Document

Exhibit 99.1

Company Contact:

Patrick S. Barrett

Chief Financial Officer

OceanFirst Financial Corp.

Tel: (732) 240-4500, ext. 27507

Email: pbarrett@oceanfirst.com

FOR IMMEDIATE RELEASE

OCEANFIRST FINANCIAL CORP.

ANNOUNCES FIRST QUARTER

FINANCIAL RESULTS

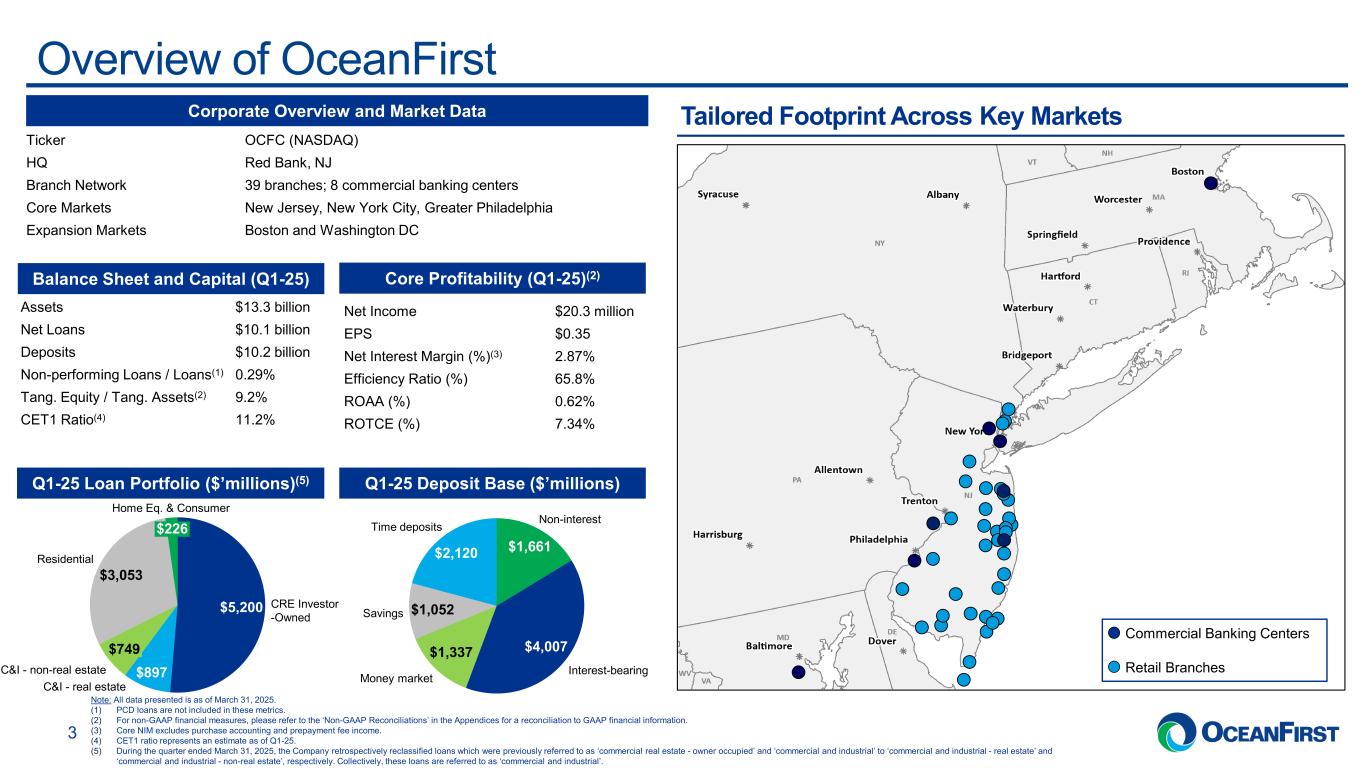

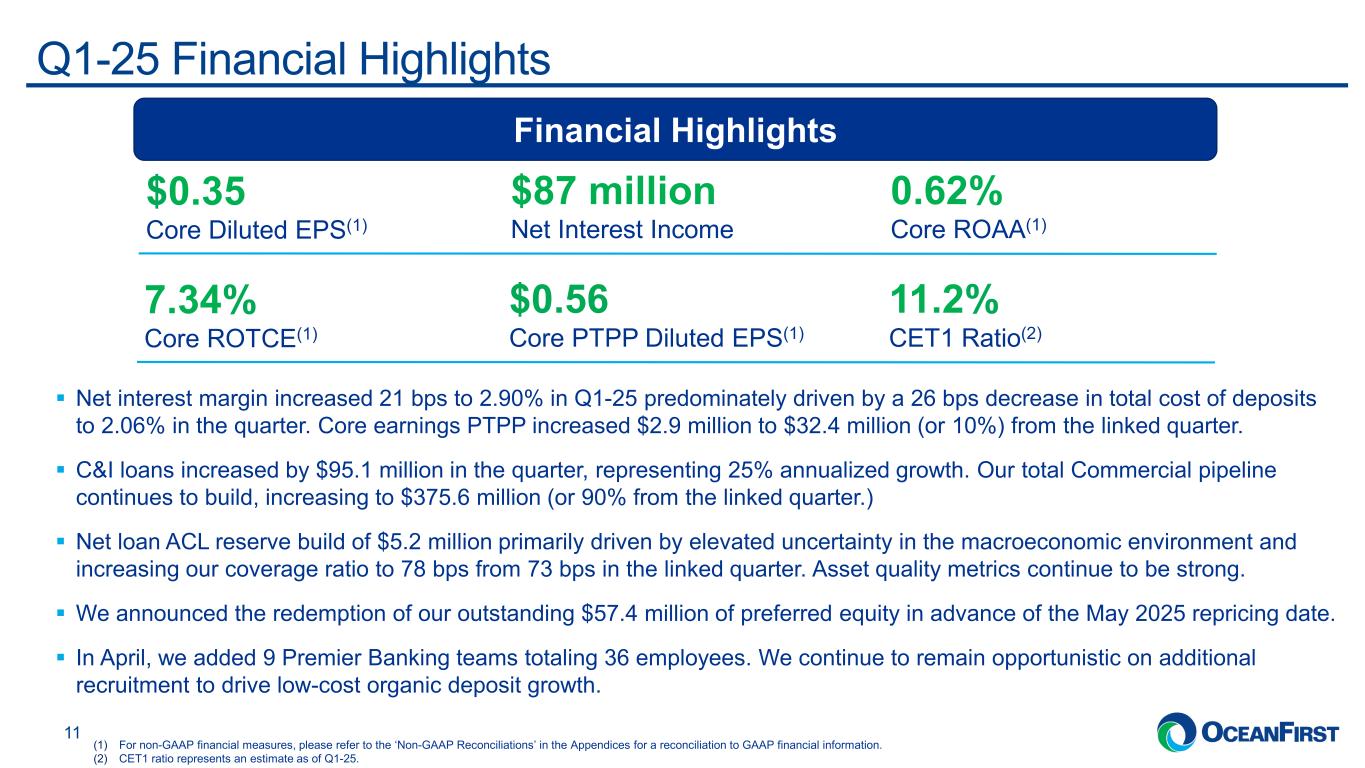

RED BANK, NEW JERSEY, April 24, 2025 - OceanFirst Financial Corp. (NASDAQ:OCFC) (the “Company”), the holding company for OceanFirst Bank N.A. (the “Bank”), announced net income available to common stockholders of $20.5 million, or $0.35 per diluted share, for the quarter ended March 31, 2025, a decrease from $27.7 million, or $0.47 per diluted share, for the corresponding prior year period, and a decrease from $20.9 million, or $0.36 per diluted share, for the linked quarter. Selected performance metrics are as follows (refer to “Selected Quarterly Financial Data” for additional information):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

|

|

| Performance Ratios (Annualized): |

March 31, |

|

December 31, |

|

March 31, |

|

|

|

|

| 2025 |

|

2024 |

|

2024 |

|

|

|

|

| Return on average assets |

0.62 |

% |

|

0.61 |

% |

|

0.82 |

% |

|

|

|

|

| Return on average stockholders’ equity |

4.85 |

|

|

4.88 |

|

|

6.65 |

|

|

|

|

|

Return on average tangible stockholders’ equity (a) |

7.05 |

|

|

7.12 |

|

|

9.61 |

|

|

|

|

|

Return on average tangible common equity (a) |

7.40 |

|

|

7.47 |

|

|

10.09 |

|

|

|

|

|

| Efficiency ratio |

65.67 |

|

|

67.86 |

|

|

59.56 |

|

|

|

|

|

| Net interest margin |

2.90 |

|

|

2.69 |

|

|

2.81 |

|

|

|

|

|

(a) Return on average tangible stockholders’ equity and return on average tangible common equity (“ROTCE”) are non-GAAP (“generally accepted accounting principles”) financial measures. Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and “Non-GAAP Reconciliation” tables for reconciliation and additional information regarding non-GAAP financial measures.

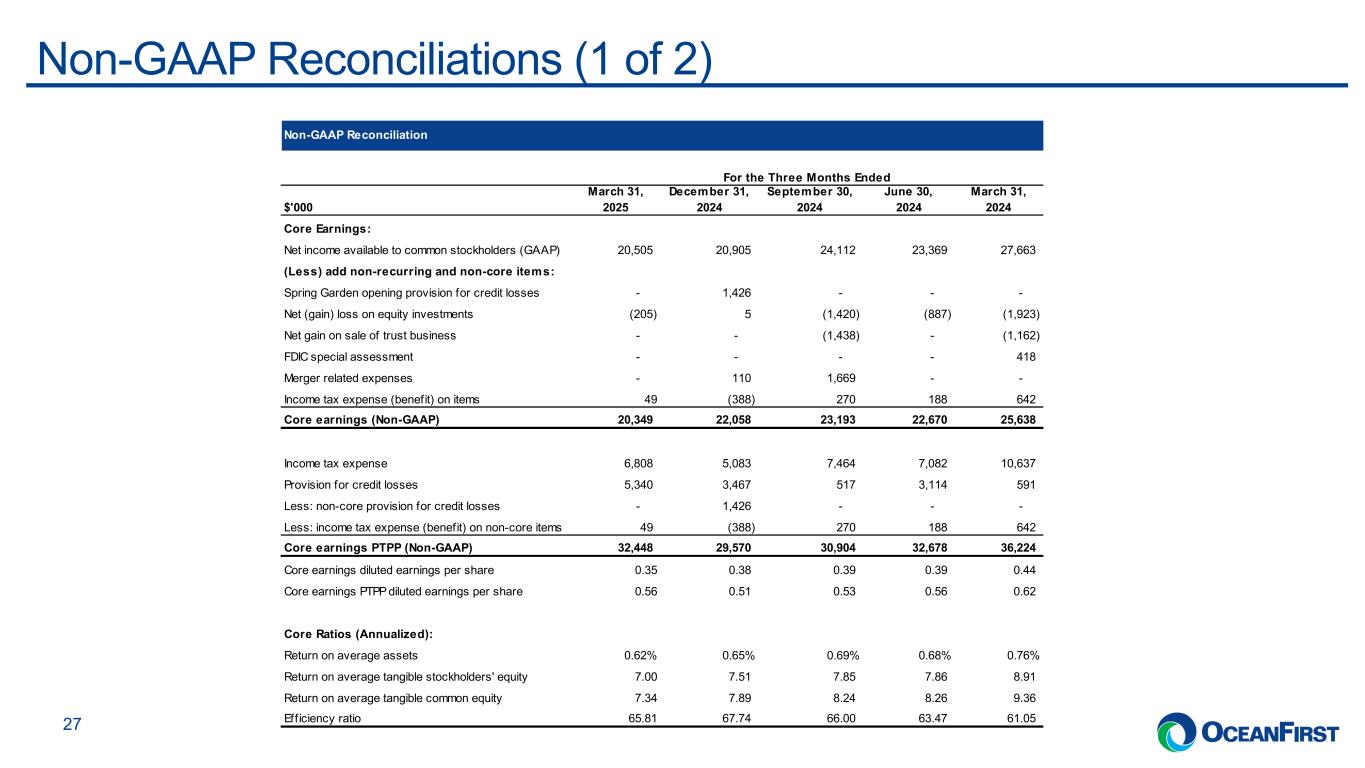

Core earnings1 for the quarter ended March 31, 2025 were $20.3 million, or $0.35 per diluted share, a decrease from $25.6 million, or $0.44 per diluted share, for the corresponding prior year period, and a decrease from $22.1 million, or $0.38 per diluted share, for the linked quarter.

