UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2024 |

DIH HOLDING US, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-41250 |

98-1624542 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

77 Accord Park Drive; Suite D-1 |

|

|||

Norwell, Massachusetts |

|

02061 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: 617 871-2101 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Class A Common Stock |

|

DHAI |

|

The Nasdaq Stock Market LLC |

Warrants |

|

DHAIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 19, 2024, DIH Holding US, Inc. (the “Registrant”) issued a press release announcing three months ended June 30, 2024 financial results. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On August 19, 2024, the Registrant posted an updated investor deck to its website. A copy of the updated deck is furnished as Exhibit 99.2 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(a)-(b) Financial Statements.

(c) Exhibits.

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File (Formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DIH HOLDING US, INC. |

|

|

|

|

Date: |

August 19, 2024 |

By: |

/s/ Jason Chen |

|

|

|

Jason Chen |

Exhibit 99.1

DIH Announces Fiscal 2025 First Quarter Financial Results

NORWELL, MA – August 19, 2024 DIH Holding US, Inc. ("DIH")(NASDAQ:DHAI), a global provider of advanced robotic devices used in physical rehabilitation, which incorporate visual stimulation in an interactive manner to enable clinical research and intensive functional rehabilitation and training in patients with walking impairments, reduced balance and/or impaired arm and hand functions, today announced financial results for the quarter ended June 30, 2024, which is the first quarter of fiscal 2025.

Recent Highlights

“We are very pleased with the Company’s performance in the first quarter of Fiscal Year 2025, showing significant progress over the same quarter last year,” said Jason Chen, Chairman and CEO of DIH. “I am excited that two of our major strategic markets, EMEA and the Americas, each achieved growth of 54% and that recurring service revenue grew by 49%. Our team has increased account penetration and enhanced productivity through workflow efficiencies, as reflected in the significant improvements in both gross margin and net income. We will continue to enrich our product solution offerings throughout the year and I remain excited about the significant growth opportunities ahead of us.”

Financial Results for the First Fiscal Quarter Ended June 30, 2024

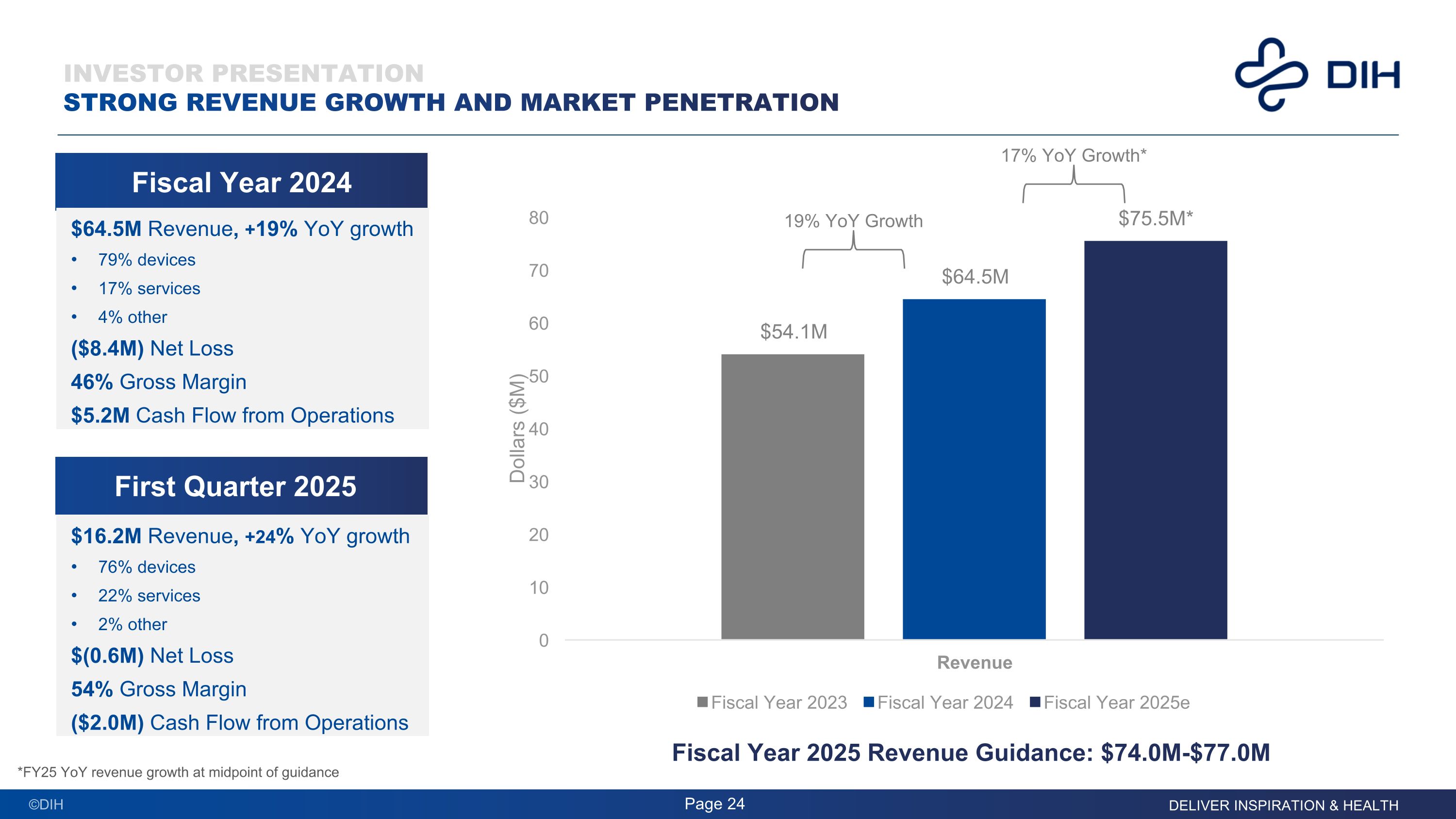

Revenue for the three months ended June 30, 2024 increased by $3.1 million, or 24.1%, to $16.2 million from $13.0 million for the three months ended June 30, 2023. The overall increase was primarily due to an increase in devices sold of $1.8 million, or 17.6% year over year. The increase in devices revenue was primarily driven by higher sales volume in EMEA. Services revenue represented an increase of $1.2 million, up 49.1% compared to the prior period. Other revenues were consistent compared to the prior period. Total revenue in EMEA and the Americas increased by $3.6 million and $1.6 million, respectively, to $10.2 million and $4.6 million for the three months ended June 30, 2024 compared to $6.6 million and $3.0 million for the three months ended June 30, 2023. The increase was partially offset by a decrease in sales in Asia.

The impact due to foreign currency translation resulted in a decrease of approximately $0.1 million in revenue for the three months ended June 30, 2024.

Gross profit for the first fiscal quarter ended June 30, 2024, was $8.7 million, an increase of 60.6% compared to the prior year period. The increase was driven by an increase of $3.1 million in sales primarily in the EMEA region. Cost of sales was improved as compared to June 30, 2023, and was driven in part by a provision adjustment in the prior year that was not recurring in the current period.

Selling, general and administrative expense for the three months ended June 30, 2024 increased by $2.8 million, or 48.2%, to $8.7 million from $5.8 million for the three months ended June 30, 2023. The increase was driven by a $0.7 million increase in professional service costs related to audit, legal and other professional services along with an investment in finance capacity to support public company reporting obligations. Additionally, the increase included a $0.7 million increase in performance-based compensation and a $0.9 million increase in overhead expenses supporting the current growth. In addition, the Company implemented new guidance for the provision of credit losses during the three months ended June 30, 2023 The adjustment during the prior period reduced reserves on receivables in the prior year and, generated a benefit to the Company in the prior year that is not recurring as of the three months ended June 30 2024.

