EX-99.1

Exhibit 99.1

URC:TSX | UROY:NASDAQ

ANNUAL INFORMATION FORM

for the fiscal year ended April 30, 2025

July 16, 2025

1830 – 1188 West Georgia Street, Vancouver, British Columbia, Canada V6E 4A2

TABLE OF CONTENTS

|

|

|

|

|

|

|

INTRODUCTORY NOTES |

1 |

|

RISK FACTORS |

61 |

|

Currency Presentation and Exchange Rate Information |

1 |

|

|

Risks Related to the Business of URC |

62 |

|

Cautionary Statement Regarding Forward-Looking Information |

1 |

|

|

Risks Related to the Company's Securities |

74 |

|

Technical and Third-Party Information |

3 |

|

DIVIDENDS AND DISTRIBUTIONS |

76 |

|

Note Regarding Mineral Reserve and Resource Estimates |

4 |

|

DESCRIPTION OF CAPITAL STRUCTURE |

77 |

GLOSSARY |

5 |

|

|

Authorized Capital |

77 |

CORPORATE STRUCTURE |

6 |

|

MARKET FOR SECURITIES |

78 |

|

Name, Address and Incorporation |

6 |

|

|

Trading Price and Volume |

78 |

|

Intercorporate Relationships |

6 |

|

|

Prior Sales |

79 |

GENERAL DEVELOPMENT OF THE BUSINESS |

6 |

|

DIRECTORS AND OFFICERS |

80 |

|

Public Offerings |

6 |

|

|

Name, Occupation and Security Holding |

80 |

|

At-the-Market Equity Program |

6 |

|

|

Cease Trade Orders, Bankruptcies, Penalties and Sanctions |

83 |

|

Graduation to the TSX |

7 |

|

|

Conflicts of Interest |

84 |

|

Royalty Acquisitions |

7 |

|

AUDIT COMMITTEE |

84 |

|

Physical Uranium |

7 |

|

|

Audit Committee Charter |

84 |

|

Developments Subsequent to April 30, 2025 |

8 |

|

|

Composition of the Audit Committee |

85 |

DESCRIPTION OF THE BUSINESS |

8 |

|

|

Relevant Education and Experience |

85 |

|

General |

8 |

|

|

Audit Committee Oversight |

86 |

|

Business Strategy |

8 |

|

|

Pre-Approval Policies and Procedures |

86 |

|

Uranium Uses and Production Process |

9 |

|

|

External Auditor Service Fees |

86 |

|

The URC Business Model |

12 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

86 |

|

Competitive Strengths |

13 |

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

86 |

|

Summary of Royalty and Other Interests |

14 |

|

TRANSFER AGENTS AND REGISTRARS |

86 |

|

Competitive Conditions |

16 |

|

MATERIAL CONTRACTS |

86 |

|

Regulation |

16 |

|

INTERESTS OF EXPERTS |

87 |

|

Environmental Policies |

18 |

|

ADDITIONAL INFORMATION |

87 |

|

Employees |

18 |

|

APPENDIX "A" ADDITIONAL TECHNICAL DISCLOSURE |

A-1 |

|

Foreign Operations |

18 |

|

|

MCARTHUR RIVER |

A-1 |

THE URC ASSET PORTFOLIO |

19 |

|

|

CIGAR LAKE |

A-16 |

|

Yellow Cake Agreement and Uranium Option |

19 |

|

APPENDIX "B" AUDIT COMMITTEE CHARTER |

B-1 |

|

Royalty Interest |

21 |

|

|

Mineral Reserve and Resource Estimates |

59 |

|

INTRODUCTORY NOTES

References to "we", "our", "us", the "Company" or "URC" in this annual information form (this "Annual Information Form") is to the consolidated operations of Uranium Royalty Corp. and its subsidiaries.

Unless otherwise indicated, the information in this Annual Information Form is given as of the date of this Annual Information Form.

Currency Presentation and Exchange Rate Information

Our reporting currency is the Canadian dollar. Unless otherwise noted, financial information and amounts contained in this Annual Information Form are in Canadian dollars and references herein to "$" are to Canadian dollars. References herein to "US$" are to United States dollars and references herein to "A$" are to Australian dollars.

The table below sets out the high and low rates of exchange for one United States dollar expressed in Canadian dollars during each of the periods noted, the average rates of exchange during such periods and the rates of exchange in effect at the end of such periods, each based on the daily exchange rate reported by the Bank of Canada for conversion of United States dollars.

|

|

|

|

|

Year ended April 30, |

|

2025 |

|

2024 |

Canadian dollars per United States dollar |

|

|

|

Highest rate during the period |

1.4603 |

|

1.3875 |

Lowest rate during the period |

1.3460 |

|

1.3128 |

Average rate during the period |

1.3940 |

|

1.3503 |

Rate at the end of the period |

1.3812 |

|

1.3746 |

Cautionary Statement Regarding Forward-Looking Information

Certain statements contained in this Annual Information Form constitute "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of securities laws in the United States (collectively, "Forward-Looking Statements"). These statements relate to the expectations of management about future events, results of operations and the Company's future performance (both operational and financial) and business prospects. All statements other than statements of historical fact are Forward-Looking Statements. The use of any of the words "anticipate", "plan", "contemplate", "continue", "estimate", "expect", "intend", "propose", "might", "may", "will", "shall", "project", "should", "could", "would", "believe", "predict", "forecast", "target", "aim", "pursue", "potential", "objective" and "capable" and the negative of these terms or other similar expressions are generally indicative of Forward-Looking Statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such Forward-Looking Statements. No assurance can be given that these expectations will prove to be correct and such Forward-Looking Statements should not be unduly relied on. These statements speak only as of the date hereof. In addition, this Annual Information Form may contain Forward-Looking Statements attributed to third party industry sources. Without limitation, this Annual Information Form contains Forward-Looking Statements pertaining to the following:

|

|

• the ongoing operations of the properties in which the Company holds or may hold uranium interests;

• future events or performance;

• the impact of general business and economic conditions;

• future financial capacity, liquidity and capital resources;

• anticipated future sources of funds to meet working capital requirements;

• future capital expenditures and contractual commitments;

|

• expectations respecting future financial results;

• expectations with respect to the Company's financial position;

• expectations regarding uranium prices and the impacts of the United States and other governmental policies on uranium demand;

• expectations regarding supply and demand for uranium;

• conditions, trends and practices pertaining to the uranium industry and other industries in which uranium is used;

|

|

|

• expectations regarding the Company's business plans, strategies, growth and results of operations;

• the financial and operational strength of counterparties;

|

• mineral resources and mine life;

• governmental regulatory regimes with respect to environmental matters.

|

With respect to Forward-Looking Statements contained in this Annual Information Form, assumptions have been made regarding, among other things, the following:

|

|

• market prices of uranium;

• global economic and financial conditions;

• global political conditions and trade policies;

• the ongoing operation of the properties in which the Company holds or may hold uranium interests;

|

• future operations and developments on the properties in which the Company holds or may hold interests; and

• the accuracy of public statements and disclosure, including future plans and expectations, made by the owners or operators of the properties underlying the Company's interests.

|

Actual results could differ materially from those anticipated in these Forward-Looking Statements as a result of, among other things, the risk factors set forth below and included elsewhere in this Annual Information Form, including the following:

|

|

• limited or no access to data or the operations underlying the Company's interests;

• dependence on third party operators;

• dependence on future payments from owners and operators;

• a majority of the Company's assets are non-producing;

• royalties, streams and similar interests may not be honoured by operators of a project;

• defects in, or disputes relating to, the existence, validity, enforceability, terms and geographic extent of royalties, streams and similar interests;

• royalty, stream and similar interests may be subject to buy-down right provisions or pre-emptive rights;

• project costs may influence the Company's future royalty returns;

• risks faced by owners and operators of the properties underlying the Company's interests;

• title, permit or licensing disputes related to any of the properties in which the Company holds or may hold royalties, streams or similar interests;

• excessive cost escalation, as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties underlying royalties, streams or similar interests;

• volatility in market prices and demand for uranium and the market price of the Company's other investments, including as a result of geopolitical factors such as the ongoing conflict in Ukraine;

• changes in general economic, financial, market and business conditions in the industries in which uranium is used;

|

• risks related to mineral reserve and mineral resource estimates;

• replacement of depleted mineral reserve;

• the public acceptance of nuclear energy in relation to other energy sources;

• alternatives to and changing demand for uranium;

• the absence of any public market for uranium;

• changes in legislation, including permitting and licensing regimes and taxation policies;

• the effects of the spread of illness or other public health emergencies;

• commodities price risks, which may affect revenue derived by the Company from its asset portfolio;

• risks associated with future acquisitions;

• competition and pricing pressures;

• any inability of the Company to obtain necessary financing when required on acceptable terms or at all;

• regulations and political or economic developments in any of the jurisdictions where properties in which the Company holds or may hold royalties, streams or similar interests are located;

• compliance with laws and regulations relating to environmental, social and governance matters;

• macroeconomic developments and changes in global general economic, financial, market and business conditions, including as a result of changes in trade policies and regulations;

• fluctuations in the market prices of the Company's investments;

• liquidity in equity investments;

• fluctuations in foreign exchange rate;

|

|

|

• any inability to attract and retain key employees;

• disruptions to the information technology systems of the Company or third-party service providers;

• risks associated with First Nations land claims;

• potential conflicts of interest;

|

• any inability to ensure compliance with anti-bribery and anti-corruption laws;

• any future expansion of the Company's business activities outside of areas of expertise;

• any failure to maintain effective internal controls;

• negative cash flow from operating activities; and

• the other risks described under "Risk Factors" herein.

|

Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in Forward-Looking Statements. Forward-Looking Statements are based on management's beliefs, estimates and opinions on the date the statements are made, and the Company undertakes no obligation to update Forward-Looking Statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are cautioned against attributing undue certainty to Forward-Looking Statements.

The risk factors referenced herein should not be construed as exhaustive. Except as required under applicable laws, the Company undertakes no obligation to update or revise any Forward-Looking Statements. An investment in the Company is speculative and involves a high degree of risk due to the nature of our business and the present state of exploration of our projects.

Please carefully consider the risk factors set out herein under "Risk Factors" starting at page 61 of this Annual Information Form.

Technical and Third-Party Information

This Annual Information Form includes market information, industry data and forecasts obtained from independent industry publications, market research and analyst reports, surveys and other publicly available sources. Although the Company believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Accordingly, the accuracy and completeness of this data is not guaranteed. Actual outcomes may vary materially from those forecast in such reports, surveys or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. The Company has not independently verified any of the data from third party sources referred to herein nor ascertained the underlying assumptions relied on by such sources.

Except where otherwise stated, the disclosures herein relating to properties underlying the Company's royalty and other interests has been prepared in accordance with the exemption set forth in Section 9.2 of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and is based on information publicly disclosed by the owners or operators of such properties. Specifically, as a royalty holder, the Company has limited, if any, access to the properties subject to its interests and the publicly available information on such properties may sometimes relate to a larger property area than that covered by the Company's interests. The Company generally relies on publicly available information regarding these properties and related operations and generally has no ability to independently verify such information, and there can be no assurance that such third-party information is complete and accurate. Additionally, the Company has, and may from time to time, receive operating information from the owners and operators of these properties, which it is not permitted to disclose to the public.

As of the date of this Annual Information Form, the Company considers its royalty interest in the McArthur River Operation and Cigar Lake Project (each as defined herein), each located in Saskatchewan, Canada as its material properties for the purposes of NI 43-101. See "URC Asset Portfolio – Royalty Interests – McArthur River" and " URC Asset Portfolio – Royalty Interests – Cigar Lake".

Unless otherwise indicated, the scientific and technical information contained herein or in the documents incorporated by reference regarding: (i) McArthur River has been derived from the technical report titled "McArthur River Operation, Northern Saskatchewan, Canada, National Instrument 43-101 Technical Report" (the "McArthur River Technical Report"), with an effective date of December 31, 2018; and (ii) Waterbury Lake / Cigar Lake has been derived from the technical report titled "Cigar Lake Operation, Northern Saskatchewan, Canada, National Instrument 43-101 Technical Report", with an effective date of December 31, 2023 (the "Cigar Lake Technical Report"), each prepared for Cameco Corporation ("Cameco") as well as Cameco's Annual Information Form for the year ended December 31, 2024 (the "Cameco 2024 AIF") and Cameco's other public disclosures, copies of which are available under its profile on the System for Electronic Document Analysis and Retrieval+ at www.sedarplus.ca ("SEDAR+").

Note Regarding Mineral Reserve and Resource Estimates

This Annual Information Form has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Unless otherwise indicated, all mineral reserve and resource estimates included in this Annual Information Form have been prepared for or by the current or former owners and operators of the relevant properties, as and to the extent indicated by them, in accordance with NI 43-101, the CIM Definition Standards, JORC or Regulation S-K 1300, as applicable.

As a foreign private issuer that is eligible to file reports with the United States Securities and Exchange Commission (the "SEC") pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosures under Regulation S-K 1300, which is applicable to domestic issuers in the United States. Accordingly, United States investors are cautioned that while terms are substantially similar to CIM Definition Standards, there are differences in the definitions under Regulation S-K 1300 and the CIM Definition Standards and there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under Regulation S-K 1300.

Investors are also cautioned that they should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports are or will be economically or legally mineable. Further, "inferred resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, the project stage classifications utilized by the Company under NI 43-101 do not conform to defined project stages under Regulation S-K 1300.

The owners and operators of certain projects underlying the Company's interests have prepared resource estimates which are referenced herein or in the Company's other disclosure documents, under JORC and/or Regulation S-K 1300, which differ from the requirements of NI 43-101. Accordingly, information contained herein may contain descriptions of the projects underlying the Company's interests that differ from similar project information made available by other Canadian issuers.

GLOSSARY

Unless the context otherwise requires, when used in this Annual Information Form, the defined technical terms and abbreviations below shall have the meanings ascribed thereto. Words importing the singular number shall include the plural and vice versa and words importing any gender shall include all genders.

"CIM" means the Canadian Institute of Mining, Metallurgy and Petroleum.

"CIM Definitions Standards" means the CIM Definition Standards on Mineral Resources and Reserves adopted by the CIM council on November 27, 2010, or the CIM Definition Standards on Mineral Resources and Reserves adopted by the CIM council on May 10, 2014, as applicable in the context used.

"eU3O8" or "U3O8 equivalent" means radiometric equivalent U3O8.

"GRR" means gross revenue royalty, a form of royalty interest entitling the holder thereof to a share of the total revenue stream from the sale of production from a property, which may or may not include deductions. GRR may also be referred to as a "gross value royalty", or GVR, a "gross proceeds royalty", or GPR, or a "gross overriding royalty", or "GORR".

"ISR" means in-situ recovery, one of two primary extraction methods currently used to extract uranium from underground.

"JORC" or "JORC Code" means the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves.

"LOM" or "life of mine" means the time in which, through the employment of the available capital, the ore reserves, or such reasonable extension of the ore reserves as conservative geological analysis may justify, will be extracted.

"Mlbs" means millions of pounds.

"NPI" means net profit interest, a form of royalty based on the profit realized after deducting costs related to production. NPI may also be referred to as "net proceeds royalties", or NPR.

"NSR" means net smelter returns royalty, a form of royalty based on the value of production or net proceeds received by the operator from a smelter or refinery.

"ppm" means parts per million.

"PR" means production royalty, a form of royalty based on metal produced, often at a predetermined fixed price.

"Regulation S-K 1300" means the mining disclosure rules under sub-part 1300 of SEC Regulation S-K under the Securities Act of 1933, as amended, titled – Disclosure by Registrants Engaged in Mining Operations.

"U3O8" means triuranium octoxide, a compound of uranium that is converted to UF6 for the purpose of uranium enrichment.

"UF6" means uranium hexafluoride, a compound used in the uranium enrichment process that produces fuel for nuclear reactors and nuclear weapons.

"V2O5" means vanadium pentoxide, a compound of vanadium that is often mined as a co-product of uranium in conventional deposits in the southwestern United States. It is often used as a catalyst in chemical reactions.

CORPORATE STRUCTUREName, Address and Incorporation

The Company was incorporated under the Canada Business Corporations Act (the "CBCA") on April 21, 2017, under the name "Uranium Royalty Corp."

The Company's head office is located at 1188 West Georgia Street, Suite 1830, Vancouver, British Columbia V6E 4A2 and its registered and records office is located at 925 West Georgia Street, Suite 1000, Vancouver, British Columbia V6C 3L2.

The Company's common shares without par value (the "Common Shares") are listed on the Toronto Stock Exchange (the "TSX") under the symbols "URC". The Common Shares are also listed on the Nasdaq Capital Market ("NASDAQ") under the stock symbol "UROY".

Intercorporate Relationships

The Company has two wholly-owned subsidiaries, Uranium Royalty (USA) Corp., a corporation incorporated under the laws of the State of Delaware on October 24, 2018, and Reserve Minerals, LLC, a limited liability company existing under the laws of the State of Delaware.

GENERAL DEVELOPMENT OF THE BUSINESS

Key aspects of the development of the Company's business over the last three completed financial years are discussed below.

Public Offerings

On October 17, 2023, the Company completed an underwritten bought deal public offering of 10,205,000 Common Shares (the "2023 Offered Shares") at a price of US$2.94 per 2023 Offered Share for gross proceeds of $40.9 million (the "2023 Offering"). Uranium Energy Corp. ("UEC") purchased 1,930,750 Common Shares, representing approximately 19% of the number of 2023 Offered Shares, under the 2023 Offering.

On February 9, 2024, the Company completed an underwritten bought deal public offering of 6,724,600 Common Shares (the "2024 Offered Shares") at a price of US$3.40 per 2024 Offered Share for gross proceeds of $30.8 million (the "2024 Offering"). UEC purchased 1,047,614 Common Shares representing approximately 16% of the number of 2024 Offered Shares under the 2024 Offering.

At-the-Market Equity Program

On August 29, 2024, the Company renewed its at-the-market equity distribution program (the "ATM Program"). The ATM Program allows the Company to distribute up to US$39 million (or the equivalent in Canadian dollars) of its Common Shares (the "ATM Shares"). Sales of ATM Shares through the ATM Program are made pursuant to an equity distribution agreement dated August 29, 2024, with a syndicate of agents led by BMO Nesbitt Burns Inc., and including BMO Capital Markets Corp., H.C. Wainwright & Co. LLC, Canaccord Genuity Corp., Canaccord Genuity LLC, Paradigm Capital Inc., TD Securities Inc. and TD Securities (USA) LLC (collectively, the "Agents").

The ATM Shares sold under the ATM Program are sold at the prevailing market price on the TSX or the NASDAQ, or any other market on which the Common Shares may be listed and posted for trading, as applicable, at the time of sale. Unless earlier terminated by the Company or the Agents as permitted therein, the ATM Program will terminate upon the earlier of (a) the date that the aggregate gross sales proceeds of the ATM Shares sold under the ATM Program reaches the aggregate amount of US$39 million (or the equivalent in Canadian dollars); or (b) August 20, 2025.

During the year ended April 30, 2025, no ATM Shares were distributed by the Company under the ATM Program.

During the year ended April 30, 2024, a total of 870,910 Common Shares were distributed by the Company under the ATM Program through the facilities of the TSX and NASDAQ for gross proceeds of $3.5 million, of which approximately $0.7 million (representing net proceeds of $0.7 million), at an average selling price of $4.05 per Common Share, was raised through the facilities of the TSX, and US$2.1 million ($2.8 million) (representing net proceeds of US$2.0 million ($2.7 million)), at an average selling price of US$2.98 per Common Share, was raised through the facilities of the NASDAQ. The Agents were paid aggregate commissions on such sales of approximately $0.02 million and US$0.5 million (representing 2.50% of the gross proceeds of the ATM Shares sold).

During the year ended April 30, 2023, a total of 4,029,021 Common Shares were distributed by the Company under the ATM Program through the facilities of the TSX Venture Exchange ("TSX-V") and the NASDAQ for gross proceeds of $14.6 million, of which approximately $3.2 million (representing net proceeds of $3.1 million) was raised through the facilities of the TSX-V and US$8.7 million ($11.4 million) (representing net proceeds of US$8.4 million ($11.1 million)) was raised through the facilities of the NASDAQ. The Agents were paid aggregate commissions on such sales of approximately $0.08 million and US$0.2 million (representing 2.50% of the gross proceeds of the ATM Shares sold).

Graduation to the TSX

On July 6, 2023, the Company graduated from the TSX-V to the TSX. Common Shares are listed on the TSX under the symbol "URC".

