UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-40451

DLocal Limited

(Exact name of registrant as specified in its charter)

Dr. Luis Bonavita 1294

Montevideo

Uruguay 11300

+1 (424) 392-7437

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

TABLE OF CONTENTS

EXHIBIT

|

|

|

99.1 |

|

|

|

||

99.2 |

|

|

|

||

99.3 |

|

Annual Report 2024 - dLocal Financial Results Full Year and 4th Quarter of 2024 |

|

||

99.4 |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

DLocal Limited |

|

|

|

|

|

|

|

By: |

/s/ Mark Ortiz |

|

|

Name: |

Mark Ortiz |

|

|

Title: |

Chief Financial Officer |

|

Date: February, 27 2025

Exhibit 99.1

dLocal Reports 2024 Fourth Quarter Financial Results

Full Year 2024 results

US$25.6 billion Total Payment Volume, up 45% year-over-year

Revenue of US$746 million, up 15% year-over-year

113% Net Revenue Retention Rate

Gross Profit of US$295 million, up 6% year-over-year

Adjusted EBITDA of US$189 million, down 7% year-over-year

Fourth Quarter 2024

US$7.7 billion Total Payment Volume, up 51% year-over-year and 18% quarter-over-quarter

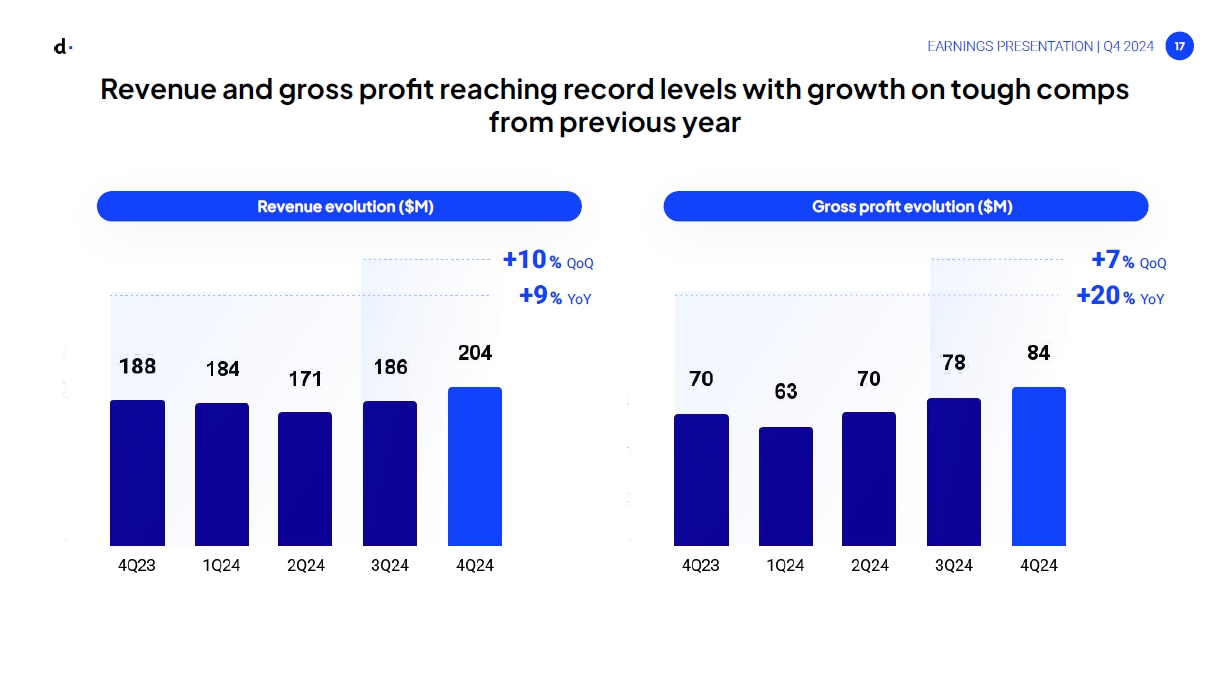

Revenue of US$204 million, up 9% year-over-year and 10% quarter-over-quarter

106% Net Revenue Retention Rate

Gross Profit of US$84 million, up 20% year-over-year and 7% quarter-over-quarter

Adjusted EBITDA of US$57 million, up 16% year-over-year and 9% quarter-over-quarter

dLocal reports in US dollars and in accordance with IFRS as issued by the IASB

Montevideo, Uruguay, February 27, 2025 — DLocal Limited (“dLocal”, “we”, “us”, and “our”) (NASDAQ:DLO), a technology - first payments platform today announced its financial results for the fourth quarter ended December 31, 2024..

As we walk through a review of our performance over the past quarter and year, and as we have repeatedly mentioned, we think of five pillars underpinning dLocal's investment thesis:

Our FY 2024 results affirm the investment thesis, highlighted by a record TPV of $26 billion, a strong TPV growth of 45% year-over-year, driven by a shift towards newer, more attractive markets, while core markets rebounded from Q3 softness. Additionally, revenue and gross profits reached record highs of $746 million and $295 million, respectively, with an adjusted EBITDA to GP margins closing the year at 64%, showing consistent improvement throughout the year. Furthermore, Net Income to FCF of Own funds3 conversion exited the year at a rate above 100%.

These strong 2024 results should be seen in the context of a weak first quarter followed by progressively stronger quarter-over-quarter performance, and the continuation of an investment cycle aimed at achieving greater scalability for our business.

Building on last quarter's positive trend, our TPV grew over 50% year-over-year, despite a strong Q4 2023 comparison. Quarter-over-quarter, TPV growth accelerated to nearly 20%, driven by commerce seasonality, and strength in remittances and ride-hailing. In constant currency3, given general weakness in Emerging Markets currencies, those growth rates are even more impressive, about 30 points higher year-over-year.

Revenues surpassed the milestone of over $200 million in Q4, representing a 9% year-over-year growth. In constant currencies4, revenue growth for the period would have been around 40% year-over-year.

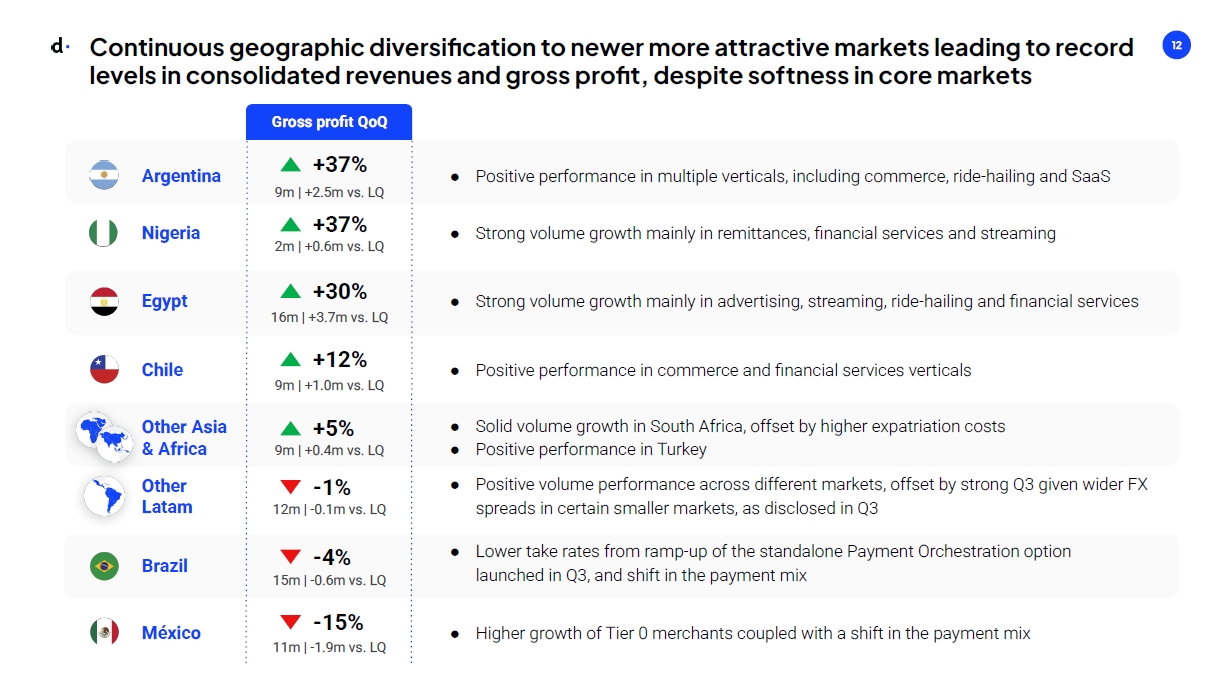

Our growth continues to reinforce our position as a trusted partner for global companies seeking to do business across emerging markets, with performance coming from a well diversified list of countries, with notable contributions from Argentina, Egypt, Other LatAm and Other Africa and Asia markets. As a result of our expansion into more frontier markets, we also continue to see solid growth in our cross-border volumes.

