UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

Date of event requiring this shell company report

Commission file number: 001-39173

I-MAB

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

2440 Research Boulevard, Suite 400

Rockville, MD 20850

United States

(Address of Principal Executive Offices)

Joseph Skelton

Chief Financial Officer

2440 Research Boulevard, Suite 400

Rockville, MD 20850

United States

Phone: (240) 745-6330

(Name, Telephone, and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange |

|

American depositary shares, each ten twenty-three (23) ordinary shares

|

|

IMAB |

|

The Nasdaq Stock Market LLC |

Ordinary shares, par value $0.0001 per share |

|

* |

|

The Nasdaq Stock Market LLC |

* Not for trading, but only in connection with the registration of the American depositary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 187,452,495 ordinary shares outstanding, par value of $0.0001 per share as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

|

Emerging growth company |

☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ |

|

International Financial Reporting Standards as issued |

|

Other ☐ |

|

|

by the International Accounting Standards Board ☐ |

|

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

TABLE OF CONTENTS

|

|

Page |

|

|

1 |

||

|

|

|

|

|

3 |

||

|

|

|

|

|

5 |

||

|

|

|

|

ITEM 1. |

|

5 |

|

ITEM 2. |

|

5 |

|

ITEM 3. |

|

5 |

|

ITEM 4. |

|

56 |

|

ITEM 4A. |

|

92 |

|

ITEM 5. |

|

92 |

|

ITEM 6. |

|

104 |

|

ITEM 7. |

|

120 |

|

ITEM 8. |

|

124 |

|

ITEM 9. |

|

126 |

|

ITEM 10. |

|

127 |

|

ITEM 11. |

|

137 |

|

ITEM 12. |

|

138 |

|

|

|

|

|

|

140 |

||

|

|

|

|

ITEM 13. |

|

140 |

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

|

140 |

ITEM 15. |

|

140 |

|

ITEM 16A. |

|

141 |

|

ITEM 16B. |

|

141 |

|

ITEM 16C. |

|

141 |

|

ITEM 16D. |

|

142 |

|

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

|

142 |

ITEM 16F. |

|

142 |

|

ITEM 16G. |

|

143 |

|

ITEM 16H. |

|

143 |

|

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

|

143 |

ITEM 16J. |

|

143 |

|

ITEM 16K. |

|

143 |

|

|

|

|

|

|

145 |

||

|

|

|

|

ITEM 17. |

|

145 |

|

ITEM 18. |

|

145 |

|

ITEM 19. |

|

146 |

|

|

|

|

|

|

150 |

||

i

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

1

In April 2024, we closed the divestiture of our Greater China assets and business operations. Among other transaction components, we transferred all of the outstanding equity interest in I-Mab Biopharma Co., Ltd. to I-Mab Biopharma (Hangzhou) Co., Ltd., an unconsolidated investee, on a cash-free and debt-free basis, for an aggregate consideration of the RMB equivalent of up to $80 million, contingent on TJ Biopharma’s achievement of certain future regulatory and sales-based milestone events as well as royalties. Upon the completion of the divestiture transaction, we ceased to consolidate the divested entity, assets and businesses as well as their corresponding financial results, which includes the future development costs of our divested Greater China assets and business operations.

Unless otherwise specifically stated, the information relating to the business operations is disclosed on a continuing operations basis, which excludes our divested Greater China assets and business operations.

TRADEMARKS AND SERVICE MARKS

This annual report includes trademarks, trade names and service marks, certain of which belong to us and others that are the property of other organizations. Solely for convenience, trademarks, trade names and service marks referred to in this annual report appear without the ®, ™ and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our rights or that the applicable owner will not assert its rights to these trademarks, trade names and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

PRESENTATION OF FINANCIAL INFORMATION

Our consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. For the years presented in our audited consolidated financial statements included elsewhere in this annual report, our reporting currency is U.S dollars. All references in this annual report to “$” are to U.S. dollars, and all references to “RMB” are to Renminbi. Tabular amounts are in U.S. dollars in thousands, except for share and per share amounts, unless otherwise noted. This annual report contains certain translations of RMB amounts into U.S. dollars. We make no representation that the RMB or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

INDUSTRY AND MARKET DATA

This annual report contains estimates, projections and other information concerning our industry, our business and the market for our drug candidates. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we believe our internal company research related to such matters is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Forward-Looking Statements.”

2

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that relate to our current expectations and views of future events. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.

Our investors can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

3

Our investors should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

Our investors should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

4

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Our Holding Company Structure

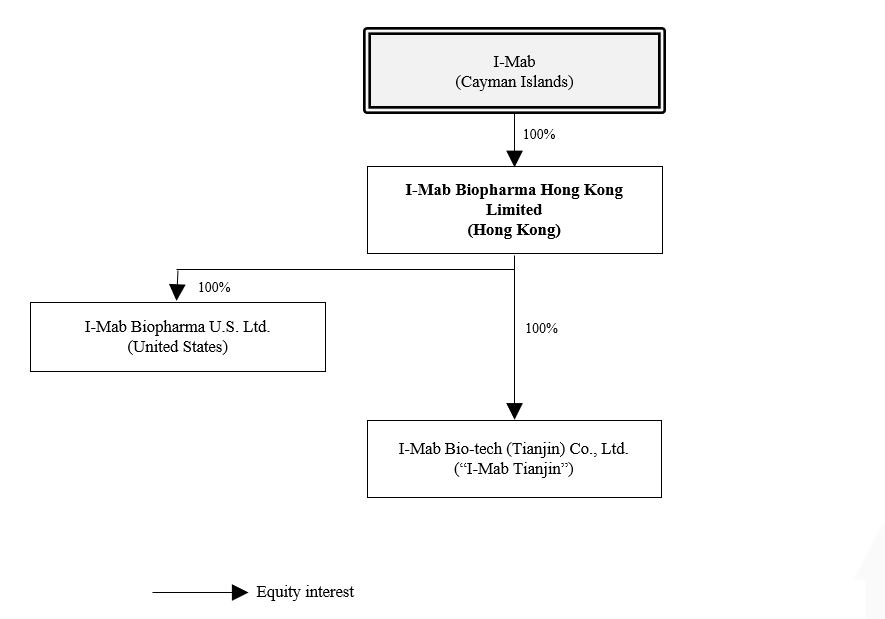

I-Mab is a Cayman Islands holding company with its current business operations primarily conducted by its subsidiary based in the United States. Investors in our ADSs are purchasing equity interest in a holding company incorporated in the Cayman Islands instead of equity interest in our operating subsidiaries. This structure involves unique risks to investors who hold our ADSs.

Prior to April 2024, we conducted business operations in China through I-Mab Biopharma Co., Ltd. (later renamed TJ Biopharma (Shanghai) Co., Ltd. and referred to herein as “TJBio Shanghai”) to advance the Greater China portfolio. In February 2024, we entered into definitive agreements with I-Mab Biopharma (Hangzhou) Co., Ltd. (later renamed TJ Biopharma (Hangzhou) Co., Ltd. and referred to herein as “TJBio Hangzhou”), an unconsolidated investee of ours, collectively “TJ Biopharma”, and a group of China-based investors to divest our Greater China assets and business operations. In April 2024, we closed the divestiture of our Greater China assets and business operations. Since the completion of these transactions, we have conducted our business operations primarily through our U.S. subsidiary, with only a small portion of business operations relating to research and development activities via collaboration with TJ Biopharma, through our PRC subsidiary, remaining in China. However, any operations that we may conduct through our PRC subsidiary are subject to complex and evolving PRC laws and regulations. For example, the PRC government has issued statements and regulatory actions relating to areas such as the regulatory approvals on offshore offerings and listings by, and foreign investment in, companies with operations in China, and implemented industry-wide regulations, including cybersecurity and data privacy related regulations. The PRC government has significant authority in regulating any operations that we may conduct through our PRC subsidiary and may influence any operations that we may conduct through our PRC subsidiary. The PRC may exert more oversight and control over offerings conducted overseas by, and foreign investment in, issuers with operations in China, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, in this nature may cause the value of such securities to significantly decline.