Royalty Acquisitions

On February 7, 2023, the Company completed its acquisition of a portfolio of royalties consisting of:

o

a 2% NSR royalty on portions of the San Rafael Project, located in Utah, USA, operated by Western Uranium & Vanadium Corp. ("Western Uranium");

o

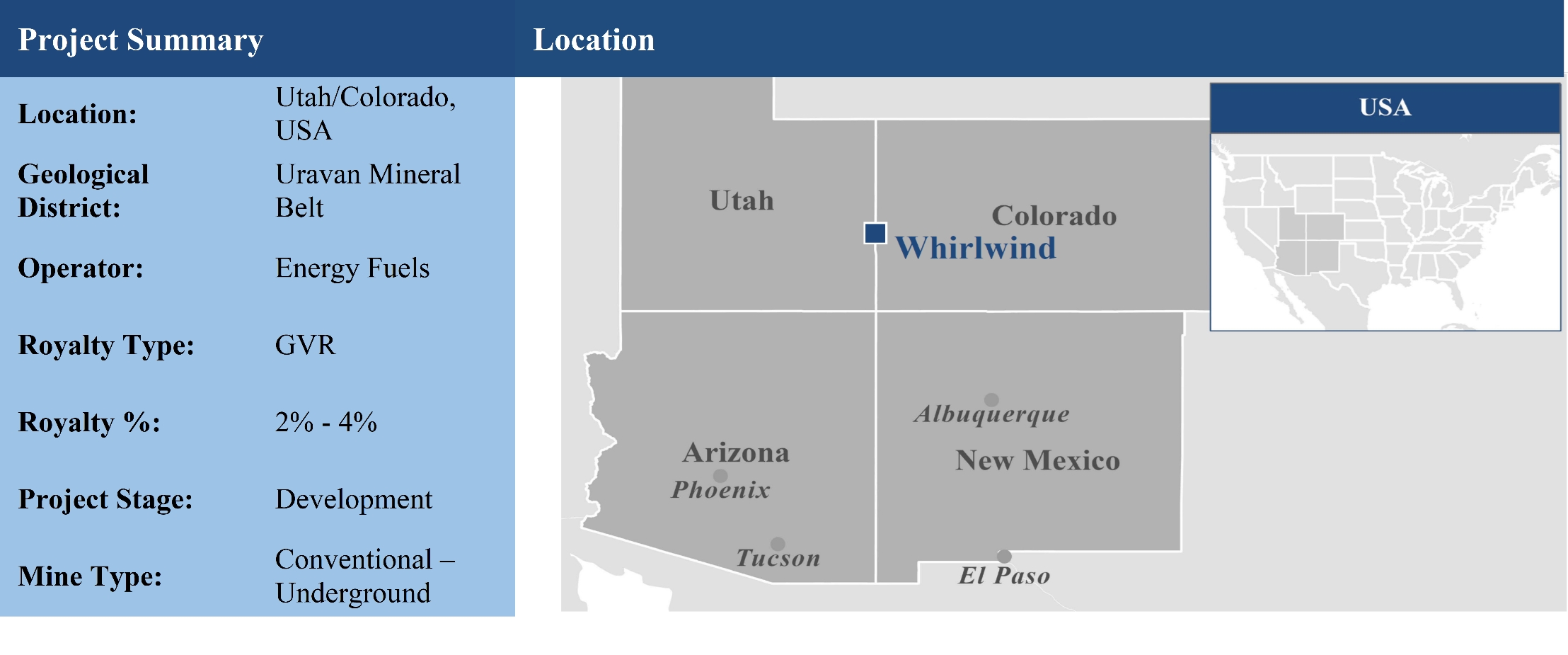

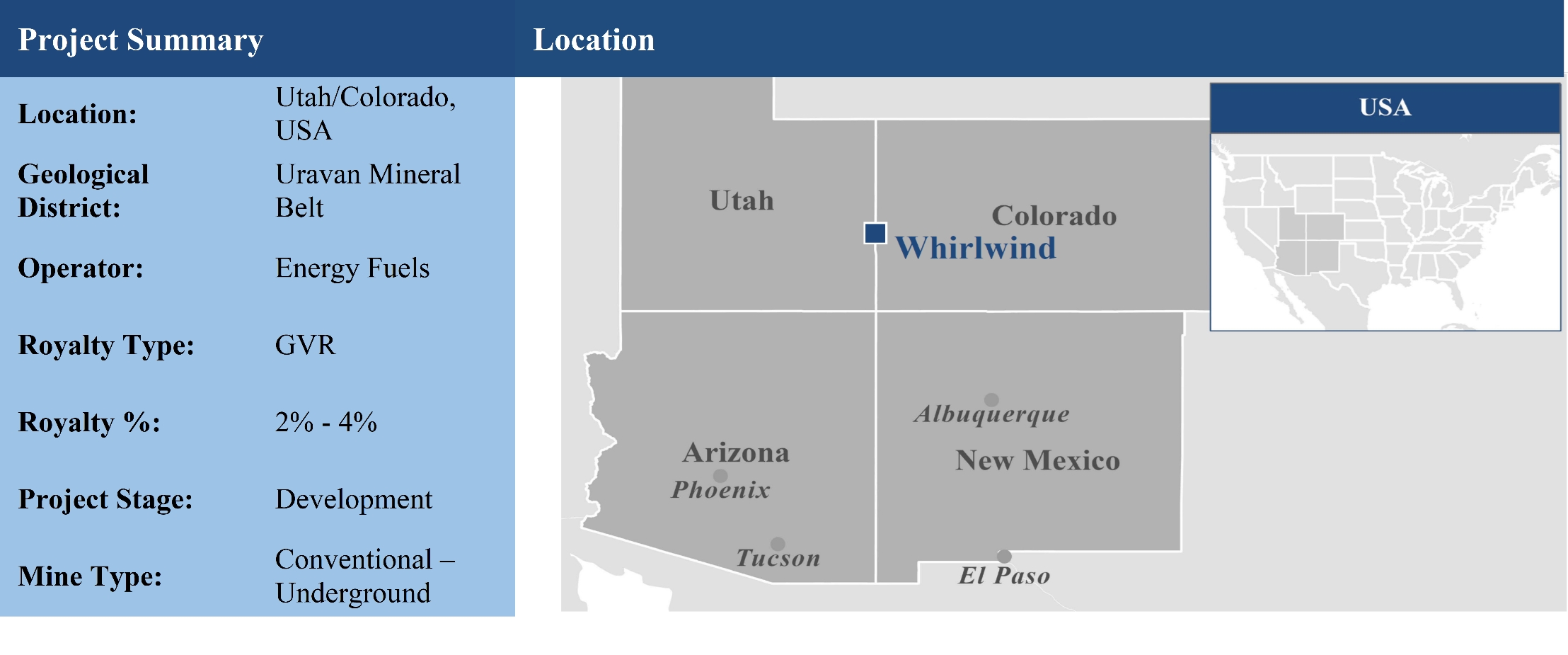

a 2% - 4% sliding scale GVR royalty on portions of the Whirlwind Project, located in Colorado and Utah, USA, operated by Energy Fuels Inc. ("Energy Fuels");

o

a 1% GVR royalty (applicable to uranium and vanadium sales) on portions of the Energy Queen Project, located in Utah and Colorado, USA, operated by Energy Fuels; and

o

a 2% - 4% sliding scale royalty on portions of the Dewey-Burdock Project located in South Dakota, USA, operated by enCore Energy Corp. ("enCore").

The consideration paid by the Company was $2.0 million (US$1.5 million) in cash.

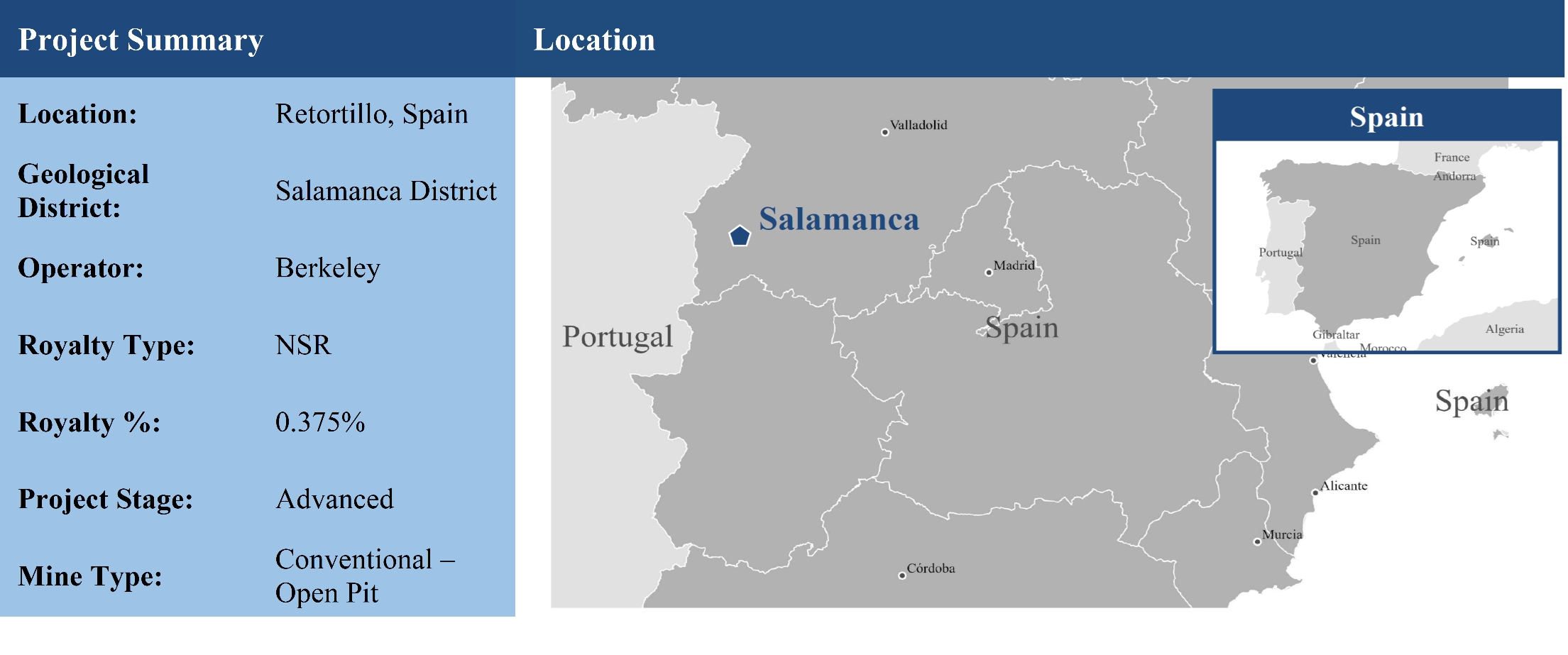

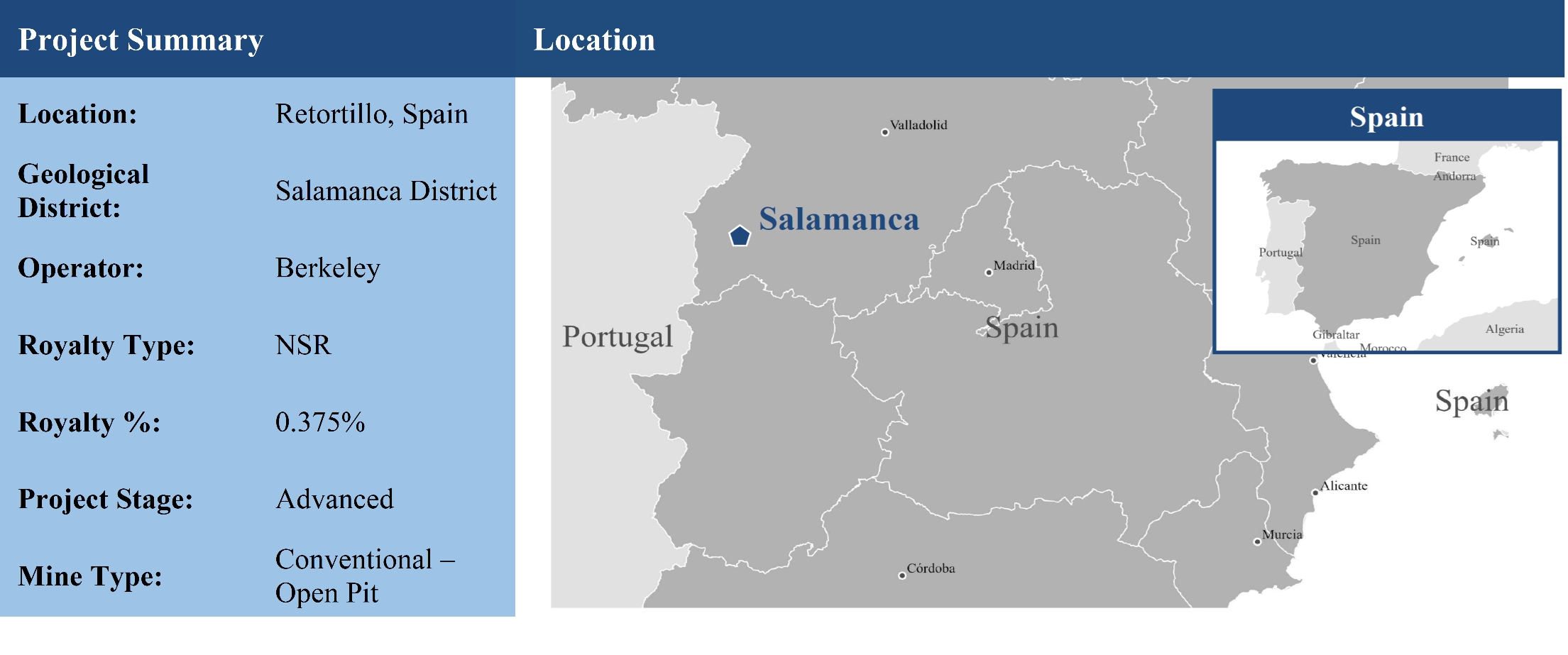

On July 3, 2024, the Company acquired a 0.375% NSR royalty on the Salamanca project for cash consideration of $0.7 million. This royalty includes the Retortillo, Zona 7 and Alameda projects, located in Spain.

On July 31, 2024, the Company acquired GORR of 6% "Mine Price" on a portion of the Churchrock Project for cash consideration of $4.9 million (US$3.5 million). The royalty is based on gross revenues after recovery of certain reasonable and actual costs to transport the mineral to the final point of sale. The royalty covers the 10 patented mining claims in Section 8 property (640 acres) that comprise New Mexico Mineral Survey 2220 on the Churchrock Project.

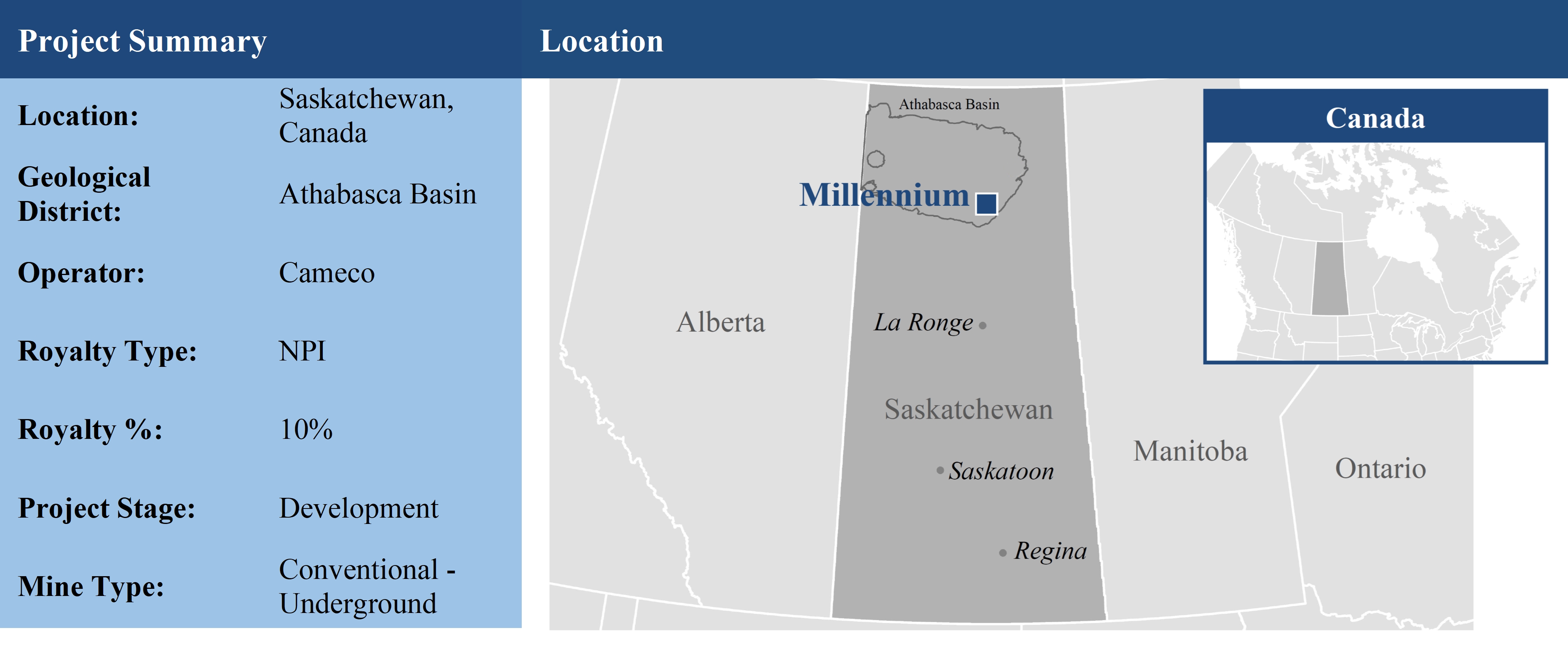

On October 25, 2024, the Company acquired a 10% NPI royalty on an approximate 20.6955% participating interest in the Millennium and Cree Extension projects for cash consideration of $6.0 million. As a profit-based NPI, the acquired royalty is calculated based upon generated revenue, with deductions for certain expenses and costs, which include cumulative expense accounts, including development costs.

Physical Uranium

As of the date hereof, the Company holds 2,379,637 pounds of U3O8 at a weighted average acquisition cost of US$59.73 per pound. As at April 30, 2025, the Company held 2,729,637 pounds of U3O8 at a weighted average cost of US$59.73 per pound.

In October 2023, the Company received 300,000 pounds of U3O8 purchased under existing agreements with CGN Global Uranium Ltd ("CGN"), pursuant to which the Company agreed to purchase an aggregate of 500,000 pounds U3O8 at a weighted average price of US$47.71 per pound.

In July 2024, the Company received an additional 100,000 pounds of U3O8 purchased under existing agreements with CGN. The delivery of the remaining 100,000 pounds for payment of approximately $6.8 million is expected to occur in January 2026. The delivery was originally scheduled to be delivered in April 2025 but was deferred to January 2026 by the parties.

In August 2024, the Company entered into a physical uranium sale and repurchase arrangement with a third party, in which the Company sold 160,000 pounds U3O8 for approximately $18.0 million (US$13.4 million) in August 2024 and repurchased 160,000 pounds U3O8 for approximately $19.7 million (US$13.7 million) in December 2024.

During the year ended April 30, 2025, the Company sold 150,000 pounds of U3O8 for approximately $15.5 million, generating a gross profit of $3.5 million.

On March 14, 2025, Orano Canada Inc. ("Orano") settled the royalty payment for the McArthur River Royalty for calendar year 2024 by delivering 18,366 pounds U3O8 to the Company's storage account at Cameco's Blind River uranium refining facility, located in Ontario, Canada.

Developments Subsequent to April 30, 2025

On June 4, 2025, the Company acquired a 2.0% GRR royalty on the Aberdeen project for cash consideration of $1.0 million. The royalty is subject to a buyback option, pursuant to which one quarter of the royalty may be repurchased upon payment to the Company of $1,000,000. This option is only exercisable for a period of six months following the announcement of a successful pre-feasibility study and expires on June 4, 2032.

Subsequent to April 30, 2025, the Company sold 350,000 pounds U3O8 at a price of US$69.27 per pound for cash consideration of $33.2 million (US$24.2 million).

On June 20, 2025, the Company participated in a public offering launched by Sprott Physical Uranium Trust ("Sprott") and purchased 1,456,028 units for cash consideration of $34.3 million (US$25 million).

DESCRIPTION OF THE BUSINESSGeneral

URC is a pure-play uranium royalty company focused on gaining exposure to uranium prices by making strategic investments in uranium interests, including royalties, streams, debt and equity investments in uranium companies, as well as through holdings of physical uranium.

Business Strategy

To date, the Company has assembled a portfolio of royalty interests on uranium projects and physical uranium holdings. URC's long-term strategy is to gain exposure to uranium prices by owning and managing a portfolio of geographically diversified uranium interests, including uranium royalties and streams, debt and equity investments in uranium companies and physical uranium. From time to time, the Company also seeks further exposure to uranium through investments in funds and other equities.

In executing its royalty strategy, the Company seeks interests that provide it with direct exposure to uranium prices, without the direct operating costs and concentrated risks that are associated with the exploration, development and mining of uranium.

The Company's strategy recognizes the inherent cyclicality of valuations based on uranium prices, including the impact of such cyclicality on the availability of capital within the uranium sector. The Company implements its strategy by leveraging the deep industry knowledge and expertise of its management team and its board of directors to identify and evaluate opportunities in the uranium industry.

The Company's primary focus is to identify, evaluate and acquire:

•

royalties on uranium projects, pursuant to which the Company would receive payments from operators of uranium mines based on production and/or sales of uranium products;

•

uranium streams, pursuant to which the Company would make an upfront payment to a project owner or operator in exchange for long-term rights to purchase a fixed percentage of future uranium production; and

•

off-take or other agreements, pursuant to which the Company would enter into long-term purchase agreements or options to acquire physical uranium products.

Such interests may be acquired by the Company directly from the owner or operator of a project or indirectly from third party holders. The Company may also seek to acquire direct joint venture or other interests in existing uranium projects, where such interests would provide the Company with exposure to a project as a non-operator or where the Company believes there is potential to convert such interests into royalties, streams or similar interests. In evaluating potential transactions, the Company utilizes a disciplined approach to manage its fiscal profile.

Ancillary to its core business, the Company also seeks to identify and complete direct strategic equity or debt investments in companies engaged in the exploration, development and/or production of uranium.

The Company also engages in purchases and sales of uranium inventories from time to time. Purchases are made where the Company believes there is an opportunity to provide attractive commodity price exposure. Sales may occur from time to time based upon market conditions and the Company's liquidity requirements. Purchases may be made pursuant to its existing option under its strategic arrangement with Yellow Cake plc ("Yellow Cake") or by other means, including direct purchases from producers or market purchases. See "The URC Asset Portfolio – Yellow Cake Strategic Investment and Uranium Option" and "General Development of the Business – Physical Uranium".

Uranium Uses and Production Process

The predominant use for uranium is as a fuel for nuclear power plants. Through the process of nuclear fission, the uranium isotope U-235 can undergo a nuclear reaction whereby its nucleus is split into smaller particles. This process releases significant amounts of energy, creating heat to generate steam to spin a turbine, and is the basis of power generation in the nuclear power industry.

Uranium has other commercial uses in the fields of medical diagnosis, agriculture, carbon dating and other industries. However, the volume of demand generated by these uses is very small compared to nuclear power generation. Uranium is also used as a feedstock for over 200 private nuclear reactors, which are operated for research purposes and the production of isotopes for commercial uses. Uranium is also the propulsion fuel source for nuclear-powered aircraft carriers, submarines and ice-breaking vessels.

Uranium Production Process

There are three main uranium mining processes:

(i)

Conventional – Open Pit Mining – This method of mining involves removal of the rock and soil over the economic ore using various types of heavy equipment and often drilling and explosive blasting methods, resulting in an open pit. The rock ore is removed by surface equipment and processed in order to access the minerals. This method is generally used where the ore is close enough to surface to make this method economical, especially in uranium mines with lower grades, but larger tonnages of ore.

