. . . 1 The 1Q 2024 Investor Presentation should be read in conjunction with the Earnings Release furnished as Exhibit 99.1 to Form 8-K filed with the SEC on April 18, 2024 and the Quarterly Report on Form 10-Q filed with the SEC on May 2, 2024. Exhibit 99.1 OceanFirst Financial Corp. Investor Presentation1 May 2024

. . .Legal Disclaimer FORWARD LOOKING STATEMENTS. In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, inflation, general economic conditions, potential recessionary conditions, levels of unemployment in the Company’s lending area, real estate market values in the Company’s lending area, potential goodwill impairment, natural disasters, potential increases to flood insurance premiums, the current or anticipated impact of military conflict, terrorism or other geopolitical events, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, changes in New York city rent regulation law, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, the availability of low-cost funding, changes in liquidity, including the size and composition of the Company’s deposit portfolio and the percentage of uninsured deposits in the portfolio, changes in capital management and balance sheet strategies and the ability to successfully implement such strategies, competition, demand for financial services in the Company’s market area, changes in consumer spending, borrowing and saving habits, changes in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks, the failure to maintain current technologies, failure to retain or attract employees, the effect of the Company’s rating under the Community Reinvestment Act, the impact of pandemics on our operations and financial results and those of our customers and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP (generally accepted accounting principles) measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included in the Company’s Earnings Release furnished as Exhibit 99.1 to Form 8-K as filed with the SEC on April 18, 2024 and the Quarterly Report on Form 10-Q filed with the SEC on May 2, 2024. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third-party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. These estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

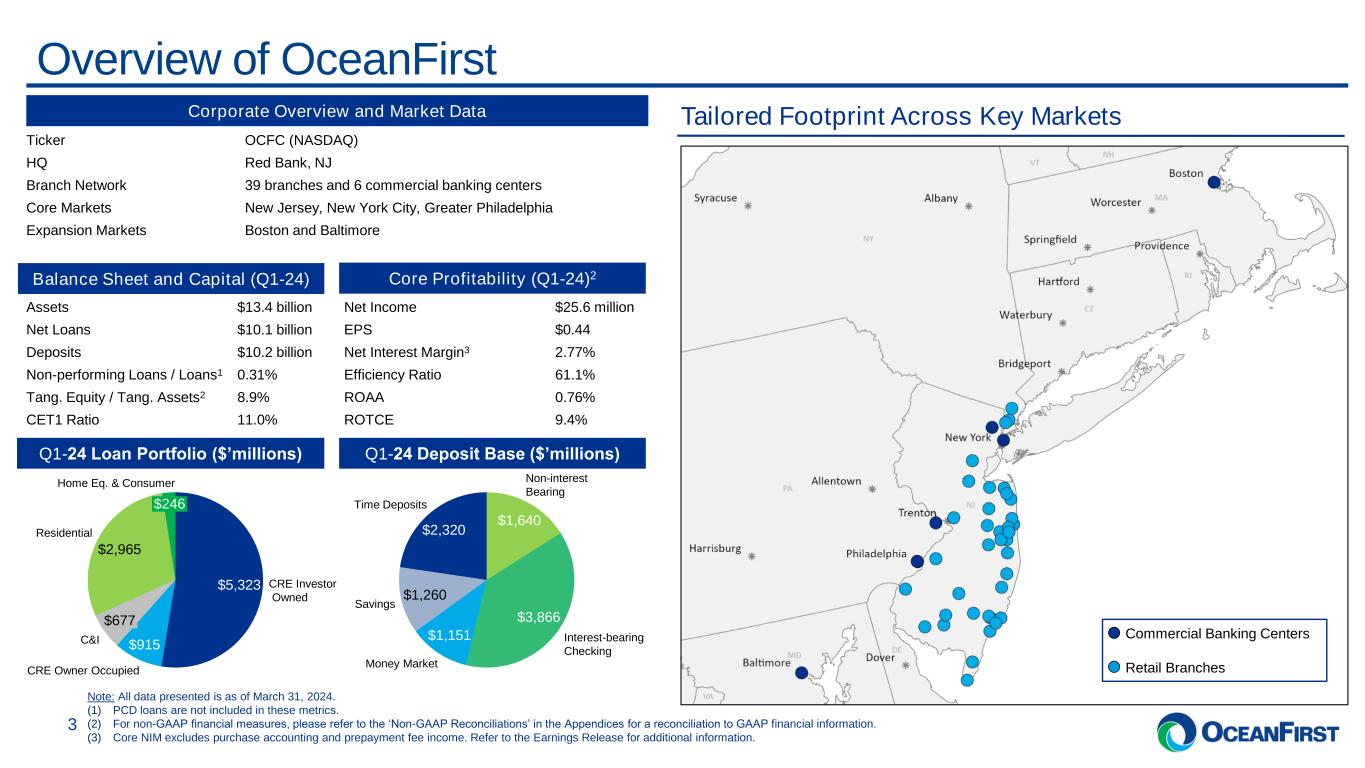

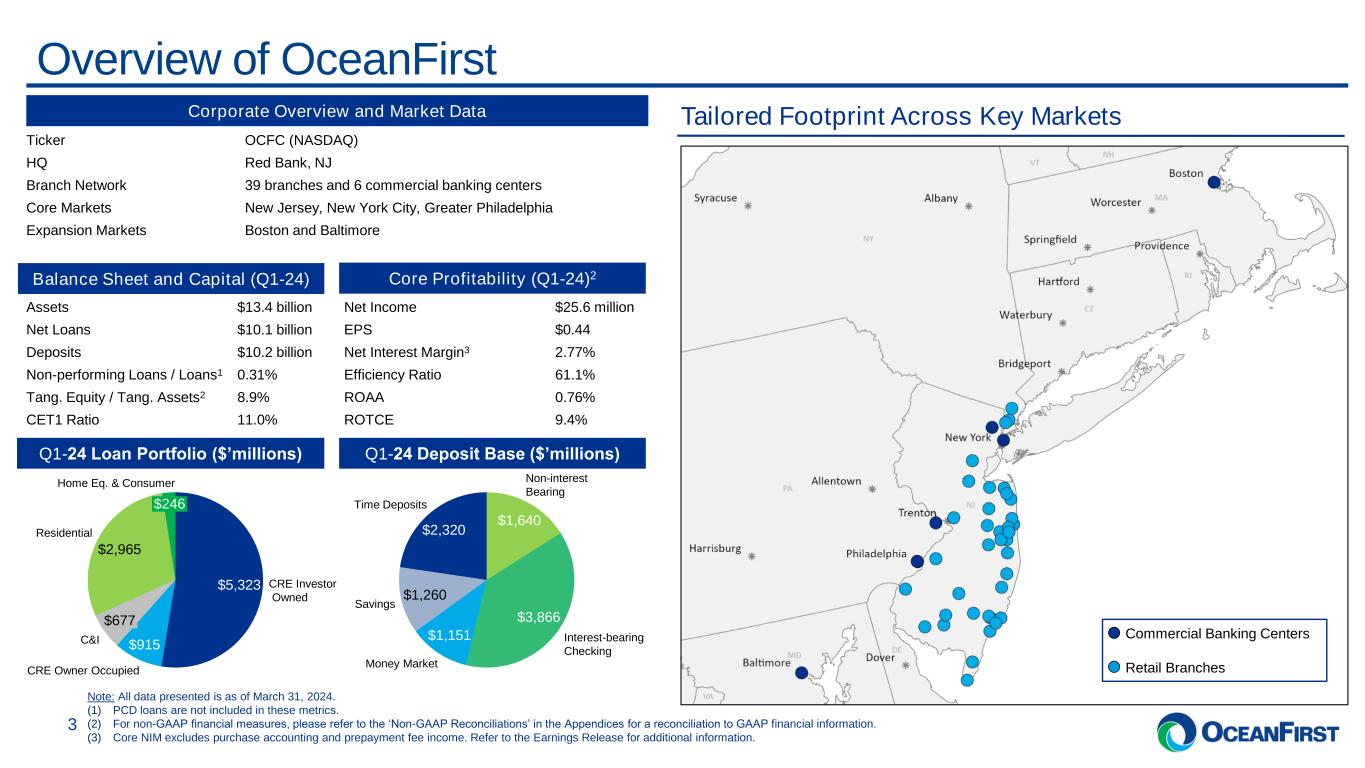

. . .Overview of OceanFirst 3 Tailored Footprint Across Key Markets Corporate Overview & Market Data Ticker OCFC (NASDAQ) HQ Red Bank, NJ Branch Network 39 branches and 6 commercial banking centers Core Markets New Jersey, New York City, Greater Philadelphia Expansion Markets Boston and Baltimore Balance Sheet and Capital (Q1-23) Assets $13.4 billion Net Loans $10.1 billion Deposits $10.2 billion Non-performing Loans / Loans1 0.31% Tang. Equity / Tang. Assets2 8.9% CET1 Ratio 11.0% Q1-24 Loan Portfolio ($’millions) Q1-24 Deposit Base ($’millions) Core Profitability (Q1-23)2 Net Income $25.6 million EPS $0.44 Net Interest Margin3 2.77% Efficiency Ratio 61.1% ROAA 0.76% ROTCE 9.4% Corporate Overview and Market Data Balance Sheet and C it l (Q1-24) Core Profitability ( 1-24)2 Commercial Banking Centers Retail Branches $5,323 CRE Investor Owned $915 CRE Owner Occupied $677 C&I $2,965 Residential $246 Home Eq. & Consumer $1,640 Non-interest Bearing $3,866 Interest-bearing Checking $1,151 Money Market $1,260 Savings $2,320 Time Deposits Note: All data presented is as of March 31, 2024. (1) PCD loans are not included in these metrics. (2) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. (3) Core NIM excludes purchase accounting and prepayment fee income. Refer to the Earnings Release for additional information.

. . .Our Shareholder Value Proposition Strong balance sheet – Strategically planned balance sheet provides opportunity to grow loan portfolio at attractive returns while realizing reduced costs of funding for improved profitability. Continued expense management and discipline – Identified and executed on opportunities for efficiencies in our existing technology and staffing infrastructure while maintaining productivity and improving the customer experience. Well positioned capital – Strategic capital utilization has allowed for significant stockholder capital returns while building flexibility for opportunistic capital deployment. 4

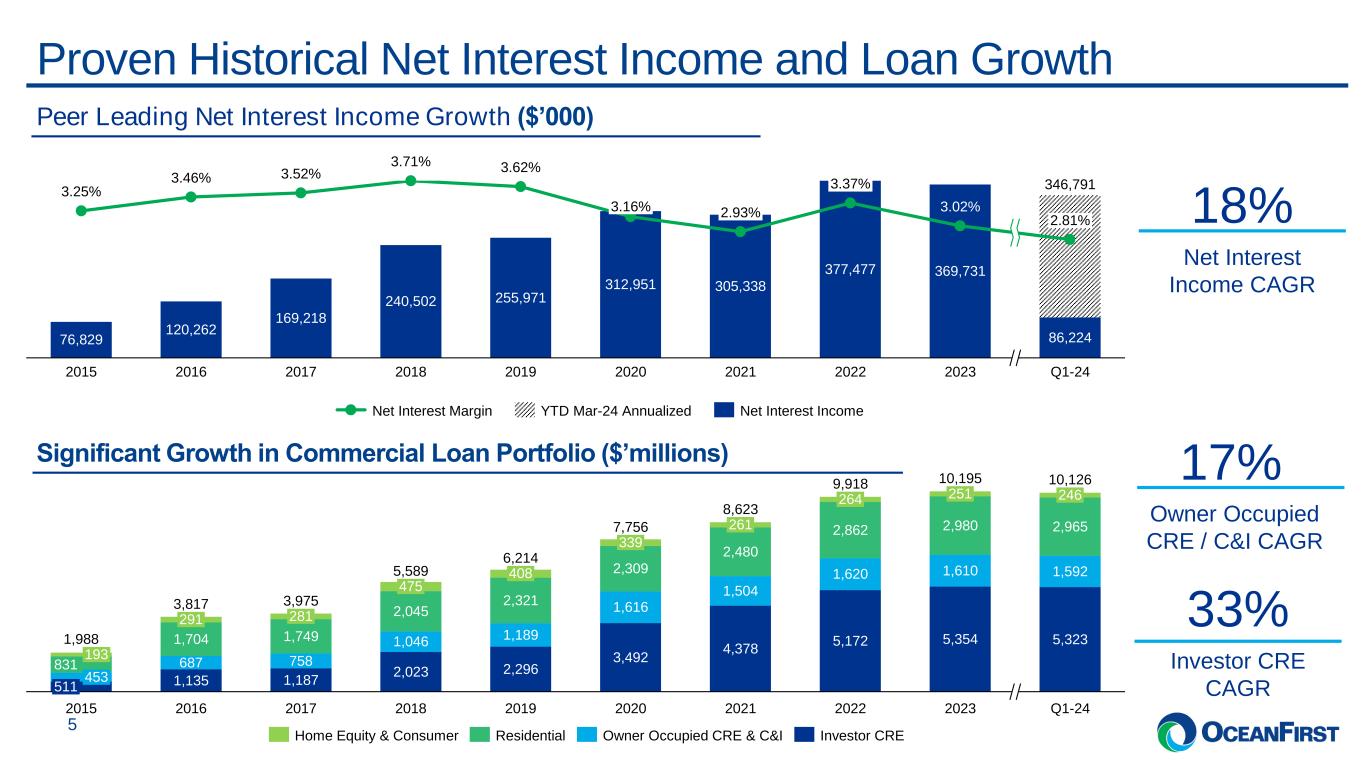

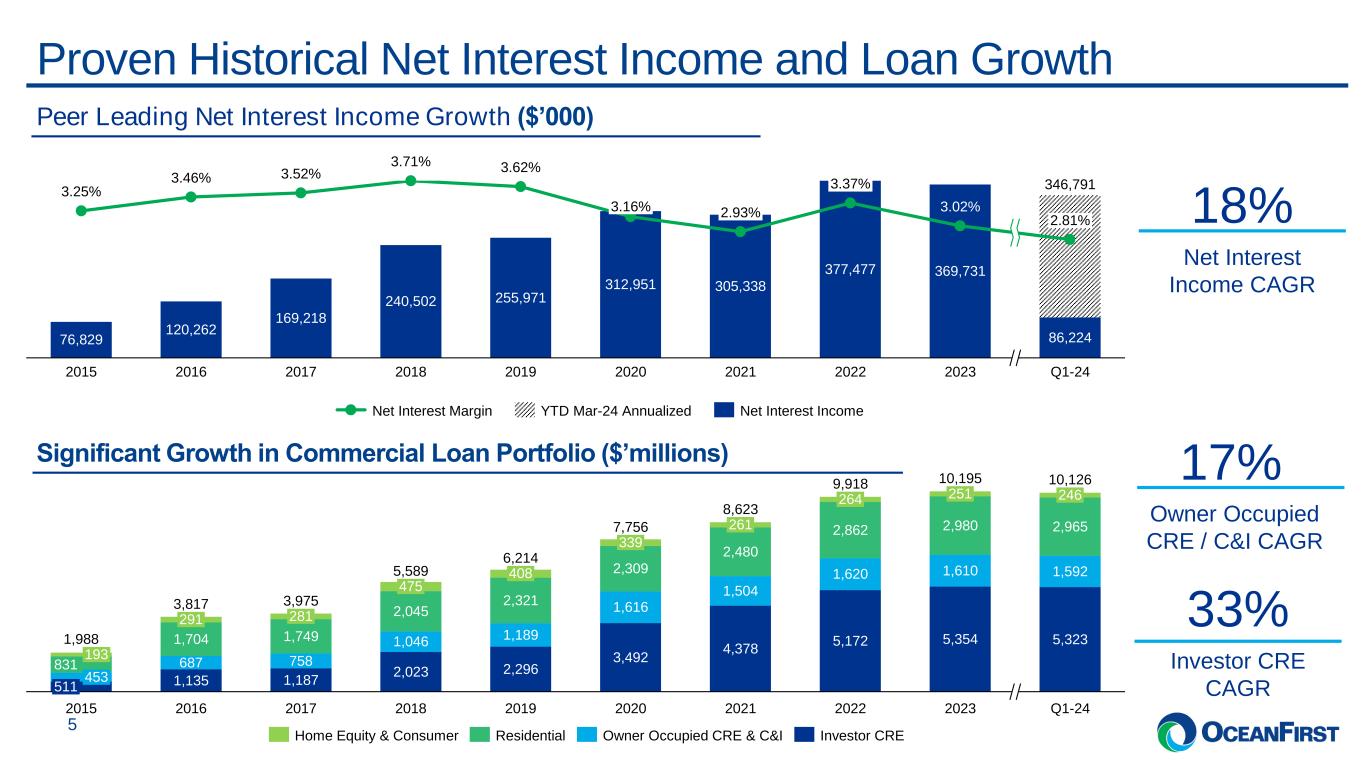

. . .Proven Historical Net Interest Income and Loan Growth 5 76,829 120,262 169,218 240,502 255,971 312,951 305,338 377,477 369,731 86,224 3.25% 2015 3.46% 2016 3.52% 2017 3.71% 2018 3.62% 2019 3.16% 2020 2.93% 2021 3.37% 2022 3.02% 2023 Q1-24 346,791 2.81% Net Interest Margin YTD Mar-24 Annualized Net Interest Income Peer Leading Net Interest Income Growth ($’000) Net Interest Income CAGR 18% 1,135 1,187 2,023 2,296 3,492 4,378 5,172 5,354 5,323 687 758 1,046 1,189 1,616 1,504 1,620 1,610 1,592 831 1,704 1,749 2,045 2,321 2,309 2,480 2,862 2,980 2,965 291 2016 281 2017 475 2018 408 2019 339 2020 261 2021 264 2022 193 2023 1,988 3,817 3,975 5,589 6,214 7,756 8,623 9,918 10,195 Q1-24 453 511 2015 246 10,126 251 Home Equity & Consumer Residential Owner Occupied CRE & C&I Investor CRE Significant Growth in Commercial Loan Portfolio ($’millions) Investor CRE CAGR 33% Owner Occupied CRE / C&I CAGR 17%

