FALSE2023FY0001000694185P1YP1Y8Mhttp://www.novavax.com/20231231#LeaseRightOfUseAssethttp://www.novavax.com/20231231#LeaseRightOfUseAssethttp://www.novavax.com/20231231#LeaseRightOfUseAssethttp://www.novavax.com/20231231#LeaseRightOfUseAssethttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent0.080.02.0073411.0089928.05P1Y00010006942023-01-012023-12-3100010006942023-06-30iso4217:USD00010006942024-02-23xbrli:shares00010006942023-10-012023-12-310001000694nvax:FilipDubovskyMDMember2023-01-012023-12-310001000694nvax:FilipDubovskyMDMember2023-10-012023-12-310001000694nvax:FilipDubovskyMDMember2023-12-310001000694us-gaap:ProductMember2023-01-012023-12-310001000694us-gaap:ProductMember2022-01-012022-12-310001000694us-gaap:ProductMember2021-01-012021-12-310001000694us-gaap:GrantMember2023-01-012023-12-310001000694us-gaap:GrantMember2022-01-012022-12-310001000694us-gaap:GrantMember2021-01-012021-12-310001000694nvax:RoyaltiesAndOtherMember2023-01-012023-12-310001000694nvax:RoyaltiesAndOtherMember2022-01-012022-12-310001000694nvax:RoyaltiesAndOtherMember2021-01-012021-12-3100010006942022-01-012022-12-3100010006942021-01-012021-12-31iso4217:USDxbrli:shares00010006942023-12-3100010006942022-12-310001000694us-gaap:CommonStockMember2020-12-310001000694us-gaap:AdditionalPaidInCapitalMember2020-12-310001000694us-gaap:RetainedEarningsMember2020-12-310001000694us-gaap:TreasuryStockCommonMember2020-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100010006942020-12-310001000694us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001000694us-gaap:CommonStockMember2021-01-012021-12-310001000694us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001000694us-gaap:RetainedEarningsMember2021-01-012021-12-310001000694us-gaap:CommonStockMember2021-12-310001000694us-gaap:AdditionalPaidInCapitalMember2021-12-310001000694us-gaap:RetainedEarningsMember2021-12-310001000694us-gaap:TreasuryStockCommonMember2021-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100010006942021-12-310001000694us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001000694us-gaap:CommonStockMember2022-01-012022-12-310001000694us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001000694us-gaap:RetainedEarningsMember2022-01-012022-12-310001000694us-gaap:CommonStockMember2022-12-310001000694us-gaap:AdditionalPaidInCapitalMember2022-12-310001000694us-gaap:RetainedEarningsMember2022-12-310001000694us-gaap:TreasuryStockCommonMember2022-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001000694us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001000694us-gaap:CommonStockMember2023-01-012023-12-310001000694us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001000694us-gaap:RetainedEarningsMember2023-01-012023-12-310001000694us-gaap:CommonStockMember2023-12-310001000694us-gaap:AdditionalPaidInCapitalMember2023-12-310001000694us-gaap:RetainedEarningsMember2023-12-310001000694us-gaap:TreasuryStockCommonMember2023-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001000694nvax:CanadaAdvancePurchaseAgreementMember2023-01-012023-12-31xbrli:pure0001000694srt:ScenarioForecastMembersrt:MinimumMember2024-01-012024-03-310001000694srt:MaximumMembersrt:ScenarioForecastMember2024-01-012024-03-310001000694srt:MinimumMember2023-01-012023-12-310001000694srt:MaximumMember2023-01-012023-12-310001000694us-gaap:SalesRevenueNetMembernvax:EuropeanCommissionMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001000694us-gaap:SalesRevenueNetMembernvax:EuropeanCommissionMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694us-gaap:AccountsReceivableMembernvax:EuropeanCommissionMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001000694us-gaap:AccountsReceivableMembernvax:EuropeanCommissionMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694nvax:GovernmentOfAustraliaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001000694nvax:GovernmentOfAustraliaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694nvax:GovernmentOfCanadaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694us-gaap:AccountsReceivableMembernvax:GovernmentOfCanadaMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001000694us-gaap:AccountsReceivableMembernvax:GovernmentOfIsraelMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694us-gaap:SalesRevenueNetMembernvax:USGovernmentMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001000694us-gaap:SalesRevenueNetMembernvax:USGovernmentMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694us-gaap:SalesRevenueNetMembernvax:USGovernmentMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001000694us-gaap:AccountsReceivableMembernvax:USGovernmentMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001000694us-gaap:SalesRevenueNetMembernvax:CoalitionForEpidemicPreparednessInnovationsMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001000694nvax:SKBioscienceCoLtdMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001000694us-gaap:BuildingMember2023-12-310001000694us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310001000694us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-310001000694us-gaap:ComputerEquipmentMember2023-12-31nvax:reporting_unit0001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:UnsecuredDebtMember2023-01-012023-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:UnsecuredDebtMember2022-12-31nvax:segment0001000694nvax:RevenueMember2023-12-310001000694nvax:AmendedAndRestatedUKSupplyAgreementMember2023-12-310001000694nvax:RevenueMember2022-12-310001000694nvax:AmendedAndRestatedUKSupplyAgreementMember2022-12-310001000694nvax:GaviAdvancePurchaseAgreementCOVAXFacilityMember2022-12-3100010006942024-01-012023-12-310001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2023-12-31nvax:dose0001000694nvax:GaviAdvancePurchaseAgreementCOVAXFacilityMember2022-11-180001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2021-12-310001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2022-12-310001000694nvax:GaviAdvancePurchaseAgreementCOVAXFacilityMember2023-12-310001000694nvax:SettlementAgreementMemberus-gaap:SubsequentEventMember2024-02-162024-02-160001000694nvax:SettlementAgreementMembersrt:ScenarioForecastMember2024-01-012024-03-310001000694nvax:SettlementAgreementMemberus-gaap:SubsequentEventMember2024-02-160001000694us-gaap:ProductMembersrt:NorthAmericaMember2023-01-012023-12-310001000694us-gaap:ProductMembersrt:NorthAmericaMember2022-01-012022-12-310001000694srt:EuropeMemberus-gaap:ProductMember2023-01-012023-12-310001000694srt:EuropeMemberus-gaap:ProductMember2022-01-012022-12-310001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2023-01-012023-12-310001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2022-01-012022-12-310001000694us-gaap:ProductMembernvax:WholesaleDistributorFeesDiscountsAndChargebacksMember2022-12-310001000694us-gaap:ProductMembernvax:ProductReturnsMember2022-12-310001000694us-gaap:ProductMember2022-12-310001000694us-gaap:ProductMembernvax:WholesaleDistributorFeesDiscountsAndChargebacksMember2023-01-012023-12-310001000694us-gaap:ProductMembernvax:ProductReturnsMember2023-01-012023-12-310001000694us-gaap:ProductMembernvax:WholesaleDistributorFeesDiscountsAndChargebacksMember2023-12-310001000694us-gaap:ProductMembernvax:ProductReturnsMember2023-12-310001000694us-gaap:ProductMember2023-12-310001000694us-gaap:AccruedLiabilitiesMemberus-gaap:ProductMember2023-12-310001000694us-gaap:ProductMemberus-gaap:AccountsReceivableMember2023-12-310001000694nvax:AustralianAPAMember2023-01-012023-12-310001000694nvax:AustralianAPAMember2023-12-310001000694srt:MinimumMembernvax:EuropeanCommissionsECMember2023-12-310001000694srt:MaximumMembernvax:EuropeanCommissionsECMember2023-12-310001000694nvax:EuropeanCommissionsECMember2023-12-310001000694nvax:EuropeanCommissionsECMember2023-01-012023-01-310001000694nvax:CanadaAdvancePurchaseAgreementMember2023-12-310001000694nvax:CanadaAdvancePurchaseAgreementMember2023-07-012023-07-310001000694us-gaap:CanadaRevenueAgencyMembernvax:CanadaAdvancePurchaseAgreementMember2023-12-3100010006942020-10-220001000694nvax:AmendedAndRestatedUKSupplyAgreementMembersrt:MinimumMember2022-07-310001000694srt:MaximumMembernvax:AmendedAndRestatedUKSupplyAgreementMember2022-07-310001000694nvax:JointCommitteeOnVaccinationAndImmunizationJCVIMember2022-07-310001000694srt:MaximumMembernvax:AmendedAndRestatedUKSupplyAgreementMember2022-11-300001000694srt:MaximumMembernvax:AmendedAndRestatedUKSupplyAgreementMember2023-11-300001000694us-gaap:GrantMembernvax:USGovernmentAgreementMember2023-01-012023-12-310001000694us-gaap:GrantMembernvax:USGovernmentAgreementMember2022-01-012022-12-310001000694us-gaap:GrantMembernvax:USGovernmentAgreementMember2021-01-012021-12-310001000694us-gaap:GrantMembernvax:USDepartmentOfDefenseDoDContractMember2023-01-012023-12-310001000694us-gaap:GrantMembernvax:USDepartmentOfDefenseDoDContractMember2022-01-012022-12-310001000694us-gaap:GrantMembernvax:USDepartmentOfDefenseDoDContractMember2021-01-012021-12-310001000694us-gaap:GrantMembernvax:CoalitionForEpidemicPreparednessInnovationsAwardMember2023-01-012023-12-310001000694us-gaap:GrantMembernvax:CoalitionForEpidemicPreparednessInnovationsAwardMember2022-01-012022-12-310001000694us-gaap:GrantMembernvax:CoalitionForEpidemicPreparednessInnovationsAwardMember2021-01-012021-12-310001000694us-gaap:GrantMembernvax:OtherGrantRevenueMember2023-01-012023-12-310001000694us-gaap:GrantMembernvax:OtherGrantRevenueMember2022-01-012022-12-310001000694us-gaap:GrantMembernvax:OtherGrantRevenueMember2021-01-012021-12-310001000694nvax:USGovernmentAgreementMember2020-07-012020-07-310001000694nvax:USGovernmentPartnershipMember2023-01-012023-12-310001000694nvax:CoalitionForEpidemicPreparednessInnovationsCEPIAgreementMember2020-05-012020-05-310001000694nvax:CEPIGrantFundingMember2022-01-012022-12-310001000694nvax:CEPIGrantFundingMember2023-01-012023-12-310001000694nvax:SalesBasedRoyaltiesMember2023-01-012023-12-310001000694nvax:MatrixMAdjuvantSalesMember2023-01-012023-12-310001000694nvax:MilestonePaymentsMember2023-01-012023-12-310001000