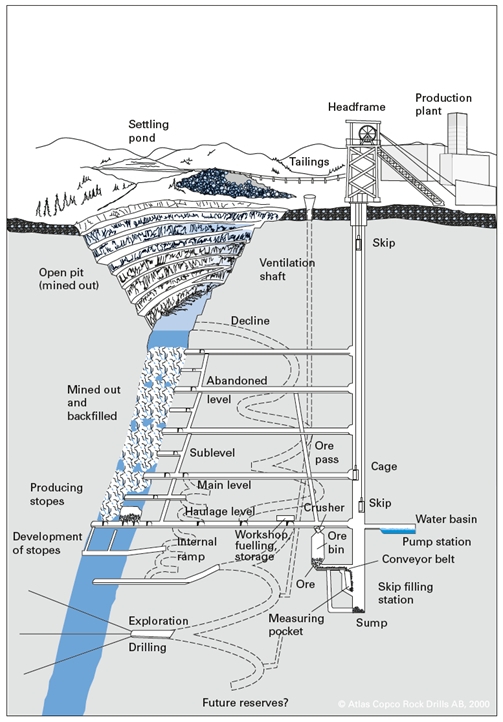

(ii)

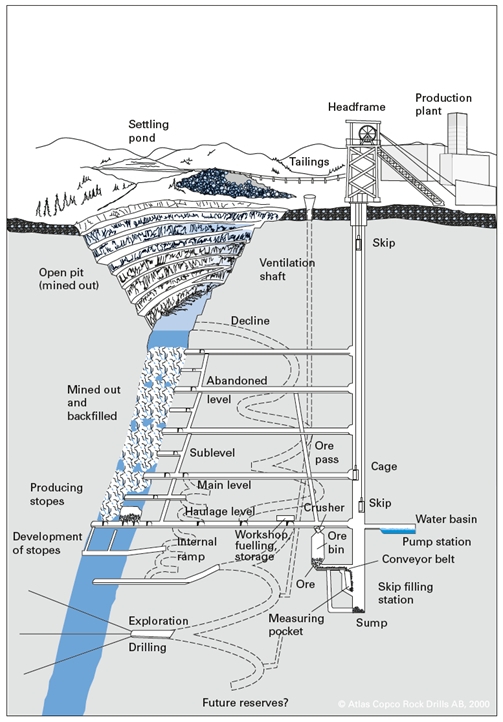

Conventional – Underground Mining – Mineral deposits that cannot be economically mined using surface mining techniques may require mining by underground methods. Underground methods are quite diverse in their techniques, due to the various sizes, shapes and orientations of underground ore bodies. This method typically uses vertical mine shafts and horizontal development tunnels. The method of extraction can vary and include open stoping, cut and fill and caving methods. In some uranium mines, a lack of geotechnical stability can result in the requirement to freeze the ore body and utilize more specialized mining methods.

Source: Atlas Copco – Mining Methods in Underground Mining, 2007

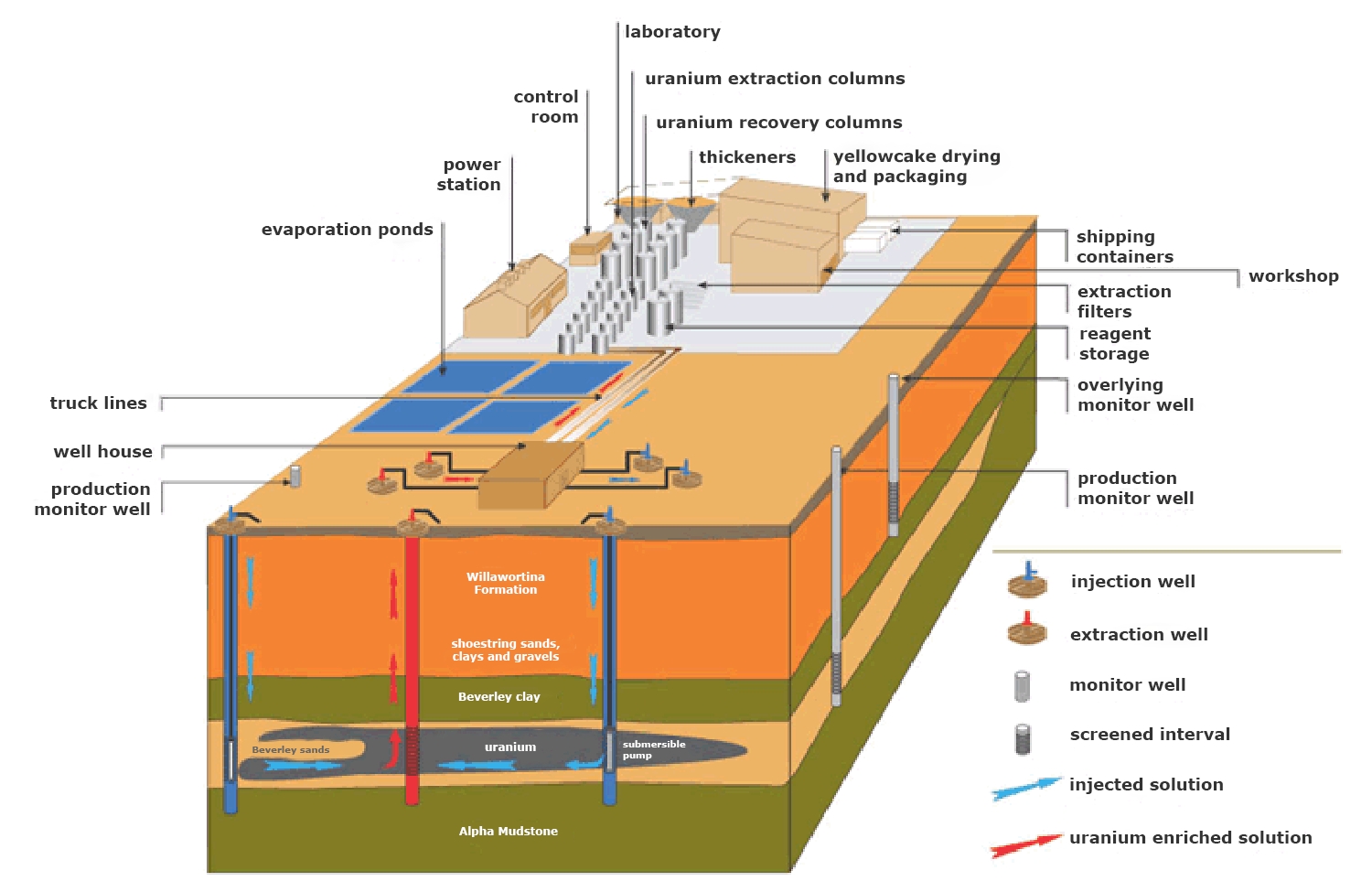

(iii)

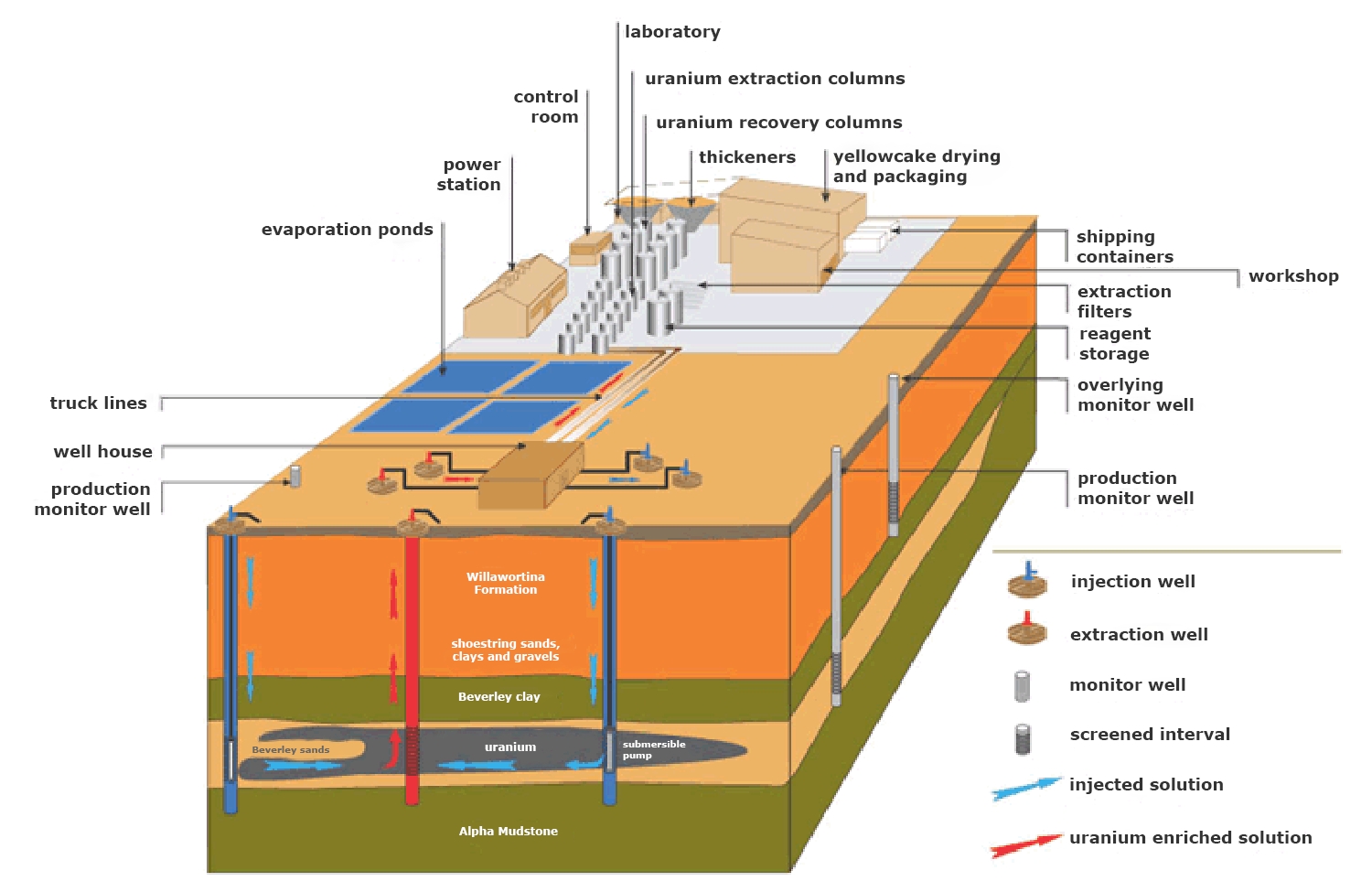

ISR Mining – In situ recovery, or "ISR", involves leaving the ore where it is in the ground, and recovering the minerals from it by dissolving them and pumping the pregnant solution to the surface where the minerals can be recovered. Consequently, there is little surface disturbance and no tailings or waste rock generated. Uranium in situ leaching uses the native groundwater in the orebody which is fortified with a complexing agent and in most cases an oxidant. It is then pumped through the underground orebody to recover the minerals in it by leaching.

Once the pregnant solution is returned to the surface, the uranium is recovered in much the same way as in any other uranium processing plant (mill).

Source: WNA website – In-situ Leach Mining of Uranium, courtesy of Heathgate Resources

An increasing amount of current global annual uranium production, now over 50%, is generated from ISR mining (World Nuclear Association). ISR mining generally requires lower start-up costs than conventional mining operations and involves relatively lower cash costs for inputs such as labor, machinery and maintenance.

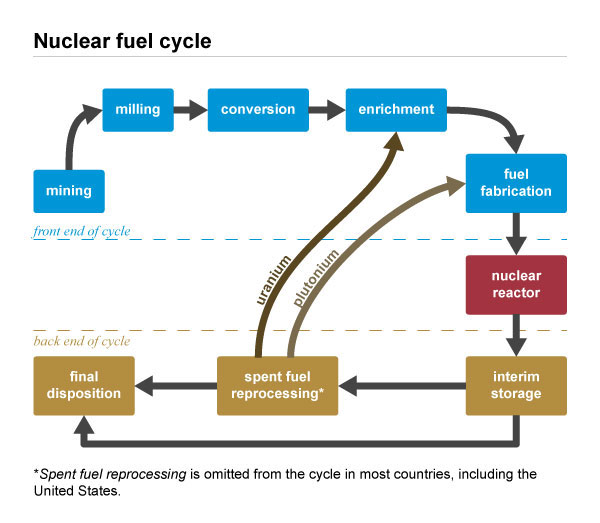

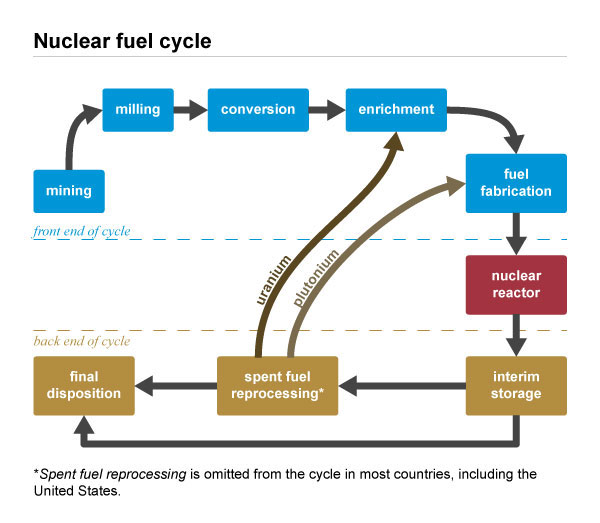

After uranium is mined and recovered, uranium ore is processed and milled to produce U3O8 concentrates. The ore from open pit or underground methods is crushed, pulverized and ground into a fine slurry. Chemicals are added through a series of processing steps to separate and concentrate the uranium. These U3O8 concentrates generally contain 80% - 90% U3O8. The resulting U3O8 is converted to UF6 (or for Candu-type reactors, to UO2).

In order to convert U3O8 to UF6, uranium concentrates are shipped to a uranium conversion facility where such conversion takes place. At temperatures greater than 56°C, UF6 becomes a gas and can be enriched in centrifuges to produce fuel for the majority of reactors. Following the production of UF6, enrichment and fuel fabrication are the next steps before the nuclear fuel is ready for loading into a nuclear reactor.

The figure below provides a general illustration of the nuclear fuel cycle.

Source: United States Energy Information Administration

The URC Business Model

The Company does not operate mines, develop projects or conduct exploration. URC's business model is focused on managing and growing its portfolio of uranium royalty and other uranium interests. The Company believes that the advantages of this business model include the following:

•

Lower Volatility Through Diversification. By investing in diversified uranium interests across a spectrum of geographies, the Company reduces its dependency on any one asset, project, location or counterparty.

•

Exposure to Uranium Price Optionality without Project Costs and Overhead. The Company believes that its model provides exposure to any future improvements in the uranium market, while at the same time minimizing fixed operating, exploration, development and sustaining costs associated with directly owning and operating uranium projects. Additionally, as the Company's interests are non-operational, the Company is not required to satisfy cash calls in order to maintain its interests in such projects.

•

Focus and Scalability. As the Company's directors and officers do not handle operational decisions and tasks relating to uranium projects, they are free to focus their time and energy on carrying out the Company's acquisition strategy and identifying and executing on growth opportunities. As such, URC's business model allows it to acquire and manage more uranium interests than an operating company can effectively manage.

The table below provides a comparison of royalty companies, mining companies, exchange traded funds and funds that hold physical uranium.

|

|

|

|

|

|

Royalty Companies |

Operating Companies |

Uranium ETF |

Physical Funds |

Exposure to Uranium Price |

ü |

ü |

ü |

ü |

Fixed Operating Costs |

ü |

û |

ü |

ü |

No Development or Sustaining Capital Costs |

ü |

û |

ü |

ü |

Exploration and Expansion Upside without the Associated Costs |

ü |

û |

û |

û |

Diversified Asset Portfolio |

ü |

ü |

ü |

û |

Ability to Grow without Increased Management |

ü |

û |

ü |

ü |

Competitive Strengths

The Company believes that its competitive strengths include the following:

•

First and Only Pure-Play Uranium Royalty Company. The Company believes that it is the first and only company to focus solely on acquiring uranium royalties, streams and other uranium interests. The Company believes that such focus gives it an advantage in seeking additional interests by providing it with increased visibility and recognition amongst potential counterparties. Additionally, URC's management has the advantage of focusing solely on growth, as it is not responsible for day-to-day project operations or development decisions respecting the projects underlying its interests.

•

Experience and Expertise. URC's directors and management have extensive experience in the uranium and nuclear energy sectors, including critical experience in mine finance, project identification and evaluation, mine development and uranium sales and trading with leading companies and institutions in the uranium and nuclear energy industries. URC seeks to leverage the experience and network of such individuals to identify, finance and execute acquisitions in furtherance of its long-term strategy.

•

Broad Geographic and Counterparty Diversification. URC's existing royalties are located in multiple mining friendly jurisdictions, giving URC exposure to diverse uranium markets, while reducing country specific risks relating to permitting, operations and other factors. At the same time, such royalty interests involve a range of counterparties, reducing the Company's reliance on any single operator or project.

•

Lean Operating Structure. The Company's relatively lean operating structure allows it to quickly assess whether a particular acquisition or investment opportunity meets its strategic requirements and respond promptly to all suitable business opportunities. The Company carefully selects the opportunities it investigates and does not move forward unless it has a high level of confidence that such an opportunity fits within its objectives and long-term strategy.

Summary of Royalty and Other Interests

The Company's royalty interests do not generate significant revenues to the Company. Only the McArthur River, Cigar Lake and Langer Heinrich mines are in production. In addition, the Company's stated business objectives include the acquisition of physical uranium from time to time through other sources.

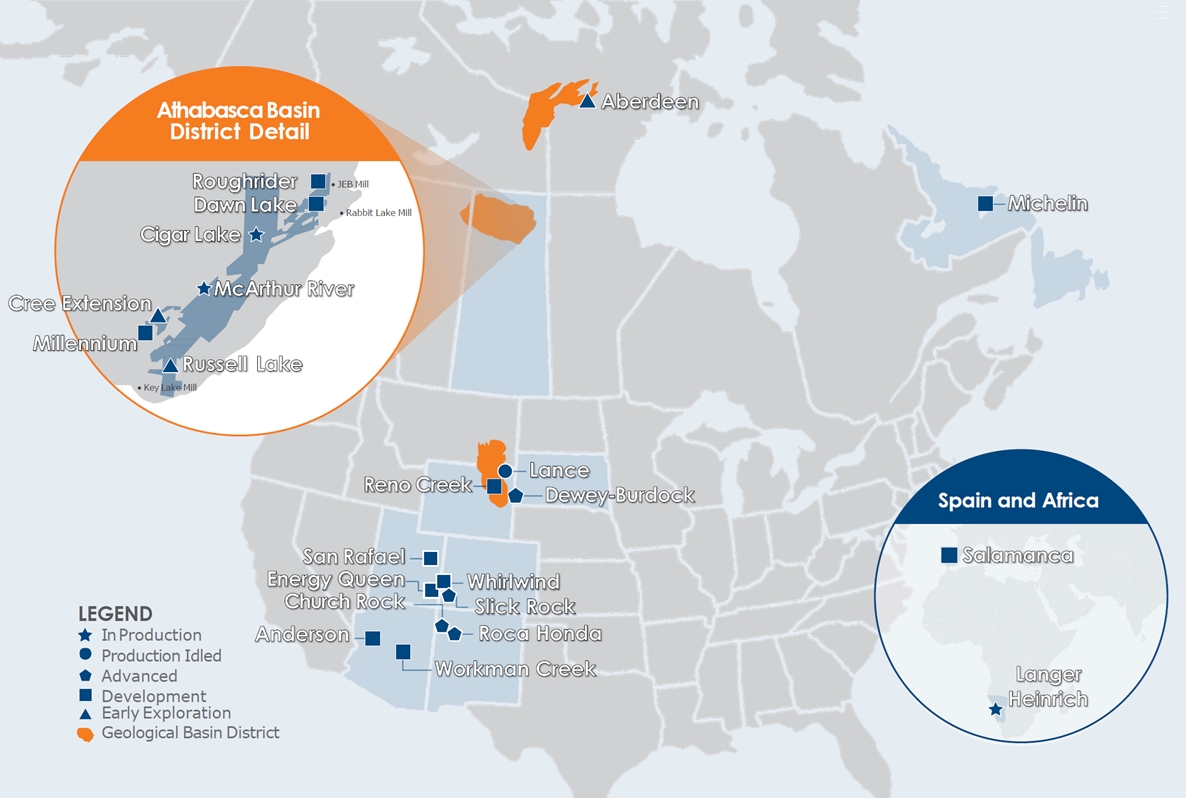

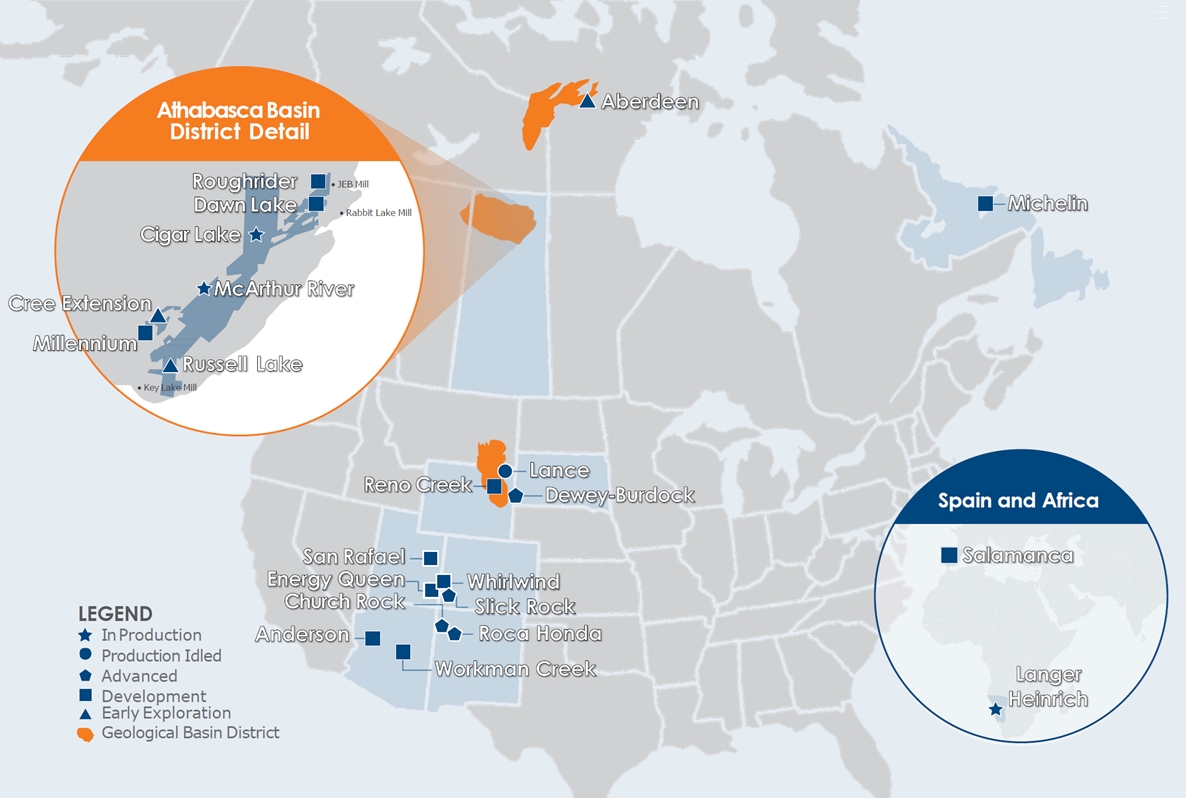

The following map sets forth the locations of the projects underlying URC's existing royalty interests.

