False--12-31Q20001828673http://fasb.org/srt/2024#ChiefExecutiveOfficerMember00018286732025-01-2700018286732025-01-220001828673hcwb:OverheadAllocationsMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673us-gaap:CommonStockMember2025-04-012025-06-300001828673us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001828673hcwb:TroubledDebtRestructuringOfSeniorSecuredNotesMember2025-06-300001828673hcwb:ConvertiblePromissoryNotesMember2025-05-150001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMemberhcwb:Pre-FundedWarrantsMember2024-11-212024-11-210001828673hcwb:ScottTGarrettMembersrt:BoardOfDirectorsChairmanMemberhcwb:ConvertiblePromissoryNotesMember2025-05-050001828673hcwb:EquityPurchaseAgreementMember2025-04-012025-06-300001828673hcwb:ClinicalMaterialsMember2025-01-012025-06-300001828673us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310001828673hcwb:TaxesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001828673hcwb:PurchaseAgreementMember2024-11-182024-11-180001828673us-gaap:FairValueInputsLevel1Member2024-12-310001828673us-gaap:RetainedEarningsMember2024-01-012024-03-310001828673us-gaap:SuretyBondMember2025-01-012025-06-3000018286732023-12-310001828673us-gaap:SeniorNotesMember2025-06-300001828673hcwb:PromissoryNoteWithPersonalGuaranteeMember2025-05-082025-05-080001828673us-gaap:OperatingSegmentsMemberhcwb:ProfessionalServicesMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:SalariesBenefitsAndRelatedExpensesMember2024-04-012024-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:InsuranceMember2024-04-012024-06-300001828673hcwb:RentAndOccupancyExpensesMemberus-gaap:OperatingSegmentsMember2025-04-012025-06-3000018286732025-01-012025-06-300001828673hcwb:PurchaseAgreementMemberhcwb:PreFundedWarrantAndCommonStockWarrantMember2025-05-1300018286732024-04-012024-06-300001828673hcwb:Follow-OnOfferingMemberhcwb:CommonStockWarrantsMember2025-05-132025-05-130001828673hcwb:ConvertiblePromissoryNotesMember2025-05-050001828673us-gaap:FairValueInputsLevel3Memberhcwb:ContingentLiabilityMember2025-06-300001828673us-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMember2024-11-1800018286732025-01-012025-03-310001828673us-gaap:CommonStockMemberhcwb:ConvertiblePromissoryNotesMember2025-05-152025-05-150001828673us-gaap:AccountsPayableAndAccruedLiabilitiesMember2025-06-300001828673us-gaap:EquityUnitPurchaseAgreementsMemberus-gaap:SubsequentEventMember2025-07-252025-07-250001828673hcwb:PurchaseAgreementMemberhcwb:CommonStockWarrantsMember2024-11-180001828673hcwb:CommonStockWarrantsMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ClinicalTrialsMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:OverheadAllocationsMember2025-04-012025-06-300001828673hcwb:DepreciationExpensesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673us-gaap:RetainedEarningsMember2024-04-012024-06-300001828673hcwb:CommonStockOptionsMember2024-01-012024-06-300001828673hcwb:AccruedLiabilitiesAndOtherCurrentLiabilitiesMember2024-01-012024-12-310001828673us-gaap:OperatingSegmentsMemberhcwb:InsuranceMember2024-01-012024-06-3000018286732025-03-310001828673us-gaap:CommonStockMember2024-03-310001828673us-gaap:FairValueInputsLevel3Member2025-06-300001828673us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2024-12-310001828673us-gaap:SeniorNotesMember2025-01-012025-06-300001828673us-gaap:FairValueInputsLevel3Member2024-12-310001828673hcwb:PurchaseAgreementMember2025-01-012025-06-300001828673us-gaap:ResearchAndDevelopmentExpenseMember2025-04-012025-06-300001828673hcwb:AccruedLiabilitiesAndOtherCurrentLiabilitiesMember2025-01-012025-06-300001828673us-gaap:RetainedEarningsMember2025-04-012025-06-300001828673us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2025-06-300001828673us-gaap:SecuredDebtMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:SalariesBenefitsAndRelatedExpensesMember2025-01-012025-06-300001828673us-gaap:AdditionalPaidInCapitalMember2024-12-310001828673us-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMember2025-06-3000018286732025-01-272025-01-2700018286732024-03-310001828673hcwb:DevelopmentSupplyMaterialsMember2024-04-012024-06-300001828673us-gaap:OperatingSegmentsMember2024-04-012024-06-300001828673us-gaap:RetainedEarningsMember2025-01-012025-03-310001828673hcwb:PutNoticeMemberhcwb:EquityPurchaseAgreementMembersrt:MaximumMember2025-02-202025-02-200001828673us-gaap:OperatingSegmentsMember2025-04-012025-06-300001828673hcwb:DepreciationExpensesMemberus-gaap:OperatingSegmentsMember2025-04-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:OtherExpensesMember2025-01-012025-06-300001828673hcwb:ClinicalMaterialsMember2024-01-012024-06-300001828673hcwb:RentAndOccupancyExpensesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-3000018286732025-06-300001828673us-gaap:OperatingSegmentsMember2025-01-012025-06-300001828673hcwb:RentAndOccupancyExpensesMemberus-gaap:OperatingSegmentsMember2025-01-012025-06-300001828673us-gaap:AccountsPayableAndAccruedLiabilitiesMember2024-12-310001828673us-gaap:ConvertibleDebtMember2025-01-012025-06-300001828673us-gaap:RetainedEarningsMember2024-12-310001828673us-gaap:OperatingSegmentsMemberhcwb:ManufacturingAndMaterialsMember2024-04-012024-06-300001828673hcwb:PurchaseAgreementMemberhcwb:CommonShareAndCommonStockWarrantMember2025-05-130001828673hcwb:DepreciationExpensesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001828673us-gaap:SeniorNotesMember2025-05-072025-05-070001828673us-gaap:AdditionalPaidInCapitalMember2025-03-310001828673us-gaap:FairValueInputsLevel2Member2025-06-300001828673hcwb:RentAndOccupancyExpensesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMemberhcwb:Pre-FundedWarrantsMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ManufacturingAndMaterialsMember2024-01-012024-06-300001828673us-gaap:InvestmentsMember2025-06-300001828673hcwb:TaxesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001828673us-gaap:RetainedEarningsMember2024-03-310001828673us-gaap:CommonStockMember2024-11-300001828673us-gaap:FairValueInputsLevel3Memberus-gaap:InvestmentsMember2025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ClinicalTrialsMember2024-04-012024-06-300001828673us-gaap:EquityUnitPurchaseAgreementsMemberus-gaap:SubsequentEventMember2025-07-220001828673hcwb:CogentBankMember2025-01-012025-06-3000018286732024-03-012024-03-010001828673hcwb:PurchaseAgreementMemberhcwb:CommonStockWarrantsMember2025-05-130001828673us-gaap:ResearchAndDevelopmentExpenseMember2025-01-012025-06-300001828673hcwb:DepreciationExpensesMemberus-gaap:OperatingSegmentsMember2025-01-012025-06-300001828673hcwb:PurchaseAgreementMemberhcwb:Pre-FundedWarrantsMember2025-05-130001828673hcwb:PreclinicalExpensesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ProfessionalServicesMember2025-04-012025-06-300001828673hcwb:EquityPurchaseAgreementMember2025-02-202025-02-200001828673us-gaap:AdditionalPaidInCapitalMember2024-06-300001828673hcwb:PromissoryNoteWithPersonalGuaranteeMember2025-01-012025-06-300001828673us-gaap:RetainedEarningsMember2025-06-300001828673hcwb:ConvertiblePromissoryNotesMember2025-05-152025-05-150001828673us-gaap:AdditionalPaidInCapitalMember2024-03-310001828673us-gaap:MoneyMarketFundsMember