694nvax:SalesBasedRoyaltiesMember2022-01-012022-12-310001000694nvax:MilestonePaymentsMember2022-01-012022-12-310001000694nvax:MatrixMAdjuvantSalesMember2022-01-012022-12-310001000694nvax:SalesBasedRoyaltiesMember2021-01-012021-12-310001000694nvax:MilestonePaymentsMember2021-01-012021-12-310001000694nvax:TakedaArrangementMember2021-09-300001000694nvax:TakedaArrangementMember2023-01-012023-12-310001000694nvax:TakedaArrangementMember2022-01-012022-12-310001000694nvax:SettlementAgreementMember2023-08-310001000694us-gaap:PrivatePlacementMembernvax:SecuritiesSubscriptionArrangementMember2023-08-012023-08-310001000694us-gaap:PrivatePlacementMembernvax:SecuritiesSubscriptionArrangementMember2023-08-310001000694nvax:SecuritiesSubscriptionArrangementMember2023-01-012023-12-310001000694nvax:SecuritiesSubscriptionArrangementMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001000694nvax:SecuritiesSubscriptionArrangementMemberus-gaap:CostOfSalesMember2023-08-012023-08-310001000694nvax:SettlementAgreementMember2022-09-30nvax:installment0001000694nvax:SettlementAgreementMember2023-12-310001000694nvax:SettlementAgreementMemberus-gaap:AccruedLiabilitiesMember2023-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001000694us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-12-310001000694us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2023-12-310001000694us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2023-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001000694us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:AgencySecuritiesMember2023-12-310001000694us-gaap:AgencySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:AgencySecuritiesMember2023-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:AgencySecuritiesMember2022-12-310001000694us-gaap:AgencySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:AgencySecuritiesMember2022-12-310001000694us-gaap:FairValueInputsLevel1Member2023-12-310001000694us-gaap:FairValueInputsLevel2Member2023-12-310001000694us-gaap:FairValueInputsLevel3Member2023-12-310001000694us-gaap:FairValueInputsLevel1Member2022-12-310001000694us-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Member2022-12-310001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2022-12-310001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-12-310001000694us-gaap:FairValueInputsLevel1Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-12-310001000694us-gaap:FairValueInputsLevel2Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-12-310001000694us-gaap:FairValueInputsLevel3Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-12-310001000694us-gaap:FairValueInputsLevel1Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2022-12-310001000694us-gaap:FairValueInputsLevel2Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2022-12-310001000694us-gaap:FairValueInputsLevel3Membernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:UnsecuredDebtMember2023-12-310001000694us-gaap:FairValueInputsLevel1Membernvax:FivePointZeroConvertibleNotesDue2027Member2023-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel2Member2023-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel3Member2023-12-310001000694us-gaap:FairValueInputsLevel1Membernvax:FivePointZeroConvertibleNotesDue2027Member2022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel2Member2022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel3Member2022-12-310001000694nvax:CMOAgreementMember2023-01-012023-12-310001000694nvax:CMOAndCMDAgreementsMember2023-01-012023-12-310001000694nvax:CMOAndCMDAgreementsMember2022-01-012022-12-310001000694nvax:A700QuinceOrchardRoadAgreementMember2020-01-012020-12-31utr:sqft0001000694nvax:A700QuinceOrchardRoadAgreementMember2021-01-012021-12-310001000694nvax:A700QuinceOrchardRoadAgreementMember2022-12-310001000694nvax:A700QuinceOrchardRoadAgreementMember2023-12-310001000694nvax:A700QuinceOrchardRoadAgreementMember2023-01-012023-12-310001000694nvax:FacilityLeaseAgreementMembersrt:MinimumMember2023-12-310001000694nvax:FacilityLeaseAgreementMembersrt:MaximumMember2023-12-310001000694nvax:ROUFacilityLeasesMember2023-01-012023-12-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-12-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:UnsecuredDebtMember2022-12-012022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:UnsecuredDebtMember2022-12-012022-12-31nvax:day0001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:UnsecuredDebtMember2022-12-012022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:UnsecuredDebtMember2022-12-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-12-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2023-01-312023-01-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-012016-12-310001000694us-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-250001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-250001000694us-gaap:CallOptionMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-012016-12-310001000694us-gaap:CallOptionMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-250001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-012016-12-310001000694srt:MaximumMemberus-gaap:UnsecuredDebtMembernvax:FivePointZeroConvertibleNotesDue2027MakeWholeFundamentalChangeMember2023-01-012023-12-310001000694srt:MaximumMemberus-gaap:UnsecuredDebtMembernvax:ThreePointSeventyFiveConvertibleNotesDue2023Member2016-01-012016-12-310001000694nvax:August2023SalesAgreementMemberus-gaap:CommonStockMember2023-08-310001000694nvax:August2023SalesAgreementMemberus-gaap:CommonStockMember2023-01-012023-12-310001000694nvax:June2021SalesAgreementMemberus-gaap:CommonStockMember2023-01-012023-12-310001000694nvax:June2021AndAugust2023SalesAgreementMemberus-gaap:CommonStockMember2023-01-012023-12-310001000694nvax:June2021AndAugust2023SalesAgreementMemberus-gaap:CommonStockMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-01-012023-12-310001000694nvax:August2023SalesAgreementMemberus-gaap:CommonStockMember2023-12-310001000694nvax:June2021SalesAgreementMemberus-gaap:CommonStockMember2022-01-012022-12-310001000694nvax:PublicOfferingMember2022-12-012022-12-310001000694nvax:UnderwriterMember2022-12-012022-12-310001000694nvax:UnderwriterMember2022-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-01-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMember2023-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMember2023-01-012023-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMember2015-06-012015-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMember2015-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMembersrt:MinimumMember2015-06-012015-06-300001000694srt:MaximumMembernvax:TwoThousandFifteenStockIncentivePlanMember2015-06-012015-06-300001000694us-gaap:CostOfSalesMember2023-01-012023-12-310001000694us-gaap:CostOfSalesMember2022-01-012022-12-310001000694us-gaap:CostOfSalesMember2021-01-012021-12-310001000694us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001000694us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001000694us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001000694us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001000694us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001000694us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2022-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMember2022-12-310001000694nvax:TwoThousandFiveStockIncentivePlanMember2022-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-01-012023-12-310001000694nvax:TwoThousandFiveStockIncentivePlanMember2023-01-012023-12-310001000694nvax:TwoThousandFiveStockIncentivePlanMember2023-12-310001000694us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001000694us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001000694us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310001000694srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-01-012022-12-310001000694srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2021-01-012021-12-310001000694srt:MaximumMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-12-310001000694us-gaap:EmployeeStockMember2023-01-012023-12-310001000694us-gaap:EmployeeStockMember2023-12-310001000694nvax:FirstThreePercentOfParticipantsDeferralMemberMember2023-01-012023-12-310001000694nvax:NextTwoPercentOfParticipantsDeferralMemberMember2023-01-012023-12-310001000694us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001000694us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001000694us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001000694us-gaap:LandAndLandImprovementsMember2023-12-310001000694us-gaap:LandAndLandImprovementsMember2022-12-310001000694us-gaap:MachineryAndEquipmentMember2023-12-310001000694us-gaap:MachineryAndEquipmentMember2022-12-310001000694us-gaap:LeaseholdImprovementsMember2023-12-310001000694us-gaap:LeaseholdImprovementsMember2022-12-310001000694nvax:ComputerSoftwareAndHardwareMemberMember2023-12-310001000694nvax:ComputerSoftwareAndHardwareMemberMember2022-12-310001000694us-gaap:ConstructionInProgressMember2023-12-310001000694us-gaap:ConstructionInProgressMember2022-12-310001000694country:CZ2023-12-310001000694country:CZ2022-12-310001000694us-gaap:DomesticCountryMember2023-12-310001000694us-gaap:StateAndLocalJurisdictionMember2023-12-310001000694us-gaap:CapitalLossCarryforwardMember2023-12-310001000694nvax:SubjectToExpirationMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001000694nvax:NoExpirationMemberus-gaap:StateAndLocalJurisdictionMember2023-12-310001000694us-gaap:ResearchMember2023-12-310001000694us-gaap:ResearchMemberus-gaap:NonUsMember2023-12-3100010006942022-12-122022-12-12nvax:defendantnvax:payment0001000694us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001000694us-gaap:EmployeeSeveranceMember2023-01-012023-12-310001000694us-gaap:EmployeeSeveranceMember2022-01-012022-12-310001000694us-gaap:EmployeeSeveranceMember2021-01-012021-12-310001000694us-gaap:SubsequentEventMember2024-01-312024-01-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 000-26770