Permissions may be Required from the PRC Authorities for the Offering of Our Securities

The PRC government has promulgated certain regulations and rules to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. In connection with the nature and scale of data processed or handled by us in our business operations and our historical issuance of securities to foreign investors, under the current PRC laws, regulations and regulatory rules, as of the date of this annual report, we and our PRC subsidiary, (i) are not required to go through the filing procedures with regard to the listing and historical issuance of securities by our company to foreign investors with the China Securities Regulatory Commission (the “CSRC”) under the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies, (ii) are not required by the Cyberspace Administration of China (the “CAC”) or any of its local counterparts, to go through the cybersecurity review under the Cybersecurity Review Measures, and (iii) have not received or were denied such permissions by the CSRC or the CAC. Nevertheless, in the event that we conduct any securities offerings in the future that will be captured by the trial administrative measures, we may be required to go through the filing procedures with the CSRC. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Financial Position and Need for Additional Capital—The approval of and filing with PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.”

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, which was enacted on December 18, 2020 and further amended by the Consolidated Appropriations Act, 2023 signed into law on December 29, 2022 (the “HFCAA”), if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board (United States) (“PCAOB”) for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our prior auditor.

5

In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. While vacating those determinations, the PCAOB noted that, should it encounter any impediment to conducting an inspection or investigation of auditors in mainland China or Hong Kong as a result of a position taken by any authority there, the PCAOB would act to immediately reconsider the need to issue new determinations consistent with the HFCAA and PCAOB’s Rule 6100.

On August 6, 2024, our Audit Committee approved the dismissal of PricewaterhouseCoopers Zhong Tian LLP as our independent registered public accounting firm, effective August 7, 2024, and the appointment of PricewaterhouseCoopers LLP as our new independent registered public accounting firm for the fiscal year ended December 31, 2024. The office of PricewaterhouseCoopers LLP is located at 400 Campus Drive, Florham Park, NJ 07932 and PricewaterhouseCoopers LLP is registered with the PCAOB and subject to PCAOB inspection. Therefore, we believe that, as of the date of this report, PricewaterhouseCoopers LLP is not subject to the determinations as to the inability to inspect or investigate registered firms completely announced by the PCAOB on December 16, 2021.

PricewaterhouseCoopers Zhong Tian LLP must still be able to produce any audit work papers upon any PCAOB inspection or investigative demand and make any relevant audit personnel available to the PCAOB upon inspection or investigative demand. The failure of PricewaterhouseCoopers Zhong Tian LLP to meet any of its legal or professional obligations with respect to PCAOB inspection and investigative demands, or the failure of the PricewaterhouseCoopers Zhong Tian LLP to comply with all applicable audit standards could result in significant liability for us or result in the delisting of our securities pursuant to the HFCAA.

Cash and Asset Flows through Our Organization

I-Mab is a holding company with no operations of its own. We primarily conduct our business through our subsidiary in the United States. As a result, although other means are available for us to obtain financing at the holding company level, our ability to pay dividends to our shareholders and holders of the ADSs and to service any debt it may incur may depend upon dividends paid by our subsidiaries. If any of our subsidiaries incur debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to I-Mab. In addition, our PRC subsidiary is permitted to pay dividends to I-Mab only out of its retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiary is required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the PRC subsidiary. For more details, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Holding Company Structure.”

Under PRC laws and regulations, our PRC subsidiary is subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by the State Administration of Foreign Exchange (“SAFE”). Furthermore, cash transfers from our PRC subsidiary to entities outside of China are subject to PRC government control of currency conversion. Shortages in the availability of foreign currency may temporarily delay the ability of our PRC subsidiary to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. For the years ended December 31, 2024, 2023 and 2022, no dividends or distributions were made to I-Mab by our existing PRC subsidiary. As of December 31, 2024 and 2023, our sole remaining PRC subsidiary held cash and cash equivalents of $0.9 million and $0.5 million, respectively.

Under PRC law, I-Mab may provide funding to our PRC subsidiary only through capital contributions or loans, subject to satisfaction of applicable government registration and approval requirements.

I-Mab has not declared or paid any cash dividends, nor does it have any present plan to pay any cash dividends on our ordinary shares in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and develop our business. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For PRC and U.S. federal income tax considerations of an investment in our ADSs, see “Item 10. Additional Information—E. Taxation.”

Not applicable.

6

Not applicable.

Our business faces significant risks. Before deciding to invest in our securities, you should carefully consider all of the information set forth in this annual report and in our other filings with the SEC, including the following risk factors which we face and which are faced by our industry. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. This annual report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this annual report and our other SEC filings. See “Forward-Looking Statements” above.

Summary of Risk Factors

An investment in our ADSs or ordinary shares involves significant risks. Below is a summary of material risks we face. These risks are discussed more fully in this section.

7

Risks Related to Our Financial Position and Need for Additional Capital

We have a limited operating history, which may make it difficult to evaluate our current business and predict our future performance.

We are a clinical-stage biopharmaceutical company with a limited operating history. Our operations to date have focused on organizing and staffing our operations, business planning, raising capital, establishing our intellectual property portfolio and conducting preclinical and clinical trials of our drug candidates. We have not yet demonstrated an ability to successfully manufacture, obtain marketing approvals for, or commercialize our drug candidates. We have no products approved for commercial sale. Consequently, any predictions about our future success or viability may not be as accurate as they could be if we had a longer operating history.

We are focused on the development of precision immuno-oncology agents for the treatment of cancer. Our limited operating history, particularly in light of the rapidly evolving drug research and development industry in which we operate and the changing regulatory and market environments we encounter, may make it difficult to evaluate our prospects for future performance.

8

As a result, any assessment of our future performance or viability is subject to significant uncertainty. We will encounter risks and difficulties frequently experienced by early-stage companies in rapidly evolving fields as we seek to transition to a company capable of supporting commercial activities. If we do not address these risks and difficulties successfully, our business will suffer.

We have incurred net losses in the past and we may not be able to maintain profitability in the future.

Investment in the development of biopharmaceutical products is highly speculative as it entails substantial upfront capital expenditures and significant risks that a drug candidate may fail to demonstrate efficacy and/or safety to gain regulatory or marketing approvals or become commercially viable. To date, we have financed our activities primarily through public and private placements, as well as revenue from licensing and collaboration deals. We have incurred significant research and development expenses and other expenses related to our ongoing operations. As a result, we incurred net losses of $22.2 million, $207.7 million and $371.1 million in 2024, 2023 and 2022, respectively. Substantially all of our net losses have resulted from costs incurred in connection with our research and development programs and from administrative costs associated with our operations.

