UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 04, 2024 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-41279 |

87-3426517 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

|||

Hesperia, California |

|

92344 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common stock, $0.01 par value per share |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ On September 4, 2024, 5E Advanced Materials, Inc. (the “Company”) issued a press release announcing certain financial, operational and other updates for the quarter and year ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

On September 4, 2024, the Company also made available a presentation relating certain financial, operational and other matters, a copy of which is furnished as Exhibit 99.2 to this Current Report and incorporated herein by reference. The presentation is also available on the Investors section of the Company’s website at www.5eadvancedmaterials.com.

Also on September 4, 2024, the Company held a conference call to discuss financial, operational and other matters. A transcript of the conference call is furnished as Exhibit 99.3 to this Current Report and incorporated herein by reference.

The information furnished in this Current Report (including Exhibits 99.1, 99.2 and 99.3) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this Current Report regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this Current Report, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Commercial Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this Current Report may be subject to additional risks. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this Current Report.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K for the fiscal year ended June 30, 2023, filed on August 30, 2023, as amended. Additional risks are also disclosed by the Company in its filings with the U.S. Securities and Exchange Commission throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, the Company expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, the Company undertakes no obligation to comment on third party analyses or statements regarding the Company’s actual or expected financial or operating results or its securities.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number |

|

Description |

99.1 |

|

|

99.2 |

|

|

99.3 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

September 5, 2024 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel |

Exhibit 99.1

5E ADVANCED MATERIALS PROVIDES SHAREHOLDER UPDATE FOR THE QUARTER AND YEAR ENDED JUNE 30, 2024

Company to host call this evening to provide updates on small-scale facility production and operations, as well as capital and commercial strategy

HESPERIA, CA., September 4, 2024 (GLOBE NEWSWIRE) – 5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E” or the “Company”), a boron and lithium company with U.S. government Critical Infrastructure designation for its 5E Boron Americas (Fort Cady) Complex, today provided a shareholder update and review of the period ended June 30, 2024.

HIGHLIGHTS

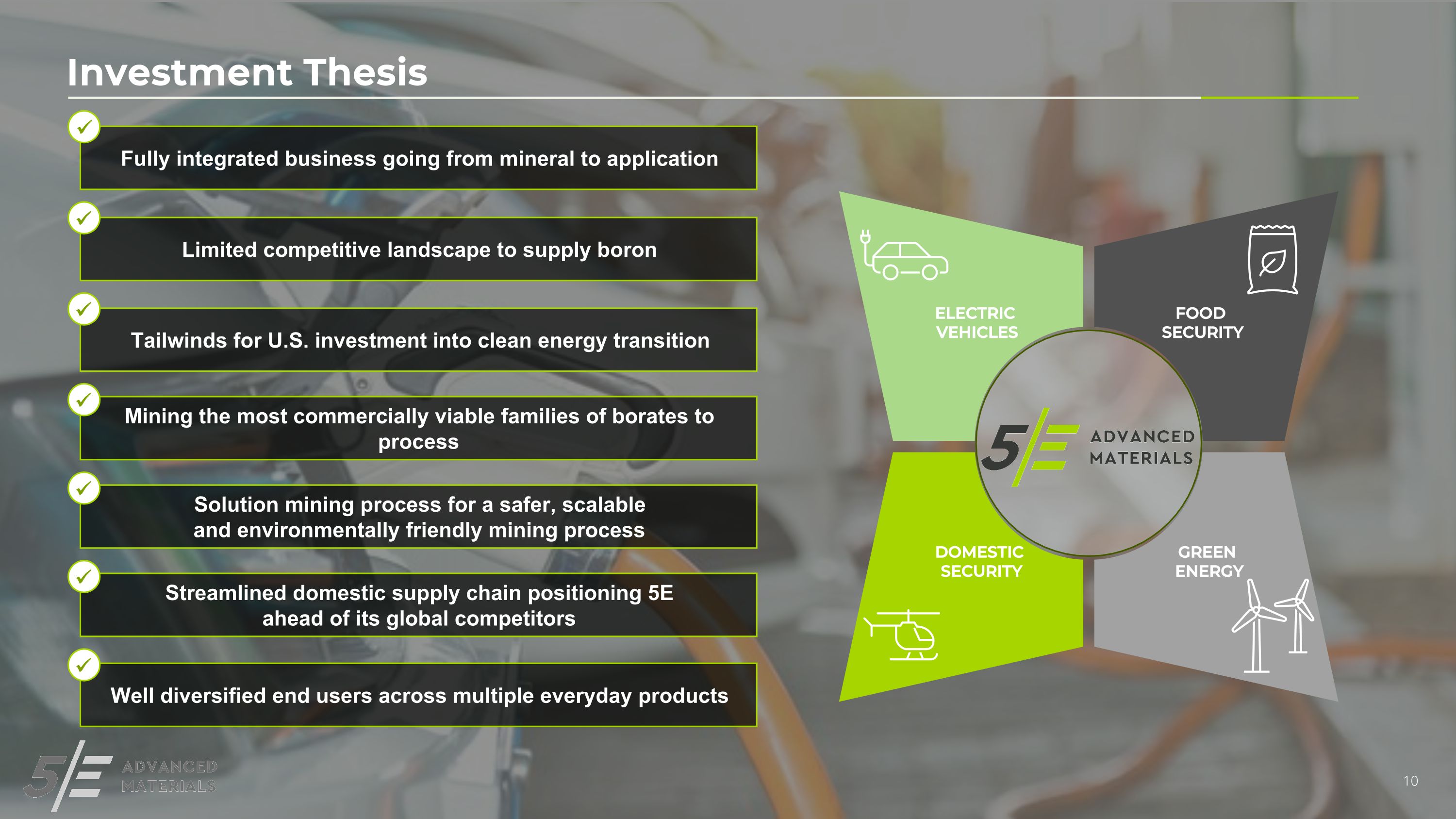

“Fiscal 2024 was a pivotal year for 5E as our team made significant progress towards production of boric acid at commercial scale, while advancing our production capabilities, as well as ongoing discussions with government and commercial partners,” said Paul Weibel, Chief Executive Officer of 5E Advanced Materials. “Following our recent capital raise, we will remain diligent as an organization with a keen focus on further operational and cost optimization as we advance our the first phase of our commercial engineering program, which we expect to conclude near year-end. Our successful initial production at our small-scale facility has helped progress our discussions with potential customers and commercial partners, which will position 5E to continue its pursuit of various government funding and project finance initiatives. We are proud to say that in 2024 we became the first new domestic producer of boron in the United States, and as we move forward into fiscal 2025, we remain dedicated to executing our vision of becoming a global leader and supplier of boric acid and boron specialty materials.”

Corporate Strategy Update

5E Boron Americas Complex - Production Update

Commercial Update

Government Affairs Update

Conference Call Information

Interested parties can access the live webcast of the conference call at 5:00pm EST today on the Company’s website at https://investors.5eadvancedmaterials.com/events-presentations, or for participants that prefer to dial in by phone, dial in using toll-free number 888-506-0062 with Participant Access Code 516663. International call participants are instructed to use toll-free number 973-528-0011. Please log in or dial in at least 10 minutes prior to the start time to ensure a connection. An archived version of the webcast will be accessible for 1 year following the call at https://investors.5eadvancedmaterials.com/ in the Investor Relations – Events and Presentations section of the website.

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) is focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on our large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward Looking Statements and Disclosures

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this press release, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development.

2

These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; our ability to successfully implement the out of court restructuring transaction and raise the maximum funding contemplated thereby; the implementation of and expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this press release may be subject to additional risks. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K filed on August 30, 2023. Additional risks are also disclosed by 5E in its filings with the U.S. Securities and Exchange Commission throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

|

Nathan Skown or Joseph Caminiti Alpha IR Group FEAM@alpha-ir.com Ph: +1 (312) 445-2870 |

J.T. Starzecki Chief Strategy Officer jstarzecki@5eadvancedmaterials.com Ph: +1 (612) 719-5076 |

3

Reshoring the United States Boron Supply Chain September 4, 2024 : FEAM : 5EA Fiscal 2024: Year-End Update Call

Disclaimer FORWARD-LOOKING STATEMENTS The information in this Presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this presentation regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this presentation, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: the substantial doubt about our ability to continue as a going concern and need to raise substantial additional capital following the proposed offering; our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to continue as a going concern and to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission (SEC) from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this Presentation. Except as otherwise required by applicable law, we disclaim any duty to update and do not intend to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Presentation. MARKET AND INDUSTRY DATA This Presentation has been prepared by 5E and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although 5E believes these third-party sources are reliable as of their respective dates for the purposes used herein, neither we nor any of our affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although we believe the sources are reliable, we have not independently verified the accuracy or completeness of data from such sources. Some data is also based on 5E’s good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only there can be no assurance that such conditions will actually occur or result in positive returns. CAUTIONARY NOTE REGARDING RESERVES Unless otherwise indicated, all mineral resource estimates included in this Presentation have been prepared in accordance with and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) - based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code”. While the SEC now recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves. For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s filings with the SEC. Additionally, 5E undertakes no obligation to comment on third-party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

Welcome Paul Weibel Chief Executive Officer J.T. Starzecki Chief Strategy Officer Today’s speakers: Today’s Agenda: Capital Funding Update Small Scale Boron Facility Progress Operations and Cost Optimization Commercial & Government Report Strategic Next Steps

5E Recently reached new capital commitments Direct offering of $4 million common equity, $6 million of convertible notes Most cost-efficient method based on cost of capital New capital ensures 5E’s ability to: Achieve FEL-2 engineering Complete pre-feasibility study (PFS), supporting pursuit of traditional debt funding Advance plant-level operations Continue operational process optimization plans Fund working capital and efficiently ramp production levels at SSBF Continue Federal funding processes and applications Advance customer qualification program and commercial off-taker discussions Capital Raise – Solidifies Pathway to Large-scale Engineering

