April 2025 FIRST QUARTER 2025 Nasdaq: LNKB ir.linkbancorp.com

IMPORTANT INFORMATION / DISCLAIMERS LINKBANCORP, Inc. (Nasdaq: LNKB) (“LINKBANCORP” or the “Company”) is the parent company of LINKBANK (the “Bank”). Company and Bank data reflect the November 30, 2023 effective date of Partners Bancorp, Inc. (“Partners”) merger with and into the Company and the merger of Partners Bancorp’s the Bank of Delmarva & Virginia Partners Bank subsidiaries with and into LINKBANK (the “Merger”). Given that the Merger with Partners was completed on November 30, 2023, fourth quarter 2023 results do not represent a full quarter of comparable combined earnings. Reported results prior to the fourth quarter of 2023 reflect legacy LINKBANCORP results only. Financial data for the most recent quarter (“MRQ”) and last twelve months (“LTM”) is for periods ended March 31, 2025. Market-pricing data is as of April 24, 2025 (Source: S&P Capital IQ Pro). Forward looking statements: This presentation may contain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of current or historical fact and involve substantial risks and uncertainties. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions can be used to identify forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: costs or difficulties associated with newly developed or acquired operations; changes in general economic trends, including inflation, tariffs and changes in interest rates; increased competition; changes in consumer demand for financial services; our ability to control costs and expenses; adverse developments in borrower industries and, in particular, declines in real estate values; changes in and compliance with federal and state laws that regulate our business and capital levels; our ability to raise capital as needed; and the effects of any cybersecurity breaches. The Company does not undertake, and specifically disclaims, any obligation to publicly revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Accordingly, you should not place undue reliance on forward-looking statements. Disclosures regarding non-GAAP financial information: To the extent that supplemental Company or Bank financial metrics presented herein are not financial measures under generally accepted accounting principles (“GAAP”), these non-GAAP metrics will be reconciled with comparable GAAP measures in the appendix to this presentation. Management may use non-GAAP measures in the analysis of the performance of the Company or the Bank, and they should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP.

Organized in 2018 with acquisition and recapitalization of distressed Stonebridge Bank High quality talent, strong culture & relationship-oriented business model Core focus on organic growth and improving profitability through operating leverage LNKB FINANCIAL HIGHLIGHTS Total Assets $2.86 B Market Capitalization $247.4 M Total Loans $2.27 B Dividend Yield 4.53% Total Deposits $2.43 B Insider Ownership 33.6% ROA (MRQ, annualized) 2.19% ROE (MRQ, annualized) 21.90% ROTCE* (MRQ, annualized) 30.10% Company data as of most recent quarter 3/31/25 (“MRQ”) end and market data as of April 24, 2025. *Refer to appendix for reconciliation of this non-GAAP financial measure to its comparable GAAP measures M&A HISTORY MID-ATLANTIC GROWTH FRANCHISE ACQUIROR BANK TARGET BANKS TRANSACTION ANNOUNCE DATE TRANSACTION CLOSE DATE TARGET TOTAL ASSETS AT ANNOUNCE 1. 6/26/2018 10/5/2018 $58 M 2. 12/10/2020 9/18/2021 $437 M 3. 2/22/2023 11/30/2023 $1.6 B LINKBANK is a premier Mid-Atlantic community bank, serving clients throughout central and southeast Pennsylvania, Maryland, Delaware and northern Virginia.

KRISTOFER PAUL - CFO | LINKBANCORP 21 years of bank credit administration and portfolio management experience also includes Susquehanna Bank, Sovereign Bank, and Waypoint Financial Experience in development and maintenance of commercial loan portfolios for more than 6 M&A transactions Named to Next 2021: Most Powerful Women in Banking by American Banker magazine TIFFANIE HORTON - Chief Credit Officer | LINKBANCORP Long track record of industry success Been involved in M&A of more than 10 companies with aggregate deal value surpassing $1.5 billion Successfully transitioned private community banks to public companies on NASDAQ Demonstrated track record of value creation: Waypoint Financial (PA), Tower Bancorp (PA), Sunshine Bancorp (FL) CARL LUNDBLAD - President | LINKBANCORP 28 years of banking, legal and other executive experience Extensive bank executive experience overseeing M&A, strategy development, regulatory and governance matters Strong transaction and value creation history, overseeing sales of Tower Bancorp and Susquehanna Bancshares BRENT SMITH - President | LINKBANK Consistent leader in growth initiatives with 20 years of banking experience Been involved in M&A of more than 5 companies with aggregate deal value surpassing $700 million Led on transformational acquisitions, private placements, debt issuances and branch acquisitions DEE BONORA - Chief Operations and Technology Officer | LINKBANCORP 20+ YEAR HISTORY OF WORKING TOGETHER IN THE MID ATLANTIC REGION 22 years of banking and financial services industry experience Oversaw financial reporting and accounting of various public companies, including Hersha Hospitality Trust and Tower Bancorp Involved in transactions totaling over $700M SEASONED EXECUTIVE TEAM Strong background in bank operations, data management and systems architecture Record of value creation through efficiencies, bringing a wealth of technology and software engineering experience 30 years of technology experience in highly regulated industries also includes Orrstown Bank and Rite Aid Corp ANDREW SAMUEL - CEO | LINKBANCORP & LINKBANK CATE EISEL - Chief Risk Officer | LINKBANK Over 10 years of risk management experience Served in a variety of roles with the FDIC including financial institution examiner, senior bank examination training specialist and supervisory training administrator

