false2023Q2000100069412/31P1Y00010006942023-01-012023-06-300001000694dei:FormerAddressMember2023-01-012023-06-3000010006942023-07-31xbrli:shares0001000694us-gaap:ProductMember2023-04-012023-06-30iso4217:USD0001000694us-gaap:ProductMember2022-04-012022-06-300001000694us-gaap:ProductMember2023-01-012023-06-300001000694us-gaap:ProductMember2022-01-012022-06-300001000694us-gaap:GrantMember2023-04-012023-06-300001000694us-gaap:GrantMember2022-04-012022-06-300001000694us-gaap:GrantMember2023-01-012023-06-300001000694us-gaap:GrantMember2022-01-012022-06-300001000694nvax:RoyaltiesAndOtherMember2023-04-012023-06-300001000694nvax:RoyaltiesAndOtherMember2022-04-012022-06-300001000694nvax:RoyaltiesAndOtherMember2023-01-012023-06-300001000694nvax:RoyaltiesAndOtherMember2022-01-012022-06-3000010006942023-04-012023-06-3000010006942022-04-012022-06-3000010006942022-01-012022-06-30iso4217:USDxbrli:shares00010006942023-06-3000010006942022-12-310001000694us-gaap:CommonStockMember2023-03-310001000694us-gaap:AdditionalPaidInCapitalMember2023-03-310001000694us-gaap:RetainedEarningsMember2023-03-310001000694us-gaap:TreasuryStockCommonMember2023-03-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100010006942023-03-310001000694us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001000694us-gaap:CommonStockMember2023-04-012023-06-300001000694us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001000694us-gaap:RetainedEarningsMember2023-04-012023-06-300001000694us-gaap:CommonStockMember2023-06-300001000694us-gaap:AdditionalPaidInCapitalMember2023-06-300001000694us-gaap:RetainedEarningsMember2023-06-300001000694us-gaap:TreasuryStockCommonMember2023-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001000694us-gaap:CommonStockMember2022-03-310001000694us-gaap:AdditionalPaidInCapitalMember2022-03-310001000694us-gaap:RetainedEarningsMember2022-03-310001000694us-gaap:TreasuryStockCommonMember2022-03-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-3100010006942022-03-310001000694us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001000694us-gaap:CommonStockMember2022-04-012022-06-300001000694us-gaap:TreasuryStockCommonMember2022-04-012022-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001000694us-gaap:RetainedEarningsMember2022-04-012022-06-300001000694us-gaap:CommonStockMember2022-06-300001000694us-gaap:AdditionalPaidInCapitalMember2022-06-300001000694us-gaap:RetainedEarningsMember2022-06-300001000694us-gaap:TreasuryStockCommonMember2022-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000010006942022-06-300001000694us-gaap:CommonStockMember2022-12-310001000694us-gaap:AdditionalPaidInCapitalMember2022-12-310001000694us-gaap:RetainedEarningsMember2022-12-310001000694us-gaap:TreasuryStockCommonMember2022-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001000694us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001000694us-gaap:CommonStockMember2023-01-012023-06-300001000694us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001000694us-gaap:RetainedEarningsMember2023-01-012023-06-300001000694us-gaap:CommonStockMember2021-12-310001000694us-gaap:AdditionalPaidInCapitalMember2021-12-310001000694us-gaap:RetainedEarningsMember2021-12-310001000694us-gaap:TreasuryStockCommonMember2021-12-310001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100010006942021-12-310001000694us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001000694us-gaap:CommonStockMember2022-01-012022-06-300001000694us-gaap:TreasuryStockCommonMember2022-01-012022-06-300001000694us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001000694us-gaap:RetainedEarningsMember2022-01-012022-06-30nvax:segment0001000694us-gaap:SubsequentEventMembernvax:CanadaAdvancePurchaseAgreementMember2023-07-012023-07-310001000694nvax:CanadaAdvancePurchaseAgreementMember2023-01-012023-06-30nvax:member0001000694nvax:JointCommitteeOnVaccinationAndImmunizationJCVIMember2023-06-300001000694us-gaap:GovernmentContractMembernvax:USGovernmentAgreementMember2023-06-300001000694nvax:GaviAdvancePurchaseAgreementCOVAXFacilityMember2023-06-3000010006942023-05-012023-05-31xbrli:pure0001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2023-06-30nvax:dose0001000694nvax:GaviAdvancePurchaseAgreementCOVAXFacilityMember2022-11-180001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2021-12-310001000694nvax:GaviAdvancePurchaseAgreementSIIPLMember2022-12-310001000694srt:NorthAmericaMemberus-gaap:ProductMember2023-04-012023-06-300001000694srt:NorthAmericaMemberus-gaap:ProductMember2022-04-012022-06-300001000694srt:NorthAmericaMemberus-gaap:ProductMember2023-01-012023-06-300001000694srt:NorthAmericaMemberus-gaap:ProductMember2022-01-012022-06-300001000694srt:EuropeMemberus-gaap:ProductMember2023-04-012023-06-300001000694srt:EuropeMemberus-gaap:ProductMember2022-04-012022-06-300001000694srt:EuropeMemberus-gaap:ProductMember2023-01-012023-06-300001000694srt:EuropeMemberus-gaap:ProductMember2022-01-012022-06-300001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2023-04-012023-06-300001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2022-04-012022-06-300001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2023-01-012023-06-300001000694nvax:RestOfTheWorldMemberus-gaap:ProductMember2022-01-012022-06-300001000694nvax:CanadaAdvancePurchaseAgreementMember2023-06-30nvax:installment0001000694nvax:USGovernmentPartnershipMember2023-06-300001000694nvax:USGovernmentPartnershipMember2023-01-012023-06-300001000694nvax:SalesBasedRoyaltiesMember2023-04-012023-06-300001000694nvax:SalesBasedRoyaltiesMember2023-01-012023-06-300001000694nvax:SalesBasedRoyaltiesMembercountry:JP2022-04-012022-06-300001000694nvax:SalesBasedRoyaltiesMembercountry:JP2022-01-012022-06-300001000694nvax:SalesBasedRoyaltiesMember2022-04-012022-06-300001000694nvax:SalesBasedRoyaltiesMember2022-01-012022-06-300001000694nvax:TakedaArrangementMember2021-09-300001000694nvax:SettlementAgreementMember2022-09-300001000694us-gaap:AccruedLiabilitiesMembernvax:SettlementAgreementMember2023-06-300001000694nvax:SettlementAgreementMember2023-06-300001000694nvax:SettlementAgreementMember2023-01-012023-06-300001000694us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-06-300001000694us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-06-300001000694us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001000694us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001000694nvax:GovernmentBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-06-300001000694nvax:GovernmentBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Membernvax:GovernmentBackedSecuritiesMember2023-06-300001000694nvax:GovernmentBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001000694nvax:GovernmentBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Membernvax:GovernmentBackedSecuritiesMember2022-12-310001000694us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-06-300001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-06-300001000694us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001000694us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001000694us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-06-300001000694us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-06-300001000694us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001000694us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001000694us-gaap:FairValueInputsLevel1Member2023-06-300001000694us-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Member2023-06-300001000694us-gaap:FairValueInputsLevel1Member2022-12-310001000694us-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Member2022-12-310001000694us-gaap:UnsecuredDebtMembernvax:FivePointZeroConvertibleNotesDue2027Member2023-06-300001000694us-gaap:FairValueInputsLevel1Membernvax:FivePointZeroConvertibleNotesDue2027Member2023-06-300001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Membernvax:FivePointZeroConvertibleNotesDue2027Member2023-06-300001000694us-gaap:FairValueInputsLevel1Membernvax:FivePointZeroConvertibleNotesDue2027Member2022-12-310001000694nvax:FivePointZeroConvertibleNotesDue2027Memberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Membernvax:FivePointZeroConvertibleNotesDue2027Member2022-12-310001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Memberus-gaap:UnsecuredDebtMember2023-06-300001000694nvax:ThreePointSevenFiveConvertibleNotesDue2023Memberus-gaap:FairValueInputsLevel1Member2023-06-300001000694nvax:ThreePointSevenFiveConvertibleNotesDue2023Memberus-gaap:FairValueInputsLevel2Member2023-06-300001000694us-gaap:FairValueInputsLevel3Membernvax:ThreePointSevenFiveConvertibleNotesDue2023Member2023-06-300001000694nvax:ThreePointSevenFiveConvertibleNotesDue2023Memberus-gaap:FairValueInputsLevel1Member2022-12-310001000694nvax:ThreePointSevenFiveConvertibleNotesDue2023Memberus-gaap:FairValueInputsLevel2Member2022-12-310001000694us-gaap:FairValueInputsLevel3Membernvax:ThreePointSevenFiveConvertibleNotesDue2023Member2022-12-3100010006942022-01-012022-12-31nvax:reporting_unit0001000694nvax:SettlementMember2023-04-012023-06-300001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Memberus-gaap:UnsecuredDebtMember2022-12-310001000694us-gaap:UnsecuredDebtMembernvax:FivePointZeroConvertibleNotesDue2027Member2022-12-310001000694nvax:ThreePointSeventyFiveConvertibleNotesDue2023Memberus-gaap:UnsecuredDebtMember2023-02-012023-02-280001000694us-gaap:CommonStockMembernvax:June2021SalesAgreementMember2021-06-300001000694us-gaap:CommonStockMembernvax:June2021SalesAgreementMember2023-01-012023-06-300001000694us-gaap:CommonStockMembernvax:June2021SalesAgreementMember2023-04-012023-06-300001000694us-gaap:CommonStockMembernvax:June2021SalesAgreementMember2023-06-300001000694us-gaap:CommonStockMembernvax:June2021SalesAgreementMember2022-01-012022-06-300001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-01-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMember2023-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMember2015-06-012015-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMember2015-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMembersrt:MinimumMember2015-06-012015-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMembersrt:MaximumMember2015-06-012015-06-300001000694us-gaap:CostOfSalesMember2023-04-012023-06-300001000694us-gaap:CostOfSalesMember2022-04-012022-06-300001000694us-gaap:CostOfSalesMember2023-01-012023-06-300001000694us-gaap:CostOfSalesMember2022-01-012022-06-300001000694us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001000694us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001000694us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001000694us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001000694us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001000694us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-012022-06-300001000694us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001000694us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-06-300001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2022-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMember2022-12-310001000694nvax:TwoThousandFiveStockIncentivePlanMember2022-12-310001000694nvax:TwoThousandTwentyThreeStockInducementPlanMember2023-01-012023-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMember2023-01-012023-06-300001000694nvax:TwoThousandFiveStockIncentivePlanMember2023-01-012023-06-300001000694nvax:TwoThousandFiveStockIncentivePlanMember2023-06-300001000694us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001000694us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001000694us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001000694us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-04-012023-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-04-012023-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-04-012022-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MaximumMember2022-04-012022-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-01-012022-06-300001000694us-gaap:EmployeeStockOptionMembersrt:MaximumMember2022-01-012022-06-300001000694us-gaap:RestrictedStockUnitsRSUMembernvax:TwoThousandTwentyThreeStockInducementPlanMember2022-12-310001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001000694us-gaap:RestrictedStockUnitsRSUMembernvax:TwoThousandTwentyThreeStockInducementPlanMember2023-01-012023-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001000694us-gaap:RestrictedStockUnitsRSUMembernvax:TwoThousandTwentyThreeStockInducementPlanMember2023-06-300001000694nvax:TwoThousandFifteenStockIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-06-300001000694us-gaap:EmployeeStockMember2013-06-300001000694us-gaap:EmployeeStockMember2023-06-300001000694us-gaap:EmployeeStockMember2023-01-012023-06-3000010006942022-01-0100010006942022-12-122022-12-12nvax:defendant00010006942022-12-012022-12-3100010006942022-12-282022-12-28nvax:lawsuit00010006942023-04-042023-04-0400010006942023-04-040001000694us-gaap:AccruedLiabilitiesMember2023-01-012023-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 000-26770

