UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2025 |

LM FUNDING AMERICA, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-37605 |

47-3844457 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

1200 West Platt Street Suite 100 |

|

|||

Tampa, Florida |

|

33606 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: 813 222-8996 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock par value $0.001 per share |

|

LMFA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 31, 2025, LM Funding America, Inc. (the “Company”) issued a press release and accompanying investor presentation announcing its financial results for the Three and Twelve Months ended December 31, 2024.

The information furnished in this Item 2.02, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that Section. This information will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit Number |

|

Description |

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL)

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

LM Funding America, Inc. |

|

|

|

|

Date: |

March 31, 2025 |

By: |

/s/ Richard Russell |

|

|

|

Richard Russell, CFO |

Exhibit 99.1

LM Funding America, Inc. Reports Fourth Quarter and Full Year 2024 Financial Results

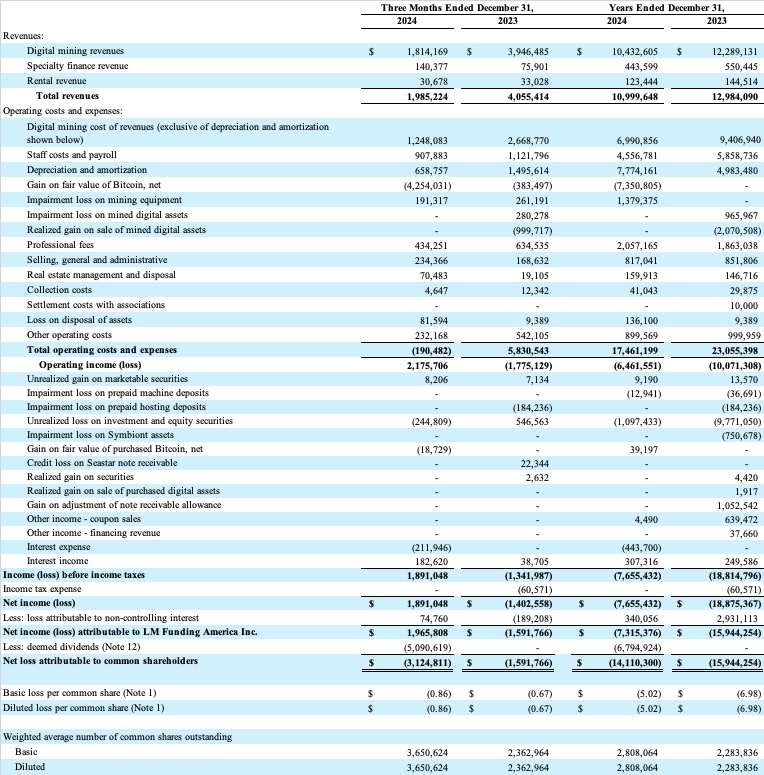

- Fourth quarter and full-year 2024 total revenue of $2.0 million and $11.0 million, respectively.

