0001674416false00-000000000016744162025-05-192025-05-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 19, 2025 |

CRISPR THERAPEUTICS AG

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Switzerland |

001-37923 |

Not Applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Baarerstrasse 14 |

|

6300 Zug, Switzerland |

|

Not Applicable |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 41 (0)41 561 32 77 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, nominal value CHF 0.03 |

|

CRSP |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

Collaboration, Option and License Agreement

On May 19, 2025, CRISPR Therapeutics AG (the “Company”) entered into a Collaboration, Option and License Agreement (the “Agreement”) with Sirius Therapeutics (“Sirius-CY”) and Sirius Therapeutics, Inc. (“Sirius-US” and together with Sirius-CY, “Sirius”), pursuant to which, among other things, (1) Sirius-US and the Company will collaborate on the research, development, manufacture and commercialization and use of certain collaboration products utilizing Sirius’ siRNA technology for targeting Factor XI (collectively, “Collaboration Products”); and (2) Sirius granted to the Company options to exclusively license Sirius siRNA technology to target up to two licensed targets for the research, develop, manufacture and commercialization of licensed products (collectively “Licensed Products”), in exchange for the potential to receive certain option fees, milestone payments and royalties.

Upfront Consideration. In connection with entering into the Agreement, the Company agreed to issue to Sirius-CY an aggregate of (i) approximately $70.0 million of its common shares, and (ii) a cash payment of $25.0 million. In connection with the issuance of the Company's common shares, the Company and Sirius-CY entered into a share issuance agreement (the “Share Issuance Agreement”) relating to the issuance of 1,842,105 common shares, nominal value CHF 0.03 per share (the “Shares”). The Shares will be issued pursuant to the Company’s shelf registration statement on Form S-3 ASR (File No. 333-281262) filed by the Company with the U.S. Securities and Exchange Commission on August 5, 2024 at an issue price of $38.00 per share within the time period set forth in the Share Issuance Agreement. The Shares will be subject to a customary lock-up.

Governance. The Company and Sirius will establish a joint steering committee (“JSC”) to provide high-level oversight, decision-making and periodic updates regarding activities under the Agreement, including formation of additional committees, as applicable. The JSC will be comprised of an equal number of representatives from each of the Company and Sirius and meet at least quarterly to review the progress of collaboration program activities and oversee the research program for licensed products. The JSC will endeavor to make all decisions by consensus. In the event the JSC is unable to reach consensus, the Company has final decision-making authority on certain matters, including all matters related to Licensed Products after option exercise.

Termination Generally. Either party can terminate the Agreement upon the other party’s material breach, subject to specified notice and cure provisions, or upon the insolvency of the other party. To the extent permissible by applicable law, Sirius may also terminate the Agreement in the event the Company commences or participates in any action or proceeding challenging the validity or enforceability of any patent that is licensed to Company pursuant to the Agreement. The Company also has the right to terminate the Agreement with respect to a Licensed Product, on a product-by-product basis, for convenience at any time upon 90 days’ written notice prior to first commercial sale of any Licensed Product and upon 180 days’ notice after first commercial sales of a Licensed Product.

Absent early termination or opt-out (and subject to the additional rights in lieu of termination described below), the Agreement will continue, (a) with respect to Collaboration Products, until the date on which such product is no longer commercialized, on a country-by-country and product-by-product basis; (b) with respect to Licensed Products, until expiration of all payment obligations under the Agreement, on a country-by-country and product-by-product basis.

Collaboration Products

With respect to Collaboration Products, the Agreement includes, among other things, provisions relating to the following:

Financial Terms. With respect to Collaboration Products, the Company and Sirius will equally share all development and commercialization costs. For the first collaboration product candidate successfully developed, the Company would be the lead party responsible for commercialization efforts in the United States and Sirius-US would be the lead party responsible for commercialization efforts in Greater China. The parties will determine the lead party responsible for commercialization in the rest of the world at a future date. The net profits and net losses, as applicable, incurred under the Agreement with respect to all Collaboration Products shall be shared equally between the Company and Sirius.

In addition, the Company will pay Sirius future development and regulatory milestones of up to an aggregate of $87.5 million one time regardless of the number of Collaboration Products that achieve the milestones, and, at the Company’s sole election, can be paid in cash, common shares of the Company or a combination thereof.

Exclusivity. Under the Agreement, from the effective date of the Agreement and for so long as Collaboration Products are commercialized, neither party nor any of its affiliates may, alone or in conjunction with a third party, engage in activities to advance any siRNA-based pharmaceutical product, medical therapy, treatment, preparation, substance or formulation targeting factor XI or activities in a specified field.

Termination.

If circumstances arise pursuant to which a party would have the right to terminate the Agreement with respect to a Collaboration Product for any reason, such party may elect to keep the Agreement in effect and cause such other party to be treated as if it had exercised its opt-out rights with respect to the products associated with such uncured material breach or other action leading to the termination right and, if there was an uncured material breach, the milestones and royalties payable to the breaching party would be reduced by a specified percentage and the breaching party may no longer participate in the JSC or any other committee, subcommittee or working group with respect to the collaboration products program.

Opt-Out Rights. Either party may opt out of the development of a Collaboration Product under the Agreement after the later of a period of time or a predetermined point in the development of such Collaboration Product, on a product-by-product basis. In the event of such opt-out, the party opting-out will no longer share in the net profits and net losses associated with such Collaboration Product and, instead, the opting-out party will be entitled to mid-single to low-double digit percentage tiered royalties on the net sales of such product, if commercialized. In addition, if the opting-out party is Sirius, Sirius will be entitled to certain milestone payments up to an aggregate of $340.0 million. If the opting-out Party is the Company, depending on the timing of the opt-out, the Company will be entitled to certain milestone payments up to an aggregate of $340.0 million, and if the opt-out is prior to the first commercial sale of the opt-out product, the opt-out milestone payments will be capped at a certain percentage of the Company’s cumulative development costs for such opt-out product.

Licensed Products

Under the Agreement, the Company has options to exclusively license Sirius siRNA technology to target up to two licensed targets from a list of seven reserved targets for the research, develop, manufacture and commercialization of Licensed Products. Each option is exercisable during a specified exercise period defined by future events for each such licensed target. If the Company elects to exercise its option to a licensed target to research, develop, manufacture and commercialize Licensed Products, the Company will make a one-time $10.0 million payment per option (each, an “Option Payment”) to Sirius, in cash, common shares of the Company or a combination thereof. The Option Payment is payable up to two (2) times.

Financial Terms. The Company will pay Sirius certain specified future development, regulatory and sales milestones of up to an aggregate of $300.0 million for the first Licensed Product relating to each licensed target, as well as tiered royalty payments in the mid-single digits to low double digits range on future sales of a commercialized Licensed Product. The royalty payments are subject to reduction under certain specified conditions set forth in the Agreement. In addition, at the Company’s sole election, certain development and regulatory milestones may be paid in cash, common shares of the Company or a combination thereof. The Company is solely responsible for all research, development, manufacturing and global commercialization activities and associated costs for Licensed Products, as well as all associated costs related to Sirius activities set forth in any applicable research plan relating thereto.

Exclusivity. Under the Agreement, Sirius has agreed to certain exclusivity obligations with respect to siRNA-based products targeting reserved targets or licensed targets. Upon expiration of the nomination period, the reserved targets that are not licensed targets by the Company will no longer be subject to the exclusivity obligations.

Rights In-lieu of Termination. If circumstances arise pursuant to which the Company would have the right to terminate the Agreement with respect to Licensed Products for any reason (except termination by the Company for convenience), the Company may elect to keep the Agreement in effect and all amounts due under the Agreement with respect to Licensed Products on or after the date of the applicable material breach would be reduced by a specified percentage.

The foregoing description of the Agreement is only a brief description of the terms of such agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder, and is qualified in its entirety by such agreement, which will be filed with the Securities and Exchange Commission as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, if not earlier.