Research and development costs for the three months ended June 30, 2024 increased by $0.2 million, or 14.3%, to $1.6 million from $1.4 million for the three months ended June 30, 2023. The increase was primarily attributable to a $0.2 million increase in personnel expenses related to increased employee compensation.

Cash and cash equivalents on June 30, 2024 totaled $2.7 million.

Fiscal Year 2025 Outlook

The Company continues to expect gross revenue for fiscal year 2025 to range between $74 million and $77 million, representing approximately 15%-20% growth over fiscal year 2024.

About DIH Holding US, Inc.

DIH stands for the vision to “Deliver Inspiration & Health” to improve the daily lives of millions of people with disabilities and functional impairments through providing devices and solutions enabling intensive rehabilitation. DIH is a global provider of advanced robotic devices used in physical rehabilitation, which incorporate visual stimulation in an interactive manner to enable clinical research and intensive functional rehabilitation and training in patients with walking impairments, reduced balance and/or impaired arm and hand functions. Built through the mergers of global-leading niche technology providers, DIH is a transformative rehabilitation solutions provider and consolidator of a largely fragmented and manual-labor-driven industry.

Caution Regarding Forward-Looking Statements

This press release contains certain statements which are not historical facts, which are forward-looking statements within the meaning of the federal securities laws, for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. These forward-looking statements include certain statements made with respect to the business combination, the services offered by DIH and the markets in which it operates, and DIH’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions provided for illustrative purposes only, and projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. These risks and uncertainties include, but are not limited to: general economic, political and business conditions; the ability of DIH to achieve its projected revenue, the failure of DIH realize the anticipated benefits of the recently-completed business combination and access to sources of additional debt or equity capital if needed. While DIH may elect to update these forward-looking statements at some point in the future, DIH specifically disclaims any obligation to do so.

Investor Contact

Greg Chodaczek

332-895-3230

Investor.relations@dih.com

DIH HOLDING US, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data, unaudited)

|

|

As of June 30, 2024 |

|

|

As of March 31, 2024 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

2,749 |

|

|

$ |

3,225 |

|

Accounts receivable, net of allowances of $631 and $667, respectively |

|

|

5,690 |

|

|

|

5,197 |

|

Inventories, net |

|

|

9,014 |

|

|

|

7,830 |

|

Due from related party |

|

|

5,728 |

|

|

|

5,688 |

|

Other current assets |

|

|

6,194 |

|

|

|

5,116 |

|

Total current assets |

|

|

29,375 |

|

|

|

27,056 |

|

Property, and equipment, net |

|

|

664 |

|

|

|

530 |

|

Capitalized software, net |

|

|

2,052 |

|

|

|

2,131 |

|

Other intangible assets, net |

|

|

380 |

|

|

|

380 |

|

Operating lease, right-of-use assets, net |

|

|

4,388 |

|

|

|

4,466 |

|

Other tax assets |

|

|

417 |

|

|

|

267 |

|

Other assets |

|

|

933 |

|

|

|

905 |

|

Total assets |

|

$ |

38,209 |

|

|

$ |

35,735 |

|

Liabilities and Deficit |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

5,368 |

|

|

$ |

4,305 |

|

Employee compensation |

|

|

3,991 |

|

|

|

2,664 |

|

Due to related party |

|

|

9,790 |

|

|

|

10,192 |

|

Current portion of deferred revenue |

|

|

6,350 |

|

|

|

5,211 |

|

Manufacturing warranty obligation |

|

|

549 |

|

|

|

513 |

|

Current portion of long-term operating lease |

|

|

1,509 |

|

|

|

1,572 |

|

Current maturities of convertible debt |

|

|

1,461 |

|

|

|

— |

|

Advance payments from customers |

|

|

9,272 |

|

|

|

10,562 |

|

Accrued expenses and other current liabilities |

|

|

9,950 |

|

|

|

9,935 |

|

Total current liabilities |

|

|

48,240 |

|

|

|

44,954 |

|

Convertible debt, net of current maturities |

|

|

1,177 |

|

|

|

— |

|

Notes payable - related party |

|

|

10,722 |

|

|

|

11,457 |

|

Non-current deferred revenues |

|

|

4,747 |

|

|

|

4,670 |

|

Long-term operating lease |

|

|

2,925 |

|

|

|

2,917 |

|

Deferred tax liabilities |

|

|

89 |

|

|

|

112 |

|

Other non-current liabilities |

|

|

4,304 |

|

|

|

4,171 |

|

Total liabilities |

|

$ |

72,204 |

|

|

$ |

68,281 |

|

Commitments and contingencies |

|

|

|

|

|

|

||

Deficit: |

|

|

|

|

|

|

||

Preferred stock, $0.00001 par value; 10,000,000 shares authorized; no shares issued and outstanding at June 30, 2024 and March 31, 2024 |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value; 100,000,000 shares authorized; 34,544,935 shares issued and outstanding at June 30, 2024 and March 31, 2024 |

|

|

3 |

|

|

|

3 |

|

Additional paid-in-capital |

|

|

3,685 |

|

|

|

2,613 |

|

Accumulated deficit |

|

|

(35,826 |

) |

|

|

(35,212 |

) |

Accumulated other comprehensive income (loss) |

|

|

(1,857 |

) |

|

|

50 |

|

Total deficit |

|

$ |

(33,995 |

) |

|

$ |

(32,546 |

) |

Total liabilities and deficit |

|

$ |

38,209 |

|

|

$ |

35,735 |

|

DIH HOLDING US, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data, unaudited)

|

For the Three Months Ended June 30, |

|

|||||

|

2024 |

|

|

2023 |

|

||

Revenue |

$ |

16,187 |

|

|

$ |

13,045 |

|

Cost of sales |

|

7,521 |

|

|

|

7,648 |

|

Gross profit |

|

8,666 |

|

|

|

5,397 |

|

Operating expenses: |

|

|

|

|

|

||

Selling, general, and administrative expense |

|

8,676 |

|

|

|

5,837 |

|

Research and development |

|

1,644 |

|

|

|

1,438 |

|

Total operating expenses |

|

10,320 |

|

|

|

7,275 |

|

Operating loss |

|

(1,654 |

) |

|

|

(1,878 |

) |

Other income (expense): |

|

|

|

|

|

||

Interest income (expense) |

|

(135 |

) |

|

|

(120 |

) |

Other income (expense), net |

|

1,898 |

|

|

|

(689 |

) |

Total other income (expense) |

|

1,763 |

|

|

|

(809 |

) |

Income (loss) before income taxes |

|

109 |

|

|

|

(2,687 |

) |

Income tax expense |

|

723 |

|

|

|

226 |

|

Net loss |

$ |

(614 |

) |

|

$ |

(2,913 |

) |

|

|

|

|

|

|

||

Net loss per share, basic and diluted |

$ |

(0.02 |

) |

|

$ |

(0.12 |

) |

Weighted average common shares outstanding, basic and diluted |

|

34,545 |

|

|

|

25,000 |

|

DIH HOLDING US, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands, unaudited)

|

|

For the Three Months Ended June 30, |

|

|||||

|

|

2024 |

|

2023 |

|

|||

Net loss |

|

$ |

(614 |

) |

|

$ |

(2,913 |

) |

Other comprehensive (loss) income, net of tax |

|

|

|

|

|

|

||

Foreign currency translation adjustments, net of tax of $0 and $0 |

|

|

(1,388 |

) |

|

|

841 |

|

Pension liability adjustments, net of tax of $0 and $0 |

|

|

(291 |

) |

|

|

(420 |

) |

Other comprehensive (loss) income |

|

|

(1,679 |

) |

|

|

421 |

|

Comprehensive loss |

|

$ |

(2,293 |

) |

|

$ |

(2,492 |

) |

DIH HOLDING US, INC. AND SUBSIDIARIES

INTERIM CONDENSED COMBINED STATEMENTS OF CHANGES IN EQUITY (DEFICIT)