NOVAVAX, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

22-2816046 |

| (State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

700 Quince Orchard Road, |

|

|

| Gaithersburg, |

Maryland |

|

20878 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (240) 268-2000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 per share |

NVAX |

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: Not Applicable

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

|

|

|

|

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

|

| Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant had elected not to use the extended transition period for complying with any new or revised financial accounting standards provide pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Exchange Act, indicate by check mark whether the financial

statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant (based on the last reported sale price of Registrants common stock on June 30, 2023 on the Nasdaq Global Select Market) was approximately $699,000,000.

As of February 23, 2024, there were 139,953,143 shares of the Registrant’s common stock outstanding.

Documents incorporated by reference: Portions of the Registrant’s Definitive Proxy Statement to be filed no later than 120 days after the fiscal year ended December 31, 2023 in connection with the Registrant’s 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent indicated herein.

NOVAVAX, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

Page |

|

PART I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

CERTAIN DEFINITIONS

All references in this Annual Report on Form 10-K to “Novavax,” the “Company,” “we,” “us,” and “our” refer to Novavax, Inc. including its wholly-owned subsidiaries (unless the context otherwise indicates). All references in this Annual Report on Form 10-K to "NVX-CoV2373,” or “prototype vaccine” refer to our Nuvaxovid™ prototype COVID-19 vaccine, and all references to “NVX-CoV2601,” or “updated vaccine” refer to our Nuvaxovid™ updated COVID-19 vaccine. We refer to our prototype vaccine and updated vaccine, collectively, as our “COVID-19 Vaccine”. Local regulatory authorities have also specified nomenclature for the prototype and updated vaccines for labeling within their territories (e.g., “Novavax COVID-19 Vaccine, Adjuvanted” and “Novavax COVID-19, Adjuvanted (2023-2024 Formula),” respectively, for the U.S.). The Company’s partner, Serum Institute of India Pvt. Ltd., markets NVX-CoV2373 as “Covovax™.”

NOTE REGARDING TRADEMARKS

Novavax™, Nuvaxovid™, Matrix-M™, Matrix™, Prepare™, Resolve™, and ResVax™ are trademarks of Novavax. Any other trademarks referred to in this Annual Report on Form 10-K are the property of their owners. All rights reserved. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. As a result of many factors, such as those set forth under “Risk Factors” and elsewhere in this Annual Report on Form 10-K, our actual results may differ materially from those anticipated in these forward-looking statements. Please also see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

SUMMARY OF RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks which are discussed more fully under the heading “Risk Factors” in this Annual Report on Form 10-K. These risks include, but are not limited to, the following:

•We have a history of losses and our future profitability is uncertain.

•We will continue to require significant funding to maintain our current level of operations and fund the further development of our vaccine candidates.

•Because our vaccine product development efforts depend on new and rapidly evolving technologies, we cannot be certain that our efforts will be successful.

•The regulatory and commercial success of our COVID-19 Vaccine remains uncertain. While we have received full marketing authorization provisional registration, conditional marketing authorization (“CMA”), or emergency use authorization (“EUA”) for our prototype COVID-19 Vaccine and our updated COVID-19 vaccine in a number of jurisdictions, we may be unable to obtain full regulatory approvals in the United States (“U.S.”) or other jurisdictions for our updated vaccine or new versions in the future, or produce a successful vaccine in a timely manner, if at all.

•The emergence and transmissibility of variants of the SARS-CoV-2 virus, and the demand for bivalent vaccines, may affect market acceptance or sales of our COVID-19 Vaccine, and our strategy to develop new versions of our COVID-19 Vaccine to protect against certain variants may not be successful.

•We are a biotechnology company and face significant risk in developing, manufacturing, and commercializing our products and product candidates.

•Because we depend on third parties to conduct some of our laboratory testing and clinical trials, and a significant amount of our vaccine manufacturing and distribution, we may encounter delays in or lose some control over our efforts to develop and supply products and product candidates.

•We are highly dependent on the commercial success of our COVID-19 Vaccine, and even though we have received provisional registration, CMA, or EUA or full marketing authorization in certain jurisdictions for our COVID-19 Vaccine, and even if we have products licensed in additional markets, our vaccine products may not be initially or ever profitable.

