BUSINESS UPDATE SECOND QUARTER 2025 August 11, 2025 NASDAQ: ASTS

Forward Looking Statements This communication contains “forward-looking statements” that are not historical facts, and involve risks and uncertainties that could cause actual results of AST SpaceMobile to differ materially from those expected and projected. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “would,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside AST SpaceMobile’s control and are difficult to predict. Factors that could cause such differences include, but are not limited to: (i) expectations regarding AST SpaceMobile’s strategies and future financial performance, including AST’s future business plans or objectives, expected functionality of the SpaceMobile Service, anticipated timing of the launch of the Block 2 BlueBird satellites, anticipated demand and acceptance of mobile satellite services, prospective performance and commercial opportunities and competitors, the timing of obtaining regulatory approvals, ability to finance its research and development activities, commercial partnership acquisition and retention, products and services, pricing, marketing plans, operating expenses, market trends, revenues, liquidity, cash flows and uses of cash, capital expenditures, and AST SpaceMobile’s ability to invest in growth initiatives; (ii) the negotiation of definitive agreements with mobile network operators relating to the SpaceMobile Service that would supersede preliminary agreements and memoranda of understanding and the ability to enter into commercial agreements with other parties or government entities; (iii) the ability of AST SpaceMobile to grow and manage growth profitably and retain its key employees and AST SpaceMobile’s responses to actions of its competitors and its ability to effectively compete; (iv) changes in applicable laws or regulations; (v) the possibility that AST SpaceMobile may be adversely affected by other economic, business, and/or competitive factors; (vi) the outcome of any legal proceedings that may be instituted against AST SpaceMobile; and (vii) other risks and uncertainties indicated in the Company’s filings with the Securities and Exchange Commission (SEC), including those in the Risk Factors section of AST SpaceMobile’s Form 10-K filed with the SEC on March 3, 2025 and Form 10-Q filed with the SEC on May 12, 2025. AST SpaceMobile cautions that the foregoing list of factors is not exclusive. AST SpaceMobile cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors in AST SpaceMobile’s Form 10-K filed with the SEC on March 3, 2025 and Form 10-Q filed with the SEC on May 12, 2025. AST SpaceMobile’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, AST SpaceMobile disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures Adjusted operating expense is an alternative financial measure used by management to evaluate our operating performance as a supplement to our most directly comparable U.S. GAAP financial measure. We define Adjusted operating expense as total operating expenses adjusted to exclude amounts of stock-based compensation expense and depreciation and amortization expense. We believe Adjusted operating expenses is a useful measure across time in evaluating the Company's operating performance as we use Adjusted operating expenses to manage the business, including in preparing our annual operating budget and financial projections. Adjusted operating expense is a non-GAAP financial measure that has no standardized meaning prescribed by U.S. GAAP, and therefore has limits in its usefulness to investors. Because of the non-standardized definition, it may not be comparable to the calculation of similar measures of other companies and are presented solely to provide investors with useful information to more fully understand how management assesses performance. This measure is not, and should not be viewed as, a substitute for its most directly comparable GAAP measure of total operating expenses. Industry and Market Data This presentation includes market data and other statistical information from sources believed to be reliable, including independent industry publications, governmental publications or other published independent sources. Although AST SpaceMobile believes these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names AST SpaceMobile owns or has rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with AST SpaceMobile, or an endorsement or sponsorship by or of AST SpaceMobile. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that AST SpaceMobile will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Space-Based Cellular Broadband Network Building the First and Only

KEY HIGHLIGHTS Preparing to deploy nationwide intermittent service in the United States by the end of 2025, followed by the United Kingdom, Japan, and Canada in Q1 2026 Expanded spectrum strategy with agreement to acquire 60 MHz of global S-Band spectrum priority rights, augmenting existing 3GPP cellular and L-Band strategies, alongside unique satellite technology to deliver up to 120 Mbps peak data rates per cell Advanced commercialization efforts with expansion of partnerships, derived from agreements with more than 50 mobile network operators globally, which have nearly 3.0 billion existing subscribers, while receiving additional U.S. Government contract awards Completed assembly of microns for phased arrays of eight Block 2 BlueBird satellites and expect to complete assembly of 40 satellites equivalent of microns by early 2026 Over $1.5 billion in balance sheet cash, cash equivalents, and restricted cash (as of June 30, 2025), pro forma for convertible notes offering and sales under the now terminated ATM facility