The foregoing description of the Share Issuance Agreement is only a brief description of the terms of such agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder, and is qualified in its entirety by such agreement, the form of which is filed as Exhibit 10.1 to this Current Report on Form 8-K. A copy of the opinion of Walder Wyss AG relating to the legality of the issuance of the Shares is filed as Exhibit 5.1 to this Current Report on Form 8-K.

Item 8.01 Other Events.

On May 19, 2025, the Company issued a press release announcing, among other things, the Agreement with Sirius, the Company’s and Sirius’ plans to co-develop and co-commercialize SRSD107 pursuant to the Agreement and highlighting the results of Phase 1 clinical trials of SRSD107. SRSD107 is a next generation, long-acting siRNA designed to selectively inhibit human coagulation factor XI (“FXI”), a key driver of pathological thrombosis with minimal impact on normal hemostasis. By targeting FXI, SRSD107 aims to reduce thrombotic events while minimizing the risk of bleeding – representing a differentiated approach compared to Factor Xa inhibitors. In addition, SRSD107 may offer the potential for reversibility not observed with other anti-Factor XI modalities. The addressable population for SRSD107 includes patients with atrial fibrillation, venous thromboembolism, cancer-associated thrombosis, chronic Coronary Artery Disease, chronic Peripheral Vascular Disease, end-stage renal disease requiring hemodialysis, and patients undergoing major orthopedic surgery, where bleeding risk limits existing therapies.

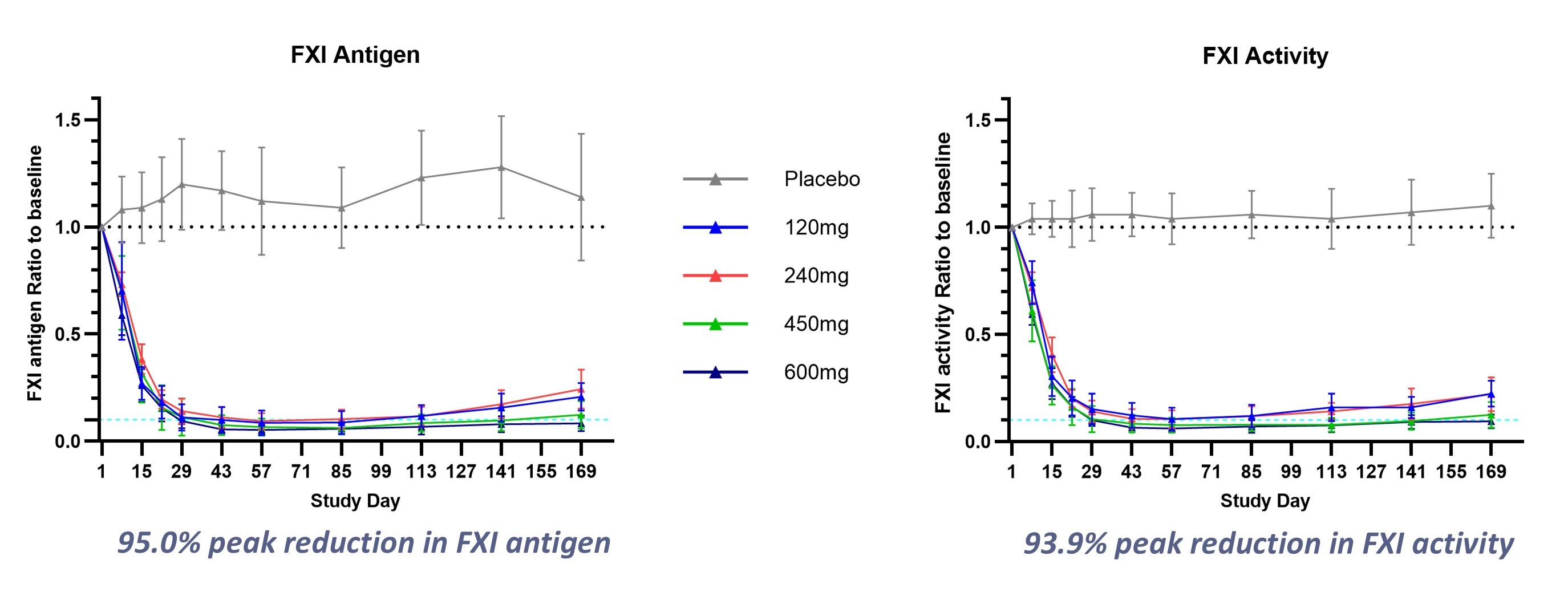

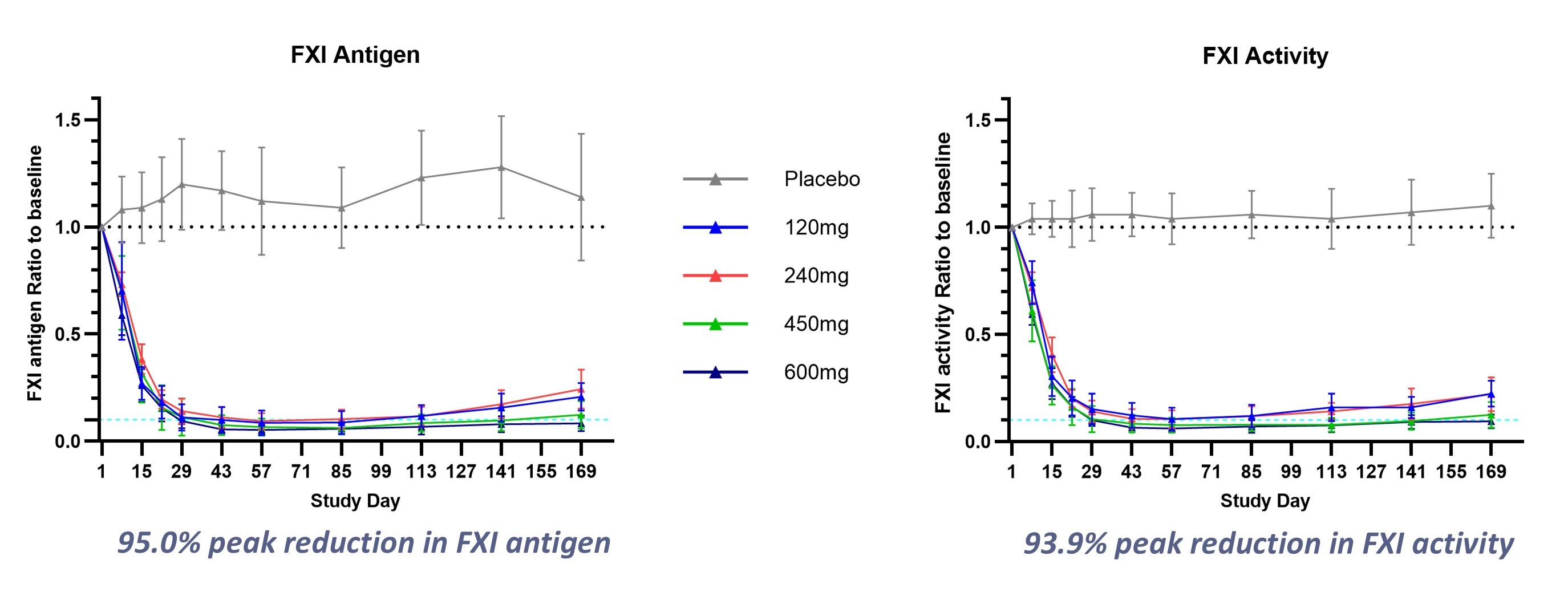

Two Phase 1 clinical trials have been completed for SRSD107, and single doses of SRSD107 have been well tolerated. SRSD107 demonstrated robust pharmacodynamic effects, including reductions of over 93% in FXI levels and FXI activity, along with more than a twofold increase in activated partial thromboplastin time relative to baseline. These effects were sustained, with responses maintained for up to six months post-dosing. SRSD107 has the potential to be a best-in-class FXI inhibitor, showing deep reductions in FXI via semi-annual subcutaneous injection. Results from the Phase 1 clinical trials were presented at both the 2025 Annual Scientific Sessions of the American College of Cardiology and the 2024 Annual Meeting of the American Society of Hematology.