We cannot assure our investors that we will be able to generate net profits in the future. Our ability to achieve and maintain profitability depends in large part on our ability to out-license some of our commercialization rights and execute our product commercialization strategies as our business further develops. Accordingly, we intend to continue to invest for the foreseeable future in certain activities relating to our development, including the following:

Typically, it takes many years to develop a new drug from the time it is discovered to when it becomes available for treating patients. During the process, we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend partially on the rate of the future growth of our expenses, our ability to generate revenues and the timing and amount of milestone payments and other payments that we receive from or pay to third parties. If any of our drug candidates fails during clinical trials or does not gain regulatory approval, or, even if approved, fails to achieve market acceptance, our business may not become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods thereafter. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our working capital and shareholders’ equity.

We recorded net cash outflow from operating activities in the past. We may need to obtain additional financing to fund our operations. If we are unable to obtain such financing, we may be unable to complete the development and commercialization of our drug candidates.

Since our inception, our operations have consumed substantial amounts of cash. We raised over $400 million in pre-IPO financing. In the past, we received total net proceeds of approximately $105.3 million, $397.2 million and $105.6 million from our initial public offering, subsequent private placement, and warrants issued and subsequently exercised in connection with the private placement, respectively. We used $52.7 million, $72.7 million and $49.6 million in net cash in our operations for the years ended December 31, 2024, 2023 and 2022, respectively.

9

Despite the divestiture of our Greater China assets and business operations, we expect to continue to incur significant expenses in connection with our ongoing activities, particularly as we advance the clinical development of our clinical-stage drug candidates, and initiate additional clinical trials of, and seek regulatory approval for, these and other potential future drug candidates.

In addition, if we obtain regulatory approvals for any of our drug candidates, we expect to incur significant commercialization expenses relating to product manufacturing, marketing, sales and distribution and post-approval commitments to continue monitoring the efficacy and safety data of our future products on the market. In particular, the costs that may be required for the manufacture of any drug candidate that has received regulatory approval may be substantial. We have incurred and may continue to incur expenses as we create additional infrastructure to support our operations as a public company. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations through public or private equity offerings, debt financing, collaborations or licensing arrangements or other sources. If we are unable to raise capital when needed or on acceptable terms, we could be forced to delay, limit, reduce or terminate our research and development programs or any future commercialization efforts.

There have been uncertainties and interruptions to the global economy and significant volatility across the financial markets, which had a cooling effect on financing and investing activities in general. We believe that our current cash, cash equivalents and short-term investments of $173.4 million will be sufficient to meet our present anticipated working capital requirements and capital expenditures into 2027. However, if the volatility in the financial markets continues, our financing activities in the future to raise additional capital may be materially and adversely affected, which may in turn have an adverse effect on our ability to meet our working capital requirement and our liquidity.

Raising additional capital may cause dilution to the interests to the holders of our ADSs and our shareholders, restrict our operations or require us to relinquish rights to our technologies or drug candidates.

We may seek additional funding through a combination of asset sales, equity offerings, debt financings, collaborations, licensing arrangements, strategic alliances or partnerships and government grants or subsidies. To the extent that we raise capital through asset sales, we can provide no assurance as to the timing of any asset sales or the proceeds that could be realized by us from any such asset sale.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, investor ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect our investors’ rights as holders of our ADSs. The incurrence of indebtedness or the issuance of certain equity securities could give rise to increased fixed payment obligations and also result in certain additional restrictive covenants, such as limitations on our ability to incur additional debt or issue additional equity, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. In addition, the issuance of additional equity securities, or the possibility of such issuance, may cause the market price of our ADSs to decline.

In the event we enter into collaborations or licensing arrangements in order to raise capital, we may be required to accept unfavorable terms, including relinquishing or licensing to a third party our rights to technologies or drug candidates on unfavorable terms, which we would have otherwise sought to develop or commercialize on our own or reserve for future potential arrangements when we are more likely to achieve more favorable terms.

The approval of and filing with PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.

The Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors adopted by six PRC regulatory agencies in 2006 and amended in 2009, require an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC persons or entities to obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. The interpretation and application of the regulations remain unclear, and our offshore offerings may ultimately require approval of the CSRC. If the CSRC approval is required, it is uncertain whether we can or how long it will take us to obtain the approval and, even if we obtain such CSRC approval, the approval could be rescinded. Any failure to obtain or delay in obtaining the CSRC approval for any of our offshore offerings, or a rescission of such approval if obtained by us, may subject us to sanctions imposed by the CSRC or other PRC regulatory authorities, which may include fines and penalties on our operations in China, restrictions or limitations on our ability to pay dividends outside of China, and other forms of sanctions that may materially and adversely affect our business, financial condition, and results of operations.

On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies along with five relevant guidelines, which came into effect on March 31, 2023. The trial administrative measures comprehensively improve and reform the existing regulatory regime for overseas offering and listing of PRC domestic companies’ securities and regulate both direct and indirect overseas offering and listing of PRC domestic companies’ securities by adopting a filing-based regulatory regime.

10

Pursuant to these trial administrative measures, an overseas offering and listing by a domestic company, whether directly or indirectly, must be filed with the CSRC. Specifically, the examination and determination of an indirect overseas offering and listing shall be conducted on a substance-over-form basis, and an offering and listing will be considered as an indirect overseas offering and listing by a domestic company if the issuer meets the following both conditions: (i) the operating income, gross profit, total assets or net assets of such domestic company in the most recent fiscal year was more than 50% of the relevant line items in the issuer’s audited consolidated financial statements for that year; and (ii) the main part of operating activities is conducted in the PRC or the main place of business is located in the PRC, or the senior management personnel responsible for business operations and management are mostly PRC citizens or are ordinarily resident in the PRC. Following the completion of the divestiture of our Greater China assets and business operations in April 2024, we conduct a majority of our business outside of China and only conduct a small portion of our research and development activities in China, we generate majority of our net assets from outside the PRC, and the majority of our senior management personnel responsible for business operations and management are neither PRC citizens nor habitually reside in the PRC, as of the date of this annual report. Given such circumstances, as advised by our PRC legal counsel, JunHe LLP, there is a possibility that we will not be subject to the CSRC filing requirements in connection with our proposed offering and listing outside China. However, the CSRC and other authorities may take a view that is contrary to the opinion of our PRC legal counsel, and we cannot assure our investors that the above-mentioned assets and business operations in China and the citizenship of our senior management personnel will not change in the future, there is no assurance that we may not be required to file the relevant documents with the CSRC in connection with our proposed offerings and listings outside mainland China in the future.

Following the issuance of the trial administrative measures, the CSRC subsequently issued several rules and regulations on overseas offerings and listings, providing further guidance on the filing requirements in connection with overseas securities issuance and listing by domestic companies. We cannot assure our investors that any new rules or regulations promulgated in the future will not impose additional requirements on us. If it is determined in the future that approval or filing from any regulatory authorities or other procedures are required for our offshore offerings, it is uncertain whether we can, or how long it will take us to, obtain such approval or complete such filing procedures and any such approval or filing could be rescinded or rejected. Any failure to obtain or delay in obtaining such approval or completing such filing procedures for our offshore offerings, or a rescission of any such approval or filing if obtained by us, may subject us to sanctions by the regulatory authorities. These regulatory authorities may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from our offshore offerings into China or take other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects, as well as the trading price of our listed securities. These regulatory authorities also may take actions requiring us, or making it advisable for us, to halt our offshore offerings before settlement and delivery of the shares offered. Consequently, if investors engage in market trading or other activities in anticipation of and prior to settlement and delivery, they do so at the risk that settlement and delivery may not occur. In addition, if any regulatory authorities later promulgate new rules or explanations requiring that we obtain their approvals or accomplish the required filing or other regulatory procedures for our prior offshore offerings, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties or negative publicity regarding such approval requirement could materially and adversely affect our business, prospects, financial condition, reputation, and the trading price of our listed securities.