. . .Successful Commercial Loan Growth and Geographic Diversification 6 49% 68% 2015 Q1-24 +19% (Commercial % of Loan Portfolio) Commercial Loans by Geography as of Q1-24 Emphasis on Commercial Increase of $6.0B in commercial loans since 2015 41% 29% 23% 7% New Jersey New York Philadelphia Boston & Baltimore Total: $6.9B

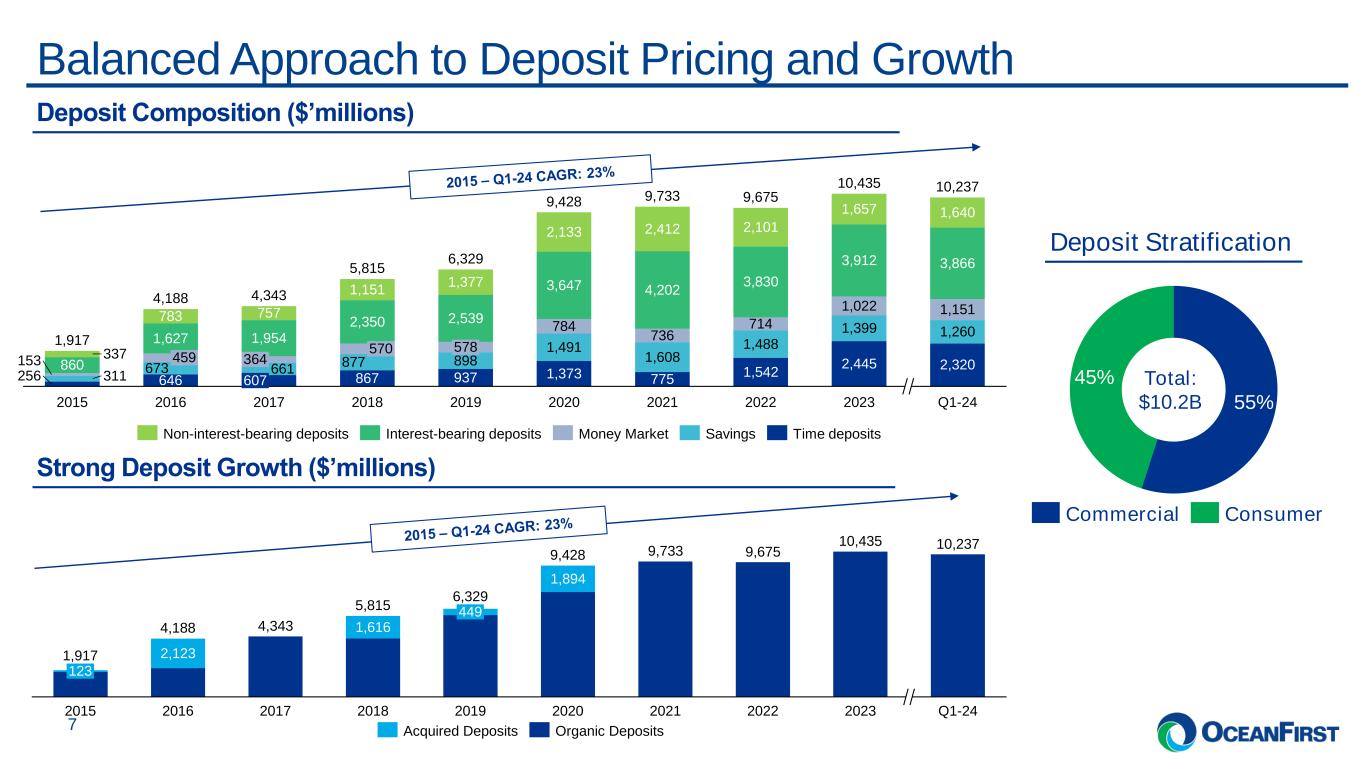

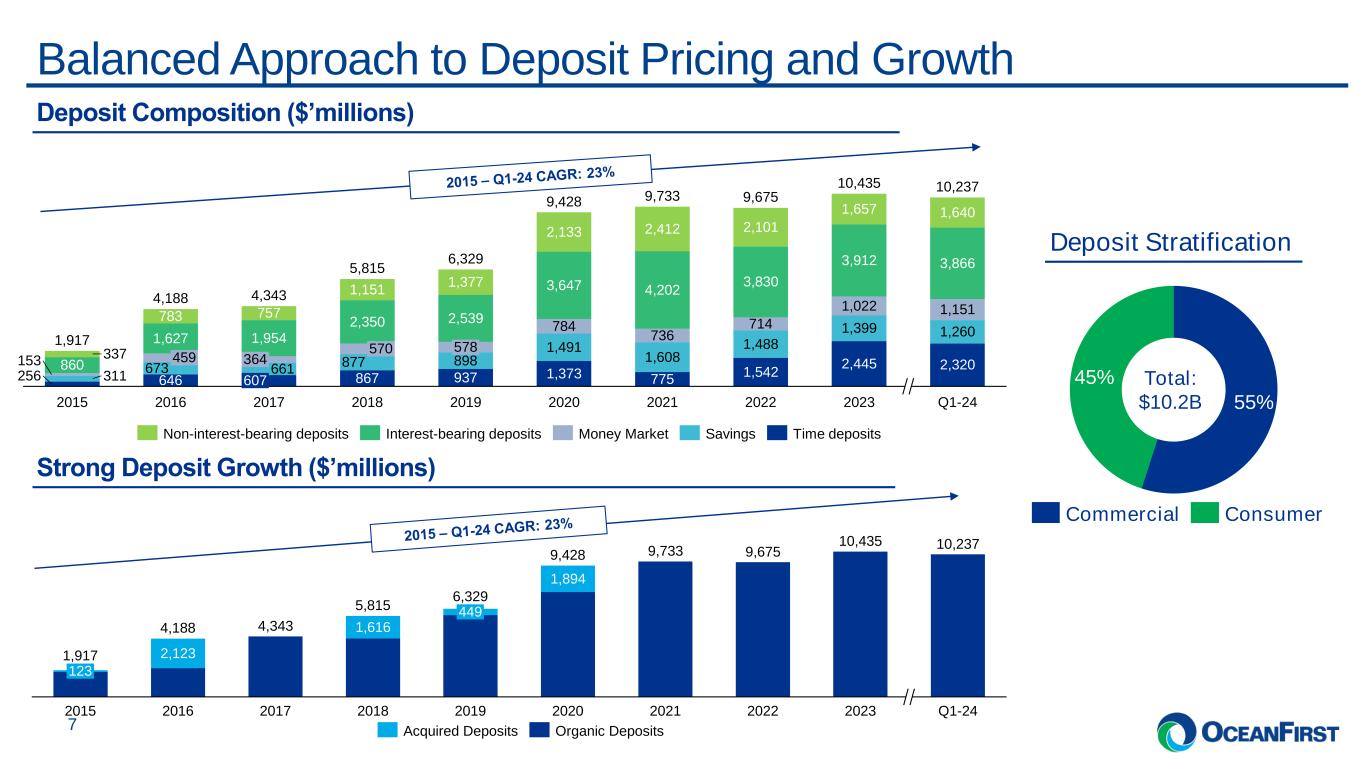

. . .Balanced Approach to Deposit Pricing and Growth 7 Deposit Composition ($’millions) 256 646 867 937 1,373 775 1,542 2,445 2,320 311 673 661 877 898 1,491 1,608 1,488 1,399 1,260 153 784 736 714 1,022 1,151 860 1,627 1,954 2,350 2,539 3,647 4,202 3,830 3,912 3,866 337 783 757 1,151 1,377 2,133 2,412 2,101 1,657 1,640 364 607 2017 570 2018 578 2019 2020 2021 2022 2023 Q1-24 1,917 4,188 4,343 5,815 6,329 9,428 9,733 9,675 2015 459 2016 10,435 10,237 Non-interest-bearing deposits Interest-bearing deposits Money Market Savings Time deposits Strong Deposit Growth ($’millions) 4,343 9,733 9,675 10,435 10,237 2,123 1,616 1,894 123 2015 2016 2017 2018 449 2019 2020 2021 2022 2023 Q1-24 1,917 4,188 5,815 6,329 9,428 Acquired Deposits Organic Deposits 55% 45% Commercial Consumer Total: $10.2B Deposit Stratification

. . .Conservative Credit Risk Profile 8 0.21% 2016 0.01% 0.36% 0.05% 0.11% 2017 0.03% 0.10% 0.05% 0.13% 2018 0.00% 0.12% 0.04% 0.12% 2019 0.02% 0.30% 0.03% 0.11% 2020 0.00% 0.12% 0.02% 0.07% 2021 0.00% 0.11% 0.02% 0.06% 2022 0.00% 0.19% 0.02% 0.05% 2023 0.01% 0.21% 0.02% 0.07% Q1-24 0.35% 0.52% 0.31% 0.29% 0.47% 0.22% 0.19% 0.01% 0.08% 0.05% 0.26% 0.31% Commercial & Industrial Commercial Real Estate Consumer Residential (1) PCD loans are not included in these metrics. Refer to “Asset Quality” section in the Earnings Release for additional information. 0.52 0.69 0.85 2017 0.25% 0.31 0.60 0.75 2018 0.22% 0.29 0.59 0.73 2019 0.32% 0.47 0.64 0.85 2020 0.16% 0.22 0.44 0.62 2021 0.15% 0.45% 0.35 0.40 0.50 2022 0.19% 0.73 0.26 2023 0.19 0.31 Q1-24 0.47 0.89 2016 0.54% 0.38 0.23% NPA/Assets NPL/Loans Peer Average NPA/Assets Peer Average NPL/Loans Continued Focus on Credit Risk1Non-performing Loans by Type as % of Loans1 Note: Peer data is on a one quarter lag.

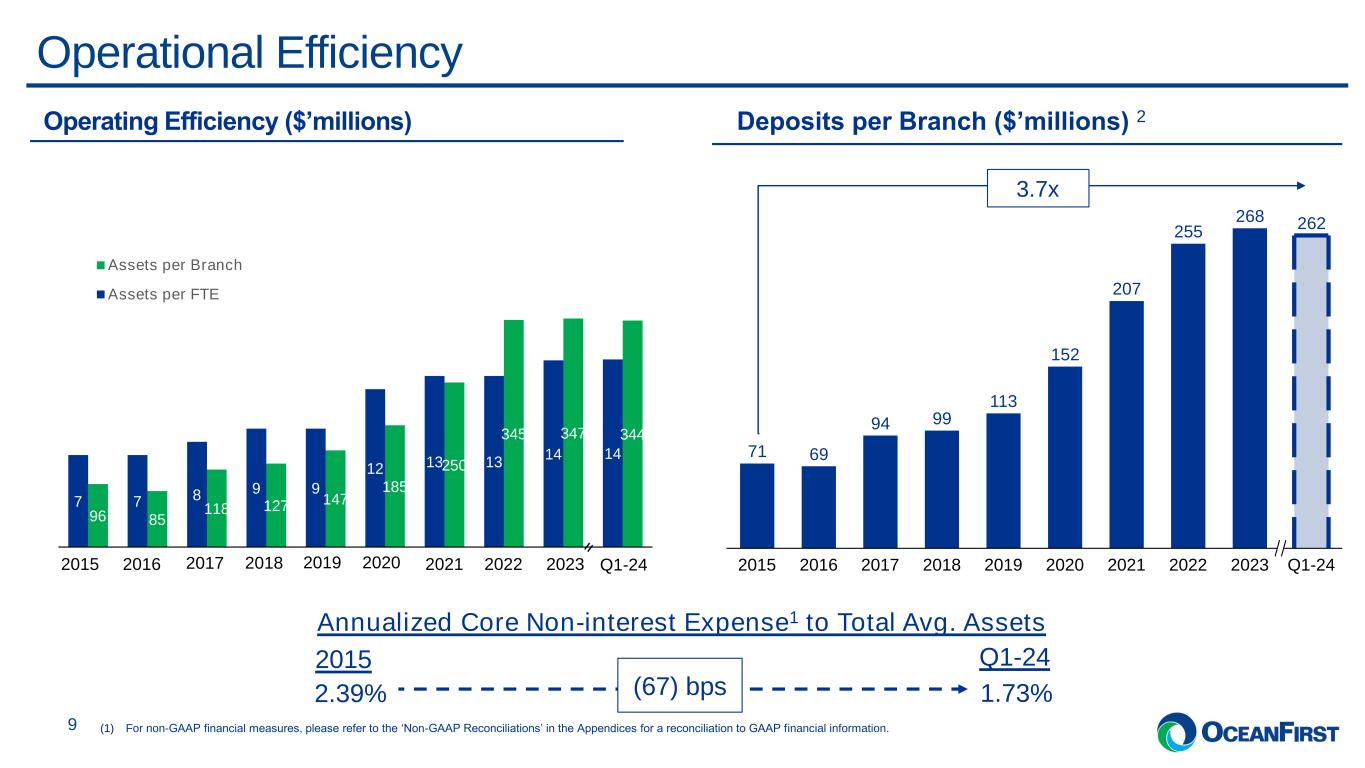

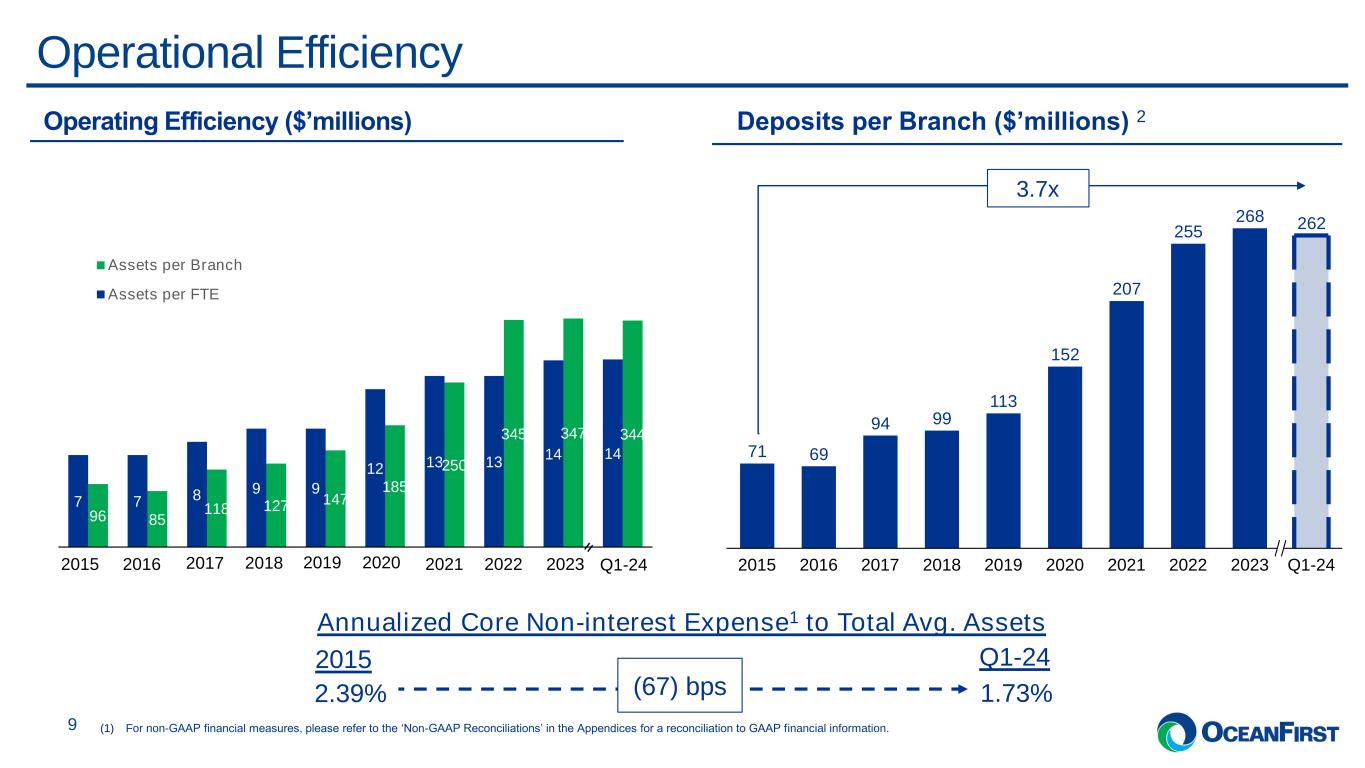

. . . 96 85 118 127 147 185 250 345 347 344 7 7 8 9 9 12 13 13 14 14 0 2 4 6 8 10 12 14 16 18 20 0 50 100 150 200 250 300 350 400 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1-24 Assets per Branch Assets per FTE Operational Efficiency 9 Deposits per Branch ($’millions) 2 (67) bps2.39% 1.73% 2015 Q1-24 Annualized Core Non-interest Expense1 to Total Avg. Assets 71 69 94 99 113 152 207 255 268 262 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1-24 3.7x Operating Efficiency ($’millions) 2015 2016 2 20 201 202 (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information.

