UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 17, 2025 |

Civista Bancshares, Inc.

(Exact name of Registrant as Specified in Its Charter)

Ohio |

001-36192 |

34-1558688 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

100 East Water Street |

|

|||

Sandusky, Ohio |

|

44870 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (419) 625 - 4121 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common shares, no par value |

|

CIVB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Beginning on March 17, 2025, senior management of Civista Bancshares, Inc. (“Civista”) will deliver a presentation to certain existing investors and potential investors as part of a non-deal roadshow. A copy of the investor presentation is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K is being furnished under Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Civista Bancshares, Inc. is a $4.1 billion financial holding company headquartered in Sandusky, Ohio. Its primary subsidiary, Civista Bank, was founded in 1884 and provides full-service banking, commercial lending, mortgage, and wealth management services. Today, Civista Bank operates 42 locations across Ohio, Southeastern Indiana, and Northern Kentucky. Civista Bank also offers commercial equipment leasing services for businesses nationwide through its Civista Leasing and Finance Division (formerly Vision Financial Group, Inc.), headquartered in Pittsburgh, Pennsylvania. Civista Bancshares’ common shares are traded on the NASDAQ Capital Market under the symbol “CIVB”. Learn more at www.civb.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibit 99.1 Investor Presentation of Civista Bancshares, Inc. for period ended December 31, 2024.

Exhibit 104 Cover Page Interactive File-the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Civista Bancshares, Inc. |

|

|

|

|

Date: |

March 17, 2025 |

By: |

/s/ Ian Whinnem |

|

|

|

Ian Whinnem |

Investor Presentation Fourth Quarter 2024 Dennis G. Shaffer - Chief Executive Officer & President Richard J. Dutton - Senior Vice President, Chief Operating Officer NASDAQ: CIVB

Forward-Looking Statements. This presentation may contain “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements express management’s current expectations, estimates or projections of future events, results or long-term goals, and are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this material speak only as of the date they are made, and we undertake no obligation to update any statement except to the extent required by law. Forward-looking statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause actual results or performance to differ materially from those expressed in or implied by the forward-looking statements. Factors that could cause actual results or performance to differ from those discussed in the forward-looking statements include the risks identified from time to time in our public filings with the SEC, including those risks identified in “Item 1A. Risk Factors” of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented by any additional risks identified in the Company’s subsequent Form 10-Qs. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Use of Non-GAAP Financial Measures. This presentation contains certain financial information determined by methods other than in accordance with accounting principals generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Tangible Book Value per Share” , “Tangible Common Equity to Tangible Assets” and “Efficiency Ratio”. The Company believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP Measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided in the Appendix section of this presentation. Sources of Information: Company Management and S&P Global Market Intelligence

Contact Information Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol “CIVB.” Additional information can be found at: www.civb.com Dennis G Shaffer Chief Executive Officer & President dgshaffer@civista.bank Telephone: 888.645.4121

Who We Are 4

Geographical Footprint Bank founded and headquartered in 1884 in Sandusky, Ohio 10th Largest Publicly Traded Commercial Bank Headquartered in Ohio 527 Employees (519 FTE) Community Banking Focused Operations in 14 Ohio, 2 Indiana and 1 Kentucky Counties 40 Branches & 2 Loan Production Offices Operations in the 5 largest Ohio MSAs Civista Leasing and Finance (CLF) is a national equipment leasing and finance operation with equipment leased in all 50 states Full-Service Banking Organization with Diversified Revenue Streams Commercial Banking Retail Banking Treasury Management Wealth Management Private Banking Mortgage Banking Equipment Leasing

Financial Footprint Deposit market share information as of June 30, 2024. Sandusky/Norwalk/Port Clinton, Ohio 9 Locations $607 million in loans $1,635 million in deposits #1 deposit market share in Sandusky, Ohio with ~65% Cleveland/Akron, Ohio 3 Locations $931 million in loans $192 million in deposits North Central, Ohio 6 Locations $44 million in loans $ 226 million in deposits ~37% deposit market share Columbus & West Central, Ohio 6 Locations $469 million in loans $285 million in deposits 28% deposit market share in the rural markets Greater Dayton, Ohio 3 Locations $135 million in loans $104 million in deposits Southeastern Indiana/Cincinnati, Ohio 9 Locations $555 million in loans $612 million in deposits ~40% deposit market share Northwest Ohio 6 Locations $211 million in loans $182 million in deposits ~14% deposit market share Civista Leasing & Finance $47 million in financing leases $54 million in commercial loans $19 million in operating leases

