NASDAQ: STAA First Quarter 2025 Earnings Call and Webcast Presentation MAY 7, 2025 Addressing the myopia epidemic as the global leader in phakic IOLs for vision correction Exhibit 99.2

STAAR Surgical Earnings Call and Webcast First Quarter 2025 STEPHEN FARRELL Chief Executive Officer WARREN FOUST DEBORAH ANDREWS President and Chief Operating Officer Interim Chief Financial Officer Today’s Speakers 02 Webcast participants may also email questions for today’s Q&A Session to ir@staar.com HOST Brian Moore, VP, Investor Relations

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that are not statements of historical fact are forward-looking statements, including statements about any of the following: financial projections and forecasts; plans, strategies, and objectives of management for 2025 and beyond or prospects for achieving such plans; expectations for sales, revenue, margin, earnings, expenses, and cost controls; estimates regarding procedural demand, inventory levels, and tariff impacts; expectations regarding regulatory approvals, uses of Collamer, manufacturing and production; use of cash and cash flows; and any statements of assumptions underlying any of the foregoing, including those relating to expected or future financial performance or results. These forward-looking statements are neither promises nor guarantees and involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from what is expressed or implied by the forward-looking statements, including, but not limited to: our ability to continue our growth and profitability trajectory; our reliance on independent distributors in international markets; a slowdown or disruption to the Chinese economy; global economic conditions; disruptions in our supply chain; fluctuations in foreign currency exchange rates; international trade disputes (including involving tariffs) and substantial dependence on demand from Asia; changes in effective tax rate or tax laws; any loss of use of our principal manufacturing facility; competition; potential losses due to product liability claims; our exposure to environmental liability; data corruption, cyber-based attacks or network security breaches and/or noncompliance with data protection and privacy regulations; acquisitions of new technologies; climate changes; the willingness of surgeons and patients to adopt a new or improved product and procedure; extensive clinical trials and resources devoted to research and development; compliance with government regulations; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before or after approval, or to take enforcement action; laws pertaining to healthcare fraud and abuse; changes in FDA or international regulations related to product approval; product recalls or failures; and other important factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 27, 2024 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Information” section of the Company’s website under the heading “SEC Filings,” as any such factors may be updated from time to time in the Company’s other filings with the SEC. Forward-looking statements speak only as of the date they are made and, except as may be required under applicable law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We intend to use our website as a means of disclosing material non-public information about the Company and for complying with our disclosure obligations under Regulation FD. Such disclosures will be included on our website in the ‘Investor Relations’ sections at investors.staar.com. Accordingly, investors should monitor such portion of our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about the Company when you enroll your email address by visiting the Email Alerts section at investors.staar.com. Forward Looking Statements 03