•The risks associated with COVID-19 and related governmental public health policies continue to evolve, which may have unpredictable effects on the prospects for commercial success of our COVID-19 commercial program.

•Many of our competitors have significantly greater resources and experience, which may negatively impact our commercial opportunities and those of our current and future licensees.

•There is significant competition in the development of a vaccine against COVID-19 and a combined vaccine against COVID-19 and influenza, and we may never see returns on the significant resources we are devoting to our vaccine candidates.

•We may not succeed in obtaining full U.S. Food and Drug Administration (“U.S. FDA”) licensure or foreign regulatory approvals necessary to sell our vaccine candidates.

•Our product candidates might fail to meet their primary endpoints in clinical trials, meaning that we will not have the clinical data required to support full regulatory approvals.

•The regulatory pathway for our COVID-19 Vaccine is continually evolving, and such evolution may result in unexpected or unforeseen challenges.

•We have conducted, are conducting, and plan to conduct in the future, a number of clinical trials for our COVID-19 Vaccine at sites outside the U.S. and the U.S. FDA may not accept data from trials conducted in such locations.

•The later discovery of previously unknown problems with a product, manufacturer, or facility may result in restrictions, including withdrawal of a vaccine that had previously received regulatory approval in certain jurisdictions from the market.

•Our success depends on our ability to maintain the proprietary nature of our technology.

•Our business may be adversely affected if we do not successfully execute our business development initiatives.

•Given our current cash position and cash flow forecast, and significant uncertainties related to 2024 revenue, substantial doubt exists regarding our ability to continue as a going concern through one year from the date that the financial statements included in this Annual Report were issued.

•Servicing our 5.00% convertible senior unsecured notes due 2027 (the “Notes”) requires a significant amount of cash, and we may not have sufficient cash flow resources to pay our debt.

•Because our stock price has been and will likely continue to be highly volatile, the market price of our common stock may be lower or more volatile than expected.

•Litigation could have a material adverse impact on our results of operation and financial condition.

•We or the third parties upon whom we depend may be adversely affected by natural or man-made disasters or public health emergencies, such as the COVID-19 pandemic.

PART I

Item 1. BUSINESS

Overview

Novavax, Inc., together with our wholly owned subsidiaries, is a biotechnology company that promotes improved global health through the discovery, development, and commercialization of innovative vaccines to prevent serious infectious diseases. Our proprietary recombinant technology platform harnesses the power and speed of genetic engineering to efficiently produce highly immunogenic nanoparticle vaccines designed to address urgent global health needs.

Our vaccine candidates are nanostructures of conformationally correct recombinant proteins that mimic those found on pathogens. This technology enables the immune system to recognize target proteins and develop protective immune responses. We believe that our vaccine technology may lead to the induction of a differentiated immune response that may be more efficacious than naturally occurring immunity or other vaccine approaches. Our vaccine candidates also incorporate our proprietary saponin-based Matrix-M™ adjuvant to enhance the immune response, stimulate higher levels of functional antibodies, and induce a cellular immune response.

We have developed an updated COVID-19 vaccine for the 2023-2024 vaccination season. In October 2023, the U.S. FDA granted EUA for our updated vaccine for active immunization to prevent COVID-19. The updated vaccine is authorized as (1) a single dose in individuals 12 years and older who have been vaccinated with any COVID-19 vaccine at least 2 months after receipt of the last previous dose of COVID-19 vaccine, and (2) a series of 2 doses administered 3 weeks apart to individuals 12 years and older who were not previously vaccinated with any COVID-19 vaccine. Our updated vaccine is available within the U.S. at many major pharmacy retailers. Outside the U.S. for our updated vaccine, in January 2024, we were granted marketing authorization by the United Kingdom’s (“UK”) Medicines and Healthcare Products Regulatory Agency (“MHRA”), in December 2023, we were granted expanded authorization by Health Canada, and in October 2023, we were granted approval by the European Commission (“EC”). We are committed to supplying of our key target markets through advance purchase agreements (“APAs”) covering such markets. We continue to work closely with regulatory authorities in many jurisdictions for authorization of our updated vaccine. We previously developed a prototype COVID-19 vaccine, which has received full marketing authorization (“MA”), marketing approval, interim authorization, provisional approval, CMA, from multiple regulatory authorities in over 40 countries globally. We continue to progress our regulatory authorizations for our prototype vaccine in select territories, as we believe these may facilitate authorization of our vaccine candidates for updated strains in the future.

Additionally, we are developing a COVID-19 Influenza Combination (“CIC”) vaccine candidate. Our other areas of focus include providing Matrix-M™ adjuvant for collaborations, including in R21/Matrix-M™ adjuvant malaria vaccine, which in December 2023 received prequalification from the World Health Organization (“WHO”) and previously received authorization in several countries, as well as other preclinical vaccine research with our Matrix-M™ adjuvant, including through a partnership with the Bill & Melinda Gates Medical Research Institute.

We were incorporated in 1987 under the laws of the State of Delaware. Our principal executive offices are located at 700 Quince Orchard Road, Gaithersburg, Maryland, 20878, and our telephone number is (240) 268-2000. Our common stock is listed on the Nasdaq Global Select Market under the symbol “NVAX.”

Technology Overview

We believe our recombinant nanoparticle vaccine technology, together with our proprietary Matrix-M™ adjuvant, is well suited for the development and commercialization of vaccine candidates targeting a broad scope of respiratory and other endemic and emerging infectious diseases at scale.

Recombinant Nanoparticle Vaccine Technology

Once a target of interest has been identified, the genetic sequence encoding the antigen is selected for developing the vaccine construct. The genetic sequence may be optimized to enhance protein stability or confer resistance to degradation. This genetic construct is inserted into the baculovirus Spodoptera frugiperda (“Sf-/BV”) insect cell-expression system, which enables efficient, large-scale expression of the optimized protein. The Sf-/BV system produces protein-based antigens that are properly folded and modified—which can be critical for functional, protective immunity. Protein antigens are purified and organized around a polysorbate-based nanoparticle core in a configuration that resembles their native presentation. This results in a highly immunogenic nanoparticle that is ready to be formulated with Matrix-M™ adjuvant.

Matrix-M™ Adjuvant

Our proprietary Matrix-M™ adjuvant has been a key differentiator within our platform. This adjuvant has enabled potent, well-tolerated, and durable efficacy by stimulating the entry of antigen presenting cells (“APCs”) into the injection site and enhancing antigen presentation in local lymph nodes. This in turn activates APCs, T-cell and B-cell populations, and plasma cells, which promotes the production of high-affinity antibodies. This potent mechanism of action enables a lower dose of antigen to achieve the desired immune response, thereby contributing to increased vaccine supply and manufacturing capacity. These immune-boosting and dose-sparing capabilities contribute to the adjuvant’s highly unique profile.

We continue to evaluate commercial opportunities for the use of our Matrix-M™ adjuvant alongside vaccine antigens produced by other manufacturers. Matrix-M™ adjuvant is being evaluated in combination with several partner-led malaria vaccine candidates, including the R21/Matrix-M™ adjuvant malaria vaccine created by the Jenner Institute, University of Oxford. The R21/Matrix-M™ adjuvant vaccine has been licensed to Serum Institute of India Pvt. Ltd. (“SIIPL”) for commercialization and in December 2023 received prequalification by the WHO, along with authorizations received earlier in the year in Burkino Faso, Ghana, and Nigeria. Additionally, in May 2023, we entered into a 3-year agreement with the Bill & Melinda Gates Medical Research Institute to provide our Matrix-M™ adjuvant for use in preclinical vaccine research. In June 2023, we signed a material transfer agreement with SK bioscience Co., Ltd. (“SK”) for use of our Matrix-M™ adjuvant in preclinical vaccine experiments for shingles, influenza, and pan-sarbecovirus vaccine. Our adjuvant technology is also being used by commercial partners as a key component in veterinary vaccines against equine influenza and Strangles, as well as the manufacture of black-widow anti-venom.