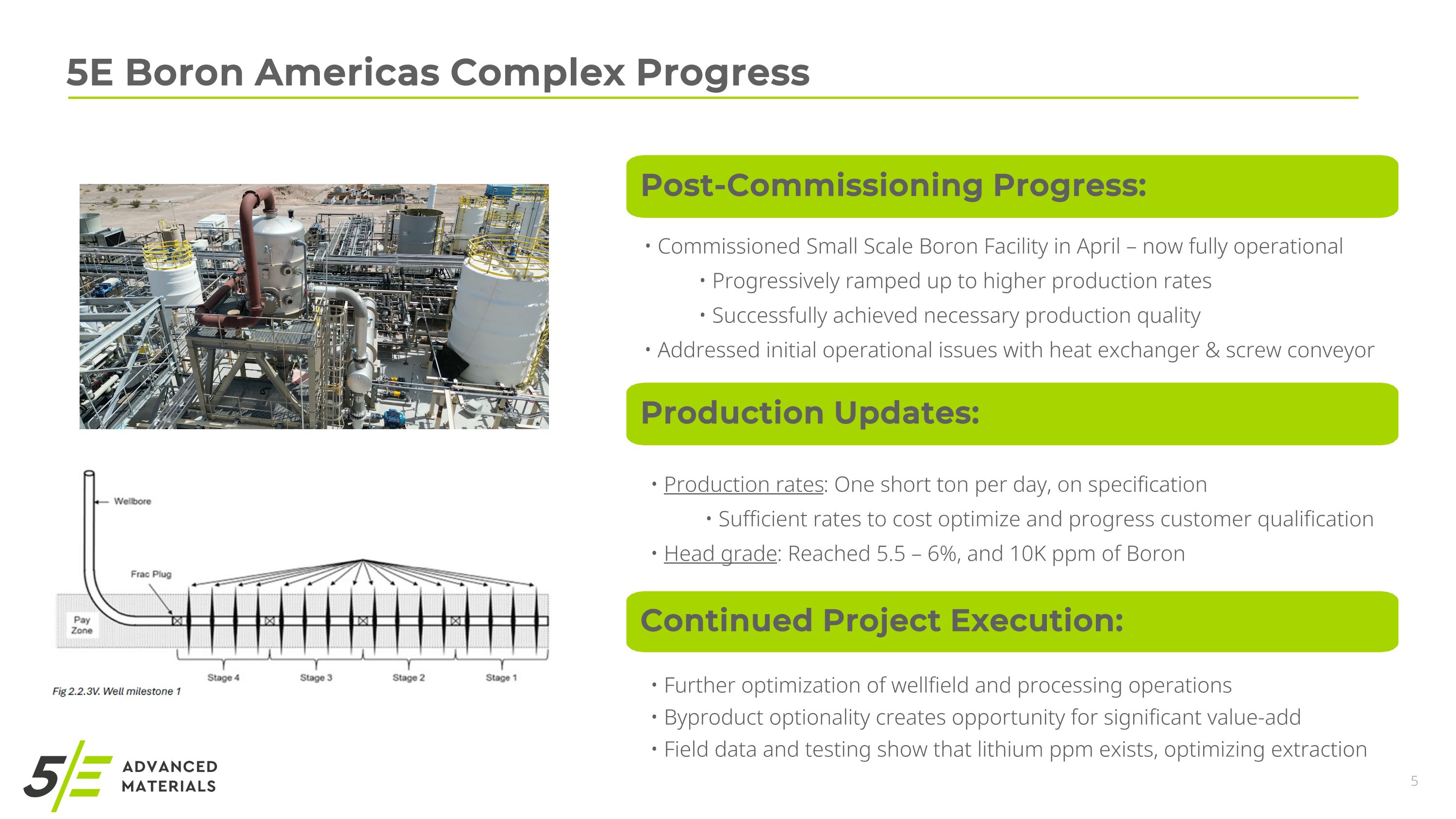

5E Boron Americas Complex Progress Post-Commissioning Progress: Commissioned Small Scale Boron Facility in April – now fully operational Progressively ramped up to higher production rates Successfully achieved necessary production quality Addressed initial operational issues with heat exchanger & screw conveyor Production Updates: Production rates: One short ton per day, on specification Sufficient rates to cost optimize and progress customer qualification Head grade: Reached 5.5 – 6%, and 10K ppm of Boron Continued Project Execution: Further optimization of wellfield and processing operations Byproduct optionality creates opportunity for significant value-add Field data and testing show that lithium ppm exists, optimizing extraction

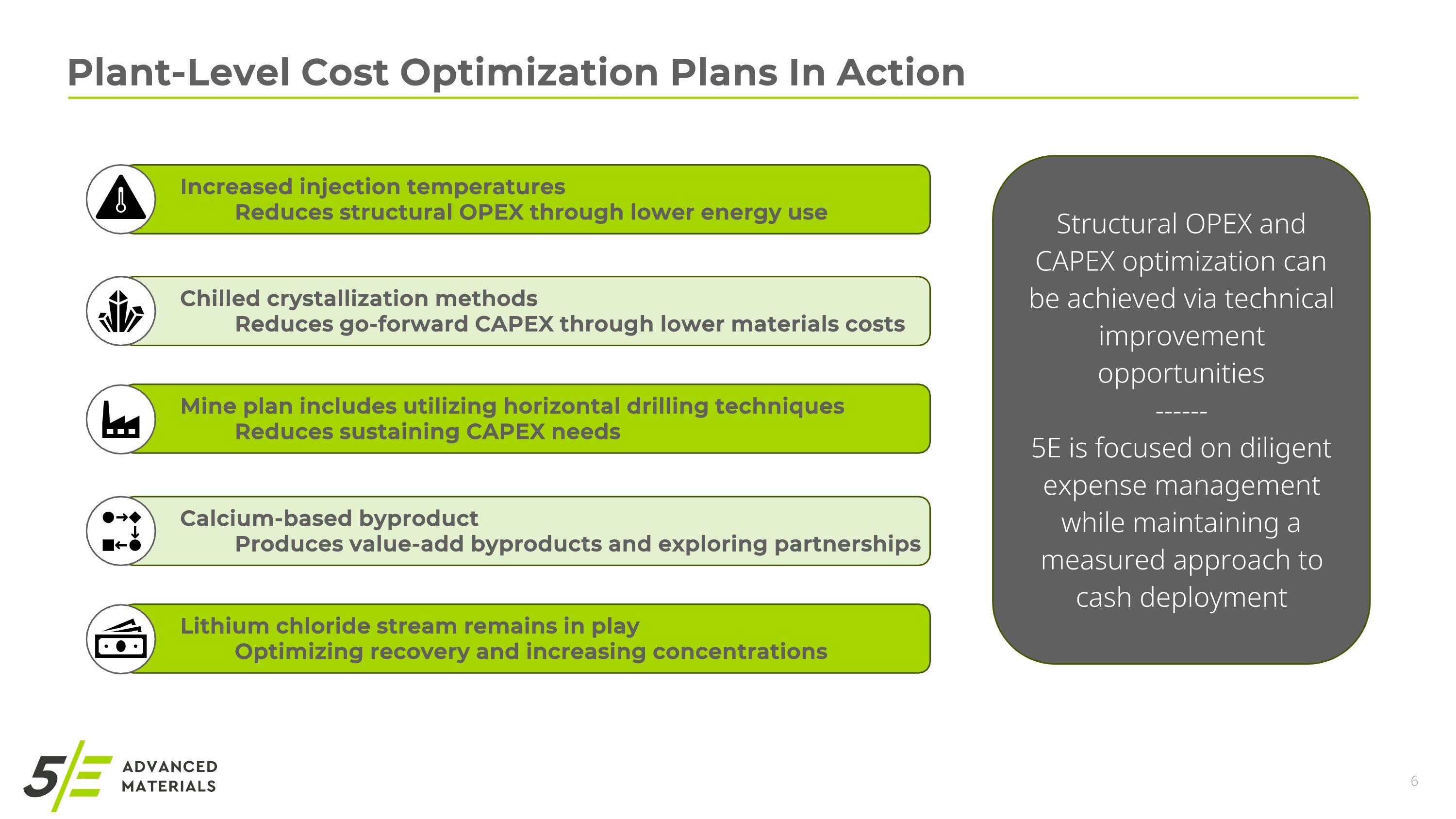

Mine plan includes utilizing horizontal drilling techniques Reduces sustaining CAPEX needs Increased injection temperatures Reduces structural OPEX through lower energy use Chilled crystallization methods Reduces go-forward CAPEX through lower materials costs Calcium-based byproduct Produces value-add byproducts and exploring partnerships Lithium chloride stream remains in play Optimizing recovery and increasing concentrations Structural OPEX and CAPEX optimization can be achieved via technical improvement opportunities ------ 5E is focused on diligent expense management while maintaining a measured approach to cash deployment Plant-Level Cost Optimization Plans In Action

