Diodes Incorporated (DIOD) Plano, TX, USA Investor Relations August 7, 2025 Exhibit 99.3

Safe Harbor Statement Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any statements set forth above that are not historical facts are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such statements include statements containing forward-looking words such as “expect,” “anticipate,” “aim,” “estimate,” and variations thereof, including without limitation statements, whether direct or implied, regarding expectations of that for the third quarter of 2025, we expect revenue to be approximately $392 million plus or minus 3 percent; we expect GAAP gross margin to be 31.6 percent, plus or minus 1 percent; non-GAAP operating expenses, which are GAAP operating expenses adjusted for amortization of acquisition-related intangible assets, are expected to be approximately 26.0 percent of revenue, plus or minus 1 percent; we expect non-GAAP net interest income to be approximately $1.0 million; we expect our income tax rate to be 18.0 percent, plus or minus 3 percent; shares used to calculate diluted EPS for the third quarter are anticipated to be approximately 46.5 million. Potential risks and uncertainties include, but are not limited to, such factors as: the risk that such expectations may not be met; the risk that the expected benefits of acquisitions may not be realized or that integration of acquired businesses may not continue as rapidly as we anticipate; the risk that we may not be able to maintain our current growth strategy or continue to maintain our current performance, costs, and loadings in our manufacturing facilities; the risk that we may not be able to increase our automotive, industrial, or other revenue and market share; risks of domestic and foreign operations, including excessive operating costs, labor shortages, higher tax rates, and our joint venture prospects; the risks of cyclical downturns in the semiconductor industry and of changes in end-market demand or product mix that may affect gross margin or render inventory obsolete; the risk of unfavorable currency exchange rates; the risk that our future outlook or guidance may be incorrect; the risks of global economic weakness or instability in global financial markets; the risks of trade restrictions, tariffs, or embargoes; the risk of breaches of our information technology systems; and other information, including the “Risk Factors” detailed from time to time in Diodes’ filings with the United States Securities and Exchange Commission. This presentation also contains non-GAAP measures. See the Company’s press release on August 7, 2025 titled, “Diodes Incorporated Reports Second Quarter Fiscal 2025 Financial Results” for detailed information related to the Company’s non-GAAP measures and a reconciliation of GAAP net income to non-GAAP net income.

Gary Yu President and CEO Experience: Diodes Incorporated, since 2008 Chief Operating Officer Senior Vice President, Business Groups President, Asia Pacific Region General Manager, Shanghai Wafer Fabrication and BCD Business Unit Vice President of Asia Pacific Sales Manager, Sensor and Satellite Business Unit Lite-On Semiconductor Corporation Vice President, Worldwide Sales Texas Instruments IT, Finance and Capacity Planning Education: MBA – University of Dallas Master’s Degree in Telecommunication Engineering, Southern Methodist University Bachelor's Degree in MIS, Fu-Jen University, Taiwan Management Representative

Company Representative Experience: Head of Corporate Marketing, Diodes Incorporated Head of Corporate Marketing, Pericom Semiconductor Vice President, Marketing, CA Technologies (Broadcom) Director, Global Marketing Strategy, EMC (Dell Technologies) Director, Marketing, Zarlink Semiconductor (Microchip) Marketing Management positions at Cisco and National Semiconductor (TI) Education: MBA, Marketing/Entrepreneurship, Saint Mary's College of California BS in Electrical and Computer Engineering, UC Santa Barbara Gurmeet Dhaliwal Head of Corporate Marketing & Investor Relations

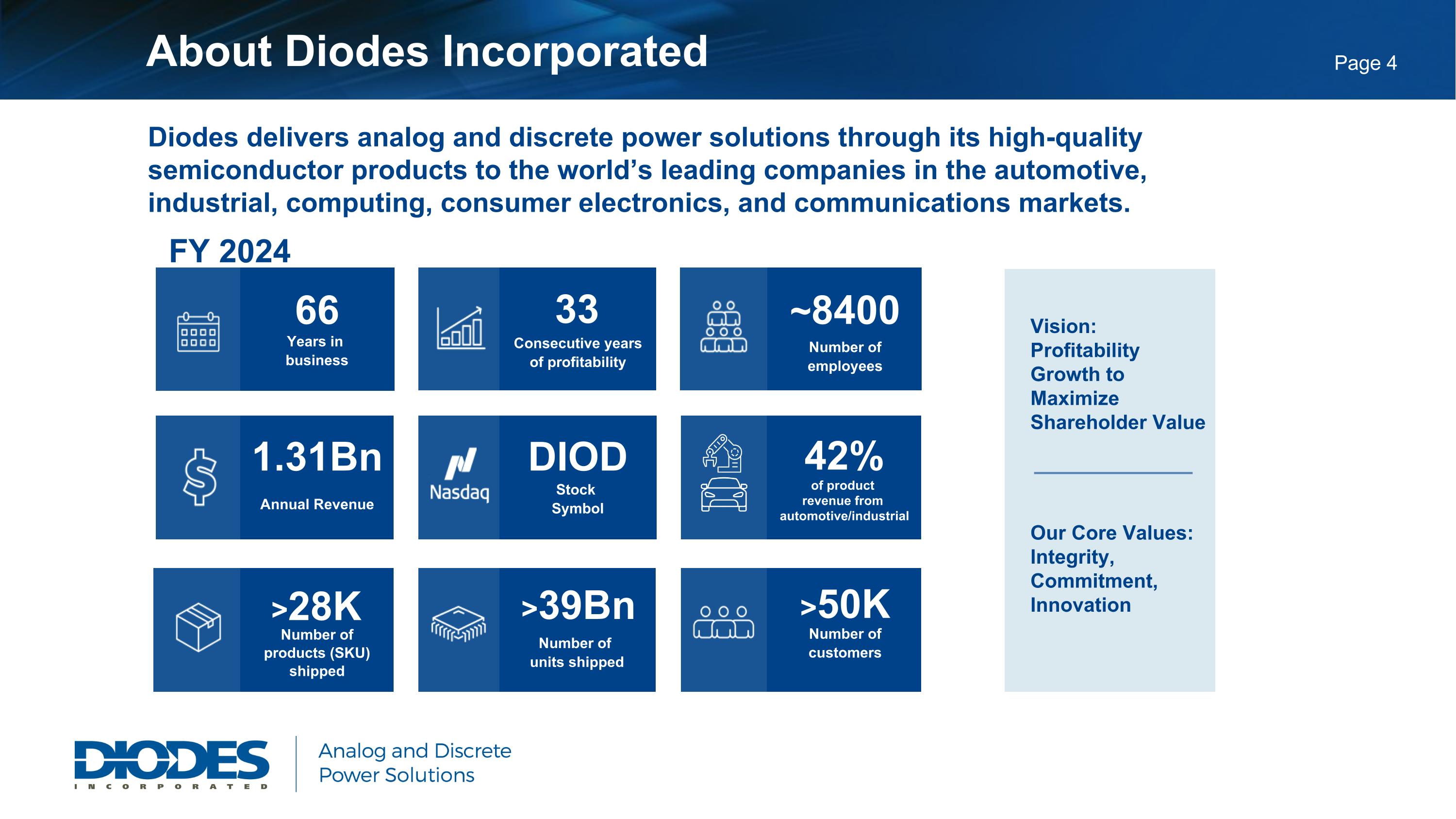

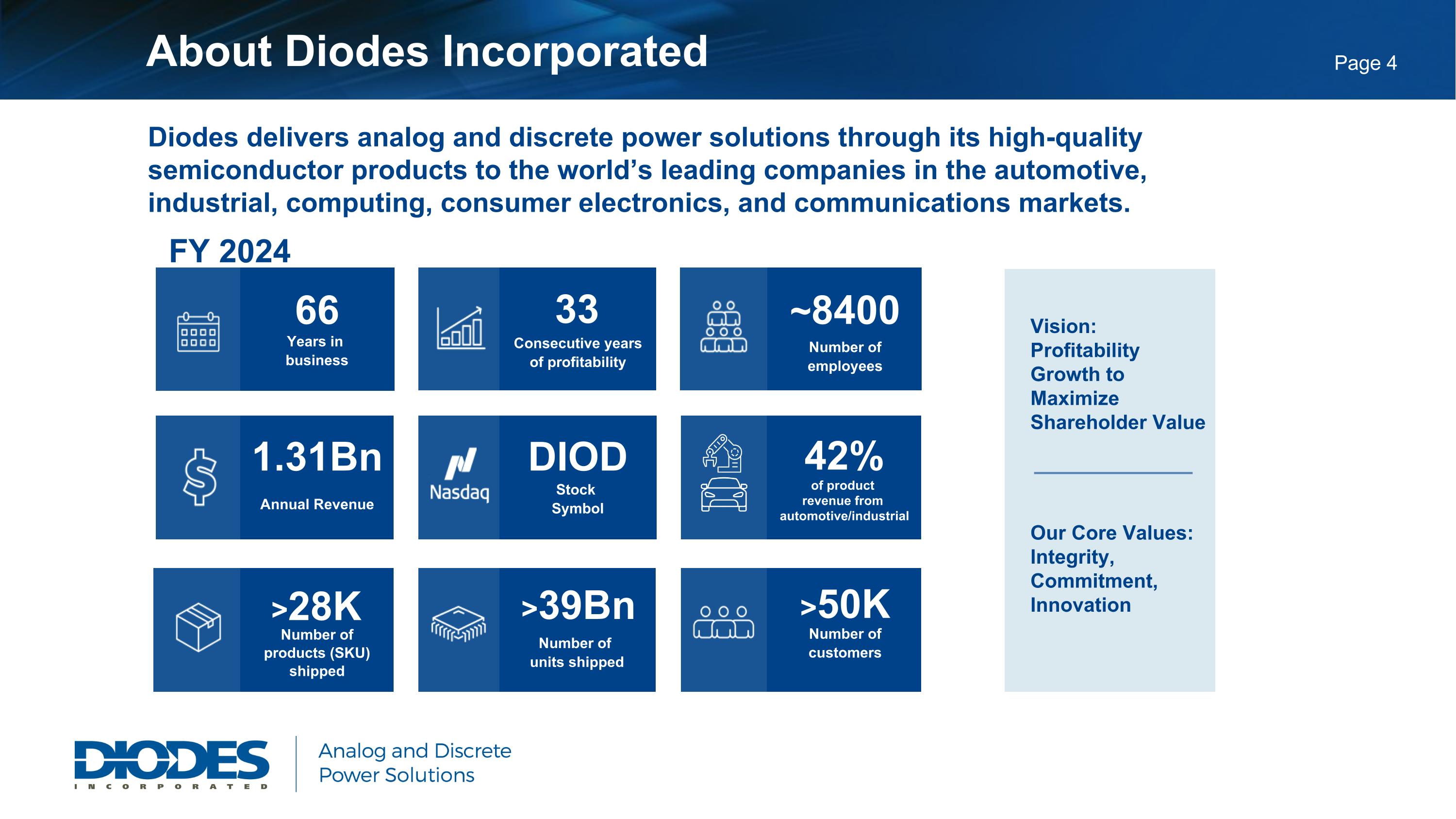

About Diodes Incorporated Vision: Profitability Growth to MaximizeShareholder Value Our Core Values: Integrity, Commitment,Innovation Diodes delivers analog and discrete power solutions through its high-quality semiconductor products to the world’s leading companies in the automotive, industrial, computing, consumer electronics, and communications markets. 66 Years in business 33 Consecutive yearsof profitability ~8400 Number ofemployees 1.31Bn Annual Revenue >39Bn >28K Number ofproducts (SKU)shipped >50K Number ofcustomers 42% of product revenue from automotive/industrial Stock Symbol Number of units shipped DIOD FY 2024

Global Operations and World-Class Manufacturing Headquartered in Plano, TX Manufacturing in US, UK, Germany, China, and Taiwan ISO 9001:2015 Certified / IATF 16949:2016 Certified ISO 14001:2015 Certified Key Acquisitions 2006 2006 2012 2015 2008 2013 2019 2020 2022 Anachip Corporation Taiwan Advanced Power Devices ZetexSemiconductors Power Analog Microelectronics BCDSemiconductor Pericom Semiconductor TI’s Greenock fab (GFAB) Lite-OnSemiconductor Onsemi‘s fab (SPFAB) 2024 Fortemedia Investing for the Future

Wuxi, China Shanghai,China Chongli,Taiwan Hsinchu,Taiwan Taipei,Taiwan Munich,Germany Neuhaus,Germany Plano, Texas Milpitas,California Greenock, UK Chengdu,China Logistics Hub and Warehouses Oldham,UK Key: Headquarters Wafer Fab Assembly/Test Design/Sales/Marketing South, Portland,Maine Tokyo,Japan Singapore Seongnam-si,South Korea Global Organization

Our commitment to a sustainable and profitable business is built around ESG. Please refer to Governance and Oversight for additional details. Social (S) Governance (G) Environment (E) Climate Change Natural Resources Pollution & Waste Biodiversity Strategy & Oversight Risks Management Business Continuity Accountability & Transparency Supply Chain Product Integrity Human Capital Community Our Sustainability Commitment

Goal 1: $1B Market Cap Goal 2: $1B Annual Revenue Goal 3: $1B Gross Profit Goal 4: $1B Profit Before Tax $1B Market Cap $1B Revenue $1B Gross Profit $1B PBT - 2010 - 2017 Next Target:$1B Gross Profit Gross Margin: 40%Revenue: $2.5B Longer Term $B Corporate Objectives

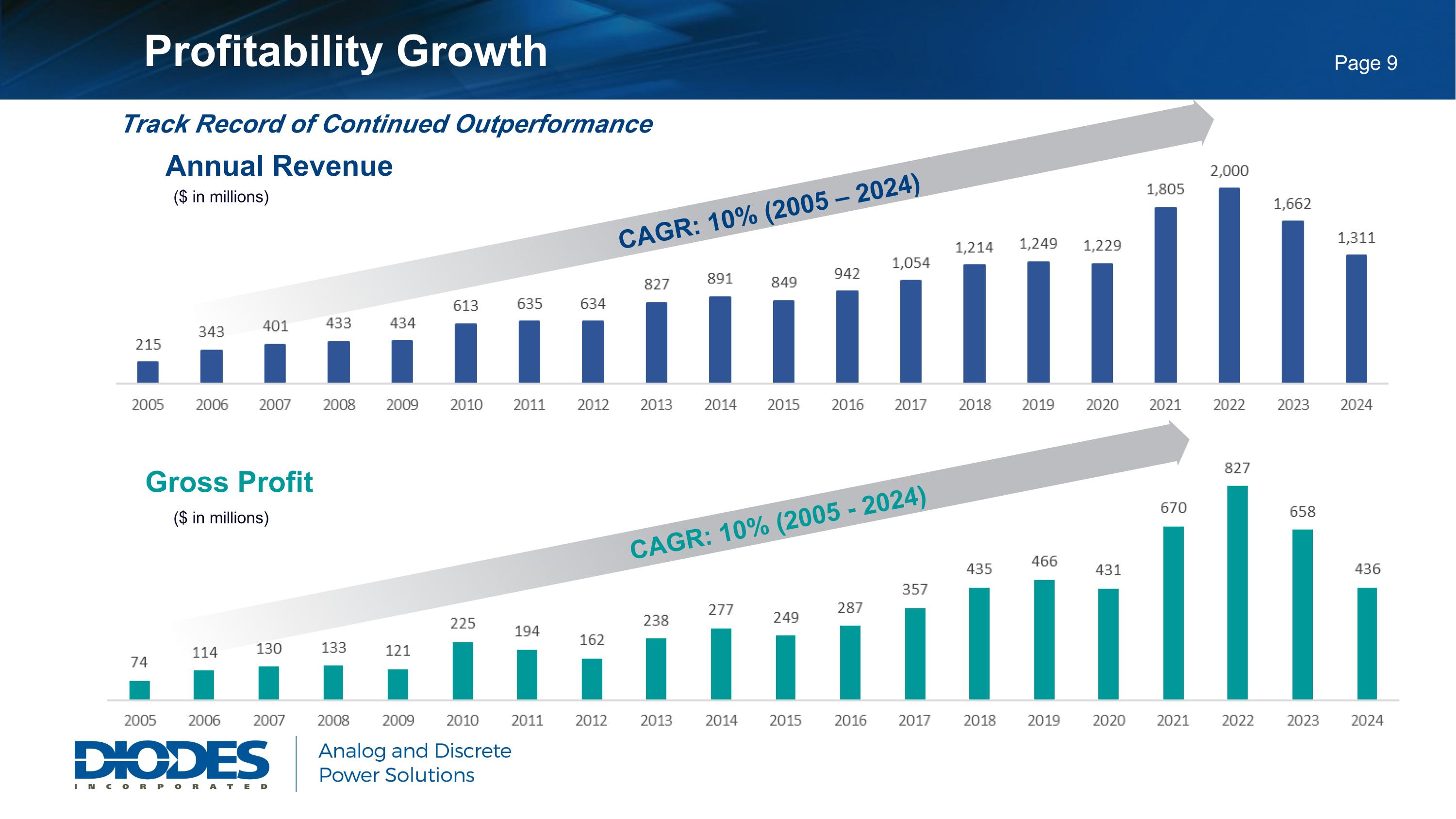

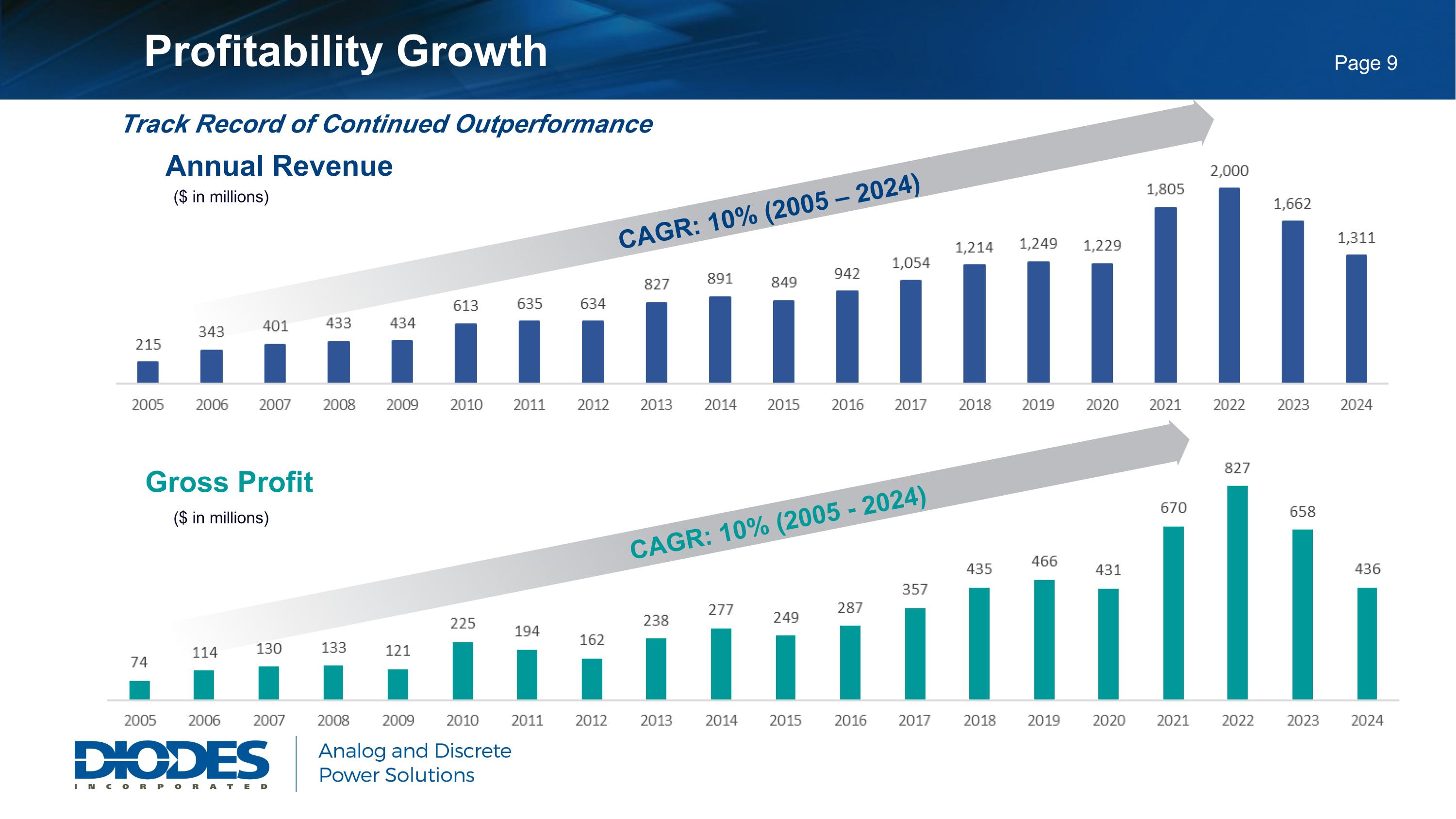

Track Record of Continued Outperformance Annual Revenue Gross Profit ($ in millions) ($ in millions) CAGR: 10% (2005 – 2024) CAGR: 10% (2005 - 2024) Profitability Growth