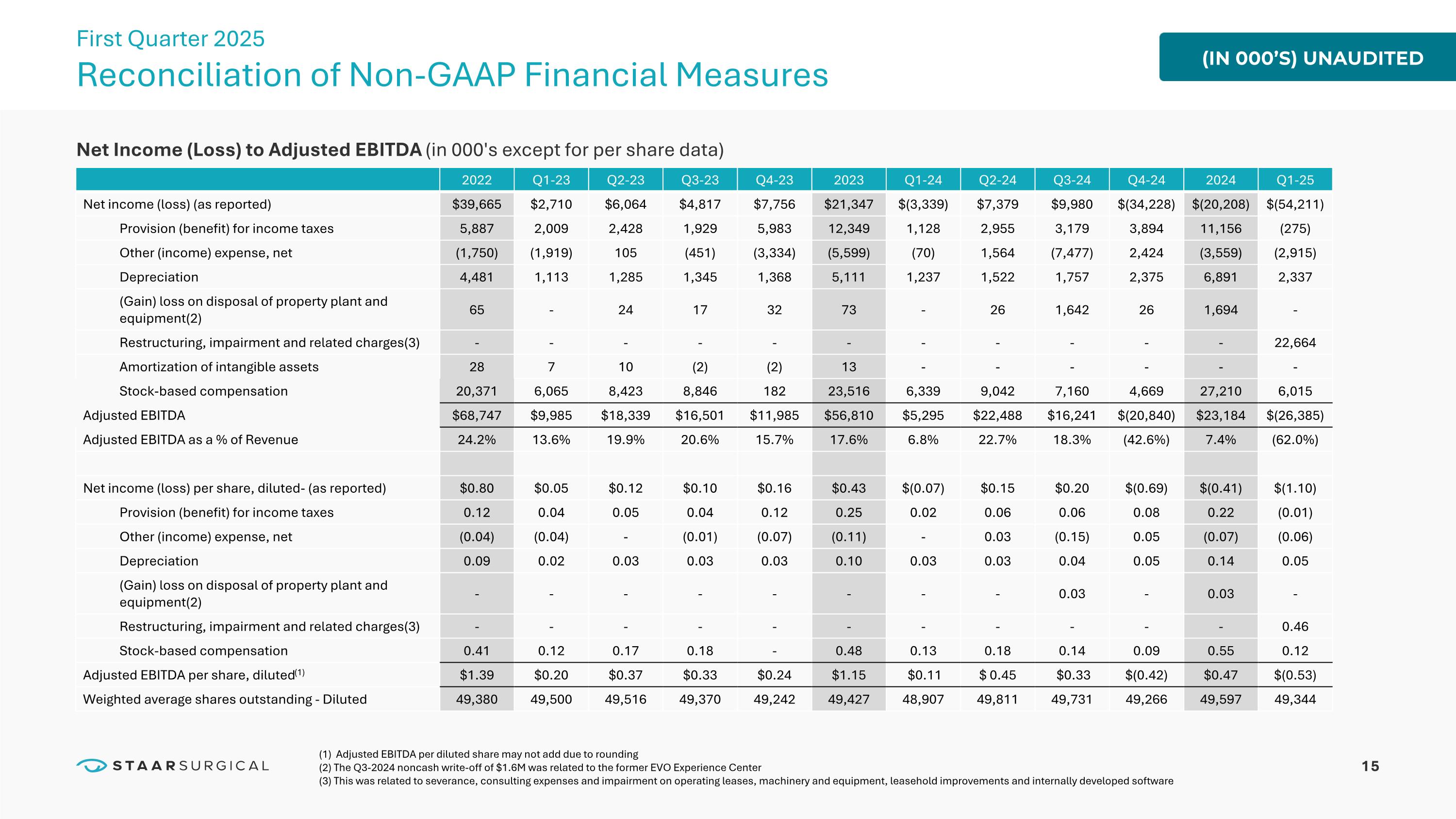

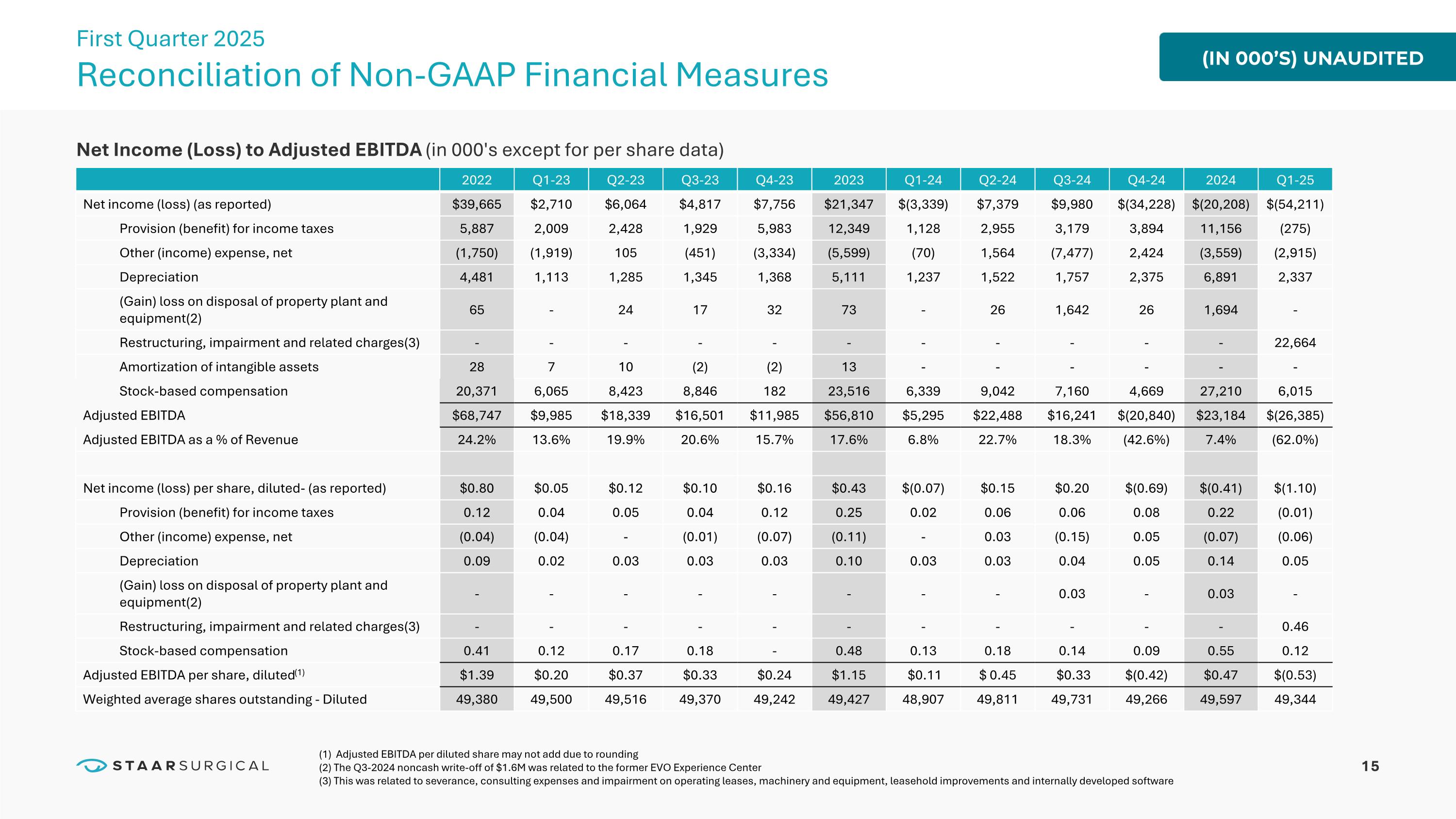

Non-GAAP Financial Information To supplement the Company’s financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this presentation and the accompanying tables include certain non-GAAP financial measures, including Adjusted EBITDA. Management uses these non-GAAP financial measures in its evaluation of Company operating performance and believes investors will find them useful in evaluating the Company’s operating performance, including cash flow generation, and in analyzing period-to-period financial performance of core business operations and underlying business trends. Non-GAAP financial measures are in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. EBITDA is a non-GAAP financial measure, which is calculated by adding interest income and expense, net; provision for income taxes; and depreciation and amortization to net income. In calculating Adjusted EBITDA and Adjusted EBITDA per diluted share, the Company further adjusts for stock-based compensation expense and for restructuring, impairment and related charges. As stock-based compensation is a non-cash expense that can vary significantly based on the timing, size and nature of awards granted, the Company believes that the exclusion of stock-based compensation expense can assist investors in comparisons of Company operating results with other peer companies because (i) the amount of such expense in any specific period may not directly correlate to the underlying performance of our business operations and (ii) such expense can vary significantly between periods as a result of the timing of grants of new stock-based awards, including inducement grants in connection with hiring. Additionally, the Company believes that excluding stock-based compensation from Adjusted EBITDA and Adjusted EBITDA per diluted share assists management and investors in making meaningful comparisons between the Company’s operating performance and the operating performance of other companies that may use different forms of employee compensation or different valuation methodologies for their stock-based compensation. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods. Investors should also note that such expenses will recur in the future. The Company believes that restructuring, impairment and related charges are not indicative of the underlying operating expense profile for the Company. These charges, which include costs related to severance, reduction in force and consulting expenses, impairment expenses on leasehold improvements and machinery and equipment, impairment on real property right-of use assets, and impairment of internally developed software, are anticipated to be completed within a finite period of time and can vary significantly in any specific period. The Company believes that excluding restructuring, impairment and related charges from Adjusted EBITDA allows investors to more consistently analyze period-to-period financial performance of its core business operations and better assess the Company’s current and future continuing operations. The Company also presents certain financial information on a constant currency basis, which is intended to exclude the effects of foreign currency fluctuations. The Company conducts a significant part of its activities outside the U.S. It receives sales revenue and pays expenses principally in U.S. dollars, Swiss francs, Japanese yen and euros. The exchange rates between dollars and non-U.S. currencies can fluctuate greatly and can have a significant effect on the Company’s results when reported in U.S. dollars. In order to compare the Company's performance from period to period without the effect of currency, the Company will apply the same average exchange rate applicable in the prior period, or the “constant currency” rate to sales or expenses in the current period as well. In the appendix to this presentation, the Company has included a reconciliation of Adjusted EBITDA and Adjusted EBITDA per diluted share to net income (loss) and net income (loss) per diluted share, the most directly comparable GAAP financial measure, as well as supplemental financial information with net sales expressed in constant currency. 04

