| Delaware | 001-11713 | 22-3412577 | ||||||||||||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) |

(IRS Employer Identification No.) |

||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol | Name of each exchange in which registered | ||||||||||||

| Common stock, $0.01 par value per share | OCFC | NASDAQ | ||||||||||||

| Depositary Shares (each representing a 1/40th interest in a share of 7.0% Series A Non-Cumulative, perpetual preferred stock) | OCFCP | NASDAQ | ||||||||||||

| (d) | EXHIBITS | |||||||

| Press Release dated | January 18, 2024 | |||||||

Text of written presentation which OceanFirst Financial Corp. intends to provide to current and prospective investors after January 18, 2024. |

||||||||

| OCEANFIRST FINANCIAL CORP. | ||||||||

| Dated | January 18, 2024 | /s/ Patrick S. Barrett | ||||||

| Patrick S. Barrett | ||||||||

| Executive Vice President and Chief Financial Officer | ||||||||

|

Press Release | |||||||

| For the Three Months Ended, | For the Year Ended, | ||||||||||||||||||||||||||||

| Performance Ratios (Quarterly Ratios Annualized): | December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||

| 2023 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||

| Return on average assets | 0.78 | % | 0.57 | % | 1.62 | % | 0.74 | % | 1.15 | % | |||||||||||||||||||

| Return on average stockholders’ equity | 6.41 | 4.75 | 13.25 | 6.13 | 9.24 | ||||||||||||||||||||||||

Return on average tangible stockholders’ equity (a) |

9.33 | 6.93 | 19.85 | 8.97 | 13.96 | ||||||||||||||||||||||||

Return on average tangible common equity (a) |

9.81 | 7.29 | 20.97 | 9.44 | 14.76 | ||||||||||||||||||||||||

| Efficiency ratio | 60.38 | 63.37 | 44.56 | 61.71 | 53.80 | ||||||||||||||||||||||||

| Net interest margin | 2.82 | 2.91 | 3.64 | 3.02 | 3.37 | ||||||||||||||||||||||||

| For the Three Months Ended, | For the Year Ended, | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | |||||||||||||||||||||||||

Core Ratios1 (Quarterly Ratios Annualized): |

2023 | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||

| Return on average assets | 0.77 | % | 0.54 | % | 1.22 | % | 0.78 | % | 1.11 | % | |||||||||||||||||||

| Return on average tangible stockholders’ equity | 9.20 | 6.54 | 15.01 | 9.39 | 13.50 | ||||||||||||||||||||||||

| Return on average tangible common equity | 9.67 | 6.88 | 15.86 | 9.89 | 14.28 | ||||||||||||||||||||||||

| Efficiency ratio | 60.02 | 64.29 | 50.78 | 60.61 | 54.21 | ||||||||||||||||||||||||

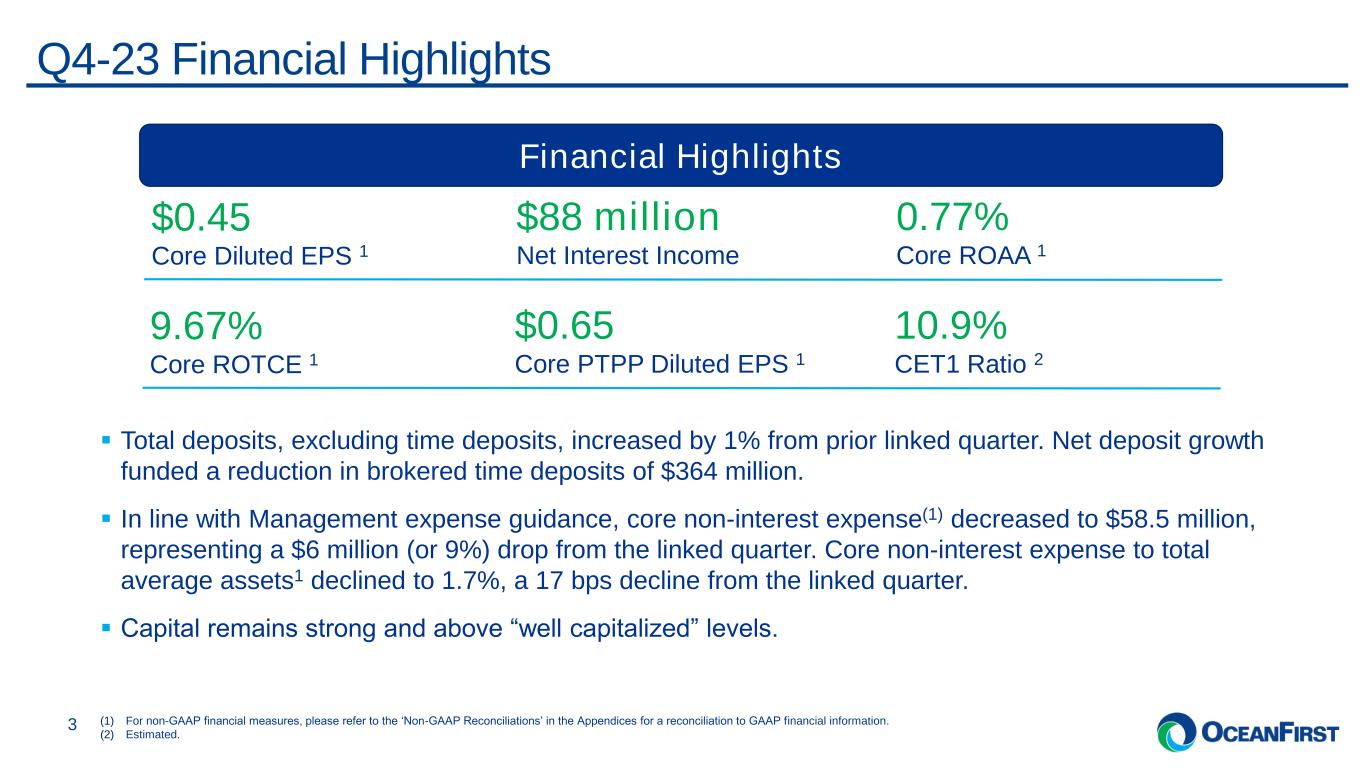

| Core diluted earnings per share | $ | 0.45 | $ | 0.32 | $ | 0.67 | $ | 1.78 | $ | 2.34 | |||||||||||||||||||

| Core PTPP diluted earnings per share | 0.65 | 0.59 | 0.96 | 2.66 | 3.24 | ||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 | December 31, 2022 | ||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||

| Assets | ||||||||||||||||||||

Cash and due from banks |

$ | 153,718 | $ | 408,882 | $ | 167,946 | ||||||||||||||

Debt securities available-for-sale, at estimated fair value |

753,892 | 453,208 | 457,648 | |||||||||||||||||

Debt securities held-to-maturity, net of allowance for securities credit losses of $1,133 at December 31, 2023, $932 at September 30, 2023, and $1,128 at December 31, 2022 (estimated fair value of $1,068,438 at December 31, 2023, $1,047,342 at September 30, 2023, and $1,110,041 at December 31, 2022) |

