UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of, October 2023

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

EXPLANATORY NOTE

Guardforce AI Co., Limited (the “Company”) is furnishing this Form 6-K to provide the unaudited consolidated financial statements for the six months ended June 30, 2023 and 2022 and incorporate such financial statements into the Company’s registration statements referenced below.

This report on Form 6-K and the attached Exhibits 99.1, 99.2 and 99.3 are incorporated by reference into (i) the prospectus contained in the Company’s registration statement on Form F-3 (SEC File No. 333-261881) declared effective by the Securities and Exchange Commission on January 5, 2022, (ii) the prospectus dated February 9, 2022 contained in the Company’s registration statement on Form F-3 (SEC File No. 333-262441) declared effective by the Securities and Exchange Commission on February 9, 2022, and (iii) the prospectus dated June 14, 2022 contained in the Company’s post-effective Amendment No. 1 to the Form F-1 registration statement on Form F-3 (SEC File No. 333-258054) declared effective by the Securities and Exchange Commission on June 14, 2022.

FORWARD-LOOKING INFORMATION

This Report on Form 6-K contains forward-looking statements and information relating to us that are based on the current beliefs, expectations, assumptions, estimates and projections of our management regarding our company and industry. When used in this report, the words “may”, “will”, “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. These statements reflect management’s current view of us concerning future events and are subject to certain risks, uncertainties and assumptions, including among many others: our negative operating profits may raise substantial doubt regarding our ability to continue as a going concern, our substantial customer concentration, with a limited number of customers accounting for a substantial portion of our recent revenues, our subsidiaries’ ability to distribute dividends to us may be subject to restrictions under the laws of their respective jurisdictions, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, political and social events in Thailand, the volatility of the securities markets, and other risks and uncertainties which are generally set forth under the heading, “Key information - Risk Factors” and elsewhere in our Annual Report on Form 20-F filed on May 1, 2023 (the “Annual Report”). Should any of these risks or uncertainties materialize, or should the underlying assumptions about our business and the commercial markets in which we operate prove incorrect, actual results may vary materially from those described as anticipated, estimated or expected in the Annual Report.

All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligations to update these forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: October 2, 2023 | Guardforce AI Co., Limited | |

| By: | /s/ Lei Wang | |

| Lei Wang | ||

| Chief Executive Officer | ||

EXHIBIT INDEX

| Exhibit Number | Description | |

| 99.1 | Unaudited Interim Consolidated Financial Statements as of June 30, 2023 and for the six months ended June 30, 2023 and 2022 | |

| 99.2 | Operating and Financial Review and Prospects in Connection with the Interim Consolidated Financial Statements for the six months ended June 30, 2023 | |

| 99.3 | Press Release titled “Guardforce AI Reports Interim Financial Results for the First Half of 2023, and Provides Business Update” dated October 2, 2023 | |

| 101.INS | Inline XBRL Instance Document | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104 | Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

4

Exhibit 99.1

GUARDFORCE AI CO., LIMITED AND SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 and 2022

F-

Guardforce AI Co., Limited and Subsidiaries

Unaudited Interim Condensed Consolidated Balance Sheets

(Expressed in U.S. Dollars)

| Note | As of June 30, 2023 |

As of December 31, 2022 |

||||||||||

| (Unaudited) | ||||||||||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | 4 | $ | 24,738,377 | $ | 6,930,639 | |||||||

| Restricted cash | 4 | 17,059 | ||||||||||

| Trade receivables | 6 | 5,127,998 | 5,400,186 | |||||||||

| Other receivables | 8 | 817,564 | ||||||||||

| Other current assets | 9 | 2,380,718 | 1,743,008 | |||||||||

| Withholding tax receivable, net | 7 | 536,974 | 757,024 | |||||||||

| Inventories | 5 | 1,636,245 | 5,105,770 | |||||||||

| Amounts due from related parties | 22 | 7,716,503 | 14,508,873 | |||||||||

| Total current assets | 42,153,874 | 35,263,064 | ||||||||||

| Non-current assets: | ||||||||||||

| Restricted cash | 4 | 1,274,956 | 1,300,005 | |||||||||

| Property, plant and equipment | 10 | 6,018,408 | 8,066,761 | |||||||||

| Right-of-use assets | 11 | 3,323,870 | 4,171,409 | |||||||||

| Intangible assets, net | 12 | 6,954,467 | 5,793,143 | |||||||||

| Goodwill | 3 | 1,416,405 | 2,679,445 | |||||||||

| Withholding tax receivable, net | 7 | 1,921,073 | 1,934,072 | |||||||||

| Deferred tax assets, net | 17 | 634,619 | 1,511,753 | |||||||||

| Other non-current assets | 9 | 397,030 | 447,322 | |||||||||

| Total non-current assets | 21,940,828 | 25,903,910 | ||||||||||

| Total assets | $ | 64,094,702 | $ | 61,166,974 | ||||||||

| Liabilities and Equity | ||||||||||||

| Current liabilities: | ||||||||||||

| Trade and other payables | 13 | $ | 3,065,838 | $ | 2,633,995 | |||||||

| Borrowings | 14 | 3,509,709 | 3,181,616 | |||||||||

| Borrowing from a related party | 22 | 1,666,846 | 3,148,500 | |||||||||

| Current portion of operating lease liabilities | 11 | 1,645,233 | 1,774,192 | |||||||||

| Current portion of finance lease liabilities, net | 16 | 200,383 | 398,136 | |||||||||

| Other current liabilities | 13 | 2,837,287 | 2,477,369 | |||||||||

| Amounts due to related parties | 22 | 3,703,038 | 3,868,691 | |||||||||

| Convertible note payables | 15 | 606,786 | 1,730,267 | |||||||||

| Total current liabilities | 17,235,120 | 19,212,766 | ||||||||||

| Non-current liabilities: | ||||||||||||

| Borrowings | 14 | 13,727,574 | 13,899,818 | |||||||||

| Operating lease liabilities | 11 | 1,686,803 | 2,340,075 | |||||||||

| Borrowings from related parties | 22 | 1,437,303 | 1,455,649 | |||||||||

| Finance lease liabilities | 16 | 229,747 | 233,550 | |||||||||

| Other non-current liabilities | 43,200 | |||||||||||

| Provision for employee benefits | 18 | 4,775,062 | 4,849,614 | |||||||||

| Total non-current liabilities | 21,856,489 | 22,821,906 | ||||||||||

| Total liabilities | 39,091,609 | 42,034,672 | ||||||||||

| Equity | ||||||||||||

| Ordinary shares – par value $0.12 authorized 300,000,000 shares, issued and outstanding 6,883,223 shares at June 30, 2023; par value $0.12 authorized 7,500,000 shares, issued and outstanding 1,618,977 shares at December 31, 2022 | 826,022 | 194,313 | ||||||||||

| Subscription receivable | (50,000 | ) | (50,000 | ) | ||||||||

| Additional paid in capital | 65,150,407 | 46,231,302 | ||||||||||

| Legal reserve | 21 | 223,500 | 223,500 | |||||||||

| Warrants reserve | 251,036 | 251,036 | ||||||||||

| Accumulated deficit | (42,588,233 | ) | (28,769,014 | ) | ||||||||

| Accumulated other comprehensive income | 1,281,904 | 1,112,494 | ||||||||||

| Capital & reserves attributable to equity holders of the Company | 25,094,636 | 19,193,631 | ||||||||||

| Non-controlling interests | (91,543 | ) | (61,329 | ) | ||||||||

| Total equity | 25,003,093 | 19,132,302 | ||||||||||

| Total liabilities and equity | $ | 64,094,702 | $ | 61,166,974 | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-

Guardforce AI Co., Limited and Subsidiaries

Unaudited Interim Condensed Consolidated Statement of Profit or Loss

(Expressed in U.S. Dollars)

| Note | For the six months ended June 30, |

|||||||||||

| 2023 | 2022 | |||||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Revenue | 2.13 | $ | 18,413,292 | $ | 16,942,522 | |||||||

| Cost of sales | 2.14 | (15,939,067 | ) | (14,998,727 | ) | |||||||

| Gross profit | 2,474,225 | 1,943,795 | ||||||||||

| Stock based compensation | (252,095 | ) | ||||||||||

| Provision for and write off of withholding tax receivable | (561,277 | ) | (263,340 | ) | ||||||||

| Provision for expected credit loss on trade and other receivables | (870,408 | ) | ||||||||||

| Provision for obsolete inventories | (3,090,283 | ) | ||||||||||

| Impairment loss on fixed assets | (1,591,766 | ) | ||||||||||

| Impairment of goodwill | (1,263,040 | ) | ||||||||||

| Selling, distribution and administrative expenses | 20 | (6,981,660 | ) | (6,977,996 | ) | |||||||

| Operating loss | (11,884,209 | ) | (5,549,636 | ) | ||||||||

| Other income, net | 77,765 | 46,859 | ||||||||||

| Foreign exchange losses, net | (583,661 | ) | (745,759 | ) | ||||||||

| Finance costs | (584,897 | ) | (410,861 | ) | ||||||||

| Loss before income tax | (12,975,002 | ) | (6,659,397 | ) | ||||||||

| Provision for income tax (expense) benefit | 17 | (874,431 | ) | 320,183 | ||||||||

| Net loss for the period | (13,849,433 | ) | (6,339,214 | ) | ||||||||

| Less: net loss attributable to non-controlling interests | 30,214 | 32,392 | ||||||||||

| Net loss attributable to equity holders of the Company | $ | (13,819,219 | ) | $ | (6,306,822 | ) | ||||||

| Loss per share | ||||||||||||

| $ | (4.35 | ) | $ | (7.16 | ) | |||||||

| Weighted average number of shares used in computation: | ||||||||||||

| 3,174,282 | 880,618 | |||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-