2025-06-300001828673us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2025-06-300001828673hcwb:WugenLicenseMembersrt:MaximumMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:OtherExpensesMember2024-04-012024-06-300001828673us-gaap:CommonStockMember2024-12-310001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMember2024-11-200001828673hcwb:ConvertiblePromissoryNotesMember2025-06-300001828673us-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentsMember2025-06-3000018286732025-04-012025-06-300001828673us-gaap:CommonStockMember2024-06-300001828673us-gaap:CommonStockMember2023-12-310001828673us-gaap:AdditionalPaidInCapitalMember2023-12-310001828673hcwb:PreclinicalExpensesMemberus-gaap:OperatingSegmentsMember2025-04-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ClinicalTrialsMember2024-01-012024-06-300001828673us-gaap:FairValueInputsLevel2Memberhcwb:ContingentLiabilityMember2025-06-300001828673hcwb:CommonStockWarrantsMember2024-01-012024-06-300001828673us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2024-12-310001828673us-gaap:OperatingSegmentsMemberhcwb:SalariesBenefitsAndRelatedExpensesMember2024-01-012024-06-300001828673hcwb:PurchaseAgreementMemberhcwb:Pre-FundedWarrantsMember2024-11-180001828673us-gaap:RetainedEarningsMember2024-06-300001828673us-gaap:SeniorNotesMemberus-gaap:CollateralPledgedMember2025-06-300001828673hcwb:PurchaseAgreementMembersrt:MaximumMemberhcwb:Pre-FundedWarrantsMember2024-11-180001828673us-gaap:FairValueInputsLevel1Memberhcwb:ContingentLiabilityMember2025-06-300001828673hcwb:BoardOfDirectorsMemberhcwb:ConvertiblePromissoryNotesMemberhcwb:GaryMWinerMember2025-05-050001828673hcwb:PurchaseAgreementMembersrt:MaximumMemberhcwb:Pre-FundedWarrantsMember2025-05-130001828673hcwb:TaxesMemberus-gaap:OperatingSegmentsMember2025-04-012025-06-300001828673us-gaap:MoneyMarketFundsMember2024-12-310001828673hcwb:WYBiotechLicenseAgreementMember2025-01-012025-06-300001828673us-gaap:NonoperatingIncomeExpenseMember2025-01-012025-06-300001828673us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ManufacturingAndMaterialsMember2025-01-012025-06-300001828673us-gaap:FairValueInputsLevel1Member2025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:FacilitiesAndOfficeExpensesMember2025-01-012025-06-300001828673hcwb:CogentBankMember2022-08-150001828673hcwb:CommonStockOptionsMember2025-01-012025-06-300001828673hcwb:TaxesMemberus-gaap:OperatingSegmentsMember2025-01-012025-06-300001828673hcwb:WugenLicenseMember2024-12-310001828673hcwb:CommonStockWarrantsMemberus-gaap:PrivatePlacementMember2024-11-180001828673hcwb:EquityPurchaseAgreementMembersrt:MaximumMember2025-02-200001828673hcwb:FounderAndCeoMemberhcwb:HingCWongMemberhcwb:ConvertiblePromissoryNotesMember2025-05-050001828673us-gaap:EquityUnitPurchaseAgreementsMember2025-02-200001828673hcwb:ConvertiblePromissoryNotesMember2025-01-012025-06-300001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMember2024-11-182024-11-180001828673us-gaap:CommonStockMemberhcwb:EquityPurchaseAgreementMember2025-03-122025-03-120001828673us-gaap:OperatingSegmentsMemberhcwb:FacilitiesAndOfficeExpensesMember2025-04-012025-06-300001828673us-gaap:CommonStockMemberhcwb:PurchaseAgreementMember2025-05-132025-05-130001828673us-gaap:CommonStockMember2024-01-012024-03-310001828673hcwb:PurchaseAgreementMemberhcwb:CommonStockWarrantsMember2024-11-200001828673us-gaap:CommonStockMember2025-03-3100018286732024-12-310001828673us-gaap:OperatingSegmentsMemberhcwb:OtherExpensesMember2025-04-012025-06-3000018286732024-06-300001828673hcwb:WugenLicenseMember2025-01-012025-06-300001828673us-gaap:FairValueInputsLevel2Member2024-12-310001828673us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310001828673us-gaap:OperatingSegmentsMemberhcwb:ProfessionalServicesMember2024-01-012024-06-300001828673hcwb:CommonStockWarrantsMember2025-04-160001828673us-gaap:OperatingSegmentsMemberhcwb:ClinicalTrialsMember2025-04-012025-06-300001828673hcwb:CommonStockWarrantsMember2025-05-150001828673us-gaap:CommonStockMember2024-11-012024-11-300001828673us-gaap:OperatingSegmentsMemberhcwb:FacilitiesAndOfficeExpensesMember2024-04-012024-06-300001828673us-gaap:EquityUnitPurchaseAgreementsMembersrt:MaximumMember2025-04-162025-04-160001828673us-gaap:SuretyBondMember2025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:ProfessionalServicesMember2024-04-012024-06-300001828673us-gaap:AdditionalPaidInCapitalMember2025-06-3000018286732024-01-012024-06-300001828673hcwb:DevelopmentSupplyMaterialsMember2025-04-012025-06-300001828673hcwb:PreclinicalExpensesMemberus-gaap:OperatingSegmentsMember2025-01-012025-06-300001828673hcwb:ContingentLiabilityMember2025-06-3000018286732024-01-012024-03-310001828673us-gaap:RetainedEarningsMember2023-12-310001828673hcwb:TroubledDebtRestructuringOfSeniorSecuredNotesMember2025-01-012025-06-3000018286732024-03-010001828673hcwb:EquityPurchaseAgreementMembersrt:MaximumMember2025-04-162025-04-160001828673hcwb:EquityPurchaseAgreementMember2025-02-200001828673us-gaap:OperatingSegmentsMemberhcwb:ManufacturingAndMaterialsMember2025-04-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:OtherExpensesMember2024-01-012024-06-300001828673srt:ScenarioForecastMemberhcwb:PromissoryNoteWithPersonalGuaranteeMember2026-02-072026-02-070001828673hcwb:PreclinicalExpensesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001828673hcwb:PurchaseAgreementMember2025-05-132025-05-130001828673us-gaap:CommonStockMember2025-06-300001828673us-gaap:CommonStockMemberhcwb:TroubledDebtRestructuringOfSeniorSecuredNotesMember2025-01-012025-06-300001828673hcwb:EquityPurchaseAgreementMember2025-01-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:FacilitiesAndOfficeExpensesMember2024-01-012024-06-300001828673us-gaap:RetainedEarningsMember2025-03-310001828673hcwb:PutNoticeMemberhcwb:EquityPurchaseAgreementMember2025-02-202025-02-200001828673us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:InsuranceMember2025-04-012025-06-300001828673hcwb:FounderAndCeoMemberhcwb:HingCWongMemberhcwb:PromissoryNoteWithPersonalGuaranteeMember2025-05-0800018286732025-04-112025-04-110001828673hcwb:WugenLicenseMember2025-06-300001828673us-gaap:CommonStockMember2025-01-012025-03-310001828673us-gaap:OperatingSegmentsMemberhcwb:SalariesBenefitsAndRelatedExpensesMember2025-04-012025-06-300001828673us-gaap:SeniorNotesMember2025-04-012025-06-300001828673us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:InsuranceMember2025-01-012025-06-300001828673us-gaap:AdditionalPaidInCapitalMember2025-04-012025-06-300001828673hcwb:PurchaseAgreementMemberhcwb:CommonShareAndCommonStockWarrantMember2024-11-1800018286732025-08-120001828673hcwb:PurchaseAgreementMemberhcwb:PreFundedWarrantAndCommonStockWarrantMember2024-11-180001828673us-gaap:OperatingSegmentsMemberhcwb:OverheadAllocationsMember2024-04-012024-06-300001828673us-gaap:EquityUnitPurchaseAgreementsMembersrt:MaximumMember2025-02-200001828673hcwb:PromissoryNoteWithPersonalGuaranteeMember2025-04-012025-06-300001828673us-gaap:OperatingSegmentsMemberhcwb:OverheadAllocationsMember2025-01-012025-06-30xbrli:pureutr:sqftxbrli:shareshcwb:Segmentiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2025

