UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2025

|

001-41208 |

|

|

(Commission File Number) |

|

NOVONIX LIMITED

(Translation of registrant’s name into English)

Level 38

71 Eagle Street

Brisbane, QLD 4000 Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

Exhibit No. |

|

Description |

|

|

|

Exhibit 99.1 |

|

ASX Announcement (Chairman’s Address to Annual General Meeting), dated April 2, 2025 |

Exhibit 99.2 |

|

Presentation to Annual General Meeting held on April 2, 2025 |

Exhibit 99.3 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

NOVONIX LIMITED

|

|

By: |

/s/ Robert Long |

|

Robert Long |

|

Chief Executive Officer |

Date: April 4, 2025

ASX ANNOUNCEMENT

(ASX: NVX)

2 April 2025

EXHIBIT 99.1

Chairman’s Address to AGM

We now move to the substantive business of the meeting. But, before doing so, I will provide my perspective on our successes and the challenges facing the company and the sector more broadly.

Recall that the 2024 priorities were:

First, to scale its operations towards production targets by year-end.

Second, to secure additional Tier 1 partnerships and customers.

Third, NOVONIX’s efforts to secure financing to scale our operations.

Lastly, maintain its industry-leading R&D efforts for battery materials.

As outlined in our various updates to the market, we have made considerable progress over the past year.

We have signed offtake agreements with Tier 1 counterparties in Panasonic, Stellantis and Powerco (the battery division of VW). And we are in advanced discussions with a number of other Tier 1 counterparties.

The contracts we have signed take up all the available capacity at our existing Riverside facility in Chattanooga and have necessitated commitment to the proposed expansion facility at Enterprise South adjacent to the VW motor vehicle assembly plant, also in Chattanooga.

Importantly, we have made substantial progress in securing the funding needed for both the build out of plant capacity at Riverside to 20,000 tonnes per annum and for the first phase of the new facility at Enterprise South with initial planned capacity of another 31,500 tonnes per annum.

A successful equity raising in the final quarter of last year added to the US DOE grant of US$100 million for Riverside, US$108 million tax credit also applicable to Riverside and a US$754 million provisional loan from DOE for Enterprise South. In addition, NOVONIX has made an application for potential loan funding through the US Department of Defence in support of its own strategic objectives.

ACN 157 690 830, Level 38, 71 Eagle Street, Brisbane QLD 4000, Australia | novonixgroup.com

The strong support we continue to receive from the US Government reflects the critical importance of synthetic graphite to the strategic energy independence of the United States and indeed the rest of North America and all other parts of the world that are currently reliant on China as the sole source of close to 95% of global supply of synthetic graphite.

Significantly, our achievements both in terms of securing offtake contracts and funding are clear illustrations of the leadership position NOVONIX has taken in the development of the technology and scale required to be globally competitive and secure the supply of this key material for lithium-ion battery manufacturing in North America.

The year has not been without challenges. The Company is navigating a change in the U.S. Presidential administration that is bringing an additional focus on new priorities that are in our favour

U.S. Policy and Strategic Alignment

To touch on the changes in Washinton DC, NOVONIX’s strategic initiatives align with the new Administration’s priorities of securing critical mineral supply chains, strengthening national security, and fostering domestic manufacturing. The policies set forth by the current administration, including Executive Orders furthering energy independence, the critical minerals imperative and correcting trade disparities, reinforce the importance of our mission. Our production squarely aligns with Trump Administration priorities, particularly with respect to producing critical minerals and removing reliance on China for key new energy materials such as synthetic graphite.

In February 2025, we welcomed the International Trade Commission’s (ITC) preliminary determinations in the Anti-Dumping and Countervailing Duties (AD/CVD) case to which we are party. These rulings are a critical step toward establishing a level playing field for North American synthetic graphite production and protecting domestic manufacturing from unfair trade practices.

Management Updates

Our commitment to long-term shareholder value remains unchanged as we transition leadership to support the next phase of the Company’s growth. Our efforts include bringing in Robert Long as Chief Financial Officer (“CFO”) in September 2024. Robert brings over 25 years of experience in finance and executive leadership with both public and private companies.

ACN 157 690 830, Level 38, 71 Eagle Street, Brisbane QLD 4000, Australia | novonixgroup.com

Robert is based in Chattanooga, where we are focusing our company and headquarters. Dr. Chris Burns, in coordination with the Board, has decided that the time is right to appoint a new CEO with deep expertise in manufacturing, operations, and scaling industrial production. This transition is a strategic step forward as we grow our operations and deliver on our key commercial agreements.

Chris is continuing to assist the Company in the role as a Strategic Advisor to the Board, ensuring continuity and a smooth leadership transition. The Board is actively engaged in a formal search process, and we expect to have a new CEO in place by mid-year, based in Chattanooga, Tennessee.

Mt Dromedary Natural Graphite Resource

Shareholders will be aware that, in relation to our natural graphite resource at Mount Dromedary in Queensland’s northwest, we have been progressing the proposed transaction to combine Mount Dromedary with the Burke and Corella natural graphite assets of Lithium Energy Limited (LEL). The aim is to enhance the scale and economics of these resources and provide a focused team for the development of a substantial natural graphite operation. The combined projects will sit within a separate company, Axon Graphite, which will be the subject of a separate IPO with eligible NOVONIX and LEL shareholders being offered priority in the public offering of shares. We believe this transaction remains on track for completion in 2025.

Governance and Board Updates

On the Board, we were very pleased to welcome Sharan Burrow AC in February 2024 as an independent Board member. And Nick Liveris also joined the Board on September 1, 2024, after having served as the Company’s CFO since July 2021. And Andrew Liveris continues to serve as a strategic advisor playing an important growth role with partners and investors.