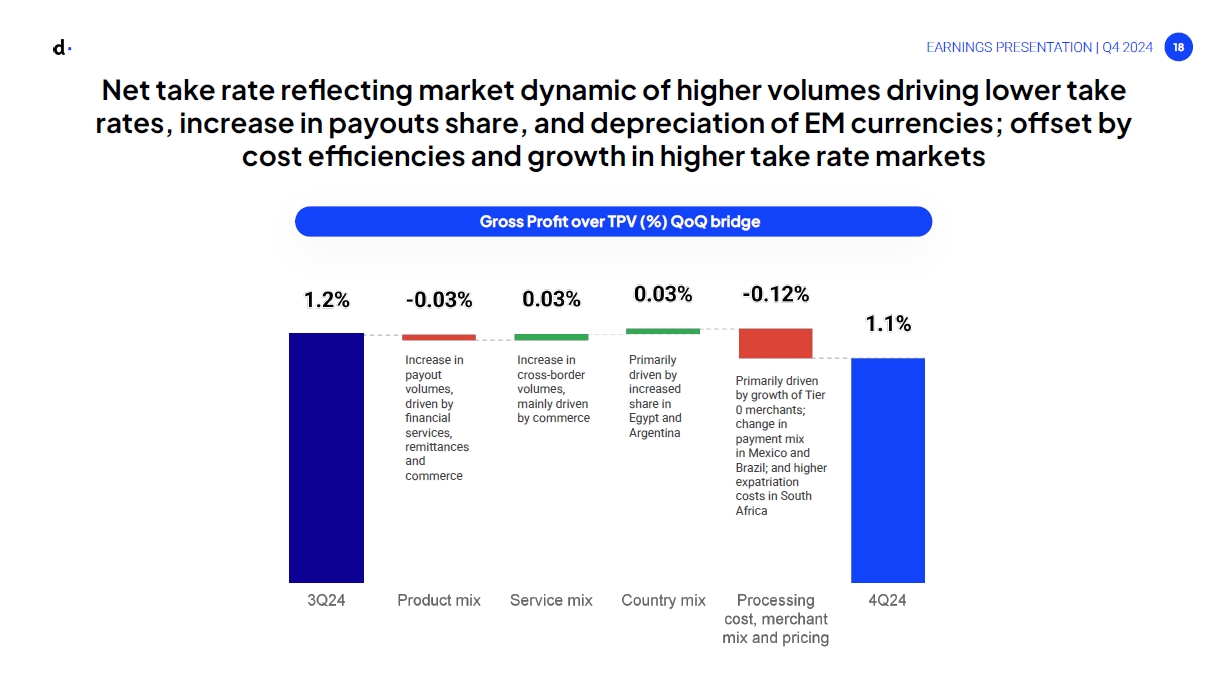

In terms of profitability, we reached a record gross profit of $84 million, with a net take rate at 1.1%, reflecting the market dynamic where higher volumes drive lower take rates, increase in the payouts share, and the depreciation of emerging market currencies. To offset this, we are driving cost efficiencies through processor and broker renegotiations and improvements in our hedging strategy. We also continue our push into higher take rate markets and verticals, which over the long term, should partially offset the take rate compression.

Exhibit 99.1

Despite the ongoing step up in investments in our engineering team, operational capabilities, and license portfolio to support our long-term growth ambitions, our Adjusted EBITDA hit a record $57 million in the quarter, with an adjusted EBITDA over gross profit margin improving quarter-over-quarter to 68%.

Cash generation was also solid, as we continue to increase free cash available to deploy behind our capital allocation strategy. This sustained cash generation increases our flexibility when thinking through M&A, buybacks or re-investing in a disciplined manner back into the business.

In 2024, we added 9 licenses and registrations, including the UK FCA's Authorised Payment Institution license, which enhances our competitive edge and demonstrates our commitment to compliant practices and regulatory oversight.

To sum up, Q4 marked the successful end to 2024 in terms of consistent TPV growth, controlled take rate decline, and balance of investment for future growth with a healthy margin and free cash profile.

Looking ahead to our 2025 guidance5, we expect a strong TPV growth of 35% - 45% year-over-year, with a revenue growth of 25% - 35% year-over-year that shows this sustained momentum of our top line. We see gross profit growth of 20% - 25% year-over-year, and Adjusted EBITDA growth between 20% and 30% year-over-year.

Considering those assumptions, we should expect a net take rate compression while delivering high TPV growth even at our scale. Over the midterm, we will work to maintain strong TPV while recognizing that given the extremely strong levels of TPV retention we deliver, our larger merchants will continue to attain lower pricing tiers. We will strive to offset this effect through growth in higher take rate new verticals, natural mix shift towards higher take rate frontier markets, and new revenue streams through product launches.

This guidance highlights that our combination of revenue growth, margin structure and free cash generation is not that common. There are not that many companies today who are as profitable as we are, growing revenues at the pace we are growing, and consistently generating free cash.

As known, our business thrives in fast-growing, dynamic markets with massive opportunities in digital payments across emerging markets, driven by strong demand and long-term growth trends. However, these markets also bring volatility from macroeconomic shifts, regulatory changes, and currency fluctuations. While we are confident in our long-term high-growth potential, providing mid-term guidance may not accurately reflect the predictability over a multi-year timeframe. For this reason, we have made the decision to discontinue mid-term guidance. We will continue to focus on delivering strong operational execution so as to hit the annual targets we disclose.

Looking ahead to 2025, we are confident in our ability to sustain momentum. Our investments in technology, product innovation, and market expansion position us well for growth. Despite the volatility of emerging markets, our disciplined scaling, local expertise, and commitment to delivering value to merchants will differentiate us. Our strategy focuses on capturing the potential of digital payments in high-growth regions, driving operational efficiencies, and reinforcing market leadership. We are excited about the opportunities ahead and committed to executing with the same rigor and discipline that have defined our success.

1 Source: Euromonitor International: Reaching the emerging middle class beyond BRIC; 2 Source: S&P Global Market Intelligence. 3 Please see Reconciliation of TPV and Revenue constant currency measures to reported results of Q4 2024 Earnings Presentation; 4 Please see Reconciliation of TPV and Revenue constant currency measures to reported results of Q4 2024 Earnings Presentation; 5 please see Full year 2025 outlook on slide 23 of Q4 2024 Earnings Presentation.

Fourth quarter 2024 financial highlights

Exhibit 99.1

1Please see Reconciliation of TPV and Revenue constant currency measures to reported results of Q4 2024 Earnings Presentation.

The following table summarizes our key performance metrics:

|

Three months ended December 31 |

Twelve months ended December 31 |

||||

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

Key Performance metrics |

(In millions of US$ except for %) |

|||||

TPV |

7,714 |

5,111 |

51% |

25,575 |

17,677 |

45% |

Revenue |

204.5 |

188.0 |

9% |

746.0 |

650.4 |

15% |

Gross Profit |

83.7 |

69.7 |

20% |

294.7 |

276.9 |

6% |

Gross Profit margin |

41% |

37% |

4p.p |

40% |

43% |

-3p.p |

Adjusted EBITDA |

56.9 |

49.2 |

16% |

188.7 |

202.3 |

-7% |

Adjusted EBITDA margin |

28% |

26% |

2p.p |

25% |

31% |

-6p.p |

Adjusted EBITDA/Gross Profit |

68% |

71% |

-3p.p |

64% |

73% |

-9p.p |

Profit |

29.7 |

28.5 |

4% |

120.5 |

149.1 |

-19% |

Profit margin |

15% |

15% |

-1p.p |

16% |

23% |

-7p.p |

Exhibit 99.1

Fourth quarter 2024 business highlights

Exhibit 99.1

The tables below present the breakdown of dLocal’s TPV by product and type of flow:

In millions of US$ except for % |

Three months ended December 31 |

Twelve months ended December 31 |

||||||

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

Pay-ins |

5,340 |

69% |

3,701 |

72% |

17,902 |

70% |

12,823 |

73% |

Pay-outs |

2,373 |

31% |

1,410 |

28% |

7,673 |

30% |

4,855 |

27% |

Total TPV |

7,714 |

100% |

5,111 |

100% |

25,575 |

100% |

17,677 |

100% |

In millions of US$ except for % |

Three months ended December 31 |

Twelve months ended December 31 |

||||||

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

Cross-border |

3,740 |

48% |

2,235 |

44% |

11,902 |

47% |

8,670 |

49% |

Local-to-local |

3,974 |

52% |

2,876 |

56% |

13,673 |

53% |

9,007 |

51% |

Total TPV |

7,714 |

100% |

5,111 |

100% |

25,575 |

100% |

17,677 |

100% |

The tables below present the breakdown of dLocal’s revenue by geography:

In millions of US$ except for % |

Three months ended December 31 |

Twelve months ended December 31 |

||||||

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

Latin America |

152.9 |

75% |

131.5 |

70% |

562.2 |

75% |

492.7 |

76% |

Brazil |

33.7 |

16% |

50.2 |

27% |

152.0 |

20% |

159.0 |

24% |

Argentina |

25.1 |

12% |

10.5 |

6% |

85.5 |

11% |

75.1 |

12% |

Mexico |

40.5 |

20% |

35.6 |

19% |

149.2 |

20% |

116.8 |

18% |

Chile |

13.5 |

7% |

14.9 |

8% |

51.2 |

7% |

55.7 |

9% |

Other LatAm |

40.1 |

20% |

20.3 |

11% |

124.4 |

17% |

86.1 |

13% |

|

|

|

|

|

|

|

|

|

Africa & Asia |

51.6 |

25% |

56.5 |

30% |

183.8 |

25% |

157.7 |

24% |

Nigeria |

2.9 |

1% |

28.4 |

15% |

13.3 |

2% |

84.0 |

13% |

Egypt |

21.4 |

10% |

18.4 |

10% |

94.0 |

13% |

36.7 |

6% |

Other Africa & Asia |

27.4 |

13% |

9.7 |

5% |

76.5 |

10% |

37.0 |

6% |

|

|

|

|

|

|

|

|

|

Total Revenue |

204.5 |

100% |

188.0 |

100% |

746.0 |

100% |

650.4 |

100% |

Exhibit 99.1

The tables below present the breakdown of dLocal’s gross profit by geography:

In millions of US$ except for % |

Three months ended December 31 |

Twelve months ended December 31 |

||||||

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

Latin America |

56.4 |

67% |

54.7 |

79% |

214.2 |

73% |

228.7 |

83% |

Brazil |

14.8 |

18% |

25.5 |

37% |

67.3 |

23% |

78.8 |

28% |

Argentina |

9.2 |

11% |

4.0 |

6% |

28.7 |

10% |

48.7 |

18% |

Mexico |

10.9 |

13% |

9.3 |

13% |

42.5 |

14% |

34.7 |

13% |

Chile |

9.2 |

11% |

9.1 |

13% |

33.1 |

11% |

34.0 |

12% |

Other LatAm |

12.4 |

15% |

7.0 |

10% |

42.6 |

14% |

32.6 |

12% |

|

|

|

|

|

|

|

|

|

Africa & Asia |

27.3 |

33% |

15.0 |

21% |

80.5 |

27% |

48.1 |

17% |

Nigeria |

2.4 |

3% |

1.5 |

2% |

6.6 |

2% |

5.8 |

2% |

Egypt |

16.0 |

19% |

9.6 |

14% |

48.4 |

16% |

26.1 |

9% |

Other Africa & Asia |

8.9 |

11% |

3.9 |

6% |

25.5 |

9% |

16.2 |

6% |

|

|

|

|

|

|

|

|

|

Total Gross Profit |

83.7 |

100% |

69.7 |

100% |

294.7 |

100% |

276.9 |

100% |

Exhibit 99.1

Special note regarding Adjusted EBITDA and Adjusted EBITDA Margin

dLocal has only one operating segment. dLocal measures its operating segment’s performance by Revenues, Adjusted EBITDA and Adjusted EBITDA Margin, and uses these metrics to make decisions about allocating resources.

Adjusted EBITDA as used by dLocal is defined as the profit from operations before financing and taxation for the year or period, as applicable, before depreciation of property, plant and equipment, amortization of right-of-use assets and intangible assets, and further excluding the finance income and costs, impairment gains/(losses) on financial assets, transaction costs, share-based payment non-cash charges,other operating gain/loss,other non-recurring costs, and inflation adjustment. dLocal defines Adjusted EBITDA Margin as the Adjusted EBITDA divided by consolidated revenues.

Although Adjusted EBITDA and Adjusted EBITDA Margin may be commonly viewed as non-IFRS measures in other contexts, pursuant to IFRS 8, (“Operating Segments”), Adjusted EBITDA and Adjusted EBITDA Margin are treated by dLocal as IFRS measures based on the manner in which dLocal utilizes these measures. Nevertheless, dLocal’s Adjusted EBITDA and Adjusted EBITDA Margin metrics should not be viewed in isolation or as a substitute for net income for the periods presented under IFRS. dLocal also believes that its Adjusted EBITDA and Adjusted EBITDA Margin metrics are useful metrics used by analysts and investors, although these measures are not explicitly defined under IFRS. Additionally, the way dLocal calculates operating segment’s performance measures may be different from the calculations used by other entities, including competitors, and therefore, dLocal’s performance measures may not be comparable to those of other entities. Finally, dLocal is unable to present a quantitative reconciliation of forward-looking guidance for Adjusted EBITDA because dLocal cannot reliably predict certain of their necessary components, such as impairment gains/(losses) on financial assets, transaction costs, and inflation adjustment.

The table below presents a reconciliation of dLocal’s Adjusted EBITDA to net income:

$ in thousands |

Three months ended December 31 |

Twelve months ended December 31 |

||

|

2024 |

2023 |

2024 |

2023 |

Profit for the period |

29,701 |

28,481 |

120,469 |

149,086 |

Income tax expense |

11,090 |

7,476 |

30,550 |

29,428 |

Depreciation and amortization |

4,888 |

3,604 |

17,177 |

12,225 |

Finance income and costs, net |

1,085 |

(996) |

(17,174) |

(11,394) |

Share-based payment non-cash charges |

6,339 |

4,850 |

23,780 |

11,922 |

Other operating loss¹ |

1,307 |

- |

5,257 |

- |

Impairment loss / (gain) on financial assets |

533 |

(657) |

440 |

(3,136) |

Inflation adjustment |

392 |

6,040 |

6,655 |

12,537 |

Other non-recurring costs² |

1,571 |

434 |

1,571 |

1,663 |

Adjusted EBITDA |

56,906 |

49,232 |

188,725 |

202,332 |

Note: 1 The company wrote-off certain amounts related to merchants/processors off-boarded by dLocal. 2 Other non-recurring costs consist of costs not directly associated with our core business activities, including costs associated with addressing the allegations made by a short-seller report and certain class action and other legal and regulatory expenses (which include fees from counsel, global expert services and a forensic accounting advisory firm) in 2023 and 2024.

