UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 7/30/2024

UMB FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

Commission File Number: 001-38481

Missouri |

|

43-0903811 |

(State or other jurisdiction of |

|

(IRS Employer |

incorporation) |

|

Identification No.) |

1010 Grand Blvd., Kansas City, MO 64106

(Address of principal executive offices, including zip code)

(816) 860-7000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $1.00 Par Value |

UMBF |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 30, 2024, UMB Financial Corporation (the “Company”) issued a press release announcing the financial results for the Company for the quarter and period ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 and the information is hereby incorporated by reference herein. The Company does not incorporate by reference information presented at any website referenced in the press release.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission (“SEC”) for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Current Report on Form 8-K in such a filing.

Item 7.01 Regulation FD Disclosure

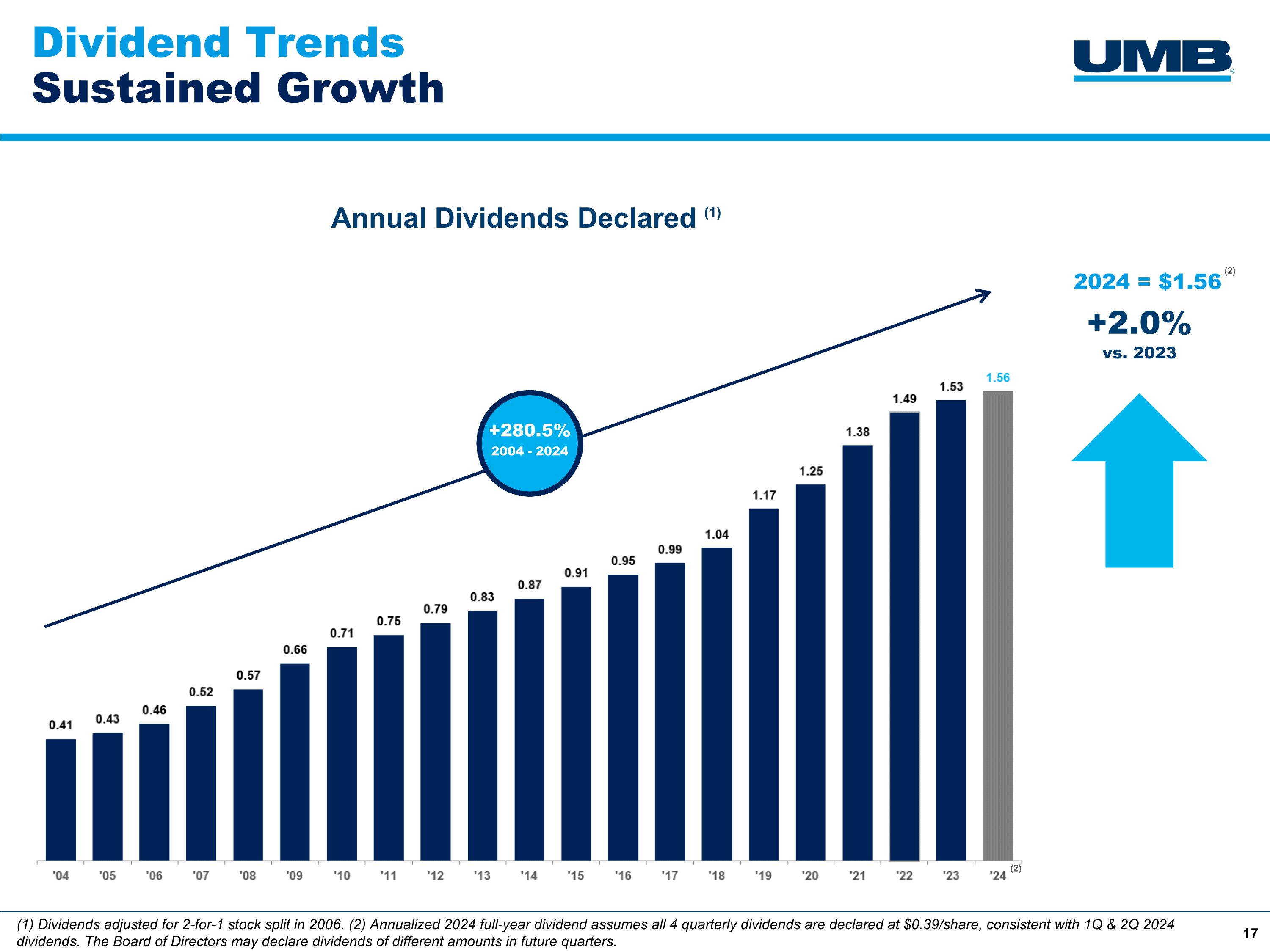

On July 30, 2024, the Company announced in the same press release that the Board of Directors of the Company had declared a quarterly dividend of $0.39 per share that is payable on October 1, 2024 to shareholders of record of the Company as of the close of business on September 10, 2024.

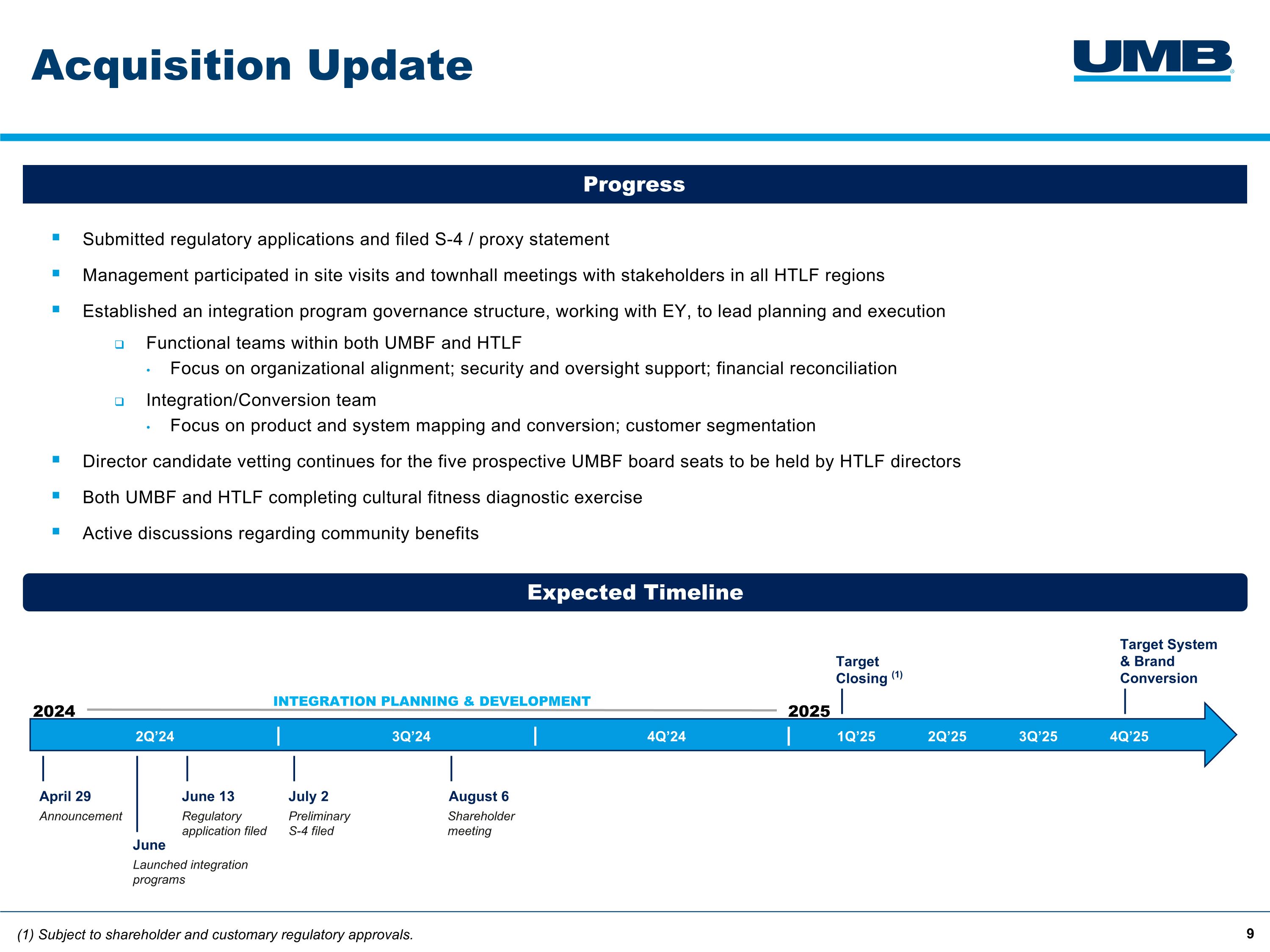

The Company is furnishing a copy of materials that will be used in the Company’s shareholder conference call at 8:30 a.m. (CT) on July 31, 2024. A copy of the materials is attached as Exhibit 99.2 and will be available on the Company’s website at www.umb.com. The materials are dated July 30, 2024, and the Company disclaims any obligation to correct or update any of the materials in the future.

The information provided under Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 hereto, is being furnished and is not deemed to be “filed” with the SEC for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Current Report on Form 8-K in such a filing. The Company does not incorporate by reference to this Current Report on Form 8-K information presented at any website referenced in this report or in any of the Exhibits attached hereto.

Item 9.01 Financial Statements and Exhibits

99.1 |

|

99.2 |

Investor Presentation Materials, dated July 30, 2024.

|

104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UMB FINANCIAL CORPORATION |

|

|

By: |

/s/ Ram Shankar |

|

Ram Shankar Chief Financial Officer |

Date: July 30, 2024

Exhibit 99.1

UMB Financial Corporation News Release

1010 Grand Boulevard

Kansas City, MO 64106

816.860.7000

umb.com

//FOR IMMEDIATE RELEASE//

Media Contact: Stephanie Hague: 816.729.1027

Investor Relations Contact: Kay Gregory: 816.860.7106

UMB Financial Corporation Reports Second Quarter Net Income of $101.3 Million and Net Operating Income(i) of $105.9 Million.

Second Quarter 2024 Financial Highlights

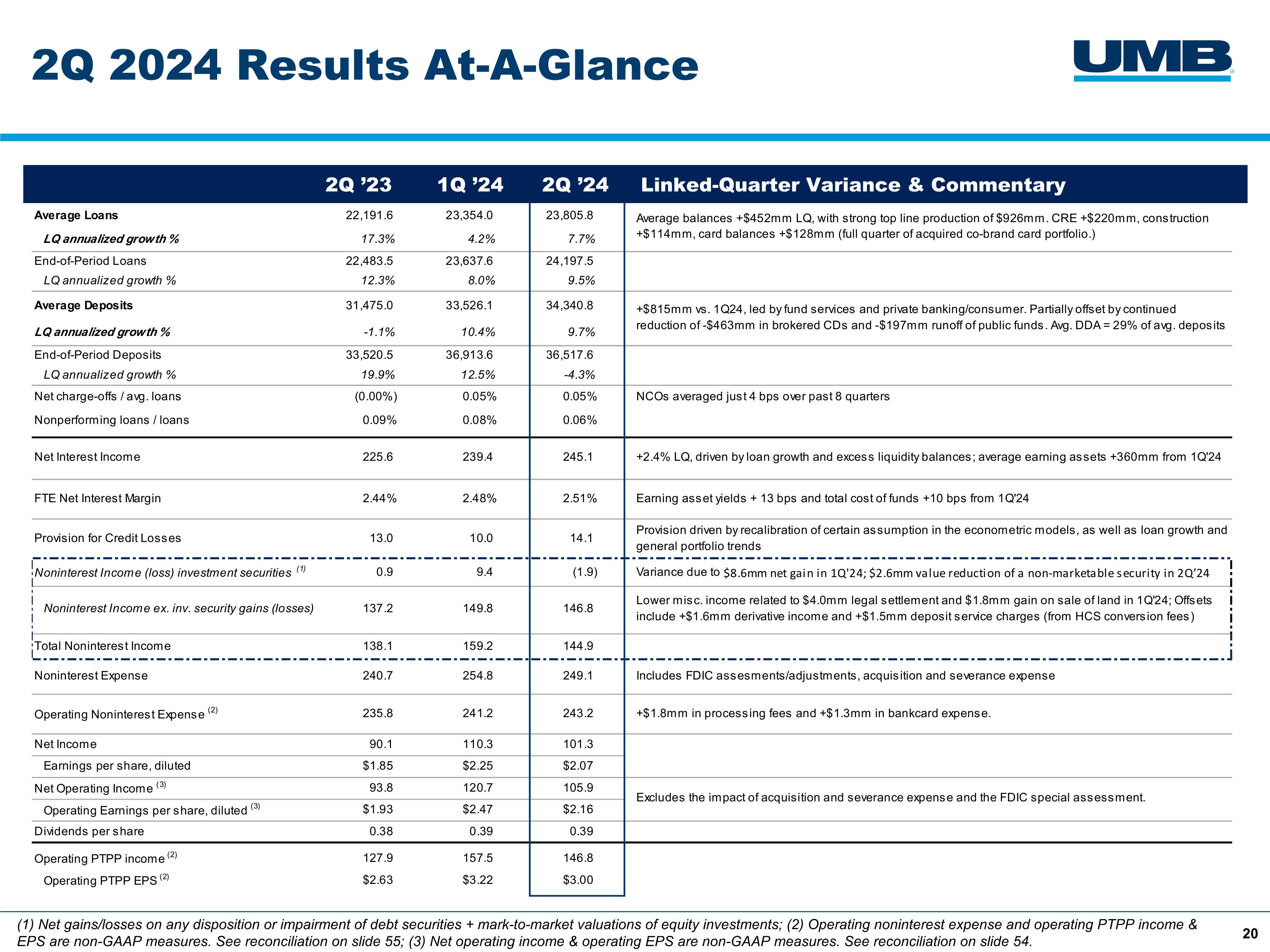

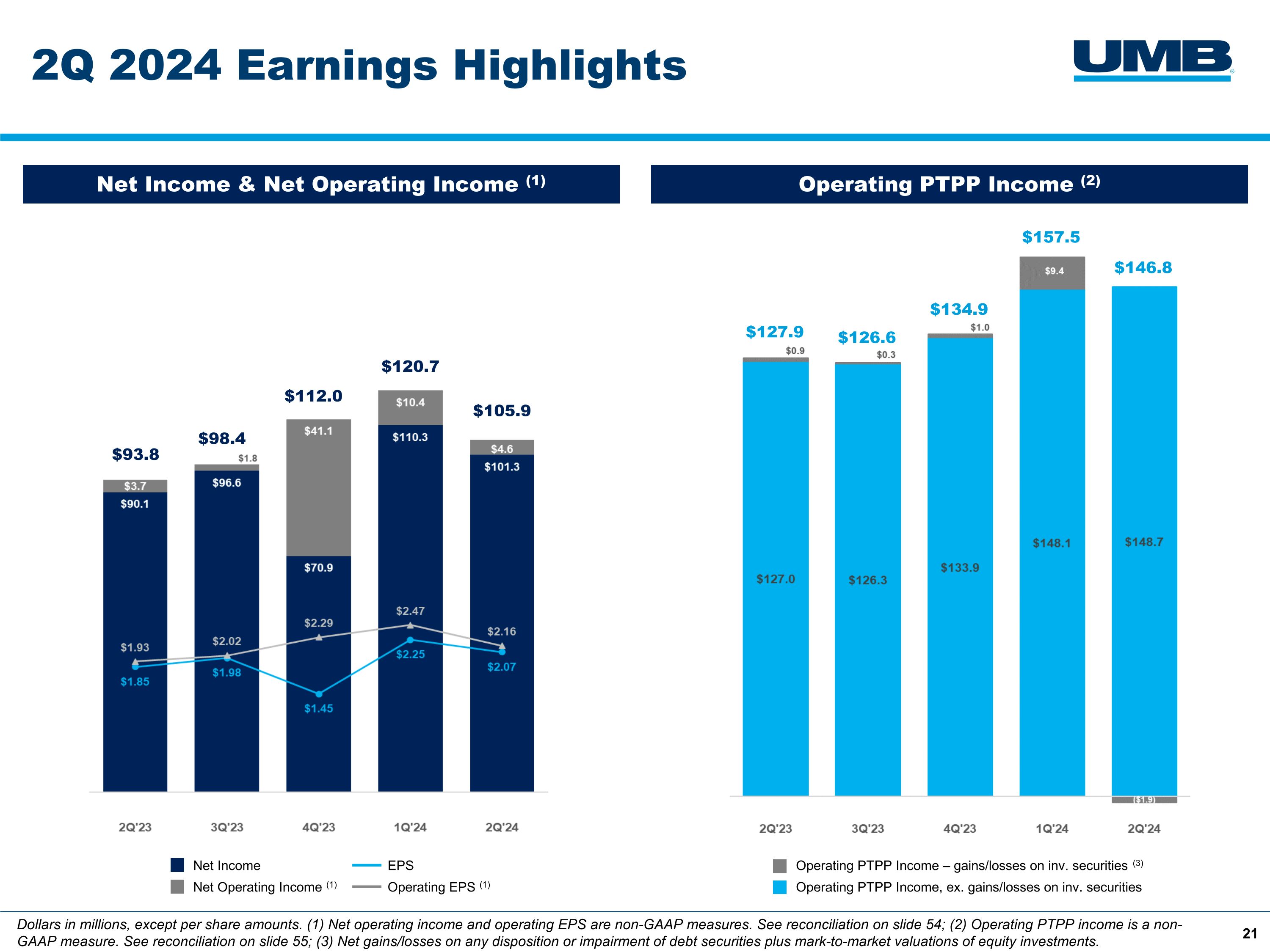

KANSAS CITY, Mo. (July 30, 2024) – UMB Financial Corporation (Nasdaq: UMBF), a financial services company, announced net income for the second quarter of 2024 of $101.3 million, or $2.07 per diluted share, compared to $110.3 million, or $2.25 per diluted share, in the first quarter (linked quarter) and $90.1 million, or $1.85 per diluted share, in the second quarter of 2023.

