s

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

|

|

(Mark One) |

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR |

|

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended December 31, 2024 |

|

|

|

OR |

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR |

|

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: Not applicable

For the transition period from _______ to _______

Commission File Number: 001-40099

Gold Royalty Corp.

(Exact name of Registrant as specified in its charter)

Not applicable |

|

Canada |

(Translation of Registrant’s name into English) |

|

(Jurisdiction of incorporation or organization) |

1188 West Georgia Street, Suite 1830

Vancouver, BC V6E 4A2

(604) 396-3066

(Address of principal executive offices)

Andrew Gubbels, Chief Financial Officer

1188 West Georgia Street, Suite 1830

Vancouver, BC V6E 4A2

Tel: (604) 396-3066

E-mail: agubbels@goldroyalty.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, without par value |

|

GROY |

|

NYSE American |

Warrants to purchase Common Shares |

|

GROY-WT |

|

NYSE American |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

On December 31, 2024, the issuer had 170,205,124 common shares, without par value, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, "accelerated filer" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Emerging growth company |

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recover period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board |

☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

|

PAGE |

|

PART I |

|

|

ITEM 1. |

2 |

|

ITEM 2. |

3 |

|

ITEM 3. |

3 |

|

ITEM 4. |

14 |

|

ITEM 4A. |

34 |

|

ITEM 5. |

35 |

|

ITEM 6. |

56 |

|

ITEM 7. |

70 |

|

ITEM 8. |

72 |

|

ITEM 9. |

73 |

|

ITEM 10. |

73 |

|

ITEM 11. |

81 |

|

ITEM 12. |

81 |

|

PART II |

|

|

ITEM 13. |

81 |

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

81 |

ITEM 15. |

82 |

|

ITEM 16. |

82 |

|

ITEM 16A. |

82 |

|

ITEM 16B. |

83 |

|

ITEM 16C. |

83 |

|

ITEM 16D. |

83 |

|

ITEM 16E. |

PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

84 |

ITEM 16F. |

84 |

|

ITEM 16G. |

84 |

|

ITEM 16H. |

84 |

|

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

84 |

ITEM 16J. |

84 |

|

ITEM 16K. |

84 |

|

PART III |

|

|

ITEM 17. |

86 |

|

ITEM 18. |

86 |

|

ITEM 19. |

86 |

|

88 |

||

BASIS OF PRESENTATION

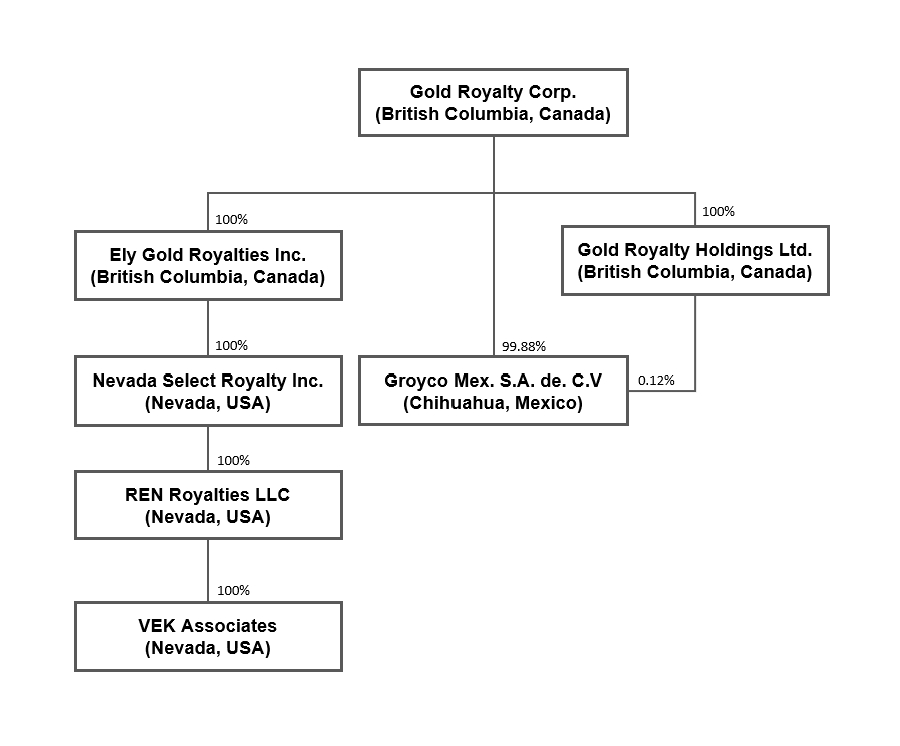

Unless otherwise indicated, references in this annual report on Form 20-F (this "Annual Report") to "Gold Royalty", "GRC", the "Company", "we", "us" and "our" refer to Gold Royalty Corp., a company incorporated under the laws of Canada, together with its subsidiaries unless the context requires otherwise.

We express all amounts in this Annual Report in U.S. dollars, except where otherwise indicated. References to "$" and "US$" are to U.S. dollars and references to "C$" are to Canadian dollars.

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

PRESENTATION OF FINANCIAL INFORMATION

We report under IFRS Accounting Standards as issued by the International Accounting Standards Board ("IFRS"), which may not be comparable to financial data prepared by many United States companies. We present our financial statements in U.S. dollars.

CAUTIONARY NOTE REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

We are subject to the reporting requirements of applicable Canadian and United States securities laws. The disclosure of scientific and technical information regarding the properties underlying our royalty and streaming interests contained herein is presented in accordance with subpart 1300 of Regulation S-K ("SK1300"), which differs from the disclosure requirements set forth under Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

In many cases, the owners and operators of the mineral properties underlying our royalty and other interests have disclosed scientific and technical information regarding such projects pursuant to NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") – CIM Definition Standards on Mineral Resources and Mineral Reserves (the "CIM Definition Standards"), adopted by the CIM Council, as amended, which differs from the requirements under SK1300. In addition, certain of the operators of the properties underlying our interests prepare mineral reserve and mineral resource estimates in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ("JORC"), which differs from NI 43-101 and SK1300.

Under SK1300, the U.S. Securities and Exchange Commission ("SEC") recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Although the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be substantially similar to the corresponding CIM Definition Standards, U.S. shareholders are cautioned that while terms are substantially similar to CIM Definition Standards, there are differences in the definitions and standards under SK1300 and the CIM Definition Standards. Accordingly, there is no assurance that estimates of mineral resources and mineral reserves disclosed by the operators underlying our royalty and other interests under NI 43-101 or JORC or disclosed by us in our Canadian disclosure documents will be the same as the reserve or resource estimates prepared by U.S. companies under SK1300.

Readers should not assume that any part or all of the mineralization in the "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Further, "inferred resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. shareholders are also cautioned not to assume that all or any part of the inferred resources exist.

TECHNICAL AND THIRD-PARTY INFORMATION

The disclosure contained herein respecting the projects underlying our royalty and other interests has been prepared in accordance with the exemption set forth in Items 1303(a)(3) and 1304(a)(2) of SK1300, in the U.S., and in Section 9.2 of NI 43-101, in Canada, and is based on information publicly disclosed by the owners and operators of such properties.