Figure 1. SRSD107 Phase 1 Clinical Results: Sustained, dose-dependent pharmacodynamic response to therapy

A Phase 2 clinical trial of SRSD107 is being initiated to evaluate the safety and efficacy of SRSD107 for the prevention of venous thromboembolism in patients undergoing total knee arthroplasty. The clinical trial aims to confirm the anticoagulant benefits of SRSD107 and to inform dose selection for future pivotal trials.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

* Filed herewith.

† Certain portions of this exhibit have been omitted because they are not material and the registrant customarily and actually treats that information as private or confidential.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CRISPR Therapeutics AG |

|

|

|

|

Date: |

May 19, 2025 |

By: |

/s/ Samarth Kulkarni |

|

|

|

Samarth Kulkarni, Ph.D.

Chief Executive Officer |

EX-5.1

2

crsp-ex5_1.htm

EX-5.1

EX-5.1

|

|

|

|

|

Walder Wyss Ltd.

Seefeldstrasse 123

P.O. Box

8034 Zurich

Switzerland

Telephone +41 58 658 58 58

Fax +41 58 658 59 59

www.walderwyss.com

|

To:

CRISPR Therapeutics AG

Baarerstrasse 14

6300 Zug

Switzerland

Zurich, as of May 19, 2025

CRISPR Therapeutics AG – Swiss Legal Opinion (Registration Statement on Form S-3)

Dear Madam, Dear Sir,

We have acted as Swiss counsel to CRISPR Therapeutics AG, Zug, Switzerland (the Company) in connection with (i) a registration statement on Form S-3ASR filed with the U.S. Securities and Exchange Commission (SEC) on August 5, 2024 (SEC file no. 333-281262) (the Registration Statement) for the purpose of registering under the United States Securities Act of 1933, as amended (the Securities Act), amongst others, an indeterminate amount of common shares, par value of CHF 0.03 each, of the Company (such common shares, the Common Shares), and (ii) a final prospectus supplement dated May 19, 2025 relating to the offering of Common Shares at an aggregate issue price per Common Share of CHF 0.03 (such Common Shares, the Offered Shares) (the Prospectus Supplement), as further addressed in a certain share issuance agreement dated May 19, 2025 (the Share Issuance Agreement), entered into between (i) Sirius Therapeutics (the Investor), on one hand, and (ii) the Company, on the other hand.

As such counsel, we have been requested to render an opinion as to certain matters of Swiss law.

|

|

Attorneys admitted in Switzerland or in a EU/EFTA state are registered with the attorneys' registry |

Page 1 of 6 |

1.

Scope and Limitation of Opinion

Our opinion is strictly confined to matters of Swiss law as in force at the date hereof and as it is presently applied by the Swiss courts. Such law and its interpretation are subject to change. In the absence of explicit statutory law or established case law, we base our opinion solely on our independent professional judgment. Our opinion is strictly limited to the Documents (as defined below) and the matters stated herein and is not to be read as extending, by implication or otherwise, to any agreement or document referred to in any of the Documents or any other matter. For purposes of this opinion, we have not conducted any due diligence or similar investigation or verification as to any matters stated herein. In this opinion, Swiss legal concepts are expressed in English terms and not in their original language. These concepts may not be identical to the concepts described by the same English language terms as they exist under the laws of other jurisdictions.

For purposes of rendering the opinion expressed herein, we have received the following documents (the Documents):

(a)

a .pdf copy of the Registration Statement;

(b)

a .pdf copy of the base prospectus dated August 5, 2024, included in the Registration Statement (the Prospectus);

(c)

a .pdf copy of the Prospectus Supplement (together with the Prospectus, the Final Prospectus, and together with the Registration Statement, the Filing Documents);

(d)

a .pdf copy of the Share Issuance Agreement;

(e)

a .pdf copy of the public deed on, inter alia, the resolution regarding the introduction of a capital band by the Company’s shareholders’ meeting held on May 30, 2024 (the AGM Resolution);

(f)

a .pdf copy of the certified articles of association of the Company in their version dated March 13, 2025 (the Articles);

(g)

a .pdf copy of the organizational regulations of the Company in their version as per February 11, 2025 (the Organizational Regulations);

(h)

a .pdf copy of a certified excerpt from the registry of the Commercial Register of the Canton of Zug, dated March 20, 2025 of the Company (the Excerpt); and

(i)

a .pdf copy of the minutes of the meeting of the Company’s board of directors (the Board) held on May 18, 2025 approving, among other things, (i) the filing of the Registration Statement, (ii) the offering of the Offered Shares to the Investor as contemplated in the Share Issuance Agreement, (iii) the offering price for the Issued Shares and (iv) the authorization granted to any member of the Board, acting individually, to resolve on a capital increase within the Company’s capital band, withdraw the pre-emptive rights of the shareholders based on the withdrawal authorization under the Articles and Swiss law and allocate the withdrawn pre-emptive rights to third parties and/or certain existing shareholders and execute and deliver, in the name and on behalf of the Company any and all documents, agreements and instruments to effectuate the resolutions (the Board Resolution).

No documents have been reviewed by us in connection with this opinion other than the Documents listed in this Section 2 (Documents).

All terms used in this opinion in uppercase form shall have the meaning ascribed to them in the Registration Statement, unless otherwise defined herein.

In rendering the opinion below, we have assumed:

(a)

the conformity to the Documents of all documents produced to us as copies, fax copies or via e-mail, and that the original was executed in the manner appearing on the copy of the draft;

(b)

the genuineness and authenticity of the signatures on all copies of the original Documents thereof which we have examined, and the accuracy of all factual information contained in, or statements given in connection with, the Documents;

(c)

the AGM Resolution is a true record of the proceedings described therein in duly convened, constituted and quorate meetings of the Company’s shareholder meeting, and the resolutions set out therein were validly passed and have not been rescinded or amended and are in full force and effect;

(d)

the Board Resolution is a true record of the proceedings described therein in duly convened, constituted and quorate meetings of the Company’s board of directors, and the resolutions set out therein were validly passed and have not been rescinded or amended and are in full force and effect;

(e)

that the information provided in the Documents (in particular in the Excerpt, the Articles and the Organizational Regulations) are true, correct, complete and up to date as of the date hereof and that there are no facts outstanding or matters resolved that are not reflected in the Documents;

(f)

the Registration Statement has been, or will be, duly filed by the Company;

(g)

the legal capacity, power and authority of each of the parties (other than the Company) to enter into and perform its obligations under the Share Issuance Agreement and the relevant transaction provided for under the Board Resolution and that all consents or approvals from and filings, registrations and notifications with or to all governmental authorities (other than in Switzerland) required in connection with the execution, delivery and performance of the Share Issuance Agreement have been or will have been obtained or made and are or will remain in full force and effect;

(h)

the Share Issuance Agreement constitutes legal, valid, binding and enforceable obligations of the Company under the governing law;

(i)

that (i) the Filing Documents will continue to be effective, (ii) the issuance of and payment for the Offered Shares will be made in compliance with the Articles, the Registration Statement, the AGM Resolution, the Board Resolution and the Share Issuance Agreement, (iii) the consideration received by the Company for the issuance of the Offered Shares will be fully paid and will not be less than the par value of such Offered Shares, and (iv) the issuance of the Offered Shares will be made in accordance with the articles 653s–653v, 647–652h, 929–930, 936a–937, 943 and 973c of the Swiss Code of Obligations (CO), the relevant intermediated securities regulations and commercial registry regulations, the Articles (as may be amended from time to time in accordance with applicable law), the Organizational Regulations (as may be amended from time to time in accordance with applicable law), any applicable law or any requirement or restriction imposed by any court or governmental body having jurisdiction on the Company;

(j)

that the issuance, transfers, offering and sale of the Offered Shares will be conducted in the manner as described in the Articles, the Filing Documents, the Share Issuance Agreement and the Board Resolution;

(k)

that the Offered Shares have not been and will not be (i) publicly offered, directly or indirectly, in Switzerland within the meaning of article 3 lit. h of the Swiss Financial Services Act of June 15, 2018, and/or (ii) admitted to any trading venue within the meaning of article 26 lit. a of the Swiss Financial Market Infrastructure Act of June 19, 2015 in Switzerland; and

(l)

all parties to the Share Issuance Agreement will perform all obligations by which they are bound in accordance with the respective terms.