Why Invest in Civista? 141-year-old community bank franchise with an established operating model in rural and growth markets Since 2019, Civista has increased total deposits $1.5 billion or 91% (85% of growth is organic) Low-cost deposit franchise (136 bps total cost of deposits (excluding brokered)) Since 2019, Civista has increased total loans $1.4 billion or 80% (80% of growth is organic) Generating loans in each of Ohio’s 5 largest MSAs Disciplined underwriting verified with strong credit quality metrics Nonaccrual and 90-days Past Due to Gross Loans of 1.07% as of 12/31/2024 Noninterest income enhanced by multiple revenue streams Accounting for 24% of our net revenue in 2024 Strong capital position Experienced management team with a deep bench Average banking experience of 31 years Use of LPOs to extend our reach (Westlake, Ohio and Fort Mitchell, Kentucky) Member Russell 2000 index

Executive Team

Community

Current Events 10

Deposits $3.21 billion in Total Deposits Excluding brokered, Cost of deposits are 136 bps and deposits grew organically 9.9% during 2024 Civista Bank is 141 years old with a generational and relationship driven deposit core 85.3%* of deposits insured Excluding $467.7 million of public deposits, Civista had no deposit concentrations “Civista’s deposit franchise is one of our most valuable characteristics and contributes significantly to our peer leading net interest margin and profitability” *Excluding Civista owned and tax program related deposit accounts - All Figures are as of December 31, 2024

Liquidity Cash and Securities are 23.4% of Total Deposits All securities are held for sale Strong on-balance sheet liquidity $499.3 million of cash and unpledged securities Ready access to off-balance sheet funding Immediate access to $1.2 billion in funding from FHLB, Federal Reserve and CDARS/IntraFi All Figures are as of December 31, 2024

Credit Credit metrics remain stable and strong ACL to loans was 1.29% Strong ALLL of $39.7 million Total nonperforming loans as percent of total loans is 1.06% Net charge offs as percent of average loans is 0.01% Virtually no central business office exposure All Figures are as of December 31, 2024

Capital Total shareholders’ equity of $391.6 million Tier 1 risk-based capital ratio of 10.47% Total risk-based capital ratio of 13.98% Civista continues to create capital through earnings “Well Capitalized” by regulatory standards Tangible Common Equity ratio of 6.43% All Figures are as of December 31, 2024

Strategic Priorities for 2024 – 2027 Grow Relationships & Core Deposits Position Digital to Grow the Bank Invest in Talent & Culture to Drive the Strategic Plan Leverage Technology to Optimize Profitability Deepen existing relationships Execute small business initiative Increase # of relationships; and lifetime customer value Automate labor intensive processes with RPA (Robotics) Optimize capital through customer profitability tools Re-skill, up-skill, cross-skill current employees Continue to focus on culture that promotes success and growth for employees and organization Increase digital deposit account openings Implement enhanced fraud prevention tools Enhance data analytics tools

Initiatives in Flight Revenue Improvement Increased Fee Income Treasury management fees 28.4% YoY Wealth management fees 15.8% YoY Launch of Small business initiative Leasing Syndication Desk Expense Reduction Replaced after hour and overflow calls with an AI virtual banking assistant saving an estimated $210,000 annually Closed branch in Dec. 2024, $238,000 of projected savings in 2025 Manage/reduce overtime and staffing saving $133 thousand from 2023 to 2024 Implemented improved and optimized Fraud prevention Renegotiated general insurance with no reduction in coverage saving $165,000 Low/Lower Cost Funding Reduced average FHLB borrowings approx. 45% in Q4 2024 ($388 million to $214 million) Ohio Homebuyer Plus Program Launched May 6, 2024 Opened 1,000 accounts equating to $100 million in deposits at a rate of 80 bps* Additional $10 million customer deposits; about 35% of customers are new to bank Wealth Management Cash Balances Transferred ~ $87 million in deposits to balance sheet from our wealth management clients’ cash balances (formally held outside the Bank) Other – Focused Marketing to: Public Fund Operating Accounts Loan Customers with low/no deposit balances * 80 bps as of Dec 31,2024