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-40591

HCW Biologics Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware |

82-5024477 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.) |

|

|

|

2929 N. Commerce Parkway

Miramar, Florida

|

33025 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 842–2024

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

Common Stock, par value $0.0001 per share |

HCWB |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

|

|

Emerging growth company |

☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 12, 2025, the registrant had 2,151,607 shares of common stock, $0.0001 par value per share, outstanding.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

HCW Biologics Inc.

Condensed Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

June 30, |

|

|

|

2024 |

|

|

2025 |

|

|

|

|

|

|

Unaudited |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,674,572 |

|

|

$ |

2,438,962 |

|

Accounts receivable, net |

|

|

582,201 |

|

|

|

21,611 |

|

Prepaid expenses |

|

|

328,181 |

|

|

|

295,543 |

|

Other current assets |

|

|

113,528 |

|

|

|

141,009 |

|

Total current assets |

|

|

5,698,482 |

|

|

|

2,897,125 |

|

Investments |

|

|

1,599,751 |

|

|

|

3,348,438 |

|

Property, plant and equipment, net |

|

|

22,909,869 |

|

|

|

22,635,596 |

|

Other assets |

|

|

28,476 |

|

|

|

28,477 |

|

Total assets |

|

$ |

30,236,578 |

|

|

$ |

28,909,636 |

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

22,332,261 |

|

|

$ |

19,354,476 |

|

Accrued liabilities and other current liabilities |

|

|

981,940 |

|

|

|

1,070,421 |

|

Short-term debt, net |

|

|

6,314,684 |

|

|

|

6,421,204 |

|

Total current liabilities |

|

|

29,628,885 |

|

|

|

26,846,101 |

|

Debt, net |

|

|

7,377,865 |

|

|

|

367,151 |

|

Contingent liability - related party |

|

|

— |

|

|

|

1,748,356 |

|

Total liabilities |

|

|

37,006,750 |

|

|

|

28,961,608 |

|

Commitments and contingencies (Note 11) |

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

Common stock: |

|

|

|

|

|

|

Common, $0.0001 par value; 250,000,000 shares authorized

and 1,113,532 shares issued at December 31, 2024; 250,000,000 shares

authorized and 2,146,601 shares issued at June 30, 2025 |

|

|

111 |

|

|

|

215 |

|

Additional paid-in capital |

|

|

93,785,854 |

|

|

|

104,628,555 |

|

Accumulated deficit |

|

|

(100,556,137 |

) |

|

|

(104,680,742 |

) |

Total stockholders’ deficit |

|

|

(6,770,172 |

) |

|

|

(51,972 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

30,236,578 |

|

|

$ |

28,909,636 |

|

See accompanying notes to the unaudited condensed interim financial statements.

HCW Biologics Inc.

Condensed Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

618,854 |

|

|

$ |

6,550 |

|

|

$ |

1,745,566 |

|

|

$ |

11,615 |

|

Cost of revenues |

|

|

(438,443 |

) |

|

|

(5,240 |

) |

|

|

(950,408 |

) |

|

|

(9,292 |

) |

Net revenues |

|

|

180,411 |

|

|

|

1,310 |

|

|

|

795,158 |

|

|

|

2,323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,029,186 |

|

|

|

1,226,824 |

|

|

|

4,152,470 |

|

|

|

2,705,536 |

|

General and administrative |

|

|

1,594,193 |

|

|

|

2,096,021 |

|

|

|

3,160,285 |

|

|

|

4,302,301 |

|

Legal expenses (recoveries), net |

|

|

10,393,042 |

|

|

|

142,542 |

|

|

|

14,812,076 |

|

|

|

(1,596,951 |

) |

Nonoperating loss |

|

|

1,300,000 |

|

|

|

— |

|

|

|

1,300,000 |

|

|

|

— |

|

Total operating expenses |

|

|

15,316,421 |

|

|

|

3,465,387 |

|

|

|

23,424,831 |

|

|

|

5,410,886 |

|

Loss from operations |

|

|

(15,136,010 |

) |

|

|

(3,464,077 |

) |

|

|

(22,629,673 |

) |

|

|

(5,408,563 |

) |

Interest expense |

|

|

(159,666 |

) |

|

|

(228,714 |

) |

|

|

(159,666 |

) |

|

|

(505,853 |

) |

Unrealized gain on investment |

|

|

- |

|

|

|

1,748,688 |

|

|

|

— |

|

|

|

1,748,688 |

|

Other income, net |

|

|

15,485 |

|

|

|

16,373 |

|

|

|

41,086 |

|

|

|

41,122 |

|

Net loss |

|

$ |

(15,280,191 |

) |

|

$ |

(1,927,730 |

) |

|

$ |

(22,748,253 |

) |

|

$ |

(4,124,606 |

) |

Equity dividend to investor |

|

|

- |

|

|

|

(10,153,799 |

) |

|

|

- |

|

|

|

(10,153,799 |

) |

Net loss attributable to Common Stockholders |

|

$ |

(15,280,191 |

) |

|

$ |

(12,081,529 |

) |

|

$ |

(22,748,253 |

) |

|

$ |

(14,278,405 |

) |

Net loss per share, basic and diluted |

|

$ |

(16.16 |

) |

|

$ |

(6.79 |

) |

|

$ |

(24.25 |

) |

|

$ |

(9.86 |

) |

Weighted average shares outstanding, basic and diluted |

|

|

945,585 |

|

|

|

1,780,113 |

|

|

|

938,087 |

|

|

|

1,448,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited condensed interim financial statements.

HCW Biologics Inc.

Condensed Statements of Changes in Stockholders’ Equity (Deficit)

For the Six Months Ended June 30, 2024 and 2025

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity (Deficit) |

|

|

|

Common Stock |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Total

Stockholders’ |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity (Deficit) |

|

Balance, January 1, 2024 |

|

|

900,628 |

|

|

$ |

90 |

|

|

$ |

83,993,950 |

|

|

$ |

(70,532,323 |

) |

|

$ |

13,461,717 |

|

Issuance of Common Stock upon exercise of stock options |

|

|

314 |

|

|

|

1 |

|

|

|

2,254 |

|

|

|

— |

|

|

|

2,255 |

|

Issuance of Common Stock upon equity subscription |

|

|

44,643 |

|

|

|

4 |

|

|

|

2,500,001 |

|

|

|

— |

|

|

|

2,500,005 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

244,685 |

|

|

|

— |

|

|

|

244,685 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,468,061 |

) |

|

|

(7,468,061 |

) |

Balance, March 31, 2024 |

|

|

945,585 |

|

|

$ |

95 |

|

|

$ |

86,740,890 |

|

|

$ |

(78,000,384 |

) |

|

$ |

8,740,601 |

|

Issuance of Common Stock upon exercise of stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