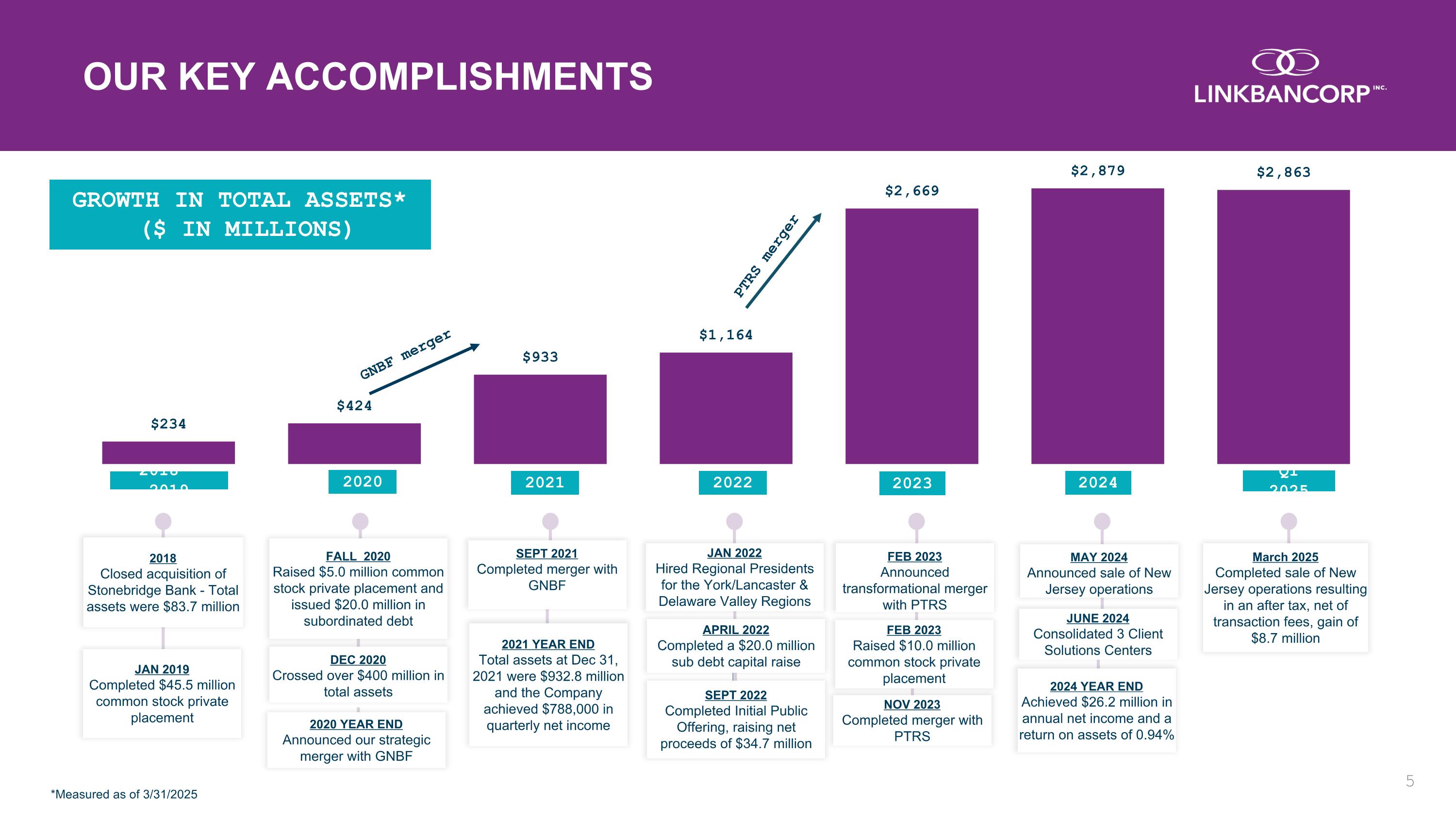

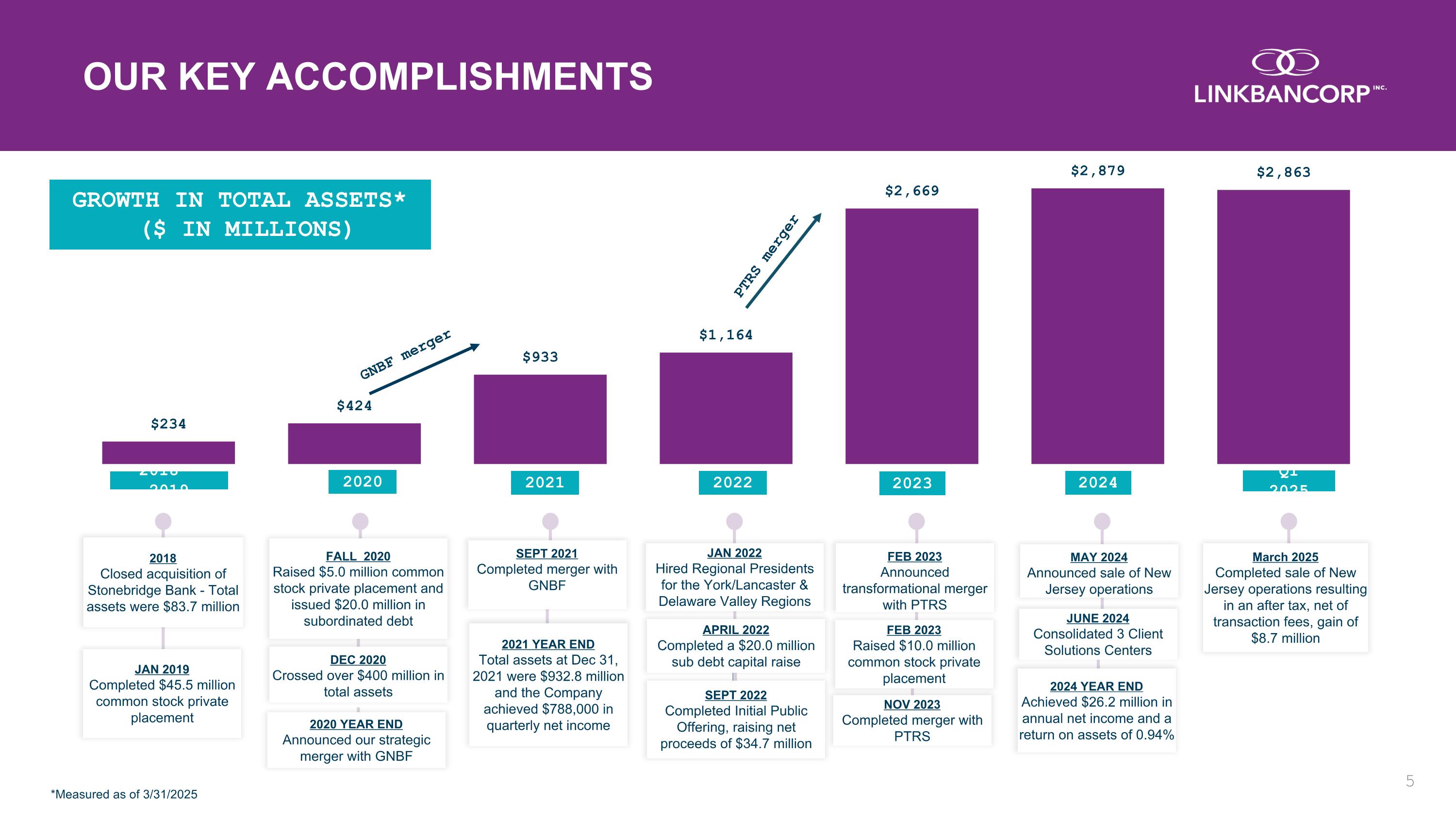

OUR KEY ACCOMPLISHMENTS GROWTH IN TOTAL ASSETS* ($ IN MILLIONS) 2018 - 2019 2020 2022 2021 2023 GNBF merger 2018 Closed acquisition of Stonebridge Bank - Total assets were $83.7 million JAN 2019 Completed $45.5 million common stock private placement FALL 2020 Raised $5.0 million common stock private placement and issued $20.0 million in subordinated debt SEPT 2021 Completed merger with GNBF 2021 YEAR END Total assets at Dec 31, 2021 were $932.8 million and the Company achieved $788,000 in quarterly net income SEPT 2022 Completed Initial Public Offering, raising net proceeds of $34.7 million APRIL 2022 Completed a $20.0 million sub debt capital raise JAN 2022 Hired Regional Presidents for the York/Lancaster & Delaware Valley Regions DEC 2020 Crossed over $400 million in total assets 2020 YEAR END Announced our strategic merger with GNBF Q1 2025 FEB 2023 Announced transformational merger with PTRS FEB 2023 Raised $10.0 million common stock private placement PTRS merger NOV 2023 Completed merger with PTRS *Measured as of 3/31/2025 2024 MAY 2024 Announced sale of New Jersey operations JUNE 2024 Consolidated 3 Client Solutions Centers 2024 YEAR END Achieved $26.2 million in annual net income and a return on assets of 0.94% March 2025 Completed sale of New Jersey operations resulting in an after tax, net of transaction fees, gain of $8.7 million

Central to the LINKBANCORP culture and brand are the core “L-I-N-K” values, which support the mission of positively impacting lives. In pursuit of the mission, LINKBANCORP: Invests in the development of strong future leaders for the banking industry and our communities Contributes to economically and socially flourishing communities Seeks to demonstrate the continued viability of and integral role of community banking for our economic and social development Our well-defined brand reflects a purpose-driven, entrepreneurial and relational organization that is highly responsive to client needs and attracts best-in-class bank professionals. Our focus on culture and brand supports: Enhanced productivity Lower employee turnover Consistent brand experience High customer loyalty DIFFERENTIATED BRAND & CULTURE The LINKBANCORP corporate culture is a differentiating factor in the Company’s demonstrated growth and ability to gain market share.

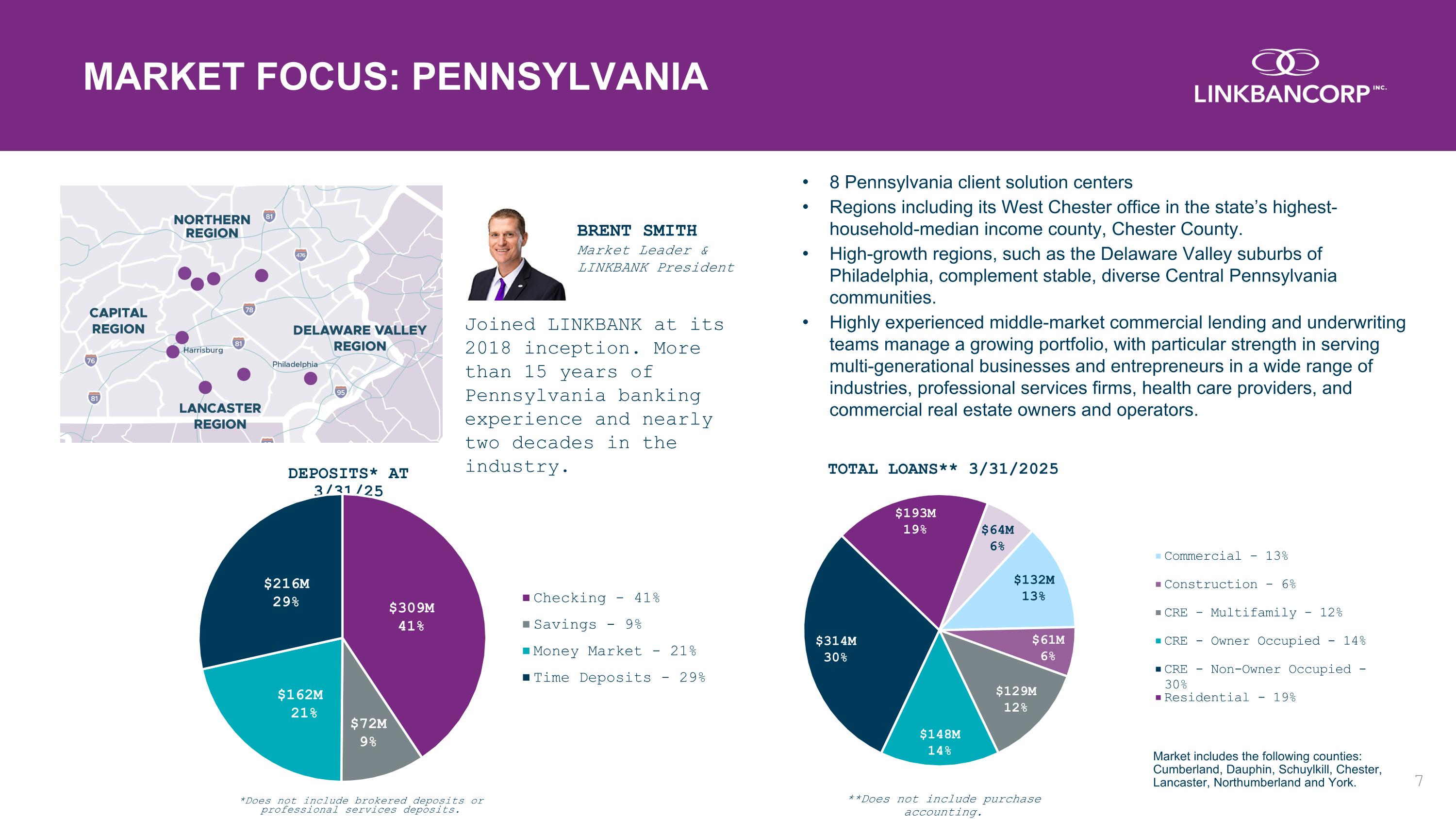

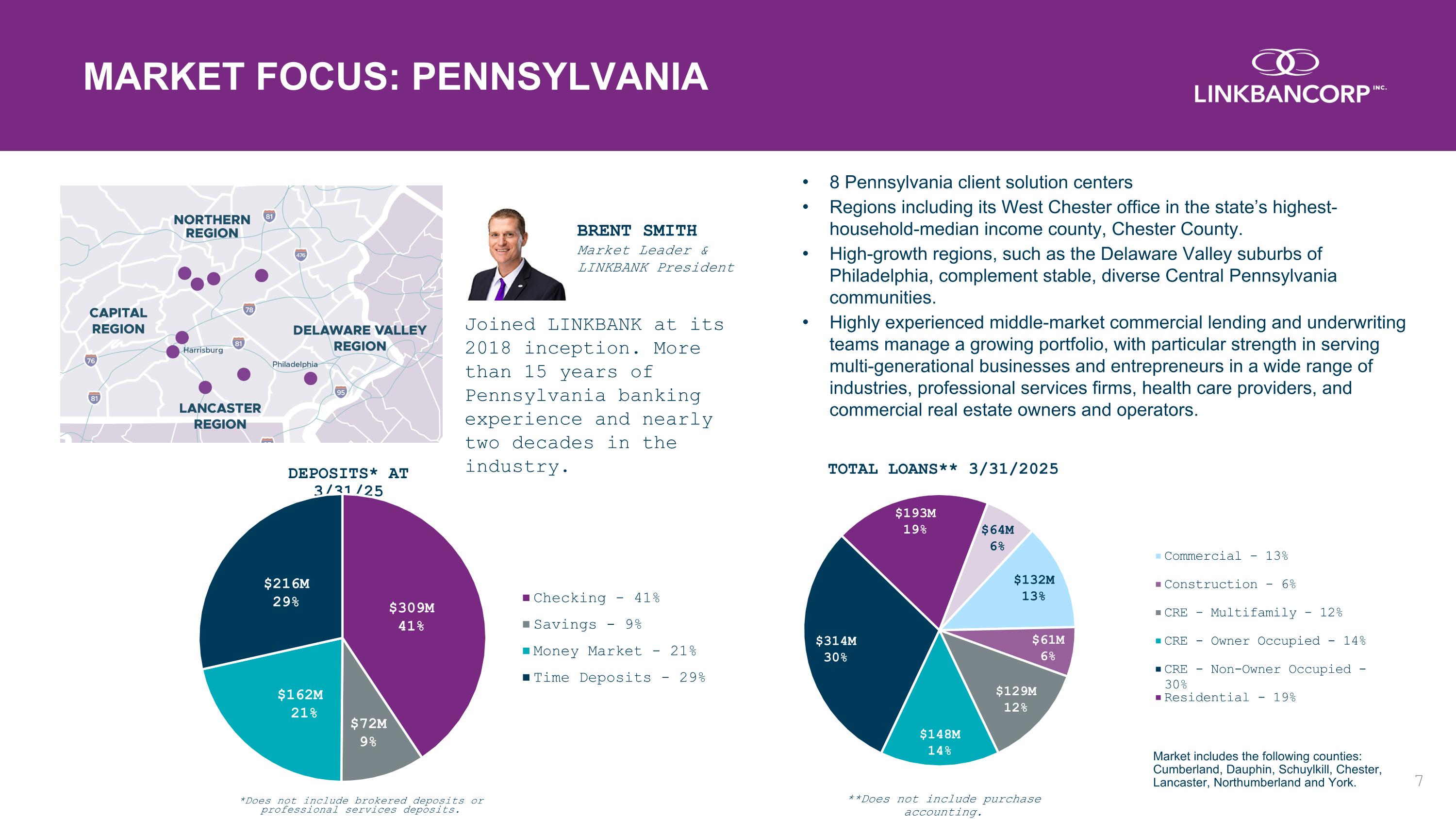

MARKET FOCUS: PENNSYLVANIA BRENT SMITH Market Leader &LINKBANK President Joined LINKBANK at its 2018 inception. More than 15 years of Pennsylvania banking experience and nearly two decades in the industry. 8 Pennsylvania client solution centers Regions including its West Chester office in the state’s highest-household-median income county, Chester County. High-growth regions, such as the Delaware Valley suburbs of Philadelphia, complement stable, diverse Central Pennsylvania communities. Highly experienced middle-market commercial lending and underwriting teams manage a growing portfolio, with particular strength in serving multi-generational businesses and entrepreneurs in a wide range of industries, professional services firms, health care providers, and commercial real estate owners and operators. **Does not include purchase accounting. TOTAL LOANS** 3/31/2025 DEPOSITS* AT 3/31/25 *Does not include brokered deposits or professional services deposits. Market includes the following counties: Cumberland, Dauphin, Schuylkill, Chester, Lancaster, Northumberland and York.

