UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: April, 2024

Commission file number: 001-41788

Lithium Americas Corp.

(Translation of Registrant’s name into English)

400-900 West Hastings Street,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

INCORPORATION BY REFERENCE

Exhibit 99.3 to this Form 6-K of Lithium Americas Corp. (the “Company”) is hereby incorporated by reference as an exhibit to the Registration Statements on Form F-3 (File No. 333-274883) and Form S-8 (File No. 333-274884) of the Company, as amended or supplemented, and to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

Exhibit |

|

Description |

|

|

|

99.1 |

|

|

99.2 |

|

|

99.3 |

|

|

99.4 |

|

|

99.5 |

|

|

99.6 |

|

|

99.7 |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Lithium Americas Corp. |

||

(Registrant) |

||

|

|

|

By: |

|

/s/ Jonathan Evans |

Name: |

|

Jonathan Evans |

Title: |

|

Chief Executive Officer |

Dated: April 17, 2024

Exhibit 99.1

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the annual general and special meeting (the “Meeting”) of the shareholders of Lithium Americas Corp. (the “Company”, “Lithium Americas”, "LAC" and “we”, “us”, “our” or similar terms) will be held:

When |

|

Where |

|

|

Friday, May 24, 2024 at 9:00 a.m. (Pacific Time) |

|

Live webcast on the Computershare meeting |

||

|

|

|

||

At the Meeting, shareholders will be asked to |

||||

1. Receive the audited consolidated financial statements of the Company for the year ended December 31, 2023 and the auditor’s report thereon;

|

||||

2. Determine the number of directors as eight;

|

||||

3. Elect directors for the ensuing year;

|

||||

4. Appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants (“PwC”), as the Company’s auditor for the ensuing year and authorize the directors to set the auditor’s remuneration;

|

||||

5. Pass, with or without variation, a special resolution to approve amendments to the Company’s Articles to create new classes of preferred shares issuable in series and attach special rights and restrictions to the Common Shares and Preferred Shares; and

|

||||

6. Transact such other business as may properly be put before the Meeting.

|

||||

Details on each item of business are described in the management information circular accompanying this notice, starting on page 13. |

||||

This year, we are having an online only Meeting. |

||||

Participation by our shareholders is important to the Company. If you owned shares as of close of business on the Record Date of April 12, 2024, you are entitled to vote as a shareholder at the Meeting. Those shareholders unable to attend the Meeting are encouraged to vote their proxy in advance. Information on how to vote is provided on page 6 of the accompanying circular. |

||||

DATED at Vancouver, British Columbia, as of April 12, 2024. |

||||

ON BEHALF OF THE BOARD |

||||

Signed “Kelvin Dushnisky” |

||||

Kelvin Dushnisky |

||||

Exhibit 99.2

LITHIUM AMERICAS CORP. Have questions about this notice? Call the Toll Free Number below or scan the QR code to find out more. Toll Free 1-866-964-0492 www.computershare.com/ notice and access Notice of Availability of Proxy Materials for LITHIUM AMERICAS CORP. Annual General and Special Meeting Meeting Date and Location: When: May 24, 2024 9:00 am (Pacific Time) Where: Virtually at: https://www.meetnow.global/MXPLS44 Fold You are receiving this notice to advise that the proxy materials for the above noted securityholders' meeting are available on the Internet. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We remind you to access and review all of the important information contained in the information circular and other proxy materials before voting. The information circular and other relevant materials are available at: https://lithiumamericas.com/investor/AGM-Materials/default.aspx OR www.sedarplus.ca How to Obtain Paper Copies of the Proxy Materials Fold Securityholders may request to receive paper copies of the current meeting materials by mail at no cost. Requests for paper copies may be made using your Control Number as it appears on your enclosed Voting Instruction Form or Proxy. To ensure you receive the materials in advance of the voting deadline and meeting date, all requests must be received no later than May 14, 2024. If you do request the current materials, please note that another Voting Instruction Form/Proxy will not be sent; please retain your current one for voting purposes. For Holders with a 15 digit Control Number: Request materials by calling Toll Free, within North America - 1-866-962-0498 or direct, from Outside of North America - (514) 982-8716 and entering your control number as indicated on your Voting Instruction Form or Proxy. To obtain paper copies of the materials after the meeting date, please contact 1-866-964-0492 - Toll Free within North America 1-514-982-8714 - Direct from outside of North America. For Holders with a 16 digit Control Number: Request materials by calling Toll Free, within North America - 1-877-907-7643 or direct, from Outside of North America - 1-303-562-9305 and entering your control number as indicated on your Voting Instruction Form. To obtain paper copies of the materials after the meeting date, please contact Toll Free within North America – 1-877-907-7643, or direct from Outside Of North America – 303-562-9305. Dual LAHQ_NOTICE_35820/000001/000001/i

Securityholder Meeting Notice The resolutions to be voted on at the meeting are listed below along with the Sections within the Information Circular where disclosure regarding the matter can be found. 1. Number of Directors - Set Number of Directors 2. Election of Directors - Elect Directors 3. Appointment of Auditors - Appoint the Auditor 4. Approval of the Amendment to the Corporation’s Articles - Approval of the Amendment to the Corporation’s Articles Fold Voting PLEASE NOTE - YOU CANNOT VOTE BY RETURNING THIS NOTICE.

To vote your securities you must vote using the methods reflected on your enclosed Voting Instruction Form or Proxy. PLEASE VIEW THE INFORMATION CIRCULAR PRIOR TO VOTING Annual Financial statement delivery No Annual Report (or Annual Financial Statements) is (are) included in this mailing

(Formerly 1397468 B.C. Ltd.)

MANAGEMENT

INFORMATION

CIRCULAR

AND NOTICE OF 2024 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

DATED MARCH 21, 2024

TABLE OF CONTENTS

Information of About Lithium Americas Corp. |

1 |

|

35 |

|

4 |

|

39 |

||

4 |

|

40 |

||

4 |

|

40 |

||

4 |

|

41 |

||

4 |

|

41 |

||

4 |

|

42 |

||

4 |

|

45 |

||

5 |

|

46 |

||

5 |

|

49 |

||

5 |

|

49 |

||

5 |

|

53 |

||

6 |

|

54 |

||

10 |

|

54 |

||

10 |

|

55 |

||

11 |

|

55 |

||

11 |

|

56 |

||

11 |

|

|

||

13 |

|

Benchmarking Review |

57 |

|

13 |

|

58 |

||

13 |

|

59 |

||

13 |

|

60 |

||

13 |

|

2023 Corporate Performance |

61 |

|

|

|

Management of Risks |

66 |

|

14 |

|

2023 Individual Performance and STI and LTI Awards |

67 |

|

14 |

69 |

|||

|

|

70 |

||

14 |

|

72 |

||

14 |

|

Outstanding Share-Based Awards and |

|

|

15 |

Option-Based Awards |

72 |

||

18 |

|

Value of Awards Vested or Earned in 2023 |

73 |

|

18 |

73 |

|||

18 |

|

73 |

||

|

|

77 |

||

18 |

|

77 |

||

18 |

|

78 |

||

|

|

Securities Authorized for Issuance Under the Plan |

78 |

|

27 |

|

78 |

||

28 |

|

79 |

||

Corporate Governance Overview |

28 |

|

85 |

|

29 |

|

SCHEDULE |

|

|

32 |

|

87 |

2024 Management Information Circular i

LETTER TO SHAREHOLDERS FROM THE EXECUTIVE CHAIR AND THE PRESIDENT & CEO

|

Dear Fellow Lithium Americas Shareholders, On behalf of the Board of Directors of Lithium Americas Corp., we invite you to attend our annual general and special meeting of shareholders on May 24, 2024 at 9 a.m. Pacific Time (the “Meeting”). To allow all of our shareholders to attend, we will hold the Meeting as an online virtual meeting. This Management Information Circular provides you with information for purposes of voting on items of business that will be considered at the Meeting, including the election of directors, appointment of auditors and an amendment of the Company’s articles to provide management with greater flexibility in raising capital for the Company. Your votes are important to us. We encourage you to read the Management Information Circular in advance to allow meaningful participation in the voting process. |

|

2023 was a monumental year for Lithium Americas. We worked to set up Thacker Pass for future success, including a strategic investment and offtake from General Motors as well as completed a corporate separation to create a pureplay North American lithium company. In early 2024, we achieved a significant milestone by receiving a conditional commitment from the U.S. Department of Energy for a loan to be used toward financing the construction of the processing facilities at Thacker Pass. We have included a corporate overview and update regarding our 2024 priorities to advance Thacker Pass toward production on page 1 of the Management Information Circular under the heading “Information About Lithium Americas Corp.” On behalf of everyone at Lithium Americas, we are excited to build a North American lithium supply chain and appreciate your ongoing support of our Company. DATED March 21, 2024 Sincerely,

|

|

|

Signed “Kelvin Dushnisky” |

Signed “Jonathan Evans” |

|

|

Kelvin Dushnisky Director & Executive Chair |

Jonathan Evans President & CEO |

|

ii

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

OF SHAREHOLDERS

NOTICE is hereby given that the annual general and special meeting (the “Meeting”) of the shareholders of Lithium Americas Corp. (the “Company”, “Lithium Americas”, “LAC” and “we”, “us”, “our” or similar terms) will be held:

When |

|

Where |

|

|

Friday, May 24, 2024 at 9:00 a.m. (Pacific Time) |

|

Live webcast on the Computershare meeting |

||

|

|

|

||

At the Meeting, shareholders will be asked to: |

||||

1. Receive the audited consolidated financial statements of the Company for the year ended December 31, 2023 and the auditor’s report thereon;

|

||||

2. Determine the number of directors as eight;

|

||||

3. Elect directors for the ensuing year;

|

||||

4. Appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants (“PwC”), as the Company’s auditor for the ensuing year and authorize the directors to set the auditor’s remuneration;

|

||||

5. Pass, with or without variation, a special resolution to approve amendments to the Company’s Articles to create new classes of preferred shares issuable in series and attach special rights and restrictions to the Common Shares and Preferred Shares; and

|

||||

6. Transact such other business as may properly be put before the Meeting.

|

||||

Details on each item of business are described in the management information circular accompanying this notice, starting on page 13. |

||||

This year, we are having an online-only Meeting. |

||||

Participation by our shareholders is important to the Company. If you owned shares as of close of business on the Record Date of April 12, 2024, you are entitled to vote as a shareholder at the Meeting. Those shareholders unable to attend the Meeting are encouraged to vote their proxy in advance. Information on how to vote is provided on page 6 of the accompanying circular. |

||||

DATED at Vancouver, British Columbia, as of April 12, 2024. |

||||

ON BEHALF OF THE BOARD |

||||

Signed “Kelvin Dushnisky” |

||||

Kelvin Dushnisky |

||||

2024 Management Information Circular iii The Company is a Canadian-based resource company focused on the advancement of significant lithium projects.

INFORMATION ABOUT LITHIUM AMERICAS CORP.

Business Overview

The Company strives to operate under the highest ESG-S standards to foster the sustainable advancement of projects that support the vital lithium supply chain and the global transition to cleaner energy. Our flagship project is Thacker Pass, a sedimentary-based lithium deposit located in the McDermitt Caldera in Humboldt County, in northern Nevada. The Company owns 100% of Thacker Pass through its wholly-owned U.S. subsidiary, Lithium Nevada Corp. ("Lithium Nevada"). The Company also holds investments in Green Technology Metals Limited and Ascend Elements, Inc., and exploration properties in the U.S. and Canada.

In January 2021, Thacker Pass was issued a Record of Decision (“ROD”) by the Bureau of Land Management and in April 2022, Thacker Pass received all state environmental permits required to commence construction. Construction commenced in February 2023 following initial appeals of the ROD, which were dismissed on February 6, 2023 and December 12, 2023. On July 20, 2022, the Company celebrated the inauguration of its Lithium Technical Development Center (“LiTDC”), which was developed to demonstrate the processing of Thacker Pass ore. The LiTDC achieved battery-quality specifications with product samples being produced for potential customers and partners. Thacker Pass is aligned with the U.S. national agenda to enhance domestic supply of critical minerals and has the potential to be a leading near-term source of lithium for the North American battery supply chain.

History

The Company was incorporated under the Business Corporations Act (British Columbia) for the sole purpose of acquiring ownership of the North American business assets and investments of Lithium Americas Corp. (“Old LAC”), which is now named Lithium Americas (Argentina) Corp. (“Lithium Argentina”), pursuant to the separation transaction that was undertaken on October 3, 2023 (the “Separation”).

Old LAC's North American and Argentine business units represented two distinct businesses in its portfolio, each of which had assets with significant value to be unlocked. The separation of Old LAC into two public entities, Lithium Argentina and the Company, was designed to provide each of them with a sharper strategic focus and enhanced operational flexibility that may not have been available to them as a consolidated company.

Specifically, decoupling Old LAC's North American business from Old LAC's Argentine business was expected to allow the Company to benefit more fully from funding opportunities available only to U.S. businesses in the critical minerals space and remove development and operational risks flowing from the Argentina portfolio, which would facilitate the advancement of Thacker Pass towards production.

The Separation also provided the Company with the potential opportunity for enhanced access to growth capital by enabling it to tailor an independent capital allocation, investment decision process and financing solutions. For instance, providing differentiated investment opportunities to investors, many of whom are solely interested in or value one of Old LAC's two business units over the other, would greatly enhance the funding options available to the separated entities.

2024 Management Information Circular 1

Additional Details Regarding the Business and Operations

A fulsome description of the finances, business and operations of the Company is available in its most recent continuous disclosure filings which are available on SEDAR+ and EDGAR, including in particular the Annual Report on Form 20-F dated March 18, 2024, its Audited Financial Statements for the year ended December 31, 2023 and its Management Discussion and Analysis for the year ended December 31, 2023.

Thacker Pass Developments

Our focus in 2024 is to advance Thacker Pass into major construction. Once all the project capital necessary to fund Thacker Pass Phase 1 is in place, we anticipate making the final investment decision (“FID”) and issuing full notice to proceed (“FNTP”) to our contractors.

In March 2024, we achieved a significant milestone for Thacker Pass by receiving a conditional commitment (the “Conditional Commitment”) from the U.S. Department of Energy (“DOE”) for a $1.97 billion loan in aggregate principal to fund eligible construction costs of Thacker Pass, plus interest to be accrued during construction, which is estimated to be $290 million over a three-year period, together totaling a $2.26 billion loan under the Advanced Technology Vehicles Manufacturing Loan Program (the “Loan”). Based on the terms of the Conditional Commitment, if finalized, the Loan will have a 24-year maturity with interest rates fixed from the date of each monthly advance for the term of the loan at applicable U.S. treasury rates, without any additional credit spread. We deeply appreciate the U.S. government’s support as we advance the responsible development of Thacker Pass to help meet the growing domestic need for lithium chemicals and strengthen the nation’s critical minerals supply chain.

The Loan plus the pending $330 million second tranche investment (the “Tranche 2 Investment”) from General Motors Holdings LLC (“GM”) (please refer to our Annual Report on Form 20-F for further details), are expected to provide the vast majority of the remaining capital necessary to fund construction of Phase 1. As of December 31, 2023, after accounting for funding from the Loan and GM’s Tranche 2 Investment, the Company estimates approximately $436 million remains to be committed to Phase 1 capital costs from the Company’s existing cash and cash equivalents and incremental funding. As of December 31, 2023, the Company had approximately $196 million of cash and cash equivalents, of which approximately $151 million is expected to be committed to fund remaining Phase 1 capital expenditures, after taking into account our 2024 operating budget of approximately $45 million, leaving approximately $285 million of Phase 1 project capital costs, net of financing-related fees and expenses, to be sourced. Our team is evaluating various financing alternatives to fund the remaining need before closing GM’s Tranche 2 Investment, which is expected before or in connection with closing of the DOE Loan later this year. Such financing alternatives may include one or more public or private offerings of equity or equity-linked securities, strategic joint ventures, pre-payment transactions and royalty transactions (collectively “Financing Alternatives”). We are discussing with different potential capital providers as we evaluate Financing Alternatives.

Once the Loan agreement is finalized, we expect to begin to draw on the Loan in early 2025. Conditions precedent to the first draw under the Loan include, but are not limited to, project finance model bring down, letters of credit to support reserve accounts, and securing additional corporate working capital to fund pre-commissioning general and operating expenses and commissioning costs through production. We expect the $195 million reserve account requirements to be satisfied with letters of credit or similar credit support facilities. The Company is in active discussions with our key project partners and other third parties to have these in place later this year. We currently expect the additional corporate working capital amount to be approximately $165 million, net of any financing-related fees and expenses, to fund activities from the start of 2025 through expected production in 2027.

2

The Financing Alternatives currently being evaluated by the Company could potentially be used to fund corporate working capital to facilitate first drawdown on the Loan.