Core earnings PTPP1 for the quarter ended March 31, 2025 was $32.4 million, or $0.56 per diluted share, as compared to $36.2 million, or $0.62 per diluted share, for the corresponding prior year period, and $29.6 million, or $0.51 per diluted share, for the linked quarter. Selected performance metrics are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

|

|

|

March 31, |

|

December 31, |

|

March 31, |

|

|

|

|

Core Ratios1 (Annualized): |

2025 |

|

2024 |

|

2024 |

|

|

|

|

| Return on average assets |

0.62 |

% |

|

0.65 |

% |

|

0.76 |

% |

|

|

|

|

| Return on average tangible stockholders’ equity |

7.00 |

|

|

7.51 |

|

|

8.91 |

|

|

|

|

|

| Return on average tangible common equity |

7.34 |

|

|

7.89 |

|

|

9.36 |

|

|

|

|

|

| Efficiency ratio |

65.81 |

|

|

67.74 |

|

|

61.05 |

|

|

|

|

|

| Core diluted earnings per share |

$ |

0.35 |

|

|

$ |

0.38 |

|

|

$ |

0.44 |

|

|

|

|

|

| Core PTPP diluted earnings per share |

0.56 |

|

|

0.51 |

|

|

0.62 |

|

|

|

|

|

1 Core earnings and core earnings before income taxes and provision for credit losses (“PTPP” or “Pre-Tax-Pre-Provision”), and ratios derived therefrom, are non-GAAP financial measures. For the periods presented, core earnings exclude merger related expenses, net (gain) loss on equity investments, net gain on sale of trust business, the opening provision for credit losses in connection with the acquisition of Spring Garden Capital Group, LLC (“Spring Garden”), the Federal Deposit Insurance Corporation (“FDIC”) special assessment, and the income tax effect of these items, (collectively referred to as “non-core” operations). PTPP excludes the aforementioned pre-tax “non-core” items along with income tax expense (benefit) and provision for credit losses (exclusive of the Spring Garden opening provision). Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and the “Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Key developments for the recent quarter are described below:

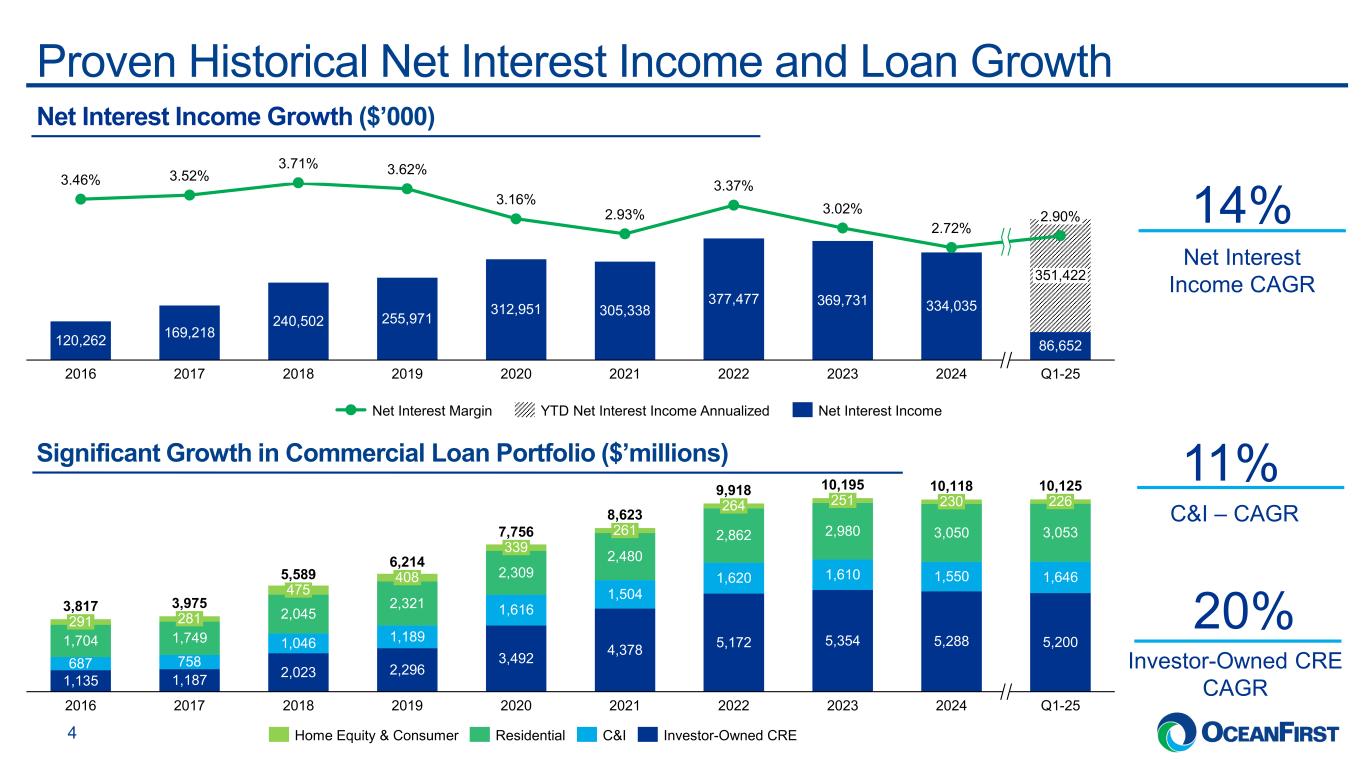

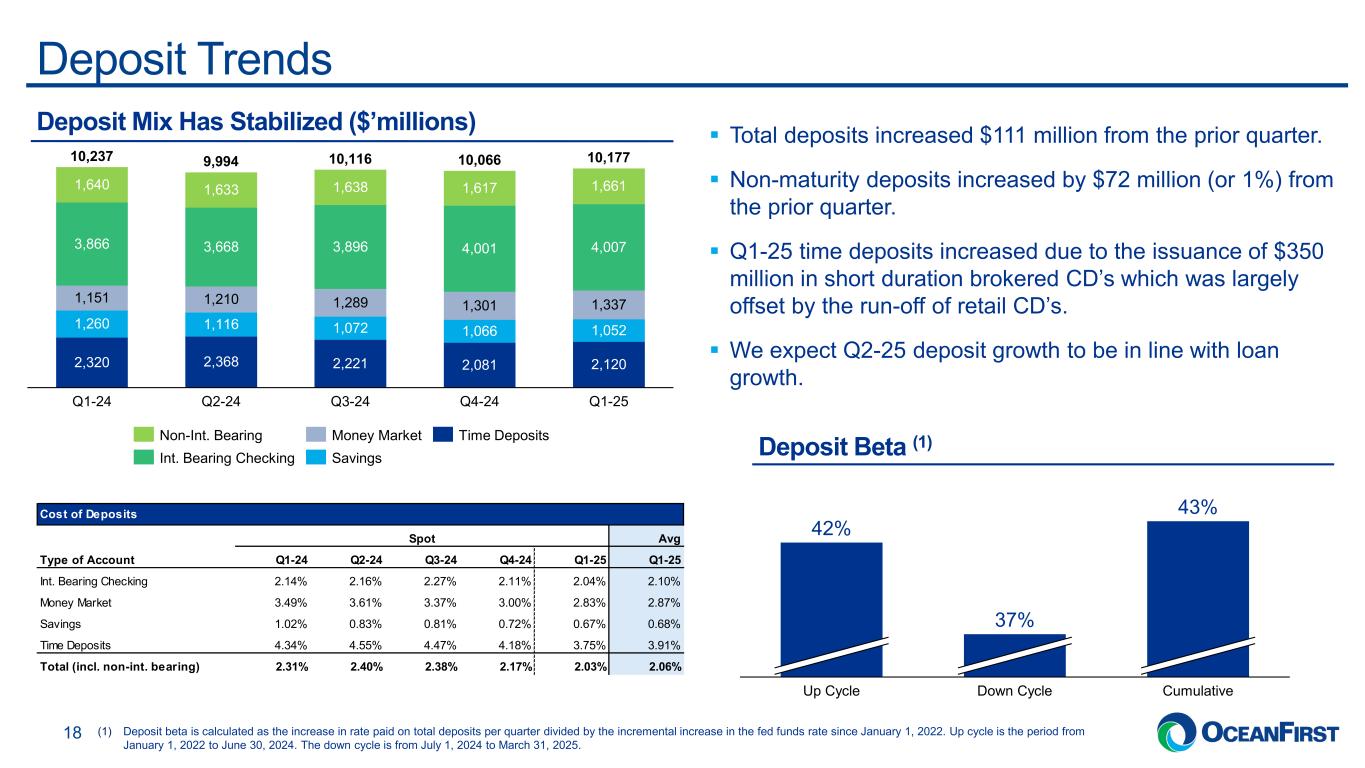

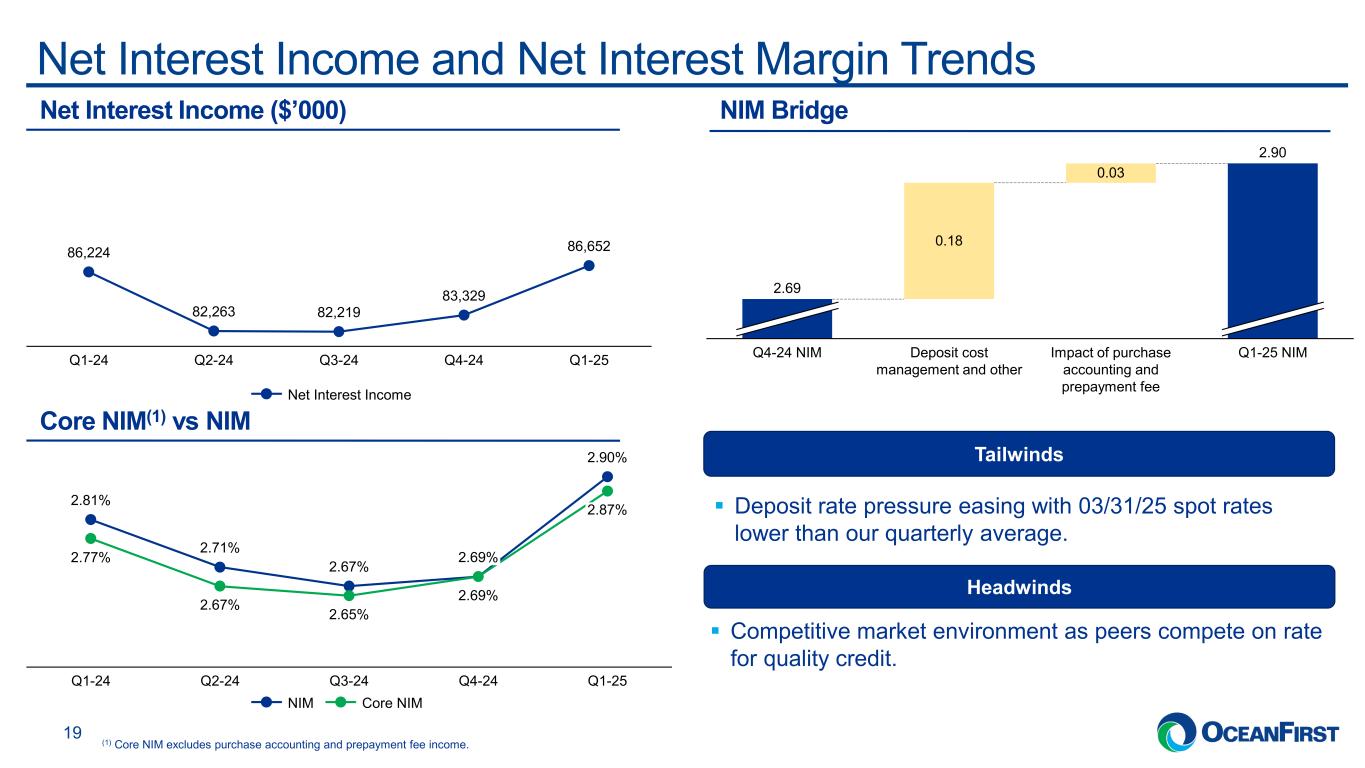

•Margin Expansion: Net interest margin increased 21 basis points to 2.90%, from 2.69%, and net interest income increased by $3.3 million to $86.7 million driven by a decrease in total cost of deposits to 2.06% from 2.32% in the linked quarter.