Exhibit 99.1

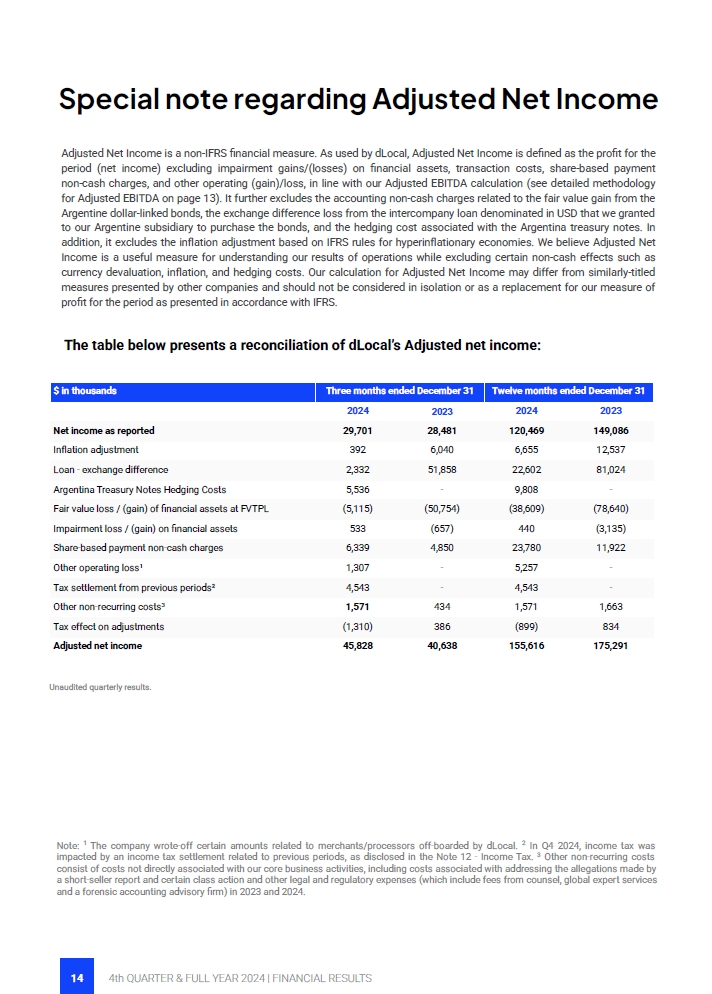

Special note regarding Adjusted Net Income

Adjusted Net Income is a non-IFRS financial measure. As used by dLocal, Adjusted Net Income is defined as the profit for the period (net income) excluding impairment gains/(losses) on financial assets, transaction costs, share-based payment non-cash charges, and other operating (gain)/loss, in line with our Adjusted EBITDA calculation (see detailed methodology for Adjusted EBITDA on page 13). It further excludes the accounting non-cash charges related to the fair value gain from the Argentine dollar-linked bonds, the exchange difference loss from the intercompany loan denominated in USD that we granted to our Argentine subsidiary to purchase the bonds, and the hedging cost associated with the Argentina treasury notes. In addition, it excludes the inflation adjustment based on IFRS rules for hyperinflationary economies. We believe Adjusted Net Income is a useful measure for understanding our results of operations while excluding certain non-cash effects such as currency devaluation, inflation, and hedging costs. Our calculation for Adjusted Net Income may differ from similarly-titled measures presented by other companies and should not be considered in isolation or as a replacement for our measure of profit for the period as presented in accordance with IFRS.

The table below presents a reconciliation of dLocal’s Adjusted net income:

$ in thousands |

Three months ended December 31 |

Twelve months ended December 31 |

||

|

2024 |

2023 |

2024 |

2023 |

Net income as reported |

29,701 |

28,481 |

120,469 |

149,086 |

Inflation adjustment |

392 |

6,040 |

6,655 |

12,537 |

Loan - exchange difference |

2,332 |

51,858 |

22,602 |

81,024 |

Argentina Treasury Notes Hedging Costs |

5,536 |

- |

9,808 |

- |

Fair value loss / (gain) of financial assets at FVTPL |

(5,115) |

(50,754) |

(38,609) |

(78,640) |

Impairment loss / (gain) on financial assets |

533 |

(657) |

440 |

(3,135) |

Share-based payment non-cash charges |

6,339 |

4,850 |

23,780 |

11,922 |

Other operating loss¹ |

1,307 |

- |

5,257 |

- |

Other non-recurring costs³ |

1,571 |

434 |

1,571 |

1,663 |

Tax effect on adjustments |

(1,310) |

386 |

(899) |

834 |

Adjusted net income |

45,828 |

40,638 |

155,616 |

175,291 |

Unaudited quarterly results.

Note: 1 The company wrote-off certain amounts related to merchants/processors off-boarded by dLocal. 2 In Q4 2024, income tax was impacted by an income tax settlement related to previous periods, as disclosed in the Note 12 - Income Tax. 3 Other non-recurring costs consist of costs not directly associated with our core business activities, including costs associated with addressing the allegations made by a short-seller report and certain class action and other legal and regulatory expenses (which include fees from counsel, global expert services and a forensic accounting advisory firm) in 2023 and 2024.

Exhibit 99.1

Earnings per share

We calculate basic earnings per share by dividing the profit attributable to owners of the group by the weighted average number of common shares outstanding during the three-month and twelve-month periods ended December 31, 2024 and 2023.

Our diluted earnings per share is calculated by dividing the profit attributable to owners of the group of dLocal by the weighted average number of common shares outstanding during the period plus the weighted average number of common shares that would be issued on conversion of all dilutive potential common shares into common shares.

The following table presents the information used as a basis for the calculation of our earnings per share:

|

Three months ended December 31 |

Twelve months ended December 31 |

||

|

2024 |

2023 |

2024 |

2023 |

Profit attributable to common shareholders (USD) |

29,682,000 |

28,515,000 |

120,416,000 |

148,964,000 |

Weighted average number of common shares |

280,443,489 |

290,657,015 |

290,014,019 |

291,982,305 |

Adjustments for calculation of diluted earnings per share |

14,417,466 |

5,008,261 |

15,122,271 |

10,976,123 |

Weighted average number of common shares for calculating diluted earnings per share |

294,860,956 |

295,665,276 |

305,136,290 |

302,958,428 |

Basic earnings per share |

0.11 |

0.10 |

0.42 |

0.51 |

Diluted earnings per share |

0.10 |

0.10 |

0.39 |

0.49 |

This press release does not contain sufficient information to constitute an interim financial report as defined in International Accounting Standards 34, “Interim Financial Reporting” nor a financial statement as defined by International Accounting Standards 1 “Presentation of Financial Statements”. The quarterly financial information in this press release has not been audited, whereas the annual results for the year ended December 31, 2024 and 2023 are audited.

Exhibit 99.1

Conference call and webcast

dLocal’s management team will host a conference call and audio webcast on February 27, 2025 at 5:00 p.m. Eastern Time. Please click here to pre-register for the conference call and obtain your dial in number and passcode.

The live conference call can be accessed via audio webcast at the investor relations section of dLocal’s website, at https://investor.dlocal.com/. An archive of the webcast will be available for a year following the conclusion of the conference call. The investor presentation will also be filed on EDGAR at www.sec.gov.

About dLocal

dLocal powers local payments in emerging markets, connecting global enterprise merchants with billions of emerging market consumers in more than 40 countries across Africa, Asia, and Latin America. Through the “One dLocal” platform (one direct API, one platform, and one contract), global companies can accept payments, send pay-outs and settle funds globally without the need to manage separate pay-in and pay-out processors, set up numerous local entities, and integrate multiple acquirers and payment methods in each market.

Exhibit 99.1

Definition of selected operational metrics

“API” means application programming interface, which is a general term for programming techniques that are available for software developers when they integrate with a particular service or application. In the payments industry, APIs are usually provided by any party participating in the money flow (such as payment gateways, processors, and service providers) to facilitate the money transfer process.

“Cross-border” means a payment transaction whereby dLocal is collecting in one currency and settling into a different currency and/or in a different geography.

“Local payment methods” refers to any payment method that is processed in the country where the end user of the merchant sending or receiving payments is located, which include credit and debit cards, cash payments, bank transfers, mobile money, and digital wallets.

“Local-to-local” means a payment transaction whereby dLocal is collecting and settling in the same currency.

“Net Revenue Retention Rate” or “NRR” is a U.S. dollar-based measure of retention and growth of dLocal’s merchants. NRR is calculated for a period or year by dividing the Current Period/Year Revenue by the Prior Period/Year Revenue. The Prior Period/Year Revenue is the revenue billed by us to all our customers in the prior period. The Current Period/Year Revenue is the revenue billed by us in the current period to the same customers included in the Prior Period/Year Revenue. Current Period/Year Revenue includes revenues from any upselling and cross-selling across products, geographies, and payment methods to such merchant customers, and is net of any contractions or attrition, in respect of such merchant customers, and excludes revenue from new customers on-boarded in the preceding twelve months. As most of dLocal revenues come from existing merchants, the NRR rate is a key metric used by management, and we believe it is useful for investors in order to assess our retention of existing customers and growth in revenues from our existing customer base.

“Pay-in” means a payment transaction whereby dLocal’s merchant customers receive payment from their customers.

“Pay-out” means a payment transaction whereby dLocal disburses money in local currency to the business partners or customers of dLocal’s merchant customers.

“Revenue from New Merchants” means the revenue billed by us to merchant customers that we did not bill revenues in the same quarter (or period) of the prior year.

“Revenue from Existing Merchants” means the revenue billed by us in the last twelve months to the merchant customers that we billed revenue in the same quarter (or period) of the prior year.

“TPV” dLocal presents total payment volume, or TPV, which is an operating metric of the aggregate value of all payments successfully processed through dLocal’s payments platform. Because revenue depends significantly on the total value of transactions processed through the dLocal platform, management believes that TPV is an indicator of the success of dLocal’s global merchants, the satisfaction of their end users, and the scale and growth of dLocal’s business.

Rounding: We have made rounding adjustments to some of the figures included in this interim report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Exhibit 99.1

Forward-looking statements

This press release contains certain forward-looking statements. These forward-looking statements convey dLocal’s current expectations or forecasts of future events, including guidance in respect of total payment volume, revenue, gross profit and Adjusted EBITDA. Forward-looking statements regarding dLocal and amounts stated as guidance are based on current management expectations and involve known and unknown risks, uncertainties and other factors that may cause dLocal’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” “Forward-Looking Statements” and “Cautionary Statement Regarding Forward-Looking Statements” sections of dLocal’s filings with the U.S. Securities and Exchange Commission. Unless required by law, dLocal undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. In addition, dLocal is unable to present a quantitative reconciliation of forward-looking guidance for Adjusted EBITDA, because dLocal cannot reliably predict certain of their necessary components, such as impairment gains/(losses) on financial assets, transaction costs, and inflation adjustment.

