Document

Exhibit 99.1

Company Contact:

Patrick S. Barrett

Chief Financial Officer

OceanFirst Financial Corp.

Tel: (732) 240-4500, ext. 27507

Email: pbarrett@oceanfirst.com

FOR IMMEDIATE RELEASE

OCEANFIRST FINANCIAL CORP.

ANNOUNCES QUARTERLY AND ANNUAL

FINANCIAL RESULTS

RED BANK, NEW JERSEY, January 22, 2026 - OceanFirst Financial Corp. (NASDAQ:“OCFC”) (the “Company”), the holding company for OceanFirst Bank N.A. (the “Bank”), announced net income available to common stockholders of $13.1 million, or $0.23 per diluted share, for the quarter ended December 31, 2025, a decrease from $20.9 million, or $0.36 per diluted share, for the corresponding prior year period, and $17.3 million, or $0.30 per diluted share, for the linked quarter. For the year ended December 31, 2025, the Company reported net income available to common stockholders of $67.1 million, or $1.17 per diluted share, a decrease from $96.0 million, or $1.65 per diluted share, for the prior year. Selected performance metrics are as follows (refer to “Selected Quarterly Financial Data” for additional information):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

|

For the Year Ended, |

| Performance Ratios (Quarterly Ratios Annualized): |

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| 2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Return on average assets |

0.36 |

% |

|

0.51 |

% |

|

0.61 |

% |

|

0.49 |

% |

|

0.71 |

% |

| Return on average stockholders’ equity |

3.12 |

|

|

4.15 |

|

|

4.88 |

|

|

4.00 |

|

|

5.70 |

|

Return on average tangible stockholders’ equity (a) |

4.57 |

|

|

6.13 |

|

|

7.12 |

|

|

5.86 |

|

|

8.24 |

|

Return on average tangible common equity (a) |

4.57 |

|

|

6.13 |

|

|

7.47 |

|

|

5.86 |

|

|

8.65 |

|

| Efficiency ratio |

80.37 |

|

|

74.13 |

|

|

67.86 |

|

|

73.16 |

|

|

63.99 |

|

| Net interest margin |

2.87 |

|

|

2.91 |

|

|

2.69 |

|

|

2.90 |

|

|

2.72 |

|

(a) Return on average tangible stockholders’ equity and return on average tangible common equity (“ROTCE”) are non-GAAP (“generally accepted accounting principles”) financial measures. Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and “Other Items - Non-GAAP Reconciliation” tables for reconciliation and additional information regarding non-GAAP financial measures.

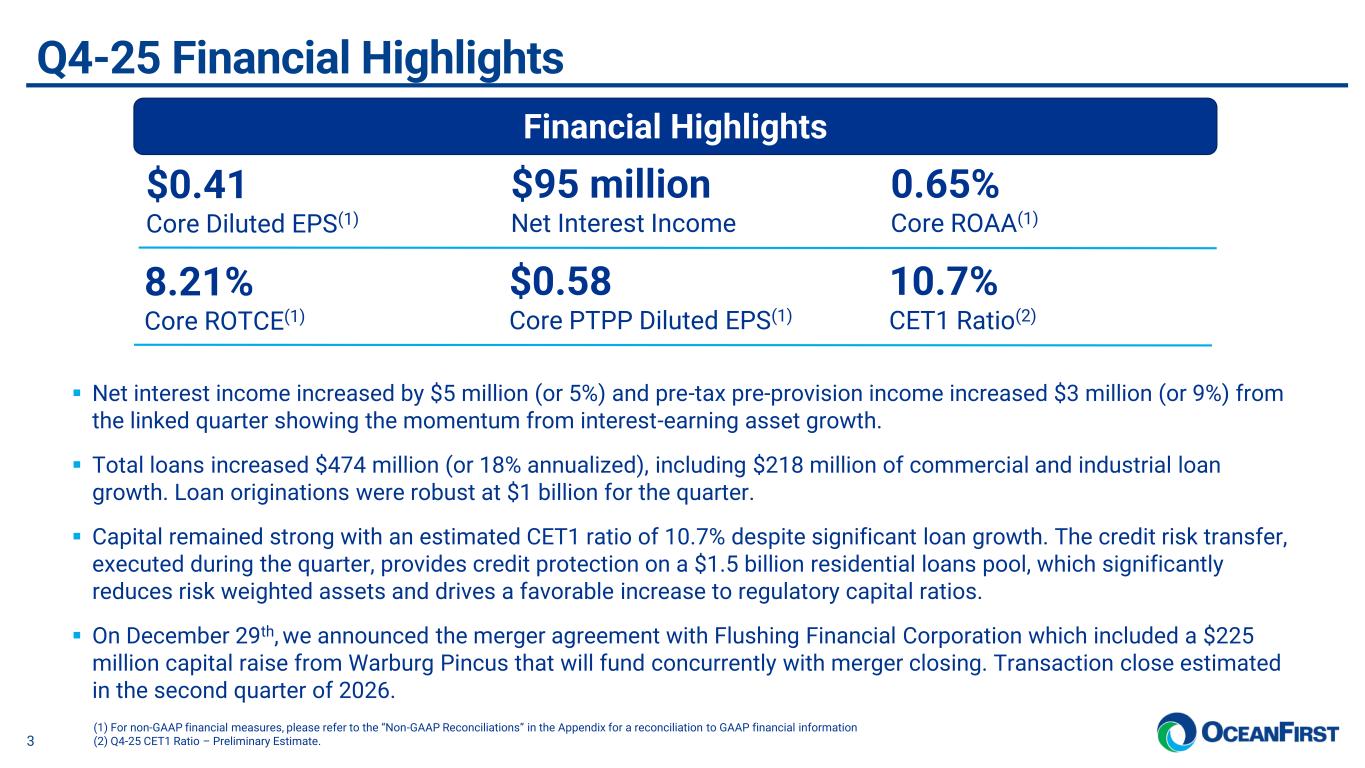

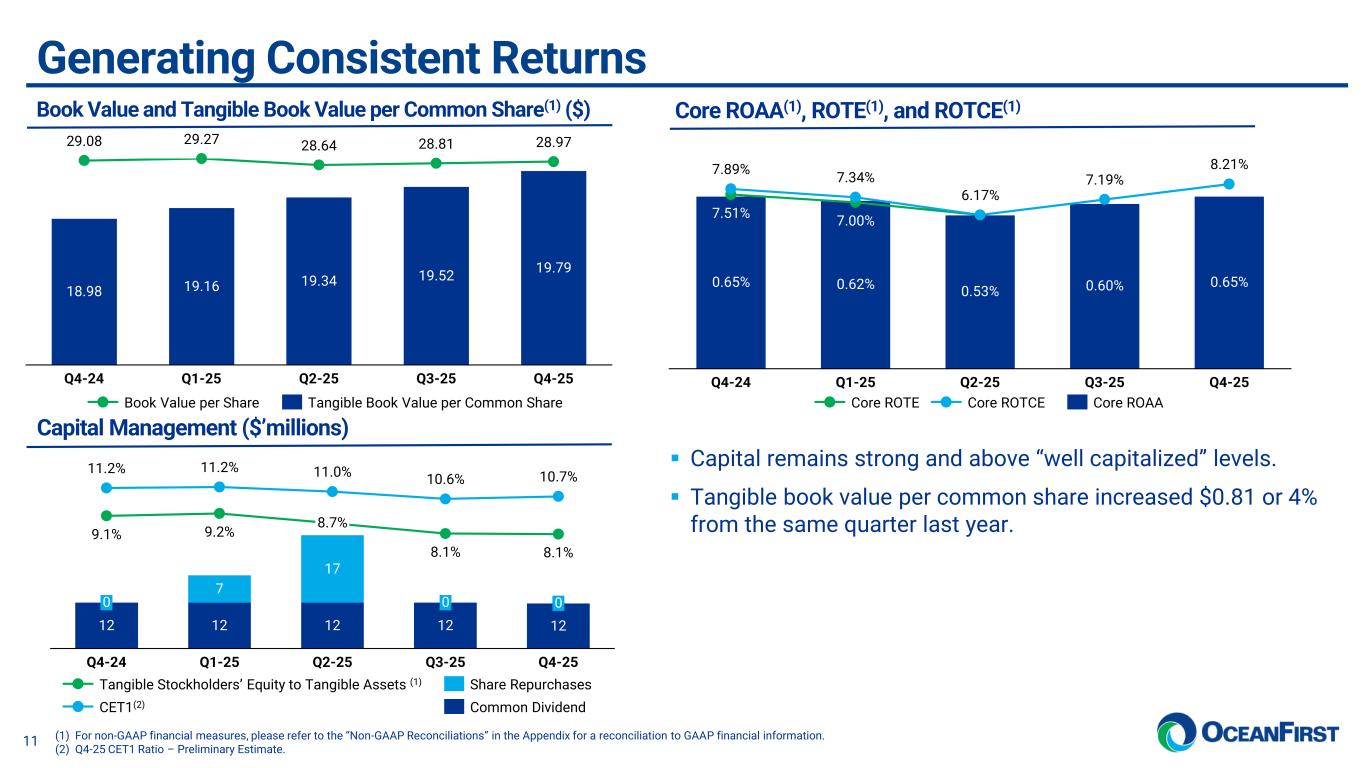

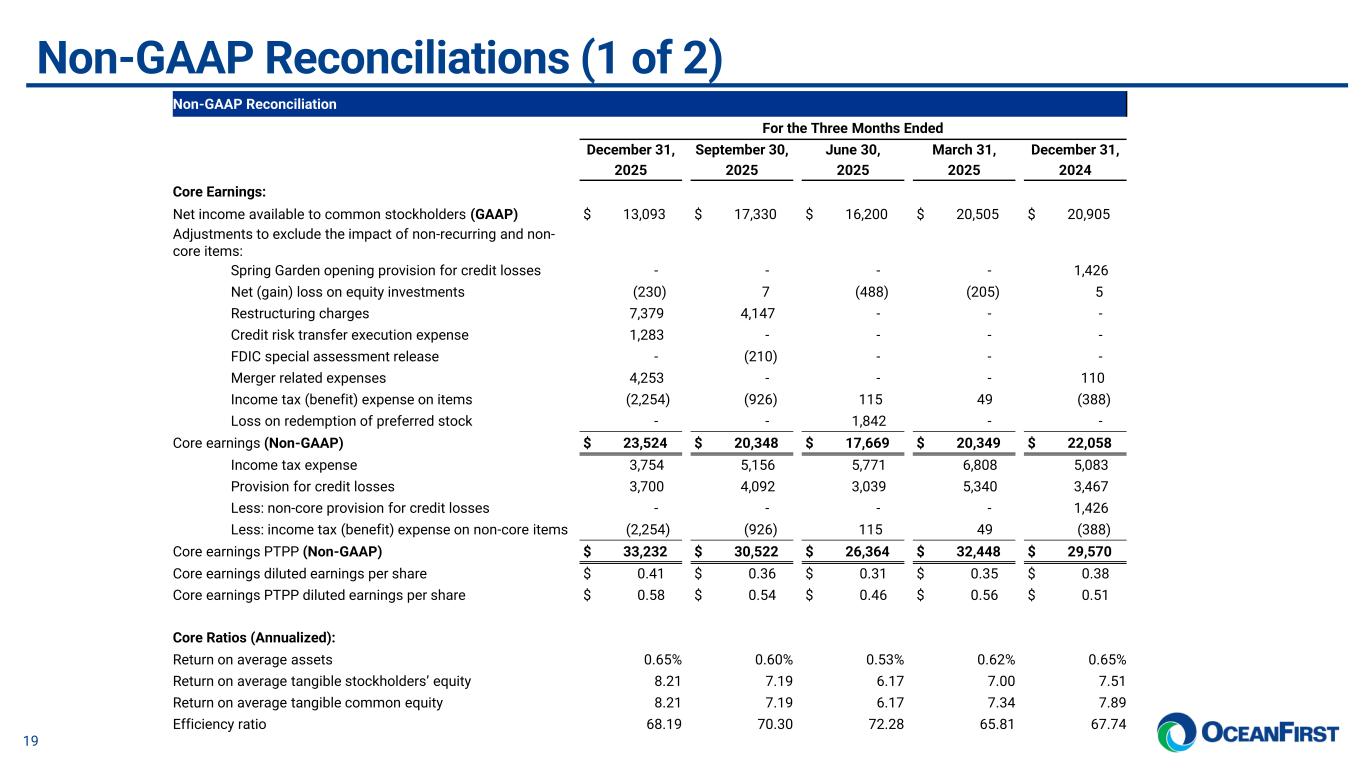

Core earnings1 for the quarter and year ended December 31, 2025 were $23.5 million and $81.9 million, respectively, or $0.41 and $1.43 per diluted share, an increase from $22.1 million and a decrease from $93.6 million, or $0.38 and $1.60 per diluted share, for the corresponding prior year periods, and an increase from $20.3 million, or $0.36 per diluted share, for the linked quarter.