As a royalty holder, we have limited, if any, access to properties underlying the royalties included in our asset portfolio. Additionally, we may from time to time receive operating information from the owners and operators of the properties, which we are not permitted to disclose to the public. We are dependent on the operators of the properties to provide information to us or on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which we hold interests and generally will have limited or no ability to independently verify such information. Although we do not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

We are relying on the exemption for royalty companies set forth Section 1302(b)(3)(ii) of SK1300, which provides that a stream, royalty or similar company is not required to file a technical report summary with the SEC with respect to an underlying property where either (a) obtaining the information would result in an unreasonable burden or expense, or (b) the technical report summary has been requested from the applicable owner, operator or other person possessing the technical report summary, who is not affiliated with the registrant, and who denied the request.

1

The summary and individual mineral property disclosures contained herein are also provided in accordance with Sections 1303(a)(3) and 1304(a)(2) of SK1300, respectively, which provide that a registrant with a stream, royalty or other similar right may omit certain information required by the summary and individual property disclosure requirements if the registrant specifies the information to which it lacks access, explains the reason it lacks the required information and provides all required information that it does possess or which it can acquire without incurring an unreasonable burden or expense.

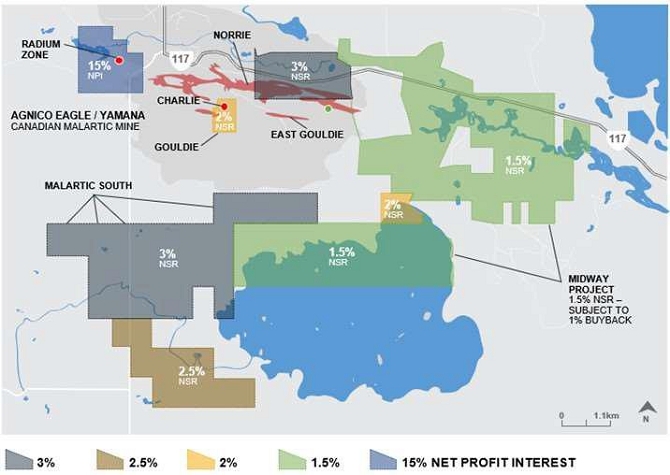

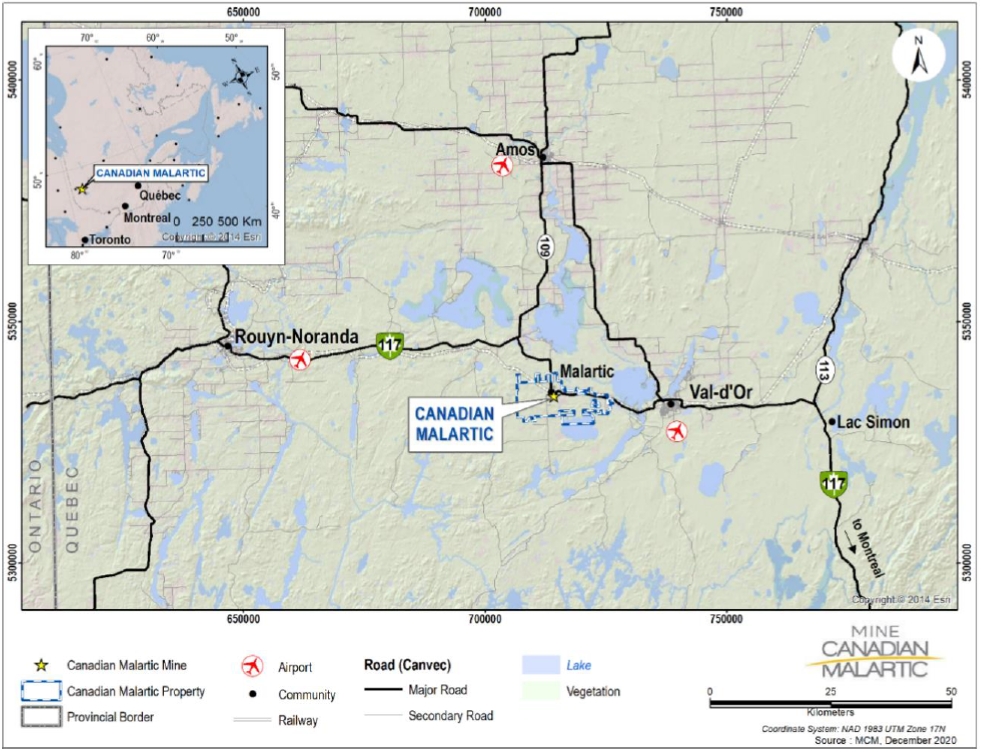

Based on relevant factors, we have determined that our royalty interest in portions of the Canadian Malartic Property, located in Québec, Canada, is currently our sole material property for the purposes of SK1300 and NI 43-101. We will continue to assess the materiality of our assets, including as new assets are acquired or as existing assets are further explored and developed.

Our agreements governing our royalty and streaming interests generally do not require the operators to prepare technical report summaries or permit us the access and information sufficient to prepare our own technical report summaries under SK1300. See "Item 4. Information on the Company – D. Property, Plants and Equipment".

Unless otherwise noted, the disclosure contained herein of a scientific or technical nature relating to the Canadian Malartic Property has been derived from the technical report titled "NI 43-101 Technical Report, Canadian Malartic Mine, Québec, Canada" dated March 25, 2021, and with an effective date of December 31, 2020, prepared for Agnico Eagle Mines Ltd. ("Agnico Eagle"), and Yamana Gold Inc. ("Yamana"), and such report is available under their respective profiles on the System for Electronic Document Analysis and Retrieval + ("SEDAR+") at www.sedarplus.ca (the "Canadian Malartic Technical Report").

The scientific and technical information contained herein relating to our royalty and streaming interests has been reviewed and approved by Alastair Still, P.Geo., who is our Director of Technical Services and a qualified person as such term is defined under NI 43-101 and SK1300.

We obtained certain statistical data, market data and other industry data and forecasts used or incorporated by reference into this Annual Report from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and do not make any representation as to the accuracy of the information.

All websites referred to herein are inactive textual references only, meaning that the information contained on such websites is not incorporated by reference herein and you should not consider information contained on such websites as part of this document unless expressly specified herein.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and "forward-looking information" within the meaning of Canadian securities laws. See "Item 5. Operating and Financial Review and Prospects – Forward-Looking Statements" and "Item 3. Key Information – D. Risk Factors".

GLOSSARY OF TECHNICAL TERMS

Abbreviations

In this Annual Report, the abbreviations "Au", "Ag", and "Cu" are used to express gold, silver, and copper, respectively, and the following abbreviations are used to express units of measurement and shorthand reference to types of royalty interests:

Abbreviation |

|

Meaning |

|

Abbreviation |

|

Meaning |

"g/t" |

|

grams per tonne |

|

"GRR" |

|

gross revenue (royalty) |

"kV" |

|

kilovolt |

|

"km" |

|

kilometres |

"NPI" |

|

net profit interest (royalty) |

|

"m" |

|

metres |

"oz" |

|

ounces |

|

"NSR" |

|

net smelter return (royalty) |

"tpd" |

|

tonnes-per-day |

|

"PTR" |

|

per ton or tonne (royalty) |

"TSF" |

|

tailings storage facility |

|

|

|

|

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

2

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should consider carefully the following risk factors, as well as the other information in this Annual Report, including our financial statements and notes thereto. If any of the following risks were to actually occur, our business, financial conditions, results of operations and prospects could be materially adversely affected and the value of our securities could decline. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See "Cautionary Note Regarding Forward-Looking Statements".