Financial Trends 16

December 31, 2024 includes $177 thousand of PPP loans; December 31, 2023 includes $326 thousand of PPP loans Presented on an annualized basis 3. Non-GAAP reconciliation on page 41 Financial Trends

Total Assets1 ($ in millions) 1. 2022 includes the addition of $316 million in assets due to Comunibanc Corp acquisition. CAGR 12.1% Financial Trends

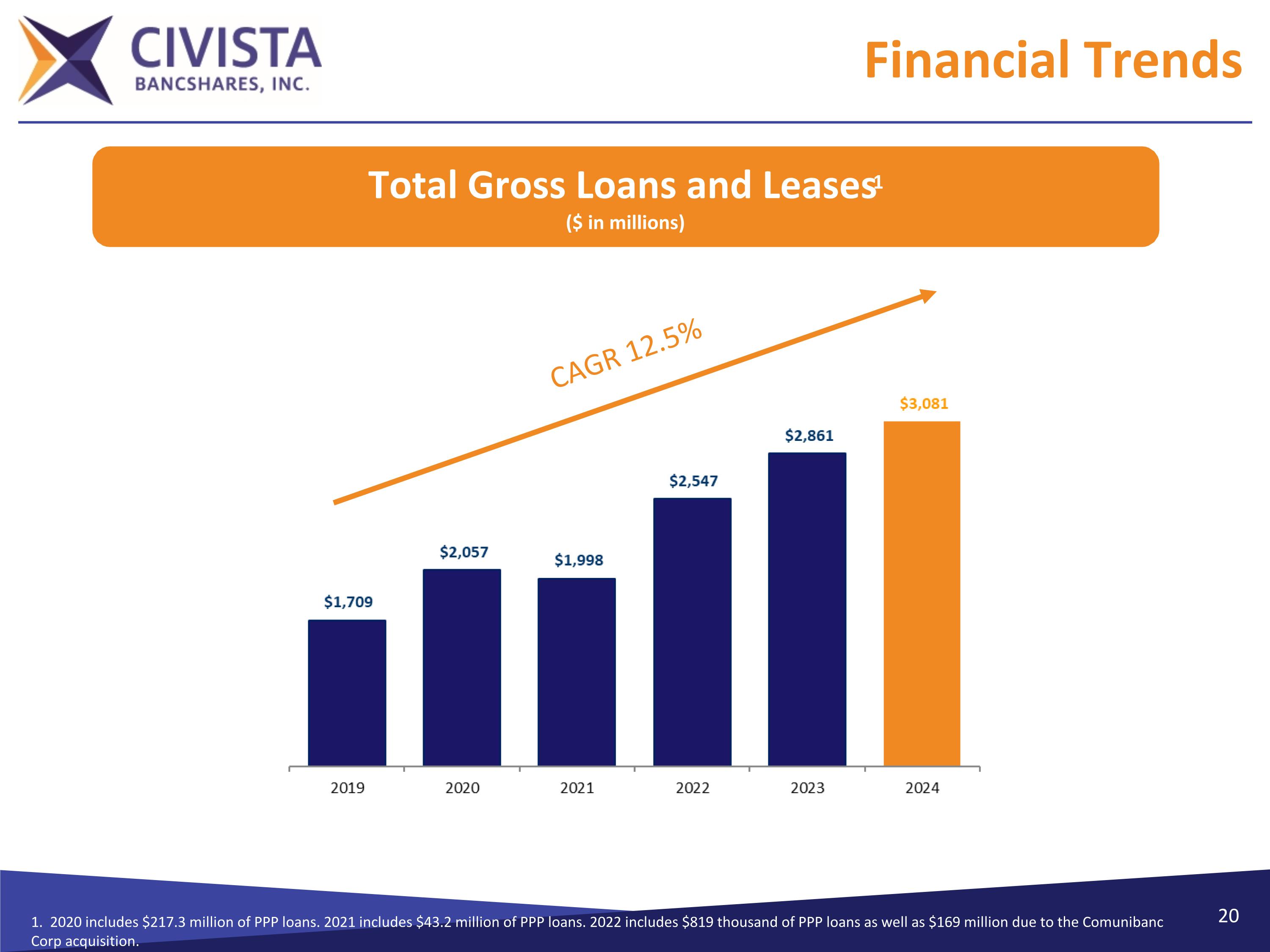

Total Gross Loans and Leases1 ($ in millions) 1. 2020 includes $217.3 million of PPP loans. 2021 includes $43.2 million of PPP loans. 2022 includes $819 thousand of PPP loans as well as $169 million due to the Comunibanc Corp acquisition. CAGR 12.5% Financial Trends