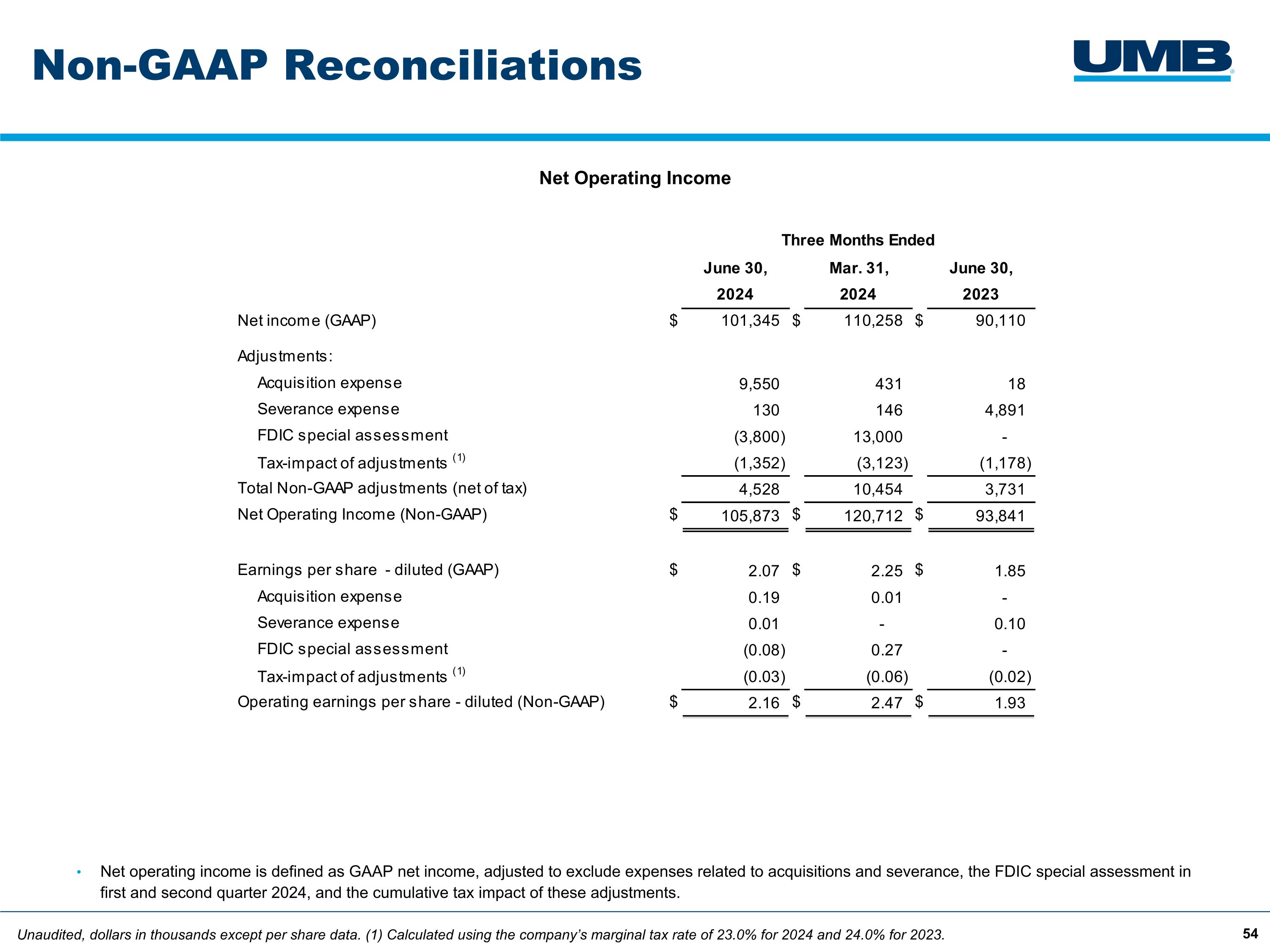

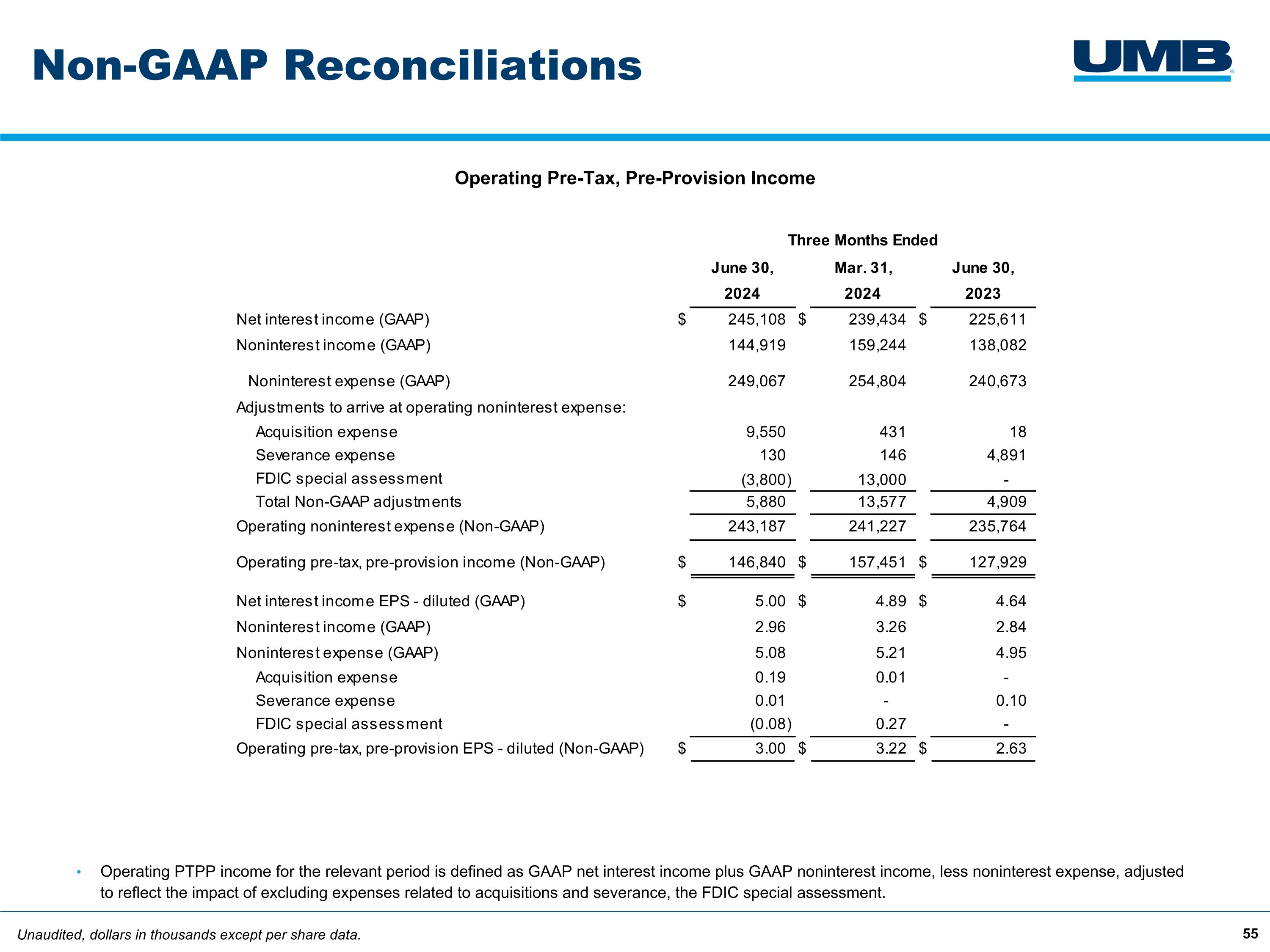

Net operating income, a non-GAAP financial measure reconciled later in this release to net income, the nearest comparable GAAP measure, was $105.9 million, or $2.16 per diluted share, for the second quarter of 2024, compared to $120.7 million, or $2.47 per diluted share, for the linked quarter and $93.8 million, or $1.93 per diluted share, for the second quarter of 2023. Operating pre-tax, pre-provision income (operating PTPP), a non-GAAP measure reconciled later in this release to the components of net income before taxes, the nearest comparable GAAP measure, was $146.8 million, or $3.00 per diluted share, for the second quarter of 2024, compared to $157.5 million, or $3.22 per diluted share, for the linked quarter, and $127.9 million, or $2.63 per diluted share, for the second quarter of 2023. These operating PTPP results represent a decrease of 6.7% on a linked-quarter basis and an increase of 14.8% compared to the second quarter of 2023.

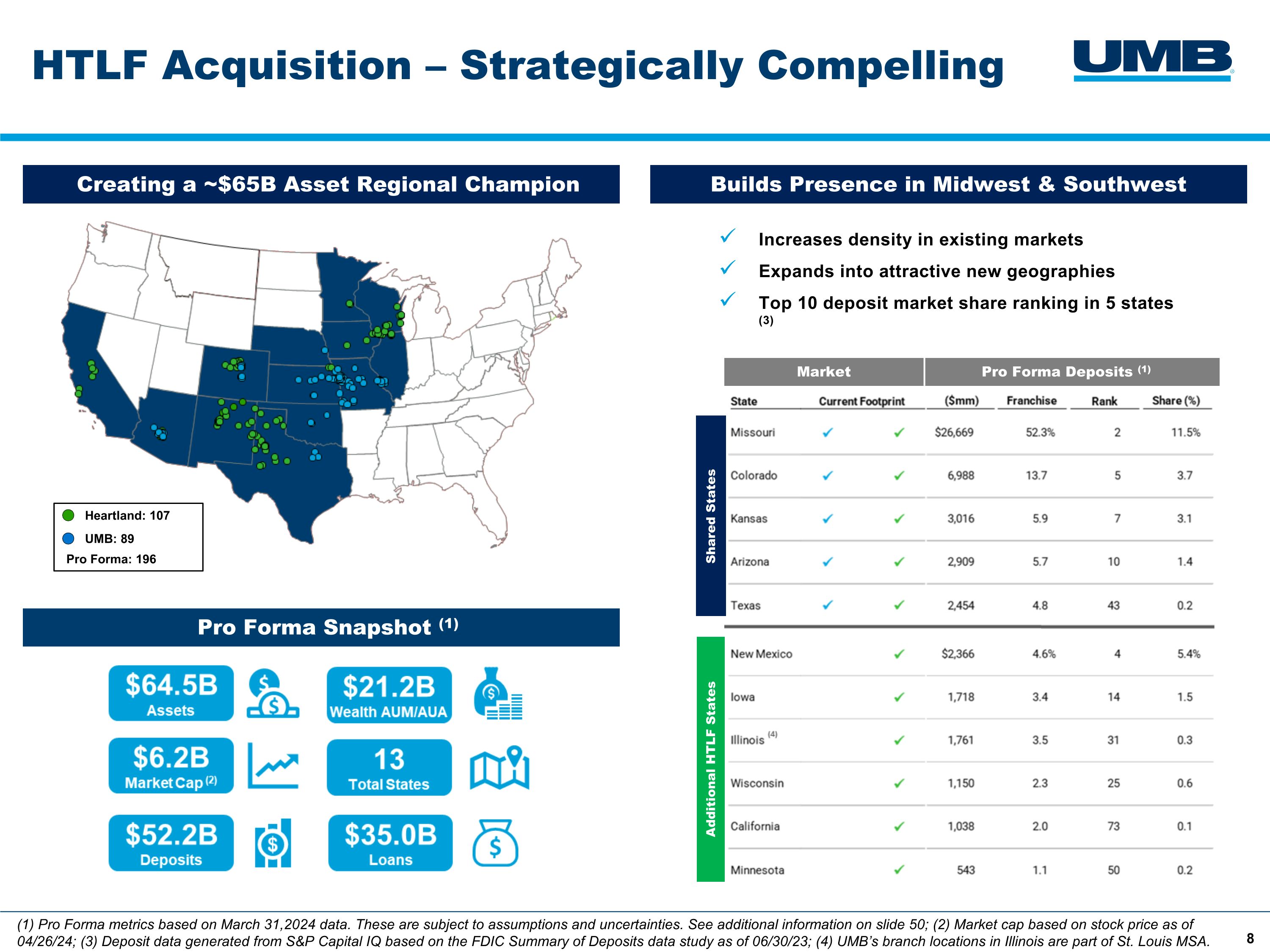

“We are pleased with our second quarter financial results, including continued net interest income growth driven by balance sheet growth and net interest margin expansion, and solid credit metrics,” said Mariner Kemper, UMB Financial Corporation chairman and chief executive officer.