. . .Business Model Strength Driving Significant Capital Return 10 $0.49 $0.55 $0.94 $1.01 $13.67 2015 $1.04 $1.55 $12.94 2016 $1.09 $2.15 $13.58 2017 $1.39 $2.77 $14.26 2018 $1.97 $3.45 $15.13 2019 $2.25 $4.13 $14.98 2020 $2.86 $4.81 $15.93 2021 $2.98 $17.08 2022 $2.98 $6.35 $18.35 2023 $12.33 $13.95 $15.62 $15.53 $16.82 $18.42 $12.33 $21.36 $23.60 $25.61 $27.68 Q1-24 $28.42 $20.55 $3.24 $6.55 2013 $12.91 2014 $5.55 $18.63 Cumulative Share Repurchase/Share Cumulative Dividends/Share TBVPCS The growth in TBV per common share (TBVPCS1) is attributed to: ▪ Minimally dilutive and strategic acquisitions in critical new markets ▪ Stable and competitive dividend ▪ 109th consecutive quarter ▪ Historical Payout Ratio of 30% to 40% ▪ Repurchased 957,827 shares in Q1-24 ▪ 2.0 million shares available to be repurchased (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. Growth Since 2013 Tangible Book Value per Share 1 48.8% Total Capital Return per Share 124.5%

. . . I N V E S T O R P R E S E N T A T I O N 11 Quarterly Earnings Update

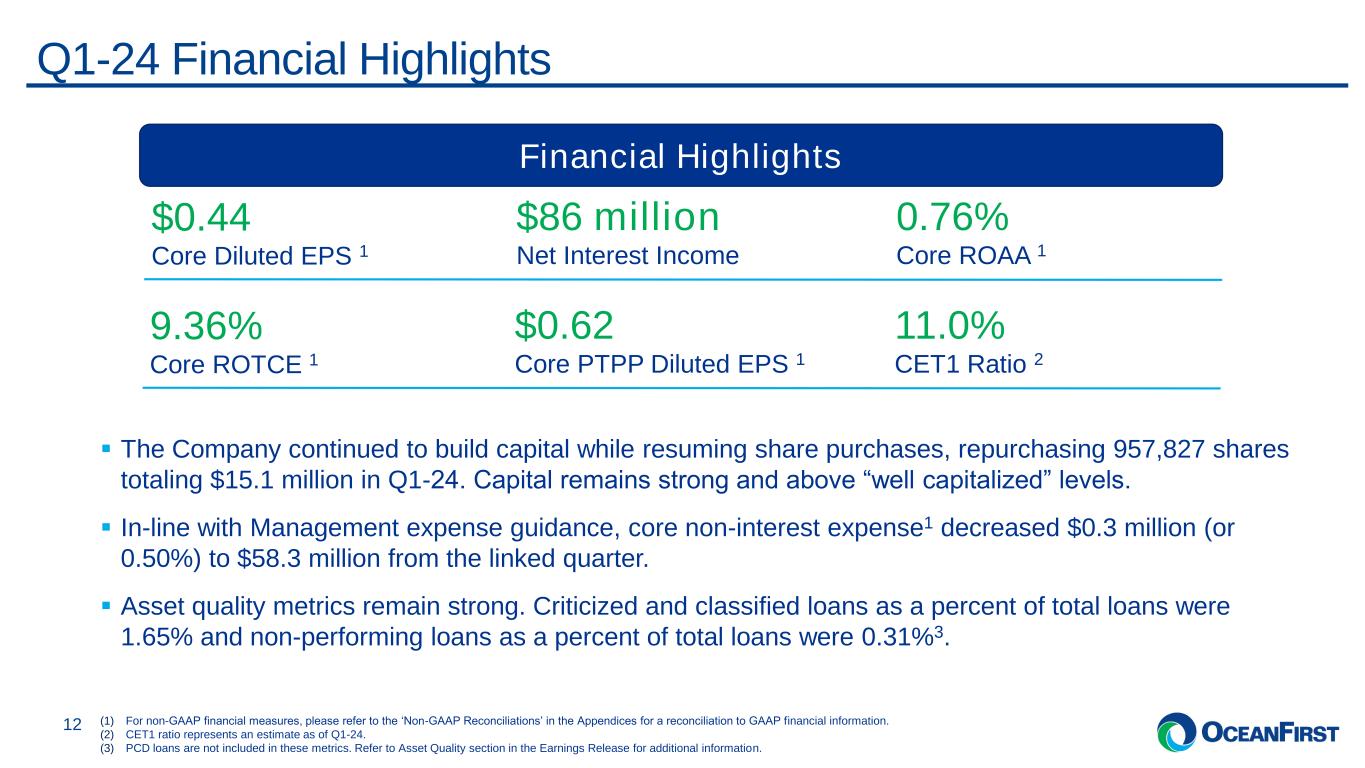

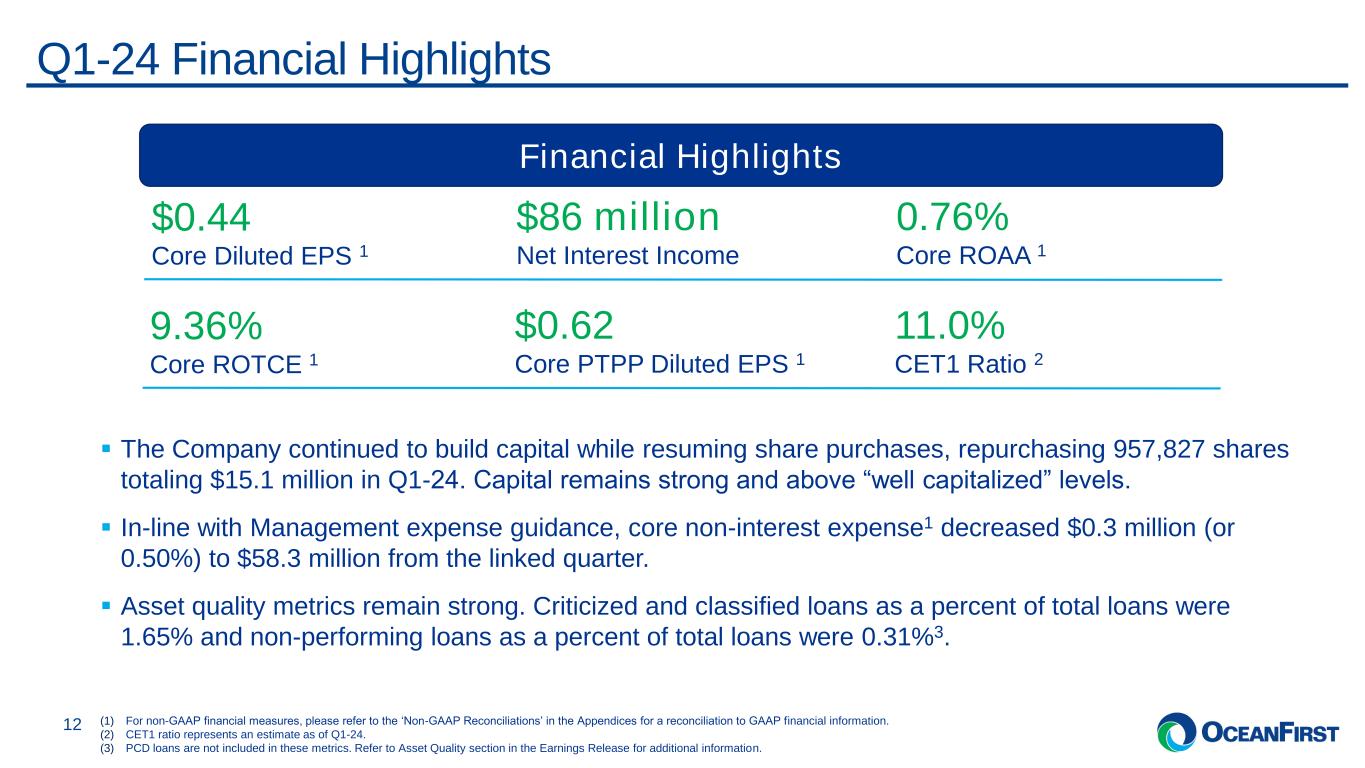

. . .Q1-24 Financial Highlights 12 (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. (2) CET1 ratio represents an estimate as of Q1-24. (3) PCD loans are not included in these metrics. Refer to Asset Quality section in the Earnings Release for additional information. Financial Highlights $0.44 Core Diluted EPS 1 $86 million Net Interest Income 0.76% Core ROAA 1 9.36% Core ROTCE 1 $0.62 Core PTPP Diluted EPS 1 11.0% CET1 Ratio 2 ▪ The Company continued to build capital while resuming share purchases, repurchasing 957,827 shares totaling $15.1 million in Q1-24. Capital remains strong and above “well capitalized” levels. ▪ In-line with Management expense guidance, core non-interest expense1 decreased $0.3 million (or 0.50%) to $58.3 million from the linked quarter. ▪ Asset quality metrics remain strong. Criticized and classified loans as a percent of total loans were 1.65% and non-performing loans as a percent of total loans were 0.31%3.

. . .Loan Portfolio Trends 13 Moderated Loan Growth in the Portfolio ($’millions) ▪ Loan growth has moderated and will likely persist through mid-year with the expectation of low to mid-single digit annualized growth during the second half of the year. ▪ Loan yields continue to improve. 5,297 5,320 5,334 5,354 5,323 986 982 957 944 915 622 620 652 666 677 2,882 2,907 2,928 2,980 2,965 4.96% 253 Q1-23 5.17% 255 Q2-23 5.30% 252 Q3-23 5.40% 251 Q4-23 Q1-24 10,040 10,084 10,124 10,195 5.46% 246 10,126 Average Loan Yield Home Equity & Consumer Residential C&I CRE Owner Occupied CRE Investor Owned