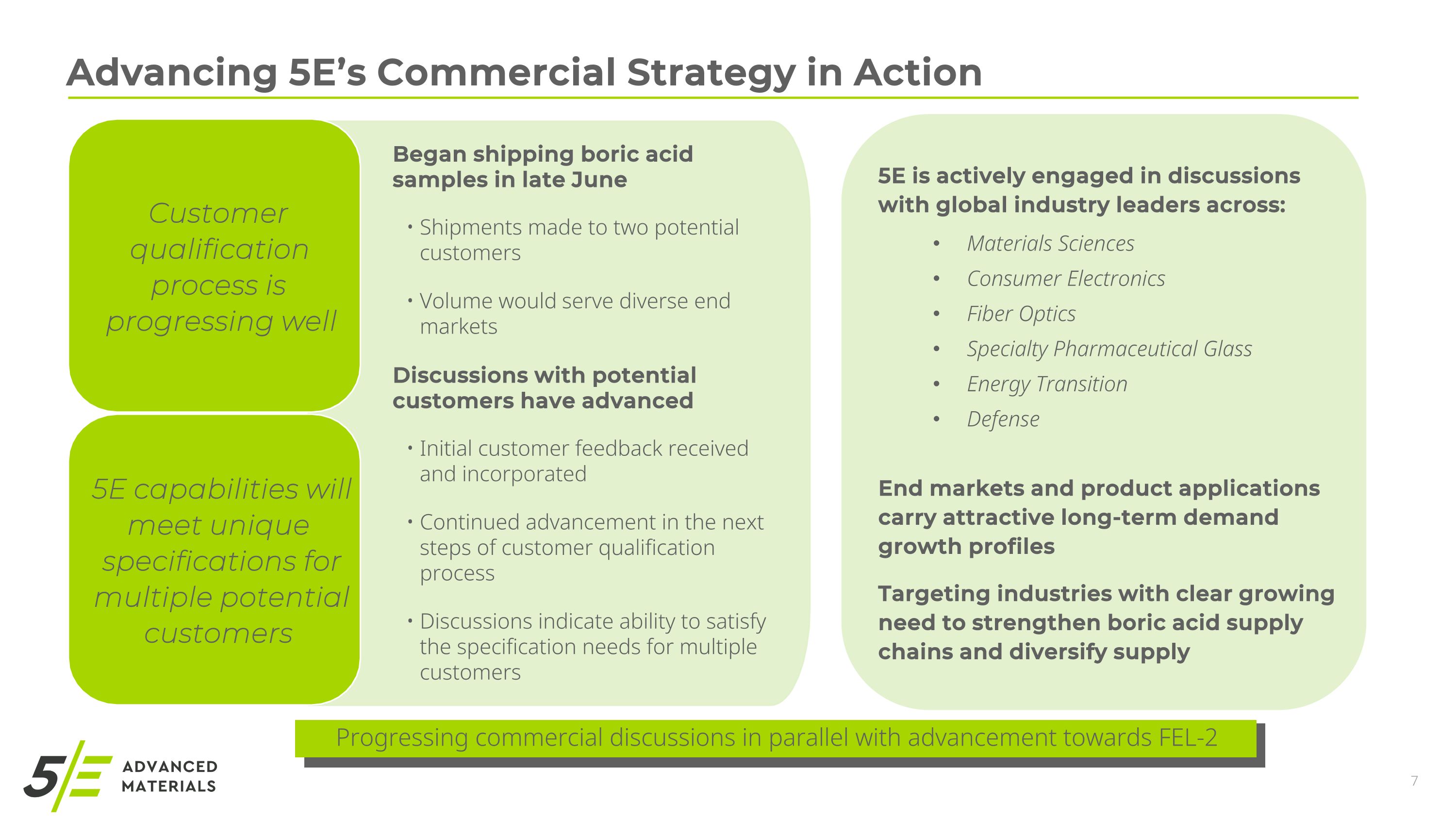

Advancing 5E’s Commercial Strategy in Action Began shipping boric acid samples in late June Shipments made to two potential customers Volume would serve diverse end markets Discussions with potential customers have advanced Initial customer feedback received and incorporated Continued advancement in the next steps of customer qualification process Discussions indicate ability to satisfy the specification needs for multiple customers Customer qualification process is progressing well 5E capabilities will meet unique specifications for multiple potential customers Progressing commercial discussions in parallel with advancement towards FEL-2 5E is actively engaged in discussions with global industry leaders across: Materials Sciences Consumer Electronics Fiber Optics Specialty Pharmaceutical Glass Energy Transition Defense End markets and product applications carry attractive long-term demand growth profiles Targeting industries with clear growing need to strengthen boric acid supply chains and diversify supply

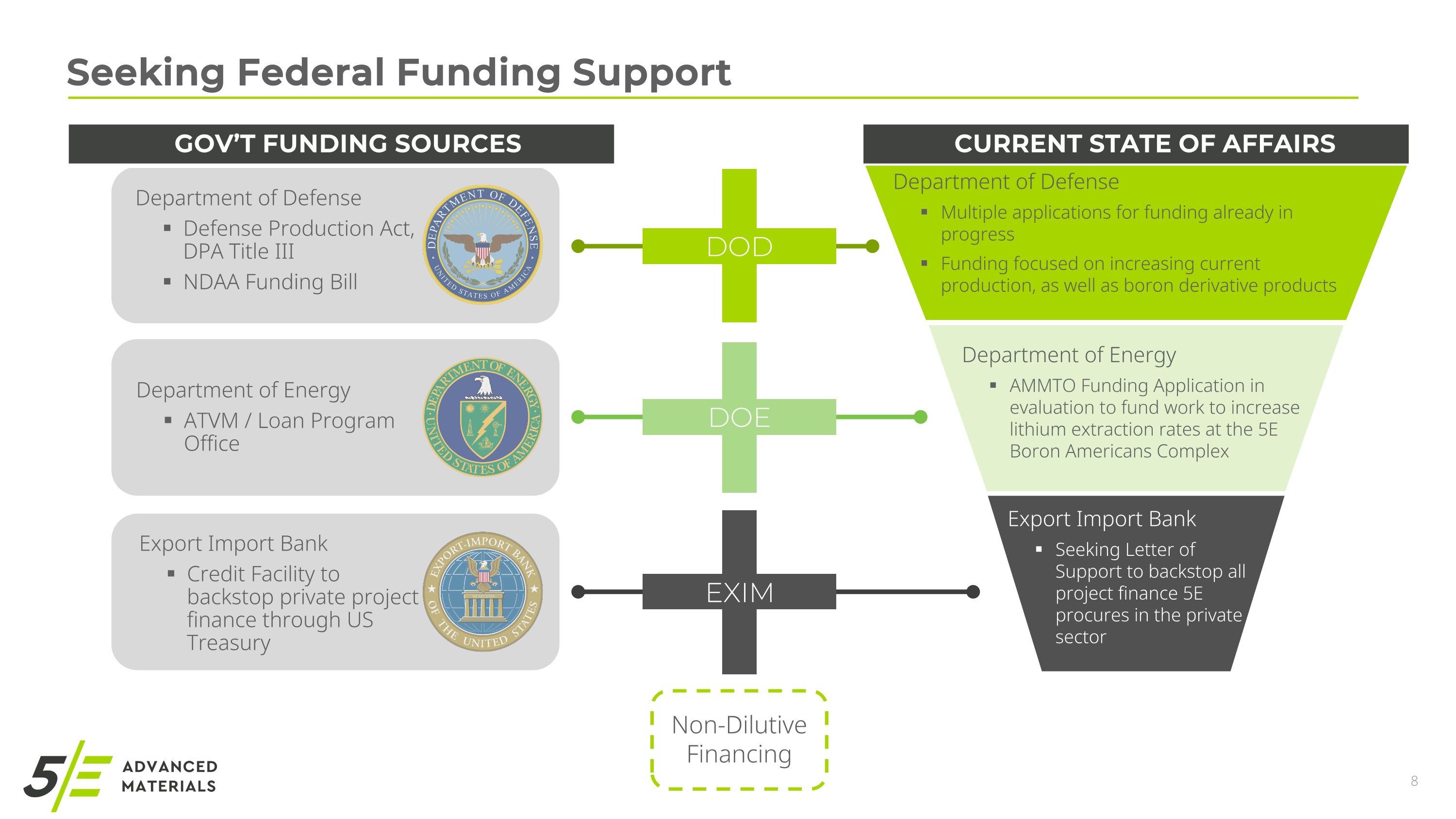

Seeking Federal Funding Support DOD DOE EXIM Non-Dilutive Financing CURRENT STATE OF AFFAIRS Department of Defense Multiple applications for funding already in progress Funding focused on increasing current production, as well as boron derivative products Export Import Bank Seeking Letter of Support to backstop all project finance 5E procures in the private sector Department of Energy AMMTO Funding Application in evaluation to fund work to increase lithium extraction rates at the 5E Boron Americans Complex Department of Defense Defense Production Act, DPA Title III NDAA Funding Bill Export Import Bank Credit Facility to backstop private project finance through US Treasury Department of Energy ATVM / Loan Program Office GOV’T FUNDING SOURCES

