with further instructions.

I want the ADS to be registered into my name

Conversion of Mobilcom ordinary shares into ADSs can be registered under the investor?s name (non- broker account) in the Direct Registration System (DRS).

What is the Direct Registration System (DRS)?

Under DRS, you can elect to have your ADS securities registered directly on the ADS records in book- entry form. With DRS, you do not receive a physical certificate. Instead, you will receive periodic account statements (at least yearly) from the ADS registry, Computershare.

What do I have to do

If you are unable to open a US brokerage account, please provide name and address in the ADS delivery instructions section of the transfer form submitted to Boardroom.

Boardroom will check the form and pass the information onto the relevant party for processing.

Once BNY Mellon (the ADS issuer) receives confirmation that your ordinary shares have been deposited with your name and address, BNY Mellon will issue the ADSs in your name and address in the Direct Registration System (DRS) of the ADS registrar Computershare. DRS advice will be mailed to the address on record confirming the credit of the ADSs.

Note: ADSs held in this form can be more of an administrative burden for investors (and take longer to sell) compared to ADSs held via a US broker in DTC.

Copies of relevant forms are attached to this announcement.

About Mobilicom

Mobilicom is a leading provider of cybersecure robust solutions for the rapidly growing defense and commercial drones and robotics market. Mobilicom’s large portfolio of field-proven technologies includes cybersecurity, software, hardware, and professional services that power, connect, guide, and secure drones and robotics. Through deployments across the globe with over 50 customers, including the world’s largest drone manufacturers, Mobilicom’s end-to-end solutions are being incorporated in mission-critical functions.

For investors, please use https://ir.mobilicom.com/

For company, please use www.mobilicom.com

This announcement has been approved for release by the Board of Mobilicom.

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. For example, the Company is using forward-looking statements when it discusses the acceleration of its penetration into the fostering its established long-term relationships with government and defense contractors and building new connections with prospective customers that seek cybersecure solutions for their autonomous vehicles. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Mobilicom Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the Company’s filings with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Mobilicom Limited undertakes no duty to update such information except as required under applicable law.

For more information on Mobilicom, please contact:

Liad Gelfer

Mobilicom Ltd

liad.gelfer@mobilicom.com

Mobilicom Limited

CONVERSION AND ISSUANCE GUIDE

| ● | Issuer Sponsored holders (shares held via SRN at Boardroom, Mobilicom’s registry) |

| ○ | Please contact Boardroom directly for the required forms and process |

| ● | CHESS sponsored holdings (shares held via an Australian broker) |

| ○ | Converting your ASX-listed ordinary shares into ADSs can be done via your broker: |

| ● | Ordinary MOB shares need to be transferred to BNY Mellon's local custodian, HSBC Bank Australia Limited (SWIFT BIC: HKBAAU2SSYD, CHESS PID: 20057, Safekeeping Account: 011- 552130-068). This process is usually completed by your broker via an electronic CHESS transfer, or broker transfer form. Your broker should be able to assist with this. |

| ● | HSBC also require the U.S. ADS delivery instructions to accompany any deposit of ordinary shares. This information should be sent via email to adrconversions.hbau@hsbc.com.au and should include details of the institution where the ADRs will be delivered to in the U.S. market (i.e., institution / broker name, DTC account number, investor name). |

| ● | Once BNY Mellon receives confirmation from HSBC that your underlying ordinary shares have been deposited, new ADSs are issued and delivered to your nominated U.S. broker, in accordance with the program’s “Deposit Agreement”. |

Your broker’s back office will be familiar with the ordinary share to ADS conversion process. Should your broker have a settlement enquiry, they can contact drsettlements@bnymellon.com.

Direct Registration System (DRS) settlement

Conversion of Mobilcom ordinary shares into ADSs can be registered under the investor’s name (non- broker account) in the Direct Registration System (DRS).

| ● | In case a shareholder does not have a US brokerage account, please provide name and address in the ADS delivery instructions section of the transfer form submitted to Boardroom. |

| ● | Once BNY Mellon receives confirmation that your ordinary shares have been deposited with your name and address, BNY Mellon will issue the ADSs in your name and address in the Direct Registration System (DRS) of the transfer agent. DRS advice will be mailed to the address on record confirming the credit of the ADSs. |

| ● | Note: ADSs held in this form can be more of an administrative burden for investors (and take longer to sell) compared to ADSs held via a US broker |

Note: All deposits must result in the issuance of whole American Depositary Shares (“ADSs”), and must respect the ADS ratio of 1 ADS = 275 ordinary shares. BNYM will not issue fractional ADSs and deposits resulting in fractional ADSs will be rejected by our custodian.

8