239,821 |

|

|

|

— |

|

|

|

239,821 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,280,191 |

) |

|

|

(15,280,191 |

) |

Balance, June 30, 2024 |

|

|

945,585 |

|

|

$ |

95 |

|

|

$ |

86,980,711 |

|

|

$ |

(93,280,575 |

) |

|

$ |

(6,299,769 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit |

|

|

|

Common Stock |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Total

Stockholders’ |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Deficit |

|

Balance, January 1, 2025 |

|

|

1,113,532 |

|

|

$ |

111 |

|

|

$ |

93,785,854 |

|

|

$ |

(100,556,137 |

) |

|

$ |

(6,770,172 |

) |

Issuance of Common Stock upon exercise of stock options |

|

|

205 |

|

|

|

— |

|

|

|

1,654 |

|

|

|

— |

|

|

|

1,654 |

|

Issuance of Common Stock to Square Gate |

|

|

9,616 |

|

|

|

1 |

|

|

|

149,999 |

|

|

|

— |

|

|

|

150,000 |

|

Issuance cost of Common Stock |

|

|

— |

|

|

|

— |

|

|

|

(22,297 |

) |

|

|

— |

|

|

|

(22,297 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

275,642 |

|

|

|

— |

|

|

|

275,642 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,196,875 |

) |

|

|

(2,196,875 |

) |

Balance, March 31, 2025 |

|

|

1,123,353 |

|

|

$ |

112 |

|

|

$ |

94,190,852 |

|

|

$ |

(102,753,012 |

) |

|

$ |

(8,562,048 |

) |

Issuance of Common Stock |

|

|

194,242 |

|

|

|

20 |

|

|

|

1,592,784 |

|

|

|

— |

|

|

|

1,592,804 |

|

Issuance of pre-funded warrants |

|

|

— |

|

|

|

— |

|

|

|

4,207,718 |

|

|

|

— |

|

|

|

4,207,718 |

|

Issuance of common stock warrants |

|

|

— |

|

|

|

— |

|

|

|

9,650,404 |

|

|

|

— |

|

|

|

9,650,404 |

|

Exercise of pre-funded warrants |

|

|

513,140 |

|

|

|

51 |

|

|

|

- |

|

|

|

— |

|

|

|

51 |

|

Issuance cost of Common Stock |

|

|

— |

|

|

|

— |

|

|

|

(70,094 |

) |

|

|

— |

|

|

|

(70,094 |

) |

Issuance cost of pre-funded warrants |

|

|

— |

|

|

|

— |

|

|

|

(504,862 |

) |

|

|

— |

|

|

|

(504,862 |

) |

Issuance cost of common stock warrants |

|

|

— |

|

|

|

— |

|

|

|

(227,646 |

) |

|

|

— |

|

|

|

(227,646 |

) |

Equity dividend to investor |

|

|

|

|

|

|

|

|

(10,153,799 |

) |

|

|

|

|

|

(10,153,799 |

) |

Issuance of Common Stock to extinguish restructured debt |

|

|

253,083 |

|

|

|

25 |

|

|

|

1,774,087 |

|

|

|

— |

|

|

|

1,774,112 |

|

Issuance of common stock warrants to extinguish restructured debt |

|

|

|

|

|

|

|

|

544,249 |

|

|

|

— |

|

|

|

544,249 |

|

Gain on conversion of debt with related parties, net |

|

|

— |

|

|

|

— |

|

|

|

3,346,562 |

|

|

|

— |

|

|

|

3,346,562 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

278,307 |

|

|

|

— |

|

|

|

278,307 |

|

Adjustment for reverse stock split |

|

|

62,783 |

|

|

|

7 |

|

|

|

(7 |

) |

|

|

— |

|

|

|

- |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

- |

|

|

|

(1,927,730 |

) |

|

|

(1,927,730 |

) |

Balance, June 30, 2025 |

|

|

2,146,601 |

|

|

$ |

215 |

|

|

$ |

104,628,555 |

|

|

$ |

(104,680,742 |

) |

|

$ |

(51,972 |

) |

See accompanying notes to the unaudited condensed interim financial statements.

HCW Biologics Inc.

Condensed Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2025 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(22,748,253 |

) |

|

$ |

(4,124,606 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and accretion |

|

|

373,433 |

|

|

|

710,926 |

|

Stock-based compensation |

|

|

484,506 |

|

|

|

553,949 |

|

Commitment fee |

|

|

— |

|

|

|

150,000 |

|

Unrealized gain on investment |

|

|

— |

|

|

|

(1,748,688 |

) |

Loss on conversion of debt with related parties |

|

|

|

|

|

(131,134 |

) |

Changes in the carrying amount of right-of-use asset |

|

|

(418 |

) |

|

|

— |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

880,784 |

|

|

|

560,590 |

|

Prepaid expenses and other assets |

|

|

703,805 |

|

|

|

5,156 |

|

Accounts payable and other liabilities |

|

|

11,896,608 |

|

|

|

(2,772,352 |

) |

Operating lease liability |

|

|

(56,541 |

) |

|

|

— |

|

Net cash used in operating activities |

|

|

(8,466,076 |

) |

|

|

(6,796,159 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(111,142 |

) |

|

|

— |

|

Net cash (used in) provided by investing activities |

|

|

(111,142 |

) |

|

|

— |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of Common Stock |

|

|

2,502,260 |

|

|

|

1,475,939 |

|

Proceeds from issuance of pre-funded warrants |

|

|

— |

|

|

|

3,822,894 |

|

Proceeds from issuance of debt |

|

|

3,700,000 |

|

|

|

150,000 |

|

Issuance costs for Common Stock and pre-funded warrants |

|

|

— |

|

|

|

(824,899 |

) |

Debt repayment |

|

|

(58,829 |

) |

|

|

(63,385 |

) |

Net cash provided by financing activities |

|

|

6,143,431 |

|

|

|

4,560,549 |

|

Net decrease in cash and cash equivalents |

|

|

(2,433,787 |

) |

|

|

(2,235,610 |

) |

Cash and cash equivalents at the beginning of the period |

|

|

3,595,101 |

|

|

|

4,674,572 |

|

Cash and cash equivalents at the end of the period |

|

$ |

1,161,314 |

|

|

$ |

2,438,962 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for interest, net of amounts capitalized |

|

$ |

159,666 |

|

|

$ |

404,162 |

|

Noncash investing activities: |

|

|

|

|

|

|

Capital expenditures accrued, but not yet paid |

|

$ |

1,769,621 |

|

|

$ |

— |

|

Purchases of property and equipment included in accounts payable and other |

|

$ |

829,207 |

|

|

$ |

13,000 |

|

Noncash financing activities: |

|

|

|

|

|

|

Extinguishment of restructured debt |

|

$ |

— |

|

|

$ |

7,440,462 |

|

Issuance of Common Stock, warrants and other rights upon extinguishment of restructured debt |

|

$ |

— |

|

|

$ |

3,962,766 |

|

Gain on extinguishment of debt with related parties |

|

$ |

— |

|

|

$ |

3,477,696 |

|

Equity dividend to investor |

|

$ |

— |

|

|

$ |

10,153,799 |

|

See accompanying notes to the unaudited condensed interim financial statements.

HCW Biologics Inc.

Notes to Condensed Interim Financial Statements

(Unaudited)

1. Organization and Summary of Significant Accounting Policies

Organization

HCW Biologics Inc. (the “Company”) is a biopharmaceutical company focused on discovering and developing novel immunotherapies to lengthen healthspan by disrupting the link between chronic, low-grade inflammation and age-related diseases. The Company believes age-related low-grade chronic inflammation, or “inflammaging,” is a significant contributing factor to several chronic diseases and conditions, such as cancer, cardiovascular disease, diabetes, neurodegenerative diseases, and autoimmune diseases. The Company is located in Miramar, Florida and was incorporated in the state of Delaware in April 2018.

Reverse Stock Split

On March 31, 2025, at a Special Meeting of the Stockholders (the “Special Meeting”), the stockholders of the Company approved a reverse stock split of all outstanding shares of the Common Stock, and the Board approved a reverse stock split of the Common Stock at a final ratio of one-for-forty (1::40) (the “Reverse Stock Split”). The Reverse Stock Split was effective at 12:01 a.m. Eastern Time on April 11, 2025. The Common Stock commenced trading on a reverse split-adjusted basis when the markets opened on April 11, 2025, under the existing trading symbol “HCWB.”

In addition to the Reverse Stock Split, the stockholders approved two other proposals at the Special Meeting: (1) use of our equity line of credit to raise up to $40.0 million through sales of shares of the Company’s Common Stock thereunder and (2) execution of the principal terms for the conversion of up to approximately $6.9 million of the outstanding principal of Secured Notes into shares of Common Stock.

All authorized, issued, and outstanding shares of common stock, preferred stock, stock option awards, and per share data included in these financial statements have been recast to give retrospective effect to the adjusted authorized shares and Reverse Stock Split for all periods presented. The Reverse Stock Split did not have any effect on the stated par value of the Company’s Common Stock or the rights and privileges of the holders of shares of Common Stock. Options, warrants and convertible securities outstanding immediately prior to the Reverse Stock Split were appropriately adjusted to reflect the Reverse Stock Split.

Liquidity and Going Concern

In accordance with ASC 205-40, Presentation of Financial Statements – Going Concern (“Topic 205-40”), we are required to evaluate whether there are conditions and events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern for at least 12 months from the issuance date of the Company’s condensed interim financial statements. This evaluation does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented or are not within control of the Company as of the date the financial statements are issued. When substantial doubt exists under this methodology, management evaluates whether the mitigating effect of its plans sufficiently alleviates substantial doubt about the Company’s ability to continue as a going concern. The mitigating effect of management’s plans, however, is only considered if both (1) it is probable that the plans will be effectively implemented within one year after the date that the financial statements are issued, and (2) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the financial statements are issued.