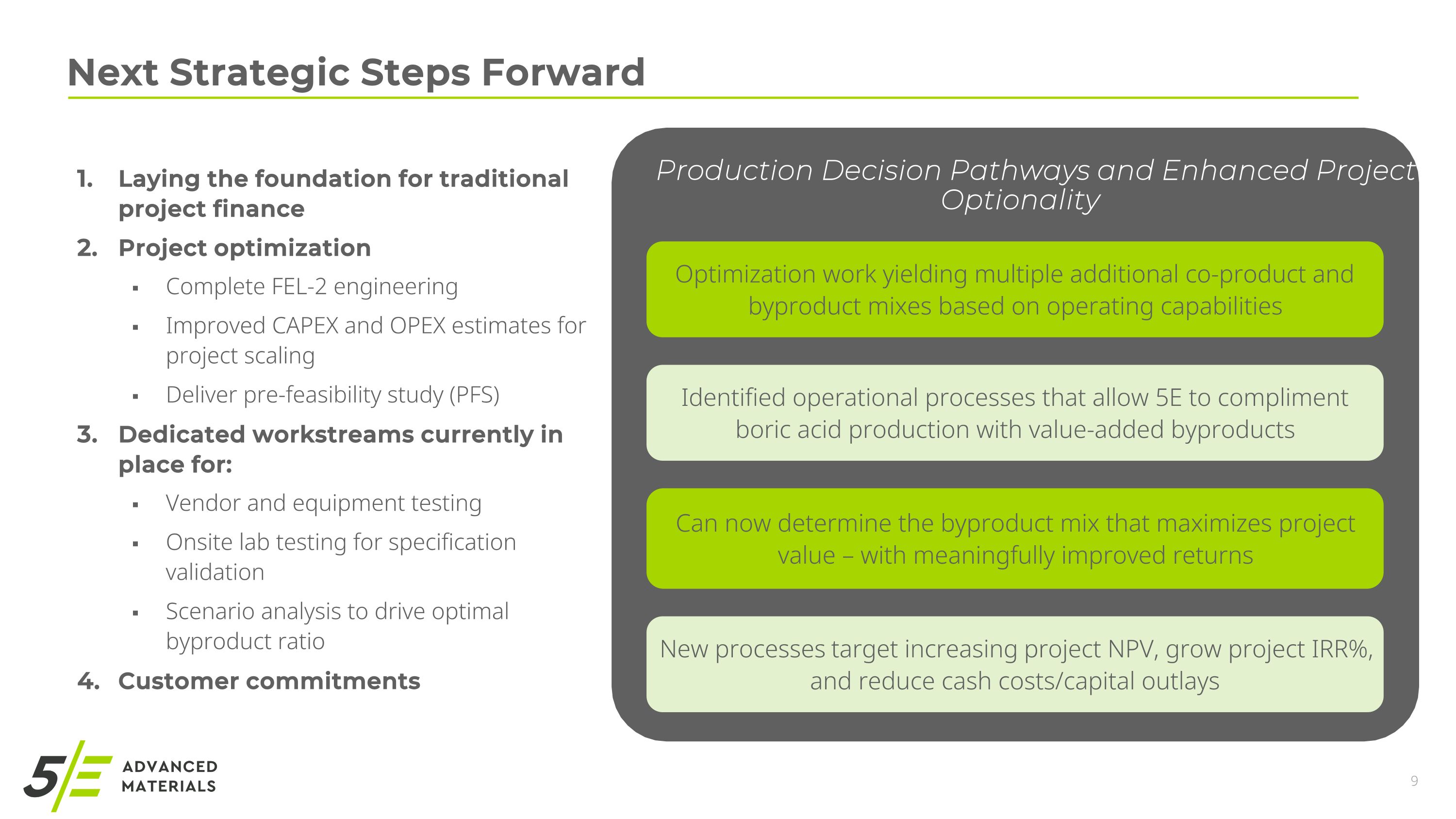

Production Decision Pathways and Enhanced Project Optionality Laying the foundation for traditional project finance Project optimization Complete FEL-2 engineering Improved CAPEX and OPEX estimates for project scaling Deliver pre-feasibility study (PFS) Dedicated workstreams currently in place for: Vendor and equipment testing Onsite lab testing for specification validation Scenario analysis to drive optimal byproduct ratio Customer commitments Next Strategic Steps Forward Optimization work yielding multiple additional co-product and byproduct mixes based on operating capabilities Identified operational processes that allow 5E to compliment boric acid production with value-added byproducts Can now determine the byproduct mix that maximizes project value – with meaningfully improved returns New processes target increasing project NPV, grow project IRR%, and reduce cash costs/capital outlays

Investment Thesis ELECTRIC VEHICLES FOOD SECURITY DOMESTIC SECURITY GREEN ENERGY Limited competitive landscape to supply boron Tailwinds for U.S. investment into clean energy transition Solution mining process for a safer, scalable and environmentally friendly mining process Streamlined domestic supply chain positioning 5E ahead of its global competitors Well diversified end users across multiple everyday products Mining the most commercially viable families of borates to process Fully integrated business going from mineral to application

Thank you

Appendix

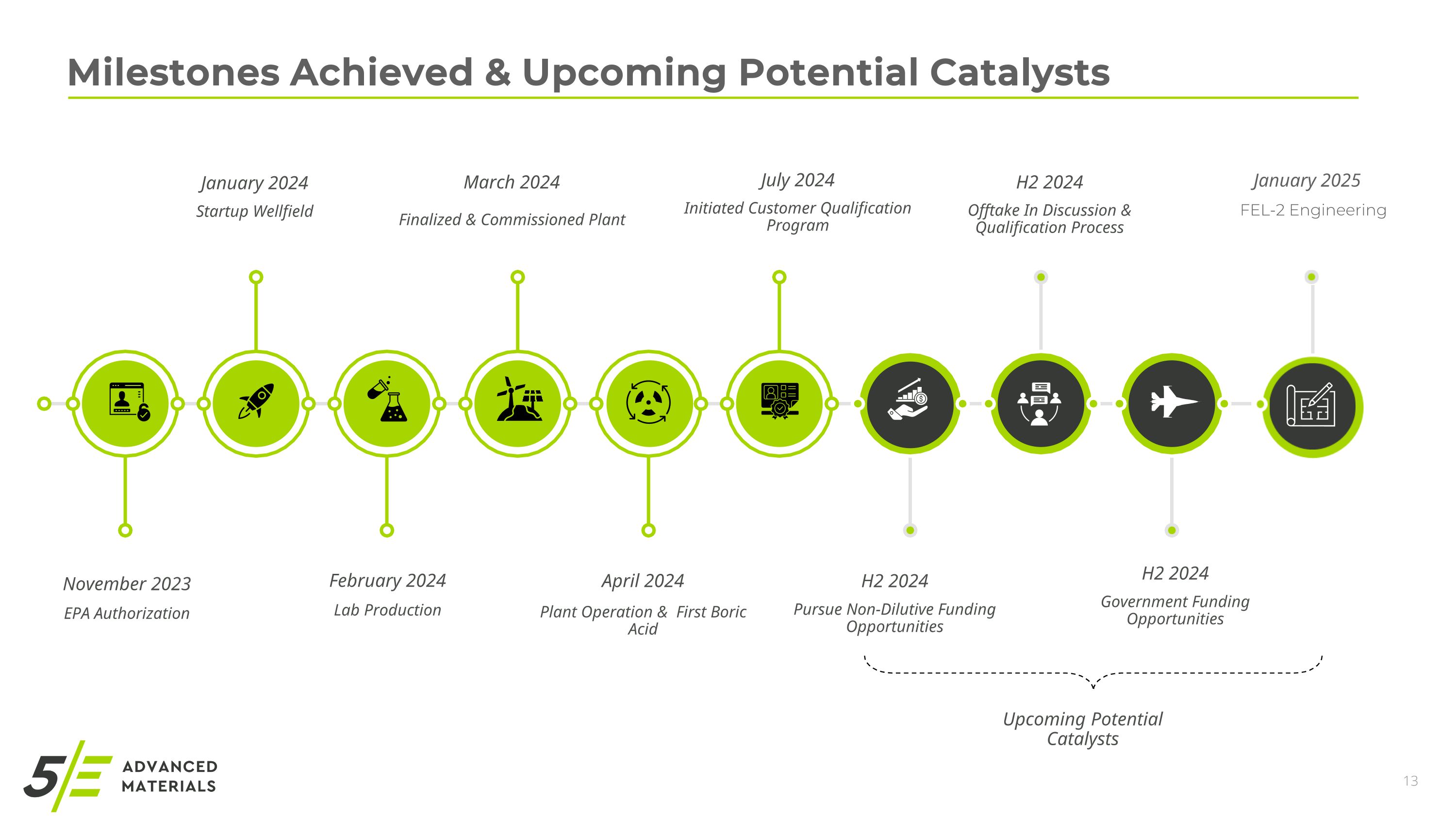

Milestones Achieved & Upcoming Potential Catalysts EPA Authorization November 2023 Lab Production February 2024 Plant Operation & First Boric Acid April 2024 Pursue Non-Dilutive Funding Opportunities H2 2024 Government Funding Opportunities H2 2024 Startup Wellfield January 2024 Finalized & Commissioned Plant March 2024 Initiated Customer Qualification Program July 2024 Offtake In Discussion & Qualification Process H2 2024 Upcoming Potential Catalysts January 2025 FEL-2 Engineering

