UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number 001-39747

SEER, INC.

(Exact name of Registrant as specified in its charter)

Delaware |

|

82-1153150 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

3800 Bridge Parkway, Suite 102

Redwood City, California 94065

650-453-0000

(Address, including zip code and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to section 12(b) of the Act:

Copies to:

Title of each class |

|

Trading Symbol(s) |

|

Name of Exchange on which registered |

Common Stock, par value $0.00001 |

|

SEER |

|

Nasdaq Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

|

|

|

|

|

|

Smaller reporting company |

☒ |

|

|

|

|

|

Non-accelerated filer |

☒ |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The Nasdaq Stock Market on June 28, 2024, was approximately $95.8 million.

As of February 26, 2025, the registrant had 55,737,066 shares of Class A common stock, $0.00001 par value per share, and 4,044,969 of Class B common stock, $0.00001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to the 2025 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. The proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2024.

TABLE OF CONTENTS

Item 1. |

||

Item 1A. |

||

Item 1B. |

||

Item 1C. |

||

Item 2. |

||

Item 3. |

||

Item 4. |

||

Item 5. |

||

Item 6. |

||

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

||

Item 8. |

||

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

||

Item 9B. |

||

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

Item 10. |

||

Item 11. |

||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

||

Item 15. |

||

Item 16. |

||

|

||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (Annual Report) contains forward-looking statements. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, business strategy, commercial activities and costs, research and development costs, timing and likelihood of success, as well as plans and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that are in some cases beyond our control and may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this Annual Report include, but are not limited to, statements about:

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and prospects, and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this Annual Report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we undertake no obligation to update or revise any forward-looking statements contained herein to reflect events or circumstances after the date of this Annual Report, whether as a result of any new information, future events or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and you are cautioned not to unduly rely upon these statements.

PART I.

Item 1. Business

Overview

Our mission is to imagine and pioneer new ways to decode the biology of the proteome to improve human health. Through our product, the ProteographTM Product Suite (Proteograph), we provide researchers with unbiased, deep, rapid and large-scale access to the proteome. With our pioneering development of the Proteograph, its unique capabilities and growing body of scientific evidence, we believe researchers view us as their trusted partner in unlocking novel biological insights that were previously beyond reach. Since our commercial launch in 2021, we have served more than 135 customers in over 20 countries to enable them to drive scientific discoveries and innovation.

The Proteograph is a comprehensive solution that includes consumables, an automation instrument and data analysis software. It leverages our proprietary engineered nanoparticle (NP) technology to provide unprecedented unbiased access to the proteome at scale. The Proteograph has detected over 36,000 proteins across multiple species, and its performance and capabilities have been demonstrated in over 33 peer-reviewed publications, preprints and reviews. With this growing body of third-party validation, a broad range of new customers, including biobanks, biopharmaceutical companies, and academic institutions, are adopting the Proteograph for large-scale proteomic studies, advancing breakthrough discoveries and multi-omics driven precision medicine.

Prior to the Proteograph, interrogating the human proteome was historically challenging due to its complexity, as multiple protein variants can arise from each gene. This complexity stems from various biological processes that contribute to the functional proteome, including transcription, translation, post-translational modifications (PTMs) and protein interactions.

To unravel this complexity, researchers require deep, unbiased population-scale studies. Before the introduction of the Proteograph, the largest published deep unbiased plasma proteomics study, which measured at least 600 proteins, was limited to just 48 samples.

Additionally, traditional proteomic approaches have struggled to provide both depth and scale in studying samples with high dynamic range. Traditional methods fall into two broad categories: (i) unbiased but not scalable; or (ii) scalable but targeted. Traditional deep, unbiased approaches require complex, lengthy, labor- and capital-intensive workflows, restricting their application to small, under-powered studies. Targeted methods, while scalable, are limited to predetermined proteins and lack the peptide-level resolution to accurately differentiate between protein variants within the same biological sample. These limitations have historically forced researchers to choose between study scale and protein coverage depth.

Today, the Proteograph eliminates this trade-off, enabling researchers to conduct deep, unbiased, population-scale studies over time, allowing them to catalog the proteome, explore protein variants, and understand the intricate relationships between the proteome and disease. Our customers have successfully completed deep, unbiased plasma proteomics studies at scale, quantifying thousands of proteins and hundreds of thousands of peptides across thousands of samples. This deeper level of analysis is driving novel insights into disease mechanisms, biomarker discovery, and potential therapeutic targets.

1

Researchers in both the proteomics and genomics markets are increasingly adopting the Proteograph to bridge the gap between genome, proteome, and disease. The Proteograph facilitates unprecedented unbiased, deep, large-scale studies, complementing genomics research by adding essential functional context to genetic variation. Advances in next-generation sequencing have enabled the sequencing of millions of human genomes and exomes, identifying more than 1.1 billion individual genetic variants, according to the dbSNP database. However, less than 0.3% of these variants have been cataloged in the ClinVar database with a known relationship to phenotype. This lack of functional annotation is partly due to the imbalance between access to genomic and proteomic data. We believe the Proteograph Product Suite is helping to close this gap.

Just as large-scale genomic access has transformed that field, large-scale proteomic access is beginning to do the same—revealing new biological insights, mapping novel protein variants, and advancing disease research, diagnostics, and treatment development. By aligning unbiased genomic data at the nucleotide level with proteomic data at the peptide and amino acid level, researchers can better connect genotype to phenotype. We believe our customers are developing more accurate disease biomarkers for diagnostics and therapeutics, accelerating multi-omics driven precision medicine.

The Importance of Proteomics

Detailed and complex biological information resides within the proteome. Nearly all functions of an organism depend on the interactions between proteins and other biological molecules. Proteins serve as dynamic indicators of health status, disease progression and therapeutic response. As depicted in Figure 1 below, the genome is a static indicator of an individual’s baseline physiology, while the proteome reveals the current physiological state. Despite its importance, the human proteome is relatively unexplored compared to the human genome.

Understanding the functional context of proteins is essential for linking genomic information with phenotypes. However, this connection remains limited, as the vast majority of genetic variants lack functional context at the protein level. We believe that enabling researchers to generate large-scale, integrated proteomic and genomic data will enhance their understanding of the relationship between variation, function and biology.

Figure 1: Utility of genomic vs. proteomic information. Over one million human genomes have been highly characterized with over 1.1 billion variants, but they have low utility and represent a static indicator of risk. The human proteome is far less characterized, but has a much higher utility as a dynamic indicator of health status.

2

Complexity of the Proteome

The human proteome is dynamic, diverse and complex, with approximately 23,000 genes giving rise to over one million protein variants. As shown in Figure 2 below, these variants arise from various mechanisms, including alternative splicing of RNA transcripts, genetic variations that alter the amino acid sequence of the protein, and post-translational modifications such as phosphorylation and glycosylation. It is estimated that our approximately 23,000 genes give rise to approximately 70,000 protein isoforms through alternative splicing. At a population level, a much larger number of protein isoforms exist because of genetic variants and somatic variants that alter RNA processing. Protein variants can have vastly different biological functions and be expressed in different tissues within the same individual. For example, two isoforms of the protein encoded by CD99L2 have different interacting proteins and those two proteins’ networks are related to distinct diseases (Yang et al.). An example of a protein that has tissue-specific isoform abundance is FOX1, which has differential isoform presence in muscle and brain tissue (Nakahata and Kawamoto). Therefore, it is essential to study and understand proteins at the level of protein variants in the appropriate biosample, and this can be achieved only through large-scale analysis of the proteome at the peptide level.

A study by Backman et al. published in Nature revealed the genomic variation identified in a cohort of approximately 455,000 participants of the UK Biobank exome sequencing study. The study identified a vast amount of protein variation, including almost nine million protein variants, of which more than six million are potentially deleterious and 915,289 are protein loss-of-function variants. On the individual level, each participant had on average 9,506 protein variants, of which 2,945 were potentially deleterious and 214 were loss-of-function variants. However, these variants were only identified at the genomic level and did not account for alternative splicing or post-translational modifications. Considering these additional sources of protein variants, the actual number of protein variants at both individual and population-wide levels is significantly higher.

These findings emphasize the unmet need to understand protein variants at the peptide level and underscore how little is currently known about the complexity of the proteome. We believe understanding protein variation at this level could revolutionize how we diagnose, treat, and monitor diseases.

Figure 2: Functional diversity exists through modifications and interactions of different molecules, from static indicators like the genome to increasingly numerous and complex indicators like the proteome and interactome. Modified from Bludau et al.

3

The Importance of Unbiased, Peptide-level Resolution Proteomics

Importance of an Unbiased Approach in the Discovery of Novel Content

The ability to perform unbiased sampling at scale has transformed biological analysis. In genomics, unbiased sequencing of the genome enabled discovery of novel content, creating new end-market opportunities in basic research and discovery, translational research and clinical applications, including early cancer detection, recurrence monitoring and non-invasive prenatal testing.

