UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 07, 2024 |

CORSAIR GAMING, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-39533 |

82-2335306 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

115 N. McCarthy Boulevard |

|

|

||

Milpitas, California |

|

95035 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (510) 657-8747 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, $0.0001 par value per share |

|

CRSR |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 7, 2024, Corsair Gaming, Inc. (“Corsair” or the “Company”) issued a press release announcing certain of its financial results for the fiscal quarter ended March 31, 2024. The full text of the press release is furnished pursuant to Item 2.02 as Exhibit 99.1 to this Current Report on Form 8-K. A presentation regarding the Company's fiscal quarter ended March 31, 2024 is furnished pursuant to Item 2.02 as Exhibit 99.2 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

The information in this Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Corsair Gaming, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CORSAIR GAMING, INC. |

|

|

|

|

|

Date: May 7, 2024 |

|

By: |

/s/ Michael G. Potter |

|

|

|

Michael G. Potter |

|

|

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

2

Exhibit 99.1

Corsair Gaming Reports First Quarter 2024 Financial Results

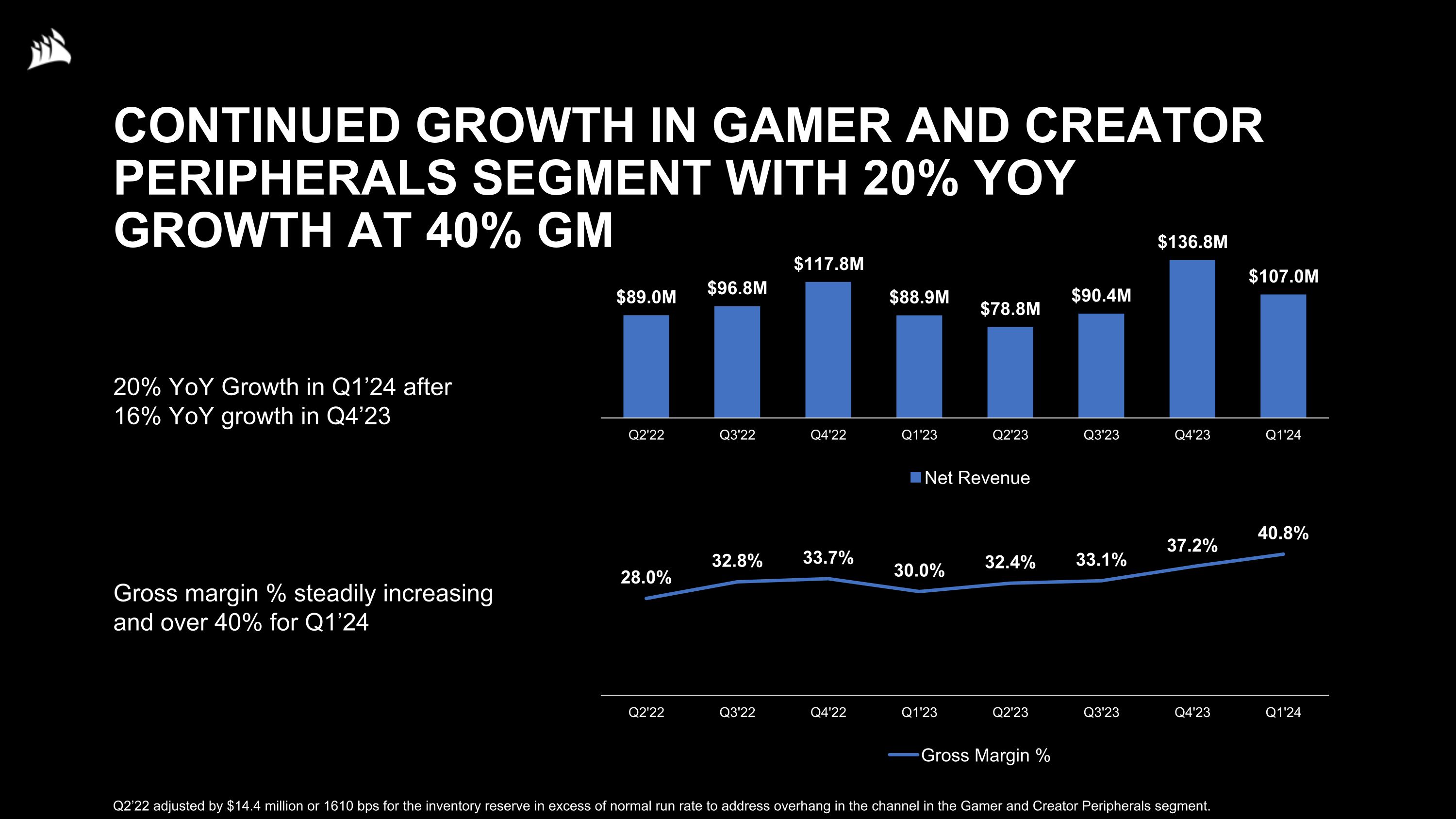

Achieved 20% Year-Over-Year Revenue Growth in Gamer and Creator Segment with Record 40% Gross Margin

MILPITAS, CA, May 7, 2024 – Corsair Gaming, Inc. (Nasdaq: CRSR) (“Corsair” or the “Company”), a leading global provider and innovator of high-performance products for gamers, streamers, content-creators, and gaming PC builders, today announced financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Select Financial Metrics

Definitions of the non-GAAP financial measures used in this press release and reconciliations of such measures to their nearest GAAP equivalents are included below under the heading “Use and Reconciliation of Non-GAAP Financial Measures.”

Andy Paul, Chief Executive Officer of Corsair, stated, “2024 is starting out as expected with new products driving healthy peripherals growth for us. Our Gamer and Creator Peripherals segment has continued its impressive performance, achieving 20% year-over-year revenue growth in the first quarter 2024 after 16% year-over-year revenue growth in the fourth quarter 2023. All product lines showed growth, including Elgato with its popular Stream Deck products, SCUF Gaming with the successful recent launch of PC controllers, and Corsair peripherals with several new keyboards, headsets and mice. We were particularly pleased to see the gross margin lift to 40% with these new product launches. Demand was more subdued in the component market as is normal in this stage of the GPU cycle but we continue to have a high market share in this space and we believe this market will start to show growth during the second half of 2024 and through 2025.”

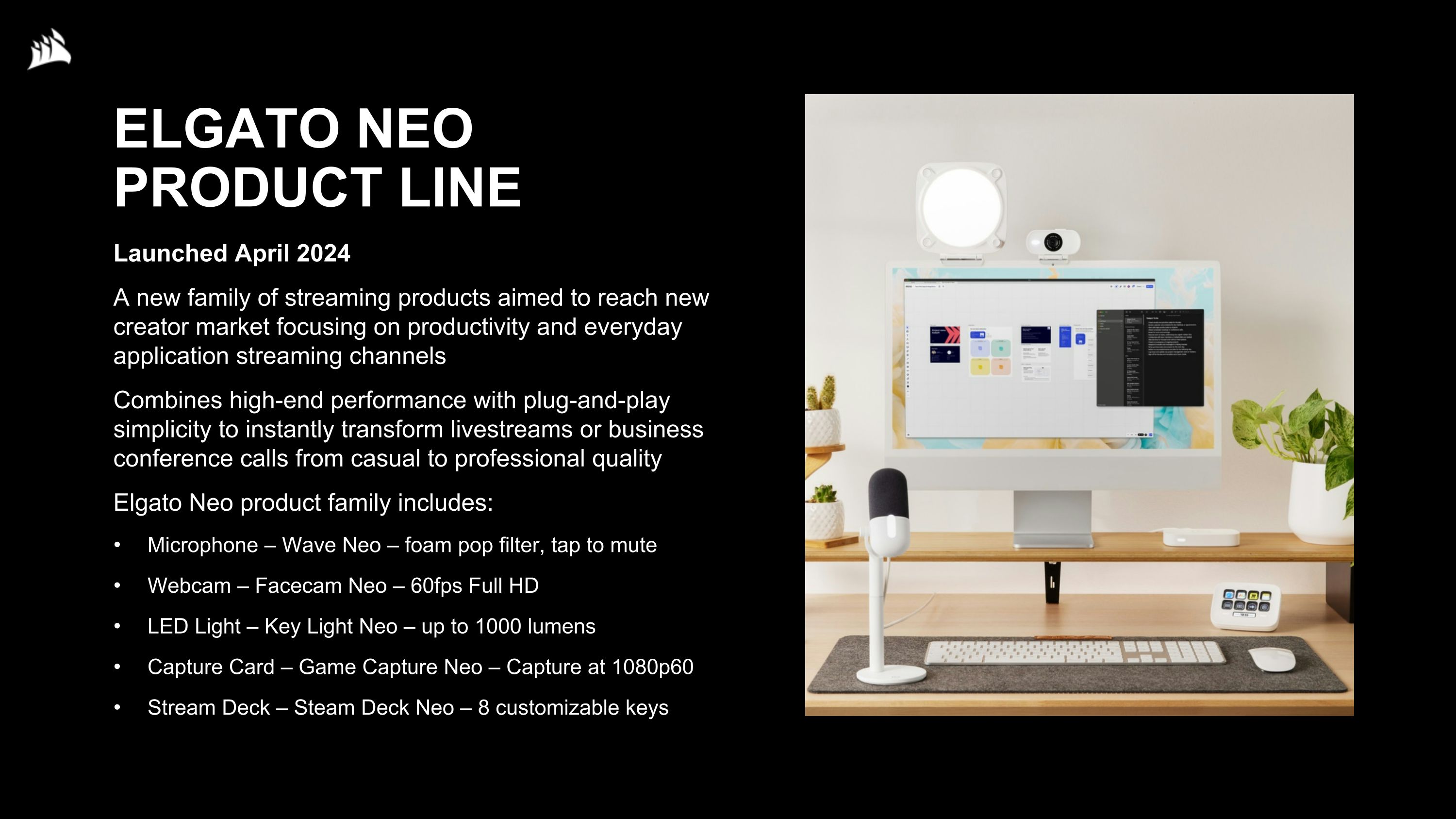

“In 2024, we’re gearing up for an exciting year of planned innovation with an impressive slate of new Corsair products, as we broaden our category reach. Two anticipated launches include our forthcoming mobile gaming controller and our upcoming SIM racing product line. These categories provide the potential for both high consumer interest and growth. Drawing on our established reputation for top-notch product design and performance, we are optimistic that both these product launches will be successful. We are also excited about our recent launch of the new Elgato Neo product family, which is targeting a different and more casual user base than our traditional prosumer Elgato customers. The initial response has been very positive and we expect sales to ramp throughout 2024 and over the coming years.”