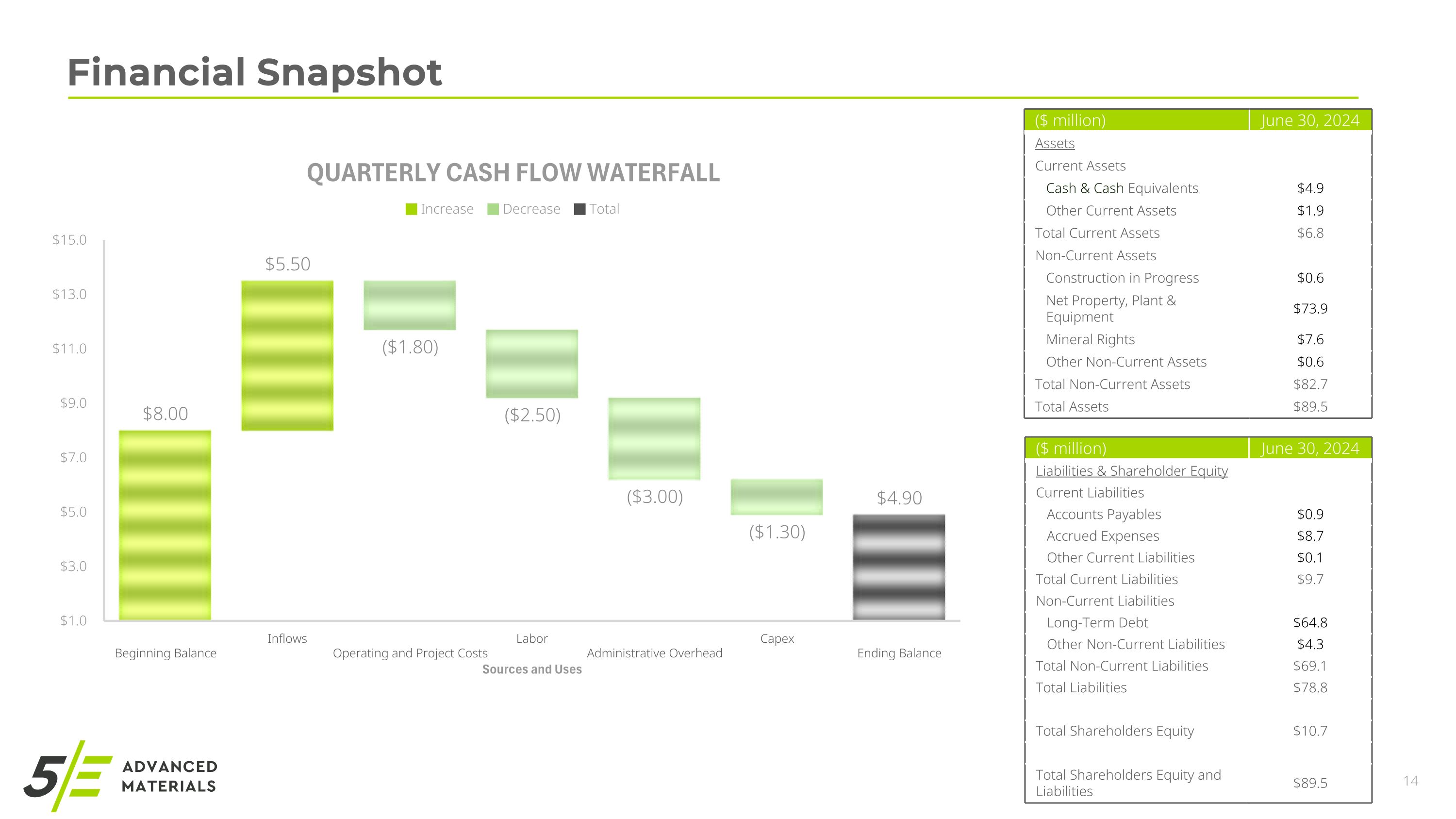

Financial Snapshot ($ million) June 30, 2024 Assets Current Assets Cash & Cash Equivalents $4.9 Other Current Assets $1.9 Total Current Assets $6.8 Non-Current Assets Construction in Progress $0.6 Net Property, Plant & Equipment $73.9 Mineral Rights $7.6 Other Non-Current Assets $0.6 Total Non-Current Assets $82.7 Total Assets $89.5 ($ million) June 30, 2024 Liabilities & Shareholder Equity Current Liabilities Accounts Payables $0.9 Accrued Expenses $8.7 Other Current Liabilities $0.1 Total Current Liabilities $9.7 Non-Current Liabilities Long-Term Debt $64.8 Other Non-Current Liabilities $4.3 Total Non-Current Liabilities $69.1 Total Liabilities $78.8 Total Shareholders Equity $10.7 Total Shareholders Equity and Liabilities $89.5

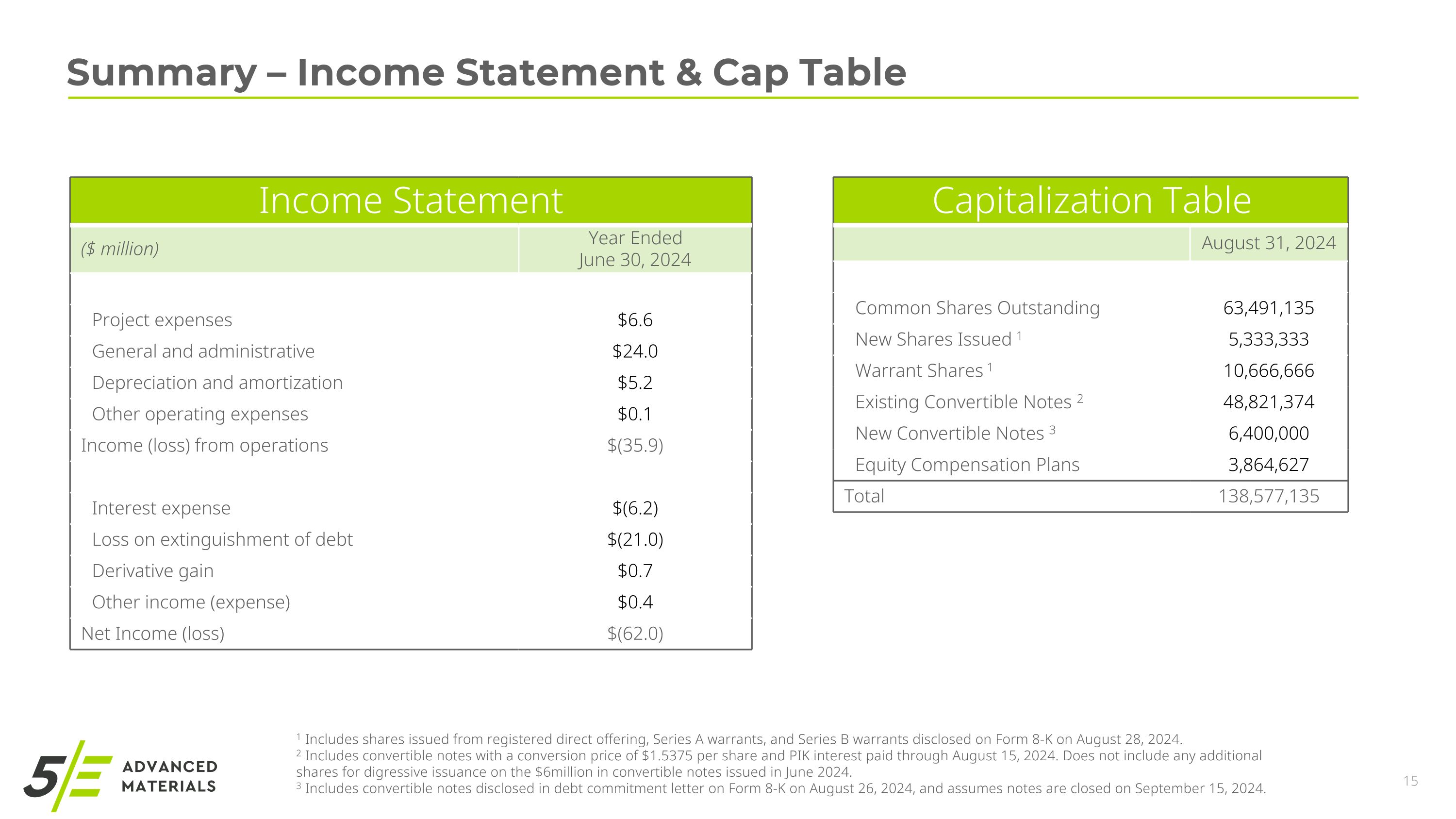

Income Statement ($ million) Year Ended June 30, 2024 Project expenses $6.6 General and administrative $24.0 Depreciation and amortization $5.2 Other operating expenses $0.1 Income (loss) from operations $(35.9) Interest expense $(6.2) Loss on extinguishment of debt $(21.0) Derivative gain $0.7 Other income (expense) $0.4 Net Income (loss) $(62.0) Summary – Income Statement & Cap Table Capitalization Table August 31, 2024 Common Shares Outstanding 63,491,135 New Shares Issued 1 5,333,333 Warrant Shares 1 10,666,666 Existing Convertible Notes 2 48,821,374 New Convertible Notes 3 6,400,000 Equity Compensation Plans 3,864,627 Total 138,577,135 1 Includes shares issued from registered direct offering, Series A warrants, and Series B warrants disclosed on Form 8-K on August 28, 2024. 2 Includes convertible notes with a conversion price of $1.5375 per share and PIK interest paid through August 15, 2024. Does not include any additional shares for digressive issuance on the $6million in convertible notes issued in June 2024. 3 Includes convertible notes disclosed in debt commitment letter on Form 8-K on August 26, 2024, and assumes notes are closed on September 15, 2024.

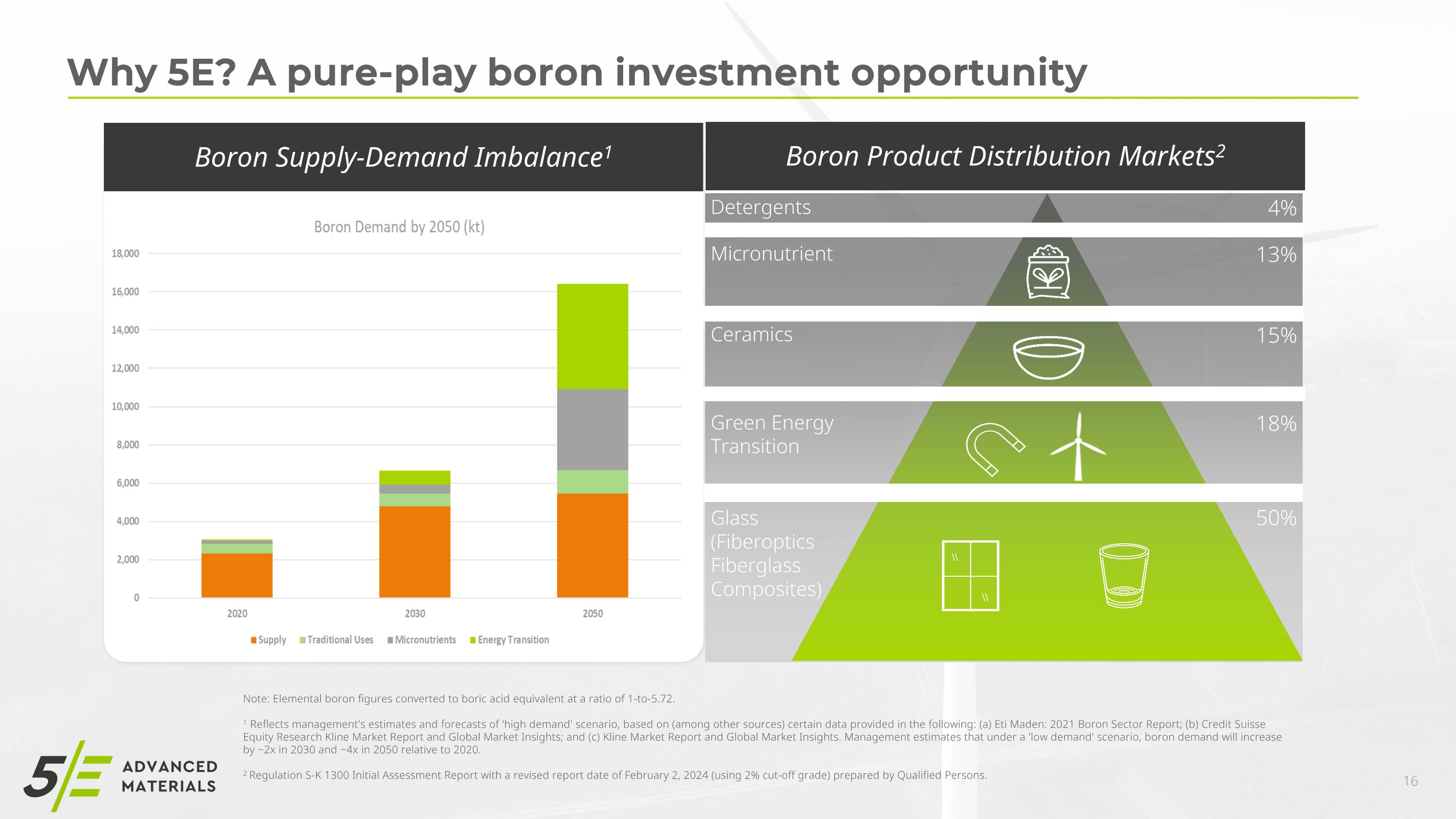

Why 5E? A pure-play boron investment opportunity Boron Supply-Demand Imbalance1 Boron Product Distribution Markets2 Detergents Micronutrient Ceramics Green Energy Transition Glass (FiberopticsFiberglass Composites) 4% 13% 15% 18% 50% Note: Elemental boron figures converted to boric acid equivalent at a ratio of 1-to-5.72. 1 Reflects management's estimates and forecasts of 'high demand' scenario, based on (among other sources) certain data provided in the following: (a) Eti Maden: 2021 Boron Sector Report; (b) Credit Suisse Equity Research Kline Market Report and Global Market Insights; and (c) Kline Market Report and Global Market Insights. Management estimates that under a 'low demand' scenario, boron demand will increase by ~2x in 2030 and ~4x in 2050 relative to 2020. 2 Regulation S-K 1300 Initial Assessment Report with a revised report date of February 2, 2024 (using 2% cut-off grade) prepared by Qualified Persons.