The table below summarizes the royalty interests held by URC as of the date of this Annual Information Form.

|

|

|

|

|

|

|

Project |

Operator |

Location |

District |

Interest |

Mining Method |

Project Stage |

Material Properties |

Cigar Lake / Waterbury Lake(1)(3)(4) |

Cameco / Orano

|

SK, Canada |

Athabasca Basin |

10% - 20% NPI |

Conventional – Underground |

In Production |

McArthur River(1)(6) |

Cameco |

SK, Canada |

Athabasca Basin |

1.0% GORR |

Conventional – Underground |

In Production |

Other Properties |

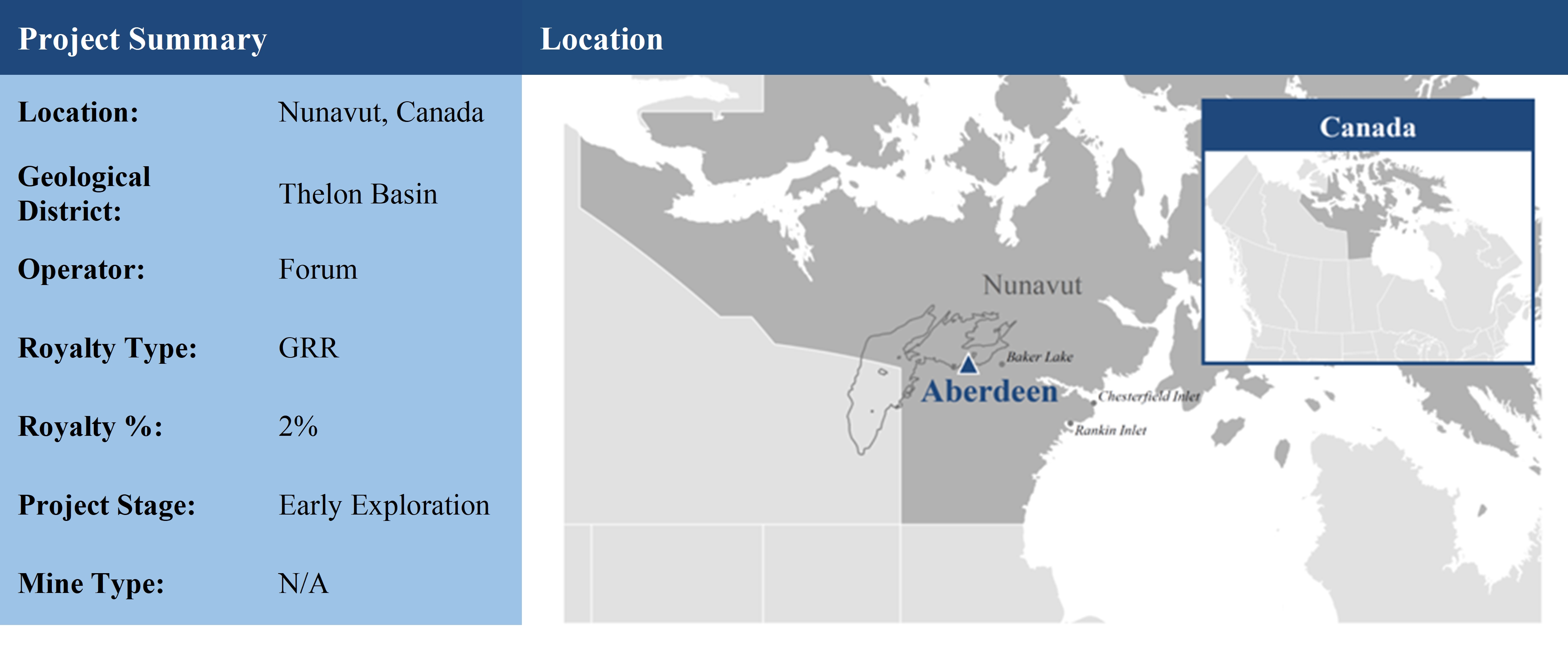

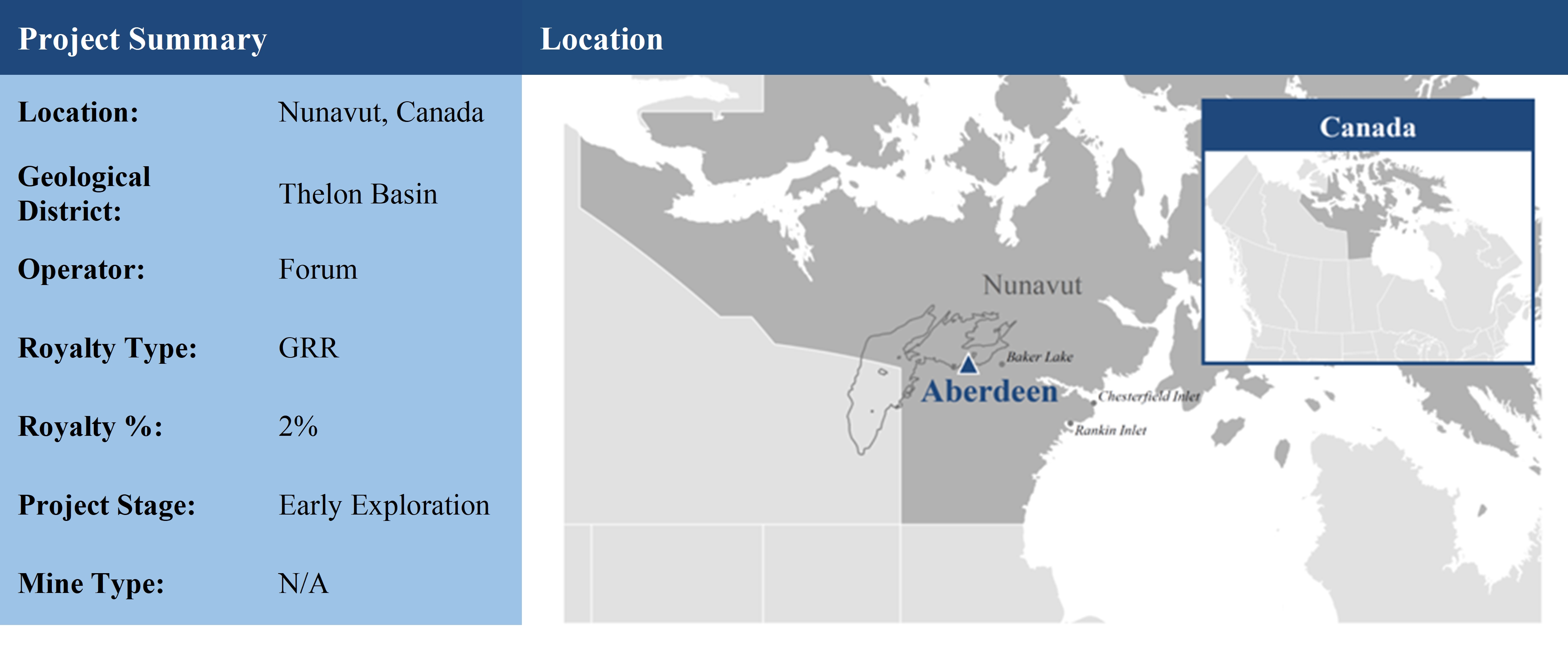

Aberdeen(2) |

Forum Energy Metals Corp. ("Forum") |

Nunavut, Canada |

Thelon Basin |

2.0% GRR |

N/A |

Early Exploration |

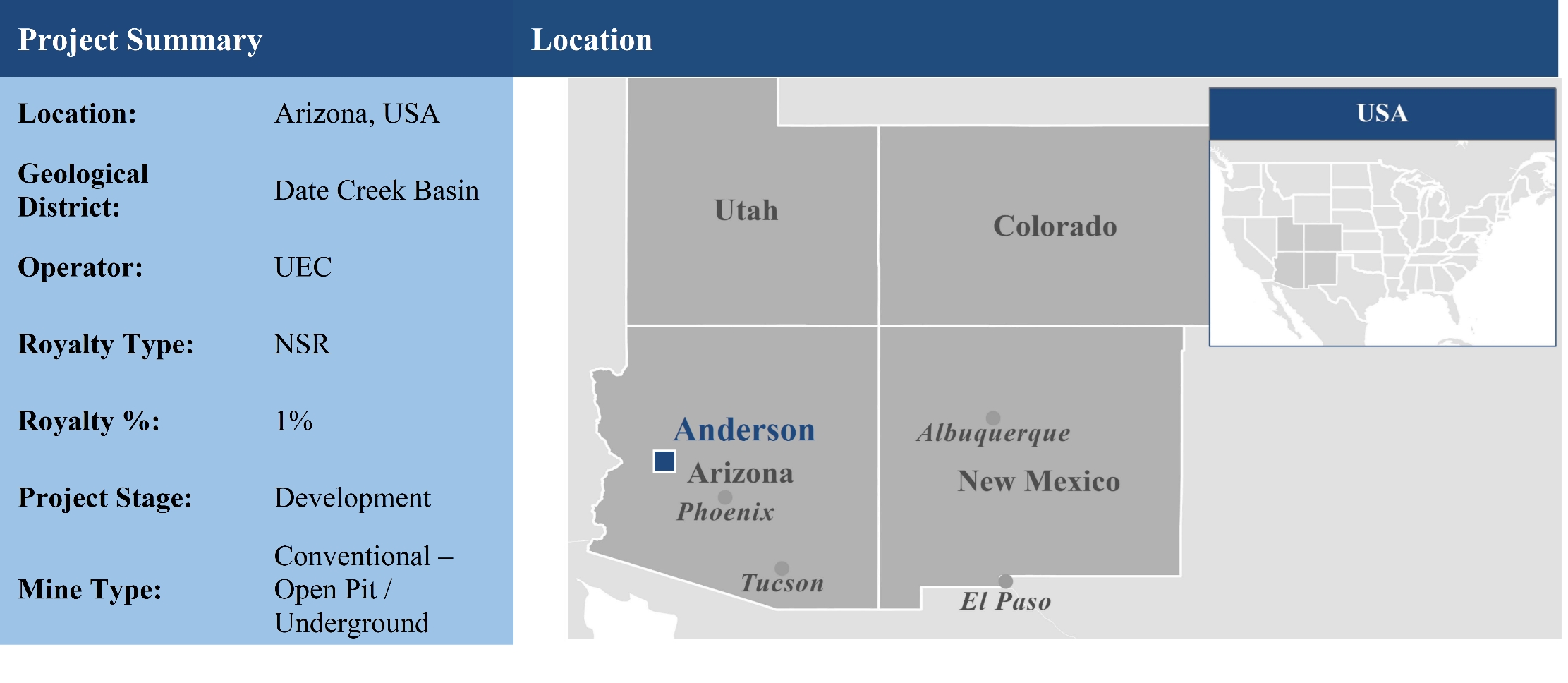

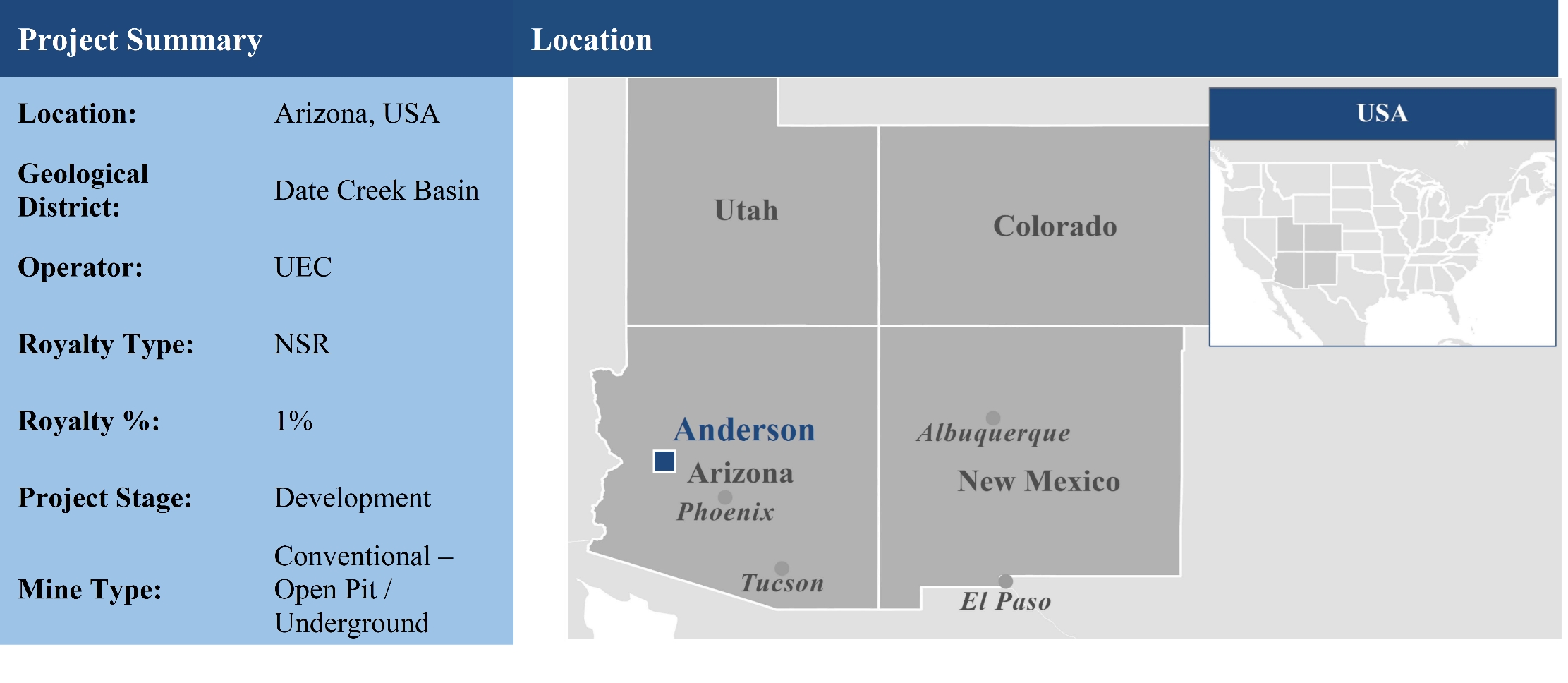

Anderson |

UEC

|

AZ, USA

|

Date Creek Basin

|

1.0% NSR

|

Conventional – Open Pit / Underground |

Development |

|

|

|

|

|

|

|

Project |

Operator |

Location |

District |

Interest |

Mining Method |

Project Stage |

|

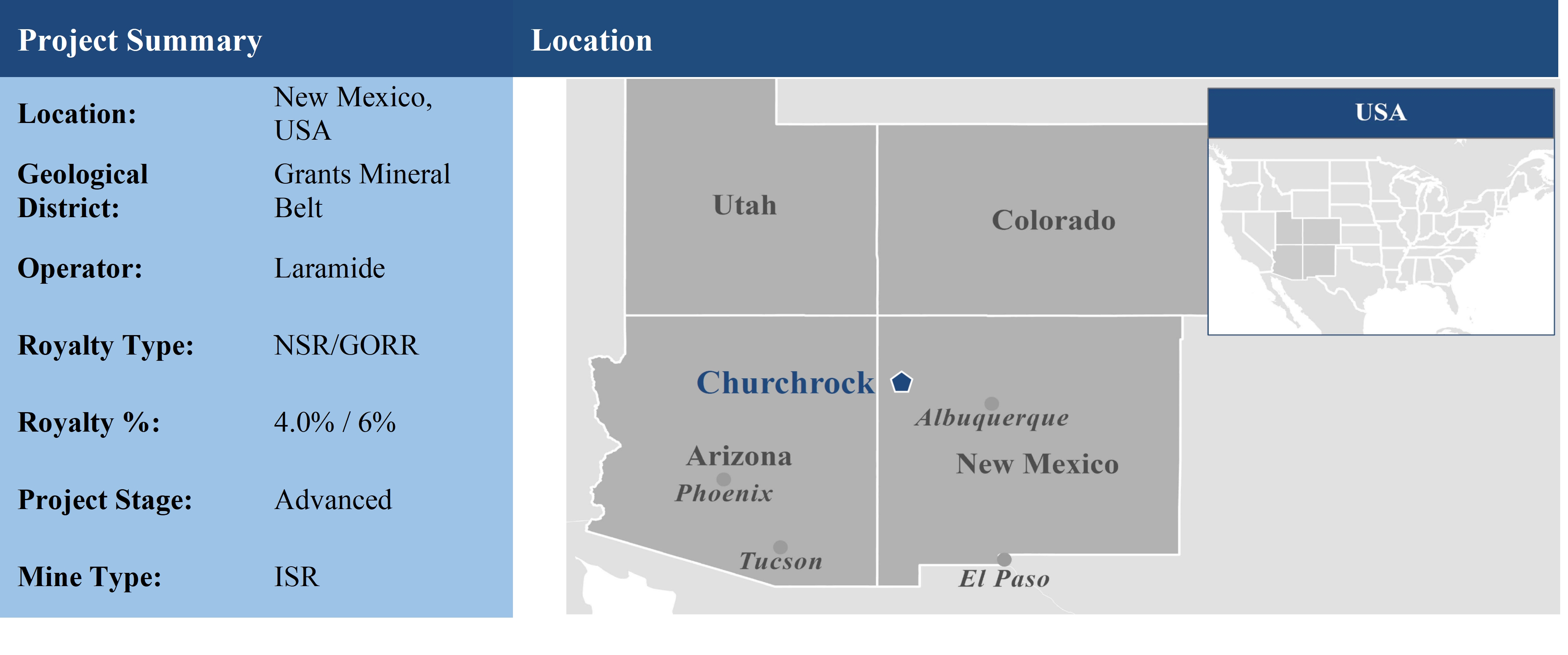

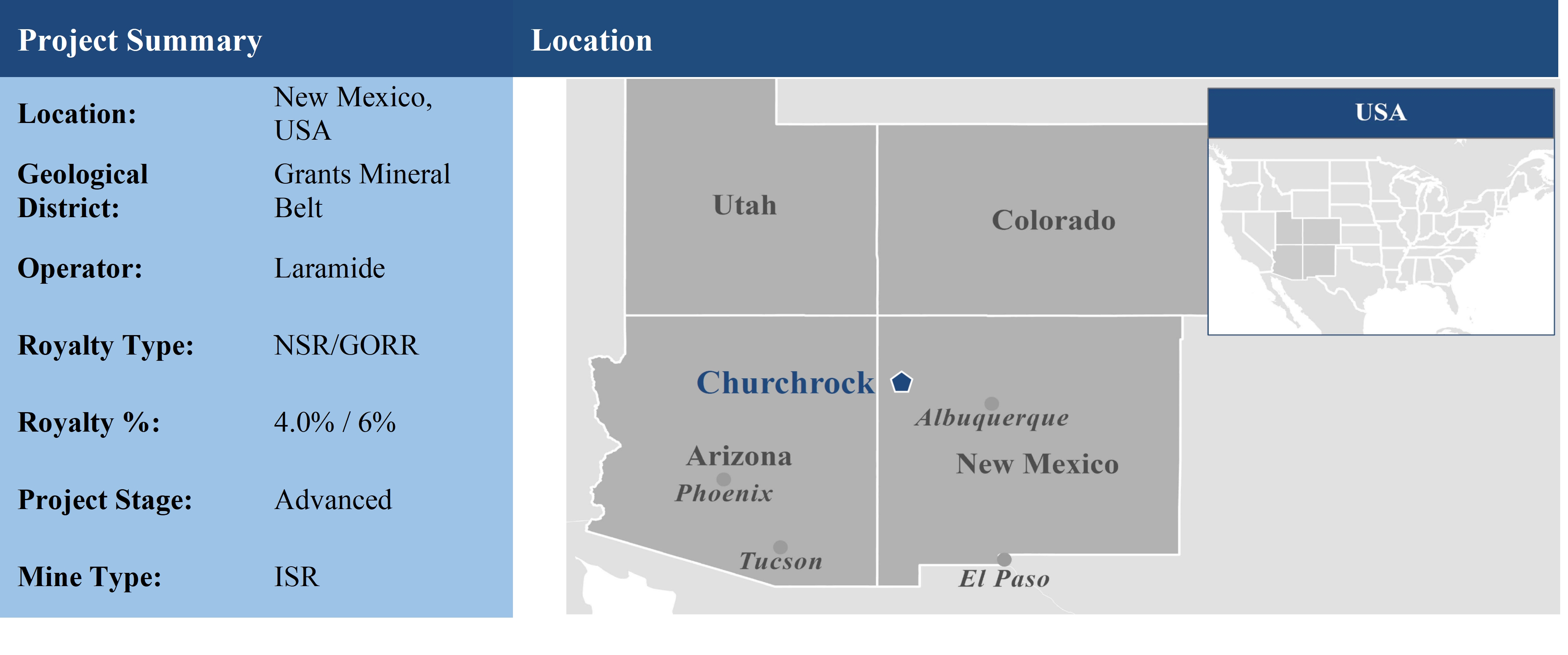

Churchrock

|

Laramide Resources Ltd. ("Laramide")