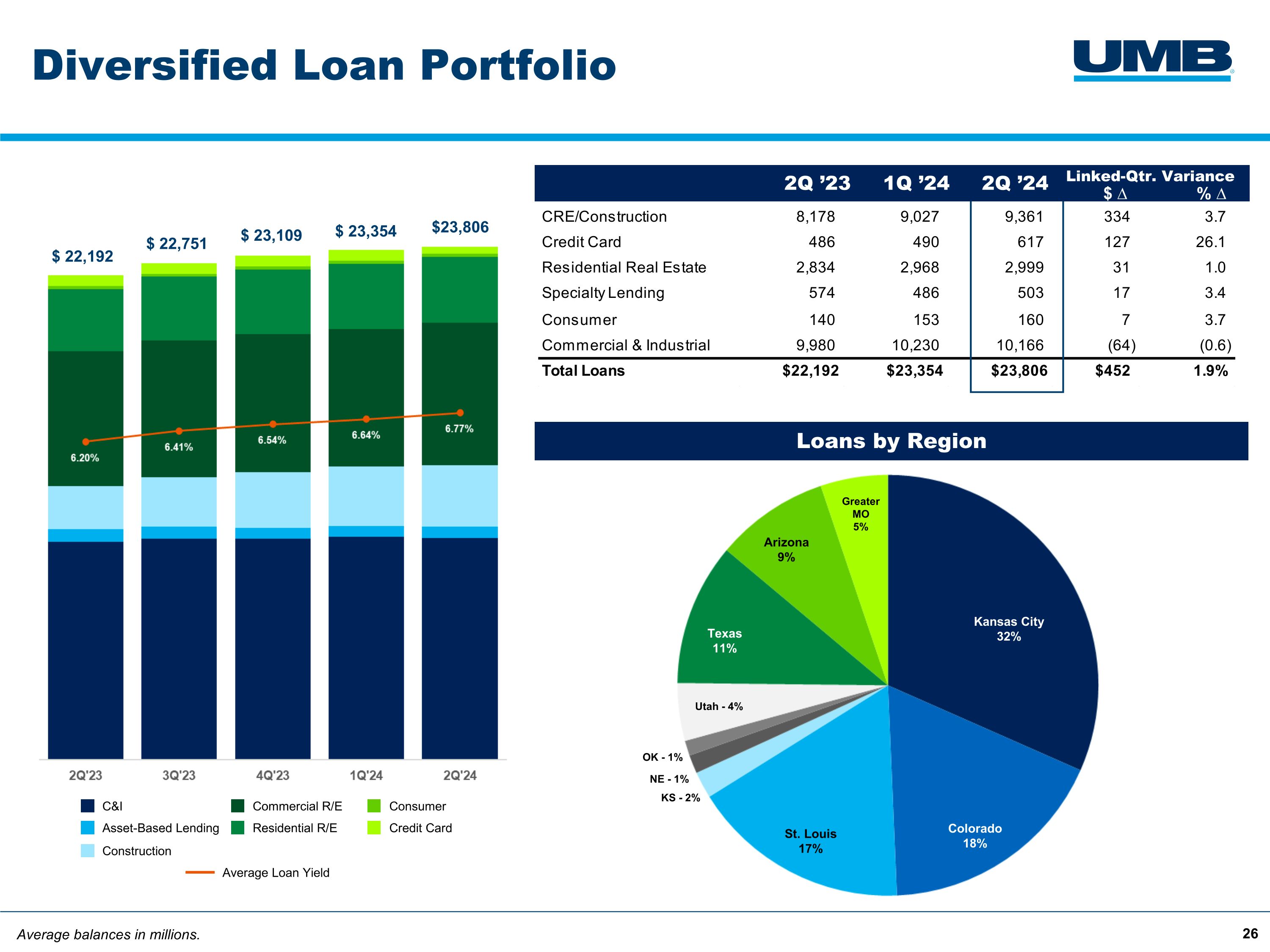

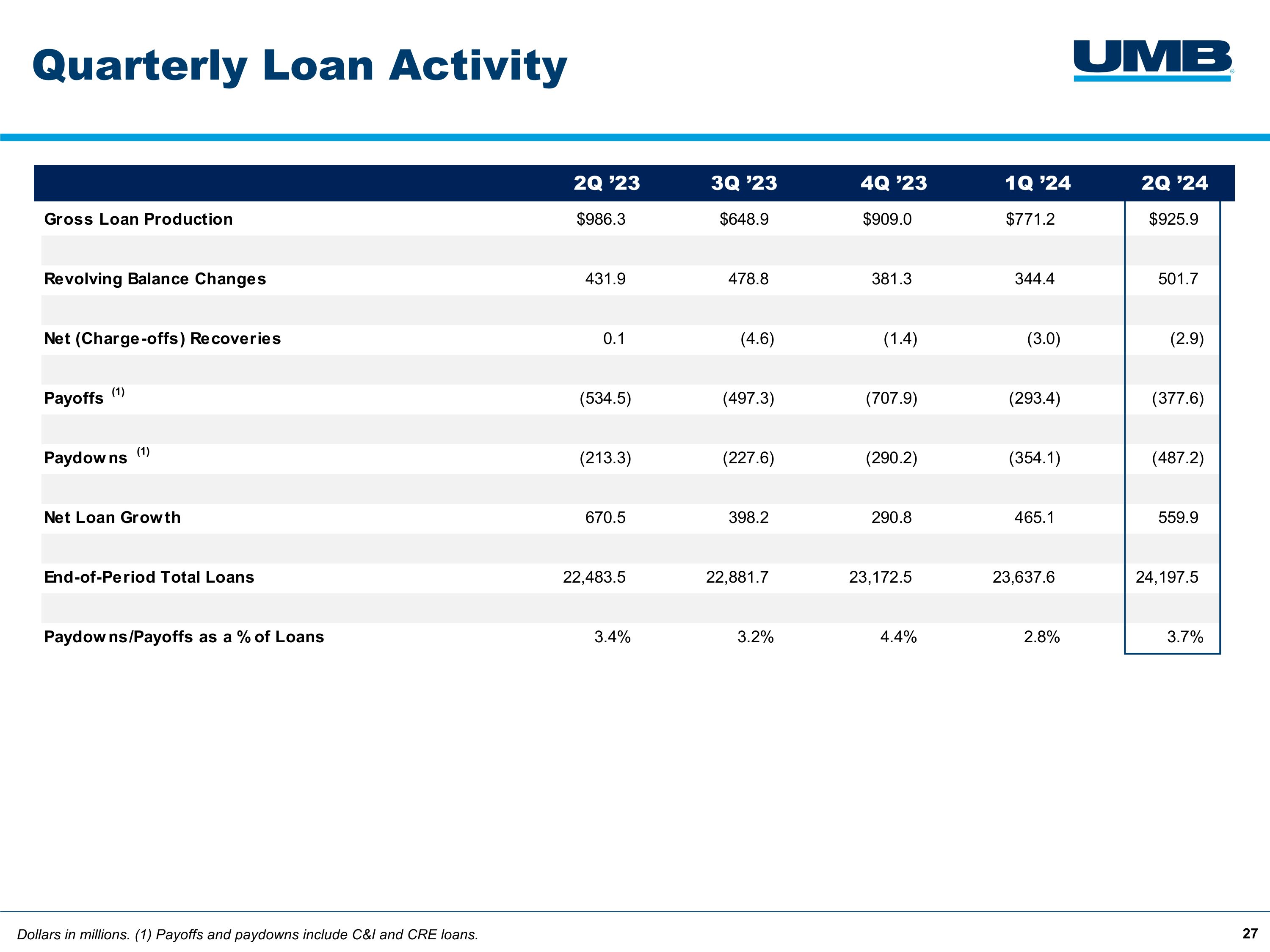

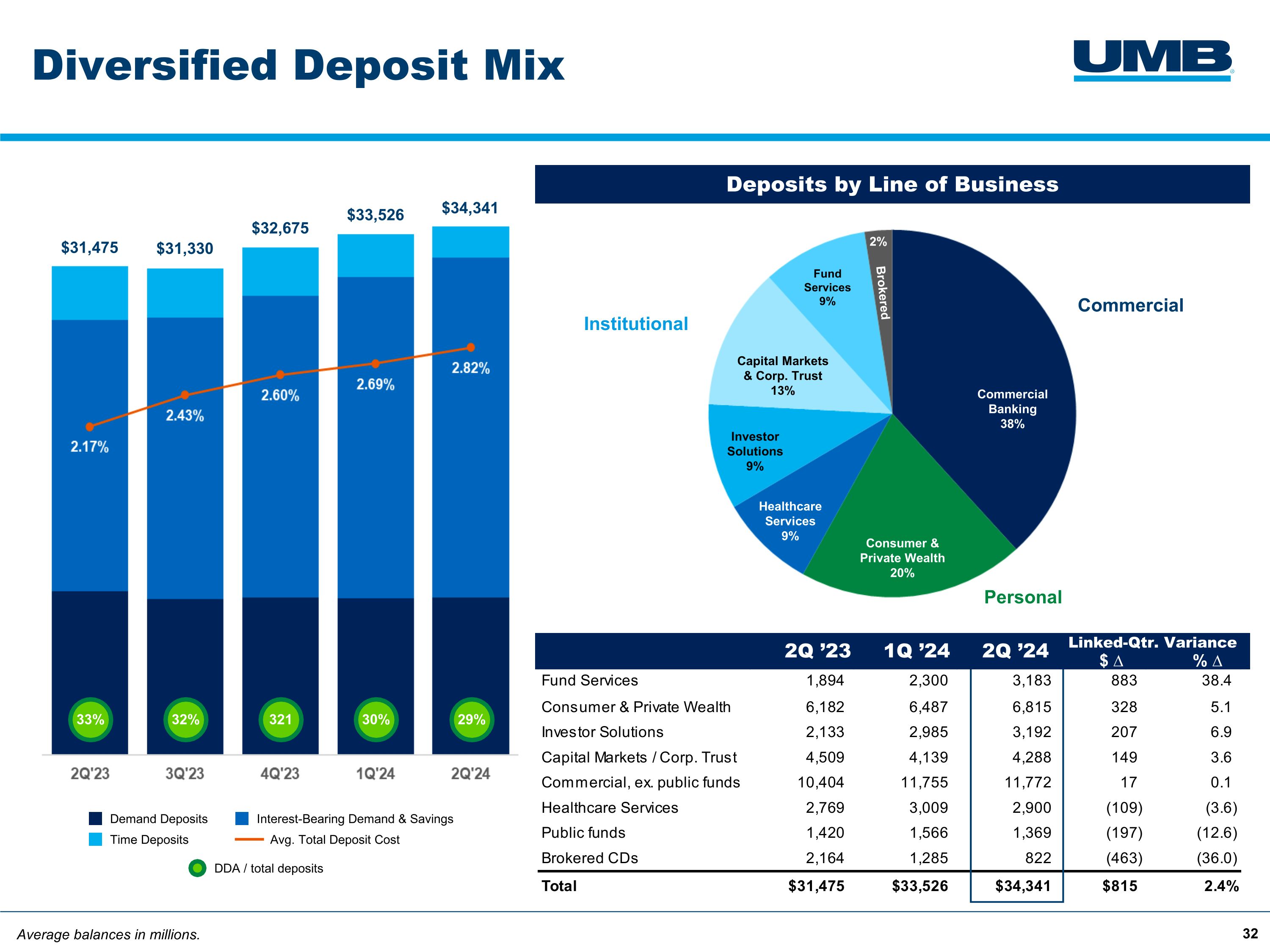

“In the second quarter, average loans increased 7.3% to $23.8 billion, and average deposits increased $2.9 billion or 9.1% from one year ago. Our borrowers remain cautiously optimistic, with some continuing concerns around the geopolitical environment, inflation, and the timing of potential rate cuts. Competition for good deals remains robust, however, our focus on relationships and service are our differentiators, allowing us to continue to take market share.

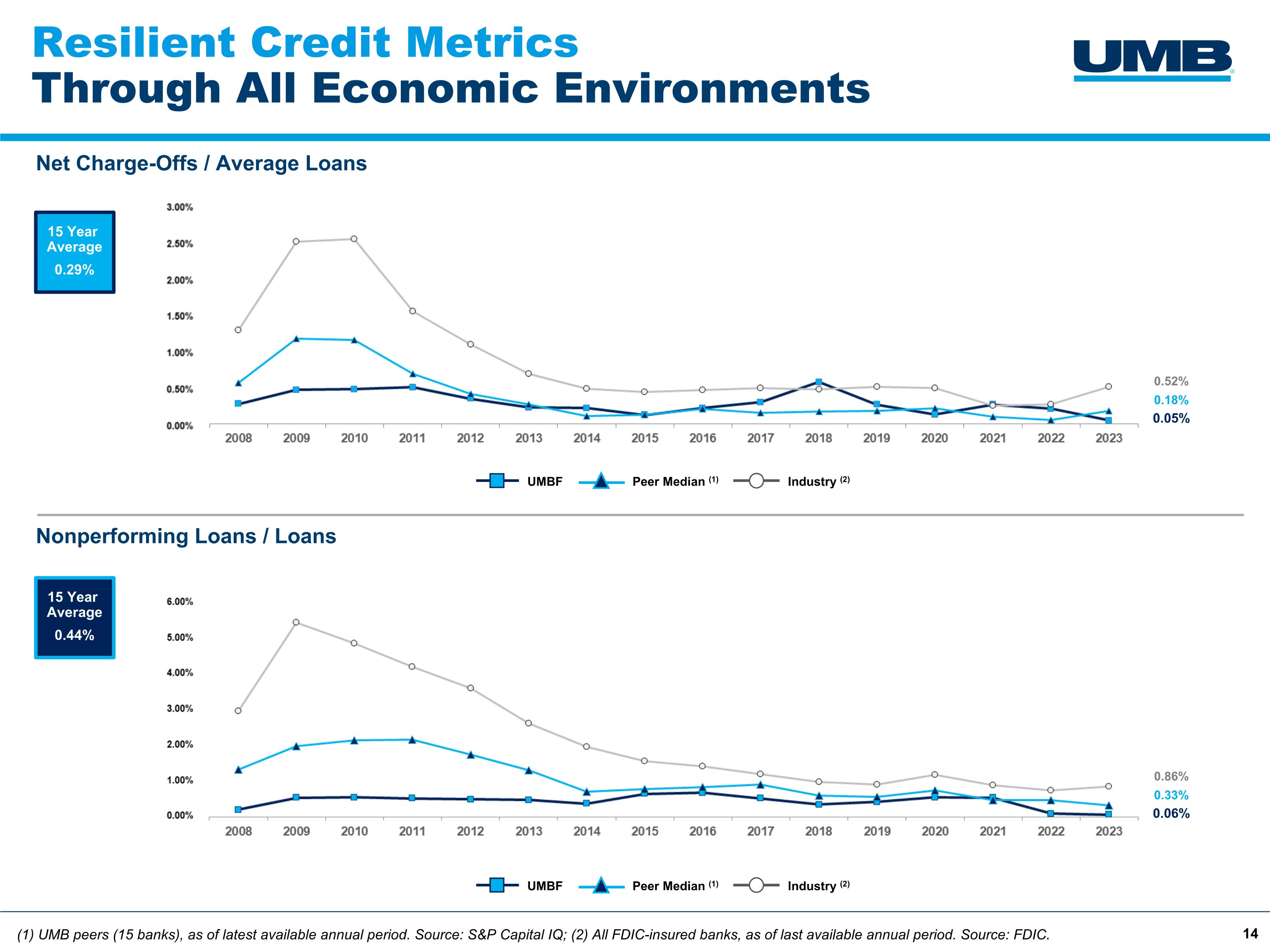

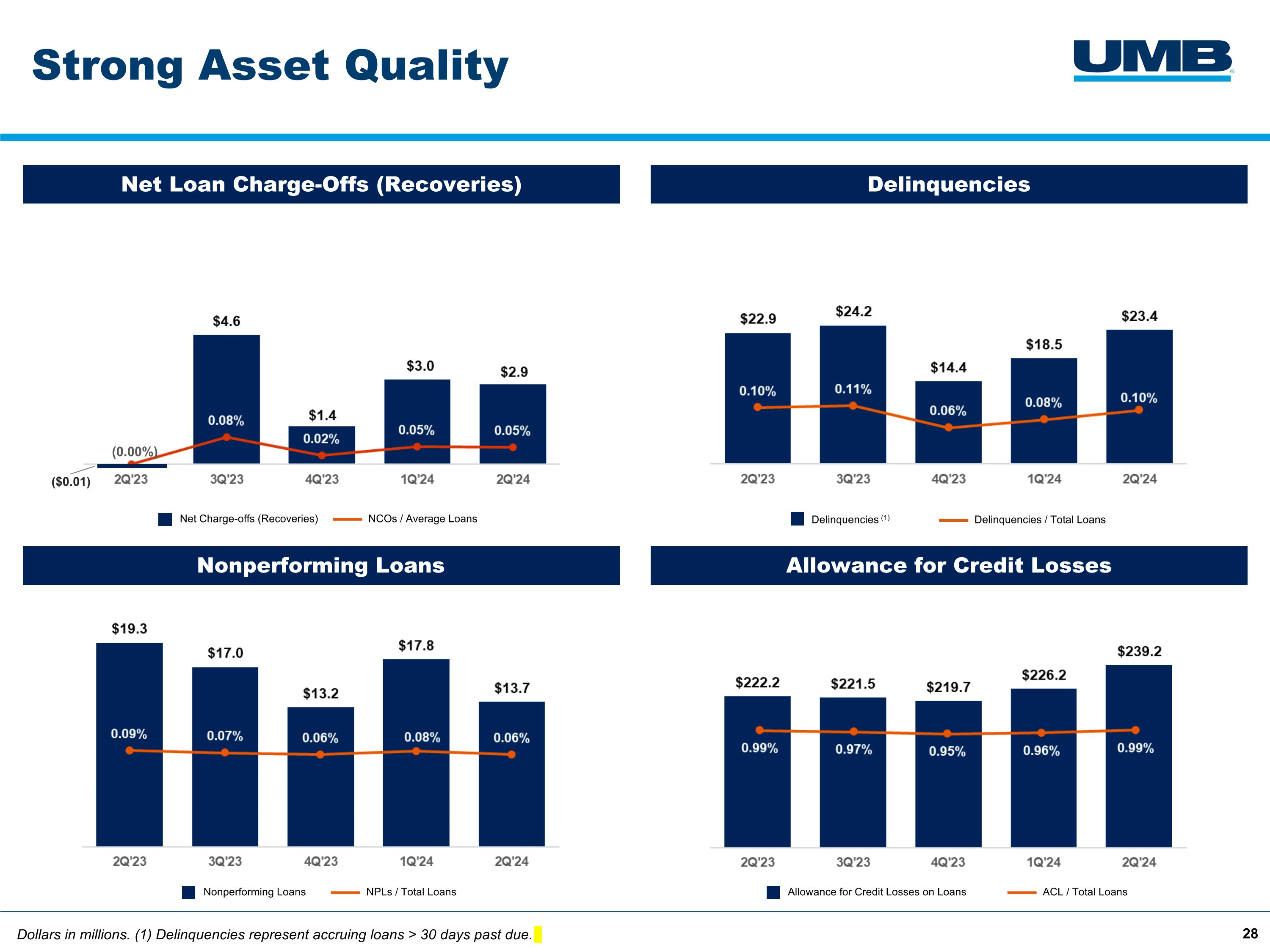

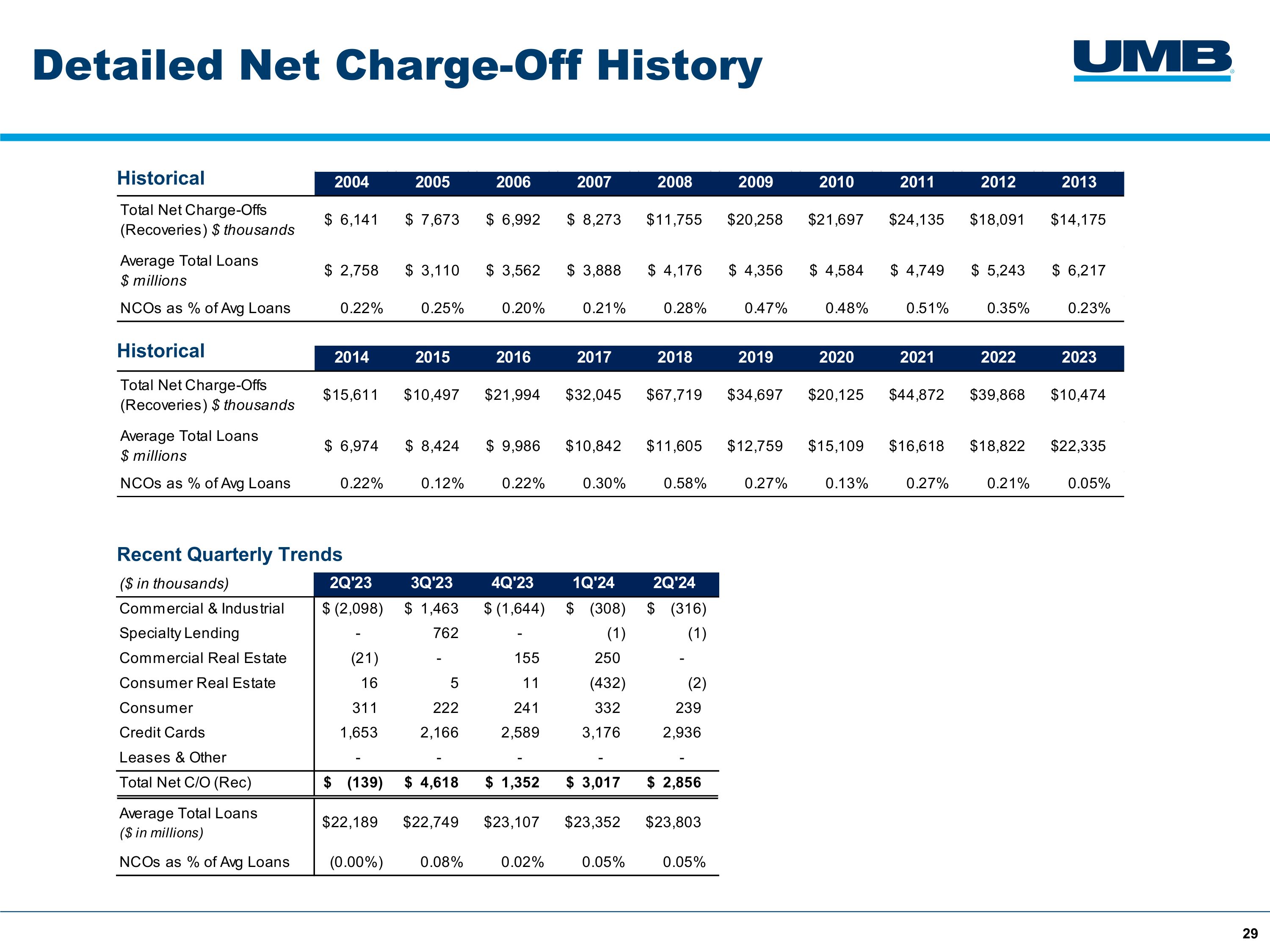

"Credit quality remains very strong, with net charge-offs just 0.05% of average loans for both the second quarter and year-to-date. Net charge-offs have averaged a mere four basis points over the past eight quarters. Non-performing loans fell to just 0.06% of loans for the second quarter.