Core earnings PTPP1 for the quarter and year ended December 31, 2025 were $33.2 million and $122.6 million, respectively, or $0.58 and $2.13 per diluted share, an increase from $29.6 million and a decrease from $129.4 million, or $0.51 and $2.22 per diluted share, for the corresponding prior year periods, and an increase from $30.5 million, or $0.54 per diluted share, for the linked quarter. Selected performance metrics are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

|

For the Year Ended, |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

Core Ratios1 (Quarterly Ratios Annualized): |

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Return on average assets |

0.65 |

% |

|

0.60 |

% |

|

0.65 |

% |

|

0.60 |

% |

|

0.69 |

% |

| Return on average tangible stockholders’ equity |

8.21 |

|

|

7.19 |

|

|

7.51 |

|

|

7.14 |

|

|

8.03 |

|

| Return on average tangible common equity |

8.21 |

|

|

7.19 |

|

|

7.89 |

|

|

7.14 |

|

|

8.43 |

|

| Efficiency ratio |

68.19 |

|

|

70.30 |

|

|

67.74 |

|

|

69.15 |

|

|

64.57 |

|

| Core diluted earnings per share |

$ |

0.41 |

|

|

$ |

0.36 |

|

|

$ |

0.38 |

|

|

$ |

1.43 |

|

|

$ |

1.60 |

|

| Core PTPP diluted earnings per share |

0.58 |

|

|

0.54 |

|

|

0.51 |

|

|

2.13 |

|

|

2.22 |

|

1 Core earnings and core earnings before income taxes and provision for credit losses (“PTPP” or “Pre-Tax-Pre-Provision”), and ratios derived therefrom, are non-GAAP financial measures. For the periods presented, the opening provision for credit losses in connection with the acquisition of Spring Garden Capital Group, LLC (“Spring Garden”), net (gain) loss on equity investments, net gain on sale of trust business, restructuring charges, credit risk transfer execution expense, the Federal Deposit Insurance Corporation (“FDIC”) special assessment (release) expense, merger related expenses, and the income tax effect of these items, as well as loss on redemption of preferred stock (collectively referred to as “non-core” operations). PTPP excludes the aforementioned pre-tax “non-core” items along with income tax expense (benefit) and provision for credit losses (exclusive of the Spring Garden opening provision). Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and the “Other Items - Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Key developments for the recent quarter are described below:

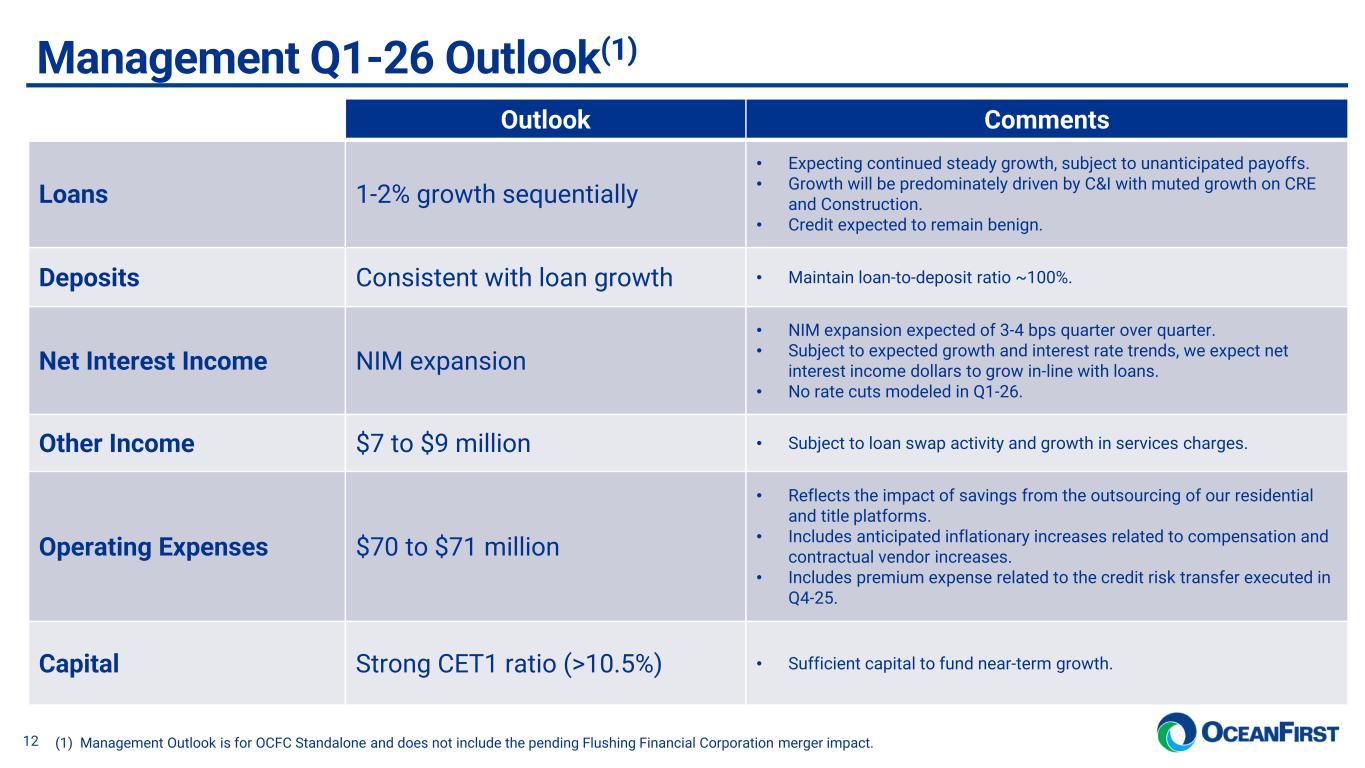

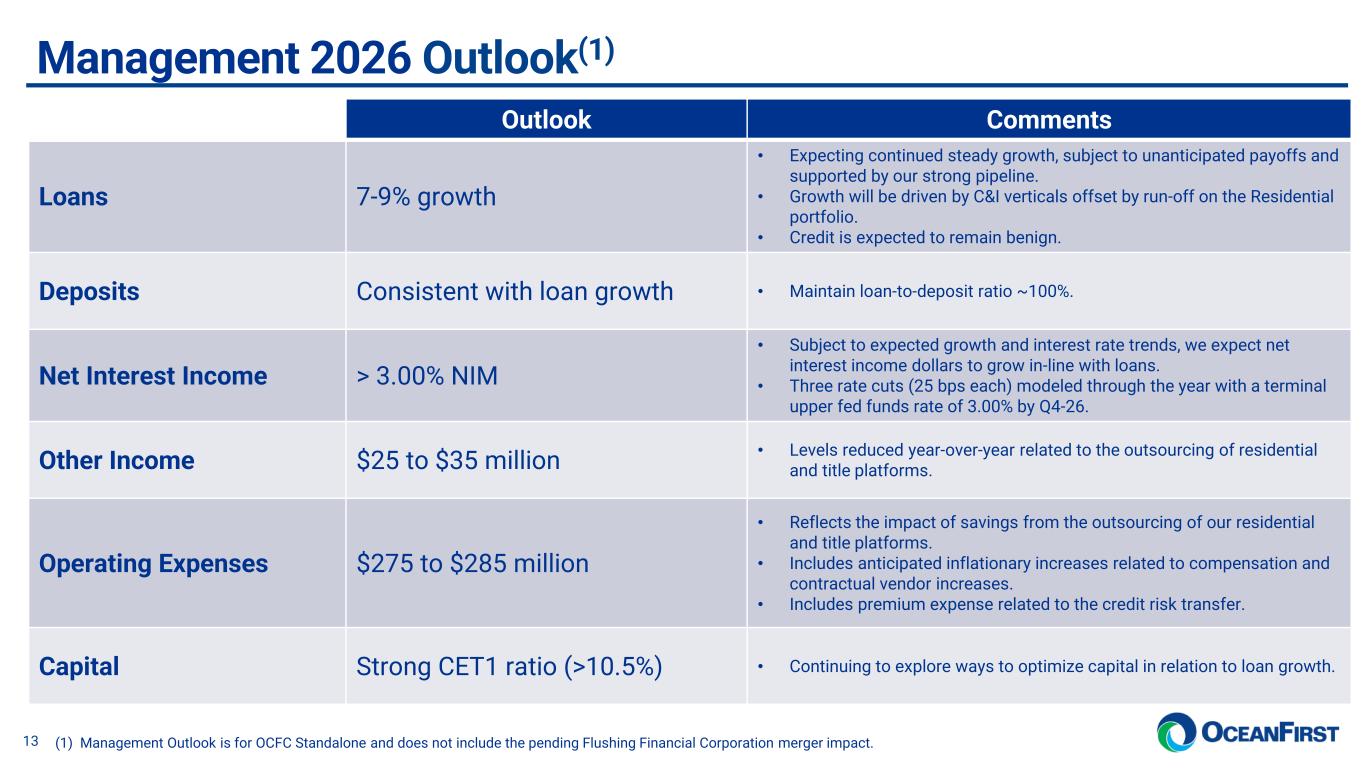

•Net Interest Income and PTPP Growth: Net interest income increased by $4.6 million, or 5%, to $95.3 million, representing a 20% annualized growth rate and driving an increase in pre-tax pre-provision income of $2.7 million, or 9%, to $33.2 million.

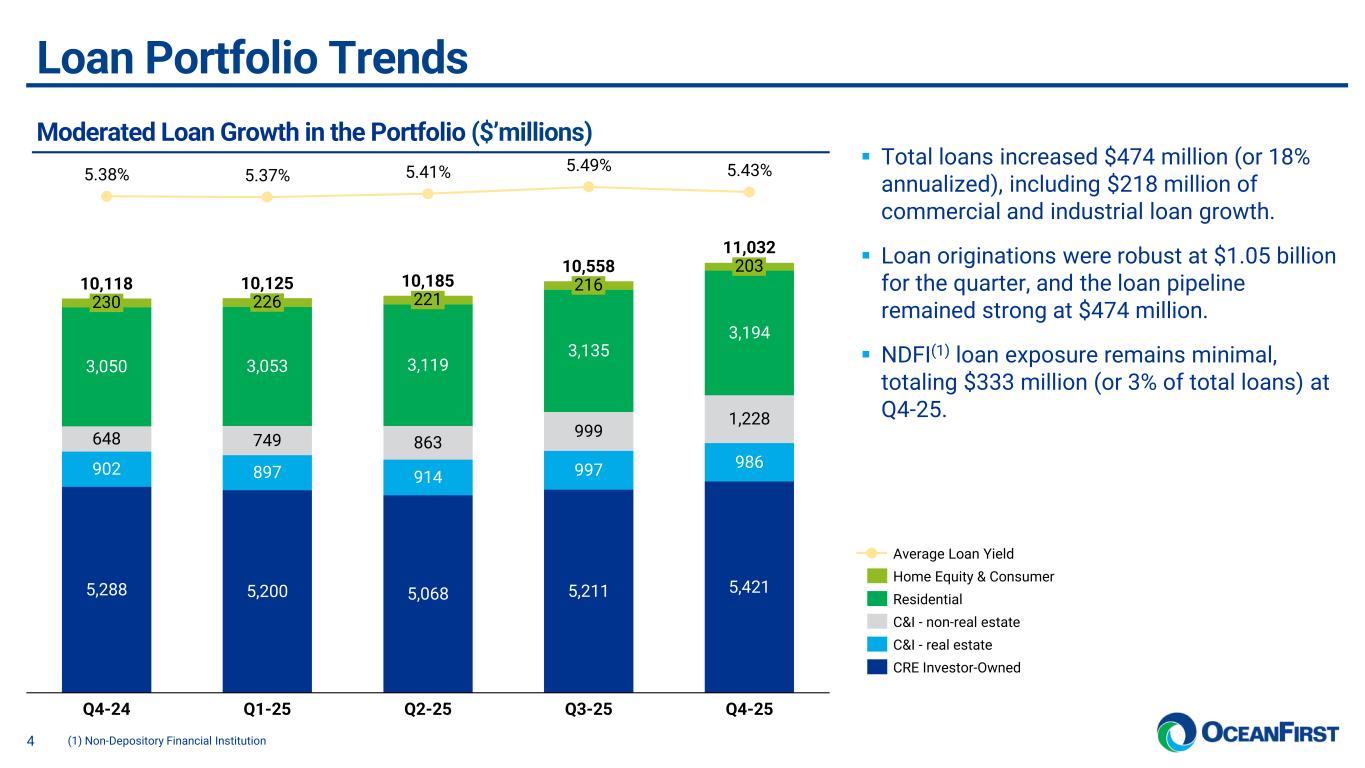

•Loan Growth: Total loans increased $474.0 million, representing an 18% annualized growth rate, primarily due to an increase in commercial loans. Loan originations were robust at $1.05 billion for the quarter, and the loan pipeline remained strong at $474.1 million.