“Furthermore, our efforts in regional and retail expansion continue to progress, with anticipated revenue boosts in the latter half of 2024. We’ve successfully expanded the retail presence of Corsair’s full suite of gaming and creator products, introduced the Drop product line to retail channels, expanded our SCUF Gaming product lines in retail, and strengthened our partnerships with several major online retailers. These initiatives solidify our position in the market and set the stage for continued growth and success in the years ahead.”

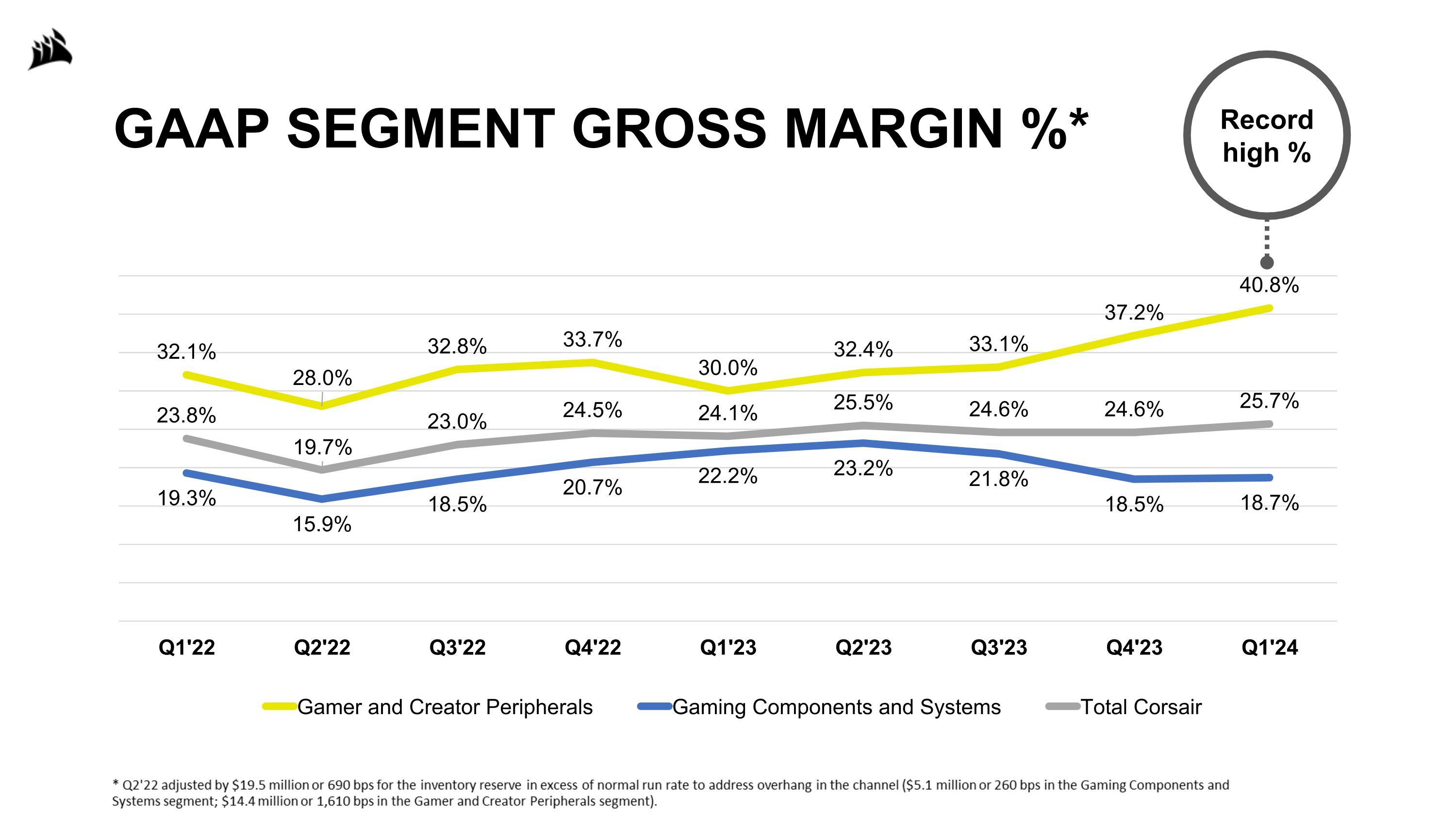

Michael G. Potter, Chief Financial Officer of Corsair, stated, “The success of our new products is driving market share gains and margin expansion. In Q1 2024, our gross margin increased by 110 basis points to 25.7 percent compared to 24.6 percent in Q4 2023. Specifically, within our Gamer and Creator Peripherals segment, gross margin rose by 360 basis points to 40.8 percent from 37.2 percent in Q4 2023, while in our Gaming Components and Systems segment, gross margin increased by 20 basis points to 18.7 percent from 18.5 percent in Q4 2023. We achieved this expansion despite challenges such as increased freight costs stemming from turmoil in the Red Sea and resulting delays necessitating incremental air-shipments. We have continued to strengthen our financial position by paying off another $15 million in debt, while simultaneously investing in new products that we believe will drive our growth and success across existing and emerging categories. With our strong balance sheet, we have the flexibility to further reduce debt and invest in our business, including pursuing potential additional M&A opportunities. These strategic moves are aimed at our goals of accelerating our growth trajectory and enhancing profitability in the long run.”

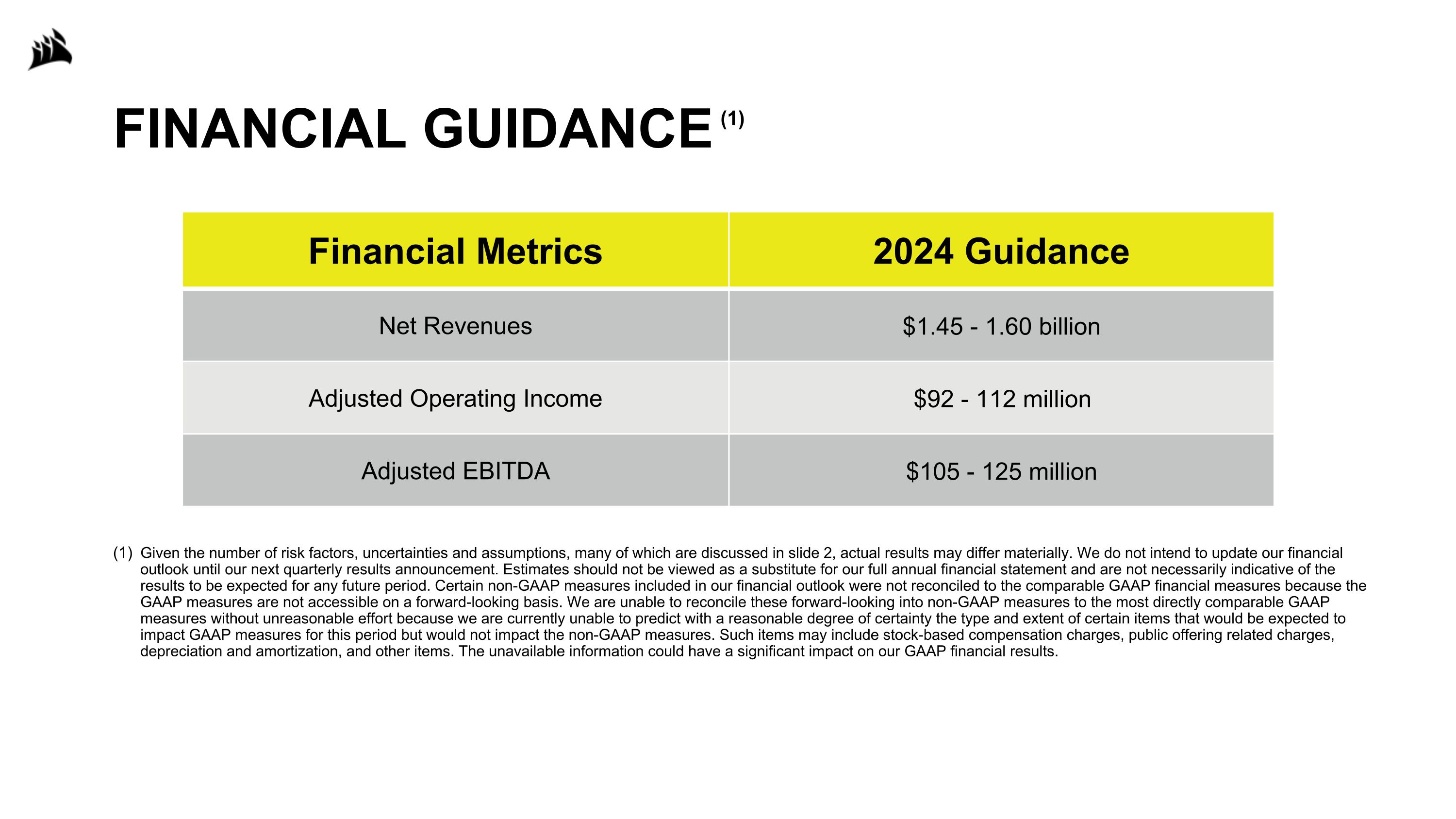

Reiterates 2024 Financial Outlook

Corsair reiterated its financial outlook for the full year 2024. The Company continues to expect revenue growth to improve through 2024, with a further improvement in adjusted EBITDA led by an additional improvement in margin, stabilized shipping costs and continued tight operating expense controls.