As of June 30, 2025, the Company had not generated any revenue from commercial product sales of its internally developed immunotherapeutic products for the treatment of cancer and other age-related diseases. During its development activities, the Company has sustained operating losses, experienced negative operating cash flows and negative working capital position and it expects to continue to incur operating losses for the foreseeable future. Since inception to June 30, 2025, the Company incurred cumulative net losses of $102.0 million. These losses reflect a $5.3 million reserve for credit losses and a $1.3 million nonoperating losses reported in prior periods.

To date, the Company has funded operations primarily through the sale of stock and warrants, issuance of Secured Notes and other debt, and revenues generated from the Company’s exclusive worldwide licenses and its development supply agreement with Wugen Inc. (“Wugen”), pursuant to which Wugen licensed limited rights to develop, manufacture, and commercialize cell-based therapy treatments for cancer based on two of our internally-developed, multi-cytokine fusion protein molecules, HCW9201 and HCW9206. In the quarter ended June 30, 2025, the Company agreed to a request from Wugen to suspend the Wugen License, including Wugen’s clinical trial due diligence obligations and its obligation to pay up to $500,000 annually to reimburse the Company for certain R&D expenses. The suspension will run for a period of one year from the effective date and will end on May 29, 2026. During the suspension, the Company has the exclusive right to seek alternate licensees and terminate the license in order to enter other business development transactions related to the ex vivo use of the licensed molecules.