NOVONIX is well-positioned to play a pivotal role in onshoring the graphite supply chain in North America. The five-year U.S. outlook for Electric Vehicles remains strong, with sales expected to reach 25% of new vehicles in 2030. Energy storage systems are increasingly important for enhancing grid reliability and supporting AI-driven growth. We appreciate your patience as we establish a new local industry and continued support as we execute our strategy and deliver long-term value. The Board will continue to monitor the execution of the strategic plan to deliver long term value to our shareholders. We look forward to providing future updates on our progress.

ACN 157 690 830, Level 38, 71 Eagle Street, Brisbane QLD 4000, Australia | novonixgroup.com

Thank you and I will now turn to the business of the meeting.

This announcement has been authorised for release by Admiral Robert J Natter, USN Ret., Chairman.

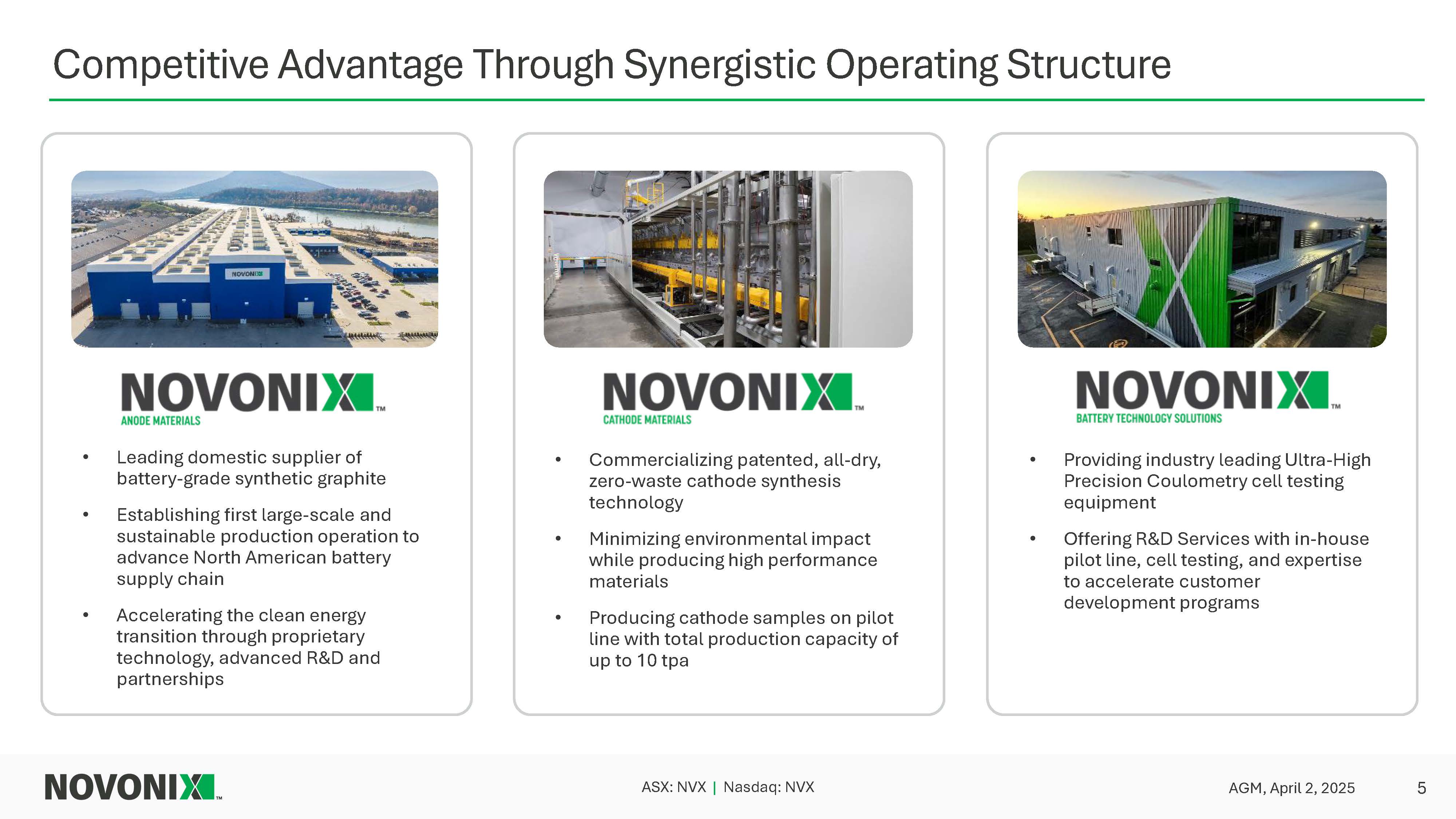

About NOVONIX

NOVONIX is a leading battery technology company revolutionizing the global lithium-ion battery industry with innovative, sustainable technologies, high-performance materials, and more efficient production methods. The Company manufactures industry-leading battery cell testing equipment, is growing its high-performance synthetic graphite material manufacturing operations, and has developed a patented all-dry, zero-waste cathode synthesis process. Through advanced R&D capabilities, proprietary technology, and strategic partnerships, NOVONIX has gained a prominent position in the electric vehicle and energy storage systems battery industry and is powering a cleaner energy future.

To learn more, visit us at www.novonixgroup.com or on LinkedIn and X.

