UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2024

|

BLACKROCK, INC. |

(Exact name of registrant as specified in its charter) |

|

DELAWARE (State or other jurisdiction of incorporation) |

001-42297 (Commission File Number) |

99-1116001 (IRS Employer Identification No.) |

|

50 Hudson Yards, New York, New York |

10001 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 810-5800

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $.01 par value |

|

BLK |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 11, 2024, BlackRock, Inc. (the “Company”) reported results of operations for the three and nine months ended September 30, 2024. A copy of the earnings release issued by the Company is attached as Exhibit 99.1 to this Form 8-K.

Item 7.01. Regulation FD Disclosure

On October 11, 2024, the Company will hold an investor conference call and webcast to discuss the Company’s earnings results for the three and nine months ended September 30, 2024. A copy of supplemental materials used during the conference call and webcast is furnished as Exhibit 99.2 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 |

Earnings release dated October 11, 2024 issued by the Company |

99.2 |

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BlackRock, Inc. |

|

|

|

(Registrant) |

|

|

|

|

|

Date: October 11, 2024 |

By: |

/s/ Martin S. Small |

|

|

|

Martin S. Small |

|

|

|

Senior Managing Director and |

|

|

|

Chief Financial Officer |

|

Exhibit 99.1

|

|

|

|

|

INVESTOR RELATIONS: Caroline Rodda 212.810.3442 |

MEDIA RELATIONS: Ed Sweeney 646.231.0268 |

|

|

BlackRock Reports Third Quarter 2024 Diluted EPS of $10.90, or $11.46 as adjusted |

|

|

New York, October 11, 2024 – BlackRock, Inc. (NYSE: BLK) today reported financial results for the three and nine months ended September 30, 2024. |

|

|

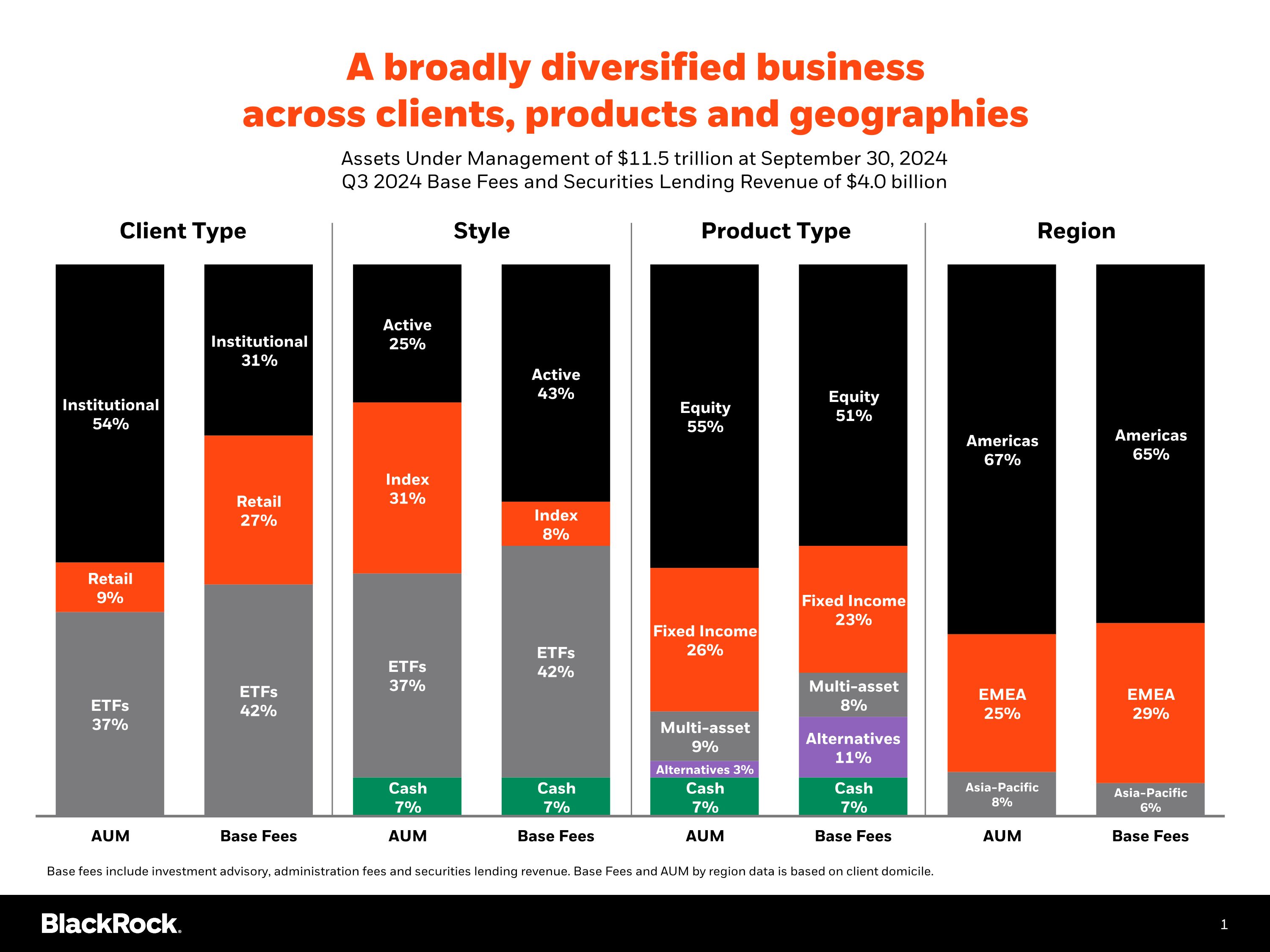

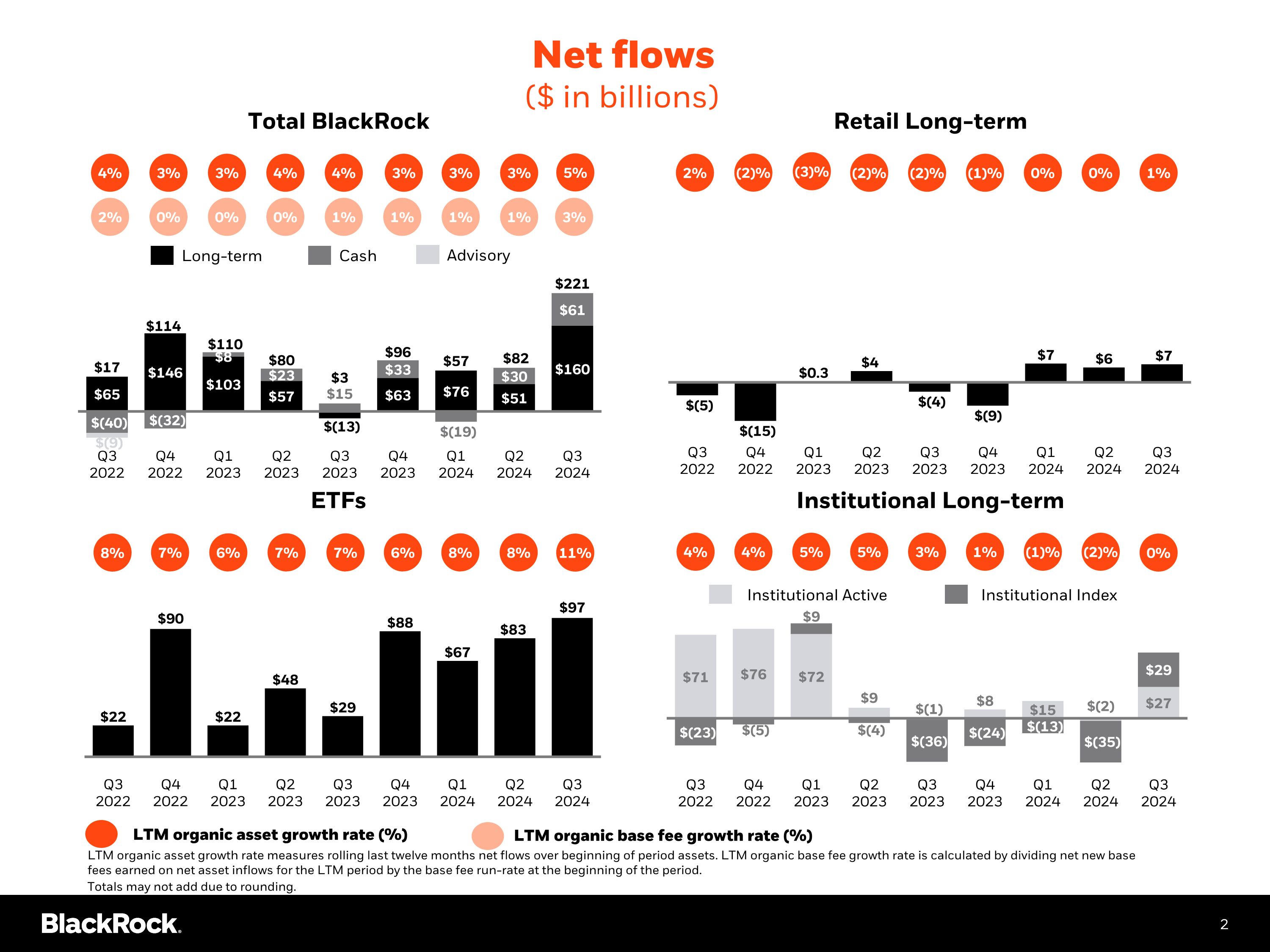

$360 billion of year-to-date total net inflows reflect continued strength of broad-based platform, and surpass full year net inflows of 2022 and 2023 Record $221 billion of quarterly total net inflows represent 8% annualized organic asset growth and were positive across client type, product type, active and index, and regions $11.5 trillion in AUM, up $2.4 trillion year-over-year, driven by $456 billion of net inflows and positive market movements