"Our teams excel at building and maintaining strong relationships across our footprint, and we’re focused on continuing our long track record of growth. We remain excited about the future, including our pending acquisition of Heartland Financial and the opportunity we see as a combined company.”

(i) A non-GAAP financial measure reconciled later in this release to net income, the nearest comparable GAAP measure.

Second Quarter 2024 earnings discussion

Summary of quarterly financial results |

|

UMB Financial Corporation |

|

|||||||||

(unaudited, dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|||

Net income (GAAP) |

|

$ |

101,345 |

|

|

$ |

110,258 |

|

|

$ |

90,110 |

|

Earnings per share - diluted (GAAP) |

|

|

2.07 |

|

|

|

2.25 |

|

|

|

1.85 |

|

|

|

|

|

|

|

|

|

|

|

|||

Operating pre-tax, pre-provision income (Non-GAAP)(i) |

|

|

146,840 |

|

|

|

157,451 |

|

|

|

127,929 |

|

Operating pre-tax, pre-provision earnings per share - diluted (Non-GAAP)(i) |

|

|

3.00 |

|

|

|

3.22 |

|

|

|

2.63 |

|

|

|

|

|

|

|

|

|

|

|

|||

Operating pre-tax, pre-provision income - FTE (Non-GAAP)(i) |

|

|

153,247 |

|

|

|

163,967 |

|

|

|

134,504 |

|

Operating pre-tax, pre-provision earnings per share - FTE - diluted (Non-GAAP)(i) |

|

|

3.13 |

|

|

|

3.35 |

|

|

|

2.77 |

|

|

|

|

|

|

|

|

|

|

|

|||

Net operating income (Non-GAAP)(i) |

|

|

105,873 |

|

|

|

120,712 |

|

|

|

93,841 |

|

Operating earnings per share - diluted (Non-GAAP)(i) |

|

|

2.16 |

|

|

|

2.47 |

|

|

|

1.93 |

|

|

|

|

|

|

|

|

|

|

|

|||

GAAP |

|

|

|

|

|

|

|

|

|

|||

Return on average assets |

|

|

0.96 |

% |

|

|

1.06 |

% |

|

|

0.90 |

% |

Return on average equity |

|

|

12.73 |

|

|

|

14.11 |

|

|

|

12.56 |

|

Efficiency ratio |

|

|

63.37 |

|

|

|

63.44 |

|

|

|

65.59 |

|

|

|

|

|

|

|

|

|

|

|

|||

Non-GAAP(i) |

|

|

|

|

|

|

|

|

|

|||

Operating return on average assets |

|

|

1.00 |

% |

|

|

1.16 |

% |

|

|

0.93 |

% |

Operating return on average equity |

|

|

13.30 |

|

|

|

15.44 |

|

|

|

13.08 |

|

Operating efficiency ratio |

|

|

61.86 |

|

|

|

60.04 |

|

|

|

64.24 |

|

(i) See reconciliation of Non-GAAP measures to their nearest comparable GAAP measures later in this release.

Summary of year-to-date financial results |

|

UMB Financial Corporation |

|

|||||

(unaudited, dollars in thousands, except per share data) |

|

June |

|

|

June |

|

||

|

|

YTD |

|

|

YTD |

|

||

|

|

2024 |

|

|

2023 |

|

||

Net income (GAAP) |

|

$ |

211,603 |

|

|

$ |

182,547 |

|

Earnings per share - diluted (GAAP) |

|

|

4.32 |

|

|

|

3.75 |

|

|

|

|

|

|

|

|

||

Operating pre-tax, pre-provision income (Non-GAAP)(i) |

|

|

304,291 |

|

|

|

263,298 |

|

Operating pre-tax, pre-provision earnings per share - diluted (Non-GAAP)(i) |

|

|

6.22 |

|

|

|

5.41 |

|

|

|

|

|

|

|

|

||

Operating pre-tax, pre-provision income - FTE (Non-GAAP)(i) |

|

|

317,214 |

|

|

|

276,428 |

|

Operating pre-tax, pre-provision earnings per share - FTE - diluted (Non-GAAP)(i) |

|

|

6.48 |

|

|

|

5.68 |

|

|

|

|

|

|

|

|

||

Net operating income (Non-GAAP)(i) |

|

|

226,585 |

|

|

|

186,677 |

|

Operating earnings per share - diluted (Non-GAAP)(i) |

|

|

4.63 |

|

|

|

3.83 |

|

|

|

|

|

|

|

|

||

GAAP |

|

|

|

|

|

|

||

Return on average assets |

|

|

1.01 |

% |

|

|

0.93 |

% |

Return on average equity |

|

|

13.41 |

|

|

|

13.14 |

|

Efficiency ratio |

|

|

63.41 |

|

|

|

64.34 |

|

|

|

|

|

|

|

|

||

Non-GAAP(i) |

|

|

|

|

|

|

||

Operating return on average assets |

|

|

1.08 |

% |

|

|

0.95 |

% |

Operating return on average equity |

|

|

14.36 |

|

|

|

13.44 |

|

Operating efficiency ratio |

|

|

60.94 |

|

|

|

63.61 |

|

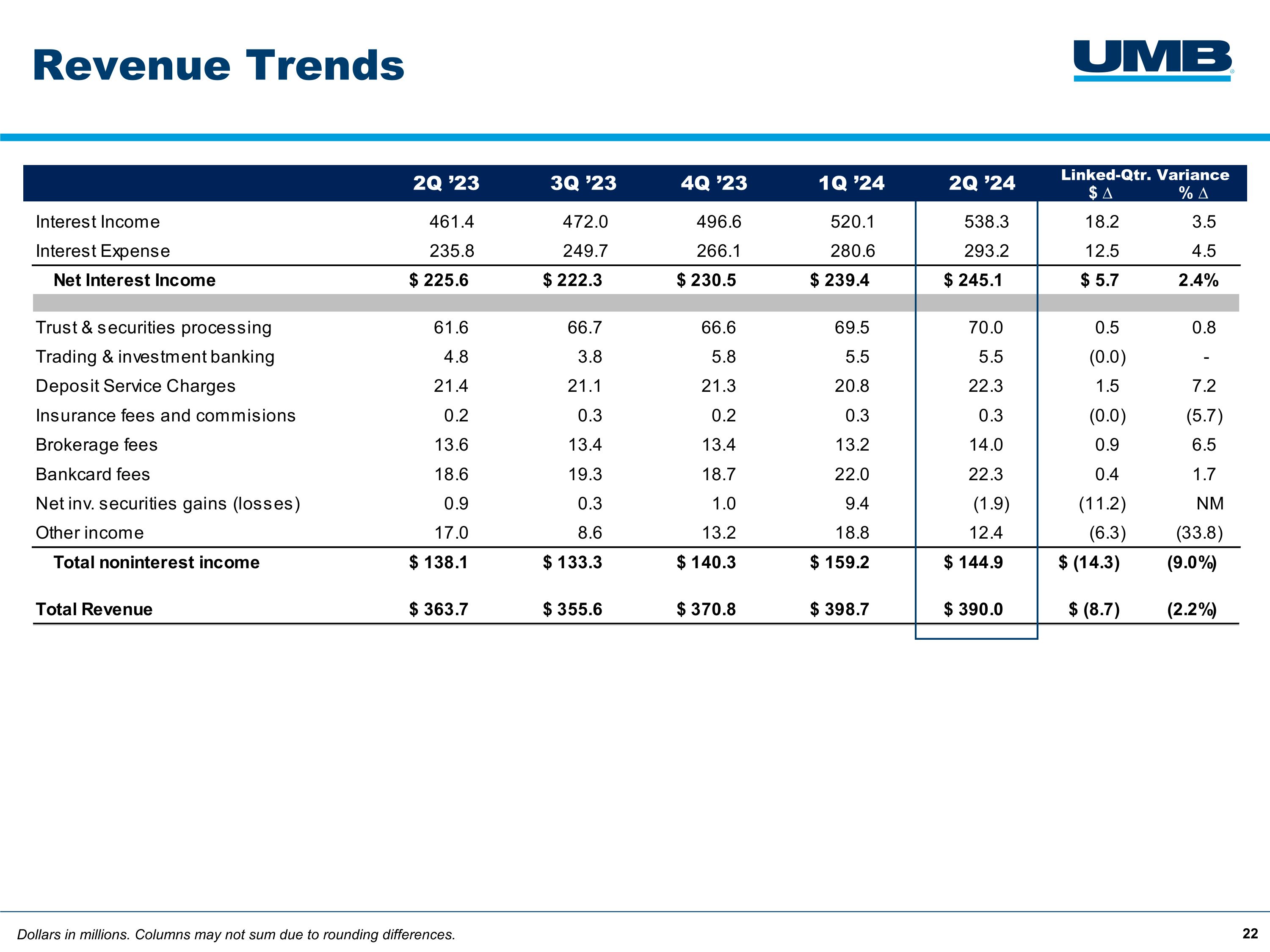

Summary of revenue |

|

UMB Financial Corporation |

|

|||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

CQ vs. |

|

|

CQ vs. |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

LQ |

|

|

PY |

|

|||||

Net interest income |

|

$ |

245,108 |

|

|

$ |

239,434 |

|

|

$ |

225,611 |

|

|

$ |

5,674 |

|

|

$ |

19,497 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Trust and securities processing |