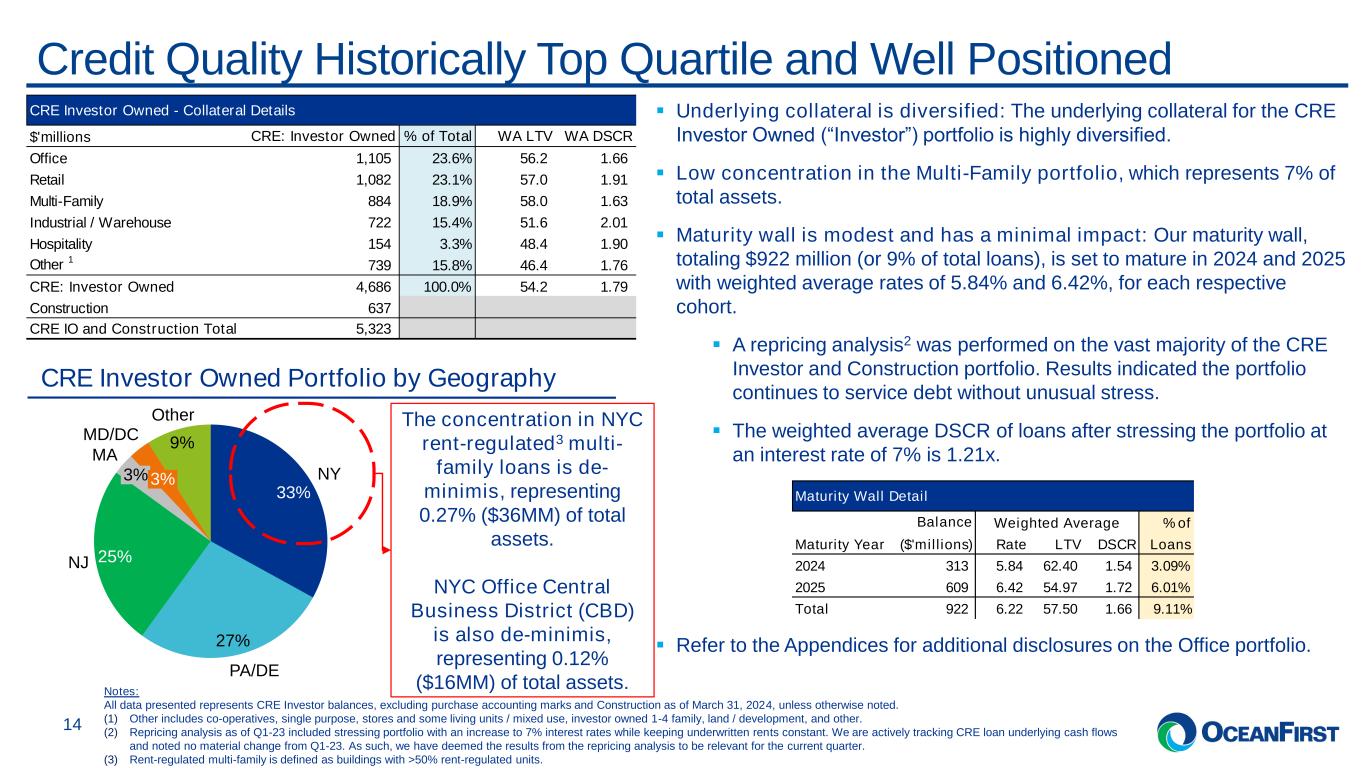

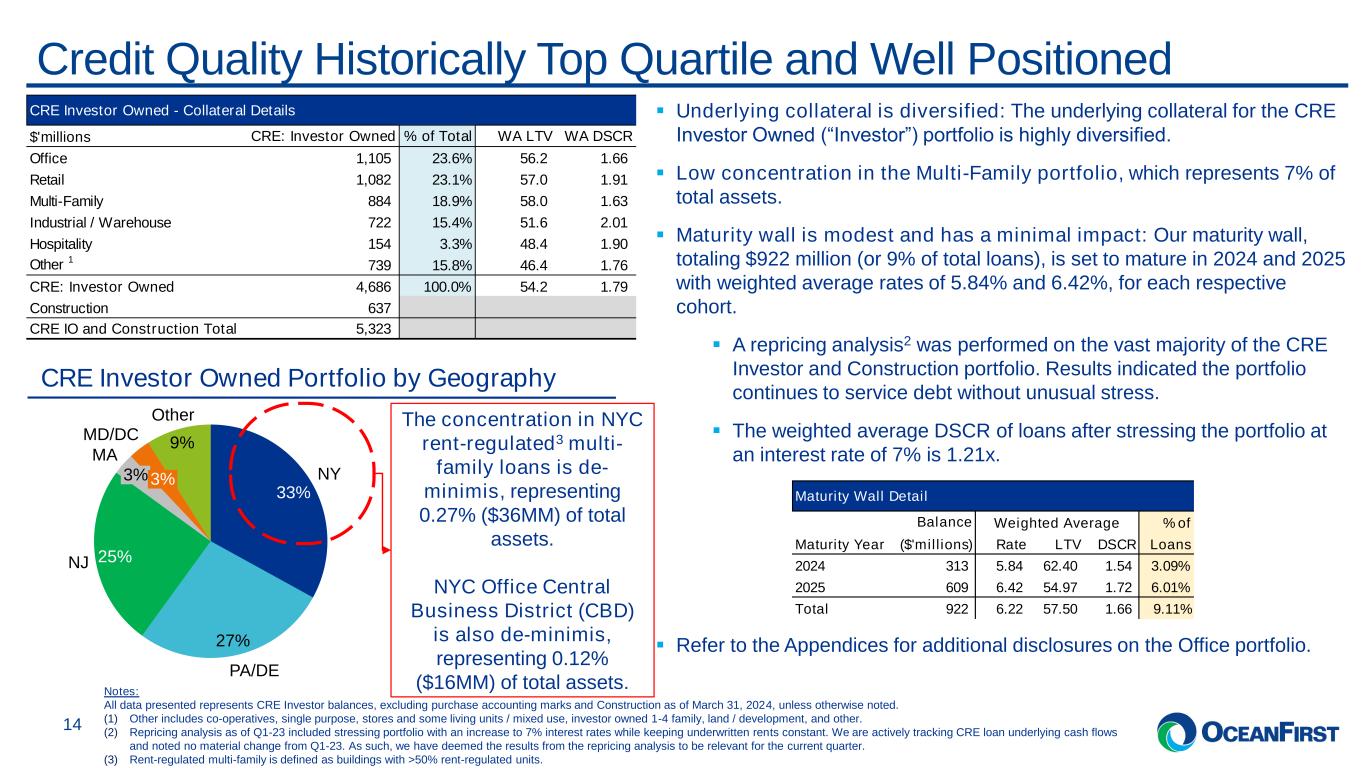

. . .Credit Quality Historically Top Quartile and Well Positioned ▪ Underlying collateral is diversified: The underlying collateral for the CRE Investor Owned (“Investor”) portfolio is highly diversified. ▪ Low concentration in the Multi-Family portfolio, which represents 7% of total assets. ▪ Maturity wall is modest and has a minimal impact: Our maturity wall, totaling $922 million (or 9% of total loans), is set to mature in 2024 and 2025 with weighted average rates of 5.84% and 6.42%, for each respective cohort. ▪ A repricing analysis2 was performed on the vast majority of the CRE Investor and Construction portfolio. Results indicated the portfolio continues to service debt without unusual stress. ▪ The weighted average DSCR of loans after stressing the portfolio at an interest rate of 7% is 1.21x. ▪ Refer to the Appendices for additional disclosures on the Office portfolio. 14 CRE Investor Owned Portfolio by Geography Notes: All data presented represents CRE Investor balances, excluding purchase accounting marks and Construction as of March 31, 2024, unless otherwise noted. (1) Other includes co-operatives, single purpose, stores and some living units / mixed use, investor owned 1-4 family, land / development, and other. (2) Repricing analysis as of Q1-23 included stressing portfolio with an increase to 7% interest rates while keeping underwritten rents constant. We are actively tracking CRE loan underlying cash flows and noted no material change from Q1-23. As such, we have deemed the results from the repricing analysis to be relevant for the current quarter. (3) Rent-regulated multi-family is defined as buildings with >50% rent-regulated units. 33% 27% 25% 9% NY PA/DE NJ 3% MA 3% MD/DC Other The concentration in NYC rent-regulated3 multi- family loans is de- minimis, representing 0.27% ($36MM) of total assets. NYC Office Central Business District (CBD) is also de-minimis, representing 0.12% ($16MM) of total assets. Maturity Wall Detail Balance Weighted Average % of Maturity Year ($'millions) Rate LTV DSCR Loans 2024 313 5.84 62.40 1.54 3.09% 2025 609 6.42 54.97 1.72 6.01% Total 922 6.22 57.50 1.66 9.11% CRE Investor Owned - Collateral Details $'millions CRE: Investor Owned % of Total WA LTV WA DSCR Office 1,105 23.6% 56.2 1.66 Retail 1,082 23.1% 57.0 1.91 Multi-Family 884 18.9% 58.0 1.63 Industrial / Warehouse 722 15.4% 51.6 2.01 Hospitality 154 3.3% 48.4 1.90 Other 1 739 15.8% 46.4 1.76 CRE: Investor Owned 4,686 100.0% 54.2 1.79 Construction 637 CRE IO and Construction Total 5,323

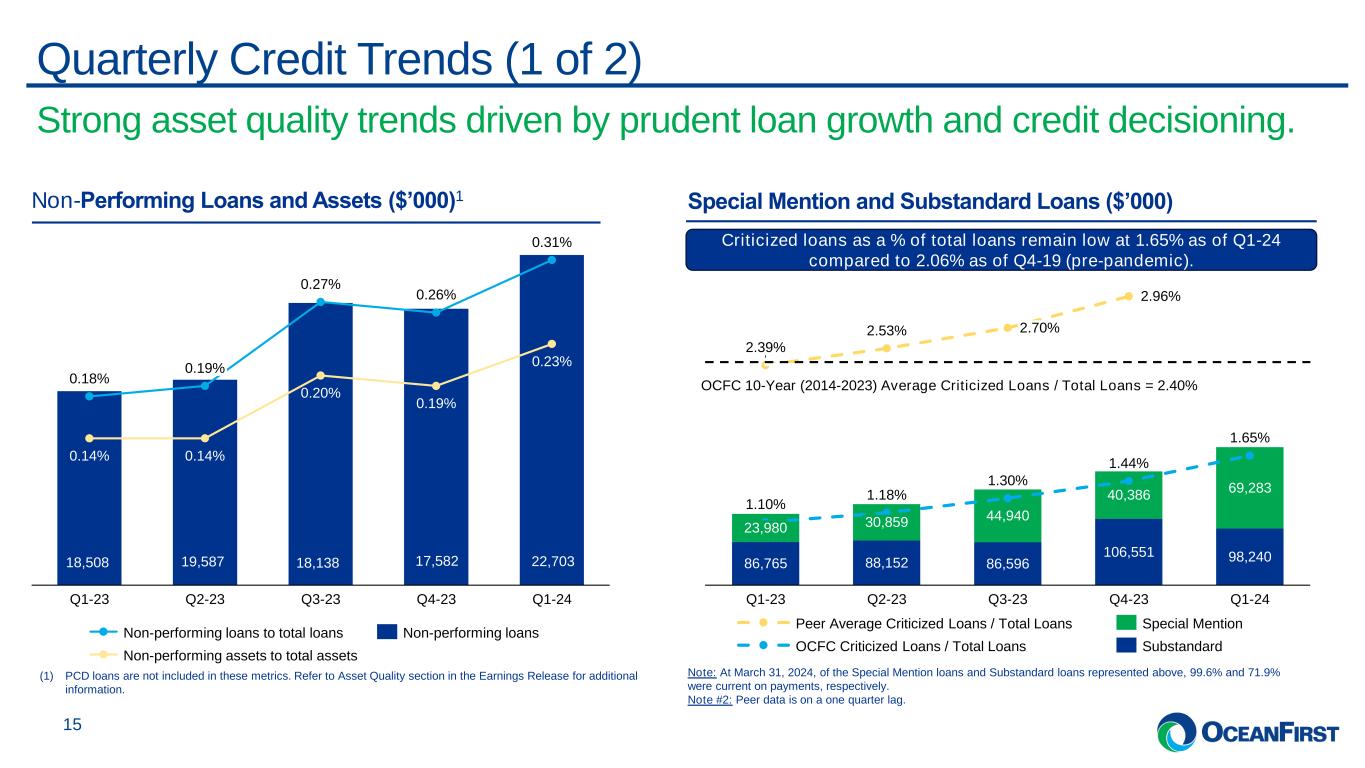

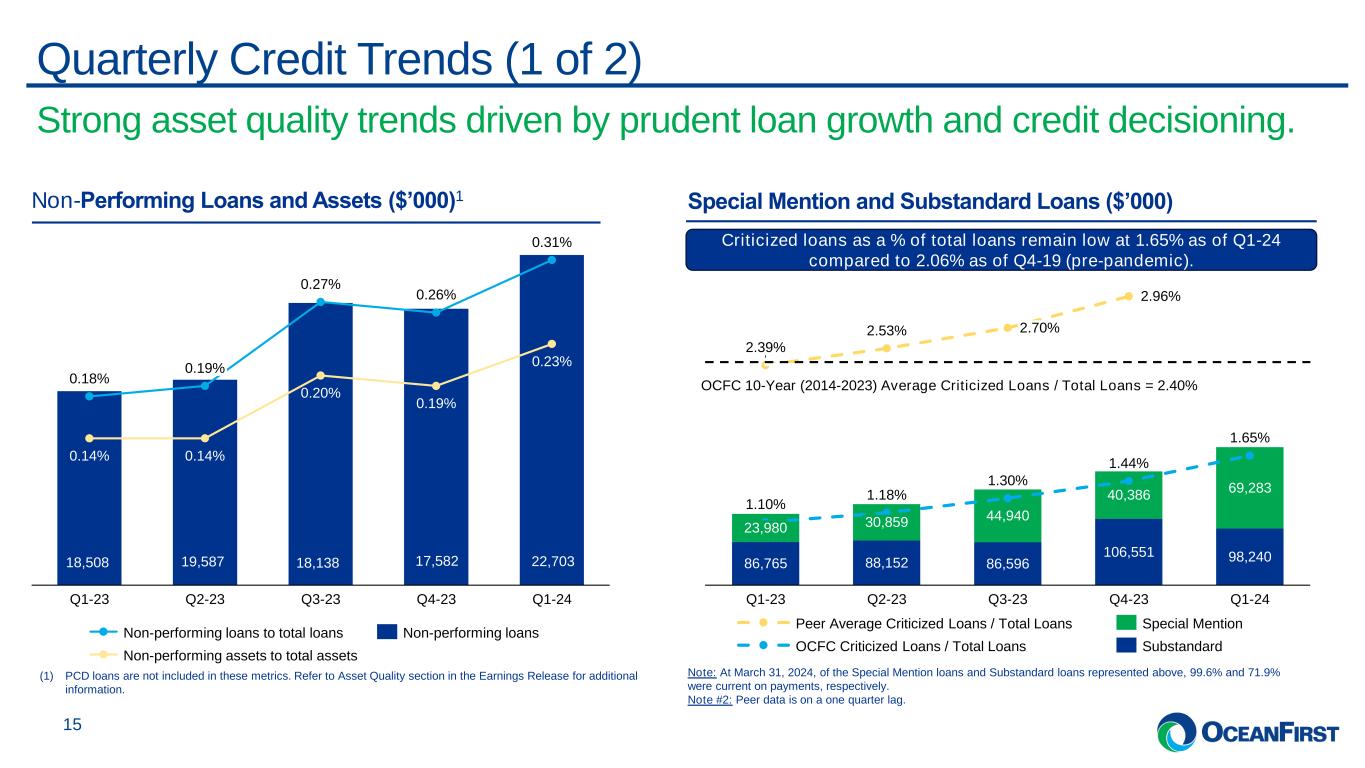

. . . Strong asset quality trends driven by prudent loan growth and credit decisioning. Quarterly Credit Trends (1 of 2) 15 Non-Performing Loans and Assets ($’000)1 Special Mention and Substandard Loans ($’000) Note: At March 31, 2024, of the Special Mention loans and Substandard loans represented above, 99.6% and 71.9% were current on payments, respectively. Note #2: Peer data is on a one quarter lag. (1) PCD loans are not included in these metrics. Refer to Asset Quality section in the Earnings Release for additional information. Criticized loans as a % of total loans remain low at 1.65% as of Q1-24 compared to 2.06% as of Q4-19 (pre-pandemic). 0.20% 0.18% 0.14% Q1-23 0.19% 0.14% Q2-23 0.27% 0.20% Q3-23 0.26% 0.19% Q4-23 0.31% 0.23% Q1-24 Non-performing loans to total loans Non-performing assets to total assets Non-performing loans 18,508 19,587 22,70318,138 17,582 86,765 88,152 86,596 106,551 98,240 44,940 40,386 69,283 1.10% 23,980 Q1-23 2.53% 1.18% 30,859 Q2-23 2.70% 1.30% Q3-23 2.96% 1.44% Q4-23 1.65% Q1-24 2.39% Peer Average Criticized Loans / Total Loans OCFC Criticized Loans / Total Loans Special Mention Substandard OCFC 10-Year (2014-2023) Average Criticized Loans / Total Loans = 2.40%

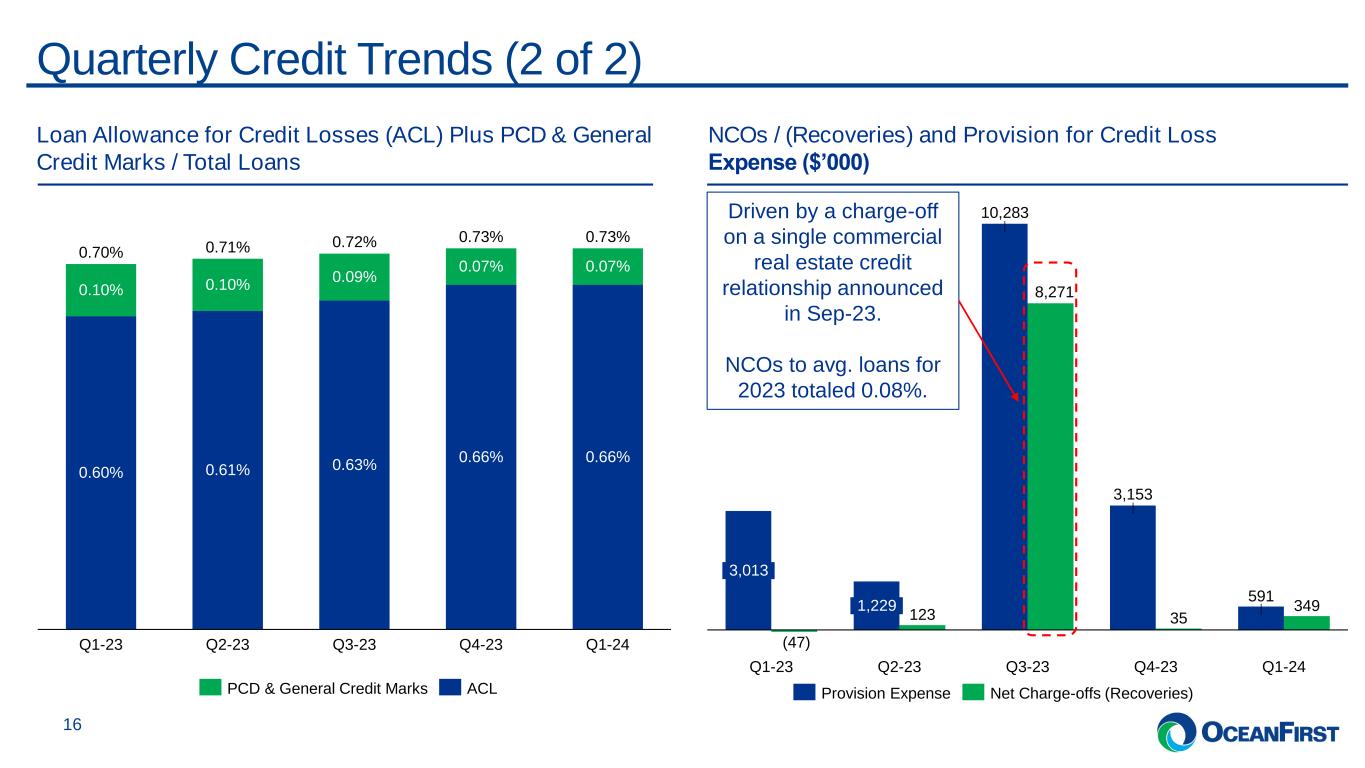

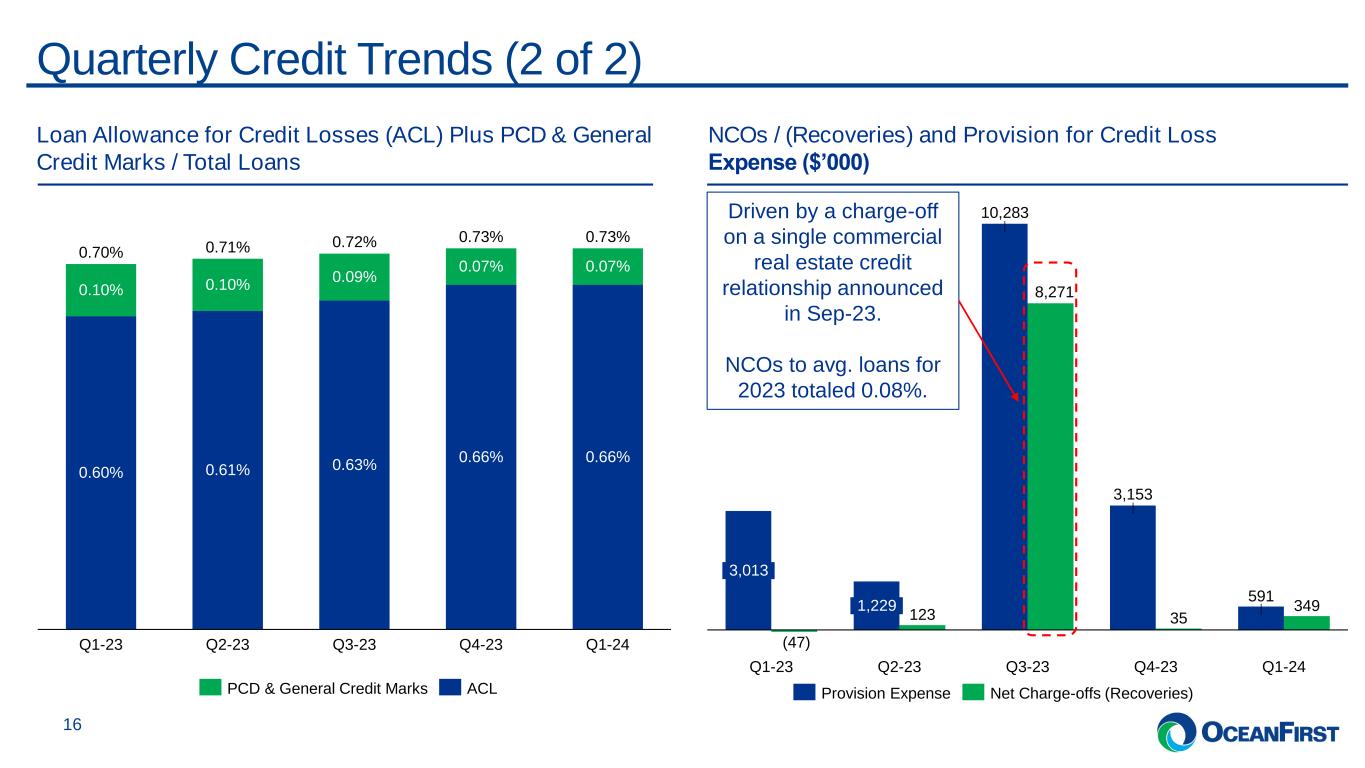

. . .Quarterly Credit Trends (2 of 2) 16 Loan Allowance for Credit Losses (ACL) Plus PCD & General Credit Marks / Total Loans NCOs / (Recoveries) and Provision for Credit Loss Expense ($’000) 0.10% 0.60% Q1-23 0.10% 0.61% Q2-23 0.09% 0.63% Q3-23 0.07% 0.66% Q4-23 Q1-24 0.70% 0.71% 0.72% 0.73% 0.73% 0.66% 0.07% PCD & General Credit Marks ACL 10,283 3,153 591 (47) 123 8,271 35 349 3,013 Q1-23 1,229 Q2-23 Q3-23 Q4-23 Q1-24 Provision Expense Net Charge-offs (Recoveries) Driven by a charge-off on a single commercial real estate credit relationship announced in Sep-23. NCOs to avg. loans for 2023 totaled 0.08%.