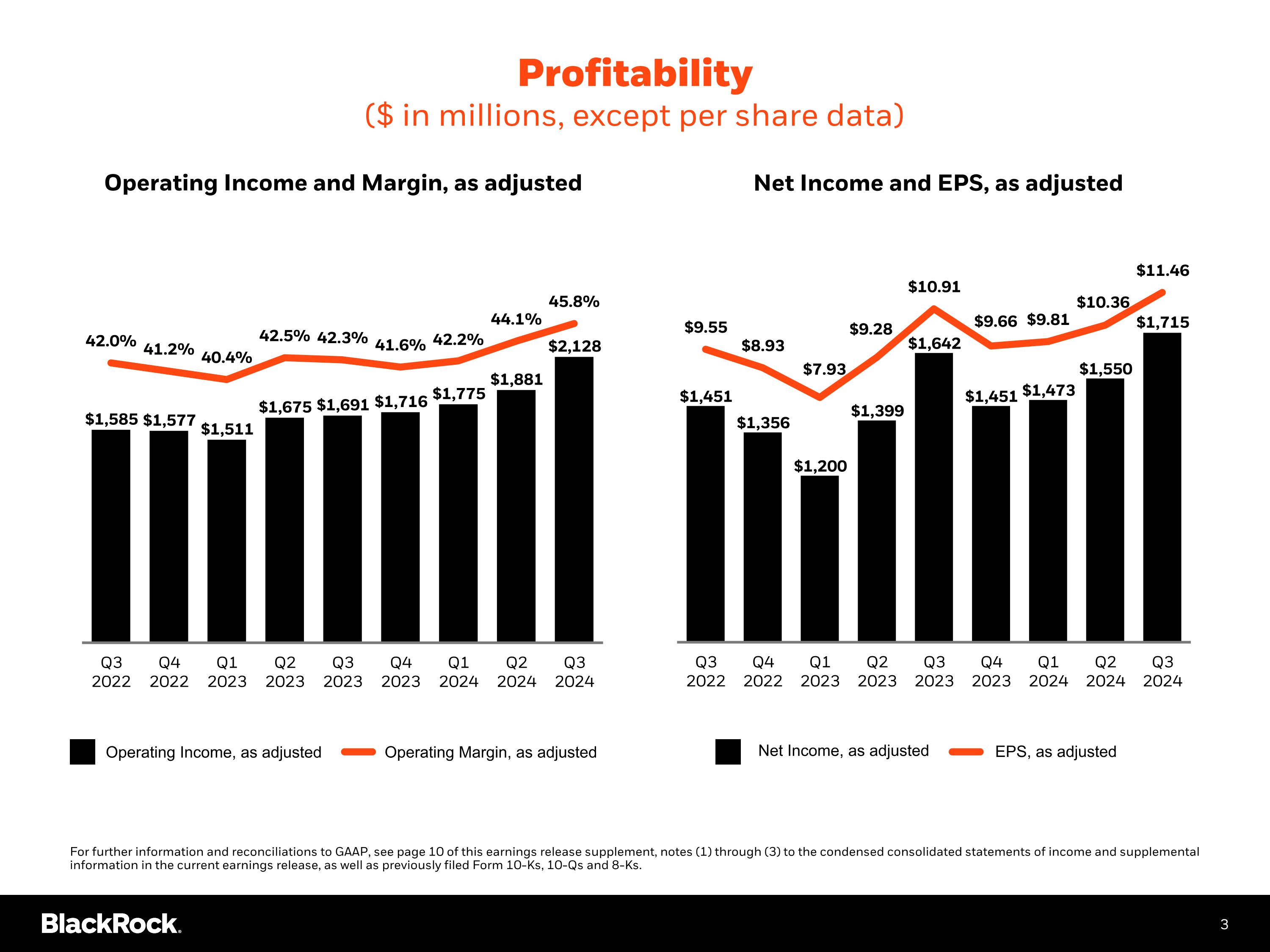

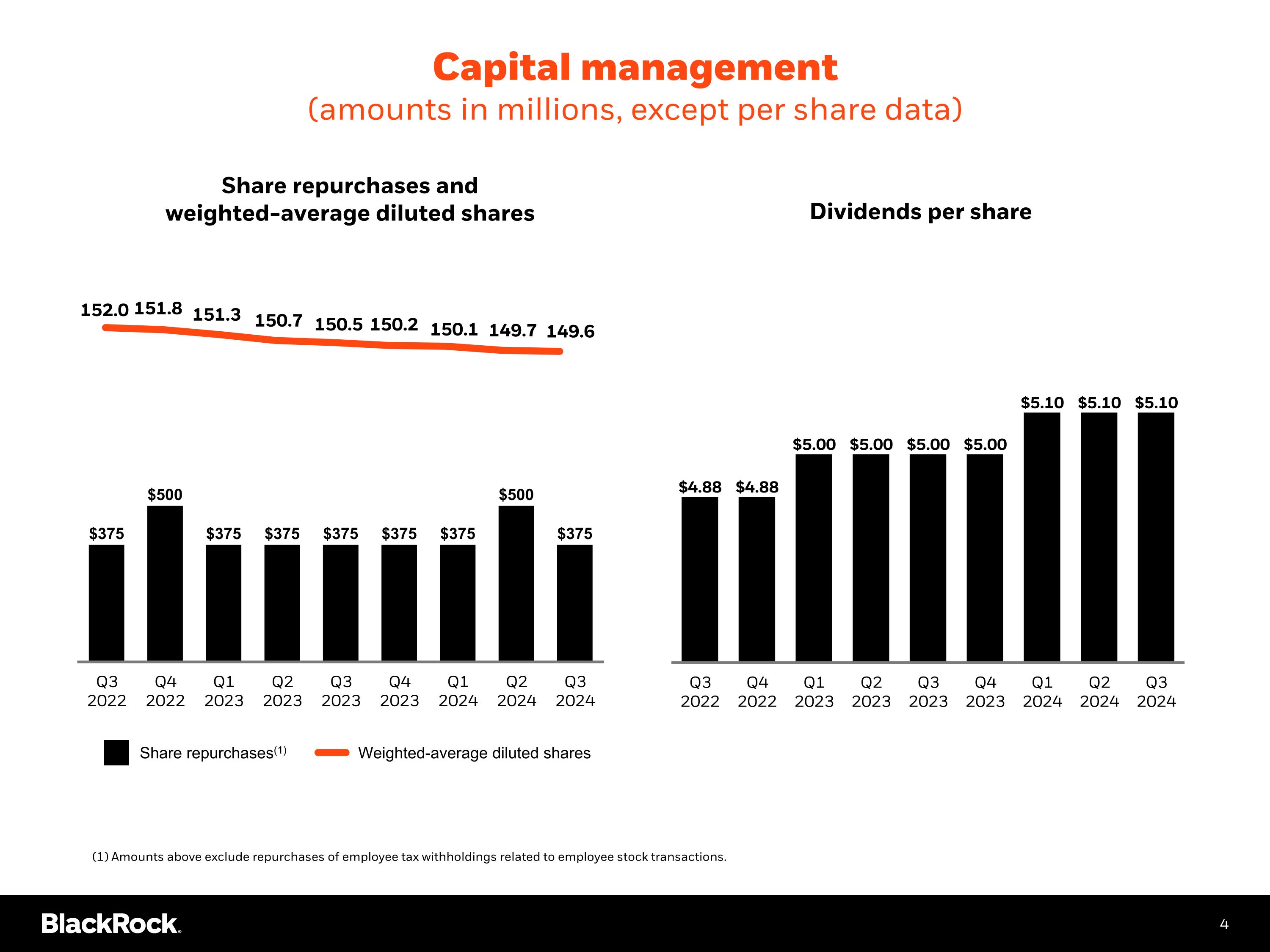

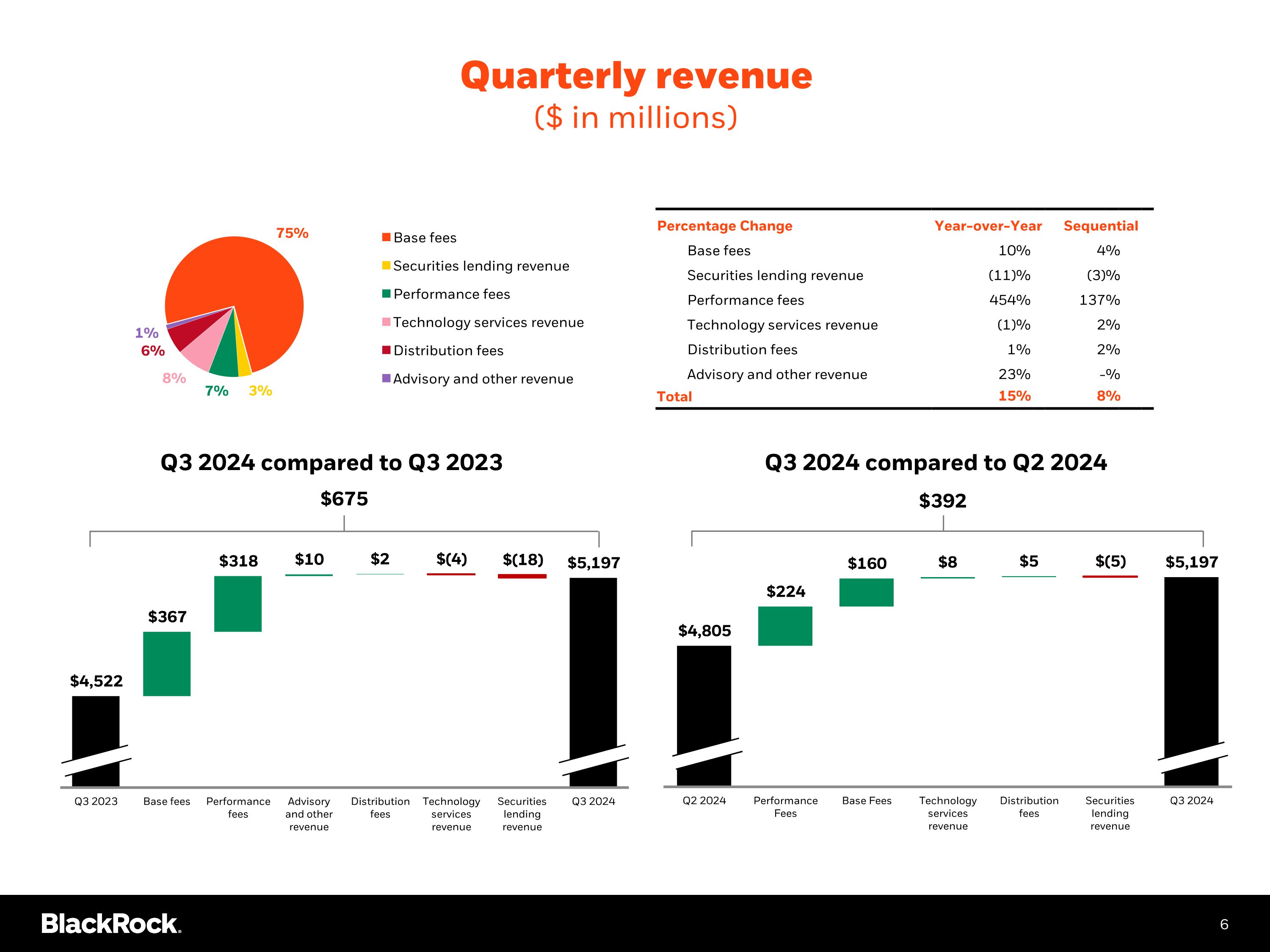

15% increase in revenue year-over-year, driven by the positive impact of markets on average AUM, organic base fee growth, and higher performance fees 23% increase in operating income year-over-year (26% as adjusted) 2% increase in diluted EPS year-over-year (5% as adjusted) also reflects a higher effective tax rate in the current quarter $375 million of share repurchases in the current quarter Closed acquisition of Global Infrastructure Partners ("GIP") on October 1st, adding $116 billion of client AUM and $70 billion of fee-paying AUM |

|

Laurence D. Fink, Chairman and CEO: “Our strategy is ambitious, and our strategy is working. The assets we manage on behalf of our clients reached a new high, ending the third quarter at $11.5 trillion, having grown $2.4 trillion over the last twelve months. In that time, clients have entrusted BlackRock with $456 billion of net inflows, including a record $221 billion in the third quarter. Third quarter organic base fee growth of 5% and technology services ACV growth of 15% are each at multi-year highs. “We are effectively leveraging our technology, scale, and global footprint to deliver profitable growth. Quarterly revenue and operating income both set new records, up 15% and 26% year-over-year, respectively. Our 45.8% operating margin is up 350 basis points. “Through coordinated investments and initiatives, we are evolving our private markets capabilities to best serve our clients. We’re already seeing the power of BlackRock and GIP together as we drive access to the enormous investment potential of infrastructure, especially to support AI innovation. We believe the model portfolio solution we are building will democratize retail access to private markets. And our planned acquisition of Preqin will enhance data and risk analytics needed to support growing private markets allocations. “Our relentless focus on clients, growth mindset and willingness to evolve has generated a compounded annual total return of over 20% for our shareholders since our IPO 25 years ago, well in excess of broader markets. The opportunities ahead of us have never been greater, and we look forward to driving growth for our clients, shareholders and employees in the years to come.” |

