UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2024

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-41250

DIH HOLDING US, INC.

(Exact name of Registrant as specified in its Charter)

Delaware |

98-1624542 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

77 Accord Park Drive; Suite D-1 Norwell, MA |

02061 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (617) 871-2101

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A Common Stock |

|

DHAI |

|

The Nasdaq Stock Market LLC |

Warrants |

|

DHAIW |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the Nasdaq Stock Market on September 30, 2023, was $60,871,668.

The number of shares of Registrant’s Common Stock outstanding as of June 30,2024 was 40,544,935

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2024 Annual Meeting of Stockholders to be filed with the U.S. Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

1 |

|

Item 1A. |

12 |

|

Item 1B. |

32 |

|

Item 1C. |

32 |

|

Item 2. |

34 |

|

Item 3. |

34 |

|

Item 4. |

34 |

|

|

|

|

PART II |

|

|

Item 5. |

35 |

|

Item 6. |

35 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

36 |

Item 7A. |

45 |

|

Item 8. |

46 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

80 |

Item 9A. |

81 |

|

Item 9B. |

82 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

82 |

|

|

|

PART III |

|

|

Item 10. |

83 |

|

Item 11. |

83 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

83 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

83 |

Item 14. |

83 |

|

|

|

|

PART IV |

|

|

Item 15. |

84 |

|

Item 16. |

84 |

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management and involve risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment from time to time of our competitive position, the industry environment, potential growth opportunities, the effects of regulation and events outside of our control, such as natural disasters, wars or health epidemics. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

Forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors which could cause the actual results to differ materially from the forward-looking statement. These uncertainties and other factors include, among other things:

● |

unexpected technical and marketing difficulties inherent in major research and product development efforts; |

|

|

● |

our ability to remain a market innovator, to create new market opportunities, and/or to expand into new markets; |

|

|

● |

the potential need for changes in our long-term strategy in response to future developments; |

|

|

● |

our ability to attract and retain skilled employees; |

|

|

● |

our ability to raise sufficient capital to support our operations and fund our growth initiatives; |

|

|

● |

unexpected changes in significant operating expenses, including components and raw materials; |

|

|

● |

any disruptions or threatened disruptions to our relations with our resellers, suppliers, customers and employees, including shortages in components for our products; |

|

|

● |

changes in the supply, demand and/or prices for our products; |

|

|

● |

the complexities and uncertainty of obtaining and conducting international business, including export compliance and other reporting and compliance requirements; |

|

|

● |

the impact of potential security and cyber threats or the risk of unauthorized access to our, our customers’ and/or our suppliers’ information and systems; |

|

|

● |

changes in the regulatory environment and the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; |

|

|

● |

our ability to continue to successfully integrate acquired companies into our operations, including the ability to timely and sufficiently integrate international operations into our ongoing business and compliance programs; |

|

|

● |

failure to develop new products or integrate new technology into current products; |

|

|

● |

unfavorable results in legal proceedings to which we may be subject; |

|

|

● |

failure to establish and maintain effective internal control over financial reporting; and |

|

|

ii

● |

general economic and business conditions in the United States and elsewhere in the world, including the impact of inflation. |

You should refer to Part I, Item 1A “Risk Factors” of this Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of the risks, uncertainties and assumptions described under “Risk Factors” and elsewhere, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to new information, actual results or changes in our expectations, except as required by law.

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

iii

PART I

Item 1. Business.

Overview

DIH Holding US, Inc., a Delaware corporation and its consolidated subsidiaries are referred to in this Form 10-K as "we," “our,” “us,” the “Company,” or “DIH.” DIH is a global provider of advanced robotic devices used in physical rehabilitation, which incorporate visual stimulation in an interactive manner to enable clinical research and intensive functional rehabilitation and training in patients with walking impairments, reduced balance and/or impaired arm and hand functions. We strive to serve the rehabilitation market by providing a broad array of devices and services focused on the customer and patient recovery. DIH stands for our vision to “Deliver Inspiration & Health” to improve the daily lives of millions of people with disabilities and functional impairments.

DIH offers innovative, robotic-enabled rehabilitation devices in an interactive environment. These solutions allow for intensive rehabilitation across the spectrum of patient specific levels of care, while also tracking patients’ progress and providing a network of collaboration and encouragement. DIH is dedicated to restoring mobility and enhancing human performance through a broad array of devices that can enable the transformation of rehabilitation care at our customers. Our revenue is concentrated in Europe, Middle East and Africa (“EMEA”) and Americas, with the remaining revenue in Asia Pacific (“APAC”).

Corporate History

DIH Technology Ltd. (“DIH Cayman”) was founded in 2014 by Chief Executive Officer and Chairman, Jason Chen, with the belief that synergies could be created by integrating the niche players in the rehabilitation therapy and research markets to build a global leading growth platform. As part of this strategy, in April 2015, DIH Hong Kong, a wholly owned subsidiary of DIH Cayman, acquired Motek ForceLink B.V. and its subsidiaries (together “Motek" or "Motek Group"), a Netherlands-based technology leader in sophisticated VR-enabled movement platforms that set the standards for human movement research and treatment; and in September 2016 acquired Hocoma AG (“Hocoma”), a Switzerland-based global market leader in the development, manufacturing and marketing of robotic and sensor-based devices for functional movement therapy.

Subsequently, DIH Hong Kong organized Motek ForceLink and Hocoma under a global management framework, with the purpose of building a scalable global business blending the technical, product and market strengths of those two firms to create a scalable and fully aligned global growth and operational bases that can be leveraged for rapid growth.

Prior to the reverse recapitalization with Aurora Technology Acquisition Corp. (“ATAK”) and the reorganization, DIH Cayman owned 100% of DIH Hong Kong and DIH Hong Kong owned 100% of various operating entities including the manufacturing entities Hocoma AG and Motek Group. Hocoma AG was the sole owner of five commercial selling entities located in the United States, Chile, Slovenia, Germany, and Singapore. The commercial entities had exclusive rights to distribute the goods produced by Hocoma AG and Motek Group. While the business under DIH Cayman historically functioned together, they maintained largely independent management teams and did not rely on corporate or other support functions from DIH Cayman.

On October 6, 2020, Hocoma AG created a new wholly owned subsidiary, DIH US Corp, a Delaware entity. The purpose of DIH US Corp was to own 100% of the commercial selling entities. On May 31, 2021, Hocoma AG completed the share transfer of commercial entities to DIH US Corp.

On June 2, 2021, DIH Cayman formed a wholly owned subsidiary, DIH Holding US Inc., a Nevada Corporation (“Legacy DIH” or “DIH Nevada”). This entity was established to serve as a US-based holding company, to which assets could be transferred, setting the foundation for the future of the Company, which would eventually engage in the Business Combination with ATAK.

On June 21, 2021, Hocoma AG formed another wholly owned subsidiary, Hocoma Medical GmbH. The purpose of Hocoma Medical GmbH was to transfer the net assets of Hocoma AG, excluding intellectual property and non-transferable debt, and then sell the entity and its assets to DIH Nevada, for inclusion in the foundation of the future Company.