For NOVONIX Limited

Scott Espenshade, ir@novonixgroup.com (investors)

Stephanie Reid, media@novonixgroup.com (media)

ACN 157 690 830, Level 38, 71 Eagle Street, Brisbane QLD 4000, Australia | novonixgroup.com

EXHIBIT 99.2

April 2, 2025 NOVONIX Annual General Meeting NOVONIX TM Important Notice and Disclaimers The information contained in this presentation (the “Presentation”) has been prepared by NOVONIX Limited (ACN 157 690 830) (“the Company” or “NOVONIX”) solely for information purposes and the Company is solely responsible for thecontents of this Presentation. It is intended to be a summary of certain information relating to the Company as at the date of the Presentation and does not purport to be a complete description of NOVONIX or contain all the information necessaryto make an investment decision. Accordingly, this Presentation is not intended to, and should not, form the basis for any investment, divestment or other financial decision with respect to the Company. Any reproduction or distribution of thePresentation, in whole or in part, or the disclosure of its contents, without prior consent of the Company, is prohibited. Not an OfferThis Presentation does not constitute, nor does it form part of an offer to sell or purchase, or the solicitation of an offer to sell or purchase, any securities of the Company. This Presentation may not be used in connection with any offer orsolicitation by anyone in any jurisdiction in which such offer or solicitation is not permitted by law or in which the person making the offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer orsolicitation. Any offering of securities will be made only by means of a registration statement (including a prospectus) filed with the U.S. Securities and Exchange Commission (the “SEC”), after such registration statement becomes effective, orpursuant to an exemption from, or in a transaction not subject to, the registration requirements under the U.S. Securities Act of 1933, as amended. No such registration statement has become effective, as of the date of this Presentation. Cautionary Note Regarding Forward-Looking Statements This Presentation contains forward-looking statements about the Company and the industry in which it operates. Forward-looking statements can generally be identified by use of words such as “anticipate,” “believe,” “contemplate,” “continue,”“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or other similar expressions. Examples of forward-looking statements in this Presentation include, among others,statements we make regarding our progress and timing of meeting our target production capacity and scaling of production at our Riverside and planned new facilities, our ability to meet the demands, qualifications and timelines of our existing and future customers and to realize the benefits of our collaborations with customers such as LG Energy Solution, our estimates of existing and future customer offtake volumes and demand,the anticipated operating costs, pricing and other operating performance metrics of our Riverside facility, the expected economic impact of the U.S. Department of Energy Office of Manufacturing & Energy Supply Chains US$100 milliongrant and the US$103 million tax credit under the Qualifying Advanced Energy Project Allocation Program, our ability to obtain and benefit from additional government funding and other support, including a loan from the DOE Loan Programs Office, our plan for financing and constructing a new greenfield facility, our expectation of generating strong cash flow and margins, future growth through sales of advanced battery materials, battery testing equipment and cell development and testing services, the continued investment in, commercialization of, and potential results of our cathode synthesis technology and pilot line, the continued progress of the proposed combination of Mount Dromedary natural graphite assets with Lithium Energy Limited graphite assets and the initial public offering of Axon Graphite, and our ability to help lead the localization of the North American supply chain for synthetic graphite and achieve and maintain market recognition as a leader in the battery materials sector. We have based such statements onour current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Such forward-looking statements involve and are subject toknown and unknown risks, uncertainties and other factors which may cause performance or achievementsexpressed or implied by such forward-looking statements. Such factors include, among others, the timely deployment and scaling of our furnace technology, our ability to meet the technical specifications and demand of our existing and future customers, the accuracy of our estimates regarding market size, current and future customer demand, and ourexpenses, future revenue, capital requirements, needs and access for additional financing, the availability and impact of government support, our ability to develop and commercialize our cathode materials and produce them at volumes with acceptable performance, yields and costs and without substantial delays or operational problems, our ability to obtain patent rights effective to protect our technologies and processes and successfully defend any challenges to such rights and prevent others from commercializing such technologies and processes, and regulatory developments in the United States, Australia and other jurisdictions. These and other factors that could affect our business and results are included in the Risk Factors section of this Presentation and in our filings with the U.S. Securities and Exchange Commission (“SEC”), including the Company’s annual report on Form 20-F.Copies of these filings may be obtained by visiting our Investor Relations website at www.novonixgroup.com or the SEC's website at www.sec.gov. Industry and Market DataThis Presentation contains estimates and information concerning our industry and our business, including estimated market size and projected growth rates of the markets for our products. Unless otherwise expressly stated, we obtained thisindustry, business, market, and other information from reports, research surveys, studies and similar data prepared by third parties, industry, and general publications, government data and similar sources. This Presentation also includes certaininformation and data that is derived from internal research. While we believe that our internal research is reliable, such research has not been verified by any third party. Estimates and information concerning our industry and our business involvea number ofassumptions and limitations. Although we are responsible forall ofthe disclosure contained in this Presentation and we believe the third-party marketposition, market opportunity and market size data included in this Presentation are reliable, we have not independently verified the accuracy or completeness of this third-party data. Information that is based on projections, assumptions andestimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, which could cause results to differ materially from thoseexpressed in these publications and reports. Trademarks, Service Marks and Trade NamesThroughout this Presentation, there are references to various trademarks, service marks and trade names that are used in the Company’s business. “NOVONIX,” the NOVONIX logo and other trademarks or service marks of NOVONIX appearing inthis Presentation are the property of NOVONIX or its subsidiaries. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation are listed without the ® or symbol, as applicable, but such referencesshould not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their right thereto. All other trademarks, trade names and service marks appearing in this Presentation are the propertyof their respective owners.

Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 2 Board of Directors & Advisors Board of Directors Science & Technical Advisors Admiral Robert J. Natter Chairman & Non-Executive Director Tony Bellas Deputy Chairman & Non-Executive Director Sharan Burrow AC Non-Executive Director Ron Edmonds Executive Director Nick A. Liveris Non-Executive Director Jean Oelwang Non-Executive Director Suresh Vaidyanathan Non-Executive Director Dr. Jeff Dahn Chief Scientific Advisor Dr.

Mark Obrovac Sponsored Researcher Andrew Liveris AO Special Advisor Dr Chris Burns Special Advisor Professional Experience Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 3 Providing Revolutionary Solutions to the Battery Industry ASX: NOVONIX Investment Thesis Leading Sustainable Battery Company – NOVONIX is a U.S. based battery materials and technology leader with a lower carbon footprint. Rapidly Growing Market – The battery industry is expanding at a double-digit rate through 2035, driven by demand from EVs and energy storage systems (ESS). U.S. Government Support – Policies aim to boost domestic manufacturing, secure critical minerals, reduce reliance on China, and enhance national security fostering a localized battery supply chain. First-Mover Advantage – NOVONIX is pioneering an innovative graphitization process, securing funding, and locking in key off-take agreements with top battery manufacturers. Proprietary Technology – NOVONIX holds a strong IP portfolio for advanced graphitization processes and cutting-edge battery testing equipment, reinforcing its competitive edge.

NOVONIX Riverside Facility in Chattanooga, Tennessee NOVONIX TM ASX: NVX | Nasdaq: NVX Gabelli, March 20, 2025 4 Competitive Advantage Through Synergistic Operating Structure NOVONIX TM NOVONIX TM NOVONIX TM Anode MaterialsCathode Materials BatteryTechnology Solutions Leading domestic supplier of battery-grade synthetic graphite Establishing first large-scale and sustainable production operation to advance North American battery supply chain Accelerating the clean energy transition through proprietary technology, advanced R&D and partnerships Commercializing patented, all-dry, zero-waste cathode synthesis technology • Minimizing environmental impact while producing high performance materials • Producing cathode samples on pilot line with total production capacity of up to 10 tpa Providing industry leading Ultra-High Precision Coulometry cell testing equipment • Offering R&D Services with in-house pilot line, cell testing, and expertise to accelerate customer development programs Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 5 Proprietary Process Technologies Lead the Clean Energy Transformation NOVONIX ESG Commitment Environmental Benefits of NOVONIX Technology Environmental Our mission is to develop innovative, sustainable technologies and high-performance materials to service the electric vehicle and energy storage industries Social The health, safety, and wellbeing of our employees and the communities we operate in are essential to NOVONIX’s success and growth Governance NOVONIX believes corporate governance is central to its business objectives and a critical element contributing to the preservation of shareholder value Environmental Benefits of NOVONIX Technology Anode Technology Inputs •Clean power sources1 •High purity input materials •Reduced power requirements •No reagents Process •Proprietary furnace and process technology •Increased energy efficiency •No chemical purification •Proprietary all-dry, zero-waste cathode synthesis technology •Simplified processing requirements and flowsheet Outputs •Support higher-performance lithium-ion batteries resulting in longer life •Negligible facility emissions •LCA2 demonstrated a ~60% decrease in global warming potential •No sodium sulfate waste •Eliminates process waste-water •Negligible facility emissions 1. Tennessee Valley Authority, 2023 Sustainability Report notes 55% of power is from carbon-free sources 2.The LCA conducted by Minviro Ltd.

demonstrated a ~60% decrease in global warming potential relative to conventional anode grade synthetic graphite versus Chinese product Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 6 2024 - Foundational Year for Future Growth Anode Materials Battery Technology Solutions Offered conditional commitment for a direct loan of up to US$754 Million from the U.S. Department of Energy for a new synthetic graphite manufacturing plant in Tennessee, NOVONIX Enterprise South Selected to receive US$103M in qualifying advanced energy project tax credits from the United States government Signed a binding supply agreement with Panasonic Energy for 10,000 tonnes over 4 years Signed binding offtake agreement with Stellantis NV (“Stellantis”) for up to a target volume of 115,000 tonnes of high-performance synthetic graphite materials from 2026 through 2031 Signed binding offtake agreement with PowerCo SE (“PowerCo”) for a minimum of 32,000 tonnes of high-performance synthetic graphite materials to be supplied to PowerCo from 2027 through 2031 Joined American graphite producers in filing trade case with U.S. government over anticompetitive graphite prices on Chinese exports Entered license agreement with Harper International (2025 Announcement) Entered collaboration agreement with ICoNiChem Widnes Limited (“ICoNiChem”), focused on sustainable cathode active materials feedstock Announced strategic partnership with Voltaiq to drive efficiency and quality in the battery industry Announced electrochemical impedance spectroscopy partnership with Gamry Instruments Inc.