The Loan remains subject to the negotiation and finalization of definitive financing documents. It is possible that the terms of the finalized Loan agreement will change from the time of Conditional Commitment. While the Conditional Commitment indicates DOE’s intent to finance the processing facilities at Thacker Pass, we must satisfy certain technical, legal, environmental and financial conditions before DOE enters into definitive financing documents and funds the Loan.

We also continue to increase the level of detailed engineering in advance of issuing FNTP to support a well-planned construction execution plan. Mechanical completion of Phase 1 is targeted for 2027 following a three-year construction period, followed by a commissioning and ramp-up period of approximately six to twelve months.

2024 Management Information Circular 3

GENERAL PROXY INFORMATION

|

Date of Information All information in this management information circular (“Circular”) is dated as of March 21, 2024, except as otherwise noted herein. |

|

Name of Shareholder |

|

Number of Common Shares Owned(1) |

|

Percentage of Outstanding Common Shares |

|

Currency All currency amounts herein are expressed in Canadian dollars (“C$” or “$”) or United States dollars (“US$”), as indicated herein. |

|

General Motors Holdings LLC(2) |

|

15,002,243 |

|

9.25% |

|

Ganfeng Lithium Co., Ltd. |

|

15,000,000 |

|

9.25% |

|

|

|

Notes: |

||||

|

Committee Abbreviations Committees of our board of directors (“Board”) are abbreviated in certain tables in this Circular as follows: •

Audit and Risk Committee – “A&R Committee”

•

Governance and Nomination Committee – “G&N Committee”

•

Compensation and Leadership Committee – “C&L Committee”

•

Safety and Sustainability Committee – “S&S Committee”

•

Technical Committee.

Principal Holders of Voting Securities To the knowledge of the directors and executive officers of the Company, no person or company, directly or indirectly, beneficially owns or exercises control or direction over, 10% or more of the Company’s issued and outstanding Common Shares (“Common Shares”), as set out in the table below. |

|

(1)

These numbers are derived from the respective shareholders, or public filings made by these shareholders on the System for Electronic Disclosure by Insiders (SEDI).

(2)

Mr. Zach Kirkman, a director of Lithium Americas, is the Vice President, Global Corporate Development and President, GM Ventures of General Motors Company.

Meeting Representations No person is authorized to give any information or to make any representation concerning the Meeting other than those contained in this Circular and, if given or made, such information or representation should not be relied upon as having been authorized. Additional Information Financial information about us is included in our annual financial statements and management’s discussion and analysis (“MD&A”) for our most recently completed financial year. These documents, along with our annual information form, are filed under our profile on SEDAR+ (www.sedarplus.ca). Information concerning the Company, including printed copies of our annual financial statements and MD&A, may be obtained by any shareholder of the Company (“Shareholder”) free of charge by registering online at: www.computershare.com/mailinglist. |

||||

|

||||||

|

||||||

4

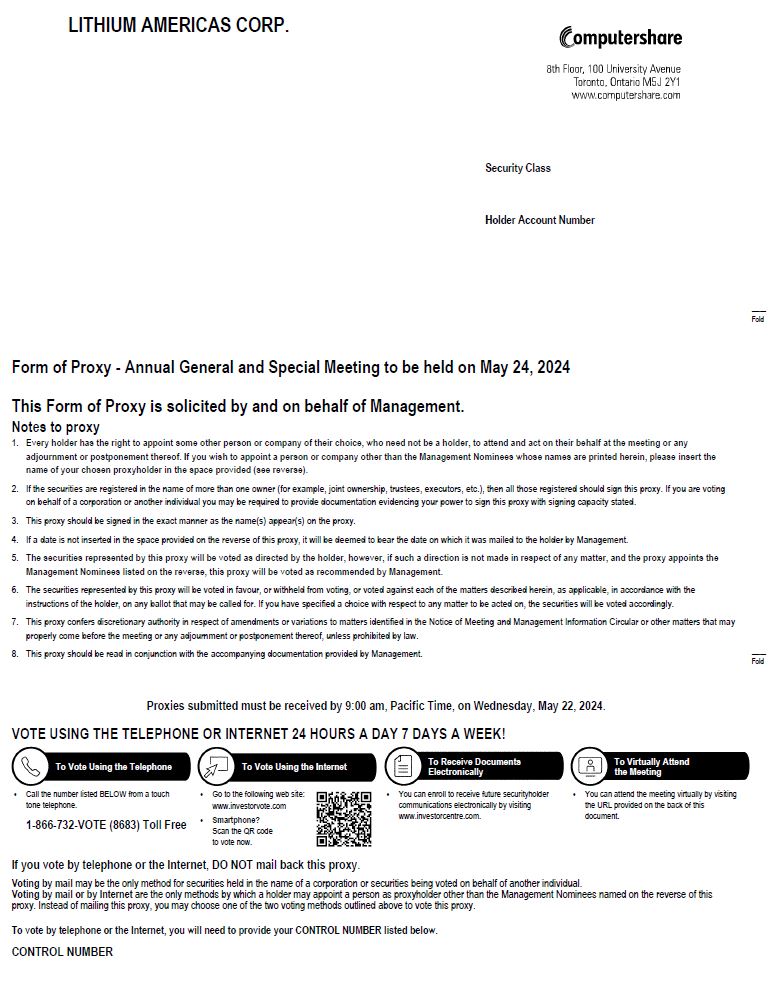

VOTING INFORMATION AND MEETING PARTICIPATION

|

Proxy Solicitation The Company is providing this Circular to Shareholders to solicit proxies for use at the annual general and special meeting of Shareholders (the “Meeting”) to be held on May 24, 2024 at 9 a.m. Pacific Time by live webcast on the Computershare meeting platform at meetnowglobal/MXPLS44. See the accompanying notice of meeting on page iii for further details. Our management is primarily soliciting proxies by mail, but may also contact Shareholders by telephone or email. The Company will pay the costs of soliciting proxies. The Company may also pay reasonable costs incurred by intermediaries who are registered owners of Common Shares (such as brokers, dealers, other registrants under applicable securities laws, nominees and/or custodians) to deliver the Notice Package (as defined below) to beneficial owners of such Common Shares. The Company will provide, without cost to such persons, upon request to the Chief Financial Officer (“CFO”) of the Company, additional copies of the foregoing documents required for this purpose. The cost of solicitation will be borne by the Company. Who Can Vote If you held Common Shares as of the close of business on April 12, 2024 (the “Record Date”), you are entitled to vote at the Meeting as a Shareholder. Only Shareholders whose names have been entered in the register of Shareholders as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting. As of the Record Date, the Company had 162,165,293 fully paid |

|

and non-assessable Common Shares issued and outstanding, each carrying the right to one vote. The Company’s authorized capital consists of an unlimited number of Common Shares without par value. As of the date of this Circular, the directors and executive officers of the Company beneficially owned, directly or indirectly, or exercised control or direction over, an aggregate of 15,701,332 Common Shares (including Common Shares held by GM), representing approximately 9.68% of the issued and outstanding Common Shares on an undiluted basis. The Company’s articles (the “Articles”) provide that the quorum for the transaction of business at the Meeting is at least two Shareholders who hold in aggregate at least 25% of the issued Common Shares entitled to vote at the Meeting. A simple majority of the votes cast at the Meeting, whether virtually, by proxy or otherwise, will constitute approval of any item of business considered at the Meeting. Voter Types Voters fall into two categories: •

registered Shareholders – meaning the share certificate is in your name; or

•

non-registered (beneficial) Shareholders – meaning the shares are registered in the name of an intermediary such as a brokerage firm, bank, trust company or clearing agency (e.g. The Canadian Depository for Securities Limited commonly known as CDS, or Cede & Co.).

|

2024 Management Information Circular 5

How to Vote

Voting occurs in advance of the Meeting by voting a proxy, or at the Meeting by attending online. How you vote will vary depending on whether you are a registered Shareholder or a non-registered (beneficial Shareholder):