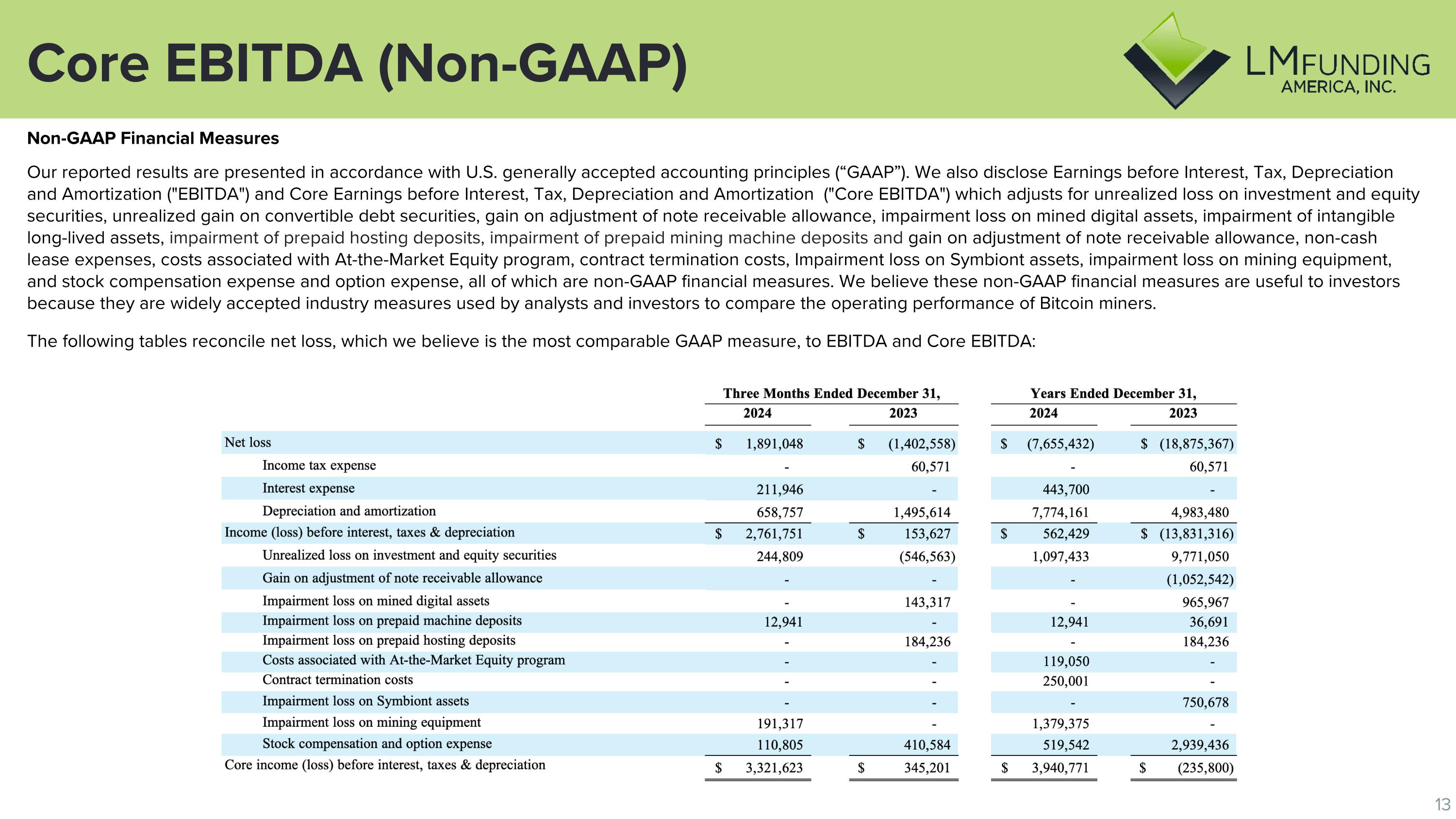

- Fourth quarter and full-year 2024 Core EBITDA of $3.3 million and $3.9 million, respectively.

- Held 165.8 Bitcoin on February 28, 2025 valued at approximately $14.4 million, as of March 26, 2025

TAMPA, FL, March 31, 2025—LM Funding America, Inc. (NASDAQ: LMFA) (“LM Funding” or the “Company”), a Bitcoin mining and technology-based specialty finance company, today reported financial results for the three months and full year ended December 31, 2024.

Q4’24 Financial Highlights

All variances are compared with prior year unless stated otherwise:

Q4’24 Operational Highlights

1 Core EBITDA is a non-GAAP financial measure, and a reconciliation of Core EBITDA to net income can be found below.

2,3 Based on shares outstanding of 5,133,412 as of December 31, 2024.

1

Exhibit 99.1

CEO Commentary

Bruce Rodgers, Chairman and CEO of LM Funding, commented, “Using the halving as our pivot point of opportunity, we transitioned from an infrastructure-light hosted mining strategy to a vertically integrated model—one where we manage the infrastructure ourselves, ensuring better margins and mitigating risks associated with third-party hosting arrangements. With our Oklahoma facility, we secured low-cost power for our miners and now we own and totally control our mining infrastructure and costs. This vertical integration significantly reduces our fleet-wide energy costs and improves our operations for enhanced uptime and mining efficiency. Looking forward, our strong balance sheet and lean operations position us to grow our mining revenue by seeking to acquire new mining sites with similar size, prices, and terms.”

CFO Commentary

Richard Russell, CFO of LM Funding, stated, "Throughout our expansion last year, we remained disciplined in our spending. By actively maintaining a low-cost structure - from power sourcing and infrastructure investments to staffing and equipment - we were able to successfully navigate a challenging year for the industry and our first Bitcoin Halving event, which occurred in April 2024. This strategic cost control enabled us to achieve profitability in 2024 on a Core EBITDA basis, as well as grow our Bitcoin treasury, which is a significant piece of our long-term strategy. By retaining a portion of our Bitcoin mined, we not only capture potential upside for shareholders but also deepen our alignment with the broader Bitcoin industry."

Full Year 2024 Financial Highlights

All variances are compared with prior year unless stated otherwise:

Investor Conference Call

LM Funding will host a conference call today, March 31, 2025, at 8:00 A.M. Eastern Time to discuss the Company’s financial results for the quarter and full year ended December 31, 2024, as well as the Company’s corporate progress and other developments. A copy of this earnings release and investor presentation are available on the Company’s Investor Relations website at https://www.lmfunding.com/investors.

Conference Call Details

2

Exhibit 99.1

About LM Funding America

LM Funding America, Inc. (Nasdaq: LMFA), operates as a Bitcoin mining and specialty finance company. The company was founded in 2008 and is based in Tampa, Florida. For more information, please visit https://www.lmfunding.com.

Forward-Looking Statements

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the Company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, our limited operating history in the cryptocurrency mining business and our ability to grow that business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, our ability to identify and acquire additional mining sites, the ability to finance our site acquisitions and cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations.

For investor and media inquiries, please contact:

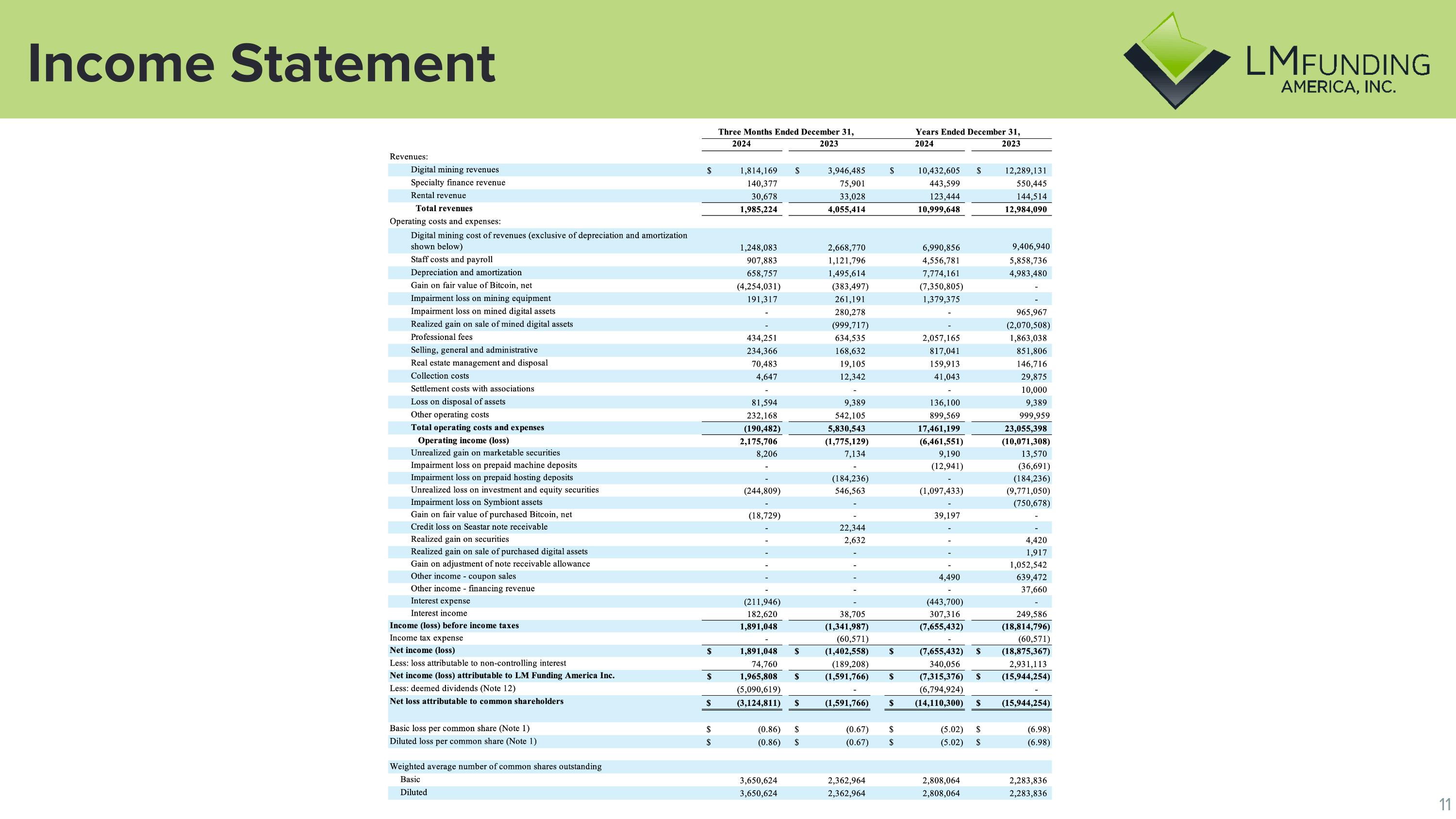

Investor Relations Orange Group Yujia Zhai lmfundingIR@orangegroupadvisors.com LM Funding America, Inc. and Subsidiaries Consolidated Statements of Operations (unaudited)