1,159,735 | 1,189,339 | 1,221,138 | |||||||||||||||||

| Equity investments | 100,163 | 97,908 | 102,037 | |||||||||||||||||

Restricted equity investments, at cost |

93,766 | 82,484 | 109,278 | |||||||||||||||||

Loans receivable, net of allowance for loan credit losses of $67,137 at December 31, 2023, $63,877 at September 30, 2023, and $56,824 at December 31, 2022 |

10,136,721 | 10,068,156 | 9,868,718 | |||||||||||||||||

Loans held-for-sale |

5,166 | — | 690 | |||||||||||||||||

Interest and dividends receivable |

51,874 | 50,030 | 44,704 | |||||||||||||||||

Premises and equipment, net |

121,372 | 122,646 | 126,705 | |||||||||||||||||

| Bank owned life insurance | 266,498 | 265,071 | 261,603 | |||||||||||||||||

Assets held for sale |

28 | 3,004 | 2,719 | |||||||||||||||||

Goodwill |

506,146 | 506,146 | 506,146 | |||||||||||||||||

Core deposit intangible |

9,513 | 10,489 | 13,497 | |||||||||||||||||

| Other assets | 179,661 | 240,820 | 221,067 | |||||||||||||||||

Total assets |

$ | 13,538,253 | $ | 13,498,183 | $ | 13,103,896 | ||||||||||||||

Liabilities and Stockholders’ Equity |

||||||||||||||||||||

Deposits |

$ | 10,434,949 | $ | 10,533,929 | $ | 9,675,206 | ||||||||||||||

Federal Home Loan Bank advances |

848,636 | 606,056 | 1,211,166 | |||||||||||||||||

| Securities sold under agreements to repurchase with customers | 73,148 | 82,981 | 69,097 | |||||||||||||||||

Other borrowings |

196,456 | 196,183 | 195,403 | |||||||||||||||||

Advances by borrowers for taxes and insurance |

22,407 | 29,696 | 21,405 | |||||||||||||||||

Other liabilities |

300,712 | 411,734 | 346,155 | |||||||||||||||||

Total liabilities |

11,876,308 | 11,860,579 | 11,518,432 | |||||||||||||||||

Stockholders’ equity: |

||||||||||||||||||||

| OceanFirst Financial Corp. stockholders’ equity | 1,661,163 | 1,636,891 | 1,584,662 | |||||||||||||||||

| Non-controlling interest | 782 | 713 | 802 | |||||||||||||||||

| Total stockholders’ equity | 1,661,945 | 1,637,604 | 1,585,464 | |||||||||||||||||

Total liabilities and stockholders’ equity |

$ | 13,538,253 | $ | 13,498,183 | $ | 13,103,896 | ||||||||||||||

| For the Three Months Ended | For the Year Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | |||||||||||||||||||||||||||||

| 2023 | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||||||

| |--------------------- (Unaudited) ---------------------| | (Unaudited) | |||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||

| Loans | $ | 137,110 | $ | 133,931 | $ | 117,046 | $ | 521,865 | $ | 390,386 | ||||||||||||||||||||||

| Debt securities | 15,444 | 15,223 | 10,951 | 59,273 | 34,407 | |||||||||||||||||||||||||||

| Equity investments and other | 7,880 | 9,256 | 2,280 | 26,836 | 6,382 | |||||||||||||||||||||||||||

| Total interest income | 160,434 | 158,410 | 130,277 | 607,974 | 431,175 | |||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||

| Deposits | 59,467 | 53,287 | 13,425 | 172,018 | 31,021 | |||||||||||||||||||||||||||

| Borrowed funds | 13,143 | 14,127 | 10,364 | 66,225 | 22,677 | |||||||||||||||||||||||||||

| Total interest expense | 72,610 | 67,414 | 23,789 | 238,243 | 53,698 | |||||||||||||||||||||||||||

| Net interest income | 87,824 | 90,996 | 106,488 | 369,731 | 377,477 | |||||||||||||||||||||||||||

| Provision for credit losses | 3,153 | 10,283 | 3,647 | 17,678 | 7,768 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 84,671 | 80,713 | 102,841 | 352,053 | 369,709 | |||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||||||||

| Bankcard services revenue | 1,531 | 1,507 | 1,437 | 5,912 | 9,219 | |||||||||||||||||||||||||||

| Trust and asset management revenue | 610 | 662 | 551 | 2,529 | 2,386 | |||||||||||||||||||||||||||

| Fees and service charges | 5,315 | 5,178 | 5,776 | 21,254 | 22,802 | |||||||||||||||||||||||||||

| Net gain on sales of loans | 309 | 66 | 10 | 428 | 358 | |||||||||||||||||||||||||||

| Net gain (loss) on equity investments | 2,176 | 1,452 | 17,187 | (3,732) | 9,685 | |||||||||||||||||||||||||||

| Net gain from other real estate operations | — | — | — | — | 48 | |||||||||||||||||||||||||||

| Income from bank owned life insurance | 1,427 | 1,390 | 1,697 | 5,280 | 6,578 | |||||||||||||||||||||||||||

| Commercial loan swap income | 29 | 11 | 519 | 741 | 7,065 | |||||||||||||||||||||||||||

| Other | 464 | 496 | 374 | 1,212 | 953 | |||||||||||||||||||||||||||

| Total other income | 11,861 | 10,762 | 27,551 | 33,624 | 59,094 | |||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 32,126 | 35,534 | 33,943 | 135,802 | 131,915 | |||||||||||||||||||||||||||

| Occupancy | 5,218 | 5,466 | 5,027 | 21,188 | 20,817 | |||||||||||||||||||||||||||

| Equipment | 1,172 | 1,172 | 1,131 | 4,650 | 4,987 | |||||||||||||||||||||||||||

| Marketing | 1,112 | 1,183 | 705 | 4,238 | 2,947 | |||||||||||||||||||||||||||

| Federal deposit insurance and regulatory assessments | 4,386 | 2,557 | 1,924 | 11,157 | 7,359 | |||||||||||||||||||||||||||

| Data processing | 6,430 | 6,086 | 4,629 | 24,835 | 23,095 | |||||||||||||||||||||||||||

| Check card processing | 991 | 1,154 | 1,243 | 4,640 | 4,971 | |||||||||||||||||||||||||||

| Professional fees | 2,858 | 5,258 | 4,697 | 18,297 | 12,993 | |||||||||||||||||||||||||||

| Amortization of core deposit intangible | 976 | 987 | 1,159 | 3,984 | 4,718 | |||||||||||||||||||||||||||

| Branch consolidation expense, net | — | — | 111 | 70 | 713 | |||||||||||||||||||||||||||

| Merger related expenses | — | — | 276 | 22 | 2,735 | |||||||||||||||||||||||||||

| Other operating expense | 4,920 | 5,087 | 4,883 | 20,029 | 17,631 | |||||||||||||||||||||||||||

| Total operating expenses | 60,189 | 64,484 | 59,728 | 248,912 | 234,881 | |||||||||||||||||||||||||||

| Income before provision for income taxes | 36,343 | 26,991 | 70,664 | 136,765 | 193,922 | |||||||||||||||||||||||||||

| Provision for income taxes | 8,591 | 6,459 | 17,353 | 32,700 | 46,565 | |||||||||||||||||||||||||||

| Net income | 27,752 | 20,532 | 53,311 | 104,065 | 147,357 | |||||||||||||||||||||||||||