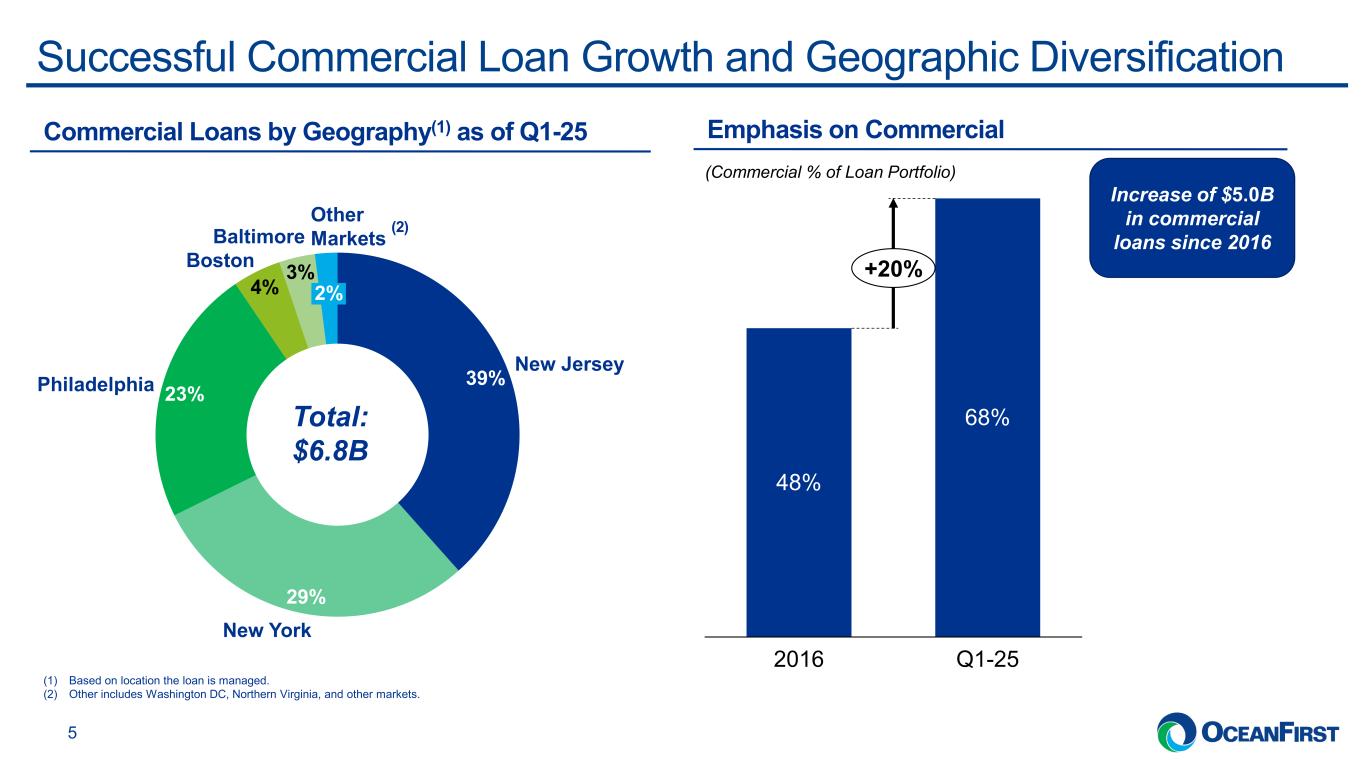

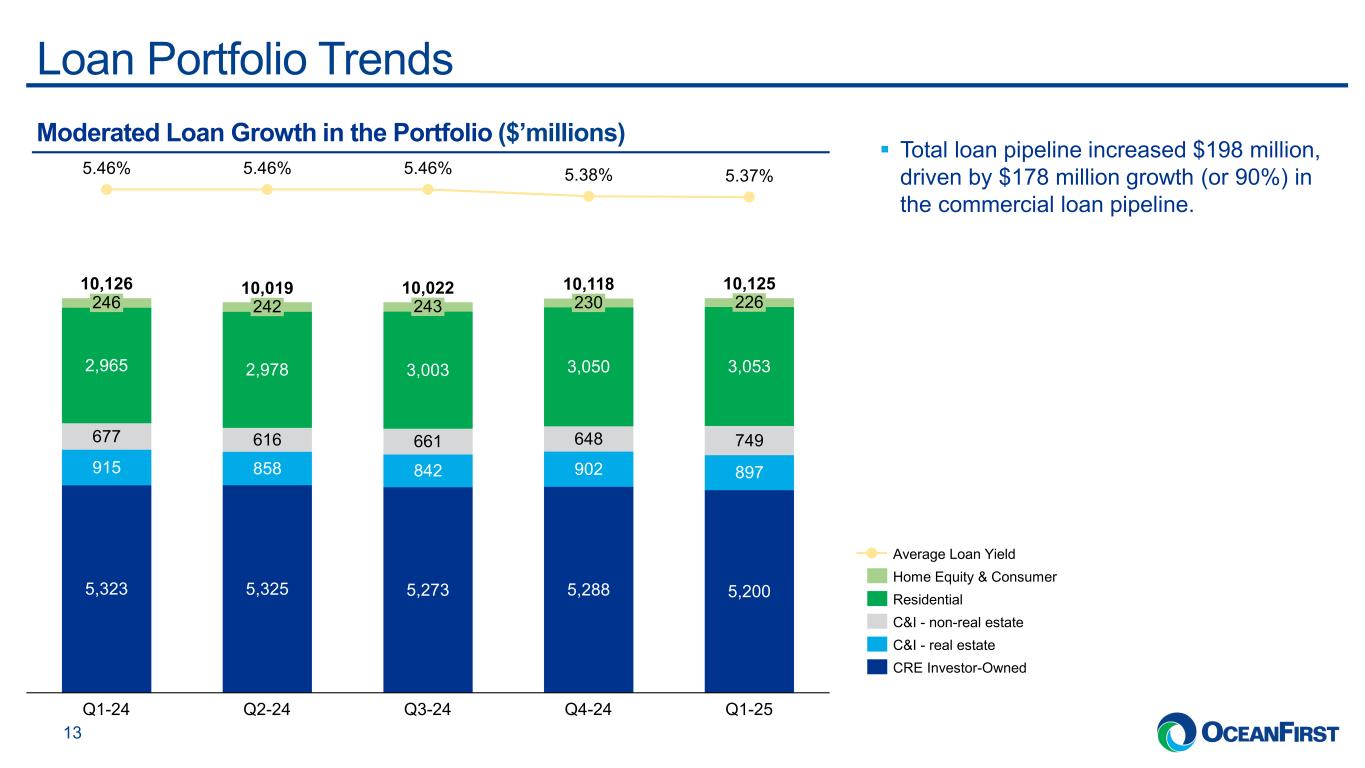

•Commercial Loans: Commercial and industrial loans increased $95.1 million, or 6.1% as compared to the linked quarter. Additionally, the total commercial loan pipeline increased 90% to $375.6 million from $197.5 million in the linked quarter.

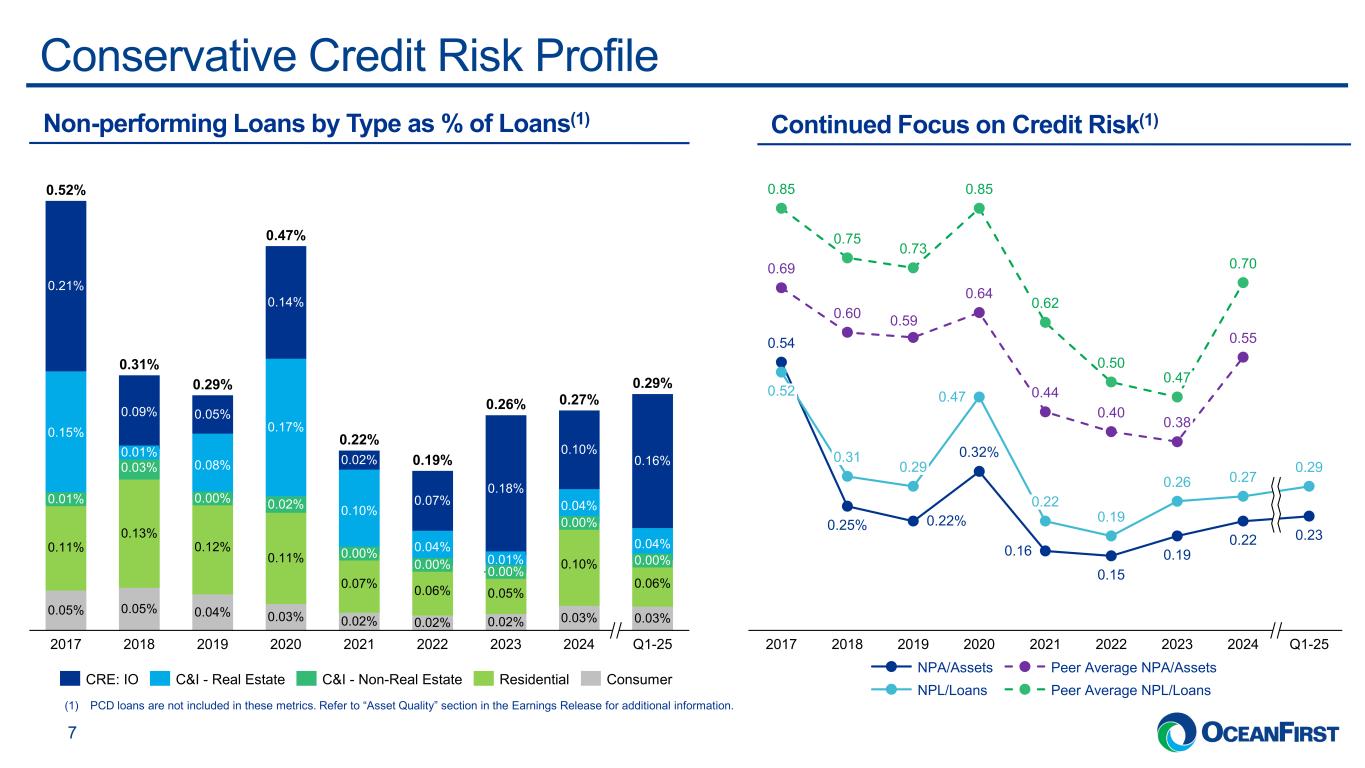

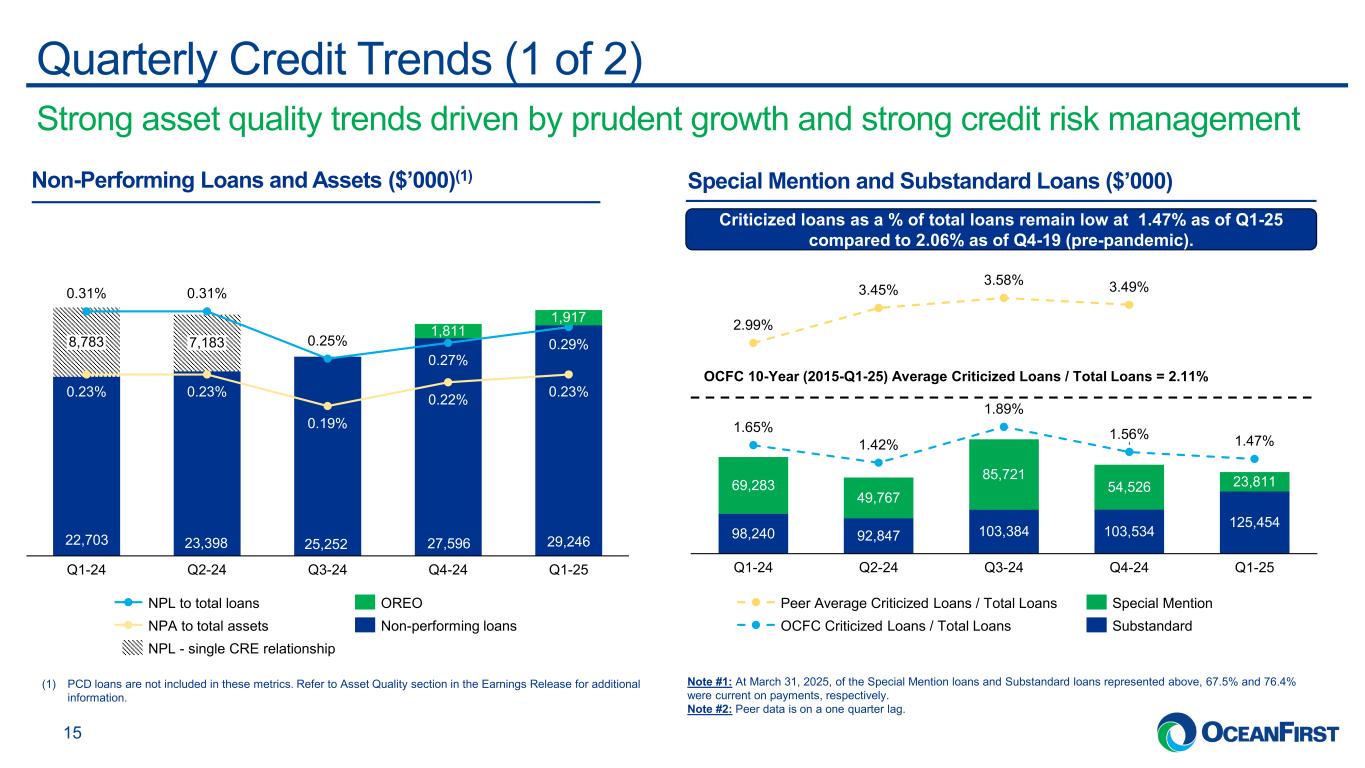

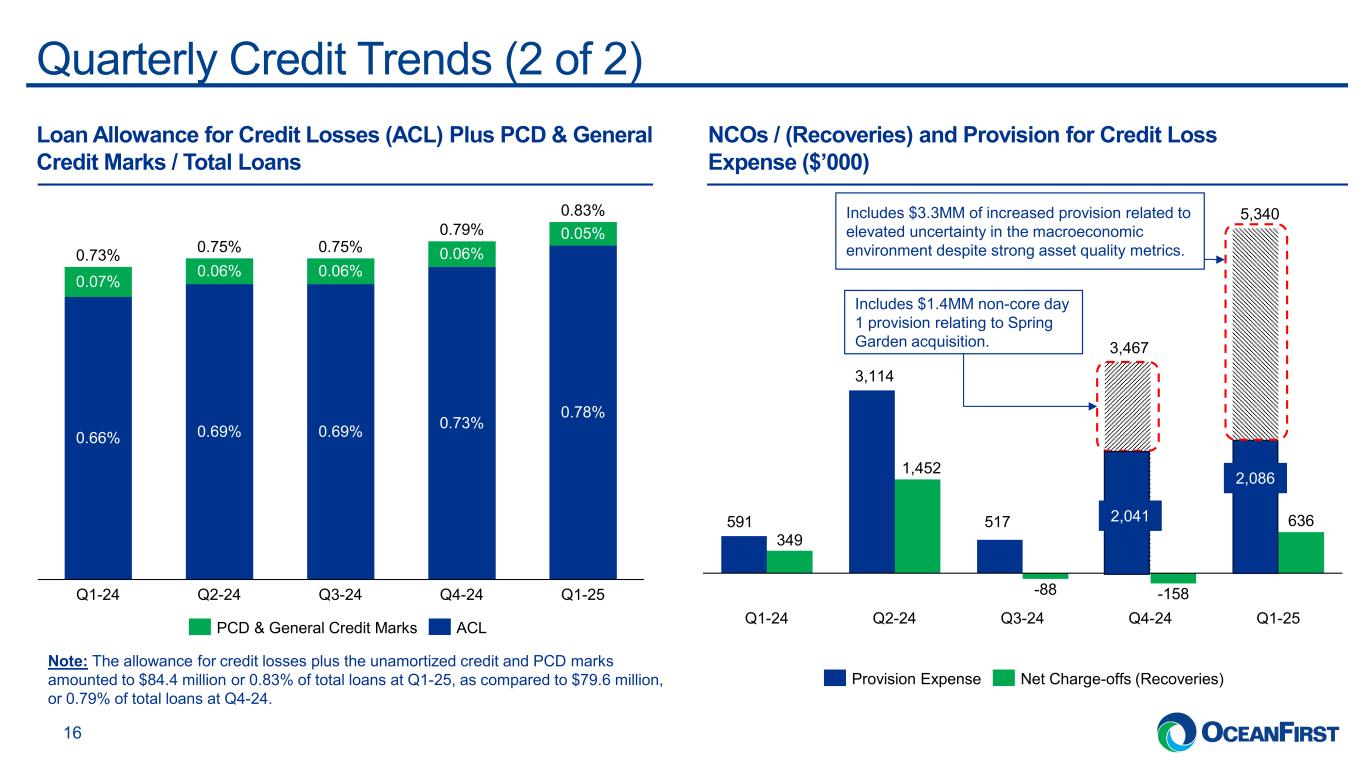

•Provision for Credit Losses: Provision for credit losses was $5.3 million reflecting a net loan reserve build of $5.2 million, primarily driven by elevated uncertainty around macroeconomic conditions. This resulted in an increase of five basis points in the allowance for loan credit losses to total loans to 0.78%. Criticized and classified loans decreased by 5% to $149.3 million compared to the linked quarter, providing strong evidence of stable credit performance for the Company’s loan portfolio.

