0000810332FYfalseNVAZhttp://fasb.org/us-gaap/2024#UsefulLifeTermOfLeaseMemberhttp://fasb.org/us-gaap/2024#UsefulLifeShorterOfTermOfLeaseOrAssetUtilityMemberhttp://fasb.org/us-gaap/2024#UsefulLifeShorterOfTermOfLeaseOrAssetUtilityMemberP1YP1YP1YP1YP1Yhttp://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxthree yearshttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligations0000810332us-gaap:RetainedEarningsMember2021-09-300000810332us-gaap:SubsequentEventMembermesa:E175AircraftMembermesa:UnitedAircraftPurchaseAgreementMember2024-12-312024-12-310000810332mesa:EnginesMember2023-10-012024-09-300000810332srt:CRJ900Member2022-10-012023-09-300000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:SubsequentEventMembermesa:UnitedAirlinesIncMember2025-04-042025-04-040000810332srt:MaximumMembermesa:TreasuryLoanMember2020-10-302020-10-300000810332mesa:PassThroughAndOtherRevenueMember2023-10-012024-09-300000810332mesa:VtolAircraftXtiAerospaceIncMemberus-gaap:FairValueInputsLevel1Member2023-10-012024-09-300000810332mesa:StandardAeroHoldingsIncMember2023-10-012024-09-3000008103322028-10-012024-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByUnderlyingEquipmentThroughTwoThousandTwentyFourMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2022-10-012023-09-300000810332us-gaap:SeniorNotesMembermesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2023-10-012024-09-300000810332us-gaap:FairValueInputsLevel1Membermesa:ArcherAviationIncMember2022-10-012023-09-300000810332us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermesa:UnitedAirlinesIncMember2022-10-012023-09-300000810332mesa:EnginesTwoMembermesa:RASPROAircraftLeaseAgreementMember2023-10-012024-09-300000810332mesa:UnitedBridgeLoanQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyFourMember2023-10-012024-09-300000810332us-gaap:PreferredStockMembermesa:HeartAerospaceIncorporatedMembermesa:ForwardPurchaseContractMember2021-07-012021-07-310000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:E175LLAircraftMembermesa:UnitedAirlinesIncMember2023-10-012024-09-300000810332us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-10-012024-09-300000810332us-gaap:SalesRevenueNetMembermesa:AmericanAirlinesIncMemberus-gaap:CustomerConcentrationRiskMember2023-10-012024-09-3000008103322024-07-012024-09-300000810332srt:MaximumMemberus-gaap:EmployeeStockMember2023-10-012024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMembermesa:UnitedAirlinesIncMember2024-09-300000810332mesa:EquipmentNotesMember2024-09-300000810332us-gaap:SubsequentEventMembermesa:E175AircraftMembermesa:UnitedAircraftPurchaseAgreementMember2025-04-032025-04-030000810332mesa:EnginesHeldForSaleMemberus-gaap:SubsequentEventMember2024-10-012024-10-010000810332us-gaap:RelatedPartyMember2024-09-300000810332us-gaap:RetainedEarningsMember2023-09-300000810332mesa:WithoutActivePurchaseAgreementMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2021-10-012022-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:UnitedAirlinesIncMembermesa:E175AircraftMember2023-10-012024-09-300000810332mesa:PeriodOneMemberus-gaap:DomesticCountryMember2024-09-300000810332mesa:EnginesHeldForSaleMemberus-gaap:SubsequentEventMember2025-04-032025-04-030000810332us-gaap:SalesRevenueNetMembermesa:AmericanAirlinesIncMemberus-gaap:CustomerConcentrationRiskMember2021-10-012022-09-300000810332srt:MinimumMemberus-gaap:StateAndLocalJurisdictionMember2023-10-012024-09-300000810332mesa:UnitedRevolvingCreditFacilityQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyEightMember2023-09-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-09-062023-09-060000810332us-gaap:RetainedEarningsMember2022-09-300000810332mesa:CRJ900AndE175AircraftMembermesa:UnitedCapacityPurchaseAgreementMemberus-gaap:SubsequentEventMembermesa:UnitedAirlinesIncMember2024-10-012024-10-0100008103322024-03-310000810332srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-09-300000810332us-gaap:WarrantMember2022-09-300000810332mesa:SecuredTermLoanFacilityMembermesa:LoanAgreementMembermesa:TreasuryLoanMember2020-10-300000810332mesa:AircraftMember2023-10-012024-09-300000810332us-gaap:RevolvingCreditFacilityMember2024-01-112024-01-110000810332mesa:EDCLoansMembermesa:LoanAgreementMember2020-11-130000810332srt:CRJ900Member2023-10-012024-09-300000810332us-gaap:CommonStockMember2021-10-012022-09-300000810332us-gaap:LeaseholdImprovementsMember2024-09-300000810332mesa:EnginesThreeMember2023-10-012024-09-300000810332mesa:SeniorAndSubordinatedNotesPayableToSecuredPartiesDueInMonthlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentySevenMember2022-10-012023-09-300000810332mesa:DecreaseInScheduledFlyingActivityMember2023-10-012024-09-300000810332mesa:Boeing737400FMembermesa:FlightServicesAgreementMember2019-12-202019-12-200000810332mesa:LoanAgreementMember2020-10-300000810332mesa:TreasuryLoanMember2024-09-300000810332us-gaap:RetainedEarningsMember2022-10-012023-09-300000810332srt:MinimumMembermesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMember2023-10-012024-09-300000810332us-gaap:SubsequentEventMembermesa:E175AircraftMembermesa:UnitedAircraftPurchaseAgreementMember2024-10-012024-10-010000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-09-062023-09-060000810332mesa:SecuredTermLoanFacilityMembermesa:LoanAgreementMember2020-10-300000810332mesa:UnitedCapacityPurchaseAgreementMembersrt:MinimumMembermesa:UnitedAirlinesIncMembermesa:E175AircraftMember2023-10-012024-09-3000008103322026-10-012024-09-300000810332mesa:AircraftPurchaseAgreementMembermesa:UstLoanMemberus-gaap:SubsequentEventMember2024-10-012024-10-010000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-09-300000810332us-gaap:CashAndCashEquivalentsMember2024-09-300000810332mesa:UstLoanMember2024-09-300000810332mesa:EnginesFourMember2023-10-012024-09-3000008103322025-10-012024-09-300000810332us-gaap:CommonStockMember2023-09-3000008103322024-12-050000810332mesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2022-10-012023-09-3000008103322023-10-012024-09-300000810332us-gaap:CommonClassAMembermesa:ArcherAviationIncMember2021-09-012021-09-300000810332mesa:EnginesFiveMembermesa:UstLoanMember2023-10-012024-09-300000810332us-gaap:SubsequentEventMember2024-10-012024-10-010000810332mesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2024-09-300000810332srt:CRJ900Member2024-09-300000810332mesa:UnitedRevolvingCreditFacilityQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyEightMember2022-10-012023-09-300000810332mesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2023-09-300000810332mesa:VtolAircraftXtiAerospaceIncMemberus-gaap:FairValueInputsLevel1Member2024-09-300000810332us-gaap:RetainedEarningsMember2021-10-012022-09-300000810332srt:MinimumMembermesa:UstLoanMemberus-gaap:SubsequentEventMember2024-12-232024-12-230000810332mesa:HeartAerospaceIncorporatedMembersrt:MaximumMembermesa:ForwardPurchaseContractMember2021-07-310000810332mesa:TreasuryLoanMember2023-10-012024-09-3000008103322020-10-012021-09-300000810332us-gaap:CommonStockMember2021-09-300000810332srt:MaximumMemberus-gaap:FlightEquipmentMember2024-09-300000810332mesa:UnitedBridgeLoanQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyFourMember2023-09-300000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMembermesa:UnitedAirlinesIncMember2023-10-012024-09-300000810332mesa:PledgedAsCollateralMemberus-gaap:AirTransportationEquipmentMember2024-09-300000810332mesa:ContractRevenueMember2021-10-012022-09-300000810332us-gaap:RetainedEarningsMember2023-10-012024-09-300000810332mesa:AirframesMembermesa:RASPROAircraftLeaseAgreementMember2023-10-012024-09-300000810332mesa:PeriodTwoMemberus-gaap:StateAndLocalJurisdictionMember2024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:E175AircraftMember2023-10-012024-09-300000810332mesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2023-10-012024-09-300000810332mesa:EnginersSevenMember2023-10-012024-09-300000810332mesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2022-10-012023-09-300000810332mesa:OtherLongLivedAssetsMember2021-10-012022-09-300000810332mesa:LongLivedAssetsMember2023-10-012024-09-3000008103322021-02-280000810332mesa:NotesPayableToTheUstQuarterlyThroughTwoThousandTwentyFiveMember2022-10-012023-09-300000810332us-gaap:RelatedPartyMember2023-10-012024-09-300000810332us-gaap:OtherMachineryAndEquipmentMember2024-09-3000008103322022-09-300000810332mesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMemberus-gaap:SeniorSubordinatedNotesMember2023-10-012024-09-300000810332us-gaap:WarrantMember2021-09-300000810332us-gaap:RestrictedStockMember2021-10-012022-09-300000810332srt:MinimumMembermesa:UstLoanMemberus-gaap:SubsequentEventMember2025-03-182025-03-180000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-12-272022-12-270000810332mesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMembersrt:MaximumMember2022-10-012023-09-300000810332mesa:GEModelMember2023-10-012024-09-300000810332mesa:SecuredTermLoanFacilityMembermesa:TreasuryLoanMembermesa:LoanAgreementMember2020-10-302020-10-300000810332mesa:AirframePurchaseAgreementMembermesa:CRJ900AirframesMembermesa:UstLoanMemberus-gaap:SubsequentEventMember2025-04-032025-04-030000810332mesa:UnitedBridgeLoanQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyFourMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-10-012024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:SubsequentEventMember2024-10-012024-10-010000810332mesa:CRJ900AirframesMembermesa:UstLoanMemberus-gaap:SubsequentEventMembermesa:PurchaseAgreementMember2025-04-032025-04-030000810332us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2023-09-060000810332srt:MinimumMembermesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMember2022-10-012023-09-300000810332us-gaap:EquipmentMembersrt:MaximumMember2024-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-12-272022-12-270000810332us-gaap:SubsequentEventMembermesa:UnitedAirlinesIncMembermesa:E175AircraftMember2024-12-232024-12-230000810332us-gaap:StateAndLocalJurisdictionMembersrt:MaximumMember2023-10-012024-09-300000810332mesa:CRJ700AircraftMemberus-gaap:SubsequentEventMember2024-10-012024-10-010000810332mesa:RotableSparePartsMember2024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:CRJ900CoveredAircraftMember2024-01-192024-01-190000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByUnderlyingEquipmentThroughTwoThousandTwentyFourMember2022-10-012023-09-300000810332us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2023-10-012024-09-300000810332srt:MinimumMemberus-gaap:FlightEquipmentMember2024-09-300000810332mesa:AarMember2023-10-012024-09-300000810332mesa:AirframePurchaseAgreementMembermesa:CRJ900AirframesMemberus-gaap:SubsequentEventMember2025-04-032025-04-030000810332us-gaap:LetterOfCreditMember2023-10-012024-09-300000810332mesa:PassThroughAndOtherRevenueMember2022-10-012023-09-300000810332mesa:AircraftAndRotableSparePartsMember2024-09-300000810332mesa:UstLoanMemberus-gaap:SubsequentEventMembersrt:MaximumMember2025-03-182025-03-180000810332us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermesa:UnitedAirlinesIncMember2023-10-012024-09-300000810332mesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMember2024-07-1600008103322022-02-280000810332srt:MinimumMemberus-gaap:EmployeeStockMember2023-10-012024-09-300000810332mesa:EnginersEightMember2023-10-012024-09-300000810332mesa:AirframesMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2021-09-300000810332mesa:UnitedRevolvingCreditFacilityQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyEightMember2023-10-012024-09-300000810332us-gaap:SubsequentEventMembermesa:TreasuryLoanMember2024-11-232024-11-230000810332mesa:LoanAgreementMember2023-10-012024-09-3000008103322021-09-300000810332us-gaap:VehiclesMember2024-09-300000810332mesa:UstLoanMemberus-gaap:SubsequentEventMembermesa:PurchaseAgreementMembermesa:CF348CengineMember2025-04-032025-04-030000810332us-gaap:RestrictedStockMember2024-09-3000008103322021-10-012022-09-300000810332srt:CRJ700Member2024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:CRJ700AircraftMember2024-09-252024-09-250000810332us-gaap:BuildingMember2024-09-300000810332mesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMember2023-10-012024-09-300000810332srt:MinimumMemberus-gaap:DomesticCountryMember2023-10-012024-09-300000810332us-gaap:CommonStockMember2022-09-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-10-012024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembermesa:UnitedAirlinesIncMember2023-10-012024-09-300000810332mesa:AirframePurchaseAgreementMembermesa:CRJ900AirframesMemberus-gaap:SubsequentEventMember2024-10-012024-10-010000810332us-gaap:CommonStockMember2022-10-012023-09-300000810332us-gaap:PropertyPlantAndEquipmentMember2021-10-012022-09-300000810332mesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMember2023-09-300000810332mesa:AirframePurchaseAgreementMembermesa:CRJ900AirframesMemberus-gaap:SubsequentEventMember2024-12-242024-12-240000810332us-gaap:RetainedEarningsMember2024-09-300000810332mesa:LongLivedAssetsMember2022-10-012023-09-300000810332srt:DirectorMember2023-10-012024-09-300000810332mesa:AircraftAndOtherFlightEquipmentMember2023-09-300000810332us-gaap:DomesticCountryMember2023-10-012024-09-300000810332mesa:EnginesSixMember2023-10-012024-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByUnderlyingEquipmentThroughTwoThousandTwentyFourMember2023-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByUnderlyingEquipmentThroughTwoThousandTwentyFourMember2023-10-012024-09-300000810332us-gaap:WarrantMember2024-09-300000810332mesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2023-09-300000810332mesa:AircraftPurchaseAgreementMemberus-gaap:SubsequentEventMembermesa:E175AircraftMember2024-12-312024-12-310000810332mesa:EnginesOneMember2023-10-012024-09-300000810332us-gaap:SubsequentEventMember2025-04-040000810332us-gaap:SubsequentEventMember2025-04-032025-04-030000810332us-gaap:SeniorNotesMembermesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2023-09-300000810332mesa:UnitedRevolvingCreditFacilityQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyEightMember2024-09-300000810332mesa:UstLoanMemberus-gaap:SubsequentEventMember2024-12-232024-12-230000810332mesa:HundredAndFiftyTwoMillionTreasuryLoanMembermesa:LoanAgreementMember2020-11-130000810332us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembermesa:UnitedAirlinesIncMember2021-10-012022-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByTheUnderlyingEquipmentThroughTwoThousandTwentyFourMember2023-09-300000810332mesa:UnitedCapacityPurchaseAgreementMember2024-01-112024-01-110000810332us-gaap:DomesticCountryMembersrt:MaximumMember2023-10-012024-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMembersrt:MaximumMember2024-09-300000810332mesa:AircraftMember2022-10-012023-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:NotesPayableToSecuredPartiesDueInSemiAnnualInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMembersrt:MinimumMember2024-09-300000810332srt:CRJ700Member2023-10-012024-09-300000810332us-gaap:WarrantMember2021-10-012022-09-300000810332mesa:UnitedRevolvingCreditFacilityMember2024-09-250000810332mesa:SeniorAndSubordinatedNotesPayableToSecuredPartiesDueInMonthlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentySevenMember2023-10-012024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembersrt:MaximumMember2023-10-012024-09-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-09-300000810332mesa:EVTOLAircraftMembermesa:ForwardPurchaseContractMembermesa:ArcherAviationIncMember2021-02-280000810332mesa:PassThroughAndOtherRevenueMember2021-10-012022-09-300000810332mesa:FortyThreeMillionTreasuryLoanMembermesa:LoanAgreementMember2020-10-300000810332mesa:NotesPayableToTheUstQuarterlyThroughTwoThousandTwentyFiveMember2023-10-012024-09-300000810332us-gaap:RevolvingCreditFacilityMembermesa:UnitedCapacityPurchaseAgreementMember2023-10-012024-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByTheUnderlyingEquipmentThroughTwoThousandTwentyFourMember2022-10-012023-09-300000810332mesa:UnitedCapacityPurchaseAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-12-272022-12-270000810332us-gaap:RelatedPartyMember2022-10-012023-09-300000810332us-gaap:WarrantMember2023-09-300000810332mesa:LoanAgreementMember2020-11-130000810332mesa:ContractRevenueMember2023-10-012024-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByTheUnderlyingEquipmentThroughTwoThousandTwentyFourMembermesa:LIBORMember2023-10-012024-09-300000810332us-gaap:RevolvingCreditFacilityMembermesa:UnitedCapacityPurchaseAgreementMember2022-12-270000810332us-gaap:DomesticCountryMember2024-09-300000810332mesa:CRJ900AirframesMembermesa:UstLoanMemberus-gaap:SubsequentEventMembermesa:PurchaseAgreementMember2024-12-242024-12-240000810332us-gaap:RelatedPartyMember2023-09-300000810332mesa:UnitedCapacityPurchaseAgreementMember2023-10-012024-09-300000810332mesa:NotesPayableToTheUstDueTwoThousandTwentyFiveMember2024-09-300000810332mesa:SecuredTermLoanFacilityMembermesa:LoanAgreementMembermesa:TreasuryLoanMember2020-11-130000810332us-gaap:SubsequentEventMembermesa:UnitedRevolvingCreditFacilityMember2024-12-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-09-300000810332us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-09-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-012023-09-300000810332mesa:UnitedBridgeLoanQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyFourMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-10-012023-09-300000810332mesa:CRJ900AircraftMembermesa:UnitedCapacityPurchaseAgreementMemberus-gaap:SubsequentEventMember2025-02-252025-02-2500008103322023-09-300000810332mesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMember2024-09-300000810332mesa:NoncurrentAssetsMember2024-09-300000810332mesa:UnitedCapacityPurchaseAgreementMembersrt:MaximumMembermesa:UnitedAirlinesIncMembermesa:E175AircraftMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2022-09-300000810332mesa:SecuredTermLoanFacilityMembermesa:TreasuryLoanMembermesa:LoanAgreementMember2020-11-140000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:SeniorAndSubordinatedNotesPayableToSecuredPartiesDueInMonthlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentySevenMember2023-10-012024-09-300000810332mesa:OtherObligationsDueToFinancialInstitutionsMonthlyOrQuarterlyCollateralizedByUnderlyingEquipmentDueTwoThousandTwentyTwoThroughTwoThousandTwentySevenMembersrt:MaximumMember2023-10-012024-09-300000810332mesa:AirframePurchaseAgreementMembermesa:CRJ900AirframesMemberus-gaap:SubsequentEventMember2024-12-232024-12-230000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:NotesPayableToTheUstQuarterlyThroughTwoThousandTwentyFiveMember2023-10-012024-09-3000008103322025-04-042025-04-040000810332us-gaap:EmployeeStockMember2019-04-092024-09-300000810332us-gaap:EmployeeStockMember2023-10-012024-09-300000810332us-gaap:RelatedPartyMember2021-10-012022-09-300000810332us-gaap:FairValueInputsLevel1Membermesa:ArcherAviationIncMember2023-10-012024-09-300000810332mesa:ContractRevenueMember2022-10-012023-09-300000810332us-gaap:SalesRevenueNetMembermesa:AmericanAirlinesIncMemberus-gaap:CustomerConcentrationRiskMember2022-10-012023-09-300000810332mesa:SeniorAndSubordinatedNotesPayableToSecuredPartiesDueInMonthlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentySevenMember2023-09-300000810332us-gaap:CommonStockMember2024-09-300000810332mesa:AircraftAndOtherFlightEquipmentMember2024-09-300000810332us-gaap:OtherMachineryAndEquipmentMember2023-09-300000810332us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermesa:UnitedRevolvingCreditFacilityQuaterlyCollateralizedByUnderlyingEquipmentAndInvestmentsThroughTwoThousandTwentyEightMember2023-10-012024-09-300000810332us-gaap:CommonStockMember2023-10-012024-09-300000810332us-gaap:RestrictedStockMember2023-10-012024-09-300000810332mesa:AircraftMember2024-09-3000008103322027-10-012024-09-300000810332us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-10-012022-09-3000008103322022-10-012023-09-300000810332mesa:CurrentAssetsMember2024-09-300000810332mesa:CRJ900AircraftMembermesa:UnitedCapacityPurchaseAgreementMember2023-10-012024-09-300000810332us-gaap:EquipmentMembersrt:MinimumMember2024-09-300000810332us-gaap:CashAndCashEquivalentsMember2023-09-300000810332srt:MinimumMembermesa:TreasuryLoanMember2020-10-302020-10-300000810332us-gaap:RevolvingCreditFacilityMember2023-09-0600008103322024-03-150000810332mesa:NotesPayableToSecuredPartiesDueInQuarterlyInstallmentsCollateralizedByUnderlyingAircraftThroughTwoThousandTwentyEightMember2023-10-012024-09-3000008103322024-10-012024-09-300000810332mesa:NotesPayableToTheUstDueTwoThousandTwentyFiveMember2023-09-300000810332mesa:NotesPayableToFinancialInstitutionDueInMonthlyInstallmentsCollateralizedByTheUnderlyingEquipmentThroughTwoThousandTwentyFourMember2023-10-012024-09-300000810332us-gaap:SubsequentEventMembermesa:TreasuryLoanMember2024-09-232024-11-220000810332us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2023-09-0600008103322024-09-300000810332mesa:AirframePurchaseAgreementMemberus-gaap:SubsequentEventMembermesa:CF34-8CEnginesMember2024-10-012024-10-01mesa:Enginexbrli:puremesa:AirCraftmesa:Segmentmesa:Vendorxbrli:sharesmesa:Citymesa:Airframesmesa:Statemesa:Enginesiso4217:USDmesa:DailyDeparture

