EX-99.1

Wallbox Announces Second Quarter 2025 Financial Results

BARCELONA, SPAIN - July 31, 2025 - Wallbox N.V. (NYSE:WBX), a leading provider of electric vehicle (“EV”) charging and energy management solutions worldwide, today announced its financial results for the second quarter ended June 30, 2025 and provided a business update.

Second Quarter 2025 Highlights and Business Update:

●

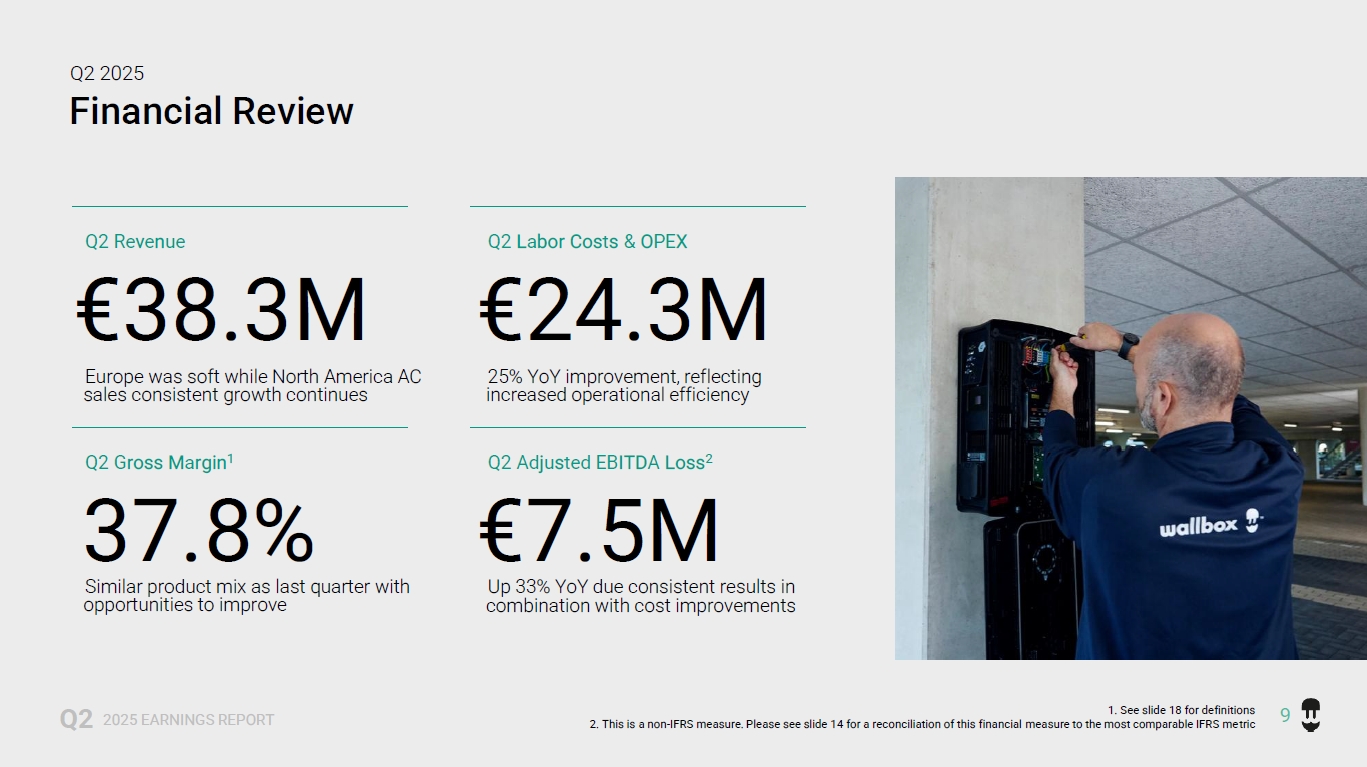

Generated revenue of €38.3 million in the quarter within the guidance provided

●

Gross Margin1 of 37.8% in the quarter

●

Adjusted EBITDA was €(7.5) million representing a 33% improvement year-over-year

●

North American AC sales grew 21% quarter over quarter as momentum in the region remains

●

Sold 140 Supernova DC units in the second quarter of 2025 up 33% compared to the first quarter

●

Labor costs and OPEX decreased 25% year over year as efficiency efforts continue to gain results

●

Expanded existing commercial partnerships with PowerGo to deploy our EV charging solutions across hotels in the Netherlands and with Ensol to deliver fast charging infrastructure in the US

●

Announced additional private placements of our Class A ordinary shares to existing investors and the government of Spain through the Spanish Society for Technological Transformation (SETT) for aggregate gross proceeds of approximately $15 million

●

Completed the installation of the first Quasar 2 units in Menifee, California, as part of a collaboration with Kia and the University of California, Irvine