(in thousands, unaudited)

|

Common Stock |

|

|

|

|

|

|

|

|

|

||||||||

|

Shares(1) |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

||||||

Balance, March 31, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(26,769 |

) |

$ |

(289 |

) |

$ |

(28,954 |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

(2,913 |

) |

|

— |

|

|

(2,913 |

) |

Other comprehensive loss, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

421 |

|

|

421 |

|

Balance, June 30, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(29,682 |

) |

$ |

132 |

|

$ |

(31,446 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Shares |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

||||||

Balance, March 31, 2024 |

|

34,544,935 |

|

$ |

3 |

|

$ |

2,613 |

|

$ |

(35,212 |

) |

$ |

50 |

|

$ |

(32,546 |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

(614 |

) |

|

— |

|

|

(614 |

) |

Transaction relates to reverse recapitalization |

|

— |

|

|

— |

|

|

710 |

|

|

— |

|

|

— |

|

|

710 |

|

Issuance of warrants |

|

— |

|

|

— |

|

|

362 |

|

|

— |

|

|

— |

|

|

362 |

|

Other comprehensive income, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,907 |

) |

|

(1,907 |

) |

Balance, June 30, 2024 |

|

34,544,935 |

|

$ |

3 |

|

$ |

3,685 |

|

$ |

(35,826 |

) |

$ |

(1,857 |

) |

$ |

(33,995 |

) |

DIH HOLDING US, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

|

|

For the Three Months Ended June 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(614 |

) |

|

$ |

(2,913 |

) |

Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

91 |

|

|

|

79 |

|

Provision for credit losses |

|

|

(36 |

) |

|

|

(432 |

) |

Allowance for inventory obsolescence |

|

|

(13 |

) |

|

|

693 |

|

Pension contributions |

|

|

(150 |

) |

|

|

(150 |

) |

Pension expense |

|

|

77 |

|

|

|

66 |

|

Foreign exchange (gain) loss |

|

|

(1,899 |

) |

|

|

689 |

|

Noncash lease expense |

|

|

422 |

|

|

|

375 |

|

Noncash interest expense |

|

|

— |

|

|

|

7 |

|

Deferred and other noncash income tax (income) expense |

|

|

(166 |

) |

|

|

4 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

(489 |

) |

|

|

705 |

|

Inventories |

|

|

(1,468 |

) |

|

|

(1,332 |

) |

Due from related parties |

|

|

(108 |

) |

|

|

1,522 |

|

Due to related parties |

|

|

(584 |

) |

|

|

(649 |

) |

Other assets |

|

|

(872 |

) |

|

|

(398 |

) |

Operating lease liabilities |

|

|

(425 |

) |

|

|

(518 |

) |

Accounts payable |

|

|

1,508 |

|

|

|

36 |

|

Employee compensation |

|

|

1,388 |

|

|

|

(160 |

) |

Other liabilities |

|

|

— |

|

|

|

189 |

|

Deferred revenue |

|

|

1,411 |

|

|

|

209 |

|

Manufacturing warranty obligation |

|

|

50 |

|

|

|

71 |

|

Advance payments from customers |

|

|

(1,136 |

) |

|

|

2,229 |

|

Accrued expense and other current liabilities |

|

|

1,003 |

|

|

|

(797 |

) |

Net cash used in operating activities |

|

|

(2,010 |

) |

|

|

(475 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

(235 |

) |

|

|

(15 |

) |

Net cash used in investing activities |

|

|

(235 |

) |

|

|

(15 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from issuance of convertible debt, net of issuance costs |

|

|

2,509 |

|

|

|

— |

|

Payments on related party notes payable |

|

|

(735 |

) |

|

|

(1,936 |

) |

Net cash provided by (used in) financing activities |

|

|

1,774 |

|

|

|

(1,936 |

) |

Effect of currency translation on cash and cash equivalents |

|

|

(5 |

) |

|

|

13 |

|

Net increase in cash, and cash equivalents, and restricted cash |

|

|

(476 |

) |

|

|

(2,413 |

) |

Cash, and cash equivalents - beginning of period |

|

|

3,225 |

|

|

|

3,175 |

|

Cash, and cash equivalents - end of period |

|

$ |

2,749 |

|

|

$ |

762 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

||

Interest paid |

|

$ |

135 |

|

|

$ |

113 |

|

Income tax paid |

|

$ |

— |

|

|

$ |

— |

|

Supplemental disclosure of non-cash investing and financing activity: |

|

|

|

|

|

|

||

Accounts payable settled upon reverse recapitalization |

|

$ |

710 |

|

|

$ |

— |

|

DIH Dedicated to restoring mobility and Enhancing human performance Investor Presentation August 2024 Nasdaq: DHAI

In this presentation, “DIH”, the “Company”, “we”, “us” and “our” mean DIH Holding US, Inc, a Delaware corporation (Nasdaq: DHAI). All amounts are in U.S. dollars unless otherwise indicated. The information contained herein does not purport to contain all of the information about the Company. The information contained herein has not been independently verified. No representations or warranties are made or implied with respect to the information contained herein. This presentation contains forward-looking statements with respect to the Company. These forward-looking statements, by their nature, require the Company to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, including without limitation the successful and timely completion and the commercialization of the products referred to herein. Forward-looking statements are not guarantees of performance. These forward-looking statements, including financial outlooks and strategies or deliverables stated herein, may involve, but are not limited to, comments with respect to the Company’s business or financial objectives, its strategies or future actions, its targets, expectations for financial condition or outlook for operations. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including perceptions of historical trends, current conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances. These assumptions are considered to be reasonable based on currently available information, but the reader is cautioned that these assumptions regarding future events, many of which are beyond its control, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Company and its business. The forward-looking information set forth therein reflects expectations as of the date hereof and is subject to change thereafter. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Undue reliance should not be placed on forward-looking statements. The forward-looking statements contained in this presentation are expressly qualified by this cautionary statement. This presentation is not intended to form the basis of any investment decision and there can be no assurance that any transaction will be undertaken or completed in whole or in part. The delivery of this presentation shall not be taken as any form of commitment on the part of the Company or its stockholders to proceed with any transaction, and no offers will subject the Company or its stockholders to any contractual obligations before definitive documentation has been executed. The Company reserves the right at any time without prior notice and without any liability to (i) negotiate with one or more prospective investors in accordance with any timetable and on any terms that the Company may decide, (ii) provide different information or access to information to different prospective investors, (iii) enter into definitive documentation and (iv) terminate the process, including any negotiations with any prospective investor without giving any reasons therefor. Investor presentationforward looking statement and disclaimer Page 2

DIH at a glance: Robotic-enabled movement platform improving the lives of people with disabilities and functional impairments