NOVAVAX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

22-2816046 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

|

|

700 Quince Orchard Road, |

Gaithersburg, |

MD |

20878 |

| (Address of principal executive offices) |

(Zip code) |

(240) 268-2000

(Registrant's telephone number, including area code)

21 Firstfield Road, Gaithersburg, MD 20878

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 per share |

NVAX |

The Nasdaq Global Select Market |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

Accelerated Filer |

o |

|

|

|

|

| Non-accelerated filer |

o |

Smaller reporting company |

o |

|

|

|

|

| Emerging growth company |

o |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares outstanding of the Registrant's Common Stock, $0.01 par value, was 94,404,185 as of July 31, 2023.

NOVAVAX, INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share information)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

June 30, |

|

For the Six Months Ended

June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue: |

|

|

|

|

|

|

|

| Product sales |

$ |

285,163 |

|

|

$ |

55,455 |

|

|

$ |

277,706 |

|

|

$ |

641,083 |

|

| Grants |

137,079 |

|

|

107,774 |

|

|

224,458 |

|

|

207,075 |

|

| Royalties and other |

2,184 |

|

|

22,696 |

|

|

3,213 |

|

|

41,738 |

|

| Total revenue |

424,426 |

|

|

185,925 |

|

|

505,377 |

|

|

889,896 |

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

| Cost of sales |

55,777 |

|

|

271,077 |

|

|

89,863 |

|

|

286,281 |

|

| Research and development |

219,475 |

|

|

289,648 |

|

|

466,576 |

|

|

673,131 |

|

| Selling, general, and administrative |

93,717 |

|

|

108,160 |

|

|

206,249 |

|

|

204,152 |

|

| Total expenses |

368,969 |

|

|

668,885 |

|

|

762,688 |

|

|

1,163,564 |

|

| Income (Loss) from operations |

55,457 |

|

|

(482,960) |

|

|

(257,311) |

|

|

(273,668) |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

(3,124) |

|

|

(6,234) |

|

|

(7,440) |

|

|

(11,110) |

|

| Other income (expense) |

5,532 |

|

|

(19,873) |

|

|

29,894 |

|

|

(18,219) |

|

| Income (Loss) before income tax expense (benefit) |

57,865 |

|

|

(509,067) |

|

|

(234,857) |

|

|

(302,997) |

|

| Income tax expense (benefit) |

(143) |

|

|

1,418 |

|

|

1,040 |

|

|

4,080 |

|

| Net income (loss) |

$ |

58,008 |

|

|

$ |

(510,485) |

|

|

$ |

(235,897) |

|

|

$ |

(307,077) |

|

|

|

|

|

|

|

|

|

| Net income (loss) per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.65 |