STAAR Surgical + EVO ICL™ Around the World FIRST QUARTER 2025 05

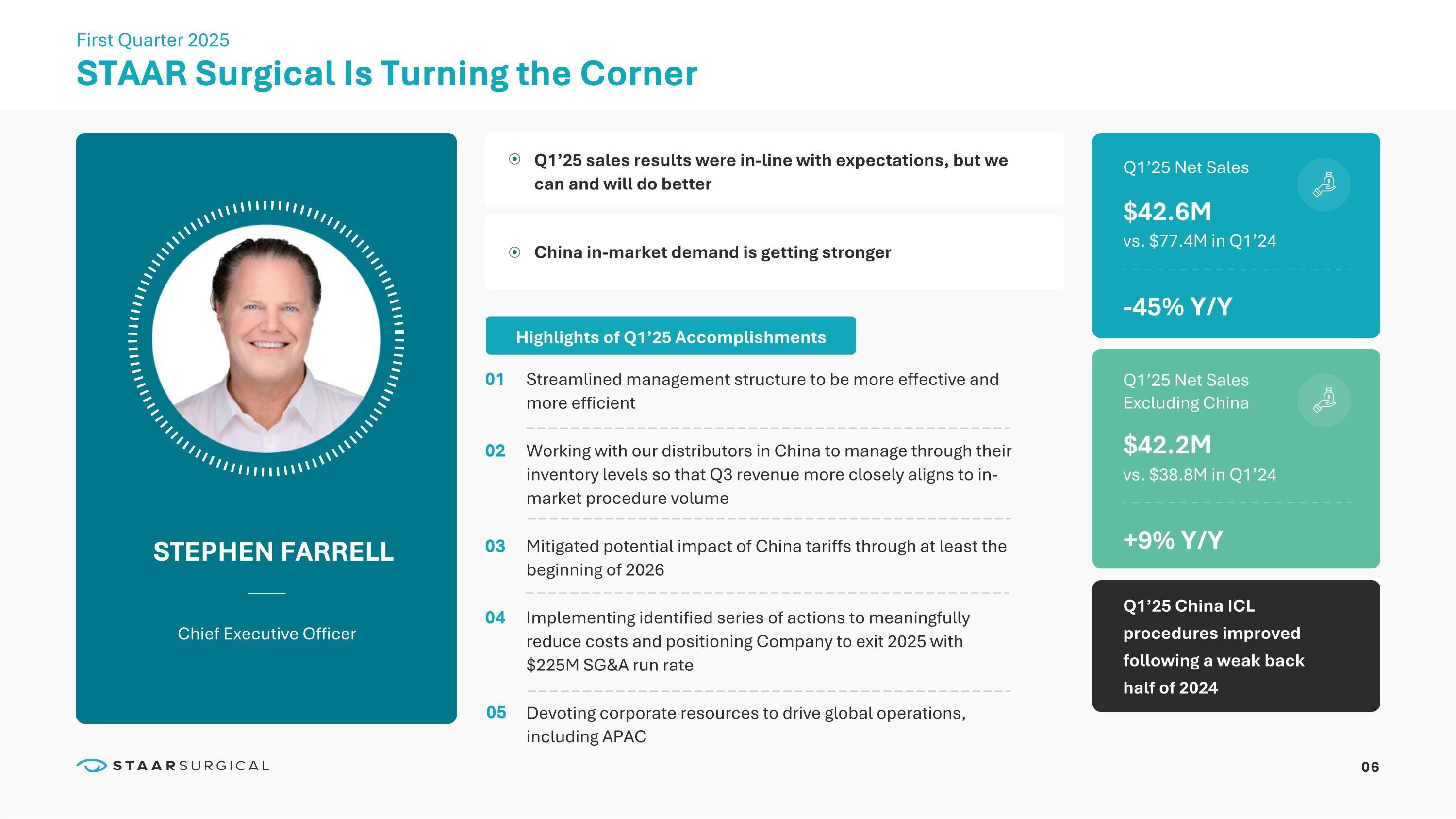

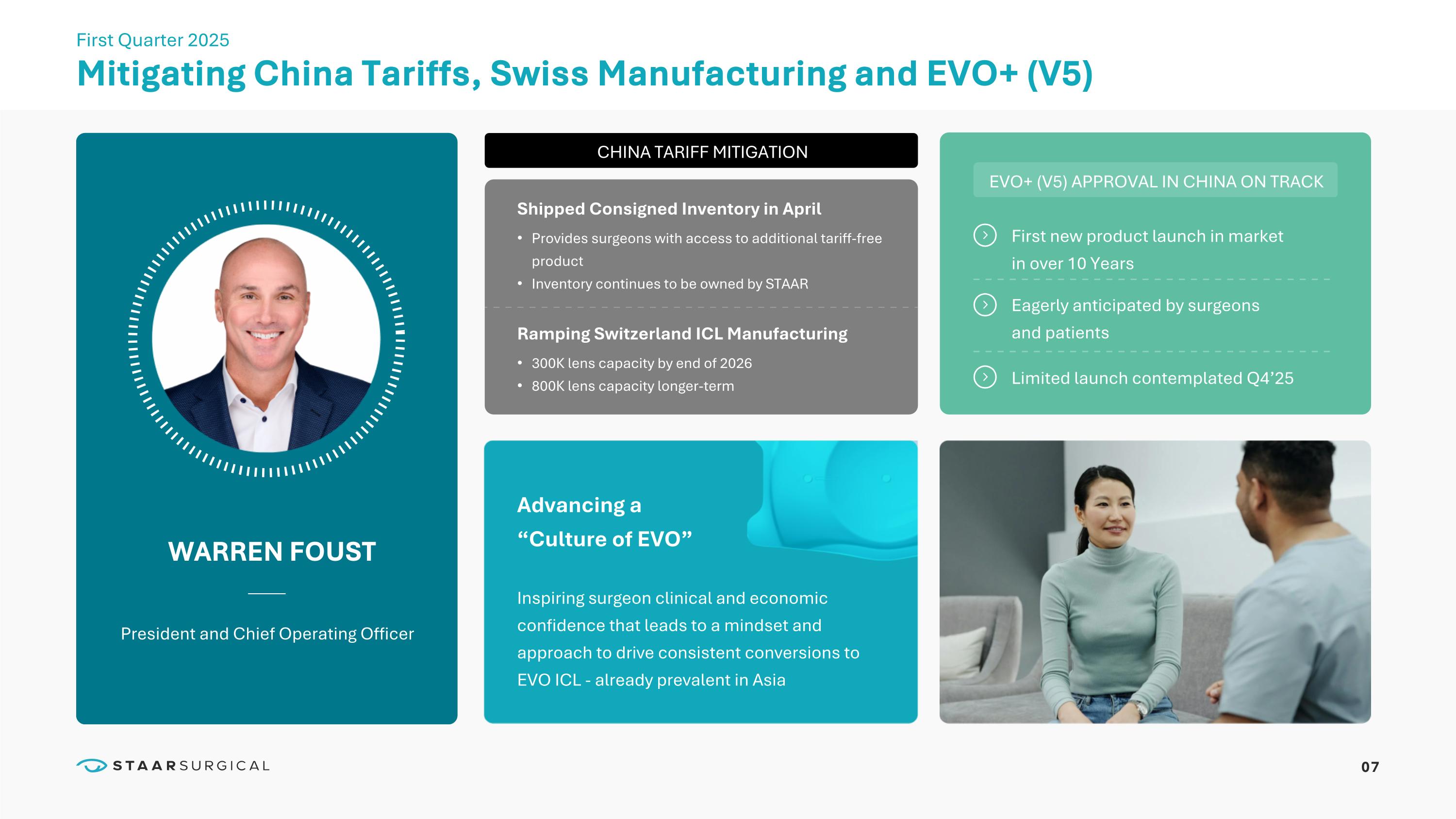

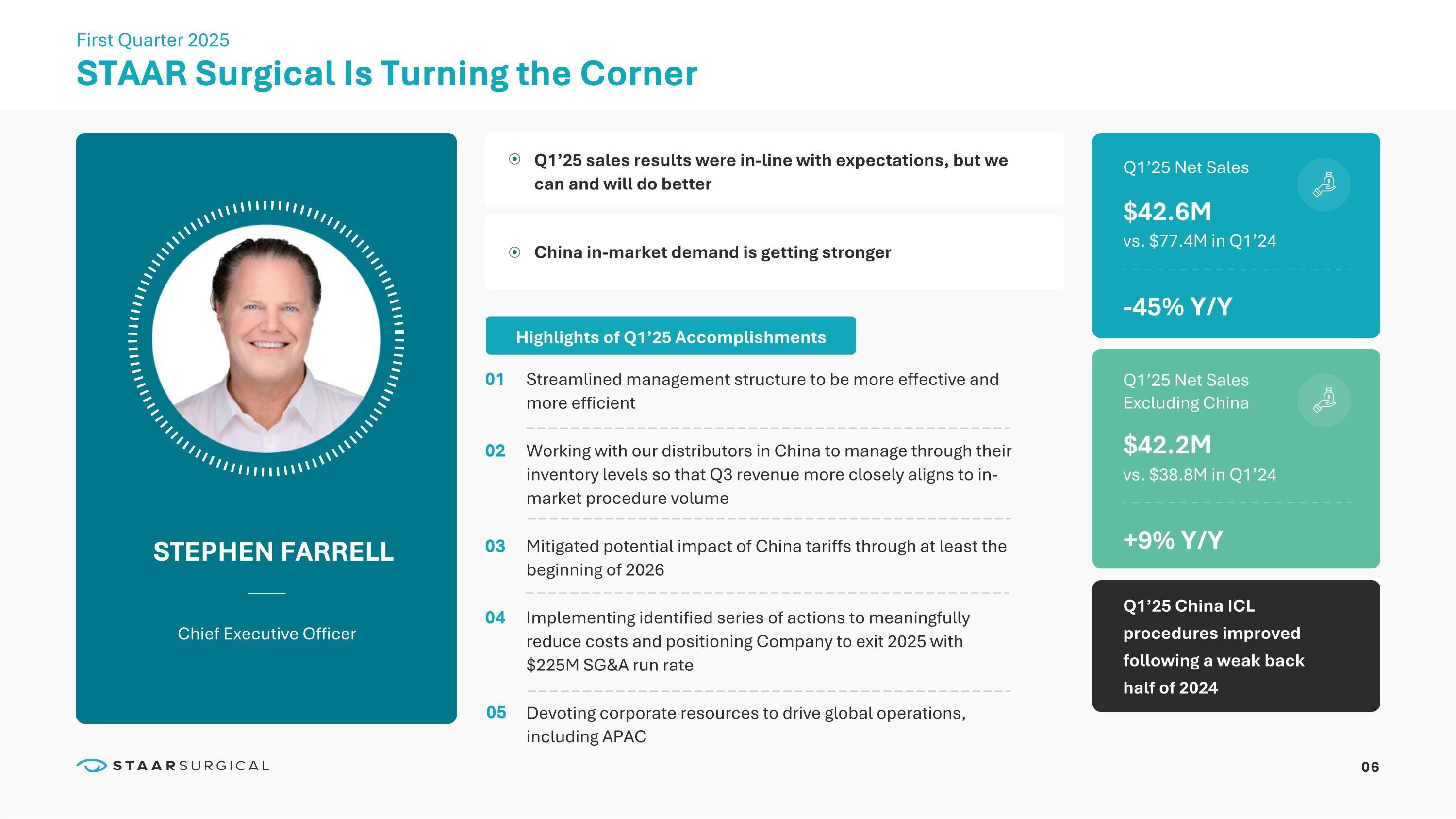

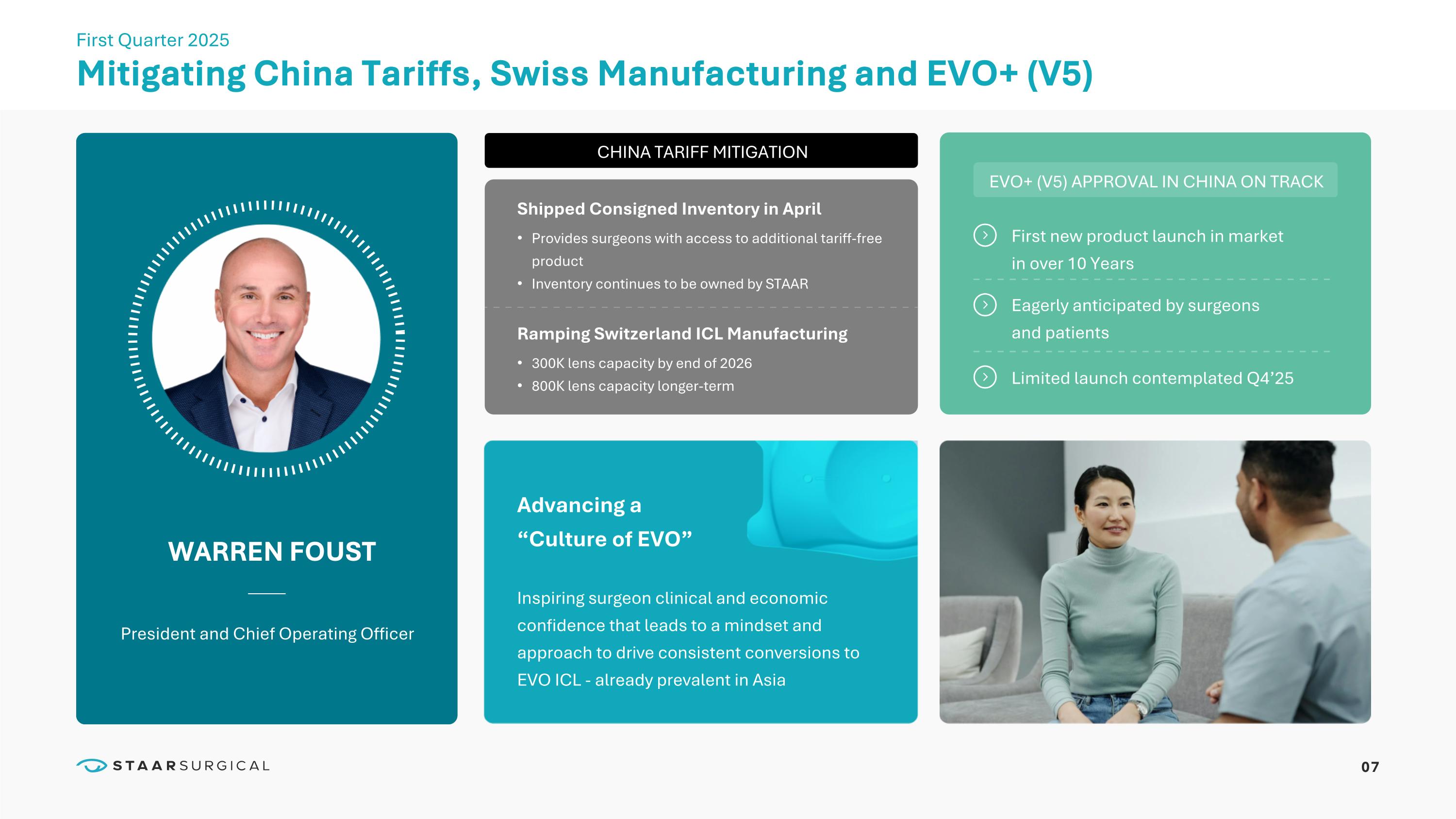

06 STAAR Surgical Is Turning the Corner STEPHEN FARRELL Chief Executive Officer First Quarter 2025 01 02 03 04 Q1’25 sales results were in-line with expectations, but we can and will do better China in-market demand is getting stronger $42.6M Q1’25 Net Sales -45% Y/Y vs. $77.4M in Q1’24 Q1’25 Net Sales Excluding China Q1’25 China ICL procedures improved following a weak back half of 2024 $42.2M +9% Y/Y vs. $38.8M in Q1’24 Highlights of Q1’25 Accomplishments Streamlined management structure to be more effective and more efficient Working with our distributors in China to manage through their inventory levels so that Q3 revenue more closely aligns to in-market procedure volume Mitigated potential impact of China tariffs through at least the beginning of 2026 Implementing identified series of actions to meaningfully reduce costs and positioning Company to exit 2025 with $225M SG&A run rate Devoting corporate resources to drive global operations, including APAC 05 07 Mitigating China Tariffs, Swiss Manufacturing and EVO+ (V5) WARREN FOUST President and Chief Operating Officer First Quarter 2025 Inspiring surgeon clinical and economic confidence that leads to a mindset and approach to drive consistent conversions to EVO ICL - already prevalent in Asia Advancing a “Culture of EVO” EVO+ (V5) APPROVAL IN CHINA ON TRACK CHINA TARIFF MITIGATION First new product launch in market in over 10 Years Shipped Consigned Inventory in April Provides surgeons with access to additional tariff-free product Inventory continues to be owned by STAAR Ramping Switzerland ICL Manufacturing 300K lens capacity by end of 2026 800K lens capacity longer-term Limited launch contemplated Q4’25 Eagerly anticipated by surgeons and patients