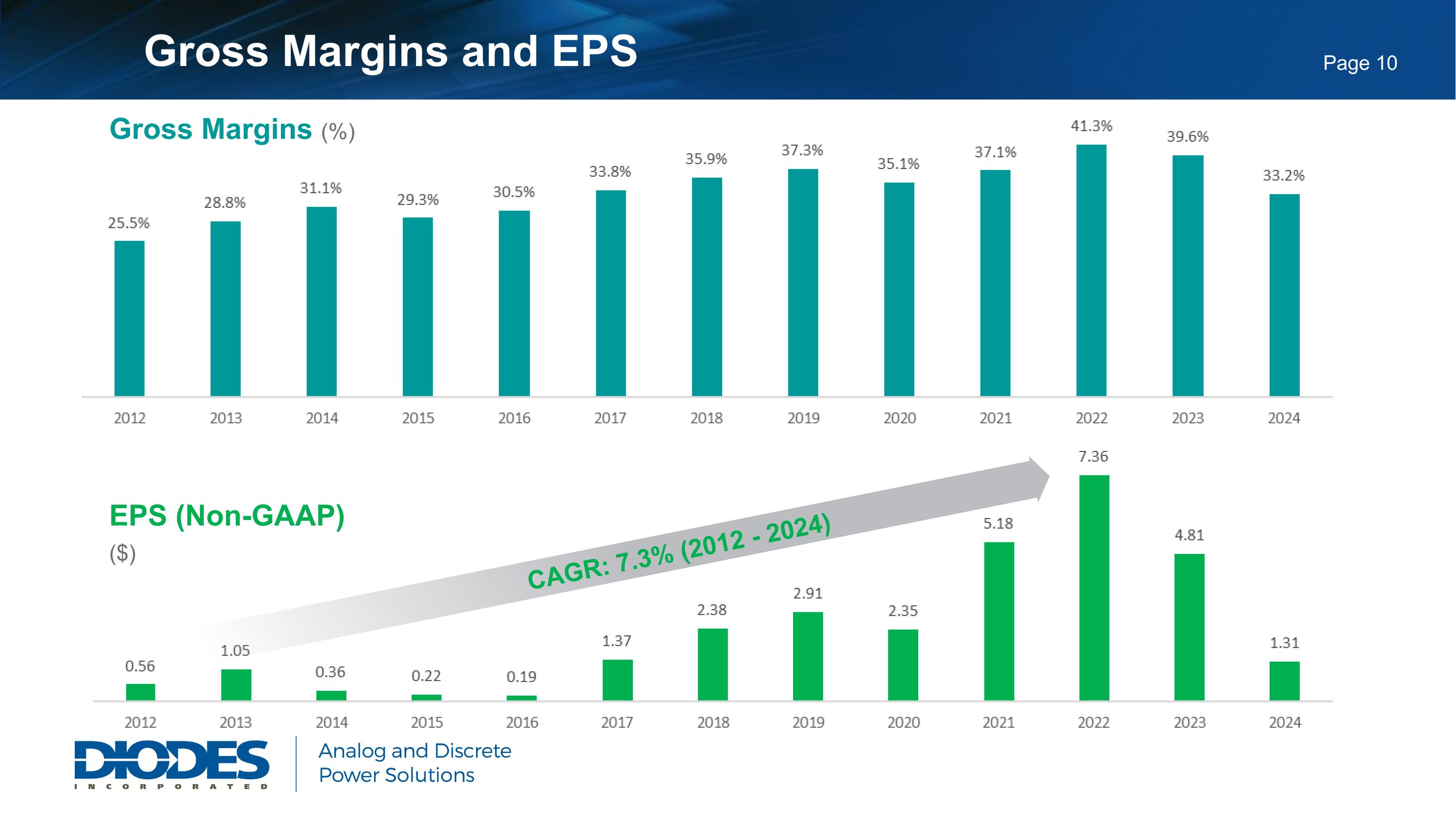

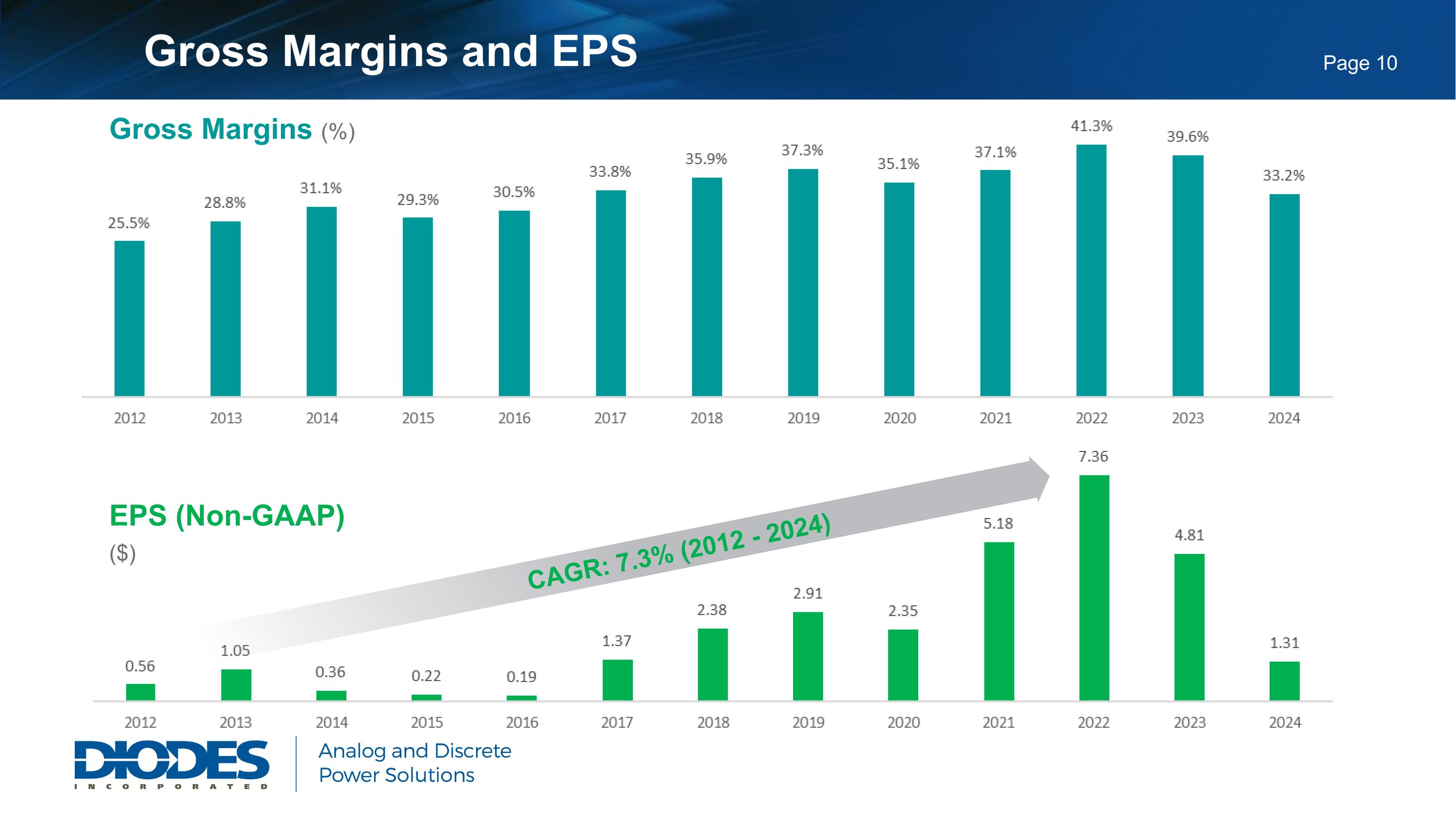

Gross Margins (%) EPS (Non-GAAP) ($) CAGR: 7.3% (2012 - 2024) Gross Margins and EPS

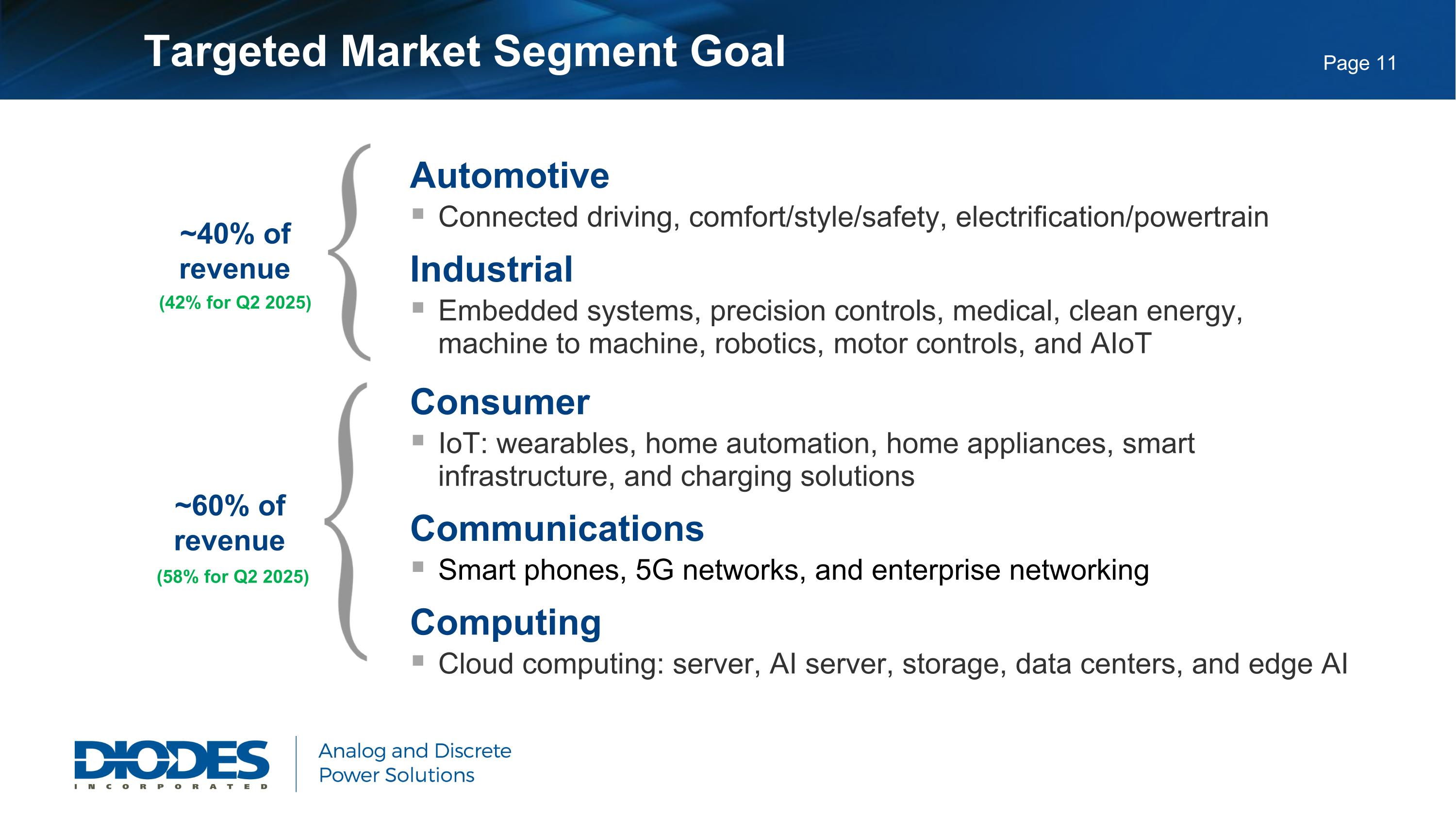

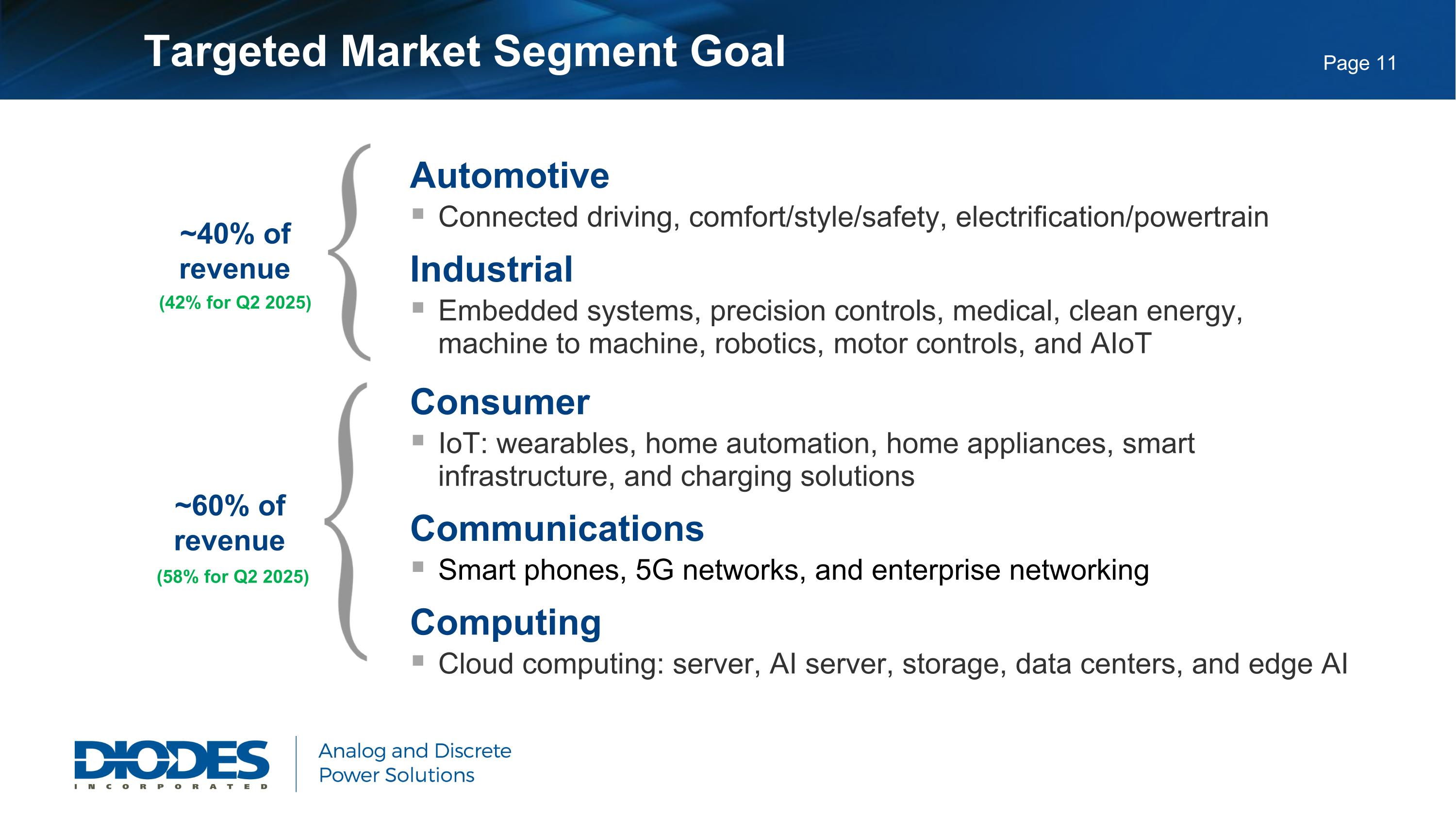

Automotive Connected driving, comfort/style/safety, electrification/powertrain Industrial Embedded systems, precision controls, medical, clean energy, machine to machine, robotics, motor controls, and AIoT Consumer IoT: wearables, home automation, home appliances, smart infrastructure, and charging solutions Communications Smart phones, 5G networks, and enterprise networking Computing Cloud computing: server, AI server, storage, data centers, and edge AI ~60% of revenue ~40% of revenue (58% for Q2 2025) (42% for Q2 2025) Targeted Market Segment Goal