. . . COVID-19 Pandemic Track Record of Strong Credit Performance 17 ▪ From 2006 to 2023, inclusive of the Global Financial Crisis, Hurricane Sandy, and the COVID-19 Pandemic, OCFC’s CRE NCO to average CRE loans totaled 7 bps per year compared to 73 bps for all commercial banks between $10 - $50 billion in assets. ▪ From 2006 to 2023, peak CRE net charge-offs for OCFC totaled 47 bps in 2020, related to proactively de-risking our balance sheet. Peak CRE charge-offs for commercial banks between $10 - $50 billion in assets were 455 bps in 2010. 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1-24 OCFC CRE NCO / Avg Assets OCFC NCO / Avg Assets Commercial Banks ($10-50 bn) CRE NCO / Avg Assets Commercial Banks ($10-50 bn) NCO / Avg Assets Global Financial Crisis Cumulative CRE charge-offs for OCFC between 2006 and Q1-24 were minimal, totaling $35 million. Hurricane Sandy Source: S&P Global. Note: Commercial bank reporting is on a one quarter lag.

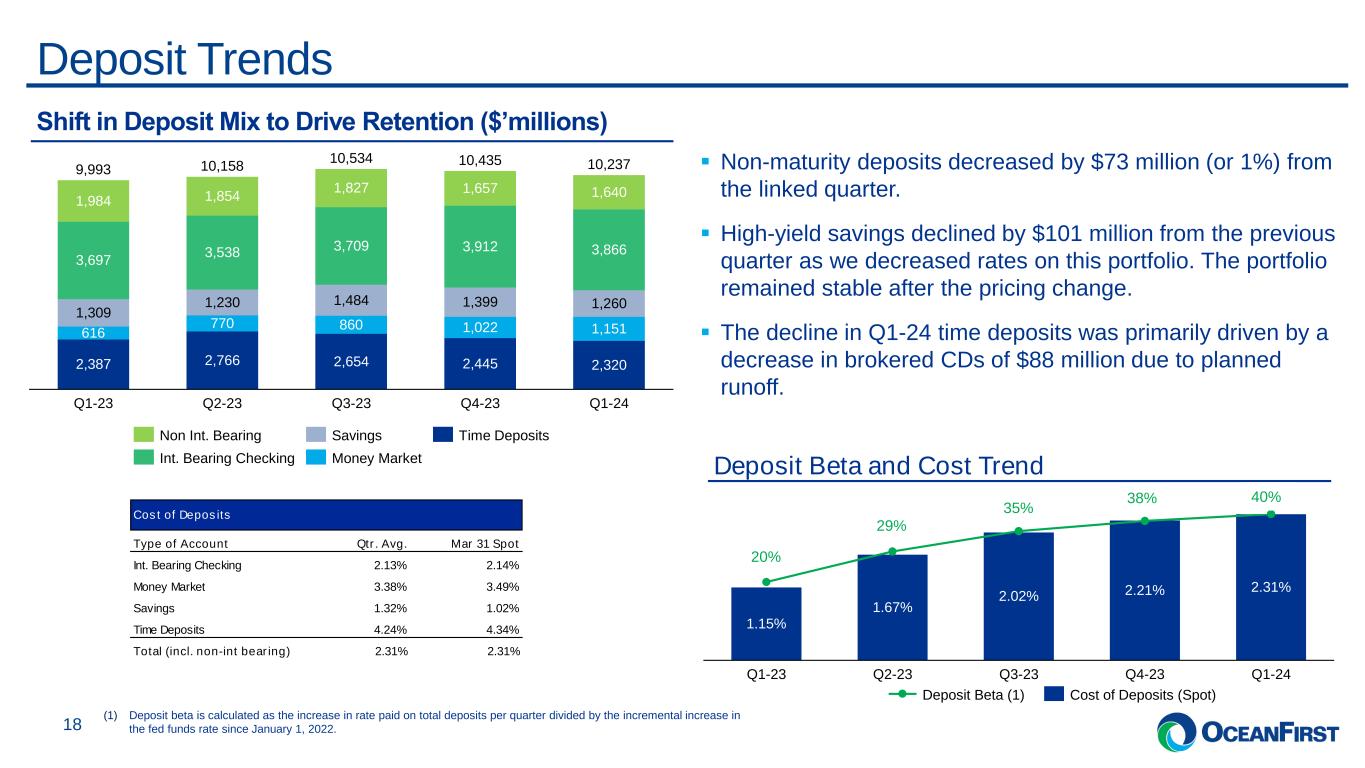

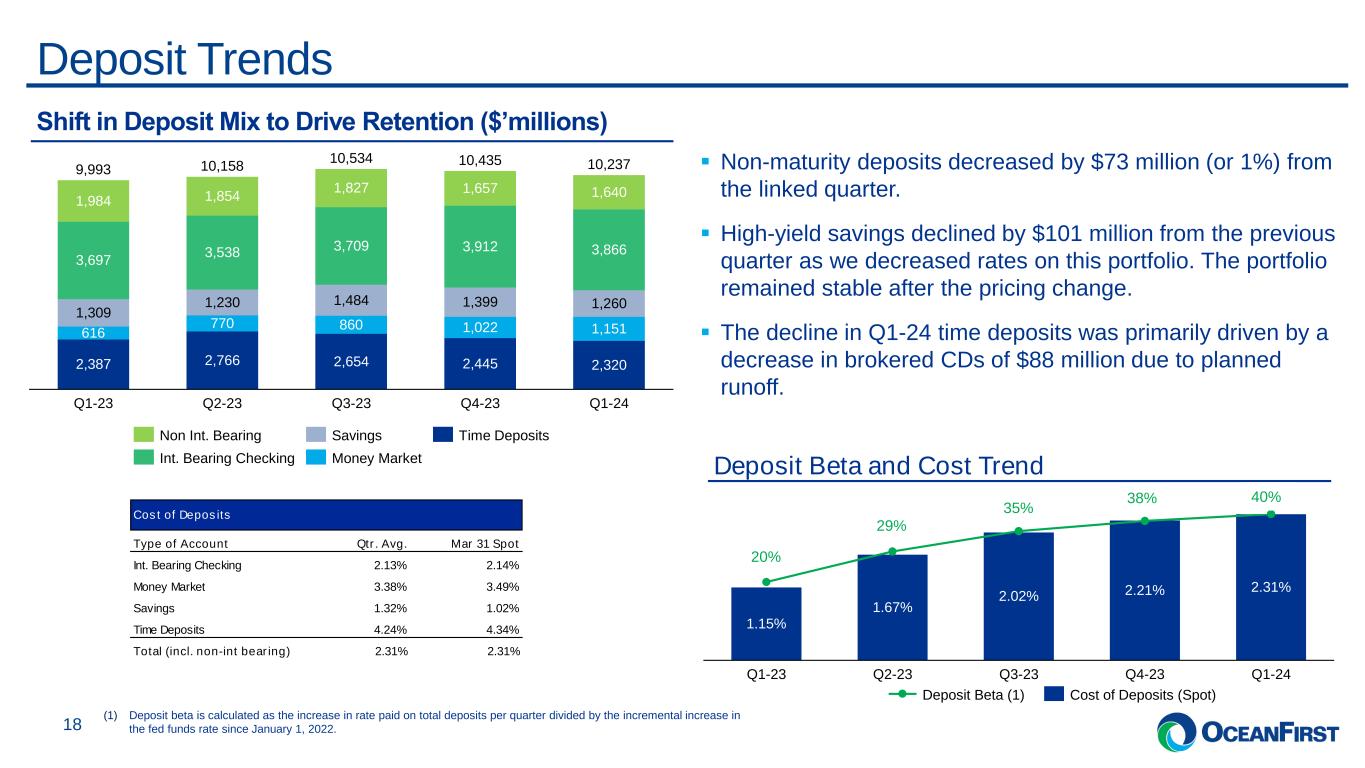

. . .Deposit Trends 18 (1) Deposit beta is calculated as the increase in rate paid on total deposits per quarter divided by the incremental increase in the fed funds rate since January 1, 2022. ▪ Non-maturity deposits decreased by $73 million (or 1%) from the linked quarter. ▪ High-yield savings declined by $101 million from the previous quarter as we decreased rates on this portfolio. The portfolio remained stable after the pricing change. ▪ The decline in Q1-24 time deposits was primarily driven by a decrease in brokered CDs of $88 million due to planned runoff. Shift in Deposit Mix to Drive Retention ($’millions) 20.00% 1.15% Q1-23 29.00% 1.67% Q2-23 35.00% 2.02% Q3-23 38.00% 2.21% Q4-23 40.00% 2.31% Q1-24 Deposit Beta (1) Cost of Deposits (Spot) 2,387 2,766 2,654 2,445 2,320 616 770 860 1,022 1,151 1,309 1,230 1,484 1,399 1,260 3,697 3,538 3,709 3,912 3,866 1,984 1,854 1,827 1,657 1,640 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 9,993 10,158 10,534 10,435 10,237 Non Int. Bearing Int. Bearing Checking Savings Money Market Time Deposits Deposit Beta and Cost Trend 20% 29% 35% 38% 40% Cost of Deposits Type of Account Qtr. Avg. Mar 31 Spot Int. Bearing Checking 2.13% 2.14% Money Market 3.38% 3.49% Savings 1.32% 1.02% Time Deposits 4.24% 4.34% Total (incl. non-int bearing) 2.31% 2.31%

. . .Net Interest Income and Net Interest Margin Trends 19 (1) Core NIM excludes purchase accounting and prepayment fee income. Refer to the Earnings Release for additional information. Core NIM1 vs NIM NIM Bridge Q4-23 NIM -0.01 Non-core impacts Q1-24 NIM 2.82% 2.81% 3.34% 3.30% Q1-23 3.02% 2.97% Q2-23 2.91% 2.85% Q3-23 2.82% 2.77% Q4-23 2.81% 2.77% Q1-24 NIM Core NIM Net Interest Income ($’000) 98,802 Q1-23 92,109 Q2-23 90,996 Q3-23 87,824 Q4-23 86,224 Q1-24 Net Interest Income Headwinds ▪ Competitive market environment as peers compete on rate for quality credit. ▪ Remaining disciplined on deposit pricing and managing funding costs.