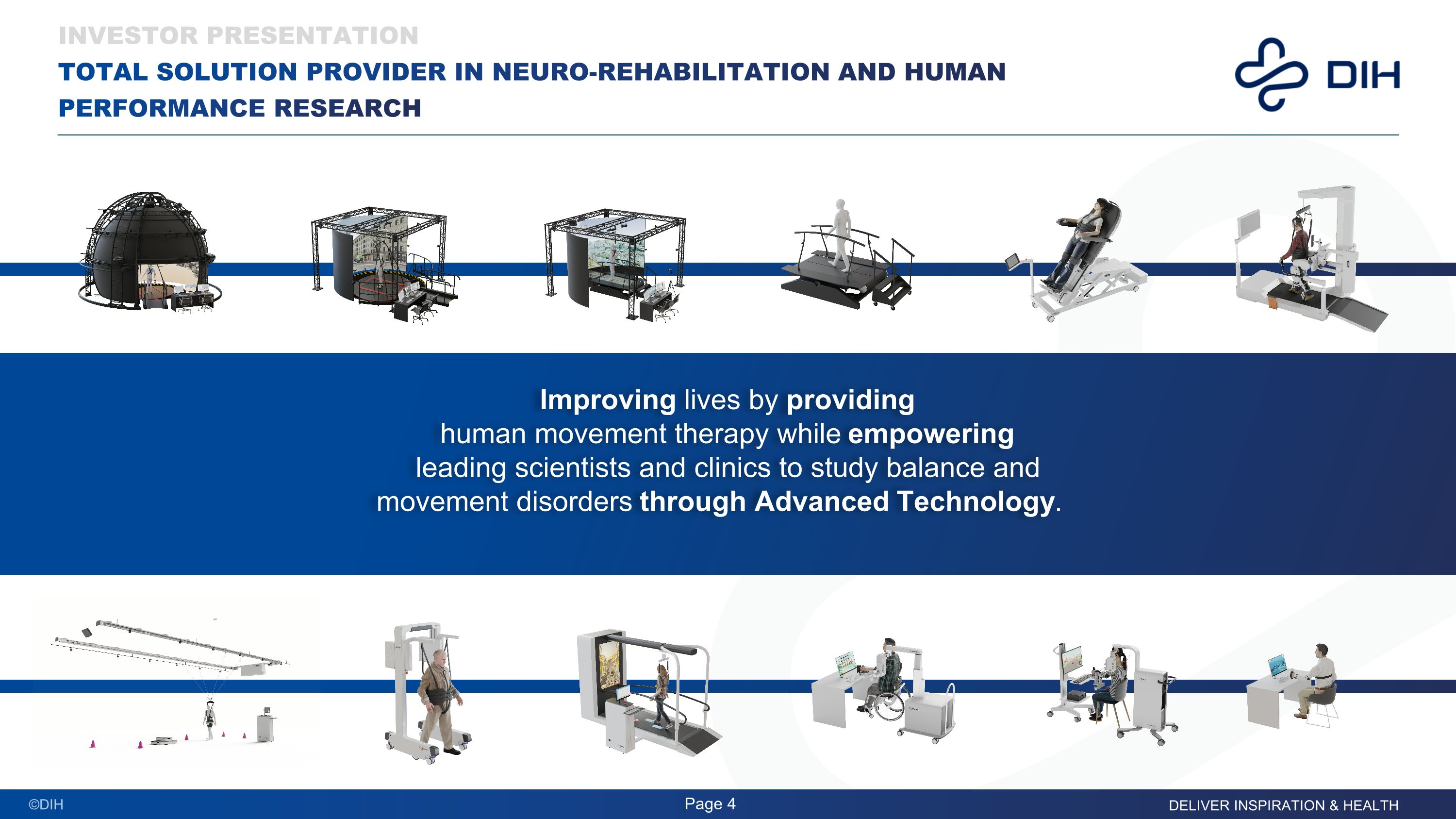

Investor presentationtotal solution provider in neuro-rehabilitation and human performance research Improving lives by providing human movement therapy while empowering leading scientists and clinics to study balance and movement disorders through Advanced Technology. Page 4

Investor presentationaddressing increased market demand by providing innovative solutions for hospitals, clinics, and research Institutions DIH – a Global Solution Provider, has the broadest portfolio in neuro-rehabilitation and human performance research, with over 4,500 devices installed. With an aging population and an increasing number of people living with neurological diseases, hospitals and clinics will be understaffed; robotic rehabilitation fills the gap and helps therapists and patients thrive. More intensive, repetition-based therapy, supported by Advanced Technology is shown to have superior patient outcomes and can send them home sooner. Technology solves the supply-demand problem in rehabilitation settings by allowing occupational and physical therapists to work with multiple patients effectively. Bridges the gap between Clinical and Research applications by enabling and inventing the most advanced technological ways to study and treat balance and movement disorders. Page 5

Investor presentationdih at a glance Page 6 Products & Systems 19 $64.5M FY242 Revenue 19% YoY increase USA, Singapore, Chile, Slovenia, Germany 5 Commercial Regions Employees 243 in 9 global locations from 33 nationalities ` Devices installed1 4,500+ 1,500+ Medical device registrations in 75 countries Sites 3 For R&D and manufacturing in CH,NL and USA 1,800 Customer Accounts HQ 1 DIH Holding US $74M - $77M FY25 Revenue Guidance 17% YoY increase3 1 Includes clinical and research install base 2 FY24 year ending March 31, 2024 3 FY25 YoY revenue growth at the midpoint of guidance

Meeting market demands with innovative Advanced Technologies

Patients Neurological Stroke SCI & cerebral palsy Parkinson’s disease Traumatic brain injury Orthopedic Amputation Osteoarthritis Musculoskeletal disorders Geriatric & Pediatric Aging population with an increased risk of falling and functional impairment Pediatric patients with mobility impairments Health Providers Rehabilitation Hospitals Research Facilities Investor presentationmarket opportunity: end-to-end broad market coverage Page 8 Physical Therapy and Rehab Clinics