Exhibit 99.1

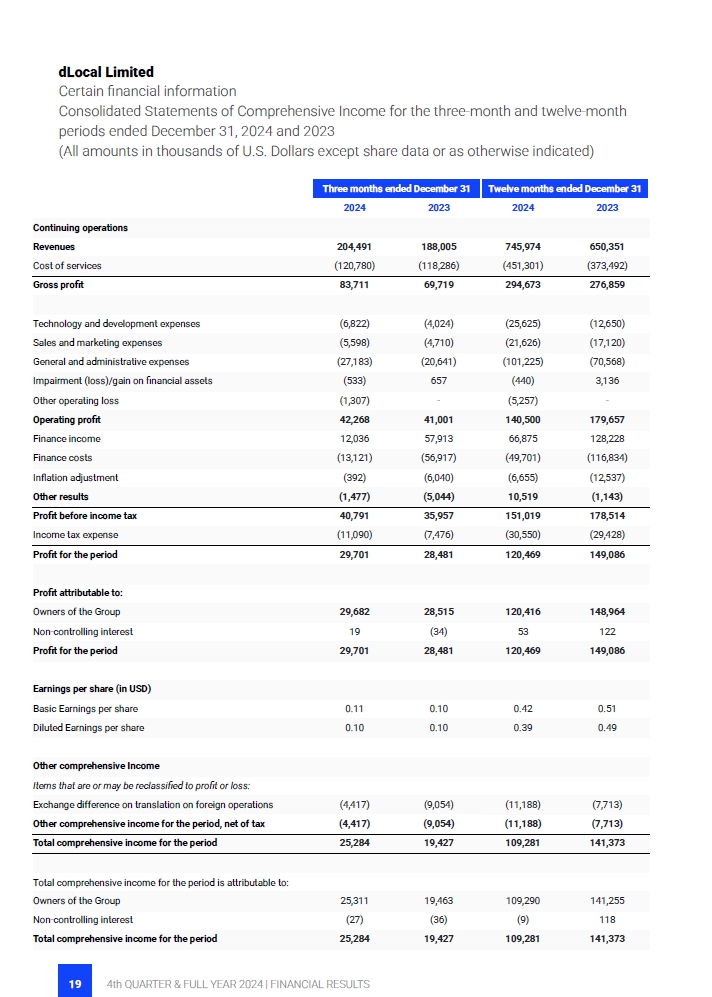

dLocal Limited

Certain financial information

Consolidated Condensed Interim Statements of Comprehensive Income for the three-month and twelve-month periods ended December 31, 2024 and 2023

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

Three months ended December 31 |

Twelve months ended December 31 |

||

|

2024 |

2023 |

2024 |

2023 |

Continuing operations |

|

|

|

|

Revenues |

204,491 |

188,005 |

745,974 |

650,351 |

Cost of services |

(120,780) |

(118,286) |

(451,301) |

(373,492) |

Gross profit |

83,711 |

69,719 |

294,673 |

276,859 |

|

|

|

|

|

Technology and development expenses |

(6,822) |

(4,024) |

(25,625) |

(12,650) |

Sales and marketing expenses |

(5,598) |

(4,710) |

(21,626) |

(17,120) |

General and administrative expenses |

(27,183) |

(20,641) |

(101,225) |

(70,568) |

Impairment (loss)/gain on financial assets |

(533) |

657 |

(440) |

3,136 |

Other operating (loss)/gain |

(1,307) |

- |

(5,257) |

- |

Operating profit |

42,268 |

41,001 |

140,500 |

179,657 |

Finance income |

12,036 |

57,913 |

66,875 |

128,228 |

Finance costs |

(13,121) |

(56,917) |

(49,701) |

(116,834) |

Inflation adjustment |

(392) |

(6,040) |

(6,655) |

(12,537) |

Other results |

(1,477) |

(5,044) |

10,519 |

(1,143) |

Profit before income tax |

40,791 |

35,957 |

151,019 |

178,514 |

Income tax expense |

(11,090) |

(7,476) |

(30,550) |

(29,428) |

Profit for the period |

29,701 |

28,481 |

120,469 |

149,086 |

|

|

|

|

|

Profit attributable to: |

|

|

|

|

Owners of the Group |

29,682 |

28,515 |

120,416 |

148,964 |

Non-controlling interest |

19 |

(34) |

53 |

122 |

Profit for the period |

29,701 |

28,481 |

120,469 |

149,086 |

|

|

|

|

|

Earnings per share (in USD) |

|

|

|

|

Basic Earnings per share |

0.11 |

0.10 |

0.42 |

0.51 |

Diluted Earnings per share |

0.10 |

0.10 |

0.39 |

0.49 |

|

|

|

|

|

Other comprehensive income |

|

|

|

|

Items that may be reclassified to profit or loss: |

|

|

|

|

Exchange difference on translation on foreign operations |

(4,417) |

(9,054) |

(11,188) |

(7,713) |

Other comprehensive income for the period, net of tax |

(4,417) |

(9,054) |

(11,188) |

(7,713) |

Total comprehensive income for the period, net of tax |

25,284 |

19,427 |

109,281 |

141,373 |

|

|

|

|

|

Total comprehensive income for the period |

|

|

|

|

Owners of the Group |

25,311 |

19,463 |

109,290 |

141,255 |

Non-controlling interest |

(27) |

(36) |

(9) |

118 |

Total comprehensive income for the period |

25,284 |

19,427 |

109,281 |

141,373 |

Exhibit 99.1

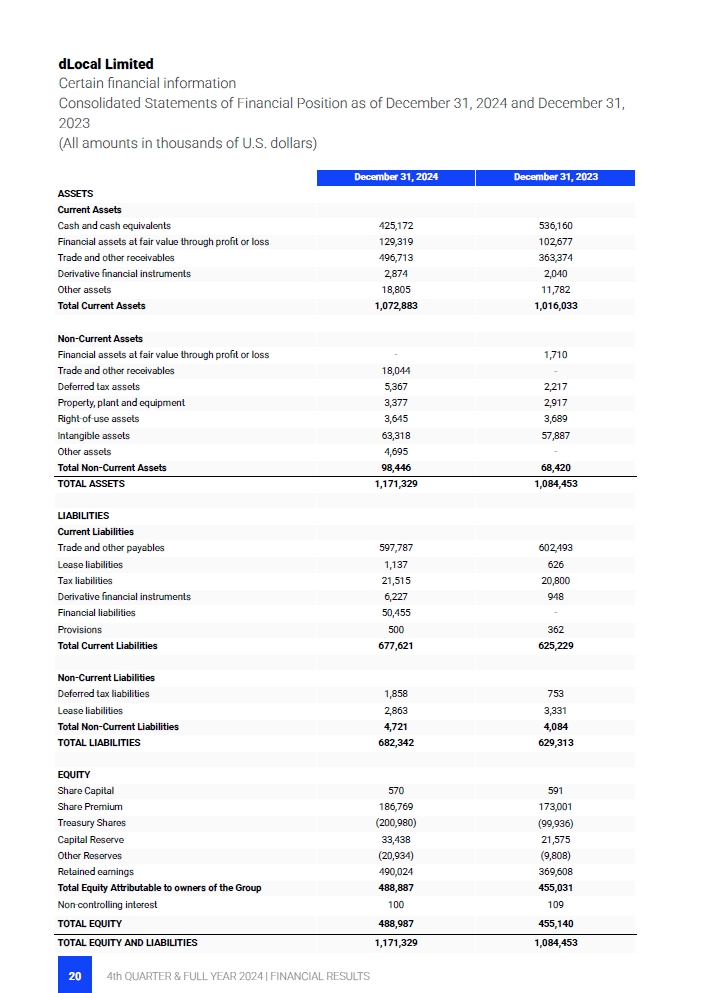

dLocal Limited

Certain financial information

Consolidated Condensed Interim Statements of Financial Position as of December 31, 2024 and December 31, 2023