●

Completed a 1-20 reverse stock split with the goal to regain compliance with NYSE listing requirements

Executive Commentary

Enric Asunción, CEO of Wallbox, said, “We delivered solid second quarter results, with revenue, Gross Margin1, and Adjusted EBITDA1 all within our guidance range. While macro conditions remain complex and challenging, we are encouraged by the improvement of the European EV market and our potential to continue to grow in North America. AC product sales improved compared to last quarter with software and services showing the fastest growth. During the quarter, Wallbox achieved a major milestone with the installation of its first Quasar 2 units in California, marking a key step in the commercial deployment of its next-generation bidirectional charging technology. Additionally, we secured approximately $15 million in new funding, which adds financial flexibility as we continue to execute on our strategy.”

Mr. Asunción continued, “As we navigate a dynamic global EV landscape, we remain focused on maintaining operational and cost discipline while investing selectively to capture growth. At the same time, we expect growth in the upcoming quarters resulting from the expanded commercial partnerships and the improving European EV market.

With our comprehensive product portfolio, diversified market presence, and clear strategic roadmap, we’re confident in our ability to achieve Adjusted EBITDA1 breakeven in the nearterm.”

Financial Outlook - Third Quarter 2025

The following reflects the company’s expectations for select key financial metrics for the third quarter 2025.

●

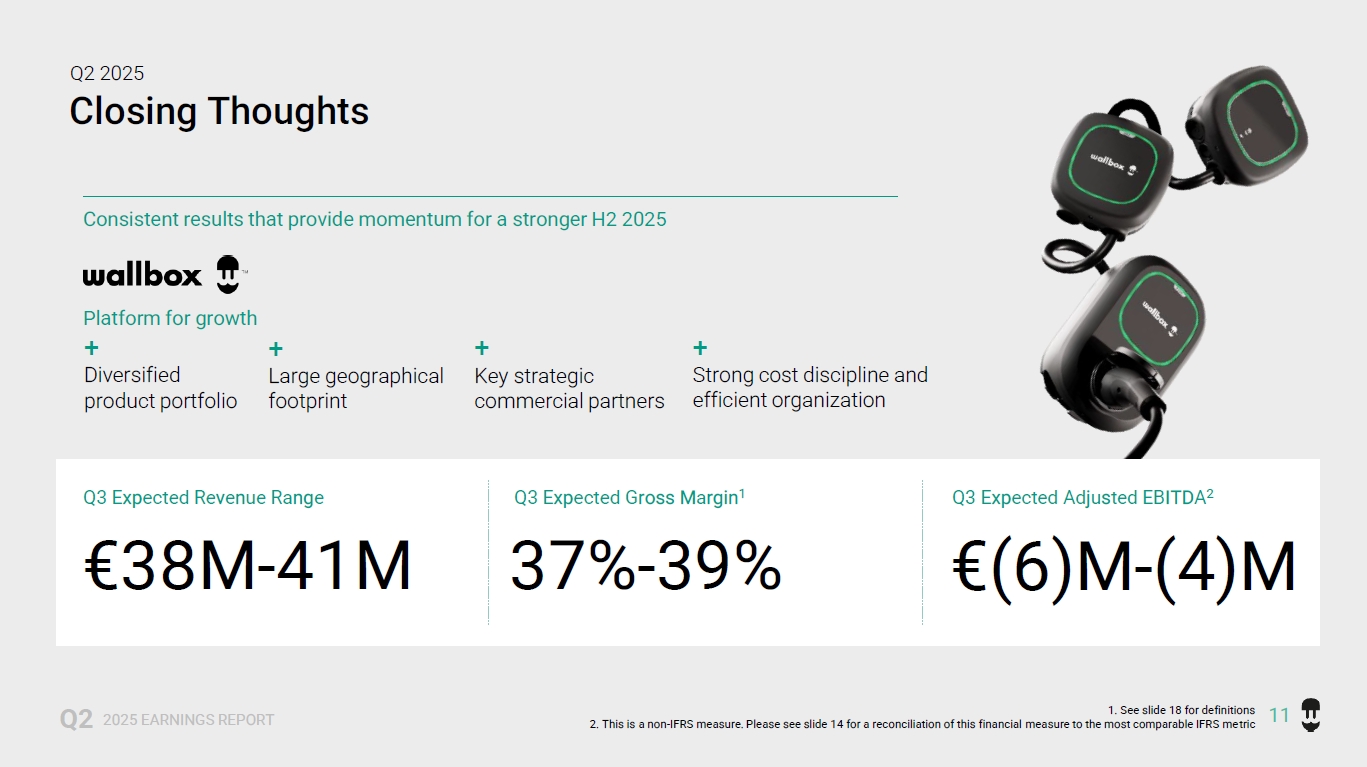

Expects third quarter 2025 revenue to be in the range of €38 million and €41 million

●

Expects Gross Margin1 between 37% and 39%

●

Expects a negative Adjusted EBITDA1 between €(4) million and €(6) million

1 See Non-IFRS Financial Measures section below

Conference Call Information

Wallbox NV will host a conference call to discuss the results and provide a business update at 8:00 AM Eastern Time today, July 31, 2025. The live audio webcast and accompanying presentation will be accessible on Wallbox’s Investor Relations website at https://investors.wallbox.com/. A recording of the webcast will also be available following the conference call.