•Capital: Capital remained strong with an estimated common equity tier one capital ratio of 10.7% as of December 31, 2025 and was favorably impacted by the Company’s execution of a credit risk transfer on a $1.5 billion pool of residential loans. The credit protection significantly reduced the risk-weighted assets associated with these loans for regulatory capital purposes.

Chairman and Chief Executive Officer, Christopher D. Maher, commented on the Company’s results, “We are pleased to present our current quarter results, which reflect strong capital and robust net loan growth, while maintaining a strong commercial loan pipeline. We recently announced entry into a merger agreement with Flushing Financial Corporation and an investment from Warburg Pincus, to further improve financial performance and operating scale.” Mr. Maher added, “As we turn to 2026, the Company remains focused on continued profitability gains, driven by the strategic initiatives undertaken during 2025 and the anticipated closing of the merger transaction in the second quarter of 2026, which is subject to receipt of regulatory approvals, approval by OceanFirst and Flushing shareholders and the satisfaction of other customary closing conditions.”

The Company’s Board of Directors declared its 116th consecutive quarterly cash dividend on common stock. The quarterly cash dividend on common stock of $0.20 per share will be paid on February 13, 2026 to common stockholders of record on February 2, 2026.

Results of Operations

The current quarter included an additional $7.4 million of restructuring charges for the outsourcing of residential loan originations and title business and $4.3 million of merger related expenses for the anticipated merger with Flushing Financial Corporation. Additionally, the current quarter results included $1.3 million of one-time costs recorded in professional fees for the execution of the credit risk transfer.

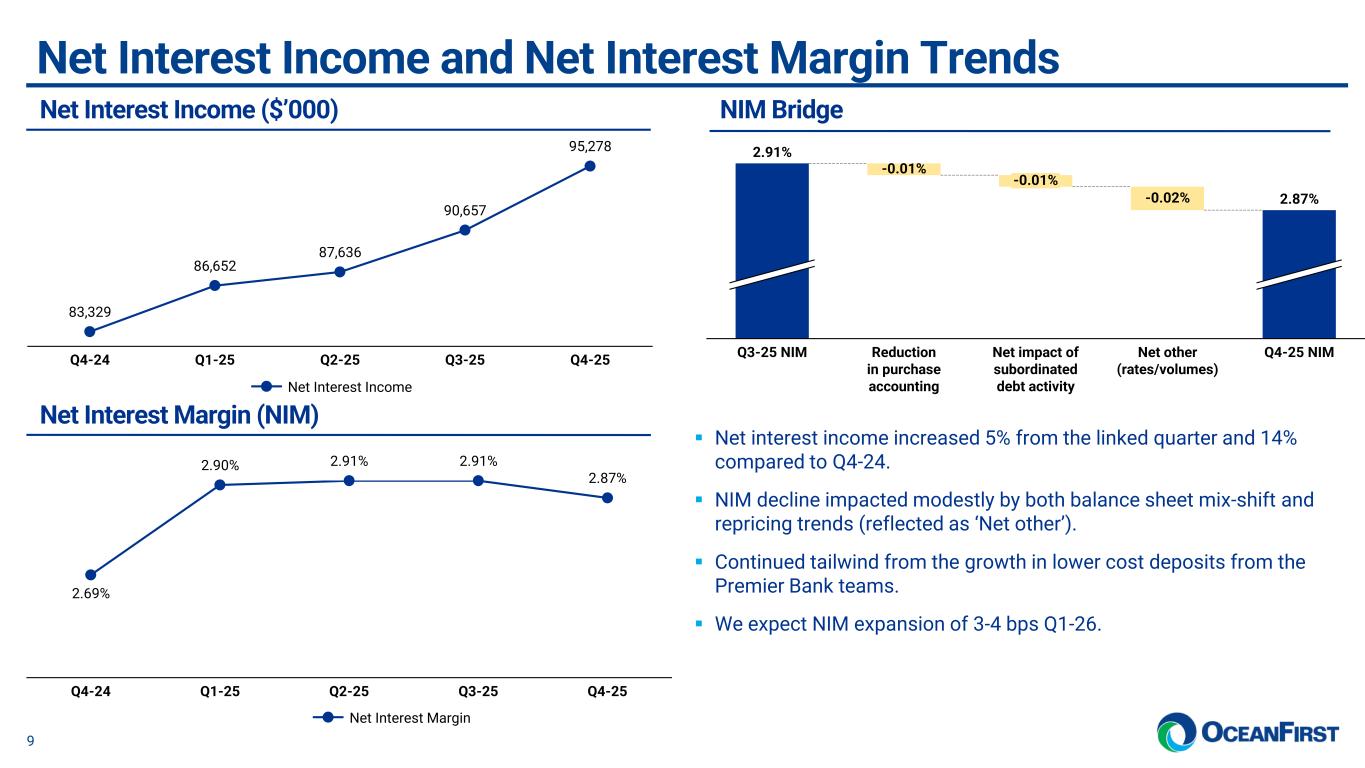

Net Interest Income and Margin

Quarter ended December 31, 2025 vs. December 31, 2024

Net interest income increased to $95.3 million, from $83.3 million primarily due to growth in average interest-earning assets. Net interest margin increased to 2.87%, from 2.69%, which included the impact of purchase accounting accretion and prepayment fees of 0.01% for the current period. Net interest margin increased primarily due to the decrease in cost of funds.

Average interest-earning assets increased by $825.9 million, due to an increase in loans and securities, partly offset by a decrease in interest-earning deposits and short-term advances. The average yield for interest-earning assets increased to 5.19%, from 5.15%.

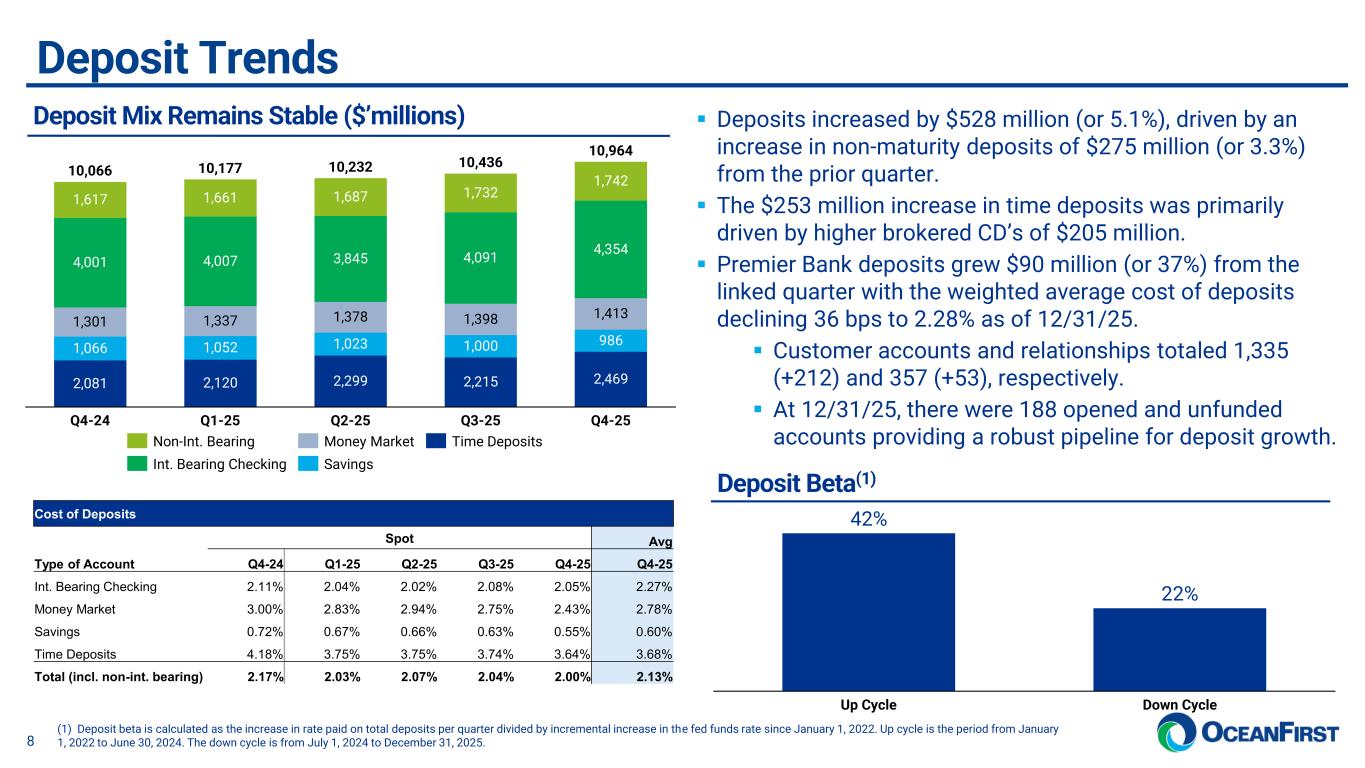

The cost of average interest-bearing liabilities decreased to 2.83%, from 3.04%, primarily due to lower cost of deposits, partially offset by higher cost of total borrowings. The total cost of deposits decreased 19 basis points to 2.13%, from 2.32%. Average interest-bearing liabilities increased by $730.7 million, primarily due to an increase in total deposits.

Year ended December 31, 2025 vs. December 31, 2024

Net interest income increased to $360.2 million, from $334.0 million. Net interest margin increased to 2.90%, from 2.72%, which included the impact of purchase accounting accretion and prepayment fees of 0.02% for both periods.

Average interest-earning assets increased by $149.1 million, primarily driven by an increase in commercial and residential loans, partly offset by a decrease in interest-earning deposits and short-term investments. The average yield decreased to 5.17%, from 5.23%.

The cost of average interest-bearing liabilities decreased to 2.81%, from 3.10%. The total cost of deposits decreased to 2.08%, from 2.36%. Average interest-bearing liabilities increased by $120.5 million, primarily due to an increase in total deposits.

Quarter ended December 31, 2025 vs. September 30, 2025

Net interest income increased by $4.6 million, to $95.3 million from $90.7 million, while net interest margin decreased to 2.87%, from 2.91%. Net interest income included the impact of purchase accounting accretion and prepayment fees of 0.01% and 0.02%, respectively.

Average interest-earning assets increased by $793.4 million, primarily due to increases in commercial loans and securities, while the yield on average interest-earning assets decreased to 5.19%, from 5.21% as a result of declining market rates combined with a mix shift to increased securities balances.

