2025 Second Quarter Earnings Presentation August 5, 2025 Exhibit 99.2

Disclaimer This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking, including statements regarding our financial condition, anticipated financial performance, achieving profitability, business strategy and plans, market opportunity and expansion and objectives of our management for future operations. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “might,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strategy,” “strive”, “target,” “will,” or “would,” the negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many important factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) rapid technological change in our industry; (ii) our ability to secure clients' contract renewals; (iii) our ability to maintain and expand our network of therapists, psychiatrists and other providers; (iv) a decline in the prevalence of enterprise-sponsored healthcare or the emergence of new technologies may adversely impact our DTE (“Direct-to-Enterprise”) business; (v) if our or our vendors’ security measures fail or are breached; (vi) changes in healthcare laws, regulations or trends and our ability to operate in the heavily regulated healthcare industry; and (vii) and the other factors, risks and uncertainties described in under the caption “Risk Factors” in our Annual Report on Form 10-K for the annual period ended December 31, 2024 filed with the Securities and Exchange Commission (“SEC”) on March 12, 2025, subsequent quarterly reports on Form 10-Q and in our other documents filed from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations. Certain information and data contained in this presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources, and you are urged not to give undue weight to such third-party information. While the Company believes its internal research is reliable, such research has not been verified by any independent source. This presentation may contain the measure Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP costs and expenses (including non-GAAP cost of revenue, research and development, sales and marketing, and general and administrative) which are non-GAAP financial measure. For additional information about the measure and a reconciliation to the most closely comparable GAAP measure see the Talkspace Investors Relations website at investors.talkspace.com. 2 2025 SECOND QUARTER EARNINGS PRESENTATION

$6454% $3934% 2Q 2025 Revenue and Adjusted Gross Profit 3 2025 SECOND QUARTER EARNINGS PRESENTATION Revenue1 Composition USD, Millions Adjusted Gross Profit and % Margin2 USD, Millions Revenue is presented on an as-reported basis. Adjusted Gross Profit is defined as Revenue less Cost of revenue, excluding depreciation and amortization. Certain prior year amounts have been reclassified to conform to the current period presentation. These reclassifications had no effect on the reported results of operations. PAYOR DTE CONSUMER