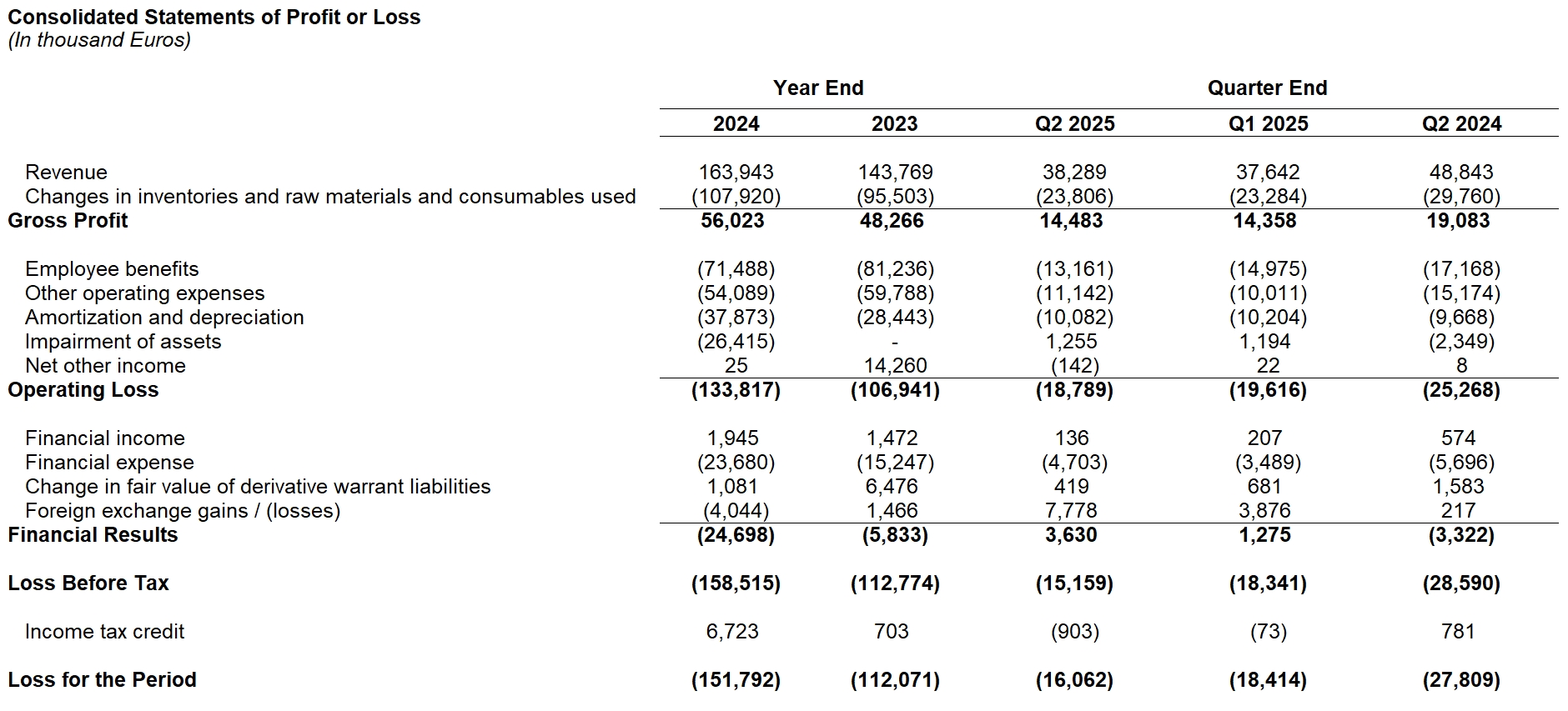

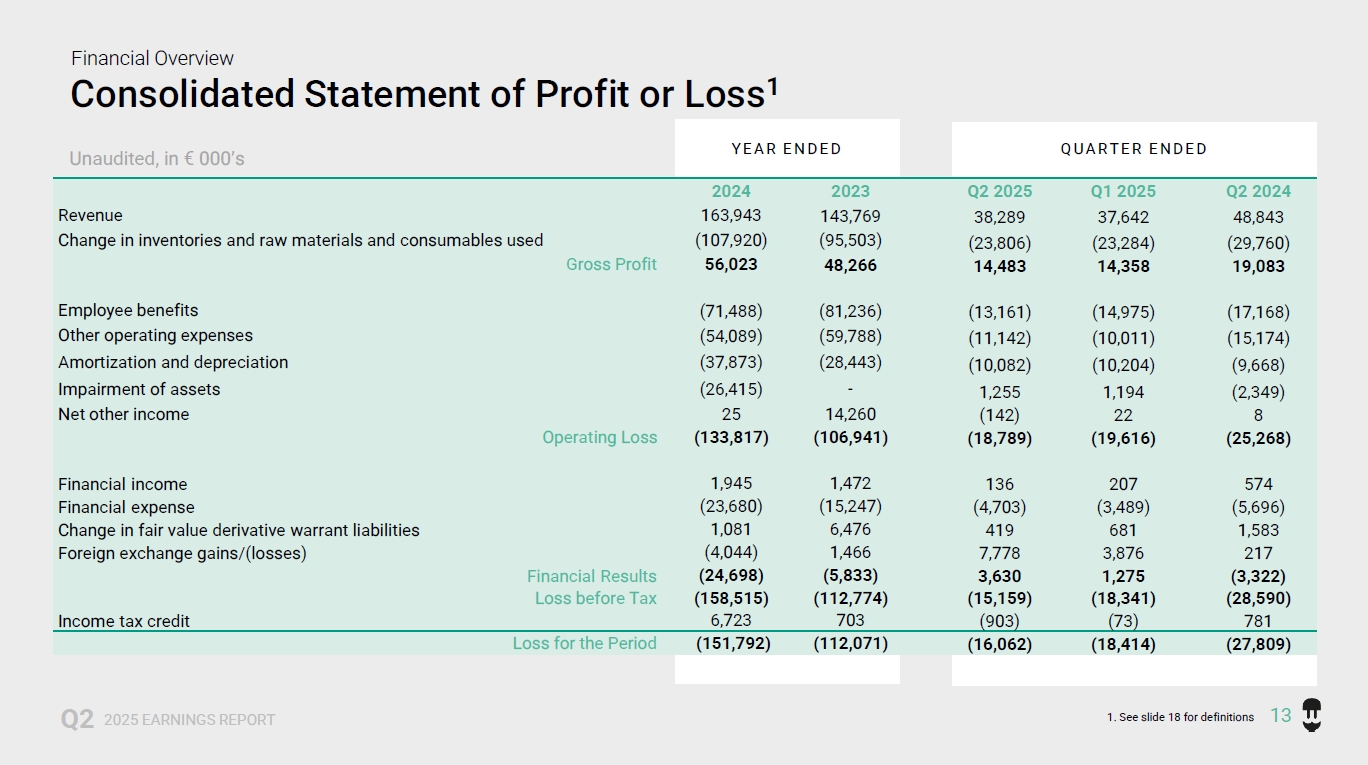