The cost of average interest-bearing liabilities decreased to 2.83%, from 2.85%, primarily due to the net impact of the issuance of $185 million subordinated debt in October 2025 and extinguishment of $125 million subordinated debt in November 2025. The total cost of deposits increased to 2.13%, from 2.06%, primarily due to the repricing of a large relationship from near zero rates at the beginning of the quarter, partly offset by the repricing of money market and time deposit accounts. Average interest-bearing liabilities increased $742.8 million, primarily due to an increase in deposits, partly offset by a decrease in Federal Home Loan Bank (“FHLB”) advances.

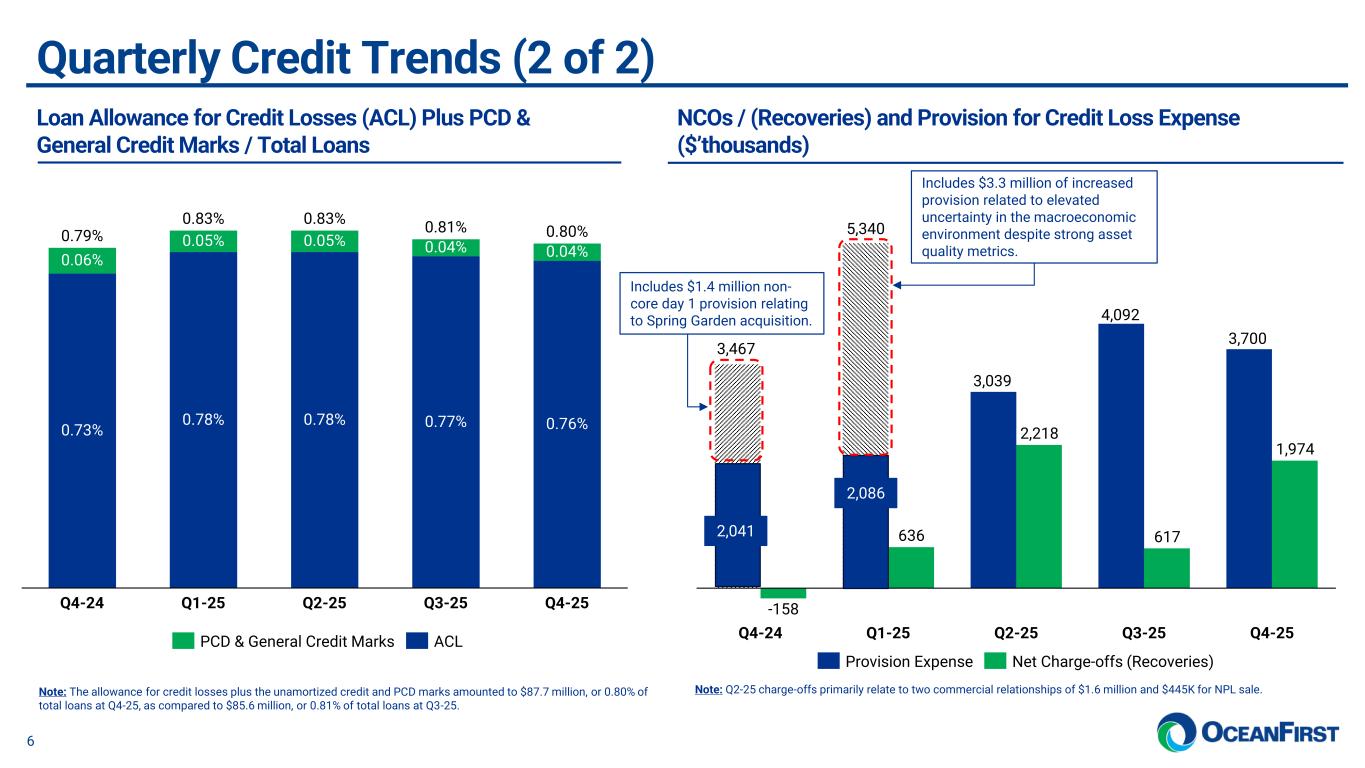

Provision for Credit Losses

Provision for credit losses for the quarter and year ended December 31, 2025, was $3.7 million and $16.2 million, respectively, as compared to $3.5 million and $7.7 million for the corresponding prior year periods and $4.1 million in the linked quarter. The prior year included a $1.4 million initial provision for credit losses related to the acquisition of Spring Garden.

The current quarter provision was primarily driven by overall improvements in asset quality and faster observed prepayment speeds, partly offset by net loan growth. The current quarter provision also includes a net reduction in reserves for unfunded loan balances of $608,000.

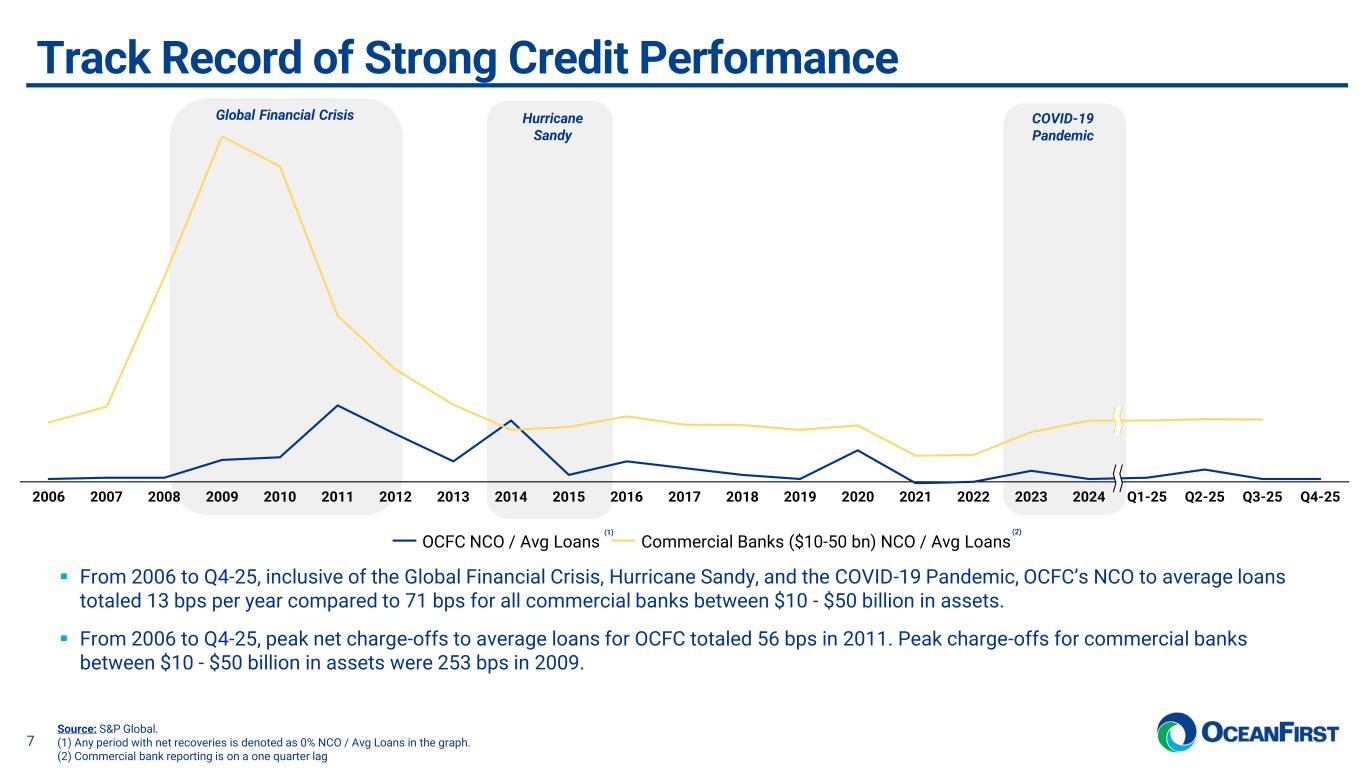

Net loan charge-offs were $2.0 million and $5.4 million for the quarter and year ended December 31, 2025, respectively, as compared to net loan recoveries of $158,000 and net loan charge-offs $1.6 million for the corresponding year periods and net loan charge-offs of $617,000 in the linked quarter. The current year included charge-offs of $2.5 million for four commercial relationships related to the Company’s Spring Garden acquisition, and charge-offs of $1.5 million related to sales of non-performing residential and consumer loans. The prior year includes the impact of a $1.6 million charge-off related to a single commercial real estate relationship that was sold in the prior year.

Non-interest Income

Quarter ended December 31, 2025 vs. December 31, 2024

Other income decreased to $9.4 million, as compared to $12.2 million. Other income was favorably impacted by non-core operations related to net gain on equity investments of $230,000 in the current period.

Excluding non-core operations, other income decreased $3.1 million. The primary drivers were decreases in fees and service charges of $3.2 million, primarily due to disposition of the title business, and in income from bank owned life insurance of $411,000, due to higher death benefits recognized in the prior year, partly offset by an increase in commercial loan swap income of $1.0 million due to new swaps.

Year ended December 31, 2025 vs. December 31, 2024

Other income decreased to $44.7 million, as compared to $50.2 million. Other income was favorably impacted by non-core operations related to net gains on equity investments of $916,000 and $4.2 million, for the respective periods, and a $2.6 million gain on sale of a portion of the Company’s trust business in the prior year.

Excluding non-core operations, other income increased $423,000. The primary drivers were increases in commercial loan swap income of $2.8 million due to new swaps, net gain on sale of loans of $1.3 million, and non-recurring other income of $1.9 million in the current year. These were partly offset by decreases in fees and service charges of $3.9 million related to lower title fees and a decrease of $855,000 related to a non-recurring gain on sale of assets in the prior year.

Quarter ended December 31, 2025 vs. September 30, 2025

Other income in the linked quarter was $12.3 million. Excluding non-core operations, other income decreased by $3.1 million. The primary drivers of the decline were decreases in fees and service charges of $2.2 million related to the disposition of the title business and commercial loan swap income of $584,000.

Non-interest Expense

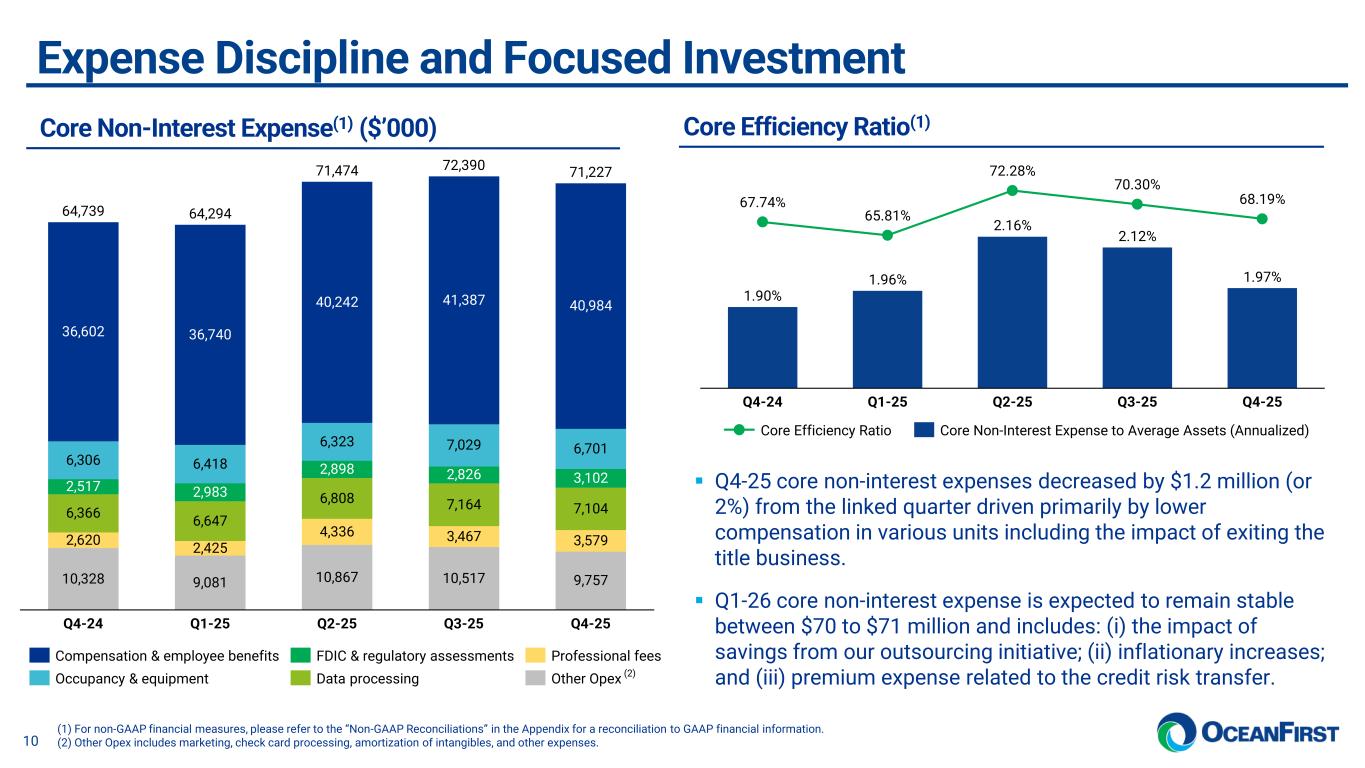

Quarter ended December 31, 2025 vs. December 31, 2024

Operating expenses increased to $84.1 million, as compared to $64.8 million. Operating expenses in the current quarter were adversely impacted by non-core operations of $12.9 million, related to restructuring charges, merger related expenses and credit risk transfer execution expenses. Operating expenses in the prior year quarter were adversely impacted by non-core operations of $110,000 for merger related expenses.