3

Exhibit 99.1

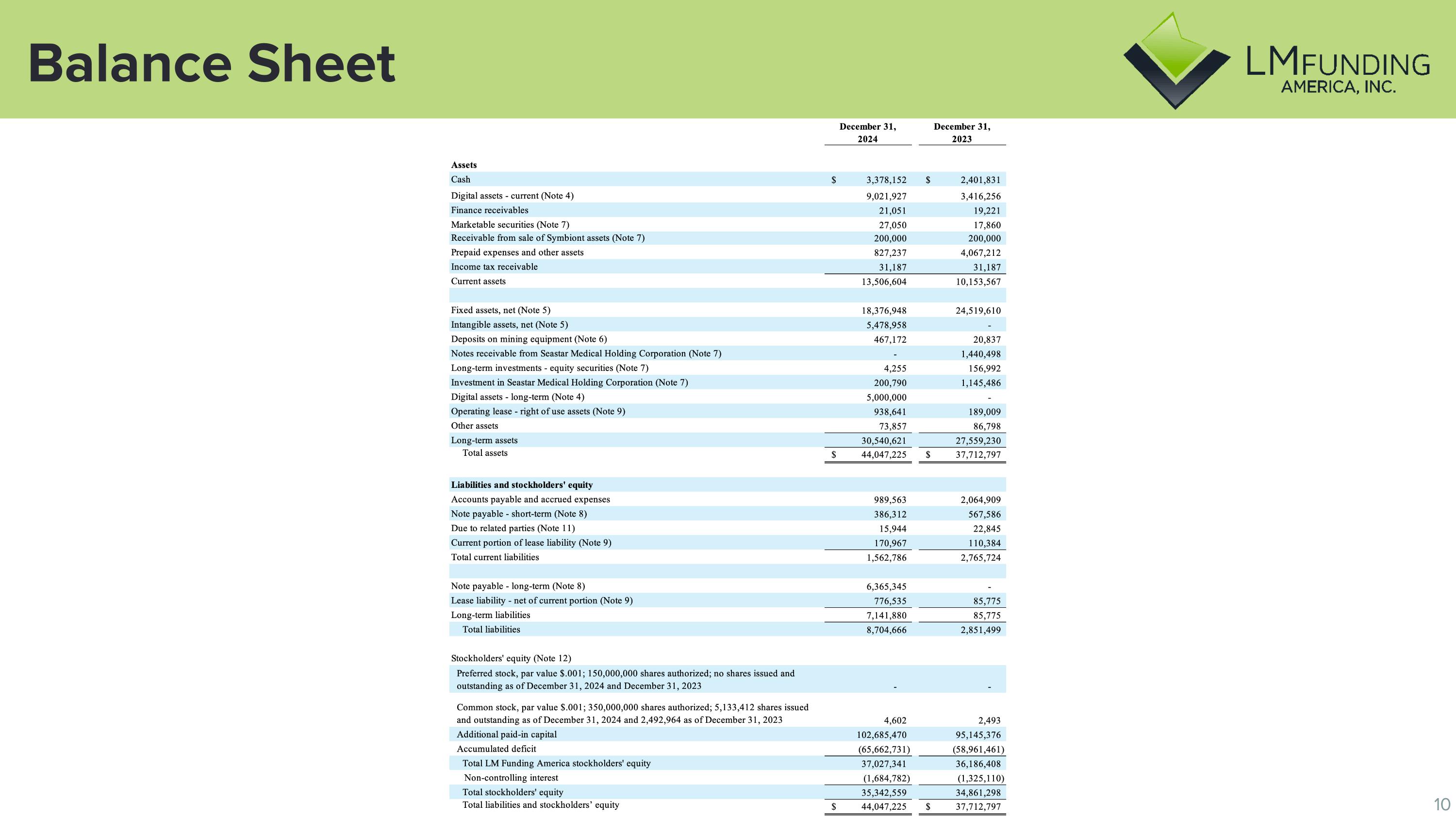

LM Funding America, Inc. and Subsidiaries Consolidated Balance Sheets

4

Exhibit 99.1

5

Exhibit 99.1

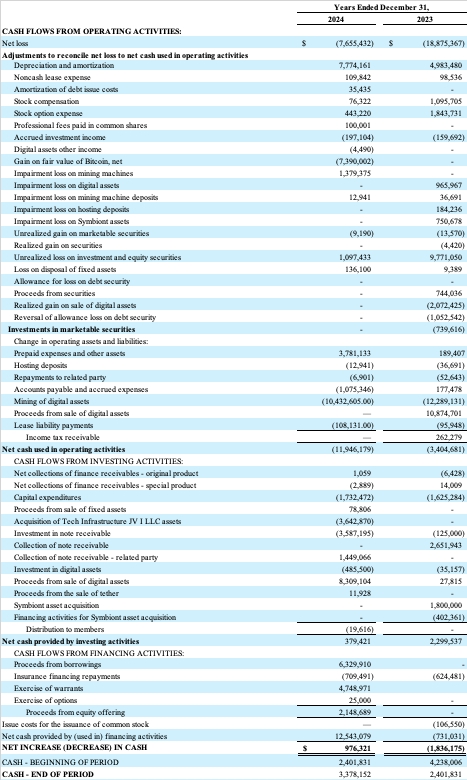

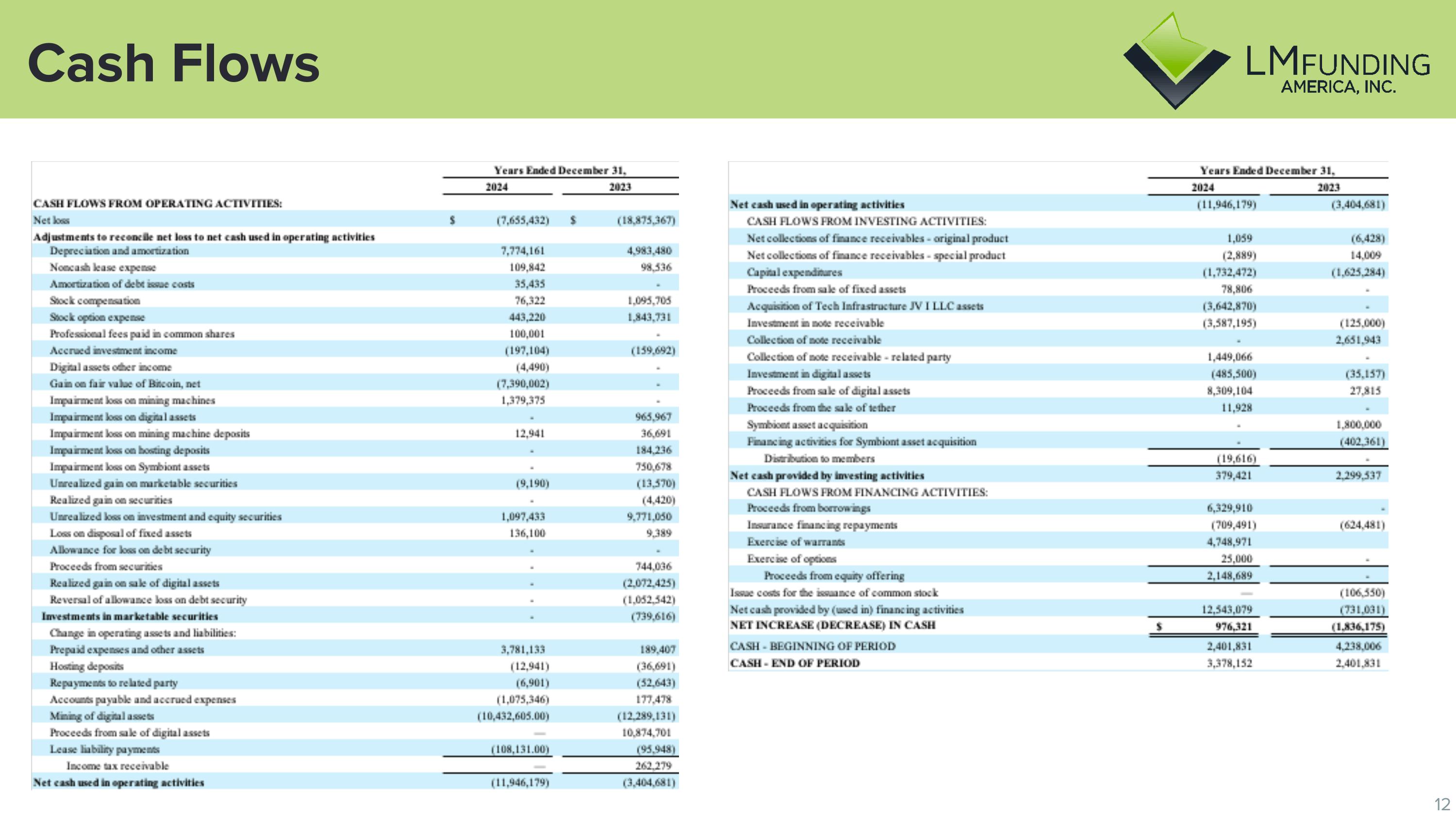

LM Funding America, Inc. and Subsidiaries Consolidated Statements of Cash Flows (Unaudited)