|

|

$ |

(6.53) |

|

|

$ |

(2.69) |

|

|

$ |

(3.97) |

|

| Diluted |

$ |

0.58 |

|

|

$ |

(6.53) |

|

|

$ |

(2.69) |

|

|

$ |

(3.97) |

|

| Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

| Basic |

89,362 |

|

|

78,143 |

|

|

87,769 |

|

|

77,305 |

|

| Diluted |

104,065 |

|

|

78,143 |

|

|

87,769 |

|

|

77,305 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

June 30, |

|

For the Six Months Ended

June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income (loss) |

$ |

58,008 |

|

|

$ |

(510,485) |

|

|

$ |

(235,897) |

|

|

$ |

(307,077) |

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

(5,011) |

|

|

(9,558) |

|

|

(1,800) |

|

|

(9,517) |

|

| Other comprehensive income (loss) |

(5,011) |

|

|

(9,558) |

|

|

(1,800) |

|

|

(9,517) |

|

| Comprehensive income (loss) |

$ |

52,997 |

|

|

$ |

(520,043) |

|

|

$ |

(237,697) |

|

|

$ |

(316,594) |

|

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share information)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2023 |

|

December 31,

2022 |

|

(unaudited) |

|

|

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

505,912 |

|

|

$ |

1,336,883 |

|

|

|

|

|

| Restricted cash |

10,361 |

|

|

10,303 |

|

| Accounts receivable |

394,890 |

|

|

82,375 |

|

| Inventory |

23,488 |

|

|

36,683 |

|

| Prepaid expenses and other current assets |

192,903 |

|

|

237,147 |

|

| Total current assets |

1,127,554 |

|

|

1,703,391 |

|

| Property and equipment, net |

299,955 |

|

|

294,247 |

|

| Right of use asset, net |

95,739 |

|

|

106,241 |

|

|

|

|

|

| Goodwill |

128,366 |

|

|

126,331 |

|

| Other non-current assets |

33,434 |

|

|

28,469 |

|

| Total assets |

$ |

1,685,048 |

|

|

$ |

2,258,679 |

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

87,246 |

|

|

$ |

216,517 |

|

| Accrued expenses |

458,397 |

|

|

591,158 |

|

| Deferred revenue |

300,473 |

|

|

370,137 |

|

| Current portion of finance lease liabilities |

953 |

|

|

27,196 |

|

| Convertible notes payable |

— |

|

|

324,881 |

|

| Other current liabilities |

749,186 |

|

|

930,055 |

|

| Total current liabilities |

1,596,255 |

|

|

2,459,944 |

|

| Deferred revenue |

606,937 |

|

|

179,414 |

|

| Convertible notes payable |

167,248 |

|

|

166,466 |

|

| Non-current finance lease liabilities |

30,744 |

|

|

31,238 |

|

| Other non-current liabilities |

38,383 |

|

|

55,695 |

|

| Total liabilities |

2,439,567 |

|

|

2,892,757 |

|

|

|

|

|

| Commitments and contingencies (Note 15) |

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 2,000,000 shares authorized at June 30, 2023 and December 31, 2022; no shares issued and outstanding at June 30, 2023 and December 31, 2022. |

— |

|

|

— |

|

|

|

|

|

| Stockholders' deficit: |

|

|

|

Common stock, $0.01 par value, 600,000,000 shares authorized at June 30, 2023 and December 31, 2022; 95,183,750 shares issued and 94,308,379 shares outstanding at June 30, 2023 and 86,806,554 shares issued and 86,039,923 shares outstanding at December 31, 2022 |

952 |

|

|

868 |

|

| Additional paid-in capital |

3,855,916 |

|

|

3,737,979 |

|

| Accumulated deficit |

(4,511,786) |

|

|

(4,275,889) |

|

Treasury stock, cost basis, 875,371 shares at June 30, 2023 and 766,631 shares at December 31, 2022 |

(91,424) |

|

|

(90,659) |

|

| Accumulated other comprehensive loss |

(8,177) |

|

|

(6,377) |

|

| Total stockholders’ deficit |

(754,519) |

|

|

(634,078) |

|

| Total liabilities and stockholders’ deficit |

$ |

1,685,048 |

|

|

$ |

2,258,679 |

|

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

Three and Six Ended June 30, 2023 and 2022

(in thousands, except share information)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

Additional

Paid-in

Capital |

|

Accumulated

Deficit |

|

Treasury

Stock |

|

Accumulated Other

Comprehensive

Loss |

|

Total Stockholders'

Equity (Deficit) |

|

Shares |

|

Amount |

|

|

|

|

|

| Balance at March 31, 2023 |

87,139,831 |

|

|

$ |

871 |

|

|

$ |

3,767,733 |

|

|

$ |

(4,569,794) |

|

|

$ |

(91,226) |

|

|

$ |

(3,166) |

|

|

$ |

(895,582) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

20,292 |

|

|

— |

|

|

— |

|

|

— |

|

|

20,292 |

|

| Stock issued under incentive programs |

95,965 |

|

|

1 |

|

|

(1) |

|

|

— |

|

|

(198) |

|

|

— |

|

|

(198) |

|

Issuance of common stock, net of issuance costs $861 |

7,947,954 |

|

|

80 |

|

|

67,892 |

|

|

— |

|

|

— |

|

|

— |

|

|

67,972 |

|

| Foreign currency translation adjustment |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5,011) |

|

|

(5,011) |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

58,008 |

|

|

— |

|

|

— |

|

|

58,008 |

|

| Balance at June 30, 2023 |

95,183,750 |

|

|

$ |

952 |

|

|

$ |

3,855,916 |

|

|

$ |

(4,511,786) |

|

|

$ |

(91,424) |

|

|

$ |

(8,177) |

|

|

$ |

(754,519) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2022 |

78,722,337 |

|

|

$ |

787 |

|

|

$ |

3,566,292 |

|

|

$ |

(3,414,542) |

|

|

$ |

(85,901) |

|

|

$ |

(1,312) |

|

|

$ |

65,324 |

|

| Stock-based compensation |

— |

|

|

— |

|

|

38,048 |

|

|

— |

|

|

— |

|

|

— |

|

|

38,048 |

|

| Stock issued under incentive programs |

53,897 |

|

|

1 |

|

|

274 |

|

|

— |

|

|

(554) |

|

|

— |

|

|

(279) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(9,558) |

|

|

(9,558) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

(510,485) |

|

|

— |

|

|

— |

|

|

(510,485) |

|

| Balance at June 30, 2022 |

78,776,234 |

|

|

$ |

788 |

|

|

$ |

3,604,614 |

|

|

$ |

(3,925,027) |

|

|

$ |

(86,455) |

|

|

$ |

(10,870) |

|

|

$ |

(416,950) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

Additional

Paid-in

Capital |

|

Accumulated

Deficit |

|

Treasury

Stock |

|

Accumulated Other

Comprehensive

Loss |

|

Total Stockholders'