| Net income (loss) attributable to non-controlling interest | 70 | (135) | 39 | 36 | 754 | |||||||||||||||||||||||||||

| Net income attributable to OceanFirst Financial Corp. | 27,682 | 20,667 | 53,272 | 104,029 | 146,603 | |||||||||||||||||||||||||||

| Dividends on preferred shares | 1,004 | 1,004 | 1,004 | 4,016 | 4,016 | |||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 26,678 | $ | 19,663 | $ | 52,268 | $ | 100,013 | $ | 142,587 | ||||||||||||||||||||||

| Basic earnings per share | $ | 0.46 | $ | 0.33 | $ | 0.89 | $ | 1.70 | $ | 2.43 | ||||||||||||||||||||||

| Diluted earnings per share | $ | 0.46 | $ | 0.33 | $ | 0.89 | $ | 1.70 | $ | 2.42 | ||||||||||||||||||||||

| Average basic shares outstanding | 59,120 | 59,104 | 58,584 | 58,948 | 58,730 | |||||||||||||||||||||||||||

| Average diluted shares outstanding | 59,123 | 59,111 | 58,751 | 58,957 | 58,878 | |||||||||||||||||||||||||||

| LOANS RECEIVABLE | At | ||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

|||||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||||||||

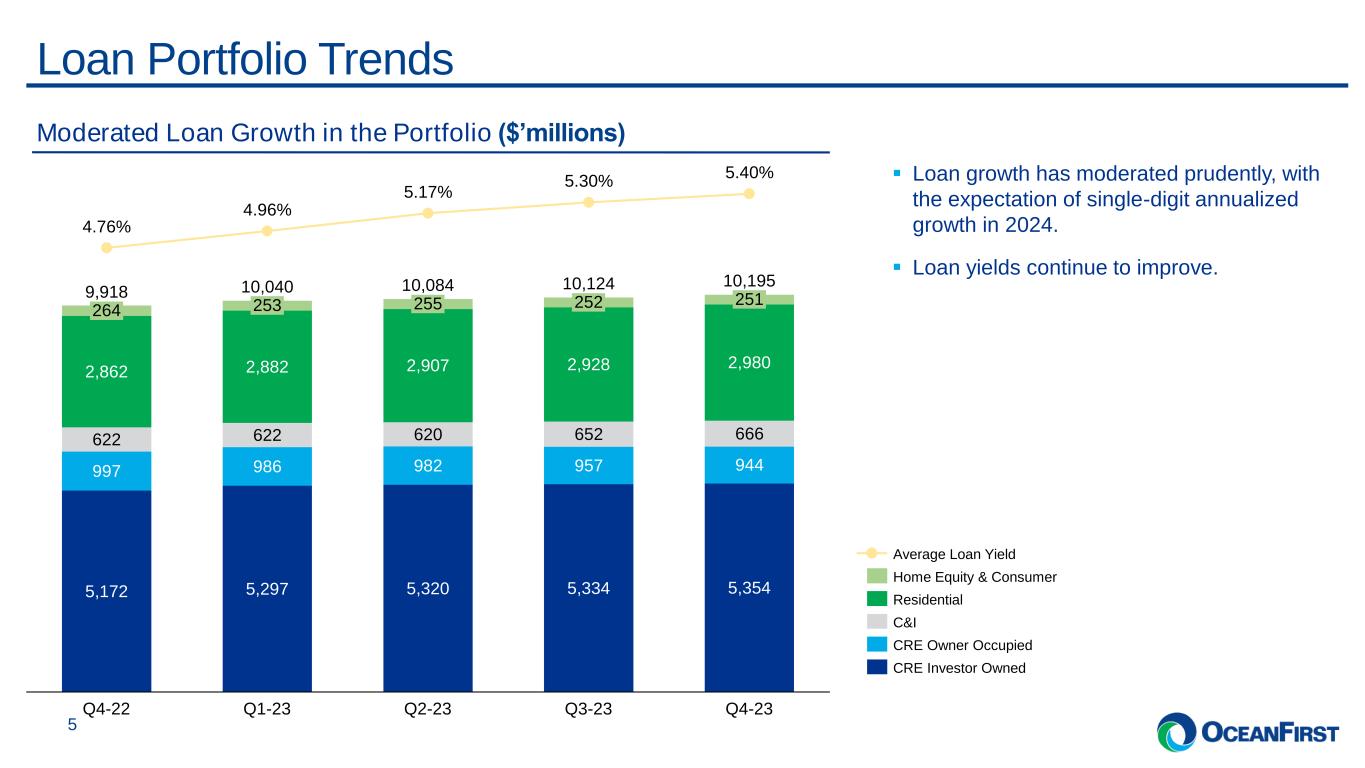

| Commercial real estate - investor | $ | 5,353,974 | $ | 5,334,279 | $ | 5,319,686 | $ | 5,296,661 | $ | 5,171,952 | |||||||||||||||||||||||||

| Commercial real estate - owner-occupied | 943,891 | 957,216 | 981,618 | 986,366 | 997,367 | ||||||||||||||||||||||||||||||

| Commercial and industrial | 666,532 | 652,119 | 620,284 | 622,201 | 622,372 | ||||||||||||||||||||||||||||||

| Total commercial | 6,964,397 | 6,943,614 | 6,921,588 | 6,905,228 | 6,791,691 | ||||||||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||||||||

| Residential real estate | 2,979,534 | 2,928,259 | 2,906,556 | 2,881,811 | 2,861,991 | ||||||||||||||||||||||||||||||

| Home equity loans and lines and other consumer (“other consumer”) | 250,664 | 251,698 | 255,486 | 252,773 | 264,372 | ||||||||||||||||||||||||||||||

| Total consumer | 3,230,198 | 3,179,957 | 3,162,042 | 3,134,584 | 3,126,363 | ||||||||||||||||||||||||||||||

| Total loans | 10,194,595 | 10,123,571 | 10,083,630 | 10,039,812 | 9,918,054 | ||||||||||||||||||||||||||||||

| Deferred origination costs (fees), net | 9,263 | 8,462 | 8,267 | 7,332 | 7,488 | ||||||||||||||||||||||||||||||

| Allowance for loan credit losses | (67,137) | (63,877) | (61,791) | (60,195) | (56,824) | ||||||||||||||||||||||||||||||

| Loans receivable, net | $ | 10,136,721 | $ | 10,068,156 | $ | 10,030,106 | $ | 9,986,949 | $ | 9,868,718 | |||||||||||||||||||||||||

| Mortgage loans serviced for others | $ | 68,217 | $ | 52,796 | $ | 50,820 | $ | 50,421 | $ | 51,736 | |||||||||||||||||||||||||

| At December 31, 2023 Average Yield | |||||||||||||||||||||||||||||||||||

Loan pipeline (1): |

|||||||||||||||||||||||||||||||||||

| Commercial | 8.61 | % | $ | 124,707 | $ | 50,756 | $ | 39,164 | $ | 236,550 | $ | 114,232 | |||||||||||||||||||||||

