UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 11, 2024 |

CleanSpark, Inc.

(Exact name of Registrant as Specified in Its Charter)

Nevada |

001-39187 |

87-0449945 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

10624 S. Eastern Ave. Suite A - 638 |

|

|||

Henderson, Nevada |

|

89052 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (702) 989-7692 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, par value $0.001 per share |

|

CLSK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On April 11, 2024, CleanSpark, Inc., a Nevada corporation (the "Company"), entered into a Supplemental Agreement (the "Supplemental Agreement") with Bitmain Technologies Delaware Limited ("Bitmain"), amending certain terms of the Future Sales and Purchase Agreement dated January 6, 2024 (the "Original Agreement").

The Original Agreement provided for the purchase of 60,000 units of S21 servers, with the option to purchase an additional 100,000 units of S21 servers. The Supplemental Agreement amends the Original Agreement by modifying the type of servers to be purchased under the option from the S21 model to the upgraded S21 Pro model at a total purchase price of $374,400,000 for 100,000 units. The upgraded S21 Pro servers feature a higher rated hashrate of 234 terahashes, a rated power consumption of 3,510 watts, and a joules per terahash (J/T) value of 15. The upgrade to the S21 Pro model allows for additional computational power, resulting in greater operational efficiency and potential revenue generated per unit of energy consumed.

The foregoing description of the Original Agreement and Supplemental Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of these documents. A copy of the Original Agreement was filed as an exhibit to the Company's Current Report on Form 8-K filed on January 6, 2024, and a copy of the Supplemental Agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K (this "Current Report").

Item 7.01 Regulation FD Disclosure.

On April 12, 2024, the Company issued a press release announcing the completion of the Supplemental Agreement with Bitmain. A copy of this press release is attached hereto as Exhibit 99.1 and is being furnished with this Current Report.

The information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is disclosed solely pursuant to this Item 7.01.

Item 8.01 Other Events.

Pursuant to the terms of the Supplemental Agreement, the Company has exercised its option under the Original Agreement to purchase the S21 Pro servers. The Company submitted an Option Exercise Notice to Bitmain, dated April 9, 2024, formally documenting the exercise of the call option and specifying a delivery schedule for the newly purchased servers starting in June 2024 and ending by December 31, 2024.

The foregoing description of the Option Exercise Notice does not purport to be complete and is qualified in its entirety by reference to the complete text of the document, a copy of which is attached as Exhibit 10.2 to this Current Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. |

Description |

|

|

10.1 |

|

10.2 |

|

99.1 |

|

104 |

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the lnline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

CLEANSPARK, INC. |

|

|

|

|

Date: |

April 12, 2024 |

By: |

/s/ Zachary Bradford |

|

|

|

Name: Zachary Bradford |

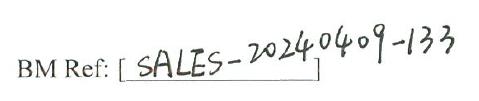

DATED April 8, 2024

BITMAIN TECHNOLOGIES DELAWARE LIMITED

("BITMAIN")

and

CleanSpark, Inc.

("PURCHASER")

___________________________________________________________________________________

SUPPLEMENTAL AGREEMENT TO FUTURE SALES AND PURCHASE AGREEMENT

relating to the purchase of Hash Super Computing Server, S21

Dated January 6, 2024

___________________________________________________________________________________

THIS SUPPLEMENTAL AGREEMENT (the "Supplemental Agreement") is made April 8, 2024

BETWEEN:

(together the "Parties" and each a "Party").

RECITALS

IT IS AGREED AS FOLLOWS:

1

and such indicators of each batch or unit of Products may differ. BITMAIN makes no representation on the rated hashrate per unit, the rated power per unit and/or J/T value of any Products.

|

Payment |

Payment Percentage |

Payment Date |

|

Down Payment |

20% |

20% of the total purchase price of Forward Deliverables shall be paid by the Purchaser within seven (7) days after the delivery of the Notice of Exercise and shall be satisfied by: (a)

BITMAIN's application of the corresponding proportionate amount of Call Purchase Fee; and

(b)

Payment by the Purchaser for any balance of the Down Payment remains due.

|

|

Interim Payment |

30% |

30% of the total purchase price of Forward Deliverables shall be paid at least three (3) months prior to the first |