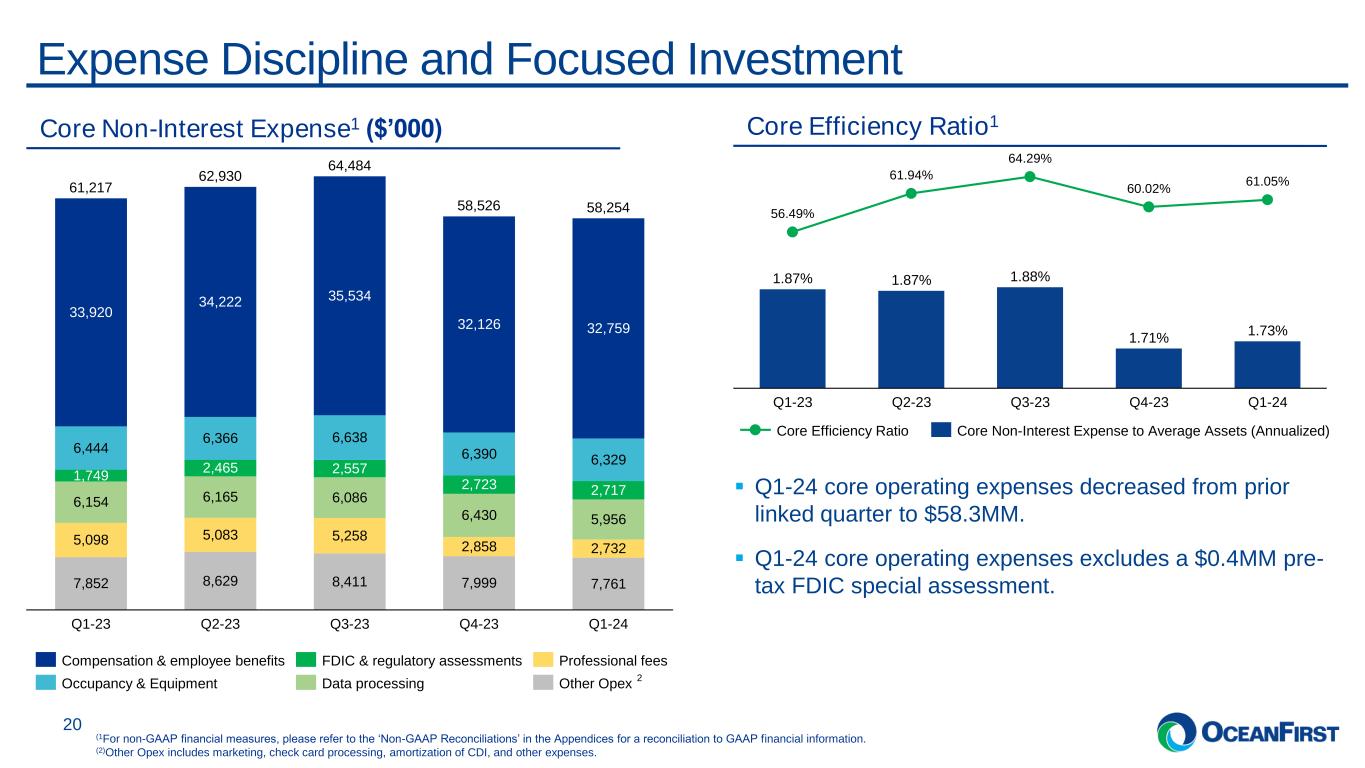

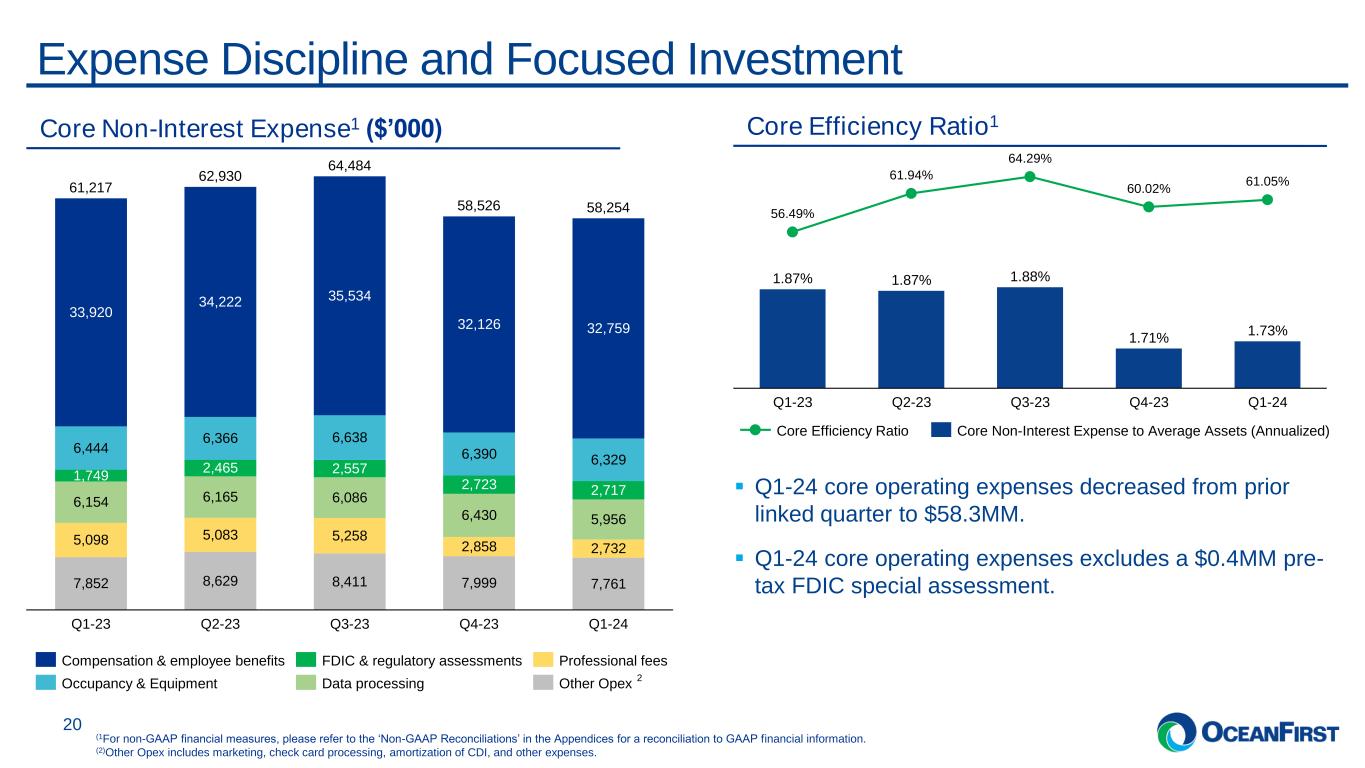

. . . Core Efficiency Ratio1 Expense Discipline and Focused Investment 20 Core Non-Interest Expense1 ($’000) 7,852 8,629 8,411 7,999 7,761 5,098 5,083 5,258 2,858 2,732 6,154 6,165 6,086 6,430 5,956 1,749 2,465 2,557 2,723 2,717 6,444 6,366 6,638 6,390 6,329 33,920 34,222 35,534 32,126 32,759 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 61,217 62,930 64,484 58,526 58,254 Compensation & employee benefits Occupancy & Equipment FDIC & regulatory assessments Data processing Professional fees Other Opex 56.49% Q1-23 61.94% Q2-23 64.29% Q3-23 60.02% Q4-23 61.05% Q1-24 1.87% 1.87% 1.88% 1.71% 1.73% Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized) (1For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. (2)Other Opex includes marketing, check card processing, amortization of CDI, and other expenses. ▪ Q1-24 core operating expenses decreased from prior linked quarter to $58.3MM. ▪ Q1-24 core operating expenses excludes a $0.4MM pre- tax FDIC special assessment. 2

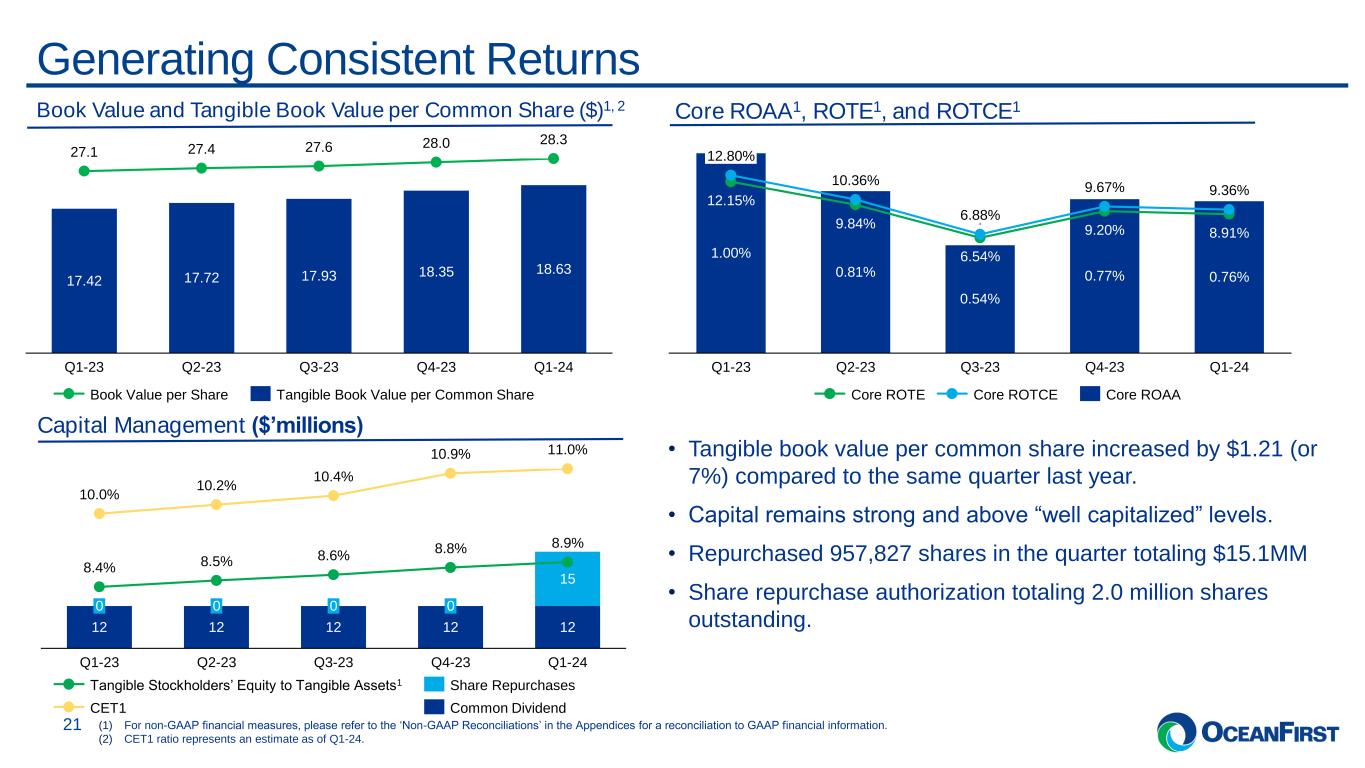

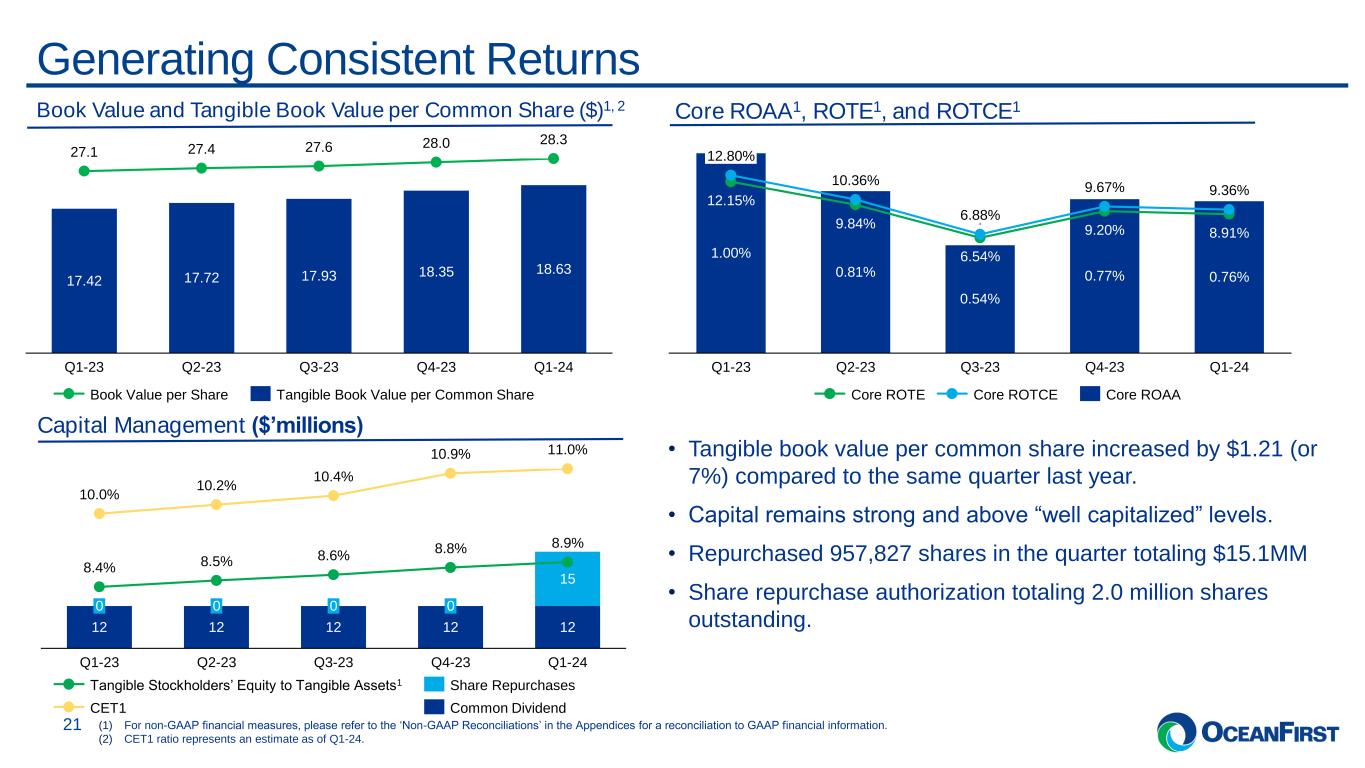

. . .Generating Consistent Returns 21 Book Value and Tangible Book Value per Common Share ($)1, 2 Core ROAA1, ROTE1, and ROTCE1 • Tangible book value per common share increased by $1.21 (or 7%) compared to the same quarter last year. • Capital remains strong and above “well capitalized” levels. • Repurchased 957,827 shares in the quarter totaling $15.1MM • Share repurchase authorization totaling 2.0 million shares outstanding. Capital Management ($’millions) 17.42 17.72 17.93 18.35 18.63 27.1 27.4 27.6 28.0 28.3 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Book Value per Share Tangible Book Value per Common Share 12.15% 12.80% 1.00% Q1-23 9.84% 10.36% 0.81% Q2-23 6.54% 6.88% 0.54% Q3-23 9.20% 9.67% 0.77% Q4-23 8.91% 9.36% 0.76% Q1-24 Core ROTE Core ROTCE Core ROAA 12 12 12 12 12 15 8.4% 10.0% 0 Q1-23 8.5% 10.2% 0 Q2-23 8.6% 10.4% 0 Q3-23 8.8% 10.9% 0 Q4-23 8.9% 11.0% Q1-24 Tangible Stockholders’ Equity to Tangible Assets1 CET1 Share Repurchases Common Dividend (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. (2) CET1 ratio represents an estimate as of Q1-24.

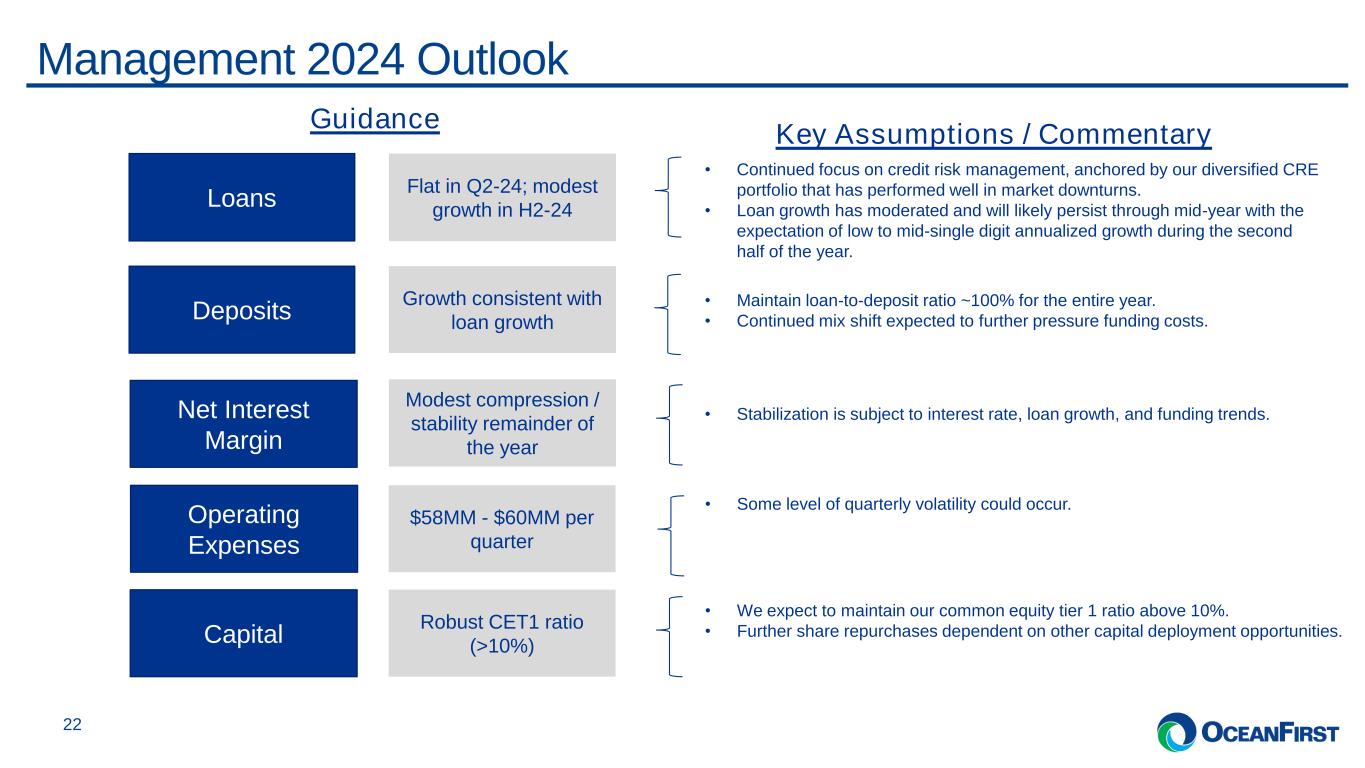

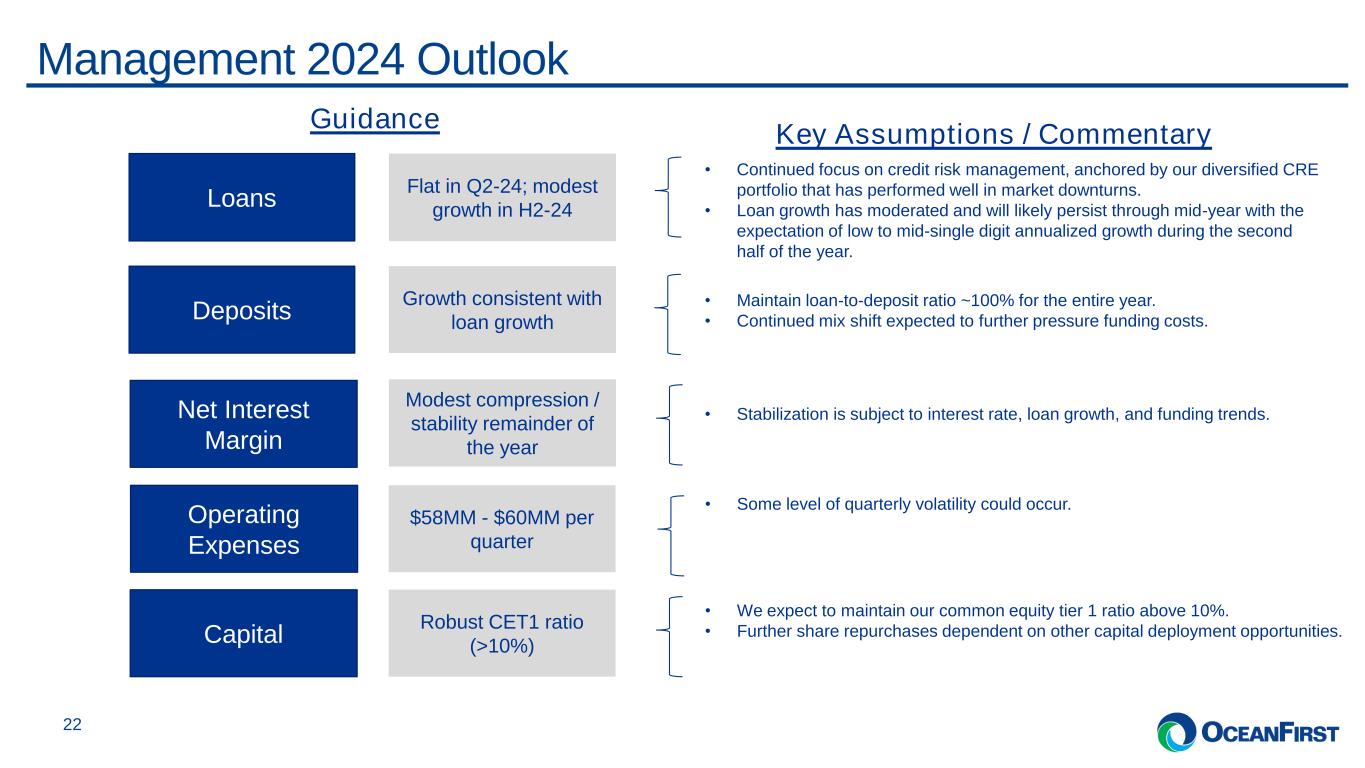

. . .Management 2024 Outlook 22 Loans Deposits Operating Expenses Net Interest Margin Capital • Continued focus on credit risk management, anchored by our diversified CRE portfolio that has performed well in market downturns. • Loan growth has moderated and will likely persist through mid-year with the expectation of low to mid-single digit annualized growth during the second half of the year. • Maintain loan-to-deposit ratio ~100% for the entire year. • Continued mix shift expected to further pressure funding costs. Flat in Q2-24; modest growth in H2-24 Growth consistent with loan growth $58MM - $60MM per quarter Modest compression / stability remainder of the year Robust CET1 ratio (>10%) Guidance Key Assumptions / Commentary • Some level of quarterly volatility could occur. • We expect to maintain our common equity tier 1 ratio above 10%. • Further share repurchases dependent on other capital deployment opportunities. • Stabilization is subject to interest rate, loan growth, and funding trends.