(All amounts in thousands of U.S. dollars)

|

December 31, 2024 |

December 31, 2023 |

ASSETS |

|

|

Current Assets |

|

|

Cash and cash equivalents |

425,172 |

536,160 |

Financial assets at fair value through profit or loss |

129,319 |

102,677 |

Trade and other receivables |

496,713 |

363,374 |

Derivative financial instruments |

2,874 |

2,040 |

Other assets |

18,805 |

11,782 |

Total Current Assets |

1,072,883 |

1,016,033 |

|

|

|

Non-Current Assets |

|

|

Financial assets at fair value through profit or loss |

- |

1,710 |

Trade and other receivables |

18,044 |

- |

Deferred tax assets |

5,367 |

2,217 |

Property, plant and equipment |

3,377 |

2,917 |

Right-of-use assets |

3,645 |

3,689 |

Intangible assets |

63,318 |

57,887 |

Other assets |

4,695 |

- |

Total Non-Current Assets |

98,446 |

68,420 |

TOTAL ASSETS |

1,171,329 |

1,084,453 |

|

|

|

LIABILITIES |

|

|

Current Liabilities |

|

|

Trade and other payables |

597,787 |

602,493 |

Lease liabilities |

1,137 |

626 |

Tax liabilities |

21,515 |

20,800 |

Derivative financial instruments |

6,227 |

948 |

Financial liabilities |

50,455 |

- |

Provisions |

500 |

362 |

Total Current Liabilities |

677,621 |

625,229 |

|

|

|

Non-Current Liabilities |

|

|

Deferred tax liabilities |

1,858 |

753 |

Lease liabilities |

2,863 |

3,331 |

Total Non-Current Liabilities |

4,721 |

4,084 |

TOTAL LIABILITIES |

682,342 |

629,313 |

|

|

|

EQUITY |

|

|

Share Capital |

570 |

591 |

Share Premium |

186,769 |

173,001 |

Treasury Shares |

(200,980) |

(99,936) |

Capital Reserve |

33,438 |

21,575 |

Other Reserves |

(20,934) |

(9,808) |

Retained earnings |

490,024 |

369,608 |

Total Equity Attributable to owners of the Group |

488,887 |

455,031 |

Non-controlling interest |

100 |

109 |

TOTAL EQUITY |

488,987 |

455,140 |

TOTAL EQUITY AND LIABILITIES |

1,171,329 |

1,084,453 |

Exhibit 99.1

dLocal Limited

Certain interim financial information

Consolidated Statements of Cash flows for the three-month and twelve-month periods ended December 31, 2024 and 2023

(All amounts in thousands of U.S. dollars)

|

Three months ended December 31 |

Twelve months ended December 31 |

||

|

2024 |

2023 |

2024 |

2023 |

Cash flows from operating activities |

|

|

|

|

Profit before income tax |

40,791 |

35,957 |

151,019 |

178,514 |

Adjustments: |

|

|

|

|

Interest Income from financial instruments |

(6,921) |

(7,159) |

(28,266) |

(49,588) |

Interest charges for lease liabilities |

370 |

110 |

501 |

578 |

Other interests charges |

739 |

2,503 |

3,758 |

5,623 |

Finance expense related to derivative financial instruments |

(627) |

5,497 |

19,462 |

28,013 |

Net exchange differences |

5,914 |

50,100 |

24,787 |

82,620 |

Fair value loss/(gain) on financial assets at FVPL |

(3,922) |

(50,754) |

(37,416) |

(78,640) |

Amortization of Intangible assets |

4,364 |

3,251 |

15,511 |

10,816 |

Depreciation and disposals of PP&E and right-of-use |

652 |

353 |

1,884 |

1,409 |

Share-based payment expense, net of forfeitures |

6,339 |

4,850 |

23,780 |

11,922 |

Other operating gain |

786 |

- |

4,736 |

- |

Net Impairment loss/(gain) on financial assets |

533 |

2,796 |

440 |

318 |

Inflation adjustment and other financial results |

(5,704) |

9,041 |

(17,063) |

9,041 |

|

43,313 |

56,546 |

163,133 |

200,626 |

Changes in working capital |

|

|

|

|

Increase in Trade and other receivables |

(109,487) |

(51,154) |

(162,645) |

(123,246) |

Decrease / (Increase) in Other assets |

4,128 |

13,258 |

5,427 |

45,007 |

Increase / (Decrease) in Trade and Other payables |

(70,700) |

52,654 |

(6,957) |

194,619 |

Increase / (Decrease) in Tax Liabilities |

(3,835) |

(6,591) |

(3,184) |

(10,967) |

Increase / (Decrease) in Provisions |

222 |

(275) |

138 |

(1,111) |

Cash (used) / generated from operating activities |

(136,359) |

64,438 |

(4,088) |

304,928 |

Income tax paid |

(4,773) |

(2,996) |

(28,696) |

(11,475) |

Net cash (used) / generated from operating activities |

(141,132) |

61,442 |

(32,784) |

293,453 |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Acquisitions of Property, plant and equipment |

(427) |

21 |

(1,705) |

(965) |

Additions of Intangible assets |

(5,699) |

(4,758) |

(20,942) |

(17,260) |

Acquisition of financial assets at FVPL |

(14,852) |

(15,847) |

(121,468) |

(117,517) |

Collections of financial assets at FVPL |

- |

3,721 |

108,097 |

1,487 |

Interest collected from financial instruments |

6,921 |

7,159 |

28,266 |

49,588 |

Payments for investments in other assets at FVPL |

(10,000) |

- |

(10,000) |

- |

Net cash (used in) / generated investing activities |

(24,057) |

(9,704) |

(17,752) |

(84,667) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Repurchase of shares |

- |

- |

(101,067) |

(97,929) |

Share-options exercise paid |

358 |

- |

1,853 |

153 |

Interest payments on lease liability |

(370) |

(110) |

(501) |

(578) |

Principal payments on lease liability |

(112) |

(315) |

(552) |

(1,103) |

Finance expense paid related to derivative financial instruments |

(8) |

(7,640) |

(15,017) |

(28,443) |

Net proceeds from financial liabilities |

33,653 |

- |

50,428 |

- |

Interest payments on financial liabilities |

(1,633) |

- |

(2,281) |

- |

Other finance expense paid |

(327) |

(2,851) |

(1,450) |

(5,971) |

Net cash used in by financing activities |

31,561 |

(10,916) |

(68,587) |

(133,871) |

Net increase in cash flow |

(133,628) |

40,822 |

(119,123) |

74,915 |

|

|

|

|

|

Cash and cash equivalents at the beginning of the period |

560,533 |

498,165 |

536,160 |

468,092 |

Net (decrease)/increase in cash flow |

(133,628) |

40,822 |

(119,123) |

74,915 |

Effects of exchange rate changes on inflation and cash and cash equivalents |

(1,732) |

(2,827) |

8,135 |

(6,847) |

Cash and cash equivalents at the end of the period |

425,172 |

536,160 |

425,172 |

536,160 |

Exhibit 99.1

Investor Relations Contact:

investor@dlocal.com

Media Contact:

media@dlocal.com

Exhibit 99.2

DLocal Limited Consolidated Financial Statements as of December 31, 2024 and 2023, and for the three years ended December 31, 2024,

with the Report of the Independent Registered Public Accounting Firm

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of DLocal Limited

Opinions on the Financial Statements

We have audited the accompanying consolidated statements of financial position of DLocal Limited and its subsidiaries (the “Company”) as of December 31, 2024 and 2023, and the related consolidated statements of income and comprehensive income, changes in equity and cash flows for each of the three years in the period ended December 31, 2024, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2024 in conformity with IFRS Accounting Standards as issued by the International Accounting Standards Board.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that (i) relates to accounts or disclosures that are material to the consolidated financial statements and (ii) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Audit of Transaction revenues

As described in Notes 2.15 and 6 to the consolidated financial statements, the Company’s transaction revenues were $739.9 million for the year ended December 31, 2024 representing 99.19% of the Company’s total consolidated revenues. These revenues are generated mainly by processing fees and foreign exchange service fees, defined either as percentage of the transaction value or a fixed amount per transaction depending on each agreement.

2

The principal considerations for our determination that performing procedures relating to the audit of transaction revenues is a critical audit matter are (i) the complexity of the Company’s processes for setting the transaction revenues with their merchants mostly defined individually, which in turn led to (ii) a significant effort in performing procedures and evaluating audit evidence related to such processes; and (iii) the involvement of professionals with specialized skills and knowledge.

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to the transaction revenue recognition process, including controls over management’s processes for calculating and recording transaction revenues. These procedures also included among others: (i) performing detailed testing of transactions recognized as transaction revenues by agreeing the amounts recognized to source documents; and (ii) testing the mathematical accuracy of transactions recognized as transaction revenues. Professionals with specialized skills and knowledge were involved in the testing of the effectiveness of controls relating to management’s processes for calculating and recording transaction revenues.

/s/ Price Waterhouse & Co. S.R.L.

/s/ Mario Angel Julio (Partner)

Autonomous City of Buenos Aires, Argentina

February 27, 2025

We have served as the Company’s auditor since 2020.