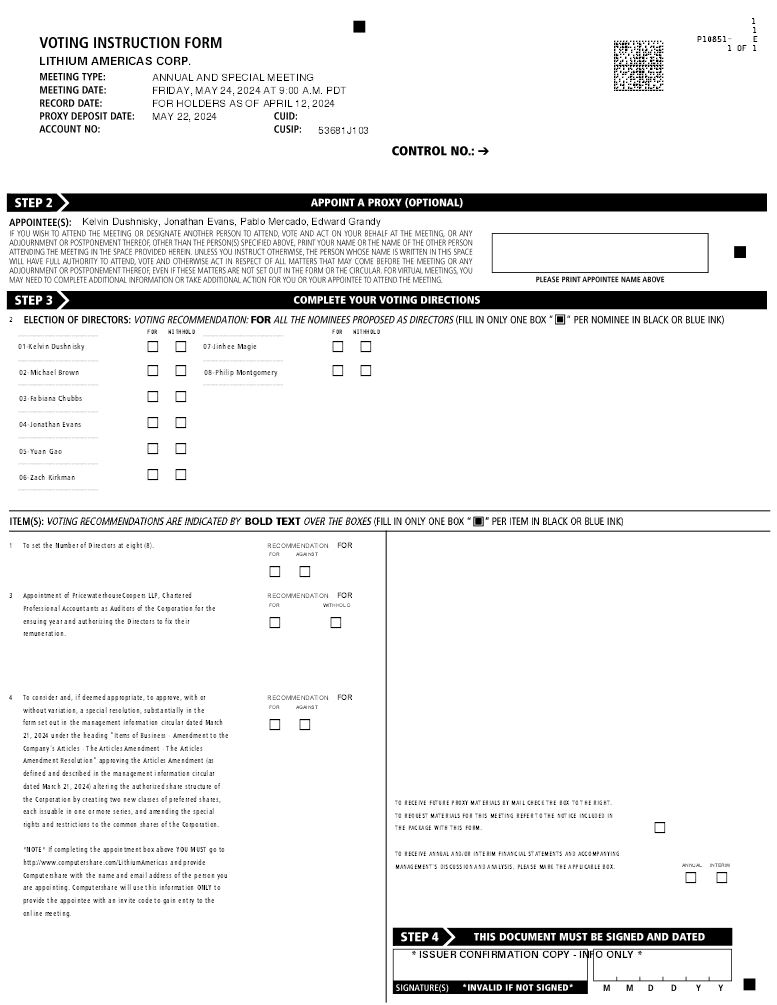

WAYS TO VOTE |

FOR REGISTERED SHAREHOLDERS |

FOR NON-REGISTERED SHAREHOLDERS |

In advance of the Meeting |

Voting by proxy means you appoint another individual – either our management or any other person of your choice – to attend the Meeting and vote your Common Shares based on your instructions to the person. This person does not need to be a Shareholder of the Company to be your proxy. The form of proxy enclosed with this Circular names the senior management of Lithium Americas who will vote your shares as proxy if you do not appoint another person. Proxies voted by our management will be voted as follows: FOR setting the number of directors at eight for the ensuing year FOR electing all director nominees FOR appointing PwC as our auditors FOR amendments to the Company’s Articles to create new classes of Preferred Shares (as defined below) issuable in series and attach special rights and restrictions to the Common Shares and Preferred Shares. To appoint a person as your proxy other than our management, you must fill in their name in the space provided on the proxy form and return your proxy. You must also register your proxyholder with Computershare Investor Services Inc. (“Computershare”) at http://www.computershare.com/ |

We send meeting materials to intermediaries for delivery to non-registered Shareholders who have not waived the right to receive them, and pay for delivery costs to objecting beneficial Shareholders. If you a non-registered Shareholder who has not waived the right to receive our meeting materials, your intermediary is required to deliver the meeting materials to you. The materials will generally include a voting instruction form (“VIF”) that will allow you to vote your shares. The VIF should be completed, signed and returned to your intermediary. You can also vote by telephone or online per the VIF instructions. |

6

WAYS TO VOTE |

FOR REGISTERED SHAREHOLDERS |

FOR NON-REGISTERED SHAREHOLDERS |

|

proxyholder with Computershare to allow that person to receive an invite code from Computershare. Otherwise that person will not be able to vote at the Meeting. Failure to register will result in the proxyholder not receiving an invite code to attend, participate or vote at the Meeting. Without an invite code, the proxyholder will only be able to attend the Meeting online as a guest. Guests are unable to vote or ask questions. |

|

|

All proxies must be completed and returned to Computershare by 9 a.m. Pacific Time on May 22, 2024, or at least 48 hours (excluding Saturdays, Sundays and holidays) before any adjourned or reconvened meeting. Proxies can be returned using one of the return methods set out below. The Chair of the meeting is permitted to accept late proxies in their discretion. Proxy Return Methods: •

Mail – complete, sign, date and mail your proxy to Computershare Investor Services Inc., Proxy Department at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1;

•

Fax – complete, sign, date and fax your proxy to Computershare Investor Services Inc. at (416) 263-9524 or 1-866-249-7775;

|

|

In advance of the Meeting |

•

Internet voting – vote your proxy online at www.investorvote.com using the 15-digit control number located at the bottom of your proxy; or

•

Telephone – vote your proxy by telephone at 1-866-732-VOTE (8683) (toll free within North America) or 1-312-588-4290 (outside North America).

|

|

2024 Management Information Circular 7

WAYS TO VOTE |

FOR REGISTERED SHAREHOLDERS |

FOR NON-REGISTERED SHAREHOLDERS |

Online at the Meeting |

Registered Shareholders can attend the Meeting online and vote their shares through the online meeting platform, rather than voting by proxy. This means you attend the Meeting online at the meeting time set out on the Notice of Meeting, and vote at that time. We recommend you consider voting by proxy even if you plan to attend the Meeting, in case you are unable to attend for any reason or you encounter technical difficulties using the online meeting platform. You can attend the Meeting in person by following these steps: •

At least a few minutes before the Meeting, go to the Computershare meeting platform website, meetnow.global/MXPLS44

•

Login by clicking on “I have a Control Number” and entering the 15-digit control number on the proxy form.

A “Virtual User Guide” is available with the meeting materials on SEDAR+ and EDGAR. |

Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Meeting (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder must: (1) follow the instructions on the VIF to indicate that they (or such other person) will virtually attend and vote at the Meeting, and (2) register their appointment at http://www.computershare.com/ Non-Registered Shareholders should carefully follow the instructions contained in the VIF of their intermediaries and contact them directly with any questions regarding the voting of Common Shares owned by them. A “Virtual User Guide” is available with the meeting materials on SEDAR+ and EDGAR. Voting instructions must be received in sufficient time to allow for the VIF to be forwarded by the intermediary to Computershare before 9 a.m. Pacific Time on May 22, 2024. To attend and vote at the Meeting, U.S. Non-Registered Shareholders must first obtain a valid legal proxy from their intermediary and then register in advance to attend the Meeting. The U.S Non-Registered Shareholder must follow the |

8

WAYS TO VOTE |

FOR REGISTERED SHAREHOLDERS |

FOR NON-REGISTERED SHAREHOLDERS |

|

|

instructions from their intermediary included with the Notice Package, or contact their intermediary to request a legal proxy form. After first obtaining a valid legal proxy from their intermediary, to then register to attend the Meeting, U.S. Non-Registered Shareholders must submit a copy of their valid legal proxy to Computershare. Requests for registration should be directed to Computershare by mail at 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, or by email at USLegalProxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 9 a.m. Pacific Time on May 22, 2024. U.S. Non-Registered Shareholders will receive a confirmation of registration by email after Computershare receives the registration materials. All U.S. Non-Registered Shareholders must also register their appointment at the following link: http://www.computershare.com/ |

2024 Management Information Circular 9

|

Voting Changes You can change how you have voted your shares by proxy in advance of the Meeting. A Registered Shareholder who has given a proxy may revoke it at any time not less than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting time or, if adjourned, any reconvened meeting time by sending written notice of revocation signed by the Registered Shareholder or their authorized attorney (or for corporations who are Registered Shareholders, by an authorized officer or attorney under the corporate seal) to our head office at Lithium Americas Corp., Suite 400, 900 West Hastings Street, Vancouver, British Columbia, V6C 1E5. A proxy may also be revoked in any other manner permitted by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the time of the revocation. A Shareholder attending the Meeting has the right to vote virtually and, if he or she does so, his or her proxy is nullified with respect to the matters such person votes upon and any subsequent matters thereafter to be voted upon at the Meeting. A Non-Registered Shareholder wishing to change their vote must, at least seven days before the Meeting, contact their intermediary to change their vote and follow their intermediary’s instructions. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation. Exercise of Discretion Common Shares represented by a properly executed proxy given in favour of the persons designated in the printed portion of the accompanying proxy at the Meeting will be voted or withheld from voting in accordance with the instructions contained therein on any ballot that may be called for and, if a Shareholder specifies a choice with respect to any matter to be acted upon at the Meeting, the Common Shares represented by the proxy shall be voted accordingly. Except with respect to broker non-votes described

|

|

below, where no choice is specified, the proxy will confer discretionary authority and will be voted in favour of each matter for which no choice has been specified. Except with respect to broker non-votes described below, the proxy when properly completed and delivered and not revoked also confers discretionary authority upon the person appointed proxy thereunder to vote with respect to any amendments or variations of matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of posting this Circular in accordance with Notice-and-Access (as defined below), management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which are not known to the management of the Company should properly come before the Meeting, the Common Shares represented by proxies given in favour of management nominees will be voted in accordance with the best judgment of the nominee. Under rules of the New York Stock Exchange (“NYSE”), brokers and other intermediaries holding shares in street name for their customers are generally required to vote the shares in the manner directed by their customers. If their customers do not give any direction, brokers may vote the securities at their discretion on routine matters, but not on non-routine matters. Other than the proposals to set the number of directors and for the appointment of our auditor, we believe all of the other matters to be voted on at the Meeting are non-routine matters and brokers governed by NYSE rules may not vote the securities held in street name for their customers in relation to these items of business without direction from their customers. The absence of a vote on a non-routine matter is referred to as a broker non-vote. Any securities represented at the Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the election of directors or any other matter to be voted on at the Meeting, except to the extent that the failure to vote for an |