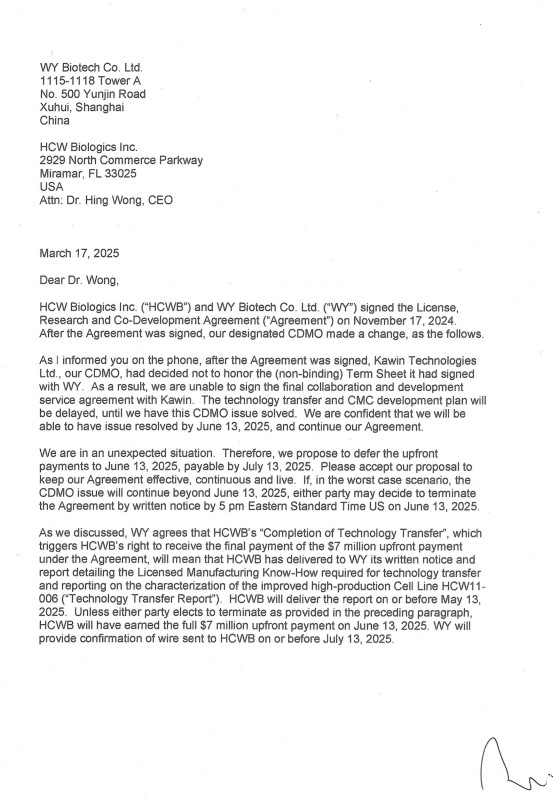

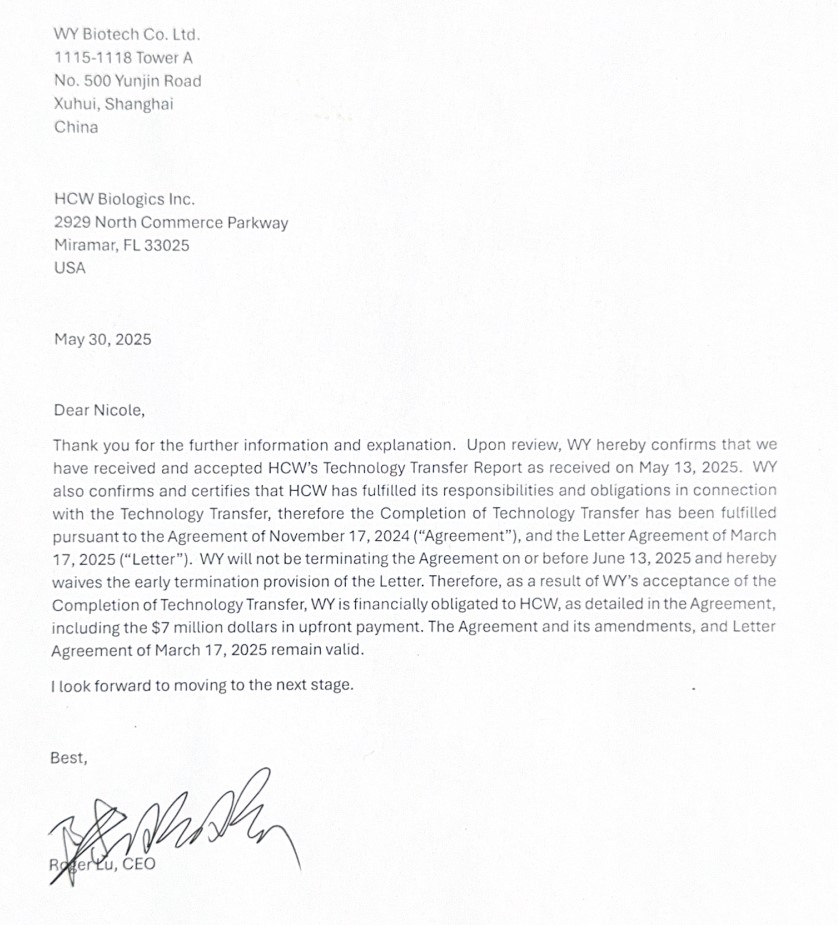

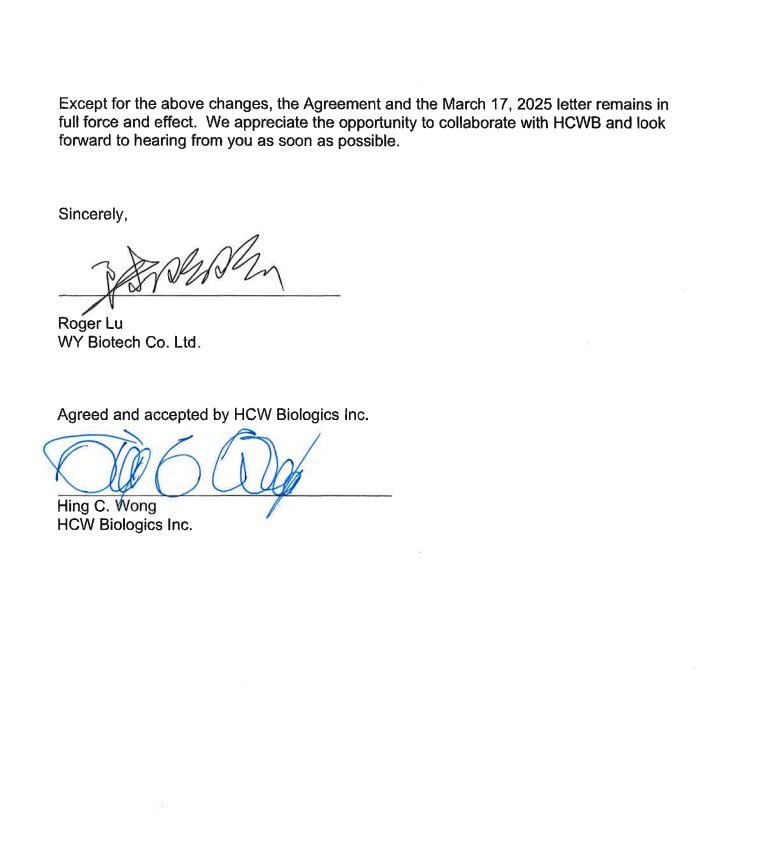

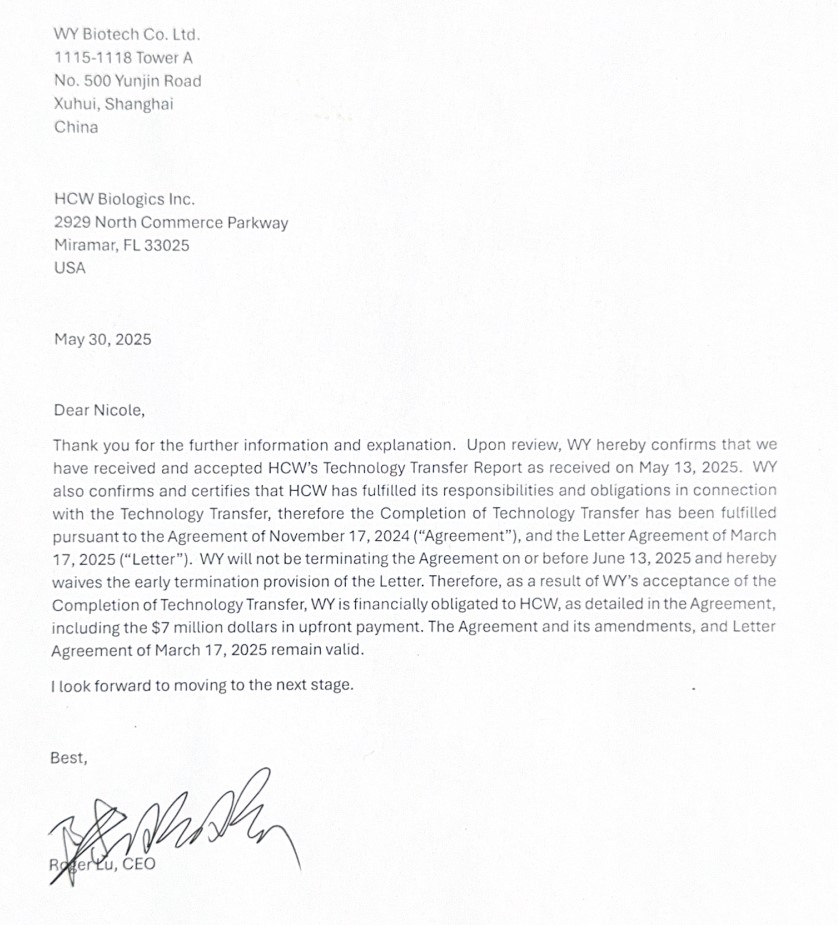

In the quarter ended June 30, 2025, WY Biotech Co., Ltd. (“WY Biotech”) notified the Company that it had completed its due diligence and review of the technical report delivered by the Company and elected to proceed with next steps pursuant to the exclusive worldwide license agreement between WY Biotech and the Company with respect to development and commercialization of one of HCWB’s preclinical product candidates, HCW11-006, for in vivo applications (as amended, the “WY Biotech License”). As a result, WY Biotech is financially obligated to the Company, as detailed in the WY Biotech License, as amended, including the obligation to pay a $7.0 million upfront license fee. WY Biotech is in the process of finalizing agreements with its contract development and manufacturing organization (“CDMO”) and investors. Since the Company has no payment history with WY Biotech, it did not recognize the upfront license fee as revenue as we concluded collectability was not probable. In order to accommodate WY Biotech’s timing in finalizing agreements, the Company and WY Biotech agreed to extend the latest date for payment of the $7.0 million license fee to September 30, 2025.

During the period ended June 30, 2025, the Company extinguished $7.7 million of debt through restructuring or conversion of debt. This was accomplished by restructuring $7.4 million of Secured Notes, including accumulated accretion of a fixed bonus payable upon Maturity Date, through the Second Amendment to the Amended and Restated Note Purchase Agreement and converting $270,000 of unsecured promissory notes according to the terms of the purchase agreement. Both transactions include the right to a portion of the proceeds received on the liquidation or sale of the Wugen shares, if such an event occurs. The Company maintains ownership of the Wugen shares included in these transactions and has recorded a contingent liability to account for the right to receive proceeds upon liquidation or sale of the Wugen shares. The noteholders for this debt consisted of officers, directors and other significant stockholders. Due to the related party nature of the converting noteholders, the gain on restructuring and loss on conversion were recorded to additional paid-in capital for the period ended June 30, 2025.

On August 15, 2022, the Company entered into a loan and security agreement (the “2022 Loan Agreement”) with Cogent Bank, pursuant to which it received $6.5 million in proceeds to purchase a property at which the Company planned to build a facility to manufacture biologics and upgrade its research laboratory facilities. The loan is secured by a first priority lien on the property. As of June 30, 2025, certain subcontractors had filed mechanics liens related to unpaid invoices issued in connection with construction of the Company’s new manufacturing facilities and upgraded research laboratories. The 2022 Loan Agreement contains a provision for a discretionary default in the event that the Company fails to pay sums due in connection with construction of any improvements; however, as of the reporting date, the lender has not elected to do so. As of June 30, 2025, the Company has reflected this loan as Short-term debt, net, to reflect that the lender has the right to accelerate the loan under a discretionary default provision.

On January 22, 2025, the Company entered into a forbearance agreement with BE&K Building Group (“BE&K”), its general contractor, to allow the Company until March 31, 2025 to continue efforts to find the financing required to complete the construction and renovation of the property. Pursuant to the forbearance agreement, the Company made an initial payment of $1.0 million in partial satisfaction of amounts owing to BE&K and its subcontractors. As the Company reported in a Form 8-K, on April 17, 2025, the Company received a summons and a copy of a complaint filed by BE&K in the Circuit Court of the 17th Judicial Circuit in and for Broward County, Florida (the “BE&K Complaint”). Other Defendants named in the BE&K Complaint who are subcontractors elected to file counterclaims and cross-claims as part of their responses to the BE&K Complaint. Cogent Bank, also named as a Defendant in the BE&K Complaint, has not elected to take legal action at this time. In addition, on April 28, 2025, the Company received a summons and a copy of a complaint filed by Fisk Electric Company (which is a defendant in the BE&K Complaint) in the Circuit Court of the 17th Judicial Circuit in and for Broward County, Florida (the “Fisk Complaint”) against the Company, BE&K, and the other defendants in the BE&K Complaint. On August 8, 2025, B&I Contractors, Inc., one of the defendants in the BE&K Complaint, filed a motion for summary judgment (the “MSJ”) as to the Count I (Foreclosure of Construction Lien). The Company has responded to the BE&K and Fisk Complaints and cross-claims and intends to file a timely response to the B&I MSJ.

As of July 13, 2024, the Company and Dr. Hing C. Wong, the Company’s Founder and Chief Executive Officer, entered into a confidential Settlement Agreement and Release (the “Settlement Agreement”) with ImmunityBio and its affiliates. The Settlement Agreement includes mutual general releases by and among the parties thereto. No party was required to make any monetary payments to any other party or person under the Settlement Agreement and each party will bear its own expenses incurred in connection with the matter. The Arbitration and related Complaint were dismissed on December 24, 2024. With the execution of the Settlement Agreement, the Company resolved the attendant uncertainties for the outcome of the Arbitration and additional complexities, and it launched its new financing plan.

In the accompanying condensed balance sheet as of June 30, 2025, the Company reported a balance of $12.3 million for legal fees incurred but not yet paid that were included within Accounts payable and an accrual of $8,000 for accrued legal fees within Accrued liabilities and other current liabilities. The Company is engaged in discussions with the law firms involved with this matter to arrange a reasonable payment plan with respect to those legal fees. In the six months ended June 30, 2025, the Company received a $2.0 million insurance payment, which was paid directly to the law firm who represented Dr. Wong for his defense during the Arbitration. The insurance payment is reported within Legal expenses, net in the condensed interim statement of operations for the six months ended June 30, 2025.

With the ability to approach the equity markets post Settlement, the Company raised gross proceeds of $11.9 million through the issuance of equity securities in two offerings to the same intuitional investor who was the sole investor in both financings (the “Investor”). The first financing occurred on November 18, 2024, when the Company raised gross proceeds of $6.9 million in a registered direct offering and a concurrent private placement of common stock and warrants. This offering priced above market under Nasdaq rules and closed on November 20, 2024. The second financing occurred pursuant to a purchase agreement entered into on May 13, 2025, when the Company raised gross proceeds of $5.0 million in a follow-on public offering of common stock and warrants. This offering priced at the market under Nasdaq rules and closed on May 15, 2025. Contemporaneously with the May 2025 financing, the Company entered into an agreement with the Investor to set a new exercise price, of $7.45 per share, with respect to certain Common Stock Warrants to purchase 167,925 shares of the Company’s Common Stock which were issued in November 2024. See Note 4. Sale of Common Stock and Warrants. Prior to the May 2025 financing, the Company obtained bridge financing in the form of a $150,000 promissory note, guaranteed by securities held by the Company’s Founder and Chief Executive Officer, and in the form of a $270,000 unsecured promissory note which converted to equity on May 15, 2025 according to the provision of the loan documents. See Note 3. Debt, Net.

