falseFY00017159250001715925ipa:CapitalManagementMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:VehiclesMember2023-04-300001715925ipa:FindersWarrantsMember2023-05-012024-04-300001715925ipa:AccumulatedDepreciationAmountMember2024-04-300001715925ipa:AccumulatedAmortizationMemberipa:IntellectualPropertiesMember2023-05-012024-04-300001715925ipa:OptionTwentyOneMember2024-05-012025-04-300001715925ipa:ProprietaryProcessesMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CertificationsMember2024-05-012025-04-300001715925ifrs-full:LeaseLiabilitiesMember2022-05-012023-04-300001715925ipa:AccumulatedAmortizationMemberipa:ProprietaryProcessesMember2024-04-300001715925ipa:UProteinIpaEuropeAndBioStrandMember2024-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-04-300001715925ipa:BiostrandMember2025-04-300001715925ipa:NetBookValueMemberifrs-full:VehiclesMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:AutomobileMember2023-04-300001715925ipa:NetBookValueMemberipa:IntellectualPropertiesMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2024-04-300001715925ipa:AccumulatedAmortizationMemberipa:InternallyGeneratedDevelopmentCostsMember2023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:LabEquipmentMember2024-05-012025-04-300001715925ifrs-full:AccumulatedOtherComprehensiveIncomeMember2025-04-300001715925ipa:LabEquipmentMemberipa:AccumulatedDepreciationAmountMember2024-05-012025-04-300001715925ipa:RangeTwoMemberipa:FindersWarrantsMember2025-04-300001715925ipa:BiostrandB.v.Member2024-04-300001715925ipa:OptionElevenMember2025-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:BuildingsMember2024-04-300001715925ipa:OptionNineMember2024-05-012025-04-300001715925ipa:NetBookValueMember2025-04-300001715925ipa:BiostrandB.v.Member2025-04-300001715925country:NL2023-04-300001715925ipa:AccumulatedAmortizationMember2024-04-300001715925ipa:ConvertibleDebenturesMember2023-04-300001715925ipa:ProprietaryProcessesMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2023-05-012024-04-300001715925ipa:OptionFourteenMember2024-05-012025-04-300001715925ipa:BiostrandB.v.Memberipa:TrancheOneMemberipa:EscrowAgreementMember2022-04-300001715925country:BE2022-05-012023-04-300001715925ifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:ComputerHardwareMember2023-05-012024-04-300001715925ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-05-012024-04-300001715925ifrs-full:AdditionalPaidinCapitalMember2025-04-300001715925srt:NorthAmericaMember2022-05-012023-04-300001715925ifrs-full:TopOfRangeMemberipa:LabAndOfficeFacilitiesMember2024-05-012025-04-300001715925ipa:ProprietaryProcessesMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925country:BE2023-05-012024-04-300001715925country:CA2022-05-012023-04-300001715925ifrs-full:LeaseLiabilitiesMember2022-04-300001715925country:US2023-05-012024-04-300001715925currency:EUR2024-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:LabEquipmentMember2025-04-300001715925ipa:OssMember2024-04-300001715925ipa:WorkInProgressLeaseholdImrpvementsMemberifrs-full:GrossCarryingAmountMember2024-04-3000017159252025-04-300001715925ipa:ProprietaryProcessesMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ipa:IdeaFamilyB.vMember2022-05-012023-04-300001715925ifrs-full:IssuedCapitalMemberifrs-full:OrdinarySharesMember2024-05-012025-04-300001715925ipa:AllOtherCountriesMember2023-05-012024-04-300001715925country:NL2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesUSALtdIPAUSAMember2024-05-012025-04-300001715925ipa:LabEquipmentMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:UtrechtMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:WorkInProgressLeaseholdImrpvementsMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:LabEquipmentMember2024-05-012025-04-300001715925ipa:RangeTwoMemberipa:FindersWarrantsMember2024-05-012025-04-300001715925ifrs-full:RestrictedShareUnitsMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:ComputerHardwareMember2024-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:BuildingsMember2023-04-300001715925ipa:BiostrandB.v.Member2024-05-012025-04-300001715925ipa:UProteinIpaEuropeAndBioStrandMember2023-04-300001715925ifrs-full:GoodsOrServicesTransferredOverTimeMember2024-05-012025-04-300001715925ifrs-full:RetainedEarningsMember2023-04-300001715925ipa:ImmunoPreciseAntibodiesCanadaLtdMember2023-05-012024-04-300001715925ifrs-full:LiquidityRiskMemberifrs-full:LaterThanFiveYearsMember2025-04-300001715925ipa:OneJanuaryTwentyTwentyFourMemberipa:EmployeesMember2024-05-012025-04-300001715925ipa:BiostrandB.v.Member2022-05-012023-04-300001715925ipa:CustomerListMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:BidCommonSharesMemberifrs-full:BottomOfRangeMember2025-07-132025-07-130001715925ifrs-full:GrossCarryingAmountMemberipa:LabEquipmentMember2023-04-300001715925ipa:OptionTwentyMember2025-04-300001715925srt:EuropeMember2023-05-012024-04-300001715925ipa:OptionSevenMember2025-04-300001715925country:US2024-05-012025-04-300001715925ipa:AccumulatedDepreciationAmountMember2024-05-012025-04-300001715925ifrs-full:VehiclesMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ipa:TalemTherapeuticsLLCTalemMember2024-05-012025-04-300001715925ifrs-full:LaterThanThreeYearsAndNotLaterThanFourYearsMember2025-04-300001715925ifrs-full:BuildingsMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:NetBookValueMemberipa:WorkInProgressLeaseholdImrpvementsMember2025-04-300001715925ipa:NineteenFebruaryTwentyTwentyThreeMemberipa:OfficersAndEmployeesMember2025-04-300001715925ipa:FinancialAssetsCashMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:InternallyGeneratedDevelopmentCostsMember2023-05-012024-04-300001715925ipa:CustomerListMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:ConvertibleDebenturesMember2024-04-300001715925ipa:FindersWarrantsMemberipa:RangeOneMember2025-04-300001715925ipa:NetBookValueMemberipa:AutomobileMember2025-04-300001715925ifrs-full:BuildingsMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:OssMember2024-04-300001715925ipa:BiostrandMember2024-04-300001715925ipa:IntellectualPropertiesMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2025-04-300001715925ipa:VictoriaOneMember2023-05-012024-04-300001715925ipa:ProjectRevenueMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMember2024-04-300001715925ipa:OptionThirteenMember2025-04-300001715925ipa:AtTheMarketEquityOfferingFacilityMember2024-05-012025-04-300001715925ipa:WorkInProgressLeaseholdImrpvementsMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:ConvertibleDebenturesMemberipa:YaIiPnLtdMember2024-07-160001715925srt:NorthAmericaMember2023-04-300001715925ipa:LabEquipmentMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:AutomobileMember2024-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:VehiclesMember2024-05-012025-04-300001715925ifrs-full:RestrictedShareUnitsMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