Awarded patent for graphite/silicon alloy composite material in the Japan, Europe and United States ASX: NVX | Nasdaq: NVX 7 Completed equity raise to support the financial need for the commercial production of high-performance battery-grade synthetic graphite Negotiated agreement with Lithium Energy Limited to combine natural graphite assets and intent to take the combined business, Axon Graphite, public Received MESC Grant reimbursement of US$12.9 million for full year 2024 Quarter-end (31 December 2024) cash balance is US$42.6 million* Announced Planned Transition in the Chief Executive Officer role (2025 Announcement) When considering the second placement of the equity raise from Phillips 66 Company of US$5 million and the accepted portion of the share purchase plan portion of the equity raise of US$20.2 million, the quarter-end cash balance would have been US$67.8 million Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 7 NOVONIX Potential Impacts by U.S. Administration Reviews NOVONIX’s plans align with the Trump Administration’s EOs through localizing the battery supply chain for graphite by: Building manufacturing plants and creating jobs in the United States Increasing the United States’ capacity to produce critical minerals for domestic supply chains Reducing import dependence on China Furthering national security, resilience and energy dominance Section 301 Tariffs, AD/CVD Case US Government Programs At Risk NOVONIX Funding Status Section 301 includes a 25% tariff on artificial graphite imported fromChinain 2026 to help remove unfair market distortions imposed by China’santicompetitive behaviors and size advantage in thebattery materials sector AAAMP petitioned Dept. of Commerce and ITC to investigate China exporting natural and synthetic graphite at unfair prices and intent to impede industry growth in the US Preliminary determination by the International Trade Commission (ITC) that China has suppressed the establishment of the domestic graphite industry by exporting artificially cheap graphite to the United States on January 31, 2025 IRA includes a $7,500 federal consumer tax credit (Section 30D) for qualifyingelectric vehicles, battery components and battery materials ─ FEOC component for graphite sourcing delayed until January 1, 2027 US$100 million of grant funding by the Department of Energy (DOE) Office of Manufacturing and Energy Supply Chains (MESC) – have drawn $12.9 million through Dec 2024 Selected for $103 million 48C investment tax credit for Riverside facility, which may be monetized Received a $754 million conditional commitment loan though DOE LPO Section 45X provides a 10% production tax credit available for Enterprise South, which is available to producers of critical minerals (measured as a percentage of total cost of production)Novonix TM ASX: NVX | Nasdaq: NVX 8 Riverside at Capacity with Current Offtake Agreements Customers* Supporting Growth 6-year commitment for up to a target volume of 115,000 tonnes starting in 2026 to cell manufacturers LGES & Samsung 5-year commitment for a minimum of 32,000 tonnes starting in 2027 4-year commitment totaling 10,000 tonnes following successful qualification in 2025Upon successful completion of JDA, LGES has the option to purchase up to 50,000 tonnes over a 10-year period Continuing discussions with other Tier 1 cell manufacturers and OEMs expected to lead to additional contracted volumes of synthetic graphite with a target of 150K+ tpa Contracted Customer Volumes1,2 200 175 0 25 50 75 100 125 150 ,000 tpa 2025 2026 2027 2028 2029 2030 2030+ Target Contracted Offtake Volumes In-discussion Customer Demand 1.Contracted volumes shown require product qualification and growth dependent on customer plans and capital availability.

NVX will add production lines at facilities to generally align with contracted volumes 2.The volumes shown are management’s annual estimates of the offtakes for Stellantis, PowerCo and Panasonic, including the assumption that Panasonic contract is renewed past 2028 *Agreements require final product qualification. The Company also had a supply agreement with KORE Power to support its proposed KOREplex facility in Arizona, but, because KORE Power has cancelled the construction of the KOREplex facility, NOVONIX has eliminated any associated volumes.

The Next Phase of Anode Materials NOVONIX Enterprise South Site Rendering NOVONIX Enterprise South is expected to reach full production capacity of 31,500 tonnes per annum (“tpa”) by the end of 2028. This facility, together with NOVONIX’s existing 20,000 tpa facility at Riverside in Chattanooga, is planned to bring the Company’s total production capacity to over 50,000 tpa by 2028. Offered Conditional Commitment for a US$754 Million Loan from the U.S. Department of Energy. NOVONIX Enterprise South is eligible for potential tax credits under the Advanced Manufacturing Production Tax Credit (Section 45X). Proposed NOVONIX Enterprise South rendering located on 182 acres in the Enterprise South Industrial Park in Chattanooga, Tennessee. The execution of the purchase and sale agreement is subject to approvals of the City of Chattanooga and Hamilton County, and the closing of the transaction will be subject to the satisfaction of certain conditions to be specified in the purchase and sale agreement. ASX: Novonix TMNVX | Nasdaq: NVX AGM, April 2, 2025 10