On February 20, 2025, the Company entered into an Equity Purchase Agreement and a related Registration Rights Agreement with Square Gate Capital Master Fund, LLC - Series 4 (“Square Gate”), pursuant to which the Company will have the right, but not the obligation, to sell to Square Gate, and Square Gate will have the obligation to purchase from the Company, up to $20.0 million (the “Maximum Commitment Amount”) worth of the Company’s shares of Common Stock, at the Company’s sole discretion, over the next 36 months (the “Put Shares”), subject to certain conditions precedent and other limitations. On April 16, 2025, the U.S. Securities and Exchange Commission (“SEC”) declared a registration statement effective to register shares required to sell up to $40.0 million of the Company’s shares to Square Gate, according to provisions of the Equity Purchase Agreement. See Note 7. Standby Equity Purchase Agreement.

On June 26, 2025, the Company announced that it received formal notice from Nasdaq that the Company was in compliance with Listing Rule 5550(b)(1) (the “Equity Rule”). On May 13, 2025, the Company received formal notice from Nasdaq that it regained compliance with the bid price requirement in Listing Rule 5550(a)(2), the public float requirement in Listing Rule 5550(a)(4), and the market value of publicly held shares requirement in Listing Rule 5550(a)(5). As a result, the Company is in compliance with all applicable criteria for continued listing on the Nasdaq Capital Market tier, and the previously disclosed listing compliance matters have been closed. The Company was also notified that it will remain subject to a “Panel Monitor,” as that term is defined in Nasdaq Listing Rule 5815(d)(4)(B), for a period of one year from the date of the Nasdaq notice, through June 23, 2026. If, during the term of the Panel Monitor, the Company does not continue to remain in compliance with the Equity Rule, the Company will not be provided with the opportunity to submit a compliance plan for review by the Listing Qualifications Staff and must instead request a hearing before the Panel to address the deficiency, with such request staying any further action with respect to the Company’s listing on Nasdaq pending completion of the hearing process.

As of June 30, 2025, the conclusion of a going concern assessment, before consideration of our financing plans, was that there is substantial doubt about the Company’s ability to continue as a going concern. Future financial transactions planned in the next twelve months consist of business development transactions for out licenses and corporate partnering, as well as the sale of Common Stock through Put Shares to Square Gate under the Equity Purchase Agreement. The Company considered future elements of its financing plan that were probable and likely to be implemented within the next year to determine if financing activities currently underway are sufficient mitigate the substantial doubt in the going concern analysis, in addition to considering continued operating losses and the burden of obligations for expenses incurred in connection with past legal proceedings. Management concluded that there were no mitigating circumstances which alleviated the substantial doubt over its ability to continue as a going concern. If the Company is not successful in raising additional capital through these activities, management intends to revise its business plan and reduce costs. If such revisions are insufficient, the Company may have to curtail or cease operations.

The accompanying condensed interim financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of the uncertainties described above. The Company believes that substantial doubt exists regarding its ability to continue as a going concern for at least 12 months from the date of issuance of the Company’s audited financial statements and that the substantial doubt that existed in its going concern analysis was not alleviated.

Summary of Significant Accounting Policies

Basis of Presentation

Unaudited Interim Financial Information

The accompanying unaudited condensed interim financial statements as of June 30, 2025 and for the three and six-month periods ended June 30, 2024 and 2025 have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to Article 10 of Regulation S-X of the Securities Act of 1933, as amended (the “Securities Act”). Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. These unaudited condensed interim financial statements include only normal and recurring adjustments that the Company believes are necessary to fairly state the Company’s financial position and the results of its operations and cash flows. The results for the three and six-month periods ended June 30, 2025 are not necessarily indicative of the results expected for the full fiscal year or any subsequent interim period. The condensed interim balance sheet at December 31, 2024 has been derived from the audited financial statements at that date but does not include all disclosures required by U.S. GAAP for complete financial statements. Because all of the disclosures required by U.S. GAAP for complete financial statements are not included herein, these unaudited condensed interim financial statements and the notes accompanying them should be read in conjunction with the Company’s audited financial statements for the year ended December 31, 2024 which appear in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2025 (the “Annual Report”) and in other filings with the SEC.

Segment Reporting

The Company operates and manages its business as one reportable and operating segment, which is the business of developing and commercializing novel immunotherapies for diseases promoted by chronic inflammation, especially age-related diseases. The Company’s chief executive officer, who is the chief operating decision maker (“CODM”), reviews financial information on an aggregate basis for allocating and evaluating financial performance. In addition, our CODM is regularly provided with detailed results of preclinical and clinical data which is considered in his decision for the allocation of resources. See Note 10. Segment Reporting for further details. The single operating segment constitutes all of the Company activity, the chief operating decision maker regularly reviews the entity-wide operating results and performance. All long-lived assets are maintained in the United States of America.

Reclassification of Prior Period Presentation of Legal Expenses

Certain prior period amounts have been reclassified to distinguish between General and administrative expenses in the ordinary course of business and legal expenses incurred in connection with the arbitration and Settlement Agreement described in Liquidity and Going Concern in this Note 1. Reclassification of legal expenses incurred in connection with legal proceedings impacts the condensed interim statements of operations. There is no effect on reporting results of operations from prior periods.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts in the financial statements and accompanying notes. Management must apply significant judgment in this process. The Company evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors and adjusts those estimates and assumptions when facts and circumstances dictate. Actual results could differ from estimates.

Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820, Fair Value Measurement (“Topic 820”), establishes a fair value hierarchy for those instruments measured at fair value that distinguishes between fair value measurements based on market data (observable inputs) and those based on the Company’s own assumptions (unobservable inputs). This hierarchy maximizes the use of observable inputs and minimizes the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1: Observable inputs such as quoted prices in active markets;

Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3: Unobservable inputs in which there is little or no market data, which require a reporting entity to develop its own assumptions.

Fair value measurements are classified based on the lowest level of input that is significant to the measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment, which may affect the valuation of the assets and liabilities and their placement within the fair value hierarchy levels. The determination of the fair values takes into account the market for the Company’s financial assets and liabilities, the associated credit risk, and other factors as required. The Company considers active markets as those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Revenue Recognition

The Company accounts for revenues in accordance with Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“Topic 606”). To determine revenue recognition for arrangements that fall within the scope of Topic 606, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies a performance obligation. The Company only applies the five-step model to contracts when it is probable that it will collect the consideration it is entitled to in exchange for the goods or services transferred to the customer.

At contract inception, the Company assesses the goods or services promised within each contract, determines those that are performance obligations, and assesses whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied. To date, the Company's revenues have been generated exclusively from the Wugen License. The Wugen License consists of licenses of intellectual property, cost reimbursements, upfront signing fees, milestone payments and royalties on future licensee’s product sales. In addition, the Company and Wugen have an agreement for the supply of clinical and research grade materials under which the Company also recognized revenues.

License Grants:

For out-licensing arrangements that include a grant of a license to the Company’s intellectual property, the Company considers whether the license grant is distinct from the other performance obligations included in the arrangement. For licenses that are distinct, the Company recognizes revenues from nonrefundable, upfront payments and other consideration allocated to the license when the license term has begun and the Company has provided all necessary information regarding the underlying intellectual property to the customer, which generally occurs at or near the inception of the arrangement.

Milestone and Contingent Payments:

At the inception of the arrangement and at each reporting date thereafter, the Company assesses whether it should include any milestone and contingent payments or other forms of variable consideration in the transaction price using the most likely amount method. If it is probable that a significant reversal of cumulative revenue would not occur upon resolution of the uncertainty, the associated milestone value is included in the transaction price. At the end of each subsequent reporting period, the Company re-evaluates the probability of achievement of each such milestone and any related constraint and, if necessary, adjusts its estimate of the overall transaction price. Since milestone and contingent payments may become payable to the Company upon the initiation of a clinical study or filing for or receipt of regulatory approval, the Company reviews the relevant facts and circumstances to determine when the Company should update the transaction price, which may occur before the triggering event. When the Company updates the transaction price for milestone and contingent payments, the Company allocates the changes in the total transaction price to each performance obligation in the agreement on the same basis as the initial allocation. Any such adjustments are recorded on a cumulative catch-up basis in the period of adjustment, which may result in recognizing revenue for previously satisfied performance obligations in such period. The Company’s licensees will generally pay milestones payments subsequent to achievement of the triggering event.

