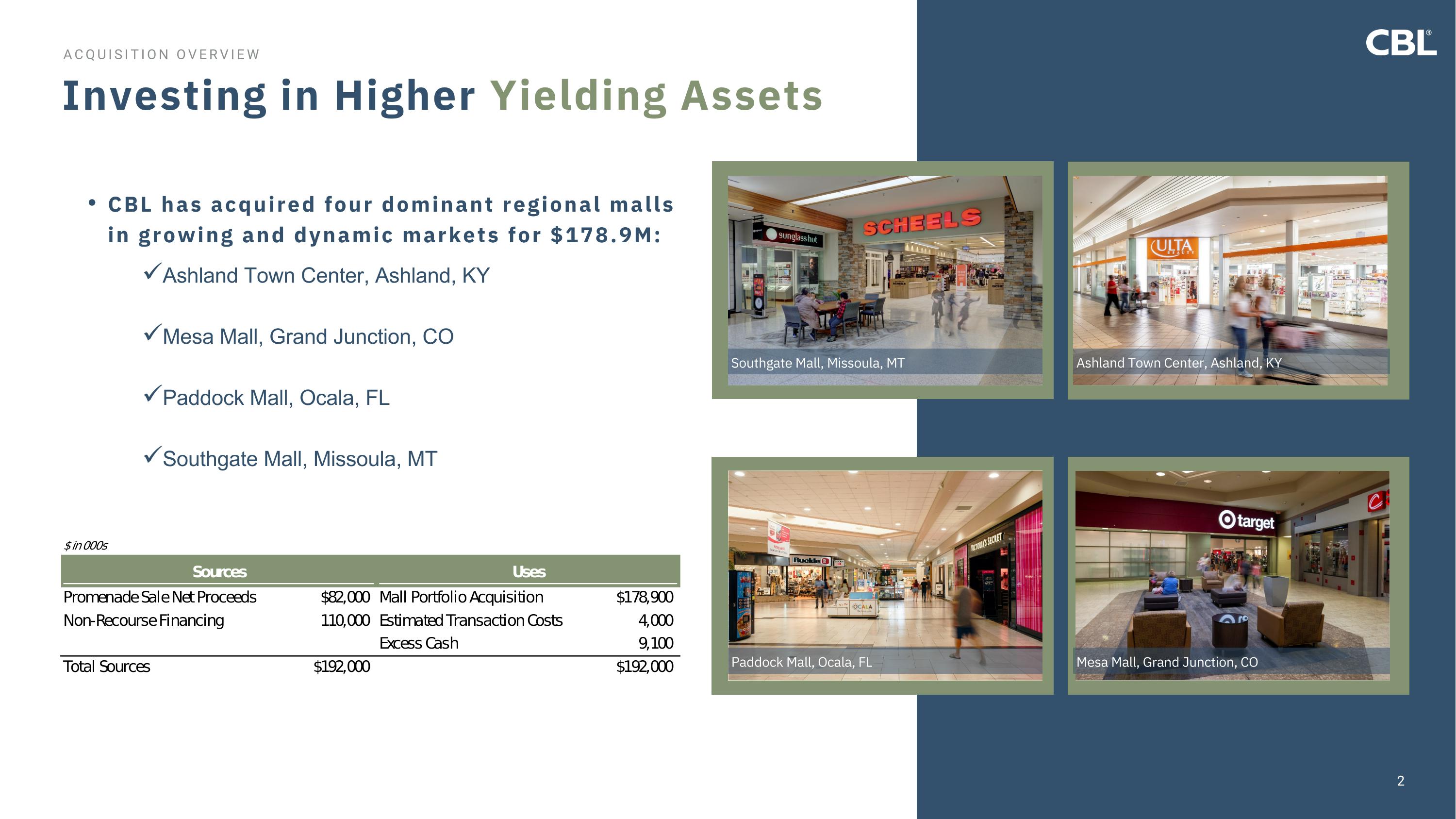

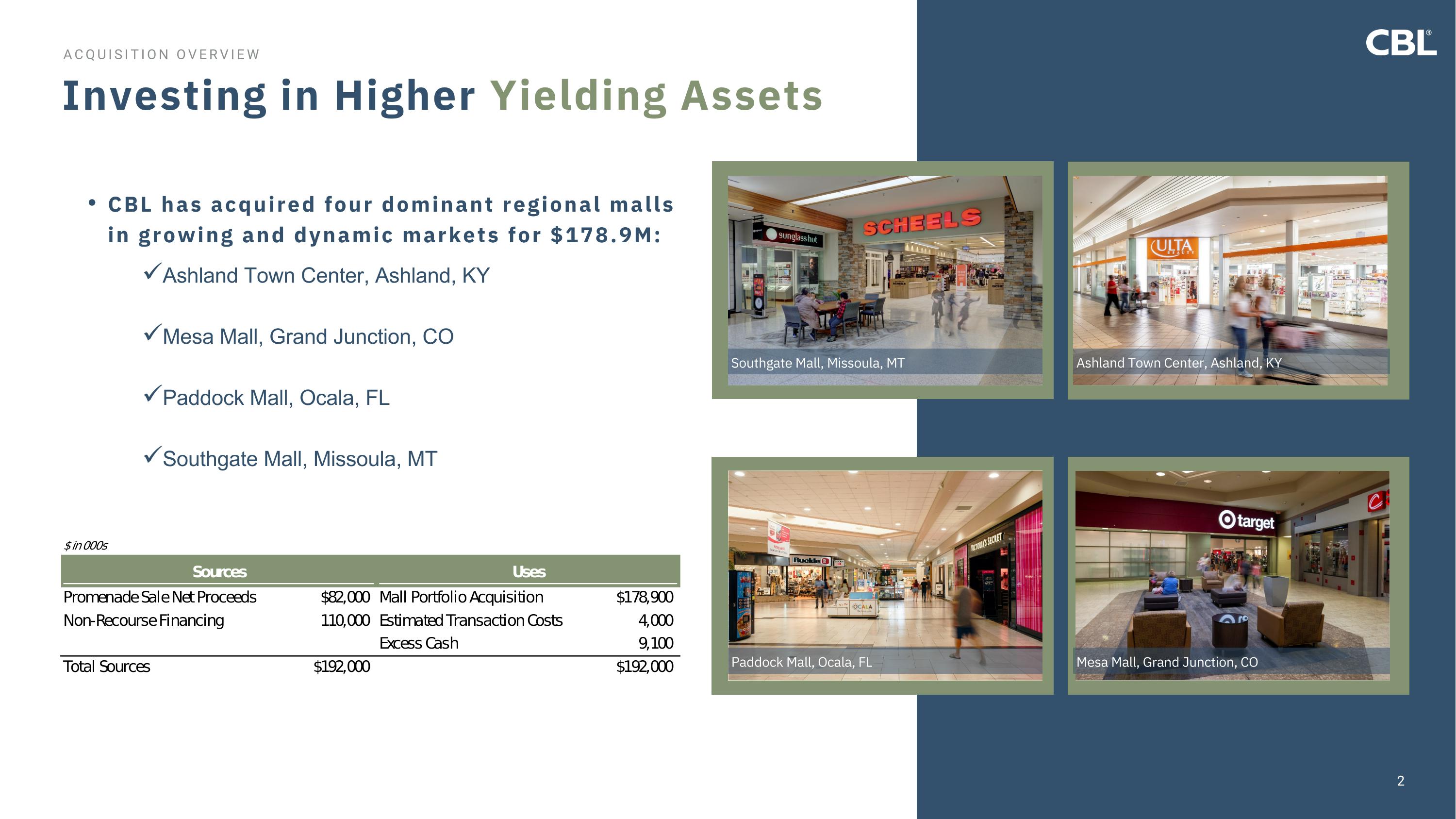

ACQUISITION OVERVIEW | JULY 2025 CBL PROPERTIES Southgate Mall, Missoula, MT Ashland Town Center, Ashland, KY Paddock Mall, Ocala, FL Mesa Mall, Grand Junction, CO Exhibit 99.2

CBL has acquired four dominant regional malls in growing and dynamic markets for $178.9M: Ashland Town Center, Ashland, KY Mesa Mall, Grand Junction, CO Paddock Mall, Ocala, FL Southgate Mall, Missoula, MT Mesa Mall, Grand Junction, CO Paddock Mall, Ocala, FL Southgate Mall, Missoula, MT Ashland Town Center, Ashland, KY Investing in Higher Yielding Assets ACQUISITION OVERVIEW

Transactions Expected to be Immediately Accretive to FFO, as adjusted and Cash Flow per Share Selling open air at a single digit cap rate and reinvesting in mid-teens Mid-teens going-in cap rate produces ~23% cash-on-cash yield ~14% accretive to annual free cash flow per share and ~5% accretive to annual FFO, as adjusted per share (1) Investment Highlights PORTFOLIO ACQUISITION Solidifies CBL as the only public REIT focused on acquiring dominant middle-market malls Leverages CBL’s deep experience in