1

On July 1, 2021, DIH Cayman completed a series of reorganization steps to transfer DIH US Corp and its subsidiaries from Hocoma AG to DIH Nevada, effectively creating the Company. Hocoma AG entered into the following transactions:

However, on July 1, 2021, the former shareholders of Hocoma AG applied for and were granted an ex-parte preliminary injunctions by a Swiss district court. The injunctions prohibited Hocoma AG to transfer any business or assets to Hocoma Medical, and as well as the sale of Hocoma Medical from DIH Hong Kong to the Company. Consequently, Hocoma AG and its shareholders challenged these preliminary injunctions through their Swiss counsels at Homburger. On January 12, 2024, the court revoked the preliminary injunctions granted on July 1, 2021. Therefore, the injunctions no longer have any legal effect on the contribution of the business/assets of Hocoma AG to Hocoma Medical and the transfer of the ownership of Hocoma Medical GmbH to the Company. Hocoma Medical GmbH, including the business/assets transferred by Hocoma AG, became a wholly-owned subsidiary of DIH Nevada as of July 1, 2021.

DIH Cayman intended to transfer Hocoma AG (remaining assets and liabilities) and Motek Group to DIH Nevada pursuant to the Business Combination Agreement. However, DIH Cayman was subject to a lien in Hong Kong related to DIH China, a company formed in the People’s Republic of China (“DIH China”) and a wholly owned subsidiary of DIH Hong Kong. The lien was filed on July 31, 2021 on the immediate parent company of Hocoma AG and Motek Group and prevented the transfer of Hocoma AG and Motek Group. This matter is currently under review by local authorities and DIH Cayman is working to facilitate the completion of the intended transfer.

While the Company’s businesses have historically functioned together with the other businesses controlled by DIH Cayman, the Company’s businesses are largely isolated and not co-dependent on corporate or other support functions. DIH Hong Kong is a wholly-owned subsidiary of DIH Cayman and the Company was a wholly-owned subsidiary of DIH Cayman prior to closing of the Business Combination.

In October 2022, DIH Nevada acquired the SafeGait 360 and SafeGait Active smart mobility trainer systems from Gorbel, an innovative United States-based developer and manufacturer of smart material handling and fall protection equipment. The SafeGait acquisition was accounted for as an asset acquisition based on an evaluation of the U.S. GAAP guidance for business combinations.

Organization structure immediately prior to the Business Combination

Immediately before closing of the Business Combination, DIH Nevada was a wholly owned subsidiary of DIH Cayman. DIH Nevada held 100% ownership of DIH US Corp, which in turn owned the commercial entities. Additionally, DIH Nevada held 100% ownership of Hocoma Medical GmbH, which contained the net assets transferred from Hocoma AG.

DIH maintained exclusive distributor agreements with Motek Group for its advanced human movement research and rehabilitation products and services designed to support efficient functional movement therapy within specified territories. Under the distribution agreements, Motek supplied the products and services to the Company at the prices detailed in the agreement, with the Company entitled to a distributor margin.

Business Combination

On February 7, 2024 (the “Closing Date”), Aurora Technology Acquisition Corp. a Cayman Island exempted company which migrated and domesticated as a Delaware corporation (“ATAK”), Aurora Technology Merger Sub, a Nevada corporation and a direct, wholly-owned subsidiary of ATAK (“Merger Sub”) and DIH Nevada consummated a previously announced business combination pursuant to a business agreement dated as of February 26, 2023 (as amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement,” and the transactions contemplated thereby, the “Business Combination”) following the receipt of the required approval by ATAK’s and DIH Nevada’s shareholders and the fulfillment or waiver of other customary closing conditions.

2

In connection with the Closing, ATAK migrated and changed its domestication to become a Delaware corporation and changed its name to “DIH Holding US, Inc.” The Amended and Restated Certificate of Incorporation of DIH authorizes one class of common stock as Class A Common Stock ("Common Stock").

The historical financial results presented in the registration statements were prepared on a combined basis including Legacy DIH, Hocoma AG and Motek Group pursuant to the Business Combination Agreement for the intended Reorganization (as such term is defined in the Business Combination Agreement). Due to the lien on DIH Hong Kong related to DIH China, the Reorganization could not be completed as defined by the Business Combination Agreement, meaning that Motek Group and Hocoma AG ownership could not be transferred to the Company prior to the Closing.

In connection with the Closing of the Business Combination and in accordance with the terms of the Business Combination Agreement, ATAK agreed to waive the closing condition that the Reorganization be completed prior to Closing. The Company agreed to use its best efforts to complete the Reorganization as defined in the Business Combination Agreement as soon as possible thereafter. The Reorganization has not been completed as of the filing date of this Annual Report on Form 10-K. In this Annual Report on Form 10-K, the Company has recast historical financial statements on a consolidated basis including only operations from Legacy DIH. Hocoma AG and the Motek Group remained with DIH Hong Kong and are excluded from the consolidation of the Company.

Upon closing of the Business Combination with ATAK, the Company owns 100% of DIH US Corp, which in turn owns the commercial entities. Additionally, the Company owns 100% ownership of Hocoma Medical GmbH, which contains the net assets transferred from Hocoma AG. The Company maintains an exclusive distribution agreement with Motek Group as of the date of this Annual Report on Form 10-K. DIH Cayman owns approximately 34.7% shares of common stock of the Company, including earn-out shares held in escrow account. Jason Chen, the Company's Chief Executive Officer and Chairman of the Board of Directors does not own any shares of DIH directly but may be deemed to have indirect ownership of DIH through his ownership of approximately 42% of the outstanding shares of DIH Cayman.