Equity (Deficit) |

|

Shares |

|

Amount |

|

|

|

|

|

| Balance at December 31, 2022 |

86,806,554 |

|

|

$ |

868 |

|

|

$ |

3,737,979 |

|

|

$ |

(4,275,889) |

|

|

$ |

(90,659) |

|

|

$ |

(6,377) |

|

|

$ |

(634,078) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

48,939 |

|

|

— |

|

|

— |

|

|

— |

|

|

48,939 |

|

| Stock issued under incentive programs |

429,242 |

|

|

4 |

|

|

1,106 |

|

|

— |

|

|

(765) |

|

|

— |

|

|

345 |

|

Issuance of common stock, net of issuance costs of $861 |

7,947,954 |

|

|

80 |

|

|

67,892 |

|

|

— |

|

|

— |

|

|

— |

|

|

67,972 |

|

| Foreign currency translation adjustment |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,800) |

|

|

(1,800) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

(235,897) |

|

|

— |

|

|

— |

|

|

(235,897) |

|

| Balance at June 30, 2023 |

95,183,750 |

|

|

$ |

952 |

|

|

$ |

3,855,916 |

|

|

$ |

(4,511,786) |

|

|

$ |

(91,424) |

|

|

$ |

(8,177) |

|

|

$ |

(754,519) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

76,433,151 |

|

|

$ |

764 |

|

|

$ |

3,351,967 |

|

|

$ |

(3,617,950) |

|

|

$ |

(85,101) |

|

|

$ |

(1,353) |

|

|

$ |

(351,673) |

|

| Stock-based compensation |

— |

|

|

— |

|

|

70,981 |

|

|

— |

|

|

— |

|

|

— |

|

|

70,981 |

|

| Stock issued under incentive programs |

145,685 |

|

|

2 |

|

|

2,303 |

|

|

— |

|

|

(1,354) |

|

|

— |

|

|

951 |

|

Issuance of common stock, net of issuance costs of $2,311 |

2,197,398 |

|

|

22 |

|

|

179,363 |

|

|

— |

|

|

— |

|

|

— |

|

|

179,385 |

|

| Foreign currency translation adjustment |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(9,517) |

|

|

(9,517) |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

(307,077) |

|

|

— |

|

|

— |

|

|

(307,077) |

|

| Balance at June 30, 2022 |

78,776,234 |

|

|

$ |

788 |

|

|

$ |

3,604,614 |

|

|

$ |

(3,925,027) |

|

|

$ |

(86,455) |

|

|

$ |

(10,870) |

|

|

$ |

(416,950) |

|

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

| Operating Activities: |

|

|

|

| Net loss |

$ |

(235,897) |

|

|

$ |

(307,077) |

|

| Reconciliation of net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization |

19,110 |

|

|

13,485 |

|

|

|

|

|

| Non-cash stock-based compensation |

48,939 |

|

|

70,981 |

|

| Provision for excess and obsolete inventory |

31,546 |

|

|

155,662 |

|

| Impairment of long-lived assets |

10,081 |

|

|

— |

|

| Right-of-use assets expensed, net of credits received |

— |

|

|

(3,291) |

|

| Other items, net |

(89) |

|

|

(642) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Inventory |

(19,361) |

|

|

(403,725) |

|

| Accounts receivable, prepaid expenses, and other assets |

(266,482) |

|

|

112,845 |

|

| Accounts payable, accrued expenses, and other liabilities |

(443,238) |

|

|

179,158 |

|

| Deferred revenue |

357,860 |

|

|

(76,809) |

|

| Net cash used in operating activities |

(497,531) |

|

|

(259,413) |

|

|

|

|

|

| Investing Activities: |

|

|

|

| Capital expenditures |

(26,774) |

|

|

(41,402) |

|

| Internal-use software |

(4,563) |

|

|

— |

|

| Net cash used in investing activities |

(31,337) |

|

|

(41,402) |

|

|

|

|

|

| Financing Activities: |

|

|

|

| Net proceeds from sales of common stock |

61,986 |

|

|

179,385 |

|

| Net proceeds from the exercise of stock-based awards |

345 |

|

|

1,050 |

|

| Finance lease payments |

(26,784) |

|

|

(15,911) |

|

| Repayment of 2023 Convertible notes |

(325,000) |

|

|

— |

|

| Payments of costs related to issuance of 2027 Convertible notes |

(3,591) |

|

|

— |

|

| Net cash provided by (used in) financing activities |

(293,044) |

|

|

164,524 |

|

| Effect of exchange rate on cash, cash equivalents, and restricted cash |

(8,992) |

|

|

(4,453) |

|

| Net decrease in cash, cash equivalents, and restricted cash |

(830,904) |

|

|

(140,744) |

|

| Cash, cash equivalents, and restricted cash at beginning of period |

1,348,845 |

|

|

1,528,259 |

|

| Cash, cash equivalents, and restricted cash at end of period |

$ |

517,941 |

|

|

$ |

1,387,515 |

|

|

|

|

|

| Supplemental disclosure of non-cash activities: |

|

|

|

|

|

|

|

|

|

|

|

| Sales of common stock not settled at end of period |

$ |

5,986 |

|

|

$ |

— |

|

| Right-of-use assets from new lease agreements |

$ |

— |

|

|

$ |

69,366 |

|

| Capital expenditures included in accounts payable and accrued expenses |

$ |

6,591 |

|

|

$ |

17,890 |

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

| Cash interest payments, net of amounts capitalized |

$ |

11,294 |

|

|

$ |

8,604 |

|

| Cash paid for income taxes |

$ |

128 |

|

|

$ |

17,778 |

|

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2023

(unaudited)