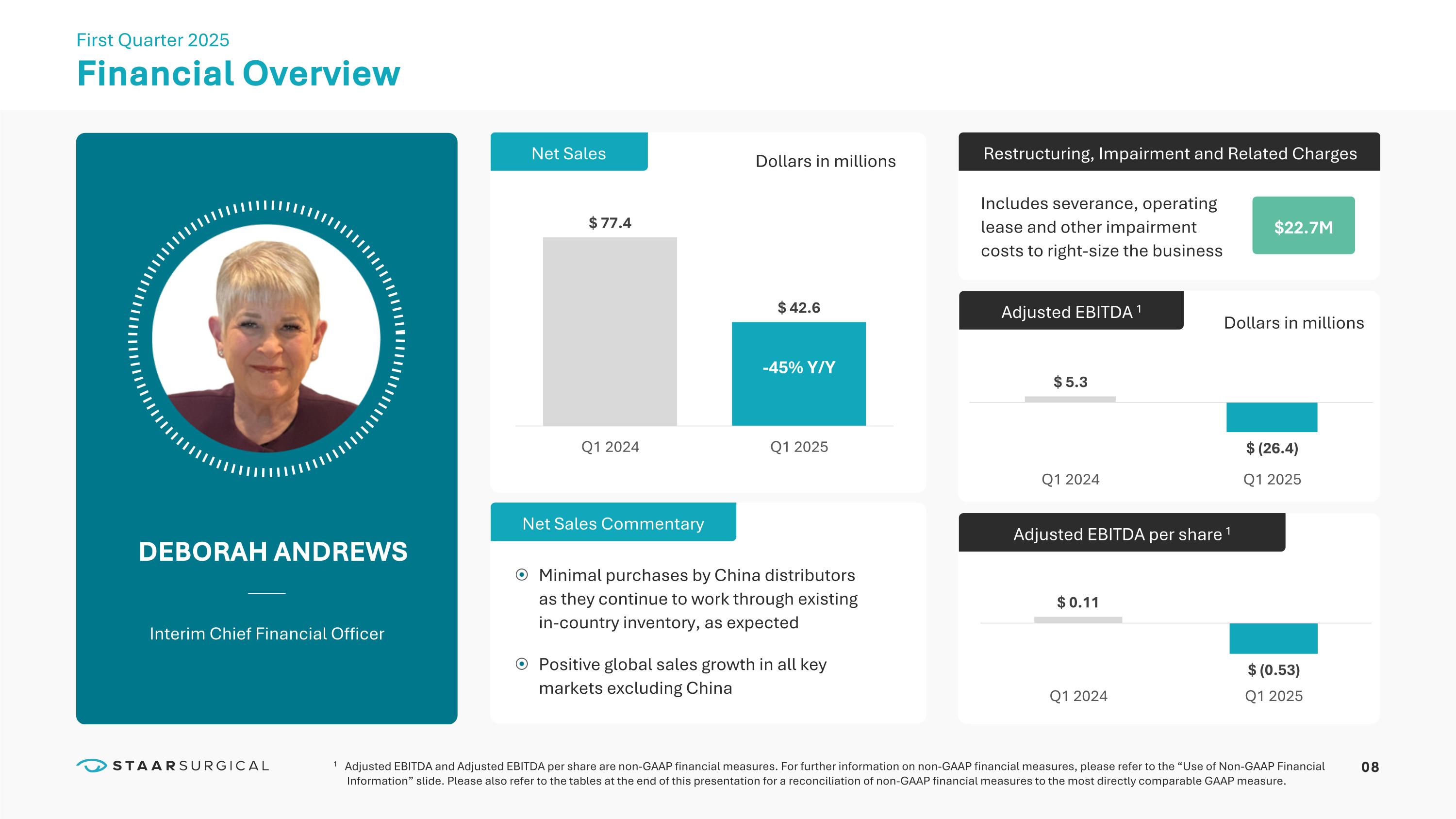

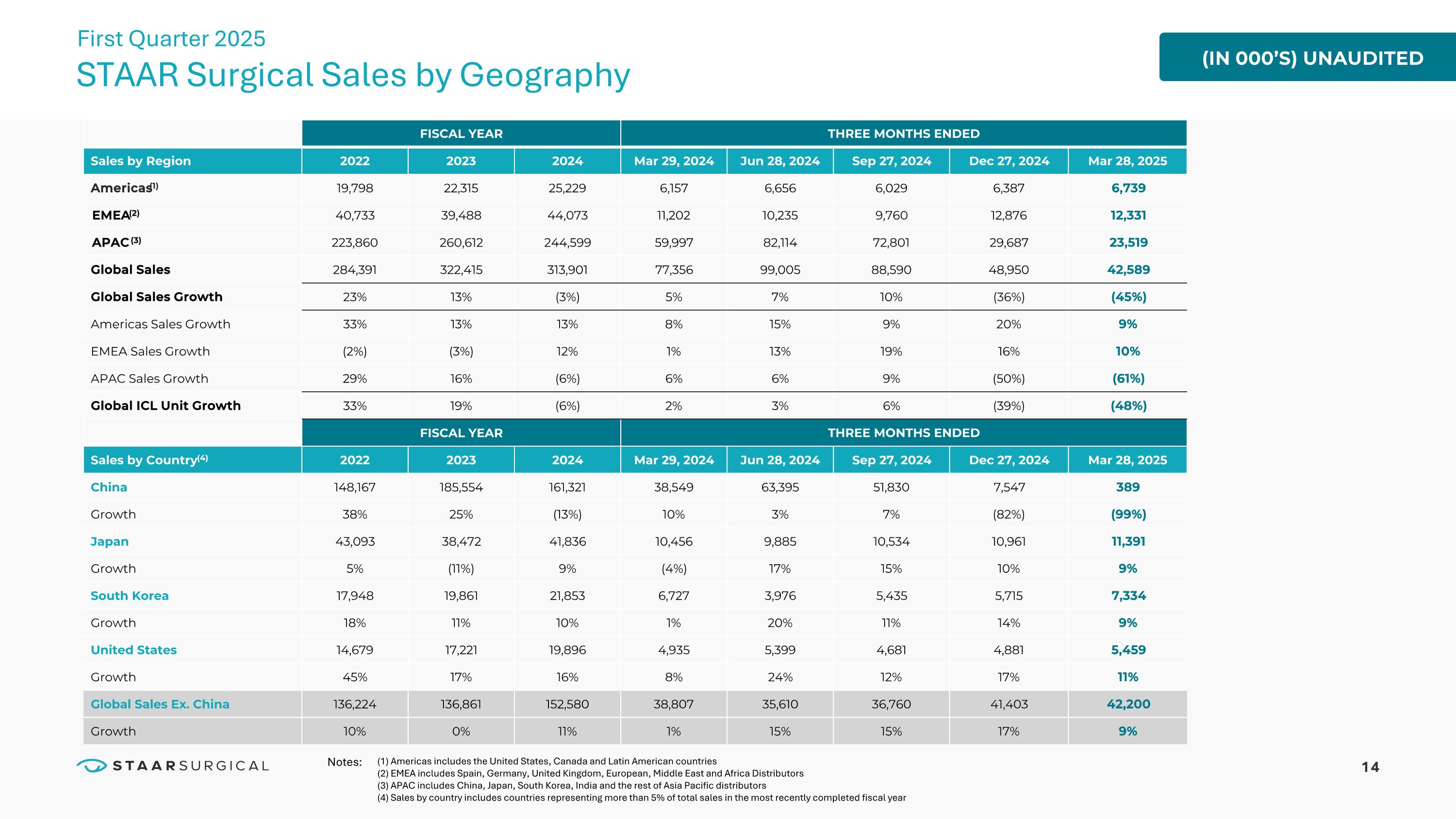

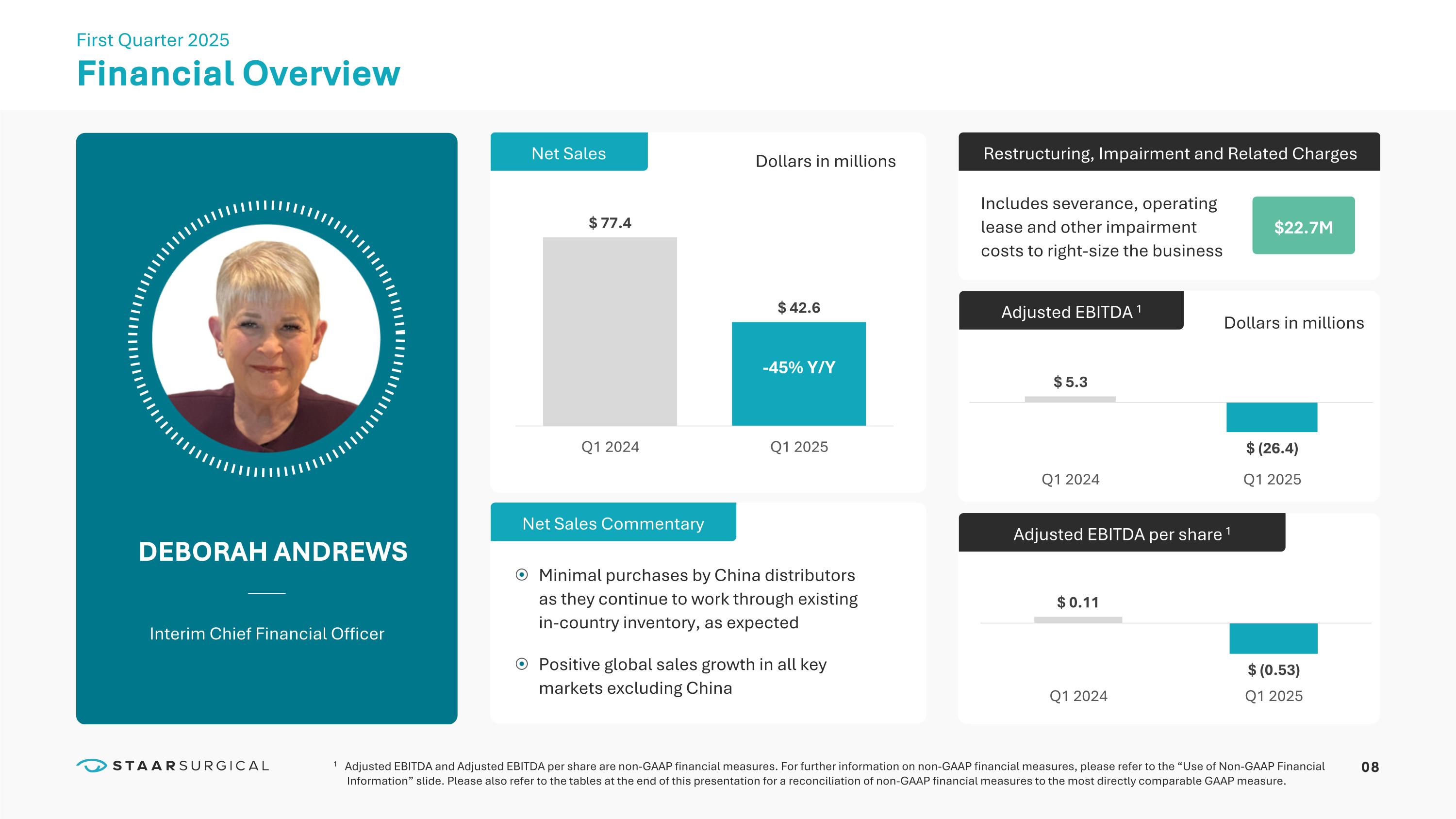

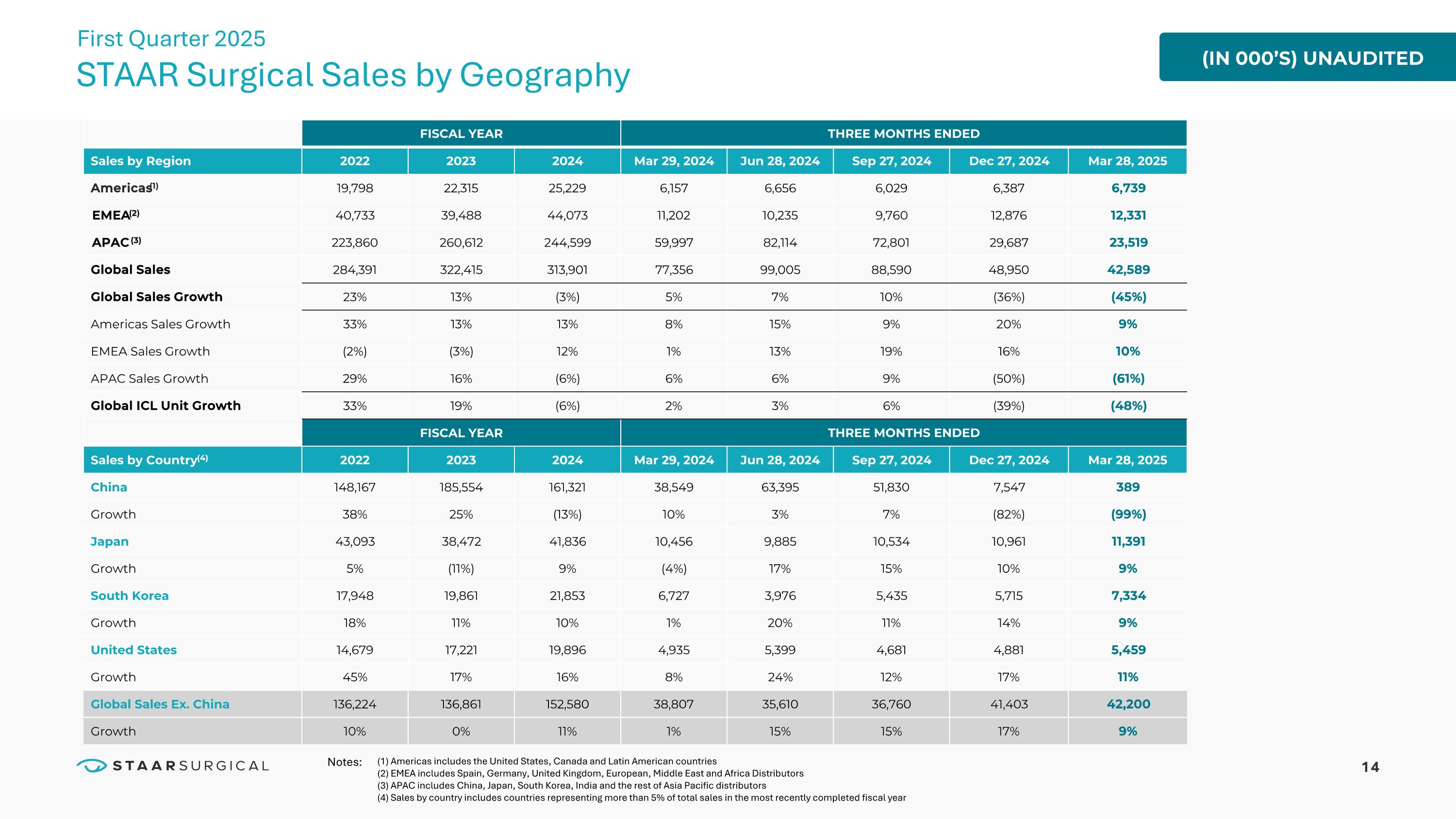

08 Financial Overview DEBORAH ANDREWS Interim Chief Financial Officer First Quarter 2025 Adjusted EBITDA 1 Restructuring, Impairment and Related Charges $22.7M Adjusted EBITDA per share 1 Dollars in millions Net Sales 1 Adjusted EBITDA and Adjusted EBITDA per share are non-GAAP financial measures. For further information on non-GAAP financial measures, please refer to the “Use of Non-GAAP Financial Information” slide. Please also refer to the tables at the end of this presentation for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measure. Net Sales Commentary Dollars in millions Minimal purchases by China distributors as they continue to work through existing in-country inventory, as expected Positive global sales growth in all key markets excluding China Includes severance, operating lease and other impairment costs to right-size the business -45% Y/Y 09 Notes: Americas includes the United States, Canada and Latin American countries; EMEA includes Spain, Germany, United Kingdom, European, Middle East and Africa Distributors; APAC includes China, Japan, South Korea, India and the rest of Asia Pacific distributors.