2025-04-300001715925ifrs-full:RetainedEarningsMember2023-05-012024-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2023-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2024-04-300001715925ipa:NetBookValueMemberifrs-full:BuildingsMember2024-04-300001715925ipa:ImmunoPreciseAntibodiesEuropeBVIPAEuropeFormerlyModiQuestResearchBVMember2022-05-012023-04-300001715925ipa:LabEquipmentMember2024-05-012025-04-300001715925ipa:OptionTwelveMember2024-05-012025-04-300001715925ipa:TalemTherapeuticsLLCTalemMember2023-05-012024-04-300001715925ifrs-full:TopOfRangeMemberipa:IntellectualPropertiesMember2024-05-012025-04-300001715925ipa:OptionEightMember2025-04-300001715925ipa:OptionTwelveMember2025-04-300001715925ifrs-full:LiquidityRiskMemberifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:AutomobileMember2023-04-300001715925ipa:OptionElevenMember2024-05-012025-04-300001715925ipa:LabEquipmentMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-05-012025-04-300001715925ifrs-full:BuildingsMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:IssuedCapitalMemberifrs-full:OrdinarySharesMember2023-04-300001715925ifrs-full:LeaseLiabilitiesMember2023-04-300001715925ipa:AccumulatedAmortizationMember2023-05-012024-04-300001715925ipa:BioStrandOneMember2024-05-012025-04-300001715925ipa:VictoriaMember2023-05-012024-04-300001715925country:AU2024-05-012025-04-300001715925ifrs-full:AccumulatedOtherComprehensiveIncomeMember2024-05-012025-04-300001715925ifrs-full:NotLaterThanOneYearMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesUSALtdIPAUSAMember2023-05-012024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:LabEquipmentMember2023-05-012024-04-300001715925ipa:LabAndOfficeFacilitiesMember2025-04-300001715925ipa:NetBookValueMemberipa:LabEquipmentMember2025-04-300001715925ifrs-full:LiquidityRiskMemberifrs-full:NotLaterThanOneYearMember2025-04-300001715925ipa:AmountsReceivableMember2024-05-012025-04-300001715925country:BE2025-04-300001715925ifrs-full:TopOfRangeMember2024-05-012025-04-300001715925ipa:NetBookValueMemberipa:InternallyGeneratedDevelopmentCostsMember2024-04-300001715925ipa:OptionNineMember2025-04-300001715925ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember2024-05-012025-04-300001715925ipa:OptionFifteenMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-04-300001715925ipa:NetBookValueMemberifrs-full:FixturesAndFittingsMember2024-04-300001715925ipa:NineteenFebruaryTwentyTwentyThreeMembersrt:DirectorMember2025-04-300001715925ipa:UProteinIpaEuropeAndBioStrandMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:WorkInProgressLeaseholdImrpvementsMember2024-05-012025-04-300001715925ipa:BiostrandMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:LabEquipmentMember2023-05-012024-04-300001715925ipa:IntellectualPropertiesMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:ConvertibleDebenturesMemberipa:YaIiPnLtdMemberipa:TrancheOneMember2024-07-160001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:AutomobileMember2024-05-012025-04-300001715925ifrs-full:ComputerEquipmentMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:ComputerHardwareMember2024-05-012025-04-300001715925ipa:ProductSalesMember2022-05-012023-04-300001715925ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:IntellectualPropertiesMember2023-04-300001715925ipa:ImmunoPreciseAntibodiesMALLCMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:ProprietaryProcessesMember2023-04-300001715925ipa:BiostrandB.v.Member2021-05-012022-04-300001715925ifrs-full:VehiclesMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:OptionFiveMember2025-04-300001715925ipa:NineteenFebruaryTwentyTwentyThreeMemberipa:OfficersAndEmployeesMember2024-05-012025-04-300001715925country:CA2023-05-012024-04-300001715925ifrs-full:EquityInvestmentsMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:InternallyGeneratedDevelopmentCostsMember2024-04-300001715925ipa:DeferredAcquisitionPaymentsMember2024-05-012025-04-300001715925ifrs-full:FinancialEffectOfCorrectionsOfAccountingErrorsMember2024-04-300001715925srt:NorthAmericaMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-04-300001715925ipa:ProjectRevenueMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:LabEquipmentMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-04-300001715925ipa:CustomerListMember2024-05-012025-04-300001715925ipa:WorkInProgressLeaseholdImrpvementsMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:CertificationsMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2023-05-012024-04-300001715925ipa:UntrechtMember2023-04-300001715925ipa:TrancheTwoMemberipa:BiostrandB.v.Memberipa:EscrowAgreementMember2022-04-3000017159252022-04-300001715925country:US2022-05-012023-04-300001715925ipa:AccumulatedDepreciationAmountMemberipa:LabEquipmentMember2025-04-300001715925ipa:NetBookValueMemberipa:ComputerHardwareMember2025-04-300001715925ipa:AugustThreeTwoThousandTwentyFourMemberipa:OfficersAndEmployeesMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CustomerListMember2024-04-300001715925ipa:ProprietaryProcessesMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:BuildingsMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:ComputerHardwareMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesUSALtdIPAUSAMember2022-05-012023-04-300001715925ipa:AccumulatedDepreciationAmountMember2025-04-300001715925ipa:EmployeesMemberipa:ThirteenNovemberTwentyTwentyThreeMember2024-05-012025-04-300001715925ifrs-full:IssuedCapitalMember2023-05-012024-04-300001715925ifrs-full:BottomOfRangeMember2024-05-012025-04-300001715925ipa:BiostrandMember2025-04-3000017159252022-05-012023-04-300001715925ipa:CertificationsMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:IntellectualPropertiesMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:OptionSixteenMember2025-04-300001715925ipa:NetBookValueMemberifrs-full:LeaseholdImprovementsMember2024-04-300001715925ipa:LabEquipmentMemberifrs-full:WeightedAverageMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMember2023-04-300001715925ifrs-full:ComputerSoftwareMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-05-012025-04-300001715925ipa:OptionTenToTwentyThreeMember2025-04-300001715925ipa:OptionSixteenMember2024-05-012025-04-300001715925ipa:ProductSalesMember2023-05-012024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-04-300001715925ipa:ImmunoPreciseAntibodiesEuropeBVIPAEuropeFormerlyModiQuestResearchBVMember2024-05-012025-04-300001715925ifrs-full:FinancialEffectOfCorrectionsOfAccountingErrorsMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:AdditionalPaidinCapitalMember2024-05-012025-04-300001715925ipa:OptionTwentyOneMember2025-04-300001715925ipa:NineteenFebruaryTwentyTwentyThreeMembersrt:DirectorMember2024-05-012025-04-300001715925ipa:CryoStorageMember2023-05-012024-04-300001715925ifrs-full:BuildingsMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