Based upon the foregoing and subject to the qualifications set out below, we are of the following opinion:

The Offered Shares, if and when issued, will be validly issued, fully paid in (up to their nominal value) and non-assessable.

5.

The above opinion is subject to the following qualifications:

(a)

The lawyers of our firm are members of the Swiss bar and do not hold themselves to be experts in any laws other than the laws of Switzerland. Accordingly, we are opining herein as to Swiss law only and we express no opinion with respect to the applicability thereto, or the effect thereon, of the laws of any other jurisdiction.

(b)

This opinion is based on the current provisions of the laws of Switzerland and the regulations thereunder in effect on the date hereof and only as currently interpreted in Switzerland. Such laws and their interpretation are subject to change.

(c)

We express no opinion as regards the withdrawal of shareholders’ pre-emptive rights (Bezugsrechte) in connection with the issuance and sale of Offered Shares.

(d)

When used in this opinion, the term “non-assessable” means that no further contributions have to be made to the Company by the relevant holder of the Offered Shares.

(e)

We express no opinion as to the future availability of authorized share capital within any capital band of the Company or conditional capital of the Company.

(f)

We express no opinion as to the accuracy or completeness of the information contained in the Filing Documents.

(g)

We express no opinion as to any commercial, calculating, auditing or other non-legal matters. Further, we express no opinion as to tax law.

(a)

We do not assume any obligation to advise you of any changes in applicable law or any other matter that may come to our attention after the date hereof that may affect our opinion expressed herein.

(b)

We hereby consent to the filing of this opinion on the date hereof with the United States Securities and Exchange Commission as an exhibit to the Registration Statement and to the incorporation by reference of this opinion in the Registration Statement. In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

(c)

This opinion and all matters relating to this opinion are governed by and shall be construed in accordance with the substantive laws of Switzerland. We confirm our understanding that all disputes arising out of or in connection with this opinion shall be subject to the exclusive jurisdiction of the courts of the Canton of Zurich, Switzerland, venue being city of Zurich.

Yours faithfully,

Walder Wyss AG

/s/ Alex Nikitine

Alex Nikitine

EX-10.1

3

crsp-ex10_1.htm

EX-10.1

EX-10.1

Exhibit 10.1

[***] Certain portions of this exhibit have been omitted because they are not material and the registrant customarily and actually treats that information as private or confidential.

Final Form

SHARE ISSUANCE AGREEMENT

This SHARE ISSUANCE AGREEMENT (this “Agreement”) is made and entered into as of [●], by and among CRISPR Therapeutics AG, a stock corporation (Aktiengesellschaft) incorporated under the laws of Switzerland (the “Company”), and [●]1, a [●] incorporated under the laws of [●] (the “Holder”).

RECITALS

A.

The Company and the Holder have entered into that certain collaboration, option and license agreement, dated as of [●] (the “Collaboration Agreement”).

B.

As partial consideration for entering into the Collaboration Agreement, the Company wishes to issue to the Holder, upon the terms and subject to the conditions stated in this Agreement and pursuant to an effective registration statement under the Securities Act (as defined below), common shares, nominal value CHF 0.03 per share (“Common Shares”), of the Company; and

C.

In consideration of the mutual promises made herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.

Definitions. For the purposes of this Agreement, the following terms shall have the meanings set forth below:

“Affiliate” of a Person means another Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such first-mentioned Person.

“Agreement” has the meaning set forth in the first paragraph to this Agreement.

“Articles of Association” means the Amended and Restated Articles of Association of the Company, as in effect as of the date hereof.

“Authorized Agent” has the meaning set forth in Section 10.10.

“Business Day” means a day, other than a Saturday or Sunday or a legal holiday or a day on which banking institutions or trust companies are authorized or obligated by law to close in New York, New York and in Zug, Switzerland.

“Closing” has the meaning set forth in Section 3.1.

“Closing Date” has the meaning set forth in Section 3.1.

“Collaboration Agreement” has the meaning set forth in the recitals to this Agreement.

1 Note to Draft: As applicable, Sirius Therapeutics, a limited liability company organized and existing under the laws of the Cayman Islands (“Sirius-CY”); Sirius Therapeutics, Inc., a corporation organized under the laws of the State of Delaware; or any other subsidiary of Sirius-CY designated by Sirius-CY.

“Common Shares” has the meaning set forth in the recitals to this Agreement.

“Company” has the meaning set forth in the first paragraph to this Agreement.

“Company’s Knowledge” means the actual knowledge of the executive officers (as defined in Rule 405 under the Securities Act) of the Company.

“Control” (including the terms “controlling,” “controlled by” or “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Disclosure Time” means, (i) if this Agreement is signed on a day that is not a Trading Day or after 9:00 a.m. (New York City time) and before midnight (New York City time) on any Trading Day, 9:01 a.m. (New York City time) on the Trading Day immediately following the date hereof, and (ii) if this Agreement is signed between midnight (New York City time) and 9:00 a.m. (New York City time) on any Trading Day, no later than 9:01 a.m. (New York City time) on the date hereof.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Holder” has the meaning set forth in the first paragraph to this Agreement.

“Holder Shares” has the meaning set forth in Section 2.

“Lock-Up Period” has the meaning set forth in Section 7(a).

“Material Adverse Effect” means a material adverse effect on (i) the assets, liabilities, results of operations, financial condition or business of the Company taken as a whole, (ii) the legality or enforceability of any of the Transaction Documents or (iii) the ability of the Company to perform its obligations under the Transaction Documents, except that for purposes of Section 6.1(j) of this Agreement, in no event shall a change in the market price of the Common Shares alone constitute a “Material Adverse Effect.”

“Nasdaq” means the Nasdaq Global Market.

“Nominal Payment” has the meaning set forth in Section 3.3.

“Person” means an individual or a corporation, partnership, limited liability company, trust, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or other entity of any kind.

“Principal Trading Market” means the Trading Market on which the Common Shares are primarily listed on and quoted for trading, which, as of the date of this Agreement and the Closing Date, shall be the Nasdaq Global Market.

“Prospectus” means the prospectus included in the Registration Statement, at the time it was declared effective by the SEC.

“Prospectus Supplement” means the supplement to the Prospectus complying with Rule 424(b) of the Securities Act that is filed with the SEC and delivered by the Company to the Holder on or prior to the date hereof.

“Registration Statement” means the effective automatic shelf registration statement on Form S-3ASR filed by the Company with the SEC on August 5, 2024 (File No. 333-281262), including all information, documents and exhibits filed with or incorporated by reference into such registration statement, which registers the sale of the Common Shares.

“Related Judgment” has the meaning set forth in Section 10.10.

“Related Proceedings” has the meaning set forth in Section 10.10.

“SEC” means the U.S. Securities and Exchange Commission.

“SEC Filings” has the meaning set forth in Section 4.5.

“Securities Act” means the Securities Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Specified Courts” has the meaning set forth in Section 10.10.