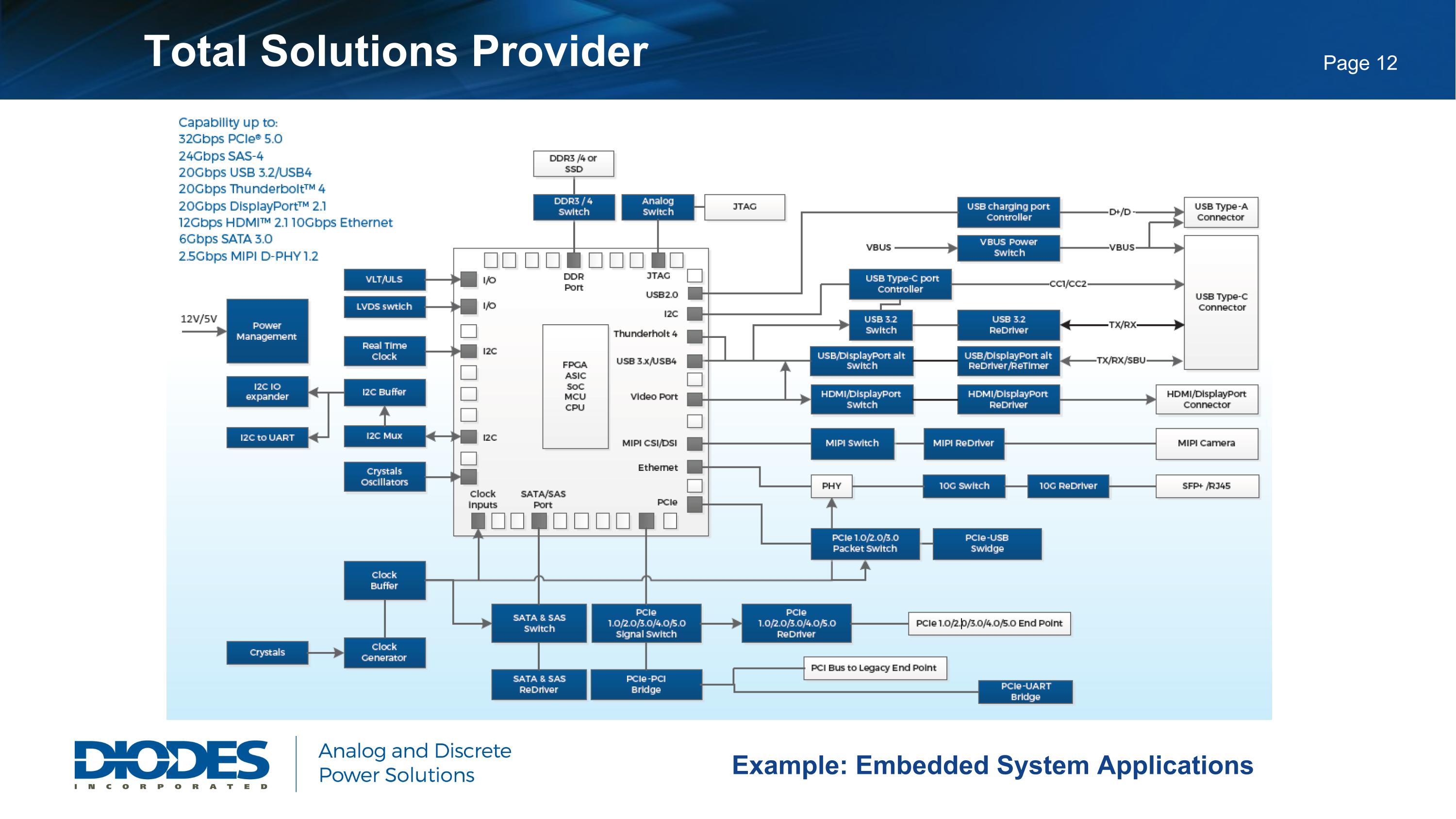

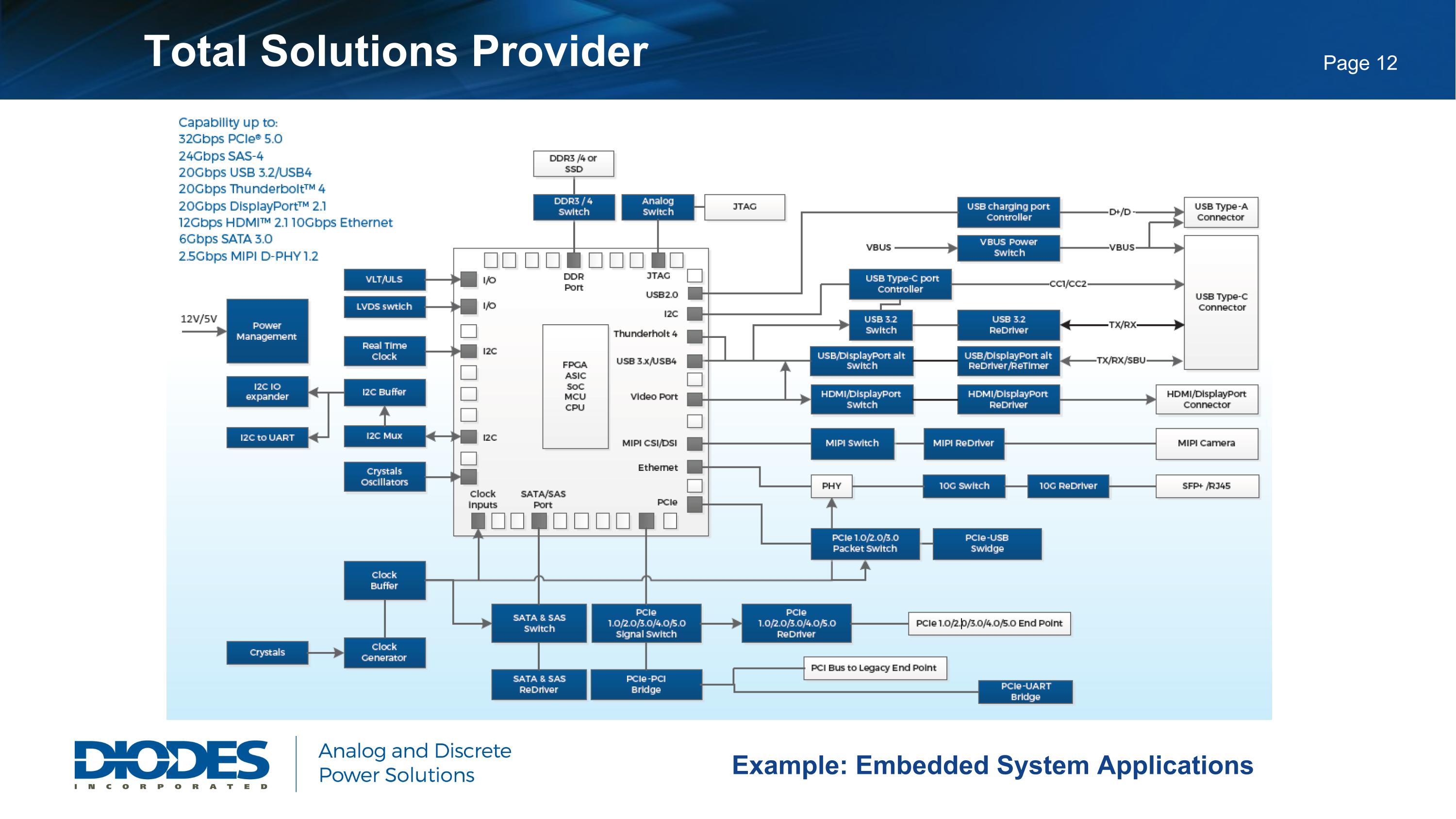

Example: Embedded System Applications Total Solutions Provider

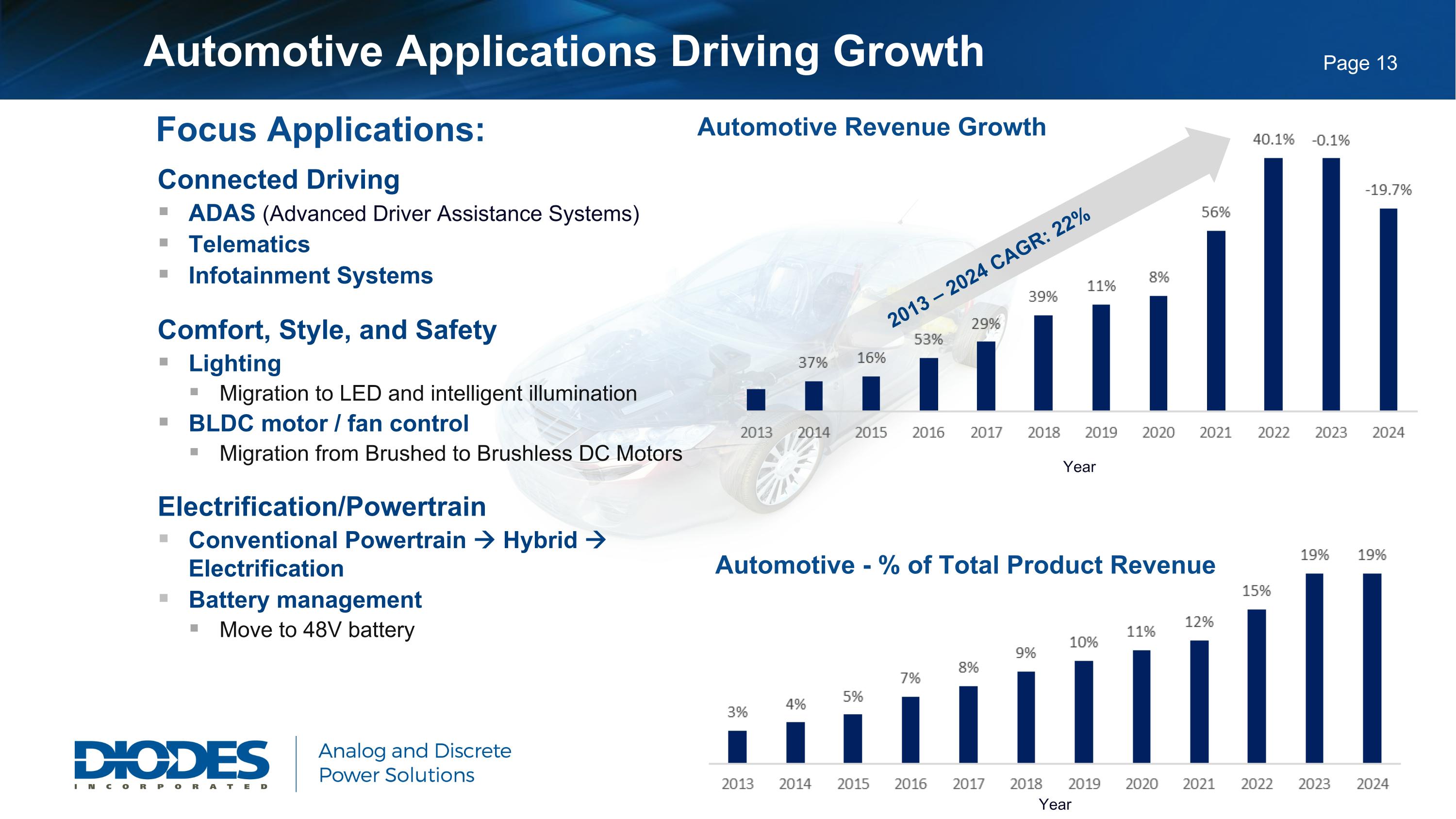

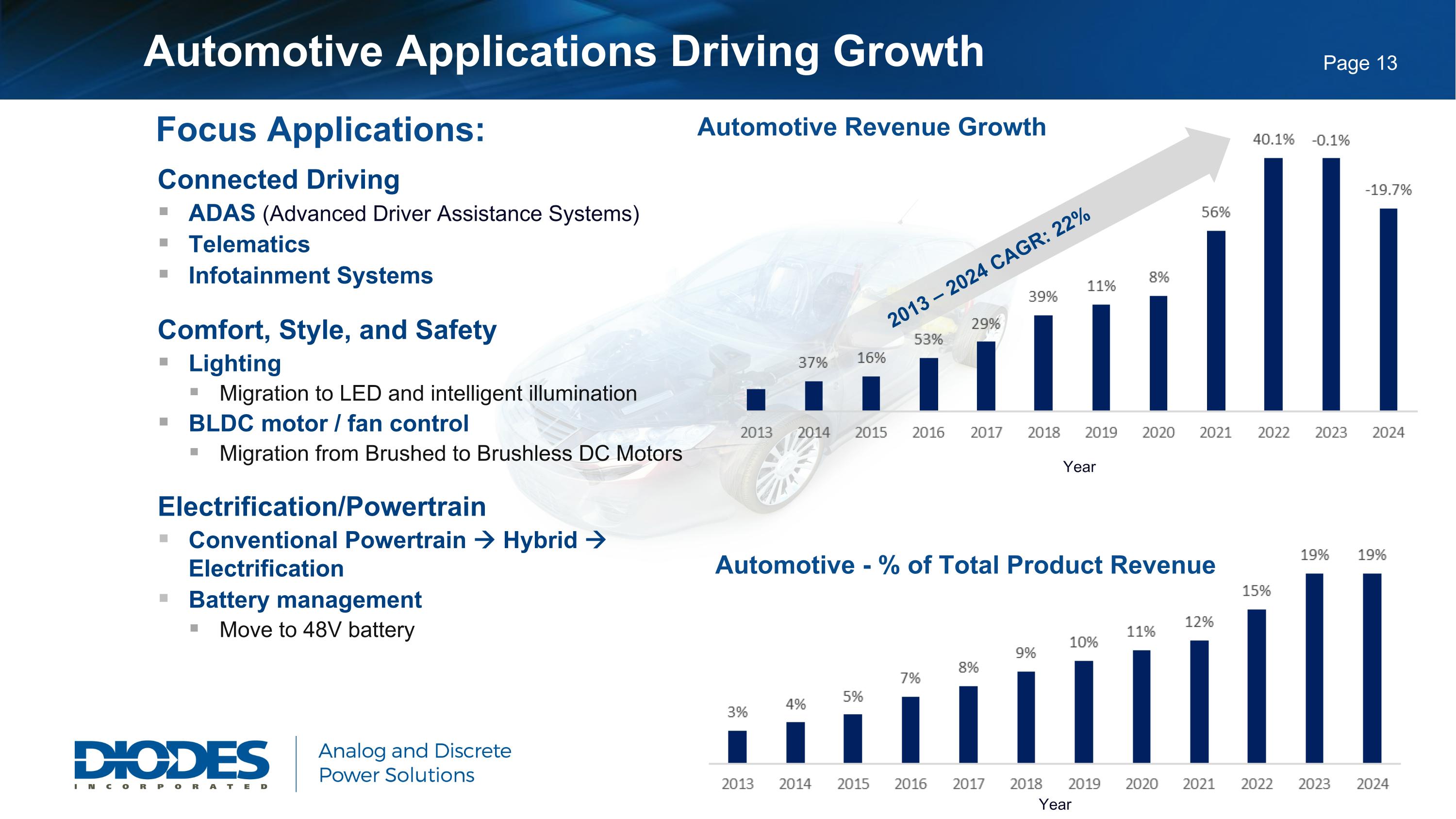

Connected Driving ADAS (Advanced Driver Assistance Systems) Telematics Infotainment Systems Comfort, Style, and Safety Lighting Migration to LED and intelligent illumination BLDC motor / fan control Migration from Brushed to Brushless DC Motors Electrification/Powertrain Conventional Powertrain Hybrid Electrification Battery management Move to 48V battery Focus Applications: Automotive Revenue Growth Year 2013 – 2024 CAGR: 22% Year Automotive - % of Total Product Revenue Automotive Applications Driving Growth

Automotive Potential Revenue $ / Car Automotive Motor Control $53.90 Connected Driving (Infotainment, Telematics & ADAS) $90.44 Powertrain, Electrification & Body Control Electronics $50.00 Lighting – Moving to LED $18.91 Total $213.25 $ Content / Car Year Automotive Opportunity

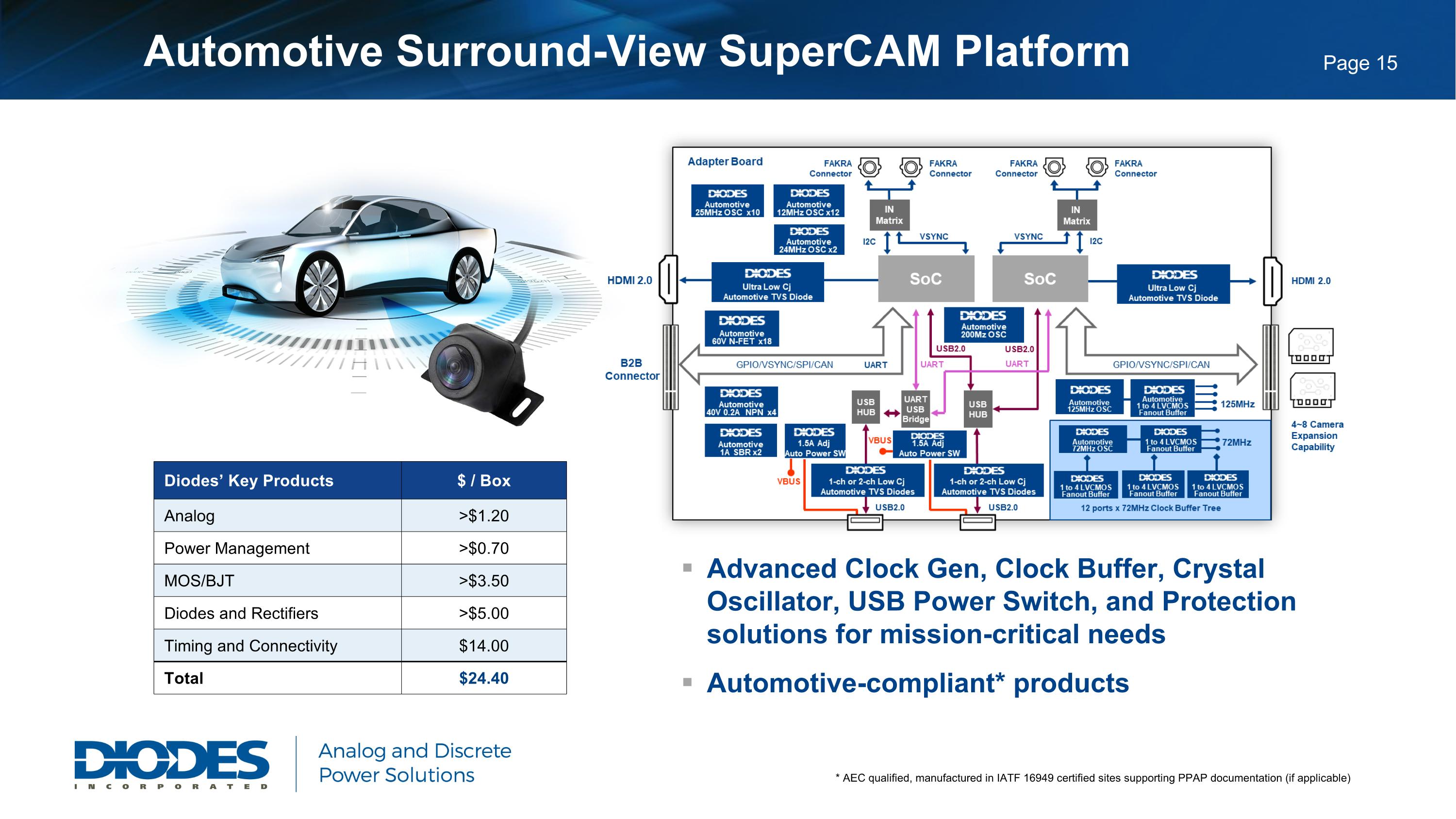

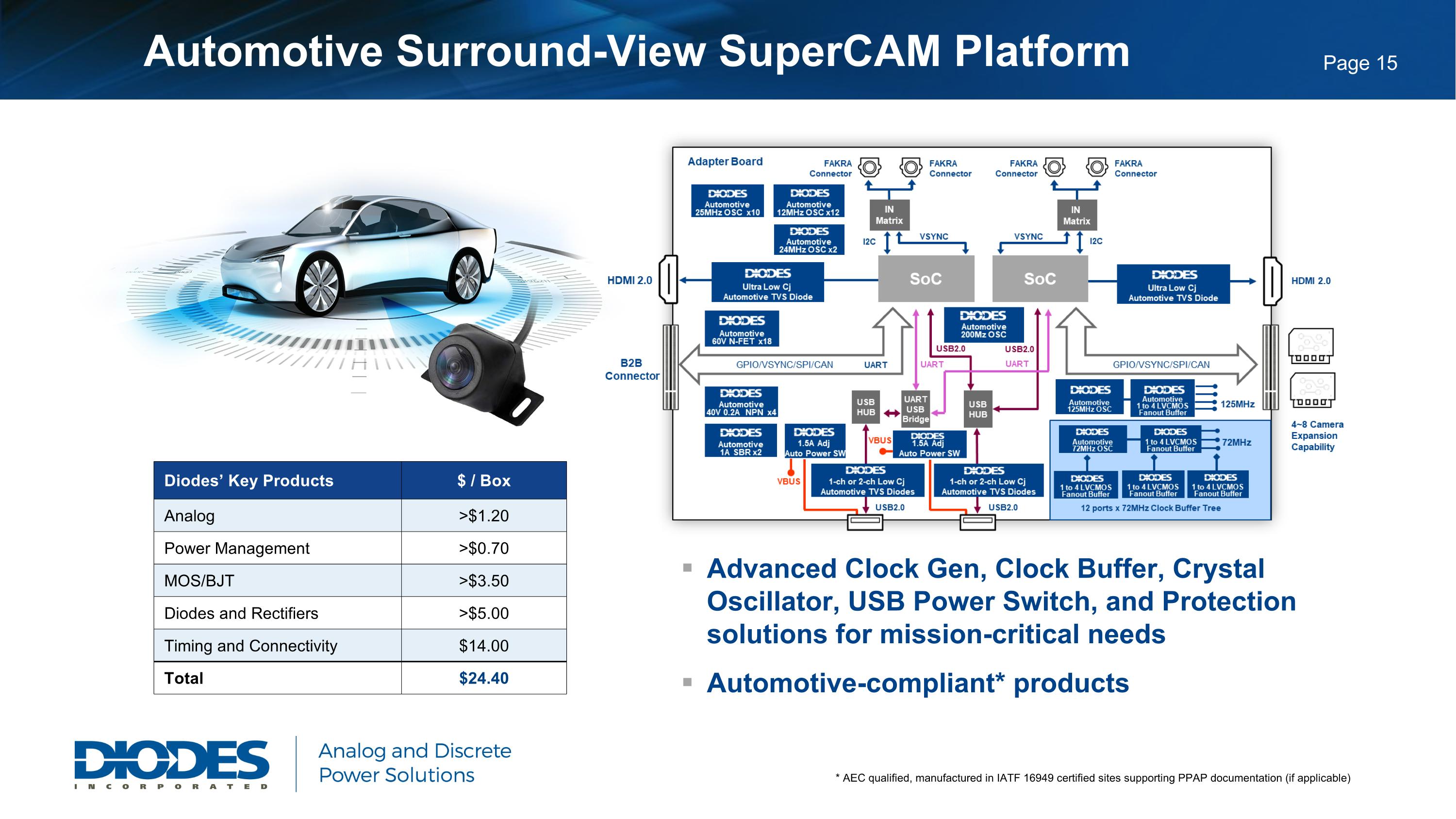

Advanced Clock Gen, Clock Buffer, Crystal Oscillator, USB Power Switch, and Protection solutions for mission-critical needs Automotive-compliant* products Diodes’ Key Products $ / Box Analog >$1.20 Power Management >$0.70 MOS/BJT >$3.50 Diodes and Rectifiers >$5.00 Timing and Connectivity $14.00 Total $24.40 * AEC qualified, manufactured in IATF 16949 certified sites supporting PPAP documentation (if applicable) Automotive Surround-View SuperCAM Platform