operating market-dominant enclosed malls Seamless integration into existing platform allows CBL to benefit from financial synergies Attractive non-recourse acquisition financing sourced through existing bank relationship 7-year term, interest only, majority fixed for 5 years at 7.70% Earnings & Cash Flow Accretion Leverages Operational Expertise Attractive Financing Strengthens Balance Sheet Match funding equity from $83mm open-air sale to maintain liquidity Extends maturity of existing outparcel/open-air loan and converts from floating to fixed Moderately de-levering to overall balance sheet Building on CBL’s strength as the preeminent owner and operator of enclosed regional malls in dynamic and growing middle markets Meaningful immediate value creation and growth through backfill of two former JoAnn locations Longer-term value creation opportunities through leasing upgrades and densification/redevelopment Embedded Upside (1) Assumes full-year, run-rate accretion from four mall acquisition net of full-year, run-rate dilution from the sale of The Promenade. The full-year impact will not be realized until 2026.

As part of the acquisition, CBL modified and extended its existing non-recourse open-air and outparcel loan to include the four mall properties: Non-recourse Loan balance: Increased by $110M to $443M Interest-only: ~$368.0M fixed at 7.70% for initial five-year term ~$75.0M floating at SOFR+ 410bps New 7-Year Term: Maturity extended on entire facility through 2032 Strengthening CBL’s Balance Sheet ACQUISITION OVERVIEW Modification of existing loan significantly extends CBL’s maturity schedule and reduces floating rate exposure

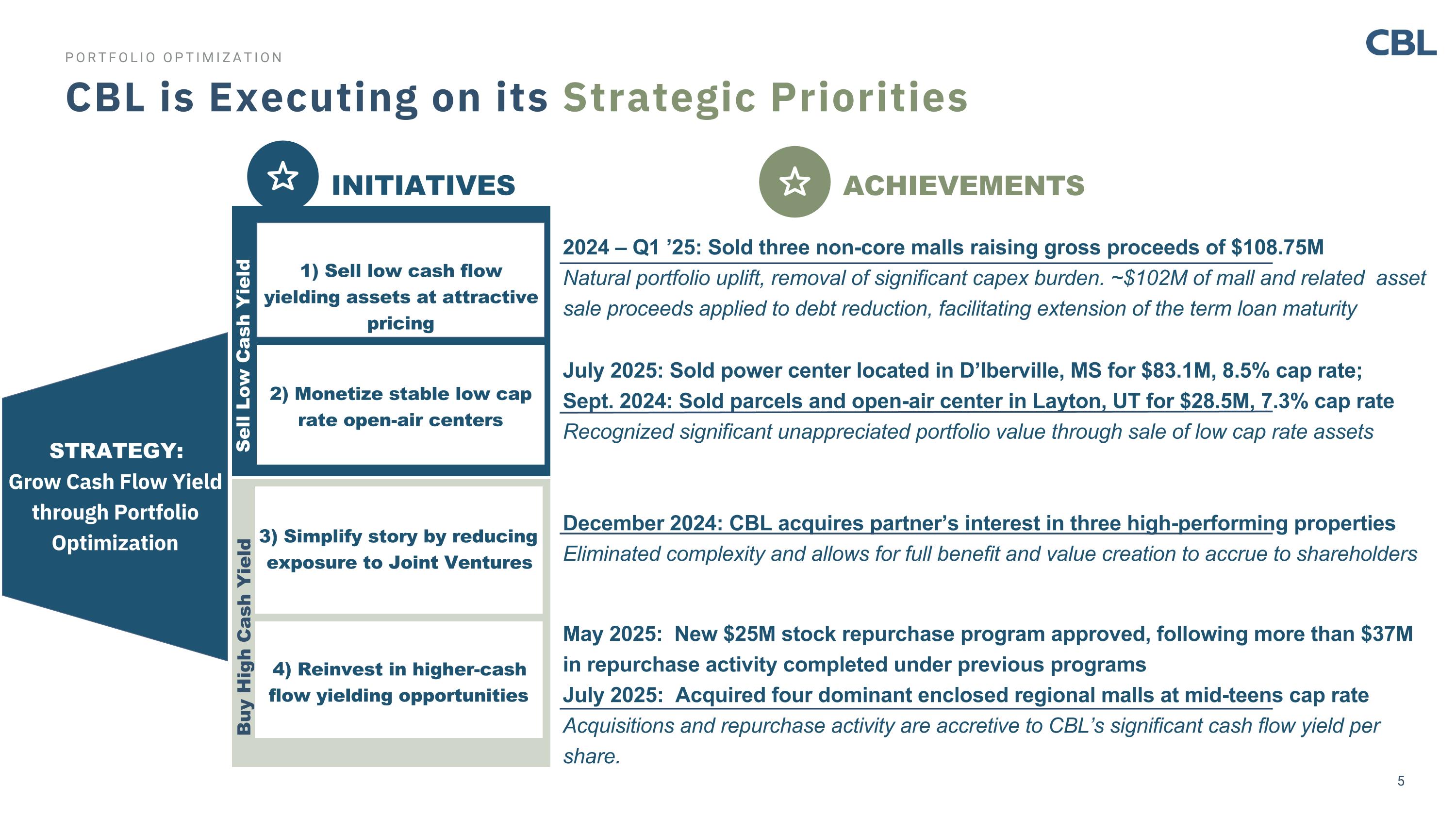

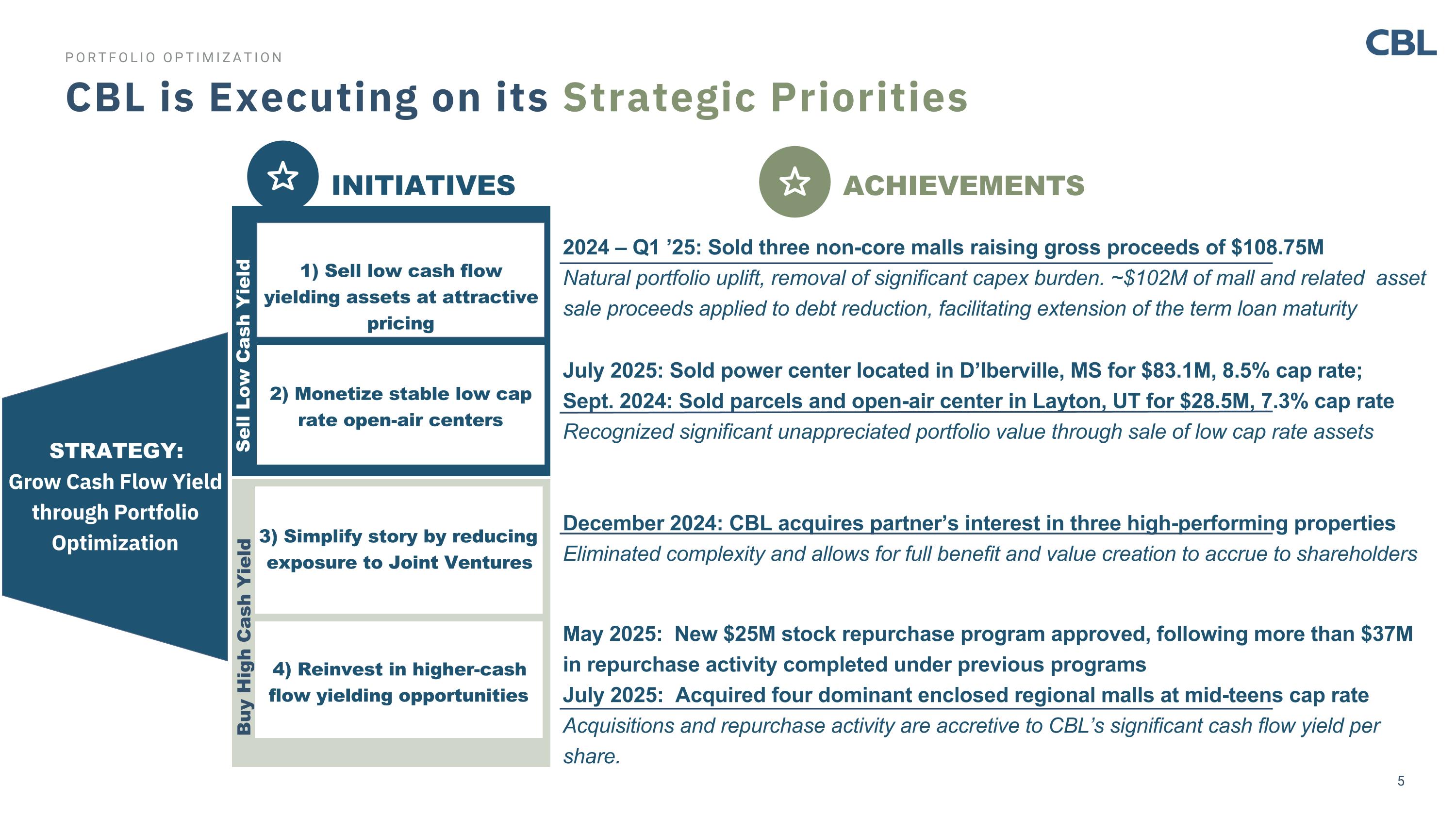

December 2024: CBL acquires partner’s interest in three high-performing properties Eliminated complexity and allows for full benefit and value creation to accrue to shareholders CBL is Executing on its Strategic Priorities PORTFOLIO OPTIMIZATION INITIATIVES Achievements 2024 – Q1 ’25: Sold three non-core malls raising gross proceeds of $108.75M Natural portfolio uplift, removal of significant capex burden. ~$102M of mall and related asset sale proceeds applied to debt reduction, facilitating extension of the term loan maturity STRATEGY: Grow Cash