3

DLocal Limited

Consolidated Statements of Income and Comprehensive Income

Years ended December 31, 2024, 2023 and 2022

(All amounts in thousands of U.S. Dollars except share data or as otherwise indicated)

|

|

Notes |

|

For the Year Ended December 31, |

|

|||||||||

|

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

|||

Continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|||

Revenues |

|

6 |

|

|

745,974 |

|

|

|

650,351 |

|

|

|

418,925 |

|

Cost of services |

|

6 |

|

|

(451,301 |

) |

|

|

(373,492 |

) |

|

|

(216,758 |

) |

Gross profit |

|

|

|

|

294,673 |

|

|

|

276,859 |

|

|

|

202,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Technology and development expenses |

|

7 |

|

|

(25,625 |

) |

|

|

(12,650 |

) |

|

|

(6,348 |

) |

Sales and marketing expenses |

|

8 |

|

|

(21,626 |

) |

|

|

(17,120 |

) |

|

|

(13,335 |

) |

General and administrative expenses |

|

8 |

|

|

(101,225 |

) |

|

|

(70,568 |

) |

|

|

(48,343 |

) |

Impairment (loss)/gain on financial assets |

|

16 |

|

|

(440 |

) |

|

|

3,136 |

|

|

|

(5,534 |

) |

Other operating loss |

|

|

|

|

(5,257 |

) |

|

|

— |

|

|

|

(697 |

) |

Operating profit |

|

|

|

|

140,500 |

|

|

|

179,657 |

|

|

|

127,910 |

|

Finance income |

|

11 |

|

|

66,875 |

|

|

|

128,228 |

|

|

|

18,078 |

|

Finance costs |

|

11 |

|

|

(49,701 |

) |

|

|

(116,834 |

) |

|

|

(24,668 |

) |

Inflation adjustment |

|

11 |

|

|

(6,655 |

) |

|

|

(12,537 |

) |

|

|

(1,037 |

) |

Other results |

|

|

|

|

10,519 |

|

|

|

(1,143 |

) |

|

|

(7,627 |

) |

Profit before income tax |

|

|

|

|

151,019 |

|

|

|

178,514 |

|

|

|

120,283 |

|

Income tax expense |

|

12 |

|

|

(30,550 |

) |

|

|

(29,428 |

) |

|

|

(11,586 |

) |

Profit for the year |

|

|

|

|

120,469 |

|

|

|

149,086 |

|

|

|

108,697 |

|

Profit attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|||

Owners of the Group |

|

|

|

|

120,416 |

|

|

|

148,964 |

|

|

|

108,683 |

|

Non-controlling interest |

|

|

|

|

53 |

|

|

|

122 |

|

|

|

14 |

|

Profit for the year |

|

|

|

|

120,469 |

|

|

|

149,086 |

|

|

|

108,697 |

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|||

Basic Earnings per share |

|

13 |

|

|

0.42 |

|

|

|

0.51 |

|

|

|

0.37 |

|

Diluted Earnings per share |

|

13 |

|

|

0.39 |

|

|

|

0.49 |

|

|

|

0.35 |

|

Other comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|||

Items that are or may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|||

Exchange difference on translation on foreign operations |

|

|

|

|

(11,188 |

) |

|

|

(7,713 |

) |

|

|

20 |

|

Other comprehensive income for the year, net of tax |

|

|

|

|

(11,188 |

) |

|

|

(7,713 |

) |

|

|

20 |

|

Total comprehensive income for the year |

|

|

|

|

109,281 |

|

|

|

141,373 |

|

|

|

108,717 |

|

Total comprehensive income for the year is attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|||

Owners of the Group |

|

|

|

|

109,290 |

|

|

|

141,255 |

|

|

|

108,708 |

|

Non-controlling interest |

|

|

|

|

(9 |

) |

|

|

118 |

|

|

|

9 |

|

Total comprehensive income for the year |

|

|

|

|

109,281 |

|

|

|

141,373 |

|

|

|

108,717 |

|

The accompanying notes are an integral part of these consolidated financial statements.

DLocal Limited

Consolidated Statements of Financial Position

At December 31, 2024 and 2023

(All amounts in thousands of U.S. Dollars)

|

|

Notes |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

||

ASSETS |

|

|

|

|

|

|

|

|

||

Current Assets |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

14 |

|

|

425,172 |

|

|

|

536,160 |

|

Financial assets at fair value through profit or loss |

|

15 |

|

|

129,319 |

|

|

|

102,677 |

|

Trade and other receivables |

|

16 |

|

|

496,713 |

|

|

|

363,374 |

|

Derivative financial instruments |

|

24 |

|

|

2,874 |

|

|

|

2,040 |

|

Other assets |

|

17 |

|

|

18,805 |

|

|

|

11,782 |

|

Total Current Assets |

|

|

|

|

1,072,883 |

|

|

|

1,016,033 |

|

Non-Current Assets |

|

|

|

|

|

|

|

|

||

Financial assets at fair value through profit or loss |

|

15 |

|

|

— |

|

|

|

1,710 |

|

Trade and other receivables |

|

16 |

|

|

18,044 |

|

|

|

— |

|

Deferred tax assets |

|

12 |

|

|

5,367 |

|

|

|

2,217 |

|

Property, plant and equipment |

|

18 |

|

|

3,377 |

|

|

|

2,917 |

|

Right-of-use assets |

|

19 |

|

|

3,645 |

|

|

|

3,689 |

|

Intangible assets |

|

20 |

|

|

63,318 |

|

|

|

57,887 |

|

Other assets |

|

17 |

|

|

4,695 |

|

|

|

— |

|

Total Non-Current Assets |

|

|

|

|

98,446 |

|

|

|

68,420 |

|

TOTAL ASSETS |

|

|

|

|

1,171,329 |

|

|

|

1,084,453 |

|

LIABILITIES |

|

|

|

|

|

|

|

|

||

Current Liabilities |

|

|

|

|

|

|

|

|

||

Trade and other payables |

|

21 |

|

|

597,787 |

|

|

|

602,493 |

|

Lease liabilities |

|

19 |

|

|

1,137 |

|

|

|

626 |

|

Tax liabilities |

|

23 |

|

|

21,515 |

|

|

|

20,800 |

|

Derivative financial instruments |

|

24 |

|

|

6,227 |

|

|

|

948 |

|

Financial liabilities |

|

22 |

|

|

50,455 |

|

|

|

— |

|

Provisions |

|

25 |

|

|

500 |

|

|

|

362 |

|

Total Current Liabilities |

|

|

|

|

677,621 |

|

|

|

625,229 |

|

Non-Current Liabilities |

|

|

|

|

|

|

|

|

||

Deferred tax liabilities |

|

12 |

|

|

1,858 |

|

|

|

753 |

|

Lease liabilities |

|

19 |

|

|

2,863 |

|

|

|

3,331 |

|

Total Non-Current Liabilities |

|

|

|

|

4,721 |

|

|

|

4,084 |

|

TOTAL LIABILITIES |

|

|

|

|

682,342 |

|

|

|

629,313 |

|

EQUITY |

|

|

|

|

|

|

|

|

||

Share Capital |

|

13 |

|

|

570 |

|

|

|

591 |

|

Share Premium |

|

13 |

|

|

186,769 |

|

|

|

173,001 |

|

Treasury Shares |

|

13 |

|

|

(200,980 |

) |

|

|

(99,936 |

) |

Capital Reserve |

|

13 |

|

|

33,438 |

|

|

|

21,575 |

|

Other Reserves |

|

13 |

|

|

(20,934 |

) |

|

|

(9,808 |

) |

Retained earnings |

|

13 |

|

|

490,024 |

|

|

|

369,608 |

|

Total Equity Attributable to owners of the Group |

|

|

|

|

488,887 |

|

|

|

455,031 |

|

Non-controlling interest |

|

|

|

|

100 |

|

|

|

109 |

|

TOTAL EQUITY |

|

|

|

|

488,987 |

|

|

|

455,140 |

|

TOTAL EQUITY AND LIABILITIES |

|

|

|

|

1,171,329 |

|

|

|

1,084,453 |

|

The accompanying notes are an integral part of these consolidated financial statements.