Similar to genomics, we believe that peptide-level resolution is crucial to the discovery of novel content and new biological insights. One example is alternative protein isoforms arising from the same gene locus. At the transcriptome level, these alternative transcripts are known as spliceforms. Most human genes can produce more than one protein spliceform and, according to the Ensembl genome database project, as many as 70,000 protein spliceforms are generated by more than 23,000 human genes through alternative splicing. If we account for additional spliceforms at the population level, arising from genetic variants and somatic variants including those responsible for cancers (which affect RNA processing), the number is much larger. Affinity-based approaches generally cannot differentiate between spliceforms, whereas unbiased MS-based approaches survey proteins at the peptide level, enabling differentiation between spliceforms.

Peptide-level resolution is critical for identifying biologically important novel cancer biomarkers, as we demonstrated in our Nature Communications paper (Blume et al.). Using data from that paper, we identified several biomarkers at the peptide level that would have been missed if we had only focused on overall protein expression, including bone morphogenic protein 1 (BMP1). In PLOS One, Donovan et al. find that the known spliceforms of BMP1 exhibit differential abundance in cases and controls; the single short form is more abundant in cancer cases, while the long forms are more abundant in controls. In that paper, we propose a mechanism to explain the differential abundance based on lack of domains in the short form. This highlights the importance of generating data at the peptide level, which is made possible by the Proteograph Product Suite.

Figure 3: Identification of peptide-level variants of BMP1 enabled by an unbiased approach. Peptide-level identification reveals individual BMP1 variants, showing an opposite pattern of differential expression in the short vs. long variants of BMP1 in individuals with non-small-cell lung cancer (NSCLC) compared to normal controls.

4

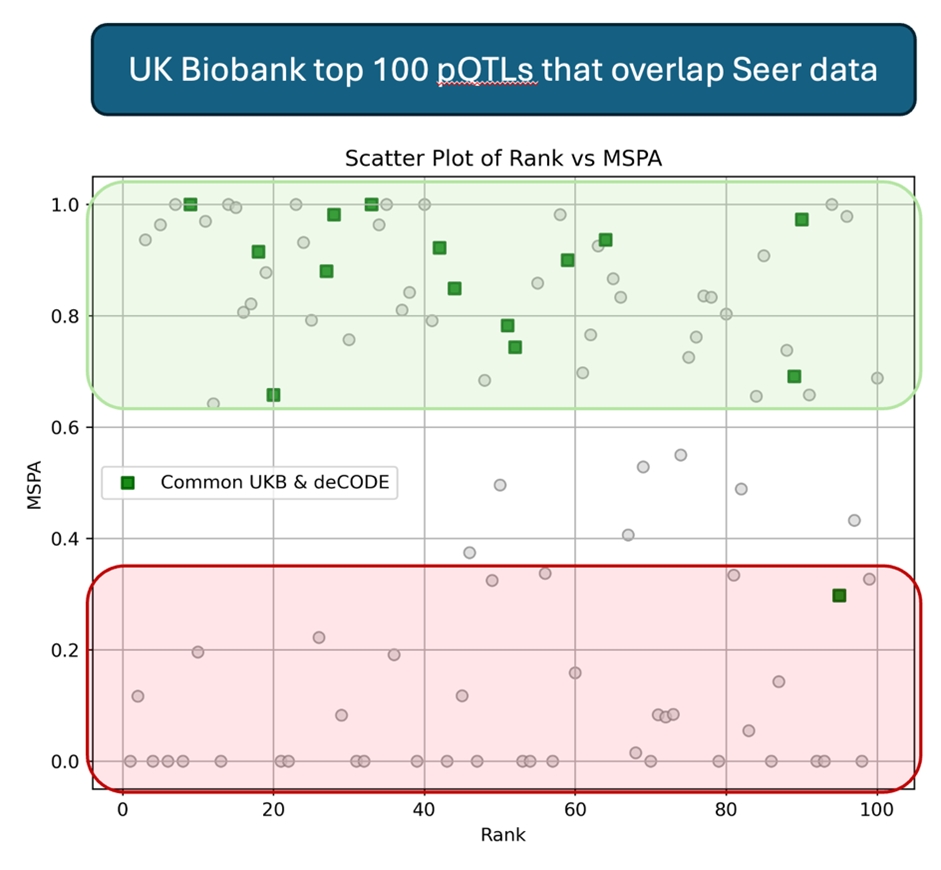

Peptide-level resolution is especially important in proteogenomic analyses, where the presence of allelic variants within proteins confounds affinity-based proteomics methods. In recent work, Karsten Suhre and colleagues in collaboration with our team conducted the first deep, large-scale mass spectrometry (MS)-based genome-wide association search (GWAS) for protein quantitative trait loci (pQTLs) (Suhre et al.). In addition to discovering 252 pQTLs across a discovery cohort of 1,260 American participants and a replication in 325 individuals from Asia with diverse ethnic backgrounds, Suhre et al. investigated 200 of the strongest cis-pQTLs previously identified using two separate leading affinity-based technologies, which were applied to a cohort of 36,000 Icelandic participants and a cohort of 55,000 UK participants, respectively. Suhre et al. found that up to one third of the affinity proteomics pQTLs may be affected by epitope effects and, therefore, be false positive identifications due to the presence of protein allelic variants that disrupt or alter the binding of the affinity reagent to the protein surface. Another third of the 200 analyzed pQTLs were confirmed by Seer-based MS proteomics. These findings are consistent with the hypothesis that genetic variants induce changes in protein expression. This study demonstrated the ability of peptide-level resolution in distinguishing between true pQTLs and putatively false identifications of affinity-based proteomics technologies, suggesting that many more pQTLs remain to be discovered using MS-based platforms.

Figure 4: The ability of peptide-level resolution to validate affinity-based pQTL identifications. The 100 strongest pQTLs identified in a cohort of 55,000 participants in UK Biobank are scored by Seer MS data obtained in a discovery cohort of 1,260 American participants and a replication cohort of 325 Asian participants. In the x-axis, each of the 100 pQTLs is sorted by statistical significance in UK Biobank, left being the most significant; in the y-axis, each pQTL is scored according to peptide-level evidence in Seer data, with 1.0 being the highest level of evidence. The pQTLs marked green were found by another affinity-based platform performed in a cohort of 36,000 Icelandic participants; such pQTLs are highly reliable, being independently discovered in two cohorts by two technologies. Almost all highly reliable pQTLs are scored highly by Seer data; conversely, pQTLs that are scored low are likely to be false discoveries, potentially due to epitope effects induced by the presence of protein allelic variants that alter the binding of the affinity reagent to the protein surface.

5

Our Proprietary Engineered Nanoparticle Technology

The Proteograph Product Suite leverages our proprietary engineered NP technology to overcome the limitations of existing methods, and enable an easy-to-use workflow for unbiased, deep, rapid and scalable proteomic analysis. Our proprietary engineered NPs provide unbiased sampling of intact proteins across the dynamic range of the proteome, capturing molecular information at the peptide-level, including protein variants. The NPs eliminate the need for complex workflows required by other unbiased approaches, which we believe will make proteomics more accessible to the broader scientific community.

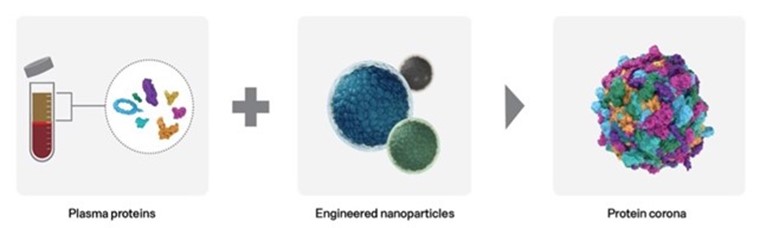

Typically, nanoparticles have a diameter in the tens to hundreds of nanometers, much smaller than a human hair, which has a diameter of 80,000 nanometers. When nanoparticles come into contact with a biological sample, a thin layer of intact proteins rapidly, selectively and reproducibly adsorbs onto their surface, forming what is called a protein “corona.” Additional intact proteins can also bind directly to proteins already attached to the nanoparticle through protein-protein interactions (PPIs), and intact protein complexes may also attach to the nanoparticle directly. Our engineered NPs capture intact proteins across the dynamic range without requiring prior knowledge of proteome composition or designing the assay for specific protein targets. In combination with an unbiased MS readout, they reveal molecular information at the peptide level revealing protein variants. At binding equilibrium, which occurs within minutes after our NPs encounter a biosample, the selective sampling of proteins by our NPs is robust and highly reproducible.

Figure 5: Nanoparticles allow unbiased interrogation of proteoform diversity. Our nanoparticle technology leverages engineered physicochemical properties to reproducibly bind to proteins without prior knowledge, forming a protein corona.