Flow Yield through Portfolio Optimization July 2025: Sold power center located in D’Iberville, MS for $83.1M, 8.5% cap rate; Sept. 2024: Sold parcels and open-air center in Layton, UT for $28.5M, 7.3% cap rate Recognized significant unappreciated portfolio value through sale of low cap rate assets May 2025: New $25M stock repurchase program approved, following more than $37M in repurchase activity completed under previous programs July 2025: Acquired four dominant enclosed regional malls at mid-teens cap rate Acquisitions and repurchase activity are accretive to CBL’s significant cash flow yield per share. 1) Sell low cash flow yielding assets at attractive pricing 3) Simplify story by reducing exposure to Joint Ventures 4) Reinvest in higher-cash flow yielding opportunities 2) Monetize stable low cap rate open-air centers Sell Low Cash Yield Buy High Cash Yield

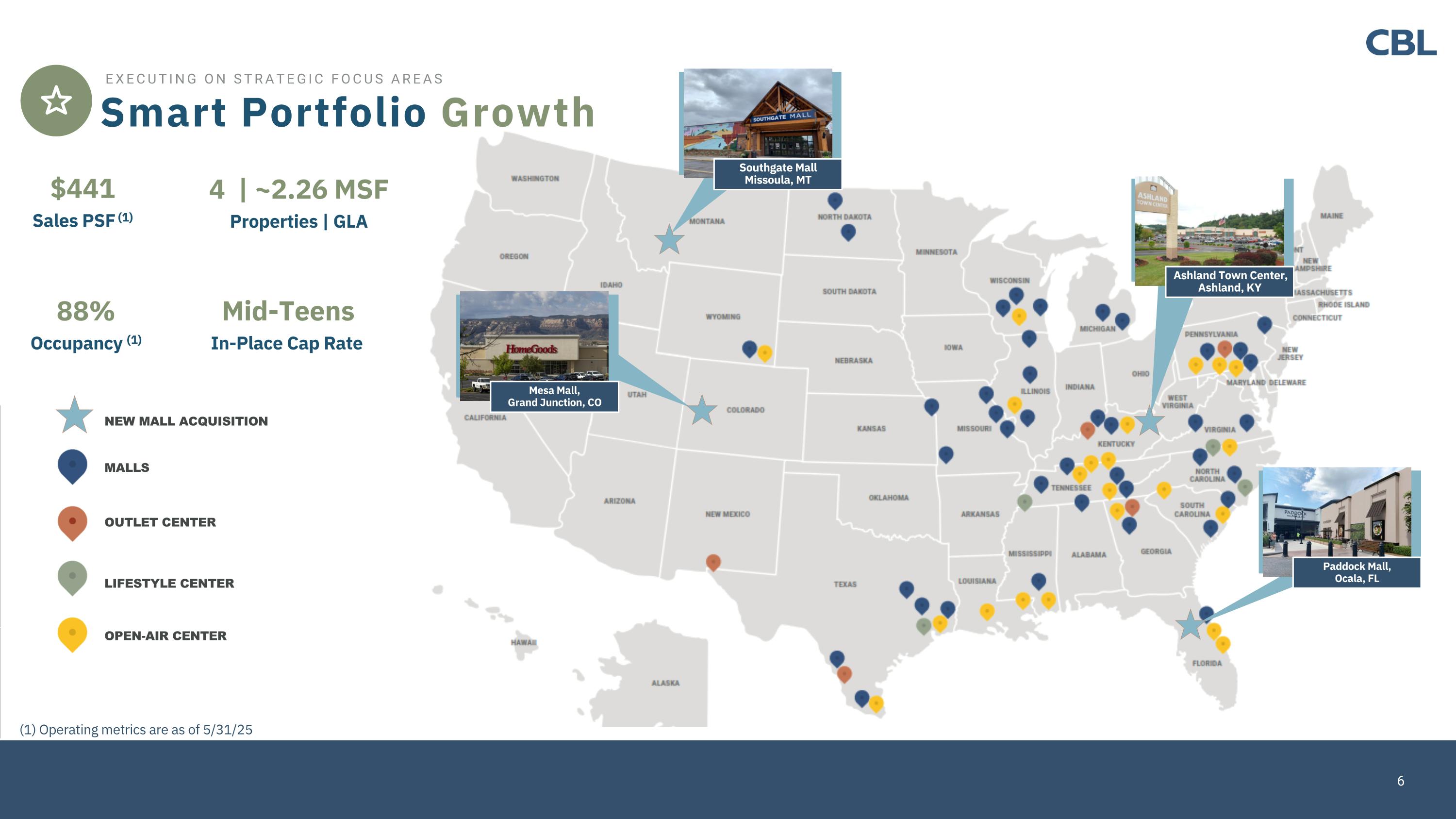

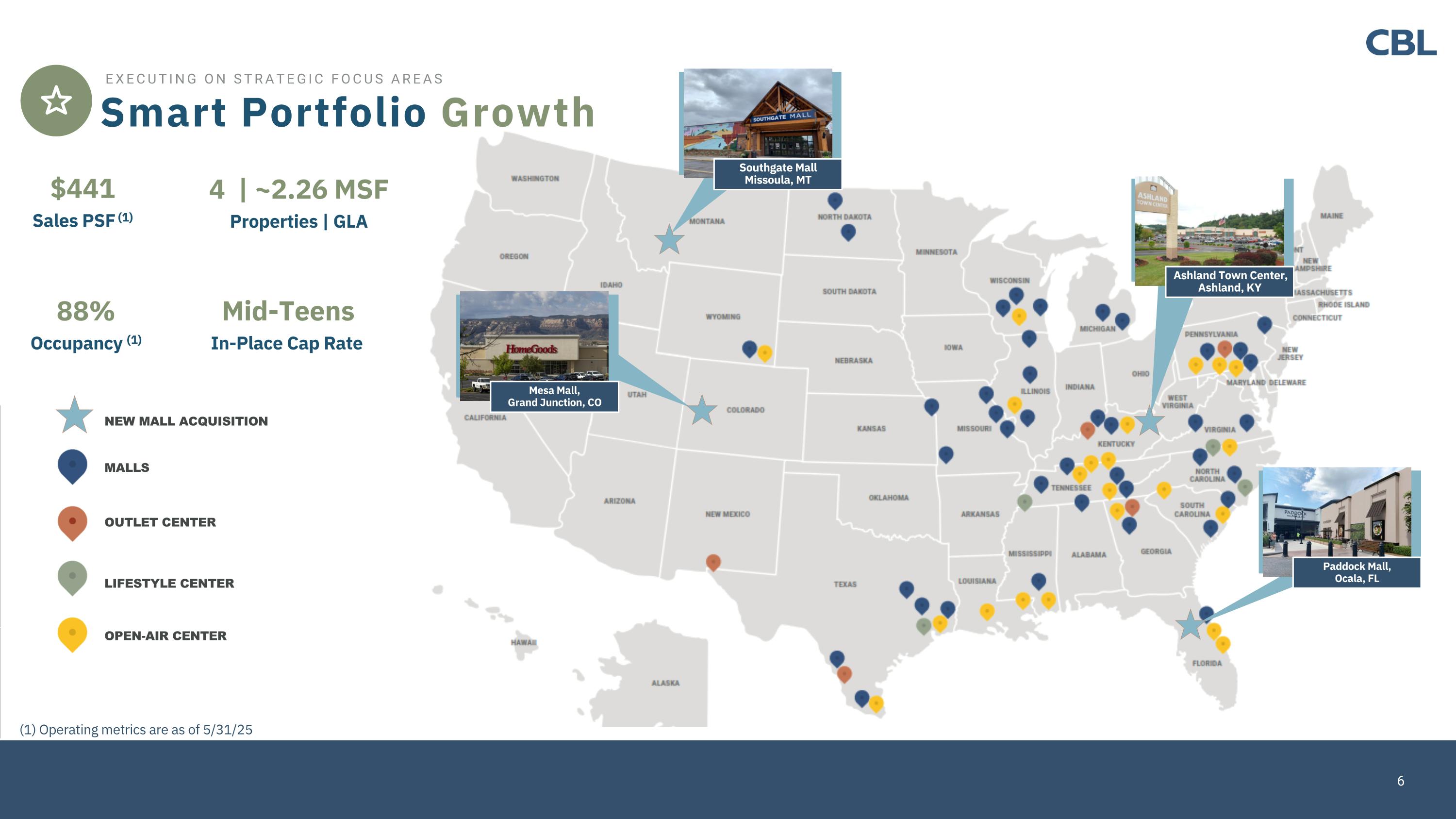

NEW MALL ACQUISITION MALLS OUTLET CENTER LIFESTYLE CENTER OPEN-AIR CENTER Smart Portfolio Growth EXECUTING ON STRATEGIC FOCUS AREAS Mesa Mall, Grand Junction, CO Southgate Mall Missoula, MT