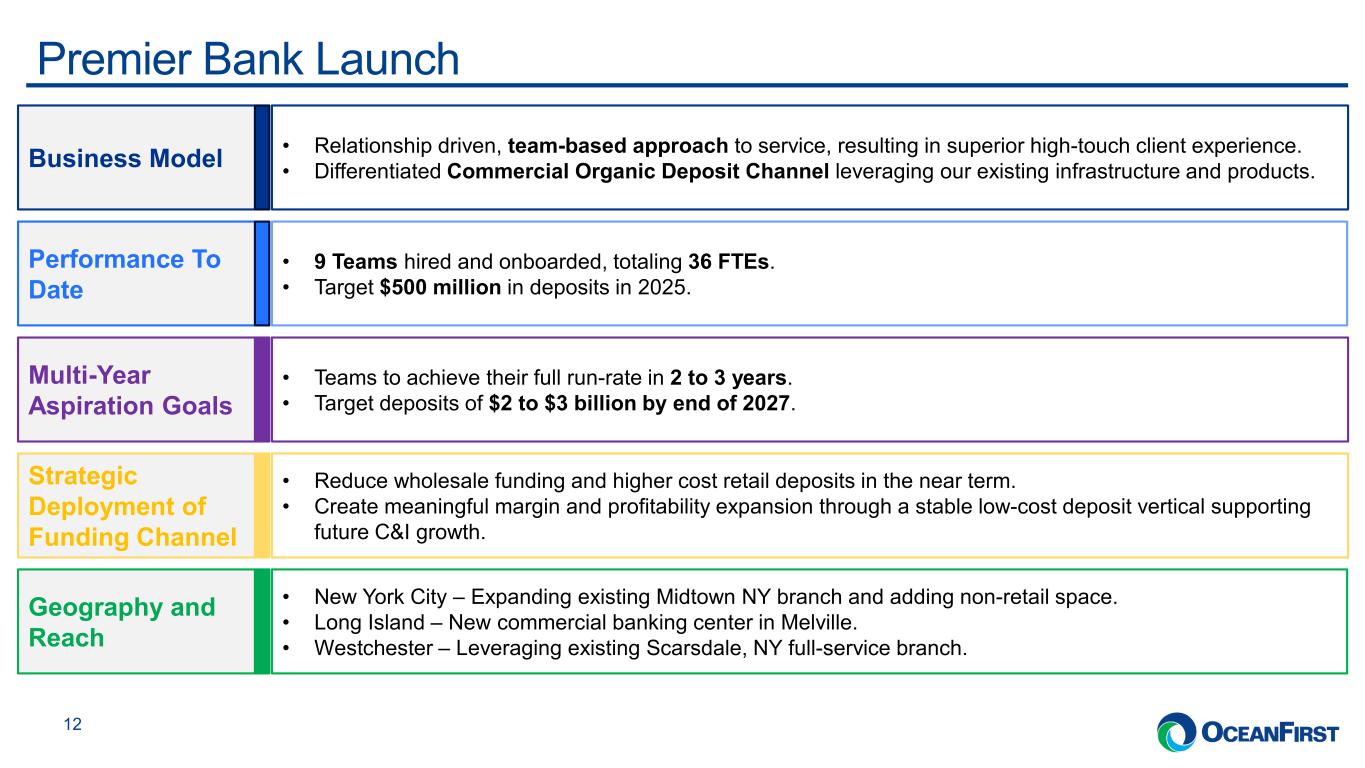

Chairman and Chief Executive Officer, Christopher D. Maher, commented on the Company’s results, “We are pleased to present our current quarter results, which reflect a meaningful expansion of net interest income and net interest margin, continued strong asset quality metrics, and further capital accretion, including share repurchases.” Mr. Maher added, “Additionally, we understand the increased market uncertainty and volatility, but we have confidence that the Company is well-positioned. Finally, we are pleased that the first quarter talent recruiting season has resulted in a robust addition of commercial banking talent. Reflecting the strength of the commercial banking platform we have built, 36 highly experienced commercial bankers have joined OceanFirst this year.”

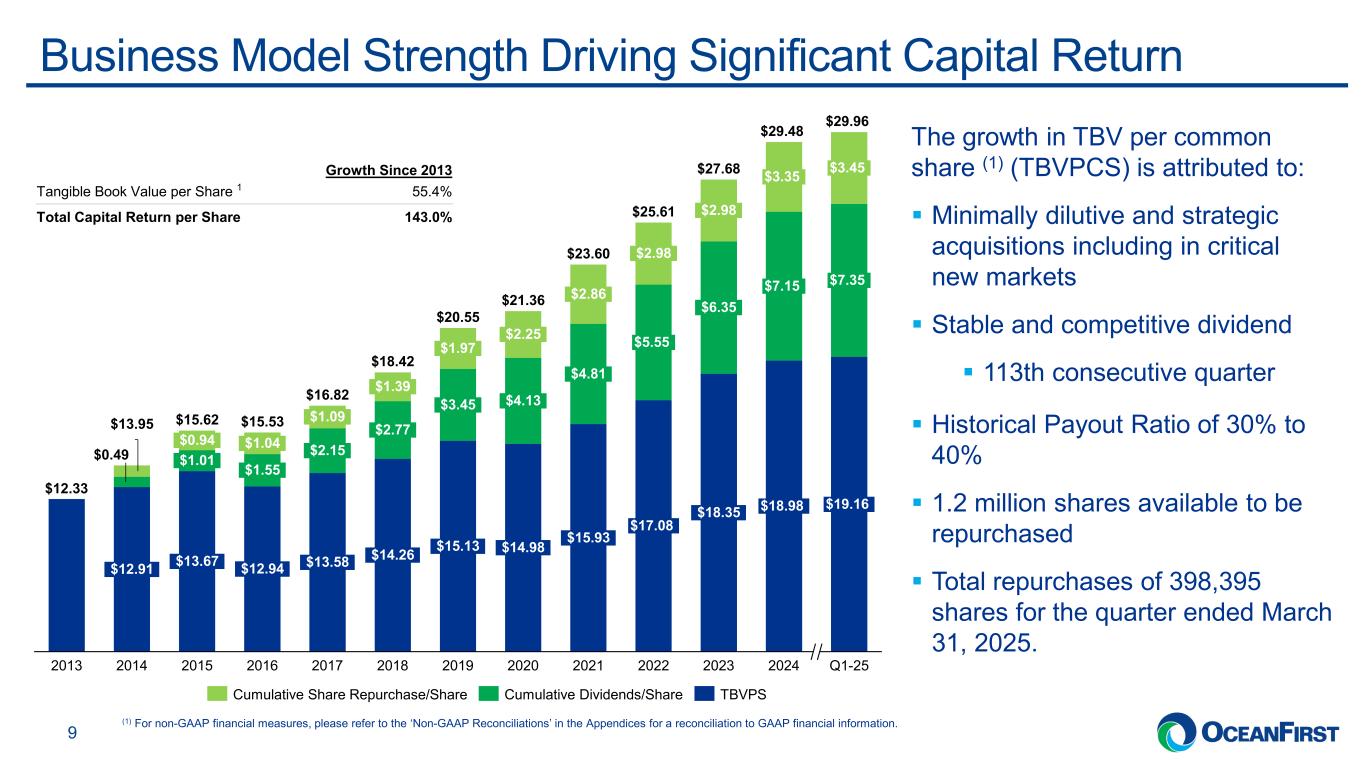

The Company’s Board of Directors declared its 113th consecutive quarterly cash dividend on common stock. The quarterly cash dividend on common stock of $0.20 per share will be paid on May 16, 2025 to common stockholders of record on May 5, 2025. The Company’s Board of Directors also previously declared a quarterly cash dividend on preferred stock of $0.4375 per depositary share, representing 1/40th interest in the Series A Preferred Stock.

This dividend will be paid on May 15, 2025 to preferred stockholders of record on April 30, 2025. The Company has notified the preferred stockholders that it intends to redeem the Series A Preferred Stock in full on May 15, 2025.

Results of Operations

The current quarter was impacted by a decrease in average interest earning assets and liabilities, benefited from funding cost repricing efforts, and included a sale of non-performing residential and consumer loans of $5.1 million, which had related charge-offs of $720,000. Additionally, the current quarter included non-recurring benefits of $842,000 in other income and $1.3 million in normal incentive related adjustments.

Net Interest Income and Margin

Three months ended March 31, 2025 vs. March 31, 2024

Net interest income increased to $86.7 million, from $86.2 million, primarily reflecting the net impact of the decreasing interest rate environment. Net interest margin increased to 2.90%, from 2.81%, which included the impact of purchase accounting accretion and prepayment fees of 0.03% and 0.04%, respectively. Net interest margin increased primarily due to the decrease in cost of funds outpacing the decrease in yield on average interest-earning assets.

Average interest-earning assets decreased by $238.4 million primarily due to a decrease in commercial loans and securities. The average yield for interest-earning assets decreased to 5.13%, from 5.26%.

The cost of average interest-bearing liabilities decreased to 2.78%, from 3.03%, primarily due to lower cost of deposits and, to a lesser extent, Federal Home Loan Bank (“FHLB”) advances. The total cost of deposits decreased 25 basis points to 2.06%, from 2.31%. Average interest-bearing liabilities decreased by $226.1 million, primarily due to decreases in savings, time deposits and other borrowings, largely offset by an increase in FHLB advances.

Three months ended March 31, 2025 vs. December 31, 2024

Net interest income increased by $3.3 million and net interest margin increased to 2.90%, from 2.69%, primarily reflecting the impact of deposit repricing. Net interest income included the impact of purchase accounting accretion and prepayment fees of 0.03% in the current quarter and none in the prior quarter.

Average interest-earning assets decreased by $219.5 million, primarily due to decreases in securities and interest-earning cash deposits. The yield on average interest-earning assets decreased to 5.13%, from 5.15%.

Average interest-bearing liabilities decreased by $211.3 million, primarily due to decreases in deposits and other borrowings, partly offset by an increase in FHLB advances. The total cost of average interest-bearing liabilities decreased to 2.78%, from 3.04%, primarily due to lower cost of deposits. The total cost of deposits decreased to 2.06%, from 2.32%.

Provision for Credit Losses

Provision for credit losses for the quarter ended March 31, 2025 was $5.3 million, as compared to $591,000 for the corresponding prior year period and $3.5 million for the linked quarter. The linked quarter included a $1.4 million initial provision for credit losses related to the acquisition of Spring Garden. The current quarter provision was primarily driven by elevated uncertainty around macroeconomic conditions.

Net loan charge-offs were $636,000 for the quarter ended March 31, 2025, as compared to net loan charge-offs of $349,000 for the corresponding prior year period and net loan recoveries of $158,000 in the linked quarter. The current quarter includes charge-offs of $720,000 related to the sale of $5.1 million non-performing residential and consumer loans. Refer to “Results of Operations” section for further discussion.

Non-interest Income

Three months ended March 31, 2025 vs. March 31, 2024

Other income decreased to $11.3 million, as compared to $12.3 million. Other income was favorably impacted by non-core operations of $205,000 related to net gains on equity investments in the current quarter. The prior year other income was favorably impacted by non-core operations of $3.1 million related to net gains on equity investments and a gain on sale of a portion of the Company’s trust business.

Excluding non-core operations, other income increased by $1.8 million. The primary drivers were increases related to net gain on sale of loans of $501,000, commercial loan swap income of $482,000, and an increase in non-recurring other income of $842,000 as noted above.

Three months ended March 31, 2025 vs. December 31, 2024

Excluding non-core operations, other income decreased by $1.2 million from $12.2 million in the linked quarter. The primary drivers were decreases in fees and service charges of $1.5 million, primarily due to lower title fee income as a result of seasonality, and income from bank owned life insurance of $686,000, related to non-recurring death benefits of $768,000 in the linked quarter. This was partly offset by increases in commercial loan swap income of $534,000 and non-recurring other income of $842,000 noted above.