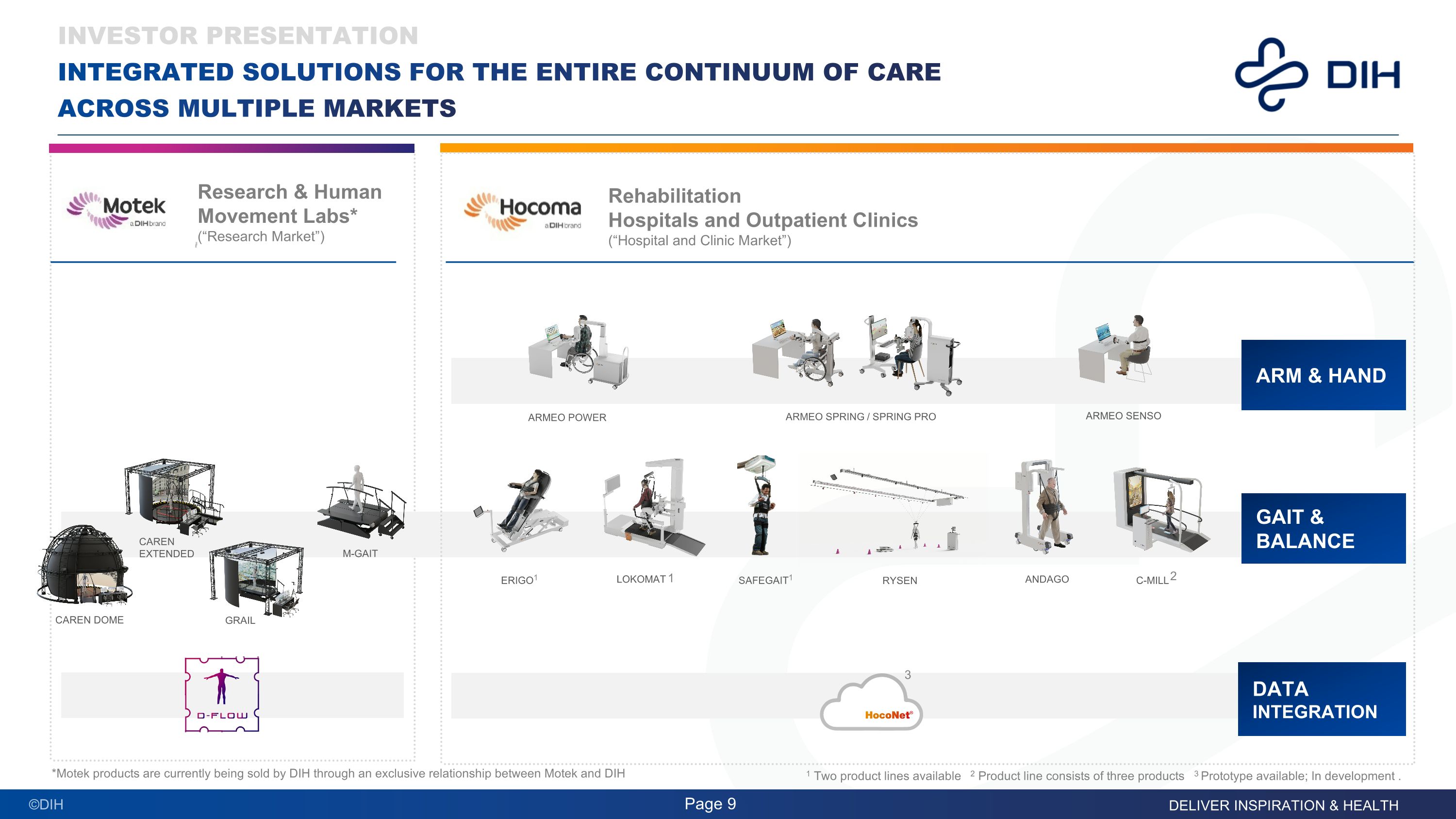

Investor presentationintegrated solutions for the entire continuum of care across multiple markets Rehabilitation Hospitals and Outpatient Clinics (“Hospital and Clinic Market”) Research & Human Movement Labs* (“Research Market”) ARM & HAND GAIT & BALANCE DATA INTEGRATION C-MILL ANDAGO RYSEN LOKOMAT CAREN DOME CAREN EXTENDED GRAIL M-GAIT ARMEO POWER ARMEO SPRING / SPRING PRO ARMEO SENSO Page 9 3 1 Two product lines available 2 Product line consists of three products 3 Prototype available; In development . 2 1 *Motek products are currently being sold by DIH through an exclusive relationship between Motek and DIH SAFEGAIT1 ERIGO1

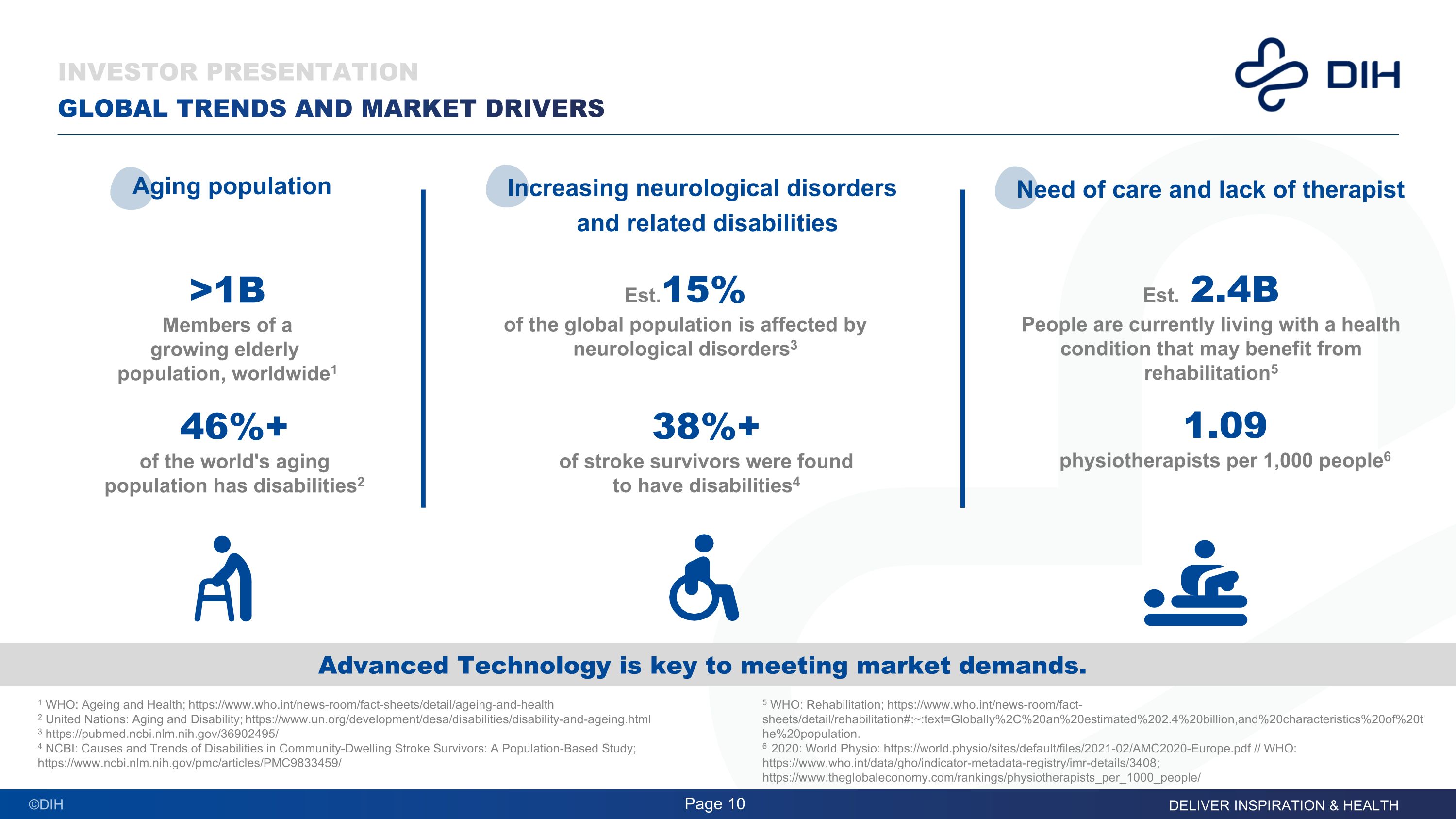

Investor presentationglobal trEnds and MARKET DRIVERS Page 10 Aging population Advanced Technology is key to meeting market demands. Increasing neurological disorders and related disabilities Need of care and lack of therapist 1 WHO: Ageing and Health; https://www.who.int/news-room/fact-sheets/detail/ageing-and-health 2 United Nations: Aging and Disability; https://www.un.org/development/desa/disabilities/disability-and-ageing.html 3 https://pubmed.ncbi.nlm.nih.gov/36902495/ 4 NCBI: Causes and Trends of Disabilities in Community-Dwelling Stroke Survivors: A Population-Based Study; https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9833459/ 5 WHO: Rehabilitation; https://www.who.int/news-room/fact-sheets/detail/rehabilitation#:~:text=Globally%2C%20an%20estimated%202.4%20billion,and%20characteristics%20of%20the%20population. 6 2020: World Physio: https://world.physio/sites/default/files/2021-02/AMC2020-Europe.pdf // WHO: https://www.who.int/data/gho/indicator-metadata-registry/imr-details/3408; https://www.theglobaleconomy.com/rankings/physiotherapists_per_1000_people/ >1B Members of a growing elderly population, worldwide1 38%+ of stroke survivors were found to have disabilities4 46%+ of the world's aging population has disabilities2 1.09 physiotherapists per 1,000 people6 Est. 2.4B People are currently living with a health condition that may benefit from rehabilitation5 Est.15% of the global population is affected by neurological disorders3