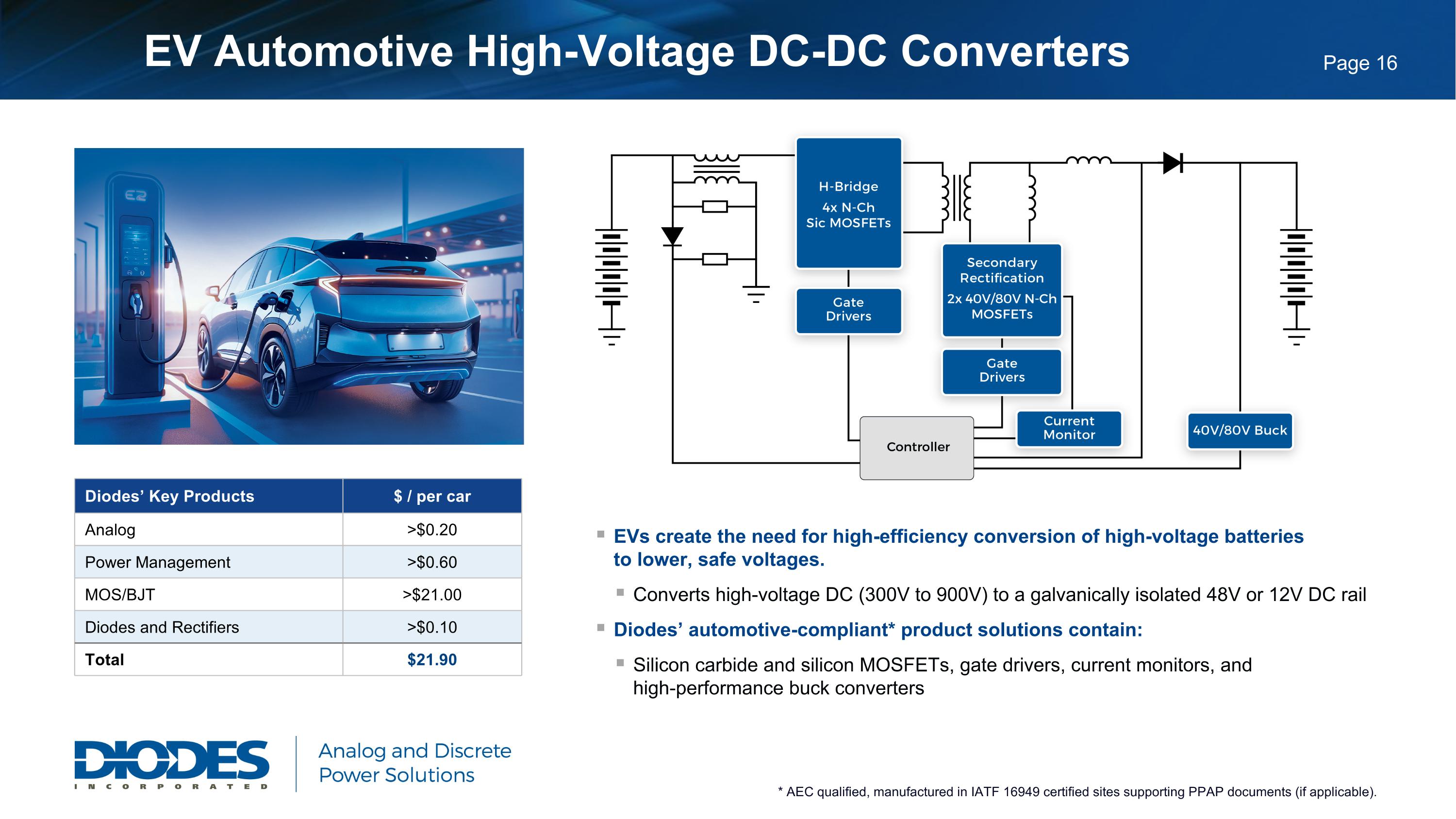

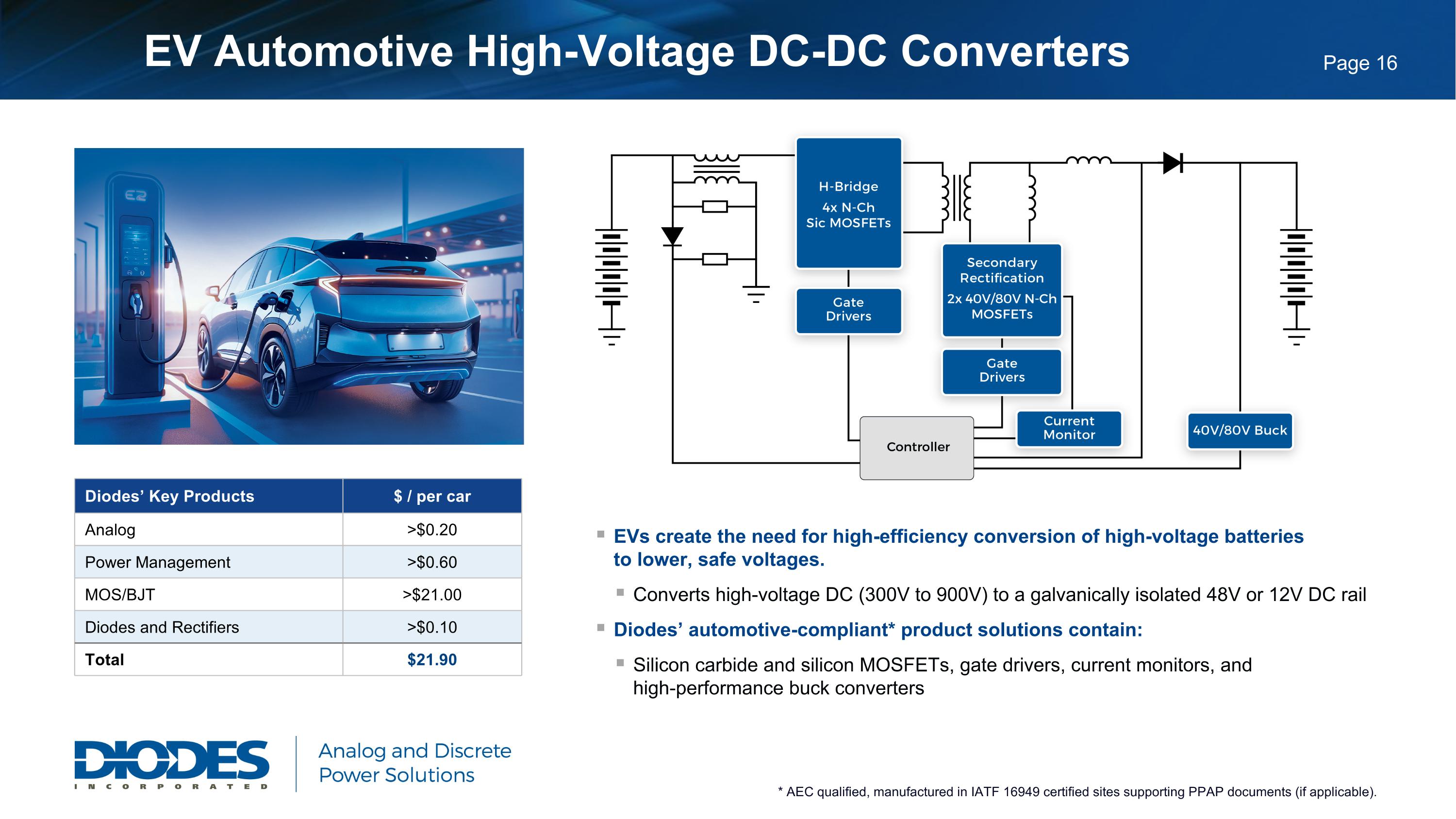

EV Automotive High-Voltage DC-DC Converters EVs create the need for high-efficiency conversion of high-voltage batteries to lower, safe voltages. Converts high-voltage DC (300V to 900V) to a galvanically isolated 48V or 12V DC rail Diodes’ automotive-compliant* product solutions contain: Silicon carbide and silicon MOSFETs, gate drivers, current monitors, and high-performance buck converters Diodes’ Key Products $ / per car Analog >$0.20 Power Management >$0.60 MOS/BJT >$21.00 Diodes and Rectifiers >$0.10 Total $21.90 * AEC qualified, manufactured in IATF 16949 certified sites supporting PPAP documents (if applicable).

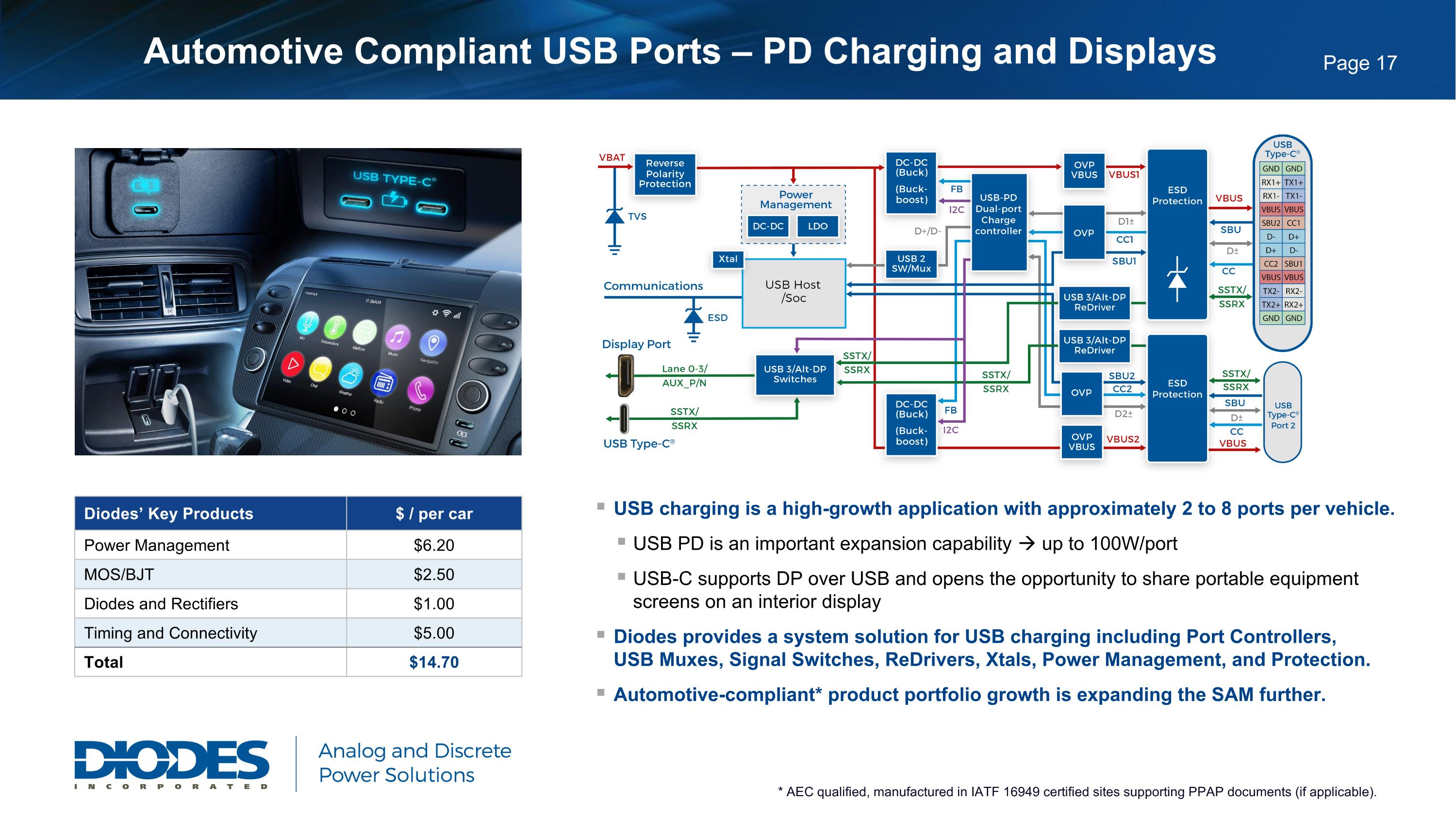

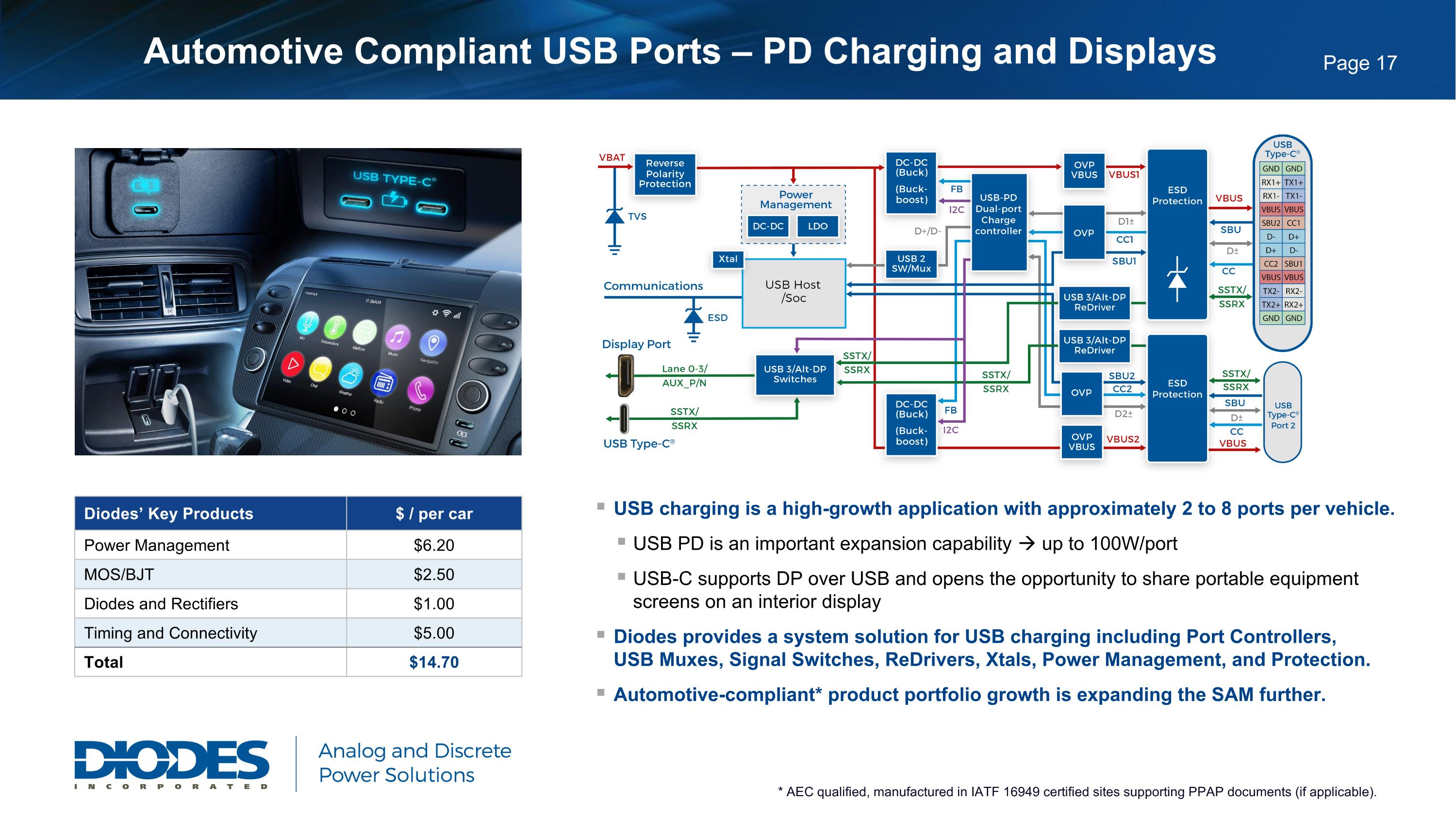

Automotive Compliant USB Ports – PD Charging and Displays Diodes’ Key Products $ / per car Power Management $6.20 MOS/BJT $2.50 Diodes and Rectifiers $1.00 Timing and Connectivity $5.00 Total $14.70 * AEC qualified, manufactured in IATF 16949 certified sites supporting PPAP documents (if applicable). USB charging is a high-growth application with approximately 2 to 8 ports per vehicle. USB PD is an important expansion capability up to 100W/port USB-C supports DP over USB and opens the opportunity to share portable equipment screens on an interior display Diodes provides a system solution for USB charging including Port Controllers, USB Muxes, Signal Switches, ReDrivers, Xtals, Power Management, and Protection. Automotive-compliant* product portfolio growth is expanding the SAM further.

Industrial Content Expansion Increasing IC content in embedded systems Switching and signal path for networked systems and automation Signal conditioning and timing for precision controls Industrial / motor controls, sensors, and power management Green power, energy storage Robotics Medical: home health systems to hospital equipment AIoT

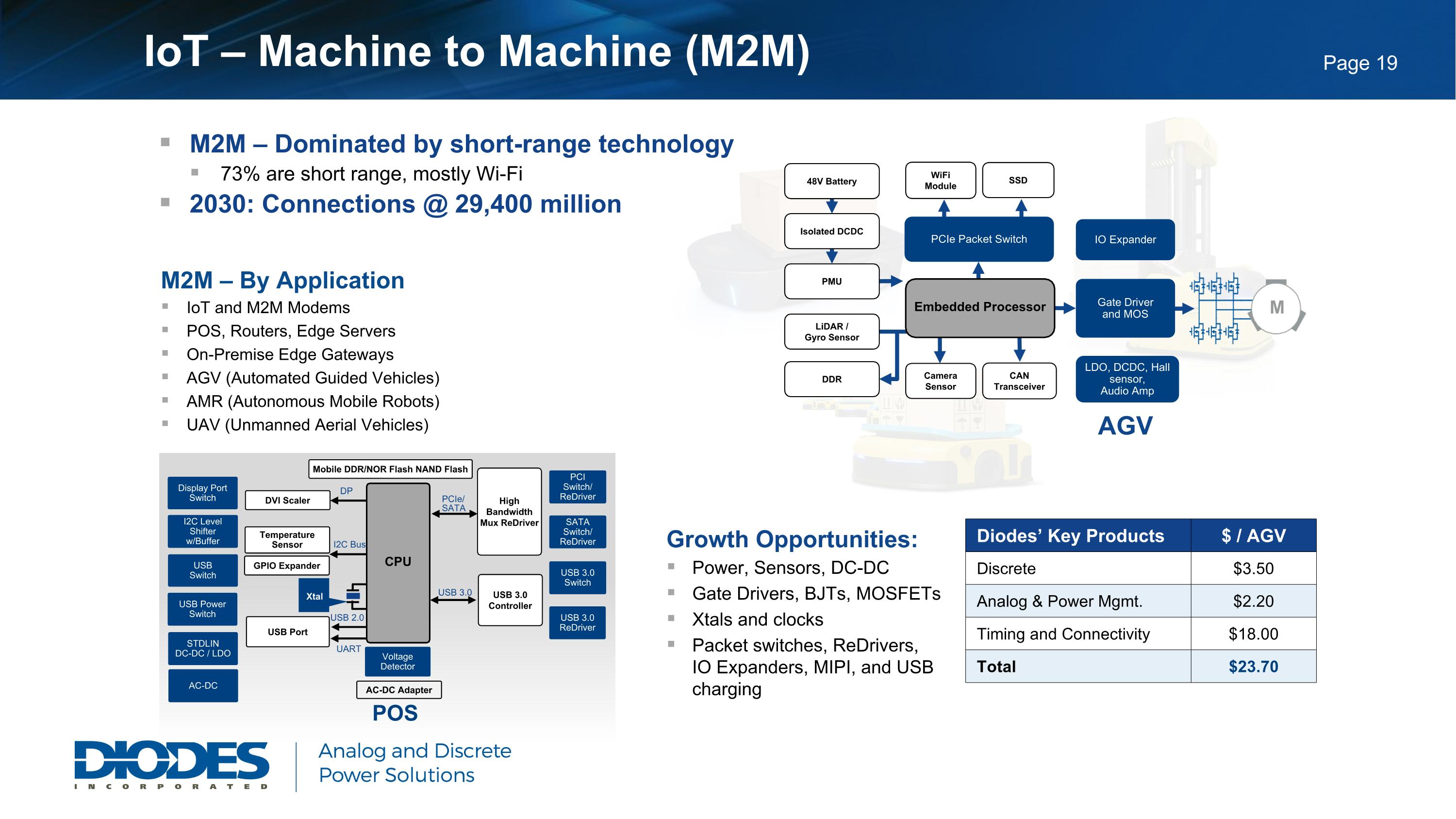

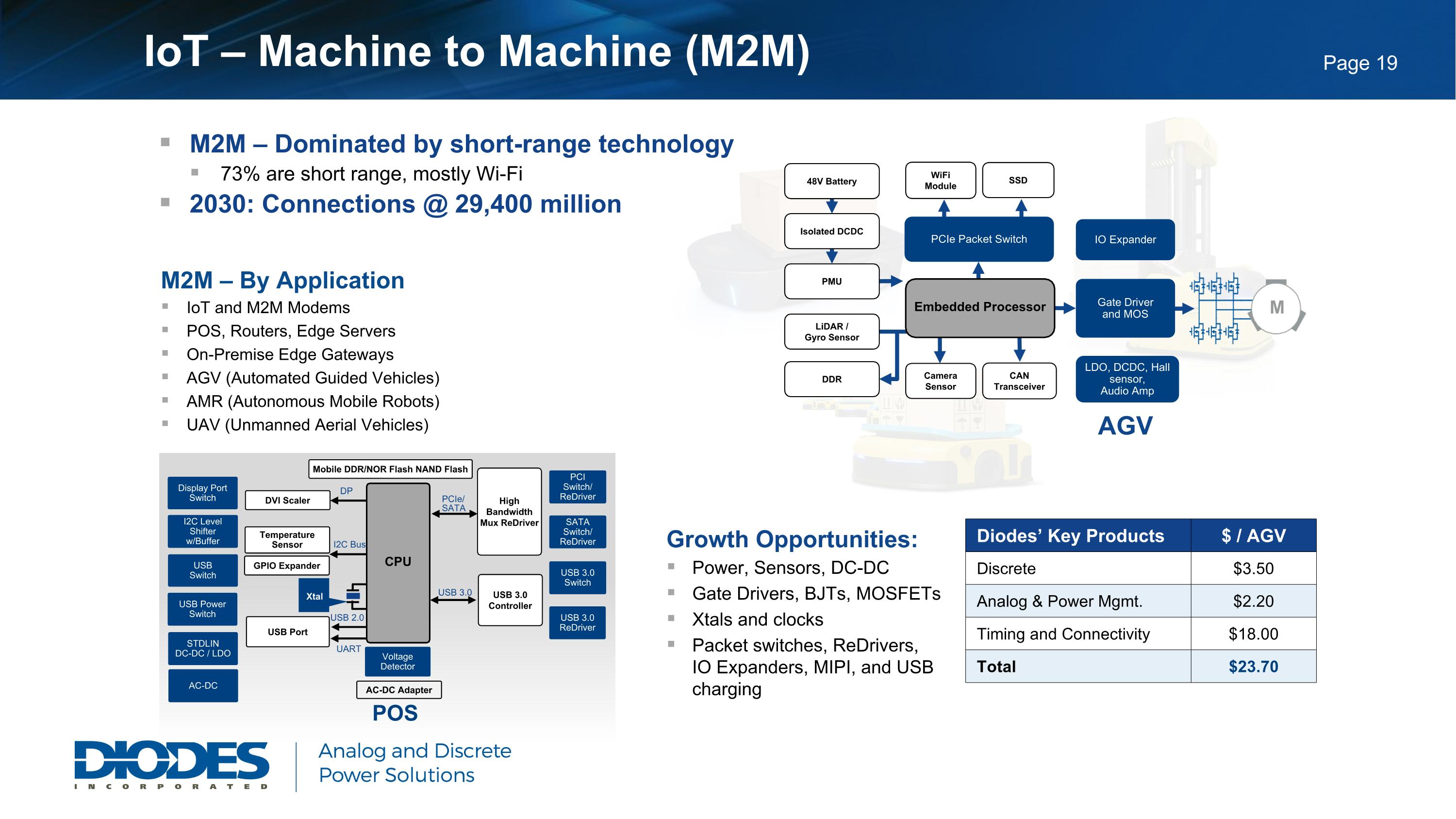

IoT – Machine to Machine (M2M) Growth Opportunities: Power, Sensors, DC-DC Gate Drivers, BJTs, MOSFETs Xtals and clocks Packet switches, ReDrivers, IO Expanders, MIPI, and USB charging M2M – Dominated by short-range technology 73% are short range, mostly Wi-Fi 2030: Connections @ 29,400 million M2M – By Application IoT and M2M Modems POS, Routers, Edge Servers On-Premise Edge Gateways AGV (Automated Guided Vehicles) AMR (Autonomous Mobile Robots) UAV (Unmanned Aerial Vehicles) POS Display PortSwitch I2C Level Shifterw/Buffer USBSwitch USB PowerSwitch USB 3.0ReDriver USB 3.0Switch PCI Switch/ReDriver SATA Switch/ReDriver VoltageDetector Xtal USB Port USB 3.0Controller HighBandwidthMux ReDriver AC-DC Adapter GPIO Expander TemperatureSensor DVI Scaler Mobile DDR/NOR Flash NAND Flash USB 3.0 PCIe/SATA DP I2C Bus UART USB 2.0 CPU STDLIN DC-DC / LDO AC-DC Diodes’ Key Products $ / AGV Discrete $3.50 Analog & Power Mgmt. $2.20 Timing and Connectivity $18.00 Total $23.70 PMU DDR WiFiModule Gate Driver and MOS LiDAR /Gyro Sensor PCIe Packet Switch CameraSensor CANTransceiver Embedded Processor SSD M Isolated DCDC 48V Battery LDO, DCDC, Hall sensor, Audio Amp IO Expander AGV