Residential real estate |

7.14 | 49,499 | 66,682 | 58,022 | 61,258 | 36,958 | |||||||||||||||||||||||||||||

| Other consumer | 8.50 | 8,819 | 13,795 | 18,621 | 20,589 | 14,890 | |||||||||||||||||||||||||||||

| Total | 8.21 | % | $ | 183,025 | $ | 131,233 | $ | 115,807 | $ | 318,397 | $ | 166,080 | |||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||||||||

| 2023 | 2023 | 2023 | 2023 | 2022 | ||||||||||||||||||||||||||||||||||

| Average Yield | ||||||||||||||||||||||||||||||||||||||

| Loan originations: | ||||||||||||||||||||||||||||||||||||||

| Commercial | 7.68 | % | $ | 94,294 | $ | 90,263 | $ | 197,732 | $ | 200,504 | $ | 539,949 | ||||||||||||||||||||||||||

| Residential real estate | 7.05 | 113,227 | 92,299 | 100,542 | 65,580 | 101,530 | (2) |

|||||||||||||||||||||||||||||||

| Other consumer | 8.19 | 16,971 | 17,019 | 22,487 | 15,927 | 42,624 | ||||||||||||||||||||||||||||||||

| Total | 7.40 | % | $ | 224,492 | $ | 199,581 | $ | 320,761 | $ | 282,011 | $ | 684,103 | ||||||||||||||||||||||||||

| Loans sold | $ | 20,138 | $ | 15,404 | $ | 18,664 | $ | 3,861 | $ | 2,340 | ||||||||||||||||||||||||||||

| DEPOSITS | At | |||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

| Type of Account | ||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 1,657,119 | $ | 1,827,381 | $ | 1,854,136 | $ | 1,984,197 | $ | 2,101,308 | ||||||||||||||||||||||

| Interest-bearing checking | 3,911,766 | 3,708,874 | 3,537,834 | 3,697,223 | 3,829,683 | |||||||||||||||||||||||||||

| Money market | 1,021,805 | 860,025 | 770,440 | 615,993 | 714,386 | |||||||||||||||||||||||||||

| Savings | 1,398,837 | 1,484,000 | 1,229,897 | 1,308,715 | 1,487,809 | |||||||||||||||||||||||||||

Time deposits (1) |

2,445,422 | 2,653,649 | 2,766,030 | 2,386,967 | 1,542,020 | |||||||||||||||||||||||||||

| Total deposits | $ | 10,434,949 | $ | 10,533,929 | $ | 10,158,337 | $ | 9,993,095 | $ | 9,675,206 | ||||||||||||||||||||||

ASSET QUALITY (1) |

December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||

| Non-performing loans: | |||||||||||||||||||||||||||||

Commercial real estate - investor |

$ | 20,820 | $ | 20,723 | $ | 13,000 | $ | 13,643 | $ | 10,483 | |||||||||||||||||||

Commercial real estate - owner-occupied |

351 | 240 | 565 | 251 | 4,025 | ||||||||||||||||||||||||

Commercial and industrial |

304 | 1,120 | 199 | 162 | 331 | ||||||||||||||||||||||||

Residential real estate |

5,542 | 5,624 | 6,174 | 5,650 | 5,969 | ||||||||||||||||||||||||

| Other consumer | 2,531 | 2,391 | 2,820 | 2,731 | 2,457 | ||||||||||||||||||||||||

| Total non-performing loans | $ | 29,548 | $ | 30,098 | $ | 22,758 | $ | 22,437 | $ | 23,265 | |||||||||||||||||||

Delinquent loans 30 to 89 days |

$ | 19,202 | $ | 20,591 | $ | 3,136 | $ | 11,232 | $ | 14,148 | |||||||||||||||||||

Modifications to borrowers experiencing financial difficulty (2) |

|||||||||||||||||||||||||||||

Non-performing (included in total non-performing loans above) |

$ | 6,420 | $ | 6,679 | $ | 6,882 | $ | 6,556 | $ | 6,361 | |||||||||||||||||||

Performing |

15,361 | 7,645 | 7,516 | 7,619 | 7,530 | ||||||||||||||||||||||||

Total modification to borrowers experiencing financial difficulty (2) |

$ | 21,781 | $ | 14,324 | $ | 14,398 | $ | 14,175 | $ | 13,891 | |||||||||||||||||||

| Allowance for loan credit losses | $ | 67,137 | $ | 63,877 | $ | 61,791 | $ | 60,195 | $ | 56,824 | |||||||||||||||||||

Allowance for loan credit losses as a percent of total loans receivable (3) |

0.66 | % | 0.63 | % | 0.61 | % | 0.60 | % | 0.57 | % | |||||||||||||||||||

Allowance for loan credit losses as a percent of total non-performing loans (3) |

227.21 | 212.23 | 271.51 | 268.28 | 244.25 | ||||||||||||||||||||||||

| Non-performing loans as a percent of total loans receivable | 0.29 | 0.30 | 0.23 | 0.22 | 0.23 | ||||||||||||||||||||||||

Non-performing assets as a percent of total assets |

0.22 | 0.22 | 0.17 | 0.17 | 0.18 | ||||||||||||||||||||||||

| Supplemental PCD and non-performing loans | |||||||||||||||||||||||||||||

| PCD loans, net of allowance for loan credit losses | $ | 16,122 | $ | 18,640 | $ | 18,872 | $ | 20,513 | $ | 27,129 | |||||||||||||||||||

| Non-performing PCD loans | 3,183 | 3,177 | 3,171 | 3,929 | 3,944 | ||||||||||||||||||||||||

| Delinquent PCD and non-performing loans 30 to 89 days | 1,516 | 13,007 | 1,976 | 2,248 | 3,657 | ||||||||||||||||||||||||

PCD modifications to borrowers experiencing financial difficulty (2) |

771 | 750 | 755 | 758 | 765 | ||||||||||||||||||||||||

Asset quality, excluding PCD loans (4) |

|||||||||||||||||||||||||||||

| Non-performing loans | 26,365 | 26,921 | 19,587 | 18,508 | 19,321 | ||||||||||||||||||||||||

Delinquent loans 30 to 89 days (excludes non-performing loans) |

17,686 | 7,584 | 1,160 | 8,984 | 10,491 | ||||||||||||||||||||||||

Modification to borrowers experiencing financial difficulty (2) |

21,010 | 13,574 | 13,643 | 13,417 | 13,126 | ||||||||||||||||||||||||

Allowance for loan credit losses as a percent of total non-performing loans (3) |

254.64 | % | 237.28 | % | 315.47 | % | 325.24 | % | 294.10 | % | |||||||||||||||||||