y

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

☒ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2024

OR

|

|

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______________ to ___________.

Commission file number 001-38626

MESA AIR GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

NEVADA |

|

85-0302351 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

410 NORTH 44TH STREET, SUITE 700

PHOENIX, ARIZONA 85008

|

|

85008 |

(Address of principal executive offices) |

|

(Zip Code) |

(602) 685-4000

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange of Which Registered |

Common Stock, no par value |

|

MESA |

|

Nasdaq Capital Market |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10-D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 31, 2024, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value the voting and non-voting stock held by non-affiliates of the registrant was approximately $36,231,551.

As of December 5, 2024, the registrant had 41,331,719 shares of common stock, no par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement relating to its 2025 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant’s definitive proxy statement for its 2025 annual meeting of shareholders will be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant’s fiscal year to which this report relates.

MESA AIR GROUP, INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended September 30, 2024

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. Many of the forward-looking statements are located in Part II, Item 7 of this Form 10-K under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as "future," "anticipates," "believes," "estimates," "expects", "intends," "plans," "predicts," "will," "would," "should," "could," "can," "may," and similar terms. Forward-looking statements are not guarantees of future performance and our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A of this Annual Report on Form 10-K under the heading "Risk Factors." Unless otherwise stated, references to particular years, quarters, months, or periods refer to our fiscal years ended September 30 and the associated quarters, months, and periods of those fiscal years. Each of the terms "the Company," "Mesa Airlines," "Mesa," "we," "us," and "our" as used herein refer collectively to Mesa Air Group, Inc. and its wholly owned subsidiaries, unless otherwise stated. We do not assume any obligation to revise or update any forward-looking statements.