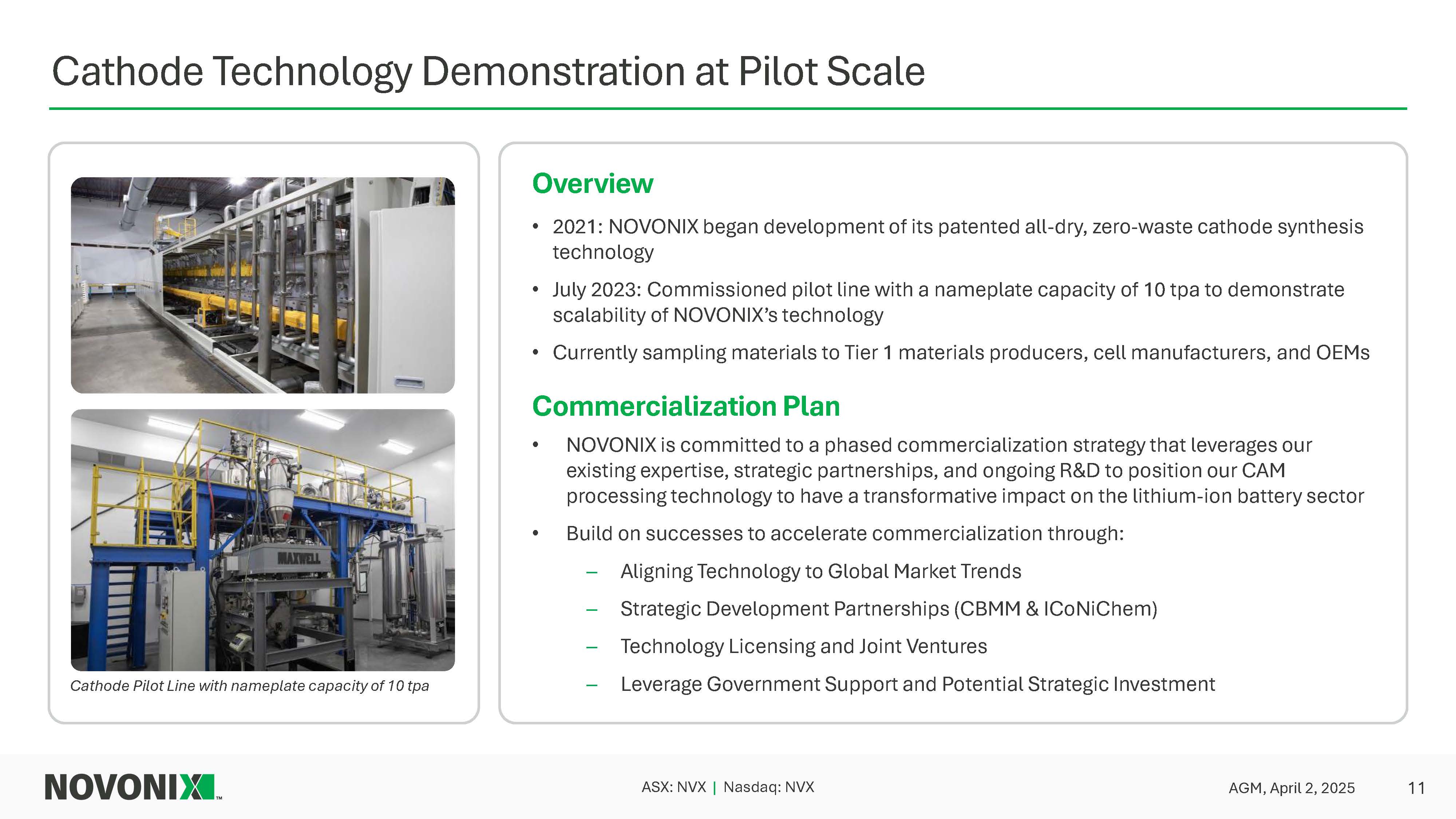

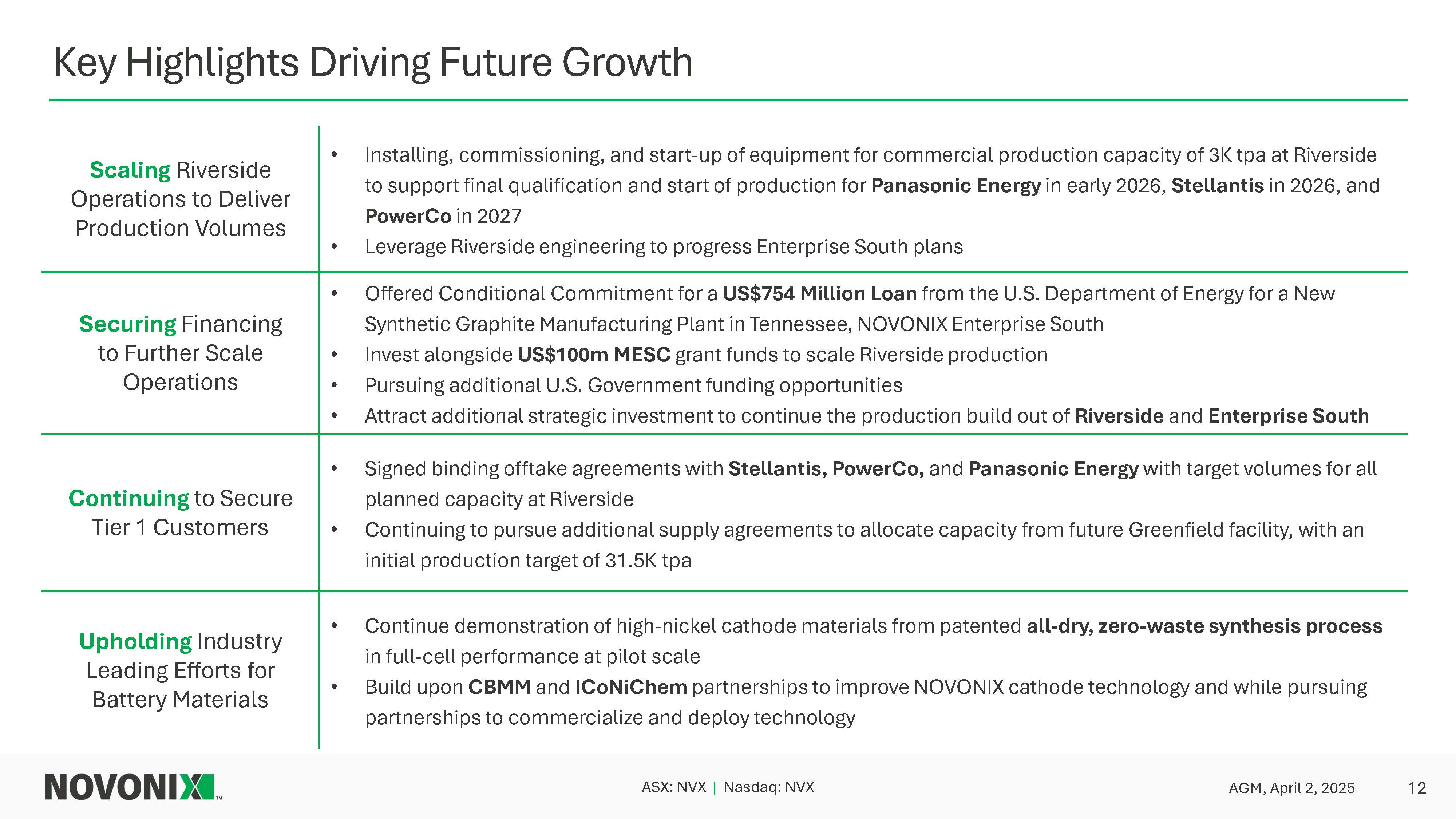

Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 9 Cathode Technology Demonstration at Pilot Scale Overview Commercialization Plan •2021: NOVONIX began development of its patented all-dry, zero-waste cathode synthesis technology•July 2023: Commissioned pilot line with a nameplate capacity of 10 tpa to demonstrate scalability of NOVONIX’s technology Currently sampling materials to Tier 1 materials producers, cell manufacturers, and OEMs NOVONIX is committed to a phased commercialization strategy that leverages our existing expertise, strategic partnerships, and ongoing R&D to position our CAM processing technology to have a transformative impact on the lithium-ion battery sector •Build on successes to accelerate commercialization through: Aligning Technology to Global Market Trends Strategic Development Partnerships (CBMM & ICoNiChem) Technology Licensing and Joint Ventures Leverage Government Support and Potential Strategic Investment Novonix TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 11 Key Highlights Driving Future Growth Scaling Riverside Operations to Deliver Production Volumes Securing Financing to Further Scale Operations Continuing to Secure Tier 1 Customers Upholding Industry Leading Efforts for Battery Materials Installing, commissioning, and start-up of equipment for commercial production capacity of 3K tpa at Riverside to support final qualification and start of production for Panasonic Energy in early 2026, Stellantis in 2026, and PowerCo in 2027 Leverage Riverside engineering to progress Enterprise South plans Offered Conditional Commitment for a US$754 Million Loan from the U.S. Department of Energy for a New Synthetic Graphite Manufacturing Plant in Tennessee, NOVONIX Enterprise South Invest alongside US$100m MESC grant funds to scale Riverside production Pursuing additional U.S. Government funding opportunities Attract additional strategic investment to continue the production build out of Riverside and Enterprise South Signed binding offtake agreements with Stellantis, PowerCo, and Panasonic Energy with target volumes for all planned capacity at Riverside Continuing to pursue additional supply agreements to allocate capacity from future Greenfield facility, with an initial production target of 31.5K tpa Continue demonstration of high-nickel cathode materials from patented all-dry, zero-waste synthesis process in full-cell performance at pilot scale Build upon CBMM and ICoNiChem partnerships to improve NOVONIX cathode technology and while