|

NM, USA

|

Grants Mineral Belt

|

4.0% NSR

6.0% GORR(1)

|

ISR

|

Advanced

|

Cree Extension(7) |

Cameco |

SK, Canada |

Athabasca Basin |

10% NPI |

Conventional |

Early Exploration |

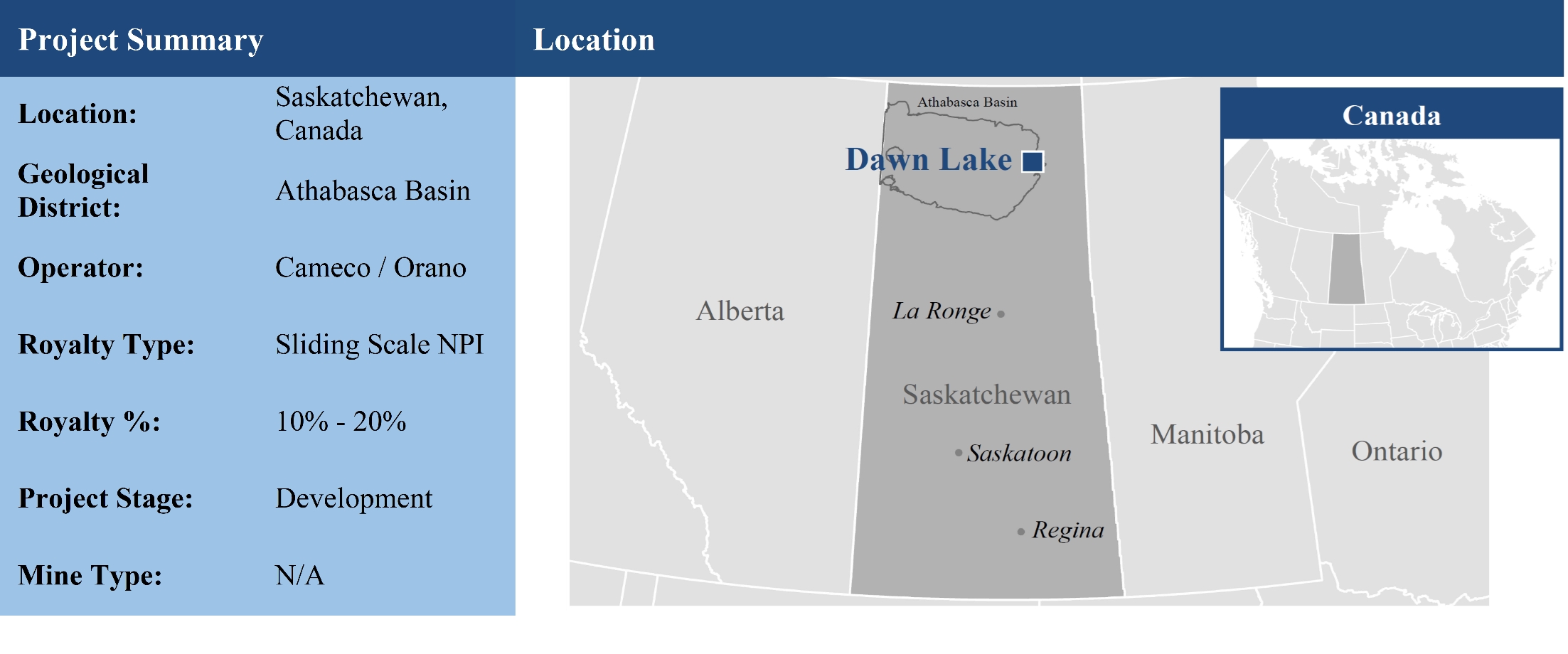

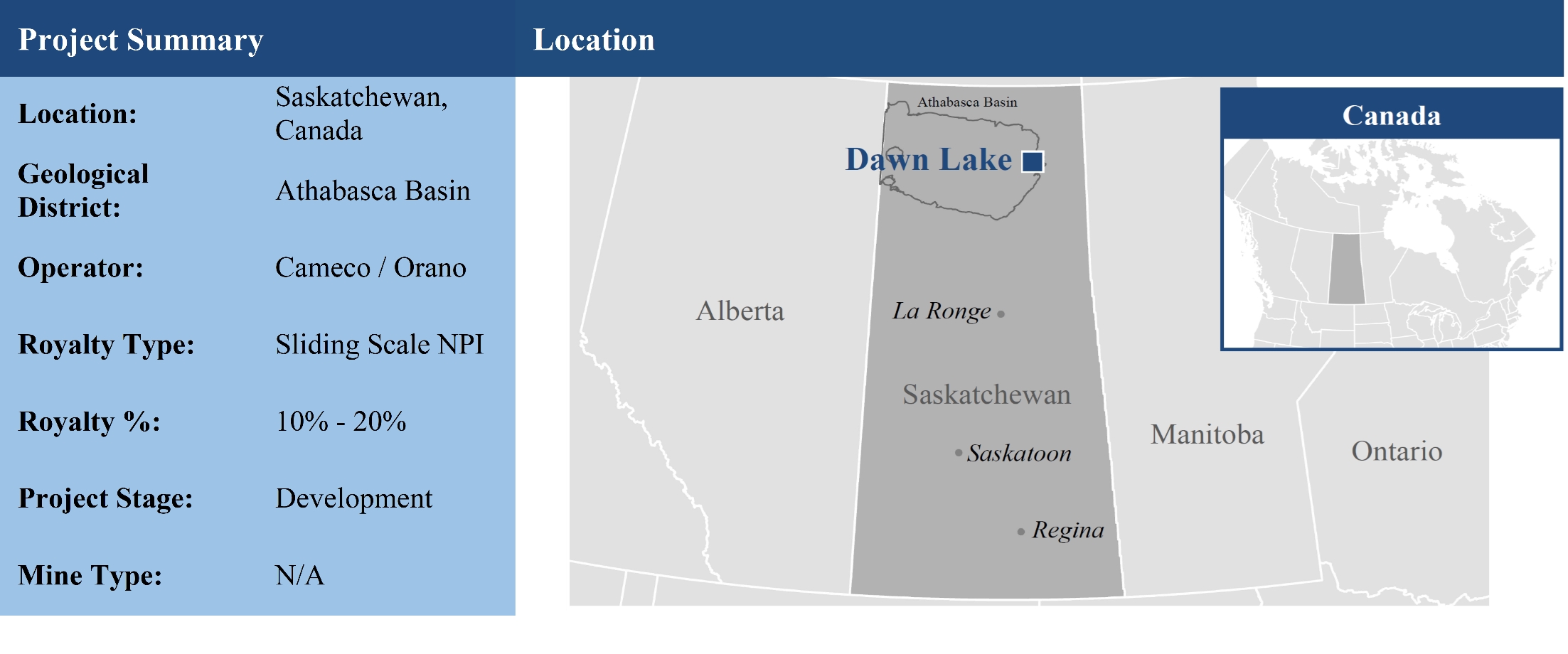

Dawn Lake(1)(3)(5) |

Cameco / Orano |

SK, Canada |

Athabasca Basin |

10% - 20% NPI |

N/A |

Development |

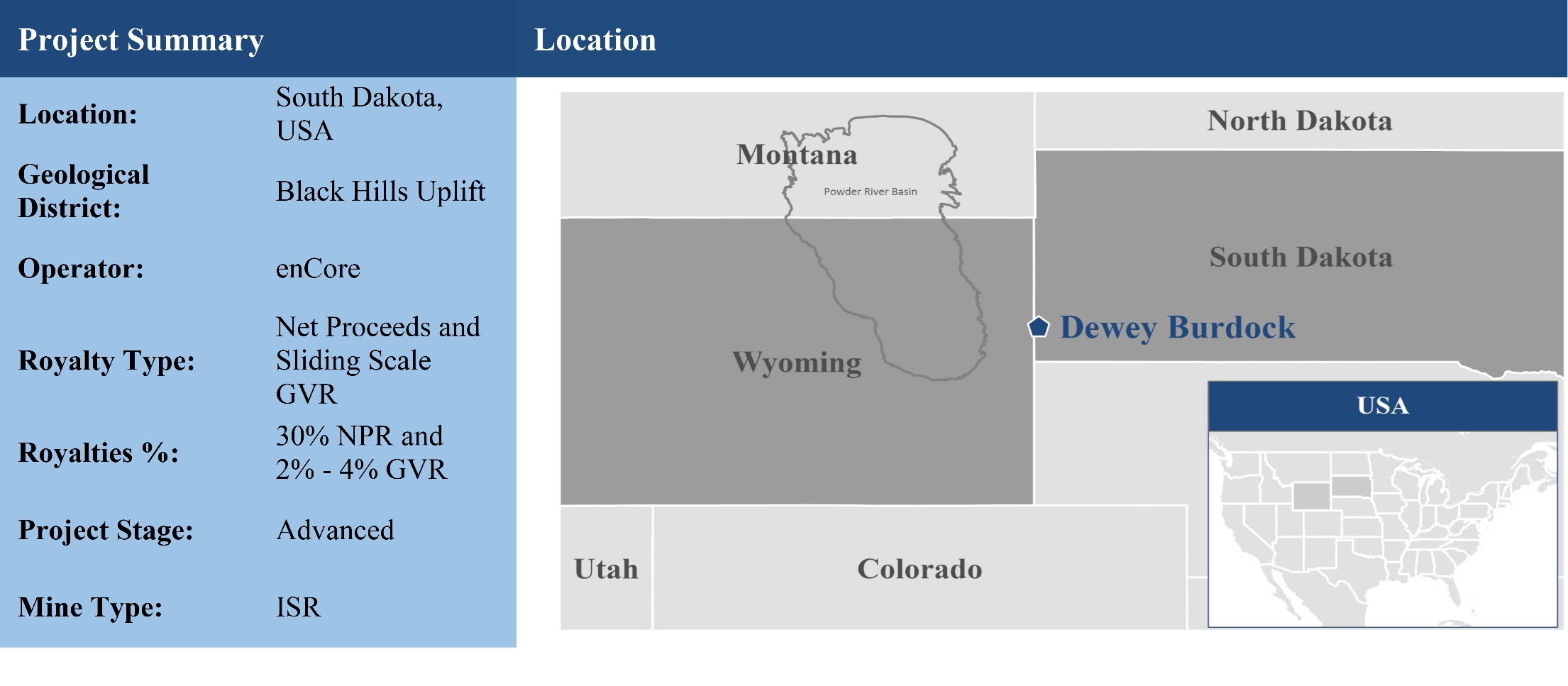

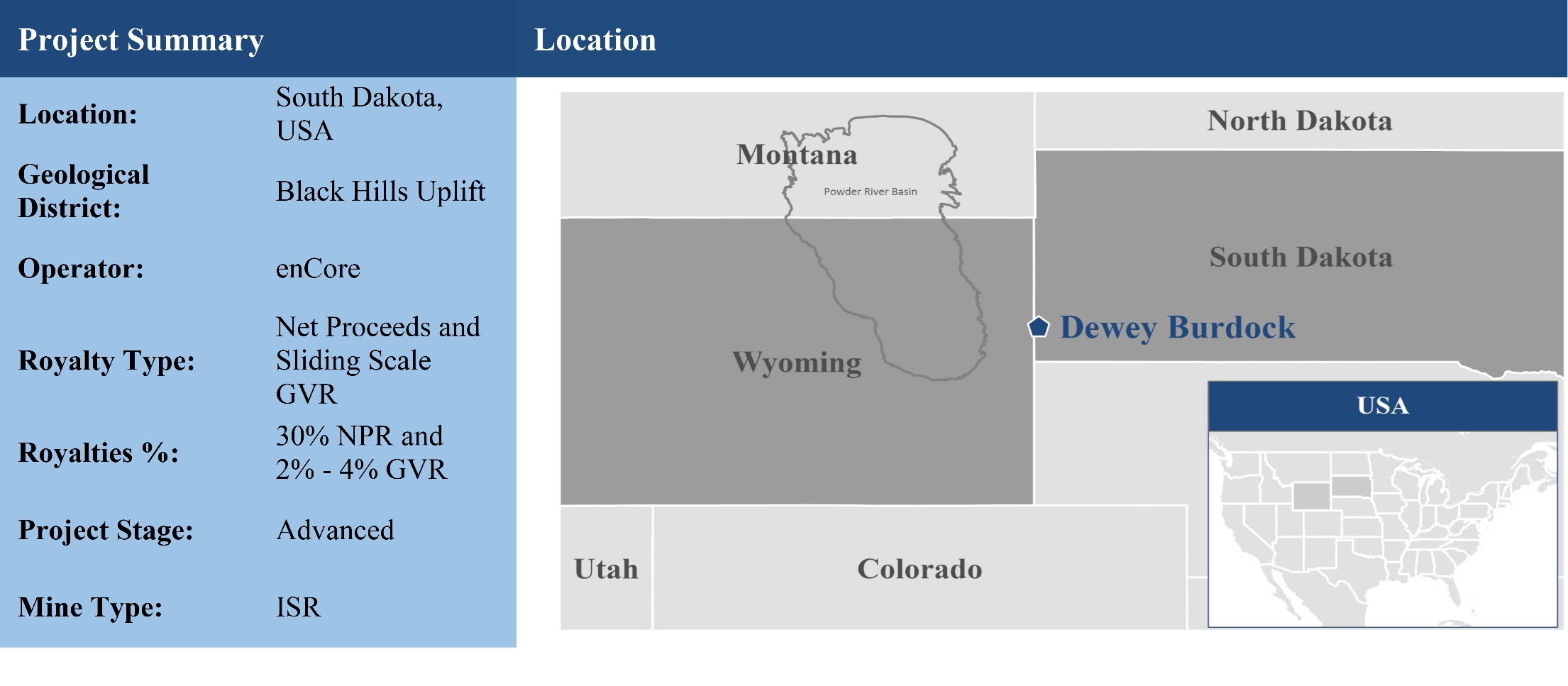

Dewey-Burdock(1) |

enCore |

SD, USA |

Black Hills Uplift |

30% NPR

2% - 4% GVR

|

ISR |

Advanced |

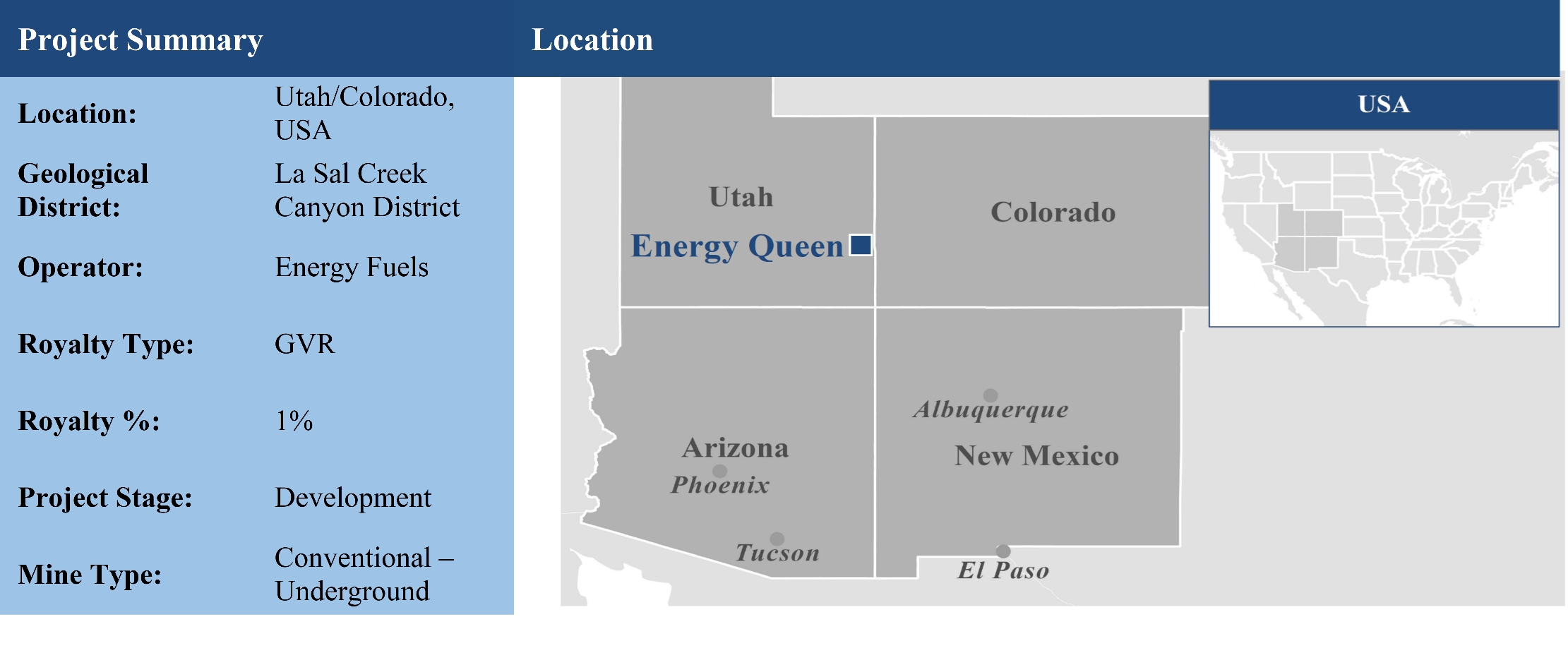

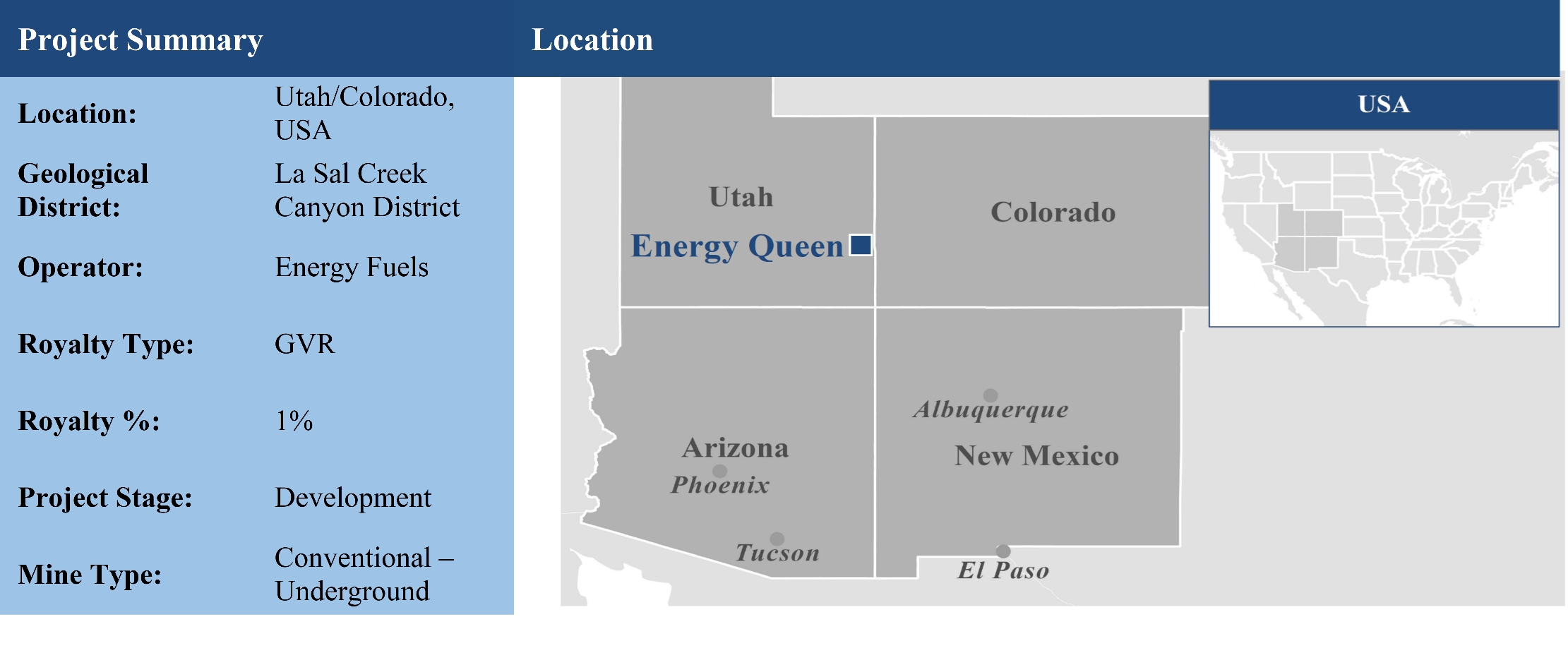

Energy Queen(1) |

Energy Fuels |

UT, USA |

La Sal District |

1% GVR |

Conventional – Underground |

Development |

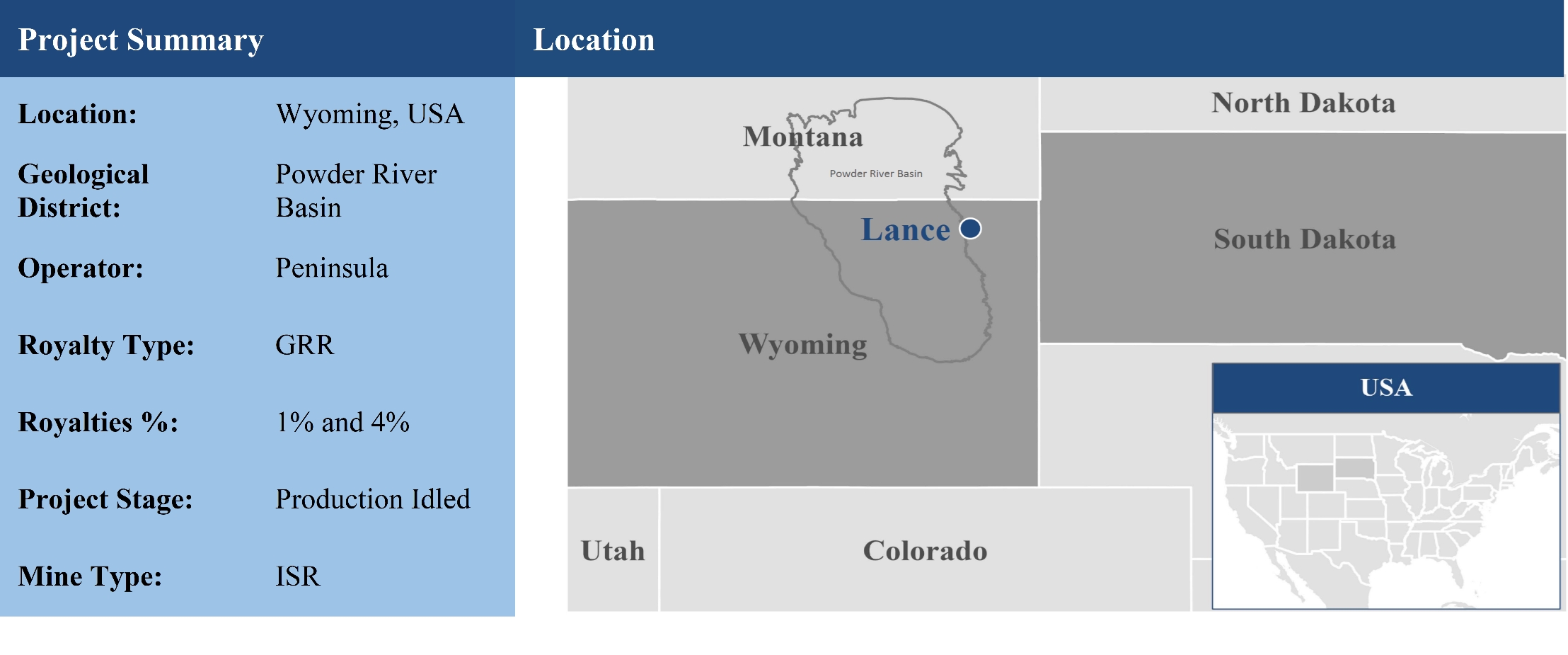

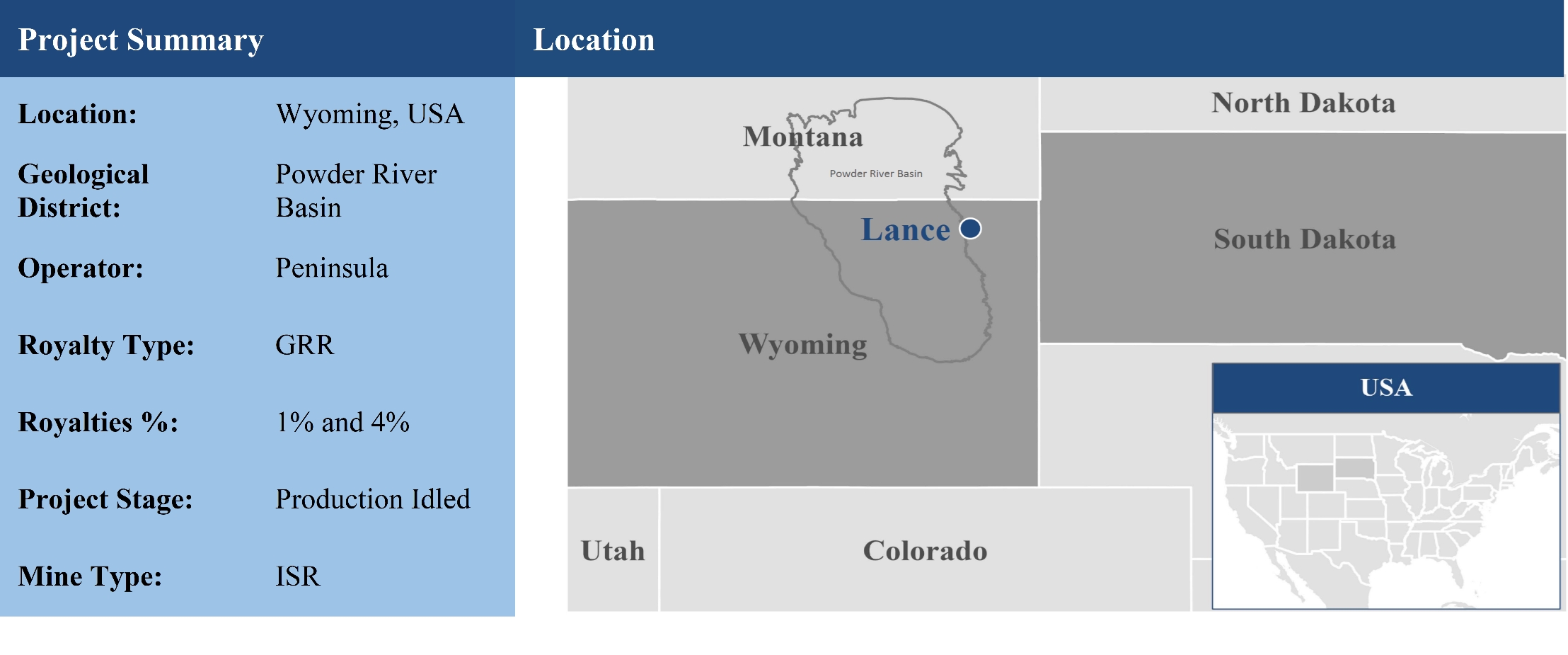

Lance |

Peninsula Energy Limited ("Peninsula") |

WY, USA |

Powder River Basin |

4.0% GRR(1)