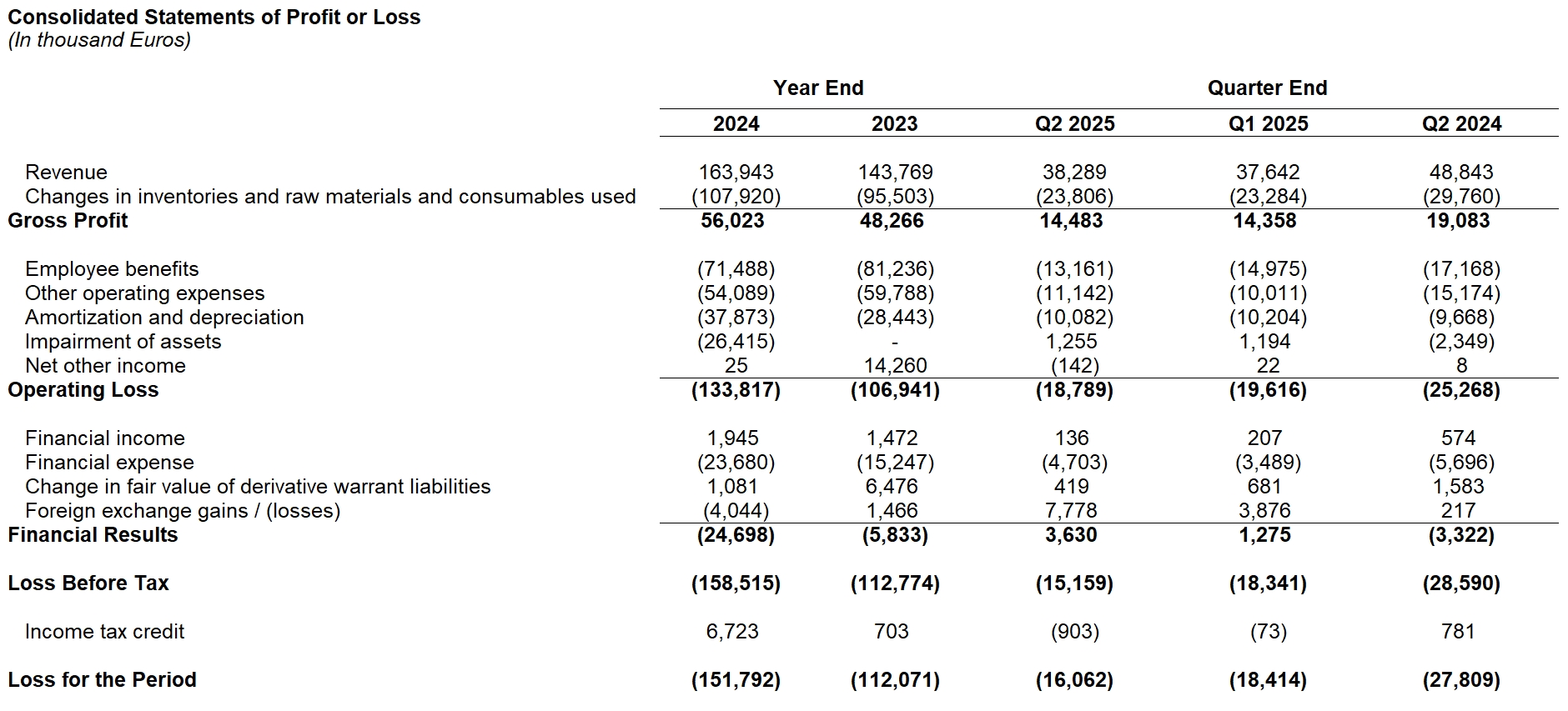

Second Quarter 2025 Unaudited Financial Results

Wallbox N.V.