FINANCIAL RESULTS |

|

|

NET FLOW HIGHLIGHTS(1) |

|

||||||||||||||

|

Q3 |

|

|

Q3 |

|

|

|

|

|

Q3 |

|

|

YTD |

|

||||

(in millions, except per share data) |

2024 |

|

|

2023 |

|

|

(in billions) |

2024 |

|

|

2024 |

|

||||||

AUM |

$ |

11,475,362 |

|

|

$ |

9,100,825 |

|

|

Long-term net flows: |

$ |

160 |

|

|

$ |

288 |

|

||

% change |

|

26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Average AUM |

$ |

11,070,964 |

|

|

$ |

9,396,597 |

|

|

By region: |

|

|

|

|

|

||||

% change |

|

18 |

% |

|

|

|

|

|

Americas |

$ |

111 |

|

|

$ |

200 |

|

||

Total net flows |

$ |

221,180 |

|

|

$ |

2,569 |

|

|

|

EMEA |

|

20 |

|

|

|

76 |

|

|

|

|

|

|

|

|

|

|

APAC |

|

29 |

|

|

|

12 |

|

|||

GAAP basis: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenue |

$ |

5,197 |

|

|

$ |

4,522 |

|

|

By client type: |

|

|

|

|

|

||||

% change |

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Operating income |

$ |

2,006 |

|

|

$ |

1,637 |

|

|

|

Retail: |

$ |

7 |

|

|

$ |

20 |

|

|

% change |

|

23 |

% |

|

|

|

|

|

|

US |

|

7 |

|

|

|

16 |

|

|

Operating margin |

|

38.6 |

% |

|

|

36.2 |

% |

|

|

|

International |

|

- |

|

|

|

4 |

|

Net income(1) |

$ |

1,631 |

|

|

$ |

1,604 |

|

|

|

|

|

|

|

|

|

|

||

% change |

|

2 |

% |

|

|

|

|

|

ETFs: |

$ |

97 |

|

|

$ |

248 |

|

||

Diluted EPS |

$ |

10.90 |

|

|

$ |

10.66 |

|

|

|

|

Core equity |

|

32 |

|

|

|

101 |

|

% change |

|

2 |

% |

|

|

|

|

|

|

Strategic |

|

45 |

|

|

|

96 |

|

|

Weighted-average diluted shares |

|

149.6 |

|

|

|

150.5 |

|

|

|

|

Precision |

|

20 |

|

|

|

51 |

|

% change |

|

(1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Institutional: |

$ |

56 |

|

|

$ |

20 |

|

|||

As Adjusted(2): |

|

|

|

|

|

|

|

|

Active |

|

27 |

|

|

|

39 |

|

||

Operating income |

$ |

2,128 |

|

|

$ |

1,691 |

|

|

|

|

Index |

|

29 |

|

|

|

(19 |

) |

% change |

|

26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Operating margin |

|

45.8 |

% |

|

|

42.3 |

% |

|

|

|

|

|

|

|

|

|

||

Net income(1) |

$ |

1,715 |

|

|

$ |

1,642 |

|

|

Cash management net flows |

$ |

61 |

|

|

$ |

72 |

|

||

% change |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Diluted EPS |

$ |

11.46 |

|

|

$ |

10.91 |

|

|

|

|

|

|

|

|

|

|

||

% change |

|

5 |

% |

|

|

|

|

Total net flows |

$ |

221 |

|

|

$ |

360 |

|

|||

_________________________ |

|

|

_________________________ |

|

||||||||||||||

(1) Net income represents net income attributable to BlackRock, Inc. |

|

|

(1) Totals may not add due to rounding. |

|

||||||||||||||

1

BUSINESS RESULTS

|

|

|

|

|

|

|

|

|

Q3 2024 |

|

|||||

|

|

|

|

|

Q3 2024 |

|

|

|

Base fees(1) |

|

|||||

|

|

|

|

|

Base fees(1) |

|

September 30, 2024 |

|

and securities |

|

|||||

|

Q3 2024 |

|

September 30, 2024 |

|

and securities |

|

AUM |

|

lending revenue |

|

|||||

(in millions), (unaudited) |

Net flows |

|

AUM |

|

lending revenue |

|

% of Total |

|

% of Total |

|

|||||

RESULTS BY CLIENT TYPE |

|

|

|

|

|

|

|

|

|

|

|||||

Retail |

$ |

6,863 |

|

$ |

1,041,201 |

|

$ |

1,085 |

|

|

9 |

% |

|

27 |

% |

ETFs |

|

97,409 |

|

|

4,188,335 |

|

|

1,726 |

|

|

37 |

% |

|

42 |

% |

Institutional: |

|

|

|

|

|

|

|

|

|

|

|||||

Active |

|

26,695 |

|

|

2,110,944 |

|

|

720 |

|

|

18 |

% |

|

18 |

% |

Index |

|

29,206 |

|

|

3,285,495 |

|

|

235 |

|

|

29 |

% |

|

6 |

% |

Total institutional |

|

55,901 |

|

|

5,396,439 |

|

|

955 |

|

|

47 |

% |

|

24 |

% |

Long-term |

|

160,173 |

|

|

10,625,975 |

|

|

3,766 |

|

|

93 |

% |

|

93 |

% |

Cash management |

|

61,007 |

|

|

849,387 |

|

|

264 |

|

|

7 |

% |

|

7 |

% |

Total |

$ |

221,180 |

|

$ |

11,475,362 |

|

$ |

4,030 |

|

|

100 |

% |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|||||

RESULTS BY INVESTMENT STYLE |

|

|

|

|

|

|

|

|

|

|

|||||

Active |

$ |

28,045 |

|

$ |

2,871,791 |

|

$ |

1,739 |

|

|

25 |

% |

|

43 |

% |

Index and ETFs |

|

132,128 |

|

|

7,754,184 |

|

|

2,027 |

|

|

68 |

% |

|

50 |

% |

Long-term |

|

160,173 |

|

|

10,625,975 |

|

|

3,766 |

|

|

93 |

% |

|

93 |

% |

Cash management |

|

61,007 |

|

|

849,387 |

|

|

264 |

|

|

7 |

% |

|

7 |

% |

Total |

$ |

221,180 |

|

$ |

11,475,362 |

|

$ |

4,030 |

|

|

100 |

% |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|||||

RESULTS BY PRODUCT TYPE |

|

|

|

|

|

|

|

|

|

|

|||||

Equity |

$ |

74,144 |

|

$ |

6,280,999 |

|

$ |

2,060 |

|

|

55 |

% |

|

51 |

% |

Fixed income |

|

62,740 |

|

|

3,023,694 |

|

|

940 |

|

|

26 |

% |

|

23 |

% |

Multi-asset |

|

17,814 |

|

|

1,001,515 |

|

|

325 |

|

|

9 |

% |

|

8 |

% |

Alternatives: |

|

|

|

|

|

|

|

|

|

|

|||||

Illiquid alternatives |

|

1,527 |

|

|

141,409 |

|

|

235 |

|

|

1 |

% |

|

6 |

% |

Liquid alternatives |

|

(851 |

) |

|

75,990 |

|

|

143 |

|

|

1 |

% |

|

3 |

% |

Currency and commodities(2) |

|

4,799 |

|

|

102,368 |

|

|

63 |

|

|

1 |

% |

|

2 |

% |

Total alternatives |

|

5,475 |

|

|

319,767 |

|

|

441 |

|

|

3 |

% |

|

11 |

% |

Long-term |

|

160,173 |

|

|

10,625,975 |

|

|

3,766 |

|

|

93 |

% |

|

93 |

% |

Cash management |

|

61,007 |

|

|

849,387 |

|

|

264 |

|

|

7 |

% |

|

7 |

% |

Total |

$ |

221,180 |

|

$ |

11,475,362 |

|

$ |

4,030 |

|

|

100 |

% |

|

100 |

% |

INVESTMENT PERFORMANCE AT SEPTEMBER 30, 2024(1)

|

One-year period |

Three-year period |

Five-year period |

Fixed income: |

|

|

|

Actively managed AUM above benchmark or peer median |

|

|

|

Taxable |

81% |

79% |

87% |

Tax-exempt |

56% |

50% |

52% |

Index AUM within or above applicable tolerance |

98% |

100% |

100% |

Equity: |

|

|

|

Actively managed AUM above benchmark or peer median |

|

|

|

Fundamental |

41% |

44% |

66% |

Systematic |

93% |

91% |

92% |

Index AUM within or above applicable tolerance |

93% |

100% |

100% |

TELECONFERENCE, WEBCAST AND PRESENTATION INFORMATION

Chairman and Chief Executive Officer, Laurence D. Fink, President, Robert S. Kapito, and Chief Financial Officer, Martin S. Small, will host a teleconference call for investors and analysts on Friday, October 11, 2024 at 7:30 a.m. (Eastern Time). Members of the public who are interested in participating in the teleconference should dial, from the United States, (786) 460-7166, or from outside the United States, (888) 600-4862, shortly before 7:30 a.m. and reference the BlackRock Conference Call (ID Number 3678546). A live, listen-only webcast will also be available via the investor relations section of www.blackrock.com.

The webcast will be available for replay by 10:30 a.m. (Eastern Time) on Friday, October 11, 2024. To access the replay of the webcast, please visit the investor relations section of www.blackrock.com.

ABOUT BLACKROCK

BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. For additional information on BlackRock, please visit www.blackrock.com/corporate.

2

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND SUPPLEMENTAL INFORMATION

(in millions, except per share data), (unaudited)

|

|

|

|

|

|

|

|

Three Months |

|

|

|

|

|

||||||||

|

Three Months Ended |

|

|

|

|

|

|

Ended |

|

|

|

|

|

||||||||

|

September 30, |

|

|

|

|

|

|

June 30, |

|

|

|

|

|

||||||||

|

2024 |

|

|

2023 |

|

|

Change |

|

|

|

2024 |

|

|

Change |

|

|

|||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Investment advisory, administration fees and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