Non-performing loans as a percent of total loans receivable |

0.26 | 0.27 | 0.19 | 0.18 | 0.19 | ||||||||||||||||||||||||

| Non-performing assets as a percent of total assets | 0.19 | 0.20 | 0.14 | 0.14 | 0.15 | ||||||||||||||||||||||||

| NET LOAN (CHARGE-OFFS) RECOVERIES | For the Three Months Ended | |||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

| Net loan (charge-offs) recoveries: | ||||||||||||||||||||||||||||||||

| Loan charge-offs | $ | (98) | $ | (8,379) | $ | (206) | $ | (10) | $ | (138) | ||||||||||||||||||||||

| Recoveries on loans | 63 | 108 | 83 | 57 | 143 | |||||||||||||||||||||||||||

| Net loan (charge-offs) recoveries | $ | (35) | $ | (8,271) | $ | (123) | $ | 47 | $ | 5 | ||||||||||||||||||||||

| Net loan (charge-offs) recoveries to average total loans (annualized) | — | % | 0.33 | % | — | % | NM* | NM* | ||||||||||||||||||||||||

| Net loan (charge-offs) recoveries detail: | ||||||||||||||||||||||||||||||||

| Commercial | $ | 9 | $ | (8,332) | $ | (117) | $ | — | $ | (46) | ||||||||||||||||||||||

| Residential real estate | 9 | 17 | 9 | 8 | 9 | |||||||||||||||||||||||||||

| Other consumer | (53) | 44 | (15) | 39 | 42 | |||||||||||||||||||||||||||

| Net loan (charge-offs) recoveries | $ | (35) | $ | (8,271) | $ | (123) | $ | 47 | $ | 5 | ||||||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 | December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Interest |

Average

Yield/

Cost (1)

|

Average Balance |

Interest |

Average

Yield/

Cost (1)

|

Average Balance |

Interest |

Average

Yield/

Cost (1)

|

||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits and short-term investments | $ | 396,843 | $ | 5,423 | 5.42 | % | $ | 470,825 | $ | 6,440 | 5.43 | % | $ | 70,023 | $ | 634 | 3.59 | % | |||||||||||||||||||||||||||||||||||

Securities (2) |

1,863,136 | 17,901 | 3.81 | 1,873,450 | 18,039 | 3.82 | 1,764,764 | 12,597 | 2.83 | ||||||||||||||||||||||||||||||||||||||||||||

Loans receivable, net (3) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | 6,937,191 | 105,260 | 6.02 | 6,923,743 | 103,069 | 5.91 | 6,715,896 | 88,991 | 5.26 | ||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | 2,957,671 | 27,934 | 3.78 | 2,918,612 | 26,765 | 3.67 | 2,841,073 | 24,532 | 3.45 | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer | 250,300 | 3,916 | 6.21 | 252,126 | 4,097 | 6.45 | 262,911 | 3,523 | 5.32 | ||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan credit losses, net of deferred loan costs and fees | (56,001) | — | — | (53,959) | — | — | (48,776) | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Loans receivable, net | 10,089,161 | 137,110 | 5.40 | 10,040,522 | 133,931 | 5.30 | 9,771,104 | 117,046 | 4.76 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 12,349,140 | 160,434 | 5.16 | 12,384,797 | 158,410 | 5.08 | 11,605,891 | 130,277 | 4.46 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets | 1,243,967 | 1,252,416 | 1,228,520 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 13,593,107 | $ | 13,637,213 | $ | 12,834,411 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing checking | $ | 3,908,517 | 19,728 | 2.00 | % | $ | 3,692,500 | 14,938 | 1.61 | % | $ | 3,989,403 | 4,911 | 0.49 | % | ||||||||||||||||||||||||||||||||||||||

| Money market | 941,859 | 7,520 | 3.17 | 832,729 | 5,698 | 2.71 | 738,637 | 917 | 0.49 | ||||||||||||||||||||||||||||||||||||||||||||

| Savings | 1,446,935 | 5,193 | 1.42 | 1,391,811 | 3,311 | 0.94 | 1,539,175 | 285 | 0.07 | ||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 2,596,706 | 27,026 | 4.13 | 2,867,921 | 29,340 | 4.06 | 1,486,410 | 7,312 | 1.95 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | 8,894,017 | 59,467 | 2.65 | 8,784,961 | 53,287 | 2.41 | 7,753,625 | 13,425 | 0.69 | ||||||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 615,172 | 7,470 | 4.82 | 701,343 | 8,707 | 4.93 | 632,207 | 6,475 | 4.06 | ||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 80,181 | 387 | 1.91 | 76,620 | 261 | 1.35 | 88,191 | 41 | 0.18 | ||||||||||||||||||||||||||||||||||||||||||||

Other borrowings (4) |

321,369 | 5,286 | 6.53 | 317,210 | 5,159 | 6.45 | 195,167 | 3,848 | 7.82 | ||||||||||||||||||||||||||||||||||||||||||||

| Total borrowings | 1,016,722 | 13,143 | 5.13 | 1,095,173 | 14,127 | 5.12 | 915,565 | 10,364 | 4.49 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 9,910,739 | 72,610 | 2.91 | 9,880,134 | 67,414 | 2.71 | 8,669,190 | 23,789 | 1.09 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposits | 1,739,499 | 1,841,198 | 2,221,884 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Non-interest-bearing liabilities (4) |

292,170 | 272,982 | 378,481 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 11,942,408 | 11,994,314 | 11,269,555 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Stockholders’ equity |

1,650,699 | 1,642,899 | 1,564,856 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 13,593,107 | $ | 13,637,213 | $ | 12,834,411 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 87,824 | $ | 90,996 | $ | 106,488 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest rate spread (5) |

2.25 | % | 2.37 | % | 3.37 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (6) |

2.82 | % | 2.91 | % | 3.64 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Total cost of deposits (including non-interest-bearing deposits) | 2.22 | % | 1.99 | % | 0.53 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| For the Year Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Interest | Average Yield/ Cost |

Average Balance |

Interest | Average Yield/ Cost |

||||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits and short-term investments | $ | 327,539 | $ | 17,084 | 5.22 | % | $ | 72,913 | $ | 1,106 | 1.52 | % | ||||||||||||||||||||||||||

Securities (2) |

1,905,413 | 69,025 | 3.62 | 1,792,598 | 39,683 | 2.21 | ||||||||||||||||||||||||||||||||

Loans receivable, net (3) |

||||||||||||||||||||||||||||||||||||||

| Commercial | 6,903,731 | 400,459 | 5.80 | 6,386,755 | 287,044 | 4.49 | ||||||||||||||||||||||||||||||||

| Residential real estate | 2,911,246 | 105,796 | 3.63 | 2,724,398 | 91,432 | 3.36 | ||||||||||||||||||||||||||||||||

| Other consumer | 255,359 | 15,610 | 6.11 | 256,912 | 11,910 | 4.64 | ||||||||||||||||||||||||||||||||

| Allowance for loan credit losses, net of deferred loan costs and fees | (53,477) | — | — | (44,446) | — | — | ||||||||||||||||||||||||||||||||

| Loans receivable, net | 10,016,859 | 521,865 | 5.21 | 9,323,619 | 390,386 | 4.19 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | 12,249,811 | 607,974 | 4.96 | 11,189,130 | 431,175 | 3.85 | ||||||||||||||||||||||||||||||||

| Non-interest-earning assets | 1,237,218 | 1,200,725 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 13,487,029 | $ | 12,389,855 | ||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing checking | $ | 3,795,502 | 52,898 | 1.39 | % | $ | 4,063,716 | 11,344 | 0.28 | % | ||||||||||||||||||||||||||||

| Money market | 794,387 | 18,656 | 2.35 | 764,837 | 2,234 | 0.29 | ||||||||||||||||||||||||||||||||

| Savings | 1,364,333 | 9,227 | 0.68 | 1,597,648 | 758 | 0.05 | ||||||||||||||||||||||||||||||||

| Time deposits | 2,440,829 | 91,237 | 3.74 | 1,167,499 | 16,685 | 1.43 | ||||||||||||||||||||||||||||||||

| Total | 8,395,051 | 172,018 | 2.05 | 7,593,700 | 31,021 | 0.41 | ||||||||||||||||||||||||||||||||

| FHLB advances | 944,219 | 46,000 | 4.87 | 389,750 | 10,365 | 2.66 | ||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 75,140 | 931 | 1.24 | 101,377 | 159 | 0.16 | ||||||||||||||||||||||||||||||||