1.0% GRR

|

ISR |

Production Idled |

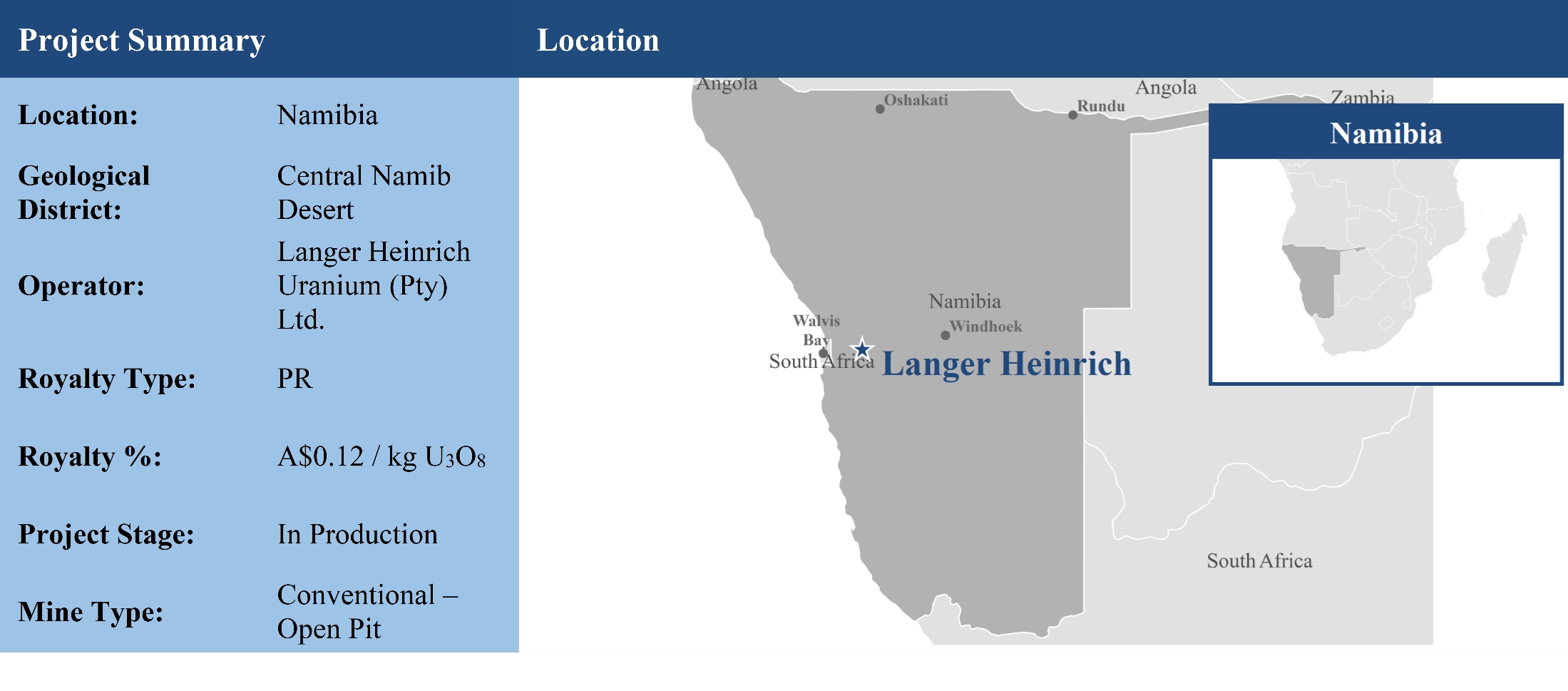

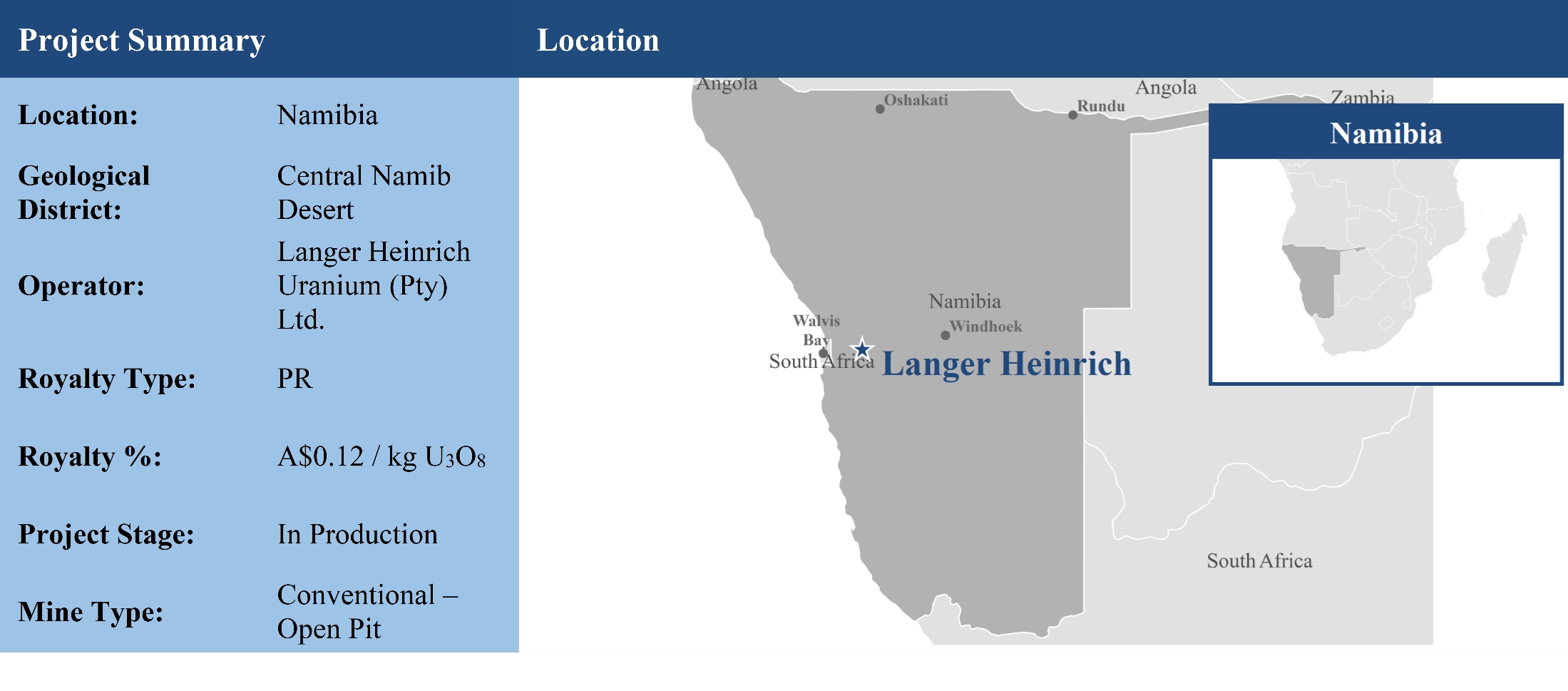

Langer Heinrich |

Langer Heinrich Uranium (Pty) Ltd. |

Namibia, Africa |

Central Namib Desert |

A$0.12 per kg U3O8 PR |

Conventional – Open Pit |

In Production |

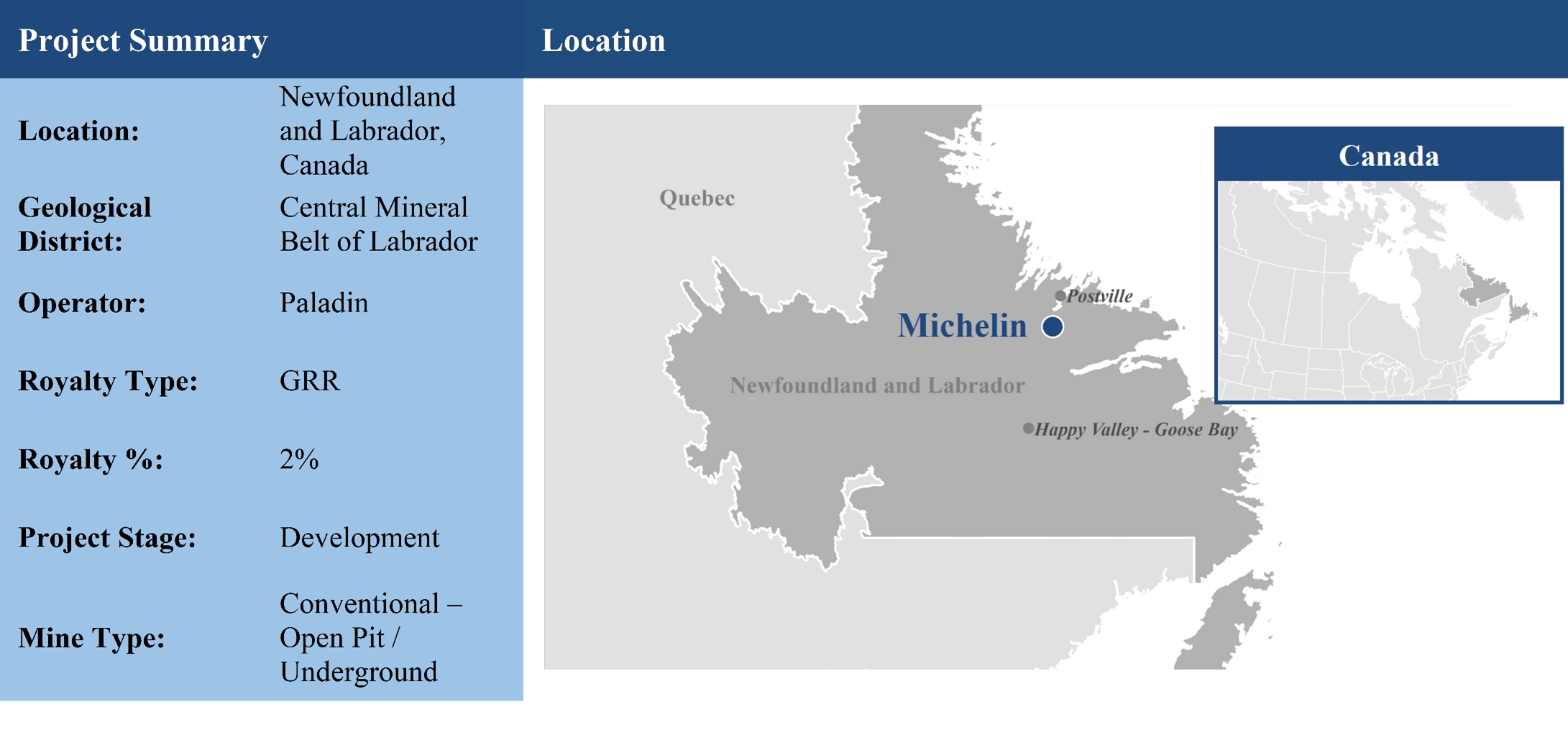

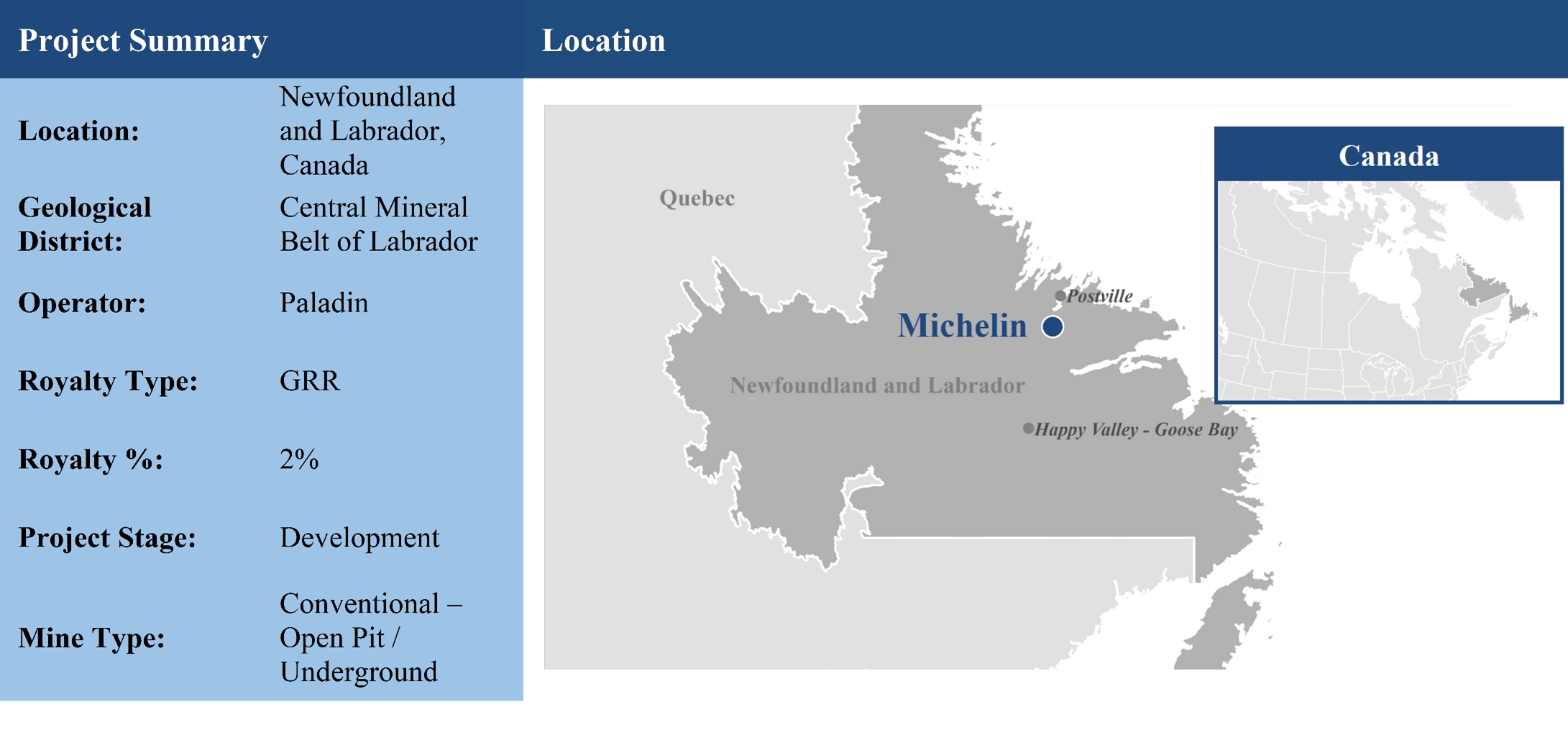

Michelin |

Paladin Energy Ltd. ("Paladin") |

NL, Canada |

Central Mineral Belt of Labrador |

2.0% GRR |

Conventional – Open Pit / Underground |

Development |

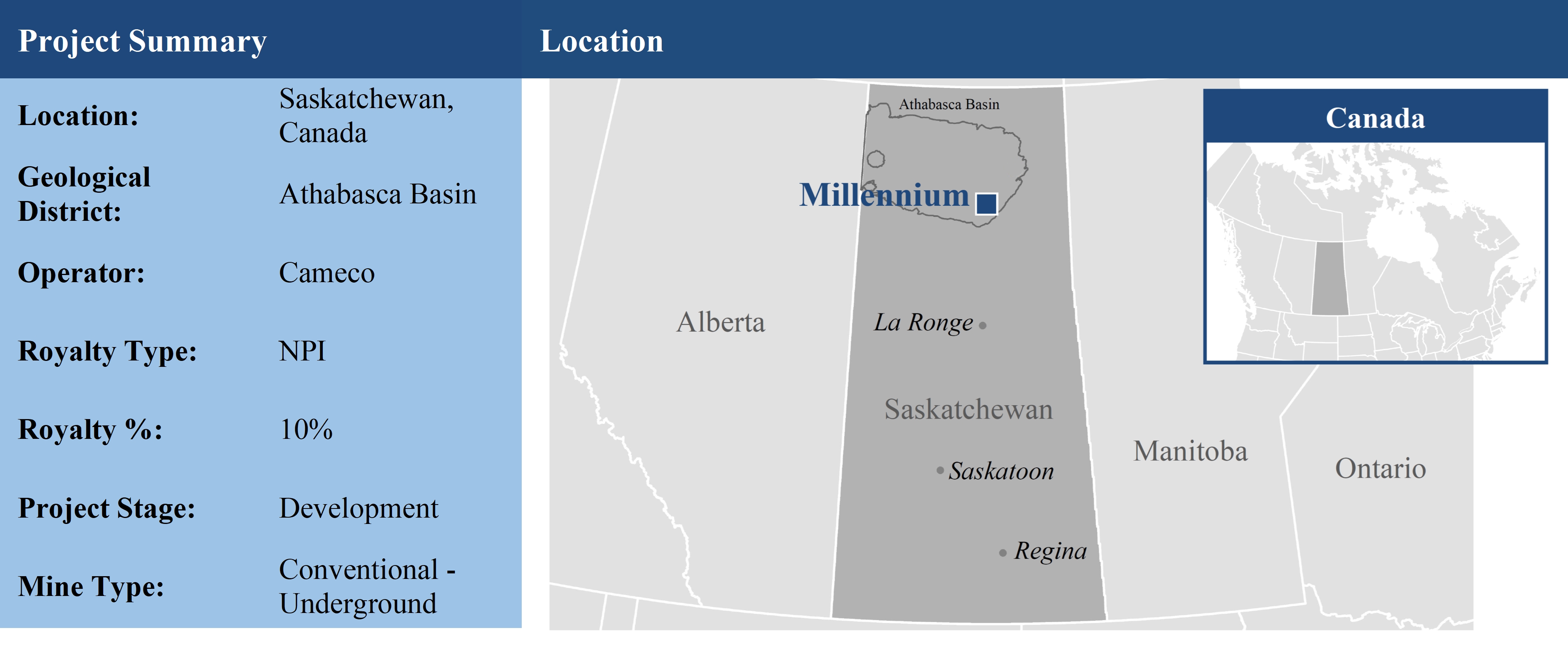

Millennium(7) |

Cameco |

SK, Canada |

Athabasca Basin |

10% NPI |

Conventional |

Development |

Reno Creek(1)(8) |

UEC |

WY, USA |

Powder River Basin |

0.5% NPI |

ISR |

Development |

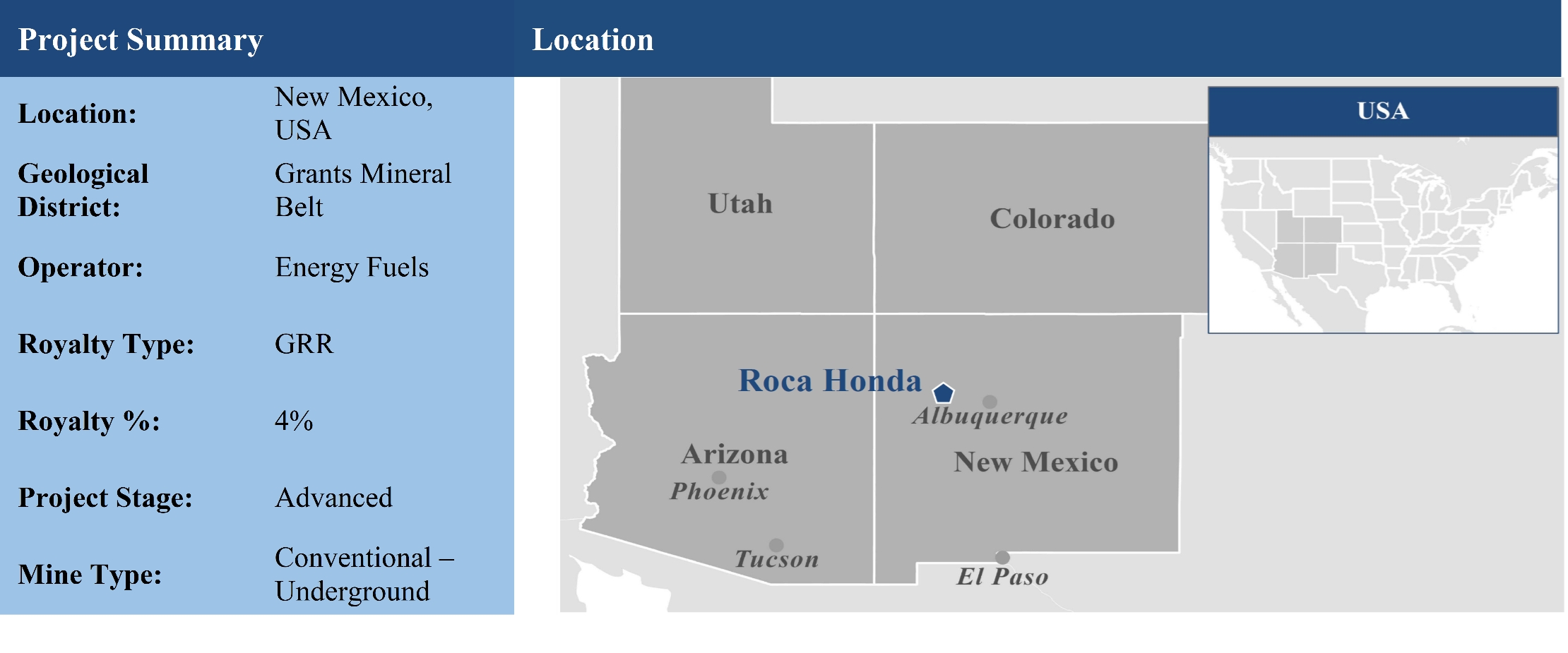

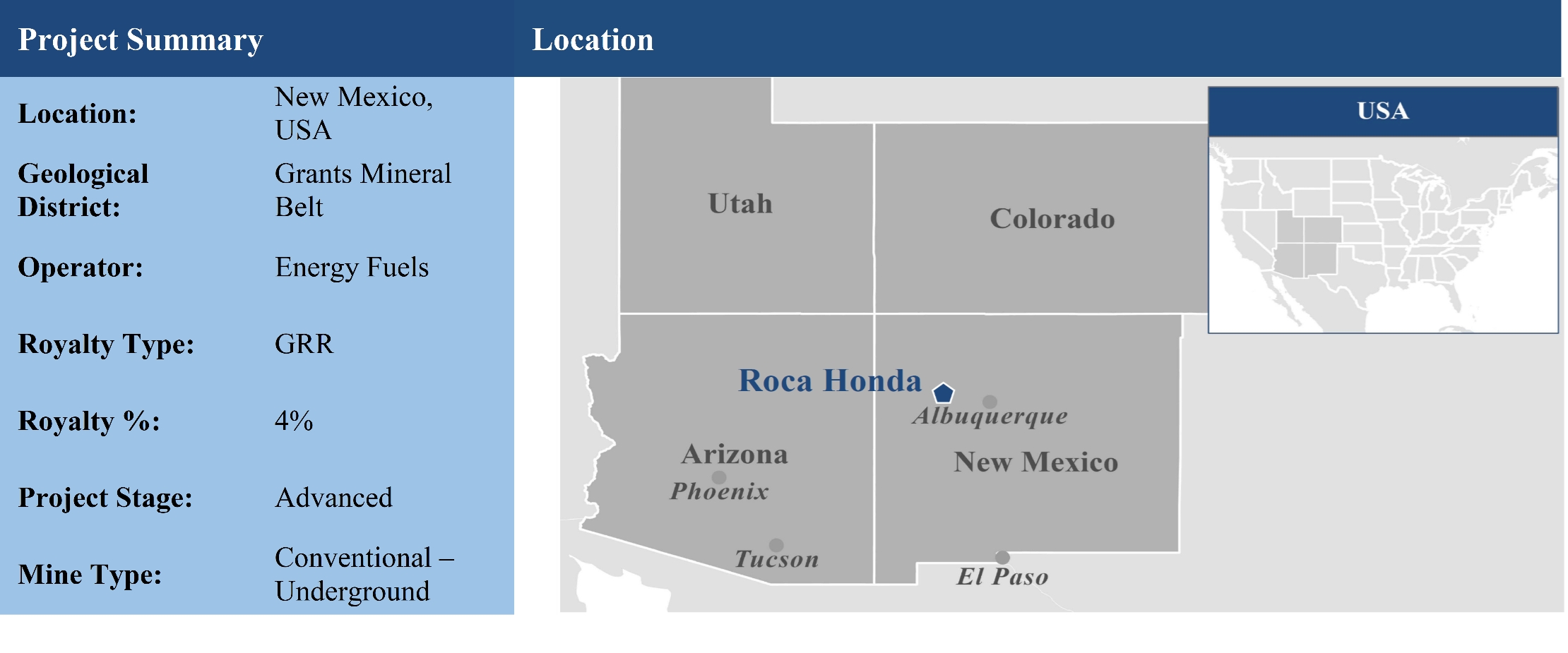

Roca Honda(1)(9) |

Energy Fuels |

NM, USA |

Grants Mineral Belt |

4.0% GRR |

Conventional – Underground |

Advanced |

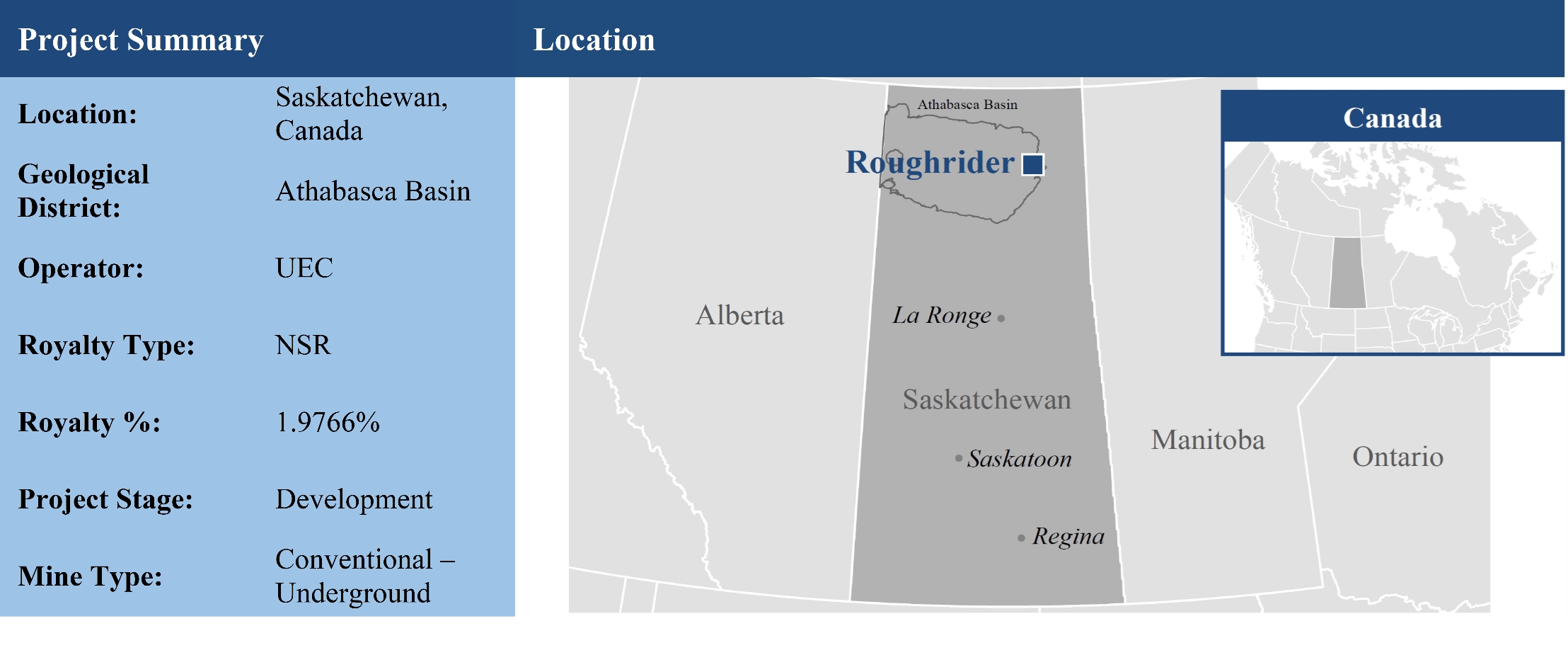

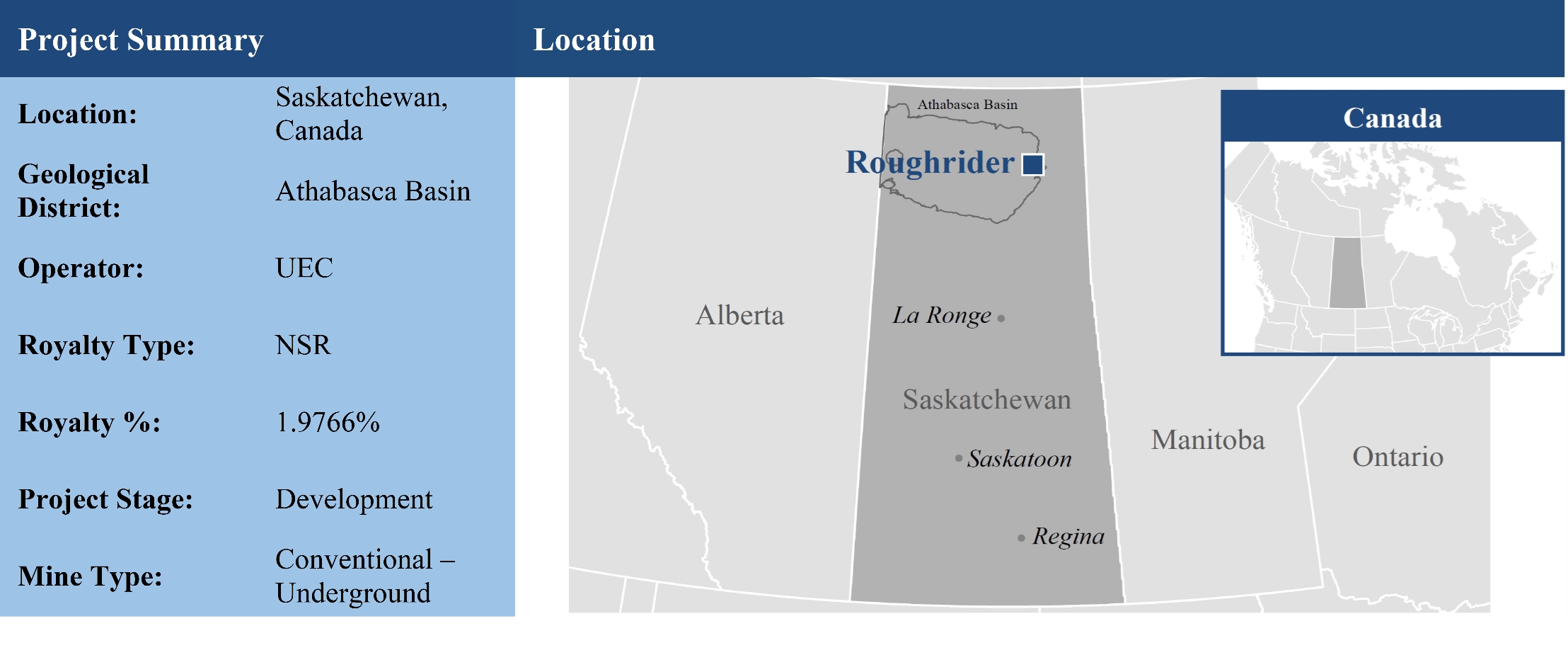

Roughrider(10) |