Exhibit 99.3

Call Participants

EXECUTIVES

Jason Thomas Starzecki

Chief Strategy Officer

Paul Weibel

CEO, Treasurer & Company Secretary

ANALYSTS

Canyon Cournoyer Hayes

D.A. Davidson & Co., Research Division

Matthew Alexander Key

B. Riley Securities, Inc., Research Division

Tate H. Sullivan

Maxim Group LLC, Research Division

ATTENDEES

Joe Caminiti

Alpha IR Group LLC

Nathan Skown

Presentation

Operator

Good afternoon, and welcome to the 5E Advanced Materials Fiscal 2024 Shareholder Update Call. [Operator Instructions] Please note that today's conference call is being recorded.

I will now pass the call over to Nathan Skown in Investor Relations. Nathan?

Nathan Skown

Good afternoon. Thank you for joining us today for 5E Advanced Materials Fiscal [Audio Gap]

2024 Conference Call. During this call, management will be referencing our earnings press release and a webcast presentation that can be found in the Investor Relations section of our website. For a copy of our press release or the supplemental presentation, you may contact Alpha IR Group at FEAM@alpha-ir.com or go to our Investor Relations page on our

[Audio Gap]

Presented our legal disclaimers. [Audio Gap]

Remarks made on today's conference call will contain forward-looking statements, including our expectation of future results, costs, production capacity, market dynamics, liquidity, cash spending and other items. Our actual results may differ materially and adversely from those projected or discussed in these forward-looking statements.

Additional information concerning factors that could cause the results to differ materially and adversely from these forward-looking statements are contained in our press release that went out earlier today, as well as the disclosures in our public filings with the SEC. The company is under no obligation to update forward-looking statements.

Today's call may also include a discussion of non-GAAP financial measures as that term is defined in Regulation G. Financial measures should not be considered in isolation from or as a substitute for financial information presented in compliance with GAAP.

This afternoon's conference call is hosted by 5E's Chief Executive Officer, Paul Weibel; and Chief Strategy Officer, J.T. Starzecki. Management will first lead off the call by making some prepared comments, after which, we will open up the call to your questions.

[Audio Gap]

Paul Weibel

CEO, Treasurer & Company Secretary

Thank you, Nathan, and thank you, everyone, for joining us today. We recently closed the books on our 2024 fiscal year. Despite fiscal year 2024 being a challenging one for 5E, there has been significant progress made, which now positions the business for a much stronger, better future in 2025.

2024, we made significant strides having obtained our final approval from the EPA, started the small- scale facility, achieved first production and recently finished the month of June by shipping first customer samples. As we enter fiscal year 2025, our goals include completing the first phase of engineering for our 90,000 ton boric acid commercial facility, securing offtake agreements, exploring partnerships for our various byproducts that we'll produce and commencing the diligence phase for project finance.

On today's call, we will discuss the recent capital raise, current state of the small-scale facility, report progress on our cost optimization and outline the outlook for fiscal year 2025.

Please turn to Slide 4. Last week, we announced a capital raise of $10 million. The new capital consists of $4 million direct common equity offering from a new U.S.-based shareholder as well as a commitment from our 2 lenders to issue via private placement, $6 million of additional convertible notes. We believe that this capital raise provides the runway to complete the first phase of commercial engineering and allows our management team to focus exclusively on this effort.

We have a strategy and a deliberate plan in place for the use of these recently raised funds. The use of proceeds from this capital includes the following: advancing the first phase of the commercial plant

engineering program, which we target to complete in December or January of 2025. Upon completing this phase of engineering, we expect to then quickly update our technical report summary.

Second, to fund the operation of the small-scale facility, where we will continue our efforts to optimize capital and operating costs and advance production of our product for customer qualification. Thirdly, the new capital will aid in our ongoing pursuit of offtake agreements and commercial negotiations.

2

And finally, advancing various government initiatives already in the works.

Please turn to Slide 5, where we will report on the progress of the small-scale facility. I'm pleased to report that we had 0 safety incidents during the quarter. I'm proud of our team, and the behavior-based safety program we have implemented continues to drive accountability, awareness and a culture of safety.

Additionally, we continue to achieve head grades of 5.5% to 6% boric acid in solution, which equates to approximately 10,000 ppms of boron when we sample. This result continues to demonstrate that 5E is in possession of a world-class resource. Despite the good results, we have not gone without headwinds that have resulted in some plant downtime.

Recent maintenance issues included downtime to repair a leak at our heat exchanger as well as revising the design of our screw conveyor that feeds boric acid from the belt filter to the dryer. Additionally, we paused operations for about 2 weeks in the month of August to install a sifter and enclose the bagging section of the plant to prevent final product from being exposed to the elements.

Our team was judicious, swift and diligent in executing the necessary solutions to have us back up and running. With the modifications made, our current production rate is 1 short ton per day of on-spec product. When we initially started producing, the goal was to first produce boric acid, the second goal was to achieve a product that meets prospective customer specifications, and the third goal was to begin increasing rates.

While we continue to assess increasing production rates, we are currently comfortable operating at a rate of 1 short ton per day as it provides us with a liquidity profile, whereby we can complete the first phase of engineering, continue to optimize costs and progress customer qualifications while we work towards

offtake agreements. As we build towards and assess higher production rates, we continue to obtain critical information that is integrated into our commercial engineering design.

On Slide 6, we have outlined our optimization plans. Two meaningful changes we have incorporated into our commercial design include a change to the method of crystallization and the temperature of our mine water injection solution. Since commencing mining operations in January 2024, we now have a higher degree of confidence in the resource and our achievable head grade. Further, we believe we can increase our head grade to higher levels by increasing the temperature of our mining solution. This increase in our solution temperatures will also decrease residence time, leading to a more efficient process.

Essentially, our data has determined that it is less expensive and more efficient to heat the solution compared to blowing off and evaporating water. This has provided us the opportunity to modify our crystallization method from evaporative to chilled crystallization.

Chilled crystallization has multiple benefits that are worth highlighting. First, the amount of energy required will be much less. And initial energy balance estimates a 60% reduction in natural gas consumption relative to evaporative crystallization, which will drive a lower structural OpEx. Further, this provides us with the opportunity to use less [ hastelloy steel ] in our crystallizer design, which will in turn reduce the overall capital cost by utilizing less expensive materials of construction.

Another area of optimization is our mine plan, where we believe we can reduce the overall levels of sustaining CapEx up to a factor of 10 by implementing horizontal wells and sidetracks. Our horizontal well program has been externally vetted and to increase confidence levels, we plan to test horizontal wells in the upcoming fiscal year.

Additionally, we continue to critically examine our potential byproduct credits. We have confirmed lithium chloride exists in our solution today, and we are monitoring the increases in concentrations of lithium and calcium to determine the optimal recovery technology. Finally, we continue to investigate calcium chloride and assess this as a byproduct relative to gypsum, and we are actively looking to explore partnerships with existing producers and technology providers.

At this point, I'll turn the presentation over to our Chief Strategy Officer, J.T. Starzecki, to talk about our commercial and government programs. J.T.?

Jason Thomas Starzecki

Chief Strategy Officer

Thanks, Paul. If we can turn to Slide 7, we will quickly touch on our commercial strategy and how we are advancing down this critical path. The commissioning of our plant and subsequent operations has allowed us to use this early production to initiate our customer qualification program, which we recently launched in late June. This is a key step forward in the development of our project as it lays the groundwork for broad product acceptance, which will underpin the platform to execute offtake agreements with a variety of customers.

Since launching the customer qualification program, we have been progressively advancing commercial discussions with interested parties who are actively looking to diversify their supply base of boric acid now and into the future. Initially, our qualification program included 2 customers who are leaders in specialty glass production for premium consumer electronics and fiber optics, as well as pharmaceutical glass products.

3

After distributing our initial samples as part of our growing discussions, we have received positive feedback and have progressed to the next stage with both customers. We note that these potential customers carry with them very attractive growth profiles and long-term demand outlooks. For these customers, the need to secure a domestic source and a reliable supply chain of boric acid is of critical importance now more than ever.

More recently, we have added 2 additional customer prospects to our pipeline and have already shipped samples to them. These customers are also industry leaders with strong long-term growth needs and demand profiles, with one being in the energy transition space and the other in a military defense related industry.

Encouragingly, with only a few months of formal discussions behind us, our commercial strategy has made and will continue to make incremental progress. Furthermore, our project continues to capture attention and recognition in the marketplace, and we continue to receive inbound inquiries and new interest from parties looking to receive product samples for testing and qualification.

If we can move to Slide 8 for a quick update on the progress towards our federal government program. Our government affairs program has always pursued 3 main outcomes as part of our initiatives in Washington, D.C.: first, federal funding support to advance current operations as well as financial commitments for our commercial Phase 1 facility; second, congressional backing on Capitol Hill for the support of domestically produced boron and its derivative products; and third, the inclusion of boron on the USGS Critical Minerals list.