Materials Supply:

The Company provides clinical and research grade materials so that licensees may develop products based on the licensed molecules. The amounts billed are recognized as revenue as the performance obligations are satisfied by the Company, once the Company determines that a contract exists.

On June 18, 2021, the Company entered into a master services agreement (“MSA”) with Wugen for the supply of materials for clinical development of licensed products. Each of these transactions represents a single performance obligation that is satisfied over time. The Company recognizes revenue using an input method based on the costs incurred relative to the total expected cost, which determines the extent of the Company’s progress toward completion. As part of the accounting for these arrangements, the Company must develop estimates and assumptions that require judgement to determine the progress towards completion. The Company reviews its estimate of the progress toward completion based on the best information available to recognize the cumulative progress toward completion as of the end of each reporting period, and makes revisions to such estimates, if facts and circumstances change during each reporting period. For each in process SOW, amounts are billed in the same quarter the costs are incurred.

For the three months ended June 30, 2024 and June 30, 2025, the Company recognized $618,854 and $6,550 in revenue, respectively, related to sale of development supply materials to the Company’s licensee, Wugen. In the six months ended June 30, 2024 and June 30, 2025, the Company recognized $1.7 million and $11,615 in revenue, respectively, related to sale of clinical materials to Wugen. In the three months ended June 30, 2025, the Company agreed to Wugen’s request to suspend the Wugen License for a period of one year, ending on May 29, 2026.

Investments

The Company holds a minority equity interest in Wugen. Prior to the current reporting period as of June 30, 2025, the Company accounted for the Wugen shares using the measurement alternative whereby the investment is recorded at cost less impairment, adjusted for observable price changes in orderly transactions for an identical or similar investment of the same investee. No impairment has been recognized. With support provided by a third-party valuation advisor for the valuation of the shares, during the current reporting period as of June 30, 2025, the Company elected to measure its investment at fair value. The Company will remeasure the change in fair value of the Wugen shares in subsequent reporting periods and recognize the change in earnings. As of December 31, 2024 and June 30, 2025, the Company included $1.6 million and $3.3 million, respectively, for its investment in Wugen in Investments in the accompanying condensed interim balance sheets. For further discussion of the impact of the fair value measurement for the investment in Wugen, see Note 3. Debt, net - “Troubled Debt Restructuring” and “Contingent Liability.”

The Company invests excess cash in bills and notes issued by the U.S. Treasury which are classified as trading securities. As of December 31, 2024 and June 30, 2025, the Company had no Short-term investments.

Operating Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in Other assets, Accrued liabilities and Other current liabilities, and Other liabilities on its condensed interim balance sheets. Operating lease Right of Use (“ROU”) assets and Operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As the Company’s leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of future payments. The operating lease ROU asset also includes any lease payments made and excludes lease incentives and initial direct costs incurred. The Company has a lease agreement with lease and non-lease components, which are accounted for separately. For short-term leases with a term of one year or less, the Company uses the practical expedient and does not record an ROU asset or lease liability for such short-term leases.

Net Loss Per Share

Basic loss per share of common stock is computed by dividing net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding during each period. Diluted loss per share of common stock includes the effect, if any, from the potential exercise of stock options and unvested shares of restricted stock, which would result in the issuance of incremental shares of common stock. For diluted net loss per share, the weighted-average number of shares of common stock is the same for basic net loss per share due to the fact that when a net loss exists, dilutive securities are not included in the calculation as the impact is anti-dilutive.

Standby Equity Purchase Agreement

The Company entered an Equity Purchase Agreement providing for an equity line of credit with an investor on February 20, 2025. This arrangement is in the nature of a Standby Equity Purchase Agreement (“SEPA”), which is an equity-linked instrument for which an entity has the right, but not the obligation, to sell the entity’s common stock to third-party investors over a specified period. The total number of shares that the entity may issue to the investor is capped by either an aggregate dollar amount or an aggregate number of shares. Furthermore, the number of shares that an entity may issue at any particular time during the life of the SEPA is also limited. The price payable by the investor for each share of common stock purchased from the entity is generally discounted. In exchange for its access to capital through the SEPA, the entity typically provides up-front consideration to the investor in the form of cash or shares of the entity’s common stock. Economically, before the entity has elected to sell shares, a SEPA represents a purchased put option on the entity’s own equity. However, once the entity “draws” on the SEPA, the related number of shares issuable constitutes a forward contract to issue common stock. Thus, a SEPA contains both a purchased put option element and a forward share issuance element. This generally means that a SEPA generally does not qualify for equity classification. Accordingly, entities must recognize an asset or liability for its SEPA. Such asset or liability must be measured at fair value, with changes in fair value recognized in net (loss) income.

Because SEPAs do not qualify for classification in equity, an entity must expense as incurred the amount by which any consideration provided to the investor at the inception of the arrangement exceeds the fair value of the asset recognized for the SEPA.

An entity should recognize at fair value the common shares issued to the investor upon settlement of a SEPA by using the quoted price of the shares on the date of issuance. The then-current fair value of the asset or liability for the associated forward share issuance contract must be derecognized in conjunction with the settlement. The proceeds received from the investor are reflected and any residual amount must be charged (or credited) to earnings. This accounting is consistent with the guidance in ASC 815 that applies upon the settlement of a derivative instrument. When an equity-linked instrument classified as an asset or liability is settled, entities should measure the instrument at its current fair value as of the settlement date and include in earnings any previously unrecognized fair value gain or loss.

In summary, upon settlement of a forward issuance contract element of a SEPA, an entity would recognize in earnings the following amounts:

•

The gain (loss) for the excess (deficit) of (a) the carrying amount of the asset or liability for the forward issuance contract plus the proceeds received and (b) the fair value of the common shares as of the issuance date.

•

Any issuance or transaction costs incurred in conjunction with the issuance of the shares.

2. Accrued Liabilities and Other Current Liabilities

As of December 31, 2024, the Company had a balance of $981,940 included in Accrued liabilities and other current liabilities in the audited condensed balance sheet, consisting of $422,000 for construction expenses, $49,000 for manufacturing expenses, $155,000 for legal fees, $121,000 for clinical expenses, $5,000 for bonus expense, $202,000 for salary expenses and $28,000 for other liabilities.

As of June 30, 2025, the Company had a balance of $1.1 million included in Accrued liabilities and other current liabilities in the accompanying condensed interim balance sheet, consisting of $422,000 for construction expenses, $87,000 for property taxes, $52,000 for manufacturing expenses, $193,000 for legal fees, $127,000 for clinical expenses, and $180,000 for salary expenses.

3. Debt, Net

Cogent Bank Loan

On August 15, 2022, the Company entered the 2022 Loan Agreement with Cogent Bank, pursuant to which it received $6.5 million in proceeds to purchase a property where the Company planned to construct a manufacturing facility for biologics and upgraded research laboratory facilities. The loan is secured by a first priority lien on the building.

As of June 30, 2025, the Company had $6.3 million in principal outstanding under the 2022 Loan Agreement. The interest-only period was one year followed by 48 months of equal payments of principal and interest beginning on September 15, 2023 based on a 25-year amortization rate. The unamortized balance is due on August 15, 2027 (the “Maturity Date”), and bears interest at a fixed per annum rate equal to 5.75%. Upon the Maturity Date, a final payment of unamortized principal will be due. The Company is in compliance with covenants related to current payment of principal and interest as of June 30, 2025. The Company has the option to prepay the outstanding balance of the loan prior to the Maturity Date without penalty.

As of December 31, 2024 and June 30, 2025, certain subcontractors filed mechanics liens related to unpaid invoices issued in connection with the Company’s construction of its new manufacturing facilities and upgraded research laboratories. The 2022 Loan Agreement contains a provision for a discretionary default in the event that the Company fails to pay sums due in connection with construction of any improvements; however, as of the reporting date, the lender has not elected to do so. As of December 31, 2024 and June 30, 2025, the Company has reflected this loan as Short-term debt, net, to reflect that the lender has the right to accelerate the loan under a discretionary default provision.

Senior Secured Notes