The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

▪

public health epidemics or pandemics;

▪

the supply and retention of qualified airline pilots and mechanics and associated costs;

▪

the volatility of pilot and mechanic attrition;

▪

dependence on, and changes to, or non-renewal of, our capacity purchase agreement;

▪

failure to meet certain operational performance targets in our capacity purchase agreement, which could result in termination of such agreement;

▪

increases in our labor costs;

▪

reduced utilization (the percentage derived from dividing (i) the number of block hours actually flown during a given month under a particular agreement by (ii) the maximum number of block hours that could be flown during such month under the particular agreement) under our capacity agreement;

▪

the direct operation of regional jets by United Airlines, Inc. ("United");

▪

the financial strength of United and its ability to successfully manage its businesses through potential adverse events impacting the industry;

▪

restrictions under our Amended and Restated United CPA to enter into new regional air carrier service agreements, which restrictions will remain in place until the earlier to occur of (i) January 1, 2026 and (ii) the Company's satisfaction of certain Performance Milestones (as defined in the Amended and Restated United CPA);

▪

our significant amount of debt and other contractual obligations;

▪

our compliance with ongoing financial covenants under our credit facilities;

▪

our ability to keep costs low and execute our business strategies; and

▪

the effects of extreme or severe weather conditions that impacts our ability to complete scheduled flights.

While we may elect to update these forward-looking statements at some point in the future, whether as a result of any new information, future events, or otherwise, we have no current intention of doing so except to the extent required by applicable law.

PART I

ITEM 1. BUSINESS

General

Headquartered in Phoenix, Arizona, Mesa Air Group, Inc. ("Mesa," the "Company," "we," "our," or "us") is the holding company of Mesa Airlines, a regional air carrier providing scheduled passenger service to 67 cities in 34 states, Cuba, and Mexico. As of September 30, 2024, Mesa operated a fleet of 67 regional aircraft consisting of 55 E-175 aircraft and 12 CRJ-900 aircraft with approximately 265 daily departures. During fiscal year 2024, Mesa’s fleet were conducted under our Capacity Purchase Agreement ("CPA") with United and Flight Services Agreement ("FSA") with DHL Network Operations (USA), inc. ("DHL"), leased to a third party, held for sale or maintained as operational spares. Mesa operates all of its flights as United Express flights pursuant to the terms of the CPA entered into with United. Prior to the voluntary wind-down of the FSA with DHL on March 1, 2024, Mesa also operated flights as DHL Express flights pursuant to the terms of the FSA. All of the Company’s consolidated contract revenues for the fiscal years ended September 30, 2024 and September 30, 2023 were derived from operations associated with the United CPA (97% of revenue), DHL FSA (2%), leases of aircraft to a third party (0.4%), and the Company's pilot development program, Mesa Pilot Development ("MPD") (0.5%). The Company also generated contract revenues for the fiscal year ended September 30, 2023 from the Company's CPA with American Airlines, Inc. ("American") prior to the wind-down and termination of the Company's CPA with American on April 3, 2023.

The United CPA involves a revenue-guarantee arrangement whereby United pays fixed fees for each aircraft under contract, departure, flight hour (measured from takeoff to landing, excluding taxi time) or block hour (measured from takeoff to landing, including taxi time), and reimbursement of certain direct operating expenses in exchange for providing flight services. United also pays certain expenses directly to suppliers, such as fuel, ground operations and landing fees. Under the terms of the CPA, United controls route selection, pricing, and seat inventories, reducing our exposure to fluctuations in passenger traffic, fare levels, and fuel prices.

Regional aircraft are optimal for short- and medium-haul scheduled flights that connect outlying communities with larger cities and act as "feeders" for domestic and international hubs. In addition, regional aircraft are well suited to serve larger city pairs during off-peak times when load factors on larger jets are low. The lower trip costs and operating efficiencies of regional aircraft, along with the competitive nature of the CPA bidding process, provide significant value to major airlines.

Merger Agreement

On April 4, 2025, the Company entered into an Agreement, Plan of Conversion and Plan of Merger (the "Merger Agreement") with Republic Airways Holdings, Inc., a Delaware corporation ("Republic"). Subject to the terms and conditions of the Merger Agreement, Republic will merge with and into the Company (the "Merger"), with the Company continuing as the surviving corporation following the Merger. In connection with the Merger, immediately prior to the effective time of the Merger (the "Effective Time"), the Company will convert from a Nevada corporation to a Delaware corporation pursuant to a Plan of Conversion (the "Conversion).

Effect on Capital Stock

At the Effective Time, each share of common stock (“Company Common Stock”), par value $0.001 per share, of the Company issued and outstanding immediately prior to the Effective Time (other than any Cancelled Shares (as defined in the Merger Agreement) and dissenting shares held by stockholders who (i) have not voted in favor of the Merger or consented to it in writing and (ii) have properly demanded appraisal of such shares of Company Common Stock in accordance with, and have complied in all respects with, the provisions of Section 262 of the Delaware General Corporation Law), shall thereupon be converted into the right to receive 584.90 validly issued, fully paid and non-assessable shares of common stock (“Mesa Common Stock”), no par value per share, of Mesa (the “Merger Consideration”).

Treatment of Equity Awards

Immediately prior to the Effective Time, (i) any vesting conditions applicable to each Parent RSU (as defined in the Merger Agreement) shall, automatically and without any required action on the part of the holder thereof, accelerate in full, and (ii) each Parent RSU shall, automatically and without any required action on the part of the holder thereof, be cancelled and shall only entitle the holder of such Parent RSU to receive the number of shares of Mesa Common Stock subject to such Parent RSU immediately prior to the Effective Time.

Immediately prior to the Effective Time, (i) each outstanding Company RSU (as defined in the Merger Agreement) that has vested in accordance with its terms (including each outstanding Company RSU that will become vested upon the closing of the Merger) (a “Vested Company RSU”) shall, automatically and without any required action on the part of the holder thereof, be cancelled and shall only entitle the holder of such Vested Company RSU to receive a number of whole shares of Company Common Stock (rounded up to the next whole share of Company Common Stock), which shares of Company Common Stock shall be converted into Mesa Common Stock, and (ii) each outstanding Company RSU that is not a Vested Company RSU (an “Unvested Company RSU”) shall, automatically and without any required action on the part of the holder thereof, be assumed by Mesa and converted into the right to receive an award of restricted shares of Mesa Common Stock pursuant to the Parent Equity Award Plan (as defined in the Merger Agreement) (each, a “Parent Restricted Stock Award”) in an amount equal to the number of whole shares of Mesa Common Stock (rounded up to the next whole share of Mesa Common Stock) equal to the product obtained by multiplying (x) the Exchange Ratio by (y) the total number of shares of Company Common Stock subject to such Unvested Company RSU immediately prior to the Effective Time. Each Company RSU Award assumed and converted into a Mesa Restricted Stock Award shall continue to have, and shall be subject to, the same terms and conditions (including with respect to vesting) as applied to the corresponding Company RSU Award as of immediately prior to the Effective Time.