pursuing partnerships to commercialize and deploy technology NOVONIX ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 12 Goals for the Future of NOVONIX Scaling anode materials production capacity to 150K tpa Recognized battery technology leader Forefront of product innovation Patented, All-Dry Zero-Waste Cathode technology supported by our propriety processing Highly developed IP with leading market positions Foresee strong cash flow generation and margins NOVONIX TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 13

NOVONIX TM ASX: NVX | Nasdaq: NVX 14

Contact Information Corporate Robert Long, Interim CEO & CFO Suzanne Yeates, Secretary Scott Espenshade, Investor Relations NOVONIX Limited (ASX:NVX) ACN 157 690 830 Level 38, 71 Eagle Street Brisbane, QLD 4000 Australia Investor Relations: IR@novonixgroup.com Media Relations: media@novonixgroup.com This announcement has been authorised for release by Admiral Robert J Natter, USN Ret., Chairman. Operations 1029 West 19th Street Chattanooga, Tennessee USA, 37408 353 Corporate Place Chattanooga, Tennessee USA, 37419 177 Bluewater Road Bedford, Nova Scotia Canada, B4B 1H1 110 Simmonds Drive Dartmouth, Nova Scotia Canada, B3B 1N9 NOVONIX TM ASX: NVX | Nasdaq: NVX AGM, April 2, 2025 15 BRISBANE, AUSTRALIA, April 2, 2025 - NOVONIX Limited (NASDAQ: NVX, ASX: NVX) (“NOVONIX” or the “Company”), a leading battery materials and technology company, advises that the results of NOVONIX Limited’s Annual General Meeting (AGM) held on Wednesday 2 April 2025 at 9:00am (AEST) are set out in the attached document.

EXHIBIT 99.3

ASX ANNOUNCEMENT

(ASX: NVX)

RESULTS OF ANNUAL GENERAL MEETING

All resolutions put to the AGM were decided by way of poll.

This announcement has been authorised for release by Admiral Robert J Natter, USN Ret., Chairman.

About NOVONIX

NOVONIX is a leading battery technology company revolutionizing the global lithium-ion battery industry with innovative, sustainable technologies, high-performance materials, and more efficient production methods. The Company manufactures industry-leading battery cell testing equipment, is growing its high-performance synthetic graphite material manufacturing operations, and has developed a patented all-dry, zero-waste cathode synthesis process. Through advanced R&D capabilities, proprietary technology, and strategic partnerships, NOVONIX has gained a prominent position in the electric vehicle and energy storage systems battery industry and is powering a cleaner energy future.

To learn more, visit us at www.novonixgroup.com or on LinkedIn and X.