Risks Relating to our Business

We own passive interests in mining properties, and it is difficult or impossible for us to ensure properties are developed or operated in our best interest.

We are generally not directly involved in the exploration, development and production of minerals from, or the continued operation of, the mineral projects underlying the royalties, streaming and similar interests that are or may be held by us. The exploration, development and operation of such properties is determined and carried out by third-party owners and operators thereof and any revenue that may be derived from our asset portfolio will be based on any production by such owners and operators. Third-party owners and operators will generally have the power to determine the manner in which the properties are exploited, including making decisions regarding the feasibility, exploration and development of such properties or making decisions to commence, continue, reduce, suspend or discontinue production.

Our interests and those of third-party owners and operators may not always be aligned. For example, it will usually be in our interest to advance development and production on properties as rapidly as possible, in order to maximize near-term cash flow, while third-party owners and operators may take a more cautious approach to development, as they are exposed to risk relating to the cost of exploration, development and operations. Likewise, it may be in the interest of owners and operators to invest in the development of, and emphasize production from, projects or areas of a project that are not subject to royalties, streaming or similar interests that are or may be held by us.

Our inability to control or influence the exploration, development or operations of the properties in which we hold or may hold royalties, streaming and similar interests may have a material adverse effect on our business, results of operations and financial condition. In addition, the owners or operators may take action contrary to our policies or objectives; be unable or unwilling to fulfill their obligations under their agreements with us; or experience financial, operational or other difficulties, including insolvency, which could limit the owner or operator's ability to advance such properties or satisfy their obligations to us.

We may not be entitled to any compensation if the owners or operators of the properties in which we hold or may hold royalties, streaming and similar interests discontinue the exploration, development or operations of such properties on a temporary or permanent basis.

The owners or operators of the projects in which we hold interests may, from time to time, announce transactions, including the sale or transfer of the projects or of the operator itself, over which we have little or no control. A new operator installed as the result of such a completed transaction may not explore, develop or operate the project in a similar manner to the current operator and as such, our business, results of operations and financial condition may be materially adversely affected. The effect of any such transaction on us may be difficult or impossible to predict.

A substantial majority of our royalties, streaming and other interests are on non-producing properties and these and any future royalties, streaming or similar interests we acquire, particularly on exploration and development stage properties, are subject to the risk that they may never achieve production.

3

A substantial majority of our royalty and streaming interests are on non-producing properties, or on properties that do not have established mineral reserves under applicable Canadian or U.S. disclosure standards. These and any future royalties, streaming or similar interests we acquire may not achieve production or produce any revenues. While the discovery of gold deposits may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, develop metallurgical processes and construct mining and processing facilities at a particular site. It is impossible to ensure that exploration or development programs planned by the owners or operators of the properties underlying royalties, streaming and similar interests that are or may be held by us will result in profitable commercial mining operations. Whether a mineral deposit will be commercially viable depends on a number of factors, including cash costs associated with extraction and processing; the particular attributes of the deposit, such as size, grade and proximity to infrastructure; mineral prices, which are highly cyclical; government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use and environmental protection; and political stability. The exact effect of these factors cannot be accurately predicted but the combination of these factors may result in one or more of the properties underlying our current or future interests not receiving an adequate return on invested capital. Accordingly, there can be no assurance the properties underlying our current or future interests will be brought into a state of commercial production.

The failure of any of the properties underlying our non-producing interests to achieve production on schedule or at all could have a material adverse effect on our asset carrying values, the other benefits we expect to realize from our royalties, streaming and other interests or the acquisition of royalty and streaming interests, and potentially our business, results of operations, cash flows and financial condition.

Our revenue is subject to volatility in metal prices, which could negatively affect our results of operations or cash flow.

Our revenue is directly tied to metal prices and is particularly sensitive to changes in the price of gold, as we derive substantially all of our revenue from our existing royalty and streaming interests on producing properties. From time to time, we may also have interests where our rate of return varies based upon commodity price thresholds. In addition, some of our royalty agreements are based on the operator's concentrate sales to smelters and allow for price adjustments between the operator and the smelter based on metals prices on a future date, typically three to five months after shipment of concentrate. These price adjustments can decrease our revenue in future periods if metal prices decline following shipment.

The volatility in gold and other commodity prices may have an adverse impact on the value of our royalty and streaming interests and/or the payments we receive thereunder in the future.

The value of our royalty and streaming interests, including the amount of payment thereunder, and the potential future development of the projects underlying our interests are directly related to the market price of gold and other commodity prices.

Market prices for gold and other metals may fluctuate widely over time and are affected by numerous factors beyond our control. These factors include metal supply and demand, industrial and jewelry fabrication, investment demand, central banking actions, economic and trade policy (including tariffs and duties), expectations with respect to the rate of inflation, the relative strength of the dollar and other currencies, interest rates, gold purchases, sales and loans by central banks, forward sales by metal producers, global or regional political, trade, economic or banking conditions, and a number of other factors.

Declines in market prices could cause an operator to cease or slowdown exploration and development activities, reduce, suspend or terminate production from an operating project, or limit, suspend or terminate construction work at a development project which would negatively impact our ability to obtain revenues from our interests in the future, could have a material adverse effect on our business, results of operations and financial condition, could prevent us from recovering our initial investment in the project or impair the value of our interest.

We have limited or no access to data or the operations underlying our existing or future royalties, streaming and other interests.

In most cases, we are not, and will not be, the owner or operator of any of the properties underlying our existing or future royalties, streaming and similar interests and generally have no input in the exploration, development or operation of such properties. Consequently, we have limited or no access to related exploration, development or operational data or to the properties themselves. This could affect our ability to assess the value of such interests. This could also result in delays in cash flow from that anticipated by us, based on the stage of development of the properties underlying our existing or future royalties, streaming and similar interests. Our entitlement to payments in relation to such interests may be calculated by the royalty payors in a manner different from our projections and we may not have rights of audit with respect to such interests. In addition, some royalties, streaming or similar interests may be subject to confidentiality arrangements that govern the disclosure of information with regard to such interests and, as a result, we may not be in a position to publicly disclose related non-public information. Our limited access to data and disclosure regarding the exploration, development and production of minerals from, or the continued operation of, the properties in which we have an interest may restrict our ability to assess value and in turn have a material adverse effect on our business, results of operations, financial condition and reporting. We attempt to mitigate this risk by building relationships with various owners, operators and counterparties, in order to encourage information sharing.

A significant portion of our revenue comes from a small number of operating properties, which means that adverse developments at these properties could have a more significant or lasting impact on our results of operations than if our revenue was less concentrated.