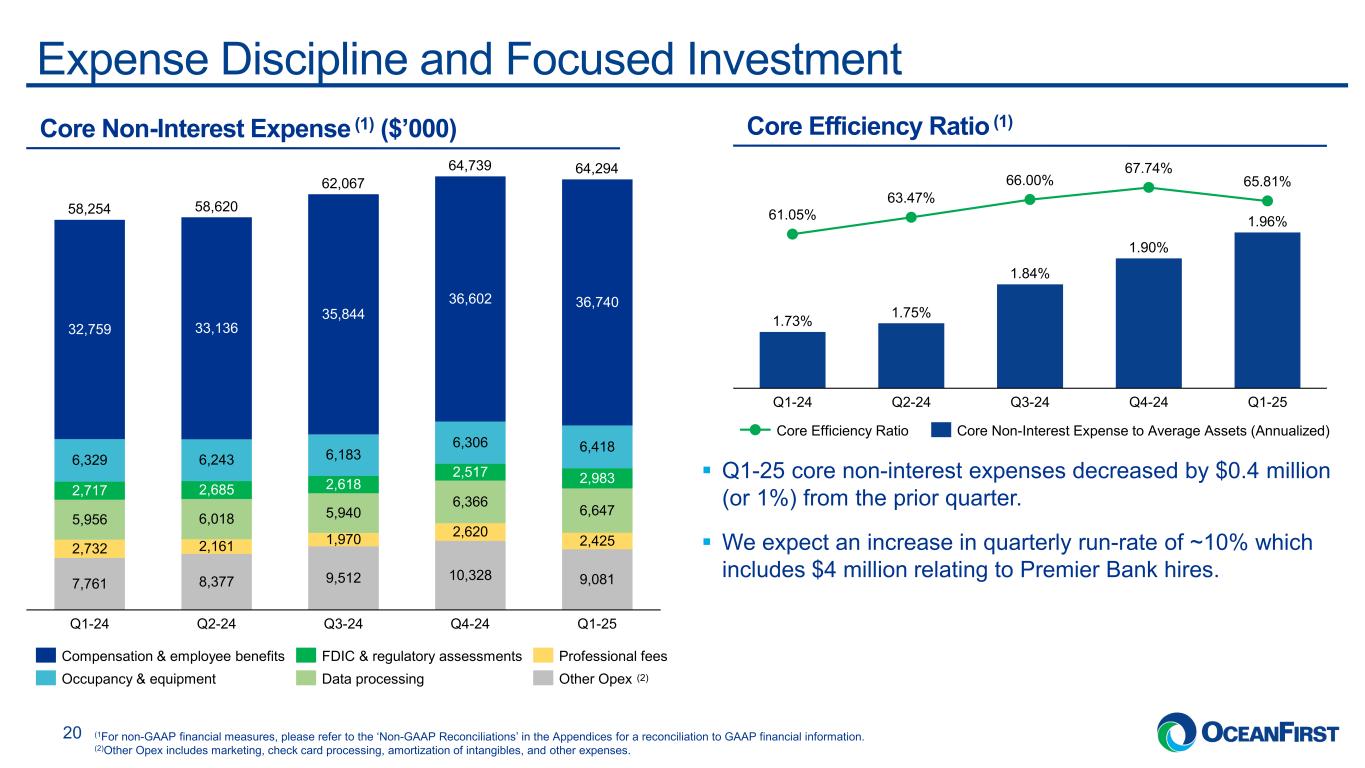

Non-interest Expense

Three months ended March 31, 2025 vs. March 31, 2024

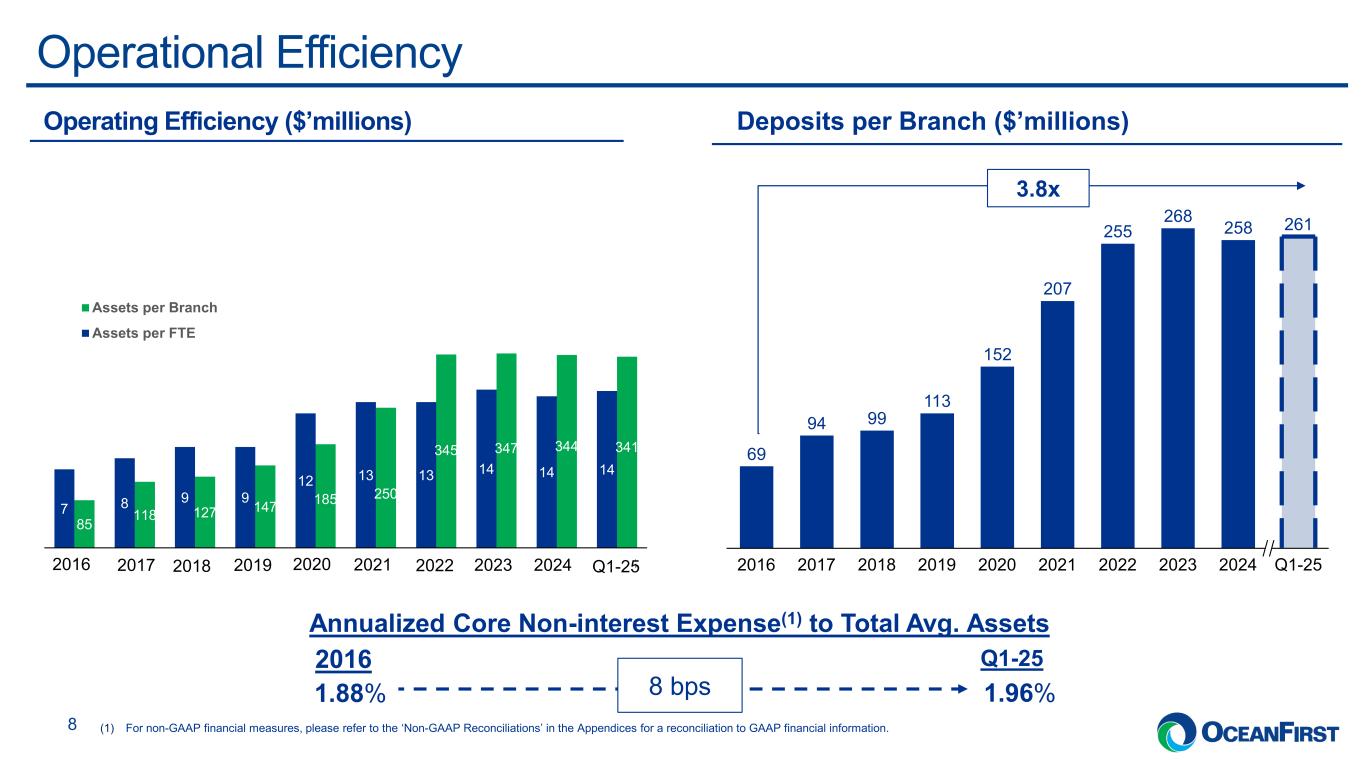

Operating expenses increased to $64.3 million, as compared to $58.7 million. Operating expenses in the prior year were adversely impacted by non-core operations of $418,000 from an FDIC special assessment.

Excluding non-core operations, operating expenses increased by $6.0 million. The primary driver was an increase in compensation and benefits of $4.0 million, mostly due to acquisitions at the end of the prior year and annual merit increases. Additional drivers were increases in other operating expenses of $1.0 million, due to additional loan servicing expense, and increases in data processing expense of $691,000, partly due to acquisitions at the end of the prior year.

Three months ended March 31, 2025 vs. December 31, 2024

Operating expenses in the linked quarter were $64.8 million and were adversely impacted by non-core items of $110,000 from merger-related expenses. Excluding non-core operations, operating expenses decreased by $445,000. This included a decrease in normal incentive related adjustments of $1.3 million, offset by annual merit increases during the year. Additionally, there were decreases in other operating expense of $840,000, mostly related to lower title costs and marketing of $507,000. This was partly offset by an increase in federal deposit insurance and regulatory assessments of $466,000.

Income Tax Expense

The provision for income taxes was $6.8 million for the quarter ended March 31, 2025, as compared to $10.6 million for the same prior year period and $5.1 million for the linked quarter. The effective tax rate was 24.1% for the quarter ended March 31, 2025, as compared to 27.1% for the same prior year period and 18.7% for the linked quarter. The prior year’s effective tax rate was negatively impacted by 3.0% due to a one-time write-off of a deferred tax asset of $1.2 million. The linked quarter’s effective tax rate was positively impacted by utilization of higher tax credits.

Financial Condition

March 31, 2025 vs. December 31, 2024

Total assets decreased by $112.0 million to $13.31 billion, from $13.42 billion, primarily due to decreases in total debt securities. Debt securities available-for-sale decreased by $81.3 million to $746.2 million, from $827.5 million, primarily due to principal reductions, maturities and calls. Debt securities held-to-maturity decreased by $40.4 million to $1.01 billion, from $1.05 billion, primarily due to principal repayments. Loans held-for-sale decreased by $11.5 million to $9.7 million from $21.2 million. Total loans increased by $7.2 million to $10.13 billion, from $10.12 billion, while the loan pipeline increased by $197.8 million to $504.4 million, from $306.7 million.

Other assets decreased by $14.9 million to $170.8 million, from $185.7 million, primarily due to a decrease in market values associated with customer interest rate swap programs.

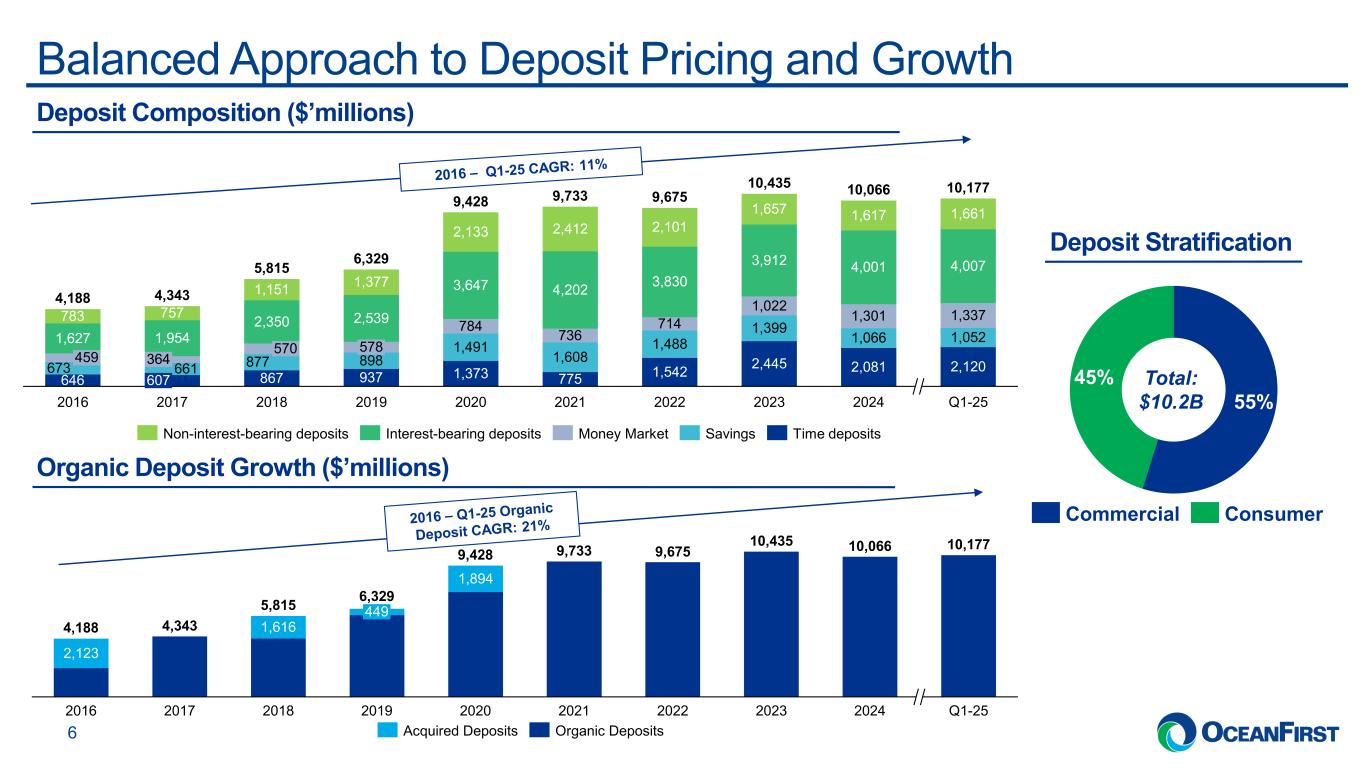

Total liabilities decreased by $118.3 million to $11.60 billion, from $11.72 billion primarily related to a funding mix-shift. Deposits increased by $110.7 million to $10.18 billion, from $10.07 billion, primarily due to increases in non-interest bearing, savings and time deposits. Time deposits increased to $2.12 billion, from $2.08 billion, representing 20.8% and 20.7% of total deposits, respectively. Time deposits included an increase in brokered time deposits of $295.8 million, offset by a decrease in retail time deposits of $251.1 million. The loan-to-deposit ratio was 99.5%, as compared to 100.5%. FHLB advances decreased by $181.6 million to $891.0 million, from $1.07 billion partly driven by a shift to slightly favorably priced brokered deposits.

Other liabilities decreased by $58.0 million to $240.4 million, from $298.4 million, primarily due to a decrease in the market values of derivatives associated with customer interest rate swaps and related collateral received from counterparties.

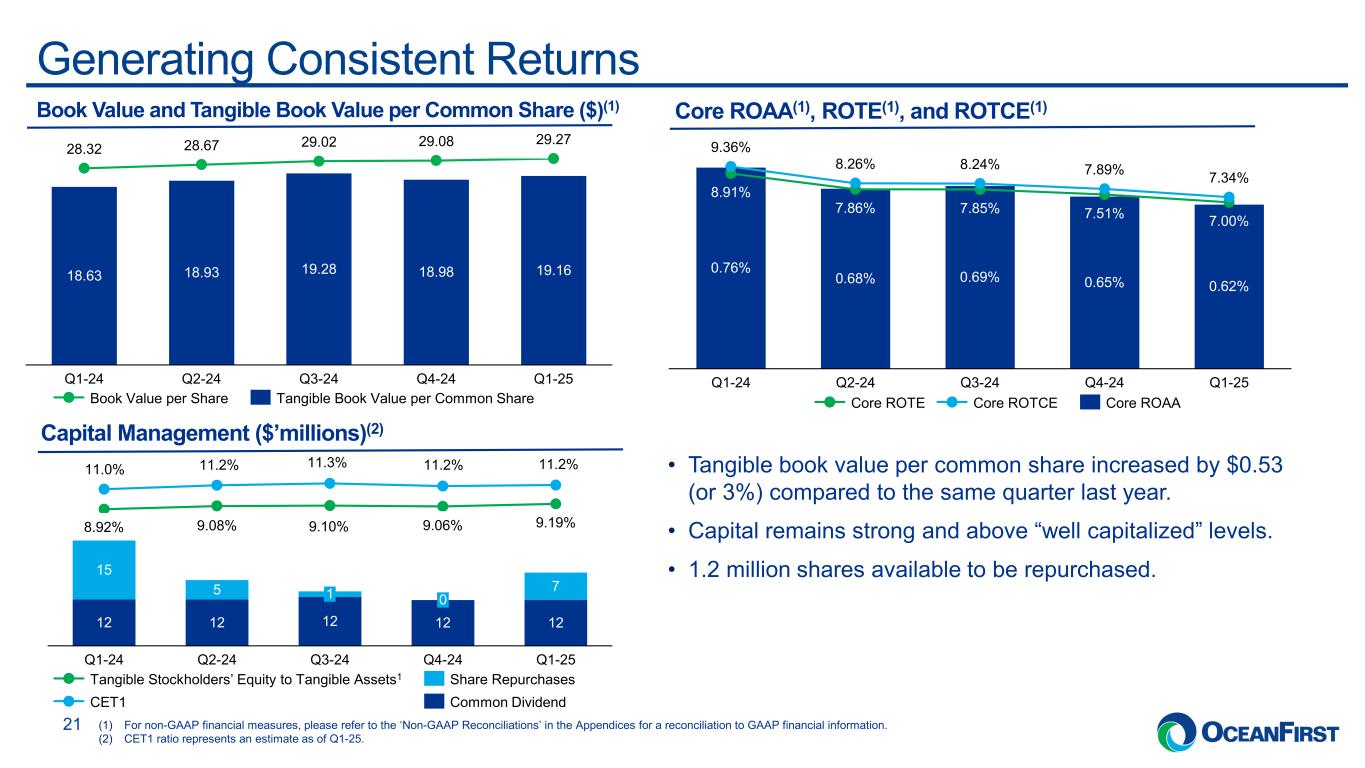

Capital levels remain strong and in excess of “well-capitalized” regulatory levels at March 31, 2025, including the Company’s estimated common equity tier one capital ratio which remained at 11.2%.