The binding of proteins to the nanoparticle surface and protein sampling are primarily driven by three factors: (i) the affinity of a particular protein for the physicochemical surface of a specific nanoparticle; (ii) the concentration of a specific protein in a biological sample; and (iii) the affinity of the proteins for other proteins on the surface of the nanoparticle, forming PPIs. A variety of materials and methods are used to create different nanoparticles with distinct physicochemical properties, which generate a unique protein corona pattern and a unique proteomic fingerprint. As the amount of proteomic data increases, we will continue to refine the unique physicochemical properties of our NPs with advanced machine learning.

6

By incorporating our nanoparticles in an assay, we achieve a representative and thorough sampling across the dynamic range of the proteome, from high- to low-abundance proteins. In this way, we have successfully replaced complex laboratory workflows for the enrichment of samples for deep, unbiased MS, enabling the capture of thousands of proteins from biofluids for large-scale proteomics studies. Nanoparticles can interrogate almost any solubilized biological sample, including cell or tissue homogenates, blood or blood components (such as plasma or serum), urine, saliva, cerebrospinal fluid and synovial fluid. This versatility, we believe, strongly suggests that a vast universe of different nanoparticles with different physicochemical properties could be employed across a broad range of sample types, to selectively, reproducibly and deeply sample the proteome in an unbiased way.

We have validated our NP technology and the principle of protein corona formation as a robust and reproducible method to deeply and broadly profile the proteome in a high-throughput manner. We have characterized our technology and its performance in three peer-reviewed publications: Nature Communications (Blume et al.), PNAS (Ferdosi et al.), and Advanced Materials (Ferdosi et al.).

The Proteograph Product Suite

The Proteograph Product Suite is an integrated solution consisting of consumables, an automation instrument, and data analysis software to perform unbiased, deep proteomic analysis at scale in a matter of hours. We designed the Proteograph workflow to be efficient and easy-to-use, and to leverage common laboratory instrumentation to enable adoption in both centralized and decentralized settings, making deep, unbiased proteomics accessible to nearly any lab.

The Proteograph consumables consist of our NPs and all other consumables necessary to assay samples in an automated workflow on our SP100 automation instrument. Our automated workflow is custom configured for researchers to assay samples in approximately eight hours, which includes approximately 30 minutes of hands-on time and seven and a half hours of automated instrument time. The output from the Proteograph workflow consists of peptides ready to be processed and evaluated on an MS instrument. The Proteograph Product Suite is detector agnostic and, we believe, will be adaptable to other protein detection instruments in the future. The MS component of the Proteograph workflow is either provided by the researcher’s laboratory, can be outsourced to a third-party provider, or be run through the Seer Technology Access Center (STAC), which is our in-house service program. The Proteograph Analysis Suite, a data analytics software suite, provides quality control and allows researchers to analyze and interpret the output from the system to gain insights from their data.

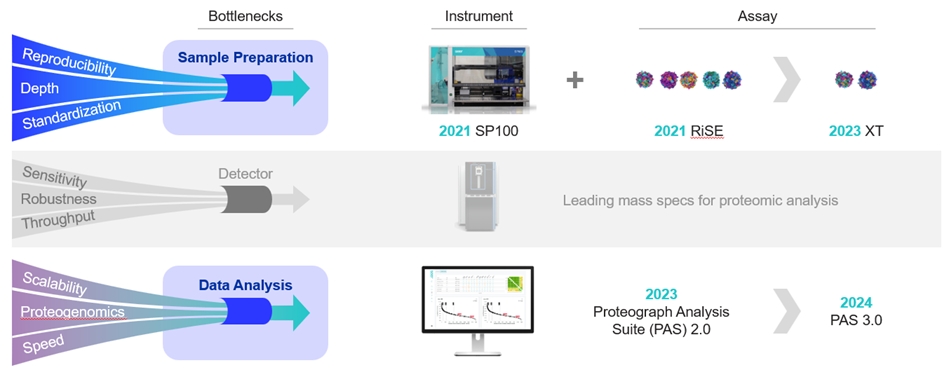

Figure 6: Proteograph Product Suite comprises consumables, an automation instrument, and software.

7

Prior to the Proteograph, conducting deep, unbiased proteomic studies at scale was not possible due to three primary bottlenecks:

Figure 7: Seer is continuously innovating to address bottlenecks across the MS proteomics workflow and enhancing products to improve performance.

Consumables

We launched our second assay, Proteograph XT, in June 2023, which significantly enhanced the sample throughput of the Proteograph Product Suite and MS instrument, while also improving performance as measured by protein group identification.

The Proteograph XT assay employs two wells of NPs, assay buffers and reagents for protein lysis and digestion, peptide purification, peptide quantification and the reconstitution of lyophilized materials. The current product allows for the interrogation and processing of up to 40 samples in parallel on a single 96-well plate in approximately eight hours. Each sample incubates separately in two wells, yielding 80 wells of peptides in a 96-well plate. The remaining 16 wells are reserved for integrated quality control samples to ensure consistent process performance and to aid in troubleshooting.

The ready availability of non-particle reagents, combined with our ability to efficiently design and fabricate different NPs with different physicochemical properties, greatly facilitates the development and production of future iterations or additional versions of the Proteograph assays to address potential customer needs, such as expanded protein coverage or specialized assays, including potential assays that can be used with clinical products.

8

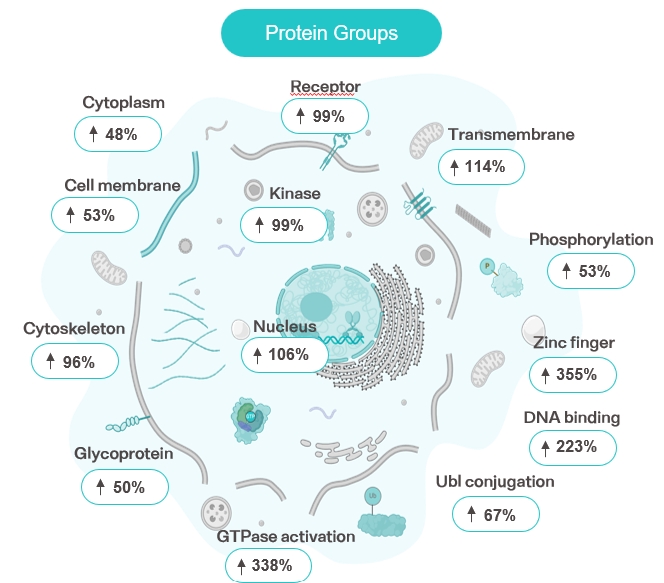

In the first quarter of 2025, we announced a new supported application on Proteograph XT for cell lysate proteomics, bringing the power of the Proteograph to intracellular proteomics. High-value and difficult-to-characterize protein compartments can now be studied more extensively. With Proteograph XT Cell Lysate, we see substantial increase in protein coverage compared to conventional MS-based cell lysate analysis across a range of protein types including cell membrane proteins, DNA binding proteins, transmembrane proteins, and receptor proteins.

Figure 8: Proteograph XT Cell Lysate enables customers to move beyond plasma proteomics and delve deeper into the intracellular proteome. Proteograph XT Cell Lysate more deeply interrogates and identifies proteins across several intracellular compartments compared to conventional MS-based cell lysate analysis.

Automation Instrument

We designed the Proteograph assay to be run in a robust and automated manner on our SP100 automation instrument, which is a custom-configured, industry-standard, liquid handling workstation. Our SP100 instrument is designed to enable studies of hundreds to thousands of samples, with an automated workflow that allows for rapid, highly-parallel sample processing with approximately 30 minutes of set-up time.

The Proteograph workflow is driven by the Instrument Control Software (ICS) on the SP100 automation instrument. The workflow has been configured to process one full 96-well plate at a time, in just eight hours, processing 40 samples in parallel. The output of the Proteograph workflow consists of peptides that are quantified, dried, and can be reconstituted when ready for injection into a MS. MS provides quantitative unbiased detection, either on an instrument provided by the user, or sent out for MS analysis to a third-party provider.

9

Software

The Proteograph Analysis Suite (PAS) is designed for ease-of-use and efficiency to help users arrive at insights quickly. To accommodate varying customer needs and scalability, we have designed the PAS to be cloud-based and, in the future, to be available via more localized solutions that accommodate different customer types and geographies. The PAS offers a predefined workflow for data management and analysis, leveraging publicly available MS data analysis tools as well as our own proprietary analysis tools. Without the PAS, proteomics analysis requires expert knowledge and a scalable high-performance computer infrastructure. We believe that the PAS can accelerate adoption of the Proteograph among non-experts by providing an intuitive user interface that automates data handling, simplifies processing and analysis and provides access to a scalable infrastructure that can be used by any lab.

The PAS also includes a dedicated proteogenomics workflow that maps peptide-level data to genomic data to identify sample-specific variant peptides not captured in canonical reference databases. The workflow provides interactive tables and plots, enables visualization of identified peptides’ relationship to gene structure, protein domain information and functional regions, and creates amino acid-level browsable peptide data maps.