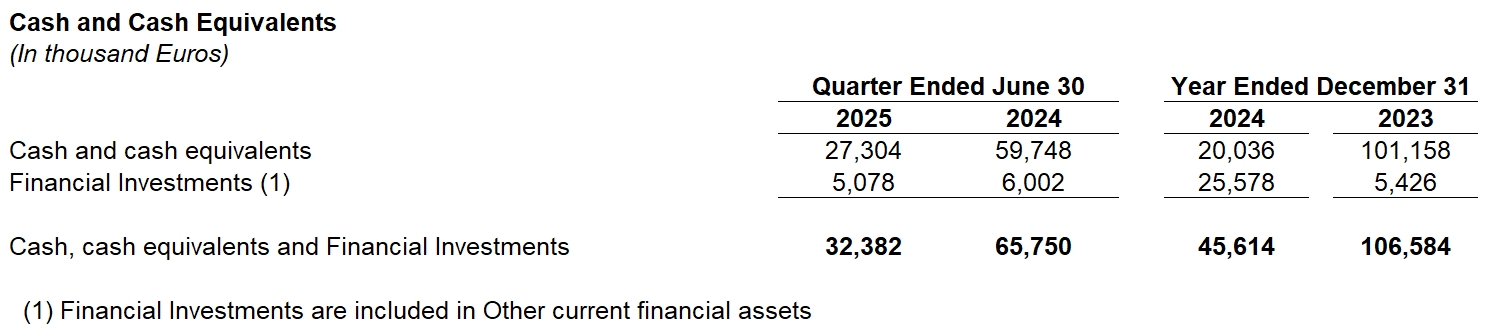

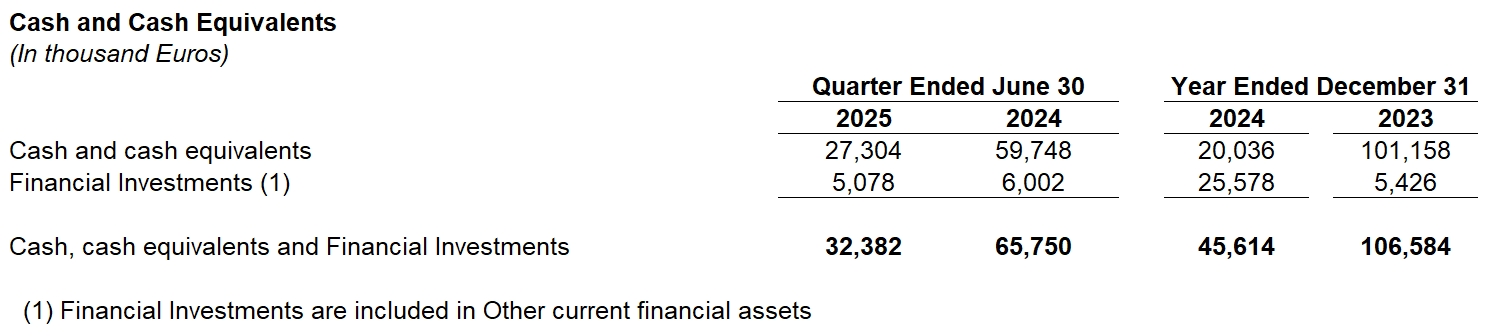

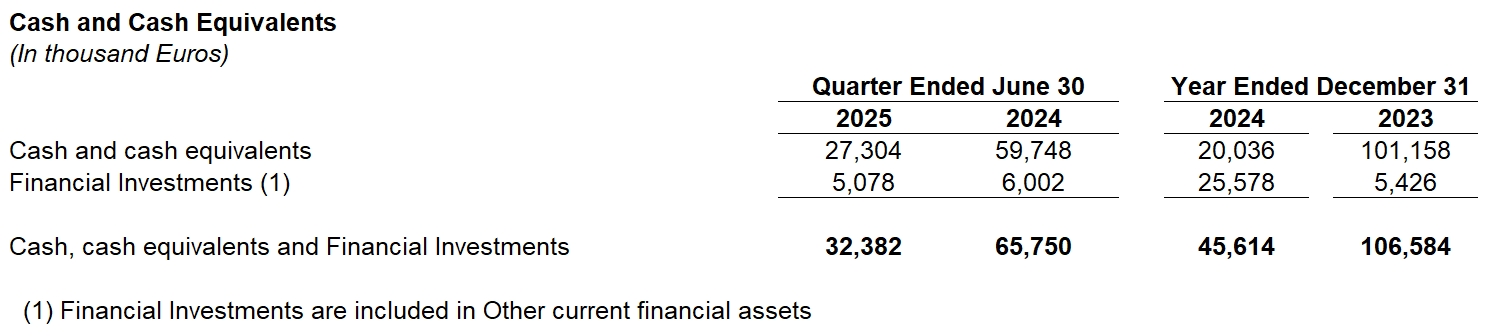

Wallbox N.V. Cash & Cash Equivalents Forward Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Wallbox N.V.

Investments and Loans & Borrowings

We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

All statements contained in this press release other than statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding Wallbox’s expected future operating results and financial position, profitability and cost optimization, industry and company growth, business strategy and plans and market opportunity. The words “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “focus,” “forecast,” “intend,” “likely,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “”target,” will,” “would” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: Wallbox’s history of operating losses; the adoption and demand for electric vehicles including the success of alternative fuels, changes to rebates, tax credits and the impact of government incentives or reduction thereof;political and economic uncertainty and macroeconomic factors, such as impacts from tariffs and trade barriers, geopolitical conflicts, consumer spending, inflation and foreign exchange rates; the accuracy of Wallbox’s forecasts and projections including those regarding its market opportunity; competition; risks related to losses or disruptions in Wallbox’s supply or manufacturing partners; Wallbox’s reliance on the third-parties outside of its control; risks related to Wallbox’s technology, intellectual property and infrastructure; executive orders and regulatory changes under the U.S. political administration and uncertainty therefrom, as well as the other important factors discussed under the caption “Risk Factors” in Wallbox’s Annual Report on Form 20-F for the fiscal year ended December 31, 2024, as such factors may be updated from time to time in its other filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov and the Investors Relations section of Wallbox’s website at investors.wallbox.com. Any such forward-looking statements represent management’s estimates as of the date of this press release. Any forward-looking statement that Wallbox makes in this press release speaks only as of the date of such statement. Except as required by law, Wallbox disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Non-IFRS Financial Measures