Certain non-GAAP measures included in our financial outlook were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. We are unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable GAAP measures without unreasonable efforts because we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for these periods but would not impact the non-GAAP measures. Such items may include stock-based compensation charges, amortization, and other items.

The unavailable information could have a significant impact on our GAAP financial results.

The foregoing forward-looking statements reflect our expectations as of today’s date. Given the number of risk factors, uncertainties and assumptions discussed below, actual results may differ materially. We do not intend to update our financial outlook until our next quarterly results announcement.

Recent Product Developments

Conference Call and Webcast Information

Corsair will host a conference call to discuss the first quarter 2024 financial results today at 2:00 p.m. Pacific Time. The conference call will be accessible on Corsair’s Investor Relations website at https://ir.corsair.com, or by dialing 1-844-825-9789 (USA) or 1-412-317-5180 (International) with conference ID 10187837. A replay will be available approximately 3 hours after the live call ends on Corsair’s Investor Relations website, or through May 14, 2024 by dialing 1-844-512-2921 (USA) or 1-412-317-6671 (International), with passcode 10187837.

About Corsair Gaming

Corsair (Nasdaq: CRSR) is a leading global developer and manufacturer of high-performance products and technology for gamers, content creators, and PC enthusiasts. From award-winning PC components and peripherals, to premium streaming equipment and smart ambient lighting, Corsair delivers a full ecosystem of products that work together to enable everyone, from casual gamers to committed professionals, to perform at their very best. Corsair also sells products under its Elgato brand, which provides premium studio equipment and accessories for content creators, SCUF Gaming brand, which builds custom-designed controllers for competitive gamers, Drop, the leading community-driven mechanical keyboard brand and ORIGIN PC brand, a builder of custom gaming and workstation desktop PCs.

Forward Looking Statements

Except for the historical information contained herein, the matters set forth in this press release are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, Corsair’s expectations regarding market headwinds and tailwinds; its expectations regarding market expansion, sales and revenue growth in 2024 and 2025; statements regarding new product launches, the entry into new product categories and demand for new products; its ability to successfully pursue M&A opportunities; and its estimated full year 2024 net revenue, adjusted operating income and adjusted EBITDA. Forward-looking statements are based on our management’s beliefs, as well as assumptions made by, and information currently available to them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to: current macroeconomic conditions, including the impacts of high inflation and risk of recession on demand for our products, consumer confidence and financial markets generally; the lingering impacts and future outbreaks of the COVID-19 pandemic and its impacts on our operations and the operations of our manufacturers, retailers and other partners, as well as its impacts on the economy overall, including capital markets; our ability to build and maintain the strength of our brand among gaming and streaming enthusiasts and our ability to continuously develop and successfully market new products and improvements to existing products; the introduction and success of new third-party high-performance computer hardware, particularly graphics processing units and central processing units as well as sophisticated new video games; fluctuations in operating results; the risk that we are not able to compete with competitors and/or that the gaming industry, including streaming and esports, does not grow as expected or declines; the loss or inability to attract and retain key management; the impacts from geopolitical events and unrest; delays or disruptions at our or third-parties’ manufacturing and distribution facilities; our ability to successfully integrate any companies or assets we have acquired or may acquire; currency exchange rate fluctuations or international trade disputes resulting in our products becoming relatively more expensive to our overseas customers or resulting in an increase in our manufacturing costs; and the other factors described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”) and our subsequent filings with the SEC. Copies of each filing may be obtained from us or the SEC. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to update forward-looking statements to reflect future events or circumstances. Our results for the quarter ended March 31, 2024 are also not necessarily indicative of our operating results for any future periods.

Use and Reconciliation of Non-GAAP Financial Measures

To supplement the financial results presented in accordance with GAAP, this earnings release presents certain non-GAAP financial information, including adjusted operating income (loss), adjusted net income (loss), adjusted net income (loss) per diluted share and adjusted EBITDA. These are important financial performance measures for us, but are not financial measures as defined by GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use adjusted operating income (loss), adjusted net income (loss), adjusted net income (loss) per share and adjusted EBITDA to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in such non-GAAP measures. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to the key financial metrics used by our management in our financial and operational decision-making.

We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider it useful in measuring our ability to meet our debt service obligations.

Our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to net revenue, operating income (loss), net income (loss), cash provided by operating activities, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these measures to the most directly comparable GAAP financial measures are presented in the attached schedules.

We calculate these non-GAAP financial measures as follows:

We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

|

Investor Relations Contact: Ronald van Veen ir@corsair.com 510-578-1407 |

Media Contact: David Ross david.ross@corsair.com +4411 8208 0542 |

Corsair Gaming, Inc.

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share amounts)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

||

Net revenue |

|

$ |

337,257 |

|

|

$ |

353,964 |

|

Cost of revenue |

|

|

250,618 |

|

|

|

268,560 |

|

Gross profit |

|

|

86,639 |

|

|

|

85,404 |

|

Operating expenses: |

|

|

|

|

|

|

||

Sales, general and administrative |

|

|

80,217 |

|

|

|

67,529 |

|

Product development |

|

|

16,641 |

|

|

|

16,838 |

|

Total operating expenses |

|

|

96,858 |

|

|

|

84,367 |

|

Operating income (loss) |

|

|

(10,219 |

) |

|

|

1,037 |

|

Other (expense) income: |

|

|

|

|

|

|

||

Interest expense |

|

|

(3,691 |

) |

|

|

(4,302 |

) |

Interest income |

|

|

1,565 |

|

|

|

1,474 |

|

Other expense, net |

|

|

(461 |

) |

|

|

(496 |

) |

Total other expense, net |

|

|

(2,587 |

) |

|

|

(3,324 |

) |

Loss before income taxes |

|

|

(12,806 |

) |

|

|

(2,287 |

) |

Income tax benefit |

|

|

1,777 |

|

|

|

639 |

|

Net loss |

|

|

(11,029 |

) |

|

|

(1,648 |

) |

Less: Net income attributable to noncontrolling interest |

|

|

536 |

|

|

|

364 |

|

Net loss attributable to Corsair Gaming, Inc. |

|

$ |

(11,565 |

) |

|

$ |

(2,012 |

) |

|

|

|

|

|

|

|

||

Calculation of net loss per share attributable to common stockholders of Corsair Gaming, Inc.: |

|

|

|

|

|

|

||

Net loss attributable to Corsair Gaming, Inc. |

|

$ |

(11,565 |

) |

|

$ |

(2,012 |

) |

Change in redemption value of redeemable noncontrolling interest |

|

|

(975 |

) |

|

|

958 |

|

Net loss attributable to common stockholders of Corsair Gaming, Inc. |

|

$ |

(12,540 |

) |

|

$ |

(1,054 |

) |

|

|

|

|

|

|

|

||

Net loss per share attributable to common stockholders of Corsair Gaming, Inc.: |

|

|

|

|

|

|

||

Basic |

|

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

Diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

Weighted-average common shares outstanding: |

|

|

|

|

|

|

||

Basic |

|

|

103,563 |

|

|

|

101,685 |

|

Diluted |

|

|

103,563 |

|

|

|

101,685 |

|

Corsair Gaming, Inc.

Segment Information

(Unaudited, in thousands, except percentages)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

||

Net revenue: |

|

|

|

|

|

|

||

Gamer and Creator Peripherals |

|

$ |

106,973 |

|

|

$ |

88,942 |

|

Gaming Components and Systems |

|

|

230,284 |

|

|

|

265,022 |

|

Total Net revenue |

|

$ |

337,257 |

|

|

$ |

353,964 |

|

|

|

|

|

|

|

|

||

Gross Profit: |

|

|

|

|

|

|

||

Gamer and Creator Peripherals |

|

$ |

43,643 |

|

|

$ |

26,648 |

|

Gaming Components and Systems |

|

|

42,996 |

|

|

|

58,756 |

|

Total Gross Profit |

|

$ |

86,639 |

|

|

$ |

85,404 |

|

|

|

|

|

|

|

|

||

Gross Margin: |

|

|

|

|

|

|

||

Gamer and Creator Peripherals |

|

|

40.8 |

% |

|

|

30.0 |

% |

Gaming Components and Systems |

|

|

18.7 |

% |

|

|

22.2 |

% |

Total Gross Margin |

|

|

25.7 |

% |

|

|

24.1 |

% |

Corsair Gaming, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, in thousands)

|

|

March 31, |

|

|

December 31, |

|

||

|

|

|

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and restricted cash |

|

$ |

129,942 |

|

|

$ |

178,325 |

|

Accounts receivable, net |

|

|

204,920 |

|

|

|

253,268 |

|

Inventories |

|

|

251,747 |

|

|

|

240,172 |

|

Prepaid expenses and other current assets |

|

|

34,573 |

|

|

|

39,824 |

|

Total current assets |

|

|

621,182 |

|

|

|

711,589 |

|

Restricted cash, noncurrent |

|

|

241 |

|

|

|

239 |

|

Property and equipment, net |

|

|

31,185 |

|

|

|

32,212 |

|

Goodwill |

|

|

354,410 |

|

|

|

354,705 |

|

Intangible assets, net |

|

|

178,151 |

|

|

|

188,009 |

|

Other assets |

|

|

72,022 |

|

|

|

70,709 |

|

Total assets |

|

$ |

1,257,191 |

|

|

$ |

1,357,463 |

|

Liabilities |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Debt maturing within one year, net |