Currently, one potential roadblock for researchers is understanding and evaluating the quality of their results. The Proteograph Assay Kit incorporates a series of controls for monitoring assay performance, and an integrated view of the results of these control runs via the PAS. Customers can evaluate trends over time and implement performance boundaries around the expected values that flag unexpected outcomes in the data. We believe providing a simple, consistent interface to evaluate the control data and generate a quality control (QC) report will help customers understand our approach to QC in the Proteograph workflow, simplifying support.

In 2024, the latest version of the PAS introduced a completely updated user interface, offering a more intuitive and professional experience for users. The update includes a completely revamped interface for the cohort analysis tools that expands functionality and makes it easier for users to generate biologically relevant information from their datasets. As we continue to improve and extend our product portfolio, we expect to continue to expand the capabilities and features in the PAS as well.

Proteograph Product Suite Performance

The Proteograph Product Suite provides five essential capabilities: (i) broad protein sampling with peptide-level resolution; (ii) deep coverage; (iii) accurate and precise measurement; (iv) reproducibility and (v) scalability for high-throughput studies. We believe that our integrated solution is the only product in the market that combines all these technical and operational capabilities. Furthermore, we rigorously measure and evaluate each of these technical attributes, as we describe below.

10

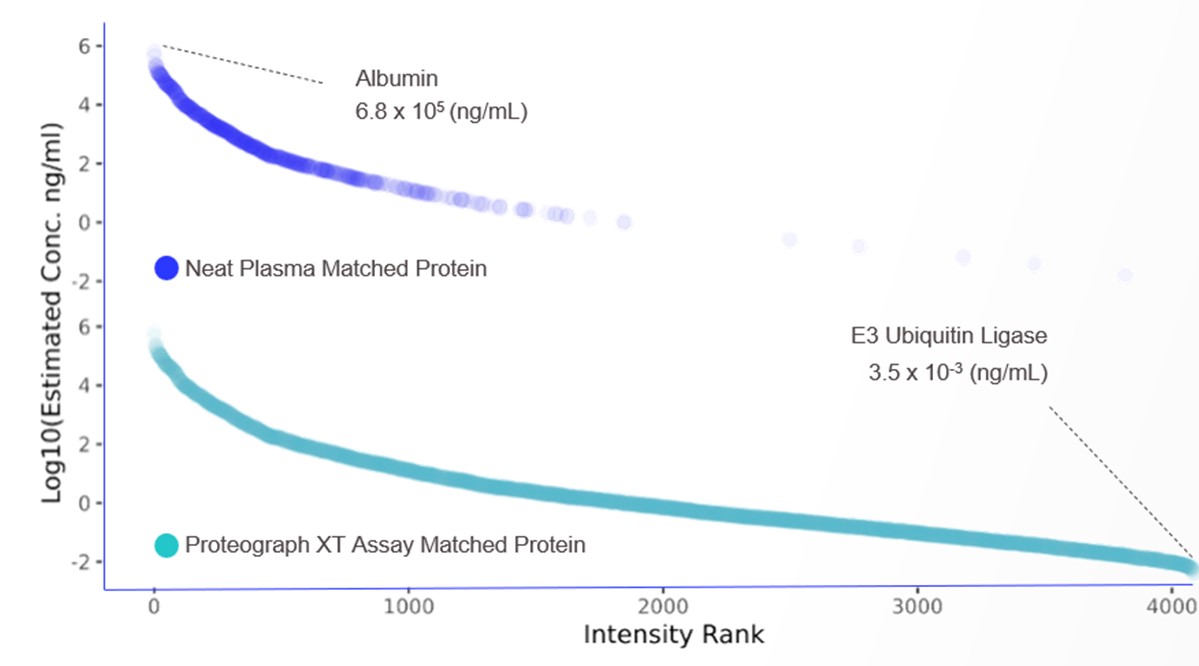

In a head-to-head experiment, Thermo ScientificTM directly compared the breadth of the Proteograph Product Suite to other unbiased proteomics methods using the same biological sample. Neat plasma, which represents the simplest form of unbiased proteomic analysis requiring minimal processing time using another method, resulted in a depth of coverage of 767 proteins. Using the Proteograph Product Suite, Thermo ScientificTM detected 6,033 proteins in plasma, representing 8.0x expansion in depth of protein coverage.

In another study performed by PrognomiQ, a 2021 spinout of Seer, across a set of 2,840 plasma samples, approximately 13,000 proteins were identified.

Figure 9: Proteograph XT demonstrates an 8.0x expansion in depth of coverage compared to neat plasma. In a study performed by PrognomiQ across 2,840 plasma samples, approximately 13,000 proteins were identified.

The Proteograph is not limited to a defined set of proteins, and samples across the dynamic range of proteins and protein variants that may be present in biosamples. We have exemplified the utility of the Proteograph in studying secreted proteins across several different sample types, including cell or tissue homogenates, blood or blood components (such as plasma or serum), urine, saliva, cerebrospinal fluid, synovial fluid and conditioned media. Importantly, the Proteograph protein data is obtained using an MS detector, which is the gold standard for proteomics, and data is conventionally reported with a less than one percent False Discovery Rate (FDR). This means that the reported proteins are identified with over 99% confidence.

11

Figure 10: The Proteograph identifies more proteomic content. The Proteograph workflow identifies protein across the dynamic range of the plasma proteome whereas neat plasma is limited to the most abundant proteins.

12

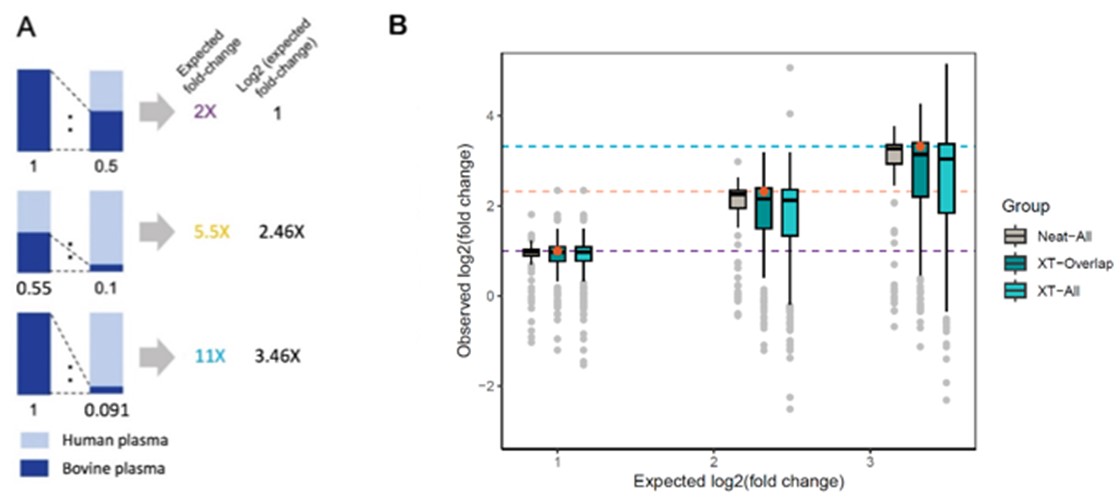

Figure 11: The Proteograph offers a high-degree of accuracy. (A) Three representative pairs of spiked-in samples and the expected fold changes of bovine proteins concentration in these pairs. (B) Distribution of observed fold changes of bovine proteins for three selected comparisons of spiked-in samples. The color indicates the data source: (i) neat digestion (gray), or (ii) Proteograph workflow constrained to proteins also identified in neat (dark blue) or (iii) Proteograph workflow all proteins (teal). The horizontal dashed lines indicate the expected fold changes.

13

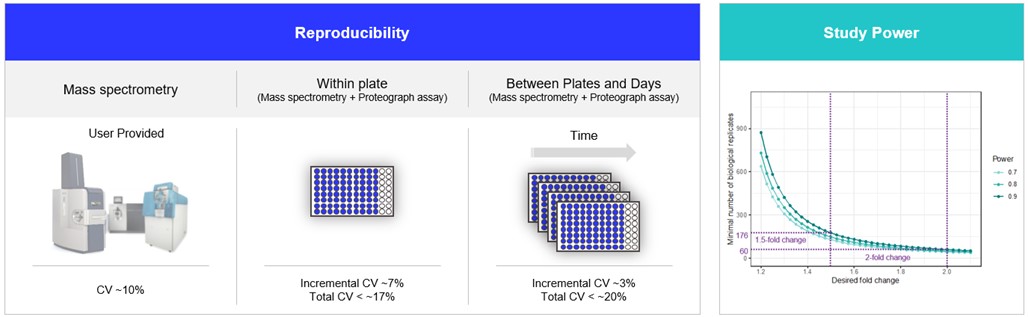

Figure 12: (A) contributors to CV; (B) smaller fold changes can be detected with increased power with larger study sizes.