. . . I N V E S T O R P R E S E N T A T I O N 23 Appendix

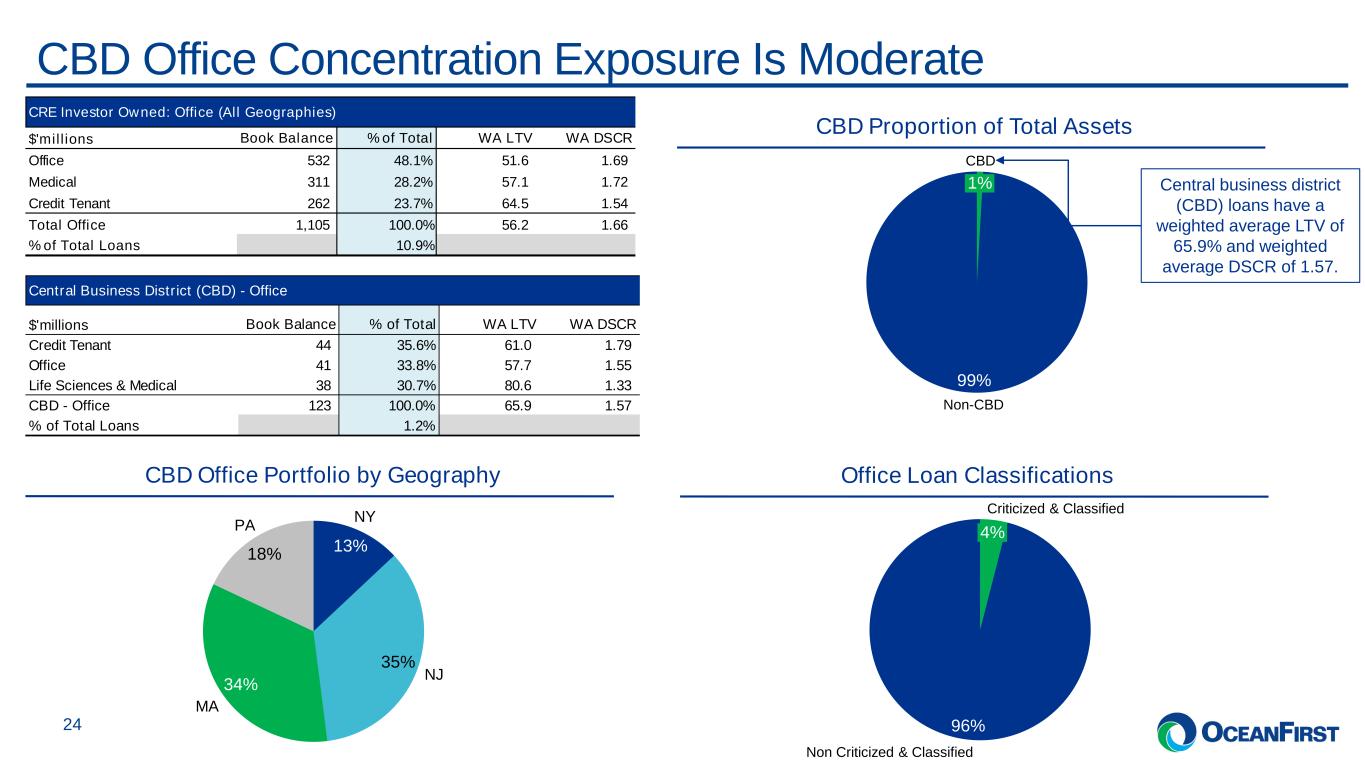

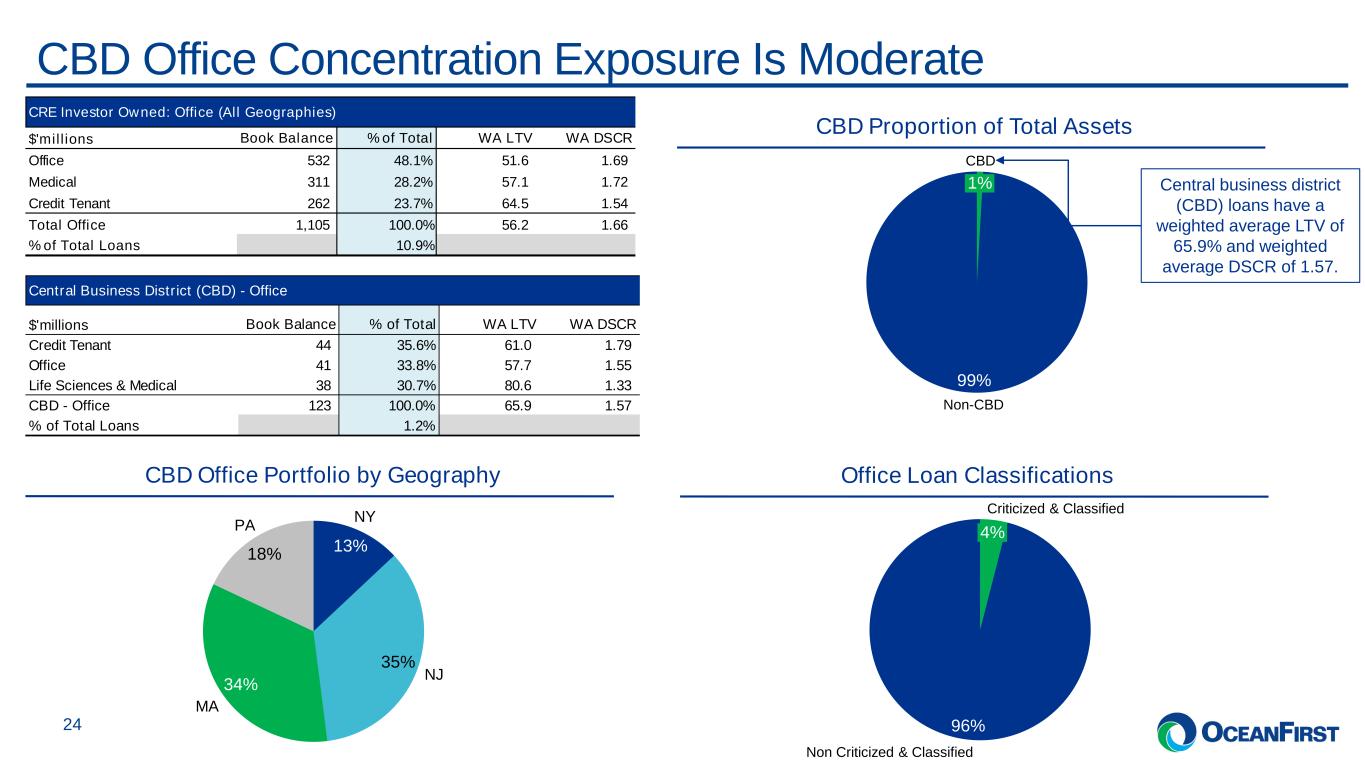

. . .CBD Office Concentration Exposure Is Moderate 24 CBD Office Portfolio by Geography 13% 35% 34% 18% NY NJ MA PA CBD Proportion of Total Assets 99% 1% CBD Non-CBD Office Loan Classifications 96% 4% Criticized & Classified Non Criticized & Classified Central business district (CBD) loans have a weighted average LTV of 65.9% and weighted average DSCR of 1.57. CRE Investor Owned: Office (All Geographies) $'millions Book Balance % of Total WA LTV WA DSCR Office 532 48.1% 51.6 1.69 Medical 311 28.2% 57.1 1.72 Credit Tenant 262 23.7% 64.5 1.54 Total Office 1,105 100.0% 56.2 1.66 % of Total Loans 10.9% Central Business District (CBD) - Office $'millions Book Balance % of Total WA LTV WA DSCR Credit Tenant 44 35.6% 61.0 1.79 Office 41 33.8% 57.7 1.55 Life Sciences & Medical 38 30.7% 80.6 1.33 CBD - Office 123 100.0% 65.9 1.57 % of Total Loans 1.2%

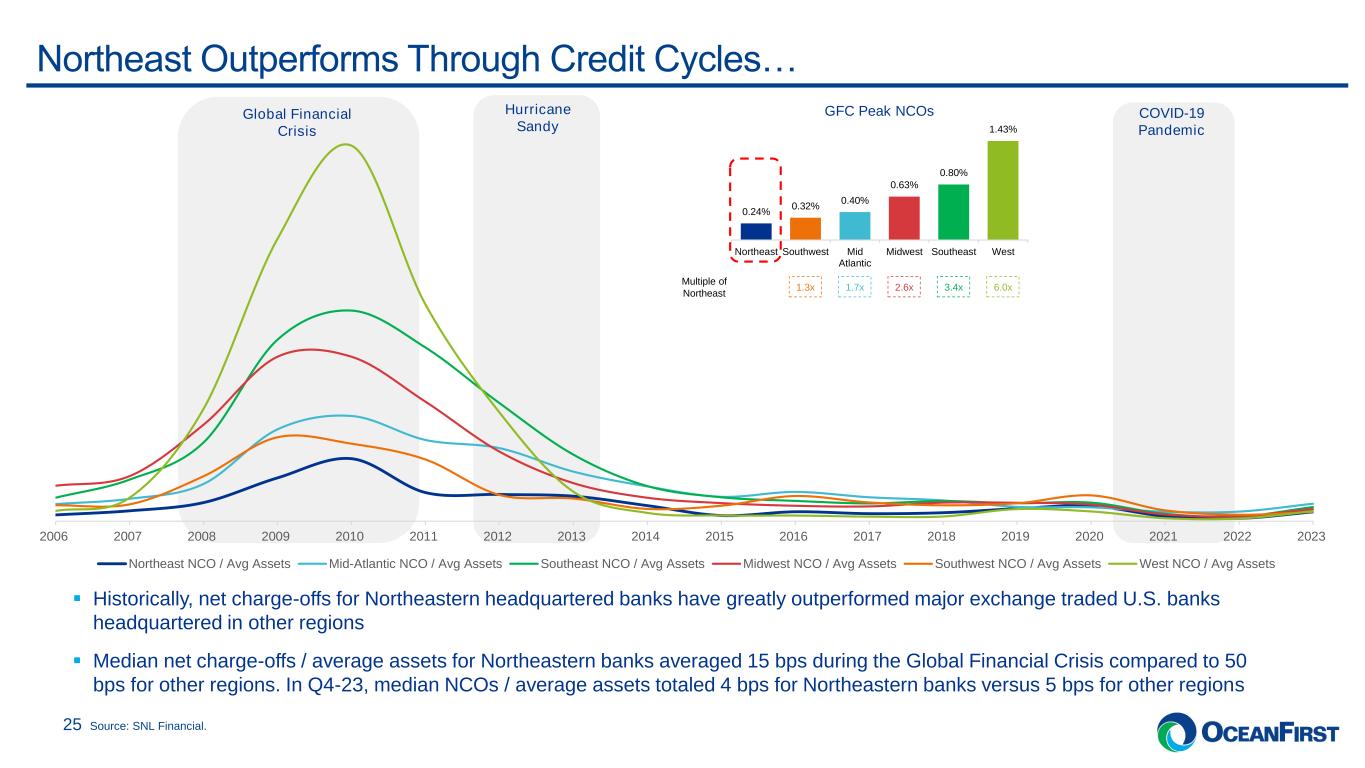

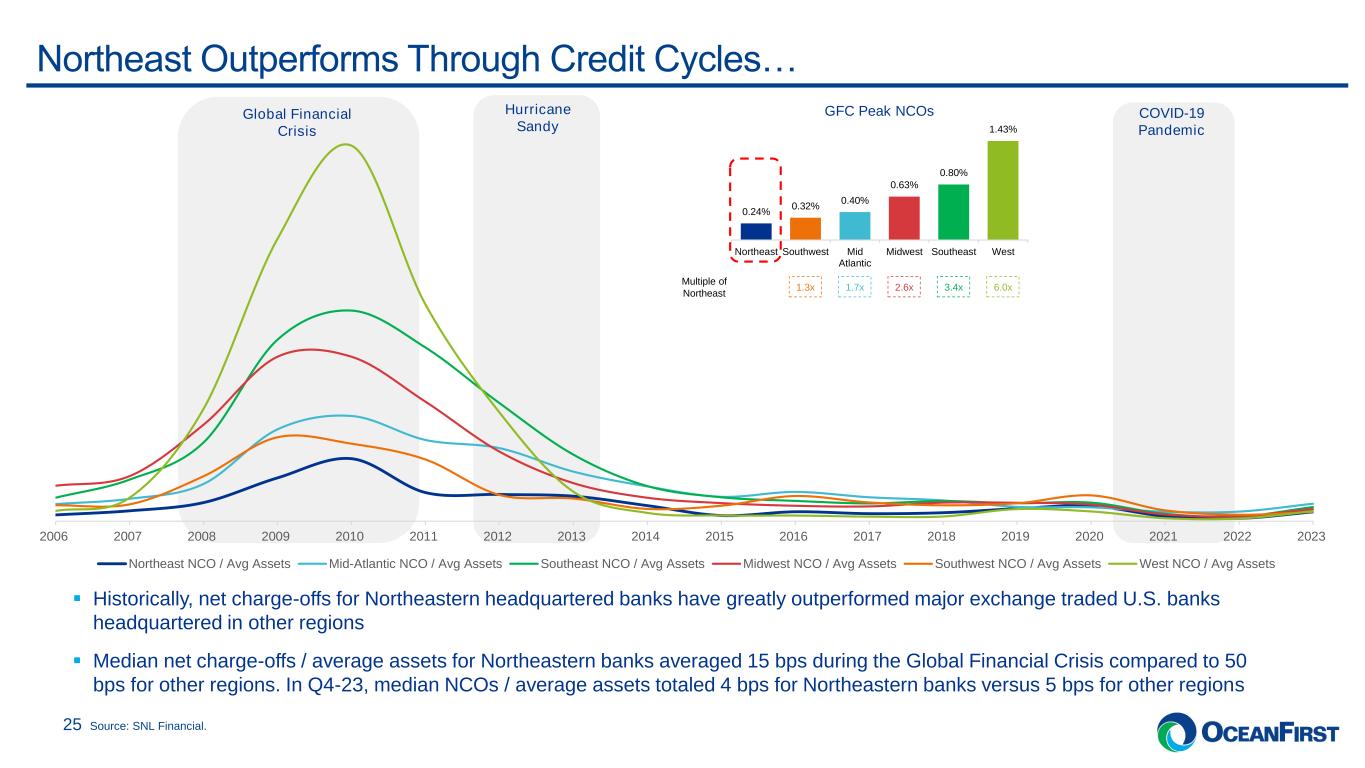

. . . Hurricane Sandy Global Financial Crisis COVID-19 Pandemic Northeast Outperforms Through Credit Cycles… 25 ▪ Historically, net charge-offs for Northeastern headquartered banks have greatly outperformed major exchange traded U.S. banks headquartered in other regions ▪ Median net charge-offs / average assets for Northeastern banks averaged 15 bps during the Global Financial Crisis compared to 50 bps for other regions. In Q4-23, median NCOs / average assets totaled 4 bps for Northeastern banks versus 5 bps for other regions Source: SNL Financial. Multiple of Northeast GFC Peak NCOs 1.3x 1.7x 2.6x 6.0x3.4x 0.24% 0.32% 0.40% 0.63% 0.80% 1.43% Northeast Southwest Mid Atlantic Midwest Southeast West 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Northeast NCO / Avg Assets Mid-Atlantic NCO / Avg Assets Southeast NCO / Avg Assets Midwest NCO / Avg Assets Southwest NCO / Avg Assets West NCO / Avg Assets