MARKET FOCUS: MARYLAND & DELAWARE JOHN BREDA Maryland & Delaware Market CEO Joined LINKBANK through merger with Partners, where he served as President & CEO, including its subsidiary The Bank of Delmarva. More than 29 years of Maryland and Delaware banking experience and 38 years of industry experience. 12 Maryland and Delaware client solution centers High-growth regions, including the Central Maryland Baltimore-Washington corridor and Annapolis, complement Delmar Peninsula communities. Highly experienced middle-market commercial lending and underwriting teams manage a growing portfolio, with particular strength in tourism, real estate development, hospitality and small family-owned businesses. TOTAL LOANS** AT 3/31/2025 DEPOSITS* AT 3/31/2025 *Does not include brokered deposits or professional services deposits Market includes the following counties: Sussex, Wicomico, Charles, Worcester, and Anne Arundel **Does not include purchase accounting. 8

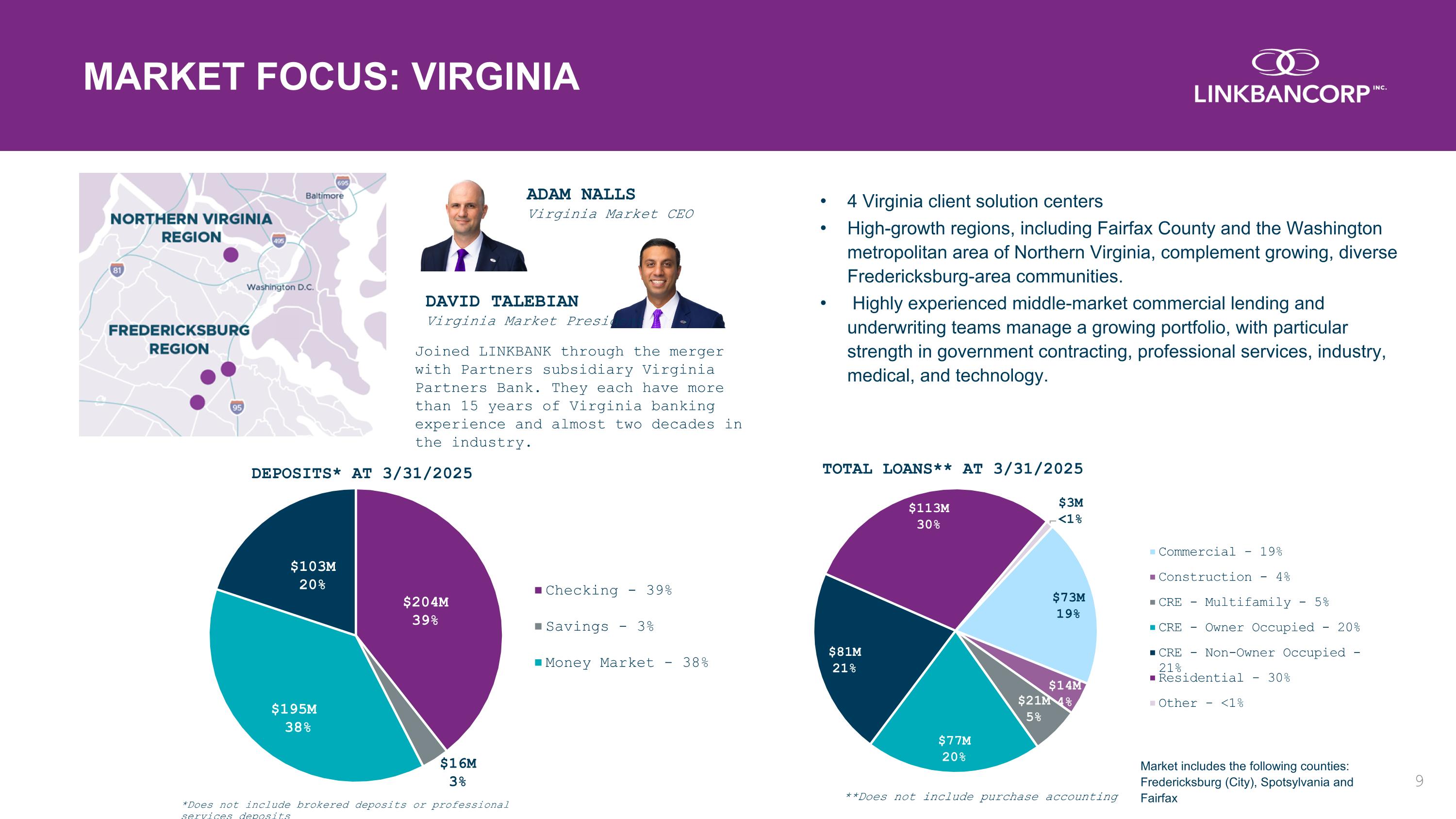

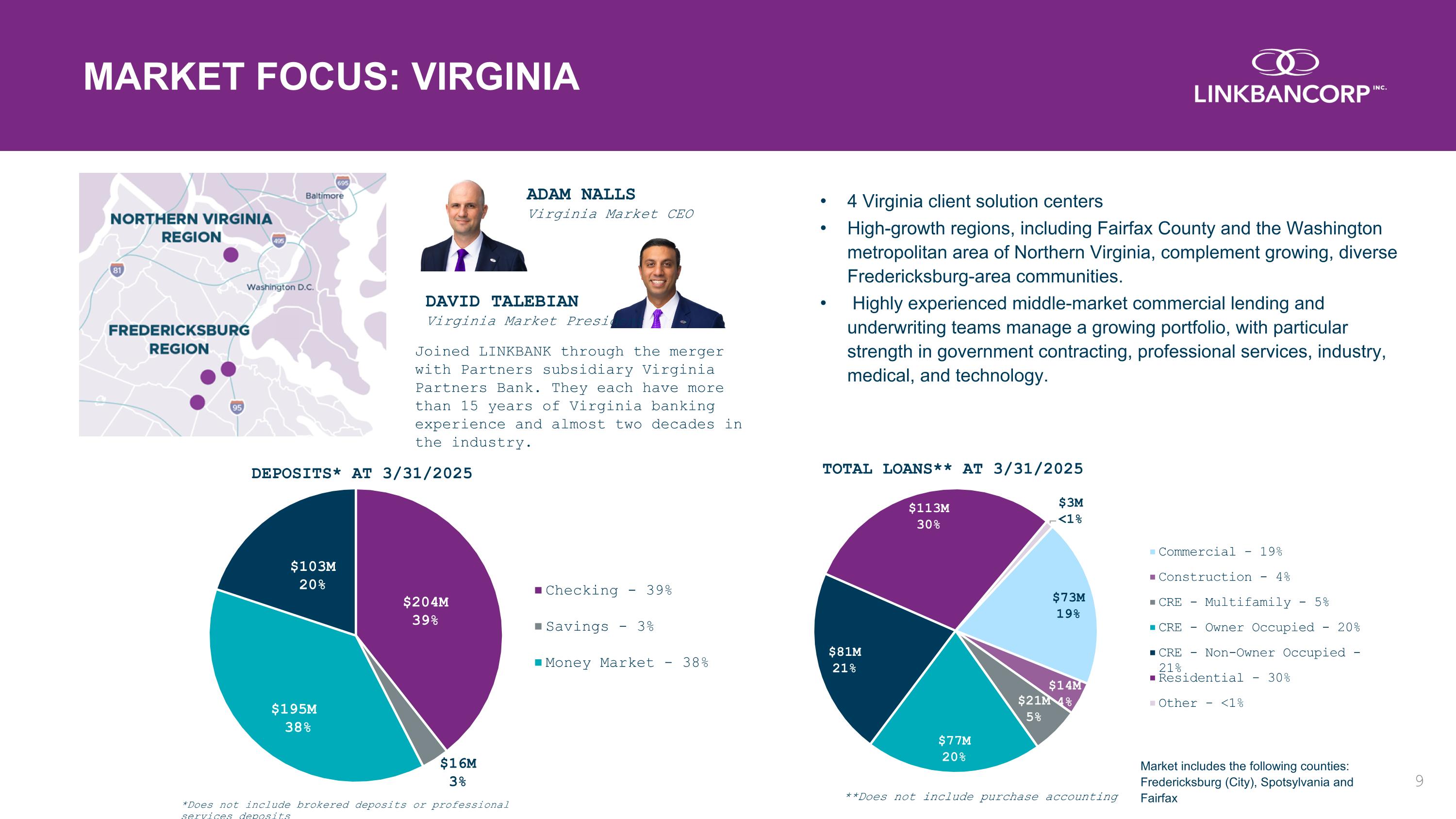

MARKET FOCUS: VIRGINIA ADAM NALLS Virginia Market CEO DAVID TALEBIAN Virginia Market President LOANS* 4 Virginia client solution centers High-growth regions, including Fairfax County and the Washington metropolitan area of Northern Virginia, complement growing, diverse Fredericksburg-area communities. Highly experienced middle-market commercial lending and underwriting teams manage a growing portfolio, with particular strength in government contracting, professional services, industry, medical, and technology. DEPOSITS Joined LINKBANK through the merger with Partners subsidiary Virginia Partners Bank. They each have more than 15 years of Virginia banking experience and almost two decades in the industry. **Does not include purchase accounting TOTAL LOANS** AT 3/31/2025 DEPOSITS* AT 3/31/2025 *Does not include brokered deposits or professional services deposits Market includes the following counties: Fredericksburg (City), Spotsylvania and Fairfax

EXECUTING ESTABLISHED STRATEGY TO MAINTAIN A BRANCH-LITE MODEL THAT TAKES FULL ADVANTAGE OF: LINKBANCORP’s organic growth engine, strategically located regional Client Solutions Centers with no teller lines and 3-4 FTEs, and innovative technology. AT THE END OF Q1 2025, LINKBANCORP: Maintained 24 client solutions centers, following the opening of a full-service client solutions center in Annapolis, MD, enhancing growth initiatives and capabilities in Central Maryland. Completed the sale of New Jersey operations, including three branches and associated loans and deposits. ONGOING, LINKBANCORP INTENDS TO: Continuously evaluate its retail operations for opportunities to leverage andoptimize efficiencies while maintaining its commitment to providing exceptional service to the customers and communities it serves. Target average deposits per client solutions center of greater than $100 million. EXECUTING A BRANCH-LITE STRATEGY +