Guardforce AI Co., Limited and Subsidiaries

Unaudited Interim Condensed Consolidated Statement of Comprehensive Loss

(Expressed in U.S. Dollars)

| Note | For the six months ended June 30, |

|||||||||

| 2023 | 2022 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||

| Net (loss) for the period | $ | (13,849,433 | ) | $ | (6,339,214 | ) | ||||

| Currency translation differences | 2.6 | 169,410 | (197,909 | ) | ||||||

| Total comprehensive (loss) for the period | $ | (13,680,023 | ) | $ | (6,537,123 | ) | ||||

| Attributable to: | ||||||||||

| Equity holders of the Company | $ | (13,651,390 | ) | $ | (6,502,884 | ) | ||||

| Non-controlling interests | (28,633 | ) | (34,239 | ) | ||||||

| $ | (13,680,023 | ) | $ | (6,537,123 | ) | |||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-

Guardforce AI Co., Limited and Subsidiaries

Unaudited Interim Condensed Consolidated Statement of Changes in Equity (Deficit)

(Expressed in U.S. Dollars)

| Accumulated | ||||||||||||||||||||||||||||||||||||||||

| Number of Shares | Amount ($0.12 par) |

Subscription Receivable |

Additional Paid-in Capital |

Legal Reserve |

Warrants Reserves |

Other Comprehensive Income |

Accumulated Deficit |

Non- controlling Interests | Total Equity |

|||||||||||||||||||||||||||||||

| Balance as of December 31, 2021 | 529,766 | $ | 63,606 | $ | (50,000 | ) | $ | 15,379,595 | $ | 223,500 | $ | 251,036 | $ | 821,527 | $ | (10,204,220 | ) | $ | 39,935 | $ | 6,524,979 | |||||||||||||||||||

| Currency translation adjustments | - | - | - | - | - | - | (197,909 | ) | - | - | (197,909 | ) | ||||||||||||||||||||||||||||

| Stock-based compensation expenses | 7,000 | 840 | - | 251,255 | - | - | - | - | - | 252,095 | ||||||||||||||||||||||||||||||

| Cancellation of shares | (2 | ) | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||

| Issuance of ordinary shares through private placements | 416,483 | 49,978 | - | 18,225,749 | - | - | - | - | - | 18,275,727 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares through exercise of warrants | 27,377 | 3,285 | - | 1,420,404 | - | - | - | - | - | 1,423,689 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares for acquisition of subsidiaries | 148,071 | 17,769 | - | 4,562,111 | - | - | - | - | - | 4,579,880 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares for deposit paid for acquisitions of subsidiaries | 243,000 | 29,160 | 4,830,840 | 4,860,000 | ||||||||||||||||||||||||||||||||||||

| Net loss for the period | - | - | - | - | - | - | - | (6,306,822 | ) | (32,392 | ) | (6,339,214 | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2022 (Unaudited) | 1,371,695 | $ | 164,638 | $ | (50,000 | ) | $ | 44,669,954 | $ | 223,500 | $ | 251,036 | $ | 623,618 | $ | (16,511,042 | ) | $ | 7,543 | $ | 29,379,247 | |||||||||||||||||||

| Balance as of December 31, 2022 | 1,618,977 | $ | 194,313 | $ | (50,000 | ) | $ | 46,231,302 | $ | 223,500 | $ | 251,036 | $ | 1,112,494 | $ | (28,769,014 | ) | $ | (61,329 | ) | $ | 19,132,302 | ||||||||||||||||||

| Currency translation adjustments | - | - | - | - | - | - | 169,410 | - | - | 169,410 | ||||||||||||||||||||||||||||||

| Cancellation of shares (Note 19) | (245,339 | ) | (29,441 | ) | - | (4,880,223 | ) | - | - | - | - | - | (4,909,664 | ) | ||||||||||||||||||||||||||

| Issuance of ordinary shares through CMPOs (Note 19) | 4,946,184 | 593,542 | - | 20,273,844 | - | - | - | - | - | 20,867,386 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares through exercise of warrants (Note 19) | 128,901 | 15,468 | - | 491,224 | - | - | - | - | - | 506,692 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares for acquisition of assets (Note 19) | 262,500 | 31,500 | - | 1,816,500 | - | - | - | - | - | 1,848,000 | ||||||||||||||||||||||||||||||

| Issuance of ordinary shares for a convertible note conversion (Note 19) | 172,000 | 20,640 | 1,217,760 | 1,238,400 | ||||||||||||||||||||||||||||||||||||

| Net loss for the period | - | - | - | - | - | - | - | (13,819,219 | ) | (30,214 | ) | (13,849,433 | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2023 (Unaudited) | 6,883,223 | $ | 826,022 | $ | (50,000 | ) | $ | 65,150,407 | $ | 223,500 | $ | 251,036 | $ | 1,281,904 | $ | (42,588,233 | ) | $ | (91,543 | ) | $ | 25,003,093 | ||||||||||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

F-

Guardforce AI Co., Limited and Subsidiaries

Unaudited Interim Condensed Consolidated Statement of Cash Flows

(Expressed in U.S. Dollars)

| For the six months ended June 30, |

||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (13,849,433 | ) | $ | (6,339,214 | ) | ||

| Adjustments for: | ||||||||

| Depreciation and Amortization of fixed and intangible assets | 2,619,001 | 2,697,378 | ||||||

| Stock-based compensation | - | 252,095 | ||||||

| Provision for and write off of withholding tax receivable | 561,277 | 263,340 | ||||||

| Provision for expected credit loss on trade and other receivables | 869,519 | - | ||||||

| Provision for obsolete inventories | 3,090,282 | - | ||||||

| Impairment loss on fixed assets | 1,591,766 | - | ||||||

| Impairment on goodwill | 1,263,040 | - | ||||||

| Finance costs | 584,897 | 506,818 | ||||||

| Loss from fixed assets disposal | 41,965 | 24,530 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Decrease (Increase) in trade and other receivables | 157,279 | (205,716 | ) | |||||

| Increase in other assets | (719,595 | ) | (968,103 | ) | ||||

| Decrease (Increase) in inventories | 296,824 | (5,521,429 | ) | |||||

| Decrease (Increase) in amounts due from/to related parties | 639,807 | (6,111,443 | ) | |||||

| Decrease (Increase) in deferred tax assets | 874,431 | (325,083 | ) | |||||

| Increase in Trade and other payables and other current liabilities | 1,285,317 | 1,265,752 | ||||||

| (Decrease) Increase in withholding tax receivable | (374,013 | ) | 663,095 | |||||

| Increase (Decrease) in provision for employee benefits | 20,774 | (29,812 | ) | |||||

| Net cash used in operating activities | (1,046,862 | ) | (13,827,792 | ) | ||||

| Cash flows from investing activities | ||||||||

| Acquisition of property, plant and equipment | (829,231 | ) | (2,309,334 | ) | ||||

| Proceeds from sale of property, plant and equipment | - | 4,120 | ||||||

| Acquisition of intangible assets | (217,077 | ) | (3,082,880 | ) | ||||

| Acquisition of subsidiaries, net of cash acquired | - | (1,793,614 | ) | |||||

| Deposits paid for business acquisitions | - | (2,160,000 | ) | |||||

| Net cash used in investing activities | (1,046,308 | ) | (9,341,708 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from issue of shares | 20,867,386 | 18,275,728 | ||||||

| Proceeds from exercise of warrants | 506,693 | 1,423,690 | ||||||

| Cash paid for the cancellation of fractional shares | (49,664 | ) | - | |||||

| Proceeds from borrowings | 1,756,738 | - | ||||||

| Repayment of borrowings | (1,937,096 | ) | (840,762 | ) | ||||

| Payment of lease liabilities | (1,267,979 | ) | (1,483,203 | ) | ||||

| Net cash generated from financing activities | 19,876,078 | 17,375,453 | ||||||

| Net decrease in cash and cash equivalents, and restricted cash | 17,782,908 | (5,794,047 | ) | |||||

| Effect of movements in exchange rates on cash | 16,840 | (519,523 | ) | |||||

| Cash and cash equivalents, and restricted cash at January 1, | 8,230,644 | 15,853,811 | ||||||

| Cash and cash equivalents, and restricted cash at June 30, | $ | 26,030,392 | $ | 9,540,241 | ||||

| Non-cash investing and financing activities | ||||||||

| Equity portion of purchase consideration paid for acquisition of subsidiaries | - | 4,579,879 | ||||||

| Equity portion of purchase consideration paid for acquisition of assets (Note 19) | 1,848,000 | - | ||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

F-

Guardforce AI Co., Limited and Subsidiaries

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(Expressed in U.S. Dollars)

| 1. | NATURE OF OPERATIONS |

Guardforce AI Co., Limited (“Guardforce”) is a company incorporated and domiciled in the Cayman Islands under the Cayman Islands Companies Act on April 20, 2018. The Company’s ordinary shares and warrants are listed under the symbol “GFAI” and “GFAIW”, respectively, on the Nasdaq Capital Market upon the completion of an initial public offering on September 28, 2021.