-05-012024-04-300001715925ipa:EmployeesMemberipa:TwentyThreeMayTwentyTwentyThreeMember2024-05-012025-04-300001715925ipa:UntrechtMember2025-04-300001715925ipa:NineteenJanuaryTwentyTwentyFourMembersrt:DirectorMember2025-04-300001715925ipa:EmployeesMemberipa:ElevenJuneTwentyTwentyThreeMember2025-04-300001715925ipa:NetBookValueMemberifrs-full:BuildingsMember2025-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:VehiclesMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2025-04-300001715925ifrs-full:TopOfRangeMember2024-08-192024-08-190001715925ifrs-full:GrossCarryingAmountMemberipa:AutomobileMember2023-05-012024-04-300001715925ifrs-full:CurrencyRiskMember2025-04-300001715925ipa:NetBookValueMemberipa:ComputerHardwareMember2024-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2024-05-012025-04-300001715925ipa:EmployeesMemberipa:NineteenFebruaryTwentyTwentyFourMember2025-04-300001715925ipa:OptionFourMember2025-04-300001715925ipa:AtTheMarketEquityOfferingFacilityMember2025-04-300001715925ipa:NetBookValueMemberipa:LabEquipmentMember2025-04-300001715925ifrs-full:RetainedEarningsMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2024-05-012025-04-300001715925ipa:OptionNineteenMember2024-05-012025-04-300001715925dei:BusinessContactMember2024-05-012025-04-300001715925ipa:AccountsPayablesAndAccruedLiabilitiesMember2024-05-012025-04-300001715925ipa:LabEquipmentMember2024-05-012025-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2025-04-300001715925ipa:OptionSevenMember2024-05-012025-04-300001715925ipa:ConvertibleDebenturesMember2025-04-300001715925ipa:OptionEighteenMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesEuropeBVIPAEuropeFormerlyModiQuestResearchBVMember2023-05-012024-04-300001715925ifrs-full:IssuedCapitalMember2023-04-300001715925ipa:CertificationsMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:OssMember2023-05-012024-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:BuildingsMember2023-05-012024-04-300001715925ifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:NetBookValueMemberipa:ProprietaryProcessesMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2023-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:VehiclesMember2024-04-300001715925ipa:DeferredAcquisitionPaymentsMember2022-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:WorkInProgressLeaseholdImrpvementsMember2023-04-300001715925ipa:NetBookValueMemberipa:CertificationsMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-04-300001715925ipa:TwentyThreeJanuaryTwentyTwentyThreeMemberipa:EmployeesMember2025-04-300001715925ipa:FifteenMayTwentyTwentyTwoMemberipa:EmployeesMember2024-05-012025-04-300001715925ipa:InternallyGeneratedDevelopmentCostsMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925country:NL2023-05-012024-04-300001715925srt:EuropeMember2022-05-012023-04-300001715925ifrs-full:GoodsOrServicesTransferredOverTimeMember2023-05-012024-04-300001715925ipa:FindersWarrantsMember2022-05-012023-04-300001715925ipa:OptionSevenAndEightMember2025-04-300001715925ipa:ProductSalesMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2025-04-300001715925ipa:AllOtherCountriesMember2024-05-012025-04-300001715925ipa:OptionThreeMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:VehiclesMember2024-05-012025-04-300001715925ifrs-full:IssuedCapitalMember2024-05-012025-04-300001715925ipa:ConvertibleDebenturesMember2022-05-012023-04-300001715925ipa:BiostrandB.v.Member2024-05-012025-04-300001715925ipa:ImmunoPreciseAntibodiesNDLtdMember2024-05-012025-04-300001715925ifrs-full:RetainedEarningsMember2024-05-012025-04-300001715925srt:NorthAmericaMember2025-04-300001715925ifrs-full:VehiclesMember2025-04-300001715925ifrs-full:IssuedCapitalMember2024-04-300001715925ipa:FindersWarrantsMemberipa:RangeOneMember2024-05-012025-04-300001715925ifrs-full:AdditionalPaidinCapitalMember2023-05-012024-04-300001715925ifrs-full:IssuedCapitalMemberifrs-full:OrdinarySharesMember2022-05-012023-04-300001715925ipa:NetBookValueMemberifrs-full:FixturesAndFittingsMember2025-04-300001715925ipa:AllOtherCountriesMember2022-05-012023-04-300001715925ipa:ProprietaryProcessesMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:AtTheMarketEquityOfferingFacilityMember2024-04-300001715925ipa:CryoStorageMember2022-05-012023-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:VehiclesMember2023-04-300001715925ipa:AccumulatedAmortizationMemberipa:InternallyGeneratedDevelopmentCostsMember2025-04-300001715925ipa:BiokeyB.vMember2023-05-012024-04-300001715925ifrs-full:AccumulatedOtherComprehensiveIncomeMember2023-04-300001715925ipa:AccumulatedDepreciationAmountMember2023-05-012024-04-300001715925ipa:InternallyGeneratedDevelopmentCostsMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ipa:TwentyThreeJanuaryTwentyTwentyThreeMemberipa:EmployeesMember2024-05-012025-04-300001715925country:AU2023-05-012024-04-300001715925ifrs-full:LaterThanFiveYearsMember2025-04-300001715925ipa:EmployeesMemberipa:NineteenFebruaryTwentyTwentyFourMember2024-05-012025-04-300001715925ipa:CertificationsMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:NetBookValueMemberipa:WorkInProgressLeaseholdImrpvementsMember2024-04-3000017159252022-05-012022-07-310001715925ifrs-full:BuildingsMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ifrs-full:LeaseLiabilitiesMember2025-04-300001715925ipa:ImmunoPreciseNetherlandsBVMember2023-05-012024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2024-04-300001715925ipa:ConvertibleDebenturesMember2024-05-012025-04-300001715925ipa:ImmunoPreciseAntibodiesNDLtdMember2023-05-012024-04-300001715925ipa:ImmunoPreciseAntibodiesMALLCMember2022-05-012023-04-300001715925ipa:TwentyFebruaryTwentyTwentyFourMemberipa:EmployeesMember2025-04-300001715925ipa:OptionThirteenMember2024-05-012025-04-300001715925ipa:NetBookValueMemberipa:ProprietaryProcessesMember2025-04-300001715925ipa:BiostrandB.v.Memberipa:ThreeYearsMember2022-04-132022-04-130001715925ipa:OssMember2025-04-300001715925ipa:NetBookValueMemberipa:InternallyGeneratedDevelopmentCostsMember2025-04-300001715925ipa:ConvertibleDebenturesMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:IntellectualPropertiesMember2024-04-300001715925ipa:NetBookValueMemberipa:CertificationsMember2024-04-300001715925ipa:OptionSixMember2024-05-012025-04-300001715925ipa:LabAndOfficeFacilitiesMemberifrs-full:WeightedAverageMember2024-05-012025-04-300001715925ipa:NetBookValueMemberipa:IntellectualPropertiesMember2025-04-300001715925ipa:AccumulatedAmortizationMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:ProprietaryProcessesMember2025-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2023-05-012024-04-300001715925ipa:InternallyGeneratedDevelopmentCostsMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-05-012024-04-300001715925ipa:OptionNineteenMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-04-300001715