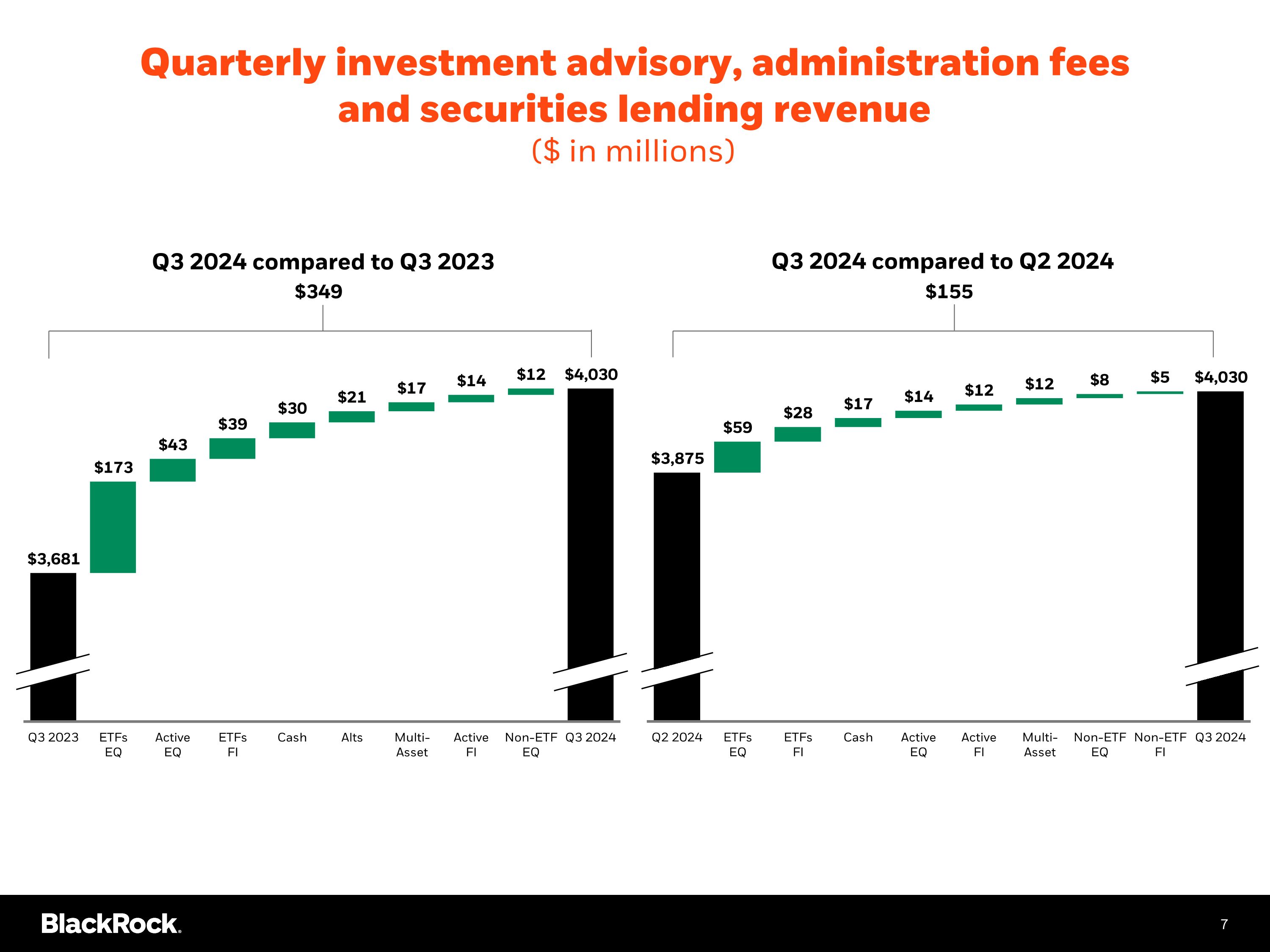

Investment advisory and administration fees |

$ |

3,881 |

|

|

$ |

3,514 |

|

|

$ |

367 |

|

|

|

$ |

3,721 |

|

|

$ |

160 |

|

|

Securities lending revenue |

|

149 |

|

|

|

167 |

|

|

|

(18 |

) |

|

|

|

154 |

|

|

|

(5 |

) |

|

Total investment advisory, administration fees |

|

4,030 |

|

|

|

3,681 |

|

|

|

349 |

|

|

|

|

3,875 |

|

|

|

155 |

|

|

Investment advisory performance fees |

|

388 |

|

|

|

70 |

|

|

|

318 |

|

|

|

|

164 |

|

|

|

224 |

|

|

Technology services revenue |

|

403 |

|

|

|

407 |

|

|

|

(4 |

) |

|

|

|

395 |

|

|

|

8 |

|

|

Distribution fees |

|

323 |

|

|

|

321 |

|

|

|

2 |

|

|

|

|

318 |

|

|

|

5 |

|

|

Advisory and other revenue |

|

53 |

|

|

|

43 |

|

|

|

10 |

|

|

|

|

53 |

|

|

|

- |

|

|

Total revenue |

|

5,197 |

|

|

|

4,522 |

|

|

|

675 |

|

|

|

|

4,805 |

|

|

|

392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Employee compensation and benefits |

|

1,578 |

|

|

|

1,420 |

|

|

|

158 |

|

|

|

|

1,503 |

|

|

|

75 |

|

|

Sales, asset and account expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Distribution and servicing costs |

|

549 |

|

|

|

526 |

|

|

|

23 |

|

|

|

|

539 |

|

|

|

10 |

|

|

Direct fund expense |

|

379 |

|

|

|

354 |

|

|

|

25 |

|

|

|

|

358 |

|

|

|

21 |

|

|

Sub-advisory and other |

|

34 |

|

|

|

28 |

|

|

|

6 |

|

|

|

|

32 |

|

|

|

2 |

|

|

Total sales, asset and account expense |

|

962 |

|

|

|

908 |

|

|

|

54 |

|

|

|

|

929 |

|

|

|

33 |

|

|

General and administration expense |

|

562 |

|

|

|

518 |

|

|

|

44 |

|

|

|

|

534 |

|

|

|

28 |

|

|

Amortization and impairment of intangible assets |

|

89 |

|

|

|

39 |

|

|

|

50 |

|

|

|

|

39 |

|

|

|

50 |

|

|

Total expense |

|

3,191 |

|

|

|

2,885 |

|

|

|

306 |

|

|

|

|

3,005 |

|

|

|

186 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Operating income |

|

2,006 |

|

|

|

1,637 |

|

|

|

369 |

|

|

|

|

1,800 |

|

|

|

206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Nonoperating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net gain (loss) on investments |

|

177 |

|

|

|

114 |

|

|

|

63 |

|

|

|

|

162 |

|

|

|

15 |

|

|

Interest and dividend income |

|

236 |

|

|

|

139 |

|

|

|

97 |

|

|

|

|

178 |

|

|

|

58 |

|

|

Interest expense |

|

(154 |

) |

|

|

(82 |

) |

|

|

(72 |

) |

|

|

|

(126 |

) |

|

|

(28 |

) |

|

Total nonoperating income (expense) |

|

259 |

|

|

|

171 |

|

|

|

88 |

|

|

|

|

214 |

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Income before income taxes |

|

2,265 |

|

|

|

1,808 |

|

|

|

457 |

|

|

|

|

2,014 |

|

|

|

251 |

|

|

Income tax expense |

|

574 |

|

|

|

213 |

|

|

|

361 |

|

|

|

|

477 |

|

|

|

97 |

|

|

Net income |

|

1,691 |

|

|

|

1,595 |

|

|

|

96 |

|

|

|

|

1,537 |

|

|

|

154 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (loss) attributable to noncontrolling |

|

60 |

|

|

|

(9 |

) |

|

|

69 |

|

|

|

|

42 |

|

|

|

18 |

|

|

Net income attributable to BlackRock, Inc. |

$ |

1,631 |

|

|

$ |

1,604 |

|

|

$ |

27 |

|

|

|

$ |

1,495 |

|

|

$ |

136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Weighted-average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Basic |

|

148.0 |

|

|

|

149.2 |

|

|

|

(1.1 |

) |

|

|

|

148.4 |

|

|

|

(0.4 |

) |

|

Diluted |

|

149.6 |

|

|

|

150.5 |

|

|

|

(0.9 |

) |

|

|

|

149.7 |

|

|

|

(0.0 |

) |

|

Earnings per share attributable to BlackRock, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Basic |

$ |

11.02 |

|

|

$ |

10.75 |

|

|

$ |

0.27 |

|

|

|

$ |

10.07 |

|

|

$ |

0.95 |

|

|

Diluted |

$ |

10.90 |

|

|

$ |

10.66 |

|

|

$ |

0.24 |

|

|

|

$ |

9.99 |

|

|

$ |

0.91 |

|

|

Cash dividends declared and paid per share |

$ |

5.10 |

|

|

$ |

5.00 |

|

|

$ |

0.10 |

|

|

|

$ |

5.10 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Supplemental information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

AUM (end of period) |

$ |

11,475,362 |

|

|

$ |

9,100,825 |

|

|

$ |

2,374,537 |

|

|

|

$ |

10,645,721 |

|

|

$ |

829,641 |

|

|

Shares outstanding (end of period) |

|

148.0 |

|

|

|

148.9 |

|

|

|

(1.0 |

) |

|

|

|

148.2 |

|

|

|

(0.2 |

) |

|

GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Operating margin |

|

38.6 |

% |

|

|

36.2 |

% |

|

|

240 |

|

bps |

|

|

37.5 |

% |

|

|

110 |

|

bps |

Effective tax rate |

|

26.0 |

% |

|

|

11.7 |

% |

|

|

1,430 |

|

bps |

|

|

24.2 |

% |

|

|

180 |

|

bps |

As adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Operating income (1) |

$ |

2,128 |

|

|

$ |

1,691 |

|

|

$ |

437 |

|

|

|

$ |

1,881 |

|

|

$ |

247 |

|

|

Operating margin (1) |

|

45.8 |

% |

|

|

42.3 |

% |

|

|

350 |

|

bps |

|

|

44.1 |

% |

|

|

170 |

|

bps |

Nonoperating income (expense), less net income |

$ |

190 |

|

|

$ |

184 |

|

|

$ |

6 |

|

|

|

$ |

165 |

|

|

$ |

25 |

|

|

Net income attributable to BlackRock, Inc. (3) |

$ |

1,715 |

|

|

$ |

1,642 |

|

|

$ |

73 |

|

|

|

$ |

1,550 |

|

|

$ |

165 |

|

|

Diluted earnings attributable to BlackRock, Inc. |

$ |

11.46 |

|

|

$ |

10.91 |

|

|

$ |

0.55 |

|

|

|

$ |

10.36 |

|

|

$ |

1.10 |

|

|

Effective tax rate |

|

26.0 |

% |

|

|

12.4 |

% |

|

|

1,360 |

|

bps |

|

|

24.2 |

% |

|

|

180 |

|

bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

See pages 11 through 13 for the reconciliation to accounting principles generally accepted in the United States ("GAAP") and notes (1) through (3) to the condensed consolidated statements of income and supplemental information for more information on as adjusted items. Beginning in the first quarter of 2024, BlackRock, Inc. updated the presentation of the Company’s expense line items within the condensed consolidated statements of income by including a new “sales, asset and account expense” income statement caption. Such expense line items have been recast for 2023 to conform to this new presentation. For a recast of 2023 expense line items, see page 12 of Exhibit 99.1 to the Current Report on Form 8-K furnished on April 12, 2024.