Guardforce AI Holding Limited (“AI Holdings”) was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on May 22, 2018. AI Holdings is a 100% owned subsidiary of Guardforce. AI Holdings is an investment holding company.

Guardforce AI Robots Limited (“AI Robots”) was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on May 22, 2018. AI Robots is a 100% owned subsidiary of Guardforce. AI Robots is an investment holding company.

Guardforce AI (Hong Kong) Co., Limited (“AI Hong Kong”) was incorporated in Hong Kong under the Hong Kong Companies’ Ordinance (Chapter 622), on May 30, 2018. AI Hong Kong is a 100% owned subsidiary of Guardforce. Beginning March 2020, AI Hong Kong commenced robotic AI solution business of selling and leasing robots.

Southern Ambition Limited (“Southern Ambition”) was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on August 3, 2018. Southern Ambition is a 100% owned subsidiary of AI Robots. Southern Ambition is an investment holding company.

Horizon Dragon Limited (“Horizon Dragon”) was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on July 3, 2018. Horizon Dragon is a 100% owned subsidiary of AI Holdings. Horizon Dragon is an investment holding company.

Guardforce AI Group Co., Limited (“AI Thailand”) was incorporated in Thailand under the Civil and Commercial Code at the Registry of partnerships and Companies, Bangkok Metropolis, Thailand, on September 21, 2018 and has 100,000 ordinary plus preferred shares outstanding. 48,999 of the shares in AI Thailand are owned by Southern Ambition Limited, with one share being held by Horizon Dragon Limited, for an aggregate of 49,000 ordinary shares, or 49%, and 51,000 cumulative preferred shares are owned by two individuals of Thailand. The two individuals owned in aggregate 49,000 ordinary shares with a value of approximately $16,000. The cumulative preferred shares are entitled to dividends of USD$0.03 per share when declared. The cumulative unpaid dividends of the preferred shares as of June 30, 2023 and December 31, 2022 is approximately $1,700. Pursuant to article of associates of AI Thailand, the holder of an ordinary share may cast one vote per share at a general meeting of shareholders, the holder of preferred shares may cast one vote for every 20 preferred shares held at a general meeting of shareholders. Southern Ambition is entitled to cast more than 95% of the votes at a general meeting of shareholders. No dividends were declared for the six months ended June 30, 2023 and 2022.

Guardforce Cash Solutions Security Thailand Co., Limited (“GF Cash (CIT)”) was incorporated in Thailand under the Civil and Commercial Code at the Registry of partnerships and Companies, Bangkok Metropolis, Thailand, on July 27, 1982 and has 3,857,144 outstanding shares. 3,799,544 ordinary shares and 21,599 preferred shares of the outstanding shares in GF Cash (CIT) (approximately 99.07% of the shares in GF Cash (CIT)) are owned by AI Thailand with one preferred share being held by Southern Ambition and 33,600 ordinary shares and 2,400 preferred shares (approximately 0.933% of the shares in GF Cash (CIT)) being held by Bangkok Bank Public Company Limited. Pursuant to the articles of association a shareholder may cast one vote per one share at a general meeting of shareholders. AI Thailand is entitled to cast 99.07% of the votes at a general meeting of shareholders. No dividends were declared for the six months ended June 30, 2023 and 2022. The Company engages principally in providing cash management and handling services located in Thailand.

F-

On March 25, 2021, the Company acquired 51% majority stake in information security consultants Handshake Networking Ltd (“Handshake”), a Hong Kong-based company specializing in penetration testing and forensics analysis in Hong Kong and the Asia Pacific region since 2004.

On November 1, 2021, the Company entered into a Transfer Agreement (the “Singapore Agreement”) to acquire 100% of the equity interests in Guardforce AI Singapore Pte. Ltd. (“AI Singapore”), a company incorporated in Singapore. Pursuant to the Agreement, AI Singapore became a wholly owned subsidiary of the Company. AI Singapore commenced robotic AI solution business of selling and leasing robots.

On November 18, 2021, the Company entered into a Transfer Agreement (the “Macau Agreement”) to acquire 100% of the equity interests in Macau GF Robotics Limited, a company incorporated in Macau (“AI Macau”). The consideration is approximately $3,205 (MOP25,000). AI Macau commenced robotic AI solution business of selling and leasing robots. The acquisition was closed on February 9, 2022. AI Macau is a 100% owned subsidiary of AI Robotics.

On November 18, 2021, the Company entered into another Transfer Agreement (the “Malaysia Agreement”) to acquire 100% of the equity interests in GF Robotics Malaysia Sdn. Bhd., a company incorporated in Malaysia (“AI Malaysia”). The consideration is approximately $1 (RM1). AI Malaysia commenced robotic AI solution business of selling and leasing robots. The acquisition was closed on January 20, 2022. AI Malaysia is a 100% owned subsidiary of AI Robotics.

GFAI Robotics Group Co., Limited (“AI Robotics”) was incorporated in the British Virgin Islands under the BVI Business Companies Act, 2004, on December 6, 2021. AI Robotics is a 100% owned subsidiary of Guardforce. AI Robotics is an investment holding company.

GFAI Robot Service (Hong Kong) Limited (“AI Robot Service”) was incorporated in Hong Kong under the Hong Kong Companies’ Ordinance (Chapter 622), on January 18, 2022. AI Robot Service is an investment holding company. AI Robot Service is a 100% owned subsidiary of AI Robotics.

Guardforce AI Robot Service (Shenzhen) Co., Limited (“AI Shenzhen”) was incorporated in the People’s Republic of China (“PRC”) on February 23, 2022. AI Shenzhen is an investment holding company. AI Shenzhen is a 100% owned subsidiary of AI Robot Service.

GFAI Robotics Services LLC (“AI US”) was incorporated in the State of Delaware on February 28, 2022. AI US commenced robotic AI solution business of selling and leasing robots. AI US is a 100% owned subsidiary of AI Robotics.

GFAI Robot Service (Australia) Pty Ltd. (“AI Australia”) was incorporated in Australia on February 28, 2022. AI Australia commenced robotic AI solution business of selling and leasing robots. AI Australia is a 100% owned subsidiary of AI Robot Service.

GFAI Robot & Smart Machines Trading LLC (“AI Dubai”) was incorporated in the United Arab Emirates (UAE) on March 13, 2022. AI Dubai commenced robotic AI solution business of selling and leasing robots. AI Dubai is a 100% owned subsidiary of AI Robot Service.

GFAI Robotic and Innovation Solution (Thailand) Company Limited (“AI R&I”) was incorporated in Thailand on March 30, 2022. AI R&I commenced robotic AI solution business of selling and leasing robots. AI R&I is 98% owned by AI Thailand, 1% owned by Horizon Dragon and 1% owned by Southern Ambition.

GFAI Robot Service (UK) Limited (“AI UK”) was incorporated in the United Kingdom on April 29, 2022. AI UK commenced robotic AI solution business of selling and leasing robots. AI UK is a 100% owned subsidiary of AI Robot Service.

F-

GFAI Robot Service Limited (“AI Canada”) was incorporated in Canada on May 6, 2022. AI Canada commenced robotic AI solution business of selling and leasing robots. AI Canada is a 100% owned subsidiary of AI Robot Service.

Guardforce AI Robot (Jian) Co., Limited (“AI Jian”) was incorporated in the People’s Republic of China (“PRC”) on May 16, 2022. AI Jian is an investment holding company. AI Jian is a 100% owned subsidiary of AI Robot Service.

GFAI Robot Service GK (“AI Japan”) was incorporated in Japan on May 24, 2022. AI Japan commenced robotic AI solution business of selling and leasing robots. AI Japan is a 100% owned subsidiary of AI Hong Kong.

GFAI Robot Service Co., Ltd. (“AI Korea”) was incorporated in South Korea on June 17, 2022. AI Korea commenced robotic AI solution business of selling and leasing robots. AI Korea is a 100% owned subsidiary of AI Hong Kong.