Other borrowings (4) |

307,368 | 19,294 | 6.28 | 203,117 | 12,153 | 5.98 | ||||||||||||||||||||||||||||||||

| Total borrowings | 1,326,727 | 66,225 | 4.99 | 694,244 | 22,677 | 3.27 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 9,721,778 | 238,243 | 2.45 | 8,287,944 | 53,698 | 0.65 | ||||||||||||||||||||||||||||||||

| Non-interest-bearing deposits | 1,869,735 | 2,319,657 | ||||||||||||||||||||||||||||||||||||

Non-interest-bearing liabilities (4) |

262,883 | 239,861 | ||||||||||||||||||||||||||||||||||||

| Total liabilities | 11,854,396 | 10,847,462 | ||||||||||||||||||||||||||||||||||||

Stockholders’ equity |

1,632,633 | 1,542,393 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 13,487,029 | $ | 12,389,855 | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 369,731 | $ | 377,477 | ||||||||||||||||||||||||||||||||||

Net interest rate spread (5) |

2.51 | % | 3.20 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (6) |

3.02 | % | 3.37 | % | ||||||||||||||||||||||||||||||||||

| Total cost of deposits (including non-interest-bearing deposits) | 1.68 | % | 0.31 | % | ||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

| Selected Financial Condition Data: | ||||||||||||||||||||||||||||||||

| Total assets | $ | 13,538,253 | $ | 13,498,183 | $ | 13,538,903 | $ | 13,555,175 | $ | 13,103,896 | ||||||||||||||||||||||

| Debt securities available-for-sale, at estimated fair value | 753,892 | 453,208 | 452,016 | 452,195 | 457,648 | |||||||||||||||||||||||||||

| Debt securities held-to-maturity, net of allowance for securities credit losses | 1,159,735 | 1,189,339 | 1,222,507 | 1,245,424 | 1,221,138 | |||||||||||||||||||||||||||

| Equity investments | 100,163 | 97,908 | 96,452 | 101,007 | 102,037 | |||||||||||||||||||||||||||

| Restricted equity investments, at cost | 93,766 | 82,484 | 105,305 | 115,750 | 109,278 | |||||||||||||||||||||||||||

| Loans receivable, net of allowance for loan credit losses | 10,136,721 | 10,068,156 | 10,030,106 | 9,986,949 | 9,868,718 | |||||||||||||||||||||||||||

| Deposits | 10,434,949 | 10,533,929 | 10,158,337 | 9,993,095 | 9,675,206 | |||||||||||||||||||||||||||

| Federal Home Loan Bank advances | 848,636 | 606,056 | 1,091,666 | 1,346,566 | 1,211,166 | |||||||||||||||||||||||||||

| Securities sold under agreements to repurchase and other borrowings | 269,604 | 279,164 | 270,377 | 266,601 | 264,500 | |||||||||||||||||||||||||||

| Total stockholders’ equity | 1,661,945 | 1,637,604 | 1,626,283 | 1,610,371 | 1,585,464 | |||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

| Selected Operating Data: | ||||||||||||||||||||||||||||||||

| Interest income | $ | 160,434 | $ | 158,410 | $ | 150,096 | $ | 139,034 | $ | 130,277 | ||||||||||||||||||||||

| Interest expense | 72,610 | 67,414 | 57,987 | 40,232 | 23,789 | |||||||||||||||||||||||||||

| Net interest income | 87,824 | 90,996 | 92,109 | 98,802 | 106,488 | |||||||||||||||||||||||||||

| Provision for credit losses | 3,153 | 10,283 | 1,229 | 3,013 | 3,647 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 84,671 | 80,713 | 90,880 | 95,789 | 102,841 | |||||||||||||||||||||||||||

| Other income (excluding activity related to debt and equity investments) | 9,685 | 9,310 | 9,487 | 9,571 | 10,364 | |||||||||||||||||||||||||||

| Net gain (loss) on equity investments | 2,176 | 1,452 | (559) | (2,193) | 17,187 | |||||||||||||||||||||||||||

| Net loss on sale of investments | — | — | — | (5,305) | — | |||||||||||||||||||||||||||

| Operating expenses (excluding FDIC special assessment, merger related and branch consolidation expense, net) | 58,526 | 64,484 | 62,930 | 61,217 | 59,341 | |||||||||||||||||||||||||||

| FDIC special assessment | 1,663 | — | — | — | — | |||||||||||||||||||||||||||

| Branch consolidation expense, net | — | — | — | 70 | 111 | |||||||||||||||||||||||||||

| Merger related expenses | — | — | — | 22 | 276 | |||||||||||||||||||||||||||

| Income before provision for income taxes | 36,343 | 26,991 | 36,878 | 36,553 | 70,664 | |||||||||||||||||||||||||||

| Provision for income taxes | 8,591 | 6,459 | 8,996 | 8,654 | 17,353 | |||||||||||||||||||||||||||

| Net income | 27,752 | 20,532 | 27,882 | 27,899 | 53,311 | |||||||||||||||||||||||||||

| Net income (loss) attributable to non-controlling interest | 70 | (135) | 85 | 16 | 39 | |||||||||||||||||||||||||||

| Net income attributable to OceanFirst Financial Corp. | $ | 27,682 | $ | 20,667 | $ | 27,797 | $ | 27,883 | $ | 53,272 | ||||||||||||||||||||||

| Net income available to common stockholders | $ | 26,678 | $ | 19,663 | $ | 26,793 | $ | 26,879 | $ | 52,268 | ||||||||||||||||||||||

| Diluted earnings per share | $ | 0.46 | $ | 0.33 | $ | 0.45 | $ | 0.46 | $ | 0.89 | ||||||||||||||||||||||

| Net accretion/amortization of purchase accounting adjustments included in net interest income | $ | 1,604 | $ | 1,745 | $ | 1,152 | $ | 1,237 | $ | 2,278 | ||||||||||||||||||||||

| At or For the Three Months Ended | ||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

Selected Financial Ratios and Other Data (1) (2): |

||||||||||||||||||||||||||||||||

| Performance Ratios (Annualized): | ||||||||||||||||||||||||||||||||

Return on average assets (3) |

0.78 | % | 0.57 | % | 0.80 | % | 0.82 | % | 1.62 | % | ||||||||||||||||||||||

Return on average tangible assets (3) (4) |

0.81 | 0.59 | 0.83 | 0.86 | 1.68 | |||||||||||||||||||||||||||

Return on average stockholders' equity (3) |

6.41 | 4.75 | 6.61 | 6.77 | 13.25 | |||||||||||||||||||||||||||

Return on average tangible stockholders' equity (3) (4) |

9.33 | 6.93 | 9.70 | 10.00 | 19.85 | |||||||||||||||||||||||||||

Return on average tangible common equity (3) (4) |

9.81 | 7.29 | 10.21 | 10.53 | 20.97 | |||||||||||||||||||||||||||

| Stockholders' equity to total assets | 12.28 | 12.13 | 12.01 | 11.88 | 12.10 | |||||||||||||||||||||||||||