“Trading Day” means (i) a day on which the Common Shares are listed or quoted and traded on its Principal Trading Market or (ii) if the Common Shares are not quoted on any Trading Market, a day on which the Common Shares are quoted in the over-the-counter market as reported in the “pink sheets” by OTC Markets Group Inc. (or any similar organization or agency succeeding to its functions of reporting prices); provided, that in the event that the Common Shares are not listed or quoted as set forth in (i) or (ii) hereof, then Trading Day shall mean a Business Day.

“Trading Market” means whichever of the New York Stock Exchange, the NYSE American, the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market on which the Common Shares are listed or quoted for trading on the date in question.

“Transaction Documents” means this Agreement.

“Transfer Agent” means the transfer agent and registrar of the Company’s Common Shares, Equiniti Trust Company, LLC.

2.

Issuance of Holder Shares. On the Closing Date, upon the terms and subject to the conditions set forth herein, the Company will issue to the Holder [●] Common Shares (the “Holder Shares”). The issue price per Holder Share shall be [●].2

3.1.

Upon the satisfaction of the conditions set forth in Section 6, the completion of the issuance of the Holder Shares (the “Closing”) shall occur remotely via exchange of documents and signatures at a time (the “Closing Date”) to be agreed to by the Company and the Holder but in no event later than the [***] ([***]) Trading Day after the date hereof.

2 Note to Draft: Issuance for first closing to equal $70.0 million of Common Shares, based on a price per Common Share equal to $38.00 per Holder Share. For any additional share issuances set forth in Sections 7.2.6 and 7.3.3 of the Collaboration Agreement, the number of Holder Shares will be determined based on a price per Common Share equal to [***] the date of achievement of such Milestone Event (as defined in the Collaboration Agreement), as applicable and as elected by CRISPR.

3.2.

On the date hereof, the Holder shall subscribe for the Holder Shares and shall execute and deliver or cause to be delivered to the Company an original subscription form regarding such subscription in the form attached hereto as Exhibit A, duly executed in wet ink by the Holder.

3.3.

In order to facilitate the issuance of the Holder Shares in accordance with Swiss law, promptly following the signing of the Agreement, the Holder shall initiate a wire transfer for delivery to the blocked bank account (Kapitaleinzahlungskonto) of the Company at UBS Switzerland AG (the “Bank”) according to the wire instructions provided by the Company, an amount equal to (i) CHF 0.03 multiplied by (ii) the number of Holder Shares to be issued on the Closing Date (the aggregate so calculated is referred to as the “Nominal Payment”). The Holder shall use commercially reasonable best efforts to cause such funds to be delivered to such blocked bank account by 5:00 p.m. Eastern time on the date that is [***] ([***]) Trading Days after the date of this Agreement. Pursuant to Swiss law (art. 633 para. 2 Swiss Code of Obligations) any amount in the blocked bank account will only be released to the Company after the Holder Shares have been registered in the commercial register of Zug, Switzerland. At the Closing, the Company shall (i) take (or procure to be taken) all necessary actions to increase the share capital of the Company and issue to the Holder (or a broker designated by the Holder) the Holder Shares and (ii) deliver or cause the Transfer Agent to deliver to the Holder (or a broker designated by the Holder) the Holder Shares hereto by electronic delivery at the Holder’s (or such broker’s) designated balance account at the Depository Trust Company.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as of the date hereof and as of the Closing Date that, except as described in the Company’s SEC Filings (excluding any exhibits to the SEC Filings), each of which qualifies the representations and warranties below in their entirety, the points as set forth under this Section 4 are true and correct (for purposes of these representations and warranties, the term the “Company” shall include any subsidiaries of the Company, unless otherwise noted herein):

4.1.

Incorporation and Good Standing. Each of the Company and its significant subsidiaries (as defined in Rule 1-02(w) of Regulation S-X) has been duly incorporated and is validly existing as a corporation in good standing (to the extent such concept is applicable) under the laws of the jurisdiction in which it is chartered or organized with full corporate power and authority to own or lease, as the case may be, and to operate its properties and conduct its business as described in the Prospectus, and is duly qualified to do business as a foreign corporation and is in good standing under the laws of each jurisdiction which requires such qualification, except where the failure to qualify would not reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect.

4.2.

Authorization. The Company has the requisite corporate power and authority and has taken all requisite corporate action necessary for, and no further action on the part of the Company, its officers, directors and shareholders is necessary for, the authorization, execution and delivery of the Transaction Documents. The Transaction Documents constitute the legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability, relating to or affecting creditors’ rights generally and to general equitable principles. As of the Closing Date, the Company has taken all requisite corporate action necessary for, and no further action on the part of the Company, its officers, directors and shareholders is necessary for, (i) the authorization of the performance of all obligations of the Company under the Transaction Documents, and (ii) the authorization, issuance (or reservation for issuance) and delivery of the Holder Shares. As of Closing Date, all statutory preemptive rights to which the existing shareholders of the Company are entitled under Swiss law with respect to the capital increases described in Section 3.3 have been validly withdrawn.

4.3.

Valid Issuance; Registration. The Holder Shares will upon Closing be duly authorized and, when issued and paid for in accordance with the applicable Transaction Documents, will be duly and validly issued, fully paid and nonassessable (which term means when used herein that no further contributions have to be made by the holders of the capital stock), free and clear of all liens imposed by the Company. The Holder Shares are being offered, issued, and sold under the Registration Statement and the Prospectus. The Company has prepared and filed the Registration Statement in conformity with the requirements of the Securities Act, including the Prospectus, and such amendments and supplements thereto as may have been required to the date of this Agreement. The Registration Statement is effective under the Securities Act and no stop order preventing or suspending the effectiveness of the Registration Statement or suspending or preventing the use of the Prospectus has been issued by the SEC and no proceedings for that purpose have been instituted or, to the knowledge of the Company, are threatened in writing by the SEC. The Company, if required by the rules and regulations of the SEC, shall file the Prospectus Supplement with the SEC pursuant to Rule 424(b). At the time the Registration Statement and any post-effective amendments thereto became effective, at the date of this Agreement and at the Closing Date, the Registration Statement and any amendments thereto conformed and will conform in all material respects to the requirements of the Securities Act and did not and will not contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading; and the Prospectus Supplement and any amendments or supplements thereto, at the time the Prospectus Supplement or any amendment or supplement thereto was issued and at the Closing Date, conformed and will conform in all material respects to the requirements of the Securities Act and did not and will not contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The Company is eligible to use Form S-3 under the Securities Act and it meets the transaction requirements as set forth in General Instruction I.B.1 of Form S-3.

4.4.

SEC Filings. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the one year period preceding the date hereof (or such shorter period as the Company was required by law or regulation to file such material) (collectively, and together with the Prospectus and the Prospectus Supplement, the “SEC Filings”). At the time of filing thereof, the SEC Filings complied in all material respects with the requirements of the Securities Act or the Exchange Act, as applicable, and the rules and regulations of the SEC thereunder.

4.5.

Compliance with Nasdaq Continued Listing Requirements. The Company is in compliance with applicable Nasdaq continued listing requirements. There are no proceedings pending or, to the Company’s Knowledge, threatened against the Company relating to the continued listing of the Common Shares on Nasdaq and the Company has not received any notice of, nor to the Company’s Knowledge is there any reasonable basis for, the delisting of the Common Shares from Nasdaq.

4.6.

Consents. Subject to the accuracy of the representations and warranties of the Holder set forth in Section 5 hereof, the execution, delivery and performance by the Company of the Transaction Documents and the offer and issuance of the Holder Shares require no consent of, action by or in respect of, or filing with, any Person, governmental body, agency, or official other than (a) filings that have been made pursuant to applicable state securities laws, (b) resolutions and filings that have been or will be made and all other actions that have been or will be taken pursuant to applicable Swiss law in order to effect the transactions contemplated by the Transaction Documents, in particular the share capital increase described in Section 3.3, (c) post-issuance filings pursuant to applicable state and federal securities laws, and (d) filings pursuant to the rules and regulations of Nasdaq, each of which the Company has filed or undertakes to file within the applicable time.