14

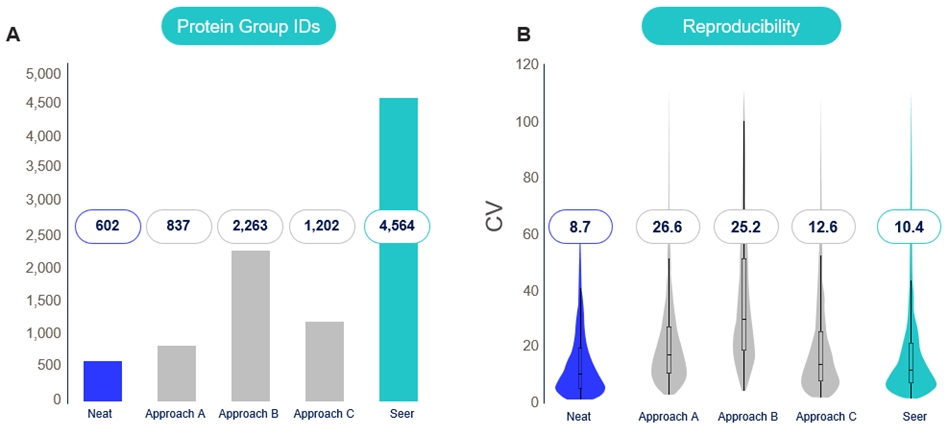

Figure 13: (A) Across six technologies and methods tested, the Proteograph provides the highest performance in protein identification across all replicates and within each replicate. (B) Demonstrates the reproducibility performance of each method by evaluating the median coefficient of variation (CV) values for proteins detected across all methods. A lower CV value indicates a higher degree of reproducibility.

The Advantages of the Proteograph Product Suite

We believe the Proteograph Product Suite and its underlying NP technology have unique advantages:

15

The Applications of the Proteograph Product Suite

We believe the ability to generate unbiased, deep, proteomic data at scale, with rich content at the protein variant level, has a wide range of applications in proteomics, including basic research and discovery, translational research, diagnostics and applied markets. This data can be used in many of the same application areas as genomics data, as well as proteomics applications that are uniquely possible with unbiased proteomic data, and in new applications that the field will develop in the future.

In addition, the Proteograph Product Suite’s versatility allows it to analyze not only plasma and serum, but also other biofluids across humans and model organisms. For example, when we compared the performance of the Proteograph Product Suite workflow with that of neat biological samples across model organism plasma, urine, cerebral spinal fluid, and conditioned media, we noted superior protein group identification by the Proteograph of 4x, 1.5x, 1.5x, and 8.6x, respectively. Importantly, in each sample, we measured tens of thousands of data points at the peptide level, providing information on thousands of proteins. We believe this extensibility offers researchers a powerful and flexible tool to utilize across a variety of applications and sample types.

Basic Research and Discovery Applications

We believe that the Proteograph is a valuable tool for researchers across a wide range of basic research and discovery applications, including cataloging protein diversity, proteogenomics and exploring the interactome. Studies in these areas are currently limited in scale by the complexity of unbiased methods or the limited set of affinity-based reagents available for biased methods. The Proteograph Product Suite is designed to enable the use of unbiased proteomic data at scale, which we believe will greatly accelerate these areas of basic research and discovery.

16

Cataloging protein diversity

The Proteograph Product Suite is designed to enable researchers to explore the complexity and diversity of the proteome with peptide level resolution. We anticipate that researchers will use the Proteograph solution to catalog protein variants in a manner similar to the cataloging of genetic variants over the past 15 years, providing functional context at a scale that is not currently accessible with other proteomics methods. We believe that identifying protein variants, including those resulting from PTMs such as glycosylation and phosphorylation, can significantly transform the life sciences field.

In 2024, we launched the Protein Discovery Catalog on our website with the goals to remove barriers to access, empower researchers, and drive new lead generation. The Protein Discovery Catalog is a fully-accessible, searchable catalog with over 36,000 proteins across multiple species and over 10,000 human proteins across 1,900 Reactome biological pathways. This catalog is our first published index of the unprecedented depth of empirically observed proteins captured by the Proteograph to date.

Proteogenomics

Proteogenomics is a rapidly growing field of research that integrates genomic and transcriptomic information with proteomic information, using personalized protein sequence databases to identify novel peptides. The Proteograph generates large-scale unbiased proteomic data at peptide-level resolution, enabling researchers to map protein variants to genomic variants, advancing the field of proteogenomics. Researchers are conducting large-scale proteogenomic studies with the Proteograph to provide functional information to existing genomics and gene expression information.

Translational Research Applications

Researchers can use the Proteograph for translational research applications aimed at shortening the time from early discovery research to clinical application. The Proteograph Product Suite allows clinical and translational researchers an opportunity to perform unbiased, deep and large-scale proteomics studies in therapeutic and diagnostic research and clinical trials, which can allow for significant advances in biomarker discovery, target identification and exploration and clinical trial applications.

Biomarker Discovery

Currently, de novo biomarker discovery research is limited by the size of unbiased studies or is targeted in nature. These approaches have yet to uncover the large number of potential single biomarkers or combinations of markers for a range of clinical applications. The Proteograph is enabling the discovery of biomarkers through large-scale, unbiased and deep proteomics studies.

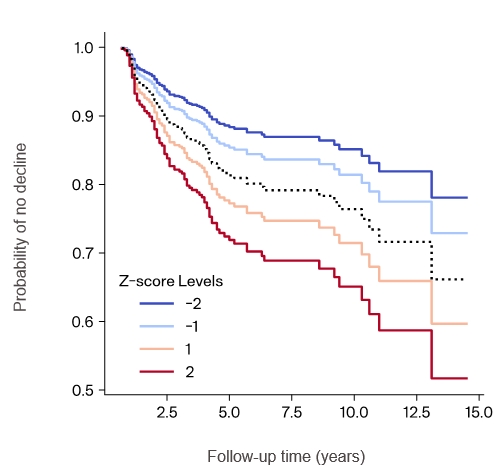

Utilizing a $2 million Small Business Innovation Research grant to the Company and Massachusetts General Hospital (MGH) from the National Institute on Aging (NIA), researchers from the Company and MGH conducted a study that analyzed 1,800 plasma samples comprising both controls and individuals diagnosed with cognitive decline, including Alzheimer’s Disease (AD) (Lacar et al.). The samples were collected over a 10-year period, allowing the researchers to investigate proteins associated with the progression of, or protection against, cognitive decline. When comparing the AD affected individuals with controls, researchers identified 138 proteins that were up or down regulated in AD individuals. Of these 138 proteins, only 44 have been previously associated with AD. The remaining 94 represent putative biomarkers of AD, potentially highlighting new biological insight.

17

Researchers used clinical information to identify the point of significant cognitive decline and determined proteins that separated the population into fast and slow decliners. Researchers identified eight such significant proteins and are now investigating how these results may be advanced to develop a score indicating the likelihood of cognitive decline in a particular timeframe. One such example is shown in Figure 14 below. Higher abundance of this protein is associated with greater probability of cognitive decline.

We believe such studies are uniquely made possible using deep, unbiased proteomics at scale using the Proteograph Product Suite because 55% of these 138 proteins are not present on a commercially available high-plex affinity based panel and there is no other practical way to do a deep unbiased proteomics study on 1,800 plasma samples other than leveraging the Proteograph Product Suite.

Figure 14: Shows the probability of no decline as a function of follow up time. Higher levels of the protein are associated with higher probability of decline.

Diagnostic Applications

We believe that the Proteograph Product Suite also holds significant diagnostic potential. The unbiased, deep and scalable proteomic data generated by the Proteograph has the potential to create ecosystems, similar to the way in which next-generation sequencing (NGS) enabled genomics-based diagnostics for cancer and rare genetic diseases. We expect that companies in the healthcare testing space, including our spin-out PrognomiQ, will utilize the Proteograph solution, and we are committed to supporting all of our customers as the ecosystem grows, not only in their basic research and translational research applications but also as they develop their own diagnostic applications.

As an example, scientists at PrognomiQ conducted a large case/control study that included those at high risk for lung cancer, using deep, unbiased proteomics as part of their development work for multi-omics-based blood test for early-stage lung cancer detection.

The current recommendation for patients at high risk for lung cancer is an annual low dose CT scan. The compliance rate for current low dose CT cancer screening is only 5-10%. PrognomiQ is developing a blood test to help close this compliance gap to identify patients at risk for lung cancer and subsequent evaluation.

18

Researchers from PrognomiQ used the Proteograph to measure over 8,300 proteins from samples from 2,513 individuals, which was then combined with over 200,000 RNA transcripts and 1,000 metabolite measurements to drive a multi-omics classifier.

As illustrated in Figure 15 below, the proteomics data performs extremely well with an AUC of 0.91. Adding the other multi-omics data increased AUC to 0.96. PrognomiQ believes this classifier represents a potentially best-in-class performance by achieving a sensitivity of 80% for stage 1 and 89% for all stages of lung cancer at 89% specificity.

Figure 15 below shows the top features contributing to the classifier ranked by their importance. The top features are heavily enriched for those derived from unbiased proteomics utilizing the Proteograph assay. Figure 15 indicates where these proteins fall in the standard plasma concentration curve, and indicates that they are across the entire dynamic range. Therefore, we believe that the capabilities of the Photograph platform to provide deep, unbiased, proteomics at scale could be used to develop this classifier.