3

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND SUPPLEMENTAL INFORMATION

(in millions, except per share data), (unaudited)

|

|

|

|

|

|

|

|

|

|

|||

|

Nine Months Ended |

|

|

|

|

|

||||||

|

September 30, |

|

|

|

|

|

||||||

|

2024 |

|

|

2023 |

|

|

Change |

|

|

|||

Revenue |

|

|

|

|

|

|

|

|

|

|||

Investment advisory, administration fees and |

|

|

|

|

|

|

|

|

|

|||

Investment advisory and administration fees |

$ |

11,229 |

|

|

$ |

10,276 |

|

|

$ |

953 |

|

|

Securities lending revenue |

|

454 |

|

|

|

518 |

|

|

|

(64 |

) |

|

Total investment advisory, administration fees |

|

11,683 |

|

|

|

10,794 |

|

|

|

889 |

|

|

Investment advisory performance fees |

|

756 |

|

|

|

243 |

|

|

|

513 |

|

|

Technology services revenue |

|

1,175 |

|

|

|

1,106 |

|

|

|

69 |

|

|

Distribution fees |

|

951 |

|

|

|

959 |

|

|

|

(8 |

) |

|

Advisory and other revenue |

|

165 |

|

|

|

126 |

|

|

|

39 |

|

|

Total revenue |

|

14,730 |

|

|

|

13,228 |

|

|

|

1,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Expense |

|

|

|

|

|

|

|

|

|

|||

Employee compensation and benefits |

|

4,661 |

|

|

|

4,276 |

|

|

|

385 |

|

|

Sales, asset and account expense: |

|

|

|

|

|

|

|

|

|

|||

Distribution and servicing costs |

|

1,606 |

|

|

|

1,549 |

|

|

|

57 |

|

|

Direct fund expense |

|

1,075 |

|

|

|

1,013 |

|

|

|

62 |

|

|

Sub-advisory and other |

|

98 |

|

|

|

81 |

|

|

|

17 |

|

|

Total sales, asset and account expense |

|

2,779 |

|

|

|

2,643 |

|

|

|

136 |

|

|

General and administration expense |

|

1,625 |

|

|

|

1,506 |

|

|

|

119 |

|

|

Amortization and impairment of intangible assets |

|

166 |

|

|

|

113 |

|

|

|

53 |

|

|

Total expense |

|

9,231 |

|

|

|

8,538 |

|

|

|

693 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Operating income |

|

5,499 |

|

|

|

4,690 |

|

|

|

809 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Nonoperating income (expense) |

|

|

|

|

|

|

|

|

|

|||

Net gain (loss) on investments |

|

510 |

|

|

|

434 |

|

|

|

76 |

|

|

Interest and dividend income |

|

555 |

|

|

|

314 |

|

|

|

241 |

|

|

Interest expense |

|

(372 |

) |

|

|

(210 |

) |

|

|

(162 |

) |

|

Total nonoperating income (expense) |

|

693 |

|

|

|

538 |

|

|

|

155 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income before income taxes |

|

6,192 |

|

|

|

5,228 |

|

|

|

964 |

|

|

Income tax expense |

|

1,341 |

|

|

|

1,041 |

|

|

|

300 |

|

|

Net income |

|

4,851 |

|

|

|

4,187 |

|

|

|

664 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|||

Net income (loss) attributable to noncontrolling |

|

152 |

|

|

|

60 |

|

|

|

92 |

|

|

Net income attributable to BlackRock, Inc. |

$ |

4,699 |

|

|

$ |

4,127 |

|

|

$ |

572 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Weighted-average common shares outstanding |

|

|

|

|

|

|

|

|

|

|||

Basic |

|

148.4 |

|

|

|

149.6 |

|

|

|

(1.2 |

) |

|

Diluted |

|

149.8 |

|

|

|

150.9 |

|

|

|

(1.1 |

) |

|

Earnings per share attributable to BlackRock, Inc. |

|

|

|

|

|

|

|

|

|

|||

Basic |

$ |

31.67 |

|

|

$ |

27.60 |

|

|

$ |

4.07 |

|

|

Diluted |

$ |

31.37 |

|

|

$ |

27.36 |

|

|

$ |

4.01 |

|

|

Cash dividends declared and paid per share |

$ |

15.30 |

|

|

$ |

15.00 |

|

|

$ |

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Supplemental information: |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

AUM (end of period) |

$ |

11,475,362 |

|

|

$ |

9,100,825 |

|

|

$ |

2,374,537 |

|

|

Shares outstanding (end of period) |

|

148.0 |

|

|

|

148.9 |

|

|

|

(1.0 |

) |

|

GAAP: |

|

|

|

|

|

|

|

|

|

|||

Operating margin |

|

37.3 |

% |

|

|

35.5 |

% |

|

|

180 |

|

bps |

Effective tax rate |

|

22.2 |

% |

|

|

20.1 |

% |

|

|

210 |

|

bps |

As adjusted: |

|

|

|

|

|

|

|

|

|

|||

Operating income (1) |

$ |

5,784 |

|

|

$ |

4,877 |

|

|

$ |

907 |

|

|

Operating margin (1) |

|

44.1 |

% |

|

|

41.8 |

% |

|

|

230 |

|

bps |

Nonoperating income (expense), less net income |

$ |

494 |

|

|

$ |

449 |

|

|

$ |

45 |

|

|

Net income attributable to BlackRock, Inc. (3) |

$ |

4,738 |

|

|

$ |

4,241 |

|

|

$ |

497 |

|

|

Diluted earnings attributable to BlackRock, Inc. |

$ |

31.63 |

|

|

$ |

28.11 |

|

|

$ |

3.52 |

|

|

Effective tax rate |

|

24.5 |

% |

|

|

20.4 |

% |

|

|

410 |

|

bps |

|

|

|

|

|

|

|

|

|

|

|||

See pages 11 through 13 for the reconciliation to GAAP and notes (1) through (3) to the condensed consolidated statements of income and supplemental information for more information on as adjusted items. Beginning in the first quarter of 2024, BlackRock, Inc. updated the presentation of the Company’s expense line items within the condensed consolidated statements of income by including a new “sales, asset and account expense” income statement caption. Such expense line items have been recast for 2023 to conform to this new presentation. For a recast of 2023 expense line items, see page 12 of Exhibit 99.1 to the Current Report on Form 8-K furnished on April 12, 2024.

4

ASSETS UNDER MANAGEMENT

(in millions), (unaudited)

Current Quarter Component Changes by Client Type and Product Type |

|

||||||||||||||||||||||

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

June 30, |

|

|

inflows |

|

|

Market |

|

|

|

|

|

September 30, |

|

|

|

|

||||||

|

2024 |

|

|

(outflows) |

|

|

change |

|

|

FX impact(1) |

|

|

2024 |

|

|

Average AUM(2) |

|

||||||

Retail: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

$ |

490,427 |

|

|

$ |

5,234 |

|

|

$ |

19,005 |

|

|

$ |

6,604 |

|

|

$ |

521,270 |

|

|

$ |

506,725 |

|

Fixed income |

|

313,632 |

|

|

|

2,718 |

|

|

|

7,127 |

|

|

|

768 |

|

|

|

324,245 |

|

|

|

318,285 |

|

Multi-asset |

|

147,719 |

|

|

|

(1,304 |

) |

|

|

7,209 |

|

|

|

454 |

|

|

|

154,078 |

|

|

|

150,787 |

|

Alternatives |

|

40,374 |

|

|

|

215 |

|

|

|

638 |

|

|

|

381 |

|

|

|

41,608 |

|

|

|

40,911 |

|

Retail subtotal |

|

992,152 |

|

|

|

6,863 |

|

|

|

33,979 |

|

|

|

8,207 |

|

|

|

1,041,201 |

|

|

|

1,016,708 |

|

ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

|

2,830,268 |

|

|

|

44,548 |

|

|

|

174,748 |

|

|

|

12,276 |

|

|

|

3,061,840 |

|

|

|

2,951,255 |

|

Fixed income |

|

931,217 |

|

|

|

47,810 |

|

|

|

34,440 |

|

|

|

5,709 |

|

|

|

1,019,176 |

|

|

|

979,055 |

|

Multi-asset |

|

9,204 |

|

|

|

314 |

|

|

|

472 |

|

|

|

46 |

|

|

|

10,036 |

|

|

|

9,605 |

|

Alternatives |

|

85,085 |

|

|

|

4,737 |

|

|

|

7,394 |

|

|

|

67 |

|

|

|

97,283 |

|

|

|

91,437 |

|

ETFs subtotal |

|

3,855,774 |

|

|

|

97,409 |

|

|

|

217,054 |

|

|

|

18,098 |

|

|

|

4,188,335 |

|

|

|

4,031,352 |

|

Institutional: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Active: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