|

|

70,010 |

|

|

|

69,478 |

|

|

|

61,589 |

|

|

|

532 |

|

|

|

8,421 |

|

Trading and investment banking |

|

|

5,461 |

|

|

|

5,462 |

|

|

|

4,800 |

|

|

|

(1 |

) |

|

|

661 |

|

Service charges on deposit accounts |

|

|

22,261 |

|

|

|

20,757 |

|

|

|

21,381 |

|

|

|

1,504 |

|

|

|

880 |

|

Insurance fees and commissions |

|

|

267 |

|

|

|

283 |

|

|

|

225 |

|

|

|

(16 |

) |

|

|

42 |

|

Brokerage fees |

|

|

14,020 |

|

|

|

13,160 |

|

|

|

13,604 |

|

|

|

860 |

|

|

|

416 |

|

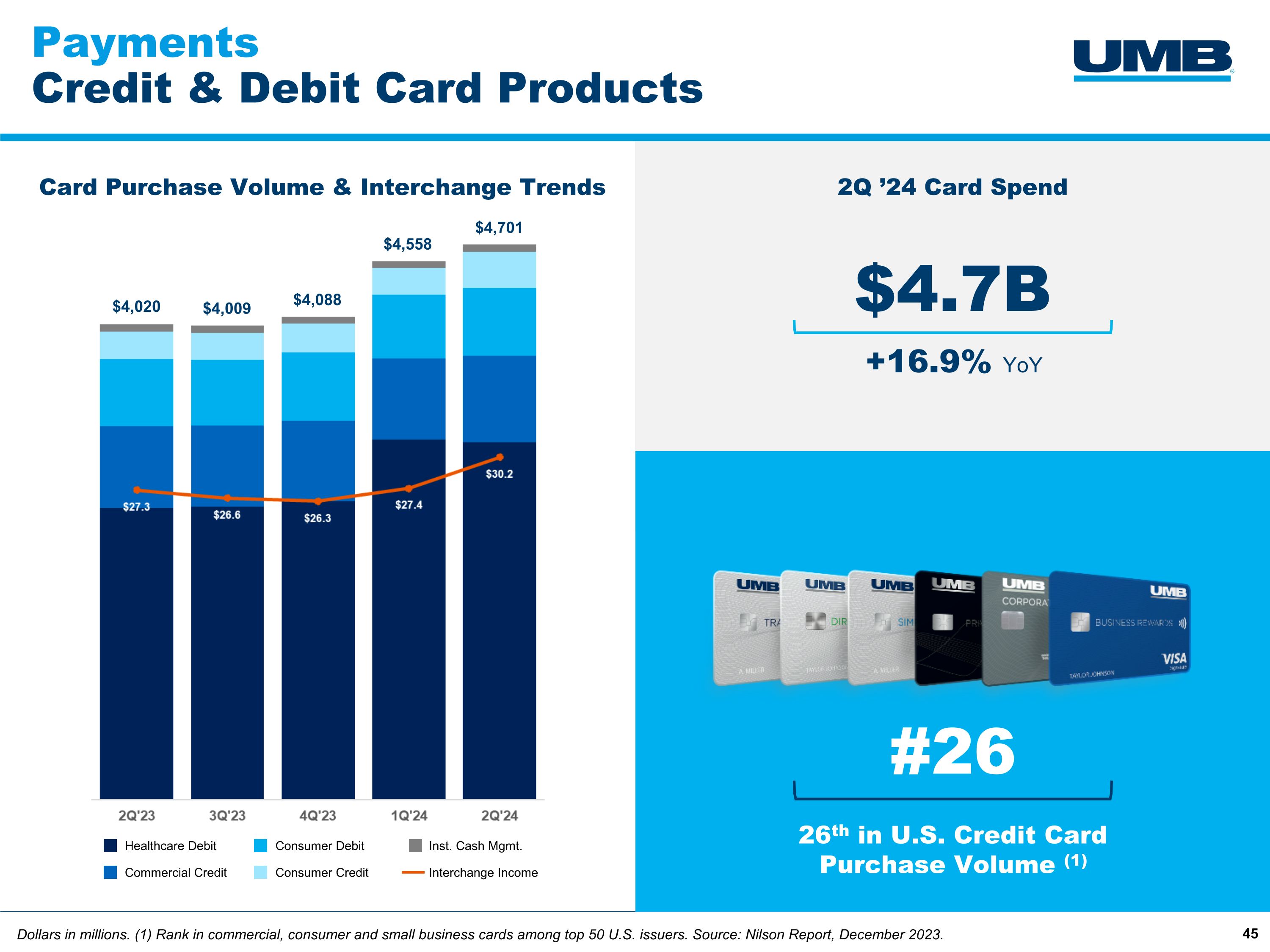

Bankcard fees |

|

|

22,346 |

|

|

|

21,968 |

|

|

|

18,579 |

|

|

|

378 |

|

|

|

3,767 |

|

Investment securities (losses) gains, net |

|

|

(1,867 |

) |

|

|

9,371 |

|

|

|

900 |

|

|

|

(11,238 |

) |

|

|

(2,767 |

) |

Other |

|

|

12,421 |

|

|

|

18,765 |

|

|

|

17,004 |

|

|

|

(6,344 |

) |

|

|

(4,583 |

) |

Total noninterest income |

|

$ |

144,919 |

|

|

$ |

159,244 |

|

|

$ |

138,082 |

|

|

$ |

(14,325 |

) |

|

$ |

6,837 |

|

Total revenue |

|

$ |

390,027 |

|

|

$ |

398,678 |

|

|

$ |

363,693 |

|

|

$ |

(8,651 |

) |

|

$ |

26,334 |

|

Net interest income (FTE) |

|

$ |

251,515 |

|

|

$ |

245,950 |

|

|

$ |

232,186 |

|

|

|

|

|

|

|

||

Net interest margin (FTE) |

|

|

2.51 |

% |

|

|

2.48 |

% |

|

|

2.44 |

% |

|

|

|

|

|

|

||

Total noninterest income as a % of total revenue |

|

|

37.2 |

|

|

|

39.9 |

|

|

|

38.0 |

|

|

|

|

|

|

|

||

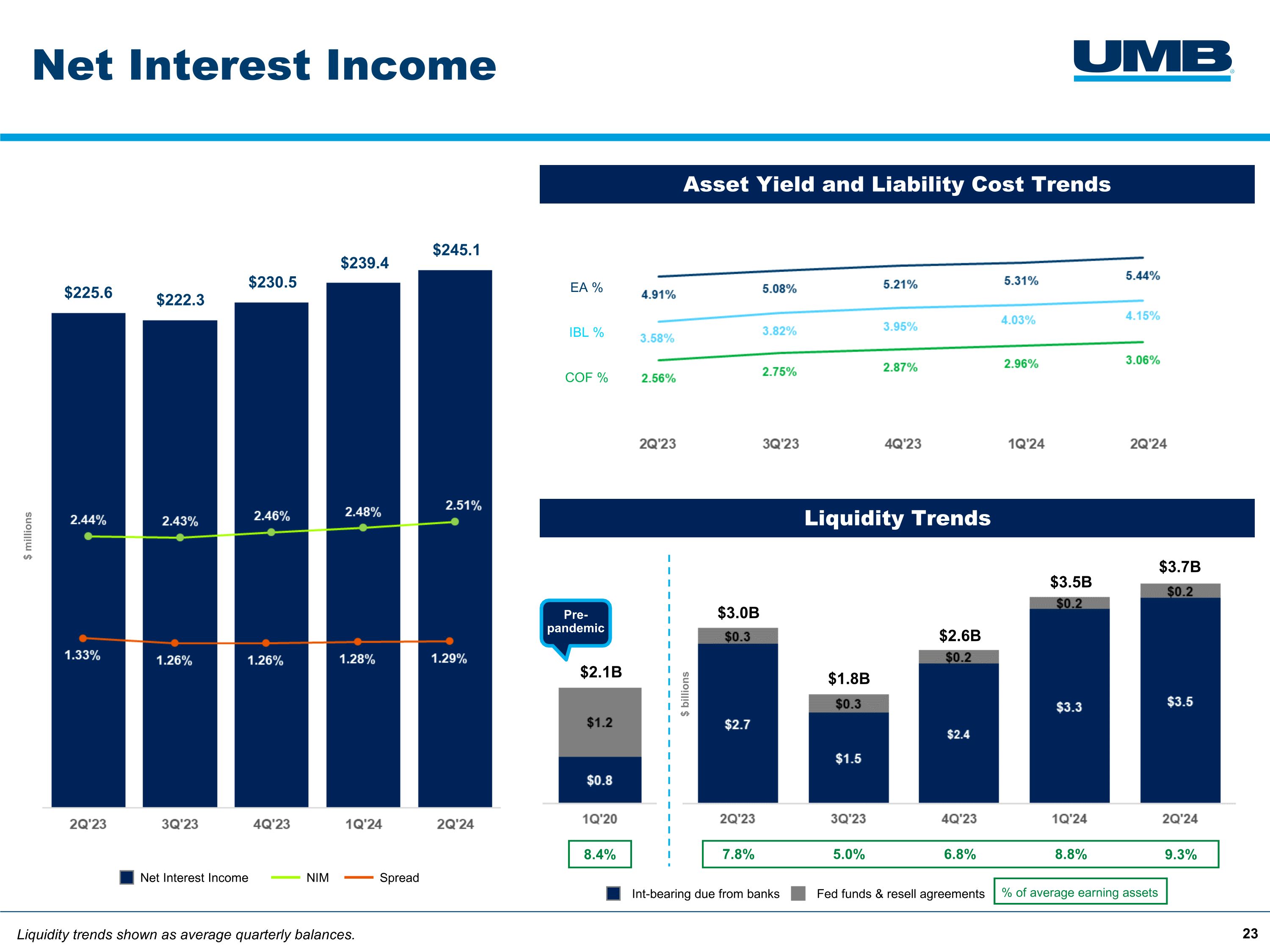

Net interest income

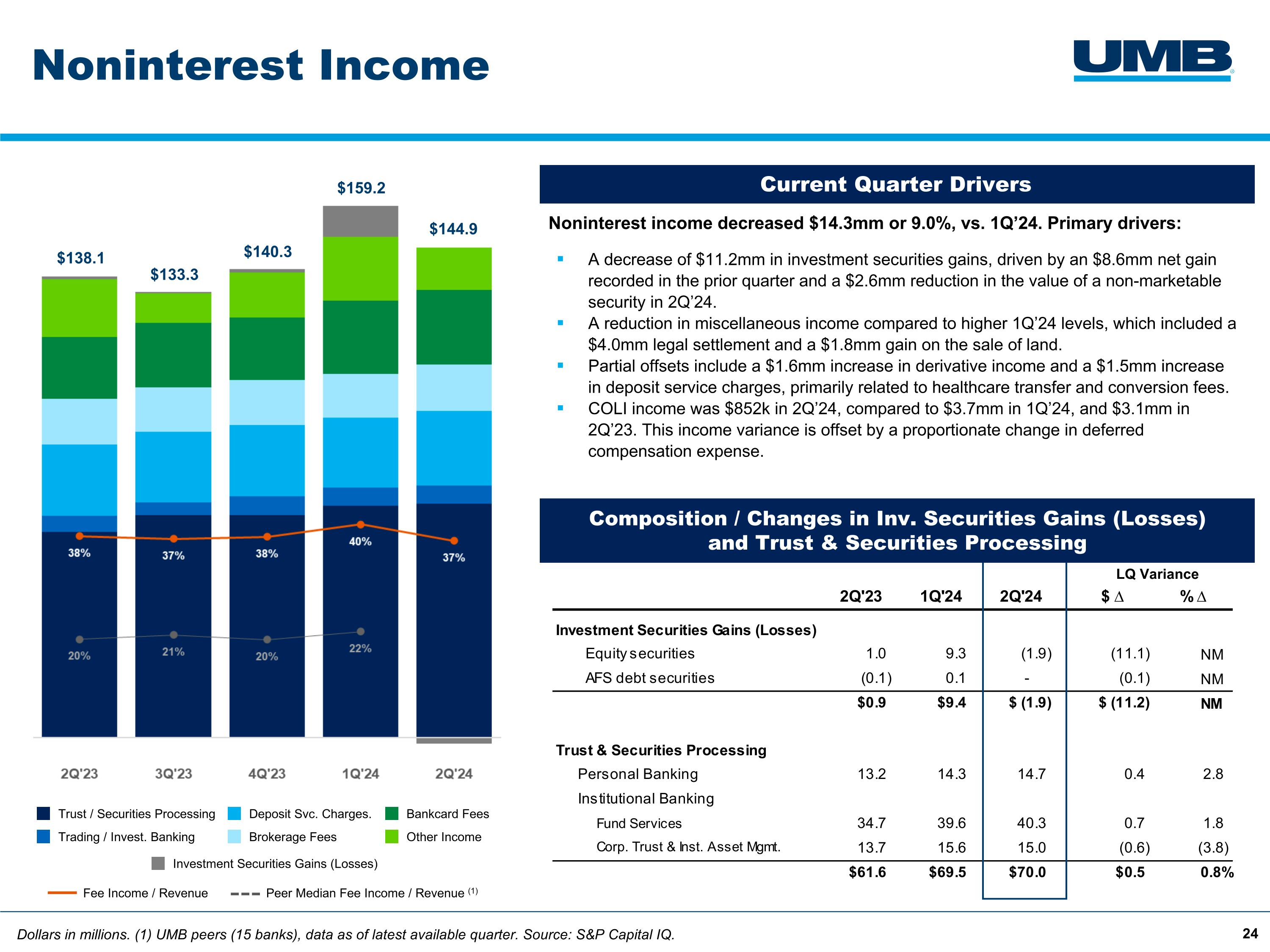

Noninterest income

Noninterest expense

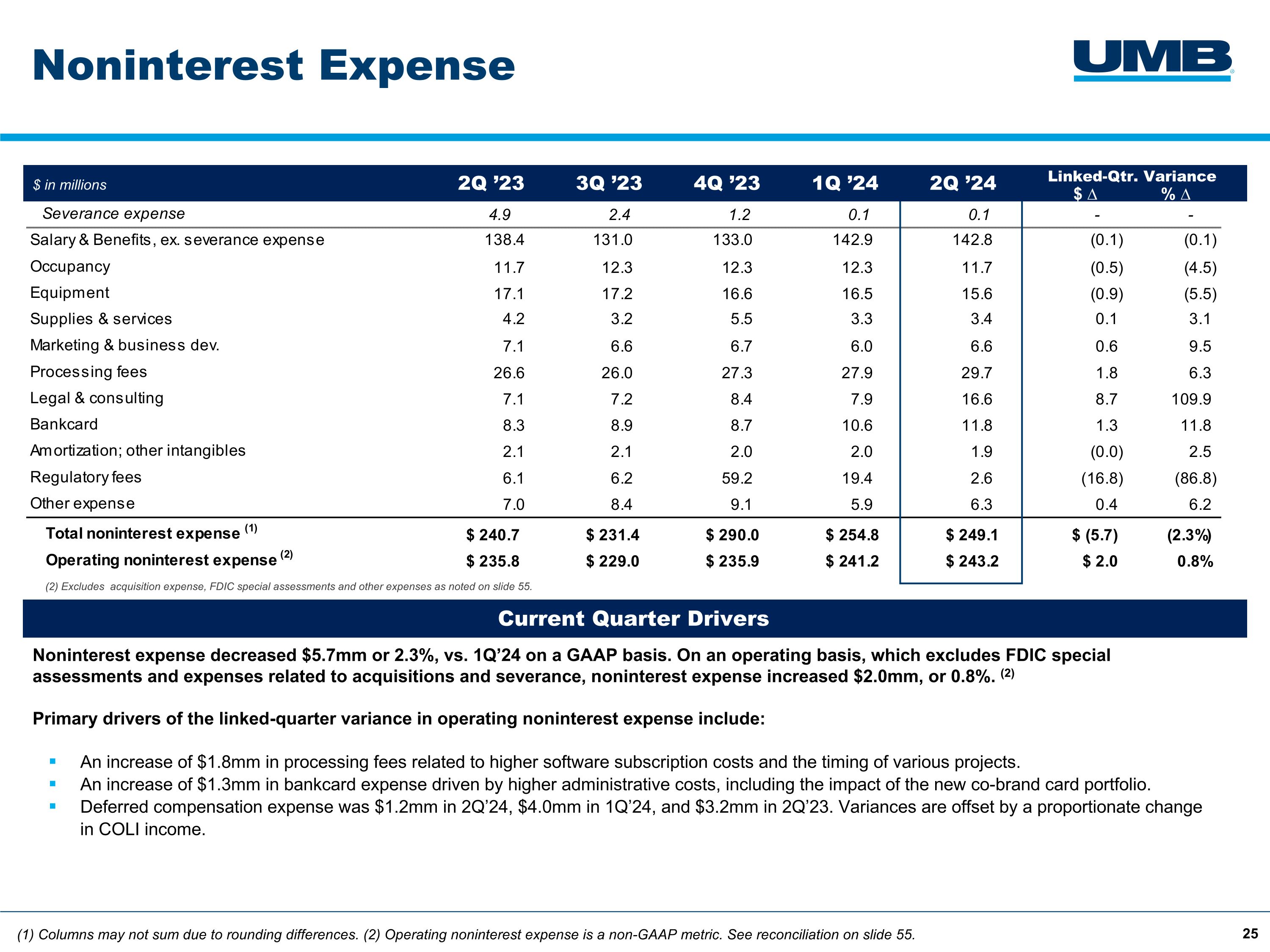

Summary of noninterest expense |

|

UMB Financial Corporation |

|

|||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

CQ vs. |

|

|

CQ vs. |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

LQ |

|

|

PY |

|

|||||

Salaries and employee benefits |

|

$ |

142,861 |

|

|

$ |

143,006 |

|

|

$ |

143,312 |

|

|

$ |

(145 |

) |

|

$ |

(451 |

) |

Occupancy, net |

|

|

11,723 |

|

|

|

12,270 |

|

|

|

11,746 |

|

|

|

(547 |

) |

|

|

(23 |

) |

Equipment |

|

|

15,603 |

|

|

|

16,503 |

|

|

|

17,086 |

|

|

|

(900 |

) |

|

|

(1,483 |

) |

Supplies and services |

|

|

3,404 |

|

|

|

3,301 |

|

|

|

4,195 |

|

|

|

103 |

|

|

|

(791 |

) |

Marketing and business development |

|

|

6,598 |

|

|

|

6,025 |

|

|

|

7,124 |

|

|

|

573 |

|

|

|

(526 |

) |

Processing fees |

|

|

29,701 |

|

|

|

27,936 |

|

|

|

26,572 |

|

|

|

1,765 |

|

|

|

3,129 |

|

Legal and consulting |

|

|

16,566 |

|

|

|

7,894 |

|

|

|

7,059 |

|

|

|

8,672 |

|

|

|

9,507 |

|

Bankcard |

|

|

11,818 |

|

|

|

10,567 |

|

|

|

8,307 |

|

|

|

1,251 |

|

|

|

3,511 |

|

Amortization of other intangible assets |

|

|

1,911 |

|

|

|

1,960 |

|

|

|

2,117 |

|

|

|

(49 |

) |

|

|

(206 |

) |

Regulatory fees |

|

|

2,568 |

|

|

|

19,395 |

|

|

|

6,123 |

|

|

|

(16,827 |

) |

|

|

(3,555 |

) |

Other |

|

|

6,314 |

|

|

|

5,947 |

|

|

|

7,032 |

|

|

|

367 |

|

|

|

(718 |

) |

Total noninterest expense |

|

$ |

249,067 |

|

|

$ |

254,804 |

|

|

$ |

240,673 |

|

|

$ |

(5,737 |

) |

|

$ |

8,394 |

|

Income taxes

Balance sheet

Summary of average loans and leases - QTD Average |

UMB Financial Corporation |

|

||||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

CQ vs. |

|

|

CQ vs. |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

LQ |

|

|

PY |

|

|||||

Commercial and industrial |

|

$ |

9,926,855 |

|

|

$ |

9,942,457 |

|

|

$ |

9,724,300 |

|

|

$ |

(15,602 |

) |

|

$ |

202,555 |

|

Specialty lending |

|

|

502,646 |

|

|

|

485,989 |

|

|

|

574,220 |

|

|

|

16,657 |

|

|

|

(71,574 |

) |

Commercial real estate |

|

|

9,360,991 |

|

|

|

9,026,511 |

|

|

|

8,178,463 |

|

|

|

334,480 |

|

|

|

1,182,528 |

|

Consumer real estate |

|

|

2,998,560 |

|

|

|

2,968,320 |

|

|

|

2,833,739 |

|

|

|

30,240 |

|

|

|

164,821 |

|

Consumer |

|

|

159,743 |

|

|

|

154,062 |

|

|

|

139,705 |

|

|

|

5,681 |

|

|

|

20,038 |

|

Credit cards |

|

|

617,502 |

|

|

|

489,546 |

|

|

|

485,749 |

|

|

|

127,956 |

|

|

|

131,753 |

|

Leases and other |

|

|

239,532 |

|

|

|

287,158 |

|

|

|

255,425 |

|

|

|

(47,626 |

) |

|

|

(15,893 |

) |

Total loans |

|

$ |

23,805,829 |

|

|

$ |

23,354,043 |

|

|

$ |

22,191,601 |

|

|

$ |

451,786 |

|

|

$ |

1,614,228 |

|

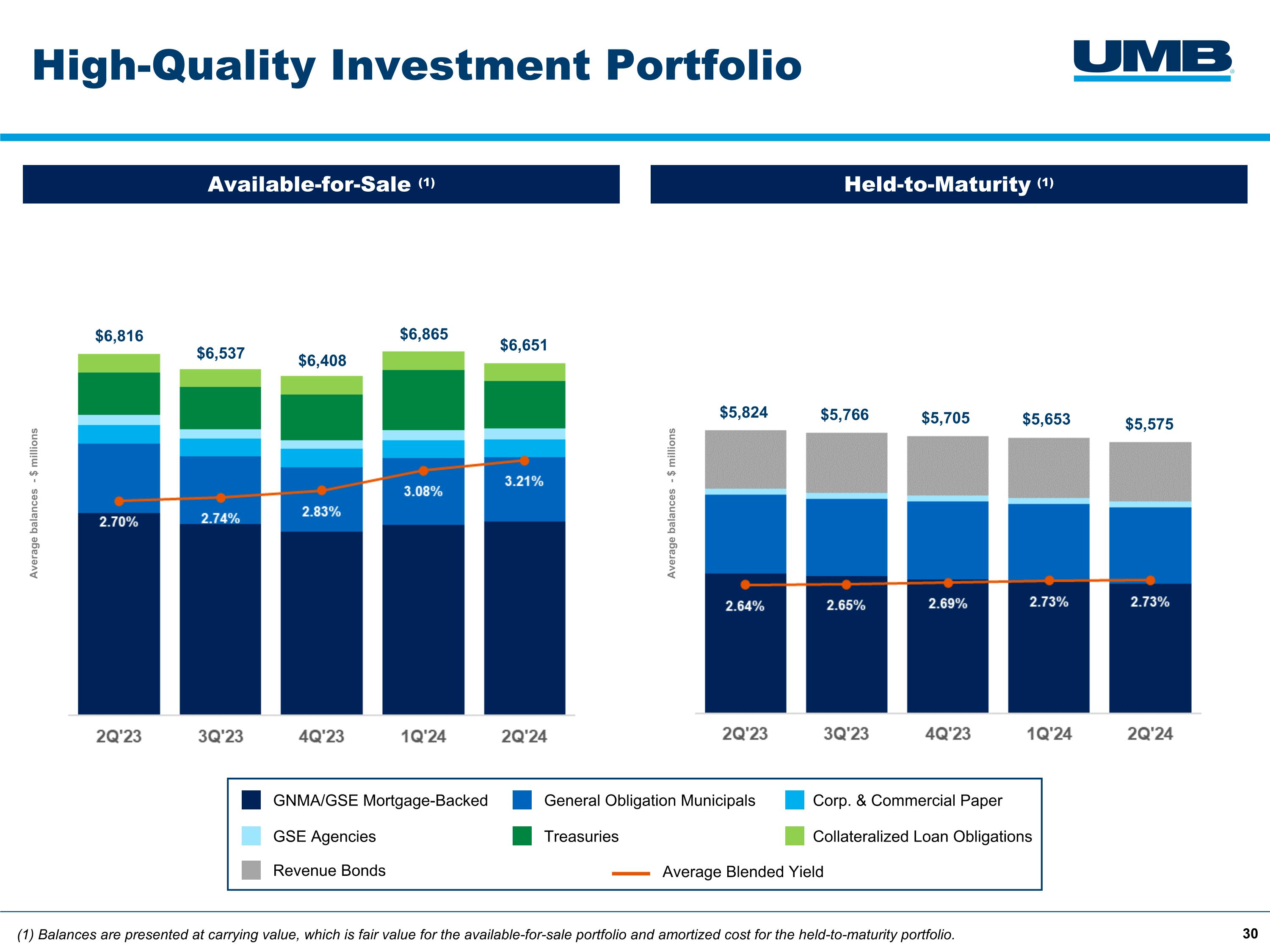

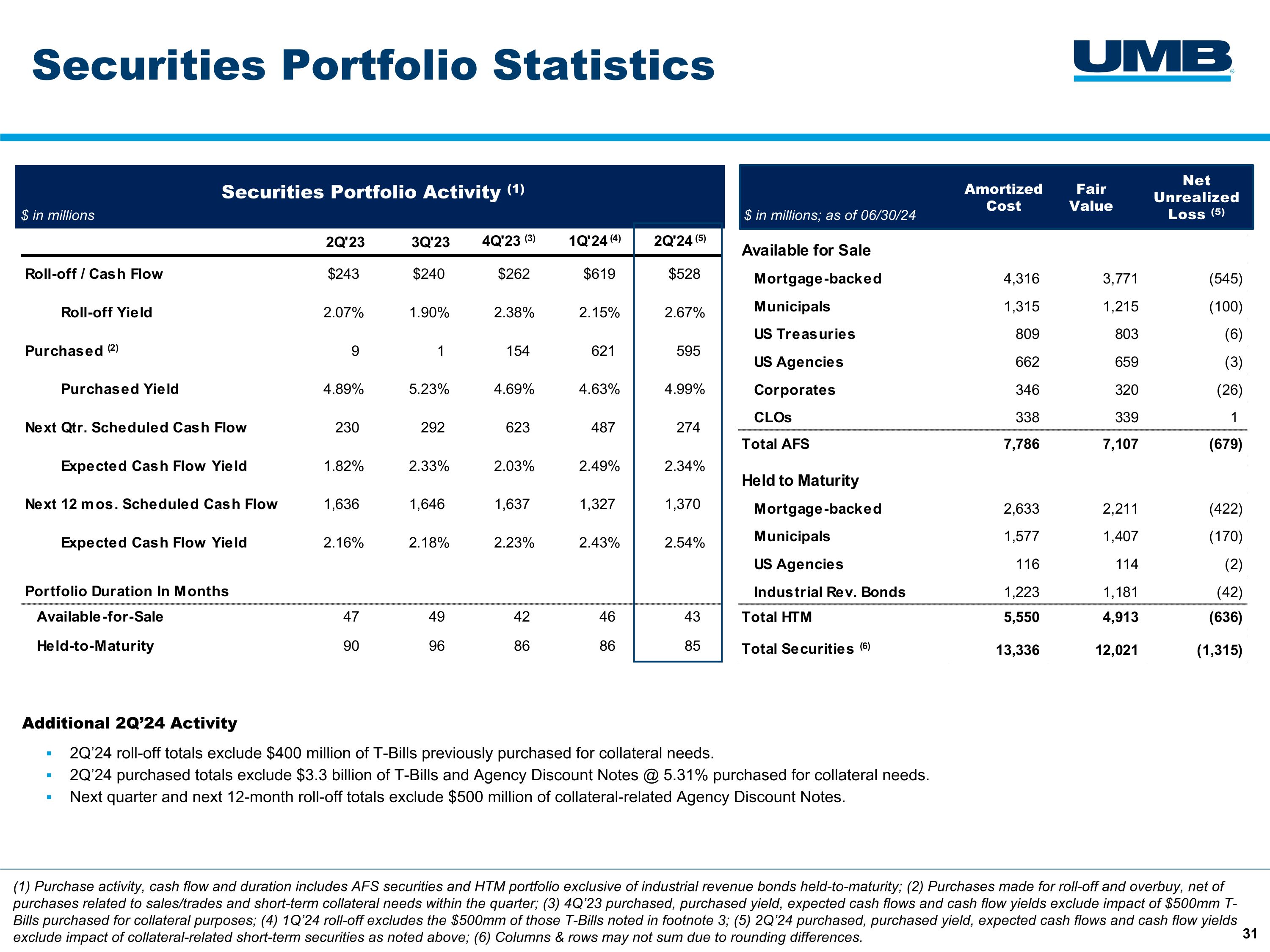

Summary of average securities - QTD Average |

|

UMB Financial Corporation |

|

|||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

CQ vs. |

|

|

CQ vs. |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

LQ |

|

|

PY |

|

|||||

Securities available for sale: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