6

Exhibit 99.1

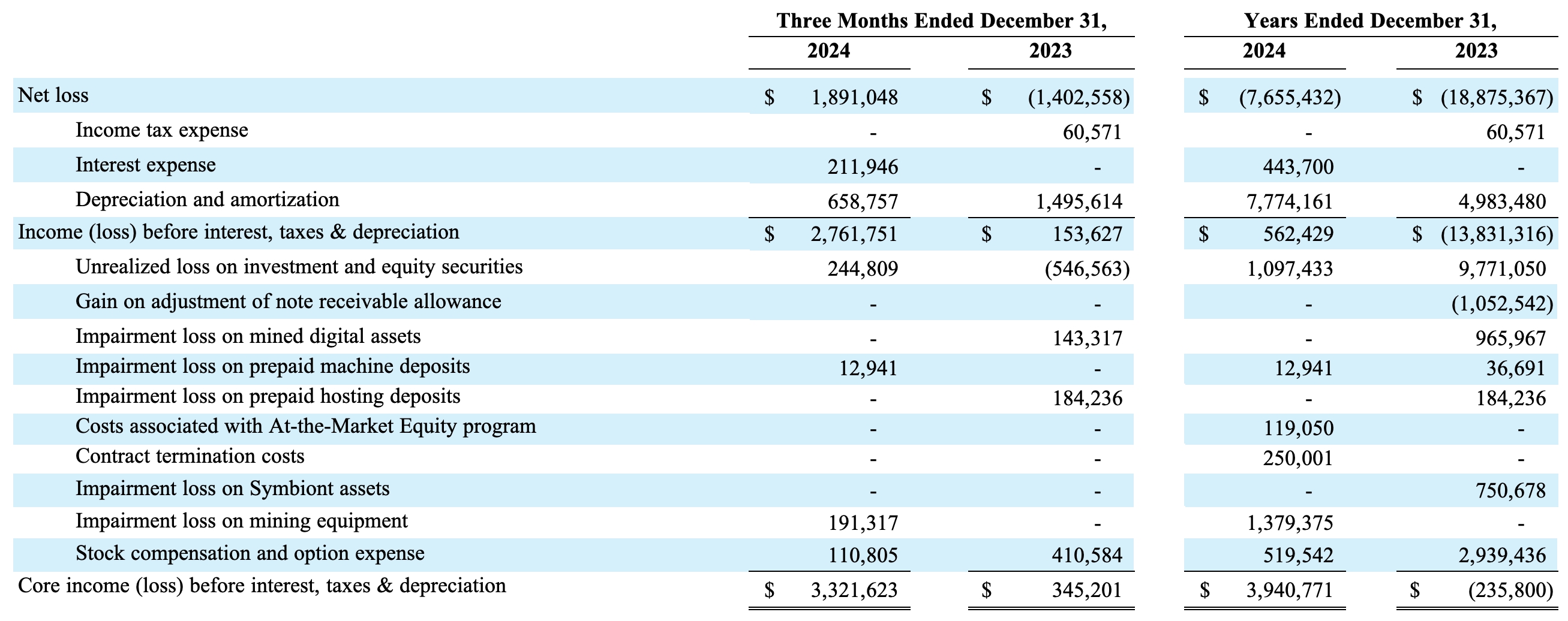

NON-GAAP CORE EBITDA RECONCILIATION

Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized loss on investment and equity securities, impairment loss on mined digital assets, impairment of long-lived assets, impairment of prepaid hosting deposits, contract termination costs and stock compensation expense and option expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of Bitcoin miners.

The following tables reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA:

7

An emerging leader in Bitcoin mining Q4 2024 Supplemental Investor PresentationNasdaq: LMFA

This presentation may contain forward-looking statements the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, our limited operating history in the cryptocurrency mining business and our ability to grow that business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, our ability to identify and acquire additional mining sites, the ability to finance our site acquisitions and cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations. For additional disclosure regarding risks faced by LM Funding America, Inc., please see our public filings with the Securities and Exchange Commission, available on the Investor Relations section of our website at www.lmfunding.com and on the SEC's website at www.sec.gov. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, such as Core EBITDA. These non-GAAP measures are presented for supplemental information and should not be considered a substitute for financial information presented in accordance with GAAP. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measures is set forth in the Appendix to this presentation Forward-Looking Statements