Total stockholders’ equity increased to $1.71 billion, as compared to $1.70 billion, primarily reflecting net income, partially offset by capital returns comprising of dividends and share repurchases. During the quarter ended March 31, 2025, the Company repurchased 398,395 shares totaling $6.9 million representing a weighted average cost of $17.20. The Company had 1,228,863 shares available for repurchase under the authorized repurchase program. Additionally, accumulated other comprehensive loss decreased by $2.6 million primarily due to increases in fair market value of available-for-sale debt securities, net of tax.

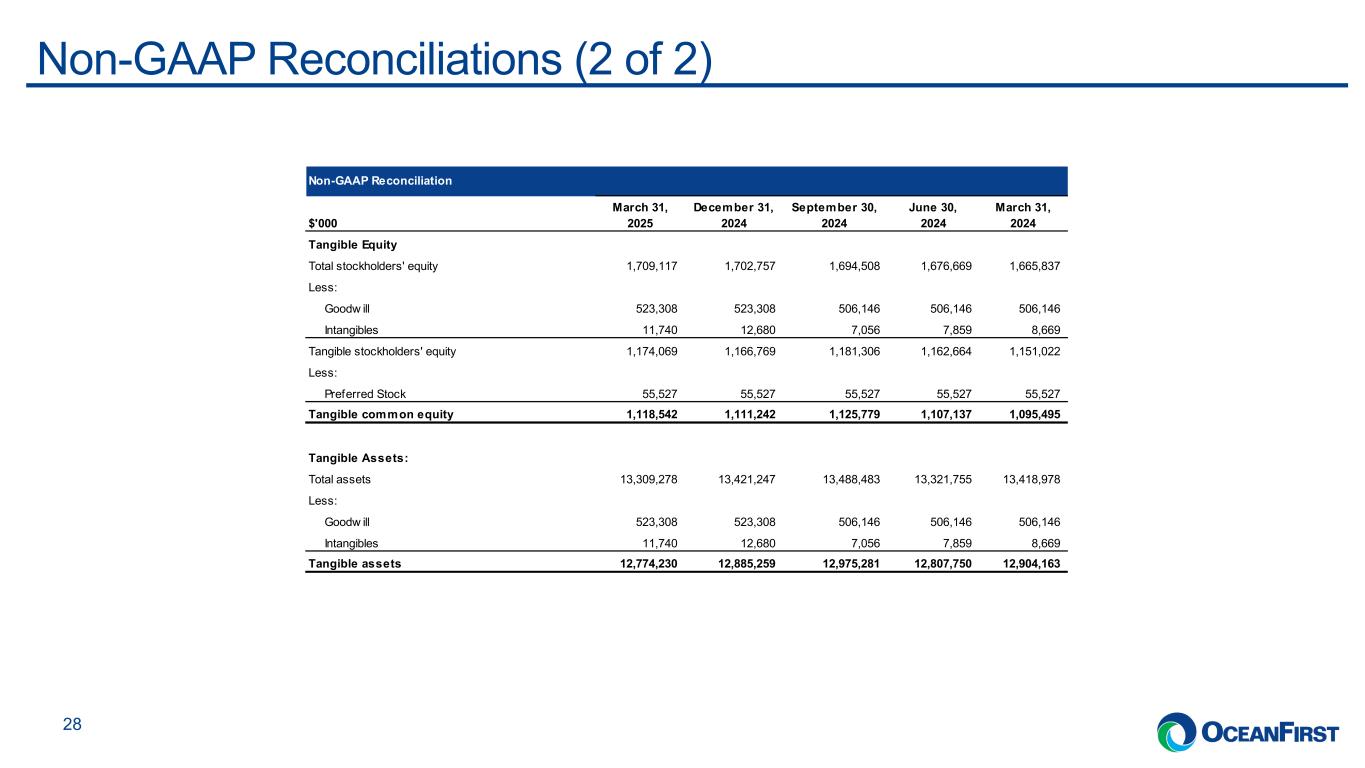

The Company’s tangible common equity2 increased by $7.3 million to $1.12 billion. The Company’s stockholders’ equity to assets ratio was 12.84% at March 31, 2025, and tangible common equity to tangible assets ratio increased by 14 basis points during the quarter to 8.76%, primarily due to the drivers described above.

Book value per common share increased to $29.27, as compared to $29.08. Tangible book value per common share2 increased to $19.16, as compared to $18.98.

Asset Quality

March 31, 2025 vs. December 31, 2024

The Company’s non-performing loans increased to $37.0 million, from $35.5 million, and represented 0.37% and 0.35% of total loans, respectively. The allowance for loan credit losses as a percentage of total non-performing loans was 213.14%, as compared to 207.19%. The level of 30 to 89 days delinquent loans increased to $46.2 million, from $36.6 million, primarily related to commercial loans. Criticized and classified assets, including other real estate owned, decreased to $151.2 million, from $159.9 million. The Company’s allowance for loan credit losses was 0.78% of total loans, as compared to 0.73%. Refer to “Provision for Credit Losses” section for further discussion.

The Company’s asset quality, excluding purchased with credit deterioration (“PCD”) loans, was as follows. Non-performing loans increased to $29.2 million, from $27.6 million. The allowance for loan credit losses as a percentage of total non-performing loans was 269.43%, as compared to 266.73%. The level of 30 to 89 days delinquent loans, excluding non-performing loans, increased to $35.8 million, from $33.6 million.

2 Tangible book value per common share and tangible common equity to tangible assets are non-GAAP financial measures and exclude the impact of intangible assets, goodwill, and preferred equity from both stockholders’ equity and total assets. Refer to “Explanation of Non-GAAP Financial Measures” and the “Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP. The Company’s management believes that the supplemental non-GAAP information, which consists of reported net income excluding non-core operations and in some instances excluding income taxes and provision for credit losses, and reporting equity and asset amounts excluding intangible assets, goodwill or preferred stock, all of which can vary from period to period, provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures, which may be presented by other companies. Refer to the Non-GAAP Reconciliation table at the end of this document for details on the earnings impact of these items.

Annual Meeting

The Company previously announced that its Annual Meeting of Stockholders will be held on Monday, May 19, 2025 at 8:00 a.m. Eastern Time. The record date for stockholders to vote at the Annual Meeting is Tuesday, March 25, 2025. Voting before the meeting is encouraged, even for stockholders planning to participate in the virtual webcast. Votes may be submitted by telephone or online according to the instructions on the proxy card or by mail. A link to the live webcast is available by visiting oceanfirst.com - Investor Relations. Access will begin at 7:45 a.m. Eastern Time to allow time for stockholders to log-in with the control number provided on the proxy card prior to the 8:00 a.m. Eastern Time scheduled start. Eligible stockholders may also vote during the live meeting online at www.virtualshareholdermeeting.com/OCFC2025 by entering the 16-digit control number included on the proxy card or notice. As a reminder, participants of the meeting are not required to vote. Additional information regarding virtual access to the meeting will be distributed prior to the meeting.

Conference Call

As previously announced, the Company will host an earnings conference call on Friday, April 25, 2025 at 11:00 a.m. Eastern Time. The direct dial number for the call is (833) 470-1428, using the access code 934356. For those unable to participate in the conference call, a replay will be available. To access the replay, dial (855) 762-8306, from one hour after the end of the call until May 2, 2025. The conference call, as well as the replay, are also available (listen-only) by internet webcast at www.oceanfirst.com in the Investor Relations section.

* * *

OceanFirst Financial Corp.’s subsidiary, OceanFirst Bank N.A., founded in 1902, is a $13.3 billion regional bank providing financial services throughout New Jersey and in the major metropolitan areas between Massachusetts and Virginia. OceanFirst Bank delivers commercial and residential financing, treasury management, trust and asset management, and deposit services and is one of the largest and oldest community-based financial institutions headquartered in New Jersey. To learn more about OceanFirst, go to www.oceanfirst.com.

Forward-Looking Statements

In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project”, “will”, “should”, “may”, “view”, “opportunity”, “potential”, or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, inflation, general economic conditions, including potential recessionary conditions, levels of unemployment in the Company’s lending area, real estate market values in the Company’s lending area, potential goodwill impairment, natural disasters, potential increases to flood insurance premiums, the current or anticipated impact of military conflict, terrorism or other geopolitical events, the imposition of tariffs or other domestic or international governmental policies, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, the availability of low-cost funding, changes in liquidity, including the size and composition of the Company’s deposit portfolio, and the percentage of uninsured deposits in the portfolio, changes in capital management and balance sheet strategies and the ability to successfully implement such strategies, competition, demand for financial services in the Company’s market area, changes in consumer spending, borrowing and saving habits, changes in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks, the failure to maintain current technologies, failure to retain or attract employees, the impact of pandemics on our operations and financial results and those of our customers and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

|

December 31, |

|

March 31, |

|

|

2025 |

|

|

|

2024 |

|

2024 |

|

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

| Assets |

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

163,721 |

|

|

|

|

$ |

123,615 |

|

|

$ |

130,422 |

|

|

|

|

|

|

|

|

|

|

| Debt securities available-for-sale, at estimated fair value |

|

746,168 |

|

|

|

|

827,500 |

|

|

744,944 |

|

Debt securities held-to-maturity, net of allowance for securities credit losses of $898 at March 31, 2025, $967 at December 31, 2024, and $1,058 at March 31, 2024 (estimated fair value of $926,075 at March 31, 2025, $952,917 at December 31, 2024, and $1,029,965 at March 31, 2024) |

|

1,005,476 |

|

|

|

|

1,045,875 |

|

|

1,128,666 |

|

| Equity investments |

|

87,365 |

|

|

|

|

84,104 |

|

|

103,201 |

|

| Restricted equity investments, at cost |

|

102,172 |

|

|

|

|

108,634 |

|

|

85,689 |

|

Loans receivable, net of allowance for loan credit losses of $78,798 at March 31, 2025, $73,607 at December 31, 2024, and $67,173 at March 31, 2024 |

|

10,058,072 |

|

|

|

|

10,055,429 |

|

|

10,068,209 |

|

| Loans held-for-sale |

|

9,698 |

|

|

|

|

21,211 |

|

|

4,702 |

|

| Interest and dividends receivable |

|

44,843 |

|

|

|

|

45,914 |

|

|

52,502 |

|

| Other real estate owned |

|

1,917 |

|

|

|

|

1,811 |

|

|

— |

|

| Premises and equipment, net |

|

114,588 |

|

|

|

|

115,256 |

|

|

119,211 |

|

|

|

|

|

|

|

|

|

|

| Bank owned life insurance |

|

269,398 |

|

|

|

|

270,208 |

|

|

266,615 |

|

|

|

|

|

|

|

|

|

|

| Assets held for sale |

|

— |

|

|

|

|

— |

|

|

28 |

|

| Goodwill |

|

523,308 |

|

|

|

|

523,308 |

|

|

506,146 |

|

| Intangibles |

|

11,740 |

|

|

|

|

12,680 |

|

|

8,669 |

|

| Other assets |

|

170,812 |

|

|

|

|

185,702 |

|

|

199,974 |

|

| Total assets |

|

$ |

13,309,278 |

|

|

|

|

$ |

13,421,247 |

|

|

$ |

13,418,978 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Deposits |

|

$ |

10,177,023 |

|

|

|

|

$ |

10,066,342 |

|

|

$ |

10,236,851 |

|

| Federal Home Loan Bank advances |

|

891,021 |

|

|

|

|

1,072,611 |

|

|

658,436 |

|

| Securities sold under agreements to repurchase with customers |

|

65,132 |

|

|

|

|

60,567 |

|

|

66,798 |

|

| Other borrowings |

|

197,808 |

|

|

|

|

197,546 |

|

|

425,722 |

|

| Advances by borrowers for taxes and insurance |

|

28,789 |

|

|

|

|

23,031 |

|

|

28,187 |

|

| Other liabilities |

|

240,388 |

|

|

|

|

298,393 |

|

|

337,147 |

|

| Total liabilities |

|

11,600,161 |

|

|

|

|

11,718,490 |

|

|

11,753,141 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| OceanFirst Financial Corp. stockholders’ equity |