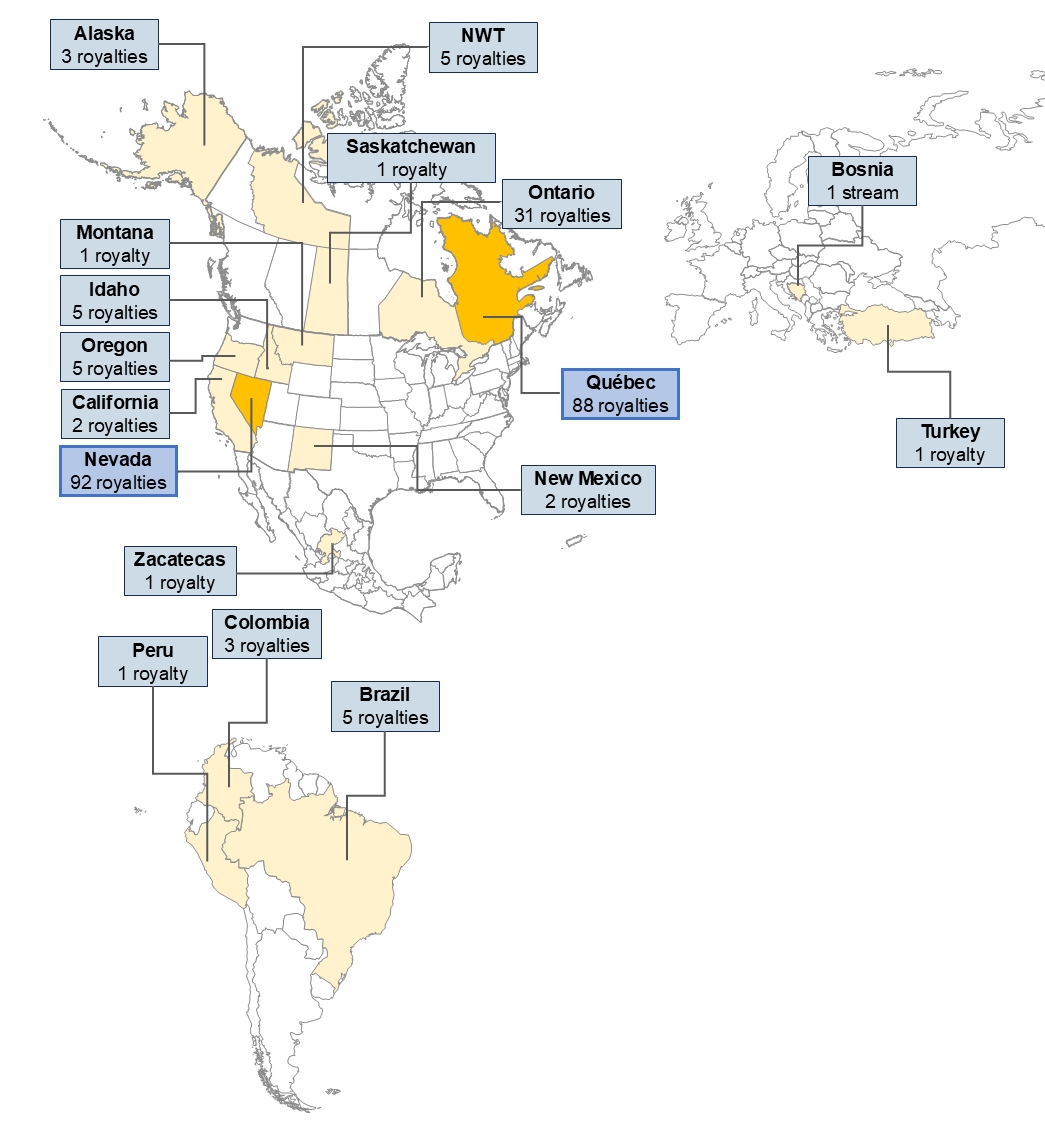

Approximately 72% of our revenues in 2024 were derived from our royalty and streaming interests in the Borborema Project, Borden Mine, Canadian Malartic Property, Cozamin Mine, Côté Gold Mine, and Vareš Mine. We expect that certain of our existing royalty and streaming interests in production stage properties will continue to represent a significant portion of revenue going forward over the near-term.

4

This concentration of revenue could mean that adverse developments, including any adverse decisions made by the operators, at one or more of these properties could have a more significant or longer-term impact on our results of operations than if the sources of our revenue was less concentrated.

The value and potential revenue from our royalties, streaming and other interests are subject to many of the risks faced by the owners and operators of our existing or future royalties, streaming and other interests.

Our royalties, streaming and similar interests generally generate revenue when the owners or operators of the underlying properties achieve and sustain production. As such, to the extent that they relate to the exploration, development and production of minerals from, or the continued operation of, the properties in which we hold or may hold royalties, streaming or similar interests, we will be subject to the risk factors applicable to the owners and operators of such mines or projects.

Mineral exploration, development and production generally involves a high degree of risk. Such operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of metals, including weather related events, unusual and unexpected geology formations, seismic activity, environmental hazards and the discharge of toxic chemicals, explosions and other conditions involved in the drilling, blasting and removal of material, any of which could result in damage to, or the destruction of, mines and other producing facilities, damage to property, injury or loss of life, environmental damage, work stoppages, delays in exploration, development and production, increased production costs and possible legal liability. Any of these hazards and risks and other acts of God could shut down such activities temporarily or permanently. Mineral exploration, development and production is subject to hazards such as the failure of equipment or retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability for the owners or operators thereof. The exploration for, and development, mining and processing of, mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate.

Our business, financial condition and results of operations could be adversely affected by market and economic conditions.

A deterioration of market and economic conditions in the jurisdictions in which the mineral properties underlying our interests are located may adversely affect our financial condition and results of operations. Continued levels of high inflation or a return to, or weak recovery from, a recession due to factors including disruptions in financial markets in the United States or globally, natural disasters, changes in trade policy, including applicable tariffs and duties, changes in energy prices, political upheavals, war or unrest could adversely impact our results of operations, including by negatively impacting the ability of the operators of the properties underlying our royalties, streaming and other interests to continue development or production operations.

Any deterioration in economic conditions may also negatively impact our ability to obtain equity or debt financing, on acceptable terms or at all. Additionally, economic conditions will impact the ability of the owners and operators of the properties underlying our interests to obtain any necessary financing arrangements to maintain such properties or continue planned development, production or other activities related thereto, which may adversely affect our financial condition or results of operations.

We may enter into acquisitions or other material transactions at any time.

In the ordinary course of business, we engage in a continual review of opportunities to acquire royalties, streaming or similar interests, to establish new royalties, streaming or similar interests on operating mines, to create new royalties, streaming or similar interests through financing mine development or exploration, or to acquire companies that hold royalties, streaming or similar interests. We currently, and generally at any time, have acquisition opportunities in various stages of active review, including, for example, our engagement of consultants and advisors to analyze particular opportunities, analysis of technical, financial, legal and other confidential information, submission of indications of interest and term sheets, participation in preliminary discussions and negotiations and involvement as a bidder in competitive processes. We may consider obtaining debt commitments for acquisition financing. In the event that we choose to raise debt capital to finance any acquisition, our leverage may be increased. We also could issue common shares or securities convertible into common shares to fund acquisitions. Issuances of such securities could dilute existing shareholders and may reduce some or all of our per share financial measures.