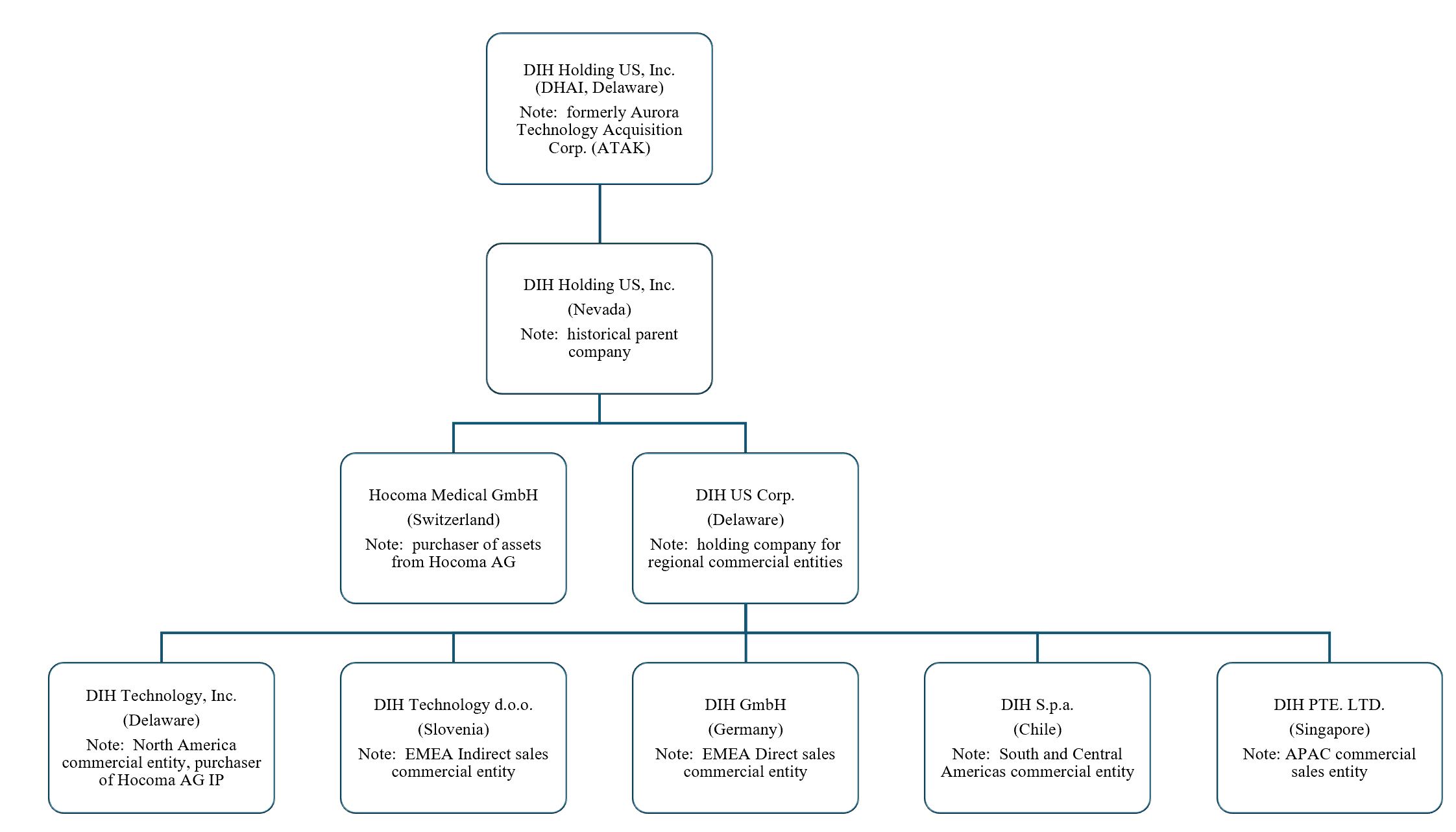

The Company’s organizational chart as of the date of this report is as follows:

3

Industry and Market Overview

Market Opportunity

The market for robotic devices for rehabilitation and human performance enhancement is rapidly growing. As populations age and the consequent demand for healthcare services increases, we expect there will be a growing need for innovative solutions that can help individuals recover from injuries and optimize their physical abilities. Additionally, there is a growing interest in the use of technology to enhance human performance, whether in sports or in everyday life.

DIH’s target market is composed of three major sub-markets:

|

■ |

Advanced Research Facilities (“ARFs”): which include advanced human performance labs or rehabilitation/biomedical research centers at universities and academic hospitals); |

|

■ |

Inpatient rehabilitation facilities (“IRFs”) which include free standing rehabilitation hospitals and rehabilitation units in acute care hospitals); |

|

■ |

Outpatient rehabilitation facilities (“ORFs”) which include outpatient rehabilitation clinics, skilled nursing or long-term care facilities). We are currently focused on the North American and European markets to accelerate market penetration, while seeking early-stage opportunities in other international markets for future expansion |

For the ARF (or Research Market), our products enable thought-provoking and sophisticated simulation and evaluation of general human performance, and specifically focuses on dynamic gait and balance-focused movement research, through our industry-leading interactive VR platform. The platform is empowered by motion capture hardware, couple with advanced human body modeling software, that creates real time visualization of the active participant. The integration of this technology with advanced robotics and other smart systems expands imaginative research interests. Most of the top 50 global leading research centers in human performance and rehabilitation have adopted our technologies as the key base of their research exploration. We believe that by integrating leading products in biomechanical research we sourced through Motek (with which we have an exclusive distribution agreement) with our advanced robotics and other AI-based innovative products we could leverage clinical results with data insights to help transform protocols and processes in the industry related to human performance and movement disorders leading to solid growth potential in this important market segment in the next 5-10 years.

For IRFs (or Hospital Market), our products enable intensive functional training in patients with walking impairments, reduced balance and/or impaired arm and hand functions. Functional training is the backbone of rehabilitation and aims to restore lost abilities and enhance performance through learning mechanisms and neuroplasticity, and thereby increase independence in daily living and quality of life. Intensive rehabilitative therapy induces stronger and faster functional recovery. Our advanced rehabilitation robots enable intensive therapy, even in high acuity patients, by providing physical assistance and mobilization to patients as needed and relieving therapists from manual workload. Gamified exercises and feedback motivating patients during movement therapy, interactive reports and data integration further enhance the clinical value of our advanced rehabilitation solutions.

For the vast ORFs (or Clinical market), we enable modern specialty rehabilitation care models that differentiate and deliver high value with better and consistent outcomes due to the 3i intervention approach empowered by our technology. By blending technology with innovative care models, such modern specialty ORFs can deliver superior values to patients and their therapists by enabling one therapist to treat multiple patients with better outcomes due to the intensive, interactive, and integral approach enabled by our smart solutions. By leveraging the treatment protocol established by our advanced robots and movements platform, we are re-configuring our solutions through modularization and further acquisitions to exploit this vast and diverse market.

Our Strategy

Physical disabilities and impairments represent significant global challenges, due to the rapid aging, increasingly severe chronic diseases, and prevailing traumatic injuries from accidents and wars. According to the Company’s internal analysis, each year, approximately 20 million people suffer from new disabilities, and it is estimated that over 300 million people are currently suffering from some form of functional impairments or disabilities globally. Those functional impairments or disabilities may ultimately result in multiple functional health problems, including cognitive, physical, emotional and spiritual issues, imposing severe burdens to health systems and significant costs to society.

4

Adding to this, the number of people aged 65 and older globally is currently approximately 1 billion, and is estimated to grow to over 1.7 billion by 2040. Approximately 87% of elders suffer from chronic diseases, and over 25% are exposed to additional disability risks according to the Company’s estimate.

According to an online article dated October 14, 2022 by Grandview Research, the global rehabilitation care market is estimated to be over $100 billion and is extremely reliant upon manual therapies, with therapists’ payroll costing more than $50 billion. We believe that such a manually dominant approach not only imposes a huge labor burden to therapists, but also may result in inconsistent outcomes due to a lack of consistent intensity, integration, standardization and optimization throughout the weeks or months of long intervention processes. Unlike a machine which can be calibrated thereby producing consistent therapy, we believe that manual therapy is likely to vary therapist to therapist or even patient to patient. Measurements of progress may also be subjective, varying from therapist to therapist which may result in a patient requiring a longer period of therapy to achieve the desired results.

The rapidly aging and increased chronic-suffering population trend will generate more demand for high quality rehabilitation care, while reducing the supply of therapists, thus adding increasing pressure and tension to the current model.