|

208,177 |

|

|

|

3,743 |

|

|

|

8,173 |

|

|

|

5,268 |

|

|

|

225,361 |

|

|

|

216,753 |

|

Fixed income |

|

823,716 |

|

|

|

3,504 |

|

|

|

36,659 |

|

|

|

9,506 |

|

|

|

873,385 |

|

|

|

852,571 |

|

Multi-asset |

|

761,194 |

|

|

|

18,866 |

|

|

|

42,870 |

|

|

|

11,045 |

|

|

|

833,975 |

|

|

|

793,568 |

|

Alternatives |

|

175,145 |

|

|

|

582 |

|

|

|

431 |

|

|

|

2,065 |

|

|

|

178,223 |

|

|

|

176,059 |

|

Active subtotal |

|

1,968,232 |

|

|

|

26,695 |

|

|

|

88,133 |

|

|

|

27,884 |

|

|

|

2,110,944 |

|

|

|

2,038,951 |

|

Index: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

|

2,298,263 |

|

|

|

20,619 |

|

|

|

109,142 |

|

|

|

44,504 |

|

|

|

2,472,528 |

|

|

|

2,387,641 |

|

Fixed income |

|

747,319 |

|

|

|

8,708 |

|

|

|

12,778 |

|

|

|

38,083 |

|

|

|

806,888 |

|

|

|

778,392 |

|

Multi-asset |

|

3,295 |

|

|

|

(62 |

) |

|

|

130 |

|

|

|

63 |

|

|

|

3,426 |

|

|

|

3,348 |

|

Alternatives |

|

2,644 |

|

|

|

(59 |

) |

|

|

11 |

|

|

|

57 |

|

|

|

2,653 |

|

|

|

2,603 |

|

Index subtotal |

|

3,051,521 |

|

|

|

29,206 |

|

|

|

122,061 |

|

|

|

82,707 |

|

|

|

3,285,495 |

|

|

|

3,171,984 |

|

Institutional subtotal |

|

5,019,753 |

|

|

|

55,901 |

|

|

|

210,194 |

|

|

|

110,591 |

|

|

|

5,396,439 |

|

|

|

5,210,935 |

|

Long-term |

|

9,867,679 |

|

|

|

160,173 |

|

|

|

461,227 |

|

|

|

136,896 |

|

|

|

10,625,975 |

|

|

|

10,258,995 |

|

Cash management |

|

778,042 |

|

|

|

61,007 |

|

|

|

3,092 |

|

|

|

7,246 |

|

|

|

849,387 |

|

|

|

811,969 |

|

Total |

$ |

10,645,721 |

|

|

$ |

221,180 |

|

|

$ |

464,319 |

|

|

$ |

144,142 |

|

|

$ |

11,475,362 |

|

|

$ |

11,070,964 |

|

Current Quarter Component Changes by Investment Style and Product Type (Long-Term) |

|

||||||||||||||||||||||

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

June 30, |

|

|

inflows |

|

|

Market |

|

|

|

|

|

September 30, |

|

|

|

|

||||||

|

2024 |

|

|

(outflows) |

|

|

change |

|

|

FX impact(1) |

|

|

2024 |

|

|

Average AUM(2) |

|

||||||

Active: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

$ |

466,518 |

|

|

$ |

2,733 |

|

|

$ |

14,916 |

|

|

$ |

8,026 |

|

|

$ |

492,193 |

|

|

$ |

479,372 |

|

Fixed income |

|

1,112,578 |

|

|

|

6,954 |

|

|

|

43,054 |

|

|

|

9,153 |

|

|

|

1,171,739 |

|

|

|

1,145,337 |

|

Multi-asset |

|

908,897 |

|

|

|

17,561 |

|

|

|

50,079 |

|

|

|

11,498 |

|

|

|

988,035 |

|

|

|

944,338 |

|

Alternatives |

|

215,513 |

|

|

|

797 |

|

|

|

1,068 |

|

|

|

2,446 |

|

|

|

219,824 |

|

|

|

216,968 |

|

Active subtotal |

|

2,703,506 |

|

|

|

28,045 |

|

|

|

109,117 |

|

|

|

31,123 |

|

|

|

2,871,791 |

|

|

|

2,786,015 |

|

Index and ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

|

2,830,268 |

|

|

|

44,548 |

|

|

|

174,748 |

|

|

|

12,276 |

|

|

|

3,061,840 |

|

|

|

2,951,255 |

|

Fixed income |

|

931,217 |

|

|

|

47,810 |

|

|

|

34,440 |

|

|

|

5,709 |

|

|

|

1,019,176 |

|

|

|

979,055 |

|

Multi-asset |

|

9,204 |

|

|

|

314 |

|

|

|

472 |

|

|

|

46 |

|

|

|

10,036 |

|

|

|

9,605 |

|

Alternatives |

|

85,085 |

|

|

|

4,737 |

|

|

|

7,394 |

|

|

|

67 |

|

|

|

97,283 |

|

|

|

91,437 |

|

ETFs subtotal |

|

3,855,774 |

|

|

|

97,409 |

|

|

|

217,054 |

|

|

|

18,098 |

|

|

|

4,188,335 |

|

|

|

4,031,352 |

|

Non-ETF index: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Equity |

|

2,530,349 |

|

|

|

26,863 |

|

|

|

121,404 |

|

|

|

48,350 |

|

|

|

2,726,966 |

|

|

|

2,631,747 |

|

Fixed income |

|

772,089 |

|

|

|

7,976 |

|

|

|

13,510 |

|

|

|

39,204 |

|

|

|

832,779 |

|

|

|

803,911 |

|

Multi-asset |

|

3,311 |

|

|

|

(61 |

) |

|

|

130 |

|

|

|

64 |

|

|

|

3,444 |

|

|

|

3,365 |

|

Alternatives |

|

2,650 |

|

|

|

(59 |

) |

|

|

12 |

|

|

|

57 |

|

|

|

2,660 |

|

|

|

2,605 |

|

Non-ETF index subtotal |

|

3,308,399 |

|

|

|

34,719 |

|

|

|

135,056 |

|

|

|

87,675 |

|

|

|

3,565,849 |

|

|

|

3,441,628 |

|

Index and ETFs subtotal |

|

7,164,173 |

|

|

|

132,128 |

|

|

|

352,110 |

|

|

|

105,773 |

|

|

|

7,754,184 |

|

|

|

7,472,980 |

|

Long-term |

$ |

9,867,679 |

|

|

$ |

160,173 |

|

|

$ |

461,227 |

|

|

$ |

136,896 |

|

|

$ |

10,625,975 |

|

|

$ |

10,258,995 |

|

Current Quarter Component Changes by Product Type (Long-Term) |

|

||||||||||||||||||||||

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

June 30, |

|

|

inflows |

|

|

Market |

|

|

|

|

|

September 30, |

|

|

|

|

||||||

|

2024 |

|

|

(outflows) |

|

|

change |

|

|

FX impact(1) |

|

|

2024 |

|

|

Average AUM(2) |

|

||||||

Equity |

$ |

5,827,135 |

|

|

$ |

74,144 |

|

|

$ |

311,068 |

|

|

$ |

68,652 |

|

|

$ |

6,280,999 |

|

|

$ |

6,062,374 |

|

Fixed income |

|

2,815,884 |

|

|

|

62,740 |

|

|

|

91,004 |

|

|

|

54,066 |

|

|

|

3,023,694 |

|

|

|

2,928,303 |

|

Multi-asset |

|

921,412 |

|

|

|

17,814 |

|

|

|

50,681 |

|

|

|

11,608 |

|

|

|

1,001,515 |

|

|

|

957,308 |

|

Alternatives: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Illiquid alternatives |

|

137,868 |

|

|

|

1,527 |

|

|

|

226 |

|

|

|

1,788 |

|

|

|

141,409 |

|

|

|

139,173 |

|

Liquid alternatives |

|

75,483 |

|

|

|

(851 |

) |

|

|

821 |

|

|

|

537 |

|

|

|

75,990 |

|

|

|

75,532 |

|

Currency and commodities(3) |

|

89,897 |

|

|

|

4,799 |

|

|

|

7,427 |

|

|

|

245 |

|

|

|

102,368 |

|

|

|

96,305 |

|

Alternatives subtotal |

|

303,248 |

|

|

|

5,475 |

|

|

|

8,474 |

|

|

|

2,570 |

|

|

|

319,767 |

|

|

|

311,010 |

|

Long-term |

$ |

9,867,679 |

|

|

$ |

160,173 |

|

|

$ |

461,227 |

|

|

$ |

136,896 |

|

|

$ |

10,625,975 |

|

|

$ |

10,258,995 |

|

5

ASSETS UNDER MANAGEMENT

(in millions), (unaudited)