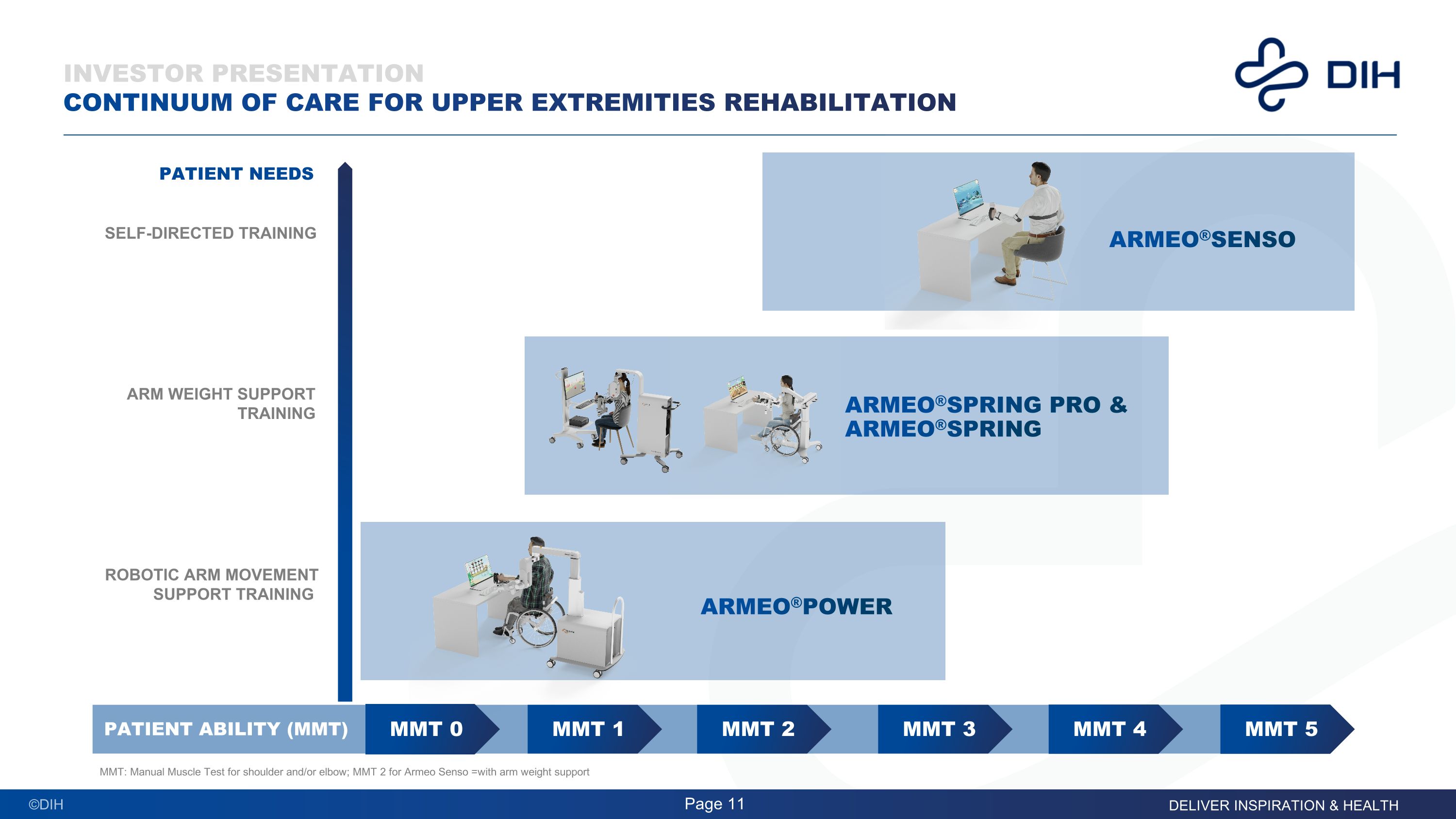

Investor presentationCONTINUUM OF CARE FOR Upper extremities REHABILITATION ARMEO®SENSO ARMEO®SPRING PRO & ARMEO®SPRING ARMEO®POWER ROBOTIC ARM MOVEMENT SUPPORT TRAINING PATIENT NEEDS PATIENT ABILITY (MMT) MMT 0 MMT 1 MMT 2 MMT 3 MMT 4 MMT 5 ARM WEIGHT SUPPORT TRAINING SELF-DIRECTED TRAINING MMT: Manual Muscle Test for shoulder and/or elbow; MMT 2 for Armeo Senso =with arm weight support Page 11