We believe the way out of such a undesirable and increasingly high pressure state is to transform the rehabilitation care model through integrated solutions empowered by our advanced technologies. The core benefits we strive to deliver to customers from our core products and solutions include:

1) Enhancing customers’ strategic positioning as leading rehabilitation facilities to attract higher paying patient groups by enabling them to attract and treat high severity and acuity patient groups, especially neurological patients;

2) Reducing total therapy costs by enabling the therapist to concurrently treat multiple patients, improve therapy outcome with the same time of stay or reduce time of stay without losing clinical efficacy;

3) Providing streamlined intervention processes with data insights and potential network effects;

4) Enabling replication and franchise established treatment protocols and best practices across chains of rehabilitation facilities;

5) Reducing total health system costs.

To build on our unique position as a global robotic and VR-enabled smart technologies and solution provider to the rehabilitation market, our strategic plan is to continue to expand our leadership through sustaining innovation, selective acquisitions, with continued focus on delivering superior value to our customers, partners, patients and other stakeholders.

Our strategic focus is on the following three areas:

|

● |

Leveraging our strengths in technologies and core products to continuously expand our market leadership, drive market penetration and accelerate growth by building intensive market penetration capability in strategic markets in the United States and Europe, enriching our product offering with innovative financing solution to accelerate customers adoption, and sustain our product and technology leadership with continued innovation and integration efforts. |

|

|

|

|

● |

Leveraging our market leadership and global platform and infrastructure and consolidating the fragmented marketplace to drive standardization and economy of scale and scope. The breadth and depth of our business model and the scale advantage enables us, not only to sustain our market leadership, but also empowers us to act as active consolidators in the highly fragmented rehabilitation market. By complementing our organic innovation and core product leadership, DIH envisions executing 2-3 acquisition with the goal to acquire proven products and technologies from sub-optimal regional players to exploit global synergies and to accelerate the growth of DIH’s integrated solution offerings. |

5

|

|

|

|

● |

Leveraging our thought-provoking industry influence backed by leading brands and products, passionate people and organizational capability; DIH strives to develop transformative Total Solutions that will fundamentally enhance the therapy and business model of our customers and enable industry-wide transformation which is expected to eventually benefits millions of people, from therapists to patients. |

Core Product Overview

DIH offers innovative, robotic-enabled devices in an augmented and interactive environment. These devices focus on restoring different functional impairment issues, while using software thereby tracking patients’ progress and providing a network of collaboration and encouragement.

We currently offer 17 robotic rehabilitation and VR-based movement systems within three major product categories through the hospital, clinical and research markets. Our objective is to establish ourselves as a product and technology leader in each of the three categories, that correspond to three key functional impact issues, i.e. 1) upper extremity devices for arm and hand functional improvement; 2) lower extremity devices for gait and balance intervention; and 3) full body integrated intervention for strength and endurance enhancement. Through software networks, we aim not only to maximize the benefits from each of the devices itself, but also to deliver multi-dimensional clinical, economic, process and administrative benefits to therapists, patients and management by connecting and integrating these various devices into cohesive and integrated caring processes and models, enabling transformative change in therapies and business models.

Upper Extremity Product Categories

To address differing clinical and economic needs, while providing consistent therapeutic interventions with similar treatment concepts and protocols, we have developed three different device models, ArmeoPower, ArmeoSpring, and ArmeoSenso. All follow the same modular Armeo Therapy Concept, that covers the “Continuum of Rehabilitation” with one software platform throughout the different stages of rehabilitation; from the early stage where the patient is very weak and needs sophisticated power-assisted dynamic intervention to help rewire the neural pattern in a safe environment which ArmeoPower provides, to self-initiated interactive ArmeoSpring which follows a similar treatment protocol of ArmeoPower for patients who have gained certain muscle power and need to transition from controlled patterns to an open environment.

6

ArmeoSenso is for patients to apply what they learned from those self-initiated but still structurally controlled movement patterns to completely open movement environments, further expanding the patient transfer skills. The economic costs of devices, and the ratio of one therapist for multiple patients also improves dramatically, thus allowing service providers and health systems to gain significant benefits of learning curves, i.e. the learning patient picks up from early acute expensive interventions, which will be increasingly beneficial for later stages, generating a win-win, both economically and clinically.

ArmeoPower is the backbone robot within our Upper Extremity portfolio; it has been specifically designed for arm and hand therapy in an early stage of rehabilitation. It enables patients with even severe motor impairments to perform exercises with a high number of repetitions. It assists the patient’s arm on an “as needed” basis to enable the patient to successfully reach the goal of the exercise. The robotic arm assistance can be adapted to the individual’s needs and the changing abilities of each patient – from full assistance for patients with very little activity to no assistance at all for more advanced patients. Such adjustable robotic assistance while exercising, enables and motivates patients to actively participate in their training, while providing weight support to enable extensive training. ArmeoPower supports 1D (joint-specific), 2D and 3D movements, with extensive game-emerged Augmented Performance Feedback ("APF") exercises simulating tasks and activities essential for daily living, while enhancing strength and range of motion. Immediate performance feedback motivates patients and helps to improve their motor abilities. It improves efficiency of the therapy session by reducing the therapist’s physical effort and the need for continuous therapeutic guidance. Moreover, it enables therapists to make better use of their clinical know-how and expertise, by focusing on the optimal exercise planning, instead of manually delivering many repetitions.

ArmeoPower precisely records how patients perform during their therapy sessions. Standardized Assessment Tools evaluate a patient’s motor functions such as joint range of motion and forces. The results can be used to analyze and document the patient’s state and therapy progress. Results can then be shared with the patient and other clinicians. ManovoPower as an add-on module for ArmeoPower enables hand opening and closing exercises.

ArmeoSpring is targeted for less severe patients; it provides self-initiated repetitive arm and hand therapy in an extensive workspace. By providing arm weight support, it encourages the patients to achieve a higher number of arm and hand movements based on specific therapy goals. It also allows simultaneous arm and hand training in an extensive workspace. This enables patients to practice the movements important for their therapy progress. ArmeoSpring also supports 1D (joint-specific), 2D and 3D movements. An extensive library of motivating game-like APF exercises has been designed to train strength and range of motion needed for activities of daily living. Immediate performance feedback motivates patients and helps to improve their motor abilities. The ArmeoSpring enables therapists to deliver higher training efficiency (more hours per day) due to self-directed therapy. Furthermore, self-directed therapy enables patients to reach an even higher therapy intensity through extra training during after-hours and weekends.

Lower Extremity Product Categories

Similar to the Armeo Therapy Concept for arm and hand, we have also developed 3+1 Robotics + VR devices to address the different clinical and economic needs of patients across different stages of the patient journey, while providing consistent therapeutic interventions with similar treatment concepts and protocols. The Erigo Robot is designed for patients right after ICU who have none or very weak muscle power, with the goal to speed up the circulation and initiate early mobilization and prepare patients for intensive therapy, while preventing or reducing secondary further impairment. LokoMat is designed to provide maximum intensive therapy to rewire the broken neuro pathway to restricted functional capabilities through Neuroplasticity effect. Andago is designed to assist patients in walking in a real environment to maximize patient transfer skills after the patient’s functional pattern has been rewired by LokoMat. C-Mill is designed to enhance the patient’s adaptability, coordination and balancing skills in a challenging and integrative environment.