Cloud Computing Accelerating the Enterprise Market ReDriver support for PCIe or USB connectivity Wide range of signal protocols: PCIe, CXL, SAS, SATA, USB MUX switch products for high-capacity solid state storage Packet switches for accelerating AI computing Crystal oscillators for increasing clocking speeds LDOs, DCDC, SBR, and TVS for power management and protection

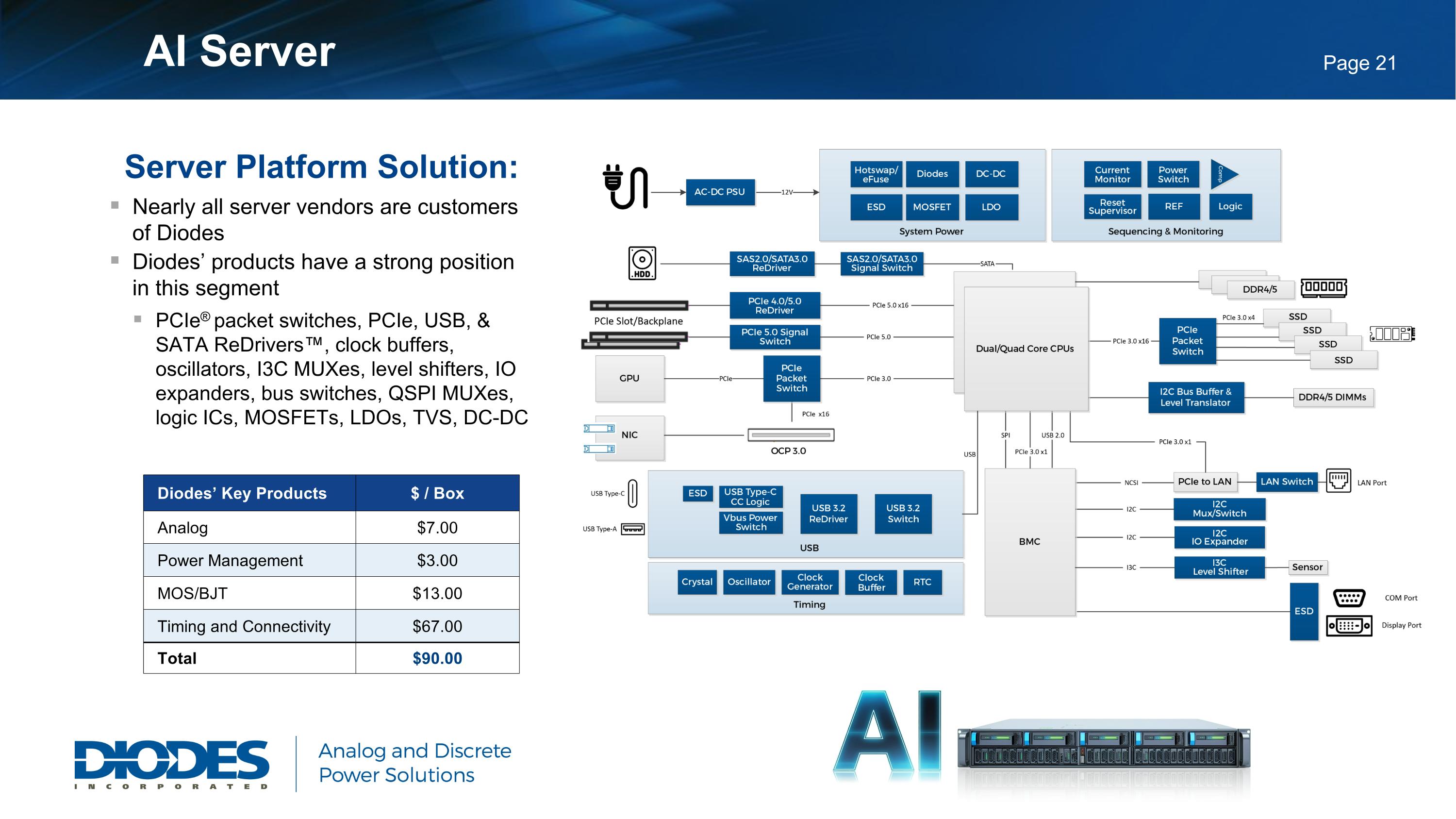

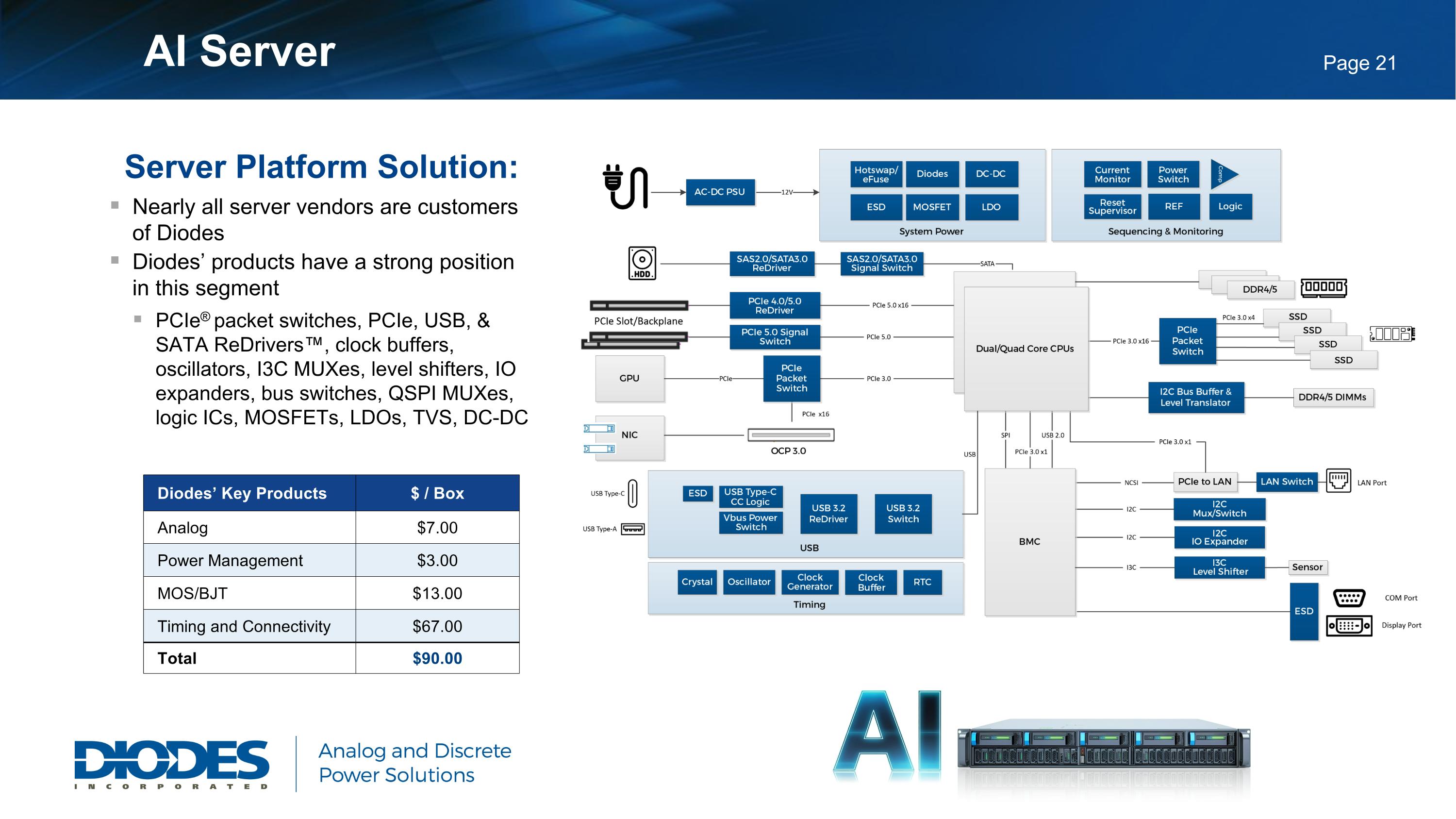

AI Server Server Platform Solution: Nearly all server vendors are customers of Diodes Diodes’ products have a strong position in this segment PCIe® packet switches, PCIe, USB, & SATA ReDrivers™, clock buffers, oscillators, I3C MUXes, level shifters, IO expanders, bus switches, QSPI MUXes, logic ICs, MOSFETs, LDOs, TVS, DC-DC Diodes’ Key Products $ / Box Analog $7.00 Power Management $3.00 MOS/BJT $13.00 Timing and Connectivity $67.00 Total $90.00

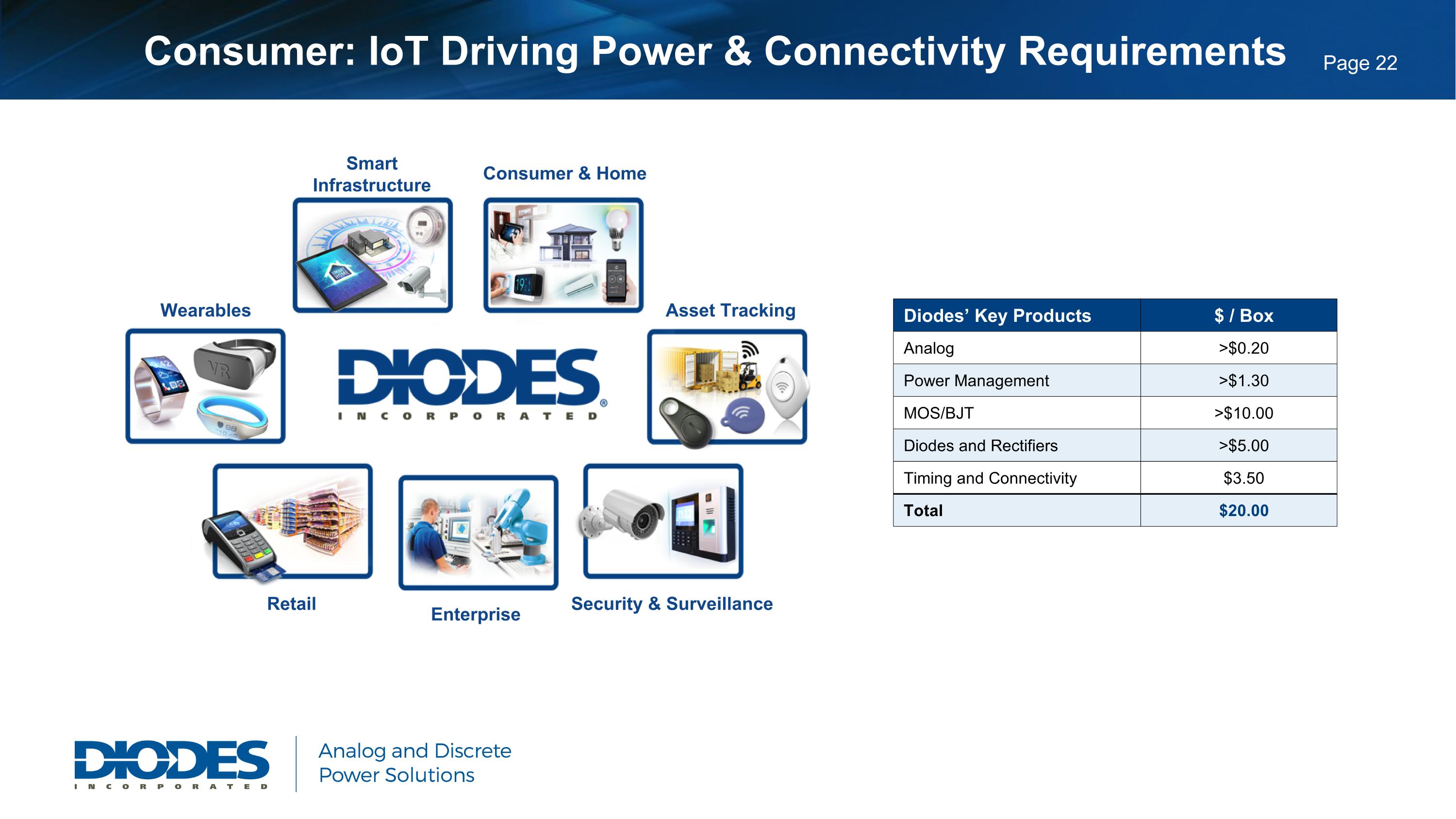

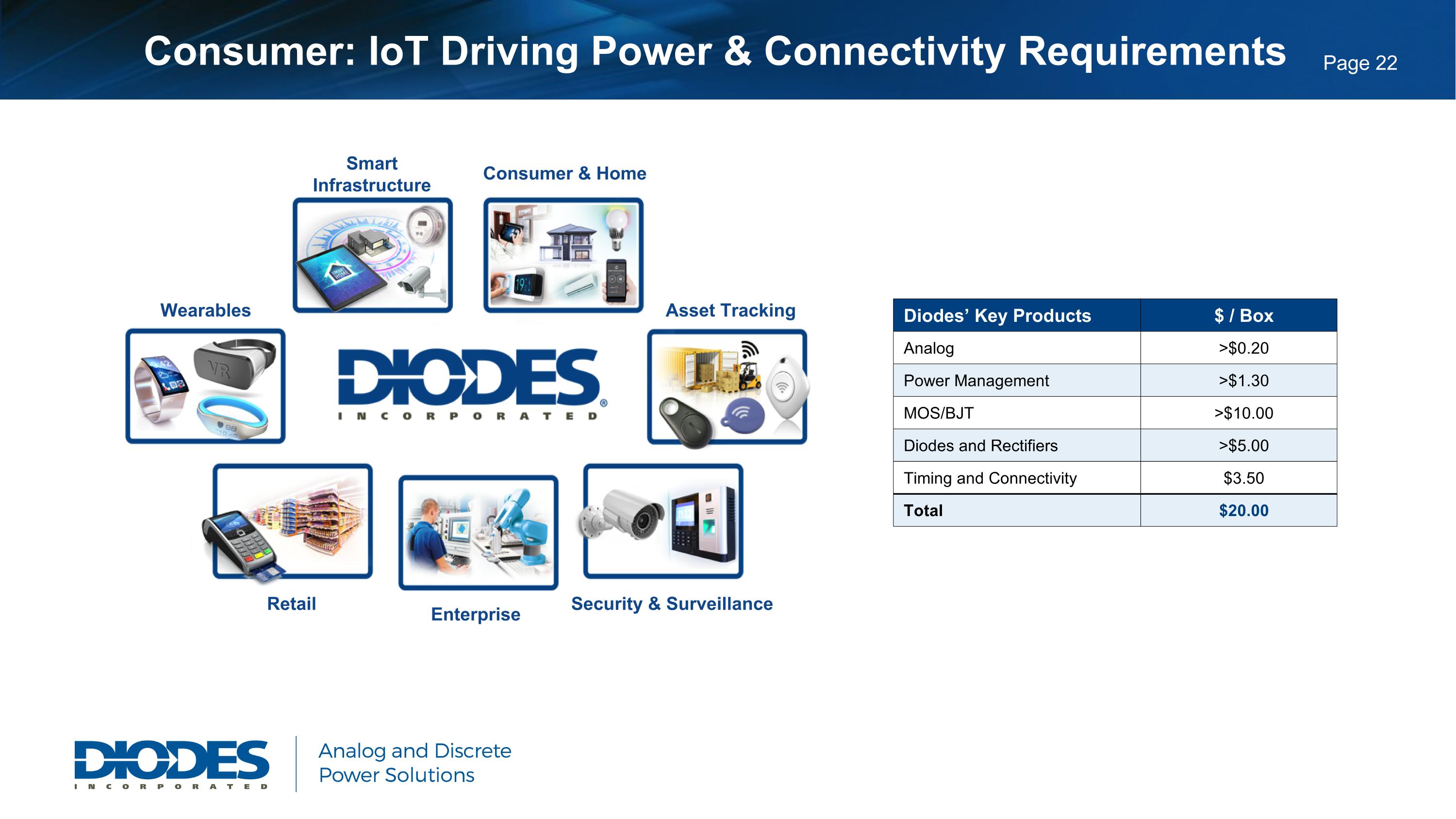

Consumer: IoT Driving Power & Connectivity Requirements Diodes’ Key Products $ / Box Analog >$0.20 Power Management >$1.30 MOS/BJT >$10.00 Diodes and Rectifiers >$5.00 Timing and Connectivity $3.50 Total $20.00 Enterprise Smart Infrastructure Wearables Consumer & Home Asset Tracking Security & Surveillance Retail