Preparing to deploy nationwide intermittent service in the United States by the end of 2025, followed by the United Kingdom, Japan, and Canada in Q1 2026

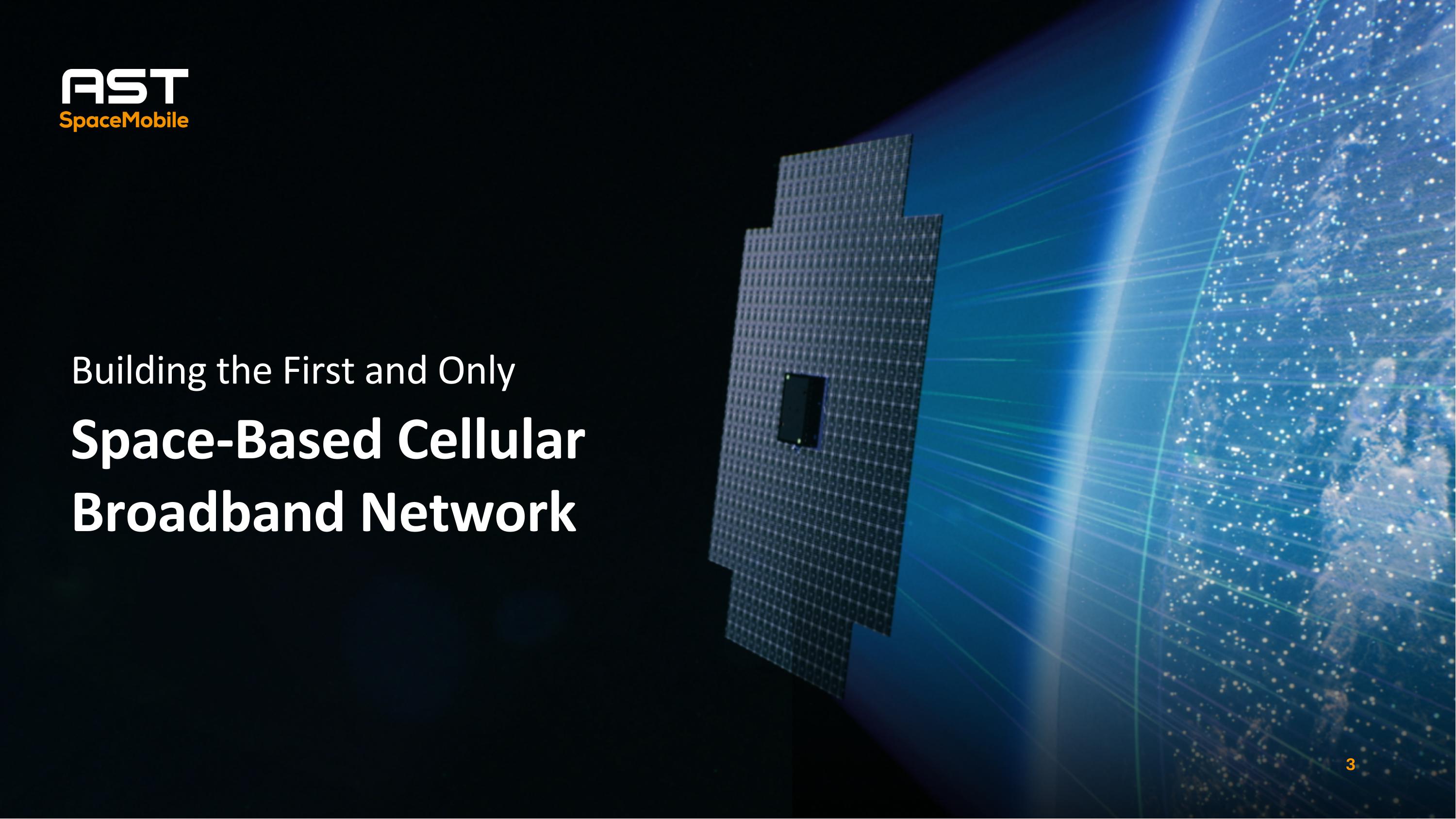

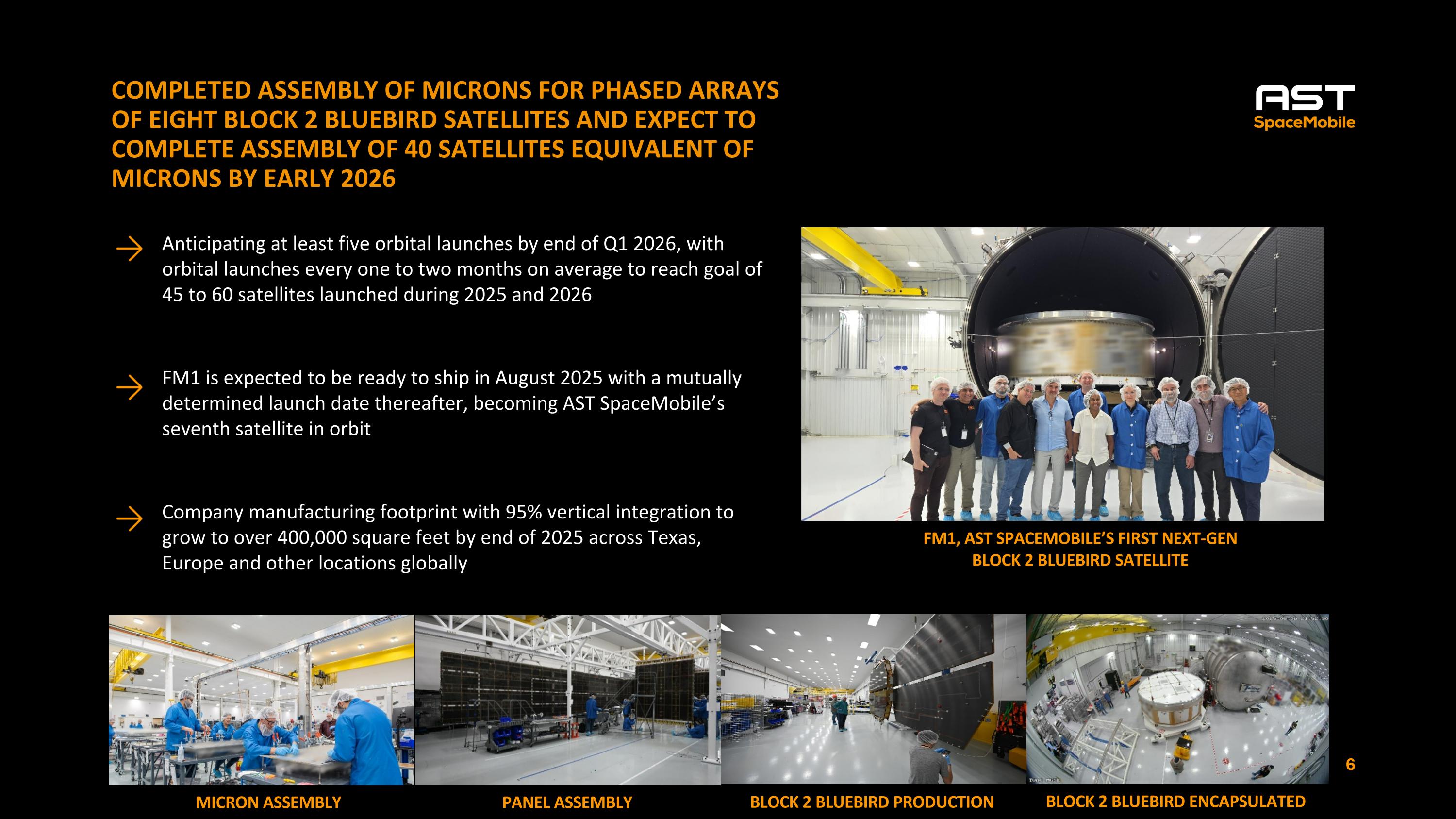

Completed assembly of microns for phased arrays of eight Block 2 BlueBird satellites and expect to complete assembly of 40 satellites equivalent of microns by early 2026 PANEL ASSEMBLY Anticipating at least five orbital launches by end of Q1 2026, with orbital launches every one to two months on average to reach goal of 45 to 60 satellites launched during 2025 and 2026 FM1 is expected to be ready to ship in August 2025 with a mutually determined launch date thereafter, becoming AST SpaceMobile’s seventh satellite in orbit Company manufacturing footprint with 95% vertical integration to grow to over 400,000 square feet by end of 2025 across Texas, Europe and other locations globally MICRON ASSEMBLY BLOCK 2 BLUEBIRD ENCAPSULATED BLOCK 2 BLUEBIRD PRODUCTION FM1, AST SPACEMOBILE’S FIRST NEXT-GEN BLOCK 2 BLUEBIRD SATELLITE