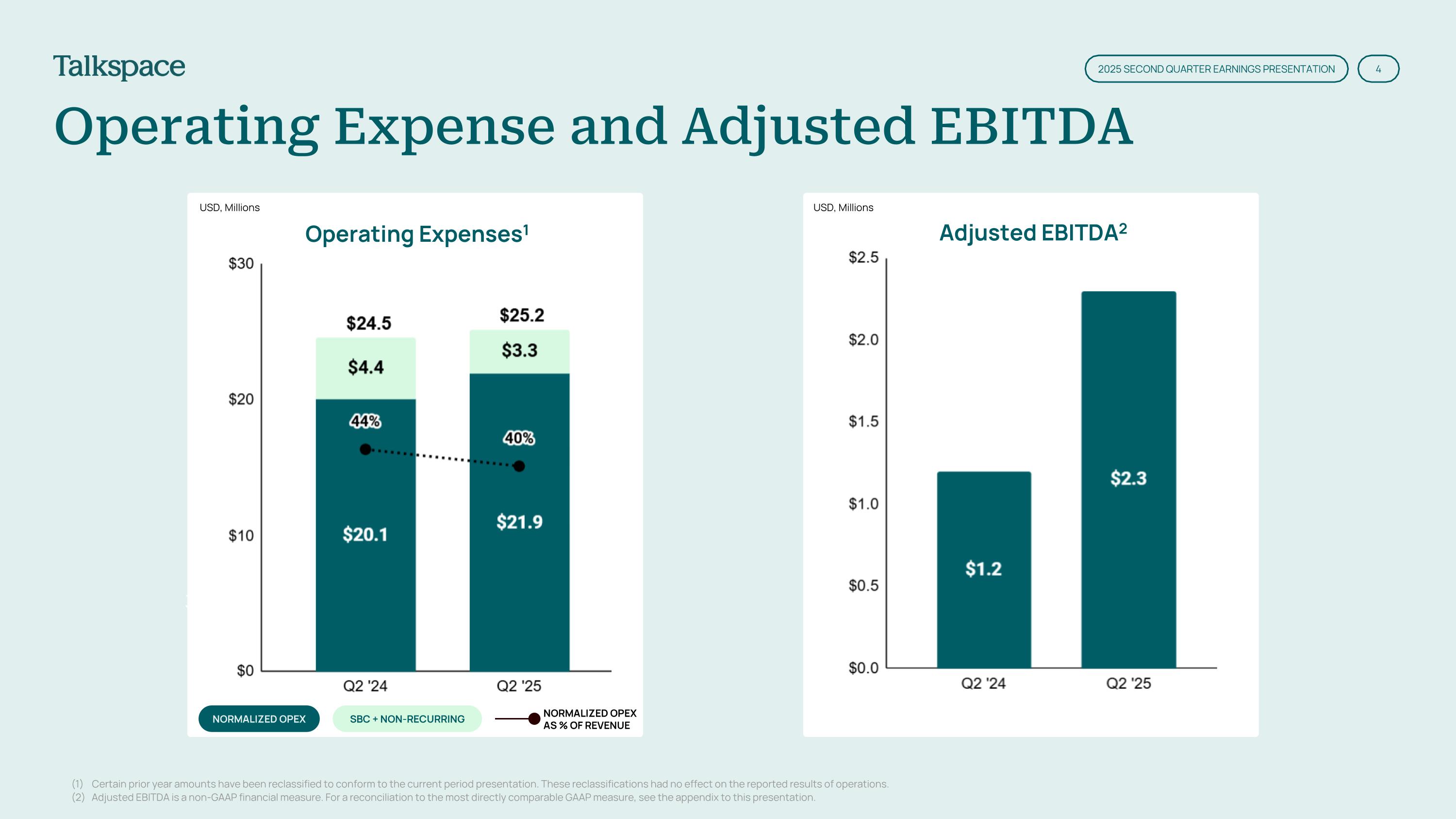

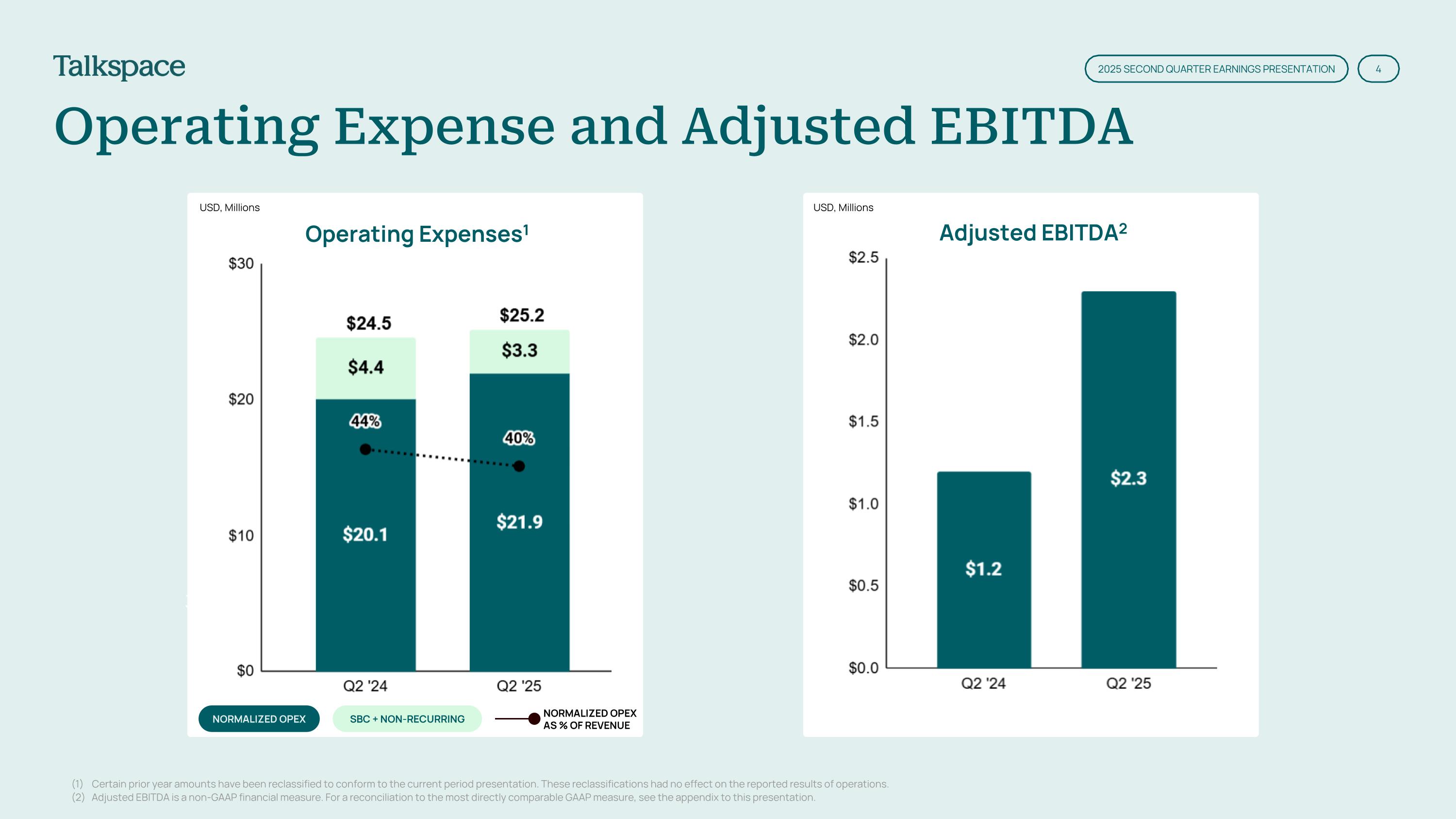

Operating Expenses1 $6454% $3934% Adjusted EBITDA2 Operating Expense and Adjusted EBITDA 4 2025 SECOND QUARTER EARNINGS PRESENTATION (1) Certain prior year amounts have been reclassified to conform to the current period presentation. These reclassifications had no effect on the reported results of operations. (2) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, see the appendix to this presentation. USD, Millions USD, Millions NORMALIZED OPEX SBC + NON-RECURRING NORMALIZED OPEX AS % OF REVENUE