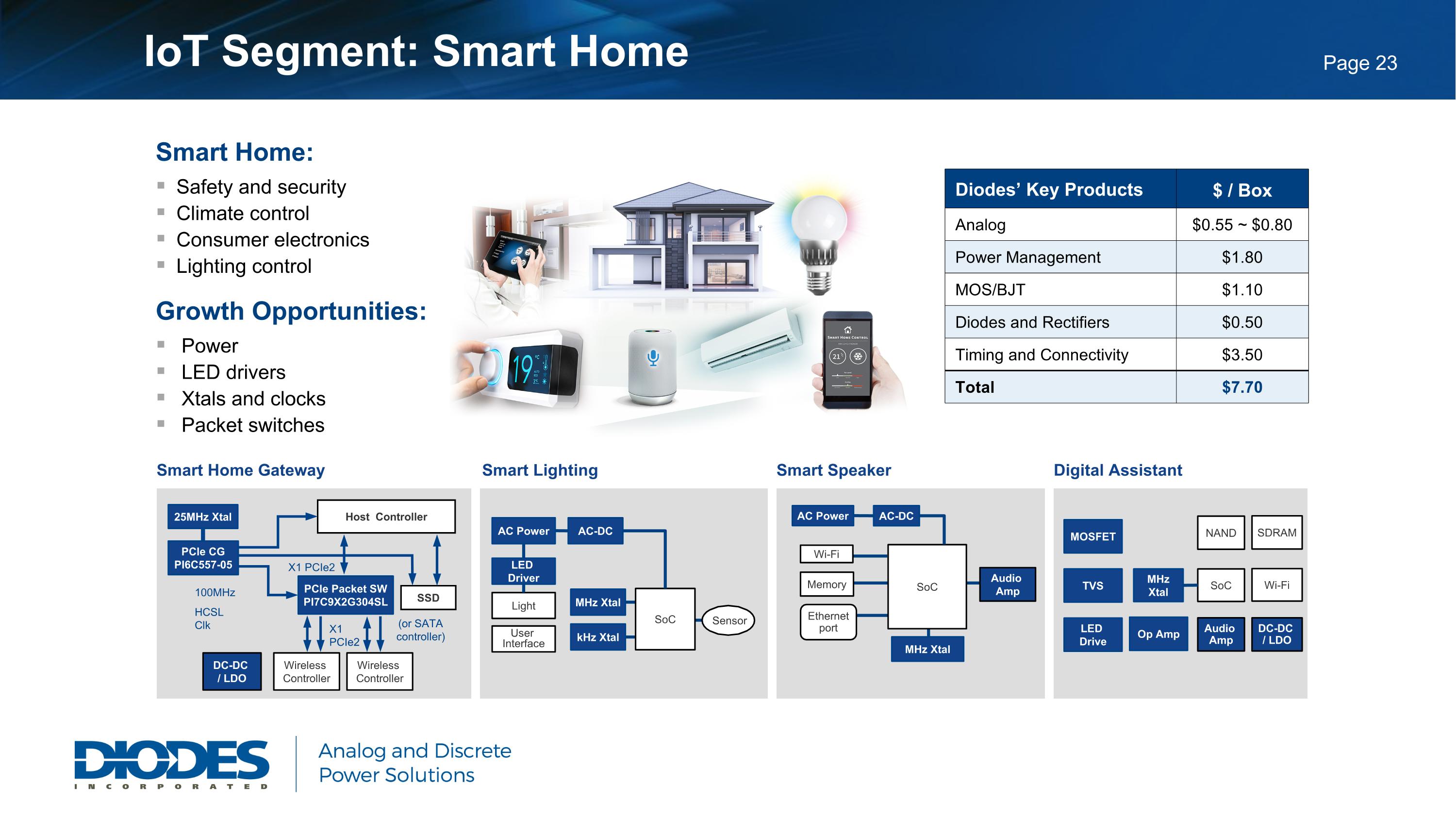

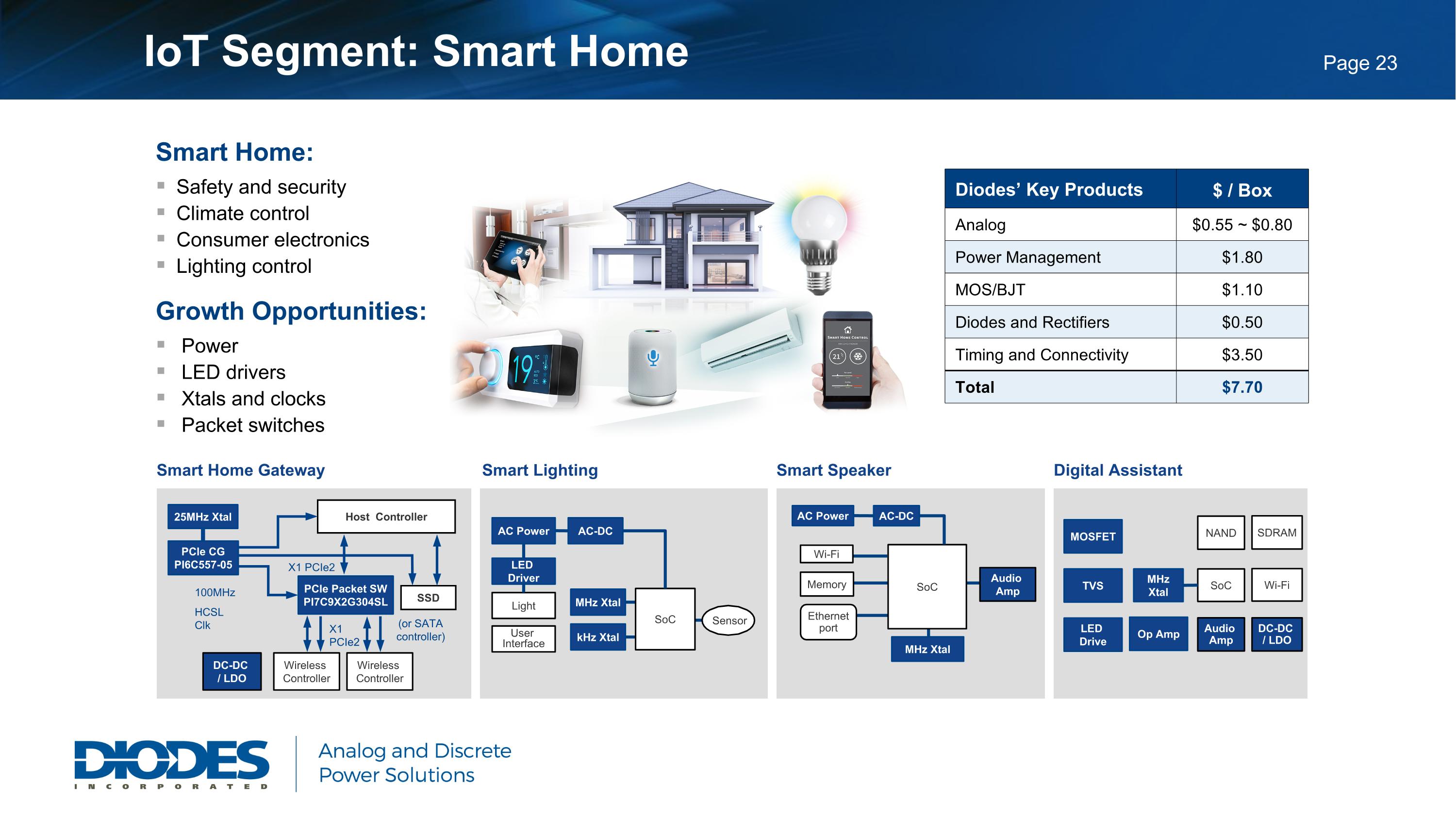

IoT Segment: Smart Home Smart Home: Safety and security Climate control Consumer electronics Lighting control Growth Opportunities: Power LED drivers Xtals and clocks Packet switches Diodes’ Key Products $ / Box Analog $0.55 ~ $0.80 Power Management $1.80 MOS/BJT $1.10 Diodes and Rectifiers $0.50 Timing and Connectivity $3.50 Total $7.70 Sensor Host Controller X1 PCIe2 100MHz HCSL Clk SSD X1 PCIe2 (or SATA controller) 25MHz Xtal PCIe CG PI6C557-05 PCIe Packet SW PI7C9X2G304SL Wireless Controller Wireless Controller Smart Home Gateway Smart Lighting MHz Xtal kHz Xtal AC Power LED Driver AC-DC Light User Interface Smart Speaker MHz Xtal SoC SoC MHzXtal MOSFET TVS NAND SDRAM Wi-Fi LED Drive Audio Amp Digital Assistant AC-DC Audio Amp Wi-Fi Memory Ethernetport AC Power SoC DC-DC / LDO DC-DC / LDO Op Amp

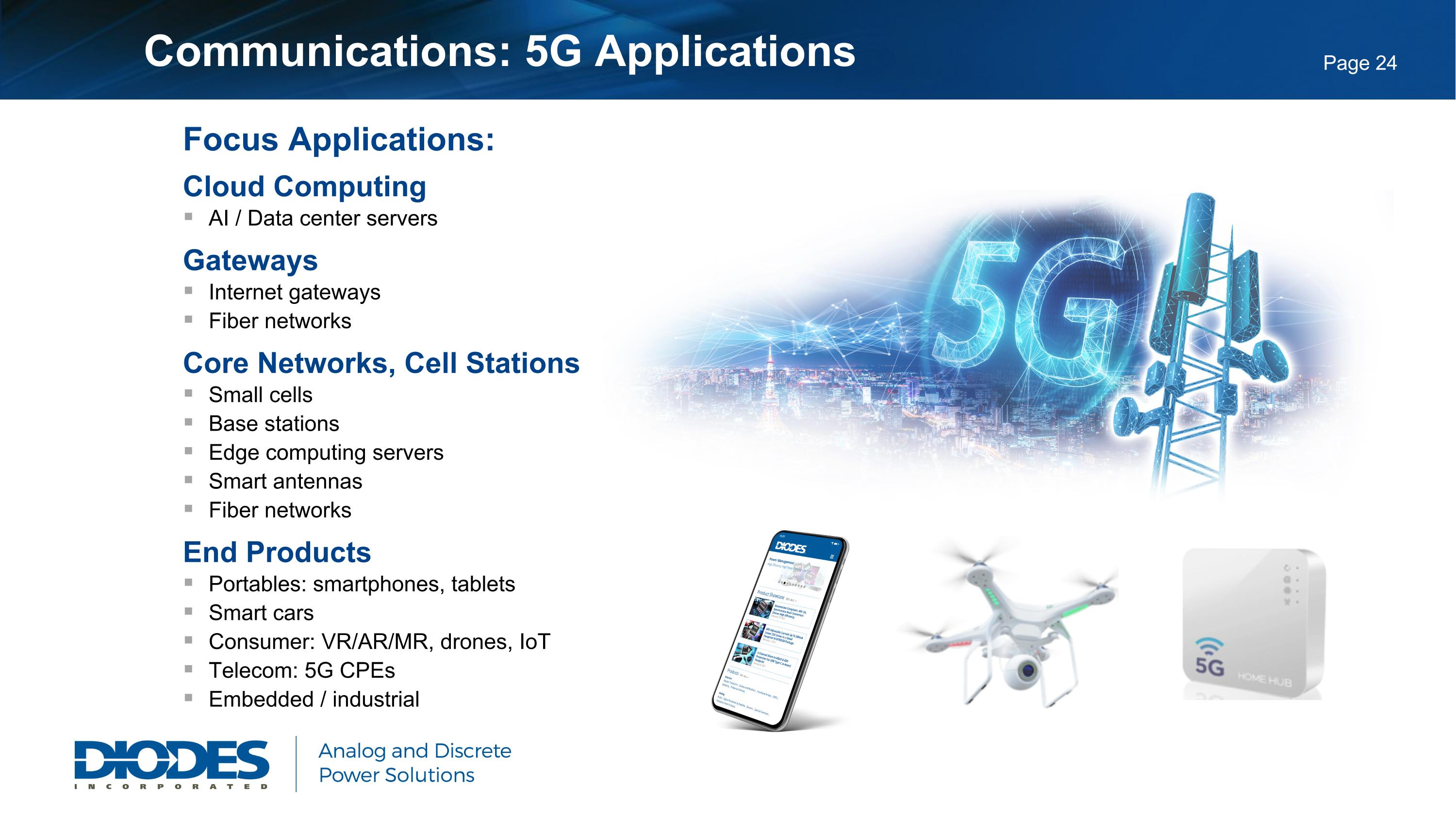

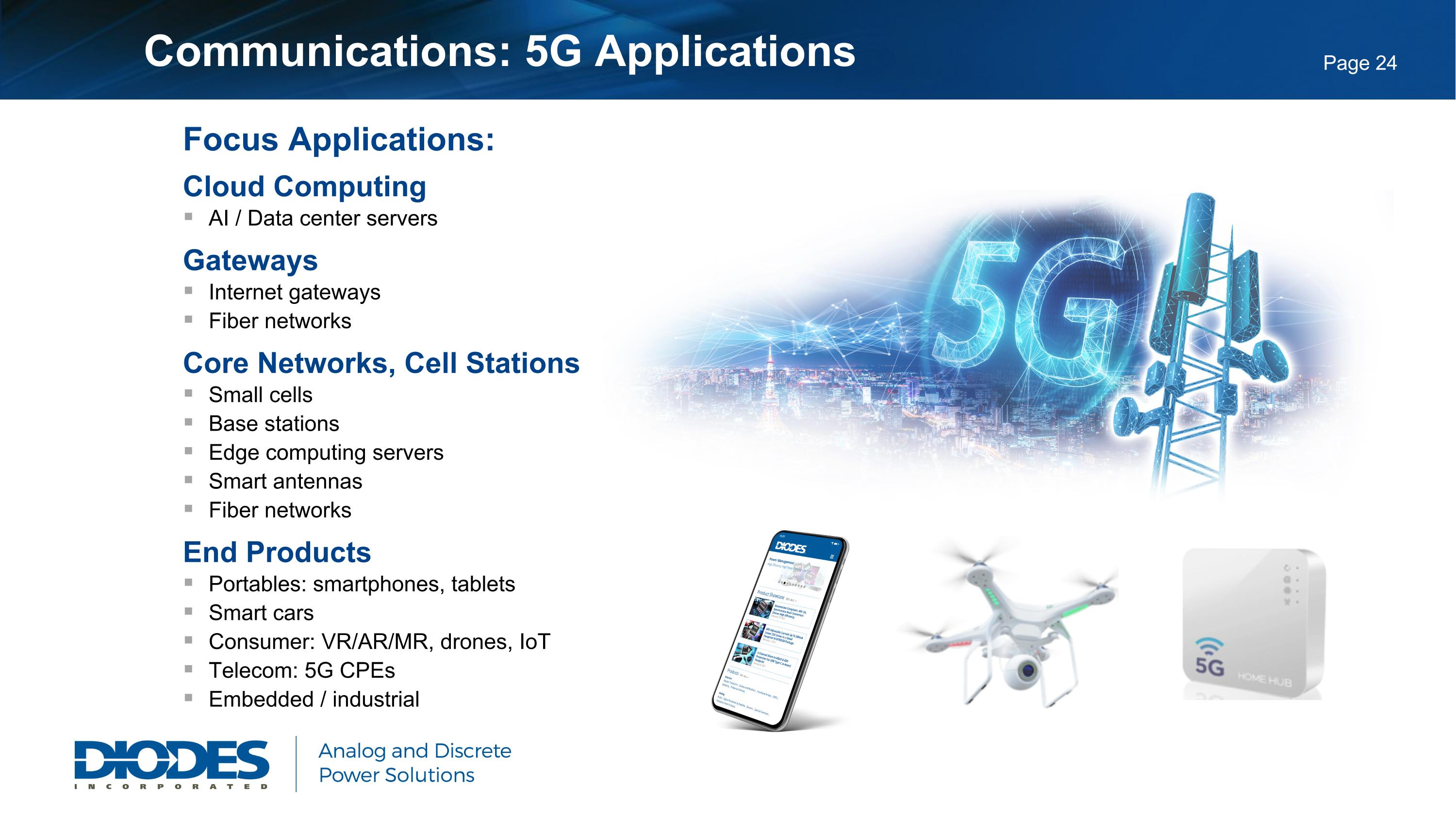

Communications: 5G Applications Focus Applications: Cloud Computing AI / Data center servers Gateways Internet gateways Fiber networks Core Networks, Cell Stations Small cells Base stations Edge computing servers Smart antennas Fiber networks End Products Portables: smartphones, tablets Smart cars Consumer: VR/AR/MR, drones, IoT Telecom: 5G CPEs Embedded / industrial

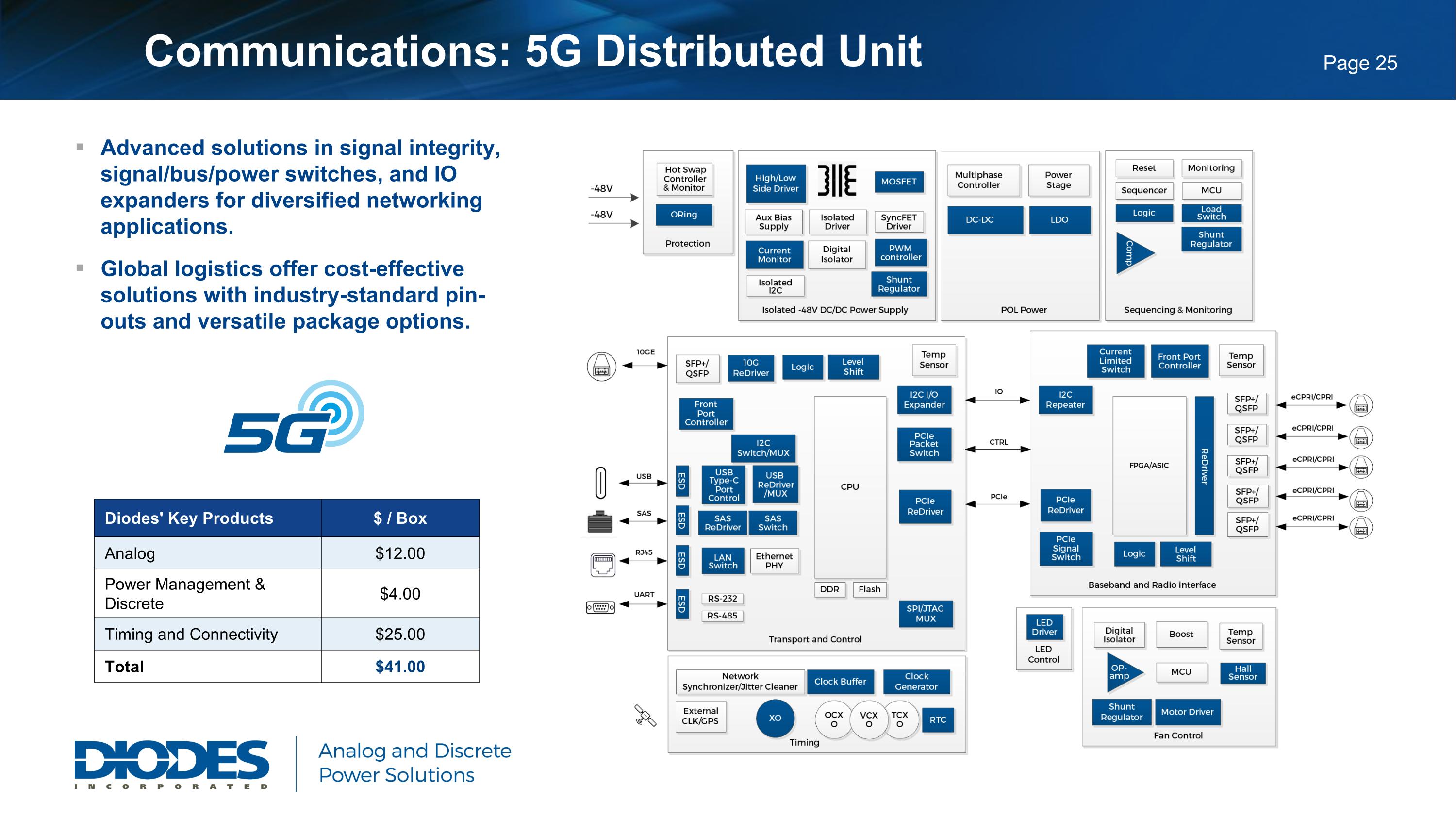

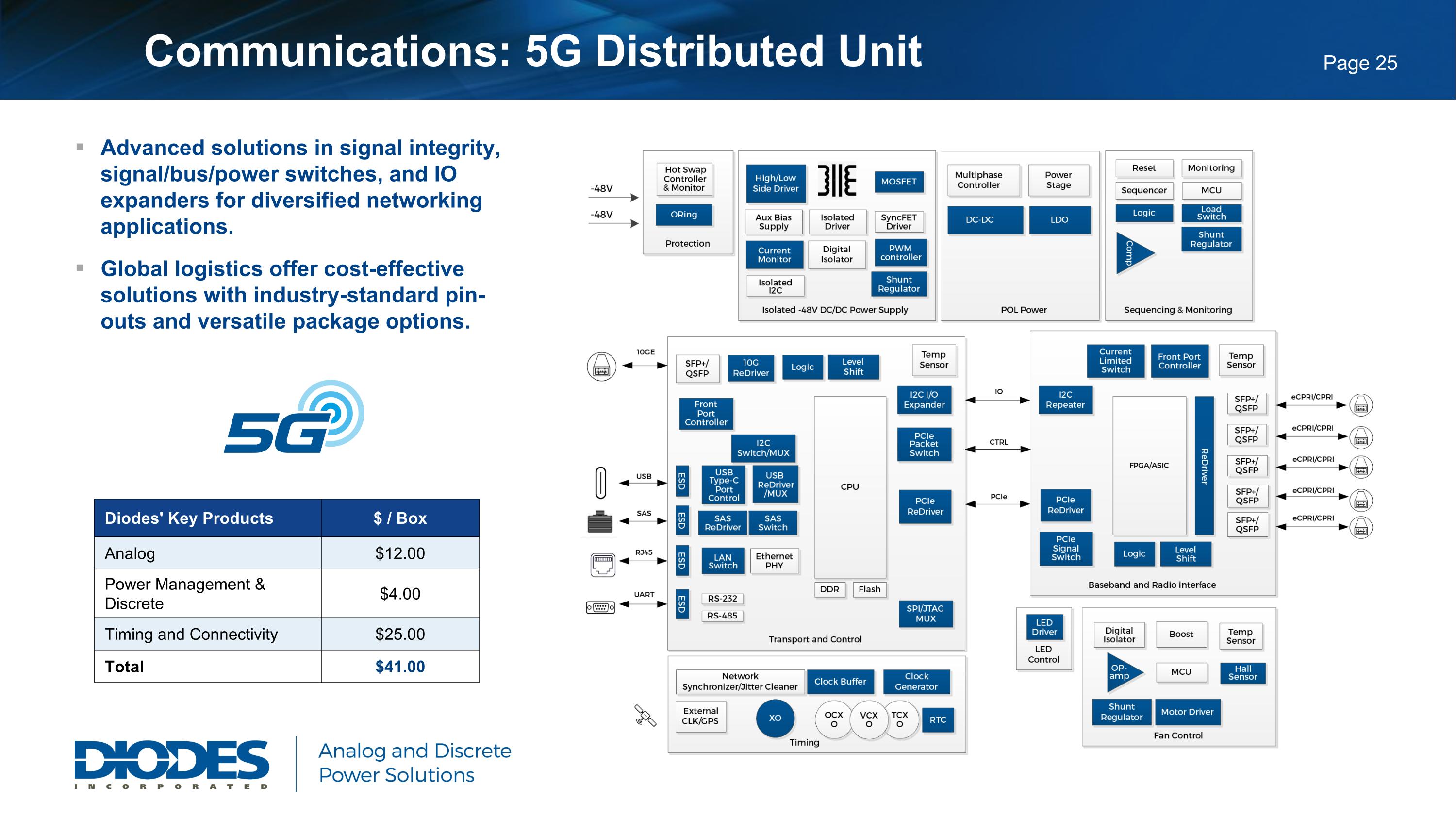

Communications: 5G Distributed Unit Diodes' Key Products $ / Box Analog $12.00 Power Management & Discrete $4.00 Timing and Connectivity $25.00 Total $41.00 Advanced solutions in signal integrity, signal/bus/power switches, and IO expanders for diversified networking applications. Global logistics offer cost-effective solutions with industry-standard pin-outs and versatile package options.