|

1,708,322 |

|

|

|

|

1,701,650 |

|

|

1,665,112 |

|

| Non-controlling interest |

|

795 |

|

|

|

|

1,107 |

|

|

725 |

|

| Total stockholders’ equity |

|

1,709,117 |

|

|

|

|

1,702,757 |

|

|

1,665,837 |

|

| Total liabilities and stockholders’ equity |

|

$ |

13,309,278 |

|

|

|

|

$ |

13,421,247 |

|

|

$ |

13,418,978 |

|

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

|

|

|

|

March 31, |

|

December 31, |

|

March 31, |

|

|

|

|

|

|

2025 |

|

2024 |

|

2024 |

|

|

|

|

|

|

|---------------------- (Unaudited) ----------------------| |

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

133,019 |

|

|

$ |

135,438 |

|

|

$ |

137,121 |

|

|

|

|

|

| Debt securities |

|

17,270 |

|

|

19,400 |

|

|

19,861 |

|

|

|

|

|

| Equity investments and other |

|

3,414 |

|

|

4,782 |

|

|

4,620 |

|

|

|

|

|

| Total interest income |

|

153,703 |

|

|

159,620 |

|

|

161,602 |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

51,046 |

|

|

59,889 |

|

|

59,855 |

|

|

|

|

|

| Borrowed funds |

|

16,005 |

|

|

16,402 |

|

|

15,523 |

|

|

|

|

|

| Total interest expense |

|

67,051 |

|

|

76,291 |

|

|

75,378 |

|

|

|

|

|

| Net interest income |

|

86,652 |

|

|

83,329 |

|

|

86,224 |

|

|

|

|

|

| Provision for credit losses |

|

5,340 |

|

|

3,467 |

|

|

591 |

|

|

|

|

|

| Net interest income after provision for credit losses |

|

81,312 |

|

|

79,862 |

|

|

85,633 |

|

|

|

|

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

| Bankcard services revenue |

|

1,463 |

|

|

1,595 |

|

|

1,416 |

|

|

|

|

|

| Trust and asset management revenue |

|

406 |

|

|

416 |

|

|

526 |

|

|

|

|

|

| Fees and service charges |

|

4,712 |

|

|

6,207 |

|

|

4,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on sales of loans |

|

858 |

|

|

1,076 |

|

|

357 |

|

|

|

|

|

| Net gain (loss) on equity investments |

|

205 |

|

|

(5) |

|

|

1,923 |

|

|

|

|

|

| Net loss from other real estate operations |

|

(16) |

|

|

(20) |

|

|

— |

|

|

|

|

|

| Income from bank owned life insurance |

|

1,852 |

|

|

2,538 |

|

|

1,862 |

|

|

|

|

|

| Commercial loan swap income |

|

620 |

|

|

86 |

|

|

138 |

|

|

|

|

|

| Other |

|

1,153 |

|

|

339 |

|

|

1,591 |

|

|

|

|

|

| Total other income |

|

11,253 |

|

|

12,232 |

|

|

12,286 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| Compensation and employee benefits |

|

36,740 |

|

|

36,602 |

|

|

32,759 |

|

|

|

|

|

| Occupancy |

|

5,497 |

|

|

5,280 |

|

|

5,199 |

|

|

|

|

|

| Equipment |

|

921 |

|

|

1,026 |

|

|

1,130 |

|

|

|

|

|

| Marketing |

|

1,108 |

|

|

1,615 |

|

|

990 |

|

|

|

|

|

| Federal deposit insurance and regulatory assessments |

|

2,983 |

|

|

2,517 |

|

|

3,135 |

|

|

|

|

|

| Data processing |

|

6,647 |

|

|

6,366 |

|

|

5,956 |

|

|

|

|

|

| Check card processing |

|

1,170 |

|

|

1,134 |

|

|

1,050 |

|

|

|

|

|

| Professional fees |

|

2,425 |

|

|

2,620 |

|

|

2,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of intangibles |

|

940 |

|

|

876 |

|

|

844 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Merger related expenses |

|

— |

|

|

110 |

|

|

— |

|

|

|

|

|

| Other operating expense |

|

5,863 |

|

|

6,703 |

|

|

4,877 |

|

|

|

|

|

| Total operating expenses |

|

64,294 |

|

|

64,849 |

|

|

58,672 |

|

|

|

|

|

| Income before provision for income taxes |

|

28,271 |

|

|

27,245 |

|

|

39,247 |

|

|

|

|

|

| Provision for income taxes |

|

6,808 |

|

|

5,083 |

|

|

10,637 |

|

|

|

|

|

| Net income |

|

21,463 |

|

|

22,162 |

|

|

28,610 |

|

|

|

|

|

| Net (loss) income attributable to non-controlling interest |

|

(46) |

|

|

253 |

|

|

(57) |

|

|

|

|

|

| Net income attributable to OceanFirst Financial Corp. |

|

21,509 |

|

|

21,909 |

|

|

28,667 |

|

|

|

|

|

| Dividends on preferred shares |

|

1,004 |

|

|

1,004 |

|

|

1,004 |

|

|

|

|

|

| Net income available to common stockholders |

|

$ |

20,505 |

|

|

$ |

20,905 |

|

|

$ |

27,663 |

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.35 |

|

|

$ |

0.36 |

|

|

$ |

0.47 |

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.35 |

|

|

$ |

0.36 |

|

|

$ |

0.47 |

|

|

|

|

|

| Average basic shares outstanding |

|

58,102 |

|

|

58,026 |

|

|

58,789 |

|

|

|

|

|

| Average diluted shares outstanding |

|

58,111 |

|

|

58,055 |

|

|

58,791 |

|

|

|

|

|

OceanFirst Financial Corp.

SELECTED LOAN AND DEPOSIT DATA

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS RECEIVABLE |

|

|

At |

|

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

|

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

| Commercial: |

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate - investor |

|

|

$ |

5,200,137 |

|

|

$ |

5,287,683 |

|

|

$ |

5,273,159 |

|

|

$ |

5,324,994 |

|

|

$ |

5,322,755 |

|

| Commercial and industrial: |

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial - real estate (1) |

|

896,647 |

|

|

902,219 |

|

|

841,930 |

|

|

857,710 |

|

|

914,582 |

|

Commercial and industrial - non-real estate (1) |

|

748,575 |

|

|

647,945 |

|

|

660,879 |

|

|

616,400 |

|

|

677,176 |

|

| Total commercial and industrial |

|

1,645,222 |

|

|

1,550,164 |

|

|

1,502,809 |

|

|

1,474,110 |

|

|

1,591,758 |

|

| Total commercial |

|

6,845,359 |

|

|

6,837,847 |

|

|

6,775,968 |

|

|

6,799,104 |

|

|

6,914,513 |

|

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

|

|

3,053,318 |

|

|

3,049,763 |

|

|

3,003,213 |

|

|

2,977,698 |

|

|

2,965,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Home equity loans and lines and other consumer ("other consumer") |

|

226,633 |

|

|

230,462 |

|

|

242,975 |

|

|

242,526 |

|

|

245,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total consumer |

|

3,279,951 |

|

|

3,280,225 |

|

|

3,246,188 |

|

|

3,220,224 |

|

|

3,211,135 |

|

| Total loans |

|

10,125,310 |

|

|

10,118,072 |

|

|

10,022,156 |

|

|

10,019,328 |

|

|

10,125,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred origination costs (fees), net |

|

11,560 |

|

|

10,964 |

|

|

10,508 |

|

|

10,628 |

|

|

9,734 |

|

| Allowance for loan credit losses |

|

|

(78,798) |

|

|

(73,607) |

|

|

(69,066) |

|

|

(68,839) |

|

|

(67,173) |

|

| Loans receivable, net |

|

$ |

10,058,072 |

|

|

$ |

10,055,429 |

|

|

$ |

9,963,598 |

|

|

$ |

9,961,117 |

|

|

$ |

10,068,209 |

|

| Mortgage loans serviced for others |

|

$ |

222,963 |

|

|

$ |

191,279 |

|

|

$ |

142,394 |

|

|

$ |

104,136 |

|

|

$ |

89,555 |

|

|

At March 31, 2025 Average Yield |

|

|

|

|

|

|

|

|

|

|

Loan pipeline (2): |

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

7.37 |

% |

|

$ |

375,622 |

|

|

$ |

197,491 |

|

|

$ |

199,818 |

|

|

$ |

166,206 |

|

|

$ |

66,167 |

|

| Residential real estate |

6.41 |

|

|

116,121 |

|

|

97,385 |

|

|

137,978 |

|

|

80,330 |

|

|

57,340 |

|

| Other consumer |

8.51 |

|

|

12,681 |

|

|

11,783 |

|

|

13,788 |

|

|

12,586 |

|

|

13,030 |

|

| Total |

7.18 |

% |

|

$ |

504,424 |

|

|

$ |

306,659 |

|

|

$ |

351,584 |

|

|

$ |

259,122 |

|

|

$ |

136,537 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

|

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

|

|

Average Yield |

|

|

|

|

|

|

|

|

|

|

|

|

| Loan originations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial (3) |

7.61 |

% |

|

$ |

233,968 |

|

|

$ |

268,613 |

|

|

$ |

245,886 |

|

|

$ |

56,053 |

|

|

$ |

123,010 |

|

|

|

| Residential real estate |

6.53 |

|

|

167,162 |

|

|

235,370 |

|

|

169,273 |

|

|

121,388 |

|

|

78,270 |

|

|

|

| Other consumer |

8.49 |

|

|

15,825 |

|

|

11,204 |

|

|

15,760 |

|

|

16,970 |

|

|

11,405 |

|

|

|

| Total |

7.21 |

% |

|

$ |

416,955 |

|

|

$ |

515,187 |

|

|

$ |

430,919 |

|

|

$ |

194,411 |

|

|

$ |

212,685 |

|

|

|

| Loans sold |

|

|

$ |

104,991 |

|

(4) |

$ |

127,508 |

|

|

$ |

65,296 |

|

|

$ |

45,045 |

|

|

$ |

29,965 |

|

|

|

(1)During the quarter ended March 31, 2025, the Company retrospectively reclassified loans which were previously referred to as ‘commercial real estate - owner occupied’ and ‘commercial and industrial’ to ‘commercial and industrial - real estate’ and ‘commercial and industrial - non-real estate’, respectively. Collectively, these loans are referred to as ‘commercial and industrial’.

(2)Loan pipeline includes loans approved but not funded.

(3)Excludes commercial loan pool purchases of $24.3 million and $76.1 million for the three months ended March 31, 2025 and December 31, 2024, respectively.

(4)Excludes sale of non-performing residential and consumer loans of $5.1 million for the three months ended March 31, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DEPOSITS |

At |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

| Type of Account |

|

|

|

|

|

|

|

|

|

| Non-interest-bearing |

$ |

1,660,738 |

|

|

$ |

1,617,182 |

|

|

$ |

1,638,447 |

|

|

$ |

1,632,521 |

|

|

$ |

1,639,828 |

|

| Interest-bearing checking |

4,006,653 |

|

|

4,000,553 |

|

|

3,896,348 |

|

|

3,667,837 |

|

|

3,865,699 |

|

| Money market |

1,337,570 |

|

|

1,301,197 |

|

|

1,288,555 |

|

|

1,210,312 |

|

|

1,150,979 |

|

| Savings |

1,052,504 |

|

|

1,066,438 |

|

|

1,071,946 |

|

|

1,115,688 |

|

|

1,260,309 |

|

Time deposits (1) |

2,119,558 |

|

|

2,080,972 |

|

|

2,220,871 |

|

|

2,367,659 |

|

|

2,320,036 |

|

| Total deposits |

$ |

10,177,023 |

|

|

$ |

10,066,342 |

|

|

$ |

10,116,167 |

|

|

$ |

9,994,017 |

|

|

$ |

10,236,851 |

|

(1)Includes brokered time deposits of $370.5 million, $74.7 million, $201.0 million, $401.6 million, and $543.4 million at March 31, 2025, December 31, 2024, September 30, 2024, June 30, 2024, and March 31, 2024, respectively.

OceanFirst Financial Corp.

ASSET QUALITY

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY (1) |

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

| 2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

| Non-performing loans: |

|

|

|

|

|

|

|

|

|

| Commercial real estate - investor |

$ |

23,595 |

|

|

$ |

17,000 |

|

|

$ |

12,478 |

|

|

$ |

19,761 |

|

|

$ |

21,507 |

|

| Commercial and industrial: |

|

|

|

|

|

|

|

|

|

| Commercial and industrial - real estate |

4,690 |

|

|

4,787 |

|

|

4,368 |

|

|

4,081 |

|

|

3,355 |

|

| Commercial and industrial - non-real estate |

22 |

|

|

32 |

|

|

122 |

|

|

434 |

|

|

567 |

|

| Total commercial and industrial |

4,712 |

|

|

4,819 |

|

|

4,490 |

|

|

4,515 |

|

|

3,922 |

|

| Residential real estate |

5,709 |

|

|

10,644 |

|

|

9,108 |

|

|

7,213 |

|

|

7,181 |

|

| Other consumer |

2,954 |

|

|

3,064 |

|

|

2,063 |

|

|

1,933 |

|

|

2,401 |

|

|

|

|

|

|

|

|

|

|

|

Total non-performing loans (1) |

$ |

36,970 |

|

|

$ |

35,527 |

|

|

$ |

28,139 |

|

|

$ |

33,422 |

|

|

$ |

35,011 |

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned |

1,917 |

|

|

1,811 |

|

|

— |

|

|

— |

|

|

— |

|

Total non-performing assets |

$ |

38,887 |

|

|

$ |

37,338 |

|

|

$ |

28,139 |

|

|

$ |

33,422 |

|

|

$ |

35,011 |

|

| Delinquent loans 30 to 89 days |

$ |

46,246 |

|

|

$ |

36,550 |

|

|

$ |

15,458 |

|

|

$ |

9,655 |

|

|

$ |

17,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications to borrowers experiencing financial difficulty (2) |

|

|

|

|

|

|

|

|

|

| Non-performing (included in total non-performing loans above) |

$ |

8,307 |

|

|

$ |

3,232 |

|

|

$ |

3,043 |

|

|

$ |

3,210 |

|

|

$ |

3,467 |

|

| Performing |

27,592 |

|

|

27,631 |

|

|

20,652 |

|

|

20,529 |

|

|

8,579 |

|

Total modifications to borrowers experiencing financial difficulty (2) |

$ |

35,899 |

|

|

$ |

30,863 |

|

|

$ |

23,695 |

|

|

$ |

23,739 |

|

|

$ |

12,046 |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan credit losses |

$ |

78,798 |

|

|

$ |

73,607 |

|

|

$ |

69,066 |

|

|

$ |

68,839 |

|

|

$ |

67,173 |

|

Allowance for loan credit losses as a percent of total loans receivable (3) |

0.78 |

% |

|

0.73 |

% |

|

0.69 |

% |

|

0.69 |

% |

|

0.66 |

% |

Allowance for loan credit losses as a percent of total non-performing loans (3) |