Conditions to the Merger

Each of Mesa’s and the Company’s obligation to consummate the Merger is subject to a number of conditions, including, among others, the following, as further described in the Merger Agreement: (i) approval of the transactions contemplated under the Merger Agreement by (a) the holders of at least two-thirds of the outstanding shares of Company Common Stock entitled to vote thereon and (b) the holders of a majority of the outstanding shares of Mesa Common Stock, (ii) expiration of the waiting period (or extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iii) effectiveness of the registration statement relating to the transaction, (iv) the shares of Mesa Common Stock to be issued in the Merger being approved for listing on NASDAQ, (v) no governmental entity shall have enacted, issued, promulgated, enforced or entered any law or order that has the effect of making illegal, enjoining, or otherwise restraining or prohibiting the consummation of the transactions contemplated under the Merger Agreement, (vi) the receipt of requisite approvals from specified aviation authorities, (vii) the representations and warranties of the other party being true and correct, subject to the materiality standards contained in the Merger Agreement, (viii) material compliance by the other party with its covenants, (ix) no material adverse effect having occurred with respect to the other party since the signing of the Merger Agreement, (x) the satisfaction of certain specified conditions of the Three Party Agreement (as defined below), (xi) United shall not have materially breached the terms of the CPA Side Letter (as defined in the Merger Agreement) or provided Mesa or the Company with written notice of its intention not to perform or comply with any of the terms or conditions under the Go-Forward CPA (as defined in the Merger Agreement), and (xiii) the filing by Mesa of its Form 10-K for the period ended September 30, 2024 and Form 10-Q for the period ended December 31, 2024.

Representations and Warranties; Covenants

The Merger Agreement contains customary representations, warranties and covenants by Mesa and the Company. The Merger Agreement also contains customary pre-closing covenants, including the obligation of Mesa and the Company to conduct their respective businesses in the ordinary course consistent with past practice and to refrain from taking specified actions without the consent of the other party. Each of Mesa and the Company has agreed not to solicit any offer or proposal for specified alternative transactions, or, subject to certain exceptions relating to the receipt of unsolicited offers that may be deemed to be “superior proposals” (as defined in the Merger Agreement), to participate in discussions or engage in negotiations regarding such an offer or proposal with, or furnish any nonpublic information regarding such an offer or proposal to, any person that has made such an offer or proposal.

Termination and Termination Fee

The Merger Agreement contains certain customary termination rights, including, among others, (i) the right of either Mesa or the Company to terminate the Merger Agreement if Mesa or the Company’s stockholders fail to approve the Merger, (ii) the right of either Mesa or the Company to terminate the Merger Agreement if (a) the board of directors of the other party changes its recommendation to approve the transactions or (b) the other party materially breaches any of its representations, warranties or covenants contained in the Merger Agreement in a manner that causes certain conditions to closing to not be satisfied, (iii) the right of either Mesa or the Company to terminate the Merger Agreement if, prior to the receipt of such party’s stockholder approval, such party accepts a superior proposal and such party enters into a definitive agreement for such superior proposal and pays the termination fee to the other party, (iv) the right of either Mesa or the Company to terminate the Merger Agreement if the Merger has not occurred by January 5, 2026, and a further extension until April 6, 2026, in certain circumstances (the “Outside Date”), and (v) the right of the Company to terminate the Merger Agreement if there is a breach of the Three Party Agreement or the CPA Side Letter in a manner that causes certain conditions to closing to not be satisfied. If the Merger Agreement is terminated pursuant to certain termination rights, the terminating party will be required to pay a termination fee of $1.5 million to the non-terminating party.

Description of Merger Agreement Not Complete

The Merger Agreement and the above description have been included to provide investors and security holders with information regarding the terms of the Merger Agreement. They are not intended to provide any other factual information about Mesa or the Company. The representations, warranties, covenants and other agreements contained in the Merger Agreement were made only for purposes of that agreement and as of specific dates; were solely for the benefit of the parties to the Merger Agreement; and may be subject to limitations agreed upon by the parties, including being qualified and modified by confidential disclosures made by each contracting party to the other for the purposes of allocating contractual risk between them. Investors should be aware that the representations, warranties, covenants and other agreements or any description thereof may not reflect the actual state of facts or condition of Mesa or the Company. Moreover, information concerning the subject matter of the representations, warranties, covenants and other agreements may change after the date of the Merger Agreement. Further, investors should read the Merger Agreement not in isolation, but only in conjunction with the other information that Mesa includes in reports, statements and other filings it makes with the Securities and Exchange Commission (the “SEC”).

Three Party Agreement

Concurrently with the execution and delivery of the Merger Agreement, Mesa, the Company and United, among other parties, entered into that certain Three Party Agreement (the “Three Party Agreement”), pursuant to which, among other things: (i) Mesa will take certain actions at or prior to the closing of the Merger to dispose of certain assets, extinguish certain liabilities and effectuate certain related transactions; (ii) United will take certain actions at or prior to the closing of the Merger to facilitate Mesa’s actions in the foregoing clause (i); and (iii) Mesa at the closing of the Merger will conduct a primary issuance of shares of Mesa Common Stock equal to six percent of the issued and outstanding shares of Mesa Common Stock after giving effect to the issuance of Mesa Common Stock in the Merger (the “Primary Issuance”), which Primary Issuance will (a) first become available to United to the extent of certain financial contributions made by United to Mesa at or prior to the effective time of the Merger, (b) second, to the extent of any remainder, become available to the surviving corporation to satisfy certain liabilities, and (c) third, to the extent of any remainder, become available on a pro rata basis to the persons who, as of immediately prior to the Effective Time, held shares of Mesa Common Stock.

Three Party Agreement

Concurrently with the execution of the Merger Agreement, the Company, Republic, and United, among other parties, entered into the Three Party Agreement, which provides for, among other things, the following, each subject to the completion of the Merger Agreement:

•

Termination of the United CPA.

•

The Company to sell or dispose of all remaining Eligible Assets (as defined in the Three Party Agreement).

•

The Company to extinguish all remaining debt with cash and sale of assets. Any remaining debt will be assumed by the surviving corporation or forgiven by United.

•

A three percent (3%) increase in CPA block hour rates, retroactive to January 1, 2025.

•

The transfer of all of the Company's rights and obligations under its agreements with Archer Aviation Inc. ("Archer") (as discussed in Note 17).

•

The issuance by the Company (referred to in the Three Party Agreement as the “Primary Issuance”) of shares of Company common stock equal to six percent (6%) of the issued and outstanding shares of Company common stock after giving effect to the issuance of Company common stock in the Merger, which shares will (a) first become available to United to the extent of certain financial contributions made by United to the Company at or prior to the effective time of the Merger, (b) second, to the extent of any remainder, become available to the surviving corporation to satisfy certain liabilities, and (c) third, to the extent of any remainder, become available on a pro rata basis to the persons who, as of immediately prior to the effective time of the Merger, held shares of Company common stock.

The foregoing description of the Merger Agreement and the Three Party Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Merger Agreement and the Three Party Agreement, which are attached as Exhibit 2.1 and 10.1, respectively, to the Current Report on Form 8-K filed by the Company with the SEC on April 8, 2025.

Liquidity and Going Concern

During our fiscal year ended September 30, 2024, the decrease in scheduled flying activity associated with the transition of our operations with American to United, increased costs associated with pilot wages, together with increasing interest rates adversely impacted our financial results, cash flows, financial position, and other key financial ratios. Additionally, United has asked us to accelerate the removal of our CRJ-900 aircraft and transition the pilots to our E-175 fleet. These events will lead to increased costs and impact our block hour capabilities while these pilots are in training.

As a result of the decrease in scheduled flying activity for United, we produced less block hours to generate revenues. During the fiscal year ended September 30, 2024, these challenges resulted in a negative impact on the Company’s financial results highlighted by net loss of $91.0 million, primarily due to impairment expense of $73.7 million related to held for sale assets during the year. These conditions and events raised concerns about our ability to continue to fund our operations and meet our debt obligations over the next twelve months from the filing of this Form 10-K.

To address such concerns, management developed and implemented certain material changes to our business designed to ensure the Company could continue to fund its operations and meet its debt obligations over the next twelve months. The following measures were implemented during the year ended September 30, 2024, and through the date of issuance of the financial statements.