Erigo is uniquely designed to provide therapy intervention to the most severe patient even at a high acute and critical post-ICU stage. It uniquely combines gradual verticalization, leg mobilization, and intensive sensorimotor stimulation through cyclic leg loading.

7

The main benefits include:

|

■ |

Early and safe mobilization even in acute care |

|

■ |

Cardiovascular stabilization |

|

■ |

Improved orthostatic tolerance using the Erigo functional stimulation. |

|

■ |

Helping to reduce patient’s length of stay, improving efficiency and outcome |

Lokomat provides robot-assisted therapy that enables effective and intensive training to increase the strength of muscles and the range of motion of joints in order to improve walking. The physiological movement of the lower extremities is ensured by the individually adjustable patient interface. Additionally, the hip and knee joint angles can be adjusted during training to the patient’s specific needs. During rehabilitation, patients need to be challenged. Therapists can help patients reach their goals by setting the training parameters according to their performance. Lokomat motivates patients to reach their goals with various game-like exercises. This Augmented Performance Feedback, or APF, maximizes the effect of Lokomat training. Lokomat allows therapists to focus on the patient and the actual therapy. It enhances staff efficiency and safety, leading to higher training intensity, more treatments per therapist, and consistent, superior patient care.

Lokomat is available in two models, LokomatNanos and LokomatPro, and has other modules such as for pediatric use available. To date, we have installed over 1,085 Lokomat systems in over 650 facilities worldwide.

Andago is designed to assist patients in walking naturally which consequently triggers continuous physiological afferent input, due to its built-in dynamic support. With its robotics smart control system, it enables patient to walk seamlessly and freely due to its robotic system. Andago bridges the gap between treadmill-based gait training and free overground walking. No dedicated space is needed as it can be used flexibly in different spaces. Its intuitive workflow allows for a quick and easy therapy start and simple integration into clinical routine. The display of key training results and export of data via USB enables training progress documentation for clinical decision-making and for health insurance providers. No infrastructure modification, meaning flexible use from room to room.

C-Mill is a powerful tool that allows for more efficient rehabilitation. Besides objective assessment of balance and gait, the C-Mill provides a safe and comfortable training environment using a treadmill, augmented reality and VR. Using our technology, patients are able to train foot placement with the C-Mill, work through balance and dual-tasks with C-Mill VR or use C-Mill VR+ for early to late rehabilitation with body weight support. It is a complete, advanced gait-lab and training center on a compact space.

CAREN, “Computer Assisted Rehabilitation Environment”, is the most advanced and sophisticated VR-enabled real time movement platform, that targets all aspects of balance and locomotion with visualization of full body participation empowered by Human Body Modeling. CAREN provides researchers with the tools to efficiently study advanced human movement by collecting objective human performance data in real time and functionally challenging environments. CAREN enables the most versatile human movement research as a result of its dual-belt instrumented treadmill mounted on a 6 degree-of-freedom movable platform, motion capture system, immersive and interactive environments and dedicated real-time and offline software packages; the CAREN is the most advanced system for your human movement research, training, and assessment. We believe CAREN will enable pioneering research in many fields of application, such as: motor control and learning, dual-tasking and feedback, balance assessment and therapy, gait analysis and adaptability, real-time human body modeling, virtual reality and integrated smart systems like robot integration. We believe CAREN is considered as the world’s most advanced biomechanics lab.

GRAIL, “Gait Real-time Analysis Interactive Lab”, the total package solution for gait analysis training and research, employs an instrumented dual-belt treadmill and motion capture system combined with virtual reality and video cameras. GRAIL provides analysis and therapy in challenging conditions to improve gait, while real-time feedback enables analysis and training during the same session.

The Total Solution

DIH’s vision includes providing a Total Solution option for our customers and their patients. The Total Solution is a product package specifically designed for our customer and is aimed at maximizing the benefits of DIH's products and solutions to achieve optimal rehabilitation outcomes.

8

This offering includes DIH’s clinical integration approach, that emphasizes three key factors:

Customer Overview

Research Market

Due to the powerfulness of our technology platform and products, and the versatile applications they enable; there are six major customer groups that are actively employing our CAREN, GRAIL and MGAIT, etc. in their leading research efforts. Universities purchase them to build modern biomedical labs and initiate systemic training, research hospitals and military purchase them to assess and define innovative interventions to restore and enhance human functions and performance, scientific and technological corporations purchase them to establish an integrated testing foundation to evaluate new concepts and accelerate new product or intervention modalities; and athletic institutions purchase them to accelerate the recovery of athletes and enhance their core performance foundations.

Hospital Market

Hospital Markets, or Inpatient rehabilitation facilities (IRFs), include free standing rehabilitation hospitals and rehabilitation units in acute care hospitals.

Our products and solutions benefit both the rehabilitation units in acute care hospitals and free standing rehabilitation hospitals. Given our limited sales resources, our primary focused customer group are rehabilitation hospitals and acute care hospitals which have a high number of neurological patients.

Within rehabilitation hospitals, it can by further broken down by 1) academic or leading national rehabilitation hospitals, 2) new modern rehabilitation hospitals, 3) neurological patient focused rehabilitation hospitals, 4) leading regional rehabilitation hospital, 5) conventional or me-too rehabilitation hospitals. Our target markets are the first two groups. Our main objective is to increase our market penetration in those groups from an estimated 25% current penetration to 66% in focused countries.

Clinical Market

The Clinical Market, or outpatient rehabilitation facilities (ORFs), include outpatient rehabilitation clinics, skilled nursing or long-term care facilities (SNF and LTC).

Given there are hundreds of thousands of facilities in these massive and diverse markets and we have limited resources, our primary focus is on the modern outpatient rehabilitation clinics (M-Clinics) and top SNFs with a focus on neurological patients (SNF-N) in our target countries. Our products can provide strategic, clinical and operational value to the M-Clinics and SNF-N, as in the hospital market.

Manufacturing and Supply Chain

Our manufacturing and supply chain strategy is founded on a commitment to blending Swiss quality mindset with Dutch agility, utilizing lean manufacturing and supply chain practices, leveraging an the Oracle ERP system implemented, ensuring efficient order fulfillment to global markets, and delivering exceptional value and commitment to our customers and patients.

Manufacturing

We manufacture the Lokomat, Andago, Erigo, Armeo Power, Armeo Spring and Armeo Senso devices at Hocoma Medical GmbH in Switzerland ). The product line we distribute for hospitals and clinics, C-Mill, is manufactured at Motek Medical B.V. in The Netherlands together with all research products (RYSEN, M-GAIT, GRAIL and CAREN).

9

For the SafeGait 360 and Active product line that we acquired from Gorbel, those two products currently are only sold in the United States and are manufactured through our manufacturing facility in Leeds, Alabama.

Supply Chain

For standardized products (for hospitals and clinics) DIH conducts production planning based on the sales budget (yearly) and sales forecast (quarterly). To have the correct alignment between all stakeholders, there is a monthly standard operating procedures (“S&OP”) meeting in place. In this meeting, all relevant stakeholders are involved, such as planning, procurement, production, order fulfillment, sales, finance, operational engineering, service and product management. Additionally, we have the inputs from regulatory and quality as well. In the S&OP the forecast and the production/procurement planning for the quarters are set and the current fulfillment situation is monitored.