|

$ |

12,213 |

|

|

$ |

12,190 |

|

Accounts payable |

|

|

191,401 |

|

|

|

239,957 |

|

Other liabilities and accrued expenses |

|

|

138,487 |

|

|

|

166,340 |

|

Total current liabilities |

|

|

342,101 |

|

|

|

418,487 |

|

Long-term debt, net |

|

|

171,106 |

|

|

|

186,006 |

|

Deferred tax liabilities |

|

|

14,104 |

|

|

|

17,395 |

|

Other liabilities, noncurrent |

|

|

40,629 |

|

|

|

41,595 |

|

Total liabilities |

|

|

567,940 |

|

|

|

663,483 |

|

Temporary equity |

|

|

|

|

|

|

||

Redeemable noncontrolling interest |

|

|

15,925 |

|

|

|

15,937 |

|

Permanent equity |

|

|

|

|

|

|

||

Corsair Gaming, Inc. stockholders’ equity: |

|

|

|

|

|

|

||

Common stock and additional paid-in capital |

|

|

640,303 |

|

|

|

630,652 |

|

Retained earnings |

|

|

27,870 |

|

|

|

40,410 |

|

Accumulated other comprehensive loss |

|

|

(4,634 |

) |

|

|

(3,487 |

) |

Total Corsair Gaming, Inc. stockholders' equity |

|

|

663,539 |

|

|

|

667,575 |

|

Nonredeemable noncontrolling interest |

|

|

9,787 |

|

|

|

10,468 |

|

Total permanent equity |

|

|

673,326 |

|

|

|

678,043 |

|

Total liabilities, temporary equity and permanent equity |

|

$ |

1,257,191 |

|

|

$ |

1,357,463 |

|

Corsair Gaming, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(11,029 |

) |

|

$ |

(1,648 |

) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

7,691 |

|

|

|

7,246 |

|

Depreciation |

|

|

3,087 |

|

|

|

2,897 |

|

Amortization |

|

|

9,515 |

|

|

|

9,741 |

|

Deferred income taxes |

|

|

(6,059 |

) |

|

|

(2,209 |

) |

Other |

|

|

758 |

|

|

|

128 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

46,928 |

|

|

|

14,623 |

|

Inventories |

|

|

(12,101 |

) |

|

|

4,672 |

|

Prepaid expenses and other assets |

|

|

4,437 |

|

|

|

(1,077 |

) |

Accounts payable |

|

|

(47,962 |

) |

|

|

18,156 |

|

Other liabilities and accrued expenses |

|

|

(21,582 |

) |

|

|

(10,703 |

) |

Net cash (used in) provided by operating activities |

|

|

(26,317 |

) |

|

|

41,826 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchase price adjustment related to business acquisition |

|

|

1,041 |

|

|

|

— |

|

Purchase of property and equipment |

|

|

(2,520 |

) |

|

|

(4,677 |

) |

Net cash used in investing activities |

|

|

(1,479 |

) |

|

|

(4,677 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Repayment of debt |

|

|

(15,000 |

) |

|

|

(10,000 |

) |

Payment of deferred and contingent consideration |

|

|

(4,942 |

) |

|

|

(950 |

) |

Proceeds from issuance of shares through employee equity incentive plans |

|

|

2,351 |

|

|

|

2,117 |

|

Payment of taxes related to net share settlement of equity awards |

|

|

(398 |

) |

|

|

(556 |

) |

Dividend paid to noncontrolling interest |

|

|

(1,960 |

) |

|

|

— |

|

Payment of other offering costs |

|

|

— |

|

|

|

(497 |

) |

Net cash used in financing activities |

|

|

(19,949 |

) |

|

|

(9,886 |

) |

Effect of exchange rate changes on cash |

|

|

(636 |

) |

|

|

730 |

|

Net (decrease) increase in cash and restricted cash |

|

|

(48,381 |

) |

|

|

27,993 |

|

Cash and restricted cash at the beginning of the period |

|

|

178,564 |

|

|

|

154,060 |

|

Cash and restricted cash at the end of the period |

|

$ |

130,183 |

|

|

$ |

182,053 |

|

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Non-GAAP Operating Income Reconciliations

(Unaudited, in thousands, except percentages)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

||

Operating Income (Loss) - GAAP |

|

$ |

(10,219 |

) |

|

$ |

1,037 |

|

Amortization |

|

|

9,515 |

|

|

|

9,741 |

|

Stock-based compensation |

|

|

7,691 |

|

|

|

7,246 |

|

One-time costs related to legal and other matters |

|

|

6,414 |

|

|

|

— |

|

Restructuring and other charges |

|

|

1,126 |

|

|

|

— |

|

Acquisition and related integration costs |

|

|

702 |

|

|

|

140 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

169 |

|

|

|

— |

|

Adjusted Operating Income - Non-GAAP |

|

$ |

15,398 |

|

|

$ |

18,164 |

|

|

|

|

|

|

|

|

||

As a % of net revenue - GAAP |

|

|

-3.0 |

% |

|

|

0.3 |

% |

As a % of net revenue - Non-GAAP |

|

|

4.6 |

% |

|

|

5.1 |

% |

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Non-GAAP Net Income and Net Income Per Share Reconciliations

(Unaudited, in thousands, except per share amounts)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Net loss attributable to common stockholders of Corsair Gaming, Inc. (1) |

|

$ |

(12,540 |

) |

|

$ |

(1,054 |

) |

Less: Change in redemption value of redeemable noncontrolling interest |

|

|

(975 |

) |

|

|

958 |

|

Net loss attributable to Corsair Gaming, Inc. |

|

|

(11,565 |

) |

|

|

(2,012 |

) |

Add: Net income attributable to noncontrolling interest |

|

|

536 |

|

|

|

364 |

|

Net Loss - GAAP |

|

|

(11,029 |

) |

|

|

(1,648 |

) |

Adjustments: |

|

|

|

|

|

|

||

Amortization |

|

|

9,515 |

|

|

|

9,741 |

|

Stock-based compensation |

|

|

7,691 |

|

|

|

7,246 |

|

One-time costs related to legal and other matters |

|

|

6,414 |

|

|

|

— |

|

Restructuring and other charges |

|

|

1,126 |

|

|

|

— |

|

Acquisition and related integration costs |

|

|

702 |

|

|

|

140 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

169 |

|

|

|

— |

|

Non-GAAP income tax adjustment |

|

|

(5,072 |

) |

|

|

(3,550 |

) |

Adjusted Net Income - Non-GAAP |

|

$ |

9,516 |

|

|

$ |

11,929 |

|

|

|

|

|

|

|

|

||

Diluted net income (loss) per share: |

|

|

|

|

|

|

||

GAAP |

|

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

Adjusted, Non-GAAP |

|

$ |

0.09 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

||

Weighted-average common shares outstanding - Diluted: |

|

|

|

|

|

|

||

GAAP |

|

|

103,563 |

|

|

|

101,685 |

|

Adjusted, Non-GAAP |

|

|

106,530 |

|

|

|

105,832 |

|

|

|

|

|

|

|

|

||

(1) Numerator for calculating net loss per share-GAAP |

|

|

|

|

|

|

||

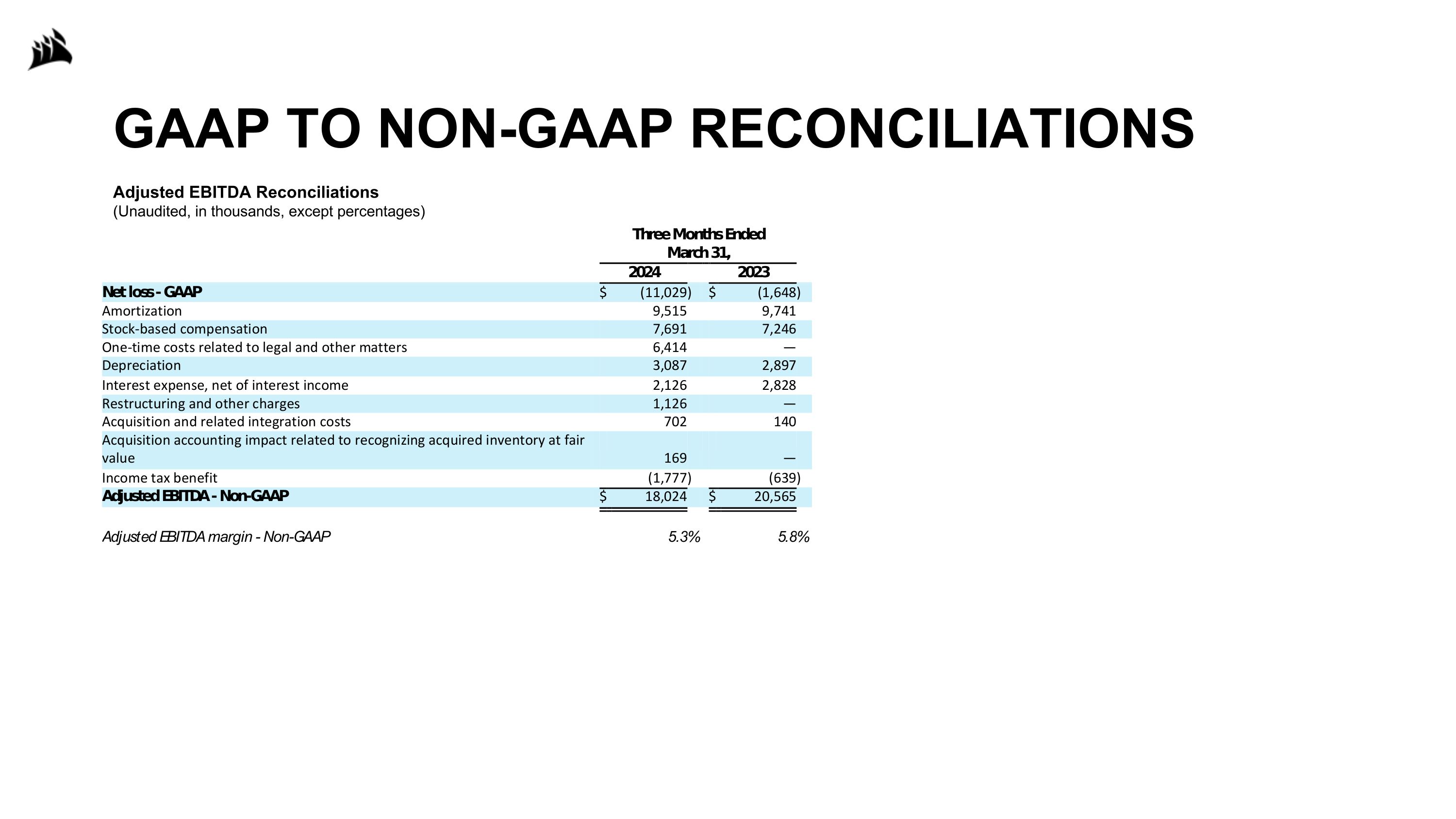

Corsair Gaming, Inc.