Any such acquisition could be material to us. All transactions include risks associated with our ability to negotiate acceptable terms with counterparties. In addition, any such acquisition or other transaction may have other transaction-specific risks associated with it, including risks related to the completion of the transaction, the project, its operators, or the jurisdictions in which the project is located, and other risks discussed in this Annual Report. There can be no assurance that any acquisitions completed will ultimately benefit us.

Current and future indebtedness could adversely affect our financial condition and impair our ability to operate our business.

As of December 31, 2024, we had $25.3 million outstanding under our secured revolving credit facility ("Credit Facility") and $40 million in aggregate principal amount of convertible debentures outstanding (the "Debentures"). We may also incur additional indebtedness in the future. The Credit Facility contains a floating interest rate. Our levels of indebtedness and higher interest rates could impact us as follows:

5

The documents underlying our indebtedness contain customary financial and other restrictive covenants. These restrictions will affect, and may limit or prohibit, our ability to, among other things, incur or guarantee additional indebtedness, pay dividends or make distributions, redeem or repurchase shares, create liens and enter into mergers, consolidations or transactions with affiliates. The Credit Facility includes covenants requiring us to maintain prescribed financial ratios and tests. Failure to comply with such covenants could result in events of default and could have a material adverse effect on our liquidity, results of operations and financial condition.

Additionally, our ability to repay or refinance our indebtedness will depend on our future financial and operating performance. Our performance, in turn, will be subject to prevailing economic and competitive conditions, as well as financial, business, industry and other factors, many of which are beyond our control. Our ability to meet our future debt service and other obligations may depend in significant part on the extent to which we can successfully implement our business strategy. We cannot assure you that we will be able to implement our strategy fully or that the anticipated results of our strategy will be realized.

We may require additional financing in the future to fund our growth strategy and maintain our operations.

In order to further our growth strategy and maintain our operations, we may require additional financing in the future. Such future financing may be in the form of debt or equity financing. We may be unable to obtain such financing on acceptable terms or at all. Failure to obtain any necessary financing in the future could delay or postpone our future business activities, which may have a material adverse effect on our profitability, results of operations and financial condition. Additionally, our existing Credit Facility matures in March 2028. Any inability to renew or refinance such Credit Facility on acceptable terms may have an adverse impact on our liquidity and financial position.

Our future growth is, to an extent, dependent on our acquisition strategy.

As part of our business strategy, we will seek to purchase or otherwise acquire gold and other precious metal royalties, streaming or similar interests from third-party natural resource companies and others. In pursuit of such opportunities, we may fail to select appropriate acquisition targets or negotiate acceptable arrangements, including arrangements to finance acquisitions. There can be no assurance that we will be able to identify and complete any acquisition, transaction or business arrangement that we pursue on favorable terms or at all, or that any acquisition, transaction or business arrangement completed will ultimately benefit us.

Our business and revenues could be adversely affected by problems concerning the existence, validity, enforceability, terms or geographic extent of our royalty and streaming interests and our interests may similarly be materially and adversely impacted by change of control, bankruptcy or the insolvency of operators.

Defects in, or disputes relating to the royalty and streaming interests we hold or acquire may prevent us from realizing the anticipated benefits from these interests and could have a material adverse effect on our business, results of operations, cash flows and financial condition. Material changes could also occur that may adversely affect management's estimate of the carrying value of our royalty and streaming interests and could result in impairment charges.

While we seek to confirm the existence, validity, enforceability, terms and geographic extent of the royalty and streaming interests we acquire, there can be no assurance that disputes or other problems concerning these and other matters or other problems will not arise. Confirming these matters is complex and is subject to the application of the laws of each jurisdiction to the particular circumstances of each parcel of mining property and to the agreement reflecting the royalty and streaming interest. Similarly, in many jurisdictions, royalty and streaming interests are contractual in nature, rather than interests in land, and therefore may be subject to risks resulting from change of control or the bankruptcy or insolvency of operators, and as such, our royalty and streaming interests could be materially restricted or set aside through judicial or administrative proceedings. Our financial condition and results of operations may also be negatively impacted as a result of an event of insolvency or bankruptcy involving the owners or operators of the properties underlying our interests.

If title to mining claims, concessions, licenses, leases or other forms of tenure is not properly maintained by the operators, or is successfully challenged by third-parties, our existing royalty and streaming interests could be found to be invalid.

Our business is subject to the risk that operators of mining projects and holders of exploration or mining claims, tenements, concessions, licenses or other interests in land and minerals may lose their exploration or mining rights, allow them to expire, or have their rights to explore and mine properties contested by private parties or the government. Internationally, exploration and mining tenures are subject to loss for many reasons, including expiration, failure of the holder to meet specific legal qualifications, failure to establish a deposit capable of economic extraction, failure to pay maintenance fees or meet expenditure or work requirements, reduction in geographic extent upon passage of time or upon conversion from an exploration tenure to a mining tenure, failure of title, expropriation and similar risks.

6

If title to exploration or mining tenures subject to our royalty and streaming interests has not been properly established or is not properly maintained, or is successfully contested, our royalty and streaming interests could be adversely affected.

Operators may interpret our existing or future royalties, streaming or other interests in a manner adverse to us or otherwise may not abide by their contractual obligations, and we could be forced to take legal action to enforce our contractual rights.

Royalty and streaming interests are generally subject to uncertainties and complexities arising from the application of contract and property laws in the jurisdictions where the mining projects are located. Operators and other parties to the agreements governing our existing or future royalties, streaming or other interests may interpret our interests in a manner adverse to us or otherwise may not abide by their contractual obligations, and we could be forced to take legal action to enforce our contractual rights. We may or may not be successful in enforcing our contractual rights, and our revenues relating to any challenged royalty or streaming interests may be delayed, curtailed or eliminated during the pendency of any such dispute or in the event our position is not upheld, which could have a material adverse effect on our business, results of operations, cash flows and financial condition. Disputes could arise challenging, among other things, methods for calculating the royalty or streaming interest; various rights of the operator or third-parties in or to the royalty or streaming interest or the underlying property; the obligations of a current or former operator to make payments on royalty and streaming interests; and various defects or ambiguities in the agreement governing a royalty or streaming interest.

Certain of our royalty interests are subject to buy-down and other rights of third-parties.

Certain of our existing royalty interests are subject to: (i) buy-down right provisions pursuant to which an operator may buy back a portion or all of the royalty, and (ii) pre-emptive rights pursuant to which certain parties have the right of first refusal or first offer with respect to a proposed sale or assignment of the royalty interest held by us. Holders may exercise these rights such that certain of our existing royalty interests would no longer be held by us or would become difficult for us to acquire. Any compensation received as a result may be significantly less than what we had budgeted receiving for the applicable interest and may have a material adverse effect on our results of operations, financial position and business.

Development and operation of mines is capital intensive and any inability of the operators of properties underlying our existing or future royalties, streaming or similar interests to meet liquidity needs, obtain financing or operate profitably could have material adverse effects on the value of, and revenue from, such interests.