Figure 15. Shows results from a study performed by scientists at PrognomiQ, using deep, unbiased proteomics as part of a multi-omics based blood test for early-stage lunch cancer detection.

Target Identification and Exploration

We believe that large-scale access to protein variant information that map to different states of health and disease, as enabled by the Proteograph and concurrent advances in proteogenomics, could lead to the discovery of personalized drug targets that could number in the hundreds of thousands. We believe that the translational application of the Proteograph for potential biomarker development may also be applied to the identification of novel targets for therapeutic development. Components of classifiers may themselves become targets for drug development, or they may point to new knowledge with respect to disease mechanisms, which could then aid in the exploration of additional targets and/or help to elucidate the function of potential targets, particularly if these targets are discovered with genomics approaches, but lack protein functional context.

Clinical Trial Applications

The Proteograph Product Suite provides clinical researchers with the opportunity to perform deep and broad proteomic profiling of subjects in therapeutic clinical trials, enabling the real-time monitoring of protein-related drug effects, distribution and metabolism. These attributes are essential in virtually all clinical drug trials. Current methods use biased or targeted panels of proteins. It is currently impractical to do this type of monitoring with unbiased proteomic methods, given the inability of these methods to scale to the hundreds or thousands of samples that are evaluated in clinical trials.

19

The Proteograph Product Suite may also enable patient selection and grouping based on patients’ proteomics profiles, leading to improved ability to confirm efficacy for novel therapies in complex diseases that involve multiple physiological systems. While genomic approaches are widely used to select patients in cancer and rare genetic disease clinical trials, their use in other indications has been limited by a lack of genetic understanding of these diseases. We believe that the Proteograph has the potential to generate useful proteomic signatures that can complement genomic and other patient selection criteria, improving patient selection and segmentation for clinical trials, particularly for indications outside of cancer and rare genetic diseases.

Applied Applications in Agriculture, Animal Health, and Bioprocessing

We see significant opportunities for the Proteograph solution to be applied in areas beyond human health, including areas where broad-scale genomics is being widely applied today, and applications where proteomics can uniquely enable the creation of end-markets. We believe that unbiased, deep and large-scale proteomic information, which can be enabled by the Proteograph, can complement and extend the value of genomics, transcriptomics and metabolomics information in fields such as agriculture, animal health and bioprocessing.

Given the robustness of the Proteograph Product Suite and its ability to work across species, we have seen significant interest and customer adoption of the Proteograph Product Suite for use in model organisms for research and the animal health markets to pursue opportunities in diagnostic and therapeutic development. We have already demonstrated the application of the Proteograph Product Suite in projects and studies that include mouse, monkey, pig, feline, chicken, canine, baboon and bovine plasmas.

In addition, we have seen increasing interest in utilizing the Proteograph in bioprocessing applications. We have certain customers who have run pilot studies with the Proteograph to enhance their liquid chromatography-mass spectrometry (LC-MS) techniques for comprehensive host cell protein (HCP) analysis. While conventional LC-MS is emerging as a versatile technique to identify and quantify HCPs, it is challenged by the inherently large dynamic range of HCPs compared to biologics. By coupling LC-MS with the standard Proteograph XT workflow, researchers identified 4-6x more HCPs for NIST monoclonal antibody (NIST 8671) without the need for additional sample pre-processing steps, providing consistent reproducibility and enhanced sensitivity without sacrificing precision.

Limitations of Other Approaches to Proteomics

Limitations of Transcriptomics to Infer Proteomics

RNA sequencing (RNAseq) has been the established method for studying transcriptomics over the last decade. It is often assumed that transcript and protein abundance levels are highly correlated because of the central dogma of molecular biology describing how transcripts are translated into proteins. However, several studies have repeatedly demonstrated a poor correlation between transcript and protein levels (Buccitelli and Selbach). This discrepancy can arise from technical factors, such as noise and bias in methods for assessing both transcripts and proteins, and biological mechanisms such as mRNA translation and degradation. Although both transcriptomics and proteomics measurements have their uses, proteins are more closely linked to phenotype, making them more useful than transcripts for understanding function. Therefore, we believe that direct analysis of the proteome via at-scale proteomics studies will provide unique biological insights for research, discovery and clinical applications.

20

Limitations of Affinity-Based Approaches to Proteomics

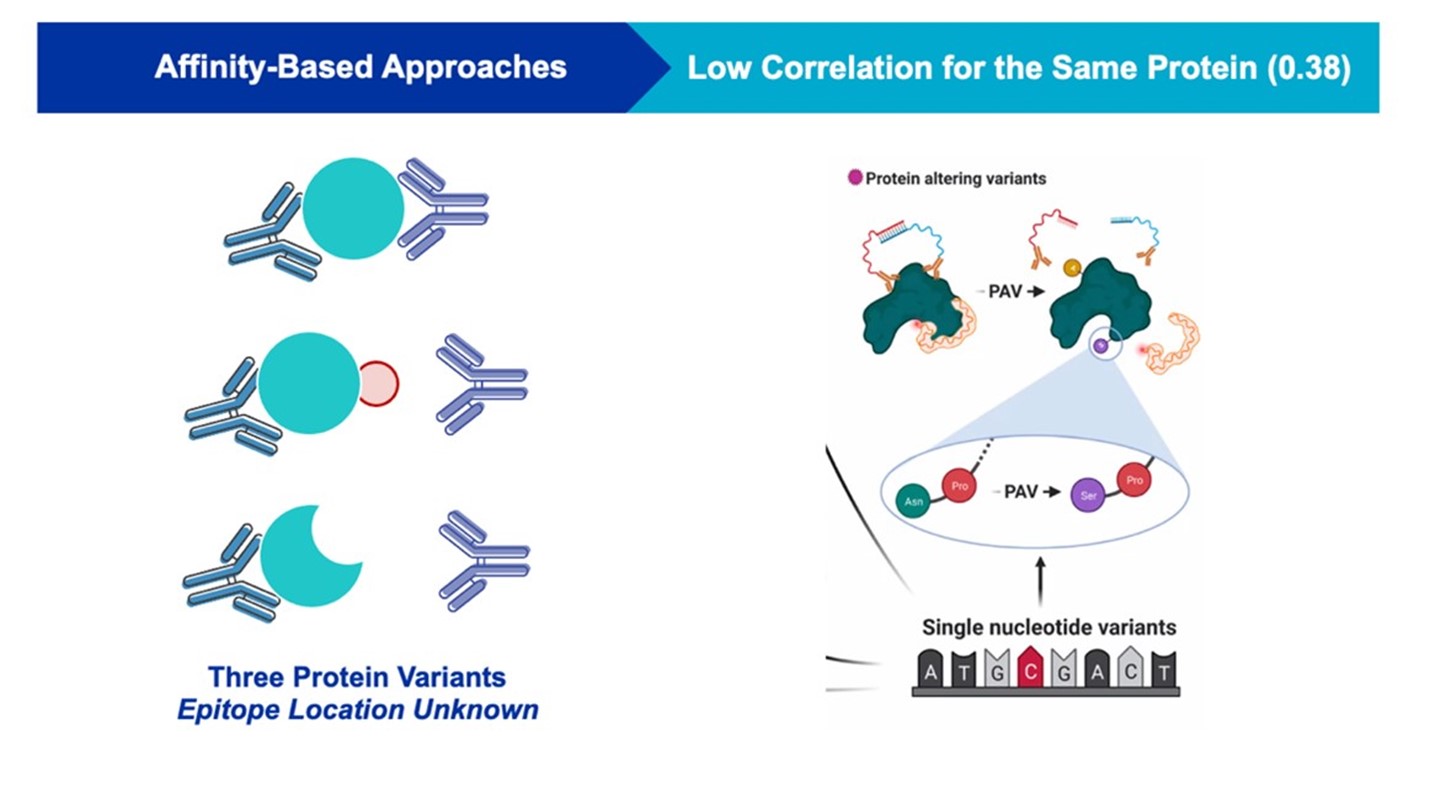

Proteins are highly variable in structure, chemistry, and concentration, presenting technological challenges for their identification at low concentration levels. Because of the lack of a common amplification mechanism, researchers often use ligands to measure proteins. However, because ligands such as antibodies or aptamers were designed to bind to specific areas of proteins, approaches utilizing them are considered targeted, or biased. The average length of a human protein is approximately 470 amino acids, whereas the average binding site of a ligand is an epitope five to eight amino acids long. Panels of ligands used for protein interrogation have several shortcomings, including: (i) they do not recognize differences in protein structure outside of the epitope binding site, so that all variants appear the same and cannot be differentiated from one another, (ii) conformational changes of the protein can affect epitope and ligand binding; for example, those induced by protein-protein interactions or post-translational modifications, and (iii) certain protein isoforms may exclude entire protein domains and remove the epitope binding site, yielding false negative results.