U.S. Treasury |

|

$ |

900,348 |

|

|

$ |

1,127,611 |

|

|

$ |

797,104 |

|

|

$ |

(227,263 |

) |

|

$ |

103,244 |

|

U.S. Agencies |

|

|

210,151 |

|

|

|

199,719 |

|

|

|

189,091 |

|

|

|

10,432 |

|

|

|

21,060 |

|

Mortgage-backed |

|

|

3,667,289 |

|

|

|

3,595,619 |

|

|

|

3,813,234 |

|

|

|

71,670 |

|

|

|

(145,945 |

) |

State and political subdivisions |

|

|

1,213,000 |

|

|

|

1,254,148 |

|

|

|

1,319,398 |

|

|

|

(41,148 |

) |

|

|

(106,398 |

) |

Corporates |

|

|

323,751 |

|

|

|

341,142 |

|

|

|

349,318 |

|

|

|

(17,391 |

) |

|

|

(25,567 |

) |

Collateralized loan obligations |

|

|

336,273 |

|

|

|

347,063 |

|

|

|

348,078 |

|

|

|

(10,790 |

) |

|

|

(11,805 |

) |

Total securities available for sale |

|

$ |

6,650,812 |

|

|

$ |

6,865,302 |

|

|

$ |

6,816,223 |

|

|

$ |

(214,490 |

) |

|

$ |

(165,411 |

) |

Securities held to maturity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

U.S. Agencies |

|

$ |

120,563 |

|

|

$ |

123,225 |

|

|

$ |

123,135 |

|

|

$ |

(2,662 |

) |

|

$ |

(2,572 |

) |

Mortgage-backed |

|

|

2,656,096 |

|

|

|

2,707,780 |

|

|

|

2,878,657 |

|

|

|

(51,684 |

) |

|

|

(222,561 |

) |

State and political subdivisions |

|

|

2,798,371 |

|

|

|

2,821,799 |

|

|

|

2,822,218 |

|

|

|

(23,428 |

) |

|

|

(23,847 |

) |

Total securities held to maturity |

|

$ |

5,575,030 |

|

|

$ |

5,652,804 |

|

|

$ |

5,824,010 |

|

|

$ |

(77,774 |

) |

|

$ |

(248,980 |

) |

Trading securities |

|

$ |

26,381 |

|

|

$ |

17,893 |

|

|

$ |

12,538 |

|

|

$ |

8,488 |

|

|

$ |

13,843 |

|

Other securities |

|

|

448,015 |

|

|

|

478,805 |

|

|

|

407,754 |

|

|

|

(30,790 |

) |

|

|

40,261 |

|

Total securities |

|

$ |

12,700,238 |

|

|

$ |

13,014,804 |

|

|

$ |

13,060,525 |

|

|

$ |

(314,566 |

) |

|

$ |

(360,287 |

) |

Summary of average deposits - QTD Average |

UMB Financial Corporation |

|

||||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q2 |

|

|

CQ vs. |

|

|

CQ vs. |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

LQ |

|

|

PY |

|

|||||

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Noninterest-bearing demand |

|

$ |

10,103,035 |

|

|

$ |

10,066,409 |

|

|

$ |

10,535,325 |

|

|

$ |

36,626 |

|

|

$ |

(432,290 |

) |

Interest-bearing demand and savings |

|

|

21,914,116 |

|

|

|

20,701,659 |

|

|

|

17,463,022 |

|

|

|

1,212,457 |

|

|

|

4,451,094 |

|

Time deposits |

|

|

2,323,610 |

|

|

|

2,758,064 |

|

|

|

3,476,616 |

|

|

|

(434,454 |

) |

|

|

(1,153,006 |

) |

Total deposits |

|

$ |

34,340,761 |

|

|

$ |

33,526,132 |

|

|

$ |

31,474,963 |

|

|

$ |

814,629 |

|

|

$ |

2,865,798 |

|

Noninterest bearing deposits as % of total |

|

|

29.4 |

% |

|

|

30.0 |

% |

|

|

33.5 |

% |

|

|

|

|

|

|

||

Capital

Capital information |

|

UMB Financial Corporation |

|

|||||||||

(unaudited, dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|||

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

|||

Total equity |

|

$ |

3,227,347 |

|

|

$ |

3,152,816 |

|

|

$ |

2,831,628 |

|

Accumulated other comprehensive loss, net |

|

|

(605,634 |

) |

|

|

(594,538 |

) |

|

|

(685,831 |

) |

Book value per common share |

|

|

66.21 |

|

|

|

64.68 |

|

|

|

58.36 |

|

Tangible book value per common share (Non-GAAP)(i) |

|

|

60.58 |

|

|

|

59.01 |

|

|

|

52.54 |

|

|

|

|

|

|

|

|

|

|

|

|||

Regulatory capital: |

|

|

|

|

|

|

|

|

|

|||

Common equity Tier 1 capital |

|

$ |

3,591,755 |

|

|

$ |

3,503,837 |

|

|

$ |

3,273,841 |

|

Tier 1 capital |

|

|

3,591,755 |

|

|

|

3,503,837 |

|

|

|

3,273,841 |

|

Total capital |

|

|

4,214,712 |

|

|

|

4,115,097 |

|

|

|

3,870,101 |

|

|

|

|

|

|

|

|

|

|

|

|||

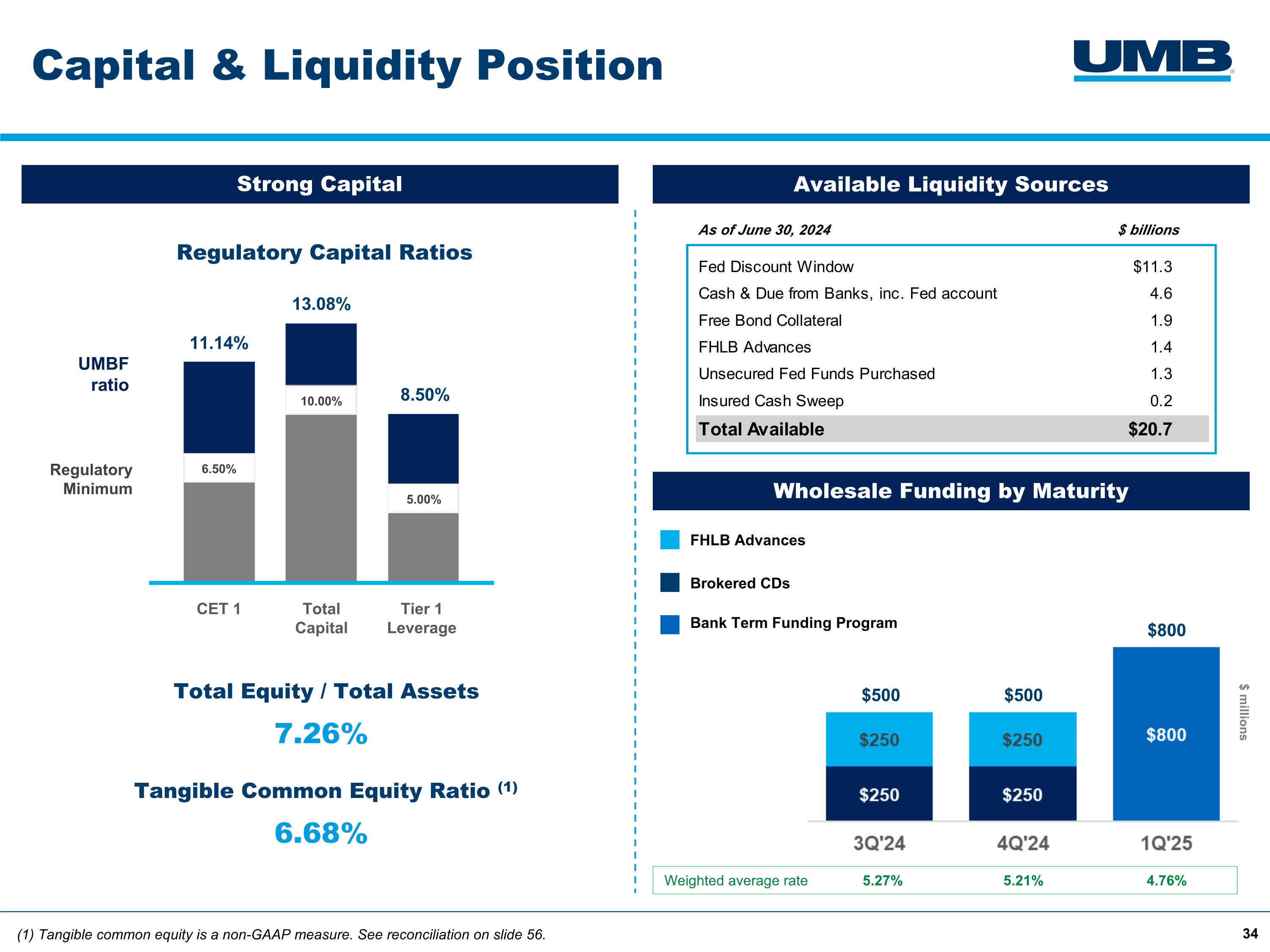

Regulatory capital ratios: |

|

|

|

|

|

|

|

|

|

|||

Common equity Tier 1 capital ratio |

|

|

11.14 |

% |

|

|

11.09 |

% |

|

|

10.65 |

% |

Tier 1 risk-based capital ratio |

|

|

11.14 |

|

|

|

11.09 |

|

|

|

10.65 |

|

Total risk-based capital ratio |

|

|

13.08 |

|

|

|

13.03 |

|

|

|

12.59 |

|

Tier 1 leverage ratio |

|

|

8.50 |

|

|

|

8.39 |

|

|

|

8.16 |

|

(i) See reconciliation of Non-GAAP measures to their nearest comparable GAAP measures later in this release.

Asset Quality

Credit quality |

|

UMB Financial Corporation |

|

|||||||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|||||

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|||||

Net charge-offs (recoveries) - total loans |

|

$ |

2,856 |

|

|

$ |

3,017 |

|

|

$ |

1,352 |

|

|

$ |

4,618 |

|

|

$ |

(139 |

) |

Net loan charge-offs (recoveries) as a % of total average loans |

|

|

0.05 |

% |

|

|

0.05 |

% |

|

|

0.02 |

% |

|

|

0.08 |

% |

|

|

(0.00 |

)% |

Loans over 90 days past due |

|

$ |

5,644 |

|

|

$ |

3,076 |

|

|

$ |

3,111 |

|

|

$ |

3,044 |

|

|

$ |

10,675 |

|

Loans over 90 days past due as a % of total loans |

|

|

0.02 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.05 |

% |

Nonaccrual and restructured loans |

|

$ |

13,743 |

|

|

$ |

17,756 |

|

|

$ |

13,212 |

|

|

$ |

17,042 |

|

|

$ |

19,347 |

|

Nonaccrual and restructured loans as a % of total loans |

|

|

0.06 |

% |

|

|

0.08 |

% |

|

|

0.06 |

% |

|

|

0.07 |

% |

|

|

0.09 |

% |

Provision for credit losses |

|

$ |

14,050 |

|

|

$ |

10,000 |

|

|

$ |

— |

|

|

$ |

4,977 |

|

|

$ |

13,000 |

|

Dividend Declaration

At the company’s quarterly board meeting, the Board of Directors declared a $0.39 per share quarterly cash dividend, payable on October 1, 2024, to shareholders of record at the close of business on September 10, 2024.

Conference Call

The company will host a conference call to discuss its second quarter 2024 earnings results on Wednesday, July 31, 2024, at 8:30 a.m. (CT).

Interested parties may access the call by dialing (toll-free) 833-470-1428 or (international) 404-975-4839 and requesting to join the UMB Financial call with access code 944750. The live call may also be accessed by visiting investorrelations.umb.com or by using the following link:

UMB Financial 2Q 2024 Conference Call

A replay of the conference call may be heard through August 14, 2024, by calling (toll-free) 866-813-9403 or (international) 929-458-6194. The replay access code required for playback is 435652. The call replay may also be accessed at investorrelations.umb.com.