Target Block 2 BlueBird Deployment Plan to Reach 45-60 Satellites in Orbit During 2025 and 2026 Note: Expected satellite(s) ready for shipment plans as of August 2025. The timing of shipment of the Block 2 BlueBird satellites are contingent on a number of factors including satisfactory and timely completion of the assembly and testing of the Block 2 BlueBird satellites, regulatory approvals for the shipment, availability of capital, many of which are beyond our control. Launch # 1 2 3 4 5 6 7 8 9 10 11 12 13 Microns For Phased Array Completed Sep 2025 Oct 2025 Dec 2025 Jan 2026 Feb 2026 Mar 2026 Apr 2026 May 2026 Jun 2026 Satellite(s) Ready to Ship Aug 2025 Sep 2025 Nov 2025 Nov 2025 Dec 2025 Jan 2026 Feb 2026 Mar 2026 Apr 2026 May 2026 Jun 2026 Jul 2026 Aug 2026

S-Band spectrum access positions AST SpaceMobile to further grow subscriber capacity and bring additional services to targeted markets around the world Both S-Band and L-Band spectrum strategies, alongside Low Band, further enable a true broadband experience directly from space to everyday smartphones, with up to 120 Mbps peak data speeds Received court approval for L-Band definitive documentation, providing AST SpaceMobile long-term access to up to 45 MHz of L-Band, premium lower mid-band spectrum, in the U.S. and Canada, subject to regulatory approvals Expanded spectrum strategy with agreement to acquire 60 MHz of global S-Band spectrum priority rights, augmenting existing 3GPP cellular and L-Band strategies, alongside unique satellite technology to deliver up to 120 Mbps peak data rates PER CELL Existing low-band 3GPP strategy is enhanced with new mid-band spectrum access Dual-Band Aggregation Leveraging both low-band coverage and mid-band capacity through carrier aggregation L-Band 1.5Ghz 1.6GHz S-Band 2.0Ghz 2.2GHz Low Band 700-950 MHz