On March 11, 2022, the Company entered into a Sale and Purchase Agreement (the “Kewei Agreement”) with Shenzhen Kewei Robot Technology Co., Limited (“Shenzhen Kewei”) to acquire 100% of the equity interests in Shenzhen Keweien Robot Service Co., Ltd. (“Shenzhen GFAI”) and Guangzhou Kewei Robot Technology Co., Ltd. (“Guangzhou GFAI”) from Shenzhen Kewei. Both acquirees are PRC-based companies. The acquisition serves an integral role in the growth of the Company’s robotic AI solution business as a service (RaaS) business initiative. The acquisition was closed on March 22, 2022. The acquisition purchase price of $10,000,000 was paid in a mix of cash (10%) and restricted ordinary shares of the Company (90%). On March 14, 2022, the Company issued 53,571 (post-consolidation) restricted Ordinary Shares to the sellers’ designated parties.

On May 24, 2022, the Company entered into a Sale and Purchase Agreement (the “Yeantec Agreement”) with Shenzhen Yeantec Co., Limited (“Yeantec”) to acquire 100% of the equity interests in Beijing Wanjia Security System Co., Ltd. (“Beijing Wanjia”) from Yeantec. Beijing Wanjia is a PRC-based company with more than 25 years of experience in providing integrated security solution, focusing on fire alarm security systems, and a well-established customer base among retail businesses. The acquisition serves the growth of the Company’s other security business. The acquisition was closed on June 22, 2022. The acquisition purchase price of $8,400,000 was paid in a mix of cash (10%) and restricted ordinary shares of the Company (90%). On June 16, 2022, the Company issued 94,500 (post-consolidation) restricted Ordinary Shares to the sellers’ designated parties.

GFAI Robot Service (Vietnam) Co., Ltd (“AI Vietnam”) was incorporated in Vietnam on July 8, 2022. AI Vietnam is a dormant company and is a 100% owned subsidiary of AI Hong Kong. On March 22, 2023, the Company deregistered AI Vietnam.

On December 21, 2022, the Company entered into an asset purchase agreement (“Agreement”) with Shenzhen Kewei Robot Technology Co., Limited (“Shenzhen Kewei”) to purchase certain of Shenzhen Kewei’s robot-related business assets in China. The Company will acquire, and Yeantec will transfer to the Company, select robotic equipment assets and Kewei’s technology platform. The purchase price for these assets is $2,100,000, which will be fully paid in the form of 262,500 (post-consolidation) restricted ordinary shares of the Company based on a price of $8.0 (post-consolidation) per share. The Company issued 262,500 shares to Shenzhen Kewei on March 1, 2023.

F-

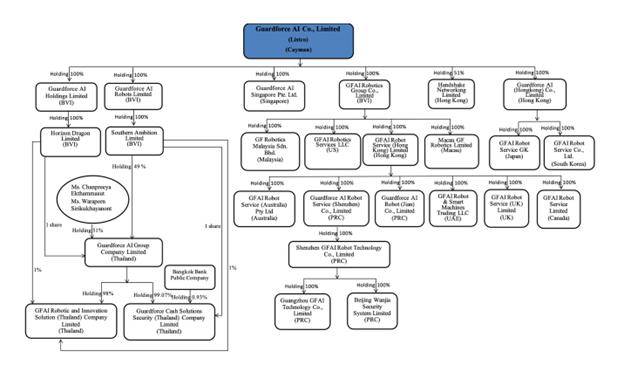

The following diagram illustrates the Company’s legal entity ownership structure as of June 30, 2023:

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The accounting policies applied for the six months ended June 30, 2023 and 2022 are consistent with those of the audited consolidated financial statements for the years ended December 31, 2022, 2021 and 2020, as described in those audited consolidated financial statements, except for the adoption of new and amended International Financial Reporting Standards (“IFRS”) effective for the year ending December 31, 2022 which are relevant to the preparation of the June 30, 2023 and 2022 interim condensed consolidated financial statements.

On September 25, 2023, the interim condensed consolidated financial statements were approved by the board of directors and authorized for issuance.

| 2.1 | Basis of presentation |

The accompanying interim condensed consolidated financial statements have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting”. These statements should be read in conjunction with the audited consolidated financial statements for the years ended December 31, 2022, 2021 and 2020, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The interim condensed consolidated financial statements have been prepared on a historical cost basis. In the opinion of management, all adjustments necessary for a fair presentation have been included in the accompanying unaudited condensed consolidated financial statements. The results of operations for the six months ended June 30, 2023 are not necessarily indicative of the results that may be expected for the full year ended December 31, 2023.

All amounts are presented in United States dollars (“USD”) and have been rounded to the nearest USD.

In addition, the accompanying condensed consolidated interim financial statements are presented on the basis that the Company is a going concern. The going concern assumption contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

F-

The Company’s operating losses and net current liability position may raise substantial doubt on the Company’s ability to continue as a going concern.

In assessing the going concern, management and the Board has considered:

| - | As of June 30, 2023, the current and non-current portion of loan outstanding with WK Venture Success Limited (“WK Venture”) were approximately $2.5 million and $13.6 million, respectively, which will be due on December 31, 2024 (Note 14). On September 28, 2023, WK Venture agreed to convert the principal and accrued interest of this loan in an aggregate amount of $15,914,615 at the conversion price of $5.40 into restricted ordinary shares of the Company. Thus, the loan with WK Venture has no impact on the Company’s liquidity and on the Company’s ability to meet its short-term financial obligations. |

| - | As of June 30, 2023, the Company has a convertible note payable of $606,786 with Streeterville Capital, LLC ( “CVP”), which will be due on October 24, 2023 (Note 15). Management believes this convertible note payable will be settled before the maturity date, either CVP will convert the outstanding balance into restricted ordinary shares or the Company will repay the amount owed in cash. |

| - | Based on the budget and financial plans of the Company, management is satisfied that the receipt of an aggregate of approximately $21.0 million, after deducting underwriting discounts and other offering expenses from the two underwritten public offering proceeds (Note 19) has provided the Company adequate financial resources to continue in operational existence for the foreseeable future, a period of at least 12 months from the date of this report. |

On January 31, 2023, the Company completed a 1 for 40 share consolidation of its authorized and issued ordinary shares whereby every forty shares were consolidated into one share. In addition, the par value of each ordinary share increased from $0.003 to $0.12. Immediately following the completion of the share consolidation, the Company increased its authorized ordinary shares from 7,500,000 ordinary shares to 300,000,000 ordinary shares. The accompanying interim condensed consolidated financial statements for the six months ended June 30, 2022 have been retroactively adjusted to reflect the effect of the share consolidation.

| 2.2 | Basis of consolidation |

The consolidated statements of profit or loss and other comprehensive loss, statements of changes in equity and statements of cash flows of the Company for the relevant periods include the results and cash flows of all companies now comprising the Company from the earliest date presented or since the date when the subsidiaries and/or businesses first came under the common control of the controlling shareholders, wherever the period is shorter.

The interim condensed consolidated balance sheet of the Company as of June 30, 2023 has been prepared to present the assets and liabilities of the subsidiaries under the historical cost convention.

Equity interests in subsidiaries held by parties other than the controlling shareholders are presented as non-controlling interests in equity.

All intra-group and inter-company transactions and balances have been eliminated on consolidation.

| 2.3 | Segment reporting |

Segment information is consistent with how management reviews the businesses, makes investing and resource allocation decisions and assesses operating performance. Transfers and sales between reportable segments, if any, are recorded at cost.

F-

The Company reports financial and operating information in the following five segments (Note 23):

| (i) | Secured logistics; |

| (ii) | Information security; |

| (iii) | Robotics AI solutions; |

| (iv) | General security solutions; and |

| (v) | Corporate and others |

| 2.4 | Business combinations |

The Company accounts for business combinations using the acquisition method when control is transferred to the Company, other than those between and among entities under common control. The consideration transferred in the acquisition is generally measured at fair value, as are the identifiable net assets acquired. Any goodwill that arises is tested annually for impairment. Any gain on the bargain purchase is recognized in the statement of profit or loss immediately. Transaction costs are expensed as incurred, except if related to the issue of debt or equity securities.

| 2.5 | Critical accounting estimate and judgements |

The preparation of the consolidated financial statements in conformity with IFRS requires management to make estimates and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from these estimates.

In preparing the interim condensed consolidated financial statements, the significant judgments made by management in applying the Company’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated financial statements for the year ended December 31, 2022.

| 2.6 | Foreign currency translation |

The presentational currency of the Company is the U.S. dollar (“USD”). The functional currency of Guardforce, AI Holdings, AI Robots, Horizon Dragon, Southern Ambition, AI Singapore, AI Robotics, AI Robots Service, AI Malaysia, AI Macau, AI US, AI Australia, AI Dubai, AI UK, AI Korea, AI Japan, AI Canada and AI Vietnam is the USD. The functional currency of AI Hong Kong and Handshake is the Hong Kong dollar (“HKD”). The functional currency of AI Thailand, GF Cash (CIT) and AI R&I is the Thai Baht (“Baht” or “THB”). The functional currency of AI Shenzhen, AI Jian, Shenzhen GFAI, Guangzhou GFAI and Beijing Wanjia is the Chinese Renminbi (“RMB”).