COVID-19 Vaccine Regulatory and Licensure

We have received full authorizations in select territories for our prototype vaccine developed for the 2022-2023 COVID-19 vaccination season and continue to receive authorizations for our updated vaccine developed for the 2023-2024 COVID-19 vaccination season in accordance with the updated strain protocol guidance. We continue to progress our regulatory authorizations for our prototype vaccine in select territories, as we believe these may facilitate authorization of our vaccine candidates for updated strains in the future. Additionally, we progress our regulatory authorizations for our updated vaccine and plan to continue to do so for subsequent future variant strains for each annual respiratory season.

Within the U.S. market, our updated vaccine received EUA in October 2023 from the U.S. FDA to prevent COVID-19 in individuals aged 12 and older. Our updated vaccine is marketed in the U.S. under the name Novavax COVID-19 Vaccine, Adjuvanted (2023-2024 Formula). The formulation for our updated vaccine aligns with global harmonized guidance from the U.S. FDA, the European Medicines Agency (“EMA”), and WHO recommendations for the 2023-2024 vaccination season. In September 2023, the U.S. Centers for Disease Control and Prevention (“CDC”) Advisory Committee on Immunization Practices (“ACIP”) voted in favor of a recommendation for the use of 2023-2024 monovalent XBB containing COVID-19 vaccines authorized under EUA or approved by Biologics License Application (“BLA”) in individuals 6 months and older, which was adopted by the CDC Director. The U.S. FDA’s grant of EUA and CDC’s September 2023 recommendation makes our updated vaccine the only protein-based non-mRNA COVID-19 vaccine available in the U.S.

Outside of the U.S. market, we continue to progress regulatory authorizations for our updated vaccine globally. We highlight as follows our fourth quarter 2023 and subsequent authorizations received through the date of filing this Annual Report on Form 10-K.

In January 2024, we were granted marketing authorization by the UK MHRA for our updated vaccine, marketed under the name Nuvaxovid™ XBB.1.5 Vaccine, in individuals aged 12 and older.

In December 2023, we were granted expanded authorization by Health Canada and EUA by the Taiwan Food and Drug Administration for our updated vaccine, marketed under the name Nuvaxovid™ XBB.1.5 Vaccine, in individuals aged 12 and older.

In November 2023, our updated vaccine received EUA in South Korea where SK bioscience has exclusive commercial rights to our updated vaccine. Additionally, in November 2023, we were granted emergency use license (“EUL”) by the WHO for our updated vaccine, marketed under the name Nuvaxovid™ XBB.1.5 Vaccine, in individuals aged 12 and older. The EUL assists WHO member states in assessing vaccines with the aim of expediting availability and enables the WHO’s 194 member states to expedite regulatory approvals to import and administer the vaccine.

In October 2023, we were granted approval by the EC for our updated vaccine in individuals aged 12 and older, which followed the positive opinion for approval from the Committee for Medicinal Products for Human Use of the EMA. We expect to deliver doses to European countries pursuant to existing APAs.

We have previously received authorizations for our prototype COVID-19 vaccine in over 40 countries globally including from major regulatory agencies such as the U.S. FDA, WHO, EMA, and MHRA. To date, we have received full MA, approval, interim authorization, provisional approval, CMA, and EUA for the adult population, aged 18 and older, the adolescent population, aged 12 to 17 years, and the pediatric population, aged 7 to 11 years in select territories. The regulatory authorizations for our prototype vaccine include primary series and both homologous and heterologous booster indications within specific countries. For the territories in which our vaccine has received regulatory authorizations, our prototype vaccine is marketed under the names (i) Nuvaxovid™ (SARS-CoV-2 rS Recombinant, adjuvanted), (ii) Covovax™ (manufacturing and commercialization by SIIPL), or (iii) Novavax COVID-19 Vaccine, Adjuvanted.

In October 2023, our prototype vaccine received full marketing authorization in the UK from the MHRA in individuals aged 12 and older, full approval in Singapore from Singapore’s Health Sciences Authority in individuals aged 12 and older, full registration in Australia from Australia’s Therapeutic Goods Administration as a booster in individuals aged 12 and older, and authorization in the EU from EMA for use as a booster in adolescents aged 12 through 17 years. We believe these authorizations for our prototype vaccine may facilitate authorizations of our vaccine candidates for our COVID-19 vaccine strain updates in the future.

We are working to continue to expand our label for heterologous boosting in adults and adolescents, to expand our label for primary and re-vaccination in younger children, and to achieve supportive policy recommendations enabling broad market access. We continue to work closely with governments, regulatory authorities, and non-governmental organizations in our commitment to facilitate global access to our COVID-19 vaccine.

APAs

We have entered into APAs (also referred to as “supply agreements” throughout this Annual Report on Form 10-K) with the EC and various countries globally. The APAs typically contain terms that include upfront payments intended to assist us in funding investments related to building out and operating our manufacturing and distribution network, among other expenses, in support of our global supply commitment. Such upfront payments generally become non-refundable upon our achievement of certain development milestones. We currently have approximately $2 billion in committed APAs anticipated for future delivery.

We had an APA with the EC, acting on behalf of various European Union member states to supply a minimum of 20 million and up to 100 million initial doses of prototype vaccine, with the option for the EC to purchase an additional 100 million doses up to a maximum aggregate of 200 million doses in one or more tranches through 2023. In 2022, we were notified by the EC that it was cancelling approximately 7 million doses of its prior commitment originally scheduled for delivery in the first and second quarters of 2022, in accordance with the APA, and reducing the order to approximately 63 million doses. In January 2023, we finalized a revised delivery schedule for the remaining 20 million committed doses under the APA that were originally scheduled for delivery during the first and second quarters of 2022. The APA expired in August 2023 and required that any open and outstanding orders from European Union member states be satisfied by February 2024. Since August 2023, any additional doses have been managed by amending outstanding orders with deliveries made by February 2024.

We have an APA with the Commonwealth of Australia for the purchase of doses of COVID-19 Vaccine (the “Australia APA”). In April 2023, we amended the Australia APA to reduce the number of doses to be delivered with a commensurate increase in the per-dose price, such that the total contract value of the Australia APA is maintained with doses to be delivered through 2024. In May 2023, we extended a credit for certain doses delivered in 2022 to Australia that qualified for replacement under the Australia APA. This credit is the result of a single lot sold to the Australian government that upon pre-planned 6-month stability testing was found to have fallen below the defined specifications and the lot therefore was removed from the market. The credit will be applied against the future sale of doses to Australia. In July 2023, we amended the Australia APA to provide for replacement doses and to extend the delivery schedule through 2025. As of February 2024, we had not yet received Therapeutic Goods Administration (“TGA”) authorization or delivered doses as contemplated in the July 2023 amendment and are in active discussions with the Australian government on both the TGA authorization and delivery of the doses previously scheduled for the fourth quarter of 2023. In February 2024, we received notice from the Australian government purporting to cancel its order for such prototype vaccine doses. We believe the cancellation was not proper under the amended Australia APA. However, if such a cancellation were determined to be allowable, $6.0 million of the deferred revenue would become a credit towards future deliveries of doses and approximately $48 million of the contract value related to future deliverables would no longer be available.

We have an APA with His Majesty the King in Right of Canada as represented by the Minister of Public Works and Government Services, as successor in interest to Her Majesty the Queen in Right of Canada, as represented by the Minister of Public Works and Government Services (the “Canadian government”), for the purchase of doses of COVID-19 Vaccine (the “Canada APA”). In April 2023, we amended the Canada APA, pursuant to which the Canadian government forfeited certain doses originally scheduled for delivery in 2022 for a payment of $100.4 million, which we received in the second quarter of 2023. In June 2023, we entered into an additional amendment (the “June 2023 Amendment”) to the Canada APA.