GAAP to Non-GAAP Reconciliations

Adjusted EBITDA Reconciliations

(Unaudited, in thousands, except percentages)

|

|

Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Net loss - GAAP |

|

$ |

(11,029 |

) |

|

$ |

(1,648 |

) |

Amortization |

|

|

9,515 |

|

|

|

9,741 |

|

Stock-based compensation |

|

|

7,691 |

|

|

|

7,246 |

|

One-time costs related to legal and other matters |

|

|

6,414 |

|

|

|

— |

|

Depreciation |

|

|

3,087 |

|

|

|

2,897 |

|

Interest expense, net of interest income |

|

|

2,126 |

|

|

|

2,828 |

|

Restructuring and other charges |

|

|

1,126 |

|

|

|

— |

|

Acquisition and related integration costs |

|

|

702 |

|

|

|

140 |

|

Acquisition accounting impact related to recognizing acquired inventory at fair value |

|

|

169 |

|

|

|

— |

|

Income tax benefit |

|

|

(1,777 |

) |

|

|

(639 |

) |

Adjusted EBITDA - Non-GAAP |

|

$ |

18,024 |

|

|

$ |

20,565 |

|

|

|

|

|

|

|

|

||

Adjusted EBITDA margin - Non-GAAP |

|

|

5.3 |

% |

|

|

5.8 |

% |

Q1 2024Company Update May 7, 2024 Exhibit 99.2

DISCLAIMER Forward Looking Statements This presentation contains forward looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the Company's results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking statements, including, but not limited to: information or predictions concerning the Company's future financial performance (including its FY2024 guidance and long-term goals), business plans and objectives, including product launches, potential growth opportunities, potential market leadership, technological, industry or market trends (including assumptions regarding the 2025 market) future demand for our products and potential market opportunities. These statements are based on estimates and information available to the Company at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from the Company's current expectations as a result of many factors, including, but not limited to: current macroeconomic conditions, including but not limited to the impacts of high inflation and the risk of a recession on demand for our products, consumer confidence and financial markets generally; the Company’s ability to build and maintain the strength of its brand among gaming and streaming enthusiasts and its ability to continuously develop and successfully market new gear and improvements to existing gear; the introduction and success of new third-party high-performance computer hardware, particularly graphics processing units and central processing units, as well as sophisticated new video games; fluctuations in operating results; the risk that the Company is not able to compete with competitors and/or that the gaming industry, including streaming and eSports, does not grow as expected or declines; the loss or inability to attract and retain key management; the impact of global instability, such as the war between Russia and Ukraine or any conflict between China and Taiwan, and any sanctions or other geopolitical tensions that may result therefrom; the impacts from any pandemic, including any lingering impacts from the COVID-19 pandemic; delays or disruptions at manufacturing and distribution facilities of the Company or third parties; the Company's ability to successfully integrate any companies or assets it may acquire; currency exchange rate fluctuations or international trade disputes resulting in the Company’s gear becoming relatively more expensive to its overseas customers or resulting in an increase in the Company’s manufacturing costs; and the other factors described under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission ("SEC") and its subsequent filings with the SEC. The Company assumes no obligation, and does not intend, to update these forward-looking statements, except as required by law. Investors are urged to review in detail the risks and uncertainties outlined in Corsair’s SEC filings. You may get these SEC documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share, which are not recognized under the generally accepted accounting principles (“GAAP”) in the United States and designed to complement the financial information presented in accordance with GAAP in the United States because management believes such measures are useful to investors. The non-GAAP measures have limitations as analytical tools and you should not consider them in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. The non-GAAP measures used by the Company may differ from the non-GAAP measures used by other companies. The Company urges you to review the reconciliation of its non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in the Appendix to this presentation, and not to rely on any single financial measure to evaluate the Company's business. Market & Industry Data This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to the Company’s industry, the Company’s business and the market for the Company’s products and its future growth. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the Company’s future performance and the future performance of the market for its products are necessarily subject to a high degree of uncertainty and risk.

GAMER AND CREATOR PERIPHERALS

CONTINUED GROWTH IN GAMER AND CREATOR PERIPHERALS SEGMENT WITH 20% YOY GROWTH AT 40% GM 20% YoY Growth in Q1’24 after 16% YoY growth in Q4’23 Gross margin % steadily increasing and over 40% for Q1’24 Q2’22 adjusted by $14.4 million or 1610 bps for the inventory reserve in excess of normal run rate to address overhang in the channel in the Gamer and Creator Peripherals segment.

M&A HAS BEEN A KEY DRIVER FOR REVENUE AND MARGIN GROWTH IN GAMER AND CREATOR PERIPHERALS SEGMENT Leading provider of hardware and software for content creators that pioneered concept of control panel designed for streamers and content creators; allowed Corsair to enter streaming market Created market category of performance controllers by adding innovative features to a standard console controller; allowed Corsair to enter the console gaming market Leader in keyboard customization and enthusiast setup accessories; allowed Corsair to expand customization capability

KEY GAMING PERIPHERAL LAUNCHES Recent growth in compact keyboard market (65 and 75%) 2 new exciting products launched to address this market K65 Plus Wireless and Drop CSTM65 Lightweight symmetrical mouse is the latest trend in gaming with the M75 Wireless

ELGATO NEO PRODUCT LINE Launched April 2024 A new family of streaming products aimed to reach new creator market focusing on productivity and everyday application streaming channels Combines high-end performance with plug-and-play simplicity to instantly transform livestreams or business conference calls from casual to professional quality Elgato Neo product family includes: Microphone – Wave Neo – foam pop filter, tap to mute Webcam – Facecam Neo – 60fps Full HD LED Light – Key Light Neo – up to 1000 lumens Capture Card – Game Capture Neo – Capture at 1080p60 Stream Deck – Steam Deck Neo – 8 customizable keys

COMPONENTS AND MEMORY Short term self build PC market stable, with next surge expected in 2H’24 and 2025 when next-gen GPUs and CPUs are launched We expect 2025 to be a big year for upgrading Gaming PC hardware

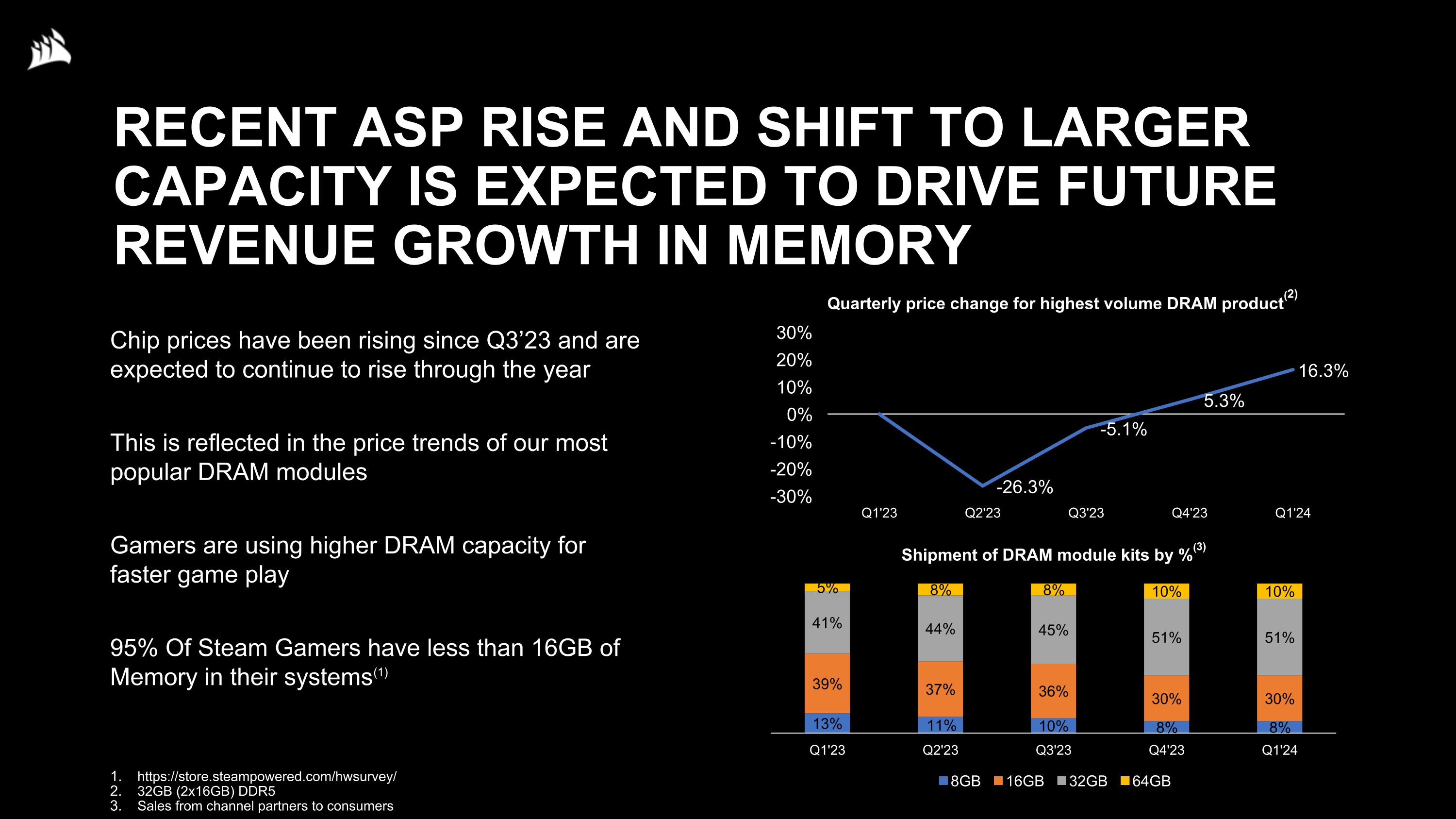

RECENT ASP RISE AND SHIFT TO LARGER CAPACITY IS EXPECTED TO DRIVE FUTURE REVENUE GROWTH IN MEMORY Chip prices have been rising since Q3’23 and are expected to continue to rise through the year This is reflected in the price trends of our most popular DRAM modules Gamers are using higher DRAM capacity for faster game play 95% Of Steam Gamers have less than 16GB of Memory in their systems(1) https://store.steampowered.com/hwsurvey/ 32GB (2x16GB) DDR5 Sales from channel partners to consumers