The currency exchange rates that impact our business are shown in the following table:

| Period End Rate | Average Rate | |||||||||||||||

| June 30, | December 31, | For the six months ended June 30, |

||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Thai Baht | 0.0283 | 0.0289 | 0.0293 | 0.0295 | ||||||||||||

| Hong Kong Dollar | 0.1282 | 0.1282 | 0.1282 | 0.1282 | ||||||||||||

| Chinese Renminbi | 0.1379 | 0.1447 | 0.1444 | 0.1544 | ||||||||||||

| 2.7 | Financial risk management |

| 2.7.1 | Financial risk factors |

The Company’s activities expose it to a variety of financial risks: foreign exchange risk, interest rate risk and liquidity risk. The Company’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Company’s financial performance.

F-

The interim condensed consolidated financial statements do not include all financial risk management information and disclosures required in the audited financial statements, and should be read in conjunction with the Company’s audited consolidated financial statements as of December 31, 2022, 2021 and 2020.

| 2.7.2 | Liquidity risk |

Prudent liquidity management implies maintaining sufficient cash and cash equivalents and the availability of funding through an adequate amount of committed credit facilities.

The Company’s primary cash requirements are for operating expenses and purchases of fixed assets. The Company mainly finances its working capital requirements from cash generated from funds raised from the public offerings, operations, proceeds from the exercise of warrants, bank borrowings and finance leases.

The Company’s policy is to regularly monitor current and expected liquidity requirements to ensure it maintains sufficient cash and cash equivalents and an adequate amount of committed credit facilities to meet its liquidity requirements in the short and long term.

At the reporting date, the contractual undiscounted cash flows of the Company’s current financial liabilities approximate their respective carrying amounts due to their short maturities.

| 2.7.3 | Capital risk management |

The Company’s objectives on managing capital are to safeguard the Company’s ability to continue as a going concern and support the sustainable growth of the Company in order to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal capital structure to enhance shareholders’ value in the long term.

In order to maintain or adjust the capital structure, the Company may adjust the amount of dividends paid to shareholders, return of capital to shareholders, issue new shares or sell assets to reduce debt.

| 2.7.4 | Impact of COVID-19 |

The COVID-19 pandemic developed rapidly in 2020. The resulting impact of the virus on the operations and measures taken by various governments to contain the virus have negatively affected the Company’s financial performance in the fiscal year 2022. The regulatory measures in response to the pandemic were relaxed and travel restrictions in most countries was lifted in late 2022, the Company might be recovered through the increase in economic activity in the fiscal year 2023. The Company is monitoring the situation closely and conscientiously managing its costs by adopting an operating cost reduction strategy and conserving liquidity by working with major creditors to align repayment obligations with receivable collections.

| 2.8 | Inventories |

Inventories consist of robots and security equipment which are stated at the lower of cost, determined on a weighted average basis, or net realizable value. Net realizable value is the estimated selling price in the ordinary course of business less the estimated cost of completion and the estimated costs necessary to make the sale. When inventory is sold, their carrying amount is charged to expense in the period in which the revenue is recognized. Write-downs for declines in net realizable value or for losses of inventories are recognized as an expense in the period the impairment or loss occurs. The Company recorded an allowance for slow-moving or obsolete robot inventories of $3,090,283 and nil for the six months ended June 30, 2023 and 2022, respectively.

During the six months ended June 30, 2023 and 2022, all robot inventories were purchased from the related parties (Note 22), and all security equipment’s inventories were purchased from third parties.

F-

| 2.9 | Related parties |

Parties are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control or significant influence, such as a family member or relative, shareholder, or a related corporation.

The Company recognizes the contractual right to receive money or products from related parties as amounts due from related parties. For those that the contractual maturity date is less than one year, the Company records as current assets.

| 2.10 | Assets under construction |

Assets under construction recorded in property, plant and equipment and intangible assets are stated at cost less impairment losses, if any. Cost comprises direct costs of construction as well as interest expense and exchange differences capitalized during the periods of construction and installation. Capitalization of these costs ceases and the construction in progress is transferred to property, plant and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation is provided for assets under construction until they are completed and ready for intended use.

| 2. 10 | Goodwill |

Following initial recognition, goodwill is stated at cost less any accumulated impairment losses. Goodwill is reviewed for impairment annually or more frequently if events or changes in circumstances indicate that the carrying value may be impaired.

At the acquisition date, any goodwill acquired is allocated to the cash-generating units (CGU) which are expected to benefit from the combination’s synergies. Impairment is determined by assessing the recoverable amount of the CGU to which the goodwill related. Where the recoverable amount of the CGU is less than the carrying amount, an impairment loss is recognized. Where goodwill forms part of a CGU and part of the operation within that unit is disposed of, the goodwill associated with the operation disposed of is included in the carrying amount of the operation when determining the gain or loss on disposal of the operation. Goodwill disposed of In these circumstances is measured on the basis of the relative values of the operation disposed of and the portion of the CGU retained. The Company recorded a goodwill impairment of 1,263,040 and nil for the six months ended June 30, 2023 and 2022, respectively.

| 2.11 | Impairment of long-lived assets |

At the end of each reporting period, the Company reviews the carrying amounts of its long-lived assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where it is not possible to estimate the recoverable amount of an individual asset, the Company estimates the recoverable amount of the cash-generating unit to which the asset belongs. For the six months ended June 30, 2023, an impairment loss on the robot assets of $1,591,766 was recognized when the carrying amount was greater than the value in use. Management estimated the value in use by estimating the expected cash flows from the cash-generating unit as well as a suitable discount rate in order to calculate the present value of those cash flows. The basis of impairment is determined based on the result of assessment. The Company did not incur any impairment loss for the six months ended June 30, 2022.

| 2.12 | Offsetting Assets and Liabilities |

During the six months ended June 30, 2023, the Company engaged in offsetting arrangements for certain financial assets and financial liabilities. These arrangements primarily involve the offsetting of related party receivables, related party payables and borrowings from a related party. The Company has established legally enforceable rights to offset financial assets and financial liabilities subject to offsetting arrangements. These rights may arise from agreements, netting arrangements, or a combination of legal and contractual rights.

F-

| 2.13 | Revenue from contracts with customers |

The Company generates its revenue primarily from four service lines: (1) Secure logistics; (2) Robotics AI resolutions; (3) Information security; and (4) General security solutions.

Each service line primarily renders the following services:

| (1) | Secure logistics |

| (i) | Cash-In-Transit – Non Dedicated Vehicle (CIT Non-DV); (ii) Cash-In-Transit – Dedicated Vehicle (CIT DV); (iii) ATM management; (iv) Cash Processing (CPC); (v) Cash Center Operations (CCT); (vi) Consolidate Cash Center (CCC); (vii) Cheque Center Service (CDC); (viii) Express Cash; (ix) Coin Processing Service; and (x) Cash Deposit Management Solutions |

| (2) | Robotics AI solutions |

| (i) | Sale of robots and (ii) Rental of robots |

| (3) | Information security |

| (i) | Penetration test; (ii) PCI ASV Scan and (iii) Rapid7 Sales |

| (4) | General security solutions |

| (i) | Installation of fire alarm security systems; (ii) Sale of security equipment |

The Company recognizes revenue at a point in time as products are delivered and services are performed. Consultancy fees typically covers a period of time, the revenue is recognized on a ratable basis over the contract term. The Company applies the following five-step model in order to determine the amount:

| ● | To identify the contract or quotation with the agreed service price. |

| ● | To evaluate the services engaged in the customer’s contract and identify the related performance obligations. |

| ● | To consider the contract terms and commonly accepted practices in the business to determine the transaction price. The transaction price is the consideration that the Company expects to be entitled for delivering the services engaged with the customer. The consideration engaged in a customer’s contract is generally a fixed amount. |

| ● | To allocate the transaction price, if necessary, to each performance obligation (to each good or service that is different) for an amount that represents the part of the benefit that the Company expects to receive in exchange for the right of delivering the services engaged with the customer. |

| ● | To recognize revenue when the Company satisfies the performance obligation through the rendering of services engaged. |

All of the conditions mentioned above are accomplished normally when the services are rendered to the customer and this moment is considered a point in time. The reported revenue reflects services delivered at the contract or agreed-upon price.

Contract liabilities consist of deferred revenue related to prepaid fees received from customers for future information security service over the term of the service agreement. The Company expects to recognize revenue of $428,839 within the next 12 months and $nil after 12 months to 36 months.

Revenue is recognized when the related performance obligation is satisfied.