925ipa:EightAugustTwentyTwentyThreeMemberipa:EmployeesMember2025-04-300001715925ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2025-04-300001715925ipa:FindersWarrantsMember2023-04-300001715925ipa:WorkInProgressLeaseholdImrpvementsMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2025-04-300001715925ifrs-full:PreviouslyStatedMember2023-05-012024-04-300001715925ipa:BiostrandMember2024-05-012025-04-3000017159252024-05-012025-04-300001715925ifrs-full:IssuedCapitalMemberifrs-full:OrdinarySharesMember2025-04-300001715925ipa:NetBookValueMember2024-04-300001715925ipa:OneJanuaryTwentyTwentyFourMemberipa:EmployeesMember2025-04-300001715925currency:USD2024-04-300001715925ifrs-full:AdditionalPaidinCapitalMember2024-04-300001715925ipa:TalemTherapeuticsLLCTalemMember2022-05-012023-04-300001715925ipa:NetBookValueMemberifrs-full:BuildingsMember2025-04-300001715925ipa:IntellectualPropertiesMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:LabEquipmentMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ifrs-full:PotentialOrdinaryShareTransactionsMemberifrs-full:TopOfRangeMemberipa:AtTheMarketEquityOfferingFacilityMember2024-02-232024-02-230001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:VehiclesMember2023-05-012024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2024-05-012025-04-300001715925ifrs-full:TopOfRangeMemberifrs-full:VehiclesMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:LabEquipmentMember2025-04-300001715925ifrs-full:BottomOfRangeMemberifrs-full:VehiclesMember2024-05-012025-04-300001715925ipa:UProteinIpaEuropeAndBioStrandMember2025-04-300001715925ipa:OptionEighteenMember2024-05-012025-04-300001715925ipa:CertificationsMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:LeaseLiabilitiesMember2024-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:ComputerHardwareMember2023-04-300001715925ipa:OptionSeventeenMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:VehiclesMember2025-04-300001715925ipa:UProteinIpaEuropeAndBioStrandMember2023-05-012024-04-300001715925ipa:AtTheMarketEquityOfferingFacilityMember2023-05-012024-04-3000017159252024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:ComputerHardwareMember2023-05-012024-04-300001715925ipa:AccumulatedAmortizationMemberipa:CertificationsMember2024-04-300001715925ipa:BiostrandB.v.Member2023-05-012024-04-300001715925ipa:NetBookValueMemberipa:AutomobileMember2024-04-300001715925country:NL2022-05-012023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:AutomobileMember2023-05-012024-04-300001715925ipa:AccumulatedAmortizationMemberipa:CertificationsMember2025-04-300001715925ipa:FirstMarchTwentyTwentyThreeMemberipa:EmployeesMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:LabEquipmentMember2024-04-300001715925ipa:EightAugustTwentyTwentyThreeMemberipa:EmployeesMember2024-05-012025-04-300001715925ifrs-full:BottomOfRangeMemberipa:LabAndOfficeFacilitiesMember2024-05-012025-04-300001715925ipa:VictoriaMember2025-04-300001715925ipa:VictoriaMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMember2025-04-300001715925ifrs-full:BuildingsMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ipa:BioclueB.vMember2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:WorkInProgressLeaseholdImrpvementsMember2025-04-300001715925ipa:FindersWarrantsMember2024-04-300001715925ifrs-full:LeaseLiabilitiesMember2024-05-012025-04-300001715925ipa:BioStrandTwoMember2025-04-300001715925ipa:BiostrandB.v.Memberipa:NinetyDaysMember2022-04-132022-04-130001715925ipa:OssMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:InternallyGeneratedDevelopmentCostsMember2024-05-012025-04-300001715925ipa:EmployeesMemberipa:EightMayTwentyTwentyThreeMember2025-04-300001715925country:BE2024-04-300001715925ipa:BiostrandB.v.Member2023-04-300001715925ipa:IntellectualPropertiesMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:AutomobileMember2024-04-300001715925ipa:BiostrandB.v.Member2022-04-130001715925ipa:NetBookValueMemberipa:CustomerListMember2025-04-300001715925ifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:FindersWarrantsMember2024-05-012025-04-3000017159252022-05-310001715925ipa:InternallyGeneratedDevelopmentCostsMemberifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:OptionSixMember2025-04-300001715925ipa:DeferredAcquisitionPaymentsMember2023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:AutomobileMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CertificationsMember2023-05-012024-04-300001715925ipa:BioclueB.vMember2023-05-012024-04-300001715925ipa:CustomerListMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:LeaseLiabilitiesMember2023-05-012024-04-300001715925ipa:ImmunoPreciseNetherlandsBVMember2024-05-012025-04-300001715925ipa:UntrechtMember2024-04-300001715925ifrs-full:GrossCarryingAmountMember2024-05-012025-04-300001715925ipa:OptionThreeMember2024-05-012025-04-300001715925ipa:NetBookValueMemberipa:CustomerListMember2024-04-300001715925ipa:AccumulatedAmortizationMemberipa:CustomerListMember2025-04-300001715925ipa:OptionTwentyMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-05-012024-04-300001715925ipa:EmployeesMemberipa:EightMayTwentyTwentyThreeMember2024-05-012025-04-300001715925ifrs-full:VehiclesMemberifrs-full:WeightedAverageMember2024-05-012025-04-300001715925ipa:FifteenMayTwentyTwentyTwoMemberipa:EmployeesMember2025-04-300001715925ipa:OptionTenMember2025-04-300001715925ifrs-full:GrossCarryingAmountMember2025-04-300001715925country:CA2024-05-012025-04-300001715925ipa:TwentyFebruaryTwentyTwentyFourMemberipa:EmployeesMember2024-05-012025-04-300001715925country:BE2024-05-012025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-05-012024-04-300001715925ifrs-full:LiquidityRiskMember2025-04-300001715925ifrs-full:GrossCarryingAmountMember2023-04-300001715925ifrs-full:BottomOfRangeMemberipa:IntellectualPropertiesMember2024-05-012025-04-300001715925ipa:FirstMarchTwentyTwentyThreeMemberipa:EmployeesMember2024-05-012025-04-300001715925ifrs-full:VehiclesMember2024-04-300001715925ifrs-full:AdditionalPaidinCapitalMember2023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:ComputerHardwareMember2024-05-012025-04-300001715925ipa:InternallyGeneratedDevelopmentCostsMemberifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:CryoStorageMember2024-05-012025-04-300001715925ifrs-full:RetainedEarningsMember2024-04-300001715925ipa:BiostrandMember2022-05-012023-04-300001715925ipa:ProjectRevenueMember2022-05-012023-04-300001715925ipa:OptionEightMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:ComputerHardwareMember2023-04-300001715925ipa:BiostrandB.v.Memberifrs-full:OrdinarySharesMember2022-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-04-300001715925ipa:OneFebruaryTwentyTwentyFourMemberipa:EmployeesMember2025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2025-04-300001715925ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember2023-05-012024-04-300001715925ipa:EmployeesMemberipa:TwentyThreeMayTwentyTwentyThreeMember2025-04-300001715925ipa:TrancheThreeMemberipa:BiostrandB.v.Memberipa:EscrowAgreementMember2022-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2023-04-300001715925country:AU2022-05-012023-04-300001715925ipa:DeferredAcquisitionPaymentsMember2022-05-012023-04-300001715925ipa:OptionFourMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:ComputerHardwareMember2024-04-300001715925ipa:AccumulatedDepreciationAmountMember2023-04-300001715925ipa:NineteenJanuaryTwentyTwentyFourMembersrt:DirectorMember2024-05-012025-04-300001715925ipa:BioStrandTwoMember2024-05-012025-04-300001715925ipa:InternallyGeneratedDevelopmentCostsMember2024-05-012025-04-300001715925country:NL2024-05-012025-04-300001715925ipa:OptionFifteenMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-05-012024-04-300001715925ipa:CustomerListMemberifrs-full:GrossCarryingAmountMember2024-04-300001715925ifrs-full:PreviouslyStatedMember2024-04-300001715925ipa:BiokeyB.vMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:ComputerHardwareMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CustomerListMember2023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:LabEquipmentMember2023-04-300001715925ipa:FourJanuaryTwentyTwentyThreeMemberipa:EmployeesMember2025-04-300001715925ipa:BiostrandB.v.Memberifrs-full:OrdinarySharesMember2022-04-130001715925ipa:AccumulatedAmortizationMemberipa:IntellectualPropertiesMember2024-05-012025-04-300001715925ipa:NetBookValueMemberifrs-full:ComputerSoftwareMember2025-04-300001715925ipa:VictoriaMember2024-04-300001715925ipa:IntellectualPropertiesMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CustomerListMember2023-05-012024-04-300001715925ipa:EmployeesMemberipa:ElevenJuneTwentyTwentyThreeMember2024-05-012025-04-300001715925ipa:SecondAprilTwentyTwentyThreeMemberipa:EmployeesMember2024-05-012025-04-300001715925ipa:OptionTwoMember2025-04-300001715925ifrs-full:GrossCarryingAmountMember2023-04-300001715925ipa:NetBookValueMemberifrs-full:LeaseholdImprovementsMember2025-04-300001715925ipa:BiostrandMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesCanadaLtdMember2022-05-012023-04-300001715925ifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-04-300001715925ipa:ImmunoPreciseAntibodiesNDLtdMember2022-05-012023-04-300001715925country:BE2023-04-3000017159252023-04-300001715925ipa:BiostrandB.v.Member2023-05-012024-04-300001715925ipa:BiokeyB.vMember2022-05-012023-04-300001715925ipa:EmployeesMemberipa:ThirteenNovemberTwentyTwentyThreeMember2025-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2022-05-012023-04-300001715925ifrs-full:VehiclesMember2024-05-012025-04-300001715925srt:NorthAmericaMemberipa:CorporateSegmentsMember2024-04-300001715925ipa:IdeaFamilyB.vMember2024-05-012025-04-300001715925ipa:AugustThreeTwoThousandTwentyFourMemberipa:OfficersAndEmployeesMember2025-04-300001715925ipa:CustomerListMemberifrs-full:GrossCarryingAmountMember2023-05-012024-04-300001715925ipa:AccumulatedDepreciationAmountMemberifrs-full:BuildingsMember2024-05-012025-04-300001715925srt:EuropeMember2024-05-012025-04-300001715925ipa:OptionOneMember2025-04-300001715925ipa:UtrechtMember2024-04-300001715925ipa:DeferredAcquisitionPaymentsMember2023-05-012024-04-300001715925ipa:NetBookValueMemberipa:LabEquipmentMember2024-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:AutomobileMember2024-05-012025-04-300001715925ipa:EmployeesMemberipa:FifteenMarchTwentyTwentyThreeMember2024-05-012025-04-300001715925ipa:OptionTwoMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2023-05-012024-04-300001715925ifrs-full:IssuedCapitalMember2025-04-300001715925ipa:OptionFourteenMember2025-04-300001715925srt:NorthAmericaMember2024-04-300001715925ipa:ConvertibleDebenturesMemberipa:YaIiPnLtdMemberipa:TrancheTwoMember2024-07-160001715925ipa:DeferredAcquisitionPaymentsMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CustomerListMember2024-05-012025-04-300001715925ifrs-full:RestrictedShareUnitsMember2024-05-012025-04-300001715925ifrs-full:FixturesAndFittingsMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:IntellectualPropertiesMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:ProprietaryProcessesMember2023-05-012024-04-300001715925ipa:OptionTenMember2024-05-012025-04-300001715925ipa:OptionFiveMember2024-05-012025-04-300001715925ipa:EmployeesMemberipa:FifteenMarchTwentyTwentyThreeMember2025-04-300001715925ipa:OneFebruaryTwentyTwentyFourMemberipa:EmployeesMember2024-05-012025-04-300001715925ipa:SecondAprilTwentyTwentyThreeMemberipa:EmployeesMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2023-04-300001715925ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2023-04-300001715925ipa:NetBookValueMemberifrs-full:ComputerSoftwareMember2024-04-300001715925ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember2022-05-012023-04-300001715925ipa:ImmunoPreciseAntibodiesMALLCMember2023-05-012024-04-300001715925ipa:ConvertibleDebenturesMember2022-04-300001715925ifrs-full:LiquidityRiskMemberifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2025-04-300001715925ipa:OptionSeventeenMember2025-04-300001715925ipa:FindersWarrantsMember2025-04-300001715925ipa:AccumulatedAmortizationMemberipa:ProprietaryProcessesMember2024-05-012025-04-300001715925ipa:AccumulatedAmortizationMemberipa:CertificationsMember2023-04-300001715925ipa:AccumulatedAmortizationMember2025-04-300001715925ipa:BioclueB.vMember2022-05-012023-04-300001715925ifrs-full:GoodsOrServicesTransferredOverTimeMember2022-05-012023-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberipa:WorkInProgressLeaseholdImrpvementsMember2024-04-300001715925ipa:VictoriaOneMember2024-04-300001715925ipa:OptionOneMember2024-05-012025-04-300001715925ipa:FourJanuaryTwentyTwentyThreeMemberipa:EmployeesMember2024-05-012025-04-300001715925ifrs-full:AccumulatedOtherComprehensiveIncomeMember2024-04-300001715925country:NL2025-04-300001715925ipa:BioStrandOneMember2025-04-300001715925ipa:ImmunoPreciseAntibodiesCanadaLtdMember2024-05-012025-04-300001715925ifrs-full:LaterThanFourYearsAndNotLaterThanFiveYearsMember2025-04-300001715925ipa:IdeaFamilyB.vMember2023-05-012024-04-300001715925ipa:WorkInProgressLeaseholdImrpvementsMemberifrs-full:GrossCarryingAmountMember2025-04-300001715925ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:BuildingsMember2024-05-012025-04-300001715925srt:NorthAmericaMember2023-05-012024-04-3000017159252023-05-012024-04-300001715925ifrs-full:LeaseholdImprovementsMember2024-05-012025-04-300001715925ifrs-full:BuildingsMember2024-05-012025-04-300001715925ifrs-full:GrossCarryingAmountMemberipa:AutomobileMember2025-04-300001715925ipa:ImmunoPreciseNetherlandsBVMember2022-05-012023-04-300001715925ipa:CertificationsMemberifrs-full:GrossCarryingAmountMember2025-04-30iso4217:EURxbrli:purexbrli:sharesiso4217:CADiso4217:USDutr:Y