Ashland Town Center, Ashland, KY Paddock Mall, Ocala, FL $441 Sales PSF (1) 4 | ~2.26 MSF Properties | GLA 88% Occupancy (1) Mid-Teens In-Place Cap Rate (1) Operating metrics are as of 5/31/25

$394 Sales PSF ~544K SF GLA 89% Occupancy Southgate Mall, Missoula, MT Mesa Mall, Grand Junction, CO $384 Sales PSF ~731K SF GLA 83% Occupancy ANCHORS: ANCHORS: Only game in town mall with high performing anchors - more than three-hour drive to the nearest competition. Southgate Mall is minutes from the University of Montana Campus with an enrollment of nearly 11,000. Future growth drivers include occupancy upside and inline tenant upgrades. Serves a wide trade area encompassing western Colorado and Eastern Utah with the nearest competition more than 250 miles away. Former JoAnn’s box provides near-term rent growth upside. Strong leasing traction driving anticipated NOI growth opportunity with both rent and occupancy upside. Property Highlights

$442 Sales PSF ~436K SF GLA 94% Occupancy Paddock Mall, Ocala, FL $545 Sales PSF ~548K SF GLA 87% Occupancy Ashland Town Center, Ashland KY ANCHORS: ANCHORS: Well-located in eastern Kentucky’s largest