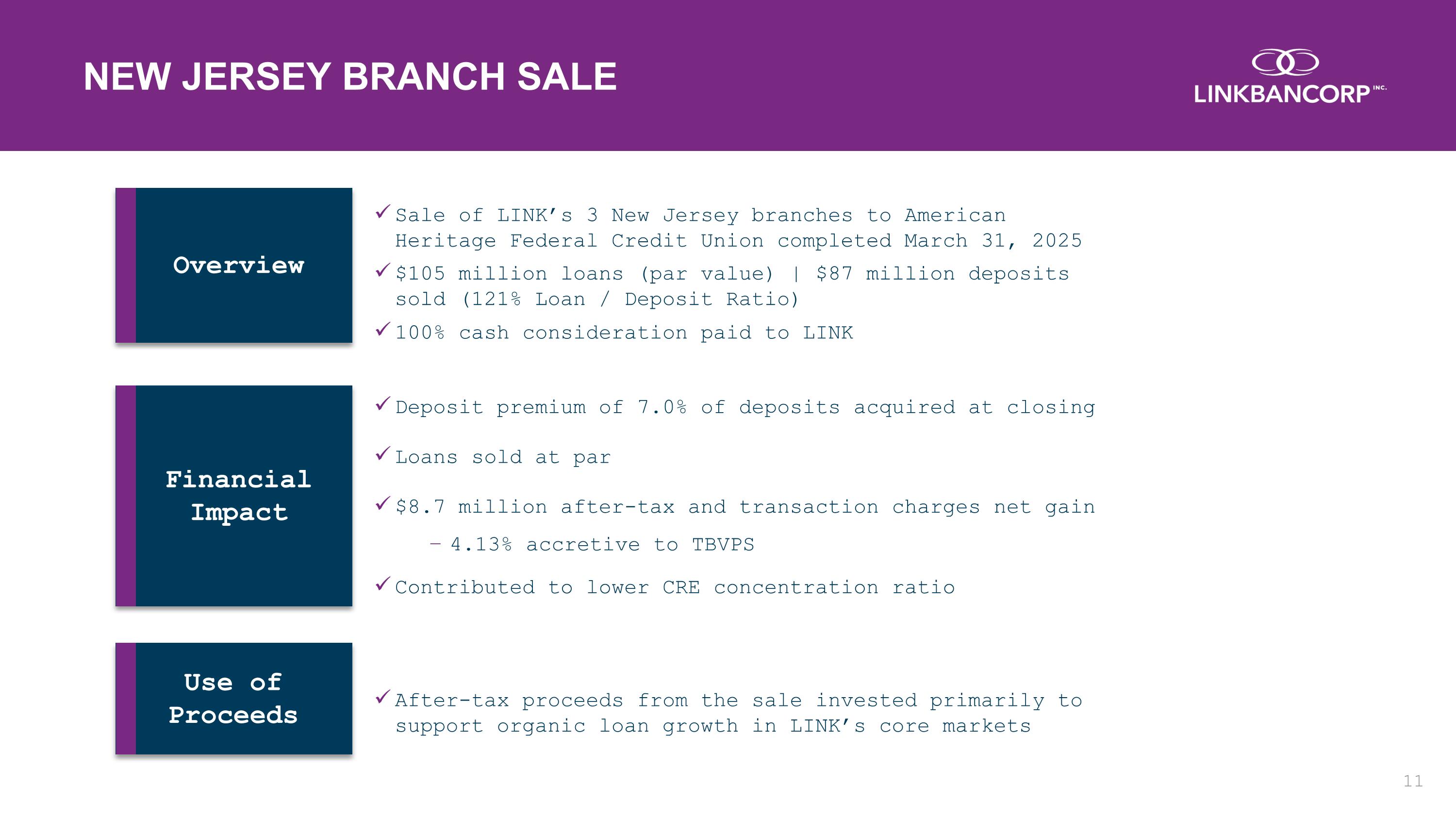

NEW JERSEY BRANCH SALE Financial Impact Use of Proceeds Overview After-tax proceeds from the sale invested primarily to support organic loan growth in LINK’s core markets Sale of LINK’s 3 New Jersey branches to American Heritage Federal Credit Union completed March 31, 2025 100% cash consideration paid to LINK $105 million loans (par value) | $87 million deposits sold (121% Loan / Deposit Ratio) Loans sold at par $8.7 million after-tax and transaction charges net gain 4.13% accretive to TBVPS Contributed to lower CRE concentration ratio Deposit premium of 7.0% of deposits acquired at closing