We have granted, and may continue to grant, options and other types of awards under our share incentive plans, which may result in increased share-based compensation expenses.

We have adopted the Second Amended and Restated 2017 Employee Stock Option Plan (the “2017 Plan”), the Second Amended and Restated 2018 Employee Stock Option Plan (the “2018 Plan”), the 2019 Share Incentive Plan (the “2019 Plan”), the 2020 Share Incentive Plan (the “2020 Plan”), the 2021 Share Incentive Plan (the “2021 Plan”), the 2022 Share Incentive Plan (the “2022 Plan”), and the 2024 Omnibus Incentive Plan (the “2024 Plan”), for the purpose of granting share-based compensation awards to employees, directors and consultants to incentivize their performance and align their interests with ours. We recognize expenses in our consolidated financial statements in accordance with U.S. GAAP. As of March 19, 2025, the awards that had been granted to our directors, officers, employees and consultants and remained outstanding included (i) options to purchase an aggregate of 291,042 ordinary shares under the 2017 Plan, 341,253 ordinary shares under the 2020 Plan, 266,455 ordinary shares under the 2021 Plan, 577,231 ordinary shares under the 2022 Plan and 9,285,758 ordinary shares under the 2024 Plan, excluding options that were forfeited, cancelled, or exercised after the grant date; and (ii) restricted share units to receive an aggregate of 2,008 ordinary shares under the 2020 Plan, an aggregate of 10,414 ordinary shares under the 2021 Plan, an aggregate of 108,252 ordinary shares under the 2022 Plan and an aggregate of 4,519,116 ordinary shares under the 2024 Plan, excluding restricted share units that were forfeited, cancelled, or vested after the grant date. See “Item 6. Directors, Senior Management and Employees—B. Compensation—Share Incentive Plans.”

We believe the granting of share-based compensation is of significant importance to our ability to attract and retain key personnel and employees, and we will continue to grant share-based compensation to employees in the future. As a result, our expenses associated with share-based compensation may increase, which may have an adverse effect on our results of operations. We may re-evaluate the vesting schedules, lock-up period, exercise price or other key terms applicable to the grants under our currently effective share incentive plans from time to time. If we choose to do so, we may experience substantial change in our share-based compensation charges.

11

Our strategic reprioritization and related reduction in force may not achieve our intended outcome.