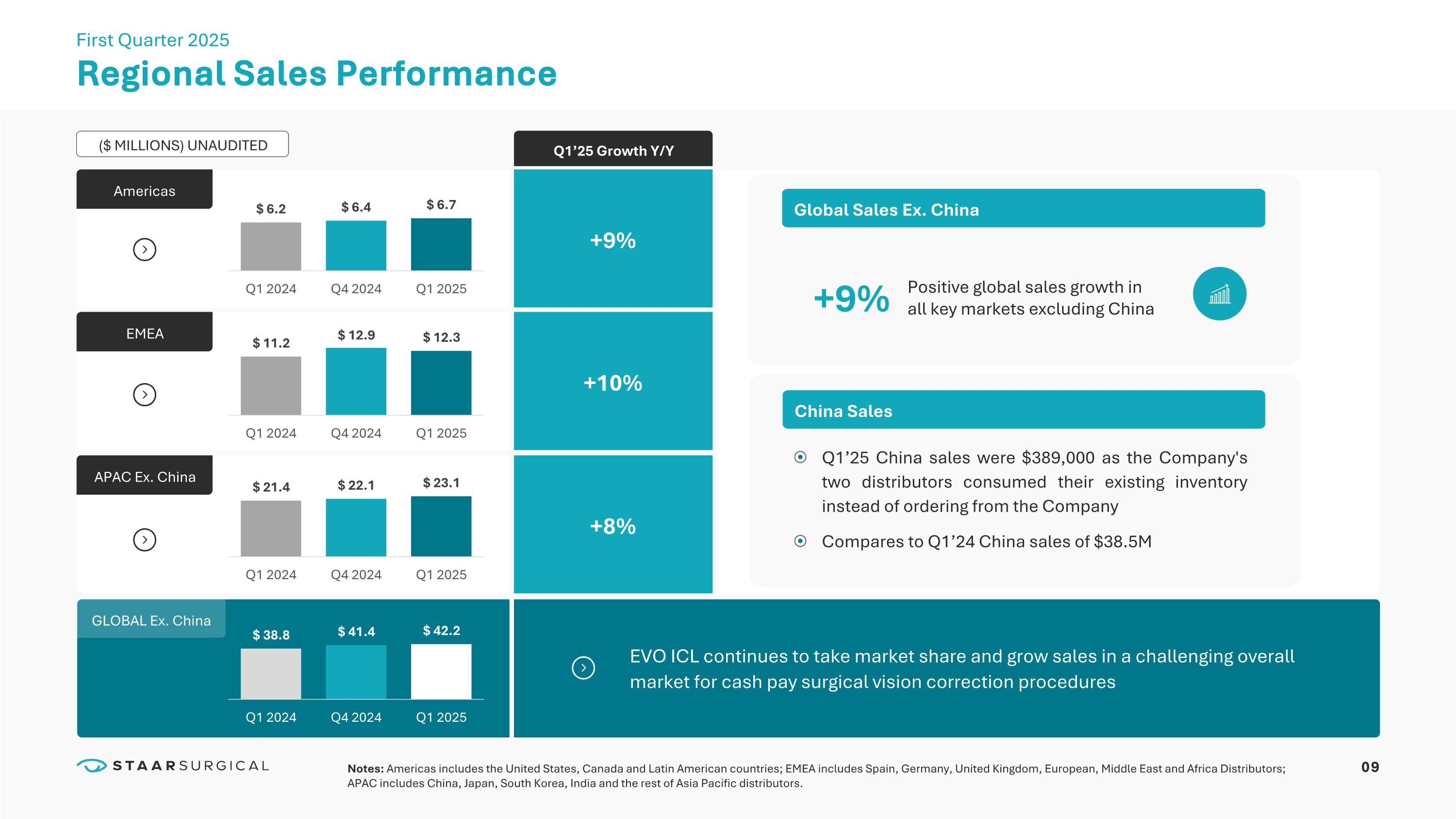

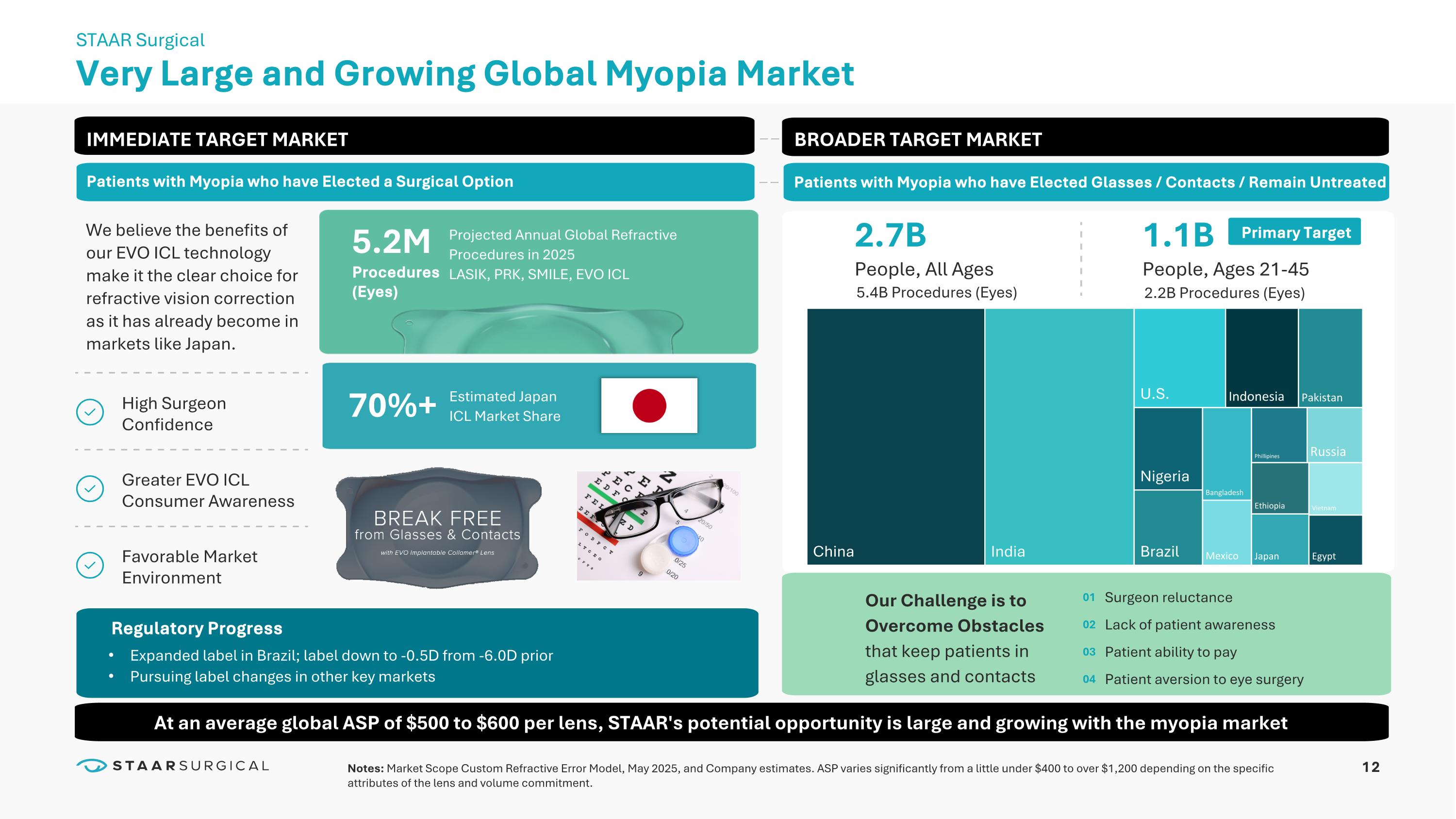

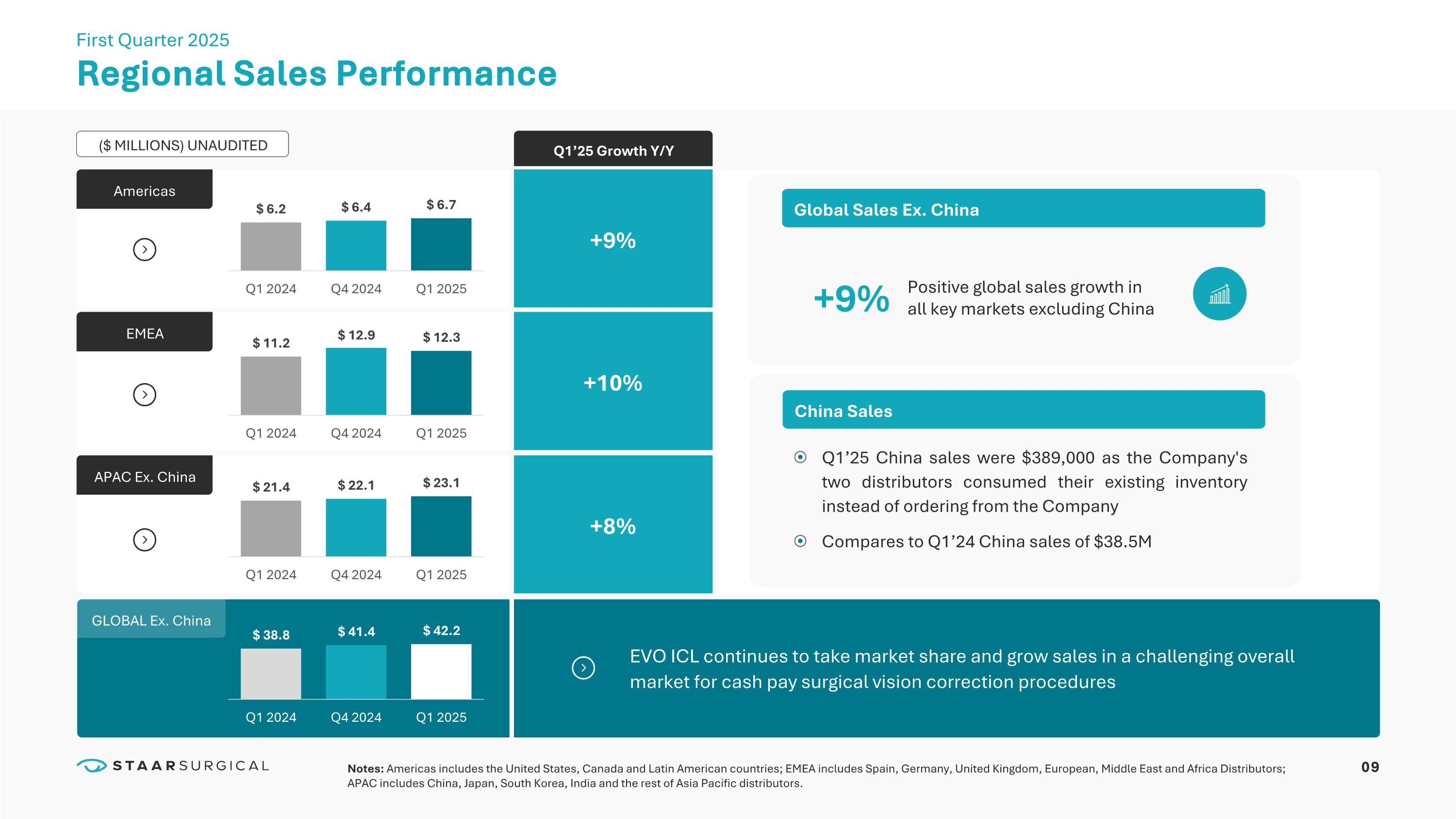

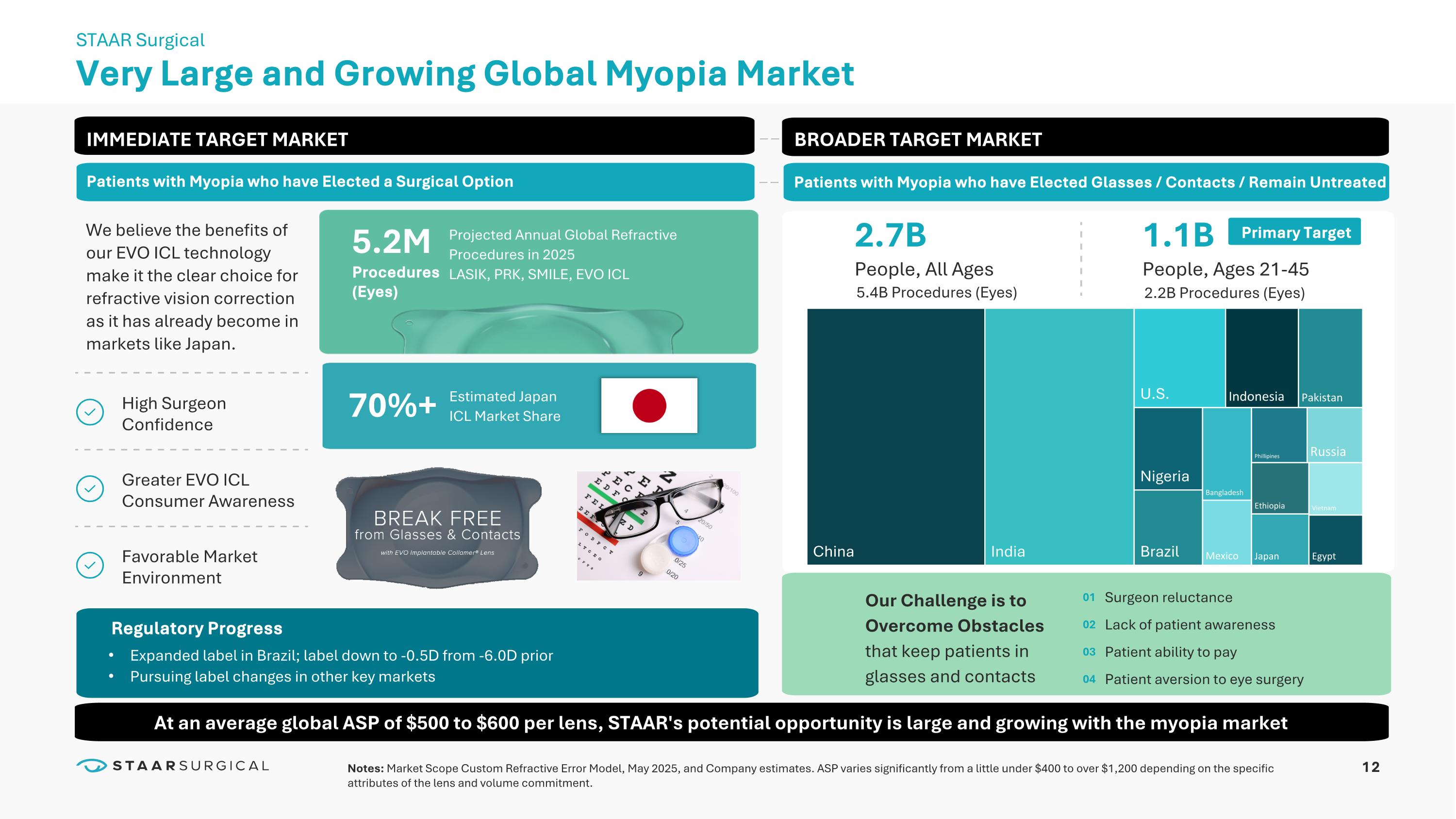

Americas EMEA APAC Ex. China GLOBAL Ex. China ($ MILLIONS) UNAUDITED EVO ICL continues to take market share and grow sales in a challenging overall market for cash pay surgical vision correction procedures Q1’25 Growth Y/Y +9% +9% +10% +8% Regional Sales Performance First Quarter 2025 China Sales Global Sales Ex. China Q1’25 China sales were $389,000 as the Company's two distributors consumed their existing inventory instead of ordering from the Company Compares to Q1’24 China sales of $38.5M Positive global sales growth in all key markets excluding China 12 Very Large and Growing Global Myopia Market STAAR Surgical 2.7B People, All Ages 1.1B People, Ages 21-45 IMMEDIATE TARGET MARKET We believe the benefits of our EVO ICL technology make it the clear choice for refractive vision correction as it has already become in markets like Japan.