2

|

|

day of the Shipping Period of Call Purchase (as defined below) of such batch of Forward Deliverables. |

|

Balance Payment |

50% |

50% of the Call Purchase Price of each batch of Forward Deliverables shall be paid by the Purchaser at least one (1) month prior to the first day of the Shipping Period of Call Purchase of such batch of Forward Deliverables. |

[Remainder of page intentionally left blank]

3

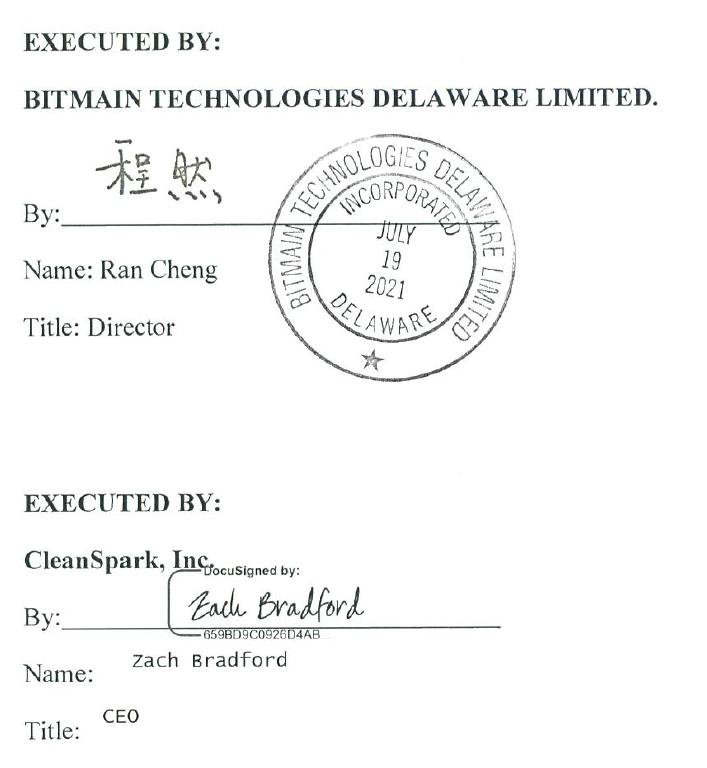

IN WITNESS whereof this Supplemental Agreement has been duly executed by the undersigned on the date first above written.

4

Notice Party:

Bitmain Technologies Delaware Limited

By Email to: Qingqing.miao@bitmain.com

CC: legal@bitmain.com & invoice@bitmain.com

NOTICE OF CALL OPTION EXERCISE, DATED APRIL 9, 2024

Pursuant to the January 6, 2024 Agreement between CleanSpark, Inc. & Bitmain Technologies Delaware Limited, as later amended on April 9, 2024, (as amended, the “Agreement”), and in accordance with Appendix C thereto, Cleanspark Inc. hereby exercises in full its option to Purchase 100,000 S21 Pro servers, having specifications as generally described at Exhibit 1 attached hereto.

The Company respectfully requests that the units be delivered evenly over the six months starting June 2024 and ending December 31, 2024, as further described on Exhibit 2 to this notice.

Executed By:

CleanSpark Inc.

By:_/s/_______________

Name: Zach Bradford

Title: CEO

EXHIBIT 1: PRODUCT SPECIFICATIONS

Summary of the general specifications of the Products are as follows:

Type |

Details |

Product Name |

HASH Super Computing Server |

Model |

S21 Pro-234.0T |

Rated Hashrate per Unit, T |

234.00 ±10% |

Rated power per Unit, W |

3,510.00 |

J/T |

15.0 |

Contracted Hashrate, T |

23,400,000 |

Quantity of the Products |

100,000 |

EXHIBIT 2: DELIVERY DATES

It is requested that each batch of Products shall be purchased and delivered in accordance with the following arrangements:

Batch |

Model |

Shipping Period |

Reference Quantity |

Total Rated Hashrate (T) |

Purchase Unit Price (US$/T) |

Corresponding Total Purchase Price (US$) |

1 |

S21 Pro |

July 2024 |

16,667 |

3,900,000 |

16 |

62,400,000 |

2 |

S21 Pro |

August 2024 |

16,667 |

3,900,000 |

16 |

62,400,000 |

3 |

S21 Pro |

September 2024 |

16,667 |

3,900,000 |

16 |

62,400,000 |

4 |

S21 Pro |

October 2024 |

16,667 |

3,900,000 |

16 |

62,400,000 |

5 |

S21 Pro |

November 2024 |

16,666 |

3,900,000 |

16 |

62,400,000 |

6 |

S21 Pro |

December 2024 |

16,666 |

3,900,000 |

16 |

62,400,000 |

In Total |

100,000 |

23,400,000 |

/ |

374,400,000 |

||

Total Purchase Price (tax exclusive): US$374,400,000.00

CleanSpark Exceeds 17 EH/s, Exercises and Upgrades Previously Announced Option

for 100,000 Bitcoin Mining Machines

Company negotiates option upgrade to new S21 Pros, increasing the total purchased hashrate by 17%, to 23.4 EH/s

The Company reached its new hashrate high as its recently acquired data center in Dalton, GA, goes online

Las Vegas, April 10--CleanSpark Inc. (Nasdaq: CLSK), America's Bitcoin Miner™, today announced it has exceeded 17 exahashes per second (EH/s) of operating hashrate and has exercised its option to purchase 100,000 Bitmain S21 Pros, or 23.4 EH/s of machines.

The machine purchase is an amendment to an existing agreement with Bitmain announced earlier this year. The amendment allowed the Company to purchase the S21 Pro model instead of the S21. The cost per terahash is maintained at the industry low price of $16 per terahash for the more efficient miner.

The S21 Pro operates at 15 joules per terahash (J/TH), a 14 percent improvement over the S21 miner which is currently the most efficient miner available on the market at 17.5 joules per terahash (J/TH). The improved efficiency of the S21 Pro means that the company will still acquire the same number of machines, but with a 17 percent increase in hashrate, or approximately 3.4 EH/s more hashrate.

“Efficiency is the most important variable as we head into the halving,” said Zach Bradford, CEO. “With the upgrade to the new S21 Pro, we expect that we have cemented our lead as the most efficient publicly traded bitcoin miner at scale in North America. Our extraordinary scale has allowed us to make meaningful gains in our bitcoin production without having to increase the energy use of our data centers. This is good not only for CleanSpark and our shareholders, but for the entire bitcoin network. After halving, many old and inefficient machines will go offline, increasing CleanSpark’s organic market share while lowering the network’s energy consumption. We are well-suited to take advantage of the opportunities that the halving affords and look forward to continuing our unmatched growth.”

Under the agreement, the new S21 Pros are scheduled for delivery between June and December 2024.

CleanSpark is among the largest publicly traded bitcoin miners in the world, consistently outpacing its peers in terms of bitcoin produced per exahash of operating hashrate, according to publicly available data.

About CleanSpark

CleanSpark (Nasdaq: CLSK) is America's Bitcoin Miner™. We own and operate data centers that primarily run on low-carbon power. Our infrastructure responsibly supports Bitcoin, the world's most important digital commodity and an essential tool for financial independence and inclusion. We cultivate trust and transparency among our employees and the communities we operate in. Visit our website at www.cleanspark.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In this press release, forward-looking statements include, but may not be limited to, statements regarding the Company's expectations, beliefs, plans, intentions, and strategies. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "anticipates," "could," "intends," "targets," "projects," "contemplates," "believes," "estimates," "forecasts," "predicts," "potential" or "continue" or the negative of these terms or other similar expressions. The forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: delivery dates and operating specifications of the purchased miners, anticipated additions to CleanSpark's hashrate and the timing thereof; the risk that the electrical power available to our facilities does not increase as expected; the success of its digital currency mining activities; the volatile and unpredictable cycles in the emerging and evolving industries in which we operate; increasing difficulty rates for bitcoin mining; bitcoin halving; new or additional governmental regulation; the anticipated delivery dates of new miners; the ability to successfully deploy new miners; the dependency on utility rate structures and government incentive programs; dependency on third-party power providers for expansion efforts; the expectations of future revenue growth may not be realized; and other risks described in the Company's prior press releases and in its filings with the Securities and Exchange Commission (SEC), including under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2023, and any subsequent filings with the SEC. Forward-looking statements contained herein are made only as to the date of this press release, and we assume no obligation to update or revise any forward-looking statements as a result of any new information, changed circumstances or future events or otherwise, except as required by applicable law.

Investor Relations Contact

Brittany Moore

702-989-7693

ir@cleanspark.com

Media Contact

Eleni Stylianou

702-989-7694

pr@cleanspark.com