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

|

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended April 30, 2025 |

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ____________________ to ____________________ |

OR

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 001-39530

ImmunoPrecise Antibodies Ltd.

(Exact name of Registrant as specified in its charter)

British Columbia

(Jurisdiction of incorporation or organization)

Industrious 823 Congress Ave Suite 300 Austin, Texas 78701, United States

(Address of principal executive offices)

Joseph Scheffler, 250-483-0308, jscheffler@ipatherapeutics.com

Industrious 823 Congress Ave Suite 300 Austin, Texas 78701, United States

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Shares, no par value |

IPA |

The Nasdaq Stock Market, LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: N/A

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 46,154,118 Common Shares

Indicate by check mark if the Company is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the Company is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Company has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Company was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the Company has used to prepare the financial statements included in this filing:

|

|

|

U.S. GAAP ☐ |

International Financial Reporting Standards as issued By the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to previous question, indicate by check mark which financial statement item the Company has elected to follow. Item 17☐ Item 18☐

If this is an annual report, indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

INTRODUCTION

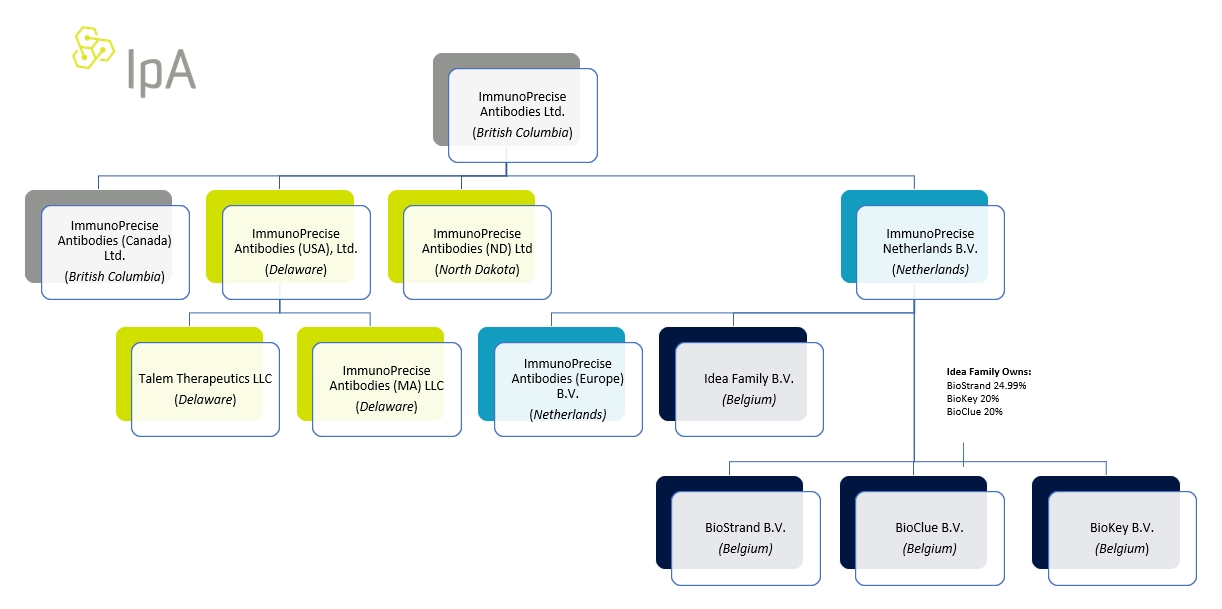

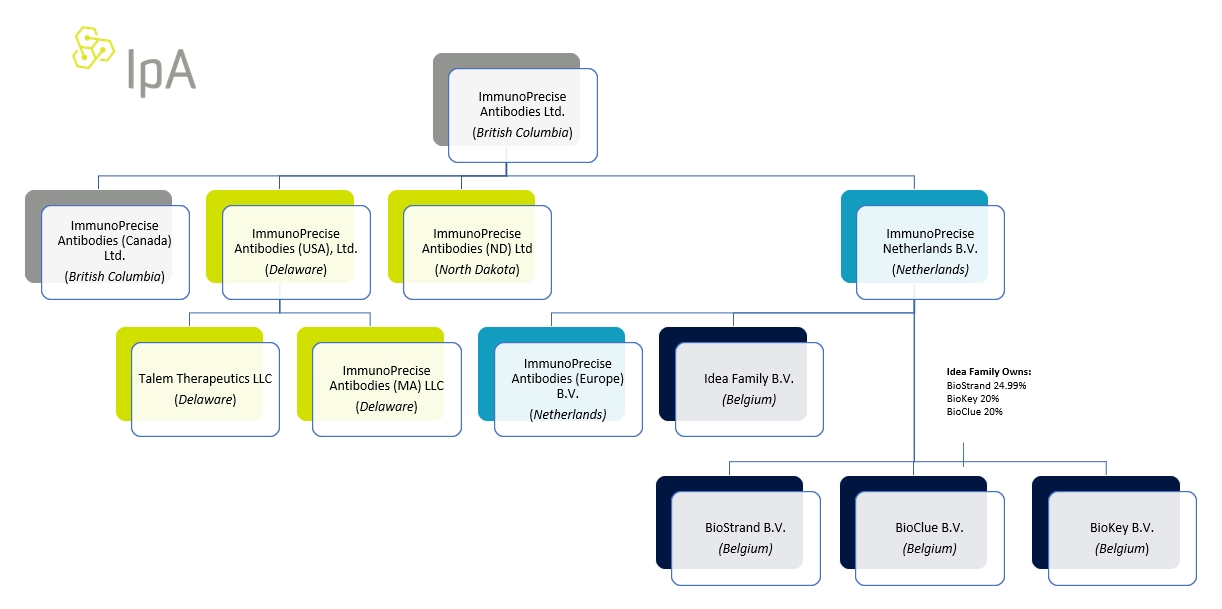

In this Annual Report on Form 20-F (the “Annual Report”), “IPA,” “Company,” “we,” “us” and “our” refer to ImmunoPrecise Antibodies Ltd. and its consolidated subsidiaries.

Information contained in this Annual Report is given as of April 30, 2025, the fiscal year end of Company, unless otherwise specifically stated.

Market and industry data used throughout this Annual Report was obtained from various publicly available sources. Although the Company believes that these independent sources are generally reliable, the accuracy and completeness of such information are not guaranteed and have not been verified due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and the limitations and uncertainty inherent in any statistical survey of market size, conditions and prospects.

Statements made in this Annual Report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we file any of these documents as an exhibit to this Annual Report, you may read the document itself for a complete description of its terms.

The Company reports under International Financial Reporting Standards as issued by the International Accounting Standards Board. None of the consolidated financial statements contained in this Annual Report were prepared in accordance with generally accepted accounting principles in the United States. The Company's financial statements are presented in Canadian dollars. In this Annual Report, unless otherwise indicated, all dollar amounts and references to "$" or "CAD$" are to Canadian dollars and references to "U.S.$" are to United States dollars, but most of the figures included in this Annual Report, including the Company's financial statements, are in Canadian dollars.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” and “forward-looking information” within the meaning of United States and Canadian securities laws (collectively, “forward-looking statements”) about the Company which reflect management's expectations regarding the Company's future growth, results of operations, operational and financial performance and business prospects and opportunities. In addition, the Company may make or approve certain statements in future filings with Canadian and United States regulatory authorities, in news releases, or in oral or written presentations by representatives of the Company that are not statements of historical fact and may also constitute forward-looking statements. All statements, other than statements of historical fact, made by the Company that address activities, events or developments that the Company expects or anticipates will or may occur in the future are forward-looking statements, including, but not limited to statements preceded by, followed by, or that include words such as "may", "would", "could", "will", "likely", "expect", "anticipate", "believe", "intends", "plan", "forecast", "budget", "schedule", "project", "estimate", "outlook", or the negative of those words or other similar or comparable words.

Forward-looking statements involve significant risks, assumptions, uncertainties, and other factors that may cause actual future performance, achievements, or other realities to differ materiality from those expressed or implied in any forward-looking statements and, accordingly, should not be read as guarantees of future performance, achievements, or realities. Although the forward-looking statements contained in this Annual Report and the documents incorporated by reference herein and therein reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, the Company cannot be certain that actual results will be consistent with these forward-looking statements. A number of risks and factors could cause actual results, performance, or achievements to differ materially from the results expressed or implied in the forward-looking statements. Such risks and factors include, but are not limited to, the following:

•

negative operating cash flow;

•

liquidity and future financing risk;

•

the financial position of the Company and its potential need for additional liquidity and capital in the future;

•

the Company may experience going concern risk;

•

the Company may fail to remediate a material weakness;

•

the success of any of the Company's current or future strategic alliances;

•

the Company may become involved in regulatory or agency proceedings, investigations and audits;

•

the Company may be subject to litigation in the ordinary course of its business;

•

the ability of the Company to obtain, protect and enforce patents on its technology and products;

•

risks associated with applicable regulatory processes;

•

the ability of the Company to achieve publicly announced milestones;

•

the effectiveness of the Company's business development and marketing strategies;

•

the competitive conditions of the industry in which the Company operates;

•

market perception of smaller companies;

•

the Company cannot assure the production of new and innovative processes, procedures or innovative approaches to antibody production or new antibodies;

•

the ability of the Company to manage growth;

•

the selection and integration of acquired businesses and technologies;

•

the Company may lose clients;

•

any reduction in demand;

•

any reduction or delay in government funding of research and development ("R&D");

•

costs of being a public company in the United States;

•

the Company may fail to meet the delivery and performance requirements set forth in client contracts;

•

the Company may become subject to patent and other intellectual property litigation;

•

the Company's dependence upon key personnel;

•

the Company may not achieve sufficient brand awareness;

•

the Company's directors and officers may have interests which conflict with those of the Company; the outsourcing trend in non-clinical discovery stages of drug discovery;

•

the Company's products, services and expertise may become obsolete or uneconomical;

•

the effect of global economic conditions;

•

the Company has a limited number of suppliers;

•

the Company may become subject to liability for risks against which it cannot insure;

•

clients may restrict the Company's use of scientific information;

•

the Company may experience failures of its laboratory facilities;

•

any contamination in animal populations;

•

any unauthorized access into information systems;

•

prospective investors' ability to enforce civil liabilities;

•

the Company's status as a foreign private issuer;

•

exposure to foreign exchange rates;

•

the effects of future sales or issuances of equity securities or debt securities;

•

the market price of the common shares of the Company (the “Common Shares”) may experience volatility;

•

the Company's failure to meet the continued listing requirements of The Nasdaq Capital Market ("Nasdaq"), particularly the minimum bid price requirements within the second extension period;

•

the anticipated use of proceeds from this offering, if any;

•

the Company has not declared or paid any dividends on the Common Shares and does not intend to do so in the foreseeable future; and

•

a liquid market for the Common Shares may not develop.