Figure 16: Sources of variation. Left panel is a graphical summary of factors contributing to variation in the affinity-based discovery of the plasma proteome. Right panel schematically describes reasons for differences in binding profile of aptamer and antibody-based proteomic profiling (PAV protein altering variant; SNV single-nucleotide variant). Adapted from Pietzner et al.

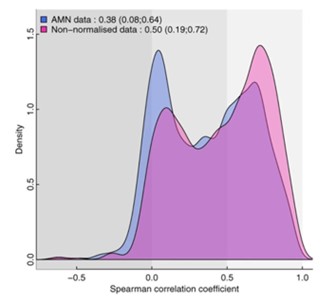

In a paper published in Nature Communications, Pietzner et al. from the University of Cambridge experimentally demonstrated the limitations of two distinct commercially-available affinity-based approaches. Specifically, the authors show that protein-altering variants can affect ligand binding, that is, each affinity-based platform interacts differently with the same protein, depending on the epitopes to which its ligands are binding. On average, the correlation between the two commercially-available affinity-based methods was 0.38. The distribution of correlations across all proteins is bimodal, with some proteins having a very good correlation, and others have a correlation close to zero (as shown in Figure 17 below). The authors attribute this poor correlation to differences in epitope binding between platforms and interference from protein-altering variants. These limitations underscore the importance of studying proteins with peptide-level resolution using a technology that is quantitatively robust in identifying protein variants.

21

Figure 17: Distribution of correlation coefficients across 937 mapping aptamer–antibody pairs (n = 871 unique protein targets). Adapted from Pietzner et al.

Affinity-based approaches are effective when a known target and a specific epitope measurement is desired but cannot cover the vast complexity of the proteome. We believe they are analogous to microarrays in genomics, where a specific DNA fragment is used in a targeted or biased manner to confirm the presence of a specific mutation or a single nucleotide polymorphism (SNP). The fundamental limitation of affinity-based approaches is their inability to differentiate between protein variants and accurately survey the complexity of the proteome.

Limitations of Traditional Unbiased Approaches to Proteomics

Rather than relying on predefined epitopes, unbiased approaches can interrogate proteins at the peptide level, providing amino-acid level resolution to protein variants. However, traditional, deep, unbiased proteomic approaches rely on complex workflows that do not scale because of the wide range of protein concentrations in biological samples with high dynamic range. In human plasma, for example, the 22 most abundant plasma proteins account for 99% of the total protein mass, while many thousands of less abundant proteins comprise the remaining one percent. Given the important biological role of both high- and low-abundance proteins, it is critical to detect proteins accurately, precisely, and reproducibly across the dynamic range.

MS is a widely used technique for unbiased discovery, basic research and clinical applications, and is considered the gold standard for protein identification. However, the wide dynamic range of protein concentrations in plasma and other biological samples has previously required complex, upfront sample preparation workflows prior to MS analysis, involving depletion of abundant proteins and fractionation of the remaining proteins and peptides. Deep unbiased proteomics analysis of complex biosamples at scale has not been feasible for wide adoption by researchers due to the high complexity, cost and time requirements. For example, in a state-of-the-art deep unbiased plasma proteomics study in 2017 prior to commercial availability of the Proteograph Product Suite, Keshishian et al.depleted the most abundant proteins with immuno-affinity columns and then separated remaining peptides by multiple and complex chromatographic steps and MS injections. The study identified 4,500 different proteins across 16 samples but took months to complete.

22

Prior to the commercial availability of the Proteograph Product Suite, we believe the critical unmet need in proteomic analysis was how to collect unbiased proteomic data on thousands of proteins in a sample spanning more than ten orders of magnitude in concentration (dynamic range) and to repeat this across thousands of samples in a reasonable amount of time and cost. Genomics faced a similar unmet need before the advent of NGS, which allowed for massively parallel sampling.

Markets

We believe that the Proteograph Product Suite has two primary near-term markets: the approximately $27 billion global proteomics market, and the $28 billion global genomics market, as reported by Allied Market Research and Technavio, respectively. The proteomics market is estimated by Allied Market Research to have spent approximately $21 billion on reagents, $4.5 billion on instruments, and $1.5 billion on services in 2022. We are competing in the proteomics reagent and instrument markets, while our STAC and Centers of Excellence (COEs) service providers address the services opportunity. Similarly in the genomics market, we are attracting spend on both products and services as genomic customers link genotype to phenotype by supplementing existing genomic data with proteomics data.

We currently sell and market the Proteograph Product Suite for research use only (RUO). However, we believe that the capabilities of the Proteograph Product Suite may enable other applications in the future, including clinical and applied applications. Like the commercial impact of broadened access to genomics products, we believe the Proteograph will enable novel applications and insights, leading to new end-markets. For example, non-invasive prenatal testing and precision oncology currently make up a significant part of the current genomics market, which would have been difficult to predict a decade ago. We anticipate that the same dynamic of new market creation will occur in proteomics, with one such application for proteomics being early disease detection.

Our Growth Strategy

Our mission is to imagine and pioneer new ways to decode the biology of the proteome to improve human health. Our growth strategy is to:

Moving forward, in order to expand and accelerate demand for our products, we are investing in market development activities to educate prospective customers, funding bodies, commercial entities, government-sponsored multi-omics programs, and other stakeholders of the importance of large-scale unbiased and deep proteomic data. This effort includes collaborations with key opinion leaders (KOL) to generate scientific data, presentations, and peer-reviewed publications. Additionally, we are strategically investing in market development activities such as sponsorship of targeted projects, joint publications and seminars, and industry partnerships.

23

In 2024, we doubled the size of our commercial team across Marketing, Sales, and Customer Experience to support growing demand, with the goal of expanding our direct sales efforts and delivering an exceptional customer experience. We believe these efforts will allow us to deliver substantial value to our customers, build long-term customer loyalty, enhance our competitive differentiation and, importantly, use our customer relationships to gain insights that inform our product development to grow our offerings in ways that will benefit our customers.

Additionally, to reduce customer capital investment barriers, we launched the Strategic Instrument Placement Program (SIPP) in 2023 to enable customer access to our Proteograph without the need for an upfront capital investment. With an upfront purchase of consumable kits, we loan the instrument for a defined period of time with an option to purchase at the end of the loan term. This is allowing customers to utilize available operating budget without the need to access capital budget in the short term.

24

Suppliers and Manufacturing

Our overall manufacturing strategy is to continuously develop and refine our processes to achieve our objectives of continuity of supply, quality of supply and margin enhancement. Over time, this may lead to in-sourcing or outsourcing certain functions, including manufacturing, in various geographic locations in order to achieve our objectives.

Consumables

We leverage well-established unit operations to formulate and manufacture our NPs at our facilities in Redwood City, California. We procure certain components of our consumables from third-party manufacturers, which includes the commonly-available raw materials needed for manufacturing our proprietary engineered NPs. We are currently manufacturing using our production-scale and pilot lines and continue to build out our manufacturing capabilities to support the broad commercial availability of our products. We obtain some of the reagents and components used in the Proteograph workflow from third-party suppliers. While some of these reagents and components are currently sourced from a single supplier, these products are readily available from numerous suppliers. While we currently perform some filling and packaging of the Proteograph assay and the related consumables, we may eventually have our filling and packaging outsourced to a third party. We conduct vendor and component qualification for components provided by third-party suppliers and quality control tests on our NPs.

25

Automation Instrument

We designed the SP100 automation instrument and have outsourced its manufacturing to Hamilton Company, a leading manufacturer of automated liquid handling workstations. We entered a non-exclusive agreement with Hamilton that covers the manufacturing of the SP100 automation instrument and its continued supply on a purchase order basis. Starting in January 2025, we renewed the agreement under an extended term through December 2027. Following this extended term, the agreement will automatically renew annually for a maximum of two one-year renewal periods. Hamilton has represented to us that it maintains ISO 9001 and ISO 13485 certification.

Competition

The life sciences technology industry is highly dynamic, marked by rapidly advancing technologies, intense competition and a strong focus on intellectual property. In the proteomics market, companies offer a range of analytical instruments, such as chromatography and MS instruments, and associated reagents. Competition in the proteomics market is based on proprietary technologies, rapid product development capabilities, applications and intellectual property. We believe that no currently commercially available products offer the capability to conduct unbiased, deep proteomics studies of high dynamic range samples at the same scale and throughput as the Proteograph Product Suite. However, given the potential market opportunity and scientific promise of proteomics, we expect the competition to increase and, as a result, one or more competing products to emerge. Competing products may emerge from various sources, including life sciences tools, diagnostics, pharmaceutical and biotechnology companies, third-party service providers, academic research institutions, governmental agencies, and public and private research institutions.

Current companies that provide proteomics products include Agilent Technologies, Bio-Techne, Bruker, Danaher, DiaSorin and Thermo Fisher Scientific. There are also a number of companies that provide proteomic analysis services. In addition, multiple emerging growth companies have developed, or are developing, proteomics products, services and solutions, such as Alamar Biosciences, Nautilus Biotechnology, Quanterix, Quantum-Si and Standard BioTools.