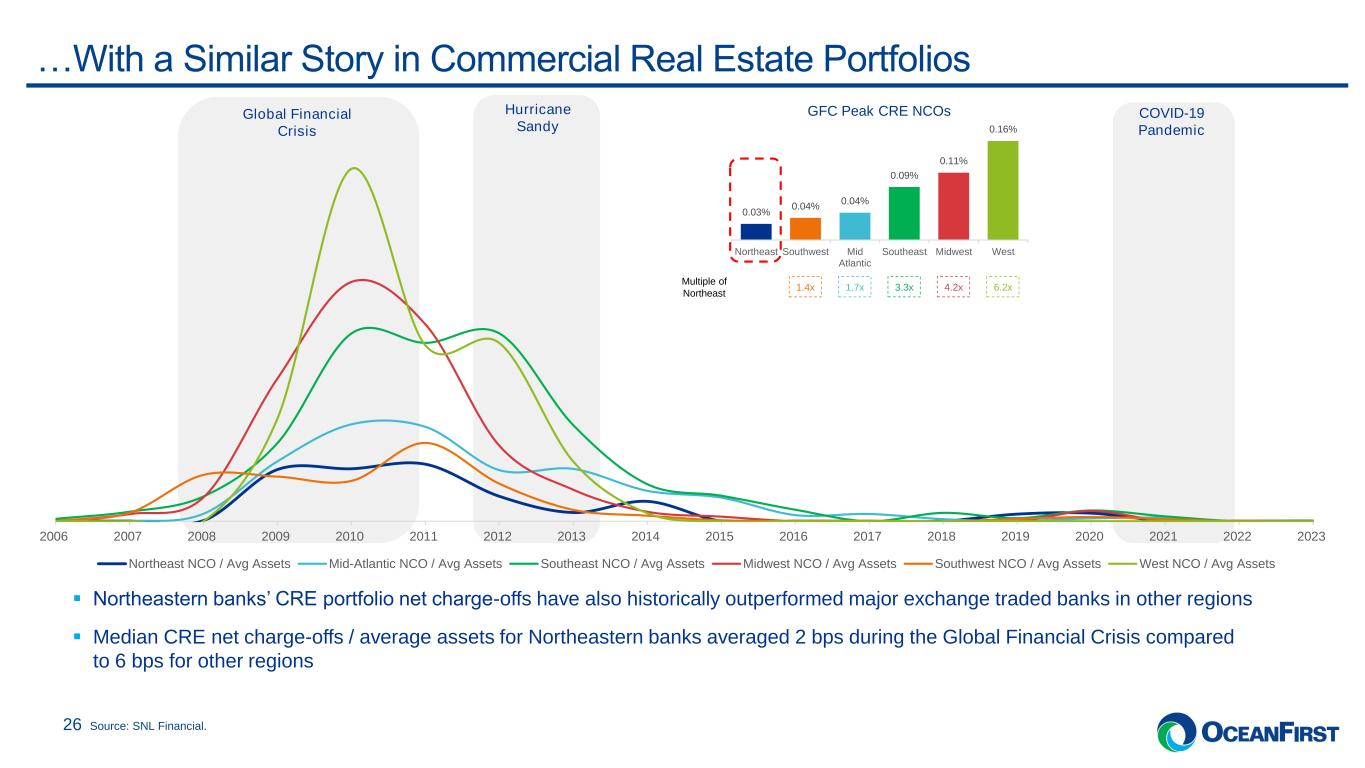

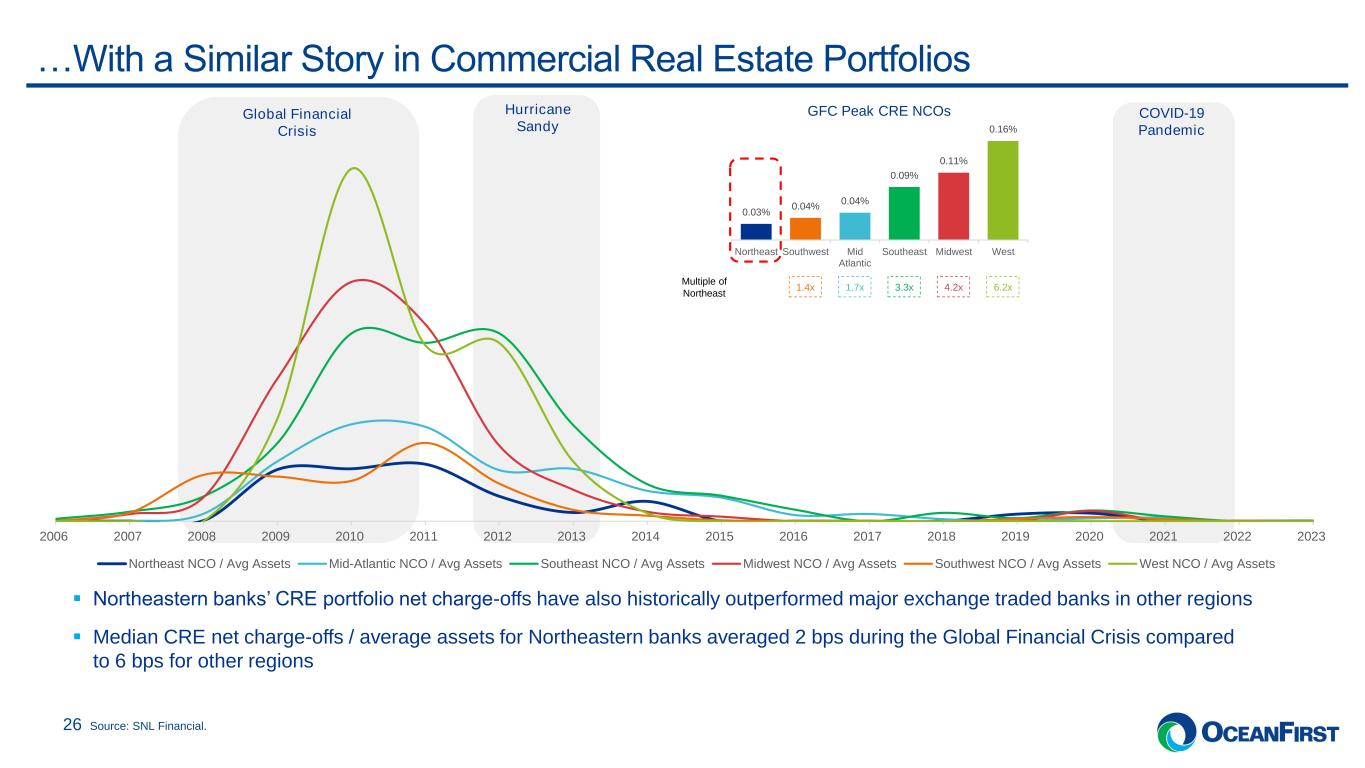

. . . Hurricane Sandy Global Financial Crisis COVID-19 Pandemic …With a Similar Story in Commercial Real Estate Portfolios 26 ▪ Northeastern banks’ CRE portfolio net charge-offs have also historically outperformed major exchange traded banks in other regions ▪ Median CRE net charge-offs / average assets for Northeastern banks averaged 2 bps during the Global Financial Crisis compared to 6 bps for other regions Source: SNL Financial. GFC Peak CRE NCOs 1.4x 1.7x 3.3x 6.2x4.2x 0.03% 0.04% 0.04% 0.09% 0.11% 0.16% Northeast Southwest Mid Atlantic Southeast Midwest West Multiple of Northeast 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Northeast NCO / Avg Assets Mid-Atlantic NCO / Avg Assets Southeast NCO / Avg Assets Midwest NCO / Avg Assets Southwest NCO / Avg Assets West NCO / Avg Assets

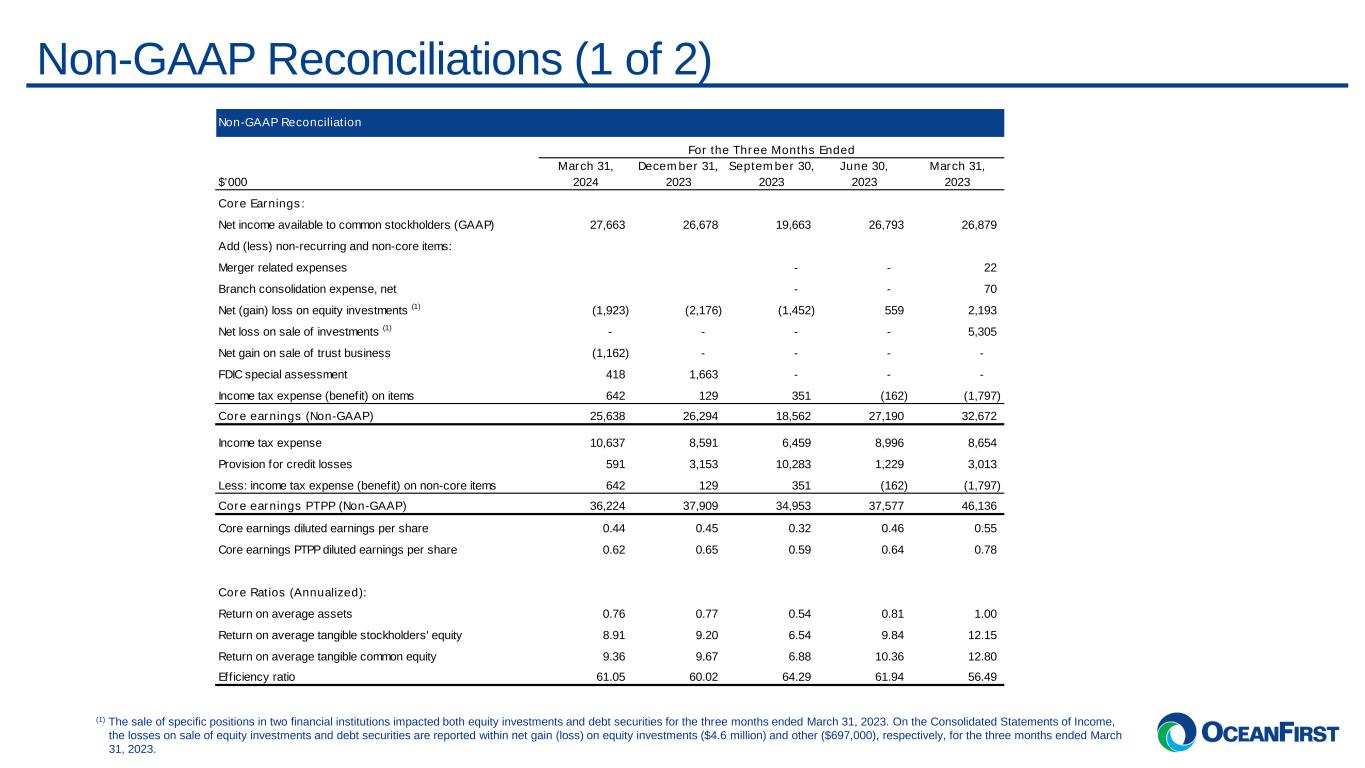

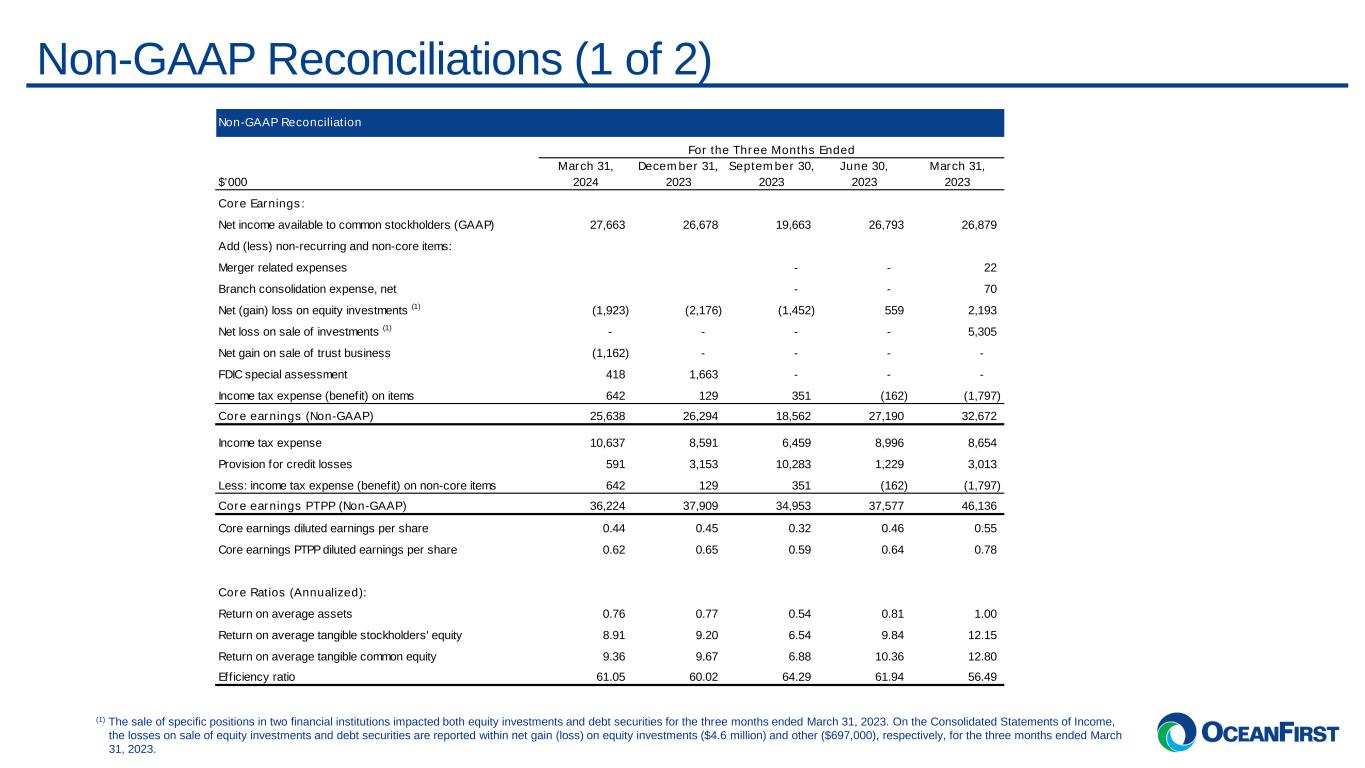

. . .Non-GAAP Reconciliations (1 of 2) (1) The sale of specific positions in two financial institutions impacted both equity investments and debt securities for the three months ended March 31, 2023. On the Consolidated Statements of Income, the losses on sale of equity investments and debt securities are reported within net gain (loss) on equity investments ($4.6 million) and other ($697,000), respectively, for the three months ended March 31, 2023. Non-GAAP Reconciliation For the Three Months Ended $'000 March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 Core Earnings: Net income available to common stockholders (GAAP) 27,663 26,678 19,663 26,793 26,879 Add (less) non-recurring and non-core items: Merger related expenses - - 22 Branch consolidation expense, net - - 70 Net (gain) loss on equity investments (1) (1,923) (2,176) (1,452) 559 2,193 Net loss on sale of investments (1) - - - - 5,305 Net gain on sale of trust business (1,162) - - - - FDIC special assessment 418 1,663 - - - Income tax expense (benefit) on items 642 129 351 (162) (1,797) Core earnings (Non-GAAP) 25,638 26,294 18,562 27,190 32,672 Income tax expense 10,637 8,591 6,459 8,996 8,654 Provision for credit losses 591 3,153 10,283 1,229 3,013 Less: income tax expense (benefit) on non-core items 642 129 351 (162) (1,797) Core earnings PTPP (Non-GAAP) 36,224 37,909 34,953 37,577 46,136 Core earnings diluted earnings per share 0.44 0.45 0.32 0.46 0.55 Core earnings PTPP diluted earnings per share 0.62 0.65 0.59 0.64 0.78 Core Ratios (Annualized): Return on average assets 0.76 0.77 0.54 0.81 1.00 Return on average tangible stockholders' equity 8.91 9.20 6.54 9.84 12.15 Return on average tangible common equity 9.36 9.67 6.88 10.36 12.80 Eff iciency ratio 61.05 60.02 64.29 61.94 56.49

. . .Non-GAAP Reconciliations (2 of 2) Non-GAAP Reconciliation $'000 March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 Tangible Equity Total stockholders' equity 1,665,837 1,661,945 1,637,604 1,626,283 1,610,371 Less: Goodw ill 506,146 506,146 506,146 506,146 506,146 Core deposit intangible 8,669 9,513 10,489 11,476 12,470 Tangible stockholders' equity 1,151,022 1,146,286 1,120,969 1,108,661 1,091,755 Less: Preferred Stock 55,527 55,527 55,527 55,527 55,527 Tangible common equity 1,095,495 1,090,759 1,065,442 1,053,134 1,036,228 Tangible Assets Total Assets 13,418,978 13,538,253 13,498,183 13,538,903 13,555,175 Less: Goodw ill 506,146 506,146 506,146 506,146 506,146 Core deposit intangible 8,669 9,513 10,489 11,476 12,470 Tangible assets 12,904,163 13,022,594 12,981,548 13,021,281 13,036,559