Excluding non-core operations, operating expenses increased by $6.5 million. The primary drivers were increases in compensation and benefits of $4.4 million, primarily due to the addition of commercial banking teams during the year, professional fees of $959,000, and data processing expense of $738,000.

Year ended December 31, 2025 vs. December 31, 2024

Operating expenses increased to $296.2 million, as compared to $245.9 million. Operating expenses in the current year were adversely impacted by non-core operations of $16.9 million related to restructuring charges, merger related expenses, and credit risk transfer execution expenses, partly offset by a reversal of FDIC special assessment fees. Operating expenses in the prior year were adversely impacted by non-core operations of $2.2 million from merger related expenses and an FDIC special assessment expense.

Excluding non-core operations, operating expenses increased by $35.7 million. The primary driver was an increase in compensation and benefits of $21.0 million related to acquisitions at the end of the prior year and the addition of commercial banking teams during the current year. Additional drivers were increases in professional fees of $4.3 million, partly related to Premier Banking recruitment fees, data processing expense of $3.4 million, other operating expenses of $3.3 million, primarily related to loan servicing expenses, occupancy expense of $2.1 million, partly due to additional space for commercial banking teams, and federal deposit insurance and regulatory assessments of $1.3 million.

Quarter ended December 31, 2025 vs. September 30, 2025

Operating expenses in the linked quarter were $76.3 million and included non-core operations of $3.9 million related to restructuring charges partly offset by a reversal of FDIC special assessment fees. Excluding non-core operations, operating expenses decreased by $1.2 million. The primary drivers were decreases in other operating expenses of $592,000, partially related to lower title costs due to the disposition of the title business, and in compensation and benefits expense of $403,000, partially related to a reduction in workforce due to the residential outsourcing initiative.

Income Tax Expense

The provision for income taxes was $3.8 million and $21.5 million for the quarter and year ended December 31, 2025, as compared to $5.1 million and $30.3 million for the same prior year periods and $5.2 million for the linked quarter.

The effective tax rate was 22.3% and 23.2% for the quarter and year ended December 31, 2025, as compared to 18.7% and 23.2% for the same prior year periods and 22.9% for the linked quarter. The effective tax rate for the current quarter and year-ended December 31, 2025 was adversely impacted by non-deductible merger expenses. The prior year quarter was positively impacted by utilization of higher tax credits and the year ended December 31, 2024 was adversely impacted by the non-recurring write-off of a deferred tax asset of $1.2 million net of other state effects and credits.

Financial Condition

December 31, 2025 vs. December 31, 2024

Total assets increased by $1.14 billion to $14.56 billion, from $13.42 billion, primarily due to increases in loans and securities. Total loans increased by $913.9 million to $11.03 billion, from $10.12 billion, primarily due to an increase of $797.1 million in the total commercial portfolio. The loan pipeline increased by $167.4 million to $474.1 million, from $306.7 million, primarily due to an increase in the commercial loan pipeline of $267.1 million. Debt securities available-for-sale increased by $404.3 million to $1.23 billion, from $827.5 million, primarily due to new purchases. Debt securities held-to-maturity decreased by $164.3 million to $881.6 million, from $1.05 billion, primarily due to principal repayments. Other assets decreased by $36.4 million to $149.3 million, from $185.7 million, primarily due to a decrease in market values associated with customer interest rate swap programs.

Total liabilities increased by $1.18 billion to $12.90 billion, from $11.72 billion primarily related to an increase in deposits and FHLB advances. Deposits increased by $898.1 million to $10.96 billion, from $10.07 billion, primarily due to increases in time deposits of $387.9 million and interest bearing deposits of $353.9 million. Time deposits increased by $387.9 million to $2.47 billion, from $2.08 billion, representing 22.5% and 20.7% of total deposits, respectively. Time deposits included an increase in brokered time deposits of $535.1 million, partly offset by a decrease in retail time deposits of $149.0 million. The loans-to-deposit ratio was 100.6%, as compared to 100.5%. FHLB advances increased by $324.6 million to $1.40 billion, from $1.07 billion as a result of lower-cost funding availability.

Other borrowings increased by $57.7 million to $255.2 million, from $197.5 million primarily due to the issuance of $185.0 million in subordinated notes in October 2025 at an initial rate of 6.375% and stated maturity of November 15, 2035. The proceeds were primarily used to redeem the Company’s subordinated notes due May 15, 2030, with principal amount of $125.0 million, in November 2025.

Other liabilities decreased by $89.1 million to $209.3 million, from $298.4 million, mostly due to a decrease in the market values of derivatives associated with customer interest rate swaps and related collateral received from counterparties.

Capital levels remain strong and in excess of “well-capitalized” regulatory levels at December 31, 2025, including the Company’s estimated common equity tier one capital ratio of 10.7%. For the fourth quarter of 2025, the ratio was impacted by the credit risk transfer entered into in December 2025, which reduced risk-weighted assets and was partially offset by an increase in risk-weighted assets from net loan growth.

Total stockholders’ equity decreased to $1.66 billion, as compared to $1.70 billion, primarily due to the redemption of preferred stock for $55.5 million and capital returns comprised of dividends and share repurchases, partially offset by net income. Additionally, accumulated other comprehensive loss decreased by $13.7 million primarily due to increases in the fair market value of available-for-sale debt securities, net of tax. Noncontrolling interest decreased by $1.1 million due to the disposition of the title business.

During the year ended December 31, 2025, the Company repurchased 1,433,537 shares totaling $24.9 million at a weighted average cost of $17.21, which includes repurchases of exercised options and awards from employees outside of the share repurchase program. On July 16, 2025, the Company announced its Board of Directors authorized a 2025 Stock Repurchase Program to repurchase up to an additional 3.0 million shares.

As of December 31, 2025, the Company had 3,226,284 shares available for repurchase under the authorized repurchase programs.

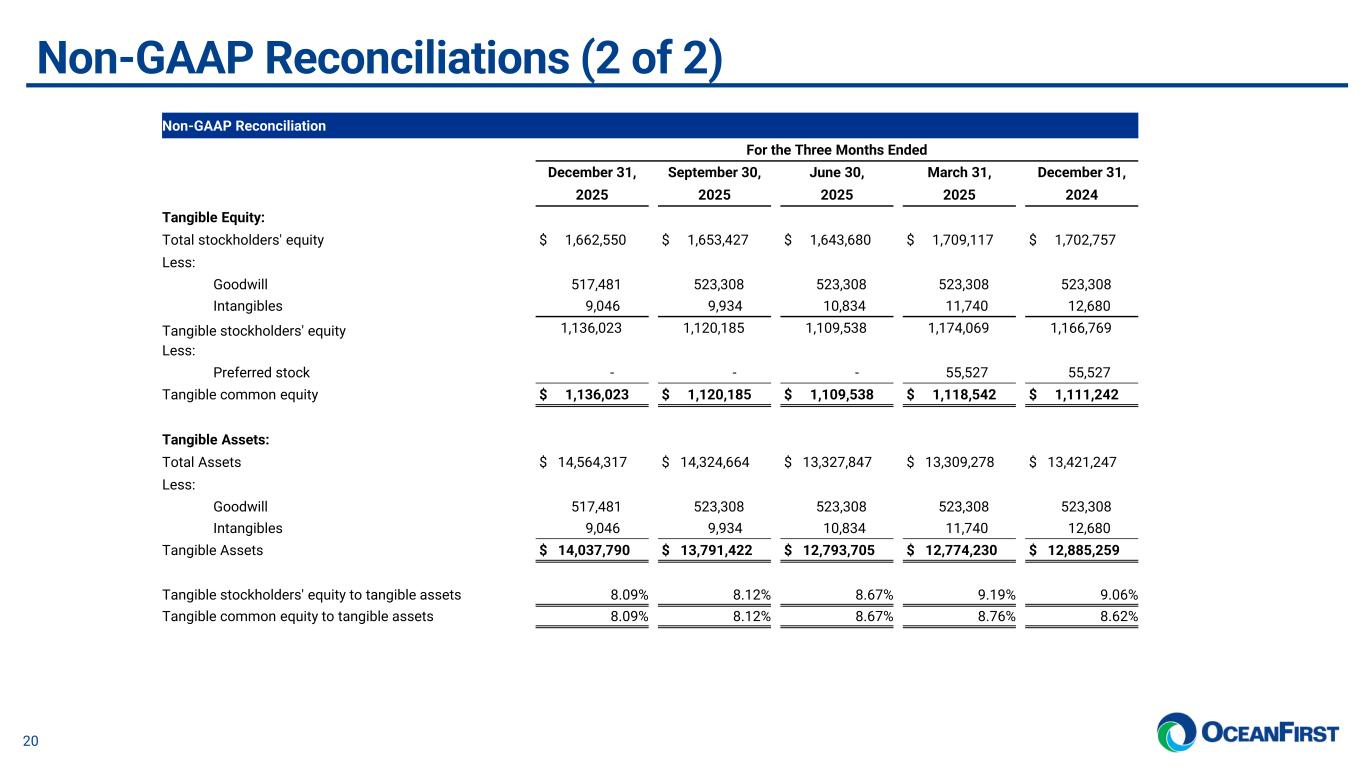

The Company’s tangible common equity2 increased by $24.8 million to $1.14 billion. The Company’s stockholders’ equity to assets ratio was 11.42% at December 31, 2025, and tangible common equity to tangible assets ratio decreased by 53 basis points during the year to 8.09%, primarily due to the drivers described above.

Book value per common share decreased to $28.97, as compared to $29.08. Tangible book value per common share3 increased to $19.79, as compared to $18.98.