Pursuant to the June 2023 Amendment, (i) the Canadian government forfeited certain doses of COVID-19 Vaccine previously scheduled for delivery and agreed to pay a total amount of $349.6 million to us in two equal installments, which total amount equaled the remaining balance owed by the Canadian government with respect to such forfeited vaccine doses, (ii) the amount of doses of COVID-19 Vaccine due for delivery was reduced, (iii) the delivery schedule for the remaining doses of COVID-19 Vaccine to be delivered was revised, and (iv) the parties agreed Novavax would use the Biologics Manufacturing Centre (“BMC”) Inc. to produce bulk antigen for doses in 2024 and 2025. The June 2023 Amendment maintained the total contract value of the original Canada APA. The first Installment of $174.8 million was payable upon execution of the June 2023 Amendment and received by Novavax in July 2023, and the second installment of $174.8 million was contingent and payable upon the delivery of vaccine doses in the second half of 2023 and received by Novavax in January 2024. The Canadian government may terminate the Canada APA, as amended, if we fail to receive regulatory approval for our COVID-19 Vaccine using bulk antigen produced at BMC on or before December 31, 2024. Our 2024 plans do not currently anticipate the submission for regulatory approval of our COVID-19 Vaccine using bulk antigen produced at BMC, and we plan to work with the Canadian government on an amendment that addresses possible alternatives, which may not be achievable. As of December 31, 2023, $102.8 million was classified as short-term Deferred revenue and $485.3 million was classified as long-term Deferred revenue with respect to the Canadian APA on our consolidated balance sheet. If the Canadian government terminates the Canada APA, $28.0 million of the deferred revenue would become refundable and approximately $224 million of the contract value related to future deliverables would no longer be available (see Note 3 to our consolidated financial statements). In the event that the contract is terminated, we would consider competing in the Canadian commercial market. Pursuant to the June 2023 Amendment, Novavax and the Canadian government will endeavor to expand the previously agreed in-country commitment to Canada and to further partner to provide health, economic, and future pandemic preparedness benefits to Canada, which value may be provided through a number of activities, including without limitation, capital investments, the performance of activities or services, or the provision of technology or intellectual property licenses. Further, the parties will endeavor to enter into a memorandum of understanding (the “MOU”) to illustrate our ability to deliver such benefits over a 15-year period with an aggregate value of not less than 100% of the amount remaining to be paid under the June 2023 Amendment and ultimately received by us. As of December 31, 2023, discussions regarding the MOU were ongoing. We agreed to hold $20.0 million of the second installment payment received in January 2024 in escrow for the benefit of the Canadian government, which amount is the sole recourse available to the Canadian government in the event of non-performance under the MOU.

In July 2022, we entered into an Amended and Restated SARS-CoV-2 Vaccine Supply Agreement (as amended on September 26, 2022, the “Amended and Restated UK Supply Agreement”) with The Secretary of State for Business, Energy and Industrial Strategy (as assigned to the UK Health Security Agency), acting on behalf of the government of the United Kingdom of Great Britain and Northern Ireland (the “Authority”), which amended and restated in its entirety the SARS-CoV-2 Vaccine Supply Agreement, dated October 22, 2020, between the parties (the “Original UK Supply Agreement”). Under the Original UK Supply Agreement, the Authority agreed to purchase 60 million doses of prototype vaccine and made an upfront payment to us. Under the terms of the Amended and Restated UK Supply Agreement, the Authority agreed to purchase a minimum of 1 million doses and up to an additional 15 million doses (the “Conditional Doses”) of prototype vaccine, with the number of Conditional Doses contingent on, and subject to reduction based on, our timely achievement of supportive recommendations from the Joint Committee on Vaccination and Immunisation (the “JCVI”) that is approved by the UK Secretary of State for Health, with respect to use of the vaccine for (a) the general adult population as part of a SARS-CoV-2 vaccine booster campaign in the United Kingdom or (b) the general adolescent population as part of a SARS-CoV-2 vaccine booster campaign in the United Kingdom or as a primary series SARS-CoV-2 vaccination, excluding where that recommendation relates only to one or more population groups comprising less than one million members in the United Kingdom. If the Authority did not purchase the Conditional Doses or if the number of such Conditional Doses was reduced below 15 million doses of prototype vaccine, we would have to repay up to $225 million related to the upfront payment previously received from the Authority under the Original UK Supply Agreement. Under the Amended and Restated UK Supply Agreement, the Authority also has the option to purchase up to an additional 44 million doses, in one or more tranches, through 2024.

As of November 30, 2022, the JCVI had not made a supportive recommendation with respect to prototype vaccine, thereby triggering, under the terms of the Amended and Restated UK Supply Agreement, (i) a reduction of the number of Conditional Doses from 15 million doses to 7.5 million doses, which reduced number of Conditional Doses were contingent on, and subject to further reduction based on, our timely achievement by November 30, 2023 of a supportive recommendation from JCVI that is approved by the UK Secretary of State for Health as described in the paragraph above, and (ii) an obligation for us to repay $112.5 million related to the upfront payment previously received from the Authority under the Original UK Supply Agreement. In April 2023, we repaid the $112.5 million related to the November 30, 2022 triggering event. As of November 30, 2023, the JCVI had not made a supportive recommendation with respect to the prototype vaccine, thereby triggering a reduction in the number of Conditional Doses from 7.5 million doses to zero. As of February 2024, the Company is in discussions with the Authority regarding the treatment of the remaining upfront payment previously received of $112.5 million, which is reflected in Other current liabilities.

In May 2021, we entered into an APA with Gavi, the Vaccine Alliance (“Gavi” and “the Gavi APA”). Under the terms of the Gavi APA and a separate purchase agreement between Gavi and SIIPL, 1.1 billion doses of the prototype vaccine were to be made available to countries participating in the COVAX Facility, which was established to allocate and distribute vaccines equitably to participating countries and economies. We expected to manufacture and distribute 350 million doses of the prototype vaccine to countries participating in the COVAX Facility. Under a separate purchase agreement with Gavi, SIIPL was expected to manufacture and deliver the balance of the 1.1 billion doses of prototype vaccine to low- and middle-income countries participating in the COVAX Facility. We expected to deliver doses with antigen and adjuvant manufactured at facilities directly funded under our funding agreement with the Coalition for Epidemic Preparedness Innovations (“CEPI”), with initial doses supplied by SIIPL and Serum Life Sciences Limited (“SLS”) under a supply agreement. We expected to supply significant doses that Gavi would allocate to low-, middle- and high-income countries, subject to certain limitations, utilizing a tiered pricing schedule and Gavi could prioritize such doses to low- and middle- income countries, at lower prices. Additionally, we could provide additional doses of prototype vaccine, to the extent available from CEPI-funded manufacturing facilities, in the event that SIIPL could not materially deliver expected vaccine doses to the COVAX Facility. Under the agreement, we received an upfront payment of $350.0 million from Gavi in 2021 and an additional payment of $350.0 million in 2022 related to our achieving an emergency use license for our prototype vaccine by the WHO (the “Advance Payment Amount”).