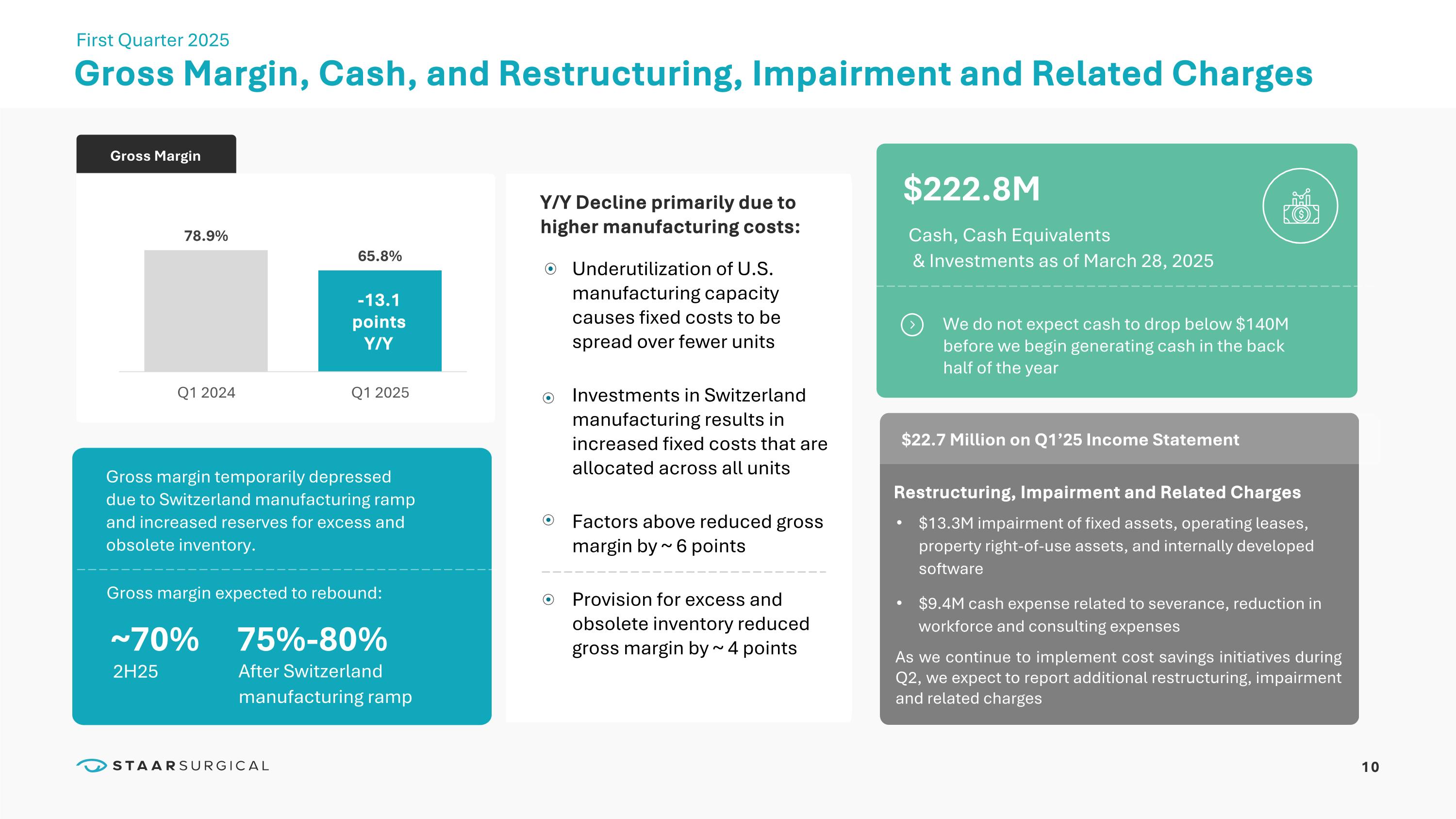

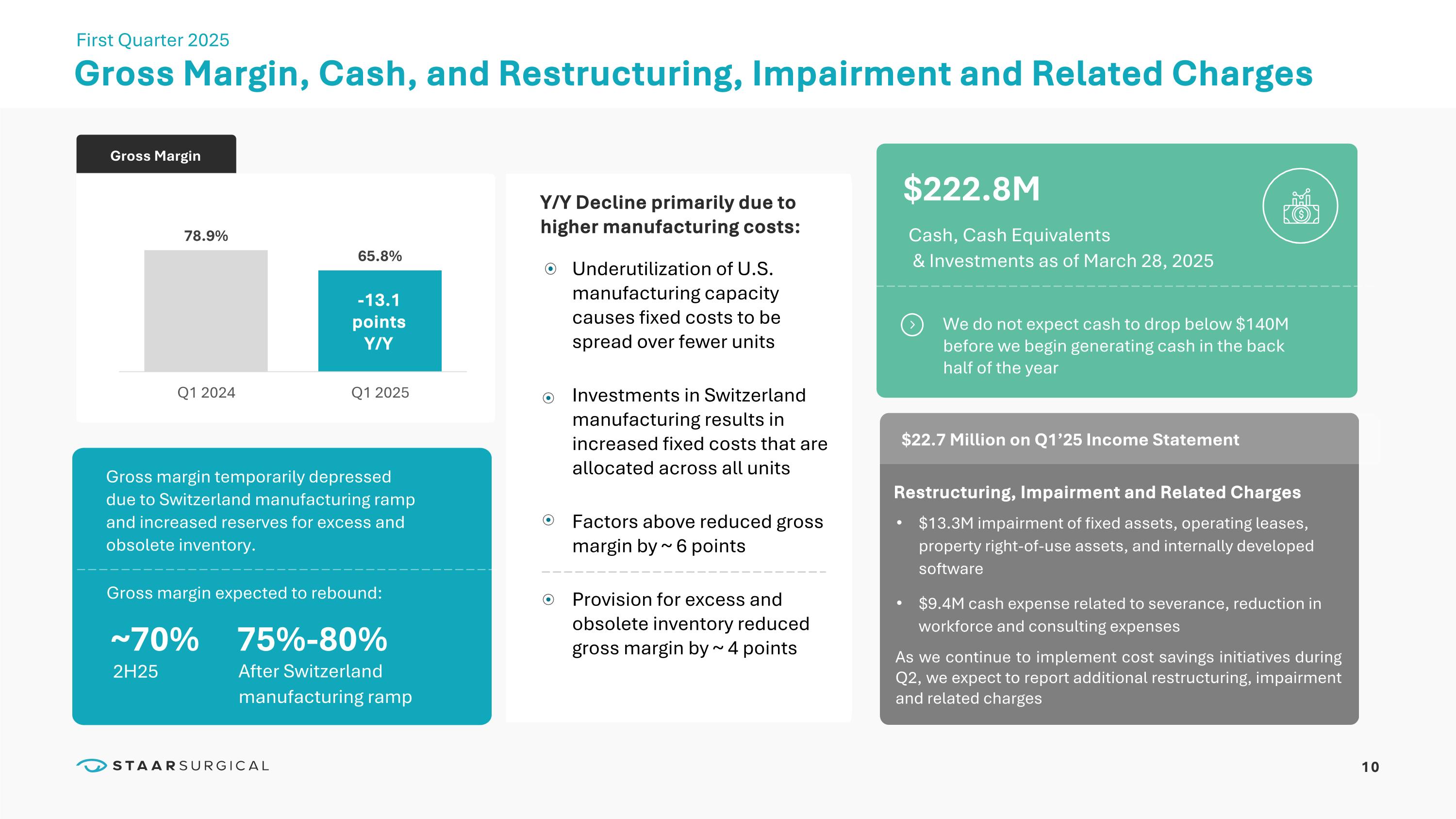

Gross Margin, Cash, and Restructuring, Impairment and Related Charges First Quarter 2025 Gross Margin ~70% 75%-80% 2H25 Gross margin temporarily depressed due to Switzerland manufacturing ramp and increased reserves for excess and obsolete inventory. $22.7 Million on Q1’25 Income Statement Restructuring, Impairment and Related Charges $13.3M impairment of fixed assets, operating leases, property right-of-use assets, and internally developed software $9.4M cash expense related to severance, reduction in workforce and consulting expenses $222.8M Cash, Cash Equivalents & Investments as of March 28, 2025 Underutilization of U.S. manufacturing capacity causes fixed costs to be spread over fewer units Investments in Switzerland manufacturing results in increased fixed costs that are allocated across all units Factors above reduced gross margin by ~ 6 points Provision for excess and obsolete inventory reduced gross margin by ~ 4 points Y/Y Decline primarily due to higher manufacturing costs: We do not expect cash to drop below $140M before we begin generating cash in the back half of the year -13.1 points Y/Y After Switzerland manufacturing ramp As we continue to implement cost savings initiatives during Q2, we expect to report additional restructuring, impairment and related charges 10 Gross margin expected to rebound:

11 Withdrawing Outlook; Return to Profitability First Quarter 2025 The Company announced that it is withdrawing the financial outlook previously provided on February 11, 2025. Withdrawing Guidance Proprietary Collamer® Material 30+ years Market Leadership and Experience Proven Clinical Outcomes The Company has identified and is taking a series of actions to meaningfully reduce costs to exit 2025 with a $225M go-forward SG&A run rate. The approach to cost optimization is designed to reinforce - not restrict - the Company's top line growth ambitions. This streamlining, which is mostly focused on inefficiencies in the Company's U.S. operations, prepares the Company for future strong cash flow generation after our revenue rebounds in Q3. Despite confidence in the Company's recent efforts to mitigate tariff exposure and optimism regarding short-term and long-term business trends, economic uncertainty and evolving tariff policy make it more challenging to forecast, particularly in the short term. Reducing SG&A

High Surgeon Confidence Greater EVO ICL Consumer Awareness Favorable Market Environment Notes: Market Scope Custom Refractive Error Model, May 2025, and Company estimates. ASP varies significantly from a little under $400 to over $1,200 depending on the specific attributes of the lens and volume commitment. 70%+ Estimated Japan ICL Market Share 5.2M Procedures (Eyes) Projected Annual Global Refractive Procedures in 2025 Expanded label in Brazil; label down to -0.5D from -6.0D prior Pursuing label changes in other key markets Surgeon reluctance Lack of patient awareness Patient ability to pay Patient aversion to eye surgery 01 02 03 04 LASIK, PRK, SMILE, EVO ICL Patients with Myopia who have Elected a Surgical Option BROADER TARGET MARKET Patients with Myopia who have Elected Glasses / Contacts / Remain Untreated Primary Target Our Challenge is to Overcome Obstacles that keep patients in glasses and contacts Regulatory Progress 5.4B Procedures (Eyes) 2.2B Procedures (Eyes) At an average global ASP of $500 to $600 per lens, STAAR's potential opportunity is large and growing with the myopia market

13 STAAR SURGICAL FIRST QUARTER 2025 EARNINGS CALL AND WEBCAST Q&A