Tangible stockholders' equity to tangible assets (4) |

8.80 | 8.64 | 8.51 | 8.37 | 8.47 | |||||||||||||||||||||||||||

Tangible common equity to tangible assets (4) |

8.38 | 8.21 | 8.09 | 7.95 | 8.03 | |||||||||||||||||||||||||||

| Net interest rate spread | 2.25 | 2.37 | 2.52 | 2.94 | 3.37 | |||||||||||||||||||||||||||

| Net interest margin | 2.82 | 2.91 | 3.02 | 3.34 | 3.64 | |||||||||||||||||||||||||||

| Operating expenses to average assets | 1.76 | 1.88 | 1.87 | 1.88 | 1.85 | |||||||||||||||||||||||||||

Efficiency ratio (5) |

60.38 | 63.37 | 62.28 | 60.78 | 44.56 | |||||||||||||||||||||||||||

| Loans-to-deposits | 97.70 | 96.10 | 99.30 | 100.50 | 102.50 | |||||||||||||||||||||||||||

| At or For the Year Ended December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| Performance Ratios: | ||||||||||||||

Return on average assets (3) |

0.74 | % | 1.15 | % | ||||||||||

Return on average tangible assets (3) (4) |

0.77 | 1.20 | ||||||||||||

Return on average stockholders' equity (3) |

6.13 | 9.24 | ||||||||||||

Return on average tangible stockholders' equity (3) (4) |

8.97 | 13.96 | ||||||||||||

Return on average tangible common equity (3) (4) |

9.44 | 14.76 | ||||||||||||

| Net interest rate spread | 2.51 | 3.20 | ||||||||||||

| Net interest margin | 3.02 | 3.37 | ||||||||||||

| Operating expenses to average assets | 1.85 | 1.90 | ||||||||||||

Efficiency ratio (5) |

61.71 | 53.80 | ||||||||||||

| At or For the Three Months Ended | ||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| 2023 | 2023 | 2023 | 2023 | 2022 | ||||||||||||||||||||||||||||

| Trust and Asset Management: | ||||||||||||||||||||||||||||||||

| Wealth assets under administration and management (“AUA/M”) | $ | 335,769 | $ | 336,913 | $ | 339,890 | $ | 333,436 | $ | 324,066 | ||||||||||||||||||||||

| Nest Egg AUA/M | 401,420 | 385,317 | 397,927 | 400,227 | 403,538 | |||||||||||||||||||||||||||

| Total AUA/M | 737,189 | 722,230 | 737,817 | 733,663 | 727,604 | |||||||||||||||||||||||||||

| Per Share Data: | ||||||||||||||||||||||||||||||||

| Cash dividends per common share | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||||||||||||||

| Book value per common share at end of period | 27.96 | 27.56 | 27.37 | 27.07 | 26.81 | |||||||||||||||||||||||||||

Tangible book value per common share at end of period (4) |

18.35 | 17.93 | 17.72 | 17.42 | 17.08 | |||||||||||||||||||||||||||

| Common shares outstanding at end of period | 59,447,684 | 59,421,498 | 59,420,859 | 59,486,086 | 59,144,128 | |||||||||||||||||||||||||||

| Preferred shares outstanding at end of period | 57,370 | 57,370 | 57,370 | 57,370 | 57,370 | |||||||||||||||||||||||||||

| Number of full-service customer facilities: | 39 | 38 | 38 | 38 | 38 | |||||||||||||||||||||||||||

| Quarterly Average Balances | ||||||||||||||||||||||||||||||||

| Total securities | $ | 1,863,136 | $ | 1,873,450 | $ | 1,931,032 | $ | 1,955,399 | $ | 1,764,764 | ||||||||||||||||||||||

| Loans receivable, net | 10,089,161 | 10,040,522 | 10,010,785 | 9,924,905 | 9,771,104 | |||||||||||||||||||||||||||

| Total interest-earning assets | 12,349,140 | 12,384,797 | 12,250,055 | 12,010,044 | 11,605,891 | |||||||||||||||||||||||||||

| Total goodwill and core deposit intangible | 516,289 | 517,282 | 518,265 | 519,282 | 520,400 | |||||||||||||||||||||||||||

| Total assets | 13,593,107 | 13,637,213 | 13,467,721 | 13,244,593 | 12,834,411 | |||||||||||||||||||||||||||

| Time deposits | 2,596,706 | 2,867,921 | 2,458,872 | 1,826,662 | 1,486,410 | |||||||||||||||||||||||||||

| Total deposits (including non-interest-bearing deposits) | 10,633,516 | 10,626,159 | 9,993,010 | 9,793,256 | 9,975,509 | |||||||||||||||||||||||||||

| Total borrowings | 1,016,722 | 1,095,173 | 1,603,126 | 1,600,845 | 915,565 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 9,910,739 | 9,880,134 | 9,722,910 | 9,365,594 | 8,669,190 | |||||||||||||||||||||||||||

| Non-interest bearing deposits | 1,739,499 | 1,841,198 | 1,873,226 | 2,028,507 | 2,221,884 | |||||||||||||||||||||||||||

| Stockholders’ equity | 1,650,699 | 1,642,899 | 1,626,693 | 1,609,677 | 1,564,856 | |||||||||||||||||||||||||||

Tangible stockholders’ equity (4) |

1,134,410 | 1,125,617 | 1,108,428 | 1,090,395 | 1,044,456 | |||||||||||||||||||||||||||

| Quarterly Yields and Costs | ||||||||||||||||||||||||||||||||

| Total securities | 3.81 | % | 3.82 | % | 3.47 | % | 3.40 | % | 2.83 | % | ||||||||||||||||||||||

| Loans receivable, net | 5.40 | 5.30 | 5.17 | 4.96 | 4.76 | |||||||||||||||||||||||||||

| Total interest-earning assets | 5.16 | 5.08 | 4.91 | 4.68 | 4.46 | |||||||||||||||||||||||||||

| Time deposits | 4.13 | 4.06 | 3.57 | 2.88 | 1.95 | |||||||||||||||||||||||||||

| Total cost of deposits (including non-interest-bearing deposits) | 2.22 | 1.99 | 1.52 | 0.88 | 0.53 | |||||||||||||||||||||||||||

| Total borrowed funds | 5.13 | 5.12 | 5.02 | 4.79 | 4.49 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 2.91 | 2.71 | 2.39 | 1.74 | 1.09 | |||||||||||||||||||||||||||

| Net interest spread | 2.25 | 2.37 | 2.52 | 2.94 | 3.37 | |||||||||||||||||||||||||||

| Net interest margin | 2.82 | 2.91 | 3.02 | 3.34 | 3.64 | |||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

December 31, 2022 |

||||||||||||||||||||||||||||

| Core Earnings: | ||||||||||||||||||||||||||||||||

Net income available to common stockholders (GAAP) |

$ | 26,678 | $ | 19,663 | $ | 26,793 | $ | 26,879 | $ | 52,268 | ||||||||||||||||||||||

| (Less) add non-recurring and non-core items: | ||||||||||||||||||||||||||||||||