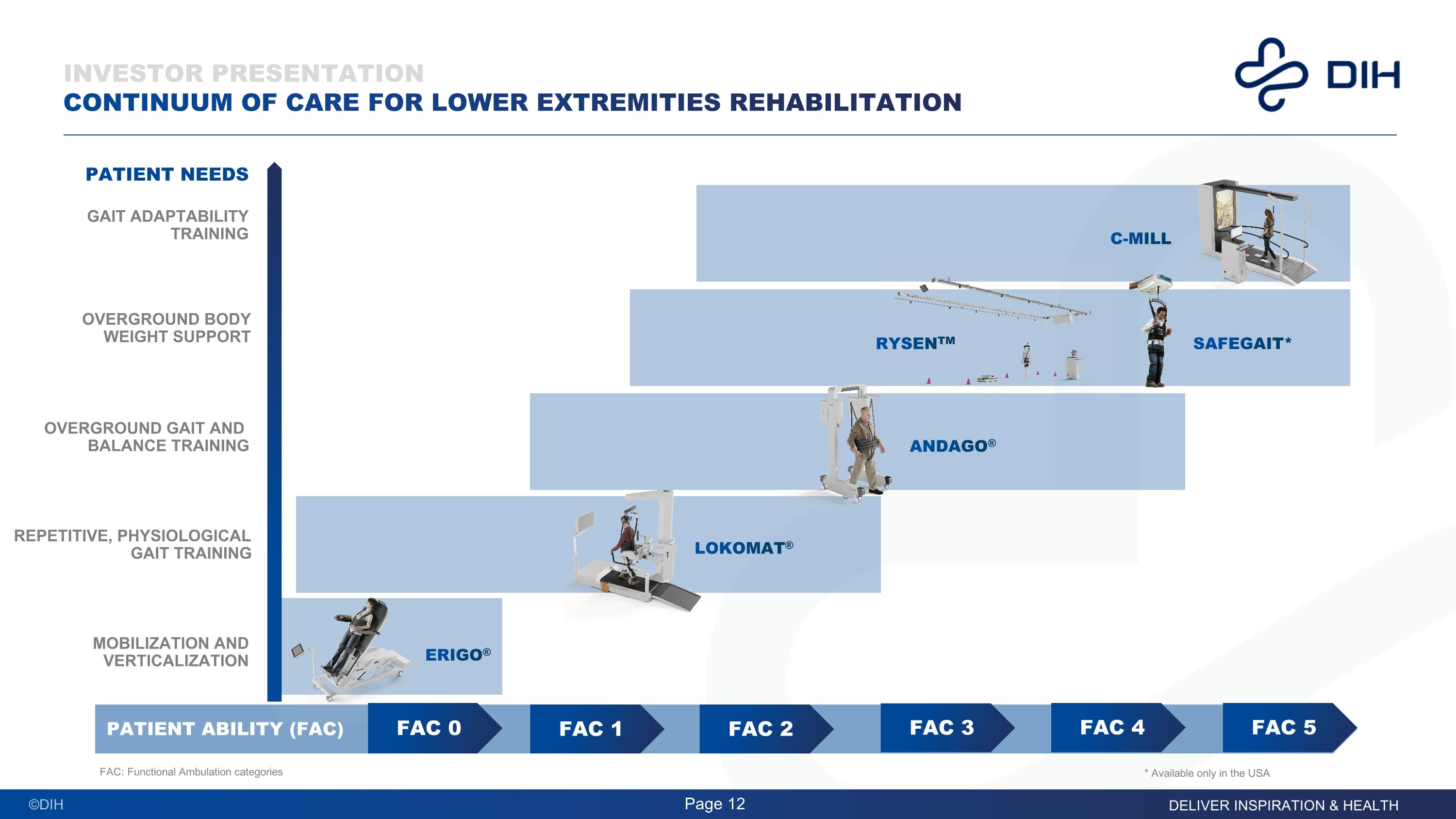

PATIENT ABILITY (FAC) Investor presentationcontinuum of CARE FOR LOWER EXTREMITIES REHABILITATION C-MIll Andago® rysenTM LOKOMAT® ERIGO® FAC 0 FAC 1 FAC 2 FAC 3 FAC 4 FAC 5 SAFEGAIT* MOBILIZATION AND VERTICALIZATION REPETITIVE, PHYSIOLOGICAL GAIT TRAINING OVERGROUND GAIT AND BALANCE TRAINING GAIT ADAPTABILITY TRAINING OVERGROUND BODY WEIGHT SUPPORT PATIENT NEEDS FAC: Functional Ambulation categories Page 12 * Available only in the USA

Investor presentationresearch PORTFOLIO Page 13 Caren extended* GRAIL* M-GAIT* Modular Gait Lab Caren high end* Targets all aspects of balance and locomotion.The use of virtual reality enables researchers to assess the subject’s behavior and includes sensory inputs like visual, auditory and vestibular. Provides analysis and therapy in challengingconditions to improve gait, while real-time feedback enables analysis and training during the same session. Enables multiple system enhancementsfor added functionality of gait-lab. INTENDED USE Gait Real-time AnalysisInteractive Lab Computer Assisted Rehabilitation Environment Computer Assisted Rehabilitation Environment *Motek products are currently being sold by DIH through an exclusive relationship between Motek and DIH

Investor presentationA trusted partner every step of the way We provide guidelines and support customers in building their rehabilitation project. We find the right solution to match the organizations’ needs, space and budget. BUSINESS MODEL and PLANNING To help make the best use of our solutions, we offer clinical integration consulting and ongoing support, as well as education and training. CLINICAL SERVICES We provide technical support and regular maintenance after installation so customers can maintain clinical routines without disruption. TECHNICAL SERVICES Research drives us forward and our support and services help institutions initiate their own research programs. RESEARCH SERVICES Customers immediately stand out from other rehabilitation facilities. With our support we make sure they are seen and heard. MARKETING SERVICES DIH provides a broad portfolio of devices and an extensive range of services, to become a Total Solution partner for our customers Page 14

Investor presentationtrusted by leading rehabilitation and research institutions >60 Leading Institutions trust DIH DIH collaborates with world renowned institutions in rehabilitation and research as reference centers and innovation partners Page 15

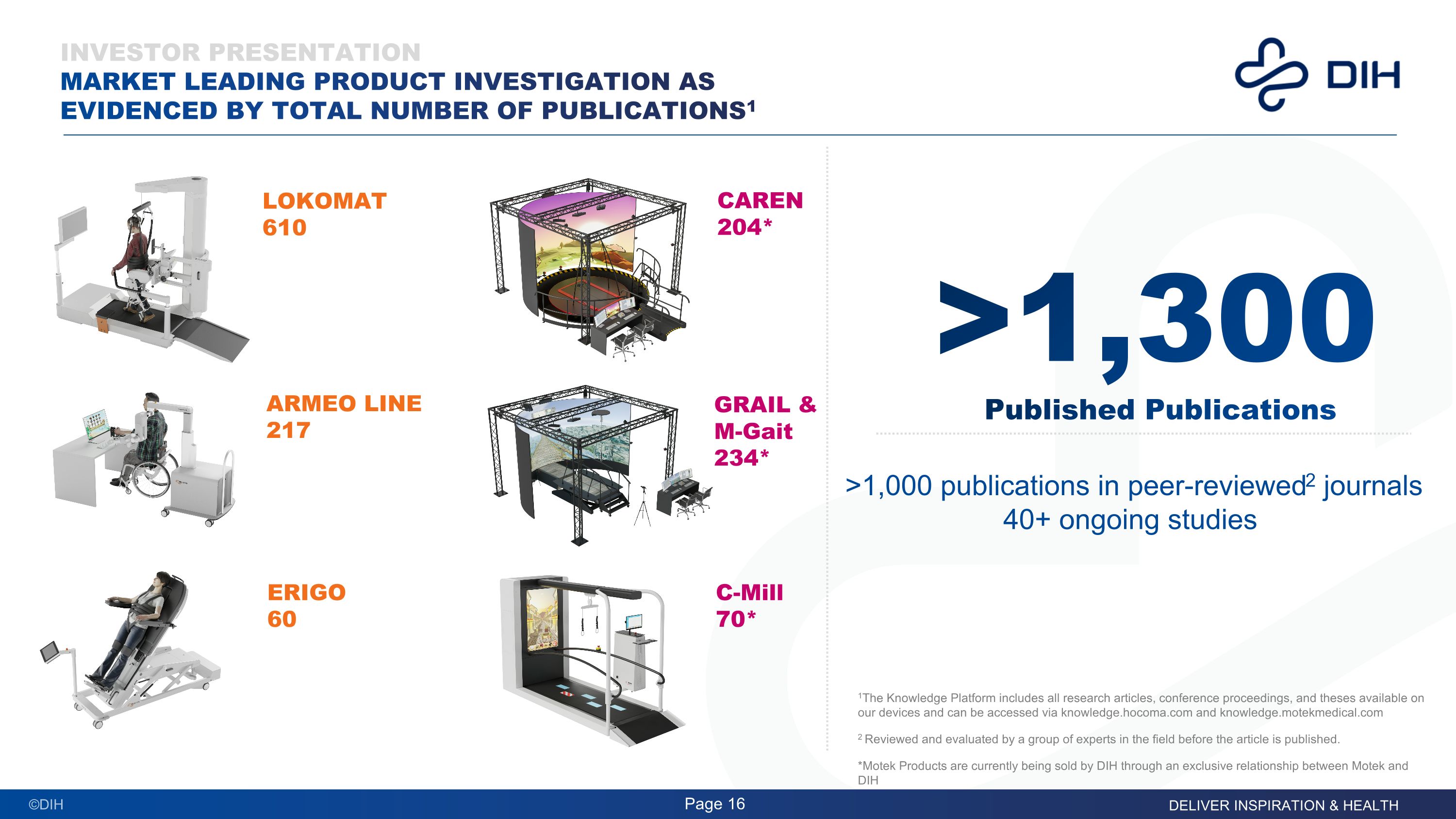

C-Mill 70* GRAIL & M-Gait 234* Investor presentationMarket leading product investigation as evidenced by ToTAL number of publications1 Page 16 1The Knowledge Platform includes all research articles, conference proceedings, and theses available on our devices and can be accessed via knowledge.hocoma.com and knowledge.motekmedical.com 2 Reviewed and evaluated by a group of experts in the field before the article is published. *Motek Products are currently being sold by DIH through an exclusive relationship between Motek and DIH LOKOMAT 610 ARMEO LINE 217 ERIGO 60 CAREN 204* >1,300 Published Publications >1,000 publications in peer-reviewed2 journals 40+ ongoing studies