urban area, capturing traffic from a trade area of up to 30 miles including southern Ohio, northern Kentucky, and parts of West Virginia. Former JoAnn’s box provides near-term rent growth upside. Anchor recapture right and potential outparcel redevelopment provide additional value-creation opportunities. High performing only game in town mall captures visitors from a five-county trade area. Ocala is known as the “horse capital of the world” with the thoroughbred horse industry employing more than 29,000 residents and contributing more than $1 billion to the local economy. Property Highlights

Safe Harbor Statement While the information contained in this presentation is provided in good faith, neither CBL & Associates Properties Inc. (together with its subsidiaries and affiliates, “CBL”, of the “Company”) nor any of its advisers, representatives, officers, agents or employees makes any representation, warranty or undertaking, express or implied, with respect to this presentation and no responsibility or liability is accepted by any of them as to the accuracy, completeness or reasonableness of this presentation. The information contained in this presentation is as of the date hereof, and CBL and any of its affiliates each expressly disclaim any obligation to update the information herein presented or to correct any inaccuracies in this presentation that may become apparent. You should conduct your own investigation into any information contained in this presentation. The information included herein contains "forward-looking statements" within the meaning of section 27a of the securities act of 1933, as amended, and section 21e of the securities exchange act of 1934. All statements, other than statements of historical facts, included or incorporated by reference in this presentation that address ongoing or projected activities, events or trends that the company expects, believes, anticipates or assumes will or may occur in the future, including such matters as future operating results, capital expenditures, development or redevelopment projects, distributions, financings or refinancings, acquisitions or dispositions (including the timing, amount and nature thereof), tenant leasing, performance and results of operations, trends of the real estate industry or markets generally, and company business strategies and other matters of such nature are forward-looking statements. Such statements are based on expectations, beliefs, anticipations or assumptions which may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Prospective investors are cautioned that any such statements or projections are not guarantees of future performance and that future events and actual events, financial and otherwise, may differ materially from the events and results discussed in forward-looking statements or projections. The company has no obligation, and makes no undertaking, to publicly update or revise any forward-looking statements or projections. The reader is directed to the company's various filings with the securities and exchange commission, including without limitation the company's most recent earnings release and supplemental financial schedules filed on form 8-k, the company's annual report on form 10-k and quarterly report on form 10-q and the "management's discussion and analysis of financial condition and results of operations" included therein, for a discussion of such risks and uncertainties.