F-

Disaggregation information of revenue by service type which was recognized based on the nature of performance obligation disclosed above is as follows:

| For the six months ended June 30, | ||||||||||||||||

| 2023 | Percentage of Total |

2022 | Percentage of Total |

|||||||||||||

| Service Type | $ | Revenue | $ | Revenue | ||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Cash-In-Transit – Non-Dedicated Vehicles (CIT Non-DV) | $ | 5,988,087 | 32.5 | % | $ | 5,377,474 | 31.8 | % | ||||||||

| Cash-In-Transit – Dedicated Vehicle to Banks (CIT DV) | 1,961,464 | 10.7 | % | 2,135,199 | 12.6 | % | ||||||||||

| ATM Management | 3,895,708 | 21.2 | % | 4,731,015 | 27.9 | % | ||||||||||

| Cash Processing (CPC) | 1,613,933 | 8.8 | % | 1,410,902 | 8.3 | % | ||||||||||

| Cash Center Operations (CCT) | 958,760 | 5.2 | % | 1,202,214 | 7.1 | % | ||||||||||

| Consolidate Cash Center (CCC) | 395,105 | 2.1 | % | 225,513 | 1.3 | % | ||||||||||

| Cheque Center Service (CDC) | - | % | 4,729 | 0.05 | % | |||||||||||

| Others ** | 4,332 | 0.02 | % | 4,399 | 0.05 | % | ||||||||||

| Cash Deposit Management Solutions (GDM) | 1,125,767 | 6.1 | % | 869,102 | 5.1 | % | ||||||||||

| Robotics AI solutions | 440,229 | 2.4 | % | 719,041 | 4.2 | % | ||||||||||

| Information security | 407,689 | 2.2 | % | 262,934 | 1.6 | % | ||||||||||

| General security solutions | 1,622,218 | 8.8 | % | - | % | |||||||||||

| Total | $ | 18,413,292 | 100.0 | % | $ | 16,942,522 | 100.0 | % | ||||||||

| ** | Others include primarily revenue from express cash and coin processing services. |

During the six months ended June 30, 2022, revenues amounting to $16,808,399 were generated from third parties; and $134,123 were generated from a related party (Note 22).

During the six months ended June 30, 2023 all revenues were generated from third parties.

| 2.14 | Cost of sales |

Cost of sales consists primarily of internal labor costs and related benefits, and other overhead costs that are directly attributable to services provided.

| 2.15 | New and amended accounting standards |

All new standards and amendments that are effective for annual reporting period commencing January 1, 2023 have been applied by the Company for the six months ended June 30, 2023. The adoption of these new and amended standards did not have material impact on the interim condensed consolidated financial statements of the Company. A number of new standards and amendments to standards have not come into effect for the year beginning January 1, 2023, and they have not been early adopted by the Company in preparing these interim condensed consolidated financial statements. None of these new standards and amendments to standards is expected to have a significant effect on the interim condensed consolidated financial statements of the Company.

F-

| 3. | BUSINESS COMBINATIONS |

In 2021 and 2022, the Company acquired a total of five subsidiaries, these acquisitions have been accounted for in accordance with IFRS 3 guidelines under acquisition accounting, whereby the Company recognized the assets and liabilities transferred at their carrying amounts with carry-over basis.

A Purchase Price Allocation exercise has been undertaken to establish the constituent parts of the acquired companies’ balance sheet at fair value on acquisition. As is customary in these circumstances, this will remain under review and subject to change during the twelve-month hindsight period. The interim condensed consolidated financial statements condensed the information and disclosures of all the acquired subsidiaries required in the audited financial statements, and should be read in conjunction with the Company’s audited consolidated financial statements as of December 31, 2022, 2021 and 2020.

The following represents the purchase price allocation at the dates of the acquisitions:

| Handshake on March 25, 2021 |

AI Macau on February 9, 2022 |

AI Malaysia on January 20, 2022 |

Beijing Wanjia on June 22, 2022 |

Shenzhen GFAI and Guangzhou GFAI on March 22, 2022 |

||||||||||||||||

| Cash and cash equivalents | $ | 24,276 | $ | 21,038 | $ | 12,500 | $ | 38,342 | $ | 2,187 | ||||||||||

| Other current assets | 32,250 | 4,162 | 2,219,318 | 2,393,558 | ||||||||||||||||

| Property, plant and equipment | 20,488 | 2,055,610 | ||||||||||||||||||

| Intangible assets | 1,593,398 | 1,592,783 | ||||||||||||||||||

| Other non-current assets | 203,765 | 23,566 | ||||||||||||||||||

| Current liabilities | (58,297 | ) | (92,350 | ) | (13,184 | ) | (1,681,573 | ) | (4,320,434 | ) | ||||||||||

| Goodwill | 329,534 | 70,355 | 685 | 411,862 | 1,867,009 | |||||||||||||||

| Total purchase price | $ | 327,763 | $ | 3,205 | $ | 1 | $ | 2,805,600 | $ | 3,614,279 | ||||||||||

During the six months ended June 30, 2023, the Company recorded impairment losses on Handshake of $329,534 and on Shenzhen GFAI and Guangzhou GFAI of $933,506.

| 4. | CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Cash on hand | $ | 465,853 | $ | 471,408 | ||||

| Cash in bank | 24,272,524 | 6,459,231 | ||||||

| Subtotal | 24,783,377 | 6,930,639 | ||||||

| Restricted cash – current (a) | 17,059 | |||||||

| Restricted cash – non-current (b) | 1,274,956 | 1,300,005 | ||||||

| Cash, cash equivalents, and restricted cash | $ | 26,030,392 | $ | 8,230,644 | ||||

| (a) | During the six months ended June 30, 2023, with regards to various labor-related lawsuits in the PRC, the PRC Court issued an order to freeze one of the Company’s bank accounts which restricted or prohibited the transfer and use of deposited funds by the Company. The sum will be released when the Company has paid to satisfy the claims. |

| (b) | The non-current restricted cash represents cash pledged with a local bank in Thailand as collateral for bank guarantees issued by those banks in respect of the Company’s Cash-In-Transit projects. |

F-

| 5. | INVENTORIES |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Robots in warehouse | $ | 4,976,219 | $ | 5,553,859 | ||||

| Robots in transit | 46,950 | |||||||

| Security equipment | 415,036 | 494,793 | ||||||

| Impairment provision for inventories | (3,801,960 | ) | (942,882 | ) | ||||

| Inventories | $ | 1,636,245 | $ | 5,105,770 | ||||

The Company recorded an allowance for slow-moving or obsolete robot inventories of $3,090,283 and nil for the six months ended June 30, 2023 and 2022, respectively.

| 6. | TRADE RECEIVABLES, NET |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Trade receivable | $ | 5,160,600 | $ | 5,392,720 | ||||

| (Impairment provision) recovery of doubtful accounts | (32,602 | ) | 7,466 | |||||

| Trade receivable, net | $ | 5,127,998 | $ | 5,400,186 | ||||

The Company recorded an allowance for doubtful accounts of $45,932 and $nil for the six months ended June 30, 2023 and 2022, respectively.

| 7. | WITHHOLDING TAX RECEIVABLE |

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Balance at January 1, | $ | 2,691,096 | $ | 3,531,953 | ||||

| Addition | 401,941 | 381,966 | ||||||

| Collection | (1,045,061 | ) | ||||||

| Write off/ Allowance for uncollectible | (561,277 | ) | (263,340 | ) | ||||

| Exchange difference | (73,713 | ) | (153,902 | ) | ||||

| Balance at June 30, | $ | 2,458,047 | $ | 2,451,616 | ||||

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Current portion | $ | 536,974 | $ | 757,024 | ||||

| Non-current portion | 1,921,073 | 1,934,072 | ||||||

| Withholding tax receivable | $ | 2,458,047 | $ | 2,691,096 | ||||

On July 12, 2023, the Company received a withholding tax refund of THB18,959,514 (approximately $0.5 million) in connection with the Company’s 2018 withholding tax refund applications of THB29,188,153 (approximately $0.8 million). The Company wrote off approximately $0.3 million, representing the difference between the receivable recorded and the amount of refund subsequently received from the Thai Revenue Department.

F-

During the six months ended June 30, 2022, the Company received a withholding tax refund of THB35,312,291 (approximately $1.0 million) in connection with the Company’s 2016 to 2017 withholding tax refund applications (totaled THB56,107,574 or approximately $1.6 million). The Company wrote off approximately $0.6 million, representing the difference between the receivable recorded and the amount of refund received from the Thai Revenue Department.