Government Regulation

The development, testing, manufacturing, marketing, post-market surveillance, distribution, advertising and labeling of certain of medical devices are subject to regulation in the United States by the Center for Devices and Radiological Health of the U.S. Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FDC Act) and comparable state and international agencies. FDA defines a medical device as an instrument, apparatus, implement, machine, contrivance, implant, in vitro reagent or other similar or related article, including any component part or accessory, which is (i) intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment, or prevention of disease, in man or other animals, or (ii) intended to affect the structure or any function of the body of man or other animals and which does not achieve any of its primary intended purposes through chemical action within or on the body of man or other animals and which is not dependent upon being metabolized for the achievement of any of its primary intended purposes. Medical devices to be commercially distributed in the United States must receive from the FDA either clearance of a premarket notification, known as 510(k), or premarket approval pursuant to the FDC Act prior to marketing, unless subject to an exemption.

26

We label and sell our products for RUO and expect to sell them to academic institutions, life sciences and research laboratories that conduct research, and biopharmaceutical and biotechnology companies for non-diagnostic and non-clinical purposes. Our products are not intended or promoted for use in clinical practice in the diagnosis of disease or other conditions, and they are labeled for research use only, not for use in diagnostic procedures. Accordingly, we believe our products, as we intend to market them, are not subject to regulation by FDA. Rather, while FDA regulations require that research use only products be labeled with – “For Research Use Only. Not for use in diagnostic procedures.” – the regulations do not subject such products to the FDA’s jurisdiction or the broader pre- and post-market controls for medical devices.

In November 2013, the FDA issued a final guidance on products labeled RUO, which, among other things, reaffirmed that a company may not make any clinical or diagnostic claims about an RUO product, stating that merely including a labeling statement that the product is for research purposes only will not necessarily render the device exempt from the FDA’s clearance, approval, or other regulatory requirements if the totality of circumstances surrounding the distribution of the product indicates that the manufacturer knows its product is being used by customers for diagnostic uses or the manufacturer intends such a use. These circumstances may include, among other things, written or verbal marketing claims regarding a product’s performance in clinical diagnostic applications and a manufacturer’s provision of technical support for such activities. If FDA were to determine, based on the totality of circumstances, that our products labeled and marketed for RUO are intended for diagnostic purposes, they would be considered medical devices that will require clearance or approval prior to commercialization. Further, sales of devices for diagnostic purposes may subject us to additional healthcare regulation. We continue to monitor the changing legal and regulatory landscape to ensure our compliance with any applicable rules, laws and regulations.

In the future, certain of our products or related applications could become subject to regulation as medical devices by the FDA. If we wish to label and expand product lines to address the diagnosis of disease, regulation by governmental authorities in the United States and other countries will become an increasingly significant factor in development, testing, production, and marketing. Products that we may develop in the molecular diagnostic markets, depending on their intended use, may be regulated as medical devices or in vitro diagnostic products (IVDs) by the FDA and comparable agencies in other countries. In the U.S., if we market our products for use in performing clinical diagnostics, such products would be subject to regulation by the FDA under pre-market and post-market control as medical devices, unless an exemption applies, we would be required to obtain either prior 510(k) clearance or prior premarket approval from the FDA before commercializing the product.

The FDA classifies medical devices into one of three classes. Devices deemed to pose lower risk to the patient are placed in either class I or II, which, unless an exemption applies, requires the manufacturer to submit a pre-market notification requesting FDA clearance for commercial distribution pursuant to Section 510(k) of the FDC Act. This process, known as 510(k) clearance, requires that the manufacturer demonstrate that the device is substantially equivalent to a previously cleared and legally marketed 510(k) device or a “pre-amendment” class III device for which pre-market approval applications (PMAs) have not been required by the FDA. This FDA review process typically takes from four to twelve months, although it can take longer. Most class I devices are exempted from this 510(k) premarket submission requirement. If no legally marketed predicate can be identified for a new device to enable the use of the 510(k) pathway, the device is automatically classified under the FDC Act as class III, which generally requires PMA approval. However, FDA can reclassify or use “de novo classification” for a device that meets the FDC Act standards for a class II device, permitting the device to be marketed without PMA approval. To grant such a reclassification, FDA must determine that the FDC Act’s general controls alone, or general controls and special controls together, are sufficient to provide a reasonable assurance of the device’s safety and effectiveness. The de novo classification route is generally less burdensome than the PMA approval process.

27

Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting, or implantable devices, or those deemed not substantially equivalent to a legally marketed predicate device, are placed in class III. Class III devices typically require PMA approval. To obtain PMA approval, an applicant must demonstrate the reasonable safety and effectiveness of the device based, in part, on data obtained in clinical studies. All clinical studies of investigational medical devices to determine safety and effectiveness must be conducted in accordance with FDA’s investigational device exemption (IDE) regulations, including the requirement for the study sponsor to submit an IDE application to FDA, unless exempt, which must become effective prior to commencing human clinical studies. PMA reviews generally last between one and two years, although they can take longer. Both the 510(k) and the PMA processes can be expensive and lengthy and may not result in clearance or approval. If we are required to submit our products for pre-market review by the FDA, we may be required to delay marketing and commercialization while we obtain premarket clearance or approval from the FDA. There would be no assurance that we could ever obtain such clearance or approval. In January 2024, FDA announced its plans to reclassify certain high-risk in vitro diagnostics, including companion diagnostics, as Class II devices.

All medical devices, including IVDs, that are regulated by the FDA are also subject to the quality system regulation. The FDA issued a final rule in February 2024 replacing the QSR with Quality Management System Regulation (QMSR), which incorporates by reference the quality management system requirements of ISO 13485:2016. The FDA has stated that the standards contained in ISO 13485:2016 are substantially similar to those set forth in the existing QSR. The FDA will begin to enforce the QMSR requirements upon the effective date, February 2, 2026. Obtaining the requisite regulatory approvals, including the FDA quality system inspections that are required for PMA approval, can be expensive and may involve considerable delay. The regulatory approval process for such products may be significantly delayed, may be significantly more expensive than anticipated, and may conclude without such products being approved by the FDA. Without timely regulatory approval, we will not be able to launch or successfully commercialize such diagnostic products. Changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time during the development or marketing of our products. This may negatively affect our ability to obtain or maintain FDA or comparable regulatory clearance or approval of our products in the future. In addition, regulatory agencies may introduce new requirements that may change the regulatory requirements for us or our customers, or both.

As noted above, although our products are currently labeled and sold for research purposes only, the regulatory requirements related to marketing, selling, and supporting such products could be uncertain and depend on the totality of circumstances. This uncertainty exists even if such use by our customers occurs without our consent. If the FDA or other regulatory authorities assert that any of our RUO products are subject to regulatory clearance or approval, our business, financial condition, or results of operations could be adversely affected.

28

For example, in some cases, our customers may use our RUO products in their own laboratory-developed tests (LDTs) or in other FDA-regulated products for clinical diagnostic use. The FDA has historically exercised enforcement discretion in not enforcing the medical device regulations against LDTs and LDT manufacturers. In August 2020, the Department of Health and Human Services (HHS) announced rescission of guidance and other informal issuances of the FDA regarding premarket review of LDT absent notice-and-comment rulemaking, stating that, absent notice-and-comment rulemaking, those seeking approval or clearance of, or an emergency use authorization, for an LDT may nonetheless voluntarily submit a premarket approval application, premarket notification or an Emergency Use Authorization request, respectively, but are not required to do so. In November 2021, HHS under the Biden administration issued a statement that withdrew the August 2020 policy announcement stating that HHS does not have a policy on LDTs that is separate from FDA’s longstanding approach. In May 2024, the FDA issued a final rule that phases out its enforcement discretion for most laboratory-developed tests (LDTs) and amends the FDA’s regulations to make explicit that in vitro diagnostics are medical devices under the Federal Food, Drug, and Cosmetic Act, including when the manufacturer of the diagnostic product is a laboratory. This final rule is being challenged in federal courts. In June 2024, the U.S. Supreme Court overruled the Chevron doctrine, which gives deference to regulatory agencies’ statutory interpretations in litigation against federal government agencies, such as the FDA, where the law is ambiguous. This landmark Supreme Court decision may invite various stakeholders to bring lawsuits against the FDA to challenge longstanding decisions and policies of the FDA, including this LDT final rule. Further, the new presidential administration, including new leadership at the FDA, may issue new policies and regulations that can impact the compliance status of our products or that of our customers.

If our products become subject to FDA regulation as medical devices, we would need to invest significant time and resources to ensure ongoing compliance with FDA quality system regulations and other post-market regulatory requirements. It is unclear how future legislation by federal and state governments and FDA regulation will impact the industry, including our business and that of our customers. Any restrictions or heightened regulatory requirements on LDTs, IVDs, or RUO products by the FDA, HHS, Congress, or state regulatory authorities may decrease the demand for our products, increase our compliance costs, and negatively impact our business and profitability. We will continue to monitor and assess the impact of changing regulatory landscape on our business.