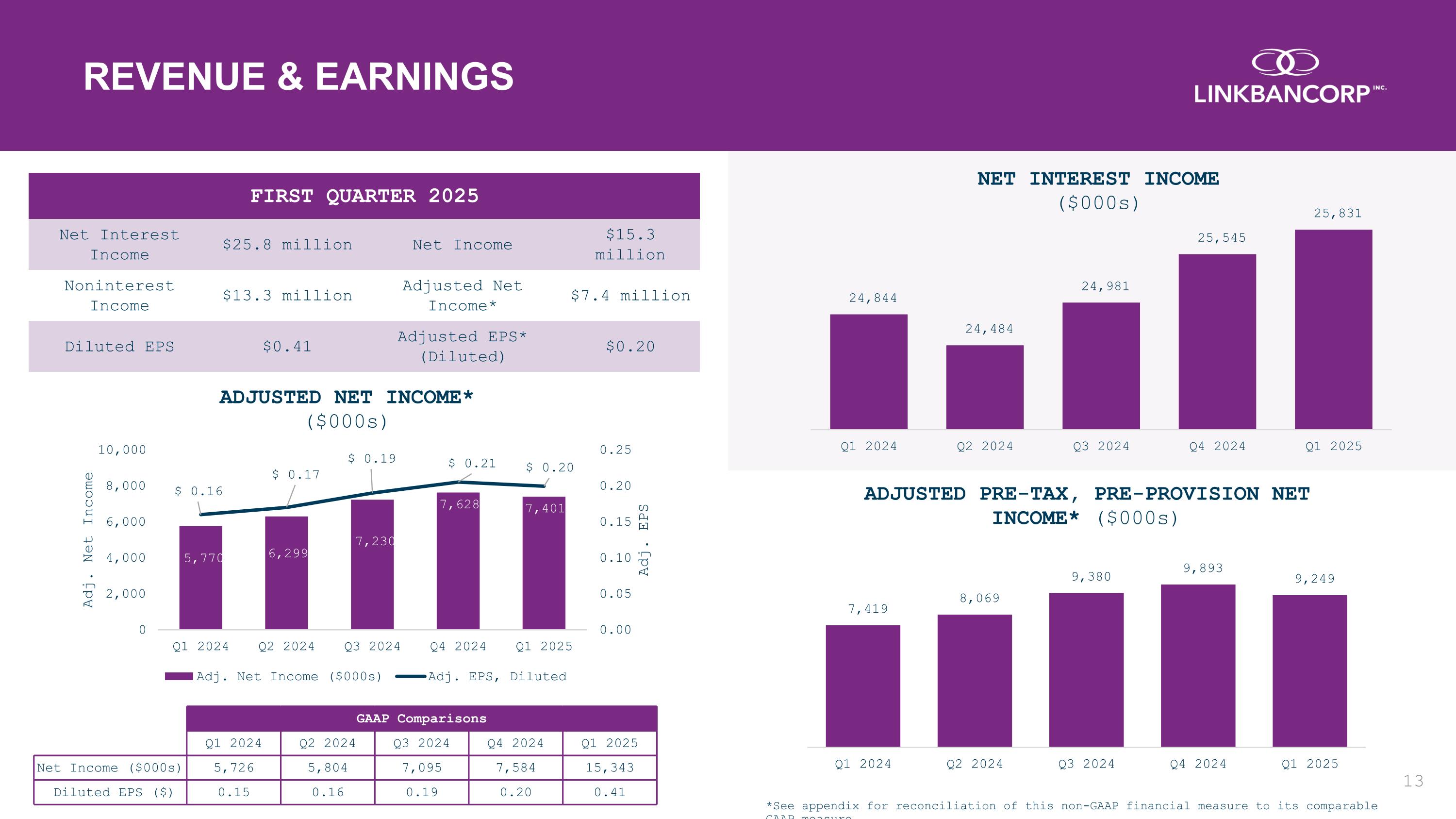

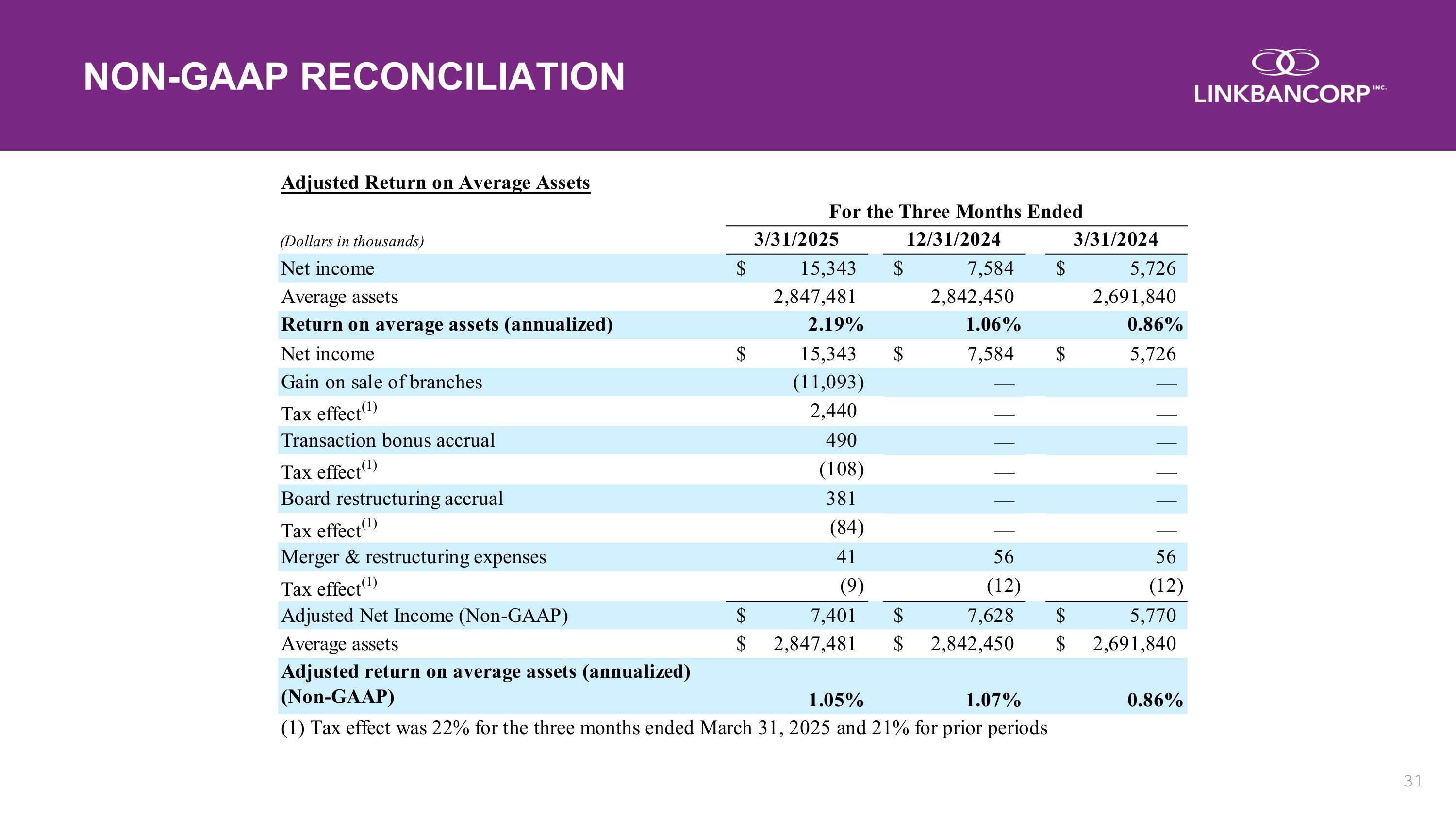

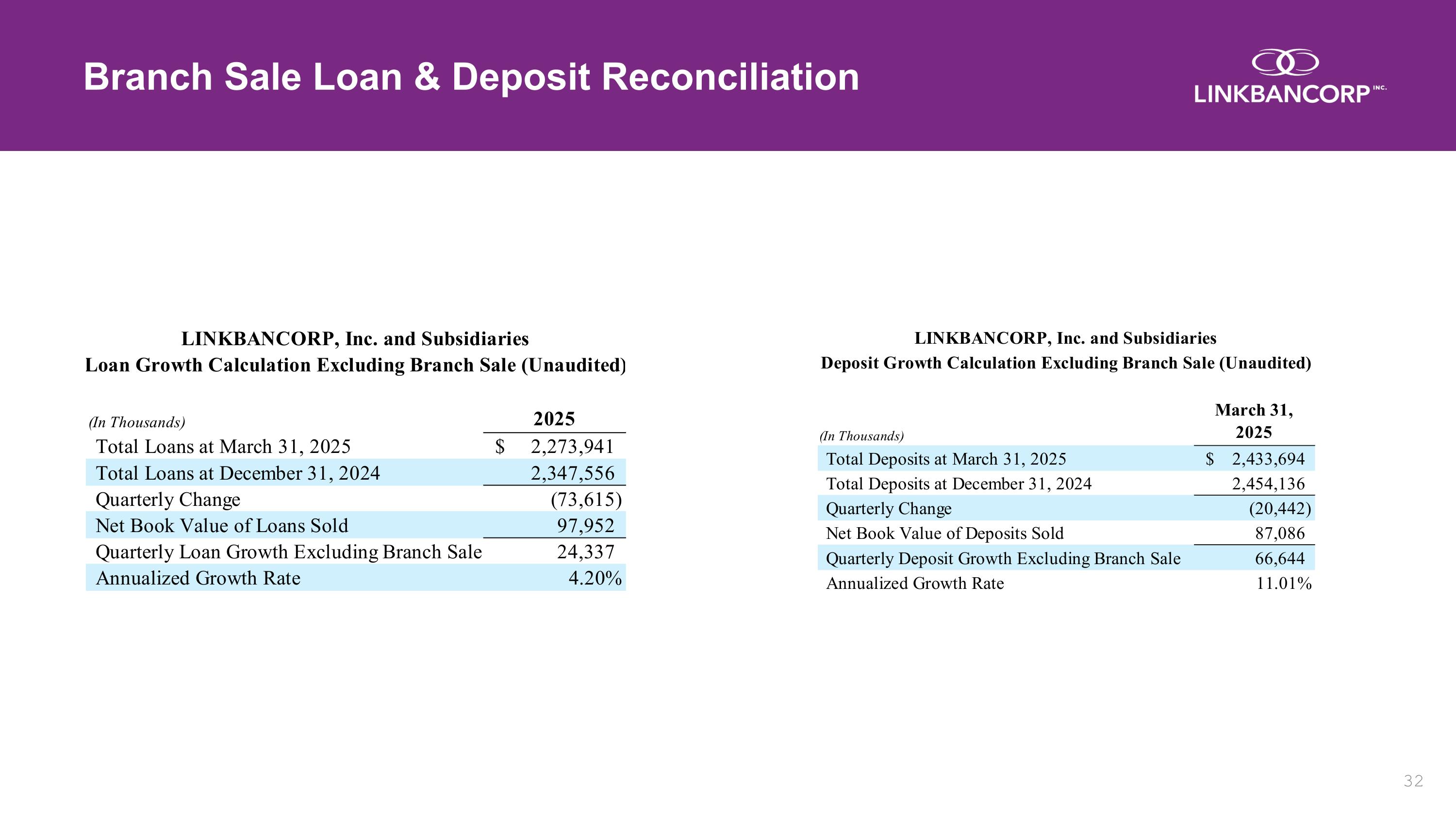

FIRST QUARTER 2025 HIGHLIGHTS2 Net income equaled $15.3 million with adjusted pre-tax pre-provision net income of $9.06 million1. Annualized return on assets and adjusted return on assets were 2.19% and 1.05%1, respectively, for the first quarter. Tangible book value increased from $5.361 at December 31, 2024 to $5.801 at March 31, 2025 with book value per share increasing from $7.50 to $7.87, respectively. Total deposits were $2.43 billion at March 31, 2025 compared to $2.36 billion at December 31, 2024, representing an increase of $66.6 million after adjusting for the Branch Sale3. Average deposits increased $5.3 million quarter over quarter to $2.38 billion at March 31, 2025. Total loans increased $24.0 million over the quarter to $2.27 billion at March 31, 2025 after adjusting for the Branch Sale3. BALANCE SHEET INCOME STATEMENT $25.8 million in net interest income Noninterest income of $13.3 million Net income of $15.3 million Earnings per diluted share of $0.41 and adjusted earnings per diluted share of $0.201 FIRST QUARTER 2025 $2.86 billion total assets $26.6 million allowance for credit losses - loans Total shareholders’ equity of $294.1 million 3.94% Net Interest Margin 2.19% Return on Assets 1.05% Adjusted Return on Assets1 $7.87 $5.80 BVPS TBVPS1 $0.41 Earnings per Diluted Share $0.20 Adjusted Earnings per Diluted Share1 1 See appendix for reconciliation of this non-GAAP financial measure to its comparable GAAP measure. 2 Balance Sheet comparison between March 31, 2025 and December 31, 2024 and comparisons between Q1 2025 and Q4 2024. 3 See Appendix for Reconciliation to Total Loan and Deposit growth adjusting for the Branch Sale.

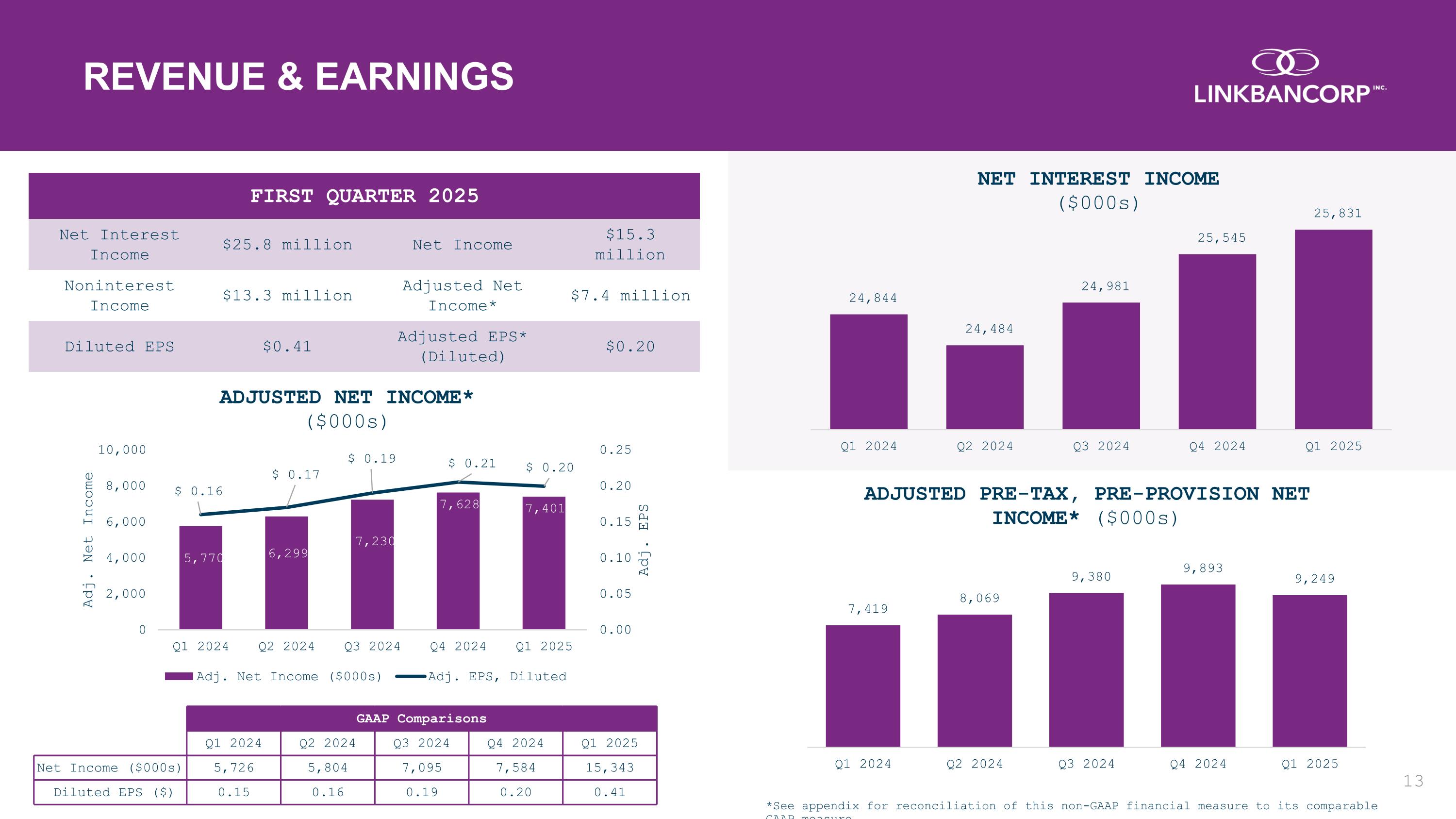

*See appendix for reconciliation of this non-GAAP financial measure to its comparable GAAP measure. REVENUE & EARNINGS FIRST QUARTER 2025 Net Interest Income $25.8 million Net Income $15.3 million Noninterest Income $13.3 million Adjusted Net Income* $7.4 million Diluted EPS $0.41 Adjusted EPS* (Diluted) $0.20 GAAP Comparisons Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Net Income ($000s) 5,726 5,804 7,095 7,584 15,343 Diluted EPS ($) 0.15 0.16 0.19 0.20 0.41

FIRST QUARTER 2025 HIGHLIGHTS* Net interest margin expanded to 3.94% for the first quarter of 2025 from 3.85% for the fourth quarter of 2024. Cost of funds decreased to 2.29% for the first quarter of 2025 compared to 2.32% for the fourth quarter of 2024 with cost of deposits decreasing from 2.15% for the fourth quarter of 2024 to 2.10% for the first quarter of 2025. NET INTEREST MARGIN *Comparisons between Q1 2025 and Q4 2024

Noninterest income was $13.26 million in the first quarter of 2025 compared to $2.59 million in the fourth quarter of 2024, and $1.79 million in the first quarter of 2024, respectively. Primary increase in noninterest income between Q1 2025 and Q4 2024 is a result of the Branch Sale resulting in a pre-tax gain of $11.1 million. The decrease in service charges from Q4 2024 to Q1 2025 is attributable to a decline in service charges on deposits primarily related to a decrease in account level fees and interchange revenue. NONINTEREST INCOME

Noninterest expense was $19.7 million in the first quarter of 2025 compared to $18.3 million in the fourth quarter of 2024. Adjusted noninterest expense was $18.7 million* for the first quarter of 2025 which was an increase from $18.3 million* for the fourth quarter of 2024 and a decrease compared to $19.2 million* for the first quarter of 2024. Adjusted non-interest expense for the first quarter of 2025 excludes accruals for director fees to departing directors included in other expense, as well as bonus expenses related to completion of the Branch Sale included in salaries and employee benefits, and other merger and restructuring costs. NONINTEREST EXPENSE *See appendix for reconciliation of this non-GAAP financial measure to its comparable GAAP measure.