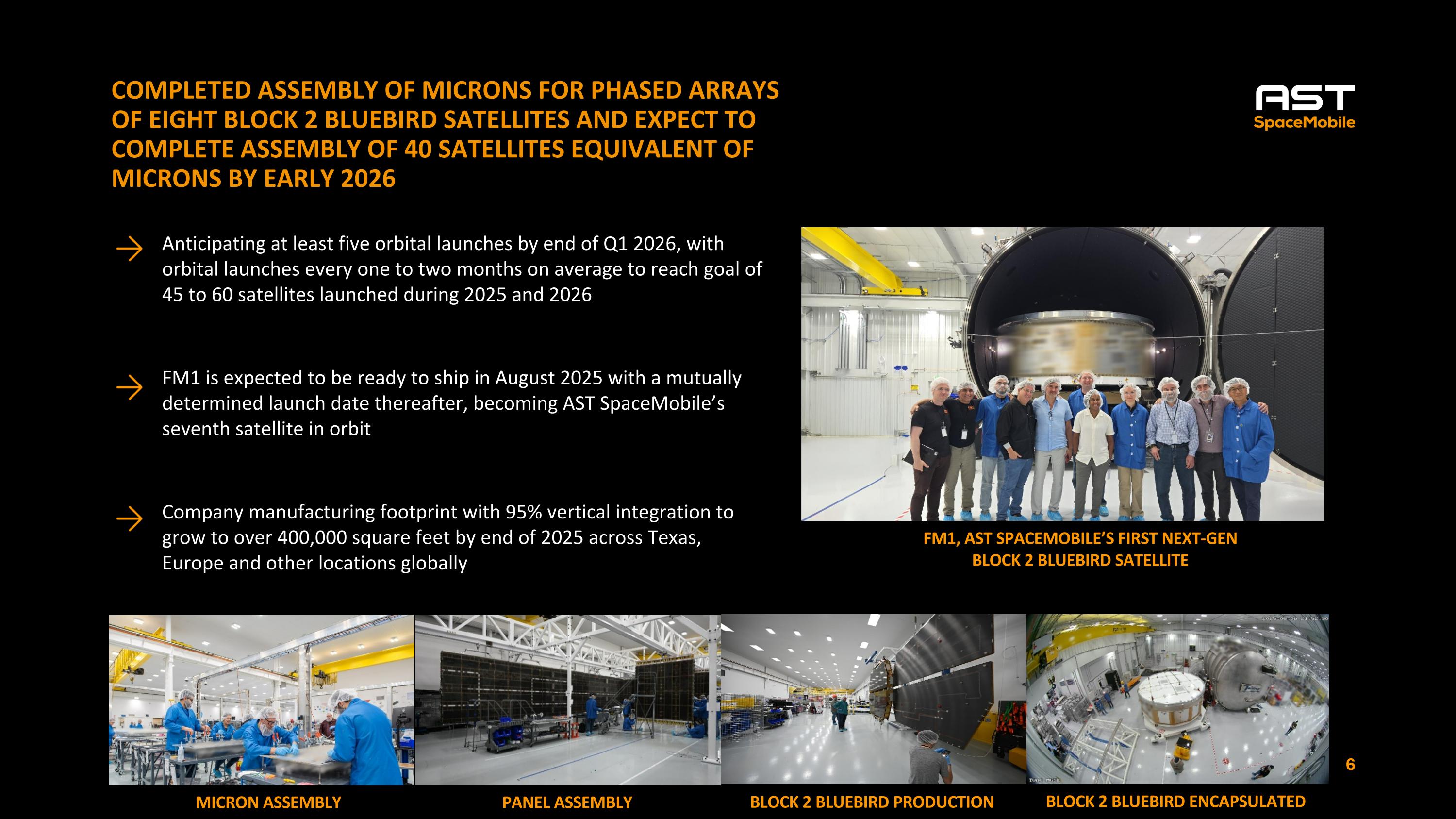

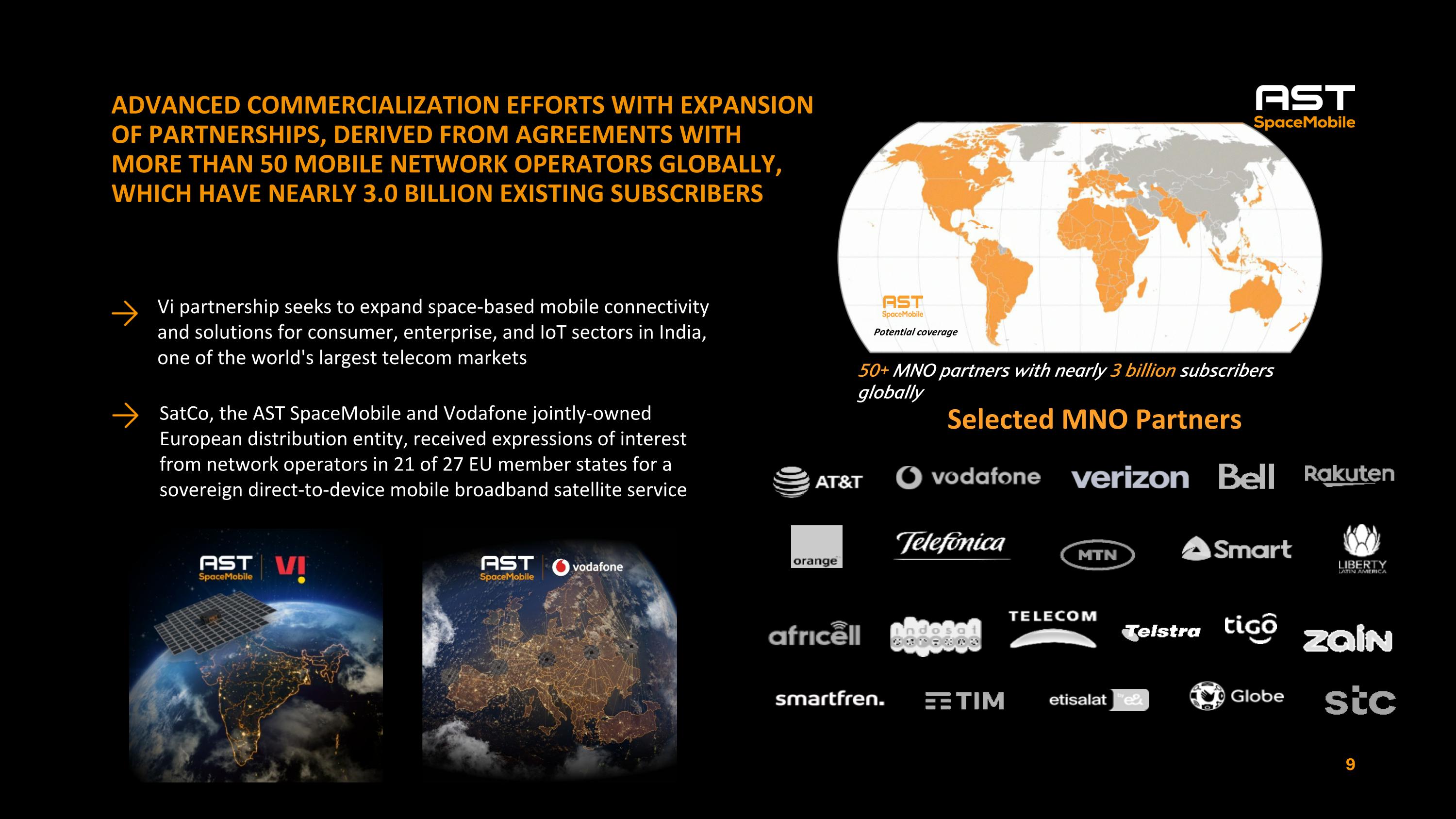

SatCo, the AST SpaceMobile and Vodafone jointly-owned European distribution entity, received expressions of interest from network operators in 21 of 27 EU member states for a sovereign direct-to-device mobile broadband satellite service Vi partnership seeks to expand space-based mobile connectivity and solutions for consumer, enterprise, and IoT sectors in India, one of the world's largest telecom markets Advanced commercialization efforts with expansion of partnerships, derived from agreements with more than 50 mobile network operators globally, which have nearly 3.0 billion existing subscribers Potential coverage 50+ MNO partners with nearly 3 billion subscribers globally Selected MNO Partners

Demonstrated first tactical non-terrestrial network (NTN) connectivity over standard mobile devices, with participation from multiple branches of U.S. armed forces under previously announced contract with the Defense Innovation Unit (DIU) U.S. Navy U.S. Marine Corps U.S. Army U.S. Space Command U.S. USDR&E U.S. Indo-Pacific Command While showing additional capabilities for the U.S. Government and receiving additional contract awards With the U.S. Government as an end customer Signed two additional early-stage contracts for the U.S. Government end customer, bringing the total to eight contracts to date with the U.S. Government as an end customer

