Financial impacts of conversion from IFRS to US GAAP April 15th, 2025

Safe Harbor This presentation has been prepared by VTEX (“we,” “us,” “our,” “VTEX” or the “Company”). This presentation may contain forward-looking statements relating to such matters as continued growth prospects for the Company, industry trends and product and technology initiatives. These statements are based on currently available information and our current assumptions, expectations and projections about future events. While we believe that our assumptions, expectations and projections are reasonable in view of currently available information, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements regarding VTEX involve known and unknown risks, uncertainties and other factors that may cause VTEX’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain risks and uncertainties are described under “Risk Factors” and “Forward-Looking Statements” sections of VTEX’s Form 20-F for the year ended December 31st, 2024 and other VTEX’s filings with the U.S. Securities and Exchange Commission which are available on our investor relations website. You should read this information together with the sections of VTEX’s Form 20-F entitled “Selected Financial Data” and “Information on the Company” our audited consolidated financial statements and our unaudited interim condensed consolidated financial statements and their respective notes, which are available on our investor relations website (https://www.investors.vtex.com/). Unless required by law, VTEX undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. Neither we nor our affiliates, advisors or representatives makes any representation as to the accuracy or completeness of that data or undertake to update such data after the date of this presentation. In connection with our transition from International Financial Reporting Standards (“IFRS”) to accounting principles generally accepted in the United States (“GAAP”), this presentation includes financial information prepared in accordance with both IFRS and GAAP, as well as certain non-GAAP financial measures. The inclusion of IFRS and GAAP data is intended to facilitate transparency, provide historical context, and enable investors to understand the impact of the transition on our financial results. We use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets, and determining compensation. The non-GAAP measures have limitations, including that they may not be directly comparable to other companies, and you should not consider them in isolation or as a substitute for or superior to our GAAP financial information. We provide in this presentation a reconciliation of non-GAAP financial measures to their nearest GAAP equivalent. All of the financial information included in this presentation is updated as of December 31, 2024, unless otherwise indicated. Except as may be required by applicable law, we assume no obligation to publicly update or revise our statements. Numbers have been calculated using whole amounts rather than rounded amounts. This might cause some figures not to total due to rounding. 2