Asset Quality

December 31, 2025 vs. December 31, 2024

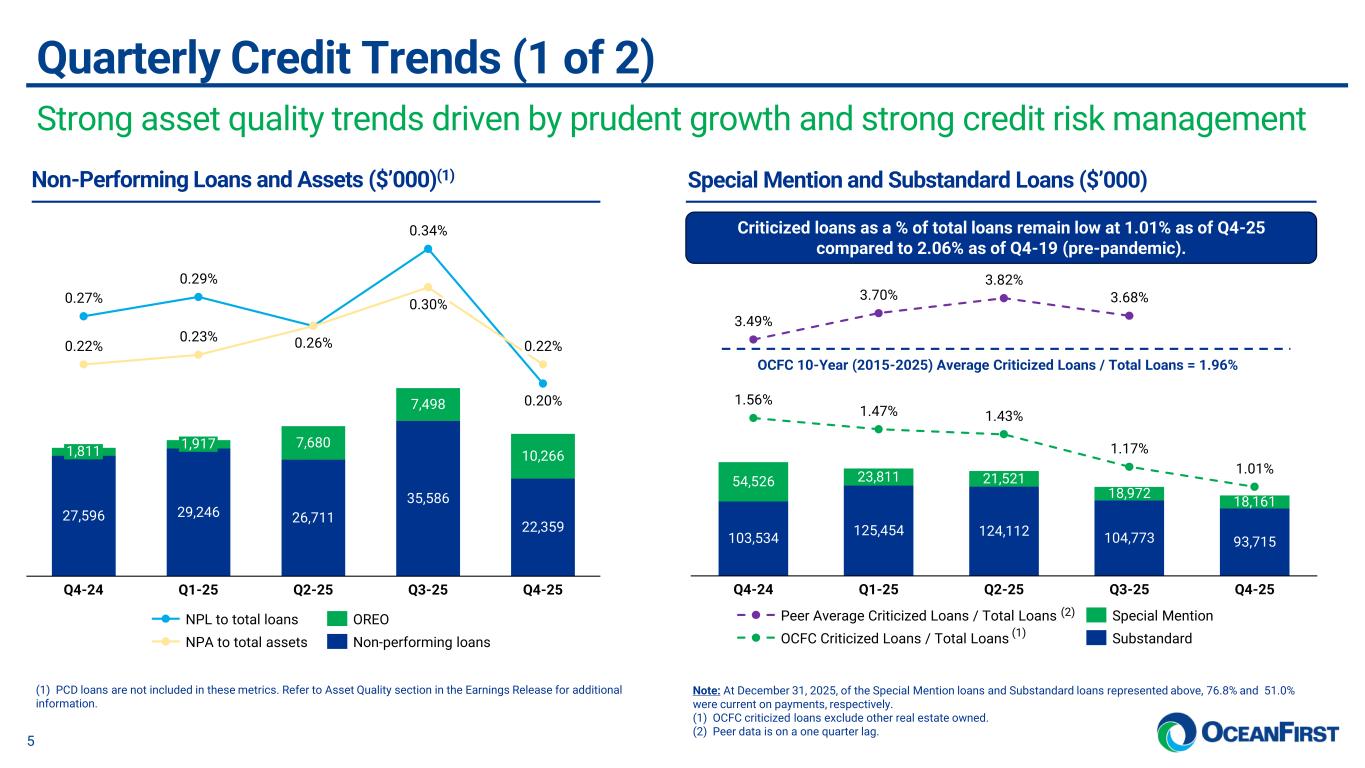

The Company’s non-performing loans decreased to $27.8 million, from $35.5 million, and represented 0.25% and 0.35% of total loans, respectively. The allowance for loan credit losses as a percentage of total non-performing loans was 301.27%, as compared to 207.19%. The level of 30 to 89 days delinquent loans increased to $47.8 million, from $36.6 million, primarily due to one commercial relationship of $20.8 million, which continued to be reported as a classified loan. Criticized and classified loans and other real estate owned decreased by $37.7 million to $122.1 million from $159.9 million. The Company’s allowance for loan credit losses was 0.76% of total loans, as compared to 0.73%. Refer to “Provision for Credit Losses” section for further discussion.

The Company’s asset quality, excluding purchased with credit deterioration (“PCD”) loans, was as follows. Non-performing loans decreased to $22.4 million, from $27.6 million. The allowance for loan credit losses as a percentage of total non-performing loans was 374.46%, as compared to 266.73%. The level of 30 to 89 days delinquent loans, also excluding non-performing loans, increased to $44.7 million, from $33.6 million.

2 Tangible book value per common share and tangible common equity to tangible assets are non-GAAP financial measures and exclude the impact of intangible assets, goodwill, and preferred equity from both stockholders’ equity and total assets. Refer to “Explanation of Non-GAAP Financial Measures” and the “Other Items - Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP. The Company’s management believes that the supplemental non-GAAP information, which consists of reported net income excluding non-core operations and in some instances excluding income taxes and provision for credit losses, and reporting equity and asset amounts excluding intangible assets, goodwill or preferred stock, all of which can vary from period to period, provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures, which may be presented by other companies. Refer to the Non-GAAP Reconciliation table at the end of this document for details on the earnings impact of these items.

Conference Call

As previously announced, the Company will host an earnings conference call on Friday, January 23, 2026 at 11:00 a.m. Eastern Time. The direct dial number for the call is 1-833-470-1428, toll free, using the access code 711318. For those unable to participate in the conference call, a replay will be available. To access the replay, dial 1-866-813-9403, access code 406472, from one hour after the end of the call until January 30, 2026. The conference call will also be available (listen-only) by internet webcast at www.oceanfirst.com - in the Investor Relations section.

* * *

OceanFirst Financial Corp.’s subsidiary, OceanFirst Bank N.A., founded in 1902, is a $14.6 billion regional bank providing financial services throughout New Jersey and in the major metropolitan areas between Massachusetts and Virginia. OceanFirst Bank delivers commercial and residential financing, treasury management, trust and asset management, and deposit services and is one of the largest and oldest community-based financial institutions headquartered in New Jersey.

To learn more about OceanFirst, go to www.oceanfirst.com.

Forward-Looking Statements

In addition to historical information, this news release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between OceanFirst Financial Corp. (“OceanFirst”) and Flushing Financial Corporation (“Flushing”) and the proposed investment by Warburg Pincus LLC (“Warburg Pincus”) in equity securities of OceanFirst. Forward-looking statements may be identified by the use of the words such as “ estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “could,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between OceanFirst and Flushing and the proposed investment by Warburg Pincus, including statements as to the expected timing, completion and effects of the proposed transaction. These statements are based on various assumptions, whether or not identified in this document, and on the current expectations of OceanFirst’s and Flushing’s management and are not predictions of actual performance, and, as a result, are subject to risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict, may differ from assumptions and many are beyond the control of OceanFirst and Flushing. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including obtaining the requisite OceanFirst and Flushing stockholder approvals or the necessary regulatory approvals (and the risk that such regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between OceanFirst and Flushing; (iv) the inability to obtain alternative capital in the event it becomes necessary to complete the proposed transaction; (v) the effect of the announcement or pendency of the proposed transaction on OceanFirst’s and Flushing’s business relationships, operating results and business generally; (vi) risks that the proposed transaction disrupts current plans and operations of OceanFirst and Flushing; (vii) potential difficulties in retaining OceanFirst and Flushing customers and employees as a result of the proposed transaction; (viii) OceanFirst’s and Flushing’s estimates of its financial performance; (ix) changes in general economic, political, or industry conditions, including persistent inflation, supply chain issues or labor shortages, instability in global economic conditions and geopolitical matters, as well as volatility in financial markets; (x) uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve; (xi) the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, and the operational risk of lending activities, including the effectiveness of OceanFirst’s and Flushing’s underwriting practices and the risk of fraud; (xii) fluctuations in the demand for loans; (xiii) the ability to develop and maintain a strong core deposit base or other low cost funding sources necessary to fund OceanFirst’s and Flushing’s activities particularly in a rising or high interest rate environment; (xiv) the rapid withdrawal of a significant amount of deposits over a short period of time; (xv) results of examinations by regulatory authorities of OceanFirst or Flushing and the possibility that any such regulatory authority may, among other things, limit OceanFirst’s or Flushing’s business activities, restrict OceanFirst’s or Flushing’s ability to invest in certain assets, refrain from issuing an approval or non-objection to certain capital or other actions, increase OceanFirst’s or Flushing’s allowance for credit losses, result in write-downs of asset values, restrict OceanFirst’s or Flushing’s ability or that of OceanFirst’s or Flushing’s bank subsidiary to pay dividends, or impose fines, penalties or sanctions; (xvi) the impact of bank failures or other adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; (xvii) changes in the markets in which OceanFirst and Flushing compete, including with respect to the competitive landscape, technology evolution or regulatory changes; (xviii) changes in consumer spending, borrowing and saving habits; (xix) slowdowns in securities trading or shifting demand for security trading products; (xx) the impact of pandemics and other catastrophic events or disasters on the global economy and financial market conditions and our business, results of operations, and financial condition; (xxi) legislative or regulatory changes; (xxii) changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs, (xxiii) impact of operating in a highly competitive industry; (xxiv) reliance on third party service providers; (xxv) competition in retaining key employees; (xxvi) risks related to data security and privacy, including the impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions; (xxvii) changes to accounting principles and guidelines; (xxviii) potential litigation relating to the proposed transaction that could be instituted against OceanFirst, Flushing or their respective directors and officers, including the effects of any outcomes related thereto; (xxix) volatility in the trading price of OceanFirst’s or Flushing’s securities; (xxx) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (xxxi) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected expenses, factors or events; (xxxii) the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where OceanFirst and Flushing do business; and (xxxiii) the dilution caused by OceanFirst’s issuance of additional shares of its capital stock in connection with the transaction.

The foregoing list of factors is not exhaustive. All forward-looking statements are expressly qualified in their entirety by the cautionary statements set forth above.

You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of OceanFirst’s registration statement on Form S-4 that will contain a joint proxy statement/prospectus discussed below, when it becomes available, and other documents filed by OceanFirst or Flushing from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings do and will identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. If any of these risks materialize or our assumptions prove incorrect, actual events and results could differ materially from those contained in the forward-looking statements. There may be additional risks that neither OceanFirst nor Flushing presently knows or that OceanFirst or Flushing currently believes are immaterial that could also cause actual events and results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect OceanFirst’s and Flushing’s expectations, plans or forecasts of future events and views as of the date of this document. OceanFirst and Flushing anticipate that subsequent events and developments will cause OceanFirst’s and Flushing’s assessments to change. While OceanFirst and Flushing may elect to update these forward-looking statements at some point in the future, OceanFirst and Flushing specifically disclaim any obligation to do so, unless required by applicable law. These forward-looking statements should not be relied upon as representing OceanFirst’s and Flushing’s assessments as of any date subsequent to the date of this document. Accordingly, undue reliance should not be placed upon the forward-looking statements. Forward-looking statements speak only as of the date they are made. Neither OceanFirst nor Flushing gives any assurance that either OceanFirst or Flushing, or the combined company, will achieve the results or other matters set forth in the forward-looking statements.

Additional Information and Where to Find It

This document is not a proxy statement or solicitation or a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of OceanFirst, Flushing Financial Corporation or the combined company, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be deemed to be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law.

This document relates to the proposed transaction between OceanFirst and Flushing and the proposed investment in OceanFirst by Warburg Pincus. OceanFirst intends to file a registration statement on Form S-4 with the SEC, which will include a preliminary joint proxy statement/prospectus to be distributed to holders of OceanFirst’s common stock and Flushing’s common stock in connection with OceanFirst’s and Flushing’s solicitation of proxies for the vote by OceanFirst’s stockholders and Flushing’s stockholders with respect to the proposed transaction. After the registration statement has been filed and declared effective, OceanFirst and Flushing will mail a definitive joint proxy statement/prospectus to their respective stockholders that, as of the applicable record date, are entitled to vote on the matters being considered at the OceanFirst stockholder meeting and at the Flushing stockholder meeting, as applicable. OceanFirst or Flushing may also file other documents with the SEC regarding the proposed transaction.

Before making any voting or investment decision, investors and security holders are urged to carefully read the entire registration statement and joint proxy statement/prospectus (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) when they become available, and any other relevant documents filed with the SEC, And the definitive versions thereof (when they become available), as well as any amendments or supplements to SUCH documents, CAREFULLY AND IN THEIR ENTIRETY because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by OceanFirst or Flushing through the website maintained by the SEC at www.sec.gov.

The documents filed by OceanFirst or Flushing with the SEC also may be obtained free of charge at OceanFirst’s or Flushing’s website at https://ir.oceanfirst.com/, under the heading “Financials” or https://investor.flushingbank.com/, under the heading “Financials”, respectively, or upon written request to OceanFirst, Attention: Investor Relations, 110 West Front Street, Red Bank, New Jersey 07701 or Flushing, Attention: Investor Relations, 220 RXR Plaza, Uniondale, New York 11556, respectively.