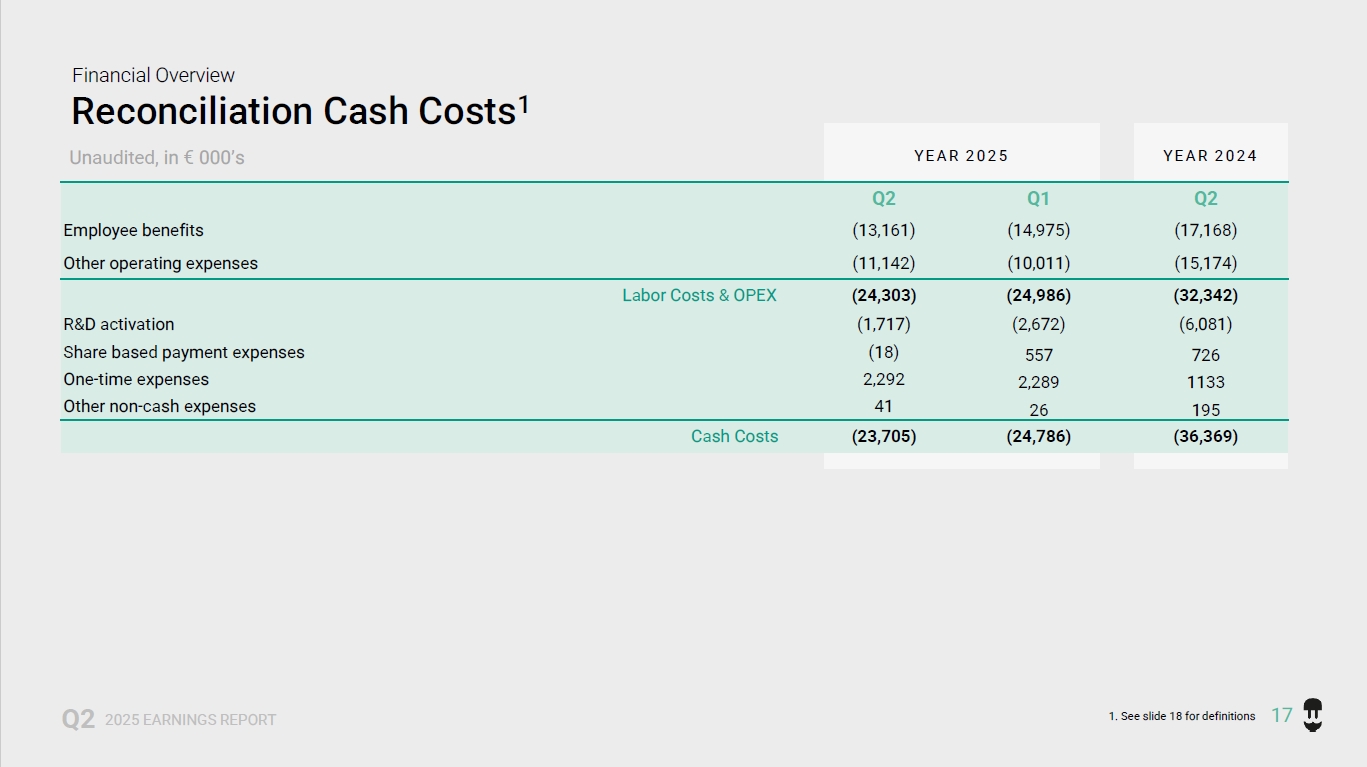

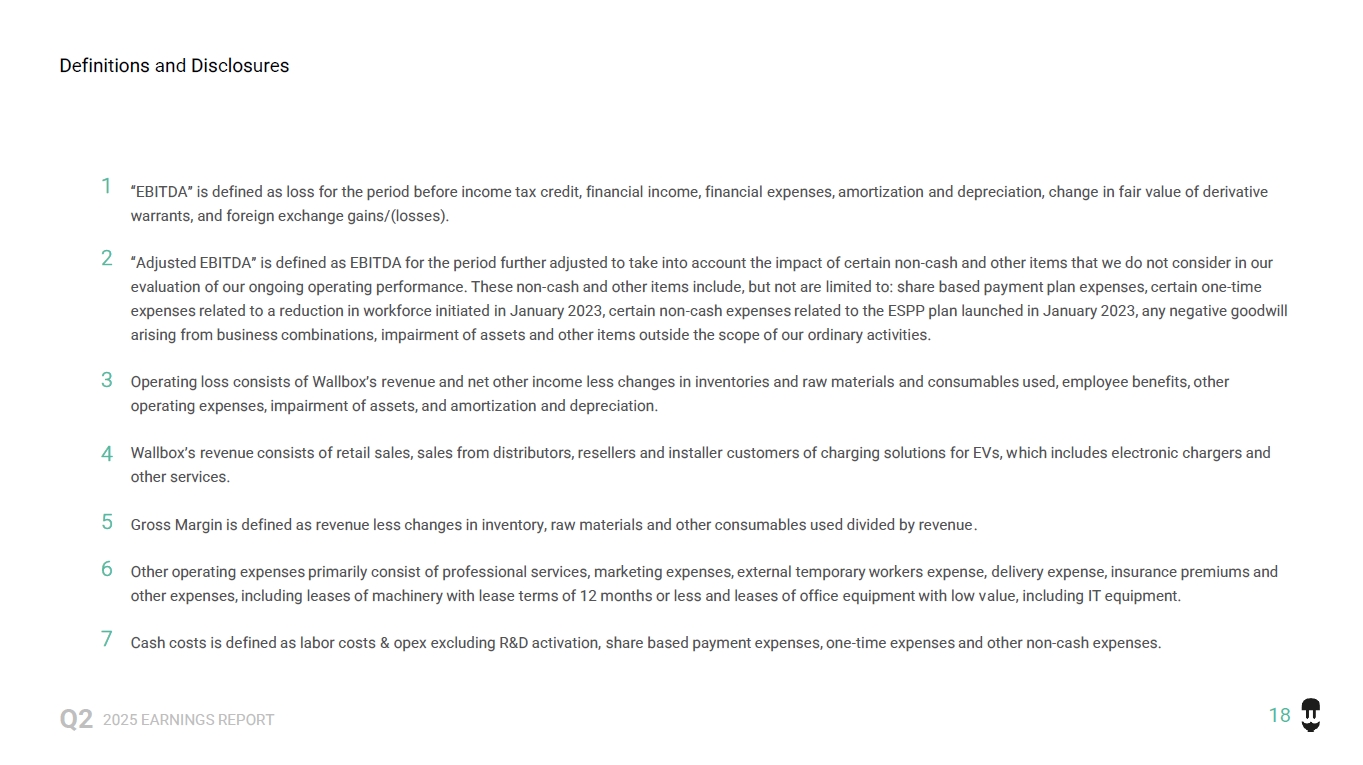

Wallbox reports its financial information required in accordance with the International Financial Reporting Standards (“IFRS”). This release includes financial measures not based on IFRS, including Adjusted EBITDA and Gross Margin (the “Non-IFRS Measure”). See the definitions set forth below for a further explanation of these terms.

Wallbox defines “Gross Margin” as revenue less changes in inventory, raw materials and other consumables used divided by revenue.

Wallbox defines EBITDA as loss for the period before income tax credit, financial income, financial expenses, amortization and depreciation, change in fair value of derivative warrants and foreign exchange gains/(losses). We define Adjusted EBITDA as EBITDA for the period further adjusted to take into account the impact of certain non-cash and other items that we do not consider in our evaluation of our ongoing operating performance.

These non-cash and other items include, but not are limited to: share based payment plan expenses, certain one-time expenses related to a reduction in workforce initiated in January 2023, certain non-cash expenses related to the ESPP plan launched in January 2023, any negative goodwill arising from business combinations, impairment of assets and other items outside the scope of our ordinary activities.

Management uses these Non-IFRS Measures as measurements of operating performance because they assist management in comparing the Company’s operating performance on a consistent basis, as they remove the impact of items not directly resulting from the Company’s core operations; for planning purposes, including the preparation of management’s internal annual operating budget and financial projections; to evaluate the performance and effectiveness of our strategic initiatives; and to evaluate the Company’s capacity to fund capital expenditures and expand its business.

The Non-IFRS Measures may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. We present the Non-IFRS Measures because we consider them to be important supplemental measures of our performance, and we believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies. Management believes that investors’ understanding of our performance is enhanced by including the Non-IFRS Measures as a reasonable basis for comparing our ongoing results of operations. By providing the Non-IFRS Measures, together with reconciliations to IFRS, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives.