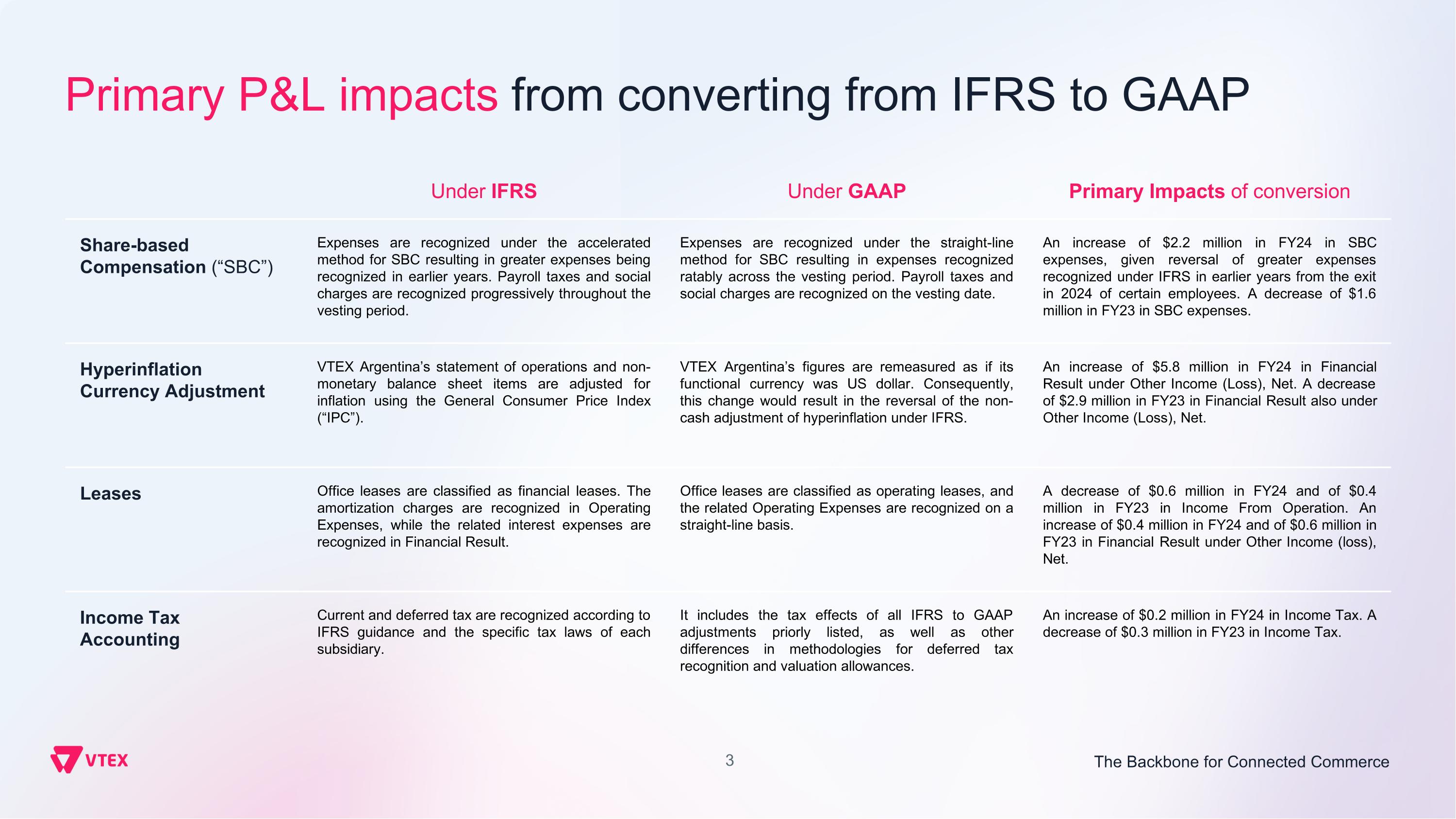

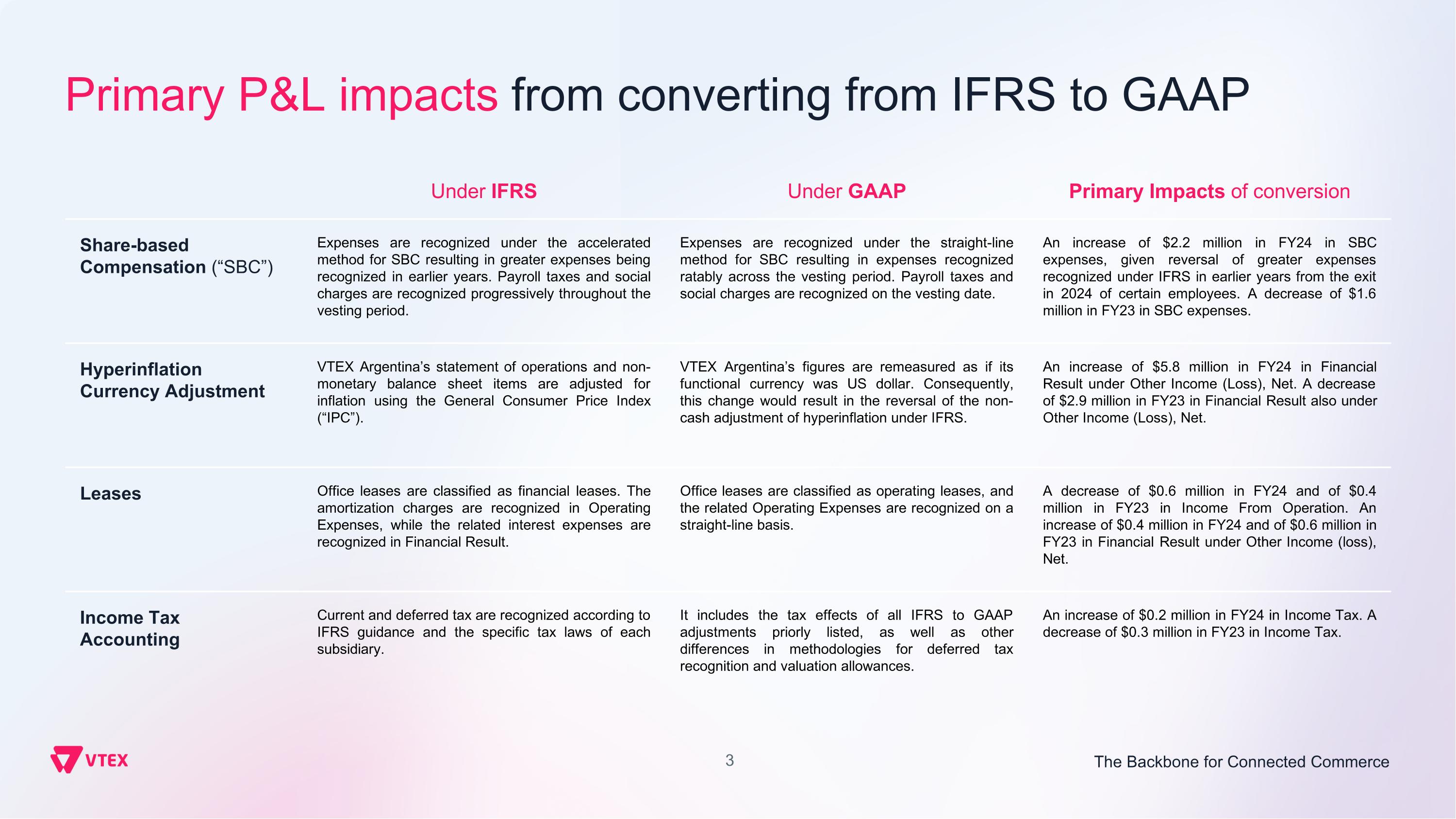

Under IFRS Under GAAP Primary Impacts of conversion Share-based Compensation (“SBC”) Expenses are recognized under the accelerated method for SBC resulting in greater expenses being recognized in earlier years. Payroll taxes and social charges are recognized progressively throughout the vesting period. Expenses are recognized under the straight-line method for SBC resulting in expenses recognized ratably across the vesting period. Payroll taxes and social charges are recognized on the vesting date. An increase of $2.2 million in FY24 in SBC expenses, given reversal of greater expenses recognized under IFRS in earlier years from the exit in 2024 of certain employees. A decrease of $1.6 million in FY23 in SBC expenses. Hyperinflation Currency Adjustment VTEX Argentina’s statement of operations and non-monetary balance sheet items are adjusted for inflation using the General Consumer Price Index (“IPC”). VTEX Argentina’s figures are remeasured as if its functional currency was US dollar. Consequently, this change would result in the reversal of the non-cash adjustment of hyperinflation under IFRS. An increase of $5.8 million in FY24 in Financial Result under Other Income (Loss), Net. A decrease of $2.9 million in FY23 in Financial Result also under Other Income (Loss), Net. Leases Office leases are classified as financial leases. The amortization charges are recognized in Operating Expenses, while the related interest expenses are recognized in Financial Result. Office leases are classified as operating leases, and the related Operating Expenses are recognized on a straight-line basis. A decrease of $0.6 million in FY24 and of $0.4 million in FY23 in Income From Operation. An increase of $0.4 million in FY24 and of $0.6 million in FY23 in Financial Result under Other Income (loss), Net. Income Tax Accounting Current and deferred tax are recognized according to IFRS guidance and the specific tax laws of each subsidiary. It includes the tax effects of all IFRS to GAAP adjustments priorly listed, as well as other differences in methodologies for deferred tax recognition and valuation allowances. An increase of $0.2 million in FY24 in Income Tax. A decrease of $0.3 million in FY23 in Income Tax. Primary P&L impacts from converting from IFRS to GAAP 3