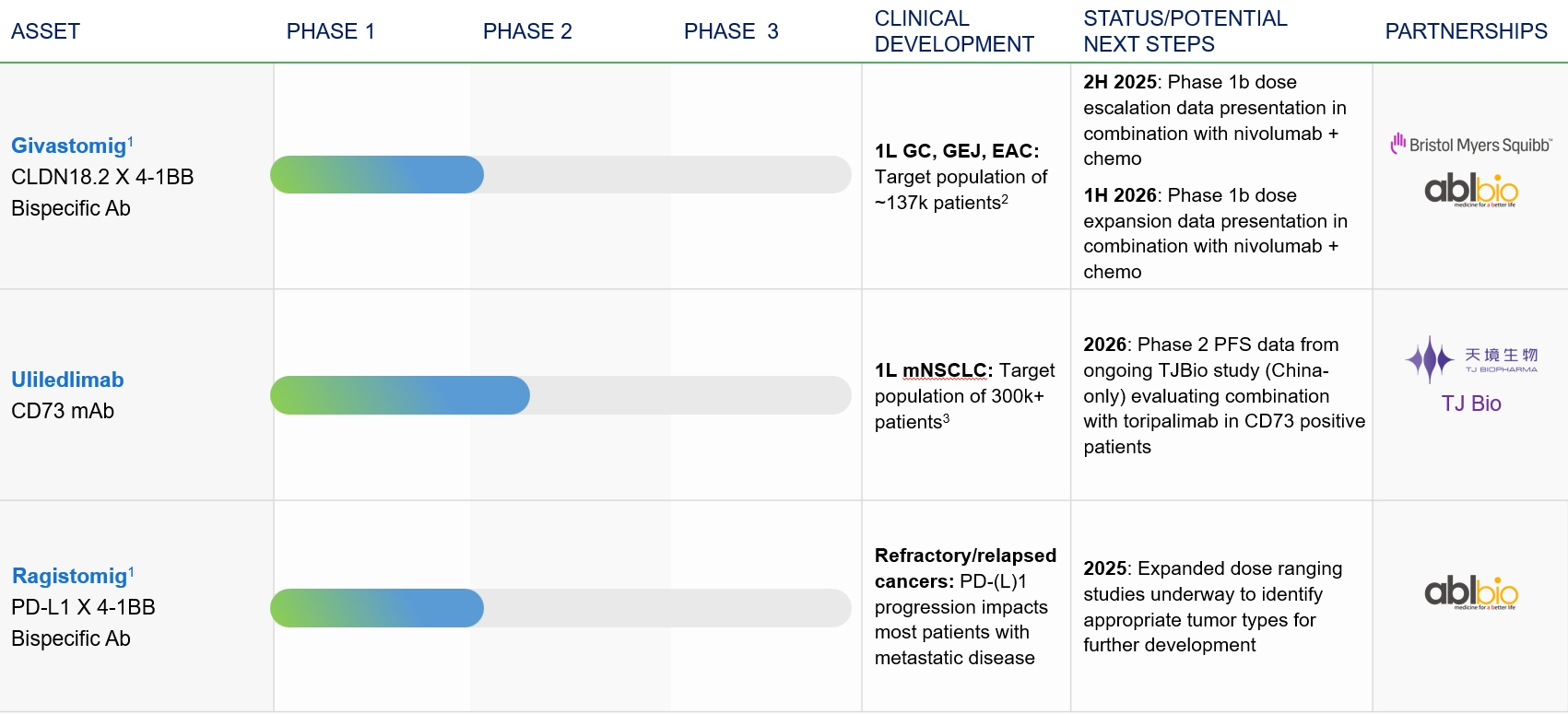

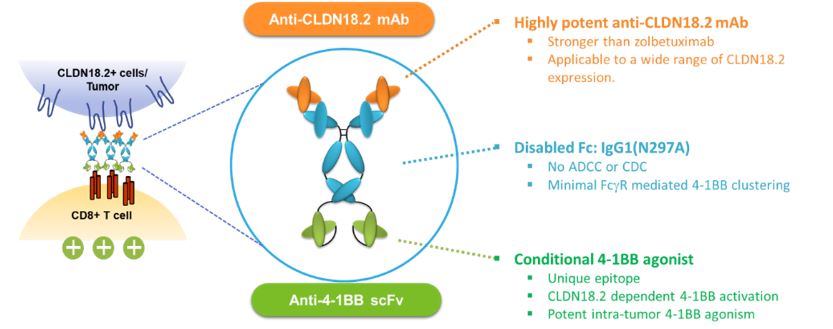

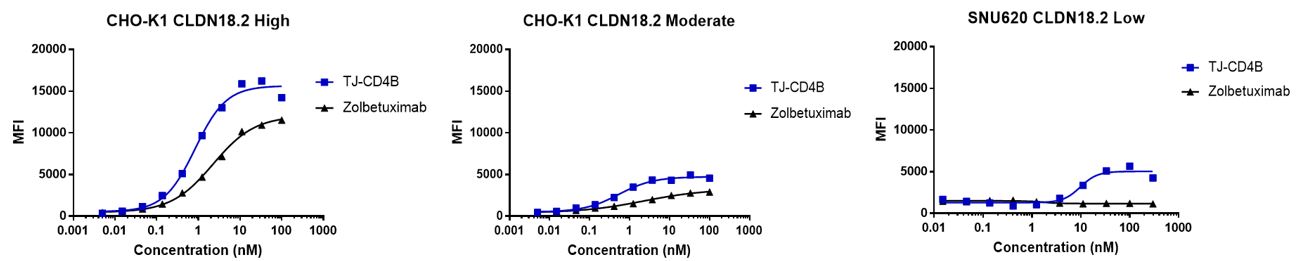

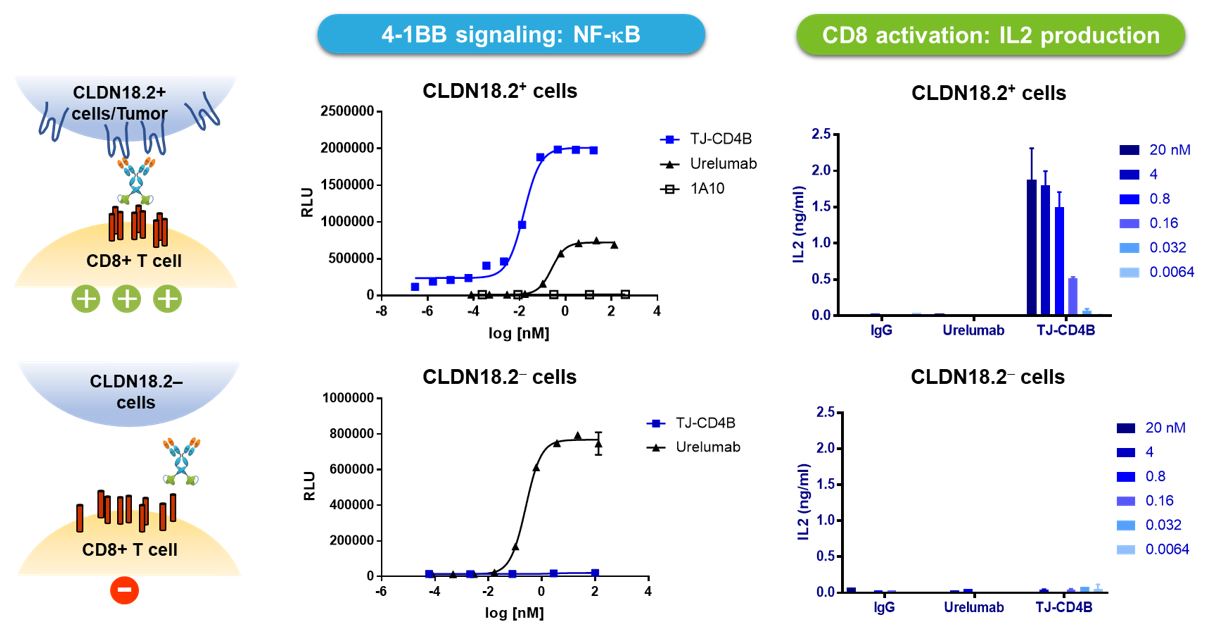

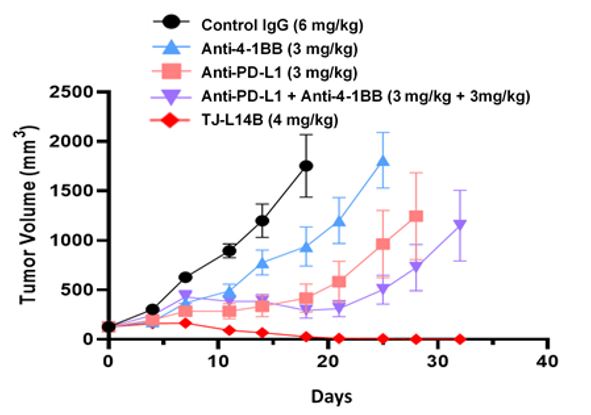

In January 2025, we announced a strategic reprioritization of resources (the “Realignment Plan”), pursuant to which we will focus our resources on advancing our lead program, givastomig, a CLDN18.2 x 4-1BB bispecific antibody, targeting first-line metastatic gastric cancers, with further potential in other solid tumors. In connection with the Realignment Plan, we reduced our workforce by approximately 27%.

The Realignment Plan may result in unintended consequences and costs, such as the loss of institutional knowledge and expertise, attrition beyond the intended number of employees, decreased morale among our remaining employees, and the risk that we may not achieve the anticipated benefits of the reduction in force. The Realignment Plan could also make it difficult for us to pursue, or prevent us from pursuing, new opportunities and initiatives due to insufficient personnel, or require us to incur additional and unanticipated costs to hire new personnel to pursue such opportunities or initiatives. The Realignment Plan could also harm our reputation, making our ability to recruit skilled personnel difficult. Any failure to attract or retain qualified personnel could prevent us from successfully developing potential drug candidates or supporting our existing license agreements. If we are unable to realize the anticipated benefits from the reduction in force, or if we experience significant adverse consequences from the reduction in force, our business, financial condition, and results of operations may be materially adversely affected.

Additionally, the prioritization of our capital resources in accordance with Realignment Plan may not prove successful, and we may forgo the pursuit of other indications, whether through future collaborations, licenses, other similar arrangements, or otherwise, that could be more successful. Furthermore, we may undertake further similar cost-saving initiatives, which may include additional restructuring or workforce reductions. These types of cost-reduction activities can be complex and result in unintended consequences and costs, including decreased employee morale, loss of institutional knowledge and expertise and could adversely impact our business and financial condition.

Risks Related to Clinical Development of Our Drug Candidates

Clinical development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

Clinical testing is expensive and lengthy, and its outcome is inherently uncertain. While our exclusive focus is to develop drug candidates with the potential to become novel or highly differentiated drugs globally, we cannot guarantee that we are able to achieve this for any of our drug candidates. Failure can occur at any time during the clinical development process. The results of preclinical studies and early clinical trials of our drug candidates may not be predictive of the results of later-stage clinical trials. Drug candidates during later stages of clinical trials may fail to show the desired results in safety and efficacy despite having progressed through preclinical studies and initial clinical trials and despite the level of scientific rigor in the study, design and adequacy of execution. In addition, there can be significant variability in safety and/or efficacy results among different trials of the same drug candidate due to numerous factors, including demographics, differences in individual patient conditions, such as genetic differences, and other compounding factors, such as other medications or pre-existing medical conditions.

In the case of any trials we conduct, results may differ from earlier trials due to the larger number of clinical trial sites, larger number of patients enrolled and additional countries and languages involved in such trials. A number of companies in the biopharmaceutical industry have suffered significant setbacks in advanced clinical trials due to a lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier trials. We cannot guarantee that our future clinical trial results will be favorable based on currently available clinical and preclinical data.

We depend substantially on the success of our drug candidates, all of which are in preclinical or clinical development, and our ability to identify additional drug candidates. If we are unable to successfully identify new drug candidates, complete clinical development, obtain regulatory approval and commercialize our drug candidates, or experience significant delays in doing so, our business will be materially harmed.