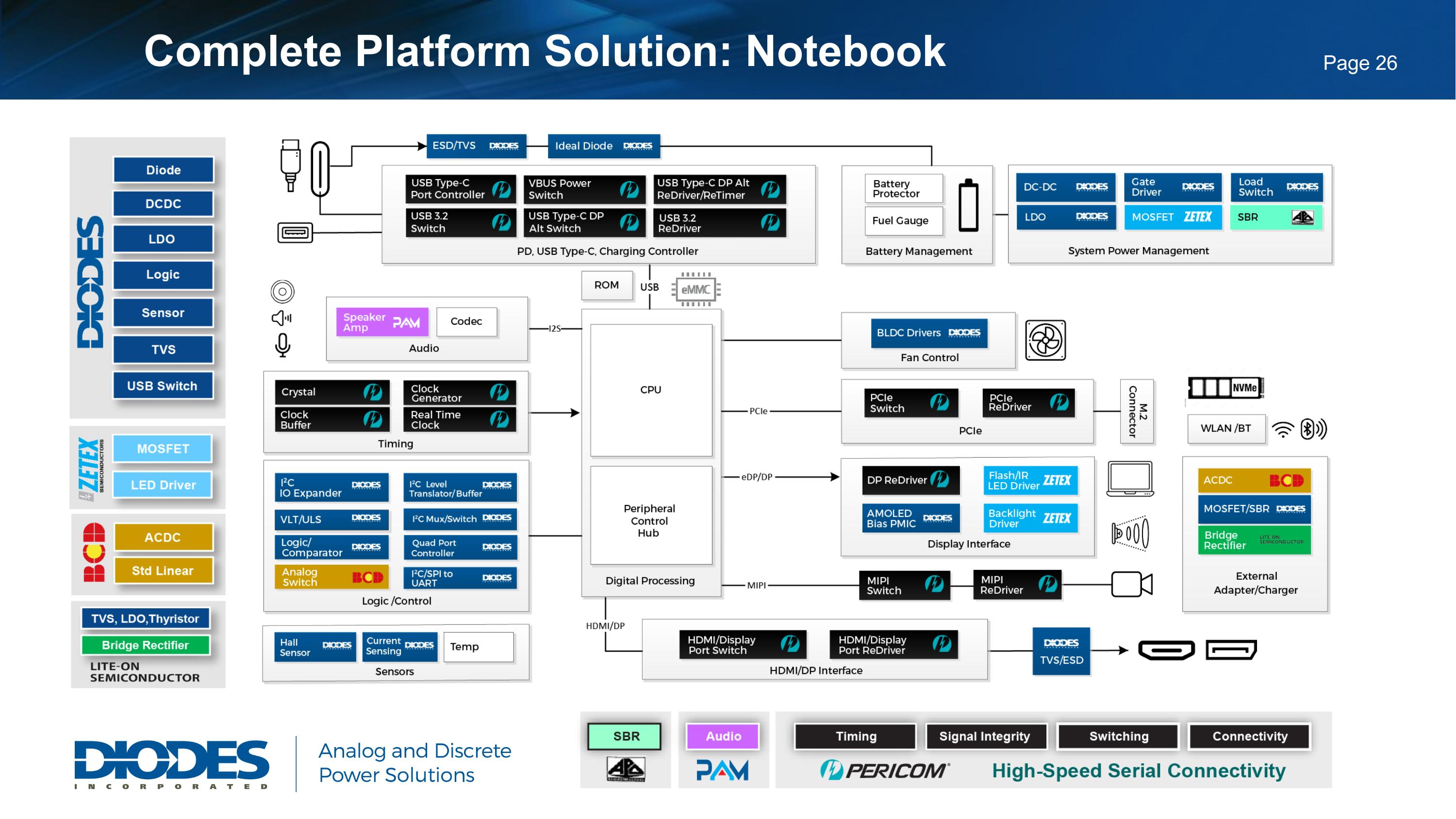

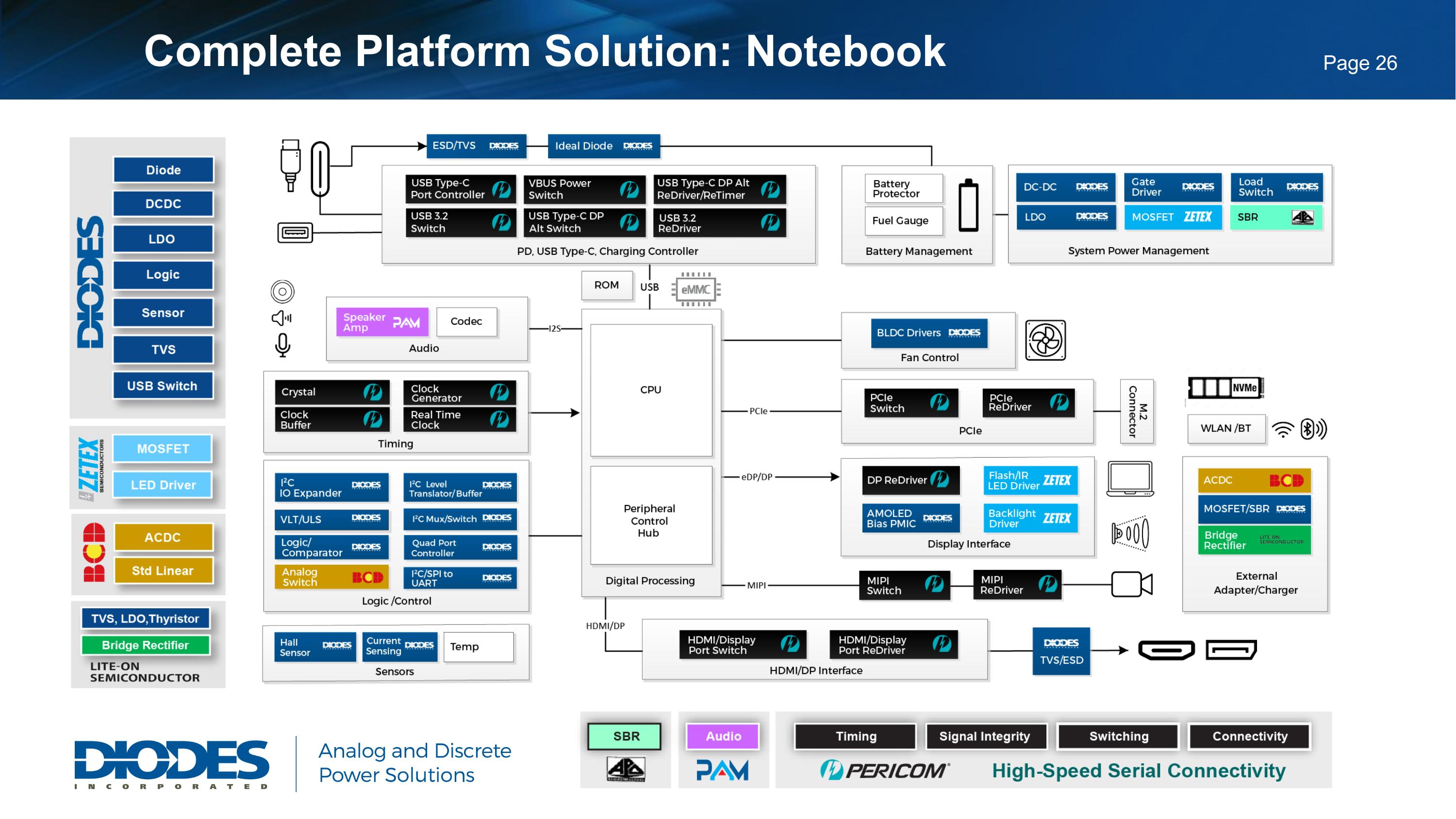

Complete Platform Solution: Notebook

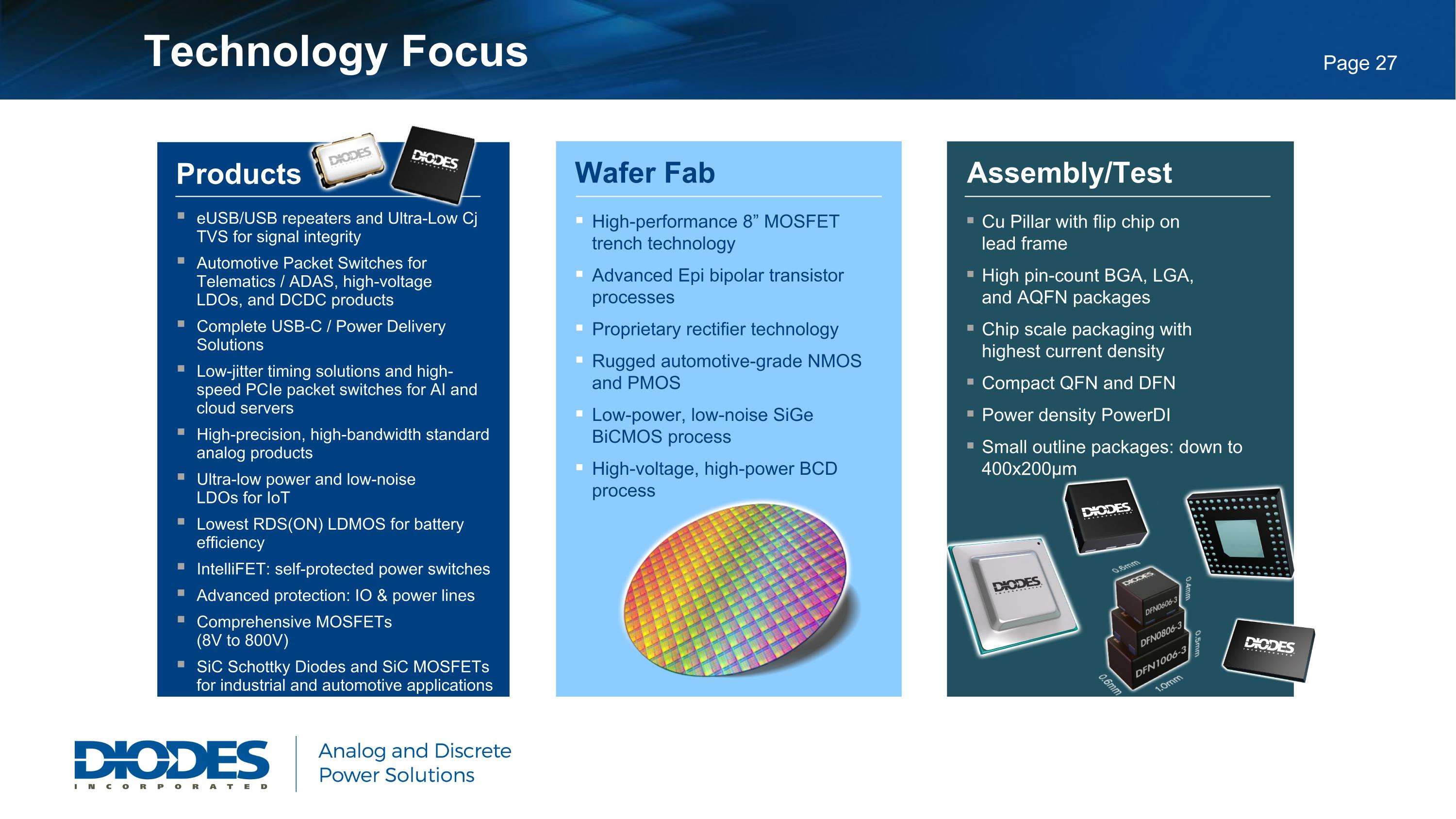

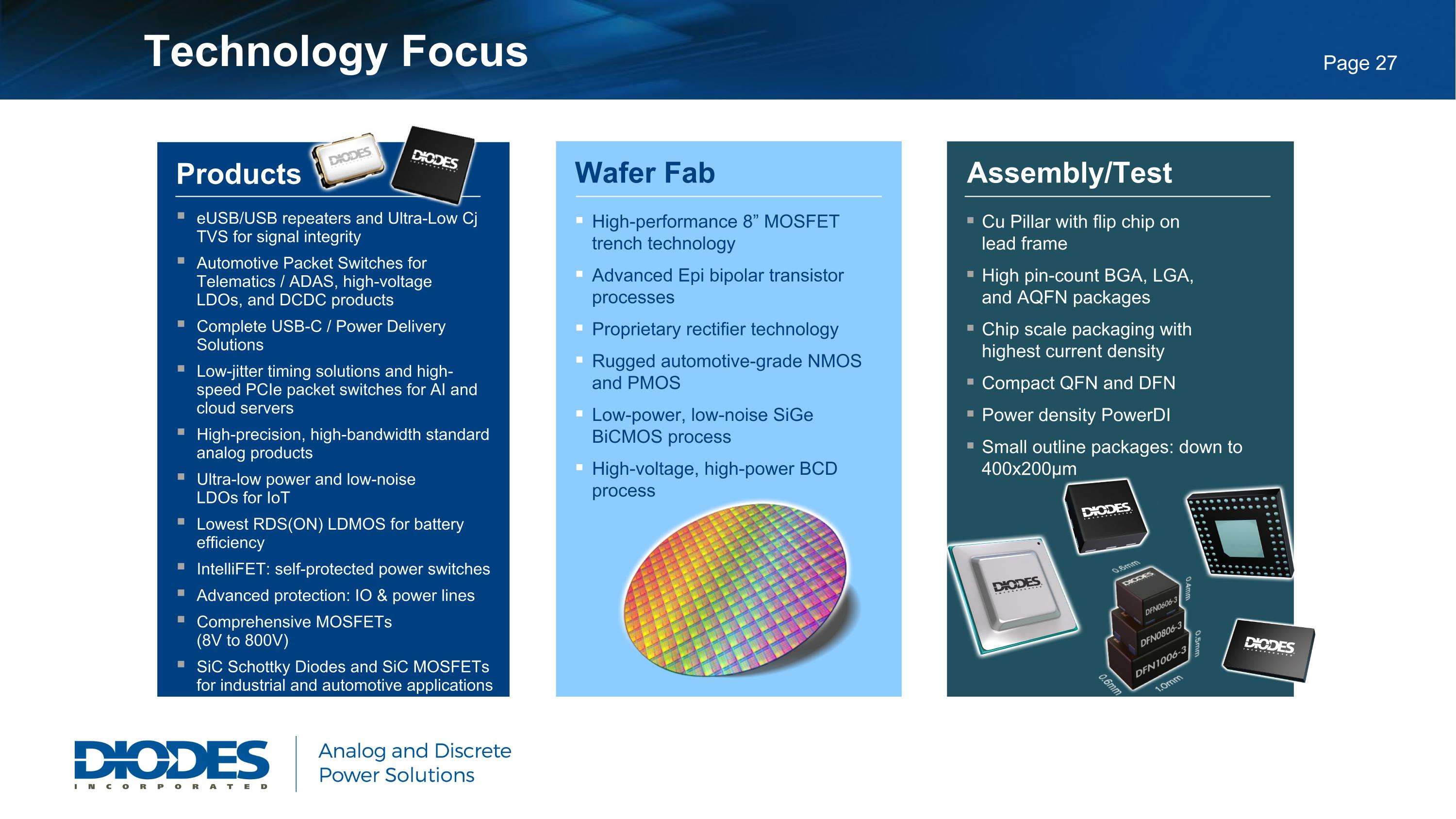

Technology Focus Products eUSB/USB repeaters and Ultra-Low Cj TVS for signal integrity Automotive Packet Switches for Telematics / ADAS, high-voltage LDOs, and DCDC products Complete USB-C / Power Delivery Solutions Low-jitter timing solutions and high- speed PCIe packet switches for AI and cloud servers High-precision, high-bandwidth standard analog products Ultra-low power and low-noise LDOs for IoT Lowest RDS(ON) LDMOS for battery efficiency IntelliFET: self-protected power switches Advanced protection: IO & power lines Comprehensive MOSFETs (8V to 800V) SiC Schottky Diodes and SiC MOSFETs for industrial and automotive applications Cu Pillar with flip chip on lead frame High pin-count BGA, LGA, and AQFN packages Chip scale packaging with highest current density Compact QFN and DFN Power density PowerDI Small outline packages: down to 400x200μm High-performance 8” MOSFET trench technology Advanced Epi bipolar transistor processes Proprietary rectifier technology Rugged automotive-grade NMOS and PMOS Low-power, low-noise SiGe BiCMOS process High-voltage, high-power BCD process Assembly/Test Wafer Fab

Efficient Manufacturing + Superior Processes Assembly and Test China: Shanghai, Chengdu, and Wuxi Taiwan: Chongli Germany: Neuhaus US: South Portland, Maine China: Shanghai and Wuxi Taiwan: Hsinchu UK: Greenock and Oldham Bipolar, BiCMOS, CMOS, and BCD process Global footprint with strong engineering capabilities Wafer Fabs