•

On April 4, 2025, the Company entered into the Three Party Agreement between United, Republic, and the Company, which provides for, among other things, the following, each subject to the completion of the Merger Agreement:

o

Termination of the United CPA.

o

The Company to sell or dispose of all remaining Eligible Assets (as defined in the Three Party Agreement).

o

The Company to extinguish all remaining debt with cash and sale of assets. Any remaining debt will be assumed by the surviving corporation or forgiven by United.

o

A three percent (3%) increase in CPA block hour rates, retroactive to January 1, 2025.

o

The transfer of all of the Company's rights and obligations under its agreements with Archer (as discussed in Note 17).

•

On April 4, 2025, we entered into the Sixth Amendment to the Third Amended and Restated Capacity Purchase Agreement with United which provides for the following:

o

The extension of the CPA rate increases agreed upon in the First Amendment to our Third Amended and Restated United CPA and the Second Amendment to our Third Amended and Restated United CPA, dated January 11, 2024, and January 19, 2024, respectively (the "January 2024 United CPA Amendments”), retroactive to January 1, 2025, through March 31, 2026.

o

The extension of incentives for achieving certain performance metrics, retroactive to July 1, 2024, through March 31, 2026.

•

On April 4, 2025, we entered into the Sixth Amendment to Second Amended and Restated Credit and Guaranty Agreement providing for the waiver of an existing financial covenant default with respect to the period ended March 31, 2025, and a projected financial covenant default with respect to the periods ending June 30, 2025, September 30, 2025, December 31, 2025, and March 31, 2026, each relating to a minimum liquidity requirement under our United Revolving Credit Facility.

•

On April 3, 2025, we entered into a purchase agreement with a third party which provides for the sale of 23 GE model CF34-8C engines to the third party for expected gross proceeds of $16.3 million, which will be used to pay down our UST Loan.

•

On December 31, 2024, we entered into an Aircraft Purchase Agreement with United which provides for the sale of 18 E-175 aircraft to United for gross proceeds of $227.7 million and net proceeds of $84.7 million after the retirement of debt. Subsequently, we closed the sale of all 18 aircraft to United.

•

On December 30, 2024, we received notice from United that $4.5 million of our Effective Date Revolving Loan balance under our United Revolving Credit Facility has been forgiven for achieving certain operational performance metrics outlined in the United CPA.

•

On December 24, 2024, we entered into a purchase agreement with a third party which provides for the sale of 15 CRJ-900 airframes to the third party for expected gross proceeds of $19.0 million, which will be used to pay down our UST Loan. On April 3, 2025, the purchase agreement was amended to include an additional 14 CRJ-900 airframes to be sold to the third party for expected gross proceeds of $9.1 million. The total expected gross proceeds of $28.1 million will be used to pay down our UST Loan.

•

On December 23, 2024, we entered into an agreement with the United States Department of the Treasury (the "UST") to lower the minimum collateral coverage ratio ("CCR") covenant to .99 to 1.0 effective as of November 22, 2024 through February 28, 2025. After such date, the CCR will revert to 1.55 to 1.0. The agreement also requires the Company to use its reasonable best efforts to cause counterparties to all Receivables (as defined in the Treasury Loan) (whether or not constituting “Eligible Receivables” (as defined in the Treasury Loan)) of the Company to be paid to the Eligible Receivables Account (as defined in the Treasury Loan). Receivables generated from the sale of assets that are not Collateral (as defined in the Treasury Loan) are excluded from the scope of the foregoing requirement. As a result of the lower CCR covenant, we are in compliance with this covenant as of September 30, 2024. Additionally, on March 18, 2025, we entered into a new CCR Modification Agreement with the UST to lower the minimum CCR covenant to .91 to 1.0 effective as of February 28, 2025 through the maturity date of the loan.

•

On December 23, 2024, we entered into a Waiver to Second Amended and Restated Credit and Guaranty Agreement providing for the waiver of an existing financial covenant default with respect to the period July 1, 2024 to December 23, 2024 and a projected financial covenant default with respect to the period December 24, 2024 to December 31, 2024, each relating to a minimum liquidity requirement under our United Revolving Credit Facility.

•

On December 23, 2024, we entered into the Fourth Amendment to our Third Amended and Restated United CPA which provides for the following:

o

Amended certain scheduled exit dates for our E-175 and CRJ-900 Covered Aircraft (as defined in the United CPA).

o

Added provisions relating to the reimbursement by United of up to $14.0 million of pilot training costs incurred by the Company with respect to its E-175 aircraft.

•

On September 25, 2024, we reached an agreement with United which provides for, among other things, the commitment to buy our two CRJ-700 aircraft out of their lease with GoJet and to purchase such aircraft for total proceeds of $11.0 million, $4.5 million of which will pay down the outstanding obligations. Subsequent to September 30, 2024, we closed the sale of the two CRJ-700 aircraft to United.

•

Based on the most recent appraisal value of our spare parts, we have $12.4 million of borrowing capacity under our United Revolving Credit Facility.

•

In addition to already executed agreements to sell aircraft, the Company is actively seeking arrangements to sell other surplus assets primarily related to the CRJ fleet including aircraft, engines, and spare parts to reduce debt and optimize operations.

•

We have delayed and/or deferred major spending on aircraft and engine maintenance to match the current and projected level of flight activity.

The Company believes the plans and initiatives outlined above have effectively alleviated the financial concerns and will allow the Company to meet its cash obligations for the next twelve months following the issuance of its financial statements. The forecast of undiscounted cash flows prepared to determine if the Company has the ability to meet its cash obligations over the next twelve months was prepared with significant judgment and estimates of future cash flows based on projections of CPA block hours, maintenance events, labor costs, and other relevant factors. Assumptions used in the forecast may change or not occur as expected.

As of July 16, 2024, the Company was not in compliance with a financial covenant related to a minimum liquidity requirement of $15.0 million of cash and cash equivalents associated with its Second Amended and Restated Credit and Guaranty Agreement with United. On December 23, 2024, the Company entered into a Waiver to Second Amended and Restated Credit and Guaranty Agreement providing for the waiver for the financial covenant default with respect to the period July 1, 2024 to December 23, 2024 and a projected financial covenant default with respect to the period December 24, 2024 to December 31, 2024. Further, on April 4, 2025, the Company entered into the Sixth Amendment to Second Amended and Restated Credit and Guaranty Agreement providing for the waiver of an existing financial covenant default with respect to the period ended March 31, 2025, and a projected financial covenant default with respect to the periods ending June 30, 2025, September 30, 2025, December 31, 2025, and March 31, 2026. As of the issuance of this Form 10-K, we are in compliance with all financial covenants.

As of September 30, 2024, the Company had $50.5 million of principal maturity payments on long-term debt due within the next twelve months. Additionally, all outstanding principal amounts of $113.7 million as of September 30, 2024, under our UST Loan are due and payable in a single installment on October 30, 2025. We plan to meet these obligations with our cash on hand, ongoing cashflows from our operations, and the liquidity created from the additional measures identified above. If our plans are not realized, we intend to explore additional opportunities to create liquidity by refinancing and deferring repayment of our principal maturity payments that are due within the next twelve months. The Company continues to monitor covenant compliance with its lenders as any noncompliance could have a material impact on the Company’s financial position, cash flows and results of operations. As of September 30, 2024, the Company is in compliance with all financial covenants. See Sources and Uses of Cash in “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional disclosure.

Our Business Strategy

Our business strategy consists of the following elements:

Maintain Low-Cost Structure

We have established ourselves as a low cost provider of regional airline and cargo flight services. We intend to continue our disciplined cost control approach through responsible outsourcing of certain operating functions, by flying large regional aircraft with associated lower maintenance costs and common flight crews across fleet types, and through the diligent control of corporate and administrative costs by implementing company-wide efforts to improve our cost structure.

Attractive Work Opportunities

We believe our employees have been, and will continue to be, a key to our success. We intend to continue to offer competitive compensation packages, foster a positive and supportive work environment and provide opportunities to fly state-of-the-art, large-gauged regional jets to differentiate us from other carriers and make us an attractive place to work and build a career.