Participants in Solicitation

OceanFirst and Flushing and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from OceanFirst’s stockholders or Flushing’s stockholders in connection with the proposed transaction under the rules of the SEC. OceanFirst’s stockholders, Flushing’s stockholders and other interested persons will be able to obtain, without charge, more detailed information regarding the names, affiliations and interests of directors and executive officers of OceanFirst and Flushing in OceanFirst’s registration statement on Form S-4 that will be filed, as well other documents filed by OceanFirst or Flushing from time to time with the SEC. Other information regarding persons who may, under the rules of the SEC, be deemed the participants in the proxy solicitation of OceanFirst’s or Flushing’s stockholders in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the preliminary joint proxy statement/prospectus and will be contained in other relevant materials to be filed with the SEC regarding the proposed transaction (if and when they become available). You may obtain free copies of these documents at the SEC’s website at www.sec.gov. Copies of documents filed with the SEC by OceanFirst or Flushing will also be available free of charge from OceanFirst or Flushing using the contact information above.

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2025 |

|

September 30, 2025 |

|

December 31, 2024 |

|

|

(Unaudited) |

|

(Unaudited) |

|

|

| Assets |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

135,130 |

|

|

$ |

274,125 |

|

|

$ |

123,615 |

|

Debt securities available-for-sale, at estimated fair value |

|

1,231,827 |

|

|

1,261,580 |

|

|

827,500 |

|

Debt securities held-to-maturity, net of allowance for securities credit losses of $811 at December 31, 2025, $968 at September 30, 2025, and $967 at December 31, 2024 (estimated fair value of $825,790 at December 31, 2025, $856,550 at September 30, 2025, and $952,917 at December 31, 2024) |

|

881,568 |

|

|

919,734 |

|

|

1,045,875 |

|

| Equity investments |

|

91,882 |

|

|

90,731 |

|

|

84,104 |

|

Restricted equity investments, at cost |

|

129,329 |

|

|

142,398 |

|

|

108,634 |

|

Loans receivable, net of allowance for loan credit losses of $83,726 at December 31, 2025, $81,236 at September 30, 2025, and $73,607 at December 31, 2024 |

|

10,970,666 |

|

|

10,489,852 |

|

|

10,055,429 |

|

Loans held-for-sale |

|

5,768 |

|

|

17,766 |

|

|

21,211 |

|

Interest and dividends receivable |

|

49,010 |

|

|

47,606 |

|

|

45,914 |

|

Other real estate owned |

|

10,266 |

|

|

7,498 |

|

|

1,811 |

|

Premises and equipment, net |

|

112,743 |

|

|

112,449 |

|

|

115,256 |

|

|

|

|

|

|

|

|

| Bank owned life insurance |

|

270,301 |

|

|

269,136 |

|

|

270,208 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

517,481 |

|

|

523,308 |

|

|

523,308 |

|

| Intangibles |

|

9,046 |

|

|

9,934 |

|

|

12,680 |

|

| Other assets |

|

149,300 |

|

|

158,547 |

|

|

185,702 |

|

Total assets |

|

$ |

14,564,317 |

|

|

$ |

14,324,664 |

|

|

$ |

13,421,247 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Deposits |

|

$ |

10,964,405 |

|

|

$ |

10,435,994 |

|

|

$ |

10,066,342 |

|

Federal Home Loan Bank advances |

|

1,397,179 |

|

|

1,705,585 |

|

|

1,072,611 |

|

| Securities sold under agreements to repurchase with customers |

|

54,434 |

|

|

64,869 |

|

|

60,567 |

|

Other borrowings |

|

255,233 |

|

|

198,138 |

|

|

197,546 |

|

Advances by borrowers for taxes and insurance |

|

21,245 |

|

|

23,708 |

|

|

23,031 |

|

Other liabilities |

|

209,271 |

|

|

242,943 |

|

|

298,393 |

|

Total liabilities |

|

12,901,767 |

|

|

12,671,237 |

|

|

11,718,490 |

|

Stockholders’ equity: |

|

|

|

|

|

|

| OceanFirst Financial Corp. stockholders’ equity |

|

1,662,550 |

|

|

1,652,537 |

|

|

1,701,650 |

|

| Non-controlling interest |

|

— |

|

|

890 |

|

|

1,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

1,662,550 |

|

|

1,653,427 |

|

|

1,702,757 |

|

Total liabilities and stockholders’ equity |

|

$ |

14,564,317 |

|

|

$ |

14,324,664 |

|

|

$ |

13,421,247 |

|

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Year Ended |

|

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

|

2025 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|--------------------- (Unaudited) ---------------------| |

|

(Unaudited) |

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

146,550 |

|

|

$ |

141,847 |

|

|

$ |

135,438 |

|

|

$ |

556,894 |

|

|

$ |

545,243 |

|

| Debt securities |

|

21,681 |

|

|

17,156 |

|

|

19,400 |

|

|

72,057 |

|

|

77,749 |

|

| Equity investments and other |

|

3,501 |

|

|

3,191 |

|

|

4,782 |

|

|

13,503 |

|

|

19,181 |

|

| Total interest income |

|

171,732 |

|

|

162,194 |

|

|

159,620 |

|

|

642,454 |

|

|

642,173 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

59,615 |

|

|

53,246 |

|

|

59,889 |

|

|

216,180 |

|

|

242,133 |

|

| Borrowed funds |

|

16,839 |

|

|

18,291 |

|

|

16,402 |

|

|

66,051 |

|

|

66,005 |

|

| Total interest expense |

|

76,454 |

|

|

71,537 |

|

|

76,291 |

|

|

282,231 |

|

|

308,138 |

|

| Net interest income |

|

95,278 |

|

|

90,657 |

|

|

83,329 |

|

|

360,223 |

|

|

334,035 |

|

| Provision for credit losses |

|

3,700 |

|

|

4,092 |

|

|

3,467 |

|

|

16,171 |

|

|

7,689 |

|

| Net interest income after provision for credit losses |

|

91,578 |

|

|

86,565 |

|

|

79,862 |

|

|

344,052 |

|

|

326,346 |

|

| Other income (loss): |

|

|

|

|

|

|

|

|

|

|

| Bankcard services revenue |

|

1,789 |

|

|

1,663 |

|

|

1,595 |

|

|

6,534 |

|

|

6,197 |

|

| Trust and asset management revenue |

|

350 |

|

|

384 |

|

|

416 |

|

|

1,514 |

|

|

1,745 |

|

| Fees and service charges |

|

2,994 |

|

|

5,190 |

|

|

6,207 |

|

|

17,865 |

|

|

21,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on sales of loans |

|

751 |

|

|

900 |

|

|

1,076 |

|

|

3,686 |

|

|

2,358 |

|

| Net gain (loss) on equity investments |

|

230 |

|

|

(7) |

|

|

(5) |

|

|

916 |

|

|

4,225 |

|

| Net (loss) gain from other real estate operations |

|

(10) |

|

|

1 |

|

|

(20) |

|

|

(285) |

|

|

(20) |

|

| Income from bank owned life insurance |

|

2,127 |

|

|

1,988 |

|

|

2,538 |

|

|

7,753 |

|

|

7,905 |

|

| Commercial loan swap income |

|

1,119 |

|

|

1,703 |

|

|

86 |

|

|

3,649 |

|

|

879 |

|

| Other |

|

61 |

|

|

482 |

|

|

339 |

|

|

3,069 |

|

|

5,107 |

|

| Total other income |

|

9,411 |

|

|

12,304 |

|

|

12,232 |

|

|

44,701 |

|

|

50,187 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| Compensation and employee benefits |

|

40,984 |

|

|

41,387 |

|

|

36,602 |

|

|

159,353 |

|

|

138,341 |

|

| Occupancy |

|

5,825 |

|

|

6,098 |

|

|

5,280 |

|

|

22,874 |

|

|

20,811 |

|

| Equipment |

|

876 |

|

|

931 |

|

|

1,026 |

|

|

3,597 |

|

|

4,250 |

|

| Marketing |

|

1,466 |

|

|

1,538 |

|

|

1,615 |

|

|

5,653 |

|

|

5,165 |

|

| Federal deposit insurance and regulatory assessments |

|

3,102 |

|

|

2,616 |

|

|

2,517 |

|

|

11,599 |

|

|

10,955 |

|

| Data processing |

|

7,104 |

|

|

7,164 |

|

|

6,366 |

|

|

27,723 |

|

|

24,280 |

|

| Check card processing |

|

1,086 |

|

|

1,170 |

|

|

1,134 |

|

|

4,582 |

|

|

4,412 |

|

| Professional fees |

|

4,862 |

|

|

3,467 |

|

|

2,620 |

|

|

15,090 |

|

|

9,483 |

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of intangibles |

|

888 |

|

|

900 |

|

|

876 |

|

|

3,634 |

|

|

3,333 |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger related expenses |

|

4,253 |

|

|

— |

|

|

110 |

|

|

4,253 |

|

|

1,779 |

|

| Restructuring charges |

|

7,379 |

|

|

4,147 |

|

|

— |

|

|

11,526 |

|

|

— |

|

| Other operating expense |

|

6,317 |

|

|

6,909 |

|

|

6,703 |

|

|

26,353 |

|

|

23,068 |

|

| Total operating expenses |

|

84,142 |

|

|

76,327 |

|

|

64,849 |

|

|

296,237 |

|

|

245,877 |

|

| Income before provision for income taxes |

|

16,847 |

|

|

22,542 |

|

|

27,245 |

|

|

92,516 |

|

|

130,656 |

|

| Provision for income taxes |

|

3,754 |

|

|

5,156 |

|

|

5,083 |

|

|

21,489 |

|

|

30,266 |

|

| Net income |

|

13,093 |

|

|

17,386 |

|

|

22,162 |

|

|

71,027 |

|

|

100,390 |

|

| Net income attributable to non-controlling interest |

|

— |

|

|

56 |

|

|

253 |

|

|

49 |

|

|

325 |

|

| Net income attributable to OceanFirst Financial Corp. |

|

13,093 |

|

|

17,330 |

|

|

21,909 |

|

|

70,978 |

|

|

100,065 |

|

| Dividends on preferred shares |

|

— |

|

|

— |

|

|

1,004 |

|

|

2,008 |

|

|

4,016 |

|

| Loss on redemption of preferred stock |

|

— |

|

|

— |

|

|

— |

|

|

1,842 |

|

|

— |

|

| Net income available to common stockholders |

|

$ |

13,093 |

|

|

$ |

17,330 |

|

|

$ |

20,905 |

|

|

$ |

67,128 |

|

|

$ |

96,049 |

|

| Basic earnings per share |

|

$ |

0.23 |

|

|

$ |

0.30 |

|

|

$ |

0.36 |

|

|

$ |

1.17 |

|

|

$ |

1.65 |

|

| Diluted earnings per share |

|

$ |

0.23 |

|

|

$ |

0.30 |

|

|

$ |

0.36 |

|

|

$ |

1.17 |

|

|

$ |

1.65 |

|

| Average basic shares outstanding |

|

56,942 |

|

|

57,031 |

|

|

58,026 |

|

|

57,419 |

|

|

58,296 |

|

| Average diluted shares outstanding |

|

56,954 |

|

|

57,036 |

|

|

58,055 |

|

|

57,425 |

|

|

58,297 |

|

OceanFirst Financial Corp.