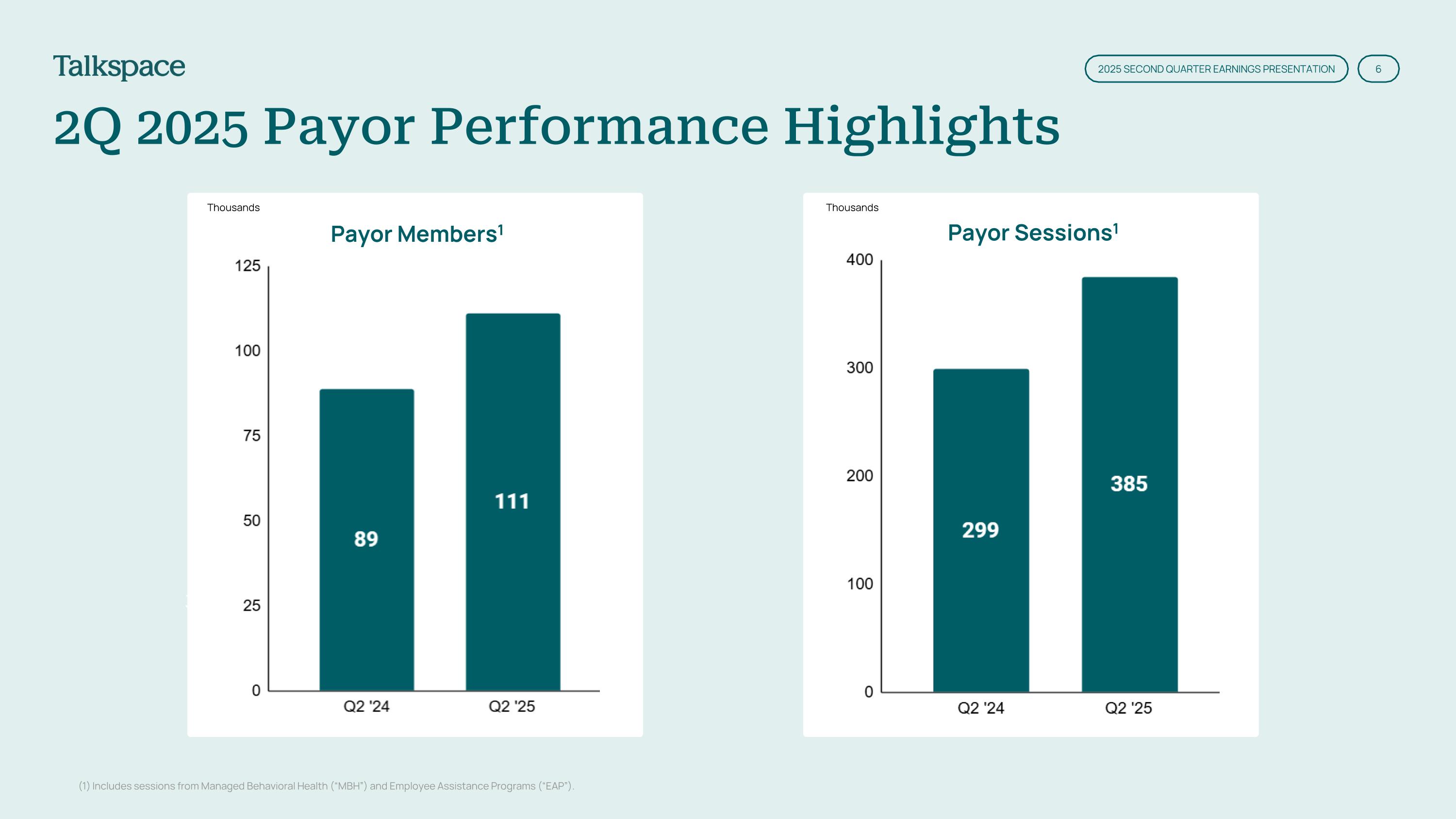

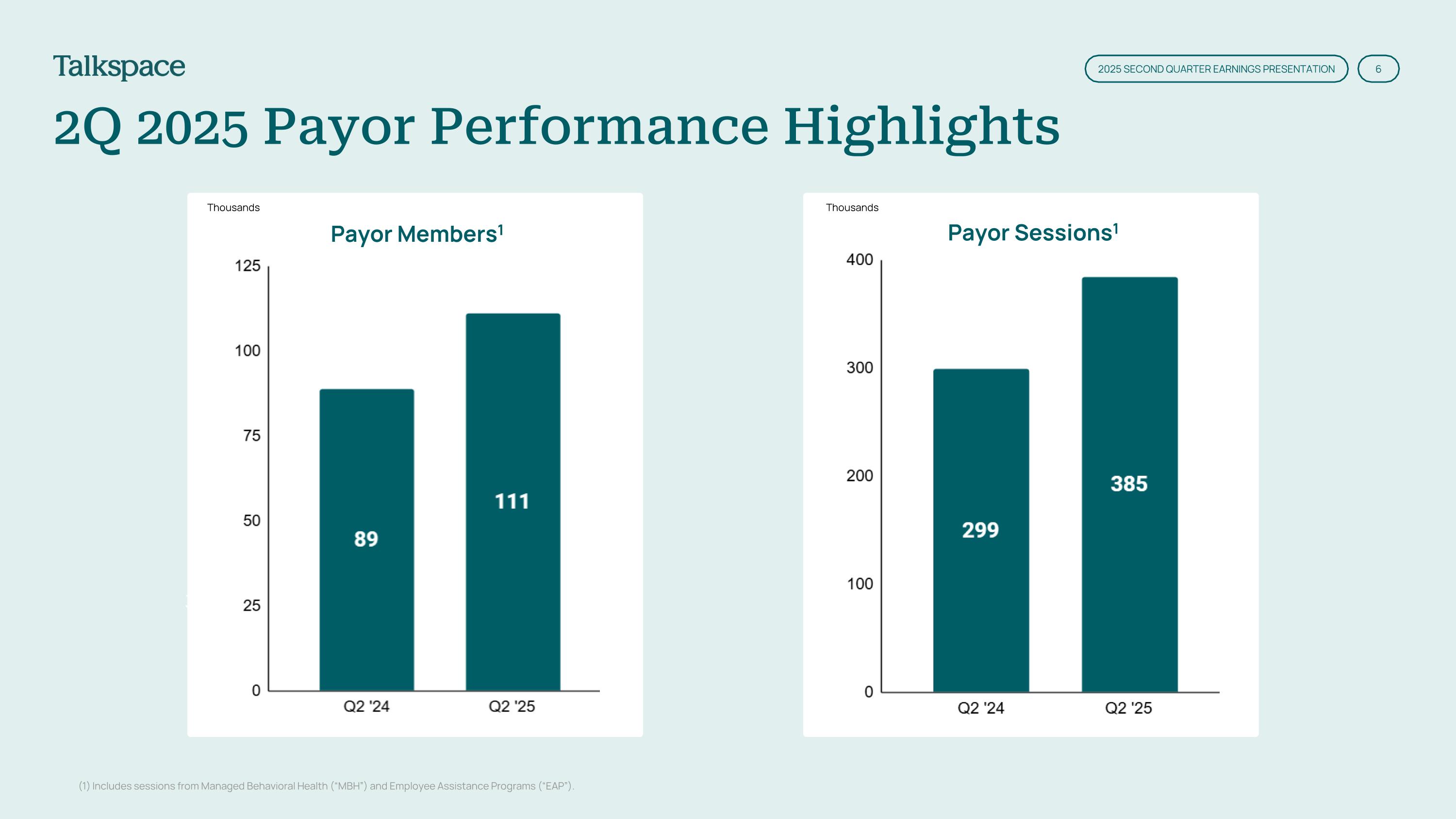

5 Building Momentum with Users & Expanding our Reach +25% growth in Unique Active Payor Members, +29% growth in Payor sessions YoY Successful member journey improvements drove more sessions Broadened reach through launch with large BCBS plan Targeted approach to engaging military communities proved successful and cost-effective Strong DTE renewals and solid pipeline conversion expected in 2H’25 Delivering scalability, sustainability, and profitability +35% YoY increase in Payor Revenue and continued adjusted EBITDA growth, up nearly 100% YoY Continued decline in operating expenses as a percentage of total revenue, demonstrating the scalability inherent in the model Strong balance sheet with $0 debt and ~$103M in cash and equivalents (incl. Available For Sale Securities) for growth investments ~$1.4m of shares repurchased under the Company’s buyback plan Strengthening Partnerships & Driving Brand Awareness Deepened Amazon relationship by launching Amazon Pharmacy Integration Expanded in women’s health through a new partnership with Tia Health, in addition to existing partnerships with Ovia Health and others Recently onboarded several additional partners who will integrate Talkspace into their ecosystem such as Genomind, Bark, and Hinge Innovating through Meaningful Investments in Technology Talkcast AI personalized podcast drives users to complete more sessions Partnering with AWS Generative AI Innovation Center to develop a foundational Safety and Quality Model Enhanced our suicide detection technology and expanded into other areas - substance misuse, and abuse or neglect Made progress on our foundational LLM, purpose built for behavioral health and trained on our massive dataset from our 10+ years of experience 2Q 2025 Business Highlights 2025 SECOND QUARTER EARNINGS PRESENTATION (1) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, see the appendix to this presentation.

Payor Members1 $6454% $3934% Payor Sessions1 2Q 2025 Payor Performance Highlights 6 Includes sessions from Managed Behavioral Health (“MBH”) and Employee Assistance Programs (“EAP”). 2025 SECOND QUARTER EARNINGS PRESENTATION Thousands Thousands