Net (gain) loss on equity investments (1) |

(2,176) | (1,452) | 559 | 2,193 | (17,187) | |||||||||||||||||||||||||||

Net loss on sale of investments (1) |

— | — | — | 5,305 | — | |||||||||||||||||||||||||||

| FDIC special assessment | 1,663 | — | — | — | — | |||||||||||||||||||||||||||

| Merger related expenses | — | — | — | 22 | 276 | |||||||||||||||||||||||||||

| Branch consolidation expense, net | — | — | — | 70 | 111 | |||||||||||||||||||||||||||

| Income tax expense (benefit) on items | 129 | 351 | (162) | (1,797) | 4,060 | |||||||||||||||||||||||||||

Core earnings (Non-GAAP) |

$ | 26,294 | $ | 18,562 | $ | 27,190 | $ | 32,672 | $ | 39,528 | ||||||||||||||||||||||

| Income tax expense | $ | 8,591 | $ | 6,459 | $ | 8,996 | $ | 8,654 | $ | 17,353 | ||||||||||||||||||||||

| Provision for credit losses | 3,153 | 10,283 | 1,229 | 3,013 | 3,647 | |||||||||||||||||||||||||||

| Less: income tax expense (benefit) on non-core items | 129 | 351 | (162) | (1,797) | 4,060 | |||||||||||||||||||||||||||

Core earnings PTPP (Non-GAAP) |

$ | 37,909 | $ | 34,953 | $ | 37,577 | $ | 46,136 | $ | 56,468 | ||||||||||||||||||||||

| Core diluted earnings per share | $ | 0.45 | $ | 0.32 | $ | 0.46 | $ | 0.55 | $ | 0.67 | ||||||||||||||||||||||

| Core earnings PTPP diluted earnings per share | $ | 0.65 | $ | 0.59 | $ | 0.64 | $ | 0.78 | $ | 0.96 | ||||||||||||||||||||||

| Core Ratios (Annualized): | ||||||||||||||||||||||||||||||||

| Return on average assets | 0.77 | % | 0.54 | % | 0.81 | % | 1.00 | % | 1.22 | % | ||||||||||||||||||||||

| Return on average tangible stockholders’ equity | 9.20 | 6.54 | 9.84 | 12.15 | 15.01 | |||||||||||||||||||||||||||

| Return on average tangible common equity | 9.67 | 6.88 | 10.36 | 12.80 | 15.86 | |||||||||||||||||||||||||||

| Efficiency ratio | 60.02 | 64.29 | 61.94 | 56.49 | 50.78 | |||||||||||||||||||||||||||

| (1) The sale of specific positions in two financial institutions impacted both equity investments and debt securities for the three months ended March 31, 2023. On the Consolidated Statements of Income, the losses on sale of equity investments and debt securities are reported within net gain (loss) on equity investments ($4.6 million) and other ($697,000), respectively, for the three months ended March 31, 2023. | ||||||||||||||||||||||||||||||||

| For the Years Ended December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| Core Earnings: | ||||||||||||||

Net income available to common stockholders (GAAP) |

$ | 100,013 | $ | 142,587 | ||||||||||

| (Less) add non-recurring and non-core items: | ||||||||||||||

Net gain on equity investments (1) |

(876) | (9,685) | ||||||||||||

Net loss on sale of investments (1) |

5,305 | — | ||||||||||||

| FDIC special assessment | 1,663 | — | ||||||||||||

| Merger related expenses | 22 | 2,735 | ||||||||||||

Branch consolidation expense, net |

70 | 713 | ||||||||||||

| Income tax (benefit) expense on items | (1,479) | 1,611 | ||||||||||||

Core earnings (Non-GAAP) |

$ | 104,718 | $ | 137,961 | ||||||||||

| Income tax expense | $ | 32,700 | $ | 46,565 | ||||||||||

| Credit loss provision | 17,678 | 7,768 | ||||||||||||

| Less: income tax (benefit) expense on non-core items | (1,479) | 1,611 | ||||||||||||

Core earnings PTPP (Non-GAAP) |

$ | 156,575 | $ | 190,683 | ||||||||||

| Core diluted earnings per share | $ | 1.78 | $ | 2.34 | ||||||||||

| Core earnings PTPP diluted earnings per share | $ | 2.66 | $ | 3.24 | ||||||||||

| Core Ratios: | ||||||||||||||

| Return on average assets | 0.78 | % | 1.11 | % | ||||||||||

| Return on average tangible stockholders’ equity | 9.39 | 13.50 | ||||||||||||

| Return on average tangible common equity | 9.89 | 14.28 | ||||||||||||

| Efficiency ratio | 60.61 | 54.21 | ||||||||||||

| (1) The sale of specific positions in two financial institutions impacted both equity investments and debt securities for the three months ended March 31, 2023. On the Consolidated Statements of Income, the losses on sale of equity investments and debt securities are reported within net gain (loss) on equity investments ($4.6 million) and other ($697,000), respectively, for the three months ended March 31, 2023. | ||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| 2023 | 2023 | 2023 | 2023 | 2022 | ||||||||||||||||||||||||||||

| Tangible Equity: | ||||||||||||||||||||||||||||||||

| Total stockholders' equity | $ | 1,661,945 | $ | 1,637,604 | $ | 1,626,283 | $ | 1,610,371 | $ | 1,585,464 | ||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||

| Goodwill | 506,146 | 506,146 | 506,146 | 506,146 | 506,146 | |||||||||||||||||||||||||||

| Core deposit intangible | 9,513 | 10,489 | 11,476 | 12,470 | 13,497 | |||||||||||||||||||||||||||

| Tangible stockholders’ equity | 1,146,286 | 1,120,969 | 1,108,661 | 1,091,755 | 1,065,821 | |||||||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||

| Preferred stock | 55,527 | 55,527 | 55,527 | 55,527 | 55,527 | |||||||||||||||||||||||||||

| Tangible common equity | $ | 1,090,759 | $ | 1,065,442 | $ | 1,053,134 | $ | 1,036,228 | $ | 1,010,294 | ||||||||||||||||||||||

| Tangible Assets: | ||||||||||||||||||||||||||||||||

| Total assets | $ | 13,538,253 | $ | 13,498,183 | $ | 13,538,903 | $ | 13,555,175 | $ | 13,103,896 | ||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||

| Goodwill | 506,146 | 506,146 | 506,146 | 506,146 | 506,146 | |||||||||||||||||||||||||||

| Core deposit intangible | 9,513 | 10,489 | 11,476 | 12,470 | 13,497 | |||||||||||||||||||||||||||

| Tangible assets | $ | 13,022,594 | $ | 12,981,548 | $ | 13,021,281 | $ | 13,036,559 | $ | 12,584,253 | ||||||||||||||||||||||

| Tangible stockholders' equity to tangible assets | 8.80 | % | 8.64 | % | 8.51 | % | 8.37 | % | 8.47 | % | ||||||||||||||||||||||

| Tangible common equity to tangible assets | 8.38 | % | 8.21 | % | 8.09 | % | 7.95 | % | 8.03 | % | ||||||||||||||||||||||