213.14 |

|

|

207.19 |

|

|

245.45 |

|

|

205.97 |

|

|

191.86 |

|

| Non-performing loans as a percent of total loans receivable |

0.37 |

|

|

0.35 |

|

|

0.28 |

|

|

0.33 |

|

|

0.35 |

|

| Non-performing assets as a percent of total assets |

0.29 |

|

|

0.28 |

|

|

0.21 |

|

|

0.25 |

|

|

0.26 |

|

| Supplemental PCD and non-performing loans |

|

|

|

|

|

|

|

|

|

| PCD loans, net of allowance for loan credit losses |

$ |

21,737 |

|

|

$ |

22,006 |

|

|

$ |

15,323 |

|

|

$ |

16,058 |

|

|

$ |

16,700 |

|

| Non-performing PCD loans |

7,724 |

|

|

7,931 |

|

|

2,887 |

|

|

2,841 |

|

|

3,525 |

|

| Delinquent PCD and non-performing loans 30 to 89 days |

10,489 |

|

|

2,997 |

|

|

1,279 |

|

|

1,188 |

|

|

2,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PCD modifications to borrowers experiencing financial difficulty (2) |

22 |

|

|

23 |

|

|

24 |

|

|

26 |

|

|

25 |

|

Asset quality, excluding PCD loans (4) |

|

|

|

|

|

|

|

|

|

Non-performing loans (1) |

29,246 |

|

|

27,596 |

|

|

25,252 |

|

|

30,581 |

|

|

31,486 |

|

Non-performing assets |

31,163 |

|

|

29,407 |

|

|

25,252 |

|

|

30,581 |

|

|

31,486 |

|

Delinquent loans 30 to 89 days (excludes non-performing loans) |

35,757 |

|

|

33,553 |

|

|

14,179 |

|

|

8,467 |

|

|

15,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications to borrowers experiencing financial difficulty (2) |

35,877 |

|

|

30,840 |

|

|

23,671 |

|

|

23,713 |

|

|

12,021 |

|

Allowance for loan credit losses as a percent of total non-performing loans (3) |

269.43 |

% |

|

266.73 |

% |

|

273.51 |

% |

|

225.10 |

% |

|

213.34 |

% |

Non-performing loans as a percent of total loans receivable |

0.29 |

|

|

0.27 |

|

|

0.25 |

|

|

0.31 |

|

|

0.31 |

|

| Non-performing assets as a percent of total assets |

0.23 |

|

|

0.22 |

|

|

0.19 |

|

|

0.23 |

|

|

0.23 |

|

(1)The quarter ended March 31, 2025 included the sale of non-performing residential and consumer loans of $5.1 million and the quarter ended September 30, 2024 included the resolution of a single commercial relationship exposure of $7.2 million.

(2)Balances have been revised to represent only modifications to borrowers experiencing financial difficulty, in accordance with ASU 2022-02 adopted on January 1, 2023.

(3)Loans acquired from acquisitions were recorded at fair value. The net unamortized credit and PCD marks on these loans, not reflected in the allowance for loan credit losses, was $5.6 million, $6.0 million, $5.7 million, $6.1 million and $7.0 million at March 31, 2025, December 31, 2024, September 30, 2024, June 30, 2024, and March 31, 2024, respectively.

(4)All balances and ratios exclude PCD loans.

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOAN (CHARGE-OFFS) RECOVERIES |

For the Three Months Ended |

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

| Net loan (charge-offs) recoveries: |

|

|

|

|

|

|

|

|

|

|

| Loan charge-offs |

$ |

(798) |

|

|

$ |

(55) |

|

|

$ |

(124) |

|

|

$ |

(1,600) |

|

|

$ |

(441) |

|

|

| Recoveries on loans |

162 |

|

|

213 |

|

|

212 |

|

|

148 |

|

|

92 |

|

|

| Net loan (charge-offs) recoveries |

$ |

(636) |

|

|

$ |

158 |

|

|

$ |

88 |

|

|

$ |

(1,452) |

|

|

$ |

(349) |

|

|

| Net loan (charge-offs) recoveries to average total loans (annualized) |

0.03 |

% |

|

NM* |

|

NM* |

|

0.06 |

% |

|

0.01 |

% |

|

| Net loan (charge-offs) recoveries detail: |

|

|

|

|

|

|

|

|

|

|

| Commercial |

$ |

25 |

|

|

$ |

92 |

|

|

$ |

129 |

|

|

$ |

(1,576) |

|

(1) |

$ |

(35) |

|

|

| Residential real estate |

(720) |

|

(2) |

(17) |

|

|

(6) |

|

|

87 |

|

|

66 |

|

|

| Other consumer |

59 |

|

|

83 |

|

|

(35) |

|

|

37 |

|

|

(380) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loan (charge-offs) recoveries |

$ |

(636) |

|

|

$ |

158 |

|

|

$ |

88 |

|

|

$ |

(1,452) |

|

|

$ |

(349) |

|

|

(1)The three months ended June 30, 2024 included a charge-off related to a single commercial real estate relationship of $1.6 million.

(2)The three months ended March 31, 2025 included charge-offs of $720,000 related to the sale of non-performing residential loans.

* Not meaningful as amounts are net loan recoveries.

OceanFirst Financial Corp.

ANALYSIS OF NET INTEREST INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| (dollars in thousands) |

Average

Balance |

|

Interest |

|

Average

Yield/

Cost (1)

|

|

Average

Balance |

|

Interest |

|

Average

Yield/

Cost (1)

|

|

Average

Balance |

|

Interest |

|

Average

Yield/

Cost (1)

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning deposits and short-term investments |

$ |

95,439 |

|

|

$ |

983 |

|

|

4.18 |

% |

|

$ |

195,830 |

|

|

$ |

2,415 |

|

|

4.91 |

% |

|

$ |

163,192 |

|

|

$ |

2,226 |

|

|

5.49 |

% |

Securities (2) |

2,003,206 |

|

|

19,701 |

|

|

3.99 |

|

|

2,116,911 |

|

|

21,767 |

|

|

4.09 |

|

|

2,098,421 |

|

|

22,255 |

|

|

4.27 |

|

Loans receivable, net (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

6,781,005 |

|

|

98,260 |

|

|

5.88 |

|

|

6,794,158 |

|

|

101,003 |

|

|

5.91 |

|

|

6,925,048 |

|

|

104,421 |

|

|

6.06 |

|

| Residential real estate |

3,065,679 |

|

|

31,270 |

|

|

4.08 |

|

|

3,049,092 |

|

|

30,455 |

|

|

4.00 |

|

|

2,974,468 |

|

|

28,596 |

|

|

3.85 |

|

| Other consumer |

228,553 |

|

|

3,489 |

|

|

6.19 |

|

|

236,161 |

|

|

3,980 |

|

|

6.70 |

|

|

248,396 |

|

|

4,104 |

|

|

6.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan credit losses, net of deferred loan costs and fees |

(61,854) |

|

|

— |

|

|

— |

|

|

(60,669) |

|

|

— |

|

|

— |

|

|

(59,141) |

|

|

— |

|

|

— |

|

| Loans receivable, net |

10,013,383 |

|

|

133,019 |

|

|

5.37 |

|

|

10,018,742 |

|

|

135,438 |

|

|

5.38 |

|

|

10,088,771 |

|

|

137,121 |

|

|

5.46 |

|

| Total interest-earning assets |

12,112,028 |

|

|

153,703 |

|

|

5.13 |

|

|

12,331,483 |

|

|

159,620 |

|

|

5.15 |

|

|

12,350,384 |

|

|

161,602 |

|

|

5.26 |

|

| Non-interest-earning assets |

1,199,865 |

|

|

|

|

|

|

1,213,569 |

|

|

|

|

|

|

1,206,336 |

|

|

|

|

|

| Total assets |

$ |

13,311,893 |

|

|

|

|

|

|

$ |

13,545,052 |

|

|

|

|

|

|

$ |

13,556,720 |

|

|

|

|

|

| Liabilities and Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing checking |

$ |

4,135,952 |

|

|

21,433 |

|

|

2.10 |

% |

|

$ |

4,050,428 |

|

|

22,750 |

|

|

2.23 |

% |

|

$ |

3,925,965 |

|

|

20,795 |

|

|

2.13 |

% |

| Money market |

1,322,003 |

|

|

9,353 |

|

|

2.87 |

|

|

1,325,119 |

|

|

10,841 |

|

|

3.25 |

|

|

1,092,003 |

|

|

9,172 |

|

|

3.38 |

|

| Savings |

1,058,015 |

|

|

1,785 |

|

|

0.68 |

|

|

1,070,816 |

|

|

2,138 |

|

|

0.79 |

|

|

1,355,718 |

|

|

4,462 |

|

|

1.32 |

|

| Time deposits |

1,916,109 |

|

|

18,475 |

|

|

3.91 |

|

|

2,212,750 |

|

|

24,160 |

|

|

4.34 |

|

|

2,414,063 |

|

|

25,426 |

|

|

4.24 |

|

| Total |

8,432,079 |

|

|

51,046 |

|

|

2.46 |

|

|

8,659,113 |

|

|

59,889 |

|

|

2.75 |

|

|

8,787,749 |

|

|

59,855 |

|

|

2.74 |

|

| FHLB Advances |

996,293 |

|

|

11,359 |

|

|

4.62 |

|

|

854,748 |

|

|

10,030 |

|

|

4.67 |

|

|

644,818 |

|

|

7,771 |

|

|

4.85 |

|

| Securities sold under agreements to repurchase |

64,314 |

|

|

428 |

|

|

2.70 |

|

|

76,856 |

|

|

513 |

|

|

2.66 |

|

|

68,500 |

|

|

411 |

|

|

2.41 |

|

| Other borrowings |

283,150 |

|

|

4,218 |

|

|

6.04 |

|

|

396,412 |

|

|

5,859 |

|

|

5.88 |

|

|

500,901 |

|

|

7,341 |

|

|

5.89 |

|

| Total borrowings |

1,343,757 |

|

|

16,005 |

|

|

4.83 |

|

|

1,328,016 |

|

|

16,402 |

|

|

4.91 |

|

|

1,214,219 |

|

|

15,523 |

|

|

5.14 |

|

| Total interest-bearing liabilities |

9,775,836 |

|

|

67,051 |

|

|

2.78 |

|

|

9,987,129 |

|

|

76,291 |

|

|

3.04 |

|

|

10,001,968 |

|

|

75,378 |

|

|

3.03 |

|

| Non-interest-bearing deposits |

1,597,972 |

|

|

|

|

|

|

1,627,376 |

|

|

|

|

|

|

1,634,583 |

|

|

|

|

|

| Non-interest-bearing liabilities |

222,951 |

|

|

|

|

|

|

227,221 |

|

|

|

|

|

|

247,129 |

|

|

|

|

|

| Total liabilities |

11,596,759 |

|

|

|

|

|

|

11,841,726 |

|

|

|

|

|

|

11,883,680 |

|

|

|

|

|

| Stockholders’ equity |

1,715,134 |

|

|

|

|

|

|

1,703,326 |

|

|

|

|

|

|

1,673,040 |

|

|

|

|

|

| Total liabilities and equity |

$ |

13,311,893 |

|

|

|

|

|

|

$ |

13,545,052 |

|

|

|

|

|

|

$ |

13,556,720 |

|

|

|

|

|

| Net interest income |

|

|

$ |

86,652 |

|

|

|

|

|

|

$ |

83,329 |

|

|

|

|

|

|

$ |

86,224 |

|

|

|

Net interest rate spread (4) |

|

|

|

|

2.35 |

% |

|

|

|

|

|

2.11 |

% |

|

|

|

|

|

2.23 |

% |

Net interest margin (5) |

|

|

|

|

2.90 |

% |

|

|

|

|

|

2.69 |

% |

|

|

|

|

|

2.81 |

% |

| Total cost of deposits (including non-interest-bearing deposits) |

|

|

|

|

2.06 |

% |

|

|

|

|

|

2.32 |

% |

|

|

|

|

|

2.31 |

% |

(1) Average yields and costs are annualized.

(2) Amounts represent debt and equity securities, including FHLB and Federal Reserve Bank stock, and are recorded at average amortized cost, net of allowance for securities credit losses.

(3) Amount is net of deferred loan costs and fees, undisbursed loan funds, discounts and premiums and allowance for loan credit losses, and includes loans held for sale and non-performing loans.

(4) Net interest rate spread represents the difference between the yield on interest-earning assets and the cost of interest-bearing liabilities.

(5) Net interest margin represents net interest income divided by average interest-earning assets.

OceanFirst Financial Corp.

SELECTED QUARTERLY FINANCIAL DATA

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

| Selected Financial Condition Data: |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

13,309,278 |

|

|

$ |

13,421,247 |

|

|

$ |

13,488,483 |

|

|

$ |

13,321,755 |

|

|

$ |

13,418,978 |

|

Debt securities available-for-sale, at estimated fair value |

|

746,168 |

|

|

827,500 |

|

|

911,753 |

|

|

721,484 |

|

|

744,944 |

|

| Debt securities held-to-maturity, net of allowance for securities credit losses |

|

1,005,476 |

|

|

1,045,875 |

|

|

1,075,131 |

|

|

1,105,843 |

|

|

1,128,666 |

|

| Equity investments |

|

87,365 |

|

|

84,104 |

|

|

95,688 |

|

|

104,132 |

|

|

103,201 |

|

| Restricted equity investments, at cost |

|

102,172 |

|

|

108,634 |

|

|

98,545 |

|

|

92,679 |

|

|

85,689 |

|

| Loans receivable, net of allowance for loan credit losses |

|

10,058,072 |

|

|

10,055,429 |

|

|

9,963,598 |

|

|

9,961,117 |

|

|

10,068,209 |

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

10,177,023 |

|

|

10,066,342 |

|