10

|

individual nominee results in another individual receiving a larger proportion of votes cast for the election of directors. For purposes of the Company’s Majority Voting Policy (as defined below), a broker non-vote is not considered to be a withhold vote. Technical Requirements If you are attending the Meeting online to vote, ensure that you are entitled to vote and that you are connected to the internet at all times to allow you to vote on the resolutions during the polling periods for each matter put before the Meeting. You are responsible for ensuring you have internet connectivity at all times during the Meeting. Participants will also need to have the latest version of Chrome, Safari, Edge or Firefox. The platform does not support access using Internet Explorer. As internal network security protocols (such as firewalls or VPN connections) may block access to the Computershare meeting platform, participants should use a network that is not restricted by the security settings of any organization or that has disabled any VPN settings. Logging in at least an hour before the start of the Meeting is recommended to check that you are able to access the online platform. If you are having technical difficulties with access, you can contact 1-888-724-2416 for technical assistance. If you are a non-registered Shareholder and wish to vote at the Meeting, you are responsible for appointing yourself or a third party as a proxyholder and submitting your VIF or proxy form with third party appointment details completed in accordance with instructions on your VIF or proxy form and registering the third party appointment online with Computershare in advance of the Meeting at http://www.computershare.com/ The Company believes that Shareholder participation at meetings is important, regardless of the online format for the meeting. As such, the meeting platform we have selected allows for registered Shareholders to ask written questions during the meeting, and during any subsequent Company presentation. |

|

This facilitates a similar level of interaction as would be expected at an in person meeting. Questions will be answered by the Chair of the meeting, or by our senior management in that person’s discretion. We may choose not to answer any question that is asked of us if we determine the question is inappropriate for any reason. This Circular is prepared in accordance with applicable disclosure requirements in Canada. As a “foreign private issuer” under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), we are exempt from proxy solicitation requirements in the United States. This means that the content of this Circular may be different from proxy circulars prepared by domestic issuers in the United States who follow U.S. Exchange Act requirements. Notice and Access We are using the notice-and-access provisions (“Notice-and-Access”) under National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 – Continuous Disclosure Obligations to distribute the proxy-related materials (including this Circular), the audited financial statements of the Company for the year ended December 31, 2023, and related auditor’s report and MD&A to Shareholders. This allows us to post electronic versions of the meeting materials on SEDAR+ at www.sedarplus.ca, and on our website (https://lithiumamericas.com/investor/AGM-Materials/default.aspx) instead of mailing paper copies to Shareholders. Notice-and-Access is more environmentally friendly, reducing the use of paper and certain physical delivery-related emissions, and more cost effective for us, as it reduces print and mailing costs. Shareholders still have the right to request paper copies of the meeting materials posted online by the Company under Notice-and-Access if you choose. We will not use the |

2024 Management Information Circular 11

|

“stratification” procedure for Notice-and-Access, where a paper copy of the meeting materials is provided along with the notice package. Shareholders may ask the Company additional questions about Notice-and-Access by calling 1-778-726-4070 or emailing ir@lithiumamericas.com. The meeting materials are available under the Company’s profile on SEDAR+ (www.sedarplus.ca) and on the Company’s website (https://lithiumamericas.com/investor/AGM-Materials/default.aspx). We will provide paper copies of the meeting materials, including proxy-related materials such as the Circular, the audited financial statements of the Company for the year ended December 31, 2023, the auditor’s report and the related MD&A free of charge, for a period of up to one year from the date the Circular is filed on SEDAR+. For registered Shareholders with a 15 digit control number: request materials by calling toll free, within North America 1-866-962-0498 or direct, from outside of North America (514) 982-8716, and entering your control number as indicated on your VIF or proxy. To obtain paper copies of the materials after the Meeting, contact 1-866-964-0492 toll free within North America, or 1-514-982-8714 direct from outside of North America. For non-registered (beneficial) Shareholders with a 16 digit control number: request materials by calling toll free, within North America 1-877-907-7643 or direct, from outside of North America, 1-303-562-9305, and entering your control number as indicated on your VIF. To obtain paper copies of the materials after the Meeting, contact toll free within North America 1-877-907-7643, or direct from outside of North America 1-303-562-9305. Shareholders who wish to receive a paper copy of the meeting materials in advance of |

|

the Meeting should submit their request to us no later than May 14, 2024 to allow sufficient time for you to receive and review the materials before the proxy submission deadline of 9 a.m. Pacific Time on May 22, 2024. We will send materials within three business days of receiving a request if the request is received before the meeting date, or within 10 days if received on or after the meeting date. Consider emailing your request to us and requesting an electronic copy of the materials to ensure you have sufficient time to review the materials. Shareholders will be sent by pre-paid mail a paper copy of a notice package (the “Notice Package”) under Notice-and-Access containing: (i) a notification about the Company’s use of Notice-and-Access with instructions about how to access the proxy-related materials online, and (ii) for registered Shareholders, a form of proxy, or for non-registered Shareholders a VIF. |

12

ITEMS OF BUSINESS

At the Meeting, the following items of business will be conducted:

1. |

|

Receive Financial Statements Shareholders will receive a link to the audited consolidated financial statements and the auditor’s report for the fiscal year ended December 31, 2023. These materials are also available at www.lithiumamericas.com. |

|

|

|

2. |

|

Set Number of Directors on the Board Shareholders will be asked to approve setting the number of directors for the Company at eight. Management recommends a vote FOR setting the number of directors at eight. |

|

|

|

3. |

|

Elect Directors Shareholders will be asked to vote on the election of eight directors to the Board, who will serve until our next annual meeting of Shareholders, or until a successor is elected or appointed in accordance with the Company’s Articles and applicable corporate law. All nominees standing for election have confirmed they are eligible and willing to serve. See page 13 for information about each of the nominees and for general information about the Board of Directors. Management recommends a vote FOR each of the nominated directors. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the nominees listed herein. Shareholders may vote ‘for’ or ‘withhold’ for each of the nominees. |

|

|

|

4. |

|

Appoint the Auditor Voting will occur by Shareholders on the appointment of PwC to serve as auditors of the Company and for their remuneration to be set by the Board of Directors. PwC has served as the Company’s auditor since formation. See page 15 for details about fees paid to the auditors. Management recommends a vote FOR the appointment of the Company’s auditors. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the appointment of PwC as auditors of the Company for the ensuing year and the authorization of the Board to fix their remuneration. The A&R Committee currently consists of Fabiana Chubbs (Chair), Michael Brown and Jinhee Magie. National Instrument 52-110 – Audit Committees provides that a member of an audit committee is “independent” if the member has no direct or indirect material relationship with the Company, which could, in the view of the Board, reasonably interfere with the exercise of the member’s independent judgment. The Board has determined that all members of the A&R Committee are “independent” directors. |

2024 Management Information Circular 13

|

|

|

5. |

|

Approval of the Amendment to the Company’s Articles Shareholders will be asked to pass, with or without variation, the Articles Amendment Resolution. Management recommends a vote FOR a special resolution to approve amendments to the Company’s Articles to create new classes of Preferred Shares (as defined below) issuable in series and attach special rights and restrictions to the Common Shares and Preferred Shares. In the absence of instructions to the contrary, the accompanying proxy will be voted FOR the Articles Amendment Resolution. |

|

|

|

6. |

|

Other Business The Company is not aware of any other business that may be raised at the Meeting. If any other matters do arise, our management who is named in the proxy intend to vote on any poll using their best judgement. They will exercise discretionary authority when considering any amendments or variations of matters set out in the Notice of Meeting, or other matters that may properly come before the Meeting or any adjournment. |

Interest of Certain Persons in Matters to be Acted Upon

No person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last completed financial year, nor any proposed nominee for director of the Company, nor any associate or affiliate of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

Interest of Informed Persons in Material Transactions

Except as set out in this Circular, or in the Company’s annual information form, annual financial statements and MD&A for its most recently completed financial year filed pursuant to applicable Canadian provincial securities laws and that are available through SEDAR+, no person who has been a director or executive officer of the Company, nor any proposed nominee for director of the Company, nor any person or company who beneficially owns, directly or indirectly, or who exercises control or direction over (or a combination of both) more than 10% of the issued and outstanding Common Shares, nor any associate or affiliate of those persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any transaction since the beginning of the Company’s last completed financial year which has materially affected or would materially affect the Company or its subsidiaries.