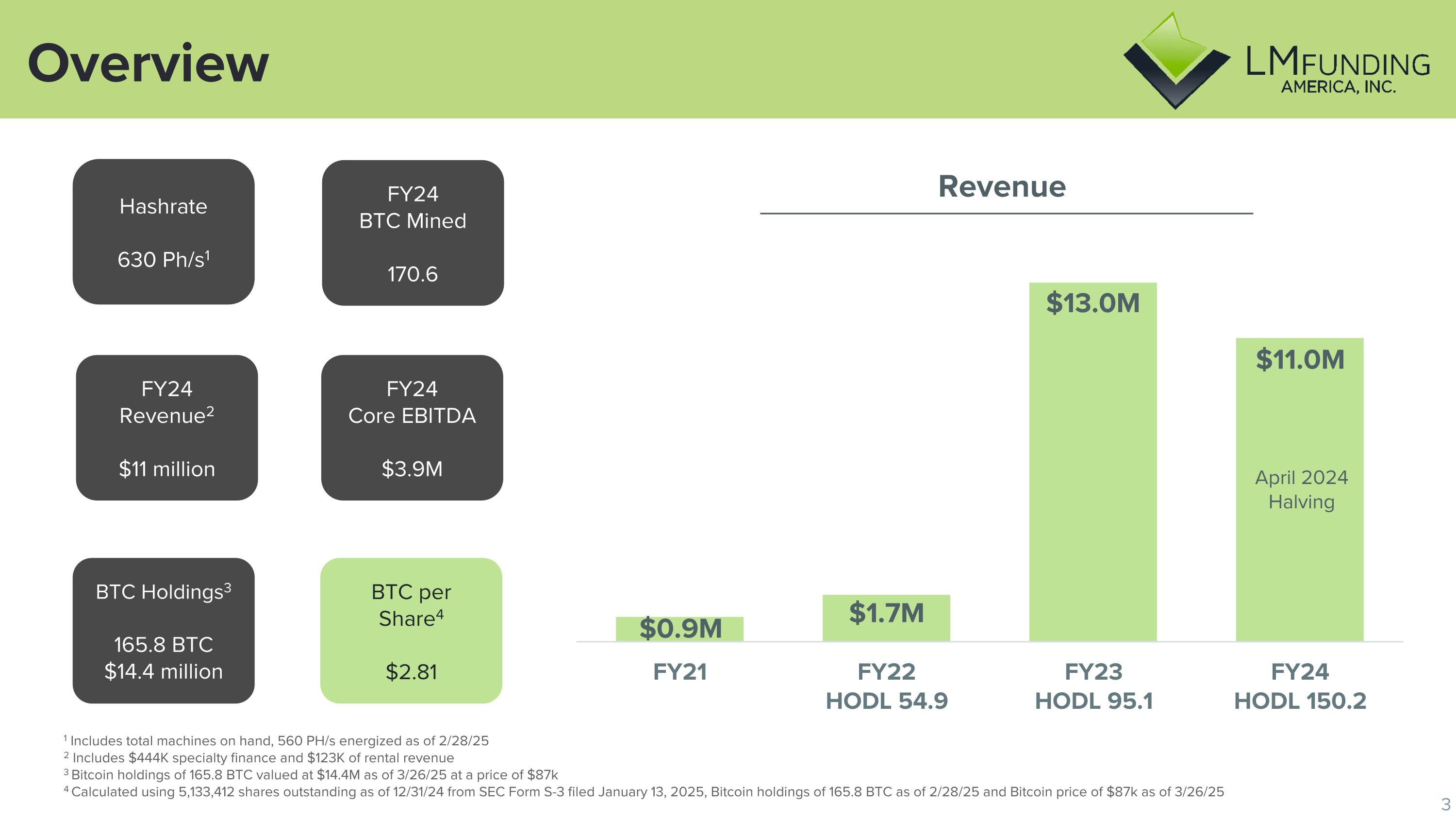

Overview 1 Includes total machines on hand, 560 PH/s energized as of 2/28/25 2 Includes $444K specialty finance and $123K of rental revenue 3 Bitcoin holdings of 165.8 BTC valued at $14.4M as of 3/26/25 at a price of $87k 4 Calculated using 5,133,412 shares outstanding as of 12/31/24 from SEC Form S-3 filed January 13, 2025, Bitcoin holdings of 165.8 BTC as of 2/28/25 and Bitcoin price of $87k as of 3/26/25 Hashrate 630 Ph/s1 FY24 BTC Mined 170.6 BTC Holdings3 165.8 BTC $14.4 million BTC per Share4 $2.81 FY24 Revenue2 $11 million FY24 Core EBITDA $3.9M April 2024 Halving Revenue

Q4’24 and YTD’25 Operational Highlights 2024 Mined 170.6 BTC for FY’24 Acquired 15 MW Mining Facility in Oklahoma in Q4’24 2025 Achieved 0.6 EH/s with Oklahoma site LuxOS firmware upgrade estimated to enhance efficiency 10-15%; increasing revenue and profits without additional capex Mined total 16.1 BTC through the two months ended February 28, 2025