RECENT COMPONENT LAUNCHES 2500 & 6500 SERIES CASES Dual-chamber cases with wrap around glass are the latest in case technology iCUE LINK RX SERIES FANS Affordable fans containing Corsair proprietary iCue Link technology

CORSAIR ONE PLATFORM UPGRADE CORSAIR ONE Compact high-end PC featuring cutting-edge components Designed to be an ultimate system for gamers, content creators Available with up to an Nvidia GeForce RTX 4090 and Intel Core i9-14900K, both liquid cooled Built to be compatible with next-gen CPU and GPU

KEY FUTURE LAUNCHES

CORSAIR RACING Corsair will be launching our first sim-racing products at Computex in June 2024 Engineered to offer an immersive sim racing experience at a competitive price point Launching a complete solution for Sim racing Chassis Seat Wheels Pedals Curved Monitors Gaming PC

SCUF MOBILE GAMING CONTROLLER Launch of dedicated mobile controller Expanding marketing, large potential install base Opportunity for huge growth

FINANCIAL RESULTS

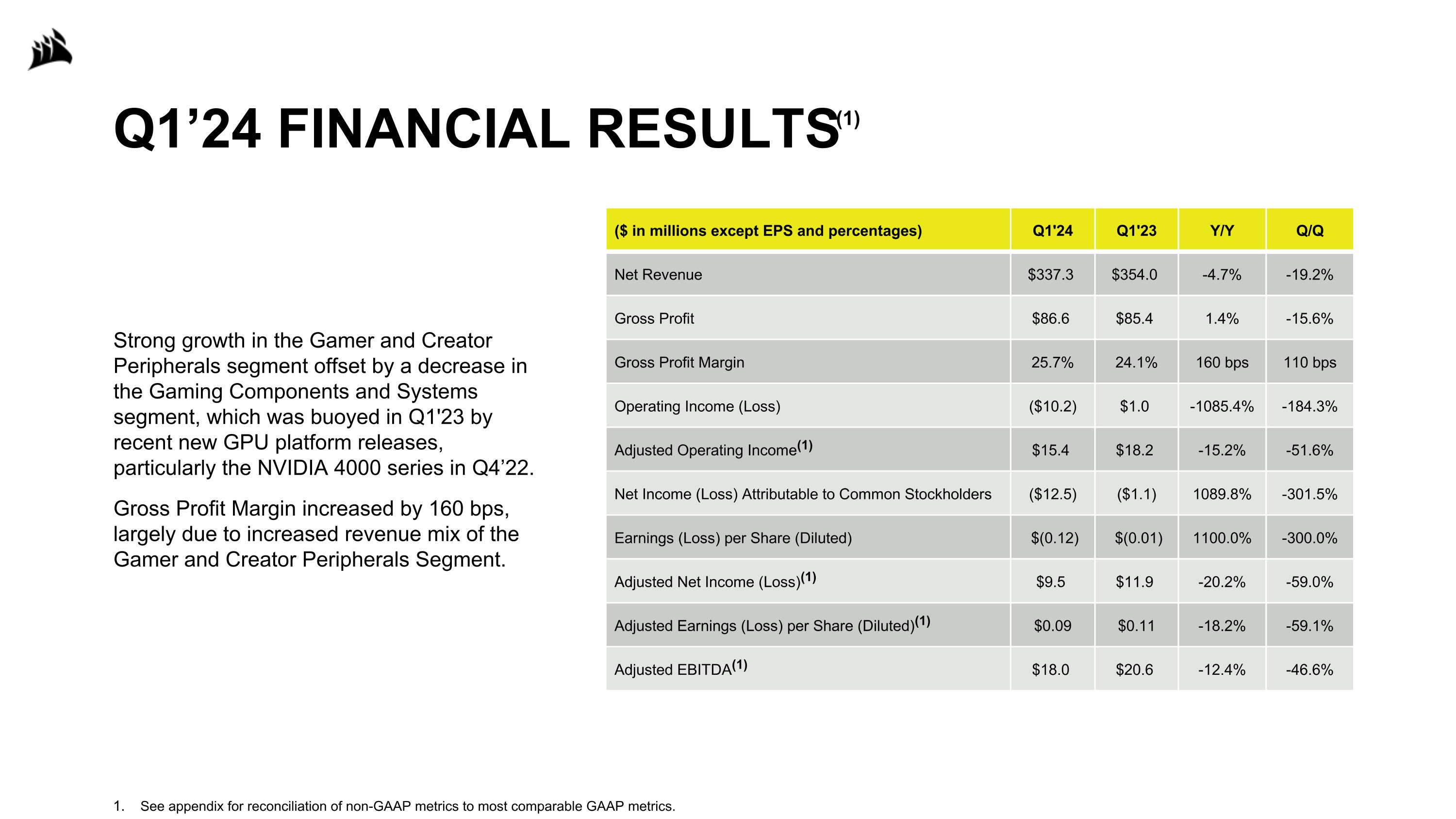

Q1’24 FINANCIAL RESULTS(1) Strong growth in the Gamer and Creator Peripherals segment offset by a decrease in the Gaming Components and Systems segment, which was buoyed in Q1'23 by recent new GPU platform releases, particularly the NVIDIA 4000 series in Q4’22. Gross Profit Margin increased by 160 bps, largely due to increased revenue mix of the Gamer and Creator Peripherals Segment. ($ in millions except EPS and percentages) Q1'24 Q1'23 Y/Y Q/Q Net Revenue $337.3 $354.0 -4.7% -19.2% Gross Profit $86.6 $85.4 1.4% -15.6% Gross Profit Margin 25.7% 24.1% 160 bps 110 bps Operating Income (Loss) ($10.2) $1.0 -1085.4% -184.3% Adjusted Operating Income(1) $15.4 $18.2 -15.2% -51.6% Net Income (Loss) Attributable to Common Stockholders ($12.5) ($1.1) 1089.8% -301.5% Earnings (Loss) per Share (Diluted) $(0.12) $(0.01) 1100.0% -300.0% Adjusted Net Income (Loss)(1) $9.5 $11.9 -20.2% -59.0% Adjusted Earnings (Loss) per Share (Diluted)(1) $0.09 $0.11 -18.2% -59.1% Adjusted EBITDA(1) $18.0 $20.6 -12.4% -46.6% See appendix for reconciliation of non-GAAP metrics to most comparable GAAP metrics.