As part of our ongoing efforts to enhance financial transparency and comparability with industry peers, VTEX intends to transition its financial reporting standards from International Financial Reporting Standards (“IFRS”) to US GAAP (“GAAP”). We believe that adopting GAAP may expand our access to a broader investor base, facilitate inclusion in additional stock indices, and improve financial reporting alignment within our sector. Our Board of Directors has approved this transition, and we will be seeking shareholder approval at the annual shareholders meeting to be held on April 25, 2025. This presentation summarizes the primary impacts of the transition from IFRS to GAAP and provides a summary of the financial results for fiscal years 2023 and 2024, under both IFRS and GAAP. The GAAP financial information included in this presentation has not been audited and is subject to change. Numbers have been calculated using whole amounts rather than rounded amounts. This might cause some figures not to total due to rounding. Overview 4

Key Financial Metrics: IFRS vs. GAAP US$ thousands, except percentages (unaudited) FY 2024 FY 2023 IFRS GAAP Delta IFRS GAAP Delta (unaudited) (unaudited) Total Revenue 226,709 226,661 (48) 201,517 200,833 (684) Total Cost (59,418) (59,705) (287) (60,949) (60,986) (37) Gross Profit 167,291 166,956 (335) 140,568 139,847 (721) Gross Margin 73.8% 73.7% (0.1) p.p. 69.8% 69.6% (0.2) p.p. General and Administrative (34,431) (34,284) 147 (33,673) (32,412) 1,261 Sales and Marketing (67,862) (68,598) (736) (59,461) (59,353) 108 Research and Development (53,620) (55,412) (1,792) (60,116) (60,206) (90) Other Losses (1,275) (1,276) (1) (1,920) (1,921) (1) Income (Loss) from Operations 10,103 7,386 (2,717) (14,602) (14,045) 557 Operating Margin 4.5% 3.3% (1.2) p.p. (7.2)% (7.0)% 0.2 p.p. Other Income (Loss), Net(1) (440) 5,884 6,324 4,015 1,580 (2,435) Income Tax 2,332 2,540 208 (3,107) (3,393) (286) Net Income (Loss) for the Period 11,995 15,810 3,815 (13,694) (15,858) (2,164) 5 (1) “Other income (loss), net” encompasses what under IFRS was disclosed as Equity Results and Financial Result lines.

Key Financial Metrics: Non-IFRS vs. Non-GAAP US$ millions, except percentages (unaudited) FY 2024 FY 2023 Non-IFRS Non-GAAP Delta Non-IFRS Non-GAAP Delta Non-GAAP Subscription Gross Profit 170.3 170.2 (0.1) 145.1 144.4 (0.7) Non-GAAP Subscription Gross Profit Margin 78.2% 78.2% (0.0) p.p. 76.2% 76.1% (0.1) p.p. Non-GAAP Income from Operations 29.5 29.0 (0.5) 7.7 6.6 (1.1) Non-GAAP Operating Margin 13.0% 12.8% (0.2) p.p. 3.8% 3.3% (0.5) p.p. Free Cash Flow 25.2 23.9 (1.3) 3.8 4.9 1.1 Free Cash Flow Margin 11.1% 10.5% (0.6) p.p. 1.9% 2.5% 0.6 p.p. 6

Reconciliation of Non-GAAP Measures US$ millions (unaudited) General and Administrative Expense GAAP General and Administrative Expense (34.3) (32.4) Share-Based Compensation Expense 8.1 5.9 Amortization Related to Acquisitions 0.0 0.0 Non-GAAP General and Administrative Expense (26.2) (26.5) Research and DevelopmentExpense GAAP Research and Development Expense (55.4) (60.2) Share-Based Compensation Expense 5.5 7.3 Amortization Related to Acquisitions 0.5 1.2 Earn Out Expenses Related to Acquisitions 0.3 - Non-GAAP Research and Development Expense (49.1) (51.8) Sales and Marketing Expense GAAP Sales and Marketing Expense (68.6) (59.4) Share-Based Compensation Expense 4.6 4.3 Amortization Related to Acquisitions 1.2 1.2 Earn Out Expenses Related to Acquisitions 0.4 - Non-GAAP Sales and Marketing Expense (62.4) (53.9) FY24 FY23 Subscription Gross Profit GAAP Subscription Gross Profit 170.2 144.2 Share-Based Compensation 0.0 0.2 Non-GAAP Subscription Gross Profit 170.2 144.4 7