Multiple funding -- federal funding applications remain in process for both the Department of Defense, both in a congressional appropriations process and under the Defense Logistics Agency. Within the last quarter, the company was recently accepted into a federal program called Cornerstone, which administers investments under the Defense Production Act and [ DIBC ] under the Defense Industrial Base, which also provides funding for companies looking to better the U.S. defense supply chain.

It's worth noting that we continuously look and apply for federal funding as both short- and long-term solutions for the business. To update everyone, we continue to monitor a submitted application we made to the Department of Energy earlier this year under an open funding call. Per the agency's website, winners of the awards are expected to be announced this fall.

The final highlight to note related to government support comes through an application submitted to the

U.S. Export-Import Bank for the Made in America initiative. 5E completed our initial application in mid-July for loan-backed guarantee of up to $285 million in project debt finance for our Phase 1 commercial plant. We hope to receive formal feedback and a letter of interest from our application this fall.

Lastly, we remain very engaged with key members in Washington, D.C. to drive support for the newest domestic source of boron in the United States. All our California representatives on Capitol Hill received frequent updates and in-person briefings, detailing project progress, and we've been successful in obtaining 10 members of Congress to put forth a signed request to have boron added to the 2025 USGS Critical Minerals list under the Department of Interior.

With that, I'll hand the presentation back over to Paul for a few closing remarks.

Paul Weibel

CEO, Treasurer & Company Secretary

Thank you, J.T. As we turn to Slide 9, we'll discuss the next steps forward we'll be taking on our project as we execute our strategic playbook and deliver catalysts over the next 5 to 6 months.

As J.T. mentioned, we have applied for the U.S. EXIM Bank's Made in America initiative. We expect the letter of interest this fall, which is an invitation to project diligence. To successfully secure project finance, we'll need to progress the first phase of commercial engineering and execute firm offtakes with bankable customers.

In June, I outlined that we would utilize the summer to optimize our design. Today, given our superior research, we know that chilled crystallization is the optimal process design to produce boric acid for our commercial facility. Fluor, our EPC firm, has already begun moving forward with this design, has started the process for budgetary bids and our team has a parallel work stream to assess gypsum against calcium chloride as our byproduct mix.

Our engineers have dedicated sub-work streams that include vendor and equipment testing, on-site lab testing for further processing improvements and multiple scenarios of material and energy balances.

Through this, we'll be using a data-driven methodology to test CapEx and OpEx, which will create the ability to drive down total cost and determine the optimal design.

Today, we know we have multiple potential pathways for co-product revenue streams, and we are putting each under its own stand-alone test. These potential revenue streams and the enhanced optionality they bring to the project's economics have come as a function of our ongoing project cost optimization work. As the first phase of engineering progresses, we will report this progress and lift the veil on catalysts that we expect will drive our share price higher.

Additionally, the product we produce at the small-scale facility will be used to increase to customers in our pipeline and our announceable letter of intents and work towards offtake agreements that will underpin bankability for project finance.

4

These efforts will drive completion of the first phase of engineering and a refresh of our technical report in early 2025.

Lastly, we continue to progress our already submitted applications and monitor the appropriations, DoD and DOE submissions with hope for a favorable result in the near term.

I'll conclude on Slide 10. Ultimately, both the progress we've made on the ground at our small-scale boron facility and with the successful recent capital raise, we have runway ahead of us to complete the first phase of commercial engineering. This has given our management team the latitude to focus on the business, improvement of economics and reporting on our progress. This is critical for 5E's next stage of development, and I'm highly confident in the plan we have in place.

Despite the headwinds of 2024, which we have overcome and advanced, our business case remains firmly intact. Our key permits are in place, our customer qualification program is underway, and we have a

clear direction to progress forward in 2025. As always, I'd like to thank the entire team at 5E Advanced Materials for their hard work and contributions as we seek to build long-term value for our shareholders. With that, we'll open up the call to your questions. Operator? [Operator Instructions] The first question comes from Matt Summerville with D.A. Davidson.

5

Question and Answer

Operator

Canyon Cournoyer Hayes

D.A. Davidson & Co., Research Division

You've got Canyon Hayes on for Matt Summerville today. Maybe just an update on recent spot market pricing. And J.T., I remember a couple of months ago, you had mentioned that they were taking issues at some of the larger market constituents. I'd be curious to hear if that was ongoing still.

Jason Thomas Starzecki

Chief Strategy Officer

Canyon, first, thanks for joining us today and having some input. So let me first address the taking comments that pertains to other producers within the market. There, we are still hearing instances based on the environments in which product is being transported into that there still is a struggle with certain producers to put product in large quantities into markets where caking is still a continued issue that potential customers are working on.

As far as spot pricing goes, recently, Fastmarkets launched coverage of boric acid, and they have continued to put some guidance into the marketplace where spot pricing for boric acid is in the range of USD 1,100 to USD 1,250 per ton.

Canyon Cournoyer Hayes

D.A. Davidson & Co., Research Division

Great. Moving over to the balance sheet, a couple of moving parts here. You've got the recent capital injection. Kind of where you're standing today and at current cash burn rates, maybe an update to where that will bring 5E over the next months, years, et cetera?

Paul Weibel

CEO, Treasurer & Company Secretary

Yes. I think -- I appreciate the question. As kind of noted in the remarks, this will get us through our first phase, the FEL-2 engineering program. And I think that gets us into early 2025.

Operator

Okay. The next question comes from Tate Sullivan with Maxim Group.

Tate H. Sullivan

Maxim Group LLC, Research Division

Paul, you mentioned the customer qualification program. Do those customers need to see the consistency of the grade more than an increasing volume? And how -- can you provide more detail on how the qualification program will work, please?

Paul Weibel

CEO, Treasurer & Company Secretary

Yes. So I think when you talk to different customers, everyone has their own spec, right? Boric acid kind of gets a wrap that it's just a commodity, whereas based on the customers we're working with, they have certain specifications that make it not so much a commodity, right? Moisture content matters, impurity profile as well as particle size.

And so, ultimately, to a certain extent today, we're very much kind of who has the best spec, right? And that's kind of -- because if you look at the chlorides and sulfates that will have to meet, if there are 25 ppms, we will -- other customers maybe 50. So we're on the current customer spec. And so it started with KD samples. And then the next step will be material handling, where they'll take 1 or 2 tons, right? And so I think we've -- and J.T., add in here, but ultimately, every customer is different and their process kind of varies by customer.

Tate H. Sullivan

Maxim Group LLC, Research Division

Yes. If I could just say -- sorry, J.T. Yes. And is 1 ton a day enough to -- and is 1 ton a day enough to satisfy most of the customer qualification program? J.T., you want to take that?

6

Paul Weibel

CEO, Treasurer & Company Secretary

Jason Thomas Starzecki

Chief Strategy Officer

Sure. So at this point, Tate, yes, it does meet the needs that the customers and the testing programs that we've launched, plus the testing programs that we're starting to queue up. As Paul mentioned in some of his opening remarks, that 1 ton a day we view as the cost optimized amount of tonnage coming out of the small-scale facility right now to feed into the customer qualification program, and it gives us runway as we continue to do that to bring in more customers into the program. So we do feel that at this point, that's the right balance for us.

Tate H. Sullivan

Maxim Group LLC, Research Division

Great. And then can you provide in terms of -- Paul, did I cut you off? In terms of operating costs, running the small-scale facility, is it mostly on the processing side now and away from the injection side? I mean -- or could you talk about where most of the costs will be operating the plant going forward?

Paul Weibel

CEO, Treasurer & Company Secretary

Yes. I think, listen, at 1 ton a day, like we have -- it's a reasonable burn from a variable cost, which really is hydrochloric acid, LNG and some lime, and a bit of sulfuric as we kind of regenerate HCl. The fixed costs are the bigger component today, right? And that's because we do operate 24/7. And so that is the bigger component. So that's kind of why, as we -- as we've gotten up to that 1 ton, and we kind of know what those utilizations are, we're comfortable here, right, given we've raised 10, right? And so that gives us that ability to continue the customer qualification.

And what I was going to add kind of on the back of the other question is ultimately a ton a day is adequate to put the offtake in place, right? So because most of these customers, like, their big focus is like long-term supply when we're at 90,000 tons, right? Listen, if we can -- and we will look to build some inventory and kind of offset some incremental sales against production credits. But where we are today and kind of our liquidity profile, it's kind of the best of all worlds.

Tate H. Sullivan

Maxim Group LLC, Research Division

And -- great. And just last for me. You mentioned some of the August work. Are you -- and you're done with the sort of shutdown related work or might more shutdown-related work come up? Or -- and was that work related to a bagging machine process? Can you go...

Paul Weibel

CEO, Treasurer & Company Secretary

Yes. No. So the plant is pretty much 100% outdoors, right? And it's very much -- it's solution mining. So it's piped into your crystallizer and to ultimately your belt filter. And so -- and then from belt filter, it goes to screw conveyor to bagging, right? And so we kind of realized we needed to enclose the back end of the plant where we come off the dryer and then into the bulk material handling, where we fill our super sack. And so we kind of -- it was a pretty basic job, but we kind of stopped any production while we enclose that.

Listen, I think there's -- we are doing preventative maintenance, but some of that's always a little tricky. And I'll be candid, like there's a bit of a novelty to our process. And as we kind of kicked off and gone through, there's been teething pains, right? And we've worked through those issues. We've kind of highlighted a couple of them here and we get back up. So you may take a step back, but we continue to find ways to take 2, 3 steps forward.

Operator

[Operator Instructions] The next question comes from Matthew Key with B. Riley Securities.

Matthew Alexander Key

B. Riley Securities, Inc., Research Division

Obviously, a lot of progress being made in terms of boric acid production. I did want to touch on lithium briefly. I think you noted in your prepared remarks, you're currently evaluating various recovery methods for the byproducts. Could you maybe go into a little bit more detail on that? And what's the current time line for producing a customer-ready lithium product from Fort Cady? So what we're seeing today is we see ppms in the range, test sample will be anywhere from about 40 ppms to 60 ppms, which is good, right? It's there.