UEC |

SK, Canada |

Athabasca Basin |

1.9766% NSR |

Conventional – Underground |

Development |

Russell Lake and Russell Lake South(10) |

Skyharbour Resources Ltd. ("Skyharbour") |

SK, Canada |

Athabasca Basin |

1.9766% NSR |

N/A |

Early Exploration |

Salamanca |

Berkeley Energia Limited ("Berkeley") |

Retortillo, Spain |

Salamanca Uranium District |

0.375% NSR |

Conventional – Open Pit |

Development |

San Rafael(1) |

Western Uranium |

UT, USA |

San Rafael Uranium District |

2% NSR |

Conventional – Underground |

Development |

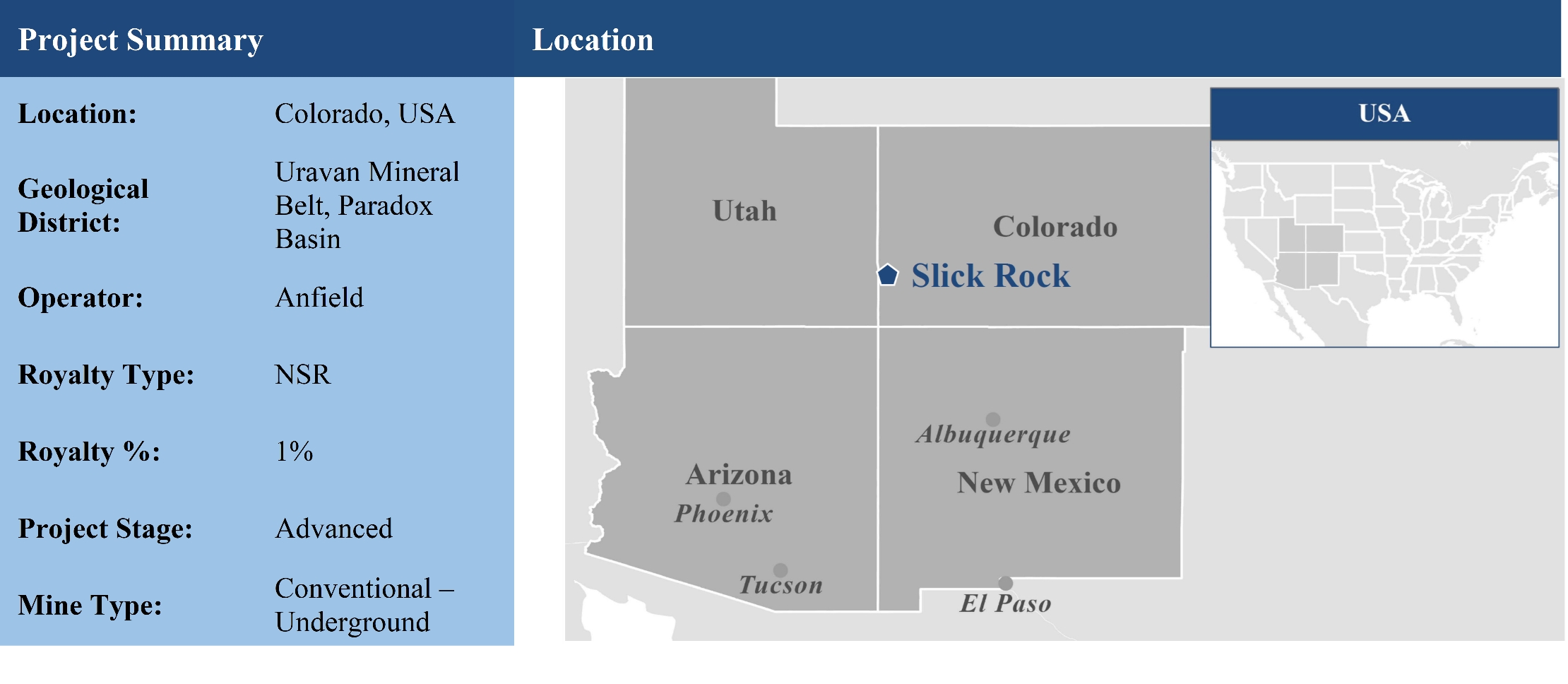

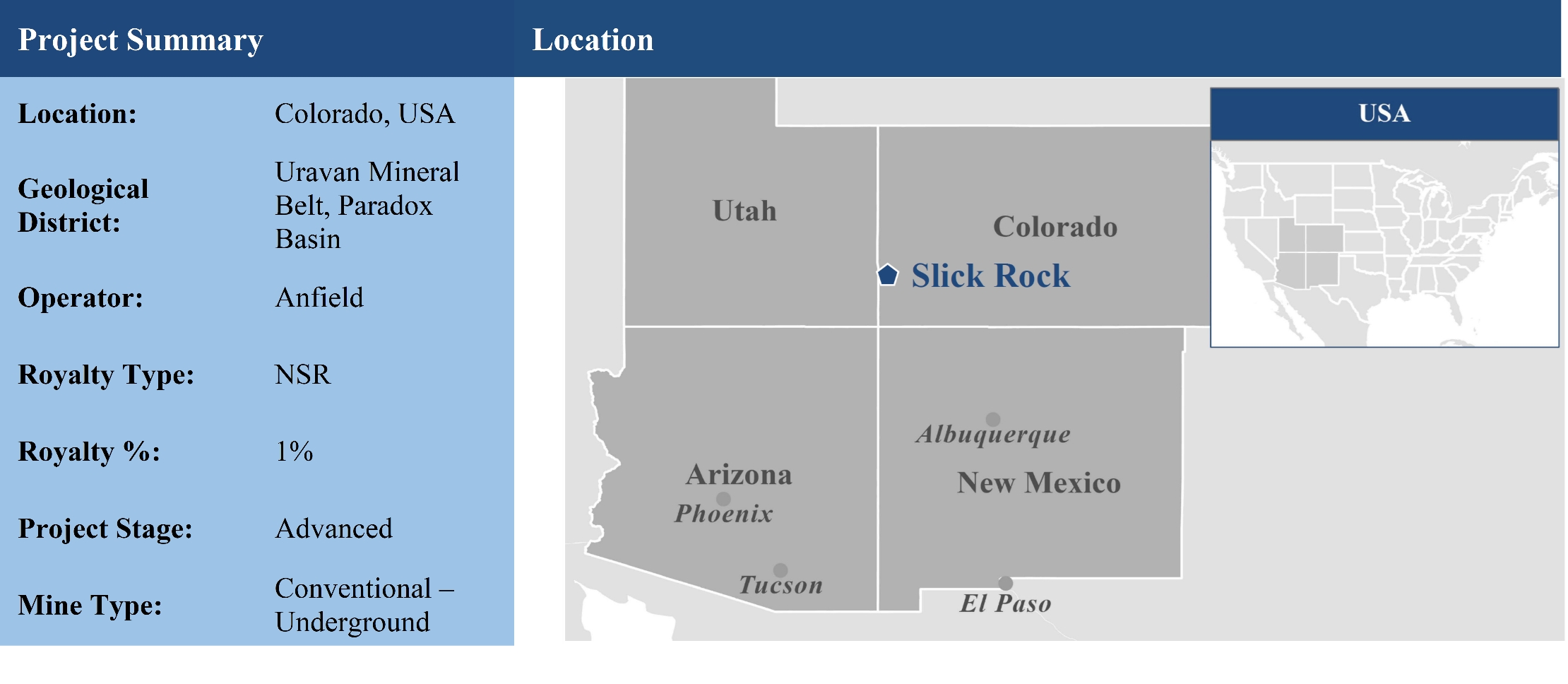

Slick Rock |

Anfield Energy Inc. ("Anfield") |

CO, USA |

Uravan Mineral Belt |

1.0% NSR |

Conventional – Underground |

Advanced |

Whirlwind(1) |

Energy Fuels |

UT/CO, USA |

Uravan Mineral Belt |

2% - 4% GVR |

Conventional – Underground |

Development |

Workman Creek |

UEC |

AZ, USA |

Sierra Ancha / Apache Basin |

1.0% NSR |

Conventional – Underground |

Development |

Notes:

(1)

Royalty applies to only a portion of the project.