Note 1 – Organization and Business

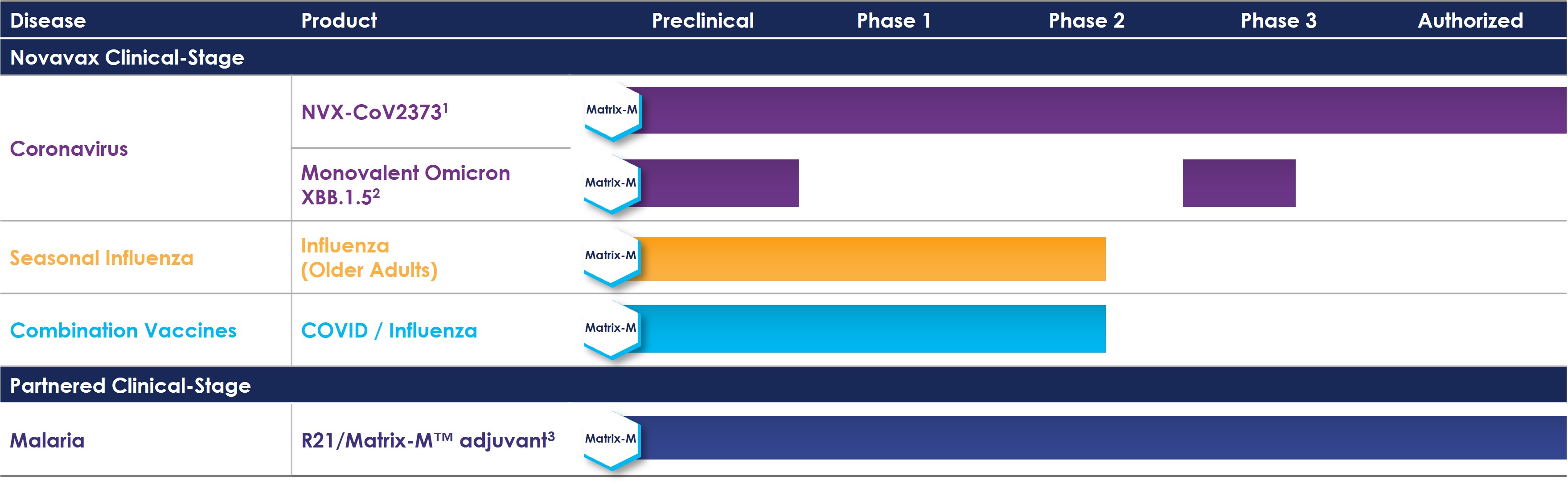

Novavax, Inc. (“Novavax,” and together with its wholly owned subsidiaries, the “Company”) is a biotechnology company that promotes improved health globally through the discovery, development, and commercialization of innovative vaccines to prevent serious infectious diseases. The Company’s vaccines and vaccine candidates are genetically engineered nanostructures of conformationally correct recombinant proteins critical to disease pathogenesis and may elicit differentiated immune responses, which may be more efficacious than naturally occurring immunity or other vaccine approaches. Novavax currently has one commercial program, for vaccines to prevent COVID (“Novavax COVID Vaccine, Adjuvanted”), which it markets in various territories where it is allowed to do so, under the brand name “Nuvaxovid™”. Novavax’s prototype COVID vaccine was derived from the prototype strain of COVID and is variously referred to here and in prior financial statements without branding as “NVX-CoV2373”. Our partners, Serum Institute of India Pvt. Ltd. (“SIIPL”) markets NVX-CoV2373 as “Covovax™.” Novavax is currently developing an updated vaccine which it refers to as its “XBB COVID vaccine.”

Beginning in 2022, the Company received approval, interim authorization, provisional approval, conditional marketing authorization, and emergency use authorization (“EUA”) from multiple regulatory authorities globally for NVX-CoV2373 for both adult and adolescent populations as a primary series and for both homologous and heterologous booster indications. Novavax is currently seeking similar approvals from multiple regulatory authorities globally for its XBB COVID vaccine as a single dose booster for the fall 2023 and subsequently. The Company exclusively depends on its supply agreement with SIIPL and its subsidiary, Serum Life Sciences Limited (“SLS”), for co-formulation, filling and finishing (other than in Europe) and on its service agreement with PCI Pharma Services (“PCI”) for finishing in Europe. The Company plans to rely on these arrangements to supply the XBB COVID vaccine, if authorized, during the 2023 fall vaccination campaign and subsequently (see Note 4).

Novavax is advancing development of other vaccine candidates, including its influenza vaccine candidate, its COVID-Influenza Combination (“CIC”) vaccine candidate and additional vaccine candidates. Novavax COVID Vaccine, Adjuvanted and its other vaccine candidates incorporate the Company’s proprietary Matrix-M™ adjuvant to enhance the immune response and stimulate higher levels of functional antibodies and induce a cellular immune response.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. The consolidated financial statements are unaudited but include all adjustments (consisting of normal recurring adjustments) that the Company considers necessary for a fair presentation of the financial position, operating results, comprehensive loss, changes in stockholders’ equity (deficit), and cash flows for the periods presented. Although the Company believes that the disclosures in these unaudited consolidated financial statements are adequate to make the information presented not misleading, certain information and footnote information normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted under the rules and regulations of the United States Securities and Exchange Commission (“SEC”).

The unaudited consolidated financial statements include the accounts of Novavax, Inc. and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. Accumulated other comprehensive loss included a foreign currency translation loss of $8.2 million and $6.4 million at June 30, 2023 and December 31, 2022, respectively. The aggregate foreign currency transaction gains and losses resulting from the conversion of the transaction currency to functional currency were a $0.2 million loss and a $16.1 million gain, and a $22.2 million and $21.0 million loss for the three months and six months ended June 30, 2023 and 2022, respectively, which are reflected in Other income (expense).

The accompanying unaudited consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022. Results for this or any interim period are not necessarily indicative of results for any future interim period or for the entire year. The Company operates in one business segment.

Liquidity and Going Concern

The accompanying unaudited consolidated financial statements have been prepared assuming that the Company will continue as a going concern within one year after the date that the financial statements are issued. In addition, as of June 30, 2023, the Company had $517.9 million in cash and cash equivalents and restricted cash. Pursuant to the June 2023 Amendment to the advance purchase agreement (“APA”) between the Company and His Majesty the King in Right of Canada, as represented by the Minister of Public Works and Government Services, as successor in interest to Her Majesty the Queen in Right of Canada, as represented by the Minister of Public Works and Government Services (“Canadian government”), the Company received $174.8 million from the Canadian government in July 2023 with a second installment of $174.8 million that is contingent and payable upon the Company’s delivery of vaccine doses in the second half of 2023 (see Note 3). During the six months ended June 30, 2023, the Company incurred a net loss of $235.9 million and had net cash flows used in operating activities of $497.5 million.

In accordance with Accounting Standards Codification 205-40, Going Concern, the Company evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year after the date that these unaudited consolidated financial statements are issued. While the Company’s current cash flow forecast for the one-year going concern look forward period estimates that there will be sufficient capital available to fund operations, this forecast is subject to significant uncertainty, including as it relates to revenue for the next 12 months, funding from the U.S. government, and a pending matter subject to arbitration proceedings. The Company’s revenue projections depend on its ability to successfully develop, manufacture, distribute and market an updated monovalent formulation of a vaccine candidate for COVID-19 for the fall 2023 COVID vaccine season, which is inherently uncertain and subject to a number of risks, including regulatory authorization, ability to timely deliver doses and commercial adoption and market acceptance. Further, failure to meet regulatory milestones, timely obtain supportive recommendations from governmental advisory committees, or achieve product volume or delivery timing obligations under the Company’s advance purchase agreements may require the Company to refund portions of upfront and other payments or result in reduced future payments. For example, if the Company fails to deliver XBB COVID vaccine doses to the Canadian government in the second half of 2023, the second installment payment of $174.8 million will be terminated and not be payable to the Company. Also, if the Company does not timely achieve supportive recommendations from the Joint Committee on Vaccination and Immunisation (the “JCVI”) of the government of the United Kingdom of Great Britain and Northern Ireland with respect to use of NVX-CoV2373 for (a) the general adult population as part of a SARS-CoV-2 vaccine booster campaign in the United Kingdom or (b) the general adolescent population as part of a SARS-CoV-2 vaccine booster campaign in the United Kingdom or as a primary series SARS-CoV-2 vaccination, excluding where that recommendation relates only to one or more population groups comprising less than one million members in the United Kingdom, then the Company would be required to repay up to $112.5 million related to the upfront payment previously received from the Authority under the Original UK Supply Agreement. In February 2023, in connection with the execution of Modification 17 to the USG Agreement (as defined in Note 3), the U.S. government indicated to the Company that the award may not be extended past its current period of performance. If the USG Agreement is not amended, as the Company’s management had previously expected, then the Company may not receive all of the remaining $250.6 million in funding as of June 30, 2023. On January 24, 2023, Gavi, the Vaccine Alliance (“Gavi”) filed a demand for arbitration with the International Court of Arbitration regarding an alleged material breach by the Company of the Company’s advance purchase agreement with Gavi (the “Gavi APA”). The arbitration hearing is scheduled for July 2024, with a written decision to follow. The outcome of that arbitration is inherently uncertain, and it is possible the Company could be required to refund all or a portion of the remaining advance payments of $696.4 million as of June 30, 2023 (see Note 3 and Note 15).