14 FISCAL YEAR THREE MONTHS ENDED Sales by Region 2022 2023 2024 Mar 29, 2024 Jun 28, 2024 Sep 27, 2024 Dec 27, 2024 Mar 28, 2025 Americas(1) 19,798 22,315 25,229 6,157 6,656 6,029 6,387 6,739 EMEA(2) 40,733 39,488 44,073 11,202 10,235 9,760 12,876 12,331 APAC (3) 223,860 260,612 244,599 59,997 82,114 72,801 29,687 23,519 Global Sales 284,391 322,415 313,901 77,356 99,005 88,590 48,950 42,589 Global Sales Growth 23% 13% (3%) 5% 7% 10% (36%) (45%) Americas Sales Growth 33% 13% 13% 8% 15% 9% 20% 9% EMEA Sales Growth (2%) (3%) 12% 1% 13% 19% 16% 10% APAC Sales Growth 29% 16% (6%) 6% 6% 9% (50%) (61%) Global ICL Unit Growth 33% 19% (6%) 2% 3% 6% (39%) (48%) FISCAL YEAR THREE MONTHS ENDED Sales by Country(4) 2022 2023 2024 Mar 29, 2024 Jun 28, 2024 Sep 27, 2024 Dec 27, 2024 Mar 28, 2025 China 148,167 185,554 161,321 38,549 63,395 51,830 7,547 389 Growth 38% 25% (13%) 10% 3% 7% (82%) (99%) Japan 43,093 38,472 41,836 10,456 9,885 10,534 10,961 11,391 Growth 5% (11%) 9% (4%) 17% 15% 10% 9% South Korea 17,948 19,861 21,853 6,727 3,976 5,435 5,715 7,334 Growth 18% 11% 10% 1% 20% 11% 14% 9% United States 14,679 17,221 19,896 4,935 5,399 4,681 4,881 5,459 Growth 45% 17% 16% 8% 24% 12% 17% 11% Global Sales Ex. China 136,224 136,861 152,580 38,807 35,610 36,760 41,403 42,200 Growth 10% 0% 11% 1% 15% 15% 17% 9% (IN 000’S) UNAUDITED STAAR Surgical Sales by Geography First Quarter 2025 (1) Americas includes the United States, Canada and Latin American countries (2) EMEA includes Spain, Germany, United Kingdom, European, Middle East and Africa Distributors (3) APAC includes China, Japan, South Korea, India and the rest of Asia Pacific distributors (4) Sales by country includes countries representing more than 5% of total sales in the most recently completed fiscal year Notes:

15 Net Income (Loss) to Adjusted EBITDA (in 000's except for per share data) 2022 Q1-23 Q2-23 Q3-23 Q4-23 2023 Q1-24 Q2-24 Q3-24 Q4-24 2024 Q1-25 Net income (loss) (as reported) $39,665 $2,710 $6,064 $4,817 $7,756 $21,347 $(3,339) $7,379 $9,980 $(34,228) $(20,208) $(54,211) Provision (benefit) for income taxes 5,887 2,009 2,428 1,929 5,983 12,349 1,128 2,955 3,179 3,894 11,156 (275) Other (income) expense, net (1,750) (1,919) 105 (451) (3,334) (5,599) (70) 1,564 (7,477) 2,424 (3,559) (2,915) Depreciation 4,481 1,113 1,285 1,345 1,368 5,111 1,237 1,522 1,757 2,375 6,891 2,337 (Gain) loss on disposal of property plant and equipment(2) 65 - 24 17 32 73 - 26 1,642 26 1,694 - Restructuring, impairment and related charges(3) - - - - - - - - - - - 22,664 Amortization of intangible assets 28 7 10 (2) (2) 13 - - - - - - Stock-based compensation 20,371 6,065 8,423 8,846 182 23,516 6,339 9,042 7,160 4,669 27,210 6,015 Adjusted EBITDA $68,747 $9,985 $18,339 $16,501 $11,985 $56,810 $5,295 $22,488 $16,241 $(20,840) $23,184 $(26,385) Adjusted EBITDA as a % of Revenue 24.2% 13.6% 19.9% 20.6% 15.7% 17.6% 6.8% 22.7% 18.3% (42.6%) 7.4% (62.0%) Net income (loss) per share, diluted- (as reported) $0.80 $0.05 $0.12 $0.10 $0.16 $0.43 $(0.07) $0.15 $0.20 $(0.69) $(0.41) $(1.10) Provision (benefit) for income taxes 0.12 0.04 0.05 0.04 0.12 0.25 0.02 0.06 0.06 0.08 0.22 (0.01) Other (income) expense, net (0.04) (0.04) - (0.01) (0.07) (0.11) - 0.03 (0.15) 0.05 (0.07) (0.06) Depreciation 0.09 0.02 0.03 0.03 0.03 0.10 0.03 0.03 0.04 0.05 0.14 0.05 (Gain) loss on disposal of property plant and equipment(2) - - - - - - - - 0.03 - 0.03 - Restructuring, impairment and related charges(3) - - - - - - - - - - - 0.46 Stock-based compensation 0.41 0.12 0.17 0.18 - 0.48 0.13 0.18 0.14 0.09 0.55 0.12 Adjusted EBITDA per share, diluted(1) $1.39 $0.20 $0.37 $0.33 $0.24 $1.15 $0.11 $ 0.45 $0.33 $(0.42) $0.47 $(0.53) Weighted average shares outstanding - Diluted 49,380 49,500 49,516 49,370 49,242 49,427 48,907 49,811 49,731 49,266 49,597 49,344 (IN 000’S) UNAUDITED Reconciliation of Non-GAAP Financial Measures First Quarter 2025 (1) Adjusted EBITDA per diluted share may not add due to rounding (2) The Q3-2024 noncash write-off of $1.6M was related to the former EVO Experience Center (3) This was related to severance, consulting expenses and impairment on operating leases, machinery and equipment, leasehold improvements and internally developed software