Although the Company has attempted to identify important risks and factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. Further, any forward-looking statements are made as of the date of the Annual Report or the documents incorporated by reference herein and therein, as applicable. Other than as required by applicable securities laws, the Company assumes no obligation to update or revise them to reflect new events or circumstances. New factors emerge from time to time, and it is not possible for management to predict all such factors and to assess in advance the impact of each such factor on the Company's business or the extent to which any factor, or combination of factors, may cause actual realities to differ materially from those contained in any forward-looking statement. Accordingly, readers should not place undue reliance on forward-looking statements contained in this Annual Report or the documents incorporated by reference herein and therein. All forward-looking statements disclosed in this Annual Report and the documents incorporated by reference herein and therein are qualified by this cautionary statement.

STATUS AS AN EMERGING GROWTH COMPANY

We are an “emerging growth company” as defined in Section 3(a) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We will continue to qualify as an "emerging growth company" until the earliest to occur of: (a) the last day of the fiscal year during which we had total annual gross revenues of U.S.$1,235,000,000 (as such amount is indexed for inflation every 5 years by the United States Securities and Exchange Commission (“SEC”)) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of equity securities pursuant to an effective registration statement under the United States Securities Act of 1933, as amended (the “Securities Act”); (c) the date on which we have, during the previous 3-year period, issued more than U.S.$1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer”, as defined in Exchange Act Rule 12b-2.

Generally, a registrant that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an “accelerated filer” or a “large accelerated filer” (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management’s assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report on management’s assessment of internal controls over financial reporting in its annual reports filed under the Exchange Act, even if we were to qualify as an “accelerated filer”. In addition, Section 103(a)(3) of the Sarbanes-Oxley Act of 2002 has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

FOREIGN PRIVATEISSUER FILINGS

We are considered a “foreign private issuer” pursuant to Rule 405 promulgated under the Securities Act. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information. For as long as we are a “foreign private issuer” we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Exchange Act. However, the information we file or furnish may not be the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for United States domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by United States residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are United States citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. If we lose our “foreign private issuer status” we would be required to comply with Exchange Act reporting and other requirements applicable to United States domestic issuers, which are more detailed and extensive than the requirement for foreign private issuers.

NON-IFRS MEASURES

The information presented in this Annual Report includes certain measures that are not recognized under IFRS and do not have a standardized meaning prescribed by IFRS. They are therefore unlikely to be comparable to similar measures presented by other companies. The Company uses non-IFRS measures, including “adjusted EBITDA” and “adjusted operating expenses” as additional information to complement IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Management believes that these measures provide useful information in that they may exclude amounts that are not indicative of the Company’s core operating results and ongoing operations and provide a more consistent basis for comparison between periods.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

B.

Capitalization and Indebtedness

Not applicable.

C.

Reasons for the Offer and Use of Proceeds

Not applicable.

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only ones we will face. If any of these risks actually occur, our business, financial condition or results of operations may be materially and adversely affected. In that case, the trading price of our securities could decline and investors in such securities could lose all or part of their investment.

We currently have negative operating cash flows.

We have negative cash flow from operating activities and have historically incurred net losses. There is no assurance that we will generate sufficient revenues in the near future. To the extent that we have negative operating cash flows in future periods, we may need to deploy a portion of our existing working capital to fund such negative cash flows. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to us as those previously obtained, or at all. If we are unable to obtain additional financing from outside sources and eventually generate enough revenues, we may be forced to sell a portion or all of our assets, curtail or discontinue our operations. If any of these events happen, investors may lose all or part of their investment.

We may have difficulties in managing our liquidity risk, which may adversely affect our financial and operating performance and limit our growth.

Although we are a going concern, we do not have cash reserves to fund all our operations for one year, and strategic future growth and expansion plans. We have historically incurred net losses. There is no assurance that sufficient revenues will be generated in the near future. To the extent that we have negative operating cash flows in future periods, we may need to deploy a portion of our existing working capital to fund such negative cash flows. We may need to raise additional funds through issuances of Common Shares or through loan financing. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to us as those previously obtained, or at all. If we are unable to obtain additional financing from outside sources and eventually generate enough revenues, we may be forced to sell a portion or all of our assets or curtail or discontinue our operations.

We have additional needs for liquidity and capital which may have an adverse impact on our business.

We are an AI-driven biopharmaceutical discovery and development company focused on creating safer and more efficacious novel therapeutic antibodies. IPA does not seek regulatory approval of its early-stage candidates, but instead, aims to out-license its assets prior to clinical trial research. We have not generated substantial revenues from collaboration and licensing agreements to date, and have incurred significant research, development and other expenses related to ongoing operations. As a result, we have not been profitable and have incurred operating losses in every reporting period since inception and have a significant accumulated deficit. Operating costs are expected to increase in the near term as we continue to build our AI-driven software development, namely LENSai, and the Company expects that this will continue until either subscription-based payments of our future product sales, partnership fees, licensing fees, milestone payments or royalty payments are sufficient to generate revenues to fund continuing operations. We are unable to predict the extent of any future losses or when our business will become profitable, if ever. Even if we achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

We may experience difficulties managing our resources to fund operations for one year, impacting our growth and business.

Although the Company is a going concern, the Company does not have cash reserves to fund all its operations for one year, and strategic future growth and expansion plans. The Company has historically incurred net losses. There is no assurance that sufficient revenues will be generated in the near future. To the extent that the Company has negative operating cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows. The Company may need to raise additional funds through issuances of Common Shares or through loan financing. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to the Company as those previously obtained, or at all. If the Company is unable to obtain additional financing from outside sources and eventually generate enough revenues, the Company may be forced to sell a portion or all of the Company's assets or curtail or discontinue the Company's operations.

We may fail to remediate a material weakness that could affect our financial reporting.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. Management concluded that we did not have sufficient resources to assist us in identifying, evaluating and addressing complex technical accounting issues that affect our consolidated financial statements on a timely basis. The remediation measures intended to correct the material weakness in internal controls may be insufficient to remediate the material weakness and could impact financial reporting.

We have and will continue to enter into strategic alliances which may have an adverse impact on our business.

We currently have, and may in the future enter into, strategic alliances with third parties that we believe will complement or augment our existing business. Our ability to enter into strategic alliances is dependent upon, and may be limited by, the availability of suitable candidates and capital. In addition, strategic alliances could present unforeseen integration obstacles or costs, may not enhance our business, and may involve risks that could adversely affect us, including significant amounts of management time that may be diverted from operations in order to pursue and complete such transactions or maintain such strategic alliances. Future strategic alliances could result in the incurrence of additional debt, costs and contingent liabilities, and there can be no assurance that future strategic alliances will achieve, or that our existing strategic alliances will continue to achieve, the expected benefits to our business or that we will be able to consummate future strategic alliances on satisfactory terms, or at all. Any of the foregoing could have a material adverse effect on our business, financial condition and results of operation.

We may not be able to enter into collaboration agreements on terms favorable to us or at all. Furthermore, some of those agreements may give substantial responsibility over our drug candidates to the collaborator.

If we enter into collaboration agreements for one or more of our drug candidates, the success of such drug candidates will depend in great part upon our collaborators’ success in promoting them as superior to other treatment alternatives. We believe that our drug candidates may be proven to offer disease treatment with notable advantages over other drugs. However, there can be no assurance that we will be able to prove these advantages or that the advantages will be sufficient to support the successful commercialization of our drug candidates.

We may become subject to litigation, regulatory or agency proceedings, investigations and audits.