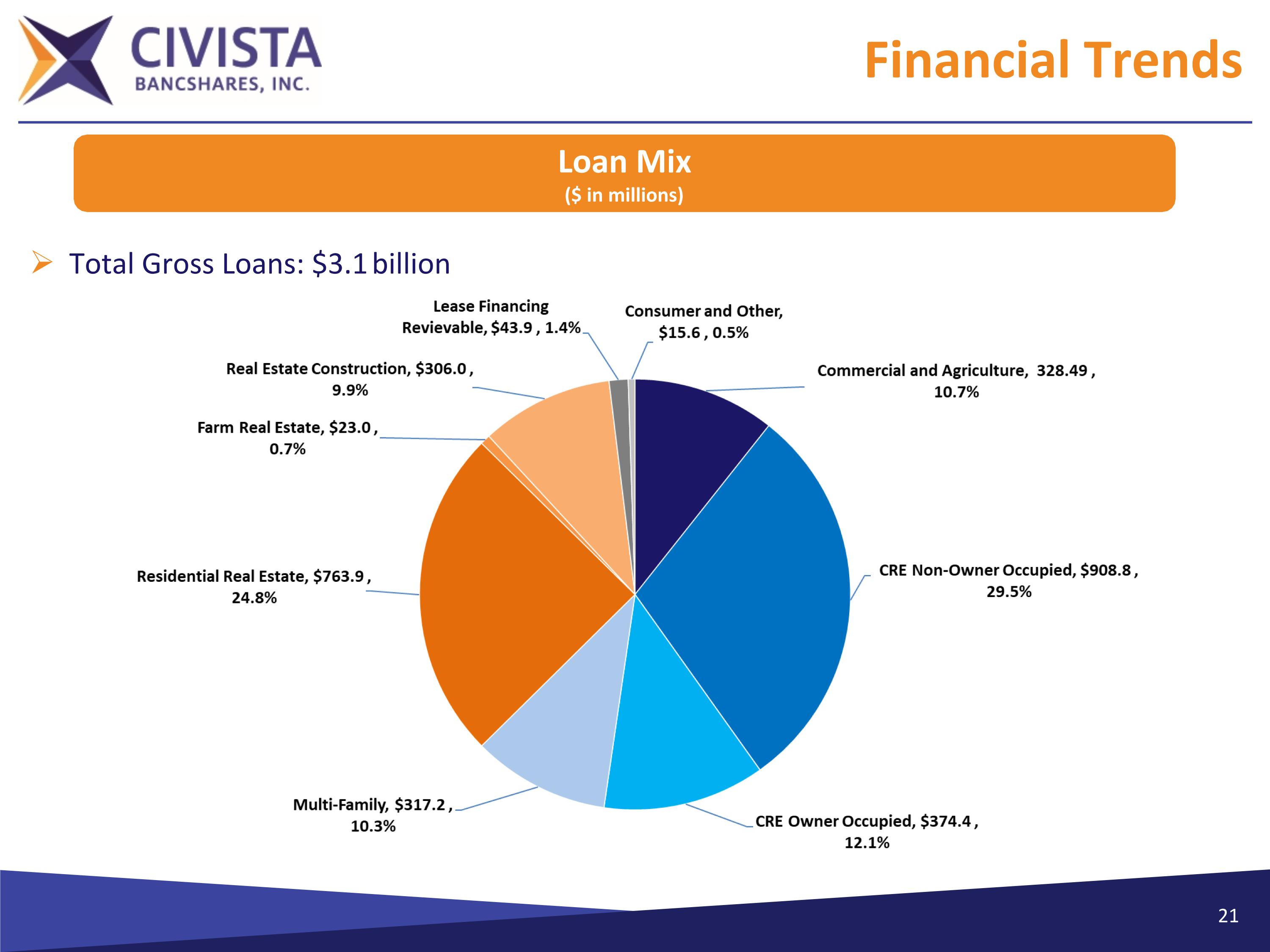

Financial Trends Total Gross Loans: $3.1 billion Loan Mix ($ in millions)