Management believes that, given the significance of these uncertainties, substantial doubt exists regarding the Company’s ability to continue as a going concern through one year from the date that these financial statements are issued.

In May 2023, the Company announced a global restructuring and cost reduction plan (the “Restructuring Plan”) which includes a more focused investment in its NVX-CoV2373 program, reduction to its pipeline spending, the continued rationalization of its manufacturing network, a reduction to the Company’s global workforce, as well as the consolidation of facilities, and infrastructure. The workforce reduction plan included an approximately 25% reduction in the Company’s global workforce, comprised of an approximately 20% reduction in full-time Novavax employees and the remainder comprised of contractors and consultants. The Company has decided to progress CIC toward late-stage development and, as such, is assessing the impact on its workforce requirements. The Company expects the full annual impact of the cost savings from the Restructuring Plan to be realized in 2024 and approximately half of the annual impact to be realized in 2023 due to timing of implementing the measures, and the applicable laws, regulations, and other factors in the jurisdictions in which the Company operates. During the three months ended June 30, 2023, the Company recorded a charge of $4.6 million related to one-time employee severance and benefit costs and $10.1 million related to the consolidation of facilities and infrastructure (see Note 16).

The Company’s ability to fund Company operations is dependent upon revenue related to vaccine sales for its products and product candidates, if such product candidates receive marketing approval and are successfully commercialized, and in particular the 2023 fall COVID vaccination campaign, which is inherently uncertain and subject to a number of risks, including regulatory authorization, ability to timely deliver doses and commercial adoption and market acceptance, the resolution of certain matters, including whether, when, and how the dispute with Gavi is resolved, and management’s plans, which includes cost reductions associated with the Restructuring Plan. Management’s plans may also include raising additional capital through a combination of equity and debt financing, collaborations, strategic alliances, and marketing, distribution, or licensing arrangements. New financings may not be available to the Company on commercially acceptable terms, or at all. Also, any collaborations, strategic alliances, and marketing, distribution, or licensing arrangements may require the Company to give up some or all of its rights to a product or technology, which in some cases may be at less than the full potential value of such rights. In addition, the regulatory and commercial success of NVX-CoV2373 and the Company’s other vaccine candidates, including an influenza vaccine candidate, a CIC vaccine candidate, and a COVID-19 variant strain-containing monovalent formulation, remains uncertain. If the Company is unable to obtain additional capital, the Company will assess its capital resources and may be required to delay, reduce the scope of, or eliminate some or all of its operations, or further downsize its organization, any of which may have a material adverse effect on its business, financial condition, results of operations, and ability to operate as a going concern.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates.

Revenue Recognition Constraints

The Company constrains the transaction price for customer arrangements until it is probable that a significant reversal in cumulative revenue recognized will not occur. Specifically, if a customer arrangement includes a provision whereby the customer may request a discount, return, or refund for a previously satisfied performance obligation or otherwise could have the effect of decreasing the transaction price, revenue is constrained based on an estimate of the impact to the transaction price recognized until it is probable that a significant reversal in cumulative revenue recognized will not occur.

Restructuring

The Company recognizes restructuring charges when such costs are incurred. The Company's restructuring charges consist of employee severance and other termination benefits related to the reduction of its workforce, the consolidation of facilities, and infrastructure and other costs. Termination benefits are expensed on the date the Company notifies the employee, unless the employee must provide future service, in which case the benefits are expensed ratably over the future service period. Ongoing benefits are expensed when restructuring activities are probable and the benefit estimable.

See Note 16 for additional information on the severance and employee benefit costs for terminated employees and impairment of assets in connection with the Company’s Restructuring Plan.

Recent Accounting Pronouncements

Adopted

In June 2016, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), with amendments in 2018, 2019, 2020, and 2022. The ASU sets forth a “current expected credit loss” model that requires companies to measure all expected credit losses for financial instruments held at the reporting date based on historical experience, current conditions, and reasonable supportable forecasts. ASU 2016-13 applies to financial instruments that are not measured at fair value, including receivables that result from revenue transactions. The Company adopted ASU 2020-06 on January 1, 2023, using a modified retrospective approach, and it did not have a material impact on the Company’s consolidated financial statements.

Note 3 – Revenue

The Company's accounts receivable included $334.4 million and $53.8 million related to amounts that were billed to customers and $60.5 million and $28.6 million related to amounts which had not yet been billed to customers as of June 30, 2023 and December 31, 2022, respectively.

During the six months ended June 30, 2023, and 2022, changes in the Company's accounts receivables, allowance for doubtful accounts, and deferred revenue balances were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, Beginning of Period |

|

Additions |

|

Deductions |

|

Balance, End of Period |

| Accounts receivable: |

|

|

|

|

|

|

|

| Six Months Ended June 30, 2023 |

$ |

96,210 |

|

|

$ |

793,039 |

|

|

$ |

(486,684) |

|

|

$ |

402,565 |

|

| Six Months Ended June 30, 2022 |

454,993 |

|

|

808,713 |

|

|

(1,069,173) |

|

|

194,533 |

|

Allowance for doubtful accounts(1): |

|

|

|

|

|

|

|

| Six Months Ended June 30, 2023 |

$ |

(13,835) |

|

|

$ |

— |

|

|

$ |

6,160 |

|

|

$ |

(7,675) |

|

| Six Months Ended June 30, 2022 |

— |

|

|

— |

|

|

— |

|

|

— |

|

Deferred revenue:(2) |

|

|

|

|

|

|

|

| Six Months Ended June 30, 2023 |

$ |

549,551 |

|

|

$ |

414,816 |

|

|

$ |

(56,957) |

|

|

$ |

907,410 |

|

| Six Months Ended June 30, 2022 |

1,595,472 |

|

|

49,107 |

|

|

(128,432) |

|

|

1,516,147 |

|

(1) There was no bad debt expense recorded during the three and six months ended June 30, 2023 or 2022. There was a $6.2 million reversal of a bad debt allowance during the three months ended June 30, 2023 due to the collection of a previously recognized allowance for doubtful accounts. To estimate the allowance for doubtful accounts, the Company evaluates the credit risk related to its customers based on historical loss experience, economic conditions, the aging of receivables, and customer-specific risks.

(2) Deductions from Deferred revenue generally related to the recognition of revenue once performance obligations on a contract with a customer are met.