Our business requires compliance with many laws and regulations. Failure to comply with these laws and regulations could subject us to regulatory or agency proceedings or investigations and could also lead to damage awards, fines and penalties. We may become involved in a number of government or agency proceedings, investigations and audits. The outcome of any regulatory or agency proceedings, investigations, audits, and other contingencies could harm our reputation, require us to take, or refrain from taking, actions that could harm our operations or require us to pay substantial amounts of money, harming our financial condition. There can be no assurance that any pending or future regulatory or agency proceedings, investigations and audits will not result in substantial costs or a diversion of management’s attention and resources or have a material adverse impact on our business, financial condition and results of operations.

We carry litigation risk.

We may become party to litigation from time to time in the ordinary course of business including, but not limited to, in connection with our operations or pursuant to the terms of any of our commercial agreements, which could adversely affect our business. Should any litigation in which we become involved be decided against us, such a decision could adversely affect our ability to continue operating and the value of our securities and could use significant resources. Even if we are involved in litigation and win, litigation can redirect a significant amount of our resources, including the time and attention of management and available working capital. Litigation may also create a negative perception of our brand.

Protecting and defending our intellectual property claims may have a material adverse effect on our business.

Our success will depend on our ability to obtain, protect and enforce patents on our technology and products. Any patents that we may own or license in the future may not afford meaningful protection for our technology and products. Our efforts to enforce and maintain our intellectual property rights may not be successful and may result in substantial costs and diversion of management time. In addition, others may challenge patents we may obtain in the future and, as a result, these patents could be narrowed, invalidated or rendered unenforceable or we may be forced to stop using the technology covered by these patents or to license the technology from third parties. In addition, current and future patent applications on which we depend may not result in the issuance of patents. Even if our rights are valid, enforceable and broad in scope, competitors may develop products based on similar technology that is not covered by our patents. Further, since there is a substantial backlog of patent applications at the various patent offices, the approval or rejection of our competitors’ patent applications may take several years.

In addition to patent protection, we also rely on copyright and trademark protection, trade secrets, know-how, continuing technological innovation and licensing opportunities. In an effort to maintain the confidentiality and ownership of our trade secrets and proprietary information, we require our employees, consultants and advisors to execute confidentiality and proprietary information agreements. However, these agreements may not provide us with adequate protection against improper use or disclosure of confidential information and there may not be adequate remedies in the event of unauthorized use or disclosure. Furthermore, like many companies in our industry, we may from time to time hire scientific personnel formerly employed by other companies involved in one or more areas similar to the activities we conduct. In some situations, our confidentiality and proprietary information agreements may conflict with, or be subject to, the rights of third parties with whom our employees, consultants or advisors have prior employment or consulting relationships. Although we require our employees and consultants to maintain the confidentiality of all confidential information of previous employers, we or these individuals may be subject to allegations of trade secret misappropriation or other similar claims as a result of their prior affiliations. Finally, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets. Our failure to protect our proprietary information and techniques may inhibit or limit our ability to exclude certain competitors from the market and execute our business strategies.

The announcements we make are forward-looking and are based on best estimates of management, which may not be updated or revised as a result of new information or future events.

From time to time, we may announce the timing of certain events which are expected to occur, such as the anticipated timing of results from partnerships or out-licensing events. These statements are forward-looking and are based on the best estimates of management at the time. However, the actual timing of such events may differ significantly from what has been publicly disclosed. The timing of events such as the initiation or completion of a transaction, may ultimately vary from what is publicly disclosed. These variations in timing may occur as a result of different events, including the nature of the results obtained during research, delays from partners, or any other event having the effect of delaying the publicly announced timeline. We undertake no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as otherwise required by law. Any variation in the timing of previously announced milestones could have a material adverse effect on our business plan, financial condition or operating results, and the trading price of the Common Shares.

Our business development and marketing strategies alter our future growth and profitability.

Our future growth and profitability will depend on the effectiveness and efficiency of our national and international business development and marketing and sales strategy, including our ability to (i) grow our brand recognition for our services internationally; (ii) determine appropriate business development, marketing and sales strategies and (iii) maintain acceptable operating margins on such costs.

There can be no assurance that business development, marketing and sales costs will result in revenues for our business in the future or will generate awareness of our products and services. In addition, no assurance can be given that we will be able to manage our business development, marketing and sales costs on a cost-effective basis.

If we are unable to compete effectively, our business, financial condition and results of operations would be materially and adversely affected.

Although we believe that there are only a limited number of full-service, biologics, CRO firms, we may face intense competition in selling our products and services. Some competitors may have marketing, financial, development and personnel resources which exceed our own. As a result of this competition, we may be unable to maintain our operations or develop them as currently proposed on terms we consider acceptable or at all. Increased competition by larger, better-financed competitors with geographic advantages could materially and adversely affect our business, financial condition and results of operations. To remain competitive, we believe that we must effectively and economically provide: (i) products and services that satisfy client demands, (ii) superior client service, (iii) high levels of quality and reliability, and (iv) dependable and efficient distribution networks. Increased competition may require us to reduce prices or increase spending on sales and marketing and client support, which may have a material adverse effect on our financial condition and results of operations. Any decrease in the quality of our products or level of service to clients or any occurrence of a price war among our competitors may adversely affect the business and results of operations.

Client reach, service and on-time delivery will continue to be a hallmark of our ability to compete with other market players. Further, the

acquisitions translate to spreading our footprint on two continents. In addition, we have deployed a sales team tasked with continually sourcing and providing market intelligence as part of our activities.

We may have difficulty raising funds due to the market perception of smaller companies.

Market perception of smaller companies may change, potentially affecting the value of investors’ holdings and our ability to raise further funds through the issuance of further Common Shares or otherwise. The share price of smaller publicly traded companies can be highly volatile. The value of the Common Shares may go down as well as up and, in particular, the share price may be subject to sudden and large falls in value given the restricted marketability of the Common Shares, results of operations, changes in earnings estimates or changes in general market, economic and political conditions.

Our employment of scientific staff does not guarantee success in research and product development.

We are an AI-driven biotherapeutic research, technology and scientifically robust life science company that discovers and develops customized and novel antibodies by generating proprietary and patented processes, procedures and innovative approaches to antibody discovery, development, and production. We have been engaged in these activities for over 60 collective years and have had several assets enter the clinical successfully. Continued investment in retaining key scientific staff, as well as an ongoing commitment in R&D activities, will continue to be a cornerstone in our development of new services, processes, and competitive advantages such as Rapid Prime, B cell Select, DeepDisplay and our methods for the production of complex proteins and antibodies. We realize that such research and product development activities endeavor, but cannot assure, the production of new and innovative processes, procedures or innovative approaches to antibody production or new antibodies. Furthermore, if we do not achieve sufficient market acceptance of our expansion of our commercialization of our products and services, it will be difficult for us to achieve consistent profitability. Our marketing and sales approach and external sales personnel continue to introduce a steady stream of new clients.

Growth may cause pressure on our management and systems.

We may be subject to growth-related risks including pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee base. Our inability to deal with this growth could have a material adverse impact on our business, operations and prospects. We may experience growth in the number of our employees and the scope of our operating and financial systems, resulting in increased responsibilities for our personnel, the hiring of additional personnel and, in general, higher levels of operating expenses. In order to manage our current operations and any future growth effectively, we will also need to continue to implement and improve our operational, financial and management information systems and to hire, train, motivate, manage and retain employees. There can be no assurance that we will be able to manage such growth effectively, that our management, personnel or systems will be adequate to support our operations or that we will be able to achieve the increased levels of revenue commensurate with the increased levels of operating expenses associated with this growth.

We are subject to risks associated with selection and integration of acquired businesses and technologies.