Financial Trends CRE Non-Owner Concentrations ($ in millions)

Financial Trends CRE Non-Owner Office Details ($ in millions) Total: $199.9 million

Financial Trends Civista Leasing and Equipment Financing ($ in millions) 2024 YTD Production YTD Funded: $108.3 million Sold: $51.4 million Net Production: $56.9 million Average Yield on Total Portfolio: 9.22% Average Yield on Q4 Originations: 9.63% Targeted Industries: Propane, Recycling/Waste Management, Environmental, Additive Manufacturing (3-D Printing), Construction, Non-destructive testing

Financial Trends 1. LTM basis Net Chargeoff Ratio1 Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets Loan Loss Reserves / Gross Loans Nonaccrual & 90 days Past Due / Gross Loans Reserves / NPLs

Financial Trends Total Deposits1 ($ in millions) 1. 2022 includes the addition of $271 million in deposits due to the Comunibanc Corp acquisition. CAGR 13.9%

Financial Trends Total Deposits: $3.2 billion Loan/Deposit Ratio: 95.9% Deposit Mix ($ in millions)

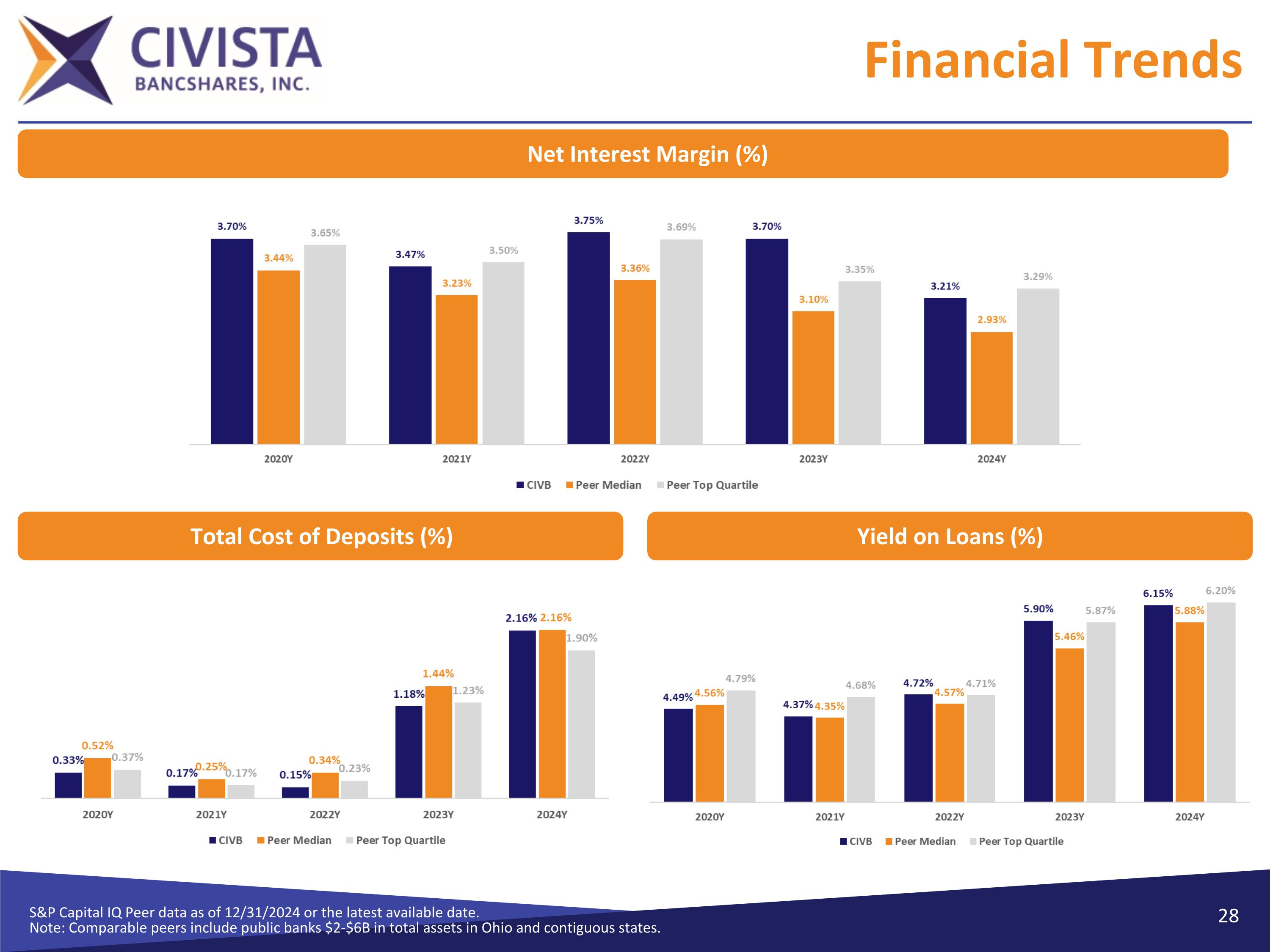

Financial Trends S&P Capital IQ Peer data as of 12/31/2024 or the latest available date. Note: Comparable peers include public banks $2-$6B in total assets in Ohio and contiguous states. Net Interest Margin (%) Total Cost of Deposits (%) Yield on Loans (%)