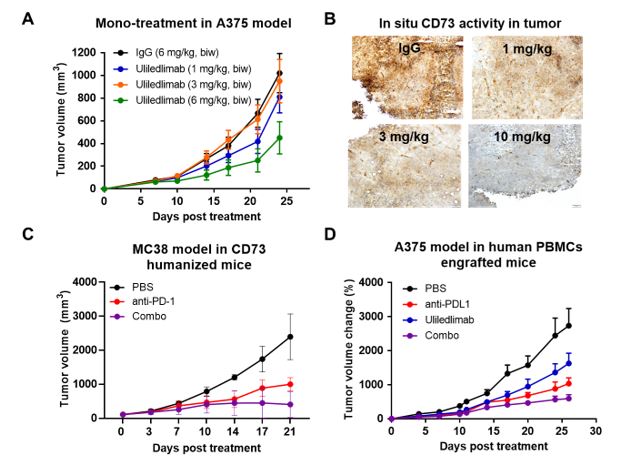

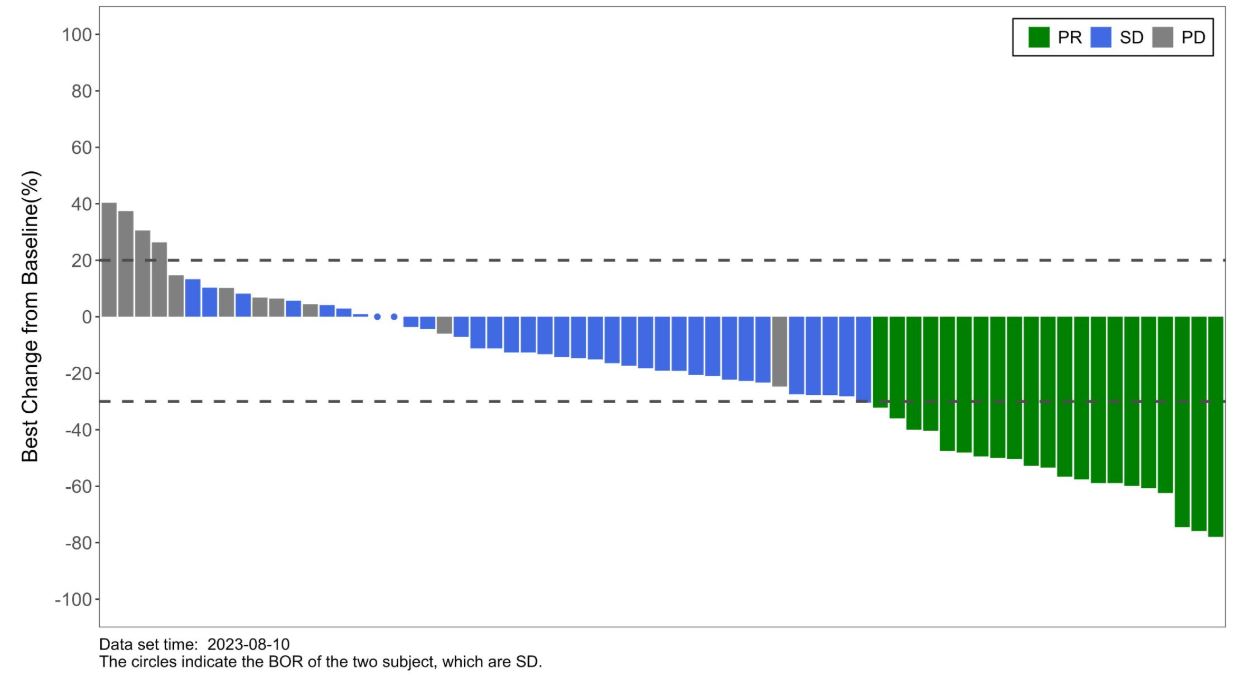

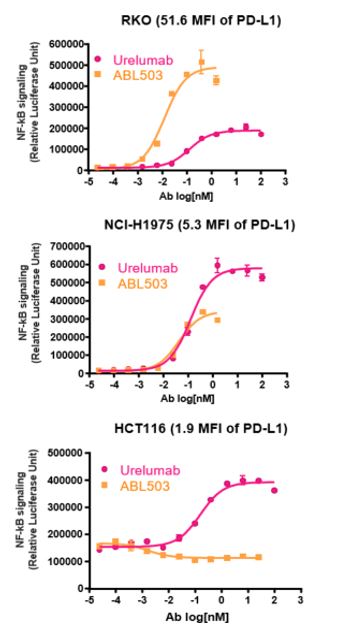

Our business will depend on the successful development, regulatory approval and commercialization of our drug candidates for the treatment of patients with our targeted indications, all of which are still in early clinical development, and other new drug candidates that we may identify and develop. As of the date of this annual report, we have open INDs with the FDA for three of our drug candidates, givastomig, uliledlimab, and ragistomig. However, we cannot guarantee that we will be able to obtain regulatory approvals to conduct clinical trials for our other existing drug candidates in a timely manner, or at all. In addition, none of our drug candidates have been approved for marketing in any jurisdiction. Each of our drug candidates will require additional preclinical and/or clinical development, regulatory approvals in multiple jurisdictions, development of manufacturing supply and capacity, substantial investment and significant marketing efforts before we generate any revenue from product sales.

12

The success of our drug candidates will depend on several factors, including, successful completion of preclinical and/or clinical trials or studies, receipt of regulatory approvals from applicable regulatory authorities for planned clinical trials, successful completion of future clinical trials or drug registrations, successful manufacturing and commercialization of our existing drug candidates, obtaining coverage and reimbursement from third-party payors, hiring sufficient technical experts to oversee all development and regulatory activities and license renewal and meeting safety requirements.

If we do not achieve one or more of these in a timely manner or at all, we could experience significant delays in our ability to obtain approval for our drug candidates, which would materially harm our business and we may not be able to generate sufficient revenues and cash flows to continue our operations. As a result, our financial condition, results of operations and prospects will be materially and adversely harmed.

We may not be able to identify, discover or in-license new drug candidates, and may allocate our limited resources to pursue a particular drug candidate or indication and fail to capitalize on drug candidates or indications that may later prove to be more profitable, or for which there is a greater likelihood of success.

Although a substantial amount of our effort will focus on the continued clinical testing, potential approval, and potential commercialization of our lead drug candidate, givastomig, the success of our business depends in part upon our ability to identify, license, discover, develop, or commercialize additional drug candidates. Research programs to identify new drug candidates require substantial technical, financial, and human resources. We may focus our efforts and resources on potential programs or drug candidates that ultimately prove to be unsuccessful. Our research programs or licensing efforts may fail to identify, discover or in-license new drug candidates for clinical development and commercialization for a number of reasons, including, without limitation, the following:

Because we have limited financial and managerial resources, we focus on research programs and drug candidates for specific indications. As a result, we may forgo or delay pursuit of opportunities with other drug candidates or for other indications that later may prove to have greater commercial potential or a greater likelihood of success. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities.

Accordingly, there can be no assurance that we will ever be able to identify additional therapeutic opportunities for our drug candidates or to develop suitable potential drug candidates through internal research programs, which could materially adversely affect our future growth and prospects.

If we encounter delays or difficulties enrolling patients in our clinical trials, our clinical development progress could be delayed or otherwise adversely affected.

We may not be able to initiate or continue clinical trials for our drug candidates if we are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA, or similar regulatory authorities, or if there are delays in the enrollment of eligible patients as a result of the competitive clinical enrollment environment. The inability to enroll a sufficient number of patients who meet the applicable criteria for our clinical trials would result in significant delays. As of the date of this annual report, we have initiated clinical trials for givastomig and uliledlimab in the United States.