FIRST QUARTER 2025 DEPOSIT TRENDS Cost of deposits was 2.10% for the first quarter. 26.5% of total deposits are noninterest bearing deposits. Expected to continue comparing favorably to $2B-$5B asset commercial bank peers Total deposits were $2.43 billion at March 31, 2025 compared to $2.36 billion at December 31, 2024, representing an increase of $66.6 million after adjusting for the Branch Sale**. Average deposits increased $5.3 million quarter over quarter to $2.38 billion at March 31, 2025. VALUABLE CORE DEPOSIT FRANCHISE *Excludes deposits held for sale at December 31, 2024 **See Appendix for Reconciliation to Total Deposit growth adjusting for the Branch Sale

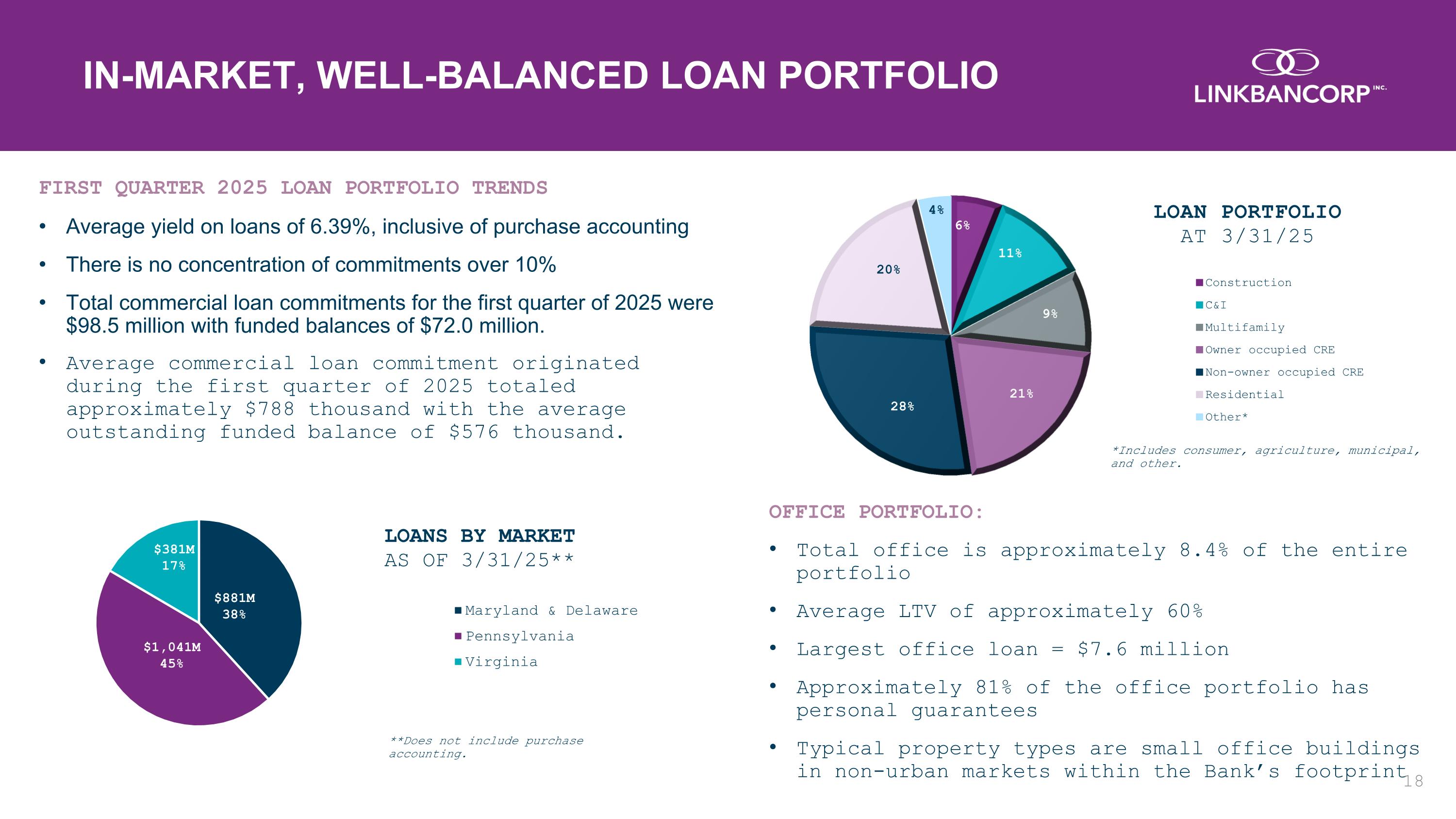

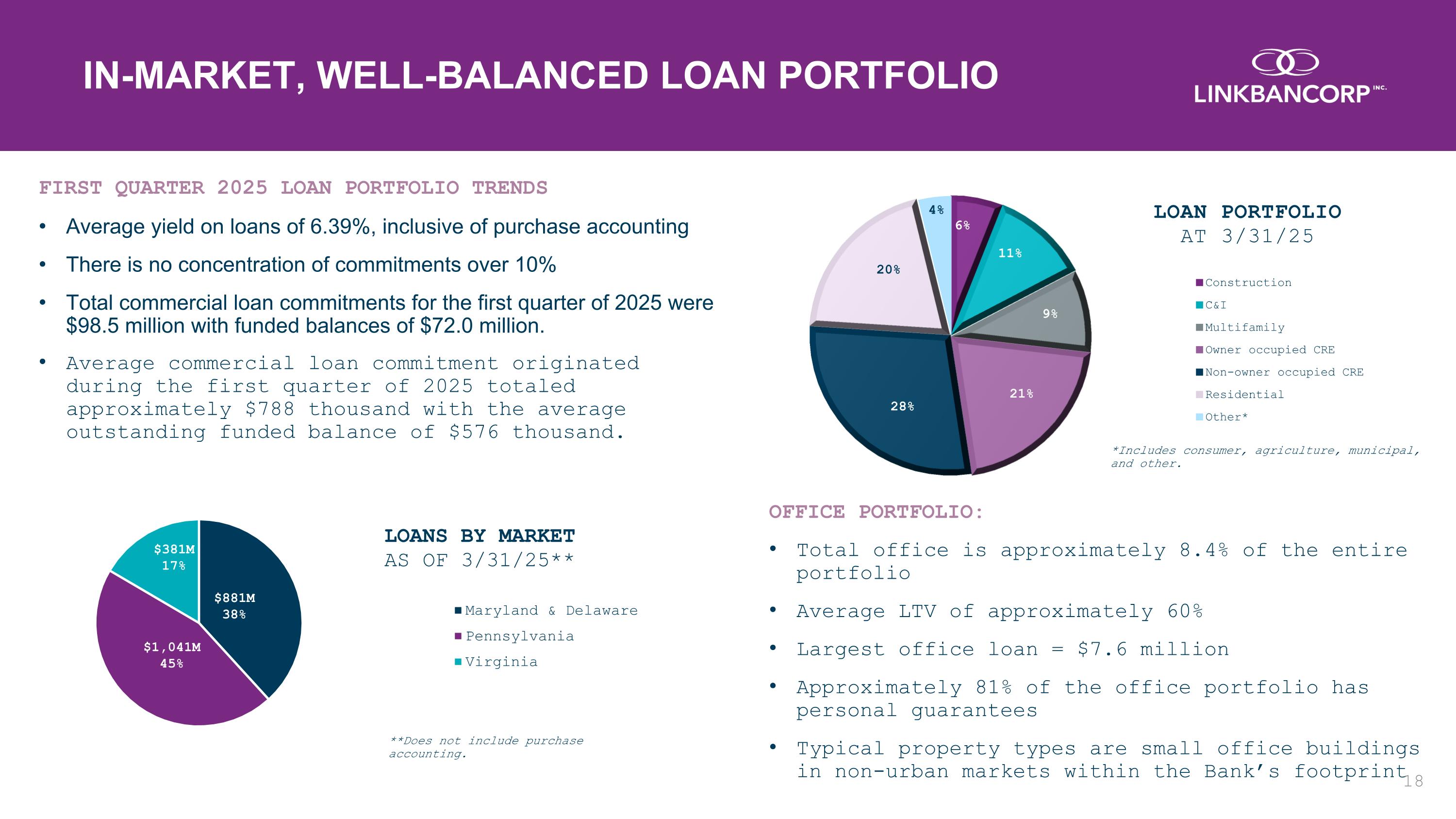

FIRST QUARTER 2025 LOAN PORTFOLIO TRENDS Average yield on loans of 6.39%, inclusive of purchase accounting There is no concentration of commitments over 10% Total commercial loan commitments for the first quarter of 2025 were $98.5 million with funded balances of $72.0 million. Average commercial loan commitment originated during the first quarter of 2025 totaled approximately $788 thousand with the average outstanding funded balance of $576 thousand. IN-MARKET, WELL-BALANCED LOAN PORTFOLIO **Does not include purchase accounting. OFFICE PORTFOLIO: Total office is approximately 8.4% of the entire portfolio Average LTV of approximately 60% Largest office loan = $7.6 million Approximately 81% of the office portfolio has personal guarantees Typical property types are small office buildings in non-urban markets within the Bank’s footprint *Includes consumer, agriculture, municipal, and other.

ASSET QUALITY

Committed to a quarterly dividend of $0.075 per share of common stock through the merger with GNB Financial in 2021 Capital ratios anticipated to increase with earnings growth trajectory $220.2 million cash & cash equivalents at March 31, 2025 Total available funding of $1.35 billion at March 31, 2025 CAPITAL MANAGEMENT AND LIQUIDITY *Wholesale deposit capacity is calculated as 10% of total deposits, less current outstanding brokered **See appendix for reconciliation of this non-GAAP financial measure to its comparable GAAP measure.

Targeted loan growth of 5% – 8% for 2025, excluding impact of the Branch Sale Self-funding loan growth with organic deposit growth, with a targeted loan to deposit ratio of 90% - 95% Net Interest Margin expectation 3.90% - 4.00% for the full year 2025 Targeting 1.10% core operating ROA for full year 2025 (excluding impact of the Branch Sale) Targeting noninterest expense to average assets of 2.50% - 2.55% for full year 2025 Assume effective tax rate of 22% 2025 OUTLOOK

Strong alignment with shareholder returns – 33.6% insider ownership Disciplined underwriting & robust enterprise risk management Highly opportunistic M&A strategy with disciplined acquisition criteria Nimble and innovative tech operating platform focused on modular architecture and cloud-based infrastructure Focused organic growth strategy, uniquely positioned in the attractive and coveted mid-Atlantic market (Harrisburg > Philadelphia > Baltimore > D.C. corridor) Seasoned executive team, led by Andrew Samuel, has significant experience and success with building, operating and creating shareholder value in the markets of focus Strong funding franchise coupled with best-in-class loan growth engine implementing a branch-lite model INVESTMENT RATIONALE

THANK YOU!