Out of prudence, based on amount refunded and written off for the receivable related to years 2013 to 2018, the Company recorded an allowance of approximately $0.3 million and $0.1 million for the six months ended June 30, 2023 and 2022, respectively. As of June 30, 2023 and December 31, 2022, an allowance balance of $1.2 million and $0.9 million, respectively were maintained against its withholding tax receivable.

| 8. | OTHER RECEIVABLES |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Cash advance to a third-party vendor | $ | 778,724 | $ | 817,564 | ||||

| Impairment provision for other receivables | (778,724 | ) | ||||||

| $ | $ | 817,564 |

||||||

The Company recorded an allowance for doubtful accounts of $815,887 and $nil for the six months ended June 30, 2023 and 2022, respectively.

| 9. | OTHER CURRENT AND OTHER NON-CURRENT ASSETS |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Input VAT and other taxes receivable | $ | 314,855 | $ | 293,429 | ||||

| Prepayments – office and warehouse rental | 1,240,967 | 780,279 | ||||||

| Prepayments - insurance | 375,985 | 106,167 | ||||||

| Prepayments - others | 166,165 | 91,926 | ||||||

| Uniforms | 14,781 | 24,699 | ||||||

| Tools and supplies | 152,035 | 155,642 | ||||||

| Deferred costs | 90,555 | 219,782 | ||||||

| Cash advances to employees | 25,375 | 71,084 | ||||||

| Other current assets | $ | 2,380,718 | $ | 1,743,008 | ||||

| Deposits | $ | 397,030 | $ | 437,602 | ||||

| Deferred costs | 9,720 | |||||||

| Other non-current assets | $ | 397,030 | $ | 447,322 | ||||

The Company recorded an allowance for doubtful accounts of $8,589 and $nil for the six months ended June 30, 2023 and 2022, respectively.

F-

| 10. | PROPERTY, PLANT and EQUIPMENT |

| Leasehold improvements |

Machinery and equipment |

Office decoration and equipment |

Vehicles | Assets under construction |

GDM machines |

Robots | Total | |||||||||||||||||||||||||

| Cost | ||||||||||||||||||||||||||||||||

| At December 31, 2021 | $ | 3,239,683 | $ | 5,108,501 | $ | 5,412,444 | $ | 16,233,868 | $ | 248,686 | $ | 1,713,926 | $ | 5,369,070 | $ | 37,326,178 | ||||||||||||||||

| Acquisitions through business combinations | 205,070 | 141,619 | 2,571,013 | 2,917,702 | ||||||||||||||||||||||||||||

| Additions | 26,342 | 18,698 | 18,603 | 80,350 | 318,905 | 2,178,914 | 2,641,812 | |||||||||||||||||||||||||

| Disposals | (101,834 | ) | (7,437 | ) | (15,463 | ) | (344,818 | ) | (211,659 | ) | (15,892 | ) | (12,273 | ) | (709,376 | ) | ||||||||||||||||

| Exchange differences | (173,963 | ) | (281,325 | ) | (298,630 | ) | (880,949 | ) | (4,472 | ) | (107,391 | ) | (392,122 | ) | (2,138,852 | ) | ||||||||||||||||

| At June 30, 2022 (Unaudited) | 2,990,228 | 4,838,437 | 5,322,024 | 15,230,070 | 32,555 | 1,909,548 | 9,714,602 | 40,037,464 | ||||||||||||||||||||||||

| At December 31, 2022 | $ | 3,146,864 | $ | 4,868,015 | $ | 5,354,351 | $ | 15,518,987 | $ | 33,222 | $ | 1,948,698 | $ | 7,194,815 | $ | 38,064,952 | ||||||||||||||||

| Additions | 1,750 | 6,964 | 624,126 | 273,779 | 906,619 | |||||||||||||||||||||||||||

| Disposals | (104,773 | ) | (105,939 | ) | (48,955 | ) | (47,155 | ) | (56,389 | ) | (363,211 | ) | ||||||||||||||||||||

| Impairment of fixed assets | (1,591,766 | ) | (1,591,766 | ) | ||||||||||||||||||||||||||||

| Exchange differences | (60,518 | ) | (95,521 | ) | (106,807 | ) | (353,552 | ) | (652 | ) | (38,238 | ) | (141,241 | ) | (796,529 | ) | ||||||||||||||||

| At June 30, 2023 (Unaudited) | 2,981,573 | 4,668,305 | 5,205,553 | 15,118,280 | 32,570 | 2,534,586 | 5,679,198 | 36,220,065 | ||||||||||||||||||||||||

| Accumulated Depreciation | ||||||||||||||||||||||||||||||||

| At December 31, 2021 | $ | 2,693,472 | $ | 4,906,277 | $ | 4,799,149 | $ | 13,447,168 | $ | $ | 891,378 | $ | 691,433 | $ | 27,428,877 | |||||||||||||||||

| Acquisitions through business combinations | 184,364 | 136,723 | 520,516 | 841,603 | ||||||||||||||||||||||||||||

| Depreciation charged for the period | 51,903 | 57,623 | 96,235 | 416,775 | 188,620 | 762,874 | 1,574,030 | |||||||||||||||||||||||||

| Disposals | (99,439 | ) | (7,396 | ) | (15,432 | ) | (330,993 | ) | (5,303 | ) | (461 | ) | (459,024 | ) | ||||||||||||||||||

| Exchange differences | (146,005 | ) | (271,901 | ) | (268,318 | ) | (742,974 | ) | (56,970 | ) | (81,330 | ) | (1,567,498 | ) | ||||||||||||||||||

| As June 30, 2022 (Unaudited) | 2,499,931 | 4,684,603 | 4,795,998 | 12,926,699 | 1,017,725 | 1,893,032 | 27,817,988 | |||||||||||||||||||||||||

| At December 31, 2022 | $ | 2,577,341 | $ | 4,748,031 | $ | 4,889,742 | $ | 13,493,656 | $ | $ | 1,230,247 | $ | 3,059,174 | $ | 29,998,191 | |||||||||||||||||

| Depreciation charged for the period | 48,922 | 34,180 | 87,164 | 263,962 | 202,983 | 516,626 | 1,153,837 | |||||||||||||||||||||||||

| Disposals | (108,213 | ) | (109,514 | ) | (44,542 | ) | (48,748 | ) | (14,847 | ) | (325,864 | ) | ||||||||||||||||||||

| Exchange differences | (48,443 | ) | (90,705 | ) | (101,287 | ) | (275,519 | ) | (30,774 | ) | (77,779 | ) | (624,507 | ) | ||||||||||||||||||

| As June 30, 2023 (Unaudited) | 2,469,607 | 4,581,992 | 4,831,077 | 13,433,351 | 1,402,456 | 3,483,174 | 30,201,657 | |||||||||||||||||||||||||

| Net book value | ||||||||||||||||||||||||||||||||

| At June 30, 2022 (Unaudited) | $ | 490,298 | $ | 153,834 | $ | 526,026 | $ | 2,303,371 | $ | 32,555 | $ | 891,822 | $ | 7,821,570 | $ | 12,219,476 | ||||||||||||||||

| At June 30, 2023 (Unaudited) | $ | 511,966 | $ | 86,313 | $ | 374,476 | $ | 1,684,929 | $ | 32,570 | $ | 1,132,130 | $ | 2,196,024 | $ | 6,018,408 | ||||||||||||||||

F-

Depreciation expense related to property, plant and equipment was $1,057,117 and $1,460,187, respectively for the six months ended June 30, 2023 and 2022.

For the six months ended June 30, 2023 and 2022, the Company recorded an impairment loss on robot assets of $1,591,766 and $nil, respectively.

As of June 30, 2023 and 2022, net book value of robot assets of approximately $695,000 and $1,145,000, respectively were leased out to third parties and the robot assets were held and used by the lessee.

| 11. | RIGHT-OF-USE ASSETS AND OPERATING LEASE LIABILITIES |

The carrying amounts of right-of-use assets are as below:

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Balance at January 1, | $ | 4,171,409 | $ | 2,364,993 | ||||

| New leases | 271,004 | 804,500 | ||||||

| New leases acquired through business combinations | 167,597 | |||||||

| Depreciation expense | (1,042,981 | ) | (1,095,227 | ) | ||||

| Exchange difference | (75,562 | ) | (108,566 | ) | ||||

| Balance at June 30, | $ | 3,323,870 | $ | 2,133,297 | ||||

Lease liabilities were measured at the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate. The weighted average incremental borrowing rate applied to new leases during the six months ended June 30, 2023 was 3.52%. The weighted average incremental borrowing rate applied to new leases during the six months ended June 30, 2022 varies from 3.49% to 5% in different regions.

For the six months ended June 30, 2023 and 2022, interest expense of $58,602 and $41,211 arising from lease liabilities was included in finance costs, respectively. Depreciation expense related to right-of-use assets was $1,026,316 and $1,064,623, respectively for the six months ended June 30, 2023 and 2022.