In addition, some of our competitors have ongoing clinical trials for drug candidates that treat the same indications as our drug candidates, and patients who would otherwise be eligible for our clinical trials may instead enroll in the clinical trials of our competitors’ drug candidates, which may further delay our clinical trial enrollments.

Patient enrollment for our clinical trials may be affected by other factors, including, the following:

13

Even if we are able to enroll a sufficient number of patients in our clinical trials, delays in patient enrollment may result in increased costs or may affect the timing or outcome of the planned clinical trials, which could prevent completion of these trials and adversely affect our ability to advance the development of our drug candidates.

If clinical trials of our drug candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or do not otherwise produce positive results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our drug candidates.

Before obtaining regulatory approval for the sale of our drug candidates, we must conduct extensive clinical trials to demonstrate the safety and efficacy of our drug candidates in humans. We may experience numerous unexpected events during, or as a result of, clinical trials that could delay or prevent our ability to receive regulatory approval or commercialize our drug candidates, including:

14

If we fail to timely and effectively address the above challenges, we may (i) be delayed in obtaining regulatory approval for our drug candidates; (ii) obtain approval for indications that are not as broad as intended; (iii) not obtain regulatory approval at all; (iv) have the drug removed from the market after obtaining regulatory approval; (v) be subject to additional post-marketing testing requirements; (vi) be subject to restrictions on how the drug is distributed or used; or (vii) be unable to obtain reimbursement for use of the drug.

Significant clinical trial delays may also increase our development costs and could shorten any periods during which we have the exclusive right to commercialize our drug candidates or allow our competitors to bring drugs to market before we do. This could impair our ability to commercialize our drug candidates and may harm our business and results of operations.

Risks Related to Obtaining Regulatory Approval for Our Drug Candidates

All material aspects of the research, development and commercialization of pharmaceutical products are heavily regulated.

Jurisdictions in which we intend to conduct our pharmaceutical-industry activities regulate these activities in great depth and detail. We intend to focus our activities in the United States and other major global markets. These jurisdictions strictly regulate the pharmaceutical industry, and in doing so they employ broadly similar regulatory strategies, including regulation of product development and approval, manufacturing, and marketing, sales and distribution of products. However, there are differences in the regulatory requirements that make for a more complex and costly regulatory compliance burden for a company like us that plans to operate in these regions.

The process of obtaining regulatory approvals and compliance with appropriate laws and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable requirements at any time during the product development process and approval process, or after approval, may subject an applicant to administrative or judicial sanctions. These sanctions could include refusal to approve pending applications, withdrawal of an approval, license revocation, clinical hold, voluntary or mandatory product recalls, product seizures; total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, providing restitution, undergoing disgorgement, or other civil or criminal penalties. Failure to comply with these regulations could have a material adverse effect on our business.

The regulatory approval processes of the FDA and other comparable regulatory authorities are time-consuming and may evolve over time, and if we are ultimately unable to obtain regulatory approval for our drug candidates, our business will be substantially harmed.

The time required to obtain the approval of the FDA and other comparable regulatory authorities is inherently uncertain and depends on numerous factors, including the substantial discretion of the regulatory authorities. Generally, such approvals take many years to obtain following the commencement of preclinical studies and clinical trials. In addition, approval policies, regulations or the type and amount of clinical data necessary to gain approval may change during the course of a drug candidate’s clinical development and may vary among jurisdictions.

Our drug candidates could fail to receive the regulatory approval of the FDA or a comparable regulatory authority for many reasons, including:

15

The FDA or a comparable regulatory authority may require more information, including additional preclinical or clinical data, to support approval, which may delay or prevent approval and our commercialization plans. Even if we were to obtain approval, regulatory authorities may approve any of our drug candidates for fewer or more limited indications than we request, grant approval contingent on the performance of costly post-marketing clinical trials, or approve a drug candidate with an indication that is not desirable for the successful commercialization of that drug candidate. Any of the foregoing scenarios could materially harm the commercial prospects of our drug candidates.

The failure to obtain a patent term extension and data exclusivity for any drug candidates we may develop could increase the risk of generic competition with our products.

In the United States, the Federal Food, Drug and Cosmetic Act provides the opportunity for patent-term restoration, meaning a patent term extension of up to five years to reflect patent term lost during clinical trials and the FDA regulatory review process. A patent term extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of drug approval, only one patent may be extended and only those claims covering the approved drug, a method for using it, or a method for manufacturing it may be extended. Depending upon the timing, duration and specifics of any FDA marketing approval process for any drug candidates we may develop, one or more of our U.S. patents, if issued, may be eligible for limited patent term extension. However, we may not be granted an extension because of, for example, failing to exercise due diligence during the testing phase or regulatory review process, failing to apply within applicable deadlines, failing to apply prior to expiration of relevant patents, or otherwise failing to satisfy applicable requirements. Furthermore, the applicable time period or the scope of patent protection afforded could be less than we request.

In addition, the Biologics Price Competition and Innovation Act of 2009 created an abbreviated pathway for the approval of biosimilar and interchangeable biologic products. Under this act, an application for a highly similar or “biosimilar” product may not be submitted to the FDA until four years following the date that the original branded product was first approved by the FDA. In addition, an application for a biosimilar product cannot be approved by the FDA until 12 years after the original branded product was approved under a biologics license application, (“BLA”). The law is complex and is still being interpreted and implemented by the FDA. As a result, its ultimate impact, implementation, and meaning are subject to uncertainty.

In other jurisdictions where we seek patent protection for our drug candidates, patent term compensation and patent linkage system may be available to us. However, there is no assurance that we may be granted a patent term extension as we request or our pending or future patent applications may qualify for patent linkage. If we are unable to obtain patent term extension or the term of any such extension is less than we request, or our pending or future patent applications do not qualify for patent linkage, our competitors may obtain approval of competing products following our patent expiration, and our business, financial condition, results of operations, and prospects could be materially harmed.

Our drug candidates may cause undesirable adverse events or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following regulatory approval.

Undesirable adverse events caused by our drug candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and may result in a more restrictive label, a delay or denial of regulatory approval by the FDA or other comparable regulatory authorities, or a significant change in our clinical protocol or even our development plan. In particular, as is the case with drugs treating cancers, it is likely that there may be side effects, such as liver toxicities, cytokine release syndrome, and infusion-related reactions, associated with the use of certain of our drug candidates.

16

Results of our trials could reveal a high and unacceptable severity or incidence of certain adverse events. In such an event, our trials could be suspended or terminated and the FDA or other comparable regulatory authorities could order us to cease further development of, or deny approval of, our drug candidates for any or all targeted indications. Adverse events related to our drug candidates may affect patient recruitment or the ability of enrolled subjects to complete the trial, and could result in potential liability claims. Any of these occurrences may significantly harm our reputation, business, financial condition and prospects.

Additionally, if we or others identify undesirable side effects caused by those of our existing drug candidates that have received regulatory approval, or our other drug candidates after having received regulatory approval, this may lead to potentially significant negative consequences which include, the following:

Any of these events could prevent us from achieving or maintaining market acceptance of any particular drug candidate that is approved and could significantly harm our business, results of operations and prospects.

Further, combination therapy, such as using our wholly-owned drug candidates as well as third-party agents, may involve unique adverse events that could be exacerbated compared with adverse events from monotherapies. Results of our trials could reveal a high and unacceptable severity or prevalence of adverse events. These types of adverse events could be caused by our drug candidates and could cause us or regulatory authorities to interrupt, delay or halt clinical trials and may result in a more restrictive indication or the delay or denial of regulatory approval by the FDA or other comparable regulatory authority.