Aircraft Fleet

We fly only large regional jets manufactured by Bombardier Aerospace ("Bombardier") and Embraer S.A. ("Embraer"). Mitsubishi Heavy Industries ("MHI"), who acquired the CRJ business from Bombardier, and Embraer are the primary manufacturers of regional jets operated in the United States, which allows us to enjoy operational, recruiting and cost advantages over other regional airlines that operate smaller regional aircraft from less prominent manufacturers.

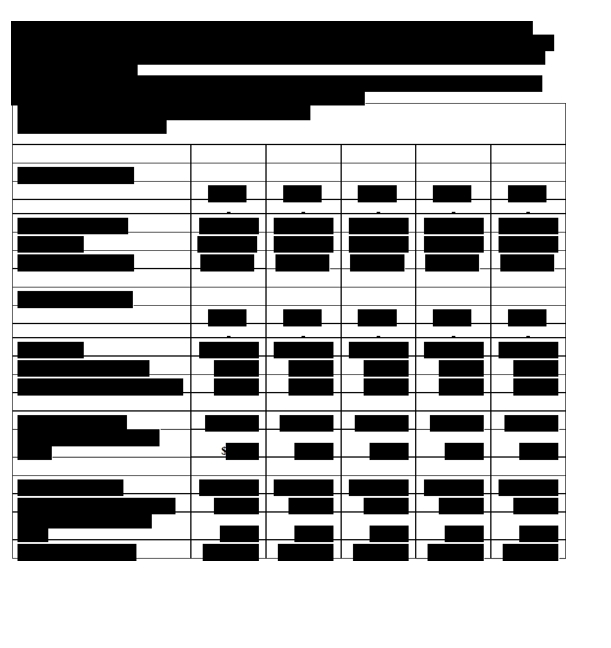

As of September 30, 2024, we had 98 aircraft (owned and leased) consisting of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Embraer

Regional

Jet-175

(70-76 seats) |

|

|

Canadair

Regional

Jet-700

(50-70 seats) |

|

|

Canadair

Regional

Jet-900

(76-79

seats) |

|

|

Total |

|

Active under CPA |

|

|

55 |

|

|

|

— |

|

|

|

12 |

|

|

|

67 |

|

Held for sale(1) |

|

|

— |

|

|

|

— |

|

|

|

24 |

|

|

|

24 |

|

Leased to third party |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

2 |

|

Subtotal |

|

|

55 |

|

|

|

2 |

|

|

|

36 |

|

|

|

93 |

|

Unassigned |

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

Total |

|

|

60 |

|

|

|

2 |

|

|

|

36 |

|

|

|

98 |

|

(1)

Two CRJ-700 aircraft and two CRJ-900 airframes held for sale are active as of September 30, 2024, and included as active in the above chart.

The following table lists the aircraft we own and lease as of September 30, 2024 and the passenger capacity of such aircraft:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Aircraft |

|

Owned |

|

|

Leased |

|

|

|

Total |

|

|

Passenger

Capacity |

E-175 Regional Jet |

|

|

18 |

|

|

|

42 |

|

(2) |

|

|

60 |

|

|

70-76 |

CRJ-900 Regional Jet |

|

|

31 |

|

|

|

5 |

|

|

|

|

36 |

|

|

76-79 |

CRJ-700 Regional Jet |

|

|

— |

|

|

|

2 |

|

|

|

|

2 |

|

|

50-70 |

Total |

|

|

49 |

|

|

|

49 |

|

|

|

|

98 |

|

|

|

(2)

All 42 of these E-175 aircraft are owned by United and leased to us at nominal amounts.

MHI and Embraer regional jets are among the quietest commercial jets currently available and offer many of the amenities of larger commercial jet aircraft, including flight attendant service, a stand-up cabin, overhead and under seat storage, lavatories and in-flight snack and beverage service. The speed of MHI and Embraer regional jets is comparable to larger aircraft operated by major airlines, and they have a range of approximately 1,600 miles and 2,100 miles, respectively. We do not currently have any existing arrangements with MHI or Embraer to acquire additional aircraft.

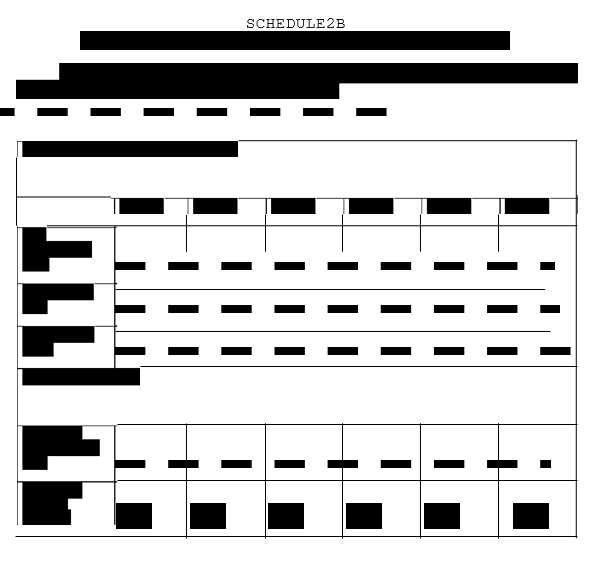

The following table summarizes our available seat miles ("ASMs") flown and contract revenue recognized under our CPAs for our fiscal years ended September 30, 2024 and 2023, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended September 30, 2024 |

|

|

Year Ended September 30, 2023 |

|

|

|

Available

Seat Miles |

|

|

Contract

Revenue |

|

|

Contract

Revenue

per ASM |

|

|

Available

Seat Miles |

|

|

Contract

Revenue |

|

|

Contract

Revenue

per ASM |

|

|

|

(in thousands) |

|

|

(in cents) |

|

|

(in thousands) |

|

|

(in cents) |

|

American |

|

|

— |

|

|

$ |

— |

|

|

|

|

— |

|

|

|

790,513 |

|

|

$ |

107,019 |

|

|

¢ |

|

13.54 |

|

United |

|

|

3,898,559 |

|

|

$ |

394,206 |

|

|

¢ |

|

10.11 |

|

|

|

3,444,900 |

|

|

$ |

294,129 |

|

|

¢ |

|

8.54 |

|

Other(3) |

|

|

— |

|

|

$ |

10,116 |

|

|

|

|

— |

|

|

|

— |

|

|

$ |

20,150 |

|

|

|

|

— |

|

Total |

|

|

3,898,559 |

|

|

$ |

404,322 |

|

|

¢ |

|

10.37 |

|

|

|

4,235,413 |

|

|

$ |

421,298 |

|

|

¢ |

|

9.95 |

|

(3)

Includes revenue from the DHL FSA, GoJet lease, and MPD.

United Capacity Purchase Agreement

Our agreement with United consists of the operation of E-175 and CRJ-900 aircraft under our United CPA. The financial arrangement between the Company and United includes a revenue-guarantee arrangement. Under the revenue-guarantee provisions, United pays us a fixed minimum monthly amount per aircraft under contract, plus additional amounts related to departures and block hours flown. We also receive direct reimbursement of certain operating expenses, including passenger liability insurance. Other expenses, including fuel and ground operations are directly paid to suppliers by United. We believe we are in material compliance with the terms of our United CPA.

We benefit from the revenue guarantee arrangement under our United CPA because we are sheltered, to an extent, from some of the elements that cause volatility in airline financial performance, including variations in ticket prices, fluctuations in number of passengers and fuel prices. However, we do not benefit from positive trends in ticket prices (including ancillary revenue programs), the number of passengers enplaned, or reductions in fuel prices. United retains all revenue collected from passengers carried on our flights. In providing regional flying under our CPA, we use the logos, service marks and aircraft paint schemes of United.