Items excluded from the Non-IFRS Measures are significant components in understanding and assessing financial performance. The Non-IFRS Measures have limitations as analytical tools and should not be considered in isolation, or as an alternative to, or a substitute for loss for the period, revenue or other financial statement data presented in our consolidated financial statements as indicators of financial performance. Some of the limitations are: such measures do not reflect revenue related to fulfillment, which is necessary to the operation of our business; such measures do not reflect our expenditures, or future requirements for capital expenditures or contractual commitments; such measures do not reflect changes in our working capital needs; such measures do not reflect our share based payments, income tax benefit/(expense) or the amounts necessary to pay our taxes; although depreciation and amortization are not included in the calculation of Adjusted EBITDA, the assets being depreciated and amortized will often have to be replaced in the future and such measures do not reflect any costs for such replacements; and other companies may calculate such measures differently than we do, limiting their usefulness as comparative measures.

Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business and are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

In addition, the Non-IFRS Measures we use may differ from the non-IFRS financial measures used by other companies and are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. Furthermore, not all companies or analysts may calculate similarly titled measures in the same manner. We compensate for these limitations by relying primarily on our IFRS results and using the Non-IFRS Measures only as supplemental measures.

Reconciliations of the forward-looking non-IFRS measures to the most directly comparable IFRS measures cannot be provided without unreasonable efforts and are not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations and certain other items reflected in our reconciliation of historical non-IFRS measures, the amounts of which could be material.

About Wallbox

Wallbox is a global technology company, dedicated to changing the way the world uses energy. Wallbox creates advanced electric vehicle charging and energy management systems that redefine the relationship between users and the network. Wallbox goes beyond charging electric vehicles to give users the power to control their consumption, save money and live more sustainably. Wallbox offers a complete portfolio of charging and energy management solutions for residential, semi-public, and public use in more than 100 countries around the world. Founded in 2015 in Barcelona, where the company’s headquarters are located, Wallbox currently has offices across Europe, Asia, and America. For more information, visit www.wallbox.com

Wallbox Public Relations Contact: Wallbox Investor Contact:

Albert Cabanes Michael Wilhelm

Public Relations Corporate Development & IR

Press@wallbox.com Investors@wallbox.com

Source: Wallbox N.V.