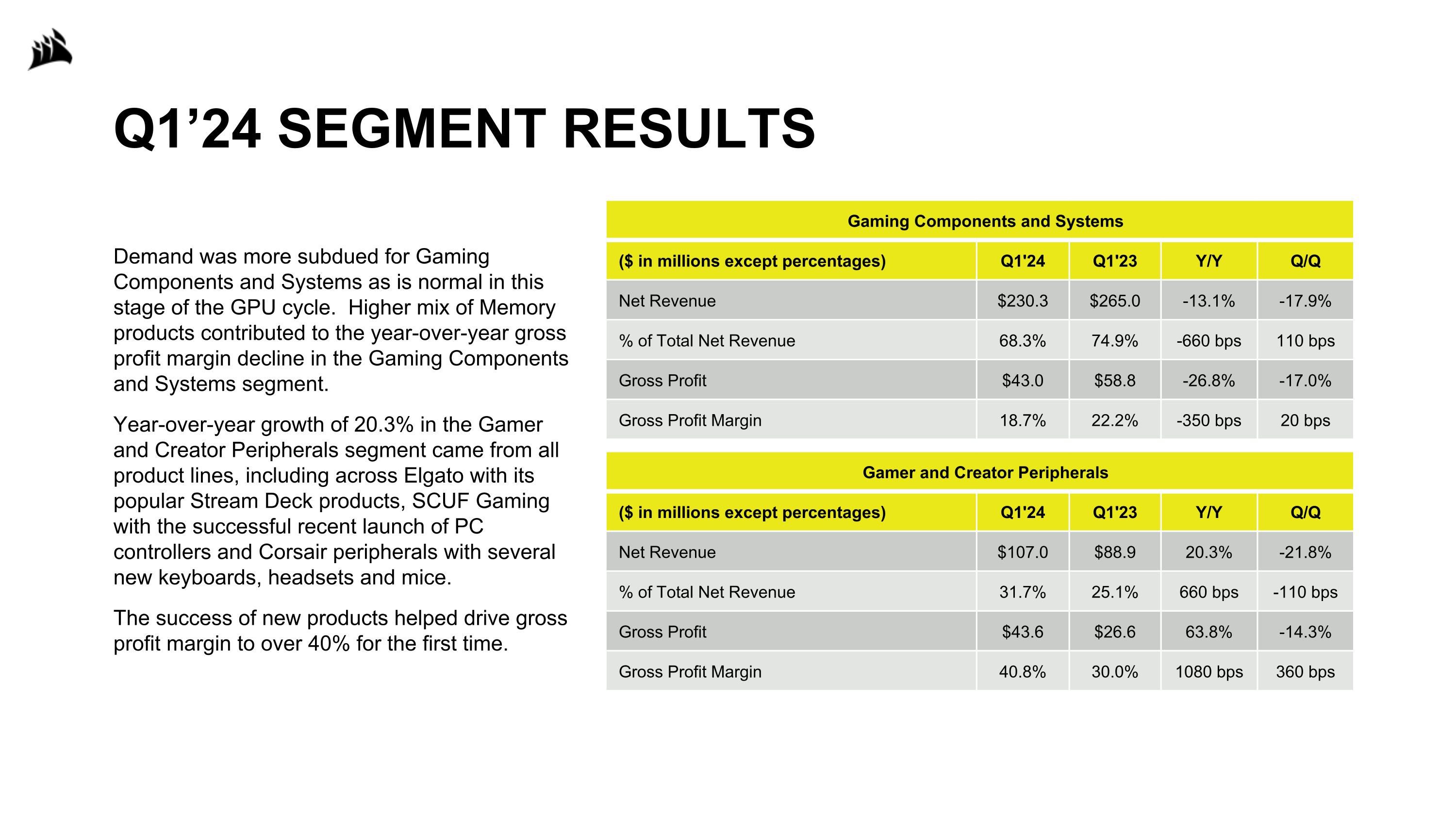

Q1’24 SEGMENT RESULTS Gaming Components and Systems ($ in millions except percentages) Q1'24 Q1'23 Y/Y Q/Q Net Revenue $230.3 $265.0 -13.1% -17.9% % of Total Net Revenue 68.3% 74.9% -660 bps 110 bps Gross Profit $43.0 $58.8 -26.8% -17.0% Gross Profit Margin 18.7% 22.2% -350 bps 20 bps Demand was more subdued for Gaming Components and Systems as is normal in this stage of the GPU cycle. Higher mix of Memory products contributed to the year-over-year gross profit margin decline in the Gaming Components and Systems segment. Year-over-year growth of 20.3% in the Gamer and Creator Peripherals segment came from all product lines, including across Elgato with its popular Stream Deck products, SCUF Gaming with the successful recent launch of PC controllers and Corsair peripherals with several new keyboards, headsets and mice. The success of new products helped drive gross profit margin to over 40% for the first time. Gamer and Creator Peripherals ($ in millions except percentages) Q1'24 Q1'23 Y/Y Q/Q Net Revenue $107.0 $88.9 20.3% -21.8% % of Total Net Revenue 31.7% 25.1% 660 bps -110 bps Gross Profit $43.6 $26.6 63.8% -14.3% Gross Profit Margin 40.8% 30.0% 1080 bps 360 bps

GAAP SEGMENT GROSS MARGIN %* Record high %

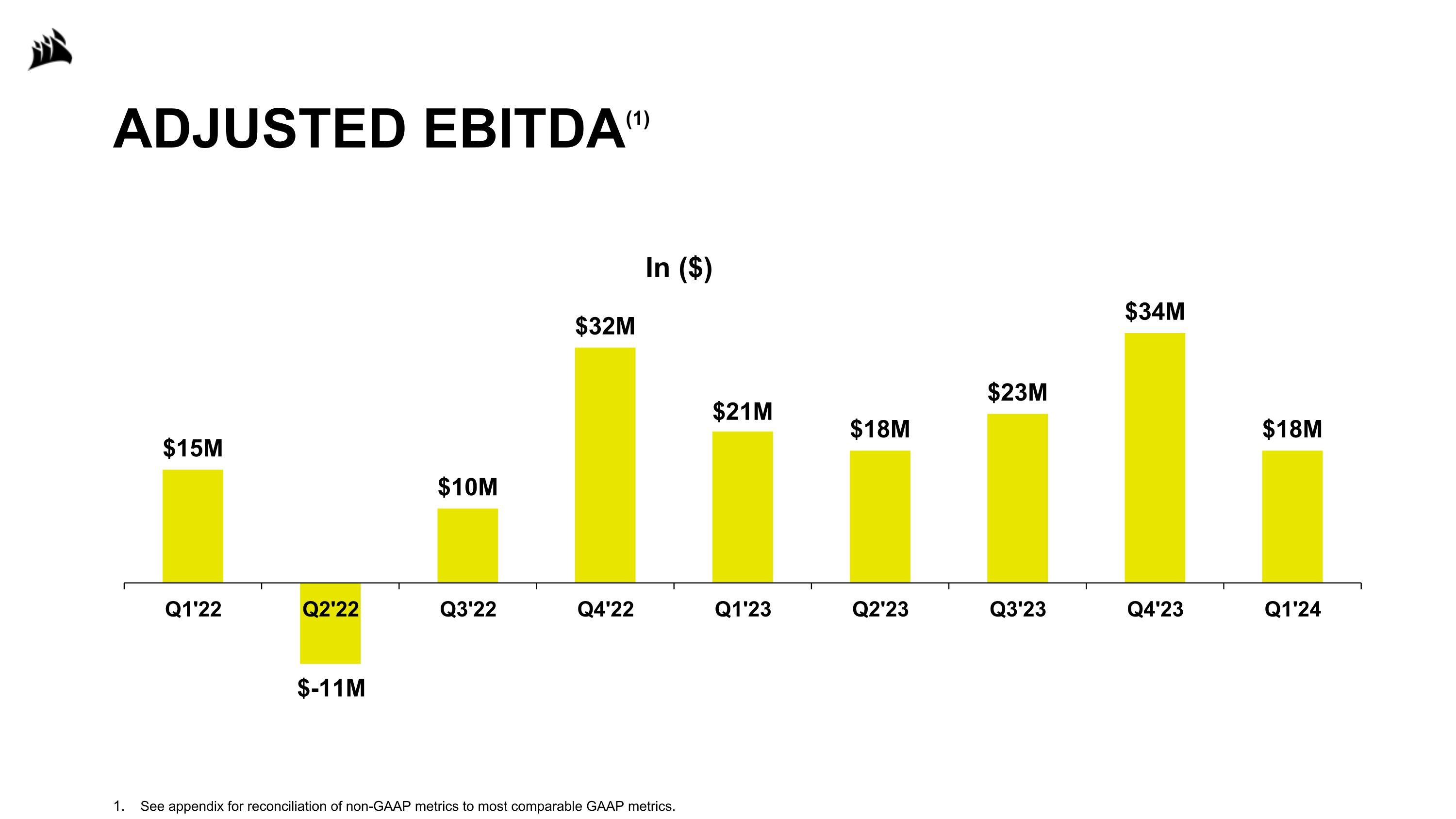

ADJUSTED EBITDA(1) See appendix for reconciliation of non-GAAP metrics to most comparable GAAP metrics.

FINANCIAL GUIDANCE (1) Given the number of risk factors, uncertainties and assumptions, many of which are discussed in slide 2, actual results may differ materially. We do not intend to update our financial outlook until our next quarterly results announcement. Estimates should not be viewed as a substitute for our full annual financial statement and are not necessarily indicative of the results to be expected for any future period. Certain non-GAAP measures included in our financial outlook were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. We are unable to reconcile these forward-looking into non-GAAP measures to the most directly comparable GAAP measures without unreasonable effort because we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for this period but would not impact the non-GAAP measures. Such items may include stock-based compensation charges, public offering related charges, depreciation and amortization, and other items. The unavailable information could have a significant impact on our GAAP financial results. Financial Metrics 2024 Guidance Net Revenues $1.45 - 1.60 billion Adjusted Operating Income $92 - 112 million Adjusted EBITDA $105 - 125 million

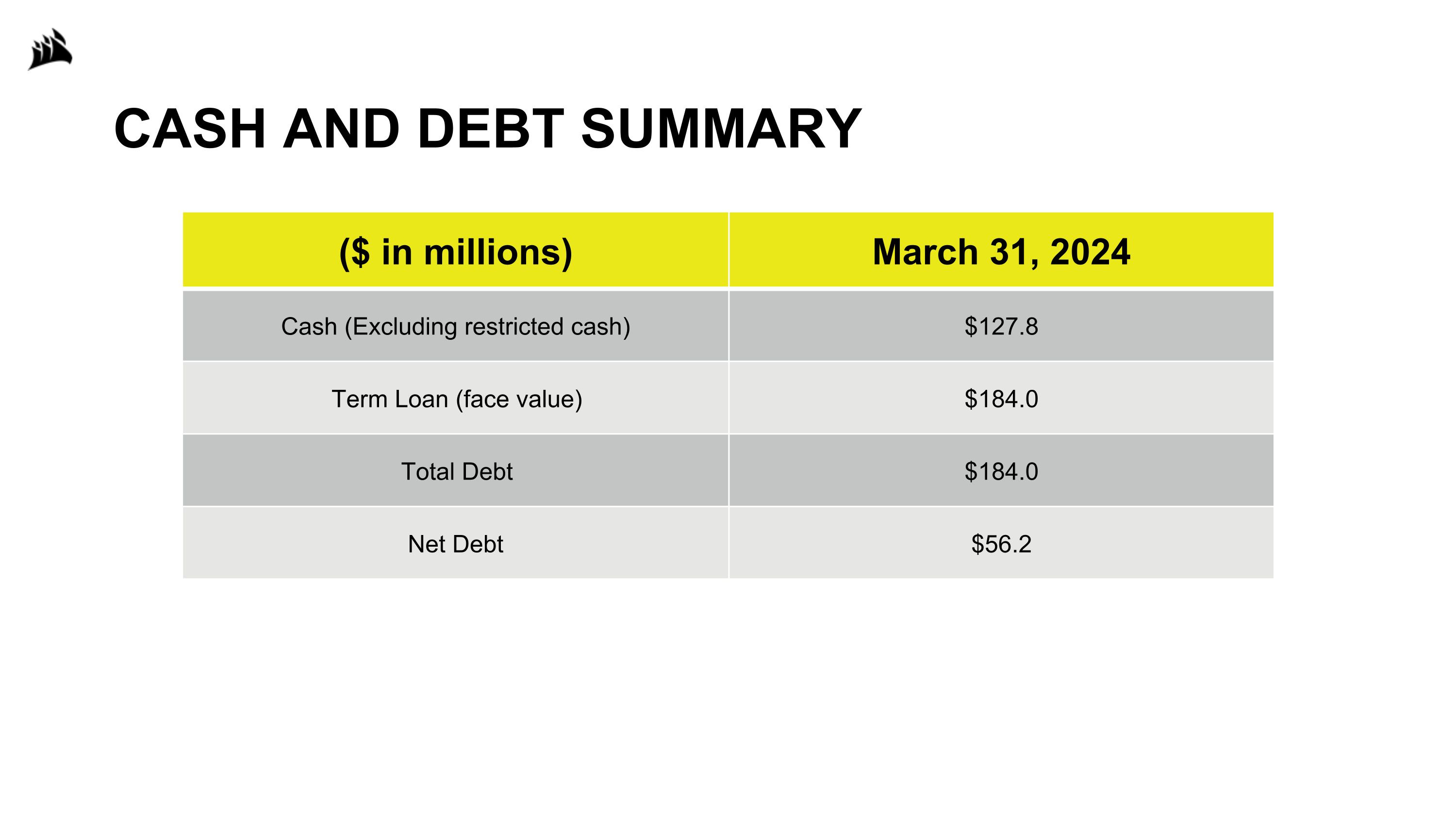

CASH AND DEBT SUMMARY ($ in millions) March 31, 2024 Cash (Excluding restricted cash) $127.8 Term Loan (face value) $184.0 Total Debt $184.0 Net Debt $56.2