Under the United CPA, we currently have the ability to fly up to 67 aircraft for United. During the year ended September 30, 2024, United began exercising its right under Section 2.4(a) of the United CPA to remove CRJ-900 Covered Aircraft (as defined in the United CPA). 14 CRJ-900 aircraft were removed from the CPA, and the remaining 12 will be removed from the CPA by the end of February 2025. As of September 30, 2024, we operated 55 E-175 and 12 CRJ-900 aircraft under our United CPA. Under the United CPA, United owns 42 of our 60 E-175 aircraft. The E-175 aircraft owned by United and leased to us have terms expiring between 2024 and 2028, and the 18 E-175 aircraft owned by us have terms expiring in 2028.

United reimburses us on a pass-through basis for certain costs related to heavy airframe and engine maintenance, landing gear, auxiliary power units ("APUs") and component maintenance for the aircraft owned by United. Our United CPA permits United, subject to certain conditions, including the payment of certain costs tied to aircraft type, to terminate the agreement in its discretion, or remove aircraft from service, by giving us notice of 90 days or more. If United elects to terminate our United CPA in its entirety or permanently remove select aircraft from service, we are permitted to return any of the affected aircraft leased from United at no cost to us. In addition, if United removes any of our 18 owned E-175 aircraft from service at its direction, United would remain obligated, at our option, to assume the aircraft ownership and associated debt with respect to such aircraft through the end of the term of the United CPA.

Subsequent to September 30, 2024, we amended our United CPA, providing for the following:

•

The extension of the CPA rate increases agreed upon in the January 2024 United CPA Amendments through March 31, 2026.

•

The extension of incentives for achieving certain performance metrics through March 2026.

•

The commitment of a combined fleet of 60 CRJ-900 and E-175 aircraft through February 2025, and an entirely E-175 fleet by March 2025.

•

Reimbursement of up to $14.0 million of expenses related to the transition to an entirely E-175 fleet.

•

Amendment of certain scheduled exit dates for our E-175 and CRJ-900 Covered Aircraft (as defined in the United CPA).

On January 11, 2024 and January 19, 2024, we entered into the January 2024 United CPA Amendments which provide for the following:

•

Increased CPA rates, retroactive to October 1, 2023 through December 31, 2024.

•

Amended certain notice requirements for removal by United of up to eight CRJ-900 Covered Aircraft (as defined in the United CPA) from the United CPA.

•

Extended United's existing utilization waiver for the Company's operation of E-175 and CRJ-900 Covered Aircraft (as defined in the United CPA) to June 30, 2024.

Our United CPA is subject to early termination prior to its expiration in various circumstances including:

▪

If certain operational performance factors fall below a specified percentage for a specified time, subject to notice under certain circumstances;

▪

If we fail to perform the material covenants, agreements, terms or conditions of our United CPA or similar agreements with United, subject to 30 days' notice and cure rights;

▪

If either United or we become insolvent, file bankruptcy, or fail to pay debts when due, the non-defaulting party may terminate the agreement;

▪

If we merge with, or if control of us is acquired by another air carrier or a corporation directly or indirectly owning or controlling another air carrier;

▪

United, subject to certain conditions, including the payment of certain costs tied to aircraft type, may terminate the agreement in its discretion, or remove E-175 aircraft from service, by giving us notice of 90 days or more; and

▪

If United elects to terminate our United CPA in its entirety or permanently remove aircraft from service, we are permitted to return any of the affected E-175 aircraft leased from United at no cost to us.

DHL Flight Services Agreement

On December 20, 2019, we entered into a FSA with DHL (the "DHL FSA"). Under the terms of the DHL FSA, we operated four Boeing 737 aircraft to provide cargo air transportation services. In exchange for providing cargo flight services, we received a fee per block hour with a minimum block hour guarantee. We were eligible for a monthly performance bonus or subject to a monthly penalty based on timeliness and completion performance. Ground support expenses including fueling and airport fees were paid directly by DHL. On March 15, 2024, we entered into Amendment No. 3 to our DHL FSA which provided for the wind-down and termination of our flight operations on behalf of DHL. As part of this Amendment, we received $1.0 million for wind-down and associated costs.

American Capacity Purchase Agreement

In December 2022, we entered into Amendment No. 11 (the “American Amendment”) to our Amended and Restated Capacity Purchase Agreement previously entered into in November 2020 (as theretofore amended, the "American CPA"). The American Amendment provided for the termination and wind-down of the American CPA by April 3, 2023 (the “Wind-down Period”), at which time all Covered Aircraft (as defined in the American CPA) were removed from the American CPA. In March 2023, we began to transition aircraft operated under the American CPA to the United CPA. The American CPA was previously set to expire by its terms on December 31, 2025.

Under the terms of the American Amendment, during the Wind-down Period (i) we continued to receive a fixed minimum monthly amount per aircraft covered by the American CPA, plus additional amounts based on the number of flights and block hours flown during each month, subject to adjustment based on the Company’s controllable completion rate and certain other factors, and (ii) American agreed not to exercise certain termination or withdrawal rights under the American CPA if we failed to meet certain operational performance targets for the three consecutive month period ended January 31, 2023.

No Material Breach (as defined in the American CPA) occurred that would have required the payment of liquidated damages. As a result, American agreed to waive Mesa’s failure to meet certain past operational performance targets and other requirements, which triggered termination and withdrawal rights for American pursuant to the terms of American CPA. All CCF targets were met during the Wind-down Period, and there were no penalties associated with that performance metric. The parties executed a written mutual release of all claims and acknowledgment that no Material Breaches occurred.

Maintenance and Repairs

Airlines are subject to extensive regulation. We have a FAA mandated and approved maintenance program. Aircraft maintenance and repair consists of routine and non-routine maintenance, and work performed is divided into three general categories: line maintenance, heavy maintenance, and component service. We also outsource certain aircraft maintenance and other operating functions. We use competitive bidding among qualified vendors to procure these services. We have long-term maintenance contracts with AAR to provide fixed-rate parts procurement and component overhaul services for our aircraft fleet. Under these agreements, AAR provides maintenance and engineering services on any aircraft that we designate during the term of the agreement, along with access to a spare parts inventory pool, in exchange for a fixed monthly fee.

Line maintenance consists of routine daily and weekly scheduled maintenance checks on our aircraft. Line maintenance is performed at certain locations throughout our system and represents the majority of and most extensive maintenance we perform. Major airframe maintenance checks consist of a series of more complex tasks that can take from one to four weeks to accomplish and typically are required approximately every 28 months, on average, across our fleet. Engine overhauls and engine performance restoration events are quite extensive and can take two months. We maintain an inventory of spare engines to provide for continued operations during engine maintenance events. We expect to begin the initial planned engine maintenance overhauls on our new engine fleet approximately four to six years after the date of manufacture and introduction into our fleet, with subsequent engine maintenance every four to six years thereafter. Due to our current fleet size, we believe outsourcing all of our heavy maintenance, engine restoration, and major part repair is more economical than performing this work using our internal maintenance team.

Competition

We consider our primary competition to be U.S. regional airlines that currently hold or compete for CPAs for passenger services with major airlines. Our competition includes, therefore, nearly every other domestic regional airline, including Air Wisconsin Airlines Corporation; Commuetair, Inc. ("Commuteair"); Endeavor Air, Inc. (owned by Delta) ("Endeavor"); Envoy Air, Inc. ("Envoy"); PSA Airlines, Inc. ("PSA"); Piedmont Airlines, Inc. ("Piedmont") (Envoy, PSA and Piedmont are owned by American); Horizon Air Industries, Inc. (owned by Alaska Air Group, Inc.) ("Horizon"); SkyWest Inc., parent of SkyWest Airlines, Inc.; Republic Airways Holdings Inc.; and Trans States Airlines, Inc.

Major airlines typically offer CPAs to regional airlines on the basis of the following criteria: availability of labor resources; proposed contract economic terms; reliable and on-time flight operations; corporate financial resources including ability to procure and finance aircraft; customer service levels; and other factors.