Subject to the accuracy of the representations and warranties of the Holder set forth in Section 5 hereof, the Company, as of Closing Date, has taken all action necessary to exempt (i) the issuance of the Holder Shares and (ii) the other transactions contemplated by the Transaction Documents from the provisions of any shareholder rights plan or other “poison pill” arrangement, any anti-takeover, business combination or control share law or statute binding on the Company or to which the Company or any of its assets and properties is subject that is or could reasonably be expected to become applicable to the Holder as a result of the transactions contemplated hereby, including without limitation, the issuance of the Holder Shares or the exercise of any right granted to the Holder pursuant to the Transaction Documents.

4.7.

No Violation or Default. Neither the Company nor any subsidiary is in violation or default of (i) any provision of its Articles of Association, (ii) the terms of any indenture, contract, lease, mortgage, deed of trust, note agreement, loan agreement or other agreement, obligation, condition, covenant or instrument to which it is a party or bound or to which its property is subject, or (iii) any statute, law, rule, regulation, judgment, order or decree of any court, regulatory body, administrative agency, governmental body, arbitrator or other authority having jurisdiction over the Company or such subsidiary or any of its properties, as applicable, except in the case of clauses (ii) and (iii), for such violation or default as would not reasonably be expected to have a Material Adverse Effect.

4.8.

Financial Statements. The consolidated historical financial statements and schedules of the Company and its consolidated subsidiaries included or incorporated by reference in the Registration Statement and the Prospectus present fairly the financial condition, results of operations and cash flows of the Company as of the dates and for the periods indicated, comply as to form, in all material respects, with the applicable accounting requirements of the Securities Act and have been prepared in conformity with generally accepted accounting principles applied on a consistent basis throughout the periods involved (except as otherwise noted therein).

4.9.

No Integrated Offering. Assuming the accuracy of the Holder’s representations and warranties set forth in Section 5, neither the Company, nor any of its Affiliates, nor any Person acting on its or their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would cause this offering of the Holder Shares to be integrated with prior offerings by the Company for purposes of any applicable shareholder approval provisions of any Trading Market on which any of the securities of the Company are listed or designated.

5.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company that:

5.1.

Organization and Existence. The Holder is a duly incorporated or organized and validly existing corporation, limited partnership, limited liability company or other legal entity, has all requisite corporate, partnership or limited liability company power and authority to enter into and consummate the transactions contemplated by the Transaction Documents to which the Holder is a party and to carry out its obligations hereunder and thereunder, and is in good standing under the laws of the jurisdiction of its incorporation or organization.

5.2.

Authorization. The execution, delivery and performance by the Holder of the Transaction Documents to which the Holder is a party have been duly authorized and each has been duly executed and when delivered will constitute the valid and legally binding obligation of the Holder, enforceable against the Holder in accordance with their respective terms, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability, relating to or affecting creditors’ rights generally, and general principles of equity.

5.3.

Disclosure of Information. The Holder has had an opportunity to receive, review and understand all information related to the Company requested by it and to ask questions of and receive answers from the Company regarding the Company, its business and the terms and conditions of the offering of the Holder Shares, and has conducted and completed its own independent due diligence.3 The Holder acknowledges that copies of the SEC Filings are available on the Electronic Data Gathering, Analysis, and Retrieval system.

Based on the information the Holder has deemed appropriate, it has independently made its own analysis and decision to enter into the Transaction Documents to which the Holder is a party. The Holder is relying exclusively on its own investment analysis and due diligence (including professional advice it deems appropriate) with respect to the execution, delivery and performance of the Transaction Documents to which the Holder is a party, the Holder Shares and the business, condition (financial and otherwise), management, operations, properties and prospects of the Company, including but not limited to all business, legal, regulatory, accounting, credit and tax matters. Neither such inquiries nor any other due diligence investigation conducted by the Holder shall modify, limit or otherwise affect the Holder’s right to rely on the Company’s representations and warranties contained in this Agreement.

5.4.

Accredited Investor. The Holder is an “accredited investor” within the meaning of Rule 501(a) of Regulation D. The Holder is a sophisticated institutional investor with sufficient knowledge and experience in investing in private equity transactions to properly evaluate the risks and merits of its acquisition of the Holder Shares. The Holder has determined based on its own independent review and such professional advice as it deems appropriate that its acquisition of the Holder Shares and participation in the transactions contemplated by the Transaction Documents (i) have been duly authorized and approved by all necessary action and (ii) are a fit, proper and suitable investment for the Holder, notwithstanding the substantial risks inherent in investing in or holding the Holder Shares.

5.5.

Brokers. No Person will have, as a result of the transactions contemplated by the Transaction Documents, any valid right, interest or claim against or upon the Company for any commission, fee or other compensation pursuant to any agreement, arrangement or understanding entered into by or on behalf of the Holder.

6.1.

Conditions to the Holder’s Obligations. The obligation of the Holder to acquire the Holder Shares at the Closing is subject to the fulfillment, on or prior to the Closing Date, of the following conditions, any of which may be waived by the Holder:

(a)

The representations and warranties made by the Company in Section 4 hereof shall be true and correct in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) as of the date hereof and as of the Closing Date, as though made on and as of such date, except to the extent any such representation or warranty expressly speaks as of an earlier date or as of Closing Date only, in which case such representation or warranty shall be true and correct in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) as of such earlier date or as of Closing Date only. The Company shall have performed in all material respects all obligations and covenants herein required to be performed by it on or prior to the Closing Date.

(b)

Except for the consents, approvals, resolutions, registrations and waivers necessary for the issuance of the Holder Shares as contemplated by the Transaction Documents, the Company shall have obtained any and all consents, permits, approvals, registrations and waivers

3 Note to Draft: First sentence to be included with respect to issuance at initial closing only.

necessary for the consummation of the other transactions contemplated by the Transaction Documents, all of which shall be in full force and effect.

(c)

The Company shall have delivered a copy of the irrevocable instructions to the Transfer Agent instructing the Transfer Agent to deliver to the Holder (or a broker designated by the Holder) on an expedited basis via The Depository Trust Company Shares the Holder Shares.

(d)

The Company shall have filed with Nasdaq a Listing of Additional Shares notice form for the Holder Shares and the Holder Shares shall be freely tradable on Nasdaq.

(e)

No judgment, writ, order, injunction, award or decree of or by any court, or judge, justice or magistrate, including any bankruptcy court or judge, or any order of or by any governmental authority, shall have been issued, and no action or proceeding shall have been instituted by any governmental authority, enjoining or preventing the consummation of the transactions contemplated hereby.

(f)

The Company shall have delivered a certificate, executed on behalf of the Company by its Chief Executive Officer or its Chief Financial Officer, dated as of the Closing Date, certifying to the fulfillment of the conditions specified in subsections (a), (b), (c), (e), (h) and (j) of this Section 6.1.

(g)

The Company shall have delivered a certificate, executed on behalf of the Company by its Secretary, dated as of the Closing Date, certifying (i) the resolutions adopted by the Board of Directors of the Company approving the transactions contemplated by this Agreement (except for the resolutions necessary for the issuance of the Holder Shares at the Closing), (ii) the current versions of the Articles of Association of the Company (as filed with the competent Swiss commercial register as of the Closing Date) and (iii) as to the signatures and authority of persons signing the Transaction Documents and related documents on behalf of the Company.

(h)

There shall have been no Material Adverse Effect with respect to the Company since the date hereof.

(i)

The Company shall have delivered the Prospectus and Prospectus Supplement (which may be delivered in accordance with Rule 172 under the Securities Act).

(j)

No stop order or suspension of trading shall have been imposed by Nasdaq, the SEC or any other governmental or regulatory body with respect to public trading in the Common Shares.

6.2.