(2)

Royalty subject to the buy back right of the operator, whereby a 0.5% GRR may be repurchased for $1 million after the announcement of a successful pre-feasibility study, exercisable for a period of six months and expiring on June 4, 2032.

(3)

Royalty to decrease to a 10% NPI after 200 Mlbs of uranium production from the combined royalty lands of the Dawn Lake and Waterbury Lake/ Cigar Lake projects.

(4)

Royalty applies to a 3.75% share of overall uranium production, drawn from Orano's 40.453% ownership interest

(5)

Royalty applies to a 7.5% share of overall uranium production.

(6)

Royalty applies to an approximate 9% share of uranium production derived from an approximate 30.195% ownership interest of Orano.

(7)

Royalty applies to an approximate 20.6955% participating interest in the project. The royalties on the Cree Extension and Millennium projects are represented by the same royalty instrument.

(8)

Royalty subject to a maximum amount payable of US$2.5 million.

(9)

Royalty subject to the right of the payor to purchase the royalty for US$5 million at any time prior to the first royalty payment becoming due thereunder.

(10)

The royalties on the Roughrider Project and Russell Lake and Russell Lake South projects are represented by the same royalty instrument.

Note on Classification of Project Stages

The Company classifies its projects based on the stage of current and historical exploration, development and production. The following is a description of the categories utilized by the Company to classify the project stage of each of its royalty interests.

|

|

Project Stage |

Description |

|

|

Early Exploration |

A project is considered to be in the Early Exploration stage when there is no current or historic mineral resource or mineral reserve defined for the project. |

|

|

Development |

A project is considered to be in the Development stage when the project has a current or historic mineral resource or reserve defined for the project, but there is no current preliminary economic assessment, pre-feasibility study or feasibility study completed by the operator thereof to support the potential economic viability of such resource or reserve. |

|

|

Advanced |

A project is considered to be in the Advanced stage when there is a current mineral resource or mineral reserve defined for the project, which is supported by a preliminary economic assessment, a pre-feasibility study or a feasibility study. |

|

|

Production Idled |

A project is considered to be in the Production Idled stage when the project, or part of it, has been in production at any time during the past three calendar years, but such production has been idled due to market conditions or otherwise. |

|

|

In Production |

A project is considered to be in the In Production stage when the underlying property, or part of it, is subject to steady-state uranium production operations. In the case of some NPI royalties, projects may be in production without the generation of royalty revenue. |

|

|

Competitive Conditions

The Company competes with other companies to identify suitable opportunities for the acquisition of royalties, streams and other uranium interests. The mining industry in general, and the royalty and streaming segments in particular, are extremely competitive. The Company competes with other royalty and streaming companies, mine operators, and financial buyers in efforts to acquire royalty, streaming and similar interests. The Company also competes with the lenders, investors, and other royalty and streaming companies providing financing to operators of mineral properties in our efforts to create new interests.

In addition, the uranium industry is small compared to other commodity industries and, in particular, other energy commodity industries. Uranium demand is international in scope, but supply is characterized by a relatively small number of companies operating in only a few countries.

The Company's competitors may be larger than it is and may have greater resources and access to capital than it has. Key competitive factors in the royalty and stream acquisition and financing business include the ability to identify and evaluate potential opportunities, transaction structures and access to capital.

The ability of the Company to complete additional acquisitions of royalties, streams and other uranium interests will depend on its ability to identify and enter into agreements for such acquisitions. See "Risk Factors – Acquisition Strategy".

Regulation

The production, handling, storage, conversion, upgrading and use of uranium are subject to extensive governmental controls and regulations.

Operators of the mines and projects that are subject to our interests must comply with numerous environmental, mine safety, land use, waste disposal, remediation and public health laws and regulations promulgated by federal, state, provincial and local governments in Canada, the United States, Namibia and Spain where the Company holds interests. Although the Company, as a royalty owner, is not responsible for ensuring compliance with these laws and regulations, failure by the operators to comply with applicable laws, regulations and permits can result in injunctive action, orders to suspend or cease operations, damages, and civil and criminal penalties on the operators, which could have a material adverse effect on our results of operations and financial condition.

Physical uranium holdings are subject to applicable laws, regulations and guidelines in the applicable jurisdictions. The Company is unable to predict what additional legislation or amendments may be proposed that might affect the uranium industry or when any proposals, if enacted, might become effective. The following is an outline of certain regulations and other governmental controls which apply to storage and shipment of uranium. As set forth above, the operations of projects underlying the Company's royalties are subject to additional regulation respecting uranium mining.

International Treaty on the Non-Proliferation of Nuclear Weapons

The Treaty on the Non-Proliferation of Nuclear Weapons (the "NPT") is an international treaty that was established in 1970. It has three principal objectives: (i) to prevent the spread of nuclear weapons and weapons technology; (ii) to foster the peaceful uses of nuclear energy; and (iii) to further the goal of achieving general and complete nuclear disarmament. The NPT establishes a safeguards system under the responsibility of the International Atomic Energy Agency (the "IAEA"). Almost all countries are signatories to the NPT, including Canada and the United States. The NPT provides that each party thereto will undertake not to provide fissionable material, or equipment designed for the processing of fissionable material, to other states unless the fissionable material will be subject to the safeguards of the NPT as enforced by the IAEA.

Uranium Regulation in Canada

The federal government of Canada has recognized that the uranium industry has special importance in relation to the national interest and therefore regulates the industry through regulations and policy announcements. Federal legislation applies to any work or undertaking in Canada for the development, production or use of nuclear energy or for the mining, production, refinement, conversion, enrichment, processing, reprocessing, possession or use of a nuclear substance. Federal policy requires that any property or plant used for any of these purposes must be legally and beneficially owned by a company incorporated in Canada.

The Nuclear Safety and Control Act (the "NSCA") is the primary federal legislation governing the control of mining, extraction, processing, use and export. The legislation grants the Canadian Nuclear Safety Commission (the "CNSC") licensing authority for all nuclear activities in Canada, including the issuance of new licences and the amendment and renewal of existing licences. A person may only possess or dispose of nuclear substances and construct, operate and decommission their nuclear facilities in accordance with the terms of a CNSC licence. Licensees must satisfy the specific conditions of the licence in order to maintain the right to operate their nuclear facilities.

Regulations made under the NSCA include those dealing with the specific licence requirements of facilities, radiation protection, physical security for all nuclear facilities and the transport of radioactive materials. The CNSC has also issued regulatory documents to assist licensees in complying with regulatory requirements, such as decommissioning, emergency planning, and optimizing radiation protection measures.

The Company's physical uranium is stored at facilities that are governed primarily by licences granted by the CNSC. Failure to comply with licence conditions or applicable statutes and regulations may result in orders being issued which may cause operations to cease or be curtailed or may require installation of additional equipment, other remedial action or the incurring of additional capital or other expenditures to remain compliant. In the event that the Company determines to export future uranium acquired and held at facilities in Canada, if any, the Company must secure export licences and export permits from the CNSC and Global Affairs Canada in order to export such uranium. These arrangements are governed by the bi-lateral and multi-lateral agreements that are in place between governments.

Uranium Regulation in the United States

In the United States, the uranium industry is primarily regulated by the United States Nuclear Regulatory Commission (the "NRC"). The Atomic Energy Act of 1954 (the "Atomic Energy Act") is the principal legislation in the United States governing civilian and military uses of nuclear materials. The Atomic Energy Act requires that civilian uses of nuclear materials and facilities be licenced, and it empowers the NRC to establish by rule or order, and to enforce, such standards to govern these uses as it may deem necessary or desirable in order to protect health and safety and minimize danger to life and property.

The NRC regulates, among other things, the export of uranium from the United States and the transport of nuclear materials within the United States. It does not review or approve specific sales contracts. In addition, the NRC grants export licences to ship uranium outside the United States. Pursuant to applicable regulations, any licensee that transfers, receives or adjusts its inventory of uranium source material or who exports or imports uranium source material, must complete a requisite transaction report in accordance with the NRC's instructions. This report is the primary mechanism for tracking physical uranium movements in the United States or any other origin uranium to foreign and domestic buyers.

Environmental Policies

The Company's sustainability governance practices are designed to grow its business, ensure the effective oversight of sustainability-related risks, and promote the interests of its stakeholders, including investors, operators and their host communities. Sustainability governance goals and objectives are set by the Chief Executive Officer. The Vice President, Environmental, Social and Governance, reporting directly to the Chief Executive Officer, assists with managing the Company's sustainability due diligence efforts and works with the executive and management team on engagement with potential or existing operators regarding their management of related risks and opportunities. The Company's board of directors reviews the Company's sustainability objectives and goals, related action plans, disclosures, and the results of sustainability due diligence as they relate to new opportunities.

The Company has adopted a Sustainability Policy, which outlines the Company's commitment to the environment and its community and is designed to ensure that sustainability-related risks and opportunities facing the Company and operators with which the Company holds royalty, stream or similar interests are assessed appropriately as part of the Company's overall investment and risk management processes.

The Company publishes its annual Sustainability Reports, which aim to enhance transparency by communicating the Company's policies, priorities and performance to its stakeholders. These reports include disclosures containing relevant, industry-specific information and data aligned with globally recognized standards, including the Sustainability Accounting Standards Board. In November 2024, the Company published its second annual Sustainability Report, in which the Company provided its first disclosure aligned with the Task Force on Climate-Related Financial Disclosures, including the Company's first disclosure and reporting on the Company's financed emissions.

The Company's Sustainability Policy and Sustainability Reports do not form part of, nor are either incorporated by reference into, this Annual Information Form. Copies of the Company's Sustainability Policy and Sustainability Reports are available on the Company's website at www.uraniumroyalty.com.

Employees

As of April 30, 2025, the Company had fourteen employees. The Company relies upon and engages consultants on a contract basis to provide services, management and personnel who assist the Company to carry on our administrative, shareholder communication and acquisition activities in Canada and in the other jurisdictions.

Foreign Operations

URC currently holds royalties in mines and projects in Canada, the United States, Namibia and Spain. Additionally, URC may, in the future, acquire interests in other projects, or purchase uranium from mines located, outside of Canada. Changes in legislation, regulations or governments in such countries are beyond the Company's control and could adversely affect the Company's business. The effect of these factors cannot be predicted with any accuracy by the Company or its management. See "Risk Factors – Risks related to foreign jurisdictions and emerging markets" for further information.

THE URC ASSET PORTFOLIO

As of April 30, 2025, URC's asset portfolio includes the following assets:

•

royalties on 21 uranium projects (not including Aberdeen, which was acquired in June 2025); and

•

2.73 Mlbs U3O8 held in the Company's account at Cameco's Port Hope / Blind River facilities.

As at the date of this Annual Information Form, the Company has determined that the McArthur River Royalty (as defined herein) and Cigar Lake Royalty (as defined herein) are the only royalty assets that are material to the Company on a standalone basis. Please refer to "- Royalty Interests" below and Appendix "A" for further information.

Yellow Cake Agreement and Uranium Option

Overview

On June 7, 2018, the Company entered into an agreement (as amended, the "Yellow Cake Agreement") with Yellow Cake, pursuant to which, among other things, the Company received an option to acquire physical uranium. The Yellow Cake Agreement is a strategic asset for URC, as it provides exposure to Yellow Cake's physical uranium, provides URC with the option to acquire physical uranium and provides for future cooperation and collaboration in relation to acquisitions of physical uranium, royalties, streams and similar interests, as described in more detail below.

Yellow Cake is a specialist company operating in the uranium sector, created to purchase and hold U3O8 with the stated objectives of offering its shareholders exposure to the price of U3O8 through the purchase and storage of physical uranium and exploiting a range of expected opportunities connected with owning U3O8, and uranium-based financing initiatives, such as commodity streaming and royalties.

The Company may, in the future, acquire additional physical uranium pursuant to its option under the Yellow Cake Agreement or otherwise. Pursuant to the Yellow Cake Agreement, the Company may acquire between US$2.5 million and US$10 million of U3O8 per year from Yellow Cake under its supply agreement that will expire on January 1, 2028, up to a maximum aggregate amount of US$21.25 million worth of U3O8. No purchases occurred under this agreement during the years ended April 30, 2022, 2023, 2024 and 2025.

Kazatomprom Agreement

JSC National Atomic Company "Kazatomprom" ("Kazatomprom"), a company existing under the laws of Kazakhstan, the state-owned uranium company of Kazakhstan, is the world's largest producer of uranium.

On May 18, 2018, Yellow Cake entered into a framework agreement with Kazatomprom, in relation to the long-term sale and purchase of uranium (the "Kazatomprom Agreement"). Pursuant to the terms of the Kazatomprom Agreement, Yellow Cake has the right to acquire up to US$100 million of U3O8 from Kazatomprom in each of the nine calendar years following July 5, 2018.

Yellow Cake Storage Arrangement

Yellow Cake has disclosed that all U3O8 owned by it will be stored at a small number of licenced conversion facilities located in Canada, the United States and France. Yellow Cake expects that any transfers of U3O8 held by Yellow Cake at such conversion facilities held by licenced operators will be completed by book transfer and that Yellow Cake will not have the right to remove, or request the removal of, the U3O8 held in storage on its behalf.

On May 18, 2018, Yellow Cake signed a storage agreement with Cameco, which provides for the storage of Yellow Cake's U3O8 at Cameco's Port Hope / Blind River facilities, located in Ontario, Canada. Under this storage agreement, if Yellow Cake elects to sell any U3O8 owned by it and stored at such facility, it will be required to sell to a purchaser that has been approved by Cameco to store U3O8 in a storage account at such facility and who wishes to store the purchased U3O8 at such facility. Any potential purchaser wishing to purchase and transfer Yellow Cake's U3O8 out of its storage accounts at the Port Hope / Blind River facilities would require, among other things, a specific governmental licence to possess and use nuclear substances in Canada.

URC Storage Arrangement

On February 1, 2019, the Company entered into a transfer and storage account agreement with Cameco, with provisions substantially the same as those described above. The agreement provides for the storage of U3O8 at Cameco's Port Hope / Blind River facilities, located in Ontario, Canada, which will permit the Company to store U3O8 received as royalty in-kind from operators and U3O8 acquired from Yellow Cake's inventory, open market purchases, book transfers and other physical uranium acquired through counterparties at the Port Hope / Blind River facilities.

As of the date of this Annual Information Form, the Company has 2,729,637 pounds U3O8 held in the Company's account at Cameco's Port Hope / Blind River facilities.

The Yellow Cake Agreement

The Yellow Cake Agreement provides for a long-term strategic relationship between URC and Yellow Cake, including, among other things:

•

Option to Purchase U3O8: Yellow Cake granted URC an option to acquire between US$2.5 million and US$10 million of U3O8 per year between January 1, 2019, and January 1, 2028, up to a maximum aggregate amount of US$21.25 million worth of U3O8. If URC exercises this option, Yellow Cake will, in turn, exercise its rights under the Kazatomprom Agreement to acquire the relevant quantity of U3O8 from Kazatomprom and sell such quantity of U3O8 to the Company at the same price at which Yellow Cake acquires the U3O8 pursuant to the Kazatomprom Agreement. To date, the Company has exercised its option to acquire 348,068 pounds U3O8 from Yellow Cake at a price of US$28.73 per pound.

In the event that URC elects to acquire U3O8 pursuant to its option under the Yellow Cake Agreement, the Yellow Cake Agreement provides that URC and Yellow Cake will agree, acting in good faith, on the conversion facility to which the underlying U3O8 will be delivered to under the Kazatomprom Agreement, provided that Yellow Cake will not be required to use a conversion facility where it does not already have a storage agreement in place. Any U3O8 acquired by URC from Yellow Cake under the Yellow Cake Agreement will be delivered to URC by book transfer at the agreed conversion facility.

•

Future Royalty and Streaming Opportunities: Yellow Cake has agreed to inform URC of any opportunities for royalties, streams or similar interests identified by Yellow Cake with respect to uranium and URC has an irrevocable option to elect to acquire up to 50% of any such opportunity alongside Yellow Cake, in which case the parties shall work together in good faith to pursue any such opportunities jointly.

•

Physical Uranium Opportunities: The Company has agreed to inform Yellow Cake of potential opportunities that it identifies in relation to the purchase and taking delivery of physical U3O8 by the Company. If such opportunities are identified, the parties will work together in good faith to negotiate, finalize and agree upon the terms of a strategic framework that is mutually agreeable from a commercial standpoint for both parties (including as to form and consideration) and a potential participation by Yellow Cake with URC in such opportunities.

Furthermore, URC and Yellow Cake have agreed to, so far as it is commercially reasonable to do so, cooperate to identify potential opportunities to work together on other uranium-related joint participation endeavours.

Royalty Interests

A description of the Company's existing royalties is set forth below. See "Mineral Reserve and Resource Estimates" for information regarding mineral resource estimates for the projects relating to these interests.

In addition, for a detailed description regarding McArthur River or Cigar Lake, please refer to Appendix "A".

McArthur River

Unless otherwise indicated, the scientific and technical information herein regarding McArthur River has been derived from the McArthur River Technical Report, the Cameco 2024 AIF and Cameco's other public disclosures, copies of which are available under its profile on SEDAR+.

Royalty Description

The royalty is a 1% GORR (the "McArthur River Royalty") on a 9.063% share of uranium production derived from Orano's current 30.195% production interest in the McArthur River operations and mine on the McArthur River property (the "McArthur River Operation") located near Toby Lake in northern Saskatchewan (the "McArthur River Royalty"). The royalty payor is Orano. The McArthur River Royalty includes an option for the holder to receive physical uranium as payment thereunder.

The McArthur River Royalty does not apply to the entirety of the project lands. However, the Company believes that the McArthur River Royalty applies to substantially all areas of the project underlying the existing mine and areas underlying estimates of mineral reserve and mineral resource. The McArthur River Royalty includes most of the area known as the McArthur River mine and the Company believes that the royalty applies to the reported reserves at the mine other than portions that are covered by the adjacent Read Lake project area which represents a nominal portion of the reported reserves and resources at the project.

In addition, the Company has the option to receive physical uranium in lieu of the royalty payment. On March 14, 2025, Orano settled the royalty payment related to the production from the McArthur River mine for calendar year 2024 by delivering 18,366 pounds U3O8 to the Company's storage account at Blind River in Canada.

About McArthur River

The McArthur River Operation includes the fully developed McArthur River mine operation, being a currently In Production underground mine operation, located in northern Saskatchewan, Canada approximately 620 km north of Saskatoon. Cameco has disclosed that the project is currently owned by a joint venture between Cameco (69.805%) and Orano (30.195%).

The current McArthur River Operation is comprised of a portion of one mineral lease, ML 5516, covering 1,380 hectares, and a further 28 mineral claims totaling 87,747 hectares as outlined in the Cameco 2024 AIF. The McArthur River deposit was discovered in 1988, and the mine went into production in 1999. In 2018, production was suspended at the mine and mill until put back into production in November 2022.

McArthur River mine is the world's largest high-grade uranium mine, with ore grades that are 100 times the world average. Estimated operating costs of $20.31 per pound for McArthur River based on operating and capital cost estimates for the estimated life of mine, stated in constant 2024 dollars and reflecting a forecast life of mine mill production of 360.0 Mlbs U3O8, including estimated milling costs. This would place McArthur River amongst the lowest-cost uranium projects in the world. McArthur River has a licenced capacity of 25.0 Mlbs U3O8 per year.

On February 20, 2025, Cameco announced that total packaged production from McArthur River mine and Key Lake mill in 2024 was 20.3 Mlbs U3O8 on a 100% basis (15.8 Mlbs U3O8 was produced at the mine and 20.3 Mlbs U3O8 packaged at the mill).

Project Milestones & Recent Developments

Cameco began construction and development of the McArthur River mine in 1997. Federal authorities issued the operating licence, and mining began at the project in December 1999 and commercial production was achieved in November 2000. Production was suspended at McArthur River mine and Key Lake mill in January 2018 due to a weak global uranium market for a period of four years before Cameco restarted both operations in November 2022. In October 2023, federal authorities granted a 20-year renewal of the licences for McArthur River mine and the Cameco operated Key Lake mill.

The operation successfully extracted 358.1 Mlbs U3O8 (100% basis) since mining began in 1999 until the end of 2024. In the Cameco 2024 AIF, Cameco disclosed estimated: (i) proven and probable mineral reserves of 359.6 Mlbs U3O8 at an average grade of 6.55% U3O8; and (ii) measured and indicated resources, exclusive of reserves, of 6.7 Mlbs at an average grade of 2.30% U3O8 and inferred resources of 2.4 Mlbs at an average grade of 2.95% U3O8. See "Mineral Reserve and Resource Estimates" and Appendix "A" for further information.

In the Cameco 2024 AIF, Cameco disclosed that a total of 20.3 Mlbs U3O8 (on a 100% basis) was produced at McArthur River mine and Key Lake mill in 2024, exceeding its plan of 19.0 Mlbs U3O8. The McArthur River mine produced 15.8 Mlbs U3O8, which was less than its planned production for the period of 18.3 Mlbs U3O8, primarily due to a shutdown at the mine to accommodate ventilation repairs to shaft two.

On February 20, 2025, Cameco announced that it plans to produce 18 Mlbs (100% basis) in calendar year 2025. Although the performance of the Key Lake mill in 2024 demonstrated production rates and capacities that, when annualized, exceeded 18 Mlbs, Cameco attributes the operation's output constraints to the McArthur River mine's limited ability to increase the production of mined ore to feed the mill, and due to the depletion of the previously mined, excess broken ore inventory. In 2025, Cameco disclosed its plans to bring zone 1 into production and advance zone 4 south development. It disclosed that the risk of unforeseen challenges during the development of these areas could impact its production schedule, the extent of which will depend on the magnitude of the delay and the mine's ability to substitute with production from alternative mining areas.

In its management's discussion and analysis for the quarter ended March 31, 2025, Cameco disclosed total production of 4.6 Mlbs U3O8 from McArthur River mine and Key Lake mill for the three months ended March 31, 2025, compared to 5.0 Mlbs U3O8 in the same period of 2024, due to differences in the annual mine plans.

For further information regarding McArthur River, please refer to Appendix "A".

Waterbury Lake / Cigar Lake

Unless otherwise indicated, the scientific and technical information herein regarding Waterbury Lake / Cigar Lake has been derived from the Cigar Lake Technical Report, the Cameco 2024 AIF and Cameco's other public disclosures, copies of which are available under Cameco's profile on SEDAR+.

Royalty Description