For NOVONIX Limited

Scott Espenshade, ir@novonixgroup.com (investors)

Stephanie Reid, media@novonixgroup.com (media)

|

|

ACN 157 690 830, Level 38, 71 Eagle Street, Brisbane QLD 4000, Australia | novonixgroup.com |

|

|

|

NOVONIX LIMITED |

|

MUFG Corporate Markets A Division of MUFG Pension & Market Services |

|

|

|

ANNUAL GENERAL MEETING Wednesday, 2 April, 2025 |

|

RESULT OF ANNUAL GENERAL MEETING (ASX REPORT)

|

|

|

As required by section 251AA(2) of the Corporations Act 2001 (Commonwealth) the following statistics are provided in respect of each resolution on the agenda. |

|

|||

Resolution Voted on at the meeting |

|

Proxy Votes (as at proxy close) |

|

Total votes cast in the poll (where applicable) |

|

|

|||||||

|

No |

Short Description |

Strike Y/N/NA |

|

For |

Against |

Discretionary (open votes) |

Abstain |

|

For |

Against |

Abstain ** |

|

Result |

01 |

REMUNERATION REPORT (NON-BINDING) |

N |

|

66,029,206 85.44% |

10,874,828 14.07% |

378,172 0.49% |

2,867,376 |

|

67,120,934 86.27% |

10,681,927 13.73% |

2,867,376 |

|

Carried |

02 |

ELECTION OF DIRECTOR - MS JEAN OELWANG |

NA |

|

84,610,833 95.07% |

3,800,111 4.27% |

586,405 0.66% |

156,926 |

|

88,510,568 95.88% |

3,800,111 4.12% |

161,686 |

|

Carried |

03 |

ELECTION OF DIRECTOR - MR TONY BELLAS |

NA |

|

83,398,772 93.71% |

5,015,144 5.64% |

583,843 0.66% |

156,516 |

|

84,692,404 94.41% |

5,015,144 5.59% |

2,764,817 |

|

Carried |

04 |

ELECTION OF DIRECTOR - MR NICK LIVERIS |

NA |

|

71,185,012 79.96% |

17,258,609 19.38% |

587,424 0.66% |

123,230 |

|

75,085,766 81.31% |

17,258,609 18.69% |

127,990 |

|

Carried |

05 |

ISSUE OF FY24 SHARE RIGHTS TO MR NICK LIVERIS |

NA |

|

65,995,921 82.43% |

13,521,343 16.89% |

542,319 0.68% |

95,061 |

|

67,251,796 83.46% |

13,328,442 16.54% |

95,061 |

|

Carried |

06 |

ISSUE OF FY25 SHARE RIGHTS TO MR TONY BELLAS |

NA |

|

77,681,716 87.26% |

10,809,887 12.14% |

536,319 0.60% |

148,853 |

|

78,931,591 88.14% |

10,616,986 11.86% |

148,853 |

|

Carried |

07 |

ISSUE OF FY25 SHARE RIGHTS TO MS SHARAN BURROW AC |

NA |

|

77,993,834 87.55% |

10,545,738 11.84% |

540,669 0.61% |

96,534 |

|

79,248,059 88.45% |

10,352,837 11.55% |

96,534 |

|

Carried |

08 |

ISSUE OF FY25 SHARE RIGHTS TO MR RON EDMONDS |

NA |

|

77,937,944 87.54% |

10,554,299 11.85% |

540,319 0.61% |

144,213 |

|

79,191,819 88.43% |

10,361,398 11.57% |

144,213 |

|

Carried |

09 |

ISSUE OF FY25 SHARE RIGHTS TO ADMIRAL ROBERT NATTER |

NA |

|

78,027,544 87.64% |

10,355,349 11.63% |

651,277 0.73% |

142,605 |

|

78,741,100 88.57% |

10,162,448 11.43% |

704,477 |

|

Carried |

10 |

ISSUE OF FY25 SHARE RIGHTS TO MS JEAN OELWANG |

NA |

|

77,998,376 87.61% |

10,387,997 11.67% |

647,601 0.73% |

142,801 |

|

79,359,533 88.62% |

10,195,096 11.38% |

142,801 |

|

Carried |

11 |

ISSUE OF FY25 SHARE RIGHTS TO PHILLIPS 66 COMPANY |

NA |

|

79,344,631 89.07% |

9,082,173 10.20% |

651,277 0.73% |

98,694 |

|

80,710,136 90.08% |

8,888,600 9.92% |

98,694 |

|

Carried |

Printed: 2/04/2025 |

This report was produced from the MUFG Corporate Markets, MUFG Pension & Market Services Meeting System |

Page 1 of 2 |

|

|

NOVONIX LIMITED |

|

MUFG Corporate Markets A Division of MUFG Pension & Market Services |

|

|

|

ANNUAL GENERAL MEETING Wednesday, 2 April, 2025 |

|

RESULT OF ANNUAL GENERAL MEETING (ASX REPORT)

|

|

|

As required by section 251AA(2) of the Corporations Act 2001 (Commonwealth) the following statistics are provided in respect of each resolution on the agenda. |

|

|||

Resolution Voted on at the meeting |

|

Proxy Votes (as at proxy close) |

|

Total votes cast in the poll (where applicable) |

|

|

|||||||

|

No |

Short Description |

Strike Y/N/NA |

|

For |

Against |

Discretionary (open votes) |

Abstain |

|

For |

Against |

Abstain ** |

|

Result |

12 |

ISSUE OF FY25 SHARE RIGHTS TO MR NICK LIVERIS |

NA |

|

68,646,743 85.87% |

10,755,150 13.45% |

540,319 0.68% |

212,432 |

|

69,900,618 86.87% |

10,562,249 13.13% |

212,432 |

|

Carried |

** - Note that votes relating to a person who abstains on an item are not counted in determining whether or not the required majority of votes were cast for or against that item

Printed: 2/04/2025 |

This report was produced from the MUFG Corporate Markets, MUFG Pension & Market Services Meeting System |

Page 2 of 2 |