Conditions to Obligations of the Company. The Company’s obligation to issue the Holder Shares at the Closing is subject to the fulfillment to the satisfaction of the Company on or prior to the Closing Date of the following conditions, any of which may be waived by the Company:

(a)

The representations and warranties made by the Holder in Section 5 hereof shall be true and correct as of the date hereof, and shall be true and correct as of the Closing Date with the same force and effect as if they had been made on and as of such date. The Holder shall have performed in all material respects all obligations and covenants herein required to be performed by it on or prior to the Closing Date.

(b)

The Holder shall have executed the Collaboration Agreement prior to the Closing The Company shall have received, by wire transfer of immediately available funds, the Nominal Payment to the Company’s blocked bank account (Kapitaleinzahlungskonto) at the Bank.

(a)

The Holder agrees that, during the applicable periods set forth below (each, a “Lock-Up Period”) the Holder will not, without the prior written consent of the Company (which consent will not be unreasonably withheld, conditioned or delayed), directly or indirectly, (1) offer, sell, contract to sell, pledge, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of the applicable portion of the Holder Shares; or (2) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the applicable portion of the Holder Shares, regardless of whether any such transaction described herein is to be settled by delivery of Common Shares or such other securities, or by delivery of cash or otherwise. Notwithstanding the foregoing, the restrictions set forth in clause (1) and (2) herein shall not apply to transfers made (i) with the prior written consent of the Company or (ii) pursuant to any merger, consolidation, business combination, tender or exchange offer or similar transaction involving the Company or the Common Shares. The Holder may distribute the applicable portion of the Holder Shares to its Affiliates or assignees; provided, however, that in each such case, prior to any such transfer, each transferee shall agree to the terms of this Section 7 in a form reasonably satisfactory to the Company, pursuant to which each transferee shall agree to receive and hold the Holder Shares subject to the provisions hereof, and there shall be no further transfer except in accordance with the provisions hereof.

The Lock-Up Period shall: a) with respect to [●]5 Holder Shares, commence on the Closing Date and continue until the [***] day following the Closing Date; b) with respect to [●]6 Holder Shares, commence on the Closing Date and continue until the [***] day following the Closing Date; and c) with respect to [●]7 Holder Shares, commence on the Closing Date and continue until the [***] day following the Closing Date.

8.

Standstill. The Holder hereby acknowledges and agrees that, unless otherwise agreed in writing by the Company, neither the Holder nor any of its Controlled subsidiaries will directly or indirectly: (a) propose (i) any merger, consolidation, business combination, tender or exchange offer, purchase of the Company’s assets or businesses, or similar transactions involving the Company or (ii) any recapitalization, restructuring, liquidation or other extraordinary transaction with respect to the Company; (b) (i) acquire beneficial ownership of any securities (including in derivative form) of the Company outside of any securities the Company chooses to issue to the Holder pursuant to the Collaboration Agreement, (ii) propose or seek, whether alone or in concert with others, any “solicitation” (as such term is used in the rules of the Securities and Exchange Commission) of proxies or consents to vote any securities (including in derivative form) of the Company, (iii) nominate any person as a director of the Company, or (iv) propose any matter to be voted upon by the stockholders of the Company; (c) form, join or in any way participate in a third party “group” (as such term is used in the rules of the Securities and Exchange Commission) (or discuss with any third party the potential formation of a group) with respect to any securities (including in derivative form) of the Company or a Business Combination involving the Company; (d) request the Company (or any of its officers, directors or Representatives) amend or waive

4 Note to Draft: To be included with respect to initial closing only.

5 Note to Draft: To equal [***]% of the Holder Shares, rounded up to the nearest whole share.

6 Note to Draft: To equal [***]% of the Holder Shares, rounded up to the nearest whole share.

7 Note to Draft: To equal [***] of the Holder Shares.

any provision of this paragraph (including this sentence); or (e) take any action that could require the Company to make a public announcement regarding a potential Business Combination; provided, however, that nothing in this paragraph shall prohibit the Holder from making a confidential proposal to the Company or the Company’s Board of Directors for a transaction involving a Business Combination following the public announcement by the Company that it has entered into a definitive agreement with a third party for a transaction involving a Business Combination. For purposes of this Section 8, a transaction specified in (a)(i) and (a)(ii) and (b)(i) involving more than a majority of the Company’s outstanding capital stock or consolidated assets, is referred to as a “Business Combination.”

9.

Covenants of the Company.

9.1.

Furnishing of Information. Until the time that the Holder no longer owns the Holder Shares, the Company covenants to timely file (or obtain extensions in respect thereof and file within the applicable grace period) all reports required to be filed by the Company after the date hereof pursuant to the Exchange Act, provided that the Company is then subject to the reporting requirements of the Exchange Act.

9.2.

Nasdaq Listing. The Company will use commercially reasonable efforts to continue the listing and trading of its Common Shares on Nasdaq and, in accordance therewith, will use commercially reasonable efforts to comply in all material respects with the Company’s reporting, filing and other obligations under the bylaws or rules of such market or exchange, as applicable.

9.3.

Securities Laws Disclosure. The Company shall (a) by the Disclosure Time, issue a press release or file a Current Report on Form 8-K disclosing the material terms of the transactions contemplated hereby, and (b) file a Current Report on Form 8-K with the SEC within the time required by the Exchange Act. From and after the issuance of such press release or Current Report on Form 8-K, the Company represents to the Holder that it shall have publicly disclosed all material, non-public information delivered to the Holder by the Company or any of its subsidiaries, or any of their respective officers, directors, employees or agents in connection with the transactions contemplated by the Transaction Documents.

10.

Survival and Indemnification.

10.1.

Survival. The representations, warranties, covenants and agreements contained in this Agreement shall survive the Closing of the transactions contemplated by this Agreement for the applicable statute of limitations.

10.2.

Indemnification. The Company agrees to indemnify and hold harmless the Holder, and its employees, officers, directors and agents, from and against any and all losses, claims, direct damages, liabilities and expenses (including without limitation reasonable and documented attorney fees and disbursements and other documented out-of-pocket expenses reasonably incurred in connection with defending any action, claim or proceeding, pending or threatened and the costs of enforcement thereof, but excluding lost profits) to which such Person may become subject as a result of any breach of representation, warranty, covenant or agreement made by or to be performed on the part of the Company under this Agreement, and will reimburse any such Person for all such amounts as they are incurred by such Person solely to the extent such amounts have been finally judicially determined not to have resulted from such Person’s fraud or willful misconduct.

10.3.

Conduct of Indemnification Proceedings.

Any person entitled to indemnification hereunder shall (i) give prompt written notice to the indemnifying party of any claim with respect to which it seeks indemnification and (ii) permit such indemnifying party to assume the defense of such claim with counsel reasonably satisfactory to the indemnified party; provided that any person entitled to indemnification hereunder shall have the right to employ separate counsel and to participate in the defense of such claim, but the fees and expenses of such counsel shall be at the expense of such person unless (a) the indemnifying party has agreed in writing to pay such fees or expenses, (b) the indemnifying party shall have failed to assume the defense of such claim and employ counsel reasonably satisfactory to such person or (c) in the reasonable judgment of any such person, based upon written advice of its counsel, a conflict of interest exists between such person and the indemnifying party with respect to such claims (in which case, if the person notifies the indemnifying party in writing that such person elects to employ separate counsel at the expense of the indemnifying party, the indemnifying party shall not have the right to assume the defense of such claim on behalf of such person); and provided, further, that the failure of any indemnified party to give written notice as provided herein shall not relieve the indemnifying party of its obligations hereunder, except to the extent that such failure to give notice shall materially adversely affect the indemnifying party in the defense of any such claim or litigation. It is understood that the indemnifying party shall not, in connection with any proceeding in the same jurisdiction, be liable for fees or expenses of more than one separate firm of attorneys at any time for all such indemnified parties. No indemnifying party will, except with the consent of the indemnified party, which consent shall not be unreasonably withheld, conditioned or delayed, consent to entry of any judgment or enter into any settlement that does not include as an unconditional term thereof the giving by the claimant or plaintiff to such indemnified party of a release from all liability in respect of such claim or litigation. No indemnified party will, except with the consent of the indemnifying party, which consent shall not be unreasonably withheld, conditioned or delayed, consent to entry of any judgment or enter into any settlement.