OPERATING AND CAPITAL METRICS $M Non-GAAP. See appendix for a reconciliation. Adjusted operating expenses is equal to total operating expense adjusted to exclude depreciation and amortization and stock based-compensation expense. Depreciation and amortization for the three months ended June 30, 2025 and March 31, 2025 was $11.7 million and $11.0 million, respectively. Stock-based compensation for the three months ended June 30, 2025 and March 31, 2025 consisted of $3.3 million and $4.0 million of engineering services costs and $7.2 million and $3.8 million of general and administrative costs, respectively. Adjusted operating expenses in Q2 2025 included transaction expenses from the completion of the L-Band spectrum transaction, related non-recourse senior-secured delayed-draw term loan facility, and significant work on our joint venture with Vodafone launched during the quarter. If you further adjust for these transaction expenses, our Adjusted operating expenses were closer to $46.5 million. Gross property and equipment as of June 30, 2025, March 31, 2025 and December 31, 2024 was $906.9 million, $584.1 million, and $460.0 million, respectively. Accumulated depreciation and amortization as of June 30, 2025, March 31, 2025 and December 31, 2024 was $145.3 million, $133.3 million, and $122.4 million, respectively. Cash Position as of June 30, 2025 and March 31, 2025 includes $15.8 million and $0.7 million of restricted cash, respectively. Over $1.5 billion in balance sheet cash, cash equivalents, and restricted cash (as of June 30, 2025), pro forma for convertible notes offering and sales under the now terminated ATM facility Adj. Operating Expenses1 Capital Expenditures3 Liquidity4 5 $M $M Over $1.5 B ~$46.5 2