14

Audit Fees

The following table sets forth the aggregate fees billed by our current external auditors, PricewaterhouseCoopers LLP, Vancouver, British Columbia, Canada (PCAOB ID #271), unless stated otherwise, for the years indicated. The table includes fees billed to Old LAC for services related to the Separation and fees billed to LAC. All fees relating to the Separation have been included in 2023.

|

December 31, 2022 |

December 31, 2023 |

Audit Fees(1) |

0 |

669,418 |

Audit-Related Fees(2) |

0 |

0 |

Tax Fees(3) |

0 |

17,122 |

All Other Fees(4) |

0 |

0 |

Total Fees |

0 |

686,539 |

Notes:

2024 Management Information Circular 15

4 AMENDMENT TO THE COMPANY’S ARTICLES

THE ARTICLES AMENDMENT

Under the Business Corporations Act (British Columbia) (the “BCBCA”) and the Articles, amendments to the Articles requires approval by a special resolution of the Shareholders and, as such, an affirmative vote of not less than two-thirds (2/3rd) of the votes cast at the Meeting.

At the Meeting, Shareholders will be asked to pass a special resolution authorizing amendments to the Notice of Articles and Articles of the Company to:

Shareholders are being asked to consider and, if thought fit, pass a special resolution approving the Articles Amendment. The full text of the special rights and restrictions attaching to the Common Shares and the Preferred Shares is attached here to as Schedule “A”.

The Board believes that the creation of the new classes of Preferred Shares, issuable in series (sometimes referred to as blank cheque preferred shares) will provide management with greater flexibility in raising capital for the Company.

While there are no present plans or arrangements to use the Preferred Shares at this time, the Preferred Shares would permit the Board to negotiate with potential investors regarding the rights and preferences of a series of Preferred Shares that may be issued to meet market conditions and financing opportunities as they arise, without the expense or delay in connection with calling a Shareholders’ meeting to approve specific terms of any class or series of Preferred Shares. The Preferred Shares may be used by the Company for any appropriate corporate purpose, including, without limitation, as a means of obtaining additional capital for use in the Company’s business and operations.

The Board will be empowered to fix the number of shares in each series of each class of the Preferred Shares and to attach special rights or restrictions to the shares of that series, before the issuance of shares of any particular series. The Board will have the authority to fix, among other things, the number of shares constituting any such series, the identifying name of the series, the voting rights in respect of the voting Preferred Shares, and other special rights or restrictions thereof, including the dividend rights and dividend rate, terms of redemption (including sinking fund provisions), redemption price or prices, conversion rights and liquidation rights of the shares constituting any series.

The authority possessed by the Board to create and issue Preferred Shares could potentially be used to discourage attempts by others to obtain control of the Company through a merger, take-over bid offer, proxy contest or otherwise by making such attempts more difficult or costly to achieve. The Board has not proposed the Articles Amendment with the intention of discouraging take-over bids, proxy contests or other attempts to obtain control of the Company.

16

Rather, the proposed Articles Amendment has been prompted by business and financial considerations, as set out above, and it is the intended purpose of the Articles Amendment to provide greater flexibility to the Board in considering and planning for our potential future corporate needs. However, as noted, the availability of Preferred Shares for issuance may have the effect of discouraging a merger, tender offer, proxy contest, or other attempt to obtain control of the Company. There are no plans or arrangements to use the Preferred Shares at the present time. Additionally, the Board may issue Preferred Shares without Shareholder approval and with voting and conversion rights, which could adversely affect the voting power of Common Shares.

Pursuant to the BCBCA, no special rights or restrictions attached to a series of Preferred Shares shall confer on that series priority over any other series of Preferred Shares in respect of: (a) dividends, or (b) a return of capital in the event of the liquidation, dissolution or winding up of the Company or on the occurrence of any other event that entitles the Shareholders holding Preferred Shares to a return of capital.

The full text of the special rights and restrictions attaching to the Common Shares and the Preferred Shares is attached here to as Schedule “A”.

The Articles Amendment Resolution

At the Meeting, the following resolution (the “Articles Amendment Resolution”), with or without variation, will be placed before the Shareholders:

BE IT RESOLVED THAT, as a special resolution of the Shareholders of the Company:

The Board believes that the Articles Amendment Resolution is in the best interests of the Company and therefore unanimously recommends that Shareholders vote FOR the Articles Amendment Resolution amending the Company’s Articles as attached hereto as Schedule “A”. The persons named in the accompanying proxy intend to vote FOR a special resolution to approve amendments to the Company’s Articles to create new classes of Preferred Shares issuable in series and attach special rights and restrictions to the Common Shares and Preferred Shares.

2024 Management Information Circular 17

DIRECTORS DISCLOSURE

Advance Notice for Nominations

Further to the Company’s advance notice requirements, any Shareholder who wishes to nominate a candidate to stand for election as a director must provide advance notice to the Corporate Secretary by personal delivery or email. Notice must be delivered at least 30 days before the date of the Meeting, resulting in a delivery date no later than Wednesday, April 24, 2024. Additional advance notice requirements are set out in the extract of the advance notice provision from the Company’s Articles available on our website (www.lithiumamericas.com).

Majority Voting Policy

The Company has a majority voting policy that establishes requirements for the election of directors at uncontested meetings of Shareholders (the “Majority Voting Policy”). Under the policy, nominees are required to stand for election individually and not as a slate. Any nominee who receives a majority of “withheld” or “against” votes (50% + 1) is deemed to have tendered their resignation to the Board. The Board has the discretion, on recommendation from the G&N Committee, to decline any deemed resignation within 90 days of the meeting at which the election occurred, but doing so will require the Company to issue a press release pursuant to the Majority Voting Policy. The nominee would be excluded from Board and committee meetings until a decision is made on whether to accept the nominee’s deemed resignation. Any acceptance of a deemed resignation will create a vacancy on the Board that can be filled as permitted by applicable corporate law in British Columbia, including a Board appointment of a new nominee.

Diverse and Independent Board with Lithium Industry Experience

5 of 8 |

2 of 8 |

3 of 8 |

7 of 8 |

|

|

|

|

nominees are “independent” |

nominees are women (both of whom are independent) |

nominees are of diverse ethnicities |

nominees have lithium industry experience at a level of general competency or above |

Nominees

The following tables set out information regarding nominees for election as directors, including the names, province or state and country of residence, the offices they hold within the Company, their principal occupations, business or employment within the five preceding years, the period or periods during which each director has served as a director, areas of expertise, attendance of meetings during the 2023 fiscal year (if applicable) and the number of securities of the Company that each beneficially owns, directly or indirectly, or over which control or direction is exercised, as of the date of this Circular:

18

Committees of our Board are abbreviated in the tables as follows:

A&R Committee |

Audit and Risk Committee |

G&N Committee |

Governance and Nomination Committee |

C&L Committee |

Compensation and Leadership Committee |

S&S Committee |

Safety and Sustainability Committee |

TC |

Technical Committee |

|

|

Kelvin Dushnisky Director and Executive Chair Toronto, Ontario, Canada NON-INDEPENDENT DIRECTOR AGE: 60 |

|

Mr. Dushnisky is the Executive Chair of the Company. He joined the Board in October 2023, and served as a Director of Old LAC from June 2021 to October 2023. Mr. Dushnisky served as Chief Executive Officer and a member of the Board of Directors of AngloGold Ashanti Ltd. From 2018 to 2020. There he led the execution of the organization’s strategic priorities and oversaw a global portfolio of mining operations and projects in Africa, South America and Australia, along with exploration interests and investments in Canada and the USA. Prior to AngloGold Ashanti, Mr. Dushnisky had a sixteen-year career with Barrick Gold Corporation (“Barrick”), ultimately as its President and a member of the Barrick Board of Directors. Prior to Barrick, Mr. Dushnisky held senior executive and board positions with a number of private and listed companies. Mr. Dushnisky holds a B.Sc. (Hon.) degree from the University of Manitoba and M.Sc. and Juris Doctor degrees from the University of British Columbia. He is a member of the Law Society of British Columbia and the Canadian Bar Association. Among numerous other industry and related associations, Mr. Dushnisky is past Chair of the World Gold Council and a former member of the International Council on Mining and metals (ICMM) CEO Council and accenture Global Mining Council. Mr. Dushnisky is a past member of the Board of Trustees of the Toronto-based University Health Network (UHN). |

||

2023 Annual General Meeting (“AGM”) Voting Results |

Other Public Company Boards and Committees |

|

N/A |

B2Gold Corp. Chair of the Board Member of the Corporate Governance and Nominating Committee |

|

|

Doman Building Materials Group Ltd. Member of the Audit Committee |

||

Rigel Resource Acquisition Corp. (“Rigel”)* |

||

* Note: On March 11, 2024, Rigel announced a business combination with Blyvoor Gold Resources Proprietary Limited and Blyvoor Gold Operations Proprietary Limited (together, “Aurous”), expected to close in the second half of 2024. Mr. Dushnisky will not join the new board following the completion of such business combination of Rigel and Aurous.

2024 Management Information Circular 19

Securities Ownership of Mr. Dushnisky |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

30,000 |

– |

295,936 |

10,548 |

115,292 |

351,776 |

(1) Share Based Awards including RSUs, DSUs and PSUs are described in the Executive Compensation section below. |

|||||

|

|

Michael Brown Director Henderson, Nevada, USA INDEPENDENT DIRECTOR AGE: 65 |

|

Mr. Brown joined the Board on October 3, 2023. He is a Fellow at the Lincy Institute at the University of Nevada, Las Vegas. He joined UNLV following service in the Cabinet of Governor Sisolak of Nevada; first as Director of the Department of Business & Industry and then as Executive Director of the Governor’s Office of Economic Development. Previously, Mr. Brown served as President of Barrick Gold North America, a subsidiary of Barrick Gold Corporation from 2015 to 2018 after serving in roles of increasing responsibility with Barrick since 1994. He is a former member of the executive committee of the U.S. National Mining Association and a past Chairman of the Nevada Mining Association. Mr. Brown holds an MBA from George Washington University. In 2023 Mr. Brown completed the Public Company Directors’ Consortium at the Stanford Graduate School of Business. |

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

N/A |

|

Securities Ownership of Mr. Brown |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

3,101 |

– |

– |

4,974 |

– |

8,075 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. |

|||||

20

|

|

Fabiana Chubbs Director Vancouver, British Columbia, Canada INDEPENDENT DIRECTOR AGE: 58 |

|

Ms. Chubbs joined the Board in October 2023, and served as Director at Old LAC from June 2019 to October 2023. Ms. Chubbs served as the Chief Financial Officer of Eldorado Gold Corporation from 2011 to 2018. She joined Eldorado Gold Corporation in 2007 and led Treasury and Risk Management functions until accepting the Chief Financial Officer position. Prior to joining Eldorado Gold Corporation, Ms. Chubbs was a Senior Manager with PwC Canada. During her ten years at PwC Canada, she specialized in audit of public mining and technology companies. Ms. Chubbs started her career in her native Argentina, with experience divided between PwC Argentina and IBM. Ms. Chubbs holds dual degrees from the University of Buenos Aires, including a Certified Public Accountant bachelor’s degree, and a Bachelor of Business Administration degree. Ms. Chubbs is a Chartered Professional Accountant in Canada. Ms. Chubbs also serves on the board of Royal Gold, Inc. |

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

Royal Gold, Inc. Member of the Audit and Finance Committee |

|

Securities Ownership of Ms. Chubbs |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

8,816 |

– |

– |

40,497 |

– |

49,313 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. |

|||||

2024 Management Information Circular 21

|

|

Jonathan Evans Director, President and CEO Atlanta, Georgia, USA NON-INDEPENDENT AGE: 54 |

|

|

Mr. Evans is the President and Chief Executive Officer of the Company, and is also a Director of the Company, since October 2023 as at the Separation. He was a Director of Old LAC from June 2017 to October 2023, and served as its President from August of 2018 and as Chief Executive Officer from May of 2019 to October 2023. Mr. Evans has more than 20 years of operations and general management experience across businesses of various sizes and industry applications. Previously, he served as Vice President and General Manager for the Lithium Division at FMC Corporation (USA), and as the Chief Operating Officer of DiversiTech Corporation, a portfolio company of the private equity group, Permira. Mr. Evans has also held executive management roles at Arysta LifeScience, AMRI Corporation and General Electric. He holds a Bachelor of Science degree in mechanical engineering from Clarkson University and an MSc from Rensselaer Polytechnic Institute.

|

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

N/A |

|

Securities Ownership of Mr. Evans |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

438,600 |

– |

493,652 |

9,747 |

245,012 |

1,187,011 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Executive Compensation section below. |

|||||

22

|

|

Yuan Gao Lead Independent Director Broomfield, Colorado, USA INDEPENDENT DIRECTOR AGE: 61 |

|

|

Dr. Yuan Gao joined the Board in October 2023 and served as Director of Old LAC from September 2019 to October 2023. He was the Vice Chairman of the board of Qinghai Taifeng Pulead Lithium-Energy Technology Co. Ltd, a leading producer of cathodes for lithium-ion batteries, from September 2019 to May 2023, having served as President and CEO from May 2014 to September 2019. Previously, Mr. Gao served as Vice President at Molycorp Inc., and as Global Marketing Director and Technology Manager at FMC Corporation (USA). Mr. Gao holds a BSc from the University of Science and Technology of China, and a PhD in Physics from the University of British Columbia. He has also completed Executive Education at The Wharton Business School, University of Pennsylvania.

|

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

N/A |

|

Securities Ownership of Mr. Gao |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

3,231 |

– |

– |

31,909 |

- |

35,140 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. |

|||||

2024 Management Information Circular 23

|

|

Zach Kirkman Director Austin, Texas, USA NON-INDEPENDENT DIRECTOR AGE: 39 |

|

Mr. Kirkman is GM’s nominee to the Board and has served as a Director of the Company since October 2023. He is the Vice President, Global Corporate Development and President, GM Ventures of General Motors Company since January 2023, and prior to that served as the Head of Corporate Development, Merger and Acquisitions of Tesla, Inc. from August 2016 to December 2022. Mr. Kirkman has extensive M&A and investing experience gained during his time leading the corporate development teams of GM and Tesla Inc., and previously as part of Apple Inc.’s corporate development department. He holds an MBA from Massachusetts Institute of Technology, and Bachelor of Science from California Polytechnic State University, San Luis Obispo. |

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

N/A |

|

Securities Ownership of Mr. Kirkman |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

– |

– |

– |

– |

– |

– |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. Pursuant to the GM Investor Rights Agreement between LAC and GM, GM Investor Rights Agreement, a director’s fee would be payable to Mr. Kirkman based on Mr. Kirkman’s service on the Board unless GM waives the fee. GM waived the director’s fee and as such Mr. Kirkman does not receive director compensation as the GM director nominee on the Board. |

|||||

24

|

|

Jinhee Magie Director Toronto, Ontario, Canada INDEPENDENT DIRECTOR AGE: 56 |

|

Ms. Magie joined the Board in October 2023, and served as a Director at Old LAC from June 2021 to October 2023. Ms. Magie served as the Chief Financial Officer and Senior Vice President of Lundin Mining Corporation (leading diversified base metals producer) from October 2018 to September 2022, overseeing financial reporting, treasury, tax, and information technology (including cybersecurity). She joined Lundin in 2008, serving in various roles of increasing responsibility, including nine years as Vice President, Finance. With over 25 years of experience, Ms. Magie began her career with Ernst & Young and has held progressively more senior roles in public companies, with the last 15 years in the mining industry. Before joining Lundin, Ms. Magie was the Director of Corporate Compliance for LionOre Mining International Ltd. She has extensive experience in acquisitions and divestitures, public and private equity fundraising and public company reporting. Ms. Magie holds a Bachelor of Commerce degree from the University of Toronto and is a Chartered Professional Accountant (CPA, CA). |

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

Anglogold Ashanti PLC Member of the Audit and Risk Committee Member of the Investment Committee

Star Royalties Ltd. Chair of the Compensation Committee Member of the Audit and Risk Committee |

|

Securities Ownership of Ms. Jinhee |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