11.1.

Successors and Assigns. This Agreement may not be assigned by a party hereto without the prior written consent of the Company or the Holder, as applicable, provided, however, that the Holder may assign its rights and delegate its duties hereunder in whole or in part to an Affiliate, or to a third party acquiring some or all of its Holder Shares in a transaction complying with applicable securities laws without the prior written consent of the Company or the Holder, provided such assignee agrees in writing to be bound by the provisions hereof that apply to the Holder, including Section 7 and Section 8 hereof. The provisions of this Agreement shall inure to the benefit of and be binding upon the respective permitted successors and assigns of the parties. Without limiting the generality of the foregoing, in the event that the Company is a party to a merger, consolidation, share exchange or similar business combination transaction in which the Common Shares are converted into the equity securities of another Person, from and after the effective time of such transaction, such Person shall, by virtue of such transaction, be deemed to have assumed the obligations of the Company hereunder, the term “Company” shall be deemed to refer to such Person and the term “Holder Shares” shall be deemed to refer to the securities received by the Holder in connection with such transaction. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective permitted successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

11.2.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signatures complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

11.3.

Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

11.4.

Notices. Unless otherwise provided, any notice required or permitted under this Agreement shall be given in writing and shall be deemed effectively given as hereinafter described (i) if given by personal delivery, then such notice shall be deemed given upon such delivery, (ii) if given by facsimile or e-mail, then such notice shall be deemed given upon receipt of confirmation of complete facsimile transmittal or confirmation of receipt of an e-mail transmission, (iii) if given by mail, then such notice shall be deemed given upon the earlier of (A) receipt of such notice by the recipient or (B) [***] ([***]) days after such notice is deposited in first class mail, postage prepaid, and (iv) if given by an internationally recognized overnight air courier, then such notice shall be deemed given [***] ([***]) Business Day after delivery to such carrier. All notices shall be addressed to the party to be notified at the address as follows, or at such other address as such party may designate by [***] ([***]) days’ advance written notice to the other party:

If to the Company:

CRISPR Therapeutics AG

Baarerstrasse 14

6300 Zug, Switzerland

Facsimile: [●]

Attention: [●]

Email: [●]

With a copy (which will not constitute notice) to:

Goodwin Procter LLP

100 Northern Avenue

Boston, MA 02210

Attention: [●]

Email: [●]

Walder Wyss Ltd

Seefeldstrasse 123

8034 Zurich

Switzerland

Attention: [●]

Email: [●]

If to the Holder:

[●]

[●]

Attn: [●]

Email: [●]

With a copy to (which shall not constitute notice) to:

Cooley LLP

55 Hudson Yards

New York, NY 10001

Attention: [●]

Email: [●]

11.5.

Expenses. The parties hereto shall pay their own costs and expenses in connection herewith regardless of whether the transactions contemplated hereby are consummated. The Company shall pay all Transfer Agent fees (including, without limitation, any fees required for same-day processing of any instruction letter delivered by the Company), stamp taxes and other taxes and duties levied in connection with the delivery of the Holder Shares to the Holder.

11.6.

Amendments and Waivers. Prior to Closing, no amendment or waiver of any provision of this Agreement will be effective with respect to any party unless made in writing and signed by a duly authorized representative of such party. Following the Closing, any term of this Agreement may be amended and the observance of any term of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively), only with the written consent of the Company and the Holder.

11.7.

Severability. Any provision of this Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof but shall be interpreted as if it were written so as to be enforceable to the maximum extent permitted by applicable law, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. To the extent permitted by applicable law, the parties hereby waive any provision of law which renders any provision hereof prohibited or unenforceable in any respect.

11.8.

Entire Agreement. This Agreement, including the signature pages and Exhibits, and the other Transaction Documents between the Company and the Holder constitute the entire agreement among the parties hereof with respect to the subject matter hereof and thereof and supersede all prior agreements and understandings, both oral and written, between the parties with respect to the subject matter hereof and thereof.

11.9.

Further Assurances. The parties shall execute and deliver all such further instruments and documents and take all such other actions as may reasonably be required to carry out the transactions contemplated hereby and to evidence the fulfillment of the agreements herein contained.

11.10.

Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions contemplated hereby (“Related Proceedings”) may be instituted in the federal courts of the United States of America located in the Borough of Manhattan in the City of New York or the courts of the State of New York in each case located in the Borough of Manhattan in the City of New York (collectively, the “Specified Courts”), and each party irrevocably submits to the exclusive jurisdiction (except for proceedings instituted in regard to the enforcement of a judgment of any such court (a “Related Judgment”), as to which such jurisdiction is non-exclusive) of such courts in any such suit, action or proceeding. Service of any process, summons, notice or document by mail to such party’s address set forth above shall be effective service of process for any suit, action or other proceeding brought in any such court. The parties irrevocably and unconditionally waive any objection to the laying of venue of any suit, action or other proceeding in the Specified Courts and irrevocably and unconditionally waive and agree not to plead or claim in any such court that any such suit, action or other proceeding brought in any such court has been brought in an inconvenient forum.

The Company hereby appoints CRISPR Therapeutics, Inc., 105 W First St., South Boston, MA 02127 as its authorized agent (the “Authorized Agent”) upon whom process may be served in any suit, action or proceeding arising out of or based upon this Agreement or the transactions contemplated herein that may be instituted in any State or U.S. federal court in The City of New York and County of New York, by the Holder, the directors, officers, employees, affiliates and agents of the Holder, or by any person who Controls the Holder, and expressly accepts the exclusive jurisdiction of any such court in respect of any such suit, action or proceeding. The Company hereby represents and warrants that the Authorized Agent has accepted such appointment and has agreed to act as said agent for service of process, and the Company agrees to take any and all action, including the filing of any and all documents that may be necessary to continue such appointment in full force and effect as aforesaid. Service of process upon the Authorized Agent shall be deemed, in every respect, effective service of process upon the Company. Notwithstanding the foregoing, any action arising out of or based upon this Agreement may be instituted by the Holder, the directors, officers, employees, affiliates and agents of the Holder, or by any person who Controls the Holder, in any court of competent jurisdiction in Switzerland. The provisions of this paragraph shall survive any termination of this Agreement.

[remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties have executed this Agreement or caused their duly authorized officers to execute this Agreement as of the date first above written.

|

|

|

|

CRISPR THERAPEUTICS AG

|

|

By: |

|

|

|

Name: Samarth Kulkarni, Ph.D. |

|

|

Title: Chief Executive Officer |

IN WITNESS WHEREOF, the parties have executed this Agreement or caused their duly authorized officers to execute this Agreement as of the date first above written.

[HOLDER NAME]8

By:_________________________

Name: _____________________

Title: ______________________

8 Note to Draft: As applicable, Sirius Therapeutics, a limited liability company organized and existing under the laws of the Cayman Islands (“Sirius-CY”); Sirius Therapeutics, Inc., a corporation organized under the laws of the State of Delaware; or any other subsidiary of Sirius-CY designated by Sirius-CY.

EXHIBIT A

SUBSCRIPTION FORM

Making reference to the contemplated capital increase of CRISPR Therapeutics AG (the “Company”) from CHF [●] through the issuance of [●] fully paid-in shares with a nominal value of CHF 0.03 each, to CHF [●] the undersigned

[Holder name],

acting in its own name and for its own account hereby subscribes for [●] common shares with a nominal value of CHF 0.03 each, with a total nominal value of CHF [●] and irrevocably and unconditionally undertakes to pay the total subscription price of CHF [●] not later than 5:00 p.m. (Zurich Time) on [●] to the following bank account:

[Bank account details]