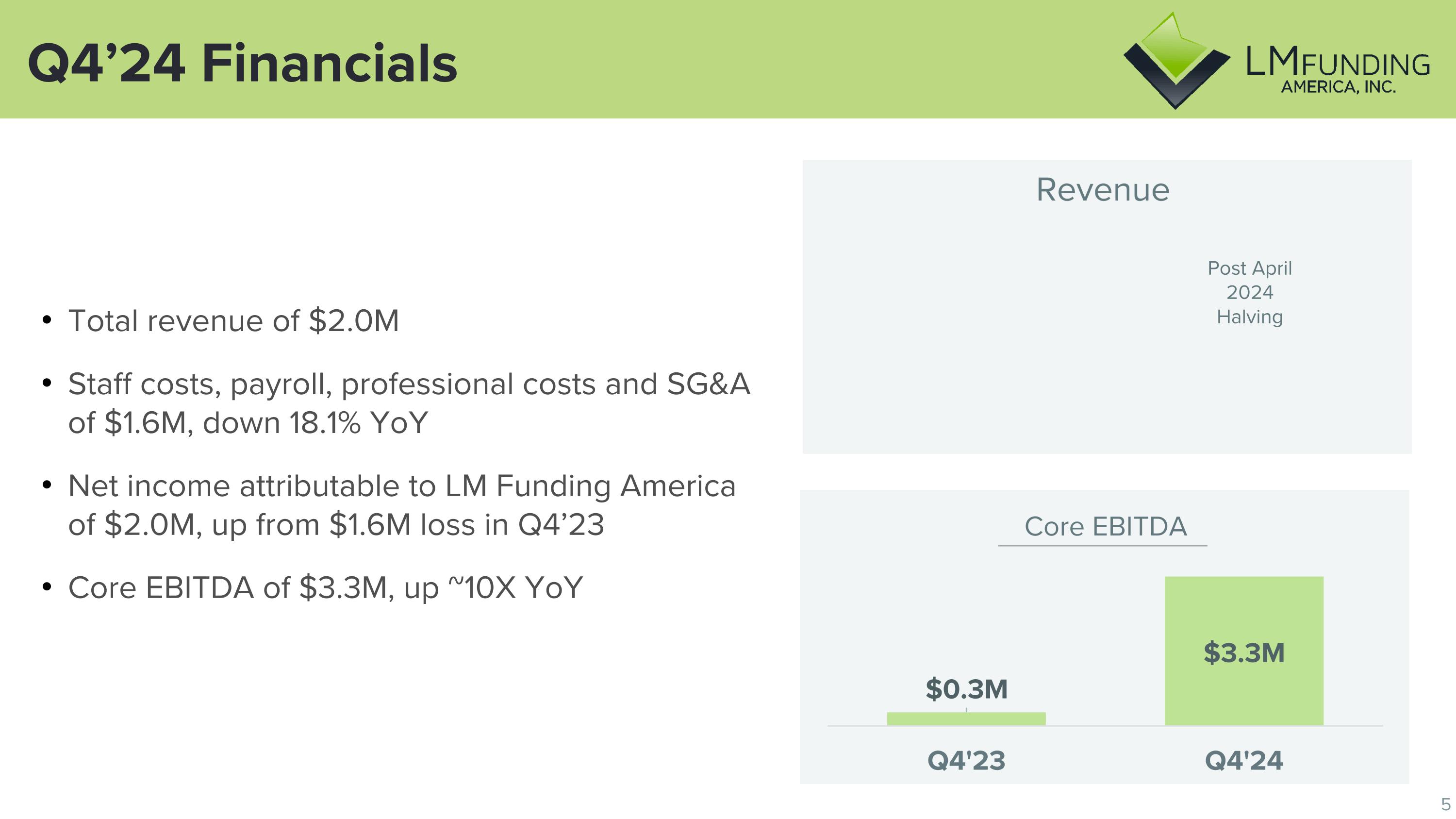

Q4’24 Financials Total revenue of $2.0M Staff costs, payroll, professional costs and SG&A of $1.6M, down 18.1% YoY Net income attributable to LM Funding America of $2.0M, up from $1.6M loss in Q4’23 Core EBITDA of $3.3M, up ~10X YoY Post April 2024 Halving

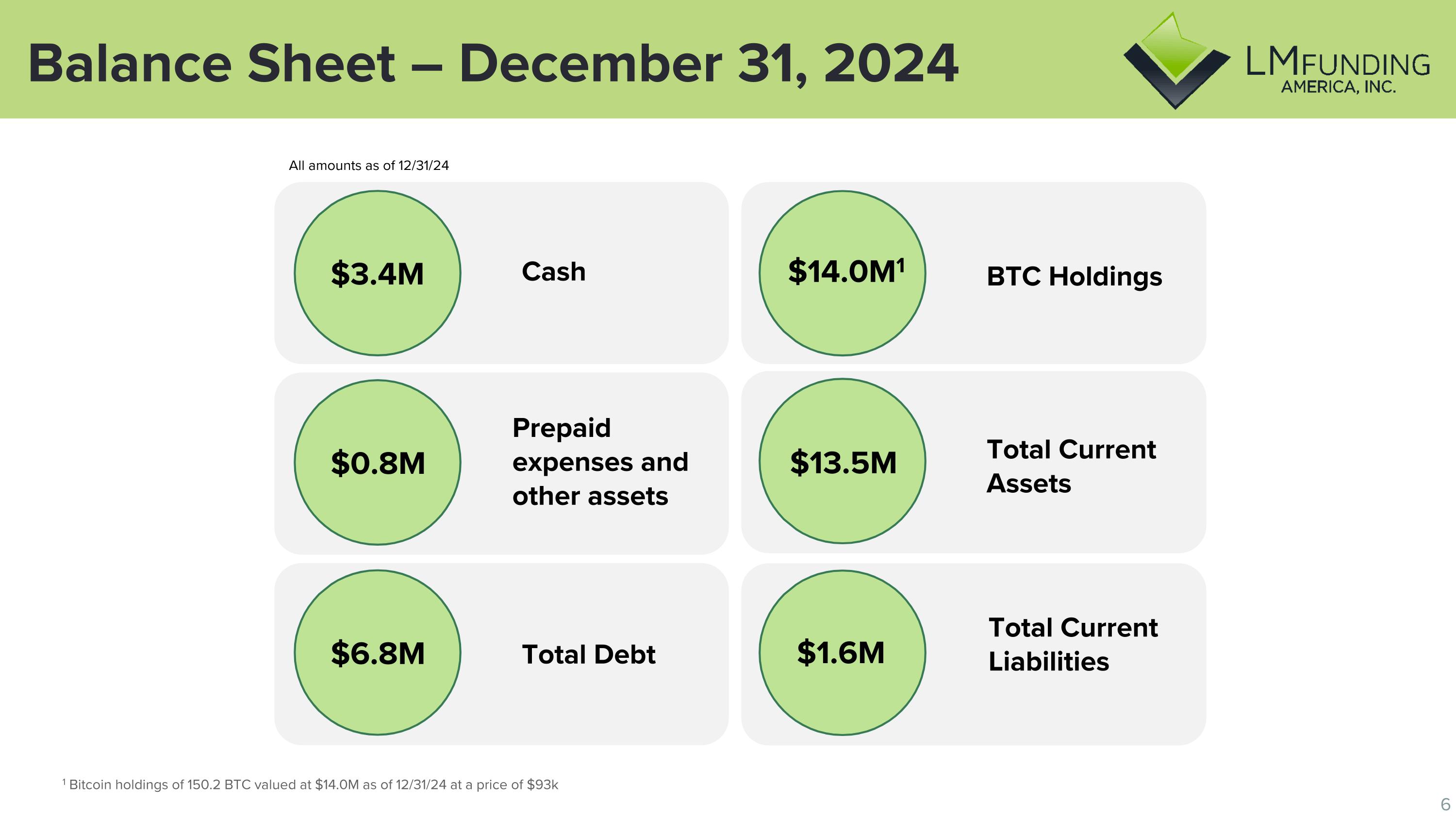

Balance Sheet – December 31, 2024 Cash Prepaid expenses and other assets Total Debt BTC Holdings Total Current Assets Total Current Liabilities $3.4M $0.8M $6.8M $14.0M1 $13.5M $1.6M All amounts as of 12/31/24 1 Bitcoin holdings of 150.2 BTC valued at $14.0M as of 12/31/24 at a price of $93k