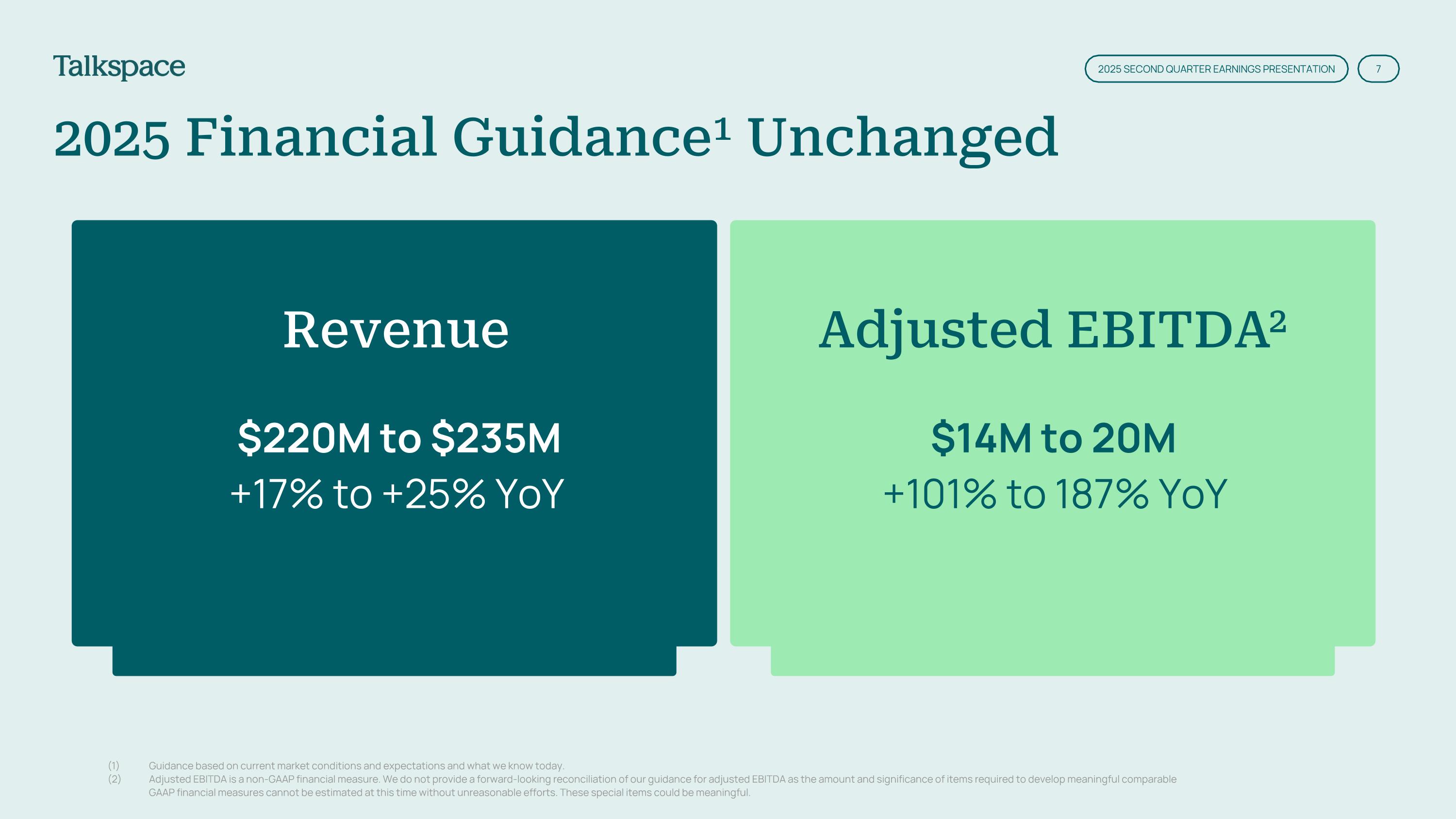

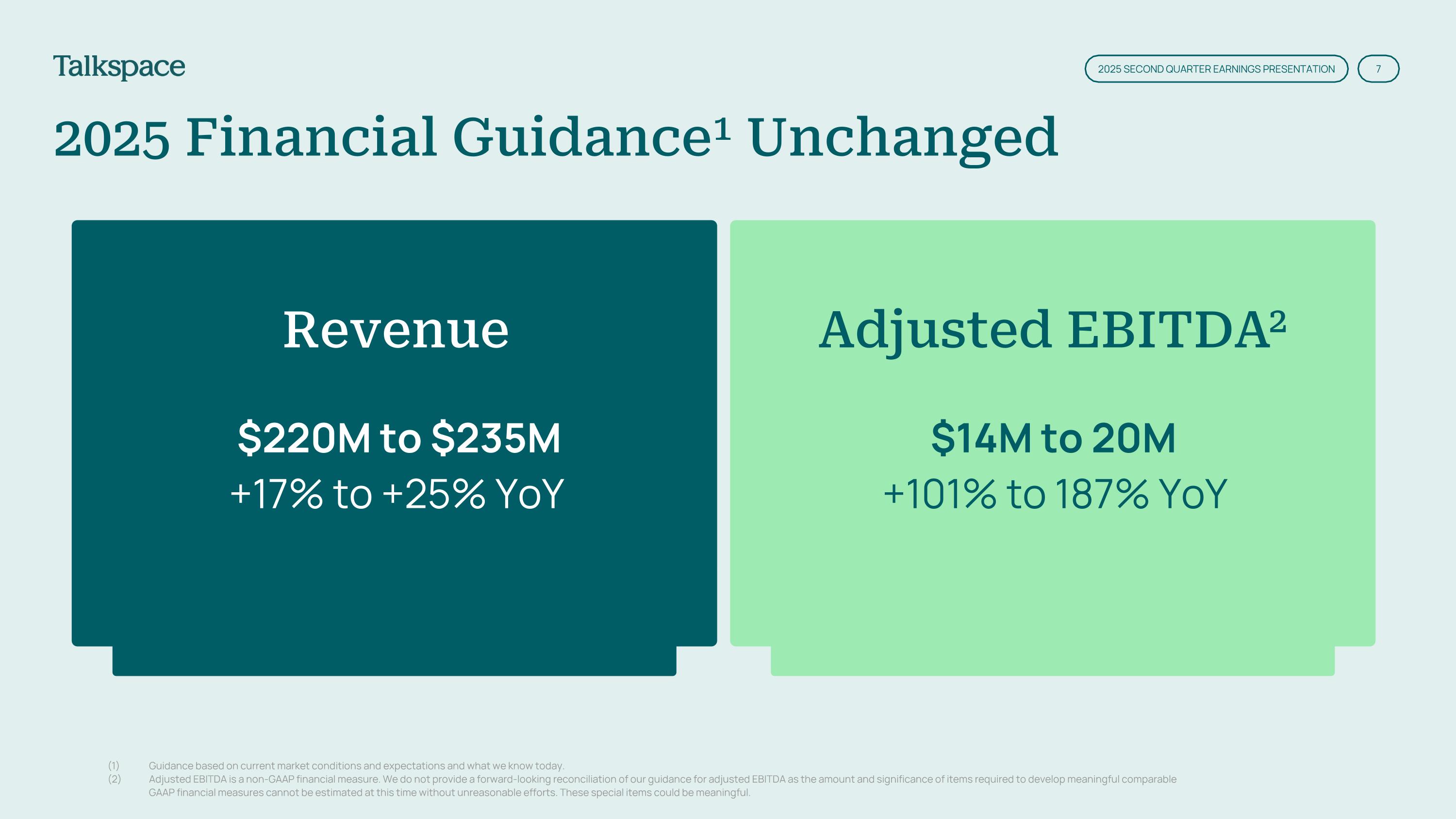

2025 Financial Guidance1 Unchanged 7 Guidance based on current market conditions and expectations and what we know today. Adjusted EBITDA is a non-GAAP financial measure. We do not provide a forward-looking reconciliation of our guidance for adjusted EBITDA as the amount and significance of items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special items could be meaningful. Reduce stress, build resilience, and increase self-understanding with self-guided courses, online classes, reflections and journal prompts Building mental fitness Revenue $220M to $235M +17% to +25% YoY Adjusted EBITDA2 $14M to 20M +101% to 187% YoY 2025 SECOND QUARTER EARNINGS PRESENTATION