– |

– |

1,079 |

12,997 |

– |

14,076 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. |

|||||

2024 Management Information Circular 25

|

|

Philip Montgomery Director Dalkeith, Western Australia, Australia INDEPENDENT DIRECTOR AGE: 60 |

|

Mr. Montgomery joined the Board in October 2023. Mr. Montgomery is a non-executive Director at Walkabout Resources Ltd. He brings extensive global experience in major capital projects. Over his 35-year career at BHP Group Limited and its predecessor organizations, Mr. Montgomery worked across various geographies and commodities, demonstrating expertise in leading assets and projects as well as senior corporate roles, including Chief Growth Officer, Global Head of Group Project Management and Vice President – Projects. Mr. Montgomery is a Professional Engineer and holds a B.Sc. in Mechanical Engineering and Business management from Oxford Brookes University. |

||

2023 AGM Voting Results |

Other Public Company Boards and Committees |

|

N/A |

Walkabout Resources Ltd. Member of the Audit Committee Chair of the Remuneration Committee |

|

Securities Ownership of Mr. Montgomery |

|||||

Common Shares |

Options |

RSUs |

DSUs |

PSUs |

Total |

– |

– |

– |

3,398 |

– |

3,398 |

(1) Share Based Awards including RSUs, DSUs and PSUs are defined and described in the Director Compensation section below. |

|||||

26

Corporate Cease Trade Orders, Bankruptcies, Penalties and Sanctions

To the knowledge of the Company, no director or proposed director of the Company is, or within the 10 years prior to the date of this Circular has been, a director or executive officer of any company, including the Company that:

To the knowledge of the Company, no director, except as to Philip Montgomery as disclosed below, proposed director or executive officer of the Company is, or within the 10 years prior to the date of this Circular has been, a director or executive officer of any company, including the Company, that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the knowledge of the Company, no director or proposed director of the Company has, within the 10 years prior to the date of this Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

In October 2021, Salt Lake Potash, an Australian company of which Philip Montgomery was a director of at the time, voluntarily declared the company insolvent and appointed KPMG LLP as receivers.

2024 Management Information Circular 27

CORPORATE GOVERNANCE

Corporate Governance Overview

The Board believes that good corporate governance is important to our effective performance and plays a significant role in protecting Shareholders’ interests and maximizing Shareholder value.

Governance Highlights |

|

|

Board independence and composition |

ü |

Independence. The Board is composed of a majority of independent directors, and 100% of the A&R Committee, C&L Committee and G&N Committee members are independent. Our Lead Independent Director and Chairs of the committees are all independent. |

ü |

Committees. Five committees with written mandates oversee key functional areas within our organization, including audit, risk, governance, compensation, safety, health, environment, sustainability, technical, nomination and leadership succession planning matters. |

|

ü |

In-Camera Sessions. Independent directors have the opportunity to meet in camera at every Board and committee meeting. |

|

Oversight and strategy |

ü |

Oversight and Strategy. The Board or its committees oversee corporate strategy, enterprise risk management, health, safety and Environmental, Social and Governance (“ESG”) matters, the Code (as defined below) and ethics matters, corporate culture, human capital and talent retention, compensation and succession planning, whistleblower matters, insurance and cybersecurity. An annual corporate strategy session is held by executives and the Board. |

Governance practices |

ü |

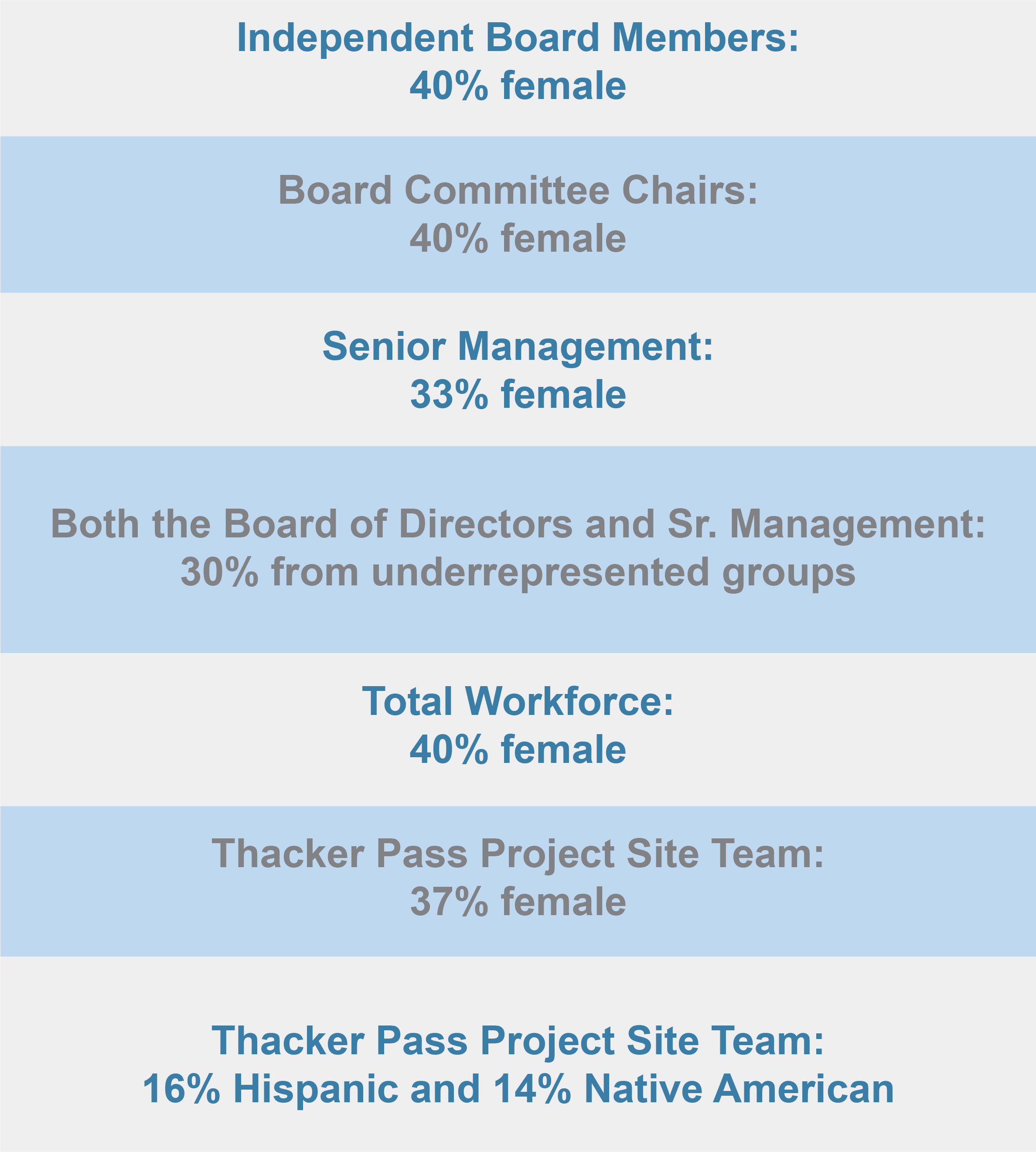

Diversity Initiative. As our organization continues to grow, we support diversity in our hiring practices as one aspect of finding the most qualified candidates for internal roles and on our Board. Two of our independent directors are women, and three of our directors come from ethnically diverse backgrounds. The Lithium Americas senior management team includes four females, along with three individuals from ethnically diverse backgrounds. Further details regarding diversity are included in the Diversity section. |

ü |

Ethical Business Conduct. Our Code applies to everyone within our organization, directors and consultants we do business with. |

|

ü |

Share Ownership Requirements. Share ownership guidelines for executive officers and independent directors were adopted in 2023 to align their interests with those of shareholders. |

|

ü |

Qualified Board. We assess board composition through a skills matrix assessment to evaluate whether Board composition aligns with the Company’s current needs. |

|

ü |

Annual Performance Assessments. The Board and committees conduct performance assessments of their effectiveness and that of individual directors. |

|

ü |

Board Mandate and Position Descriptions. We have a Board mandate, governance framework, and formal position descriptions for the Board Chair, CEO and CFO roles. |

|

ü |

Board Education. We have an orientation program for new directors, and an annual board education program. |

|

Shareholder voting and rights |

ü |

Annual Election and Majority Voting. Directors stand for election annually at the meeting of Shareholders, and are elected by majority vote pursuant to our Majority Voting Policy (no slate voting). |

ü |

No Dual Class or Non-Voting Shares. We currently have a single class of Common Shares whose holders are entitled to call meetings and vote. |