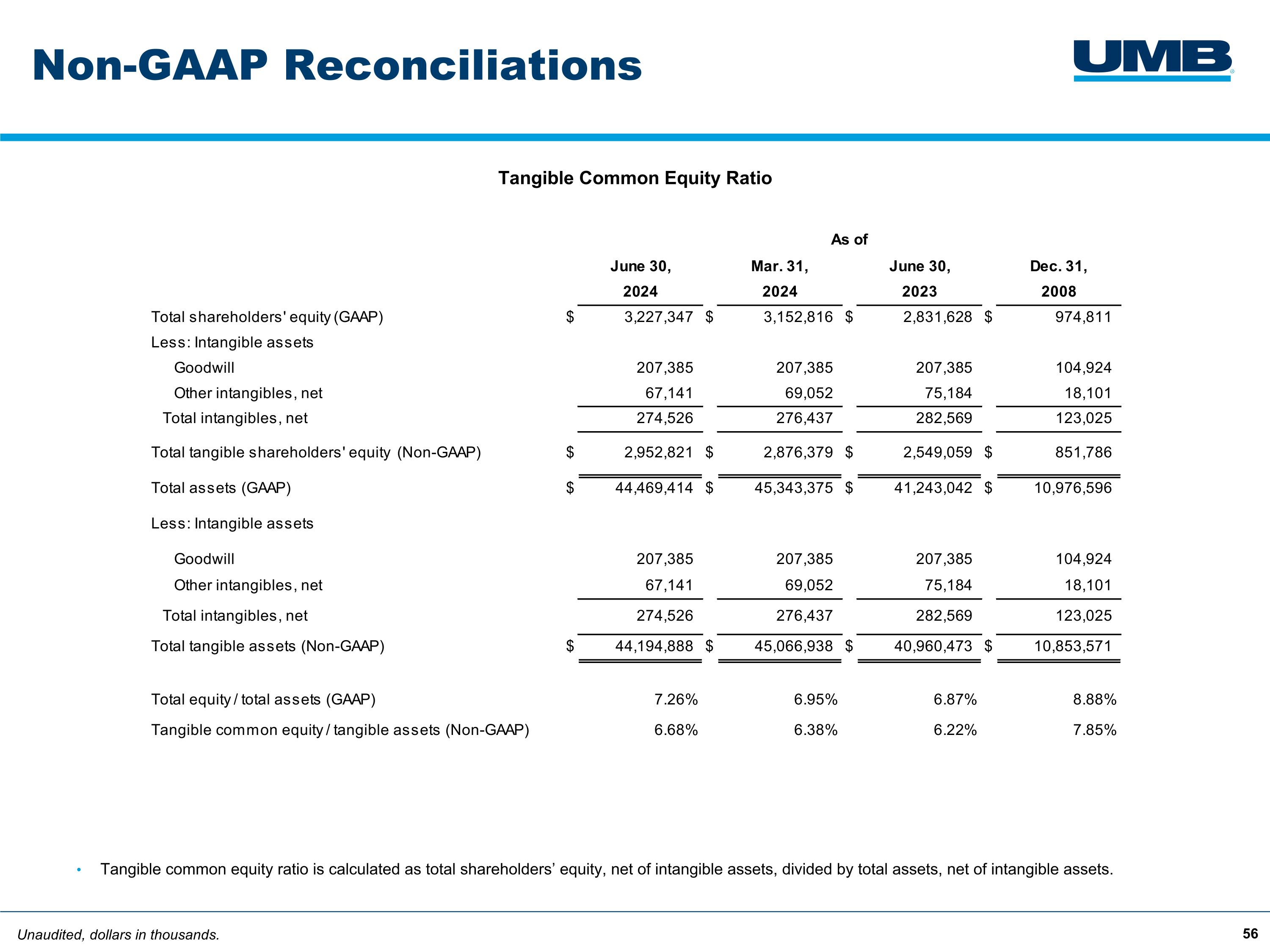

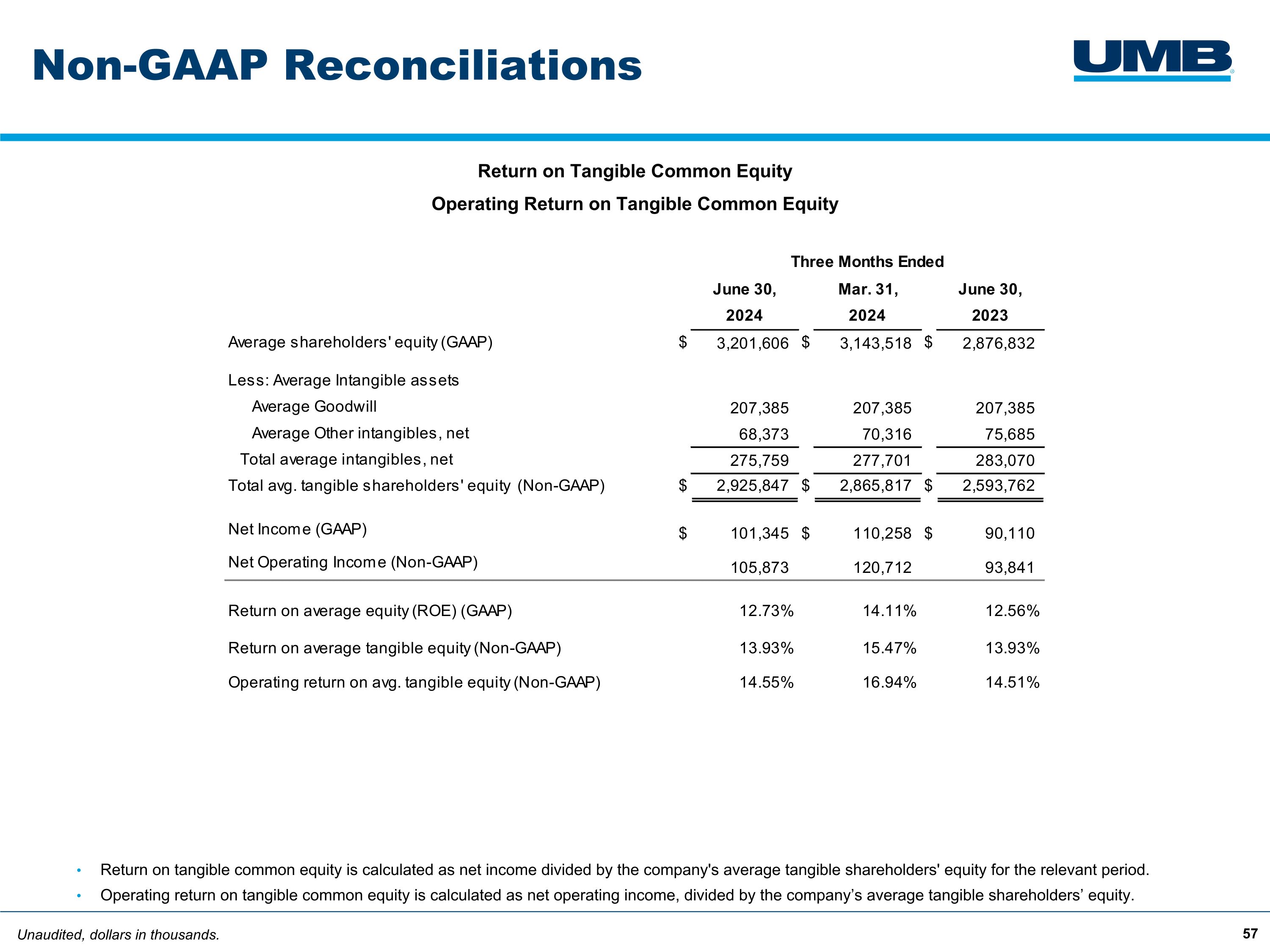

Non-GAAP Financial Information

In this release, we provide information about net operating income, operating earnings per share – diluted (operating EPS), operating return on average equity (operating ROE), operating return on average assets (operating ROA), operating noninterest expense, operating efficiency ratio, operating pre-tax, pre-provision income (operating PTPP), operating pre-tax, pre-provision earnings per share – diluted (operating PTPP EPS), operating pre-tax, pre-provision income on a fully tax equivalent basis (operating PTPP-FTE), operating pre-tax, pre-provision FTE earnings per share – diluted (operating PTPP-FTE EPS), tangible shareholders’ equity, and tangible book value per share, all of which are non-GAAP financial measures. This information supplements the results that are reported according to generally accepted accounting principles in the United States (GAAP) and should not be viewed in isolation from, or as a substitute for, GAAP results. The differences between the non-GAAP financial measures – net operating income, operating EPS, operating ROE, operating ROA, operating noninterest expense, operating efficiency ratio, operating PTPP, operating PTPP EPS, operating PTPP-FTE, operating PTPP-FTE EPS, tangible shareholders’ equity, and tangible book value per share – and the nearest comparable GAAP financial measures are reconciled later in this release. The company believes that these non-GAAP financial measures and the reconciliations may be useful to investors because they adjust for acquisition- and severance-related items, and the FDIC special assessment that management does not believe reflect the company’s fundamental operating performance.

Net operating income for the relevant period is defined as GAAP net income, adjusted to reflect the impact of excluding expenses related to acquisitions, severance expense, the FDIC special assessment, and the cumulative tax impact of these adjustments.

Operating EPS (diluted) is calculated as earnings per share as reported, adjusted to reflect, on a per share basis, the impact of excluding the non-GAAP adjustments described above for the relevant period. Operating ROE is calculated as net operating income, divided by the company’s average total shareholders’ equity for the relevant period. Operating ROA is calculated as net operating income, divided by the company’s average assets for the relevant period. Operating noninterest expense for the relevant period is defined as GAAP noninterest expense, adjusted to reflect the pre-tax impact of non-GAAP adjustments described above. Operating efficiency ratio is calculated as the company’s operating noninterest expense, net of amortization of other intangibles, divided by the company’s total non-GAAP revenue (calculated as net interest income plus noninterest income, less gains on sales of securities available for sale, net).

Operating PTPP income for the relevant period is defined as GAAP net interest income plus GAAP noninterest income, less noninterest expense, adjusted to reflect the impact of excluding expenses related to acquisitions and severance, and the FDIC special assessment.

Operating PTPP-FTE for the relevant period is defined as GAAP net interest income on a fully tax equivalent basis plus GAAP noninterest income, less noninterest expense, adjusted to reflect the impact of excluding expenses related to acquisitions and severance, and the FDIC special assessment.

Tangible shareholders’ equity for the relevant period is defined as GAAP shareholders’ equity, net of intangible assets. Tangible book value per share is defined as tangible shareholders’ equity divided by the Company’s total shares outstanding.

Forward-Looking Statements:

This press release contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (SEC). In addition to such factors that have been disclosed previously: macroeconomic and adverse developments and uncertainties related to the collateral effects of the collapse of, and challenges for, domestic and international banks, including the impacts to the U.S. and global economies; sustained levels of high inflation and the potential for an economic recession on the heels of aggressive quantitative tightening by the Federal Reserve; and impacts related to or resulting from instability in the Middle East and Russia’s military action in Ukraine, such as the broader impacts to financial markets and the global macroeconomic and geopolitical environments, may also cause actual results or other future events, circumstances, or aspirations to differ from our forward-looking statements. Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

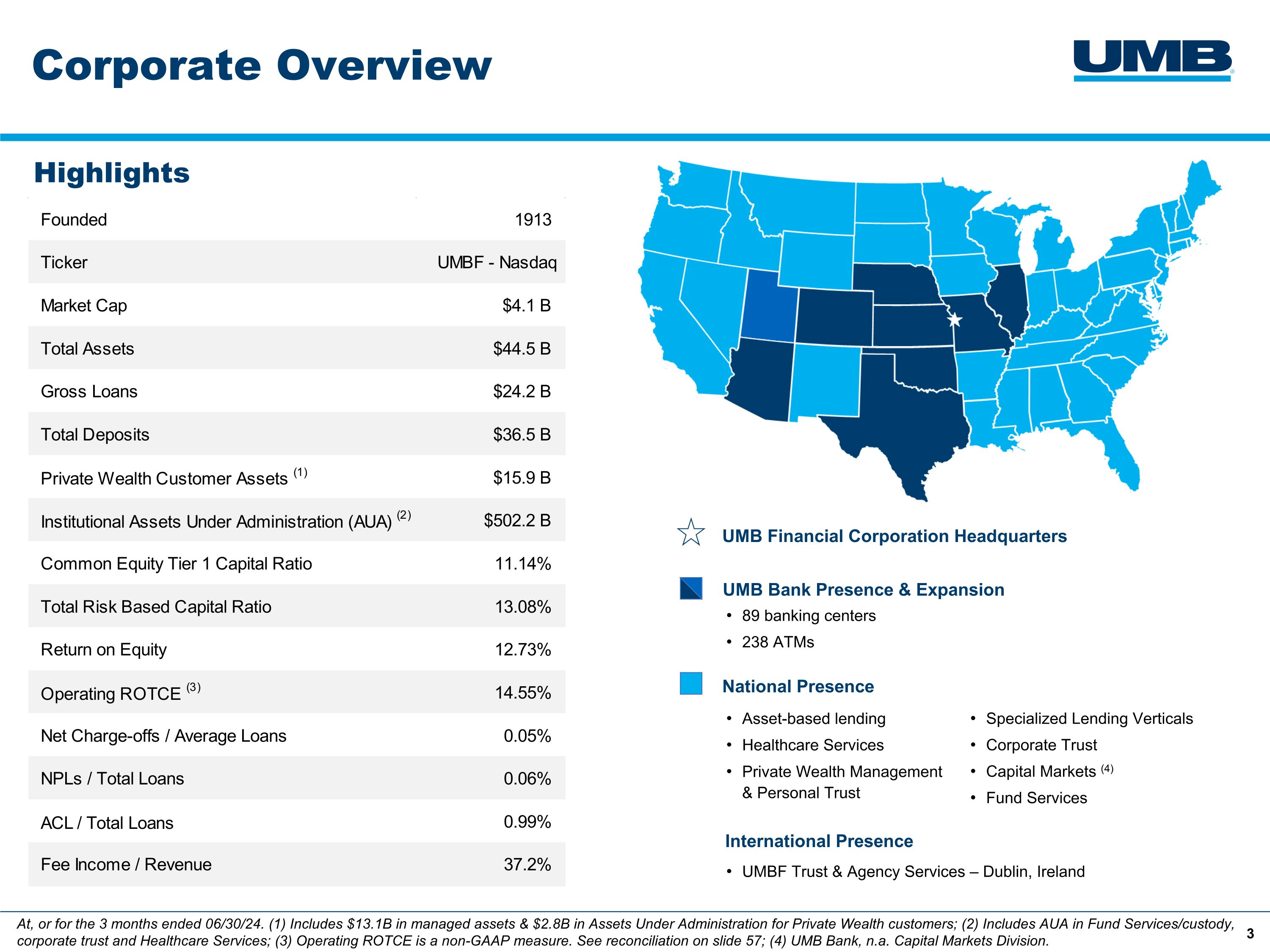

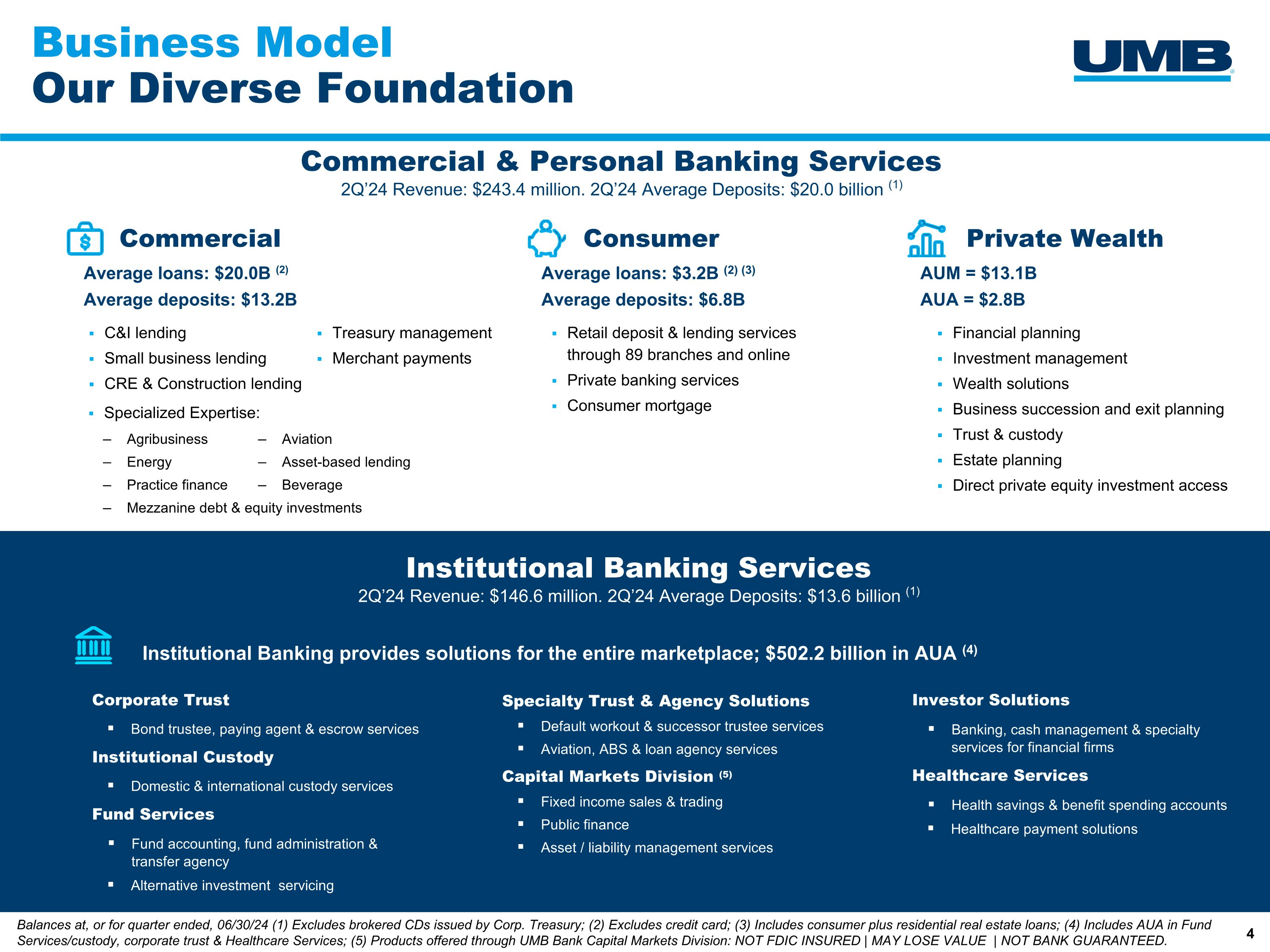

About UMB:

UMB Financial Corporation (Nasdaq: UMBF) is a financial services company headquartered in Kansas City, Missouri. UMB offers commercial banking, which includes comprehensive deposit, lending and investment services, personal banking, which includes wealth management and financial planning services, and institutional banking, which includes asset servicing, corporate trust solutions, investment banking, and healthcare services. UMB operates branches throughout Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona and Texas. As the company’s reach continues to grow, it also serves business clients nationwide and institutional clients in several countries. For more information, visit UMB.com, UMB Blog, UMB Facebook and UMB LinkedIn.