F-

| 12. | INTANGIBLE ASSETS |

| Assets under construction | ||||||||||||||||||||||||||||||||||||

| Computer software |

Right-of-use Platform |

Customer base |

Technical know-how |

Security Surveillance system |

Cash Management Systems |

Intelligent Cloud Platform |

Intelligent Cloud Platforms |

Total | ||||||||||||||||||||||||||||

| Cost | ||||||||||||||||||||||||||||||||||||

| At December 31, 2021 | $ | 907,304 | $ | $ | $ | $ | $ | $ | $ | $ | 907,304 | |||||||||||||||||||||||||

| Acquisitions through business combinations | 733,311 | 1,120,688 | 514,968 | 1,102,647 | 3,471,614 | |||||||||||||||||||||||||||||||

| Additions | 1,761 | 81,119 | 3,000,000 | 3,082,880 | ||||||||||||||||||||||||||||||||

| Exchange differences | (49,955 | ) | (3,525 | ) | (53,480 | ) | ||||||||||||||||||||||||||||||

| At June 30, 2022 (Unaudited) | 859,110 | 733,311 | 1,120,688 | 514,968 | 1,102,647 | 77,594 | 3,000,000 | 7,408,318 | ||||||||||||||||||||||||||||

| At December 31, 2022 | $ | 887,745 | $ | 673,029 | $ | 1,042,110 | $ | 499,344 | $ | 1,360,898 | $ | 194,495 | $ | 3,000,000 | $ | $ | 7,657,621 | |||||||||||||||||||

| Additions | 195,087 | 1,597,754 | 1,792,841 | |||||||||||||||||||||||||||||||||

| Transfer | (2,821,882 | ) | 2,821,882 | |||||||||||||||||||||||||||||||||

| Exchange differences | (17,419 | ) | (31,974 | ) | (49,509 | ) | (23,723 | ) | (306,604 | ) | (3,816 | ) | (433,045 | ) | ||||||||||||||||||||||

| At June 30, 2023 (Unaudited) | 870,326 | 641,055 | 992,601 | 475,621 | 1,249,381 | 190,679 | 178,118 | 4,419,636 | 9,017,417 | |||||||||||||||||||||||||||

| Accumulated amortization | ||||||||||||||||||||||||||||||||||||

| At December 31, 2021 | $ | 742,988 | $ | $ | $ | $ | $ | $ | $ | $ | 742,988 | |||||||||||||||||||||||||

| Acquisitions through business combinations | 285,433 | 285,433 | ||||||||||||||||||||||||||||||||||

| Amortization charged for the period | 25,290 | 17,951 | 129,327 | 172,568 | ||||||||||||||||||||||||||||||||

| Exchange differences | (41,944 | ) | (41,944 | ) | ||||||||||||||||||||||||||||||||

| As June 30, 2022 (Unaudited) | 726,334 | 17,951 | 129,327 | 285,433 | 1,159,045 | |||||||||||||||||||||||||||||||

| At December 31, 2022 | $ | 767,168 | $ | 50,477 | $ | 405,868 | $ | 28,405 | $ | 612,560 | $ | $ | $ | $ | 1,864,478 | |||||||||||||||||||||

| Amortization charged for the period | 26,139 | 33,582 | 201,013 | 28,346 | 63,817 | 182,671 | 535,568 | |||||||||||||||||||||||||||||

| Exchange differences | (15,908 | ) | (3,927 | ) | (28,438 | ) | (2,641 | ) | (286,182 | ) | (337,096 | ) | ||||||||||||||||||||||||

| As June 30, 2023 (Unaudited) | 777,399 | 80,132 | 578,443 | 54,110 | 390,195 | 182,671 | 2,062,950 | |||||||||||||||||||||||||||||

| Net book value | ||||||||||||||||||||||||||||||||||||

| At June 30, 2022 (Unaudited) | $ | 132,776 | $ | 715,360 | $ | 991,361 | $ | 514,968 | $ | 817,214 | $ | 77,594 | $ | 3,000,000 | $ | $ | 6,249,273 | |||||||||||||||||||

| At June 30, 2023 (Unaudited) | $ | 92,927 | $ | 560,923 | $ | 414,158 | $ | 421,511 | $ | 859,186 | $ | 190,679 | $ | 178,118 | $ | 4,236,965 | $ | 6,954,467 | ||||||||||||||||||

Amortization expense related to intangible assets was $535,568 and $172,568, respectively for the six months ended June 30, 2023 and 2022.

F-

| 13. | TRADE AND OTHER PAYABLES AND OTHER CURRENT LIABILITIES |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Trade payables – third parties | $ | 2,596,576 | $ | 2,060,856 | ||||

| Accrued salaries and bonus | 454,218 | 515,758 | ||||||

| Accrued customer claims, cash loss and shortage ** | 15,044 | 57,381 | ||||||

| Trade and other payables | $ | 3,065,838 | $ | 2,633,995 | ||||

| Output VAT | $ | 74,171 | $ | 118,125 | ||||

| Accrued expenses | 389,318 | 522,059 | ||||||

| Payroll payable | 1,776,907 | 979,027 | ||||||

| Other payables | 168,052 | 289,494 | ||||||

| Deferred revenue | 428,839 | 568,664 | ||||||

| Other current liabilities | $ | 2,837,287 | $ | 2,477,369 | ||||

| ** | Includes a provision for penalty for failure to meet performance indicators as stipulated in certain customer contracts for approximately $7,108 and $11,800 as of June 30, 2023 and 2022, respectively. |

| 14. | BORROWINGS |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Current portion of long-term bank borrowings | $ | 1,039,988 | $ | 947,559 | ||||

| Current portion of long-term third-party borrowing | 2,469,721 | 2,234,057 | ||||||

| Long-term bank borrowings | 138,212 | 432,179 | ||||||

| Long-term third-party borrowing | 13,589,362 | 13,467,639 | ||||||

| Total borrowings | $ | 17,237,283 | $ | 17,081,434 | ||||

The Company maintains two borrowings with one financial institution. The borrowings are used for working capital purposes to support its business operations in Thailand. Those borrowings carry interest at the rates of 4.72% and 4.69% per annum. The borrowings mature on July 29, 2023 and April 7, 2025. For the six months ended June 30, 2023 and 2022, the interest expense was $33,394 and $33,745, respectively.

As of June 30, 2023, the Company has unused bank overdraft availability of approximately $283,000 (THB10 million) and no unused trust receipts availability.

The Company obtained a loan in the principal amount of $13.42 million from WK Venture Success Limited (“WK Venture”), a third party on April 25, 2018. The Loan bears interest at 4% and is due on December 31, 2024. In accordance with the terms of the Agreements, the Company is required to pay the full principal amount of the Loan, along with accrued interest, on December 31, 2024 and the Company is not required to make monthly payments on this obligation. For the six months ended June 30, 2023 and 2022, interest expense was $411,270 and $400,920, respectively. The accrued interest portion of this loan is classified as short-term borrowing and the principal portion of this loan is classified as long-term borrowing. On September 28, 2023, WK Venture agreed to convert the principal and accrued interest of this loan in an aggregate amount of $15,914,615 at the conversion price of $5.40 into restricted ordinary shares of the Company.

| 15. | CONVERTIBLE NOTE PAYABLE |

On October 25, 2022, the Company entered into a securities purchase agreement with Streeterville Capital, LLC ( “CVP”), pursuant to which the Company issued CVP an unsecured convertible promissory note on October 25, 2022 in the original principal amount of $1,707,500.00 (the “Note”), convertible into the Company’s ordinary shares.

The Note bears simple interest at a rate of 8% per annum. All outstanding principal and accrued interest on the Note will become due and payable on the maturity date, which is twelve months after the purchase price of the Note is delivered by Investor to the Company. Subject to the occurrence of any triggering events as defined in the Note, the Investor shall have the right to increase the balance of the Note by 5% or 10%. The Company may pay all or any portion of the amount owed earlier than it is due; provided that in the event the Company elects to prepay all or any portion of the outstanding balance, the Company shall pay to the Investor 120% of the portion of the outstanding balance the Company elects to prepay. Early payments of less than all principal, fees and interest outstanding will not, unless agreed to by Investor in writing, relieve the Company of the Company’s remaining obligations hereunder.

F-

On April 17, 2023, CVP delivered to the Company a conversion notice informing the Company that CVP had elected to convert a portion of the Note balance $1,238,400 at the conversion price of $7.20 into restricted ordinary shares of the Company. In connection with this conversion, the Company issued 172,000 restricted ordinary shares to CVP on April 19, 2023. As of April 17, 2023, the date of conversion notice, $534,744 remained outstanding under the Note. For the six months ended June 30, 2023, the interest expense was $65,644.

| 16. | FINANCE LEASE LIABILITIES |

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Current portion | $ | 200,383 | $ | 398,136 | ||||

| Non-current portion | 229,747 | 233,550 | ||||||

| Finance lease liabilities | $ | 430,130 | $ | 631,686 | ||||

For the six months ended June 30, 2023 and 2022, interest expense was $15,987 and $30,942, respectively.

The minimum lease payments under finance lease agreements are as follows:

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Within 1 year | $ | 212,173 | $ | 423,514 | ||||

| After 1 year but within 5 years | 248,490 | 253,448 | ||||||

| Less: Finance charges | (30,533 | ) | (45,276 | ) | ||||

| Present value of finance lease liabilities, net | $ | 430,130 | $ | 631,686 | ||||

Finance lease assets comprise primarily vehicles and office equipment as follow:

| As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | ||||||||

| Cost | $ | 1,540,416 | $ | 1,571,075 | ||||

| Less: Accumulated depreciation | (618,097 | ) | (564,844 | ) | ||||

| Net book value | $ | 922,319 | $ | 1,006,231 | ||||

| 17. | TAXATION |

Value added tax (“VAT”)