CONTACT US: NICK WEST Director, Corporate Development IR@linkbancorp.com | (717) 678-7935

APPENDIX

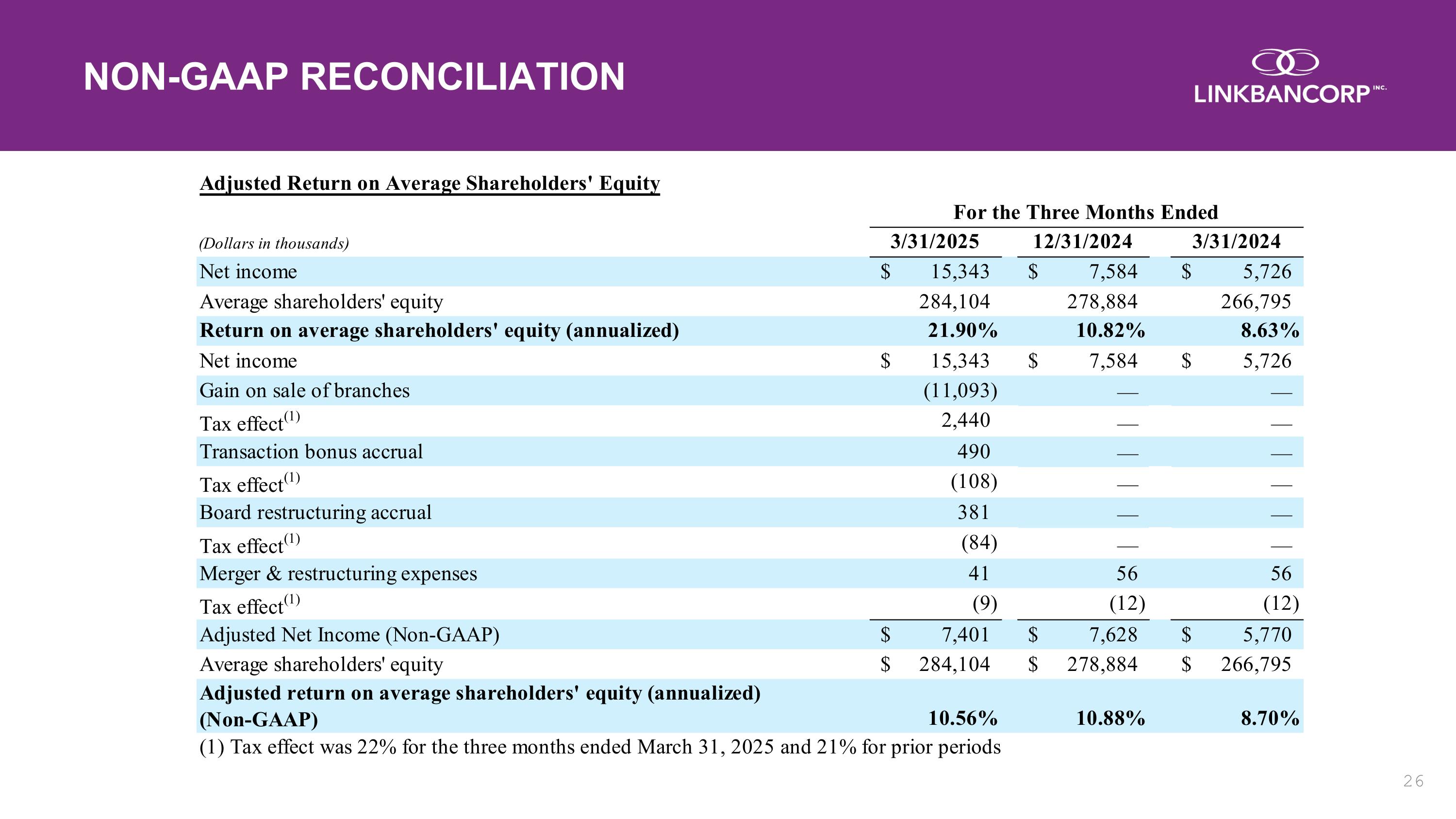

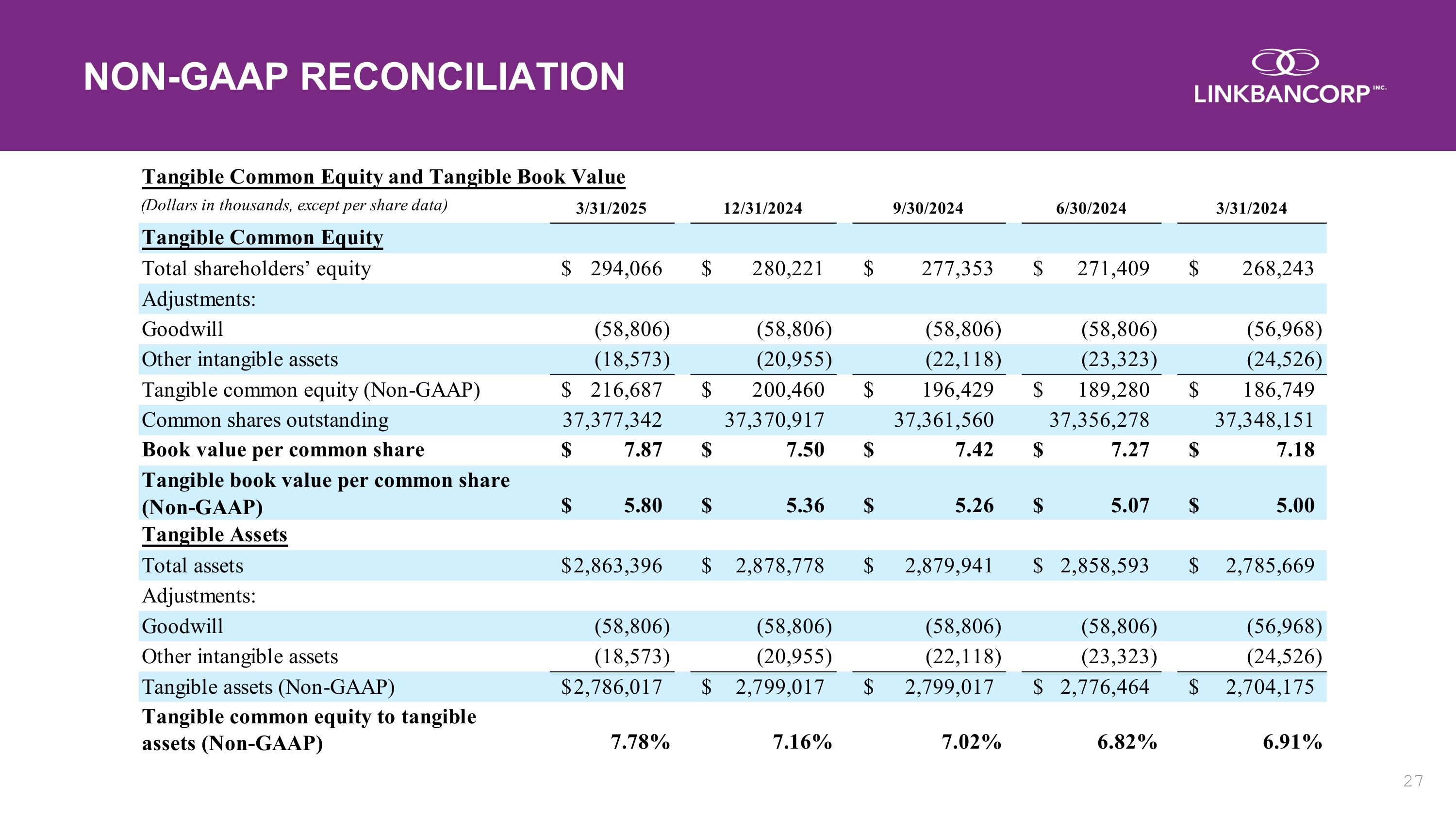

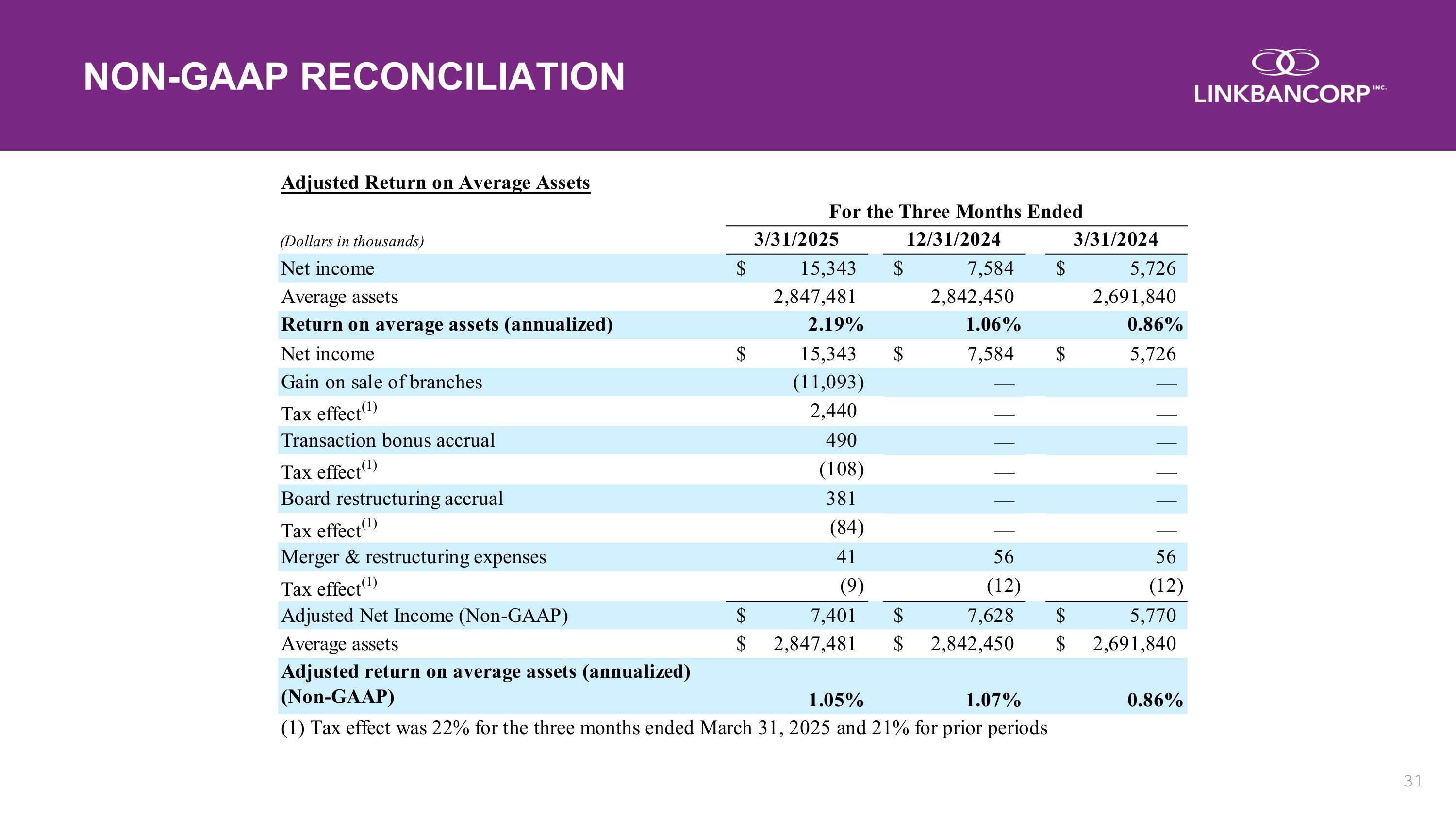

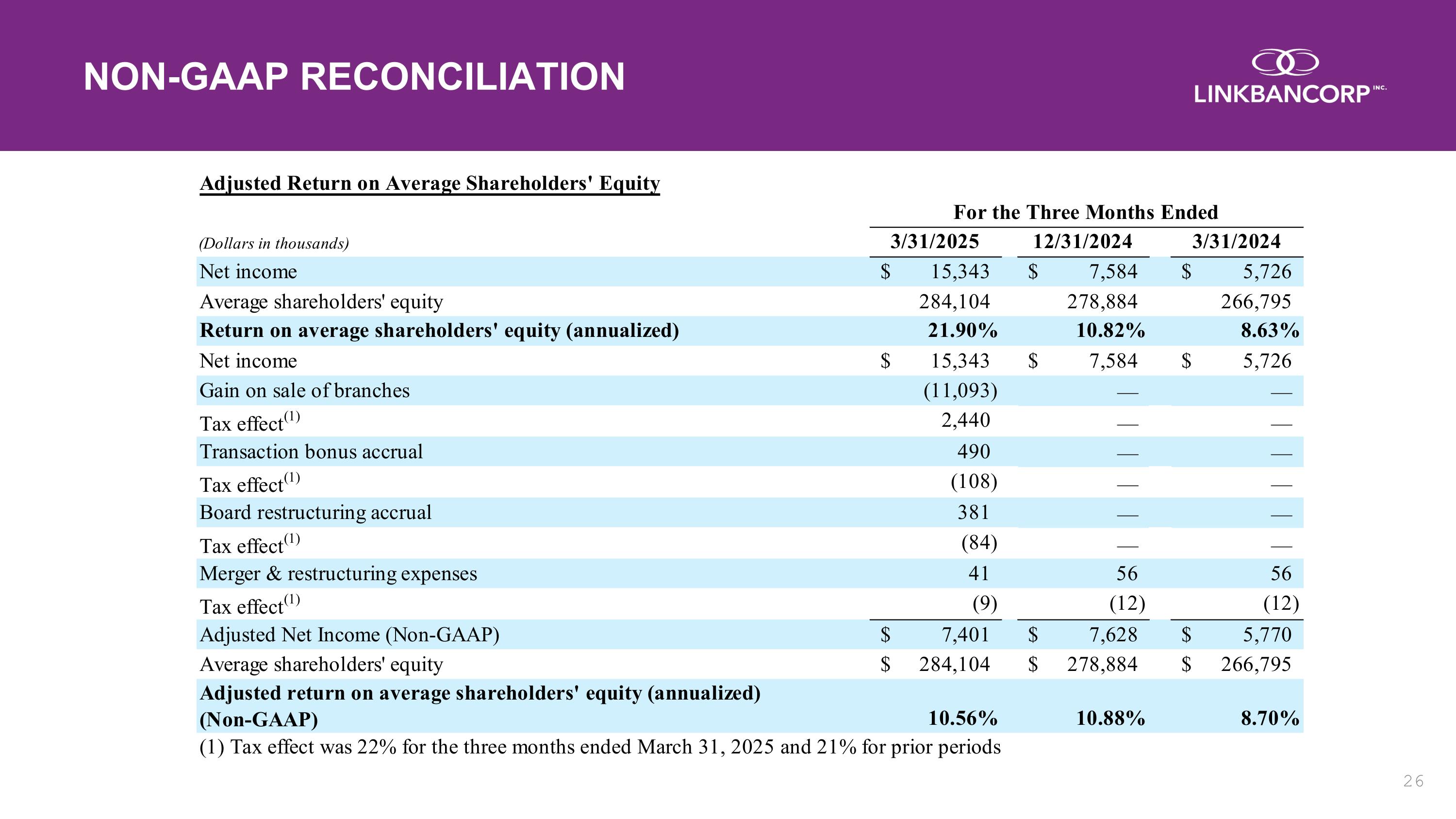