DLocal Limited

Consolidated Statements of Changes in Equity

Years ended December 31, 2024, 2023 and 2022

(All amounts in thousands of U.S. Dollars)

|

|

Notes |

|

Share |

|

|

Share |

|

|

Treasury Shares |

|

|

Capital |

|

|

Other Reserves |

|

|

Retained |

|

|

Total |

|

|

Non- |

|

|

Total |

|

|||||||||

Balance as of January 1st, 2024 |

|

|

|

|

591 |

|

|

|

173,001 |

|

|

|

(99,936 |

) |

|

|

21,575 |

|

|

|

(9,808 |

) |

|

|

369,608 |

|

|

|

455,031 |

|

|

|

109 |

|

|

|

455,140 |

|

Comprehensive Income for the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Profit of the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

120,416 |

|

|

|

120,416 |

|

|

|

53 |

|

|

|

120,469 |

|

Exchange difference on translation on foreign |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,126 |

) |

|

|

— |

|

|

|

(11,126 |

) |

|

|

(62 |

) |

|

|

(11,188 |

) |

Total Comprehensive Income for the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,126 |

) |

|

|

120,416 |

|

|

|

109,290 |

|

|

|

(9 |

) |

|

|

109,281 |

|

Transactions with Group owners in their |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Share-options exercise |

|

13 |

|

|

2 |

|

|

|

13,768 |

|

|

|

— |

|

|

|

(11,917 |

) |

|

|

— |

|

|

|

— |

|

|

|

1,853 |

|

|

|

— |

|

|

|

1,853 |

|

Share-based payments net of forfeitures |

|

9 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23,780 |

|

|

|

— |

|

|

|

— |

|

|

|

23,780 |

|

|

|

— |

|

|

|

23,780 |

|

Repurchase of shares |

|

13 |

|

|

(23 |

) |

|

|

— |

|

|

|

(101,044 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(101,067 |

) |

|

|

— |

|

|

|

(101,067 |

) |

Transactions with Group owners in their |

|

|

|

|

(21 |

) |

|

|

13,768 |

|

|

|

(101,044 |

) |

|

|

11,863 |

|

|

|

— |

|

|

|

— |

|

|

|

(75,434 |

) |

|

|

— |

|

|

|

(75,434 |

) |

Balance as of December 31st, 2024 |

|

|

|

|

570 |

|

|

|

186,769 |

|

|

|

(200,980 |

) |

|

|

33,438 |

|

|

|

(20,934 |

) |

|

|

490,024 |

|

|

|

488,887 |

|

|

|

100 |

|

|

|

488,987 |

|

Balance as of January 1st, 2023 |

|

|

|

|

592 |

|

|

|

166,328 |

|

|

|

(2,021 |

) |

|

|

16,185 |

|

|

|

(1,448 |

) |

|

|

219,993 |

|

|

|

399,629 |

|

|

|

(9 |

) |

|

|

399,620 |

|

Comprehensive Income for the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Profit of the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

148,964 |

|

|

|

148,964 |

|

|

|

122 |

|

|

|

149,086 |

|

Exchange difference on translation on foreign |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,360 |

) |

|

|

651 |

|

|

|

(7,709 |

) |

|

|

(4 |

) |

|

|

(7,713 |

) |

Total Comprehensive Income for the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,360 |

) |

|

|

149,615 |

|

|

|

141,255 |

|

|

|

118 |

|

|

|

141,373 |

|

Transactions with Group owners in their |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Share-options exercise |

|

13 |

|

|

— |

|

|

|

5,051 |

|

|

|

— |

|

|

|

(4,898 |

) |

|

|

— |

|

|

|

— |

|

|

|

153 |

|

|

|

— |

|

|

|

153 |

|

Warrant Exercise |

|

9 |

|

|

13 |

|

|

|

1,622 |

|

|

|

— |

|

|

|

(1,634 |

) |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

Share-based payments net of forfeitures |

|

9 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,922 |

|

|

|

— |

|

|

|

— |

|

|

|

11,922 |

|

|

|

— |

|

|

|

11,922 |

|

Repurchase of shares |

|

13 |

|

|

(14 |

) |

|

|

— |

|

|

|

(97,915 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(97,929 |

) |

|

|

— |

|

|

|

(97,929 |

) |

Transactions with Group owners in their |

|

|

|

|

(1 |

) |

|

|

6,673 |

|

|

|

(97,915 |

) |

|

|

5,390 |

|

|

|

— |

|

|

|

— |

|

|

|

(85,853 |

) |

|

|

— |

|

|

|

(85,853 |

) |

Balance as of December 31st, 2023 |

|

|

|

|

591 |

|

|

|

173,001 |

|

|

|

(99,936 |

) |

|

|

21,575 |

|

|

|

(9,808 |

) |

|

|

369,608 |

|

|

|

455,031 |

|

|

|

109 |

|

|

|

455,140 |

|

Balance as of January 1st, 2022 |

|

|

|

|

590 |

|

|

|

157,151 |

|

|

|

— |

|

|

|

12,741 |

|

|

|

(30 |

) |

|

|

109,867 |

|

|

|

280,319 |

|

|

|

(18 |

) |

|

|

280,301 |

|

Comprehensive Income for the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Profit of the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

108,683 |

|

|

|

108,683 |

|

|

|

14 |

|

|

|

108,697 |

|

Exchange difference on translation on foreign |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,418 |

) |

|

|

1,443 |

|

|

|

25 |

|

|

|

(5 |

) |

|

|

20 |

|

Total Comprehensive Income for the year |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,418 |

) |

|

|

110,126 |

|

|

|

108,708 |

|

|

|

9 |

|

|

|

108,717 |

|

Transactions with Group owners in their |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Share-options exercise |

|

13 |

|

|

2 |

|

|

|

9,177 |

|

|

|

— |

|

|

|

(5,240 |

) |

|

|

— |

|

|

|

— |

|

|

|

3,939 |

|

|

|

— |

|

|

|

3,939 |

|

Forfeitures of share-based payment |

|

9 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(896 |

) |

|

|

— |

|

|

|

— |

|

|

|

(896 |

) |

|

|

— |

|

|

|

(896 |

) |

Share-based payments |

|

9 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,580 |

|

|

|

— |

|

|

|

— |

|

|

|

9,580 |

|

|

|

— |

|

|

|

9,580 |

|

Repurchase of shares |

|

13 |

|

|

— |

|

|

|

— |

|

|

|

(2,021 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,021 |

) |

|

|

— |

|

|

|

(2,021 |

) |

Transactions with Group owners in their |

|

|

|

|

2 |

|

|

|

9,177 |

|

|

|

(2,021 |

) |

|

|

3,444 |

|

|

|

— |

|

|

|

— |

|

|

|

10,602 |

|

|

|

— |

|

|

|

10,602 |

|

Balance as of December 31st, 2022 |

|

|

|

|

592 |

|

|

|

166,328 |

|

|

|

(2,021 |

) |

|

|

16,185 |

|

|

|

(1,448 |

) |

|

|

219,993 |

|

|

|

399,629 |

|

|

|

(9 |

) |

|

|

399,620 |

|

The accompanying notes are an integral part of these consolidated financial statements.

DLocal Limited

Consolidated Statements of Cash Flows

Years ended December 31, 2024, 2023 and 2022

(All amounts in thousands of U.S. Dollars)

|

|

Notes |

|

2024 |

|

2023 |

|

2022 |

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Profit before income tax |

|

|

|

151,019 |

|

178,514 |

|

120,283 |

Adjustments: |

|

|

|

|

|

|

|

|

Interest income from financial instruments |

|

11 |

|

(28,266) |

|

(49,588) |

|

(18,114) |

Interest charges for lease liabilities |

|

11 |

|

501 |

|

578 |

|

177 |

Other interests charges |

|

|

|

3,758 |

|

5,623 |

|

3,851 |

Finance expense related to derivative financial instruments |

|

|

|

19,462 |

|

28,013 |

|

17,074 |

Amortization of Intangible assets |

|

10 |

|

15,511 |

|

10,816 |

|

6,891 |

Depreciation and disposals of Property, plant and equipment and right-of-use |

|

10 |

|

1,884 |

|

1,409 |

|

1,256 |

Revenue reduction related to prepaid assets |

|

|

|

— |

|

— |

|

567 |

Share-based payment expense, net of forfeitures |

|

9 |

|

23,780 |

|

11,922 |

|

8,684 |

Net exchange differences |

|

|

|

24,787 |

|

82,620 |

|

1,877 |

Fair value loss/(gain) on financial assets at FVPL |

|

11 |

|

(37,416) |

|

(78,640) |

|

36 |

Other operating gain |

|

|

|

4,736 |

|

— |

|

— |

Net Impairment loss/(gain) on financial assets |

|

16 |

|

440 |

|

318 |

|

(42) |

Inflation adjustment and other financial results |

|

|

|

(17,063) |

|

9,041 |

|

— |

|

|

|

|

163,133 |

|

200,626 |

|

142,540 |

Changes in working capital |

|

|

|

|

|

|

|

|

Increase in Trade and other receivables |

|

16 |

|

(162,645) |

|