If operators of properties where we hold interests do not have the financial strength or sufficient credit or other financing capability to cover the costs of developing or operating a mine, they may curtail, delay or cease development or operations at a mine site, or enter into bankruptcy proceedings. An operator's ability to raise and service sufficient capital may be affected by, among other things, macroeconomic conditions, future commodity prices of metals to be mined, or further economic volatility in the United States, Canada and global financial markets. If certain of the operators of the properties on which we have royalty and streaming interests suffer these material adverse effects, then our existing or future royalties, streaming or similar interests, including the value of and revenue from them, and the ability of operators to obtain debt or equity financing for the exploration, development and operation of their properties may be materially adversely affected.

In addition, our ability to generate future cash flows and our financial condition will be dependent to a large extent on the financial viability and operational effectiveness of owners and operators of the properties underlying the royalties, streaming and similar interests that are or may be held by us. Payments from production generally flow through the operator and there is a risk of delay and additional expense in receiving such revenues. Payments may be delayed by restrictions imposed by lenders, delays in the sale or delivery of products, recovery by the operators of expenses, the establishment by the operators of mineral reserves for such expenses or the bankruptcy, insolvency or other adverse financial condition of the operator. Our rights to payment under royalties, streaming and other interests must, in many cases, be enforced by contract without the protection of a security interest over property that we could readily liquidate. This may inhibit our ability to collect outstanding payment in the event of a default. In the event of a bankruptcy, insolvency or other arrangement of an operator or owner, in many instances, we may be treated like any other unsecured creditor, and therefore have a limited prospect for full recovery.

Estimates of mineral resources and mineral reserves disclosed by the owners and operators of the properties underlying our royalties, streaming and other interests may be subject to significant revision.

There are numerous uncertainties inherent in estimating mineral resources and mineral reserves, including many factors beyond our control and the control of the operators of properties in which we have royalties, streaming and other interests. Such estimates are prepared by the operator of the underlying property. We do not participate in the preparation or verification of such reports and have not independently assessed or verified the accuracy of such information.

In addition, the mineral resources and mineral reserves referenced in the disclosure by the owners and operators of the properties underlying our royalties, streaming and other interests and in our other disclosure documents have been determined by the project operator based on assumed future prices, cut-off grades, operating costs and other key assumptions. However, until mineral deposits are actually mined and processed, any mineral resources and mineral reserves must be considered as estimates only. Any such estimates are expressions of judgment based on knowledge, analysis of drilling results and industry practices. Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. In addition, the grade and/or quantity of the metals ultimately recovered may differ from that interpreted from drilling results.

7

There can be no assurance that metals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production scale. The grade of the reported mineral resources is uncertain in nature and it is uncertain whether further technical studies will result in an upgrade to them. Any material change in the quantity of mineralization, grade or mill feed to waste ratio or extended declines in market prices for the underlying metals may render some or all of our mineralization uneconomic and result in reduced reported mineral resources or mineral reserves. Any material reductions in estimates of mineral resources or mineral reserves reported by the operators of our interests, or of their potential ability to extract such mineral resources or mineral reserves in the future, could have a material adverse effect on our results of operations and financial condition.

Depleted mineral reserves may not be replenished, which could reduce the income we would have expected to receive from a particular royalties, streaming or similar interest.

Mines have a limited time of operation as a result of the proven and probable mineral reserves attributed to a specific mine. A mining company operating a specific mine will be required to replace and expand mineral reserves depleted by a mine's production to maintain production levels over a long term. It is possible to replace depleted mineral reserves by expanding known ore bodies through exploration, locating new deposits or acquiring new mines or projects. Mineral exploration is highly speculative in nature. It can take several years to develop a potential site of mineralization. There is no assurance that current or future exploration programs conducted by mining companies will be successful. There is a risk that the depletion of mineral reserves by operators will not be replenished by discoveries or acquisitions which could have a material adverse effect on our results of operations and financial condition.

Operations in foreign countries or other sovereign jurisdictions are subject to many risks, which could decrease our revenues.

Our royalties, streaming and other interests on properties outside of the United States are located in Canada, Mexico, Colombia, Brazil, Bosnia and Herzegovina, Turkey and Peru. In addition, future acquisitions may expose us to new jurisdictions. Our activities and those of the operators of properties on which we hold royalty and streaming interests are subject to the risks normally associated with conducting business in foreign countries or within the jurisdiction of Indigenous peoples that may be recognized as sovereign entities in the United States and elsewhere. These risks may impact the operators of our interests, depending on the jurisdiction, and include such things as:

These risks may limit or disrupt the exploration and development of mines or projects on which we hold royalties, streaming and other interests, restrict the movement of funds, or result in the deprivation of contract rights or the taking of property by nationalization or expropriation without fair compensation, and could have a material adverse effect on our business, results of operations, cash flows and financial condition.

We may enter into transactions with related parties and such transactions present possible conflicts of interest.

Transactions entered into with any entity in which a related party has an interest may not align with the interests of our security holders. There can be no assurance that we may have been able to achieve more favorable terms, including as to value and other key terms, if such transaction had not been with a related party.

8

We may enter into transactions with entities in which our board of directors and other related parties hold ownership interests. We expect that material transactions with related parties, if any, will be reviewed and approved by our nominating and corporate governance committee or our audit committee, each of which is comprised solely of independent directors. There can be no assurance that any such transactions will result in terms that are more favorable to us than if such transactions are not entered into with related parties. We may achieve more favorable terms if such transactions had not been entered into with related parties and, in such case, these transactions, individually or in the aggregate, may have an adverse effect on our business, financial position and results of operations.

Opposition from Indigenous peoples may delay or suspend development or operations at the properties where we hold royalty or similar interests, which could decrease our revenues.

Various international and national, state and provincial laws, rules, regulations and other practices relate to the rights of Indigenous peoples. Some of the properties where we hold royalty and other interests are located in areas presently or previously inhabited or used by Indigenous peoples. Many of these laws impose obligations on governments to respect the rights of Indigenous people. Some mandate that governments consult with Indigenous people regarding government actions which may affect them, including actions to approve or grant mining rights or permits. One or more groups of Indigenous people may oppose continued operation, further development or new development of the properties where we hold royalty and streaming interests. Such opposition may be directed through legal or administrative proceedings or protests, roadblocks or other forms of public expression, and claims and protests of Indigenous peoples may disrupt or delay activities of the operators of the properties.

In addition, the Supreme Court of Canada in Tsilhqot'in Nation v. British Columbia held that Aboriginal title is a beneficial interest in the land, the underlying control of which is retained by the Crown. The rights conferred by the Aboriginal title include the right to determine how the land will be used, to enjoy, occupy and, possess and to proactively use and manage the land including the natural resources. The Tsilhqot'in Nation case sets out criteria by which the Crown can override the Aboriginal title in the public interest which includes consultations and accommodation, substantive and compelling objectives and respecting the fiduciary obligations to the Aboriginal body in question. Our royalty and streaming interests in Canada and other jurisdictions may now or in the future be the subject of Indigenous land claims. The legal nature of such claims is a matter of considerable complexity. The impact of any such claim on our royalty and streaming interests cannot be predicted with any degree of certainty and no assurance can be given that a broad recognition of Indigenous rights by way of a negotiated settlement or judicial pronouncement would not have an adverse effect on the activities of the operator of underlying projects or other existing or future interests.