APPENDIX

USE OF NON-GAAP FINANCIAL MEASURES To supplement the financial results presented in accordance with GAAP, this presentation includes certain non-GAAP financial information, including Adjusted Operating Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share. These are important financial performance measures for us but are not financial measures as defined by GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in such non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to the key financial metrics used by our management in our financial and operational decision-making. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider them useful in measuring our ability to meet our debt service obligations. Our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to revenues, operating income, net income, cash provided by operating activities or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these measures to the most directly comparable GAAP financial measures are presented in the appendix. We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view these non-GAAP financial measures in conjunction with the related GAAP financial measures.

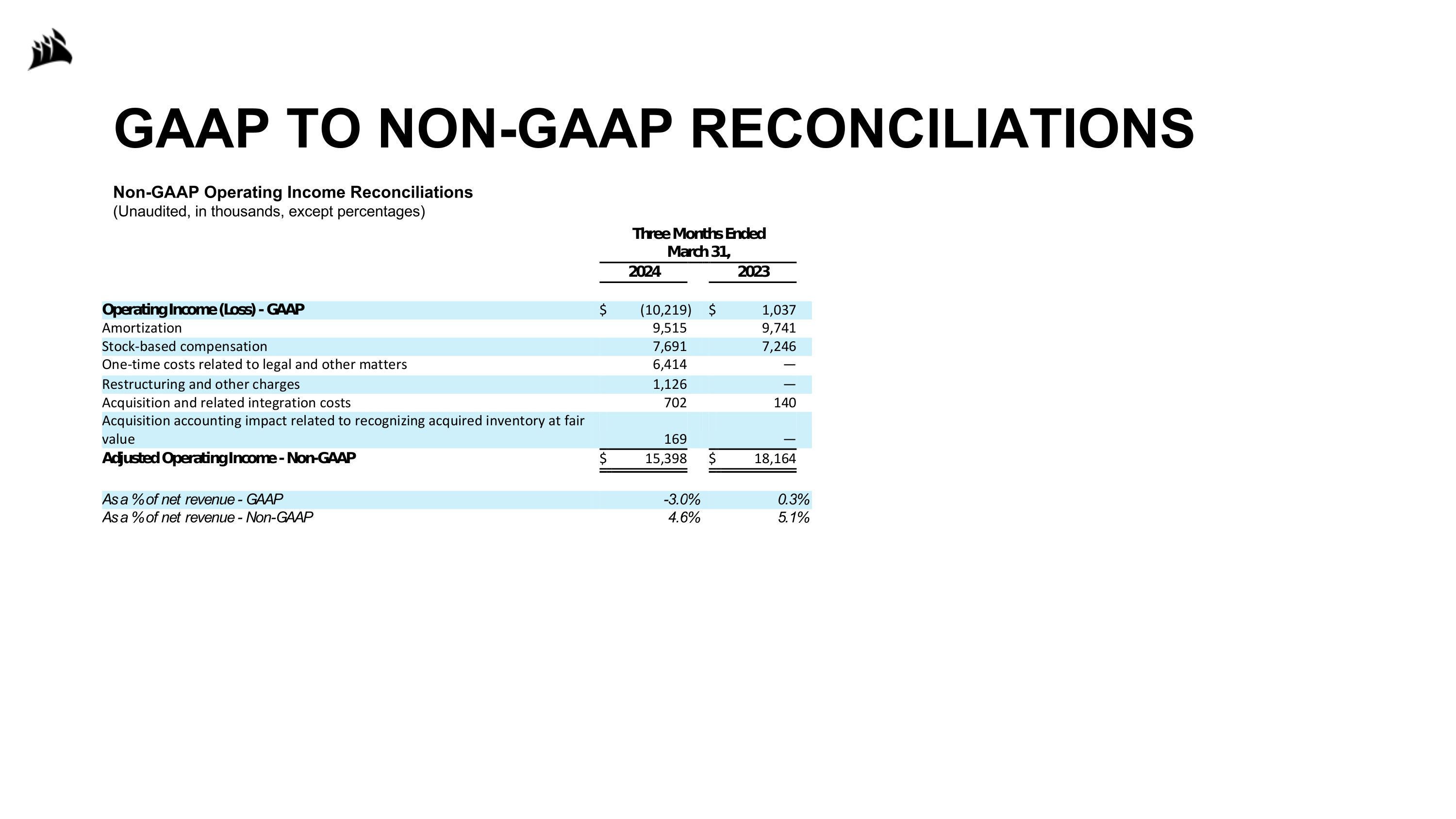

GAAP TO NON-GAAP RECONCILIATIONS Non-GAAP Operating Income Reconciliations (Unaudited, in thousands, except percentages)

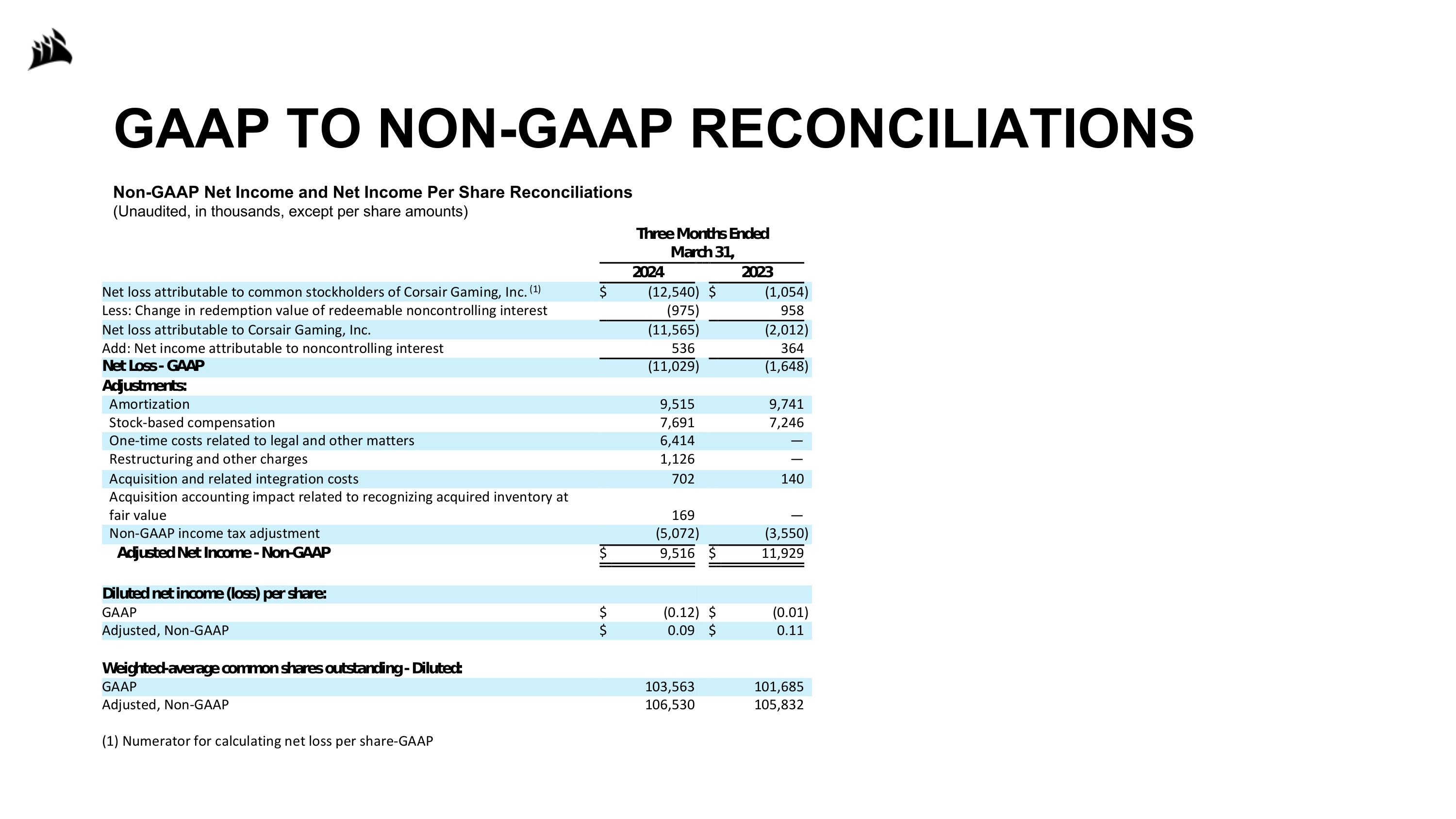

GAAP TO NON-GAAP RECONCILIATIONS Non-GAAP Net Income and Net Income Per Share Reconciliations (Unaudited, in thousands, except per share amounts)

GAAP TO NON-GAAP RECONCILIATIONS Adjusted EBITDA Reconciliations (Unaudited, in thousands, except percentages)