Our research products are generally fairly differentiated, which makes it difficult to manage supply chain dynamics far in advance. Many of the parts are completely customized, and inputs are only known during the project phase when the order has been received. Basic parts such as treadmills, drives and motors can be planned and procured accordingly. For these research projects, there is also an S&OP in place limited to the research group.

Facilities

Our executive offices are located at 77 Accord Drive, Suite D-1 Norwell, MA. We do not own any properties, rather we lease properties to meet our needs. Currently, we have a research and development and operational campus that we lease for Hocoma operation in Switzerland located at Industriestrasse 2 and 4a in 8604 Volketswil.

Beside the main campuses, we also lease five commercial offices space at the following locations to house the regional Sales & Marketing, Clinical Application & Training, Technical Services, Finance, Logistics, Administration and other local market support functions.

|

■ |

DIH Technology Inc. leases commercial office for the American team at 77 Accord Park Dr., Suite D-1, Norwell, MA 02061, United States |

|

■ |

DIH Technology d.o.o leases commercial office for EMEA Indirect sales team at Letališka 29a, 1000 Ljubljana, Slovenia |

|

■ |

DIH GmbH leases commercial office for the Direct Sales team in DACH region, at Konrad-Adenauer Strasse 13, 50996 Köln, Germany |

|

■ |

DIH Pte Ltd leases commercial office for APAC team at 67 Ubi Avenue 1, #06-17 Starhub Green, Singapore 408942 |

|

■ |

DIH SpA leases commercial office for LATAM team at Pdte. Kennedy Lateral 5488, Oficina 1402; Vitacura, Santiago, Chile |

Human Capital

As of April 30, 2024, we employed 192 employees, of which approximately 78 percent were outside the U.S. Our employees are the Company’s most valued asset and the driving force behind our success. For this reason, we aspire to be an employer that is known for cultivating a positive and welcoming work environment and one that fosters growth, provides a safe place to work, supports diversity and embraces inclusion.

Diversity, Equity, and Inclusion

We are committed to fostering, cultivating and preserving a culture of diversity, equity and inclusion (DE&I). We recognize that a diverse, extensive talent pool provides the best opportunity to acquire unique perspectives, experiences, ideas, and solutions to drive our business forward. We believe that diverse teams solving complex problems leads to the best business results. We promote diversity by developing policies, programs, and procedures that foster a work environment where differences are respected, and all employees are treated fairly.

Employee Health and Safety

10

During the fiscal year ending March 31, 2024, there have been no OSHA recordable or lost time injuries in the United States and zero injuries at our other global sites.

Intellectual Property

We have over 20 different trademark families registered, including our most prominent product family names such as Lokomat, Armeo, Andago, and RYSEN. These trademarks are registered in 18 strategically important countries, resulting in a total of 411 registrations. The latest registration was made in 2020, and the earliest in 2004.

Name/Description of Patent |

|

Status |

|

Owned or Licensed |

|

Type of patent protection |

|

Expiration Date |

|

Jurisdictions |

US8834169/Method and apparatus for automating arm and grasping movement training for rehabilitation of patients with motor impairment |

|

Issued |

|

Licensed |

|

Utility |

|

24.11.2030 |

|

US |

|

|

|

|

|

|

|

|

|

|

|

US8192331/Device for adjusting the prestress of an elastic means around a predetermined tension or position |

|

Issued |

|

Owned |

|

Utility |

|

10.09.2028 |

|

US, DE, FR, UK, IT, CH, CN, RU |

|

|

|

|

|

|

|

|

|

|

|

US9017271/System for Arm therapy |

|

Issued |

|

Licensed |

|

Utility |

|

10.02.2031 |

|

US, DE, FR |

|

|

|

|

|

|

|

|

|

|

|

US8924010 /Method to Control a Robot Device and Robot Device |

|

Issued |

|

Owned |

|

Utility |

|

06.10.2031 |

|

US, DE, FR, NL, CH, UK |

|

|

|

|

|

|

|

|

|

|

|

US9987511/Gait training apparatus |

|

Issued |

|

Owned |

|

Utility |

|

19.09.2034 |

|

US, DE, FR, UK, IT, CH, CN, PL, KR |

|

|

|

|

|

|

|

|

|

|

|

EP3095430/Gait training apparatus (Div) |

|

Issued |

|

Owned |

|

Utility |

|

09.11.2032 |

|

DE, FR, UK, CH |

|

|

|

|

|

|

|

|

|

|

|

US10780009/Apparatus for locomotion therapy |

|

Issued |

|

Owned |

|

Utility |

|

06.01.2037 |

|

US, DE, FR, UK, CH, CN, RU |

|

|

|

|

|

|

|

|

|

|

|

EP3100707/Apparatus for locomotion therapy (Div) |

|

Issued |

|

Owned |

|

Utility |

|

16.11.2032 |

|

DE, FR, UK, IT, CH TR, PL, CN |

|

|

|

|

|

|

|

|

|

|

|

US9808668/Apparatus for automated walking training |

|

Issued |

|

Owned |

|

Utility |

|

10.08.2034 |

|

US, DE, FR, UK, IT, CH, CN, PL, TR, NL, FI, ES |

|

|

|

|

|

|

|

|

|

|

|

EP3035901/ Hand motion exercising device |

|

Issued |

|

Owned |

|

Utility |

|

14.08.2034 |

|

DE, FR, UK, NL, SI, CH, CN |

|

|

|

|

|

|

|

|

|

|

|

US10349869/Method and system for an assessment of a movement of a limb-related point in a predetermined 3D space |

|

Issued |

|

Owned |

|

Utility |

|

16.02.2036 |

|

US, DE, FR, UK, CH, AU, IT, CN |

|

|

|

|

|

|

|

|

|

|

|

US10500122/Apparatus for gait training |

|

Issued, |

|

Owned |

|

Utility |

|

20.08.2037 |

|

US, DE, FR, UK, CH, CN, |

11

|

|

Pending for KR |

|

|

|

|

|

|

|

TR, NL, SE, ES, RU, KR |

|

|

|

|

|

|

|

|

|

|

|

US10925799/ Suspension device for balancing a weight |

|

Issued |

|

Owned |

|

Utility |

|

27.06.2037 |

|

US, AU, CH, DE, FR, UK, IT, NL, PL, CN, KR |

|

|

|

|

|

|

|

|

|

|

|

US-20230039187-A1/Leg Actuation Apparatus and Gait Rehabilitation Apparatus |

|

Pending |

|

Owned |

|

Utility |

|

|

|

US, IN, CN, RU, EP, KR |

|

|

|

|

|

|

|

|

|

|

|

US-2023-0039187-A1/User Attachment for Gait and Balance Rehabilitation Apparatus |

|

Pending |

|

Owned |

|

Utility |

|

|

|

US, CN, EP, KR |

|

|

|

|

|

|

|

|

|

|

|

DM/091 450/Wheeled walking frame |

|

Issued |

|

Owned |

|

Design |

|

08.06.2041 |

|

CH, EM, US, UK |

|

|

|

|

|

|

|

|

|

|

|

DM/221 948/ArmeoSpring Pro-Design |

|

Issued |

|

Owned |

|

Design |

|

01.07.2047 |

|

CH, EM, US, UK |

Item 1A. Risk Factors.