The mining industry is subject to environmental risks in the jurisdictions where projects underlying our interests are located, including risk associated with climate change.

Exploration, development and mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Laws and regulations intended to ensure the protection of the environment are constantly changing and evolving in a manner expected to result in stricter standards and enforcement, larger fines and liability, and potentially increased capital expenditures and operating costs. Furthermore, mining may be subject to significant environmental and other permitting requirements regarding the use of raw materials needed for operations, particularly water and power. Concerns regarding climate change have resulted in international, national and local treaties, legislation and initiatives that affect mineral exploration and production, including those intended to reduce industrial emissions and increase energy efficiency. Compliance with all such laws and regulations, treaties and initiatives could increase permitting requirements, result in stricter standards and enforcement, and require significant increases in capital expenditures and operating costs by operators of properties subject to our interests. Further, breach of an environmental law, regulation, treaty or initiative may result in the imposition of fines and penalties or other adverse impacts on operators and their properties, which may be material. If an operator is forced to incur significant costs to comply with environmental laws and regulations, treaties and initiatives, becomes subject to related restrictions that limit its ability to develop our projects, or expand operations, loses its right to use or access power, water or other raw materials necessary to operate a mine, or if the costs to comply with such laws and regulations, treaties and initiatives materially increase the capital or operating costs on the properties where we hold royalties, streaming or other interests, our revenues could be reduced, delayed or eliminated.

Our operations and those of the owners and operators of the properties underlying our interests may be negatively impacted by the effects of the spread of illnesses or other public health emergencies.

Pandemics and other public health crises may impact the ability of the owners and operators of the properties underlying our royalties, streaming or other interests to conduct activities at, or operate, such properties. Additionally, volatility in metal prices and the global economy resulting from pandemics, could cause the delay, suspension or termination of exploration, development or operational activities at the projects underlying our royalties, streaming or other interests, which could adversely impact our financial condition and results of operations. The global economy, metal prices and financial markets have experienced, and may in the future experience, significant volatility and uncertainty due to the effects of the spread of illness or other public health emergencies. Travel and other restrictions could limit or delay acquisition opportunities or other business activities. In addition, economic volatility, supply chain issues, labor shortages, disruptions in the financial markets, or severe price declines for gold or other metals could adversely affect our ability to obtain future debt or equity financing for acquisitions on acceptable terms or at all.

We depend on the services of our Chief Executive Officer, Chief Financial Officer, Chief Development Officer and other management and key employees.

9

We believe that our success depends on the continued service of our key executive management personnel. The loss of services of key members of management or other key employees could disrupt the conduct of our business and jeopardize our ability to maintain our competitive position in the industry. From time to time, we may also need to identify and retain additional skilled management and specialized technical personnel to efficiently operate our business. The number of persons skilled in the acquisition, exploration and development of royalty and streaming interests is limited and there is competition for such persons. Recruiting and retaining qualified executive management and other key employees is critical to our success and there can be no assurance of such success. If we are not successful in attracting and retaining qualified personnel, our ability to execute our business model and growth strategy could be affected, which could have a material adverse effect on our business, results of operations, cash flows and financial condition.

Certain of our directors and officers also serve as directors and officers of other companies in the mining sector, which may cause them to have conflicts of interest.

Certain of our directors and officers also serve as directors and officers of, or have significant shareholdings in, other companies involved in natural resources investment, exploration, development and production and, to the extent that such other companies may engage in transactions or participate in the same ventures in which we participate, or in transactions or ventures in which we may seek to participate, they may have a conflict of interest in negotiating and concluding terms with respect to such participation. In cases where our directors and officers have an interest in other companies, such other companies may also compete with us for the acquisition of royalties, streaming or similar interests. Such potential conflicts of interests of our directors and officers may have a material adverse effect on our business, results of operations and financial condition.

A significant disruption to our information technology systems or those of our third-party service providers could adversely affect our business and operating results.

We rely on a variety of information technology and automated operating systems to manage and support our operations. For example, we depend on our information technology systems for financial reporting, operational and investment management, and email. These systems contain, among other information, our proprietary business information and personally identifiable information of our employees. The proper functioning of these systems and the security of such data is critical to the efficient operation and management of our business, and these functions are outsourced by us to third-party service providers on whom we rely for the security and proper functioning of these systems. In addition, these systems could require modifications or upgrades from time to time as a result of technological changes or growth in our business, and we might change the third-party service providers with whom we contract to maintain the functioning or security of these systems from time to time, which modifications, upgrades or changes could be costly and disruptive to our operations and could impose substantial demands on management's time. Our systems, and those of our third-party service providers, could be vulnerable to damage or disruption caused by catastrophic events, power outages, natural disasters, computer system or network failures, viruses, ransomware or malware, physical or electronic break-ins, unauthorized access, or cyber-attacks. Any security breach could compromise our networks, and the information stored on them could be improperly accessed, disclosed, lost, stolen or restricted. Because techniques used to sabotage, obtain unauthorized access to systems or prohibit authorized access to systems change frequently and generally are not detected until successfully launched against a target, we or our third party service providers might be unable to anticipate these techniques, and the steps that we or our third party service providers have taken to secure our systems and electronic information might not be adequate to prevent a disruption or attack. Any unauthorized activities could disrupt our operations or those of our third-party service providers on which we are dependent, damage our reputation, or result in legal claims or proceedings, any of which could adversely affect our business, reputation, or operating results. See "Item 16K. Cybersecurity".

Potential litigation affecting the properties that we have royalties, streaming or similar interests in could have a material adverse effect on us.

Potential litigation may arise between the operators of properties on which we have royalties, streaming or similar interests or on which we acquire royalty and streaming interests in the future and third-parties. As a holder of such interests, we generally do not have any influence on litigation such as this and generally will not have access to non-public information concerning such litigation. Any such litigation that results in the reduction, suspension or termination of a project or production from a property, whether temporary or permanent, could have a material adverse effect on our business, results of operations, cash flows and financial condition.

We may use certain financial instruments that subject us to a number of inherent risks.

From time to time, we may use certain financial instruments to manage the risks associated with changes in gold and other commodity prices, interest rates and foreign currency exchange rates. The use of financial instruments involves certain inherent risks including, among other things: (i) credit risk, the risk of default on amounts owing to us by the counterparties with whom we entered into such transaction; (ii) market liquidity risk, the risk that any such position cannot be closed out quickly, either by liquidating such financial instrument or by establishing an offsetting position; and (iii) unrealized mark-to-market risk, the risk that, in respect of certain financial instruments, an adverse change in market prices for commodities, currencies or interest rates will result in us incurring an unrealized mark-to-market loss in respect of such derivative products.

Risks Related to Our Securities

10

We may lose our "foreign private issuer" status in the future, which could result in additional costs and expenses to us.