Appendix 8

Non-GAAP Financial Measures In addition to our financial results determined in accordance with GAAP, we believe adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance, and our management uses it as a key performance measure to assess our operating performance. Because adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We also use adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measures, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations or outlook. We believe that the use of adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of adjusted EBITDA include (i) adjusted EBITDA does not necessarily reflect capital commitments to be paid in the future and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and adjusted EBITDA does not reflect these requirements. In evaluating adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments described herein. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. Adjusted EBITDA should not be considered as an alternative to income (loss) before income taxes, net income (loss), income (loss) per share, or any other performance measures derived in accordance with U.S. GAAP. When evaluating our performance, you should consider adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. A reconciliation is provided below for adjusted EBITDA to net loss, the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review our financial statements prepared in accordance with GAAP and the reconciliation of our non-GAAP financial measure to its most directly comparable GAAP financial measure, and not to rely on any single financial measure to evaluate our business. We do not provide a forward-looking reconciliation of adjusted EBITDA guidance as the amount and significance of the reconciling items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These reconciling items could be meaningful. 9 2025 SECOND QUARTER EARNINGS PRESENTATION

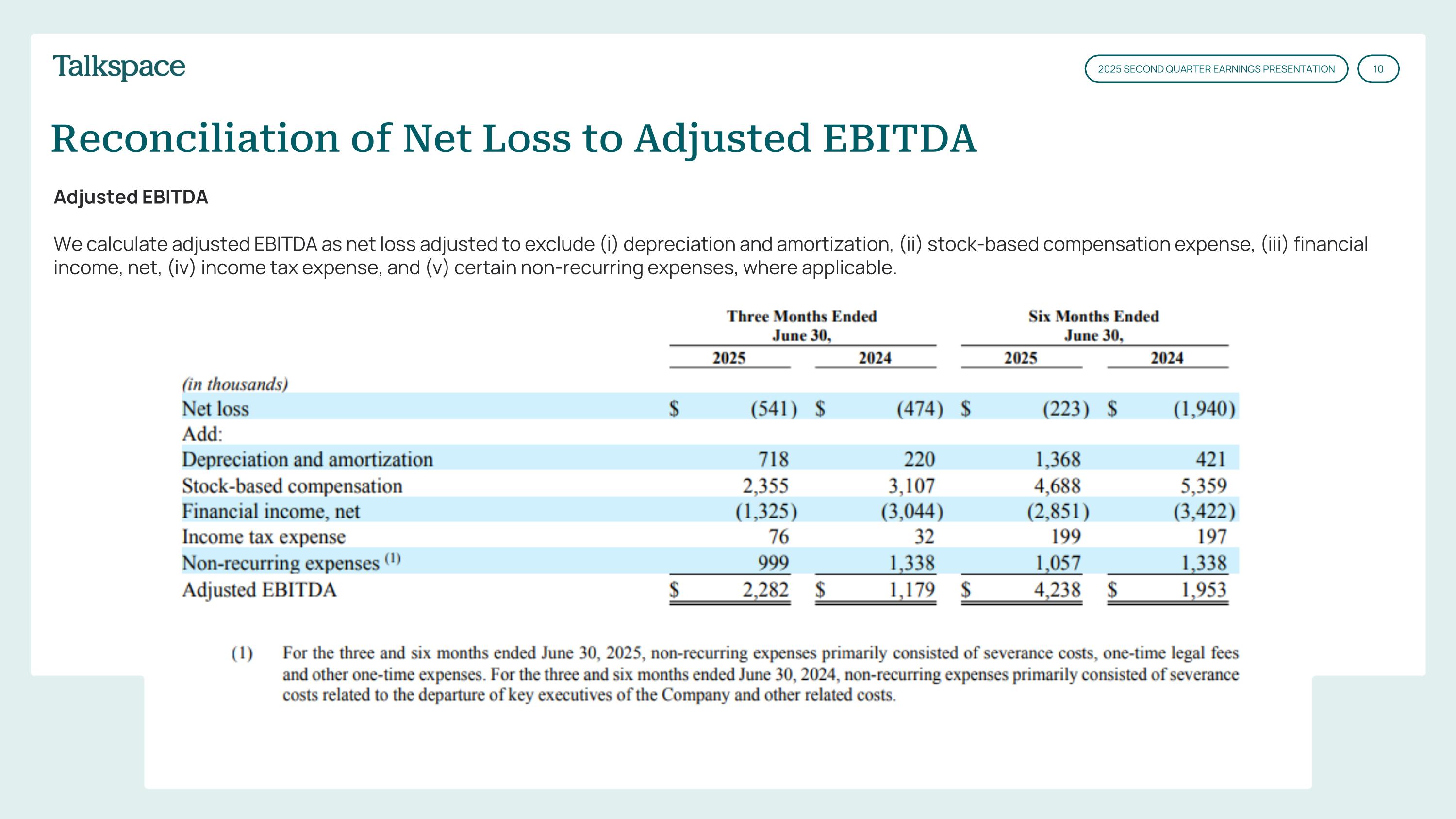

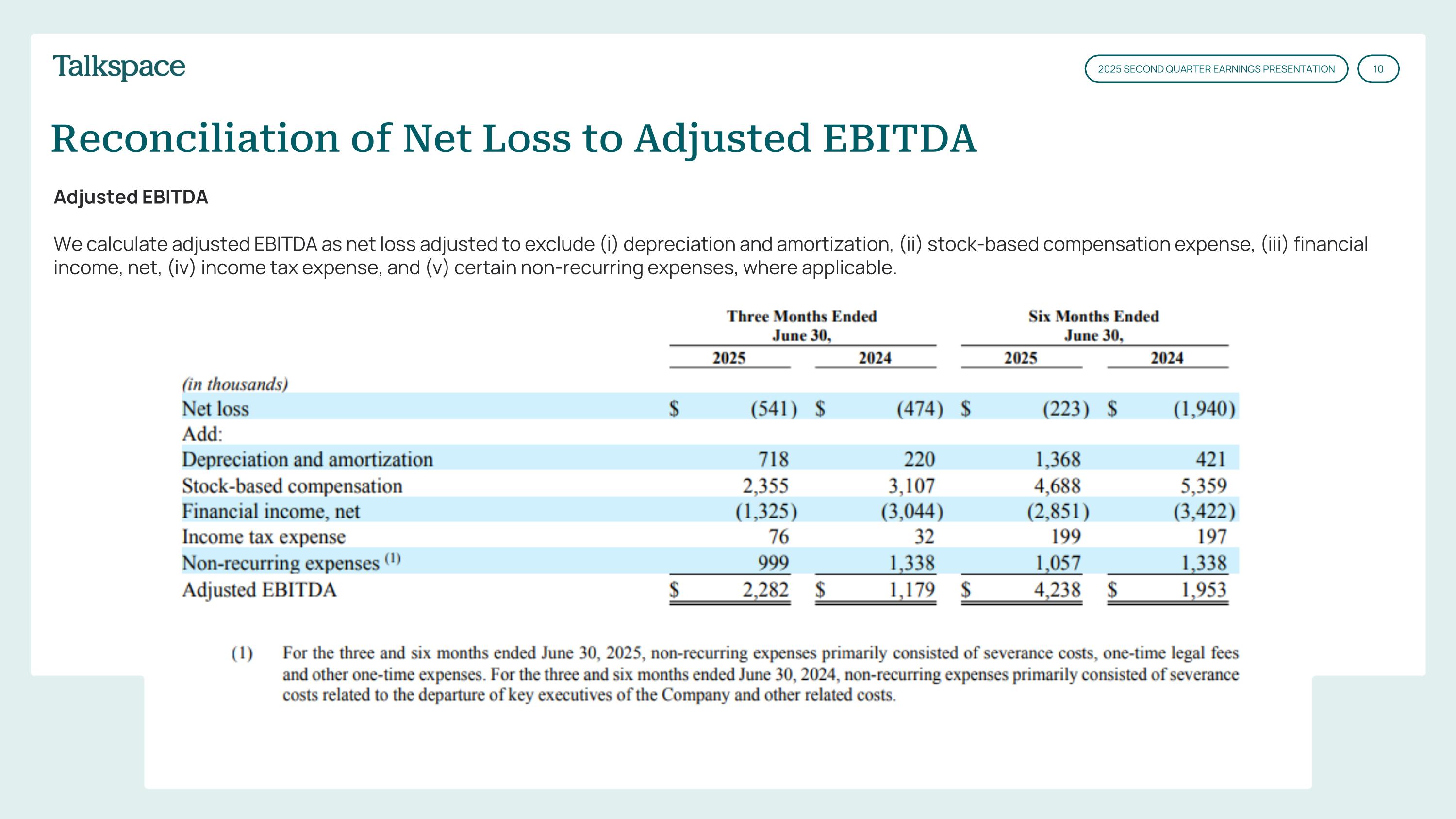

Reconciliation of Net Loss to Adjusted EBITDA Adjusted EBITDA We calculate adjusted EBITDA as net loss adjusted to exclude (i) depreciation and amortization, (ii) stock-based compensation expense, (iii) financial income, net, (iv) income tax expense, and (v) certain non-recurring expenses, where applicable. 10 2025 SECOND QUARTER EARNINGS PRESENTATION