Year-to-Date Component Changes by Client Type and Product Type |

|

||||||||||||||||||||||||||

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

December 31, |

|

|

inflows |

|

|

|

|

|

Market |

|

|

|

|

|

September 30, |

|

|

|

|

|||||||

|

2023 |

|

|

(outflows) |

|

|

Acquisition(1) |

|

|

change |

|

|

FX impact(2) |

|

|

2024 |

|

|

Average AUM(3) |

|

|||||||

Retail: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

$ |

435,734 |

|

|

$ |

15,411 |

|

|

$ |

4,074 |

|

|

$ |

61,467 |

|

|

$ |

4,584 |

|

|

$ |

521,270 |

|

|

$ |

476,890 |

|

Fixed income |

|

312,799 |

|

|

|

7,517 |

|

|

|

- |

|

|

|

6,306 |

|

|

|

(2,377 |

) |

|

|

324,245 |

|

|

|

315,181 |

|

Multi-asset |

|

139,537 |

|

|

|

(1,904 |

) |

|

|

- |

|

|

|

16,329 |

|

|

|

116 |

|

|

|

154,078 |

|

|

|

145,865 |

|

Alternatives |

|

41,627 |

|

|

|

(1,306 |

) |

|

|

- |

|

|

|

1,078 |

|

|

|

209 |

|

|

|

41,608 |

|

|

|

41,077 |

|

Retail subtotal |

|

929,697 |

|

|

|

19,718 |

|

|

|

4,074 |

|

|

|

85,180 |

|

|

|

2,532 |

|

|

|

1,041,201 |

|

|

|

979,013 |

|

ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

|

2,532,631 |

|

|

|

125,756 |

|

|

|

- |

|

|

|

402,936 |

|

|

|

517 |

|

|

|

3,061,840 |

|

|

|

2,769,010 |

|

Fixed income |

|

898,403 |

|

|

|

100,506 |

|

|

|

- |

|

|

|

18,665 |

|

|

|

1,602 |

|

|

|

1,019,176 |

|

|

|

932,580 |

|

Multi-asset |

|

9,140 |

|

|

|

(45 |

) |

|

|

- |

|

|

|

994 |

|

|

|

(53 |

) |

|

|

10,036 |

|

|

|

9,178 |

|

Alternatives |

|

59,125 |

|

|

|

21,574 |

|

|

|

- |

|

|

|

16,587 |

|

|

|

(3 |

) |

|

|

97,283 |

|

|

|

79,853 |

|

ETFs subtotal |

|

3,499,299 |

|

|

|

247,791 |

|

|

|

- |

|

|

|

439,182 |

|

|

|

2,063 |

|

|

|

4,188,335 |

|

|

|

3,790,621 |

|

Institutional: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Active: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

|

186,688 |

|

|

|

7,431 |

|

|

|

- |

|

|

|

28,443 |

|

|

|

2,799 |

|

|

|

225,361 |

|

|

|

204,027 |

|

Fixed income |

|

836,823 |

|

|

|

(1,334 |

) |

|

|

- |

|

|

|

35,143 |

|

|

|

2,753 |

|

|

|

873,385 |

|

|

|

840,954 |

|

Multi-asset |

|

717,182 |

|

|

|

31,043 |

|

|

|

- |

|

|

|

80,939 |

|

|

|

4,811 |

|

|

|

833,975 |

|

|

|

755,639 |

|

Alternatives |

|

171,980 |

|

|

|

2,182 |

|

|

|

- |

|

|

|

3,169 |

|

|

|

892 |

|

|

|

178,223 |

|

|

|

174,049 |

|

Active subtotal |

|

1,912,673 |

|

|

|

39,322 |

|

|

|

- |

|

|

|

147,694 |

|

|

|

11,255 |

|

|

|

2,110,944 |

|

|

|

1,974,669 |

|

Index: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

|

2,138,291 |

|

|

|

(49,596 |

) |

|

|

- |

|

|

|

373,927 |

|

|

|

9,906 |

|

|

|

2,472,528 |

|

|

|

2,283,907 |

|

Fixed income |

|

756,001 |

|

|

|

33,196 |

|

|

|

- |

|

|

|

9,321 |

|

|

|

8,370 |

|

|

|

806,888 |

|

|

|

756,389 |

|

Multi-asset |

|

4,945 |

|

|

|

(1,723 |

) |

|

|

- |

|

|

|

205 |

|

|

|

(1 |

) |

|

|

3,426 |

|

|

|

3,813 |

|

Alternatives |

|

3,252 |

|

|

|

(755 |

) |

|

|

- |

|

|

|

147 |

|

|

|

9 |

|

|

|

2,653 |

|

|

|

2,791 |

|

Index subtotal |

|

2,902,489 |

|

|

|

(18,878 |

) |

|

|

- |

|

|

|

383,600 |

|

|

|

18,284 |

|

|

|

3,285,495 |

|

|

|

3,046,900 |

|

Institutional subtotal |

|

4,815,162 |

|

|

|

20,444 |

|

|

|

- |

|

|

|

531,294 |

|

|

|

29,539 |

|

|

|

5,396,439 |

|

|

|

5,021,569 |

|

Long-term |

|

9,244,158 |

|

|

|

287,953 |

|

|

|

4,074 |

|

|

|

1,055,656 |

|

|

|

34,134 |

|

|

|

10,625,975 |

|

|

|

9,791,203 |

|

Cash management |

|

764,837 |

|

|

|

71,982 |

|

|

|

- |

|

|

|

8,084 |

|

|

|

4,484 |

|

|

|

849,387 |

|

|

|

779,369 |

|

Total |

$ |

10,008,995 |

|

|

$ |

359,935 |

|

|

$ |

4,074 |

|

|

$ |

1,063,740 |

|

|

$ |

38,618 |

|

|

$ |

11,475,362 |

|

|

$ |

10,570,572 |

|

Year-to-Date Component Changes by Investment Style and Product Type (Long-Term) |

|

||||||||||||||||||||||||||

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

December 31, |

|

|

inflows |

|

|

|

|

|

Market |

|

|

|

|

|

September 30, |

|

|

|

|

|||||||

|

2023 |

|

|

(outflows) |

|

|

Acquisition(1) |

|

|

change |

|

|

FX impact(2) |

|

|

2024 |

|

|

Average AUM(3) |

|

|||||||

Active: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

$ |

427,448 |

|

|

$ |

1,724 |

|

|

$ |

4,074 |

|

|

$ |

54,677 |

|

|

$ |

4,270 |

|

|

$ |

492,193 |

|

|

$ |

457,176 |

|

Fixed income |

|

1,123,422 |

|

|

|

7,604 |

|

|

|

- |

|

|

|

41,139 |

|

|

|

(426 |

) |

|

|

1,171,739 |

|

|

|

1,130,958 |

|

Multi-asset |

|

856,705 |

|

|

|

29,133 |

|

|

|

- |

|

|

|

97,271 |

|

|

|

4,926 |

|

|

|

988,035 |

|

|

|

901,490 |

|

Alternatives |

|

213,603 |

|

|

|

873 |

|

|

|

- |

|

|

|

4,247 |

|

|

|

1,101 |

|

|

|

219,824 |

|

|

|

215,123 |

|

Active subtotal |

|

2,621,178 |

|

|

|

39,334 |

|

|

|

4,074 |

|

|

|

197,334 |

|

|

|

9,871 |

|

|

|

2,871,791 |

|

|

|

2,704,747 |

|

Index and ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

ETFs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

|

2,532,631 |

|

|

|

125,756 |

|

|

|

- |

|

|

|

402,936 |

|

|

|

517 |

|

|

|

3,061,840 |

|

|

|

2,769,010 |

|

Fixed income |

|

898,403 |

|

|

|

100,506 |

|

|

|

- |

|

|

|

18,665 |

|

|

|

1,602 |

|

|

|

1,019,176 |

|

|

|

932,580 |

|

Multi-asset |

|

9,140 |

|

|

|

(45 |

) |

|

|

- |

|

|

|

994 |

|

|

|

(53 |

) |

|

|

10,036 |

|

|

|

9,178 |

|

Alternatives |

|

59,125 |

|

|

|

21,574 |

|

|

|

- |

|

|

|

16,587 |

|

|

|

(3 |

) |

|

|

97,283 |

|

|

|

79,853 |

|

ETFs subtotal |

|

3,499,299 |

|

|

|

247,791 |

|

|

|

- |

|

|

|

439,182 |

|

|

|

2,063 |

|

|

|

4,188,335 |

|

|

|

3,790,621 |

|

Non-ETF index: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Equity |

|

2,333,265 |

|

|

|

(28,478 |

) |

|

|

- |

|

|

|

409,160 |

|

|

|

13,019 |

|

|

|

2,726,966 |

|

|

|

2,507,648 |

|

Fixed income |

|

782,201 |

|

|

|

31,775 |

|

|

|

- |

|

|

|

9,631 |

|

|

|

9,172 |

|

|

|

832,779 |

|

|

|

781,566 |

|

Multi-asset |

|

4,959 |

|

|

|

(1,717 |

) |

|

|

- |

|

|

|

202 |

|

|

|

- |

|

|

|

3,444 |

|

|

|

3,827 |

|

Alternatives |

|

3,256 |

|

|

|

(752 |

) |

|

|

- |

|

|

|

147 |

|

|

|

9 |

|

|

|

2,660 |

|

|

|

2,794 |

|

Non-ETF index subtotal |

|

3,123,681 |

|

|

|

828 |

|

|

|

- |

|

|

|

419,140 |

|

|

|

22,200 |

|

|

|

3,565,849 |

|

|

|

3,295,835 |

|

Index and ETFs subtotal |

|

6,622,980 |

|

|

|

248,619 |

|

|

|

- |

|

|

|

858,322 |

|

|

|

24,263 |

|

|

|

7,754,184 |

|

|

|

7,086,456 |

|

Long-term |

$ |

9,244,158 |

|

|

$ |

287,953 |

|

|

$ |

4,074 |

|

|

$ |

1,055,656 |

|

|

$ |

34,134 |

|

|

$ |

10,625,975 |

|

|

$ |

9,791,203 |

|

Year-to-Date Component Changes by Product Type (Long-Term) |

|