On November 18, 2022, we delivered written notice to Gavi to terminate the Gavi APA on the basis of Gavi’s failure to procure the purchase of 350 million doses of our prototype vaccine from us as required by the Gavi APA. As of November 18, 2022, we had only received orders under the Gavi APA for approximately 2 million doses. On December 2, 2022, Gavi issued a written notice purporting to terminate the Gavi APA based on Gavi’s contention that we had repudiated the agreement and, therefore, materially breached the Gavi APA. Gavi also contended that, based on its purported termination of the Gavi APA, it was entitled to a refund of the Advance Payment Amount less any amounts that have been credited against the purchase price for binding orders placed by a buyer participating in the COVAX Facility. The remaining Gavi Advance Payment Amount, which was $696.4 million as of December 31, 2023 has been classified within Other current liabilities in the Company’s consolidated balance sheet. On January 24, 2023, Gavi filed a demand for arbitration with the International Court of Arbitration based on the claims described above. We filed our Answer and Counterclaims on March 2, 2023. On April 5, 2023, Gavi filed its Reply to our Counterclaims. On February 16, 2024, we and Gavi entered into a Termination and Settlement Agreement (the “ Gavi Settlement Agreement”) terminating the Gavi APA, settling the arbitration proceedings and releasing both parties of all claims arising from, under or otherwise in connection with the Gavi APA. Pursuant to the Settlement Agreement, we are responsible for payment to Gavi of (i) an initial settlement payment of $75 million, which we paid on February 20, 2024, and (ii) deferred payments, in equal annual amounts of $80 million payable each calendar year through a deferred payment term ending December 31, 2028. The deferred payments are due in variable quarterly installments beginning in the first quarter of 2024 and total $400 million during the deferred payment term. Such deferred payments may be reduced through Gavi’s use of an annual vaccine credit equivalent to the unpaid balance of such deferred payments each year, which may be applied to qualifying sales of any of our vaccines for supply to certain low-income and lower-middle income countries. We have the right to price the vaccines offered to such low-income and lower-middle income countries at our discretion, and, when utilized by Gavi, we will credit the actual price per vaccine paid against the applicable credit. We intend to price vaccines offered via the tender process, consistent with our shared goal with Gavi to provide equitable access to those countries. Also in the Settlement Agreement, we grant Gavi an additional credit of up to $225 million, which may be applied against any additional qualifying sales, exceeding the $80 million deferred payment amount in any calendar year, of our vaccines in such countries during such deferred payment term. In addition, we and Gavi entered into a security agreement pursuant to which we granted Gavi a security interest in accounts receivable from SIIPL under the SIIPL R21 Agreement (see Note 4 to our consolidated financial statements for more details on SIIPL R21 Agreement), which will continue for the deferred payment term of the Gavi Settlement Agreement.

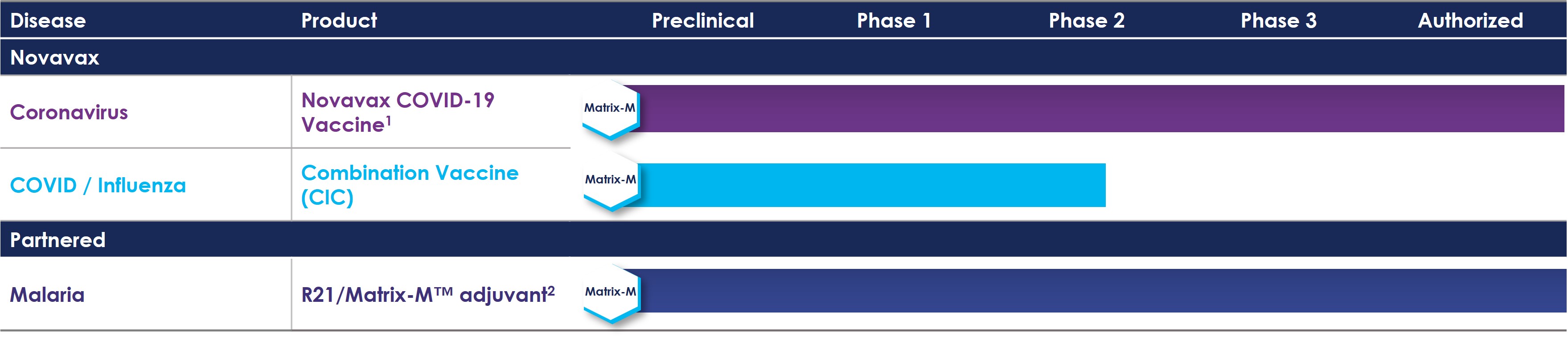

Product Pipeline

(1) Authorized in select geographies under trade names Novavax COVID-19 Vaccine, Adjuvanted; Covovax™; and Nuvaxovid™, and authorized in the U.S. under trade name, Novavax COVID-19 Vaccine, Adjuvanted (2023-2024 Formula); Ongoing post-authorization Phase 3 strain change trial.

(2) Authorized in Ghana, Nigeria, and Burkina Faso; Commercialized by Serum Institute of India; Granted prequalification by the WHO.

Pipeline Overview

Our clinical pipeline encompasses vaccine candidates for infectious diseases, with our COVID-19 prototype vaccine (NVX-CoV2373) and our COVID-19 updated vaccine (NVX-CoV2601), as our lead products. Our prototype and updated vaccine has received authorizations for both adult and adolescent populations globally. Our updated vaccine has received authorization from the U.S. FDA, the EC, the WHO, and several other countries globally. We advanced our updated vaccine to a post-authorization Phase 3 safety and immunogenicity trial. Beyond our COVID-19 vaccine, our clinical pipeline includes a CIC vaccine candidate, in addition to our Matrix-M™ adjuvant being used for collaboration in R21/Matrix-M™ adjuvant malaria vaccine.

We are developing a CIC vaccine candidate, which combines our COVID-19 vaccine and our updated seasonal nanoparticle influenza vaccine candidate in a single formulation. We continue to progress a Phase 2 trial of our CIC vaccine candidate. We have selected the CIC dose formulation for advanced development, and contingent upon U.S. FDA concurrence, we are prepared to move directly into a Phase 3 trial in the second half of 2024 to support accelerated approval, with a potential launch in the U.S. in the fall of 2026.

In addition to our CIC vaccine candidate, we believe our partner-led R21/Matrix™ adjuvant malaria vaccine presents significant potential. Based on preliminary results from an ongoing Phase 3 trial in infants and toddlers in Africa, showing 72-79% efficacy, the R21/Matrix™ adjuvant malaria vaccine has been authorized in Ghana, Nigeria, and Burkina Faso, and in December 2023, was granted prequalification by the WHO.

Coronavirus Vaccine Clinical Development

We remain focused on expanding our COVID-19 vaccine label within the booster, adolescent, and pediatric indications. We continue to evaluate vaccine safety, immunogenicity, and effectiveness through ongoing clinical trials and collaborative evidence-generating real-world studies. We expect to leverage these clinical insights to advance additional regulatory approvals of our COVID-19 vaccine globally, amidst the evolving COVID-19 landscape.

Phase 3 Strain-Change and Re-vaccination Studies

Study 311 Part 2: In August 2023, we announced topline results demonstrating immunologic superiority of our bivalent prototype and Omicron BA.5 vaccine compared to our prototype vaccine (NVX-CoV2373) for Omicron BA.5 specific responses. This study is ongoing with the last patient visit expected to occur in the first quarter of 2024. This study design was developed in consultation with regulatory agencies to support our U.S. BLA and regulatory filings in other territories for our strain-change request for our updated vaccine (NVX-CoV2601), and to demonstrate that our protein-based vaccine can be successfully adapted to new variant strains.

Study 313: In September 2023, we fully enrolled 332 adults aged 18 and older in Part 1 of the study to evaluate the immunogenicity and safety of our updated vaccine (NVX-CoV2601) in previously mRNA vaccinated individuals. Preliminary topline results indicate that the study achieved its co-primary endpoints and successfully demonstrated immunological superiority of NVX-CoV2601 compared to our prototype vaccine for Omicron XBB.1.5 specific immune responses.

In November 2023, we fully enrolled 338 adults aged 18 and older in Part 2 of the study which will evaluate the immunogenicity of our updated vaccine (NVX-CoV2601) in previously unvaccinated individuals. Part 2 topline results are expected in the second quarter of 2024. Data from Study 313 are intended to support BLA supplements and similar regulatory submissions in other territories for future variant strain formulations.