RISK FACTORS

You should carefully consider the risks and uncertainties described below, together with the other information in this Annual Report, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before making an investment in our securities. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and growth prospects. If that were to happen, the trading price of our securities could decline. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations or financial condition. In this section, we first provide a summary of the principal risks and uncertainties we face and then provide a full set of risk factors and discuss them in greater detail.

Risks Related to Our Business and Our Industry

We have not fully completed our planned corporate reorganization

In connection with the Business Combination, we had anticipated completing a corporate reorganization in which, among other changes, Motekforce Link BV and its subsidiaries and Hocoma AG were to become wholly owned subsidiaries of DIH Holding US, Inc. The parties were unable to complete this corporate reorganization prior to the Business Combination and, as previously disclosed, the parties opted to close the Business Combination and waive the condition to close that this reorganization be completed. These entities are owned by DIH Technology, Inc., our largest stockholder.

The products produced by Motek remain a key part of our product line and we operate with Motek pursuant to the terms of an exclusive contract which obligates Motek to provide these products to us. While we do not believe this arrangement currently has a material adverse effect on our results of operations, there can be no assurance that Motek will not begin to sell its products to our competitors which would have an adverse impact on us.

There can be no assurance that the complete reorganization will be completed Our success is substantially dependent on our ability to continue to generate and grow revenue from the sales of our current key product lines, LokoMat, Erigo, Armeo, C-Mill and CAREN/Grail, which represent approximately 90% of our revenue.

We are substantially dependent on the commercial success of our current key product lines

12

Our success will depend on many factors including, but not limited to, our ability to:

|

● |

develop and execute our sales and marketing strategies and maintain and manage the necessary sales, marketing and other capabilities and infrastructure that are required to successfully commercialize our products; |

|

● |

achieve, maintain and grow market acceptance of, and demand for our current products; |

|

|

|

|

● |

establish or demonstrate in the medical community the safety and efficacy of our rehabilitation products and their potential advantages over in comparison to, existing competing products and devices and products currently in development; |

|

|

|

|

● |

offer our products at competitive prices as compared to alternative options, and our ability to achieve a suitable profit margin from the sales of our products; |

|

|

|

|

● |

comply with applicable legal and regulatory requirements, including medical device compliance; |

|

|

|

|

● |

maintain our distribution and supply arrangements with third parties; and |

|

|

|

|

● |

enforce our intellectual property rights related to current and future products, if any. |

If we do not achieve one or more of these factors, many of which are beyond our control, in a timely manner or at all, we may not be able to continue to generate and grow revenue from the sales of our current products, which may materially impact the success of our business.

We rely on sales from certain key products and markets, any disruptions to those products or markets due to change of market environment, regulatory requirements, or personal and sales practices, could generate adverse effects to our sales and business performance.

One of our key product lines, LokoMat accounts for more than 45% of our revenue; our other key products, Erigo, Armeo, C-Mill and CAREN/Grail collectively account for 55% of our revenues. In addition, approximately 80% of our revenue is concentrated in Europe, Middle East and Africa (“EMEA”) and Americas, with the remaining portion in Asia Pacific (“APAC”). Any disruptions to those key products and/or markets due to changes in market conditions, regulatory requirements, or personal and sales practices, could generate adverse effects to our sales and business performance.

Global, regional, and local economic weakness and uncertainty could adversely affect our demand for our products and services and our business and financial performance.

Our business and financial performance depends on worldwide economic conditions and the demand for our products and services in the markets in which we compete. Ongoing economic weakness, including an economic slowdown or recession, uncertainty in markets throughout the world and other adverse economic conditions, including inflation, changes in monetary policy and increased interest rates, may result in decreased demand for our products and services and increased expenses and difficulty in managing inventory levels and accurately forecasting revenue, gross margin, cash flows and expenses.

Prolonged or more severe economic weakness and uncertainty could also cause our expenses to vary materially from our expectations. Any financial turmoil affecting the banking system and financial markets or any significant financial services institution failures could negatively impact our treasury operations, as the financial condition of such parties may deteriorate rapidly and without notice.

War, geopolitical factors, and foreign exchange fluctuations could adverse effect the performance of our business.

Due to our significant presence in Europe, and emerging needs from South East Asia and the Middle East, war or geopolitical instability in those regions could adversely affect demand and supply chain disruptions from those regions; and foreign exchange, especially the Euro’s depreciation versus the US dollar would adversely depress our US dollar-denominated revenue and profitability We believe that an increasing percentage of our future revenue will come from international sales as we continue to expand our operations and develop opportunities in additional territories.

13

International sales are subject to a number of additional risks, including:

|

● |

difficulties in staffing and managing our foreign operations; |

|

|

|

|

● |

difficulties in penetrating markets in which our competitors’ products are more established; |

|

|

|

|

● |

reduced protection for intellectual property rights in some countries; |

|

|

|

|

● |

export restrictions, trade regulations and foreign tax laws; |

|

|

|

|

● |

fluctuating foreign currency exchange rates; |

|

|

|

|

● |

obtaining and maintaining foreign certification and compliance with other regulatory requirements; |

|

|

|

|

● |

customs clearance and shipping delays; and |

|

|

|

|

● |

political and economic instability. |

If one or more of these risks were realized, we could be required to dedicate significant resources to remedy the situation, and if we are unsuccessful at finding a solution, our revenue may decline.

Geopolitical risks associated with the ongoing conflict in Israel and Palestine could result in increased market volatility and uncertainty, which could negatively impact our business, financial condition, and results of operations.

The uncertain nature, scope, magnitude, and duration of hostilities stemming from recent events in Israel and Palestine have disrupted global markets and contributed to increased market volatility and uncertainty, which could have an adverse impact on macroeconomic and other factors that affect our business and supply chain. Any disruption in our supply chain could reduce our revenue and adversely impact our financial results. Such a disruption could occur as a result of any number of events, including, but not limited to, military conflicts, geopolitical developments, war or terrorism, including the ongoing conflict in Israel and Palestine, regional or global pandemics, and disruptions in utility and other services. Any inability to obtain adequate deliveries or any other circumstance that would require us to seek alternative sources of supply or to manufacture, assemble, and test such components internally could significantly delay our ability to ship our products, which could damage relationships with current and prospective customers and could harm our reputation and brand and could adversely affect our business, financial condition, and results of operations.

We may not have sufficient funds to meet certain future operating needs or capital requirements, which could impair our efforts to develop and commercialize existing and new products, and as a result, we may in the future consider one or more capital-raising transactions, including future equity or debt financings, strategic transactions, or borrowings which may also dilute our shareholders.