Even if we receive regulatory approval for our drug candidates, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expenses and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our drug candidates.

If the FDA or a comparable regulatory authority approves any of our drug candidates, the manufacturing processes, labeling, packaging, distribution, adverse event reporting, storage, advertising, promotion and recordkeeping for the drug will be subject to extensive and ongoing regulatory requirements on pharmacovigilance. These requirements include submissions of safety and other post-marketing information and reports, registration, random quality control testing, adherence to any chemistry, manufacturing and controls, variations, continued compliance with current good manufacturing practice, and good clinical practices and potential post-approval studies for the purposes of license renewal.

Any regulatory approvals that we receive for our drug candidates may also be subject to limitations on the approved indicated uses for which the drug may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing studies, including Phase 4 studies for the surveillance and monitoring of the safety and efficacy of the drug.

In addition, once a drug is approved by the FDA or a comparable regulatory authority for marketing, it is possible that there could be a subsequent discovery of previously unknown problems with the drug, including problems with third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements.

17

If any of the foregoing occurs with respect to our drug products, it may result in, among other things:

Any government investigation of alleged violations of law could require us to expend significant time and resources and could generate negative publicity. Moreover, regulatory policies may change or additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our drug candidates. If we are not able to maintain regulatory compliance, we may lose the regulatory approvals that we have already obtained and may not achieve or sustain profitability, which in turn could significantly harm our business, financial condition and prospects.

Risks Related to Commercialization of Our Drug Candidates

Our drug candidates may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the medical community necessary for commercial success.

Even if our drug candidates receive regulatory approval, they may nonetheless fail to gain sufficient market acceptance by physicians and patients and others in the medical community. Physicians and patients may prefer other drugs or drug candidates to ours. If our drug candidates do not achieve an adequate level of acceptance, we may not generate significant revenue from sales of our drugs or drug candidates and may not become profitable.

The degree of market acceptance of our drug candidates, if and only when they are approved for commercial sale, will depend on a number of factors, including:

18

If our drug candidates are approved but fail to achieve market acceptance among physicians, patients, hospitals or others in the medical community, we will not be able to generate significant revenue or become profitable. Even if our drugs achieve market acceptance, we may not be able to maintain such market acceptance over time if new products or technologies are introduced which are more favorably received than our drugs, are more cost effective or render our drugs obsolete.

We face intense competition and rapid technological change and the possibility that our competitors may develop therapies that are similar, more advanced, or more effective than ours, which may adversely affect our financial condition and our ability to successfully commercialize our drug candidates.

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. While our exclusive focus is to develop drug candidates with potential to become novel or highly differentiated drugs, we continue to face competition with respect to our current drug candidates, and will face competition with respect to any drug candidates that we may seek to develop or commercialize in the future. Our competitors include major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. We are developing our drug candidates for the treatment of cancer in competition with a number of large biopharmaceutical companies that currently market and sell drugs or are pursuing the development of drugs also for the treatment of cancer. Some of these competitive drugs and therapies are based on scientific approaches that are the same as or similar to our approach, and others are based on entirely different approaches. For details, see “Item 4. Information on the Company—B. Business Overview—Our Drug Pipeline.” Potential competitors further include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.

Many of our competitors have substantially greater financial, technical, and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations. Additional mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated in our competitors. As a result, these companies may obtain regulatory approval from the FDA or other comparable regulatory authorities more rapidly than we are able to and may be more effective in selling and marketing their products as well.

Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring, or licensing on an exclusive basis, products that are more effective or less costly than any drug candidate that we may develop, or achieve earlier patent protection, regulatory approval, product commercialization, and market penetration than we do. Additionally, technologies developed by our competitors may render our potential drug candidates uneconomical or obsolete, and we may not be successful in marketing our drug candidates against competitors.

We have no experience in launching and marketing drug candidates. We may not be able to effectively build and manage our sales network, or benefit from third-party collaborators’ sales network.

We currently have no sales, marketing or commercial product distribution capabilities and have no experience in marketing drugs. We and our third-party collaborators will have to compete with other biopharmaceutical companies to recruit, hire, train and retain marketing and sales personnel.

If we are unable or decide not to establish internal sales, marketing and commercial distribution capabilities for any or all of the drugs we develop, we will likely pursue collaborative arrangements regarding the sales and marketing of our drugs. However, there can be no assurance that we will be able to establish or maintain such collaborative arrangements, or, if we are able to do so, that they will have effective sales forces. Any revenue we receive will depend on the efforts of such third parties, which may not be successful. We may have little or no control over the marketing and sales efforts of such third parties, and our revenue from product sales may be lower than if we had commercialized our drug candidates ourselves. We will also face competition in our search for third parties to assist us with the sales and marketing efforts of our drug candidates.

19

There can be no assurance that we will be able to develop in-house sales and commercial distribution capabilities or establish or maintain relationships with third-party collaborators to successfully commercialize any product, and as a result, we may not be able to generate product sales revenue.

Even if we are able to commercialize any approved drug candidates, reimbursement may be limited or unavailable in certain market segments for our drug candidates, and we may be subject to unfavorable pricing regulations, which could harm our business.

The regulations that govern regulatory approvals, pricing and reimbursement for new therapeutic products vary widely from country to country. Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or licensing approval is granted. In some non-U.S. markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we might obtain regulatory approval for a drug in a particular country, but then be subject to price regulations that delay our commercial launch of the drug and negatively impact the revenues we are able to generate from the sale of the drug in that country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more drug candidates, even if our drug candidates obtain regulatory approval.

Our ability to commercialize any drugs successfully will also depend in part on the extent to which reimbursement for these drugs and related treatments will be available from government health administration authorities, private health insurers and other organizations. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which medications they will pay for and establish reimbursement levels. A primary trend in the global healthcare industry is cost containment. Government authorities and these third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payors are requiring that companies provide them with predetermined discounts from list prices and are challenging the prices charged for medical products. We cannot be sure that reimbursement will be available for any drug that we commercialize and, if reimbursement is available, what the level of reimbursement will be. Reimbursement may impact the demand for, or the price of, any drug for which we obtain regulatory approval. Obtaining reimbursement for our drugs may be particularly difficult because of the higher prices often associated with drugs administered under the supervision of a physician. If reimbursement is not available or is available only to limited levels, we may not be able to successfully commercialize any drug candidate that we successfully develop. Further, coverage policies and third-party payor reimbursement rates may change at any time. Even if favorable coverage and reimbursement status is attained for a product for which we receive regulatory approval, less favorable coverage policies and reimbursement rates may be implemented in the future.

There may be significant delays in obtaining reimbursement for approved drug candidates, and coverage may be more limited than the purposes for which the drug candidates are approved by the FDA or other comparable regulatory authorities. Moreover, eligibility for reimbursement does not imply that any drug will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution. Interim payments for new drugs, if applicable, may also not be sufficient to cover our costs and may not be made permanent. Payment rates may vary according to the use of the drug and the clinical setting in which it is used, may be based on payments allowed for lower cost drugs that are already reimbursed, and may be incorporated into existing payments for other services. Net prices for drugs may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors and by any future weakening of laws that presently restrict imports of drugs from countries where they may be sold at lower prices than in the United States. Our inability to promptly obtain coverage and profitable payment rates from both government-funded and private payors for any future approved drug candidates and any new drugs that we develop could have a material adverse effect on our business, our operating results, and our overall financial condition.

Current and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our drug candidates and affect the prices we may obtain.