As of June 30, 2023, the aggregate amount of the transaction price allocated to performance obligations that were unsatisfied (or partially unsatisfied), excluding amounts related to sales-based royalties, the Gavi APA, and the reduction in doses related to the Amended and Restated UK Supply Agreement, was approximately $2 billion of which $907.4 million was included in Deferred revenue. Failure to meet regulatory milestones, timely obtain supportive recommendations from governmental advisory committees, or achieve product volume or delivery timing obligations under the Company’s advance purchase agreements may require the Company to refund portions of upfront and other payments or result in reduced future payments, which could adversely impact the Company’s ability to realize revenue from its unsatisfied performance obligations. The timing to fulfill performance obligations related to grant agreements will depend on the results of the Company's research and development activities, including clinical trials, and delivery of doses. The timing to fulfill performance obligations related to APAs will depend on the timing of product manufacturing, receipt of marketing authorizations for additional indications, delivery of doses based on customer demand, and the ability of the customer to request variant vaccine in place of the prototype NVX-CoV2373 vaccine under certain of the Company’s APAs.

Under the terms of the Gavi APA and a separate purchase agreement between Gavi and SIIPL, 1.1 billion doses of NVX-CoV2373 were to be made available to countries participating in the COVAX Facility. The Company expected to manufacture and distribute 350 million doses of NVX-CoV2373 to countries participating under the COVAX Facility. Under a separate purchase agreement with Gavi, SIIPL was expected to manufacture and deliver the balance of the 1.1 billion doses of NVX-CoV2373 for low- and middle-income countries participating in the COVAX Facility. The Company expected to deliver doses with antigen and adjuvant manufactured at facilities directly funded under the Company's funding agreement with Coalition for Epidemic Preparedness Innovations (“CEPI”), with initial doses supplied by SIIPL and SLS under a supply agreement. The Company expected to supply significant doses that Gavi would allocate to low-, middle- and high-income countries, subject to certain limitations, utilizing a tiered pricing schedule and Gavi could prioritize such doses to low- and middle- income countries, at lower prices. Additionally, the Company could provide additional doses of NVX-CoV2373, to the extent available from CEPI-funded manufacturing facilities, in the event that SIIPL could not materially deliver expected vaccine doses to the COVAX Facility. Under the agreement, the Company received an upfront payment of $350.0 million from Gavi in 2021 and an additional payment of $350 million in 2022 related to the Company’s achieving an emergency use license for NVX-CoV2373 by the WHO (the “Advance Payment Amount”).

On November 18, 2022, the Company delivered written notice to Gavi to terminate the Gavi APA on the basis of Gavi’s failure to procure the purchase of 350 million doses of NVX-CoV2373 from the Company as required by the Gavi APA. As of November 18, 2022, the Company had only received orders under the Gavi APA for approximately 2 million doses. On December 2, 2022, Gavi issued a written notice purporting to terminate the Gavi APA based on Gavi’s contention that the Company repudiated the agreement and, therefore, materially breached the Gavi APA. Gavi also contends that, based on its purported termination of the Gavi APA, it is entitled to a refund of the Advance Payment Amount less any amounts that have been credited against the purchase price for binding orders placed by a buyer participating in the COVAX Facility. Since December 31, 2022, the remaining Gavi Advance Payment Amount, which is $696.4 million as of June 30, 2023, pending resolution of the dispute with Gavi related to a return of the remaining Advance Payment Amount, has been classified within Other current liabilities in the Company’s consolidated balance sheet. On January 24, 2023, Gavi filed a demand for arbitration with the International Court of Arbitration based on the claims described above. The Company filed its Answer and Counterclaims on March 2, 2023. On April 5, 2023, Gavi filed its Reply to the Company’s Counterclaims. The arbitration hearing is scheduled for July 2024, with a written decision to follow. Arbitration is inherently uncertain, and while the Company believes that it is entitled to retain the remaining Advance Payment Amount received from Gavi, it is possible that it could be required to refund all or a portion of the remaining Advance Payment Amount from Gavi.

Product Sales

Product sales by the Company’s customer’s geographic location was as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|

2023 |

|

2022 |

2023 |

|

2022 |

North America |

$ |

— |

|

|

$ |

— |

|

$ |

— |

|

|

$ |

64,762 |

|

| Europe |

1,518 |

|

|

— |

|

58,785 |

|

|

413,745 |

|

Rest of the world |

283,645 |

|

|

55,455 |

|

218,921 |

|

|

162,576 |

|

| Total product sales revenue |

$ |

285,163 |

|

|

$ |

55,455 |

|

$ |

277,706 |

|

|

$ |

641,083 |

|

In May 2023, the Company extended a credit for certain doses delivered in 2022 that qualified for replacement under the contract with the Australian government. This credit is the result of a single lot sold to the Australian government that upon pre-planned 6-month stability testing was found to have fallen below the defined specifications and the lot therefore was removed from the market. The credit will be applied against the future sale of doses to the customer and, during the six months ended June 30, 2023, the Company recorded a reduction of $64.7 million in product sales, with a corresponding increase to Deferred revenue, non-current.

In April 2023, the Company amended its APA with the Canadian government, for the purchase of doses of NVX-CoV2373 (the “Canada APA”) to forfeit certain doses originally scheduled for delivery in 2022 for a payment of $100.4 million received in the second quarter of 2023. On June 30, 2023, the Company entered into an additional amendment (the “June 2023 Amendment”) to the Canada APA. Pursuant to the June 2023 Amendment, the parties revised the Canadian government’s previous commitment by (i) forfeiting certain doses of the NVX-CoV2373 previously scheduled for delivery, (ii) reducing the amount of doses of NVX-CoV2373 due for delivery, (iii) revising the delivery schedule for the remaining doses of NVX-CoV2373 to be delivered, and (iv) requiring use of the Biologics Manufacturing Centre (“BMC”) Inc. to produce bulk antigen for doses in 2024 and 2025. In connection with the forfeiture of doses of NVX-CoV2373, the Canadian government agreed to pay a total amount of $349.6 million to the Company in two equal installments in 2023, which total amount equals the remaining balance owed by the Canadian government with respect to such forfeited vaccine doses. The first installment was payable upon execution of the June 2023 Amendment and the second installment is contingent and payable upon the Company’s delivery of vaccine doses in the second half of 2023. The first installment of $174.8 million was received from the Canadian government in July 2023. If the Company fails to deliver COVID-19 vaccine doses to the Canadian government in the second half of 2023, the second installment payment of $174.8 million will be terminated and not be payable to the Company. The Canadian Government may terminate the Canada APA, as amended, if the Company fails to achieve regulatory approval for use of BMC for NVX-CoV2373 production on or before December 31, 2024. The June 2023 Amendment maintained the total contract value of the original Canada APA. Pursuant to the June 2023 Amendment, the Company and the Canadian government will endeavor to expand the Company’s previously agreed in-country commitment to Canada and to further partner to provide health, economic, and future pandemic preparedness benefits to Canada, which value may be provided through a number of activities, including without limitation, capital investments, the performance of activities or services, or the provision of technology or intellectual property licenses. Further, the parties will endeavor to enter into a memorandum of understanding (the “MOU”) to illustrate the Company’s ability to deliver such benefits over a 15 year period with an aggregate value of not less than 100% of the amount remaining to be paid under the June 2023 Amendment and ultimately received by the Company. The Company agreed to hold $20 million in escrow for the benefit of the Canadian government, which amount is the sole recourse available to the Canadian government in the event of non-performance under the MOU.