Study 314: In September 2023, we fully enrolled 401 adolescents aged 12 to 17 years who were previously vaccinated with mRNA vaccines to evaluate the immunogenicity of boosting with our updated vaccine (NVX-CoV2601) and with a bivalent format vaccine containing our updated vaccine (NVX-CoV2373 + NVX-CoV2601). These data are intended to support adolescent heterologous booster label expansion in some territories with topline results expected in the second quarter of 2024.

Phase 2b/3 Pediatric Hummingbird™ Study

In August 2023, we announced topline results from our Phase 2b/3 Hummingbird™ trial that met its primary endpoints in children aged 6 through 11 years demonstrating both tolerability and immunologic responses. We remain on track to submit data for this cohort to the U.S. FDA in the first half of 2024. This ongoing trial is evaluating the safety, effectiveness (immunogenicity), and efficacy of two doses of our prototype vaccine (NVX-CoV2373), followed by a booster 6 months after the primary vaccination series. The trial includes three age de-escalation cohorts of 1,200 children each. The next cohort aged 2 through 5 years is fully enrolled, with topline results expected in the first quarter of 2024. The last cohort aged 6 to 23 months is fully enrolled and topline results are expected in the second quarter of 2024.

COVID-19 Vaccine Funding

We obtained critical funding from the U.S. government to support the development of COVID-19 Vaccine for the U.S. population, including $1.8 billion from a partnership formerly known as Operation Warp Speed. In July 2020, we entered into a Project Agreement (the “Project Agreement”) with Advanced Technology International, Inc. (“ATI”), the Consortium Management Firm acting on behalf of the Medical CBRN Defense Consortium in connection with the partnership. The partnership was among components of the U.S. Department of Health and Human Services and the U.S. Department of Defense working to accelerate the development, manufacturing, and distribution of COVID-19 vaccines, therapeutics, and diagnostics. The Project Agreement relates to the Base Agreement we entered into with ATI in June 2020 (the “Base Agreement,” together with the Project Agreement, the “USG Agreement”). The original USG Agreement required us to conduct certain clinical, regulatory, and other activities, including a pivotal Phase 3 clinical trial to determine the safety and efficacy of prototype vaccine, and to manufacture and deliver to the U.S. government 100 million doses of the vaccine candidate. Funding under the USG Agreement is payable to us for various development, clinical trial, manufacturing, regulatory, and other activities. The USG Agreement contains terms and conditions that are customary for U.S. government agreements of this nature, including provisions giving the U.S. government the right to terminate the Base Agreement or the Project Agreement based on a reasonable determination that the funded project will not produce beneficial results commensurate with the expenditure of resources and that termination would be in the U.S. government’s interest. If the Project Agreement was terminated prior to completion, we were entitled to be paid for work performed and costs or obligations incurred prior to termination and consistent with the terms of the USG Agreement. As of December 31, 2023, we have recognized the full $1.8 billion-funding under the USG Agreement in grant revenue.

Our funding agreement with CEPI, under which CEPI agreed to fund up to $399.5 million to us to support the development of prototype vaccine, provided up to $257.0 million in CEPI Grant Funding and up to $142.5 million in CEPI Forgivable Loan Funding, which are loans in the form of one or more forgivable no-interest term loans to fund certain manufacturing activities and are not subject to restrictive or financial covenants. Payments received under the CEPI Forgivable Loan Funding are only repayable if project vaccine, as defined under the CEPI funding agreement, manufactured by the contract manufacturing organization (“CMO”) network funded by CEPI is sold to one or more third parties (which could include sales credited under the Gavi Settlement Agreement), and such sales cover our costs of manufacturing such vaccine, not including manufacturing costs funded by CEPI. The timing and amount of any loan repayments is currently uncertain.

A summary and status of our historical COVID-19 funding developments follows:

|

|

|

|

|

|

|

|

|

| Funding Partner |

Amount |

Additional Details |

| CEPI |

$399.5 million |

•Funding of up to $399.5 million to support the development of prototype vaccine

•To supply prototype vaccine through the COVAX Facility

|

| U.S. Government through USG Agreement |

$1.8 billion |

•Allotted $1.8 billion to support the development of prototype vaccine

•Full $1.8 billion recognized in revenue as of December 31, 2023

|

COVID-19-Influenza Combination Vaccine

Phase 2 Clinical Trial of COVID-19-Influenza Combination Vaccine

In November 2023, we shared that we previously evaluated 11 discrete CIC formulations in our Phase 2 dose-confirming trial, in which we then selected the CIC dose formulation and remain on track to initiate the Phase 3 trial. We also observed a favorable reactogenicity profile with our combination vaccine that was clinically indistinguishable from the licensed influenza vaccine comparators. This preliminary data suggests that our technology can increase the antigen load while maintaining acceptable tolerability. Pending regulatory concurrence from the U.S. FDA, we expect to initiate a pivotal Phase 3 trial for our CIC vaccine candidate in the second half of 2024, with potential accelerated approval and launch in the fall of 2026.

In May 2023, we announced preliminary topline data from our Phase 2 trial for CIC, stand-alone influenza, and high-dose COVID-19 vaccine candidates. All three vaccine candidates contain our Matrix-M™ adjuvant, showed preliminary robust immune responses, reassuring safety profiles, and reactogenicity that was comparable to the licensed influenza vaccine comparator arms. The Phase 2 dose-confirming randomized, observer-blinded trial evaluated the safety and effectiveness (immunogenicity) of different formulations of the CIC and influenza vaccine candidates, and higher doses of Novavax's COVID-19 vaccine in 1,575 adults aged 50 through 80 years. The CIC vaccine candidate achieved both anti-SARS-CoV-2 immunoglobulin G (IgG) and neutralizing levels comparable to our prototype vaccine. In addition, several of the combination formulations achieved responses to both SARS-CoV-2 and to the four homologous influenza strains that were comparable to the reference comparators, supporting their prioritization for advanced development.

High-dose COVID-19 Vaccine Study

Study 205: In October 2023, we completed enrollment in a Phase 2 trial to evaluate our high-dose COVID-19 vaccine for annual vaccination in 994 adults ages 50 years and older. The trial will compare immunogenicity levels of 5 micrograms of our prototype vaccine (NVX-CoV2373) against 5 micrograms, 35 micrograms, and 50 micrograms of our updated vaccine (NVX-CoV2601) that are matched with different levels of adjuvant. Data from this trial is intended to potentially support further development of a higher-dose formulation for older adults, similar to that of influenza vaccines. Topline results are expected in the first quarter of 2024.

Malaria

Malaria is a life-threatening disease caused by a parasite that infects mosquitos and is subsequently transmitted to humans. According to the 2023 WHO World Malaria Report, in 2022, there were an estimated 249 million malaria cases and 608,000 malaria-related deaths worldwide. We believe malaria has the potential to be preventable through our partner-led R21/Matrix-M™ adjuvant malaria vaccine, which in 2023 received authorization in several countries and prequalification by the WHO.

R21/Matrix-M™ Adjuvant Malaria Vaccine

R21/Matrix-M™ adjuvant malaria vaccine, formulated with our Matrix-M™ adjuvant is developed by our partner, the Jenner Institute, University of Oxford, and manufactured by SIIPL. We have an agreement with SIIPL related to its manufacture of R21/Matrix-M™ adjuvant malaria vaccine under which SIIPL purchases our Matrix-M™ adjuvant for use in development activities at cost and for commercial purposes at a tiered commercial supply price, and pays a royalty in the single-to low-double digit range based on vaccine sales for a period of 15 years after the first commercial sale of the vaccine in each country.

Phase 3 Clinical Trial of R21/Matrix-M™ Adjuvant Malaria Vaccine