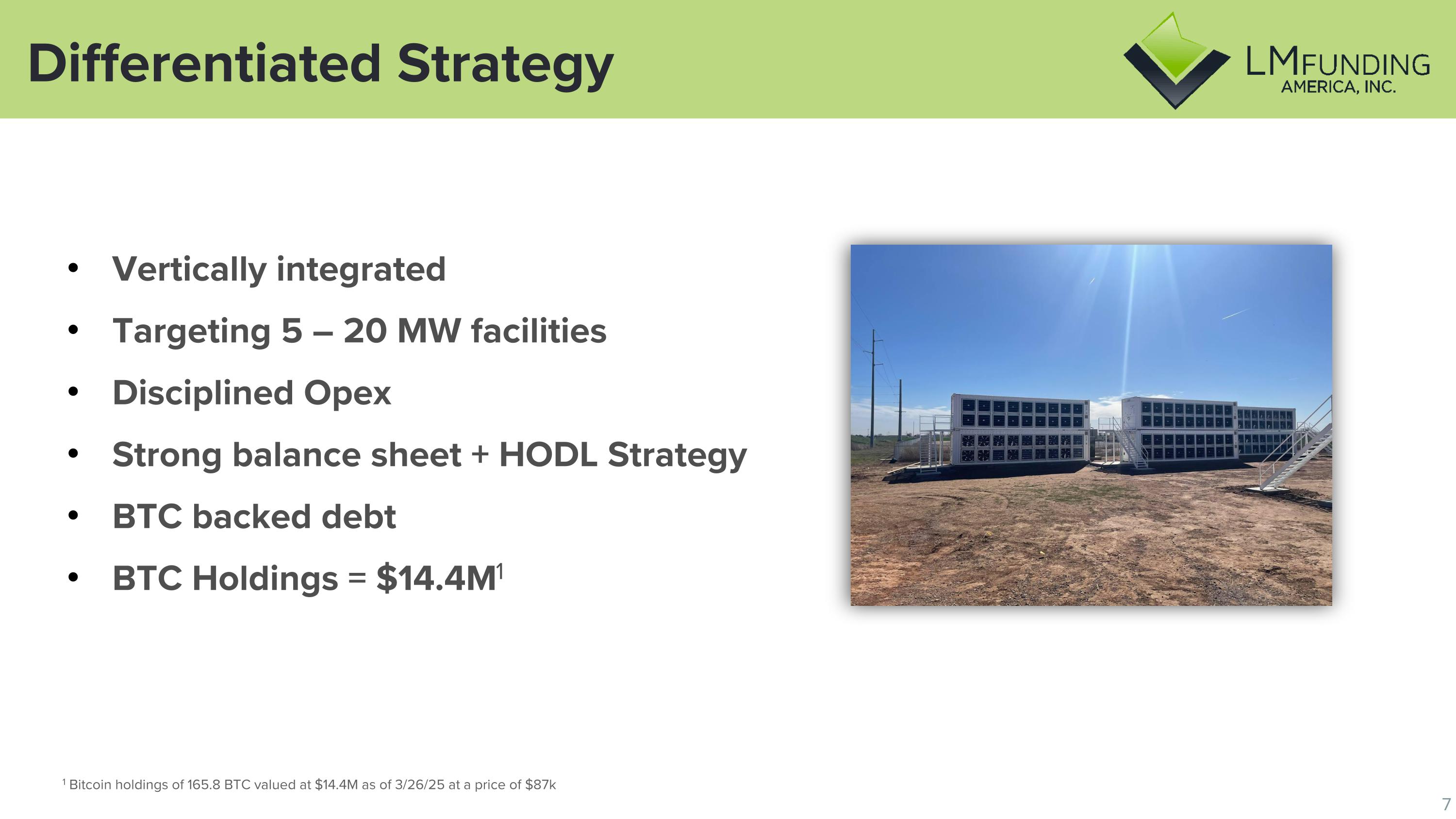

Differentiated Strategy Vertically integrated Targeting 5 – 20 MW facilities Disciplined Opex Strong balance sheet + HODL Strategy BTC backed debt BTC Holdings = $14.4M1 1 Bitcoin holdings of 165.8 BTC valued at $14.4M as of 3/26/25 at a price of $87k

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Q&A

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Financials

Balance Sheet

Income Statement

Cash Flows

Core EBITDA (Non-GAAP) Non-GAAP Financial Measures Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized loss on investment and equity securities, unrealized gain on convertible debt securities, gain on adjustment of note receivable allowance, impairment loss on mined digital assets, impairment of intangible long-lived assets, impairment of prepaid hosting deposits, impairment of prepaid mining machine deposits and gain on adjustment of note receivable allowance, non-cash lease expenses, costs associated with At-the-Market Equity program, contract termination costs, Impairment loss on Symbiont assets, impairment loss on mining equipment, and stock compensation expense and option expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of Bitcoin miners. The following tables reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA:

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Thank You