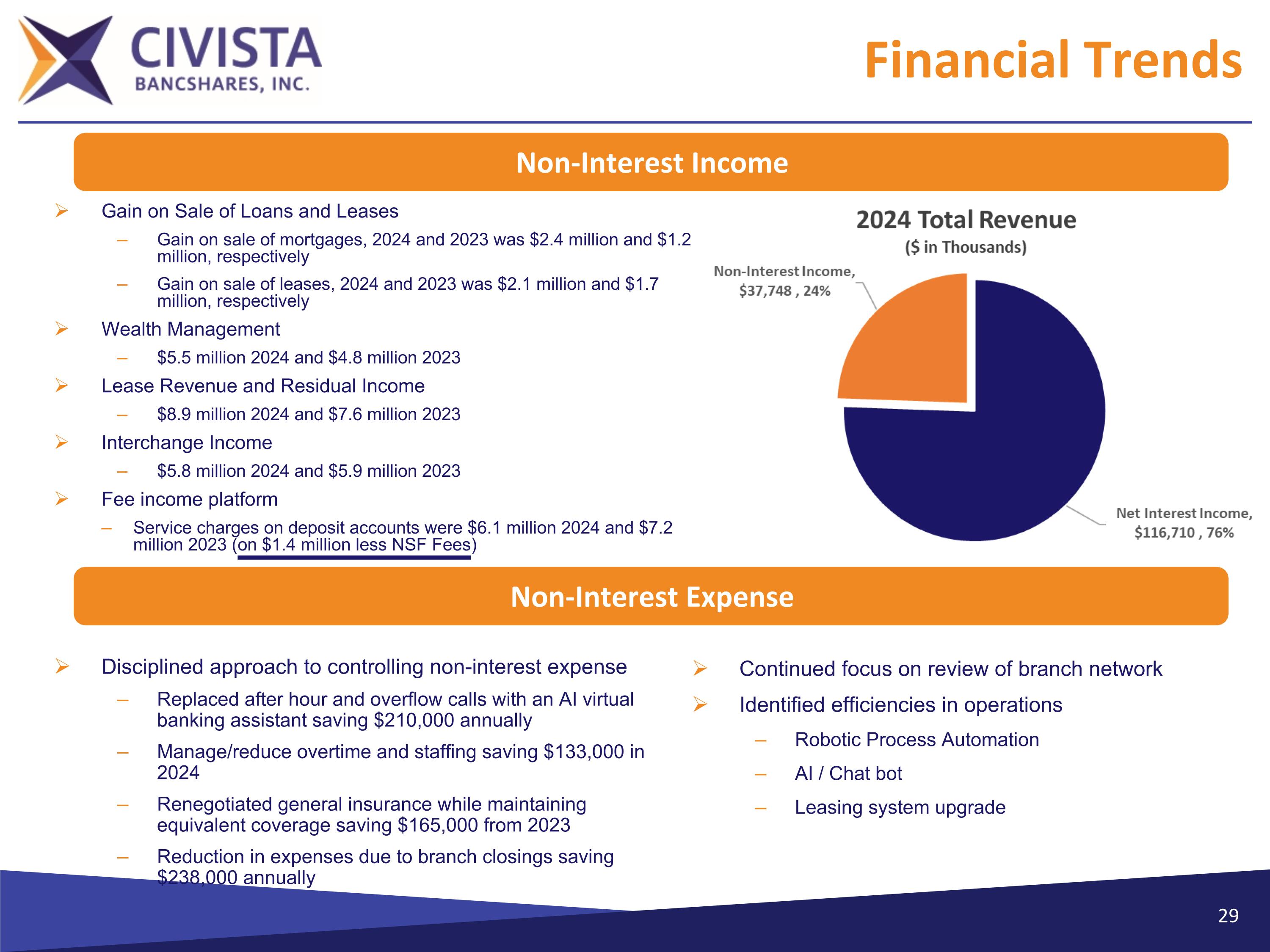

Financial Trends Gain on Sale of Loans and Leases Gain on sale of mortgages, 2024 and 2023 was $2.4 million and $1.2 million, respectively Gain on sale of leases, 2024 and 2023 was $2.1 million and $1.7 million, respectively Wealth Management $5.5 million 2024 and $4.8 million 2023 Lease Revenue and Residual Income $8.9 million 2024 and $7.6 million 2023 Interchange Income $5.8 million 2024 and $5.9 million 2023 Fee income platform Service charges on deposit accounts were $6.1 million 2024 and $7.2 million 2023 (on $1.4 million less NSF Fees) Continued focus on review of branch network Identified efficiencies in operations Robotic Process Automation AI / Chat bot Leasing system upgrade Non-Interest Income Disciplined approach to controlling non-interest expense Replaced after hour and overflow calls with an AI virtual banking assistant saving $210,000 annually Manage/reduce overtime and staffing saving $133,000 in 2024 Renegotiated general insurance while maintaining equivalent coverage saving $165,000 from 2023 Reduction in expenses due to branch closings saving $238,000 annually Non-Interest Expense

Financial Trends 1. TCE Non-GAAP reconciliation on page 41 2. LTM basis November 2021 issued $75 million in 3.25% subordinated debt (becomes floating in Q4 2026) Authorized $13.5 million stock repurchase plan in April 2024 During 2024, no repurchases were made $200 million shelf offering completed in fourth quarter 2024 Increased quarterly common dividend to $0.17 per share in the first quarter 2025 Dividend payout ratio 25.5% as of 12/31/2024 ($0.16 per share dividend) Capital Management

Why Civista? 31