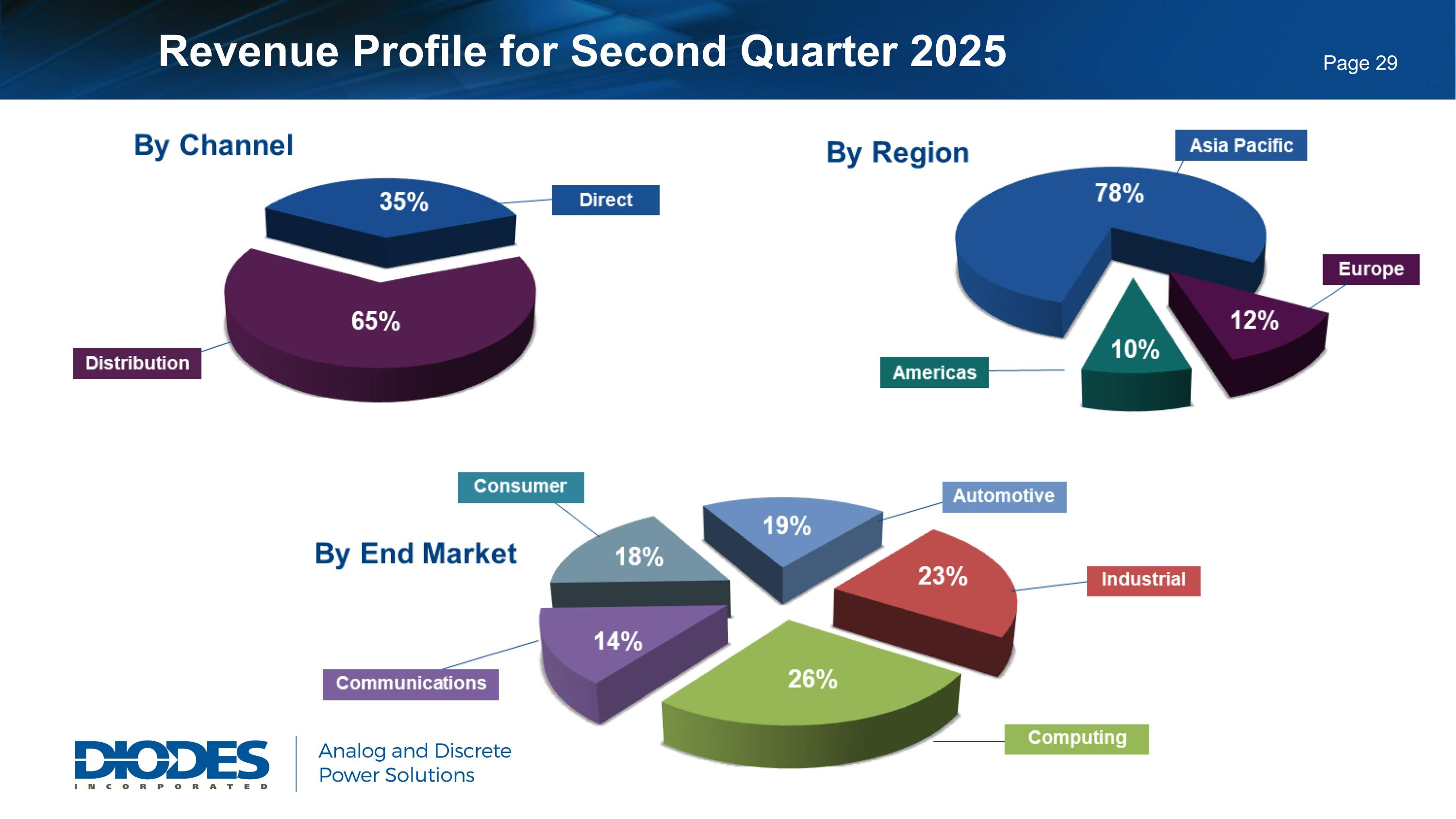

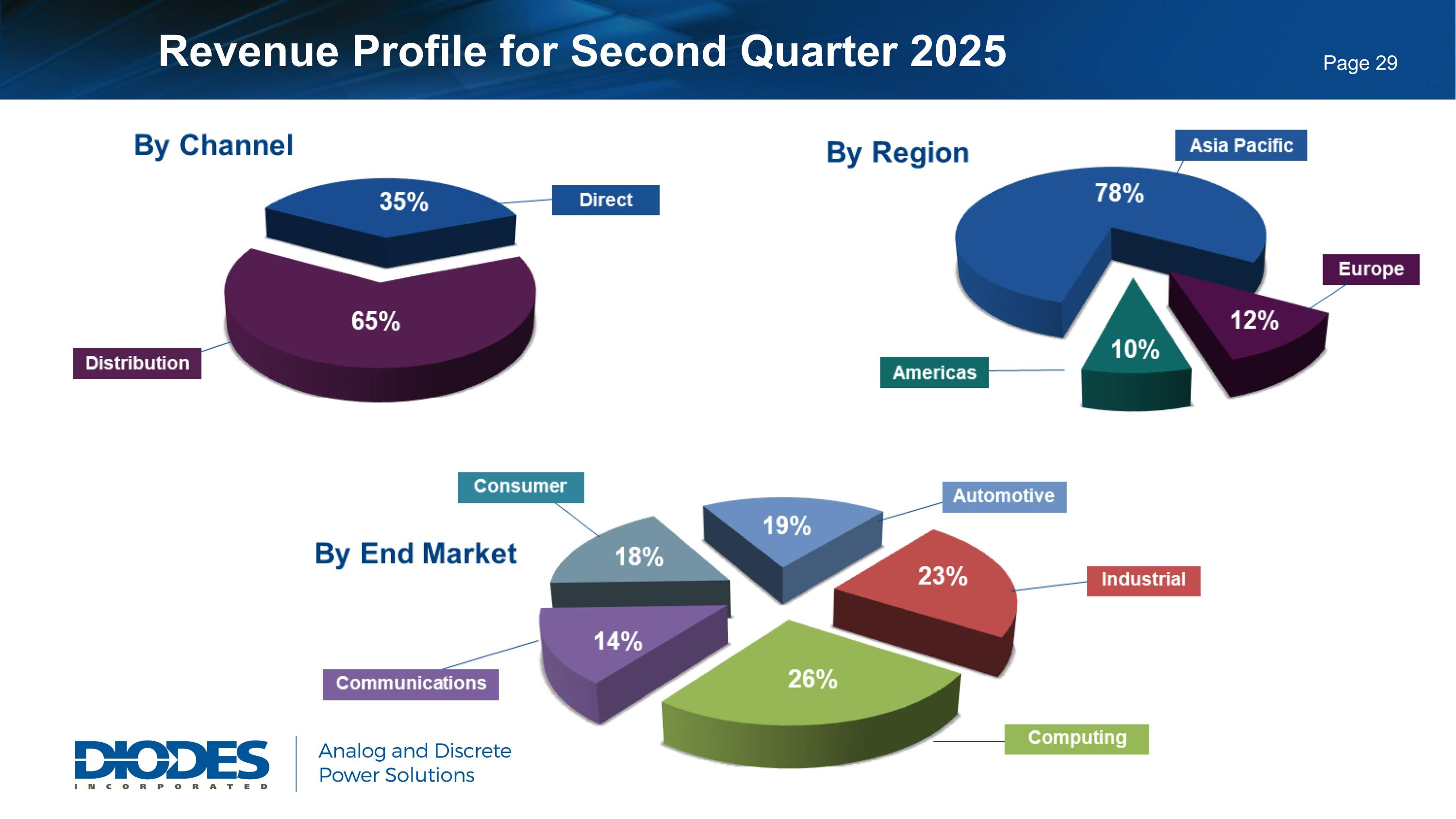

Revenue Profile for Second Quarter 2025

Income Statement – Second Quarter 2025 ($ in millions, except EPS) 2Q24 1Q25 2Q25 Net sales 319.8 332.1 366.2 Gross profit (GAAP) 107.4 104.7 115.3 Gross profit margin % (GAAP) 33.6% 31.5% 31.5% Net income (GAAP) 8.0 (4.4) 46.1 Net income (non-GAAP) 15.4 8.8 15.0 Diluted EPS (non-GAAP) 0.33 0.19 0.32 Cash flow from operations 14.4 56.7 41.5 EBITDA (non-GAAP) 41.1 26.2 84.5

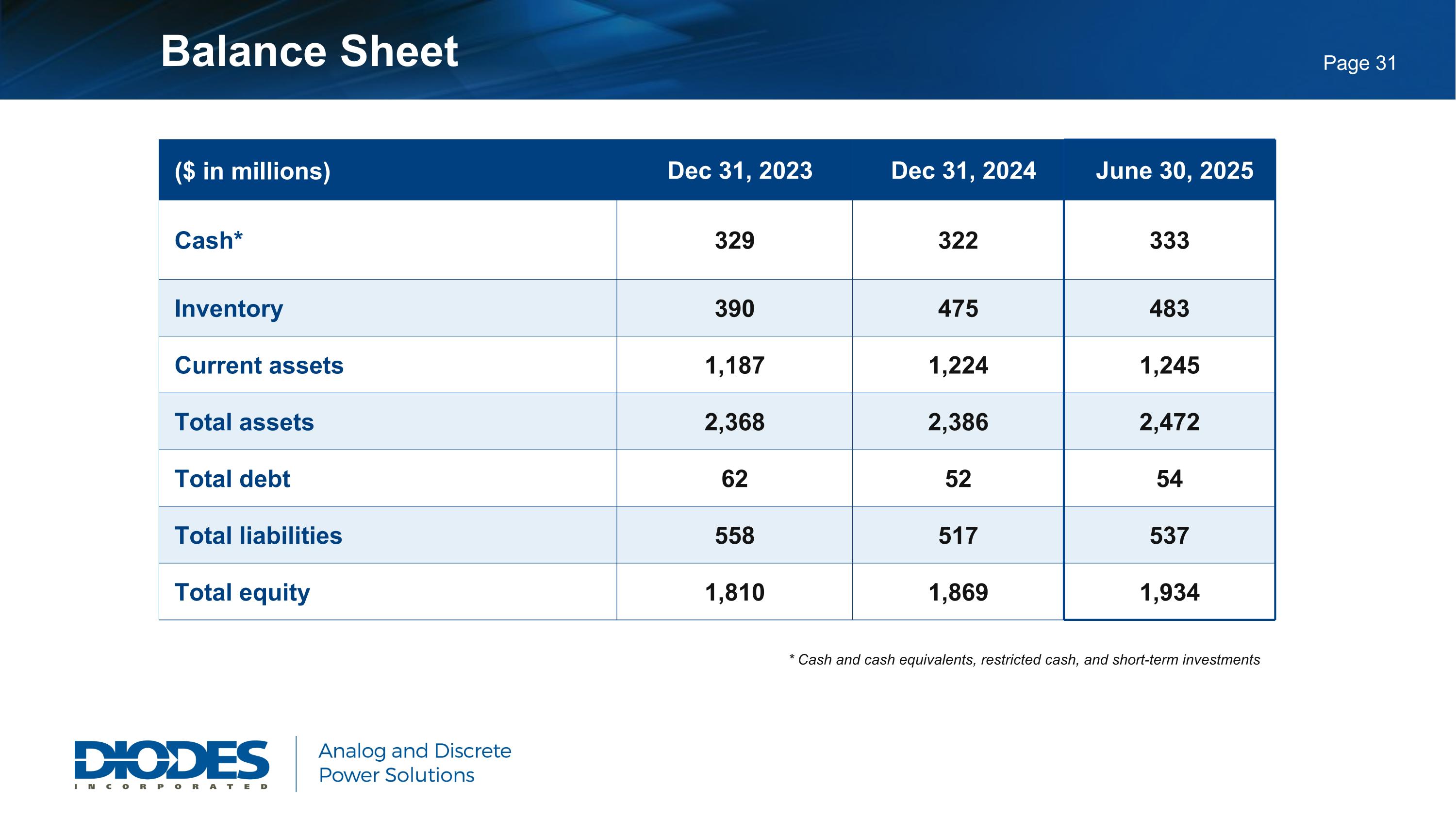

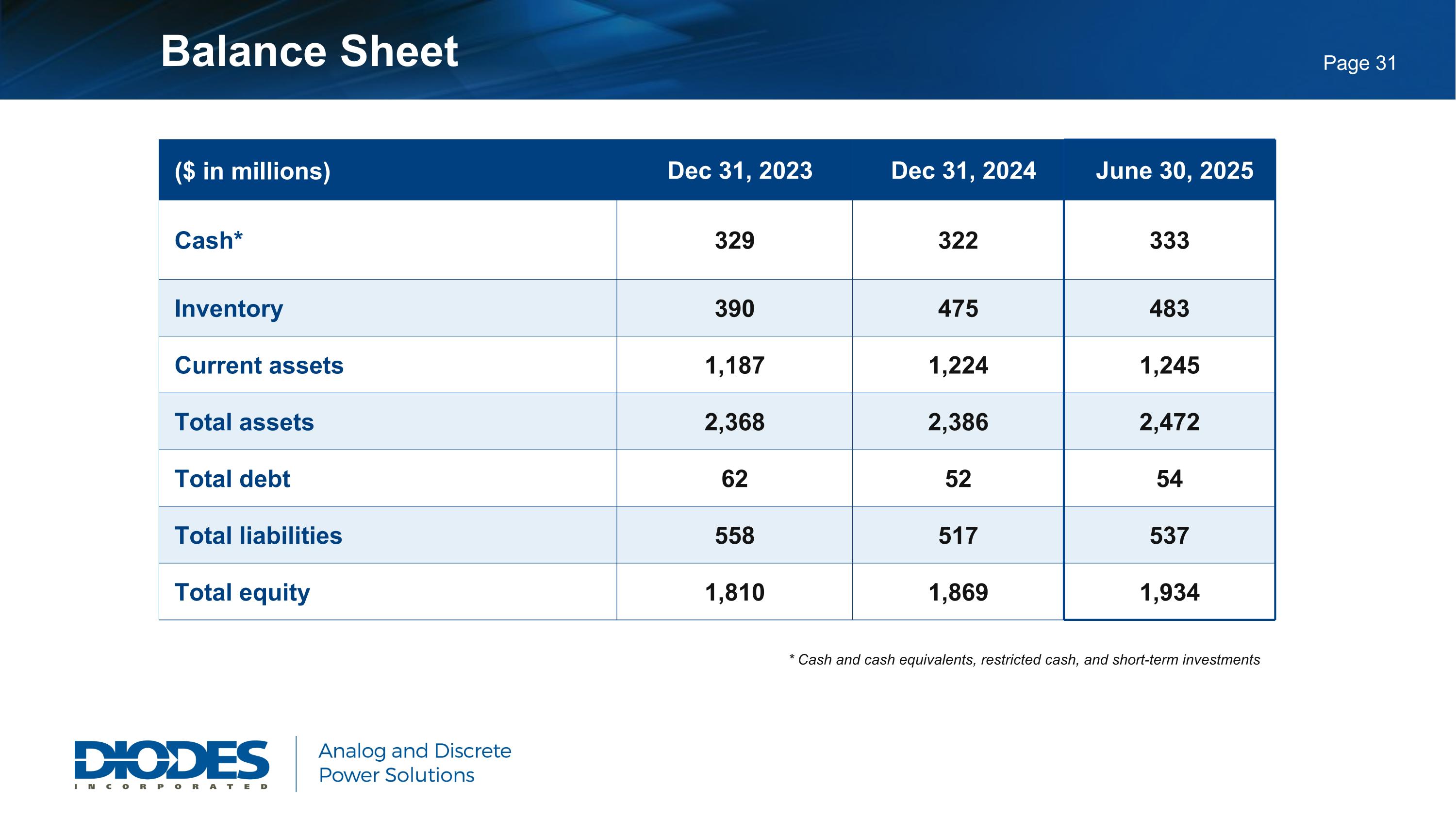

Balance Sheet ($ in millions) Dec 31, 2023 Dec 31, 2024 June 30, 2025 Cash* 329 322 333 Inventory 390 475 483 Current assets 1,187 1,224 1,245 Total assets 2,368 2,386 2,472 Total debt 62 52 54 Total liabilities 558 517 537 Total equity 1,810 1,869 1,934 * Cash and cash equivalents, restricted cash, and short-term investments

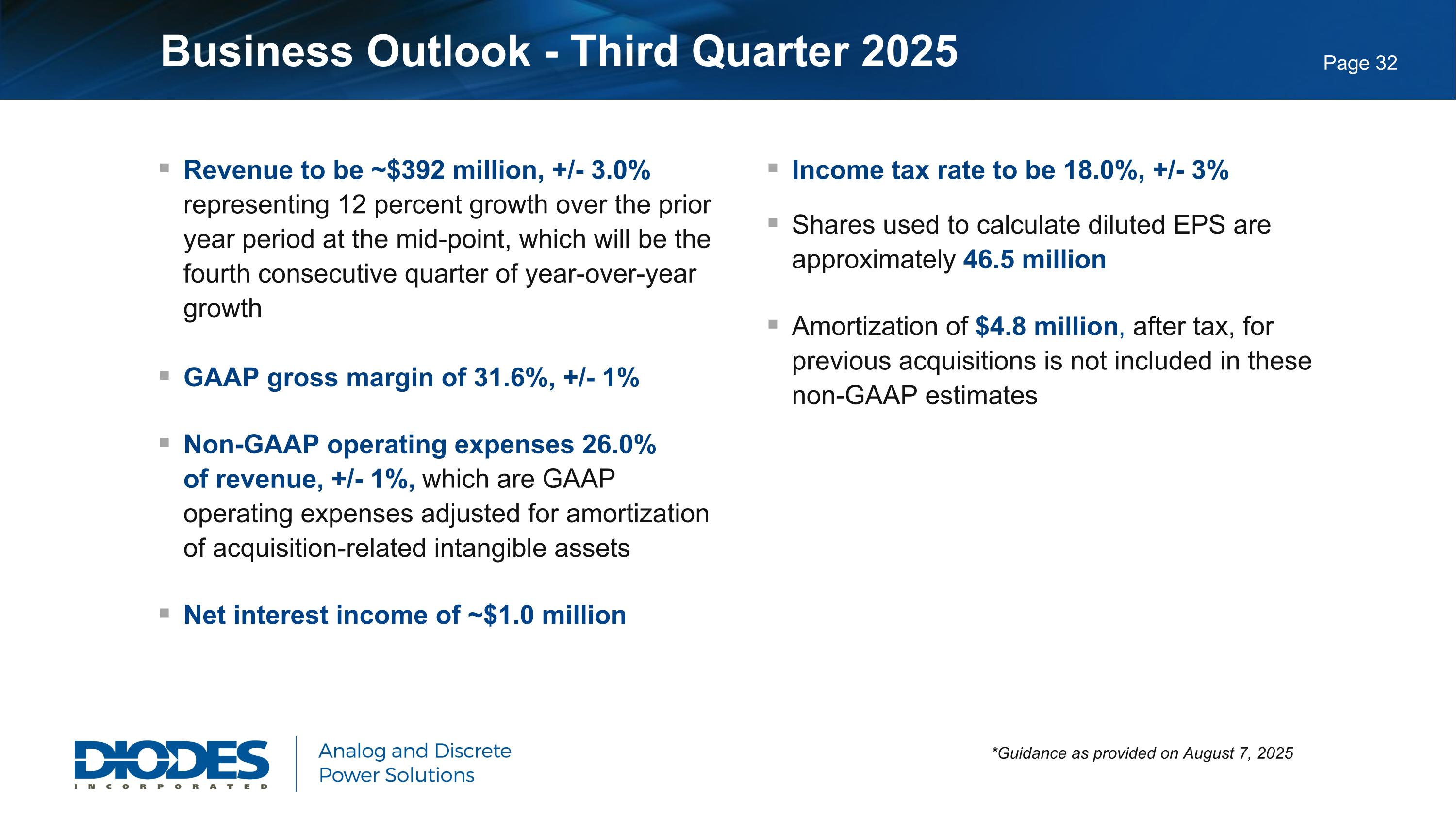

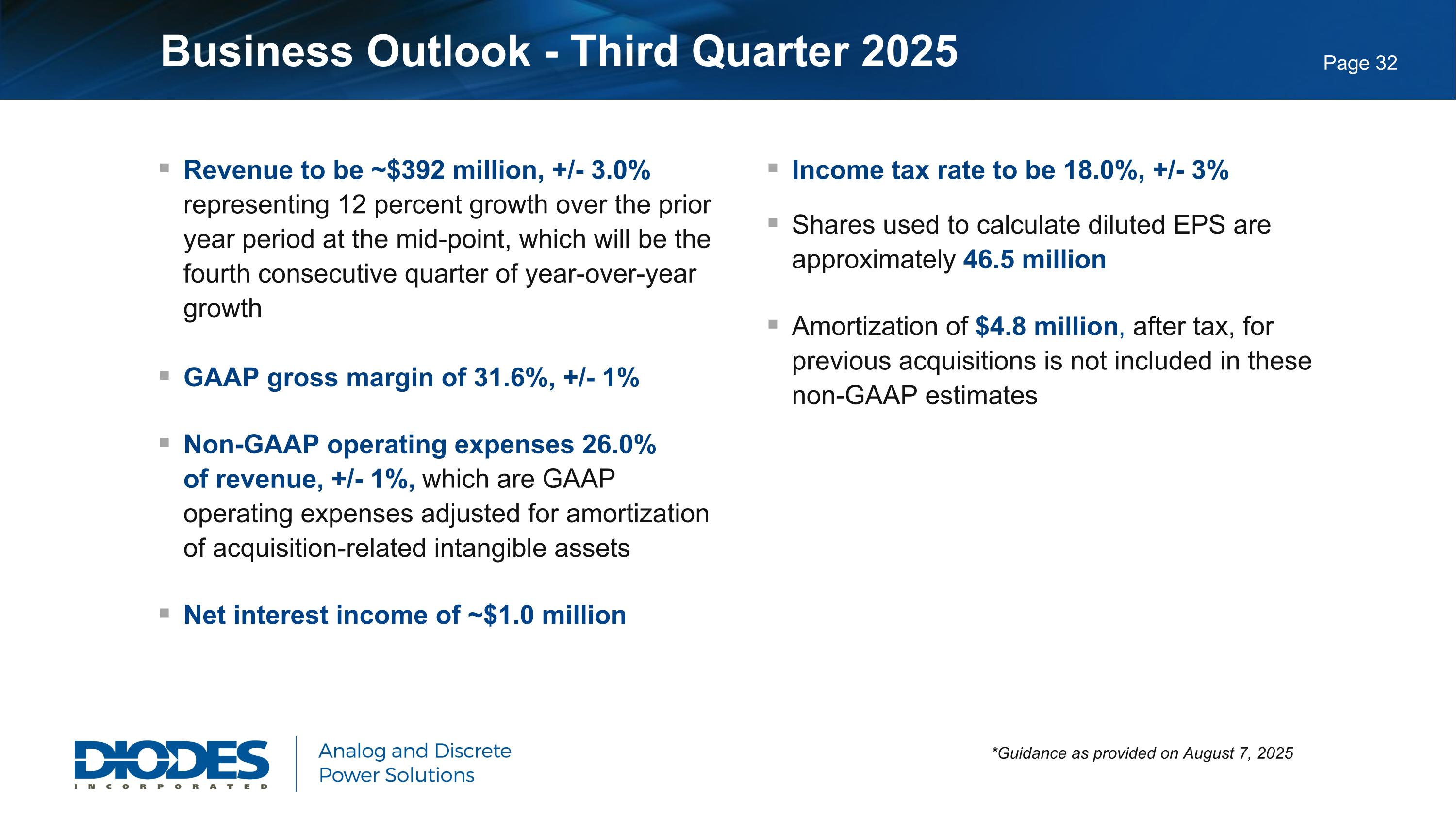

Revenue to be ~$392 million, +/- 3.0% representing 12 percent growth over the prior year period at the mid-point, which will be the fourth consecutive quarter of year-over-year growth GAAP gross margin of 31.6%, +/- 1% Non-GAAP operating expenses 26.0% of revenue, +/- 1%, which are GAAP operating expenses adjusted for amortization of acquisition-related intangible assets Net interest income of ~$1.0 million Income tax rate to be 18.0%, +/- 3% Shares used to calculate diluted EPS are approximately 46.5 million Amortization of $4.8 million, after tax, for previous acquisitions is not included in these non-GAAP estimates *Guidance as provided on August 7, 2025 Business Outlook - Third Quarter 2025

Investment Summary Vision: Expand shareholder value Mission: Profitability growth to drive 20%+ operating profit Next Strategic Goal: $1B gross profit Tactics: Total system solutions sales approach and content expansion driving growth Focus on key accounts Increased focus on high-margin automotive, industrial, analog and discrete power solutions Investment for technology leadership in target products, fab processes, and advanced packaging Accelerate fab process and product qualifications