Early Entrants Emerging Players Industry Leader DIH is uniquely positioned as a leader in rehabilitation-tech and research markets Investor presentationCompetitive Landscape Page 17 LFWD (NASDAQ) EKSO (NASDAQ) DVL (ASX) DHAI (NASDAQ)

Investor presentationSources of Competitive Advantage Page 18 Leading Technology Highly recognized premier brands and technologies in our industry, endorsed by leading rehabilitation institutes and opinion leaders Product Portfolio Broadest product portfolio in advanced robotics and sophisticated VR-enabled movement systems; most competitors operate in a single product category Commercial Reach Strong global market coverage with approx. 3-5x more sales volume than competitors Innovation Sustained innovation capabilities with decades of proven expertise and resources Tech Partnerships Platform and core technology (hardware and software) supported by strong partnerships with leading research groups Network Effect Strong supporting functions and operational infrastructure that establish a platform network effect which will be difficult to replicate Industry Experience Organizational breadth and depth with significant experience in acquisition integration; key to our growth strategy and differentiation from competitors that are early in their organizational life cycles

Page 19 Global solution provider combining innovative robotic and VR technologies with clinical integration and proprietary insights. Transformative total solutions provider and consolidator in a fragmented and manual-labor-driven industry. Innovative and broad product portfolio, covering the entire continuum of care. Strong growth opportunity with $64.5M revenue in FY24, representing 19% year-over-year growth. Investor presentationInvestment highlights $14.9B1 Total global rehabilitation equipment market ~$590M1 Rehabilitation Robots Market ~27%1 Estimated market CAGR through 2027 1 “Rehabilitation Robots Market by Product, End user and Geography – Forecast and Analysis (2023 – 2027)” November 2022 Global Market

Way Forward - Investment Opportunity

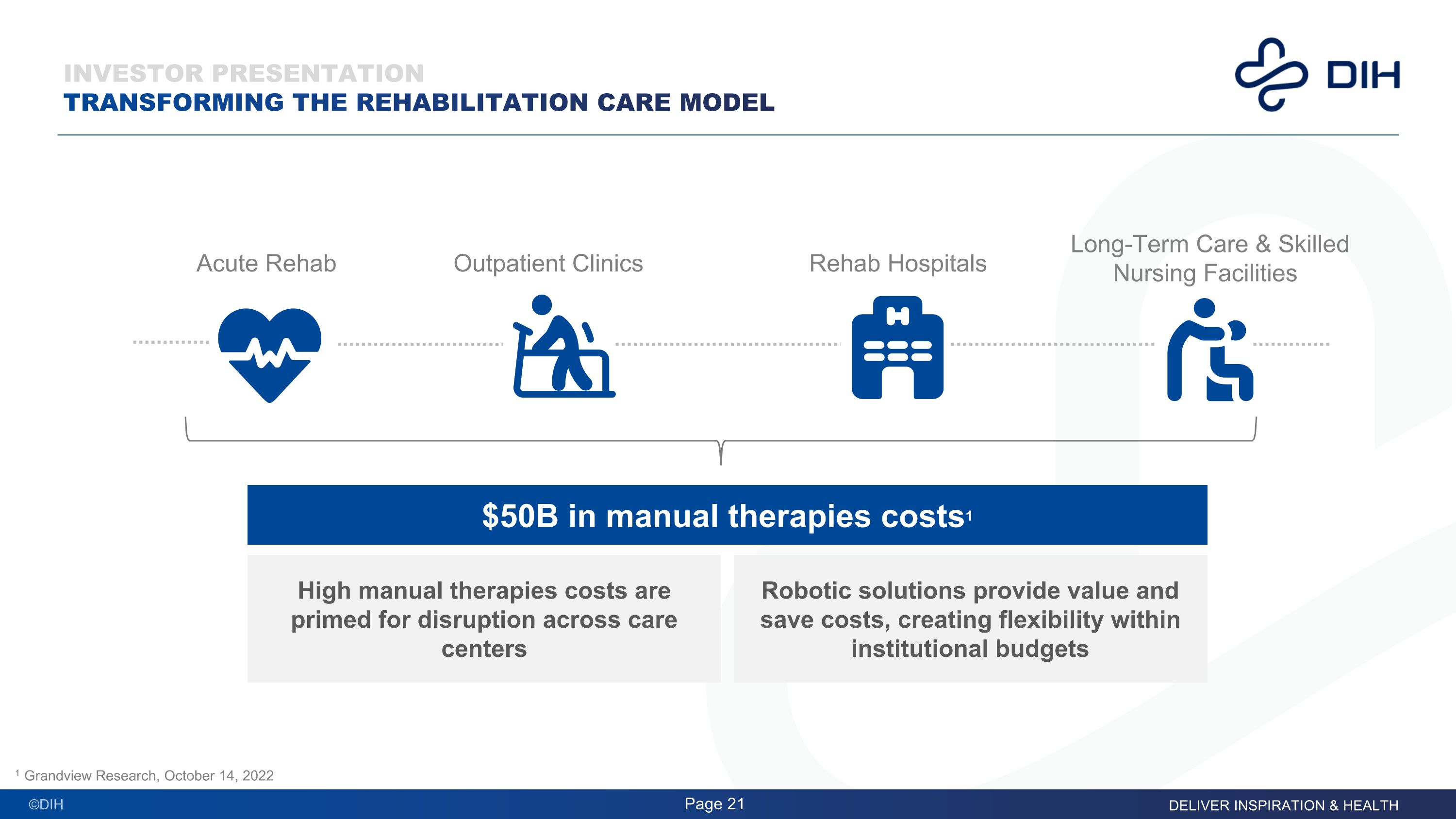

High manual therapies costs are primed for disruption across care centers Robotic solutions provide value and save costs, creating flexibility within institutional budgets Investor presentationTransforming the rehabilitation care model Page 21 Rehab Hospitals Long-Term Care & Skilled Nursing Facilities Outpatient Clinics Acute Rehab $50B in manual therapies costs1 1 Grandview Research, October 14, 2022

Phase 3 Phase 2 Penetrate Markets Drive Market Standardization Develop Total Solutions Expand presence in US and EU Prioritize product innovation and integration efforts Enter new institutions Further penetrate existing accounts Leverage global platforms and infrastructure Realize economies of scale Execute strong M&A targeting Provide fully supported product ecosystems Create significant value and cost savings for providers Enhance the therapy business model Phase 1 Investor presentationStrategic Growth Page 22

Financial Highlights

Page 24 Investor presentationStrong revenue growth and market penetration $64.5M Revenue, +19% YoY growth 79% devices 17% services 4% other ($8.4M) Net Loss 46% Gross Margin $5.2M Cash Flow from Operations Fiscal Year 2024 Fiscal Year 2025 Revenue Guidance: $74.0M-$77.0M 19% YoY Growth 17% YoY Growth* *FY25 YoY revenue growth at midpoint of guidance $16.2M Revenue, +24% YoY growth 76% devices 22% services 2% other $(0.6M) Net Loss 54% Gross Margin ($2.0M) Cash Flow from Operations First Quarter 2025

Investor presentationDIH executive Officers Page 25 Jason Chen Chief Executive Officer and Chairman of the Board Lynden Bass Chief Financial Officer Dr. Patrick Bruno Chief Market Officer

Investor presentationInternational management team Page 26 CEO and Chairman of the Board Jason Chen Chief Financial Officer Lynden Bass Chief Market Officer Hospital & Clinic Patrick Bruno Senior Vice President Sales – EMEA Indirect Slavko Skafar Vice President Global Operations Walther Geiger Vice President FP&A and Commercial Operations Finance LaTonya Vincent Vice President Research Frans Steenbrink

Thank you For more information contact investor.relations@dih.com