Experienced Acquirer Completed 6 acquisitions since 2007, including the acquisition of Comunibanc Corp, which closed July 2022 and acquisition of Vision Financial Group, which closed October 2022 In June 2022, opened de novo branch in Gahanna, Ohio, located in Franklin County (Columbus MSA)

Organic Growth Model Expanded commercial loan growth in Columbus, Cleveland, Akron, Dayton, Toledo and Cincinnati markets Loan portfolios in these markets has increased from $1.3 billion in 2019 to $2.4 billion at year-end 2024. Growth of $1.2 billion or 91% (represents 84% of Civista’s total loan growth) Deposits in these markets has increased from $789 million in 2019 to $1.52 billion at year-end 2024. Growth of $731 million or 93% (represents 48% of Civista’s total deposit growth) Low cost, locally generated deposit base Core Deposits have grown 9.9% YoY Strong Net Interest Margin 3.36% for Q4 2024 3.21% for Full-Year 2024

Why Invest in Civista? 141-year-old community bank franchise with an established operating model in rural and growth markets Since 2019, Civista has increased total deposits $1.5 billion or 91% (85% of growth is organic) Low-cost deposit franchise (136 bps total cost of deposits (excluding brokered)) Since 2019, Civista has increased total loans $1.4 billion or 80% (80% of growth is organic) Generating loans in each of Ohio’s 5 largest MSAs Disciplined underwriting verified with strong credit quality metrics Nonaccrual and 90-days Past Due to Gross Loans of 1.07% as of 12/31/2024 Noninterest income enhanced by multiple revenue streams Accounting for 24% of our net revenue in 2024 Strong capital position Experienced management team with a deep bench Average banking experience of 31 years Use of LPOs to extend our reach (Westlake, Ohio and Fort Mitchell, Kentucky) Member Russell 2000 index

Additional Information 35

Operating Results

Non-GAAP Reconciliation 1. LTM basis

Thank You