SELECTED LOAN AND DEPOSIT DATA

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS RECEIVABLE |

|

|

At |

|

|

|

December 31, 2025 |

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

| Commercial: |

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate - investor |

|

$ |

5,420,989 |

|

|

$ |

5,211,220 |

|

|

$ |

5,068,125 |

|

|

$ |

5,200,137 |

|

|

$ |

5,287,683 |

|

| Commercial and industrial: |

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial - real estate |

|

986,431 |

|

|

997,122 |

|

|

914,406 |

|

|

896,647 |

|

|

902,219 |

|

| Commercial and industrial - non-real estate |

|

1,227,556 |

|

|

998,860 |

|

|

862,504 |

|

|

748,575 |

|

|

647,945 |

|

| Total commercial and industrial |

|

2,213,987 |

|

|

1,995,982 |

|

|

1,776,910 |

|

|

1,645,222 |

|

|

1,550,164 |

|

| Total commercial |

|

|

7,634,976 |

|

|

7,207,202 |

|

|

6,845,035 |

|

|

6,845,359 |

|

|

6,837,847 |

|

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

|

|

3,194,264 |

|

|

3,135,200 |

|

|

3,119,232 |

|

|

3,053,318 |

|

|

3,049,763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Home equity loans and lines and other consumer (“other consumer”) |

|

202,763 |

|

|

215,581 |

|

|

220,820 |

|

|

226,633 |

|

|

230,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total consumer |

|

|

3,397,027 |

|

|

3,350,781 |

|

|

3,340,052 |

|

|

3,279,951 |

|

|

3,280,225 |

|

| Total loans |

|

|

11,032,003 |

|

|

10,557,983 |

|

|

10,185,087 |

|

|

10,125,310 |

|

|

10,118,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred origination costs (fees), net |

|

22,389 |

|

|

13,105 |

|

|

13,960 |

|

|

11,560 |

|

|

10,964 |

|

| Allowance for loan credit losses |

|

|

(83,726) |

|

|

(81,236) |

|

|

(79,266) |

|

|

(78,798) |

|

|

(73,607) |

|

| Loans receivable, net |

|

$ |

10,970,666 |

|

|

$ |

10,489,852 |

|

|

$ |

10,119,781 |

|

|

$ |

10,058,072 |

|

|

$ |

10,055,429 |

|

| Mortgage loans serviced for others |

|

$ |

365,431 |

|

|

$ |

340,740 |

|

|

$ |

288,211 |

|

|

$ |

222,963 |

|

|

$ |

191,279 |

|

|

At December 31, 2025 Average Yield |

|

|

|

|

|

|

|

|

|

|

Loan pipeline (1): |

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

6.81 |

% |

|

$ |

464,602 |

|

|

$ |

710,933 |

|

|

$ |

790,768 |

|

|

$ |

375,622 |

|

|

$ |

197,491 |

|

Residential real estate (2) |

6.09 |

|

|

9,457 |

|

|

136,797 |

|

|

146,921 |

|

|

116,121 |

|

|

97,385 |

|

Other consumer (2) |

— |

|

|

— |

|

|

16,184 |

|

|

17,110 |

|

|

12,681 |

|

|

11,783 |

|

| Total |

6.80 |

% |

|

$ |

474,059 |

|

|

$ |

863,914 |

|

|

$ |

954,799 |

|

|

$ |

504,424 |

|

|

$ |

306,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

|

2025 |

|

2025 |

|

2025 |

|

2025 |

|

2024 |

|

Average Yield |

|

|

|

|

|

|

|

|

|

|

| Loan originations: |

|

|

|

|

|

|

|

|

|

|

|

Commercial (3) |

6.57 |

% |

|

$ |

786,186 |

|

|

$ |

739,154 |

|

|

$ |

425,877 |

|

|

$ |

233,968 |

|

|

$ |

268,613 |

|

| Residential real estate |

6.00 |

|

|

249,540 |

|

|

250,066 |

|

|

274,314 |

|

|

167,162 |

|

|

235,370 |

|

| Other consumer |

8.14 |

|

|

14,859 |

|

|

18,087 |

|

|

15,813 |

|

|

15,825 |

|

|

11,204 |

|

| Total |

6.46 |

% |

|

$ |

1,050,585 |

|

|

$ |

1,007,307 |

|

|

$ |

716,004 |

|

|

$ |

416,955 |

|

|

$ |

515,187 |

|

Loans sold (4) |

|

|

$ |

107,486 |

|

|

$ |

145,735 |

|

|

$ |

142,431 |

|

|

$ |

104,991 |

|

|

$ |

127,508 |

|

(1)Loan pipeline includes loans approved but not funded.

(2)As of December 31, 2025, the Company has outsourced its residential and consumer originations, and the pipeline represents the remaining commitments expected to close in 2026.

(3)Excludes commercial loan pool purchases of $24.3 million and $76.1 million for the three months ended March 31, 2025 and December 31, 2024, respectively.

(4)Excludes sale of non-performing residential and consumer loans of $2.5 million, $2.2 million and $5.1 million for the three months ended December 31, 2025, June 30, 2025 and March 31, 2025, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DEPOSITS |

|

At |

|

|

December 31, 2025 |

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

| Type of Account |

|

|

|

|

|

|

|

|

|

|

| Non-interest-bearing |

|

$ |

1,741,958 |

|

|

$ |

1,731,760 |

|

|

$ |

1,686,627 |

|

|

$ |

1,660,738 |

|

|

$ |

1,617,182 |

|

| Interest-bearing checking |

|

4,354,485 |

|

|

4,090,930 |

|

|

3,845,602 |

|

|

4,006,653 |

|

|

4,000,553 |

|

| Money market |

|

1,412,917 |

|

|

1,397,434 |

|

|

1,377,999 |

|

|

1,337,570 |

|

|

1,301,197 |

|

| Savings |

|

986,195 |

|

|

1,000,488 |

|

|

1,022,918 |

|

|

1,052,504 |

|

|

1,066,438 |

|

Time deposits (1) |

|

2,468,850 |

|

|

2,215,382 |

|

|

2,299,296 |

|

|

2,119,558 |

|

|

2,080,972 |

|

| Total deposits |

|

$ |

10,964,405 |

|

|

$ |

10,435,994 |

|

|

$ |

10,232,442 |

|

|

$ |

10,177,023 |

|

|

$ |

10,066,342 |

|

(1)Includes brokered time deposits of $609.8 million, $405.1 million, $522.8 million, $370.5 million, and $74.7 million at December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively.

OceanFirst Financial Corp.

ASSET QUALITY

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY (1) (2) |

December 31, 2025 |

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

| Non-performing loans: |

|

|

|

|

|

|

|

|

|

| Commercial real estate - investor |

$ |

13,636 |

|

|

$ |

23,570 |

|

|

$ |

20,457 |

|

|

$ |

23,595 |

|

|

$ |

17,000 |

|

| Commercial and industrial: |

|

|

|

|

|

|

|

|

|

| Commercial and industrial - real estate |

4,813 |

|

|

7,469 |

|

|

4,499 |

|

|

4,690 |

|

|

4,787 |

|

| Commercial and industrial - non-real estate |

640 |

|

|

394 |

|

|

311 |

|

|

22 |

|

|

32 |

|

| Total commercial and industrial |

5,453 |

|

|

7,863 |

|

|

4,810 |

|

|

4,712 |

|

|

4,819 |

|

| Residential real estate |

6,200 |

|

|

7,334 |

|

|

5,318 |

|

|

5,709 |

|

|

10,644 |

|

| Other consumer |

2,502 |

|

|

2,496 |

|

|

2,926 |

|

|

2,954 |

|

|

3,064 |

|

|

|

|

|

|

|

|

|

|

|

Total non-performing loans(2) |

$ |

27,791 |

|

|

$ |

41,263 |

|

|

$ |

33,511 |

|

|

$ |

36,970 |

|

|

$ |

35,527 |

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned |

10,266 |

|

|

7,498 |

|

|

7,680 |

|

|

1,917 |

|

|

1,811 |

|

| Total non-performing assets |

$ |

38,057 |

|

|

$ |

48,761 |

|

|

$ |

41,191 |

|

|

$ |

38,887 |

|

|

$ |

37,338 |

|

Delinquent loans 30 to 89 days |

$ |

47,808 |

|

|

$ |

19,817 |

|

|

$ |

14,740 |

|

|

$ |

46,246 |

|

|

$ |

36,550 |

|

| Modifications to borrowers experiencing financial difficulty |

|

|

|

|

|

|

|

|

|

Non-performing (included in total non-performing loans above) |

$ |

956 |

|

|

$ |

7,693 |

|

|

$ |

8,129 |

|

|

$ |

8,307 |

|

|

$ |

3,232 |

|

Performing |

23,898 |

|

|

23,952 |

|

|

31,986 |

|

|

27,592 |

|

|

27,631 |

|

| Total modification to borrowers experiencing financial difficulty |

$ |

24,854 |

|

|

$ |

31,645 |

|

|

$ |

40,115 |

|

|

$ |

35,899 |

|

|

$ |

30,863 |

|

| Allowance for loan credit losses |

$ |

83,726 |

|

|

$ |

81,236 |

|

|

$ |

79,266 |

|

|

$ |

78,798 |

|

|

$ |

73,607 |

|

| Allowance for unfunded commitments |

4,028 |

|

|

4,636 |

|

|

3,289 |

|

|

2,846 |

|

|

3,264 |

|

Allowance for loan credit losses as a percent of total loans receivable (3) |

0.76 |

% |

|

0.77 |

% |

|

0.78 |

% |

|

0.78 |

% |

|

0.73 |

% |

Allowance for loan credit losses as a percent of total non-performing loans (3) |

301.27 |

|

|

196.87 |

|

|

236.54 |

|

|

213.14 |

|

|

207.19 |

|

| Non-performing loans as a percent of total loans receivable |

0.25 |

|

|

0.39 |

|

|

0.33 |

|

|

0.37 |

|

|

0.35 |

|

Non-performing assets as a percent of total assets |

0.26 |

|

|

0.34 |

|

|

0.31 |

|

|

0.29 |

|

|

0.28 |

|

| Supplemental PCD and non-performing loans |

|

|

|

|

|

|

|

|

|

| PCD loans, net of allowance for loan credit losses |

$ |

14,968 |

|

|

$ |

19,003 |

|

|

$ |

20,934 |

|

|

$ |

21,737 |

|

|

$ |

22,006 |

|

| Non-performing PCD loans |

5,432 |

|

|

5,677 |

|

|

6,800 |

|

|

7,724 |

|

|

7,931 |

|

| Delinquent PCD and non-performing loans 30 to 89 days |

3,103 |

|

|

2,987 |

|

|

2,590 |

|

|

10,489 |

|

|

2,997 |

|

| PCD modifications to borrowers experiencing financial difficulty |

18 |

|

|

20 |

|

|

20 |

|

|

22 |

|

|

23 |

|

| Asset quality, excluding PCD loans |

|

|

|

|

|

|

|

|

|

Non-performing loans (2) |

22,359 |

|

|

35,586 |

|

|

26,711 |

|

|

29,246 |

|

|

27,596 |

|

| Non-performing assets |

32,625 |

|

|

43,084 |

|

|

34,391 |

|

|

31,163 |

|

|

29,407 |

|

Delinquent loans 30 to 89 days (excludes non-performing loans) |

44,705 |

|

|

16,830 |

|

|

12,150 |

|

|

35,757 |

|

|

33,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Modification to borrowers experiencing financial difficulty |

24,836 |

|

|

31,625 |

|

|

40,095 |

|

|

35,877 |

|

|

30,840 |

|

Allowance for loan credit losses as a percent of total non-performing loans (3) |

374.46 |

% |

|

228.28 |

% |

|

296.75 |

% |

|

269.43 |

% |

|

266.73 |

% |

Non-performing loans as a percent of total loans receivable |

0.20 |

|

|

0.34 |

|

|

0.26 |

|

|

0.29 |

|

|

0.27 |

|

| Non-performing assets as a percent of total assets |

0.22 |

|

|

0.30 |

|

|

0.26 |

|

|

0.23 |

|

|

0.22 |

|

(1)Asset quality metrics exclude loans held for sale.

(2)The quarters ended December 31, 2025, June 30, 2025 and March 31, 2025 included the sale of non-performing residential and consumer loans of $2.5 million, $2.2 million and $5.1 million, respectively.

(3)Loans acquired from acquisitions were recorded at fair value. The net unamortized credit and PCD marks on these loans, not reflected in the allowance for loan credit losses, was $4.0 million, $4.4 million, $5.0 million, $5.6 million, and $6.0 million at December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively.

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOAN (CHARGE-OFFS) RECOVERIES |

|

For the Three Months Ended |

|

|

December 31, 2025 |

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

| Net loan (charge-offs) recoveries: |

|

|

|

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

(2,190) |

|

|

$ |

(850) |

|

|