7

Paul Weibel

CEO, Treasurer & Company Secretary

And that's -- and some of that could be -- the genesis is we really want more data, right? And ultimately, as we look at some of the byproducts that we'll produce, if it's calcium chloride, you could build up lithium concentrations over time, and that could crash out with your sodium or you could potentially do ion exchange on the -- with the remaining piece of the calcium. Or if you go to gypsum route, you could extract the lithium on ion exchange after you've removed your metal salts.

And so there's -- from -- like ultimately, we want to -- DOE is expensive and sort of what you're seeing in market conditions has put where pricing is where it is, it's been a lot of headwinds on up-and-coming producers in that space. So we're very mindful of -- we want to -- while we feel good about the bullish trend of lithium, like we want to extract and recover that in the lowest cost rate possible, right?

And we have a couple of avenues to pursue that in the current design. And so I -- yes, I think we also are doing ongoing testing where that 40 to 60 ppm in the lab has actually 3x when we modify and change our HCl rate. So at 9%, we [ 3xed ] it. And so that -- those are the good data that is kind of, like, okay, wow, this could be a game changer for economics. And so I think that's -- it's just -- it's been really good and comforting to see that, that stream is there.

We have it in the resource table. And ultimately -- and this kind of dovetails into the DOE grant application we applied for is how can we really maximize that. I think once we do a little bit more homework, we then would be able to speak to time lines, but that's a great question.

Matthew Alexander Key

B. Riley Securities, Inc., Research Division

Got it. That's helpful. And you mentioned that 5E has submitted applications for funding with both the

[ DoD and DOE ]. Assuming that's all successful, could you remind me a ballpark of how much financing could potentially be received from those programs?

Paul Weibel

CEO, Treasurer & Company Secretary

J.T., you want to take that one?

Jason Thomas Starzecki

Chief Strategy Officer

Sure. So in our opening comments, Matt, we talked about the magnitude of the EXIM credit back guarantee that we've asked for. We have pretty significant grant applications that we've put in process in 2024 in terms of tens of millions of dollars across multiple different programs. We have seen some progress in where those advancements or where the applications have advanced through.

There's obviously different points that when you're talking about one of them, which is an appropriations request. There's obviously a process that you need to go through similar to any other federal funding item that falls under the appropriations, right? There's 12 appropriations dealing with agriculture, all the way to defense. And we do continually track and get updates.

The political process, just given the election season has sort of temporarily slowed things down. But the funding that we've put in place, both from the asks that we've made from the DOE, but also, most

importantly, the DoD are of a size and a magnitude that will be very, very impactful to that Phase 1 CapEx number. And remember, all of that is in conjunction with the credit back guarantee.

So it will be -- we'll -- if we're successful in the EXIM process, we'll get the $285 million that we've asked for to backstop project finance. And then on top of that, we will get the grant money. And I think the secret sauce within the grant programs within the DoD are there are programs that we can ask for on an annual basis, right? So appropriations is an annual request.

Under the DPA Title III, you're not limited to just one request. So there are multiple avenues, almost a bit like the spider web. We don't control the time lines, but certainly, the applications and the amounts that we've asked for are -- will be very impactful and very beneficial to the broader stakeholders.

Matthew Alexander Key

B. Riley Securities, Inc., Research Division

Got it. That's very helpful. Yes, that's it for me, and good luck moving forward.

8

Operator

We have a follow-up question from Tate Sullivan with Maxim Group.

Tate H. Sullivan

Maxim Group LLC, Research Division

It's Tate Sullivan from Maxim just following up. I know you have time to file a 10-K given your fiscal year ended in June. Are you planning to file it tonight by chance or to be determined?

Paul Weibel

CEO, Treasurer & Company Secretary

Yes. So we -- as you can imagine, based on the deal last week, all the subevent disclosure are getting updated. They're in final review. If things go well, it's out first thing next week.

Tate H. Sullivan

Maxim Group LLC, Research Division

Okay. And then J.T., the last one is that you mentioned getting on the USGS list of critical materials for 2025. Does that increase funding eligibility? Can you just list some of the benefits of potentially being on that list?

Jason Thomas Starzecki

Chief Strategy Officer

Great question, Tate. Does it unlock additional funding opportunities? The broad answer is yes. Because of the way sort of the Critical Minerals list operates and it sort of spans across both the DOE and the DoD, it does cover extract -- funding opportunities for extraction projects that are extracting critical minerals.

Therefore, should boron be placed on to the Department of Interior's list, which is the USGS list, it would open up other pockets of money more specifically in the Department of Energy and sort of then it sort of unlocks the opportunities to get into the Loan Program Office.

Should we decide to pursue that route, there are other gating items that are in sort of what Paul has already laid out for our strategy that would actually also play into that. But it's -- the short answer is yes, getting added to it would add to our profile and would also unlock additional funding opportunities.

Operator

Okay. Now I'd like to turn the floor back to Joseph Caminiti in Investor Relations for investor submitted questions.

Joe Caminiti

Alpha IR Group LLC

Thank you, John. For a moment, I will recite a number of frequently asked questions that were submitted by our investors in advance of this call. While a number of the questions that were submitted were

also asked by our sell-side analysts, I will go through the most frequently asked questions now to the management team.

Can you provide any additional detail on the funding applications that the company has submitted and any anticipated expectations regarding the level of funds related to these applications?

Jason Thomas Starzecki

Chief Strategy Officer

Paul, do you want to take that or would you like me to?

Paul Weibel

CEO, Treasurer & Company Secretary

No, that's kind of government, so go forward.

Jason Thomas Starzecki

Chief Strategy Officer

Okay. Thanks, Joe. I appreciate that. It is a question that we do get answered on a fairly regular basis.

I'll give you some ranges or I'll provide stakeholders some ranges of the funding request. I won't get into specifics into how it sort of -- where it falls within the specifics of the DoD, but we made an appropriations request earlier in the year for $20 million that essentially fit within the defense budget for the ongoing and increased production of domestic boric acid as it does play into a lot of different derivatives products.

9

We've also made a request under the DPA Title III under the Defense Logistics Agency to also look at additional engineering work, equipment prepurchase and scalability of the current facility, and the magnitude for that request was up to $35 million. Now we'll caveat all of that by saying that the U.S.

government reserves the right to adjust those figures, so they can make a recommendation and they can reduce that number. They can increase that number. They can come to an agreement on is it split between the DLA? Or is it split under the industrial base? They can make sort of that -- those decisions internally.

But I think the message here is very clearly that it's significant funding that we've applied for, and we do feel that our base case and the case that we've made in these funding applications is as strong as anything that is in the market today.

Joe Caminiti

Alpha IR Group LLC

Thank you. And another investor submitted question. What are the anticipated next forthcoming steps in your customer qualification program?

Jason Thomas Starzecki

Chief Strategy Officer

I can talk in terms of sort of some general steps. Every customer is different in how they're going to utilize boric acid in their production. So you will have some that essentially will test the impurity profile, the chemical content and really are interested in the particle size. And really, as long as you fit that parameter, they will go into incorporating that into what we'll call sort of production testing.

Some customers, based on the conversations and the process we're in, will add things like storage and handling testing because of the environment that it moves in and out of. So you'll always start with lab testing, so -- which is where we've initiated with a handful of customers. You then start to move down that value chain. Some will have storage and handling, some skip right over that, depends on where we're going with the end market.

You then typically will have some small-scale production, where they're going to produce laboratory based, very small scale end products, and they'll do it more from a raw materials perspective. And then if you go all the way through, some customers will actually want to do full batches of a run with all of the inputs, including the boric acid.

And so it sort of -- it runs the gamut. We're beholden to customer timelines because we're using -- they're using their facilities, they're using their personnel and they're fitting it into their work schedules. I think what the broader audience would be very interested in and understanding is to know that we are in constant dialogue. So we're constantly getting feedback and where things are in the testing process.

We're constantly plotting out what is the next step. We're constantly plotting out how much tonnage or kgs or pounds are going to be needed for the next either round of testings or the next customers. So we do have a very clear roadmap of where we sit today, what's in the pipeline and where we're going to end up. And as that evolves, we will continue to update the market.

Joe Caminiti

Alpha IR Group LLC

Thank you. And another investor submitted question. Do you anticipate that you will have production- based revenues in fiscal 2025?

Paul Weibel

CEO, Treasurer & Company Secretary

Thanks. I can take that. Yes, I think we want to build inventory of on-spec product, continuing to progress with customer qualification. And then as we clear kind of the hurdles, get set up vendors, any incremental inventory will -- we can make those sales, which then come back as production credits, right? And so to keep the pace of play, yes, would want to sell any excess product.

Joe Caminiti

Alpha IR Group LLC

Thank you. And the final investor submitted question is regarding the company's existing FEL-2 engineering program. What are the biggest risks ahead of completing 5E's FEL-2 commercial engineering program and submitting a pre-feasibility study?

Paul Weibel

CEO, Treasurer & Company Secretary

Thanks. Good question there. I think we feel really good about where we are on the boric acid side. And kind of as I noted, [ boris ], kind of moving forward with budgetary bids, which is great. Know where we are basically up until that calcium stream, and that's what we continue to assess. And so I think that's a little bit of the unknown today, but we have the parallel work stream where we have optionality to kind of keep going on gypsum.

10

And as we kind of do more homework and go to partnership opportunities, whether it's existing producers or on the licensing side with existing technology packages, can we bolt that on because there's a better outcome for project economics? So I think that's like well aware of what we need to kind of do and team is working really hard to make sure we hit that timeline.

Joe Caminiti

Alpha IR Group LLC

Thank you. That concludes the investor submitted questions, and I will now turn the call back over to Paul Weibel, CEO of 5E Advanced Materials.

Paul Weibel

CEO, Treasurer & Company Secretary

Thank you, everyone, for your time and interest in 5E Advanced Materials. This does conclude our remarks. We have a tremendous opportunity in front of us to become the next producer of boric acid and lithium producer in the world. We do have that proven asset and a strategy to modularly expand the asset over the next several years. Look forward to sharing this journey with all of you in the upcoming quarters to come. Thank you.

Operator

Thank you. This concludes today's conference, and you may disconnect your lines at this time. Thank you for your participation.

11