Consolidated Balance Sheets |

|

UMB Financial Corporation |

|

|||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

||

|

|

June 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

ASSETS |

|

|

|

|

|

|

||

Loans |

|

$ |

24,197,462 |

|

|

$ |

22,483,542 |

|

Allowance for credit losses on loans |

|

|

(239,167 |

) |

|

|

(222,161 |

) |

Net loans |

|

|

23,958,295 |

|

|

|

22,261,381 |

|

Loans held for sale |

|

|

4,211 |

|

|

|

3,819 |

|

Securities: |

|

|

|

|

|

|

||

Available for sale |

|

|

7,107,373 |

|

|

|

6,668,615 |

|

Held to maturity, net of allowance for credit losses |

|

|

5,546,634 |

|

|

|

5,807,763 |

|

Trading securities |

|

|

28,981 |

|

|

|

28,887 |

|

Other securities |

|

|

447,650 |

|

|

|

428,149 |

|

Total securities |

|

|

13,130,638 |

|

|

|

12,933,414 |

|

Federal funds sold and resell agreements |

|

|

247,462 |

|

|

|

319,838 |

|

Interest-bearing due from banks |

|

|

4,640,418 |

|

|

|

3,369,911 |

|

Cash and due from banks |

|

|

464,719 |

|

|

|

431,527 |

|

Premises and equipment, net |

|

|

226,860 |

|

|

|

255,127 |

|

Accrued income |

|

|

237,874 |

|

|

|

190,387 |

|

Goodwill |

|

|

207,385 |

|

|

|

207,385 |

|

Other intangibles, net |

|

|

67,141 |

|

|

|

75,184 |

|

Other assets |

|

|

1,284,411 |

|

|

|

1,195,069 |

|

Total assets |

|

$ |

44,469,414 |

|

|

$ |

41,243,042 |

|

|

|

|

|

|

|

|

||

LIABILITIES |

|

|

|

|

|

|

||

Deposits: |

|

|

|

|

|

|

||

Noninterest-bearing demand |

|

$ |

12,034,606 |

|

|

$ |

12,142,906 |

|

Interest-bearing demand and savings |

|

|

22,400,255 |

|

|

|

18,184,063 |

|

Time deposits under $250,000 |

|

|

1,421,513 |

|

|

|

2,665,166 |

|

Time deposits of $250,000 or more |

|

|

661,196 |

|

|

|

528,326 |

|

Total deposits |

|

|

36,517,570 |

|

|

|

33,520,461 |

|

Federal funds purchased and repurchase agreements |

|

|

2,217,033 |

|

|

|

2,050,583 |

|

Short-term debt |

|

|

1,300,000 |

|

|

|

1,800,000 |

|

Long-term debt |

|

|

384,245 |

|

|

|

382,280 |

|

Accrued expenses and taxes |

|

|

352,778 |

|

|

|

256,845 |

|

Other liabilities |

|

|

470,441 |

|

|

|

401,245 |

|

Total liabilities |

|

|

41,242,067 |

|

|

|

38,411,414 |

|

|

|

|

|

|

|

|

||

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

||

Common stock |

|

|

55,057 |

|

|

|

55,057 |

|

Capital surplus |

|

|

1,132,301 |

|

|

|

1,124,977 |

|

Retained earnings |

|

|

2,984,152 |

|

|

|

2,681,448 |

|

Accumulated other comprehensive loss, net |

|

|

(605,634 |

) |

|

|

(685,831 |

) |

Treasury stock |

|

|

(338,529 |

) |

|

|

(344,023 |

) |

Total shareholders' equity |

|

|

3,227,347 |

|

|

|

2,831,628 |

|

Total liabilities and shareholders' equity |

|

$ |

44,469,414 |

|

|

$ |

41,243,042 |

|

Consolidated Statements of Income |

|

UMB Financial Corporation |

|

|||||||||||||

(unaudited, dollars in thousands except share and per share data) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loans |

|

$ |

400,351 |

|

|

$ |

342,994 |

|

|

$ |

785,917 |

|

|

$ |

651,435 |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Taxable interest |

|

|

61,582 |

|

|

|

54,587 |

|

|

|

122,693 |

|

|

|

107,636 |

|

Tax-exempt interest |

|

|

25,077 |

|

|

|

25,550 |

|

|

|

50,410 |

|

|

|

50,856 |

|

Total securities income |

|

|

86,659 |

|

|

|

80,137 |

|

|

|

173,103 |

|

|

|

158,492 |

|

Federal funds and resell agreements |

|

|

3,674 |

|

|

|

3,889 |

|

|

|

6,736 |

|

|

|

9,540 |

|

Interest-bearing due from banks |

|

|

47,174 |

|

|

|

34,206 |

|

|

|

91,862 |

|

|

|

50,372 |

|

Trading securities |

|

|

424 |

|

|

|

154 |

|

|

|

729 |

|

|

|

288 |

|

Total interest income |

|

|

538,282 |

|

|

|

461,380 |

|

|

|

1,058,347 |

|

|

|

870,127 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Deposits |

|

|

240,525 |

|

|

|

170,550 |

|

|

|

464,400 |

|

|

|

298,449 |

|

Federal funds and repurchase agreements |

|

|

28,081 |

|

|

|

24,745 |

|

|

|

55,743 |

|

|

|

48,047 |

|

Other |

|

|

24,568 |

|

|

|

40,474 |

|

|

|

53,662 |

|

|

|

56,324 |

|

Total interest expense |

|

|

293,174 |

|

|

|

235,769 |

|

|

|

573,805 |

|

|

|

402,820 |

|

Net interest income |

|

|

245,108 |

|

|

|

225,611 |

|

|

|

484,542 |

|

|

|

467,307 |

|

Provision for credit losses |

|

|

14,050 |

|

|

|

13,000 |

|

|

|

24,050 |

|

|

|

36,250 |

|

Net interest income after provision for credit losses |

|

|

231,058 |

|

|

|

212,611 |

|

|

|

460,492 |

|

|

|

431,057 |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Trust and securities processing |

|

|

70,010 |

|

|

|

61,589 |

|

|

|

139,488 |

|

|

|

123,948 |

|

Trading and investment banking |

|

|

5,461 |

|

|

|

4,800 |

|

|

|

10,923 |

|

|

|

10,108 |

|

Service charges on deposit accounts |

|

|

22,261 |

|

|

|

21,381 |

|

|

|

43,018 |

|

|

|

42,540 |

|

Insurance fees and commissions |

|

|

267 |

|

|

|

225 |

|

|

|

550 |

|

|

|

499 |

|

Brokerage fees |

|

|

14,020 |

|

|

|

13,604 |

|

|

|

27,180 |

|

|

|

27,280 |

|

Bankcard fees |

|

|

22,346 |

|

|

|

18,579 |

|

|

|

44,314 |

|

|

|

36,751 |

|

Investment securities (losses) gains, net |

|

|

(1,867 |

) |

|

|

900 |

|

|

|

7,504 |

|

|

|

(4,424 |

) |

Other |

|

|

12,421 |

|

|

|

17,004 |

|

|

|

31,186 |

|

|

|

31,580 |

|

Total noninterest income |

|

|

144,919 |

|

|

|

138,082 |

|

|

|

304,163 |

|

|

|

268,282 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Salaries and employee benefits |

|

|

142,861 |

|

|

|

143,312 |

|

|

|

285,867 |

|

|

|

285,810 |

|

Occupancy, net |

|

|

11,723 |

|

|

|

11,746 |

|

|

|

23,993 |

|

|

|

23,923 |

|

Equipment |

|

|

15,603 |

|

|

|

17,086 |

|

|

|

32,106 |

|

|

|

34,935 |

|

Supplies and services |

|

|

3,404 |

|

|

|

4,195 |

|

|

|

6,705 |

|

|

|

8,070 |

|

Marketing and business development |

|

|

6,598 |

|

|

|

7,124 |

|

|

|

12,623 |

|

|

|

12,459 |

|

Processing fees |

|

|

29,701 |

|

|

|

26,572 |

|

|

|

57,637 |

|

|

|

49,812 |

|

Legal and consulting |

|

|

16,566 |

|

|

|

7,059 |

|

|

|

24,460 |

|

|

|

14,344 |

|

Bankcard |

|

|

11,818 |

|

|

|

8,307 |

|

|

|

22,385 |

|

|

|

15,440 |

|

Amortization of other intangible assets |

|

|

1,911 |

|

|

|

2,117 |

|

|

|

3,871 |

|

|

|

4,415 |

|

Regulatory fees |

|

|

2,568 |

|

|

|

6,123 |

|

|

|

21,963 |

|

|

|

11,674 |

|

Other |

|

|

6,314 |

|

|

|

7,032 |

|

|

|

12,261 |

|

|

|

16,843 |

|

Total noninterest expense |

|

|

249,067 |

|

|

|

240,673 |

|

|

|

503,871 |

|

|

|

477,725 |

|

Income before income taxes |

|

|

126,910 |

|

|

|

110,020 |

|

|

|

260,784 |

|

|

|

221,614 |

|

Income tax expense |

|

|

25,565 |

|

|

|

19,910 |

|

|

|

49,181 |

|

|

|

39,067 |

|

NET INCOME |

|

$ |

101,345 |

|

|

$ |

90,110 |

|

|

$ |

211,603 |

|

|

$ |

182,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

PER SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income – basic |

|

$ |

2.08 |

|

|

$ |

1.86 |

|

|

$ |

4.34 |

|

|

$ |

3.77 |

|

Net income – diluted |

|

|

2.07 |

|

|

|

1.85 |

|

|

|

4.32 |

|

|

|

3.75 |

|

Dividends |

|

|

0.39 |

|

|

|

0.38 |

|

|

|

0.78 |

|

|

|

0.76 |

|

Weighted average shares outstanding – basic |

|

|

48,744,636 |

|

|

|

48,514,277 |

|

|

|

48,704,075 |

|

|

|

48,474,865 |

|

Weighted average shares outstanding – diluted |

|

|

48,974,265 |

|

|

|

48,668,413 |

|

|

|

48,952,054 |

|

|

|

48,707,487 |

|

Consolidated Statements of Comprehensive Income |

|

UMB Financial Corporation |

|

|||||||||||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Net income |

|

$ |

101,345 |

|

|

$ |

90,110 |

|

|

$ |

211,603 |

|

|

$ |

182,547 |

|

Other comprehensive (loss) income, before tax: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Unrealized gains and losses on debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in unrealized holding gains and losses, net |

|

|

(12,727 |

) |

|

|

(87,505 |

) |

|

|

(54,280 |

) |

|

|

6,152 |

|

Less: Reclassification adjustment for net (gains) losses included in net income |

|

|

— |

|

|

|

— |

|

|

|

(139 |

) |

|

|

433 |

|

Amortization of net unrealized loss on securities transferred from available-for-sale to held-to-maturity |

|

|

8,938 |

|

|

|

10,312 |

|

|

|

17,727 |

|

|

|

20,295 |

|

Change in unrealized gains and losses on debt securities |

|

|

(3,789 |

) |

|

|

(77,193 |

) |

|

|

(36,692 |

) |

|

|

26,880 |

|

Unrealized gains and losses on derivative hedges: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in unrealized gains and losses on derivative hedges, net |

|

|

(8,775 |

) |

|

|

1,848 |

|

|

|

(22,433 |

) |

|

|

321 |

|

Less: Reclassification adjustment for net gains included in net income |

|

|

(2,066 |

) |

|

|

(2,660 |

) |

|

|

(5,726 |

) |

|

|

(5,221 |

) |

Change in unrealized gains and losses on derivative hedges |

|

|

(10,841 |

) |

|

|

(812 |

) |

|

|

(28,159 |

) |

|

|

(4,900 |

) |

Other comprehensive (loss) income, before tax |

|

|

(14,630 |

) |

|

|

(78,005 |

) |

|

|

(64,851 |

) |

|

|

21,980 |

|

Income tax benefit (expense) |

|

|

3,534 |

|

|

|

18,950 |

|

|

|

16,152 |

|

|

|

(5,076 |

) |

Other comprehensive (loss) income |

|

|

(11,096 |

) |

|

|

(59,055 |

) |

|

|

(48,699 |

) |

|

|

16,904 |

|

Comprehensive income |

|

$ |

90,249 |

|

|

$ |

31,055 |

|

|

$ |

162,904 |

|

|

$ |

199,451 |

|

Consolidated Statements of Shareholders' Equity |

UMB Financial Corporation |

|

||||||||||||||||||||||

(unaudited, dollars in thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Common |

|

|

Capital |

|

|

Retained |

|

|

Accumulated Other Comprehensive (Loss) Income |

|

|

Treasury |

|

|

Total |

|

||||||

Balance - January 1, 2023 |

|

$ |

55,057 |

|

|

$ |

1,125,949 |

|

|

$ |

2,536,086 |

|

|

$ |

(702,735 |

) |

|

$ |

(347,264 |

) |

|

$ |

2,667,093 |

|

Total comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

182,547 |

|

|

|

16,904 |

|

|

|

— |

|

|

|

199,451 |

|

Dividends ($0.76 per share) |

|

|

— |

|

|

|

— |

|

|

|

(37,185 |

) |

|

|

— |

|

|

|

— |

|

|

|

(37,185 |

) |

Purchase of treasury stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,902 |

) |

|

|

(7,902 |

) |

Issuances of equity awards, net of forfeitures |

|

|

— |

|

|

|

(9,764 |

) |

|

|

— |

|

|

|

— |

|

|

|

10,483 |

|

|

|

719 |

|

Recognition of equity-based compensation |

|

|

— |

|

|

|

8,455 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,455 |

|

Sale of treasury stock |

|

|

— |

|

|

|

115 |

|

|

|

— |

|

|

|

— |

|

|

|

140 |

|

|

|

255 |

|

Exercise of stock options |

|

|

— |

|

|

|

222 |

|

|

|

— |

|

|

|

— |

|

|

|

520 |

|

|

|

742 |

|

Balance - June 30, 2023 |

|

$ |

55,057 |

|

|

$ |

1,124,977 |

|

|

$ |

2,681,448 |

|

|

$ |

(685,831 |

) |

|

$ |

(344,023 |

) |

|

$ |

2,831,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance - January 1, 2024 |

|

$ |

55,057 |

|

|

$ |

1,134,363 |

|

|

$ |

2,810,824 |

|

|

$ |

(556,935 |

) |

|

$ |

(342,890 |

) |

|

$ |

3,100,419 |

|

Total comprehensive income (loss) |

|

|

— |

|

|

|

— |

|

|

|

211,603 |

|

|

|

(48,699 |

) |

|

|

— |

|

|

|

162,904 |

|

Dividends ($0.78 per share) |

|

|

— |

|

|

|

— |

|

|

|

(38,275 |

) |

|

|

— |

|

|

|

— |

|

|

|

(38,275 |

) |

Purchase of treasury stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,537 |

) |

|

|

(7,537 |

) |

Issuances of equity awards, net of forfeitures |

|

|

— |

|

|

|

(10,964 |

) |

|

|

— |

|

|

|

— |

|

|

|

11,667 |

|

|

|

703 |

|

Recognition of equity-based compensation |

|

|

— |

|

|

|

10,040 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,040 |

|

Sale of treasury stock |

|

|

— |

|

|

|

125 |

|

|

|

— |

|

|

|

— |

|

|

|

107 |

|

|

|

232 |

|

Exercise of stock options |

|

|

— |

|

|

|

54 |

|

|

|

— |

|

|

|

— |

|

|

|

124 |

|

|

|

178 |

|

Common stock issuance costs |

|

|

— |

|

|

|

(1,317 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,317 |

) |

Balance - June 30, 2024 |

|

$ |

55,057 |

|

|

$ |

1,132,301 |

|

|

$ |

2,984,152 |

|

|

$ |

(605,634 |

) |

|

$ |

(338,529 |

) |

|

$ |

3,227,347 |

|

Average Balances / Yields and Rates |

|

UMB Financial Corporation |

|

|||||||||||||

(tax - equivalent basis) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Three Months Ended June 30, |

|

|||||||||||||

|

|

2024 |

|

|

2023 |

|

||||||||||

|

|

Average |

|

|

Average |

|

|

Average |

|

|

Average |

|

||||

|

|

Balance |

|

|

Yield/Rate |

|

|

Balance |

|

|

Yield/Rate |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loans, net of unearned interest |

|

$ |

23,805,829 |

|

|

|

6.77 |

% |

|

$ |

22,191,601 |

|

|

|

6.20 |

% |

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Taxable |

|

|

9,033,829 |

|

|

|

2.74 |

|

|

|

9,228,103 |

|

|

|

2.37 |

|

Tax-exempt |

|

|

3,640,028 |

|

|

|

3.47 |

|

|

|

3,819,884 |

|

|

|

3.36 |

|

Total securities |

|

|

12,673,857 |

|

|

|

2.95 |

|

|

|

13,047,987 |

|

|

|

2.66 |

|

Federal funds and resell agreements |

|

|

246,132 |

|

|

|

6.00 |

|

|

|

276,459 |

|

|

|

5.64 |

|

Interest bearing due from banks |

|

|

3,486,907 |

|

|

|

5.44 |

|

|

|

2,707,740 |

|

|

|

5.07 |

|

Trading securities |

|

|

26,381 |

|

|

|

6.95 |

|

|

|

12,538 |

|

|

|

5.37 |

|

Total earning assets |

|

|

40,239,106 |

|

|

|

5.44 |

|

|

|

38,236,325 |

|

|

|

4.91 |

|

Allowance for credit losses |

|

|

(228,369 |

) |

|

|

|

|

|

(216,876 |

) |

|

|

|

||

Other assets |

|

|

2,465,492 |

|

|

|

|

|

|

2,345,714 |

|

|

|

|

||

Total assets |

|

$ |

42,476,229 |

|

|

|

|

|

$ |

40,365,163 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest-bearing deposits |

|

$ |

24,237,726 |

|

|

|

3.99 |

% |

|

$ |

20,939,638 |

|

|

|

3.27 |

% |

Federal funds and repurchase agreements |

|

|

2,421,727 |

|

|

|

4.66 |

|

|

|

2,336,929 |

|

|

|

4.25 |

|

Borrowed funds |

|

|

1,744,448 |

|

|

|

5.66 |

|

|

|

3,137,267 |

|

|

|

5.17 |

|

Total interest-bearing liabilities |

|

|

28,403,901 |

|

|

|

4.15 |

|

|

|

26,413,834 |

|

|

|

3.58 |

|

Noninterest-bearing demand deposits |

|

|

10,103,035 |

|

|

|

|

|

|

10,535,325 |

|

|

|

|

||

Other liabilities |

|

|

767,687 |

|

|

|

|

|

|

539,172 |

|

|

|

|

||

Shareholders' equity |

|

|

3,201,606 |

|

|

|

|

|

|

2,876,832 |

|

|

|

|

||

Total liabilities and shareholders' equity |

|

$ |

42,476,229 |

|

|

|

|

|

$ |

40,365,163 |

|

|

|

|

||

Net interest spread |

|

|

|

|

|

1.29 |

% |

|

|

|

|

|

1.33 |

% |

||

Net interest margin |

|

|

|

|

|

2.51 |

|

|

|

|

|

|

2.44 |

|

||

Average Balances / Yields and Rates |

|

UMB Financial Corporation |

|

|||||||||||||

(tax - equivalent basis) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(unaudited, dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Six Months Ended June 30, |

|

|||||||||||||

|

|

2024 |

|

|

2023 |

|

||||||||||

|

|

Average |

|

|

Average |

|

|

Average |

|

|

Average |

|

||||

|

|

Balance |

|

|

Yield/Rate |

|

|

Balance |

|

|

Yield/Rate |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loans, net of unearned interest |

|

$ |

23,579,936 |

|

|

|

6.70 |

% |

|

$ |

21,734,142 |

|

|

|

6.05 |

% |

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Taxable |

|

|

9,149,309 |

|

|

|

2.70 |

|

|

|

9,288,392 |

|

|

|