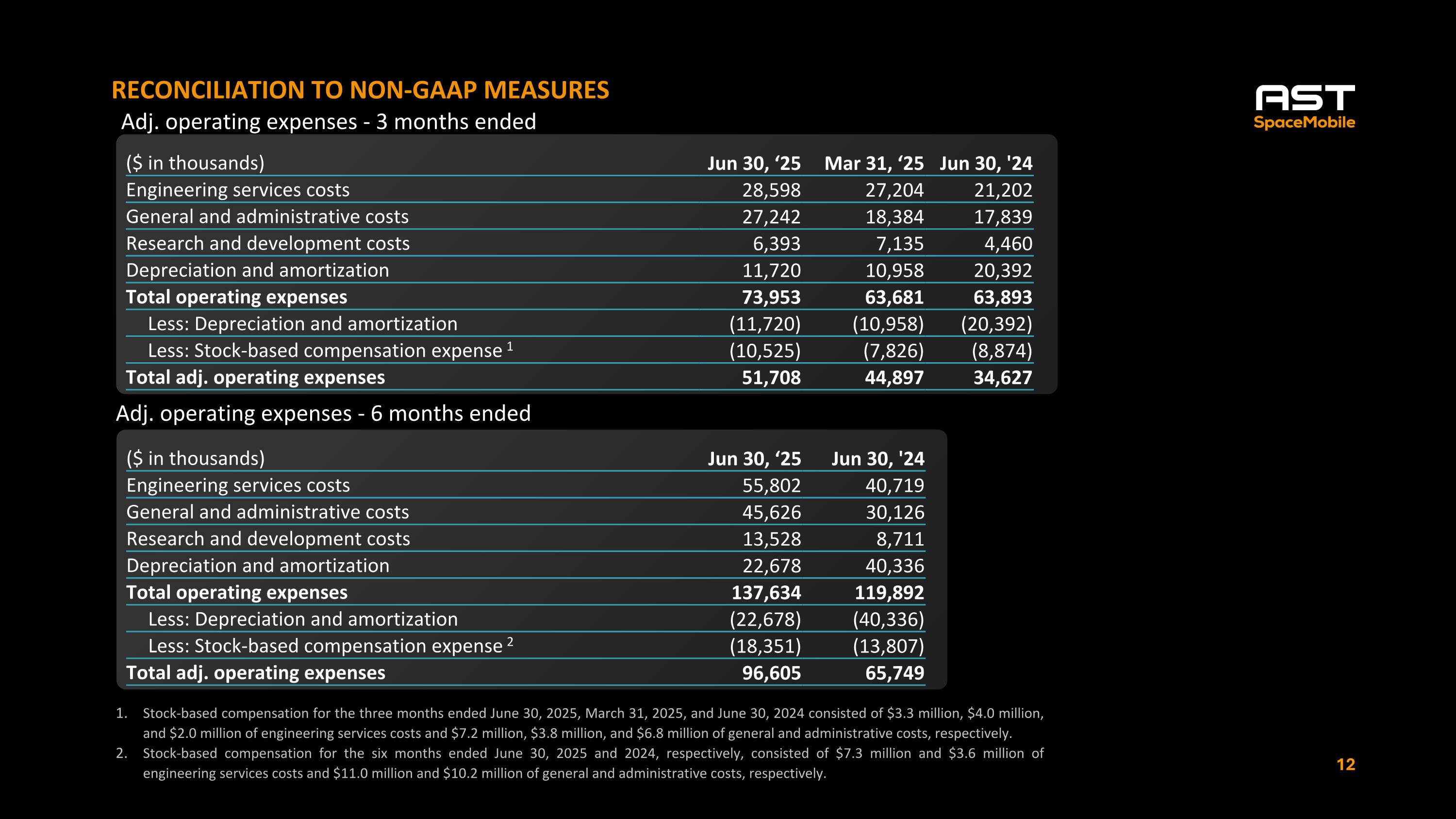

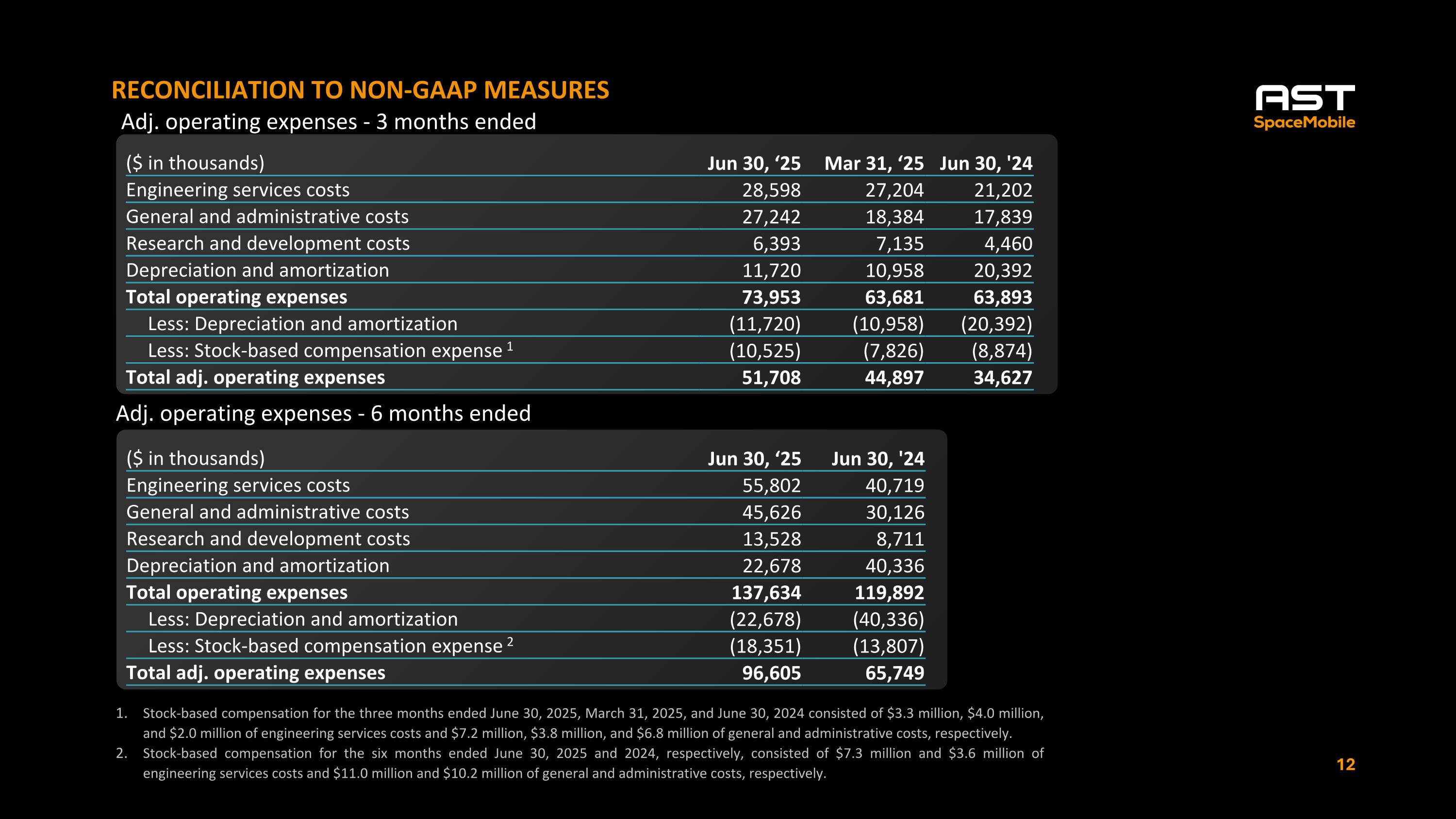

RECONCILIATION TO NON-GAAP MEASURES Adj. operating expenses - 3 months ended Stock-based compensation for the three months ended June 30, 2025, March 31, 2025, and June 30, 2024 consisted of $3.3 million, $4.0 million, and $2.0 million of engineering services costs and $7.2 million, $3.8 million, and $6.8 million of general and administrative costs, respectively. Stock-based compensation for the six months ended June 30, 2025 and 2024, respectively, consisted of $7.3 million and $3.6 million of engineering services costs and $11.0 million and $10.2 million of general and administrative costs, respectively. ($ in thousands) Jun 30, ‘25 Mar 31, ‘25 Jun 30, '24 Engineering services costs 28,598 27,204 21,202 General and administrative costs 27,242 18,384 17,839 Research and development costs 6,393 7,135 4,460 Depreciation and amortization 11,720 10,958 20,392 Total operating expenses 73,953 63,681 63,893 Less: Depreciation and amortization (11,720) (10,958) (20,392) Less: Stock-based compensation expense 1 (10,525) (7,826) (8,874) Total adj. operating expenses 51,708 44,897 34,627 ($ in thousands) Jun 30, ‘25 Jun 30, '24 Engineering services costs 55,802 40,719 General and administrative costs 45,626 30,126 Research and development costs 13,528 8,711 Depreciation and amortization 22,678 40,336 Total operating expenses 137,634 119,892 Less: Depreciation and amortization (22,678) (40,336) Less: Stock-based compensation expense 2 (18,351) (13,807) Total adj. operating expenses 96,605 65,749 Adj. operating expenses - 6 months ended