We are a "foreign private issuer", as such term is defined in Rule 405 under the Securities Act, and are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. We may in the future lose foreign private issuer status if a majority of our common shares are held in the United States and we fail to meet the additional requirements necessary to avoid loss of foreign private issuer status, such as if: (i) a majority of our directors or executive officers are U.S. citizens or residents; (ii) a majority of our assets are located in the United States; or (iii) our business is administered principally in the United States. The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer will be significantly more than the costs incurred as a Canadian foreign private issuer. If we are not a foreign private issuer, we would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are generally more detailed and extensive than the forms available to a foreign private issuer. In addition, we may lose the ability to rely upon exemptions from corporate governance requirements that are available to foreign private issuers.

We are a "foreign private issuer" and may have disclosure obligations that are different from those of U.S. domestic reporting companies. As a foreign private issuer, we are subject to different U.S. securities laws and rules than a domestic U.S. issuer, which could limit the information publicly available to our shareholders.

As a "foreign private issuer", we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We may not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. Furthermore, our officers, directors and principal shareholders are exempt from the insider reporting and short-swing profit recovery requirements in Section 16 of the Exchange Act. Accordingly, our shareholders may not know on as timely a basis when our officers, directors and principal shareholders purchase or sell their common shares. As a foreign private issuer, we are also exempt from the requirements of Regulation FD (Fair Disclosure) which, generally, are meant to ensure that select groups of investors are not privy to specific information about an issuer before other investors. As a result of such varied reporting obligations, shareholders should not expect to receive the same information at the same time as information provided by U.S. domestic companies.

In addition, as a foreign private issuer, we have the option to follow certain Canadian corporate governance practices rather than those of the United States, except to the extent that such laws would be contrary to U.S. securities laws, provided that we disclose the requirements we are not following and describe the Canadian practices we follow instead. See "Item 16G. Corporate Governance". As a result, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all domestic U.S. corporate governance requirements.

We are an "emerging growth company", and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our securities less attractive to investors.

We are an "emerging growth company", as defined in the Jumpstart Our Business Startups Act. For as long as we continue to be an "emerging growth company", we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies that are not "emerging growth companies", including, but not limited to, not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an "emerging growth company" for up to five years following the completion of our initial public offering (our "IPO"). However, if our non-convertible debt issued within a three-year period exceeds $1.0 billion or revenues exceed $1.235 billion, or the market value of our common shares that are held by non-affiliates exceeds $700 million on the last day of the second fiscal quarter of any given fiscal year, we would cease to be an emerging growth company as of the following fiscal year. Even after we no longer qualify as an emerging growth company, we may still qualify as a "smaller reporting company", which would allow us to take advantage of many of the same exemptions from disclosure requirements, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. Investors could find our securities less attractive if we choose to rely on these exemptions. If some investors find our securities less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common shares and our share price may be more volatile.

The market price of our securities may be volatile, which could result in substantial losses.

Securities markets worldwide have experienced, and are likely to continue to experience, significant price and volume fluctuations. This market volatility, as well as general economic, market or political conditions, could subject the market price of our securities to wide price fluctuations regardless of our operating performance. Some of the factors that may cause the market price of our securities to fluctuate include:

11

In addition, stock markets have historically experienced substantial price and volume fluctuations. Broad market and industry factors may harm the market price of our securities. Hence, the market price of our securities could fluctuate based upon factors that have little or nothing to do with us, and these fluctuations could materially reduce the market price of our securities regardless of our operating performance. In the past, following periods of volatility in the market price of a company's securities, securities class action litigation has been instituted against that company. If we were involved in any similar litigation, we could incur substantial costs, our management's attention and resources could be diverted and it could harm our business, operating results and financial condition.

The NYSE American may delist our securities, which could limit investors' ability to make transactions in our securities and subject us to additional trading restrictions.

While our common shares and common share purchase warrants are listed for trading on the NYSE American under the trading symbols "GROY" and "GROY-WT", respectively, we cannot assure you that our securities will continue to be listed on the NYSE American. If the NYSE American delists our common shares and common share purchase warrants from trading on its exchange, we could face significant material adverse consequences, including:

We are governed by the corporate laws of Canada which in some cases have a different effect on shareholders than the corporate laws of the United States and may have the effect of delaying or preventing a change in control.

We are governed by the Canada Business Corporations Act ("CBCA") and other relevant laws, which may affect the rights of shareholders differently than those of a company governed by the laws of a U.S. jurisdiction, and may, together with our charter documents, have the effect of delaying, deferring or discouraging another party from acquiring control of our Company by means of a tender offer, a proxy contest or otherwise, or may affect the price an acquiring party would be willing to offer in such an instance.

The material differences between the CBCA and Delaware General Corporation Law ("DGCL") that may have the greatest such effect include, but are not limited to, the following: (i) for certain corporate transactions (such as mergers and amalgamations or amendments to our Articles of Incorporation (the "Articles")) the CBCA generally requires the voting threshold to be a special resolution approved by 66 2/3% of shareholders, or as set out in the Articles, as applicable, whereas DGCL generally only requires a majority vote; and (ii) under the CBCA a holder of 5% or more of our common shares can requisition a special meeting of shareholders, whereas such right does not exist under the DGCL. We cannot predict whether investors will find our Company and our securities less attractive because we are governed by foreign laws. If some investors find our securities less attractive as a result of us being governed by the CBCA, there may be a less active trading market for our securities and the price of our securities may be more volatile.

In addition, a non-Canadian must file an application for review with the Minister responsible for the Investment Canada Act and obtain approval of the Minister prior to acquiring control of a "Canadian Business" within the meaning of the Investment Canada Act, where prescribed financial thresholds are exceeded. Finally, limitations on the ability to acquire and hold our common shares may be imposed by the Competition Act (Canada). The Competition Act (Canada) establishes a pre-merger notification regime for certain types of merger transactions that exceed certain statutory shareholding and financial thresholds. Transactions that are subject to notification cannot be closed until the required materials are filed and the applicable statutory waiting period has expired or been waived by the Commissioner. However, the Competition Act (Canada) permits the Commissioner of Competition to review any acquisition or establishment, directly or indirectly, including through the acquisition of shares, of control over or of a significant interest in us, whether or not it is subject to mandatory notification.

12

Otherwise, there are no limitations either under the laws of Canada, or in our Articles or amended and restated bylaws ("bylaws") on the rights of non-Canadians to hold or vote our common shares. Any of these provisions may discourage a potential acquirer from proposing or completing a transaction that may have otherwise presented a premium to our shareholders. We cannot predict whether investors will find our Company and our common shares less attractive because we are governed by foreign laws.

U.S. civil liabilities may not be enforceable against us, our directors, our officers or certain experts named in this Annual Report. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors and officers residing outside of Canada.

We are governed by the CBCA and our principal place of business is in Canada. Many of our directors and officers, as well as certain experts named herein, reside outside of the United States, and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us and such directors, officers and experts or to enforce judgments obtained against us or such persons, in U.S. courts, in any action, including actions predicated upon the civil liability provisions of U.S. federal securities laws or any other laws of the United States. Additionally, rights predicated solely upon civil liability provisions of U.S. federal securities laws or any other laws of the United States may not be enforceable in original actions, or actions to enforce judgments obtained in U.S. courts, brought in Canadian courts.

Our bylaws provide that any derivative actions, actions relating to breach of fiduciary duties and other matters relating to our internal affairs will be required to be litigated in Canada, which could limit shareholders' ability to obtain a favorable judicial forum for disputes with us.