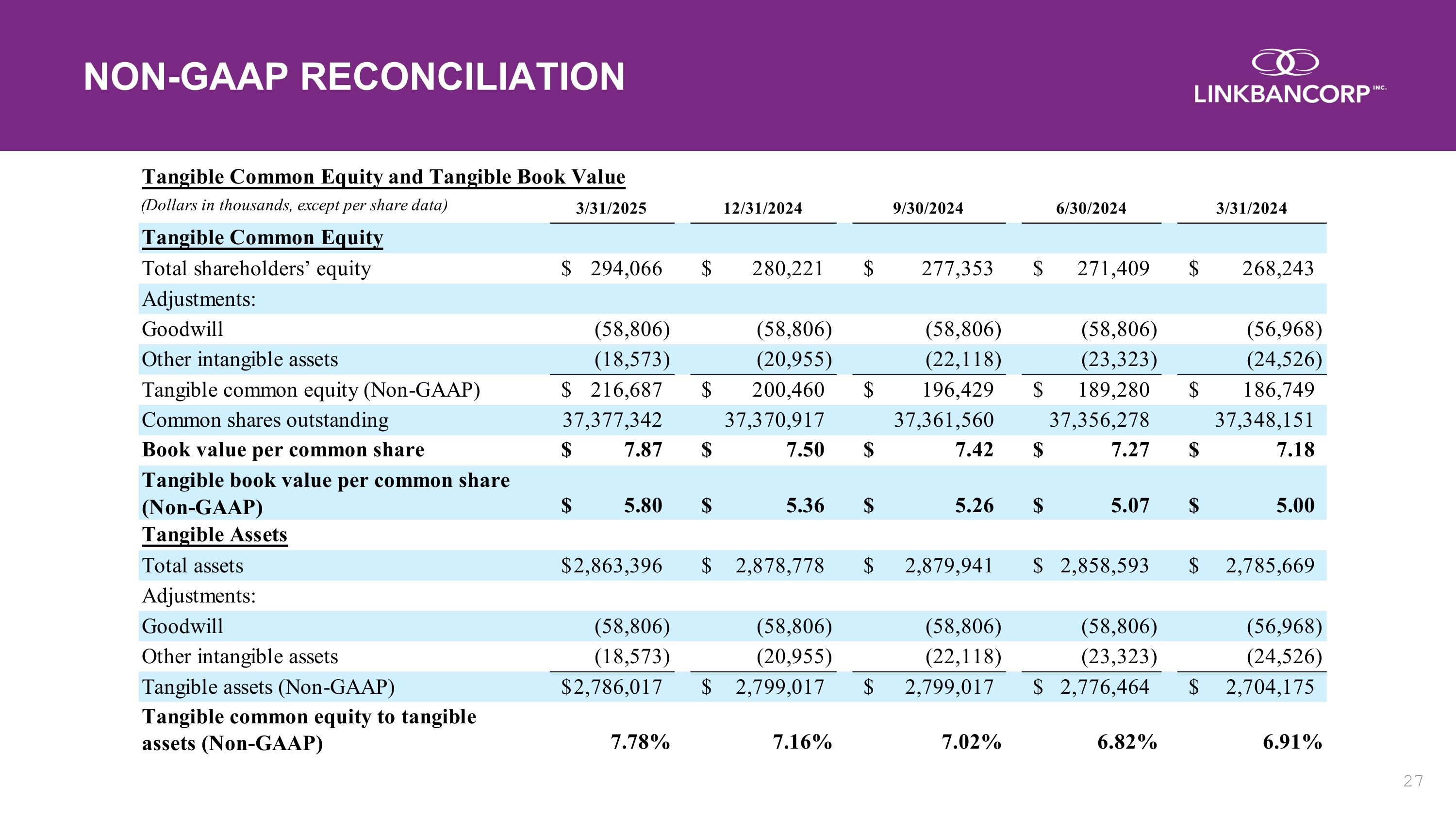

NON-GAAP RECONCILIATION

NON-GAAP RECONCILIATION

NON-GAAP RECONCILIATION

NON-GAAP RECONCILIATION

NON-GAAP RECONCILIATION

NON-GAAP RECONCILIATION

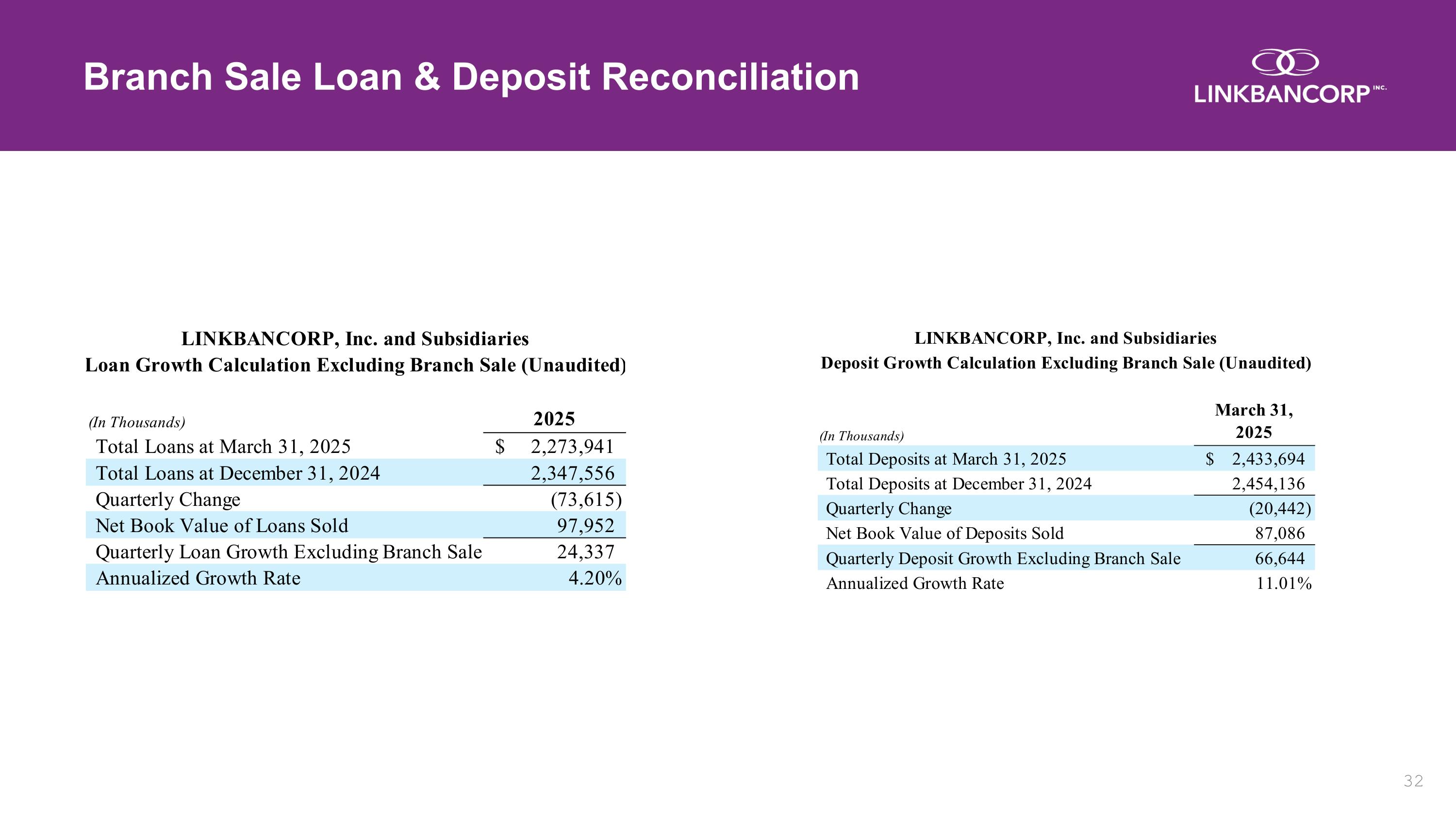

Branch Sale Loan & Deposit Reconciliation