We may need to raise additional capital to fund our growth, working capital and strategic expansion. Given the turbulent global environment and volatile capital market, we may not be able to secure such financing in a timely manner and with favorable terms. Any such capital raise involving the sale of equity securities would result in dilution to our shareholders. If we cannot raise the required funds, or cannot raise them on terms acceptable to us or investors, we may be forced to curtail substantially our current operations and scale down our growth plan.

The market for robotics and VR-enabled smart rehabilitation systems are in the early growth stage, and important assumptions about the potential market for our current and future products may not be realized.

Although the market for robotics and VR-enabled “smart” rehabilitation systems has enjoyed increasing recognition from our customers, to date, the market is small. Significant market development efforts are still required to cross in order for us to enjoy accelerating growth.

14

As such, it is difficult to predict the future size and rate of growth of the market; and we cannot assure you that our estimate regarding our current products is achievable or that our estimate regarding future products profile will remain the same. If our estimates of our current or future addressable market are incorrect, our business may not develop as we expect, and the price of our securities may suffer.

Currently, most of our products are purchased by customers as capital equipment, funded by our customers’ own capital budgets, government grants, or charitable organizations’ donations. There is a risk that such grants or donations may not be secured timely or at all or capital budgets reduced; which could adversely impact our sales forecasts.

While we have seen significant interest in our products to support our growth plan, due to limited sales and clinician application personnel that are instrumental to our efforts to convert such interest into sales orders, at any quarter we can only focus on a fraction of the total sales opportunities. Accordingly, if there are delays or disruptions to potential customers’ budgeting processes due to customers’ internal capital budget limitations, delays in funding of government grants or charitable organizations’ donations, our sales opportunities may not be realized.

In the future, we may develop operational leasing or vendor-enabled financing to expand our growth beyond capital budget limitations, as part of our efforts to enrich and expanding our business models. There can be no assurance that we will have adequate working capital to do so after the Business Combination.

If we are unable to train customers on the safe and appropriate use of our products, we may be unable to achieve our expected growth.

It is critical to the success of our commercialization efforts to train a sufficient number of customers and provide them with adequate instruction in the safe and appropriate use of our products. This training process may take longer than expected and may therefore affect our ability to increase sales. Following completion of training, we rely on the trained customers to advocate the benefits of our products in the marketplace. Convincing our customers to dedicate the time and energy necessary for adequate training is challenging, and we cannot assure you that we will be successful in these efforts. If we cannot attract potential new customers to our education and training programs, we may be unable to achieve our expected growth. If our customers are not properly trained, they may misuse or ineffectively use our products. This may also result in, among other things, unsatisfactory patient outcomes, patient injury, negative publicity or lawsuits against us, any of which could have an adverse effect on our business and reputation.

If customers misuse our products, we may become subject to prohibitions on the sale or marketing of our products, significant fines, penalties, sanctions, or product liability claims, and our image and reputation within the industry and marketplace could be harmed.

Our customers may also misuse our devices, or our future products or use improper techniques, potentially leading to adverse results, side effects or injury, which may lead to product liability claims. If our current or future products are misused or used with improper techniques or are determined to cause or contribute to consumer harm, we may become subject to costly litigation by our customers or their patients. Product liability claims could divert management’s attention from our core business, be expensive to defend, result in sizable damage awards against us that may not be covered by insurance and subject us to negative publicity resulting in reduced sales of our products. Furthermore, the use of our current or future products for indications other than those cleared by the FDA may not effectively treat such conditions, which could harm our reputation in the marketplace among physicians and consumers. Any of these events could harm our business and results of operations and cause our stock price to decline.

If we are unable to educate clinicians on the safe, effective and appropriate use of our products, we may experience increased claims of product liability and may be unable to achieve our expected growth.

Certain of our products require the use of specialized techniques and/or product-specific knowledge. It is critical to the success of our business to broadly educate clinicians who use or desire to use our products in order to provide them with adequate instructions in the appropriate use of our products. It is also important that we educate our other customers and patients on the risks associated with our products. Failure to provide adequate training and education could result in, among other things, unsatisfactory patient outcomes, patient injury, negative publicity or increased product liability claims or lawsuits against us, any of which could have a material and adverse effect on our business and reputation.

15

We make extensive educational resources available to clinicians and our other customers in an effort to ensure that they have access to current treatment methodologies, are aware of the advantages and risks of our products, and are educated regarding the safe and appropriate use of our products. However, there can be no assurance that these resources will successfully prevent all negative events and if we fail to educate clinicians, our other customers and patients, they may make decisions or form conclusions regarding our products without full knowledge of the risks and benefits or may view our products negatively. In addition, claims against us may occur even if such claims are without merit and/or no product defect is present, due to, for example, improper surgical techniques, inappropriate use of our products, or other lack of awareness regarding the safe and effective use of our products. Any of these events could harm our business and results of operations.

As an emerging leader in a fragmented industry, we need time and efforts to develop talent, expertise, competencies, process and infrastructure; if we lose key employees or fail to replicate and leverage our sales, marketing, and training infrastructure, our growth would suffer adverse effects.

A key element of our long-term business strategy is the continued leveraging of our sales, marketing, clinical training and services infrastructure, through the training, retention, and motivation of skilled sales, marketing, clinical applications training, and services representatives with industry experience and knowledge. In order to continue growing our business efficiently, we need coordinate the development of our sales, marketing, clinical training and services infrastructure with the timing of market expansion, new product launch, regulatory approvals, limited resources consideration and other factors in various geographies. Managing and maintaining our sales and marketing infrastructure is expensive and time consuming, and an inability to leverage such an organization effectively, or in coordination with regulatory or other developments, could inhibit potential sales and the penetration and adoption of our products into both existing and new markets.

Newly hired sales representatives require training and take time to achieve full productivity. If we fail to train new hires adequately, or if we experience high turnover in our sales force in the future, we cannot be certain that new hires will become as productive as may be necessary to maintain or increase our sales. In addition, if we are not able to retain existing and recruit new trainers to our clinical staff, we may not be able to successfully train customers on the use of our sophisticated products, which could inhibit new sales and harm our reputation. If we are unable to expand our sales, marketing, and training capabilities, we may not be able to effectively commercialize our products, or enhance the strength of our brand, which could have a material adverse effect on our operating results.

The health benefits of our products have not yet been substantiated by long-term large randomized clinical data, which could limit sales of such products.

Although there have been numerous published research studies supporting the benefits of our products and users of our products have reported encouraging health benefits of our products, currently there is no large scale, randomized clinical trial establishing the long-term health benefits of our or competitors’ products due to the relatively small size of the applicable user population, and the fragmented application practice that we are still in the early stage to change through consolidation and integration. While many of the top rehabilitation hospitals have purchased some of our products, many potential conservative customers and healthcare providers may be slower to adopt or recommend our products.

Our success depends largely upon consumer satisfaction with the effectiveness of our products.

In order to generate repeat and referral business, consumers must be satisfied with the effectiveness of our products. If consumers are not satisfied with the benefits of our products, our reputation and future sales could suffer.

For certain of our products, we rely on sole source third parties to manufacture and supply certain raw materials. If these manufacturers are unable to supply these raw materials or products in a timely manner, or at all, we may be unable to meet customer demand, which would have a material adverse effect on our business.