Reconciliation of Non-GAAP Measures US$ millions (unaudited) Free Cash Flow Net Cash Provided by (Used in) Operating Activities 26.0 5.4 Acquisitions of Property and Equipment (2.1) (0.5) Free Cash Flow 23.9 4.9 Income (Loss) from Operations GAAP Income (Loss) from Operations 7.4 (14.0) Share-Based Compensation Expense 19.2 18.0 Amortization Related to Acquisitions 1.8 2.6 Earn Out Expenses Related to Acquisitions 0.6 - Non-GAAP Income from Operations 29.0 6.6 FY24 FY23 8 Net Income (Loss) GAAP Net Income (Loss) 15.8 (15.9) Share-Based Compensation Expense 19.2 18.0 Amortization Related to Acquisitions 1.8 2.6 Earn Out Expenses Related to Acquisitions 0.6 - Net (Gain) Loss on Equity Investments (1.6) (1.0) Income Taxes Related to Non-GAAP Adjustments (4.2) (3.8) Non-GAAP Net Income 31.6 0.0

Financial impacts of conversion from IFRS to US GAAP Appendix 9

FY 2024 FY 2023 IFRS GAAP Delta IFRS GAAP Delta (unaudited) (unaudited) Assets Total Current Assets 284,590 284,590 - 266,253 266,255 2 Non-Current Assets Deferred Tax Assets 19,047 13,968 (5,079) 19,926 13,726 (6,200) A Property, Plant and Equipment 2,999 2,970 (29) 2,697 2,678 (19) Right-of-Use 2,783 3,220 437 3,277 4,295 1,018 Other Non-Current Assets 57,359 57,358 (1) 48,992 48,991 (1) Total Non-Current Assets 82,188 77,516 (4,672) 74,892 69,690 (5,202) Total Assets 366,778 362,106 (4,672) 341,145 335,945 (5,200) Liabilities Current Liabilities Accounts Payable 36,951 36,003 (948) 39,728 37,978 (1,750) B Lease Liabilities 1,617 1,617 - 1,863 2,263 400 Other Current Liabilities 42,402 42,402 - 35,653 35,653 - Total Current Liabilities 80,970 80,022 (948) 77,244 75,894 (1,350) Non-Current Liabilities Accounts Payable 2,151 1,754 (397) 1,632 1,003 (629) B Deferred Tax Liabilities 2,478 808 (1,670) 2,668 1,062 (1,606) A Other Non-Current Liabilities 25,378 25,376 (2) 19,269 19,268 (1) Total Non-Current Liabilities 30,007 27,938 (2,069) 23,569 21,333 (2,236) Total Shareholders Equity 255,801 254,146 (1,655) 240,332 238,718 (1,614) Total Liabilities and Equity 366,778 362,106 (4,672) 341,145 335,945 (5,200) Balance Sheet: IFRS vs. GAAP US$ thousands (unaudited) 10 Commentary A) Deferred Tax Assets and Liabilities are influenced by SBC impact, valuation allowances of certain subsidiaries, and the tax impacts of all adjustments made when reconciling IFRS to GAAP. B) Payroll taxes and social charges related to SBC are recognized on the vesting date under GAAP, unlike IFRS, where these expenses are allocated progressively throughout the vesting period.

A) Under GAAP, interest and dividends received and all lease payments are reclassified to Operating Activities. B) Under GAAP, interest and dividends received are reclassified to Operating Activities. C) Under GAAP, all lease payments are reclassified to operating activities. Under GAAP, 2023 Restricted Cash change is reclassified from Financial Activities and included in opening and closing cash balances. Cash Flow Statement: IFRS vs. GAAP US$ thousands (unaudited) FY 2024 FY 2023 IFRS GAAP Delta IFRS GAAP Delta (unaudited) (unaudited) Net Cash Provided by Operating Activities 27,256 25,964 (1,292) 4,259 5,408 1,149 A Net Cash Provided by (Used in) Investing Activities (20,014) (20,706) (692) 38,425 35,176 (3,249) B Net Cash Used in Financing Activities (14,034) (12,050) 1,984 (38,430) (37,938) 492 C Net Increase (Decrease) in Cash and Cash Equivalents (6,792) (6,792) - 4,254 2,646 (1,608) C 11 Commentary