Grants

The Company’s U.S. government agreement consists of a Project Agreement (the “Project Agreement”) and a Base Agreement with Advanced Technology International, the Consortium Management Firm acting on behalf of the Medical CBRN Defense Consortium in connection with the partnership formerly known as Operation Warp Speed (the Base Agreement together with the Project Agreement are referred to as the “USG Agreement”). In February 2023, in connection with the execution of Modification 17 to the Project Agreement, the U.S. government indicated to the Company that the award may not be extended past its current period of performance, which is December 31, 2023. Also, Modification 17 included provisions requiring that the payment of $60.0 million of consideration associated with manufacturing work now be contingent upon meeting certain milestones, including the delivery of up to 1.5 million doses of NVX-CoV2373 and development and regulatory milestones related to commercial readiness, expansion of the EUA and development of multiple vial presentations. As of June 30, 2023, the Company constrained the total transaction price by $48.0 million for consideration associated with milestones that are not fully within the Company’s control. This constraint, in addition to other contract changes included within Modification 17, resulted in an approximately $29 million cumulative reduction to revenue previously recognized under the contract for the six months ended June 30, 2023.

Royalties and Other

During the three and six months ended June 30, 2023, the Company did not recognize revenue related to milestone payments or sales-based royalties. During the three and six months ended June 30, 2022, the Company recognized a $20.0 million milestone payment upon the first sale of NVX-CoV2373 in Japan and $1.7 million and $9.2 million, respectively in revenue related to sales-based royalties.

Note 4 – Collaboration, License, and Supply Agreements

SIIPL

The Company previously granted SIIPL exclusive and non-exclusive licenses for the development, co-formulation, filling and finishing, registration, and commercialization of NVX-CoV2373, its proprietary COVID-19 variant antigen candidate(s), its quadrivalent influenza vaccine candidate, and its CIC vaccine candidate. SIIPL agreed to purchase the Company's Matrix-M™ adjuvant and the Company granted SIIPL a non-exclusive license to manufacture the antigen drug substance component of NVX-CoV2373 in SIIPL’s licensed territory solely for use in the manufacture of NVX-CoV2373. The Company and SIIPL equally split the revenue from SIIPL’s sale of NVX-CoV2373 in its licensed territory, net of agreed costs. The Company also has a supply agreement with SIIPL and SLS under which SIIPL and SLS supply the Company with NVX-CoV2373, its proprietary COVID-19 variant antigen candidate(s), its quadrivalent influenza vaccine candidate, and its CIC vaccine candidate for commercialization and sale in certain territories, as well as a contract development manufacture agreement with SLS, under which SLS manufactures and supplies finished vaccine product to the Company using antigen drug substance and Matrix-M™ adjuvant supplied by the Company. In March 2020, the Company granted SIIPL a non-exclusive license for the use of Matrix-M™ adjuvant supplied by the Company to develop, manufacture, and commercialize R21, a malaria candidate developed by the Jenner Institute, University of Oxford (“R21/Malaria”). Under the agreement, SIIPL purchases the Company's Matrix-M™ adjuvant to manufacture R21/Malaria and SIIPL pays a royalty in the single to low double-digit range for a period of 15 years after the first commercial sale of product in each country.

Takeda Pharmaceutical Company Limited

The Company has a collaboration and license agreement with Takeda Pharmaceutical Company Limited (“Takeda”) under which the Company granted Takeda an exclusive license to develop, manufacture, and commercialize NVX-CoV2373 in Japan. Under the agreement, Takeda purchases Matrix-M™ adjuvant from the Company to manufacture doses of NVX-CoV2373, and the Company is entitled to receive payments from Takeda based on the achievement of certain development and commercial milestones, as well as a portion of net profits from the sale of NVX-CoV2373. In September 2021, Takeda finalized an agreement with the Government of Japan’s Ministry of Health, Labour and Welfare ("MHLW") for the purchase of 150 million doses of NVX-CoV2373. In February 2023, MHLW cancelled the remainder of doses under its agreement with Takeda. As a result, it is uncertain whether the Company will receive future payments from Takeda under the terms and conditions of their current collaboration and licensing agreement.

Bill & Melinda Gates Medical Research Institute

In May 2023, we entered into a 3-year agreement with the Bill & Melinda Gates Medical Research Institute to provide our Matrix-M™ adjuvant for use in preclinical vaccine research.

Other Supply Agreements

On September 30, 2022, the Company, FUJIFILM Diosynth Biotechnologies UK Limited (“FDBK”), FUJIFILM Diosynth Biotechnologies Texas, LLC (“FDBT”), and FUJIFILM Diosynth Biotechnologies USA, Inc. (“FDBU” and together with FDBK and FDBT, “Fujifilm”) entered into a Confidential Settlement Agreement and Release (the “Fujifilm Settlement Agreement”) regarding amounts due to Fujifilm in connection with the termination of manufacturing activity at FDBT under the Commercial Supply Agreement (the “CSA”) dated August 20, 2021 and Master Services Agreement dated June 30, 2020 and associated statements of work (the “MSA”) by and between the Company and Fujifilm. The MSA and CSA established the general terms and conditions applicable to Fujifilm’s manufacturing and supply activities related to NVX-CoV2373 under the associated statements of work.

Pursuant to the Fujifilm Settlement Agreement, the Company is responsible for payment of up to $185.0 million (the “Settlement Payment”) to Fujifilm in connection with cancellation of manufacturing activity at FDBT under the CSA, of which (i) $47.8 million, constituting the initial reservation fee under the CSA, was credited against the Settlement Payment on September 30, 2022 and (ii) the remaining balance is to be paid in four equal quarterly installments of $34.3 million each, which began on March 31, 2023. As of June 30, 2023, the remaining payment of $68.6 million was reflected in Accrued expenses. Under the Fujifilm Settlement Agreement, Fujifilm is required to use commercially reasonable efforts to mitigate the losses associated with the vacant manufacturing capacity caused by the termination of manufacturing activities at FDBT under the Fujifilm CSA, and the final two quarterly installments will be mitigated by any replacement revenue achieved by Fujifilm between July 1, 2023 and December 31, 2023.

In May 2023, the Company issued a notice to SK bioscience Co., Ltd. (“SK bioscience) to cancel and wind down all drug substance and drug product manufacturing activities for supply by SK bioscience to the Company. The Company recognized $20.4 million of research and development expense associated with a take-or-pay obligation that became due as a result of the cancellation.

The Company continues to assess its manufacturing needs and intends to modify its global manufacturing footprint consistent with its contractual obligations to supply, and anticipated demand for, NVX-CoV2373, and in doing so, recognizes that significant costs may be incurred.

Note 5 – Earnings (Loss) per Share

Basic and diluted net income (loss) per share were calculated as follows (in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Numerator: |

|

|

|

|

|

|

|

| Net income (loss), basic |

$ |

58,008 |

|

|

$ |

(510,485) |

|

|

$ |

(235,897) |

|

|

$ |

(307,077) |

|